BNY Mellon Fourth Quarter 2016 Financial Highlights January 19, 2017

2 Fourth Quarter 2016 – Financial Highlights Cautionary Statement A number of statements in the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate”, “forecast”, “project”, “anticipate”, “target”, “expect”, “intend”, “continue”, “seek”, “believe”, “plan”, “goal”, “could”, “should”, “may”, “will”, “strategy”, “opportunities”, “trends” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: expense control, capital plans, strategic priorities, financial goals, client experience, driving revenue growth, the business improvement process, estimated capital ratios and expectations regarding those ratios, preliminary business metrics; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual results may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2015 (the “2015 Annual Report”), the Quarterly Report on Form 10-Q for the period ended September 30, 2016 and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”), including the Corporation's Earnings Release for the quarter ended December 31, 2016, included as an exhibit to our Current Report on Form 8-K filed on January 19, 2017 (the “Earnings Release”). Such forward-looking statements speak only as of January 19, 2017, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Non-GAAP Measures: In this presentation we may discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP adjusted measures are contained in the Corporation’s reports filed with the SEC, including the 2015 Annual Report and Earnings Release, available at www.bnymellon.com/investorrelations.

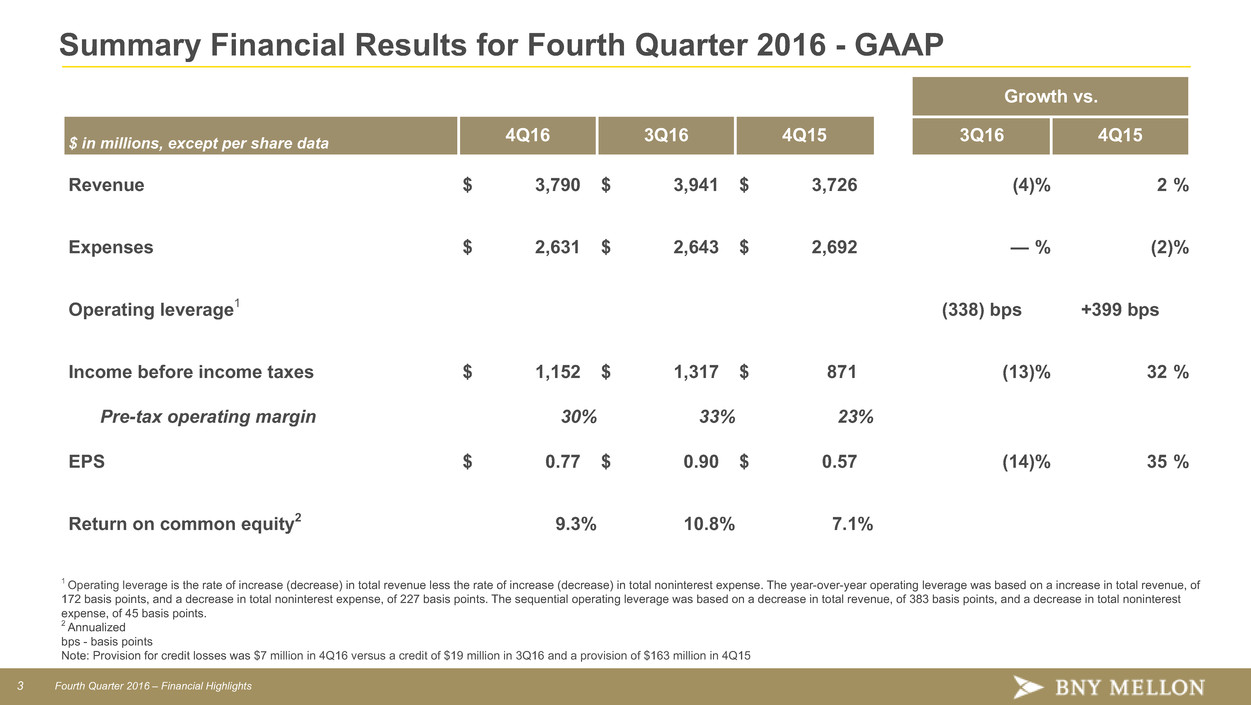

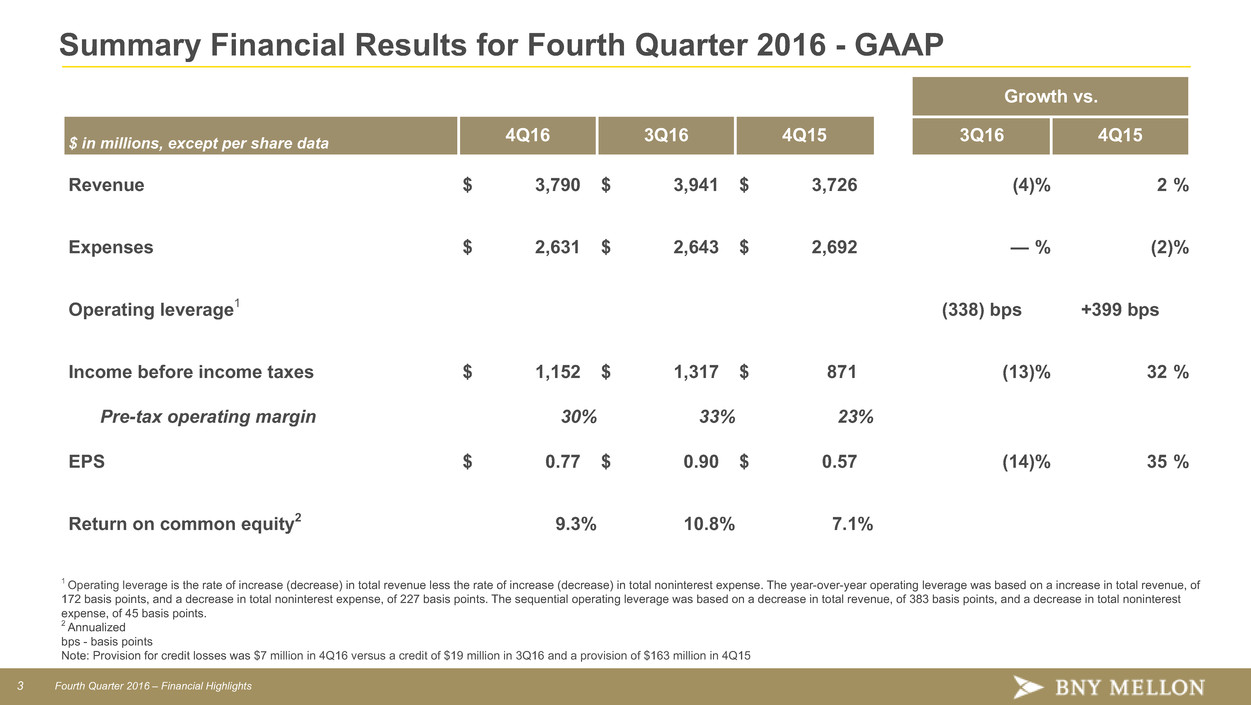

3 Fourth Quarter 2016 – Financial Highlights Summary Financial Results for Fourth Quarter 2016 - GAAP Growth vs. $ in millions, except per share data 4Q16 3Q16 4Q15 3Q16 4Q15 Revenue $ 3,790 $ 3,941 $ 3,726 (4)% 2 % Expenses $ 2,631 $ 2,643 $ 2,692 — % (2)% Operating leverage1 (338) bps +399 bps Income before income taxes $ 1,152 $ 1,317 $ 871 (13)% 32 % Pre-tax operating margin 30% 33% 23% EPS $ 0.77 $ 0.90 $ 0.57 (14)% 35 % Return on common equity2 9.3% 10.8% 7.1% 1 Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year operating leverage was based on a increase in total revenue, of 172 basis points, and a decrease in total noninterest expense, of 227 basis points. The sequential operating leverage was based on a decrease in total revenue, of 383 basis points, and a decrease in total noninterest expense, of 45 basis points. 2 Annualized bps - basis points Note: Provision for credit losses was $7 million in 4Q16 versus a credit of $19 million in 3Q16 and a provision of $163 million in 4Q15

4 Fourth Quarter 2016 – Financial Highlights Summary Financial Results for Fourth Quarter 2016 (Non-GAAP)1 Growth vs. $ in millions, except per share data 4Q16 3Q16 4Q15 3Q16 4Q15 Revenue $ 3,786 $ 3,932 $ 3,721 (4)% 2 % Expenses $ 2,564 $ 2,564 $ 2,610 — % (2)% Adjusted operating leverage2 (371) bps +351 bps Income before income taxes $ 1,215 $ 1,374 $ 1,118 (12)% 9 % Adjusted pre-tax operating margin 32% 35% 30% EPS $ 0.77 $ 0.90 $ 0.68 (14)% 13 % Return on tangible common equity 20.4% 23.5% 16.2% Adjusted return on tangible common equity 20.5% 23.6% 19.0% 1 Represents Non-GAAP measures. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 2 Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year operating leverage (Non-GAAP) was based on an increase in total revenue, as adjusted (Non-GAAP), of 175 basis points, and a decrease in total noninterest expense, as adjusted (Non-GAAP), of 176 basis points. The sequential operating leverage (Non-GAAP) was based on a decrease in total revenue, as adjusted (Non-GAAP), of 371 basis points, and flat total noninterest expense, as adjusted (Non-GAAP), of 0 basis points. bps - basis points

5 Fourth Quarter 2016 – Financial Highlights Summary Financial Results for Full-Year 2016 - GAAP Growth vs. $ in millions, except per share data FY 2016 FY 2015 FY 2015 Revenue $ 15,237 $ 15,194 — % Expenses $ 10,523 $ 10,799 (3) % Operating leverage1 +284 bps Income before income taxes $ 4,725 $ 4,235 12 % Pre-tax operating margin 31% 28% EPS $ 3.15 $ 2.71 16 % Return on common equity 9.6% 8.6% 1 Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year operating leverage was based on an increase in total revenue, of 28 basis points, and a decrease in total noninterest expense, of 256 basis points. bps - basis points Note: Provision for credit losses was a credit of $11 million in FY 2016 versus a provision of $160 million in FY 2015

6 Fourth Quarter 2016 – Financial Highlights Summary Financial Results for Full-Year 2016 (Non-GAAP)1 1 Represents Non-GAAP measures. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 2Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year operating leverage was based on an increase in total revenue, of 67 basis points, and a decrease in total noninterest expense, of 207 basis points. bps - basis points Growth vs. $ in millions, except per share data FY 2016 FY 2015 FY 2015 Revenue $ 15,227 $ 15,126 1 % Expenses $ 10,237 $ 10,453 (2)% Adjusted operating leverage2 +274 bps Income before income taxes $ 4,988 $ 4,683 7 % Adjusted pre-tax operating margin 33% 31% EPS $ 3.17 $ 2.85 11 % Return on tangible common equity 21.2% 19.7% Adjusted return on tangible common equity 21.4% 20.7%

