Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-164629

| Maximum Available Units | ||||||||

| Class 1/1a | Class 2/2a | |||||||

Frontier Diversified Series | 4,469,976 | 4,352,867 | ||||||

Frontier Masters Series | 1,480,687 | 1,718,509 | ||||||

Frontier Long/Short Commodity Series | 948,531 | 1,013,275 | ||||||

Trust and Managing Owner

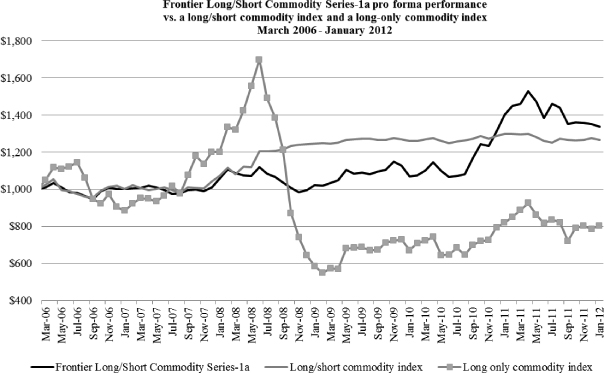

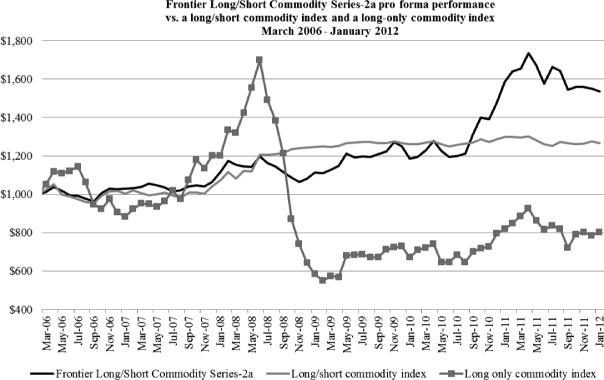

The Frontier Fund is a Delaware statutory trust that is currently continuously publicly offering participation in three separate series. Each series engages in the speculative trading of a diversified portfolio of futures, forwards (including interbank foreign currencies) and swaps and options contracts and/or other derivative instruments. Equinox Fund Management, LLC, a commodity pool operator and the managing owner of the trust, allocates the assets of each series to a diverse group of experienced commodity trading advisors and/or, from time to time, may also enter into swaps or other derivatives with respect to certain reference trading programs. Units are available for subscription on each business day at the then applicable net asset value per unit. As of April 24, 2012, the net asset value per unit was: Frontier Diversified Series: $96.29 (Class 1), $101.27 (Class 2); Frontier Masters Series: $99.28 (Class 1), $104.40 (Class 2); and Frontier Long/Short Commodity Series: $120.52 (Class 1a), $126.69 (Class 2a). The net asset value per unit on the date of your purchase may differ significantly from the net asset value per unit stated in the previous sentence.

Units

Each series is available in two classes. Class 1 (and in the case of the Frontier Long/Short Commodity Series, class 1a) units are subject to an initial service fee equal to up to 2.0% of the purchase price and, after the first year, an ongoing annual service fee of up to 2.0% of the net asset value of your units, which is payable either monthly or quarterly (as agreed with the selling agent). The initial service fee will generally be prepaid by the managing owner to the applicable selling agent and will be reimbursed by the applicable series over the first 12 months of your investment. Class 2 (and in the case of the Frontier Long/Short Commodity Series, class 2a) units are not subject to an initial service fee and will only be offered to investors who invest through approved selling agents who are separately compensated by the investor directly. Class 2 and 2a units may be subject to ongoing service fees for certain administrative services provided by the selling agents in an amount equal to 0.25% annually of the net asset value of each unit (an additional amount of up to 0.25% may be paid by the managing owner).See “Fees and Expenses—Service Fees.” All initial service fees and annual ongoing service fees are subject to compensation limitations imposed by FINRA Rule 2310. Units that have reached the compensation limitations as determined by the managing owner will be designated as class 3 (and in the case of the Frontier Long/Short Commodity Series, class 3a) units for reporting purposes and will not be subject to additional ongoing service fees.See “Plan of Distribution” beginning on page 71.

Before you invest you will be required to represent and warrant that you meet applicable state minimum financial suitability standards. You are encouraged to discuss an investment in a series with your financial, legal and tax advisors before investing.

Selling Agents

Equinox Group Distributors, LLC, or EGD, an affiliate of the managing owner, is a selling agent and will use its “best efforts” to sell units. The managing owner may appoint additional selling agents in the future in its sole discretion.

Minimum Subscription Amounts per Series

Initial subscription* | $ | 1,000 | Additional subscriptions* | $ | 100 |

| * | Plan investors (including IRAs), employees (including family members of employees) of the managing owner and its affiliates, and charitable organizations have no minimum investment requirement. Higher minimum subscription amounts apply to Texas residents. |

The units are speculative securities and you could lose all or substantially all of your investment in a series. Read this entire prospectus carefully and consider the “Risk Factors” beginning on page 19. In particular, you should be aware that:

| • | Past performance is not necessarily indicative of future results. |

| • | Futures, forwards and options trading is speculative, volatile and highly leveraged. |

| • | Each series will rely on its trading advisors for success. |

| • | Your annual tax liability is anticipated to exceed cash distributions to you. |

| • | There is no secondary market for the units and the transfer of units is restricted. If you redeem all or a portion of your class 1 or 1a units before the end of 12 full months following your purchase, you will be charged a redemption fee of up to 2.0% of the purchase price of the units being redeemed. |

| • | Each series is subject to substantial charges. You will sustain losses if the series is unable to generate sufficient trading profits to offset its fees and expenses. |

| • | The trust is not a mutual fund and is not subject to regulation under the Investment Company Act of 1940, as amended. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

The date of this prospectus is April 30, 2012.

Table of Contents

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 70 THROUGH 79 AS WELL AS IN THE APPENDICES ATTACHED TO THIS PROSPECTUS FOR EACH SERIES OF UNITS AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 17 THROUGH 18.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 19 THROUGH 34.

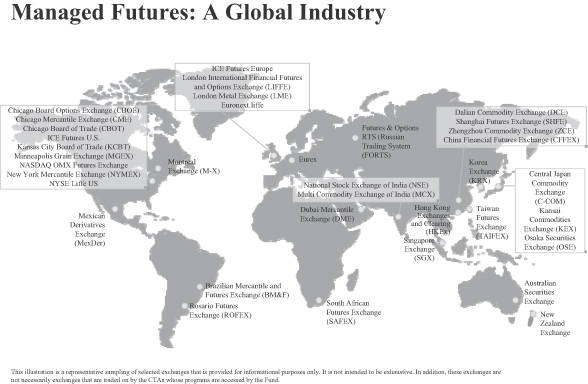

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

Table of Contents

PART ONE

DISCLOSURE DOCUMENT

Table of Contents

Table of Contents

| 33 | ||||

Foreign Investors May Face Exchange Rate Risk and Local Tax Consequences. | 33 | |||

| 34 | ||||

| 34 | ||||

The Trading Companies Are Subject to Speculative Position Limits. | 34 | |||

CFTC Registrations Could Be Terminated, Which Could Adversely Affect the Trust or a Series. | 34 | |||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 42 | ||||

| 42 | ||||

| 58 | ||||

| 62 | ||||

| 66 | ||||

| 67 | ||||

| 70 | ||||

| 80 | ||||

| 84 | ||||

| 86 | ||||

| 90 | ||||

| 91 | ||||

| 108 | ||||

| 112 | ||||

| 112 | ||||

| 112 | ||||

| 112 |

| FRONTIER DIVERSIFIED APP. - 1 | ||

| FRONTIER MASTERS APP. - 1 | ||

| FRONTIER LONG/SHORT COMMODITY APP. - 1 |

PART TWO

STATEMENT OF ADDITIONAL INFORMATION

THE NON-MAJOR COMMODITY TRADING ADVISORS AND/OR REFERENCE PROGRAMS | SAI – 1 | |||

| SAI – 6 | ||||

| SAI – 10 | ||||

| SAI – 15 | ||||

| SAI – 16 | ||||

| SAI – 20 | ||||

| SAI – 39 | ||||

| SAI – 45 | ||||

DESCRIPTION OF INDICES REFERENCED IN THIS STATEMENT OF ADDITIONAL INFORMATION | SAI – 70 |

Table of Contents

The Series of The Frontier Fund at a Glance

Series | Trading/Reference Programs | |||

Frontier Diversified | Major Commodity Trading Advisors and/or Reference Programs | |||

Beach Horizon LLP Cantab Capital Partners LLP Graham Capital Management, L.P. Quantitative Investment Management, LLC QuantMetrics Capital Management LLP Tiverton Trading Winton Capital Management Ltd. | Horizon Program CCP Quantitative Fund Aristarchus Program K4D-15 Program Global Program QM Futures Program Discretionary Trading Methodology Program Diversified Program | |||

| Non-Major Commodity Trading Advisors and/or Reference Programs | Various Programs | |||

