PROPOSAL NO. 1

REASONS TO VOTE AGAINST THE TRANSACTIONS PROPOSAL

We strongly believe that the Acquisition of Valtech is detrimental to, and not in the best interest of, the Company’s stockholders. We remain baffled by the decision-making process that led to the Board’s decision to acquire Valtech. We cannot comprehend how the Board came to the conclusion that pursuing a risky, expensive acquisition of a pre-revenue company was a better risk-adjusted alternative than continuing to execute in the Company’s core ventricular assist device (VAD) business or selling the Company at a premium. Moreover, as explained below, the inclusion of certain terms in the Business Combination Agreement (including the acceleration provision) and governance structure of Holdco, the Company’s parent company in the event the Business Combination Agreement is approved, makes us question whether the Board is properly prioritizing the stockholders’ best interests.

We Believe the Company’s Rationale for Pursuing Valtech is Flawed

HeartWare has focused on Valtech’s Cardioband System (“Cardioband”) as the key value-creating asset in the Valtech portfolio that justifies the Acquisition of Valtech, which is not surprising given it is the only device within the Valtech portfolio expected to generate any material revenue for the next five years. Management has cited the performance of Abbott Laboratories’ MitraClip device (“MitraClip”) and the “conventional wisdom” that mitral valve repair is preferable to mitral valve replacement in the treatment of mitral regurgitation (“MR”) as some of the reasons to believe Cardioband will generate significant revenues. As we discuss below, this thesis is based on tenuous assumptions and ignores the significant clinical, competitive and regulatory risks facing the device.

First, brand new clinical data calls into question the thesis that transcatheter repair of MR will continue to be preferred to transcatheter replacement. An article posted to the New England Journal of Medicine website on November 9, 2015 contained updated two year data from the Cardiothoracic Surgical Trials Network’s study comparing mitral valve repair to mitral valve replacement in patients with severe ischemic MR. Significantly, this is the only randomized trial that compares the outcomes of mitral valve repair vs. mitral valve replacement in patients with MR. The results of this study are not supportive of a robust future for mitral valve repair. To quote the authors:

“The rate of recurrence of moderate or severe mitral regurgitation over 2 years was higher in the repair group than in the replacement group (58.8% vs. 3.8%, P<0.001). There were no significant between-group differences in rates of serious adverse events and overall readmissions, but patients in the repair group had more serious adverse events related to heart failure (P = 0.05) and cardiovascular readmissions (P = 0.01). On the Minnesota Living with Heart Failure questionnaire, there was a trend toward greater improvement in the replacement group (P = 0.07).” 1

Digging further into the published data reveals that on nearly every measure of cardiovascular adverse events, the replacement arm outperformed the repair arm. Again, to quote the authors:

“…we observed that the recurrence of mitral regurgitation, which was mostly moderate in degree, remained a progressive and excess hazard for patients undergoing mitral-valve repair… This deficiency in the durability of correction of mitral regurgitation is disconcerting, given that recurrence confers a predisposition to heart failure, atrial fibrillation, and repeat interventions and hospitalizations. We found that patients in the repair group had more serious adverse events of heart failure and hospital readmission for cardiovascular causes.”1

Not only did patients in the replacement arm have less cardiovascular adverse events, these patients also had a better quality of life than patients in the repair arm:

“The findings of the Minnesota Living with Heart Failure questionnaire, although not conclusive, were consistent with these clinical events. The 7.9-point difference in average improvement over baseline in favor of the replacement group was not significant (P = 0.07), but the magnitude of change exceeded the 5-point threshold for clinically meaningful improvement used in other studies.”1

Historically, the preference for mitral valve repair over replacement was driven by the presumption that while both were equally effective at correcting MR, repair was the safer procedure. This landmark study – the first of its kind – demonstrates that not only is the safety advantage associated with repair statistically insignificant, repair is clearly inferior to replacement in preventing the recurrence of MR and on many clinical measures, the outcomes for patients receiving repair were inferior at 2 years.

