Filed pursuant to Rule 433

Registration No. 333-141585

“Home”

Welcome to Prairie Creek Ethanol, LLC

Our Mission: To successfully construct and operate a state of the art and environmentally friendly 100 MGY ethanol facility that positively impacts investor shareholders, US agriculture, and the local economy as we contribute to the decrease of our nation’s dependence on foreign oil.

Our Plant: Prairie Creek Ethanol, LLC will build a 100 million gallon fuel - grade ethanol plant at Wesley, Iowa.

To learn more about our company, please view our slide show [Link to “Presentation”] and read our latest press release.

(Please note: The presentation is large and may take a while to load. This presentation requires the Flash plug-in. If you don’t see the presentation on the window that opens when you click the link above, go to Adobe.com [Link to “www.adobe.com”] to get it.)

The issuer has filed a registration state (including a prospectus) with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC. For more complete information about the issuer and this offering, you may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov [Link to “www.sec.gov”]. Alternatively, the issuer will arrange to send you the prospectus if you request it by calling 1-515-825-3161 or e-mailing Vivian at vkitley@prairiecreekethanol.com [Link to “vkitley@prairiecreekethanol.com”].

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Investing”

Investment Information

This offering is open to residents of the states of Iowa, Wisconsin, Illinois, Missouri, Kansas, South Dakota and Florida. Investors in the states of Minnesota, North Dakota, New York, Montana, Nevada, and Georgia are subject to additional restrictions.

Please proceed only if you are a resident of one of the above states.

View our slide show [Link to “Presentation”]

View a copy of the Preliminary Prospectus [Link to preliminary prospectus]

Indicate your interest/intent to purchase [Link to “Intent”]

The issuer has filed a registration state (including a prospectus) with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC. For more complete information about the issuer and this offering, you may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov [Link to “www.sec.gov”]. Alternatively, the issuer will arrange to send you the prospectus if you request it by calling 1-515-825-3161 or e-mailing Vivian at vkitley@prairiecreekethanol.com [Link to “vkitley@prairiecreekethanol.com”].

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Presentation”

2 of 25

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete infor-

mation about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. Alter-

natively, the issuer will arrange to send you the prospectus if you request it by calling 1-515-825-3161 or emailing jstelzer@prairiecreekethanol.com

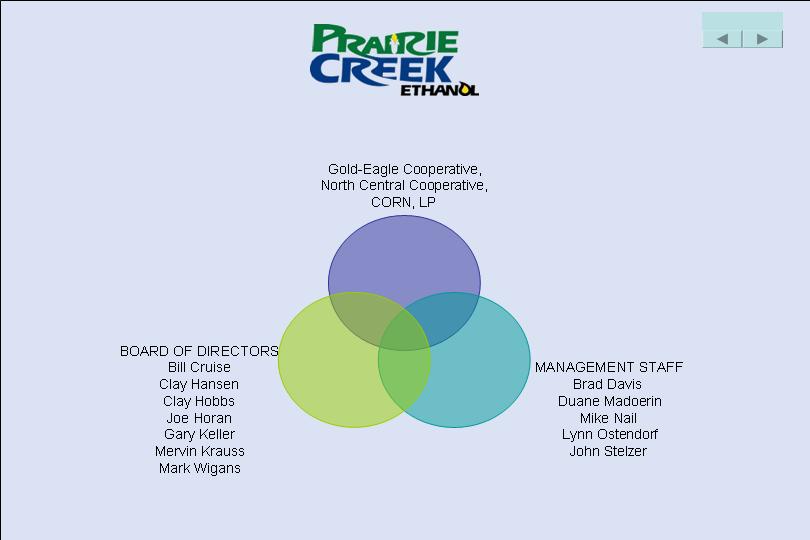

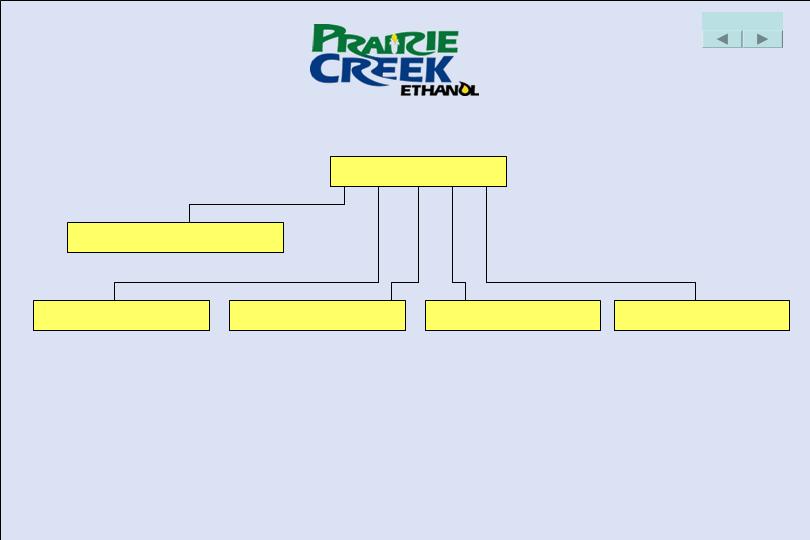

Project Leadership

Board of Directors

Project Management

Accounting

Legal

Strategic Partners

Construction/Engineering

Gold-Eagle Cooperative

Fagen, Inc

ICM, Inc.