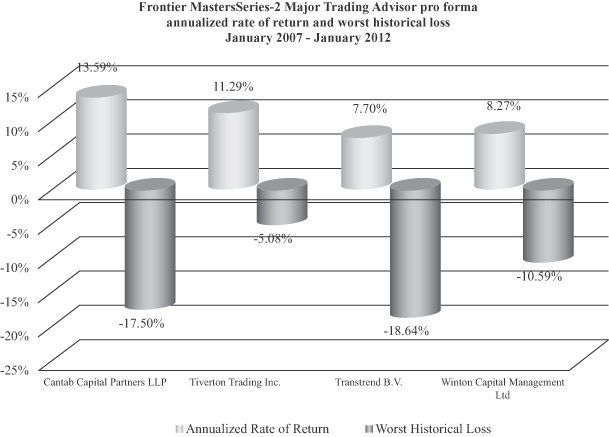

Frontier Masters | Major Commodity Trading Advisors and/or Reference Programs | |||

Cantab Capital Partners LLP Tiverton Trading Transtrend B.V. Winton Capital Management Ltd. | CCP Quantitative Fund Aristarchus Program Discretionary Trading Methodology Program Diversified Trend Program—Enhanced Risk/USD Diversified Program | |||

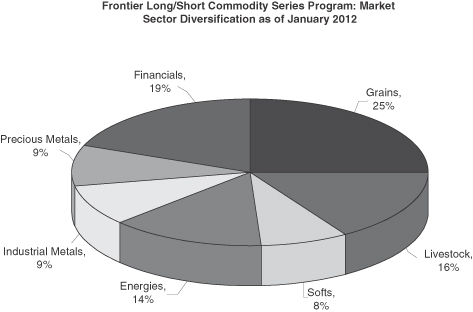

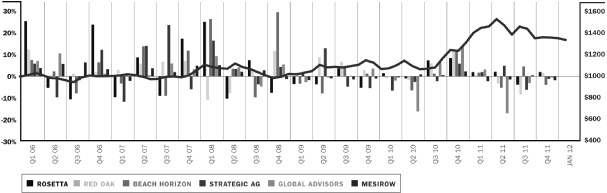

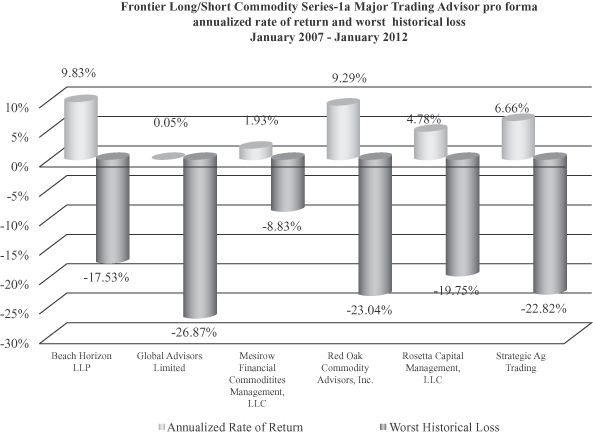

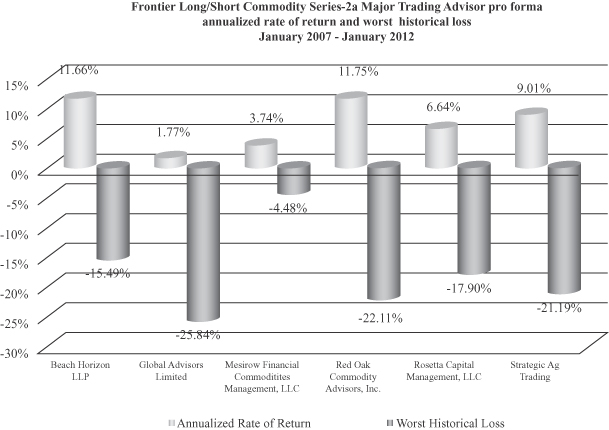

Frontier Long/Short Commodity | Major Commodity Trading Advisors and/or Reference Programs | |||

Beach Horizon LLP Global Advisors (Jersey) Limited Mesirow Financial Commodities Management, LLC Red Oak Commodity Advisors, Inc. Rosetta Capital Management, LLC Skyline Management, Inc. | Horizon Program Global Commodity Systematic Strategy Absolute Return Strategy Diversified Discretionary Trading Rosetta Trading Program Grains Trading Program | |||

| Non-Major Commodity Trading Advisors and/or Reference Programs | Various Programs | |||

A commodity trading advisor (“CTA”) that may be allocated at least 10% of the assets of a series is referred to as a major CTA. A non-major CTA is a CTA whose allocation will be less than 10% of a series’ assets.

A reference program refers to a commodity trading program in which the exposure to such program is through a swap or other over-the-counter derivative instrument. A reference program whose exposure may be 10% or more of a series’ assets is referred to as a major reference program. A non-major reference program is a reference program whose exposure will be less than 10% of a series’ assets.

The trust will not own any of the investments or indices referenced by any swap or other derivative instrument, and acting as the advisor of a reference program will not cause such advisor to be considered a trading advisor to the trust or the related series. In addition, advisors to the trading companies on behalf of any series are not required to be registered under the Commodity Exchange Act as commodity trading advisors or to be members of the NFA solely as a result of managing programs referenced by, or being the counterparties to, a swap. Additionally, the counterparty is not the trading advisor of the reference program. The managing owner may add, replace or substitute trading advisors and reference programs in its sole discretion, without prior notice to or consent of investors.

Table of Contents

This summary highlights certain information contained elsewhere in this prospectus. The remainder of this prospectus contains more detailed information. You should read the entire prospectus, including the appendix for each series, the Statement of Additional Information, all exhibits to the prospectus, and all documents incorporated herein by reference before deciding to invest in any series.

The Trust | The Frontier Fund is a Delaware statutory trust (formed on August 8, 2003) that is currently continuously publicly offering units in three separate series. Each series engages in the speculative trading of a diversified portfolio of futures, forwards (including interbank foreign currencies) and swaps and options contracts and/or other derivative instruments. The purpose of each series is to seek capital appreciation while attempting to control risk and volatility. Equinox Fund Management, LLC, a commodity pool operator and the managing owner of the trust, allocates the assets of each series to a diverse group of experienced commodity trading advisors and/or, from time to time, may also enter into swaps or other derivative instruments with respect to certain reference trading programs. Units are available for subscription on each business day at the then current net asset value per unit. The trust has offered other series in the past and may offer additional series. |

| Since each series has a unique trading strategy, you should review the information relating to each series and its trading strategy(see “Appendices to Part 1” for additional information regarding each series and its trading strategy). |

| The trust will terminate on December 31, 2053 (unless terminated earlier in certain circumstances).See “Summary of Agreements—Trust Agreement.” The principal offices of the trust and the managing owner are located at 1775 Sherman Street, Suite 2500, Denver, Colorado 80203, and their telephone number is (303) 837-0600. The trust and each series of the trust is a multi-advisor pool as defined in CFTC Rule 4.10(d)(2). |

The Managing Owner | Equinox Fund Management, LLC is a limited liability company formed in the state of Delaware in June 2003. The managing owner is the commodity pool operator of the trust and each series. The managing owner has been registered with the CFTC as a commodity pool operator since August 6, 2003, and has been a member of the NFA since that date. The managing owner is ultimately responsible for the selection, retention and termination of the trading advisors and swap reference trading programs on behalf of each series.See “The Managing Owner.” |

| The managing owner will maintain a 1% interest with respect to the publicly registered units of each series of the trust at all times.See “The Managing Owner—Managing Owner’s Commitments—Minimum Purchase Commitment” and “The Managing Owner—Managing Owner’s Commitments—Net Worth Commitment.” The managing owner has agreed to accept liability for the obligations of each series that exceed that series’ net assets. |

Table of Contents

| The managing owner, with respect to each series, will: |

| • | engage in the speculative trading of a diversified portfolio of futures, forwards (including interbank foreign currencies) and options contracts and/or other derivative instruments, including one or more swap contracts and may, from time to time, engage in cash and spot transactions; |

| • | maintain a portion of such series’ assets at the trust level for cash management; |

| • | maintain separate, distinct records for each series, and account for its assets separately from the other series and the other trust assets; and |

| • | calculate the net asset value of its units separately from the other series. |

The Units | Each series is available in two classes. Class 1 (and in the case of the Frontier Long/Short Commodity Series, class 1a) units are subject to an initial service fee equal to up to 2.0% of the purchase price and, after the first year, an ongoing annual service fee of up to 2.0% of the net asset value of your units, which is payable either monthly or quarterly (as agreed with the selling agent). The initial service fee will generally be prepaid by the managing owner to the applicable selling agent and will be reimbursed by the applicable series over the first 12 months of your investment. Class 2 (and in the case of the Frontier Long/Short Commodity Series, class 2a) units are not subject to an initial service fee and will only be offered to investors who invest through approved selling agents who are separately compensated by the investor directly.See “Fees and Expenses—Service Fees.”Class 2 and 2a units may be subject to ongoing service fees for certain administrative services provided by the selling agents in an amount equal to 0.25% annually of the net asset value of each unit (an additional amount of up to 0.25% may be paid by the managing owner). |

| See “Fees and Expenses” for a description of all fees and expenses applicable to an investment in a series of the trust. |

| Class 1 and 1a units and class 2 and 2a units will be redesignated as class 3 or class 3a units, respectively, of such series, for administrative purposes as of any business day when the managing owner determines in its sole discretion that the service fee limit will be reached. The service fee limit applicable to each unit sold pursuant to this prospectus is reached upon the earlier of (i) the aggregate initial and ongoing service fees received by the selling agent with respect to such unit equals 9% of the purchase price of such unit or (ii) the aggregate underwriting compensation (determined in accordance with FINRA Rule 2310) paid in respect of such unit totals 10% of the purchase price of such unit. There are no service fees or redemption fees associated with the class 3 or 3a units. |