What does this mean for transcatheter mitral valve repair devices like Cardioband? As transcatheter mitral valve replacement devices are developed and refined, it is quite likely any periprocedural safety advantage associated with repair (both surgical and transcatheter) will diminish and may eventually vanish entirely. As such, we find it hard to believe Cardioband will achieve the robust revenues projected by HeartWare management if transcatheter repair offers little, if any, safety advantage and is clearly inferior in durably correcting MR when compared to replacement.

Second, the path to U.S. approval for Cardioband is murky at best. HeartWare management has already begun walking back their initial expectations for a late 2018 U.S. launch of Cardioband, recently saying that a 2019 launch “hopefully is not overly ambitious.”2 Given that management is still “brainstorming”3 potential trial designs and has not yet had any formal meetings with the FDA, a 2019 approval certainly appears to be an optimistic outcome. We need only look to MitraClip – the only transcatheter mitral valve repair device with U.S. approval to date – to observe how long (and risky) the path to U.S. approval may be for Cardioband. MitraClip secured U.S. approval in 2013 – a full 5 ½ years after receiving CE Mark and only after two substantial clinical trials (EVEREST I and EVEREST II) were conducted. Even then, MitraClip barely squeaked by a 5-3 FDA advisory panel vote for approval – which included five out of nine panel members voting against the efficacy of the device4 – and a sizeable post-marketing study was required. Nothing in the limited Cardioband dataset suggests that it is any more efficacious than MitraClip – U.S. approval appears far from certain.

2 HeartWare CEO Douglas Godshall, HeartWare Investor Day, November 5, 2015 3 HeartWare CEO Douglas Godshall, HeartWare Investor Day, November 5, 2015 4 http://www.wsj.com/articles/SB10001424127887324103504578372951720541928

Even if the Premarket Approval-enabling trial of Cardioband yields data supportive of approval, the timeline for securing FDA approval will likely stretch beyond 2020. The COAPT trial, Abbott Laboratories’ U.S. trial comparing MitraClip to guideline-directed medical therapy (“GDMT”) in surgery-ineligible patients with MR, has been enrolling for over 3 years, and based on the pace of enrollment to date, it will take at least another year to complete enrollment. We are hard-pressed to believe that HeartWare would be quicker than Abbott Laboratories in enrolling patients in a future Cardioband pivotal trial. Assuming it takes six months to finalize a trial design and qualify study sites, 2-4 years to enroll the trial (as fast or faster than both EVEREST II and COAPT enrollment), one year of patient follow-up, 3-6 months to analyze and publish results and 6-9 months of FDA review time, FDA approval of Cardioband – if it is approved at all – would not be secured until sometime between mid-2020 and the end of 2022.

Third, acquiring Valtech would expose HeartWare stockholders to a significant risk that is completely out of the control of HeartWare and Valtech management: the results of the COAPT trial itself. The key opinion leaders who presented at HeartWare’s November 5, 2015 Investor Day (the “Investor Day”) expressed concern that the COAPT trial will miss its ill-specified primary endpoint (superiority in reducing recurrent heart failure hospitalizations vs. GDMT). These same experts also stated that, should this be the case, “reimbursement will disappear… overnight” for MitraClip and any other transcatheter repair device, including Cardioband. Securing reimbursement for Cardioband in the European Union would then likely require positive results from a rigorous, randomized (and risky) clinical trial – which would add years of additional expense and cash burn. Similarly, the consequence of a negative COAPT trial for Cardioband would likely include increased scrutiny and more onerous approval requirements from the FDA.

