UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22023

Nuveen Managed Accounts Portfolios Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: January 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

Item 1. Reports to Stockholders.

Mutual Fund

Nuveen Managed Accounts Portfolios Trust

Designed to provide dependable, tax-free income because it’s not what you earn, it’s what you keep.®

Semi-Annual Report

January 31, 2012

| | | | |

| |

| Fund Name | | Ticker Symbol | |

Municipal Total Return Managed Accounts Portfolio | | | NMTRX | |

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account.

OR

www.nuveen.com/accountaccess

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

These are perplexing times for investors. The global economy continues to struggle. The solutions being implemented in the eurozone to deal with the debt crises of many of its member countries are not yet seen as sufficient by the financial markets. The political paralysis in the U.S. has prevented the compromises necessary to deal with the fiscal imbalance and government spending priorities. The efforts by individual consumers, governments and financial institutions to reduce their debts are increasing savings but reducing demand for the goods and services that drive employment. These developments are undermining the rebuilding of confidence by consumers, corporations and investors that is so essential to a resumption of economic growth.

Although it is painfully slow, progress is being made. In Europe, the turnover of a number of national governments reflects the realization by politicians and voters alike that leaders who practiced business as usual had to be replaced by leaders willing to face problems and accept the hard choices needed to resolve them. The recent coordinated efforts by central banks in the U.S. and Europe to provide liquidity to the largest European banks indicates that these monetary authorities are committed to facilitating a recovery in the European banking sector.

In the U.S., the failure of the congressionally appointed Debt Reduction Committee was a blow to those who hoped for a bipartisan effort to finally begin addressing the looming fiscal crisis. Nevertheless, Congress and the administration cannot ignore the issue for long. The Bush era tax cuts are scheduled to expire on December 31, 2012, and six months later the $1.2 trillion of mandatory across-the-board spending cuts under the Budget Control Act of 2011 begin to go into effect. Any legislative modification would require bipartisan support and the prospects for a bipartisan solution are unclear. The impact of these two developments would be a mixed blessing: a meaningful reduction in the annual budget deficit at the cost of slowing the economic recovery.

It is in these particularly volatile markets that professional investment management is most important. Skillful investment teams who have experienced challenging markets and remain committed to their investment disciplines are critical to the success of an investor’s long-term objectives. In fact, many long-term investment track records are built during challenging markets when managers are able to protect investors against these economic crosscurrents. Experienced investment teams know that volatile markets put a premium on companies and investment ideas that will weather the short-term volatility and that compelling values and opportunities are opened up when markets overreact to negative developments. By maintaining appropriate time horizons, diversification and relying on practiced investment teams, we believe that investors can achieve their long-term investment objectives.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

March 22, 2012

Portfolio Manager’s Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Portfolio disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

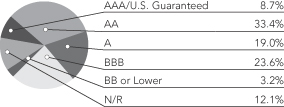

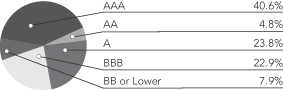

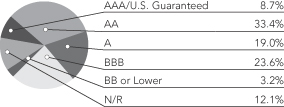

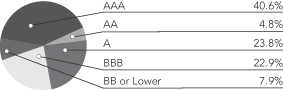

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

This Portfolio was developed exclusively for use within Nuveen-sponsored separately managed accounts. It enables certain Nuveen municipal separately managed account investors to achieve greater diversification and return potential than otherwise might be achievable.

The Portfolio is managed by Marty Doyle, CFA, who has 20 years of investment experience and has managed the Portfolio since its inception in 2007. Here Marty discusses the Portfolio’s investment strategy and its performance over the six-month period ended January 31, 2012.

How did the Portfolio perform during the six-month period ended January 31, 2012?

The tables in the Fund Performance and Expense Ratios section of this report provide Class A Share total returns for the Portfolio for the six-month, one-year and since inception periods ended January 31, 2012. The Portfolio’s Class A Share total returns at net asset value are compared with the performance of a corresponding market index. The Portfolio outperformed the Barclays Capital 7-Year Municipal Bond Index during the six-month reporting period. A more detailed account of the Portfolio’s performance is provided later in this report.

What strategies were used to manage the Portfolio during the reporting period? How did these strategies influence performance?

The Portfolio uses a value-oriented strategy and looks for higher-yielding and undervalued municipal bonds that offer the potential for above-average total return. The Portfolio invests in various types of municipal securities, including investment grade (rated BBB/Baa or better), below investment grade (rated BB/Ba or lower), high yield, and unrated municipal securities. The Portfolio focuses on securities with intermediate to longer-term maturities. This investment strategy did not change during the reporting period.

The Portfolio’s diversified yield curve positioning was one factor that contributed to the relative outperformance experienced over the period. We also increased the Portfolio’s exposure to mid-investment grade (A and BBB rated) bonds that offered solid total return and income potential, especially in a lower yield environment. Additionally, we continued to selectively add to the Portfolio’s high yield exposure, which added to the Portfolio’s relative performance. Throughout the period, we gradually increased our exposure to longer duration securities and sought improved call protection to increase the Portfolio’s income sustainability, while trying to minimize potential duration volatility and enhance

long-term return prospects. Replacing older, lower-yielding investments that were called or matured, and selling other holdings at opportune times, allowed us to utilize the comparatively steep yield curve and take advantage of attractive situations in the market to boost relative performance.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the fund, are subject to market risk, credit risk, interest rate risk, call risk, and income risk. As interest rates rise, bond prices fall. Credit risk refers to an issuers ability to make interest and principal payments when due. Below investment grade or high yield debt securities are subject to liquidity risk and heightened credit risk. The fund’s potential use of inverse floaters creates effective leverage. Leverage involves the risk that the fund could lose more than its original investment and also increases the fund’s exposure to volatility and interest rate risk.

Fund Performance and Expense Ratios (Unaudited)

This Fund is a specialized municipal bond portfolio developed exclusively for use within Nuveen-sponsored separately managed accounts.

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between the Fund and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Fund’s investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Fund shares have no sales charge. Fund returns assume reinvestment of dividends and capital gains.

The expense ratios shown reflect the Fund’s total operating expenses (before fee waivers or expense reimbursements, if any) as shown in the Fund’s most recent prospectus.

Municipal Total Return Managed Accounts Portfolio

Fund Performance

Average Annual Total Returns as of January 31, 2012*

| | | | | | | | | | | | |

| | |

| | | Cumulative | | | Average Annual | |

| | | |

| | | 6-Month | | | 1-Year | | | Since

Inception** | |

Class I Shares | | | 9.48% | | | | 18.26% | | | | 7.03% | |

Barclays Capital 7-Year Municipal Bond Index*** | | | 5.95% | | | | 11.78% | | | | 6.31% | |

Latest Calendar Quarter – Average Annual Total Returns as of December 31, 2011*

| | | | | | | | | | | | |

| | |

| | | Cumulative | | | Average Annual | |

| | | |

| | | 6-Month | | | 1-Year | | | Since

Inception** | |

Class I Shares | | | 7.75% | | | | 13.43% | | | | 6.49% | |

Expense Ratios as of Most Recent Prospectus

| | | | | | | | |

| | |

| | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

Class I Shares | | | 0.09% | | | | 0.01% | |

The Adviser has agreed irrevocably during the existence of the Portfolio to waive all fees and pay or reimburse all expenses of the Portfolio, except for interest expense, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses.

| * | Six-Month returns are cumulative; all other returns are annualized. |

| ** | Since inception returns are from 5/31/07. |

| *** | Refer to the Glossary of Terms Used in this Report for definitions. |

Yields (Unaudited) as of January 31, 2012

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of the Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the Fund’s portfolio. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

The Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis at a specified tax rate. With respect to investments that generate qualified dividend income that is taxable at a maximum rate of 15%, the Taxable-Equivalent Yield is lower.

| | | | | | | | | | | | |

| | | Dividend

Yield | | | SEC 30-Day

Yield | | | Taxable-

Equivalent

Yield1 | |

Class I Shares | | | 4.86% | | | | 3.91% | | | | 5.43% | |

| 1 | The Taxable-Equivalent Yield is based on the Fund’s SEC 30-Day Yield on the indicated date and a federal income tax rate of 28%. |

Holding Summaries (Unaudited) as of January 31, 2012

This data relates to the securities held in the Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by a national rating agency.

Bond Credit Quality1

| | | | |

| Portfolio Composition1 | | | |

| Health Care | | | 17.8% | |

| Tax Obligation/Limited | | | 17.6% | |

| Education and Civic Organizations | | | 16.8% | |

| Tax Obligation/General | | | 16.0% | |

| Transportation | | | 8.1% | |

| Water and Sewer | | | 7.2% | |

| Utilities | | | 6.5% | |

| Short-Term Investments | | | 0.1% | |

| Other | | | 9.9% | |

| | | | |

| States1 | | | |

| Illinois | | | 12.5% | |

| California | | | 11.8% | |

| Texas | | | 8.8% | |

| Florida | | | 7.4% | |

| Pennsylvania | | | 5.2% | |

| North Carolina | | | 4.6% | |

| New York | | | 4.5% | |

| Washington | | | 3.0% | |

| Indiana | | | 2.5% | |

| Colorado | | | 2.5% | |

| Wisconsin | | | 2.5% | |

| Georgia | | | 2.3% | |

| Massachusetts | | | 2.2% | |

| New Jersey | | | 2.0% | |

| Missouri | | | 1.9% | |

| Virgin Islands | | | 1.8% | |

| Maryland | | | 1.8% | |

| Idaho | | | 1.8% | |

| Kentucky | | | 1.6% | |

| Arizona | | | 1.5% | |

| Utah | | | 1.4% | |

| Kansas | | | 1.3% | |

| Rhode Island | | | 1.3% | |

| Other | | | 13.8% | |

| 1 | As a percentage of total investments as of January 31, 2012. Holdings are subject to change. |

Expense Examples (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | Actual Performance | | | Hypothetical Performance

(5% annualized return

before expenses) | |

| Beginning Account Value (8/01/11) | | | | | | | | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (1/31/12) | | | | | | | | | | $ | 1,094.80 | | | $ | 1,025.14 | |

| Expenses Incurred During Period | | | | | | | | | | $ | — | | | $ | — | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.00% for the six-month period.