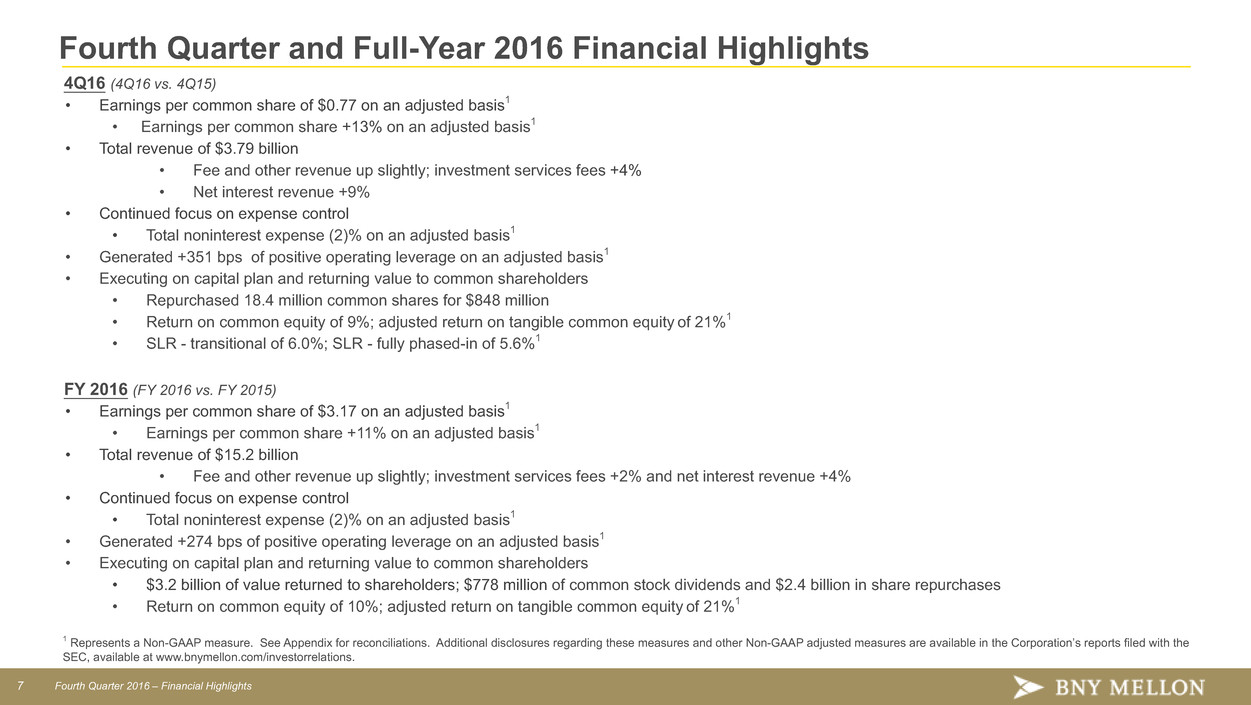

7 Fourth Quarter 2016 – Financial Highlights Fourth Quarter and Full-Year 2016 Financial Highlights 4Q16 (4Q16 vs. 4Q15) • Earnings per common share of $0.77 on an adjusted basis1 • Earnings per common share +13% on an adjusted basis1 • Total revenue of $3.79 billion • Fee and other revenue up slightly; investment services fees +4% • Net interest revenue +9% • Continued focus on expense control • Total noninterest expense (2)% on an adjusted basis1 • Generated +351 bps of positive operating leverage on an adjusted basis1 • Executing on capital plan and returning value to common shareholders • Repurchased 18.4 million common shares for $848 million • Return on common equity of 9%; adjusted return on tangible common equity of 21%1 • SLR - transitional of 6.0%; SLR - fully phased-in of 5.6%1 FY 2016 (FY 2016 vs. FY 2015) • Earnings per common share of $3.17 on an adjusted basis1 • Earnings per common share +11% on an adjusted basis1 • Total revenue of $15.2 billion • Fee and other revenue up slightly; investment services fees +2% and net interest revenue +4% • Continued focus on expense control • Total noninterest expense (2)% on an adjusted basis1 • Generated +274 bps of positive operating leverage on an adjusted basis1 • Executing on capital plan and returning value to common shareholders • $3.2 billion of value returned to shareholders; $778 million of common stock dividends and $2.4 billion in share repurchases • Return on common equity of 10%; adjusted return on tangible common equity of 21%1 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

8 Fourth Quarter 2016 – Financial Highlights 2016 Key Messages • Executing on our strategic priorities; delivering on our three-year financial goals set at our 2014 Investor Day • Focused on enhancing the client experience and driving profitable revenue growth ◦ Broadening existing client relationships and selectively adding new business • Business Improvement Process designed to leverage scale, increase efficiency and effectiveness, and reduce risk and structural costs ◦ In a low organic revenue growth environment, the Business Improvement Process is enabling us to fund: ▪ Additional global regulatory requirements ▪ Enhancements to our technology and servicing platforms ▪ Revenue growth initiatives ▪ Improving our operating margin and shareholder return • Continue to return significant value to shareholders through share repurchases and dividends

9 Fourth Quarter 2016 – Financial Highlights Fourth Quarter 2016 Key Performance Drivers (comparisons are 4Q16 versus 4Q15) • Earnings per common share of $0.77, +13% on an adjusted basis1 (Non-GAAP), driven by strength in investment services fees, net interest revenue and continued execution of our business improvement process • Investment management and performance fees (2)% primarily due to unfavorable impact of a stronger U.S. dollar (principally versus the British pound) and lower performance fees, partially offset by higher market values and money market fees • Investment services fees +4% reflecting higher money market fees • Market-sensitive revenue increased • Net Interest Revenue increased $71 million driven by higher interest rates, impact of interest rate hedging activities and premium amortization adjustments, partially offset by lower interest-earning assets • Foreign Exchange +6% primarily reflecting higher volatility • Securities Lending +17% driven by higher spreads • Investment and Other income decreased $23 million driven by lower other income related to termination fees in our clearing business • Provision for credit losses was $7 million in 4Q16 versus $163 million in 4Q15. The 4Q15 provision was related to a court decision regarding Sentinel Management Group, Inc. (“Sentinel”) • Noninterest expense on an adjusted basis1 (Non-GAAP) (2)%, reflects lower staff expense driven by the favorable impact of a stronger U.S. dollar, lower employee benefits and severance expense • Effective tax rate of 24.3% 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

10 Fourth Quarter 2016 – Financial Highlights Full-Year 2016 Key Performance Drivers (comparisons are FY 2016 versus FY 2015) • Earnings per common share of $3.17, +11% on an adjusted basis1 (Non-GAAP), driven by strength in investment service revenue, net interest revenue and continued execution of our business improvement process • Investment management and performance fees (3)% due to the unfavorable impact of a stronger U.S. dollar, net outflows of assets under management and lower performance fees, partially offset by higher money market fees and higher market values • Investment services fees +2% reflecting higher money market fees and new business, partially offset by previously disclosed lost business in clearing services and the impact of downsizing our UK retail transfer agency business • Market-sensitive revenue increased overall • Net Interest Revenue increased $112 million driven by higher interest rates, the impact of interest rate hedging activities and premium amortization adjustments, partially offset by the actions taken to reduce deposits and corresponding lower yielding interest- earning assets. Substantially all of the interest rate hedging activities impact is offset in foreign exchange and other trading revenue • Securities Lending +18% driven by higher spreads • Foreign Exchange (9)% reflecting lower volumes, higher volatility, and clients migrating to lower margin products • Provision for credit losses was a credit of $11 million in FY 2016 versus a provision of $160 million in FY 2015. The FY 2015 provisions was primarily related to a court decision regarding Sentinel Management Group, Inc. • Noninterest expense on an adjusted basis1 (Non-GAAP) (2)%, reflecting lower expenses in nearly all categories, partially offset by abating fee waivers driving higher distribution and servicing expense. Lower staff expense, professional legal and other services, software and equipment, and business development reflect the benefit of the business improvement process and the impact of strength in the U.S. dollar • Effective tax rate of 24.9% 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

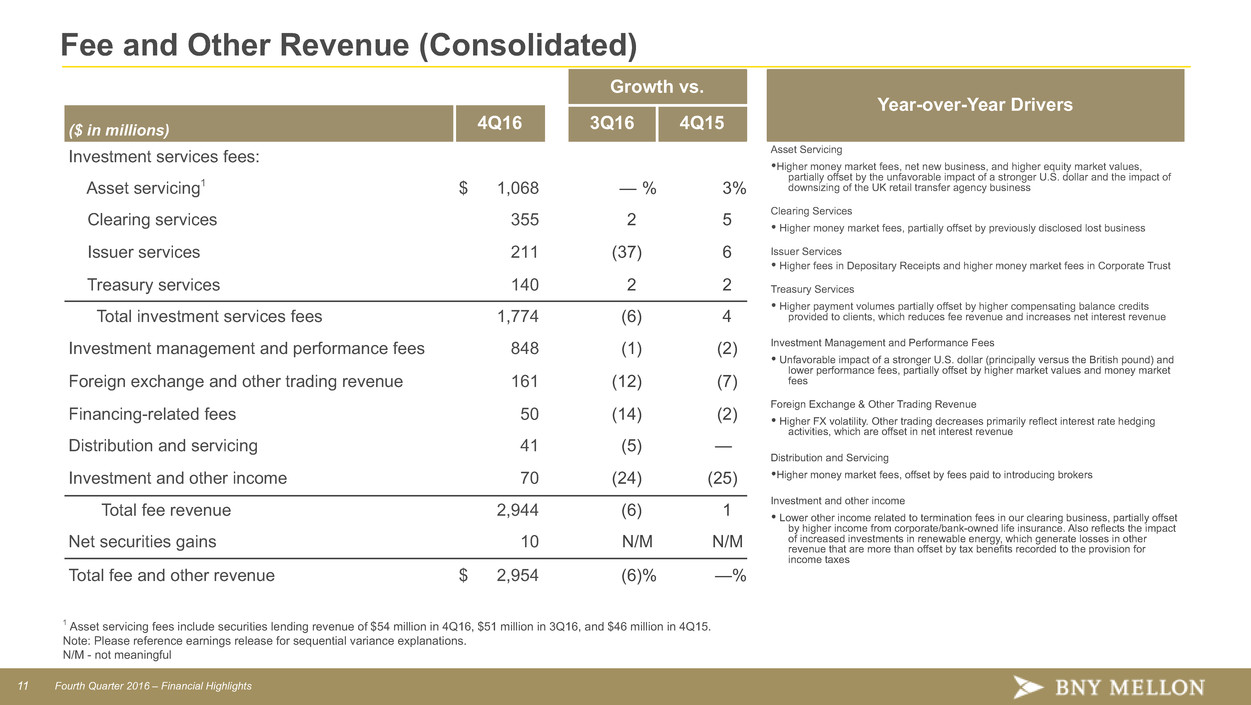

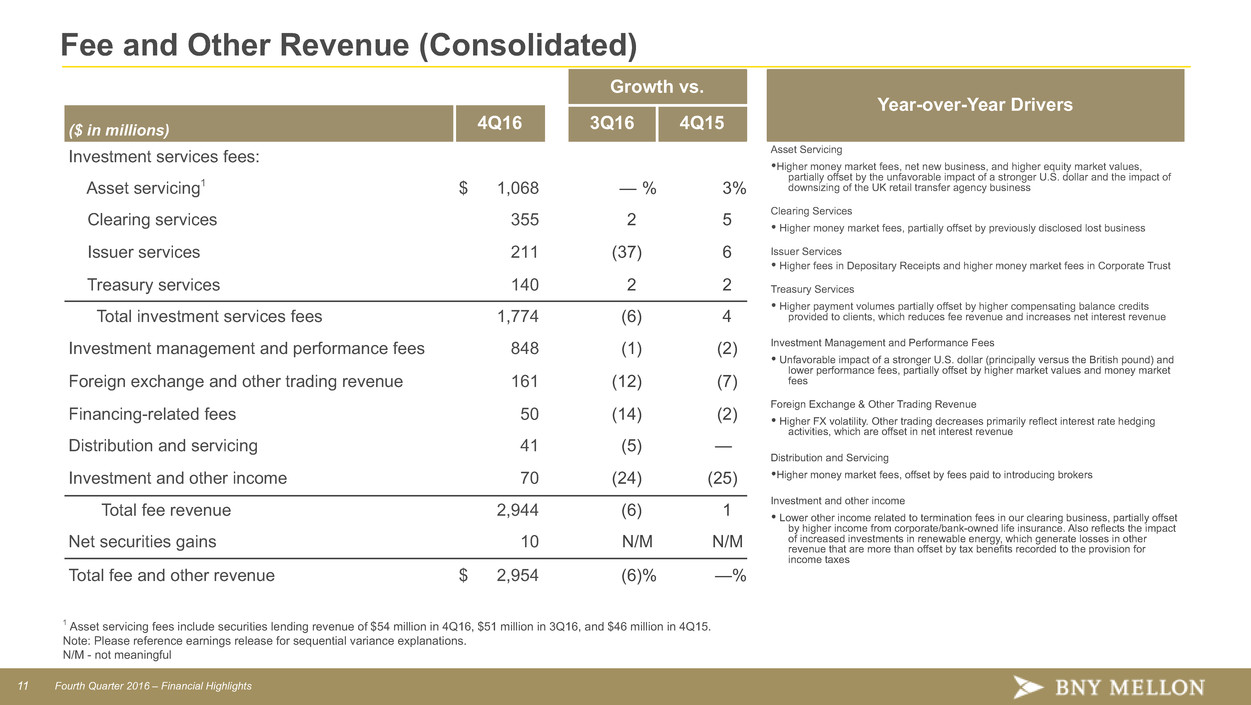

11 Fourth Quarter 2016 – Financial Highlights Fee and Other Revenue (Consolidated) Growth vs. Year-over-Year Drivers ($ in millions) 4Q16 3Q16 4Q15 Investment services fees: Asset ServicingŸHigher money market fees, net new business, and higher equity market values, partially offset by the unfavorable impact of a stronger U.S. dollar and the impact of downsizing of the UK retail transfer agency business Clearing Services Ÿ Higher money market fees, partially offset by previously disclosed lost business Issuer Services Ÿ Higher fees in Depositary Receipts and higher money market fees in Corporate Trust Treasury Services Ÿ Higher payment volumes partially offset by higher compensating balance credits provided to clients, which reduces fee revenue and increases net interest revenue Investment Management and Performance Fees Ÿ Unfavorable impact of a stronger U.S. dollar (principally versus the British pound) and lower performance fees, partially offset by higher market values and money market fees Foreign Exchange & Other Trading Revenue Ÿ Higher FX volatility. Other trading decreases primarily reflect interest rate hedging activities, which are offset in net interest revenue Distribution and Servicing ŸHigher money market fees, offset by fees paid to introducing brokers Investment and other income Ÿ Lower other income related to termination fees in our clearing business, partially offset by higher income from corporate/bank-owned life insurance. Also reflects the impact of increased investments in renewable energy, which generate losses in other revenue that are more than offset by tax benefits recorded to the provision for income taxes Asset servicing1 $ 1,068 — % 3% Clearing services 355 2 5 Issuer services 211 (37) 6 Treasury services 140 2 2 Total investment services fees 1,774 (6) 4 Investment management and performance fees 848 (1) (2) Foreign exchange and other trading revenue 161 (12) (7) Financing-related fees 50 (14) (2) Distribution and servicing 41 (5) — Investment and other income 70 (24) (25) Total fee revenue 2,944 (6) 1 Net securities gains 10 N/M N/M Total fee and other revenue $ 2,954 (6)% —% 1 Asset servicing fees include securities lending revenue of $54 million in 4Q16, $51 million in 3Q16, and $46 million in 4Q15. Note: Please reference earnings release for sequential variance explanations. N/M - not meaningful

