Fourth Quarter 2019 Financial Highlights January 16, 2020

4Q19 Financial Results Profits Returns Balance Sheet › Net Income: $1,391 million › ROE: 14.6% › CET1: 11.5% (a) › Includes $460 million of notable items › ROTCE: 29.3% › SLR: 6.1% › Diluted EPS: $1.52 › Returned $1.3 billion to shareholders › Includes $0.50 of notable items Pre-tax Income Total Revenue ($ million) ($ million) 79% 42% 3,040 › Investment Services revenue impacted 75 by lower net interest and foreign 1,822 70 65 3,044 (2)% exchange revenue; fees up 60 1,287 55 Services 50 Investment › Investment Management revenue 1,020 45 2,991 40 primarily reflects higher market values 35 38% 30 33% 25 20 › Good expense control 25% 15 10 963 5 › Strong capital returns 4Q18 3Q19 4Q19 890 1% Pre-tax operating margin Investment (a) Management 975 Ex notable items 4Q18 4Q19 PTI ($m) 1,289 1,218 4Q18 3Q19 4Q19 Op Margin 32% 31% (a) Represents a non-GAAP measure. See page 16 in the Appendix for corresponding reconciliation of notable items and page 18 for corresponding reconciliation of ROTCE. 22 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

2019 Financial Highlights – non-GAAP (a) Adjusted revenue of $15.7bn despite interest rate headwinds Operating EPS Operating margin (a) (a) $ 4.02 32 % Net interest revenue down reflecting deposit mix shift and lower interest rates Expenses down AUC/A (a) Investment servicing fees stable, ~50% of total revenue (1) % $ 37.1 trillion; +12 % Expense discipline with higher technology investment Payout ratio Capital generated over 100 % over $5bn Strong capital generation while investing for the future (a) Represents a non-GAAP Measure. See page 17 in the Appendix for corresponding reconciliation. 33 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

4Q19 Financial Highlights ($ millions, except per share data) 4Q19 3Q19 4Q18 Total revenue $4,778 24% 19% Fee revenue 3,971 27 26 Net interest revenue 815 12 (8) Provision for credit losses (8) N/M N/M Noninterest expense 2,964 14 (1) Income before income taxes 1,822 42 79 Net income applicable to common shareholders $1,391 39% 67% Earnings per common share $1.52 42% 81% Operating leverage (a) 931 bps 2,001 bps Pre-tax operating margin 38% 485 bps 1,272 bps Return on common equity 14.6% 402 bps 588 bps Return on tangible common equity (b) 29.3% 785 bps 1,141 bps (c) Notable items › 4Q19 includes gain from the sale of an equity investment, partially offset by Increase / (decrease) Revenue Expense EPS severance, net securities losses and litigation 4Q19 790 186 $0.50 › 3Q19 includes a lease-related impairment negatively impacting net interest revenue