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio

January 31, 2012

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | MUNICIPAL BONDS – 96.6% | | | | | | | | | | | | | | |

| | | | | |

| | | | Alabama – 0.7% | | | | | | | | | | | | | | |

| | | | | |

| $ | 850 | | | Alabama State Board of Education, Revenue Bonds, Faulkner State Community College, Series 2009, 6.125%, 10/01/28 | | | | | 10/18 at 100.00 | | | | A1 | | | $ | 995,537 | |

| | | | | |

| | 500 | | | Auburn University, Alabama, General Fee Revenue Bonds, Series 2011A, 5.000%, 6/01/41 | | | | | 6/21 at 100.00 | | | | Aa2 | | | | 561,585 | |

| | 1,350 | | | Total Alabama | | | | | | | | | | | | | 1,557,122 | |

| | | | Alaska – 0.4% | | | | | | | | | | | | | | |

| | | | | |

| | 145 | | | Alaska Municipal Bond Bank Authority, General Obligation Bonds, Series 2006-2, 5.500%, 12/01/21 – NPFG Insured (Alternative Minimum Tax) | | | | | 12/16 at 100.00 | | | | AA | | | | 160,132 | |

| | | | | |

| | 720 | | | Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed Bonds, Series 2006A, 4.625%, 6/01/23 | | | | | 6/14 at 100.00 | | | | Ba1 | | | | 707,501 | |

| | 865 | | | Total Alaska | | | | | | | | | | | | | 867,633 | |

| | | | Arizona – 1.4% | | | | | | | | | | | | | | |

| | | | | |

| | 410 | | | Arizona School Facilities Board, School Improvement Revenue Bonds, Series 2004A, 5.500%, 7/01/14 - AMBAC Insured | | | | | No Opt. Call | | | | AA | | | | 439,762 | |

| | | | | |

| | 1,195 | | | Maricopa County, Arizona, Hospital Revenue Bonds, Sun Health Corporation, Series 2005, 5.000%, 4/01/25 (Pre-refunded 4/01/24) | | | | | 4/24 at 100.00 | | | | N/R | (4) | | | 1,467,771 | |

| | | | | |

| | 500 | | | Salt River Project Agricultural Improvement and Power District, Arizona, Electric System Revenue Bonds, Tender Option Bond Trust 10-9W, 18.210%, 1/01/38 (IF) (5) | | | | | 1/18 at 100.00 | | | | Aa1 | | | | 693,160 | |

| | | | | |

| | 345 | | | Yavapai County Industrial Development Authority, Arizona, Charter School Revenue Bonds, Arizona Agribusiness and Equine Center Charter School, Series 2011, 7.625%, 3/01/31 | | | | | 3/21 at 100.00 | | | | BB+ | | | | 369,988 | |

| | | | | |

| | 75 | | | Yuma County Industrial Development Authority, Arizona, Exempt Revenue Bonds, Far West Water & Sewer Inc. Refunding, Series 2007A, 6.500%, 12/01/17 (Alternative Minimum Tax) | | | | | No Opt. Call | | | | N/R | | | | 74,888 | |

| | 2,525 | | | Total Arizona | | | | | | | | | | | | | 3,045,569 | |

| | | | California – 11.4% | | | | | | | | | | | | | | |

| | | | | |

| | 500 | | | ABAG Finance Authority for Non-Profit Corporations, California, Revenue Bonds, Casa de Lad Campanas, Series 2010, 6.000%, 9/01/37 | | | | | 9/20 at 100.00 | | | | A– | | | | 549,715 | |

| | | | | |

| | 1,200 | | | California Department of Veteran Affairs, Home Purchase Revenue Bonds, Series 2007B, 5.150%, 12/01/27 (Alternative Minimum Tax) | | | | | 12/16 at 100.00 | | | | AA | | | | 1,267,380 | |

| | | | | |

| | 500 | | | California Educational Facilities Authority, Revenue Bonds, University of Southern California, Tender Option Bond Trust 3144, 19.600%, 10/01/16 (IF) | | | | | No Opt. Call | | | | Aa1 | | | | 752,620 | |

| | | | | |

| | 1,000 | | | California Health Facilities Financing Authority, Revenue Bonds, Catholic Healthcare West, Series 2009F, 5.625%, 7/01/25 | | | | | 7/19 at 100.00 | | | | A | | | | 1,144,750 | |

| | | | | |

| | 100 | | | California Health Facilities Financing Authority, Revenue Bonds, Kaiser Permanente System, Series 1993A, 5.400%, 5/01/28 (ETM) | | | | | 5/12 at 100.00 | | | | AA+ | (4) | | | 100,419 | |

| | | | | |

| | 1,500 | | | California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center, Series 2010A, 5.500%, 7/01/30 | | | | | 7/20 at 100.00 | | | | Baa2 | | | | 1,577,775 | |

| | | | | |

| | 575 | | | California State Public Works Board, Lease Revenue Bonds, Department of Corrections & Rehabilitation, Series 2009H, 5.500%, 11/01/27 | | | | | 11/19 at 100.00 | | | | A2 | | | | 652,895 | |

| | | | | |

| | 1,000 | | | California State, General Obligation Bonds, Various Purpose Series 2009, 6.500%, 4/01/33 | | | | | 4/19 at 100.00 | | | | A1 | | | | 1,231,760 | |

| | | | | |

| | 90 | | | California State, General Obligation Veterans Bonds, Refunding Series 2005CB, 5.050%, 12/01/36 (Alternative Minimum Tax) | | | | | 6/15 at 100.00 | | | | AA | | | | 91,692 | |

| | | | | |

| | 720 | | | California, Various Purpose General Obligation Bonds, Series 1997, 5.625%, 10/01/21 – BHAC Insured | | | | | 4/12 at 100.00 | | | | AA+ | | | | 726,106 | |

| | | | | |

| | 1,000 | | | Culver City Redevelopment Agency, California, Tax Allocation Revenue Bonds, Redevelopment Project, Capital Appreciation Series 2011A, 0.000%, 11/01/21 | | | | | No Opt. Call | | | | A | | | | 585,900 | |

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio (continued)

January 31, 2012

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | California (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,000 | | | Gilroy Unified School District, Santa Clara County, California, General Obligation Bonds, Series 2009A, 6.000%, 8/01/25 – AGC Insured | | | | | No Opt. Call | | | | AA– | | | $ | 1,243,270 | |

| | | | | |

| | | | Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Series 2005A: | | | | | | | | | | | | | | |

| | 1,100 | | | 5.000%, 6/01/17 | | | | | 6/12 at 100.00 | | | | A2 | | | | 1,100,110 | |

| | 200 | | | 5.000%, 6/01/45 | | | | | 6/15 at 100.00 | | | | A2 | | | | 200,686 | |

| | 135 | | | 4.625%, 6/01/45 – RAAI Insured | | | | | No Opt. Call | | | | A2 | | | | 127,549 | |

| | | | | |

| | 1,000 | | | Long Beach, California, Harbor Revenue Bonds, Series 2005A, 5.000%, 5/15/23 – NPFG Insured (Alternative Minimum Tax) | | | | | 5/15 at 100.00 | | | | AA | | | | 1,068,070 | |

| | | | | |

| | 1,000 | | | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Series 2009A, 5.250%, 5/15/29 | | | | | 5/19 at 100.00 | | | | AA | | | | 1,143,110 | |

| | | | | |

| | 500 | | | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Series 2008A-2, 5.250%, 7/01/32 | | | | | No Opt. Call | | | | AA– | | | | 568,175 | |

| | | | | |

| | 500 | | | Murrieta, California, Special Tax Bonds, Community Facilities District 2003-3, Creekside Village Improvement Area 1, Series 2005, 5.200%, 9/01/35 | | | | | 9/12 at 100.00 | | | | N/R | | | | 482,850 | |

| | | | | |

| | 85 | | | Novato Redevelopment Agency, California, Tax Allocation Bonds, Hamilton Field Redevelopment Project, Series 2011, 6.750%, 9/01/40 | | | | | 9/21 at 100.00 | | | | A– | | | | 96,489 | |

| | | | | |

| | 1,000 | | | Palm Drive Health Care District, Sonoma County, California, Certificates of Participation, Parcel Tax Secured Financing Program, Series 2010, 7.500%, 4/01/35 | | | | | No Opt. Call | | | | BB | | | | 1,022,360 | |

| | | | | |

| | 1,000 | | | Peralta Community College District, Alameda County, California, General Obligation Bonds, Series 2004C, 5.500%, 8/01/24 – NPFG Insured | | | | | 8/12 at 102.00 | | | | AA– | | | | 1,043,190 | |

| | | | | |

| | 850 | | | Public Utilities Commission of the City and County of San Francisco, California, Water Revenue Bonds, Series 2006A, 5.000%, 11/01/25 – AGM Insured | | | | | 5/16 at 100.00 | | | | AA– | | | | 941,367 | |

