As filed with the Securities and Exchange Commission on April 23, 2007

Registration No. ________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PENGRAM CORPORATION

(Name of small business issuer in its charter)

| NEVADA | 1000 | 68-0643436 |

| (State or jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

1200 Dupont Street, Suite 2J

Bellingham, WA 98225

Telephone: (360) 255-3436

(Address and telephone number of principal executive offices)

CAMLEX MANAGEMENT (NEVADA) INC.

8275 S. Eastern Avenue, Suite 200

Las Vegas, NV 89123

Tel: (702) 990-8800

(Name, address and telephone number of agent for service)

Copies to:

O’NEILL LAW GROUP PLLC

435 Martin Street, Suite 1010

Blaine, WA 98230

Tel: (360) 332-3300

Approximate date of proposed sale to the public: As soon as practicable after this Registration Statement isdeclared effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. [ ]

| CALCULATION OF REGISTRATION FEE |

Title of Each Class of

Securities to be Registered | Dollar Amount

to be

Registered(1) | Proposed Maximum

Offering Price Per

Unit(2) | Proposed Maximum

Aggregate Offering

Price(3) |

Amount of

Registration Fee(3) |

Common Stock, par value

$0.001 per share, previously

issued to investors |

$239,961.92

|

$0.04

|

$239,961.92

|

$7.37

|

| (1) | Represents 5,999,048 shares issued by Pengram Corporation in a private placement transaction completed on September 30, 2006. |

| (2) | This price was arbitrarily determined by Pengram Corporation. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended (the “Securities Act”). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (the “SEC”), acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED APRIL 19, 2007

The information contained in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PENGRAM CORPORATION

Prospectus

--------------------------

5,999,048 SHARES

COMMON STOCK

-------------------------

The selling stockholders named in this prospectus are offering the 5,999,048 shares of common stock of Pengram Corporation (“Pengram”) offered through this prospectus. Pengram has set a price of $0.04 per share of its common stock offered through this prospectus.

|

Offering Price |

Commissions | Proceeds to Selling Stockholders

Before Expenses and Commissions |

| Per Share | $0.04 | Not Applicable | $0.04 |

| Total | $239,961.92 | Not Applicable | $239,961.92 |

Pengram is not selling any shares of its common stock in this Offering and therefore will not receive any proceeds from this Offering.

Pengram’s common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.04 per share until such time as the shares of the Pengram’s common stock are traded on the Over-The-Counter Bulletin Board (the “OTC Bulletin Board”). Although Pengram intends to apply for trading of its common stock on the OTC Bulletin Board, public trading of its common stock may never materialize. If Pengram’s common stock becomes traded on the OTC Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling stockholders.

---------------

The purchase of the securities offered through this prospectus involves a high degree of risk. You should carefully read and consider the section of this prospectus entitled “Risk Factors” on pages 6 through 9 before buying any shares of Pengram’s common stock.

This Offering will terminate nine months after this prospectus is declared effective by the SEC. None of the proceeds from the sale of stock by the selling stockholders will be placed in escrow, trust or similar account.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Date Of This Prospectus Is: April 19, 2007

--------------------------

i

PENGRAM CORPORATION

Prospectus

Table of Contents

Until ninety days after the date this registration statement is declared effective, all dealers that effect transactions in these securities whether or not participating in this Offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

SUMMARY

As used in this prospectus, unless the context otherwise requires, “we,” “us,” “our,” the “Company” and “Pengram” refers to Pengram Corporation. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. You should read the entire prospectus before making an investment decision to purchase our common stock.

PENGRAM CORPORATION

Overview of Our Business

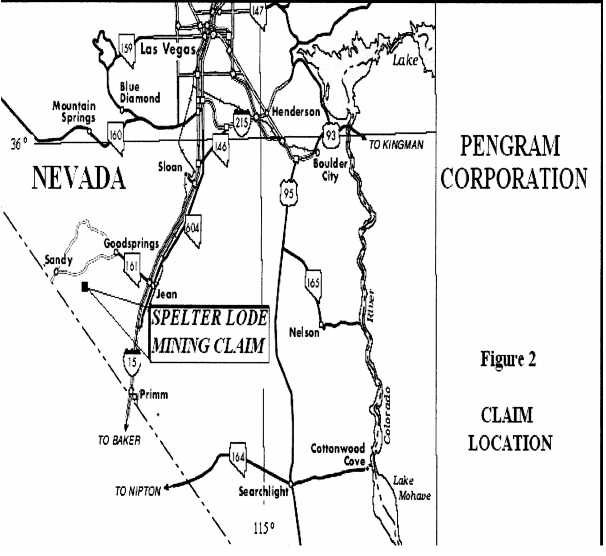

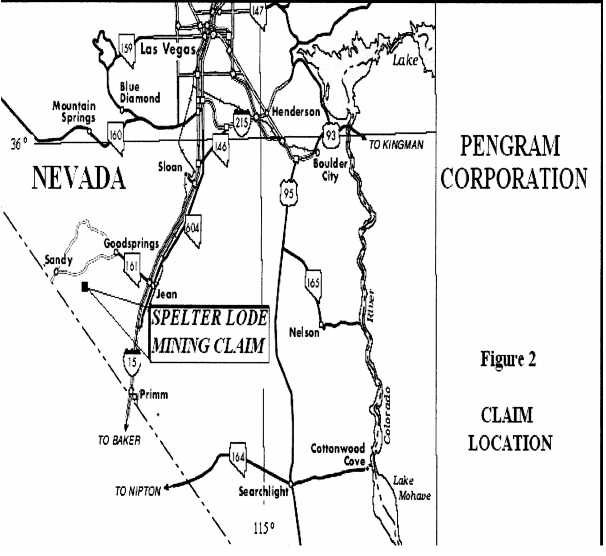

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We acquired a 100% undivided interest in a mineral claim known as the Spelter Claim comprised of a mineral claim block totaling 20 acres located on the Yellow Pine Mining District, Clark County, Nevada. We acquired our Spelter Claim pursuant to a purchase agreement dated June 16, 2006 with Kimberly Sinclair. Our plan of operation is to conduct mineral exploration activities on the Spelter Claim in order to assess whether it possesses commercially extractable deposits of zinc, lead, galena or vanadium. Phase I of our exploration program was completed in September, 2006. The objective of the Phase I exploration program was to trench and sample the known mineral zone to determine the geological controls and the nature of the mineralization. Based on the results of Phase I of our exploration program, our geological consultant recommended that Phase II be commenced. We intend to complete Phase II of our recommended exploration program during the summer exploration season of 2007. See “Description of Property”, below.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Summary Financial Information

