Exhibit 99.1

Investor Symposium on Galinpepimut - S September 15, 2022 NASDAQ: SLS

NASDAQ: SLS Forward Looking Statements This presentation contains forward - looking statements. Such forward - looking statements can be identified by the use of the word s “expect,” “believe,” “will,” “anticipate,” “estimate,” “plan,” “project” and other words of similar import. The forward - looking statements in this presentation include, but are not limited to, statements related to the potential commercial opportunity for our clin ica l candidate, galinpepimut - S (GPS). These forward - looking statements are based on current plans, objectives, estimates, expectations and intentions, and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially f rom those anticipated in such forward - looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with the COVID - 19 pandemic and its impact on the Company’s clinical plans and business strategy, immune - oncology product development and clinical success thereof, the uncertainty of regulatory approval, and other risks and uncert ain ties affecting SELLAS and its development programs. These risks and uncertainties are described more fully under the caption ”Risk Fa ctors” in SELLAS’ Annual Report on Form 10 - K filed on March 31, 2022 and in its other filings with the Securities and Exchange Commiss ion. Other risks and uncertainties of which SELLAS is not currently aware may also affect SELLAS’ forward - looking statements. The for ward - looking statements herein are made only as of the date hereof. SELLAS undertakes no obligation to update or supplement any fo rwa rd - looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstan ces that exist after the date as of which the forward - looking statements were made. All statements in this presentation assume a statistically significant and clinically meaningful data outcome from the Phase 3 R EGAL study for GPS, a successful BLA filing with the FDA and marketing approval by the FDA. 2

Angelos M. Stergiou, M.D., ScD h.c. President & Chief Executive Officer, SELLAS Life Sciences Welcome & Introduction

Robert Francomano Chief Commercial Officer, SELLAS Life Sciences Galinpepimut - S (GPS): Commercial Overview

NASDAQ: SLS Agenda 5 Topic Establishing Commercial Capability and Infrastructure Overview of Current and Emerging AML Treatment Landscape Global Market Epidemiology and Size: Complete Remission (CR2) Patient Numbers Phase 3 REGAL Trial Overview and Emerging Product Profile AML Market Pricing Overview U.S. Reimbursement Expectations for GPS Commercial Activities Key Takeaways

