As filed with the Securities and Exchange Commission on May 4, 2007

Securities Act File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ATLAS INDUSTRIES HOLDINGS LLC

(Exact name of Registrant as specified in charter)

Delaware | | 2670 | | 20-8100498 |

(State or other jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer |

incorporation or organization) | | Classification Code Number) | | Identification Number) |

One Sound Shore Drive, Suite 302

Greenwich, CT 06830

(203) 983-7933

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Andrew M. Bursky

Chief Executive Officer

Atlas Industries Holdings LLC

One Sound Shore Drive, Suite 302

Greenwich, CT 06830

(203) 983-7933

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Christopher M. Zochowski | | Stephen C. Mahon |

McDermott Will & Emery LLP | | Squire, Sanders & Dempsey L.L.P. |

600 Thirteenth Street, N.W. | | 312 Walnut Street, Suite 3500 |

Washington, DC 20005 | | Cincinnati, OH 45202 |

(202) 756-8000 | | (513) 361-1200 |

(202) 756-8087 – Facsimile | | (513) 361-1201 – Facsimile |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

CALCULATION OF REGISTRATION FEE

Title of Each Class of Security Being Registered | | | | Amount Being

Registered | | | | Maximum Offering

Price Per Security | | | | Proposed Maximum

Aggregate

Offering Price(1) | | | | Amount of

Registration Fee | |

Common shares of Atlas Industries Holdings LLC | | | | | | | | | | | | | $ | 184,000,000 | | | | | | $5,649 | | |

Total | | | | | | | | | | | | | $ | 184,000,000 | | | | | | $5,649 | | |

(1) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion, dated May 4, 2007

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Common Shares

We are making an initial public offering of common shares representing limited liability company interests in Atlas Industries Holdings LLC, which we refer to as the company.

Various accredited investors including certain institutions have agreed to purchase, in separate private placement transactions to close in conjunction with the closing of this offering, a number of common shares in the company having an aggregate purchase price of approximately $ million, at a per share price equal to the initial public offering price (which will be approximately common shares, assuming an initial public offering price per share of $15.00 and that our initial businesses are acquired for the purchase prices disclosed in this prospectus).

The underwriters have reserved up to common shares of this offering for sale pursuant to a directed share program. Currently, no public market exists for our common shares. We expect the initial public offering price to be between $14.00 and $16.00 per share. We have applied to list our common shares on the Nasdaq Global Market under the symbol “AAAA”.

Investing in the common shares involves risks. See the section entitled “Risk Factors” beginning on page 14 of this prospectus for a discussion of the risks and other information that you should consider before making an investment in our securities.

| | Per Share | | Total | |

Public offering price | | | | | | | |

Underwriting discount and commissions* | | | | | | | |

Proceeds, before expenses, to us | | | | | | | |

* Includes the financial advisory fee payable solely to Ferris, Baker Watts, Incorporated of 0.5% of the total offering price.

The underwriters may also purchase up to an additional common shares from us at the public offering price, less the underwriting discount and commissions (including the financial advisory fee) within 30 days from the date of this prospectus to cover overallotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We expect to deliver the common shares to the underwriters for delivery to investors on or about , 2007.

Book Runner

Ferris, Baker Watts

Incorporated

J.J.B. Hilliard, W.L. Lyons, Inc. | | Oppenheimer & Co. |

The date of this prospectus is , 2007

NOTE TO READER

Frequently Used Terms

Except as otherwise specified:

· “Atlas,” “we,” “us” and “our” refer to the company and our initial businesses together;

· “CanAmPac” refers to CanAmPac ULC and its consolidated subsidiaries prior to their acquisition as contemplated herein and includes Atlas CanAmPac Acquisition Corp. and its consolidated subsidiaries, including CanAmPac ULC, following such acquisition;

· “Forest” refers to Forest Resources LLC and its consolidated subsidiaries, other than CanAmPac, prior to their acquisition as contemplated herein and includes Atlas Forest Acquisition Corp. and its consolidated subsidiaries, including Forest Resources LLC, following such acquisition;

· “Pangborn” refers to Capital Equipment Resources LLC and its consolidated subsidiaries prior to their acquisition as contemplated herein and includes Atlas Pangborn Acquisition Corp. and its consolidated subsidiaries, including Capital Equipment Resources LLC, following such acquisition;

· “acquisition subsidiaries” refers, collectively, to Atlas Forest Acquisition Corp., Atlas CanAmPac Acquisition Corp. and Atlas Pangborn Acquisition Corp.;

· “our initial businesses” refers, collectively, to Forest, CanAmPac and Pangborn;

· “our businesses” refers, collectively, to the businesses in which we may own a controlling interest from time to time; and

· “our shareholders” refers to holders of our common shares.

Our Structure

An illustration of our proposed structure is set forth in the diagram on page 8 of this prospectus. See the section entitled “Description of Shares” for more information about certain terms of the common shares and the allocation shares of the company.

Information in This Prospectus

All information and transactions discussed in this prospectus relating to the initial public offering assume an initial public offering price per share of $15.00 (which is the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus) and that the initial businesses are acquired for the purchase prices set forth in this prospectus. However, the actual initial public offering price and purchase prices may be higher or lower than these assumed amounts. In addition, the information and transactions discussed in this prospectus relating to the initial public offering assume that the underwriters have not exercised their overallotment option.

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. We, and the underwriters, are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

This prospectus contains forward-looking statements that involve substantial risks and uncertainties as they are not based on historical facts, but rather are based on current expectations, estimates, projections, beliefs and assumptions about our businesses and the industries in which they operate. These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of

i

which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on any forward-looking statements, which apply only as of the date of this prospectus.

Market Data

In this prospectus, we rely on and refer to information and statistics regarding market data and the industries of our initial businesses that are obtained from internal surveys, market research, independent industry publications, the experience of our manager and its affiliates within their respective industries and other publicly available information, including information regarding public companies. The market data used in this prospectus has been prepared for other purposes. We have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this prospectus.

Unless we tell you otherwise, the information set forth in this prospectus assumes that the underwriters have not exercised their overallotment option. Further, unless the context otherwise indicates, numbers in this prospectus are presented in thousands and have been rounded and are, therefore, approximate. Prior to reading this prospectus, you should read the section entitled “Note to Reader” to understand the assumptions upon which information is based and how certain terms are used.