2

Table of Contents

| Class 3 and 3a units are not offered directly to investors and have been registered, and will be maintained, under federal and state securities laws to administer the designation of class 1, 1a, 2 and 2a units that have reached the service fee limit as class 3 or 3a units.See “Plan of Distribution.” |

| The percent return (and associated dollar amount) that your investment must earn in the indicated series, after taking into account estimated interest income, in order to break-even after one year is as follows (please see the “Break-Even Analysis” on page 17): Frontier Diversified Series: Class 1 – 5.37% ($53.70); Class 2 – 3.03% ($30.30); Class 3 – 2.78% ($27.80); Frontier Masters Series: Class 1 – 6.19% ($61.90); Class 2 – 4.01% ($40.10); Class 3 – 3.76% ($37.60); and Frontier Long/Short Commodity Series: Class 1a – 6.32% ($63.20); Class 2a – 4.14% ($41.40); Class 3a – 3.83% ($38.30). |

| The offering of units is subject to federal state securities laws and regulations, federal laws and regulations relating to investments in commodities and related products, and the rules of FINRA and NFA. |

The Series | The trust publicly offers units in three separate series: Frontier Diversified Series, Frontier Masters Series and Frontier Long/Short Commodity Series. The trust has offered other series in the past and may offer additional series and/or units. |

| The trust allocates the assets of each series to one or more of the trading advisors or reference programs described below through the use of one or more trading companies formed in the state of Delaware. The managing owner may add, replace or substitute trading advisors or reference programs, in its sole discretion, without prior notice to or consent of investors. |

| The actual allocation among trading advisors for each series will vary based upon the relative trading performance of the trading advisors and/or reference programs, and the managing owner may otherwise vary such percentages from time to time in its sole discretion. Each series permits its trading advisor(s) to trade assets allocated to it using notional equity in order to keep each series’ annual return volatility between 10% and 15%. |

| A portion of the assets of a series may be committed as initial margin for strategic investments in one or more swaps or other derivative instruments. The trust will not own any of the investments or indices referenced by any swap or other derivative instrument, and the trading advisors of the reference programs will not be trading advisors to the trust or the related series. Although the series will not be directly invested in any fund or program with respect to a swap or other derivative instrument, the assets of such series are subject to the credit risk of the counterparty with respect to any swap or other derivative instrument.See “Risk Factors—Risks Relating to Trading and the Markets—OTC Transactions Are Subject to Little, if Any, Regulation and May Be Subject to the Risk of Counterparty Default.” |

3

Table of Contents

| You should review the appendix for each series in Part 1 for additional information. |

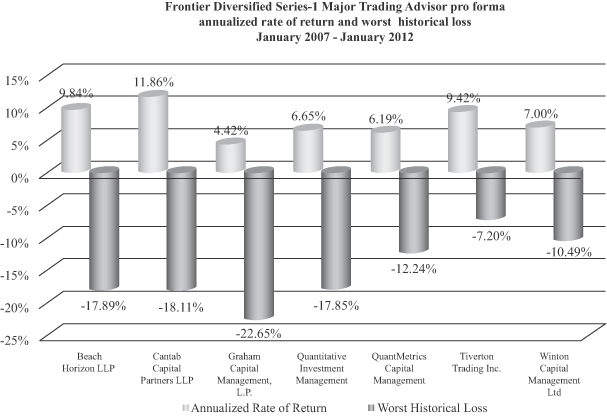

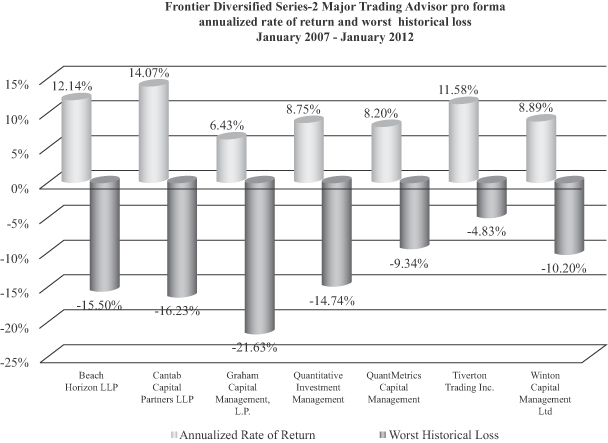

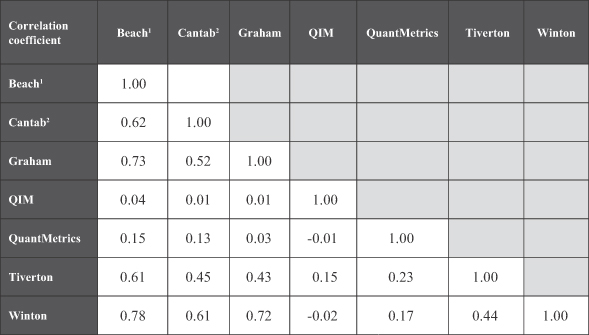

Frontier Diversified Series | The current major commodity trading advisors and/or reference programs for the Frontier Diversified Series are: |

| • | Beach Horizon LLP; |

| • | Cantab Capital Partners LLP; |

| • | Graham Capital Management, L.P.; |

| • | Quantitative Investment Management, LLC; |

| • | QuantMetrics Capital Management LLP; |

| • | Tiverton Trading; and |

| • | Winton Capital Management Ltd. |

| The managing owner anticipates that up to 15% of the assets of the Frontier Diversified Series will be allocated to each of the major commodity trading advisors and/or reference programs. |

| See the appendix for the Frontier Diversified Series attached to Part I of this prospectus for more information regarding the Frontier Diversified Series. |

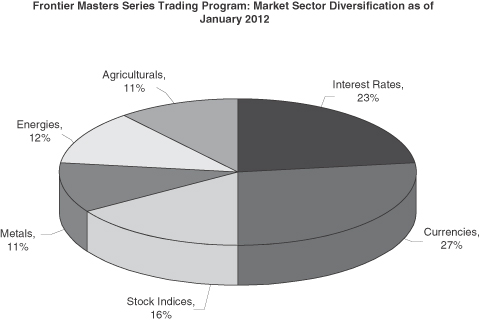

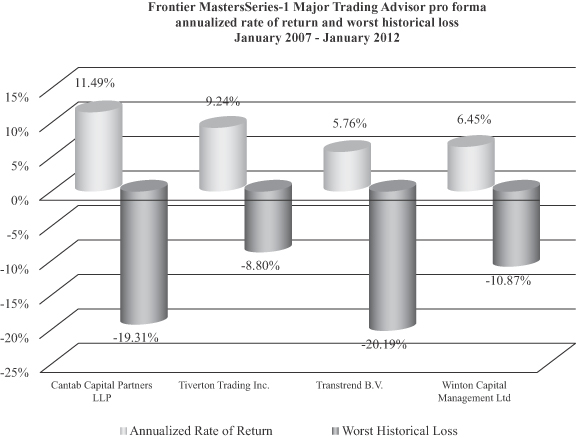

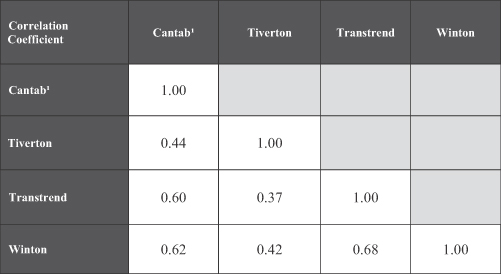

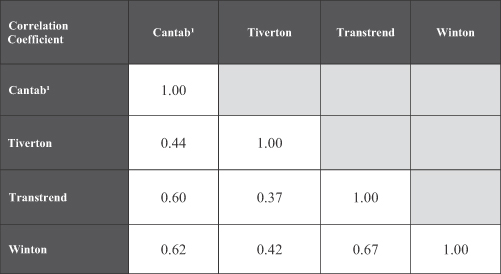

Frontier Masters Series | The current major commodity trading advisors and/or reference programs for the Frontier Masters Series are: |

| • | Cantab Capital Partners LLP; |

| • | Tiverton Trading; |

| • | Transtrend B.V.; and |

| • | Winton Capital Management Ltd. |

| The managing owner anticipates that approximately 25% of the assets of the Frontier Masters Series will be allocated to each of the major commodity trading advisors and/or reference programs. |

| See the appendix for the Frontier Masters Series attached to Part I of this prospectus for more information regarding the Frontier Masters Series. |