| | | | | |

| | 1,000 | | | San Gorgonio Memorial Healthcare District, Riverside County, California, General Obligation Bonds, Series 2009C, 7.000%, 8/01/27 | | | | | 8/17 at 100.00 | | | | A3 | | | | 1,152,930 | |

| | | | | |

| | 1,275 | | | San Mateo Union High School District, San Mateo County, California, Certificates of Participation, Phase 1, Series 2007A, 5.000%, 12/15/30 (Pre-refunded 12/15/17) – AMBAC Insured | | | | | 12/17 at 100.00 | | | | AA– | (4) | | | 1,569,308 | |

| | | | | |

| | 2,000 | | | Santa Monica Community College District, Los Angeles County, California, Certificates of Participation, Refunding Series 2004A, 5.000%, 2/01/27 – AMBAC Insured | | | | | 2/14 at 100.00 | | | | N/R | | | | 2,071,260 | |

| | | | | |

| | | | Twentynine Palms Redevelopment Agency, California, Tax Allocation Bonds, Four Corners Project Area, Series 2011A: | | | | | | | | | | | | | | |

| | 500 | | | 7.125%, 9/01/26 | | | | | 9/21 at 100.00 | | | | BBB+ | | | | 567,845 | |

| | 500 | | | 7.400%, 9/01/32 | | | | | 9/21 at 100.00 | | | | BBB+ | | | | 560,105 | |

| | | | | |

| | 750 | | | Western Municipal Water District Facilities Authority, California, Water Revenue Bonds, Series 2009B, 5.000%, 10/01/34 | | | | | 10/19 at 100.00 | | | | AA+ | | | | 834,908 | |

| | 22,580 | | | Total California | | | | | | | | | | | | | 24,474,594 | |

| | | | Colorado – 2.4% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Total Longterm Care National Obligated Group Project, Series 2010A, 5.250%, 11/15/20 | | | | | No Opt. Call | | | | N/R | | | | 1,033,330 | |

| | | | | |

| | 500 | | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Valley View Hospital Association, Series 2008, 5.750%, 5/15/36 | | | | | 5/18 at 100.00 | | | | BBB+ | | | | 527,005 | |

| | | | | |

| | 75 | | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Yampa Valley Medical Center, Series 2007, 5.000%, 9/15/15 | | | | | No Opt. Call | | | | BBB | | | | 80,384 | |

| | | | | |

| | 530 | | | Denver City and County, Colorado, Airport System Revenue Bonds, Series 1991D, 7.750%, 11/15/13 – AMBAC Insured | | | | | No Opt. Call | | | | A+ | | | | 567,524 | |

| | | | | |

| | 300 | | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2007B-1, 5.500%, 9/01/24 – NPFG Insured | | | | | 9/15 at 100.00 | | | | BBB | | | | 313,344 | |

| | | | | |

| | 535 | | | Fitzsimons Village Metropolitan District 1, Aurora, Arapahoe County, Colorado, Tax Increment Public Improvement Fee Supported Revenue Bonds, Series 2010A, 7.500%, 3/01/40 | | | | | 3/20 at 100.00 | | | | N/R | | | | 561,338 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Colorado (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | Fossil Ridge Metropolitan District 1, Lakewood, Colorado, Tax-Supported Revenue Bonds, Refunding Series 2010, 7.250%, 12/01/40 | | | | | 12/20 at 100.00 | | | | N/R | | | $ | 515,025 | |

| | | | | |

| | 1,000 | | | Regional Transportation District, Colorado, Denver Transit Partners Eagle P3 Project Private Activity Bonds, Series 2010, 6.500%, 1/15/30 | | | | | 7/20 at 100.00 | | | | Baa3 | | | | 1,122,890 | |

| | | | | |

| | 500 | | | Three Springs Metropolitan District 3, Durango, La Plata County, Colorado, Property Tax Supported Revenue Bonds, Series 2010, 7.750%, 12/01/39 | | | | | 12/20 at 100.00 | | | | N/R | | | | 511,870 | |

| | 4,940 | | | Total Colorado | | | | | | | | | | | | | 5,232,710 | |

| | | | Connecticut – 0.4% | | | | | | | | | | | | | | |

| | | | | |

| | 670 | | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Yale University, Series 2009, Trust 3363, 13.799%, 7/01/16 (IF) | | | | | No Opt. Call | | | | AAA | | | | 908,956 | |

| | | | District of Columbia – 0.2% | | | | | | | | | | | | | | |

| | | | | |

| | 450 | | | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2001, 6.750%, 5/15/40 | | | | | 5/12 at 100.00 | | | | Baa1 | | | | 455,306 | |

| | | | Florida – 7.1% | | | | | | | | | | | | | | |

| | | | | |

| | 1,440 | | | Bay County, Florida, Educational Facilities Revenue Refunding Bonds, Bay Haven Charter Academy, Inc. Project, Series 2010A, 5.250%, 9/01/30 | | | | | No Opt. Call | | | | BBB | | | | 1,353,686 | |

| | | | | |

| | 25 | | | Beacon Lakes Community Development District, Florida, Special Assessment Bonds, Series 2007A, 6.000%, 5/01/38 | | | | | 5/17 at 100.00 | | | | N/R | | | | 24,834 | |

| | | | | |

| | 300 | | | Brevard County, Florida, South Brevard Recreation Special District, Limited Ad Valorem Tax Bonds, Parks and Recreation Program, Series 2007, 5.000%, 7/01/13 – AMBAC Insured (ETM) | | | | | No Opt. Call | | | | A3 | (4) | | | 319,761 | |

| | | | | |

| | 105 | | | Brevard County, Florida, South Brevard Recreation Special District, Limited Ad Valorem Tax Bonds, Parks and Recreation Program, Series 2007, 5.000%, 7/01/22 (Pre-refunded 7/01/16) – AMBAC Insured | | | | | 7/16 at 100.00 | | | | A3 | (4) | | | 124,475 | |

| | | | | |

| | | | Broward County, Florida, Port Facilities Revenue Bonds, Refunding Series 2011B: | | | | | | | | | | | | | | |

| | 1,000 | | | 5.000%, 9/01/23 – AGM Insured (Alternative Minimum Tax) | | | | | 9/21 at 100.00 | | | | AA– | | | | 1,115,860 | |

| | 1,250 | | | 4.625%, 9/01/27 – AGM Insured (Alternative Minimum Tax) | | | | | 9/21 at 100.00 | | | | AA– | | | | 1,317,250 | |

| | | | | |

| | 500 | | | Crystal River, Florida, Water and Sewer Revenue Bonds, Refunding & Improvement Series 2002, 5.000%, 10/01/25 – AMBAC Insured | | | | | 10/12 at 100.00 | | | | N/R | | | | 504,165 | |

| | | | | |

| | 750 | | | Florida Board of Education, Lottery Revenue Bonds, Series 2006A, 5.000%, 7/01/21 – AMBAC Insured | | | | | 7/15 at 101.00 | | | | AAA | | | | 828,840 | |

| | | | | |

| | 330 | | | Florida Housing Finance Corporation, Homeowner Mortgage Revenue Bonds, Series 2008-1, 6.450%, 1/01/39 (Alternative Minimum Tax) | | | | | 7/17 at 100.00 | | | | AA+ | | | | 357,007 | |

| | | | | |

| | 2,000 | | | Florida Ports Financing Commission, Revenue Bonds, State Transportation Trust Fund, Refunding Series 2011B, 5.125%, 6/01/27 (Alternative Minimum Tax) | | | | | 6/21 at 100.00 | | | | AA+ | | | | 2,281,580 | |

| | | | | |

| | 885 | | | Gulf Breeze, Florida, Revenue Improvement Non-Ad Valorem Bonds, Series 2007, 5.000%, 12/01/32 – AMBAC Insured | | | | | 12/17 at 100.00 | | | | N/R | | | | 906,284 | |

| | | | | |

| | 2,000 | | | Hillsborough County, Florida, Solid Waste and Resource Recovery Revenue Bonds, Series 2006A, 5.000%, 9/01/25 – AMBAC Insured (Alternative Minimum Tax) | | | | | 9/16 at 100.00 | | | | AA | | | | 2,128,400 | |

| | | | | |

| | 1,000 | | | Miami-Dade County Health Facility Authority, Florida, Hospital Revenue Bonds, Miami Children’s Hospital, Series 2010A, 5.250%, 8/01/21 | | | | | 8/20 at 100.00 | | | | A | | | | 1,148,780 | |

| | | | | |

| | 250 | | | Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Aiport, Series 2005B, 5.000%, 10/01/12 – SYNCORA GTY Insured (Alternative Minimum Tax) | | | | | No Opt. Call | | | | A2 | | | | 257,185 | |

| | | | | |

| | 60 | | | Okaloosa County Gas District, Florida, Gas System Revenue Bonds, Series 2005A, 4.400%, 10/01/29 – AMBAC Insured | | | | | 10/14 at 100.00 | | | | A+ | | | | 61,584 | |

| | | | | |

| | 1,600 | | | Saint Lucie County School Board, Florida, Certificates of Participation, Master Lease Program, Refunding Series 2012B, 5.000%, 7/01/22 – AGM Insured | | | | | 7/21 at 100.00 | | | | AA– | | | | 1,840,944 | |

| | | | | |

| | 400 | | | Sanibel, Florida, General Obligaiton Bonds, Series 2006, 4.350%, 2/01/36 – AMBAC Insured | | | | | 8/16 at 100.00 | | | | N/R | | | | 404,644 | |

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio (continued)