Our financial information as of our three months ended February 28, 2007 and our fiscal period from inception on April 28, 2006 to November 30, 2006 is summarized below:

Summary

Balance Sheet Information: | As at

February 28, 2007

(Unaudited) | As at

November 30, 2006

(Audited) |

| Cash | $71,436 | $96,319 |

| Total Assets | $81,666 | $110,119 |

| Liabilities | $2,220 | $1,250 |

| Total Stockholders’ Equity | $79,446 | $108,869 |

Summary

Statement of Operations: |

Three Months Ended

February 28, 2007

(Unaudited) | Period from April 28, 2006

(Date of Inception)

to November 30, 2006

(Audited) |

| Revenue | $Nil | $Nil |

| Expenses | $29,423 | $20,112 |

| Net Loss | $(29,423) | $(20,112) |

About Us

We were incorporated on April 28, 2006 under the laws of the State of Nevada. Our principal offices are located at 1200 Dupont Street, Suite 2J, Bellingham, WA 98225. Our telephone number is (360) 255-3436.

1

| THE OFFERING |

| | |

| The Issuer: | Pengram Corporation |

| | |

| Selling Security Holders: | The selling stockholders named in this prospectus are existing stockholders of Pengram who purchased shares of our common stock in a private placement transaction completed on September 30, 2006. The issuance of the shares by Pengram to the selling stockholders was exempt from the registration requirements of the Securities Act of 1933 (the “Securities Act”). See “Selling Security Holders.” |

| | |

| Securities Being Offered: | Up to 5,999,048 shares of our common stock, par value $0.001 per share. |

| | |

| Offering Price: | The offering price of the common stock is $0.04 per share. We intend to apply to the OTC Bulletin Board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange Act”). Public trading of our common stock may never materialize. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders. |

| | |

| Duration of Offering: | This Offering will terminate nine months after this prospectus is declared effective by the SEC. |

| | |

| Minimum Number of Shares To Be | None. |

| Sold in This Offering: | |

| | |

| Common Stock Outstanding Beforeand After the Offering: | 14,999,048 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing stockholders. |

| | |

| Use of Proceeds: | We will not receive any proceeds from the sale of the common stock by the selling stockholders. |

| | |

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

2

Glossary Of Technical Geological Terms

The following defined technical geological terms are used in our prospectus:

| Anglesite | A native sulphate of lead. It occurs in white or yellowish transparent, prismatic crystals. |

| | |

| Azurite | Blue carbonate of copper; blue malachite. |

| | |

| Basalt | A general term for dark-colored mafic igneous rocks, commonly extrusive but locally intrusive (e.g., as in dikes). |

| | |

| Breccia | A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

| | |

| Brecciation | The formation of angular rock fragments. |

| | |

| Calamine | A white mineral; a common ore of zinc. |

| | |

| Carbonate | A salt or ester of carbonic acid. |

| | |

| Cerussite | A mineral consisting of lead carbonate that is an important source of lead. |

| | |

| Chrysocolla | A hydrous silicate of copper, occurring massive, of a blue or greenish blue color. |

| | |

| Cinnabar | A heavy reddish mineral consisting of mercuric sulfide; the chief source of mercury. |

| | |

| Clastic | Fragments of minerals, rocks, or organic structures that have been moved individually from their places of origin. |

| | |

| Cretaceous | Rocks laid down during the last period of the Mesozoic era (between the Jurassic and Tertiary periods, about 146 to 65 million years ago), at the end of which dinosaurs and many other organisms died out. |

| | |

| Diamond drill(ing) | A rotary type of rock drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water or other fluid is pumped to the cutting face as a lubricant. The drill cuts a core of rock that is recovered in long cylindrical sections, two centimeters or more in diameter. |

| | |

| Fault Zones | A network of interconnected fractures representing the surficial expression of a fault. |

| | |

| Fold | A planar feature, such as a bedding plane, that has been strongly warped, presumably by deformation. |

| | |

| Galena | The chief ore of lead, commonly found in shallow ore veins in which open cavities are frequent; hence, crystals are common and well developed. Galena is widely distributed and constitutes by far the most important ore for lead. Silver, antimony, arsenic, copper, and zinc minerals often occur in intimate association with galena; consequently, galena ores mined for lead also include other valuable by-products. |

| | |

| Granite | Plutonic igneous rock having visibly crystalline texture; generally composed of feldspar and mica and quartz. |

| | |

| Hydrozincite | An abundant element of the magnesium-cadmium group, extracted principally from the minerals zinc blende, smithsonite, calamine, and franklinite, as an easily fusible bluish white metal, which is malleable, especially when heated. |

| | |

| Igneous | A type of rock which has been formed by the consolidation of magma, a molten substance from the earth’s core. |

| | |

| Intrusive | A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

| | |

| Jurassic | Second Period of Mesozoic Era, which covered span of time between 190 – 135 million years before the present time. |