and a net reduction of reserves for tax-related exposure of certain investment 3Q19 (70) (74) $0.01 management funds benefiting expenses 4Q18 - 269 ($0.16) › 4Q18 includes severance, real estate and litigation, partially offset by adjustments to estimates for U.S. tax legislation and other changes Note: See page 15 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 44 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

2019 Financial Highlights ($ millions, except per share data) 2019 2018 Total revenue $16,462 - % Fee revenue 13,236 3 Net interest revenue 3,188 (12) Provision for credit losses (25) N/M Noninterest expense 10,900 (3) Income before income taxes 5,587 8 Net income applicable to common shareholders $4,272 4% Earnings per common share $4.51 12% Operating leverage (a) 320 bps Pre-tax operating margin 34% 227 bps Return on common equity 11.4% 56 bps Return on tangible common equity (b) 23.2% 71 bps (c) Notable items › 2019 includes gain from the sale of an equity investment and a net reduction of Increase / (decrease) Revenue Expense EPS reserves for tax-related exposure of certain investment management funds, partially 2019 720 113 $0.49 offset by severance, a lease-related impairment, securities losses from a portfolio rebalance and litigation expenses 2018 (13) 343 ($0.17) › 2018 includes severance, real estate consolidation, litigation expenses, and adjustments to provisional estimates for U.S. tax legislation and other changes Note: See page 15 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 55 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Capital and Liquidity 4Q19 3Q19 4Q18 Consolidated regulatory capital ratios: (a) Common Equity Tier 1 (“CET1”) ratio 11.5% 11.1% 10.7% Tier 1 capital ratio 13.6 13.2 12.8 Total capital ratio 14.4 14.0 13.6 Tier 1 leverage ratio 6.6 6.5 6.6 Supplementary leverage ratio (“SLR”) 6.1 6.0 6.0 Average liquidity coverage ratio (“LCR”) 120% 117% 118% Book value per common share $42.12 $40.75 $38.63 Tangible book value per common share – non-GAAP (b) $21.33 $20.59 $19.04 Cash dividends per common share $0.31 $0.31 $0.28 Common shares outstanding (thousands) 900,683 922,199 960,426 Note: See page 15 in the Appendix for corresponding footnotes. 66 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Balance Sheet ($ billions unless otherwise noted) Average Interest-Earning Assets Average Deposits +4% +1% +5% 294 298 +2% › Higher net interest revenue sequentially, excluding 3Q19 286 (a) impairment 232 51 53 226 › interest and noninterest-bearing deposits up 54 (a) 221 2.72% › loans and securities up (a) › NIM stable, excluding 3Q19 