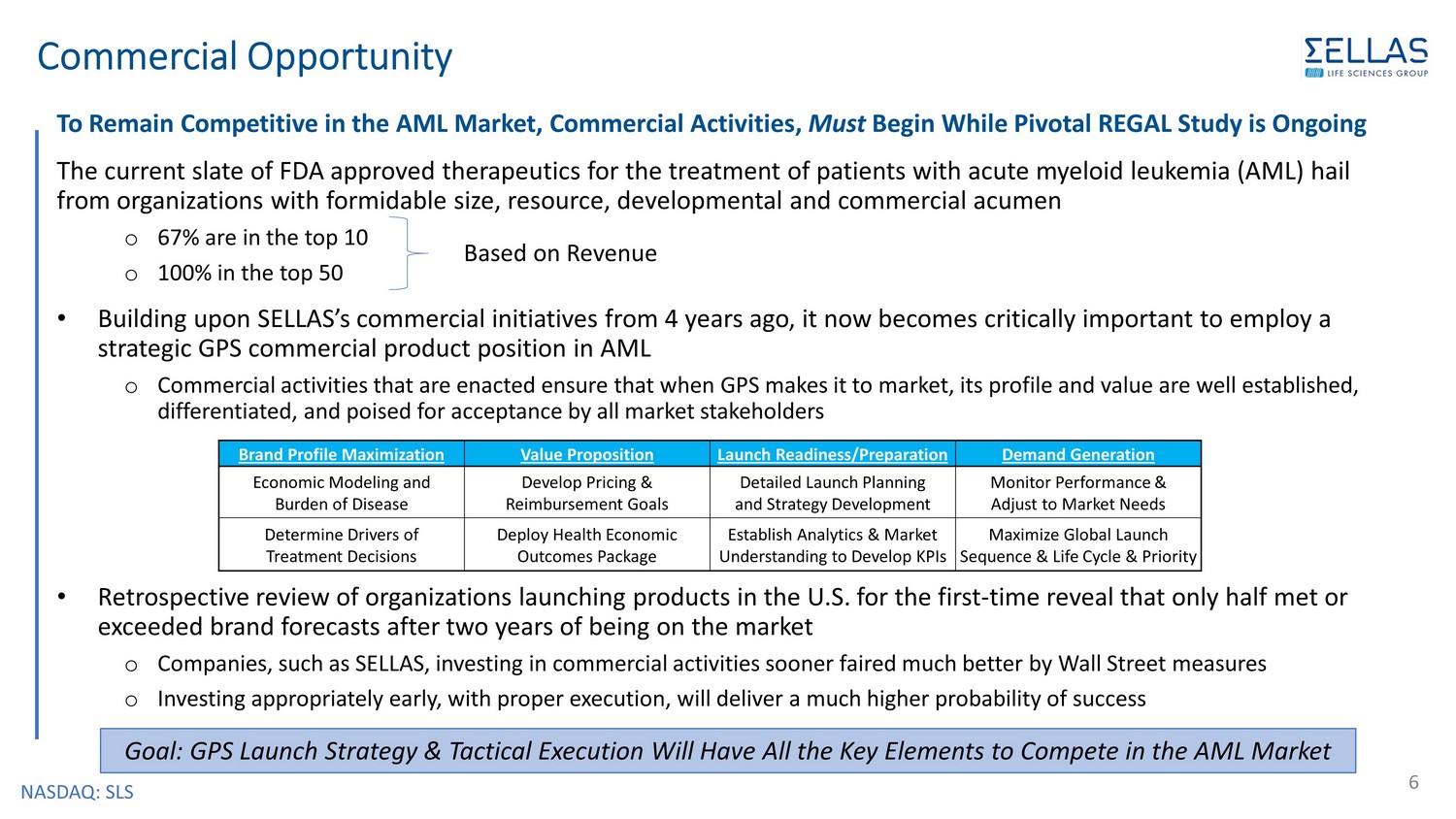

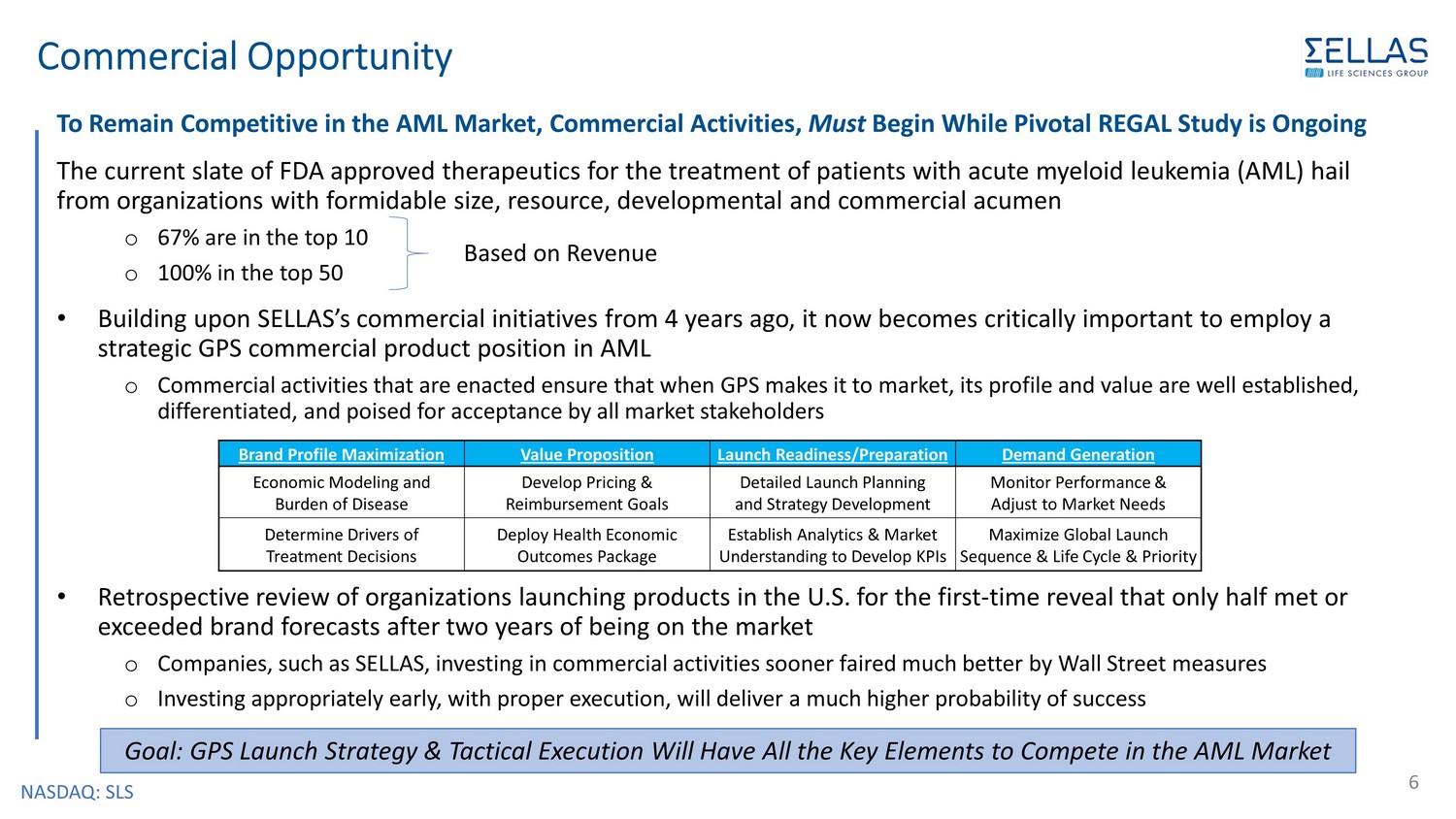

NASDAQ: SLS Commercial Opportunity 6 To Remain Competitive in the AML Market, Commercial Activities, Must Begin While Pivotal REGAL Study is Ongoing The current slate of FDA approved therapeutics for the treatment of patients with acute myeloid leukemia (AML) hail from organizations with formidable size, resource, developmental and commercial acumen o 67% are in the top 10 o 100% in the top 50 • Building upon SELLAS’s commercial initiatives from 4 years ago, it now becomes critically important to employ a strategic GPS commercial product position in AML o Commercial activities that are enacted ensure that when GPS makes it to market, its profile and value are well established, differentiated, and poised for acceptance by all market stakeholders • Retrospective review of organizations launching products in the U.S. for the first - time reveal that only half met or exceeded brand forecasts after two years of being on the market o Companies, such as SELLAS, investing in commercial activities sooner faired much better by Wall Street measures o Investing appropriately early, with proper execution, will deliver a much higher probability of success Based on Revenue Brand Profile Maximization Value Proposition Launch Readiness/Preparation Demand Generation Economic Modeling and Burden of Disease Develop Pricing & Reimbursement Goals Detailed Launch Planning and Strategy Development Monitor Performance & Adjust to Market Needs Determine Drivers of Treatment Decisions Deploy Health Economic Outcomes Package Establish Analytics & Market Understanding to Develop KPIs Maximize Global Launch Sequence & Life Cycle & Priority Goal: GPS Launch Strategy & Tactical Execution Will Have All the Key Elements to Compete in the AML Market

