Exhibit 13.1

THE BANK OF NEW YORK MELLON CORPORATION

2007 Annual Report  Financial Section

Financial Section

THE BANK OF NEW YORK MELLON CORPORATION

2007 ANNUAL REPORT

FINANCIAL SECTION

TABLE OF CONTENTS

Introduction

On July 1, 2007, The Bank of New York Company, Inc. (“The Bank of New York”) and Mellon Financial Corporation (“Mellon”) merged into The Bank of New York Mellon Corporation (“The Bank of New York Mellon” or “BNY Mellon”), with BNY Mellon being the surviving entity. For accounting and financial reporting purposes the merger was accounted for as a purchase of Mellon for a value of $17 billion. The Bank of New York Mellon’s financial results for 2007 include six months of the combined company’s results and six months of legacy The Bank of New York only. Financial results for periods prior to 2007 reflect legacy The Bank of New York only.

The merger transaction resulted in The Bank of New York shareholders receiving .9434 shares of The Bank of New York Mellon common stock for each share of The Bank of New York common stock outstanding at the closing date of the merger. All legacy The Bank of New York earnings per share and common stock outstanding amounts in this Annual Report have been restated to reflect this exchange ratio. See page 62 for additional information.

We expect to realize annual expense synergies of $700 million by 2010 and our targeted run rate for revenue synergies is $250-$400 million by 2011. Merger and integration costs to combine the operations of The Bank of New York and Mellon were approximately $550 million in 2007 with

approximately $355 million recognized as expense and $195 million recorded as goodwill. Total merger and integration costs are currently expected to be approximately $1.325 billion.

The Bank of New York Mellon is a leading provider of financial services for institutions, corporations and high-net-worth individuals, providing superior asset and wealth management, asset servicing, issuer services, clearing and execution services, and treasury services through a worldwide client-focused team. We have more than $23 trillion in assets under custody and administration, more than $1.1 trillion in assets under management and service $11 trillion in outstanding debt.

Throughout this Annual Report, certain measures, which are noted, exclude certain items. We believe the presentation of this information enhances investor understanding of period-to-period results. In addition, they reflect the principal basis on which our management monitors financial performance.

In this Annual Report, references to “our,” “we,” “us,” the “company,” the “Company,” the “Corporation” and similar terms for periods prior to July 1, 2007 refer to The Bank of New York Company, Inc., and references to “our,” “we,” “us,” the “Company,” the “Corporation” and similar terms for periods on or after July 1, 2007 refer to BNY Mellon.

2 The Bank of New York Mellon Corporation

FINANCIAL SUMMARY

| | | | | | | | | | | | | | | | | | | | |

| The Bank of New York Mellon Corporation(and its subsidiaries) | | | | | | | | | | | | | | | |

| | | | | | Legacy The Bank of New York only | |

(dollar amounts in millions, except per share amounts or unless otherwise noted) | | 2007(a) | | | 2006(b) | | | 2005 | | | 2004 | | | 2003 | |

| Year ended Dec. 31 | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Fee and other revenue | | $ | 9,031 | | | $ | 5,339 | | | $ | 4,715 | | | $ | 4,394 | | | $ | 3,737 | |

Net interest revenue | | | 2,300 | | | | 1,499 | | | | 1,340 | | | | 1,157 | | | | 1,143 | |

Total revenue | | | 11,331 | | | | 6,838 | | | | 6,055 | | | | 5,551 | | | | 4,880 | |

Provision for credit losses | | | (10 | ) | | | (20 | ) | | | (7 | ) | | | (4 | ) | | | 132 | |

Merger and integration expense | | | 404 | | | | 106 | | | | - | | | | - | | | | 96 | |

Noninterest expense excluding merger and integration expense | | | 7,712 | | | | 4,582 | | | | 4,084 | | | | 3,715 | | | | 3,222 | |

Income from continuing operations before income taxes | | | 3,225 | | | | 2,170 | | | | 1,978 | | | | 1,840 | | | | 1,430 | |

Income taxes | | | 998 | | | | 694 | | | | 635 | | | | 587 | | | | 458 | |

Income from continuing operations | | | 2,227 | | | | 1,476 | | | | 1,343 | | | | 1,253 | | | | 972 | |

Income from discontinued operations, net of tax | | | (8 | ) | | | 1,371 | | | | 228 | | | | 187 | | | | 185 | |

Income before extraordinary (loss) | | | 2,219 | | | | 2,847 | | | | 1,571 | | | | 1,440 | | | | 1,157 | |

Extraordinary (loss) on consolidation of commercial paper conduit, net of tax | | | (180 | ) | | | - | | | | - | | | | - | | | | - | |

Net Income | | $ | 2,039 | | | $ | 2,847 | | | $ | 1,571 | | | $ | 1,440 | | | $ | 1,157 | |

Per common share – diluted (c): | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations excluding merger and integration expense | | $ | 2.64 | | | $ | 2.14 | | | $ | 1.84 | | | $ | 1.71 | | | $ | 1.45 | |

Income from continuing operations | | | 2.38 | | | | 2.04 | | | | 1.84 | | | | 1.71 | | | | 1.36 | |

Income (loss) from discontinued operations, net of tax | | | (.01 | ) | | | 1.90 | | | | .31 | | | | .25 | | | | .26 | |

Income before extraordinary (loss) | | | 2.37 | | | | 3.94 | | | | 2.16 | (d) | | | 1.96 | | | | 1.62 | |

Extraordinary (loss), net of tax | | | (.19 | ) | | | - | | | | - | | | | - | | | | - | |

Net income | | $ | 2.18 | | | $ | 3.94 | | | $ | 2.16 | | | $ | 1.96 | | | $ | 1.62 | |

Selected data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Return on tangible common shareholders’ equity | | | 39.06 | % | | | 56.08 | % | | | 31.13 | % | | | 31.46 | % | | | 31.90 | % |

Return on tangible common shareholders’ equity excluding merger and integration expense | | | 43.21 | | | | 57.47 | | | | 31.13 | | | | 31.46 | | | | 33.68 | |

Return on common shareholders’ equity | | | 10.08 | | | | 27.56 | | | | 16.59 | | | | 16.37 | | | | 15.12 | |

Return on common shareholders’ equity excluding merger and integration expense | | | 11.25 | | | | 28.25 | | | | 16.59 | | | | 16.37 | | | | 15.97 | |

Return on assets | | | 1.37 | | | | 2.67 | | | | 1.55 | | | | 1.45 | | | | 1.27 | |

Return on assets excluding merger and integration expense | | | 1.53 | | | | 2.73 | | | | 1.55 | | | | 1.45 | | | | 1.34 | |

Pre-tax operating margin (FTE) (continuing operations) | | | 29 | | | | 32 | | | | 33 | | | | 33 | | | | 30 | |

Pre-tax operating margin (FTE) excluding merger and integration expense and intangible amortization expense (continuing operations) | | | 35 | | | | 35 | | | | 34 | | | | 34 | | | | 32 | |

Average common equity to average assets | | | 13.61 | | | | 9.67 | | | | 9.34 | | | | 8.86 | | | | 8.37 | |

Fee and other revenue as a percent of total revenue (FTE) | | | 80 | % | | | 78 | % | | | 78 | % | | | 79 | % | | | 76 | % |

Annualized fee and other revenue per employee(in thousands)(based on average headcount) | | $ | 283 | | | $ | 262 | | | $ | 240 | | | $ | 229 | | | $ | 220 | |

Non-U.S. percent of revenue (FTE) | | | 32 | % | | | 30 | % | | | 30 | % | | | 30 | % | | | 25 | % |

Net interest margin (FTE) (continuing operations) | | | 2.08 | | | | 2.01 | | | | 2.02 | | | | 1.79 | | | | 1.97 | |

Cash dividends per share (c) | | $ | 0.95 | | | $ | 0.91 | | | $ | 0.87 | | | $ | 0.84 | | | $ | 0.81 | |

Common dividend payout ratio | | | 43.58 | % | | | 23.10 | % | | | 40.28 | % | | | 42.86 | % | | | 50.00 | % |

Dividend yield | | | 1.9 | | | | 2.2 | | | | 2.6 | | | | 2.4 | | | | 2.3 | |

Closing common stock price (c) | | $ | 48.76 | | | $ | 41.73 | | | $ | 33.76 | | | $ | 35.43 | | | $ | 35.11 | |

Market capitalization(in billions) | | | 55.9 | | | | 29.8 | | | | 24.6 | | | | 26.0 | | | | 25.7 | |

Book value per common share(c) | | | 25.66 | | | | 16.03 | | | | 13.57 | | | | 12.66 | | | | 11.52 | |

Employees (continuing operations) | | | 42,100 | | | | 22,400 | | | | 19,900 | | | | 19,600 | | | | 18,700 | |

Common shares outstanding(in thousands) (c) | | | 1,145,983 | | | | 713,079 | | | | 727,483 | | | | 734,079 | | | | 731,316 | |

Assets under management (in billions) | | $ | 1,121 | | | $ | 142 | | | $ | 115 | | | $ | 111 | | | $ | 95 | |

Assets under custody (in trillions) | | | 23.1 | | | | 15.5 | | | | 11.4 | | | | 10.0 | | | | 8.6 | |