NOTICE TO RESIDENTS OF THE UNITED KINGDOM

WE HAVE NOT PREPARED OR FILED, AND WILL NOT PREPARE OR FILE, IN THE UNITED KINGDOM AN APPROVED PROSPECTUS (WITHIN THE MEANING OF SECTION 85 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (“FSMA”)) REGARDING THE COMMON SHARES OF THE COMPANY. ACCORDINGLY, THE COMMON SHARES OF THE COMPANY ARE NOT BEING OFFERED AND MAY NOT BE OFFERED OR RESOLD TO PERSONS IN THE UNITED KINGDOM EXCEPT (I) TO PERSONS WHOSE ORDINARY ACTIVITIES INVOLVE THEM IN ACQUIRING, HOLDING, MANAGING, OR DISPOSING OF INVESTMENTS (AS PRINCIPAL OR AGENT) FOR THE PURPOSES OF THEIR BUSINESSES OR (II) IN CIRCUMSTANCES THAT WILL NOT CONSTITUTE OR RESULT IN AN OFFER OF TRANSFERABLE SECURITIES TO THE PUBLIC IN THE UNITED KINGDOM WITHIN THE MEANING OF SECTION 102B OF FSMA. THE DISTRIBUTION (WHICH TERM SHALL INCLUDE ANY FORM OF COMMUNICATION) OF THIS DOCUMENT IS RESTRICTED PURSUANT TO SECTION 21 (RESTRICTIONS ON FINANCIAL PROMOTION) OF FSMA. IN RELATION TO THE UNITED KINGDOM, THIS DOCUMENT IS ONLY DIRECTED AT, AND MAY ONLY BE DISTRIBUTED TO (I) PERSONS WHO ARE “INVESTMENT PROFESSIONALS” WITHIN THE MEANING OF ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (THE “FINANCIAL PROMOTION ORDER”), (II) RECIPIENTS CLASSED AS A HIGH NET WORTH COMPANY, UNINCORPORATED ASSOCIATION, ETC., IN ACCORDANCE WITH ARTICLE 49 OF THE FINANCIAL PROMOTION ORDER, AND (III) PERSONS WHO MAY OTHERWISE LAWFULLY RECEIVE IT AS EXEMPT RECIPIENTS UNDER THE FINANCIAL PROMOTION ORDER. THIS DOCUMENT MUST NOT BE ISSUED OR PASSED TO ANY OTHER PERSON IN THE UNITED KINGDOM.

ii

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. For a more complete understanding of this offering, you should read this entire prospectus carefully, including the “Risk Factors” section and the pro forma condensed combined financial statements, the financial statements of our initial businesses and the notes relating thereto and the related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Overview of Our Business

We have been formed to acquire and manage a group of small to middle market businesses. Through our structure, we offer investors an opportunity to participate in the ownership and growth of a portfolio of businesses that traditionally have been owned and managed by private equity firms, private individuals or families, financial institutions or large conglomerates. The acquisitions of our initial businesses will provide our investors with an immediate opportunity to participate in the ongoing cash flows of a diversified portfolio of businesses through the receipt of regular quarterly distributions. Further, we believe that our management and acquisition strategies will allow us to achieve our goals of growing distributions to our shareholders and increasing shareholder value over time.

We will seek to acquire controlling interests in small to middle market businesses that operate primarily in commercial and industrial sectors in which members of our management team have historically invested and operated businesses, or in which our management team will develop expertise or experience. In addition, we expect to focus on complex acquisitions in which we believe the value of the underlying business is masked, depressed or not otherwise apparent to other potential buyers due to legal, financial or operational issues. We will also seek to acquire under-managed or under-performing businesses that we believe can be improved under the guidance of our management team and the management teams of the businesses that we own. We expect to improve our businesses over the long term through organic growth opportunities, add-on acquisitions and operational improvements.

Approximately $161.0 million, comprised of cash and non-voting preferred stock of our acquisition subsidiaries, will be used to acquire the equity interests in, and provide debt financing to, the following businesses, which we refer to collectively as our initial businesses:

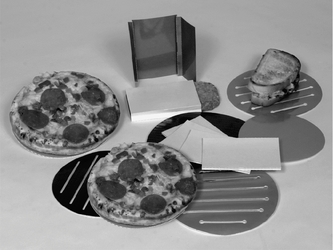

· Forest, a diversified paper and specialty packaging company serving primarily industrial markets;

· CanAmPac, a manufacturer of paperboard and paperboard packaging used for the packaging of food, beverages and other consumer goods; and

· Pangborn, a designer and marketer of surface preparation equipment and related aftermarket parts and services used in metal manufacturing processes within a diverse range of industries.

Importantly, we believe that our initial businesses alone will produce sufficient positive cash flows to enable us to make regular quarterly distributions to our shareholders over the long term, regardless of future acquisitions or operational improvements. In addition, immediately following this offering, we will have approximately $23.0 million of the net proceeds remaining from this offering and the separate private placement transactions, as well as approximately $120.0 million available for borrowing under our proposed third-party credit facility.

Our Manager

The company will engage Atlas Industries Management LLC, which we refer to as our manager, to manage the day-to-day operations and affairs of the company, oversee the management and operations of our businesses and perform certain other services on our behalf, subject to the oversight of our board of directors. We believe our manager’s expertise and experience will be a critical factor in executing our

1

strategy to meet the goals of growing distributions to our shareholders and increasing shareholder value. In conjunction with the closing of this offering, all of the employees of Atlas FRM LLC (d/b/a Atlas Holdings LLC), which we refer to as Atlas Holdings, will become employees of our manager. Andrew M. Bursky, our Chief Executive Officer, and Timothy J. Fazio, our President, are the managing members of our manager and, as a result, our manager is and will be an affiliate of the other entities controlled by Messrs. Bursky and Fazio, including Atlas Holdings.

Initially, our manager will employ seven experienced professionals. These professionals, together with Henry C. Newell, our Chief Financial Officer and Secretary, are referred to collectively as our management team. The senior members of our management team are Andrew M. Bursky, Timothy J. Fazio, David I. J. Wang, Henry C. Newell, Daniel E. Cromie and Philip E. Schuch. A majority of the senior members of our management team have worked together for over five years, and some have worked together for over 14 years. The senior members of our management team and certain members of our board of directors, through Atlas Titan Management Investments LLC, which we refer to as AT Management, have agreed to purchase approximately $ million of common shares in a separate private placement transaction to close in conjunction with this offering at a per share price equal to the initial public offering price. See the section entitled “Our Manager” for more information about our manager, our management team and our relationship with our manager and our management team.

Since 2002, our management team has developed and grown multiple sector-specific platform businesses, through the consummation of over ten acquisitions. Under the guidance of our management team, the revenue of these platform businesses grew, due to a combination of organic growth, add-on acquisitions and operational improvements, from approximately $45.4 million for the year ended December 31, 2002 to approximately $588.7 million for the year ended December 31, 2006. Collectively, our management team has over 100 years of combined experience in acquiring and managing small and middle market businesses and has overseen the acquisition of over 100 businesses.

The company and our manager will enter into a management services agreement pursuant to which we will pay our manager a quarterly management fee equal to 0.5% (2.0% annualized) of the company’s adjusted net assets for services performed. The management fee will be subject to offset pursuant to fees paid to our manager by our businesses under separate management services agreements that our manager will enter into with our initial businesses, which we refer to as offsetting management services agreements. See the sections entitled “Management Services Agreement” and “Our Manager—Our Relationship with Our Manager—Our Manager as a Service Provider—Management Fee” for more information about the terms of the management services agreement and the calculation of the management fee, respectively.

Our Chief Executive Officer, President and Chief Accounting Officer will be employees of our manager and will be seconded to the company, which means that these employees will be assigned by our manager to work for the company during the term of the management services agreement. The company will employ Henry C. Newell, our Chief Financial Officer and Secretary, as well as his staff, other than our Chief Accounting Officer. Although our Chief Executive Officer, President and Chief Accounting Officer will be employees of our manager, they will report directly to our board of directors.

