Investor Day March 8, 2018 Exhibit 99.1

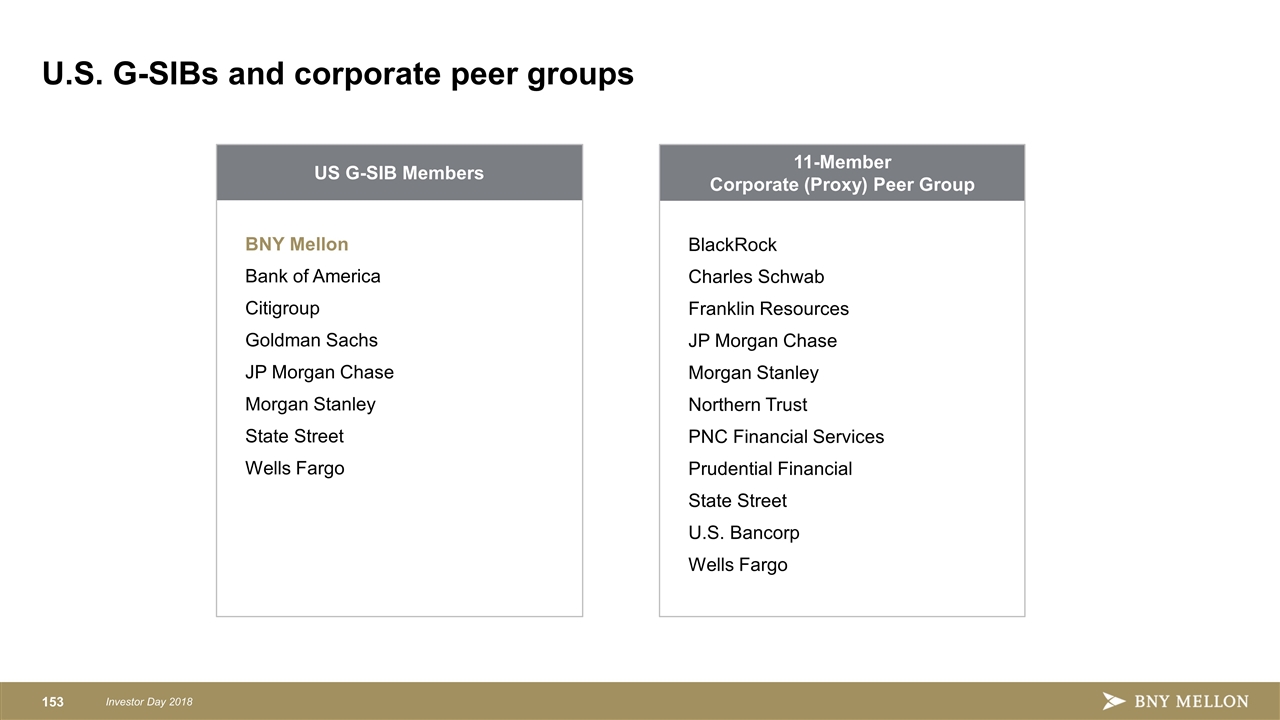

A number of statements in our presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate”, “forecast”, “project”, “anticipate”, “target”, “expect”, “intend”, “continue”, “seek”, “believe”, “plan”, “goal”, “could”, “should”, “may”, “will”, “strategy”, “opportunities”, “trends” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: capital plans, strategic priorities, financial goals, client experience, driving revenue growth, estimated capital ratios and expectations regarding those ratios, preliminary business metrics; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, outlooks,estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2017 (the “2017 Annual Report”) and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of March 8, 2018, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding the Corporation, please refer to the Corporation's SEC filings available at www.bnymellon.com/investorrelations. Non-GAAP Measures: In this presentation we discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP measures are contained in the Corporation’s reports filed with the SEC, including the 2017 Annual Report, and are available at www.bnymellon.com/investorrelations. Cautionary Statement NOTE: All financial data for the Corporation throughout the presentation is as of March 8, 2018 unless otherwise noted.

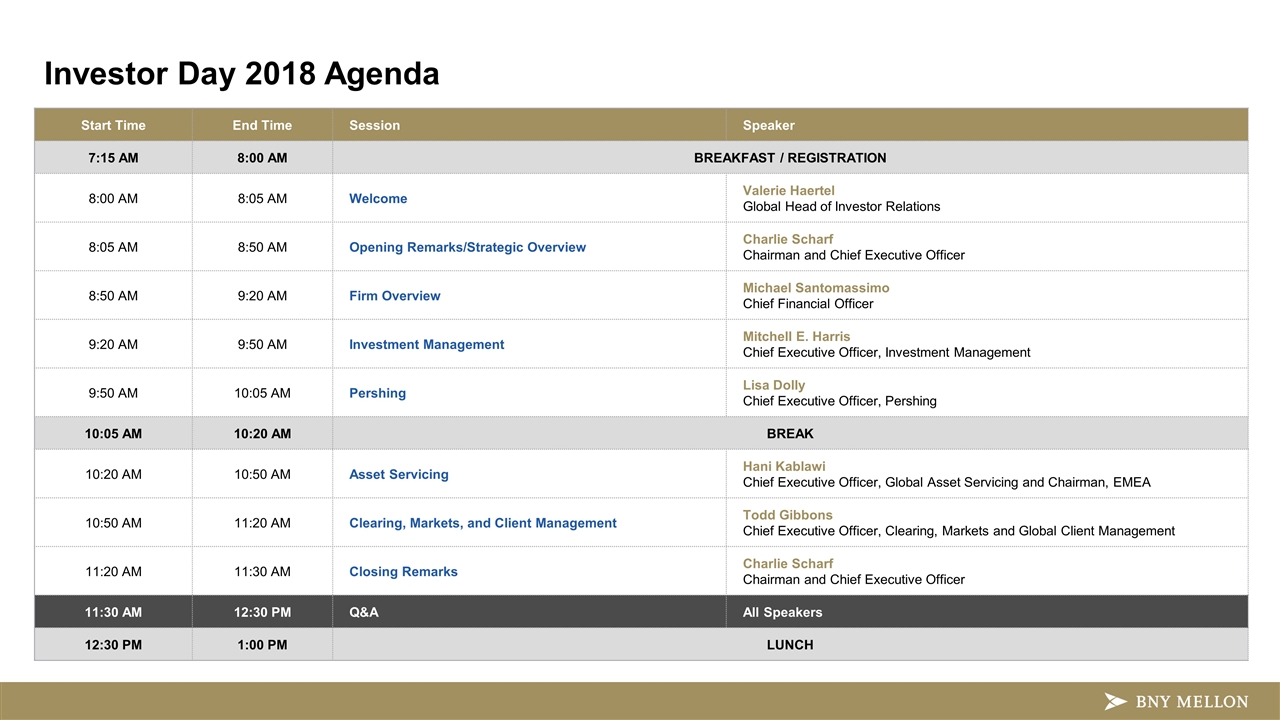

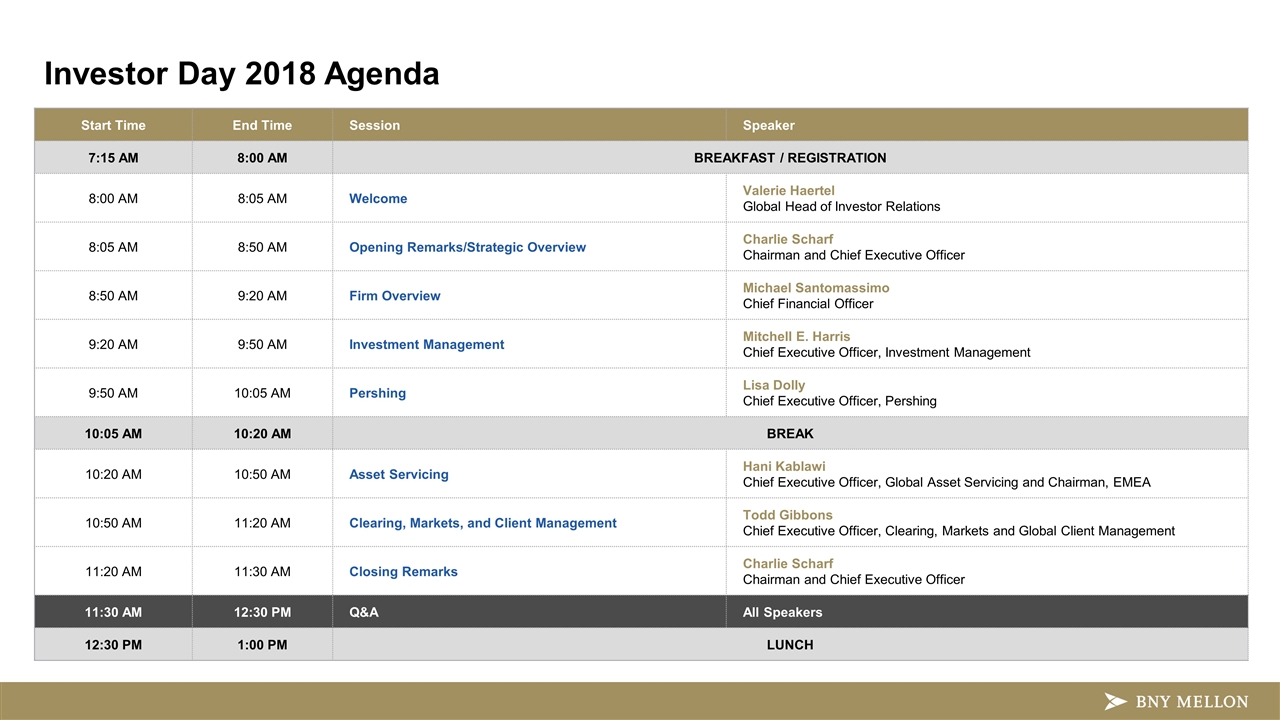

Investor Day 2018 Agenda Start Time End Time Session Speaker 7:15 AM 8:00 AM BREAKFAST / REGISTRATION 8:00 AM 8:05 AM Welcome Valerie Haertel Global Head of Investor Relations 8:05 AM 8:50 AM Opening Remarks/Strategic Overview Charlie Scharf Chairman and Chief Executive Officer 8:50 AM 9:20 AM Firm Overview Michael Santomassimo Chief Financial Officer 9:20 AM 9:50 AM Investment Management Mitchell E. Harris Chief Executive Officer, Investment Management 9:50 AM 10:05 AM Pershing Lisa Dolly Chief Executive Officer, Pershing 10:05 AM 10:20 AM BREAK 10:20 AM 10:50 AM Asset Servicing Hani Kablawi Chief Executive Officer, Global Asset Servicing and Chairman, EMEA 10:50 AM 11:20 AM Clearing, Markets, and Client Management Todd Gibbons Chief Executive Officer, Clearing, Markets and Global Client Management 11:20 AM 11:30 AM Closing Remarks Charlie Scharf Chairman and Chief Executive Officer 11:30 AM 12:30 PM Q&A All Speakers 12:30 PM 1:00 PM LUNCH

Investor Day 2018 Strategic Overview Charlie Scharf Chairman and CEO March 8, 2018

Great history and culture A strong and unique franchise Clear, focused, and financially attractive business model Continued focus on operating leverage Investing for growth by Improving execution Expanding technology-enabled solutions Leveraging all of BNY Mellon

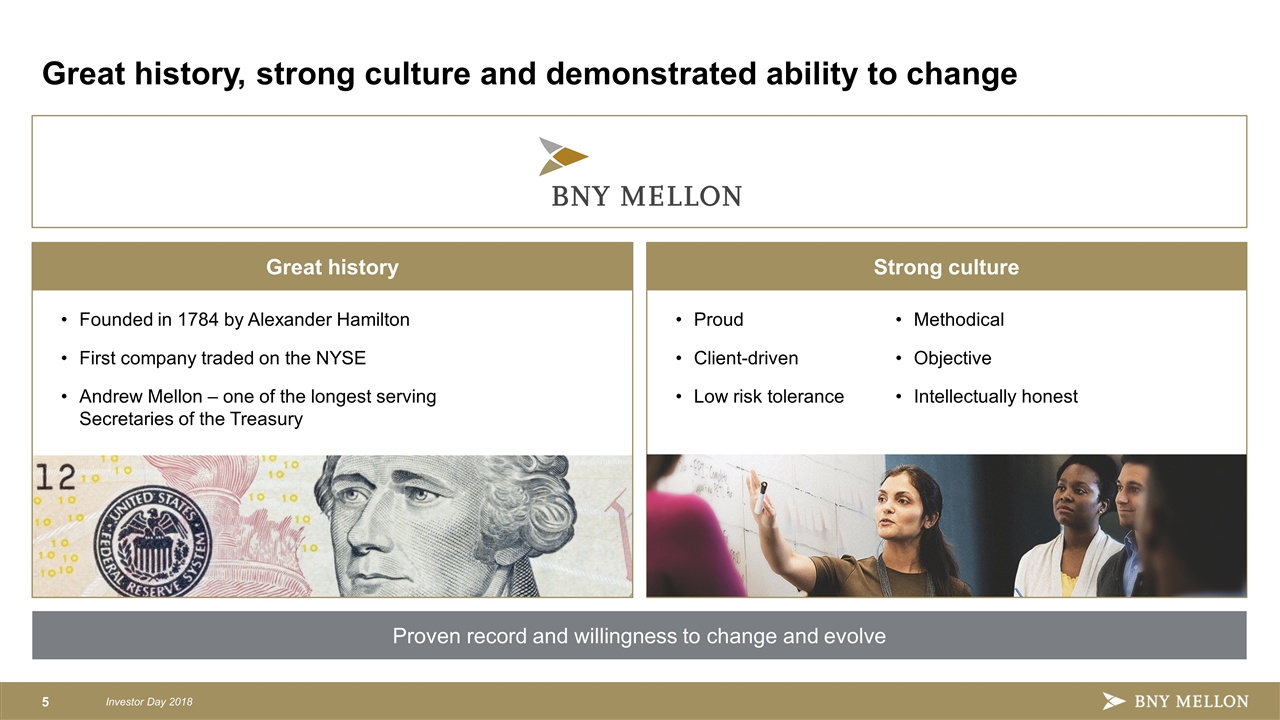

Great history, strong culture and demonstrated ability to change Proven record and willingness to change and evolve Strong culture Proud Client-driven Low risk tolerance Methodical Objective Intellectually honest Great history Founded in 1784 by Alexander Hamilton First company traded on the NYSE Andrew Mellon – one of the longest serving Secretaries of the Treasury

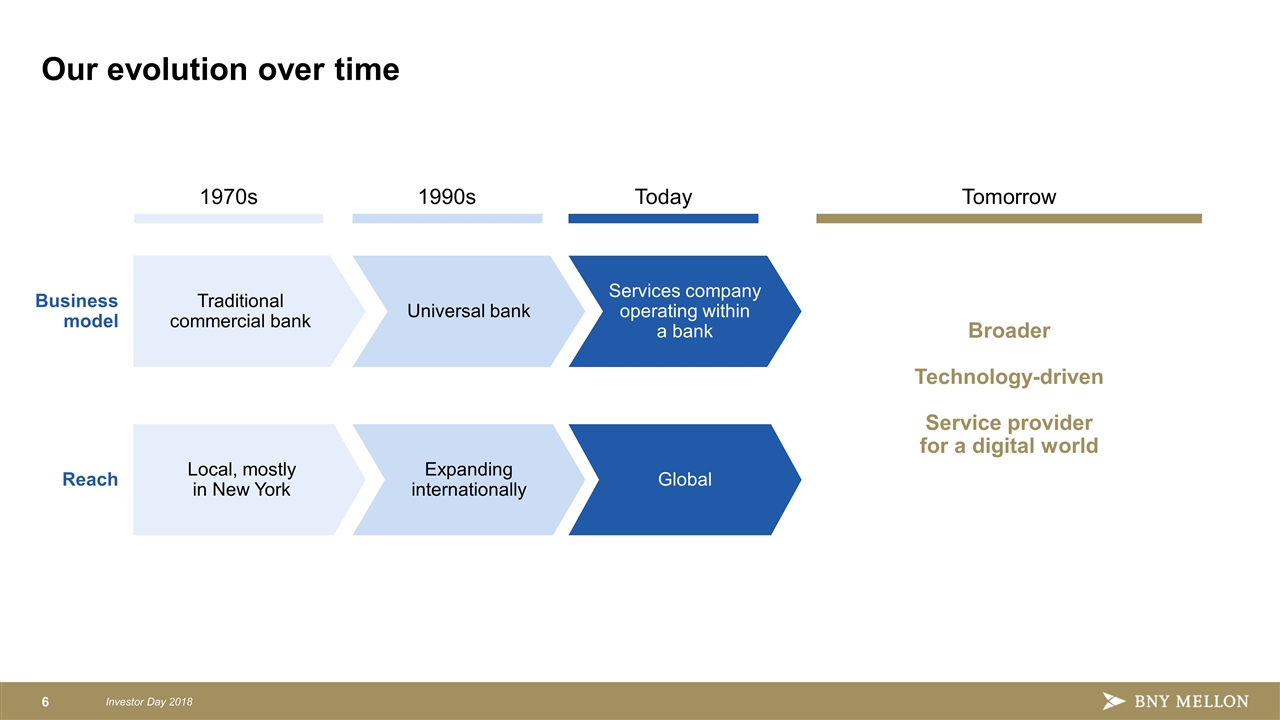

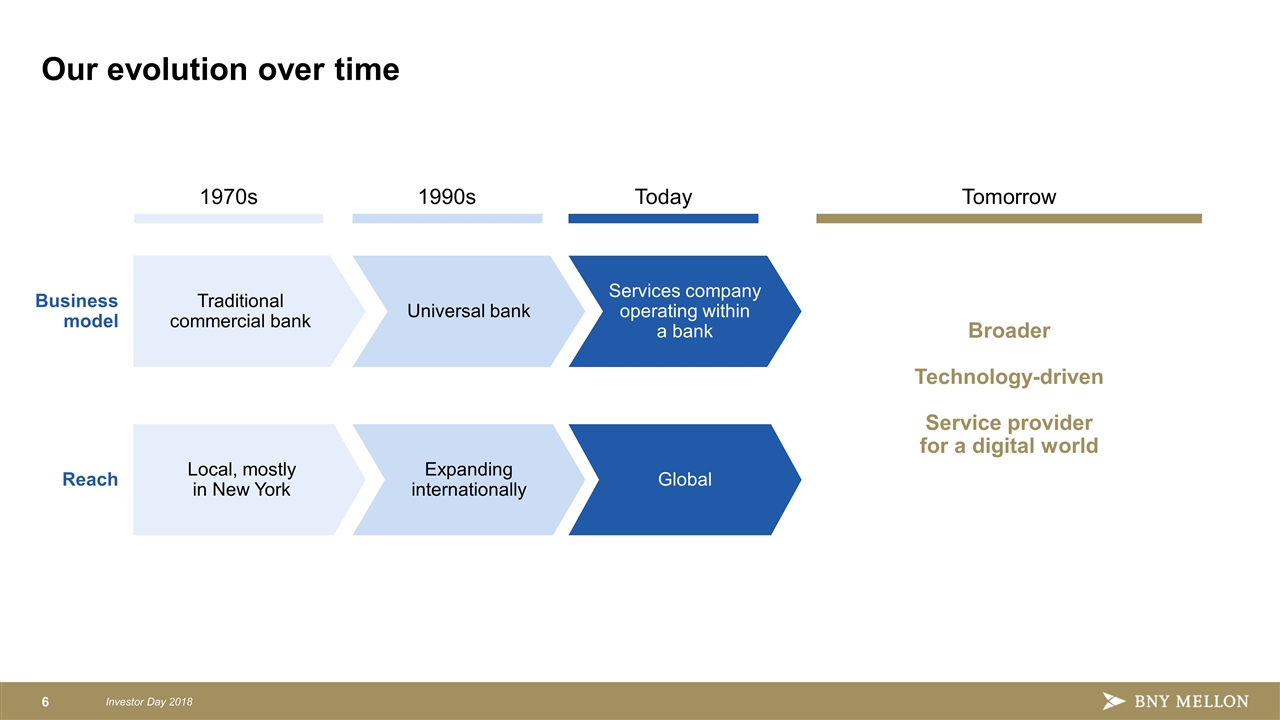

Our evolution over time Business model Reach Traditional commercial bank Universal bank Services company operating within a bank Local, mostly in New York Expanding internationally Global 1970s 1990s Today Tomorrow Broader Technology-driven Service provider for a digital world

Great history and culture A strong and unique franchise Clear, focused, and financially attractive business model Continued focus on operating leverage Investing for growth by Improving execution Expanding technology-enabled solutions Leveraging all of BNY Mellon

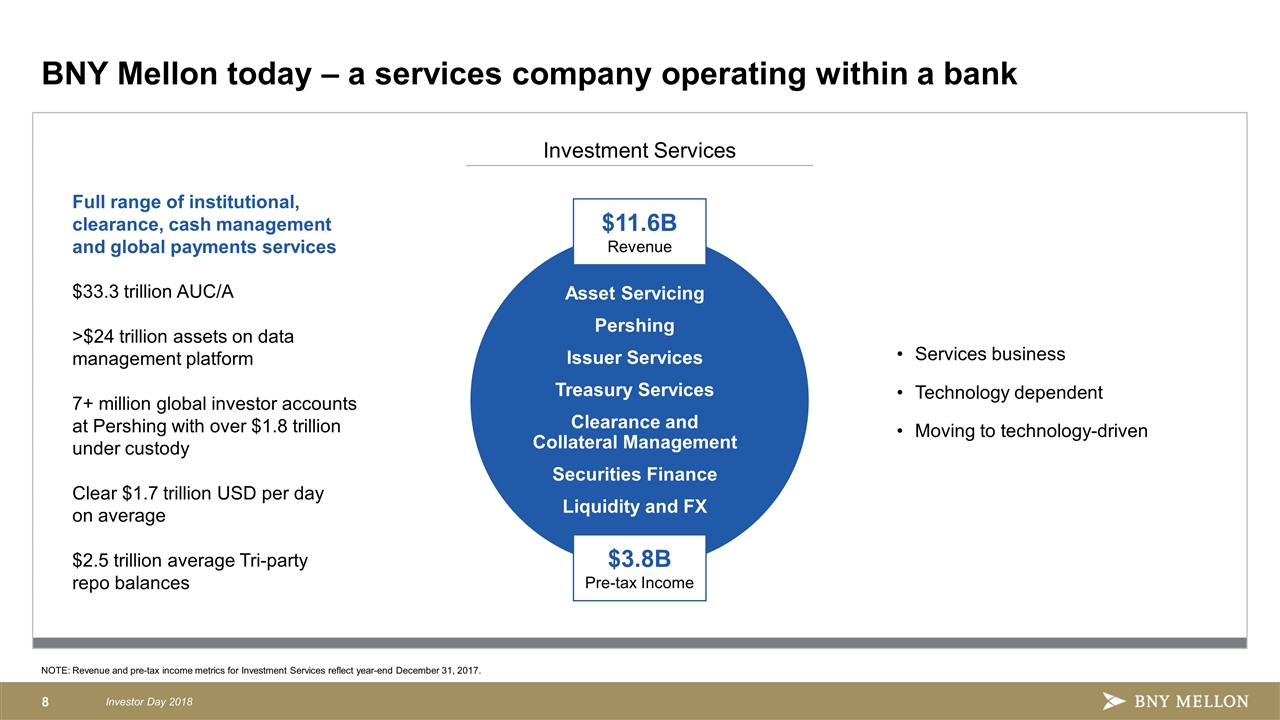

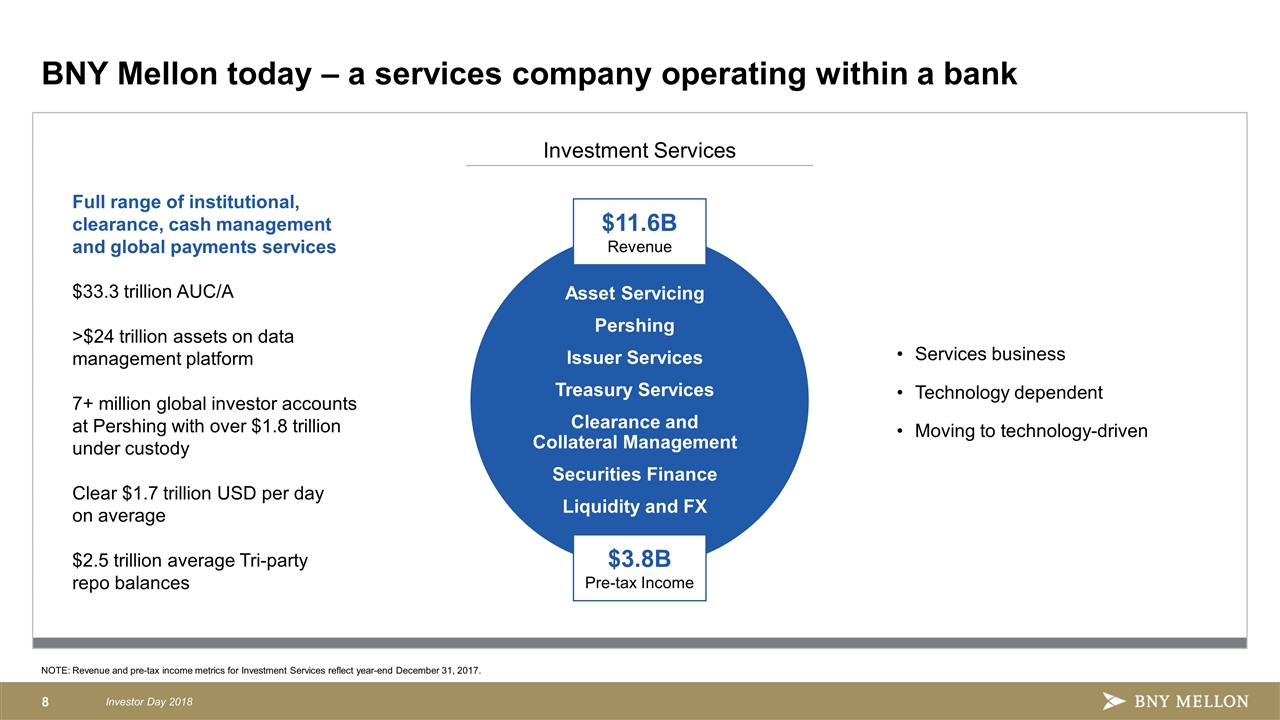

NOTE: Revenue and pre-tax income metrics for Investment Services reflect year-end December 31, 2017. BNY Mellon today – a services company operating within a bank Asset Servicing Pershing Issuer Services Treasury Services Clearance and Collateral Management Securities Finance Liquidity and FX $11.6B Revenue $3.8B Pre-tax Income Investment Services Full range of institutional, clearance, cash management and global payments services $33.3 trillion AUC/A >$24 trillion assets on data management platform 7+ million global investor accounts at Pershing with over $1.8 trillion under custody Clear $1.7 trillion USD per day on average $2.5 trillion average Tri-party repo balances Services business Technology dependent Moving to technology-driven

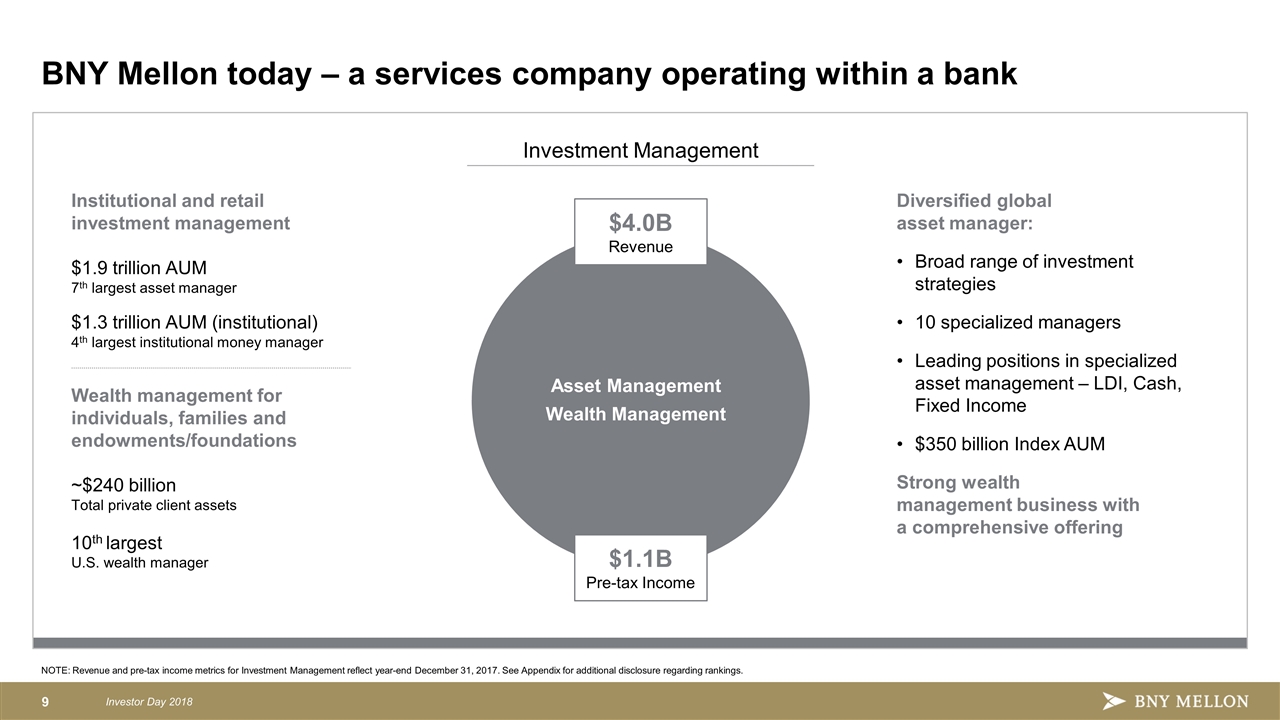

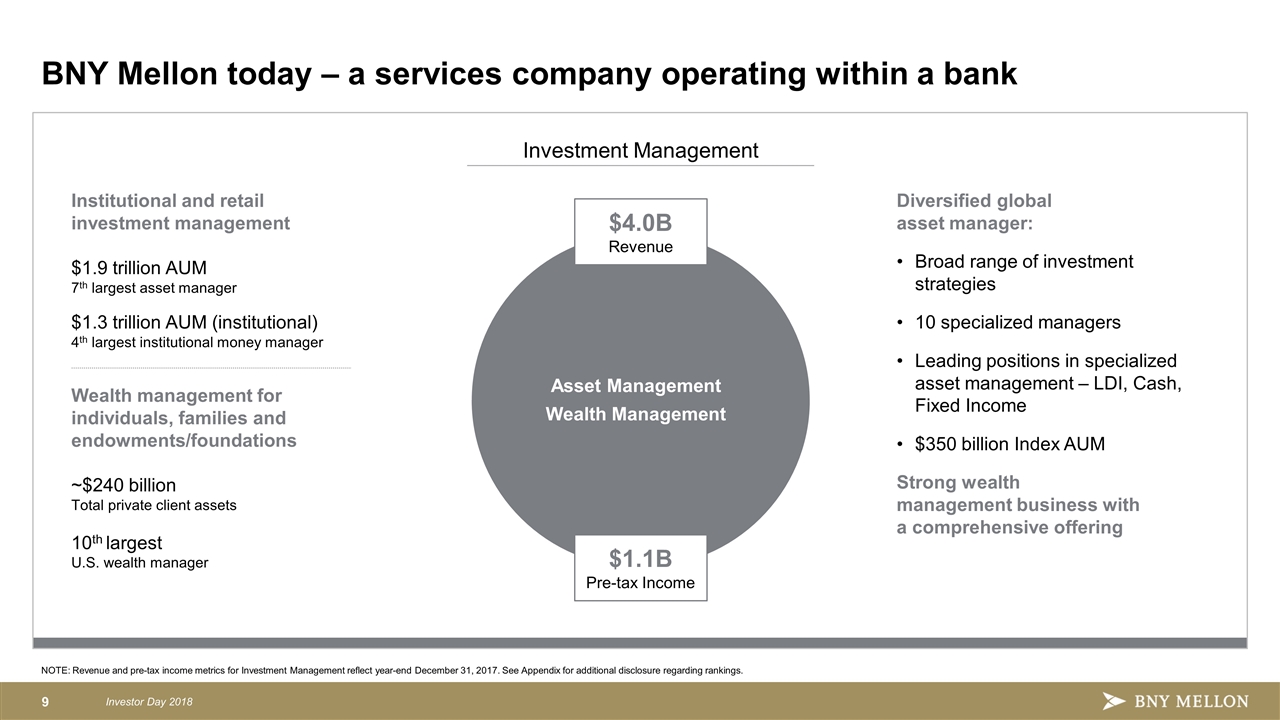

BNY Mellon today – a services company operating within a bank Asset Management Wealth Management $4.0B Revenue $1.1B Pre-tax Income Investment Management Diversified global asset manager: Broad range of investment strategies 10 specialized managers Leading positions in specialized asset management – LDI, Cash, Fixed Income $350 billion Index AUM Strong wealth management business with a comprehensive offering Institutional and retail investment management $1.9 trillion AUM 7th largest asset manager $1.3 trillion AUM (institutional) 4th largest institutional money manager Wealth management for individuals, families and endowments/foundations ~$240 billion Total private client assets 10th largest U.S. wealth manager NOTE: Revenue and pre-tax income metrics for Investment Management reflect year-end December 31, 2017. See Appendix for additional disclosure regarding rankings.

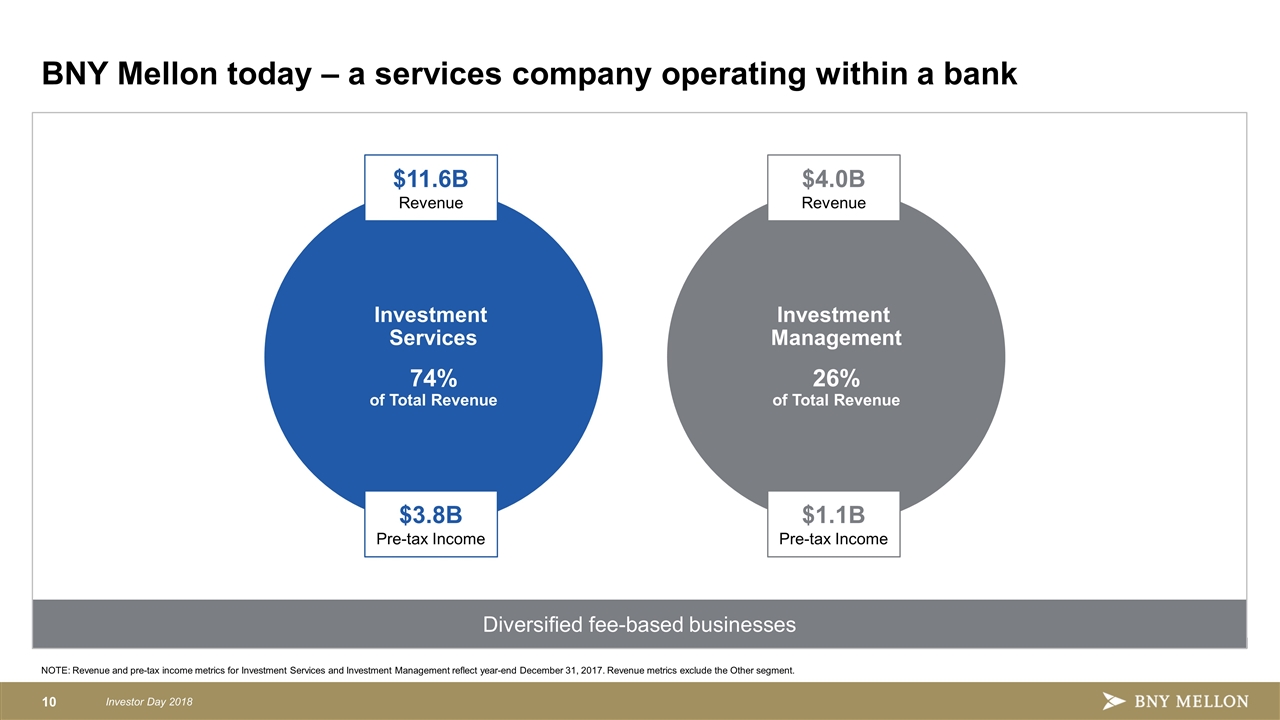

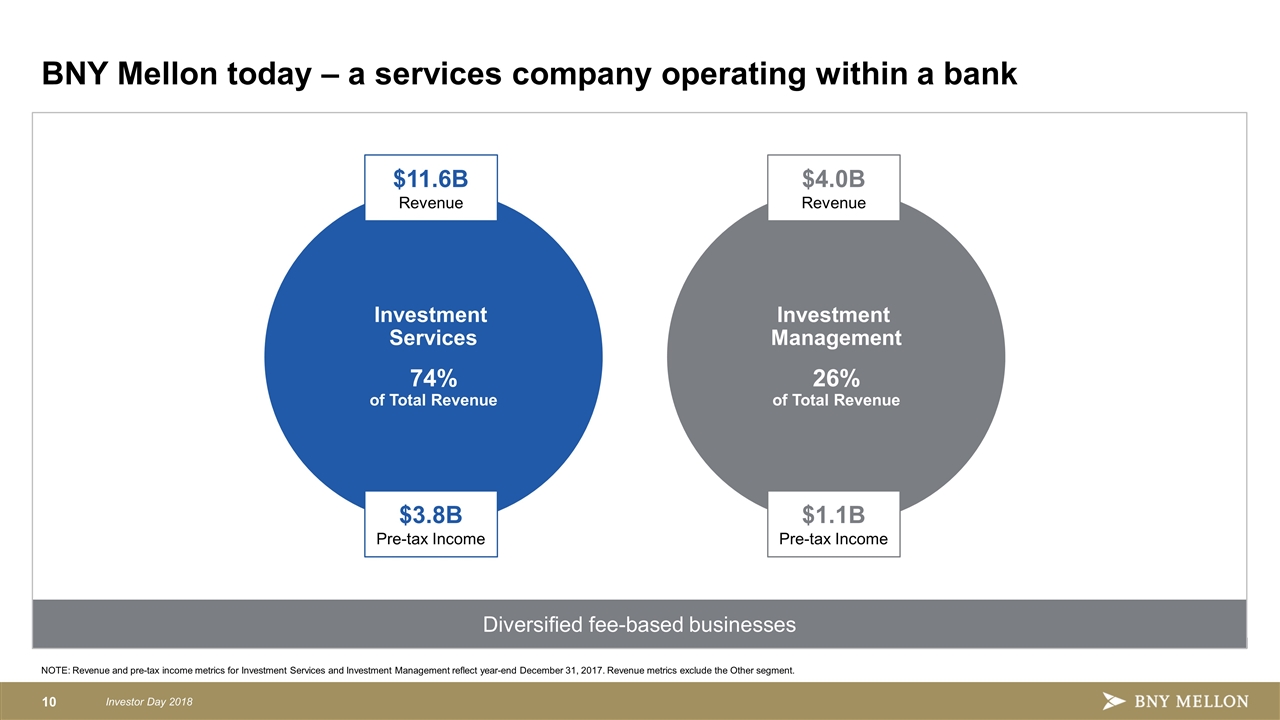

BNY Mellon today – a services company operating within a bank Diversified fee-based businesses Investment Services 74% of Total Revenue $11.6B Revenue $3.8B Pre-tax Income Investment Management 26% of Total Revenue $4.0B Revenue $1.1B Pre-tax Income NOTE: Revenue and pre-tax income metrics for Investment Services and Investment Management reflect year-end December 31, 2017. Revenue metrics exclude the Other segment.

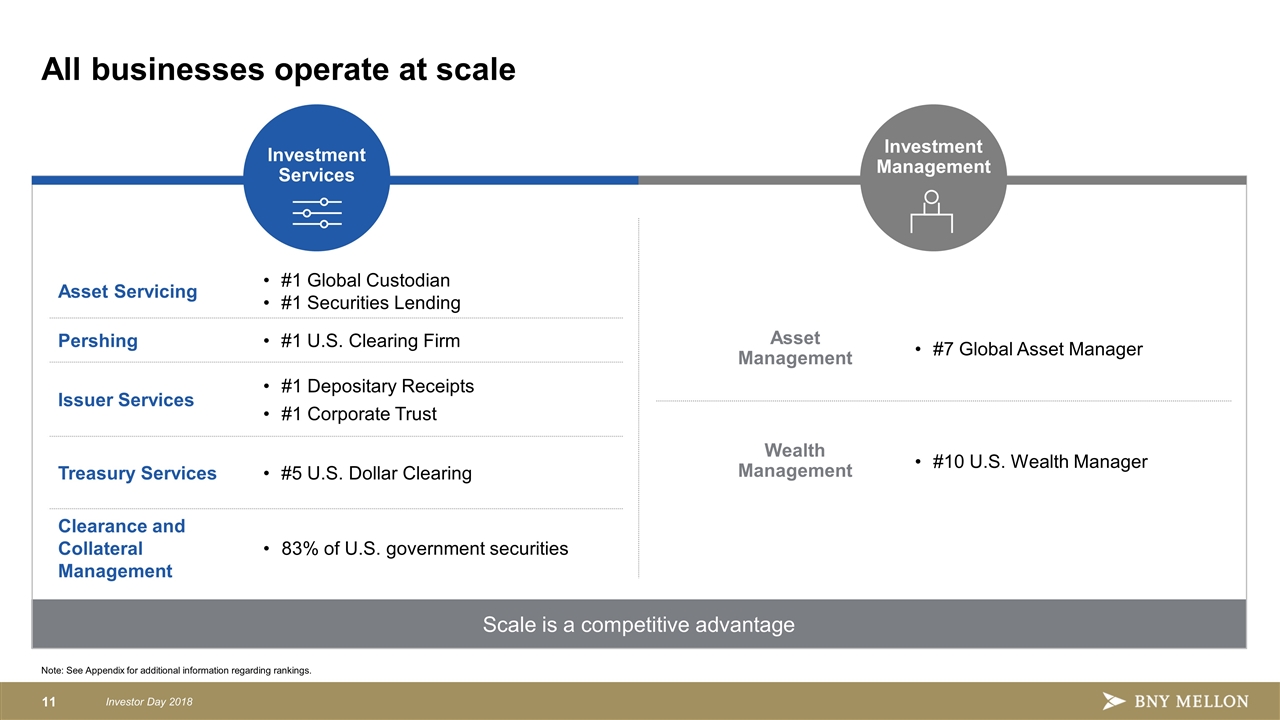

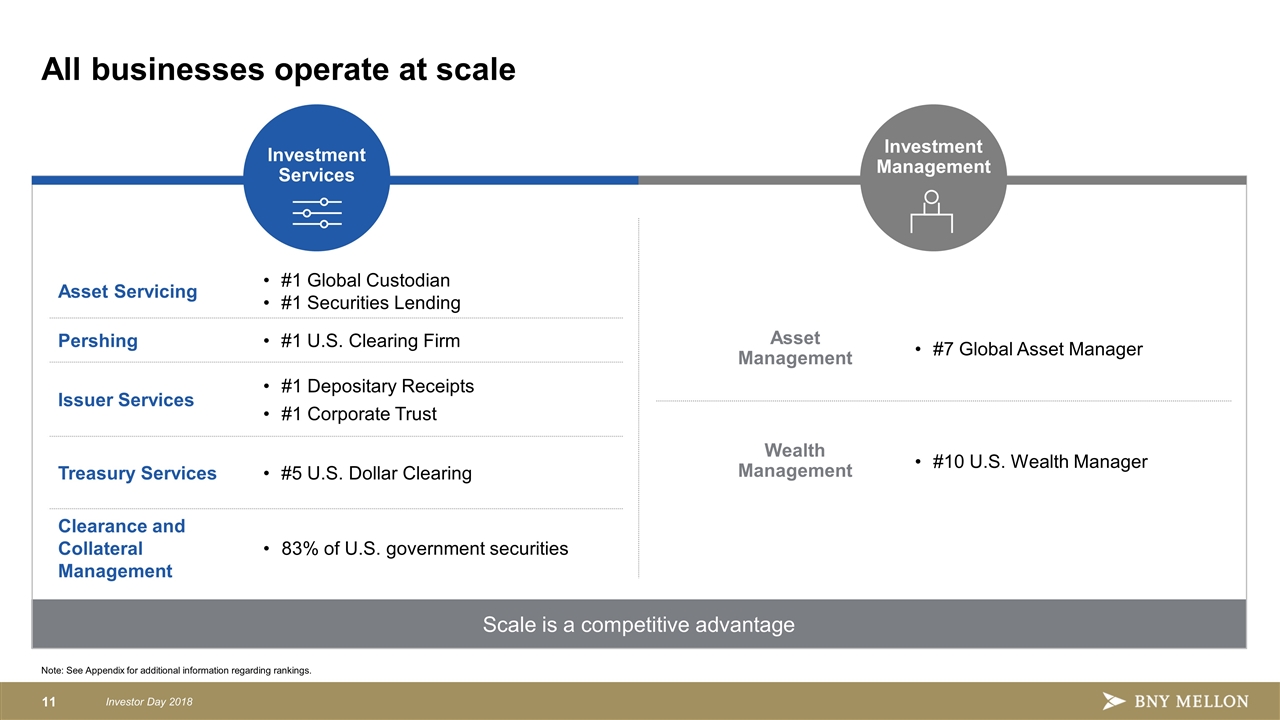

Scale is a competitive advantage All businesses operate at scale Asset Management Wealth Management #7 Global Asset Manager #10 U.S. Wealth Manager Asset Servicing #1 Global Custodian #1 Securities Lending Pershing #1 U.S. Clearing Firm Issuer Services #1 Depositary Receipts #1 Corporate Trust Treasury Services #5 U.S. Dollar Clearing Clearance and Collateral Management 83% of U.S. government securities Note: See Appendix for additional information regarding rankings. Investment Services Investment Management

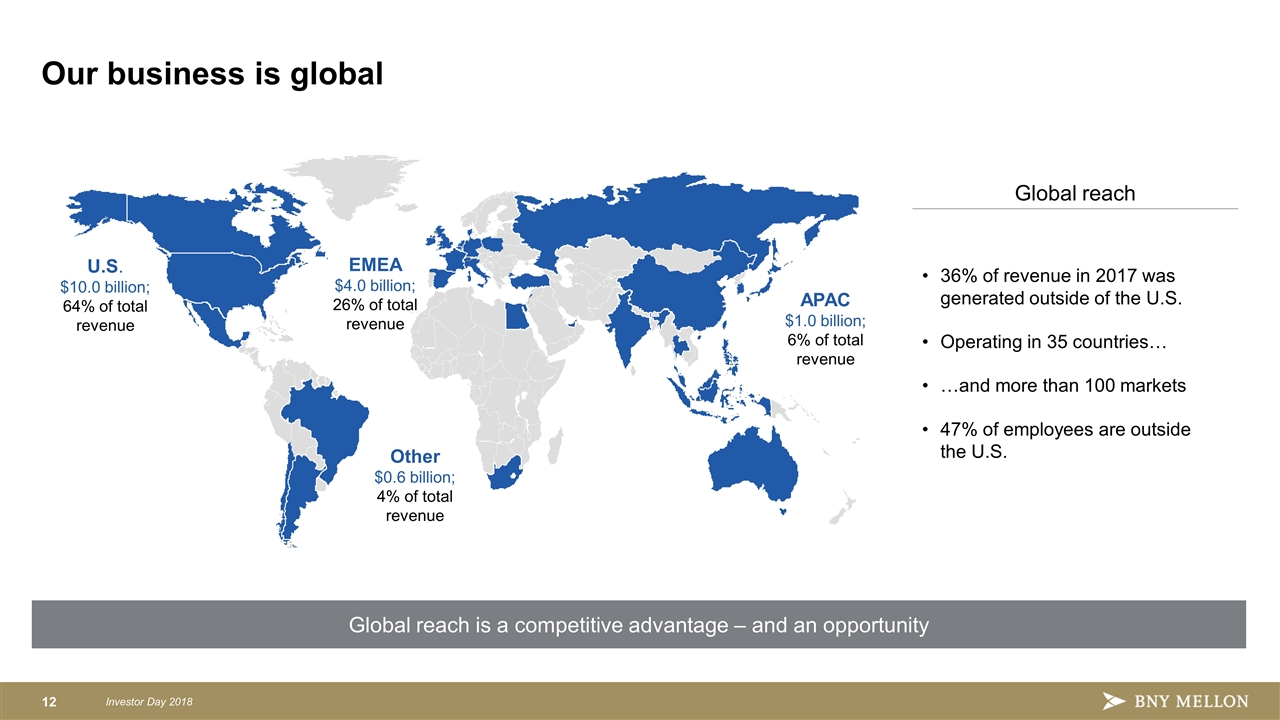

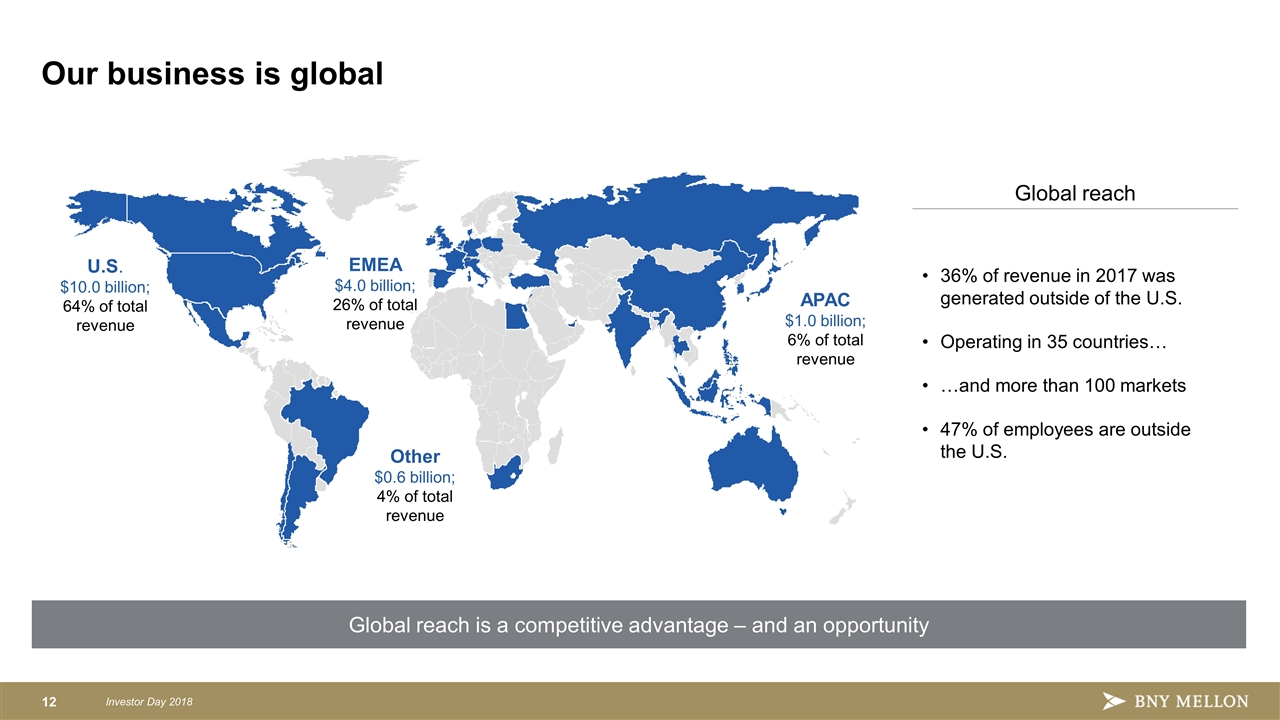

Our business is global U.S. $10.0 billion; 64% of total revenue EMEA $4.0 billion; 26% of total revenue APAC $1.0 billion; 6% of total revenue Other $0.6 billion; 4% of total revenue 36% of revenue in 2017 was generated outside of the U.S. Operating in 35 countries… …and more than 100 markets 47% of employees are outside the U.S. Global reach is a competitive advantage – and an opportunity Global reach

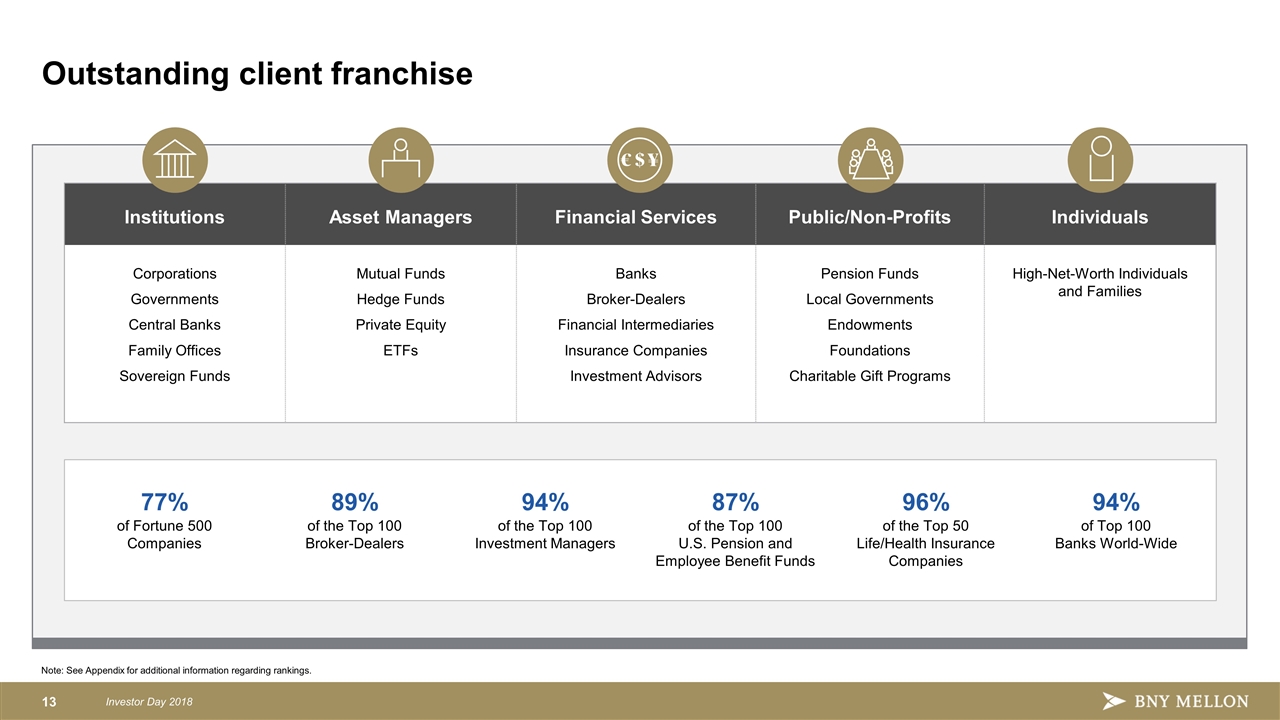

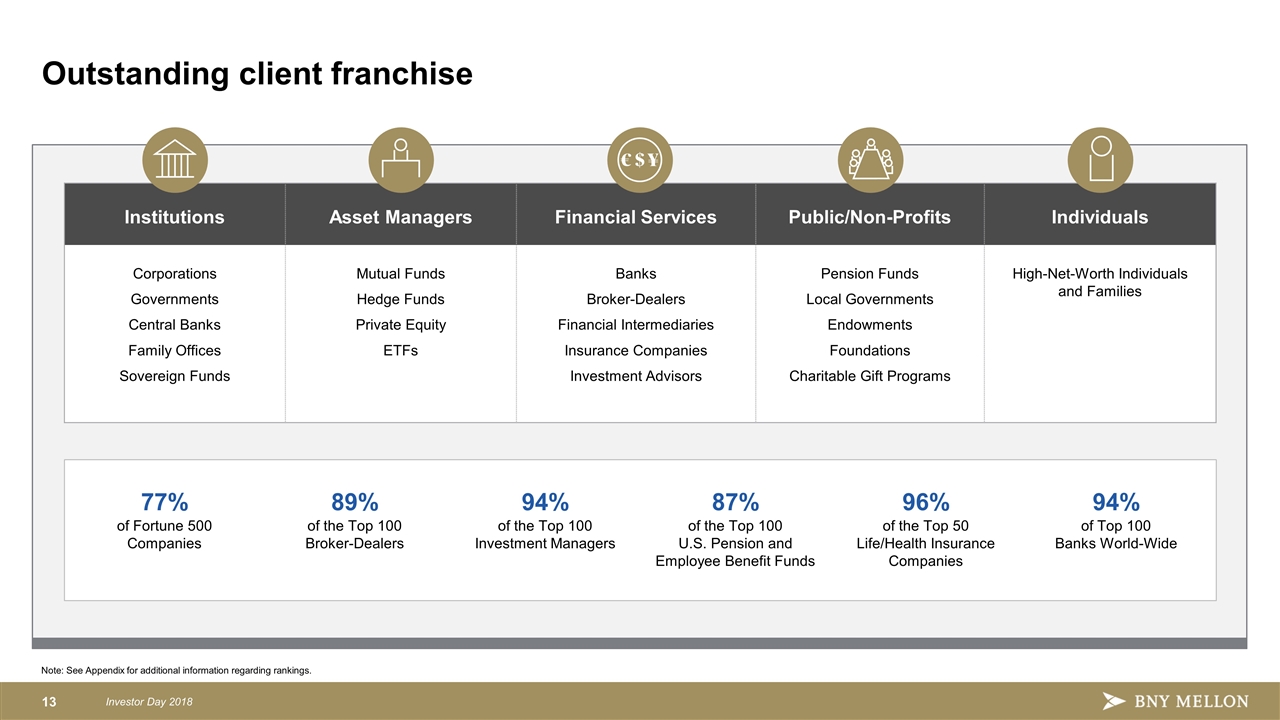

Institutions Asset Managers Financial Services Public/Non-Profits Individuals Corporations Governments Central Banks Family Offices Sovereign Funds Mutual Funds Hedge Funds Private Equity ETFs Banks Broker-Dealers Financial Intermediaries Insurance Companies Investment Advisors Pension Funds Local Governments Endowments Foundations Charitable Gift Programs High-Net-Worth Individuals and Families 77% of Fortune 500 Companies 89% of the Top 100 Broker-Dealers 94% of the Top 100 Investment Managers 87% of the Top 100 U.S. Pension and Employee Benefit Funds 96% of the Top 50 Life/Health Insurance Companies 94% of Top 100 Banks World-Wide Outstanding client franchise Note: See Appendix for additional information regarding rankings.

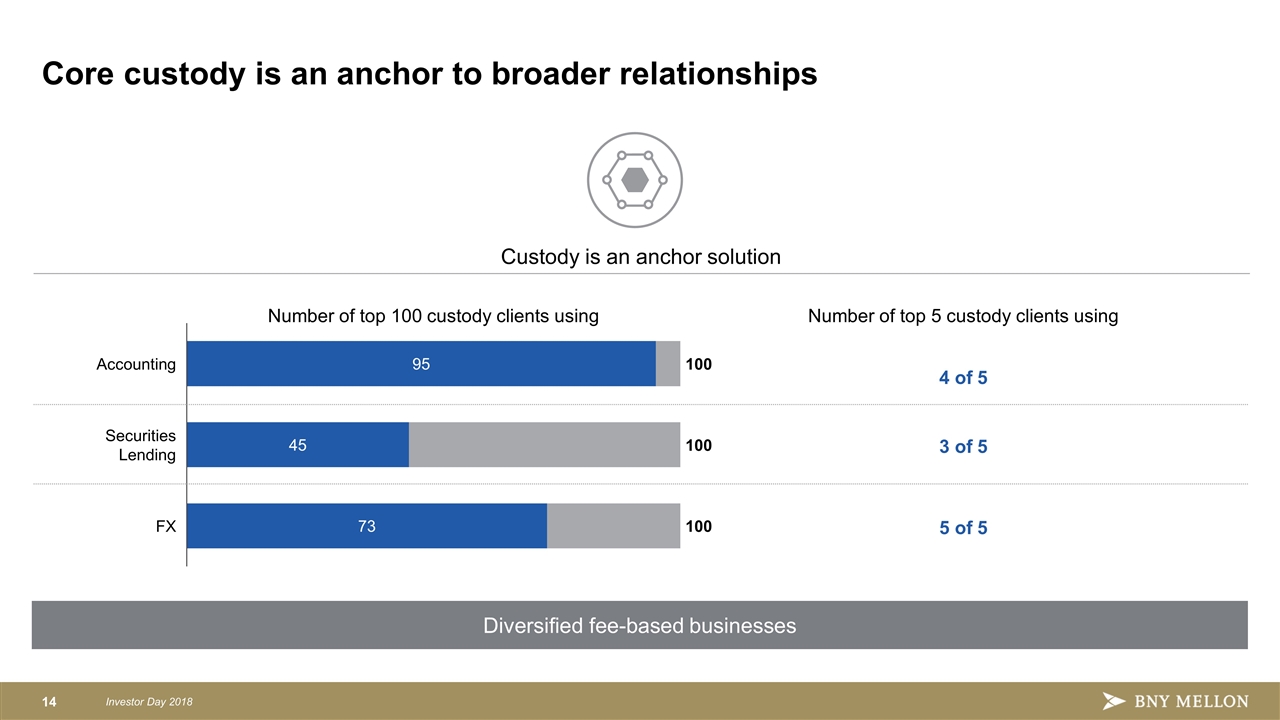

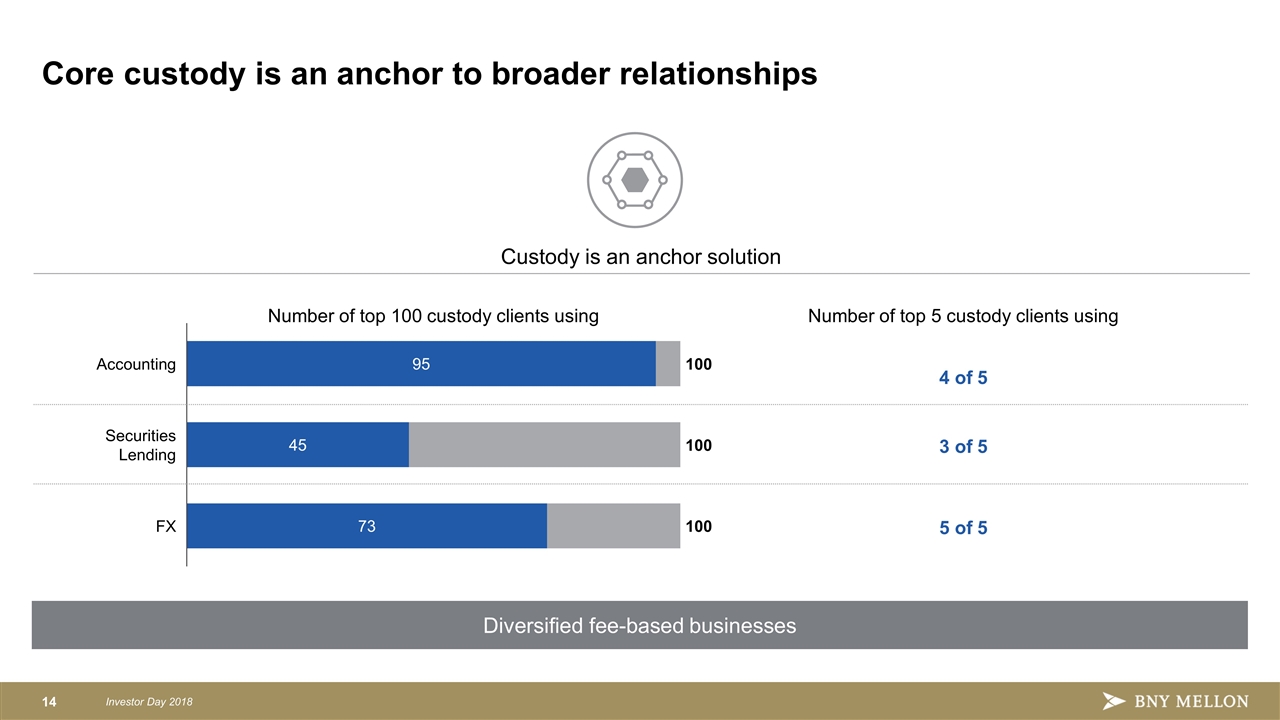

Diversified fee-based businesses Core custody is an anchor to broader relationships Custody is an anchor solution Number of top 100 custody clients using Number of top 5 custody clients using 4 of 5 3 of 5 5 of 5

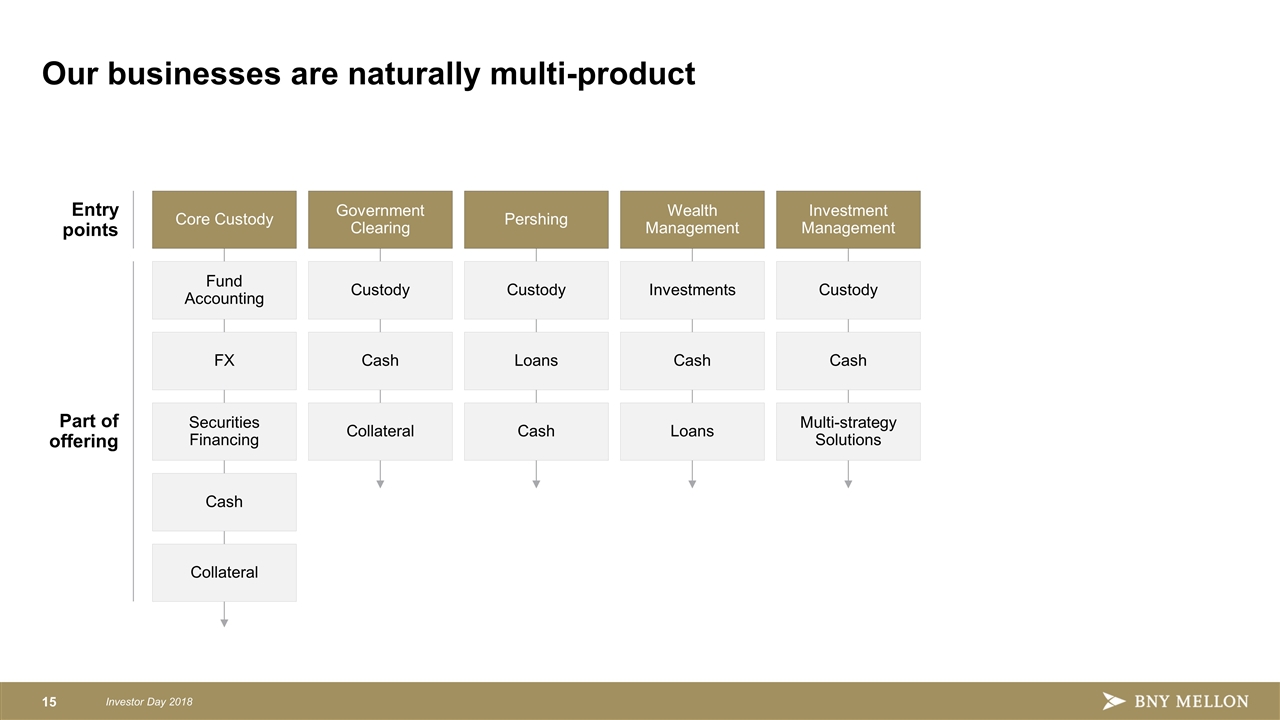

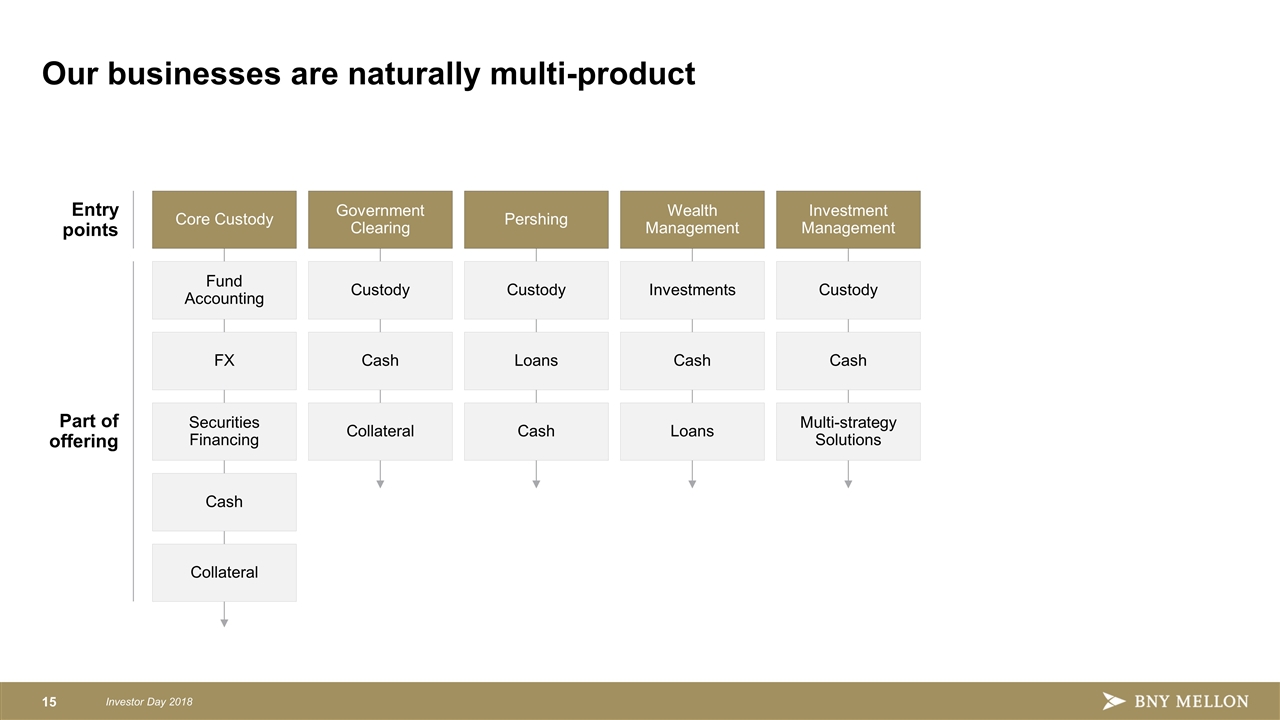

Our businesses are naturally multi-product Entry points Part of offering Core Custody FX Securities Financing Cash Fund Accounting Collateral Government Clearing Custody Cash Collateral Pershing Custody Loans Cash Wealth Management Investments Cash Loans Investment Management Custody Cash Multi-strategy Solutions

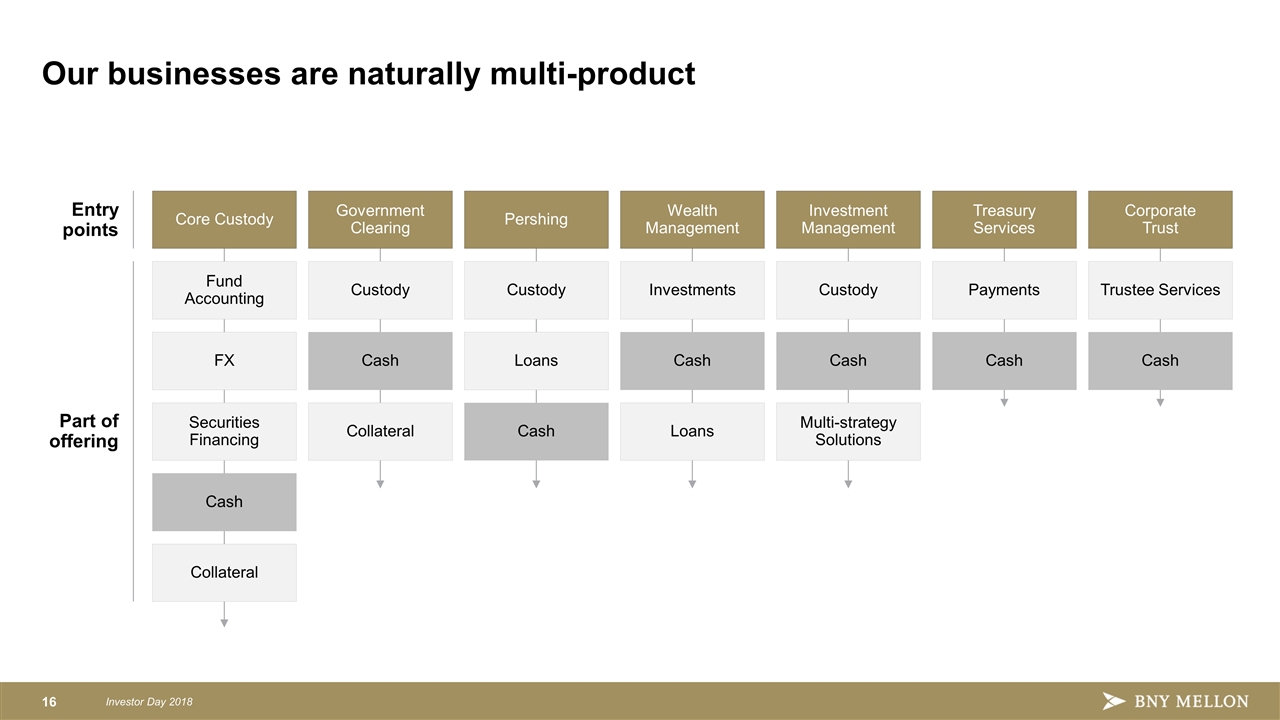

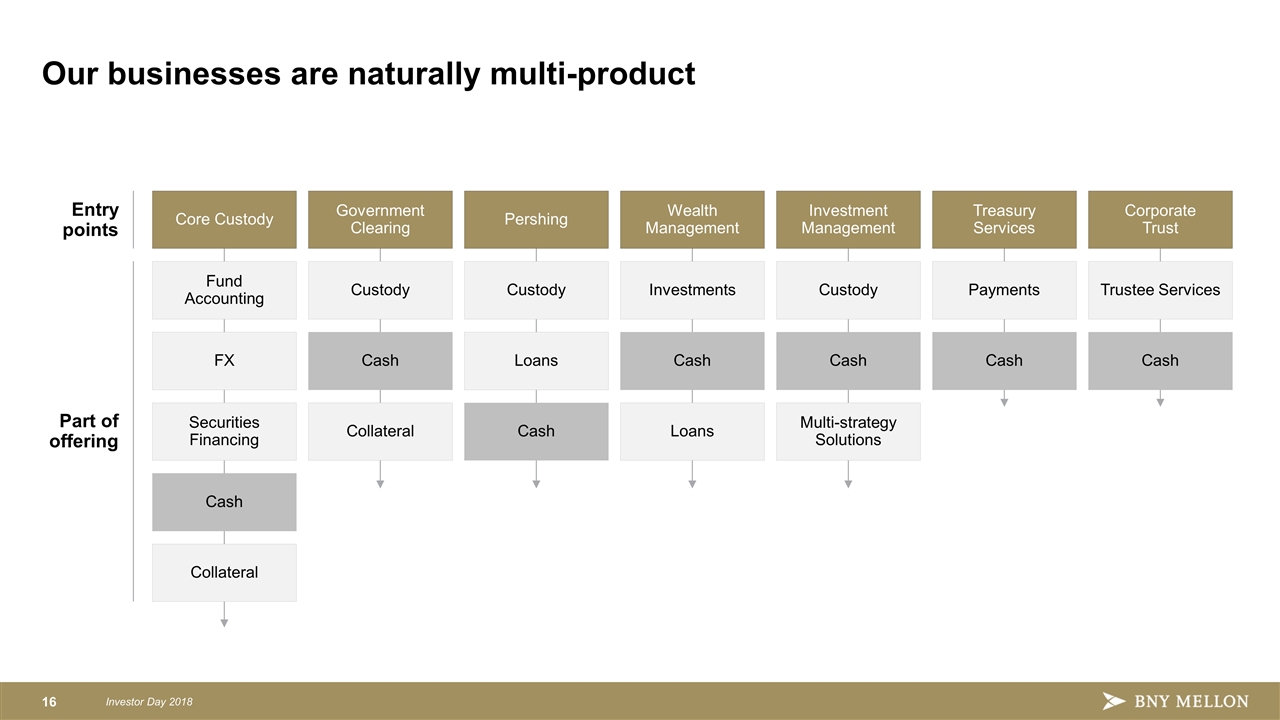

Our businesses are naturally multi-product Entry points Part of offering Core Custody FX Securities Financing Cash Fund Accounting Collateral Government Clearing Custody Cash Collateral Pershing Custody Loans Cash Wealth Management Investments Cash Loans Investment Management Custody Cash Multi-strategy Solutions Treasury Services Payments Cash Corporate Trust Trustee Services Cash

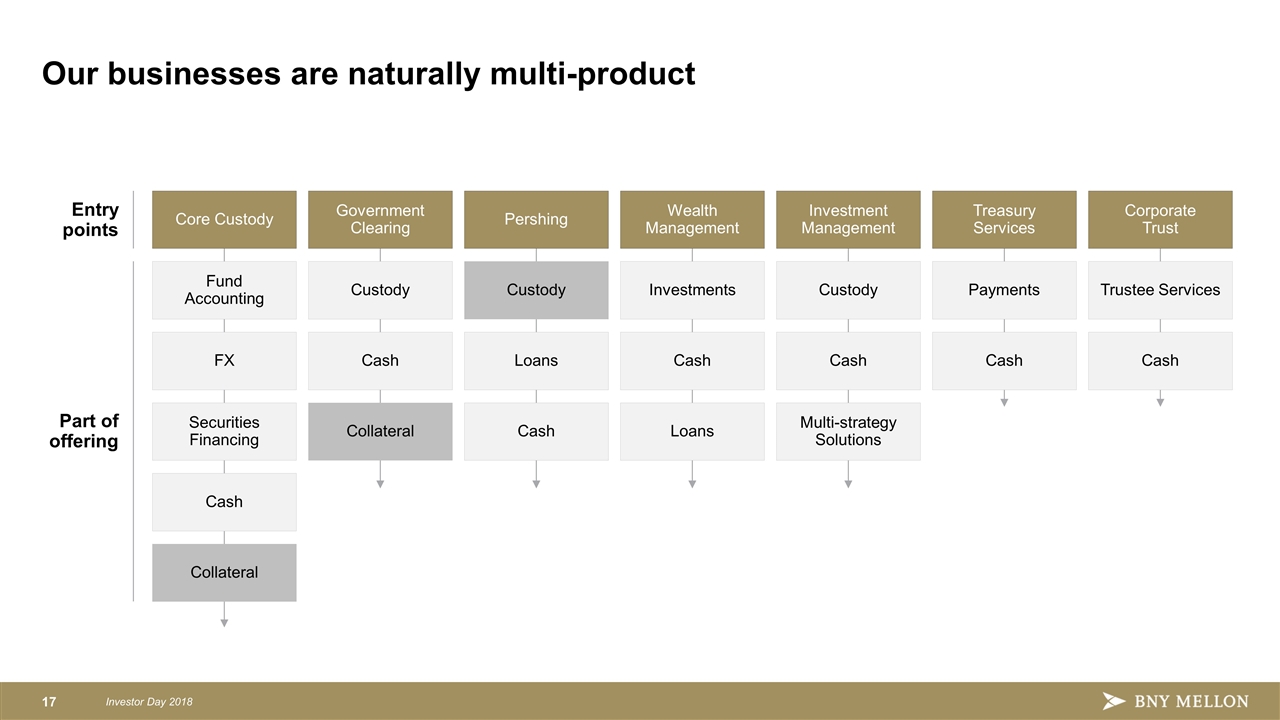

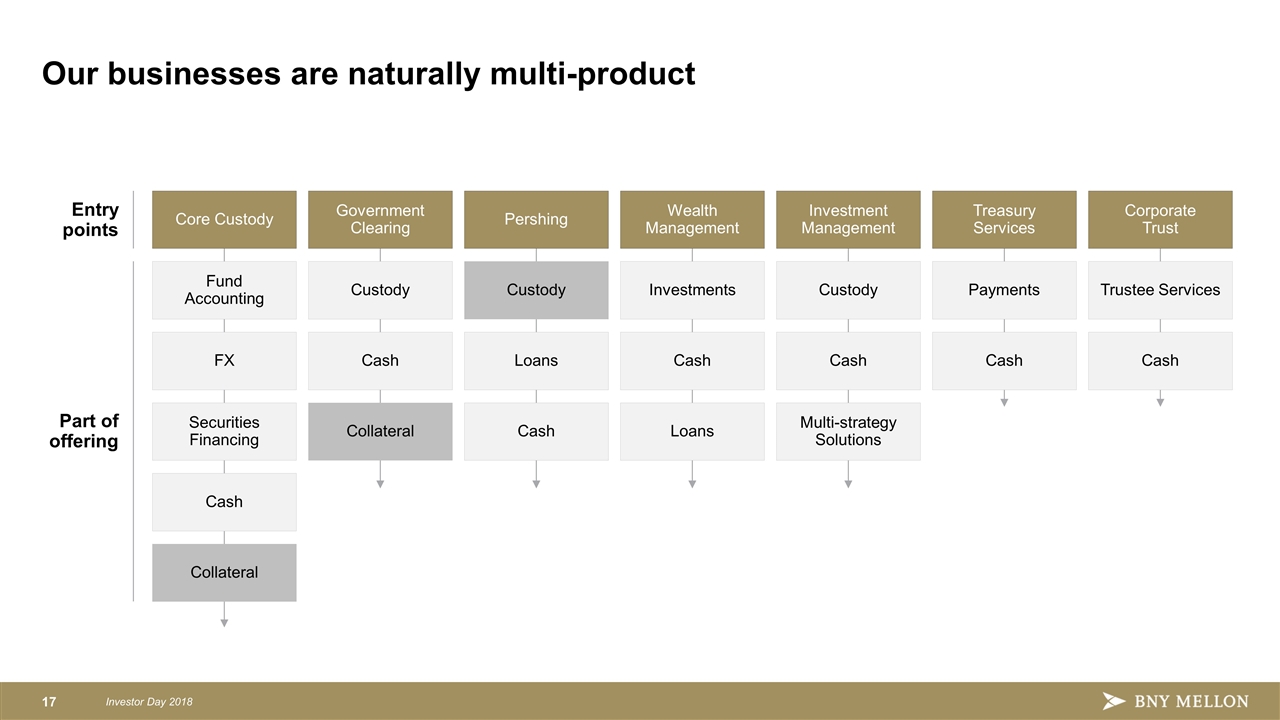

Our businesses are naturally multi-product Entry points Part of offering Core Custody FX Securities Financing Cash Fund Accounting Collateral Government Clearing Custody Cash Collateral Pershing Custody Loans Cash Wealth Management Investments Cash Loans Investment Management Custody Cash Multi-strategy Solutions Treasury Services Payments Cash Corporate Trust Trustee Services Cash

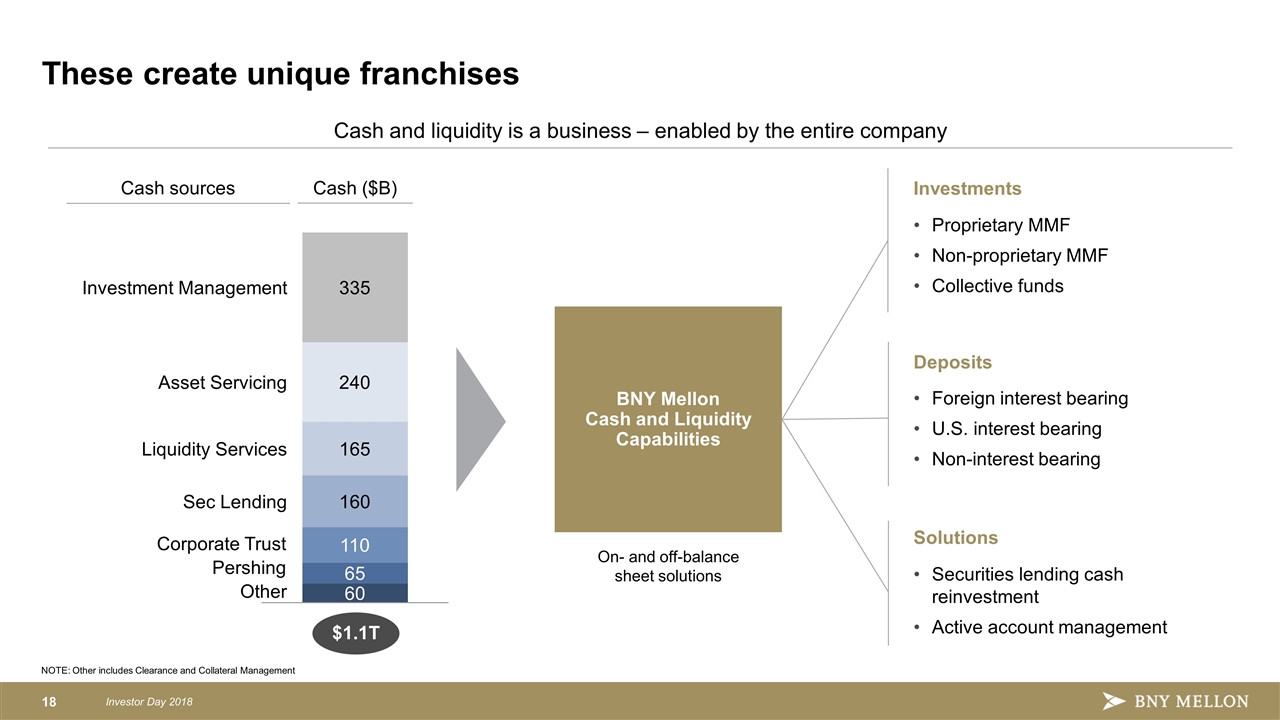

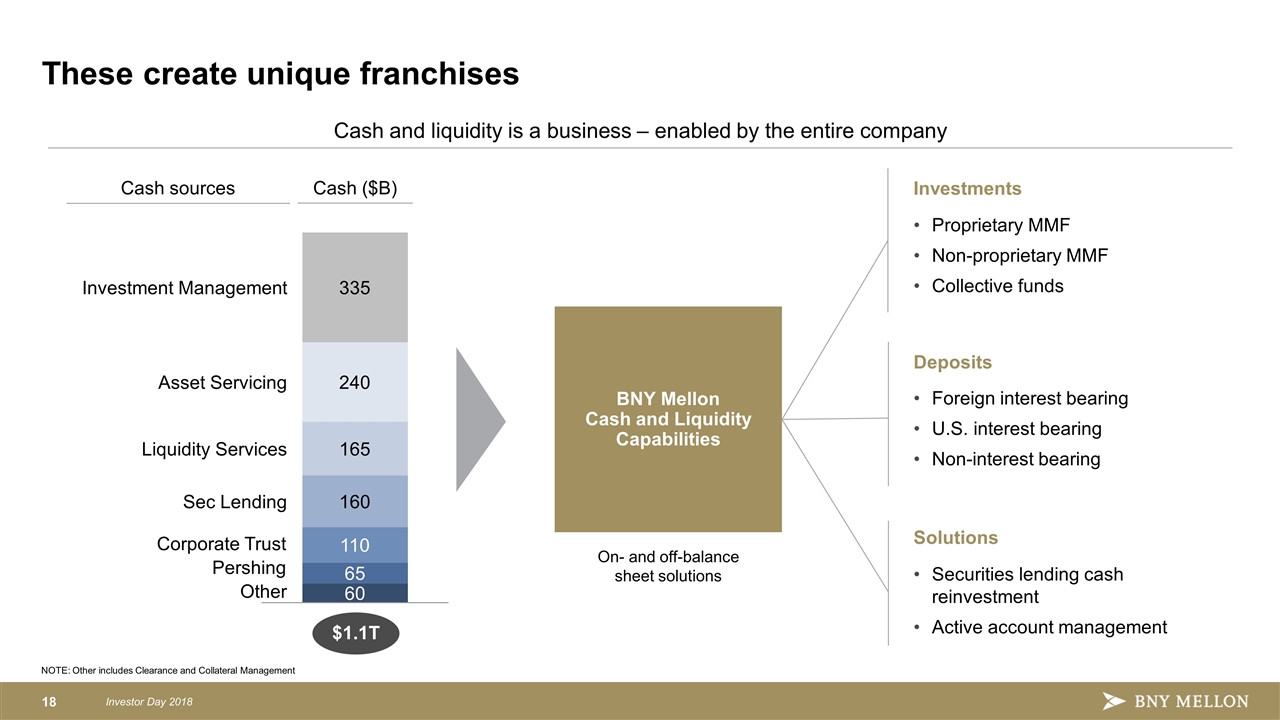

These create unique franchises NOTE: Other includes Clearance and Collateral Management Cash sources Investments Deposits Solutions Proprietary MMF Non-proprietary MMF Collective funds Foreign interest bearing U.S. interest bearing Non-interest bearing Securities lending cash reinvestment Active account management BNY Mellon Cash and Liquidity Capabilities Cash ($B) $1.1T On- and off-balance sheet solutions Cash and liquidity is a business – enabled by the entire company 335 240 165 160 110 65 60 Other Pershing Corporate Trust

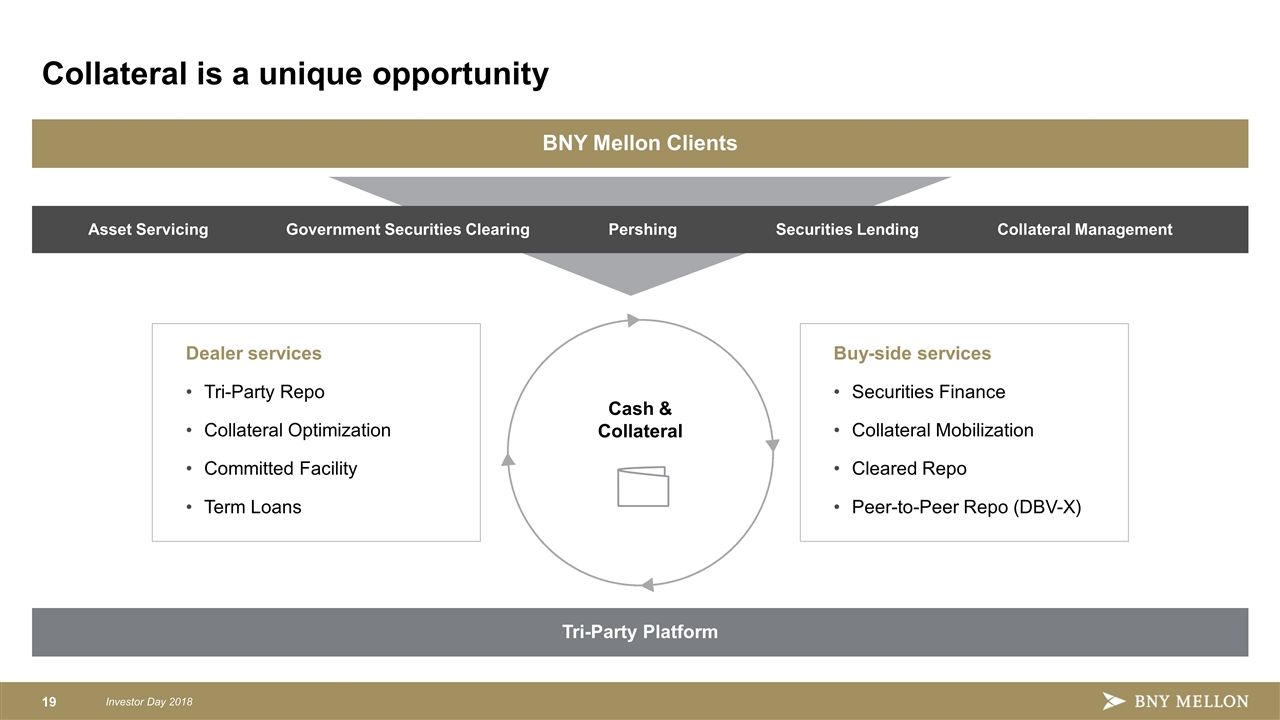

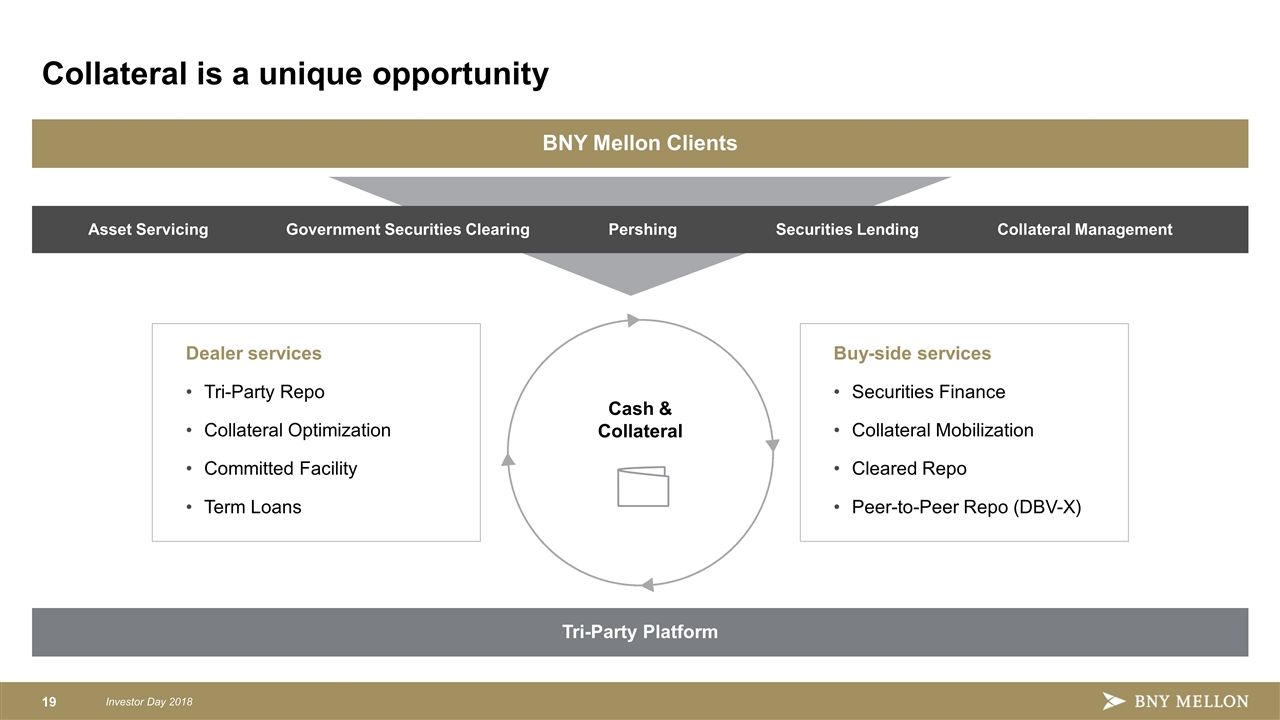

Tri-Party Platform Collateral is a unique opportunity Dealer services Tri-Party Repo Collateral Optimization Committed Facility Term Loans Buy-side services Securities Finance Collateral Mobilization Cleared Repo Peer-to-Peer Repo (DBV-X) BNY Mellon Clients Collateral Management Asset Servicing Pershing Government Securities Clearing Securities Lending Cash & Collateral

Great history and culture Continued focus on operating leverage A strong and unique franchise Clear, focused, and financially attractive business model Investing for growth by Improving execution Expanding technology-enabled solutions Leveraging all of BNY Mellon

