BNY Mellon First Quarter 2017 Financial Highlights April 20, 2017

2 First Quarter 2017 – Financial Highlights Cautionary Statement A number of statements in the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate”, “forecast”, “project”, “anticipate”, “target”, “expect”, “intend”, “continue”, “seek”, “believe”, “plan”, “goal”, “could”, “should”, “may”, “will”, “strategy”, “opportunities”, “trends” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: expense control, capital plans, strategic priorities, financial goals, client experience, driving revenue growth, the business improvement process, estimated capital ratios and expectations regarding those ratios, preliminary business metrics; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual results may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 Annual Report”), and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”), including the Corporation’s Earnings Release for the quarter ended March 31, 2017, included an exhibit to our Current Report on Form 8-K filed on April 20, 2017 (the “Earnings Release”). Such forward-looking statements speak only as of April 20, 2017, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Non-GAAP Measures: In this presentation we may discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP adjusted measures are contained in the Corporation’s reports filed with the SEC, including the 2016 Annual Report and Earnings Release, available at www.bnymellon.com/investorrelations.

3 First Quarter 2017 – Financial Highlights Summary Financial Results for First Quarter 2017 - GAAP Growth vs. $ in millions, except per share data 1Q17 4Q16 1Q16 4Q16 1Q16 Revenue $ 3,843 $ 3,790 $ 3,730 1% 3% Expenses $ 2,642 $ 2,631 $ 2,629 —% —% Operating leverage1 +98 bps +254 bps Income before income taxes $ 1,206 $ 1,152 $ 1,091 5% 11% Pre-tax operating margin 31% 30% 29% EPS $ 0.83 $ 0.77 $ 0.73 8% 14% Return on common equity2 10.2% 9.3% 9.2% 1 Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year operating leverage was based on an increase in total revenue, of 303 basis points, and an increase in total noninterest expense, of 49 basis points. The sequential operating leverage was based on an increase in total revenue, of 140 basis points, and an increase in total noninterest expense, of 42 basis points. 2 Annualized Note: Provision for credit losses was a credit of $5 million in 1Q17 versus a provision of $7 million in 4Q16 and a provision of $10 million in 1Q16 bps - basis points

4 First Quarter 2017 – Financial Highlights Summary Financial Results for First Quarter 2017 (Non-GAAP)1 Growth vs. $ in millions, except per share data 1Q17 4Q16 1Q16 4Q16 1Q16 Revenue $ 3,825 $ 3,786 $ 3,737 1% 2% Expenses $ 2,582 $ 2,564 $ 2,555 1% 1% Adjusted operating leverage2 +33 bps +129 bps Income before income taxes $ 1,248 $ 1,215 $ 1,172 3% 6% Adjusted pre-tax operating margin 33% 32% 31% EPS $ 0.83 $ 0.77 $ 0.74 8% 12% Return on tangible common equity3 22.2% 20.4% 20.6% Adjusted return on tangible common equity3 22.4% 20.5% 20.8% 1 Represents Non-GAAP measures. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 2 Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. The year-over-year operating leverage (Non-GAAP) was based on an increase in total revenue, as adjusted (Non-GAAP), of 235 basis points, and an increase in total noninterest expense, as adjusted (Non-GAAP), of 106 basis points. The sequential operating leverage (Non-GAAP) was based on an increase in total revenue, as adjusted (Non-GAAP), of 103 basis points, and an increase of total noninterest expense, as adjusted (Non-GAAP), of 70 basis points. 3Annualized bps - basis points

5 First Quarter 2017 – Financial Highlights First Quarter Financial Highlights (comparisons are 1Q17 versus 1Q16) • Earnings per common share of $0.83 • Includes $0.03 per common share tax benefit related to new accounting guidance for stock awards • Earnings per common share +14% year-over-year • Total revenue of $3.84 billion, increased +3% year-over-year • Investment management and performance fees increased +4% • Investment services fees increased +4% • Net interest revenue increased +3% • Continued focus on expense control • Total noninterest expense up less than 1% year-over-year driven by increased regulatory and compliance costs • Generated +254 bps of positive operating leverage • Executing on capital plan and returning value to common shareholders • Returned nearly $1.1 billion to shareholders through share repurchases and dividends • Return on common equity of 10%; adjusted return on tangible common equity of 22%1 • SLR - transitional of 6.1%; SLR - fully phased-in of 5.9%1 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

6 First Quarter 2017 – Financial Highlights First Quarter Operating Key Messages (comparisons are 1Q17 versus 1Q16)1 • Solid revenue and asset growth • Fee growth of +4% on a GAAP basis for both investment services fees and investment management and performance fees • Record Assets under Custody and/or Administration of $30.6 trillion, up +5% year-over-year • Assets under Management of $1.7 trillion, +5% year-over-year, overall asset management inflows of $27 billion improved to their highest levels since 2014 • Net interest revenue (“NIR”) and net interest margin (“NIM”) growth mainly reflect higher rates • Higher rates and interest rate hedging activities partially offset by lower average interest earning assets and higher average long-term debt • NIR FTE up +3%, NIM FTE up +13 bps • Generated positive operating leverage and higher operating margins • Positive operating leverage of +129 bps • Increased operating margin to 33% from improved revenue performance and continued focus on Business Improvement Process • Business improvement process driving efficiencies but high regulatory compliance and staff costs pressured expenses • Enhancing the client experience through continued investments in growth initiatives and roll out of our NEXEN digital platform • Improving efficiencies by changing the way we work, continued impact from location strategy and vendor renegotiations, and optimizing our physical footprint • Maintained strong/resilient capital ratios • Key ratios meeting fully phased-in requirements • Returned significant capital to shareholders through share repurchases and dividends • Remain on track to achieve or exceed three-year Investor Day goals 1 Represents a Non-GAAP measure unless otherwise noted. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

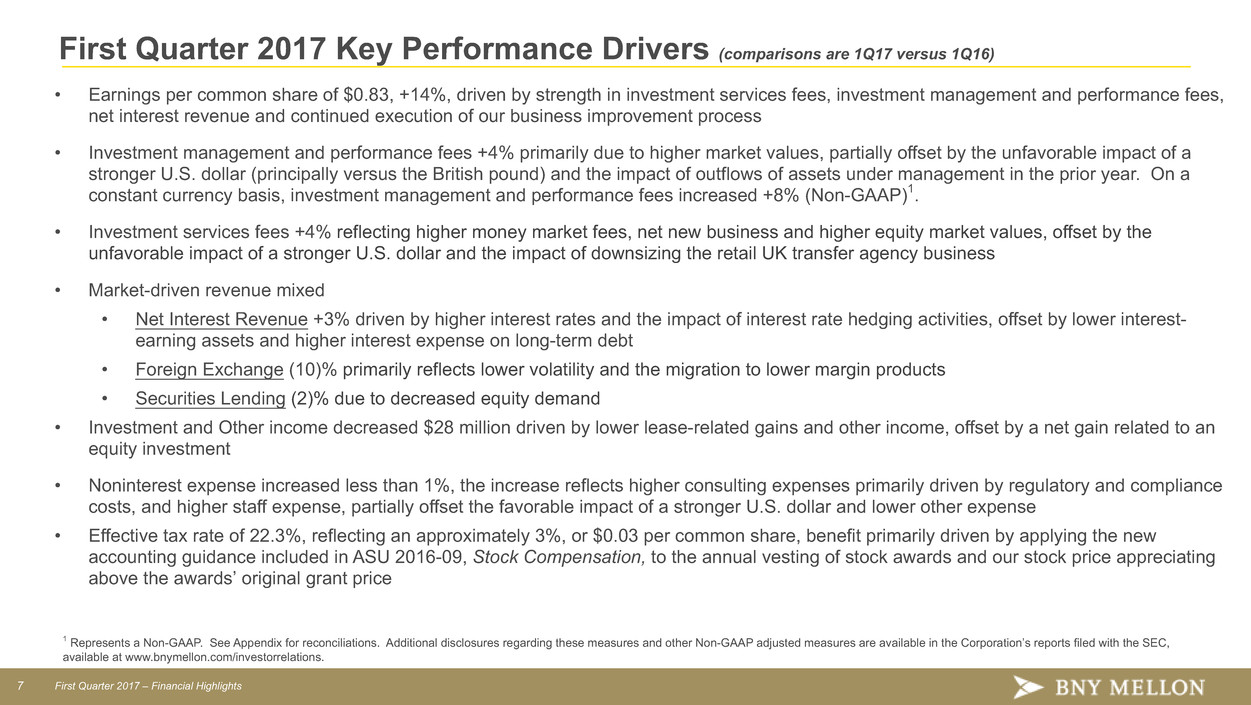

7 First Quarter 2017 – Financial Highlights First Quarter 2017 Key Performance Drivers (comparisons are 1Q17 versus 1Q16) • Earnings per common share of $0.83, +14%, driven by strength in investment services fees, investment management and performance fees, net interest revenue and continued execution of our business improvement process • Investment management and performance fees +4% primarily due to higher market values, partially offset by the unfavorable impact of a stronger U.S. dollar (principally versus the British pound) and the impact of outflows of assets under management in the prior year. On a constant currency basis, investment management and performance fees increased +8% (Non-GAAP)1. • Investment services fees +4% reflecting higher money market fees, net new business and higher equity market values, offset by the unfavorable impact of a stronger U.S. dollar and the impact of downsizing the retail UK transfer agency business • Market-driven revenue mixed • Net Interest Revenue +3% driven by higher interest rates and the impact of interest rate hedging activities, offset by lower interest- earning assets and higher interest expense on long-term debt • Foreign Exchange (10)% primarily reflects lower volatility and the migration to lower margin products • Securities Lending (2)% due to decreased equity demand • Investment and Other income decreased $28 million driven by lower lease-related gains and other income, offset by a net gain related to an equity investment • Noninterest expense increased less than 1%, the increase reflects higher consulting expenses primarily driven by regulatory and compliance costs, and higher staff expense, partially offset the favorable impact of a stronger U.S. dollar and lower other expense • Effective tax rate of 22.3%, reflecting an approximately 3%, or $0.03 per common share, benefit primarily driven by applying the new accounting guidance included in ASU 2016-09, Stock Compensation, to the annual vesting of stock awards and our stock price appreciating above the awards’ original grant price 1 Represents a Non-GAAP. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