Securities

Brown, Winick, PLC

Local

Malloy Law Firm

McGladrey & Pullen

Kossuth County Economic

Development

Prairie Energy Cooperative

4 of 24

Project Details

PLANT PRODUCTION CAPACITY

100 million gallons of ethanol annually

320,000 tons of dried distillers grains annually

PLANT LOCATION

Wesley, Iowa

CORN DEMAND

35 million bushels annually

PROJECT BUDGET

$196,250,000

DIRECT EMPLOYMENT

45 new jobs within the plant

PAYROLL

$2.5 million annually

Estimated Project Timeline

APRIL 19, 2006

Articles of Organization filed

with Iowa Secretary of State

MAY 2006

Site search commenced

DECEMBER 2006

Seed Capital raised

FEBRUARY 2007

Letter of Intent signed with Fagen, Inc.

SUMMER 2007

Public offering begins

SEPTEMBER 2007

Groundbreaking

FEBRUARY 2009

Ethanol production begins

5 of 25

8 of 25

19,000,000

22,000,000

21,190,000

29,260,000

30,400,000

26,845,000

34,010,000

32,260,000

28,883,000

54,950,000

57,188,000

53,785,000

24,720,000

24,280,000

23,556,000

22,440,000

24,080,000

21,669,000

30,360,000

31,349,000

30,712,000

32,260,000

32,390,000

31,711,000

19,150,000

20,670,000

21,669,000

28,670,000

31,832,000

26,649,000

33,810,000

34,262,000

32,781,000

Total bushels produced each year

Source: USDA

2004

2005

2006

Wesley

Holmes

Hutchins

Gold Eagle Cooperative

North Central Cooperative

CORN LP

PRAIRIE CREEK ETHANOL

9 of 25

Wesley

Assumptions used: 80% tillable, 70% planted to corn, 175 bushels per acre

Compiled by BTD

10 of 25

Wesley

Assumptions used: 80% tillable, 70% planted to corn, 175 bushels per acre

Compiled by BTD

11 of 25

Today, ethanol is

blended into more

than 46% of the

gasoline sold in the

United States.

FEECO International2007

MTBE has been

phased out as a

gasoline

oxygenate by

most states.

Flex-fuel vehicles can

burn a gasoline-

ethanol blend of up to

85% ethanol.

America consumes

25% of the world’s

total oil production, but

controls only 3% of

the world’s known oil

reserves.