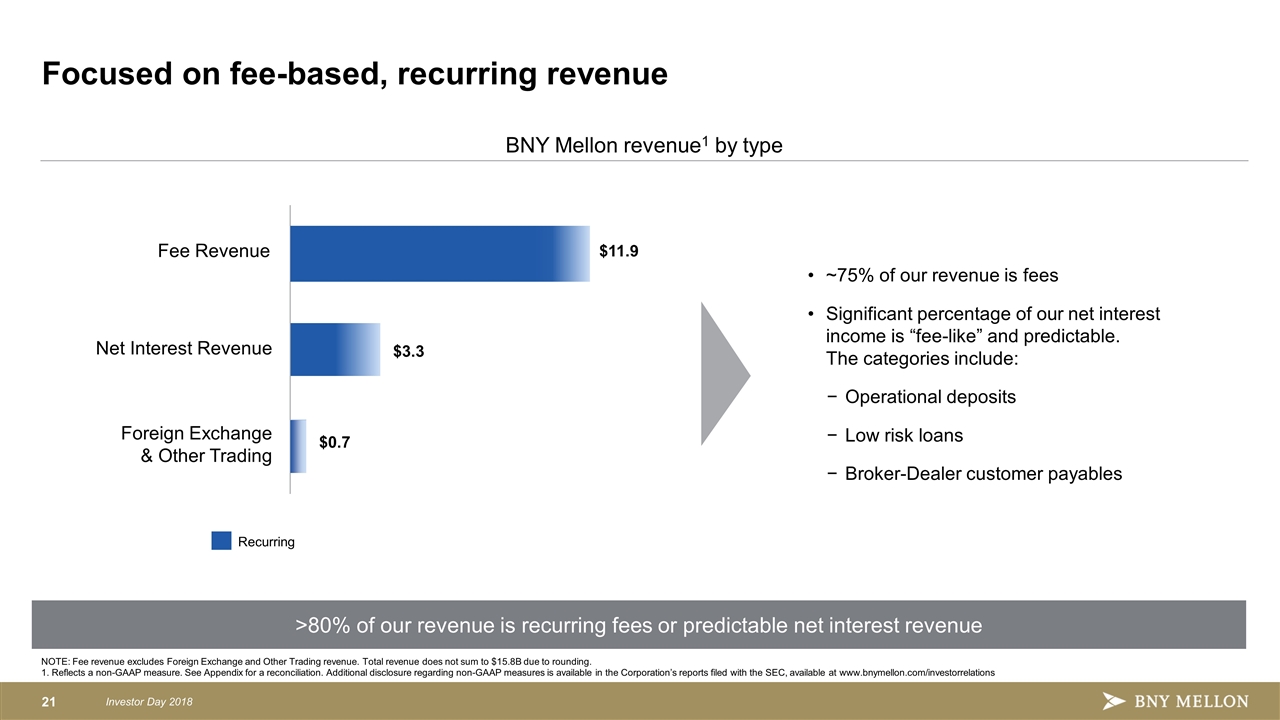

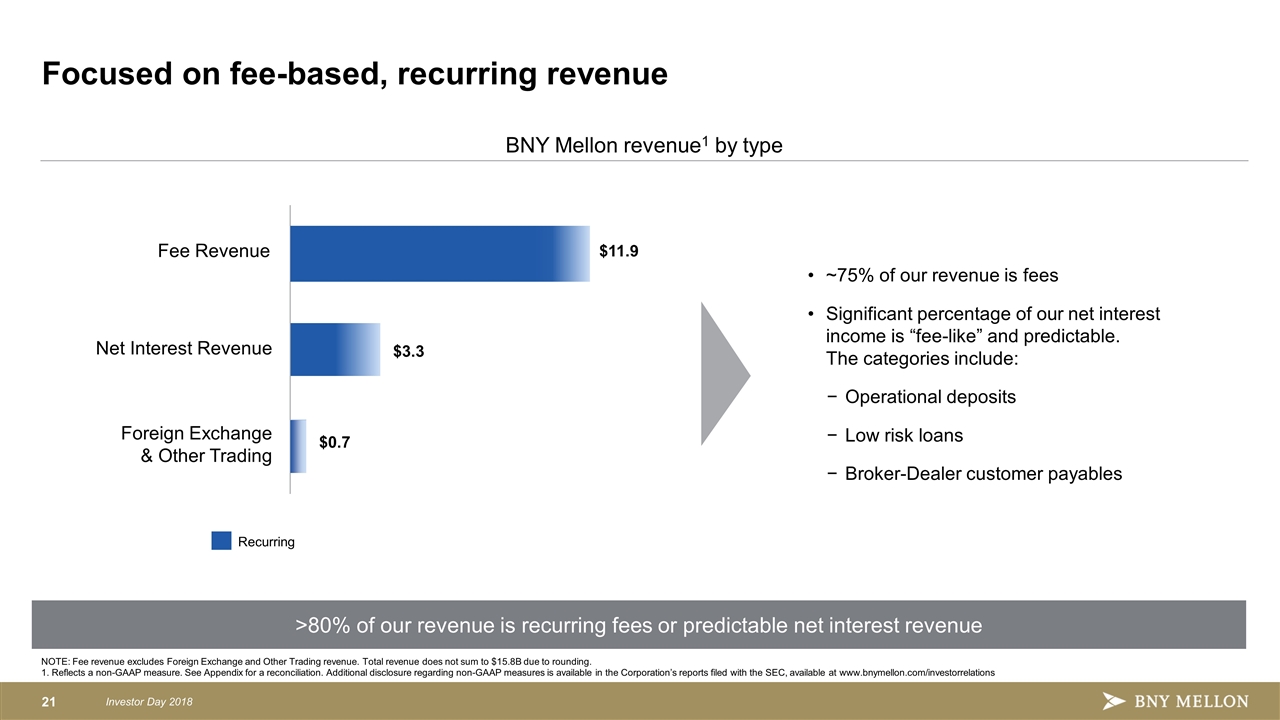

BNY Mellon revenue1 by type Focused on fee-based, recurring revenue ~75% of our revenue is fees Significant percentage of our net interest income is “fee-like” and predictable. The categories include: Operational deposits Low risk loans Broker-Dealer customer payables >80% of our revenue is recurring fees or predictable net interest revenue Recurring Net Interest Revenue Fee Revenue Foreign Exchange & Other Trading NOTE: Fee revenue excludes Foreign Exchange and Other Trading revenue. Total revenue does not sum to $15.8B due to rounding. 1. Reflects a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations

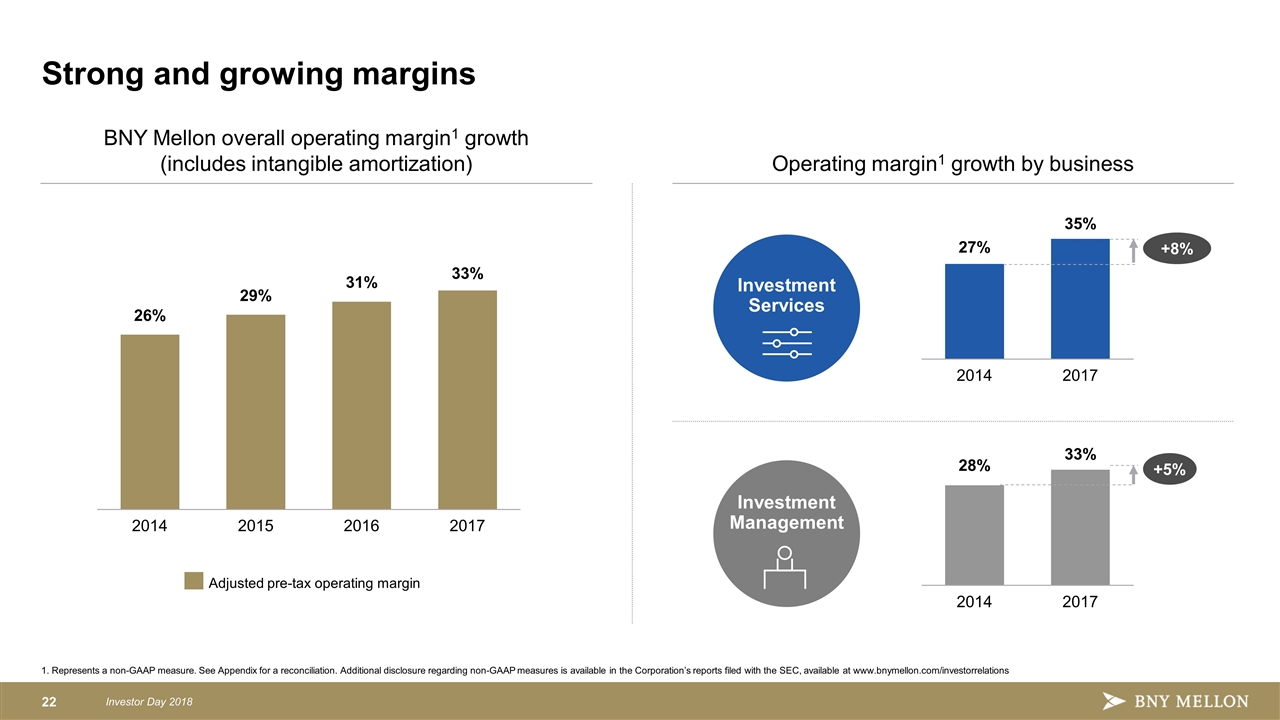

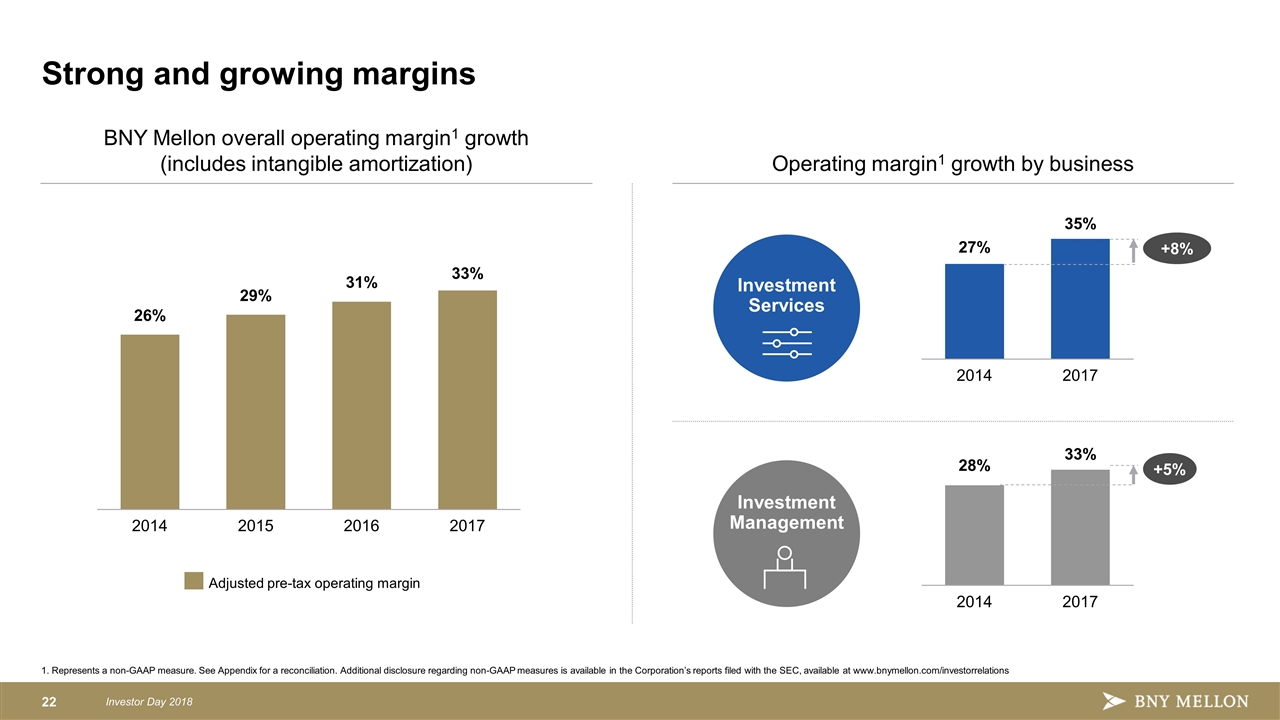

BNY Mellon overall operating margin1 growth (includes intangible amortization) Strong and growing margins +8% +5% Operating margin1 growth by business 1. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations Investment Services Investment Management

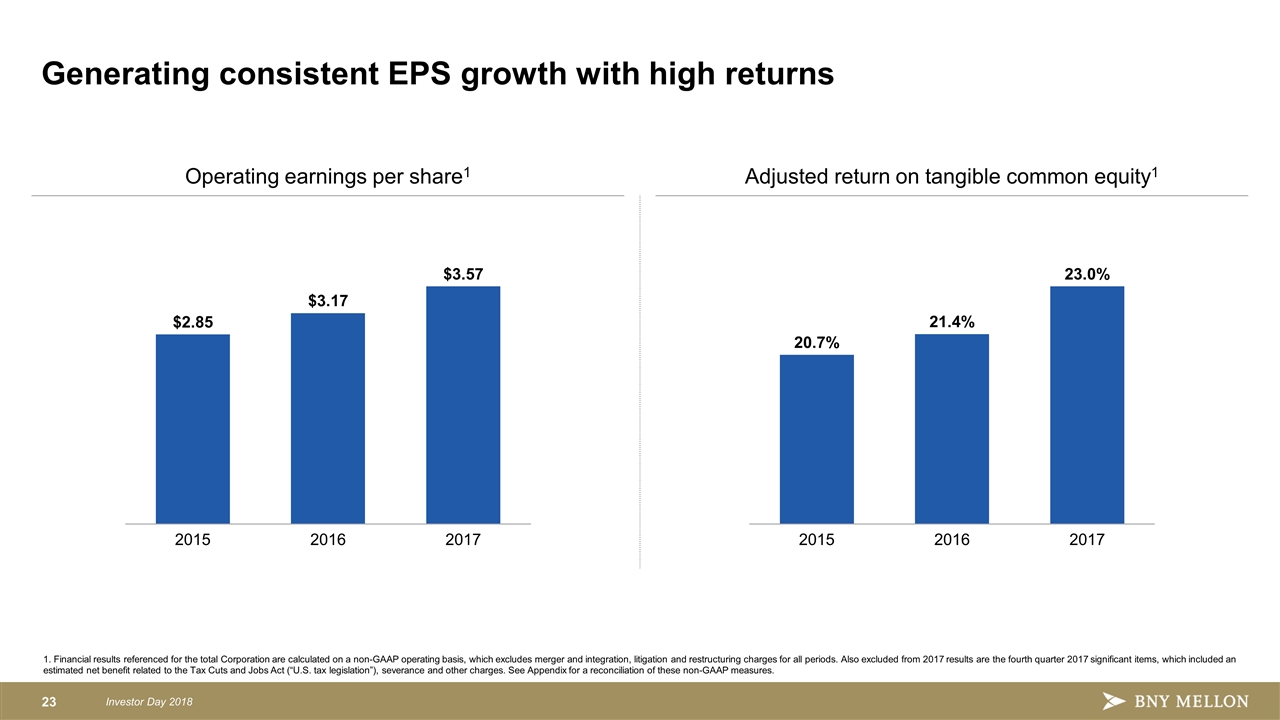

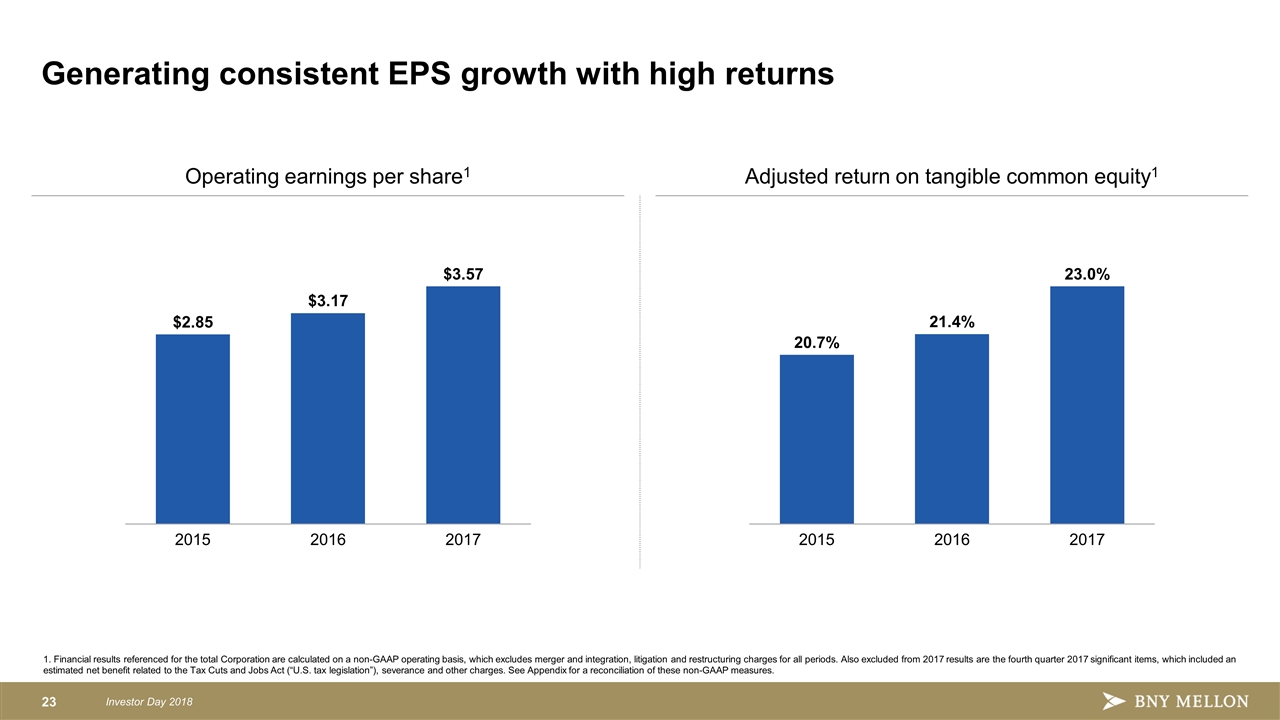

Generating consistent EPS growth with high returns 1. Financial results referenced for the total Corporation are calculated on a non-GAAP operating basis, which excludes merger and integration, litigation and restructuring charges for all periods. Also excluded from 2017 results are the fourth quarter 2017 significant items, which included an estimated net benefit related to the Tax Cuts and Jobs Act (“U.S. tax legislation”), severance and other charges. See Appendix for a reconciliation of these non-GAAP measures. Adjusted return on tangible common equity1 Operating earnings per share1

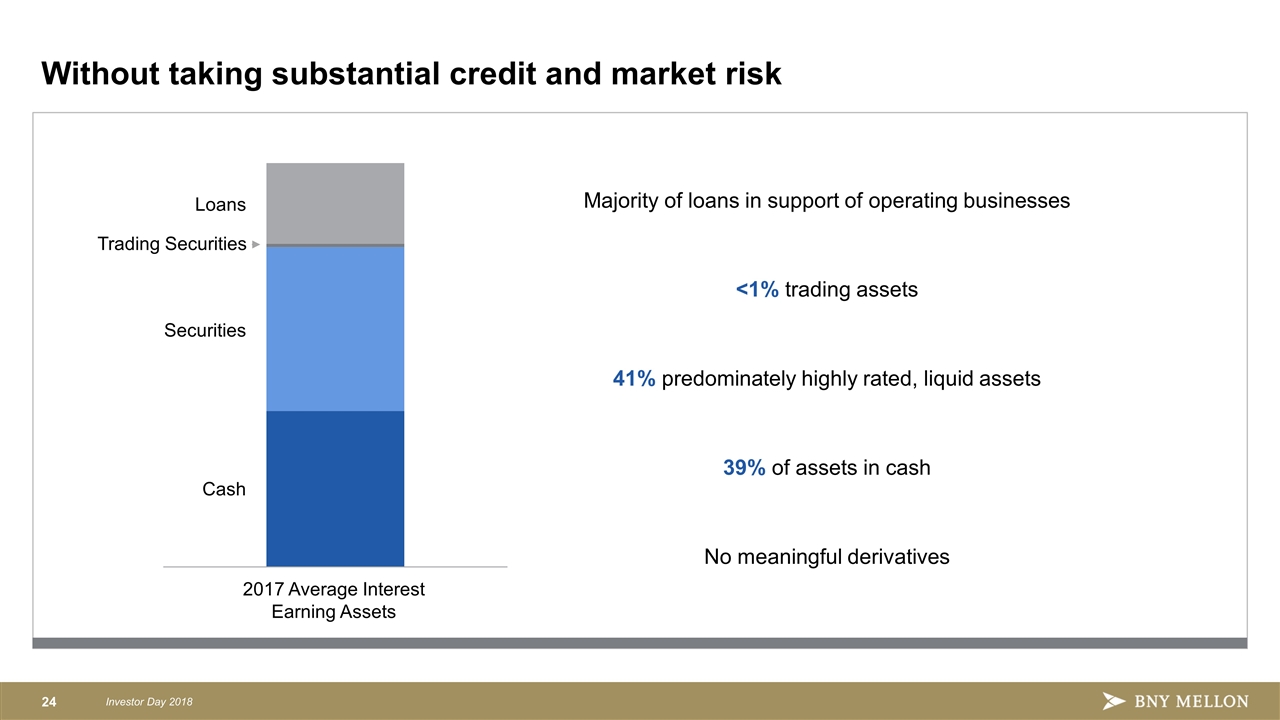

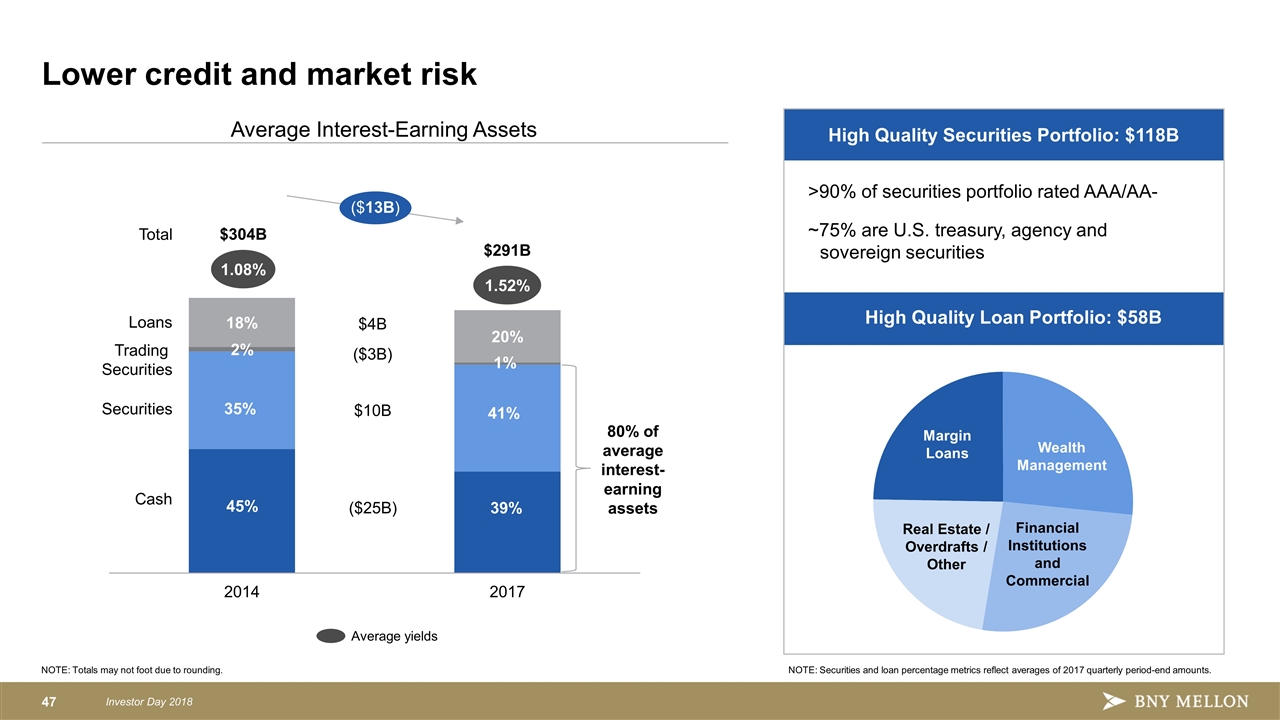

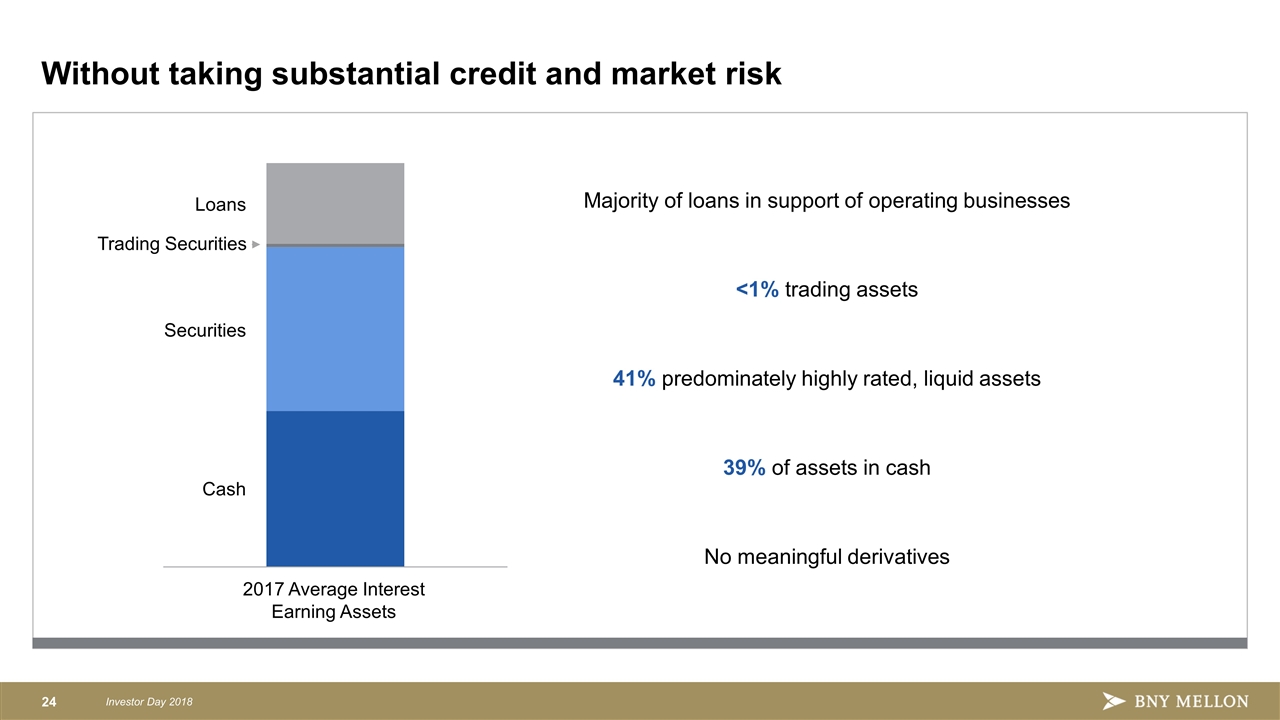

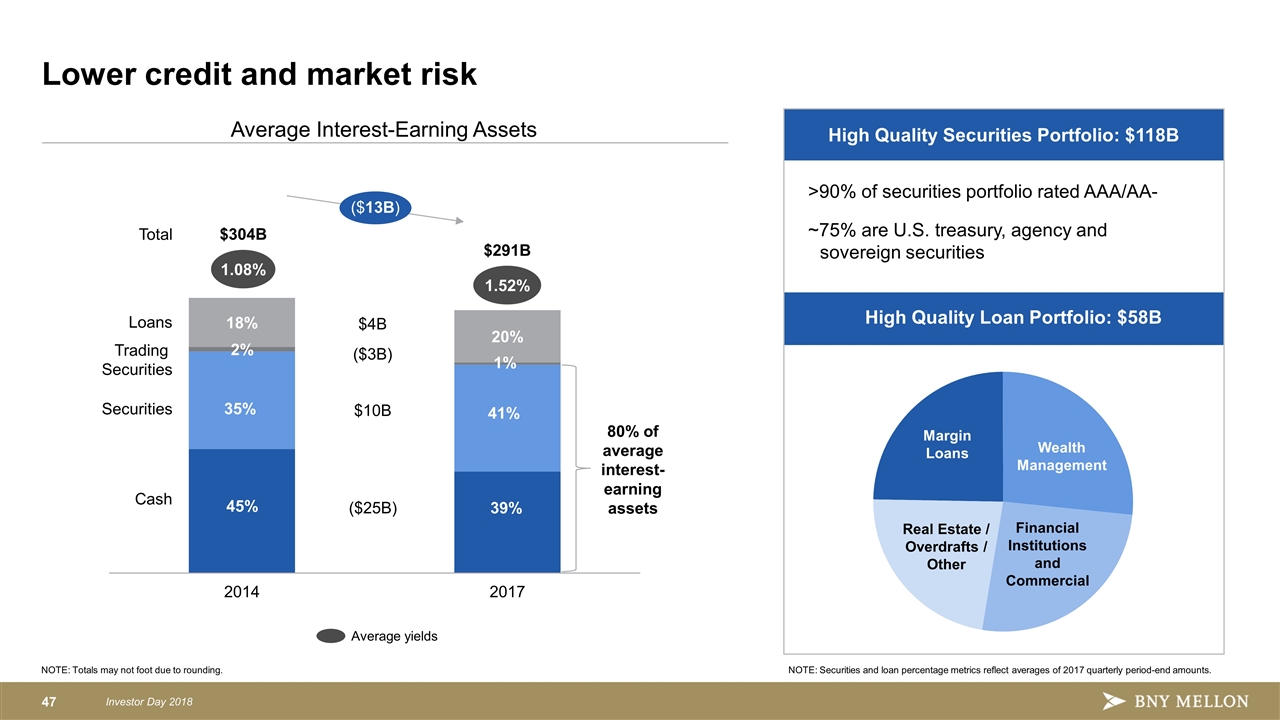

Without taking substantial credit and market risk Majority of loans in support of operating businesses <1% trading assets 41% predominately highly rated, liquid assets 39% of assets in cash No meaningful derivatives Cash Loans Securities Trading Securities 2017 Average Interest Earning Assets

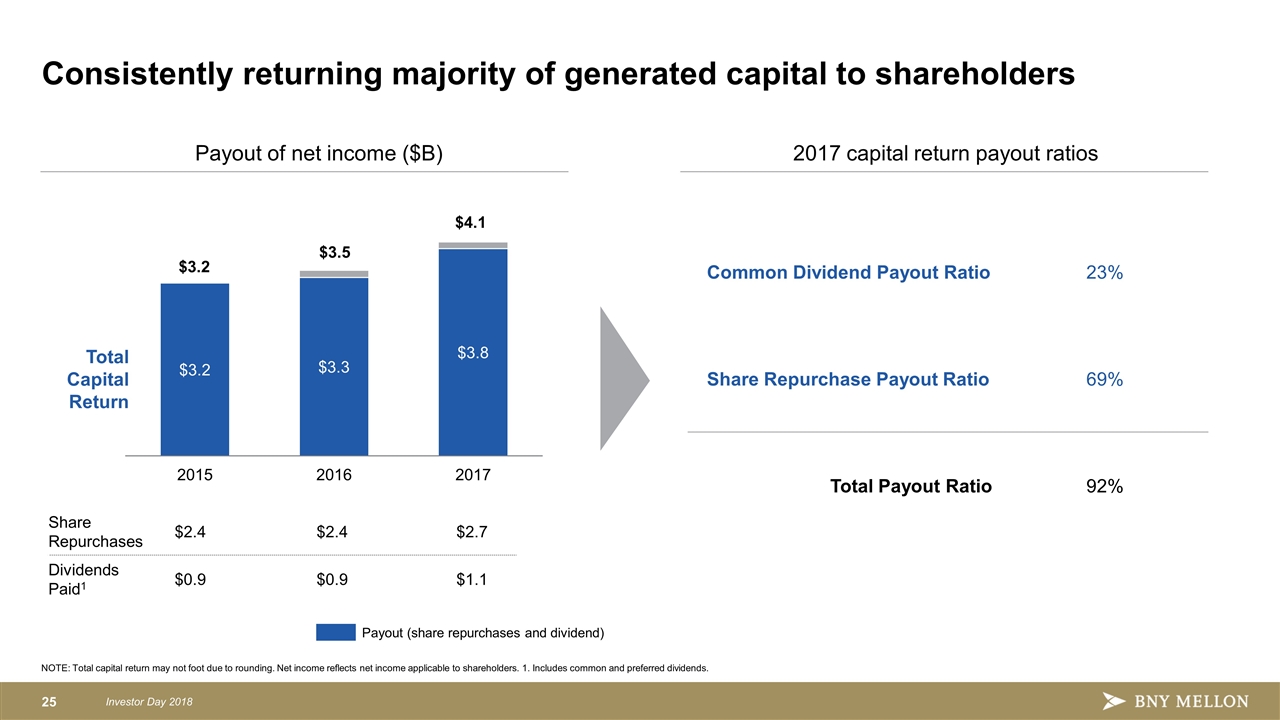

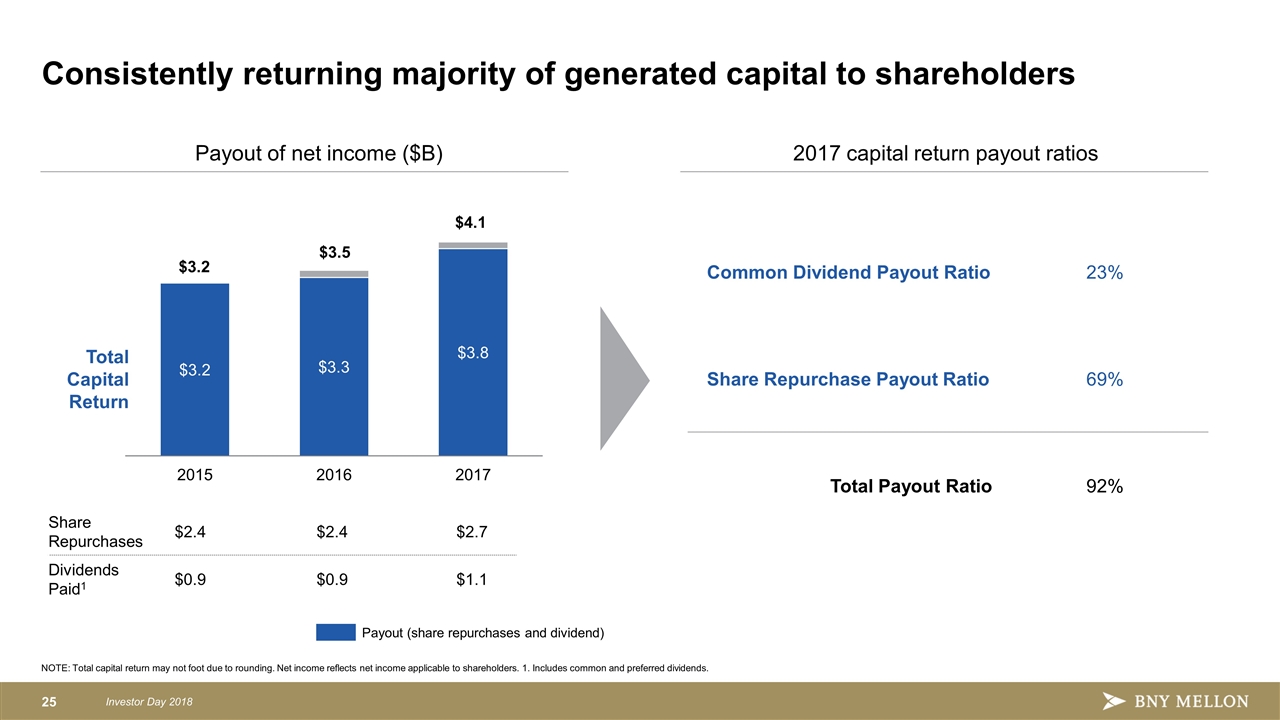

NOTE: Total capital return may not foot due to rounding. Net income reflects net income applicable to shareholders. 1. Includes common and preferred dividends. Common Dividend Payout Ratio 23% Share Repurchase Payout Ratio 69% Total Payout Ratio 92% Share Repurchases $2.4 $2.4 $2.7 Dividends Paid1 $0.9 $0.9 $1.1 2017 capital return payout ratios Total Capital Return $3.2 $3.5 $4.1 Payout of net income ($B) Payout (share repurchases and dividend) Consistently returning majority of generated capital to shareholders

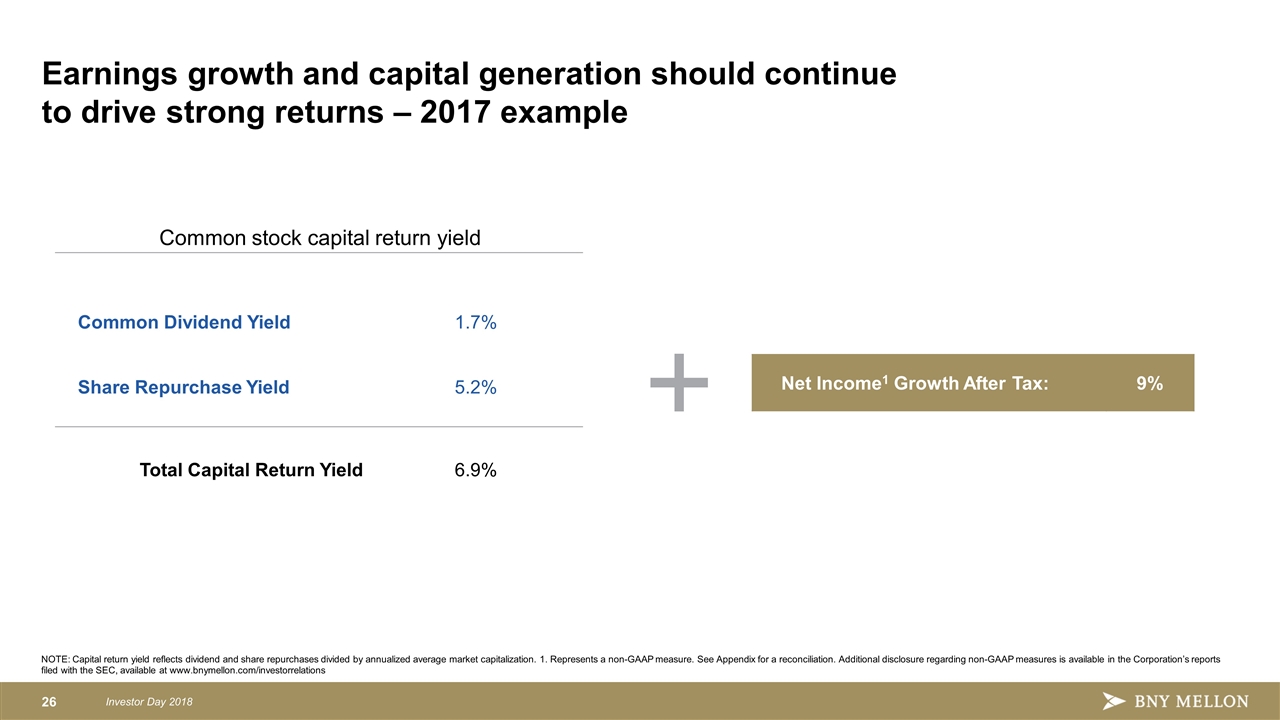

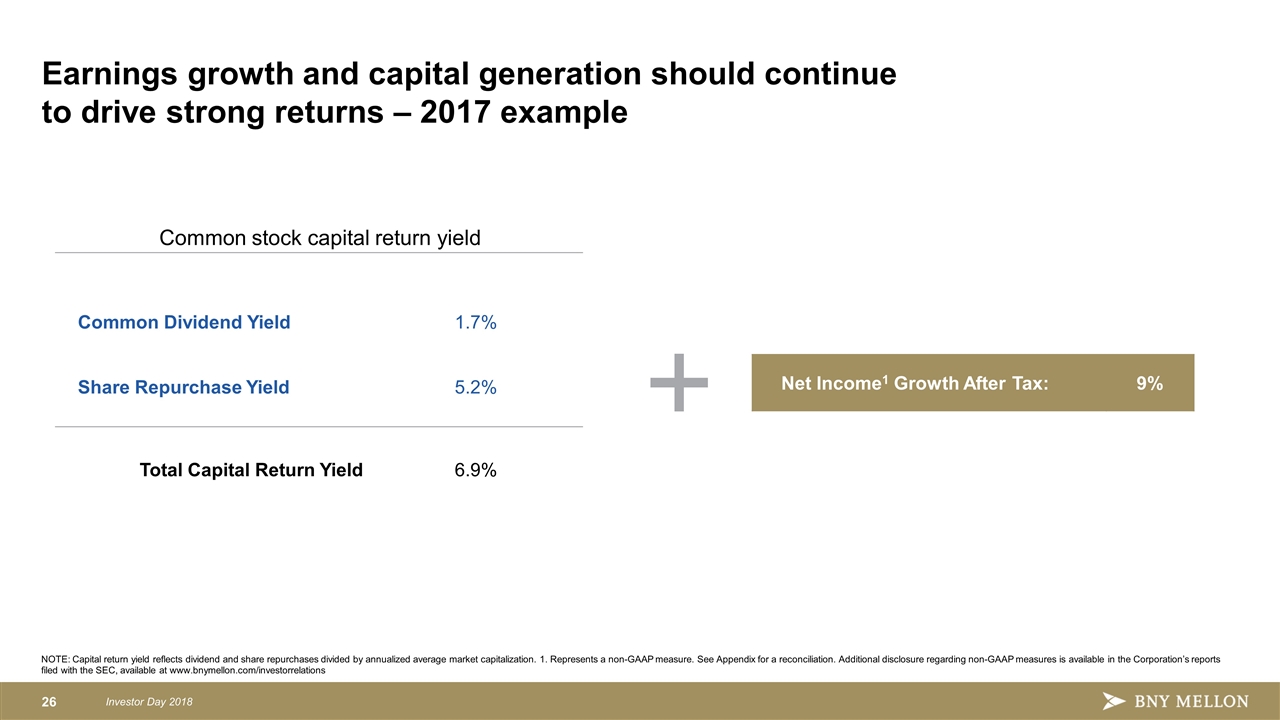

Earnings growth and capital generation should continue to drive strong returns – 2017 example NOTE: Capital return yield reflects dividend and share repurchases divided by annualized average market capitalization. 1. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations Net Income1 Growth After Tax: 9% Common Dividend Yield 1.7% Share Repurchase Yield 5.2% Total Capital Return Yield 6.9% Common stock capital return yield

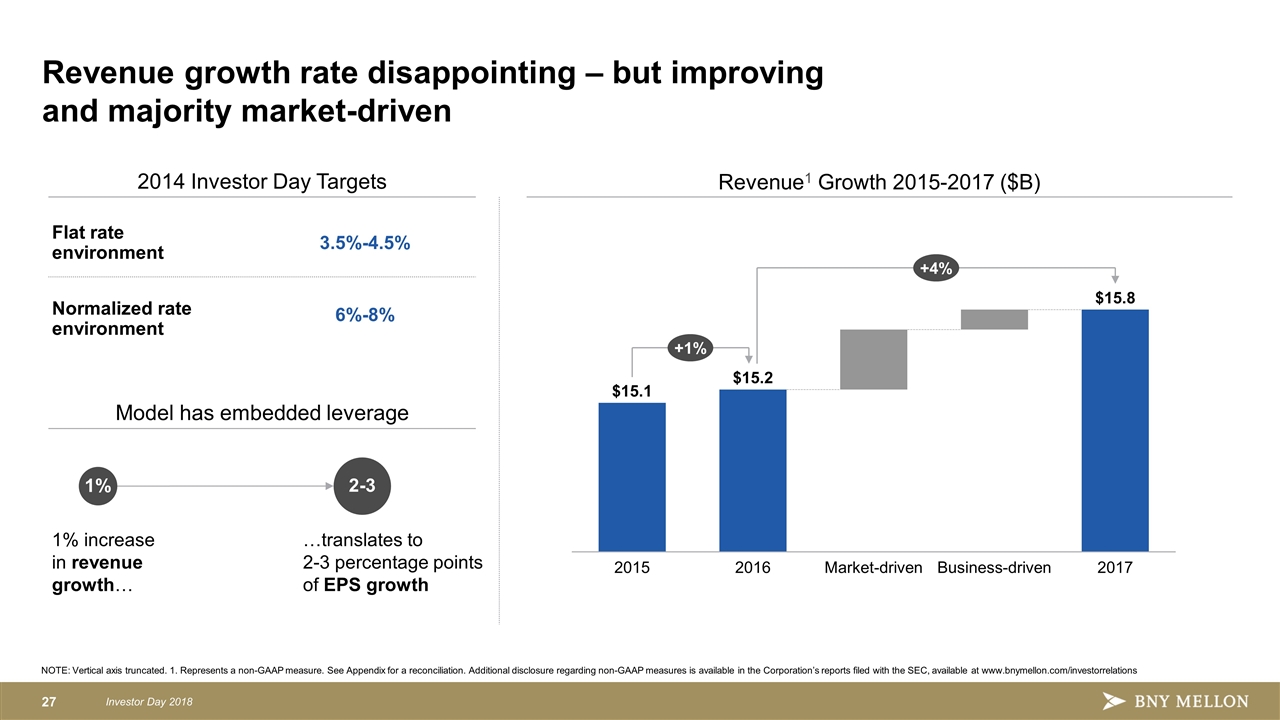

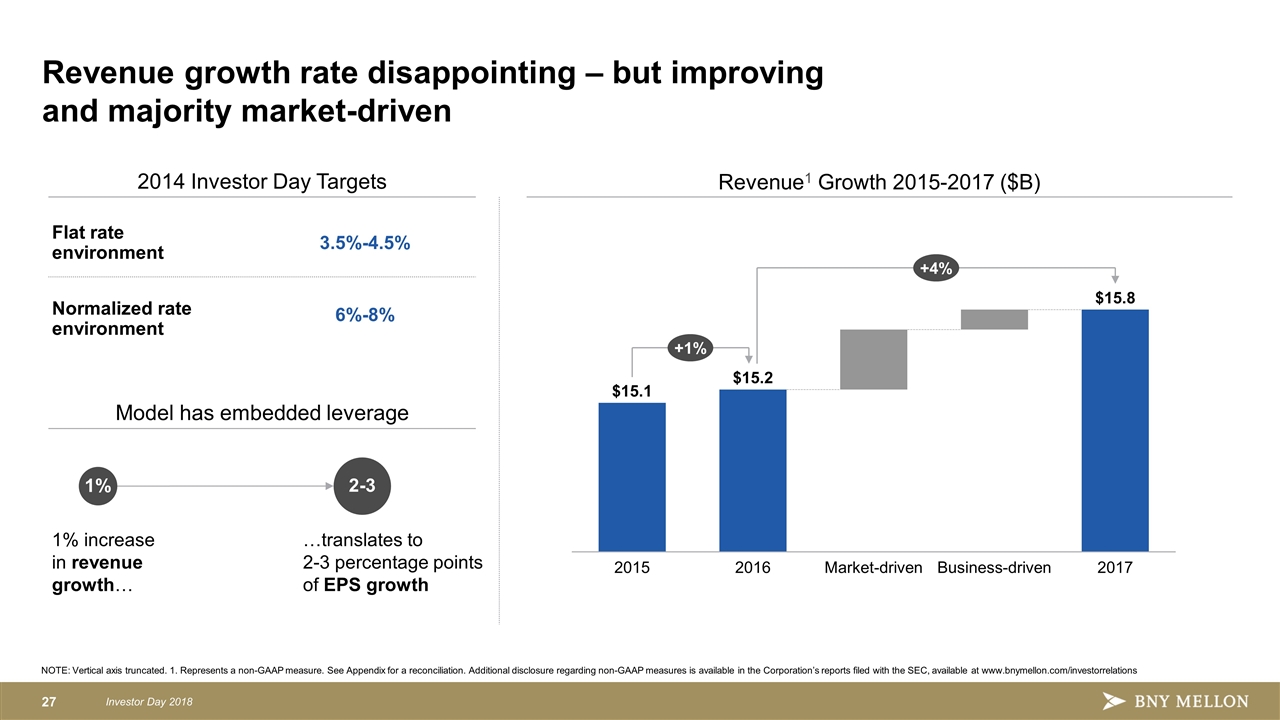

Revenue growth rate disappointing – but improving and majority market-driven Revenue1 Growth 2015-2017 ($B) $ $ $ 2014 Investor Day Targets Flat rate environment Normalized rate environment 3.5%-4.5% 6%-8% Model has embedded leverage 1% increase in revenue growth… 1% …translates to 2-3 percentage points of EPS growth NOTE: Vertical axis truncated. 1. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations 2-3

Great history and culture Continued focus on operating leverage A strong and unique franchise Investing for growth by Improving execution Expanding technology-enabled solutions Leveraging all of BNY Mellon Clear, focused, and financially attractive business model

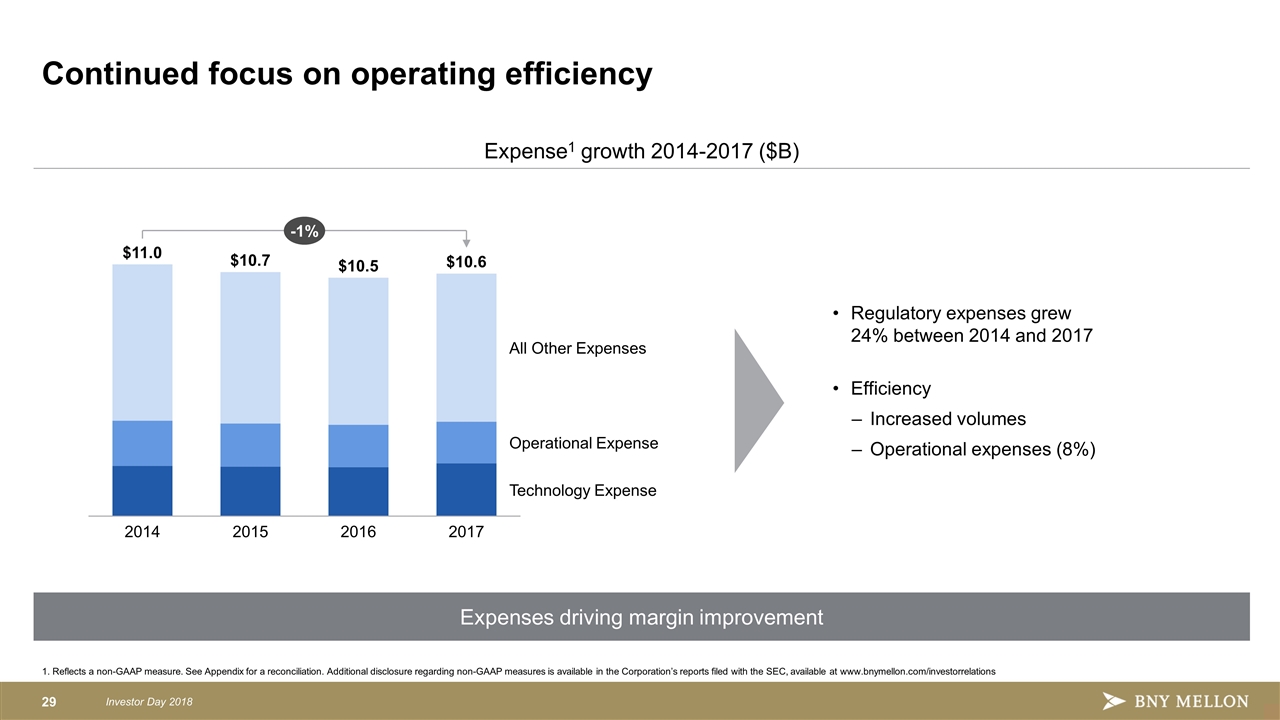

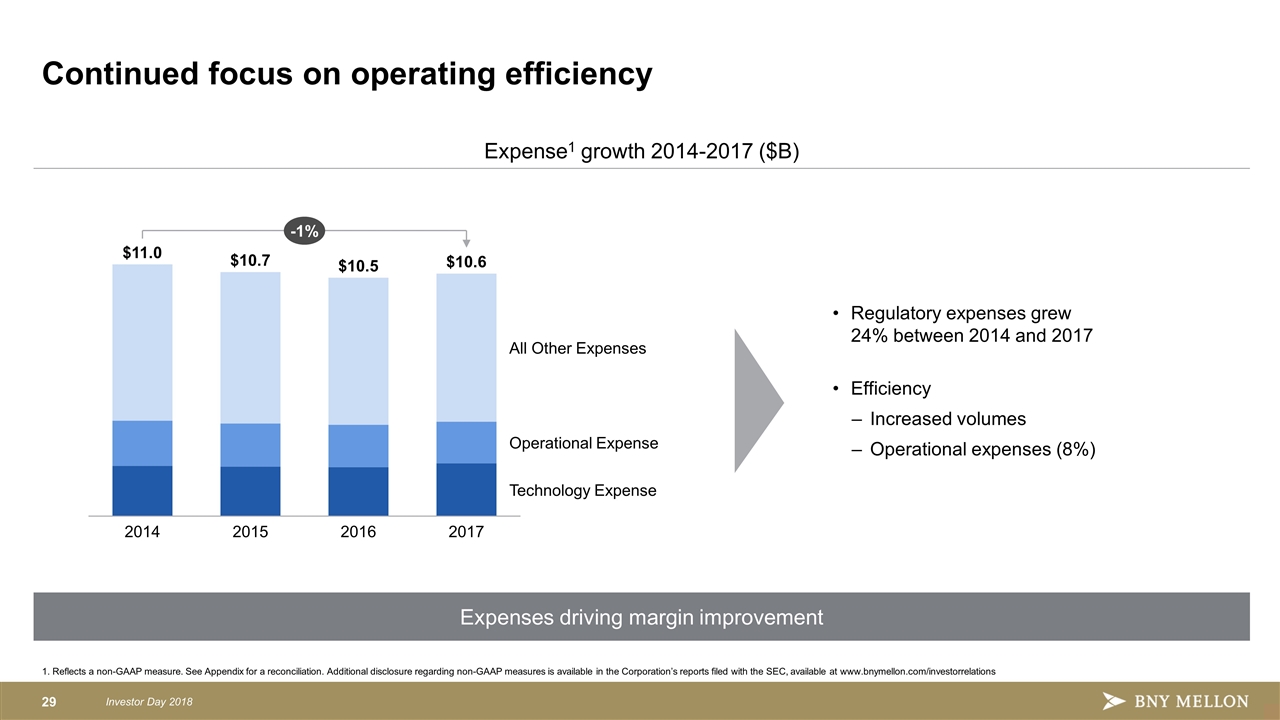

Continued focus on operating efficiency Regulatory expenses grew 24% between 2014 and 2017 Efficiency Increased volumes Operational expenses (8%) Expense1 growth 2014-2017 ($B) Expenses driving margin improvement 1. Reflects a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations $11.0 $10.7 $10.5 $10.6 -1% 29 Investor Day 2018

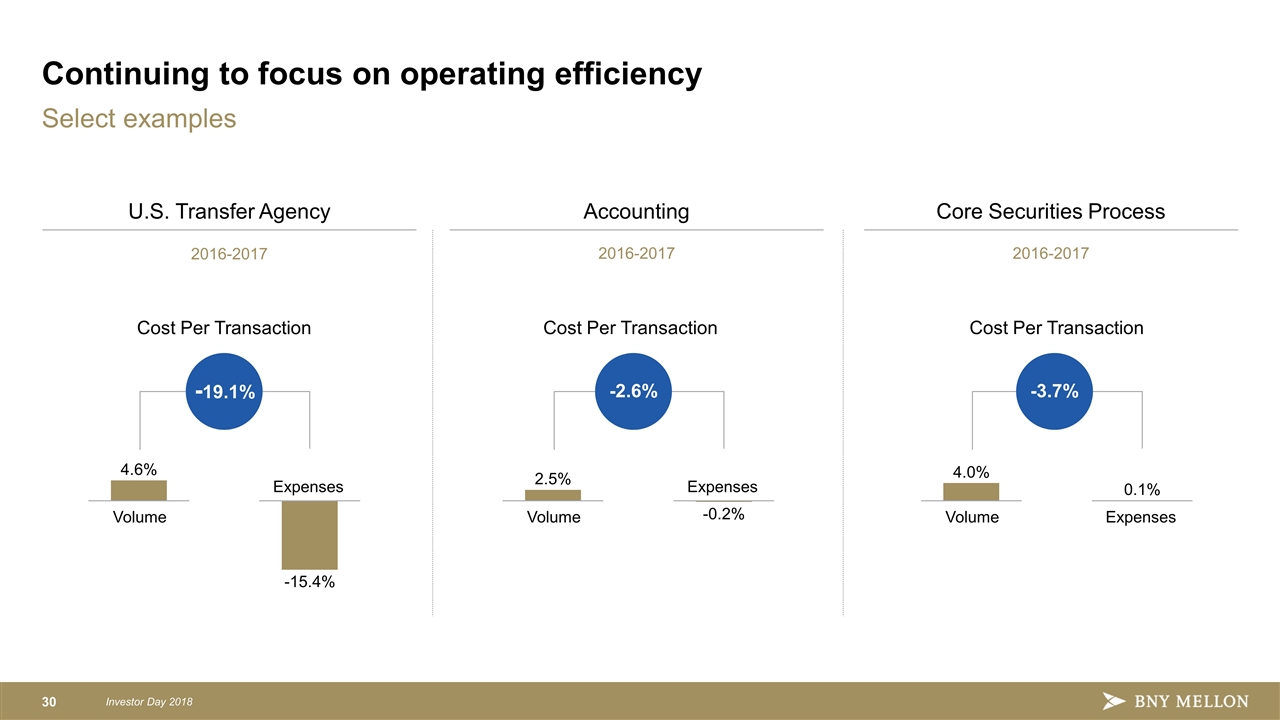

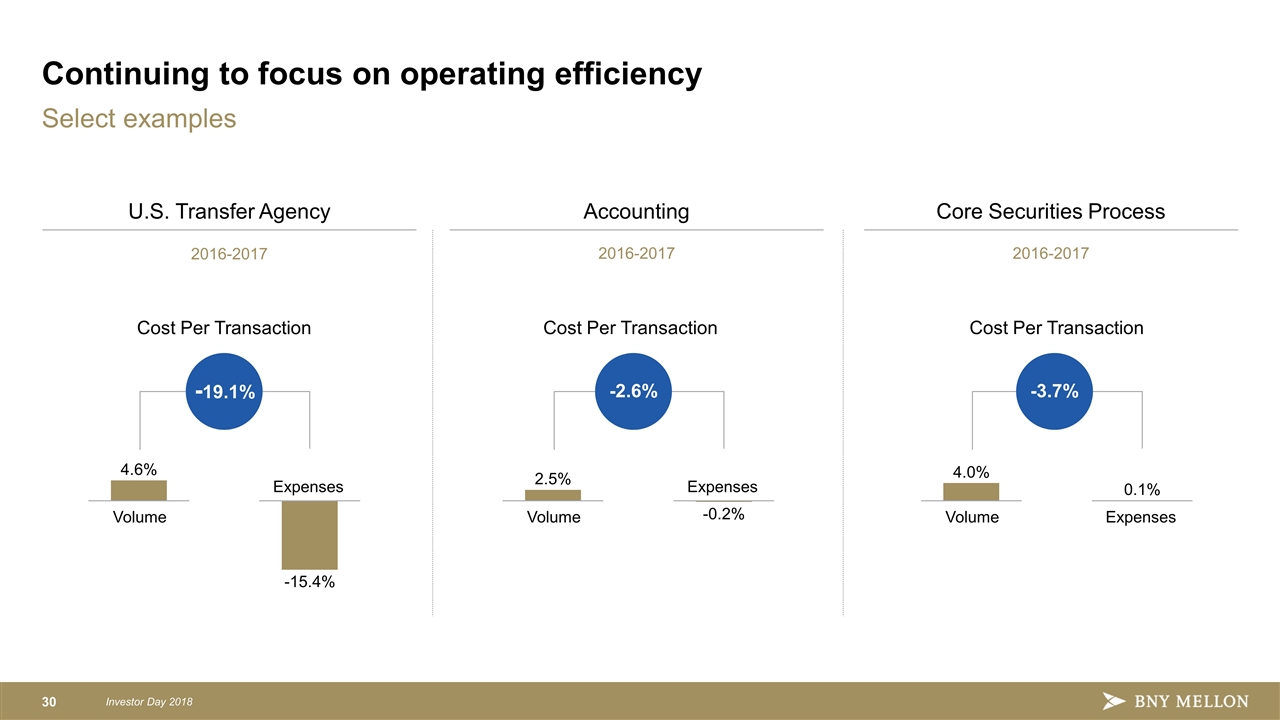

Continuing to focus on operating efficiency Select examples U.S. Transfer Agency Accounting Core Securities Process Volume Expenses Cost Per Transaction -2.6% Volume Expenses Cost Per Transaction -3.7% Volume Expenses Cost Per Transaction 2016-2017 2016-2017 2016-2017 -19.1%

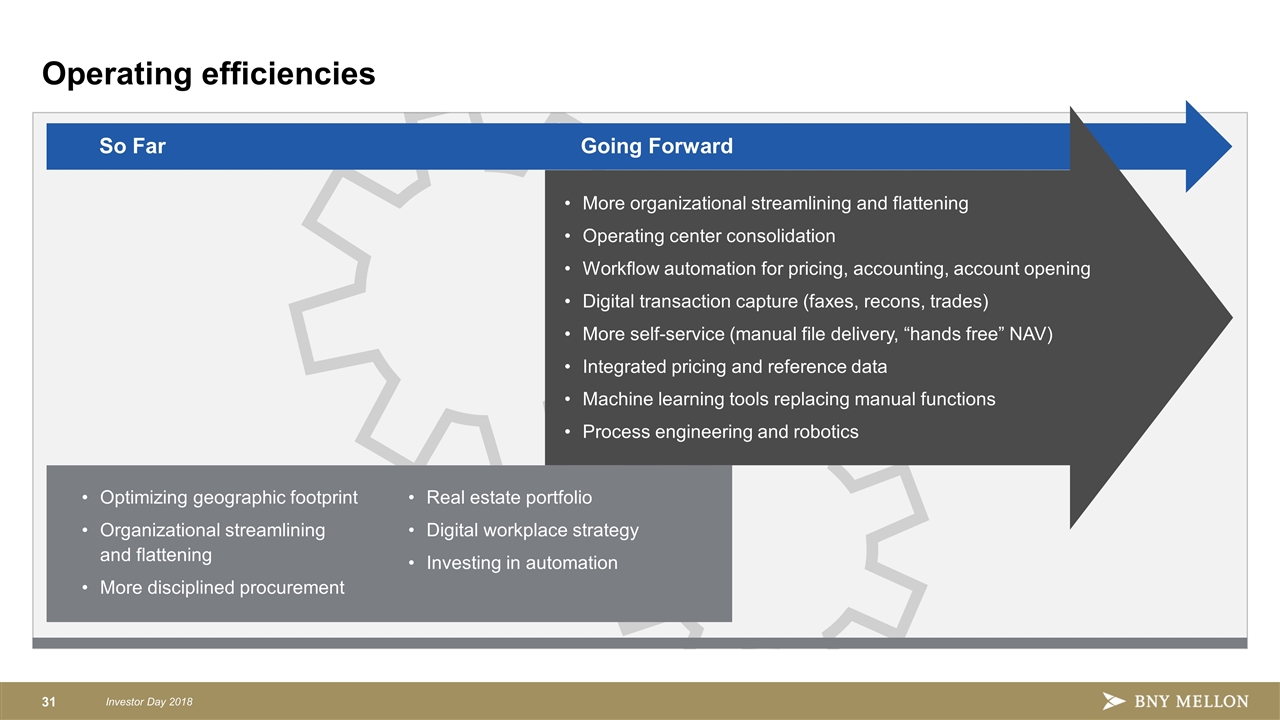

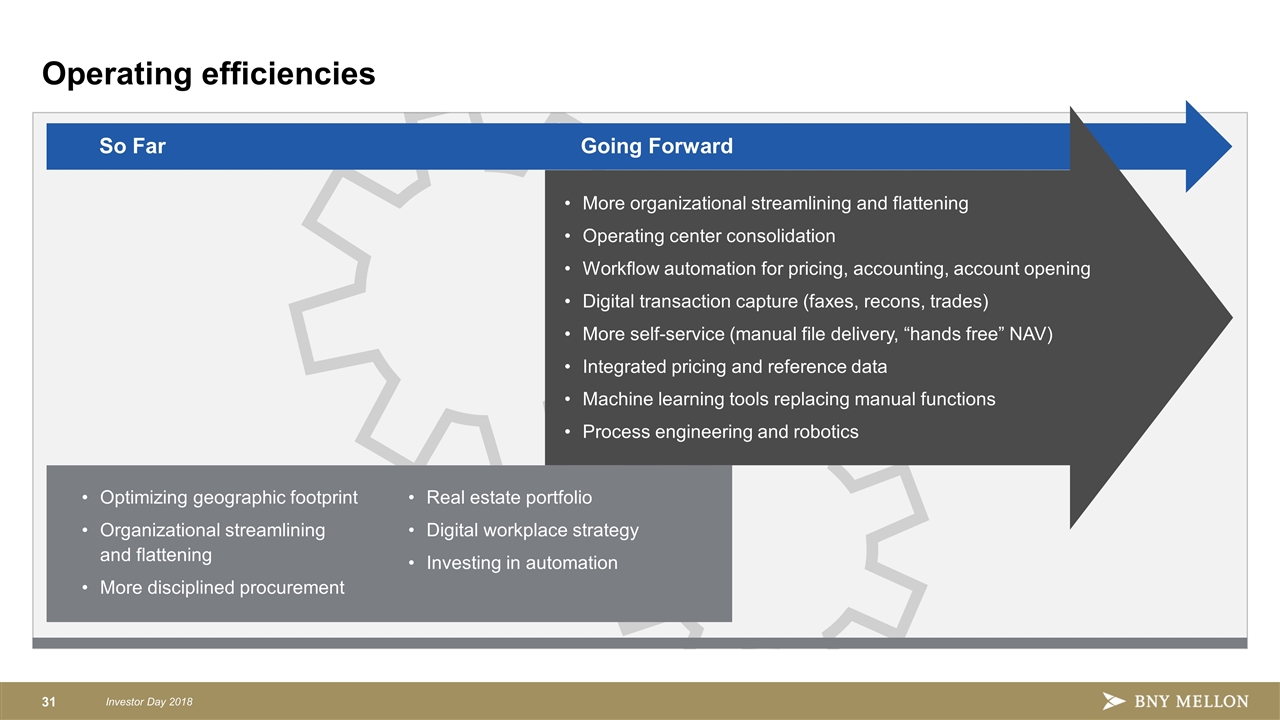

Operating efficiencies So Far Going Forward More organizational streamlining and flattening Operating center consolidation Workflow automation for pricing, accounting, account opening Digital transaction capture (faxes, recons, trades) More self-service (manual file delivery, “hands free” NAV) Integrated pricing and reference data Machine learning tools replacing manual functions Process engineering and robotics Optimizing geographic footprint Organizational streamlining and flattening More disciplined procurement Real estate portfolio Digital workplace strategy Investing in automation

Great history and culture A strong and unique franchise Investing for growth by Improving execution Expanding technology-enabled solutions Leveraging all of BNY Mellon Clear, focused, and financially attractive business model Continued focus on operating leverage

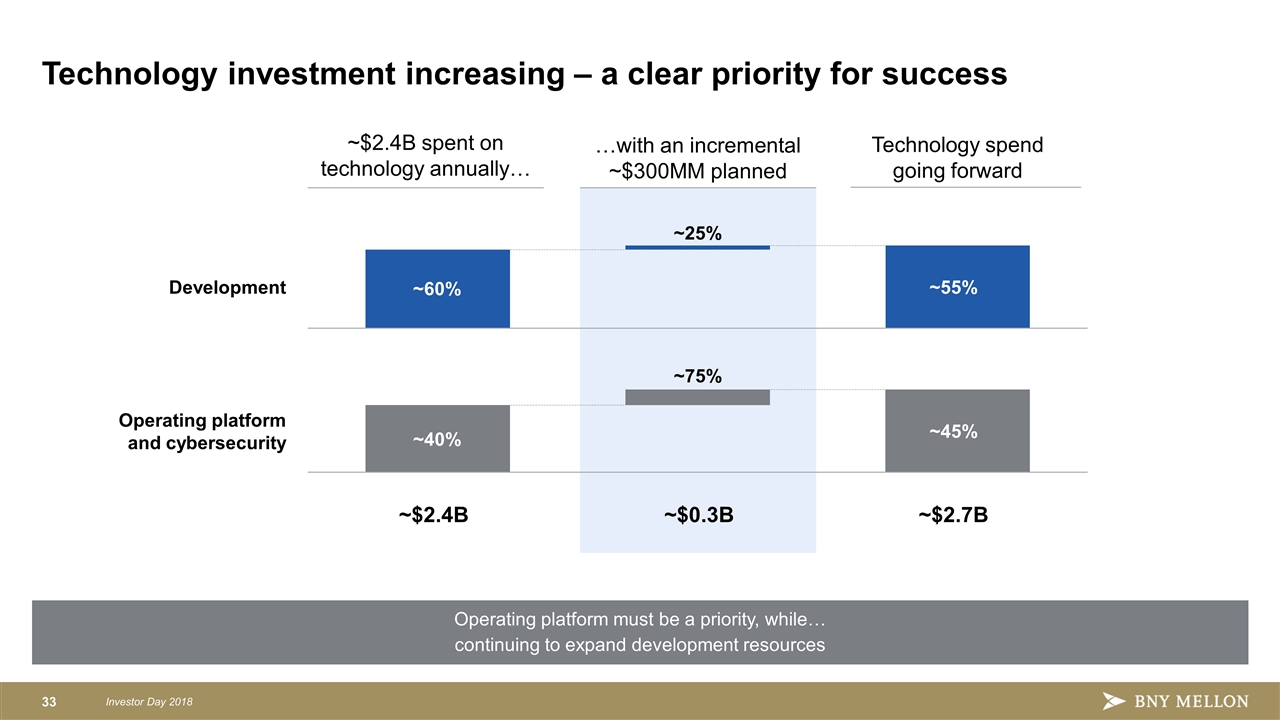

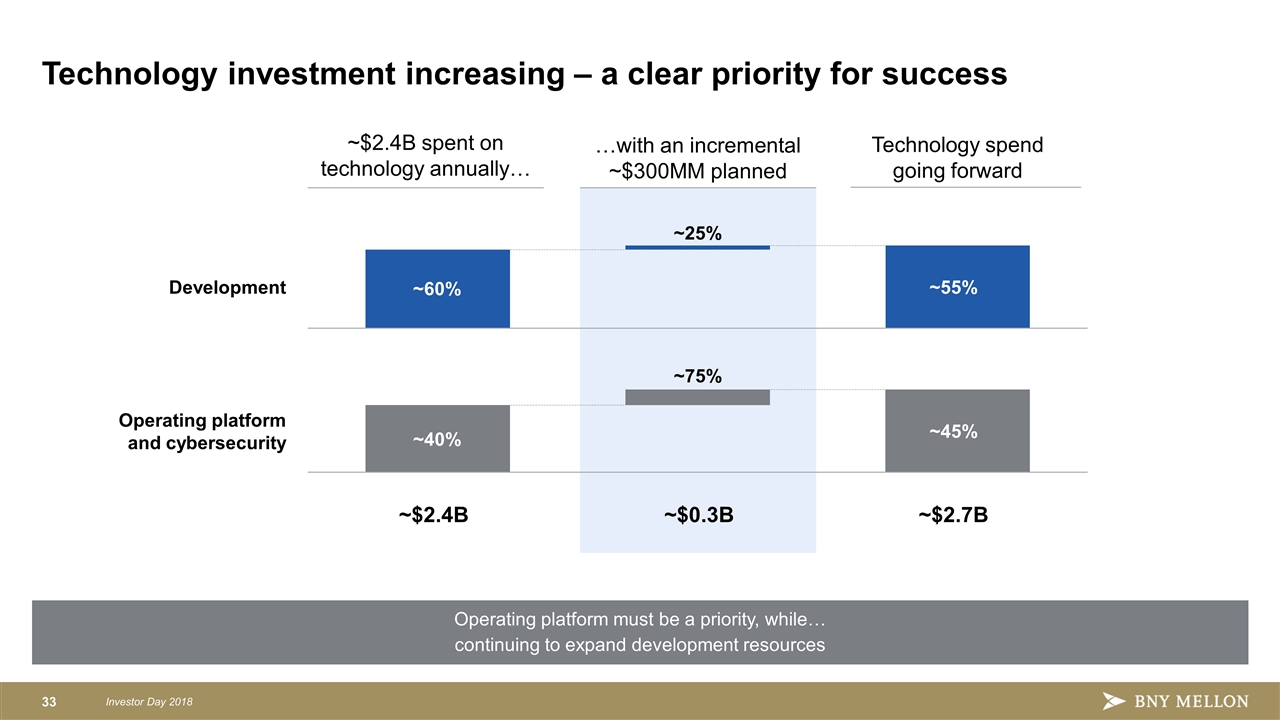

…with an incremental ~$300MM planned Technology investment increasing – a clear priority for success ~$2.4B spent on technology annually… ~75% ~25% ~40% ~60% Operating platform and cybersecurity Development ~$2.4B ~$0.3B ~$2.7B Technology spend going forward ~55% ~45% Operating platform must be a priority, while… continuing to expand development resources

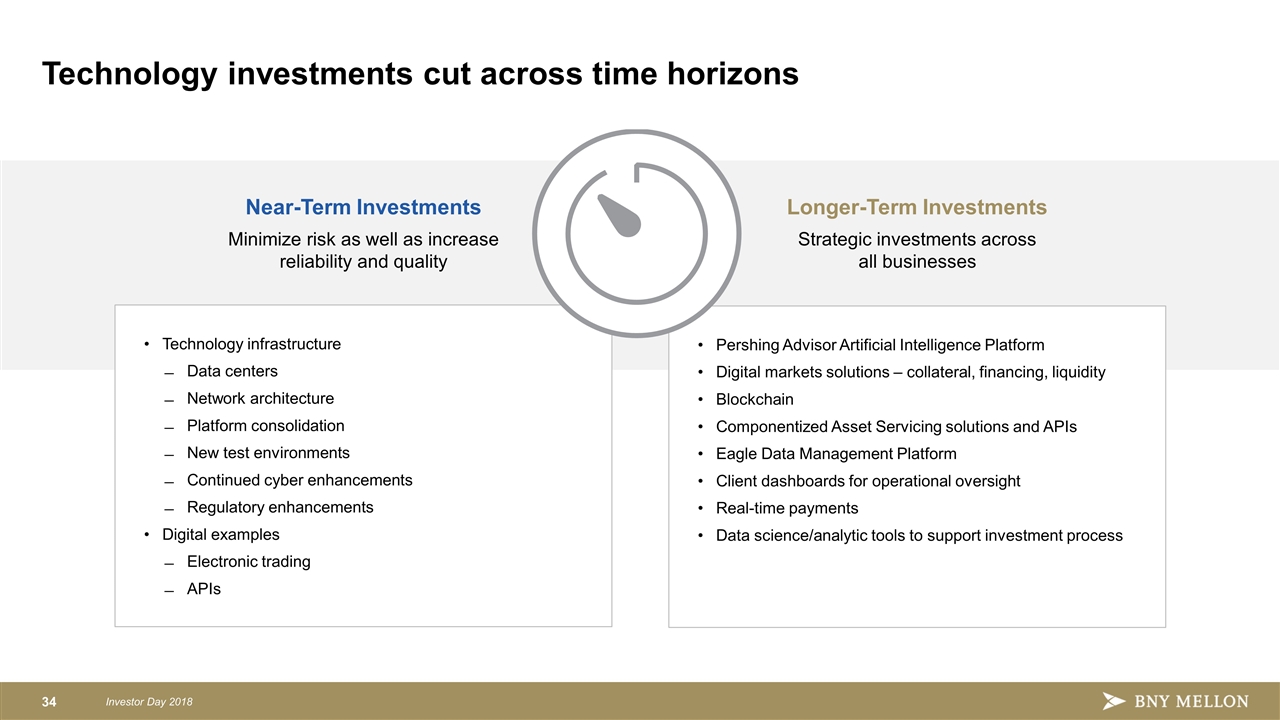

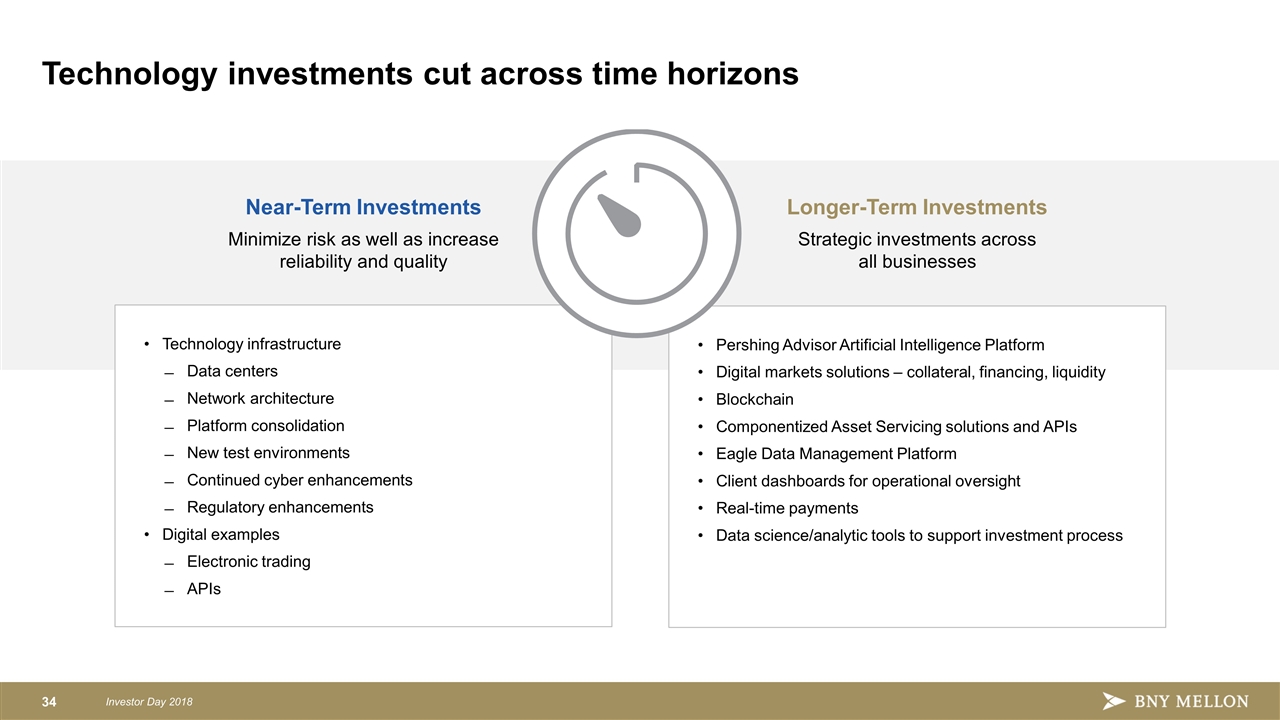

Technology investments cut across time horizons Near-Term Investments Minimize risk as well as increase reliability and quality Longer-Term Investments Strategic investments across all businesses Technology infrastructure Data centers Network architecture Platform consolidation New test environments Continued cyber enhancements Regulatory enhancements Digital examples Electronic trading APIs Pershing Advisor Artificial Intelligence Platform Digital markets solutions – collateral, financing, liquidity Blockchain Componentized Asset Servicing solutions and APIs Eagle Data Management Platform Client dashboards for operational oversight Real-time payments Data science/analytic tools to support investment process

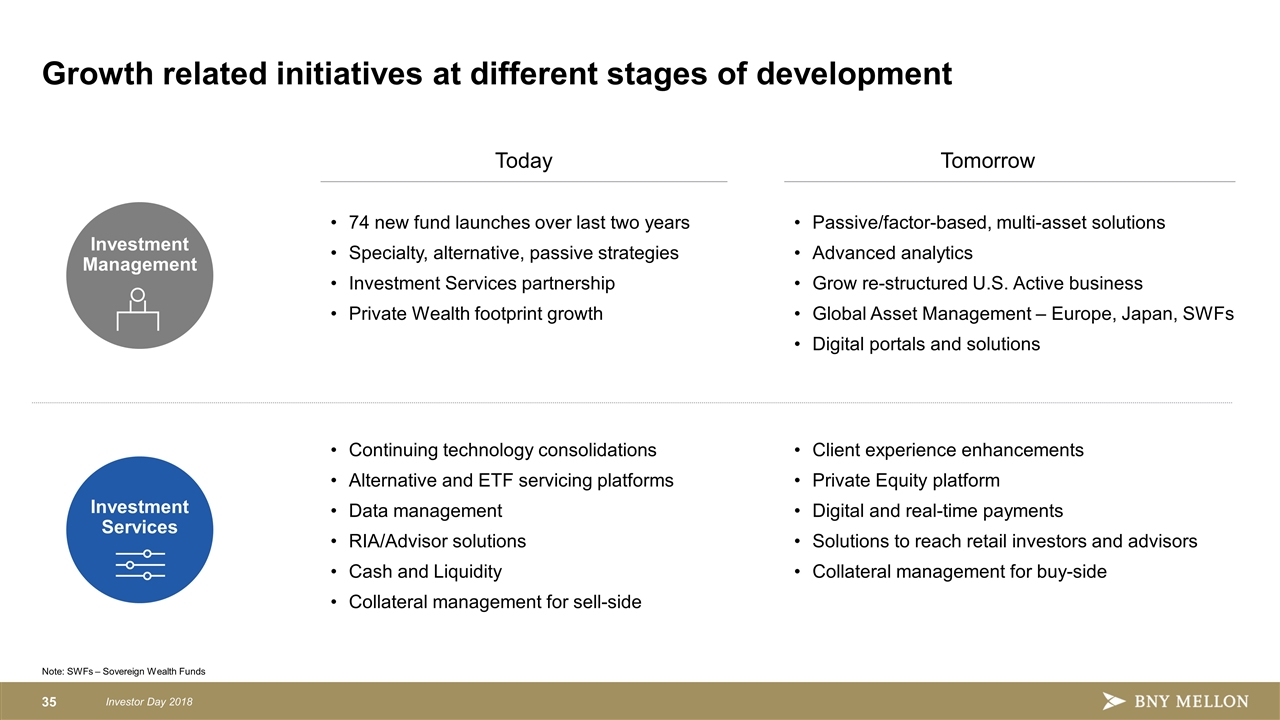

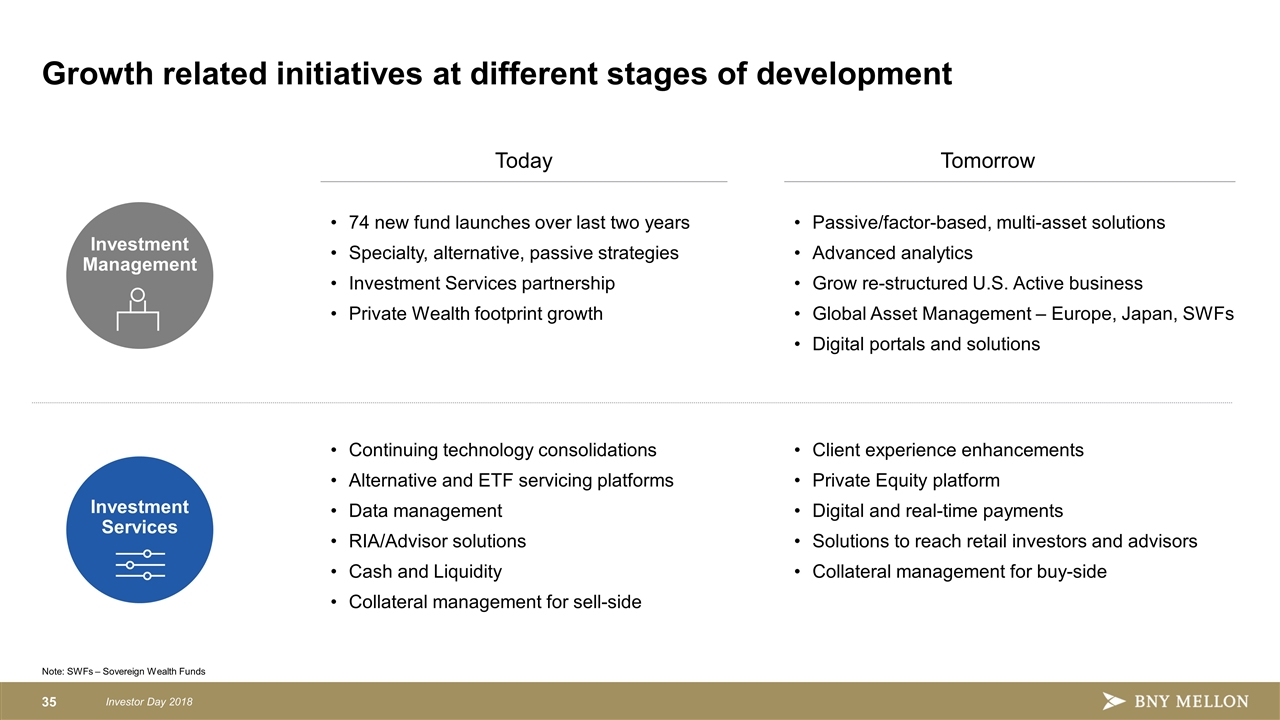

Growth related initiatives at different stages of development 74 new fund launches over last two years Specialty, alternative, passive strategies Investment Services partnership Private Wealth footprint growth Today Tomorrow Continuing technology consolidations Alternative and ETF servicing platforms Data management RIA/Advisor solutions Cash and Liquidity Collateral management for sell-side Passive/factor-based, multi-asset solutions Advanced analytics Grow re-structured U.S. Active business Global Asset Management – Europe, Japan, SWFs Digital portals and solutions Client experience enhancements Private Equity platform Digital and real-time payments Solutions to reach retail investors and advisors Collateral management for buy-side Investment Services Investment Management Note: SWFs – Sovereign Wealth Funds

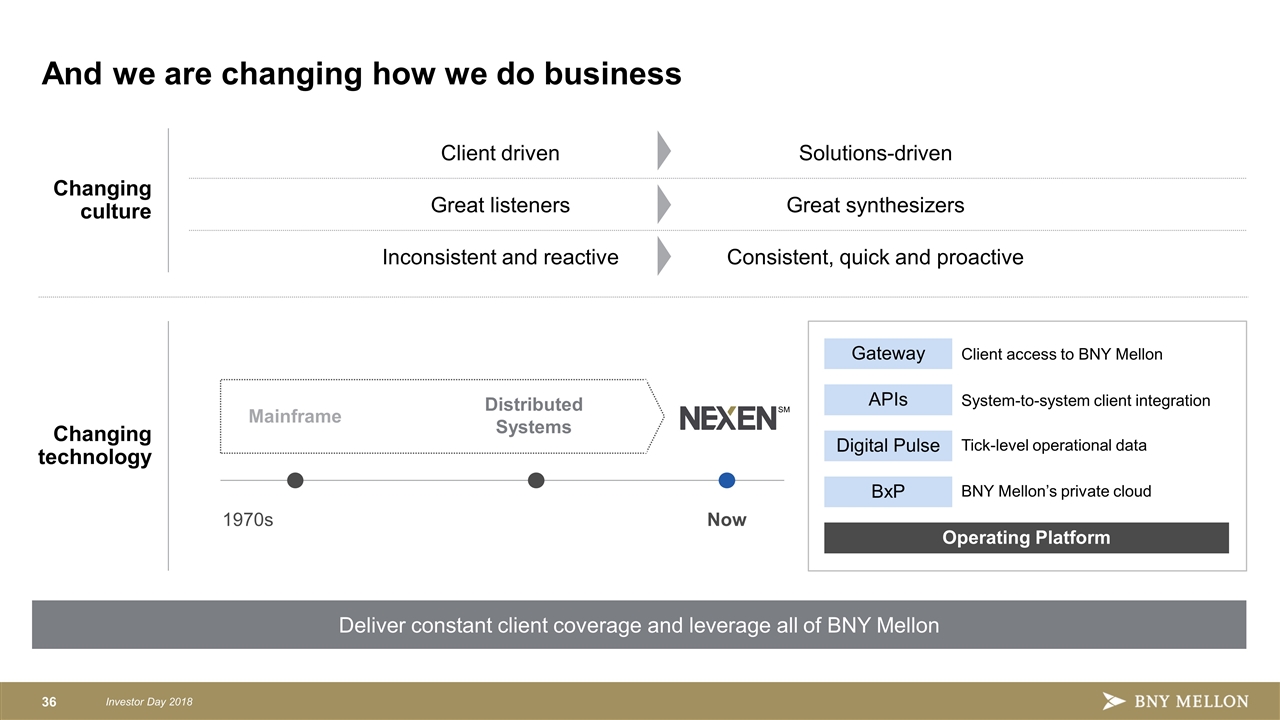

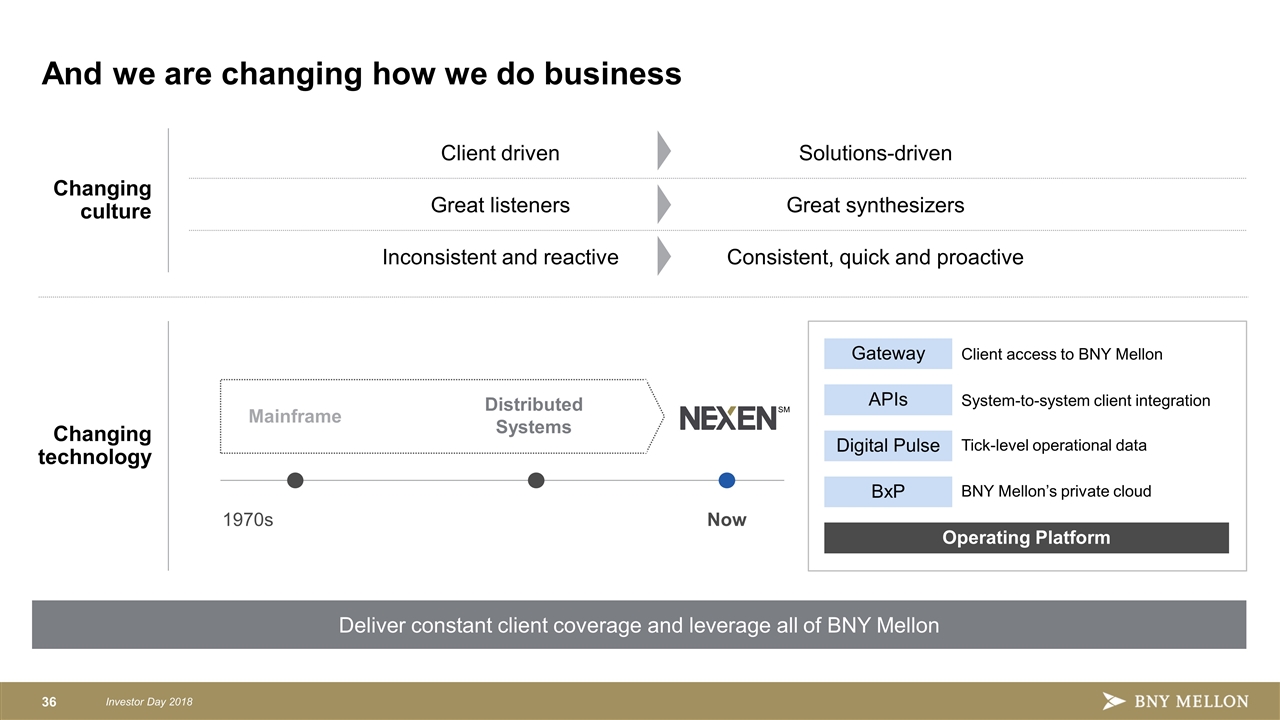

And we are changing how we do business Changing culture Changing technology Client driven Solutions-driven Great listeners Great synthesizers Inconsistent and reactive Consistent, quick and proactive Mainframe Distributed Systems Client access to BNY Mellon System-to-system client integration Tick-level operational data BNY Mellon’s private cloud 1970s Now Deliver constant client coverage and leverage all of BNY Mellon Operating Platform BxP Digital Pulse APIs Gateway SM

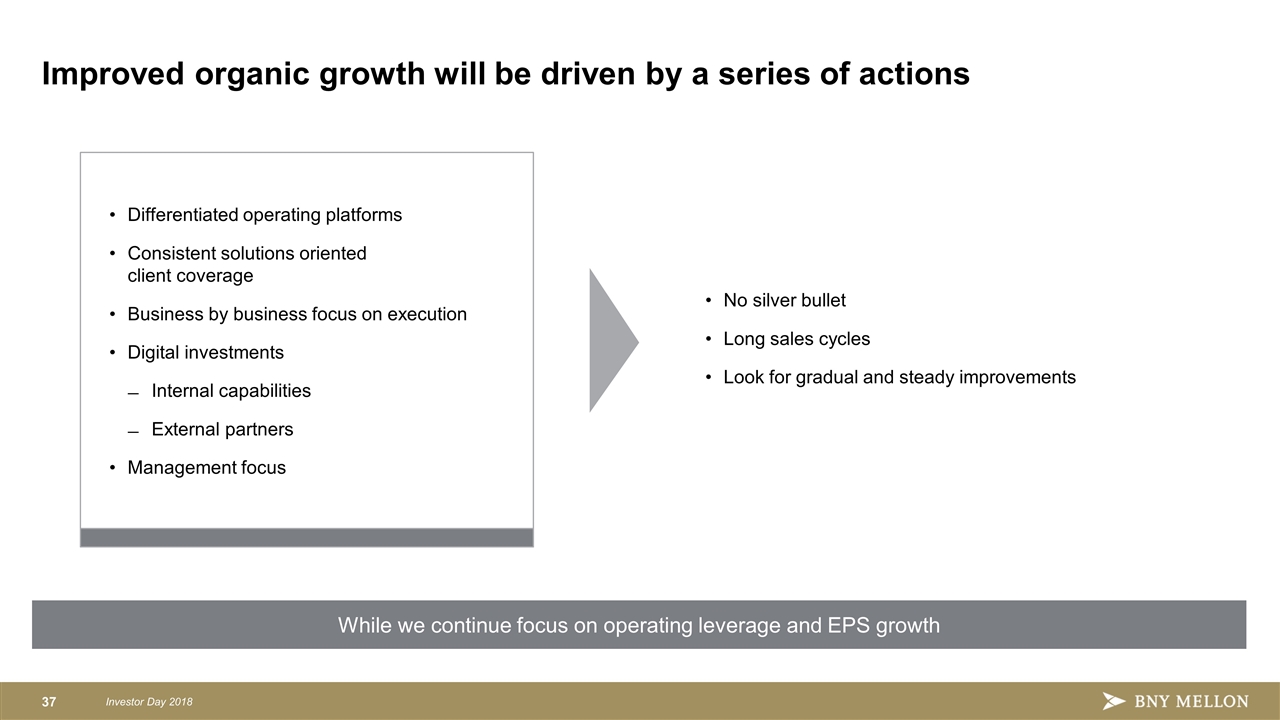

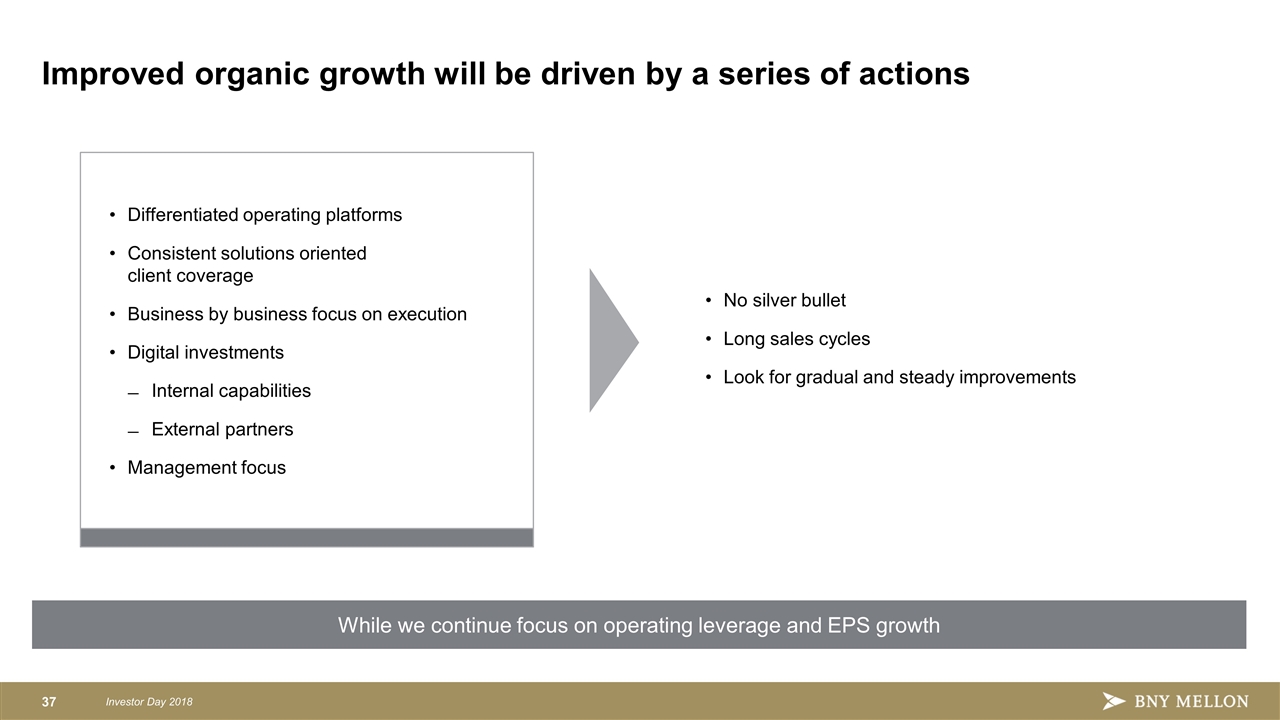

Improved organic growth will be driven by a series of actions Differentiated operating platforms Consistent solutions oriented client coverage Business by business focus on execution Digital investments Internal capabilities External partners Management focus While we continue focus on operating leverage and EPS growth No silver bullet Long sales cycles Look for gradual and steady improvements