8 First Quarter 2017 – Financial Highlights Fee and Other Revenue (Consolidated) Growth vs. Year-over-Year Drivers ($ in millions) 1Q17 4Q16 1Q16 Investment services fees: Asset ServicingŸIncrease reflects net new business, including growth of collateral optimization solutions, and higher equity market values, partially offset by the unfavorable impact of a stronger U.S. dollar and the impact of downsizing the retail UK transfer agency business Clearing Services Ÿ Higher money market fees and mutual funds fees Issuer Services Ÿ Higher fees in Depositary Receipts, partially offset by lower fees in Corporate Trust Treasury Services Ÿ Primarily reflects higher payment volumes, partially offset by higher compensating balance credits provided to clients, which reduces fee revenue and increases net interest revenue Investment Management and Performance Fees Ÿ Reflecting higher market values, partially offset by the unfavorable impact of a stronger U.S. dollar (principally versus the British pound) and the impact of outflows of assets under management in the prior year. On a constant currency basis, investment management and performance fees increased 8% (Non- GAAP) year-over-year2 Foreign Exchange & Other Trading Revenue Ÿ Principally lower FX volatility and the migration to lower margin products Distribution and Servicing ŸHigher money market fees, partially offset by fees paid to introducing brokers Investment and other income Ÿ Primarily reflects the net gain related to an equity investment and decreases in other income due to our increased investments in renewable energy. Also reflects lower lease-related gains Asset servicing1 $ 1,063 — % 2% Clearing services 376 6 7 Issuer services 251 19 3 Treasury services 139 (1) 6 Total investment services fees 1,829 3 4 Investment management and performance fees 842 (1) 4 Foreign exchange and other trading revenue 164 2 (6) Financing-related fees 55 10 2 Distribution and servicing 41 — 5 Investment and other income 77 10 (27) Total fee revenue 3,008 2 2 Net securities gains 10 N/M N/M Total fee and other revenue $ 3,018 2 % 2% 1 Asset servicing fees include securities lending revenue of $49 million in 1Q17, $54 million in 4Q16, and $50 million in 1Q16. 2Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Please reference earnings release for sequential variance explanations where applicable. N/M - not meaningful

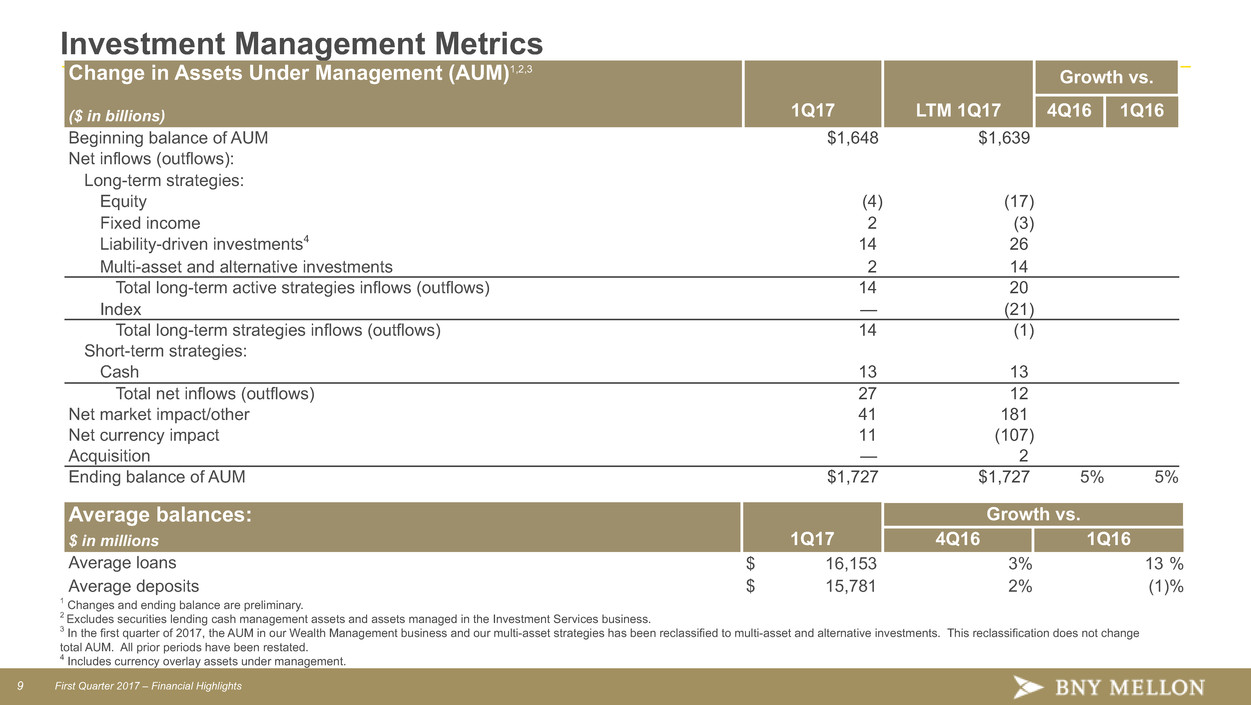

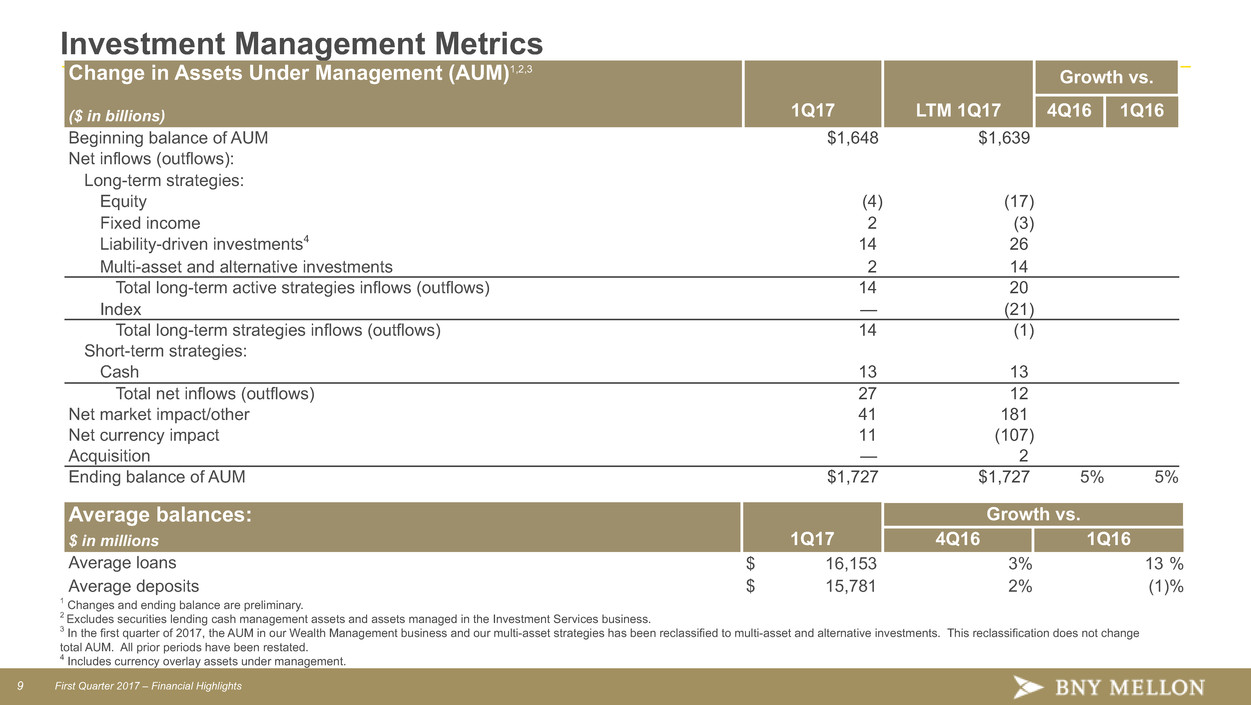

9 First Quarter 2017 – Financial Highlights Investment Management Metrics Change in Assets Under Management (AUM)1,2,3 Growth vs. ($ in billions) 1Q17 LTM 1Q17 4Q16 1Q16 Beginning balance of AUM $1,648 $1,639 Net inflows (outflows): Long-term strategies: Equity (4) (17) Fixed income 2 (3) Liability-driven investments4 14 26 Multi-asset and alternative investments 2 14 Total long-term active strategies inflows (outflows) 14 20 Index — (21) Total long-term strategies inflows (outflows) 14 (1) Short-term strategies: Cash 13 13 Total net inflows (outflows) 27 12 Net market impact/other 41 181 Net currency impact 11 (107) Acquisition — 2 Ending balance of AUM $1,727 $1,727 5% 5% Average balances: Growth vs. $ in millions 1Q17 4Q16 1Q16 Average loans $ 16,153 3% 13 % Average deposits $ 15,781 2% (1)% 1 Changes and ending balance are preliminary. 2 Excludes securities lending cash management assets and assets managed in the Investment Services business. 3 In the first quarter of 2017, the AUM in our Wealth Management business and our multi-asset strategies has been reclassified to multi-asset and alternative investments. This reclassification does not change total AUM. All prior periods have been restated. 4 Includes currency overlay assets under management.

10 First Quarter 2017 – Financial Highlights Investment Services Metrics Growth vs. 1Q17 4Q16 1Q16 Assets under custody and/or administration at period end (trillions)1,2 $ 30.6 2 % 5 % Estimated new business wins (AUC/A) (billions)1 $ 109 Market value of securities on loan at period end (billions)3 $ 314 6 % 5 % Average loans (millions) $ 42,818 (7)% (5)% Average deposits (millions) $ 197,690 (7)% (8)% Broker-Dealer Average tri-party repo balances (billions) $ 2,373 3 % 13 % Clearing Services Average active clearing accounts (U.S. platform) (thousands) 6,058 2 % 2 % Average long-term mutual fund assets (U.S. platform) (millions) $ 460,977 5 % 11 % Depositary Receipts Number of sponsored programs 1,050 (1)% (7)% 1 Preliminary. 2 Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.2 trillion at March 31, 2017 and Dec. 31, 2016, and $1.1 trillion at March 31, 2016. 3 Represents the total amount of securities on loan in our agency securities lending program managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $65 billion at March 31, 2017, $63 billion at Dec. 31, 2016 and $56 billion at March 31, 2016.

11 First Quarter 2017 – Financial Highlights Net Interest Revenue Growth vs. Year-over-Year Drivers ($ in millions) 1Q17 4Q16 1Q16 Net interest revenue - GAAP $ 792 (5)% 3 % Net Interest Revenue Ÿ Primarily reflects higher interest rates and the impact of interest rate hedging activities (which negatively impacted 1Q17 less than 1Q16), partially offset by lower average interest-earning assets and higher average long-term debt Ÿ Substantially all of the impact of interest rate hedging activities in 4Q16 was offset in foreign exchange and other trading revenue Tax equivalent adjustment 12 N/M N/M Net interest revenue (FTE) - Non-GAAP1 $ 804 (5)% 3 % Net interest margin - GAAP 1.13% (3) bps 14 bps Net interest margin (FTE) - Non-GAAP1 1.14% (3) bps 13 bps Selected Average Balances: Cash/interbank investments $ 106,069 2 % (17)% Trading account securities 2,254 (1) (32) Securities 114,786 (2) (3) Loans 60,312 (5) (1) Interest-earning assets 283,421 (2) (9) Interest-bearing deposits 139,820 (4) (14) Noninterest-bearing deposits 73,555 (11) (11) Long-term debt 25,882 4 20 1 Net interest revenue (FTE) – Non-GAAP and net interest margin (FTE) – Non-GAAP include the tax equivalent adjustments on tax-exempt income which allows for comparisons of amounts arising from both taxable and tax-exempt sources and is consistent with industry practice. The adjustment to an FTE basis has no impact on net income. Note: Please reference earnings release for sequential variance explanations. FTE – fully taxable equivalent N/M - Not meaningful, bps – basis points