Natural Resources Defense

Council, 2006

12 of 25

-1.00

0.00

1.00

2.00

3.00

4.00

2002

2003

2004

China

Rest of World

Total World Supply

13 of 25

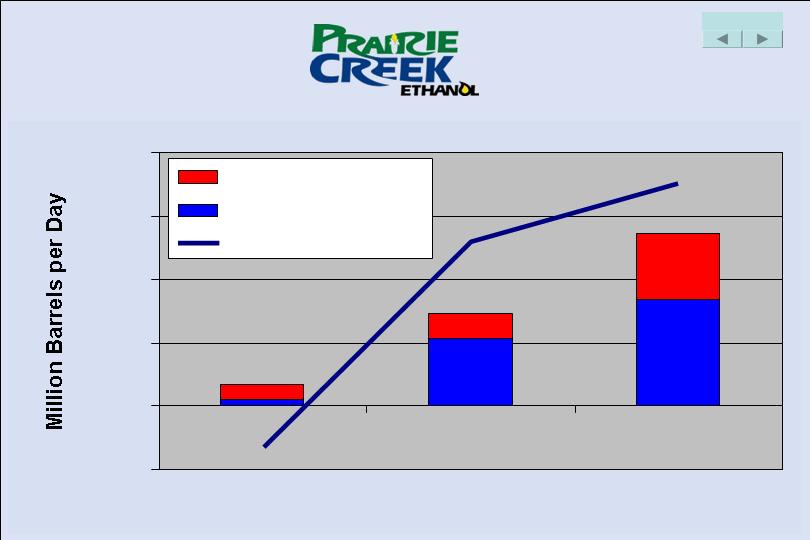

Oil Consumption

Source: EIA

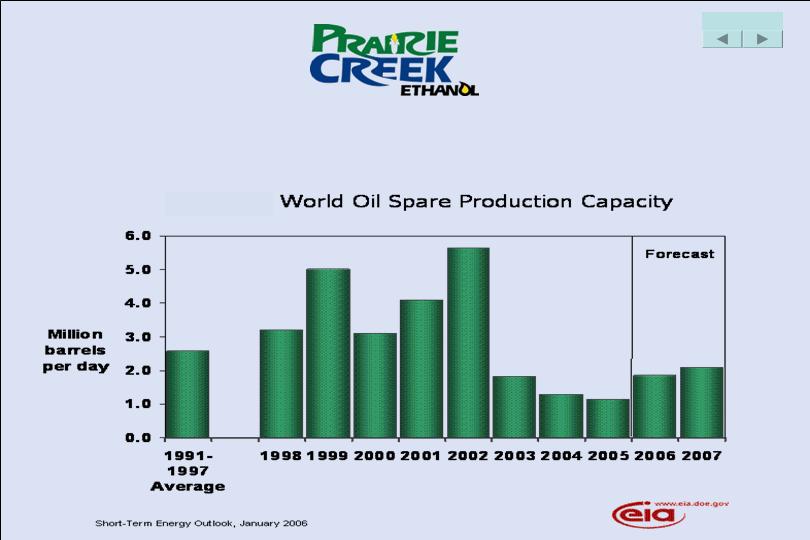

Global Spare Production

Capacity

15 of 25

34,149

34,124

Total OPEC Supply

4,479

4,484

Other Liquids

1,300 - 1,800

30,970 -

31,470

29,670

29,640

Crude Oil Total

0

1,900

1,900

2,000

Iraq

1,300 - 1,800

29,070 -

29,570

27,770

27,640

28,000

OPEC 10

0

2,450

2,450

2,450

3,223

Venezuela

0

2,600

2,600

2,600

2,444

United Arab Emirates

1,300 - 1,800

10,500 -

11,000

9,200

9,200

9,099

Saudi Arabia

0

850

850

850

726

Qatar

0

2,300

2,300

2,200

2,306

Nigeria

0

1,700

1,700

1,700

1,500

Libya

0

2,600

2,600

2,600

2,247

Kuwait

0

3,750

3,750

3,750

4,110

Iran

0

890

890

890

1,451

Indonesia

0

1,430

1,430

1,400

894

Algeria

Surplus

Capacity

Capacity

Production

Production

OPEC 10 Quota

October 2006

September 2006

07/01/2005

16 of 25

Source: EIA

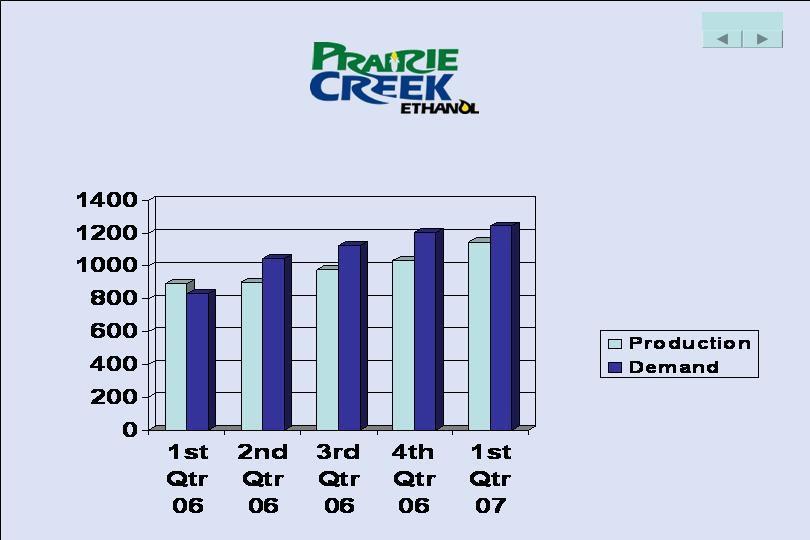

2006 Ethanol Production and Demand

(1,000 barrels per day)

Source:

Renewable Fuels Association &

Energy Information Administration

18 of 25

Risks Associated with Investing in Prairie Creek Ethanol

Some of the risks involved with investing in Prairie Creek Ethanol include, but are not limited to:

· You are investing in illiquid securities and will not be able to readily sell your units;

· We will need to obtain significant debt financing to fund construction of our proposed ethanol plant;

· Changes in or elimination of governmental laws, tariffs, trade or other controls or enforcement practices;

· Income allocations assigned to an investor's units may result in taxable income in excess of cash distributions;

· The operation of the company involves transactions between the company and certain members or affiliates which may involve conflicts of interest;

· Overcapacity within the ethanol industry;

· Availability and cost of corn and natural gas;

· Changes in the price and market for ethanol and distillers grains; and

· Changes in plant production capacity or technical difficulties in operating the plant.

Please see our prospectus for a more complete summary of these and other risks associated with investing in Prairie Creek Ethanol.

19 of 25

20 of 25

Source: Fagen Inc.