Investor Day 2018 BNY Mellon Financial Overview Michael Santomassimo Chief Financial Officer March 8, 2018

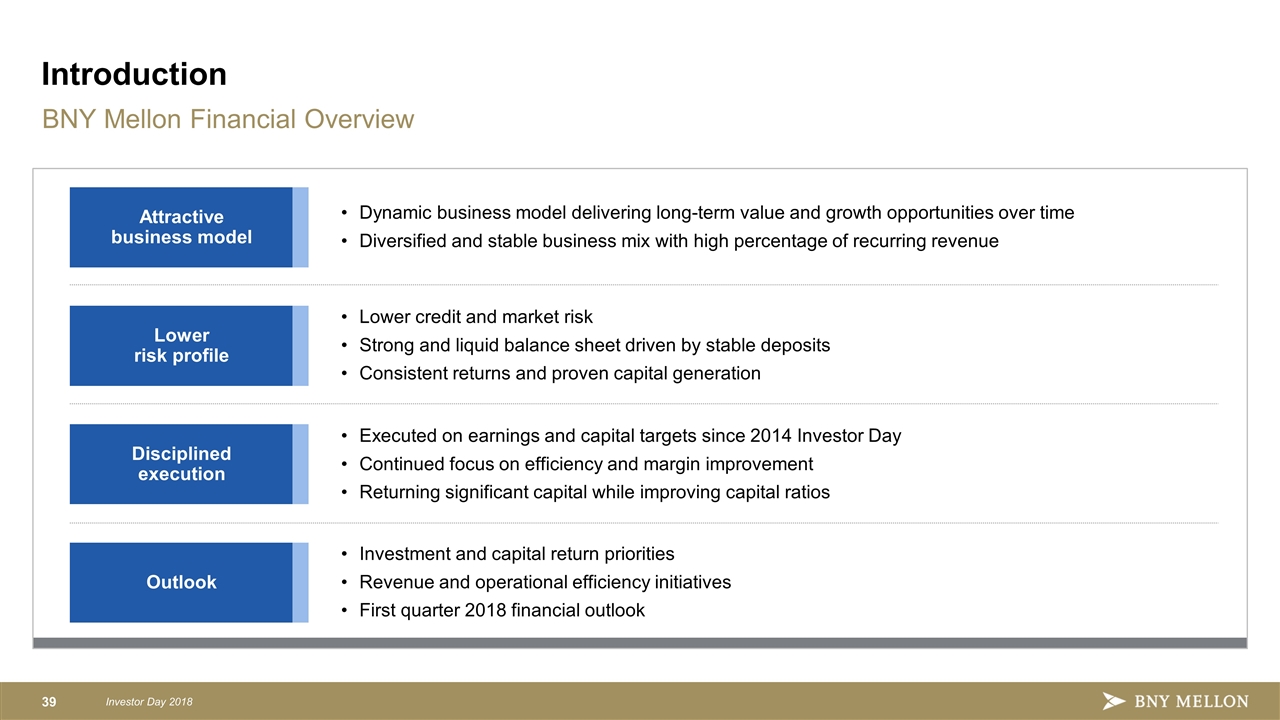

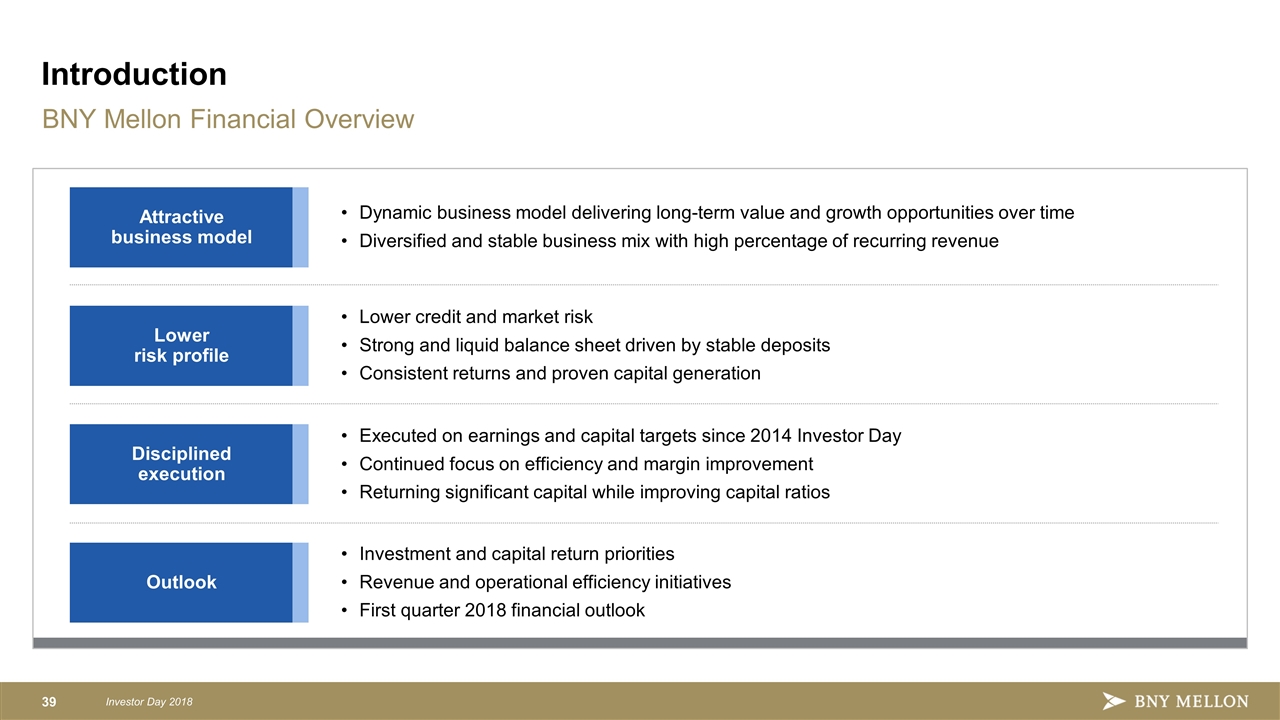

BNY Mellon Financial Overview Introduction Dynamic business model delivering long-term value and growth opportunities over time Diversified and stable business mix with high percentage of recurring revenue Lower credit and market risk Strong and liquid balance sheet driven by stable deposits Consistent returns and proven capital generation Investment and capital return priorities Revenue and operational efficiency initiatives First quarter 2018 financial outlook Executed on earnings and capital targets since 2014 Investor Day Continued focus on efficiency and margin improvement Returning significant capital while improving capital ratios Attractive business model Disciplined execution Lower risk profile Outlook

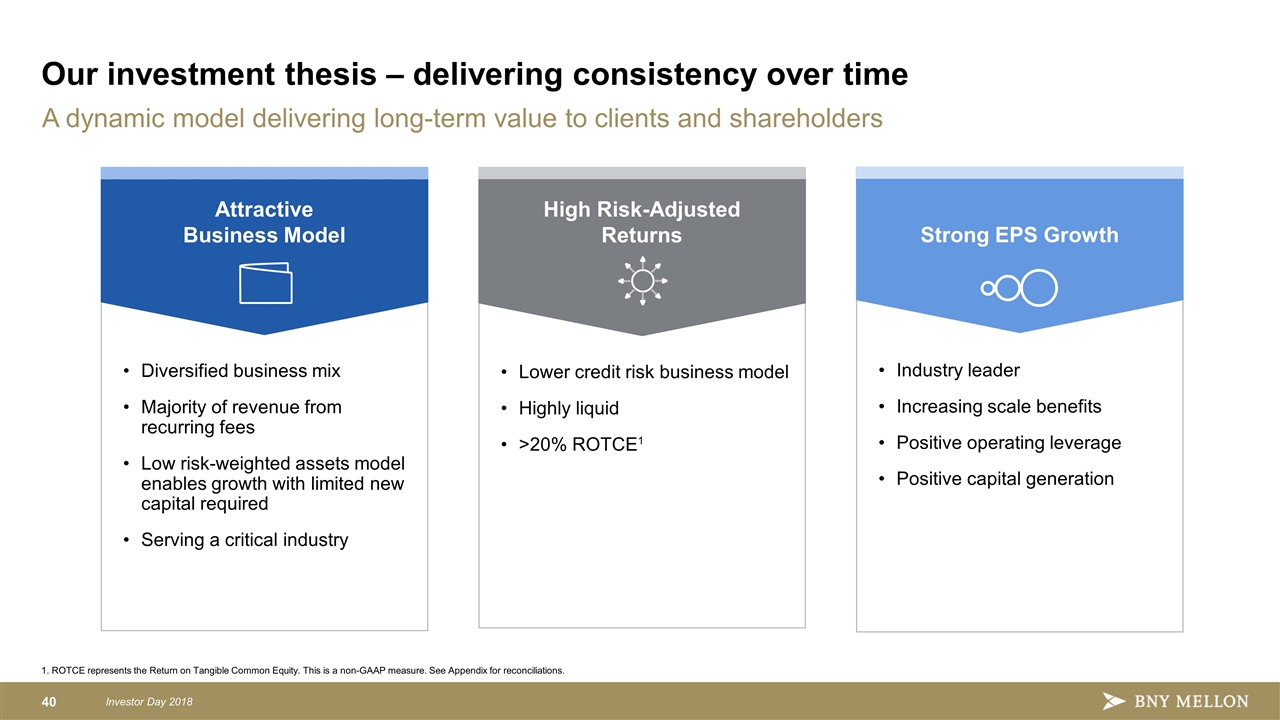

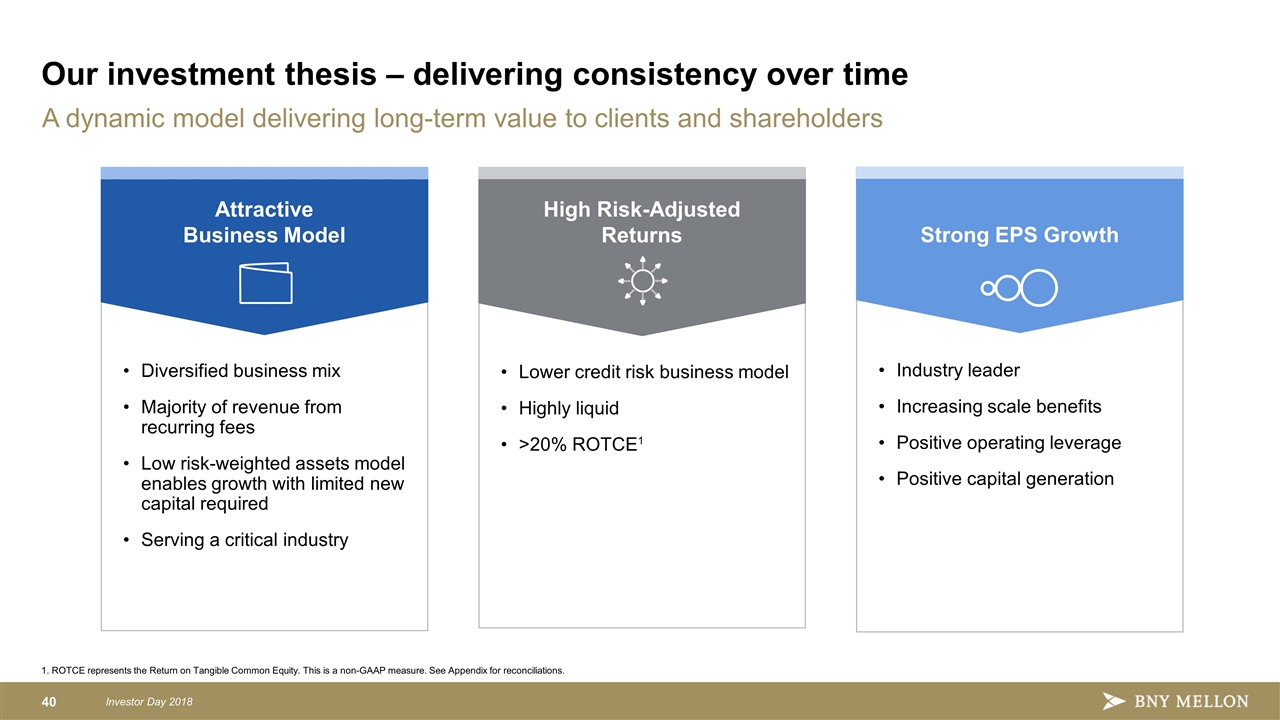

A dynamic model delivering long-term value to clients and shareholders Our investment thesis – delivering consistency over time Strong EPS Growth Industry leader Increasing scale benefits Positive operating leverage Positive capital generation Attractive Business Model Diversified business mix Majority of revenue from recurring fees Low risk-weighted assets model enables growth with limited new capital required Serving a critical industry High Risk-Adjusted Returns Lower credit risk business model Highly liquid >20% ROTCE1 1. ROTCE represents the Return on Tangible Common Equity. This is a non-GAAP measure. See Appendix for reconciliations.

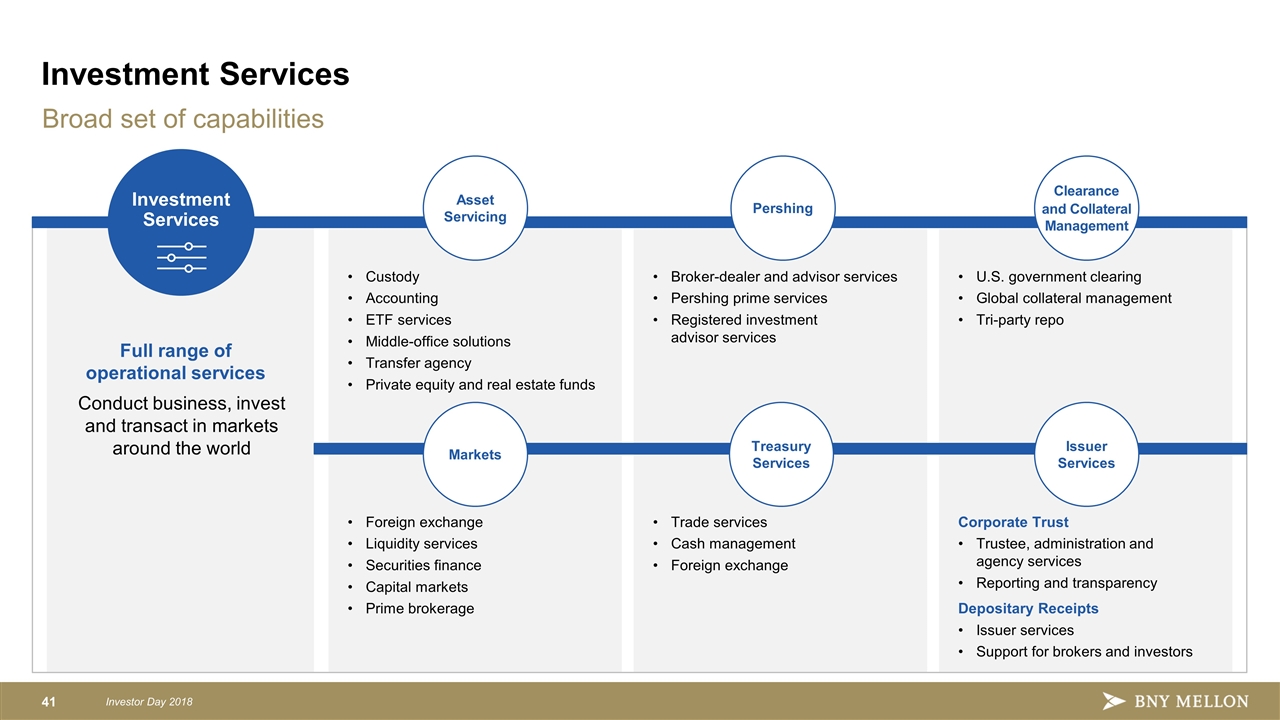

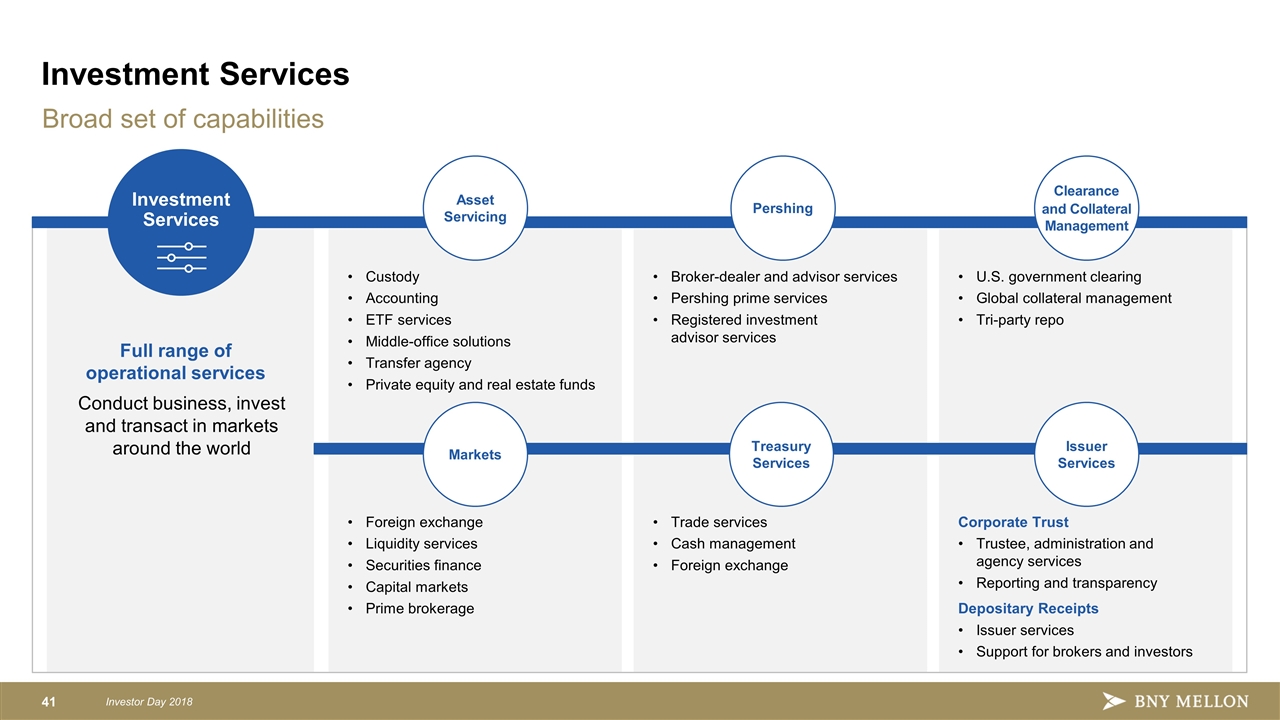

Full range of operational services Conduct business, invest and transact in markets around the world Custody Accounting ETF services Middle-office solutions Transfer agency Private equity and real estate funds Broker-dealer and advisor services Pershing prime services Registered investment advisor services U.S. government clearing Global collateral management Tri-party repo Broad set of capabilities Investment Services Asset Servicing Pershing Foreign exchange Liquidity services Securities finance Capital markets Prime brokerage Trade services Cash management Foreign exchange Corporate Trust Trustee, administration and agency services Reporting and transparency Depositary Receipts Issuer services Support for brokers and investors Clearance and Collateral Management Markets Treasury Services Issuer Services Investment Services

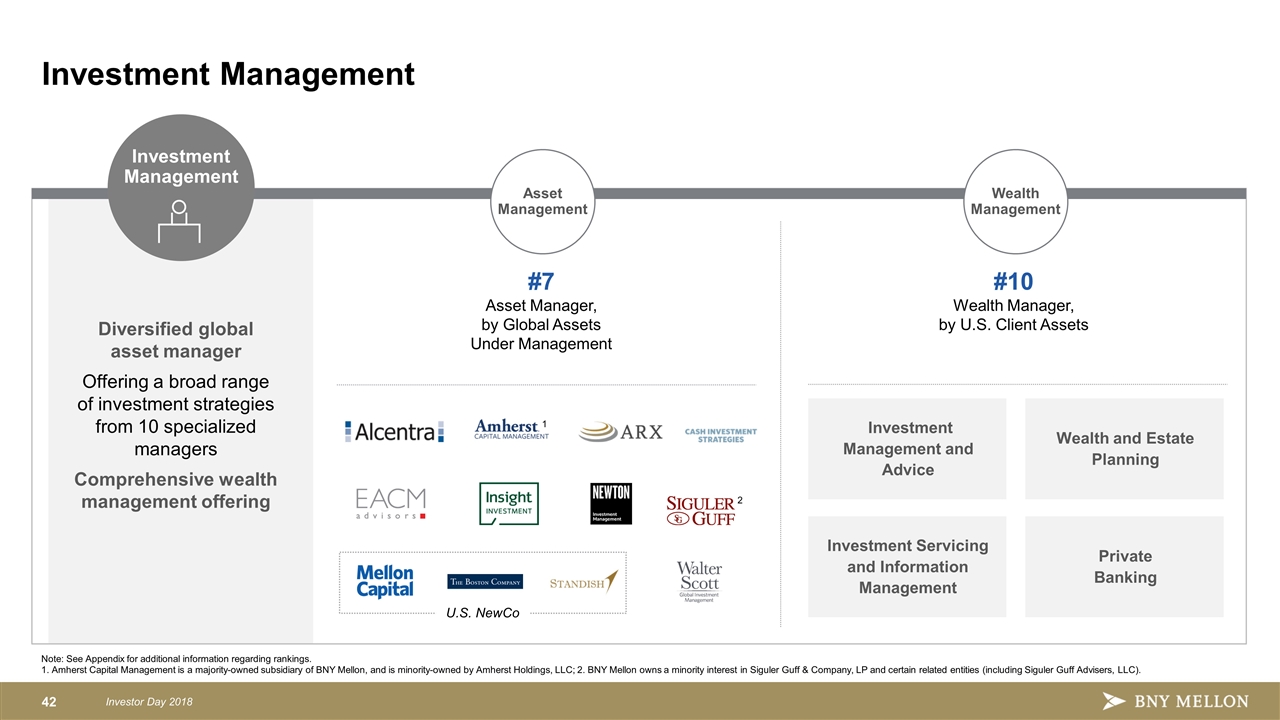

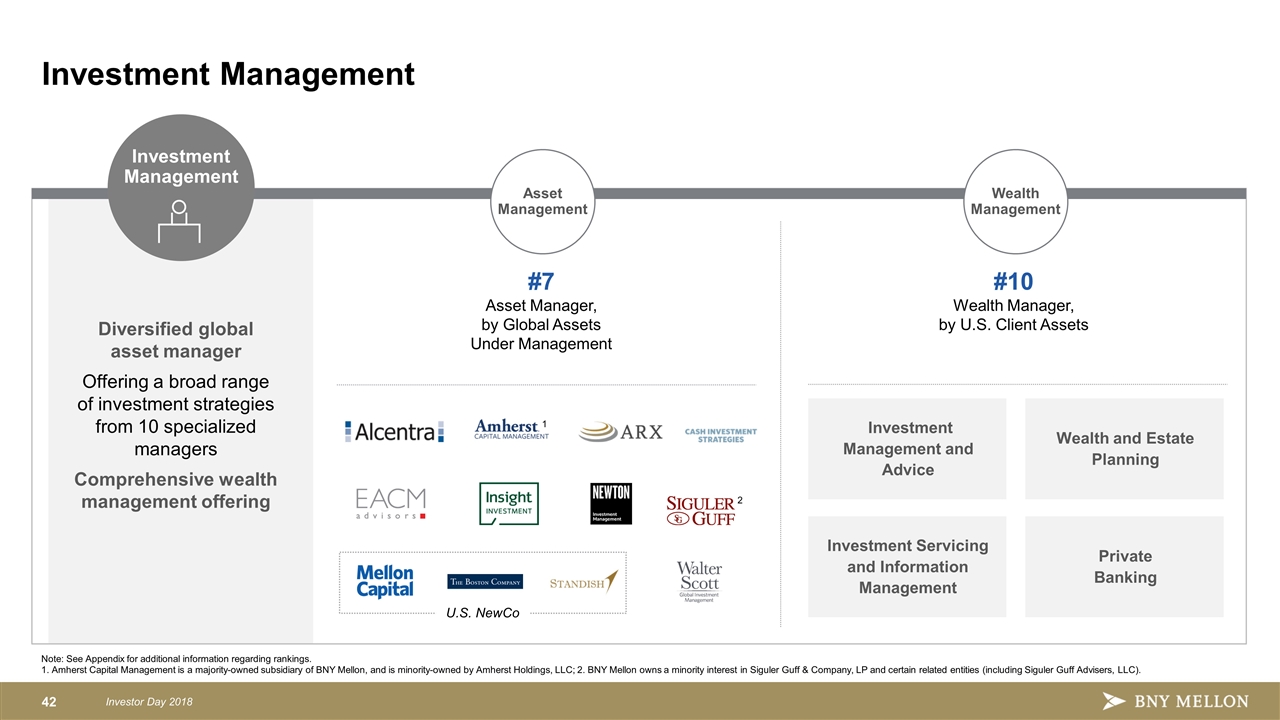

Diversified global asset manager Offering a broad range of investment strategies from 10 specialized managers Comprehensive wealth management offering Investment Management #7 Asset Manager, by Global Assets Under Management #10 Wealth Manager, by U.S. Client Assets Investment Servicing and Information Management Wealth and Estate Planning Investment Management and Advice Private Banking U.S. NewCo Asset Management Wealth Management Note: See Appendix for additional information regarding rankings. 1. Amherst Capital Management is a majority-owned subsidiary of BNY Mellon, and is minority-owned by Amherst Holdings, LLC; 2. BNY Mellon owns a minority interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers, LLC). 1 2 Investment Management

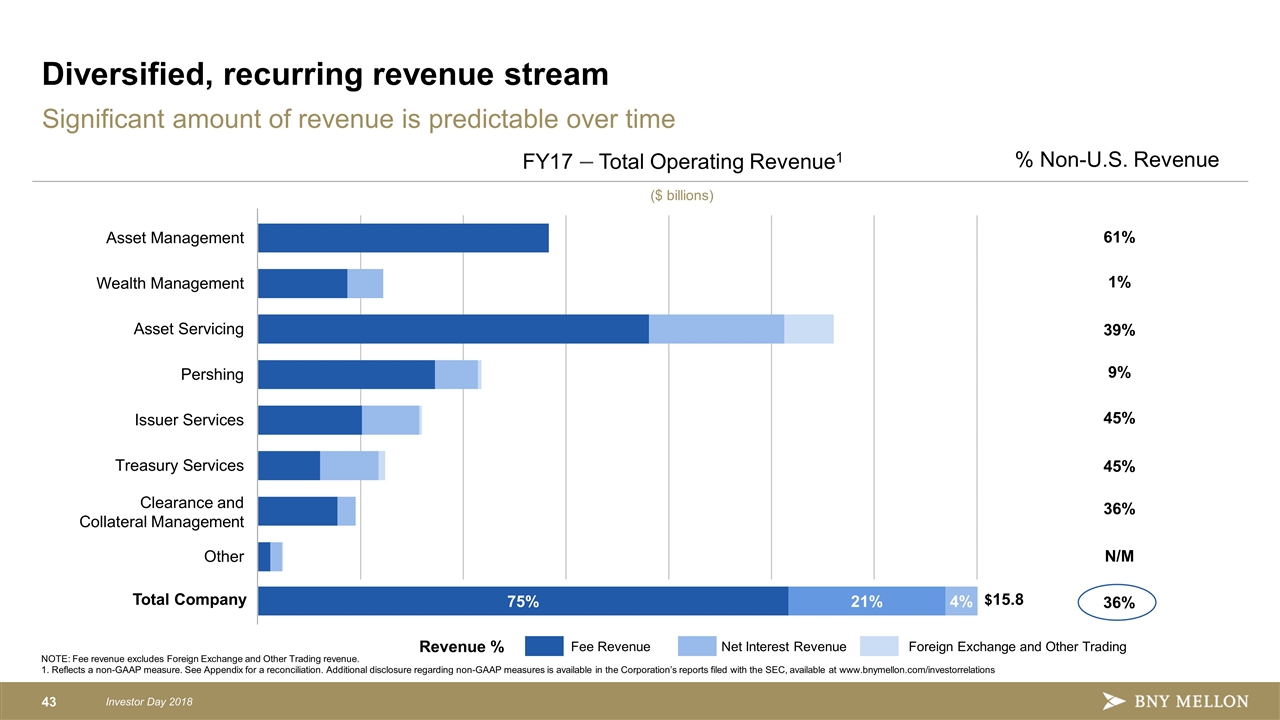

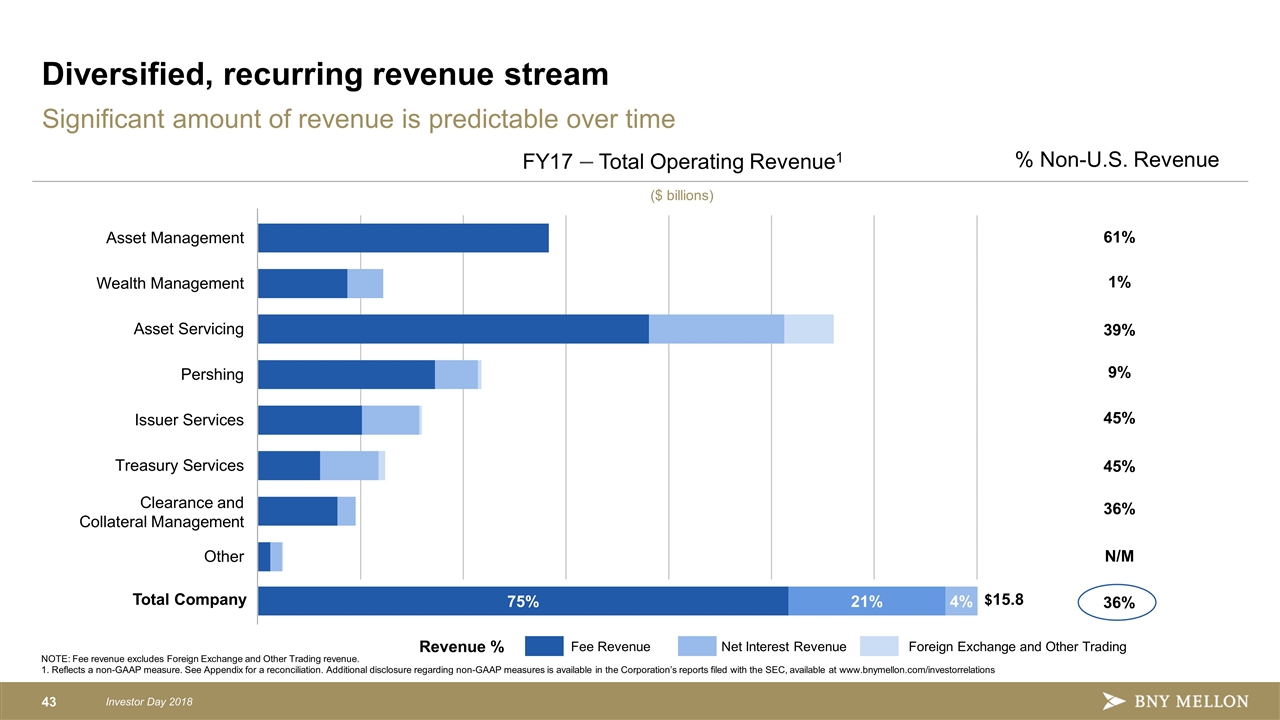

Diversified, recurring revenue stream FY17 – Total Operating Revenue1 ($ billions) % Non-U.S. Revenue 61% 9% 39% N/M 45% 36% 45% 36% 75% 21% 4% Total Company $15.8 1% Significant amount of revenue is predictable over time Revenue % Fee Revenue Foreign Exchange and Other Trading Net Interest Revenue Clearance and Collateral Management NOTE: Fee revenue excludes Foreign Exchange and Other Trading revenue. 1. Reflects a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations

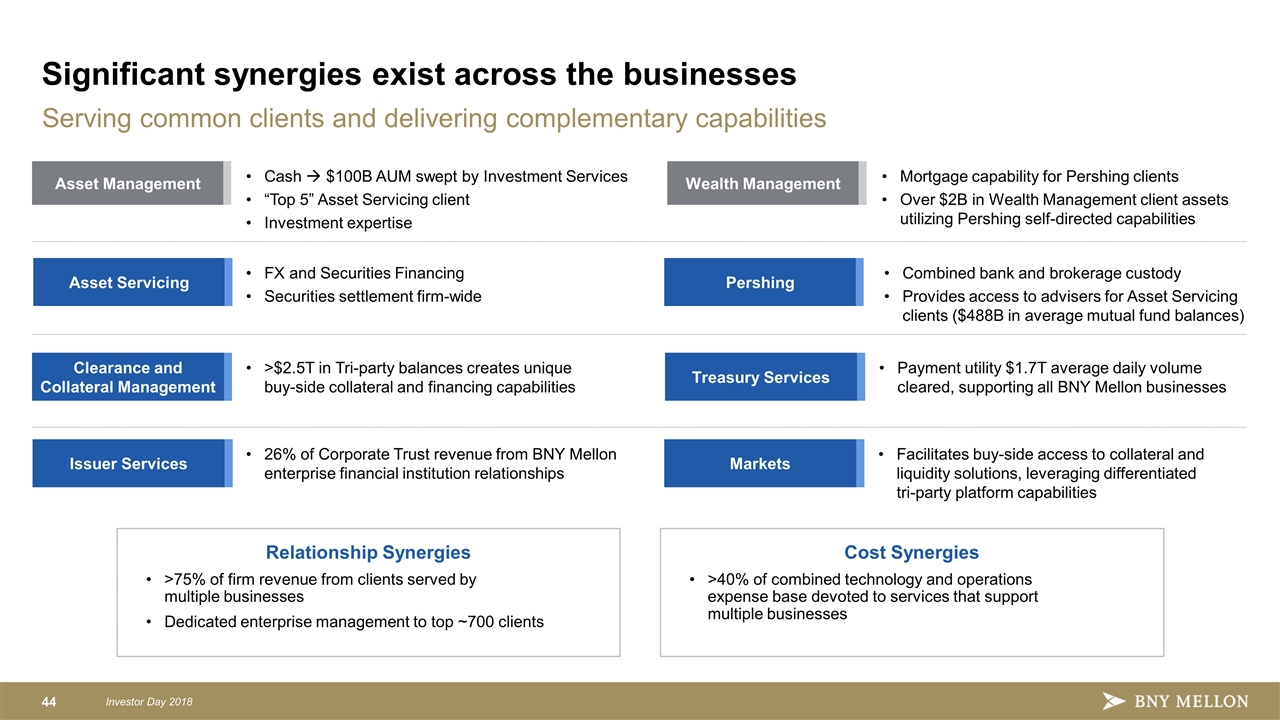

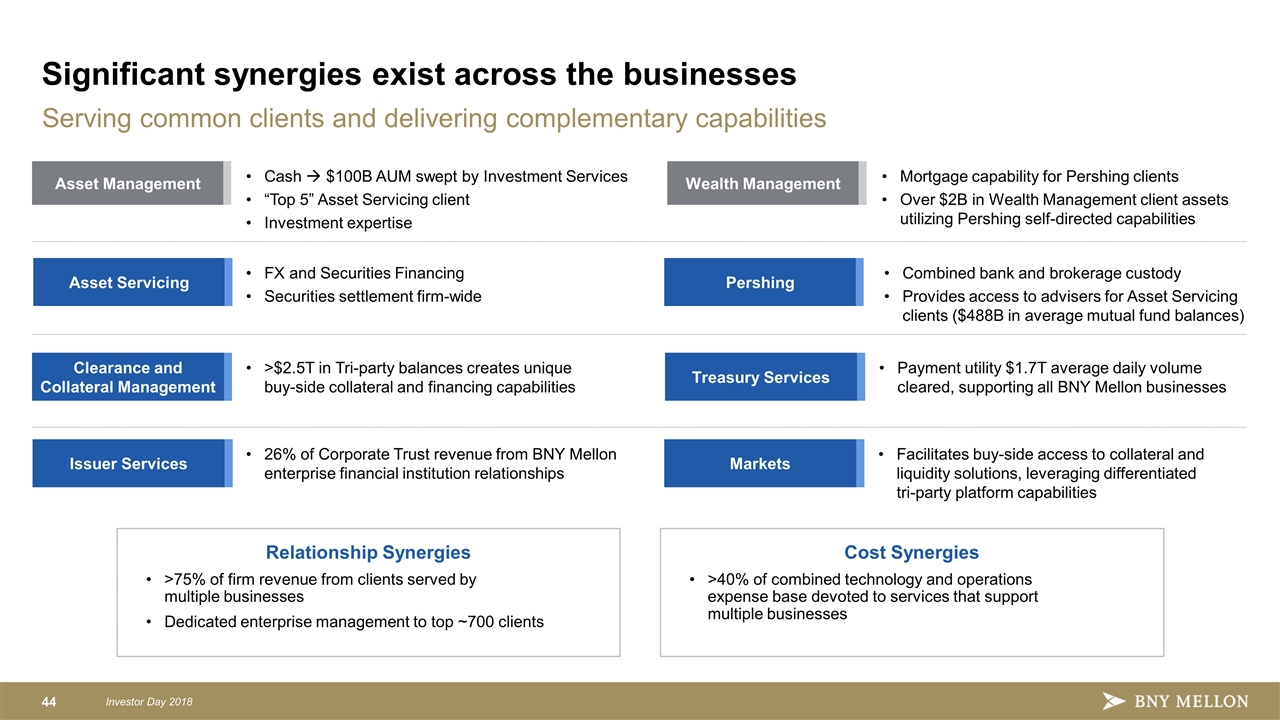

Significant synergies exist across the businesses Relationship Synergies >75% of firm revenue from clients served by multiple businesses Dedicated enterprise management to top ~700 clients Cost Synergies >40% of combined technology and operations expense base devoted to services that support multiple businesses Serving common clients and delivering complementary capabilities 26% of Corporate Trust revenue from BNY Mellon enterprise financial institution relationships Cash à $100B AUM swept by Investment Services “Top 5” Asset Servicing client Investment expertise FX and Securities Financing Securities settlement firm-wide >$2.5T in Tri-party balances creates unique buy-side collateral and financing capabilities Asset Management Asset Servicing Issuer Services Clearance and Collateral Management Mortgage capability for Pershing clients Over $2B in Wealth Management client assets utilizing Pershing self-directed capabilities Combined bank and brokerage custody Provides access to advisers for Asset Servicing clients ($488B in average mutual fund balances) Payment utility $1.7T average daily volume cleared, supporting all BNY Mellon businesses Wealth Management Pershing Treasury Services Facilitates buy-side access to collateral and liquidity solutions, leveraging differentiated tri-party platform capabilities Markets

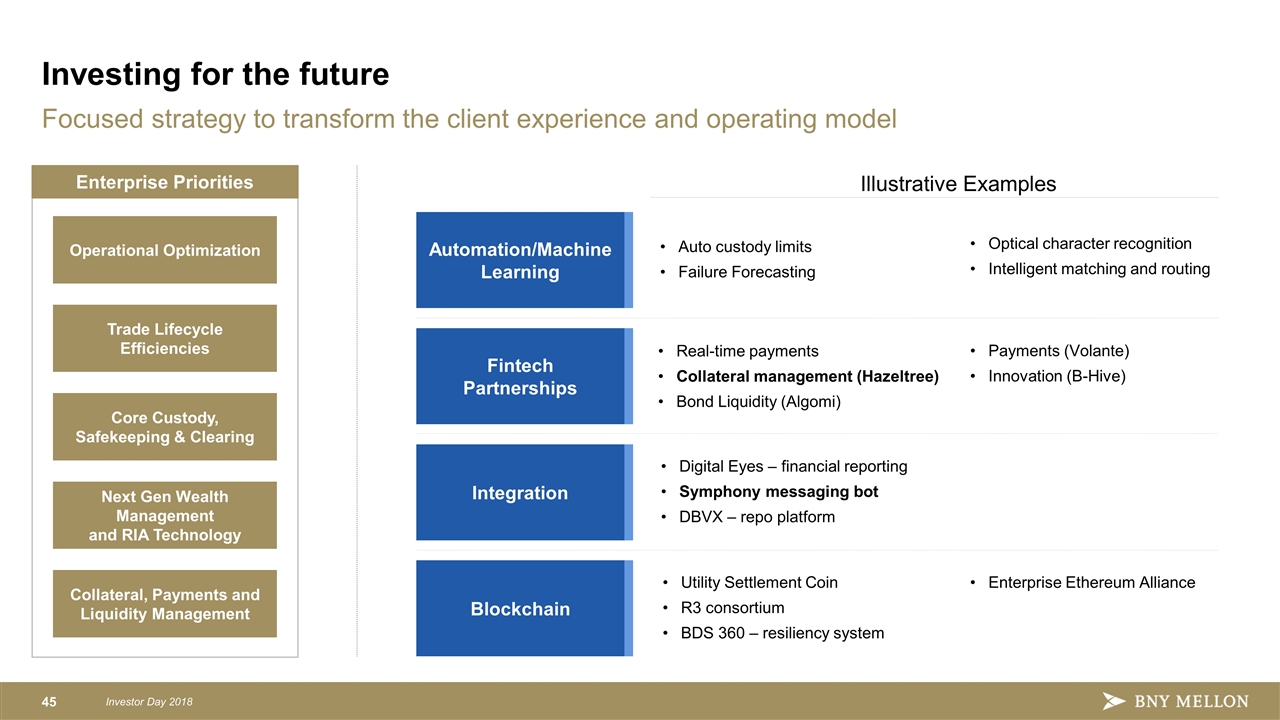

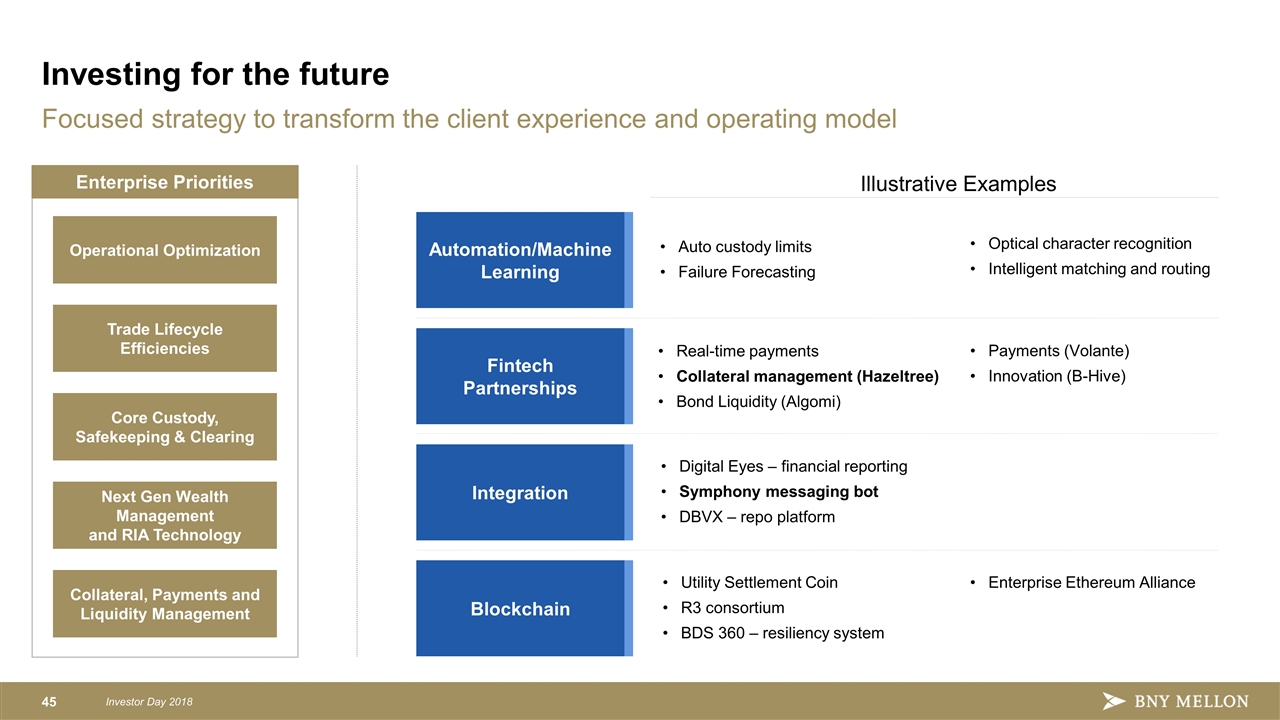

Focused strategy to transform the client experience and operating model Investing for the future Enterprise Priorities Collateral, Payments and Liquidity Management Trade Lifecycle Efficiencies Core Custody, Safekeeping & Clearing Next Gen Wealth Management and RIA Technology Operational Optimization Payments (Volante) Innovation (B-Hive) Optical character recognition Intelligent matching and routing Utility Settlement Coin R3 consortium BDS 360 – resiliency system Digital Eyes – financial reporting Symphony messaging bot DBVX – repo platform Real-time payments Collateral management (Hazeltree) Bond Liquidity (Algomi) Enterprise Ethereum Alliance Blockchain Fintech Partnerships Automation/Machine Learning Integration Auto custody limits Failure Forecasting Illustrative Examples

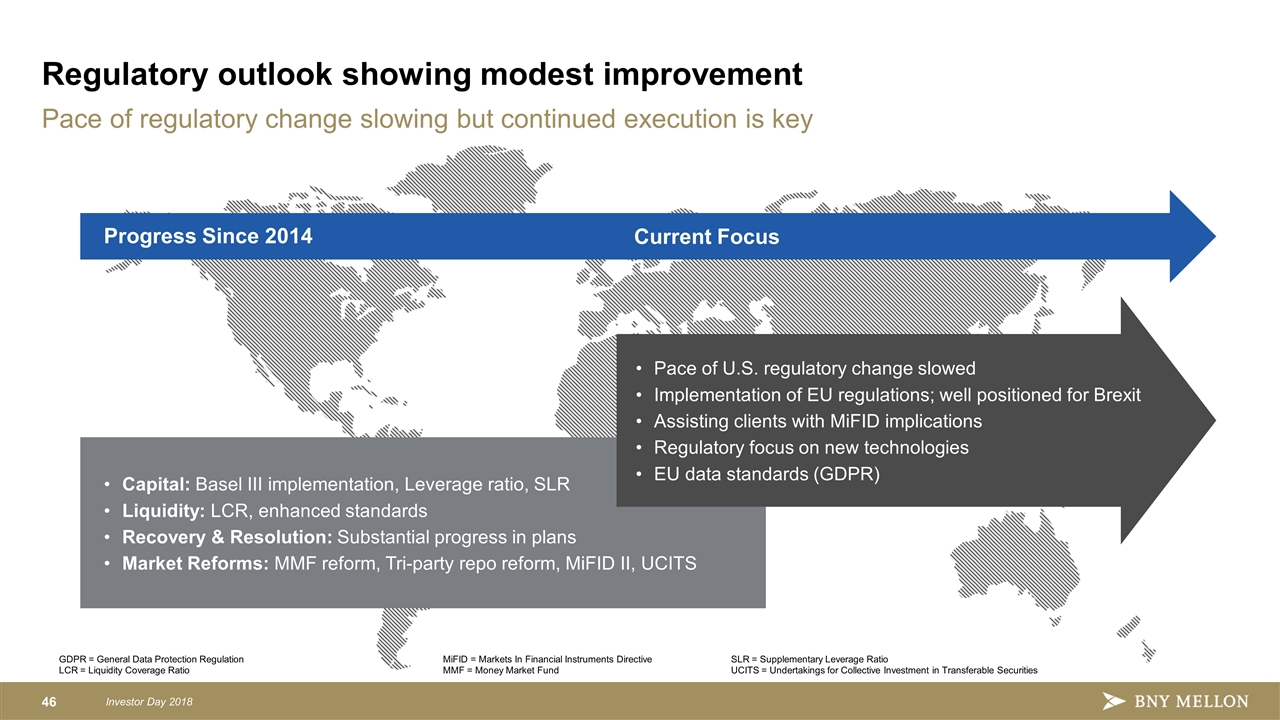

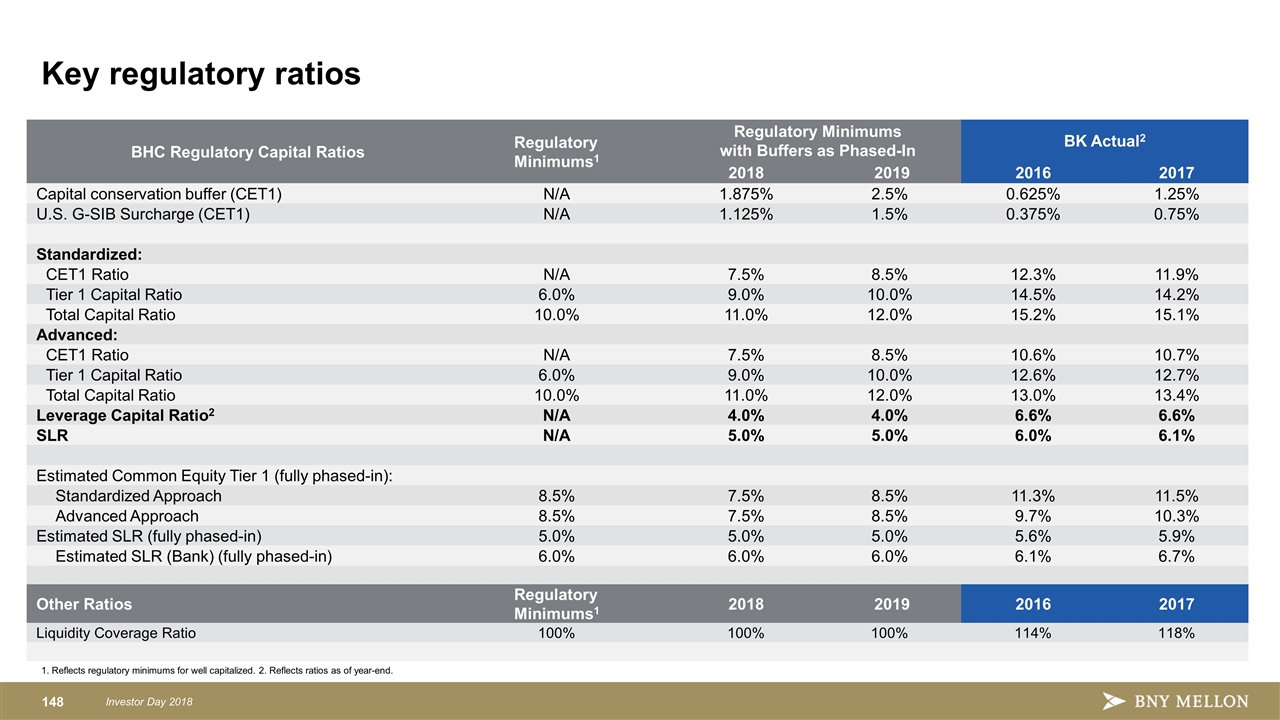

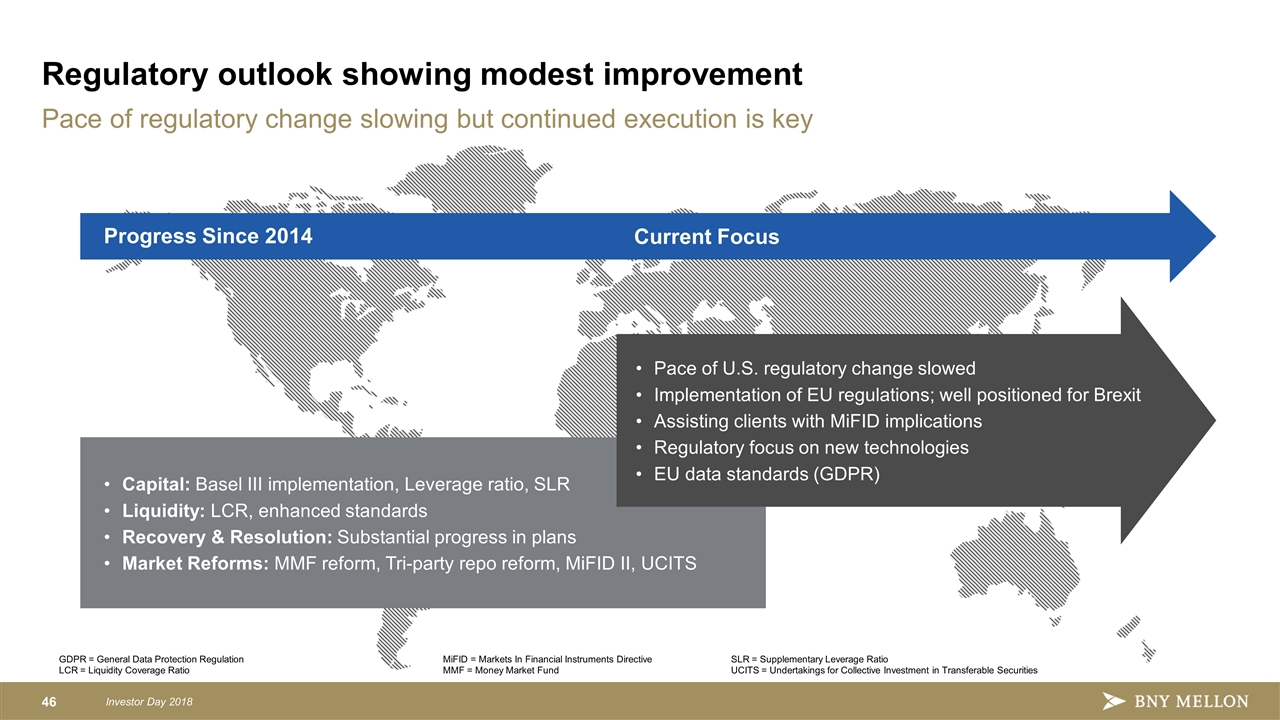

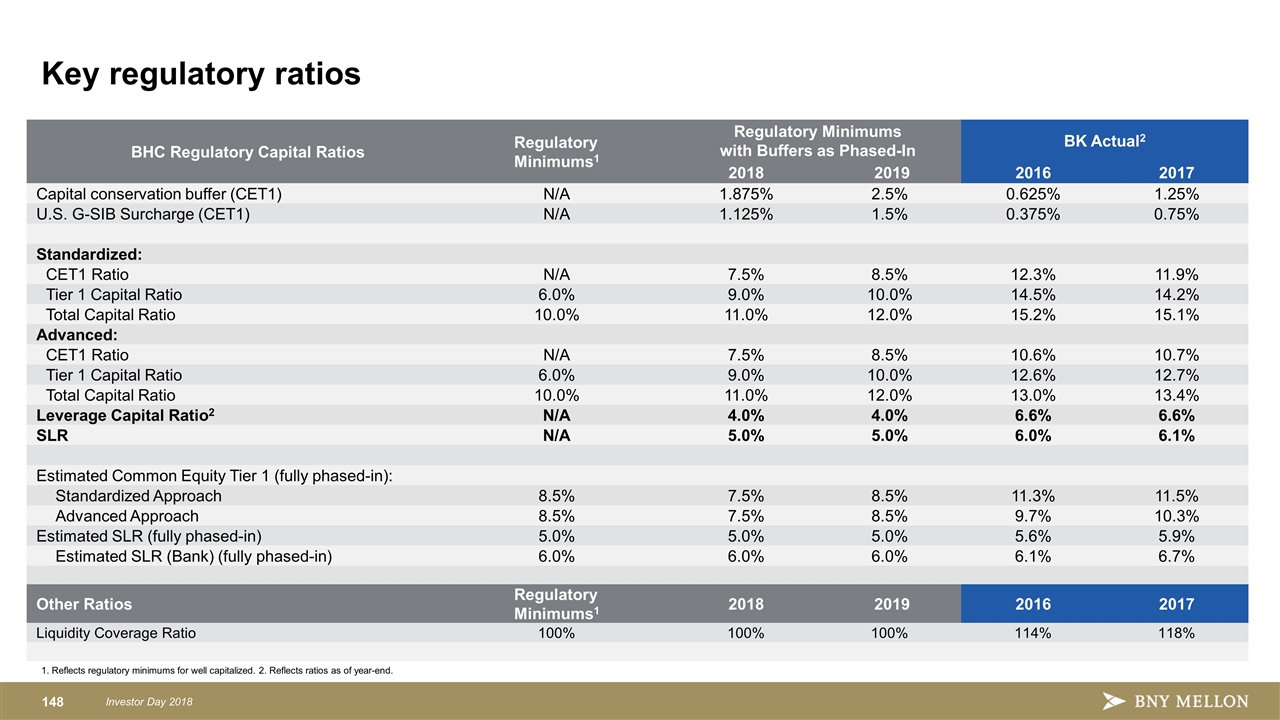

Pace of regulatory change slowing but continued execution is key Regulatory outlook showing modest improvement Capital: Basel III implementation, Leverage ratio, SLR Liquidity: LCR, enhanced standards Recovery & Resolution: Substantial progress in plans Market Reforms: MMF reform, Tri-party repo reform, MiFID II, UCITS Progress Since 2014 Current Focus Pace of U.S. regulatory change slowed Implementation of EU regulations; well positioned for Brexit Assisting clients with MiFID implications Regulatory focus on new technologies EU data standards (GDPR) GDPR = General Data Protection RegulationMiFID = Markets In Financial Instruments DirectiveSLR = Supplementary Leverage Ratio LCR = Liquidity Coverage RatioMMF = Money Market FundUCITS = Undertakings for Collective Investment in Transferable Securities

Lower credit and market risk ($13B) $291B Average Interest-Earning Assets $4B ($25B) $10B Cash Loans Securities $304B Average yields 1.52% 1.08% Total Trading Securities ($3B) 80% of average interest-earning assets High Quality Securities Portfolio: $118B >90% of securities portfolio rated AAA/AA- ~75% are U.S. treasury, agency and sovereign securities High Quality Loan Portfolio: $58B NOTE: Totals may not foot due to rounding. NOTE: Securities and loan percentage metrics reflect averages of 2017 quarterly period-end amounts. Margin Loans Wealth Management Financial Institutions and Commercial Real Estate / Overdrafts / Other

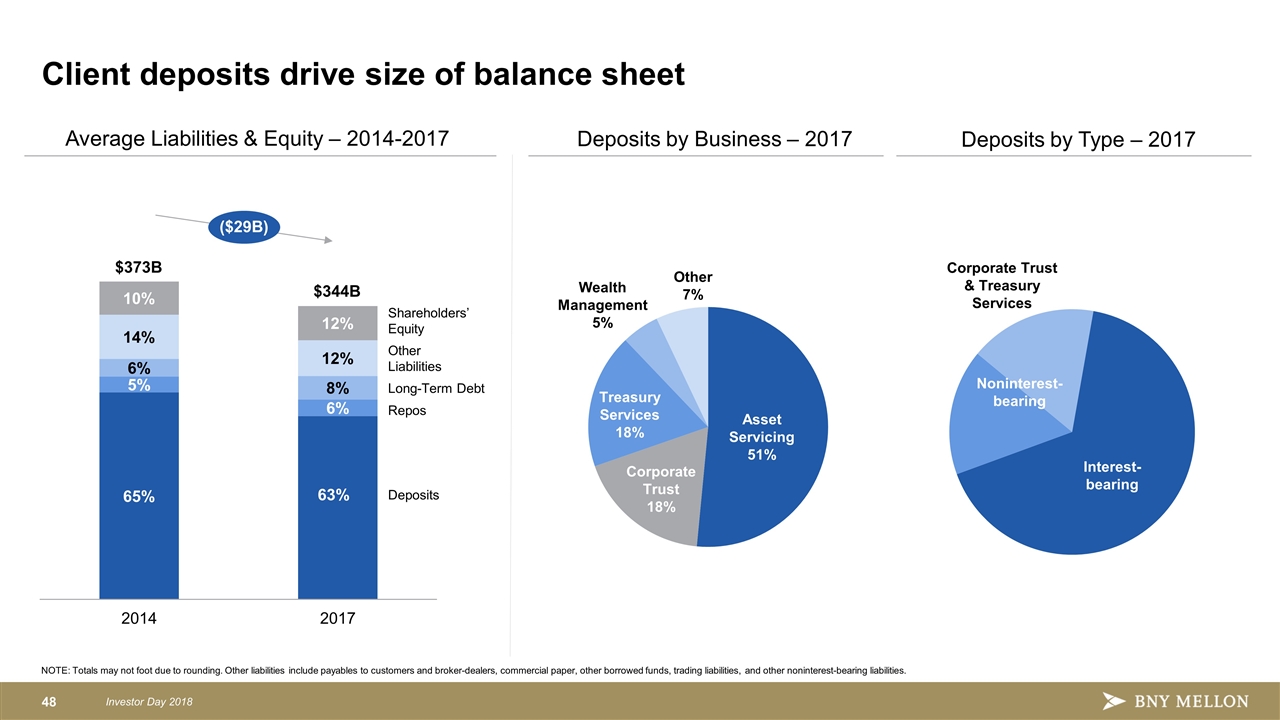

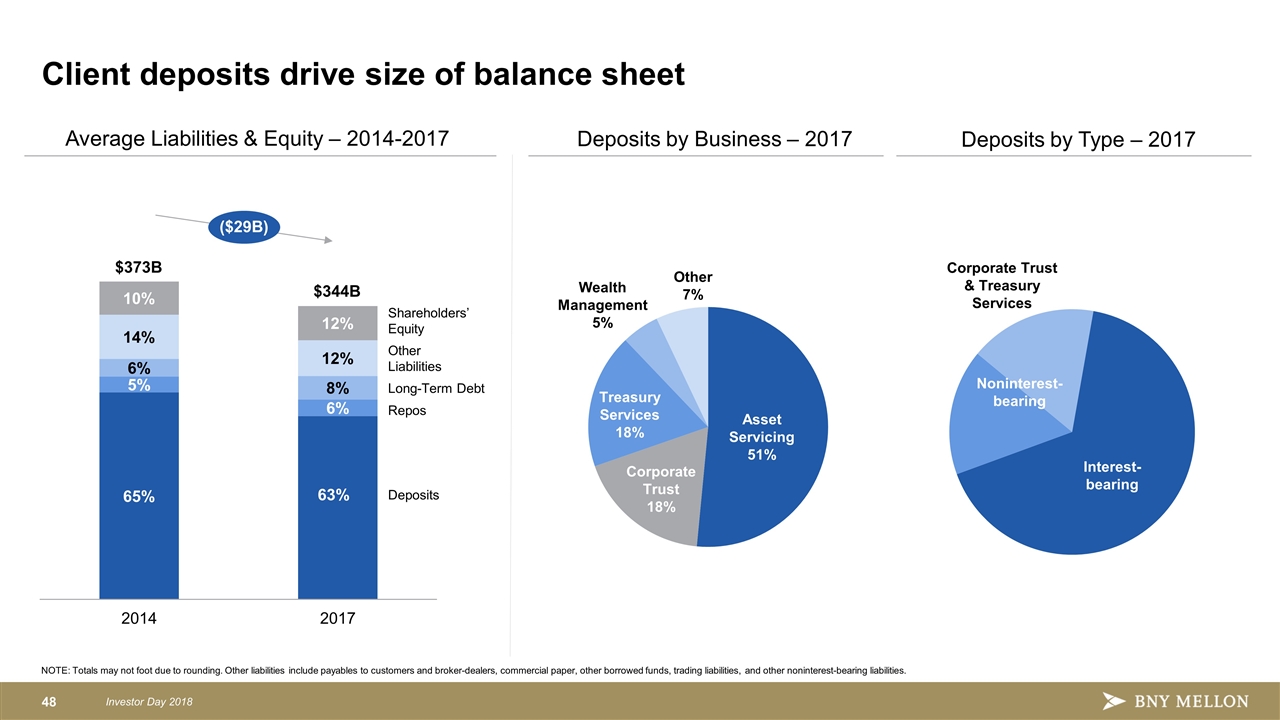

Client deposits drive size of balance sheet NOTE: Totals may not foot due to rounding. Other liabilities include payables to customers and broker-dealers, commercial paper, other borrowed funds, trading liabilities, and other noninterest-bearing liabilities. Average Liabilities & Equity – 2014-2017 Deposits Long-Term Debt Repos Shareholders’ Equity Other Liabilities $373B $344B ($29B) Interest-bearing Noninterest-bearing Interest-bearing Asset Servicing 51% Corporate Trust 18% Wealth Management 5% Treasury Services 18% Corporate Trust & Treasury Services Other 7%

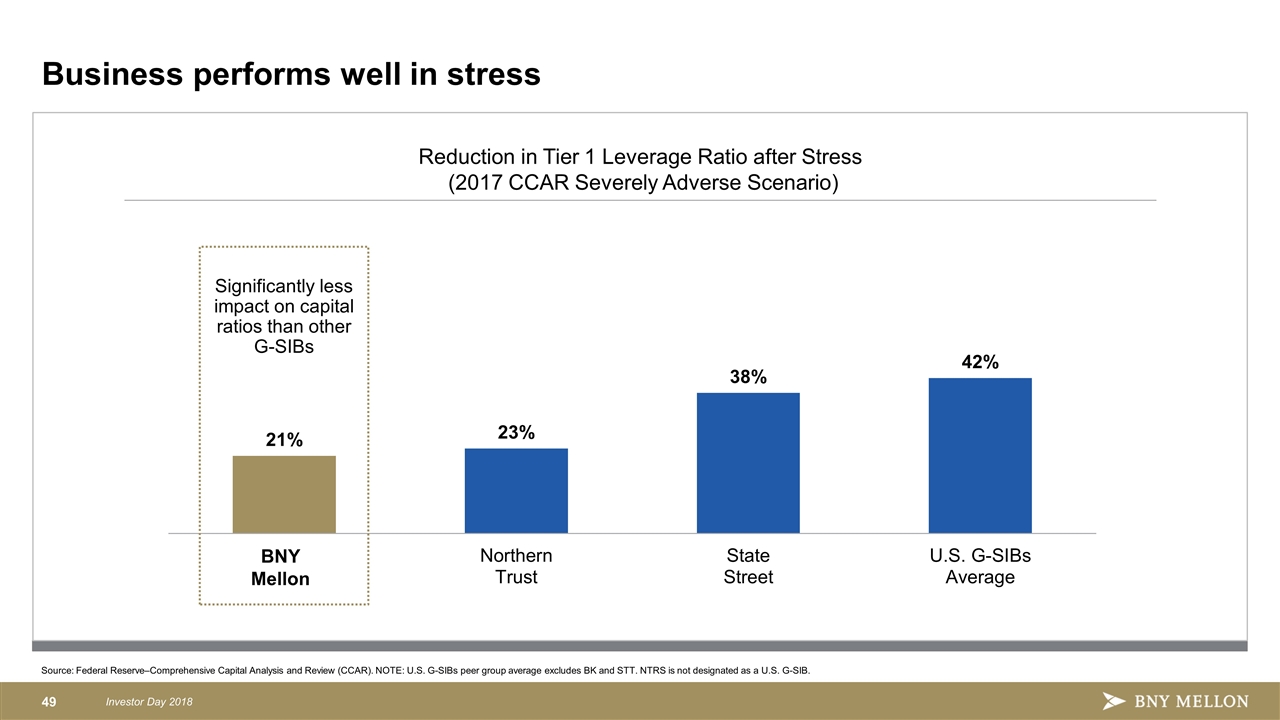

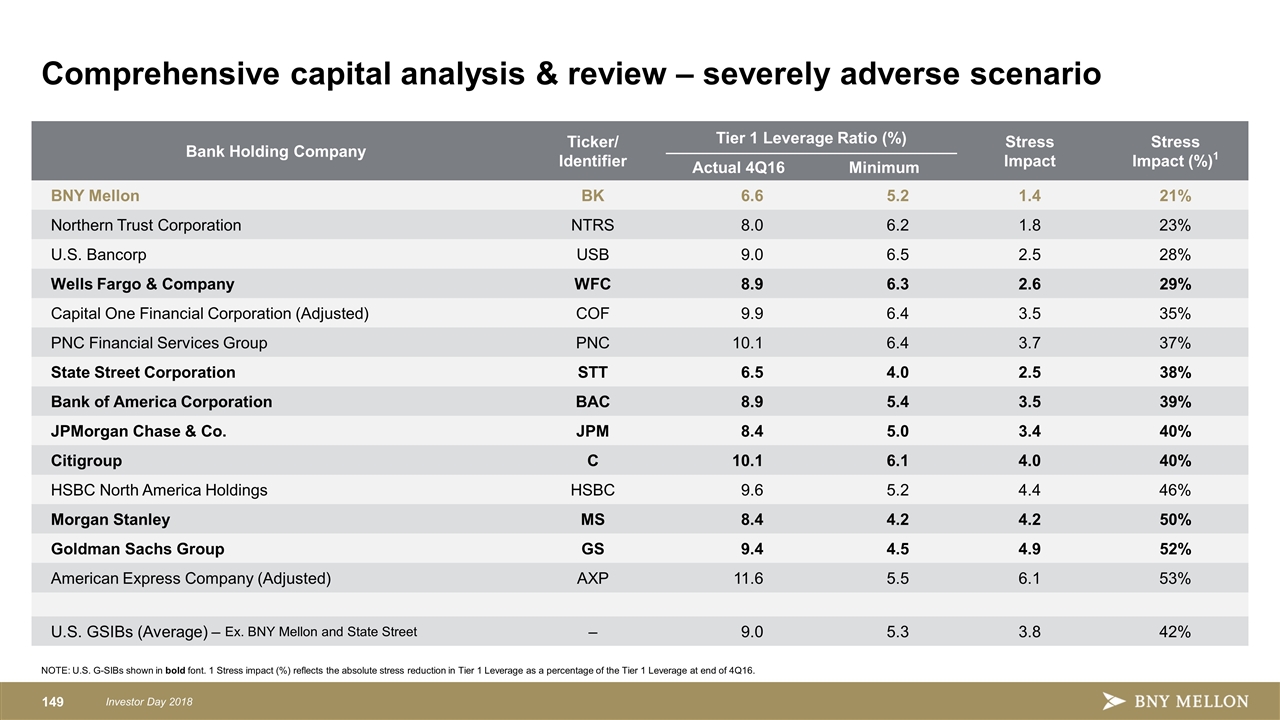

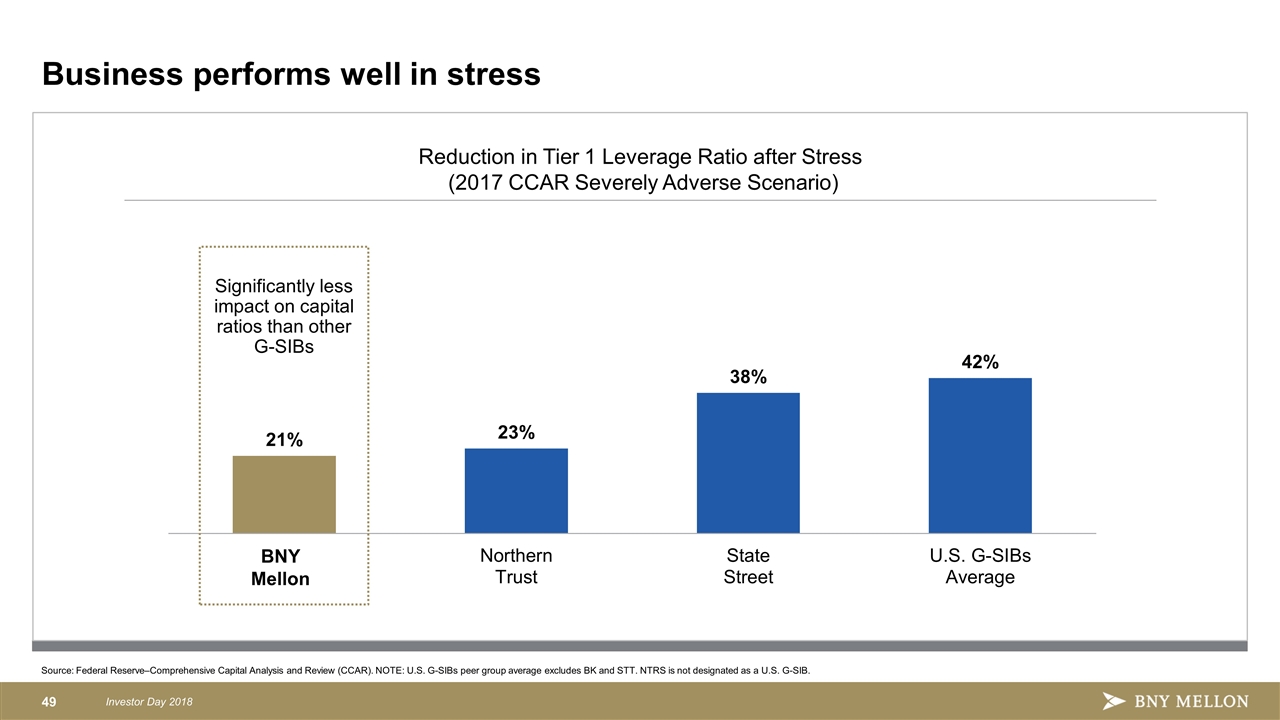

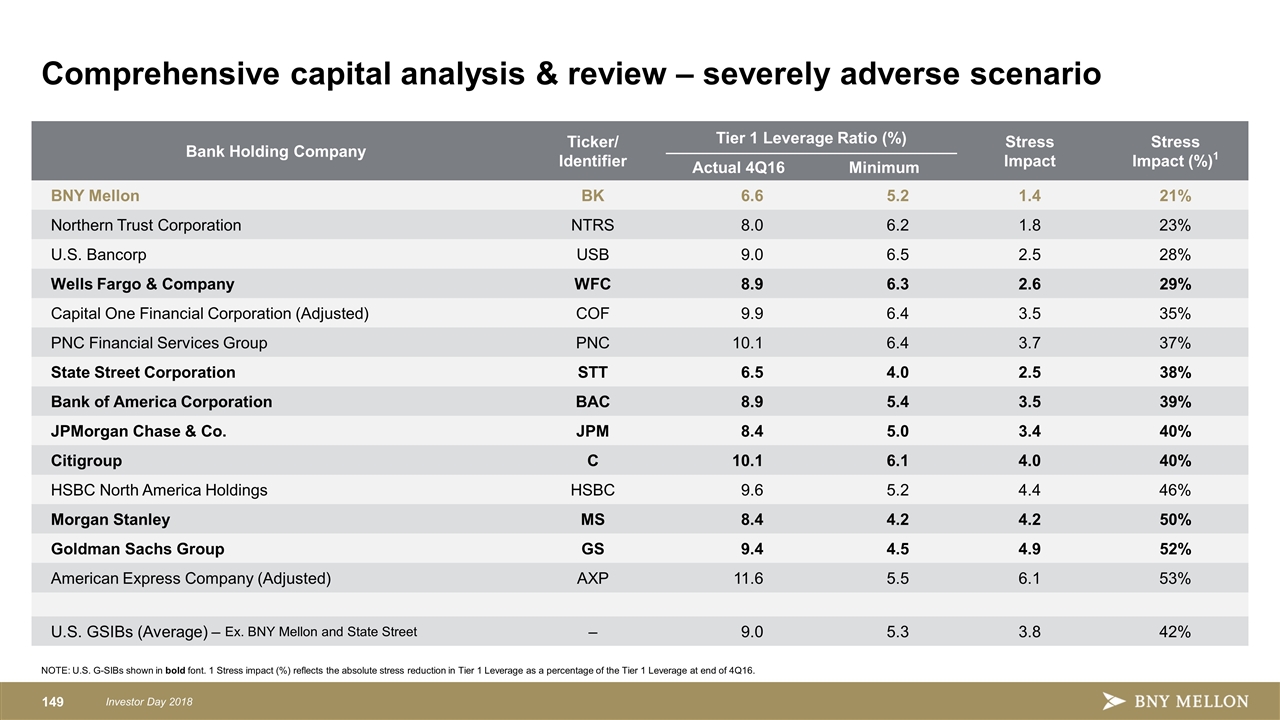

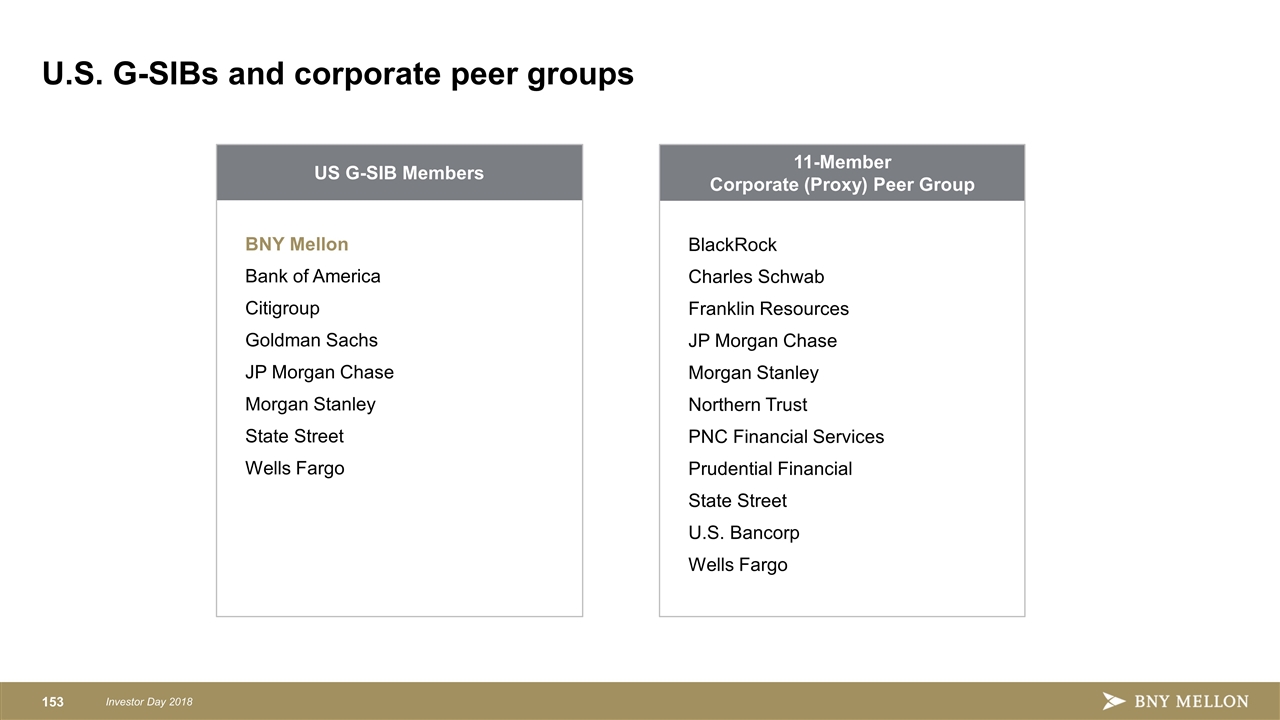

Business performs well in stress Source: Federal Reserve–Comprehensive Capital Analysis and Review (CCAR). NOTE: U.S. G-SIBs peer group average excludes BK and STT. NTRS is not designated as a U.S. G-SIB. Reduction in Tier 1 Leverage Ratio after Stress (2017 CCAR Severely Adverse Scenario) Significantly less impact on capital ratios than other G-SIBs BNY Mellon

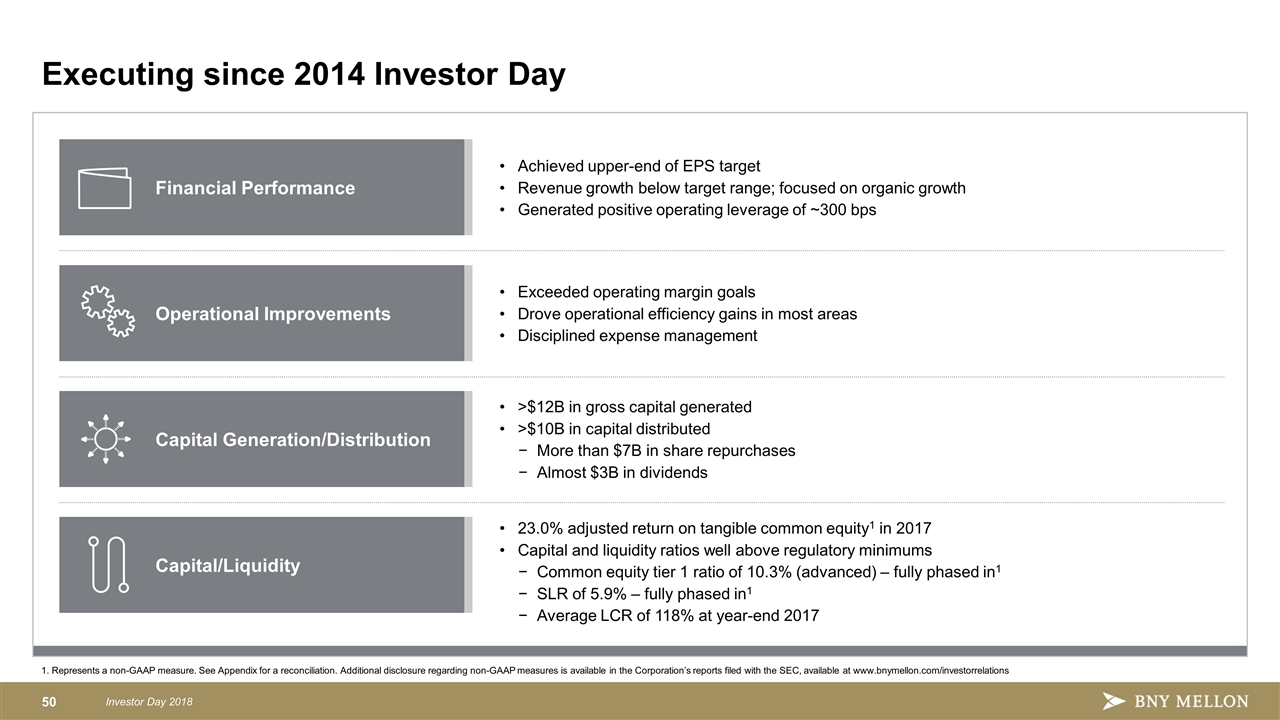

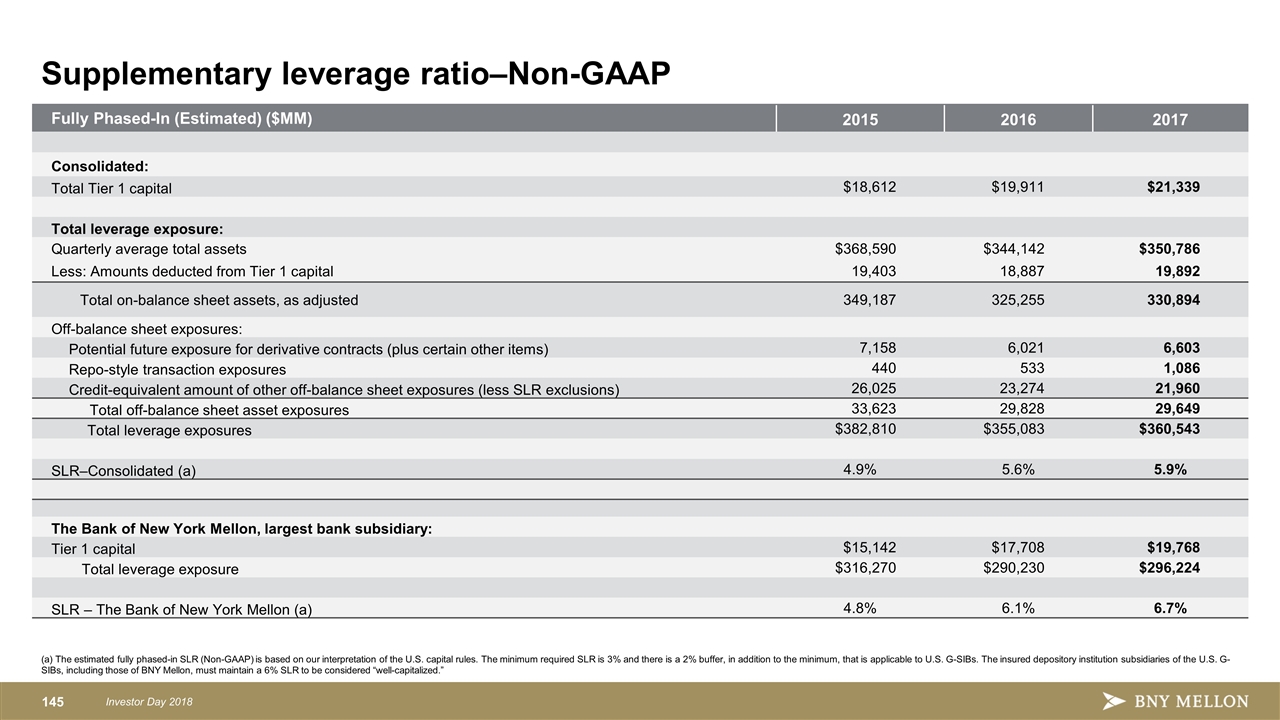

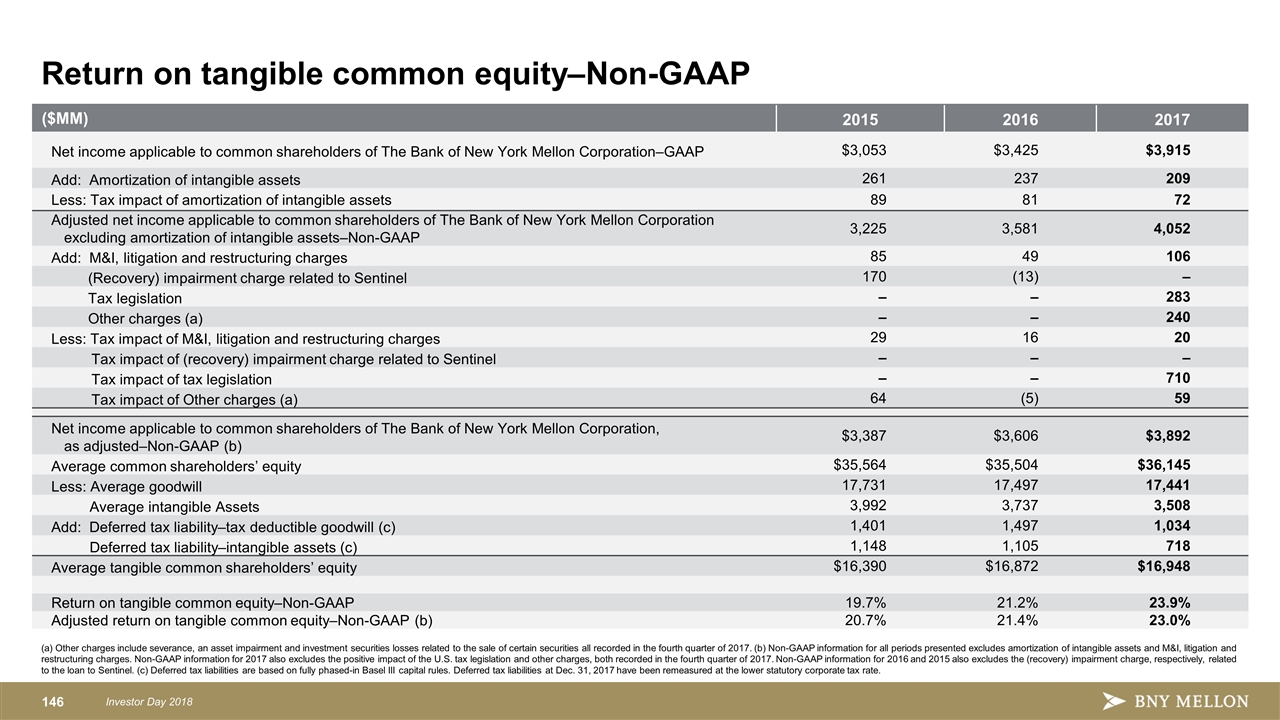

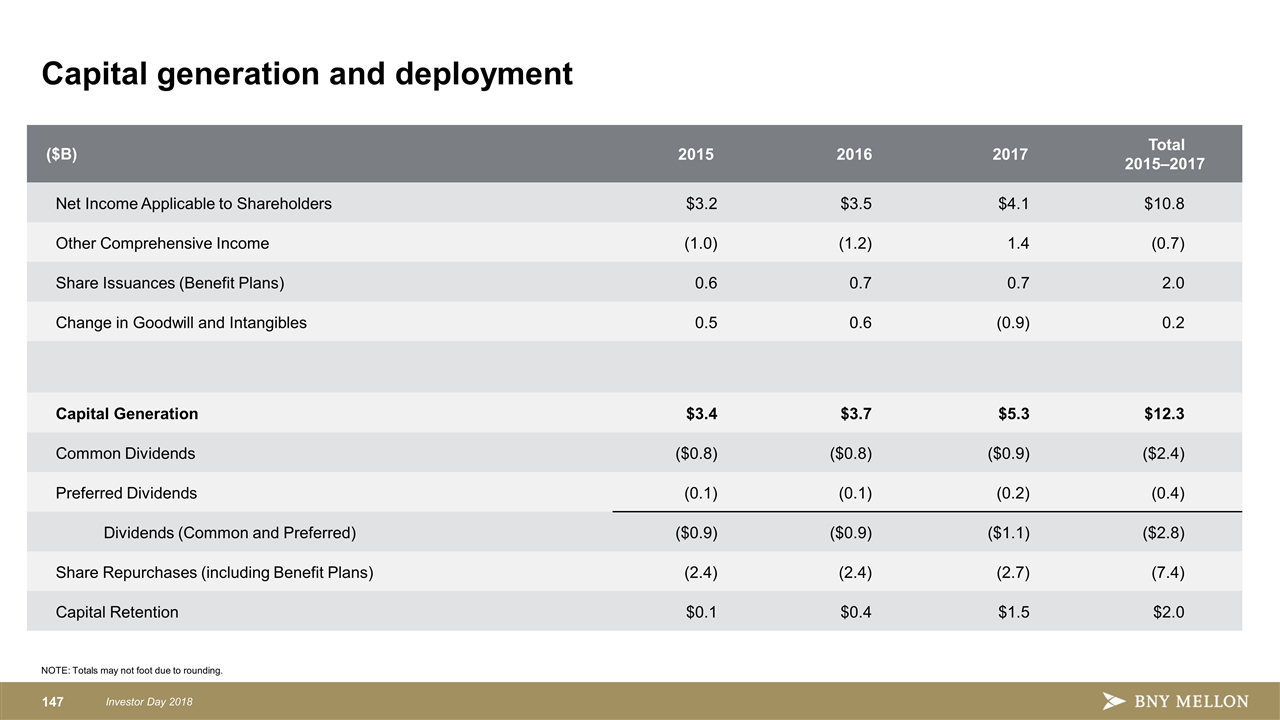

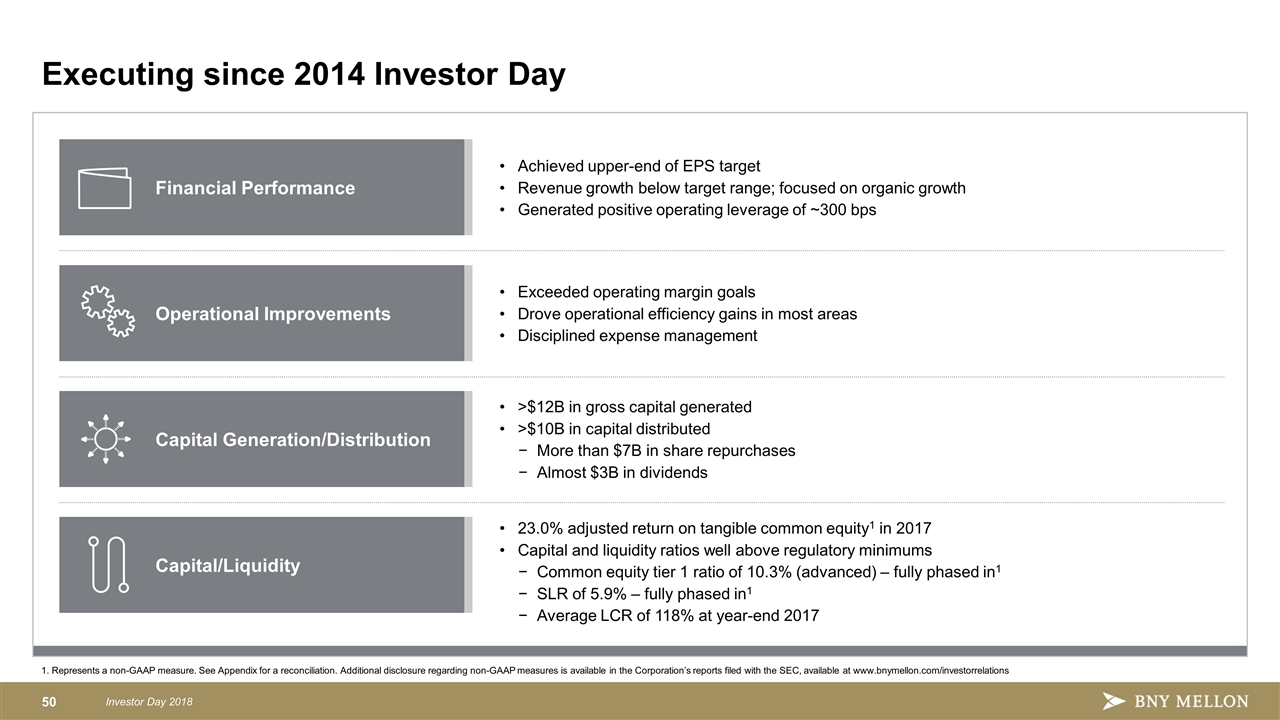

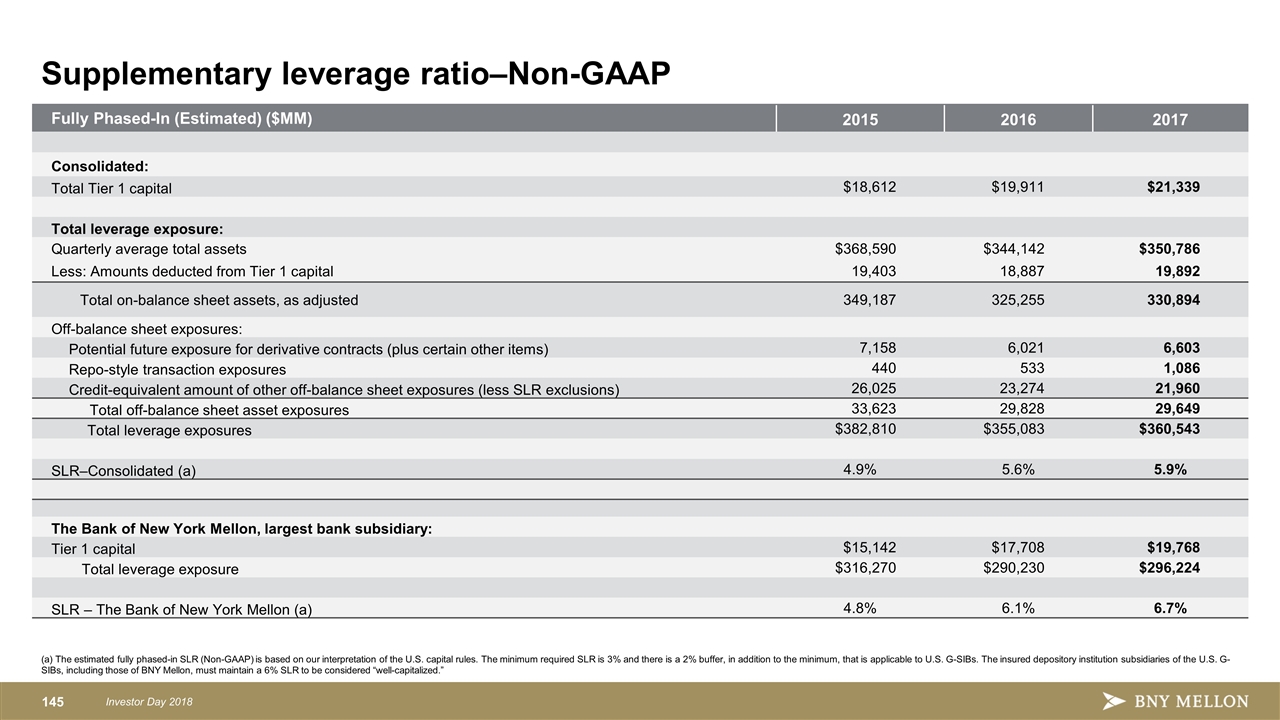

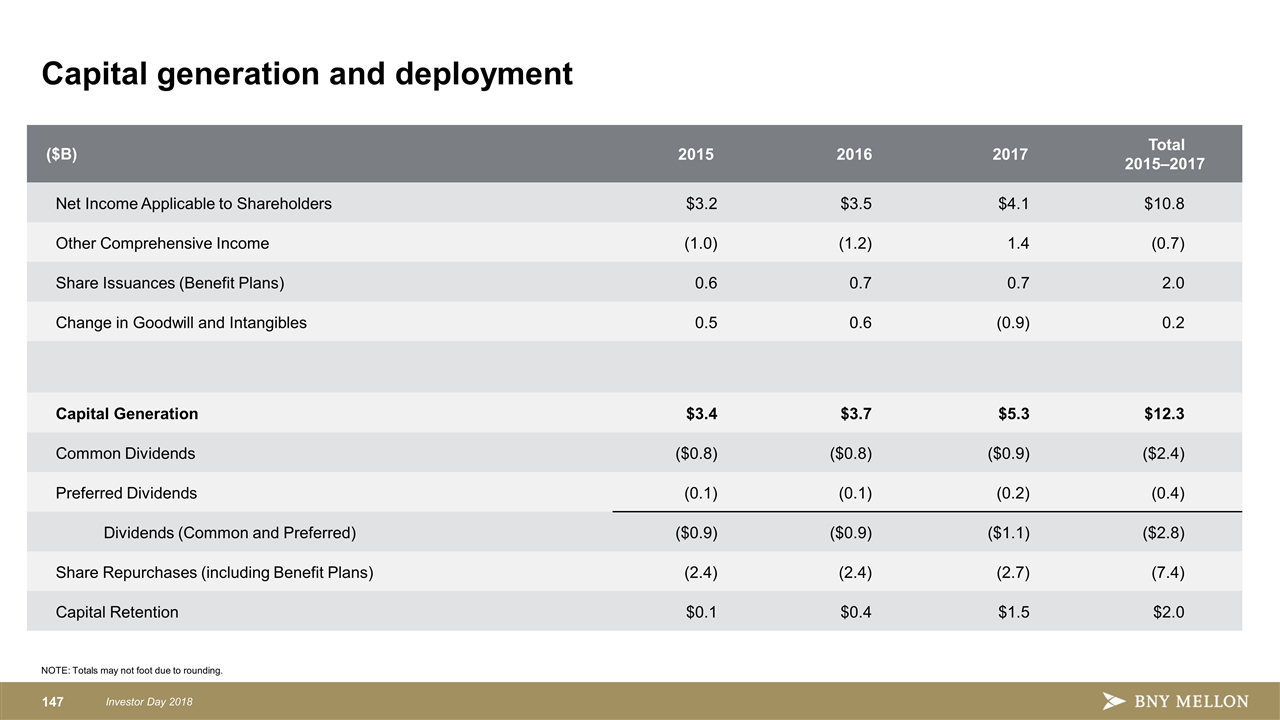

Executing since 2014 Investor Day 1. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations Achieved upper-end of EPS target Revenue growth below target range; focused on organic growth Generated positive operating leverage of ~300 bps Exceeded operating margin goals Drove operational efficiency gains in most areas Disciplined expense management >$12B in gross capital generated >$10B in capital distributed More than $7B in share repurchases Almost $3B in dividends 23.0% adjusted return on tangible common equity1 in 2017 Capital and liquidity ratios well above regulatory minimums Common equity tier 1 ratio of 10.3% (advanced) – fully phased in1 SLR of 5.9% – fully phased in1 Average LCR of 118% at year-end 2017 Financial Performance Operational Improvements Capital Generation/Distribution Capital/Liquidity