Cross-border assets(in trillions) | | | 10.0 | | | | 6.3 | | | | 3.4 | | | | 2.7 | | | | 2.3 | |

Market value of securities on loan(in billions) | | | 633 | | | | 399 | | | | 311 | | | | 232 | | | | 174 | |

| | | | | |

| Capital ratios at Dec. 31 | | | | | | | | | | | | | | | | | | | | |

Tier I capital ratio (e) | | | 9.32 | % | | | 8.19 | % | | | 8.38 | % | | | 8.31 | % | | | 7.44 | % |

Total (Tier I plus Tier II capital ratio) (e) | | | 13.25 | | | | 12.49 | | | | 12.48 | | | | 12.21 | | | | 11.49 | |

Adjusted tangible shareholders’ equity to assets(e) (f) | | | 4.96 | | | | 5.31 | | | | 5.57 | | | | 5.56 | | | | 4.91 | |

| | | | | |

| At Dec. 31 | | | | | | | | | | | | | | | | | | | | |

Securities | | $ | 48,698 | | | $ | 21,106 | | | $ | 27,218 | | | $ | 23,770 | | | $ | 22,780 | |

Loans | | | 50,931 | | | | 37,793 | | | | 32,927 | | | | 28,375 | | | | 28,414 | |

Total assets | | | 197,656 | | | | 103,206 | | | | 102,118 | | | | 94,529 | | | | 92,397 | |

Deposits | | | 118,125 | | | | 62,146 | | | | 49,787 | | | | 43,052 | | | | 40,753 | |

Long-term debt | | | 16,873 | | | | 8,773 | | | | 7,817 | | | | 6,121 | | | | 6,121 | |

Common shareholders’ equity | | | 29,403 | | | | 11,429 | | | | 9,876 | | | | 9,290 | | | | 8,428 | |

| (a) | 2007 includes six months of The Bank of New York Mellon’s results. See Note 4 of Notes to Consolidated Financial Statements for details of the merger. |

| (b) | Certain amounts have been revised, see Note 2 of Notes to Consolidated Financial Statements. |

| (c) | Legacy The Bank of New York earnings per share and all other share-related data are presented in post-merger share count terms. See page 62 for additional information. Also see page 63 for a reconciliation of reported net income and diluted earnings per share to non-GAAP net income and diluted earnings per share. |

| (d) | Does not foot due to rounding. |

| (e) | Includes discontinued operations. |

| (f) | As defined on page 73. The deferred tax liability totaled $2.006 billion for 2007, $159 million in 2006 and none in 2005, 2004 and 2003. |

Note: FTE denotes presentation on a fully taxable equivalent basis.

The Bank of New York Mellon Corporation 3

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

BNY Mellon’s actual results of future operations may differ from those estimated or anticipated in certain forward-looking statements contained herein for reasons which are discussed below and under the heading “Forward-Looking Statements and Risk Factors.” When used in this report, words such as “estimate,” “forecast,” “project,” “anticipate,” “confident,” “target,” “expect,” “intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,” “should,” “may,” “will,” “strategy,” “synergies,” “opportunities,” “trends,” and words of similar meaning, signify forward-looking statements in addition to statements specifically identified as forward-looking statements. In addition, certain business terms used in this document are defined in the Glossary.

Overview

Our businesses

The Bank of New York Mellon Corporation (NYSE: BK) is a global leader in providing a comprehensive array of services that enable institutions and individuals to manage and service their financial assets in more than 100 markets worldwide. We have a long tradition of collaborating with clients to deliver innovative solutions through our core competencies: asset and wealth management, securities servicing and treasury services. Our extensive global client base includes a broad range of leading financial institutions, corporations, government entities, endowments/foundations and high-net-worth individuals. One of our two principal subsidiaries, The Bank of New York (the “Bank”), founded in 1784, is the oldest bank in the United States. Our other principal subsidiary, Mellon Bank, N.A. (“Mellon Bank”), was founded in 1869. Both institutions have consistently played a prominent role in the evolution of financial markets worldwide.

BNY Mellon’s businesses benefit from the global growth in financial assets. Our success is based on continuing to provide superior client service, strong investment performance and the highest fiduciary standards. We seek to deploy capital effectively to our businesses to accelerate their long-term growth and deliver top-tier returns to our shareholders.

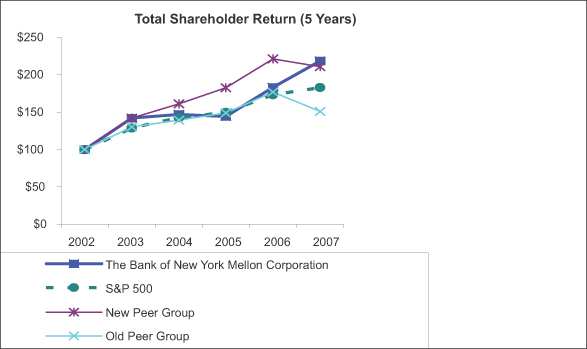

Our long-term financial goals are focused on achieving superior total returns to shareholders by generating first quartile earnings per share growth over time relative to a group of 12 peer companies. Key components of this strategy include: providing the best client service versus peers (as measured

through independent surveys); strong investment performance (relative to investment benchmarks); above median revenue growth (relative to peer companies for each of our businesses); competitive margins; and positive operating leverage.

Based on the growth opportunities in our businesses, we expect that an increasing percentage of our revenue and income will be derived outside the U.S.

As measurements of efficiency, over time we expect to increase the level of fee revenue per employee and increase our pre-tax margins.

We believe that our businesses are compatible with our strategy and goals for the following reasons:

| | · | | Demand for our products and services is driven by market and demographic trends in the markets in which we compete. These trends include growth in worldwide retirement and financial assets; the growth and concentration of the wealth segments; global growth in assets managed by financial institutions; and the globalization of the investment process. |

| | · | | Many of our products complement one another. |

| | · | | We are able to leverage sales, distribution and technology across our businesses benefiting our clients and shareholders. |

| | · | | The revenue generated by our businesses is principally fee-based. |

| | · | | Our businesses generally do not require as much capital for growth as traditional banking. |

We pursue our long-term financial goals by focusing on organic revenue growth, expense management, superior client service, successful integration of acquisitions and disciplined capital management.

In 2007, we established a Tier I capital target of 8% as our principal capital measure. We also revised our secondary targeted capital ratio from 5% of tangible common equity to 5% of adjusted tangible common equity. The change from “tangible common equity” to “adjusted tangible common equity” reflects the impact of the merger with Mellon and associated goodwill, intangibles and related deferred tax liability. The goodwill and intangibles created in the merger have no economic impact but reduce tangible equity.

How we reported results

All information in this Annual Report is reported on a continuing operations basis, unless otherwise noted.

4 The Bank of New York Mellon Corporation

Results of Operations(continued)

For a description of discontinued operations, see Note 5 of Notes to Consolidated Financial Statements.

Certain amounts are presented on a fully taxable equivalent (FTE) basis. We believe that this presentation allows for comparison of amounts arising from both taxable and tax-exempt sources and is consistent with industry practice. The adjustment to an FTE basis has no impact on net income. In addition, results for 2007 include six months of the combined company’s results, while the results for the first half of 2007 and all prior periods include legacy The Bank of New York only.

Summary of financial results

2007

In 2007, we reported consolidated net income of $2.039 billion and diluted earnings per share of $2.18 compared with net income of $2.847 billion and diluted earnings per share of $3.94 in 2006. Net income in 2006 included net income from discontinued operations of $1.371 billion and diluted earnings per share of $1.90, primarily from the sale of our Retail Business.

In December of 2007, we consolidated the assets of our bank-sponsored conduit, Three Rivers Funding Corporation (“TRFC”) which resulted in an extra-ordinary after-tax loss of $180 million or $0.19 per share. See pages 16 and 17 for a further explanation of this consolidation.

Income from continuing operations before extra-ordinary loss in 2007 was $2.227 billion and diluted earnings per share was $2.38, compared with $1.476 billion and $2.04 per share in 2006.

Results for 2007 and 2006 include merger and integration expense of $404 million and $106 million pre-tax, respectively. Excluding these amounts, diluted earnings per share from continuing operations was $2.64 per share in 2007 and $2.14 per share in 2006.