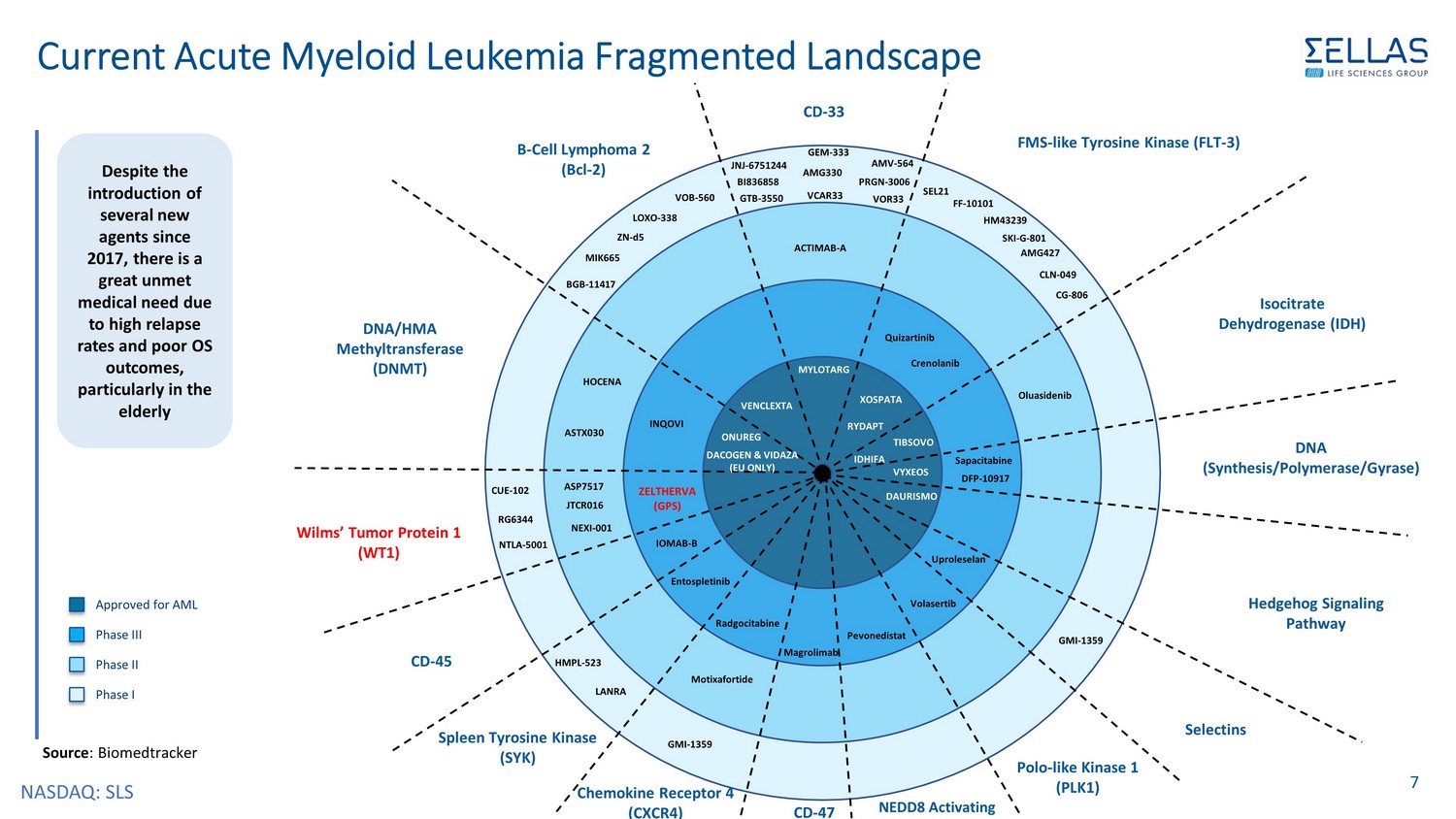

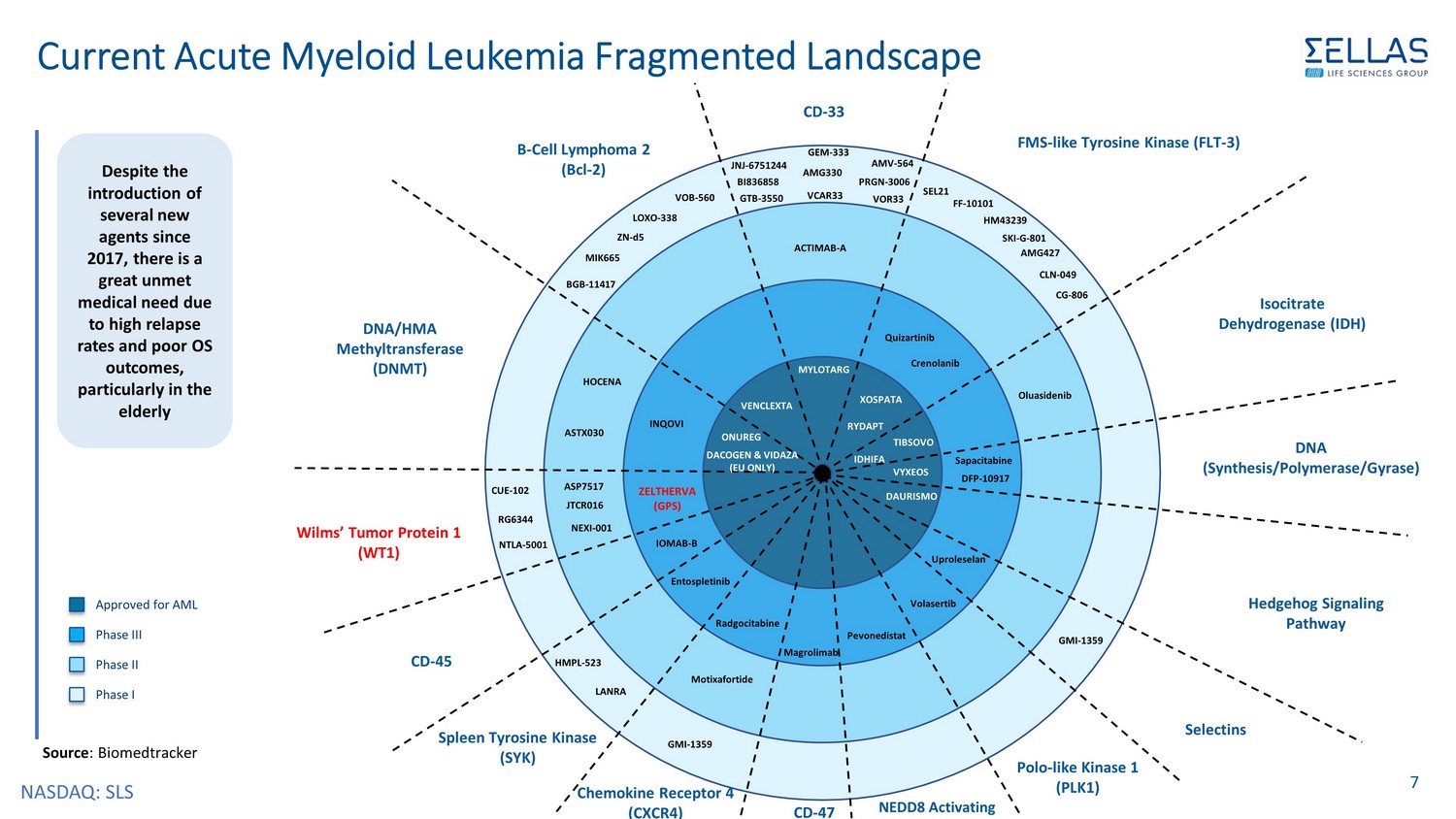

NASDAQ: SLS 7 Approved for AML Phase III Phase II Phase I Isocitrate Dehydrogenase (IDH) TIBSOVO IDHIFA Sapacitabine VYXEOS XOSPATA MYLOTARG RYDAPT ACTIMAB - A GTB - 3550 VCAR33 VOR33 BI836858 PRGN - 3006 Quizartinib DAURISMO SEL21 BGB - 11417 VENCLEXTA ONUREG INQOVI DNA (Synthesis/Polymerase/Gyrase) FMS - like Tyrosine Kinase (FLT - 3) CD - 33 JNJ - 6751244 AMG330 AMV - 564 GEM - 333 Crenolanib FF - 10101 HM43239 SKI - G - 801 AMG427 CLN - 049 CG - 806 Hedgehog Signaling Pathway B - Cell Lymphoma 2 (Bcl - 2) MIK665 LOXO - 338 VOB - 560 ZN - d5 DNA/HMA Methyltransferase (DNMT) DACOGEN & VIDAZA (EU ONLY) ASTX030 HOCENA Wilms’ Tumor Protein 1 (WT1) JTCR016 NEXI - 001 ASP7517 RG6344 NTLA - 5001 ZELTHERVA (GPS) Oluasidenib Selectins Uproleselan GMI - 1359 Source : Biomedtracker IOMAB - B CD - 45 Spleen Tyrosine Kinase (SYK) Entospletinib HMPL - 523 LANRA Chemokine Receptor 4 (CXCR4) Radgocitabine Motixafortide GMI - 1359 DFP - 10917 CD - 47 Magrolimab Pevonedistat Volasertib Polo - like Kinase 1 (PLK1) NEDD8 Activating CUE - 102 Despite the introduction of several new agents since 2017, there is a great unmet medical need due to high relapse rates and poor OS outcomes, particularly in the elderly Current Acute Myeloid Leukemia Fragmented Landscape

NASDAQ: SLS Acute Myeloid Leukemia Key Market Incidence • AML is the most common acute leukemia in adults and primarily affects older people with a median age at diagnosis of ~67 years • The AML market is expected to grow at a 21.85% CAGR between 2018 – 2030 to $5 billion Source: Delveinsight AML Market Insight, Epidemiology & Market Forecast - 2030, June 2021 Parameter Sub - Parameter 2018 2030 CAGR Epidemiology Total Incident Population 40,552 48,000 1.42% US 19,438 24,012 1.78% EU5 16,559 19,244 1.20% Japan 4,455 4,744 1.52% Market Size Total Market Size $475.6 M $5.01 B 21.85% US $358.3 M $3.74 B 21.59% EU5 $91.7 M $1.15 B 23.46% Japan $25.6 M $203.6 M 18.87% GPS’ WT1 First - Mover CR2 Status & Differentiated Profile Should Be Well Received in the Evolving Competitive Landscape