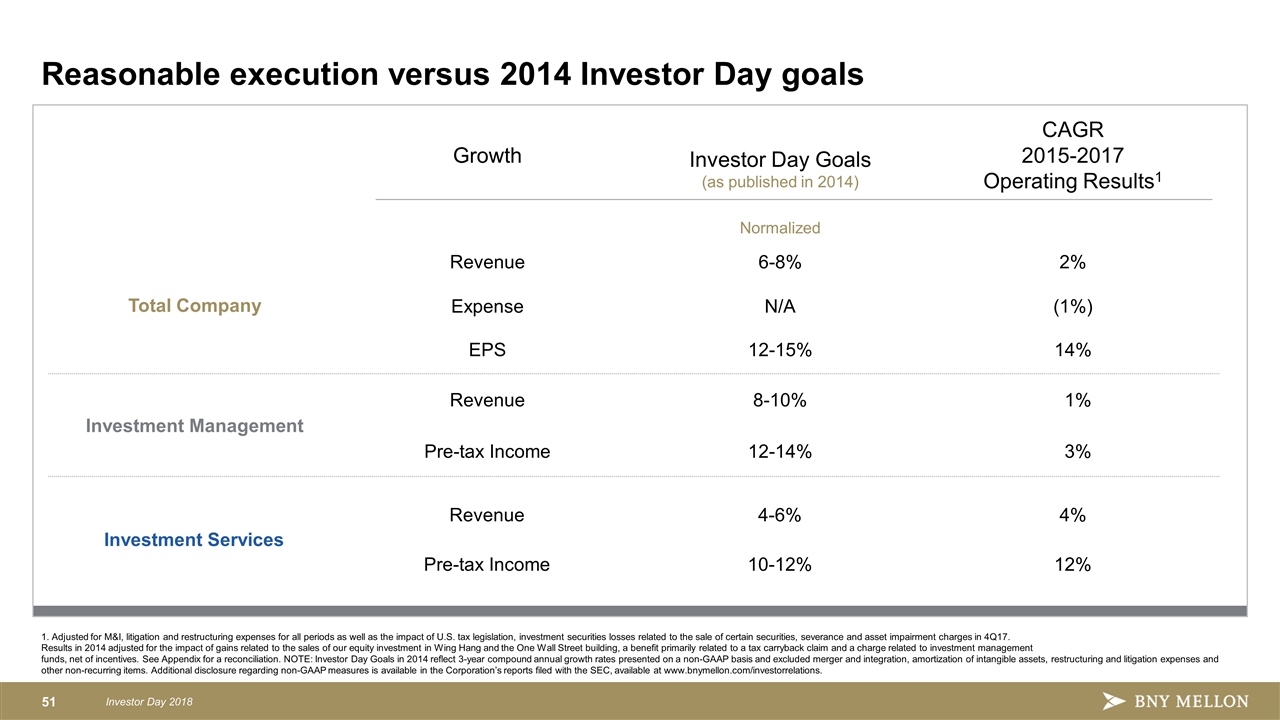

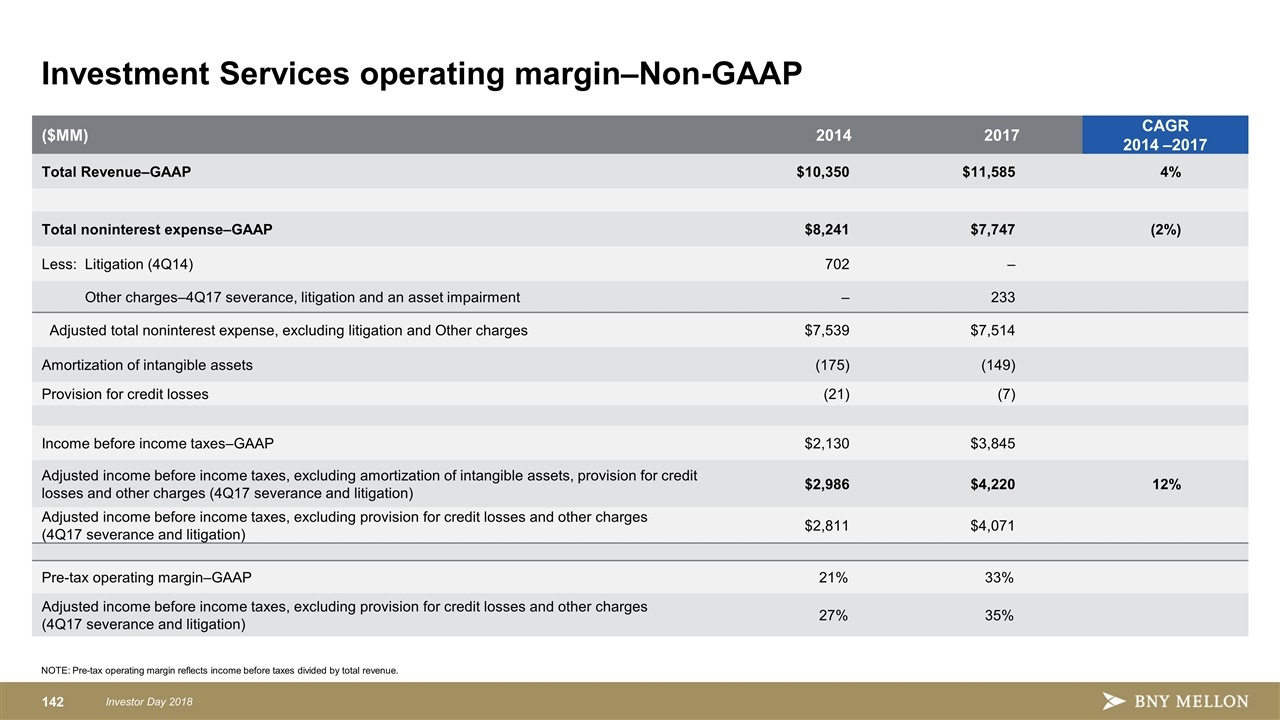

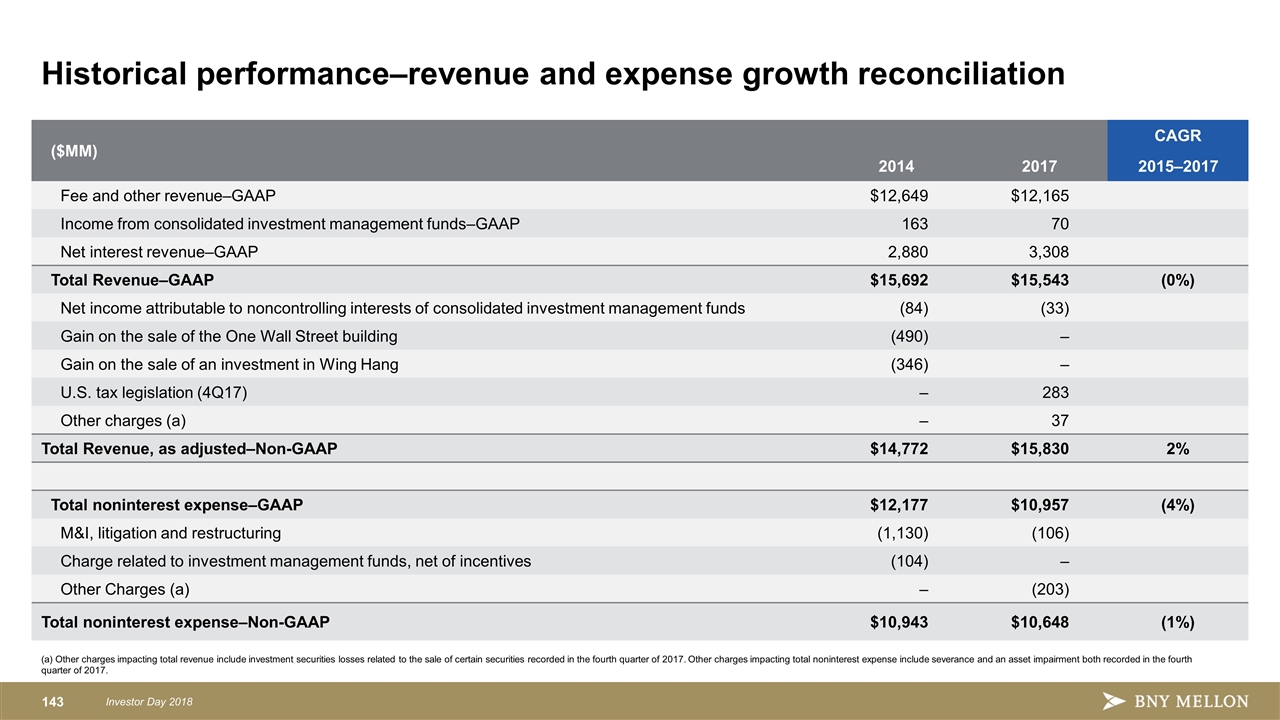

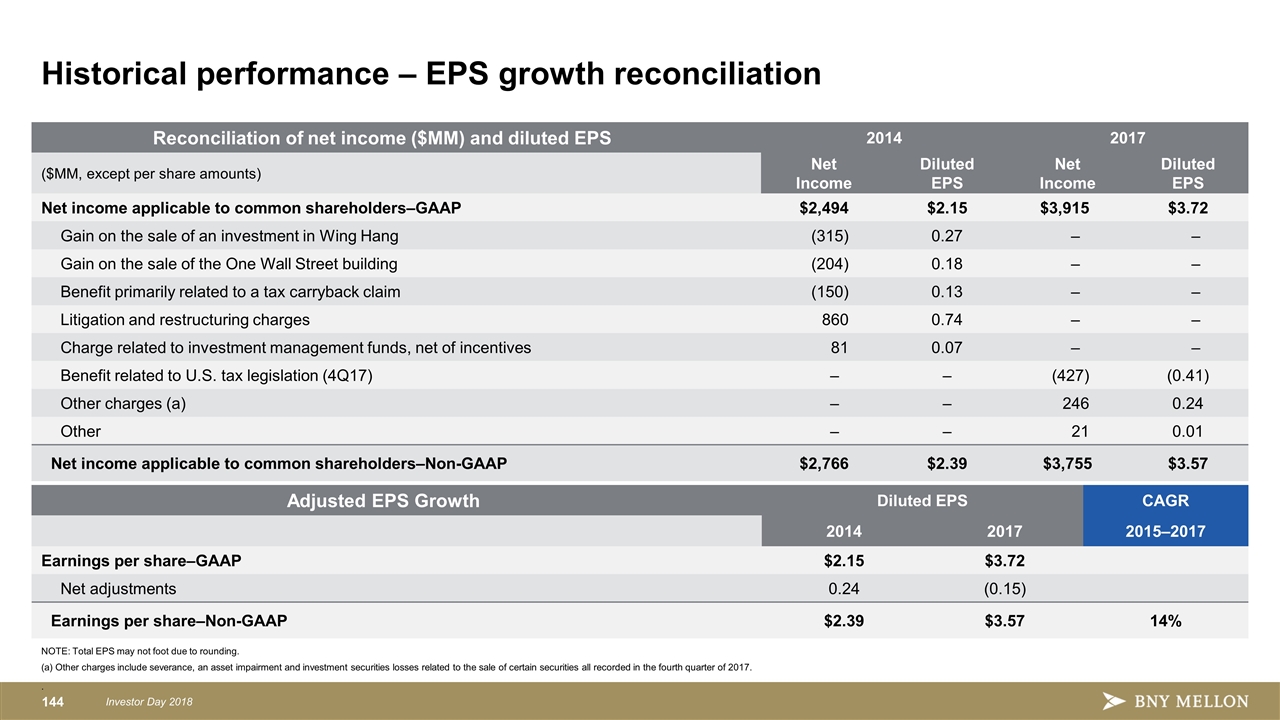

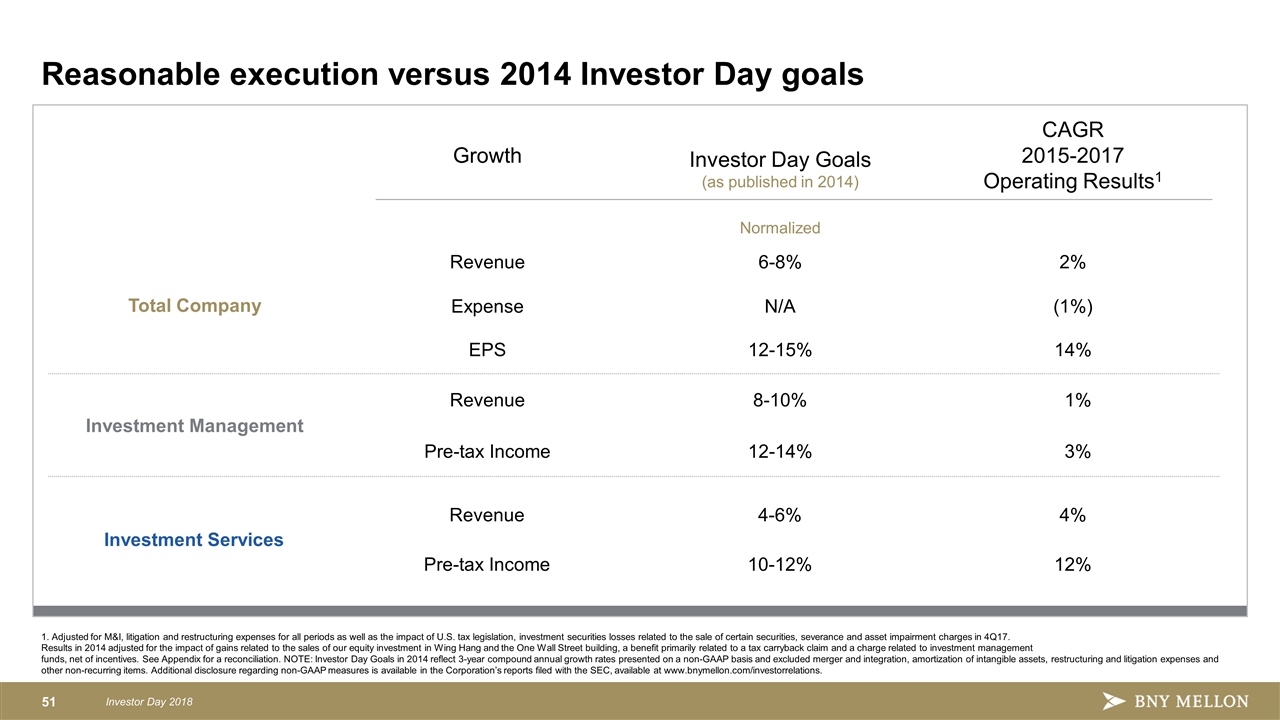

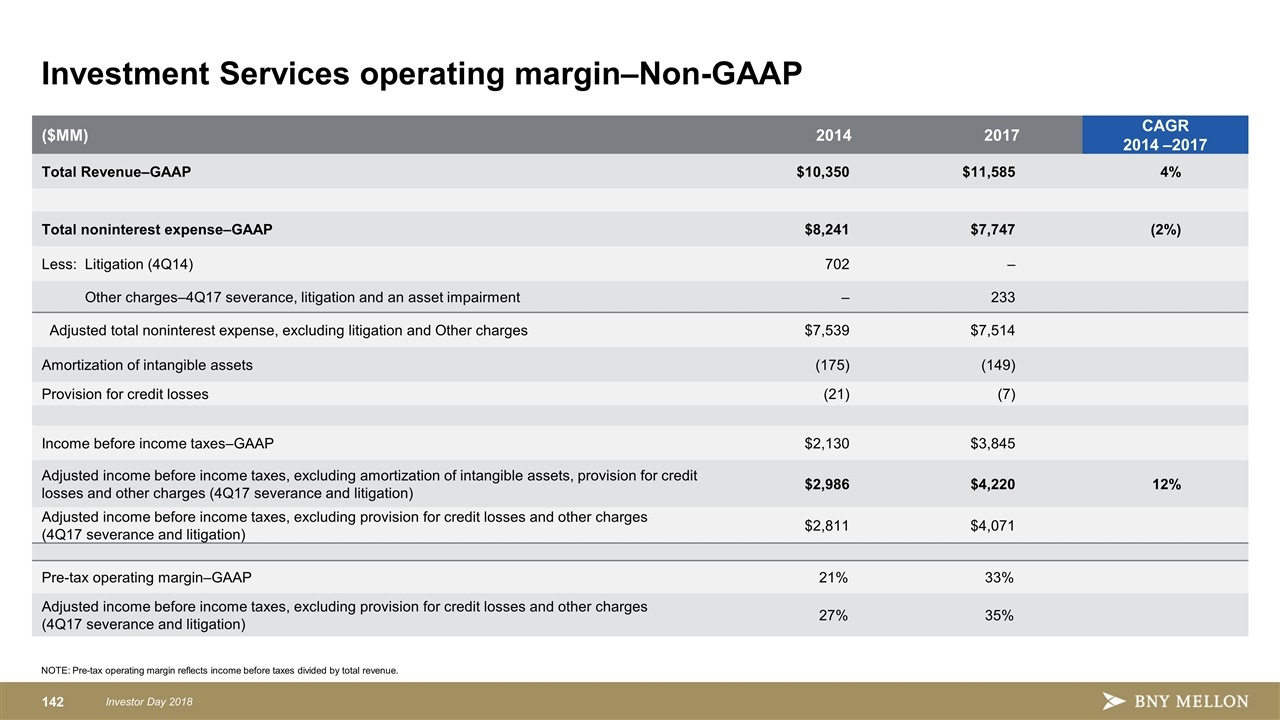

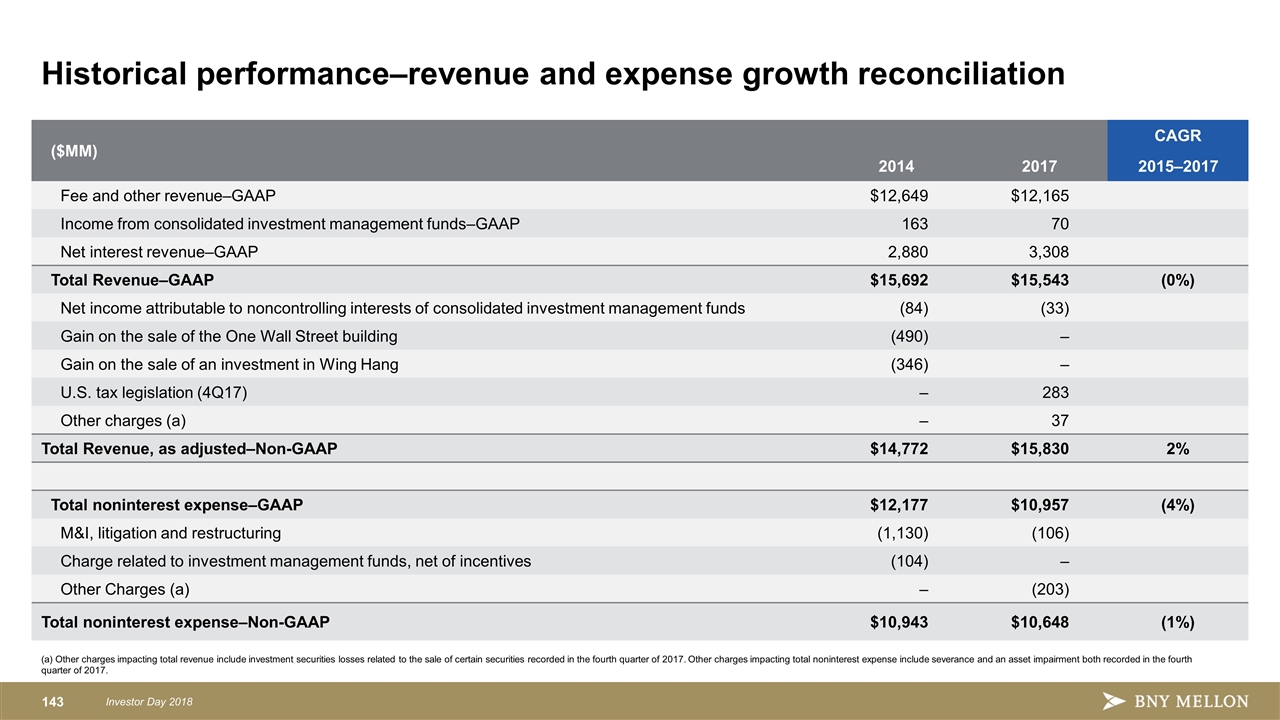

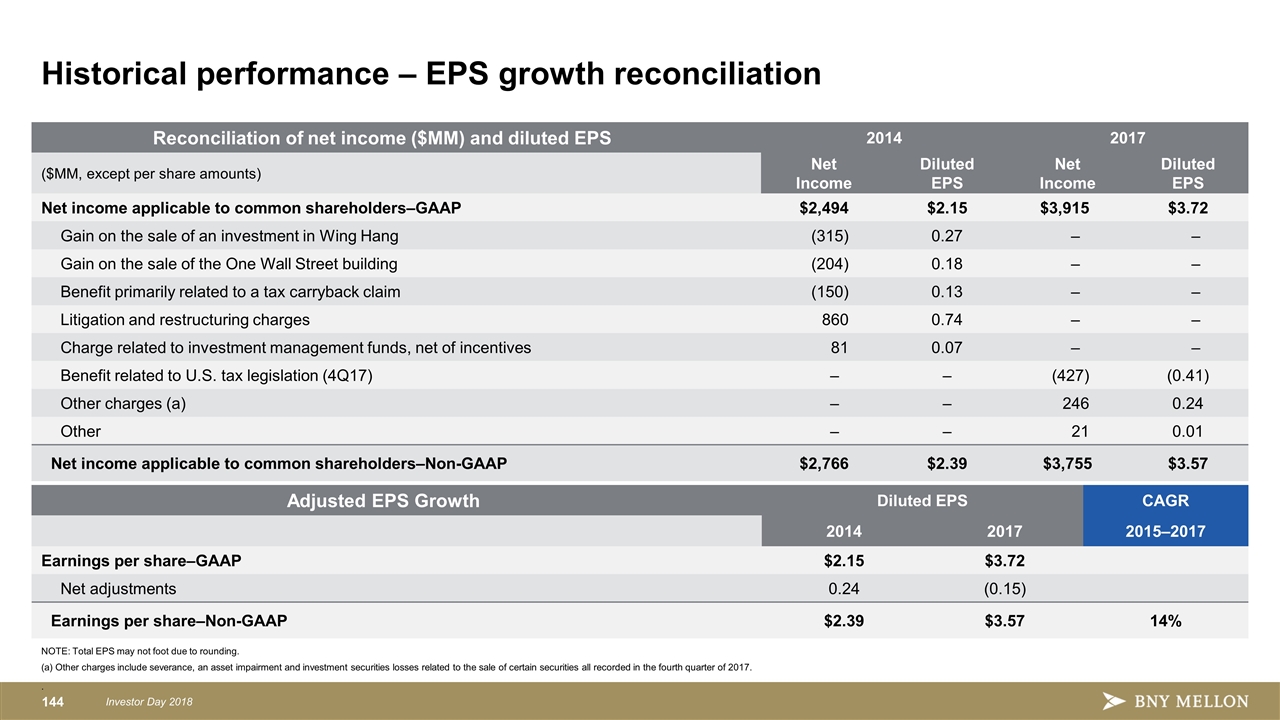

1. Adjusted for M&I, litigation and restructuring expenses for all periods as well as the impact of U.S. tax legislation, investment securities losses related to the sale of certain securities, severance and asset impairment charges in 4Q17. Results in 2014 adjusted for the impact of gains related to the sales of our equity investment in Wing Hang and the One Wall Street building, a benefit primarily related to a tax carryback claim and a charge related to investment management funds, net of incentives. See Appendix for a reconciliation. NOTE: Investor Day Goals in 2014 reflect 3-year compound annual growth rates presented on a non-GAAP basis and excluded merger and integration, amortization of intangible assets, restructuring and litigation expenses and other non-recurring items. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Reasonable execution versus 2014 Investor Day goals Growth Investor Day Goals (as published in 2014) CAGR 2015-2017 Operating Results1 Normalized Total Company Revenue 6-8% 2% Expense N/A (1%) EPS 12-15% 14% Investment Management Revenue 8-10% 1% Pre-tax Income 12-14% 3% Investment Services Revenue 4-6% 4% Pre-tax Income 10-12% 12%

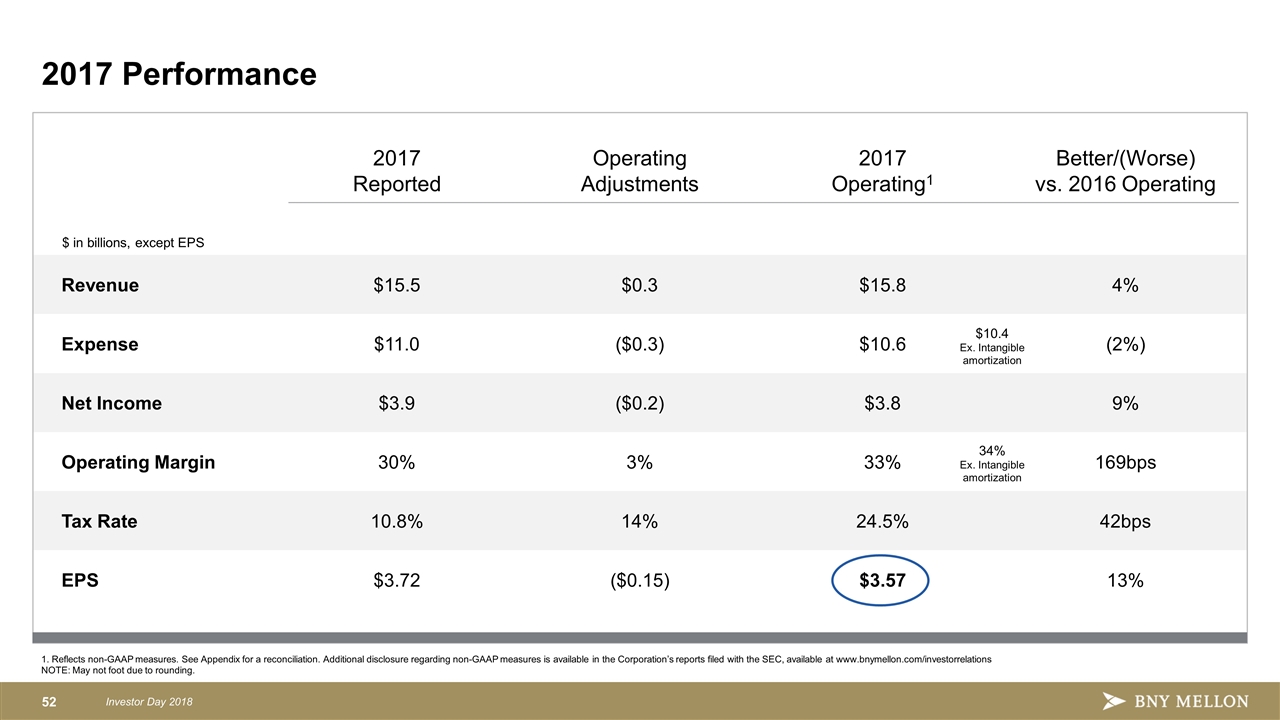

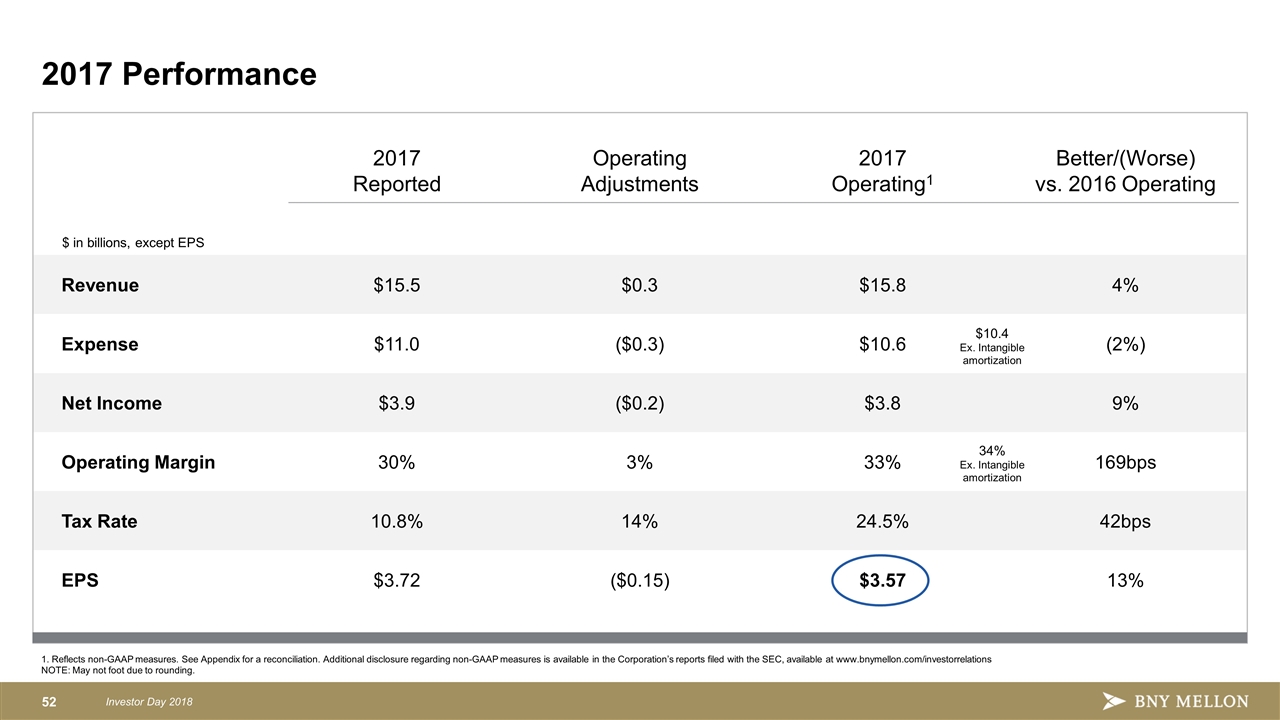

2017 Reported Operating Adjustments 2017 Operating1 Better/(Worse) vs. 2016 Operating Revenue $15.5 $0.3 $15.8 4% Expense $11.0 ($0.3) $10.6 (2%) Net Income $3.9 ($0.2) $3.8 9% Operating Margin 30% 3% 33% 169bps Tax Rate 10.8% 14% 24.5% 42bps EPS $3.72 ($0.15) $3.57 13% 2017 Performance 1. Reflects non-GAAP measures. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations NOTE: May not foot due to rounding. $ in billions, except EPS 34% Ex. Intangible amortization $10.4 Ex. Intangible amortization

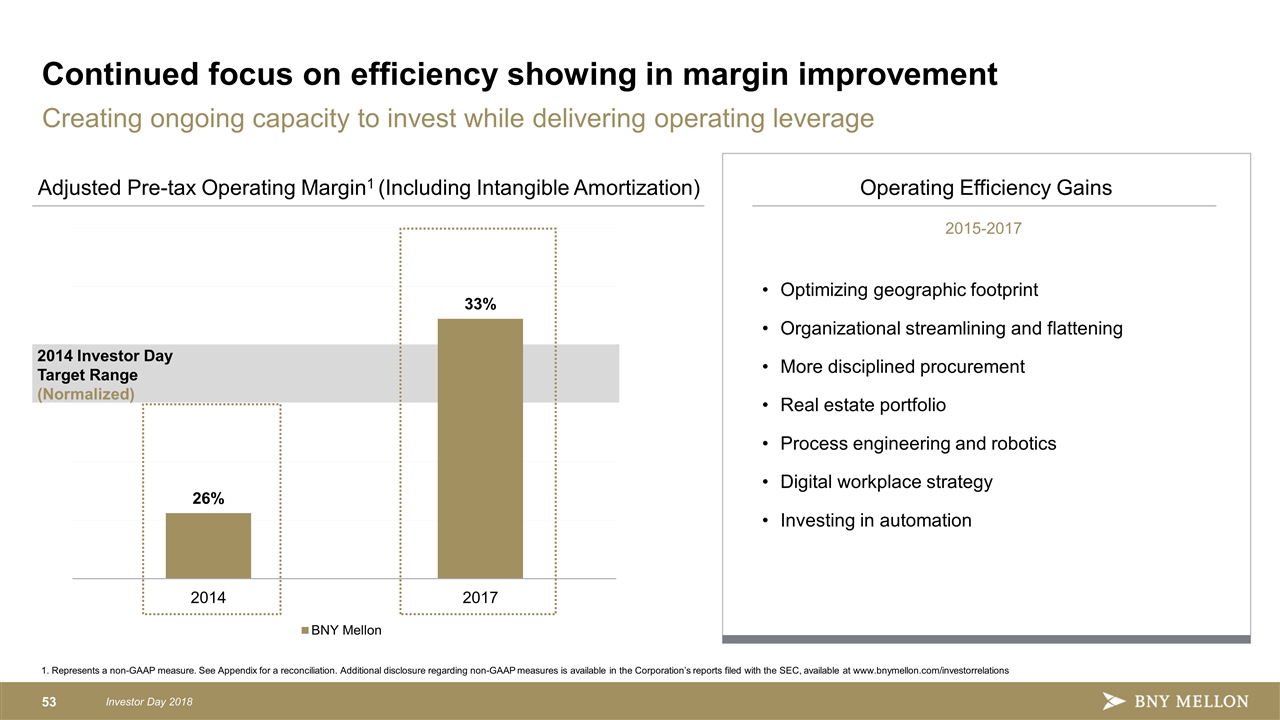

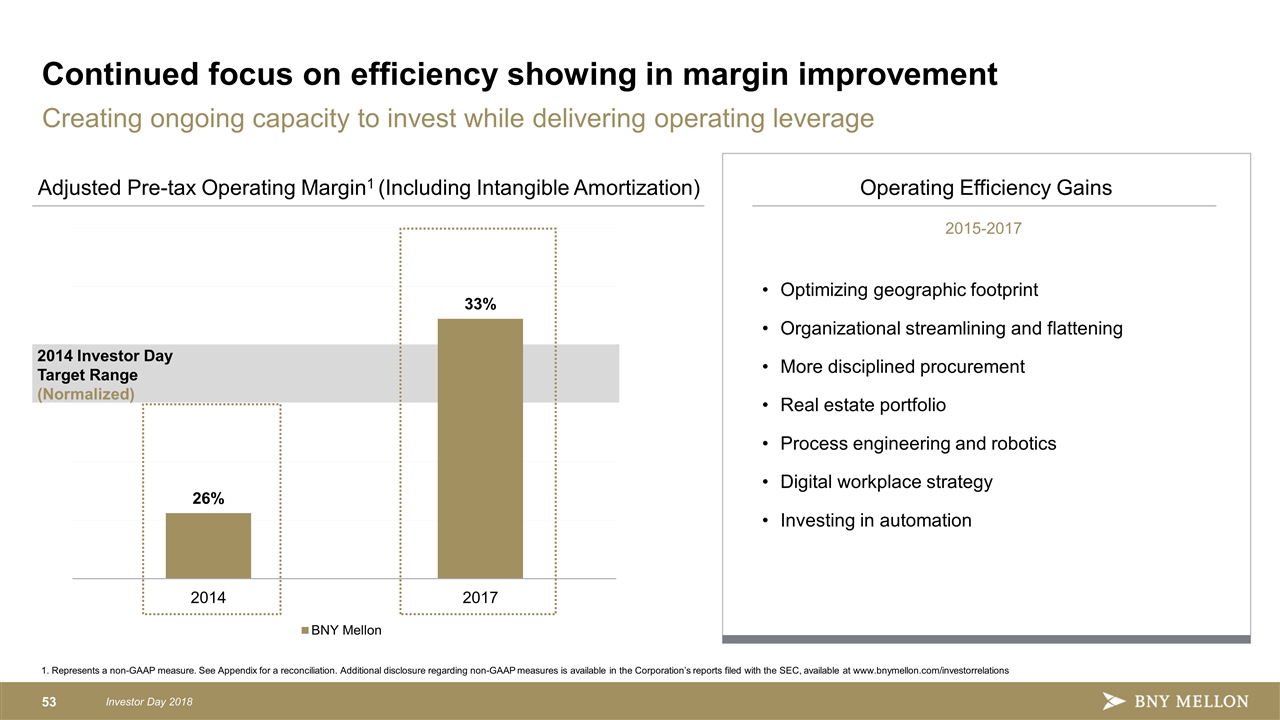

Continued focus on efficiency showing in margin improvement 1. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations Creating ongoing capacity to invest while delivering operating leverage 2014 Investor Day Target Range (Normalized) Operating Efficiency Gains Adjusted Pre-tax Operating Margin1 (Including Intangible Amortization) 2015-2017 Optimizing geographic footprint Organizational streamlining and flattening More disciplined procurement Real estate portfolio Process engineering and robotics Digital workplace strategy Investing in automation

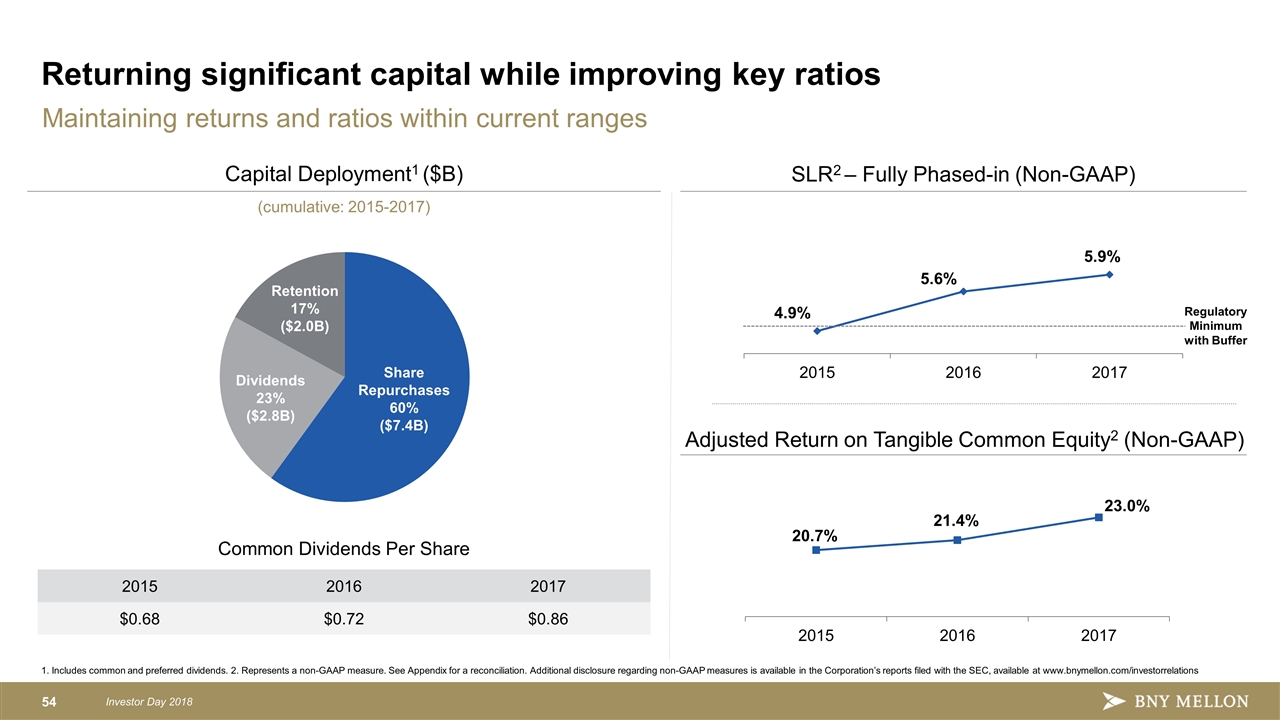

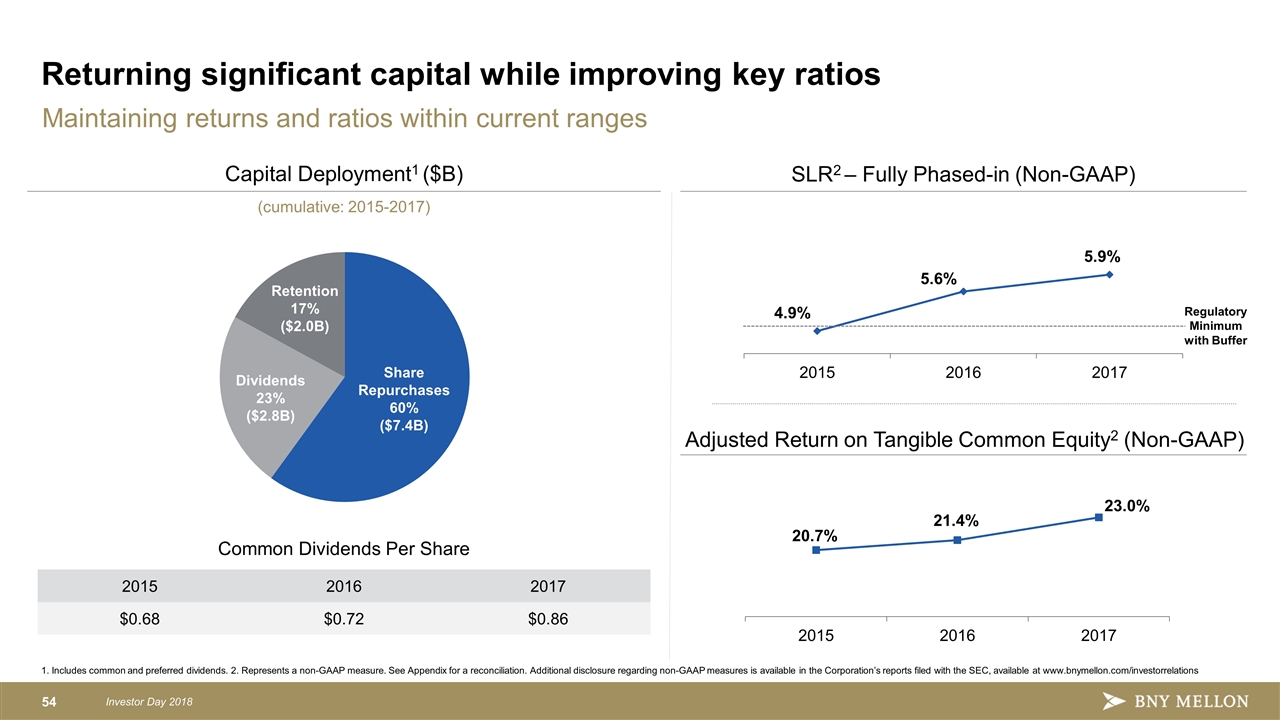

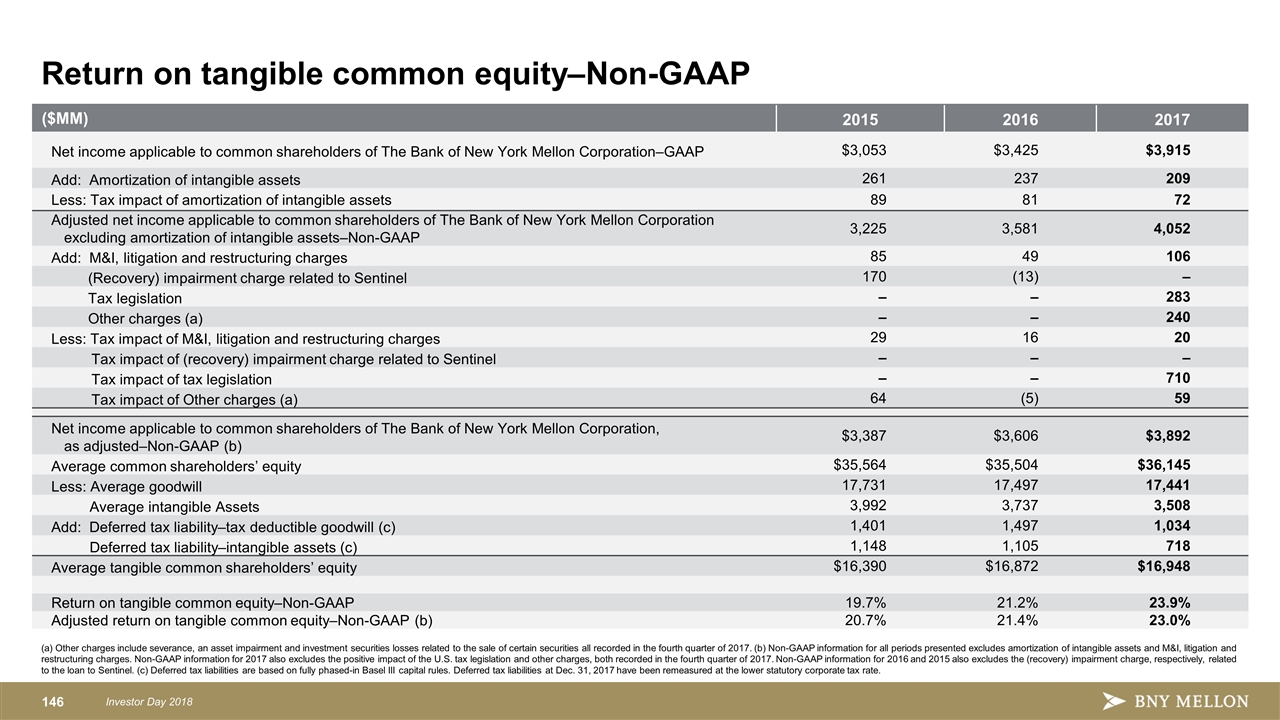

Maintaining returns and ratios within current ranges 1. Includes common and preferred dividends. 2. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations Returning significant capital while improving key ratios Adjusted Return on Tangible Common Equity2 (Non-GAAP) SLR2 – Fully Phased-in (Non-GAAP) Capital Deployment1 ($B) (cumulative: 2015-2017) 2015 2016 2017 $0.68 $0.72 $0.86 Common Dividends Per Share Regulatory Minimum with Buffer Share Repurchases 60% ($7.4B) Dividends 23% ($2.8B) Retention 17% ($2.0B)

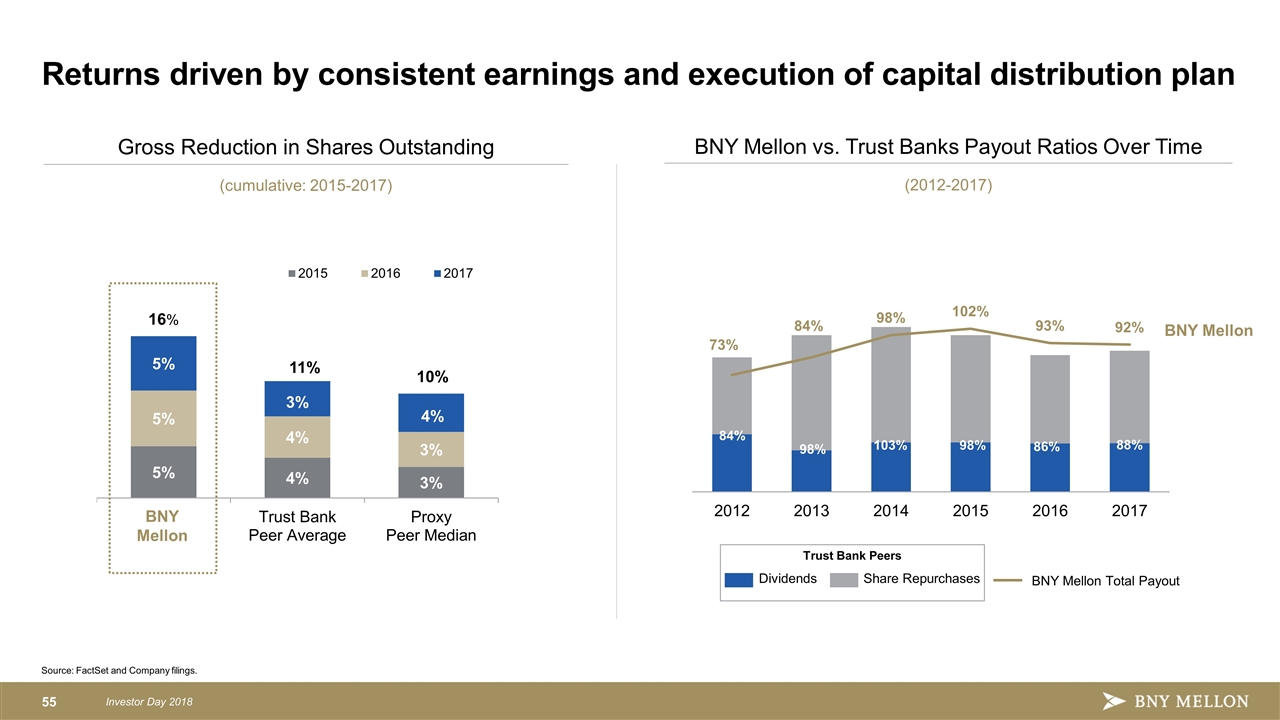

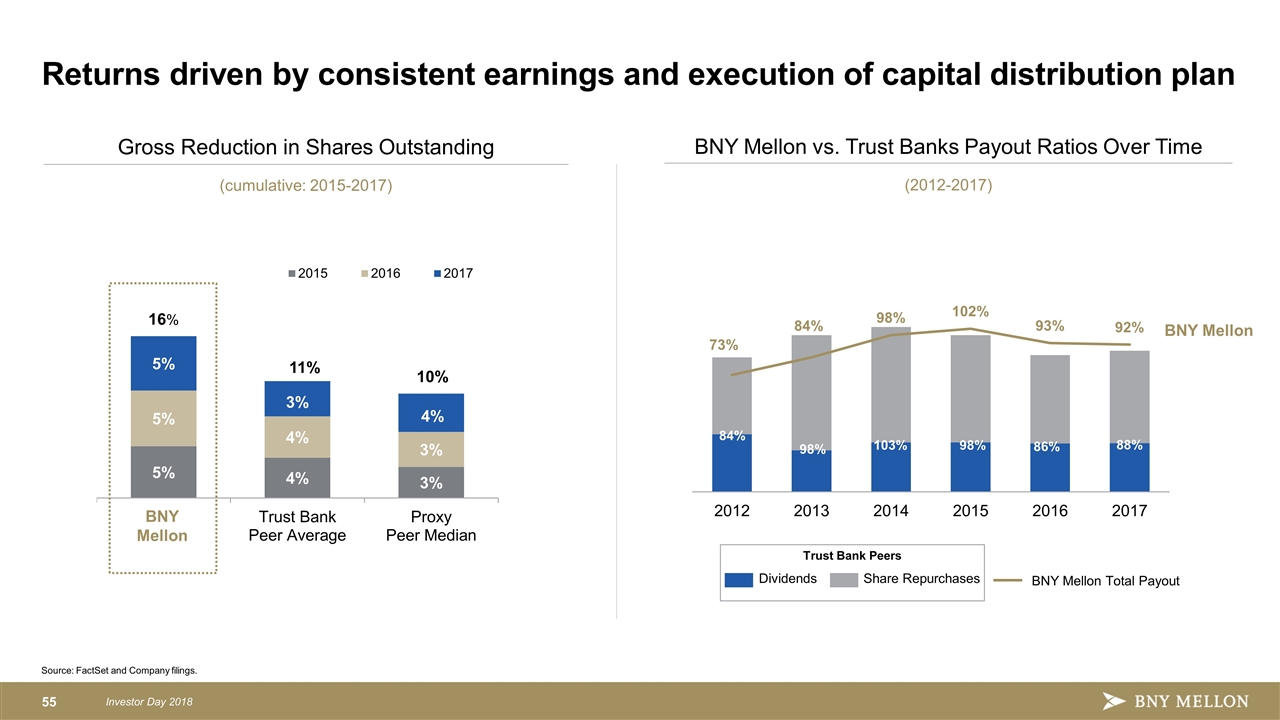

Returns driven by consistent earnings and execution of capital distribution plan Source: FactSet and Company filings. Gross Reduction in Shares Outstanding (cumulative: 2015-2017) BNY Mellon BNY Mellon vs. Trust Banks Payout Ratios Over Time (2012-2017) 11% 10% BNY Mellon Dividends Share Repurchases BNY Mellon Total Payout Trust Bank Peers

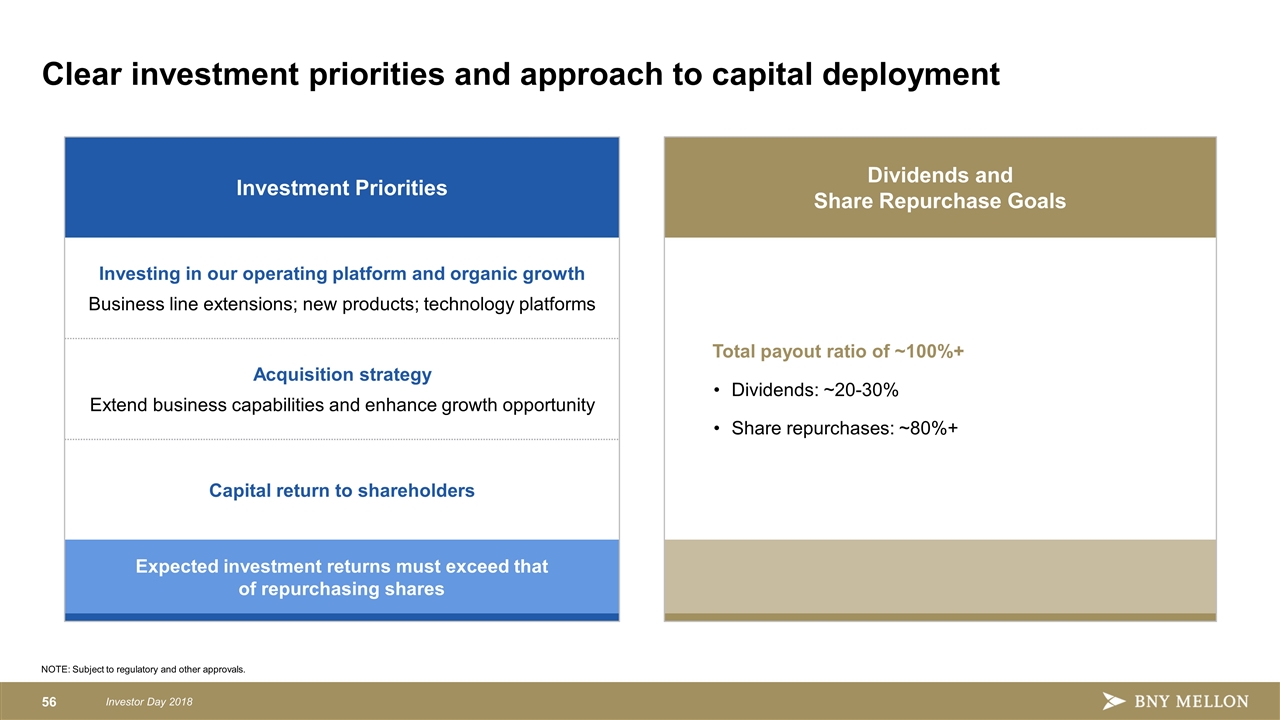

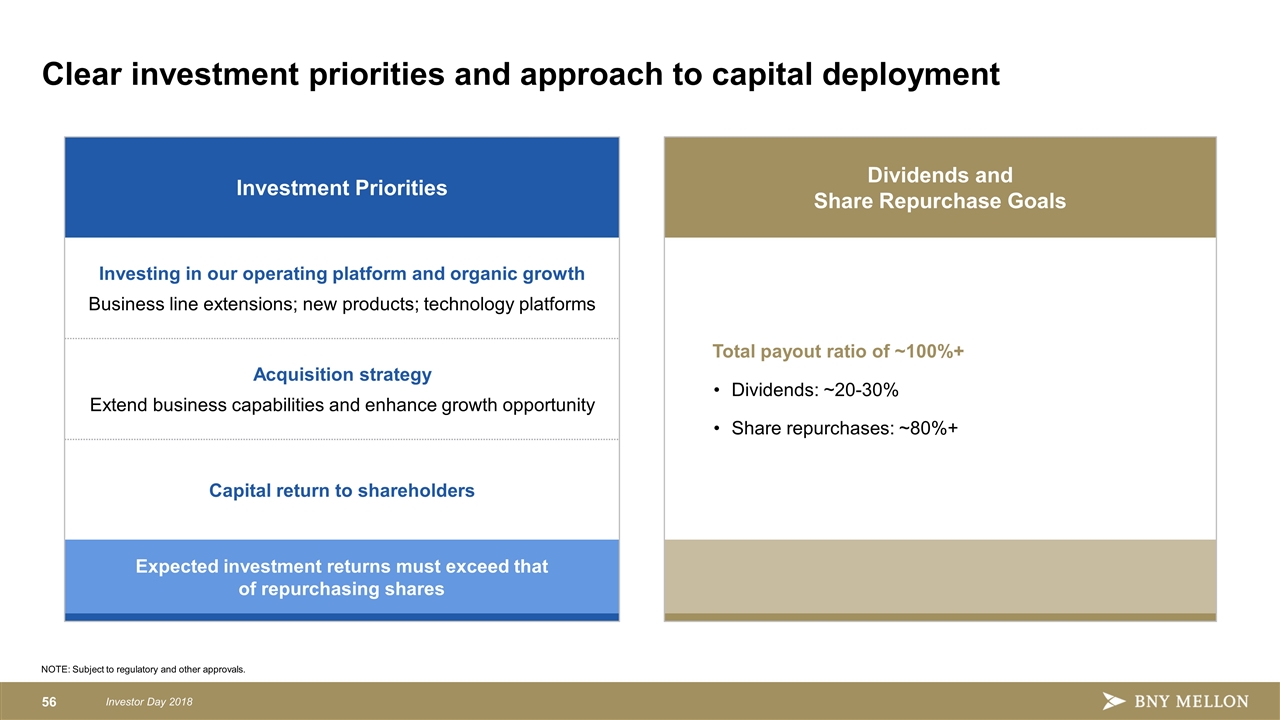

Clear investment priorities and approach to capital deployment NOTE: Subject to regulatory and other approvals. Investment Priorities Dividends and Share Repurchase Goals Investing in our operating platform and organic growth Business line extensions; new products; technology platforms Total payout ratio of ~100%+ Dividends: ~20-30% Share repurchases: ~80%+ Acquisition strategy Extend business capabilities and enhance growth opportunity Capital return to shareholders Expected investment returns must exceed that of repurchasing shares

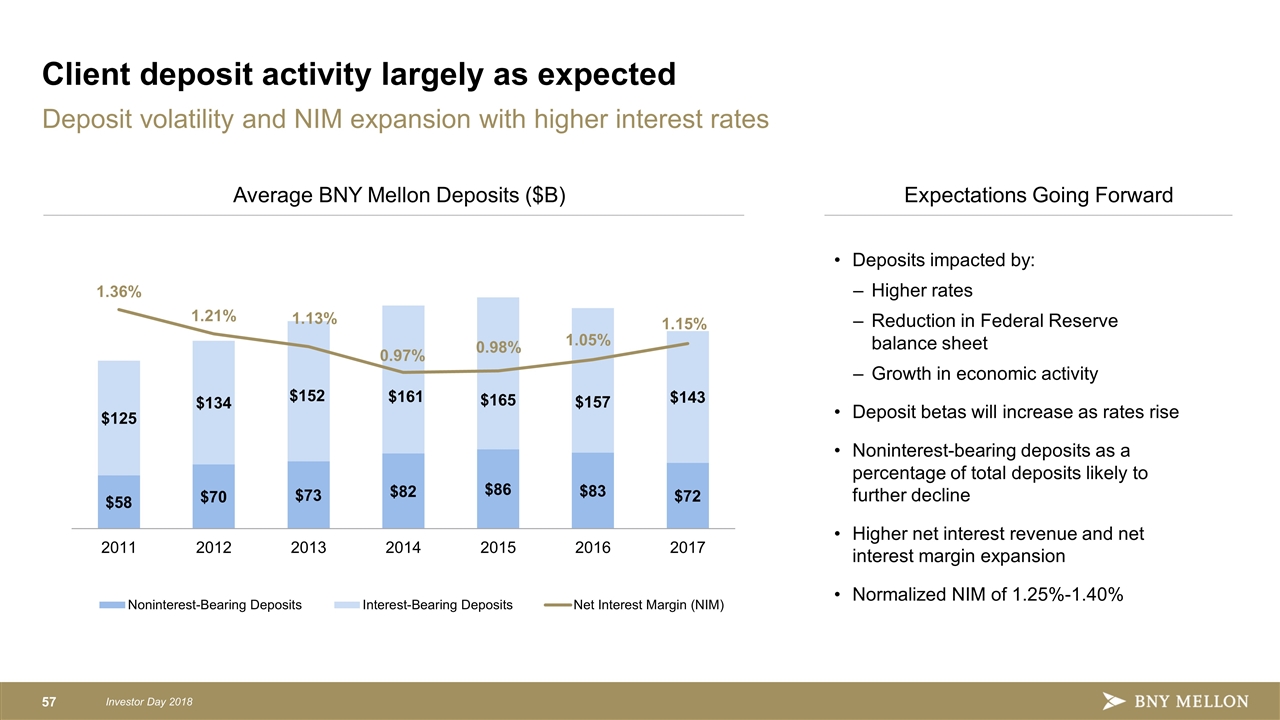

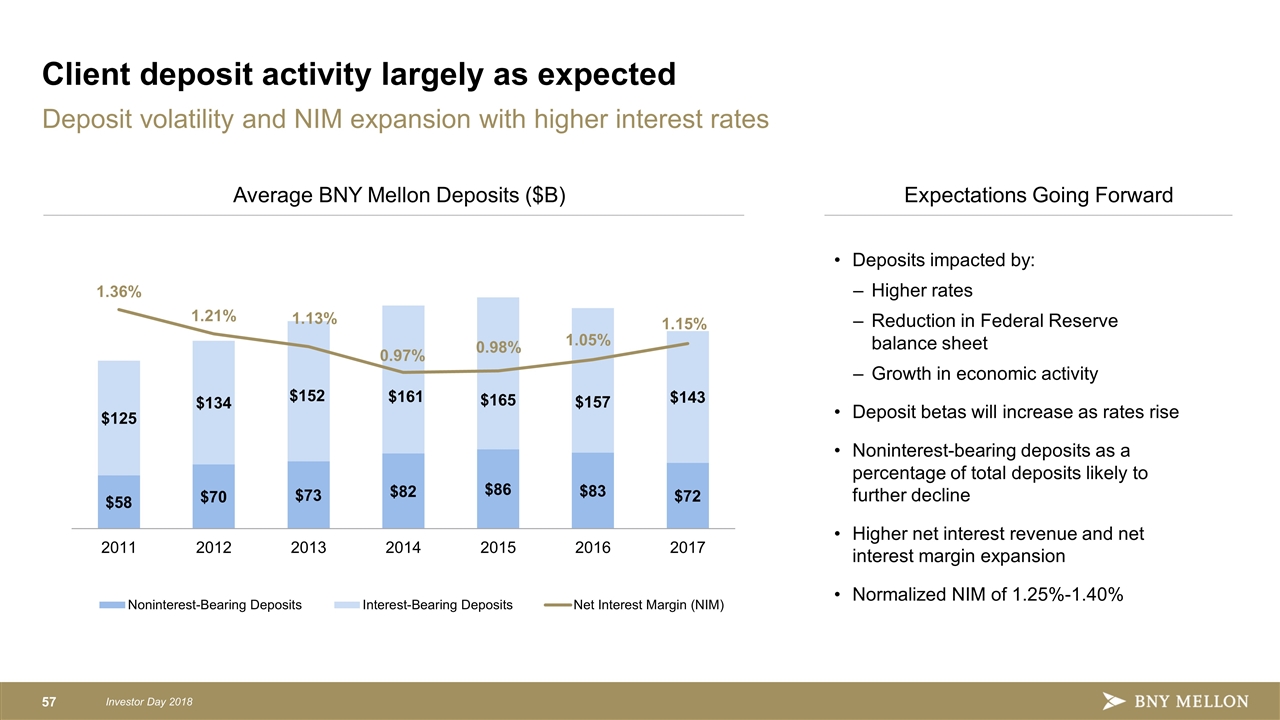

Client deposit activity largely as expected Average BNY Mellon Deposits ($B) Deposits impacted by: Higher rates Reduction in Federal Reserve balance sheet Growth in economic activity Deposit betas will increase as rates rise Noninterest-bearing deposits as a percentage of total deposits likely to further decline Higher net interest revenue and net interest margin expansion Normalized NIM of 1.25%-1.40% Expectations Going Forward Deposit volatility and NIM expansion with higher interest rates

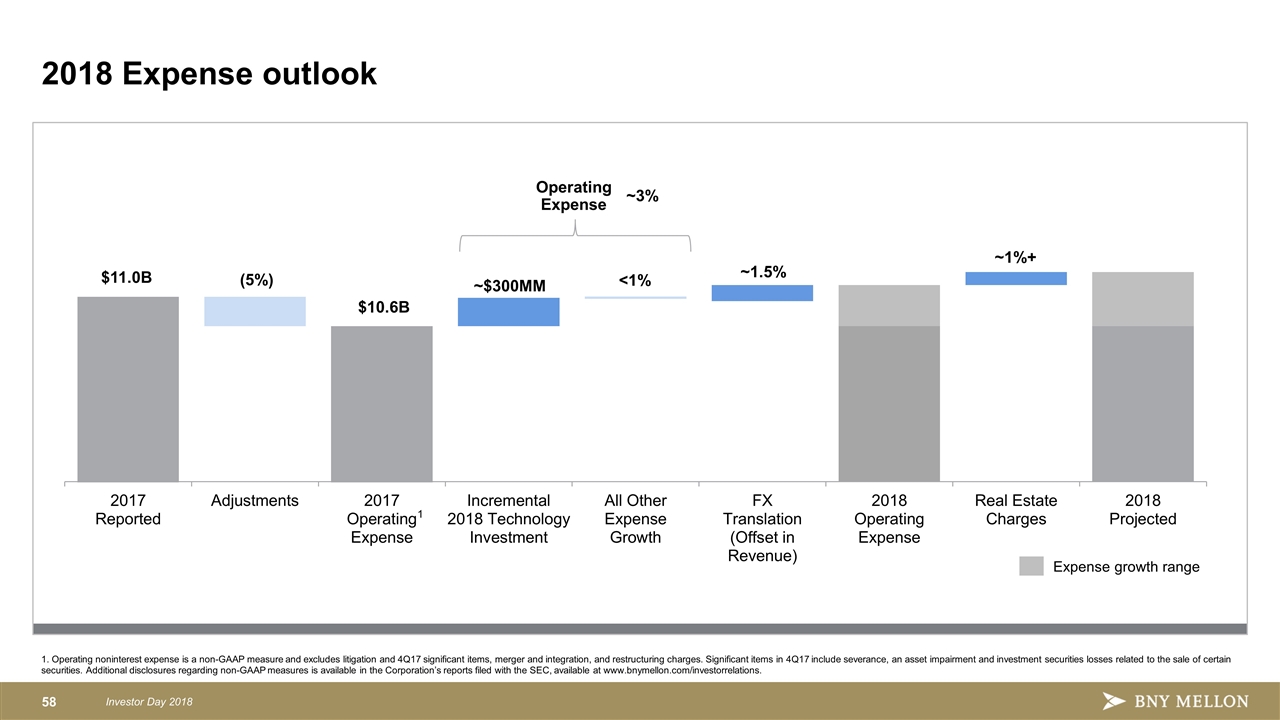

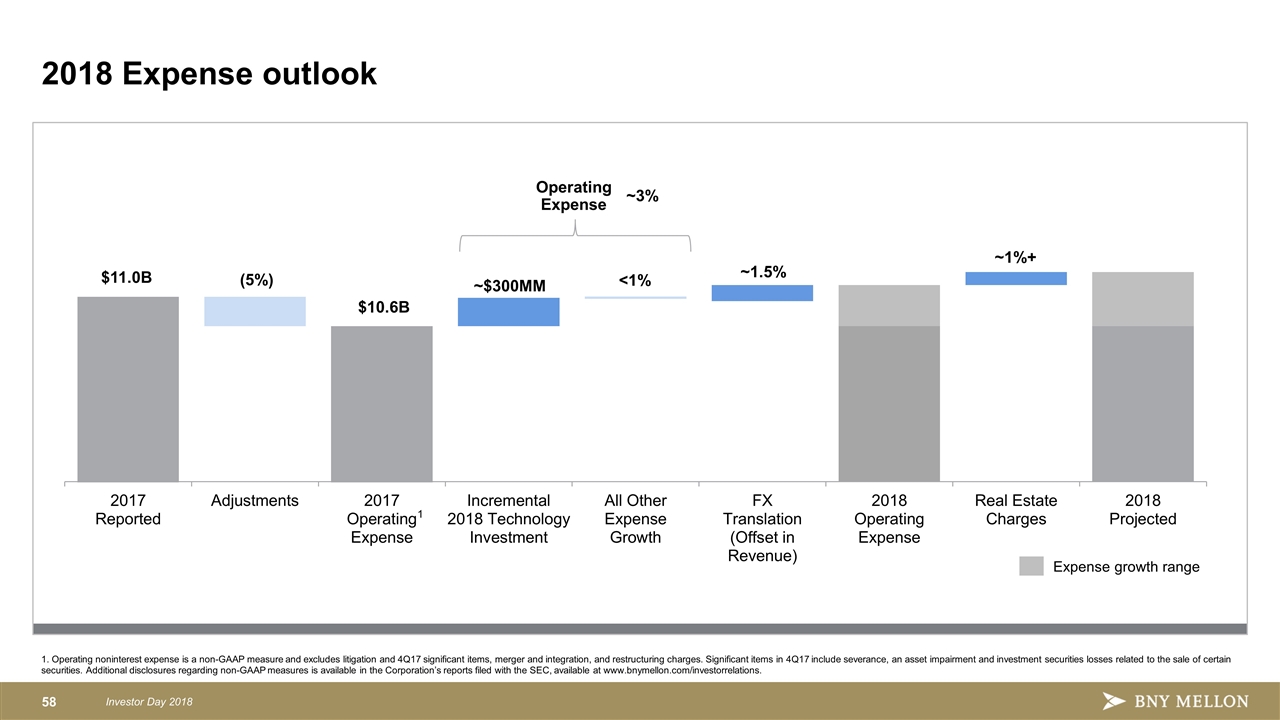

1. Operating noninterest expense is a non-GAAP measure and excludes litigation and 4Q17 significant items, merger and integration, and restructuring charges. Significant items in 4Q17 include severance, an asset impairment and investment securities losses related to the sale of certain securities. Additional disclosures regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. ~$300MM $11.0B (5%) <1% $10.6B 2018 Expense outlook ~1.5% Operating Expense ~3% 1 Expense growth range ~1%+

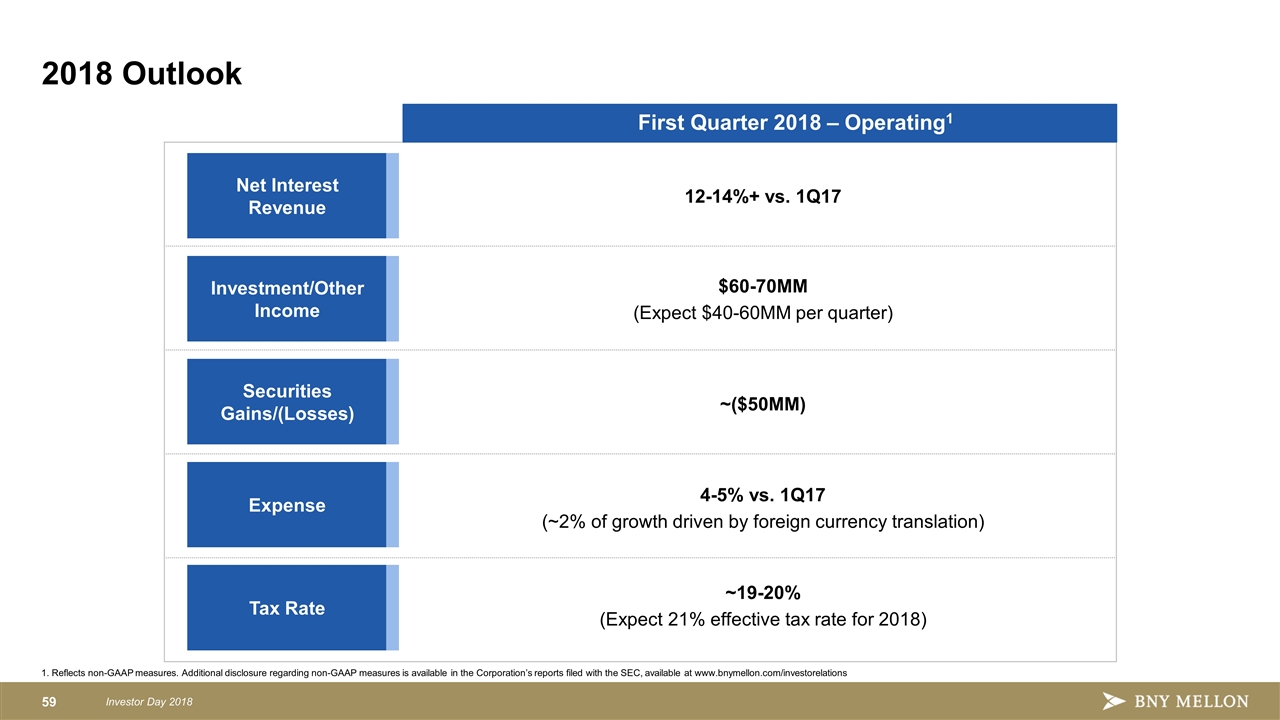

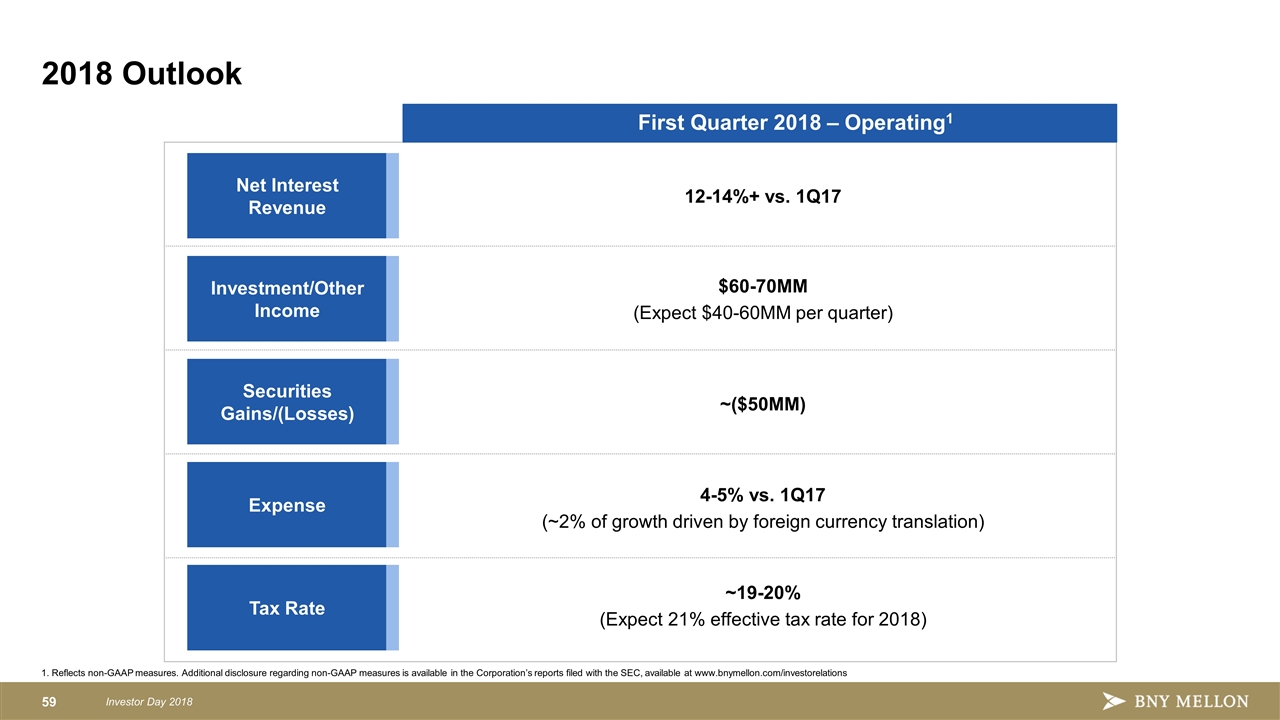

12-14%+ vs. 1Q17 2018 Outlook Net Interest Revenue Investment/Other Income Securities Gains/(Losses) Expense Tax Rate $60-70MM (Expect $40-60MM per quarter) ~($50MM) 4-5% vs. 1Q17 (~2% of growth driven by foreign currency translation) ~19-20% (Expect 21% effective tax rate for 2018) First Quarter 2018 – Operating1 1. Reflects non-GAAP measures. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorelations

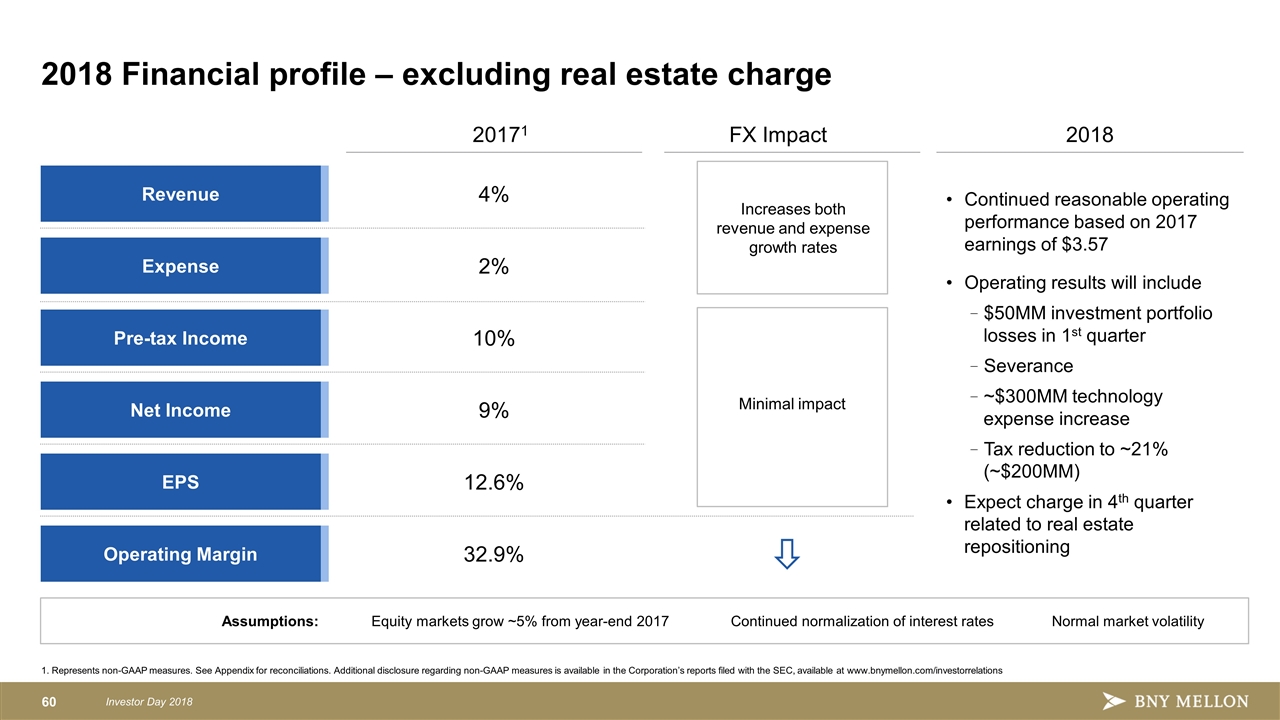

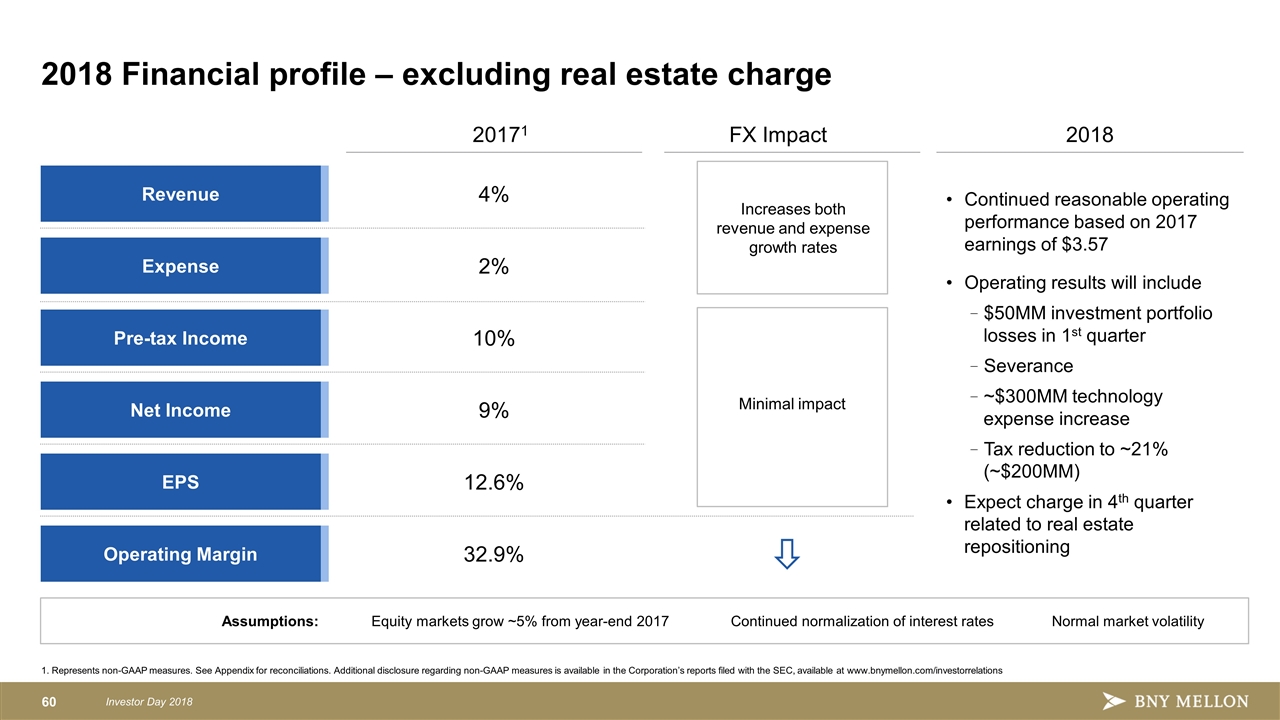

1. Represents non-GAAP measures. See Appendix for reconciliations. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations 2018 Financial profile – excluding real estate charge Revenue Expense Pre-tax Income Net Income EPS Operating Margin 4% 2% 10% 9% 12.6% 32.9% 20171 . FX Impact . Equity markets grow ~5% from year-end 2017 Assumptions: Normal market volatility Continued normalization of interest rates ñ Minimal impact Increases both revenue and expense growth rates Continued reasonable operating performance based on 2017 earnings of $3.57 Operating results will include $50MM investment portfolio losses in 1st quarter Severance ~$300MM technology expense increase Tax reduction to ~21% (~$200MM) Expect charge in 4th quarter related to real estate repositioning 2018

A dynamic model delivering long-term value to clients and shareholders 1. ROTCE represents the Return on Tangible Common Equity. This is a non-GAAP measure. See Appendix for reconciliations. Our investment thesis – delivering consistency over time Strong EPS Growth Industry leader Increasing scale benefits Positive operating leverage Positive capital generation Attractive Business Model Diversified business mix Majority of revenue from recurring fees Low risk weighted asset model enables growth with limited new capital required Serving a critical industry High Risk-Adjusted Returns Lower credit risk business model Highly liquid >20% ROTCE1

Mitchell E. Harris CEO, Investment Management Investor Day 2018 Investment Management March 8, 2018