3

| Limestone | A bedded, sedimentary deposit consisting chiefly of calcium carbonate. |

| | |

| Limonite | A widely occurring iron oxide ore; a mixture of goethite and hematite and lepidocrocite. |

| | |

| Lode | A mineral deposit in solid rock. |

| | |

| Malachite | Green mineral used as an ore of copper and for making ornamental objects. |

| | |

| Mesozoic | One of the eras of geologic time. It includes the Triassic, Jurassic and Cretaceous periods. |

| | |

| Mineralization | The concentration of metals and their chemical compounds within a body of rock. |

| | |

| Monte Cristo LimestoneFormation | A local name for a geological series of rocks. |

| |

| Normal Fault | A dip-slip fault in which the block above the fault has moved downward relative to the block below. |

| | |

| Ore | A mixture of minerals and gangue from which at least one metal can be extracted at a profit. |

| | |

| Oxidization | A chemical reaction caused by exposure to oxygen that results in a change in the chemical composition of a mineral |

| | |

| Paleozoic | Rocks that were laid down during the Paleozoic Era (between 544 and 230 million years before the present time). |

| | |

| Pluton | Body of rock exposed after solidification at great depth. |

| | |

| Porphyritic | Containing relatively large isolated crystals in a mass of fine texture. |

| | |

| Porphyry | A heterogeneous rock characterized by the presence of crystals in a relatively finer-grained matrix |

| | . |

| Pyrite | The most common of the sulphide minerals. It is usually found associated with other sulphides or oxides in quartz veins, sedimentary rock and metamorphic rock, as well as in coal beds, and as the replacement mineral in fossils. |

|

| Quartz | A mineral whose composition is silicon dioxide. A crystalline form of silica. |

| | |

| Quarzite | Metamorphic rock commonly formed by metamorphism of sandstone and composed of quartz. |

| | |

| Reserve | For the purposes of this prospectus: that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

| | 1) | Proven (Measured) Reserves.Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | | |

| | 2) | Probable (Indicated) Reserves.Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

4

| Sedimentary | A type of rock which has been created by the deposition of solids from a liquid. |

| | |

| Smithsonite | Native zinc carbonate. It generally occurs in stalactitic, reniform, or botryoidal shapes, of a white to gray, green, or brown color. |

| | |

| Stratigraphy | Strictly, the description of bedded rock sequences; used loosely, the sequence of bedded rocks in a particular area. |

| | |

| Structural | Pertaining to geologic structure. |

| | |

| Tertiary | Relating to the first period of the Cenozoic era, about 65 to 1.64 million years ago. |

| | |

| Thrust Faults (Faulting) | A dip-slip fault in which the upper block above the fault plane moves up and over the lower block, so that older strata are placed over younger. |

|

| Trenching | The removal of overburden to expose the underlying bedrock. |

| | |

| Triassic | The system of strata that was deposited between 210 and 250 million years before the present time. |

| | |

| Vein | An occurrence of ore with an irregular development in length, width and depth usually from an intrusion of igneous rock. |

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, if we publicly trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Business

If we do not obtain additional financing, our business will fail.

Our current operating funds are sufficient to meet the anticipated costs of Phases II and III of our exploration program on the Spelter Claim. However, our existing funds may be insufficient if the actual costs of our exploration program significantly exceed our estimates or if we decide to proceed beyond Phase III of our exploration program or if we decide to begin mining efforts in the event that it is determined that our property contains mineral reserves. Therefore, we will need to obtain additional financing in order to complete our full business plan. As of the date of this prospectus, we had cash on hand in the amount of approximately $70,000. We have not earned any revenues from our mineral exploration since our inception. Our plan of operation calls for significant expenses in connection with the exploration of our Spelter Claim. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors outside of our control, including the results from our exploration program, and any unanticipated problems relating to our mineral exploration activities, including environmental assessments and additional costs and expenses that may exceed our current estimates. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us in which case our business will fail.

We have yet to earn revenue from our mineral exploration and, because our ability to sustain our operations is dependent on our ability to raise financing, our accountants believe that there is substantial doubt about our ability to continue as a going concern.

We have a cumulative net loss of $49,535 for the period from our inception on April 28, 2006 to February 28, 2007, and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claim. These factors raise substantial doubt that we will be able to continue as a going concern. Telford Sadovnick, P.L.L.C., Certified Public Accountants, our independent auditors, have expressed substantial doubt about our ability to continue as a going concern given our accumulated losses. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital, we will not be able to complete our business plan. As a result we may have to liquidate our business and you may lose your investment. You should consider our auditor's comments when determining if an investment in Pengram is suitable.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Our Spelter Claim does not contain a known body of commercial ore and, therefore, any program conducted on the Spelter Claim would be an exploratory search of ore. There is no certainty that any expenditures made in the exploration of the Spelter Claim will result in discoveries of commercial quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of Phase II of our exploration program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

6

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no mineral reserves. If we do not find a mineral reserve containing zinc, lead, galena or vanadium, or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and you will lose your investment. Mineral exploration, particularly for zinc, lead, galena or vanadium, is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our property our production capability is subject to further risks including:

| | (i) | Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for; |

| | (ii) | Availability and costs of financing; |

| | (iii) | Ongoing costs of production; and |

| | (iv) | Environmental compliance regulations and restraints. |

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near the Spelter Claim, and such other factors as government regulations, including regulations relating to allowable production, importing and exporting of minerals, and environmental protection.

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of mineral exploration claims and leases on zinc, lead, galena or vanadium and other precious metal prospects and in connection with the recruitment and retention of qualified personnel. There is significant competition for the limited number of zinc, lead, galena, vanadium or other precious metals and, as a result, we may be unable to acquire an interest in attractive mineral exploration properties on terms we consider acceptable on a continuing basis.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may result in our inability to complete our planned exploration program and/or obtain additional financing to fund our exploration program.

