UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22023

Nuveen Managed Accounts Portfolios Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: January 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

Item 1. Reports to Stockholders.

NUVEEN INVESTMENTS MUTUAL FUNDS

| | |

| | |

Semi-Annual Report dated January 31, 2008 | | Dependable, tax-free income because

it’s not what you earn, it’s what you keep.® |

Nuveen Managed Accounts Portfolios Trust

Municipal Total Return Managed Accounts Portfolio

NOW YOU CAN RECEIVE YOUR

NUVEEN INVESTMENTS FUND REPORTS FASTER.

NO MORE WAITING.

SIGN UP TODAY TO RECEIVE NUVEEN INVESTMENTS FUND INFORMATION BY E-MAIL.

It only takes a minute to sign up for E-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Investments Fund information is ready — no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report, and save it on your computer if your wish.

IT’S FAST, EASY & FREE:

www.investordelivery.com

if you get your Nuveen Investments Fund dividends and statements from your financial advisor or brokerage account.

(Be sure to have the address sheet that accompanied this report handy. You’ll need it to complete the enrollment process.)

OR

www.nuveen.com/accountaccess

if you get your Nuveen Investments Fund dividends and statements directly from Nuveen Investments.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

“But one thing we do know is that a well-balanced portfolio can provide diversification that can reduce overall investment risk.”

Dear Shareholder,

As we begin a new year, no one knows for certain what the future will bring. But one thing we do know is that a well-balanced portfolio can provide diversification that can reduce overall investment risk. To learn more about the potential benefits of portfolio diversification, we encourage you to consult a trusted financial advisor. He or she should be able to help you understand how an investment like your Nuveen Fund can be an important building block in a portfolio crafted to perform well through a variety of market conditions.

Detailed information on the Municipal Total Return Managed Accounts Portfolio’s performance can be found in the Portfolio Manager’s Comments and Fund Spotlight sections of this report. The Fund features portfolio management by Nuveen Asset Management. I urge you to take the time to read the Portfolio Manager’s Comments.

I also wanted to update you on some important news about Nuveen Investments. The firm recently was acquired by a group led by Madison Dearborn Partners, LLC. While this affected the corporate structure of Nuveen Investments, it had no impact on the investment objectives, portfolio management strategies or dividend policy of your Fund.

Since 1898, Nuveen Investments has offered financial products and solutions that incorporate careful research, diversification, and the application of conservative risk-management principles. We are grateful that you have chosen us as a partner as you pursue your financial goals. We look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Timothy R. Schwertfeger

Chairman of the Board

March 14, 2008

Semi-Annual Report Page 1

Portfolio Manager’s Comments

Portfolio manager Marty Doyle examines the investment strategy of the Portfolio and how it was applied to the Municipal Total Return Managed Accounts Portfolio. Marty, who has 20 years of investment experience, has managed the Municipal Total Return Managed Accounts Portfolio since its inception.

What is the Portfolio’s investment strategy and how was it applied during the six-month reporting period?

The table on page 3 provides performance information for six-month and since inception periods ended January 31, 2008. The table also compares the Fund’s performance to its appropriate benchmark. A more detailed account of performance is provided later in this report. For the six-month period ended January 31, 2008, the Fund underperformed its benchmark.

Developed exclusively for use within Nuveen-sponsored separately managed accounts, the Municipal Total Return Managed Accounts Portfolio is a specialized municipal bond portfolio to be used in combination with selected individual securities to effectively model institutional-level investment strategies. Certain securities in which the Portfolio invests are highly speculative. The Portfolio enables certain Nuveen municipal separately managed account investors to achieve greater diversification and return potential by using lower quality, higher yielding securities than smaller managed accounts might otherwise achieve and to gain access to special investment opportunities normally only available to institutional investors.

This Portfolio is combined with a Separately Managed Account portfolio of high quality intermediate bonds and uses the Lehman Brothers 7-Year Municipal Bond Index as a comparative benchmark. The longer duration and relatively lower quality exposure that the Fund had resulted in its underperformance. Also contributing to underperformance were market conditions that included a steepening of the municipal yield curve and widening of credit spreads.

The Portfolio was seeded shortly before the period began and as inflows came in during the beginning of the reporting period we were able to add several new holdings. Due to the reduction in capital allocated by broker/dealer firms to longer maturity municipal bonds, we maintained a higher quality portfolio and shorter duration relative to our long-term strategic targets. Additionally, we used AA- and AAA-rated temporary holdings to provide liquidity to opportunistically purchase mid-grade and high yield municipal bonds. As credit spreads widened, we were able to add A- and BBB-rated municipal bonds, which we expect to be long-term core holdings.

Recent Developments Regarding Bond Insurance Companies

The AAA ratings shown in the Portfolio of Investments reflects the AAA ratings on certain bonds insured by AMBAC, FGIC or MBIA as of January 31, 2008. Subsequent to January 31, 2008, at least one rating agency reduced the rating for AMBAC-insured bonds to AA and the rating for FGIC-insured bonds experienced further downgrades such that they no longer carry AAA ratings which had the effect of reducing the ratings of many (if not all) of the bonds insured by that particular insurer. One or more rating agencies have placed each of these insurers on “negative credit watch”, which may presage one or more rating reductions for such insurer or insurers in the future. If one or more insurers’ ratings are reduced below AAA by these rating agencies, it would likely reduce the effective rating of many of the bonds insured by that insurer or insurers. It is important to note that municipal bonds historically have had a very low rate of default.

Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The views expressed herein represent those of the portfolio manager as of the date of this report and are subject to change at any time, based on market conditions and other factors. The Fund disclaims any obligation to advise shareholders of such changes.

Semi-Annual Report Page 2

Cumulative Total Returns as of 1/31/08

| | | | |

| | | 6-Month | | Since inception

(5/31/07) |

| | |

Municipal Total Return Managed Accounts Portfolio | | 1.94% | | 3.16% |

Lehman Brothers 7-Year Municipal Bond Index1 | | 6.40% | | 7.00% |

Returns quoted represent past performance, which is no guarantee of future results. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance, visit www.nuveen.com or call (800) 257-8787.

Please see the Fund’s Spotlight Page later in this report for more complete performance data and expense ratios.

| 1 | The Lehman Brothers 7-Year Municipal Bond Index is an unmanaged index composed of a broad range of investment-grade municipal bonds and does not reflect any initial or ongoing expenses. This index more closely compares to the duration of the bonds in the Fund’s portfolio. An index is not available for direct investment. |

Semi-Annual Report Page 3

Fund Spotlight as of 1/31/08 Municipal Total Return Managed

Accounts Portfolio

| | |

| Quick Facts | | |

| | | |

NAV | | $10.06 |

Latest Monthly Dividend1 | | $0.0306 |

Inception Date | | 5/31/07 |

Returns quoted represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Fund returns assume reinvestment of dividends and capital gains. Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| | |

| Cumulative Total Return as of 1/31/08 |

| |

| | | NAV |

Since Inception | | 3.16% |

| Cumulative Total Return as of 12/31/07 |

| |

| | | NAV |

Since Inception | | 2.24% |

| Tax-Free Yields |

| |

| | | NAV |

Dividend Yield2 | | 3.65% |

SEC 30-Day Yield2 | | 4.08% |

Taxable-Equivalent Yield3 | | 5.67% |

| | | | | | |

| Expense Ratios | | | | | | |

| | | |

| | | Gross

Expense

Ratio | | Net

Expense

Ratio | | As of

Date |

| | | 1.26% | | 0.00% | | 7/31/07 |

The expense ratios shown factor in Total Annual Fund Operating Expenses. The Adviser has agreed irrevocably during the existence of the Fund to waive all fees and pay or reimburse all expenses of the Fund, except for interest expense, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses.