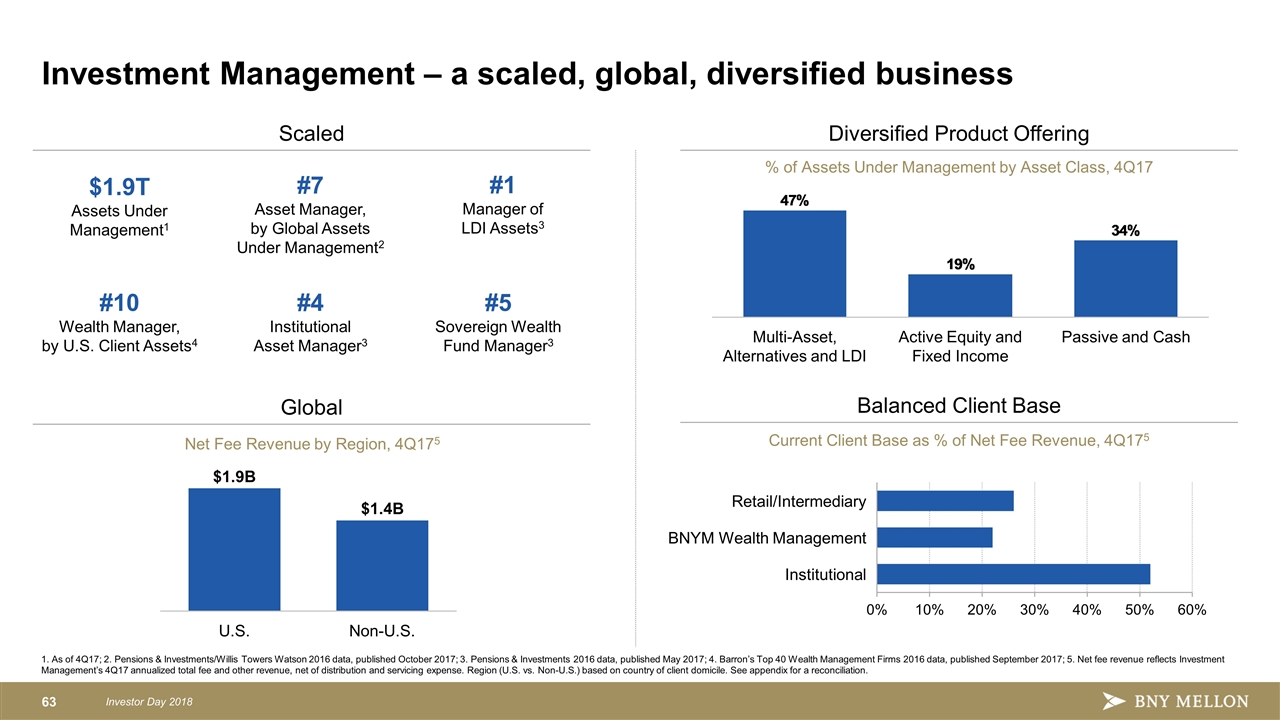

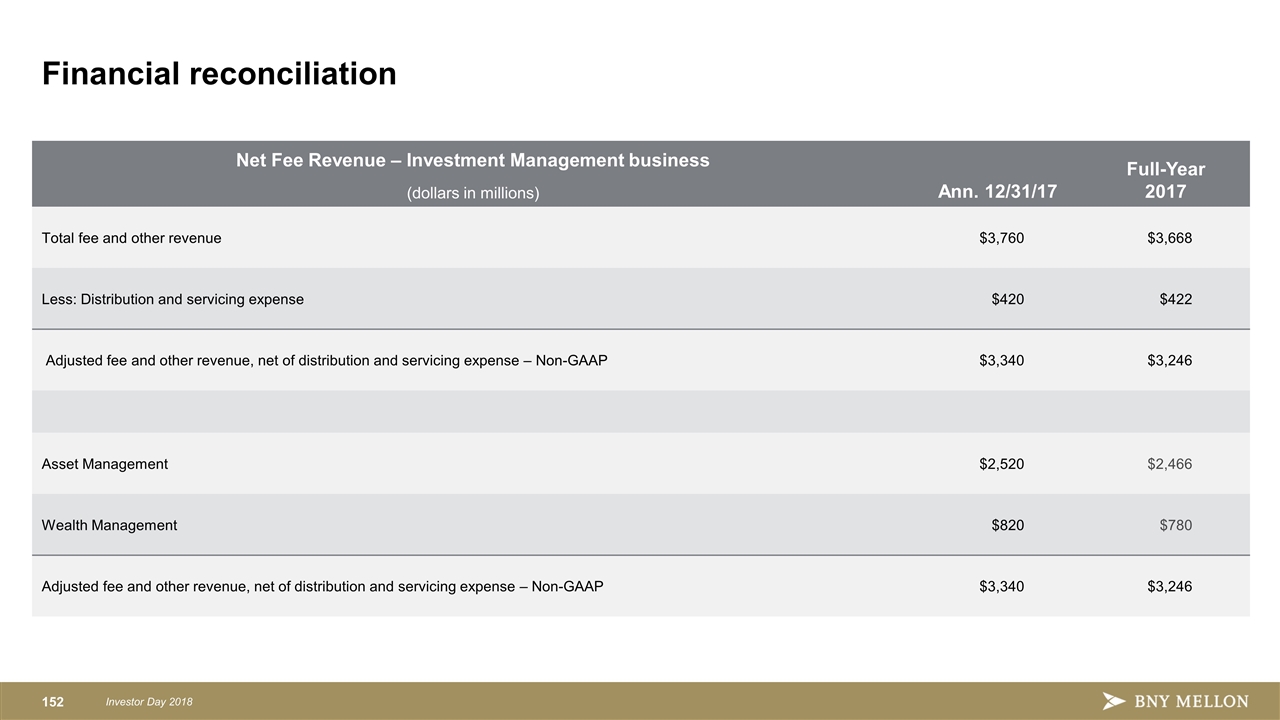

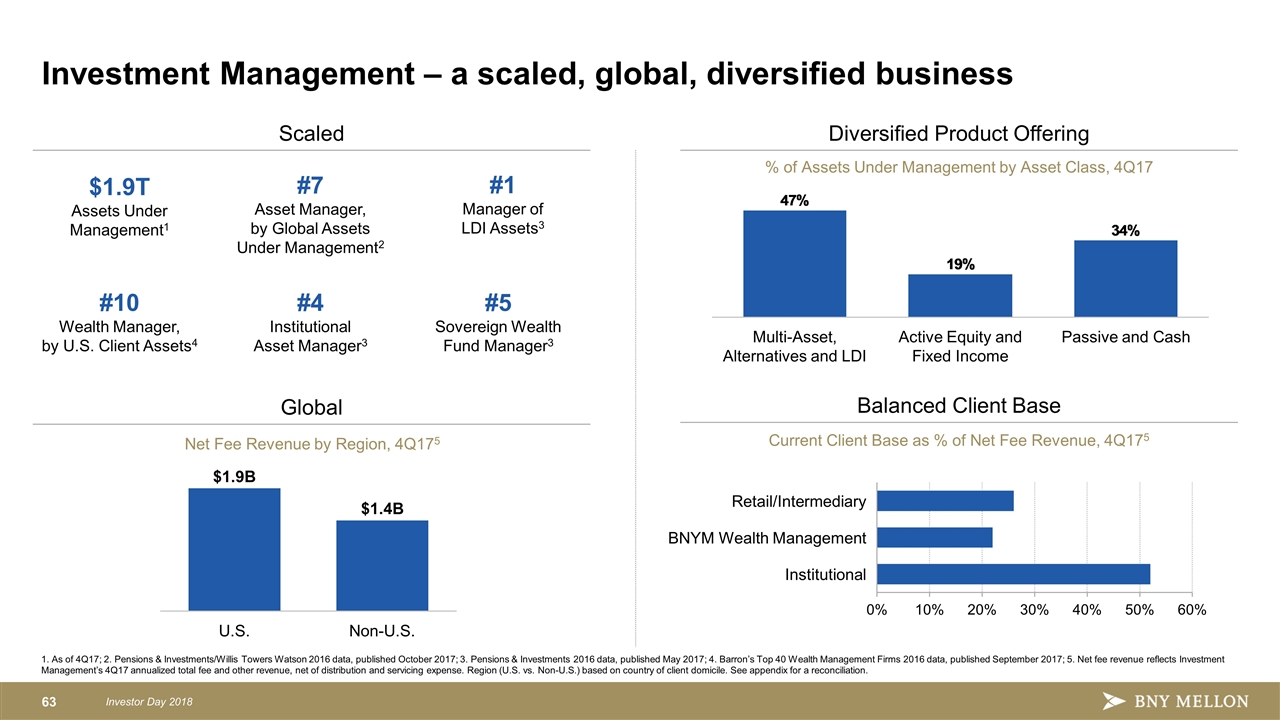

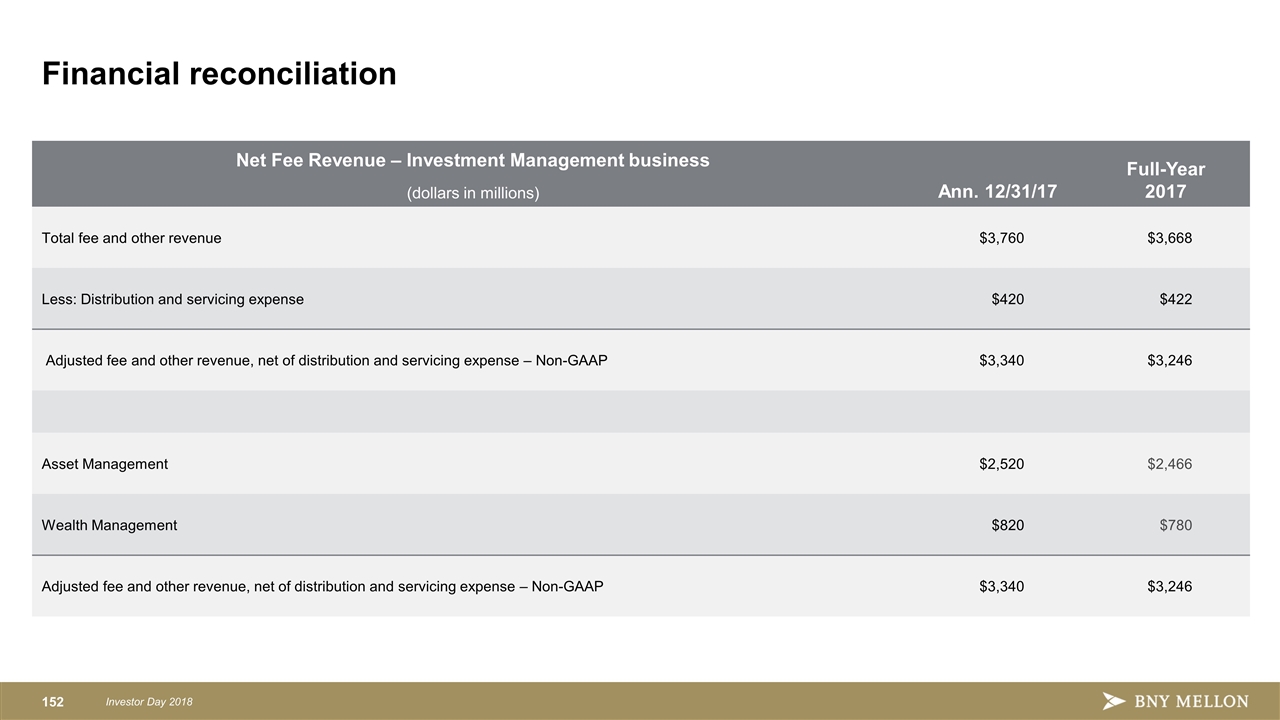

Investment Management – a scaled, global, diversified business 1. As of 4Q17; 2. Pensions & Investments/Willis Towers Watson 2016 data, published October 2017; 3. Pensions & Investments 2016 data, published May 2017; 4. Barron’s Top 40 Wealth Management Firms 2016 data, published September 2017; 5. Net fee revenue reflects Investment Management’s 4Q17 annualized total fee and other revenue, net of distribution and servicing expense. Region (U.S. vs. Non-U.S.) based on country of client domicile. See appendix for a reconciliation. $1.9T Assets Under Management1 Net Fee Revenue by Region, 4Q175 #7 Asset Manager, by Global Assets Under Management2 #10 Wealth Manager, by U.S. Client Assets4 #4 Institutional Asset Manager3 Retail/Intermediary Current Client Base as % of Net Fee Revenue, 4Q175 #1 Manager of LDI Assets3 #5 Sovereign Wealth Fund Manager3 % of Assets Under Management by Asset Class, 4Q17 Scaled Global Diversified Product Offering Balanced Client Base

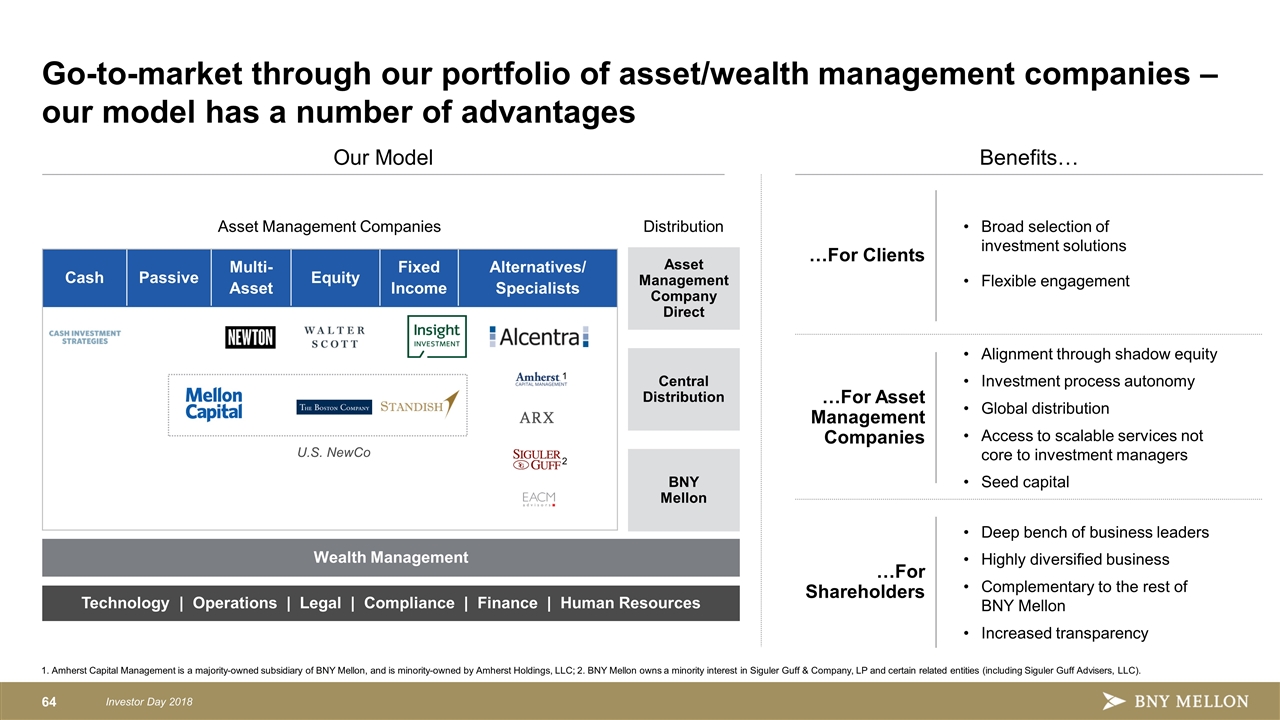

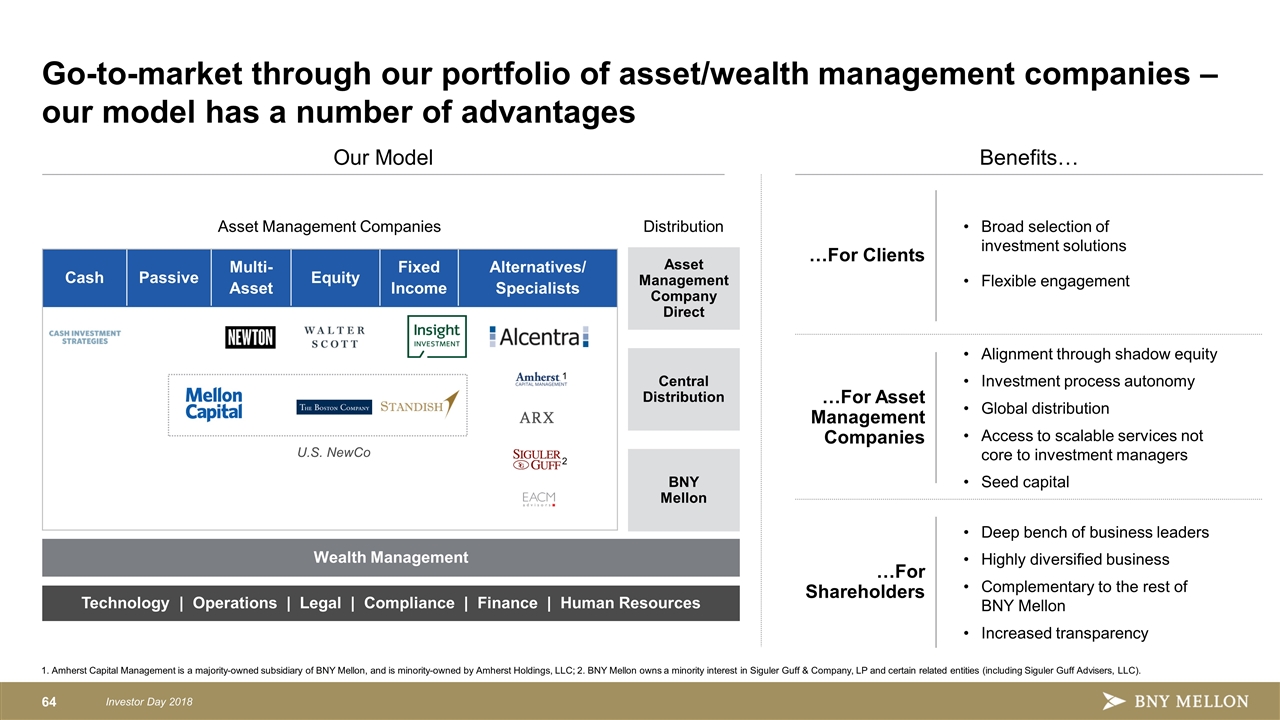

1. Amherst Capital Management is a majority-owned subsidiary of BNY Mellon, and is minority-owned by Amherst Holdings, LLC; 2. BNY Mellon owns a minority interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers, LLC). Go-to-market through our portfolio of asset/wealth management companies – our model has a number of advantages Our Model Benefits… Alignment through shadow equity Investment process autonomy Global distribution Access to scalable services not core to investment managers Seed capital Broad selection of investment solutions Flexible engagement Deep bench of business leaders Highly diversified business Complementary to the rest of BNY Mellon Increased transparency …For Clients …For Asset Management Companies …For Shareholders Cash Passive Multi-Asset Equity Fixed Income Alternatives/ Specialists Asset Management Companies U.S. NewCo Distribution Wealth Management Central Distribution Asset Management Company Direct BNY Mellon 2 1 Technology | Operations | Legal | Compliance | Finance | Human Resources

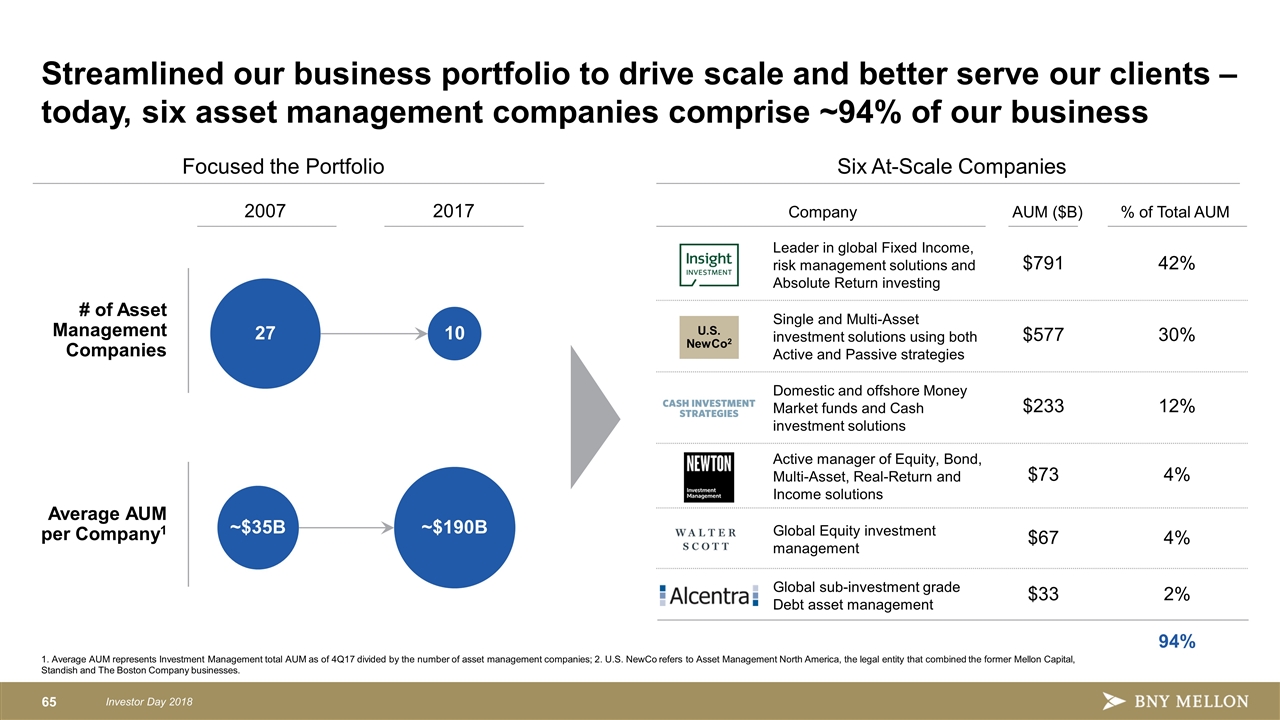

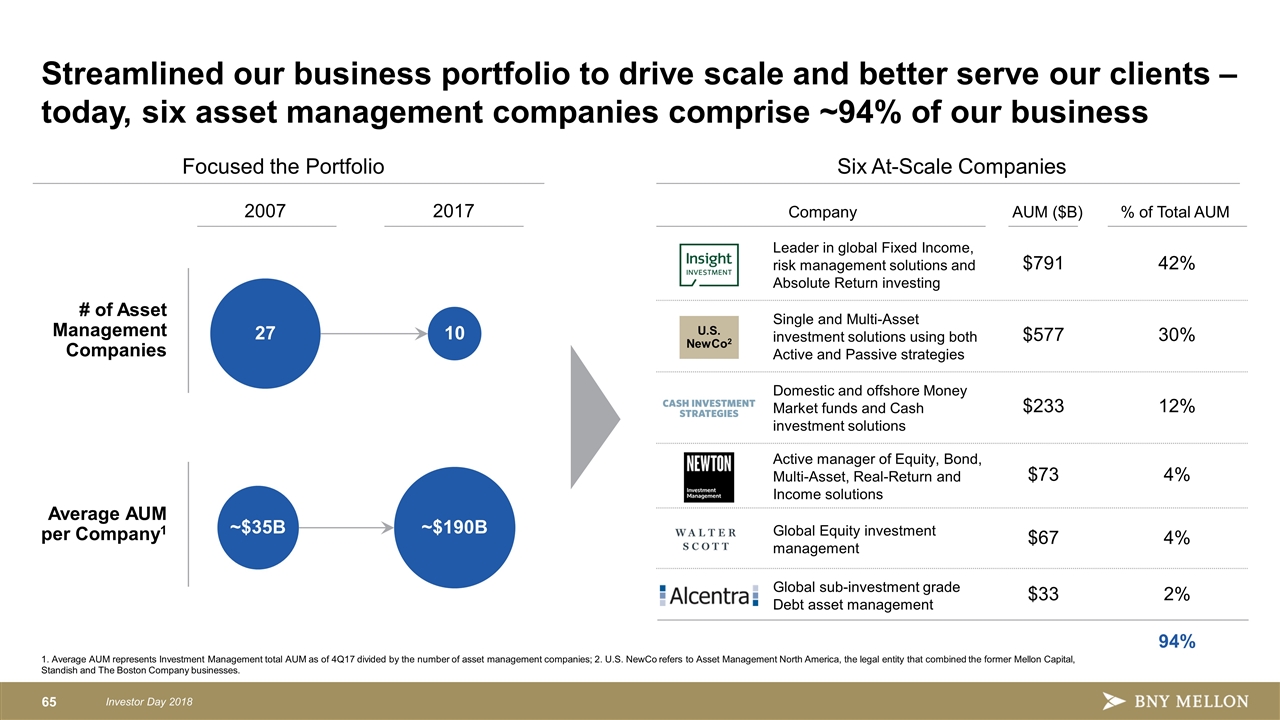

1. Average AUM represents Investment Management total AUM as of 4Q17 divided by the number of asset management companies; 2. U.S. NewCo refers to Asset Management North America, the legal entity that combined the former Mellon Capital, Standish and The Boston Company businesses. Streamlined our business portfolio to drive scale and better serve our clients – today, six asset management companies comprise ~94% of our business Focused the Portfolio 10 2017 27 2007 ~$35B ~$190B # of Asset Management Companies Average AUM per Company1 Six At-Scale Companies U.S. NewCo2 Global sub-investment grade Debt asset management Global Equity investment management Active manager of Equity, Bond, Multi-Asset, Real-Return and Income solutions Single and Multi-Asset investment solutions using both Active and Passive strategies Leader in global Fixed Income, risk management solutions and Absolute Return investing Company AUM ($B) % of Total AUM $33 $67 $73 $577 $791 2% 4% 4% 30% 42% 94% Domestic and offshore Money Market funds and Cash investment solutions $233 12%

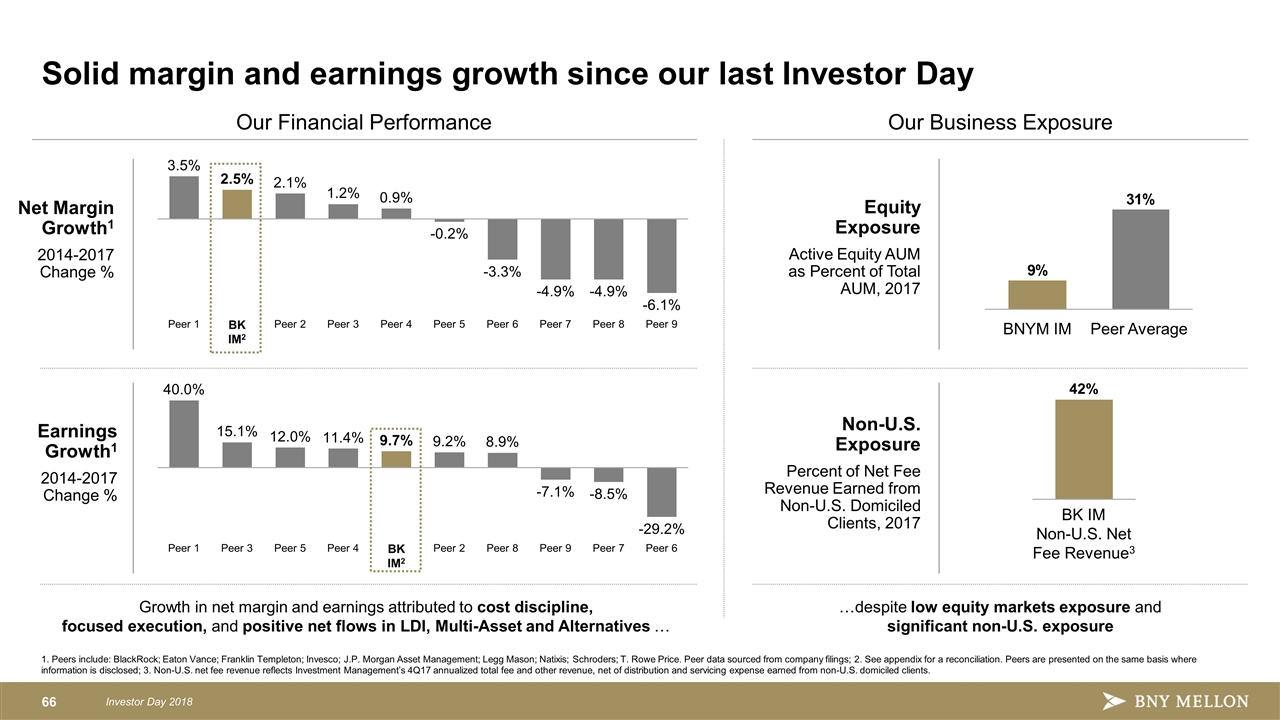

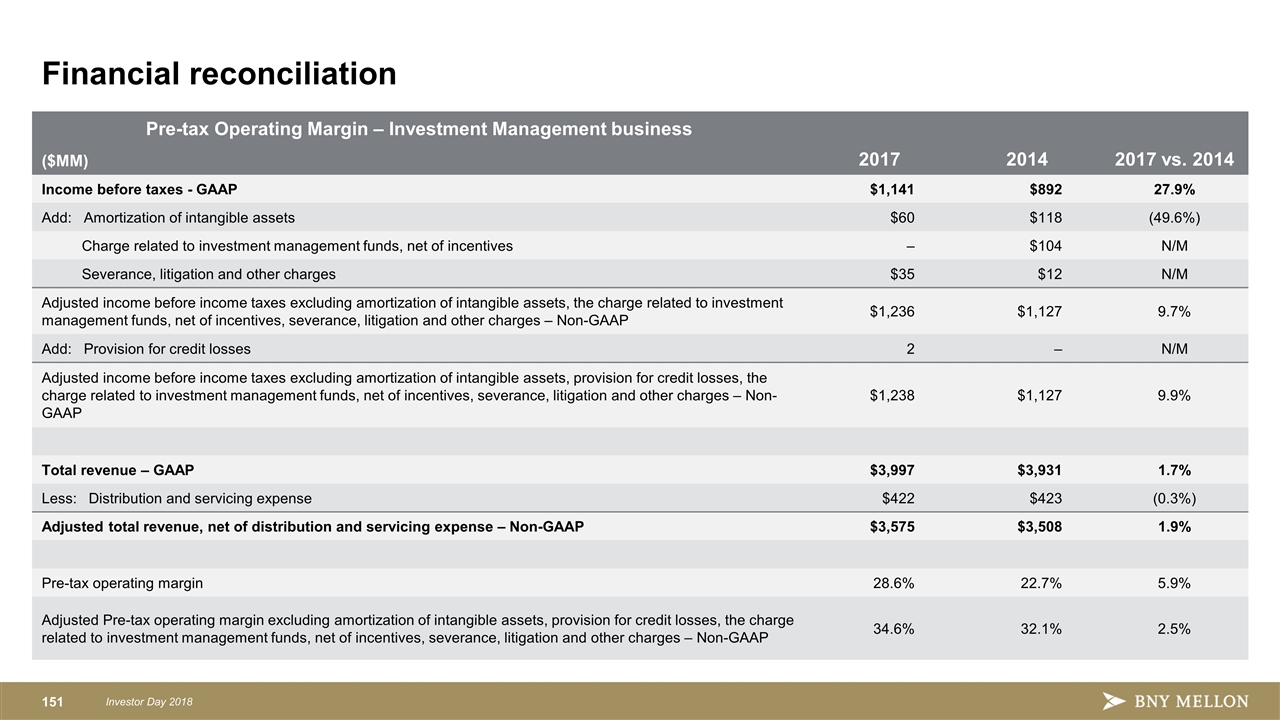

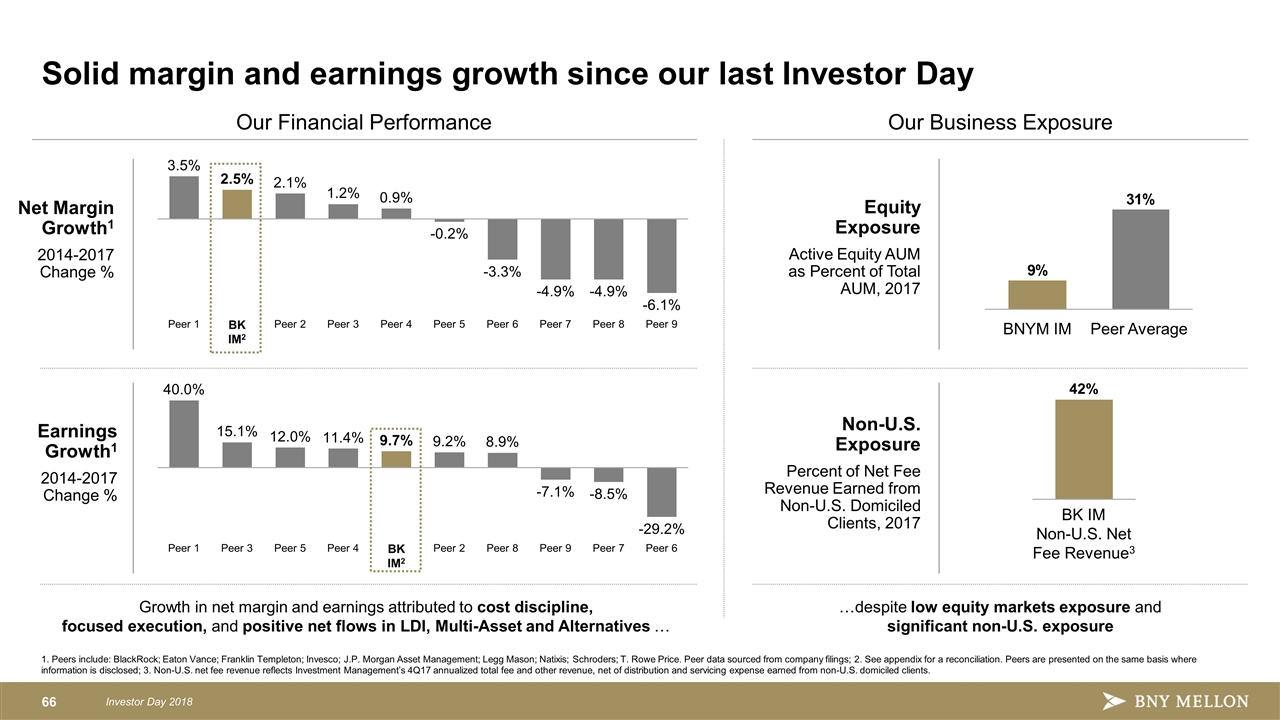

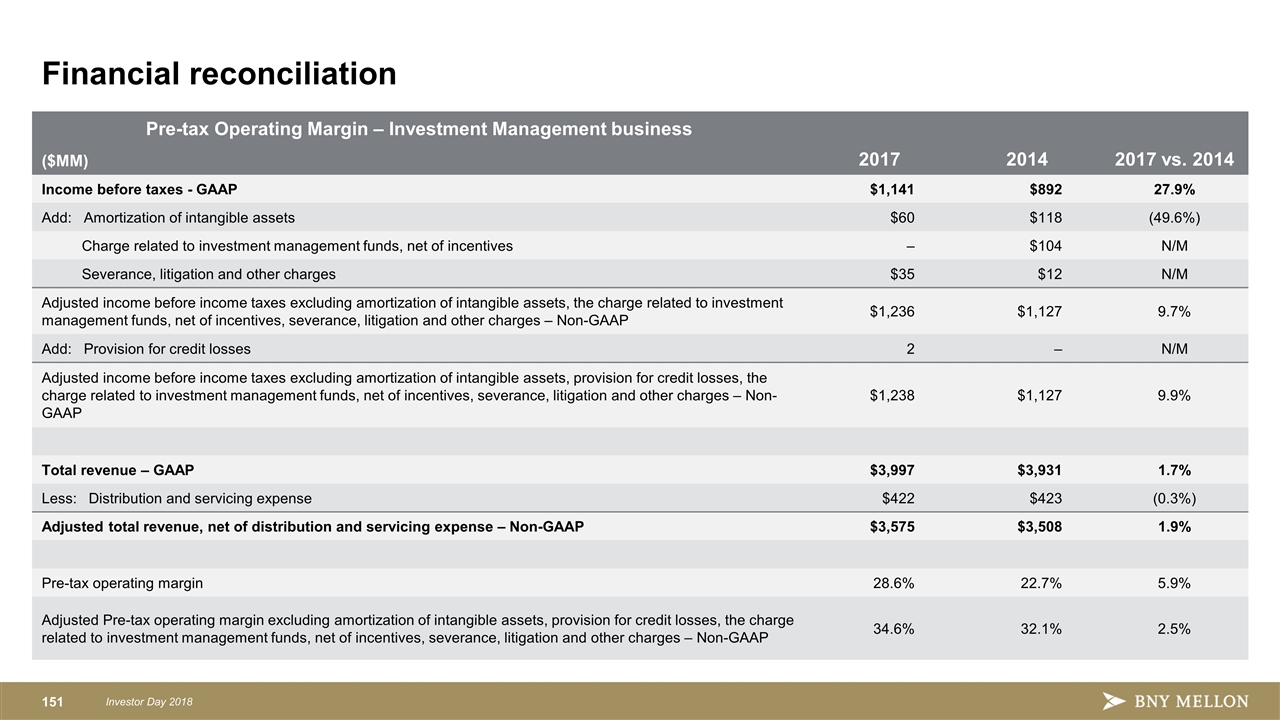

1. Peers include: BlackRock; Eaton Vance; Franklin Templeton; Invesco; J.P. Morgan Asset Management; Legg Mason; Natixis; Schroders; T. Rowe Price. Peer data sourced from company filings; 2. See appendix for a reconciliation. Peers are presented on the same basis where information is disclosed; 3. Non-U.S. net fee revenue reflects Investment Management’s 4Q17 annualized total fee and other revenue, net of distribution and servicing expense earned from non-U.S. domiciled clients. Solid margin and earnings growth since our last Investor Day Our Financial Performance Earnings Growth1 2014-2017 Change % BK IM2 Net Margin Growth1 2014-2017 Change % Our Business Exposure Growth in net margin and earnings attributed to cost discipline, focused execution, and positive net flows in LDI, Multi-Asset and Alternatives … 2.5% BK IM2 Equity Exposure Active Equity AUM as Percent of Total AUM, 2017 Non-U.S. Exposure Percent of Net Fee Revenue Earned from Non-U.S. Domiciled Clients, 2017 BK IM Non-U.S. Net Fee Revenue3 42% …despite low equity markets exposure and significant non-U.S. exposure

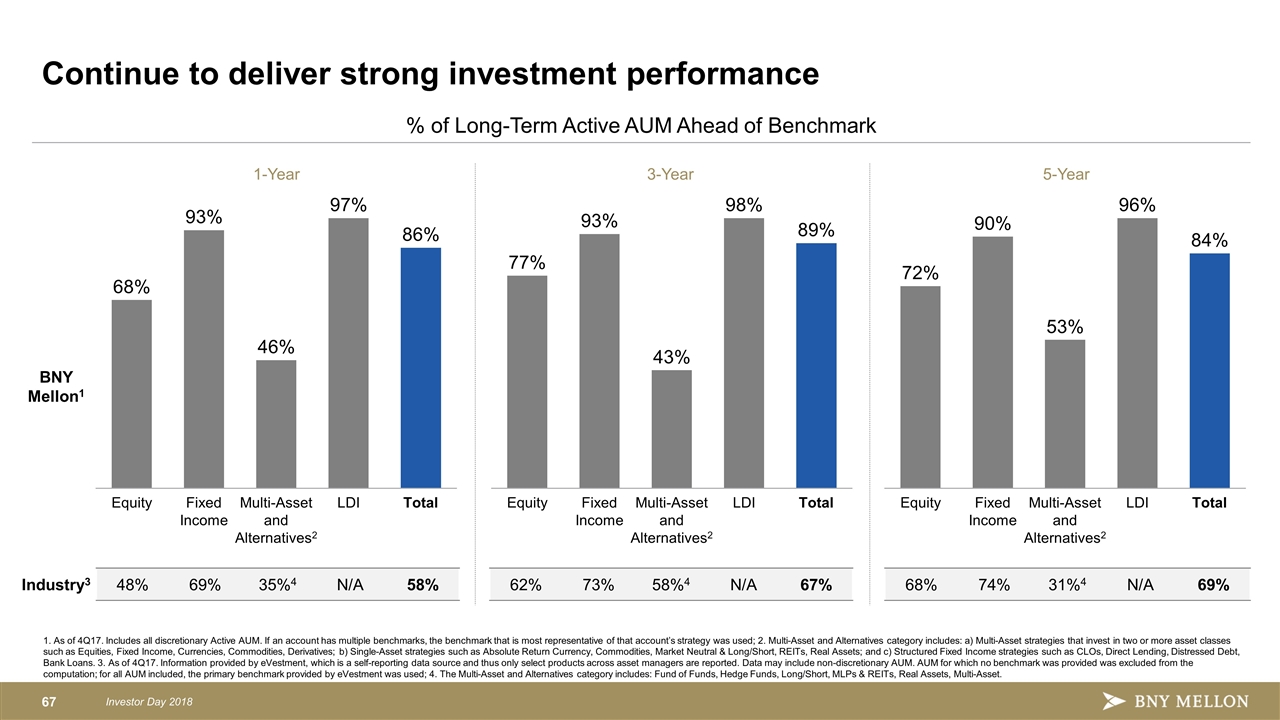

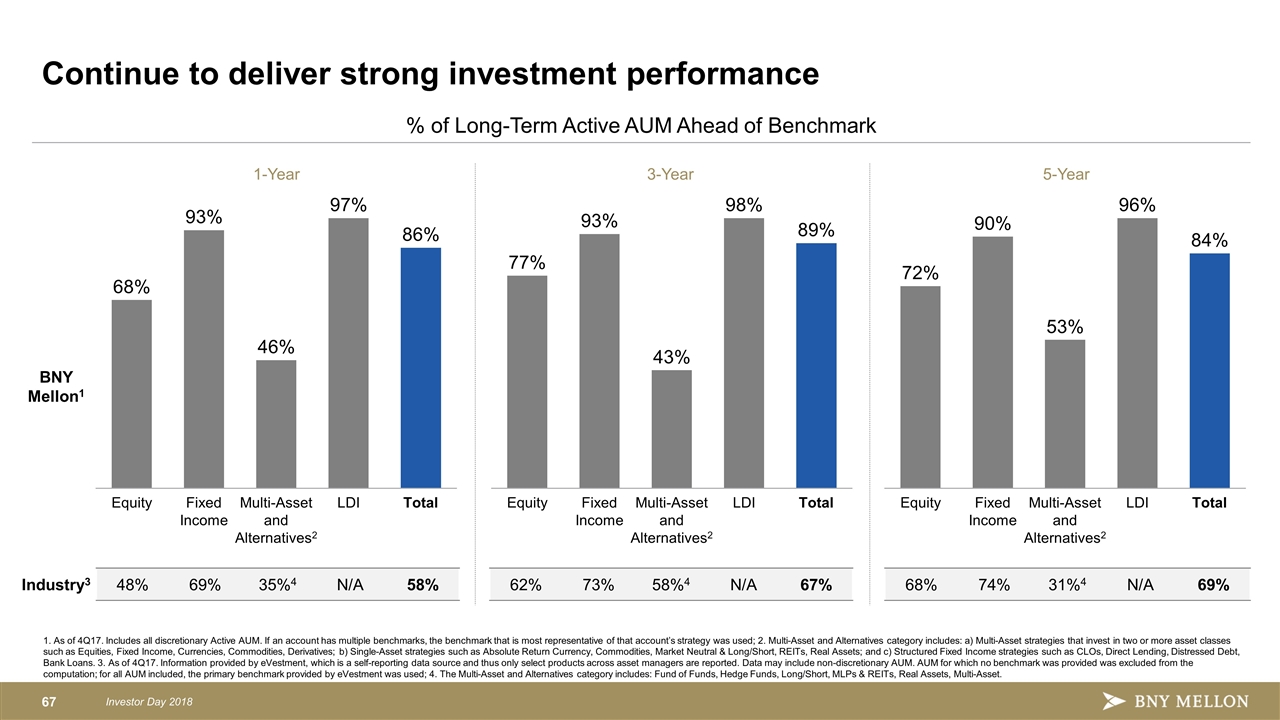

Continue to deliver strong investment performance % of Long-Term Active AUM Ahead of Benchmark 5-Year 2 3-Year 1-Year 2 2 1. As of 4Q17. Includes all discretionary Active AUM. If an account has multiple benchmarks, the benchmark that is most representative of that account’s strategy was used; 2. Multi-Asset and Alternatives category includes: a) Multi-Asset strategies that invest in two or more asset classes such as Equities, Fixed Income, Currencies, Commodities, Derivatives; b) Single-Asset strategies such as Absolute Return Currency, Commodities, Market Neutral & Long/Short, REITs, Real Assets; and c) Structured Fixed Income strategies such as CLOs, Direct Lending, Distressed Debt, Bank Loans. 3. As of 4Q17. Information provided by eVestment, which is a self-reporting data source and thus only select products across asset managers are reported. Data may include non-discretionary AUM. AUM for which no benchmark was provided was excluded from the computation; for all AUM included, the primary benchmark provided by eVestment was used; 4. The Multi-Asset and Alternatives category includes: Fund of Funds, Hedge Funds, Long/Short, MLPs & REITs, Real Assets, Multi-Asset. 48% 69% 35%4 N/A 58% Industry3 62% 73% 58%4 N/A 67% 68% 74% 31%4 N/A 69% BNY Mellon1

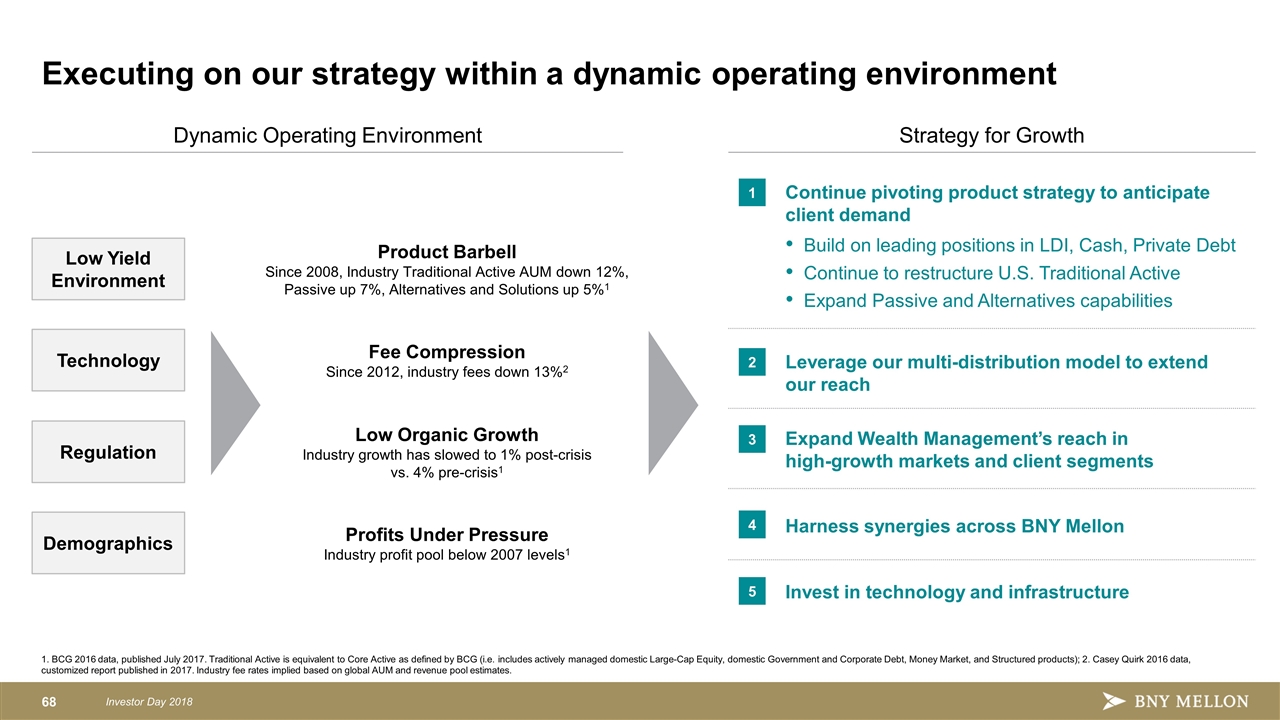

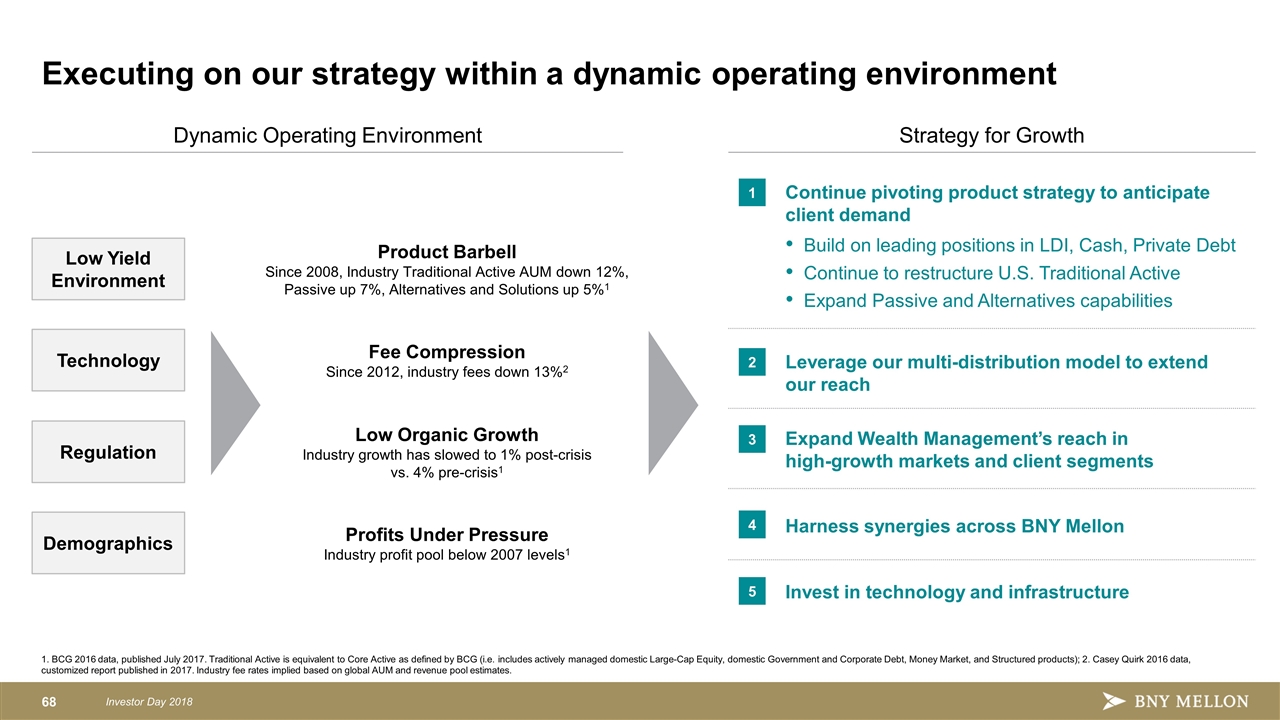

Executing on our strategy within a dynamic operating environment 1. BCG 2016 data, published July 2017. Traditional Active is equivalent to Core Active as defined by BCG (i.e. includes actively managed domestic Large-Cap Equity, domestic Government and Corporate Debt, Money Market, and Structured products); 2. Casey Quirk 2016 data, customized report published in 2017. Industry fee rates implied based on global AUM and revenue pool estimates. Dynamic Operating Environment Strategy for Growth Low Yield Environment Technology Regulation Demographics Product Barbell Since 2008, Industry Traditional Active AUM down 12%, Passive up 7%, Alternatives and Solutions up 5%1 Fee Compression Since 2012, industry fees down 13%2 Profits Under Pressure Industry profit pool below 2007 levels1 Low Organic Growth Industry growth has slowed to 1% post-crisis vs. 4% pre-crisis1 Continue pivoting product strategy to anticipate client demand Build on leading positions in LDI, Cash, Private Debt Continue to restructure U.S. Traditional Active Expand Passive and Alternatives capabilities Leverage our multi-distribution model to extend our reach Expand Wealth Management’s reach in high-growth markets and client segments Invest in technology and infrastructure Harness synergies across BNY Mellon 1 2 3 4 5

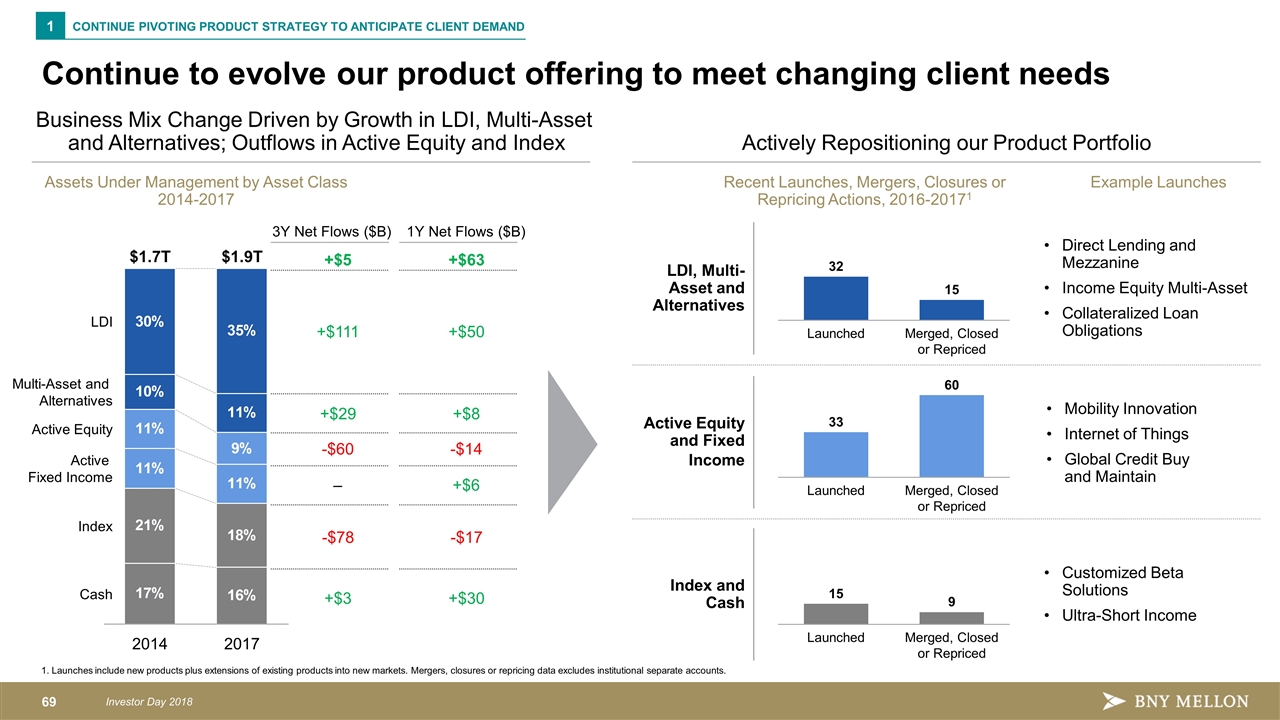

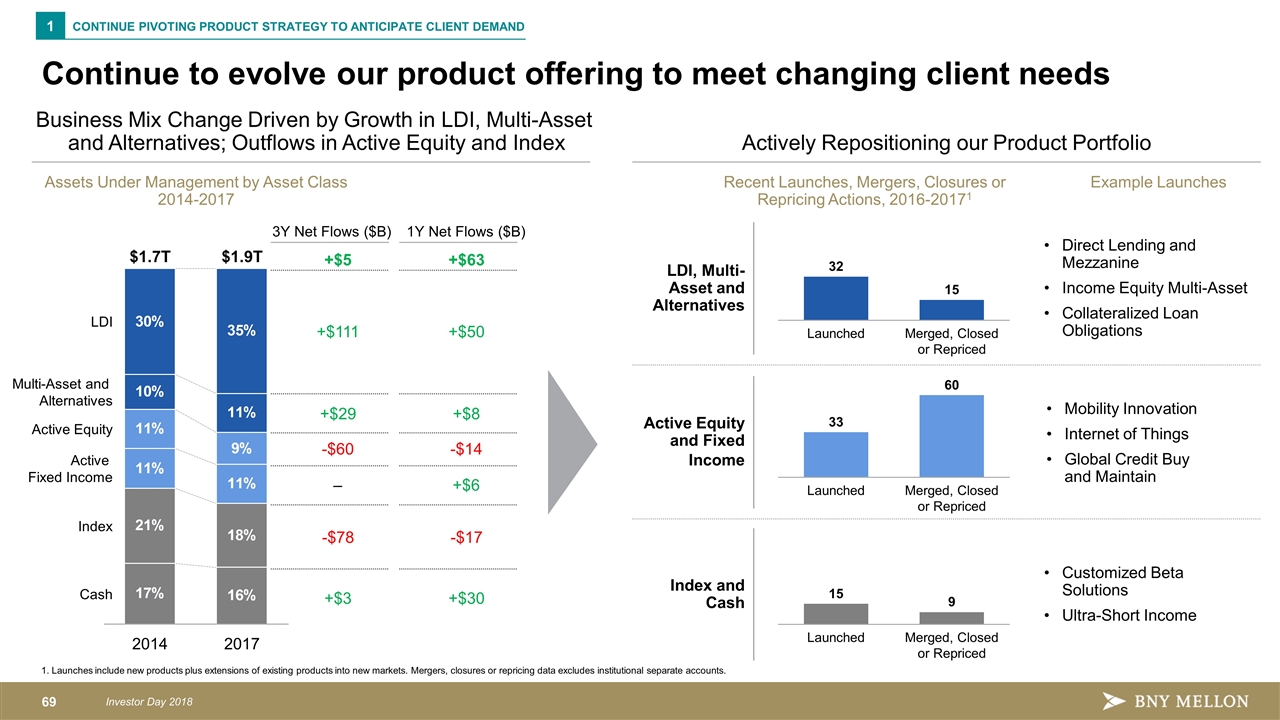

Continue to evolve our product offering to meet changing client needs 1. Launches include new products plus extensions of existing products into new markets. Mergers, closures or repricing data excludes institutional separate accounts. Business Mix Change Driven by Growth in LDI, Multi-Asset and Alternatives; Outflows in Active Equity and Index Assets Under Management by Asset Class 2014-2017 CONTINUE PIVOTING PRODUCT STRATEGY TO ANTICIPATE CLIENT DEMAND 1 $1.7T $1.9T 3Y Net Flows ($B) -$60 – +$111 +$29 -$78 +$3 +$5 1Y Net Flows ($B) -$14 +$6 +$50 +$8 -$17 +$30 +$63 Actively Repositioning our Product Portfolio Recent Launches, Mergers, Closures or Repricing Actions, 2016-20171 Mobility Innovation Internet of Things Global Credit Buy and Maintain Direct Lending and Mezzanine Income Equity Multi-Asset Collateralized Loan Obligations Customized Beta Solutions Ultra-Short Income Example Launches Active Equity and Fixed Income LDI, Multi-Asset and Alternatives Index and Cash

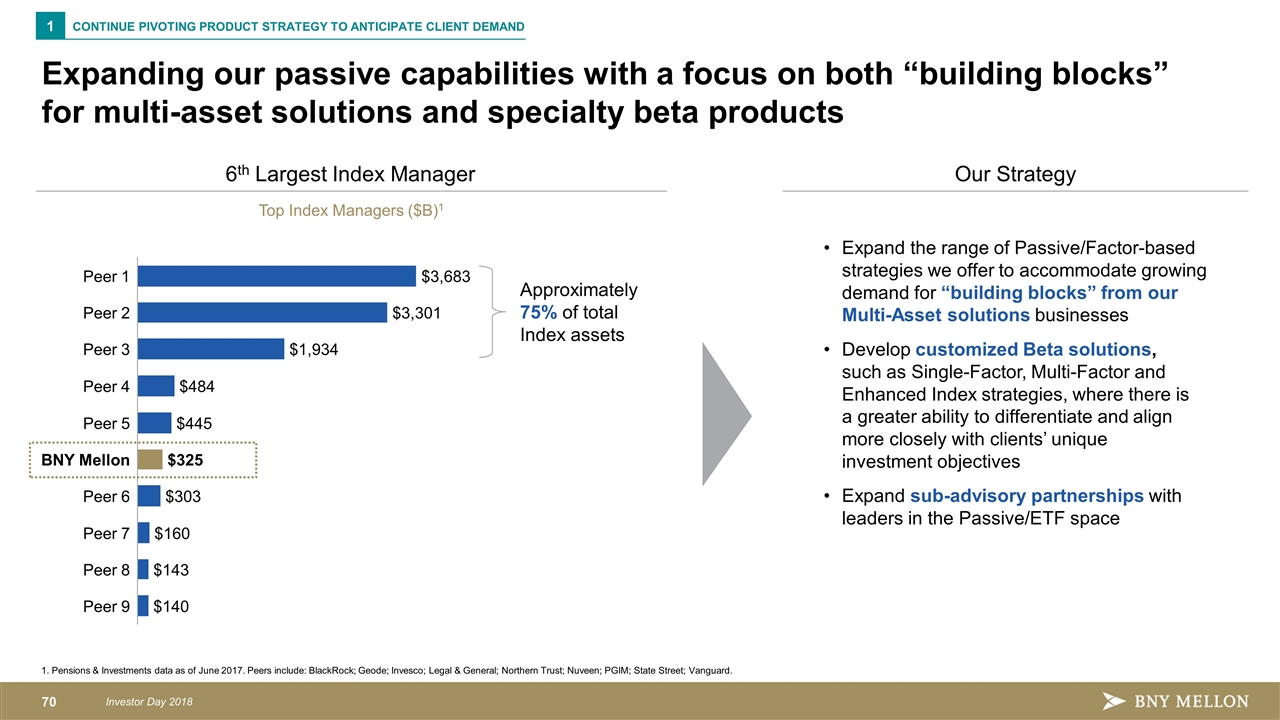

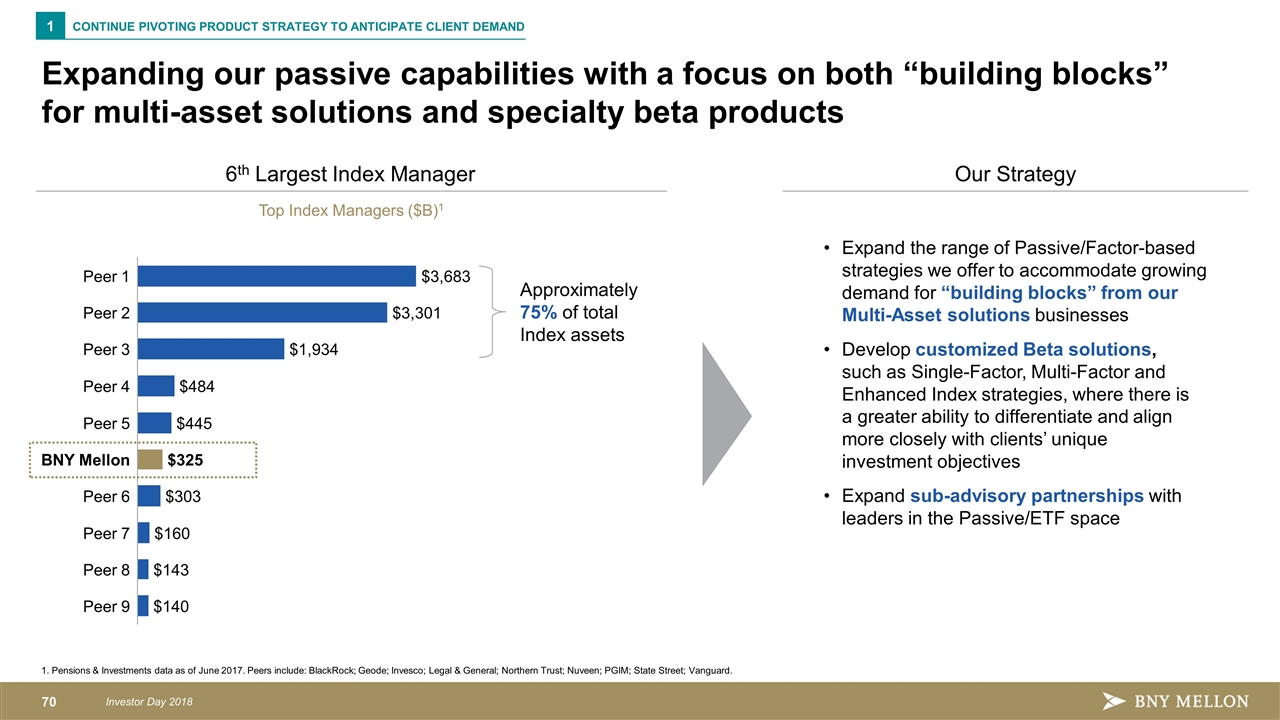

Expanding our passive capabilities with a focus on both “building blocks” for multi-asset solutions and specialty beta products 1. Pensions & Investments data as of June 2017. Peers include: BlackRock; Geode; Invesco; Legal & General; Northern Trust; Nuveen; PGIM; State Street; Vanguard. Expand the range of Passive/Factor-based strategies we offer to accommodate growing demand for “building blocks” from our Multi-Asset solutions businesses Develop customized Beta solutions, such as Single-Factor, Multi-Factor and Enhanced Index strategies, where there is a greater ability to differentiate and align more closely with clients’ unique investment objectives Expand sub-advisory partnerships with leaders in the Passive/ETF space Top Index Managers ($B)1 6th Largest Index Manager Peer 5 Peer 9 Peer 3 Peer 2 Peer 4 Peer 1 Peer 6 Peer 8 Peer 7 Our Strategy Approximately 75% of total Index assets CONTINUE PIVOTING PRODUCT STRATEGY TO ANTICIPATE CLIENT DEMAND 1

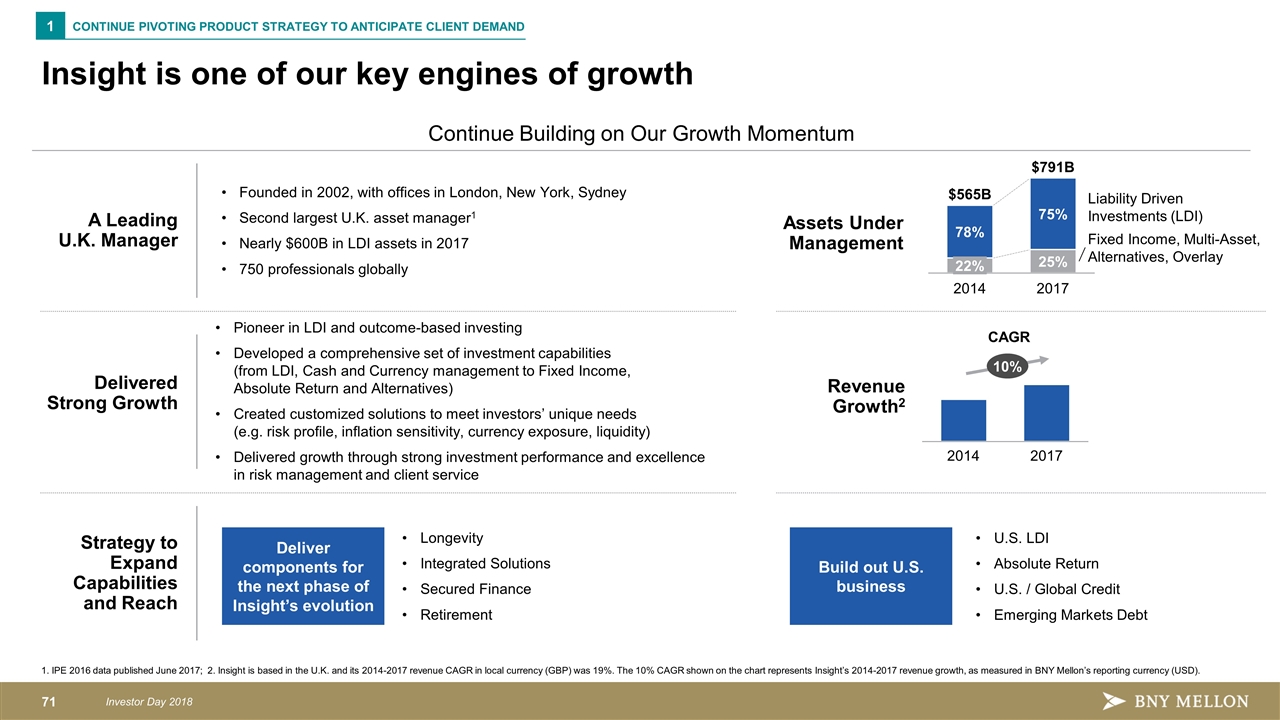

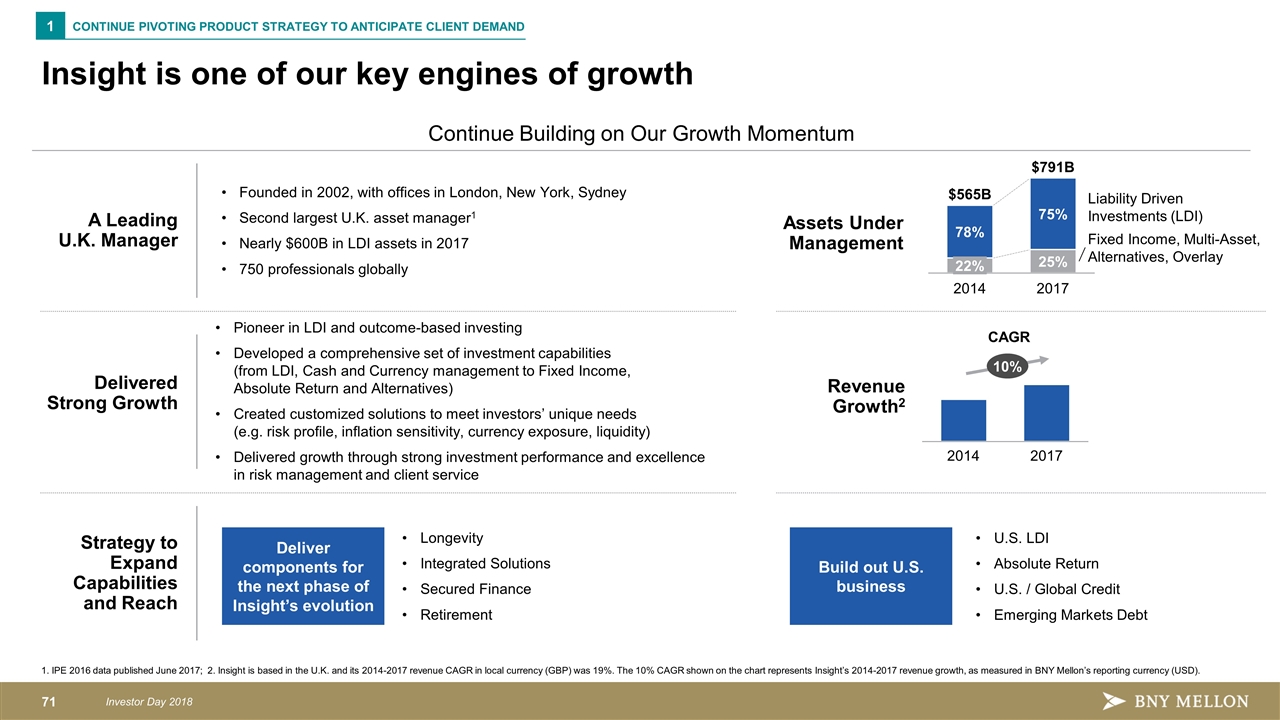

Insight is one of our key engines of growth 1. IPE 2016 data published June 2017; 2. Insight is based in the U.K. and its 2014-2017 revenue CAGR in local currency (GBP) was 19%. The 10% CAGR shown on the chart represents Insight’s 2014-2017 revenue growth, as measured in BNY Mellon’s reporting currency (USD). A Leading U.K. Manager Continue Building on Our Growth Momentum Delivered Strong Growth Strategy to Expand Capabilities and Reach $565B $791B CAGR Founded in 2002, with offices in London, New York, Sydney Second largest U.K. asset manager1 Nearly $600B in LDI assets in 2017 750 professionals globally Pioneer in LDI and outcome-based investing Developed a comprehensive set of investment capabilities (from LDI, Cash and Currency management to Fixed Income, Absolute Return and Alternatives) Created customized solutions to meet investors’ unique needs (e.g. risk profile, inflation sensitivity, currency exposure, liquidity) Delivered growth through strong investment performance and excellence in risk management and client service Longevity Integrated Solutions Secured Finance Retirement U.S. LDI Absolute Return U.S. / Global Credit Emerging Markets Debt Deliver components for the next phase of Insight’s evolution Build out U.S. business Revenue Growth2 Assets Under Management 10% CONTINUE PIVOTING PRODUCT STRATEGY TO ANTICIPATE CLIENT DEMAND 1

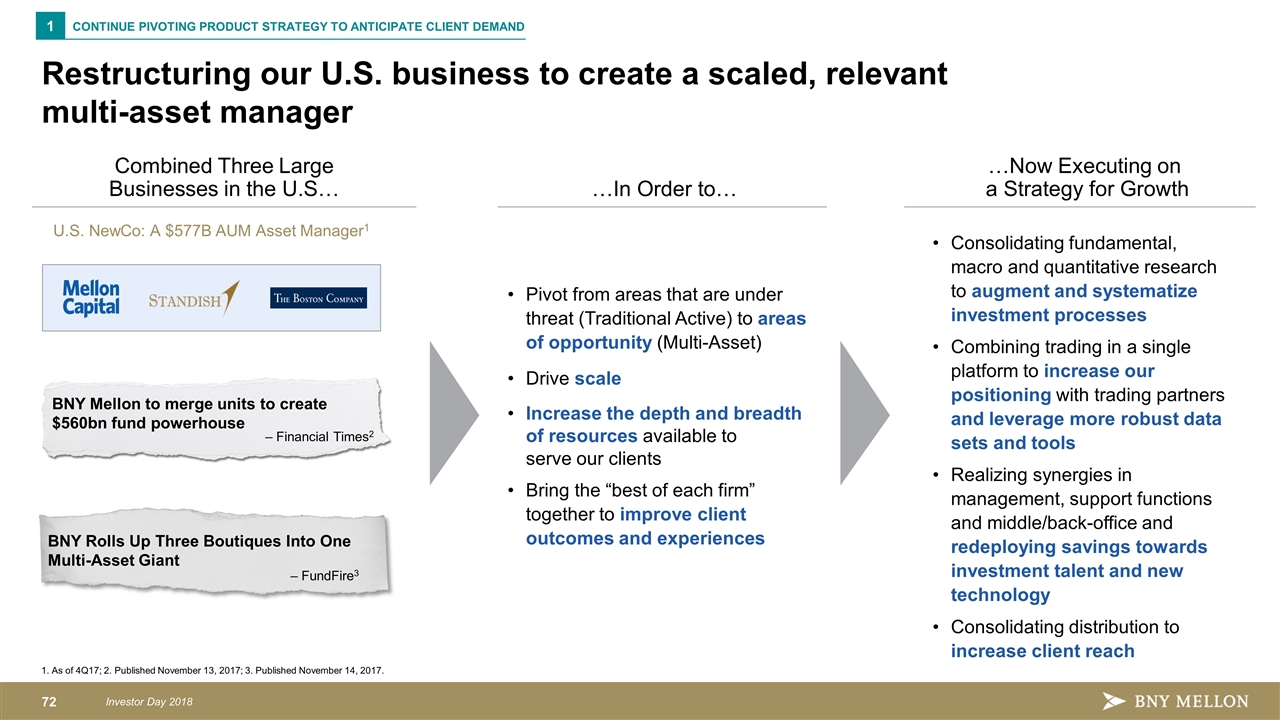

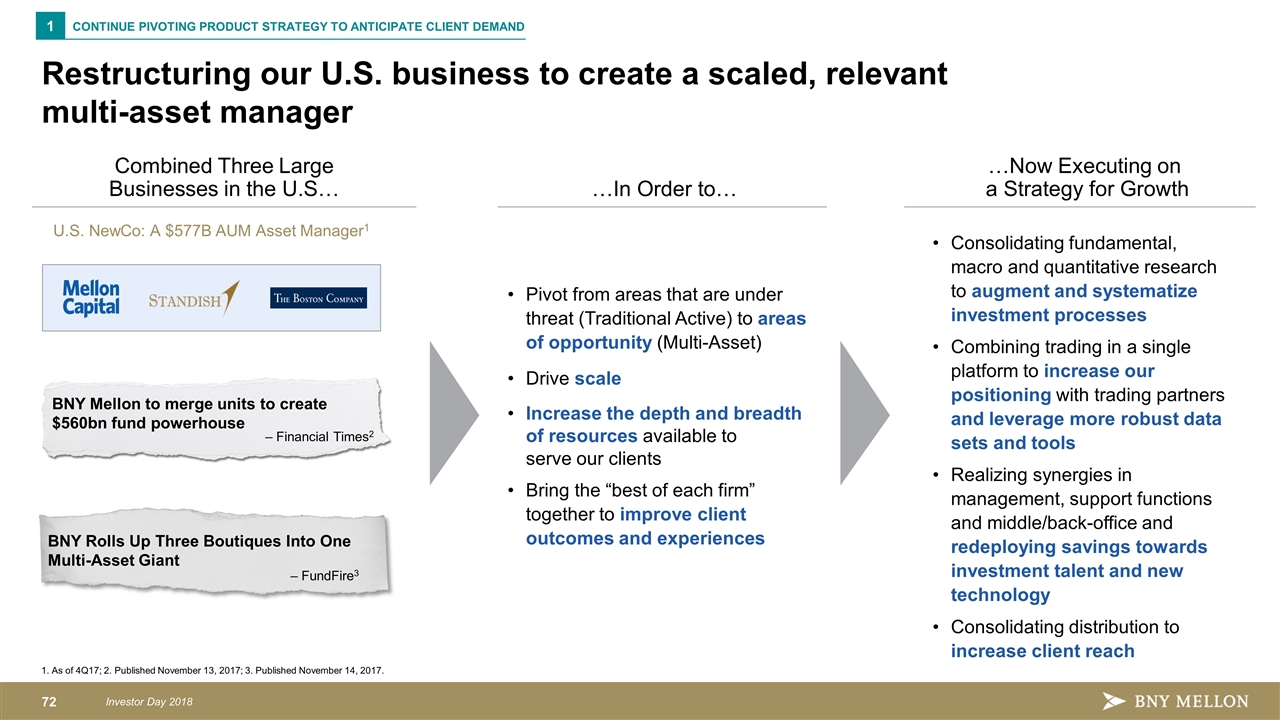

1. As of 4Q17; 2. Published November 13, 2017; 3. Published November 14, 2017. Restructuring our U.S. business to create a scaled, relevant multi-asset manager Combined Three Large Businesses in the U.S… U.S. NewCo: A $577B AUM Asset Manager1 Consolidating fundamental, macro and quantitative research to augment and systematize investment processes Combining trading in a single platform to increase our positioning with trading partners and leverage more robust data sets and tools Realizing synergies in management, support functions and middle/back-office and redeploying savings towards investment talent and new technology Consolidating distribution to increase client reach BNY Mellon to merge units to create $560bn fund powerhouse – Financial Times2 BNY Rolls Up Three Boutiques Into One Multi-Asset Giant – FundFire3 …In Order to… Pivot from areas that are under threat (Traditional Active) to areas of opportunity (Multi-Asset) Drive scale Increase the depth and breadth of resources available to serve our clients Bring the “best of each firm” together to improve client outcomes and experiences …Now Executing on a Strategy for Growth CONTINUE PIVOTING PRODUCT STRATEGY TO ANTICIPATE CLIENT DEMAND 1

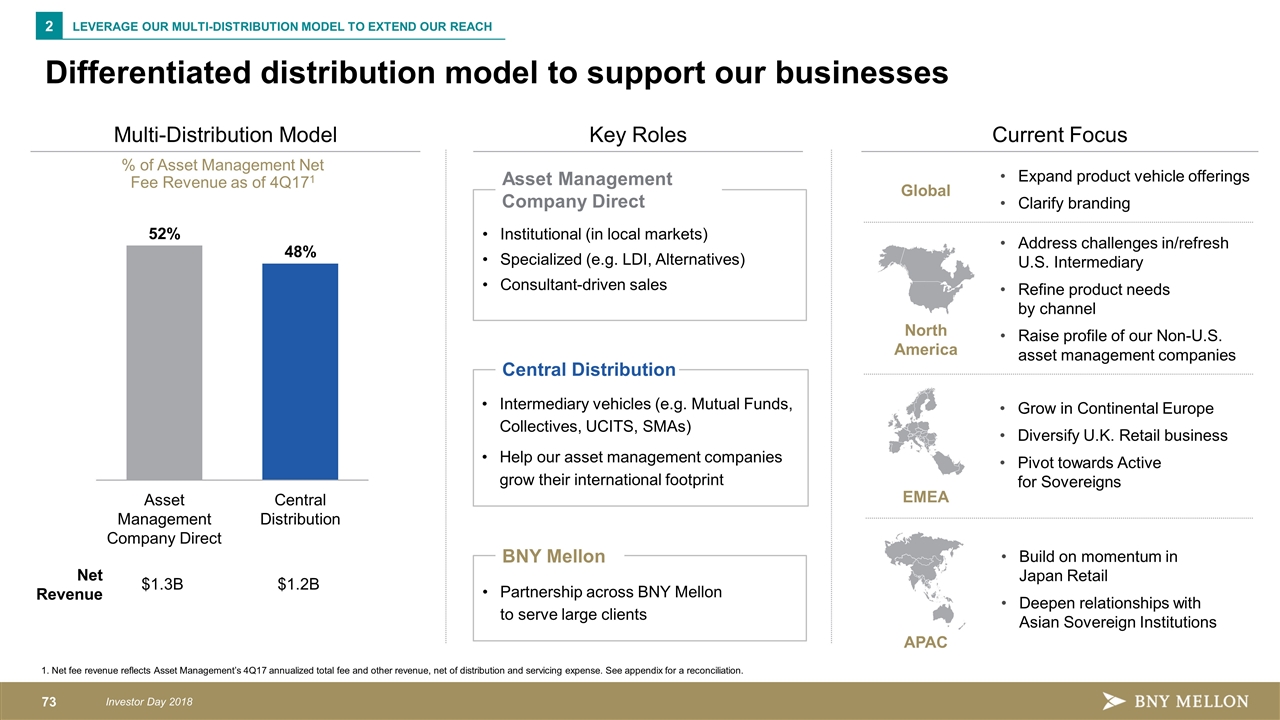

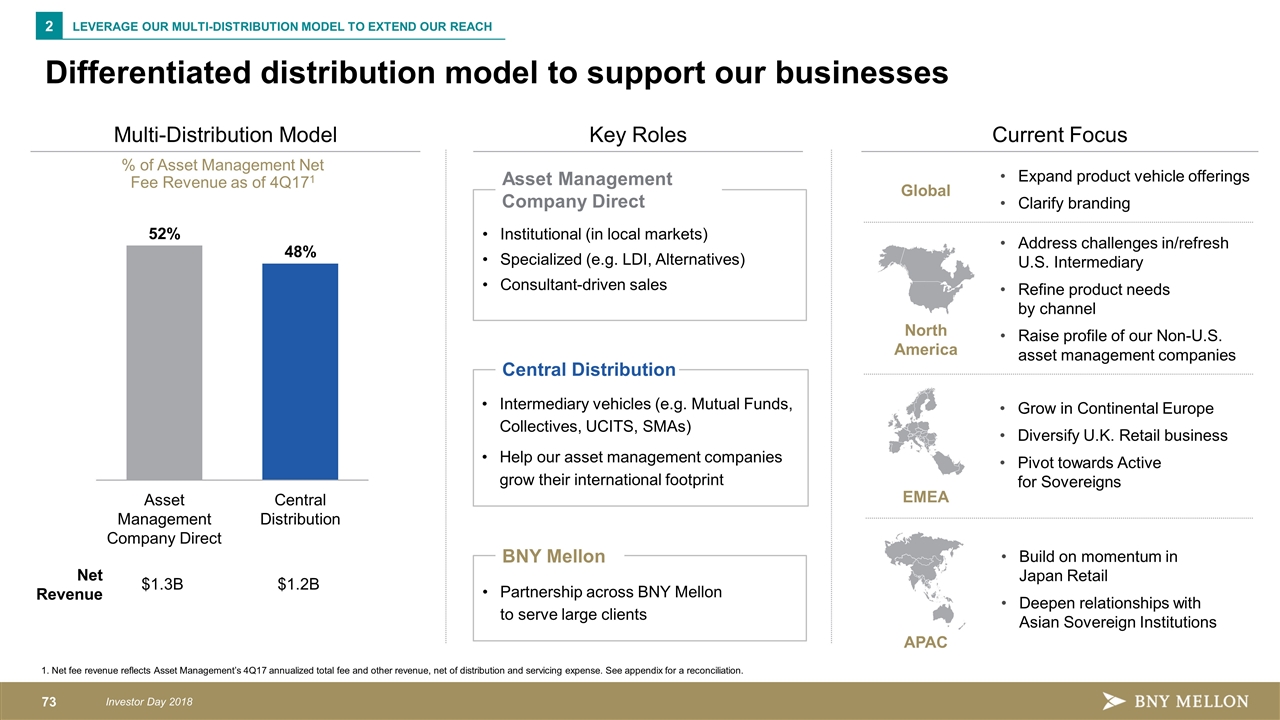

Differentiated distribution model to support our businesses 1. Net fee revenue reflects Asset Management’s 4Q17 annualized total fee and other revenue, net of distribution and servicing expense. See appendix for a reconciliation. Multi-Distribution Model % of Asset Management Net Fee Revenue as of 4Q171 Net Revenue $1.3B $1.2B Key Roles Current Focus Institutional (in local markets) Specialized (e.g. LDI, Alternatives) Consultant-driven sales Intermediary vehicles (e.g. Mutual Funds, Collectives, UCITS, SMAs) Help our asset management companies grow their international footprint Asset Management Company Direct Central Distribution North America EMEA APAC Address challenges in/refresh U.S. Intermediary Refine product needs by channel Raise profile of our Non-U.S. asset management companies Grow in Continental Europe Diversify U.K. Retail business Pivot towards Active for Sovereigns Build on momentum in Japan Retail Deepen relationships with Asian Sovereign Institutions LEVERAGE OUR MULTI-DISTRIBUTION MODEL TO EXTEND OUR REACH 2 Partnership across BNY Mellon to serve large clients BNY Mellon Global Expand product vehicle offerings Clarify branding

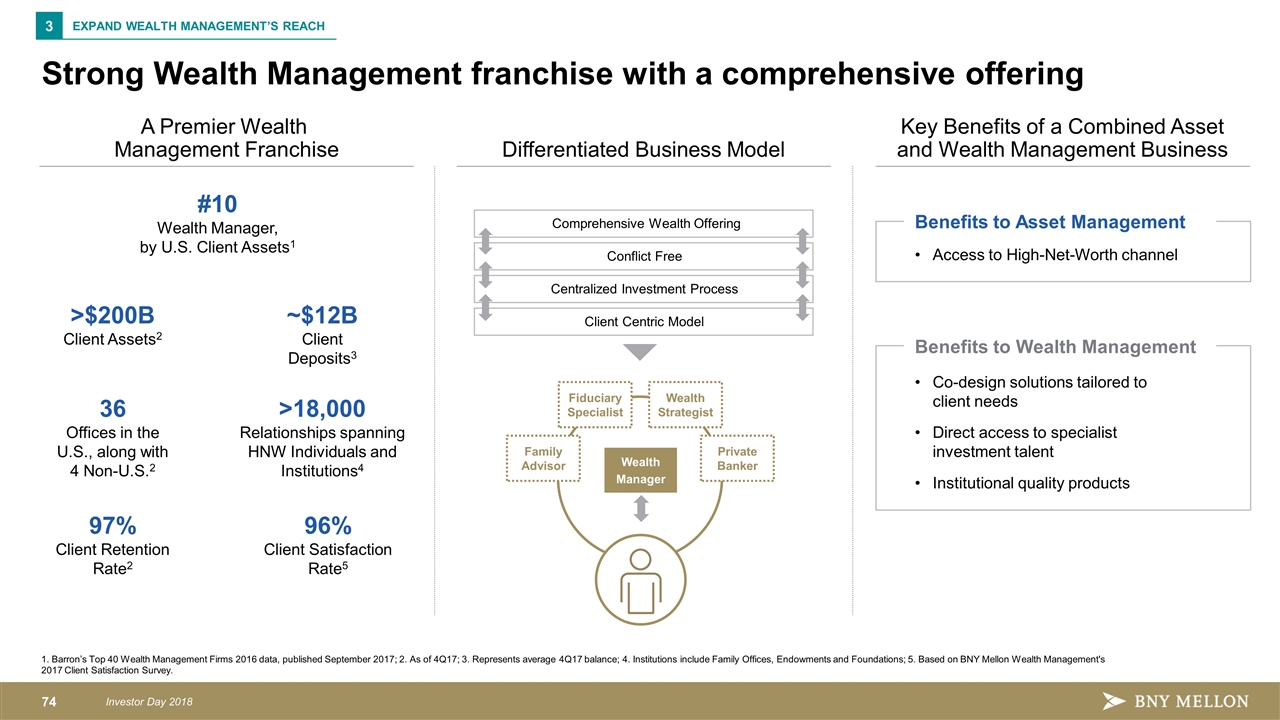

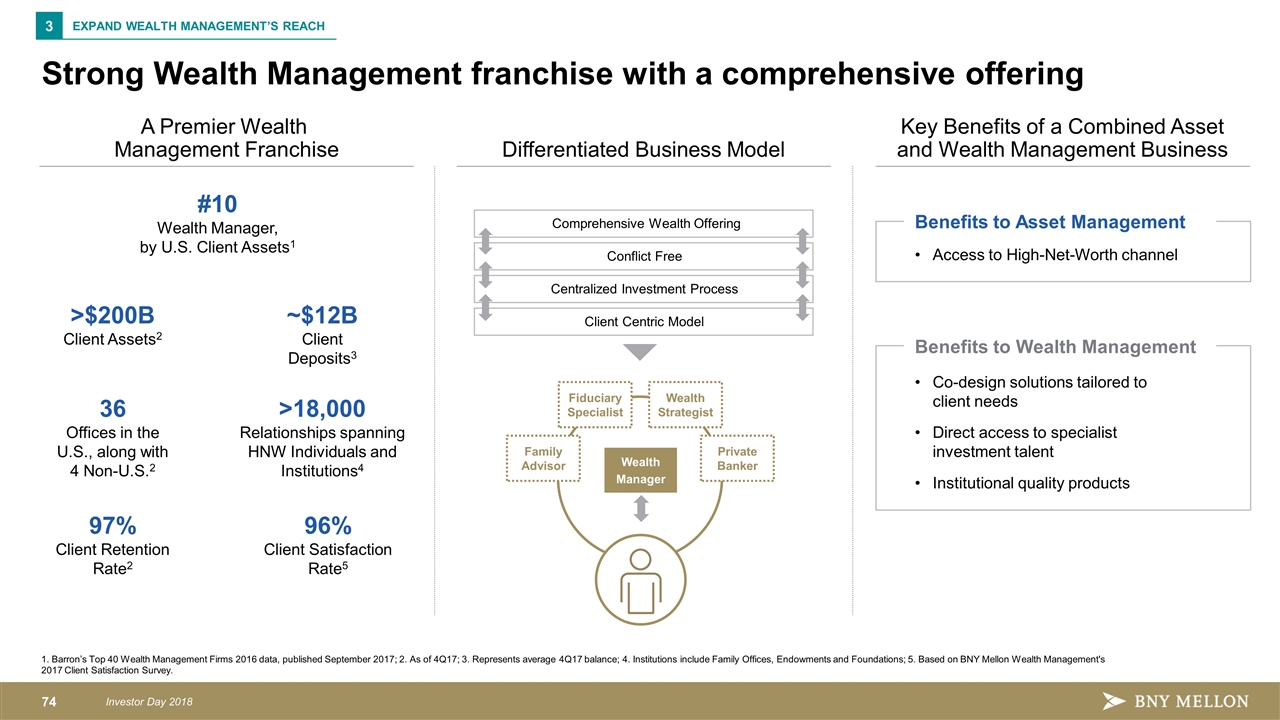

Differentiated Business Model Key Benefits of a Combined Asset and Wealth Management Business Strong Wealth Management franchise with a comprehensive offering 1. Barron’s Top 40 Wealth Management Firms 2016 data, published September 2017; 2. As of 4Q17; 3. Represents average 4Q17 balance; 4. Institutions include Family Offices, Endowments and Foundations; 5. Based on BNY Mellon Wealth Management's 2017 Client Satisfaction Survey. A Premier Wealth Management Franchise Benefits to Asset Management Access to High-Net-Worth channel Benefits to Wealth Management Co-design solutions tailored to client needs Direct access to specialist investment talent Institutional quality products EXPAND WEALTH MANAGEMENT’S REACH 3 >$200B Client Assets2 ~$12B Client Deposits3 #10 Wealth Manager, by U.S. Client Assets1 Wealth Strategist Private Banker Fiduciary Specialist Family Advisor Wealth Manager Client Centric Model Conflict Free Comprehensive Wealth Offering Centralized Investment Process 36 Offices in the U.S., along with 4 Non-U.S.2 >18,000 Relationships spanning HNW Individuals and Institutions4 97% Client Retention Rate2 96% Client Satisfaction Rate5

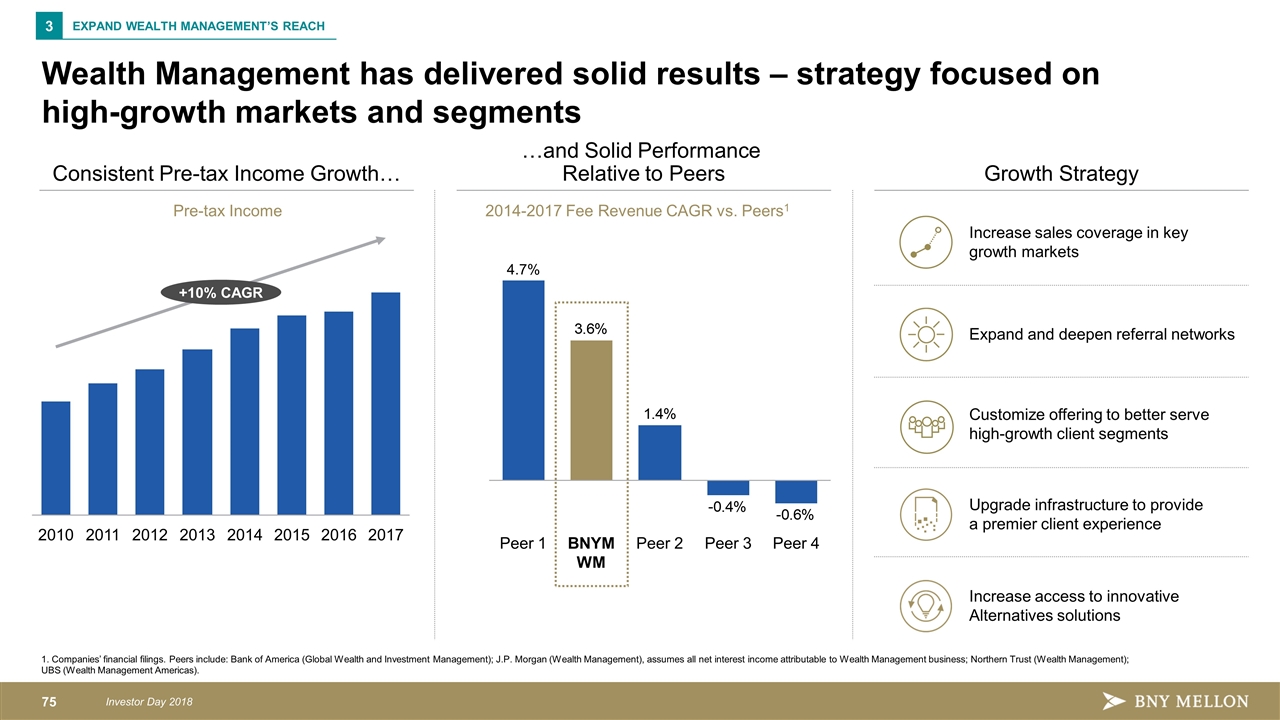

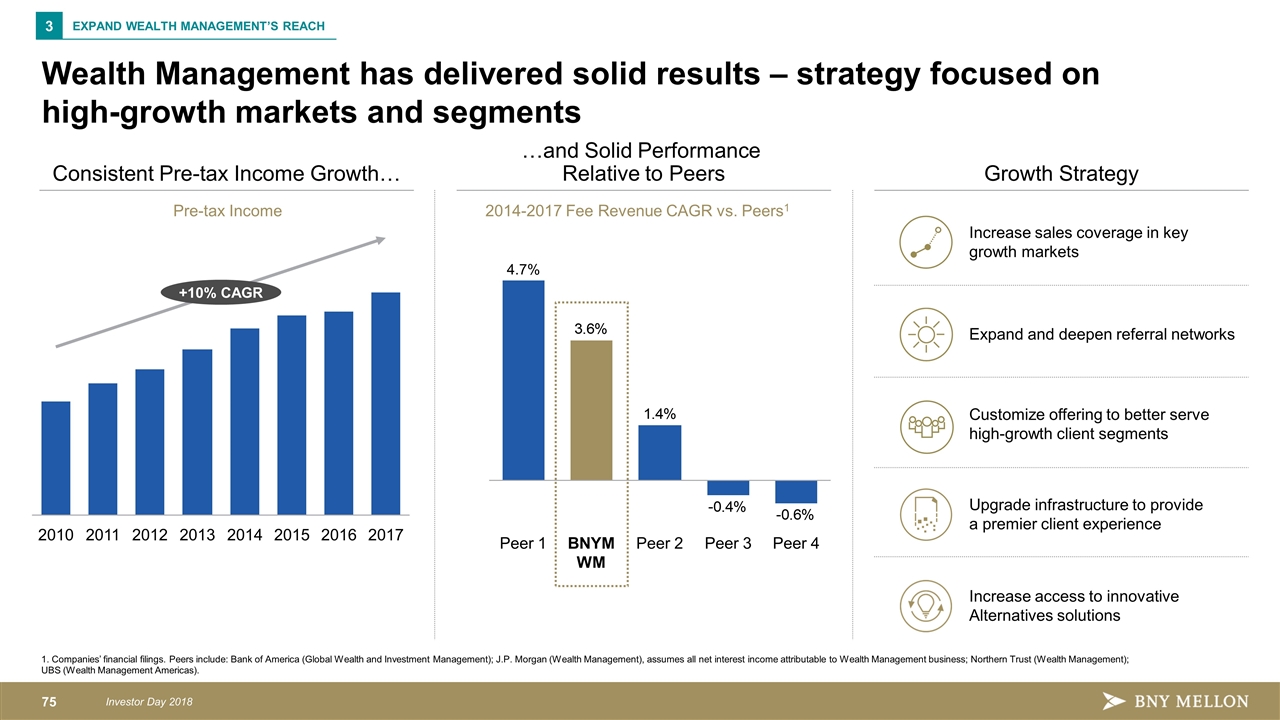

…and Solid Performance Relative to Peers Wealth Management has delivered solid results – strategy focused on high-growth markets and segments 1. Companies’ financial filings. Peers include: Bank of America (Global Wealth and Investment Management); J.P. Morgan (Wealth Management), assumes all net interest income attributable to Wealth Management business; Northern Trust (Wealth Management); UBS (Wealth Management Americas). Pre-tax Income Consistent Pre-tax Income Growth… EXPAND WEALTH MANAGEMENT’S REACH 3 Growth Strategy Increase sales coverage in key growth markets Customize offering to better serve high-growth client segments Expand and deepen referral networks Upgrade infrastructure to provide a premier client experience Increase access to innovative Alternatives solutions 4.7% 2014-2017 Fee Revenue CAGR vs. Peers1 CAGR