impairment, as positive 2.60% 2.63% 2.30% balance sheet mix offset the impact of lower interest rates 127 129 162 177 182 124 0.98% 4Q19 3Q19 4Q18 0.86% 0.73% Net interest revenue ($m) 815 12% (8)% (a) excluding impairment 2% 107 116 116 59 Net interest margin 1.09% 10 bps (15) bps 49 50 (a) excluding impairment - bps (a) Represents a non-GAAP measure; 3Q19 NIR was $730 million ($800 million, excluding a $70 million 4Q18 3Q19 4Q19 4Q18 3Q19 4Q19 lease-related impairment), which impacted NIM and interest-earning asset yields by 9-10 bps. Total interest-earning assets average rate Interest-bearing deposits rate Loans Interest-bearing deposits Securities Noninterest-bearing deposits Cash/Reverse Repo Note: May not foot due to rounding. bps – basis points 77 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Yield Curve Net Interest Revenue 10/17/19 1/10/20 2.2% 2.0% 1.8% 1.6% 1.4% 1m 3m 12m 2Y 5Y 10Y Drivers of Sequential NIR Change ($ millions) USD LIBOR US Treasury 815 70 800 730 3Q19 + Lease-related 3Q19 excluding + Average + Average IB + Lower − Lower interest- 4Q19 impairment impairment(a) NIB deposit deposit funding earning asset balances up balances up costs yields ~$0.6bn by $5bn + Higher earning assets (a) Represents a non-GAAP measure. See page 7 for additional information. 88 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Noninterest Expense ($ millions) 4Q19 3Q19 4Q18 › Noninterest expense down 1% year-over-year, or Staff $1,639 11% 2% up 2% excluding notable items(a) Professional, legal and other purchased 367 16 (4) services – increase primarily reflects continued investments in technology Software and equipment 326 6 9 Net occupancy 151 9 (23) › Technology expenses are included in staff, Sub-custodian and clearing 119 7 3 professional, legal and other purchased services and software and equipment Distribution and servicing 92 (5) (3) Business development 65 38 2 › Both year-over-year and sequential growth rates Bank assessment charges 32 3 45 are impacted by notable items Amortization of intangible assets 28 (7) (20) Other 145 N/M (17) Total noninterest expense $2,964 14% (1)% (a) Represents a non-GAAP measure. See page 16 in the Appendix for corresponding reconciliation. N/M - not meaningful 99 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Investment Services Financial Highlights ($ millions unless otherwise noted) 4Q19 3Q19 4Q18 › Asset Servicing down 3% year-over-year on lower net Total revenue by line of business: interest revenue and foreign exchange revenue, partially Asset Servicing $1,397 (1)% (3)% Pershing 570 - 2 offset by the impact of higher equity markets