12 Fourth Quarter 2016 – Financial Highlights Full-Year 2016 Performance (Non-GAAP)1 Earnings Per Share $3.50 $3.25 $3.00 $2.75 $2.50 $2.25 $2.00 FY 2015 FY 2016 $2.85 $3.17 Noninterest Expense ($ in millions) $10,800 $10,600 $10,400 $10,200 $10,000 FY 2015 FY 2016 $10,453 $10,237 Pre-Tax Operating Margin 34% 32% 30% 28% 26% 24% FY 2015 FY 2016 31% 33% Return on Tangible Common Equity 23% 21% 19% 17% 15% FY 2015 FY 2016 20.7% 21.2% 1 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 2 Pre-tax operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year pre-tax operating leverage (Non-GAAP) was based on growth in total revenue, as adjusted (Non-GAAP), of 67 basis points, and a decrease in total noninterest expense, as adjusted (Non-GAAP), of 207 basis points. Operating Leverage2 ~274 bps ~180 bps

13 Fourth Quarter 2016 – Financial Highlights Investment Management Metrics Change in Assets Under Management (AUM)1,3 Growth vs. ($ in billions) 4Q16 FY 2016 3Q16 4Q15 Beginning balance of AUM $1,715 $1,625 Net inflows (outflows): Long-Term Strategies: Equity (4) (12) Fixed income (1) (3) Liability-driven investments2 (7) 26 Alternative investments 2 6 Total long-term active strategies (outflows) inflows (10) 17 Index (1) (31) Total long-term strategies (outflows) inflows (11) (14) Short-term strategies: Cash (3) (9) Total net (outflows) (14) (23) Net market impact/other (11) 181 Net currency impact (42) (137) Acquisition — 2 Ending balance of AUM $1,648 $1,648 (4)% 1% Average balances: Growth vs. $ in millions 4Q16 3Q16 4Q15 Average loans $ 15,673 2 % 17% Average deposits $ 15,511 (1)% —% 1 Excludes securities lending cash management assets and assets managed in the Investment Services business. 2 Includes currency overlay assets under management. 3 Changes and ending balance are preliminary

14 Fourth Quarter 2016 – Financial Highlights Investment Services Metrics Growth vs. 4Q16 3Q16 4Q15 Assets under custody and/or administration at period end (trillions)1,2 $ 29.9 (2)% 3 % Estimated new business wins (AUC/A) (billions)2 $ 141 Market value of securities on loan at period end (billions)3 $ 296 3 % 7 % Average loans (millions) $ 45,832 3 % — % Average deposits (millions) $ 213,531 (3)% (7)% Broker-Dealer Average tri-party repo balances (billions) $ 2,307 4 % 7 % Clearing Services Average active clearing accounts (U.S. platform) (thousands) 5,960 — % — % Average long-term mutual fund assets (U.S. platform) (millions) $ 438,460 (1)% — % Depositary Receipts Number of sponsored programs 1,062 (3)% (7)% 1 Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.2 trillion at Dec. 31, 2016 and Sept. 30, 2016, and $1.0 trillion at Dec. 31, 2015. 2 Preliminary. 3 Represents the total amount of securities on loan managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $63 billion at Dec. 31, 2016, $64 billion at Sept. 30, 2016 and $55 billion at Dec. 31, 2015.

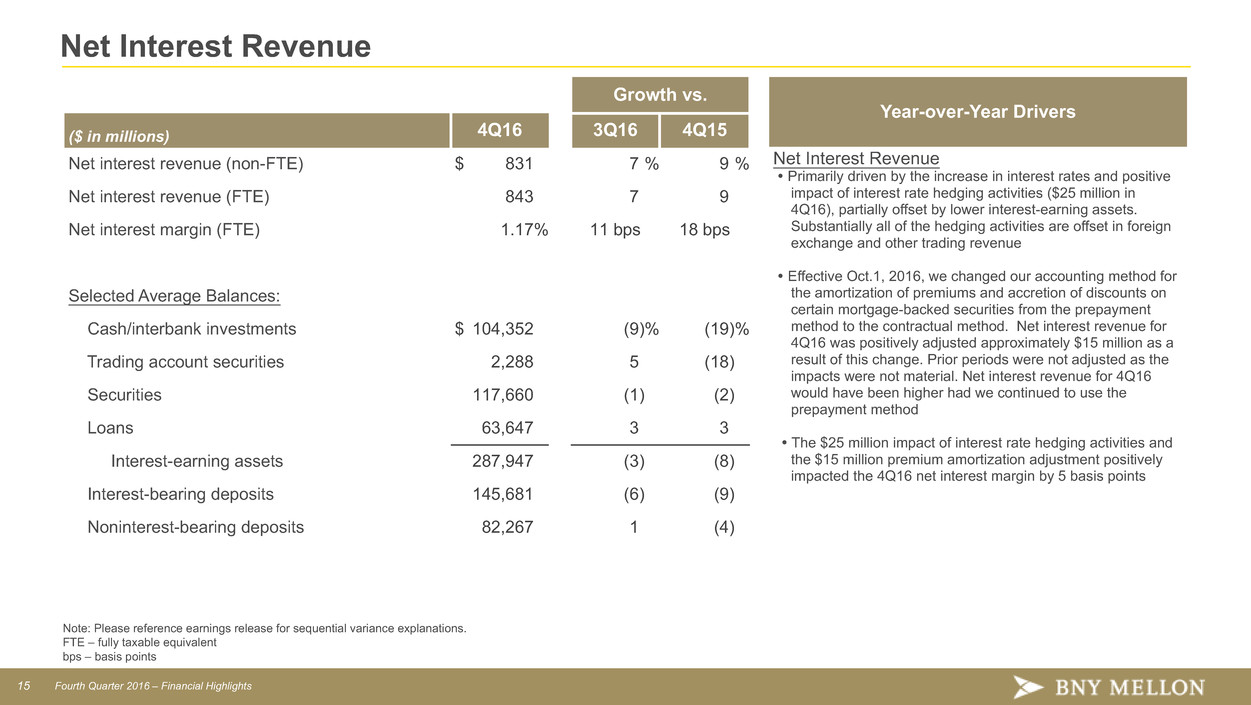

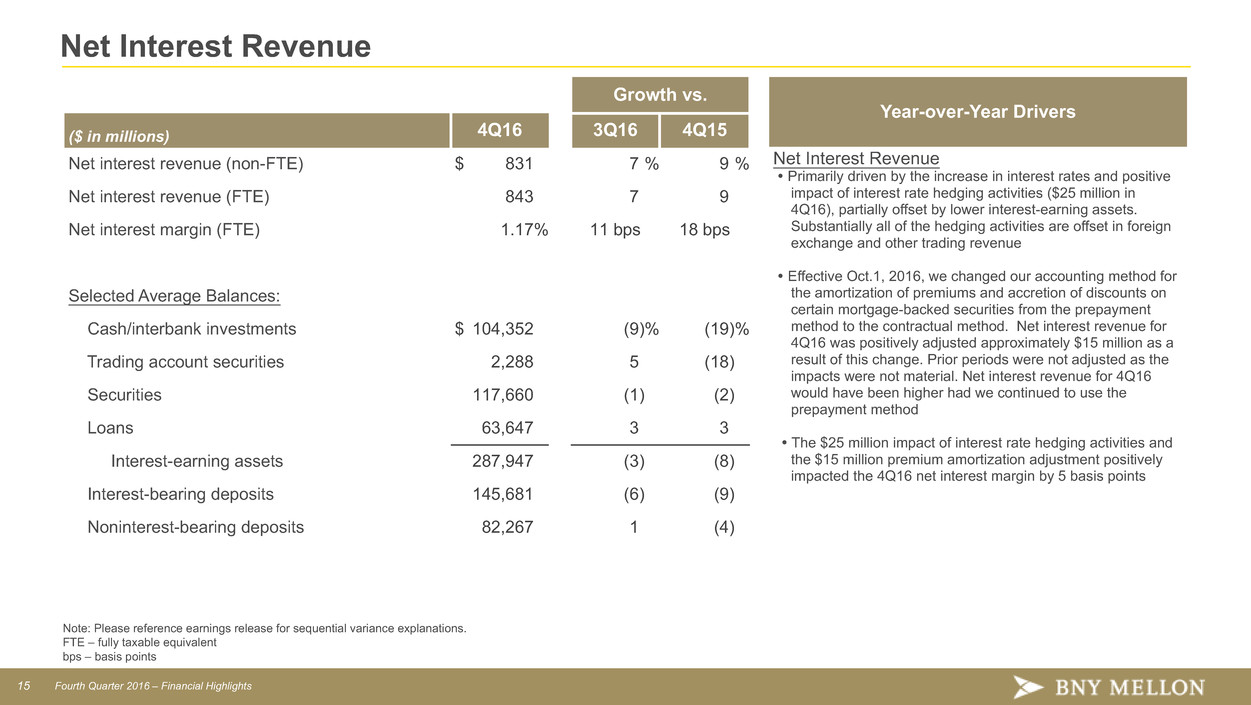

15 Fourth Quarter 2016 – Financial Highlights Net Interest Revenue Growth vs. Year-over-Year Drivers ($ in millions) 4Q16 3Q16 4Q15 Net interest revenue (non-FTE) $ 831 7 % 9 % Net Interest Revenue Ÿ Primarily driven by the increase in interest rates and positive impact of interest rate hedging activities ($25 million in 4Q16), partially offset by lower interest-earning assets. Substantially all of the hedging activities are offset in foreign exchange and other trading revenue Ÿ Effective Oct.1, 2016, we changed our accounting method for the amortization of premiums and accretion of discounts on certain mortgage-backed securities from the prepayment method to the contractual method. Net interest revenue for 4Q16 was positively adjusted approximately $15 million as a result of this change. Prior periods were not adjusted as the impacts were not material. Net interest revenue for 4Q16 would have been higher had we continued to use the prepayment method Ÿ The $25 million impact of interest rate hedging activities and the $15 million premium amortization adjustment positively impacted the 4Q16 net interest margin by 5 basis points Net interest revenue (FTE) 843 7 9 Net interest margin (FTE) 1.17% 11 bps 18 bps Selected Average Balances: Cash/interbank investments $ 104,352 (9)% (19)% Trading account securities 2,288 5 (18) Securities 117,660 (1) (2) Loans 63,647 3 3 Interest-earning assets 287,947 (3) (8) Interest-bearing deposits 145,681 (6) (9) Noninterest-bearing deposits 82,267 1 (4) Note: Please reference earnings release for sequential variance explanations. FTE – fully taxable equivalent bps – basis points

16 Fourth Quarter 2016 – Financial Highlights Noninterest Expense Growth vs. Year-over-Year Drivers ($ in millions) 4Q16 3Q16 4Q15 Staff $ 1,395 (5)% (6)% Ÿ Lower staff expense and M&I, litigation and restructuring charges, partially offset by higher other and software and equipment expenses. The decrease in staff expense is driven by the favorable impact of a stronger U.S. dollar, lower employee benefits and severance expense. Ÿ The increase in other expense primarily reflects a downward adjustment in bank assessment charges recorded in 4Q15 Professional, legal and other purchased services 325 11 (1) Software and equipment 237 10 5 Net occupancy 153 7 3 Distribution and servicing 98 (7) 7 Sub-custodian 57 (3) (5) Business development 71 37 (5) Other 228 (1) 13 Amortization of intangible assets 60 (2) (6) M&I, litigation and restructuring charges 7 N/M N/M Total noninterest expense – GAAP $ 2,631 — % (2)% Total noninterest expense excluding amortization of intangible assets and M&I, litigation and restructuring charges – Non-GAAP1 $ 2,564 — % (2)% Full-time employees 52,000 (300) 800 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Please reference earnings release for sequential variance explanations. N/M - not meaningful