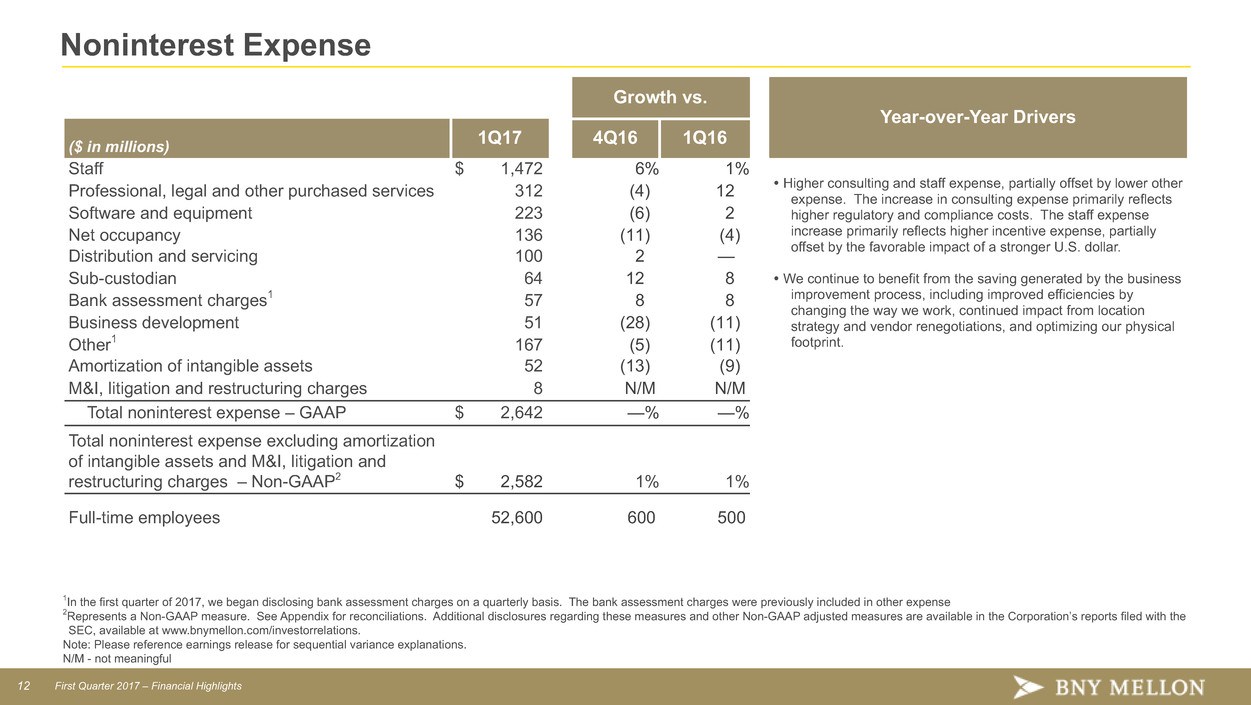

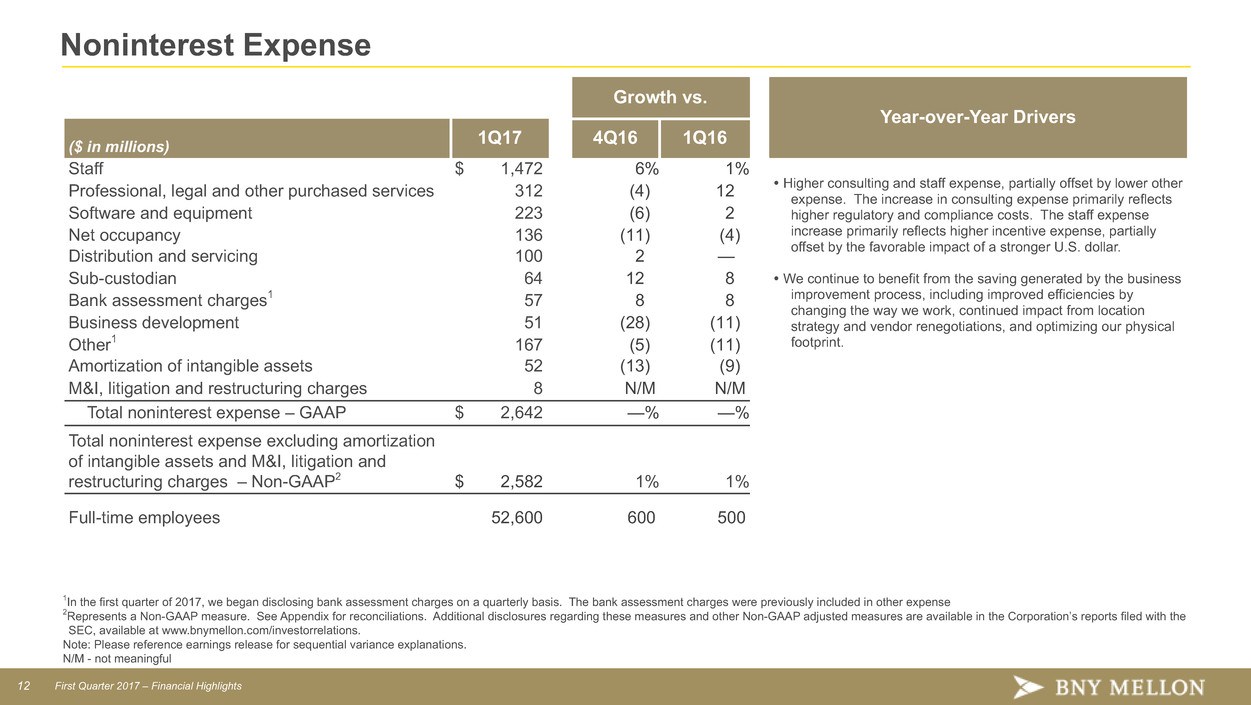

12 First Quarter 2017 – Financial Highlights Noninterest Expense Growth vs. Year-over-Year Drivers ($ in millions) 1Q17 4Q16 1Q16 Staff $ 1,472 6% 1% Ÿ Higher consulting and staff expense, partially offset by lower other expense. The increase in consulting expense primarily reflects higher regulatory and compliance costs. The staff expense increase primarily reflects higher incentive expense, partially offset by the favorable impact of a stronger U.S. dollar. Ÿ We continue to benefit from the saving generated by the business improvement process, including improved efficiencies by changing the way we work, continued impact from location strategy and vendor renegotiations, and optimizing our physical footprint. Professional, legal and other purchased services 312 (4) 12 Software and equipment 223 (6) 2 Net occupancy 136 (11) (4) Distribution and servicing 100 2 — Sub-custodian 64 12 8 Bank assessment charges1 57 8 8 Business development 51 (28) (11) Other1 167 (5) (11) Amortization of intangible assets 52 (13) (9) M&I, litigation and restructuring charges 8 N/M N/M Total noninterest expense – GAAP $ 2,642 —% —% Total noninterest expense excluding amortization of intangible assets and M&I, litigation and restructuring charges – Non-GAAP2 $ 2,582 1% 1% Full-time employees 52,600 600 500 1In the first quarter of 2017, we began disclosing bank assessment charges on a quarterly basis. The bank assessment charges were previously included in other expense 2Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. Note: Please reference earnings release for sequential variance explanations. N/M - not meaningful

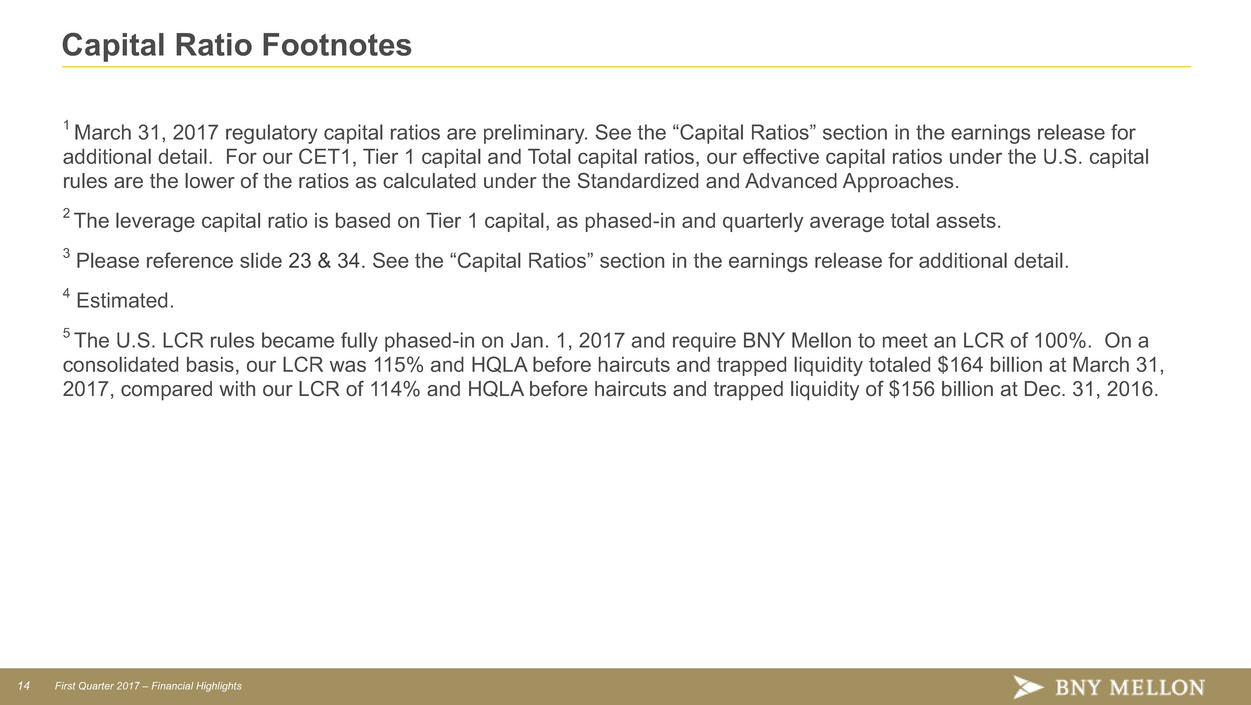

13 First Quarter 2017 – Financial Highlights Capital Ratios Highlights 03/31/17 12/31/16 03/31/16 Consolidated regulatory capital ratios:1 Ÿ Repurchased 19 million common shares for $879 million in 1Q17 Ÿ Supplementary Leverage Ratio (“SLR”) increased to 5.9% - compliant on a fully phased-in basis Ÿ Compliant with U.S. Liquidity Coverage Ratio (“LCR”)5 Standardized Approach Common equity Tier 1 (“CET1”) ratio 12.0% 12.3% 12.3% Tier 1 capital ratio 14.4 14.5 14.5 Total (Tier 1 plus Tier 2) capital ratio 15.0 15.2 15.2 Advanced Approach CET1 ratio 10.4 10.6 10.6 Tier 1 capital ratio 12.5 12.6 12.6 Total (Tier 1 plus Tier 2) capital ratio 12.8 13.0 13.0 Leverage capital ratio2 6.6 6.6 6.6 Supplementary leverage ratio ("SLR") 6.1 6.0 6.0 Selected regulatory capital ratios - fully phased-in - Non-GAAP:1,3,4 CET1 ratio: Standardized approach 11.5% 11.3% 11.3% Advanced approach 10.0 9.7 9.7 SLR 5.9 5.6 5.6 Note: See corresponding footnotes on following slide.