As we undertake exploration of our mineral claim, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We are subject to the laws of the State of Nevada as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| | (i) | Water discharge will have to meet drinking water standards; |

| | (ii) | Dust generation will have to be minimal or otherwise re-mediated; |

| | (iii) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| | (iv) | An assessment of all material to be left on the surface will need to be environmentally benign; |

| | (v) | Ground water will have to be monitored for any potential contaminants; |

| | (vi) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and |

7

| | (vii) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

Our annual cost of compliance with the Bureau of Land Management in the State of Nevada is presently approximately $125 per year. There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. If remediation costs exceed our cash reserves we may be unable to complete our exploration program and have to abandon our operations. See “Description of Business - Compliance with Government Regulation,” below.

Because our sole executive officer and director does not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Bernie J. Hoing, our sole executive officer and sole director, does not have any formal training as a geologist and only limited training in the technical aspects of managing a mineral exploration company. With very limited direct training or experience in these areas, our management may not be fully aware of the specific requirements related to working within this industry. Our management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

Because the prices of metals fluctuate, if the price of metals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those metals and we will cease operations.

Prices of metals are determined by such factors as expectations for inflation, the strength of the United States dollar, global and regional supply and demand, and political and economic conditions and production costs in metals producing regions of the world. The aggregate effect of these factors on metal prices is impossible for us to predict. In addition, the prices of metals such as zinc, lead, galena, vanadium are sometimes subject to rapid short-term and/or prolonged changes because of speculative activities. The current demand for and supply of these metals affect the metal prices, but not necessarily in the same manner as current supply and demand affect the prices of other commodities. The supply of these metals primarily consists of new production from mining. If the prices of the metals are, for a substantial period, below our foreseeable cost of production, we could cease operations and you could lose your entire investment.

Risks Related To The Ownership of Our Stock

Because our sole executive officer and director, Bernie J. Hoing, owns 60% of our outstanding common stock, investors may find that corporate decisions controlled by Mr. Hoing are inconsistent with the interests of other stockholders.

Bernie J. Hoing, our President, Secretary and Treasurer, controls 60% of our issued and outstanding shares of common stock. Accordingly, in accordance with our Articles of Incorporation and Bylaws, Mr. Hoing is able to control who is elected to our board of directors and thus could act, or could have the power to act, as our management. Since Mr. Hoing is not simply a passive investor, but is also our sole active executive officer, his interests as an executive officer may, at times, be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon Mr. Hoing exercising, in a manner fair to all of our shareholders, his fiduciary duties as an officer or as a member of our board of directors. Also, due to his stock ownership position, Mr. Hoing will have: (i) the ability to control the outcome of most corporate actions requiring stockholder approval, including amendments to our Articles of Incorporation; (ii) the ability to control corporate combinations or similar transactions that might benefit minority stockholders which may be rejected by Mr. Hoing to their detriment, and (iii) control over transactions between him and Pengram.

8

We may conduct further offerings in the future in which case your shareholdings will be diluted.

We completed an offering of 5,999,048 shares of our common stock at a price of $0.02 per share to investors on September 30, 2006. Since our inception, we have relied on such equity sales of our common stock to fund our operations. We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, your percentage interest in us will be diluted. The result of this could reduce the value of your stock.

If a market for our common stock does not develop, stockholders may be unable to sell their shares.

There is currently no market for our common stock and we can provide no assurance that a market will develop. We intend to apply for trading of our common stock on the OTC Bulletin Board. However, we can provide no assurance that our shares will be approved for trading on the OTC Bulletin Board or, if traded, that a public market will materialize. If our common stock is not traded on the OTC Bulletin Board or if a public market for our common stock does not develop, stockholders may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock.

The shares offered by this prospectus constitute a penny stock under the Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. The classification as a penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to Rules 15g-1 through 15g-10 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling stockholders.

DETERMINATION OF OFFERING PRICE

The $0.04 per share offering price of our common stock was determined based on our internal assessment of what the market would support. However, the selection of this particular price was influenced by the last sales price from our most recent private offering of 5,999,048 shares of our common stock which was completed on September 30, 2006 at a price of $0.02 per share. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value.

We intend to apply to the OTC Bulletin Board for the trading of our common stock upon our becoming a reporting entity under the Exchange Act. We intend to file a registration statement under the Exchange Act concurrently with the effectiveness of the registration statement of which this prospectus forms a part. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling stockholders named in this prospectus. Although Pengram intends to apply for trading of its common stock on the OTC Bulletin Board, public trading of its common stock may never materialize.

DILUTION

The common stock to be sold by the selling stockholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing stockholders.

9

SELLING SECURITY HOLDERS

The selling stockholders named in this prospectus are offering all of the 5,999,048 shares of common stock offered through this prospectus. The selling stockholders acquired the 5,999,048 shares of common stock offered through this prospectus from us in an offering that was exempt from registration under Regulation S of the Securities Act and completed on September 30, 2006.

The following table provides as of April 19, 2007 information regarding the beneficial ownership of our common stock held by each of the selling stockholders, including:

| 1. | the number of shares beneficially owned by each prior to this Offering; |

| 2. | the total number of shares that are to be offered by each; |

| 3. | the total number of shares that will be beneficially owned by each upon completion of the Offering; |

| 4. | the percentage owned by each upon completion of the Offering; and |

| 5. | the identity of the beneficial holder of any entity that owns the shares. |