Performance highlights for 2007 include:

| | · | | Assets under management, excluding securities lending assets, amounted to $1.121 trillion at Dec. 31, 2007 compared to $142 billion at Dec. 31, 2006. Assets under custody and administration amounted to $23.1 trillion at Dec. 31, 2007 compared with $15.5 trillion at Dec. 31, 2006. Both increases primarily resulted from the merger with Mellon; |

| | · | | Asset and wealth management fees totaled $2.060 billion in 2007 compared with $545 million in 2006. The increase was primarily due to the merger with Mellon as well as net new business and higher equity market levels; |

| | · | | Asset servicing revenue was $2.350 billion in 2007 compared with $1.401 billion in 2006. The increase was primarily due to the merger with Mellon, as well as a higher level of securities lending revenue and increased client activity related to market volatility and net new business; |

| | · | | Issuer services revenue was $1.560 billion in 2007 compared with $895 million in 2006. The increase was primarily due to the acquisition of the corporate trust business (“the Acquired Corporate Trust Business”) of J.P. Morgan Chase & Co., strong growth in Depositary Receipts revenue, and to a lesser extent, the merger with Mellon; |

| | · | | Revenue from foreign exchange and other trading activities was $786 million in 2007, compared with $415 million in 2006. The increase reflects the merger with Mellon, record customer volumes, the favorable impact that resulted from increased currency volatility in the second half of 2007 and a higher valuation of the credit derivatives portfolio; |

| | · | | Net interest revenue was $2.3 billion in 2007, compared with $1.499 billion in 2006. The increase was primarily due to the merger with Mellon, as well as growth in client deposits and wider spreads on investment securities; |

| | · | | Securities losses totaled $201 million in 2007 primarily reflecting a $200 million loss on collateralized debt obligations (CDOs) recorded in the fourth quarter, and |

| | · | | Noninterest expense was $8.116 billion in 2007 compared with $4.688 billion in 2006. The increase resulted from the merger with Mellon, the purchase of the Acquired Corporate Trust Business, as well as $404 million pre-tax of merger and integration expense and $319 million pre-tax of intangible amortization expense in 2007, partially offset by the disposition of certain businesses in the BNY ConvergEx transaction and $175 million of merger-related synergies generated in 2007. |

2006

In 2006, we reported net income of $2.847 billion and diluted earnings per share of $3.94 and income from continuing operations of $1.476 billion and diluted

The Bank of New York Mellon Corporation 5

Results of Operations(continued)

earnings per share of $2.04. This compares to net income of $1.571 billion and diluted earnings per share of $2.16 and income from continuing operations of $1.343 billion and diluted earnings per share of $1.84 in 2005. Discontinued operations for 2006 included a net after-tax gain of $1.371 billion, or diluted earnings per share of $1.90.

Adjusting for the impact of merger and integration expense ($106 million pre-tax), diluted earnings per share from continuing operations for 2006 were $2.14 compared with $1.84 for 2005.

Performance highlights for 2006 include:

| | · | | A 13% increase in securities servicing fees; |

| | · | | A 12% increase in net interest revenue; |

| | · | | A 9% increase in foreign exchange and other trading activities, and |

| | · | | A 20% increase in asset and wealth management fees. |

On Oct. 1, 2006, we purchased the Acquired Corporate Trust Business from and sold our Retail Business to, JP Morgan Chase.

On October 2, 2006, we completed the transaction resulting in the formation of BNY ConvergEx Group. BNY ConvergEx Group brought together BNY Securities Group’s trade execution, commission management, independent research and transition management business with Eze Castle Software, a leading provider of trade order management and related investment technologies.

2005

In 2005, we reported net income of $1.571 billion and diluted earnings per share of $2.16. Income from continuing operations was $1.343 billion, or $1.84 of diluted earnings per share.

Securities servicing fees were up 10% from 2004. Net interest revenue increased $183 million compared with 2004. Asset and wealth management fees and foreign exchange and other trading activities also rose from the prior year. We repurchased 5 million net shares in 2005.

During 2005, we formed strategic alliances to penetrate faster-growing markets in France, Germany, the Nordic and Baltic region, Japan, Australia, and India. We also continued to expand our market

presence in high-growth areas such as hedge fund servicing and collateral management, while extending our capabilities in the rapidly growing area of alternative investments.

Revenue overview

The vast majority of BNY Mellon’s revenue consists of fee and other revenue, given our mix of businesses, with net interest revenue comprising the balance.

Fee and other revenue represented 80% of total revenue, on a fully taxable equivalent (FTE) basis in 2007, compared with 78% in 2006.

Since fee and other revenue constitutes the majority of our total revenue, we discuss it in greater detail by type of fee in the following sections, as well as in the business segments review section beginning on page 17. There we note the specific drivers of such revenue and the factors that caused the various types of fee and other revenue to increase or decline in 2007 compared with 2006. The business segments discussion combines, for each business segment, all types of fee and other revenue generated directly by that segment as well as fee and other revenue transferred between segments under revenue transfer agreements, with net interest revenue generated directly by or allocated to that segment. The discussion of revenue by business segment is fundamental to an understanding of BNY Mellon’s results as it represents a principal measure by which management reviews the performance of our businesses compared with performance in prior periods, with our operating plan and with the performance of our competitors.

Net interest revenue comprised 20% of total revenue, on an FTE basis, in 2007 compared with 22% in 2006. Net interest revenue is generated from a combination of loans, investment securities, interest-bearing deposits with banks and federal funds sold and securities purchased under resale agreements. For more information, see page 11.

6 The Bank of New York Mellon Corporation

Results of Operations(continued)

Sector overview

| | |

| Sector/Segment | | Primary types of fee revenue |

Asset & Wealth Management sector |

Asset Management segment | | · Asset and wealth management fees from: Institutional clients Mutual funds Private clients · Performance fees · Distribution and servicing fees |

Wealth Management segment | | · Wealth management fees from high-net-worth individuals, families, family offices and business enterprises, charitable gift programs and foundations and endowments |

Institutional Services sector |

Asset Servicing segment | | · Asset servicing fees, including: Institutional trust and custody fees Broker-dealer services Securities lending · Foreign exchange |

Issuer Services segment | | · Issuer services fees, including: Corporate Trust Depositary receipts Employee investment plan services Shareowner services |

Clearing & Execution Services segment | | · Clearing and execution services fees, including: Broker Dealer and Registered Investment Advisor services Electronic trading services |

Treasury Services segment | | · Treasury services fees, including: Global payment services Working capital solutions Global markets and institutional banking services · Financing-related fees |

Other segment | | · Leasing operations · Corporate Treasury activities · Business exits · Merger and integration expenses |

The Bank of New York Mellon Corporation 7

Results of Operations(continued)

Fee and other revenue

| | | | | | | | | | | | | | | | | | |

| Fee and other revenue(a) | | 2007 | | | Legacy The Bank

of New York only | | | 2007

vs. 2006 | | | 2006

vs. 2005 | |

| (in millions unless otherwise noted) | | | 2006 | | | 2005 | | | �� |

Securities servicing fees: | | | | | | | | | | | | | | | | | | |

Asset servicing | | $ | 2,350 | | | $ | 1,401 | | | $ | 1,267 | | | 68 | % | | 11 | % |

Issuer services | | | 1,560 | | | | 895 | | | | 639 | | | 74 | | | 40 | |

Clearing and execution services | | | 1,192 | | | | 1,248 | | | | 1,242 | | | (4 | ) | | - | |

Total securities servicing fees | | | 5,102 | | | | 3,544 | | | | 3,148 | | | 44 | | | 13 | |

Asset and wealth management fees | | | 2,060 | | | | 545 | | | | 455 | | | 278 | | | 20 | |

Performance fees | | | 93 | | | | 35 | | | | 9 | | | 166 | | | 289 | |

Foreign exchange and other trading activities | | | 786 | | | | 415 | | | | 379 | | | 89 | | | 9 | |

Treasury services | | | 348 | | | | 209 | | | | 206 | | | 67 | | | 1 | |

Financing-related fees | | | 216 | | | | 250 | | | | 282 | | | (14 | ) | | (11 | ) |

Distribution and servicing | | | 212 | | | | 6 | | | | 5 | | | N/M | | | N/M | |

Investment income | | | 149 | | | | 160 | | | | 90 | | | (7 | ) | | 78 | |

Securities gains (losses) | | | (201 | ) | | | 2 | | | | 22 | | | N/M | | | N/M | |

Other | | | 266 | | | | 173 | | | | 119 | | | 54 | | | 45 | |

Total fee and other revenue | | $ | 9,031 | | | $ | 5,339 | | | $ | 4,715 | | | 69 | % | | 13 | % |

Fee and other revenue as a percentage of total revenue (FTE) | | | 80 | % | | | 78 | % | | | 78 | % | | | | | | |

Market value of assets under management at period-end(in billions) | | $ | 1,121 | | | $ | 142 | | | $ | 115 | | | 689 | % | | 23 | % |

Market value of assets under custody and administration at period-end(in trillions) | | $ | 23.1 | | | $ | 15.5 | (b) | | $ | 11.4 | (b) | | 49 | % | | 36 | % |

| (a) | Results for 2007 include six months of the combined Company’s results and six months of legacy The Bank of New York only. All other periods prior to 2007 include legacy The Bank of New York only. |

| (b) | Revised for the Acquired Corporate Trust Business and harmonization adjustments. |

Fee and other revenue

Fee and other revenue totaled $9.031 billion in 2007, an increase of $3.692 billion, or 69%, from $5.339 billion in 2006. The increase in revenue in 2007 was primarily driven by the merger with Mellon, the full-year impact of the acquisition in October 2006 of the Acquired Corporate Trust Business and stronger performances in securities servicing, asset and wealth management, foreign exchange and other trading activities and treasury services. Partially offsetting the growth in fee and other revenue was the disposition of certain execution businesses in the October 2006 BNY ConvergEx transaction and securities losses.

Securities servicing fees

The increase in securities servicing fees compared to 2006 reflects the merger with Mellon and the Acquired Corporate Trust Business, as well as strong organic growth in securities lending revenue, Depositary Receipts and broker-dealer services. These results were partially offset by the BNY ConvergEx transaction. See the “Institutional Services Sector” in “Business segments review” for additional details.