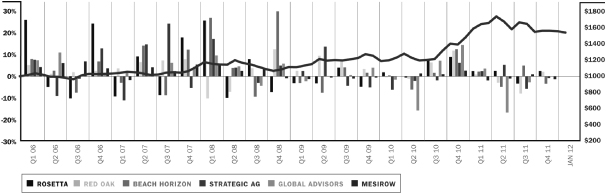

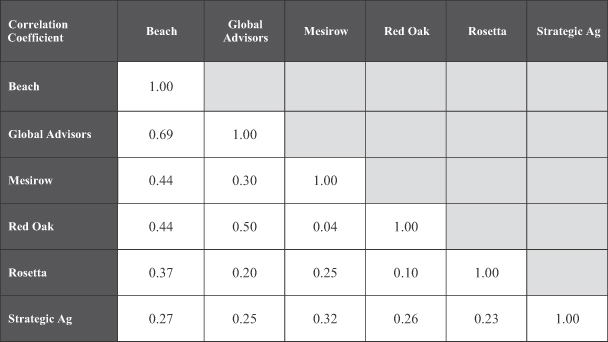

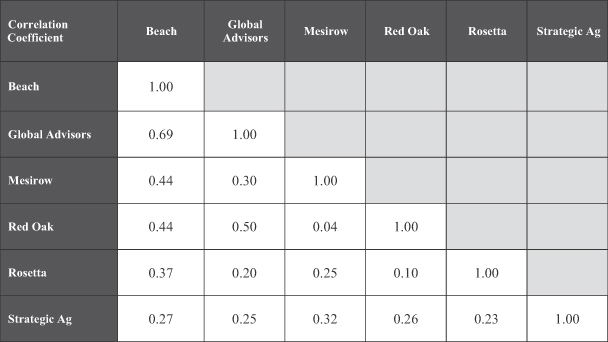

Frontier Long/Short Commodity Series | The current major commodity trading advisors and/or reference programs for the Frontier Long/Short Commodity Series are: |

| • | Beach Horizon LLP; |

| • | Global Advisors (Jersey) Limited; |

| • | Mesirow Financial Commodities Management, LLC; |

| • | Red Oak Commodity Advisors, Inc.; |

| • | Rosetta Capital Management, LLC; and |

| • | Skyline Management, Inc. |

| The managing owner anticipates that between 10% and 20% of the assets of the Frontier Long/Short Commodity Series will be allocated to each of the major commodity trading advisors and/or reference programs. |

4

Table of Contents

| See the appendix for the Frontier Long/Short Commodity Series attached to Part I of this prospectus for more information regarding the Frontier Long/Short Commodity Series. |

Investment Risks | Units of each series are speculative securities and you could lose all or substantially all of your investment in a series. In particular, you should be aware that: |

| • | Past performance is not necessarily indicative of future results. |

| • | Futures, forwards and options trading is speculative, volatile and highly leveraged. Due to the volatile nature of the commodities markets and the high degree of leverage to be employed by the trust, a relatively small change in the price of a contract can cause significant losses for a series. |

| • | There is no secondary market for the units and the transfer of units is restricted. If you redeem all or a portion of your class 1 or 1a units before the end of 12 full months following your purchase, you will be charged a redemption fee of up to 2.0% of the purchase price of the units being redeemed. |

| • | The incentive nature of the compensation to be paid to the trading advisors may encourage the trading advisors to take riskier or more speculative positions. |

| • | Each of the trust’s series relies on its trading advisors for success. |

| • | Your annual tax liability may exceed cash distributions to you. |

| • | Each series is subject to substantial charges. You will sustain losses if the series is unable to generate sufficient trading profits to offset its fees and expenses. We estimate that each series will have to achieve minimum net trading profits and interest income ranging from 2.78% to 6.32% (with the specific percentage varying from series to series) each year for investors in units of such series to break-even on their investments.See “Break-Even Analysis” on page 17. |

| • | You will have limited voting rights and no control over the trust’s business. |

| • | Actual and potential conflicts of interest exist among the managing owner and the trading advisors. Other conflicts of interest may exist as well.See “Actual and Potential Conflicts of Interest.” |

The Trading Companies | For administrative and operational reasons, the trust currently allocates assets of each series to trading advisors or reference programs through the use of one or more trading companies. The trading companies are limited liability companies formed in Delaware. The assets of each trading company are generally segregated from each other trading company. Certain trading companies have entered into contractual arrangements with one or more independent commodity trading advisors that will manage all or a portion of such trading company’s assets and make the trading |

5

Table of Contents

decisions with respect to the assets of each series invested in such trading company. Certain other trading companies have entered into swaps or other over-the-counter derivative instruments with independent counterparties.The trading companies currently utilized by the trust are as follows: Frontier Trading Company I LLC, Frontier Trading Company II LLC, Frontier Trading Company V LLC, Frontier Trading Company VII LLC, Frontier Trading Company XIV LLC, Frontier Trading Company XV LLC, Frontier Trading Company XVIII LLC, Frontier Trading Company XXI LLC, and Frontier Trading Company XXIII LLC. |

| See “—Organizational Charts.” For additional disclosure regarding the risks and potential conflicts of interest associated with investment through the trading companies, please see “Risk Factors—Trading Company Allocations” and “Actual and Potential Conflicts of Interest—Trading Companies.” |

The Trustee | Wilmington Trust Company, a Delaware banking corporation, serves as the trust’s trustee. The trustee delegated to the managing owner all of the power and authority to manage the business and affairs of the trust and has only nominal duties (such as accepting service of legal process on behalf of the trust and making filings under the Delaware Statutory Trust Act, or the Trust Act) and liabilities to the trust. |

The Clearing Brokers | For trading companies managed by the managing owner, UBS Securities LLC and Newedge USA, LLC, act as futures clearing brokers, although other brokers may serve as futures clearing brokers for any of the trading companies in the future. In addition, Deutsche Bank AG London and Newedge Alternative Strategies, Inc. generally serve as the foreign exchange counterparties (the FX Counterparties) for the trading companies that trade over-the-counter (OTC) foreign currencies. The futures clearing brokers and the FX Counterparties are collectively referred to as the clearing brokers. The clearing brokers will execute and clear the futures, options and OTC foreign currency transactions, as applicable, and perform certain administrative services for each trading company. |

Administrator | The trust and the managing owner have appointed BNP Paribas Financial Services, LLC (“BNP Financial Services”), to act as an independent, third party administrator for the trust and its trading companies in certain capacities related to accounting and financial bookkeeping effective April 1, 2012. The managing owner itself provides registrar, transfer agency and other administrative services to the trust and its trading companies. |

The Selling Agents | Equinox Group Distributors, LLC, or EGD (an affiliate of the managing owner), is a selling agent of the trust. EGD and/or the managing owner may also appoint other broker-dealers that are registered under the Securities Exchange Act of 1934, as amended, and are members of FINRA as selling agents to assist in the marketing and sales of units. The selling agents are not required to sell any specific number or dollar amount of units but will use their best efforts to sell the units offered. |

6

Table of Contents

Liabilities You Assume | You cannot lose more than your investment in any series in which you invest, and you will not be subject to the losses or liabilities of any series in which you have not invested.See “Summary ofAgreements—Trust Agreement—Liabilities” for a more complete explanation. |

Limitation of Liabilities | The debts, liabilities, obligations, claims and expenses of a particular series will be enforceable against the assets of such series only, and not against the assets of the trust generally or the assets of any other series, except to the extent described in the sections titled “Risk Factors—Trading Company Allocations” and “Actual and Potential Conflicts of Interest—Trading Companies.” |

Who May Subscribe | An investment in the trust is speculative and involves a high degree of risk. The trust is not suitable for all investors. An investment in the trust should represent only a limited portion of your overall portfolio. To subscribe in the units of any series: |

| • | You must have at a minimum (1) a net worth (exclusive of your home, home furnishings and automobiles) of at least $250,000 or (2) a net worth (exclusive of your home, home furnishings and automobiles) of at least $70,000 and an annual gross income of at least $70,000. A significant number of states impose substantially higher suitability standards than the minimums described above. Before investing, you should review the minimum suitability requirements for your state of residence which are described in“State Suitability Requirements” in“SUBSCRIPTION INFORMATION” attached to this prospectus as Exhibit B. These suitability requirements are regulatory minimums only. Just because you meet such requirements does not mean that an investment in the units is a suitable investment for you. |

| • | You may not invest more than 10% of your net worth (exclusive of your home, furnishings and automobiles) in any series or combination of series. |

| • | IRAs, Keogh plans covering no common law employees and employee benefit plans not subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA), may not invest more than 10% of the subscriber’s and their participants’ net worth (exclusive of home, home furnishings and automobiles) in any series or combination of series. |

| • | Employee benefit plans subject to ERISA are subject to special suitability requirements and may not invest more than 10% of their assets in any series or combination of series. |

| See “Who May Subscribe” beginning on page 80 of the prospectus. |

Minimum Subscription Amounts | The minimum initial subscription in any one series is $1,000. If you are an individual retirement account, pension, profit-sharing, stock bonus, Keogh, welfare benefit or other employee benefit plan whether or not subject to ERISA or Section 4975 of the Code, each a Plan, an employee or family member of an employee of the managing owner or its affiliates, or a charitable organization, you have no minimum initial subscription requirements and are able to invest a lesser amount. |

7

Table of Contents

| Existing limited owners may purchase additional units in increments of $100, or, if you are a Plan (including an IRA), an employee or family member of an employee of the managing owner or its affiliates, or a charitable organization, you have no minimum initial subscription requirements and are able to invest a lesser amount. |

| If you are a resident of Texas, then your minimum initial subscription requirement is $5,000, or, if you are a Plan (including an IRA), an employee or family member of an employee of the managing owner or its affiliates, or a charitable organization (each, residing in Texas), then your minimum initial subscription requirement is $1,000. |

How to Subscribe | To subscribe for units you will be required to complete a subscription agreement. Any subscription may be rejected by the managing owner for any reason or for no reason in its sole discretion. |

Subscription Effective Dates | The effective date of your subscription will generally be two business days after the day on which your subscription agreement or exchange request is received by the managing owner. A subscription agreement or exchange request received by the managing owner after 4:00 PM Eastern Standard Time will be deemed to be received on the immediately following business day. Business day means a day other than a Saturday, Sunday or other day when banks and/or securities exchanges in the city of New York or the city of Wilmington are authorized or obligated by law to close. The managing owner in its sole and absolute discretion may change such notice requirement upon written notice to you. |