| Name Of Selling Stockholder(1) | Beneficial Ownership

Before Offering(1) |

Number of

Shares Being

Offered | Beneficial Ownership

After Offering(1) |

Number of

Shares |

Percent(2) |

Number of

Shares |

Percent(2) |

| John Boschert | 500,000 | 3.3% | 500,000 | Nil | * |

| Robert Chasmar | 150,000 | 1.0% | 150,000 | Nil | * |

| Mark Coupé | 100,000 | * | 100,000 | Nil | * |

| Christina De Pape | 75,000 | * | 75,000 | Nil | * |

| Artin Deyrmenjian | 25,000 | * | 25,000 | Nil | * |

| Jozef Englmaier | 375,000 | 2.5% | 375,000 | Nil | * |

| Stacy Ewing Cyr | 50,000 | * | 50,000 | Nil | * |

| Stephen Feddersen | 250,000 | 1.7% | 250,000 | Nil | * |

| Kaj Furer | 150,000 | 1.0% | 150,000 | Nil | * |

| GM Bain Real Estate Services Ltd.(3) | 200,000 | 1.3% | 200,000 | Nil | * |

| Kevin Hansen | 200,000 | 1.3% | 200,000 | Nil | * |

| Christopher Hansen | 134,048 | * | 134,048 | Nil | * |

| Rupinder Hofer | 50,000 | * | 50,000 | Nil | * |

| Kulwant Hoonjan | 100,000 | * | 100,000 | Nil | * |

| Jeffrey D. King | 100,000 | * | 100,000 | Nil | * |

| Ed Lingel | 75,000 | * | 75,000 | Nil | * |

| Elizabeth Macoomb | 50,000 | * | 50,000 | Nil | * |

| Gordon MacPherson | 200,000 | 1.3% | 200,000 | Nil | * |

| Dan Marshall | 125,000 | * | 125,000 | Nil | * |

| Riordan McCarthy | 100,000 | * | 100,000 | Nil | * |

| Carolyn McDonald | 200,000 | 1.3% | 200,000 | Nil | * |

| Corey McDonald | 75,000 | * | 75,000 | Nil | * |

| Rula Mielke | 200,000 | 1.3% | 200,000 | Nil | * |

| Cam Mitchell | 150,000 | 1.0% | 150,000 | Nil | * |

| Randy Moffatt | 250,000 | 1.7% | 250,000 | Nil | * |

| Chris Morrison | 200,000 | 1.3% | 200,000 | Nil | * |

10

| Name Of Selling Stockholder(1) | Beneficial Ownership

Before Offering(1) |

Number of

Shares Being

Offered | Beneficial Ownership

After Offering(1) |

Number of

Shares |

Percent(2) |

Number of

Shares |

Percent(2) |

| Leon Ng | 125,000 | * | 125,000 | Nil | * |

| May Ng | 125,000 | * | 125,000 | Nil | * |

| Stacy Nickel | 50,000 | * | 50,000 | Nil | * |

| Bradley Pascall | 50,000 | * | 50,000 | Nil | * |

| Audrey M. Plevy | 250,000 | 1.7% | 250,000 | Nil | * |

| Brad Prince | 25,000 | * | 25,000 | Nil | * |

| Craig Procter | 100,000 | * | 100,000 | Nil | * |

| Lori Quinton | 100,000 | * | 100,000 | Nil | * |

| Kelly Revell | 25,000 | * | 25,000 | Nil | * |

| Cheri Roberge | 50,000 | * | 50,000 | Nil | * |

| Don Rollins | 50,000 | * | 50,000 | Nil | * |

| Linda Ryan | 250,000 | 1.7% | 250,000 | Nil | * |

| Robert Dean Seymour | 25,000 | * | 25,000 | Nil | * |

| Kathie Simpson | 150,000 | 1.0% | 150,000 | Nil | * |

| Arlyn Stoik | 200,000 | 1.3% | 200,000 | Nil | * |

| Christopher Taylor | 50,000 | * | 50,000 | Nil | * |

| Jacqueline Tweedlie | 90,000 | * | 90,000 | Nil | * |

| Norman Williams | 200,000 | 1.3% | 200,000 | Nil | * |

| TOTAL | 5,999,048 | 40% | 5,999,048 | NIL | * |

| Notes: | |

| * | Represents less than 1%. |

| (1) | The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling stockholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. |

| (2) | Applicable percentage of ownership is based on 14,999,048 common shares outstanding as of the date of this prospectus, plus any securities held by such security holder exercisable for or convertible into common shares within sixty (60) days after the date of this prospectus, in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

| (3) | GM Bain Real Estate Services Ltd. is beneficially owned by Gary Bain. |

Bernie J. Hoing has been a member of our board of directors since inception on April 28, 2006. Except as disclosed above, none of the selling stockholders:

| | (i) | has had a material relationship with Pengram other than as a stockholder at any time within the past three years; or |

| | (ii) | has ever been one of our officers or directors. |

11

PLAN OF DISTRIBUTION

This prospectus is part of a registration statement that enables the selling stockholders to sell their shares on a continuous or delayed basis for a period of nine months after this registration statement is declared effective. The selling stockholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | On such public markets as the common stock may from time to time be trading; |

| | |

| 2. | In privately negotiated transactions; |

| | |

| 3. | Through the writing of options on the common stock; |

| | |

| 4. | In short sales; or |

| | |

| 5. | In any combination of these methods of distribution. |

The sales price to the public is fixed at $0.04 per share until such time as the shares of our common stock are traded on the OTC Bulletin Board. Although we intend to apply for trading of our common stock on the OTC Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the OTC Bulletin Board, then the sales price to the public will vary according to the selling decisions of each selling stockholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

| 1. | The market price of our common stock prevailing at the time of sale; |

| | |

| 2. | A price related to such prevailing market price of our common stock; or |

| | |

| 3. | Such other price as the selling stockholders determine from time to time. |

The selling stockholders named in this prospectus may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as agent may receive a commission from the selling stockholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling stockholders will likely pay the usual and customary brokerage fees for such services.