Asset and wealth management fees

Asset and wealth management fees increased from 2006 primarily due to the merger with Mellon, net new business and improved equity markets. See the “Asset and Wealth Management Sector” in “Business segments review” for additional details regarding the drivers of asset and wealth management fees. Total assets under management for the Asset and Wealth management sector were $1.121 trillion at Dec. 31, 2007, up from $142 billion at Dec. 31, 2006. The increase resulted from the merger with Mellon and net new business. Net asset inflows totaled $55 billion in 2007 resulting from $70 billion of money market inflows partially offset by $15 billion of long-term outflows.

A large category of Asset and Wealth management fees are from managed mutual funds generated in the Asset Management segment. These fees are based on the daily average net assets of each fund and the basis point management fee paid by that fund. Managed mutual fund revenue was $637 million in 2007 compared with $10 million in 2006. The increase resulted from the merger with Mellon.

8 The Bank of New York Mellon Corporation

Results of Operations(continued)

Performance fees

Performance fees, which are reported in the Asset Management segment, are generally calculated as a percentage of a portfolio’s performance in excess of a benchmark index or a peer group’s performance. There is an increase/decrease in incentive expense with a related change in performance fees. Performance fees totaled $93 million in 2007, an increase of $58 million compared with 2006, reflecting the merger with Mellon. As a result of the turbulent market environment in 2007, performance fees were impacted by a lower outperformance on certain alternative and quantitative strategies.

Foreign exchange and other trading activities

Foreign exchange and other trading activities revenue, which is primarily reported in the Asset Servicing segment, was $786 million in 2007, an increase of $371 million, or 89%, compared with 2006. The increase was due to the merger with Mellon, record customer volumes due to increased activity of the existing client base, new clients, and the favorable impact that resulted from increased currency volatility in the second half of 2007. Other trading activities increased reflecting a higher valuation of the credit derivative portfolio caused by the widening of credit spreads.

Treasury services

Treasury services, which is primarily reported in the Treasury services segment, includes fees related to funds transfer, cash management, and liquidity management. Treasury services fees increased $139 million from 2006 reflecting the merger with Mellon, as well as higher client volumes and net new business in the global payments business, partially offset by customers paying with compensating balances in lieu of fees. Earnings on compensating balance deposits are recognized in net interest revenue.

Financing-related fees

Financing-related fees, which are primarily reported in the Treasury Services segment, include capital markets fees, loan commitment fees and credit-related trade fees.

Financing-related fees decreased $34 million from 2006 reflecting a lower level of credit-related activities consistent with our strategic direction.

Distribution and servicing fees

Distribution and servicing fees earned from mutual funds are primarily based on average assets in the

funds and the sales of funds managed or administered by BNY Mellon and are primarily reported in the Asset Management segment. These fees, which include 12b-1 fees, fluctuate with the overall level of net sales, the relative mix of sales between share classes and the funds’ market values.

The $206 million increase in distribution and servicing fee revenue in 2007 compared with 2006 primarily reflects the merger with Mellon, as well as higher sales volumes and higher market values of mutual funds. The impact of these fees on income in any one period can be more than offset by distribution and servicing expense paid to other financial intermediaries to cover their costs for distribution and servicing of mutual funds. Distribution and servicing expense is recorded as noninterest expense on the income statement.

Investment income

Investment income, which is primarily reported in the Other and Asset Management segments, includes the gains and losses on private equity investments and seed capital investments, income from insurance contracts, and lease residual gains and losses. The decline compared to prior periods principally reflects lower private equity investment income as well as the lower market value of seed capital investments due to the market environment. Private equity investment income was $67 million in 2007, down from $97 million in 2006. This decrease was partially offset by higher returns from insurance contracts and the merger with Mellon.

Securities gains (losses)

The $201 million securities loss in 2007 primarily reflects a $200 million loss on CDOs recorded in the fourth quarter. Based on deteriorating conditions in the U.S. housing market, we recognized a pre-tax loss of $200 million ($118 million after-tax) for other than temporary impairment related to these securities. Within our securities available for sale portfolio, we held $179 million (par value $379 million) of CDOs that contained subprime exposure at Dec. 31, 2007.

Other revenue

Other revenue is comprised of expense reimbursements from joint ventures, merchant card fees, asset-related gains, equity investment income, net economic value payments and other transactions. Expense reimbursements from joint ventures relate to expenses incurred by BNY Mellon on behalf of joint

The Bank of New York Mellon Corporation 9

Results of Operations(continued)

ventures. Asset-related gains (losses) include loan and real estate dispositions. Equity investment income primarily reflects our proportionate share of the income from our investment in Wing Hang Bank Limited. Other transactions primarily include low-income housing, other investments and various miscellaneous revenues. The breakdown among these categories is shown in the following table:

| | | | | | | | | | |

| Other revenue | | 2007 | | Legacy The Bank

of New York only | |

| (in millions) | | | 2006 | | 2005 | |

Expense reimbursements from joint ventures | | $ | 58 | | $ | - | | $ | - | |

Merchant card fees | | | 25 | | | - | | | - | |

Asset-related gains | | | 9 | | | 100 | | | 88 | |

Equity investment income | | | 56 | | | 47 | | | 39 | |

Net economic value payments | | | 41 | | | 23 | | | - | |

Other | | | 77 | | | 3 | | | (8 | ) |

Total other revenue | | $ | 266 | | $ | 173 | | $ | 119 | |

Other revenue increased from 2006 reflecting the merger with Mellon, higher net economic value payments, a settlement received for early termination of a contract that occurred in 2005 associated with the clearing business ($28 million) and revenue related to transitional services agreements ($15 million). Net economic value payments were $41 million in 2007 and $23 million in 2006. These payments were primarily related to the Acquired Corporate Trust Business, for international customers whose net revenue had not previously been transferred. Upon conversion, revenue from the Acquired Corporate Trust Business clients was reflected in Issuer Services fees and net interest revenue. Asset-related gains in 2006 include a pre-tax gain of $35 million related to

the conversion of our New York Stock Exchange (“NYSE”) seats into cash and shares of NYSE Group, Inc. common stock, some of which were sold.

2006 compared with 2005

The increase in fee and other revenue in 2006 versus 2005 primarily reflected stronger performance in securities servicing, asset and wealth management fees, performance fees, foreign exchange and other trading activities as well as higher level of investment income and other income. Securities servicing fee growth in 2006 reflected the Acquired Corporate Trust Business and strong organic growth in issuer services, investor services and broker-dealer services. Growth in these areas was partly offset by disposition of certain execution businesses in the BNY ConvergEx transaction and weaker results in our clearing and remaining domestic execution business. Asset and wealth management fees increased over 2005 primarily resulting from acquisitions. The increase in performance fees reflected improved performance fees at Ivy Asset Management Corp. (“Ivy”). Foreign exchange and other trading activities grew strongly in 2006 versus 2005 reflecting higher customer volumes driven by cross-border investment flows, greater business from existing clients, and favorable market conditions in the first half of 2006. Other trading revenues increased in 2006 as a result of higher fixed income activities partially offset by lower trading revenue at Pershing Group LLC (“Pershing”). Investment income in 2006 included a realized gain of $11 million from the sale of a private equity investment. The increase in other revenue reflects the gain on the sale of NYSE seats and net economic value payments.

10 The Bank of New York Mellon Corporation

Results of Operations(continued)

Net interest revenue

| | | | | | | | | | | | | | | | | | |

| Net interest revenue | | | | | Legacy The Bank of

New York only | | | 2007 vs. 2006 | | | 2006

vs. 2005 | |

| (dollar amounts in millions) | | 2007 (a) | | | 2006 | | | 2005 | | | |

Net interest revenue | | $ | 2,300 | | | $ | 1,499 | | | $ | 1,340 | | | 53 | % | | 12 | % |

Tax equivalent adjustment | | | 12 | | | | 22 | | | | 27 | | | N/M | | | N/M | |

Net interest revenue on an FTE basis | | $ | 2,312 | | | $ | 1,521 | | | $ | 1,367 | | | 52 | % | | 11 | % |

| | | | | |

Net interest margin (FTE) | | | 2.08 | % | | | 2.01 | % (b) | | | 2.02 | % (b) | | 7bp | | | (1 | )bp |

| (a) | Results for 2007 include six months of the combined company’s results and six months of legacy The Bank of New York only. All other periods reflect legacy The Bank of New York only. |

| (b) | Calculated on a continuing operations basis even though the balance sheet, in accordance with GAAP, is not restated for discontinued operations. |

bp - basis points

The increase in net interest revenue from 2006 principally reflects the merger with Mellon, as well as a higher level of average interest-earning assets driven by growth in client deposits, as well as higher deposit balances associated with the Acquired Corporate Trust Business, wider spreads on investment securities and lower bond premium amortization due to slowing prepayments. This growth was partially offset by the required recalculation of the yield on leverage leases under FSP-FAS 13-2, for changes to New York state tax rates resulting from the merger with Mellon ($22 million). We received net economic value payments on the Acquired Corporate Trust Business deposits post-acquisition but prior to the transfer of the deposits to us. These payments, which totaled $41 million in 2007 and $23 million in 2006, are recorded in Other revenue.