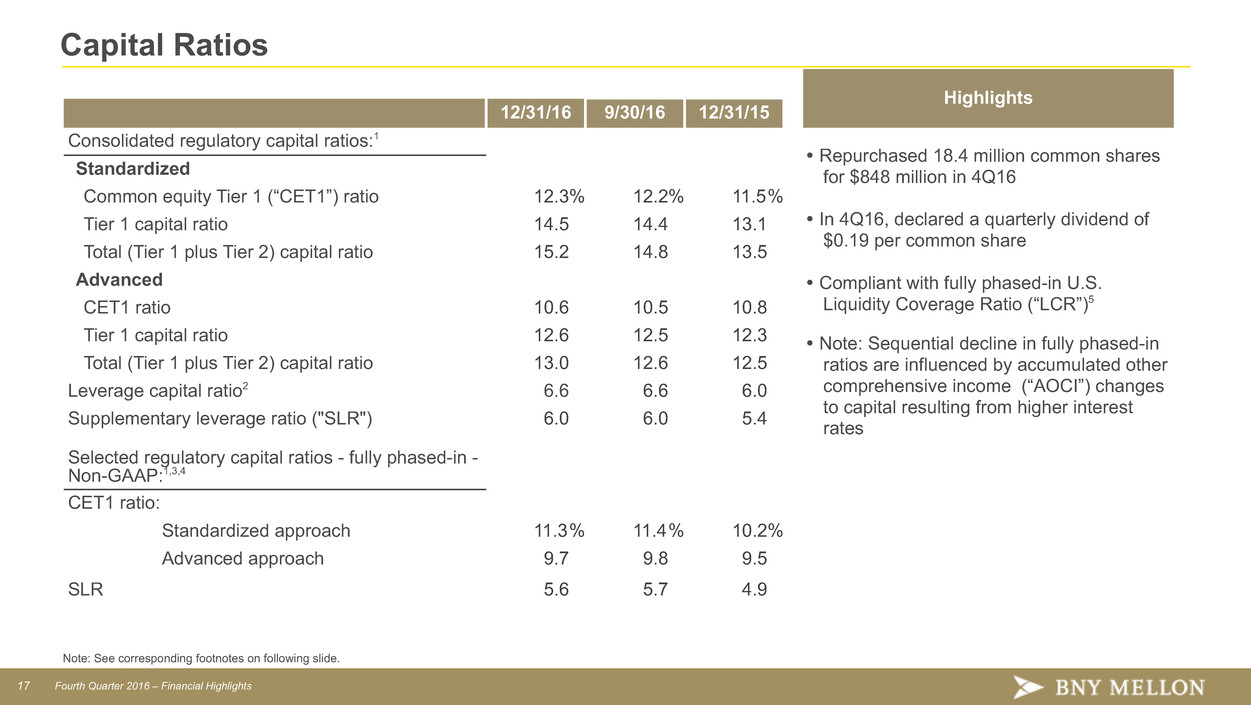

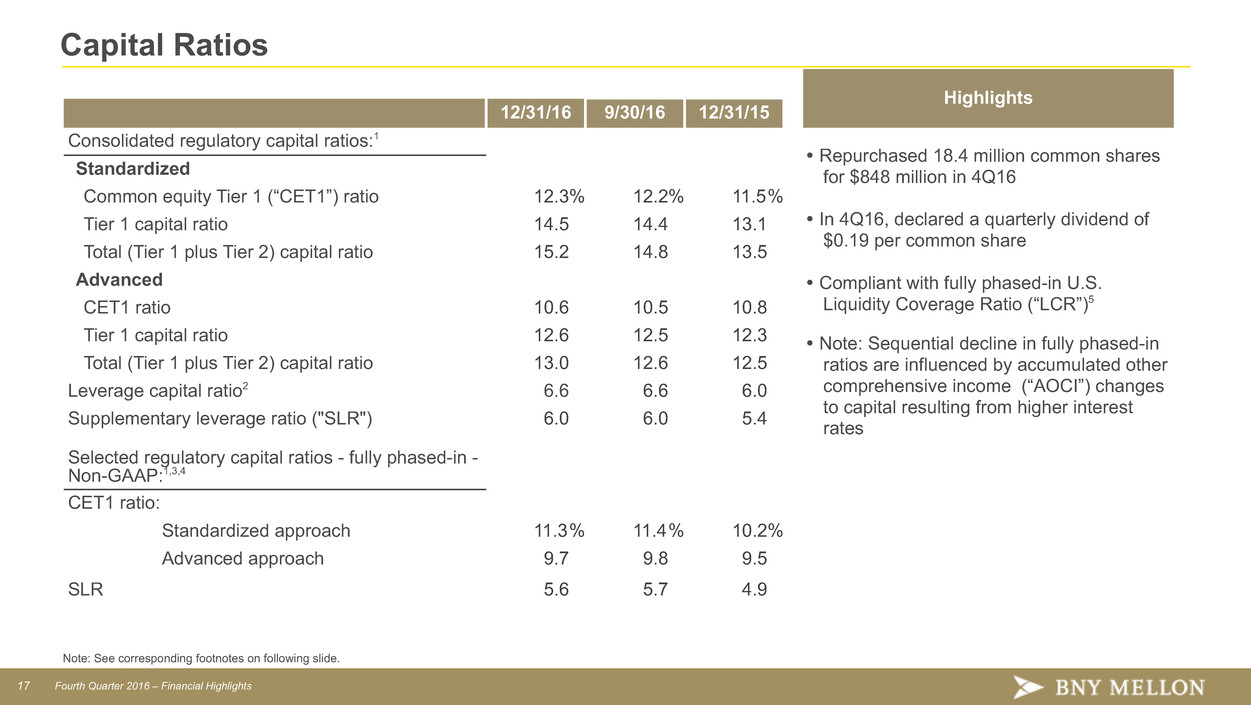

17 Fourth Quarter 2016 – Financial Highlights Capital Ratios Highlights 12/31/16 9/30/16 12/31/15 Consolidated regulatory capital ratios:1 Ÿ Repurchased 18.4 million common shares for $848 million in 4Q16 Ÿ In 4Q16, declared a quarterly dividend of $0.19 per common share Ÿ Compliant with fully phased-in U.S. Liquidity Coverage Ratio (“LCR”)5 Ÿ Note: Sequential decline in fully phased-in ratios are influenced by accumulated other comprehensive income (“AOCI”) changes to capital resulting from higher interest rates Standardized Common equity Tier 1 (“CET1”) ratio 12.3% 12.2% 11.5% Tier 1 capital ratio 14.5 14.4 13.1 Total (Tier 1 plus Tier 2) capital ratio 15.2 14.8 13.5 Advanced CET1 ratio 10.6 10.5 10.8 Tier 1 capital ratio 12.6 12.5 12.3 Total (Tier 1 plus Tier 2) capital ratio 13.0 12.6 12.5 Leverage capital ratio2 6.6 6.6 6.0 Supplementary leverage ratio ("SLR") 6.0 6.0 5.4 Selected regulatory capital ratios - fully phased-in - Non-GAAP:1,3,4 CET1 ratio: Standardized approach 11.3% 11.4% 10.2% Advanced approach 9.7 9.8 9.5 SLR 5.6 5.7 4.9 Note: See corresponding footnotes on following slide.

18 Fourth Quarter 2016 – Financial Highlights Capital Ratio Footnotes 1 Dec. 31, 2016 regulatory capital ratios are preliminary. See the “Capital Ratios” section in the earnings release for additional detail. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches. 2 The leverage capital ratio is based on Tier 1 capital, as phased-in and quarterly average total assets. 3 Please reference slide 29 & 30. See the “Capital Ratios” section in the earnings release for additional detail. 4 Estimated. 5 The U.S. LCR rules became effective Jan. 1, 2015 and require BNY Mellon to meet an LCR of 100% when fully phased- in on Jan. 1, 2017. Our estimated LCR on a consolidated basis is compliant with the fully phased-in requirements of the U.S. LCR as of Dec. 31, 2016. Our consolidated HQLA before haircuts totaled $156 billion at Dec. 31, 2016, compared with $195 billion at Sept. 30, 2016 and $218 billion at Dec. 31, 2015.