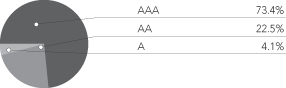

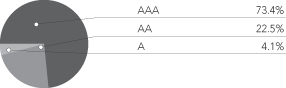

Bond Credit Quality4

| | |

| Portfolio Statistics |

Net Assets ($000) | | $12,898 |

Average Effective Maturity on Securities (Years) | | 15.06 |

Average Duration | | 6.58 |

| 1 | Paid February 1, 2008. This is the latest monthly tax-exempt dividend declared during the period ended January 31, 2008. |

| 2 | Dividend Yield is the most recent dividend per share (annualized) divided by the appropriate price per share. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium. |

| 3 | The Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis at a specified tax rate. With respect to investments that generate qualified dividend income that is taxable at a maximum rate of 15%, the Taxable-Equivalent Yield is lower. The Taxable-Equivalent Yield is based on the Fund’s SEC 30-Day Yield on the indicated date and a federal income tax rate of 28%. |

| 4 | As a percentage of total long-term investments as of January 31, 2008. Holdings are subject to change. The percentage of AAA ratings shown in the foregoing chart reflects the AAA ratings on certain bonds insured by AMBAC, FGIC or MBIA as of January 31, 2008. As explained earlier in the Portfolio Manager’s Comments section of this report, at least one rating agency reduced the rating for AMBAC-insured bonds to AA and FGIC-insured bonds experienced further downgrades such that they no longer carry AAA ratings which had the effect of reducing the rating of many (if not all) of the bonds insured by that particular insurer. One or more rating agencies have placed each of these insurers on “negative credit watch”, which may presage one or more rating reductions for such insurer or insurers in the future. If one or more insurers’ ratings are reduced below AAA by these rating agencies, it would likely reduce the effective rating of many of the bonds insured by that insurer or insurers, and thereby reduce the percentage of the portfolio rated AAA from the percentage shown in the foregoing chart. |

Semi-Annual Report Page 4

Fund Spotlight as of 1/31/08 Municipal Total Return Managed

Accounts Portfolio

Industries1

| | |

Education and Civic Organizations | | 20.4% |

Tax Obligation/Limited | | 15.9% |

Health Care | | 14.6% |

Water and Sewer | | 9.9% |

Tax Obligation/General | | 8.4% |

Utilities | | 8.0% |

Transportation | | 5.7% |

Housing/Multifamily | | 4.5% |

Other | | 12.6% |

States1

| | |

Illinois | | 14.3% |

Ohio | | 9.0% |

Indiana | | 8.0% |

Michigan | | 7.3% |

Florida | | 6.6% |

Texas | | 6.0% |

North Carolina | | 4.5% |

New York | | 4.2% |

Colorado | | 4.1% |

Washington | | 4.0% |

Georgia | | 2.9% |

Kansas | | 2.4% |

New Mexico | | 2.3% |

Utah | | 2.3% |

New Hampshire | | 2.2% |

Minnesota | | 2.1% |

Wisconsin | | 2.1% |

California | | 2.1% |

Other | | 13.6% |

| 1 | As a percentage of total long-term investments as of January 31, 2008. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front and back end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front and back end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | | | | | | | Hypothetical Performance |

| | | Actual Performance | | (5% annualized return before expenses) |

Beginning Account Value (8/01/07) | | | | $ | 1,000.00 | | | | | | $ | 1,000.00 | | |

Ending Account Value (1/31/08) | | | | $ | 1,019.40 | | | | | | $ | 1,025.21 | | |

Expenses Incurred During Period | | | | $ | — | | | | | | $ | — | | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.00% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Semi-Annual Report Page 5

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio

January 31, 2008

| | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | Ratings (3) | | Value |

| | | | | | | | | | |

| | | Alabama – 0.7% | | | | | | | |

| | | | |

| $ | 90 | | Birmingham Special Care Facilities Financing Authority, Alabama, Revenue Bonds, Baptist Health System Inc., Series 2005A, 5.250%, 11/15/20 | | 11/15 at 100.00 | | Baa1 | | $ | 89,372 |

| | | Alaska – 1.2% | | | | | | | |

| | | | |

| | 145 | | Alaska Municipal Bond Bank Authority, General Obligation Bonds, Series 2006-2, 5.500%, 12/01/21 – MBIA Insured (Alternative Minimum Tax) | | 12/16 at 100.00 | | AAA | | | 157,345 |

| | | Arizona – 0.8% | | | | | | | |

| | | | |

| | 100 | | Yuma County Industrial Development Authority, Arizona, Exempt Revenue Bonds, Far West Water & Sewer Inc. Refunding, Series 2007A, 6.500%, 12/01/17 (Alternative Minimum Tax) | | No Opt. Call | | N/R | | | 103,049 |

| | | California – 1.8% | | | | | | | |

| | | | |

| | 225 | | Daly City Housing Development Finance Agency, California, Mobile Home Park Revenue Bonds, Franciscan Mobile Home Park Refunding, Series 2007A, 5.250%, 12/15/23 | | 12/17 at 100.00 | | A– | | | 231,359 |

| | | Colorado – 3.5% | | | | | | | |

| | | | |

| | 75 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Yampa Valley Medical Center, Series 2007, 5.000%, 9/15/15 | | No Opt. Call | | BBB– | | | 76,930 |

| | | | |

| | 200 | | Colorado Health Facilities Authority, Revenue Bonds, Evangelical Lutheran Good Samaritan Society, Series 2006, 5.250%, 6/01/17 | | 6/16 at 100.00 | | A– | | | 213,682 |

| | | | |

| | 150 | | Denver City and County, Colorado, Airport System Revenue Refunding Bonds, Series 2001A, 5.500%, 11/15/14 – FGIC Insured | | 11/11 at 100.00 | | Aaa | | | 161,573 |

| | 425 | | Total Colorado | | | | | | | 452,185 |

| | | Florida – 5.7% | | | | | | | |

| | | | |

| | 25 | | Beacon Lakes Community Development District, Florida, Special Assessment Bonds, Series 2007A, 6.000%, 5/01/38 | | 5/17 at 100.00 | | N/R | | | 22,083 |

| | | | |

| | 300 | | Broward County School Board, Florida, Certificates of Participation, Series 2004B, 5.250%, 7/01/16 | | No Opt. Call | | Aaa | | | 334,704 |

| | | | |

| | 25 | | Boynton Village Community Development District, Florida, Special Assessment Bonds, Series 2007-A1, 5.750%, 5/01/37 | | 5/17 at 100.00 | | N/R | | | 21,500 |

| | | | |

| | 75 | | Seminole Tribe of Florida, Special Obligation Bonds, Series 2007A, 5.750%, 10/01/22 | | 10/17 at 100.00 | | BBB | | | 76,188 |

| | | | |

| | 75 | | Tolomato Community Development District, Florida, Special Assessment Bonds, Series 2007, 6.375%, 5/01/17 | | No Opt. Call | | N/R | | | 74,578 |

| | | | |

| | 200 | | University of Florida Research Foundation, Inc., Capital Improvement Revenue Bonds, Series 2003, 5.125%, 9/01/33 – AMBAC Insured | | 9/09 at 100.00 | | Aaa | | | 203,640 |

| | 700 | | Total Florida | | | | | | | 732,693 |

| | | Georgia – 2.5% | | | | | | | |

| | | | |

| | 250 | | Atlanta Development Authority, Georgia, Educational Facilities Revenue Bonds, Science Park LLC Project, Series 2007, 5.250%, 7/01/27 | | 7/17 at 100.00 | | A1 | | | 261,130 |

| | | | |

| | 60 | | Houston County Hospital Authority, Georgia, Revenue Bonds, Houston Healthcare Project, Series 2007, 5.250%, 10/01/18 | | 10/17 at 100.00 | | A2 | | | 64,737 |