The company will not reimburse our manager for any of our manager’s overhead expenses related to the services performed by our manager pursuant to the management services agreement, including the compensation of our Chief Executive Officer, President, Chief Accounting Officer and other seconded personnel providing services to us, which are encompassed by the management fee. In addition, our manager will bear all expenses incurred, which can be significant, in the identification, evaluation, management, performance of due diligence on, negotiation and oversight of a potential acquisition if our board of directors does not resolve to pursue such acquisition. These expenses may also include expenses related to travel, marketing and attendance at industry events and the retention of outside service providers. However, the company generally will otherwise be responsible for paying costs and expenses

2

relating to its business and operations, including all costs and expenses incurred by our manager or its affiliates on behalf of the company during the term of the management services agreement. The compensation committee of our board of directors will review, on an annual basis, all costs and expenses reimbursed to our manager. See the sections entitled “Management” and “Management Services Agreement” for more information about the secondment of our Chief Executive Officer, President and Chief Accounting Officer and “Our Manager—Our Relationship with Our Manager—Our Manager as a Service Provider—Reimbursement of Expenses” for more information about the reimbursement of expenses to our manager.

Our manager owns 100% of the allocation shares of the company, which are a separate class of limited liability company interests that, together with the common shares, will comprise all of the classes of equity interests of the company. The allocation shares generally will entitle our manager to receive a 20% profit allocation as a form of equity incentive, calculated by reference to our market appreciation and distributions to our shareholders, when considered together with distributions so paid to our manager, subject to an annual hurdle rate of 7.0% with respect to distributions to our shareholders. See the section entitled “Our Manager—Our Relationship with Our Manager¾Our Manager as an Equity Holder¾Manager’s Profit Allocation” for more information about the calculation and payment of profit allocation. In addition, we intend to enter into a supplemental put agreement with our manager pursuant to which our manager will have the right, subject to certain conditions, to cause the company to purchase the allocation shares then owned by our manager following the termination of the management services agreement for a price to be determined in accordance with the supplemental put agreement, which we refer to as the put price. See the section entitled “Our Manager—Our Relationship with Our Manager—Our Manager as an Equity Holder—Supplemental Put Agreement” for more information about the supplemental put agreement.

The management fee, put price and profit allocation will be payment obligations of the company and, as a result, will be senior in right to the payment of any distributions to our shareholders.

Our Strategy

Our goals are to grow distributions to our shareholders and to increase shareholder value over the long term. We intend to do this by focusing on increasing the cash flows of our businesses as well as seeking to acquire and manage other small to middle market businesses. We believe we can increase the cash flows of our businesses by applying our intellectual capital to continually improve and grow our businesses.

Management Strategy

Our management strategy is to operate our businesses in a manner that leverages our “intellectual capital”—the knowledge base built upon the combined years of operating experience, expertise and strategic relationships developed by our management team.

In executing our management strategy, our manager intends to work with operating advisors, whom we refer to as our manager’s operating partners, who are seasoned managers of operating companies in business sectors in which we have focused or intend to focus in the future. Our manager’s operating partners provide our manager and our businesses with additional intellectual capital, independent technical assistance and advice with respect to acquiring and operating businesses in particular sectors on a level that is not otherwise achievable without expending significant time and expense. See the section entitled “Our Manager—Operating Partners” for more information about our manager’s operating partners.

3

Our management strategy of applying our intellectual capital to our businesses provides us with certain advantages, including the ability to:

· identify, analyze and pursue prudent organic growth strategies, including selective capital investments to increase capacity or reduce operating costs;

· identify attractive external growth and acquisition opportunities;

· identify and execute operational improvements and integration opportunities that will lead to lower operating costs and operational optimization;

· instill financial discipline by monitoring financial and operational performance from an operator’s perspective;

· implement structured incentive compensation programs, including management equity ownership, tailored to each of our businesses to attract and retain talented personnel; and

· provide the management teams of our businesses the opportunity to leverage our experience and expertise to develop and implement business and operational strategies.

We also believe that our long-term perspective provides us with certain additional advantages, including the ability to:

· recruit and develop talented management teams for our businesses that are familiar with the industries in which our businesses operate and will generally seek to manage and operate our businesses with a long-term focus, rather than a short-term investment objective;

· focus on developing and implementing business and operational strategies to build and sustain shareholder value over the long term;

· create sector-specific platform businesses enabling us to take advantage of vertical and horizontal acquisition opportunities within a given sector;

· achieve exposure in certain industries in order to create opportunities for future acquisitions; and

· develop and maintain long-term collaborative relationships with customers and suppliers.

We intend to continually increase our intellectual capital as we operate our businesses and acquire new businesses and as our manager identifies and recruits qualified operating partners and managers for our businesses.

Acquisition Strategy

Our acquisition strategy is to identify attractive horizontal and vertical small and middle market acquisition opportunities with purchase prices between $20 million and $100 million in the industry sectors in which we own businesses or in which we have or will develop intellectual capital. In particular, we intend to pursue complex transactions where, we believe, the value of the underlying businesses is masked, depressed or not otherwise apparent to other potential buyers due to legal, financial or operational issues. In addition, we intend to pursue acquisitions of under-managed or under-performing businesses that, we believe, can be improved pursuant to our management strategy. We believe that our intellectual capital offers us an advantage in identifying opportunities and acquiring target businesses at attractive prices and on favorable terms.

We believe that the merger and acquisition market for small to middle market businesses is highly fragmented and provides opportunities to purchase businesses at attractive prices relative to larger market transactions. For example, according to Mergerstat, during the twelve-month period ended December 31, 2006, businesses that sold for less than $100 million were sold for a median of approximately 7.9x the trailing twelve months of earnings before interest, taxes, depreciation and amortization as compared to a median of approximately 9.3x for businesses that sold for between $100 million and $300 million and 11.7x

4

for businesses that sold for over $300 million. In addition, we believe that our management team’s understanding of the merger and acquisition market for small to middle market businesses facing legal, financial or operational issues provides us with certain competitive advantages.

Our acquisition strategy is predicated on the following guiding principles:

· investing primarily in business sectors and industries in which we have, or will develop, operating experience or expertise;

· seeking opportunities in sectors and industries where entrepreneurial businesses with capable management teams, acting under the guidance and support of our management team and our manager’s operating partners, can achieve attractive financial results;

· acquiring under-managed and under-performing businesses where implementation and application of our management strategy can improve financial and operational performance;

· pursuing complex transactions where value is masked, depressed or not otherwise apparent to other potential buyers due to legal, financial or operational issues; and

· acquiring and integrating businesses that are complementary to our businesses or the products that our businesses produce and sell.

We expect the process of acquiring new businesses to be time-consuming and complex. Our management team has historically taken from 3 to 18 months to perform due diligence on, negotiate and close acquisitions. We intend to raise capital for additional acquisitions primarily through debt financing at the company level such as our proposed third-party credit facility, additional equity offerings, the sale of all or a part of our businesses or by undertaking a combination of any of the above.