January 31, 2012

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Florida (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 75 | | | Seminole Tribe of Florida, Special Obligation Bonds, Series 2007A, 144A, 5.750%, 10/01/22 | | | | | 10/17 at 100.00 | | | | BBB– | | | $ | 78,872 | |

| | | | | |

| | 170 | | | The City of Miami, Florida, Special Revenue Refunding Bonds, Series 1987, 0.000%, 1/01/15 – NPFG Insured | | | | | No Opt. Call | | | | BBB | | | | 146,152 | |

| | | | | |

| | 75 | | | Tolomato Community Development District, Florida, Special Assessment Bonds, Series 2007, 6.375%, 5/01/17 (6) | | | | | No Opt. Call | | | | N/R | | | | 32,032 | |

| | 14,215 | | | Total Florida | | | | | | | | | | | | | 15,232,335 | |

| | | | Georgia – 2.2% | | | | | | | | | | | | | | |

| | | | | |

| | 650 | | | Atlanta Development Authority, Georgia, Educational Facilities Revenue Bonds, Science Park LLC Project, Series 2007, 5.250%, 7/01/27 | | | | | 7/17 at 100.00 | | | | Aa3 | | | | 714,240 | |

| | | | | |

| | | | Atlanta, Georgia, Water and Wastewater Revenue Bonds, Series 2009A: | | | | | | | | | | | | | | |

| | 500 | | | 6.000%, 11/01/22 | | | | | 11/19 at 100.00 | | | | A1 | | | | 624,455 | |

| | 500 | | | 6.000%, 11/01/24 | | | | | 11/19 at 100.00 | | | | A1 | | | | 616,315 | |

| | | | | |

| | 1,500 | | | Fulton County Development Authority, Georgia, Revenue Bonds, Georgia Tech Athletic Association, Series 2001, 5.125%, 10/01/32 – AMBAC Insured | | | | | 4/12 at 100.00 | | | | N/R | | | | 1,501,830 | |

| | | | | |

| | 500 | | | La Grange-Troup County Hospital Authority, Georgia, Revenue Anticipation Certificates, Series 2008A, 5.500%, 7/01/38 | | | | | 7/18 at 100.00 | | | | Aa2 | | | | 541,030 | |

| | | | | |

| | 750 | | | Private Colleges and Universities Authority, Georgia, Revenue Bonds, Emory University, Series 2008C, 5.000%, 9/01/38 | | | | | 9/18 at 100.00 | | | | AA | | | | 822,315 | |

| | 4,400 | | | Total Georgia | | | | | | | | | | | | | 4,820,185 | |

| | | | Guam – 0.9% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series 2010, 4.500%, 7/01/18 | | | | | No Opt. Call | | | | Ba2 | | | | 1,016,690 | |

| | | | | |

| | 315 | | | Guam Government, General Obligation Bonds, 2009 Series A, 5.750%, 11/15/14 | | | | | No Opt. Call | | | | B+ | | | | 329,219 | |

| | | | | |

| | 500 | | | Guam International Airport Authority, Revenue Bonds, Series 2003C, 5.375%, 10/01/19 – NPFG Insured (Alternative Minimum Tax) | | | | | 10/13 at 100.00 | | | | BBB | | | | 516,050 | |

| | 1,815 | | | Total Guam | | | | | | | | | | | | | 1,861,959 | |

| | | | Hawaii – 0.7% | | | | | | | | | | | | | | |

| | | | | |

| | 1,500 | | | Hawaii Department of Budget and Finance, Special Purpose Revenue Bonds, Hawaiian Electric Company Inc., Refunding Series 2007B, 4.600%, 5/01/26 – FGIC Insured (Alternative Minimum Tax) | | | | | No Opt. Call | | | | Baa1 | | | | 1,505,475 | |

| | | | Idaho – 1.7% | | | | | | | | | | | | | | |

| | | | | |

| | 750 | | | Boise-Kuna Irrigation District, Ada and Canyon Counties, Idaho, Arrowrock Hydroelectric Project Revenue Bonds, Series 2008, 7.375%, 6/01/34 | | | | | 6/18 at 100.00 | | | | A3 | | | | 883,215 | |

| | | | | |

| | 1,000 | | | Idaho Housing and Finance Association, Economic Development Facilities Recovery Zone Revenue Bonds, TDF Facilities Project, Series 2010A, 6.500%, 2/01/26 | | | | | 2/21 at 100.00 | | | | A | | | | 1,112,250 | |

| | | | | |

| | 110 | | | Idaho Housing and Finance Association, Single Family Mortgage Revenue Bonds, Series 2008A-1, 6.250%, 7/01/38 (Alternative Minimum Tax) | | | | | 1/17 at 100.00 | | | | Aa1 | | | | 115,678 | |

| | | | | |

| | | | Idaho Water Resource Board, Water Resource Loan Program Revenue, Ground Water Rights Mittigation Series 2012A: | | | | | | | | | | | | | | |

| | 430 | | | 4.750%, 9/01/25 (WI/DD, Settling 2/08/12) | | | | | 9/22 at 100.00 | | | | Baa1 | | | | 449,952 | |

| | 1,070 | | | 4.600%, 9/01/27 (WI/DD, Settling 2/08/12) | | | | | 9/22 at 100.00 | | | | Baa1 | | | | 1,084,210 | |

| | 3,360 | | | Total Idaho | | | | | | | | | | | | | 3,645,305 | |

| | | | Illinois – 12.1% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Berwyn, Illinois, General Obligation Bonds, Refunding Series 2004, 5.000%, 12/01/13 – AMBAC Insured | | | | | No Opt. Call | | | | N/R | | | | 1,058,440 | |

| | | | | |

| | 1,000 | | | Bourbonnais, Illinois, Industrial Project Revenue Bonds, Olivet Nazarene University Project, Series 2010, 6.000%, 11/01/35 | | | | | 11/20 at 100.00 | | | | BBB | | | | 1,106,660 | |

| | | | | |

| | 1,085 | | | Chicago State University, Illinois, Auxiliary Facilities System Revenue Bonds, Series 1998, 5.500%, 12/01/23 – NPFG Insured | | | | | No Opt. Call | | | | BBB | | | | 1,303,996 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Illinois (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | Chicago, Illinois, Second Lien General Airport Revenue Refunding Bonds, O’Hare International Airport, Series 1999, 5.500%, 1/01/16 – AMBAC Insured (Alternative Minimum Tax) | | | | | 7/12 at 100.00 | | | | AA– | | | $ | 501,585 | |

| | | | | |

| | | | Community College District 537, Macon, Christian, Dewitt, Logan, Moultrie, Pliatt, Sangamon and Shelby Counties, Illinois, General Obligation Bonds, Richland Community College, Series 2011: | | | | | | | | | | | | | | |

| | 400 | | | 5.250%, 11/01/20 | | | | | No Opt. Call | | | | AA | | | | 464,548 | |

| | 760 | | | 5.250%, 11/01/21 | | | | | No Opt. Call | | | | AA | | | | 884,518 | |

| | | | | |

| | 500 | | | Cook County, Illinois, Recovery Zone Facility Revenue Bonds, Navistar International Corporation Project, Series 2010, 6.500%, 10/15/40 | | | | | 10/20 at 100.00 | | | | BB– | | | | 532,215 | |

| | | | | |

| | 1,000 | | | Illinois Development Finance Authority, Revenue Bonds, St Vincent De Paul Center, Series 2000A, 1.400%, 11/15/39 (Mandatory put 2/28/13) | | | | | No Opt. Call | | | | AA+ | | | | 1,011,740 | |

| | | | | |

| | 1,000 | | | Illinois Finance Authority, Charter School Revenue Bonds, Uno Charter School Network, Refunding and Improvement Series 2011A, 6.875%, 10/01/31 | | | | | 10/21 at 100.00 | | | | BBB– | | | | 1,041,560 | |

| | | | | |

| | 750 | | | Illinois Finance Authority, Revenue Bonds, Children’s Memorial Hospital, Series 2008B, 5.500%, 8/15/21 | | | | | 8/18 at 100.00 | | | | A– | | | | 846,983 | |

| | | | | |

| | 650 | | | Illinois Finance Authority, Revenue Bonds, Elmhurst Memorial Healthcare, Series 2008A, 5.625%, 1/01/37 | | | | | 1/18 at 100.00 | | | | Baa1 | | | | 674,765 | |

| | | | | |

| | 1,000 | | | Illinois Finance Authority, Revenue Bonds, Illinois Institute of Technology, Series 2009, 6.250%, 2/01/19 | | | | | No Opt. Call | | | | Baa3 | | | | 1,033,710 | |

| | | | | |

| | 1,000 | | | Illinois Finance Authority, Revenue Bonds, Northwestern University, Series 2008B, 1.200%, 12/01/46 (Mandatory put 3/01/13) | | | | | No Opt. Call | | | | AAA | | | | 1,011,100 | |

| | | | | |

| | 990 | | | Illinois Finance Authority, Revenue Bonds, OSF Healthcare System, Refunding Series 2010A, 6.000%, 5/15/39 | | | | | 5/20 at 100.00 | | | | A | | | | 1,105,137 | |

| | | | | |

| | 150 | | | Illinois Finance Authority, Revenue Bonds, Palos Community Hospital, Series 2007A, 5.000%, 5/15/35 – NPFG Insured | | | | | 5/17 at 100.00 | | | | BBB | | | | 153,804 | |

| | | | | |

| | 700 | | | Illinois Finance Authority, Revenue Refunding Bonds, Silver Cross Hospital and Medical Centers, Series 2008A, 6.000%, 8/15/23 | | | | | 8/18 at 100.00 | | | | BBB– | | | | 751,520 | |

| | | | | |

| | 665 | | | Illinois Health Facilities Authority, Revenue Refunding Bonds, Elmhurst Memorial Healthcare, Series 2002, 6.250%, 1/01/17 | | | | | 1/13 at 100.00 | | | | Baa1 | | | | 697,944 | |