| | 310 | | Total Georgia | | | | | | | 325,867 |

| | | Illinois – 12.3% | | | | | | | |

| | | | |

| | 150 | | Illinois Finance Authority, Revenue Bonds, Roosevelt University, Series 2007, 5.400%, 4/01/27 | | 4/17 at 100.00 | | Baa1 | | | 150,689 |

| | | | |

| | 100 | | Illinois Finance Authority, Revenue Bonds, Sherman Health Systems, Series 2007A, 5.500%, 8/01/37 | | 8/17 at 100.00 | | A– | | | 98,493 |

| | | | |

| | 75 | | Illinois Finance Authority, Student Housing Revenue Bonds, Educational Advancement Fund Inc., University Center Project, Series 2006B, 5.000%, 5/01/13 | | No Opt. Call | | Baa3 | | | 76,890 |

| | | | |

| | 200 | | Illinois Housing Development Authority, Housing Finance Bonds, Series 2006G, 4.800%, 7/01/32 | | 7/16 at 100.00 | | A+ | | | 193,156 |

| | | | |

| | 205 | | Kane County, Illinois, Community Unit School District 304 Geneva, General Obligation Bonds, Series 2008, 5.250%, 1/01/23 – FSA Insured | | 1/18 at 100.00 | | AAA | | | 225,361 |

| | | | |

| | 250 | | Lombard Public Facilities Corporation, Illinois, Second Tier Conference Center and Hotel Revenue Bonds, Series 2005B, 5.250%, 1/01/30 | | 1/16 at 100.00 | | AA– | | | 251,518 |

6

| | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | Ratings (3) | | Value |

| | | | | | | | | | |

| | | Illinois (continued) | | | | | | | |

| | | | |

| $ | 250 | | Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 1991, 6.700%, 11/01/21 – FGIC Insured | | No Opt. Call | | Aaa | | $ | 308,093 |

| | | | |

| | 250 | | Saint Clair County High School District 203, O’Fallon, Illinois, General Obligation Bonds, Series 2007, 5.750%, 12/01/26 – AMBAC Insured | | 12/17 at 100.00 | | AAA | | | 284,285 |

| | 1,480 | | Total Illinois | | | | | | | 1,588,485 |

| | | Indiana – 6.9% | | | | | | | |

| | | | |

| | 250 | | Central Nine Career Charter School Building Corporation, Indiana, General Obligation Bonds, Series 2007, 5.500%, 1/15/17 | | No Opt. Call | | A | | | 278,765 |

| | | | |

| | 200 | | Noblesville Redevelopment Authority, Indiana, Lease Rental Revenue Bonds, Hamilton Town Project, Series 2006, 5.000%, 8/01/23 | | 8/16 at 100.00 | | A+ | | | 206,928 |

| | | | |

| | 300 | | Portage Redevelopment District, Indiana, Tax Increment Revenue Bonds, Series 2008,

5.250%, 1/15/19 – CIFG Insured | | 1/18 at 100.00 | | AAA | | | 321,972 |

| | | | |

| | 75 | | Portage, Indiana, Revenue Bonds, Series 2006, 5.000%, 7/15/23 | | 7/16 at 100.00 | | BBB+ | | | 74,639 |

| | 825 | | Total Indiana | | | | | | | 882,304 |

| | | Kansas – 2.1% | | | | | | | |

| | | | |

| | 65 | | Labette County Medical Center, Kansas, Revenue Bonds, Series 2007A, 5.750%, 9/01/29 | | 9/17 at 100.00 | | N/R | | | 64,797 |

| | | | |

| | 200 | | Olathe, Kansas, Health Facilities Revenue Bonds, Olathe Medical Center, Series 2008A, 4.125%, 9/01/37 (Mandatory put 3/01/13) | | 3/12 at 100.00 | | A+ | | | 202,394 |

| | 265 | | Total Kansas | | | | | | | 267,191 |

| | | Louisiana – 0.8% | | | | | | | |

| | | | |

| | 100 | | Greystone Community Development District, Louisiana, Special Assessment Bonds, Livingston Parish, Series 2007, 6.750%, 12/01/22 | | 12/14 at 100.00 | | N/R | | | 101,763 |

| | | Michigan – 6.3% | | | | | | | |

| | | | |

| | 360 | | Northern Michigan University, Revenue Bonds, Series 2006, 6.500%, 12/01/35 | | 4/08 at 100.00 | | AAA | | | 360,000 |

| | | | |

| | 150 | | Michigan Higher Education Facilities Authority, Revenue Bonds, Kalamazoo College Project, Series 2007, 5.000%, 12/01/33 | | 12/17 at 100.00 | | A1 | | | 149,235 |

| | | | |

| | 200 | | Michigan Higher Education Student Loan Authority, Revenue Bonds, Series 2003, XVII-I, 4.750%, 3/01/18 – AMBAC Insured (Alternative Minimum Tax) | | 3/14 at 100.00 | | AAA | | | 204,120 |

| | | | |

| | 100 | | Michigan State Building Authority, Revenue Bonds, Facilities Program, Series 2001I, 4.750%, 10/15/25 | | 4/08 at 100.00 | | A+ | | | 100,001 |

| | 810 | | Total Michigan | | | | | | | 813,356 |

| | | Minnesota – 1.8% | | | | | | | |

| | | | |

| | 200 | | Becker, Minnesota, Pollution Control Revenue Bonds, Northern States Power Company, Series 1992A, 8.500%, 3/01/19 | | 8/12 at 101.00 | | A | | | 238,140 |

| | | Missouri – 0.6% | | | | | | | |

| | | | |

| | 75 | | St. Louis County Industrial Development Authority, Missouri, Revenue Bonds, Friendship Village of West County, Series 2007A, 5.250%, 9/01/15 | | No Opt. Call | | N/R | | | 74,696 |

| | | New Hampshire – 1.9% | | | | | | | |

| | | | |

| | 250 | | New Hampshire Health and Educational Facilities Authority, Revenue Bonds, Saint Anselm College, Series 2004, 4.500%, 7/01/32 – MBIA Insured | | 4/08 at 100.00 | | AAA | | | 249,625 |

| | | New Jersey – 0.8% | | | | | | | |

| | | | |

| | 100 | | New Jersey Economic Development Authority, Cigarette Tax Revenue Bonds, Series 2004, 5.625%, 6/15/19 | | 6/10 at 100.00 | | BBB | | | 100,499 |

| | | New Mexico – 1.9% | | | | | | | |

| | | | |

| | 250 | | Farmington, New Mexico, Pollution Control Revenue Bonds, Public Service Company of New Mexico San Juan Project, Series 2007A, 5.150%, 6/01/37 – FGIC Insured (Alternative Minimum Tax) | | 6/12 at 100.00 | | Aaa | | | 251,040 |

7

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio (continued)