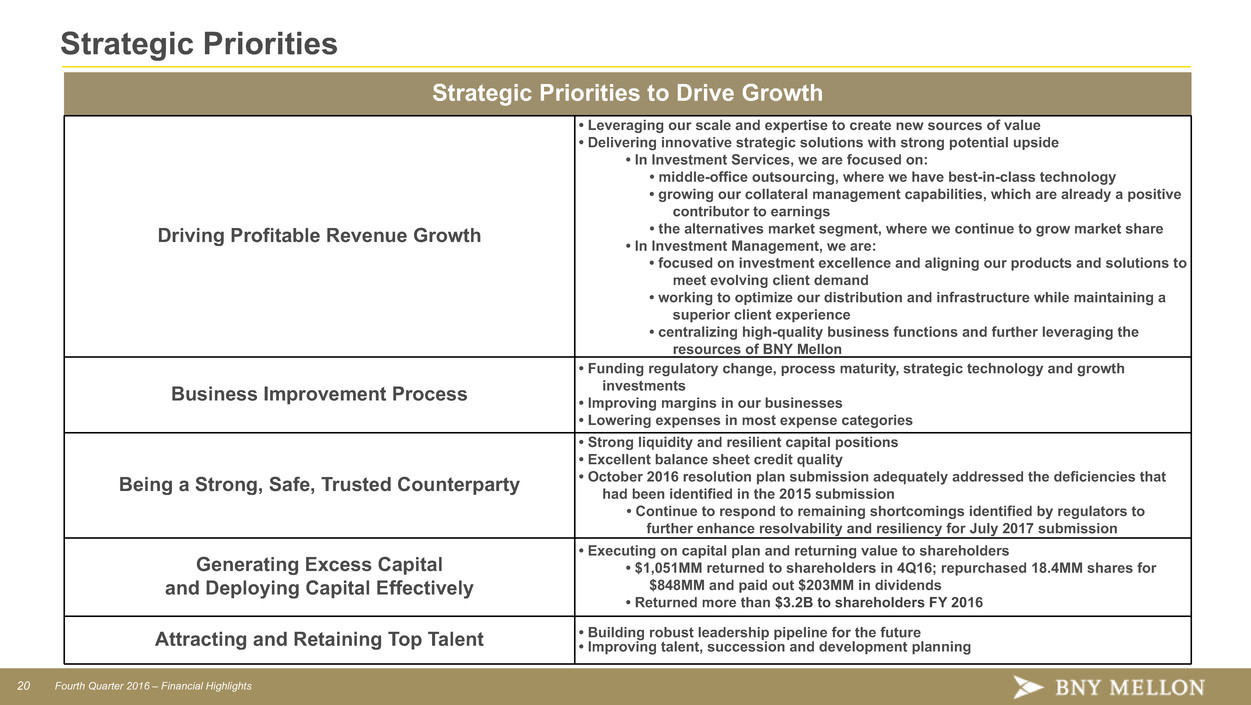

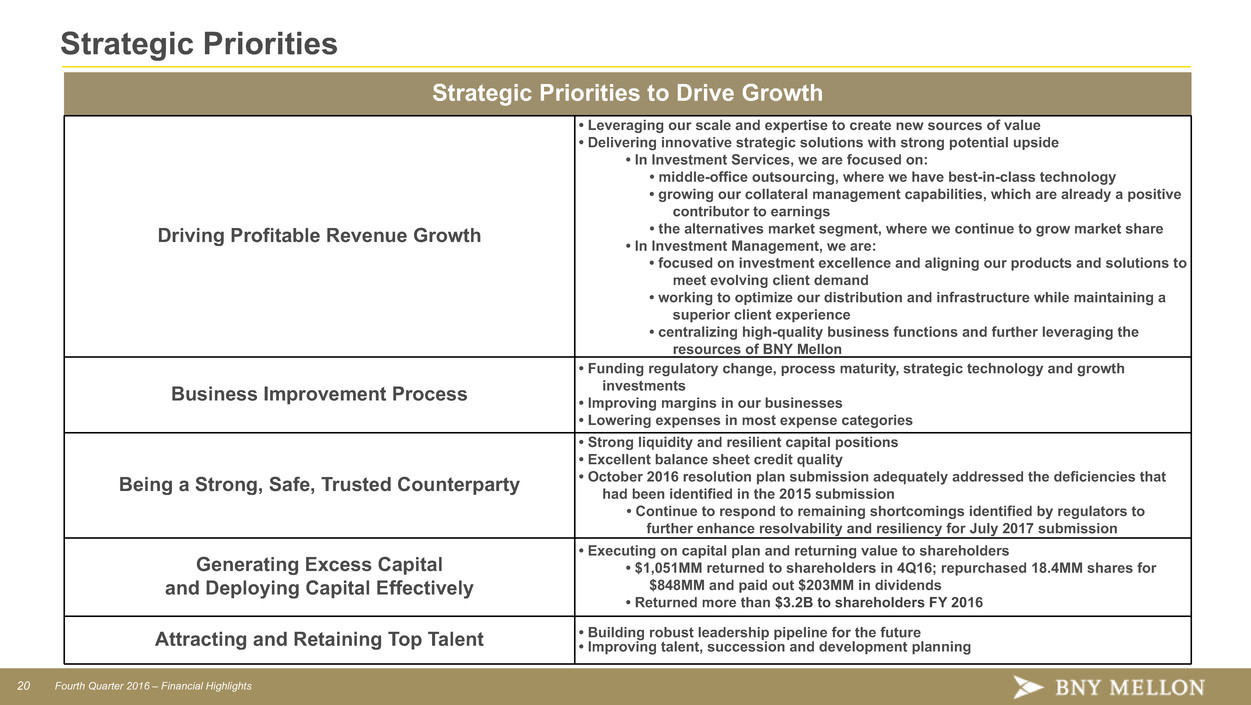

20 Fourth Quarter 2016 – Financial Highlights Strategic Priorities Strategic Priorities to Drive Growth Driving Profitable Revenue Growth • Leveraging our scale and expertise to create new sources of value • Delivering innovative strategic solutions with strong potential upside • In Investment Services, we are focused on: • middle-office outsourcing, where we have best-in-class technology • growing our collateral management capabilities, which are already a positive contributor to earnings • the alternatives market segment, where we continue to grow market share • In Investment Management, we are: • focused on investment excellence and aligning our products and solutions to meet evolving client demand • working to optimize our distribution and infrastructure while maintaining a superior client experience • centralizing high-quality business functions and further leveraging the resources of BNY Mellon Business Improvement Process • Funding regulatory change, process maturity, strategic technology and growth investments • Improving margins in our businesses • Lowering expenses in most expense categories Being a Strong, Safe, Trusted Counterparty • Strong liquidity and resilient capital positions • Excellent balance sheet credit quality • October 2016 resolution plan submission adequately addressed the deficiencies that had been identified in the 2015 submission • Continue to respond to remaining shortcomings identified by regulators to further enhance resolvability and resiliency for July 2017 submission Generating Excess Capital and Deploying Capital Effectively • Executing on capital plan and returning value to shareholders • $1,051MM returned to shareholders in 4Q16; repurchased 18.4MM shares for $848MM and paid out $203MM in dividends • Returned more than $3.2B to shareholders FY 2016 Attracting and Retaining Top Talent • Building robust leadership pipeline for the future• Improving talent, succession and development planning

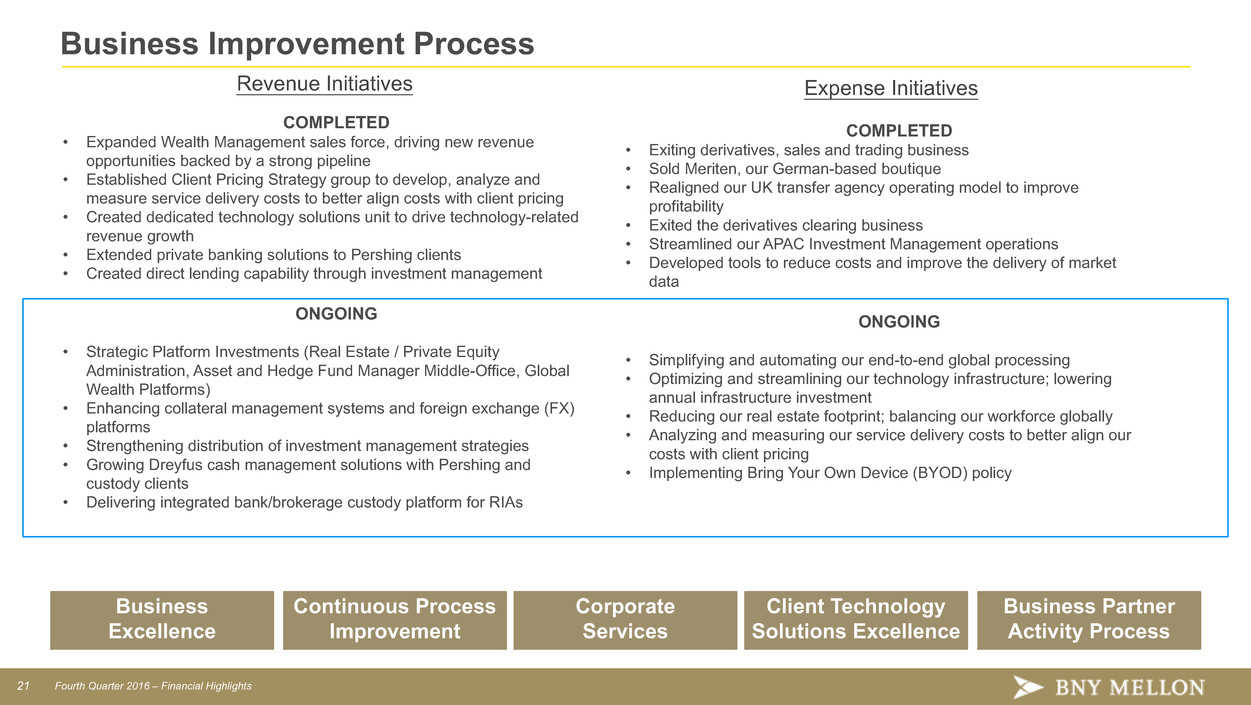

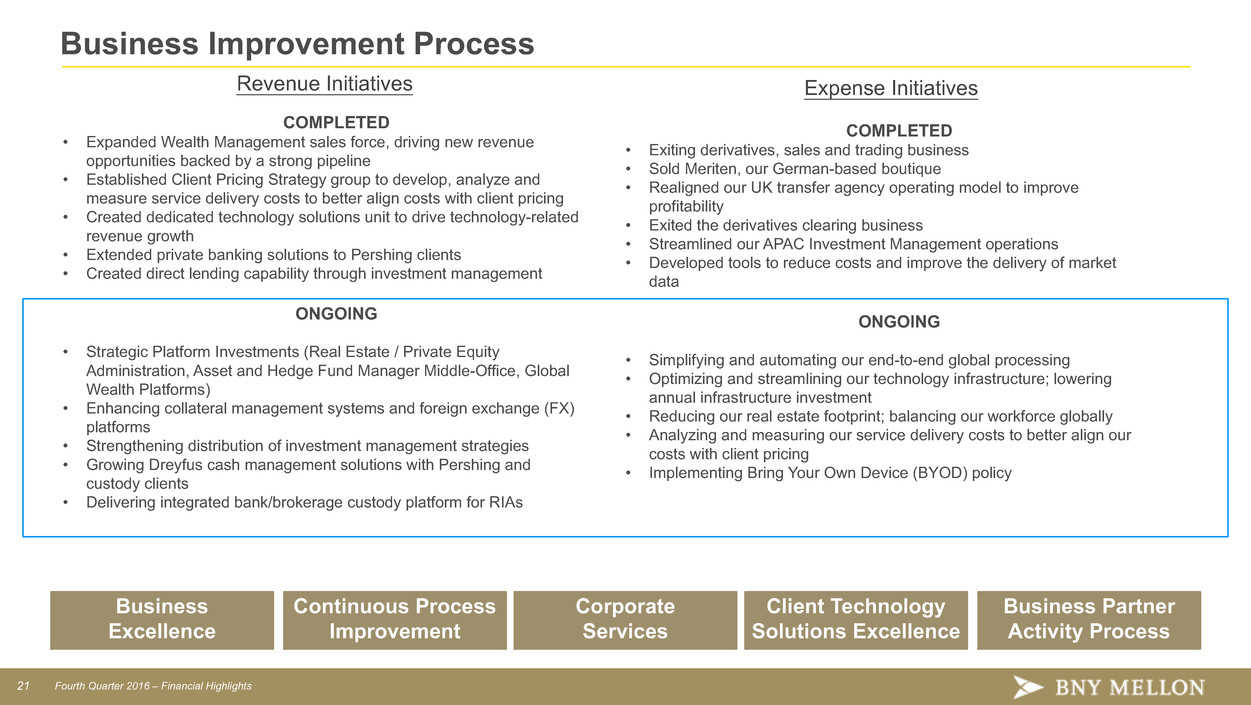

21 Fourth Quarter 2016 – Financial Highlights Business Improvement Process COMPLETED • Expanded Wealth Management sales force, driving new revenue opportunities backed by a strong pipeline • Established Client Pricing Strategy group to develop, analyze and measure service delivery costs to better align costs with client pricing • Created dedicated technology solutions unit to drive technology-related revenue growth • Extended private banking solutions to Pershing clients • Created direct lending capability through investment management ONGOING • Strategic Platform Investments (Real Estate / Private Equity Administration, Asset and Hedge Fund Manager Middle-Office, Global Wealth Platforms) • Enhancing collateral management systems and foreign exchange (FX) platforms • Strengthening distribution of investment management strategies • Growing Dreyfus cash management solutions with Pershing and custody clients • Delivering integrated bank/brokerage custody platform for RIAs COMPLETED • Exiting derivatives, sales and trading business • Sold Meriten, our German-based boutique • Realigned our UK transfer agency operating model to improve profitability • Exited the derivatives clearing business • Streamlined our APAC Investment Management operations • Developed tools to reduce costs and improve the delivery of market data ONGOING • Simplifying and automating our end-to-end global processing • Optimizing and streamlining our technology infrastructure; lowering annual infrastructure investment • Reducing our real estate footprint; balancing our workforce globally • Analyzing and measuring our service delivery costs to better align our costs with client pricing • Implementing Bring Your Own Device (BYOD) policy Business Excellence Continuous Process Improvement Corporate Services Client Technology Solutions Excellence Business Partner Activity Process Revenue Initiatives Expense Initiatives

22 Fourth Quarter 2016 – Financial Highlights EPS Reconciliation for Fourth Quarter 2016 N/A - Not Applicable Reconciliation of net income and diluted EPS – GAAP to Non-GAAP 4Q16 3Q16 4Q15 Net IncomeGrowth vs. Diluted EPS Growth vs. (in millions, except per common share amounts) Net income Diluted EPS Net income Diluted EPS Net income Diluted EPS 3Q16 4Q15 3Q16 4Q15 Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 822 $ 0.77 $ 974 $ 0.90 $ 637 $ 0.57 (16)% 29% (14)% 35% Add: M&I, litigation and restructuring charges 7 18 18 Tax impact of M&I, litigation and restructuring charges (3) (5) (6) Net impact of M&I, litigation and restructuring charges 4 — 13 0.01 12 0.01 Add: (Recovery) impairment charge related to Sentinel N/A (13) 170 Tax impact of recovery (impairment charge) related to Sentinel N/A 5 (64) (Recovery) impairment charge related to Sentinel – after-tax N/A N/A (8) (0.01) 106 0.10 Non-GAAP adjustments – after-tax 4 — 5 — 118 — Non-GAAP results $ 826 $ 0.77 $ 979 $ 0.90 $ 755 $ 0.68 (16)% 9% (14)% 13%

23 Fourth Quarter 2016 – Financial Highlights EPS Reconciliation for Full-Year 2016 Reconciliation of net income and diluted EPS – GAAP to Non-GAAP FY 2016 FY 2015 Growth vs. FY 2015 (in millions, except per common share amounts) Net income Diluted EPS Net income Diluted EPS Net income Diluted EPS Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 3,425 $ 3.15 $ 3,053 $ 2.71 12% 16% Add: M&I, litigation and restructuring charges 49 85 Tax impact of M&I, litigation and restructuring charges (16) (29) Net impact of M&I, litigation and restructuring charges 33 0.03 56 0.05 Add: (Recovery) impairment charge related to Sentinel (13) 170 Tax impact of recovery (impairment charge) related to Sentinel 5 (64) (Recovery) impairment charge related to Sentinel – after-tax (8) (0.01) 106 0.09 Non-GAAP adjustments – after-tax 25 0.02 162 0.14 Non-GAAP results $ 3,450 $ 3.17 $ 3,215 $ 2.85 7% 11%