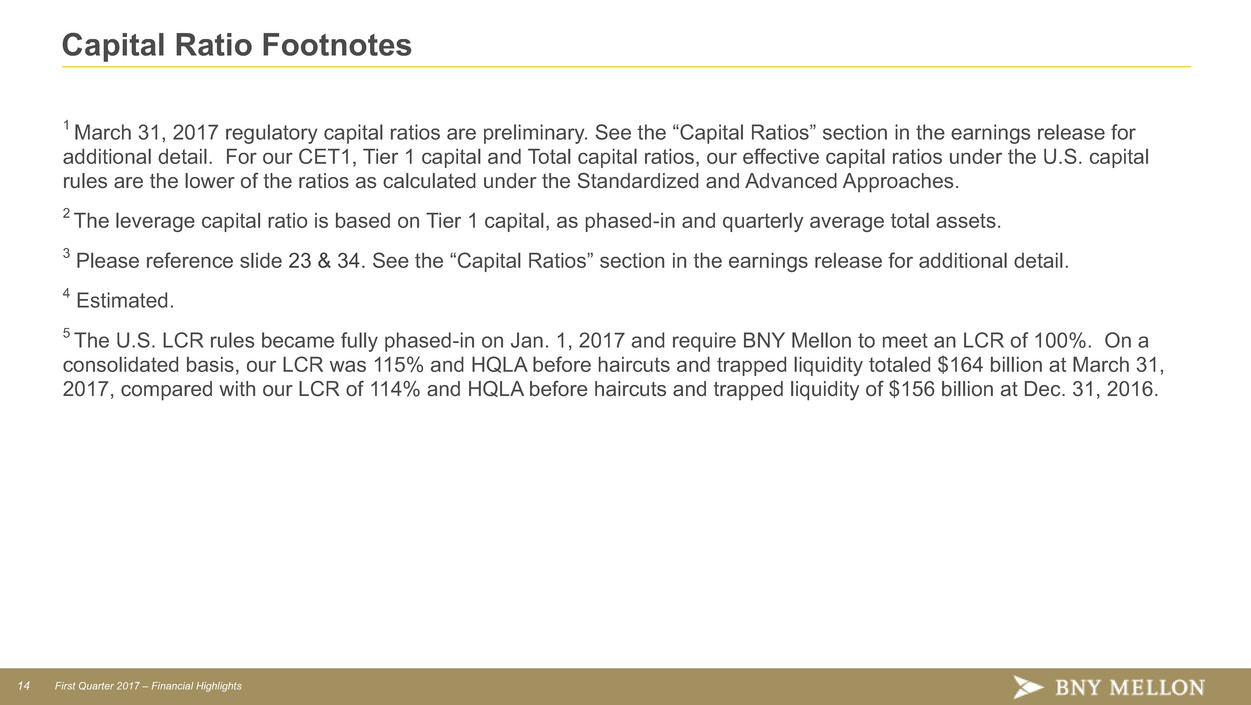

14 First Quarter 2017 – Financial Highlights Capital Ratio Footnotes 1 March 31, 2017 regulatory capital ratios are preliminary. See the “Capital Ratios” section in the earnings release for additional detail. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches. 2 The leverage capital ratio is based on Tier 1 capital, as phased-in and quarterly average total assets. 3 Please reference slide 23 & 34. See the “Capital Ratios” section in the earnings release for additional detail. 4 Estimated. 5 The U.S. LCR rules became fully phased-in on Jan. 1, 2017 and require BNY Mellon to meet an LCR of 100%. On a consolidated basis, our LCR was 115% and HQLA before haircuts and trapped liquidity totaled $164 billion at March 31, 2017, compared with our LCR of 114% and HQLA before haircuts and trapped liquidity of $156 billion at Dec. 31, 2016.

Appendix

16 First Quarter 2017 – Financial Highlights 2017 Key Messages • Executing on our strategic priorities; delivering on our three-year financial goals set at our 2014 Investor Day • Focused on enhancing the client experience and driving profitable revenue growth • Broadening existing client relationships and selectively adding new business • Business Improvement Process designed to leverage scale, increase efficiency and effectiveness, improve service quality and experience while reducing risk and structural costs • In a low organic revenue growth environment, the Business Improvement Process is enabling us to fund: • Additional global regulatory requirements • Enhancements to our technology and servicing platforms • Revenue growth initiatives • Improving our operating margin and shareholder return • Continue to return significant value to shareholders through share repurchases and dividends

17 First Quarter 2017 – Financial Highlights Strategic Priorities Strategic Priorities to Drive Growth Driving Profitable Revenue Growth and Enhancing the Client Experience • Leveraging our scale and expertise to create increased value for clients and shareholders through all environments • In IM, vs. 1Q16, revenue grew +8% and income before taxes, excluding amortization of intangibles +24%: • Adjusted pretax operating margin rose to 34%, helped by increased revenue and expense actions • Overall asset management flows improved to their highest levels in several years • Our cash business bucked industry trend of outflows in 1Q17, adding $13B in asset inflows • We continue to see strong performance, with two-thirds of our actively managed mutual fund assets ranked ahead of their peer median on a 3- and 5-year basis • In IS, we are enhancing client experience by: • Investing in cutting-edge collateral optimization and management solutions we deliver to both the buy- and sell-side • In 1Q17, collateral balances continued to show robust growth, demonstrating strong client uptake • Building best-in-class technology and services that enable asset managers to leverage our scale and expertise Executing on our Business Improvement Process • Funding regulatory change, process maturity, strategic technology and growth investments • Improving margins in our businesses • Reducing structural costs Being a Strong, Safe, Trusted Counterparty • Strengthened our key regulatory capital ratios • Estimated SLR of 5.9% (fully phased-in) • Strong capital and liquidity positions • Excellent balance sheet credit quality • Continuing to enhance our resolvability and resiliency • Upgraded and streamlined risk reporting systems Generating Excess Capital and Deploying Capital Effectively • Executing on capital plan and returning value to shareholders • Nearly $1.1B returned to shareholders in 1Q17; repurchased 19MM shares for $879MM and paid $201MM in dividends to common shareholders Attracting, Developing, and Retaining Top Talent • Expanding Workplace Excellence programs • Released second annual People Report • Building robust leadership pipeline for the future • Improving talent, succession and development planning

18 First Quarter 2017 – Financial Highlights Business Improvement Process COMPLETED • Expanded Wealth Management sales force, driving new revenue opportunities backed by a strong pipeline • Delivered revised pricing transactions initiated through manual processes to better align costs with client pricing • Created dedicated technology solutions unit to drive technology-related revenue growth • Extended private banking solutions to Pershing clients • Delivered integrated bank and brokerage custody platform for joint Wealth Management and Pershing clients • Created direct lending capability through investment management ONGOING • Strategic Platform Investments (Real Estate / Private Equity Administration, Asset and Hedge Fund Manager Middle-Office, Global Wealth Platforms) • Enhancing collateral management systems and foreign exchange (FX) platforms • Strengthening distribution of investment management strategies • Growing Dreyfus cash management solutions with Investment Services clients • Expanding integrated bank/brokerage custody with trust platform • Analyzing and measuring our service delivery costs to better align our costs with client pricing • Offering new solutions to help clients meet regulatory changes • Developing pricing standards for value-added solutions available through NEXEN COMPLETED • Exited derivatives clearing and transition management businesses • Sold Meriten, our German-based boutique • Streamlined our APAC Investment Management operations • Realigned our UK transfer agency operating model to improve profitability • Exiting the retail UK transfer agency business • Developed tools to reduce costs and improve the delivery of market data • Sold EMEA Central Securities Depository and Pershing money manager outsourcing business • Exited selected areas of our mortgage-backed securities business • Implemented Bring Your Own Devices (BYOD) policy • Consolidated real estate footprint in NY, London and Pittsburgh • Implemented over 200 bots through Robotic Process Automation ONGOING • Simplifying and automating our end-to-end global processing • Expanding robotics, re-engineering and workflow to drive efficiency and productivity • Optimizing and streamlining our technology infrastructure with a focus on making it highly resilient while lowering the annual operating costs • Continuing to reduce market data costs • Reducing our real estate footprint; balancing our workforce globally • Implementing Workforce Excellence standards across the real estate footprint • Continuing vendor management and negotiation process • Ongoing reviews of product, service, and solution portfolio • Aligning drivers of costs and client pricing • Executing NEXEN platform to improve client experience and growth while retiring legacy platforms Business Excellence Continuous Process Improvement Corporate Services Client Technology Solutions Excellence Business Partner Activity Process Revenue Initiatives Expense Initiatives