Overview of this Offering and the Related Transactions

We are making an initial public offering of common shares. Atlas Titan Investments LLC, which we refer to as AT Investments and AT Management have each agreed to purchase approximately $ million and $ million of our common shares, respectively, at a per share price equal to the initial public offering price, pursuant to private placement transactions to close in conjunction with the closing of this offering. In addition, each of Allstate Life Insurance Company, Hancock Mezzanine Partners III, LLC, John Hancock Life Insurance Company and John Hancock Variable Life Insurance Company have collectively agreed to purchase an aggregate of $ million of our common shares, at a per share price equal to the initial public offering price, pursuant to private placement transactions to close in conjunction with the closing of this offering. We refer to these institutional investors together with AT Management and AT Investments as the private placement participants. We also intend to enter into a third-party credit facility allowing for the borrowing of up to $120.0 million.

In conjunction with this offering, our subsidiary, Atlas Forest Acquisition Corp., will acquire Forest from a group of private investors, including affiliates of our manager that are controlled by our Chief Executive Officer, Andrew M. Bursky, and our President, Timothy J. Fazio, certain members of management of Forest, certain members of the company’s board of directors and certain other private investors in Forest. We refer to this group of sellers as the Forest selling group. Our subsidiary, Atlas CanAmPac Acquisition Corp., will acquire CanAmPac from Forest and an institutional investor. We refer to this group of sellers as the CanAmPac selling group. Our subsidiary, Atlas Pangborn Acquisition Corp., will acquire Pangborn from a group of private investors, including affiliates of our manager that are controlled by Messrs. Bursky and Fazio, certain members of management of Forest and the subsidiaries of Forest, certain members of management of Pangborn, certain members of the company’s board of directors and certain other private investors in Pangborn. We refer to this group of sellers as the Pangborn selling group, and we refer to all of the above-described selling groups collectively as the selling groups.

5

The selling groups will receive approximately $161.0 million, comprised of $159.1 million in cash and $1.9 million of non-voting preferred stock of our acquisition subsidiaries, for all of the equity interests in our initial businesses. Entities that are affiliated with Messrs. Bursky and Fazio, which entities we refer to as members of the AH Group, are in certain cases direct or indirect members of the selling groups. Members of the AH Group will receive approximately $ million for selling approximately % of the equity interest in our initial businesses. Messrs. Bursky and Fazio and the members of the AH Group will directly or indirectly reinvest approximately $ in our common shares through AT Management.

Summary of Our Initial Businesses

A summary of our initial businesses is as follows:

Forest

Forest, headquartered in Bridgeview, Illinois, is a producer of recycled paper and specialty packaging products. Forest operates from 11 manufacturing facilities located throughout North America, including eight packaging plants in Illinois, California, Pennsylvania, Ohio, Missouri, Georgia, Ontario and Quebec and three paper mills located in Indiana and Illinois. Forest serves approximately 2,500 customers who operate in diverse industrial and consumer markets on a local, regional and national basis.

CanAmPac

CanAmPac, headquartered in Toronto, Ontario, operates from two facilities in Ontario and is an integrated manufacturer of recycled paperboard and paperboard packaging used in the consumer packaged goods industry. CanAmPac paperboard products package a wide range of consumer items including frozen and dry foods, beverages, pet products, diverse household products and hardware. CanAmPac has over 250 customers including many of the leading consumer packaged goods manufacturers in the world.

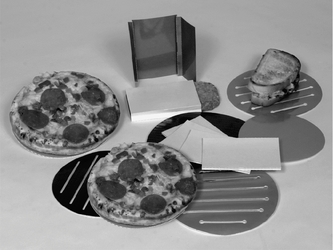

Pangborn

Pangborn, headquartered in Hagerstown, Maryland, designs and markets surface preparation equipment and related aftermarket parts and services used in metal manufacturing processes within a diverse range of industries. The equipment and aftermarket parts Pangborn produces are used in shot-blasting, a process by which the surfaces of objects are cleaned through the controlled propulsion of shot or other abrasive particles at such objects. Pangborn has been in operation for over 100 years serving customers in the automotive, building and infrastructure, heavy duty trucking, national defense, construction, petroleum and aerospace industries. Pangborn has approximately 1,500 customers in these and other markets and has sold its products throughout the world.

Corporate Structure

The company is a recently formed Delaware limited liability company. Your rights as a holder of common shares, and the fiduciary duties of our board of directors and executive officers, and any limitations relating thereto, are set forth in the documents governing the company, and may differ from those applying to a Delaware corporation. However, the documents governing the company specify that the duties of its directors and officers will be generally consistent with the duties of directors and officers of a Delaware corporation. In addition, investors in this offering will be shareholders in the company, which is a limited liability company, and, as such, will be subject to tax under partnership income tax provisions.

6

We are selling common shares in connection with this offering and additional common shares in the separate private placement transactions. The company will have two classes of limited liability company interests following this offering – the common shares, which are being offered in this offering, and the allocation shares, all of which have been and will continue to be held by our manager. See the section entitled “Description of Shares” for more information about the common shares and the allocation shares.

Our board of directors will oversee the management of the company, our businesses and the performance of our manager. Initially, our board of directors will be comprised of eight directors, all of whom will be appointed by our manager, as holder of the allocation shares, and at least five of whom will be independent directors. Following this initial appointment, six of the directors will be elected by our shareholders.

As holder of the allocation shares, our manager will have the continuing right to appoint two directors to our board of directors, subject to adjustment. Appointed directors will not be required to stand for election by our shareholders. See the section entitled “Description of Shares—Voting and Consent Rights—Appointed Directors” for more information about our manager’s right to appoint a director.

Corporate Information

Our principal executive offices are located at One Sound Shore Drive, Suite 302, Greenwich, Connecticut 06830, and our telephone number is 203-983-7933. We have applied to list the common shares on the Nasdaq Global Market under the symbol “AAAA”.

7

Our Proposed Organizational Structure(1)

(1) All percentages are approximate and assume that we sell all of the common shares offered in this offering and the separate private placement transactions and that the underwriters do not exercise their overallotment option. The supplemental put agreement, offsetting management services agreements, transaction services agreements, our proposed third-party credit facility and the inter-company loans and certain other elements of the transactions are not shown. You should read this entire prospectus for a complete understanding of all the transactions being undertaken, including their participants, in connection with this offering.

(2) See the sections entitled “—Overview of this Offering and the Related Transactions” and “Certain Relationships and Related Persons Transactions” for further information regarding the private placement transactions.

(3) The allocation shares, which carry the right to receive a profit allocation, will represent less than a 0.1% equity interest in the company upon closing of this offering assuming that we sell all of the common shares offered in this offering and the separate private placement transactions.

(4) Includes Messrs. Bursky and Fazio who serve as its managing members and Atlas Titan Carry I LLC and Atlas Titan Carry II LLC as its limited members. Messrs. Bursky and Fazio are the managing members of Atlas Titan Carry I LLC and TRAL Carry LLC is its limited member. Messrs. Bursky and Fazio are the non-economic managing members of Atlas Titan Carry II LLC and certain members of our management team are its limited members.