Fourth, there are numerous potential competitors to Cardioband. HeartWare management has portrayed the transcatheter mitral valve repair market as a two-horse race between MitraClip and Cardioband. Indeed, the financial forecast HeartWare management presented during the Investor Day assumes Cardioband will hold 40% market share in transcatheter repair in the future5. We believe this is, to put it mildly, an overly optimistic view of how the market will develop. Besides MitraClip, there are at least 21 transcatheter mitral valve repair devices under development today, at least ten of which are in human testing and/or are already approved for use in Europe. This number does not consider the internal efforts underway by both Edwards Lifesciences Corporation (“Edwards”) and Medtronic, Inc. (“Medtronic”) to develop transcatheter repair technologies as well.

Finally, we do not believe it is realistic to ascribe meaningful value to any of Valtech’s products outside of Cardioband. Valtech’s Cardiovalve for mitral valve replacement has yet to reach first-in-man, and even then, faces enormous risk in demonstrating it is a viable device. Edwards recently shelved its FORTIS valve for transcatheter mitral valve replacement after a series of adverse events were observed in the first 20 patients receiving the device. With all due respect to the R&D team at Valtech – if Edwards, the unquestionable leader in transcatheter approaches to structural heart repair, with resources and expertise far beyond what Valtech and HeartWare can call upon, could not successfully internally develop a transcatheter mitral valve replacement device, what probability of success can investors realistically assign to Cardiovalve?

Even if Cardiovalve successfully overcomes the developmental and clinical hurdles to produce an approvable device, HeartWare will be a late entrant to a highly competitive market. We can identify at least 15 transcatheter mitral valve replacement technologies under development, at least seven of which have achieved first-in-man. In comparison, Valtech’s Cardiovalve device does not yet have a finalized design, and even in a best-case scenario, is 18 months away from first-in-man trials.

Given the relative paucity of clinical data regarding the surgical treatment of tricuspid regurgitation and the absence of any meaningful data on transcatheter techniques to repair the tricuspid valve, we view the opportunity for Cardioband and Cardiovalve in tricuspid repair and replacement as highly uncertain and of limited value. As a result, while HeartWare management may describe Valtech as “quadrupling the number of milestones”6 ahead of the Company, we think the better term to describe these “milestones” is “risks.”

We Believe the Acquisition of Valtech adds Significant Long-term Risks to the Company

Despite the large purchase price, it is clear to us that Valtech is a collection of unproven assets. While Valtech’s valve repair and replacement assets may ultimately have the potential to generate significant revenues, these assets will have to clear numerous clinical and regulatory hurdles before providing any meaningful revenue. In fact, a significant portion of the expected long-term revenue from Valtech is from products that have yet to be fully designed, let alone validated in the clinic. The enormous upfront dilution borne by the Company’s stockholders is incongruous with the significant risk associated with achieving management’s forecast for Valtech’s products. It is entirely possible that stockholders will bear dilution in excess of 30% for an acquisition that never generates any material revenue for the Company.

The seriousness of this risk can be seen in HeartWare’s own limited M&A track record. HeartWare’s only acquisition of note, CircuLite, Inc. and its SYNERGY pump, has experienced numerous delays and design changes despite management’s assurance at the time of the acquisition that it was a “straightforward logical fix”7 to make the design change necessary to bring the SYNERGY pump back into the clinic. Now, nearly two years post-acquisition, there is still no timeline for returning SYNERGY to the market. Management’s failure to execute upon the CircuLite acquisition, a far smaller and less complex asset than Valtech, gives us no confidence that management’s assessment of the clinical and commercial timelines for Valtech will be achieved.

From a strategic standpoint, the Valtech acquisition represents a “poison pill” for many of the logical strategic acquirers of HeartWare. Abbott Laboratories, Edwards and Medtronic have each recently acquired mitral valve replacement companies that will directly compete with Valtech’s valve replacement assets. These companies – all of which are logical acquirers of HeartWare – would assign little to no value to these duplicative assets for which HeartWare is paying hundreds of millions of dollars.