Average interest-earning assets were $111.2 billion in 2007, compared with $75.6 billion in 2006 and $67.7 billion in 2005. The increase in 2007 from 2006 reflects the merger with Mellon, the impact of higher deposits related to the Acquired Corporate Trust

Business, as well as a higher level of interest and noninterest-bearing deposits driven by higher client activity across our businesses. Average loans were $41.5 billion in 2007, compared with $33.6 billion in 2006 and $32.1 billion in 2005. Average securities were $37.4 billion in 2007, up from $25.9 billion in 2006 and $24.3 billion in 2005.

The net interest margin was 2.08% in 2007 compared with 2.01% in 2006 and 2.02% in 2005. The increase in the net interest margin from 2006 principally reflects the merger with Mellon as well as a higher average level of noninterest-bearing deposits, wider spreads on investment securities and lower bond premium amortization due to slowing prepayments.

2006 compared with 2005

The increase in net interest revenue in 2006 compared to 2005 primarily reflects the impact of higher deposit balances related to the Acquired Corporate Trust Business, higher amounts of interest-earning assets and interest-free balances, as well as the higher value of interest-free balances in a rising rate environment.

The Bank of New York Mellon Corporation 11

Results of Operations(continued)

CONSOLIDATED BALANCE SHEET – AVERAGE BALANCES AND INTEREST YIELDS/RATES(a)

| | | | | | | | | | | |

| | | 2007(b) | |

| (dollar amounts in millions, presented on an FTE basis) | | Average

balance | | | Interest | | | Average

yields/rates | |

Assets | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | |

Interest-bearing deposits with banks (primarily foreign banks) | | $ | 26,505 | | | $ | 1,242 | | | 4.68 | % |

Federal funds sold and securities under resale agreements | | | 5,727 | | | | 290 | | | 5.06 | |

Margin loans | | | 5,392 | | | | 332 | | | 6.16 | |

Non-margin loans: | | | | | | | | | | | |

Domestic offices | | | | | | | | | | | |

Consumer | | | 4,722 | | | | 278 | | | 5.90 | |

Commercial | | | 18,806 | | | | 913 | | | 4.85 | |

Foreign offices | | | 12,595 | | | | 693 | | | 5.50 | |

Total non-margin loans | | | 36,123 | | | | 1,884 | (c) | | 5.22 | |

Securities: | | | | | | | | | | | |

U.S. government obligations | | | 270 | | | | 12 | | | 4.45 | |

U.S. government agency obligations | | | 7,314 | | | | 390 | | | 5.33 | |

Obligations of states and political subdivisions | | | 408 | | | | 27 | | | 6.73 | |

Other securities: | | | | | | | | | | | |

Domestic offices | | | 19,832 | | | | 1,125 | | | 5.67 | |

Foreign offices | | | 7,529 | | | | 363 | | | 4.81 | |

Total other securities | | | 27,361 | | | | 1,488 | | | 5.44 | |

Trading securities: | | | | | | | | | | | |

Domestic offices | | | 1,121 | | | | 47 | | | 4.19 | |

Foreign offices | | | 953 | | | | 51 | | | 5.39 | |

Total trading securities | | | 2,074 | | | | 98 | | | 4.74 | |

Total securities | | | 37,427 | | | | 2,015 | | | 5.38 | |

Total interest-earning assets | | | 111,174 | | | $ | 5,763 | (e) | | 5.18 | % |

Allowance for credit losses | | | (303 | ) | | | | | | | |

Cash and due from banks | | | 3,945 | | | | | | | | |

Other assets | | | 33,773 | | | | | | | | |

Assets of discontinued operations | | | 53 | | | | | | | | |

Total assets | | $ | 148,642 | | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | | | | |

Interest-bearing deposits | | | | | | | | | | | |

Domestic offices: | | | | | | | | | | | |

Money market rate accounts | | $ | 11,535 | | | $ | 349 | | | 3.03 | % |

Savings | | | 610 | | | | 16 | | | 2.56 | |

Certificates of deposits of $100,000 & over | | | 2,845 | | | | 152 | | | 5.35 | |

Other time deposits | | | 1,012 | | | | 60 | | | 5.93 | |

Total domestic | | | 16,002 | | | | 577 | | | 3.61 | |

Foreign offices: | | | | | | | | | | | |

Banks | | | 9,720 | | | | 358 | | | 3.69 | |

Government & official institutions | | | 1,108 | | | | 45 | | | 4.03 | |

Other | | | 39,492 | | | | 1,409 | | | 3.57 | |

Total foreign | | | 50,320 | | | | 1,812 | | | 3.60 | |

Total interest-bearing deposits | | | 66,322 | | | | 2,389 | | | 3.60 | |

Federal funds purchased & securities under repurchase agreements | | | 2,890 | | | | 125 | | | 4.30 | |

Other funds borrowed: | | | | | | | | | | | |

Domestic offices | | | 1,762 | | | | 76 | | | 4.28 | |

Foreign offices | | | 761 | | | | 15 | | | 2.02 | |

Total other funds borrowed | | | 2,523 | | | | 91 | | | 3.59 | |

Payables to customers and broker-dealers | | | 5,113 | | | | 177 | | | 3.47 | |

Long term debt | | | 12,327 | | | | 669 | | | 5.43 | |

Total interest-bearing liabilities | | $ | 89,175 | | | $ | 3,451 | | | 3.87 | % |

Total noninterest-bearing deposits | | | 21,677 | | | | | | | | |

Other liabilities | | | 17,503 | | | | | | | | |

Liabilities of discontinued operations | | | 53 | | | | | | | | |

Total liabilities | | | 128,408 | | | | | | | | |

Shareholders’ equity | | | 20,234 | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 148,642 | | | | | | | | |

Net interest margin-taxable equivalent basis | | | | | | | | | | 2.08 | % |

Assets attributable to foreign offices(d) | | | 36.68 | % | | | | | | | |

Liabilities attributable to foreign offices | | | 37.55 | | | | | | | | |

| (a) | Average balances and rates have been impacted by allocations made to match assets of discontinued operations with liabilities of discontinued operations. |

| (b) | Average balances and rates for 2007 include six months of the combined Company’s results and six months legacy The Bank of New York only. |

| (c) | Includes fees of $32 million in 2007. Nonaccrual loans are included in the average loan balance; the associated income, recognized on the cash basis, is included in interest. |

| (d) | Includes Cayman Islands branch offices. |

| (e) | The tax equivalent adjustment was $12 million in 2007 and is based on the federal statutory tax rate (35%) and applicable state and local taxes. |

12 The Bank of New York Mellon Corporation

Results of Operations(continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Legacy The Bank of New York only | |

| | | 2006(a) | | | 2005(a) | |

| (dollar amounts in millions, presented on an FTE basis) | | Average

balance | | | Interest | | | Average

yields/rates | | | Average

balance | | | Interest | | | Average yields/

rates | |

Assets | | | | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits with banks (primarily foreign banks) | | $ | 13,327 | | | $ | 538 | | | 4.04 | % | | $ | 8,996 | | | $ | 274 | | | 3.04 | % |

Federal funds sold and securities under resale agreements | | | 2,791 | | | | 130 | | | 4.67 | | | | 2,399 | | | | 70 | | | 2.90 | |

Margin loans | | | 5,372 | | | | 330 | | | 6.15 | | | | 6,403 | | | | 267 | | | 4.17 | |

Non-margin loans: | | | | | | | | | | | | | | | | | | | | | | |

Domestic offices | | | | | | | | | | | | | | | | | | | | | | |

Consumer | | | 2,985 | | | | 168 | | | 5.64 | | | | 1,740 | | | | 91 | | | 5.25 | |

Commercial | | | 14,955 | | | | 707 | | | 4.72 | | | | 14,631 | | | | 558 | | | 3.81 | |

Foreign offices | | | 10,300 | | | | 574 | | | 5.57 | | | | 9,295 | | | | 396 | | | 4.25 | |

Total non-margin loans | | | 28,240 | | | | 1,449 | (b) | | 5.13 | | | | 25,666 | | | | 1,045 | (b) | | 4.07 | |

Securities: | | | | | | | | | | | | | | | | | | | | | | |

U.S. government obligations | | | 190 | | | | 8 | | | 4.32 | | | | 273 | | | | 9 | | | 3.43 | |

U.S. government agency obligations | | | 3,565 | | | | 169 | | | 4.73 | | | | 3,766 | | | | 153 | | | 4.05 | |

Obligations of states and political subdivisions | | | 105 | | | | 9 | | | 8.34 | | | | 141 | | | | 12 | | | 8.39 | |

Other securities: | | | | | | | | | | | | | | | | | | | | | | |

Domestic offices | | | 15,702 | | | | 850 | | | 5.42 | | | | 14,640 | | | | 630 | | | 4.30 | |

Foreign offices | | | 2,746 | | | | 114 | | | 4.15 | | | | 1,882 | | | | 83 | | | 4.44 | |

Total other securities | | | 18,448 | | | | 964 | | | 5.23 | | | | 16,522 | | | | 713 | | | 4.32 | |

Trading securities | | | | | | | | | | | | | | | | | | | | | | |

Domestic offices | | | 660 | | | | 30 | | | 4.56 | | | | 593 | | | | 22 | | | 3.77 | |