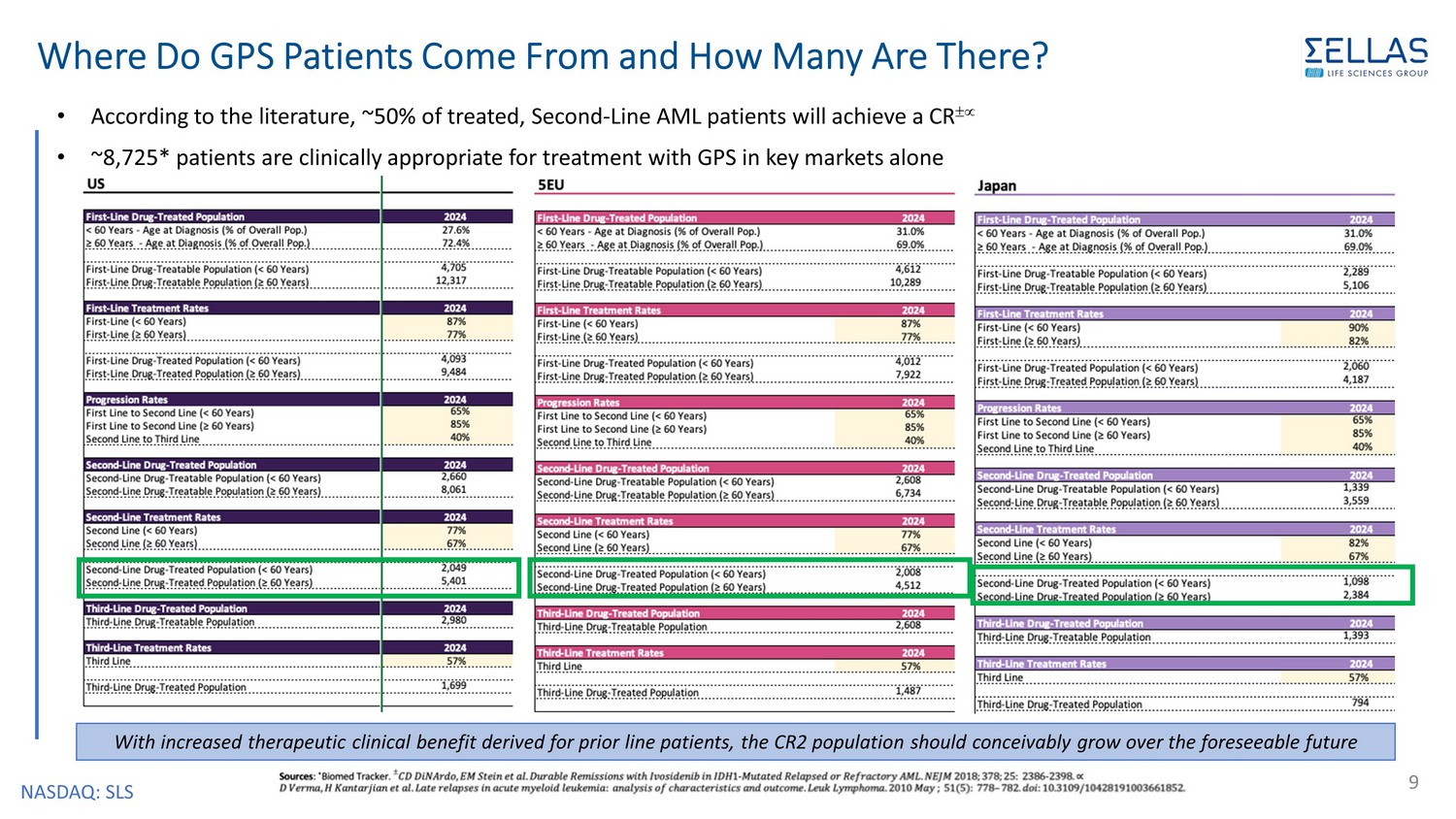

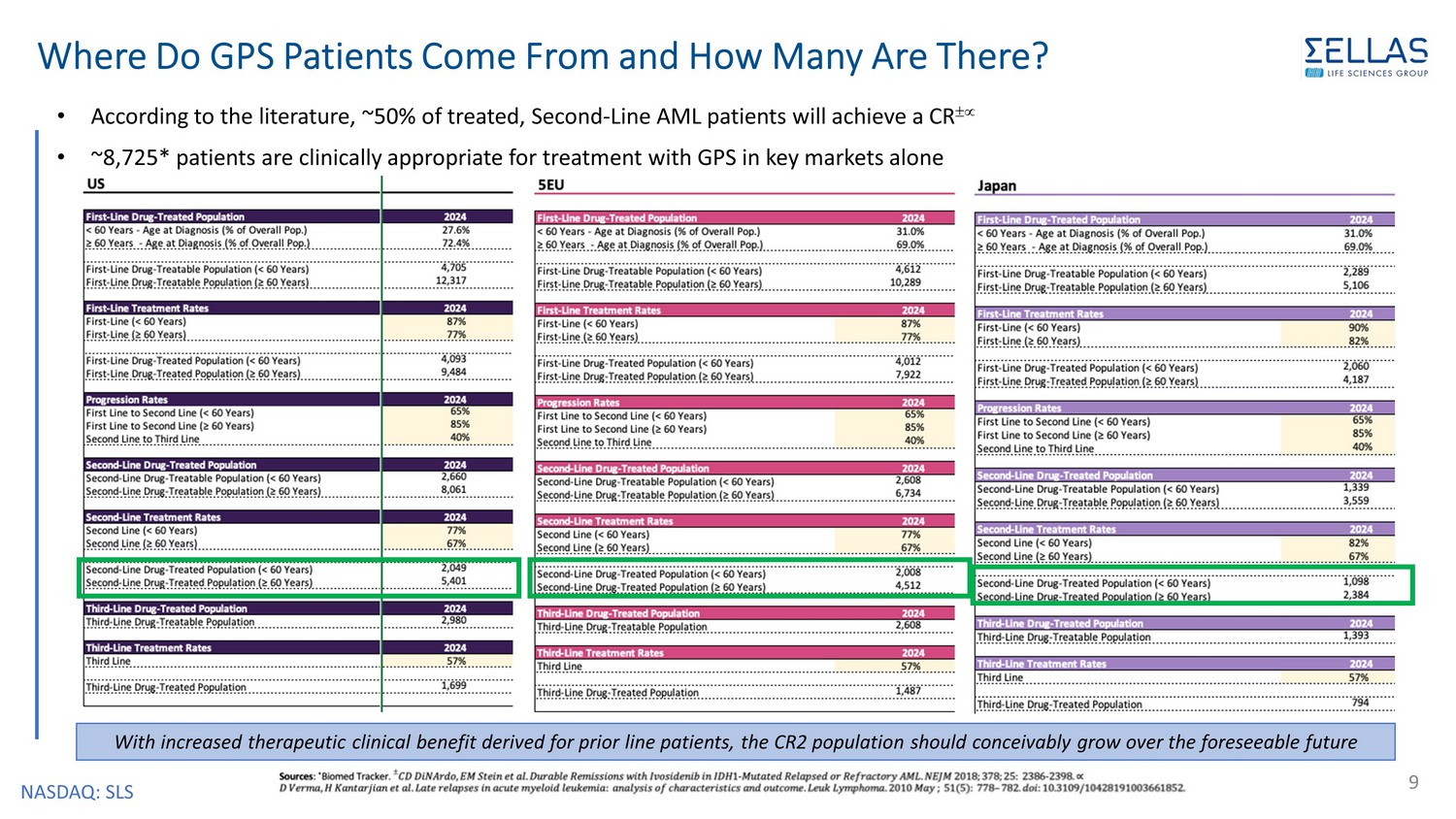

NASDAQ: SLS Where Do GPS Patients Come From and How Many Are There? • According to the literature, ~50% of treated, Second - Line AML patients will achieve a CR • ~8,725* patients are clinically appropriate for treatment with GPS in key markets alone 9 With increased therapeutic clinical benefit derived for prior line patients, the CR2 population should conceivably grow over the foreseeable future