Issuer Services 415 (11) (6) Treasury Services 329 5 - › Pershing up 2% on growth in client assets and accounts, Clearance and Collateral Management 280 (4) 1 partially offset by lower net interest revenue Total revenue 2,991 (2) (2) Provision for credit losses (5) N/M N/M › Issuer Services down 6% on lower Depositary Receipts Noninterest expense 2,161 10 2 revenue, partially offset by higher client activity in Income before taxes $835 (24)% (9)% Corporate Trust Pre-tax operating margin 28% (805) bps (242) bps › Treasury Services largely flat on higher payment fees offset by lower net interest revenue Key Metrics › Clearance and Collateral Management up 1% on growth Foreign exchange and other trading revenue $151 (6)% (7)% Securities lending revenue 40 3 (7) in collateral management and clearance volumes, which were mostly offset by lower net interest revenue Average loans 34,238 5 (4) Average deposits 215,388 4 6 › AUC/A of $37.1 trillion up 12% primarily reflecting higher AUC/A at period end (tr) (a) 37.1 4 12 market values and client inflows (b) Market value of securities on loan at period end (bn) $378 4% 1% Pershing Average active clearing accounts (U.S. platform) (thousands) 6,340 1 4 Clearance and Collateral Management Average tri-party collateral mgmt. balances (tr) $3.6 -% 12% Note: See page 15 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 1010 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Investment Services - Revenue Drivers ($ millions) (3)% +2% (6)% - % +1% 1,435 570 441 329 280 1,397 558 415 328 278 4Q18 4Q19 4Q18 4Q19 4Q18 4Q19 4Q18 4Q19 4Q18 4Q19 Asset Servicing Pershing Issuer Services Treasury Services Clearance and Collateral + AUC/A + Client assets and + Corporate Trust new + Payment volumes + New business from new + Equity markets accounts from new business and + Interest-bearing and existing clients and existing clients volumes - Net interest revenue deposits + Average tri-party balances + Equity markets - Depositary Receipts - FX volatility - Noninterest-bearing + U.S. government securities - Margin loans and corporate actions deposits clearance volumes and volumes interest rates - Net interest revenue - Noninterest-bearing - Net interest revenue deposits - Loan volumes 1111 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Investment Management Financial Highlights ($ millions unless otherwise noted) 4Q19 3Q19 4Q18 › Asset Management revenue up 4% year-over-year Total revenue by line of business: Asset Management $688 14% 4% on higher market values and the impact of hedging Wealth Management 287 1 (5) activities, partially offset by cumulative AUM