We can provide no assurance that all or any of the common stock offered will be sold by the selling stockholders named in this prospectus. The estimated costs of this Offering are $17,008. We are bearing all costs relating to the registration of the common stock. The selling stockholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling stockholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling stockholders and any broker-dealers who execute sales for the selling stockholders may be deemed to be an “underwriter” within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling stockholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may among other things:

| 1. | Not engage in any stabilization activities in connection with our common stock; |

| | |

| 2. | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| | |

| 3. | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

If an underwriter is selected in connection with this Offering, an amendment will be filed to identify the underwriter, disclose the arrangements with the underwriter, and we will file the underwriting agreement as an exhibit to this prospectus.

12

The selling stockholders should be aware that the anti-manipulation provisions of Regulation M under the Exchange Act will apply to purchases and sales of shares of common stock by the selling stockholders, and that there are restrictions on market-making activities by persons engaged in the distribution of the shares. Under Regulation M, the selling stockholders or their agents may not bid for, purchase, or attempt to induce any person to bid for or purchase, shares of our common stock while such selling stockholder is distributing shares covered by this prospectus. Accordingly, the selling stockholders are not permitted to cover short sales by purchasing shares while the distribution is taking place. The selling stockholders are advised that if a particular offer of common stock is to be made on terms constituting a material change from the information set forth above with respect to the Plan of Distribution, then, to the extent required, a post-effective amendment to the accompanying registration statement must be filed with the SEC.

LEGAL PROCEEDINGS

There are no material proceedings to which any of our directors, officers or our affiliates, any owner of record or beneficially of more than 5% of our common stock, or security holder is a party adverse to us or has a material interest adverse to us.

We are required by Section 78.090 of the Nevada Revised Statutes (the “NRS”) to maintain a resident agent in the State of Nevada. Our resident agent for this purpose is Camlex Management (Nevada) Inc. of 8275 S. Eastern Avenue, Suite 200, Las Vegas, Nevada, 89123. All legal process and any demand or notice authorized by law to be served upon us may be served upon our resident agent in the State of Nevada in the manner provided in NRS 14.020(2) ..

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Our sole executive officer and director and his age and titles as of April 19, 2007 are as follows:

| Name of Director | Age | Position |

| Bernie J. Hoing | 43 | President, Secretary, Treasurer, and Director |

Bernie J. Hoingis the President, Secretary, Treasurer and the sole director of the Company and has served in those capacities since inception. Currently, Mr. Hoing has also served as the president of Elmwood Home Ltd., a private company that is engaged in the construction business. From 1994 to 2000, Mr. Hoing was the general manager of Tozai Construction Ltd., based in Kobe, Japan. Mr. Hoing provides his services on a part-time basis as required for our business. Mr. Hoing presently commits approximately 30% of his business time to our business.

Mr. Hoing does not have formal training as a geologist and very limited training on the technical and managerial aspects of managing a mineral exploration company. His prior managerial and consulting positions have not been in the mineral exploration industry. Accordingly, we will have to rely on the technical services of others to advise us on the managerial aspects specifically associated with a mineral exploration company. We do not have any employees who have professional training or experience in the mining industry. We rely on independent geological consultants to make recommendations to us on work programs on our property, to hire appropriately skilled persons on a contract basis to complete work programs and to supervise, review, and report on such programs to us.

Term of Office

Members of our board of directors are appointed to hold office until the next annual meeting of our stockholders or until his or her successor is elected and qualified, or until they resign or are removed in accordance with the provisions of the Nevada Revised Statutes. Our officers are appointed by our board of directors and hold office until removed by the board.

13

Significant Employees

We have no significant employees other than our sole officer and director. Mr. Hoing provides management services to Pengram in consideration of a management fee of $2,800 per month commencing August, 2006. The services are provided on a month to month basis with no formal agreement.

We conduct our business through agreements with consultants and arms-length third parties. Currently, we have no formal consulting agreements in place. We have a verbal arrangement with the consulting geologist currently conducting the exploratory work on the Spelter Claim. We pay to this geologist the usual and customary rates received by geologists performing similar consulting services.

Committees of the Board of Directors

We do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee or any other committees of our board of directors. As such, Mr. Hoing acts in those capacities as our sole director.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of April 19, 2007 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities of our shares of common stock, (ii) our sole executive officer and sole director, and (iii) our named executive officers as defined in Item 402(a)(2) of Regulation S-B. Unless otherwise indicated, the stockholders listed possess sole voting and investment power with respect to the shares shown.

Title of Class |

Name and Address of Beneficial Owner | Amount and Nature

of Beneficial

Ownership | Percentage of

Common

Stock(1) |

Security Ownership of Management |

|

| Common Stock | Bernie J. Hoing

President, Secretary, Treasurer, and Director

1200 Dupont Street, Suite 2J

Bellingham, WA 98225 | 9,000,000

Direct | 60% |

| Common Stock | All Officers and Directors as a Group (1 person) | 9,000,000 | 60% |

| Security Ownership of Certain Beneficial Owners |

|

| Common Stock | Bernie J. Hoing

President, Secretary, Treasurer, and Director

1200 Dupont Street, Suite 2J

Bellingham, WA 98225 | 9,000,000

Direct | 60% |

| Notes: | |

| (1) | A beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on April 19, 2007. As of April 19, 2007, there were 14,999,048 shares of our common stock issued and outstanding. |

14

Changes in Control

There are no arrangements which may result in a change in control of Pengram.

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 100,000,000 shares of common stock, with a par value of $0.001 per share, and 100,000,000 shares of preferred stock, with a par value of $0.001 per share. As of April 19, 2007, there were 14,999,048 shares of our common stock issued and outstanding that are held of record by forty five (45) registered stockholders. We have not issued any shares of preferred stock.

Common Stock

The following is a summary of the material rights and restrictions associated with our common stock. This description does not purport to be a complete description of all of the rights of our stockholders and is subject to, and qualified in its entirety by, the provisions of our most current Articles of Incorporation and Bylaws, which are included as exhibits to this registration statement.

