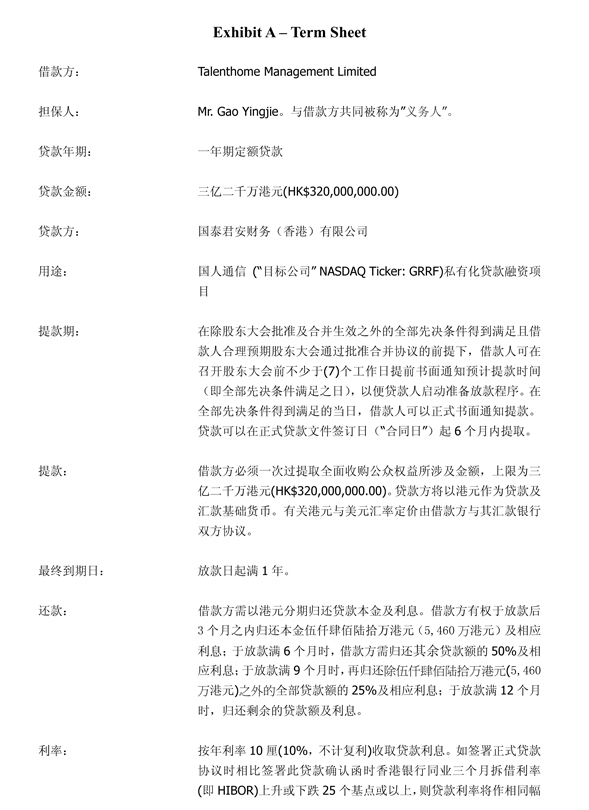

Exhibit 7.03

GUOTAI JUNAN FINANCE (HONG KONG) LIMITED

CONFIDENTIAL

11 January 2012

Talenthome Management Limited (BVI) (“Parent” or “you”)

15th Floor, Block A, Guoren Building

Keji Central 3rd Road

Hi-Tech Park, Nanshan District

Shenzhen 518057, People’s Republic of China

Attention: Mr. Gao Yingjie

Re: Financing Commitment

SECURED TERM LOAN HK$320,000,000

COMMITMENT LETTER

Gentlemen:

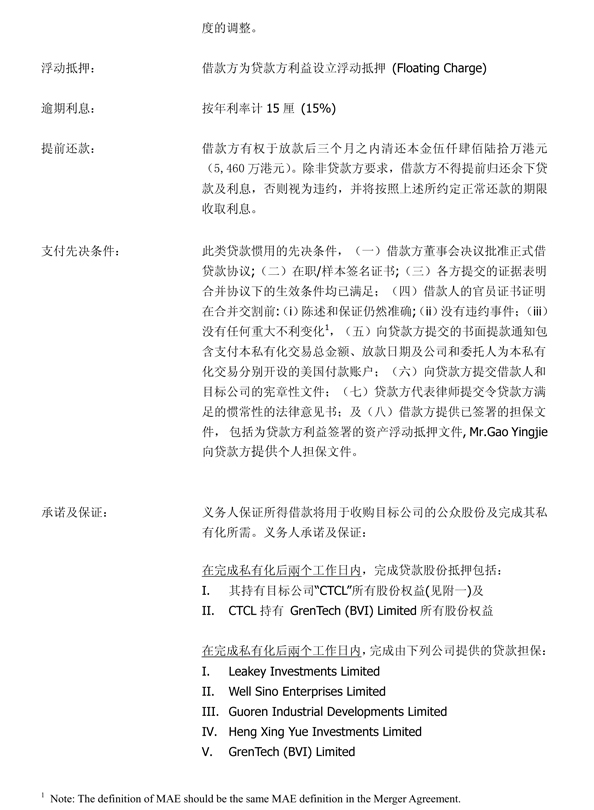

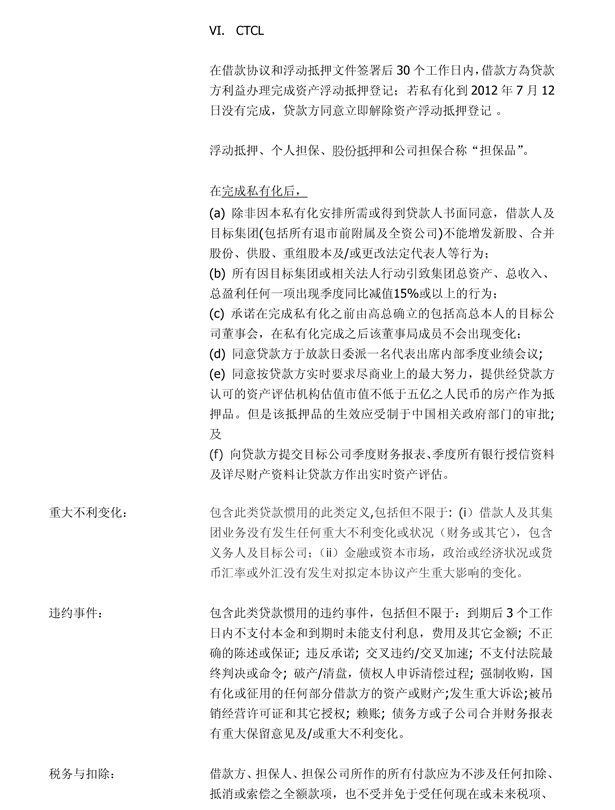

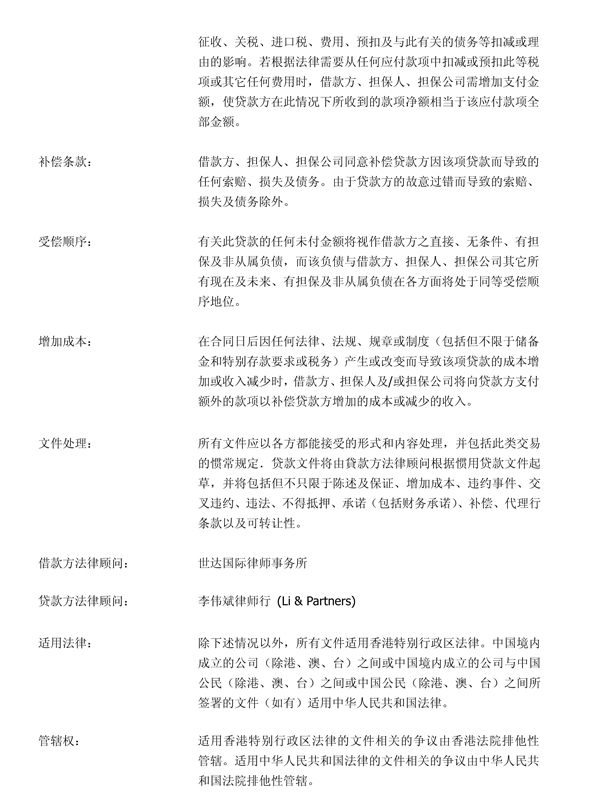

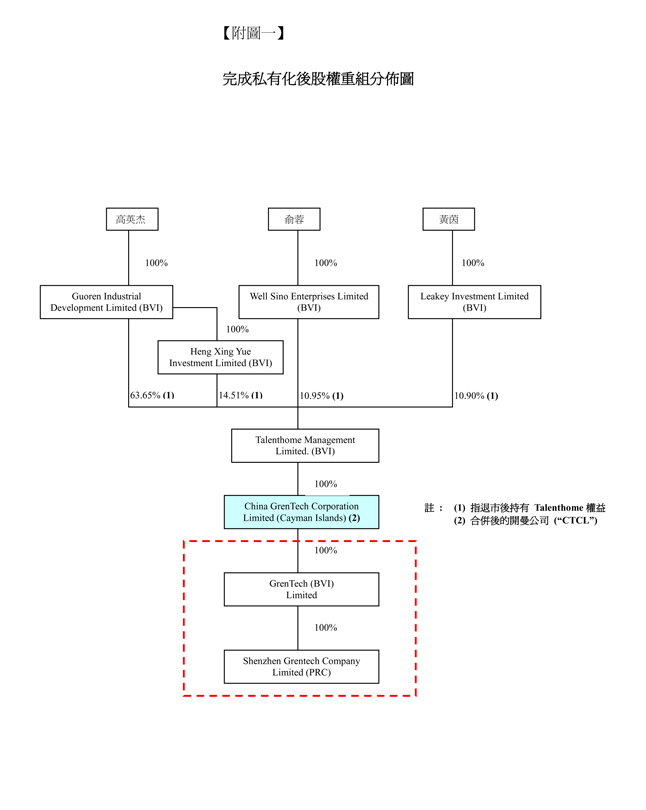

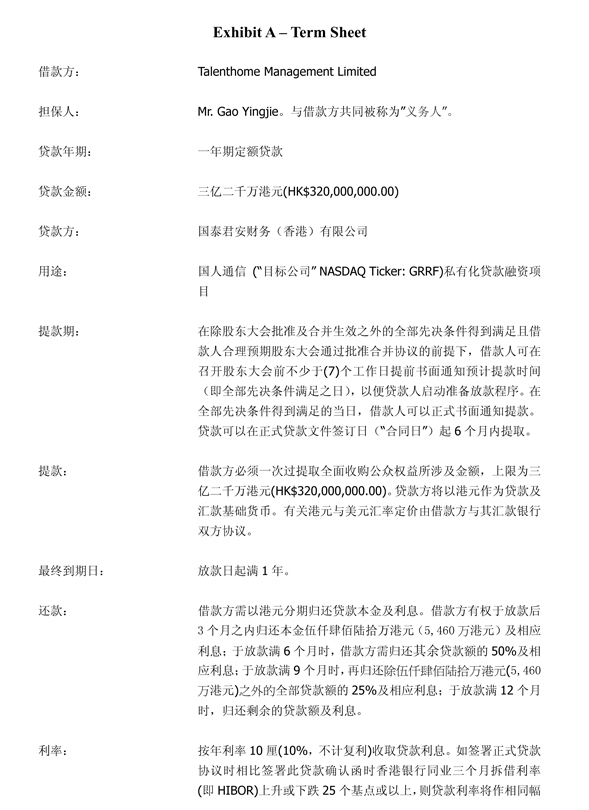

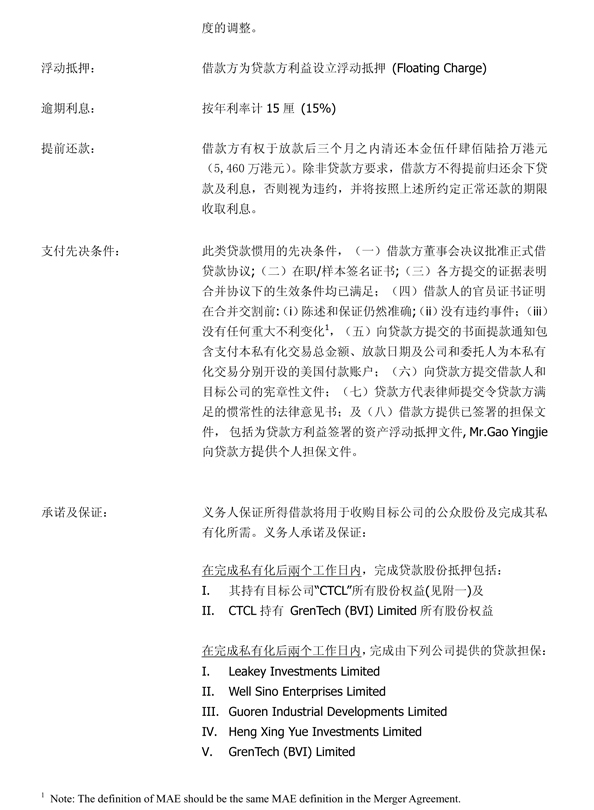

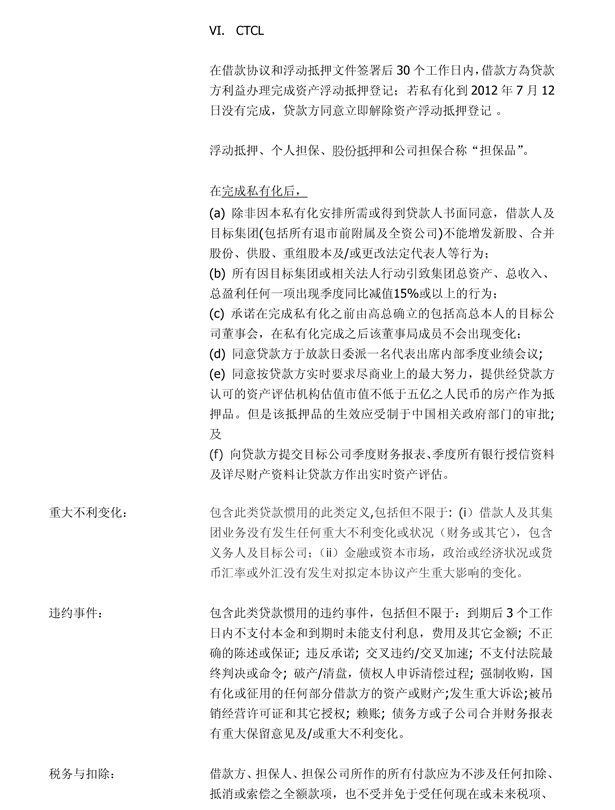

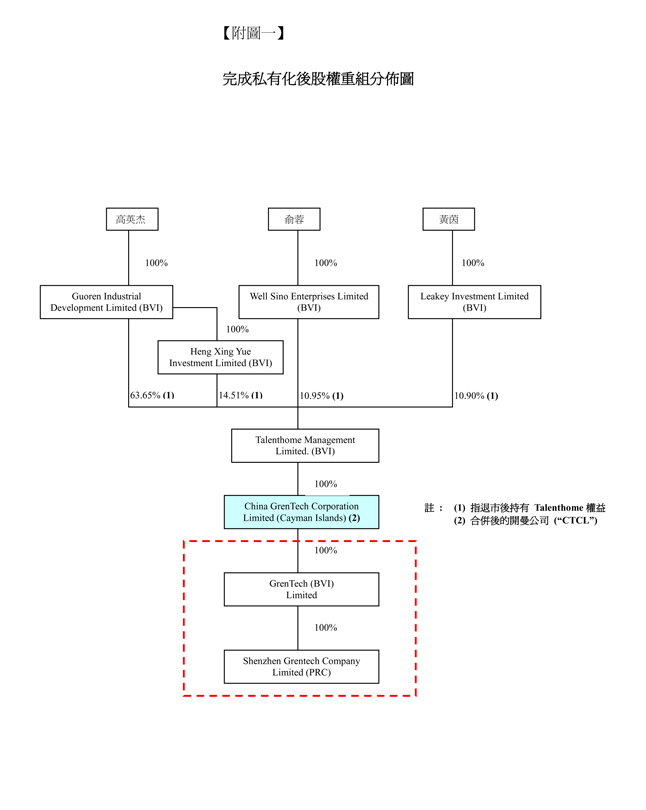

1. You have advised us that certain members of the management team of China GrenTech Corporation Limited, an exempted company with limited liability incorporated under the Cayman Islands Companies Law (the “Company”, with its NASDAQ Ticker as “GRRF”), through Talenthome Management Limited (BVI) (“Parent”), will acquire (the “Acquisition”) all of the outstanding shares of the Company (the “Shares”) not currently owned by you and such certain members of the management team of the Company (the “Rollover Shareholders”). In order to consummate the Acquisition, Parent