24 Fourth Quarter 2016 – Financial Highlights Investment Management . Growth vs. ($ in millions) 4Q16 3Q16 4Q15 Investment management and performance fees $ 833 (1)% (2)% Distribution and servicing 48 (2) 23 Other1 (1) N/M N/M Net interest revenue 80 (2) (5) Total Revenue 960 — (4) Provision for credit losses 6 N/M N/M Noninterest expense (ex. amortization of intangible assets) 672 (1) (2) Amortization of intangible assets 22 — (8) Total noninterest expense 694 (1) (3) Income before taxes $ 260 2 % (10)% Income before taxes (ex. amortization of intangible assets) - Non-GAAP $ 282 1 % (10)% Pre-tax operating margin 27% +41 bps (197) bps Adjusted pre-tax operating margin - Non-GAAP2,3 33% +83 bps (85) bps 1 Total fee and other revenue includes the impact of the consolidated investment management funds, net of noncontrolling interests. Additionally, other revenue includes asset servicing, treasury services, foreign exchange and other trading revenue and investment and other income. 2 Excludes amortization of intangible assets, provision for credit losses and distribution and servicing expense. 3 Represents a Non-GAAP measure. See Slide 31 for reconciliation. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. N/M - not meaningful bps – basis points

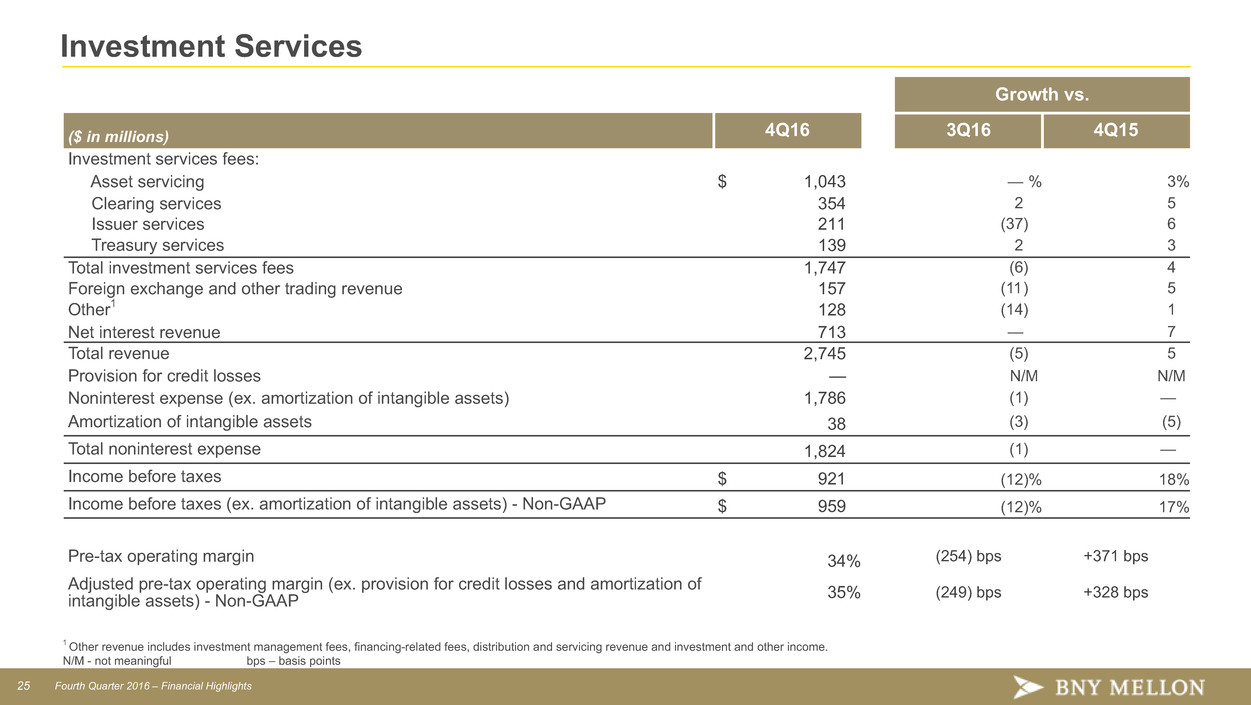

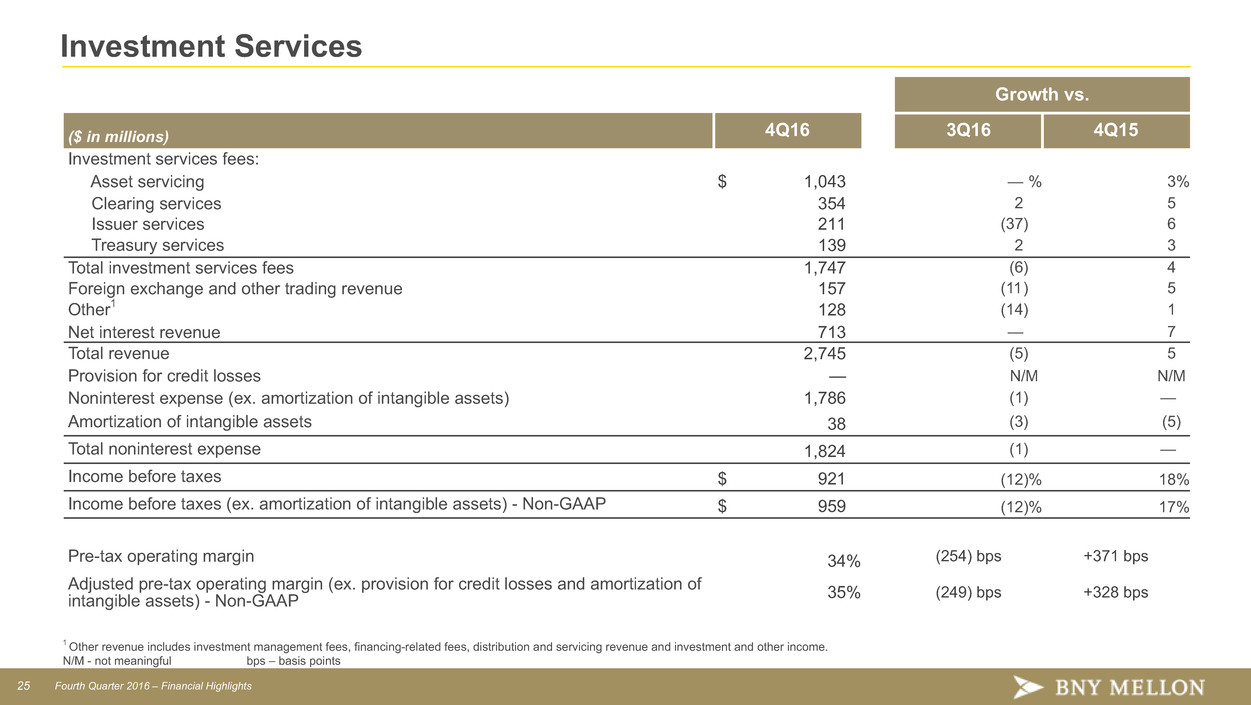

25 Fourth Quarter 2016 – Financial Highlights Investment Services Growth vs. ($ in millions) 4Q16 3Q16 4Q15 Investment services fees: Asset servicing $ 1,043 — % 3% Clearing services 354 2 5 Issuer services 211 (37) 6 Treasury services 139 2 3 Total investment services fees 1,747 (6) 4 Foreign exchange and other trading revenue 157 (11) 5 Other1 128 (14) 1 Net interest revenue 713 — 7 Total revenue 2,745 (5) 5 Provision for credit losses — N/M N/M Noninterest expense (ex. amortization of intangible assets) 1,786 (1) — Amortization of intangible assets 38 (3) (5) Total noninterest expense 1,824 (1) — Income before taxes $ 921 (12)% 18% Income before taxes (ex. amortization of intangible assets) - Non-GAAP $ 959 (12)% 17% Pre-tax operating margin 34% (254) bps +371 bps Adjusted pre-tax operating margin (ex. provision for credit losses and amortization of intangible assets) - Non-GAAP 35% (249) bps +328 bps 1 Other revenue includes investment management fees, financing-related fees, distribution and servicing revenue and investment and other income. N/M - not meaningful bps – basis points

26 Fourth Quarter 2016 – Financial Highlights Expense, Pre-Tax Operating Margin & Operating Leverage - Non-GAAP Reconciliations 4Q16 3Q16 4Q15 Growth vs. ($ in millions) 3Q16 4Q15 Total revenue – GAAP $ 3,790 $ 3,941 $ 3,726 (3.83)% 1.72 % Less: Net income (loss) attributable to noncontrolling interests of consolidated investment management funds 4 9 5 Total revenue, as adjusted – Non-GAAP2 $ 3,786 $ 3,932 $ 3,721 (3.71)% 1.75 % Total noninterest expense – GAAP $ 2,631 $ 2,643 $ 2,692 (0.45)% (2.27)% Less: Amortization of intangible assets 60 61 64 M&I, litigation and restructuring charges 7 18 18 Total noninterest expense excluding amortization of intangible assets and M&I, litigation and restructuring charges – Non-GAAP2 $ 2,564 $ 2,564 $ 2,610 — % (1.76)% Less: Provision for credit losses 7 (19) 163 Add: (Recovery) impairment charge related to Sentinel — (13) 170 Operating Leverage Income before income taxes, as adjusted – Non-GAAP2 $ 1,215 $ 1,374 $ 1,118 (338) bps +399 bps Adjusted Operating Leverage (Non-GAAP) Adjusted pre-tax operating margin – Non-GAAP1,2,3 32% 35% 30% (371) bps +351 bps 1 Income before taxes divided by total revenue. 2 Non-GAAP information for all periods presented excludes net income (loss) attributable to noncontrolling interests of consolidated investment management funds, amortization of intangible assets and M&I, litigation and restructuring charges. Non-GAAP information for 3Q16 also excludes a recovery of the previously impaired Sentinel loan and 4Q15 also excludes the impairment charge related to a court decision regarding Sentinel. 3 Our GAAP earnings include tax-advantaged investments such as low income housing, renewable energy, bank-owned life insurance and tax-exempt securities. The benefits of these investments are primarily reflected in tax expense. If reported on a tax-equivalent basis, these investments would increase revenue and income before taxes by $92 million for 4Q16, $74 million for 3Q16 and $73 million for 4Q15 and would increase our pre- tax operating margin by approximately 1.7% for 4Q16, 1.2% for 3Q16, and 1.5% for 4Q15. bps - basis points