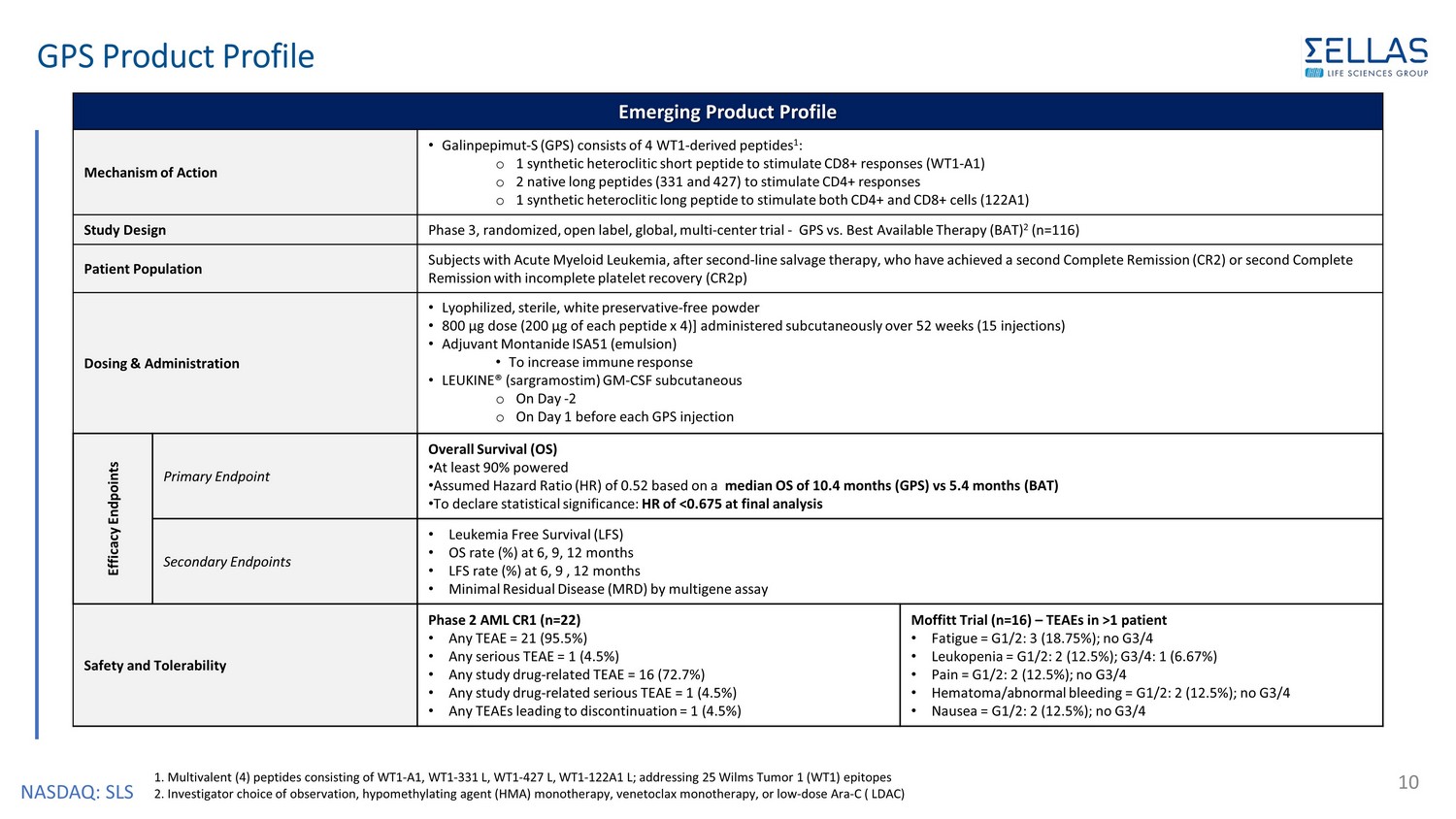

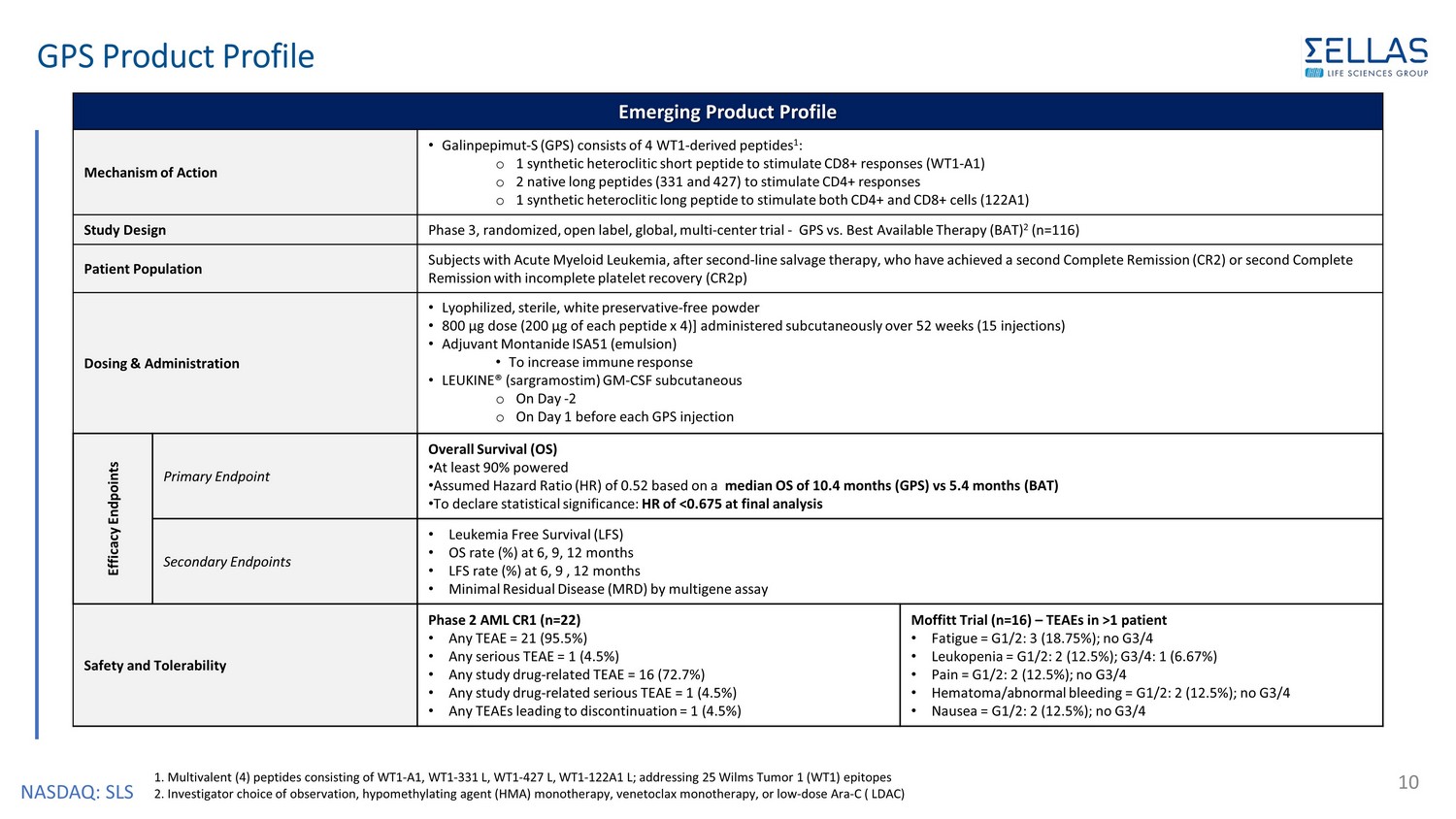

NASDAQ: SLS GPS Product Profile 10 1. Multivalent (4) peptides consisting of WT1 - A1, WT1 - 331 L, WT1 - 427 L, WT1 - 122A1 L; addressing 25 Wilms Tumor 1 (WT1) epitopes 2. Investigator choice of observation, hypomethylating agent (HMA) monotherapy, venetoclax monotherapy, or low - dose Ara - C ( LDAC) Emerging Product Profile Mechanism of Action • Galinpepimut - S (GPS) consists of 4 WT1 - derived peptides 1 : o 1 synthetic heteroclitic short peptide to stimulate CD8+ responses (WT1 - A1) o 2 native long peptides (331 and 427) to stimulate CD4+ responses o 1 synthetic heteroclitic long peptide to stimulate both CD4+ and CD8+ cells (122A1) Study Design Phase 3, randomized, open label, global, multi - center trial - GPS vs. Best Available Therapy (BAT) 2 (n=116) Patient Population Subjects with Acute Myeloid Leukemia, after second - line salvage therapy, who have achieved a second Complete Remission (CR2) or second Complete Remission with incomplete platelet recovery (CR2p) Dosing & Administration • Lyophilized, sterile, white preservative - free powder • 800 µg dose (200 µg of each peptide x 4)] administered subcutaneously over 52 weeks (15 injections) • Adjuvant Montanide ISA51 (emulsion) • To increase immune response • LEUKINE ® ( sargramostim ) GM - CSF subcutaneous o On Day - 2 o On Day 1 before each GPS injection Efficacy Endpoints Primary Endpoint Overall Survival (OS) • At least 90% powered • Assumed Hazard Ratio (HR) of 0.52 based on a median OS of 10.4 months (GPS) vs 5.4 months (BAT) • To declare statistical significance: HR of <0.675 at final analysis Secondary Endpoints • Leukemia Free Survival (LFS) • OS rate (%) at 6, 9, 12 months • LFS rate (%) at 6, 9 , 12 months • Minimal Residual Disease (MRD) by multigene assay Safety and Tolerability Phase 2 AML CR1 (n=22) • Any TEAE = 21 (95.5%) • Any serious TEAE = 1 (4.5%) • Any study drug - related TEAE = 16 (72.7%) • Any study drug - related serious TEAE = 1 (4.5%) • Any TEAEs leading to discontinuation = 1 (4.5%) Moffitt Trial (n=16) – TEAEs in >1 patient • Fatigue = G1/2: 3 (18.75%); no G3/4 • Leukopenia = G1/2: 2 (12.5%); G3/4: 1 (6.67%) • Pain = G1/2: 2 (12.5%); no G3/4 • Hematoma/abnormal bleeding = G1/2: 2 (12.5%); no G3/4 • Nausea = G1/2: 2 (12.5%); no G3/4

