RICHARDSON & PATEL LLP

10900 Wilshire Boulevard

Suite 500

Los Angeles, CA 90024

Telephone (310) 208-1182

Facsimile (310) 208-1154

May 6, 2009

VIA EDGAR AND FEDERAL EXPRESS

United States Securities and Exchange Commission

Division of Corporation Finance

100 First Street, N.E.

Washington, D.C. 20249

Attn: H. Christopher Owings, Mara Ransom, and Chris Chase

| RE: | Premier Power Renewable Energy, Inc. |

Amendment No. 2 to Registration Statement on Form S-1

Filed April 1, 2009

File No. 333-155241

Form 10-Q/A for Fiscal Quarter Ended September 30, 2008

Filed February 5, 2009

Form 10-K for Fiscal Year Ended December 31, 2008

Filed March 31, 2009

File No. 333-140637

Dear Mr. Owings, Ms. Ransom, and Mr. Chase:

Set forth below are the Company’s responses to the comments received from the staff (“Staff”) of the Securities and Exchange Commission (the “Commission”) in the letter dated April 29, 2009. We have reproduced the Staff’s comments for your convenience and have followed each comment with the Company’s response. References in this letter to “we,” “our,” or “us” mean the Company or its advisors, as the context may require. Capitalized terms not defined herein have the meaning set forth in the Company’s Registration Statement on Form S-1 referenced above.

Amendment No. 2 to Registration Statement on Form S-1

General

| 1. | We note that this Amendment No. 2 to your Registration Statement was submitted under an inaccurate file number, 333-140637. Please withdraw Amendment No. 2 and re-file it under the applicable file number, 333-155241. Refer to Rule 477 under the Securities Act of 1933. Please note that because you are withdrawing only Amendment No. 2, as opposed the entire registration statement, your withdrawal should use the Edgar tag “AW.” |

Response: We withdrew Amendment No. 2 to the Registration Statement filed under the file number 333-140637 and re-filed Amendment No. 2 under the applicable file number, 333-155241, on April 30, 2009.

H. Christopher Owings

Mara Ransom

Chris Chase

Securities and Exchange Commission

May 6, 2009

Page 2 of 7

Selling Security Holders, page 19

Selling Security Holder Table, page 20

| 2. | We note that footnote two on page 20 states that 24,448,000 shares were cancelled by Vision Opportunity Master Fund, Ltd., but your response to comment 15 in your February 15, 2009 letter and comment three in your March 31, 2009 letter both state that 25,448,000 shares were cancelled. We also note that your 8-K filed on September 11, 2008 indicates that 25,448,000 shares were cancelled by Vision. Please revise your disclosure on page 20 and make conforming changes as needed to reflect the accurate number of shares that Vision cancelled. |

Response: Vision Opportunity Master Fund, Ltd. agreed to cancel 25,448,000 shares rather than 24,448,000 shares. We have revised our disclosures in footnote 2 on page 20 and on page II-3 of Amendment No. 3 to our Registration Statement (the “Amended S-1”) accordingly.

Business, page 22

Financing Transaction, page 22

| 3. | We note your statement in the fourth paragraph on page 23 that you will not receive any proceeds from the exercise of 1.6 million options held by Vision Opportunity Master Fund, Ltd. Please expand your disclosure to explain why you will not receive any proceeds from the exercise of these options. In this regard, we note your response to comment 18 of our November 10, 2008 letter which includes a footnote stating that “the 1.6 million options were not issued by the Company, but, rather from stockholders of the Company.” |

Response: We have expanded our disclosure on page 23 of the Amended S-1 to clarify that the options were issued by stockholders of the Company.

| 4. | We note that in response to comment five of our March 6, 2009 letter you state a dollar value per share of $4.25 for the shares underlying the options held by Vision Opportunity Master Fund, Ltd. And this value is stated at the top of the table you provide on page 23. It appears, however, that the following calculations for “Combined Total Market Price” and “Total Possible Discount” are based on a dollar value per share of $3.30, which is the value you previously provided in response to comment 18 of our November 10, 2008. Please revise your calculations in the table on page 23 to utilize the dollar value per share of $4.25 or advise us why you do not believe this is appropriate. |

Response: We have revised such calculations in the table on page 23 to utilize the dollar value per share of $4.25.