January 31, 2008

| | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | Ratings (3) | | Value |

| | | | | | | | | | |

| | | New York – 3.6% | | | | | | | |

| | | | |

| $ | 350 | | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Series 2006A, 5.000%, 11/15/25 | | 11/16 at 100.00 | | A | | $ | 365,278 |

| | | | |

| | 100 | | New York City Industrial Development Agency, New York, Civic Facility Revenue Bonds, Special Needs Facilities Pooled Program, Series 2008A-1, 5.700%, 7/01/13 | | No Opt. Call | | N/R | | | 99,668 |

| | 450 | | Total New York | | | | | | | 464,946 |

| | | North Carolina – 3.9% | | | | | | | |

| | | | |

| | 100 | | Albemarle Hospital Authority, North Carolina, Health Care Facilities Revenue Bonds, Series 2007, 5.250%, 10/01/21 | | 10/17 at 100.00 | | BBB | | | 101,875 |

| | | | |

| | 350 | | North Carolina Eastern Municipal Power Agency, Power System Revenue Refunding Bonds, Series 1993B, 6.000%, 1/01/22 – FGIC Insured | | No Opt. Call | | Aaa | | | 396,652 |

| | 450 | | Total North Carolina | | | | | | | 498,527 |

| | | Ohio – 7.8% | | | | | | | |

| | | | |

| | 100 | | Buckeye Tobacco Settlement Financing Authority, Ohio, Tobacco Settlement Asset-Backed Revenue Bonds, Senior Lien, Series 2007A-2, 5.125%, 6/01/24 | | 6/17 at 100.00 | | BBB | | | 96,769 |

| | | | |

| | 240 | | Cuyahoga County, Ohio, Revenue Refunding Bonds, Cleveland Clinic Health System, Series 2003A, 6.000%, 1/01/32 | | 7/13 at 100.00 | | AA– | | | 260,062 |

| | | | |

| | 300 | | Hamilton County, Ohio, Sewer System Revenue Bonds, Greater Cincinnati Metropolitan Sewer District, Series 2007A, 5.250%, 12/01/22 | | 12/17 at 100.00 | | AA | | | 331,120 |

| | | | |

| | 200 | | Huron County, Ohio, Hospital Facilities Revenue Bonds, Fisher-Titus Medical Center, Series 2007, 5.250%, 12/01/17 | | 6/17 at 100.00 | | A | | | 216,788 |

| | | | |

| | 100 | | Toledo-Lucas County Port Authority, Ohio, Special Assessment Revenue Bonds, Crocker Park Project, Series 2003, 5.375%, 12/01/35 | | 12/13 at 102.00 | | N/R | | | 97,595 |

| | 940 | | Total Ohio | | | | | | | 1,002,334 |

| | | Oklahoma – 1.6% | | | | | | | |

| | | | |

| | 200 | | Norman Regional Hospital Authority, Oklahoma, Revenue Bonds, Series 2007, 5.250%, 9/01/21 – RAAI Insured | | 9/17 at 100.00 | | AA | | | 210,134 |

| | | Oregon – 1.2% | | | | | | | |

| | | | |

| | 150 | | Oregon Facilities Authority, Revenue Bonds, University of Portland Projects, Series 2007A, 5.500%, 4/01/27 | | 4/18 at 100.00 | | BBB+ | | | 159,600 |

| | | Pennsylvania – 0.8% | | | | | | | |

| | | | |

| | 100 | | Lancaster County Hospital Authority, Pennsylvania, Revenue Bonds, Brethren Village Project, Series 2008A, 5.200%, 7/01/12 | | 7/10 at 101.00 | | N/R | | | 101,048 |

| | | Rhode Island – 1.6% | | | | | | | |

| | | | |

| | 200 | | Rhode Island Housing & Mortgage Finance Corporation, Homeownership Opportunity Bond Program, 2007 Series 57-B, 5.150%, 4/01/22 (Alternative Minimum Tax) | | 4/17 at 100.00 | | AA+ | | | 205,278 |

| | | South Carolina – 0.8% | | | | | | | |

| | | | |

| | 100 | | Tobacco Settlement Revenue Management Authority, South Carolina, Tobacco Settlement Asset-Backed Bonds, Series 2001B, 6.375%, 5/15/30 | | No Opt. Call | | BBB | | | 101,420 |

| | | Texas ��� 5.2% | | | | | | | |

| | | | |

| | 250 | | Houston, Texas, First Lien Combined Utility System Revenue Bonds, Series 2004A, 5.250%, 5/15/23 – FGIC Insured | | 5/14 at 100.00 | | Aaa | | | 262,878 |

| | | | |

| | 380 | | North Texas Municipal Water District, Water System Revenue Bonds, Series 2006, 5.000%, 9/01/20 – FGIC Insured | | 9/16 at 100.00 | | Aaa | | | 406,452 |

| | 630 | | Total Texas | | | | | | | 669,330 |

| | | Utah – 1.9% | | | | | | | |

| | | | |

| | 100 | | Utah State Charter School Finance Authority, Revenue Bonds, Channing Hall Project, Series 2007A, 5.750%, 7/15/22 | | 7/15 at 102.00 | | N/R | | | 100,033 |

8

| | | | | | | | | | |

Principal

Amount (000) | | Description (1) | | Optional Call

Provisions (2) | | Ratings (3) | | Value |

| | | | | | | | | | |

| | | Utah (continued) | | | | | | | |

| | | | |

| $ | 150 | | Utah State Charter School Finance Authority, Revenue Bonds, Summit Academy Project, Series 2007A, 5.125%, 6/15/17 | | No Opt. Call | | BBB– | | $ | 149,604 |

| | 250 | | Total Utah | | | | | | | 249,637 |

| | | Virginia – 0.8% | | | | | | | |

| | | | |

| | 100 | | Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Series 2002A, 5.250%, 10/01/32 – FGIC Insured (Alternative Minimum Tax) | | 10/12 at 100.00 | | Aaa | | | 100,981 |

| | | Washington – 3.4% | | | | | | | |

| | | | |

| | 100 | | Kalispel Indian Tribe, Washington, Priority Distribution Bonds, Series 2008, 6.625%, 1/01/28 | | No Opt. Call | | N/R | | | 99,609 |

| | | | |

| | 250 | | Pierce County, Washington, General Obligation Bonds, Series 2005, 5.000%, 8/01/22 – AMBAC Insured | | 8/15 at 100.00 | | AAA | | | 263,823 |

| | | | |

| | 75 | | Skagit County Public Hospital District 1 , Washington, Skagit Valley Hospital, Series 2007, 5.750%, 12/01/28 | | 12/17 at 100.00 | | Baa2 | | | 76,375 |

| | 425 | | Total Washington | | | | | | | 439,807 |

| | | Wisconsin – 1.8% | | | | | | | |

| | | | |

| | 75 | | Badger Tobacco Asset Securitization Corporation, Wisconsin, Tobacco Settlement Asset-Backed Bonds, Series 2002, 6.125%, 6/01/27 | | 6/12 at 100.00 | | BBB | | | 76,997 |

| | | | |

| | 150 | | Wisconsin Health and Educational Facilities Authority, Revenue Bonds, Marshfield Clinic, Series 2006A, 5.000%, 2/15/12 | | No Opt. Call | | BBB+ | | | 156,023 |

| | 225 | | Total Wisconsin | | | | | | | 233,020 |

| $ | 10,570 | | Total Long-Term Investments (cost $11,078,765) – 86.0% | | | | | | | 11,095,031 |

| | | | |

| | | Short-Term Investments – 17.9% | | | | | | | |

| | | | |

| $ | 2,309 | | State Street Global Advisors Money Market Fund, Tax Free Obligation | | | | | | | 2,308,672 |

| | | | |

| | | Total Short-Term Investments (cost $2,308,672) | | | | | | | 2,308,672 |

| | | |

| | | Total Investments (cost $13,387,437) – 103.9% | | | | | | | 13,403,703 |

| | | |

| | | Other Assets Less Liabilities – (3.9)% | | | | | | | (505,944) |

| | | |

| | | Net Assets – 100% | | | | | | $ | 12,897,759 |

| | | |

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. |

| | (3) | | Ratings: Using the higher of Standard & Poor’s Group (“Standard & Poor’s”) or Moody’s Investor Service, Inc. (“Moody’s”) rating. Ratings below BBB by Standard & Poor’s or Baa by Moody’s are considered to be below investment grade. |

| | | | The AAA ratings shown in the Portfolio of Investments reflect the AAA ratings on certain bonds insured by AMBAC, FGIC or MBIA as of January 31, 2008. Subsequent to January 31, 2008, at least one rating agency reduced the rating for AMBAC-insured bonds to AA and FGIC-insured bonds experienced further downgrades such that they no longer carry AAA ratings which had the effect of reducing the rating of many (if not all ) of the bonds insured by that particular insurer. One or more rating agencies have placed each of these insurers on “negative credit watch”, which may presage one or more rating reductions for such insurer or insurers in the future. If one or more insurers’ ratings are reduced below AAA by these rating agencies, it would likely reduce the effective rating of many of the bonds insured by that insurer or insurers. |

See accompanying notes to financial statements.