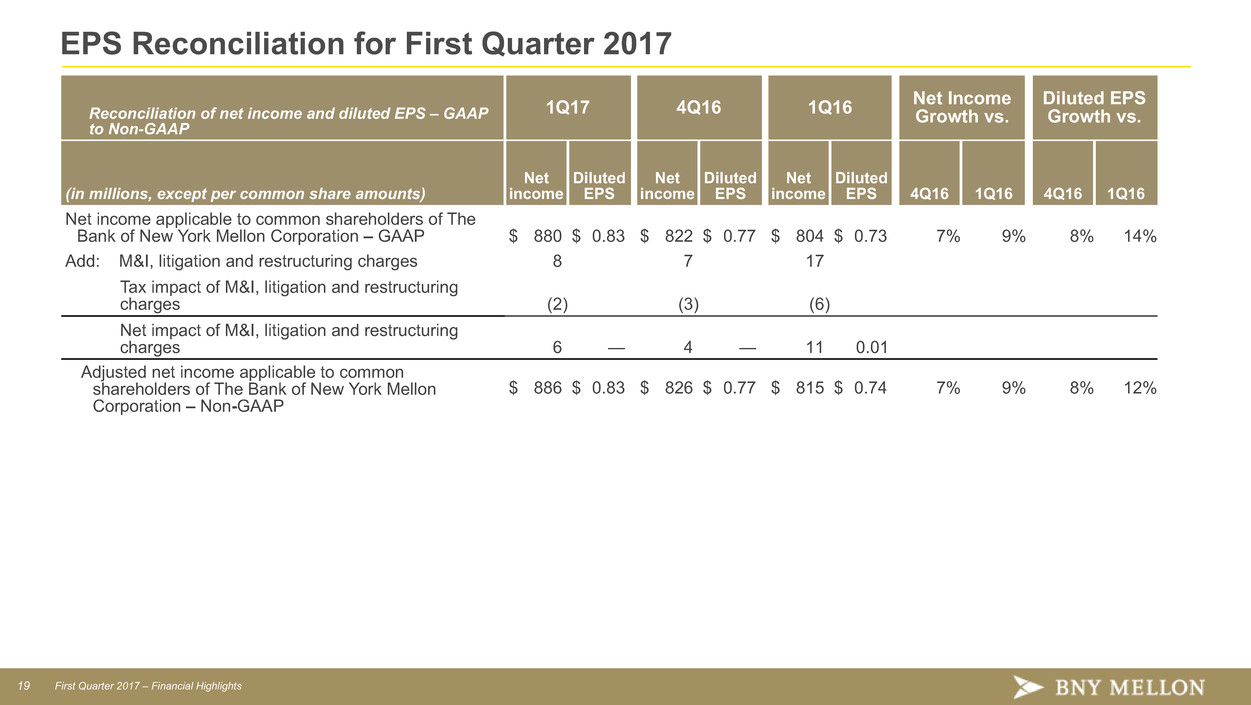

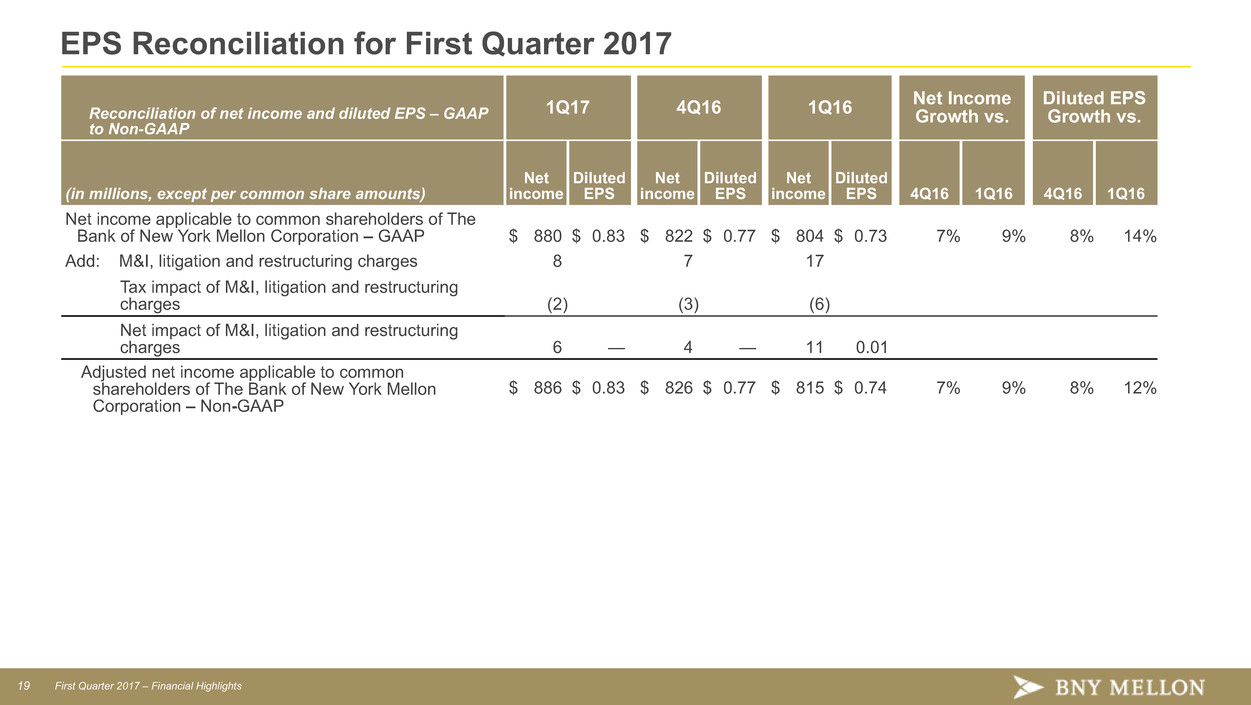

19 First Quarter 2017 – Financial Highlights Reconciliation of net income and diluted EPS – GAAP to Non-GAAP 1Q17 4Q16 1Q16 Net IncomeGrowth vs. Diluted EPS Growth vs. (in millions, except per common share amounts) Net income Diluted EPS Net income Diluted EPS Net income Diluted EPS 4Q16 1Q16 4Q16 1Q16 Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 880 $ 0.83 $ 822 $ 0.77 $ 804 $ 0.73 7% 9% 8% 14% Add: M&I, litigation and restructuring charges 8 7 17 Tax impact of M&I, litigation and restructuring charges (2) (3) (6) Net impact of M&I, litigation and restructuring charges 6 — 4 — 11 0.01 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation – Non-GAAP $ 886 $ 0.83 $ 826 $ 0.77 $ 815 $ 0.74 7% 9% 8% 12% EPS Reconciliation for First Quarter 2017

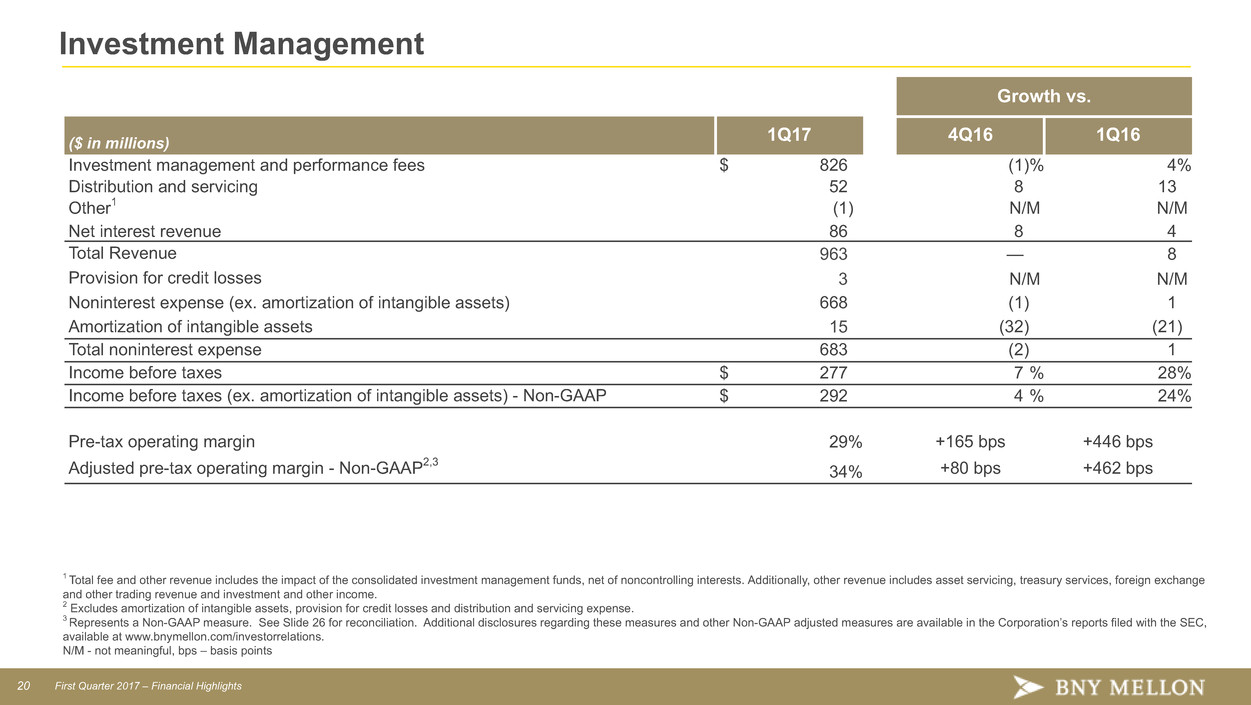

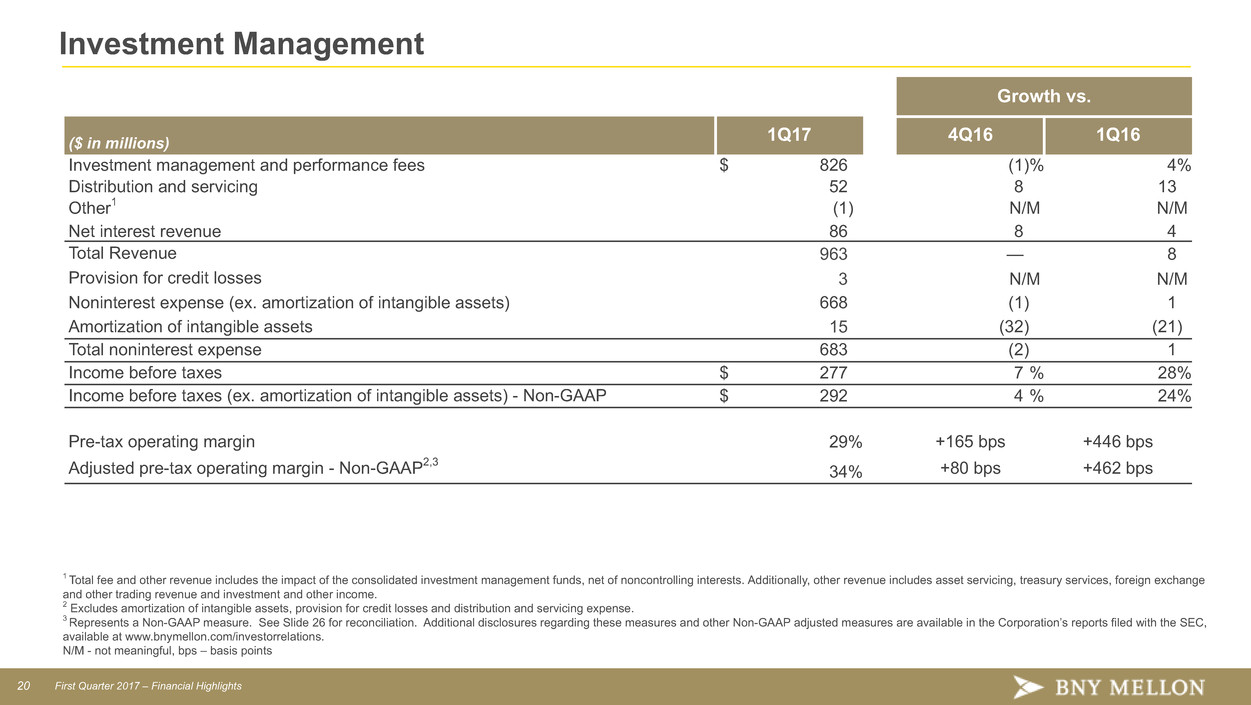

20 First Quarter 2017 – Financial Highlights Investment Management . Growth vs. ($ in millions) 1Q17 4Q16 1Q16 Investment management and performance fees $ 826 (1)% 4% Distribution and servicing 52 8 13 Other1 (1) N/M N/M Net interest revenue 86 8 4 Total Revenue 963 — 8 Provision for credit losses 3 N/M N/M Noninterest expense (ex. amortization of intangible assets) 668 (1) 1 Amortization of intangible assets 15 (32) (21) Total noninterest expense 683 (2) 1 Income before taxes $ 277 7 % 28% Income before taxes (ex. amortization of intangible assets) - Non-GAAP $ 292 4 % 24% Pre-tax operating margin 29% +165 bps +446 bps Adjusted pre-tax operating margin - Non-GAAP2,3 34% +80 bps +462 bps 1 Total fee and other revenue includes the impact of the consolidated investment management funds, net of noncontrolling interests. Additionally, other revenue includes asset servicing, treasury services, foreign exchange and other trading revenue and investment and other income. 2 Excludes amortization of intangible assets, provision for credit losses and distribution and servicing expense. 3 Represents a Non-GAAP measure. See Slide 26 for reconciliation. Additional disclosures regarding these measures and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. N/M - not meaningful, bps – basis points