| | | | | |

| | 1,000 | | | Illinois State, Sales Tax Revenue Bonds, Series 2004, 5.000%, 6/15/27 | | | | | 6/14 at 100.00 | | | | AAA | | | | 1,048,850 | |

| | | | | |

| | 630 | | | Markham, Cook County, Illinois, General Obligation Bonds, Library Purpose Series 2005B, 5.250%, 1/01/18 – RAAI Insured | | | | | No Opt. Call | | | | N/R | | | | 668,310 | |

| | | | | |

| | | | Markham, Illinois, General Obligation Bonds, Series 2008A: | | | | | | | | | | | | | | |

| | 455 | | | 4.750%, 2/01/17 | | | | | No Opt. Call | | | | BBB | | | | 484,102 | |

| | 355 | | | 4.750%, 2/01/18 | | | | | No Opt. Call | | | | BBB | | | | 376,854 | |

| | 400 | | | 6.000%, 2/01/25 | | | | | 2/18 at 100.00 | | | | BBB | | | | 427,992 | |

| | | | | |

| | 1,220 | | | Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Series 2002A, 5.250%, 6/15/42 – NPFG Insured | | | | | 6/12 at 101.00 | | | | AAA | | | | 1,231,248 | |

| | | | | |

| | 500 | | | Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Hospitality Facility, Series 1996A, 7.000%, 7/01/26 (ETM) | | | | | No Opt. Call | | | | AAA | | | | 712,645 | |

| | | | | |

| | | | Railsplitter Tobacco Settlement Authority, Illinois, Tobacco Settlement Revenue Bonds, Series 2010: | | | | | | | | | | | | | | |

| | 195 | | | 3.000%, 6/01/12 | | | | | No Opt. Call | | | | A | | | | 196,447 | |

| | 1,250 | | | 5.000%, 6/01/18 | | | | | No Opt. Call | | | | A | | | | 1,409,700 | |

| | | | | |

| | 250 | | | Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 1991, 6.700%, 11/01/21 – FGIC Insured | | | | | No Opt. Call | | | | AA | | | | 302,348 | |

| | | | | |

| | 2,100 | | | Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties, Illinois, General Obligation Bonds, Series 2002A, 6.000%, 7/01/29 – NPFG Insured | | | | | No Opt. Call | | | | AA | | | | 2,772,105 | |

| | | | | |

| | 750 | | | Southwestern Illinois Development Authority, Local Goverment Program Bonds, St. Clair County Community Unit School District 19 Mascoutah, Series 2009, 5.750%, 2/01/29 – AGC Insured | | | | | No Opt. Call | | | | AA– | | | | 845,783 | |

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio (continued)

January 31, 2012

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Illinois (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,000 | | | University of Illinois, Auxiliary Facilities Systems Revenue Bonds, Series 2012C, 5.000%, 4/01/26 | | | | | No Opt. Call | | | | Aa2 | | | $ | 1,162,600 | |

| | 23,255 | | | Total Illinois | | | | | | | | | | | | | 25,819,209 | |

| | | | Indiana – 2.5% | | | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Central Nine Career Charter School Building Corporation, Indiana, General Obligation Bonds, Series 2007, 5.500%, 1/15/17 | | | | | No Opt. Call | | | | A | | | | 291,893 | |

| | | | | |

| | 1,000 | | | Fishers Redevelopment District, Indiana, General Obligation Bonds, Saxony Project Series 2009, 5.250%, 7/15/34 | | | | | 1/20 at 100.00 | | | | AA | | | | 1,116,540 | |

| | | | | |

| | 885 | | | Hendricks County, Indiana, Redevelopment District Tax Increment Revenue Bonds, Refunding Series 2010B, 6.450%, 1/01/23 | | | | | 1/16 at 100.00 | | | | Baa2 | | | | 942,083 | |

| | | | | |

| | 525 | | | Indiana Finance Authority, Educational Facilities Revenue Bonds, Drexel Foundation For Educational Excellence, Inc., Series 2009A, 7.000%, 10/01/39 | | | | | 10/19 at 100.00 | | | | BBB– | | | | 549,607 | |

| | | | | |

| | 1,000 | | | Indiana Health Facility Financing Authority, Hospital Revenue Bonds, Union Hospital, Series 1993, 5.125%, 9/01/18 | | | | | 3/12 at 100.00 | | | | Baa2 | | | | 1,001,580 | |

| | | | | |

| | 250 | | | Merrillville Multi-School Building Corporation, Lake County, Indiana, First Mortgage Revenue Bonds, Series 2008, 5.250%, 7/15/22 | | | | | 1/18 at 100.00 | | | | A+ | | | | 285,843 | |

| | | | | |

| | 855 | | | Portage Redevelopment District, Indiana, Tax Increment Revenue Bonds, Series 2008, 5.250%, 1/15/19 – CIFG Insured | | | | | 1/18 at 100.00 | | | | AA– | | | | 954,847 | |

| | | | | |

| | 100 | | | Tri-Creek Middle School Building Corporation, Indiana, First Mortgage Bonds, Series 2008, 6.000%, 1/15/16 – AGM Insured | | | | | No Opt. Call | | | | AA+ | | | | 119,477 | |

| | 4,865 | | | Total Indiana | | | | | | | | | | | | | 5,261,870 | |

| | | | Iowa – 0.4% | | | | | | | | | | | | | | |

| | | | | |

| | 745 | | | Des Moines, Iowa, Aviation System Revenue Bonds, Refunding Capital Loan Notes Series 2010B, 5.750%, 6/01/33 – AGM Insured (Alternative Minimum Tax) | | | | | 6/20 at 100.00 | | | | AA– | | | | 821,310 | |

| | | | Kansas – 1.2% | | | | | | | | | | | | | | |

| | | | | |

| | 1,240 | | | Kansas Development Finance Authority, Health Facilities Revenue Bonds, KU Health System, Series 2011H, 5.375%, 3/01/30 | | | | | 3/20 at 100.00 | | | | A+ | | | | 1,358,073 | |

| | | | | |

| | 1,250 | | | Kansas State Independent College Finance Authority, Revenue Anticipation Notes, Ottawa University, Private Education Short-Term Loan Program, Series 2011D, 6.000%, 5/01/12 | | | | | No Opt. Call | | | | N/R | | | | 1,250,513 | |

| | 2,490 | | | Total Kansas | | | | | | | | | | | | | 2,608,586 | |

| | | | Kentucky – 1.6% | | | | | | | | | | | | | | |

| | | | | |

| | 500 | | | Kentucky Economic Development Finance Authority, Louisville Arena Project Revenue Bonds, Louisville Arena Authority, Inc., Series 2008-A1, 5.750%, 12/01/28 – AGC Insured | | | | | 6/18 at 100.00 | | | | AA– | | | | 559,320 | |

| | | | | |

| | 1,000 | | | Pikeville, Kentucky, Educational Facilities Revenue Bond, Pikeville College of Osteopathic Medicine, Bond Anticipation Notes, Series 2011, 4.000%, 5/01/13 | | | | | No Opt. Call | | | | N/R | | | | 1,019,050 | |

| | | | | |

| | 1,570 | | | Pikeville, Kentucky, Hospital Revenue Bonds, Pikeville Medical Center, Inc. Project, Improvement and Refunding Series 2011, 5.250%, 3/01/19 | | | | | No Opt. Call | | | | A3 | | | | 1,796,237 | |

| | 3,070 | | | Total Kentucky | | | | | | | | | | | | | 3,374,607 | |

| | | | Louisiana – 0.2% | | | | | | | | | | | | | | |

| | | | | |

| | 430 | | | Tobacco Settlement Financing Corporation, Louisiana, Tobacco Settlement Asset-Backed Bonds, Series 2001B, 5.875%, 5/15/39 | | | | | 5/12 at 100.00 | | | | A– | | | | 433,956 | |

| | | | Maryland – 1.7% | | | | | | | | | | | | | | |

| | | | | |

| | 110 | | | Baltimore, Maryland, Senior Lien Convention Center Hotel Revenue Bonds, Series 2006A, 5.250%, 9/01/39 – SYNCORA GTY Insured | | | | | 9/16 at 100.00 | | | | BB+ | | | | 103,008 | |

| | | | | |

| | 300 | | | Maryland Community Development Administration, Residential Revenue Bonds, Series 1999D, 5.250%, 9/01/19 (Alternative Minimum Tax) | | | | | 3/12 at 100.00 | | | | Aa2 | | | | 300,366 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Maryland (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 260 | | | Maryland Community Development Administration, Residential Revenue Bonds, Series 2001B, 5.375%, 9/01/22 (Alternative Minimum Tax) | | | | | 3/12 at 100.00 | | | | Aa2 | | | $ | 260,281 | |

| | | | | |

| | 1,000 | | | Maryland Economic Development Corporation, Lease Revenue Bonds, Maryland Public Health Laboratory Project, Series 2011, 4.000%, 6/01/29 | | | | | No Opt. Call | | | | AA+ | | | | 1,072,840 | |

| | | | | |

| | 500 | | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Adventist Healthcare, Series 2011A, 6.125%, 1/01/36 | | | | | 1/22 at 100.00 | | | | Baa2 | | | | 528,310 | |

| | | | | |

| | | | Maryland Health and Higher Educational Facilities Authority, Revenue Bonds, Civista Medical Center, Series 2005: | | | | | | | | | | | | | | |

| | 155 | | | 4.000%, 7/01/17 – RAAI Insured | | | | | 7/14 at 100.00 | | | | N/R | | | | 155,279 | |