H. Christopher Owings

Mara Ransom

Chris Chase

Securities and Exchange Commission

May 6, 2009

Page 3 of 7

| 5. | We note the table you provide at the bottom of page 23 with the column headings “Gross Proceeds Paid/Payable in Financing Transaction” and “Combined Total Possible Profit to be Realized as a Result of all Conversion Discounts Regarding the Shares of Common Stock Underlying the Options to be Registered.” In light of the disclosure you provide beginning on page 22 regarding the Financing and your decision to no longer register the shares of common stock underlying the warrants or Series A Preferred shares issued as part of the Financing, please delete this table. |

Response: We have deleted that table from page 23 of the Amended S-1.

| 6. | We note the first paragraph on page 24 describing the contents of the table that follows. Please revise this paragraph to specifically state that the table represents the Share Exchange and Financing that are described beginning on page 22. Please also provide an explanatory footnote describing the current status of the 7 million shares that are issuable to Vision Opportunities Master Fund. |

Response: We have made such revisions on page 24 of the Amended S-1.

| 7. | We note that in the first table on page 24 you indicate that the market price per share of your common stock immediately prior to the Share Exchange and financing transactions was $0. In comparison, we note your response to comment one of our March 6, 2009 letter where you state you obtained an independent valuation of $0.42 per share with respect to the same shares. Please revise this table to utilize the $0.42 per share value. If you deem it appropriate, you should also provide explanatory footnote disclosure describing the manner in which this value was determined. |

Response: We have revised the per share value and added an explanatory footnote in the first table on page 24.

Customers, page 27

| 8. | We note your revised disclosure in the first paragraph of this section stating that “one customer accounted for 16%” of your revenues in 2007. Please revise your disclosure to include the name of this customer. |

Response: We have revised our disclosure accordingly on page 27 of the Amended S-1.

H. Christopher Owings

Mara Ransom

Chris Chase

Securities and Exchange Commission

May 6, 2009

Page 4 of 7

Financial Statements, page F-2

Consolidated Statements of Operations, page F-4

| 9. | We note from your response to comment 14 in our letter dated March 6, 2009 that the shares transferred to Genesis Capital Advisors, LLC by Mr. Marks and Mr. de Anquin were not transferred as payment for any expenses of or services to the Company. Please tell what consideration Mr. Marks and Mr. de Anquin received for the transfer of these shares. |

Response: In exchange for the shares transferred to Genesis Capital Advisors, LLC, Mr. Marks and Mr. de Anquin each received individual consulting services from Genesis. Specifically, services were provided to Mr. Marks in December 2006 with respect to a private acquisition of shares of Premier Power California’s common stock from the principals of Premier Homes Properties, Inc., which was the entity that spun-off its solar division to form Premier Power California. Services were also provided to both Mr. Marks and Mr. de Anquin (i) in May 2008 with respect to an offer by a certain company to acquire a portion of each of their shares of Premier Power California; (ii) in June 2008 with respect to another offer by a certain other company to acquire a portion of each of their shares of Premier Power California; (iii) and in June 2008 with respect to a private sale of shares of Premier Power California’s common stock by Mr. Marks to Mr. de Anquin.

Note 7. Equity, page F-14

| 10. | Please revise to disclose the amount of net proceeds received from the issuance of the preferred stock and the amounts recorded in the financial statements for the preferred stock and the warrants. |

Response: We have revised footnote 7 accordingly.

| 11. | We reviewed your response to comment number one in our letter dated March 6, 2009 and have the following comments: |