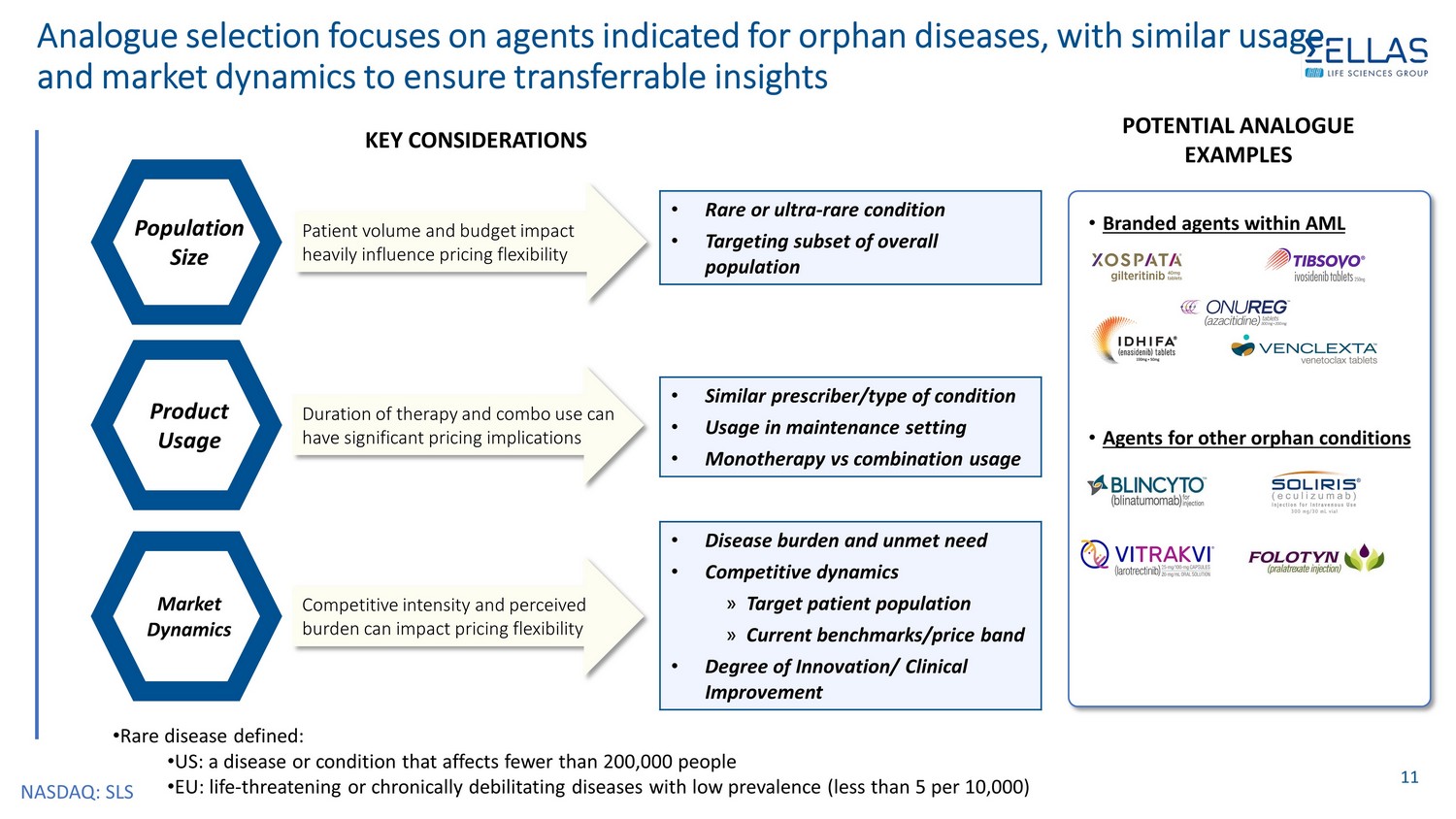

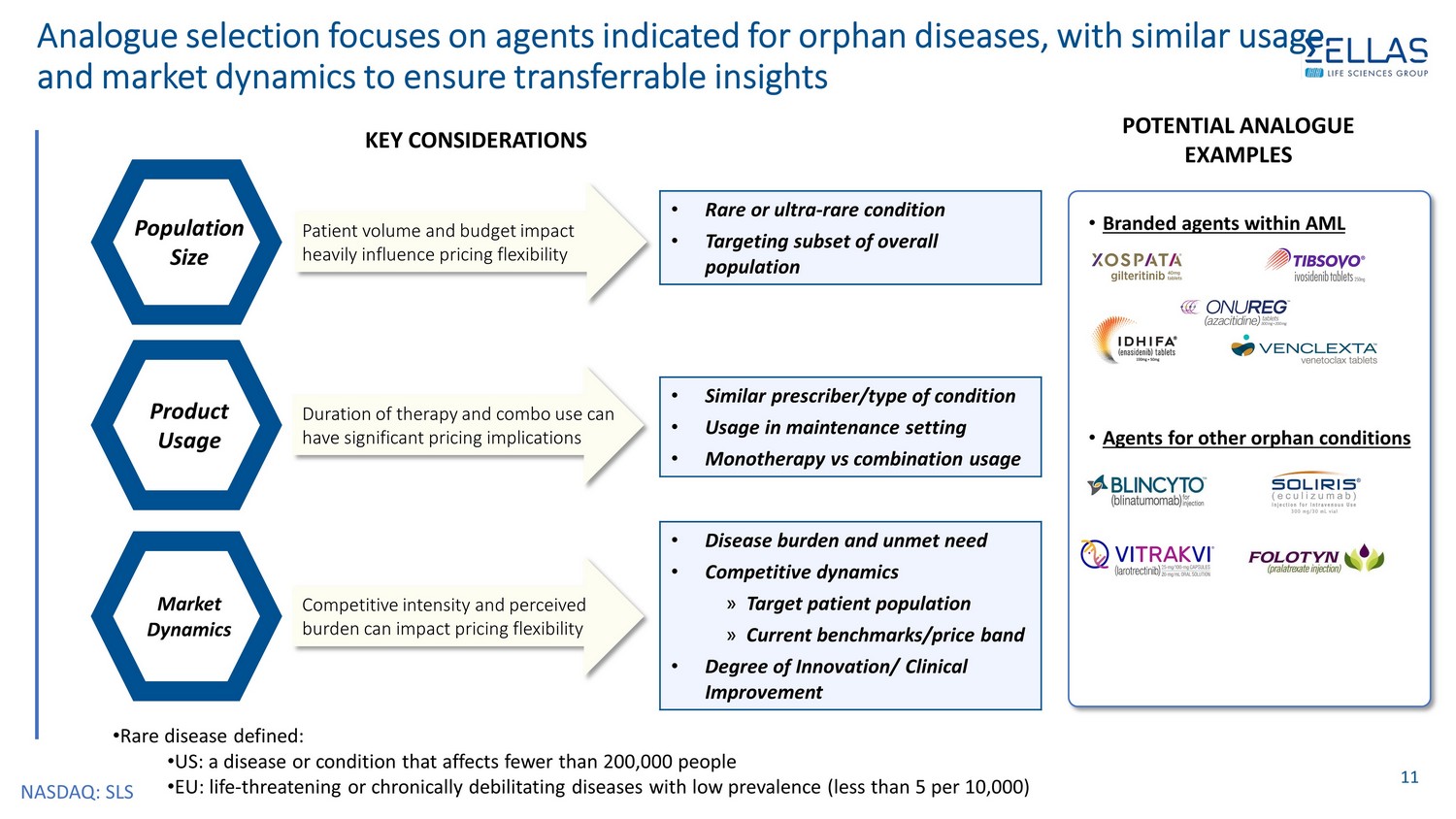

NASDAQ: SLS Analogue selection focuses on agents indicated for orphan diseases, with similar usage and market dynamics to ensure transferrable insights 11 KEY CONSIDERATIONS Population Size Patient volume and budget impact heavily influence pricing flexibility Product Usage Market Dynamics POTENTIAL ANALOGUE EXAMPLES • Rare or ultra - rare condition • Targeting subset of overall population Duration of therapy and combo use can have significant pricing implications Competitive intensity and perceived burden can impact pricing flexibility • Similar prescriber/type of condition • Usage in maintenance setting • Monotherapy vs combination usage • Disease burden and unmet need • Competitive dynamics » Target patient population » Current benchmarks/price band • Degree of Innovation/ Clinical Improvement • Branded agents within AML • Agents for other orphan conditions • Rare disease defined: • US: a disease or condition that affects fewer than 200,000 people • EU: life - threatening or chronically debilitating diseases with low prevalence (less than 5 per 10,000)