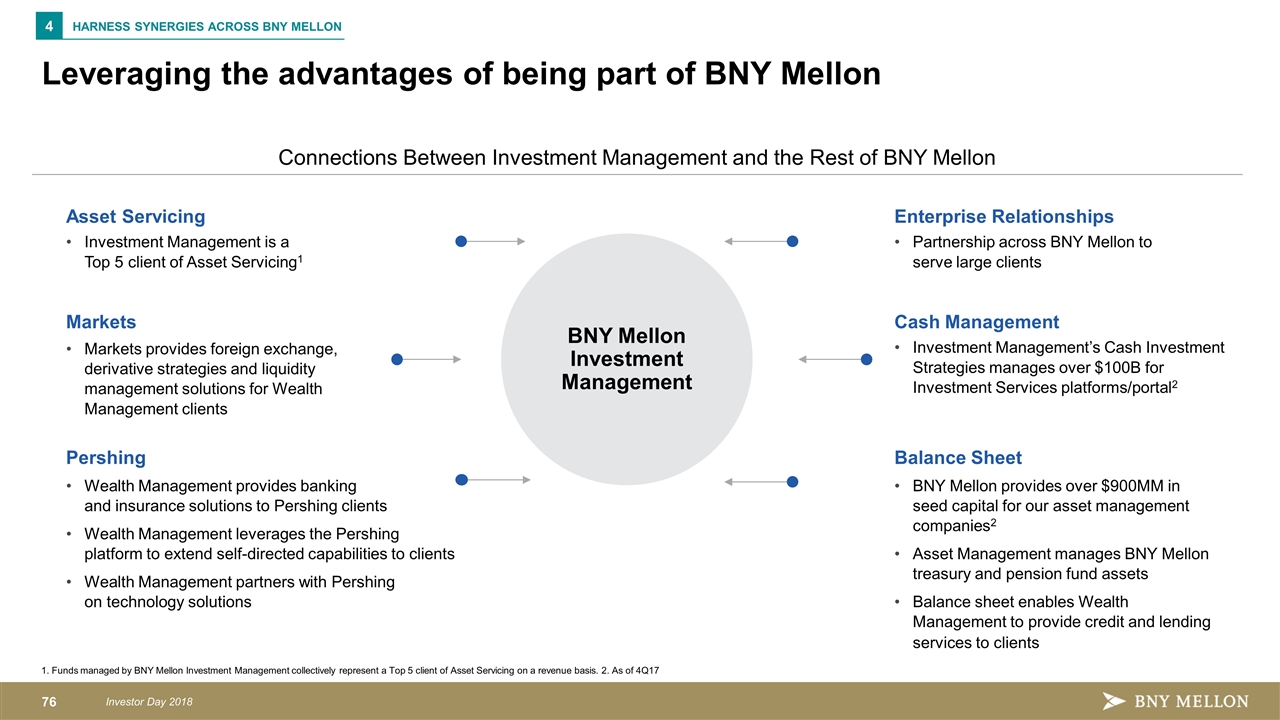

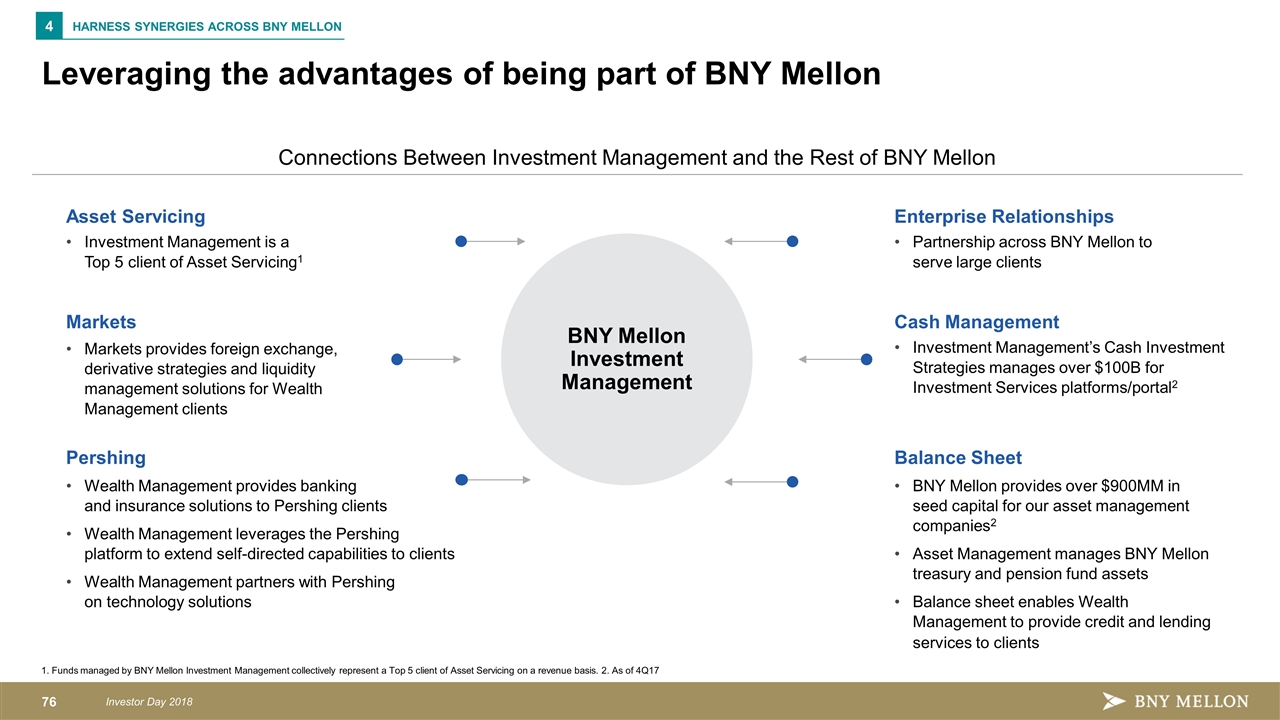

Leveraging the advantages of being part of BNY Mellon 1. Funds managed by BNY Mellon Investment Management collectively represent a Top 5 client of Asset Servicing on a revenue basis. 2. As of 4Q17 HARNESS SYNERGIES ACROSS BNY MELLON 4 BNY Mellon Investment Management Cash Management Investment Management’s Cash Investment Strategies manages over $100B for Investment Services platforms/portal2 Asset Servicing Investment Management is a Top 5 client of Asset Servicing1 Pershing Wealth Management provides banking and insurance solutions to Pershing clients Wealth Management leverages the Pershing platform to extend self-directed capabilities to clients Wealth Management partners with Pershing on technology solutions Markets Markets provides foreign exchange, derivative strategies and liquidity management solutions for Wealth Management clients Balance Sheet BNY Mellon provides over $900MM in seed capital for our asset management companies2 Asset Management manages BNY Mellon treasury and pension fund assets Balance sheet enables Wealth Management to provide credit and lending services to clients Enterprise Relationships Partnership across BNY Mellon to serve large clients Connections Between Investment Management and the Rest of BNY Mellon

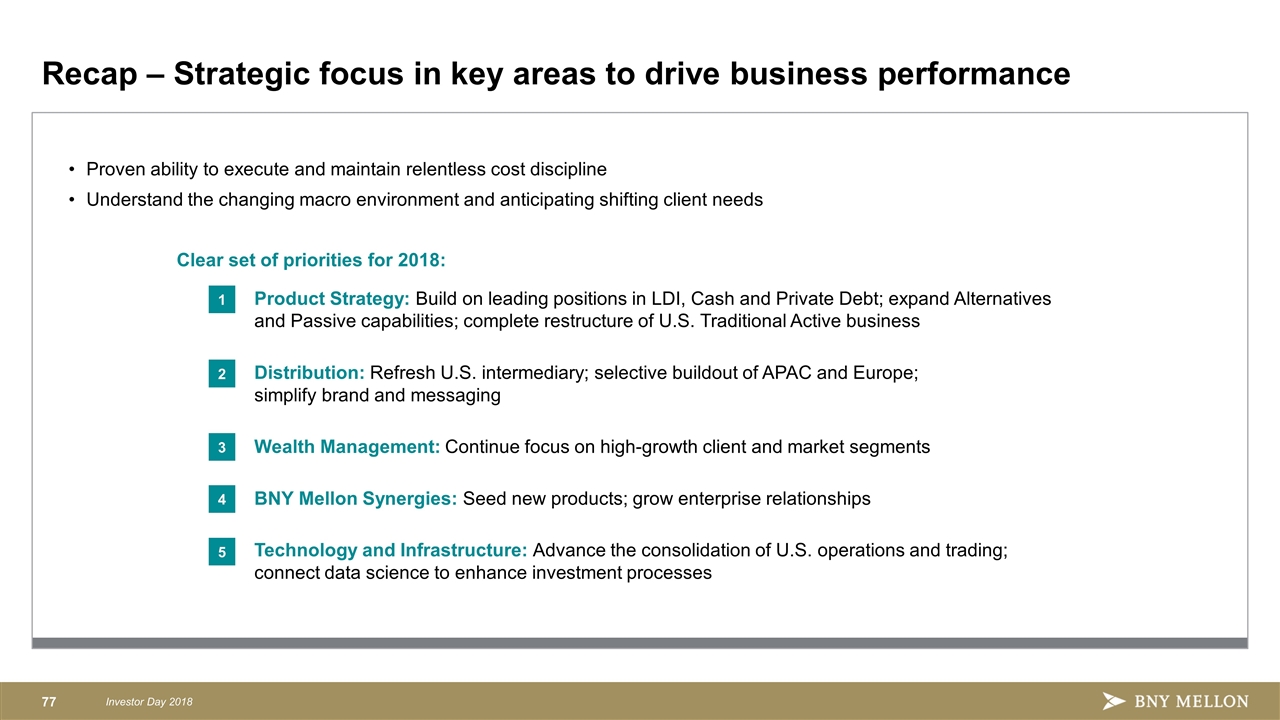

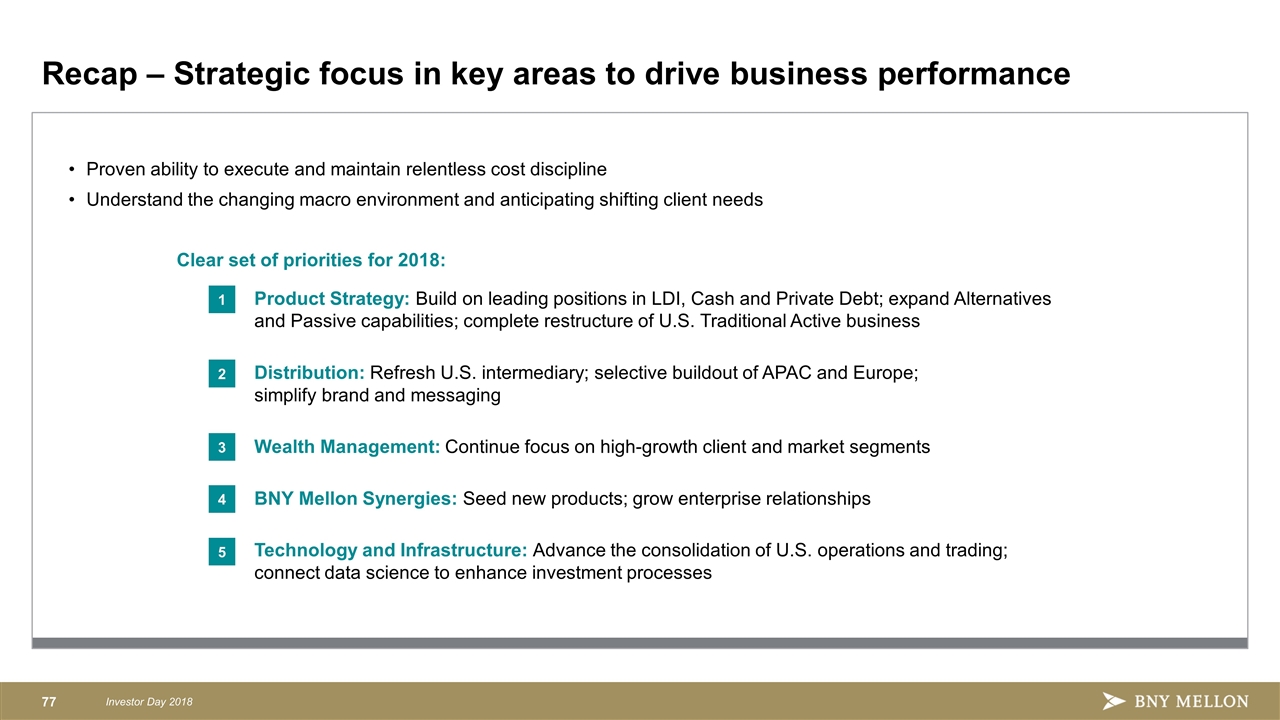

Clear set of priorities for 2018: Product Strategy: Build on leading positions in LDI, Cash and Private Debt; expand Alternatives and Passive capabilities; complete restructure of U.S. Traditional Active business Distribution: Refresh U.S. intermediary; selective buildout of APAC and Europe; simplify brand and messaging Wealth Management: Continue focus on high-growth client and market segments BNY Mellon Synergies: Seed new products; grow enterprise relationships Technology and Infrastructure: Advance the consolidation of U.S. operations and trading; connect data science to enhance investment processes Recap – Strategic focus in key areas to drive business performance Proven ability to execute and maintain relentless cost discipline Understand the changing macro environment and anticipating shifting client needs 1 2 3 4 5

Investor Day 2018 Pershing Lisa Dolly CEO, Pershing March 8, 2018

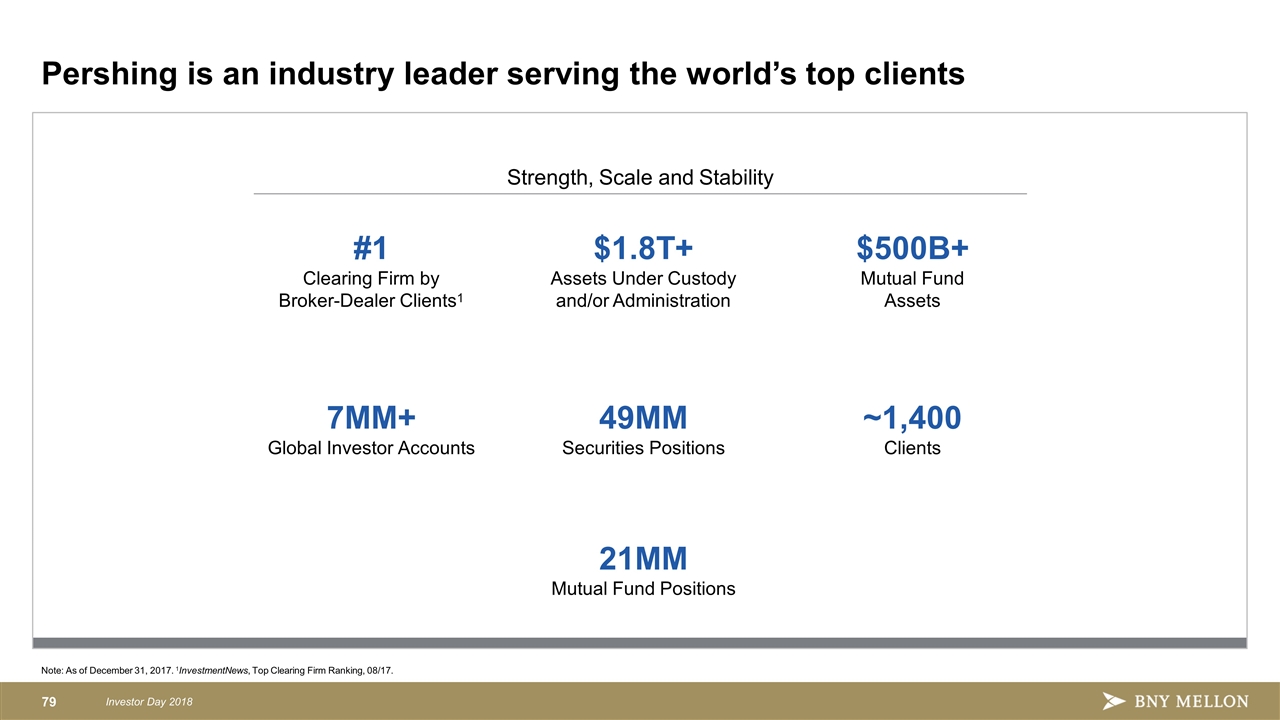

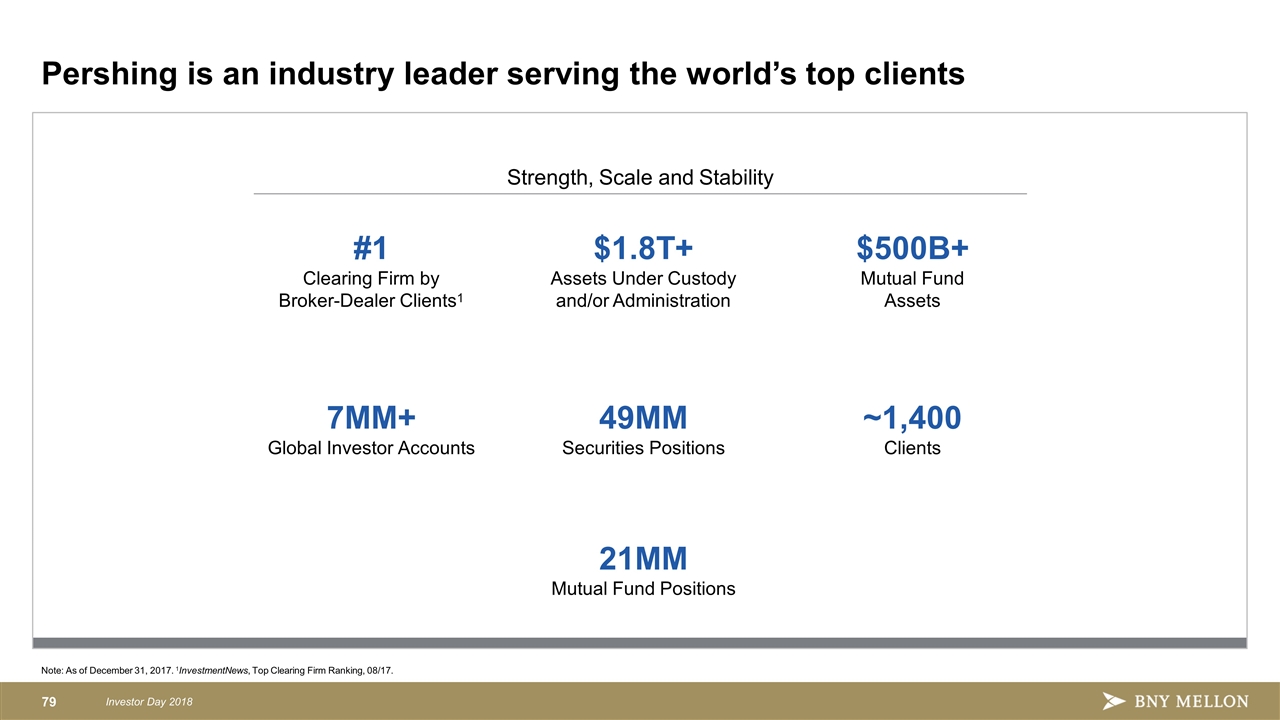

Note: As of December 31, 2017. 1InvestmentNews, Top Clearing Firm Ranking, 08/17. Pershing is an industry leader serving the world’s top clients $500B+ Mutual Fund Assets ~1,400 Clients #1 Clearing Firm by Broker-Dealer Clients1 7MM+ Global Investor Accounts Strength, Scale and Stability $1.8T+ Assets Under Custody and/or Administration 49MM Securities Positions 21MM Mutual Fund Positions

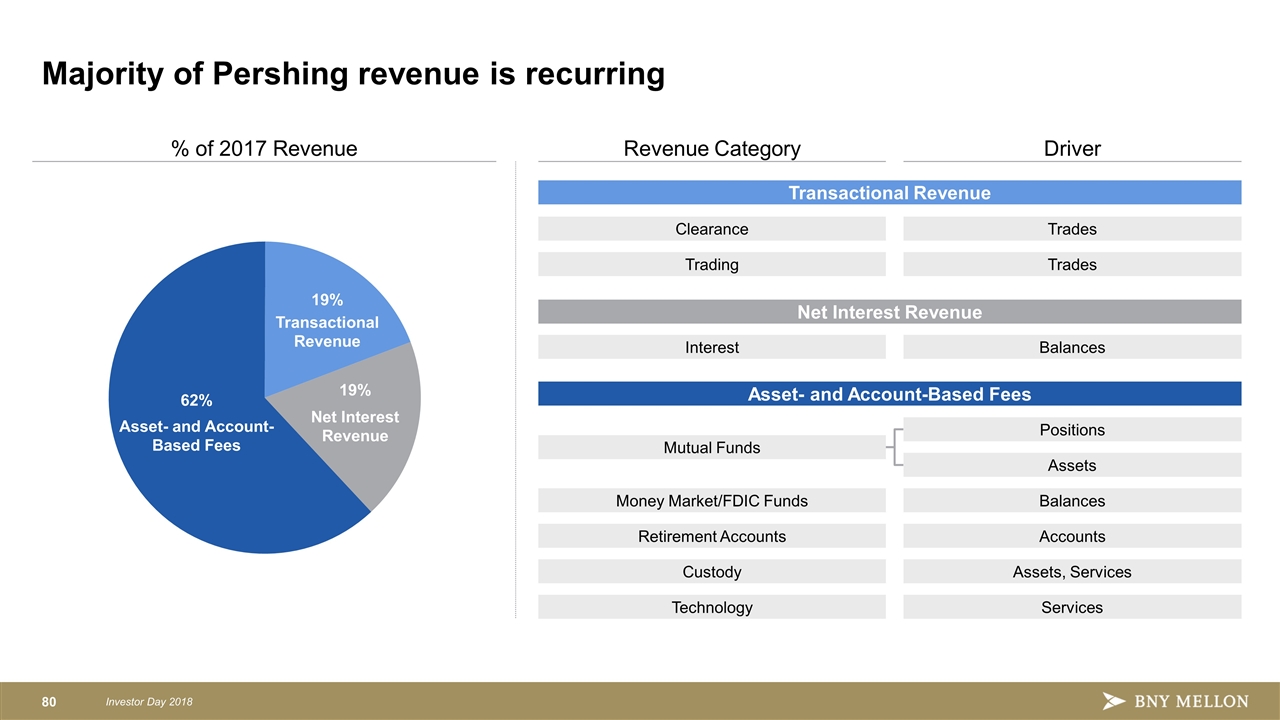

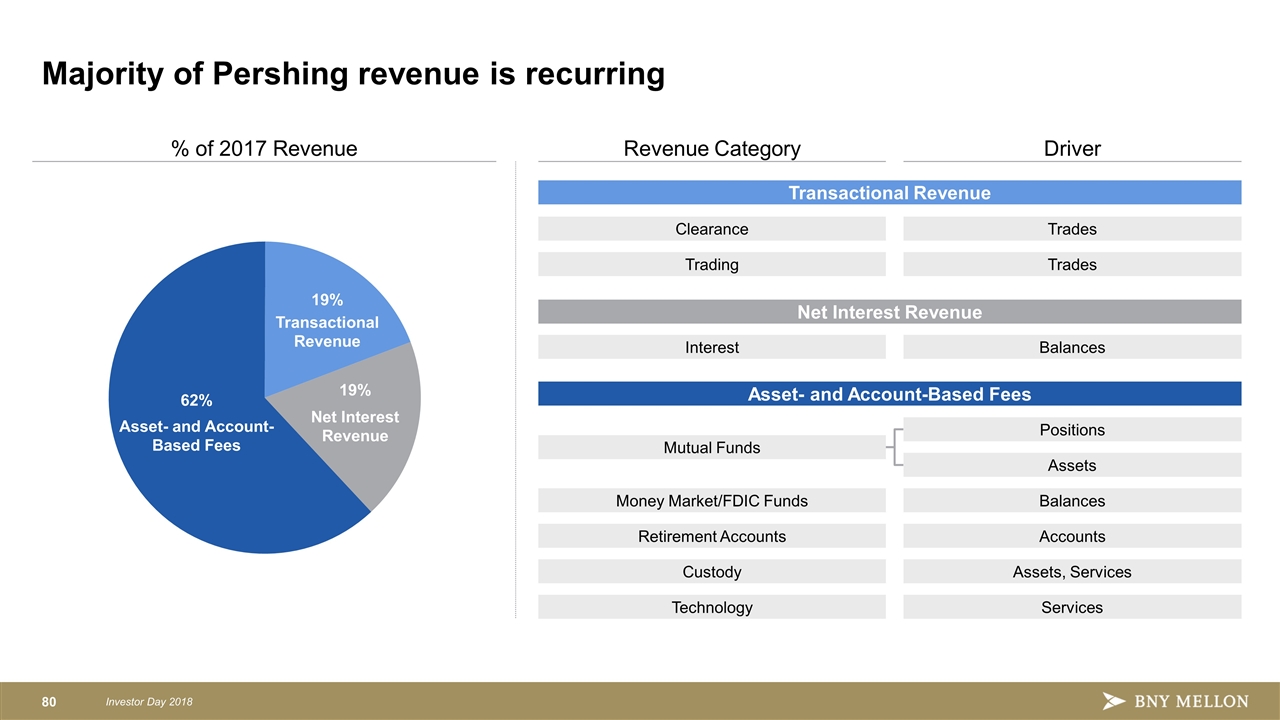

Majority of Pershing revenue is recurring % of 2017 Revenue Transactional Revenue Asset- and Account- Based Fees Net Interest Revenue Asset- and Account-Based Fees Transactional Revenue Revenue Category Driver Balances Accounts Assets, Services Services Money Market/FDIC Funds Retirement Accounts Custody Technology Positions Mutual Funds Assets Trades Trades Clearance Trading Balances Interest Net Interest Revenue 19% 19% 62%

Positioning clients for opportunity Remaining relevant to financial intermediaries for almost 80 years Core Clearing and Custody Financial Solutions Technology Platforms Wealth Management Business and Practice Management Thought Leadership Advisor and Marketing Programs Data Analytics Time Delivering Increased Value to Clients Value ONGOING SUCCESS STRONG FOUNDATION Client base has expanded over time: Broker-Dealers ∙ RIAs ∙ Family Offices ∙ Hedge/‘40 Act Funds ∙ Wealth Managers

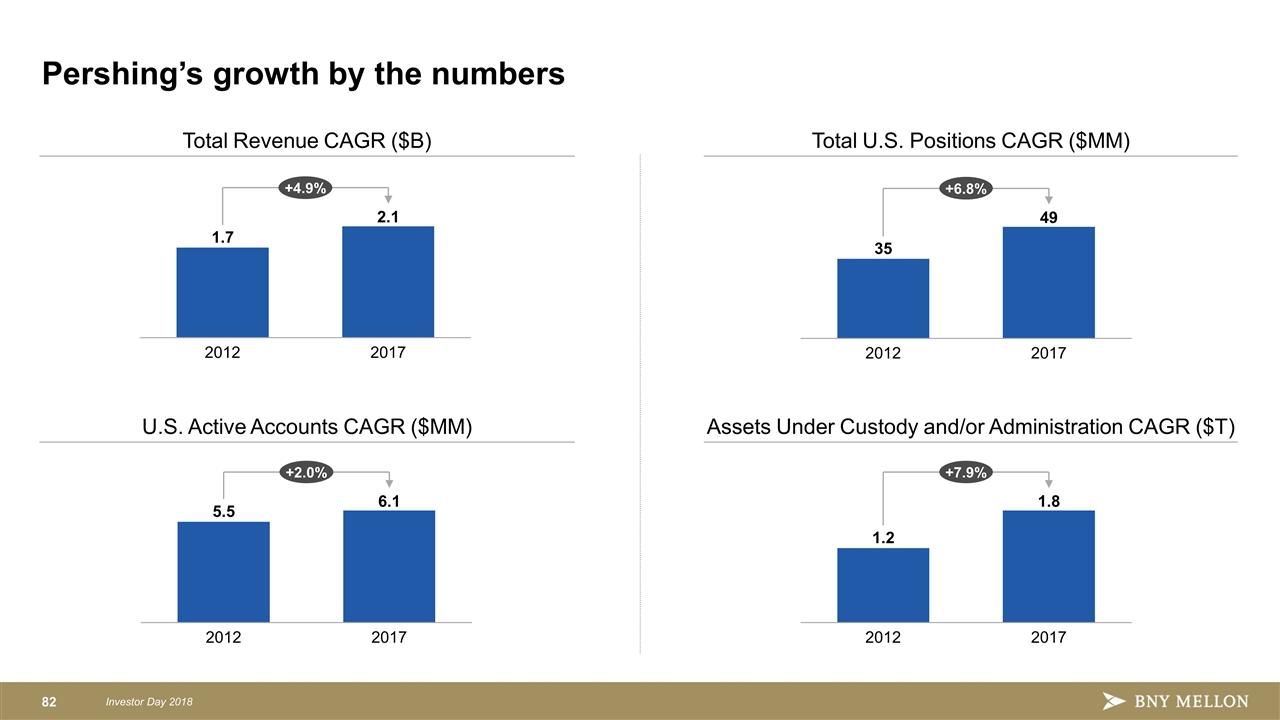

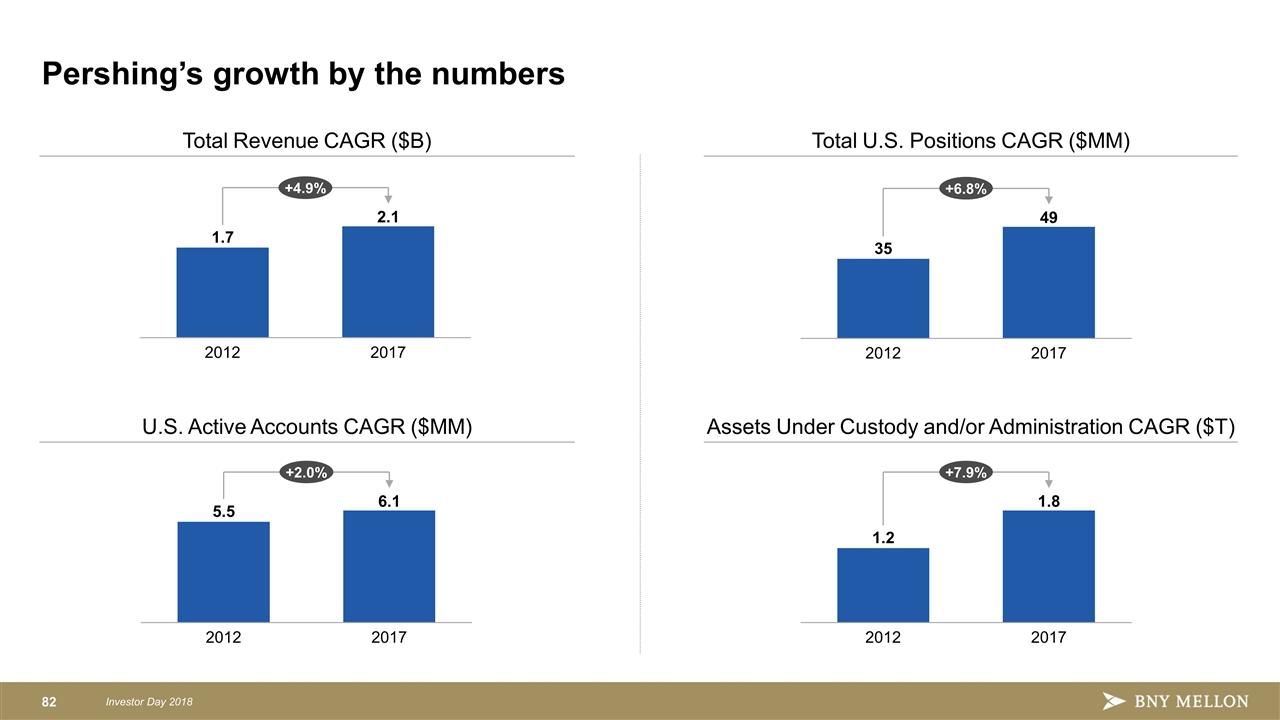

Pershing’s growth by the numbers Total Revenue CAGR ($B) Total U.S. Positions CAGR ($MM) U.S. Active Accounts CAGR ($MM) Assets Under Custody and/or Administration CAGR ($T) +4.9% +6.8% +2.0% +7.9%

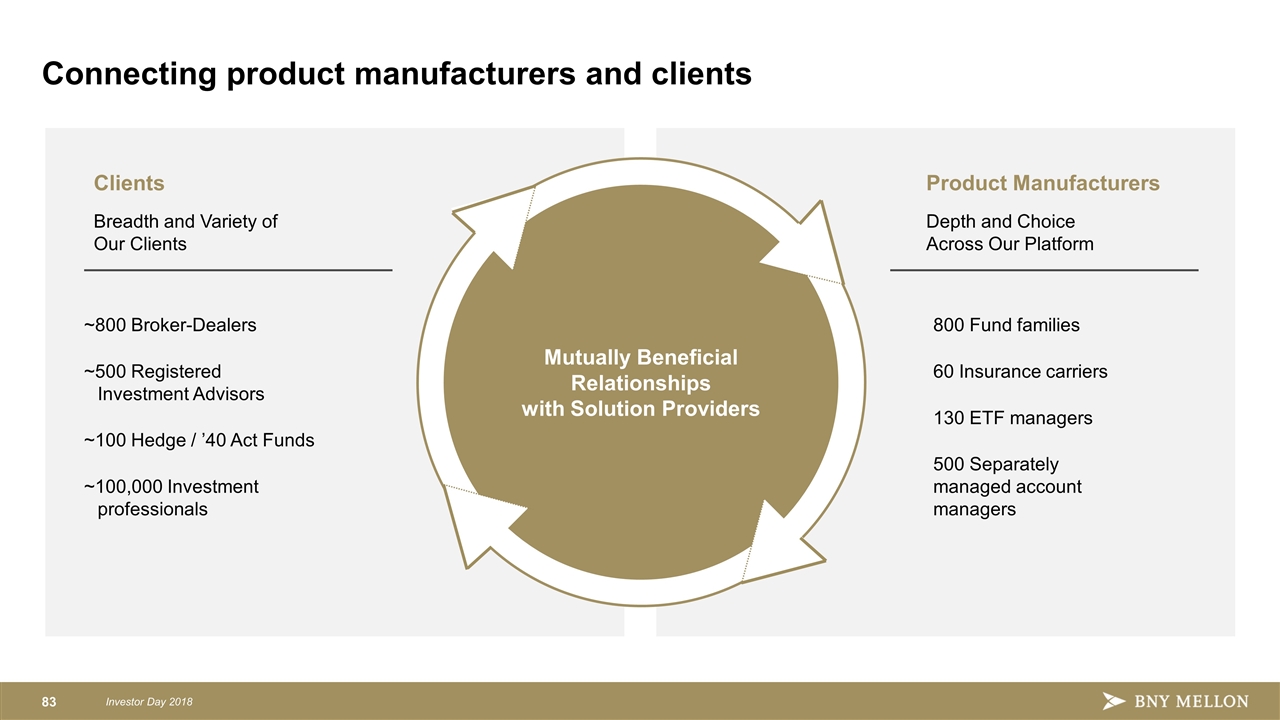

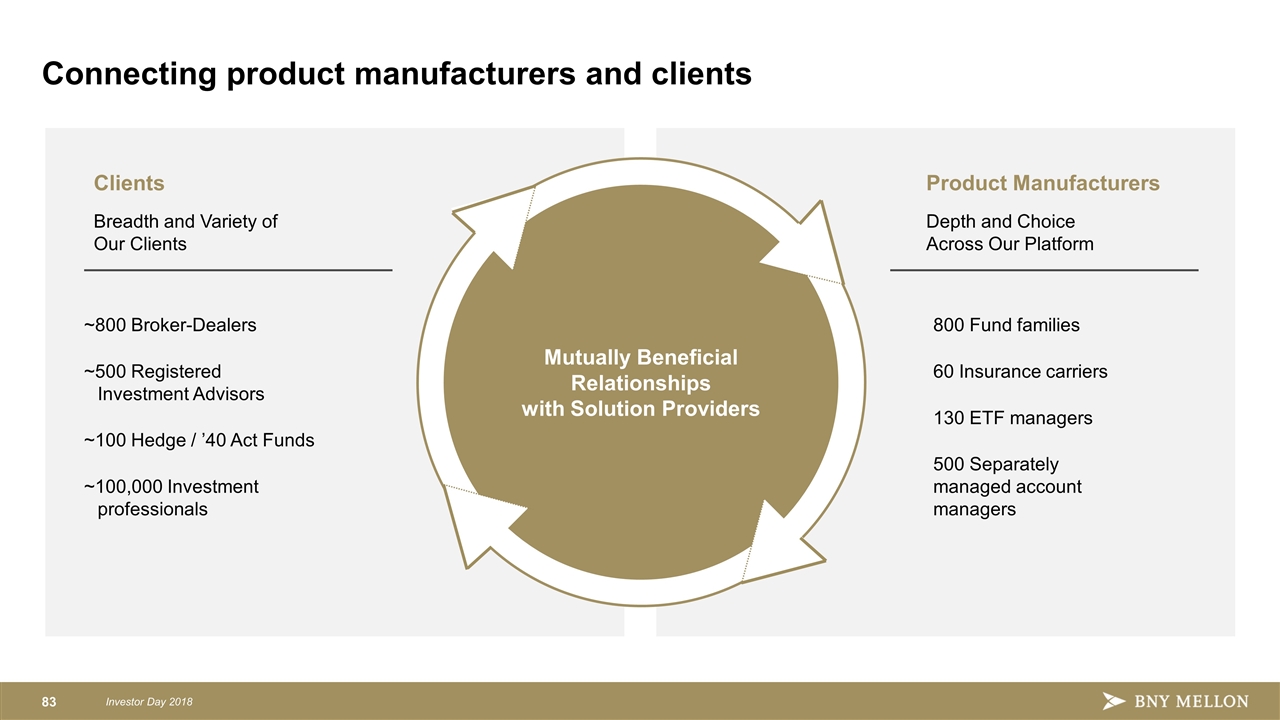

Connecting product manufacturers and clients Clients ~800 Broker-Dealers ~500 Registered Investment Advisors ~100 Hedge / ’40 Act Funds ~100,000 Investment professionals Breadth and Variety of Our Clients Product Manufacturers 800 Fund families 60 Insurance carriers 130 ETF managers 500 Separately managed account managers Depth and Choice Across Our Platform Mutually Beneficial Relationships with Solution Providers

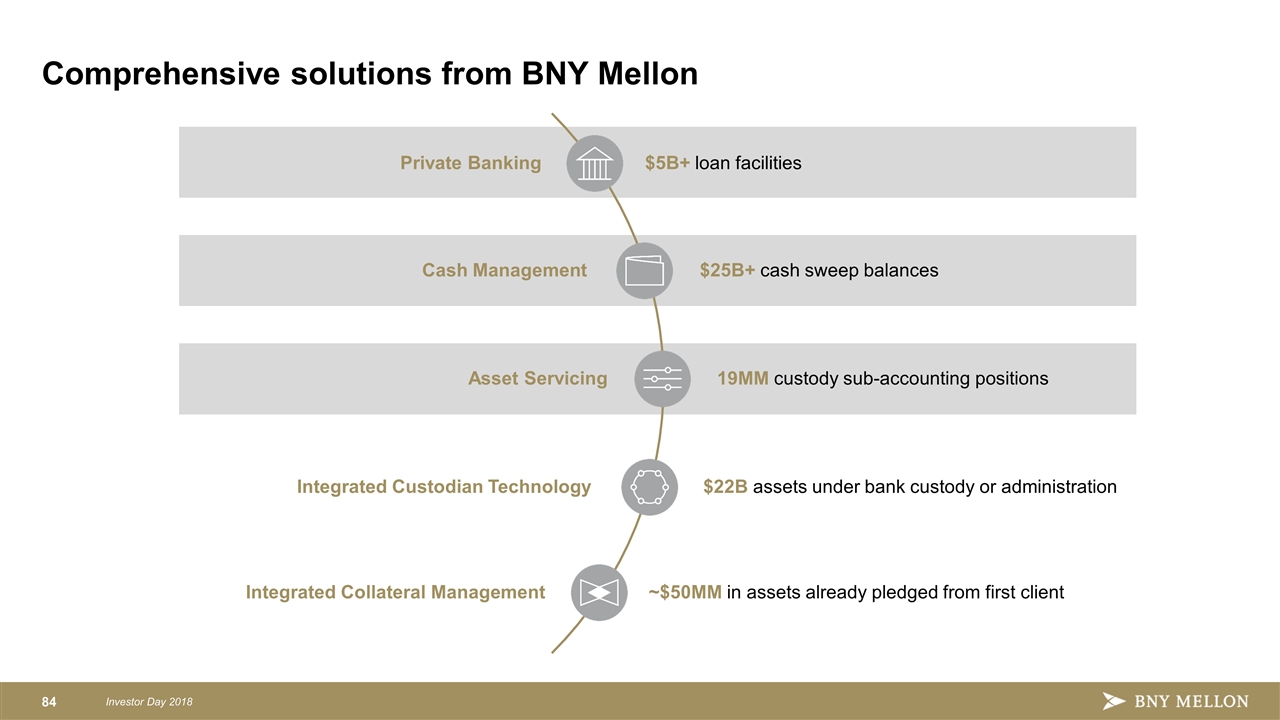

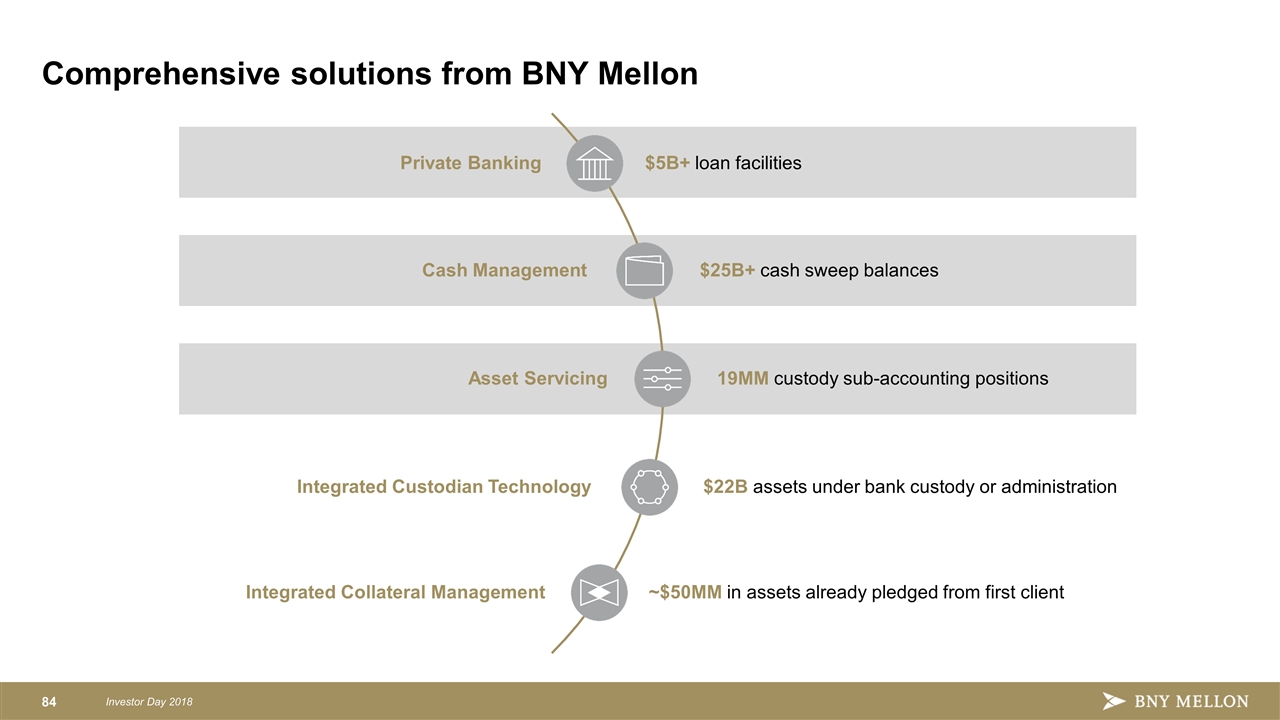

Comprehensive solutions from BNY Mellon $25B+ cash sweep balances Cash Management Private Banking $5B+ loan facilities $22B assets under bank custody or administration Integrated Custodian Technology 19MM custody sub-accounting positions Asset Servicing ~$50MM in assets already pledged from first client Integrated Collateral Management

Technology as a business enabler

Note: Pershing has over 400 third-party solutions including those providing market data and analytics. The above are examples specific to technology integration. Trademark(s) belong to their respective owners. Delivering integrated proprietary and third-party solutions Wealth Planning Client Onboarding Trade/Order Management Proposal, Model Management and Performance Prospecting and Client Relationship Aggregation/ Portfolio Analytics Digital Advice

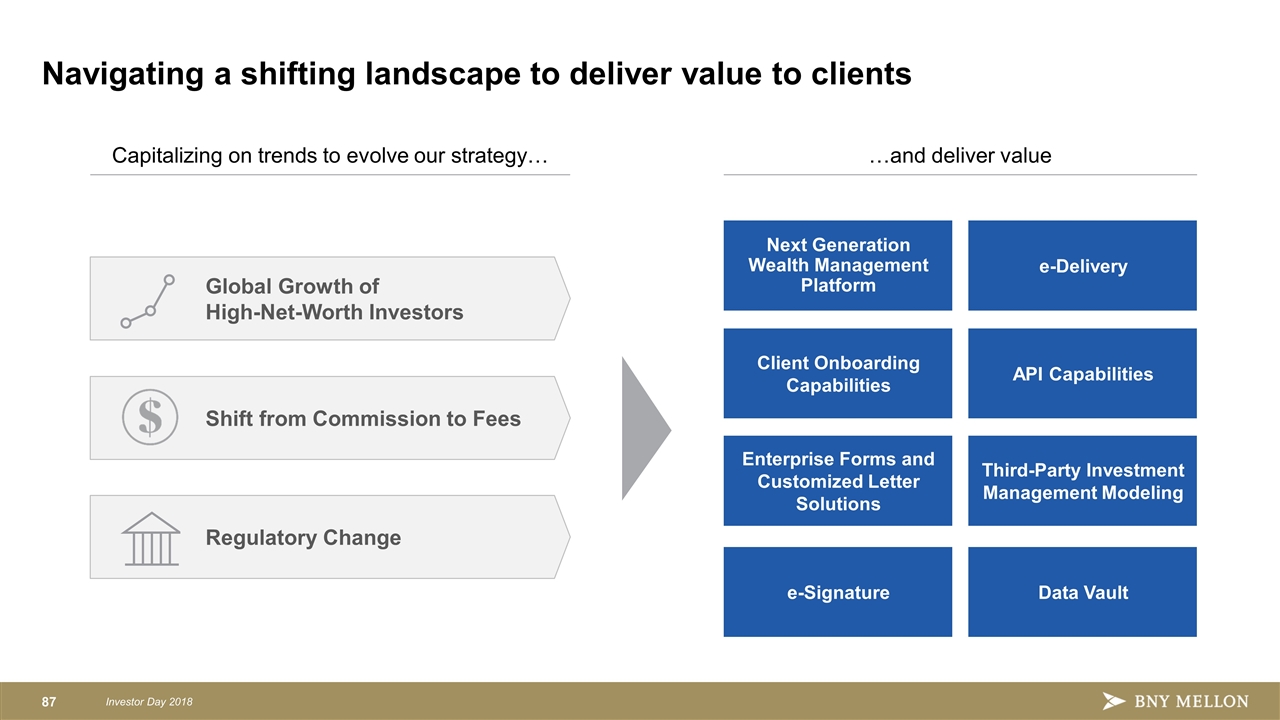

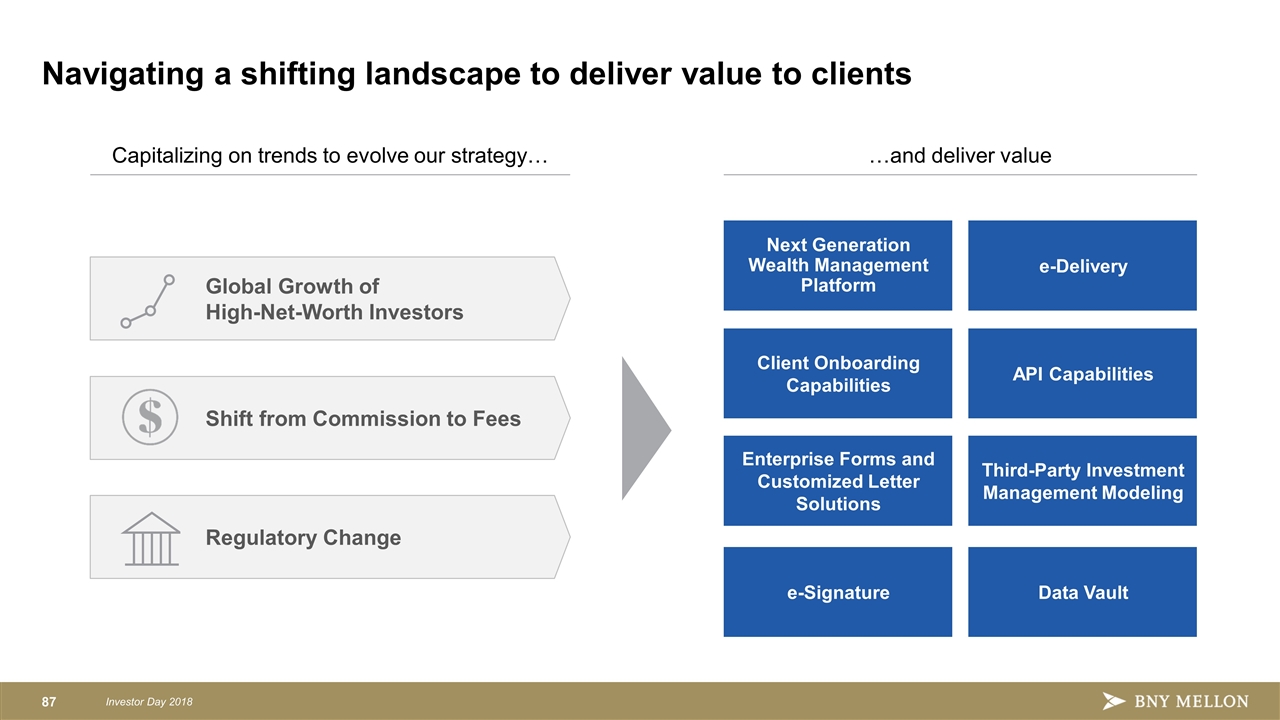

Navigating a shifting landscape to deliver value to clients Capitalizing on trends to evolve our strategy… …and deliver value Next Generation Wealth Management Platform e-Delivery Client Onboarding Capabilities API Capabilities Enterprise Forms and Customized Letter Solutions Third-Party Investment Management Modeling e-Signature Data Vault Global Growth of High-Net-Worth Investors Regulatory Change Shift from Commission to Fees

Summary Unique set of capabilities More than a clearing firm A platform of size and scale Powered by structural change Diversified revenue streams not dependent on trade volumes 88 Investor Day 2018

We’ll be returning shortly Investor Day 2018

Investor Day 2018 Asset Servicing Hani Kablawi CEO, Asset Servicing March 8, 2018

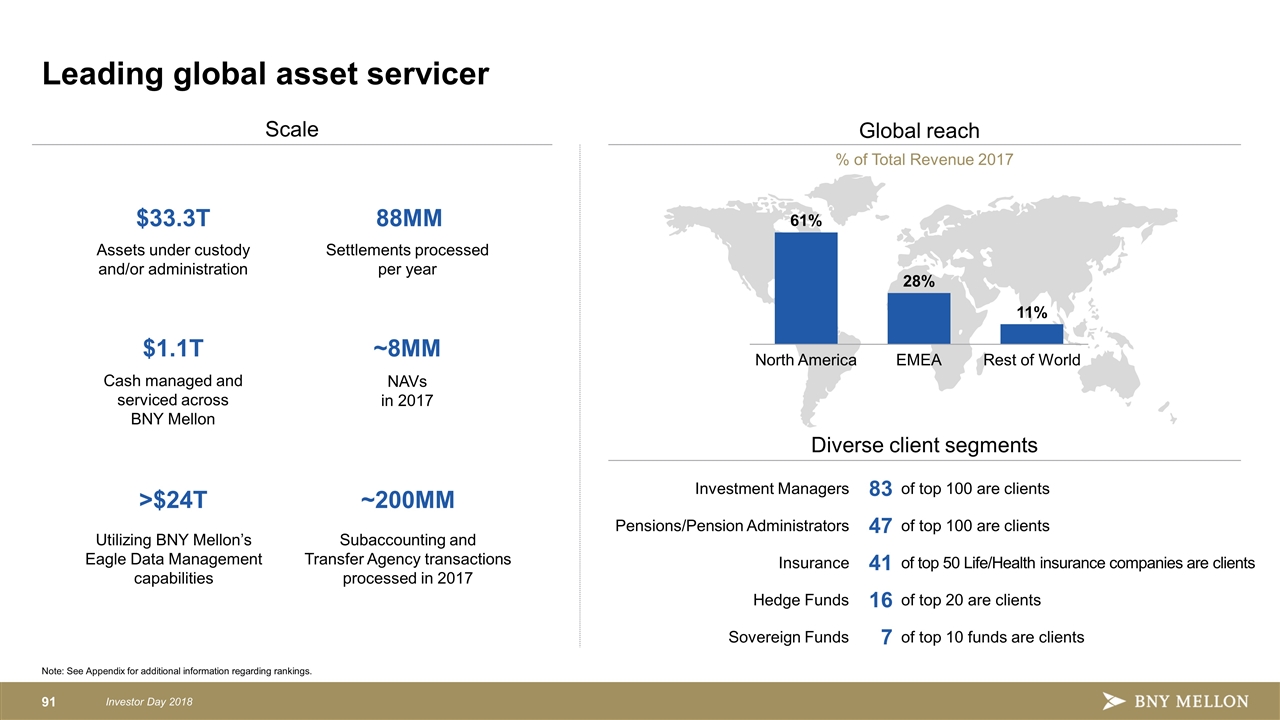

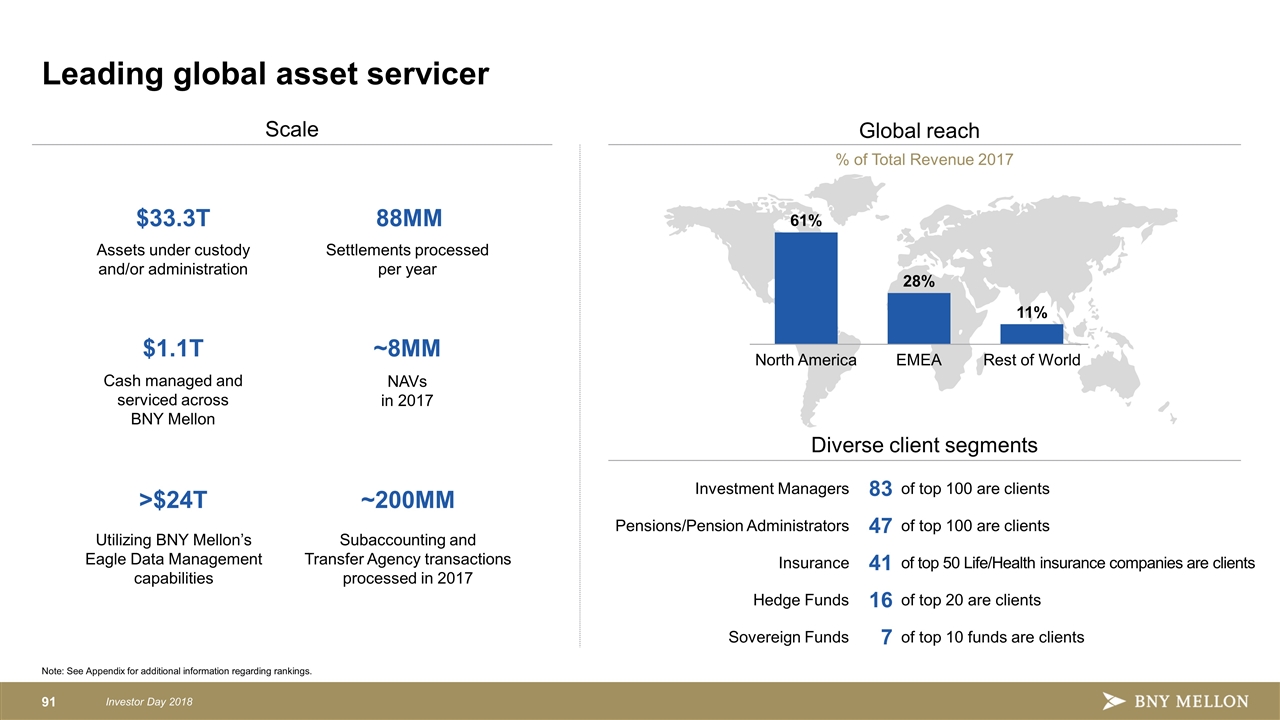

Leading global asset servicer 83 Investment Managers Scale Global reach Diverse client segments Pensions/Pension Administrators 47 Hedge Funds 16 7 % of Total Revenue 2017 $33.3T Assets under custody and/or administration 88MM Settlements processed per year $1.1T Cash managed and serviced across BNY Mellon ~8MM NAVs in 2017 >$24T Utilizing BNY Mellon’s Eagle Data Management capabilities ~200MM Subaccounting and Transfer Agency transactions processed in 2017 41 Insurance Note: See Appendix for additional information regarding rankings. of top 100 are clients of top 100 are clients of top 20 are clients of top 10 funds are clients of top 50 Life/Health insurance companies are clients Sovereign Funds

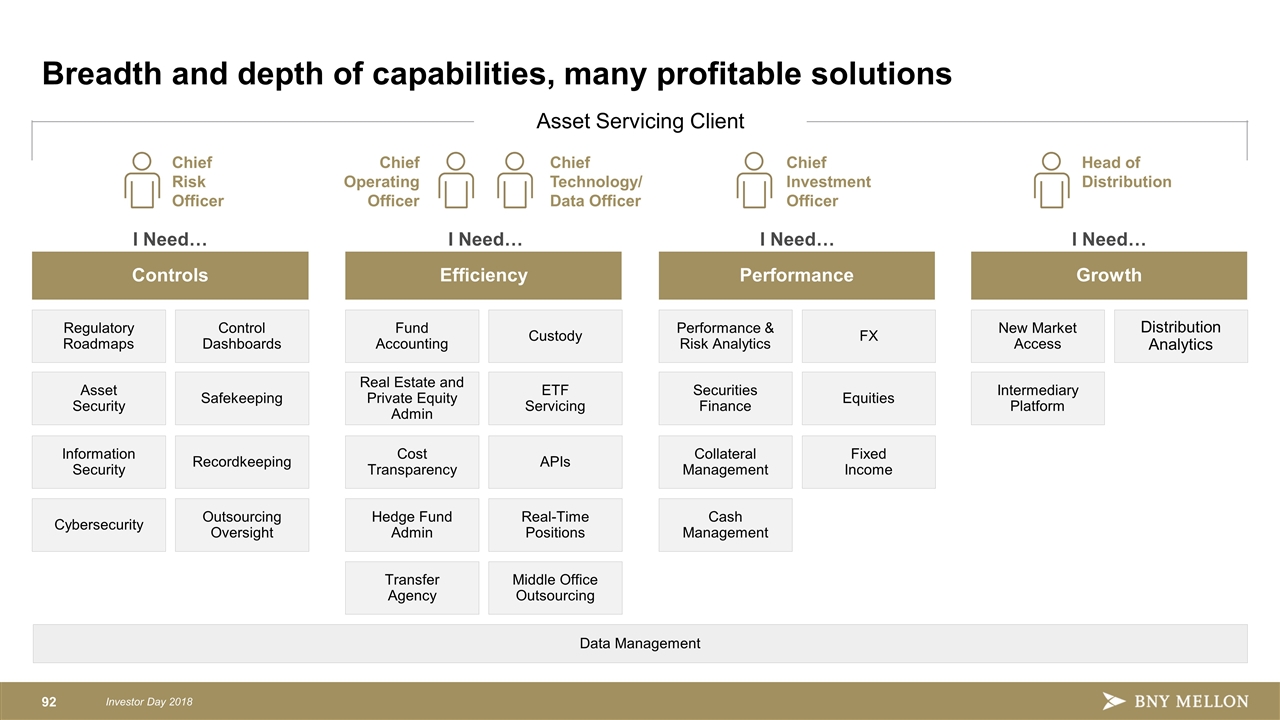

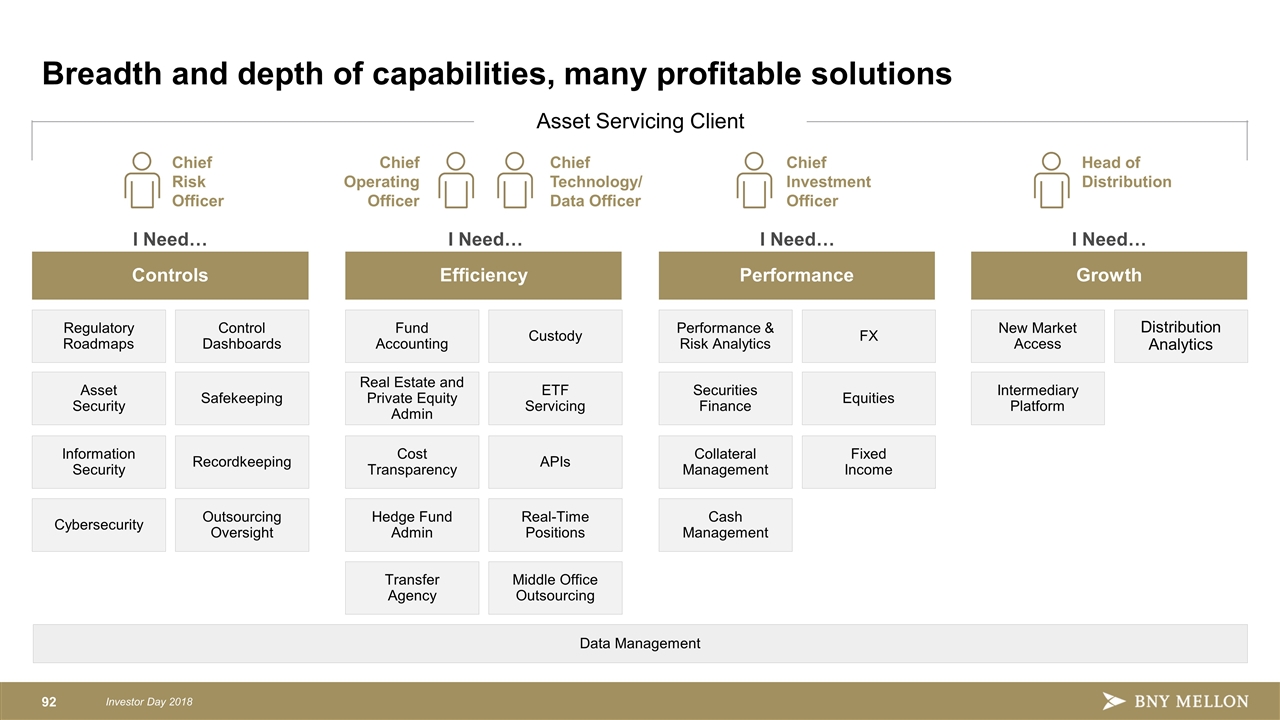

Breadth and depth of capabilities, many profitable solutions Asset Servicing Client Chief Investment Officer Head of Distribution Chief Operating Officer Chief Technology/ Data Officer Chief Risk Officer I Need… Performance I Need… Growth I Need… Efficiency Transfer Agency Middle Office Outsourcing I Need… Controls Performance & Risk Analytics FX New Market Access Distribution Analytics Fund Accounting Custody Regulatory Roadmaps Control Dashboards Securities Finance Equities Intermediary Platform Real Estate and Private Equity Admin ETF Servicing Asset Security Safekeeping Collateral Management Fixed Income Cost Transparency APIs Information Security Recordkeeping Cash Management Hedge Fund Admin Real-Time Positions Cybersecurity Outsourcing Oversight Data Management

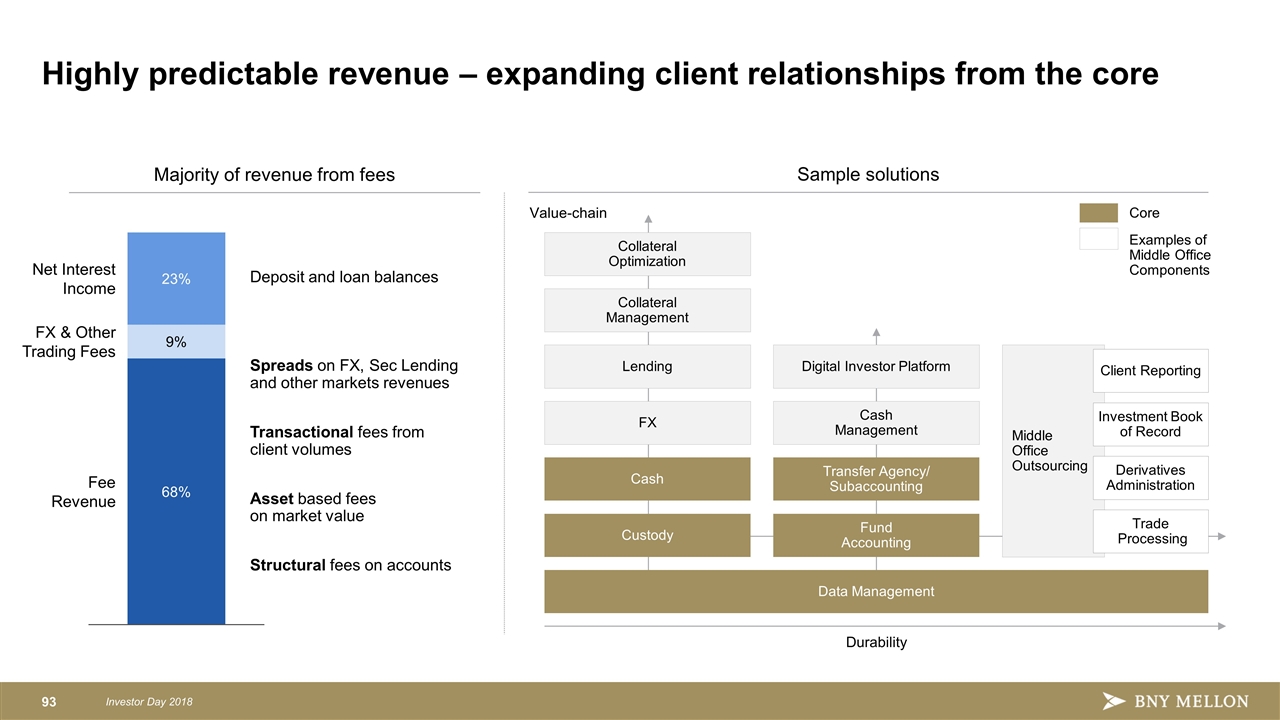

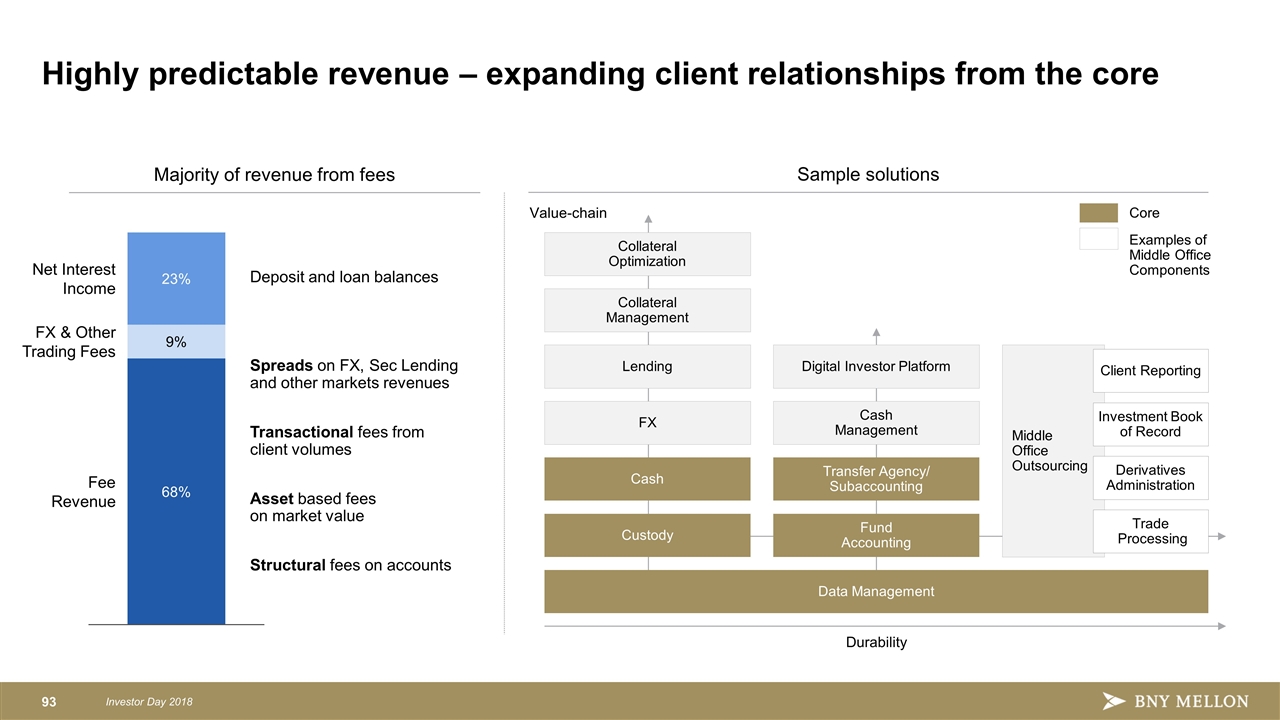

Highly predictable revenue – expanding client relationships from the core Deposit and loan balances Spreads on FX, Sec Lending and other markets revenues Transactional fees from client volumes Asset based fees on market value Structural fees on accounts Custody Cash FX Lending Collateral Management Collateral Optimization Digital Investor Platform Cash Management Transfer Agency/ Subaccounting Fund Accounting Middle Office Outsourcing Data Management Durability Core Majority of revenue from fees Sample solutions Trade Processing Derivatives Administration Value-chain Investment Book of Record Client Reporting Examples of Middle Office Components

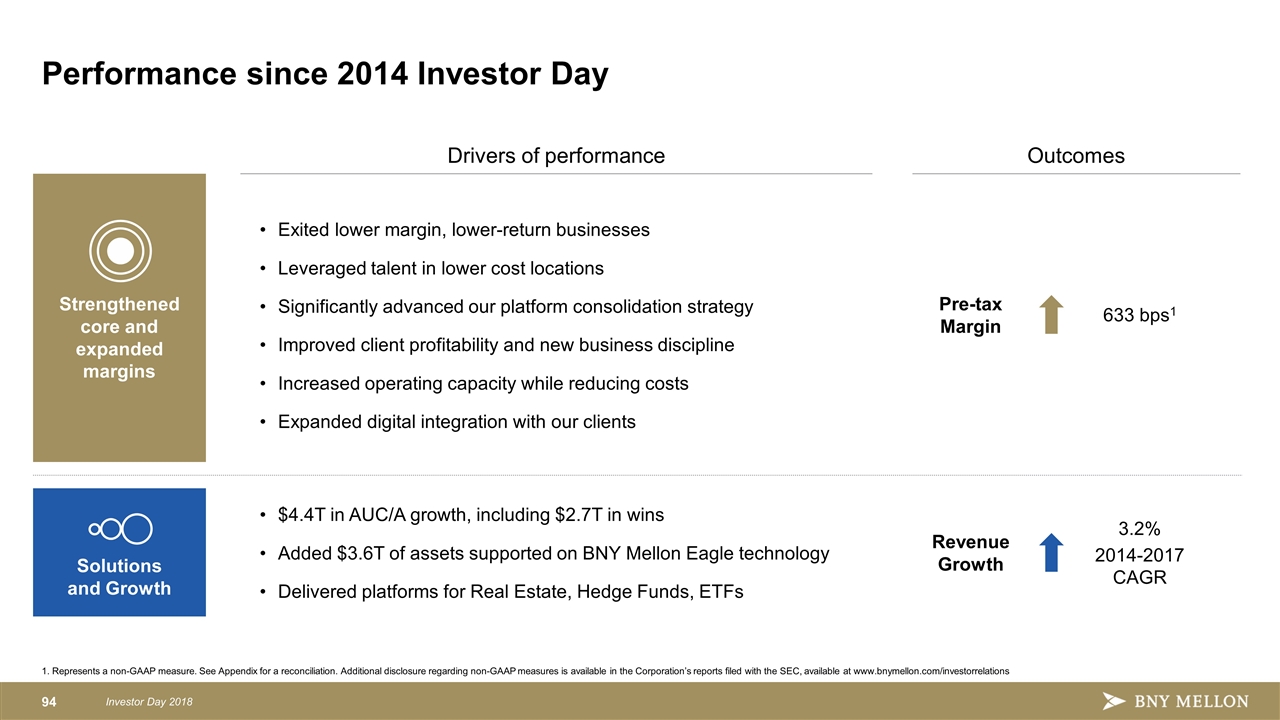

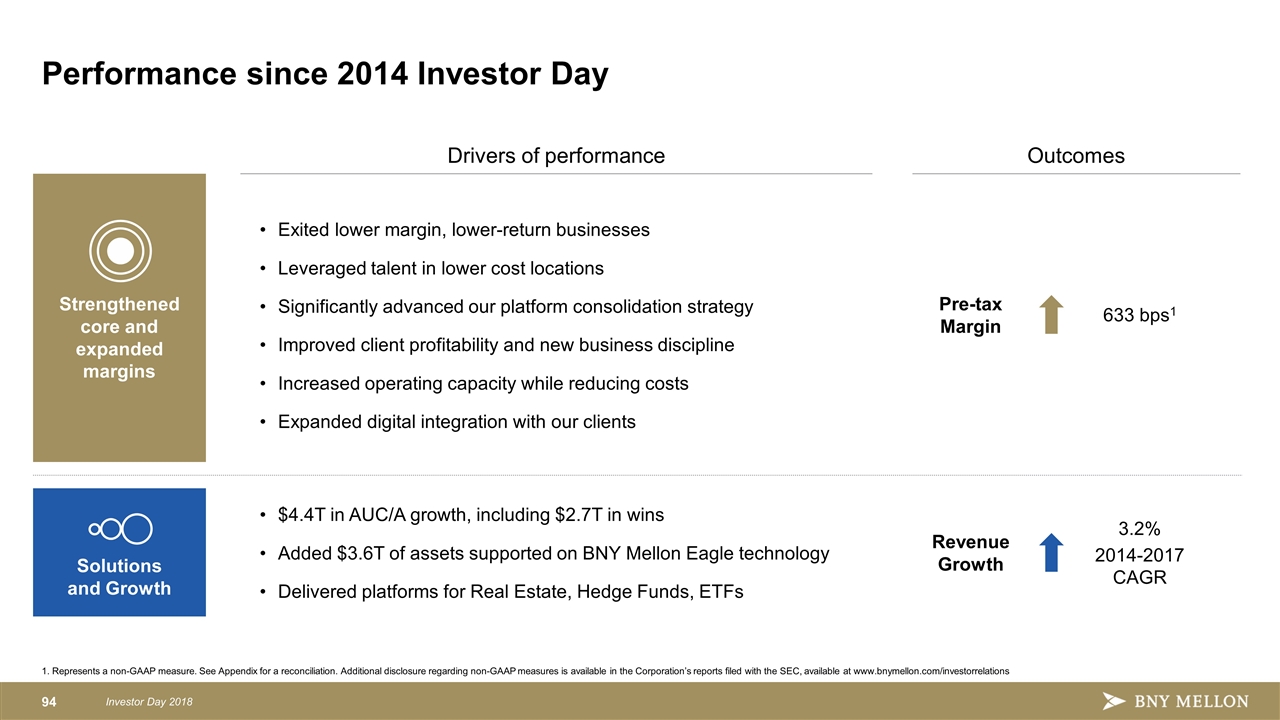

Performance since 2014 Investor Day Drivers of performance Exited lower margin, lower-return businesses Leveraged talent in lower cost locations Significantly advanced our platform consolidation strategy Improved client profitability and new business discipline Increased operating capacity while reducing costs Expanded digital integration with our clients $4.4T in AUC/A growth, including $2.7T in wins Added $3.6T of assets supported on BNY Mellon Eagle technology Delivered platforms for Real Estate, Hedge Funds, ETFs Outcomes Pre-tax Margin 633 bps1 Revenue Growth 3.2% 2014-2017 CAGR Strengthened core and expanded margins Solutions and Growth 1. Represents a non-GAAP measure. See Appendix for a reconciliation. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations

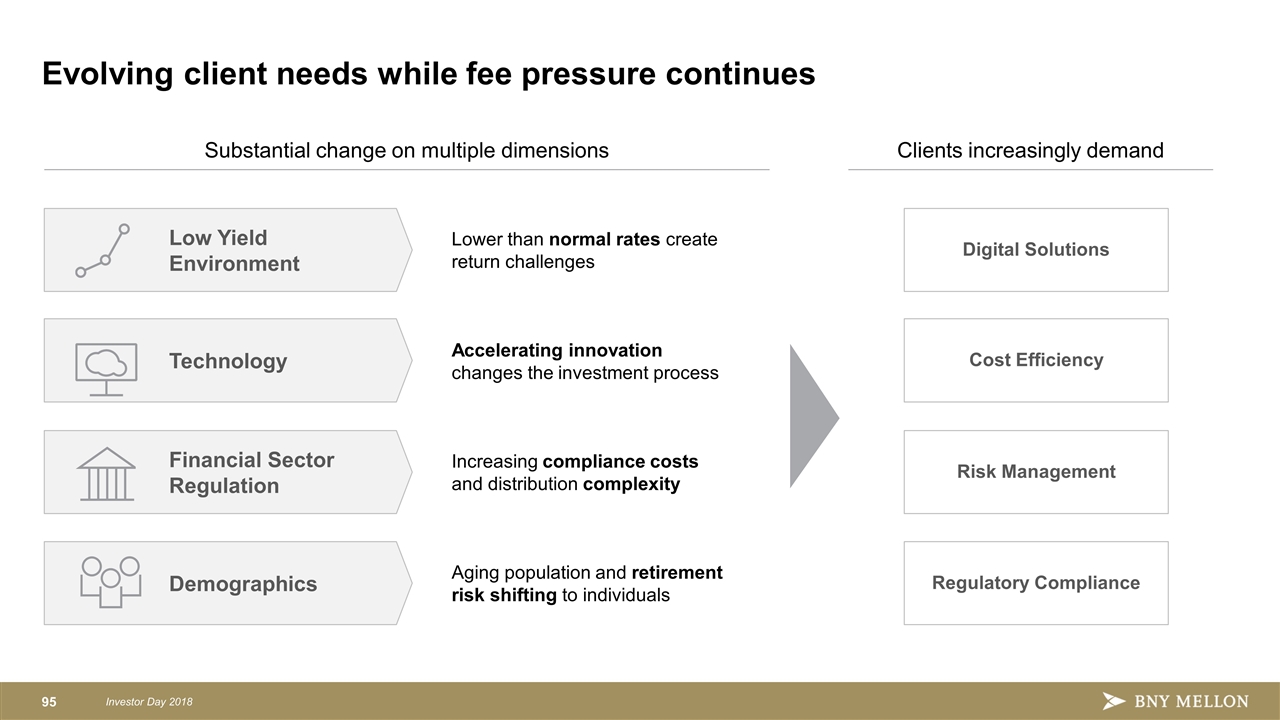

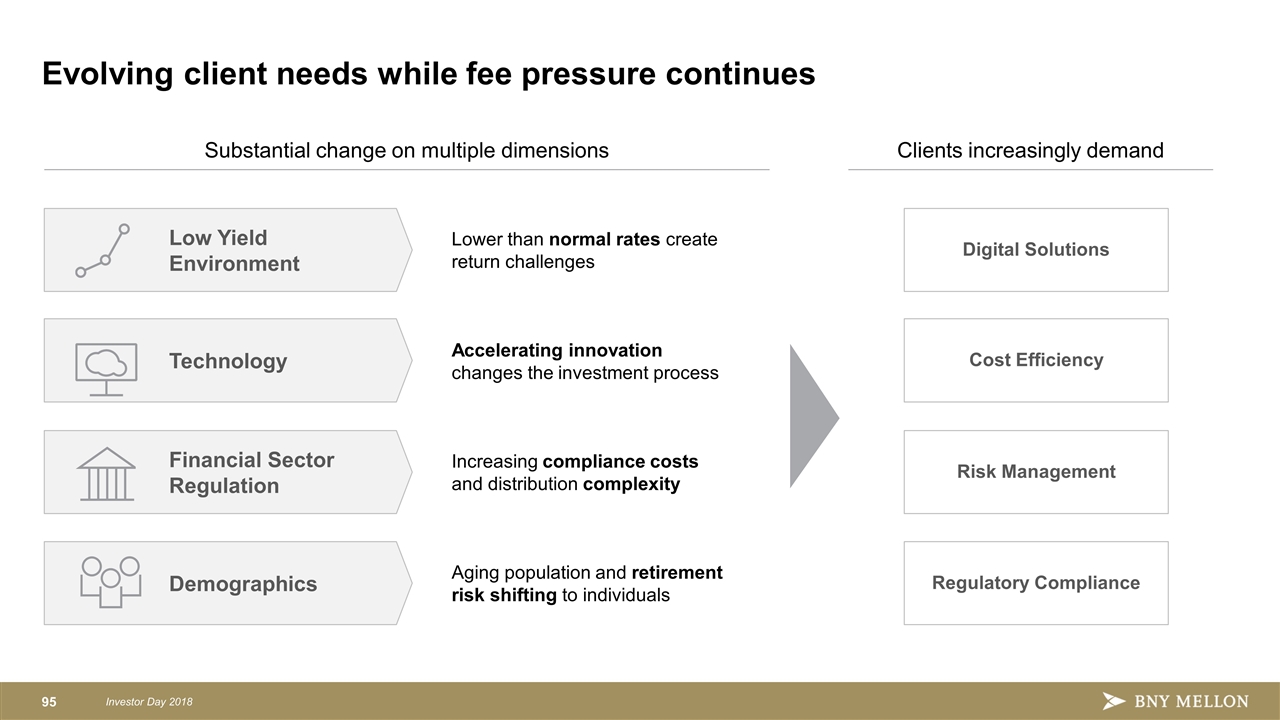

Demographics Evolving client needs while fee pressure continues Substantial change on multiple dimensions Financial Sector Regulation Low Yield Environment Technology Lower than normal rates create return challenges Accelerating innovation changes the investment process Increasing compliance costs and distribution complexity Aging population and retirement risk shifting to individuals Clients increasingly demand Digital Solutions Cost Efficiency Risk Management Regulatory Compliance

Focus going forward Competing more effectively in the core business Custody, Fund Administration, Investor Solutions 1 Creating markets capabilities that enhance client outcomes Trading, financing, collateral, liquidity 4 Automate by enhancing workflow, increasing digital intake of data, and deploying machine learning Provide operational transparency Continually focus on strengthening our operating platform Building solutions and integrating with clients Continuing to strengthen our core and improve operational efficiency Serving faster-growing Alternative and ETF managers Private Equity, Real Estate, Hedge Funds, ETFs 2 Delivering industry-leading data management solutions Software solutions, integration, analytics, APIs 3 Helping our clients service their investor base End investors, distribution efficiency/effectiveness 5 Maintain expanded margins and focus on accelerating fee growth

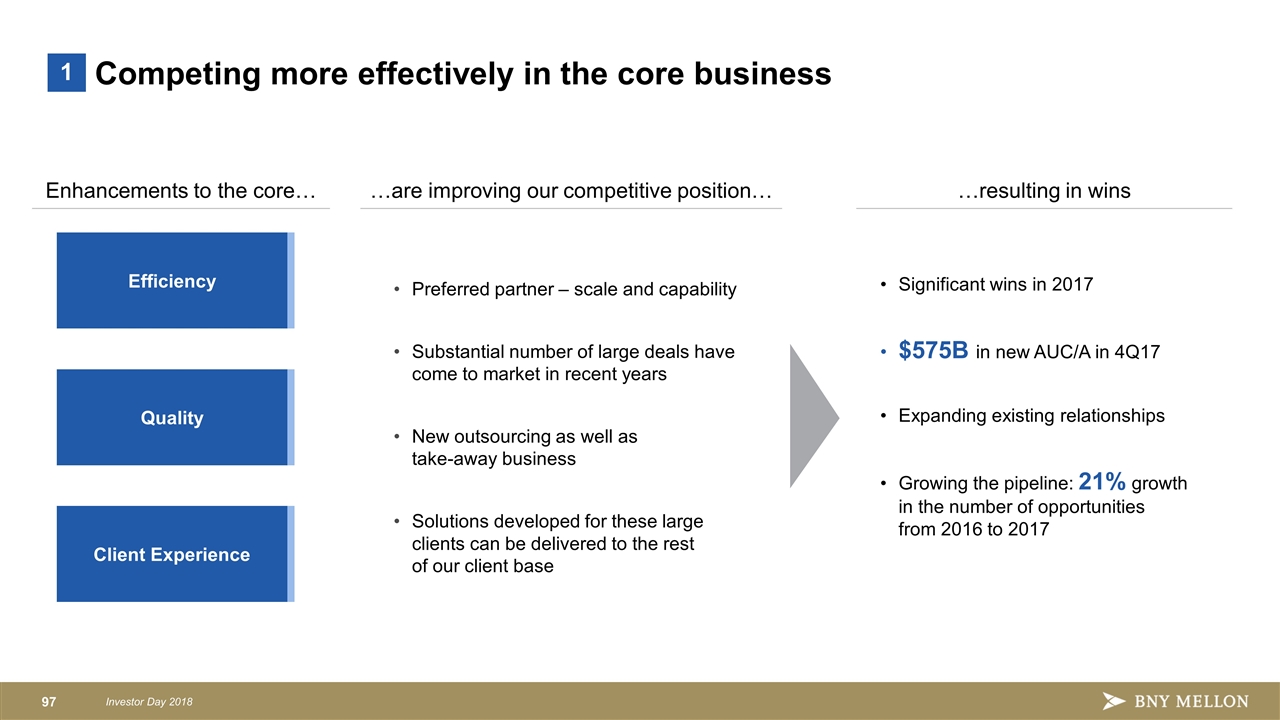

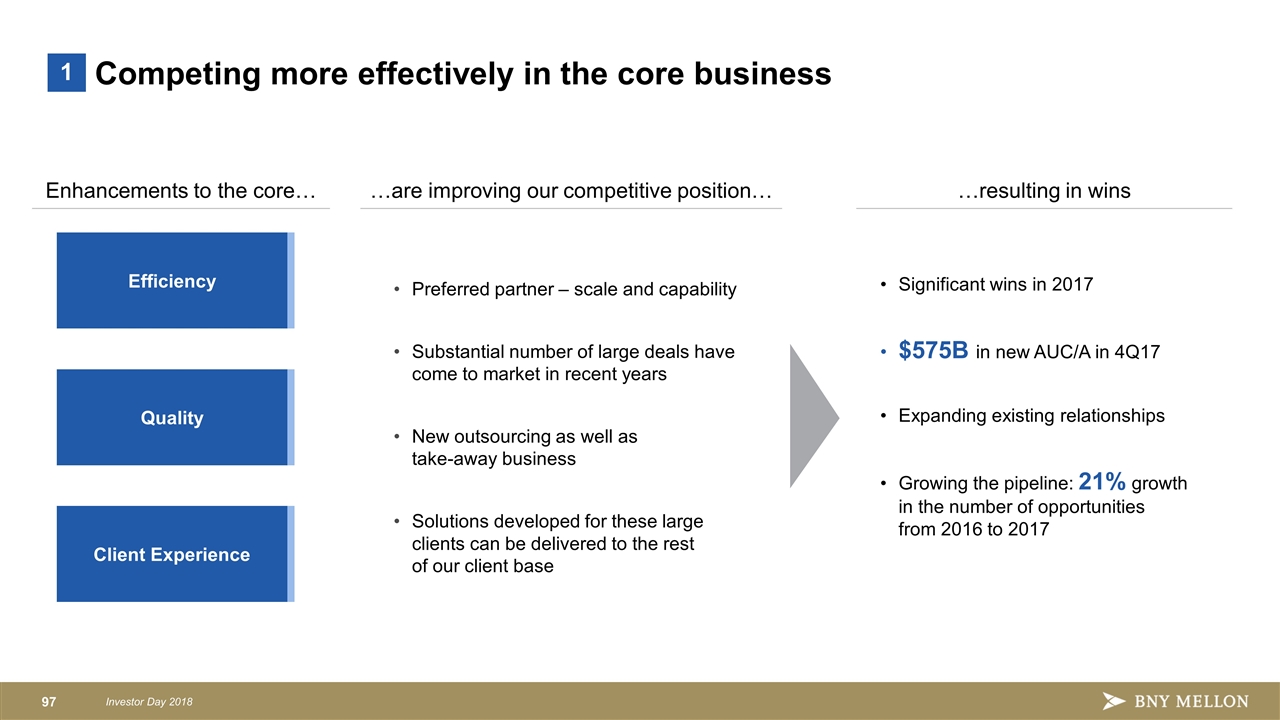

Competing more effectively in the core business 1 Enhancements to the core… …are improving our competitive position… …resulting in wins Efficiency Quality Client Experience Preferred partner – scale and capability Substantial number of large deals have come to market in recent years New outsourcing as well as take-away business Solutions developed for these large clients can be delivered to the rest of our client base Significant wins in 2017 $575B in new AUC/A in 4Q17 Expanding existing relationships Growing the pipeline: 21% growth in the number of opportunities from 2016 to 2017

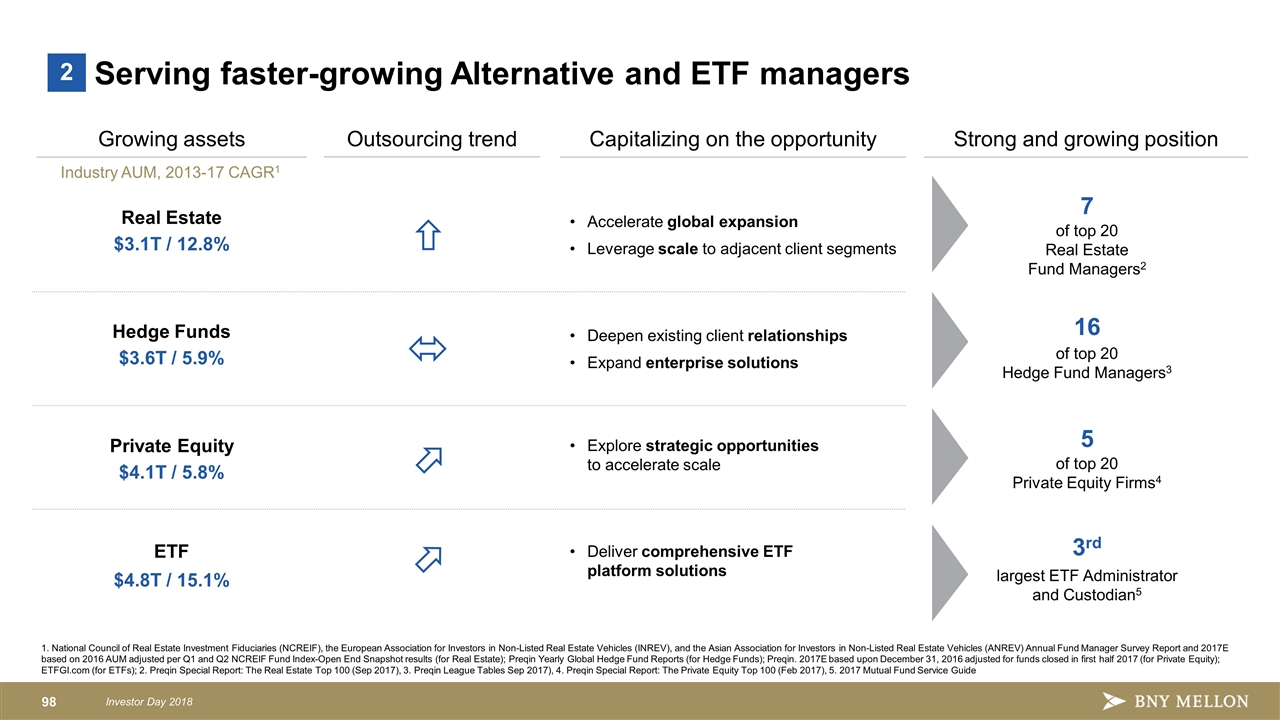

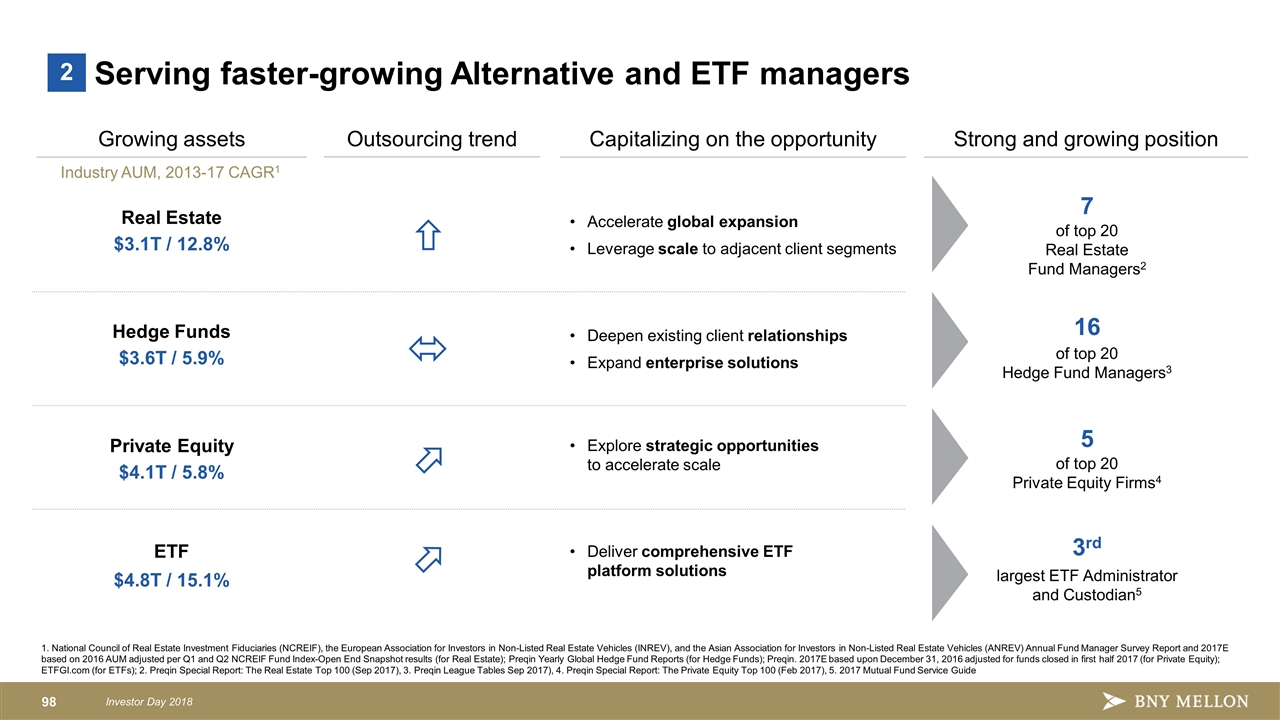

1. National Council of Real Estate Investment Fiduciaries (NCREIF), the European Association for Investors in Non-Listed Real Estate Vehicles (INREV), and the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV) Annual Fund Manager Survey Report and 2017E based on 2016 AUM adjusted per Q1 and Q2 NCREIF Fund Index-Open End Snapshot results (for Real Estate); Preqin Yearly Global Hedge Fund Reports (for Hedge Funds); Preqin. 2017E based upon December 31, 2016 adjusted for funds closed in first half 2017 (for Private Equity); ETFGI.com (for ETFs); 2. Preqin Special Report: The Real Estate Top 100 (Sep 2017), 3. Preqin League Tables Sep 2017), 4. Preqin Special Report: The Private Equity Top 100 (Feb 2017), 5. 2017 Mutual Fund Service Guide Serving faster-growing Alternative and ETF managers 2 Growing assets Capitalizing on the opportunity Strong and growing position Outsourcing trend ñ ó Accelerate global expansion Leverage scale to adjacent client segments Deepen existing client relationships Expand enterprise solutions $3.1T / 12.8% Real Estate $3.6T / 5.9% Hedge Funds 16 of top 20 Hedge Fund Managers3 7 of top 20 Real Estate Fund Managers2 ö Explore strategic opportunities to accelerate scale $4.1T / 5.8% Private Equity 5 of top 20 Private Equity Firms4 Deliver comprehensive ETF platform solutions $4.8T / 15.1% ETF 3rd largest ETF Administrator and Custodian5 Industry AUM, 2013-17 CAGR1 ñ