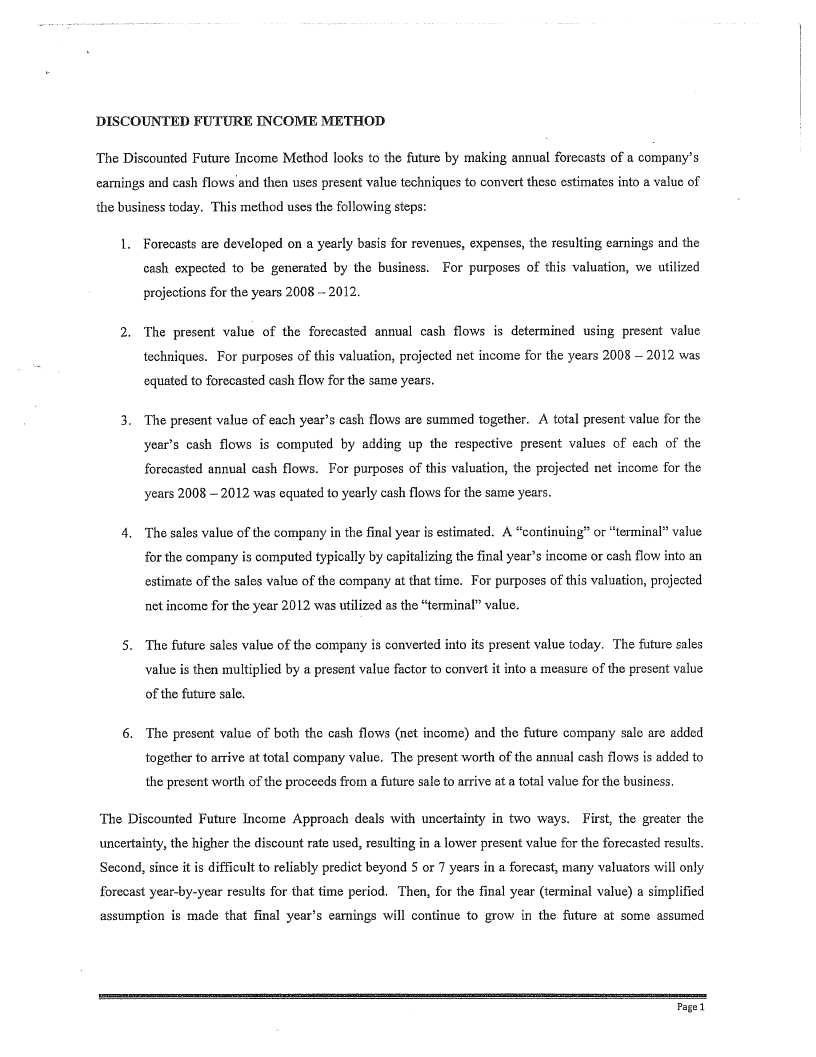

| · | Please provide us with a copy of the independent valuation you obtained for determining the fair value of your common stock used in your assessment of whether there was a beneficial conversion feature associated with the convertible preferred stock issuance and for allocating the proceeds from your financing transaction. We may have further comment. |

| · | We note that you believe a change in control transaction is an event within your control. In supporting this stance, please confirm that Board approval is required for any Change of Control Transaction, as defined in your preferred stock agreement, under state law in your state of incorporation and that the preferred shareholders do not control your Board. If certain changes in control or other liquidation events, including those deemed hostile, trigger cash redemption and do not require Board approval, it appears that you would be required to present your preferred shares within mezzanine equity even if the likelihood of redemption is considered remote. See EITF Topic D-98. |

H. Christopher Owings

Mara Ransom

Chris Chase

Securities and Exchange Commission

May 6, 2009

Page 5 of 7

| · | We note that you determined the combined fair value of the convertible preferred stock and related warrants to be approximately $2 million. Please explain in further detail why you believe your valuations are appropriate, as we are unclear why an investor would pay $7 million for securities deemed to be worth only $2 million. As previously requested, please clarify how you determined the fair value of the preferred stock should equal the value of the common shares available upon conversion on the issuance date as opposed to an amount derived from a generally accepted valuation method, such as discounted cash flow model. If you believe your valuations to be in error, please provide us with a revised relative fair value calculation and revise your financial statements accordingly. |

| · | In previous correspondences, you indicated that offering costs of the financing included those for outside legal counsel, investment banking, preparation with auditing historical data, identifying and remediating material weakness and completion of the filing and related documents. Please describe in further detail the nature of these costs and why you consider all of them to be specific incremental costs directly attributable to the offering. For example, it appears the costs to remediate material weaknesses and certain auditing and filing costs would have been incurred absent the financing transaction. |