| | 1,405 | | | 5.000%, 7/01/37 – RAAI Insured | | | | | 7/14 at 100.00 | | | | N/R | | | | 1,227,830 | |

| | 3,730 | | | Total Maryland | | | | | | | | | | | | | 3,647,914 | |

| | | | Massachusetts – 2.1% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Massachusetts Development Finance Agency, Revenue Bonds, The Broad Institute, Series 2011A, 5.000%, 4/01/31 | | | | | 4/21 at 100.00 | | | | AA– | | | | 1,113,810 | |

| | | | | |

| | 750 | | | Massachusetts Development Finance Agency, Revenue Bonds, The Sabis International Charter School, Series 2009A, 8.000%, 4/15/31 | | | | | 10/19 at 100.00 | | | | BBB | | | | 876,653 | |

| | | | | |

| | 300 | | | Massachusetts Health and Educational Facilities Authority Revenue Bonds, Quincy Medical Center Issue, Series 2008A, 6.250%, 1/15/28 (6) | | | | | 1/18 at 100.00 | | | | N/R | | | | 2,997 | |

| | | | | |

| | 535 | | | Massachusetts Health and Educational Facilities Authority, Revenue Bonds, Harvard University, Tender Option Bond Trust 2010-20W, 13.995%, 12/15/34 (IF) (5) | | | | | 12/19 at 100.00 | | | | AAA | | | | 782,309 | |

| | | | | |

| | 1,675 | | | Massachusetts State, General Obligation Bonds, Refunding Series 2012A, 0.640%, 2/01/16 | | | | | 8/15 at 100.00 | | | | AA+ | | | | 1,675,000 | |

| | 4,260 | | | Total Massachusetts | | | | | | | | | | | | | 4,450,769 | |

| | | | Michigan – 1.2% | | | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Detroit, Michigan, General Obligation Bonds, Series 2003A, 5.250%, 4/01/14 – SYNCORA GTY Insured | | | | | 4/13 at 100.00 | | | | BB | | | | 240,885 | |

| | | | | |

| | | | Detroit, Michigan, General Obligation Bonds, Series 2004B-1: | | | | | | | | | | | | | | |

| | 595 | | | 5.000%, 4/01/14 – AMBAC Insured | | | | | No Opt. Call | | | | BB | | | | 572,949 | |

| | 100 | | | 4.000%, 4/01/14 – AMBAC Insured | | | | | No Opt. Call | | | | BB | | | | 94,314 | |

| | | | | |

| | 500 | | | Michigan Finance Authoirty, Public School Academy Limited Obligation Revenue Bonds, Voyageur Academy Project, Series 2011, 7.750%, 7/15/26 | | | | | 7/21 at 100.00 | | | | BB | | | | 507,655 | |

| | | | | |

| | 750 | | | Michigan Higher Education Facilities Authority, Limited Obligation Revenue Bonds, Alma College Project, Series 2008, 5.500%, 6/01/28 | | | | | 6/18 at 100.00 | | | | A3 | | | | 838,350 | |

| | | | | |

| | 300 | | | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, Series 2008A, 6.875%, 6/01/42 | | | | | 6/18 at 100.00 | | | | B2 | | | | 276,801 | |

| | 2,495 | | | Total Michigan | | | | | | | | | | | | | 2,530,954 | |

| | | | Minnesota – 0.6% | | | | | | | | | | | | | | |

| | | | | |

| | 55 | | | Glencoe, Minnesota, Health Care Facilities Revenue Bonds, Glencoe Regional Health Services Project, Series 2005, 4.150%, 4/01/12 | | | | | No Opt. Call | | | | BBB | | | | 55,214 | |

| | | | | |

| | 500 | | | Rochester, Minnesota, Health Care Facilities Revenue Bonds, Olmsted Medical Center Project, Series 2010, 3.750%, 7/01/15 | | | | | No Opt. Call | | | | N/R | | | | 510,775 | |

| | | | | |

| | 835 | | | St. Paul Housing and Redevelopment Authority, Minnesota, Hospital Revenue Bonds, HealthEast Inc., Refunding Series 1997A, 5.700%, 11/01/15 – ACA Insured | | | | | 5/12 at 100.00 | | | | BB+ | | | | 835,877 | |

| | 1,390 | | | Total Minnesota | | | | | | | | | | | | | 1,401,866 | |

| | | | Missouri – 1.9% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Carroll County Public Water Supply District 1, Missouri, Water System Revenue Bonds, Refunding Series 2009, 5.625%, 3/01/34 | | | | | 3/18 at 100.00 | | | | A | | | | 1,110,000 | |

| | | | | |

| | 900 | | | Hannibal Industrial Development Authority, Missouri, Health Facilities Refunding Revenue Bonds, Hannibal Regional Hospital, Refunding Series 2010, 5.500%, 9/01/20 | | | | | 9/13 at 100.00 | | | | BBB+ | | | | 944,289 | |

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio (continued)

January 31, 2012

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Missouri (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,000 | | | Missouri Development Finance Board, Independence, Infrastructure Facilities Revenue Bonds, Water System Improvement Projects, Series 2009C, 5.750%, 11/01/29 | | | | | No Opt. Call | | | | A– | | | $ | 1,059,120 | |

| | | | | |

| | 600 | | | Missouri Development Finance Board, Infrastructure Facilities Leasehold Revenue Bonds, Independence Electric System Projects, Series 2009D, 5.750%, 6/01/34 | | | | | No Opt. Call | | | | A– | | | | 625,788 | |

| | | | | |

| | 287 | | | Saint Louis, Missouri, Tax Increment Financing Revenue Notes, Marquette Building Redevelopment Project, Series 2008-A, 6.500%, 1/23/28 | | | | | No Opt. Call | | | | N/R | | | | 266,818 | |

| | 3,787 | | | Total Missouri | | | | | | | | | | | | | 4,006,015 | |

| | | | Nebraska – 0.3% | | | | | | | | | | | | | | |

| | | | | |

| | 500 | | | Douglas County Hospital Authority 2, Nebraska, Health Facilities Revenue Refunding Bonds, Children’s Hospital Obligated Group, Series 2008B, 6.125%, 8/15/31 | | | | | 8/17 at 100.00 | | | | A2 | | | | 559,020 | |

| | | | Nevada – 1.0% | | | | | | | | | | | | | | |

| | | | | |

| | 815 | | | Clark County, Nevada, Subordinate Lien Airport Revenue Bonds, Series 2007A1, 5.000%, 7/01/19 – AMBAC Insured (Alternative Minimum Tax) | | | | | 7/17 at 100.00 | | | | Aa3 | | | | 903,216 | |

| | | | | |

| | 1,000 | | | North Las Vegas, Nevada, General Obligation Bonds, Series 2006, 5.000%, 5/01/28 – NPFG Insured | | | | | 5/16 at 100.00 | | | | A+ | | | | 1,064,190 | |

| | | | | |

| | 100 | | | Sparks Local Improvement District 3, Legends at Sparks Marina, Nevada, Limited Obligation Improvement Bonds, Series 2008, 6.750%, 9/01/27 | | | | | 9/18 at 100.00 | | | | N/R | | | | 100,942 | |

| | 1,915 | | | Total Nevada | | | | | | | | | | | | | 2,068,348 | |

| | | | New Jersey – 2.0% | | | | | | | | | | | | | | |

| | | | | |

| | | | Monmouth County Improvement Authority, New Jersey, Governmental Loan Revenue Bonds, Series 2004: | | | | | | | | | | | | | | |

| | 750 | | | 5.250%, 12/01/18 – AMBAC Insured | | | | | 12/14 at 100.00 | | | | N/R | | | | 799,620 | |

| | 1,100 | | | 5.250%, 12/01/20 – AMBAC Insured | | | | | 12/14 at 100.00 | | | | N/R | | | | 1,161,919 | |

| | | | | |

| | 310 | | | New Jersey Economic Development Authority, Cigarette Tax Revenue Bonds, Series 2004, 5.750%, 6/15/34 | | | | | 6/14 at 100.00 | | | | BBB | | | | 321,895 | |

| | | | | |

| | 1,000 | | | New Jersey Health Care Facilities Financing Authority, Trinitas Hospital Obligated Group, Refunding Series 2007B, 4.800%, 7/01/13 | | | | | No Opt. Call | | | | BBB– | | | | 1,036,480 | |

| | | | | |

| | 50 | | | New Jersey Housing and Mortgage Finance Agency, Single Family Housing Revenue Bonds, Series 2007U, 5.000%, 10/01/37 (Alternative Minimum Tax) | | | | | 4/17 at 100.00 | | | | AA | | | | 51,057 | |

| | | | | |

| | 805 | | | New Jersey Housing and Mortgage Finance Agency, Single Family Housing Revenue Bonds, Series 2008X, 5.000%, 4/01/17 (Alternative Minimum Tax) | | | | | No Opt. Call | | | | AA | | | | 862,485 | |

| | 4,015 | | | Total New Jersey | | | | | | | | | | | | | 4,233,456 | |

| | | | New Mexico – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Farmington, New Mexico, Pollution Control Revenue Bonds, Public Service Company of New Mexico San Juan Project, Series 2007A, 5.150%, 6/01/37 – FGIC Insured (Alternative Minimum Tax) | | | | | 6/12 at 100.00 | | | | BBB– | | | | 231,193 | |

| | | | | |

| | 715 | | | New Mexico Mortgage Finance Authority, Single Family Mortgage Program Bonds CL 1, Series 2008-A2, 5.600%, 1/01/39 (Alternative Minimum Tax) | | | | | 1/18 at 102.00 | | | | AA+ | | | | 769,941 | |