9

Statement of Assets and Liabilities (Unaudited)

Municipal Total Return Managed Accounts Portfolio

January 31, 2008

| | | | |

Assets | | | | |

Investments, at value (cost $13,387,437) | | $ | 13,403,703 | |

Receivables: | | | | |

From Adviser | | | 16,869 | |

Interest | | | 121,507 | |

Shares sold | | | 102,241 | |

Total assets | | | 13,644,320 | |

Liabilities | | | | |

Cash overdraft | | | 360,695 | |

Payable for investments purchased | | | 334,704 | |

Accrued other expenses | | | 11,956 | |

Dividends payable | | | 39,206 | |

Total liabilities | | | 746,561 | |

Net assets | | $ | 12,897,759 | |

Shares outstanding | | | 1,281,863 | |

Net asset value per share | | $ | 10.06 | |

| |

Net Assets Consist of: | | | | |

Capital paid-in | | $ | 12,879,792 | |

Undistributed (Over-distribution of) net investment income | | | 12,511 | |

Accumulated net realized gain (loss) from investments | | | (10,810 | ) |

Net unrealized appreciation (depreciation) of investments | | | 16,266 | |

Net assets | | $ | 12,897,759 | |

See accompanying notes to financial statements.

10

Statement of Operations (Unaudited)

Municipal Total Return Managed Accounts Portfolio

Six Months Ended January 31, 2008

| | | | |

Investment Income | | $ | 149,678 | |

Expenses | | | | |

Shareholders’ servicing agent fees and expenses | | | 88 | |

Custodian’s fees and expenses | | | 4,162 | |

Trustees’ fees and expenses | | | 63 | |

Professional fees | | | 5,797 | |

Shareholders’ reports – printing and mailing expenses | | | 12,735 | |

Federal and state registration fees | | | 157 | |

Other expenses | | | 565 | |

Total expenses before expense reimbursement | | | 23,567 | |

Expense reimbursement | | | (23,567 | ) |

Net expenses | | | — | |

Net investment income | | | 149,678 | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from investments | | | (7,545 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | (18,801 | ) |

Net realized and unrealized gain (loss) | | | (26,346 | ) |

Net increase (decrease) in net assets from operations | | $ | 123,332 | |

See accompanying notes to financial statements.

11

Statement of Changes in Net Assets (Unaudited)

Municipal Total Return Managed Accounts Portfolio

| | | | | | | | |

| | | Six

Months Ended

1/31/08 | | | For the Period

5/31/07

(commencement

of operations)

through 7/31/07 | |

Operations | | | | | | | | |

Net investment income | | $ | 149,678 | | | $ | 36,241 | |

Net realized gain (loss) from investments | | | (7,545 | ) | | | (3,283 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | (18,801 | ) | | | 35,067 | |

Net increase (decrease) in net assets from operations | | | 123,332 | | | | 68,025 | |

Distributions to Shareholders | | | | | | | | |

From net investment income | | | (173,390 | ) | | | — | |

Decrease in net assets from distributions to shareholders | | | (173,390 | ) | | | — | |

Fund Share Transactions | | | | | | | | |

Proceeds from sale of shares | | | 7,643,860 | | | | 5,400,000 | |

| | | 7,643,860 | | | | — | |

Cost of shares redeemed | | | (265,552 | ) | | | — | |

Net increase (decrease) in net assets from Fund share transactions | | | 7,378,308 | | | | 5,400,000 | |

Capital contribution from Adviser | | | 627 | | | | 857 | |

Net increase (decrease) in net assets | | | 7,328,877 | | | | 5,468,882 | |

Net assets at the beginning of period | | | 5,568,882 | | | | 100,000 | |

Net assets at the end of period | | $ | 12,897,759 | | | $ | 5,568,882 | |

Undistributed (Over-distribution of) net investment income at the end of period | | $ | 12,511 | | | $ | 36,223 | |

See accompanying notes to financial statements.

12

Notes to Financial Statements (Unaudited)

1. General Information and Significant Accounting Policies

The Nuveen Managed Accounts Portfolios Trust (the “Trust��) is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Trust is comprised of the Municipal Total Return Managed Accounts Portfolio (the “Fund”), among others. The Trust was organized as a Massachusetts business trust on November 14, 2006.

The Fund is developed exclusively for use within Nuveen-sponsored separately managed accounts. The Fund is a specialized municipal bond fund to be used in combination with selected individual securities to effectively model institutional-level investment strategies. Certain securities in which the Fund invests are highly speculative. The Fund enables certain Nuveen municipal separately managed account investors to achieve greater diversification and return potential by using lower quality, higher yielding securities than smaller managed accounts might otherwise achieve and to gain access to special investment opportunities normally available only to institutional investors.

Prior to the commencement of operations, the Fund had no operations other than those related to organizational matters. The initial capital contribution of $100,000 was made by Nuveen Asset Management (the “Adviser”), a wholly owned subsidiary of Nuveen Investments, Inc. (“Nuveen”). Nuveen Investments, LLC (the “Distributor”), also a wholly owned subsidiary of Nuveen, assumed all of the organization costs approximately ($6,000) and offering costs approximately ($85,000).

The Fund primarily seeks to provide attractive total return. The Fund also seeks to provide high current income exempt from regular and federal income taxes. Under normal circumstances the Fund invests in various types of municipal securities, including investment grade rated BBB/Baa or better, below investment grade rated BB/Ba or lower (high yield), and unrated leveraged municipal securities. The Fund will focus on securities with intermediate to longer term maturities.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States.

Investment Valuation

The prices of municipal bonds in the Fund’s investment portfolio are provided by a pricing service approved by the Fund’s Board of Trustees. When market price quotes are not readily available (which is usually the case for municipal securities), the pricing service may establish fair value based on yields or prices of municipal bonds of comparable quality, type of issue, coupon, maturity and rating, indications of value from securities dealers, evaluations of anticipated cash flows or collateral and general market conditions. If the pricing service is unable to supply a price for a municipal bond, the Fund may use market quotes provided by major broker/dealers in such investments. If it is determined that the market price for an investment is unavailable or inappropriate, the Board of Trustees of the Fund, or its designee, may establish fair value in accordance with procedures established in good faith by the Board of Trustees. Temporary investments in securities that have variable rate and demand features qualifying them as short-term investments are valued at amortized cost, which approximates market value.

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from transactions are determined on the specific identification method. Investments purchased on a when-issued/delayed delivery basis may have extended settlement periods. Any investments so purchased are subject to market fluctuation during this period. The Fund has instructed the custodian to segregate assets with a current value at least equal to the amount of the when-issued/delayed delivery purchase commitments. At January 31, 2008, the Fund had no such outstanding purchase commitments.

Investment Income

Interest income, which includes the amortization of premiums and accretion of discounts for financial reporting purposes, is recorded on an accrual basis. Investment income also includes paydown gains and losses, if any.

Federal Income Taxes

The Fund intends to distribute substantially all net investment income and net capital gains to shareholders and to otherwise comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no federal income tax provision is required. Furthermore, the Fund intends to satisfy conditions which will enable interest from municipal securities, which is exempt from regular federal income tax, to retain such tax-exempt status when distributed to shareholders of the Fund. Net realized capital gains and ordinary income distributions paid by the Fund are subject to federal taxation.