Additionally, these potential competitors all have significantly more resources and expertise than HeartWare. Even if HeartWare is successful in bringing Valtech’s valve replacement assets to market, HeartWare would likely be the fourth or fifth market entrant competing with some of the largest medical device companies in the world; companies with sales and R&D budgets many times that of HeartWare. This is in stark contrast to the Company’s core VAD market, where HeartWare has competed in a virtual duopoly with a similarly-sized peer.

6 HeartWare CEO Douglas Godshall, Canaccord Genuity Medical Technology and Diagnostics Forum, November 19, 2015 7 HeartWare CEO Douglas Godshall, Acquisition of Circulite Conference Call, December 2, 2013

We Believe the Valtech Acquisition Dilutes the Company’s Stockholders and Drains its Cash

The upfront equity dilution to HeartWare stockholders from the Acquisition is approximately 30%, which is equivalent to $425 million based on the closing price of HeartWare prior to the announcement. Additional milestones and equity warrants have the potential to more than double the total cost of the transaction over time.

In our view, the cost of the Acquisition of Valtech goes far beyond the purchase price. In order to bring Valtech’s products to market, HeartWare must invest significant amounts of cash into added R&D expenses. By management’s own admission, Valtech will increase HeartWare’s operating losses by $30 to $40 million annually over the next two years. This is on top of HeartWare’s already significant R&D expense of $120 million over the last twelve months – a sum which represents a staggering 42% of revenue and is $10 million greater than HeartWare’s main competitor, Thoratec Corporation (“Thoratec”), spent in R&D over the same period, despite the fact that Thoratec generated 70% more revenue than HeartWare8.

We believe this cash drain only compounds the risk Valtech presents to HeartWare stockholders. Not only will Valtech take management’s focus away from the core VAD business at a critical juncture, the added R&D burden will compete for HeartWare’s limited cash resources. In a worst case scenario, Valtech-related spending will siphon needed cash from the core VAD business and increase the risk that HeartWare must raise capital at unfavorable rates.

We Believe Management’s Investor Day Forecast for Valtech is Misleading

On October 15, 2015, Holdco filed a registration statement on Form S-4, as amended on November 25, 2015 (the “S-4”) in connection with the Transactions, which included a preliminary proxy statement of HeartWare that also constitutes a preliminary prospectus of Holdco. The S-4 contained four “representative cases” depicting management’s projections of Valtech’s financial performance through 2025. During the Company’s Investor Day, management presented financial projections for Valtech from “Case 2” – the second-most optimistic case – to investors. Typically, when management teams publicly present financial projections, it is safe for investors to assume these forecasts represent management’s best estimate of the expected performance of the business in question. However, this is not true of the forecast HeartWare’s management presented for Valtech at the Investor Day.

During the Investor Day, HeartWare appears to have misled investors by presenting a forecast for Valtech that is nearly 40% above management’s own probability-weighted forecast for the business. The indisputable evidence confirming our assertion is contained within the fairness opinion issued by the Company’s own financial advisors. The fairness opinion issued by Canaccord Genuity Inc. (“Canaccord”) to the Company and published in the S-4 is based upon HeartWare management’s probability-adjusted revenue forecast for Valtech9. It is a simple exercise to derive the revenue forecast supporting Canaccord’s valuation calculations used in the fairness opinion. The chart below illustrates the mismatch between HeartWare management’s probability-adjusted internal forecast for Valtech and the publicly-presented forecast highlighted at the Investor Day.

8 HeartWare Forms 10-Q for the periods ending 9/30/2014, 3/31/2015 and 6/30/2015 and Form 10-K for the period ending 12/31/2014; Thoratec Forms 10-Q for the periods 9/27/2014, 4/4/2015 and 7/4/2015 and Form 10-K for the period ending 1/3/2015

It would not surprise us to hear management justify this after the fact by claiming that “Case 2” is now their best forecast for Valtech. Revising long-term revenue and synergy forecasts upward is a common tactic used by management teams to defend contested transactions. Such upward revisions generally lack credibility and are usually discarded as soon as the contest has ended. Management’s upward revision to their Valtech forecast is no exception. We believe it strains credulity to believe that management’s revised forecast of how the mitral valve repair and replacement market will evolve over the next ten years will be any more accurate than the forecasts management provided to their financial advisors just a few months prior. Additionally, we believe the likelihood that HeartWare’s current management team will still be in place ten years from now when the performance of Valtech can actually be judged is low. Management therefore can promise the moon to the Company’s investors knowing full well that they are not very likely to ever be held accountable for, nor will their compensation be tied to, achieving the optimistic forecast presented at the Investor Day.