VeraSunEnergy, LLC in Aurora, SD

21 of 25

Use of Funds

Plant Construction

Construction Cost Index Contingency

Natural Gas Installation

Grain Storage & Handling

Water Treatment Plant

Administration Bldg/Equipment

Construction Performance Bond

Construction Insurance – Builders Risk

Capitalized Interest

Construction Contingency

Site Costs

Railroad

Fire Protection / Water Supply

Rolling Stock

Financing Costs

Inventory – Working Capital

Pre-Production Costs (expense)

Organizational Costs (expense)

$128,085,190

8,414,810

8,000,000

3,600,000

8,000,000

450,000

100,000

275,000

3,000,000

3,025,000

6,500,000

5,300,000

2,500,000

250,000

1,000,000

15,500,000

1,000,000

1,250,000

$196,250,000

22 of 25

We offer you the opportunity

to indicate your interest to invest in

Prairie Creek Ethanol, LLC.

The ethanol industry is rapidly expanding, and we cannot guarantee our offering

will stay open for any period of time. Therefore, we urge you to contact us as

soon as possible. The date and time of your response will be recorded. In the

event the project becomes over-funded, our Board of Directors has discretion

with regards to allocation. However, we expect that in most cases, investing

will be prioritized on a first-response basis.

23 of 25

This offer is open to residents of Iowa, Wisconsin, Illinois, Missouri,

Kansas, South Dakota, and Florida. A limited number of shares are

available in other states including Minnesota, Georgia, North Dakota,

New York and Montana.

If you would like more information or want to be kept informed of

developments, please fill out the email registration

or phone 1-515-825-3161

and ask to speak to Brad Davis, John Stelzer,

Duane Madoerin or Viv Kitley.

We look forward to having you as a partner in this exciting project!

24 of 25

25 of 25

The issuer has filed a registration statement (including a prospectus) with the SEC for

the offering to which this communication relates. Before you invest, you should read

the prospectus in that registration statement and other documents the issuer has filed

with the SEC for more complete information about the issuer and this offering. You

may get these documents for free by visiting EDGAR on the SEC website

at http://www.sec.gov. Alternatively, the issuer will arrange to send you the

prospectus if you request it by calling 1-515-825-3161 or

emailing vkitley@prairiecreekethanol.com

Please indicate your interest now by going to

Indicate your interest / intent to purchase

“Presentation Script”

Thank you for visiting Prairie Creek Ethanol, a limited liability company. We are excited to be able to share our offering with you. Imagine a simple seed planted in the rich Iowa soil. Imagine that seed becoming ethanol, the fuel powering an ever-increasing percentage of the vehicles driven each day. Imagine yourself harvesting the rewards of our nation’s growing ethanol market. Prairie Creek Ethanol offers investors the opportunity to be a part of the growing ethanol industry.

Prairie Creek Ethanol is located in north-central Iowa, an area that leads the nation in corn production. Three area agribusinesses originated the project, and the Board of Directors, all area farmers, contributes additional insight and expertise.

The Prairie Creek Ethanol Board of Directors was appointed or elected by and from the boards of the three founding entities. The Board works in conjunction with Gold-Eagle Cooperative and North Central Cooperative management staff.

Our Board of Directors and Management Staff are utilizing some of the industry’s leading professionals to help develop this project.

Constructing an ethanol facility is a multi-faceted undertaking.

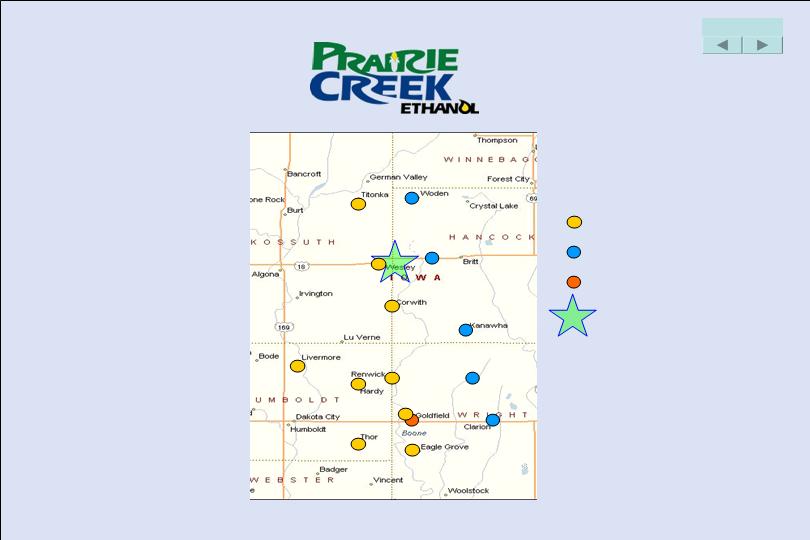

Obviously, the current concentration of ethanol plants is in the Midwest. The reason for that is simply because that’s where the greatest amount of corn is produced.

Wesley, Iowa, was chosen as the location for this ethanol plant for a number of reasons.