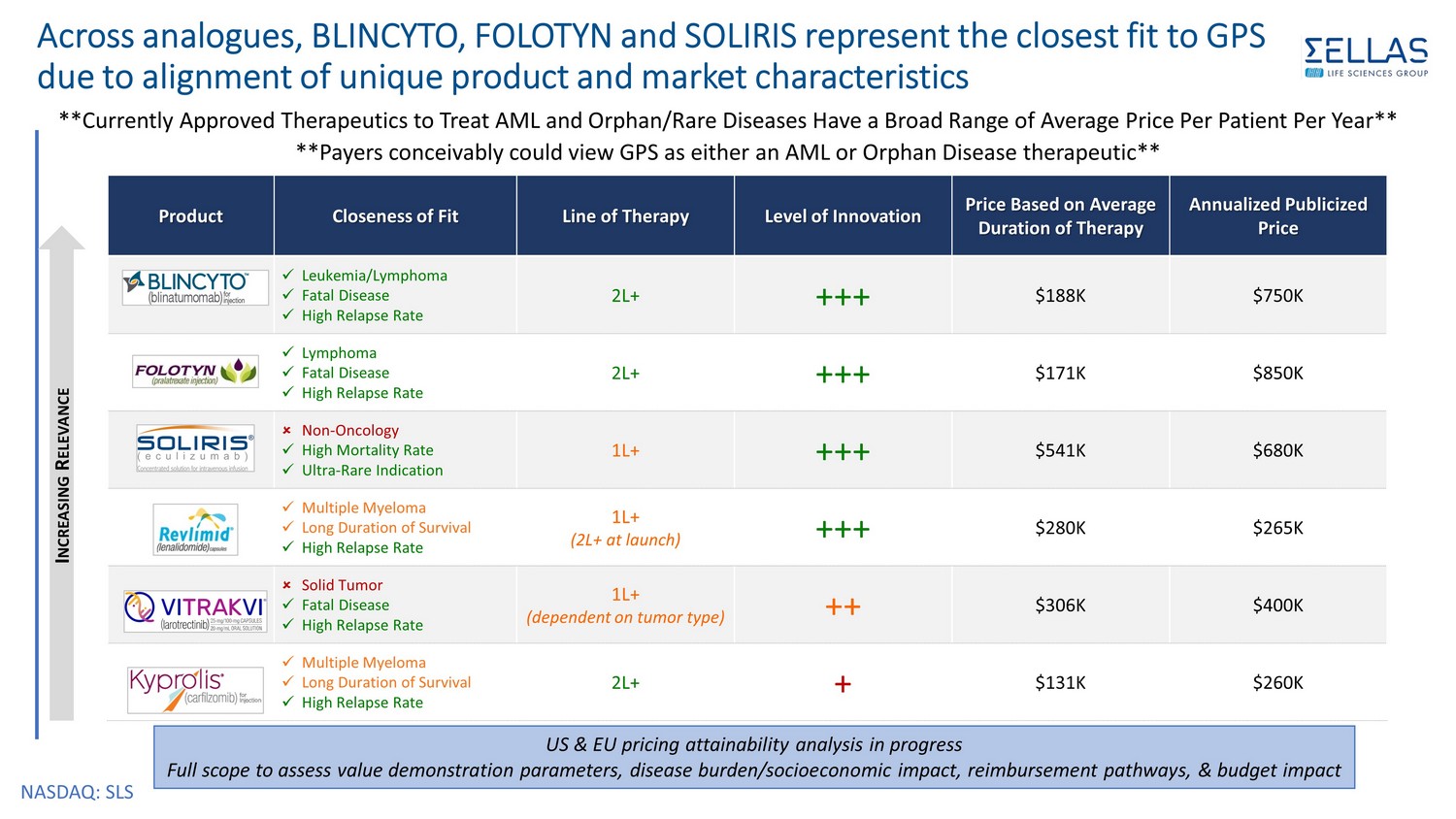

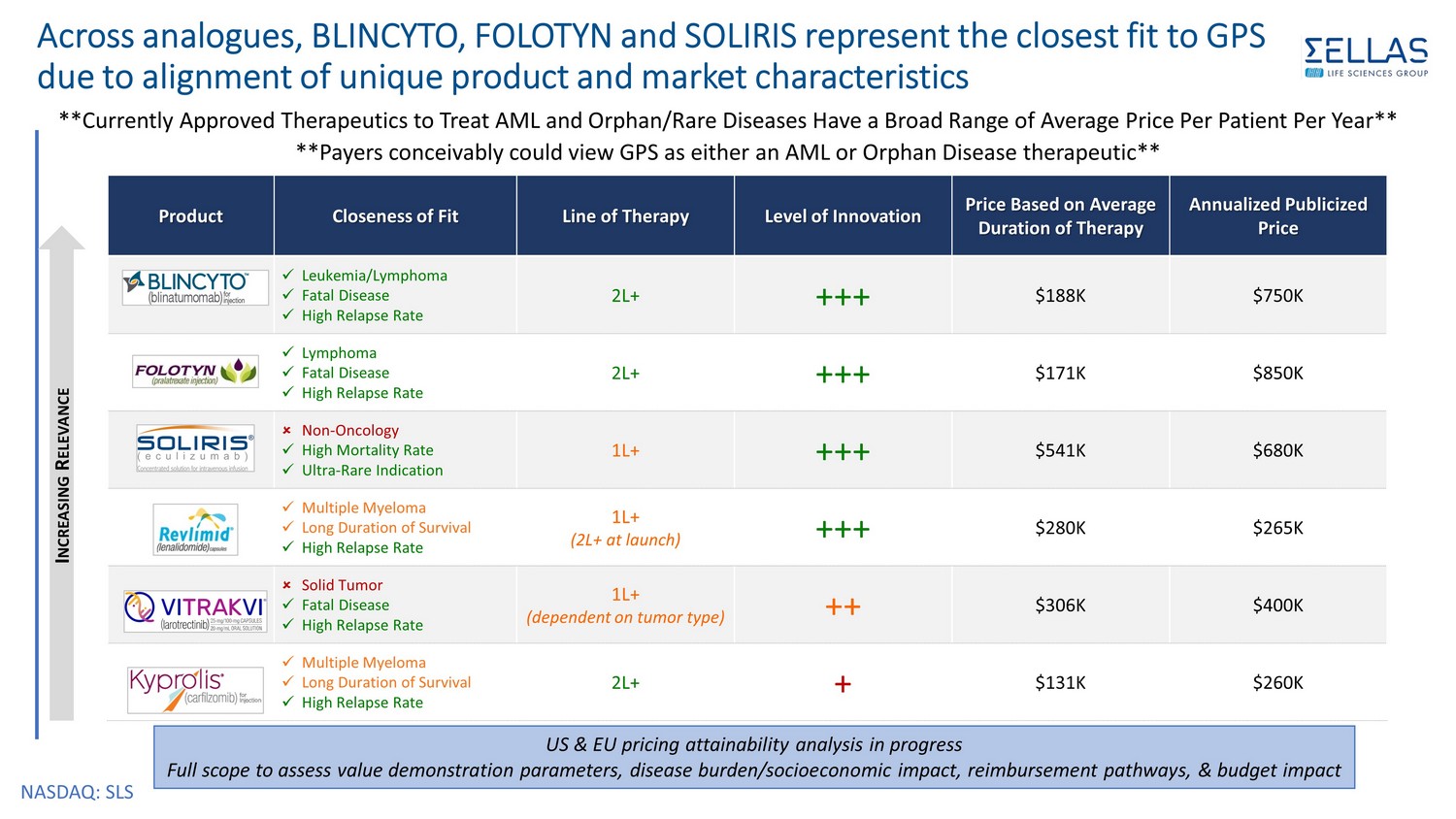

NASDAQ: SLS **Currently Approved Therapeutics to Treat AML and Orphan/Rare Diseases Have a Broad Range of Average Price Per Patient Per Y ear ** **Payers conceivably could view GPS as either an AML or Orphan Disease therapeutic** Product Closeness of Fit Line of Therapy Level of Innovation Price Based on Average Duration of Therapy Annualized Publicized Price x Leukemia/Lymphoma x Fatal Disease x High Relapse Rate 2L+ +++ $188K $750K x Lymphoma x Fatal Disease x High Relapse Rate 2L+ +++ $171K $850K Non - Oncology x High Mortality Rate x Ultra - Rare Indication 1L+ +++ $541K $680K x Multiple Myeloma x Long Duration of Survival x High Relapse Rate 1L+ (2L+ at launch) +++ $280K $265K Solid Tumor x Fatal Disease x High Relapse Rate 1L+ (dependent on tumor type) ++ $306K $400K x Multiple Myeloma x Long Duration of Survival x High Relapse Rate 2L+ + $131K $260K Across analogues, BLINCYTO, FOLOTYN and SOLIRIS represent the closest fit to GPS due to alignment of unique product and market characteristics I NCREASING R ELEVANCE US & EU pricing attainability analysis in progress Full scope to assess value demonstration parameters, disease burden/socioeconomic impact, reimbursement pathways, & budget im pac t

NASDAQ: SLS GPS Payer Value Proposition Anticipated to be Widely Accepted by Public and Private Payers • Given average age of the AML patient, CMS is expected to be the primary payer • Likely minimal out of pocket expense given most patients will have supplemental Medigap supplemental insurance • Reimbursement pathway evaluation currently in progress for GPS 13 Public Payer (~70 - 80% of Claims)

NASDAQ: SLS GPS Payer Value Proposition Anticipated to be Widely Accepted by Public and Private Payers (cont.) • Expected to cover 20 - 30% of GPS claims • May reasonably assume that commercial plans will follow CMS for coverage • Prior authorization relatively standard • Treatment Guideline inclusion can greatly increase reimbursement acceptability 14 Private Payer (~20 - 30% of Claims)