21 First Quarter 2017 – Financial Highlights Investment Services Growth vs. ($ in millions) 1Q17 4Q16 1Q16 Investment services fees: Asset servicing $ 1,038 — % 2% Clearing services 375 6 8 Issuer services 250 18 2 Treasury services 139 — 8 Total investment services fees 1,802 3 4 Foreign exchange and other trading revenue 153 (3) (9) Other1 129 1 3 Net interest revenue 707 (1) 4 Total revenue 2,791 2 3 Provision for credit losses — N/M N/M Noninterest expense (ex. amortization of intangible assets) 1,812 1 2 Amortization of intangible assets 37 (3) (3) Total noninterest expense 1,849 1 2 Income before taxes $ 942 2 % 6% Income before taxes (ex. amortization of intangible assets) - Non-GAAP $ 979 2 % 6% Pre-tax operating margin 34% +22 bps +104 bps Adjusted pre-tax operating margin (ex. provision for credit losses and amortization of intangible assets) - Non-GAAP 35% +12 bps +42 bps 1 Other revenue includes investment management fees, financing-related fees, distribution and servicing revenue and investment and other income. N/M - not meaningful bps – basis points

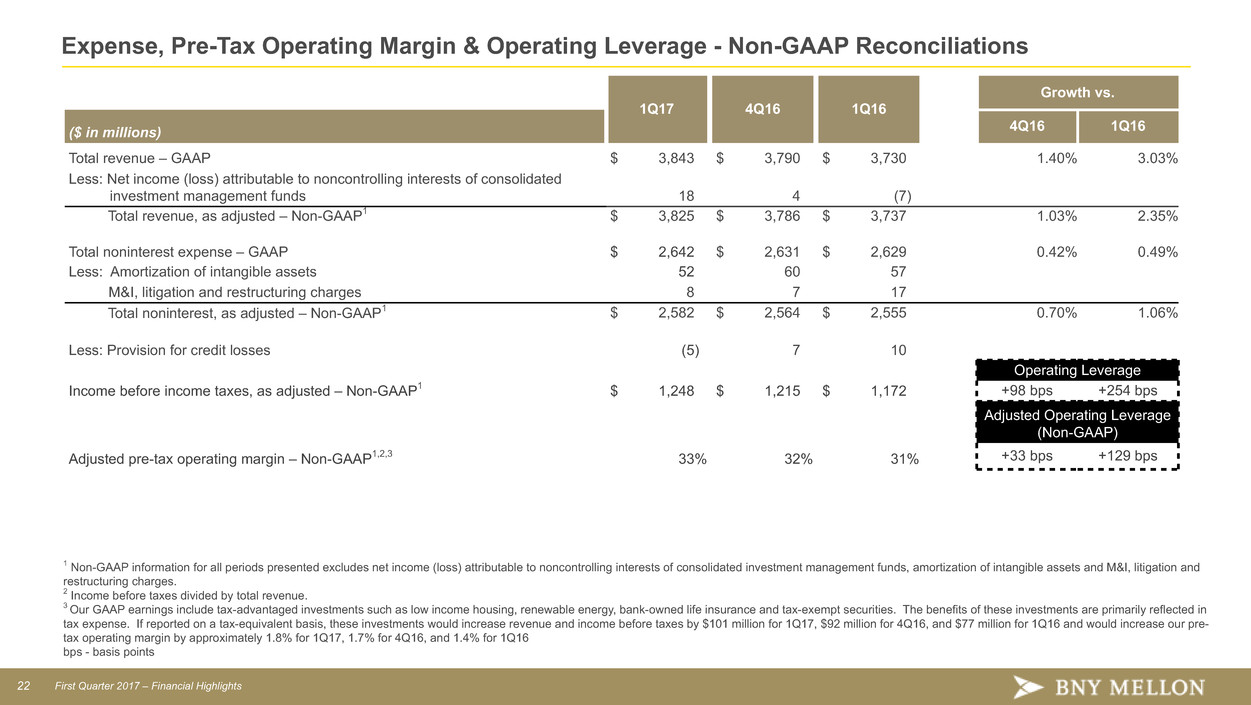

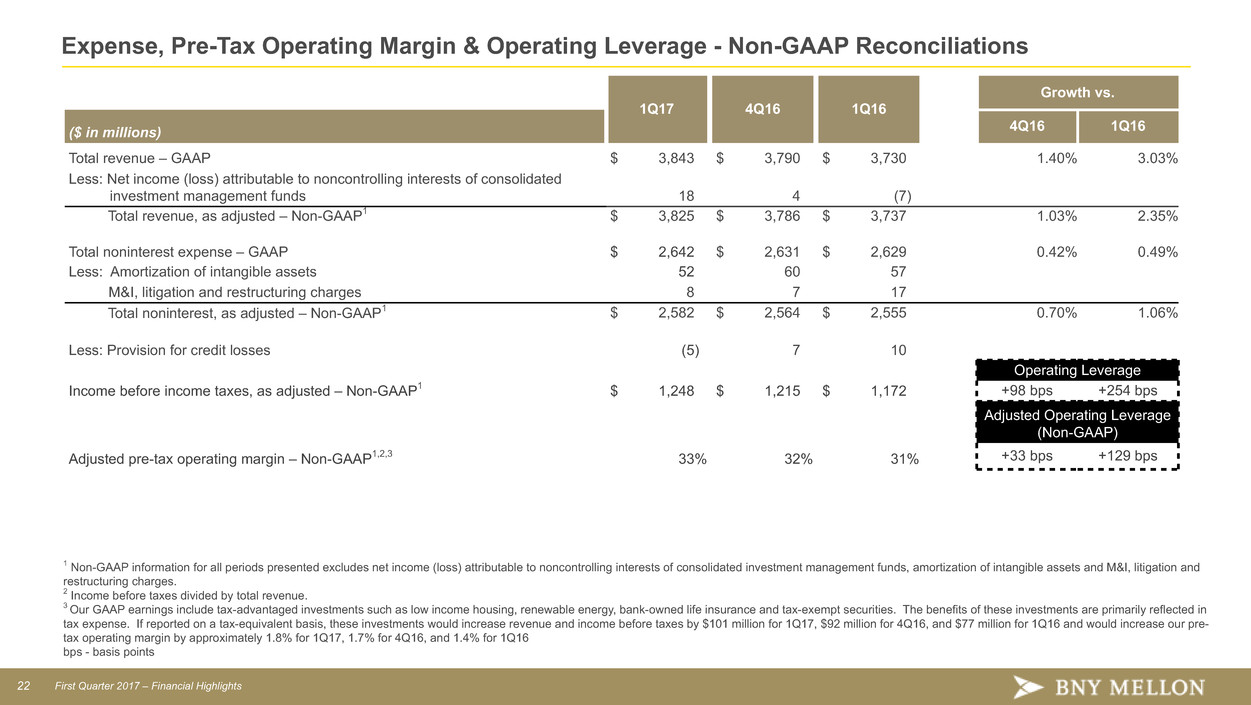

22 First Quarter 2017 – Financial Highlights Expense, Pre-Tax Operating Margin & Operating Leverage - Non-GAAP Reconciliations 1Q17 4Q16 1Q16 Growth vs. ($ in millions) 4Q16 1Q16 Total revenue – GAAP $ 3,843 $ 3,790 $ 3,730 1.40% 3.03% Less: Net income (loss) attributable to noncontrolling interests of consolidated investment management funds 18 4 (7) Total revenue, as adjusted – Non-GAAP1 $ 3,825 $ 3,786 $ 3,737 1.03% 2.35% Total noninterest expense – GAAP $ 2,642 $ 2,631 $ 2,629 0.42% 0.49% Less: Amortization of intangible assets 52 60 57 M&I, litigation and restructuring charges 8 7 17 Total noninterest, as adjusted – Non-GAAP1 $ 2,582 $ 2,564 $ 2,555 0.70% 1.06% Less: Provision for credit losses (5) 7 10 Operating Leverage Income before income taxes, as adjusted – Non-GAAP1 $ 1,248 $ 1,215 $ 1,172 +98 bps +254 bps Adjusted Operating Leverage (Non-GAAP) Adjusted pre-tax operating margin – Non-GAAP1,2,3 33% 32% 31% +33 bps +129 bps 1 Non-GAAP information for all periods presented excludes net income (loss) attributable to noncontrolling interests of consolidated investment management funds, amortization of intangible assets and M&I, litigation and restructuring charges. 2 Income before taxes divided by total revenue. 3 Our GAAP earnings include tax-advantaged investments such as low income housing, renewable energy, bank-owned life insurance and tax-exempt securities. The benefits of these investments are primarily reflected in tax expense. If reported on a tax-equivalent basis, these investments would increase revenue and income before taxes by $101 million for 1Q17, $92 million for 4Q16, and $77 million for 1Q16 and would increase our pre- tax operating margin by approximately 1.8% for 1Q17, 1.7% for 4Q16, and 1.4% for 1Q16 bps - basis points