(5) Acquired through our subsidiary, Atlas Forest Acquisition Corp. “Forest” refers to Forest Resources LLC and its consolidated subsidiaries, other than CanAmPac, prior to their acquisitions as contemplated herein; and includes Atlas Forest Acquisition Corp. and its consolidated subsidiaries, including Forest Resources LLC, following such acquisition.

(6) Acquired through our subsidiary, Atlas CanAmPac Acquisition Corp. “CanAmPac” refers to CanAmPac ULC and its consolidated subsidiaries, prior to their acquisitions as contemplated herein; and includes Atlas CanAmPac Acquisition Corp. and its consolidated subsidiaries, including CanAmPac ULC, following such acquisition.

(7) Acquired through our subsidiary, Atlas Pangborn Acquisition Corp. “Pangborn” refers to Capital Equipment Resources LLC and its consolidated subsidiaries, prior to their acquisitions as contemplated herein; and includes Atlas Pangborn Acquisition Corp. and its consolidated subsidiaries, including Capitial Equipment Resources LLC, following such acquisition.

(8) In conjunction with the acquisitions of our initial businesses, each of Atlas Forest Acquisition Corp., Atlas CanAmPac Acquisition Corp. and Atlas Pangborn Acquisition Corp. will issue non-voting preferred shares that will ultimately be held by an unaffiliated entity. All other equity interests of Forest, CanAmPac and Pangborn will be owned by the company.

8

The Offering

Common shares offered by us in this offering | |

common shares (represents approximately % of common shares and voting power to be outstanding following this offering)

|

Common shares offered by us in the separate private placement transactions | |

common shares (represents approximately % of common shares and voting power to be outstanding following this offering)

|

Common shares outstanding after this offering and the separate private placement transactions. | | common shares |

Use of proceeds | | We estimate that our net proceeds from the sale of common shares in this offering will be approximately $148.8 million (or approximately $171.1 million if the underwriters’ overallotment option is exercised in full) after deducting underwriting discounts and commissions (including a financial advisory fee) of approximately $11.2 million (or approximately $12.9 million if the underwriters’ overallotment is exercised), but without giving effect to the payment of public offering fees, costs and expenses of approximately $6.0 million. We intend to use the net proceeds from this offering and the approximately $42.9 million of proceeds from the separate private placement transactions, each of which are to close in conjunction with this offering, to: |

| | · pay approximately $161.0 million, comprised of $159.1 in cash and $1.9 million in non-voting preferred stock of our acquisition subsidiaries, to acquire the equity interests of our initial businesses on a debt free basis, with the exception of a financing lease obligation of approximately $10.7 million at Forest. Approximately $107.3 million of the $161.0 million will represent loans to our initial businesses; |

| | · pay, through our subsidiaries, approximately $6.0 million in public offering fees, costs and expenses. Our initial businesses have each agreed to reimburse us for any such fees, costs and expenses we incur in connection with this offering, which are currently estimated to be approximately $6.0 million. See the section entitled “The Acquisitions of and Loans to Our Initial Businesses—Reimbursement Agreements” for more information about the reimbursement agreements; |

| | · pay approximately $3.6 million in fees associated with a proposed third-party credit facility; and |

| | · provide approximately $23.0 million of funds for general corporate purposes and to acquire future businesses. |

9

| | See the section entitled “Use of Proceeds” for more information about the use of the proceeds of this offering. |

Nasdaq Global Market symbol | | AAAA |

Dividend and distribution policy | | Our board of directors intends to declare and pay regular quarterly cash distributions on all outstanding common shares. Our board of directors intends to declare and pay an initial quarterly distribution for the quarter ending , 2007 of $0.2625 per share. Our board of directors also intends to declare an initial distribution equal to the amount of the initial quarterly distribution for the quarter ended , 2007, but pro rated for the period from the completion of this offering to , 2007, which will be paid at the same time as such initial quarterly distribution. The declaration and payment of our initial distribution, initial quarterly distribution and, if declared, the amount of any future distribution will be subject to the approval of our board of directors, which will include a majority of independent directors, and will be based on the results of operations of our initial businesses and the desire to provide sustainable levels of distributions to our shareholders. |

| | See the sections entitled “Dividend and Distribution Policy” for a discussion of our intended distribution rate and “Material U.S. Federal Income Tax Considerations” for more information about the tax treatment of distributions by the company. |

Management fee | | We will pay our manager a quarterly management fee equal to 0.5% (2.0% annualized) of adjusted net assets, as defined in the management services agreement, subject to certain adjustments. The company’s compensation committee, which is comprised solely of independent directors, will review the calculation of the management fee on an annual basis. |

| | See the section entitled “Our Manager—Our Relationship with Our Manager—Our Manager as a Service Provider—Management Fee” for more information about the calculation and payment of the management fee and the specific definitions of the terms used in such calculation, as well as an example of the quarterly calculation of the management fee. |

Profit allocation | | Our manager owns 100% of the allocation shares of the company that generally will entitle our manager to receive a 20% profit allocation as a form of equity incentive, calculated by reference to our market appreciation and distributions to our shareholders, when considered together with distributions so paid to our manager, subject to an annual hurdle rate of 7.0% with respect to distributions to our shareholders. |

10

| | The amount of profit allocation that will be payable in the future cannot be estimated with any certainty or reliability as of the date of this prospectus, and such profit allocation, if and when paid, may be greater than the management fee paid to our manager pursuant to the management services agreement. |

| | See the section entitled “Our Manager—Our Relationship with Our Manager—Our Manager as an Equity Holder—Manager’s Profit Allocation” for more information about the calculation and payment of profit allocation and the specific definitions of the terms used in such calculation. |

Anti-takeover provisions | | Certain provisions of the management services agreement and the LLC agreement, which we will enter into upon the closing of this offering, may make it more difficult for third parties to acquire control of the company by various means. These provisions could deprive the shareholders of opportunities to realize a premium on our common shares owned by them. In addition, these provisions may adversely affect the prevailing market price of our common shares. |

| | See the section entitled “Description of Shares—Anti-Takeover Provisions” for more information about these anti-takeover provisions. |

U.S. Federal Income Tax Considerations | | Subject to the discussion in “Material U.S. Federal Income Tax Considerations,” the company will be classified as a partnership for U.S. federal income tax purposes. Accordingly, the company will not incur U.S. federal income tax liability; rather, each of our shareholders will be required to take into account his or her allocable share of company income, gain, loss, deduction, and other items. |

| | See the section entitled “Material U.S. Federal Income Tax Considerations” for information about the potential U.S. federal income tax consequences of the purchase, ownership and disposition of our common shares. |

Risk factors | | Investing in our common shares involves risks. See the section entitled “Risk Factors” and read this prospectus carefully before making an investment decision with respect to the common shares or the company. |

The number of common shares outstanding after this offering includes approximately common shares sold to the private placement participants, representing approximately % of the total common shares and voting power that will be purchased in the separate private placement transactions, at a per share price equal to the initial public offering and assumes that the underwriters’ overallotment option is not exercised. If the overallotment option is exercised in full, we will issue and sell an additional common shares to the public.