requires financing (i) to fund a portion of the offer price of the Acquisition and (ii) to pay fees and expenses related to the financing contemplated by this commitment letter and Acquisition. We are pleased to advise you that we hereby commit to provide Parent with a senior secured term loan facility in the maximum aggregate amount of HK$320,000,000 (the “Financing Facility”) substantially on the terms and conditions set forth in the Indicative Term Sheet for the proposed Acquisition attached hereto as Exhibit A (the “Term Sheet”). Subject to the provisions and limitations set forth in this commitment letter and the Term Sheet, Parent’s obligations under the Financing Facility will be secured by a first priority lien on, and security interest in, substantially all of Parent’s assets. Our commitment to provide the Financing Facility is subject in all respects to satisfaction of the terms and conditions contained in this commitment letter and in the Term Sheet.

2. You acknowledge that this commitment letter and the Term Sheet do not include all of the provisions (other than Drawdown Conditions and Financial Covenants) which would be contained in the definitive legal documentation for the Financing Facility (“Definitive Loan Documentation”).The loan documentation for the Financing Facility will include, in addition to the provisions that are summarized in this commitment letter and the Term Sheet, provisions (other than Drawdown Conditions and Financial Covenants) that are customary or typical for this type of financing transaction so long as such additional provisions are not inconsistent with the provisions set forth in this commitment letter and the Term Sheet. Such Definitive Loan Documentation shall be in form and substance reasonably satisfactory to you and us.