The holders of our common stock have the right to cast one vote for each share held of record on all matters submitted to a vote of the holders of our common stock, including the election of directors. Holders of our common stock do not have cumulative voting rights in the election of directors. Pursuant to the provisions of Section 78.320 of the Nevada Revised Statutes (the “NRS”) and Section 5 of our Bylaws, at lease one percent of the outstanding shares of stock entitled to vote must be present, in person or by proxy, at any meeting of our stockholders in order to constitute a valid quorum for the transaction of business. Actions taken by stockholders at a meeting in which a valid quorum is present are approved if the number of votes cast at the meeting in favor of the action exceeds the number of votes cast in opposition to the action, provided, however, that directors shall be elected by a plurality of the votes of the shares present at the meeting and entitled to vote. Certain fundamental corporate changes such as the liquidation of all of our assets, mergers or amendments to our Articles of Incorporation require the approval of holders of a majority of the outstanding shares entitled to vote.

Holders of our common stock do not have any preemptive rights to purchase shares in any future issuances of our common stock or any other securities. There are no redemption or sinking fund provisions applicable to our common stock. All outstanding shares of our common stock are fully paid and non-assessable.

The holders of our common stock are entitled to receive dividends pro rata based on the number of shares held, when and if declared by our board of directors, from funds legally available for that purpose. In the event of the liquidation, dissolution or winding up of the affairs of the Company, all our assets and funds remaining after the payment of all debts and other liabilities are to be distributed, pro rata, among the holders of our common stock.

Preferred Stock

Our Board of Directors is authorized by our Articles of Incorporation to divide the authorized shares of our preferred stock into one or more series, each of which shall be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our Board of Directors is authorized, within any limitations prescribed by law and our Articles of Incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including but not limited to the following:

| | (a) | the rate of dividend, the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue; |

| | | |

| | (b) | whether shares may be redeemed, and, if so, the redemption price and the terms and conditions of redemption; |

15

| | (c) | the amount payable upon shares of preferred stock in the event of voluntary or involuntary liquidation; |

| | | |

| | (d) | sinking fund or other provisions, if any, for the redemption or purchase of shares of preferred stock; |

| | | |

| | (e) | the terms and conditions on which shares of preferred stock may be converted, if the shares of any series are issued with the privilege of conversion; |

| | | |

| | (f) | voting powers, if any, provided that if any of the preferred stock or series thereof shall have voting rights, such preferred stock or series shall vote only on a share for share basis with our common stock on any matter, including but not limited to the election of directors, for which such preferred stock or series has such rights; and |

| | | |

| | (g) | subject to the above, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences, if any, of shares or such series as our Board of Directors may, at the time so acting, lawfully fix and determine under the laws of the State of Nevada. |

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or Bylaws. Chapter 78 of the NRS does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

| (a) | we would not be able to pay our debts as they become due in the usual course of business; or |

| | |

| (b) | except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution. |

Nevada Anti-Takeover Laws

Nevada Revised Statutes (“NRS”) Sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our Articles of Incorporation and Bylaws do not state that these provisions do not apply.

The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The restrictions on the acquisition of controlling interests contained in NRS Sections 78.378 to 78.3793 apply only to a Nevada corporation that:

| | (a) | has 200 stockholders of record (at least 100 of whom have addresses in the State of Nevada appearing on the stock ledgers of the corporation); and |

| | | |

| | (b) | does business in the State of Nevada, either directly or through an affiliated corporation. |

Currently, we do not have 200 stockholders of record, nor do we have any stockholders of record with addresses in the State of Nevada. Furthermore, we do not conduct business in the State of Nevada and we do not intend to conduct business in the State of Nevada in the near future. Accordingly, the anti-takeover provisions contained in NRS Sections 78.378 to 78.3793 do not apply to us, and are not likely to apply to us in the foreseeable future.

16

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the Offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company, or any of its parents or subsidiaries, a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

EXPERTS

O’Neill Law Group PLLC has assisted us in the preparation of this prospectus and registration statement and will provide counsel with respect to other legal matters concerning the registration and offering of the common stock.

Telford Sadovnick, P.L.L.C., Certified Public Accountants (“Telford”), our independent registered public accountants, have audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Telford has presented its report with respect to our audited financial statements. The report of Telford is included in reliance upon their authority as experts in accounting and auditing.

Laurence Sookochoff, P. Eng., our consulting geologist, has prepared the geological reports entitled “Geological Evaluation Report on the Spelter Lode Mining Claim” dated June 10, 2006 and Report on Phase I Exploration Program on the Spelter Lode Mining Claim dated September 25, 2006. Mr. Sookochoff’s consent to the inclusion of geological information from the geological reports is attached to this prospectus as an exhibit.

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our Bylaws provide that we will indemnify an officer, director, or former officer or director, to the full extent permitted by law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities, other than the payment by us of expenses incurred or paid by one of our directors, officers, or controlling persons in the successful defense of any action, suit or proceeding, is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification is against public policy as expressed in the Securities Act, and we will be governed by the final adjudication of such issue.

ORGANIZATION WITHIN LAST FIVE YEARS

We were incorporated on April 28, 2006 under the laws of the State of Nevada.

Bernie J. Hoing, our President, Secretary, Treasurer and sole director, has been our sole promoter since our inception. Mr. Hoing acquired from us 9,000,000 shares of our common stock at a price of $0.001 per share on June 13, 2006. Mr. Hoing paid a total purchase price of $9,000 for these shares. Since August, 2006 Mr. Hoing has provided management services to Pengram in consideration of a management fee of $2,800 per month. The services are provided on a month to month basis with no formal agreement. Other than as mentioned above, Mr. Hoing has not entered into any other agreement with us in which he is to receive from us or provide to us anything of value.