Transfer of Units | The trust agreement restricts the transferability and assignability of the units. There is not now, nor is there expected to be, a secondary trading market for the units. |

Exchange Privilege | You may exchange your units of a series for units of another series. Class 1 units in any one series may only be exchanged for class 1 units in any other offered series; similarly, class 2 units in any one series may only be exchanged for class 2 units in any other offered series. You will be allowed to exchange your units in one series for units of another series only if units of the series being exchanged into are currently being offered for sale, are registered for sale in your state and only if there are a sufficient number of registered units of the series being exchanged into. Please confirm availability of a series prior to requesting an exchange. An exchange of units will be treated as a redemption of units of one series (with the related tax consequences) and the immediate purchase of units of another series.See “U.S. Federal Income Tax Consequences.” No redemption fees or initial services fees will be charged with respect to exchanged units. Upon any exchange, each unit being purchased (exchanged into) will be subject to annual ongoing service fees as described above in “The Units” and such new units will be subject to a new service fee limit determined without regard to the amount of service fees previously charged with respect to your redeemed (exchanged out of) units. |

Exchanges are made at the applicable series’ then-current net asset value per unit at the close of business on each day immediately |

8

Table of Contents

preceding the day on which your exchange will become effective. An exchange will be effective on the day which occurs at least two business days after the managing owner receives your exchange request. An exchange request received by the managing owner after 4:00 PM Eastern Time on any business day will be deemed to be received on the immediately following business day for purposes of the foregoing. The managing owner, in its sole and absolute discretion, may change such requirements or reject any exchange request.See “Summary of Agreements—Trust Agreement—Exchange Privilege.” |

Redemptions | You may redeem your units, in whole or in part, on a daily basis. Your units will be redeemed one business day after the managing owner’s receipt of your redemption request. A request for redemption received by the managing owner after 4:00 PM Eastern Time on any business day will be deemed to be received on the immediately following business day. The managing owner, in its sole and absolute discretion, may change such notice requirement. Redemptions are made at the applicable series’ then-current net asset value per unit on the business day following the receipt of your redemption request. If you redeem all or a portion of your class 1 or 1a units on or before the end of 12 full months following the purchase of such units being redeemed, you will be charged a redemption fee of up to 2.0% of the purchase price of any units redeemed to reimburse the managing owner for the then-unamortized balance of the prepaid initial service fee. Redemption fees will be paid to the managing owner.See “Summary of Agreements—Trust Agreement—Redemption of Units.” |

Distributions | The managing owner does not currently intend to make any distributions of profits. |

Income Tax Consequences | We have obtained an opinion of counsel to the effect that either the trust or each of its series will be treated as a partnership for U.S. federal, or federal, income tax purposes and, assuming that at least 90% of the gross income of each series has always constituted, and will continue to constitute, “qualifying income” within the meaning of Section 7704(d) of the Internal Revenue Code of 1986, as amended, or the Code, neither the trust nor any series will be a publicly traded partnership treated as a corporation.See “U.S. Federal Income Tax Consequences—The Tax Status of the Trust and the Series.” |

As long as the trust or each series is treated as a partnership for federal income tax purposes, neither the trust nor any series will be subject to federal income tax. Instead, as a limited owner, you generally will be taxed on an amount equal to your allocable share of the income generated by the series in which you have purchased units (whether or not any cash is distributed to you). Your ability to deduct losses and expenses allocated to you may be subject to significant limitations. Special tax risks apply with respect to tax-exempt limited owners, foreign investors and others. The tax laws applicable to the trust and an investment in units of each series are subject to change and to differing interpretations.For a more complete discussion of tax risks relating to this investment, see |

9

Table of Contents

“Risk Factors—Taxation and ERISA Risks.” We urge you to consult your own tax advisor regarding the federal, state, local and foreign income tax consequences to you of the purchase, ownership, and disposition of units in light of your individual tax circumstances, and of the effects of possible changes in the tax laws. |

Important Information About This Prospectus | This prospectus is part of a registration statement that was filed with the SEC on behalf of the trust by its managing owner. Before purchasing any units, you should carefully read this prospectus, together with the additional information incorporated by reference into this prospectus, including financial statement information, as described under the heading “Incorporation of Certain Information by Reference,” and information described under the heading “Where You Can Find More Information.” |

| You should assume that the information appearing in this prospectus, as well as information that was previously filed with the SEC and incorporated by reference hereto, is accurate as of the date of such document. You should be aware that each series’ performance information, financial condition and results of operations may have changed since that date. |

Incorporation of Certain Information by Reference | The U.S. Securities Exchange Commission, or the SEC, allows the trust and each series to “incorporate by reference” into this prospectus certain information that it has filed with the SEC. This means that the trust and each series can disclose important information to you by referring you to those documents without restating that information in this prospectus. The information incorporated by reference into this prospectus is considered to be part of this prospectus. We incorporate by reference into this prospectus the documents listed below, including their exhibits, except to the extent information in those documents differs from information contained in this prospectus: |

| • | The Frontier Fund’s Annual Report on Form 10-K for the year ended December 31, 2011, as filed with the SEC on March 30, 2012; and |

| • | Equinox Fund Management LLC and Subsidiaries’ Consolidated Statement of Financial Condition on Form 8-K filed on April 9, 2012. |

| We will provide to any person to whom a copy of this prospectus is delivered, a copy of any or all of the information that we have incorporated by reference into this prospectus contained in the registration statement, but not delivered with this prospectus. We will provide this information upon written or oral request and at no cost to the requester. You may request this information by contacting the managing owner at: Equinox Fund Management, LLC, 1775 Sherman Street, Suite 2500, Denver, Colorado 80203; Attention: Investor Relations, or by calling (303) 837-0600. You may also access these documents at the managing owner’s website at http://www.thefrontierfund.com. |

10

Table of Contents

Where You Can Find More Information | The trust filed its registration statement relating to this offering of units with the SEC. This prospectus is part of the registration statement, but the registration statement includes additional information. You may read and copy any of the materials the trust has filed with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. For further information on the Public Reference Room, please call the SEC at 1-800-SEC-0330. These materials are also available to the public from the SEC’s website at http://www.sec.gov. |

Fees and Expenses

The fees and expenses related to an investment in a series are described below.

Series | Initial Service Fee(1) | Ongoing Service Fee(2) | Management Fee(3) | Incentive Fee (4) | Brokerage Commission (5) | Interest Expense (6) | Due Diligence (7) | |||||||

| % | % | % | % | % | % | % | ||||||||

Frontier | ||||||||||||||

Diversified | ||||||||||||||

Class 1 | 2 | 2 | 0.75 | 25 | 3.60 | 0.44 | 0.12 | |||||||

Class 2 | 0 | 0.25 | 0.75 | 25 | 3.60 | 0.44 | 0.12 | |||||||

Class 3(8) | 0 | 0 | 0.75 | 25 | 3.60 | 0.44 | 0.12 | |||||||

Frontier | ||||||||||||||

Masters | ||||||||||||||

Class 1 | 2 | 2 | 2 | 20 | 3.35 | 0.44 | 0.12 | |||||||

Class 2 | 0 | 0.25 | 2 | 20 | 3.35 | 0.44 | 0.12 | |||||||

Class 3(8) | 0 | 0 | 2 | 20 | 3.35 | 0.44 | 0.12 | |||||||

Frontier | ||||||||||||||

Long/Short Commodity | ||||||||||||||

Class 1a | 2 | 2 | 2 | 20 | 3.48 | 0.44 | 0.12 | |||||||

Class 2a | 0 | 0.25 | 2 | 20 | 3.48 | 0.44 | 0.12 | |||||||

Class 3a(8) | 0 | 0 | 2 | 20 | 3.48 | 0.44 | 0.12 |

| (1) | Initial Service Fee—Class 1 and 1a units of each series are subject to an initial service fee of up to 2.0% of the purchase price. Except in the case of units issued as rebates, the initial service fee will be prepaid by the managing owner to the applicable selling agent and will be reimbursed by the applicable series over the first 12 months of your investment.See “Fees and Expenses—Service Fees—Class 1 and Class 1a—Initial Service Fee.”Since the managing owner is paying the initial service fee in full upon the sale of the units and is being reimbursed by the trust monthly in arrears over the following 12 months based upon the trust’s current net asset value, it bears the risk of the downside and enjoys the benefit of the upside potential of any difference between the amount of the initial service fee prepaid by it and the amount of the reimbursement. |

| (2) | Ongoing Service Fee—After the expiration of 12 months following the purchase of class 1 or 1a units, investors will be charged an annual ongoing service fee of up to 2.0% of the net asset value of each unit purchased. Such fee will be paid on a monthly or quarterly basis, depending on the selling agent. Investors who purchase class 2 or 2a units may be charged an ongoing service fee of 0.25% annually of the net asset value of each unit purchased, for the benefit of selling agents selling such units. Ongoing service fees will be paid until such time as the service fee limit is reached.See footnote 8 below. |

| (3) | Management Fee—Each series will pay to the managing owner the referenced monthly management fee equal to a percentage of the assets attributable (including any notional funds) to the series as indicated. The |