Effective January 31, 2008, the Fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 ‘‘Accounting for Uncertainty in Income Taxes’’ (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the affirmative evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is ‘‘more-likely-than-not’’ (i.e. greater than 50-percent) of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold may result in a tax benefit or expense in the current year.

Implementation of FIN 48 required management of the Fund to analyze all open tax years, as defined by the statute of limitations, for all major jurisdictions, which includes federal and certain states. Open tax years are those that are open for examination by taxing authorities (i.e. generally the last four tax year ends and the interim tax period since then). The Fund has no examinations in progress.

13

Notes to Financial Statements (Unaudited) (continued)

For all open tax years and all major taxing jurisdictions through the end of the reporting period, management of the Fund has reviewed all tax positions taken or expected to be taken in the preparation of the Fund’s tax returns and concluded the adoption of FIN 48 resulted in no impact to the Fund’s net assets or results of operations as of and during the six months ended January 31, 2008.

The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Dividends and Distributions to Shareholders

Dividends from tax-exempt net investment income are declared monthly. Generally, reinvestment is credited to shareholder accounts on the last business day of the month declared and payment is made to shareholder accounts on the first business day after month-end. Net realized capital gains and/or market discount from investment transactions, if any, are declared and distributed to shareholders annually. Furthermore, capital gains are distributed only to the extent they exceed available capital loss carryforwards.

Distributions to shareholders of tax-exempt net investment income, net realized capital gains and/or market discount, if any, are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States.

Municipal Money Market Funds

The Fund is authorized to invest in municipal money market funds that pay interest income exempt from regular federal, and in some cases state and local, income taxes. The Fund indirectly bears its proportionate share of the money market fund’s fees and expenses. The Adviser does, however, reimburse the Fund for the 12b-1 fees it indirectly incurs from its investments in money market funds. During the six months ended January 31, 2008, the Adviser reimbursed the Fund $627 for such indirectly incurred 12b-1 fees.

Indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts that provide general indemnifications to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results may differ from those estimates.

2. Fund Shares

Transactions in Fund shares were as follows:

| | | | | | | | | | | | |

| | | Six Months Ended

1/31/08 | | | For the Period May 31, 2007

(Commencement of Operations)

through July 31, 2007 |

| | | Shares | | | Amount | | | Shares | | Amount |

Shares sold | | 757,998 | | | $ | 7,643,860 | | | 540,040 | | $ | 5,400,000 |

Shares redeemed | | (26,175 | ) | | | (265,552 | ) | | — | | | — |

Net increase (decrease) | | 731,823 | | | $ | 7,378,308 | | | 540,040 | | $ | 5,400,000 |

14

3. Investment Transactions

Purchases and sales (including maturities but excluding short-term investments) during the six months ended January 31, 2008, aggregated $8,470,817 and $2,702,290, respectively.

4. Income Tax Information

The following information is presented on an income tax basis. Differences between amounts for financial statement and federal income tax purposes are primarily due to the treatment of paydown gains and losses, timing differences in recognizing taxable market discount and timing differences in recognizing certain gains and losses on investment transactions. To the extent that differences arise that are permanent in nature, such amounts are reclassified within the capital accounts on the Statement of Assets and Liabilities presented in the annual report, based on their federal tax basis treatment; temporary differences do not require reclassification. Temporary and permanent differences do not impact the net asset value of the Fund.

At January 31, 2008, the cost of investments was $13,387,391.

Gross unrealized appreciation and gross unrealized depreciation of investments at January 31, 2008, were as follows:

| | | | |

Gross unrealized: | | | | |

Appreciation | | $ | 85,401 | |

Depreciation | | | (69,089 | ) |

Net unrealized appreciation (depreciation) of investments | | $ | 16,312 | |

The tax components of undistributed net tax-exempt income, net ordinary income and net long-term capital gains at July 31, 2007, the Fund’s last tax year end, were as follows:

| | | |

Undistributed net tax-exempt income | | $ | 36,212 |

Undistributed net ordinary income* | | | — |

Undistributed net long-term capital gains | | | — |

* Net ordinary income consists of taxable market discount income and net short-term capital gains, if any.

During the period May 31, 2007 (commencement of operations) through July 31, 2007, the Fund’s last tax year end, the Fund made no distributions to its shareholders.

The Fund elected to defer net realized losses from investments incurred from November 1, 2006 through July 31, 2007, the Fund’s last tax year end, (“post-October losses”) in accordance with federal income tax regulations. Post-October losses of $3,265 were treated as having arisen on the first day of the current taxable year.

5. Management Fee and Other Transactions with Affiliates

The Adviser does not charge any investment advisory or administrative fees directly to the Fund. The Adviser also agreed to reimburse all expenses of the Fund (excluding interest expense, taxes, fees incurred in acquiring and disposing of portfolio securities, and extraordinary expenses). The Adviser is compensated for its services to the Fund from the fee charged at the separately managed account level.

At January 31, 2008, Nuveen and the Adviser owned 500,000 and 50,040 shares of the Fund, respectively.

Agreement and Plan of Merger

On June 20, 2007, Nuveen Investments announced that it had entered into a definitive Agreement and Plan of Merger (“Merger Agreement”) with Windy City Investments, Inc. (“Windy City”), a corporation formed by investors led by Madison Dearborn Partners, LLC (“Madison Dearborn”), pursuant to which Windy City would acquire Nuveen Investments. Madison Dearborn is a private equity investment firm based in Chicago, Illinois. The merger was consummated on November 13, 2007.

The consummation of the merger was deemed to be an “assignment” (as that term is defined in the Investment Company Act of 1940) of the investment management agreement between the Fund and the Adviser, and resulted in the automatic termination of the Fund’s agreement. The Board of Trustees of the Fund considered and approved a new investment management agreement with the Adviser on the same terms as the previous agreement. The new agreement was approved by the shareholders of the Fund and took effect on November 13, 2007.

The investors led by Madison Dearborn includes an affiliate of Merrill Lynch. As a result, Merrill Lynch is an indirect “affiliated person” (as that term is defined in the Investment Company Act of 1940) of the Fund. Certain conflicts of interest may arise as a result of such indirect affiliation. For example, the Fund is generally prohibited from entering into principal transactions with Merrill Lynch and its affiliates. The Adviser does not believe that any such prohibitions or limitations as a result of Merrill Lynch’s affiliation will significantly impact the ability of the Fund to pursue its investment objectives and policies.

15

Notes to Financial Statements (Unaudited) (continued)

6. New Accounting Pronouncement

Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this standard relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of January 31, 2008, management does not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements included within the Statement of Operations for the period.

7. Subsequent Events

Distributions to Shareholders

The Fund declared dividend distributions from its tax-exempt net investment income of $.0289. The distribution was paid on March 3, 2008, to shareholders of record on February 28, 2008.

16

Financial Highlights (Unaudited)

Selected data for a share outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Investment Operations | | Less Distributions | | | | | | | | Ratios/Supplemental Data | |

| | | | | | | | | | | | | | | | | | | | | | | Ratios to Average

Net Assets Before

Reimbursement | | | Ratios to Average

Net Assets After

Reimbursement(c) | | | | |

Year Ended

July 31, | | Beginning

Net

Asset

Value | | Net

Invest-

ment

Income(a) | | Net

Realized/

Unrealized

Gain

(Loss) | | | Total | | Net

Invest-

ment

Income | | | Capital

Gains | | Total | | | Ending

Net

Asset

Value | | Total

Return(b) | | | Ending

Net

Assets

(000) | | Expenses | | | Net

Invest-

ment

Income | | | Expenses | | | Net

Invest-

ment

Income | | | Portfolio

Turnover

Rate | |

2008(e) | | $ | 10.12 | | $ | .22 | | $ | (.03 | ) | | $ | .19 | | $ | (.25 | ) | | $ | — | | $ | (.25 | ) | | $ | 10.06 | | 1.94 | % | | $ | 12,898 | | .69 | %* | | 3.67 | %* | | — | %* | | 4.35 | %* | | 42 | % |

2007(d) | | | 10.00 | | | .07 | | | .05 | | | | .12 | | | — | | | | — | | | — | | | | 10.12 | | 1.20 | | | | 5,569 | | 1.26 | * | | 2.67 | * | | — | * | | 3.92 | * | | 7 | |

| (a) | Per share Net Investment Income is calculated using the average daily shares method. |

| (b) | Total return is the combination of changes in net asset value without any sales charge, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total return is not annualized. |

| (c) | After expense reimbursement from the Adviser. |

| (d) | For the period May 31, 2007 (commencement of operations) through July 31, 2007. |

| (e) | For the six months ended January 31, 2008. |

See accompanying notes to financial statements.