11

SUMMARY FINANCIAL DATA

The company was formed on December 26, 2006 and has conducted no operations and has generated no revenues to date. We will use the net proceeds from this offering and the separate private placement transactions to acquire and make loans to our initial businesses.

The following summary financial data presents the historical financial information for Forest, CanAmPac and Pangborn and does not reflect the accounting for these businesses upon completion of the acquisitions and the operation of the businesses as a consolidated entity. This historical financial data does not reflect the recapitalization of these businesses upon acquisition by the company. As a result, this historical data may not be indicative of the future performance of these businesses following their acquisition by the company and recapitalization. You should read this information in conjunction with the sections entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, the financial statements and notes thereto, and the pro forma condensed combined financial statements and notes thereto which reflect the completion of the acquisitions and related transactions thereto, all included elsewhere in this prospectus.

The summary financial data for Forest for the year ended December 31, 2005 were derived from Forest’s audited consolidated financial statements included elsewhere in this prospectus. The summary financial data for Forest at December 31, 2006 and for the year ended December 31, 2006 were derived from “Note 21—Consolidating Balance Sheet and Statement of Operations”, which we refer to as Note 21, to the audited financial statements of Forest, excluding all financial data related to CanAmPac as of the date and for the periods indicated therein, included elsewhere in this prospectus.

The summary financial data for CanAmPac for the year ended December 31, 2005 (predecessor) and the four month period ended April 30, 2006 (predecessor) were derived from Roman’s Paperboard and Packaging’s audited carve-out financial statements (predecessor) included elsewhere in this prospectus. The summary financial data for CanAmPac for the eight month period ended December 31, 2006 (successor) and at December 31, 2006 (successor) were derived from Note 21 to the audited financial statements of Forest, including only financial data related to CanAmPac as of the date and for the periods indicated therein, included elsewhere in this prospectus. The balances presented for the year ended December 31, 2005 and for the four month period ended April 30, 2006 were converted to U.S. dollars for the convenience of the reader at a conversion rate of one Canadian dollar to $0.87 (actual) U.S. dollar, which approximates the mean exchange rate in effect during 2006.

The summary financial data for Pangborn for the year ended December 31, 2005 (predecessor), for the period January 1, 2006 to June 4, 2006 (predecessor), for the period June 5, 2006 to December 31, 2006 (successor) and at December 31, 2006 (successor) were derived from Pangborn’s audited consolidated financial statements included elsewhere in this prospectus.

12

Forest

| | Years Ended December 31, | |

| | 2005 | | 2006 | |

| | ($ in thousands) | |

Statement of Operations Data: | | | | | | | |

Net sales | | $ | 83,870 | | | $ | 162,282 | | |

Income from operations | | 3,464 | | | 9,880 | | |

Net income (loss) | | (256 | ) | | 4,427 | | |

| | | | | | | | | |

| | | | At December 31,

2006 | |

| | | | ($ in thousands) | |

Balance Sheet Data: | | | | | | | |

Total assets | | | | | $ | 92,246 | | |

Total liabilities | | | | | 88,191 | | |

Participating preferred units | | | | | 26,055 | | |

Members’ deficit | | | | | (22,000 | ) | |

| | | | | | | | |

CanAmPac

| | Predecessor | | Successor | |

| | Year ended

December 31,

2005 | | January 1,2006

through

April 30, 2006 | | May 1, 2006

through

December 31,

2006 | |

| | ($ in thousands) | |

Statement of Operations Data: | | | | | | | | | | | | | |

Net sales | | | $ | 93,895 | | | | $ | 32,155 | | | | $ | 62,622 | | |

Income (loss) from operations | | | (1,752 | ) | | | 332 | | | | 873 | | |

Net loss | | | (2,251 | ) | | | (132 | ) | | | (1,622 | ) | |

| | | | | | | | | | | | | | | | |

| | | | | | At December 31,

2006 | |

| | | | | | ($ in thousands) | |

Balance Sheet Data: | | | | | | | | | | | | | |

Total assets | | | | | | | | | | | $ | 51,661 | | |

Total liabilities | | | | | | | | | | | 35,791 | | |

Minority interests | | | | | | | | | | | 4,146 | | |

Members’ equity | | | | | | | | | | | 11,724 | | |

| | | | | | | | | | | | | | |

Pangborn

| | Predecessor | | Successor | |

| | Year ended

December 31,

2005 | | January 1, 2006

through

June 4, 2006 | | June 5, 2006

through

December 31,

2006 | |

| | ($ in thousands) | |

Statement of Operations Data: | | | | | | | | | | | | | |

Revenues | | | $ | 25,171 | | | | $ | 10,674 | | | | $ | 19,158 | | |

Income from operations | | | 3,259 | | | | 1,079 | | | | 1,404 | | |

Net income | | | 1,736 | | | | 603 | | | | 204 | | |

| | | | | | | | | | | | | | | | |

| | | | | | At December 31,

2006 | |

| | | | | | ($ in thousands) | |

Balance Sheet Data: | | | | | | | | | | | | | |

Total assets | | | | | | | | | | | $ | 22,106 | | |

Total liabilities | | | | | | | | | | | 20,067 | | |

Members’ equity | | | | | | | | | | | 2,039 | | |

| | | | | | | | | | | | | | |

13

RISK FACTORS

An investment in our common shares involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this prospectus, before making an investment decision with respect to our common shares or the company. If any of the following events occur, our financial condition, business and results of operations (including cash flows) may be materially adversely affected. In that event, the market price of our common shares could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Structure

We are a new company with no history and we may not be able to successfully manage our initial businesses on a combined basis.

We were formed on December 26, 2006 and have conducted no operations and have generated no revenues to date. We will use the net proceeds from this offering and the separate private placement transactions, in substantial part, to acquire the equity interests in and make loans to our initial businesses. Our manager will manage the day-to-day operations and affairs of the company and oversee the management and operations of our initial businesses, subject to the oversight of our board of directors. Our management team has collectively over 100 years of experience in acquiring and managing small and middle market businesses. However, if we do not develop effective systems and procedures, including accounting and financial reporting systems, to manage our operations as a consolidated public company, we may not be able to manage the combined enterprise on a profitable basis, which could adversely affect our ability to pay distributions to our shareholders. In addition, the pro forma condensed combined financial statements of our initial businesses cover periods during which some of our initial businesses were not under common control or management and, therefore, may not be indicative of our future financial condition, business and results of operations.

Our audited financial statements will not include meaningful comparisons to prior years and may differ substantially from the pro forma condensed combined financial statements included in this prospectus.

Our audited financial statements will include consolidated results of operations and cash flows only for the period from the date of the acquisition of our initial businesses to year-end. Because we will purchase our initial businesses only after the closing of this offering and recapitalize each of them, we anticipate that our audited financial statements will not contain full-year consolidated results of operations and cash flows until the end of our 2008 fiscal year, which may differ substantially from the pro forma combined financial statements included in this prospectus. Consequently, meaningful year-to-year comparisons will not be available, at the earliest, until two fiscal years following the completion of this offering.