11

Table of Contents

| managing owner will pay all or a portion of such management fee to the trading advisors and/or waive (up to the percentage specified) any such management fee to the extent any related management fee is paid by a trading company or estimated management fee is embedded in a swap or other derivative instrument. |

| (4) | Incentive Fee—Each series will pay to the managing owner an incentive fee equal to the percentage indicated of profits (net of certain fees and expenses) generated by each trading advisor for such series, including realized and unrealized gains and losses thereon, as of the close of business on the last day of each calendar month or quarter. The managing owner will pay all or a portion of such incentive fee to the trading advisors and/or waive (up to the percentage specified) any such incentive fee to the extent any related incentive fee is paid by a trading company or estimated incentive fee is embedded in a swap or other derivative instrument. |

| (5) | Brokerage Commission—Each series pays the clearing brokers and the managing owner amounts equal to the percentage indicated of the assets attributable (including any notional funds) to such series annually for brokerage commissions and other investment and trading fees and expenses charged in connection with such series’ trading activities. The amount indicated is an estimate based upon historical experience. The clearing brokers receive all brokerage commissions and applicable exchange fees, NFA fees, give up fees, pit brokerage fees and all other trading fees and expenses. The clearing brokers’ brokerage commissions and applicable fees currently average approximately $3.01 for the Frontier Diversified Series, the Frontier Masters Series and the Frontier Long/Short Commodity Series, per round-turn trade. The aggregate amount paid by each series includes a fee to the managing owner of up to 2.25% of the assets attributable (including any notional funds) annually to the applicable series. |

| (6) | Interest Expense—Except for that portion of each trading company’s assets used as margin to maintain forward currency contract or swap positions and assets held at the trust level for cash management, the proceeds of the offering for each series will be deposited in cash in segregated accounts in the name of each relevant trading company at the clearing brokers in accordance with CFTC segregation requirements. The clearing brokers credit each trading company with 80% to 100% of the interest earned on its average net assets (other than those assets held in the form of U.S. Government securities) on deposit with the clearing brokers each week. The managing owner also may invest non-margin assets in U.S. government securities which include any security issued or guaranteed as to principal or interest by the United States, or by a person controlled by or supervised by and acting as an instrumentality of the government of the United States pursuant to authority granted by Congress of the United States or any certificate of deposit for any of the foregoing, including U.S. Treasury bonds, U.S. Treasury bills and issues of agencies of the U.S. government, and certain cash items such as money market funds, certificates of deposit (under nine months) and time deposits. |

Twenty percent of interest income earned per annum by the trust will be paid to the managing owner (or one or more brokers determined by the managing owner), and the remaining 80% of interest income earned by the trust will be retained for the benefit of each series. Interest income is currently estimated at 2.21% per annum, before any payment of interest income to the managing owner. Such payment to the managing owner by each series is estimated to be 0.44%.

Each of the trading companies currently holds substantially all cash deposits not used for margin with U.S. Bank, although the managing owner may choose to hold the trading companies’ cash at other banks in its sole discretion.

| (7) | Due Diligence Expenses—The trust will pay for due diligence and custodial fees and expenses associated with the trading and custody of the assets allocable to such units. Such due diligence and custodial fees and expenses are not currently expected to exceed 0.12% of the net asset value of such units on an annual basis. |

| (8) | Class 3 and 3a units are not being offered by this prospectus. Class 1 and 1a units and class 2 and 2a units will be designated as class 3 or class 3a units, respectively, of such series, as applicable, for administrative purposes as of any business day when the managing owner determines, in its sole discretion, that the service fee limit with respect to such units has been reached. The service fee limit applicable to each unit sold |

12

Table of Contents

| pursuant to this prospectus is reached upon the earlier of (i) the aggregate initial and ongoing service fees received by the selling agent with respect to such unit equals 9% of the purchase price of such unit or (ii) the aggregate underwriting compensation (determined in accordance with FINRA Rule 2310) paid in respect of such unit totals 10% of the purchase price of such unit. There are no service fees or redemption fees associated with the class 3 or 3a units.See “Plan of Distribution.” |

Extraordinary Expenses

Each series is obligated to pay any extraordinary expenses it may incur. Extraordinary expenses will be determined in accordance with generally accepted accounting principles, and generally include events that are both unusual in nature and occur infrequently, such as litigation.

Managing Owner Fees and Expenses

The managing owner is responsible for the payment of all of the ordinary expenses for each series and the trading companies (including organizational costs, accounting, auditing, legal and routine operational and administrative expenses) associated with the organization of the trust and the offering of each series of units (except for any initial service fee) without reimbursement from any series, except that each series will reimburse the managing owner over the first 12 months for initial service fees advanced by it on behalf of the series to the selling agent. Initial and/or ongoing account start-up, platform access, account maintenance, and technology fees and expense reimbursements to certain selling agents will also be paid by the managing owner without reimbursement from any series. Expenses (including but not limited to accounting, auditing, legal and operational and administrative fees) of trading companies that are disregarded entities for tax purposes are ordinary expenses payable by the managing owner. Generally, expenses (including but not limited to accounting, auditing, legal and operational and administrative fees) of trading companies that are not disregarded entities for tax purposes and/or have members other than The Frontier Fund (or any series of The Frontier Fund) are not considered ordinary expenses of the trust and shall be indirectly borne by each applicable series.

Certain selling agents may be paid customary ongoing service fees for certain administrative services of up to 0.50% annually of the net asset value of the class 2 and 2a units of each series sold pursuant to this prospectus (of which 0.25% will be charged to holders of class 2 and 2a units).

Redemptions Fees

Investors who redeem all or a portion of their class 1 or 1a units during the first 12 months following the effective date of their purchase will be subject to a redemption fee of up to 2.0% of the purchase price of any units redeemed to reimburse the managing owner for the then-unamortized balance of the prepaid initial service fee relating to such units. There are no initial service fees or redemption fees associated with the class 2, 2a, 3 or 3a units.

13

Table of Contents

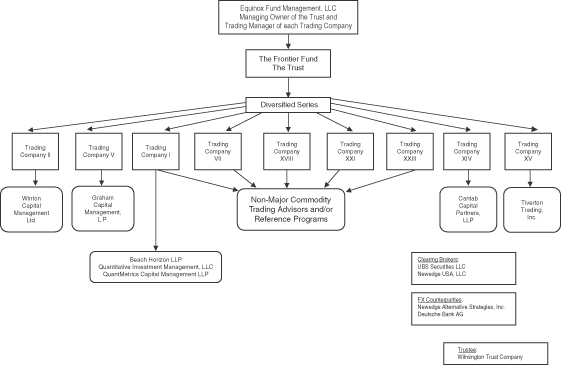

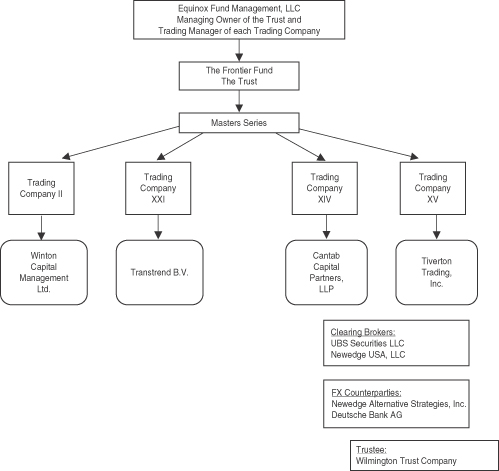

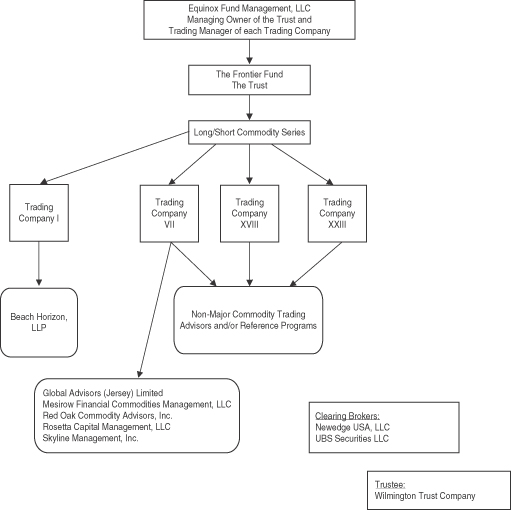

Organizational Charts

The following organizational charts showing the relationship among the various series, trading companies, and trading advisors involved with this offering. The particular trading companies in which the assets of each series are invested may vary from time to time.

Frontier Diversified Series

14

Table of Contents

Frontier Masters Series

15

Table of Contents

Frontier Long/Short Commodity Series

16

Table of Contents

Following are tables that set forth the fees and expenses that you would incur on an investment of $1,000 in each class of each series of the trust and the amount that your investment must earn, after taking into account estimated interest income, in order to break-even after one year. The fees and expenses applicable to each series are described above. The footnotes below are an integral part of the Break-Even Analysis.