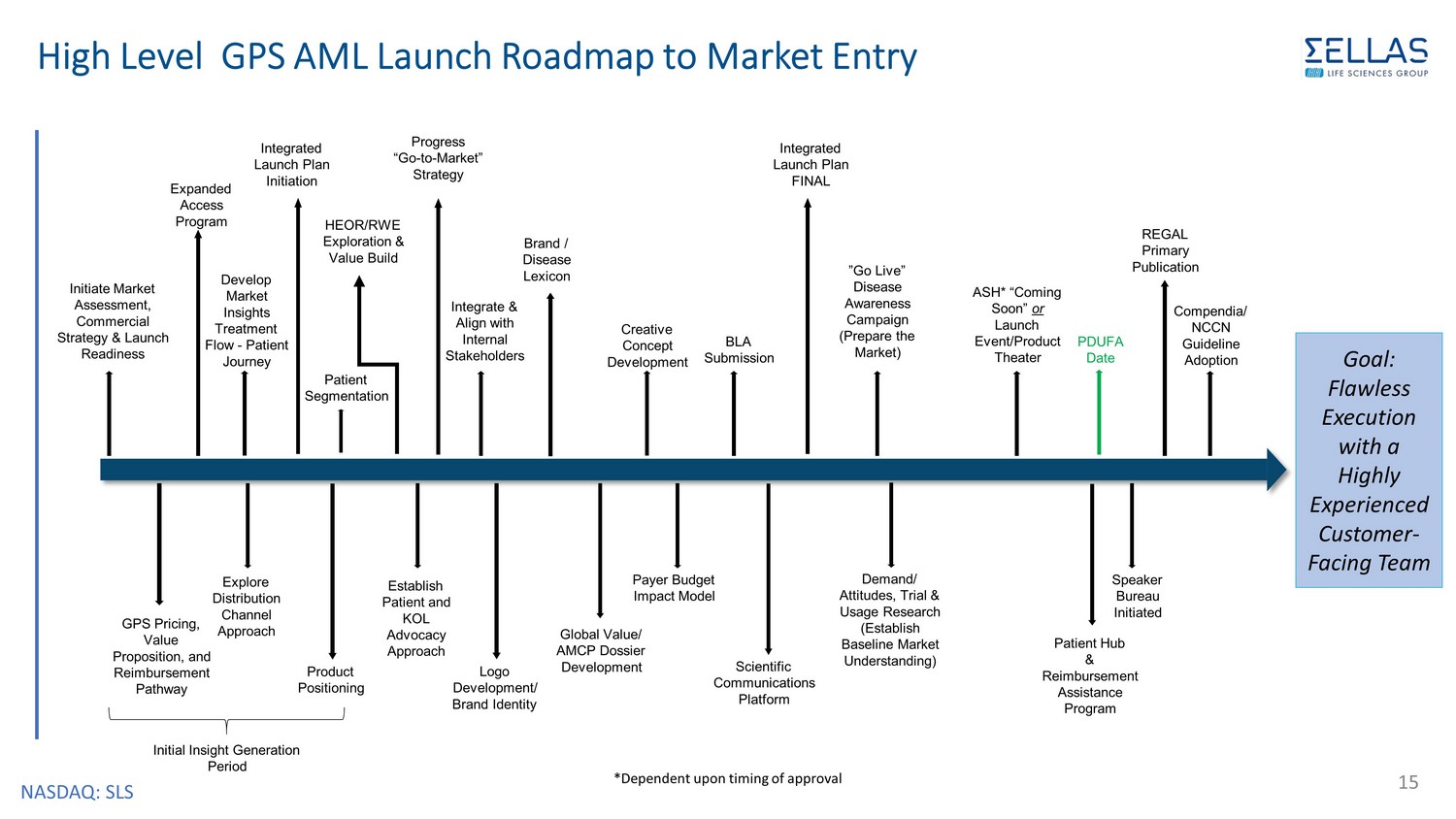

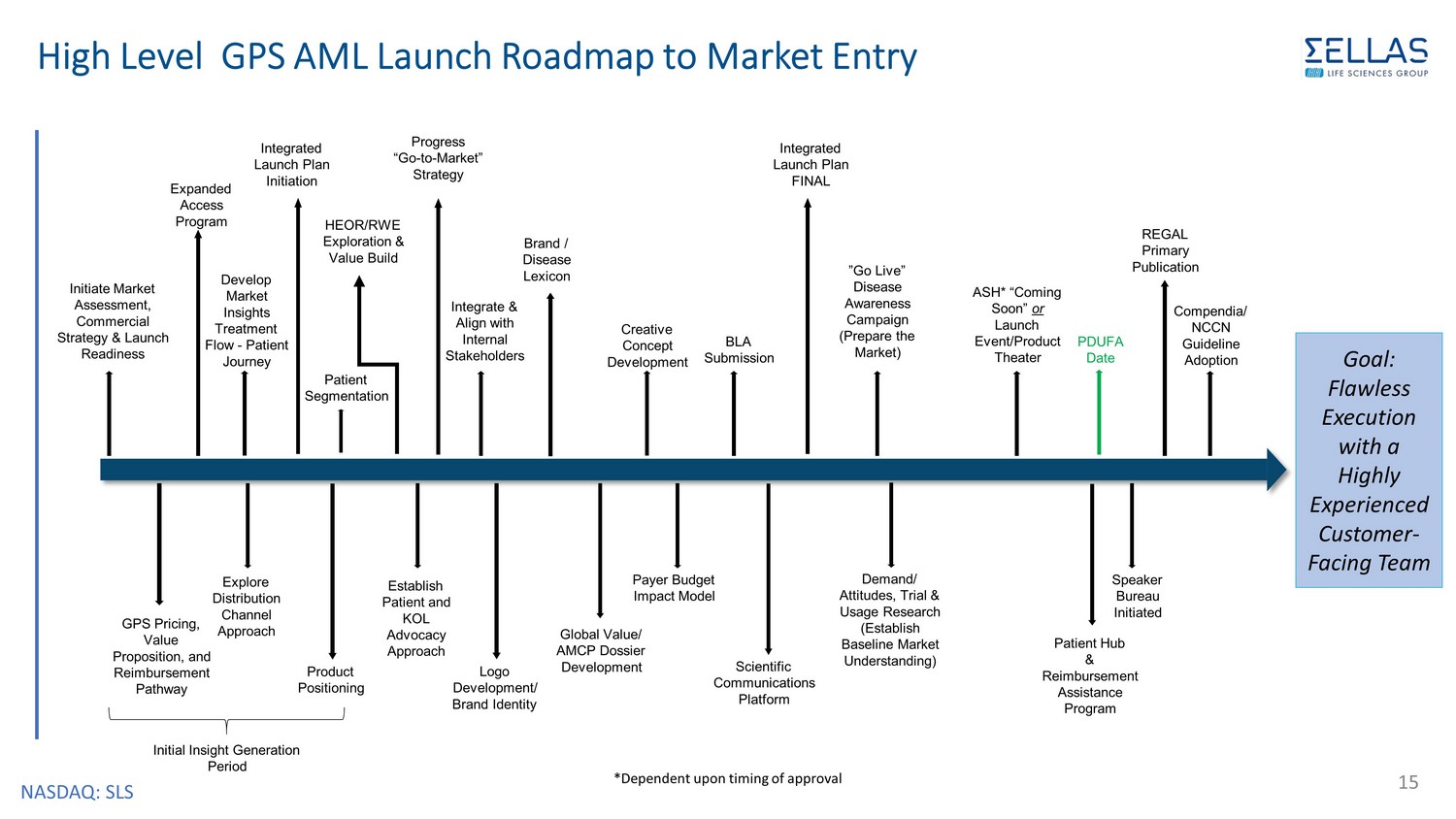

NASDAQ: SLS High Level GPS AML Launch Roadmap to Market Entry 15 BLA Submission Initiate Market Assessment, Commercial Strategy & Launch Readiness PDUFA Date ”Go Live” Disease Awareness Campaign (Prepare the Market) Compendia/ NCCN Guideline Adoption REGAL Primary Publication Expanded Access Program GPS Pricing, Value Proposition, and Reimbursement Pathway Explore Distribution Channel Approach Integrate & Align with Internal Stakeholders Develop Market Insights Treatment Flow - Patient Journey Brand / Disease Lexicon Patient Segmentation Creative Concept Development Logo Development/ Brand Identity Global Value/ AMCP Dossier Development Establish Patient and KOL Advocacy Approach Speaker Bureau Initiated Progress “Go - to - Market” Strategy Initial Insight Generation Period Product Positioning Integrated Launch Plan Initiation HEOR/RWE Exploration & Value Build ASH* “Coming Soon” or Launch Event/Product Theater Integrated Launch Plan FINAL Demand/ Attitudes, Trial & Usage Research (Establish Baseline Market Understanding) Patient Hub & Reimbursement Assistance Program Payer Budget Impact Model Scientific Communications Platform *Dependent upon timing of approval Goal: Flawless Execution with a Highly Experienced Customer - Facing Team

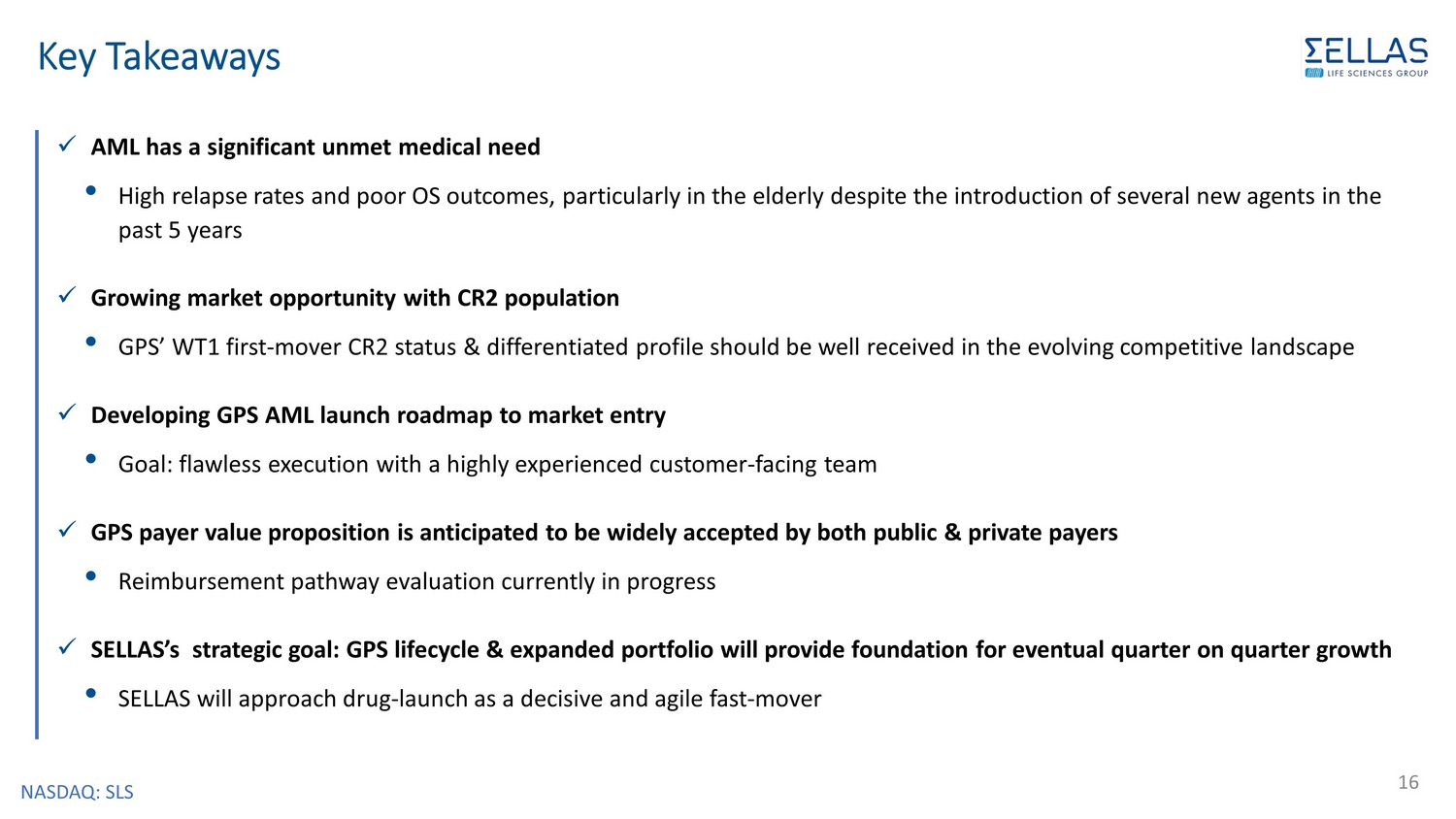

NASDAQ: SLS Key Takeaways x AML has a significant unmet medical need • High relapse rates and poor OS outcomes, particularly in the elderly despite the introduction of several new agents in the past 5 years x Growing market opportunity with CR2 population • GPS’ WT1 first - mover CR2 status & differentiated profile should be well received in the evolving competitive landscape x Developing GPS AML launch roadmap to market entry • Goal: flawless execution with a highly experienced customer - facing team x GPS payer value proposition is anticipated to be widely accepted by both public & private payers • Reimbursement pathway evaluation currently in progress x SELLAS’s strategic goal: GPS lifecycle & expanded portfolio will provide foundation for eventual quarter on quarter growth • SELLAS will approach drug - launch as a decisive and agile fast - mover 16

17 For additional information, please contact: SELLAS Life Sciences Group, Inc. (Nasdaq: SLS) info@sellaslife.com SELLAS@kcsa.com Thank You!