Page 1

3. By your execution hereof and your acceptance of the commitment contained herein, you agree to fully indemnify and hold harmless us and each of our assignees and affiliates and our and their respective directors, partners, members, officers, employees and agents (each an “Indemnified Party”) from and against any and all losses, claims, damages, liabilities or other reasonable and documented out-of-pocket expenses to which such Indemnified Party may become subject, insofar as such losses, claims, damages, liabilities (or actions or other proceedings commenced or threatened in respect thereof) or other reasonable and documented out-of-pocket expenses arise out of or in any way relate to or result from, this commitment letter, the Term Sheet, the Acquisition or the extension of the Financing Facility contemplated by this commitment letter, the Term Sheet, or in any way arise from any use or intended use of this commitment letter, the Term Sheet, the Acquisition or the proceeds of the Financing Facility contemplated by this commitment letter, the Term Sheet; you also agree to reimburse each Indemnified Party for reasonable and documented legal fees and out-of-pocket expenses of one outside counsel and one counsel in each relevant jurisdiction and other reasonable and documented out-of-pocket expenses incurred in connection with investigating, defending or participating in any such loss, claim, damage, liability or action or other proceeding (whether or not such Indemnified Party is a party to any action or proceeding out of which indemnified expenses arise), but excluding therefrom all expenses, losses, claims, damages and liabilities which have resulted (i) from the gross negligence or willful misconduct of the Indemnified Party, (ii) from a breach of our obligations under this commitment letter, the Term Sheet or the Financing Facility or (iii) out of any loss, claim, damage, litigation, investigation or proceeding that does not involve an act or omission of you or any of your affiliates and that is brought by an Indemnified Party against another Indemnified Party. In the event of any litigation or dispute involving this commitment letter or the Financing Facility, we shall not be responsible or liable to you, Parent, the Company or any other person for any special, indirect, consequential, incidental or punitive damages. Your obligations under this paragraph (save for those already accrued prior to the execution of the Definitive Loan Documentation, which shall survive the execution of the Definitive Loan Documentation) shall terminate upon the execution of Definitive Loan Documentation wherein you agree to assume such obligations under the Definitive Loan Documentation.

4. Our commitment to provide the Financing Facility is subject to the satisfaction of the Drawdown Conditions set forth in the Term Sheet (it being understood that the Drawdown Conditions set forth in the Term Sheet are the only conditions to availability of the Financing Facility on the Closing Date).

5. Notwithstanding anything in this commitment letter (including the Term Sheet) to the contrary, (i) the only representations and warranties relating to Parent, its subsidiaries and their respective businesses the making of which shall be a condition to availability of the Financing Facility on the Closing Date in accordance with this commitment letter and the Term Sheet shall be (A) such of the representations made by Parent in the merger agreement for the Acquisition (the “Merger Agreement”) as are material to our interests, but only to the extent that Company has the right to terminate its obligations under Section 9.1 of the Merger Agreement as a result of a breach of such representations in the Merger Agreement and (B) the Specified Representations (as

Page 2

defined below) and (ii) the terms and provisions of the Definitive Loan Documentation for the Financing Facility shall be in form and substance satisfactory to us and in a form such that they do not impair the availability of the Financing Facility on the Closing Date in accordance with this commitment letter and the Term Sheet. For the purposes hereof, “Specified Representations” means the representations and warranties of Parent relating to organization, corporate power and authority, non-contravention and enforceability of the Merger Agreement and the Definitive Loan Documentation, in each case as they relate to entering into and performance of the Merger Agreement and the Financing Facility, solvency on a consolidated basis, use of proceeds, compliance with applicable law and securities regulations, no event of default, no existent security, no petition for liquidation or winding up, no debts other than those already disclosed to us in your financial reports, no litigation or threatened litigation which will have material adverse impact on you, the status of the Financing Facility as senior debt and, subject to the limitations set forth in the previous sentence, the perfection of the security interests granted in the Security.

6. You represent and warrant that to the best of your knowledge (i) all written information and other materials concerning you, Parent and/or the Company (collectively, the “Information”) which has been, or is hereafter, made available by, or on behalf of you, Parent, the Company or any of their respective subsidiaries (other than projections and information of a general economic nature) is, or when delivered will be, when considered as a whole, complete and correct in all material respects and does not, or will not when delivered, contain any untrue statement of material fact or omit to state a material fact necessary in order to make the statements contained therein not materially misleading in light of the circumstances under which such statement has been made and (ii) to the extent that any such Information contains projections, such projections were prepared in good faith on the basis of (A) assumptions, methods and tests stated therein which you believe to be reasonable at the time such projections were prepared and (B) information that you believe to have been accurate based upon the information available to you at the time such projections were furnished to us (it being understood that such projections are not to be viewed as facts and that actual results may differ materially from projected results). You agree that if at any time prior to the full drawdown of the Financing Facility, any of the representations in the preceding sentence would be incorrect in any material respect if the information and projections were being furnished, and such representations were being made, at such time, then you will promptly supplement, or cause to be supplemented, the information and projections so that such representations will be correct in all material respects under those circumstances after giving effect to such supplements.