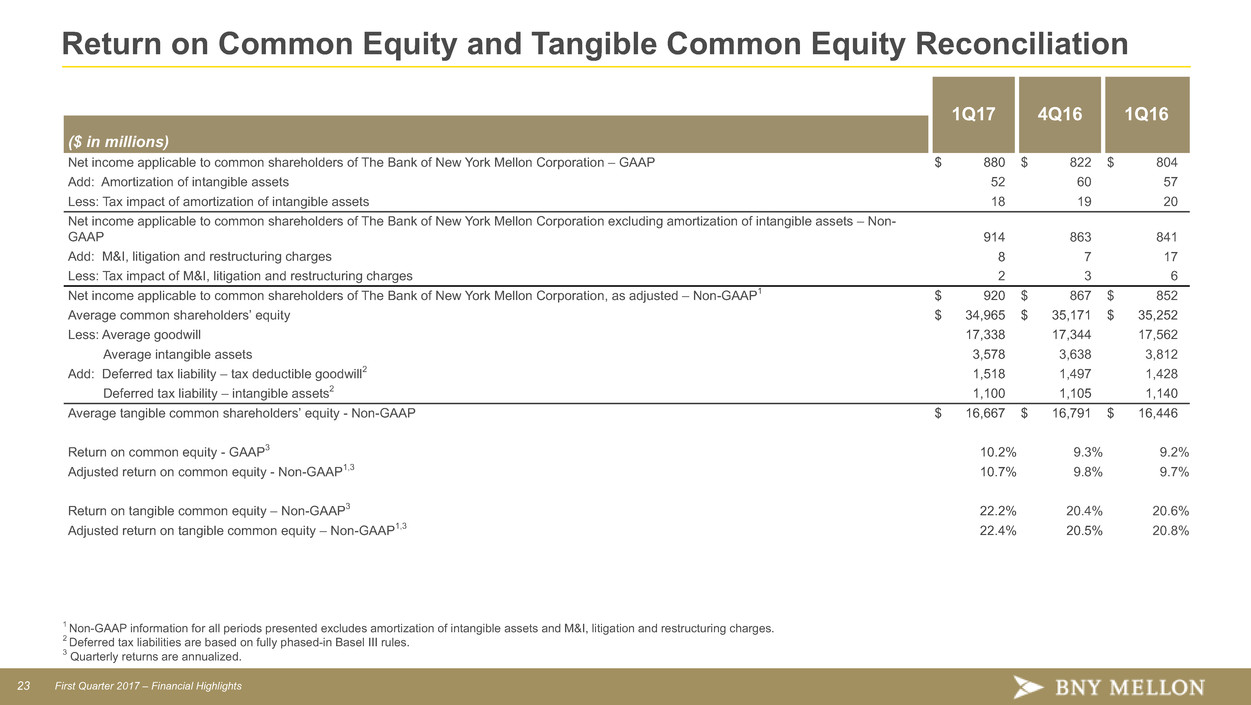

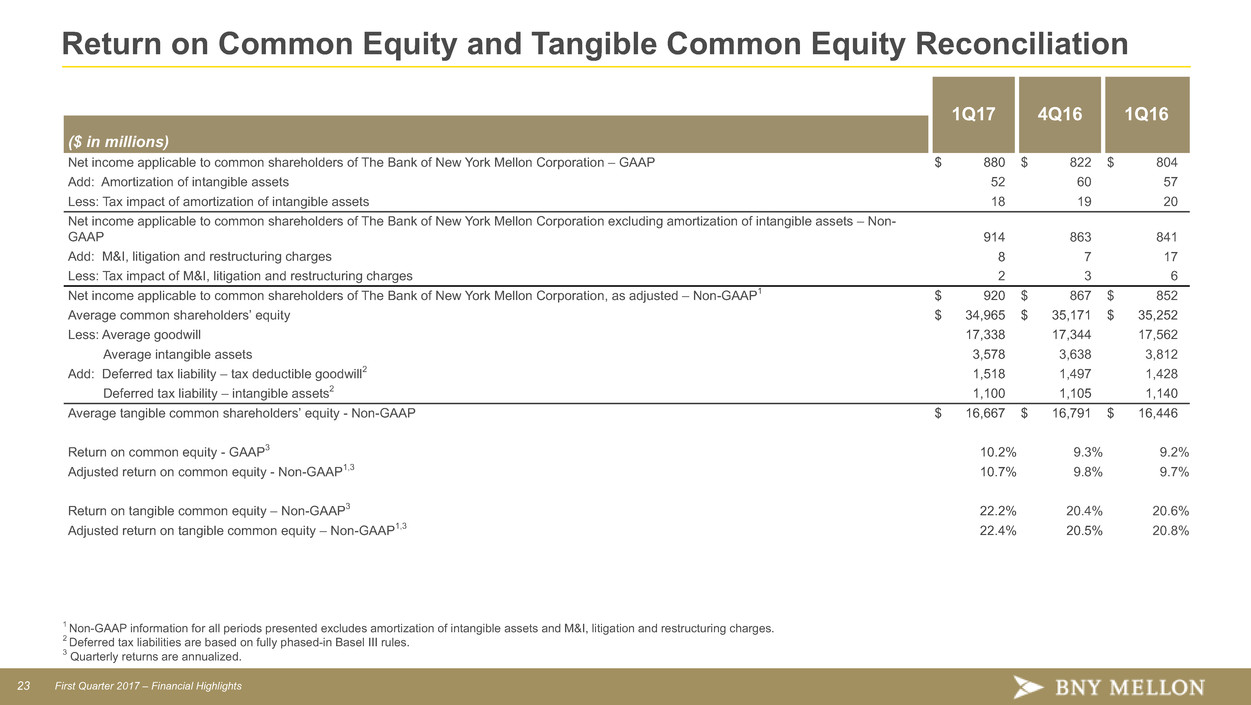

23 First Quarter 2017 – Financial Highlights Return on Common Equity and Tangible Common Equity Reconciliation 1Q17 4Q16 1Q16 ($ in millions) Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 880 $ 822 $ 804 Add: Amortization of intangible assets 52 60 57 Less: Tax impact of amortization of intangible assets 18 19 20 Net income applicable to common shareholders of The Bank of New York Mellon Corporation excluding amortization of intangible assets – Non- GAAP 914 863 841 Add: M&I, litigation and restructuring charges 8 7 17 Less: Tax impact of M&I, litigation and restructuring charges 2 3 6 Net income applicable to common shareholders of The Bank of New York Mellon Corporation, as adjusted – Non-GAAP1 $ 920 $ 867 $ 852 Average common shareholders’ equity $ 34,965 $ 35,171 $ 35,252 Less: Average goodwill 17,338 17,344 17,562 Average intangible assets 3,578 3,638 3,812 Add: Deferred tax liability – tax deductible goodwill2 1,518 1,497 1,428 Deferred tax liability – intangible assets2 1,100 1,105 1,140 Average tangible common shareholders’ equity - Non-GAAP $ 16,667 $ 16,791 $ 16,446 Return on common equity - GAAP3 10.2% 9.3% 9.2% Adjusted return on common equity - Non-GAAP1,3 10.7% 9.8% 9.7% Return on tangible common equity – Non-GAAP3 22.2% 20.4% 20.6% Adjusted return on tangible common equity – Non-GAAP1,3 22.4% 20.5% 20.8% 1 Non-GAAP information for all periods presented excludes amortization of intangible assets and M&I, litigation and restructuring charges. 2 Deferred tax liabilities are based on fully phased-in Basel III rules. 3 Quarterly returns are annualized.