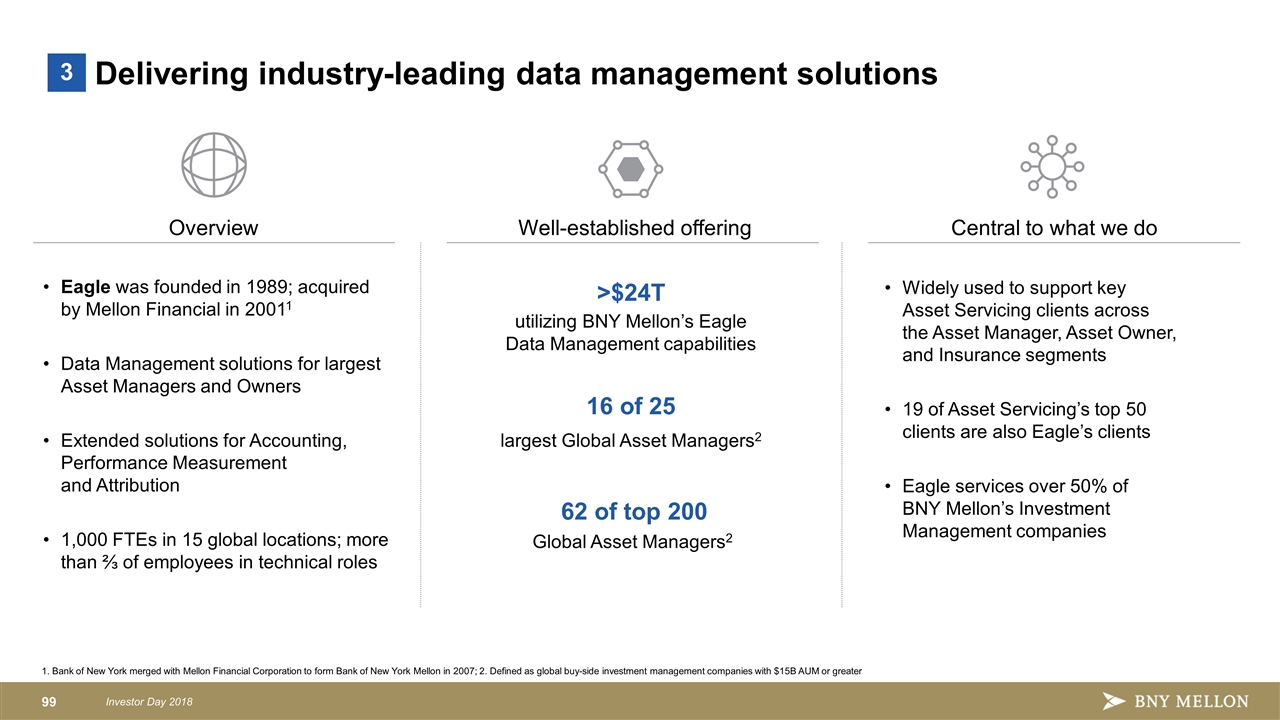

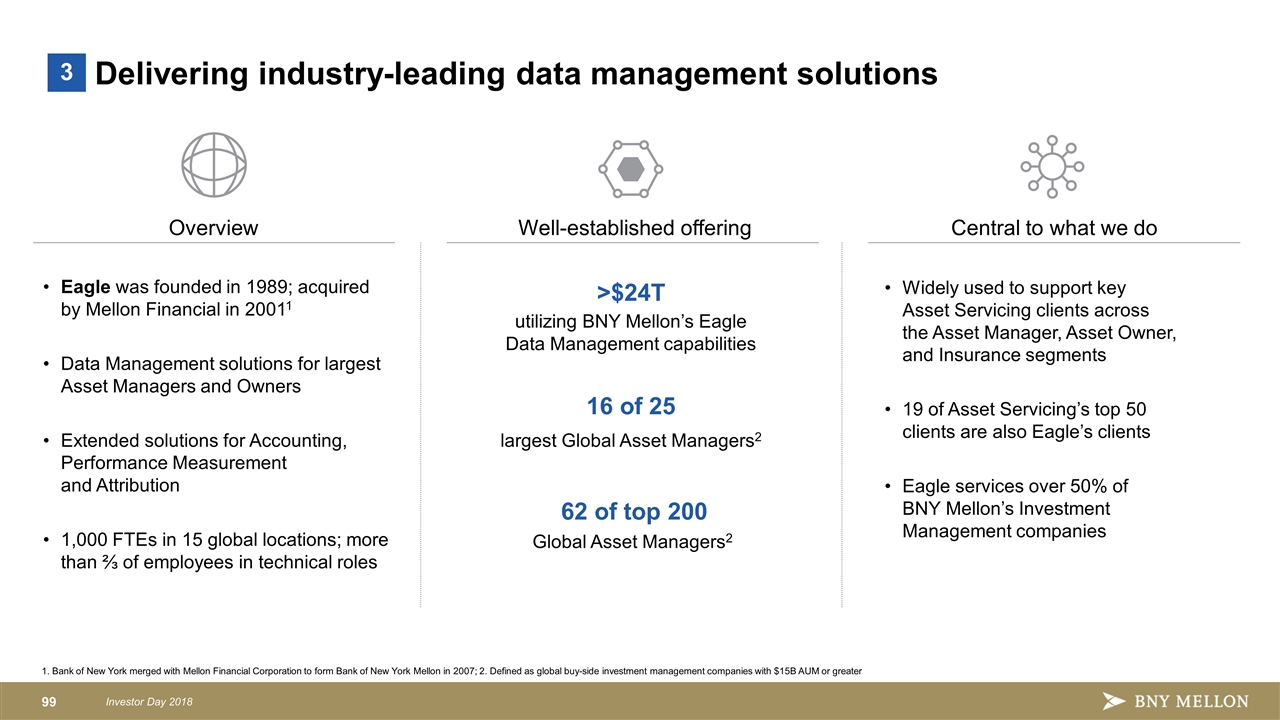

16 of 25 largest Global Asset Managers2 Well-established offering >$24T utilizing BNY Mellon’s Eagle Data Management capabilities Delivering industry-leading data management solutions Overview Eagle was founded in 1989; acquired by Mellon Financial in 20011 Data Management solutions for largest Asset Managers and Owners Extended solutions for Accounting, Performance Measurement and Attribution 1,000 FTEs in 15 global locations; more than ⅔ of employees in technical roles Central to what we do Widely used to support key Asset Servicing clients across the Asset Manager, Asset Owner, and Insurance segments 19 of Asset Servicing’s top 50 clients are also Eagle’s clients Eagle services over 50% of BNY Mellon’s Investment Management companies 3 62 of top 200 Global Asset Managers2 1. Bank of New York merged with Mellon Financial Corporation to form Bank of New York Mellon in 2007; 2. Defined as global buy-side investment management companies with $15B AUM or greater

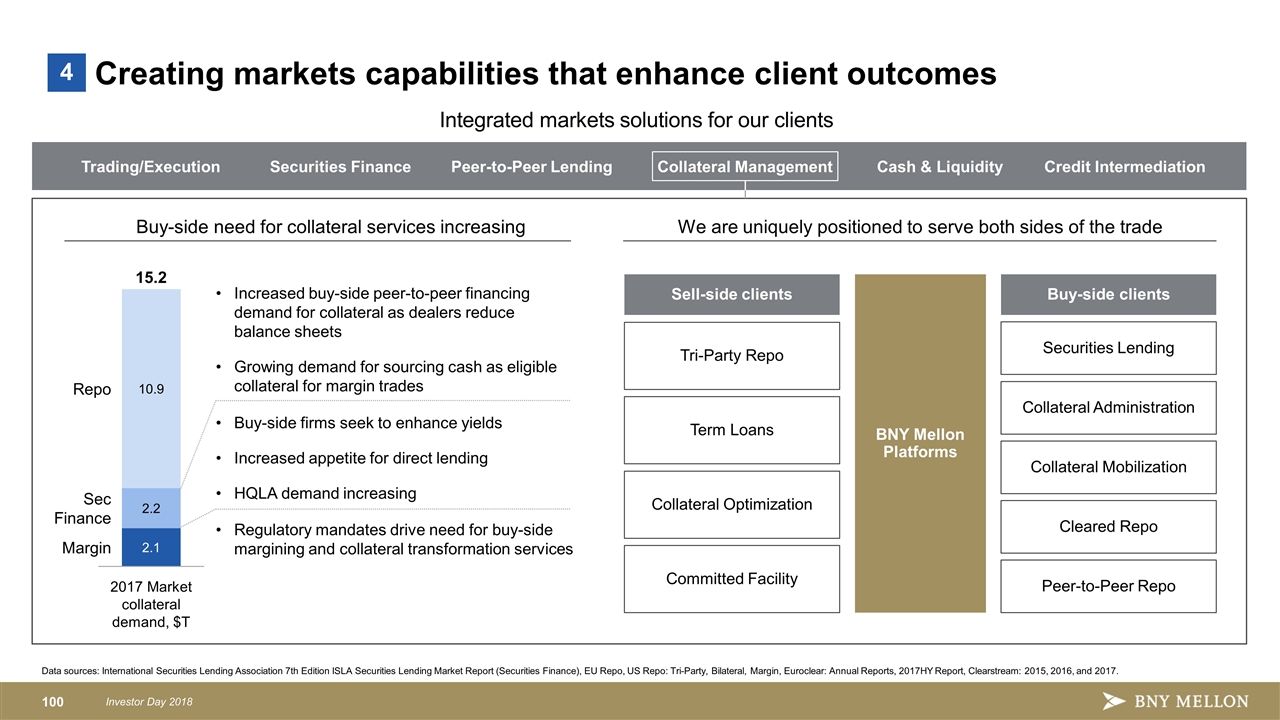

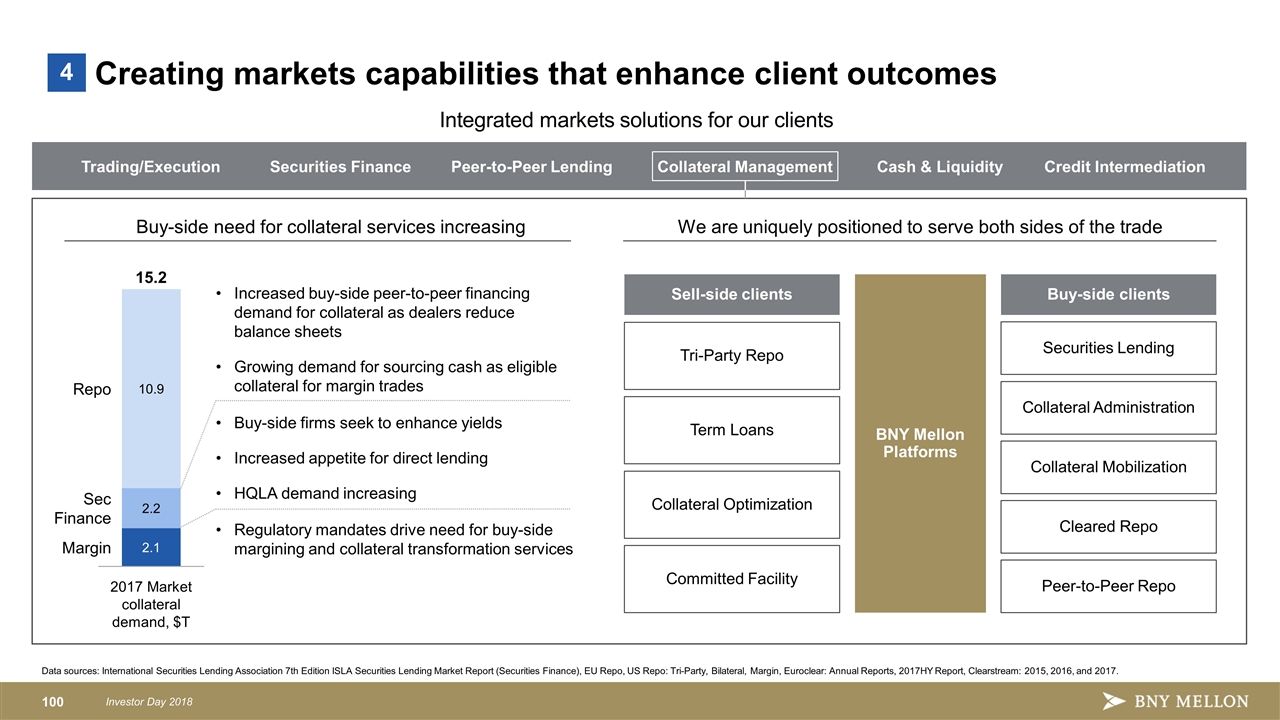

Creating markets capabilities that enhance client outcomes 4 Increased buy-side peer-to-peer financing demand for collateral as dealers reduce balance sheets Growing demand for sourcing cash as eligible collateral for margin trades Buy-side firms seek to enhance yields Increased appetite for direct lending HQLA demand increasing Regulatory mandates drive need for buy-side margining and collateral transformation services 2017 Market collateral demand, $T Buy-side need for collateral services increasing We are uniquely positioned to serve both sides of the trade Sell-side clients BNY Mellon Platforms Tri-Party Repo Term Loans Collateral Optimization Committed Facility Securities Lending Collateral Administration Collateral Mobilization Cleared Repo Peer-to-Peer Repo Buy-side clients Cash & Liquidity Trading/Execution Peer-to-Peer Lending Securities Finance Collateral Management Credit Intermediation Integrated markets solutions for our clients Data sources: International Securities Lending Association 7th Edition ISLA Securities Lending Market Report (Securities Finance), EU Repo, US Repo: Tri-Party, Bilateral, Margin, Euroclear: Annual Reports, 2017HY Report, Clearstream: 2015, 2016, and 2017.

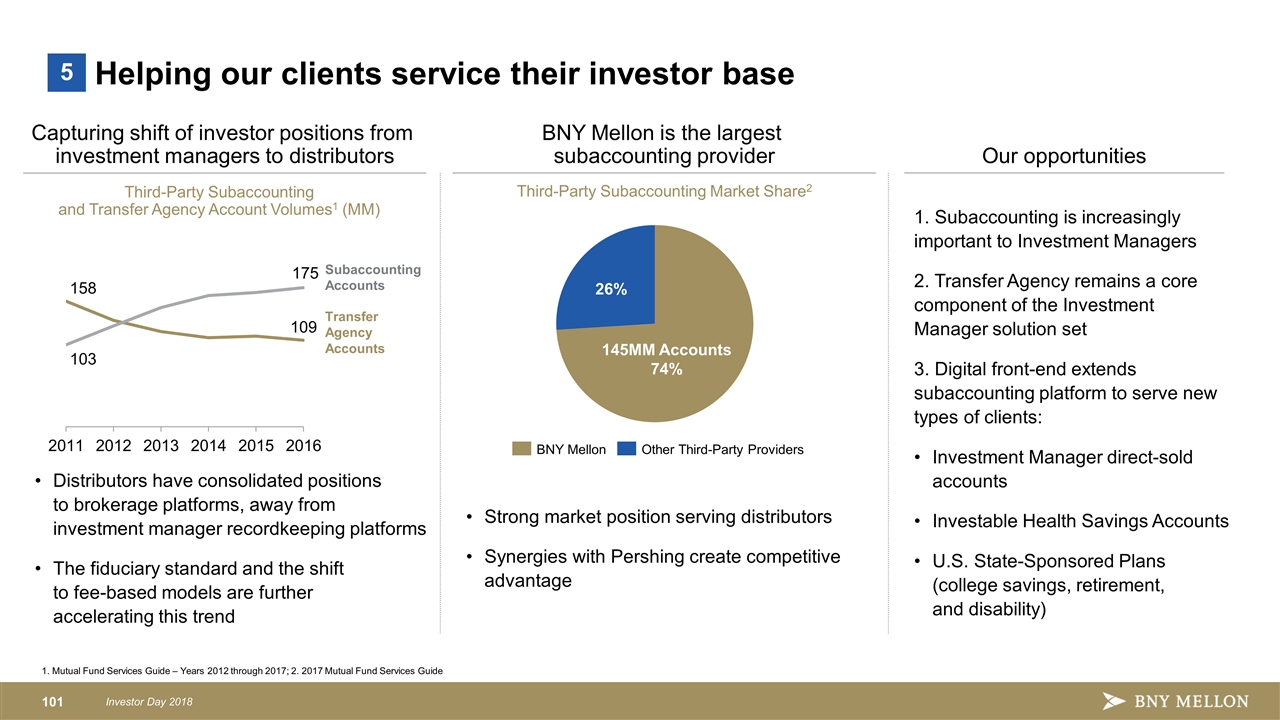

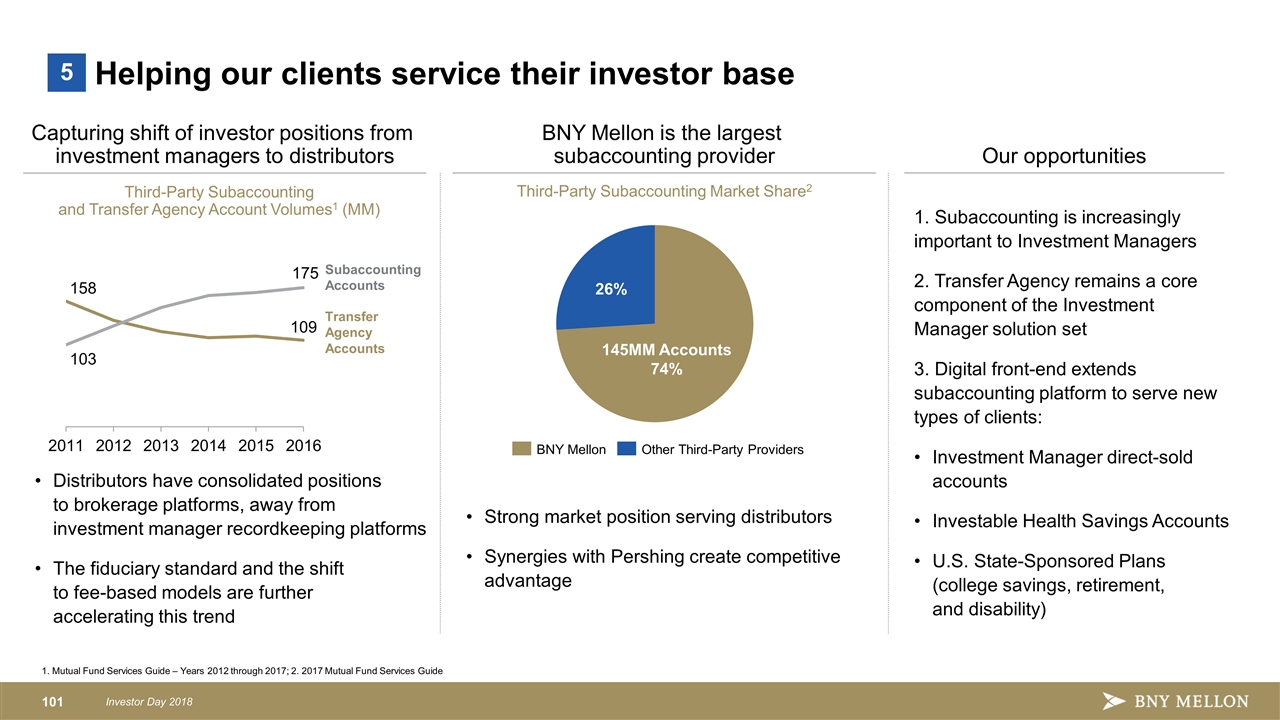

Strong market position serving distributors Synergies with Pershing create competitive advantage Subaccounting Accounts Transfer Agency Accounts Helping our clients service their investor base 5 BNY Mellon is the largest subaccounting provider Our opportunities 1. Subaccounting is increasingly important to Investment Managers 2. Transfer Agency remains a core component of the Investment Manager solution set 3. Digital front-end extends subaccounting platform to serve new types of clients: Investment Manager direct-sold accounts Investable Health Savings Accounts U.S. State-Sponsored Plans (college savings, retirement, and disability) Third-Party Subaccounting and Transfer Agency Account Volumes1 (MM) Third-Party Subaccounting Market Share2 Other Third-Party Providers Capturing shift of investor positions from investment managers to distributors Distributors have consolidated positions to brokerage platforms, away from investment manager recordkeeping platforms The fiduciary standard and the shift to fee-based models are further accelerating this trend 1. Mutual Fund Services Guide – Years 2012 through 2017; 2. 2017 Mutual Fund Services Guide 145MM Accounts 74% 26%

Positioned for growth Investment management, cash and passive capabilities Markets for trading, financing, collateral, liquidity High quality, low risk balance sheet Pershing capabilities for advisors and investors Enterprise synergies Trust and scale Breadth and depth of services and solutions Client-centric culture Subject matter expertise Unique data and technology assets Why clients have chosen us Sustainable growth in revenue and earnings Competing more effectively Markets capabilities 4 Alternatives and ETFs 2 Data management 3 Investor servicing 5 1 Efficient operating platform Focus going forward

Investor Day 2018 Delivering Differentiated Solutions to Clients Todd Gibbons CEO, Clearing, Markets & Client Management March 8, 2018

Key Points: Service capital market participants, not just investors Multiple foundational products offering alternative relationship entry points Breadth enables greater expertise, deeper client relationships and more high-value services BNY Mellon Model Clients Served Investment Management Asset Servicing Markets (Securities Lending and FX) Investors Intermediaries Issuers Treasury Services Issuer Services Pershing Clearance and Collateral Management Traditional Trust Bank Model Universal Bank Model Delivering broad servicing capabilities to our clients

Building valuable and enduring relationships with our top clients Global Client Management consists of teams of senior bankers with deep industry expertise in our client segments Global footprint with executives positioned in every client region GCM Clients account for approximately 50% of revenue Engage all businesses with an average uptake of six or more services Offer buy- and sell-side clients expertise and solutions Represent long-term relationships with significant upside

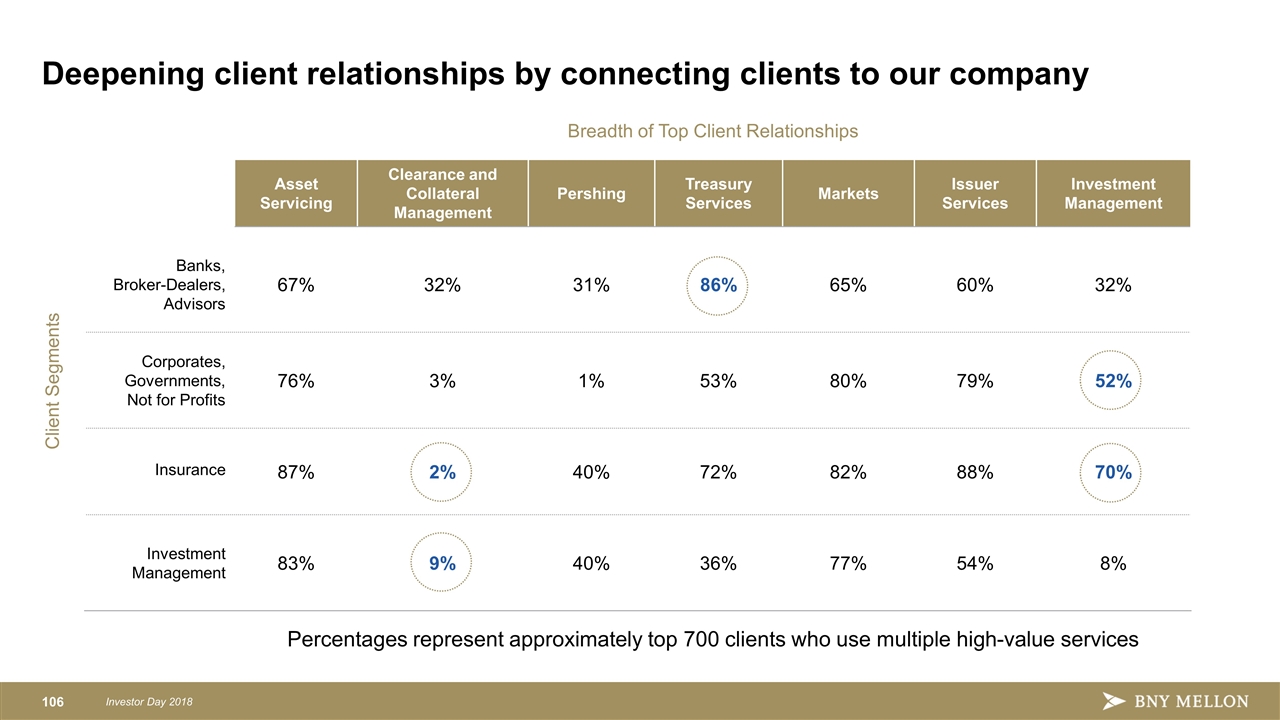

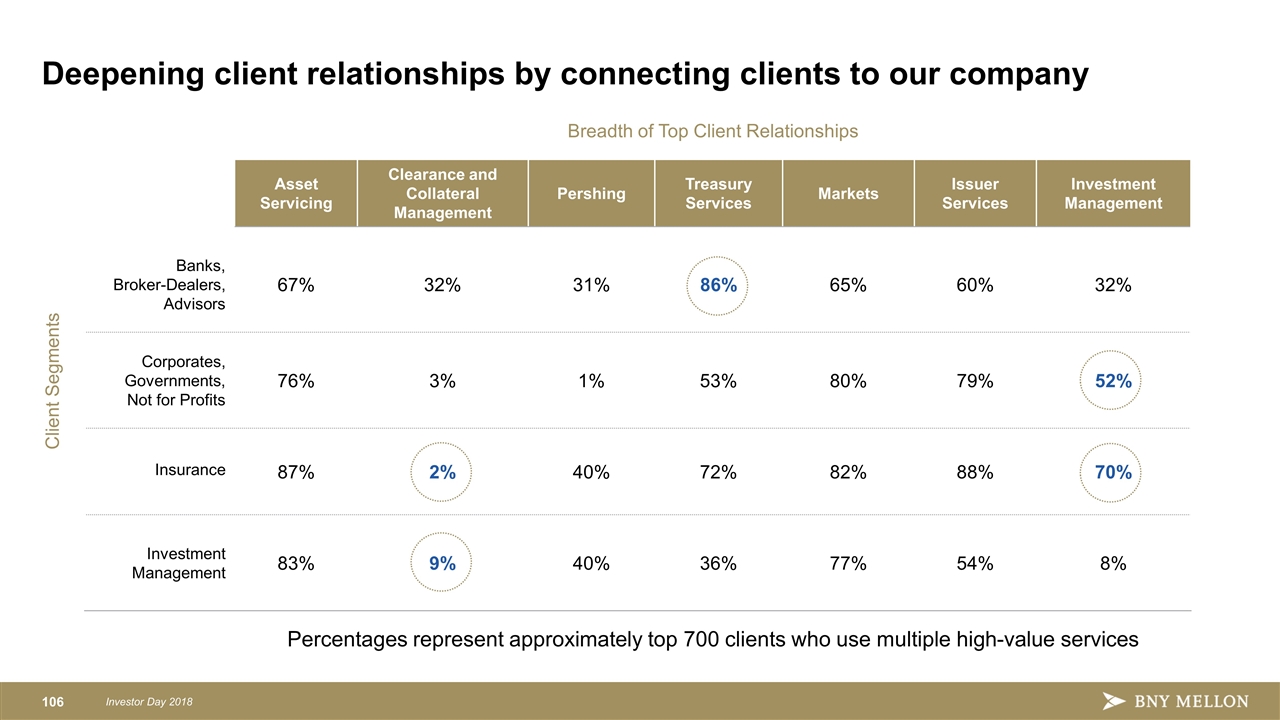

Asset Servicing Clearance and Collateral Management Pershing Treasury Services Markets Issuer Services Investment Management Banks, Broker-Dealers, Advisors 67% 32% 31% 86% 65% 60% 32% Corporates, Governments, Not for Profits 76% 3% 1% 53% 80% 79% 52% Insurance 87% 2% 40% 72% 82% 88% 70% Investment Management 83% 9% 40% 36% 77% 54% 8% Client Segments Percentages represent approximately top 700 clients who use multiple high-value services Deepening client relationships by connecting clients to our company Breadth of Top Client Relationships