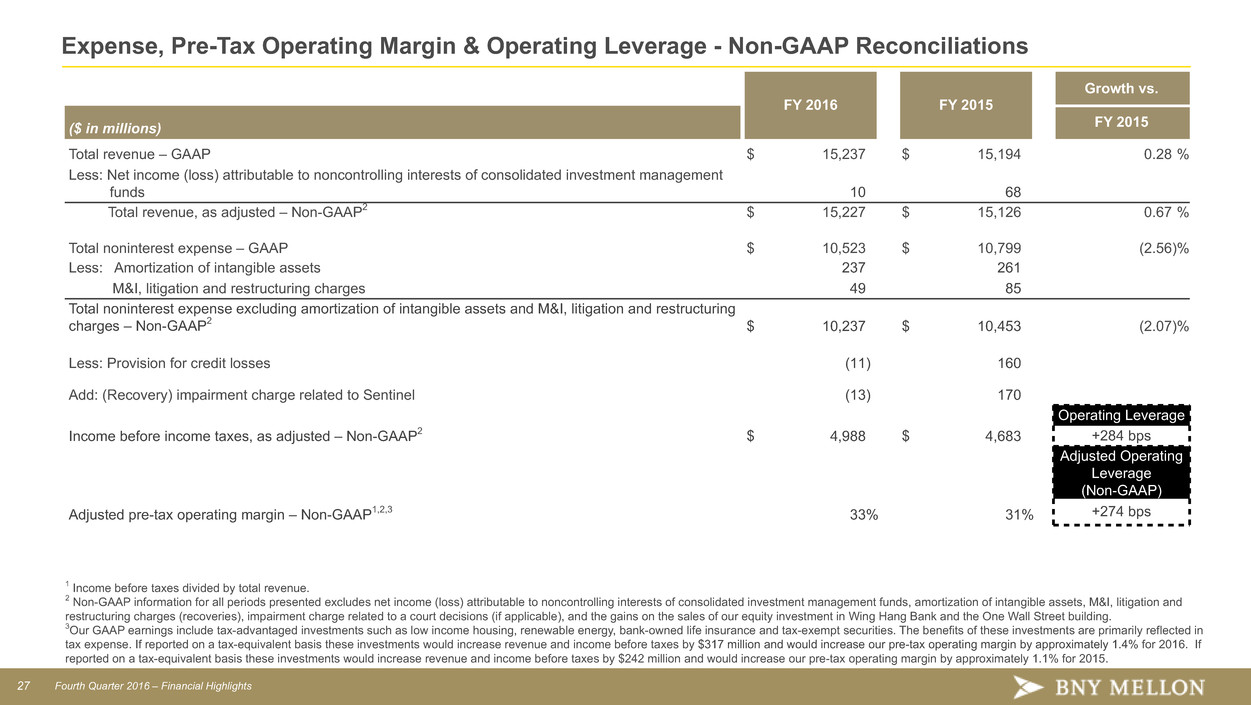

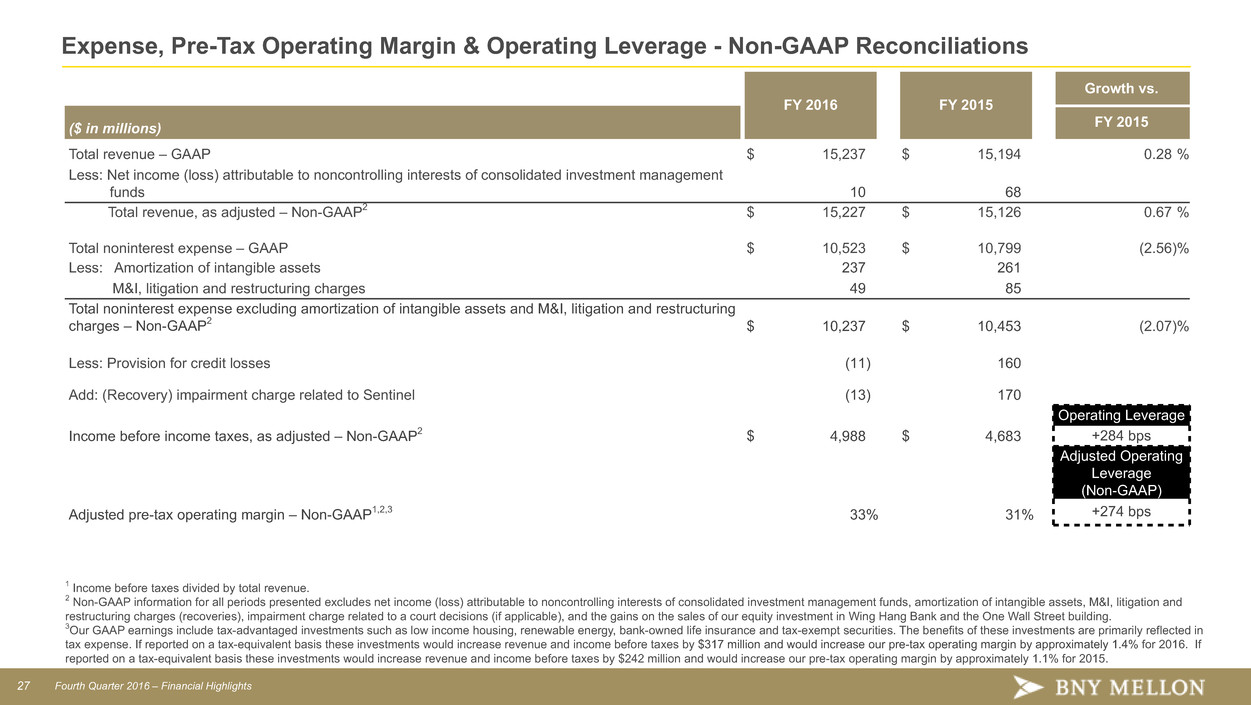

27 Fourth Quarter 2016 – Financial Highlights Expense, Pre-Tax Operating Margin & Operating Leverage - Non-GAAP Reconciliations FY 2016 FY 2015 Growth vs. ($ in millions) FY 2015 Total revenue – GAAP $ 15,237 $ 15,194 0.28 % Less: Net income (loss) attributable to noncontrolling interests of consolidated investment management funds 10 68 Total revenue, as adjusted – Non-GAAP2 $ 15,227 $ 15,126 0.67 % Total noninterest expense – GAAP $ 10,523 $ 10,799 (2.56)% Less: Amortization of intangible assets 237 261 M&I, litigation and restructuring charges 49 85 Total noninterest expense excluding amortization of intangible assets and M&I, litigation and restructuring charges – Non-GAAP2 $ 10,237 $ 10,453 (2.07)% Less: Provision for credit losses (11) 160 Add: (Recovery) impairment charge related to Sentinel (13) 170 Operating Leverage Income before income taxes, as adjusted – Non-GAAP2 $ 4,988 $ 4,683 +284 bps Adjusted Operating Leverage (Non-GAAP) Adjusted pre-tax operating margin – Non-GAAP1,2,3 33% 31% +274 bps 1 Income before taxes divided by total revenue. 2 Non-GAAP information for all periods presented excludes net income (loss) attributable to noncontrolling interests of consolidated investment management funds, amortization of intangible assets, M&I, litigation and restructuring charges (recoveries), impairment charge related to a court decisions (if applicable), and the gains on the sales of our equity investment in Wing Hang Bank and the One Wall Street building. 3Our GAAP earnings include tax-advantaged investments such as low income housing, renewable energy, bank-owned life insurance and tax-exempt securities. The benefits of these investments are primarily reflected in tax expense. If reported on a tax-equivalent basis these investments would increase revenue and income before taxes by $317 million and would increase our pre-tax operating margin by approximately 1.4% for 2016. If reported on a tax-equivalent basis these investments would increase revenue and income before taxes by $242 million and would increase our pre-tax operating margin by approximately 1.1% for 2015.

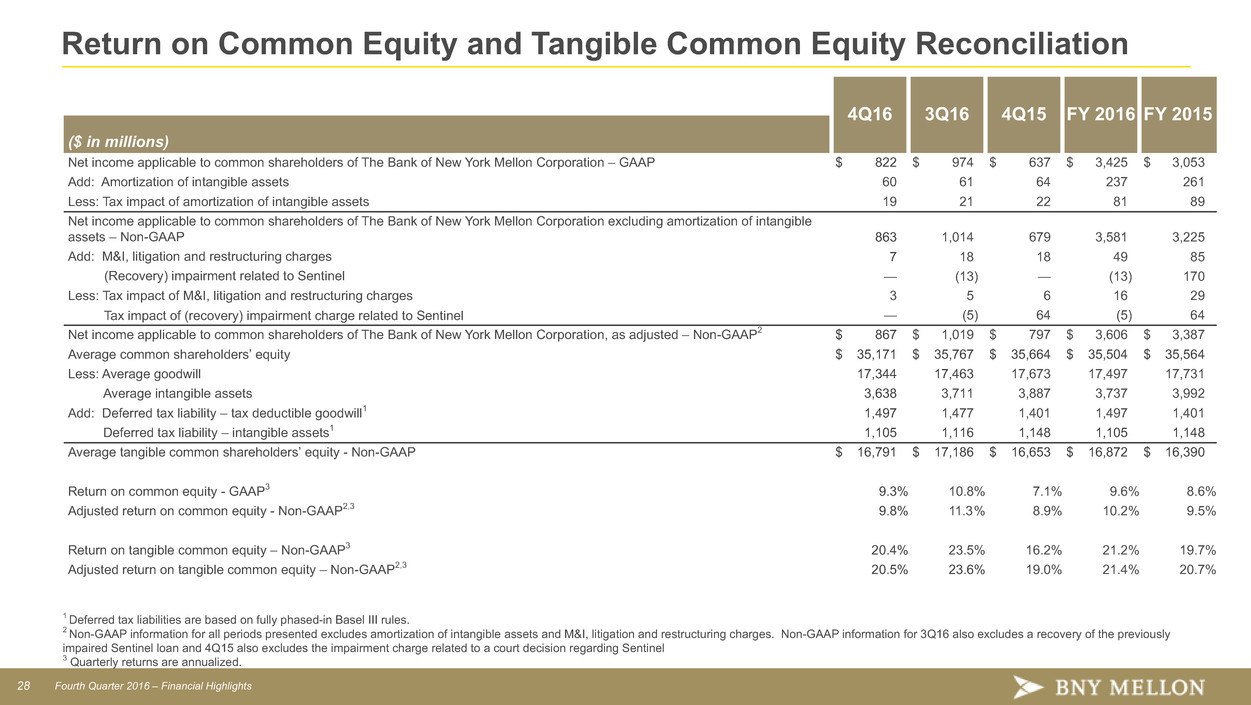

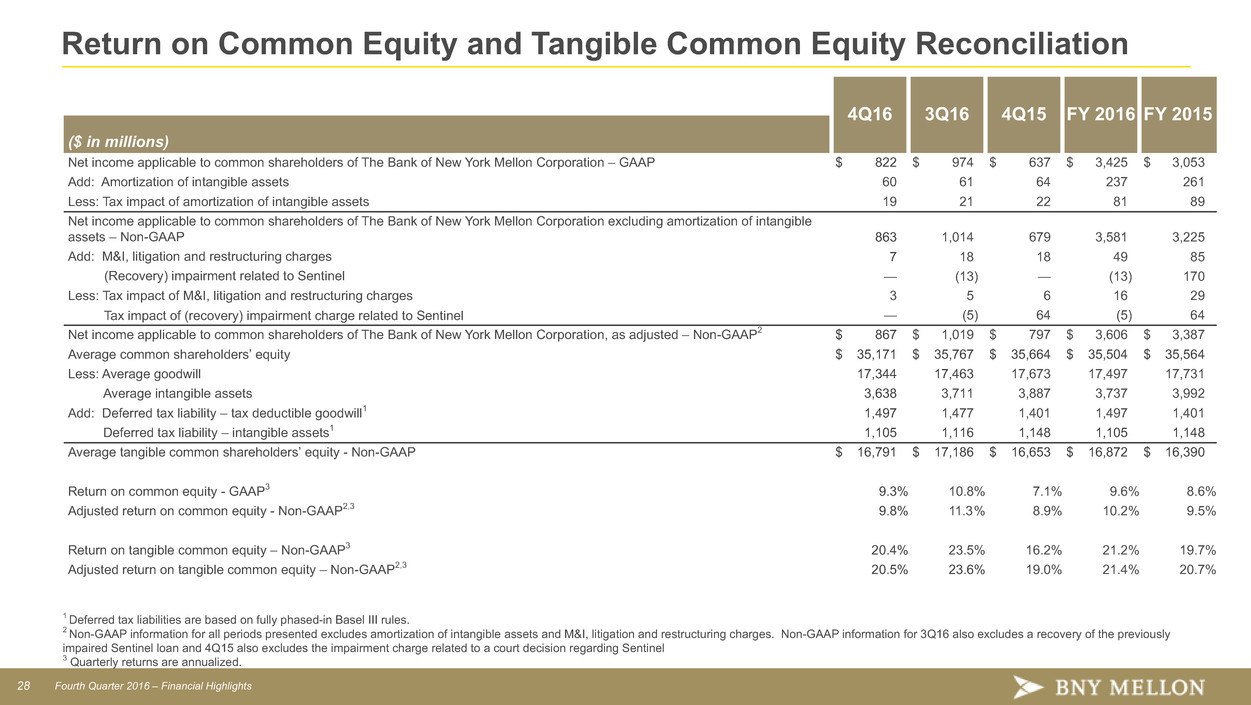

28 Fourth Quarter 2016 – Financial Highlights Return on Common Equity and Tangible Common Equity Reconciliation 4Q16 3Q16 4Q15 FY 2016 FY 2015 ($ in millions) Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 822 $ 974 $ 637 $ 3,425 $ 3,053 Add: Amortization of intangible assets 60 61 64 237 261 Less: Tax impact of amortization of intangible assets 19 21 22 81 89 Net income applicable to common shareholders of The Bank of New York Mellon Corporation excluding amortization of intangible assets – Non-GAAP 863 1,014 679 3,581 3,225 Add: M&I, litigation and restructuring charges 7 18 18 49 85 (Recovery) impairment related to Sentinel — (13) — (13) 170 Less: Tax impact of M&I, litigation and restructuring charges 3 5 6 16 29 Tax impact of (recovery) impairment charge related to Sentinel — (5) 64 (5) 64 Net income applicable to common shareholders of The Bank of New York Mellon Corporation, as adjusted – Non-GAAP2 $ 867 $ 1,019 $ 797 $ 3,606 $ 3,387 Average common shareholders’ equity $ 35,171 $ 35,767 $ 35,664 $ 35,504 $ 35,564 Less: Average goodwill 17,344 17,463 17,673 17,497 17,731 Average intangible assets 3,638 3,711 3,887 3,737 3,992 Add: Deferred tax liability – tax deductible goodwill1 1,497 1,477 1,401 1,497 1,401 Deferred tax liability – intangible assets1 1,105 1,116 1,148 1,105 1,148 Average tangible common shareholders’ equity - Non-GAAP $ 16,791 $ 17,186 $ 16,653 $ 16,872 $ 16,390 Return on common equity - GAAP3 9.3% 10.8% 7.1% 9.6% 8.6% Adjusted return on common equity - Non-GAAP2,3 9.8% 11.3% 8.9% 10.2% 9.5% Return on tangible common equity – Non-GAAP3 20.4% 23.5% 16.2% 21.2% 19.7% Adjusted return on tangible common equity – Non-GAAP2,3 20.5% 23.6% 19.0% 21.4% 20.7% 1 Deferred tax liabilities are based on fully phased-in Basel III rules. 2 Non-GAAP information for all periods presented excludes amortization of intangible assets and M&I, litigation and restructuring charges. Non-GAAP information for 3Q16 also excludes a recovery of the previously impaired Sentinel loan and 4Q15 also excludes the impairment charge related to a court decision regarding Sentinel 3 Quarterly returns are annualized.