FRONTIER DIVERSIFIED SERIES

| Class 1 | Class 2 | Class 3(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee(1) | 7.50 | 0.75 | 7.50 | 0.75 | 7.50 | 0.75 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3, 9) | 36.00 | 3.60 | 36.00 | 3.60 | 36.00 | 3.60 | ||||||||||||||||||

Incentive Fee(4) | 6.70 | 0.67 | 0.80 | 0.08 | 0.80 | 0.08 | ||||||||||||||||||

Less Interest income (5, 9) | (17.70 | ) | (1.77 | ) | (17.70 | ) | (1.77 | ) | (17.70 | ) | (1.77 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6, 9) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 53.70 | 5.37 | 30.30 | 3.03 | 27.80 | 2.78 | ||||||||||||||||||

FRONTIER MASTERS SERIES

| Class 1 | Class 2 | Class 3(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee(1) | 20.00 | 2.00 | 20.00 | 2.00 | 20.00 | 2.00 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3, 9) | 33.50 | 3.35 | 33.50 | 3.35 | 33.50 | 3.35 | ||||||||||||||||||

Incentive Fee(4) | 4.90 | 0.49 | 0.60 | 0.06 | 0.60 | 0.06 | ||||||||||||||||||

Less Interest income (5, 9) | (17.70 | ) | (1.77 | ) | (17.70 | ) | (1.77 | ) | (17.70 | ) | (1.77 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6, 9) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 61.90 | 6.19 | 40.10 | 4.01 | 37.60 | 3.76 | ||||||||||||||||||

FRONTIER LONG/SHORT COMMODITY SERIES

| Class 1a | Class 2a | Class 3a(8) | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

Management Fee(1) | 20.00 | 2.00 | 20.00 | 2.00 | 20.00 | 2.00 | ||||||||||||||||||

Service Fee(2) | 20.00 | 2.00 | 2.50 | 0.25 | 0.00 | 0.00 | ||||||||||||||||||

Brokerage Commissions and Investment and Trading Fees and Expenses(3, 9) | 34.80 | 3.48 | 34.80 | 3.48 | 34.80 | 3.48 | ||||||||||||||||||

Incentive Fee(4) | 4.90 | 0.49 | 0.60 | 0.06 | 0.00 | 0.00 | ||||||||||||||||||

Less Interest income (5, 9) | (17.70 | ) | (1.77 | ) | (17.70 | ) | (1.77 | ) | (17.70 | ) | (1.77 | ) | ||||||||||||

Due Diligence and Custodial Fees and Expenses(6, 9) | 1.20 | 0.12 | 1.20 | 0.12 | 1.20 | 0.12 | ||||||||||||||||||

Redemption Fee(7) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

Trading profit the series must earn for you to recoup your investment after one year | 63.20 | 6.32 | 41.40 | 4.14 | 38.30 | 3.83 | ||||||||||||||||||

| (1) | See footnote 3 under “Fees and Expenses.” |

| (2) | See footnotes 1 and 2 under “Fees and Expenses.” |

17

Table of Contents

| (3) | See footnote 5 under “Fees and Expenses.” |

| (4) | A portion of the 2% initial service fee and ongoing service fee is not deductible on the incentive fee calculation with respect to certain trading advisors, thereby requiring class 1 to achieve trading profits in an amount that, after being reduced by a corresponding incentive fee, offsets such nondeductible portion. Otherwise, incentive fees are paid to trading advisors only on new trading profits earned by the trading advisor. |

| (5) | See footnote 6 under “Fees and Expenses.” |

| (6) | See footnote 7 under “Fees and Expenses.” |

| (7) | Investors who redeem all or a portion of their class 1 or 1a units during the first 12 months following the effective date of their purchase will be subject to a redemption fee of up to 2.0% of the purchase price of any units redeemed to reimburse the managing owner for the then-unamortized balance of the prepaid initial service fee relating to such units. There are no redemption fees associated with the class 2, 2a, 3 or 3a units. At the end of 12 months, no redemption fee will apply. |

| (8) | Class 3 is not being offered to investors pursuant to this prospectus.See footnote 8 under “Fees and Expenses.” |

| (9) | These fees and expenses may not be paid directly by the series; rather may be an element of the pricing of swap and derivative instruments. Such fees and expenses are estimated based on our historical experience. |

18

Table of Contents

This section describes some of the principal risk factors that you will face if you invest in any series of the trust. All trading activities take place at the trading company level, but since the trust invests substantially all of the assets of each series in one or more trading companies, each of the risks applicable to the trading companies flows through to the series.

You should carefully consider the risks and uncertainties described below, as well as all of the other information included in this prospectus, before you decide whether to purchase units in any series of the trust.The units in each series are highly speculative and involve a high degree of risk. You should not invest in the units unless you can afford to lose all of your investment.

Risks Relating to the Trust and the Offering of Units

Possible Total Loss of an Investment in a Series of the Trust.

You could lose all or substantially all of your investment in any series of the trust. Neither the trust nor the trust’s trading advisors have any ability to control or predict market conditions. The investment approach utilized on behalf of each series of the trust may not be successful, and there is no guarantee that the strategies employed by each series will be successful. Additionally, each series of the trust is not guaranteed as to principal, so you are not assured of any minimum return. You could lose your entire investment (including any undistributed profits) in addition to losing the use of your subscription funds for the period you maintain an investment in any series.

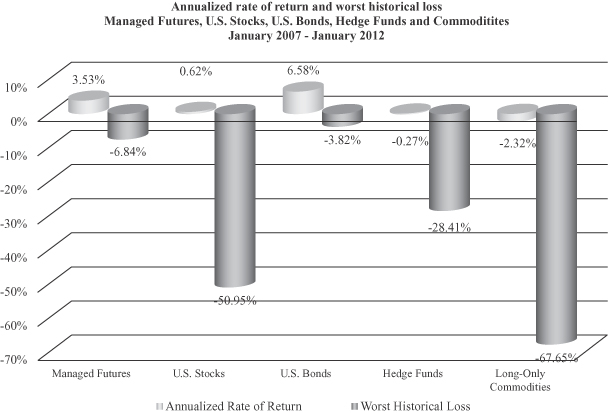

You Should Not Rely on Past Performance of the Managing Owner or the Trading Advisors in Deciding to Purchase Units in Any Series.

The performance of any series of the trust is entirely unpredictable, and the past performance of other entities managed by the managing owner and the trading advisors is not necessarily indicative of a series’ or a trading companies’ future results. No assurance can be given that the managing owner will succeed in meeting the investment objectives of any series. The managing owner believes that the past performance of the trading advisors may be of interest to prospective investors, but encourages you to look at such information as an example of the respective objectives of the managing owner and each trading advisor rather than as any indication that the investment objectives of any series will be achieved. Past performance is not indicative of future results.

Neither the Trust nor any of the Trading Companies is a Registered Investment Company.

Neither the trust nor any of the trading companies is an investment company subject to the Investment Company Act. Accordingly, you do not have the protections afforded by that statute. For example, the Investment Company Act requires investment companies to have a majority of disinterested directors and regulates the relationship between the investment company and its investment adviser.

You Should Not Rely on Past Performance of Any Series in Deciding to Purchase Units in any Other Series.

You and other investors will invest in different series with different trading strategies. Each series’ assets are valued and accounted for separately from every other series. Consequently, the past performance of one series has no bearing on the past performance of another series. You should not, for example, consider the Frontier Diversified Series’ past performance in deciding whether to invest in any other series. Past performance is not indicative of future results.

Certain Restrictions on Redemption and Transfer of the Units Will Apply.

Investors may redeem units daily on one business day notice, but certain restrictions on redemption and transfer will apply. For example, if you invest in class 1 or 1a units and redeem all or a portion of such units on

19

Table of Contents

or before the end of the 12 full months following the purchase of such units, you will be charged a redemption fee of up to 2.0% of the purchase price of any such units being redeemed. Also, transfers of units are permitted only with the prior written consent of the managing owner and provided that conditions specified in the trust agreement are satisfied. There is no secondary market for the units and none is expected to develop.

Redemptions May Be Temporarily Suspended.

The managing owner may temporarily suspend redemptions for some or all of the series for up to 30 days if the effect of any redemption, either alone or in conjunction with other redemptions, would be to impair the trust’s ability to operate in pursuit of its objectives (for example, if the managing owner believes a redemption, if allowed, would materially advantage one investor over another investor). The managing owner anticipates suspending redemptions only under extreme circumstances, such as a natural disaster, force majeure, act of war, terrorism or other event which results in the closure of financial markets. During any suspension of redemptions, a redeeming limited owner invested in a series for which redemptions were suspended would remain subject to market risk with respect to such series.

An Unanticipated Number of Redemption Requests over a Short Period of Time Could Result in Losses.

Substantial redemptions of units could require a series to liquidate investments more rapidly than otherwise desirable in order to raise the necessary cash to fund the redemptions, which could result in losses. Illiquidity in the markets could make it difficult to liquidate positions on favorable terms, which could result in additional losses. It may also be difficult for the series to achieve a market position appropriately reflecting a smaller equity base.

Reserves for Contingent Liabilities May Be Established Upon Redemption, and the Trust May Withhold a Portion of Your Redemption Amount.

When you redeem your units, the trust may find it necessary to set up a reserve for undetermined or contingent liabilities and withhold a certain portion of your redemption amount. This could occur, for example, (i) if some of the positions of the series in which you were invested were illiquid, (ii) if there are any assets which cannot be properly valued on the redemption date, or (iii) if there is any pending transaction or claim by or against the trust involving or which may affect your capital account or your obligations.

You Have Limited Rights, and You Cannot Prevent the Trust from Taking Actions Which Could Cause Losses.

You will exercise no control over the trust’s day-to-day business. Therefore, the trust will take certain actions and enter into certain transactions or agreements without your approval. For example, the trust may retain a trading advisor for a series in which you are invested, and such trading advisor may ultimately incur losses for the series. As a limited owner, you will have no ability to influence the hiring, retention or firing of such trading advisor. However, certain actions, such as termination or dissolution of a series, may only be taken upon the affirmative vote of limited owners holding units representing at least a majority (over 50%) of the net asset value of the series (excluding units owned by the managing owner and its affiliates).See “Summary of Agreements—Trust Agreement.”