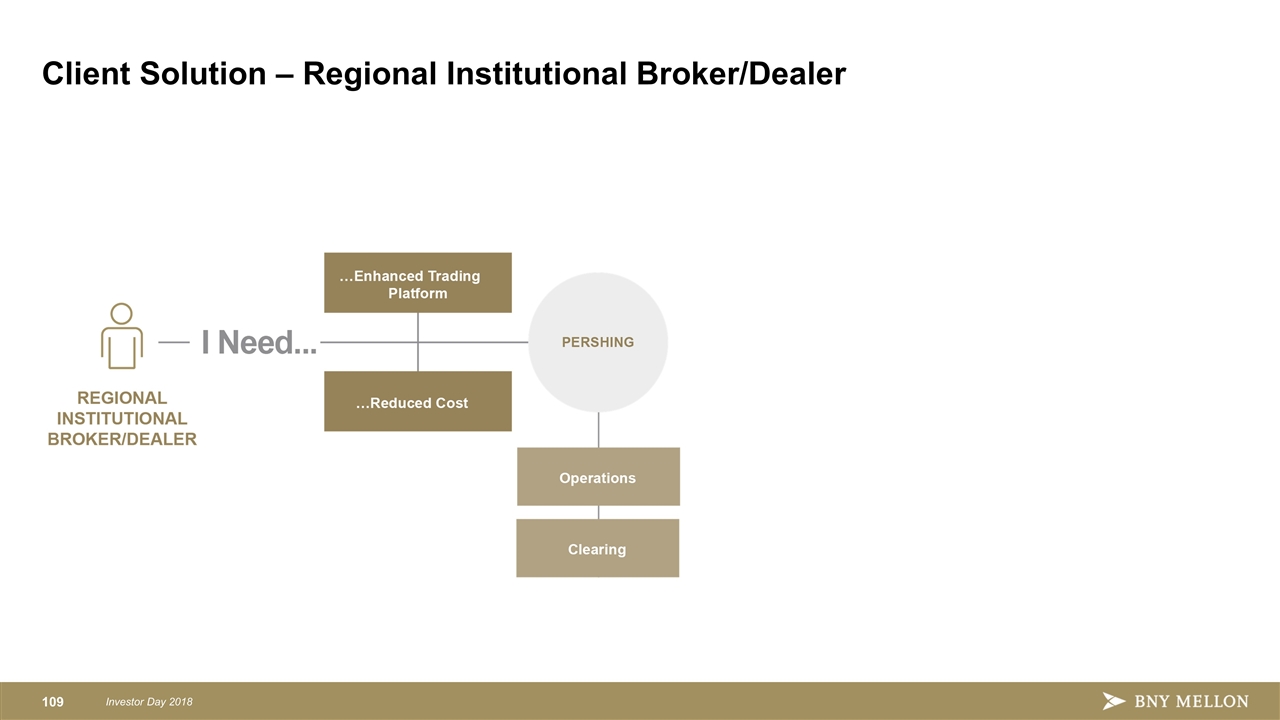

Identify Needs Solve Problems Build Enduring Relationships Case Studies

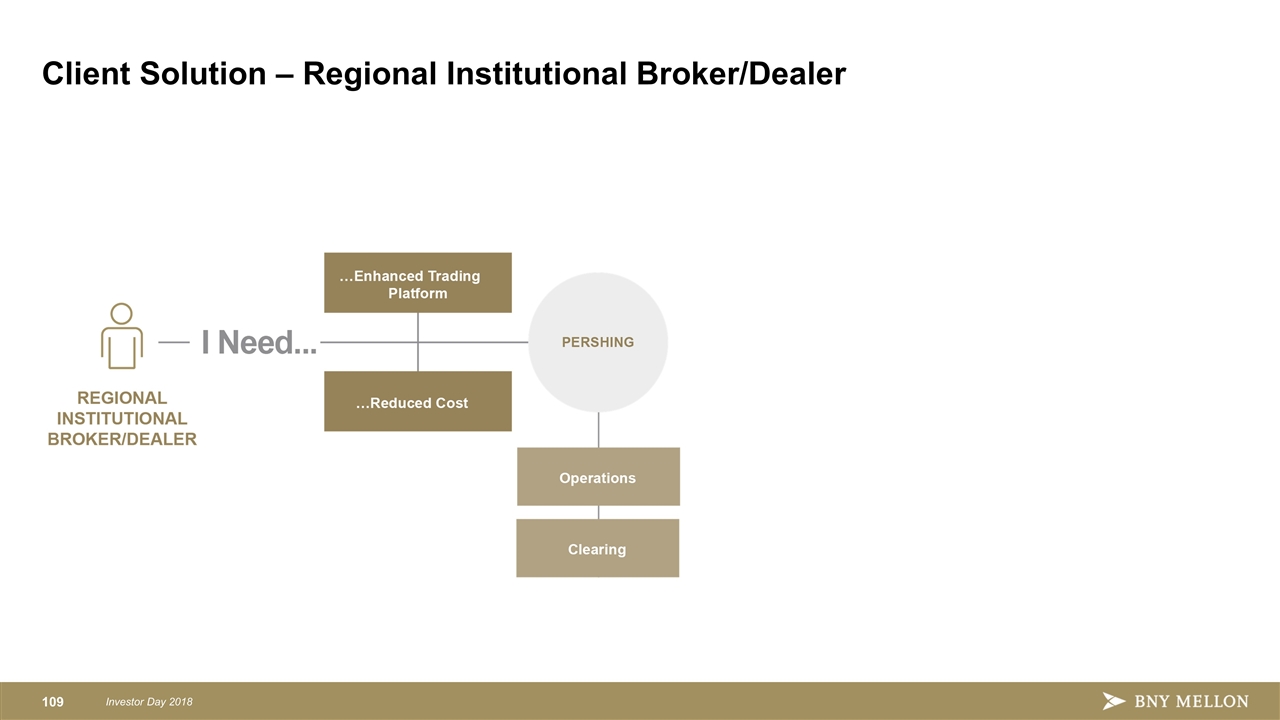

Client Solution – Regional Institutional Broker/Dealer

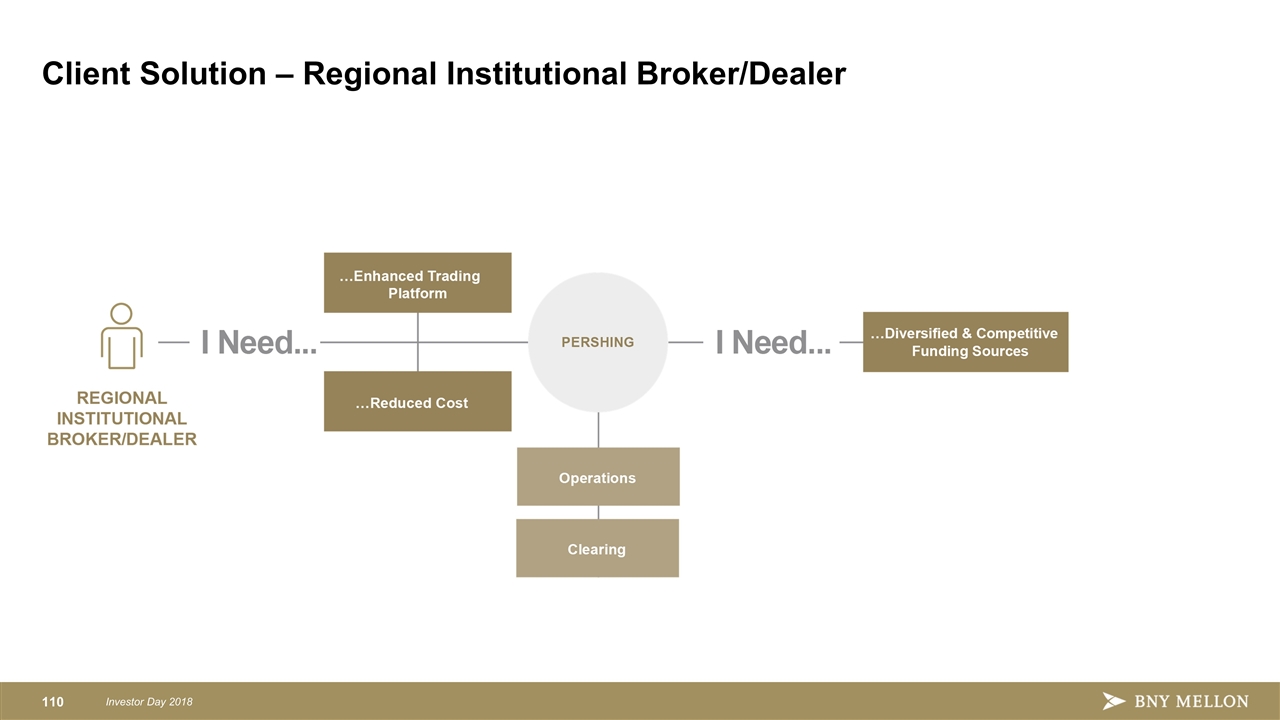

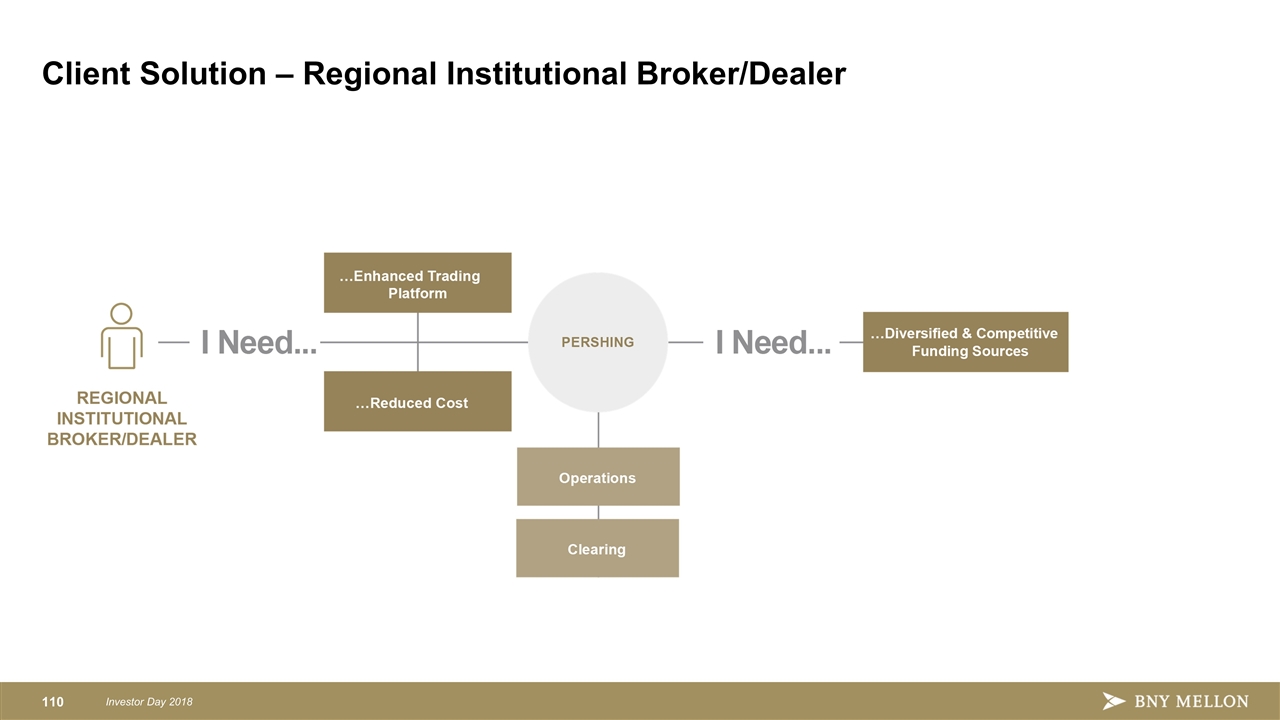

Client Solution – Regional Institutional Broker/Dealer

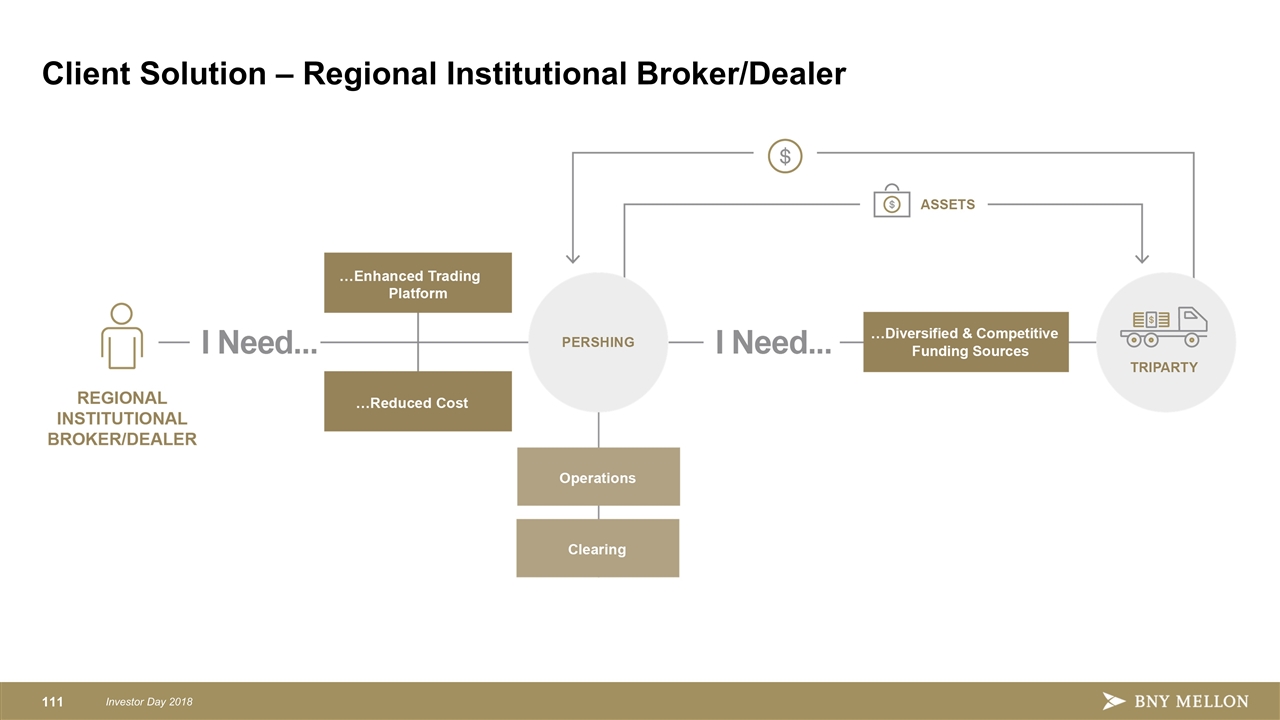

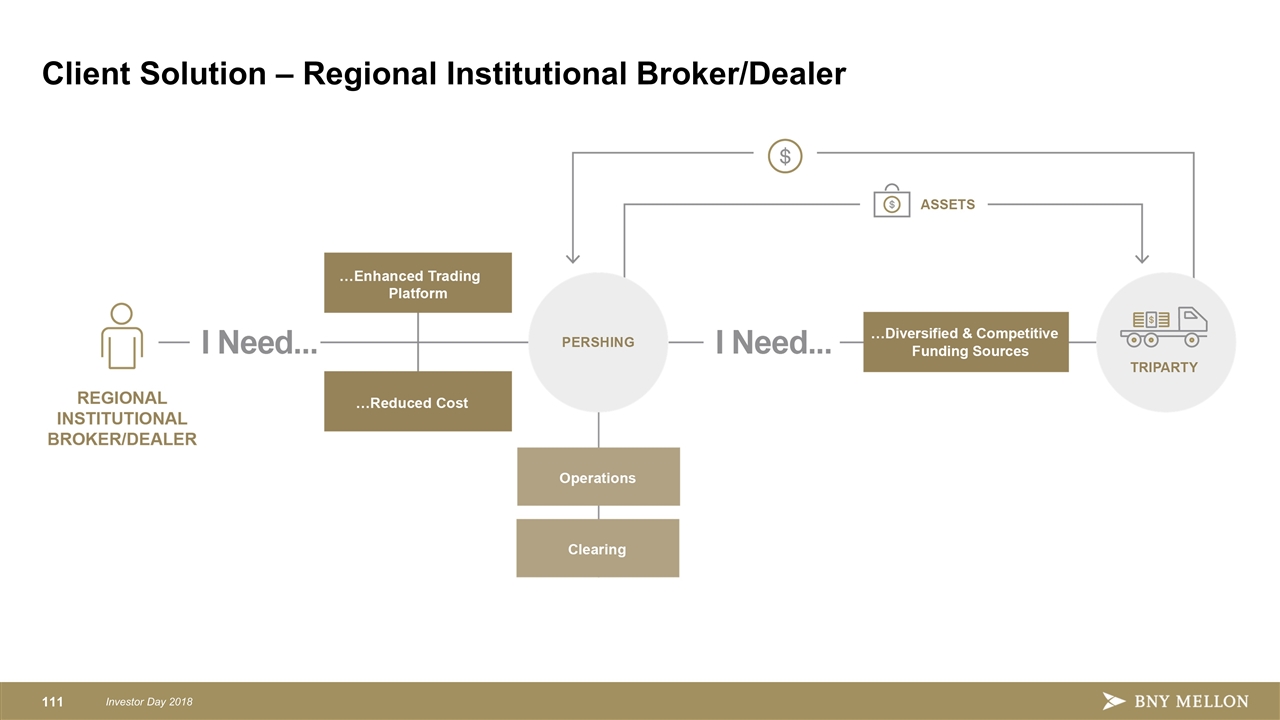

Client Solution – Regional Institutional Broker/Dealer

Client Solution – Regional Institutional Broker/Dealer

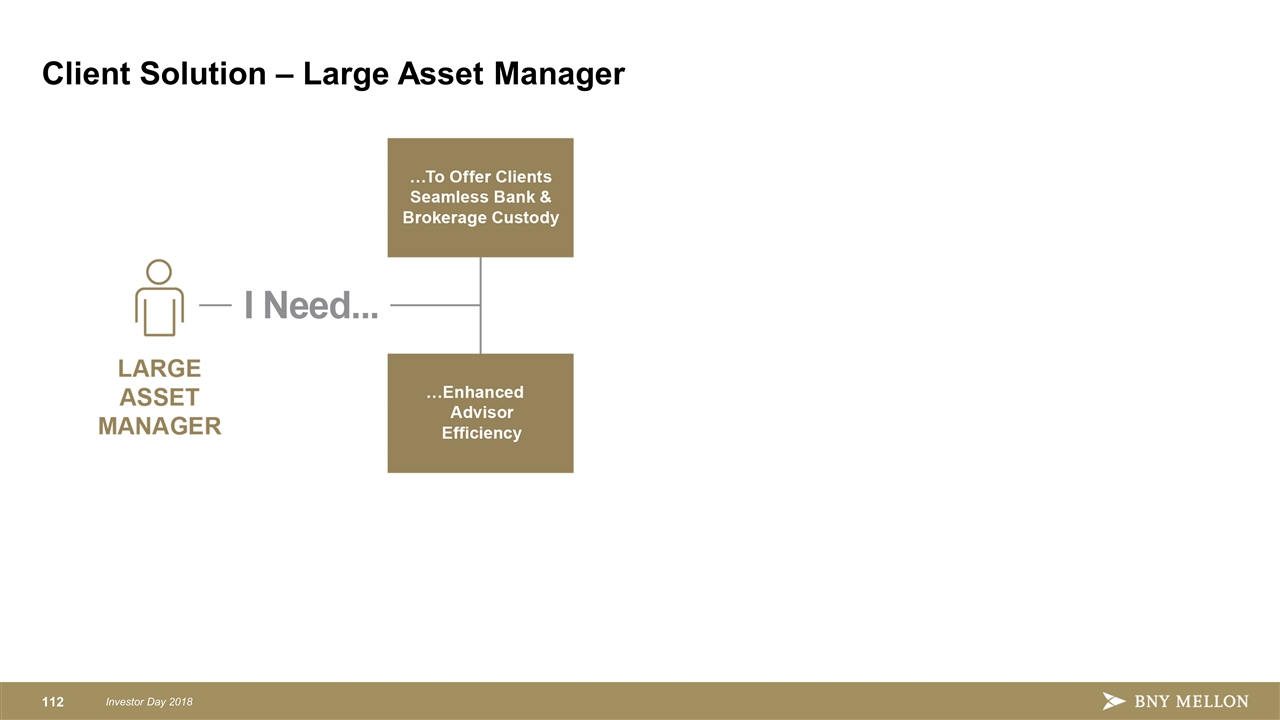

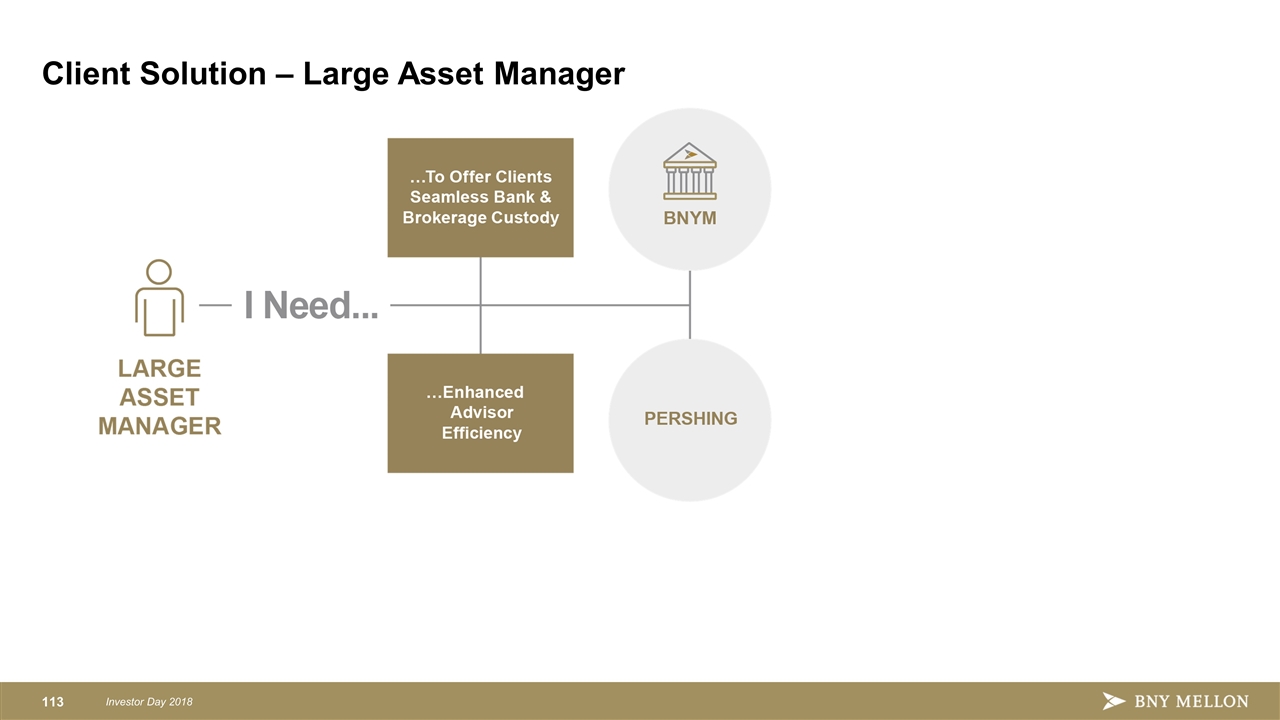

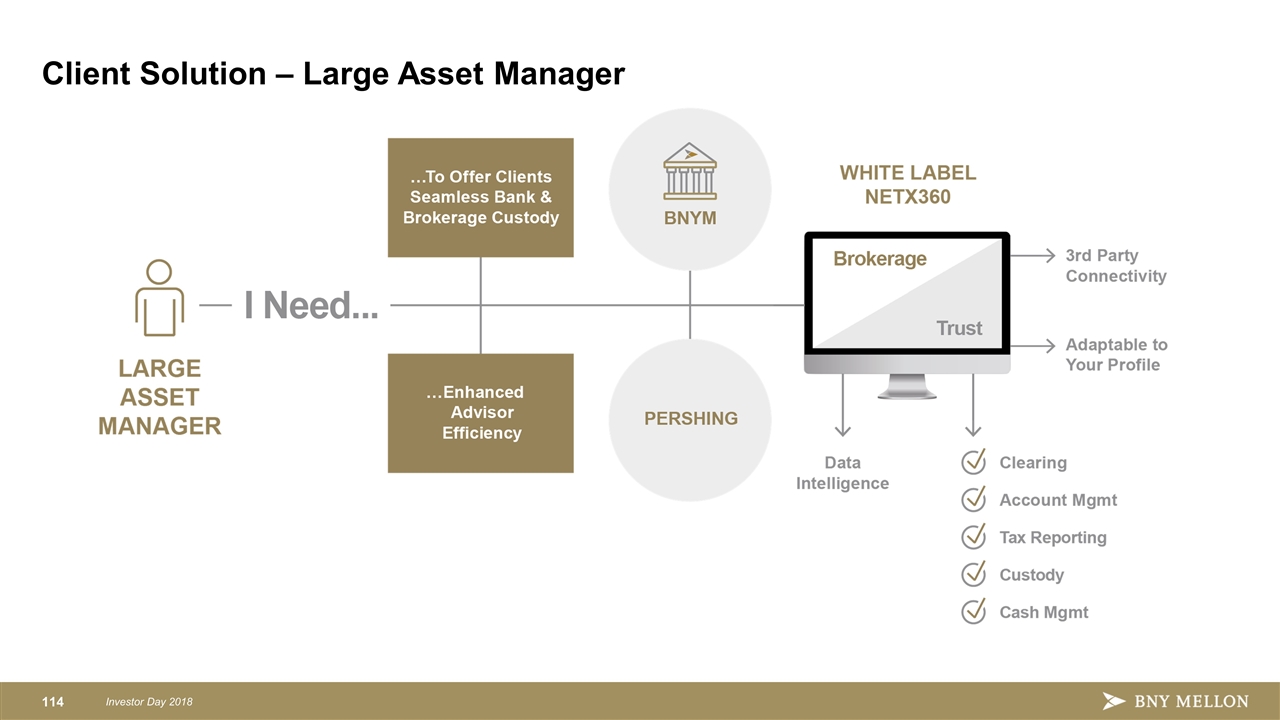

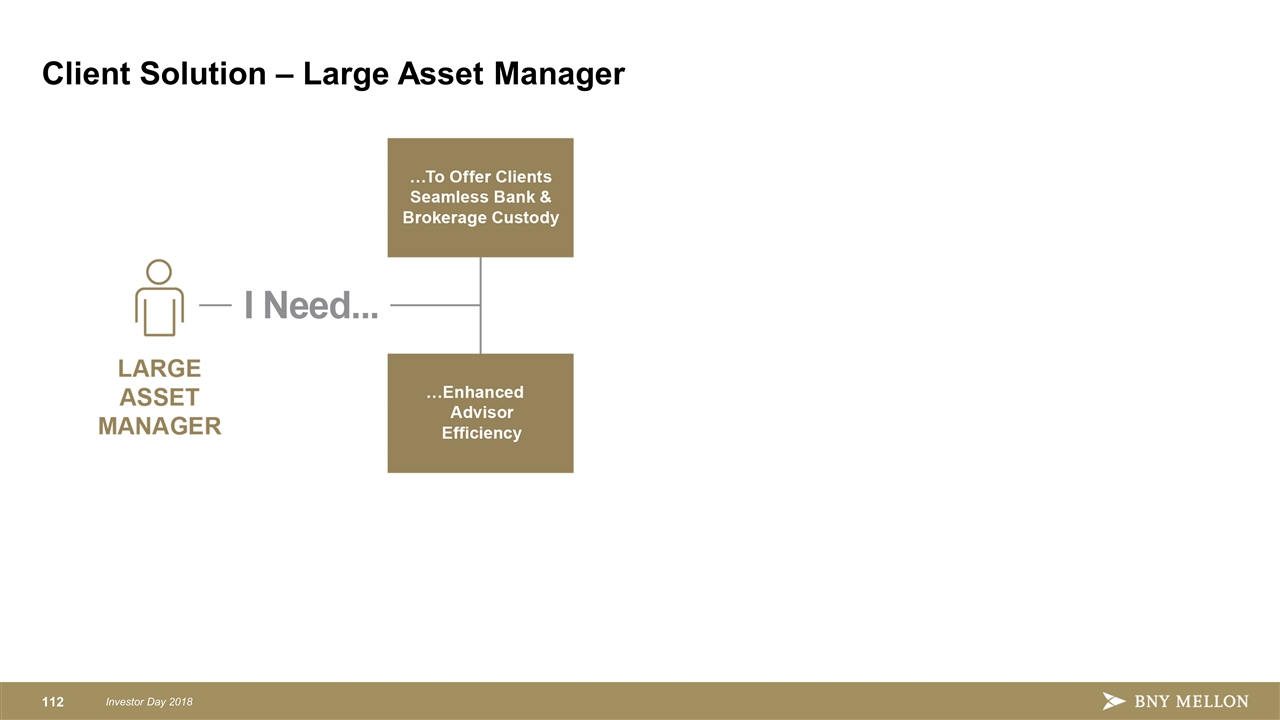

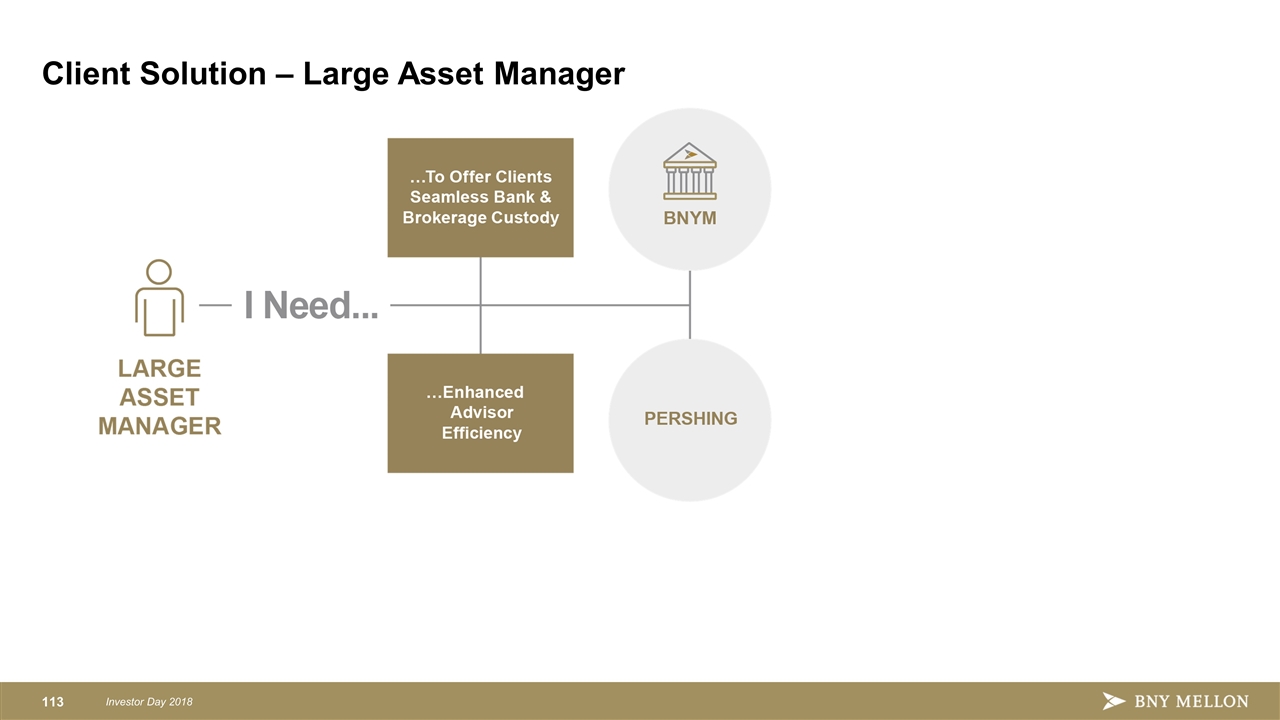

Client Solution – Large Asset Manager

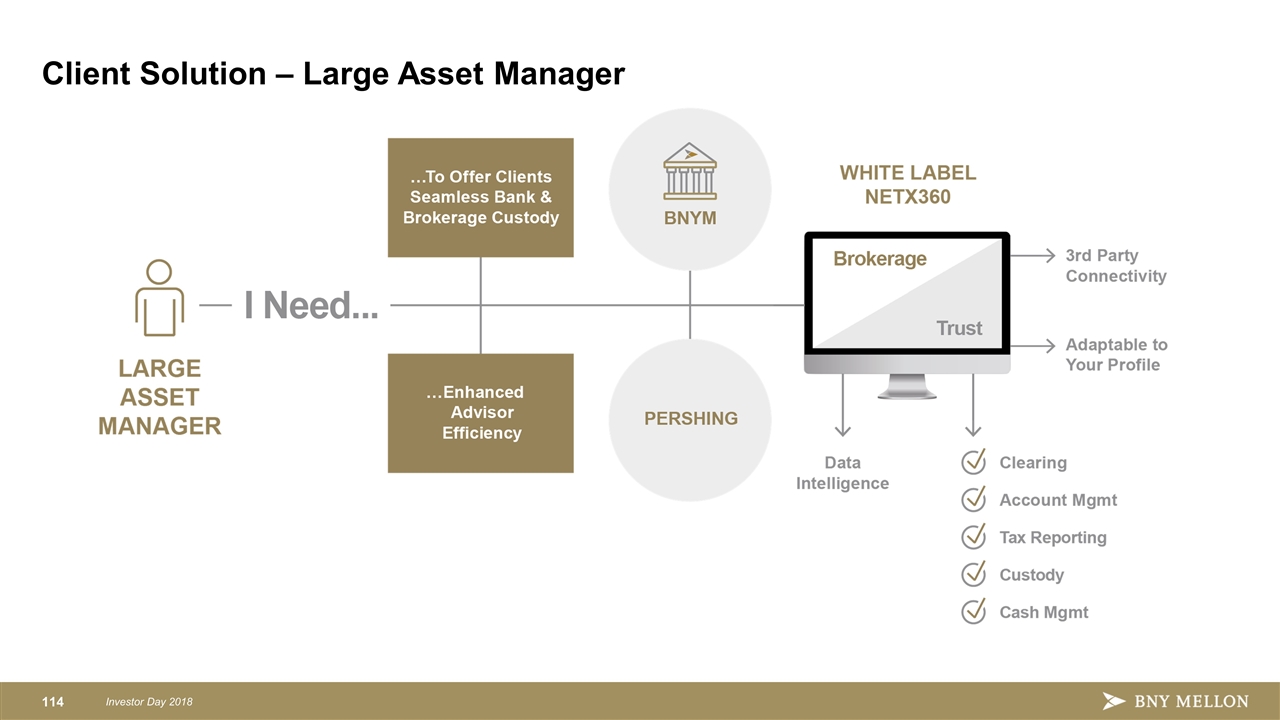

Client Solution – Large Asset Manager

Client Solution – Large Asset Manager

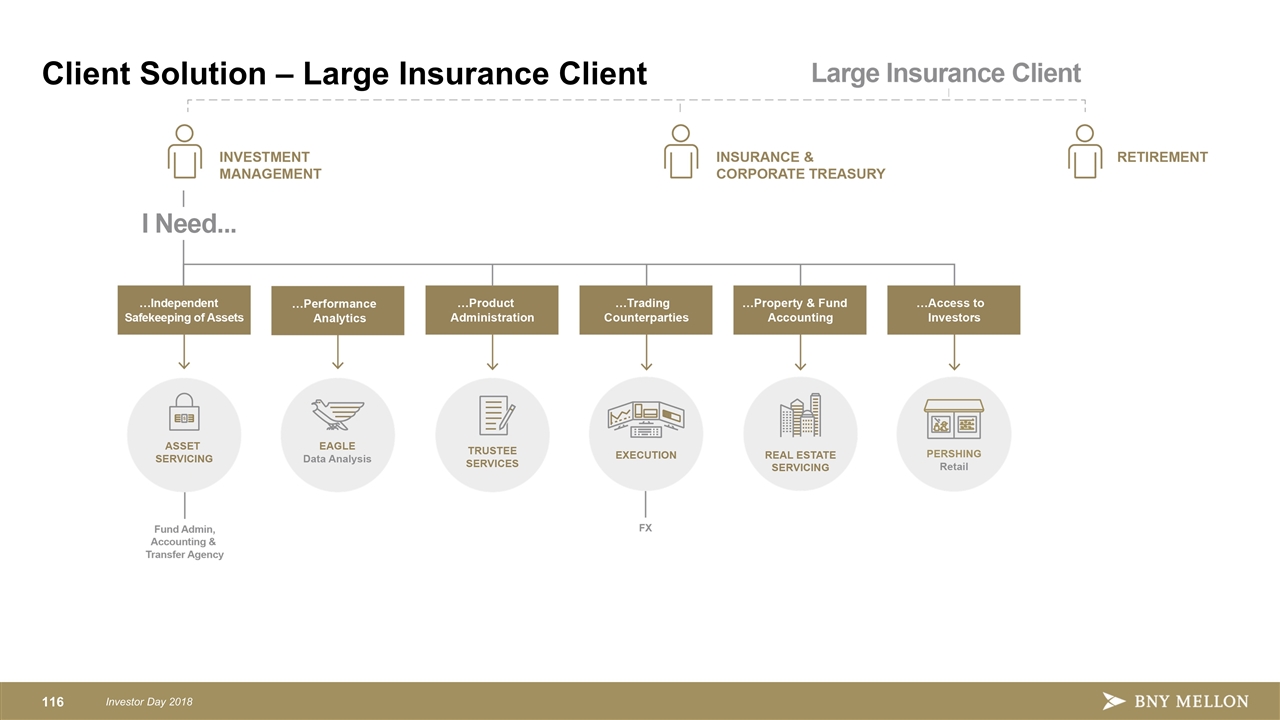

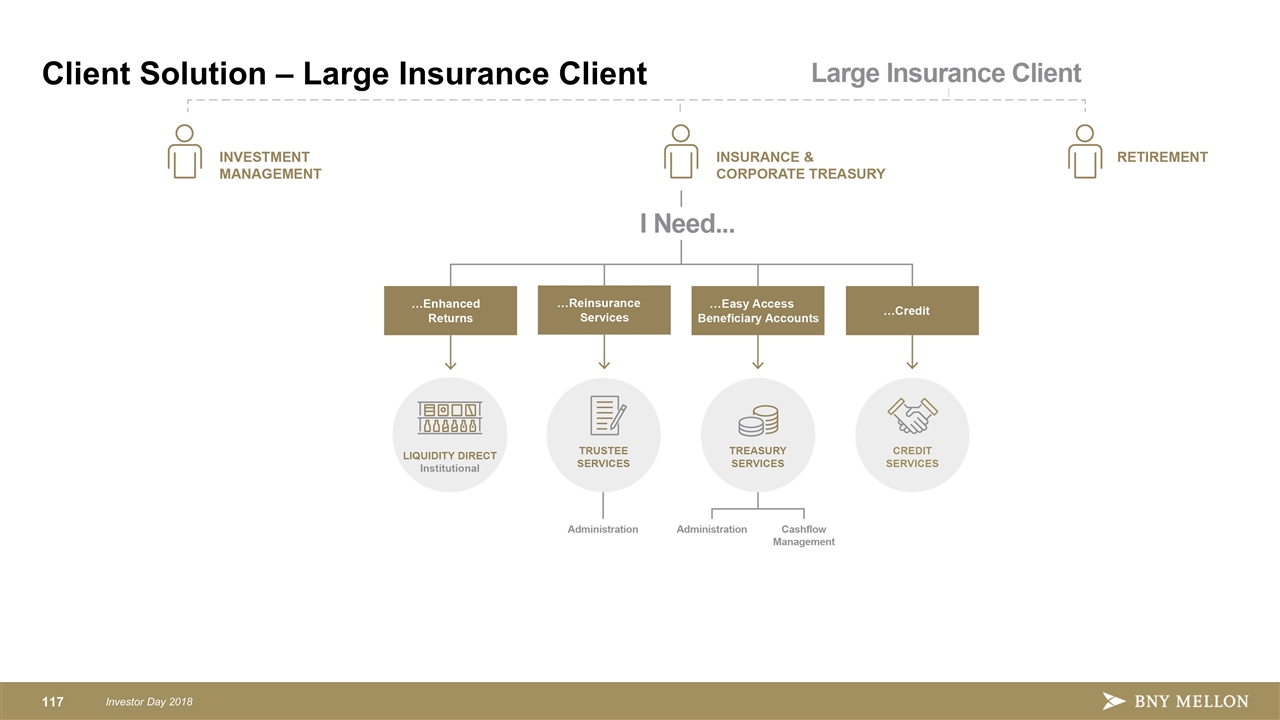

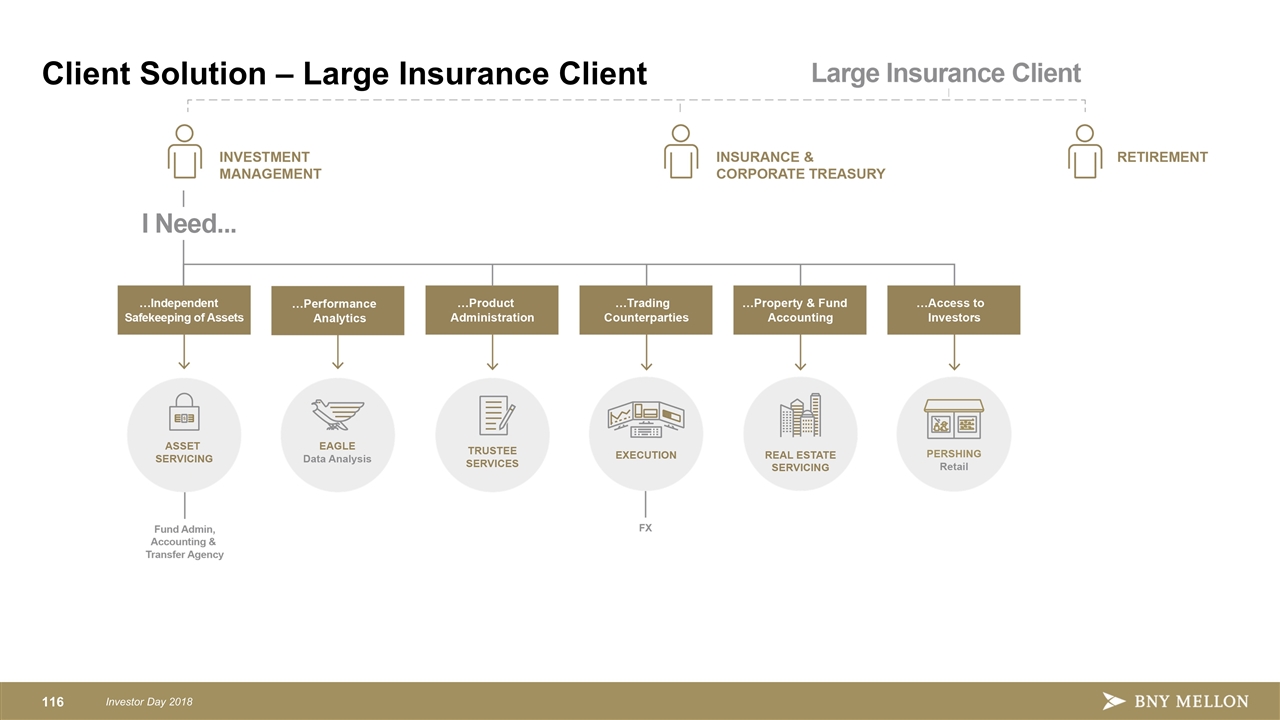

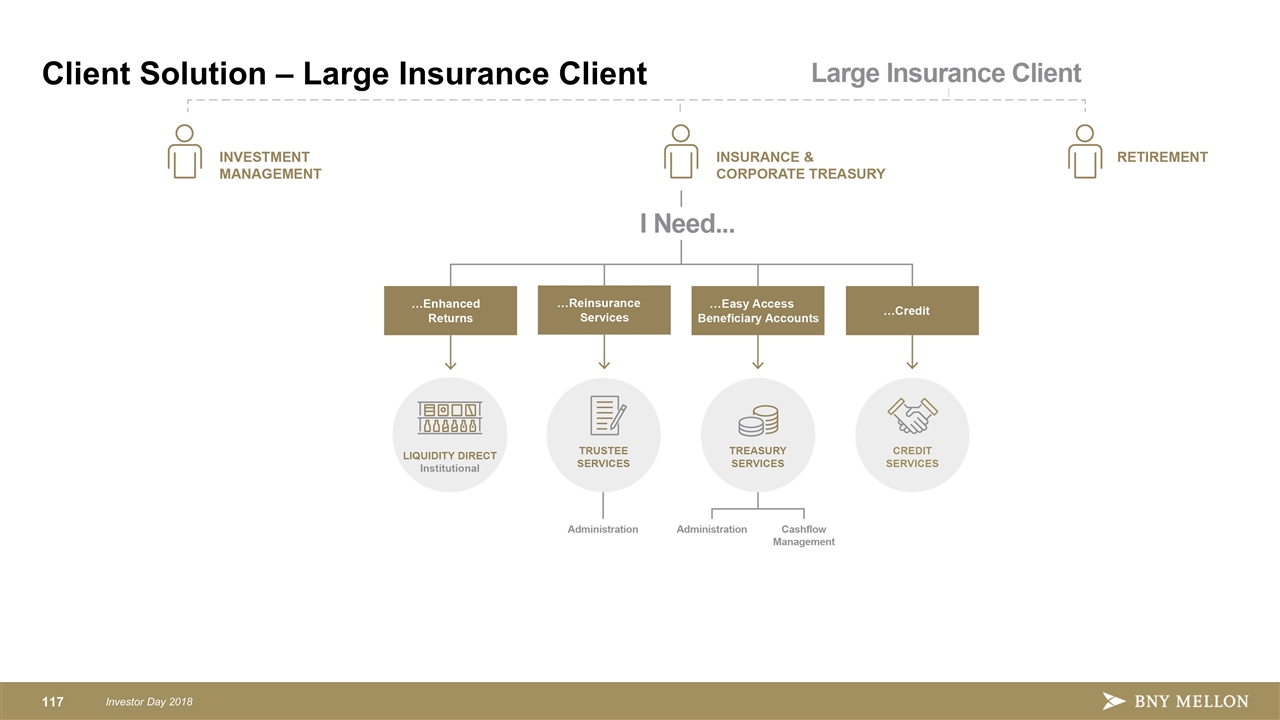

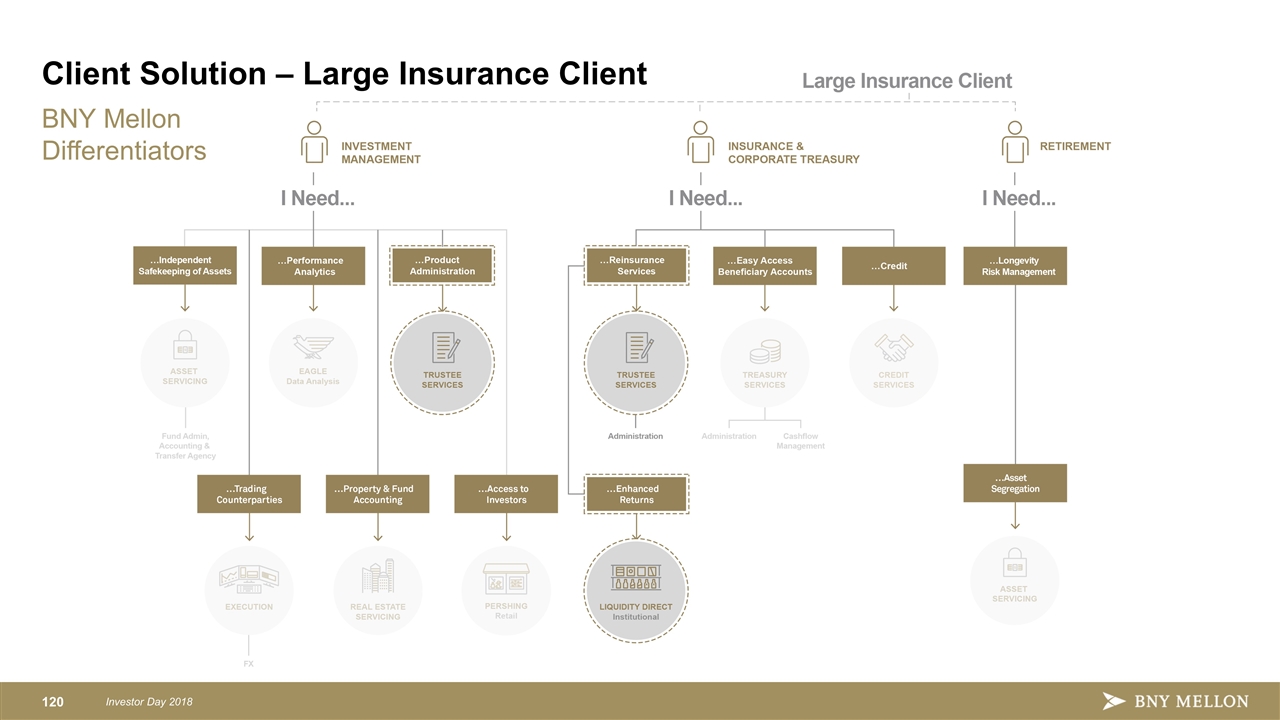

Client Solution – Large Insurance Client

Client Solution – Large Insurance Client

Client Solution – Large Insurance Client

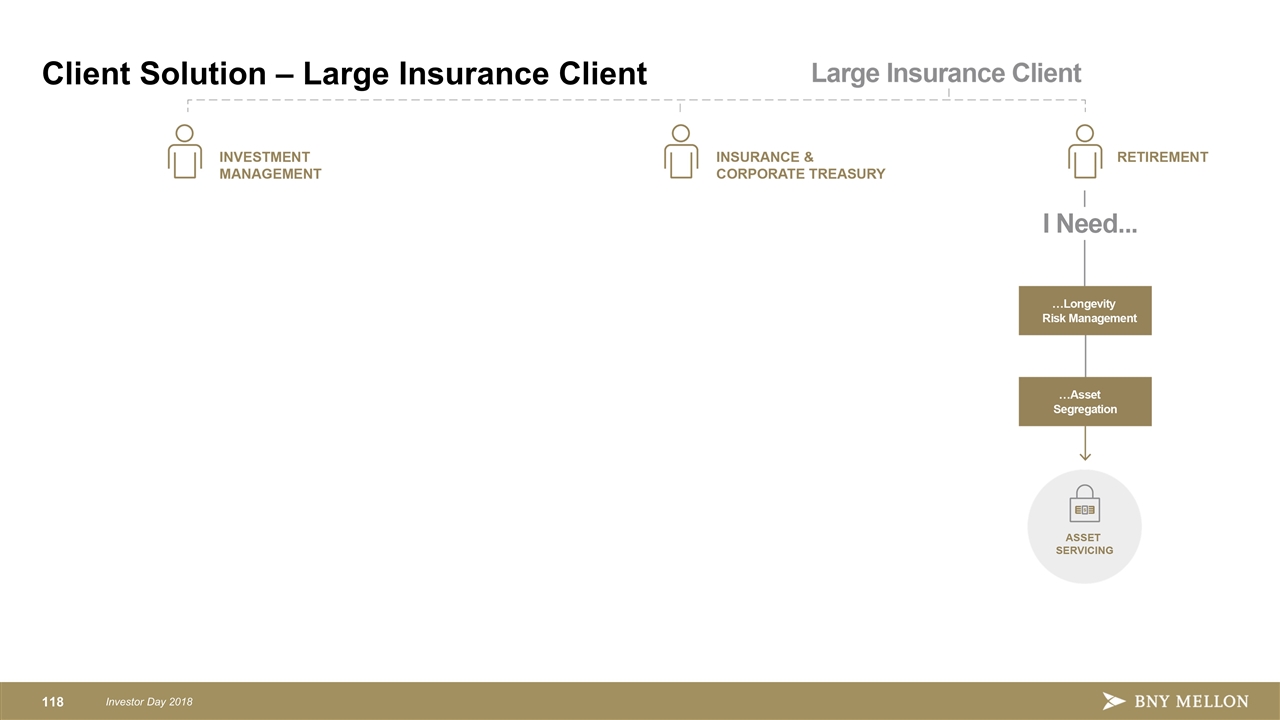

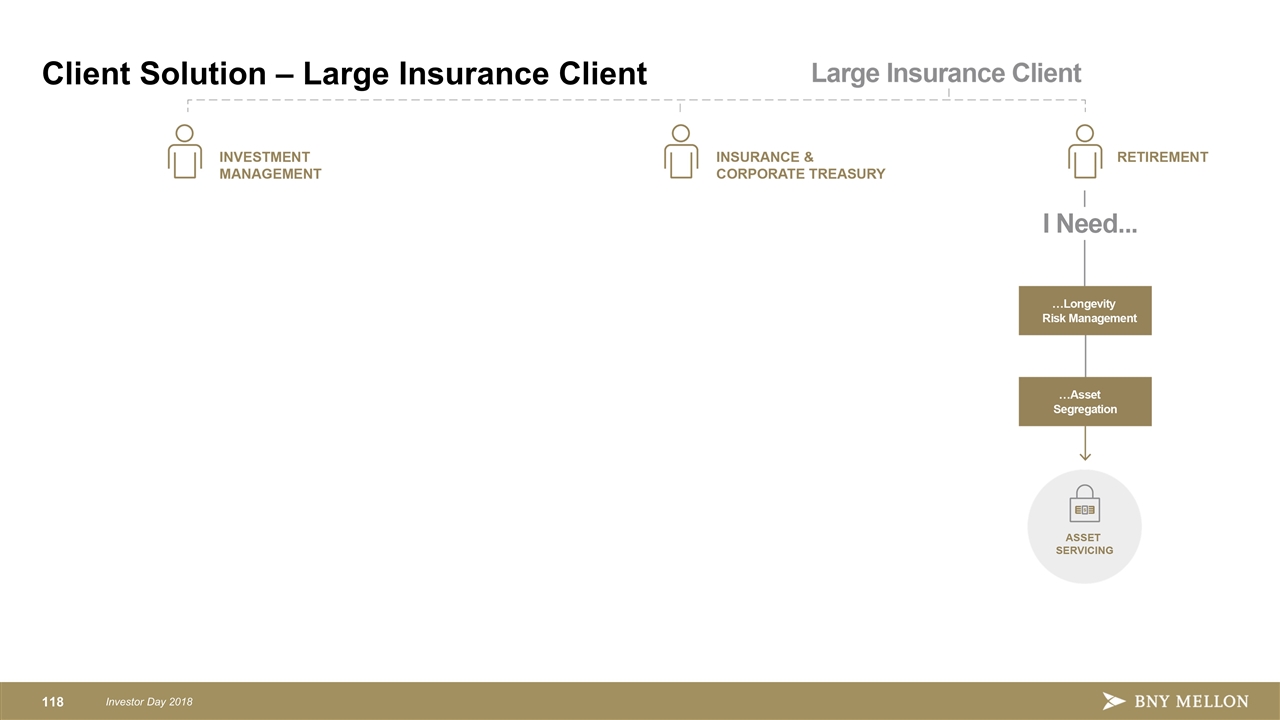

Client Solution – Large Insurance Client

Client Solution – Large Insurance Client

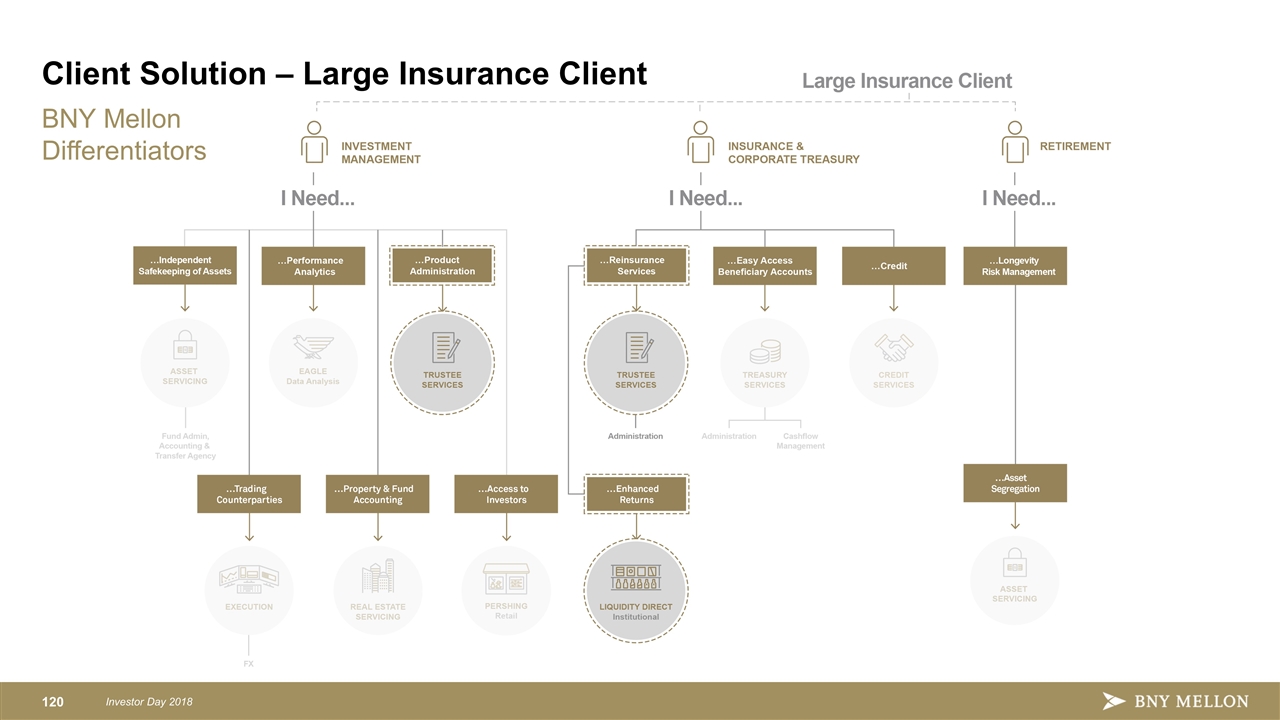

BNY Mellon Differentiators Client Solution – Large Insurance Client

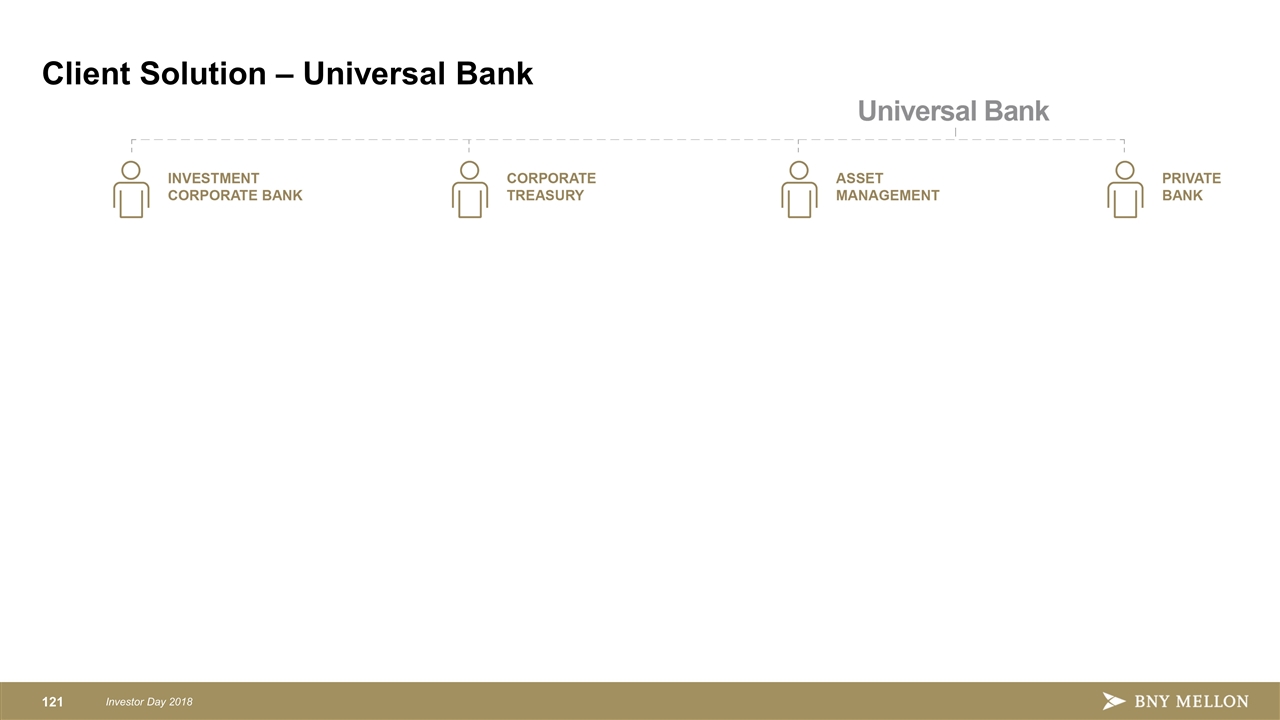

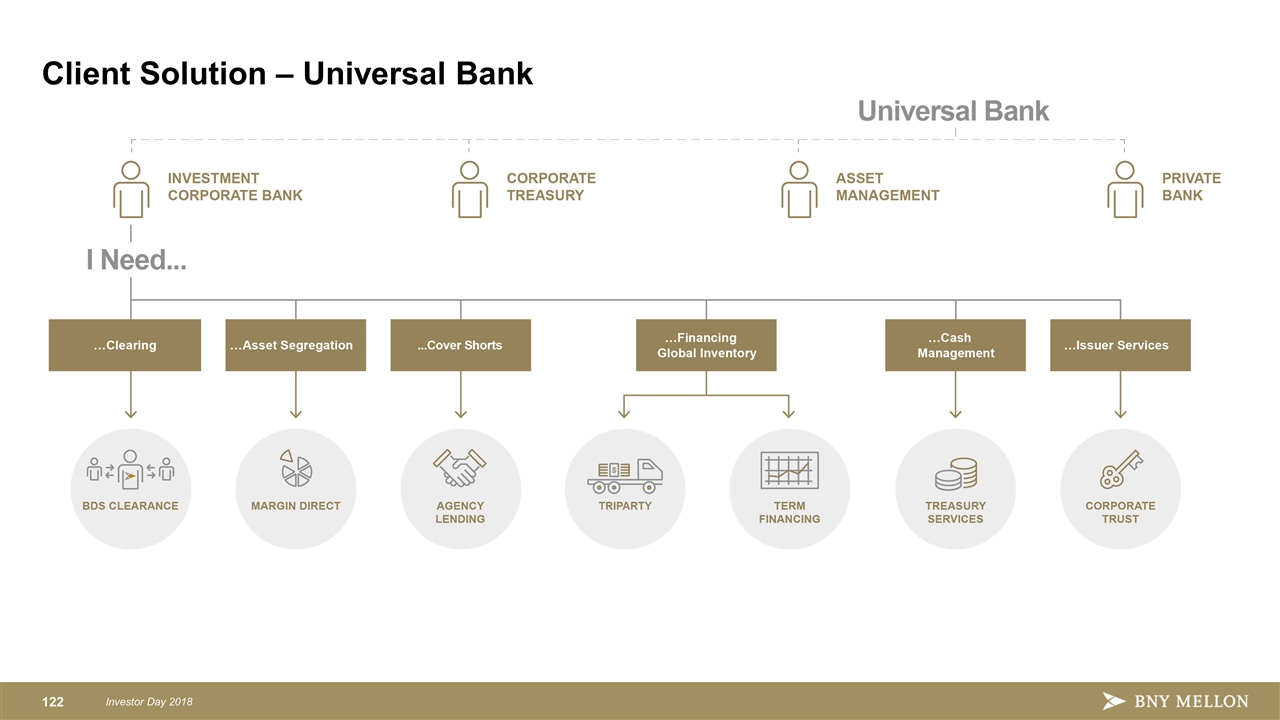

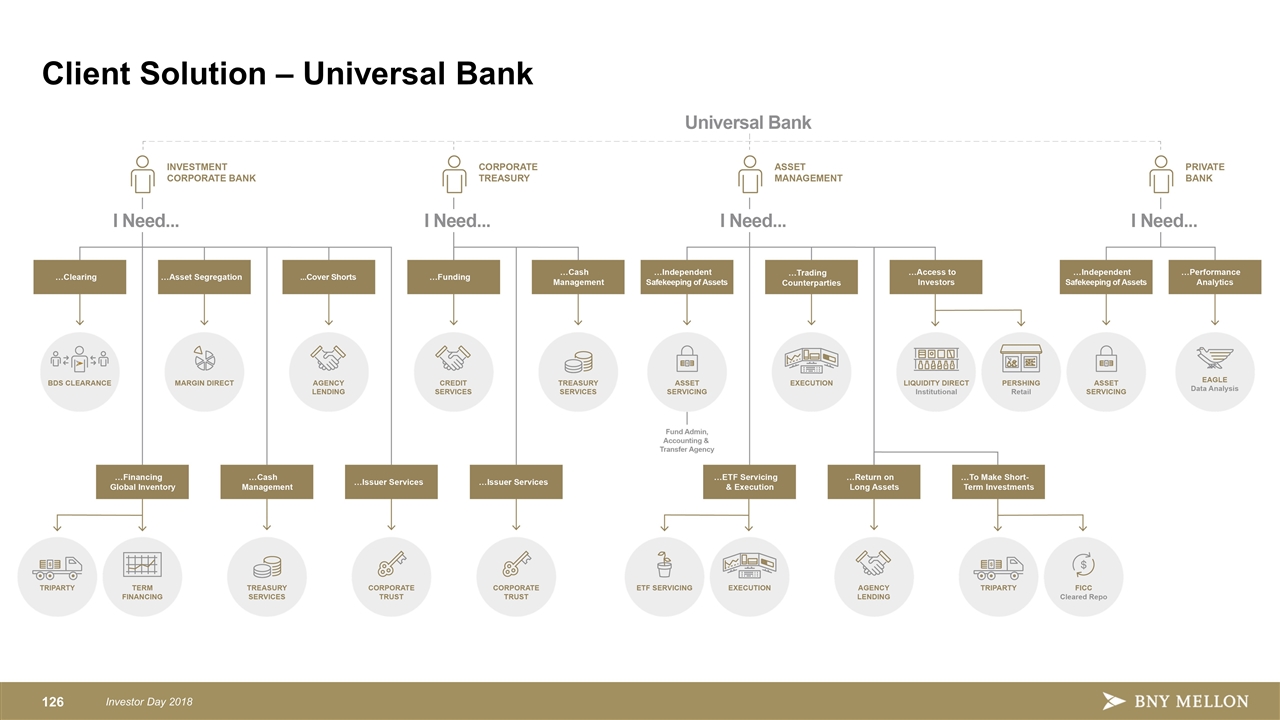

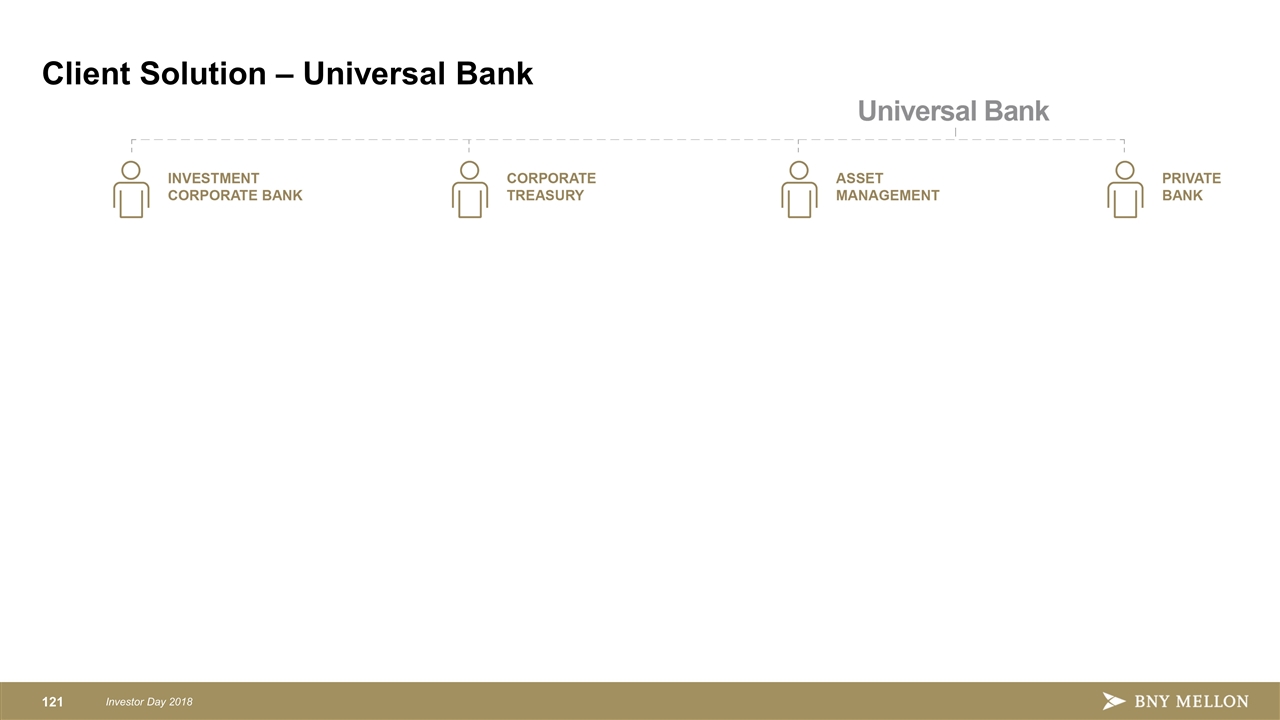

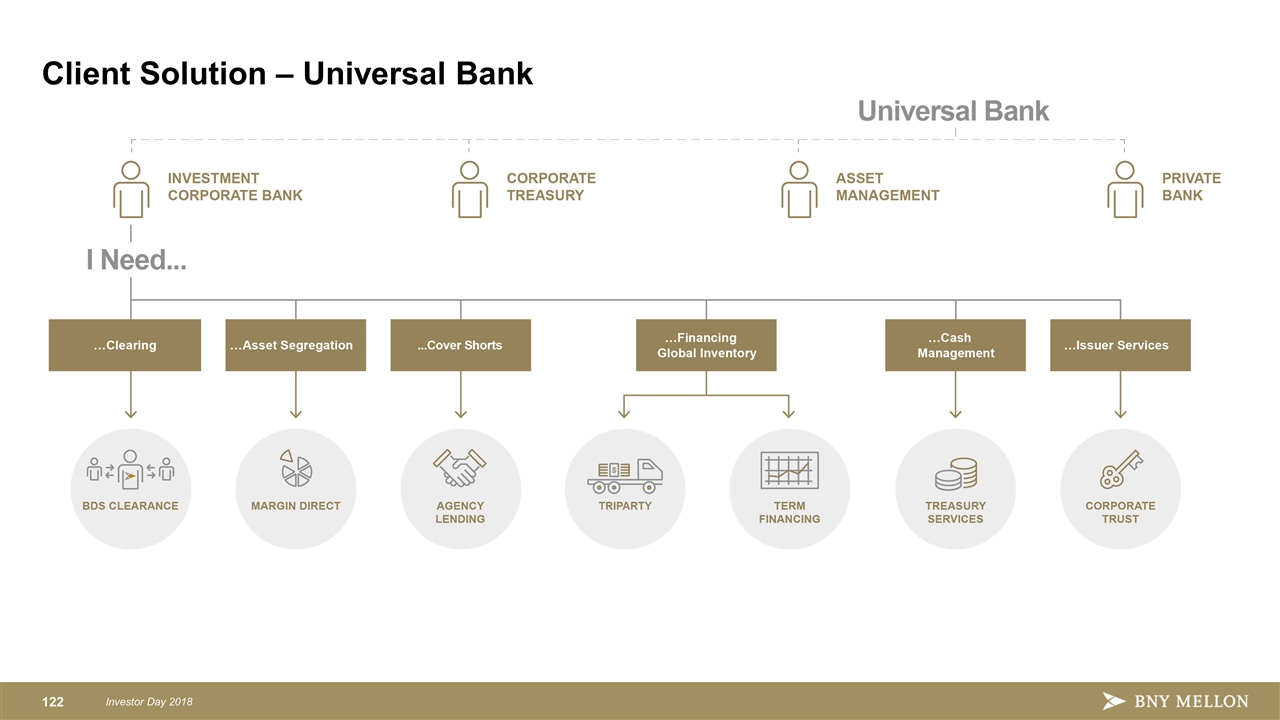

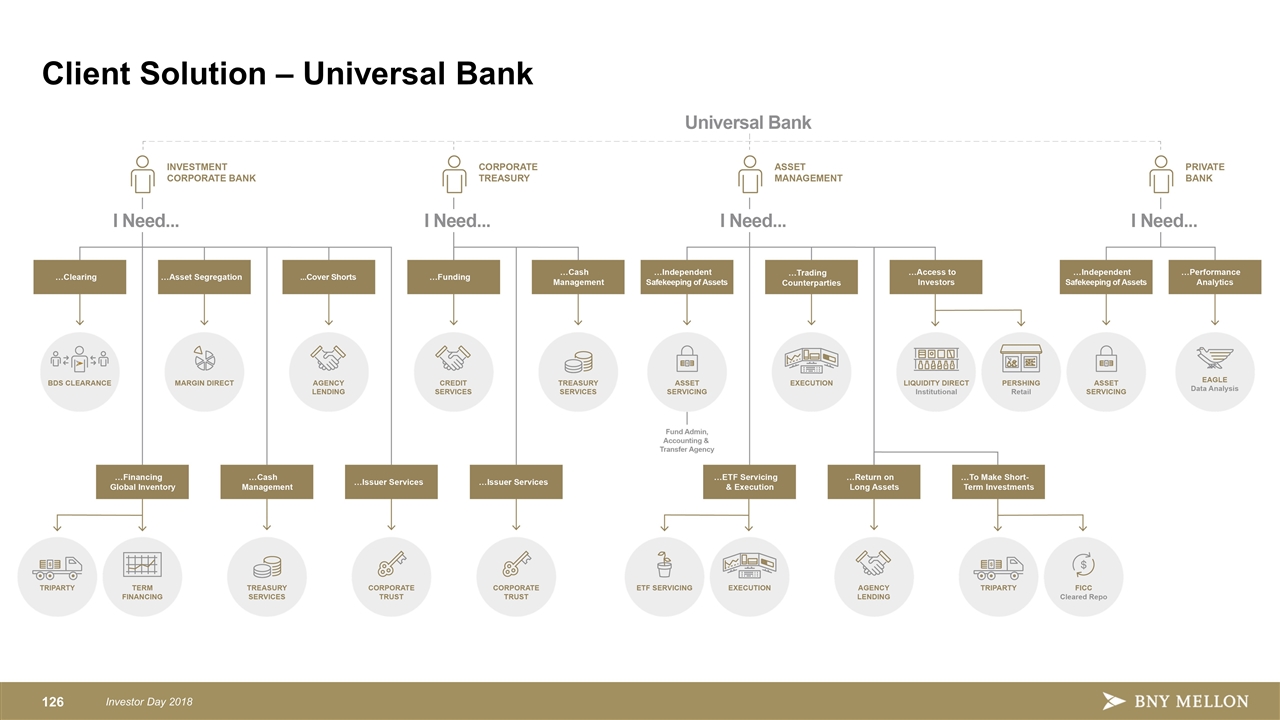

Client Solution – Universal Bank

Client Solution – Universal Bank

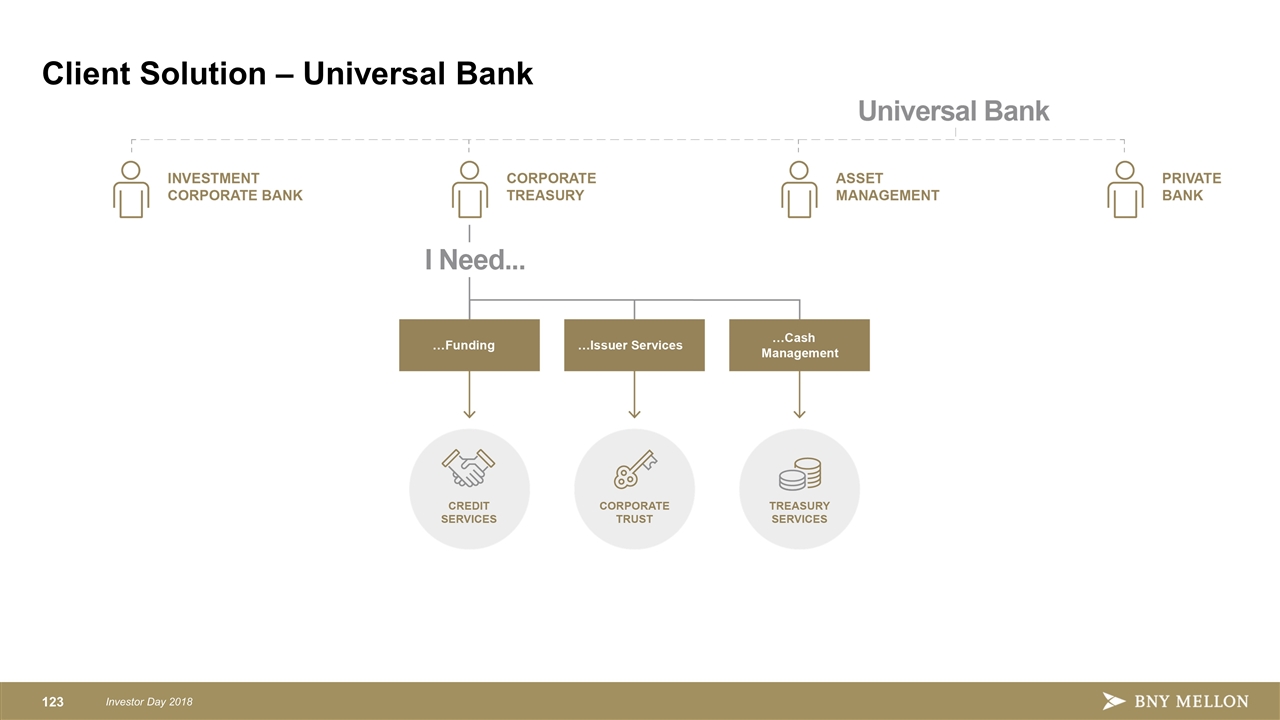

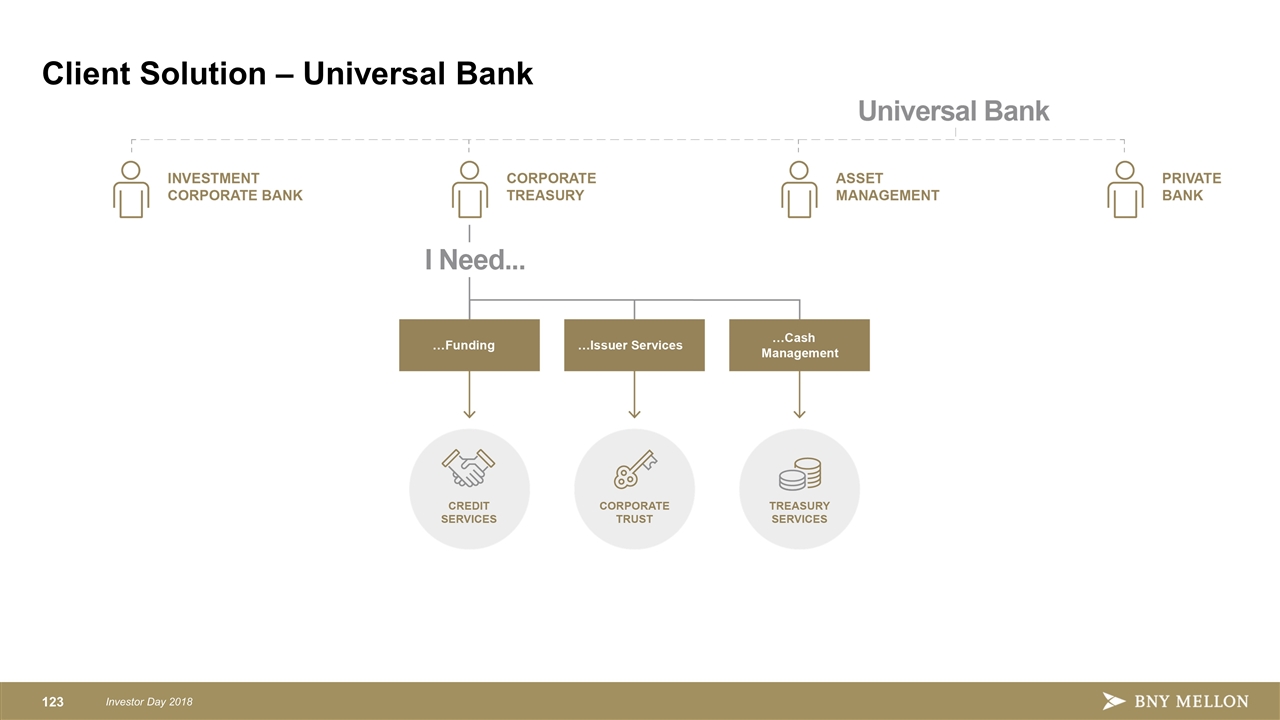

Client Solution – Universal Bank

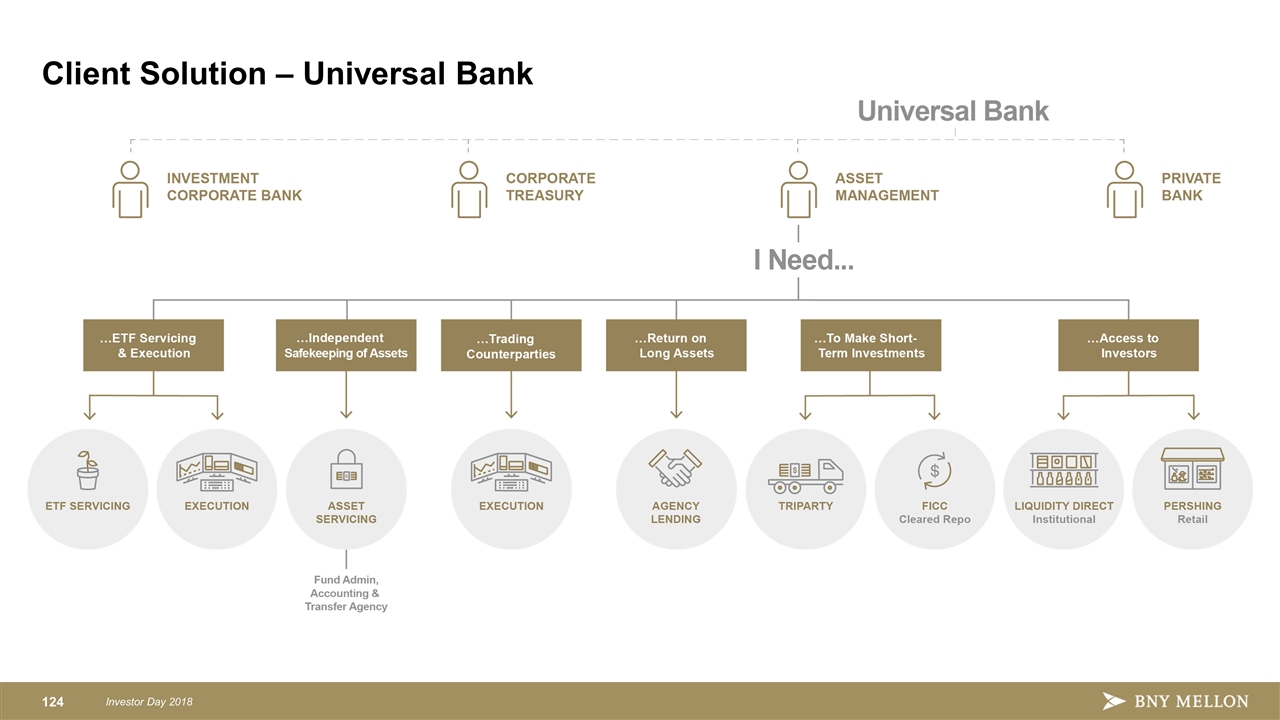

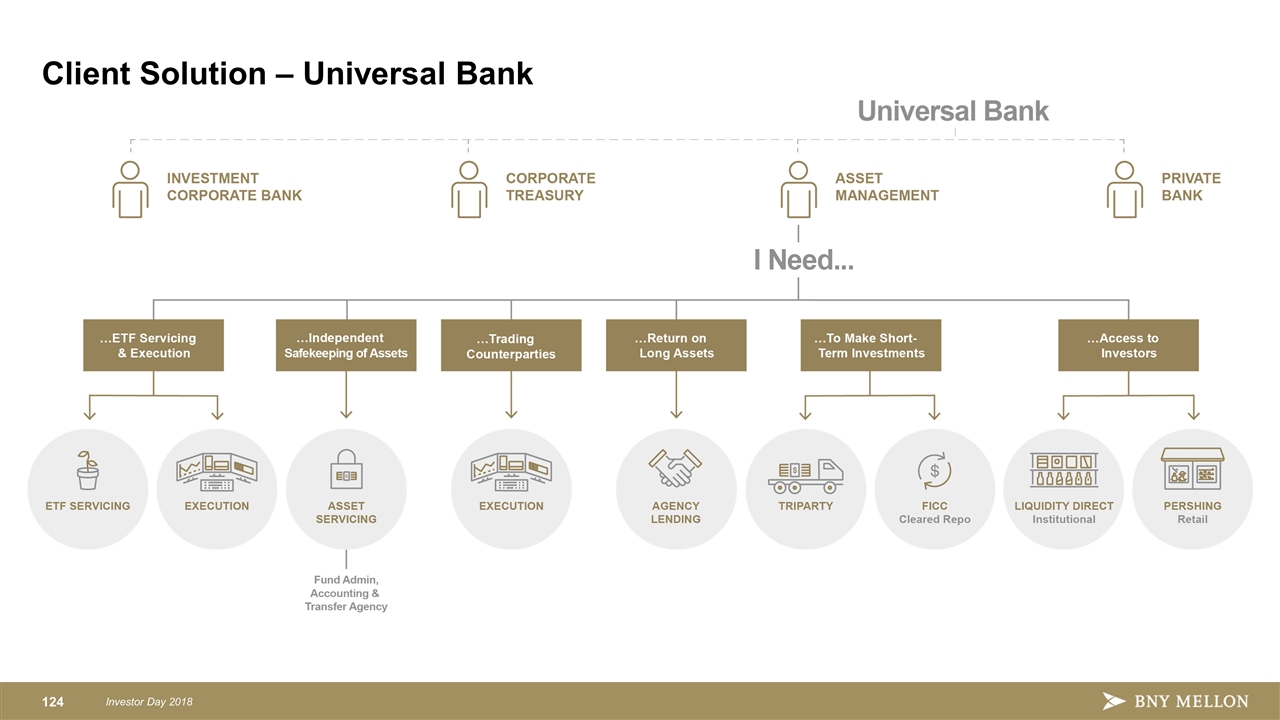

Client Solution – Universal Bank

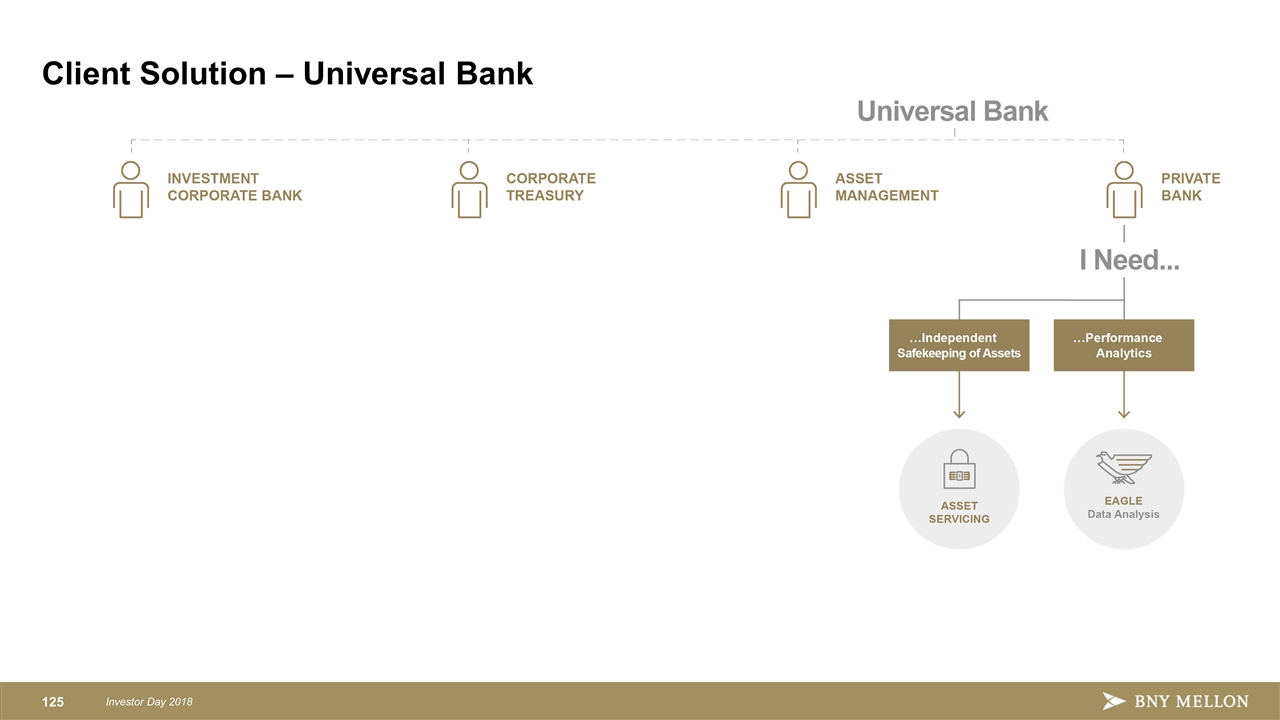

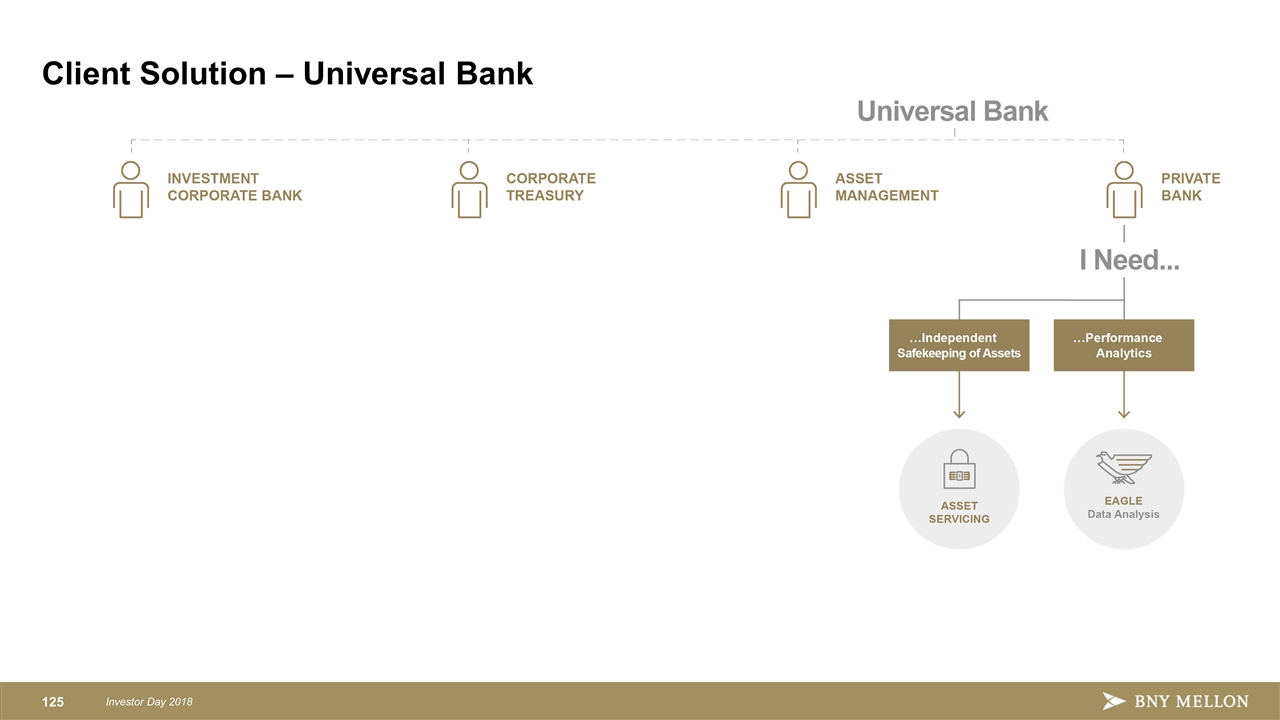

Client Solution – Universal Bank

Client Solution – Universal Bank

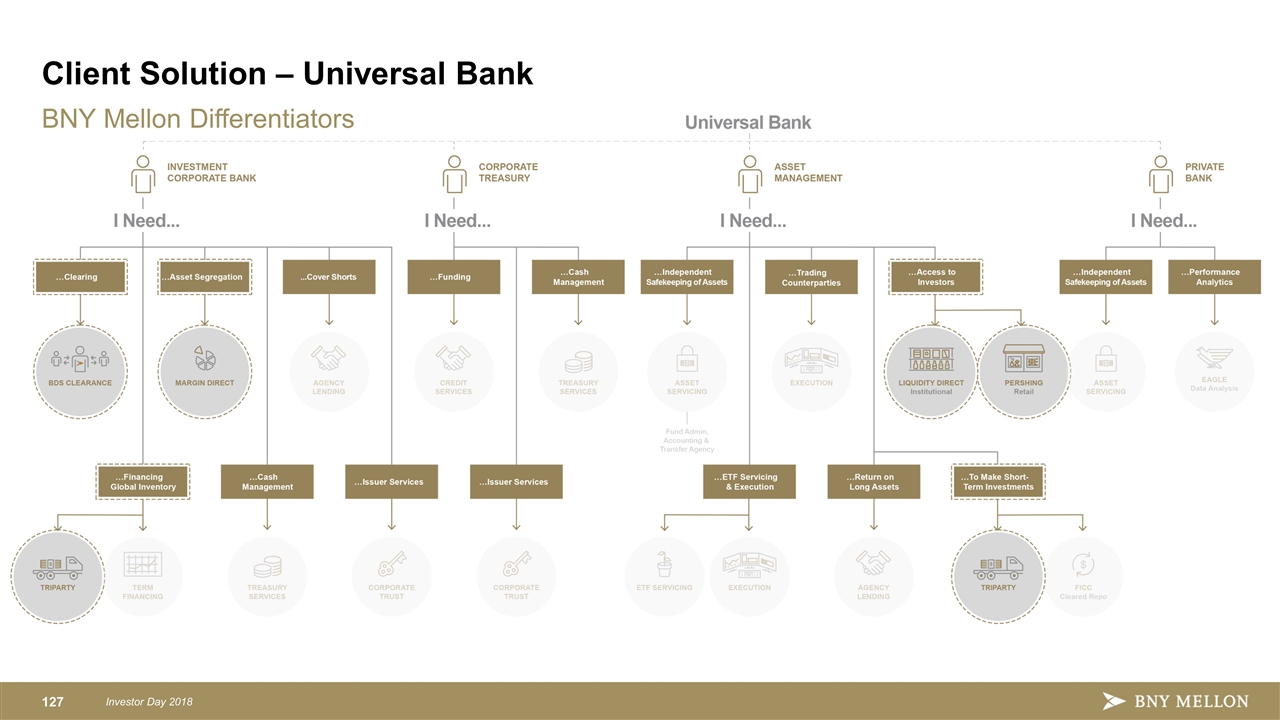

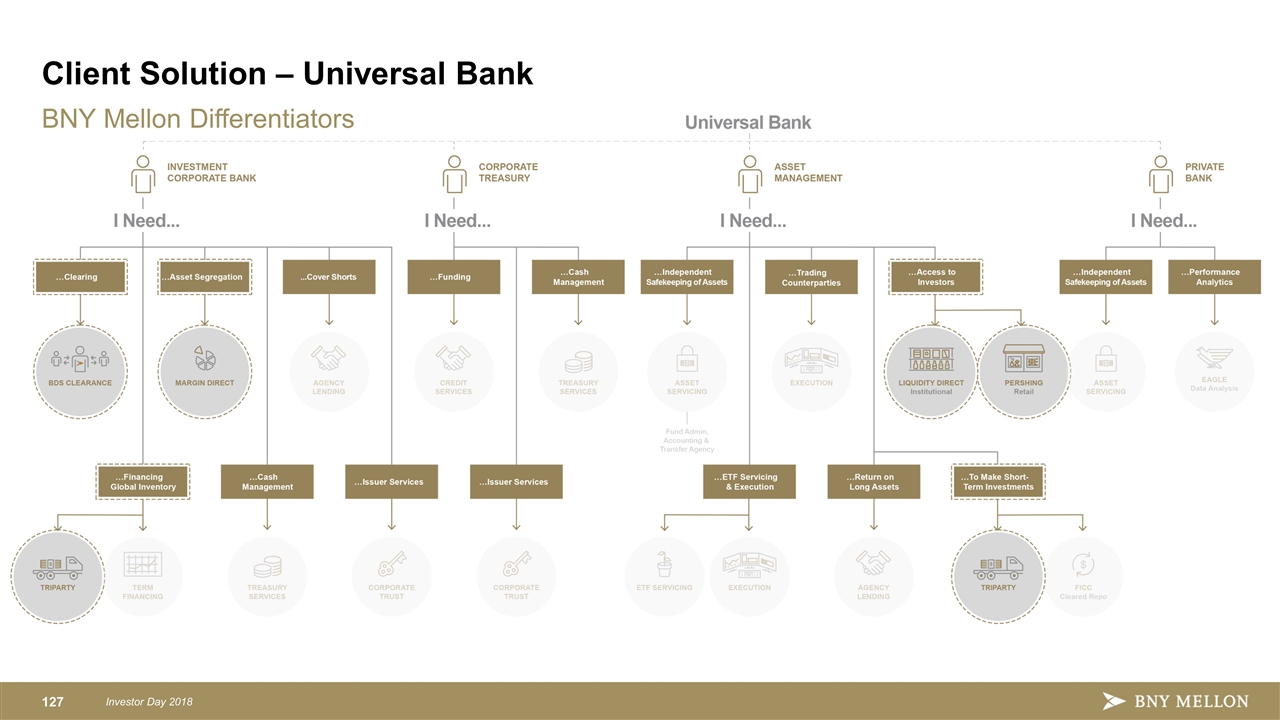

BNY Mellon Differentiators Client Solution – Universal Bank

Deep Client Relationships Distinctive Model Sustainable Growth = 124 Investor Day 2018 Key takeaways =

Investor Day 2018 Closing and Outlook Charlie Scharf Chairman and CEO March 8, 2018

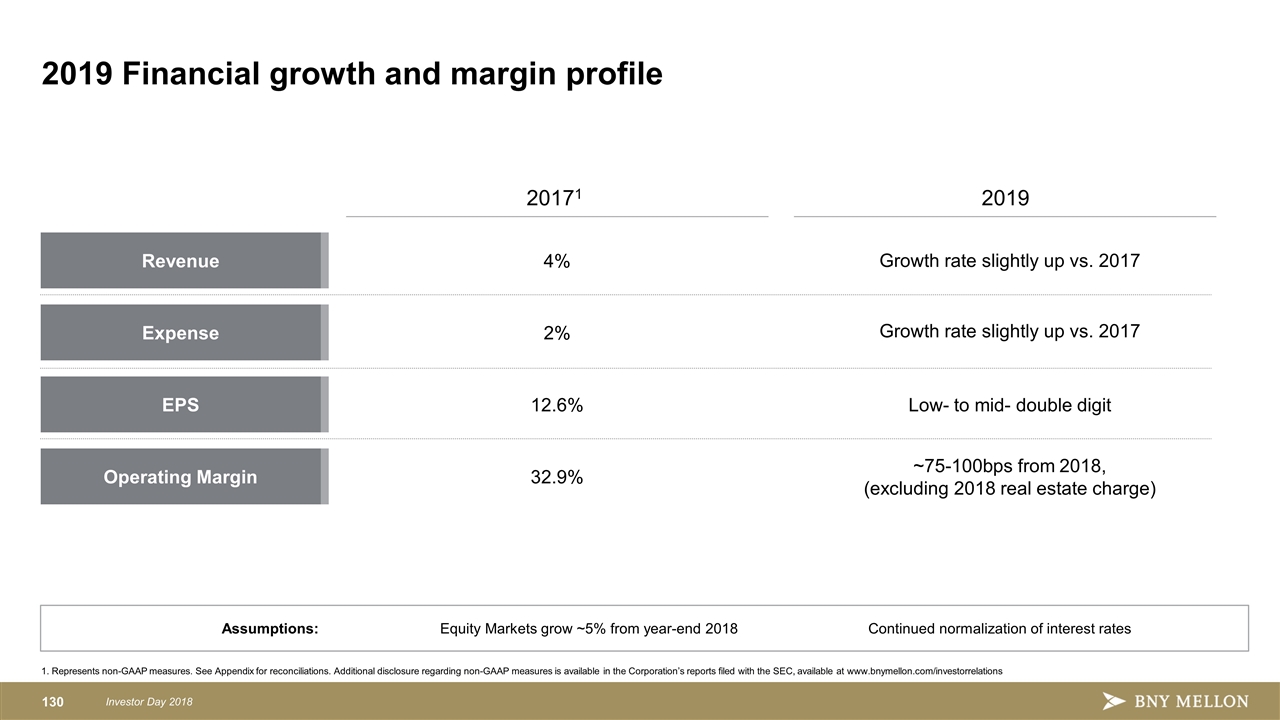

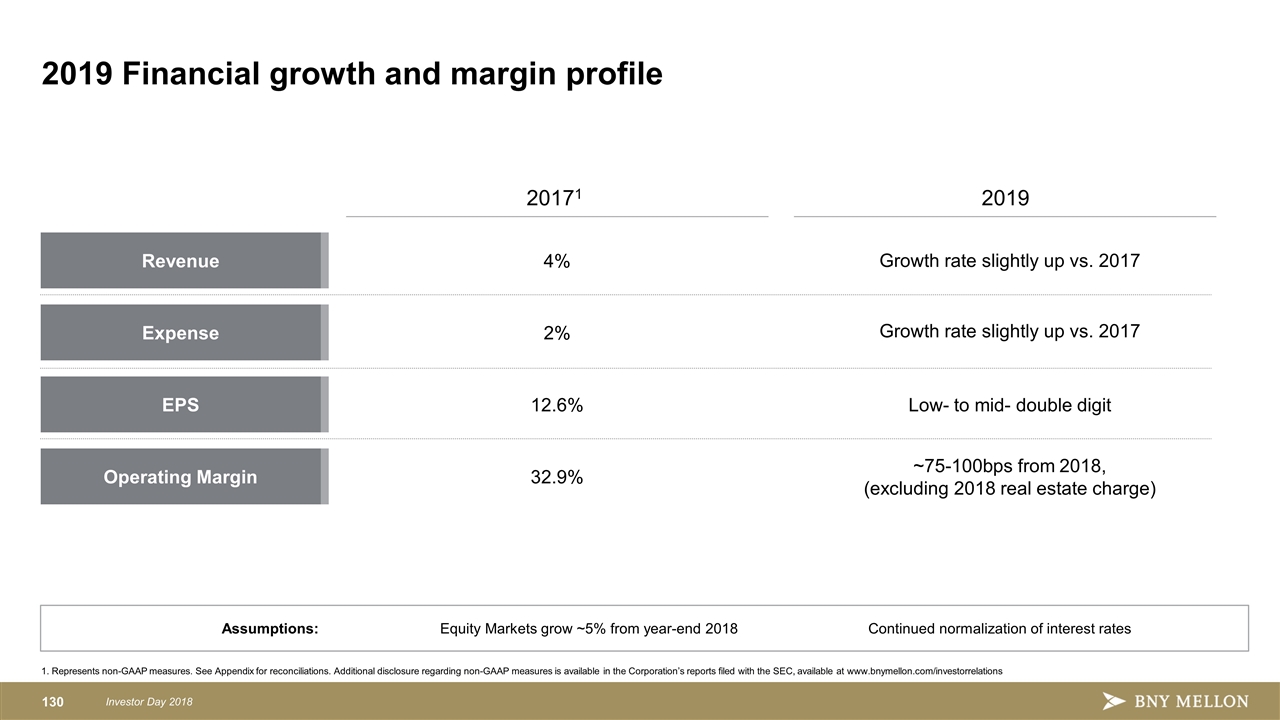

2019 Financial growth and margin profile Revenue Expense EPS Operating Margin Equity Markets grow ~5% from year-end 2018 Assumptions: 4% 2% 12.6% 32.9% 20171 . Continued normalization of interest rates 2019 . Low- to mid- double digit ~75-100bps from 2018, (excluding 2018 real estate charge) Growth rate slightly up vs. 2017 Growth rate slightly up vs. 2017 1. Represents non-GAAP measures. See Appendix for reconciliations. Additional disclosure regarding non-GAAP measures is available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations

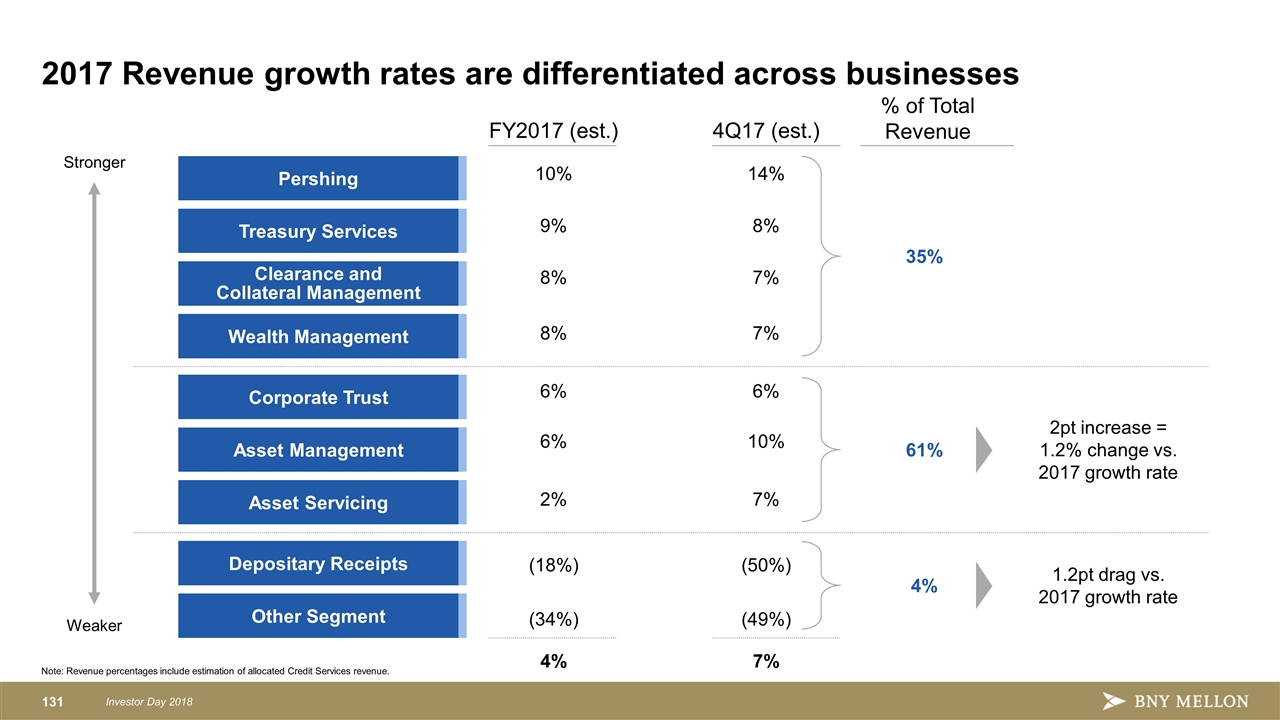

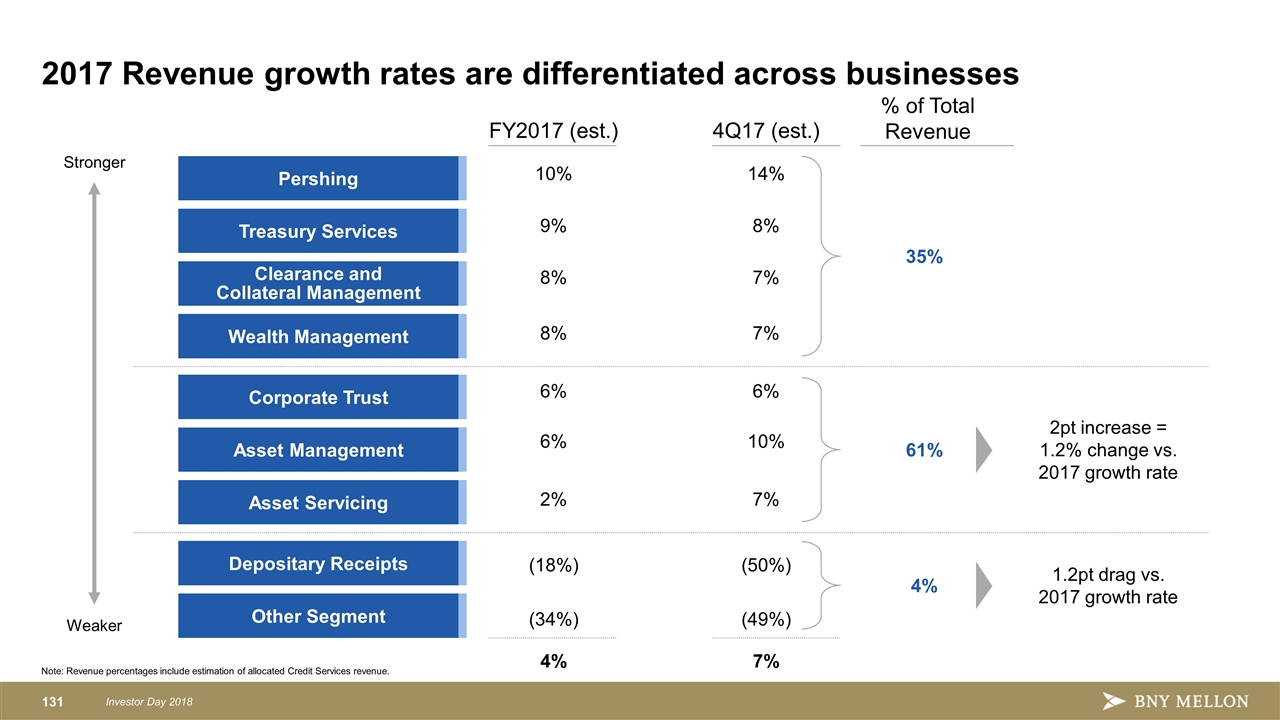

2017 Revenue growth rates are differentiated across businesses Pershing Treasury Services Clearance and Collateral Management Wealth Management Corporate Trust FY2017 (est.) 4Q17 (est.) 10% 14% 9% 8% 8% 7% 8% 7% 6% 6% 6% 10% 2% 7% (18%) (50%) (34%) (49%) 4% 7% Asset Servicing Depositary Receipts Asset Management Other Segment Stronger Weaker 35% 4% 61% 2pt increase = 1.2% change vs. 2017 growth rate 1.2pt drag vs. 2017 growth rate % of Total Revenue Note: Revenue percentages include estimation of allocated Credit Services revenue. 131 Investor Day 2018

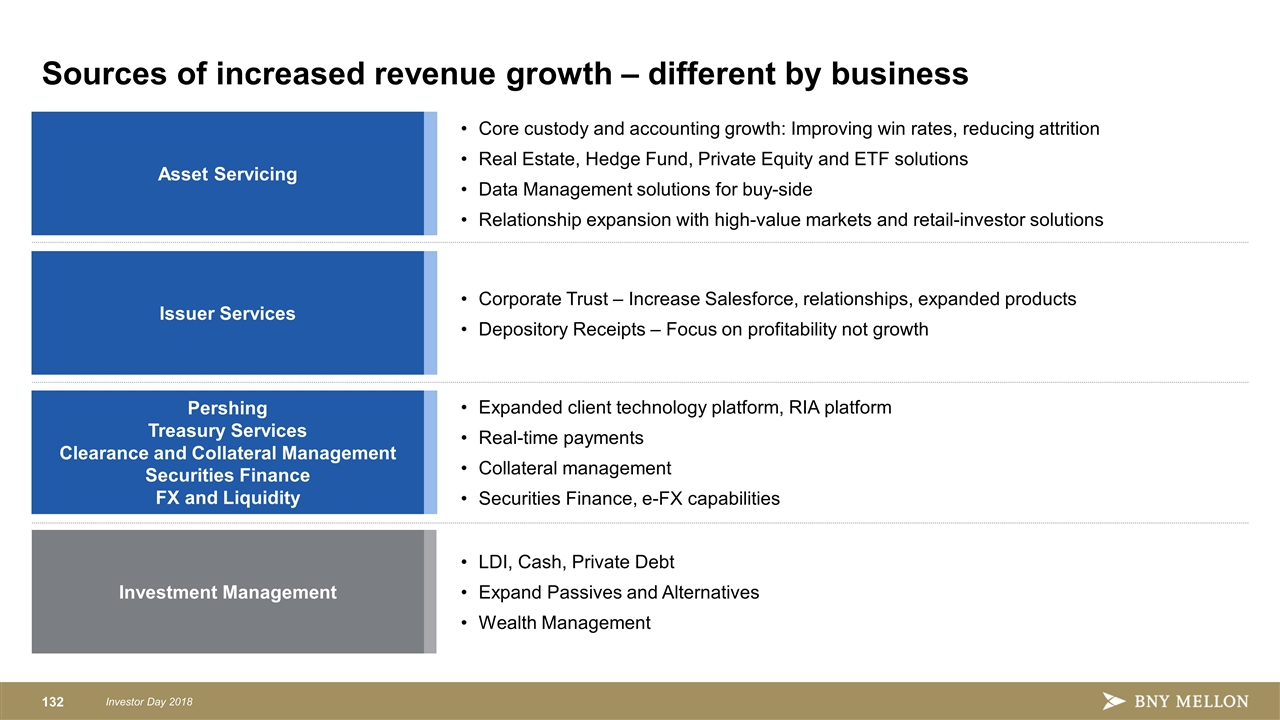

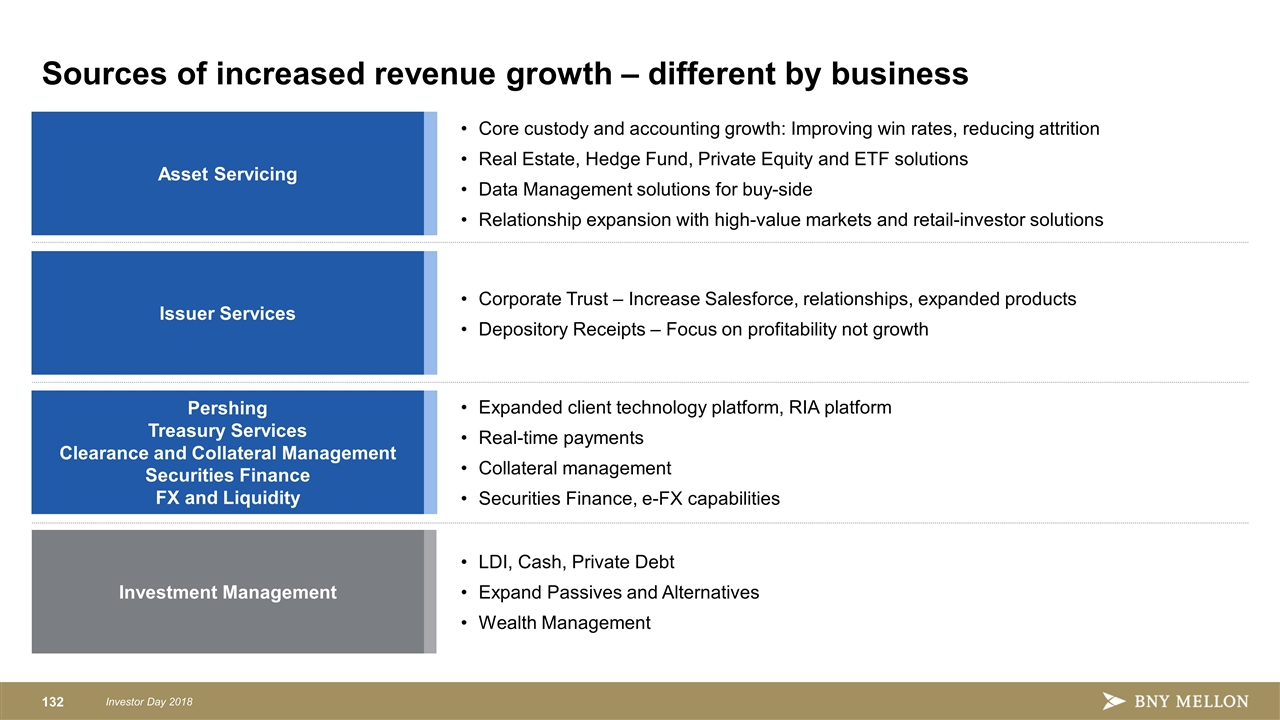

Sources of increased revenue growth – different by business Corporate Trust – Increase Salesforce, relationships, expanded products Depository Receipts – Focus on profitability not growth Expanded client technology platform, RIA platform Real-time payments Collateral management Securities Finance, e-FX capabilities LDI, Cash, Private Debt Expand Passives and Alternatives Wealth Management Core custody and accounting growth: Improving win rates, reducing attrition Real Estate, Hedge Fund, Private Equity and ETF solutions Data Management solutions for buy-side Relationship expansion with high-value markets and retail-investor solutions Asset Servicing Issuer Services Pershing Treasury Services Clearance and Collateral Management Securities Finance FX and Liquidity Investment Management

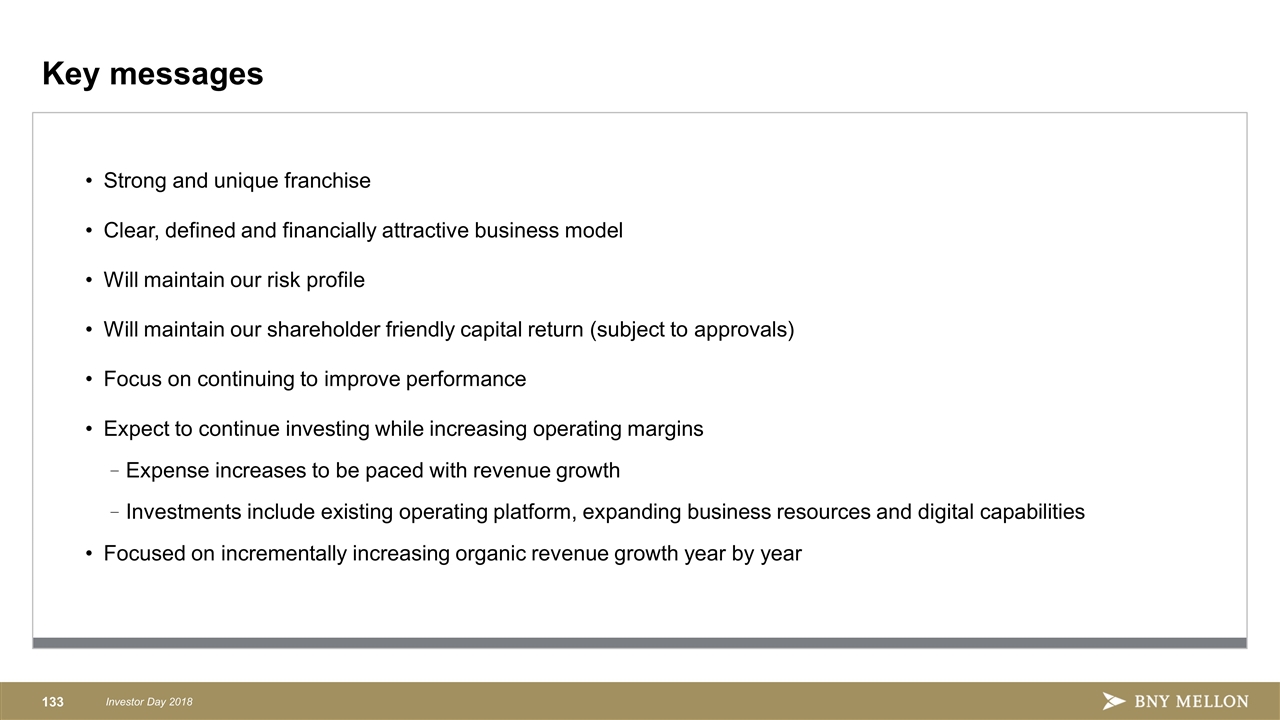

Key messages Strong and unique franchise Clear, defined and financially attractive business model Will maintain our risk profile Will maintain our shareholder friendly capital return (subject to approvals) Focus on continuing to improve performance Expect to continue investing while increasing operating margins Expense increases to be paced with revenue growth Investments include existing operating platform, expanding business resources and digital capabilities Focused on incrementally increasing organic revenue growth year by year

Q&A Investor Day 2018 134 Investor Day 2018

Appendix

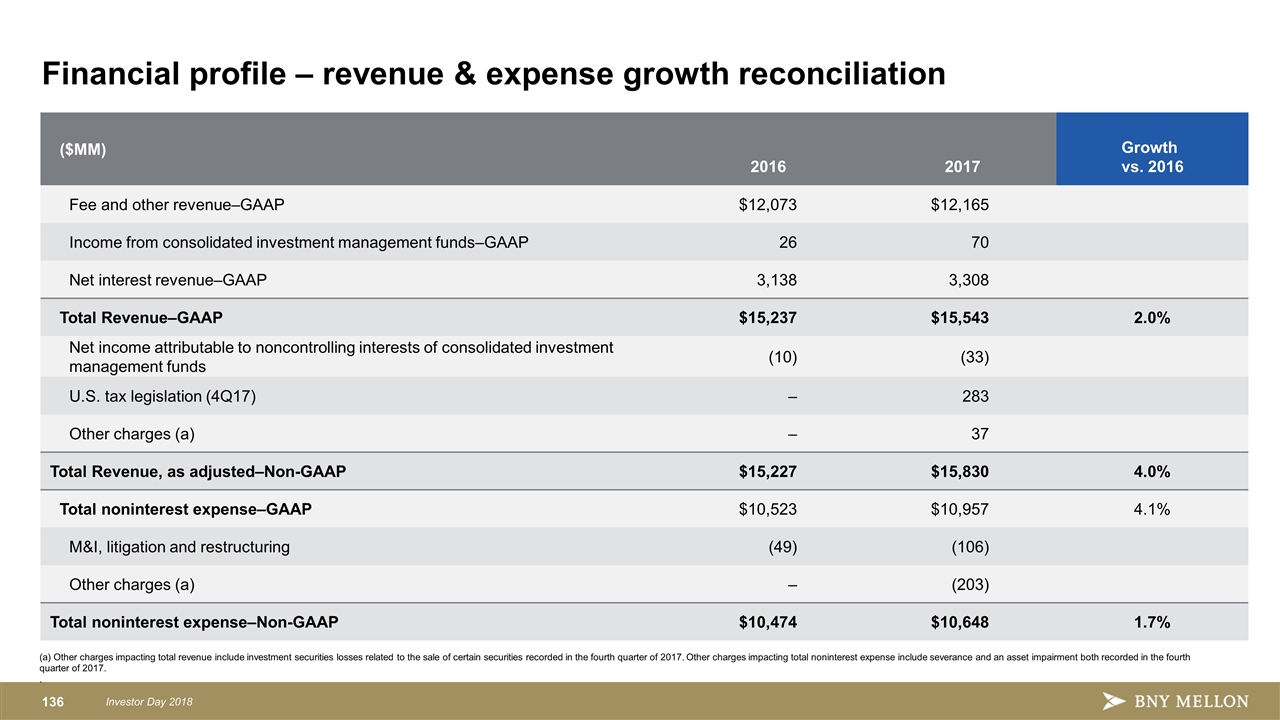

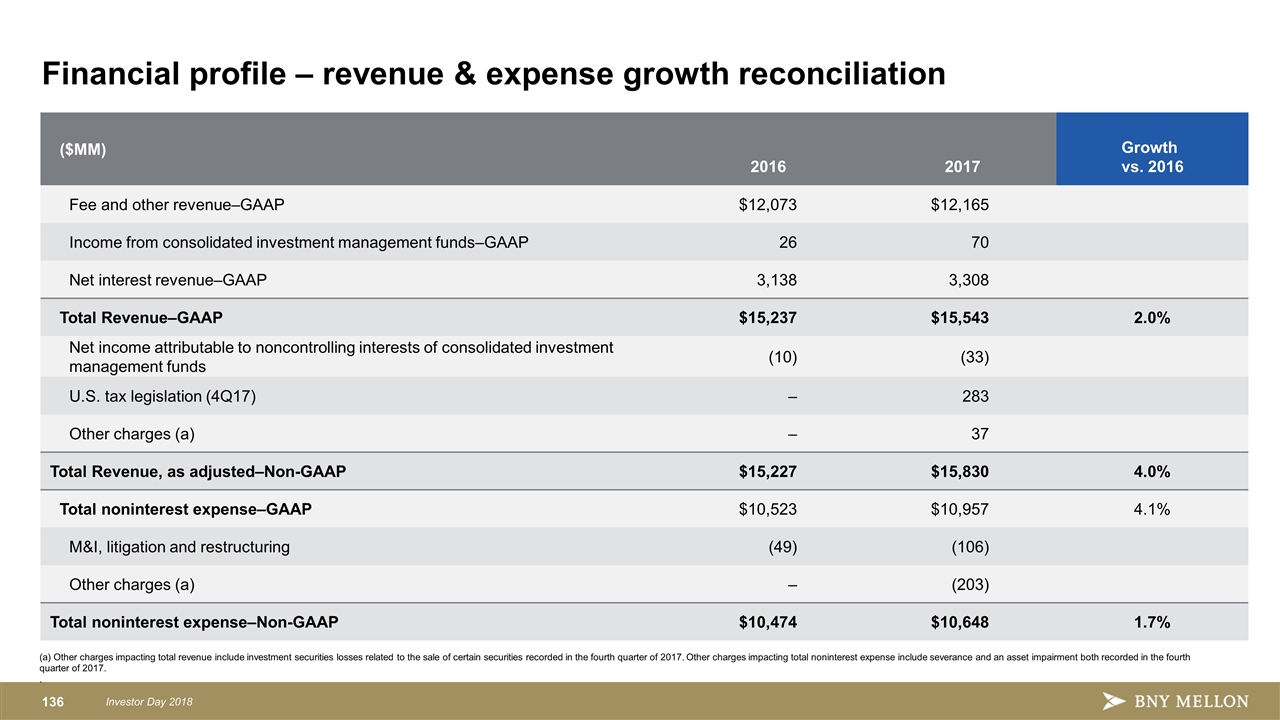

Financial profile – revenue & expense growth reconciliation ($MM) Growth vs. 2016 2016 2017 Fee and other revenue–GAAP $12,073 $12,165 Income from consolidated investment management funds–GAAP 26 70 Net interest revenue–GAAP 3,138 3,308 Total Revenue–GAAP $15,237 $15,543 2.0% Net income attributable to noncontrolling interests of consolidated investment management funds (10) (33) U.S. tax legislation (4Q17) – 283 Other charges (a) – 37 Total Revenue, as adjusted–Non-GAAP $15,227 $15,830 4.0% Total noninterest expense–GAAP $10,523 $10,957 4.1% M&I, litigation and restructuring (49) (106) Other charges (a) – (203) Total noninterest expense–Non-GAAP $10,474 $10,648 1.7% (a) Other charges impacting total revenue include investment securities losses related to the sale of certain securities recorded in the fourth quarter of 2017. Other charges impacting total noninterest expense include severance and an asset impairment both recorded in the fourth quarter of 2017. .

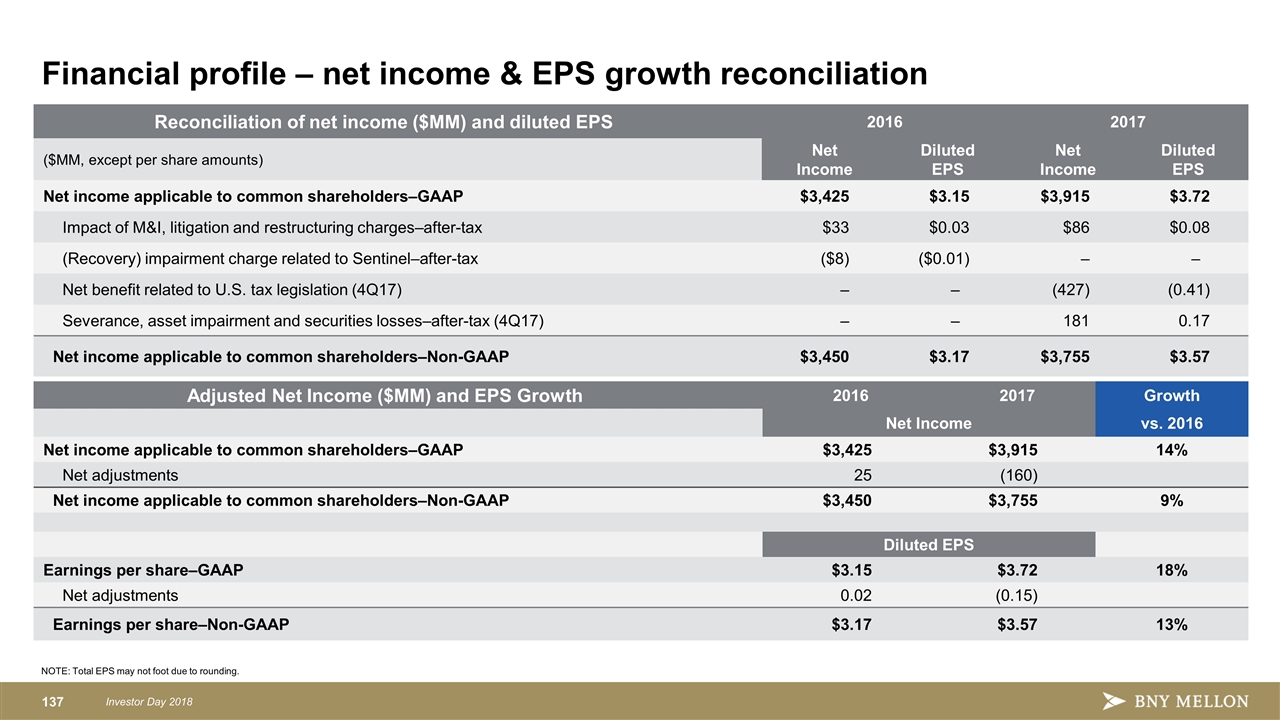

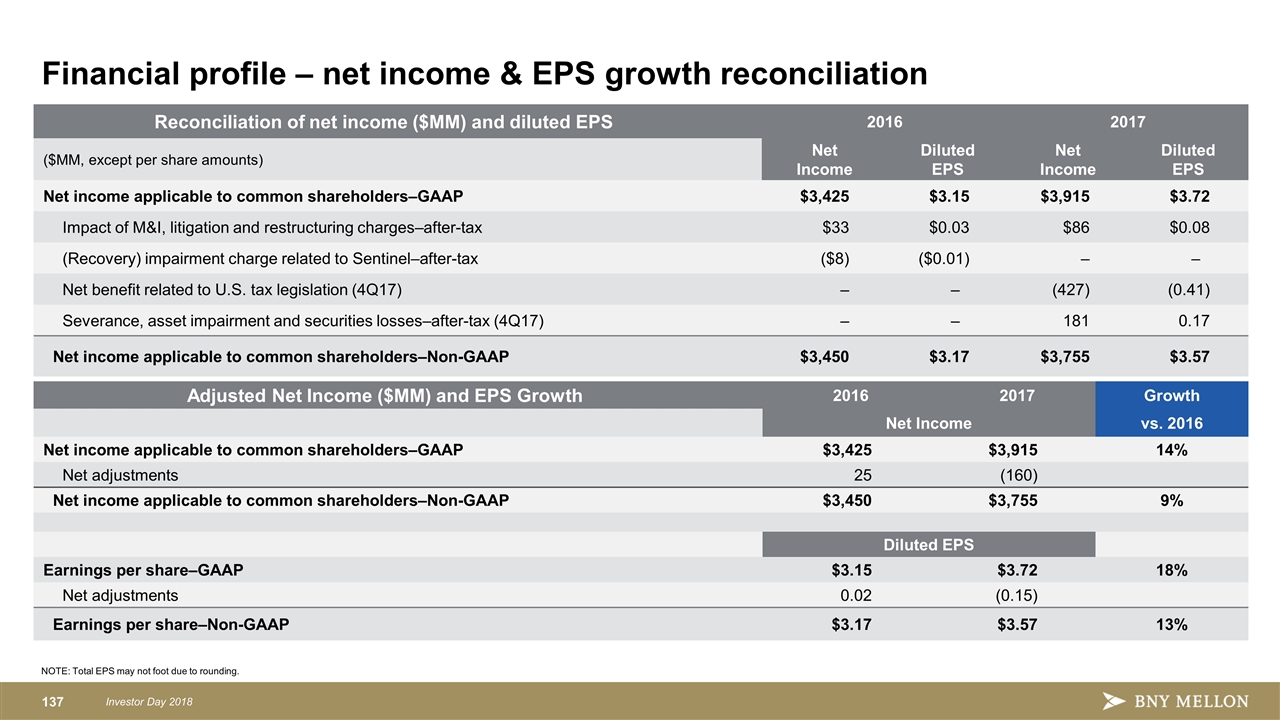

Financial profile – net income & EPS growth reconciliation Reconciliation of net income ($MM) and diluted EPS 2016 2017 ($MM, except per share amounts) Net Income Diluted EPS Net Income Diluted EPS Net income applicable to common shareholders–GAAP $3,425 $3.15 $3,915 $3.72 Impact of M&I, litigation and restructuring charges–after-tax $33 $0.03 $86 $0.08 (Recovery) impairment charge related to Sentinel–after-tax ($8) ($0.01) – – Net benefit related to U.S. tax legislation (4Q17) – – (427) (0.41) Severance, asset impairment and securities losses–after-tax (4Q17) – – 181 0.17 Net income applicable to common shareholders–Non-GAAP $3,450 $3.17 $3,755 $3.57 Adjusted Net Income ($MM) and EPS Growth 2016 2017 Growth Net Income vs. 2016 Net income applicable to common shareholders–GAAP $3,425 $3,915 14% Net adjustments 25 (160) Net income applicable to common shareholders–Non-GAAP $3,450 $3,755 9% Diluted EPS Earnings per share–GAAP $3.15 $3.72 18% Net adjustments 0.02 (0.15) Earnings per share–Non-GAAP $3.17 $3.57 13% NOTE: Total EPS may not foot due to rounding.

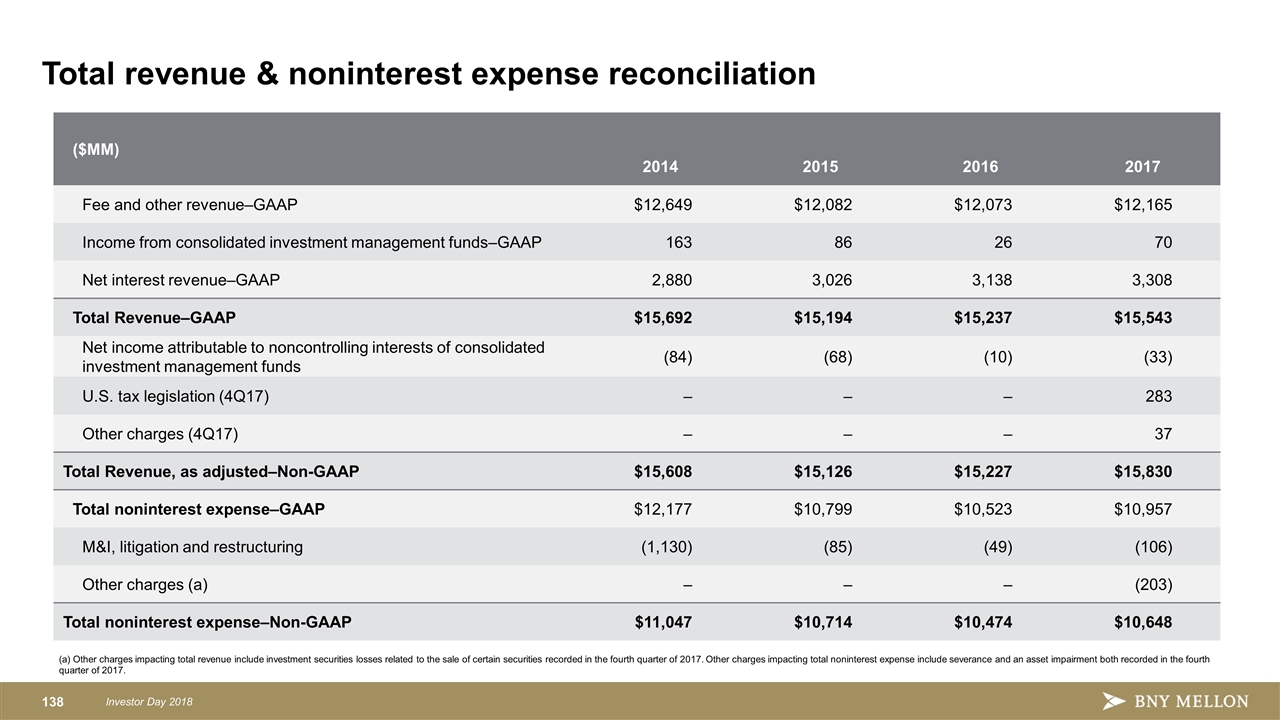

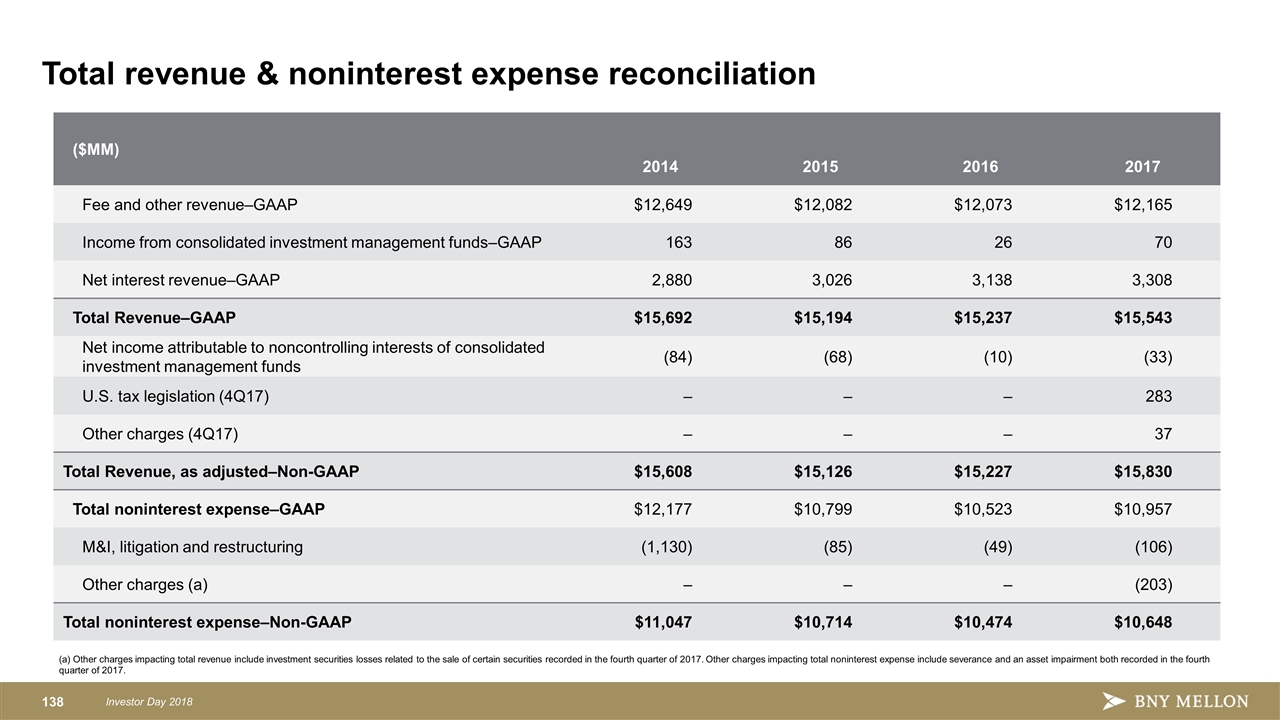

Total revenue & noninterest expense reconciliation ($MM) 2014 2015 2016 2017 Fee and other revenue–GAAP $12,649 $12,082 $12,073 $12,165 Income from consolidated investment management funds–GAAP 163 86 26 70 Net interest revenue–GAAP 2,880 3,026 3,138 3,308 Total Revenue–GAAP $15,692 $15,194 $15,237 $15,543 Net income attributable to noncontrolling interests of consolidated investment management funds (84) (68) (10) (33) U.S. tax legislation (4Q17) – – – 283 Other charges (4Q17) – – – 37 Total Revenue, as adjusted–Non-GAAP $15,608 $15,126 $15,227 $15,830 Total noninterest expense–GAAP $12,177 $10,799 $10,523 $10,957 M&I, litigation and restructuring (1,130) (85) (49) (106) Other charges (a) – – – (203) Total noninterest expense–Non-GAAP $11,047 $10,714 $10,474 $10,648 (a) Other charges impacting total revenue include investment securities losses related to the sale of certain securities recorded in the fourth quarter of 2017. Other charges impacting total noninterest expense include severance and an asset impairment both recorded in the fourth quarter of 2017.

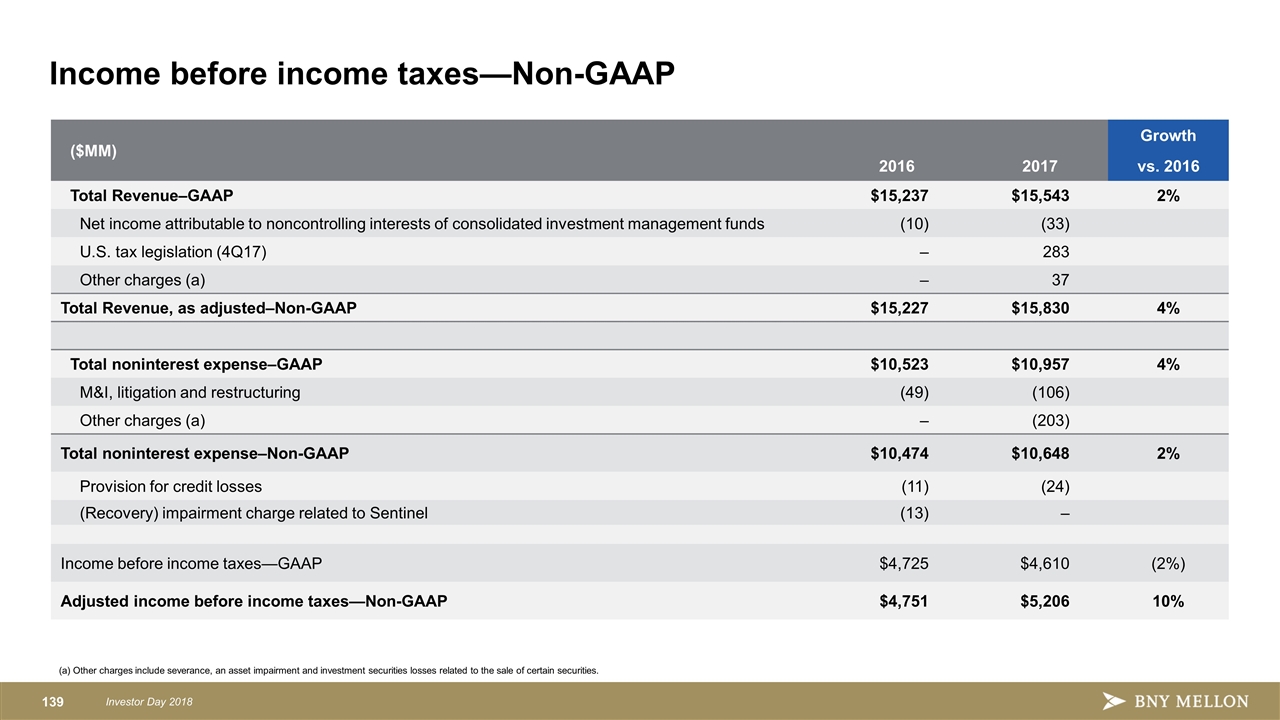

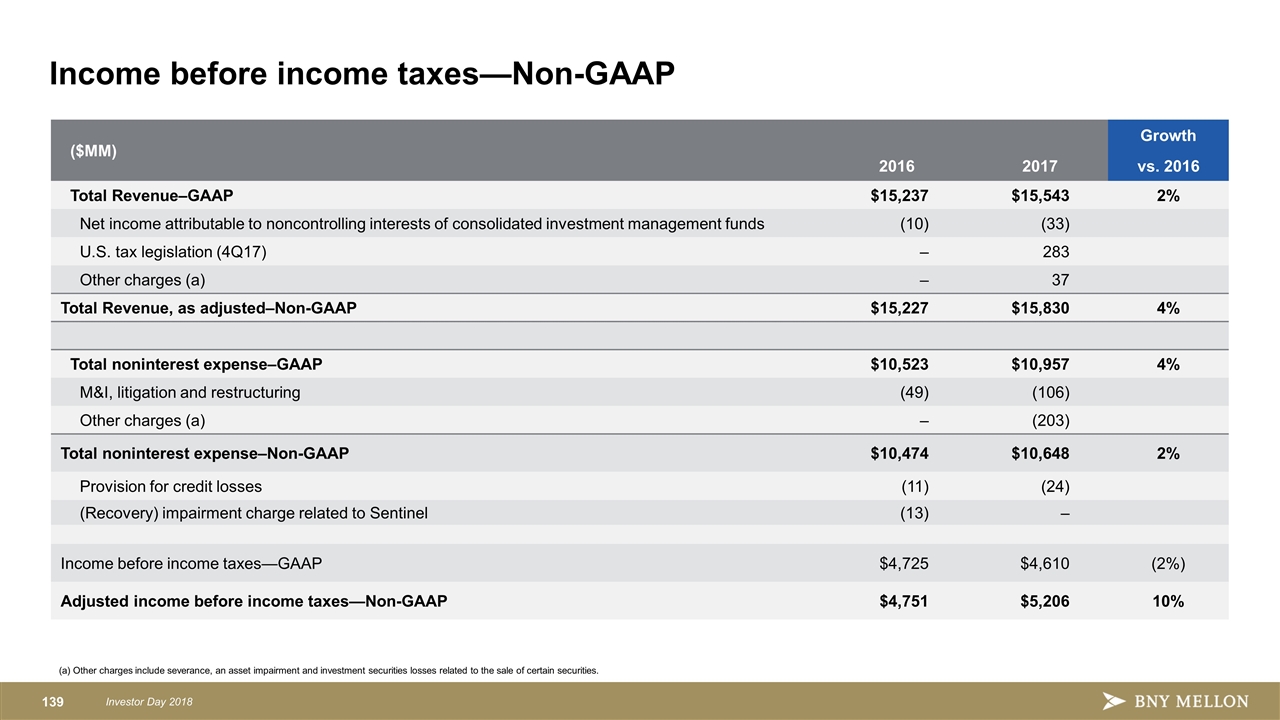

Income before income taxes—Non-GAAP ($MM) Growth 2016 2017 vs. 2016 Total Revenue–GAAP $15,237 $15,543 2% Net income attributable to noncontrolling interests of consolidated investment management funds (10) (33) U.S. tax legislation (4Q17) – 283 Other charges (a) – 37 Total Revenue, as adjusted–Non-GAAP $15,227 $15,830 4% Total noninterest expense–GAAP $10,523 $10,957 4% M&I, litigation and restructuring (49) (106) Other charges (a) – (203) Total noninterest expense–Non-GAAP $10,474 $10,648 2% Provision for credit losses (11) (24) (Recovery) impairment charge related to Sentinel (13) – Income before income taxes—GAAP $4,725 $4,610 (2%) Adjusted income before income taxes—Non-GAAP $4,751 $5,206 10% (a) Other charges include severance, an asset impairment and investment securities losses related to the sale of certain securities.

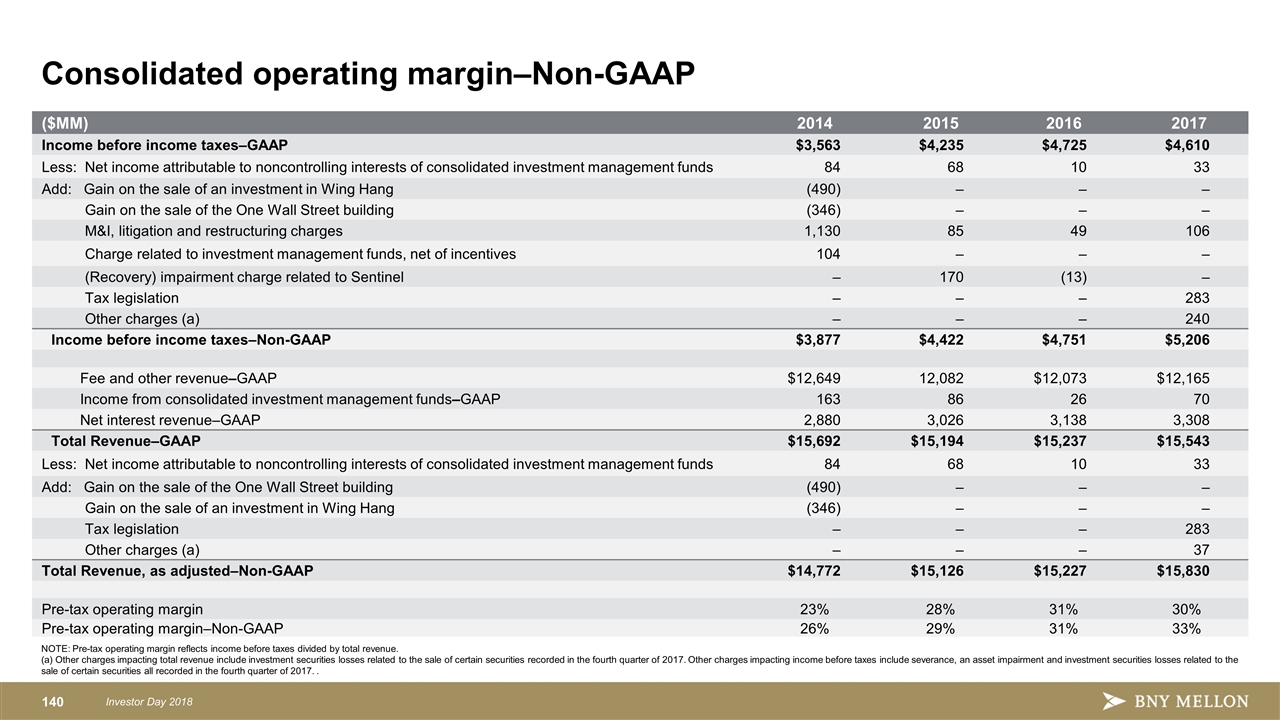

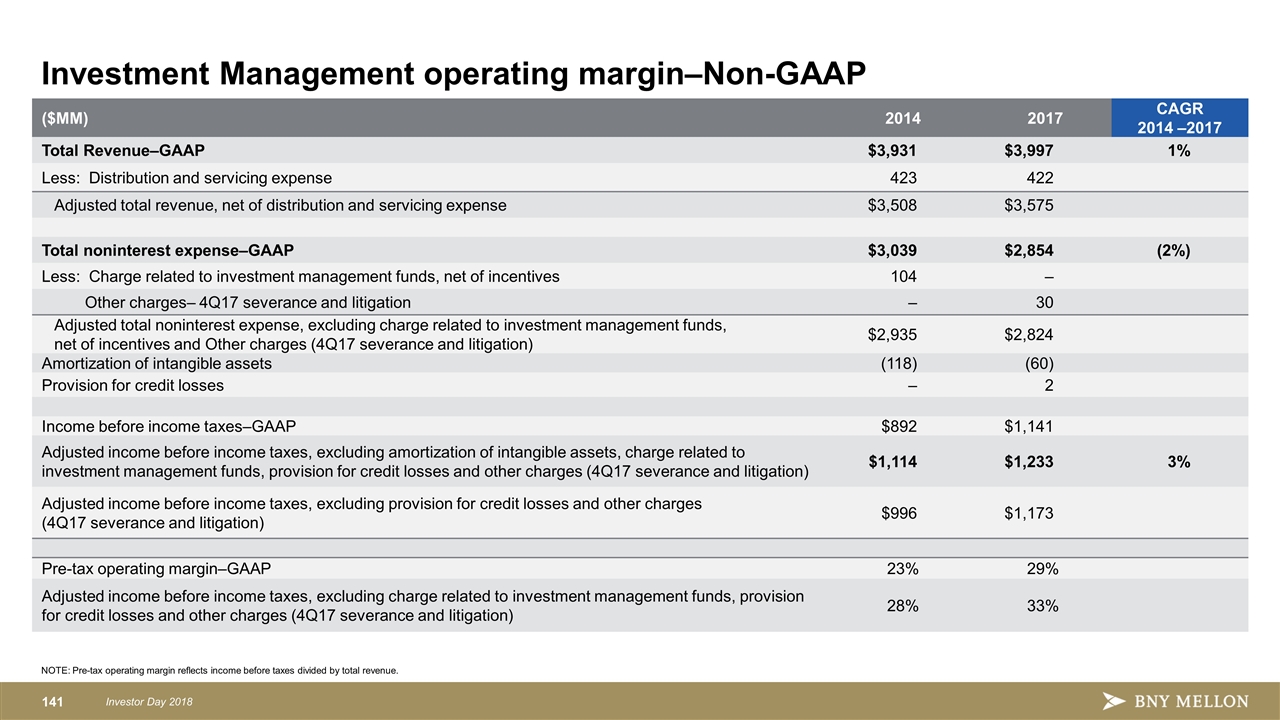

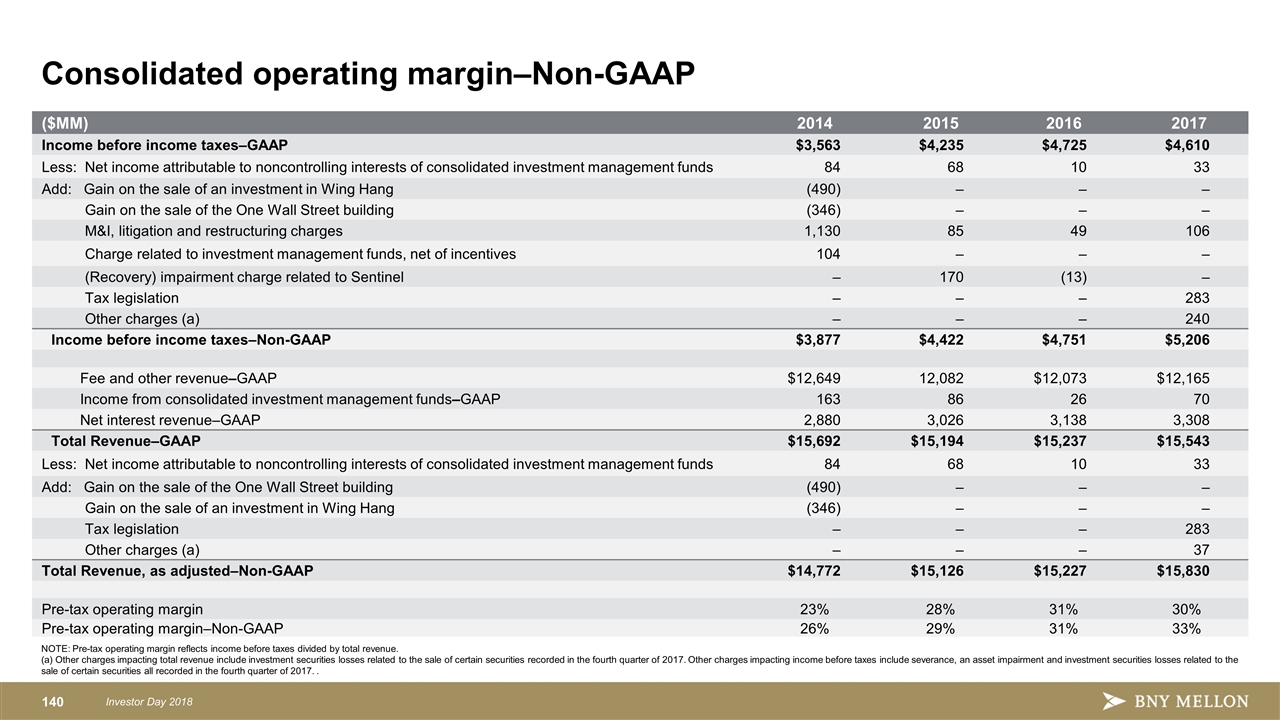

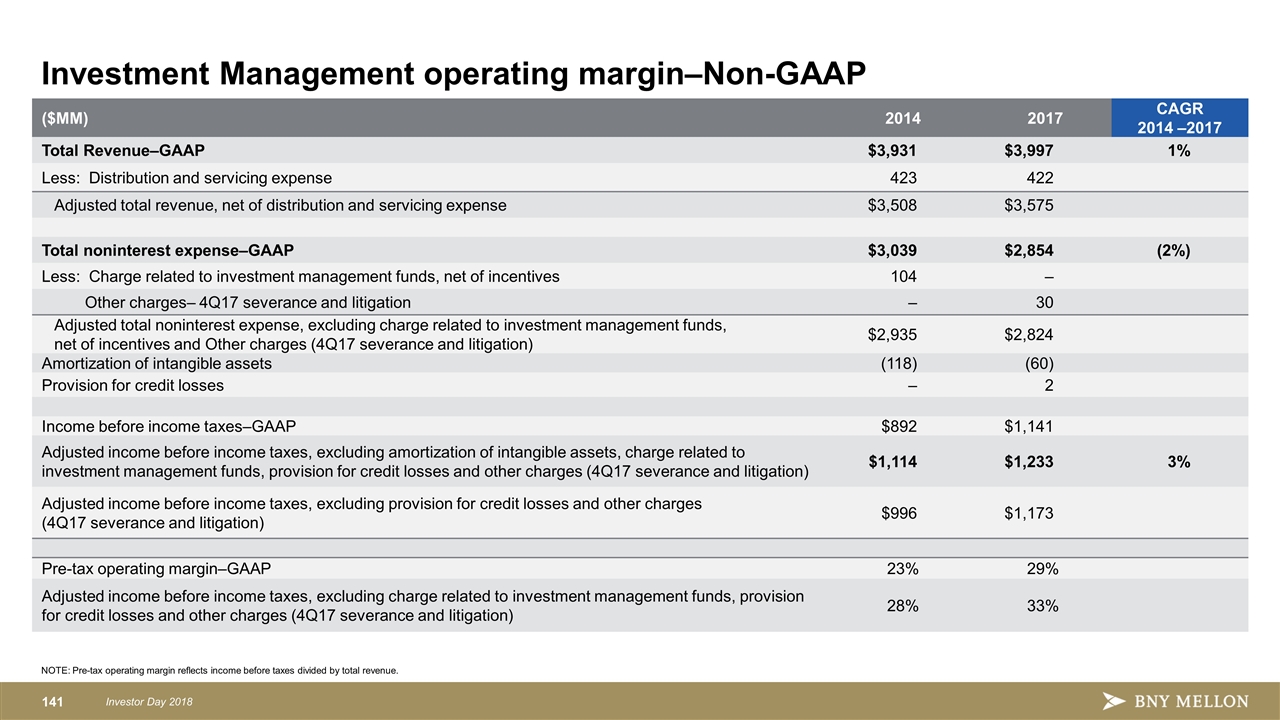

NOTE: Pre-tax operating margin reflects income before taxes divided by total revenue. (a) Other charges impacting total revenue include investment securities losses related to the sale of certain securities recorded in the fourth quarter of 2017. Other charges impacting income before taxes include severance, an asset impairment and investment securities losses related to the sale of certain securities all recorded in the fourth quarter of 2017. . Consolidated operating margin–Non-GAAP ($MM) 2014 2015 2016 2017 Income before income taxes–GAAP $3,563 $4,235 $4,725 $4,610 Less: Net income attributable to noncontrolling interests of consolidated investment management funds 84 68 10 33 Add: Gain on the sale of an investment in Wing Hang (490) – – – Gain on the sale of the One Wall Street building (346) – – – M&I, litigation and restructuring charges 1,130 85 49 106 Charge related to investment management funds, net of incentives 104 – – – (Recovery) impairment charge related to Sentinel – 170 (13) – Tax legislation – – – 283 Other charges (a) – – – 240 Income before income taxes–Non-GAAP $3,877 $4,422 $4,751 $5,206 Fee and other revenue–GAAP $12,649 12,082 $12,073 $12,165 Income from consolidated investment management funds–GAAP 163 86 26 70 Net interest revenue–GAAP 2,880 3,026 3,138 3,308 Total Revenue–GAAP $15,692 $15,194 $15,237 $15,543 Less: Net income attributable to noncontrolling interests of consolidated investment management funds 84 68 10 33 Add: Gain on the sale of the One Wall Street building (490) – – – Gain on the sale of an investment in Wing Hang (346) – – – Tax legislation – – – 283 Other charges (a) – – – 37 Total Revenue, as adjusted–Non-GAAP $14,772 $15,126 $15,227 $15,830 Pre-tax operating margin 23% 28% 31% 30% Pre-tax operating margin–Non-GAAP 26% 29% 31% 33%