Finally, even under the most optimistic scenario provided in the S-4, Valtech would generate no meaningful cash flow until 2021. Therefore, the entire value (or lack thereof) of the proposed Acquisition hinges on the performance of Valtech, and the state of the competitive environment, at least 6-10 years from now. No one, not us, not HeartWare management, not Valtech’s competitors and not the treating physicians, can predict with any degree of certainty how the mitral valve repair and replacement market will develop over the next decade, much less predict which companies and devices will succeed. We believe it is the peak of hubris for management to claim otherwise and rationalize taking on the enormous and unnecessary risks associated with Valtech, when there is a clear, lower-risk path to significant stockholder value creation - executing in the Company’s core VAD business.

The Milestone Acceleration Provision of the Business Combination Agreement Effectively Serves as a 10-year Poison Pill

Our conversations with the Company’s stockholders has revealed that many are either unaware, or do not fully appreciate the impact, of the milestone payment acceleration provision that the Board agreed to as part of the Business Combination Agreement. As we detail below, this provision has the potential to serve as a 10-year entrenchment mechanism for HeartWare’s Board and management team by creating a significant barrier to a future sale of the Company. We feel obligated to highlight the significant cost and risk this provision imposes on HeartWare’s stockholders while benefiting the pecuniary interests of the Company’s Board, management team and the current owners of Valtech.

The Business Combination Agreement provides that, in the event Holdco is acquired within 10 years post the closing of the Transactions, all of the milestone payments owed to Valtech’s former owners accelerate or become more readily achievable, significantly lowering the consideration HeartWare’s stockholders would otherwise receive in a sale. Specifically:

| | 1. | The 700,000-share milestone payment associated with first-in-man trials of Valtech’s Cardioband Tricuspid or Cardiovalve products becomes immediately payable regardless of whether or not either product has achieved first-in-man |

| | 2. | The warrants to purchase 850,000 Holdco shares at a strike price of $83.73 that vest upon achieving $75 million in trailing twelve-month (“TTM”) revenues from Valtech products immediately vest regardless of whether or not this level of revenue has been achieved |

| | 3. | $175 million of the $375 million milestone payment associated with achieving $450 million in TTM revenues from Valtech products becomes immediately payable |

| | 4. | $75 million of the $375 million milestone payment becomes payable at a lowered TTM revenue threshold of $75 million, rather than $450 million |

| | 5. | The remaining $125 million of the $375 million milestone payment becomes payable at a lowered TTM revenue threshold of $150 million, rather than $450 million |

It is important that the Company’s directors take time to fully understand the implications of this acceleration provision for stockholders of the Company. The acceleration provision would force Holdco’s acquirer to make milestone payments to Valtech’s former owners regardless of Valtech’s performance. Thus, the raison d'être of utilizing a milestone payment provision – to mitigate the damage to stockholders from the underperformance of an acquired asset – is rendered pointless.