Foreign offices | | | 2,908 | | | | 135 | | | 4.64 | | | | 2,956 | | | | 131 | | | 4.45 | |

Total trading securities | | | 3,568 | | | | 165 | | | 4.63 | | | | 3,549 | | | | 153 | | | 4.34 | |

Total securities | | | 25,876 | | | | 1,315 | | | 5.09 | | | | 24,251 | | | | 1,040 | | | 4.29 | |

Total interest-earning assets | | | 75,606 | | | $ | 3,762 | (d) | | 4.98 | % | | | 67,715 | | | $ | 2,696 | (d) | | 3.98 | % |

Allowance for credit losses | | | (340 | ) | | | | | | | | | | (474 | ) | | | | | | | |

Cash and due from banks | | | 2,910 | | | | | | | | | | | 2,772 | | | | | | | | |

Other assets | | | 18,302 | | | | | | | | | | | 16,306 | | | | | | | | |

Assets of discontinued operations | | | 10,364 | | | | | | | | | | | 15,116 | | | | | | | | |

Total assets | | $ | 106,842 | | | | | | | | | | $ | 101,435 | | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | | | | | | | | | | | | | | | | | | | | | |

Domestic offices: | | | | | | | | | | | | | | | | | | | | | | |

Money market rate accounts | | $ | 5,465 | | | $ | 145 | | | 2.66 | % | | $ | 6,320 | | | $ | 109 | | | 1.73 | % |

Savings | | | 452 | | | | 6 | | | 1.36 | | | | 597 | | | | 5 | | | 0.87 | |

Certificates of deposit of $100,000 & over | | | 4,114 | | | | 210 | | | 5.12 | | | | 3,155 | | | | 107 | | | 3.40 | |

Other time deposits | | | 551 | | | | 26 | | | 4.70 | | | | 437 | | | | 16 | | | 3.38 | |

Total domestic | | | 10,582 | | | | 387 | | | 3.66 | | | | 10,509 | | | | 237 | | | 2.25 | |

Foreign offices: | | | | | | | | | | | | | | | | | | | | | | |

Banks | | | 6,764 | | | | 243 | | | 3.59 | | | | 6,050 | | | | 129 | | | 2.13 | |

Government & official institutions | | | 705 | | | | 25 | | | 3.50 | | | | 581 | | | | 14 | | | 2.44 | |

Other | | | 25,092 | | | | 779 | | | 3.11 | | | | 19,930 | | | | 459 | | | 2.30 | |

Total foreign | | | 32,561 | | | | 1,047 | | | 3.22 | | | | 26,561 | | | | 602 | | | 2.26 | |

Total interest-bearing deposits | | | 43,143 | | | | 1,434 | | | 3.33 | | | | 37,070 | | | | 839 | | | 2.26 | |

Federal funds purchased & securities under repurchase agreements | | | 2,237 | | | | 104 | | | 4.65 | | | | 1,284 | | | | 35 | | | 2.73 | |

Other funds borrowed: | | | | | | | | | | | | | | | | | | | | | | |

Domestic offices | | | 1,632 | | | | 94 | | | 5.74 | | | | 1,480 | | | | 55 | | | 3.68 | |

Foreign offices | | | 459 | | | | 6 | | | 1.32 | | | | 385 | | | | 3 | | | 0.84 | |

Total other funds borrowed | | | 2,091 | | | | 100 | | | 4.77 | | | | 1,865 | | | | 58 | | | 3.10 | |

Payables to customers and broker-dealers | | | 4,899 | | | | 167 | | | 3.40 | | | | 6,014 | | | | 128 | | | 2.12 | |

Long term debt | | | 8,295 | | | | 436 | | | 5.26 | | | | 7,312 | | | | 269 | | | 3.68 | |

Total interest-bearing liabilities | | | 60,665 | | | $ | 2,241 | | | 3.69 | % | | | 53,545 | | | $ | 1,329 | | | 2.48 | % |

Total noninterest-bearing deposits | | | 11,609 | | | | | | | | | | | 10,078 | | | | | | | | |

Other liabilities | | | 13,871 | | | | | | | | | | | 13,223 | | | | | | | | |

Liabilities of discontinued operations | | | 10,364 | | | | | | | | | | | 15,116 | | | | | | | | |

Total liabilities | | | 96,509 | | | | | | | | | | | 91,962 | | | | | | | | |

Shareholders’ equity | | | 10,333 | | | | | | | | | | | 9,473 | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 106,842 | | | | | | | | | | $ | 101,435 | | | | | | | | |

Net interest margin-taxable equivalent basis | | | | | | | | | | 2.01 | % | | | | | | | | | | 2.02 | % |

Assets attributable to foreign offices(c) | | | 33.19 | % | | | | | | | | | | 29.51 | % | | | | | | | |

Liabilities attributable to foreign offices | | | 36.21 | | | | | | | | | | | 32.97 | | | | | | | | |

| (a) | Average balances and rates have been impacted by allocations made to match assets of discontinued operations with liabilities of discontinued operations. |

| (b) | Includes fees of $42 million in 2006 and $66 million in 2005. Nonaccrual loans are included in the average loan balance; the associated income, recognized on the cash basis, is included in interest. |

| (c) | Includes Cayman Islands branch office. |

| (d) | The tax equivalent adjustments were $22 million in 2006 and $27 million in 2005, and are based on the federal statutory tax rate (35%) and applicable state and local taxes. |

The Bank of New York Mellon Corporation 13

Results of Operations(continued)

Noninterest expense

| | | | | | | | | | | | | | | | | | |

| Noninterest expense | | 2007(a) | | | Legacy The Bank of

New York only | | | 2007

vs. 2006 | | | 2006

vs. 2005 | |

| (dollars in millions) | | | 2006 | | | 2005 | | | |

Staff: | | | | | | | | | | | | | | | | | | |

Compensation | | $ | 2,453 | | | $ | 1,615 | | | $ | 1,567 | | | 52 | % | | 3 | % |

Incentives | | | 1,114 | | | | 621 | | | | 347 | | | 79 | | | 79 | |

Employee benefits | | | 553 | | | | 404 | | | | 396 | | | 37 | | | 2 | |

Total staff | | | 4,120 | | | | 2,640 | | | | 2,310 | | | 56 | | | 14 | |

Professional, legal and other purchased services | | | 781 | | | | 381 | | | | 344 | | | 105 | | | 11 | |

Net occupancy | | | 449 | | | | 279 | | | | 250 | | | 61 | | | 12 | |

Software | | | 280 | | | | 220 | | | | 214 | | | 27 | | | 3 | |

Distribution and servicing | | | 268 | | | | 17 | | | | 17 | | | N/M | | | - | |

Furniture and equipment | | | 267 | | | | 190 | | | | 199 | | | 41 | | | (5 | ) |

Sub-custodian | | | 200 | | | | 134 | | | | 96 | | | 49 | | | 40 | |

Business development | | | 190 | | | | 108 | | | | 97 | | | 76 | | | 11 | |

Clearing and execution | | | 183 | | | | 199 | | | | 204 | | | (8 | ) | | (2 | ) |

Communications | | | 109 | | | | 97 | | | | 91 | | | 12 | | | 7 | |

Other | | | 546 | | | | 241 | | | | 222 | | | 127 | | | 9 | |

Subtotal | | | 7,393 | | | | 4,506 | | | | 4,044 | | | 64 | | | 11 | |

Amortization of intangible assets | | | 319 | | | | 76 | | | | 40 | | | 320 | | | 90 | |

Merger and integration expense: | | | | | | | | | | | | | | | | | | |

The Bank of New York Mellon | | | 355 | | | | - | | | | - | | | - | | | - | |

Acquired Corporate Trust Business | | | 49 | | | | 106 | | | | - | | | (54 | ) | | - | |

Total noninterest expense | | $ | 8,116 | | | $ | 4,688 | | | $ | 4,084 | | | 73 | % | | 15 | % |

Total staff expense as a percentage of total revenue (FTE) | | | 36 | % | | | 38 | % | | | 38 | % | | | | | | |

Employees at period-end | | | 42,100 | | | | 22,400 | | | | 19,900 | | | 88 | % | | 13 | % |

| (a) | Results for 2007 include six months of the combined Company’s results and six months of legacy The Bank of New York only. All other periods reflect legacy The Bank of New York only. |

Total noninterest expense, excluding intangible amortization and merger and integration expense, was $7.393 billion in 2007, an increase of $2.887 billion or 64% compared with 2006. The merger with Mellon, the purchase of the Acquired Corporate Trust Business and the disposition of certain execution businesses in the BNY ConvergEx transaction significantly impacted comparisons of 2007 to 2006. The net impact of these transactions increased nearly all expense categories. Noninterest expense for 2007 also includes the pre-tax write-off of the value of the remaining interest in a hedge fund manager that was disposed of in 2006 ($32 million). Noninterest expense reflects $175 million in expense synergies associated with the merger with Mellon in 2007. We expect to realize annual expense synergies of $700 million by 2010.

The increase in merger and integration expense and intangible amortization expense compared to 2006 resulted from the merger with Mellon, partially offset by a decrease in merger and integration expense related to the Acquired Corporate Trust Business.

Total merger and integration costs associated with the Mellon merger are currently expected to be approximately $1.325 billion.