You Will Not Be Able to Review Any Series’ Holdings on a Daily Basis, and You May Suffer Unanticipated Losses.

The trading advisors make trading decisions on behalf of the assets of each series (other than assets invested in swaps or derivatives). While the trading advisors receive daily trade confirmations from the clearing brokers of each transaction entered into on behalf of each series for which they manage the trading, each series’ trading results are only reported to investors monthly in summary fashion. Accordingly, an investment in the units does not offer investors the same transparency that a personal trading account offers. As a result, you may suffer unanticipated losses.

20

Table of Contents

You Will Not Be Aware of Changes to Trading Programs.

Because of the proprietary nature of each trading advisor’s trading programs, you generally will not be advised if adjustments are made to a trading program in order to accommodate additional assets under management or for any other reason.

The Trust Could Terminate Before You Achieve Your Investment Objective, Causing Potential Loss of Your Investment or Upsetting Your Investment Portfolio.

Unforeseen circumstances, including substantial losses or withdrawal of the trust’s managing owner, could cause the trust to terminate before its stated termination date of December 31, 2053. The trust’s termination would cause the liquidation and potential loss of your investment and could upset the overall maturity and timing of your investment portfolio.

Each Series may be Charged Substantial Fees and Expenses Regardless of Profitability.

Each series is charged brokerage charges, over-the-counter (or OTC) dealer spreads and related transaction fees and expenses, and management fees in all cases regardless of whether any series’ activities are profitable. In addition, the managing owner charges each series an incentive fee based on a percentage of the trading profits generated by each trading advisor for such series, and the managing owner pays all or a portion of such incentive fees to the appropriate trading advisors. As a result of the fact that incentive fees are calculated on a trading advisor by trading advisor basis and each series allocates assets to multiple trading advisors, it is possible that substantial incentive fees may be paid out of the net assets of a series during periods in which such series has no net trading profits or in which such series actually loses money. In addition, each series must earn trading profits and interest income sufficient to cover these fees and expenses in order for it to be profitable.See “Fees and Expenses” and “Break-Even Analysis.”

Trading Company Allocations.

Certain of the trading companies may be organized as series limited liability companies. This means that, under the Delaware Limited Liability Company Act, the assets of one series are not available to pay the liabilities of another series or the trading company as a whole. This statute has not been tested in a court of law in the United States. In the event series liability is not enforceable, a segregated series could be obligated to pay the liabilities of another series or the trading company.

Each of the Frontier Diversified Series and the Frontier Long/Short Commodity Series invests in trading companies that, although they are organized as series limited liability companies, allocate assets to more than one commodity trading advisor without the establishment of separate series with segregated liabilities. For these trading companies, losses incurred by one commodity trading advisor may negatively impact the trading company as a whole, as the assets allocated to a different commodity trading advisor may be made available to pay the liabilities of the commodity trading advisor that has incurred the loss. Since both the Frontier Diversified Series and the Frontier Long/Short Commodity Series currently invest in such trading companies, this could indirectly cause the assets of one series to be used to pay the liabilities of another series. For trading companies that allocate assets to more than one commodity trading advisor, a series may be allowed to allocate a portion of its assets to a particular commodity trading advisor accessed by the trading company, rather than to the trading company as a whole.

Conflicts of Interest Exist in the Structure and Operation of the Trust.

A number of actual and potential conflicts of interest exist in the operation of the trust’s business. The managing owner, the trading advisors, and their respective principals are all engaged in other investment activities, and are not required to devote substantially all of their time to the trust’s business.See “Actual and Potential Conflicts of Interest.”

21

Table of Contents

Each Series May Incur Higher Fees and Expenses Upon Renewing Existing or Entering into New Contractual Relationships.

The clearing agreements between the clearing brokers and the trading companies generally are terminable by the clearing brokers once the clearing broker has given the trading company the required notice. Upon termination of a clearing agreement, the managing owner may be required to renegotiate that agreement or make other arrangements for obtaining clearing. The services of the clearing brokers may not be available, or even if available, these services may not be available on the terms as favorable as those contained in the expired or terminated clearing agreements.

The Series May Be Obligated to Make Payments Under Guarantee Agreements.

Each of the Frontier Diversified Series and the Frontier Long/Short Commodity Series has guaranteed the obligations of one of the trading companies under its customer agreement with UBS Securities. In the event that one series is unable to meet its obligations to UBS Securities, the assets of the other series will be available to UBS Securities as part of the guarantee, but only to the extent of such series’pro rata allocation to the trading company. As such, even if you are not invested in the defaulting series, your investment could be impacted. The trust, or any series of the trust, may enter into similar guarantees in the future.

The Failure or Bankruptcy of One of its Futures Clearing Brokers, Banks or Other Custodians Could Result in a Substantial Loss of One or More Series’ Assets.

The trust is subject to the risk of insolvency of an exchange, clearinghouse, commodity broker, and counterparties with whom the trading companies trade. Trust assets could be lost or impounded in such an insolvency during lengthy bankruptcy proceedings. Were a substantial portion of the trust’s capital tied up in a bankruptcy, the managing owner might suspend or limit trading, perhaps causing a series to miss significant profit opportunities. The trust is subject to the risk of the inability or refusal to perform on the part of the counterparties with whom contracts are traded. In the event that the clearing brokers are unable to perform their obligations, the trust’s assets are at risk and investors may only recover apro ratashare of their investment, or nothing at all.

Exchange-traded futures and futures-styled option contracts are marked to market on a daily basis, with variations in value credited or charged to the trust’s account on a daily basis. The clearing brokers, as futures commission merchants for the trust’s exchange-traded contracts, are required, pursuant to CFTC regulations, to segregate from their own assets, and for the sole benefit of its commodity customers, all funds held by such clients with respect to exchange-traded futures and futures-styled options contracts, including an amount equal to the net unrealized gain on all open futures and futures-styled options contracts. Bankruptcy law applicable to all U.S. futures brokers requires that, in the event of the bankruptcy of such a broker, all property held by the broker, including certain property specifically traceable to the trust, will be returned, transferred, or distributed to the broker’s customers only to the extent of each customer’spro rata share of the assets held by such futures broker. The managing owner will attempt to limit the trust’s deposits and transactions to well-capitalized institutions in an effort to mitigate such risks, but there can be no assurance that even a well-capitalized, major institution will not become bankrupt.

With respect to transactions a series enters into that are not traded on an exchange, there are no daily settlements of variations in value and there is no requirement to segregate funds held with respect to such accounts. Thus, the funds a series invests in such transactions may not have the same protections as funds used as margin or to guarantee exchange-traded futures and options contracts. If the counterparty becomes insolvent and a series has a claim for amounts deposited or profits earned on transactions with the counterparty, the series’ claim may not receive a priority. Without a priority, the trust is a general creditor and its claim will be paid, along with the claims of other general creditors, from any monies still available after priority claims are paid. Even funds of the trust that the counterparty keeps separate from its own operating funds may not be safe from the claims of other general and priority creditors. There are no limitations on the amount of allocated assets a portfolio manager can trade on foreign exchanges or in forward contracts.

22

Table of Contents

You May Not Be Able to Establish a Basis for Liability Against a Trading Advisor, a Clearing Broker or a Swap Counterparty.

Each trading advisor, clearing broker, and swap counterparty acts only as a trading advisor, clearing broker or swap counterparty, respectively, to the applicable series and/or trading company. These parties do not act as trading advisors, clearing brokers, or swap counterparties to you. Therefore, you have no contractual privity with the trading advisors, the clearing brokers, or any swap counterparty. Due to this lack of contractual privity, you may not be able to establish a basis for liability against a trading advisor, clearing broker, or swap counterparty.

The Managing Owner is Leanly Staffed and Relies Heavily on its Key Personnel to Manage the Trust’s Trading Activities. The Loss of Such Personnel Could Adversely Affect the Trust.

In managing and directing the day-to-day activities and affairs of the trust, the managing owner relies heavily on its principals. The managing owner is leanly staffed, although there are back-up personnel for every key function. If any of the managing owner’s key persons were to leave or be unable to carry out his or her present responsibilities, it may have an adverse effect on the management of the trust.

In addition, under the operating agreement of the managing owner, Richard E. Bornhoft’s ability to serve as the Chief Investment Officer of the managing owner is dependent upon certain factors. If Mr. Bornhoft ceases to be the Chief Investment Officer of the managing owner, the trust may be adversely affected.

The Trust and the Managing Owner Have Been Represented by Unified Counsel, and Neither the Trust Nor the Managing Owner Will Retain Independent Counsel to Review of this Offering.

In connection with this offering, the trust and the managing owner have been represented by unified counsel, and the offering and this prospectus have only been reviewed by such unified counsel. To the extent that the trust, the managing owner or you could benefit from further independent review, such benefit will not be available unless you separately retain such independent counsel.

Risks Relating to Trading and the Markets

Futures Interests Trading is Speculative and Volatile.

The rapid fluctuations in the market prices of futures, forwards, and options make an investment in any of the series volatile. Volatility is caused by, among other things: changes in supply and demand relationships; weather; agriculture, trade, fiscal, monetary and exchange control programs; domestic and foreign political and economic events and policies; and changes in interest rates. The trading advisors’ technical trading methods may not take account of these factors except as they may be reflected in the technical input data analyzed by the trading advisors. In addition, governments from time to time intervene, directly and by regulation, in certain markets, often with the intent to influence prices directly. The effects of governmental intervention may be particularly significant at certain times in the financial instrument and currency markets, and this intervention may cause these markets to move rapidly.