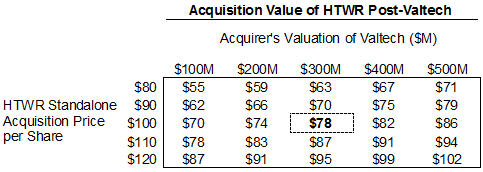

For illustrative purposes, let us assume that a potential acquirer of HeartWare is willing to pay $100 per share for the Company, pre-Valtech. Additionally, assume this same acquirer values the Valtech assets at $300 million. Due to the dilution and milestone acceleration provision associated with the Valtech acquisition, rather than receiving the full $100 per share, HeartWare stockholders would instead only receive $78 per share10 in an acquisition of Holdco, a 22% discount to the pre-Valtech per-share value of the Company. The table below illustrates the price per share the Company’s stockholders would receive in an acquisition based on a range of values for HeartWare as a standalone company and following the Valtech acquisition.

10 See Exhibit 1 to DFAN on Schedule 14A filed by Engaged Capital on January 7, 2016 for calculation

In order for the Company’s stockholders to actually receive the full $100 per share in an acquisition of the Company post-Valtech, the acquirer must assign a value to Valtech in excess of $850 million – an amount greater than HeartWare’s current market capitalization. This “breakeven” valuation for Valtech only increases as the value of HeartWare’s core VAD franchise increases.

The ramifications of the acceleration provision are troubling. Since the most logical acquirers of the Company already possess assets that would be either partly or wholly duplicative to Valtech’s portfolio, it is unlikely that these acquirers would assign much value to Valtech. Unfortunately for HeartWare’s stockholders, the acceleration provision would force these potential acquirers of HeartWare to pay full value for the Valtech assets. As a result, this acceleration provision effectively serves, whether intentionally or not, as a ten-year poison pill. Rather than trading with an embedded M&A premium like most of its mid-cap medical device peers, the Acquisition of Valtech will cause Holdco to trade with an M&A discount.

We are Concerned the Acquisition of Valtech Entrenches HeartWare’s Board and Management Team at the Expense of Stockholders

Conversations with numerous bankers and industry executives have supported our assertion that the Company’s acquisition of Valtech makes HeartWare a less attractive acquisition target. The most likely potential acquirers of HeartWare have categorically expressed to us that they would have no interest in acquiring the Company should the Valtech acquisition close. This fact, which directly contradicts claims being made by the Company’s management team, is particularly disheartening as many HeartWare stockholders have an investment thesis predicated upon an eventual sale of the Company to a large strategic acquirer at a significant premium.

While we agree with many of the Company’s stockholders that the ultimate destiny for HeartWare is a sale to a strategic acquirer, let us be clear – we are not advocating for a sale of the Company today. Given the currently depressed share price and uncertainty regarding the restart of the MVAD CE Mark clinical trial, we believe it is unlikely that the Board would be able to negotiate a sale of the Company at a premium that would be acceptable to stockholders today. However, it is unacceptable to the Company’s stockholders to permanently impair a future sale of the Company by acquiring an asset – Valtech – which makes the Company less attractive to the most likely acquirers.

Perhaps the Acquisition of Valtech is a product of misaligned incentives between HeartWare’s insiders and the Company’s stockholders. Troubling to us, the Board and management team have collectively purchased a total of only 4,150 Shares (valued at $300,000) on the open market over the last five years, while selling nearly 680,000 Shares (valued at $56 million) over the same time period11. Given the sparse shareholdings and past trading history of the Board and management team, investors are left to wonder if the Company’s leadership has an incentive to continue receiving (and subsequently selling) significant annual stock grants, rather than positioning the Company for an eventual sale. Unfortunately for stockholders, the Acquisition of Valtech would increase the likelihood that the Company remains independent and the annual stock grants keep flowing.

Furthermore, the approval of the Business Combination Agreement would have the added consequence of disenfranchising current HeartWare stockholders to an extent. Should the Acquisition of Valtech close, Valtech and the Company would become wholly-owned subsidiaries of Holdco. Holdco, as a newly formed company, would not be required to hold a stockholder meeting for the election of directors until the spring of 2017, which would frustrate stockholders’ ability to vote for directors of their choice. Even if Holdco elects to hold its first annual meeting at an earlier date, the Company’s current independent stockholders would have difficulty effecting any strategic or governance changes (including to the composition of Holdco’s board) as current Valtech stockholders and HeartWare insiders would collectively control approximately 25% of Holdco’s shares. Further limiting stockholders’ rights is the fact that Holdco intends to adopt a classified board structure so that only approximately one-third of all directors will be up for election each year. Accordingly, we encourage the Company’s stockholders to exercise their rights to vote against the Transactions Proposal while they still have the power to meaningfully influence the Company’s future.