Our future success is dependent on the employees of our manager, our manager’s operating partners and the management teams of our businesses, the loss of any of whom could materially adversely affect our financial condition, business and results of operations.

Our future success depends, to a significant extent, on the continued services of the employees of our manager, most of whom have worked together for a number of years. Because certain employees of our manager were involved in the acquisitions of these initial businesses while working for Atlas Holdings and, since such acquisitions, have overseen the operations of these businesses, the loss of their services may materially adversely affect our ability to manage the operations of our initial businesses. While our manager may have employment agreements with certain of its employees, these employment agreements may not prevent our manager’s employees from leaving our manager or from competing with us in the future. In addition, we will depend on the assistance provided by our manager’s operating partners in evaluating, performing diligence on and managing our businesses. The loss of any employees of our

14

manager or any of our manager’s operating partners may materially adversely affect our ability to implement or maintain our management strategy or our acquisition strategy.

The future success of our businesses also depends on their respective management teams because we intend to operate our businesses on a stand-alone basis, primarily relying on their existing management teams for management of our businesses’ day-to-day operations. Consequently, their operational success, as well as the success of any organic growth strategy, will be dependent on the continuing efforts of the management teams of our businesses. We will seek to provide these individuals with equity incentives in the company and to have employment agreements with certain persons we have identified as key to their businesses. However, these measures may not prevent these individuals from leaving their employment. The loss of services of one or more of these individuals may materially adversely affect our financial condition, business and results of operations.

We may experience difficulty with respect to the evaluation and management of future acquisitions.

A component of our strategy is to acquire additional businesses. We will focus on small to middle market businesses in various industries. Generally, because such businesses are privately held, we may experience difficulty in evaluating potential target businesses as much of the information concerning these businesses is not publicly available. Therefore, our estimates and assumptions used to evaluate the operations, management and market risks with respect to potential target businesses may be subject to various risks and uncertainties. Further, the time and costs associated with identifying and evaluating potential target businesses and their industries may cause a substantial drain on our resources and may divert our management team’s attention away from the operations of our businesses for significant periods of time.

In addition, we may have difficulty effectively integrating and managing future acquisitions. The management or improvement of businesses we acquire may be hindered by a number of factors, including limitations in the standards, controls, procedures and policies implemented in connection with such acquisitions. Further, the management of an acquired business may involve a substantial reorganization of the business’ operations resulting in the loss of employees and customers or the disruption of our ongoing businesses. We may experience greater than expected costs or difficulties relating to an acquisition, in which case, we might not achieve the anticipated returns from any particular acquisition. Any of these events or factors may have a material adverse effect on our financial condition, business and results of operations.

We face competition for acquisitions of businesses that fit our acquisition strategy.

We have been formed to acquire and manage small to middle market businesses. In pursuing such acquisitions, we expect to face strong competition from a wide range of other potential purchasers. Although the pool of potential purchasers for such businesses is typically smaller than for larger businesses, those potential purchasers can be aggressive in their approach to acquiring such businesses. Furthermore, we expect that we may need to use third-party financing in order to fund some or all of these potential acquisitions, thereby increasing our acquisition costs. To the extent that other potential purchasers do not need to obtain third-party financing or are able to obtain such financing on more favorable terms, they may be in a position to be more aggressive with their acquisition proposals. As a result, in order to be competitive, our acquisition proposals may need to be aggressively priced, including at price levels that exceed what we originally determined to be fair or appropriate in order to remain competitive. Alternatively, we may determine that we cannot pursue on a cost effective basis what would otherwise be an attractive acquisition opportunity. These events may have a material adverse effect on our financial condition, business and results of operations.

15

We may acquire businesses in bankruptcy or that are facing legal, financial or operational difficulties, which could cause us to assume greater risk than if we acquired healthy businesses.

As part of our acquisition strategy, we may acquire businesses that are facing legal, financial or operational difficulties, including businesses that may be operating under the protection of bankruptcy or similar laws or that may be engaged in significant litigation. Distressed businesses often experience one or more of the following: loss of customers, loss of key employees, failure to make capital investments to maintain assets and damage to brand names and goodwill, any of which can create long-term challenges for such businesses, even after emerging from the bankruptcy process. The risks we may face when acquiring a distressed business may be greater than if we acquire a healthy business. These risks may result in events or circumstances that have a material adverse effect on our financial condition, business and results of operations.

We may not be able to successfully fund future acquisitions of new businesses due to the unavailability of debt or equity financing on acceptable terms, which could impede the implementation of our acquisition strategy and materially adversely affect our financial condition, business and results of operations.

In order to make future acquisitions, we intend to raise capital primarily through debt financing at the company level, additional equity offerings, the sale of equity or assets of our businesses, offering equity in the company or our businesses to the sellers of target businesses or by undertaking a combination of any of the above. Because the timing and size of acquisitions cannot be readily predicted, we may need to be able to obtain funding on short notice to benefit fully from attractive acquisition opportunities. Such funding may not be available on acceptable terms. In addition, the level of our indebtedness may impact our ability to borrow at the company level. The sale of additional common shares will also be subject to market conditions and investor demand for the common shares at prices that may not be in the best interest of our shareholders. These risks may materially adversely affect our ability to pursue our acquisition strategy, as well as affect our financial condition, business and results of operations.

We may change our management and acquisition strategies without the consent of our shareholders, which may result in a determination by us to pursue riskier business activities.

We may change our strategy at any time without the consent of our shareholders, which may result in our acquiring businesses or assets that are different from, and possibly riskier than, the strategy described in this prospectus. A change in our strategy may increase our exposure to interest rate and currency fluctuations or other risks and uncertainties.

Although we currently intend to make regular cash distributions to our shareholders, our board of directors has full authority and discretion over the distributions of the company, other than the profit allocation, and it may decide to reduce or not declare distributions at any time, which may materially adversely affect the market price of our common shares.

To date, we have not declared or paid any distributions, but our board of directors intends to declare and pay a regular quarterly cash distribution to our common shareholders, including an initial quarterly distribution of $0.2625 per share for the quarter ended , 2007, and a distribution that is pro rated based on the initial quarterly distribution for the period from the completion of this offering to , 2007. If you purchase common shares in this offering but do not hold such common shares on the record date set by our board of directors with respect to these distributions, you will not receive such distributions.

Although we currently intend to pursue a policy of paying regular quarterly distributions, our board of directors will have full authority and discretion to determine whether or not a distribution by the company should be declared and paid to our shareholders, as well as the amount and timing of any distribution. Our board of directors may, based on their review of our financial condition and results of operations and

16

pending acquisitions, determine to reduce or not declare distributions, which may have a material adverse effect on the market price of our common shares.

In addition, the management fee, put price and profit allocation will be payment obligations of the company and, as a result, will be senior in right to the payment of any distributions to our shareholders. Further, we are required to make a profit allocation to our manager upon satisfaction of applicable conditions to payment.

Our Chief Executive Officer, President, Chief Accounting Officer, directors, manager, other members of our management team and our manager’s operating partners may allocate some of their time to other businesses, thereby causing conflicts of interest in their determination as to how much time to devote to our affairs, which may materially adversely affect our business and operations.