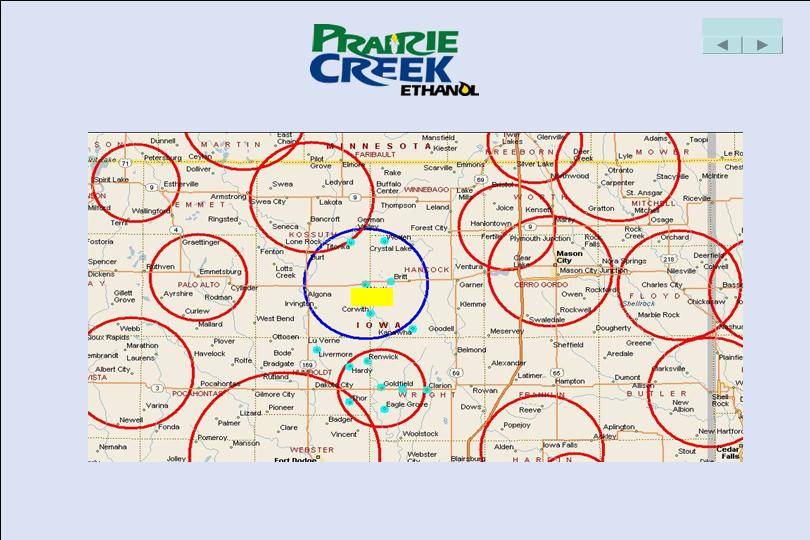

The eleven-county area surrounding Wesley consistently shows high corn yields. Iowa produces more corn than any other state; in fact, 2.16 billion bushels in 2005. In 2005, 29% of all the corn produced in Iowa was produced within a 60-mile radius of Wesley. In 2006, 28.9% of Iowa’s corn came from this 60-mile radius.

We anticipate that Prairie Creek Ethanol will procure corn from Gold-Eagle and North Central, although there is currently no definite agreement in place to that effect. Gold-Eagle and North Central have a combined total of fourteen grain elevator storage sites from which to procure corn. The combined storage of these locations plus the storage planned at Prairie Creek Ethanol total more than 45 million bushels. Rail access and proximity to major highways were other deciding factors.

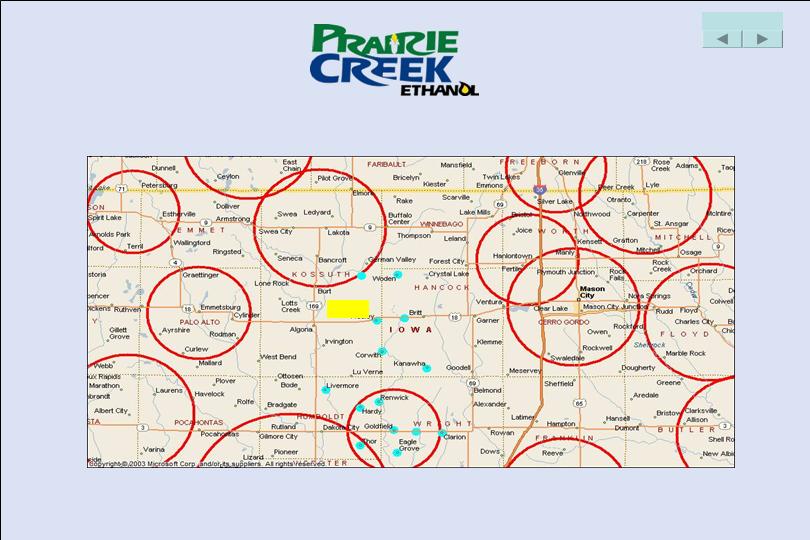

The red circles on this area map represent existing ethanol plants. Each ethanol plant needs 100% of the corn produced within the circle to feed its plant. Notice the “plant void” in the Wesley area.

We expect that Prairie Creek Ethanol will have a large area from which to procure corn.

We can understand the growth in ethanol production facilities when we look at the growing demand for ethanol. Americans are driving more and are demanding more fuel. Federal Clean Air standards have created a high demand for ethanol as an oxygenate for gasoline. Auto manufacturers are introducing an increasing number of flex-fuel vehicles each year. And a renewed feeling of nationalism has led for a desire to break our dependence on an unstable foreign oil supply.

The key driver of strong oil prices today is the unprecedented growth in consumption witnessed during 2004 that continues today. The single driving factor was world economic growth - at over 4% in 2004; the growth was synchronized across every region. Daily oil consumption nearly doubled above 2003 levels, and China’s consumption tripled. The rest of the world, represented in the bright blue on the graph, increased its consumption also. The total world supply kept ahead of the growth, but by fewer than one million barrels per day.

The global refining capacity has barely kept ahead of the global demand. There has not been a new refinery built in the US since the late 1970s. As the difference between capacity and demand shrinks, so does the supply of surplus oil. A refinery breakdown can send gasoline prices soaring.

As we look at the global spare production capacity, we see that we are once again at two million barrels per day. Thus, daily world-wide oil consumption is only 2 million barrels per day less than the world’s ability to pump crude out of the ground.