29 Fourth Quarter 2016 – Financial Highlights Basel III Capital Components & Ratios ($ in millions) 12/31/161 9/30/16 12/31/15 Transitional basis2 Fully Phased-inNon-GAAP3 Transitional basis 2 Fully Phased-in Non-GAAP3 Transitional basis 2 Fully Phased-in Non-GAAP3 CET1: Common shareholders’ equity $ 35,794 $ 35,269 $ 36,450 $ 36,153 $ 36,067 $ 35,485 Goodwill and intangible assets (17,314) (18,312) (17,505) (18,527) (17,295) (18,911) Net pension fund assets (54) (90) (56) (94) (46) (116) Equity method investments (313) (344) (314) (347) (296) (347) Deferred tax assets (19) (32) (15) (25) (8) (20) Other (1) (1) (1) (1) (5) (9) Total CET1 18,093 16,490 18,559 17,159 18,417 16,082 Other Tier 1 capital: Preferred stock 3,542 3,542 3,542 3,542 2,552 2,552 Trust preferred securities — — — — 74 — Deferred tax assets (13) — (10) — (12) — Net pension fund assets (36) — (38) — (70) — Other (121) (121) (110) (109) (25) (22) Total Tier 1 capital 21,465 19,911 21,943 20,592 20,936 18,612 Tier 2 capital: Trust preferred securities 148 — 156 — 222 — Subordinated debt 550 550 149 149 149 149 Allowance for credit losses 281 281 274 274 275 275 Other (12) (11) (6) (6) (12) (12) Total Tier 2 capital - Standardized Approach 967 820 573 417 634 412 Excess of expected credit losses 61 61 33 33 37 37 Less: Allowance for credit losses 281 281 274 274 275 275 Total Tier 2 capital - Advanced Approach $ 747 $ 600 $ 332 $ 176 $ 396 $ 174 Total capital: Standardized Approach $ 22,432 $ 20,731 $ 22,516 $ 21,009 $ 21,570 $ 19,024 Advanced Approach $ 22,212 $ 20,511 $ 22,275 $ 20,768 $ 21,332 $ 18,786 Risk-weighted assets: Standardized Approach $ 147,581 $ 146,392 $ 152,410 $ 151,173 $ 159,893 $ 158,015 Advanced Approach $ 170,519 $ 169,259 $ 176,232 $ 174,912 $ 170,384 $ 168,509 Standardized Approach: CET1 ratio 12.3% 11.3% 12.2% 11.4% 11.5% 10.2% Tier 1 capital ratio 14.5 13.6 14.4 13.6 13.1 11.8 Total (Tier 1 plus Tier 2) capital ratio 15.2 14.2 14.8 13.9 13.5 12.0 Advanced Approach: CET1 ratio 10.6% 9.7% 10.5% 9.8% 10.8% 9.5% Tier 1 capital ratio 12.6 11.8 12.5 11.8 12.3 11.0 Total (Tier 1 plus Tier 2) capital ratio 13.0 12.1 12.6 11.9 12.5 11.1 1 Preliminary. 2 Reflects transitional adjustments to CET1, Tier 1 capital and Tier 2 capital required under the U.S. capital rules. 3 Estimated.

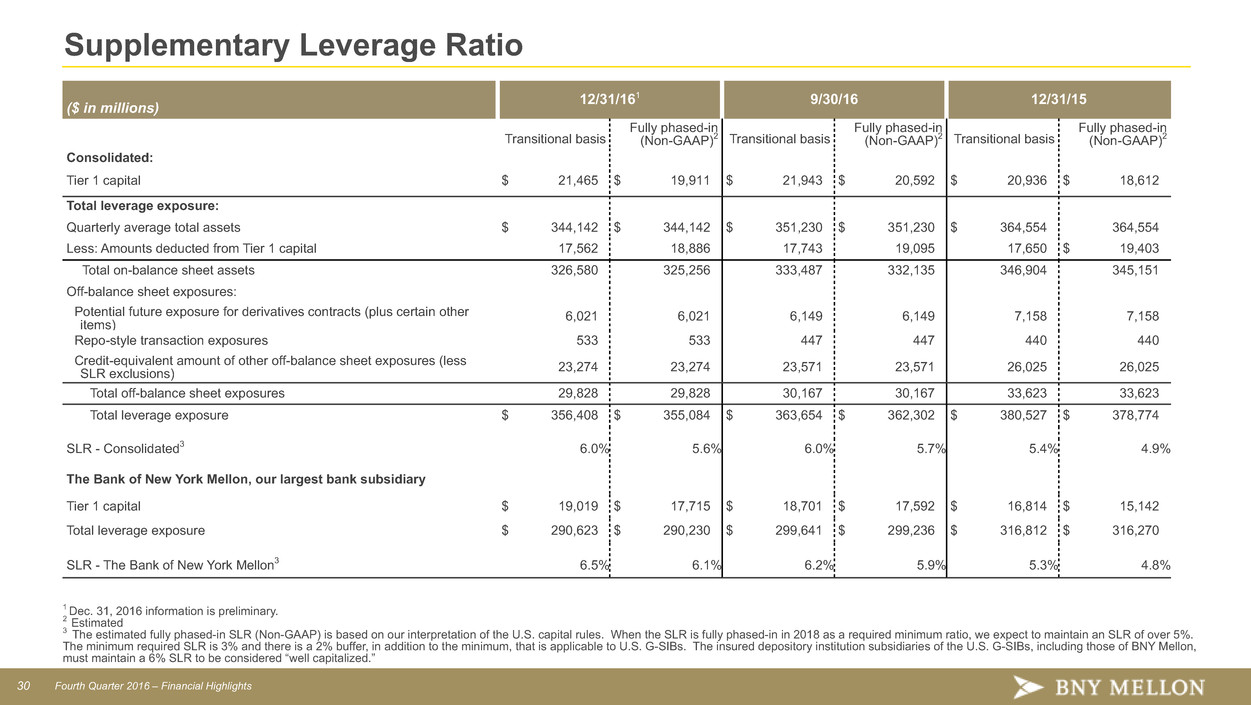

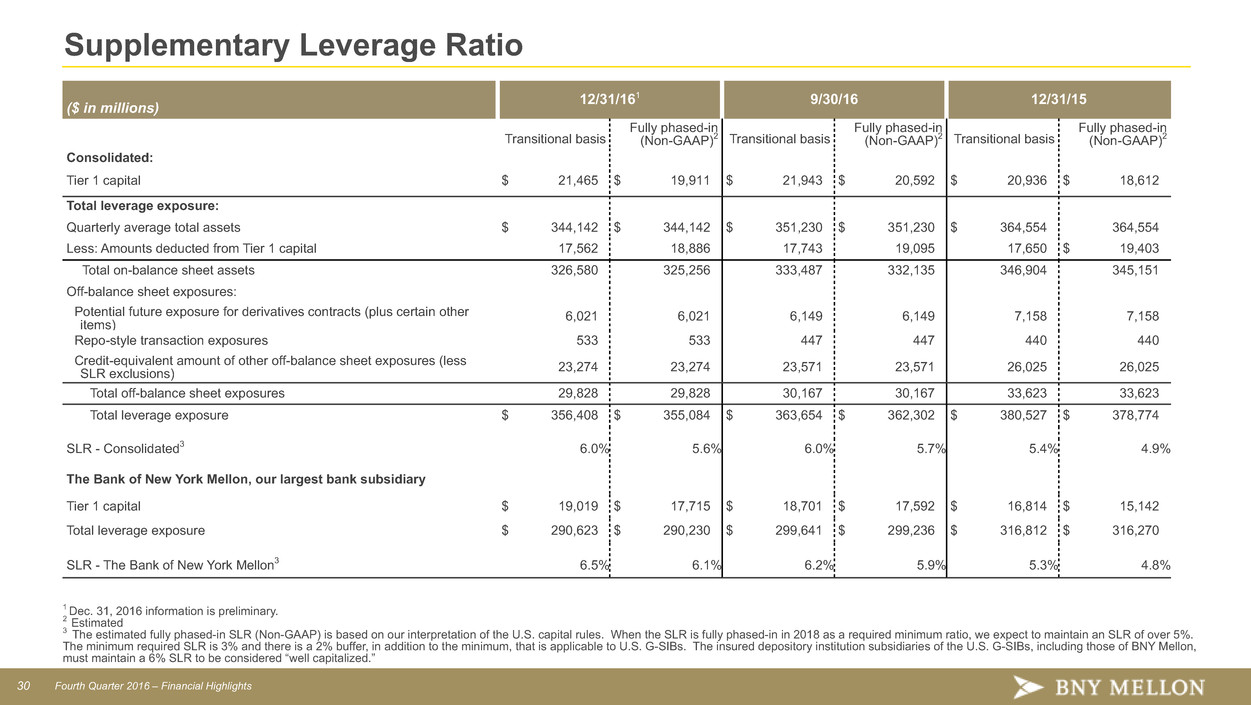

30 Fourth Quarter 2016 – Financial Highlights Supplementary Leverage Ratio ($ in millions) 12/31/16 1 9/30/16 12/31/15 Transitional basis Fully phased-in (Non-GAAP)2 Transitional basis Fully phased-in (Non-GAAP)2 Transitional basis Fully phased-in (Non-GAAP)2 Consolidated: Tier 1 capital $ 21,465 $ 19,911 $ 21,943 $ 20,592 $ 20,936 $ 18,612 Total leverage exposure: Quarterly average total assets $ 344,142 $ 344,142 $ 351,230 $ 351,230 $ 364,554 364,554 Less: Amounts deducted from Tier 1 capital 17,562 18,886 17,743 19,095 17,650 $ 19,403 Total on-balance sheet assets 326,580 325,256 333,487 332,135 346,904 345,151 Off-balance sheet exposures: Potential future exposure for derivatives contracts (plus certain other items) 6,021 6,021 6,149 6,149 7,158 7,158 Repo-style transaction exposures 533 533 447 447 440 440 Credit-equivalent amount of other off-balance sheet exposures (less SLR exclusions) 23,274 23,274 23,571 23,571 26,025 26,025 Total off-balance sheet exposures 29,828 29,828 30,167 30,167 33,623 33,623 Total leverage exposure $ 356,408 $ 355,084 $ 363,654 $ 362,302 $ 380,527 $ 378,774 SLR - Consolidated3 6.0% 5.6% 6.0% 5.7% 5.4% 4.9% The Bank of New York Mellon, our largest bank subsidiary Tier 1 capital $ 19,019 $ 17,715 $ 18,701 $ 17,592 $ 16,814 $ 15,142 Total leverage exposure $ 290,623 $ 290,230 $ 299,641 $ 299,236 $ 316,812 $ 316,270 SLR - The Bank of New York Mellon3 6.5% 6.1% 6.2% 5.9% 5.3% 4.8% 1 Dec. 31, 2016 information is preliminary. 2 Estimated 3 The estimated fully phased-in SLR (Non-GAAP) is based on our interpretation of the U.S. capital rules. When the SLR is fully phased-in in 2018 as a required minimum ratio, we expect to maintain an SLR of over 5%. The minimum required SLR is 3% and there is a 2% buffer, in addition to the minimum, that is applicable to U.S. G-SIBs. The insured depository institution subsidiaries of the U.S. G-SIBs, including those of BNY Mellon, must maintain a 6% SLR to be considered “well capitalized.”

31 Fourth Quarter 2016 – Financial Highlights Investment Management Pre-Tax Operating Margin - Non-GAAP Reconciliation Pre-tax operating margin 4Q16 3Q16 4Q15 ($ in millions) Income before income taxes – GAAP $ 260 $ 256 $ 290 Add: Amortization of intangible assets 22 22 24 Provision for credit losses 6 — (4) Income before income taxes excluding amortization of intangible assets and provision for credit losses – Non-GAAP $ 288 $ 278 $ 310 Total revenue – GAAP $ 960 $ 958 $ 999 Less: Distribution and servicing expense 98 104 92 Total revenue net of distribution and servicing expense - Non-GAAP $ 862 $ 854 $ 907 Pre-tax operating margin1 27% 27% 29% Adjusted Pre-tax operating margin, excluding amortization of intangible assets, provision for credit losses and distribution and servicing expense – Non-GAAP1 33% 33% 34% 1 Income before taxes divided by total revenue.