17

DESCRIPTION OF BUSINESS

Background

We were incorporated on April 28, 2006 pursuant to the laws of the State of Nevada. We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We acquired a 100% undivided interest in a mineral claim known as Spelter Lode Mining Claim (the “Spelter Claim”) comprised of one located claim of 20 acres located on the Yellow Pine Mining District, Clark County, Nevada. Our plan of operation is to conduct mineral exploration activities on the Spelter Claim in order to assess whether it possesses mineral deposits of zinc, lead, galena or vanadium capable of commercial extraction. Phase I of our exploration program was completed in September, 2006. The objective of the Phase I exploration program was to trench and sample the known mineral zone to determine the geological controls and the nature of the mineralization. Based on the results of Phase I of our exploration program, our geological consultant recommended that Phase II be commenced. We intend to complete Phase II of our recommended exploration program during the summer exploration season of 2007. See “Description of Property”, below.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that a commercially viable mineral deposit exists on our mineral claim or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final evaluation as to the economic and legal feasibility is required to determine whether our mineral claim possesses commercially exploitable mineral deposits of zinc, lead, galena or vanadium. See “Item 2. Management’s Discussion and Analysis or Plan of Operation – Plan of Operation.”

Compliance with Government Regulation

Our activities are subject to extensive federal, state, and local regulations in the United States. These statutes regulate the mining of and exploration for mineral properties, and also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development of the Spelter Claim, the extent of which cannot be predicted. Our Spelter Claim is comprised of an unpatented mining claim located on federal land managed by the U.S. Bureau of Land Management. Mining activities on the Spelter Claim must be carried out in accordance with a permit issued by the Bureau of Land Management.

Other regulatory requirements monitor the following:

| | (a) | Explosives and explosives handling. |

| | (b) | Use and occupancy of site structures associated with mining. |

| | (c) | Hazardous materials and waste disposal. |

| | (d) | State Historic site preservation. |

| | (e) | Archaeological and paleontological finds associated with mining. |

The State of Nevada adopted the Mined Land Reclamation Act (the “Nevada Act”) in 1989 that established design, operation, monitoring and closure requirements for all mining facilities. The Nevada Act has increased the cost of designing, operating, monitoring and closing new mining facilities and could affect the cost of operating, monitoring and closing existing mining facilities. The State of Nevada has also adopted reclamation regulations. The Nevada Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance.

In the context of environmental permitting, we must comply with known standards, existing laws and regulations that may entail greater or lesser costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraints affecting our property that would preclude the economic development or operation of any specific property.

If our property merits additional exploration or extraction work, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on our mineral property.

18

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We will also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Employees

As of the date of this prospectus, we have no employees other than our sole executive officer and director. We conduct our business largely through consultants.

Research and Development Expenditures

We have not incurred any research expenditures since our incorporation. We have expended approximately $9,500 on our exploration program as of the date of this prospectus.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Plan of Operation

Our plan of operation is to conduct mineral exploration activities on the Spelter Claim in order to assess whether the claim possesses mineral reserves capable of commercial extraction. Our exploration program is designed to explore for commercially viable deposits of zinc, lead, galena or vanadium mineralization. We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals on our mineral claim.

Spelter Claim

We received the geological evaluation report on the Spelter Claim entitled “Geological Evaluation Report on the Spelter Lode Mining Claim” prepared by Mr. Sookochoff on June 10, 2006. The geological report summarizes the results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The geological report also gives conclusions regarding potential mineralization of the mineral claims and recommends a further geological exploration program on the mineral claims. See “Description of Property”, below.

19

We anticipate that we will incur the following expenses over the next twelve months:

Category | Planned Expenditures Over

The Next 12 Months (US$) |

| Legal and Accounting Fees(1) | $15,000 |

| Office Expenses | $4,000 |

| Consulting Fees | $33,600 |

| Mineral Property Exploration Expenses | $9,500 |

| Offering Expenses | $17,008(1) |

| TOTAL | $79,108 |

| Notes: | |

| (1) | We have expended $10,000 on our offering expenses to date. |

Our current operating funds are sufficient to meet the anticipated costs of Phases II and III of our exploration program on the Spelter Claim. However, our existing funds may be insufficient if the actual costs of our exploration program significantly exceed our estimates or if we decide to proceed beyond Phase III of our exploration program or if we decide to begin mining efforts in the event that it is determined that our property contains mineral reserves. Therefore, we will need to obtain additional financing in order to complete our full business plan. As of the date of this prospectus, we had cash on hand in the amount of approximately $70,000.

We have not earned any revenues from our mineral exploration since our inception. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors outside of our control, including the results from our exploration program, and any unanticipated problems relating to our mineral exploration activities, including environmental assessments and additional costs and expenses that may exceed our current estimates. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us in which case our business will fail.

LIQUIDITY AND CAPITAL RESOURCES

| Working Capital | | | |

| | As At | As At | |

| | February 28, 2007 | November 30, 2006 | |

| Current Assets | $74,236 | $104,119 | |

| Current Liabilities | (2,220) | (1,250) | |

| Working Capital (Deficit) | $72,016 | $102,869 | |

| | | | |

| Cash Flows | | | |

| | | Period from | Period from |

| | Three Months | Inception (April 28, | Inception (April 28, |

| | Ended February 28, | 2006) to | 2006) to |

| | 2007 | February 28, 2007 | November 30, 2006 |

| Cash Flows Used In Operating Activities | $(23,368) | $(50,030) | $(26,662) |

| Cash Flows Used in Investing Activities | (1,515) | (7,515) | (6,000) |

| Cash Flows Provided By Financing Activities | - | 128,981 | 128,891 |

| Increase (Decrease) In Cash During Period | $(24,883) | $71,436 | $96,319 |

20

As of February 28, 2007, we had cash on hand of $71,436 and a working capital surplus of $72,016. We have incurred a cumulative net loss of $49,535 for the period from the date of our inception on April 28, 2006 to February 28, 2007 and have not attained profitable operations to date.

Future Financing