| | 965 | | | Total New Mexico | | | | | | | | | | | | | 1,001,134 | |

| | | | New York – 4.4% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Long Island Power Authority, New York, Electric System Revenue Bonds, Series 2008A, 6.000%, 5/01/33 | | | | | 5/19 at 100.00 | | | | A– | | | | 1,187,310 | |

| | | | | |

| | 675 | | | Madison County Industrial Development Agency, New York, Civic Facility Revenue Bonds, Oneida Health System, Series 2007A, 5.250%, 2/01/27 | | | | | No Opt. Call | | | | BBB– | | | | 683,721 | |

| | | | | |

| | 250 | | | Monroe County Industrial Development Corporation, New York, FHA Insured Mortgage Revenue Bonds, Unity Hospital of Rochestor Project, Series 2010, 5.750%, 8/15/30 | | | | | 2/21 at 100.00 | | | | Aa2 | | | | 308,420 | |

| | | | | |

| | 100 | | | New York City Industrial Development Agency, New York, Civic Facility Revenue Bonds, Special Needs Facilities Pooled Program, Series 2008A-1, 5.700%, 7/01/13 | | | | | No Opt. Call | | | | N/R | | | | 99,860 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | New York (continued) | | | | | | | | | | | | | | |

| | | | | |

| $ | 1,000 | | | New York City Industrial Development Authority, New York, PILOT Revenue Bonds, Yankee Stadium Project, Series 2006, 5.000%, 3/01/46 – FGIC Insured | | | | | 9/16 at 100.00 | | | | BBB– | | | $ | 1,018,600 | |

| | | | | |

| | 500 | | | New York City Municipal Water Finance Authority, New York, Water and Sewerage System Revenue Bonds, Tender Option Bond Trust 3484, 18.374%, 10/01/16 (IF) | | | | | No Opt. Call | | | | AA+ | | | | 659,400 | |

| | | | | |

| | 500 | | | New York State Environmental Facilities Corporation, State Clean Water and Drinking Water Revolving Funds Revenue Bonds, Pooled Loan Issue, Series 2005B, 5.500%, 10/15/27 | | | | | No Opt. Call | | | | AAA | | | | 693,590 | |

| | | | | |

| | 185 | | | New York State Mortgage Agency, Homeowner Mortgage Revenue Refunding Bonds, Series 87, 5.150%, 4/01/17 | | | | | 3/12 at 100.00 | | | | Aa1 | | | | 188,609 | |

| | | | | |

| | 500 | | | New York State Tobacco Settlement Financing Corporation, Tobacco Settlement Asset-Backed and State Contingency Contract-Backed Bonds, Series 2003A-1, 5.250%, 6/01/20 – AMBAC Insured | | | | | 6/13 at 100.00 | | | | AA– | | | | 530,030 | |

| | | | | |

| | 930 | | | New York State Tobacco Settlement Financing Corporation, Tobacco Settlement Asset-Backed and State Contingency Contract-Backed Bonds, Series 2003B-1C, 5.500%, 6/01/19 | | | | | No Opt. Call | | | | AA– | | | | 988,934 | |

| | | | | |

| | 1,250 | | | Port Authority of New York and New Jersey, Consolidated Revenue Bonds, One Hundred Sixty-Ninth Series 2011, 5.000%, 10/15/24 (Alternative Minimum Tax) | | | | | 10/21 at 100.00 | | | | Aa2 | | | | 1,473,863 | |

| | | | | |

| | 450 | | | Saratoga County Water and Sewer Authority, New York, Revenue Bonds, Series 2008, 5.000%, 9/01/38 | | | | | 9/18 at 100.00 | | | | AA | | | | 491,720 | |

| | | | | |

| | 1,000 | | | Syracuse, New York, General Obligation Bonds, Airport Terminal Security Access Improvement Series 2011A, 5.000%, 11/01/36 (Alternative Minimum Tax) | | | | | 11/21 at 100.00 | | | | A1 | | | | 1,047,490 | |

| | 8,340 | | | Total New York | | | | | | | | | | | | | 9,371,547 | |

| | | | North Carolina – 4.5% | | | | | | | | | | | | | | |

| | | | | |

| | 100 | | | Albemarle Hospital Authority, North Carolina, Health Care Facilities Revenue Bonds, Series 2007, 5.250%, 10/01/21 | | | | | 10/17 at 100.00 | | | | N/R | | | | 99,022 | |

| | | | | |

| | 1,000 | | | Charlotte, North Carolina, Airport Revenue Bonds, Charlotte Douglas International Refunding Series 2010B, 5.375%, 7/01/28 (Alternative Minimum Tax) | | | | | 7/20 at 100.00 | | | | Aa3 | | | | 1,106,820 | |

| | | | | |

| | 665 | | | Charlotte, North Carolina, Water and Sewer System Refunding Bonds, Tender Option Bond Trust 43W, 14.136%, 7/01/38 (IF) (5) | | | | | 7/20 at 100.00 | | | | AAA | | | | 948,536 | |

| | | | | |

| | 2,000 | | | Charlotte-Mecklenberg Hospital Authority, North Carolina, Health Care Refunding Revenue Bonds, Carolinas HealthCare System, Series 2009A, 5.250%, 1/15/34 (UB) (5) | | | | | 1/19 at 100.00 | | | | AA– | | | | 2,180,220 | |

| | | | | |

| | 2,000 | | | Charlotte-Mecklenberg Hospital Authority, North Carolina, Health Care Revenue Bonds, Carolinas HealthCare System, Series 2011A, 5.000%, 1/15/31 | | | | | 1/21 at 100.00 | | | | AA– | | | | 2,215,120 | |

| | | | | |

| | 350 | | | North Carolina Eastern Municipal Power Agency, Power System Revenue Refunding Bonds, Series 1993B, 6.000%, 1/01/22 – FGIC Insured | | | | | No Opt. Call | | | | Baa1 | | | | 453,604 | |

| | | | | |

| | 500 | | | North Carolina Eastern Municipal Power Agency, Power System Revenue Refunding Bonds, Series 2008A, 5.250%, 1/01/20 | | | | | 1/18 at 100.00 | | | | A– | | | | 581,900 | |

| | | | | |

| | 340 | | | North Carolina Medical Care Commission, Healthcare Facilities Revenue Bonds, Duke University Health System, Tender Option Bond Trust 11808, 22.376%, 6/01/18 (IF) | | | | | No Opt. Call | | | | AA | | | | 462,842 | |

| | | | | |

| | 740 | | | North Carolina Medical Care Commission, Revenue Bonds, Maria Parham Medical Center, Series 2003, 5.500%, 10/01/17 (Pre-refunded 10/01/13) – RAAI Insured | | | | | 10/13 at 100.00 | | | | N/R | (4) | | | 797,779 | |

| | | | | |

| | 500 | | | North Carolina Municipal Power Agency 1, Catawba Electric Revenue Bonds, Series 2008C, 5.250%, 1/01/19 | | | | | 1/18 at 100.00 | | | | A | | | | 599,660 | |

| | | | | |

| | 100 | | | University of North Carolina System, Pooled Revenue Bonds, Series 2004B, 4.000%, 4/01/15 – AMBAC Insured | | | | | 4/14 at 100.00 | | | | N/R | | | | 104,030 | |

| | 8,295 | | | Total North Carolina | | | | | | | | | | | | | 9,549,533 | |

Portfolio of Investments (Unaudited)

Municipal Total Return Managed Accounts Portfolio (continued)

January 31, 2012

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | North Dakota – 0.2% | | | | | | | | | | | | | | |

| | | | | |

| $ | 340 | | | Ward County Health Care, North Dakota, Revenue Bonds, Trinity Obligated Group, Series 2006, 5.125%, 7/01/29 | | | | | 7/16 at 100.00 | | | | BBB+ | | | $ | 341,646 | |

| | | | | |

| | 150 | | | Ward County Health Care, North Dakota, Revenue Bonds, Trinity Obligated Group, Series 2006, 5.250%, 7/01/16 | | | | | No Opt. Call | | | | BBB+ | | | | 165,591 | |

| | 490 | | | Total North Dakota | | | | | | | | | | | | | 507,237 | |

| | | | Ohio – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | | | Cuyahoga County, Ohio, Revenue Refunding Bonds, Cleveland Clinic Health System, Series 2003A: | | | | | | | | | | | | | | |

| | 70 | | | 6.000%, 1/01/32 (Pre-refunded 7/01/13) | | | | | 7/13 at 100.00 | | | | Aa2 | (4) | | | 75,652 | |

| | 70 | | | 6.000%, 1/01/32 (Pre-refunded 7/01/13) | | | | | 7/13 at 100.00 | | | | Aa2 | (4) | | | 75,652 | |

| | | | | |

| | 750 | | | Lorain, Ohio, General Obligation Bonds, Pellet Terminal Improvement Series 2008, 6.750%, 12/01/23 | | | | | 12/18 at 100.00 | | | | A3 | | | | 889,845 | |

| | 890 | | | Total Ohio | | | | | | | | | | | | | 1,041,149 | |

| | | | Oklahoma – 0.6% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Oklahoma State Turnpike Authority, Turnpike System Revenue Bonds, Second Senior Series 2011B, 5.000%, 1/01/26 | | | | | No Opt. Call | | | | AA– | | | | 1,208,020 | |

| | | | Oregon – 0.5% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Clackamas County School District 12, North Clackamas, Oregon, General Obligation Bonds, Series 2007B, 5.000%, 6/15/27 – AGM Insured | | | | | 6/17 at 100.00 | | | | AA+ | | | | 1,131,370 | |