11 Includes all current directors and named executive officers. Data per the Company’s SEC filings and Factset.

We Believe HeartWare is a Desirable and Undervalued Asset

Given the significant amount of Holdco shares to be issued to Valtech stockholders upon the close of the Transactions, any evaluation of the proposed Acquisition of Valtech requires assessing the value of HeartWare’s Shares (as current HeartWare stockholders will have their Shares represent the right to receive Holdco shares on a one-for-one basis upon the closing of the Transactions). We firmly believe the true cost of the Valtech acquisition is not based on the currently-depressed trading value of the Company’s Shares; rather it is based on the risk-adjusted fair value of the Company’s long-term standalone business plan. While the recent disclosure of a handful of adverse events observed in the MVAD CE Mark trial is unfortunate, the attractive fundamentals of the Company’s core VAD franchise are unchanged from this summer, when the Shares were trading well above $80. Barring a catastrophic MVAD pump redesign – which by all accounts is highly unlikely – the Shares should steadily close the gap to fair value as MVAD returns to the clinic.

We believe the fair value of the Shares is significantly greater than the current trading price. During the Investor Day, management provided its long-term forecast for the VAD franchise, projecting revenues of $524 million in 2020. This scenario yields a $141 per share valuation for HeartWare at the end of 201912, representing over 200% upside from today’s levels. Of course, it is only prudent to examine a more conservative scenario for the core business. We believe the Shares are undervalued even if we assume management’s forecast is aggressive. Under a scenario where VAD revenues in 2020 are only $450 million, and revenue growth beyond 2020 is a more modest 10% rather than the 18% projected by management, fair value at the end of 2019 would be $92 per share – a 100% premium from today’s levels13.

We cannot comprehend, if the Board truly believes the forecast presented at the Investor Day, how the Board can justify the Valtech acquisition as being a superior risk-adjusted alternative to simply executing in the Company’s core business – a strategy which would double to triple the value of the Company in four years.

As a result, we believe it is false to portray the Valtech acquisition as being “cheaper” now than it was at the time the Acquisition was initially disclosed – the 30% upfront dilution, additional shares and warrants and $375 million in milestone payments remain unchanged. Even in the downside scenario discussed above, the future value of the consideration offered to Valtech exceeds $900 million in cash and stock – an amount greater than the Company’s current market capitalization.

Additionally, as we have stated previously, we believe the ultimate destination of the Company’s VAD portfolio is in the hands of a larger medical device manufacturer. It is evident to us that the potential acquirers of HeartWare are very familiar with the Company, and would be able to move quickly to evaluate acquiring it should the opportunity present itself, now or in the future.

12 See Exhibit 1 to DFAN on Schedule 14A filed by Engaged Capital on January 7, 2016 for calculation 13 See Exhibit 1 to DFAN on Schedule 14A filed by Engaged Capital on January 7, 2016 for calculation

Using the valuation multiple Thoratec commanded in its sale to St. Jude Medical Inc., the value of the Company’s long-term plan in an acquisition is $178 per share at the end of 2019 – a 290% increase from today14 However, for the reasons discussed above, should the Company complete the Acquisition of Valtech, we believe a sale to a strategic acquirer will become unlikely and stockholders will be left to wonder what could have been.

Engaged Capital urges you to vote against the Transactions Proposal by signing, dating and returning the enclosed WHITE proxy card as soon as possible.

14 See Exhibit 1 to DFAN on Schedule 14A filed by Engaged Capital on January 7, 2016 for calculation