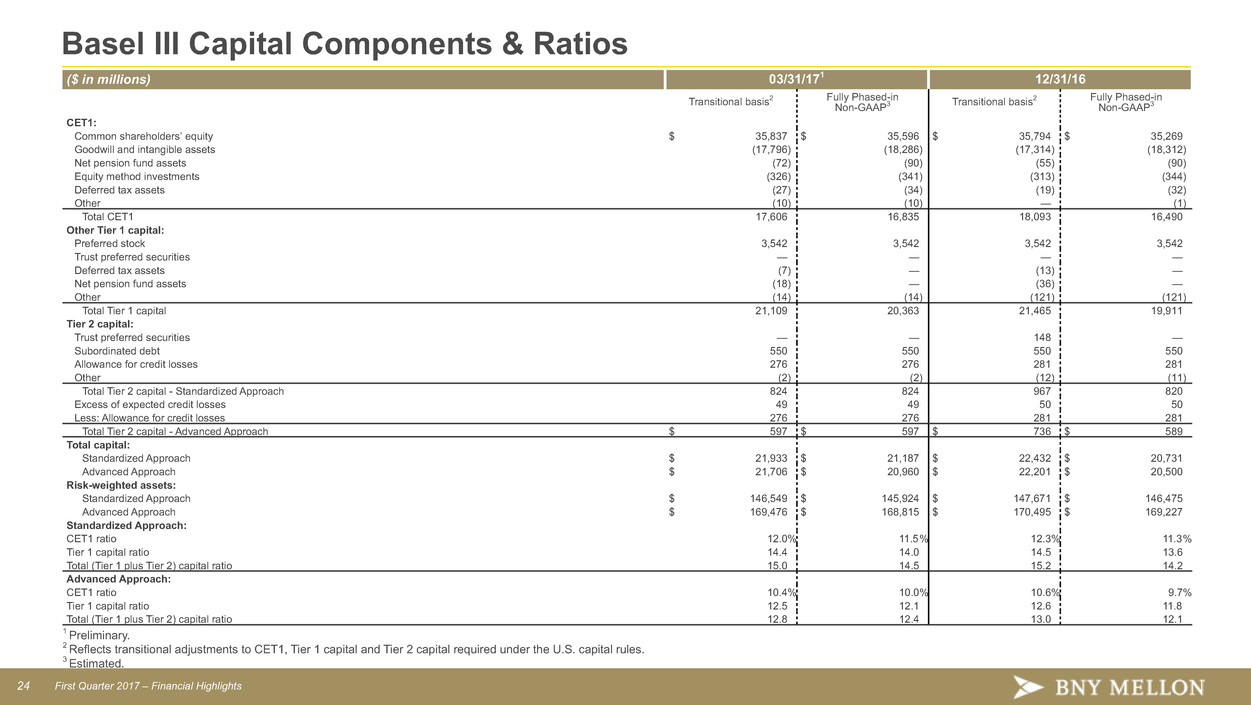

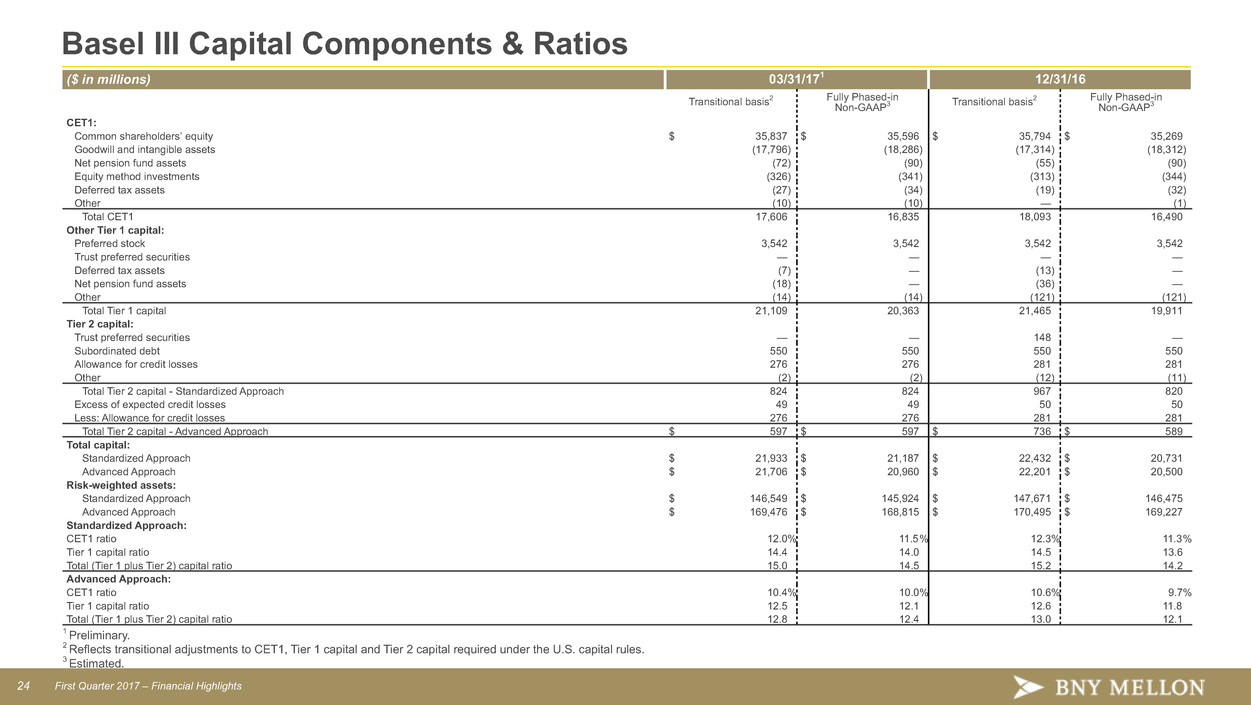

24 First Quarter 2017 – Financial Highlights Basel III Capital Components & Ratios ($ in millions) 03/31/171 12/31/16 Transitional basis2 Fully Phased-inNon-GAAP3 Transitional basis 2 Fully Phased-in Non-GAAP3 CET1: Common shareholders’ equity $ 35,837 $ 35,596 $ 35,794 $ 35,269 Goodwill and intangible assets (17,796) (18,286) (17,314) (18,312) Net pension fund assets (72) (90) (55) (90) Equity method investments (326) (341) (313) (344) Deferred tax assets (27) (34) (19) (32) Other (10) (10) — (1) Total CET1 17,606 16,835 18,093 16,490 Other Tier 1 capital: Preferred stock 3,542 3,542 3,542 3,542 Trust preferred securities — — — — Deferred tax assets (7) — (13) — Net pension fund assets (18) — (36) — Other (14) (14) (121) (121) Total Tier 1 capital 21,109 20,363 21,465 19,911 Tier 2 capital: Trust preferred securities — — 148 — Subordinated debt 550 550 550 550 Allowance for credit losses 276 276 281 281 Other (2) (2) (12) (11) Total Tier 2 capital - Standardized Approach 824 824 967 820 Excess of expected credit losses 49 49 50 50 Less: Allowance for credit losses 276 276 281 281 Total Tier 2 capital - Advanced Approach $ 597 $ 597 $ 736 $ 589 Total capital: Standardized Approach $ 21,933 $ 21,187 $ 22,432 $ 20,731 Advanced Approach $ 21,706 $ 20,960 $ 22,201 $ 20,500 Risk-weighted assets: Standardized Approach $ 146,549 $ 145,924 $ 147,671 $ 146,475 Advanced Approach $ 169,476 $ 168,815 $ 170,495 $ 169,227 Standardized Approach: CET1 ratio 12.0% 11.5% 12.3% 11.3% Tier 1 capital ratio 14.4 14.0 14.5 13.6 Total (Tier 1 plus Tier 2) capital ratio 15.0 14.5 15.2 14.2 Advanced Approach: CET1 ratio 10.4% 10.0% 10.6% 9.7% Tier 1 capital ratio 12.5 12.1 12.6 11.8 Total (Tier 1 plus Tier 2) capital ratio 12.8 12.4 13.0 12.1 1 Preliminary. 2 Reflects transitional adjustments to CET1, Tier 1 capital and Tier 2 capital required under the U.S. capital rules. 3 Estimated.

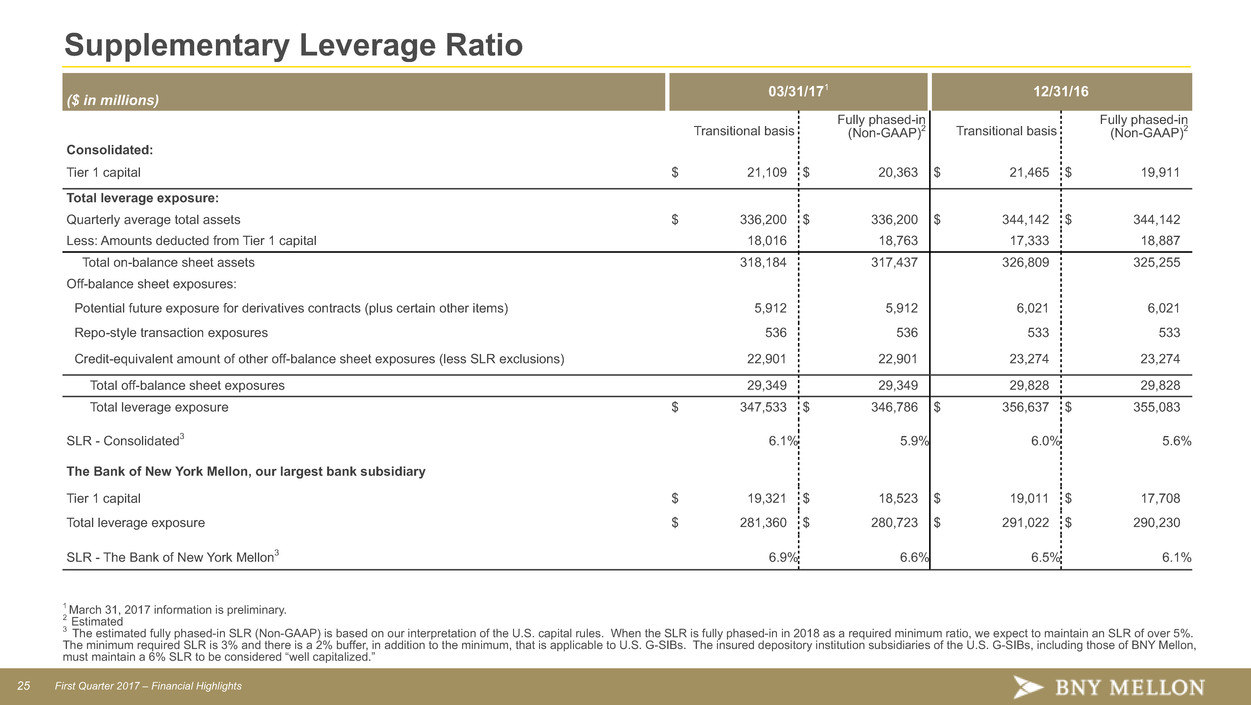

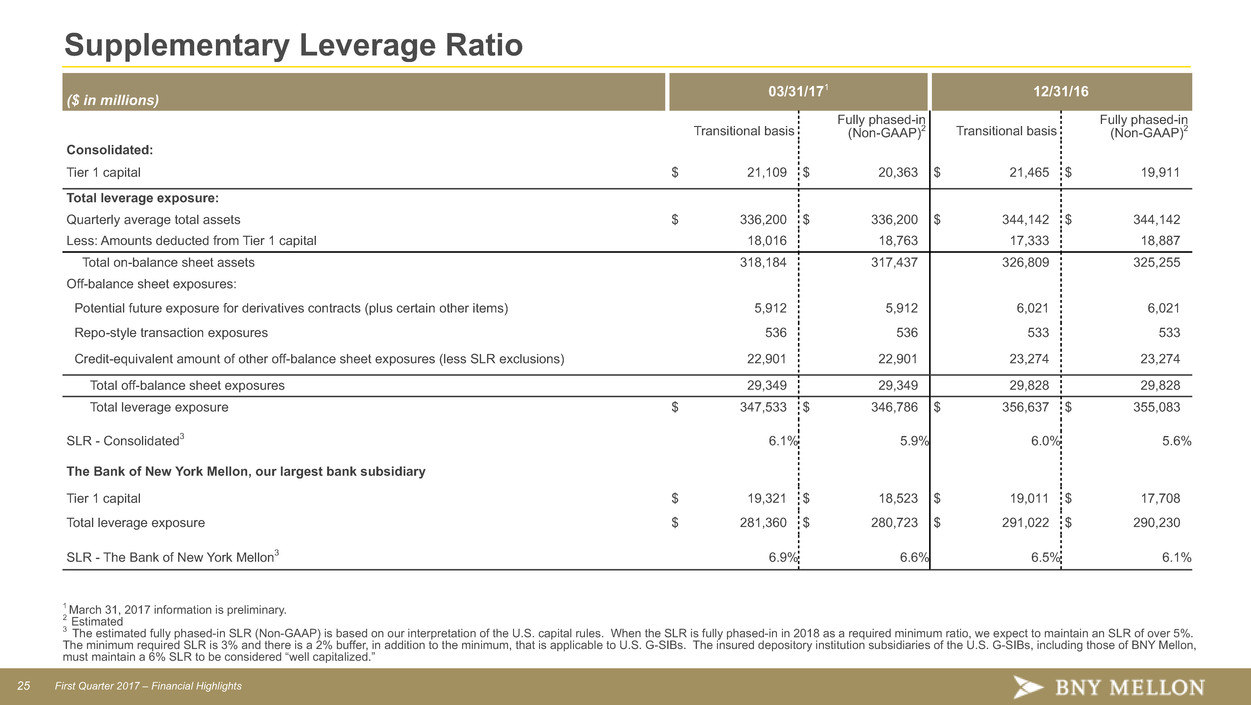

25 First Quarter 2017 – Financial Highlights Supplementary Leverage Ratio ($ in millions) 03/31/17 1 12/31/16 Transitional basis Fully phased-in (Non-GAAP)2 Transitional basis Fully phased-in (Non-GAAP)2 Consolidated: Tier 1 capital $ 21,109 $ 20,363 $ 21,465 $ 19,911 Total leverage exposure: Quarterly average total assets $ 336,200 $ 336,200 $ 344,142 $ 344,142 Less: Amounts deducted from Tier 1 capital 18,016 18,763 17,333 18,887 Total on-balance sheet assets 318,184 317,437 326,809 325,255 Off-balance sheet exposures: Potential future exposure for derivatives contracts (plus certain other items) 5,912 5,912 6,021 6,021 Repo-style transaction exposures 536 536 533 533 Credit-equivalent amount of other off-balance sheet exposures (less SLR exclusions) 22,901 22,901 23,274 23,274 Total off-balance sheet exposures 29,349 29,349 29,828 29,828 Total leverage exposure $ 347,533 $ 346,786 $ 356,637 $ 355,083 SLR - Consolidated3 6.1% 5.9% 6.0% 5.6% The Bank of New York Mellon, our largest bank subsidiary Tier 1 capital $ 19,321 $ 18,523 $ 19,011 $ 17,708 Total leverage exposure $ 281,360 $ 280,723 $ 291,022 $ 290,230 SLR - The Bank of New York Mellon3 6.9% 6.6% 6.5% 6.1% 1 March 31, 2017 information is preliminary. 2 Estimated 3 The estimated fully phased-in SLR (Non-GAAP) is based on our interpretation of the U.S. capital rules. When the SLR is fully phased-in in 2018 as a required minimum ratio, we expect to maintain an SLR of over 5%. The minimum required SLR is 3% and there is a 2% buffer, in addition to the minimum, that is applicable to U.S. G-SIBs. The insured depository institution subsidiaries of the U.S. G-SIBs, including those of BNY Mellon, must maintain a 6% SLR to be considered “well capitalized.”

26 First Quarter 2017 – Financial Highlights Investment Management Pre-Tax Operating Margin - Non-GAAP Reconciliation Pre-tax operating margin 1Q17 4Q16 1Q16 ($ in millions) Income before income taxes – GAAP $ 277 $ 260 $ 217 Add: Amortization of intangible assets 15 22 19 Provision for credit losses 3 6 (1) Adjusted income before income taxes excluding amortization of intangible assets and provision for credit losses – Non-GAAP $ 295 $ 288 $ 235 Total revenue – GAAP $ 963 $ 960 $ 895 Less: Distribution and servicing expense 101 98 100 Adjusted total revenue net of distribution and servicing expense - Non-GAAP $ 862 $ 862 $ 795 Pre-tax operating margin - GAAP1 29% 27% 24% Adjusted pre-tax operating margin, excluding amortization of intangible assets, provision for credit losses and distribution and servicing expense – Non-GAAP1 34% 33% 30% 1 Income before taxes divided by total revenue. Investment Management and Performance Fees - Non-GAAP Reconciliation Growth vs. ($ in millions) 1Q17 1Q16 1Q16 Investment management and performance fees - GAAP $ 842 $ 812 4% Impact of changes in foreign currency exchange rates — (30) Investment management and performance fees, as adjusted - Non-GAAP $ 842 $ 782 8%