While the members of our management team anticipate devoting a substantial amount of their time to the affairs of the company, only Henry C. Newell, our Chief Financial Officer and Secretary and an employee of the company, will devote 100% of his time to our affairs. As such, our Chief Executive Officer, President, Chief Accounting Officer, directors, manager, other members of our management team and our manager’s operating partners may engage in other business activities. This may result in a conflict of interest in allocating their time between our operations and the management and operations of other businesses. Their other business endeavors may be related to Atlas Holdings and its affiliates, which will continue to have ownership interests in, manage or otherwise participate in the control of several other businesses along with other parties, including possibly our manager’s operating partners. Conflicts of interest that arise over the allocation of time may not always be resolved in our favor and may materially adversely affect our financial condition, business and results of operations. See the section entitled “Certain Relationships and Related Persons Transactions” for more information about the potential conflicts of interest of which you should be aware.

We will rely entirely on dividends and interest payments from our businesses to make distributions to our shareholders.

The company’s only business is holding controlling interests in our businesses. Therefore, we will be dependent upon the ability of our businesses to generate cash flows and, in turn, distribute cash to us in the form of interest and principal payments on indebtedness and distributions on equity to enable us, first, to satisfy our financial obligations and, second, to make distributions to our shareholders. The ability of our businesses to make payments to us may also be subject to limitations under laws of the jurisdictions in which they are incorporated or organized. If, as a consequence of these various restrictions or otherwise, we are unable to generate sufficient cash flow from our businesses, we may not be able to declare, or may have to delay or cancel payment of, distributions to our shareholders. See the section entitled “Dividend and Distribution Policy—Restrictions on Dividend Payments” for a more detailed description of these restrictions.

Certain provisions of the LLC agreement of the company could make it difficult for third parties to acquire control of the company and could deprive you of the opportunity to obtain a takeover premium for your common shares.

The amended and restated operating agreement of the company, which we refer to as the LLC agreement, contains a number of provisions that could make it more difficult for a third party to acquire, or may discourage a third party from acquiring, control of the company. These provisions, among others things:

· restrict the company’s ability to enter into certain transactions with our major shareholders, with the exception of our manager, modeled on the limitation contained in Section 203 of the Delaware General Corporation Law, which we refer to as the DGCL;

17

· allow only our board of directors to fill newly created directorships, for those directors who are elected by our shareholders, and allow only our manager, as holder of the allocation shares, to fill vacancies with respect to the directors appointed by our manager;

· require that directors elected by our shareholders be removed, with or without cause, only by an affirmative vote of the holders of 85% or more of the then outstanding common shares;

· require advance notice for nominations of candidates for election to our board of directors or for proposing matters that can be acted upon by our shareholders at a meeting of our shareholders;

· provide for a substantial number of additional authorized but unissued common shares that may be issued without action by our shareholders;

· provide our board of directors with certain authority to amend the LLC agreement subject to certain voting and consent rights of the holders of common shares and allocation shares;

· provide for a staggered board of directors of the company, the effect of which could be to deter a proxy contest for control of our board of directors or a hostile takeover; and

· limit calling special meetings and obtaining written consents of our shareholders.

These provisions, as well as other provisions in the LLC agreement, may delay, defer or prevent a transaction or a change in control that might otherwise result in you receiving a takeover premium for your common shares. See the section entitled “Description of Shares—Anti-Takeover Provisions” for more information about voting and consent rights and the anti-takeover provisions.

Our proposed third-party credit facility may expose us to additional risks associated with leverage and inhibits our operating flexibility and reduces cash flow available for distributions to our shareholders.

We will initially have no debt outstanding under our proposed third-party credit facility, but we expect to increase our level of debt in the future. We expect that our proposed third-party credit facility will require us to pay a commitment fee on the undrawn amount. We also expect that our proposed third-party credit facility will contain a number of affirmative and restrictive covenants.

If we violate any such covenants, our lender could accelerate the maturity of any debt outstanding and we may be prohibited from making any distributions to our shareholders. Such debt may be secured by our assets, including the stock we own in our businesses and the rights we have under the loan agreements with our businesses. Our ability to meet our debt service obligations may be affected by events beyond our control and will depend primarily upon cash produced by our businesses and distributed or paid to the company. Any failure to comply with the terms of our indebtedness may have a material adverse effect on our financial condition, business and results of operations.

Changes in interest rates could materially adversely affect us.

We expect that our proposed third-party credit facility will bear interest at floating rates which will generally change as interest rates change. We bear the risk that the rates we are charged by our lender will increase faster than we can grow the cash flow of our businesses, which could reduce profitability, materially adversely affect our ability to service our debt, cause us to breach covenants contained in our proposed third-party credit facility and reduce cash flow available for distribution, any of which may have a material adverse effect on our financial condition, business and results of operations.

18

We may engage in a business transaction with one or more target businesses that have relationships with our officers, our directors, our manager, our manager’s employees or our manager’s operating partners, or any of their respective affiliates, which may create or present conflicts of interest.

We may decide to engage in a business transaction with one or more target businesses with which our officers, our directors, our manager, our manager’s employees or our manager’s operating partners, or any of their respective affiliates, have a relationship, which may create or present conflicts of interest. While we might obtain a fairness opinion from an independent investment banking firm with respect to such a transaction, conflicts of interest may still exist with respect to a particular acquisition and, as a result, the terms of the acquisition of a target business may not be as advantageous to our shareholders as it would have been absent any conflicts of interest.

We will incur increased costs as a result of being a publicly traded company.

As a publicly traded company, we will incur legal, accounting and other expenses, including costs associated with the periodic reporting requirements applicable to a company whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act, recently adopted corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, and other rules implemented by the Securities and Exchange Commission, which we refer to as the SEC, and Nasdaq. We believe that complying with these rules and regulations will increase substantially our legal and financial compliance costs and will make some activities more time-consuming and costly and may divert significant portions of our management team from operating and acquiring businesses to these and related matters. We also believe that being a publicly traded company will make it more difficult and more expensive for us to obtain directors and officers’ liability insurance. These factors may have a material adverse effect on our financial condition, business and results of operations.

If in the future we cease to control and operate our businesses, we may be deemed to be an investment company under the Investment Company Act of 1940, as amended.

We have the ability to make investments in businesses that we will not operate or control. If we make significant investments in businesses that we do not operate or control, or that we cease to operate or control, or if we commence certain investment-related activities, we may be deemed to be an investment company under the Investment Company Act of 1940, as amended, which we refer to as the Investment Company Act. If we were deemed to be an investment company, we would either have to register as an investment company under the Investment Company Act, obtain exemptive relief from the SEC or modify our investments or organizational structure or our contract rights to fall outside the definition of an investment company. Registering as an investment company could, among other things, materially adversely affect our financial condition, business and results of operations, materially limit our ability to borrow funds or engage in other transactions involving leverage and require us to add directors who are independent of us or our manager and otherwise will subject us to additional regulation that will be costly and time-consuming.

Risks Relating to Our Relationship with Our Manager

Our manager, its affiliates and our manager’s operating partners may engage in activities that compete with us or our businesses.