Total revenue 975 10 1 outflows since 4Q18 Provision for credit losses - N/M N/M Noninterest expense 730 24 2 › Wealth Management revenue down 5% primarily Income before taxes $245 (18)% (1)% due to lower net interest revenue, partially offset by Pre-tax operating margin 25% (844) bps (48) bps higher market values Adjusted pre-tax operating margin – non-GAAP (a) 28% (997) bps (65) bps › Noninterest expense up 2% primarily reflecting Key Metrics higher staff expense Average loans $16,505 2% -% Average deposits 15,195 8 2 › AUM of $1.9 trillion up 11% primarily reflecting Wealth Management client assets (bn) (b) $266 3% 11% higher market values and the favorable impact of a weaker U.S. dollar, partially offset by net outflows Changes in AUM (bn) (c) 4Q19 3Q19 4Q18 Beginning balance $1,881 $1,843 $1,828 Equity (6) (4) (8) Fixed income 5 2 (1) Liability-driven investments (3) (4) 14 Multi-asset and alternatives 3 (1) (2) Index (5) (3) (11) Cash (7) 11 (10) Total net (outflows) inflows (13) 1 (18) Net market impact (20) 66 (69) Net currency impact 62 (29) (19) Ending balance $1,910 $1,881 $1,722 Note: See page 15 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 1212 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Other Segment ($($ millions) millions) 4Q19 3Q19 4Q18 › Total revenue increased primarily reflecting the gain $836 $5 $29 Fee revenue on sale of an equity investment Net securities (losses) (23) (1) - Total fee and other revenue 813 4 29 › Net interest expense decreased sequentially Net interest (expense) (10) (80) (15) primarily reflecting the lease-related impairment of Total revenue (loss) 803 (76) 14 $70 million recorded in 3Q19 Provision for credit losses (3) (1) (7) › Noninterest expense decreased year-over-year Noninterest expense 73 35 160 primarily reflecting expenses associated with Income (loss) before taxes $733 $(110) $(139) relocating our corporate headquarters recorded in 4Q18 and lower severance expense 1313 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Appendix

Footnotes 4Q19 Financial Highlights - Page 4 (a) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (b) Quarterly returns are annualized. See page 18 for corresponding reconciliation of this non-GAAP measure. (c) Represents a non-GAAP measure. See page 16 in the Appendix for corresponding reconciliation. 