17

Notes

18

Notes

19

Glossary of Terms Used in this Report

Average Annual Total Return: This is a commonly used method to express an investment’s performance over a particular, usually multi-year time period. It expresses the return that would have been necessary each year to equal the investment’s actual cumulative performance (including change in NAV or offer price and reinvested dividends and capital gains distributions, if any) over the time period being considered.

Average Effective Maturity: The average of the number of years to maturity of the bonds in a Fund’s portfolio, computed by weighting each bond’s time to maturity (the date the security comes due) by the market value of the security. This figure does not account for the likelihood of prepayments or the exercise of call provisions unless an escrow account has been established to redeem the bond before maturity.

Average Duration: Duration is a measure of the expected period over which a bond’s principal and interest will be paid, and consequently is a measure of the sensitivity of a bond’s (or bond fund’s) value to changes when market interest rates change. Generally, the longer a bond or Fund’s duration, the more the price of the bond or Fund will change as interest rates change.

Dividend Yield (also known as Market Yield or Current Yield): An investment’s current annualized dividend divided by its current offering price.

Net Asset Value (NAV): A Fund’s NAV is the dollar value of one share in the Fund. It is calculated by subtracting the liabilities of the Fund from its total assets and then dividing the remainder by the number of shares outstanding. Fund NAVs are calculated at the end of each business day.

SEC 30-Day Yield: A standardized measure of a Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the Fund’s portfolio.

Taxable-Equivalent Yield: The yield necessary from a fully taxable investment to equal, on an after-tax basis at a specified assumed tax rate, the yield of a municipal bond investment.

20

Fund Information

| | | | |

| | |

Fund Manager Nuveen Asset Management 333 West Wacker Drive Chicago, IL 60606 | | Legal Counsel Chapman and Cutler LLP Chicago, IL Independent Registered Public Accounting Firm PricewaterhouseCoopers LLP Chicago, IL Custodian State Street Bank & Trust Company Boston, MA | | Transfer Agent and Shareholder Services Boston Financial Data Services, Inc. Nuveen Investor Services P.O. Box 8530 Boston, MA 02266-8530 (800) 257-8787 |

Quarterly Portfolio of Investments and Proxy Voting information: The Fund’s (i) quarterly portfolio of investments, (ii) information regarding how the Fund voted proxies relating to portfolio securities held during the most recent period ended June 30, 2007, and (iii) a description of the policies and procedures that the Fund used to determine how to vote proxies relating to portfolio securities are available without charge, upon request, by calling Nuveen Investments at (800) 257-8787 or on Nuveen’s website at www.nuveen.com.

You may also obtain this and other Fund information directly from the Securities and Exchange Commission (“SEC”). The SEC may charge a copying fee for this information. Visit the SEC on-line at http://www.sec.gov or in person at the SEC’s Public Reference Room in Washington, D.C. Call the SEC at 1-202-942-8090 for room hours and operation. You may also request fund information by sending an e-mail request to publicinfo@sec.gov or by writing to the SEC’s Public Reference Section at 450 Fifth Street NW, Washington, D.C. 20549.

The Financial Industry Regulatory Authority (FINRA) provides a Public Disclosure Program which supplies certain information regarding the disciplinary history of FINRA members and their associated persons in response to either telephone inquiries at (800) 289-9999 or written inquiries at www.finra.org. Financial Industry Regulatory Authority also provides an investor brochure that includes information describing the Public Disclosure Program.

21

Learn more

about Nuveen Funds at

www.nuveen.com/mf

Nuveen Investments:

SERVING Investors

For GENERATIONS

Since 1898, financial advisors and their clients have relied on Nuveen Investments to provide dependable investment solutions. Over this time, Nuveen Investments has adhered to the belief that the best approach to investing is to apply conservative risk-management principles to help minimize volatility.

Building on this tradition, we today offer a range of high quality equity and fixed-income solutions that can be integral parts of a well-diversified core portfolio. Our clients have come to appreciate this diversity, as well as our continued adherence to proven, long-term investing principles.

We offer many different investing solutions for our clients’ different needs.

Managing approximately $164 billion in assets as of December 31, 2007, Nuveen Investments offers access to a number of different asset classes and investing solutions through a variety of products. Nuveen Investments markets its capabilities under six distinct brands: NWQ, specializing in value-style equities; Nuveen, managing fixed-income investments; Santa Barbara, committed to growth equities; Tradewinds, specializing in global value equities; Rittenhouse, focused on “blue-chip” growth equities; and Symphony, with expertise in alternative investments as well as equity and income portfolios.

Find out how we can help you reach your financial goals.

An investor should carefully consider the Fund’s objectives, risks, charges and expenses before investing. For a prospectus containing this and other information about the Fund, please contact your financial advisor or Nuveen Investments at (800) 257-8787. Read the prospectus carefully before you invest or send money.

MSA-MAPS-0108D

NUVEEN INVESTMENTS MUTUAL FUNDS

| | |

| | |

Semi-Annual Report dated January 31, 2008 | | For investors seeking attractive monthly income potential |

Nuveen Managed

Accounts Portfolios Trust

International Income Managed Accounts Portfolio

Enhanced Multi-Strategy Income Managed Accounts Portfolio

NOW YOU CAN RECEIVE YOUR

NUVEEN INVESTMENTS FUND REPORTS FASTER.

NO MORE WAITING.

SIGN UP TODAY TO RECEIVE NUVEEN INVESTMENTS FUND INFORMATION BY E-MAIL.

It only takes a minute to sign up for E-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Investments Fund information is ready — no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report, and save it on your computer if your wish.

IT’S FAST, EASY & FREE:

www.investordelivery.com

if you get your Nuveen Investments Fund dividends and statements from your financial advisor or brokerage account.

(Be sure to have the address sheet that accompanied this report handy. You’ll need it to complete the enrollment process.)

OR

www.nuveen.com/accountaccess

if you get your Nuveen Investments Fund dividends and statements directly from Nuveen Investments.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

“But one thing we do know is that a well-balanced portfolio can provide diversification that can reduce overall investment risk.”

Dear Shareholder,

I am very pleased to introduce the new International Income Managed Accounts Portfolio and Enhanced Multi-Strategy Income Managed Accounts Portfolio covered by this report. These Funds began investment operations on December 27, 2007. For more information on the Funds’ performance, please read the Portfolio Manager’s Comments and the Fund Spotlight sections of this report.

As we begin a new year, no one knows for certain what the future will bring. But one thing we do know is that a well-balanced portfolio can provide diversification that can reduce overall investment risk. To learn more about the potential benefits of portfolio diversification, we encourage you to consult a trusted financial advisor. He or she should be able to help you understand how an investment like your Nuveen Fund can be an important building block in a portfolio crafted to perform well through a variety of market conditions.