The shrinking oil surplus can be brought further into perspective when we look at the oil production from OPEC, a Middle Eastern oil cartel made up of many nations with whom the United States has a precarious relationship. With a world-wide surplus oil supply of only 2 million barrels per day, the loss of oil from even one of these small countries could deplete the surplus immediately. Iran alone produces 3,750,000 barrels each day - nearly double the daily world surplus. Civil wars, natural disasters, diplomatic sanctions, refinery breakdowns - any of these could spell disaster for the rest of the world as demand would exceed supply immediately. The instability in many of the world’s leading oil-producing countries intensifies the need for alternative fuel sources.

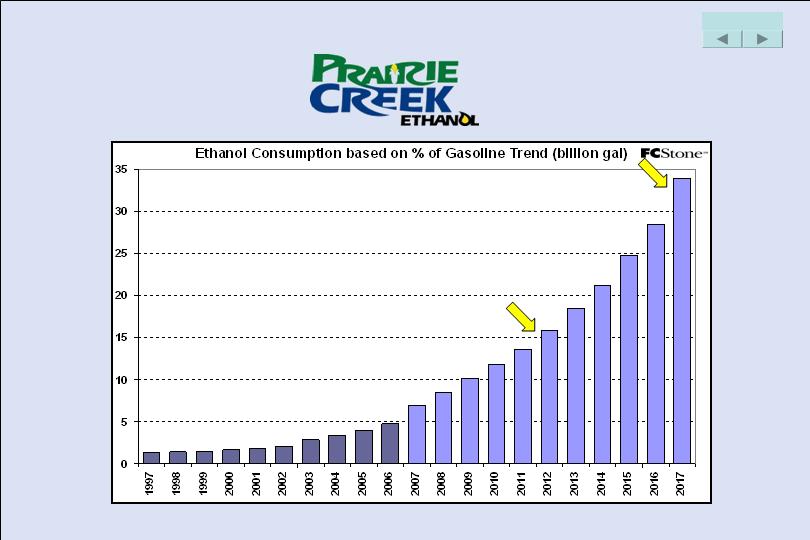

In his 2007 State of the Union Address, President Bush praised the ethanol industry and called for the nation to continue to reduce its dependency on foreign oil by using renewable and alternative fuels. The Renewable Fuels Standard program requires that the equivalent of at least 7.5 billion gallons of renewable fuel be blended into motor vehicle fuel sold in the US by 2012. The Renewable Fuels Standard is an important first step toward meeting President Bush’s call for our nation to reduce crude oil use by 20 percent within 10 years by growing our renewable and alternative fuel use to 35 billion gallons by the year 2017. This graph represents only a forecast for future ethanol demand: actual ethanol demand may vary from this forecast.

Ethanol production in 2006 was a record-setting 4.86 billion gallons. That was an increase of 25.3% over 2005. Demand for ethanol in 2006 was 5.4 billion gallons, a stunning increase of 33%. With over six million flex-fuel vehicles on our roads today, and auto manufacturers’ pledge to double the production of flex-fuel vehicles by 2010, the ethanol market appears to be strong.

There are also risks involved with investing in Prairie Creek Ethanol, and in the ethanol industry in general. Please see our prospectus for a more complete summary of these and other risks.

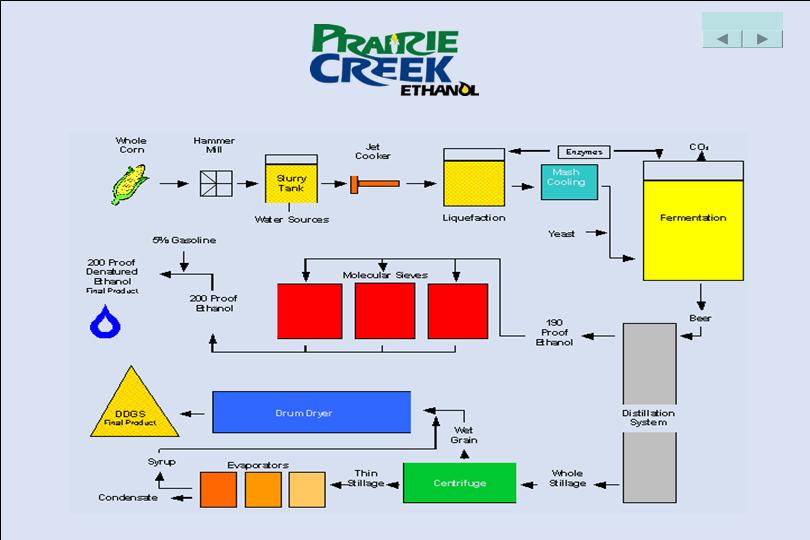

The process for producing ethanol has not changed much over the past few years, but huge strides have been made in the efficiency and purity of the process. The cost of producing ethanol has been reduced drastically over the past few decades, making it a competitively-priced fuel compared to gasoline. Prairie Creek Ethanol will produce and sell both ethanol and its valuable co-product, Dried Distillers Grains with Solubles.