2019 Financial Highlights - Page 5 (a) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (b) Represents a non-GAAP measure. See page 18 in the Appendix for corresponding reconciliation. (c) Represents a non-GAAP measure. See page 17 in the Appendix for corresponding reconciliation. Capital and Liquidity, Page 6 (a) Regulatory capital ratios for Dec. 31, 2019 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for the periods included was the Advanced Approaches. (b) Tangible book value per common share – non-GAAP – excludes goodwill and intangible assets, net of deferred tax liabilities. See page 18 for corresponding reconciliation of this non-GAAP measure. Investment Services, Page 10 (a) Current period is preliminary. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.5 trillion at Dec. 31, 2019, $1.4 trillion at Sept. 30, 2019 and $1.2 trillion at Dec. 31, 2018. (b) Represents the total amount of securities on loan in our agency securities lending program managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $60 billion at Dec. 31, 2019, $66 billion at Sept. 30, 2019 and $58 billion at Dec. 31, 2018. Investment Management, Page 12 (a) Net of distribution and servicing expense. See page 19 for corresponding reconciliation of this non-GAAP measure. (b) Current period is preliminary. Includes AUM and AUC/A in the Wealth Management business. (c) Current period is preliminary. Excludes securities lending cash management assets and assets managed in the Investment Services business. 1515 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Fourth Quarter Results – Impact of Notable Items 4Q19 4Q18 4Q19 vs 4Q18 Results - Notable Results – Results – Notable Results – GAAP non- ($ in millions, except per share data unless otherwise noted) GAAP items(a) non-GAAP GAAP items(b) non-GAAP GAAP Fee revenue $3,971 $815 $3,156 $3,146 $— $3,146 26% —% Net securities (losses) (25) (25) — — — — N/M N/M Total fee and other revenue 3,946 790 3,156 3,146 — 3,146 25 — Income (loss) from consolidated investment management funds 17 — 17 (24) — (24) N/M N/M Net interest revenue 815 — 815 885 — 885 (8) (8) Total revenue 4,778 790 3,988 4,007 — 4,007 19 — Provision for credit losses (8) — (8) — — — N/M N/M Noninterest expense 2,964 186 2,778 2,987 269 2,718 (1) 2 Income (loss) before income taxes 1,822 604 1,218 1,020 (269) 1,289 79 (6) Provision (benefit) for income taxes 373 144 229 150 (114) 264 149 (13) Net income (loss) $1,449 $460 $989 $870 $(155) $1,025 67% (4)% Net income (loss) applicable to common shareholders $1,391 $460 $931 $832 $(155) $987 67% (6)% Operating leverage(c) 2,001 bps (268) bps Diluted earnings per common share(d) $1.52 $0.50 $1.01 $0.84 $(0.16) $0.99 81% 2% Average common shares and equivalents outstanding – diluted (in thousands) 914,739 988,650 Pre-tax operating margin 38% 31% 25% 32% Notable Items by Business Segment 4Q19 3Q19 4Q18 ($ millions) IS IM Other Total IS IM Other