Staff expense

Given our mix of fee-based businesses, which are staffed with high quality professionals, staff expense comprised approximately 56% of total noninterest expense, excluding merger and integration and intangible amortization expense in 2007.

Staff expense is comprised of:

| | · | | compensation expense, which includes: |

| | · | | base salary expense, primarily driven by headcount; |

| | · | | the cost of temporary help and overtime, and |

| | · | | incentive expense, which includes: |

| | · | | additional compensation earned under a wide range of sales commission plans and incentive plans designed to reward a |

14 The Bank of New York Mellon Corporation

Results of Operations(continued)

| | combination of individual, business unit and corporate performance goals; as well as |

| | · | | stock-based compensation expense, and |

| | · | | employee benefit expense, primarily medical benefits, payroll taxes, pension and other retirement benefits. |

The increase in compensation, incentive and employee benefits expense reflects a net increase in headcount associated with the Mellon merger, the Acquired Corporate Trust Business, and organic business growth, partially offset by the BNY ConvergEx transaction.

Non-staff expense

Non-staff expense includes certain expenses that vary with the levels of business activity and levels of expensed business investments, fixed infrastructure costs and expenses associated with corporate activities related to technology, compliance, productivity initiatives and corporate development.

Non-staff expense, excluding merger and integration expense and intangible amortization expense, totaled $3.273 billion in 2007 compared with $1.866 billion in 2006. Non-staff expense was impacted by the merger with Mellon, the Acquired Corporate Trust Business, and the BNY ConvergEX transaction, and also included the following activity:

| | · | | A $251 million increase in distribution and servicing expense. Distribution and servicing expense represents amounts paid to other financial intermediaries to cover their costs for distribution (marketing support, administration and record keeping) and servicing of mutual funds. Generally, increases in distribution and servicing expense reflect higher net sales. Distribution and servicing expense in any one year is not expected to be fully recovered by higher distribution and service revenue; rather it contributes to future growth in mutual fund management revenue reflecting the growth in mutual fund assets generated through certain distribution channels; |

| | · | | An increase in professional, legal and other purchased services, business development, furniture and equipment, software and communications expense resulting from business growth and strategic initiatives; |

| | · | | An increase in sub-custodian expenses reflecting increased asset values, higher transaction volumes of assets under custody and increased depositary receipts activity, and |

| | · | | An increase in other expense reflecting organic business growth, the write-off of the remaining interest in a hedge fund manager ($32 million pre-tax), and a $17 million pre-tax loss related to Structured Investment Vehicle (“SIV”) securities purchased from a commingled Net Asset Value (NAV) fund, which is managed to the specifications of a money market fund. |

In 2007, we incurred $355 million of merger and integration expenses related to the merger with Mellon, comprised of the following:

| | · | | Personnel related—includes severance, retention, relocation expenses, accelerated vesting of stock options and restricted stock expense ($122 million); |

| | · | | Integration/conversion costs—including consulting, system conversions and staff ($136 million); |

| | · | | Transaction costs—includes investment banker and legal fees, and foundation funding ($67 million), and |

| | · | | One-time costs—includes facilities related costs, asset write-offs, vendor contract modifications, rebranding and net gain (loss) on disposals ($30 million). |

We also incurred $49 million of merger and integration expense associated with the Acquired Corporate Trust Business in 2007.

Amortization of intangible assets increased to $319 million in 2007 compared with $76 million in 2006, primarily reflecting the merger with Mellon.

2006 compared with 2005

Total noninterest expense increased in 2006 compared with 2005 reflecting increased costs associated with new business, acquisitions, higher pension costs, as well as merger and integration costs. Staff expense was up in 2006 compared with 2005, reflecting higher staff levels tied to new businesses, acquisitions, higher incentive compensation and increased temporary help, partially offset by the BNY ConvergeEx transaction. Employee benefits expense increased compared with 2005, reflecting acquisitions and expenses for incentive payments and pensions. Subcustodian expenses increased in 2006 compared with 2005 reflecting increased asset values and transaction volumes of assets under custody, and increased activity in Depositary Receipts. Professional, legal and other purchased services increased, reflecting the impact of the Acquired Corporate Trust Business.

The Bank of New York Mellon Corporation 15

Results of Operations(continued)

Merger and integration expenses in 2006 primarily included a loss in connection with the restructuring of our investment portfolio and employee-related costs, including severance. The swap of the Acquired Corporate Trust Business for the Retail Business resulted in a more liability-sensitive balance sheet because corporate trust liabilities reprice more quickly than retail deposits. We sold $5.5 billion of investment securities in the third quarter of 2006 to adjust our interest rate sensitivity.

Income taxes

On a continuing operations basis, the effective tax rate for 2007 was 31.0%, compared to 32.0% for 2006 and 32.1% for 2005. The lower effective tax rate in 2007 compared with 2006 reflects the benefit of higher foreign tax credits and lower state and local taxes, partially offset by the phase out of the benefits received from synthetic fuel credits. The slight decrease in the effective tax rate in 2006 compared with 2005 primarily reflected the increased benefit from foreign operations offset by lower tax-exempt income and lower credits from low-income housing.

The projected effective tax rate for 2008, excluding merger and integration expense, is expected to range between 33.75% and 34.25%. The projected increase in the effective tax rate over 2007 is primarily attributable to the loss of synthetic fuel credits, higher expected pre-tax income, and the adverse effect of the merger with Mellon on New York state and local income taxes.

We made synthetic fuel and low-income housing (Sections 29 and 42 of the Internal Revenue Code, respectively) investments that generate tax credits, which have the effect of reducing our tax expense. We invested in leveraged leases which, through accelerated depreciation, postpone the payment of taxes to future years. For financial statement purposes, deferred taxes are recorded as a liability for future payment.

In 2007, our effective tax rate benefited from synthetic fuel tax credits. These credits are related to investments that produce alternative fuel from coal by-products and were impacted by the price of oil. To manage our exposure in 2007 to the risk of increases in oil prices that could have reduced synthetic fuel tax credits, we entered into an option contract covering a specified number of barrels of oil that settled at the end of 2007. The option contract economically hedges a portion of our projected 2007 synthetic fuel tax credit benefit. The contract did not qualify for hedge

accounting and, as a result, changes in the fair value of the option were recorded in trading income. The synthetic fuel program terminated at the end of 2007.

Extraordinary (loss) - Consolidation of Three Rivers Funding Corporation (“TRFC”)

On Dec. 31, 2007, we called the first loss notes of TRFC, making us the primary beneficiary and triggering the consolidation of TRFC. The consolidation resulted in the recognition of an extraordinary (loss) (non-cash accounting charge) of $180 million after-tax, or $0.19 per share, representing the mark to market discount from par associated with spread widening for the assets in TRFC.

Strategically TRFC was not core to our focus on high growth global opportunities in Asset Management and Securities Servicing; it had an immaterial impact on our consolidated financial results, generating only $4 million of fee revenue in 2007. Furthermore, the continuing disruption in the capital markets negatively impacted TRFC funding costs and related returns, which was in sharp contrast to our funding costs and balance sheet strength. Consolidation improves the profitability of this portfolio by enabling use of cheaper funding generated by BNY Mellon as opposed to costlier funding generated by TRFC.

In addition to the extraordinary (loss), the size of the Dec. 31, 2007 balance sheet increased by the full amount of third party commercial paper funding previously issued by TRFC of approximately $4.0 billion. At Dec. 31, 2007, we held $136 million of TRFC’s commercial paper, which was eliminated upon consolidation.

As a result of our excess liquidity, we were able to eliminate the TRFC commercial paper in the first quarter of 2008. Eliminating the TRFC commercial paper is expected to result in an improvement in our adjusted tangible common equity ratio of approximately 10 basis points during the first quarter of 2008.

Also prospectively, the $180 million after-tax mark to market on the TRFC assets is expected to be accreted into income over the remaining lives of the assets, which are currently projected to average approximately 4-5 years, dependent upon the credit quality of the assets.

The fair value of TRFC’s asset-backed securities portfolio, which is included in our securities available for sale portfolio, totaled approximately $3.5 billion at

16 The Bank of New York Mellon Corporation

Results of Operations(continued)

Dec. 31, 2007. Below are TRFC’s asset and mortgage-backed securities by credit rating received from external rating agencies.

| | | | | | | | | | | | | | | | |

Credit ratings for TRFC’s asset and mortgage-backed securities

Dec. 31, 2007 | | | | | | | | | |

| (dollar amounts in millions) | | AAA | | | AA | | | A | | | Total | |

Variable & fixed rate mortgages | | $ | 1,608 | | | | - | | | | - | | | $ | 1,608 | |

Home equity lines of credit | | | 799 | | | | - | | | | - | | | | 799 | |

Credit cards | | | - | | | | 39 | | | | 701 | | | | 740 | |

Subprime mortgage loans | | | 270 | | | | - | | | | - | | | | 270 | |

Other asset-backed securities | | | 30 | | | | 20 | | | | - | | | | 50 | |

Total | | $ | 2,707 | (a) | | $ | 59 | | | $ | 701 | | | $ | 3,467 | |

Percent | | | 78 | % | | | 2 | % | | | 20 | % | | | 100 | % |

| (a) | Includes $802 million wrapped with monoline insurance. |

In addition to these securities, TRFC has approximately $400 million of securitizations of client receivables that are structured to meet a credit rating of A. These securitizations are recorded as commercial loans in the loan portfolio.