The Prairie Creek Ethanol production facility will be very similar to this Fagen-built one-hundred-million gallon plant in Aurora, South Dakota.

Our one-hundred-million-gallon ethanol plant is budgeted to be built at a cost of one hundred ninety-six million, two hundred fifty thousand dollars.

We offer you the opportunity to indicate your interest to invest in Prairie Creek Ethanol, LLC. The ethanol industry is rapidly expanding, and we cannot guarantee our offering will stay open for any period of time. Therefore, we urge you to contact us as soon as possible. The date and time of your response will be recorded. In the event the project becomes over-funded, our Board of Directors has discretion with regards to allocation. However, we expect that in most cases, investing will be prioritized on a first-response basis.

Once our offering begins, it will remain open for a limited time. Don’t miss your opportunity to harvest the rewards with Prairie Creek Ethanol. We look forward to having you as a partner in this exciting project!

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at http://www.sec.gov. Alternatively, the issuer will arrange to send you the prospectus if you request it by calling 1-515-825-3161 or e-mailing vkitley@prairiecreekethanol.com. Please indicate your interest now by going to Indicate your Interest/Intent to Purchase.

“Intent”

Please fill in the form below indicating your interest in our facility and the amount you are considering investing. We are soliciting indications of interest only from residents of the following states: Florida, Georgia, Iowa, Illinois, Kansas, Minnesota, Missouri, Montana, North Dakota, Nevada, New York, South Dakota, and Wisconsin.

Name: _______________________ *

Address: ______________________ | | |

| | | |

City: ___________ State: _________ Zip:__________ Phone: (Day)_____________ Evening: _____________ | [The “State” field is a drop- down box that lists the states in which we are registering our securities or utilizing an exemption from registration; no other states can be added] |

| | |

Email: _______________________________________ Amount you are considering investing: ______________ *

Questions: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Officers and Directors:

I understand and acknowledge the following:

1. Any preliminary prospectus is subject to amendment. The Final Prospectus will not be available until such time as the Securities and Exchange Commission has completed its review of the registration filing of Prairie Creek Ethanol, LLC and the Offering becomes effective.

2. That you cannot accept investment funds, a firm commitment to invest or my Subscription Agreement until such time as the Offering has become effective and you have delivered to me a copy of the Final Prospectus.

3. That my indication of the amount I am considering investing, set forth above, in no way obligates me, in any way, to invest.

4. That you are under no obligation, in any case, to accept my Subscription Agreement or investment.

5. I understand that I must only rely on the information contained in the Final Prospectus, its Exhibits and any free writing prospectuses filed by Prairie Creek Ethanol, LLC, and that I am not to rely on any other representations, either written or verbal, in making my investment decision.

In acknowledging the foregoing, I request that you send me, at the mailing address or email address above, a copy of your Final Prospectus when it becomes available.

_____

Submit [Submits the information above to a database and returns the user to the “Investing” page]

____

Reset [Clears all information typed into the “Intent” form]

No offer to buy the securities can be accepted and no part of the purchase price can be received until the registration statement has become effective, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to notice of its acceptance given after the effective date.

View a copy of the Preliminary Prospectus [Link to preliminary prospectus].

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Contacts”

Contact Us

Prairie Creek Ethanol, LLC

P.O. Box 280

Goldfield, IA 50542

Phone: 800-825-3331

Fax: 515-825-3732

Click to view our Board of Directors and management staff [Link to “Board of Directors and Management”].

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Board of Directors and Management”

About Us

Brad Davis [Link to “bdavis@prairiecreekethanol.com”] | Senior Vice-President of Project Development |

| | |

Duane Madoerin [Link to “dmadoerin@prairecreekethanol.com”] | Vice-President of Commodities |

| | |

Mike Nail [Link to “mnail@prairiecreekethanol.com”] | Vice-President of Marketing |

| | |

Lynn Ostendorf [Link to “lostendorf@prairiecreekethanol.com”] | Vice-President of Development |

| | |

John Rohrer [Link to “jrohrer@prairiecreekethanol.com”] | Vice-President of Transportation |

| | |

John Stelzer [Link to “jstelzer@prairiecreekethanol.com”] | Treasurer |

Board of Directors

Name | Position |

| Clay Hansen | President |

| Mervin Krauss | Vice-President |

| Mark Wigans | Secretary |

| Bill Cruise | Director |

| Gary Keller | Director |

| Clay Hobbs | Director |

| Joe Horan | Director |

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“News”

News/Meeting Schedule

Equity Drive Announcements

Meeting Schedule When Available

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Research”

Ethanol Information

By clicking on the links below you are accessing a third party website. Prairie Creek Ethanol, LLC has no control over the content of these websites.

| · | American Coalition for Ethanol [Link to “www.ethanol.org”] |

| · | Fagen Inc. homepage [Link to “www.fageninc.com”] |

| · | Renewable Fuels Association [Link to “www.ethanolrfa.org”] |

| · | Canadian Renewable Fuels Assoc. [Link to “www.greenfuels.org/ethanol/index”] |

| · | National Corn Growers Assoc. [Link to “www.ncga.com/ethanol/main/”] |

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Outlook”

Industry Outlook

See the future of Ethanol Production, download the Ethanol Industry Outlook (.PDF File. May take a minute to download)

The Industry Outlook below has been produced by the Renewable Fuels Association:

Ethanol Industry Outlook 2007 [Link to “http://www.ethanolrfa.org/objects/pdf/outlook/RFA_Outlook_2007.pdf”]

(PDF Viewer) [Link to “www.adobe.com”]

Why is the Ethanol Industry Experiencing Such Growth?