Total IS IM Other Total Fee and other revenue $ — $ — $790 $790 $ — $ — $ — $ — $ — $ — $ — $ — Net interest revenue — — — — — — (70) (70) — — — — Total revenue — — 790 790 — — (70) (70) — — — — Total noninterest expense 119 16 51 186 — (74) — (74) 110 28 131 269 Income (loss) before taxes $(119) $(16) $739 $604 $ — $74 $(70) $4 $(110) $(28) $(131) $269 (a) Includes a gain on sale of an equity investment, severance, net securities losses and litigation expense. (b) Includes adjustments to provisional estimates for U.S. tax legislation and other changes, severance, expenses associated with consolidating real estate and litigation expense. (c) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (d) Does not foot due to rounding IS – Investment Services; IM – Investment Management; N/M - not meaningful; bps - basis points 1616 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

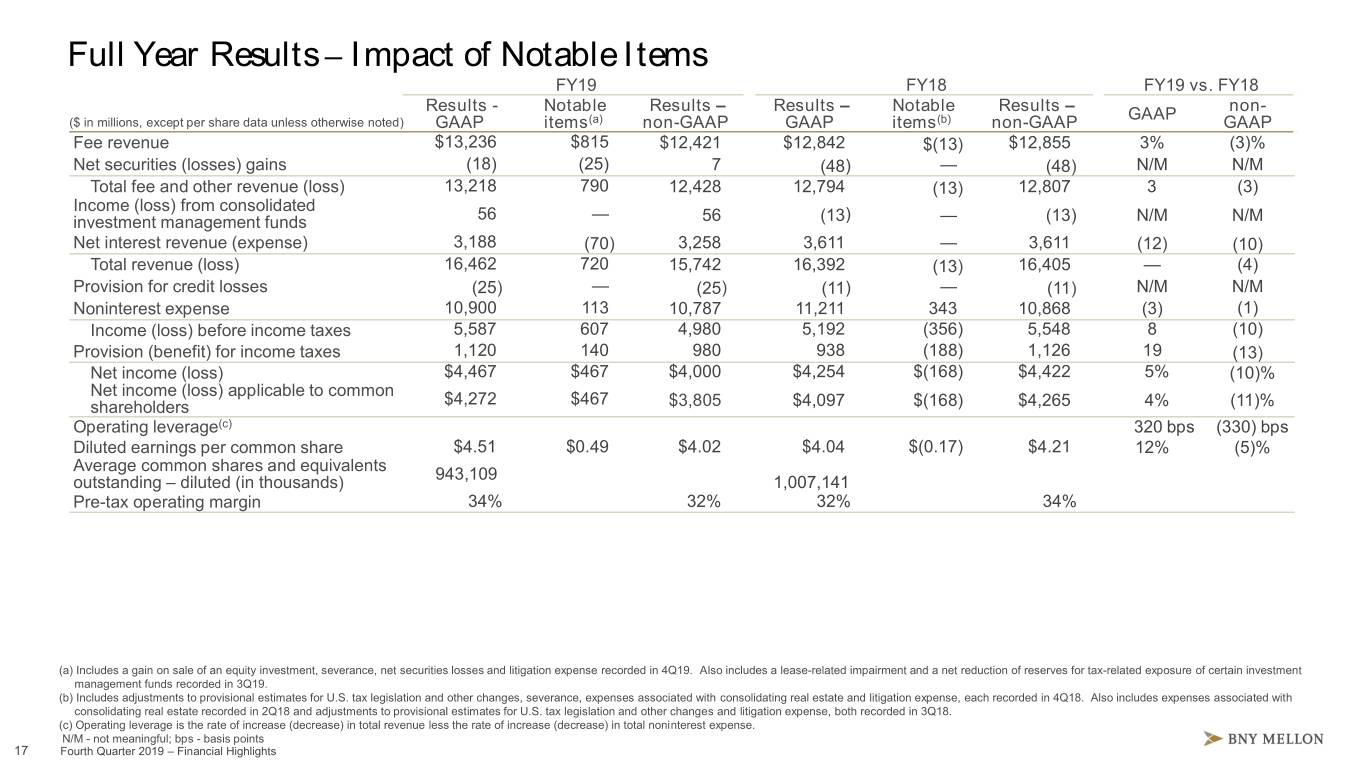

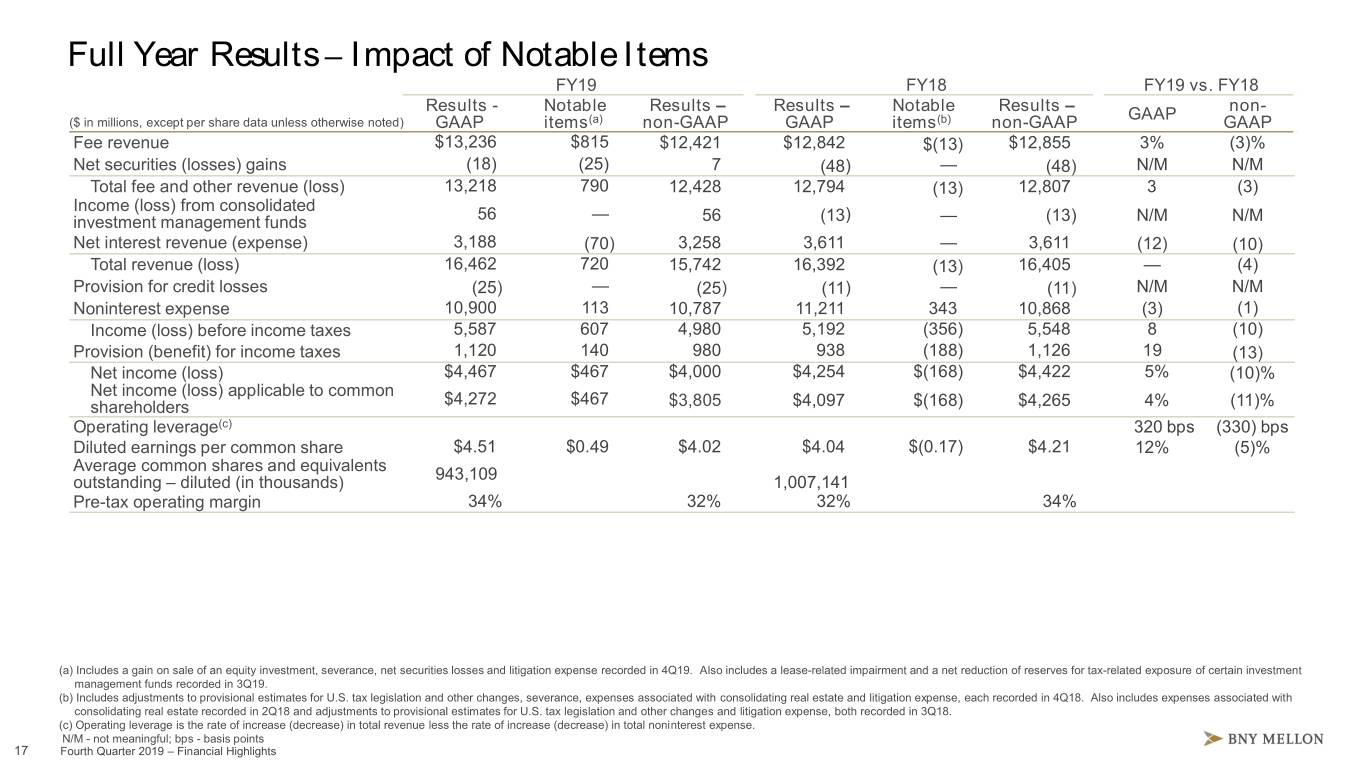

Full Year Results – Impact of Notable Items FY19 FY18 FY19 vs. FY18 Results - Notable Results – Results – Notable Results – GAAP non- ($ in millions, except per share data unless otherwise noted) GAAP items(a) non-GAAP GAAP items(b) non-GAAP GAAP Fee revenue $13,236 $815 $12,421 $12,842 $(13) $12,855 3% (3)% Net securities (losses) gains (18) (25) 7 (48) — (48) N/M N/M Total fee and other revenue (loss) 13,218 790 12,428 12,794 (13) 12,807 3 (3) Income (loss) from consolidated investment management funds 56 — 56 (13) — (13) N/M N/M Net interest revenue (expense) 3,188 (70) 3,258 3,611 — 3,611 (12) (10) Total revenue (loss) 16,462 720 15,742 16,392 (13) 16,405 — (4) Provision for credit losses (25) — (25) (11) — (11) N/M N/M Noninterest expense 10,900 113 10,787 11,211 343 10,868 (3) (1) Income (loss) before income taxes 5,587 607 4,980 5,192 (356) 5,548 8 (10) Provision (benefit) for income taxes 1,120 140 980 938 (188) 1,126 19 (13) Net income (loss) $4,467 $467 $4,000 $4,254 $(168) $4,422 5% (10)% Net income (loss) applicable to common shareholders $4,272 $467 $3,805 $4,097 $(168) $4,265 4% (11)% Operating leverage(c) 320 bps (330) bps Diluted earnings per common share $4.51 $0.49 $4.02 $4.04 $(0.17) $4.21 12% (5)% Average common shares and equivalents outstanding – diluted (in thousands) 943,109 1,007,141 Pre-tax operating margin 34% 32% 32% 34% (a) Includes a gain on sale of an equity investment, severance, net securities losses and litigation expense recorded in 4Q19. Also includes a lease-related impairment and a net reduction of reserves for tax-related exposure of certain investment management funds recorded in 3Q19. (b) Includes