Since 1898, Nuveen Investments has offered financial products and solutions that incorporate careful research, diversification, and the application of conservative risk-management principles. We are grateful that you have chosen us as a partner as you pursue your financial goals. We look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Timothy R. Schwertfeger

Chairman of the Board

March 14, 2008

Semi-Annual Report Page 1

Portfolio Manager’s Comments

Portfolio manager Andy Stenwall, Chief Investment Officer and Co-Director of Taxable Fixed Income of Nuveen Asset Management, examines the investment strategies of and how they were applied to the International Income Managed Accounts Portfolio and Enhanced Multi-Strategy Income Managed Accounts Portfolio. Andy has managed the Portfolios since their inception.

What are the Funds’ investment strategies and how were they applied during the period since inception through January 31, 2008?

Both the International Income Managed Accounts Portfolio and Enhanced Multi-Strategy Income Managed Account Portfolio began investment operations on December 27, 2007. During the period from inception to period end, we were involved in the initial invest-up phase. The table on page three provides performance information for the Funds since inception through January 31, 2008. The table also compares the Funds’ performance to appropriate benchmarks.

Developed exclusively for use within Nuveen-sponsored separately managed accounts, each Fund is a specialized fund to be used in combination with selected individual securities to effectively model institutional-level investment strategies. Certain securities in which the Funds invest may be highly speculative. The Funds enable certain Nuveen-sponsored separately managed account investors to receive greater diversification and return potential than smaller managed accounts might otherwise achieve and to gain access to special investment opportunities normally available only to institutional investors.

The investment strategy for the International Income Managed Accounts Portfolio is that under normal circumstances, the Fund will invest directly or indirectly (with currency forwards and similar derivative investments being measured on a notional basis) at least 80% of its net assets in securities and instruments issued or backed by non-U.S. governments and other non-U.S. issuers. The Fund’s portfolio will contain various types of global government debt securities, including debt securities of non-U.S. government and supranational entities, U.S. government and government-related debt securities, interest rate and total return swaps, government bond futures and forward contracts. In investing in non-U.S. dollar instruments, we may elect to hedge the currency exposure through the use of currency forward contracts, futures, and other hedging instruments including, but not limited to, options, interest rate and total return swaps, and similar instruments.

The Fund strives for an average credit quality of its investment portfolio to be between BBB to AA and expects to maintain intermediate term average duration, generally between four to eight years, under normal market conditions. We may use a variety of investment techniques to seek to hedge, or help protect against declines in investment portfolio value due to its exposure to interest rate movements, movements in the securities markets and non-U.S. currency exposure. These techniques include the use of derivative instruments, such as interest rate swap transactions, futures, options on futures and non-U.S. exchange transactions on a cash or forward basis, and credit default swaps.

The investment strategy for the Enhanced Multi-Strategy Income Managed Accounts Portfolio is under normal conditions, the Fund will invest at least 80% of its net assets in fixed income securities using a risk-controlled, multi-strategy approach that invests across multiple sectors of the taxable fixed income market. The Fund will invest in various types of debt securities, including U.S. Treasury and U.S. agency bonds, asset backed

Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The views expressed herein represent those of the portfolio manager as of the date of this report and are subject to change at any time, based on market conditions and other factors. The Funds disclaim any obligation to advise shareholders of such changes.

Semi-Annual Report Page 2

Class A Shares

Cumulative Total Returns as of 1/31/08

| | |

| | | Since

Inception

(12/27/07) |

International Income Managed Accounts Portfolio | | 0.50% |

Citigroup World Government Bond ex-U.S. (Hedged) Index1 | | 1.88% |

| |

Enhanced Multi-Strategy Income Managed Accounts Portfolio | | 3.60% |

Lehman Brothers Credit/Mortgage Index2 | | 2.48% |

Returns quoted represent past performance, which is no guarantee of future results. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. For the most recent month-end performance, visit www.nuveen.com or call (800) 257-8787.

Please see each Fund’s Spotlight Page later in this report for more complete performance data and expense ratios.

securities, U.S. agency mortgage backed securities, commercial mortgage-backed securities, U.S. investment grade corporate debt securities, U.S. high yield corporate debt securities, U.S. dollar-denominated non-U.S. government bonds, non-U.S. dollar non-U.S. government bonds, emerging market debt, futures, options, interest rate derivatives, currency forwards, total return swaps, credit default swaps, and other short-term securities. In investing in non-U.S. dollar instruments, the Fund may elect to hedge the currency exposure through the use of currency forward contracts, futures, and other hedging instruments including, but not limited to, options, interest rate and total return swaps, and similar instruments.

The average credit quality of the Fund’s investment portfolio is expected to be rated between A to AA, and expects to maintain an intermediate average duration, generally between four to seven years, under normal market conditions. We may use a variety of investment techniques to seek to hedge, or help protect against declines in portfolio value due to its exposure to interest rate movements, movements in the securities markets and non-U.S. currency exposure. These techniques include the use of derivative instruments, such as interest rate swap transactions, futures, options on futures and non-U.S. exchange transactions on a cash or forward basis, and credit default swaps.

| 1 | The Citigroup World Government Bond ex-U.S. (Hedged) Index is a market capitalization weighted index consisting of the government bond markets of the following countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, the Netherlands, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. Country eligibility is determined based on market capitalization and investability criteria. All issues have a remaining maturity of at least one year. The since inception data for the index was calculated as of 12/31/07, as index returns are calculated on a calendar-month basis. The returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in an index. |

| 2 | The Lehman Brothers Credit/Mortgage Index is a market-weighted blend of the Lehman Brothers U.S. Credit Index and the Lehman Brothers MBS Index. The returns assume reinvestment of dividends and do not reflect any applicable sales charges. You cannot invest directly in an index. |

Semi-Annual Report Page 3

Fund Spotlight as of 1/31/08 | International Income Managed |

Accounts Portfolio

| | | | | | | | |

| Quick Facts | | | | | | | | |

| | | | | | | | | |

NAV | | | | | | | | $10.05 |

Inception Date | | | | | | | | 12/27/07 |

Returns quoted represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Fund returns assume reinvestment of dividends and capital gains. Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| | | | |

| Cumulative Total Return as of 1/31/08 |

| | | NAV | | |

Since Inception | | 0.50% | | |

| Cumulative Total Return as of 12/31/07 |

| | | NAV | | |

Since Inception | | 0.00% | | |

| | | | | | |

| | | |

| Expense Ratios | | | | | | |

| | | |

| | | Gross

Expense

Ratio | | Net

Expense

Ratio | | As of

Date |

| | | 0.24% | | 0.00% | | 12/27/07 |

The expense ratios shown factor in Total Annual Fund Operating Expenses, and are estimated for the Fund’s first fiscal year. The Net Expense Ratio reflects a contractual commitment by the Fund’s investment adviser to waive fees and reimburse all expenses (other than interest expense, taxes, fees incurred in acquiring and disposing of investment portfolio securities and extraordinary expenses). These expense ratios may vary from the expense ratios shown elsewhere in this report.

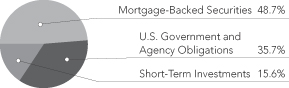

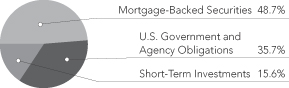

Portfolio Credit Quality1

Portfolio Allocation1

| | |

|

| Portfolio Statistics |

Net Assets ($000) | | $3,318 |

Average Effective Maturity on Securities (years) | | 5.38 |

Average Duration | | 3.30 |

| 1 | As a percentage of total investments (excluding derivative transactions) as of January 31, 2008. Holdings are subject to change. |

Semi-Annual Report l Page 4

Fund Spotlight as of 1/31/08 | International Income Managed |

Accounts Portfolio

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front and back end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Since the expense examples below reflect only the first 36 days of the Fund’s operations they may not provide a meaningful understanding of the Fund’s ongoing expenses.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.