Business segments review

We have an internal information system that produces performance data for our seven business segments along product and service lines.

Business segments accounting principles

Our segment data has been determined on an internal management basis of accounting, rather than the generally accepted accounting principles used for consolidated financial reporting. These measurement principles are designed so that reported results of the segments will track their economic performance.

The accounting policies of the business segments are the same as those described in Note 1 of Notes to Consolidated Financial Statements except that segment results are subject to restatement whenever improvements are made in the measurement principles or when organizational changes are made. Net interest revenue differs from the amounts shown in the Consolidated Income Statement because amounts presented in the Business Segments are on an FTE basis. In 2007, in connection with the merger with Mellon, business segment reporting was realigned to reflect the new business structure of the combined company. In addition, several allocation methodologies were also revised to achieve greater harmonization with Mellon’s methodologies. Segment

data for 2006 and 2005 has been restated to reflect these revisions. The operations of acquired businesses are integrated with the existing business segments soon after most acquisitions are completed. As a result of the integration of staff support functions, management of customer relationships, operating processes and the financial impact of funding the acquisitions, we cannot precisely determine the impact of acquisitions on income before taxes and therefore do not report it.

We provide segment data for seven segments, with certain segments combined into sector groupings as shown below:

| | · | | Asset and Wealth Management Sector |

| | · | | Asset Management segment |

| | · | | Wealth Management segment |

| | · | | Institutional Services Sector |

| | · | | Asset Servicing segment |

| | · | | Issuer Services segment |

| | · | | Clearing and Execution Services segment |

| | · | | Treasury Services segment |

Business segment information is reported on a continuing operations basis for all periods presented. See Note 5 of Notes to Consolidated Financial Statements for a discussion of discontinued operations.

The results of our business segments are presented and analyzed on an internal management reporting basis:

| | · | | Revenue amounts reflect fee and other revenue generated by each segment, as well as fee and other revenue transferred between segments under revenue transfer agreements. |

| | · | | Revenues and expenses associated with specific client bases are included in those segments. For example, foreign exchange activity associated with clients using custody products is allocated to the Asset Servicing segment within the Institutional Services Sector. |

| | · | | Balance sheet assets and liabilities and their related income or expense are specifically assigned to each segment. Segments with a net liability position have also been allocated assets from the securities portfolio. |

| | · | | Net interest revenue is allocated to segments based on the yields on the assets and liabilities generated by each segment. We employ a funds transfer pricing system that matches funds with |

The Bank of New York Mellon Corporation 17

Results of Operations(continued)

| | the specific assets and liabilities of each segment based on their interest sensitivity and maturity characteristics. |

| | · | | The measure of revenues and profit or loss by a segment has been adjusted to present segment data on an FTE basis. |

| | · | | The provision for credit losses is allocated to segments based on changes in each segment’s credit risk during the period. Previously, the provision for credit losses was based on management’s judgment as to average credit losses that would have been incurred in the |

| | operations of the segment over a credit cycle of a period of years. |

| | · | | Support and other indirect expenses are allocated to segments based on internally-developed methodologies. |

| | · | | Goodwill and intangible assets are reflected within individual business segments. |

| | · | | The operations of the Acquired Corporate Trust Business are included only from Oct. 1, 2006, the date on which it was acquired. |

| | · | | The operations of Mellon are included only from July 1, 2007, the effective date of the merger. |

| | | | | | | | | | | | |

| Market indexes | | | | | | | | Inc/(Dec) | |

| | | 2007 | | 2006 | | 2005 | | 2007

vs.

2006 | | | 2006

vs.

2005 | |

| | | | | | | | | | | | |

S&P 500 Index(a) | | 1468 | | 1418 | | 1248 | | 4 | % | | 14 | % |

FTSE 100 Index (a) | | 6457 | | 6221 | | 5619 | | 4 | | | 11 | |

NASDAQ Composite Index(a) | | 2652 | | 2415 | | 2205 | | 10 | | | 10 | |

Lehman Brothers Aggregate BondSM Index(a) | | 257.5 | | 226.6 | | 206.2 | | 14 | | | 10 | |

MSCI EAFE® Index(a) | | 2253.4 | | 2074.5 | | 1680.1 | | 9 | | | 23 | |

NYSE Volume(in billions) | | 532.0 | | 458.5 | | 415.1 | | 16 | | | 10 | |

NASDAQ Volume(in billions) | | 539.7 | | 502.6 | | 449.2 | | 7 | | | 12 | |

The merger with Mellon in July 2007, the acquisition of the Acquired Corporate Trust Business and the BNY ConvergEx transaction in October 2006, had a considerable impact on the business segment results in 2007 compared with 2006. The merger with Mellon significantly impacted the Asset Management, Wealth Management and the Asset Servicing segments and, to a lesser extent, the Issuer Services, Treasury Services and the Other segments. The Acquired Corporate Trust Business primarily impacted the Issuer Services segment. The BNY ConvergEx transaction primarily impacted the Clearing and Execution Services segment. The volatile market environment also impacted the business segments in 2007, as reflected by a strong year in securities lending, foreign exchange and other trading activities, as well as clearing and execution revenue. The growth in clearing and execution revenue was offset by the disposition of certain businesses in the BNY ConvergEx transaction. Depositary Receipts were also

strong in 2007, reflecting business growth and corporate actions. Non-program equity trading volumes increased 17% in 2007 compared with 2006. In addition, average daily U.S. fixed-income trading volume was up 13%. Total debt issuance decreased 6% in 2007 compared with 2006. The issuance of global collateralized debt obligations decreased 12% compared with 2006.

The changes in the value of market indices impact fee revenue in the Asset and Wealth Management segments and our securities servicing businesses. Using the S&P 500 as a proxy for the equity markets, we estimate that a 100 point change in the value of the S&P 500, sustained for one year, impacts fee revenue by approximately 1% and fully diluted EPS on a continuing operations basis by $0.05 per share. The consolidating schedules below show the contribution of our segments to our overall profitability.

18 The Bank of New York Mellon Corporation

Results of Operations(continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the year ended

Dec. 31, 2007(a) (in millions, presented on an

FTE basis) | | Asset

Management | | | Wealth

Management | | | Total Asset &

Wealth

Management

Sector | | | Asset

Servicing | | | Issuer

Services | | | Clearing &

Execution

Services | | | Treasury

Services | | | Total

Institutional

Services

Sector | | | Other

Segment | | | Total

Continuing

Operations | |

Fee and other revenue | | $ | 1,865 | | | $ | 436 | | | $ | 2,301 | | | $ | 2,928 | | | $ | 1,660 | | | $ | 1,360 | | | $ | 748 | | | $ | 6,696 | | | $ | 54 | | | $ | 9,051 | |

Net interest revenue | | | 14 | | | | 199 | | | | 213 | | | | 721 | | | | 567 | | | | 304 | | | | 489 | | | | 2,081 | | | | 18 | | | | 2,312 | |

Total revenue | | | 1,879 | | | | 635 | | | | 2,514 | | | | 3,649 | | | | 2,227 | | | | 1,664 | | | | 1,237 | | | | 8,777 | | | | 72 | | | | 11,363 | |

Provision for credit losses | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (10 | ) | | | (10 | ) |

Noninterest expense | | | 1,392 | | | | 479 | | | | 1,871 | | | | 2,481 | | | | 1,159 | | | | 1,220 | | | | 650 | | | | 5,510 | | | | 735 | | | | 8,116 | |

Income before taxes | | $ | 487 | | | $ | 156 | | | $ | 643 | | | $ | 1,168 | | | $ | 1,068 | | | $ | 444 | | | $ | 587 | | | $ | 3,267 | | | $ | (653 | ) | | $ | 3,257 | |

Pre-tax operating margin(b) | | | 26 | % | | | 25 | % | | | 26 | % | | | 32 | % | | | 48 | % | | | 27 | % | | | 47 | % | | | 37 | % | | | N/M | | | | 29 | % |

Average assets(c) | | $ | 7,387 | | | $ | 8,062 | | | $ | 15,449 | | | $ | 17,095 | | | $ | 6,331 | | | $ | 15,482 | | | $ | 18,057 | | | $ | 56,965 | | | $ | 76,175 | | | $ | 148,589 | |

Excluding intangible amortization: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest expense | | $ | 1,244 | | | $ | 437 | | | $ | 1,681 | | | $ | 2,466 | | | $ | 1,084 | | | $ | 1,196 | | | $ | 636 | | | $ | 5,382 | | | $ | 734 | | | $ | 7,797 | |

Income before taxes | | | 635 | | | | 198 | | | | 833 | | | | 1,183 | | | | 1,143 | | | | 468 | | | | 601 | | | | 3,395 | | | | (652 | ) | | | 3,576 | |

Pre-tax operating margin(b) | | | 34 | % | | | 31 | % | | | 33 | % | | | 32 | % | | | 51 | % | | | 28 | % | | | 49 | % | | | 39 | % | | | N/M | | | | 31 | % |

| (a) | Results for 2007 include six months of the combined Company’s results and six months of legacy The Bank of New York only. |

| (b) | Income before taxes divided by total revenue. |