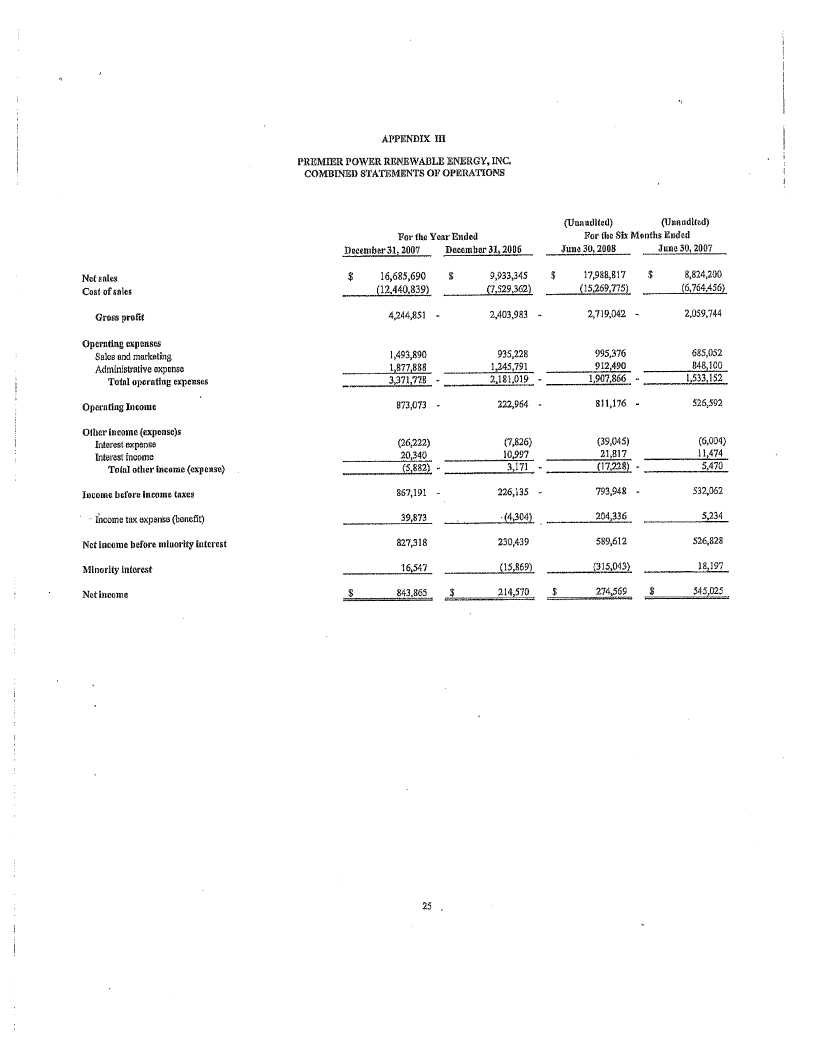

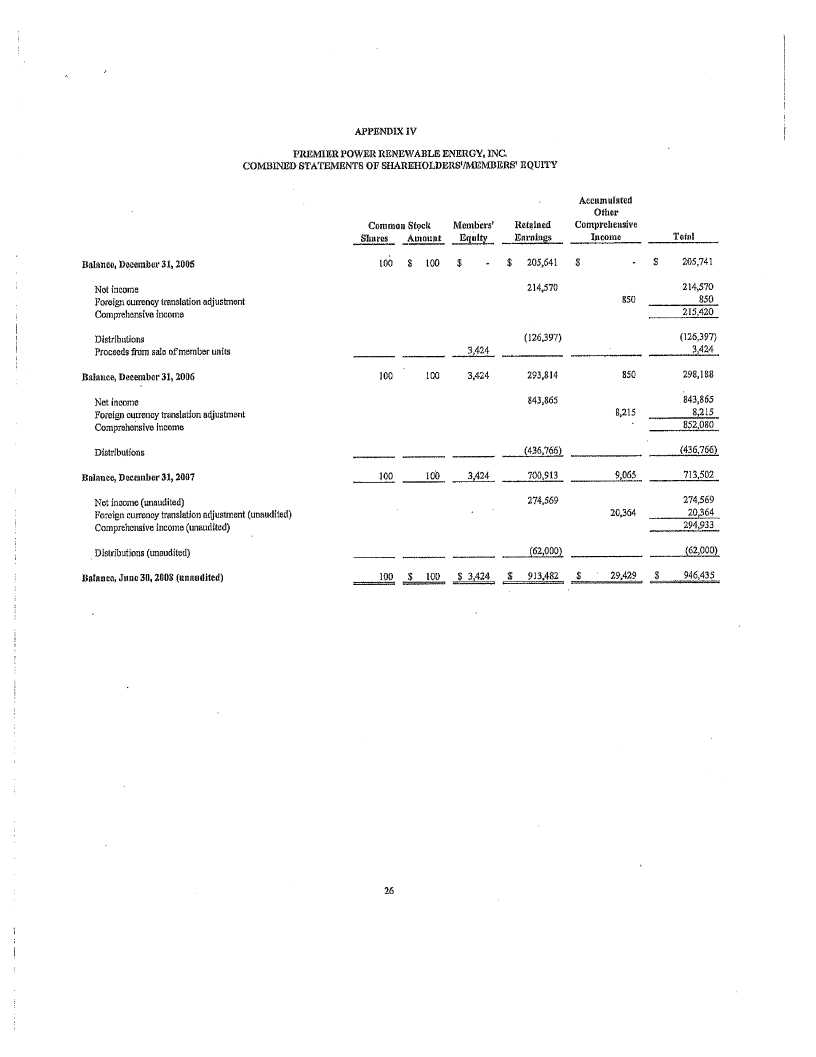

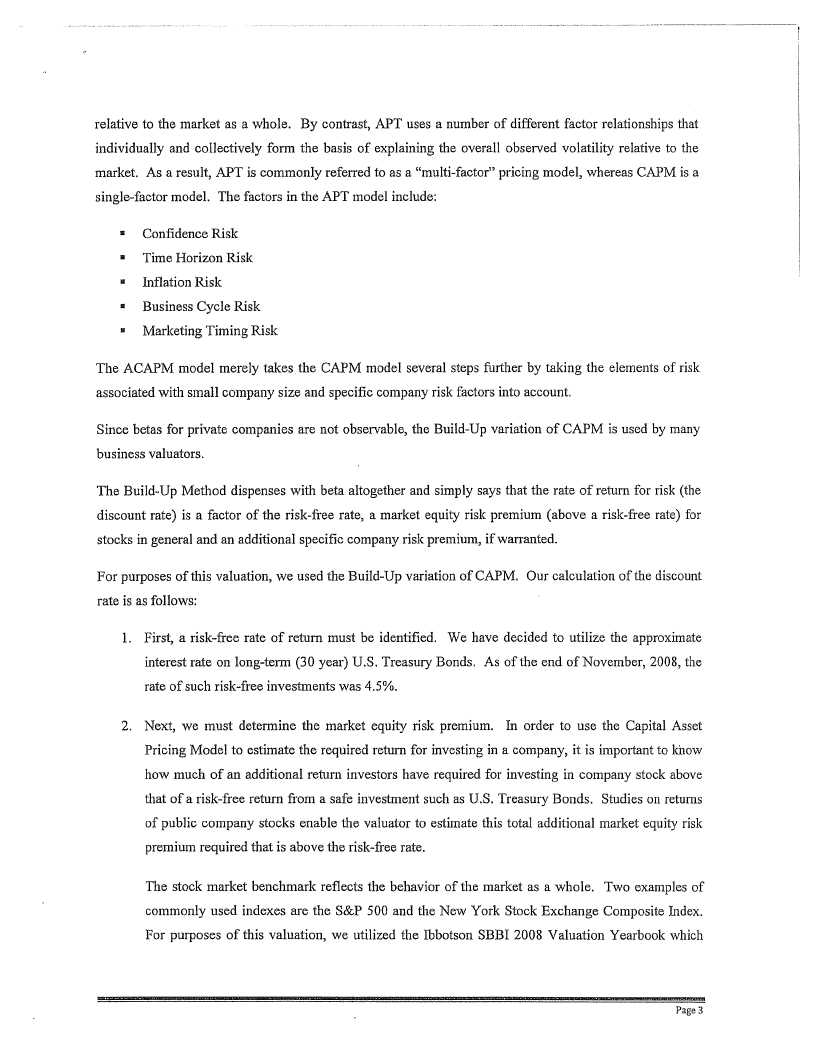

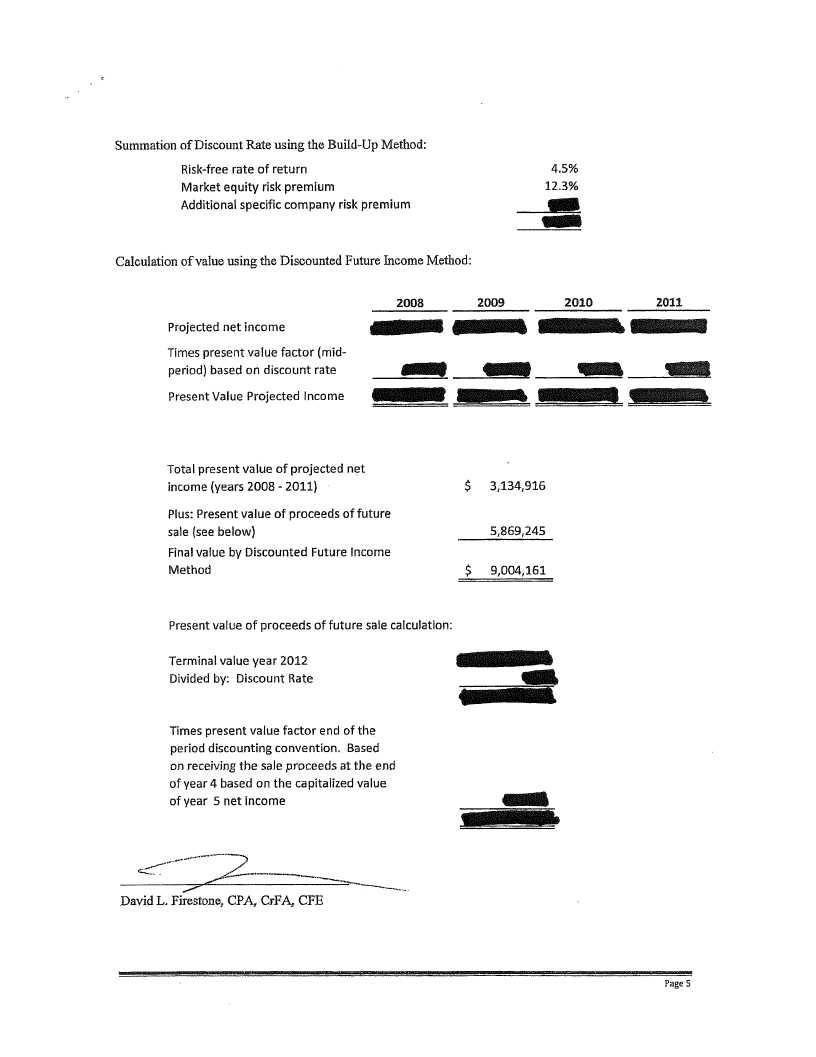

Response: Regarding the Staff’s first bullet point, enclosed is a copy of the independent valuation, for which we have sought confidential treatment.

Regarding the Staff’s second bullet point, we confirm that the holder of 100% of the Company’s Series A Preferred stock does not control the Board, and any “Change of Control” transaction (as defined by the Company’s Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock) requires the approval of the Board under the General Corporation Law of the State of Delaware.

Regarding the Staff’s third bullet point:

| · | The valuation of the Company’s common stock was performed in conformity with Statement on Standards for Valuation Services #1, issued by the AICPA. Please see the enclosed copy of the independent valuation report and addendum, for which we have sought confidential treatment. |

| · | Those standards include a reference to a valuation date, which in this case is September 9, 2008, the specific date of the estimation of the interest in the Company. The standards the Company followed ensured the valuation analyst consider only circumstances existing at the valuation date and events occurring up to the valuation date, and not the date of its valuation report, which was November 3, 2008. |

| · | The Company’s management determined that the fair value of the preferred stock should equal the value of the shares of common stock available upon conversion on the issuance date by using the independent valuation obtained by the Company for its common stock as the most significant unobservable input since there was no active market for the Company’s common stock or preferred stock. Management had no observable inputs from any market for its preferred stock. |

| · | Management considered future cash flows and appropriately risk-adjusted discount rates (see FSP SFAS 157-3), but knowing there are no observable inputs for the valuation preferred stock, the Company could not apply this approach for the value of the preferred stock. |