A number of factors are contributing to the tremendous growth in the ethanol industry:

Americans are driving more and are demanding more fuel.

Each year the number of licensed drivers grows, and the number of miles those drivers travel increases, also. It therefore stands to reason that the number of gallons of gasoline consumed each year increases. Record oil and gasoline prices, federal and state clean fuel programs, and mounting concerns about our nation’s growing dependence on imported energy prompted unprecedented ethanol demand. Today, ethanol is blended into more than 46% of the gasoline sold in the United States. In 2006, 70% of all gasoline sold in Iowa was a 10% ethanol blend. Iowa Renewable Fuels Assoc. | |

| Clean Air Standards

Federal clean air standards have created a high demand for ethanol as an oxygenate for gasoline. Ethanol use reduces harmful vehicle emissions, ozone pollution, greenhouse gas-forming emissions and groundwater pollution. |

| | | |

Increased Awareness and Expanded Market Opportunities

Ethanol is certainly not a new product, but the public awareness of it has increased dramatically in recent years. When MTBE (methyl-tert-butyl ether) was banned for use as a gasoline oxygenate by most states, ethanol was the natural, most economical replacement. | |

| | | |

Flex-fuel vehicles were introduced and drivers began seeking out suppliers for E-85. Flex-fuel vehicles were introduced and drivers began seeking out suppliers for E-85. |

Even the Indy-Car Series is making the switch. After running a 90-10 blend of gasoline and ethanol during the 2006 season, they are using 100% ethanol in their tanks for this 2007 season.

Risks Associated with Investing in Prairie Creek Ethanol

Some of the risks involved with investing in Prairie Creek Ethanol include, but are not limited to:

| | · | You are investing in illiquid securities and will not be able to readily sell your units; |

| | · | We will need to obtain significant debt financing to fund construction of our proposed ethanol plant; |

| | · | Changes in or elimination of governmental laws, tariffs, trade or other controls or enforcement practices; |

| | · | Income allocations assigned to an investor's units may result in taxable income in excess of cash distributions; |

| | · | The operation of the company involves transactions between the company and certain members or affiliates which may involve conflicts of interest; |

| | · | Overcapacity within the ethanol industry; |

| | · | Availability and cost of corn and natural gas; |

| | · | Changes in the price and market for ethanol and distillers grains; and |

| | · | Changes in plant production capacity or technical difficulties in operating the plant. |

Please see our prospectus for a more complete summary of these and other risks associated with investing in Prairie Creek Ethanol.

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

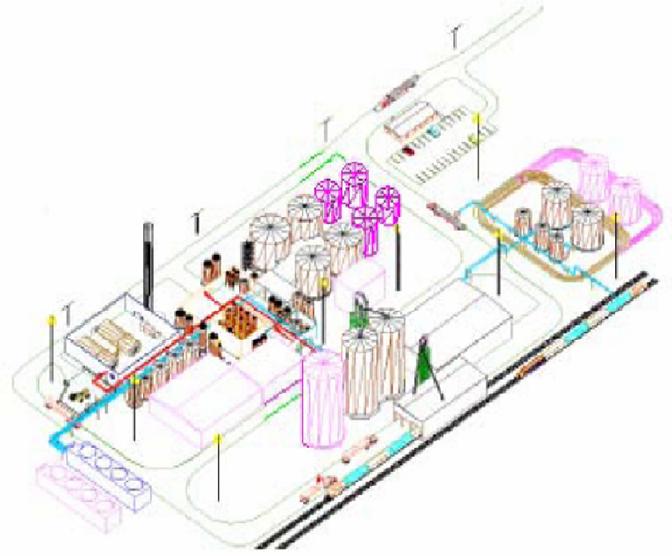

“Plant Images”

Plant Images

3D Drawing of the plant layout

[Link to “Large Plant Image”]

Copyright © 2007 Prairie Creek Ethanol Questions Contact: Webmaster [Link to “webmaster@prairiecreekethanol.com”]

[Link to “Home” | Link to “Investing” | Link to “Contacts” | Link to “News” | Link to “Research” | Link to “Outlook” | Link to “Images”]

“Large Plant Image”

Flex-fuel vehicles were introduced and drivers began seeking out suppliers for E-85.

Flex-fuel vehicles were introduced and drivers began seeking out suppliers for E-85.