7. This commitment letter is delivered to you upon the condition that, prior to your acceptance of this offer, neither the existence of this commitment letter or the Term Sheet, nor any of their contents, shall be disclosed by you, Parent, or any of your and its affiliates, except as may be compelled to be disclosed in a judicial or administrative proceeding or as otherwise required by law or, on a confidential and “need to know” basis, solely to the directors, officers, employees, advisors and agents of you or Parent. In addition, you agree, on behalf of yourself and Parent, that you will (i) consult with us prior to the making of any filing or public announcement in which reference is made to us or the commitment contained herein, and (ii) obtain our prior approval before releasing any filing or public announcement in which reference is made to us or to the commitment contained herein, except for, in the case of this clause (ii), any filing or public announcement that is required to be filed or made by law, securities regulation or any stock exchange rule. You acknowledges that we and our affiliates may now or hereafter provide financing or obtain other interests in other companies in respect of which you or your affiliates may be business competitors, and that we and our affiliates will have no obligation to provide to you or any of your affiliates any confidential information obtained from or in respect of such other companies.

Page 3

8. The offer made by us in this commitment letter shall expire, unless otherwise agreed by us in writing, five working days from the date of the issue of this Commitment Letter, unless prior thereto we have received a copy of this commitment letter, signed by you accepting the terms and conditions of this commitment letter and the Term Sheet. Our commitment to provide the Financing Facility shall expire upon the earlier of (i) the termination of the Merger Agreement in accordance with its terms, (ii) the closing of the Acquisition without the use of the Financing Facility proposed by this commitment letter and (iii) 5:00 p.m. (New York City time) on the date falling six months from the date of the Merger Agreement, unless prior thereto, Definitive Loan Documentation shall have been agreed to in writing by all parties and the conditions set forth therein shall have been satisfied (it being understood that your obligation to pay all amounts in respect of indemnification and expenses shall survive termination of this commitment letter, subject to the final sentence of the third paragraph hereof.)

9. This commitment letter, including the attached Term Sheet (i) supersedes all prior discussions, agreements, commitments, arrangements, negotiations or understandings, whether oral or written, of the parties with respect thereto, (ii) shall be governed by the law of Hong Kong SAR, without giving effect to the conflict of laws provisions thereof that would require the application of the laws of another jurisdiction, (iii) shall be binding upon the parties and their respective successors and assigns, (iv) may not be relied upon or enforced by any other person or entity, and (v) may be signed in multiple counterparts and delivered by facsimile or other electronic transmission, each of which shall be deemed an original and all of which together shall constitute one and the same instrument. If this commitment letter becomes the subject of a dispute, each of the parties hereto hereby waives trial by jury. To the fullest extent permitted by applicable law, any dispute, controversy or claim arising out of or relating to this commitment letter or the Term Sheet, including the interpretation, breach, termination, validity or invalidity thereof, shall be referred to and settled by arbitration in Hong Kong in accordance with the Hong Kong International Arbitration Centre Administered Arbitration Rules then in force. The arbitral proceedings shall be conducted in English. The award of the arbitral tribunal shall be final and binding upon the parties thereto, and the prevailing party may apply to a court of competent jurisdiction for enforcement of such award.

10. This commitment letter may be amended, modified or waived only in a writing signed by each of the parties hereto. Should the terms and conditions of the offer contained herein meet with your approval, please indicate your acceptance by signing and returning a copy of this letter to us.

[Remainder of Page Intentionally Left Blank]

Page 4

| | |

| Very truly yours, |

| Guotai Junan Finance (Hong Kong) Limited |

| |

| By | | /s/ Paul Wang |

| Name: | | Paul Wang |

| Title: | | Director, Credit and Risk Management |

Agreed and accepted on January, 2012 by

Talenthome Management Limited (BVI)

| | |

| By | | /s/ Yingjie Gao |

| Name: | | Yingjie Gao |

| Title: | | Director |

[Signature Page to Commitment Letter]

Page 5

Page 6

Page 7

Page 8

Page 9

Page 10