| · | With regard to the $7 million private placement of the Company’s Series A Convertible Preferred Stock and Series A and Series B Warrants, management did not deem it appropriate to automatically conclude that the transaction price is determinative of fair value (See FSP SFAS 157-3). In fact, the offering costs of $1,499,105 (over 21% versus approximately 8% in active markets) are indicative of a dislocated market. In addition, the preferred shares and warrants issued can convert to 7 million shares of common stock representing a 21.2% interest of the Company for a total investment of $16.6 million. Such an investment would value the Company (100%) at over $78 million. At September 9, 2008, management concluded using reasonable judgment that to value the Company at $78 million is not representative of the Company’s fair value as the valuation for the Company completed by the independent firm, conformed with Statement on Standards for Valuation Services #1, stated a value of $11 million. |

| · | Lastly, although management can only surmise the investor’s intent, a possible belief would be that the investor paid $7 million for preferred stock and warrants in a solar energy company as a speculative investment, which in today’s political, social, and economic environment, the investor perceived as an opportunity. |

H. Christopher Owings

Mara Ransom

Chris Chase

Securities and Exchange Commission

May 6, 2009

Page 6 of 7

Regarding the Staff’s last bullet point, below is a more detailed description of the nature of the financing-related costs. Please note that the Company has not recorded costs attributable to the remediation of material weaknesses or significant deficiencies as financing-related costs. .

| · | Legal: The Company incurred legal costs specific to the financing transaction, including negotiations and drafting of documents, and specific to the preparation and review of the registration statement and related documents. Audit and interim review costs associated with the Company’s recurring reporting obligations as a registrant are excluded from such costs and have not been recorded as financing-related costs. |

| · | Investment banking: The Company incurred investment banking costs specific to the financing transaction. |

| · | Audit: The Company incurred audit costs specific to the preparation of the registration statement, including the accounting of proceeds received and costs associated with the financing transaction. |

| · | Filing: The Company incurred filing costs specific to the filing of the registration statement. |

| · | Investor Costs: The Company also incurred the investor’s legal fees and other fees related to the financing that the Company was obligated to pay. |

The Company considers all of these costs to be specific incremental costs directly attributable to the offering because each was a cost specifically required by the financing transaction, including the costs associated with the registration statement.

Note 8. Income Tax, page F-15

| 12. | We reviewed your response to comment 16 in our letter dated March 6, 2009 and the disclosure added in Note 8 beginning on page F-15. Please revise your disclosure to reconcile the amounts of deferred tax assets and liabilities presented in your balance sheet with the amounts of deferred tax assets and liabilities presented in your balance sheet with the amounts of deferred tax assets and liabilities presented in the table on page F-17. It appears that the difference results from the exclusion of your long-term deferred tax asset balance from the table on page F-17. |

Response: We have revised our disclosures in Note 8 accordingly.

Form 10-K for Fiscal Year Ended December 31, 2008

| 13. | The comments on the Form S-1 should be complied with in the Form 10-K to the extent applicable. |

Response: We have amended the annual report on Form 10-K for the fiscal year ended December 31, 2008 accordingly.

H. Christopher Owings

Mara Ransom

Chris Chase

Securities and Exchange Commission

May 6, 2009

Page 7 of 7

Item 9A. Controls and Procedures page 25

Management’s Annual Report on Internal Control Over Financial Reporting, page 25

| 14. | Please revise your management’s report on internal control to include your management’s conclusion as to whether your internal controls over financial reporting were effective or ineffective as of December 31, 2008. Refer to Item 308T(a) of Regulation S-K. |

Response: We have revised management’s report accordingly.

* * *

If you have any questions or further comments, please do not hesitate to contact the undersigned at (310) 208-1182 or via fax at (310) 208-1154.

| | Sincerely, |

| | |

| | RICHARDSON & PATEL, LLP |

| | |

| | /s/ Jamie H. Kim |

| | Jamie H. Kim, Esq. |

cc: Dean Marks, Premier Power Renewable Energy, Inc.

Teresa Kelley, Premier Power Renewable Energy, Inc.

Kevin Leung, Esq., Richardson & Patel LLP

Dominador Tolentino, Esq., Richardson & Patel LLP