| | | | Pennsylvania – 5.1% | | | | | | | | | | | | | | |

| | | | | |

| | 1,980 | | | Blair County, Pennsylvania, General Obligation Bonds, Series 2001A, 5.375%, 8/01/16 – AMBAC Insured | | | | | No Opt. Call | | | | N/R | | | | 2,293,771 | |

| | | | | |

| | 500 | | | Delaware County Authority, Revenue Bonds, Elwyn, Inc. Project, Series 2010, 5.000%, 6/01/25 | | | | | 6/17 at 100.00 | | | | BBB | | | | 508,150 | |

| | | | | |

| | | | Harrisburg, Dauphin County, Pennsylvania, General Obligation Refunding Bonds, Series 1997D: | | | | | | | | | | | | | | |

| | 30 | | | 0.000%, 3/15/15 – AMBAC Insured | | | | | No Opt. Call | | | | N/R | | | | 23,210 | |

| | 1,200 | | | 0.000%, 3/15/17 – AMBAC Insured | | | | | No Opt. Call | | | | N/R | | | | 773,304 | |

| | | | | |

| | 1,250 | | | Lackawanna County, Pennsylvania, General Obligation Notes, Series 2009B, 6.000%, 9/15/32 – AGC Insured | | | | | 9/19 at 100.00 | | | | AA– | | | | 1,393,238 | |

| | | | | |

| | 1,250 | | | Lycoming County Authority, Pennsylvania, Revenue Bonds, Pennsylvania College of Technology, Refunding Series 2011, 5.500%, 7/01/26 | | | | | 7/21 at 100.00 | | | | A | | | | 1,462,713 | |

| | | | | |

| | 500 | | | Pennsylvania Economic Development Financing Authority, Sewage Sludge Disposal Revenue Bonds, Philadelphia Biosolids Facility Project, Series 2009, 5.000%, 1/01/14 | | | | | No Opt. Call | | | | Baa3 | | | | 522,955 | |

| | | | | |

| | 1,000 | | | Pennsylvania Economic Development Financing Authority, Water Facilities Revenue Refunding Bonds, Aqua Pennsylvania, Inc. Project, Series 2010A, 5.000%, 12/01/34 (Alternative Minimum Tax) | | | | | 12/20 at 100.00 | | | | AA– | | | | 1,081,870 | |

| | | | | |

| | 375 | | | Pennsylvania State University, General Revenue Bonds, Series 2005, 5.000%, 9/01/35 | | | | | 9/15 at 100.00 | | | | Aa1 | | | | 416,801 | |

| | | | | |

| | 310 | | | Philadelphia Authority for Industrial Development, Pennsylvania, Revenue Bonds, MaST Charter School Project, Series 2010, 5.000%, 8/01/20 | | | | | No Opt. Call | | | | BBB+ | | | | 323,631 | |

| | | | | |

| | 1,000 | | | Philadelphia Gas Works, Pennsylvania, Revenue Bonds, Nineth Series, 2010, 5.000%, 8/01/30 | | | | | 8/20 at 100.00 | | | | BBB+ | | | | 1,067,370 | |

| | | | | |

| | 870 | | | Philadelphia Municipal Authority, Philadelphia, Pennsylvania, Lease Revenue Bonds, Series 2009, 6.000%, 4/01/23 | | | | | No Opt. Call | | | | A2 | | | | 980,899 | |

| | 10,265 | | | Total Pennsylvania | | | | | | | | | | | | | 10,847,912 | |

| | | | Puerto Rico – 0.4% | | | | | | | | | | | | | | |

| | | | | |

| | 300 | | | Puerto Rico Highway and Transportation Authority, Grant Anticipation Revenue Bonds, Series 2004, 5.000%, 9/15/16 – NPFG Insured | | | | | No Opt. Call | | | | A+ | | | | 315,744 | |

| | | | | |

| | 500 | | | Puerto Rico, Highway Revenue Bonds, Highway and Transportation Authority, Series 2005BB, 5.250%, 7/01/18 – AMBAC Insured | | | | | No Opt. Call | | | | A3 | | | | 571,635 | |

| | 800 | | | Total Puerto Rico | | | | | | | | | | | | | 887,379 | |

| | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | Optional Call

Provisions (2) | | | Ratings (3) | | | Value | |

| | | | | | | | | | | | | | | | | | |

| | | | Rhode Island – 1.2% | | | | | | | | | | | | | | |

| | | | | |

| $ | 970 | | | Pawtucket Housing Authority, Rhode Island, Capital Fund Housing Revenue Bonds, Series 2010, 5.500%, 9/01/29 | | | | | 9/20 at 103.00 | | | | AA | | | $ | 1,132,359 | |

| | | | | |

| | 250 | | | Rhode Island Student Loan Authority, Student Loan Program Revenue Bonds, Series 2008A, 6.750%, 12/01/28 (Alternative Minimum Tax) | | | | | 12/17 at 100.00 | | | | A | | | | 277,748 | |

| | | | | |

| | | | Rhode Island Tobacco Settlement Financing Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2002A: | | | | | | | | | | | | | | |

| | 955 | | | 6.000%, 6/01/23 | | | | | 6/12 at 100.00 | | | | Baa1 | | | | 959,393 | |

| | 150 | | | 6.125%, 6/01/32 | | | | | 6/12 at 100.00 | | | | BBB | | | | 150,128 | |

| | 75 | | | 6.250%, 6/01/42 | | | | | 6/12 at 100.00 | | | | Ba1 | | | | 75,000 | |

| | 2,400 | | | Total Rhode Island | | | | | | | | | | | | | 2,594,628 | |

| | | | South Carolina – 1.2% | | | | | | | | | | | | | | |

| | | | | |

| | 500 | | | Berkeley County School District, South Carolina, Installment Purchase Revenue Bonds, Series 2006, 5.125%, 12/01/30 | | | | | 12/16 at 100.00 | | | | A1 | | | | 536,850 | |

| | | | | |

| | 500 | | | Lexington County Health Services District, Inc., South Carolina, Hospital Revenue Bonds, Refunding Series 2011, 5.000%, 11/01/26 | | | | | 11/21 at 100.00 | | | | AA– | | | | 578,705 | |

| | | | | |

| | 400 | | | Piedmont Municipal Power Agency, South Carolina, Electric Revenue Bonds, Series 2008A-3, 5.250%, 1/01/19 | | | | | 1/18 at 100.00 | | | | A– | | | | 470,604 | |

| | | | | |

| | 740 | | | South Carolina JOBS Economic Development Authority, Hospital Refunding and Improvement Revenue Bonds, Palmetto Health Alliance, Series 2003C, 6.000%, 8/01/13 | | | | | No Opt. Call | | | | BBB+ | | | | 783,823 | |

| | | | | |

| | 250 | | | South Carolina Transportation Infrastructure Bank, Revenue Bonds, Series 2010A, 5.250%, 10/01/40 | | | | | 10/19 at 100.00 | | | | A1 | | | | 275,735 | |

| | 2,390 | | | Total South Carolina | | | | | | | | | | | | | 2,645,717 | |

| | | | South Dakota – 0.1% | | | | | | | | | | | | | | |

| | | | | |

| | 210 | | | South Dakota Educational Enhancement Funding Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2002B, 6.500%, 6/01/32 | | | | | 6/12 at 101.00 | | | | A3 | | | | 215,947 | |

| | | | Tennessee – 1.1% | | | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Claiborne County Industrial Development Board, Tennessee, Revenue Refunding Bonds, Lincoln Memorial University Project, Series 2010, 6.000%, 10/01/30 | | | | | 10/20 at 100.00 | | | | N/R | | | | 1,103,950 | |

| | | | | |

| | 100 | | | Memphis-Shelby County Airport Authority, Tennessee, Special Facilities Revenue Refunding Bonds, FedEx., Series 2002, 5.050%, 9/01/12 | | | | | No Opt. Call | | | | Baa1 | | | | 102,253 | |

| | | | | |

| | 1,000 | | | Sullivan County Health Educational and Housing Facilities Board, Tennessee, Revenue Bonds, Wellmont Health System, Series 2006C, 5.250%, 9/01/36 | | | | | 9/16 at 100.00 | | | | BBB+ | | | | 1,021,370 | |

| | | | | |

| | 50 | | | The Tennessee Energy Acquisition Corporation, Gas Revenue Bonds, Series 2006A, 5.000%, 9/01/16 | | | | | No Opt. Call | | | | A2 | | | | 53,935 | |

| | 2,150 | | | Total Tennessee | | | | | | | | | | | | | 2,281,508 | |

| | | | Texas – 8.4% | | | | | | | | | | | | | | |

| | | | | |

| | 750 | | | La Vernia Higher Education Financing Corporation, Texas, Charter School Revenue Bonds, Kipp Inc., Series 2009A, 6.000%, 8/15/29 | | | | | 8/19 at 100.00 | | | | BBB | | | | 818,730 | |

| | | | | |

| | 1,385 | | | Capital Area Cultural Education Facilities Finance Corporation, Texas, Revenue Bonds, The Roman Catholic Diocese of Austin, Series 2005A. Remarketed, 5.750%, 4/01/26 | | | | | No Opt. Call | | | | Baa2 | | | | 1,513,016 | |

| | | | | |

| | 500 | | | Clifton, Texas, Higher Education Finance Corporation, Education Revenue Bonds, Idea Public Schools, Series 2011, 4.800%, 8/15/21 | | | | | No Opt. Call | | | | BBB+ | | | | 537,450 | |

| | | | | |

| | 675 | | | Clifton, Texas, Higher Education Finance Corporation, Education Revenue Bonds, Uplift Education Charter School, Series 2010A, 4.300%, 12/01/16 | | | | | No Opt. Call | | | | BBB– | | | | 687,953 | |

| | | | | |