adjustments to provisional estimates for U.S. tax legislation and other changes, severance, expenses associated with consolidating real estate and litigation expense, each recorded in 4Q18. Also includes expenses associated with consolidating real estate recorded in 2Q18 and adjustments to provisional estimates for U.S. tax legislation and other changes and litigation expense, both recorded in 3Q18. (c) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. N/M - not meaningful; bps - basis points 1717 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Return on Common Equity and Tangible Common Equity Reconciliation ($ millions) 4Q19 3Q19 4Q18 FY19 FY18 Net income applicable to common shareholders of The Bank of New York Mellon Corporation – $1,391 $1,002 $832 $4,272 $4,097 GAAP Add: Amortization of intangible assets 28 30 35 117 180 Less: Tax impact of amortization of intangible assets 7 7 8 28 42 Adjusted net income applicable to common shareholders of The Bank of New York Mellon $1,412 $1,025 $859 $4,361 $4,235 Corporation, excluding amortization of intangible assets – non-GAAP Average common shareholders’ equity $37,842 $37,597 $37,886 $37,505 $37,818 Less: Average goodwill 17,332 17,267 17,358 17,329 17,458 Average intangible assets 3,119 3,141 3,239 3,162 3,314 Add: Deferred tax liability – tax deductible goodwill 1,098 1,103 1,072 1,098 1,072 Deferred tax liability – intangible assets 670 679 692 670 692 Average tangible common shareholders’ equity – non-GAAP $19,159 $18,971 $19,053 $18,782 $18,810 Return on common equity (annualized) – GAAP 14.6% 10.6% 8.7% 11.4% 10.8% Return on tangible common equity (annualized) – non-GAAP 29.3% 21.4% 17.9% 23.2% 22.5% Book Value and Tangible Book Value Per Common Share Reconciliation ($ millions, except common shares) Dec. 31, 2019 Sept. 30, 2019 Dec. 31, 2018 BNY Mellon shareholders’ equity at period end – GAAP $41,483 $41,120 $40,638 Less: Preferred stock 3,542 3,542 3,542 BNY Mellon common shareholders’ equity at period end – GAAP 37,941 37,578 37,096 Less: Goodwill 17,386 17,248 17,350 Intangible assets 3,107 3,124 3,220 Add: Deferred tax liability – tax deductible goodwill 1,098 1,103 1,072 Deferred tax liability – intangible assets 670 679 692 BNY Mellon tangible common shareholders’ equity at period end – non-GAAP $19,216 $18,988 $18,290 Period-end common shares outstanding (in thousands) 900,683 922,199 960,426 Book value per common share – GAAP $42.12 $40.75 $38.63 Tangible book value per common share – non-GAAP $21.33 $20.59 $19.04 1818 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

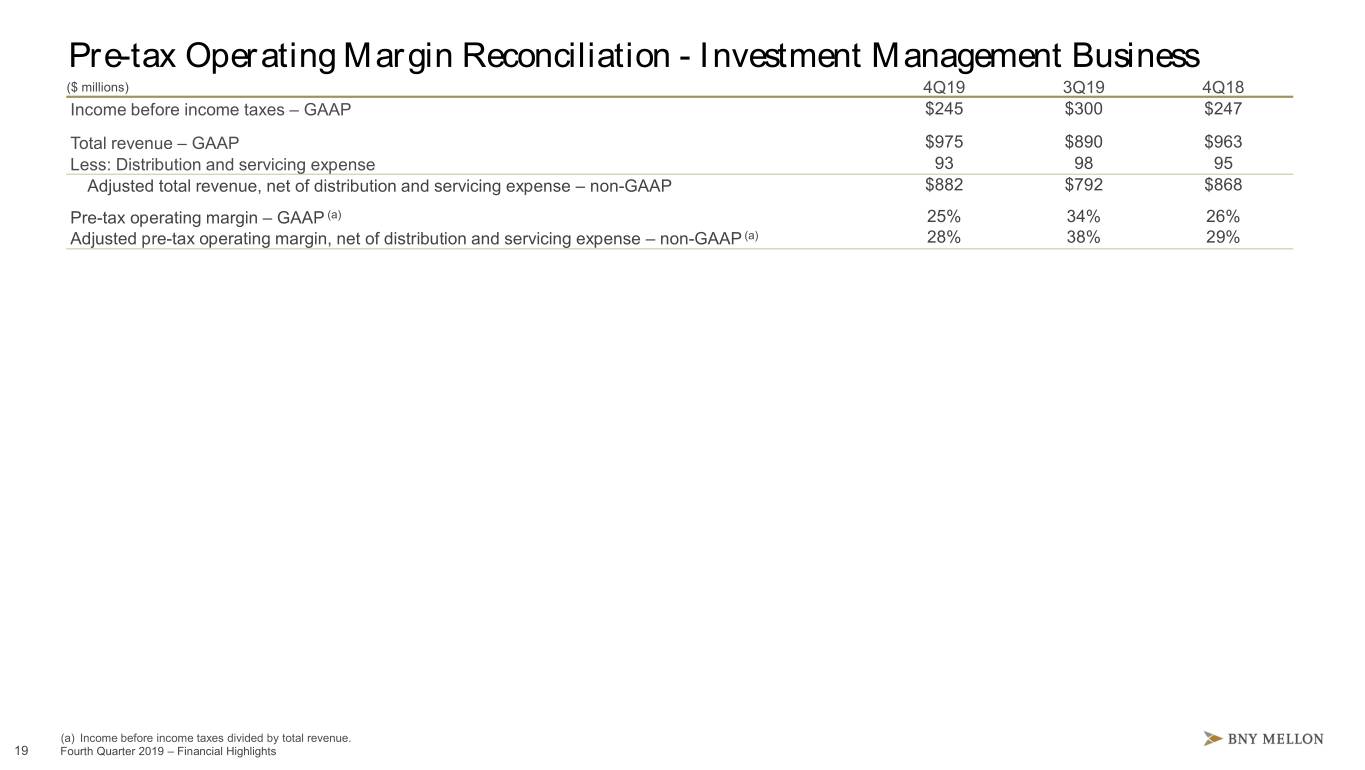

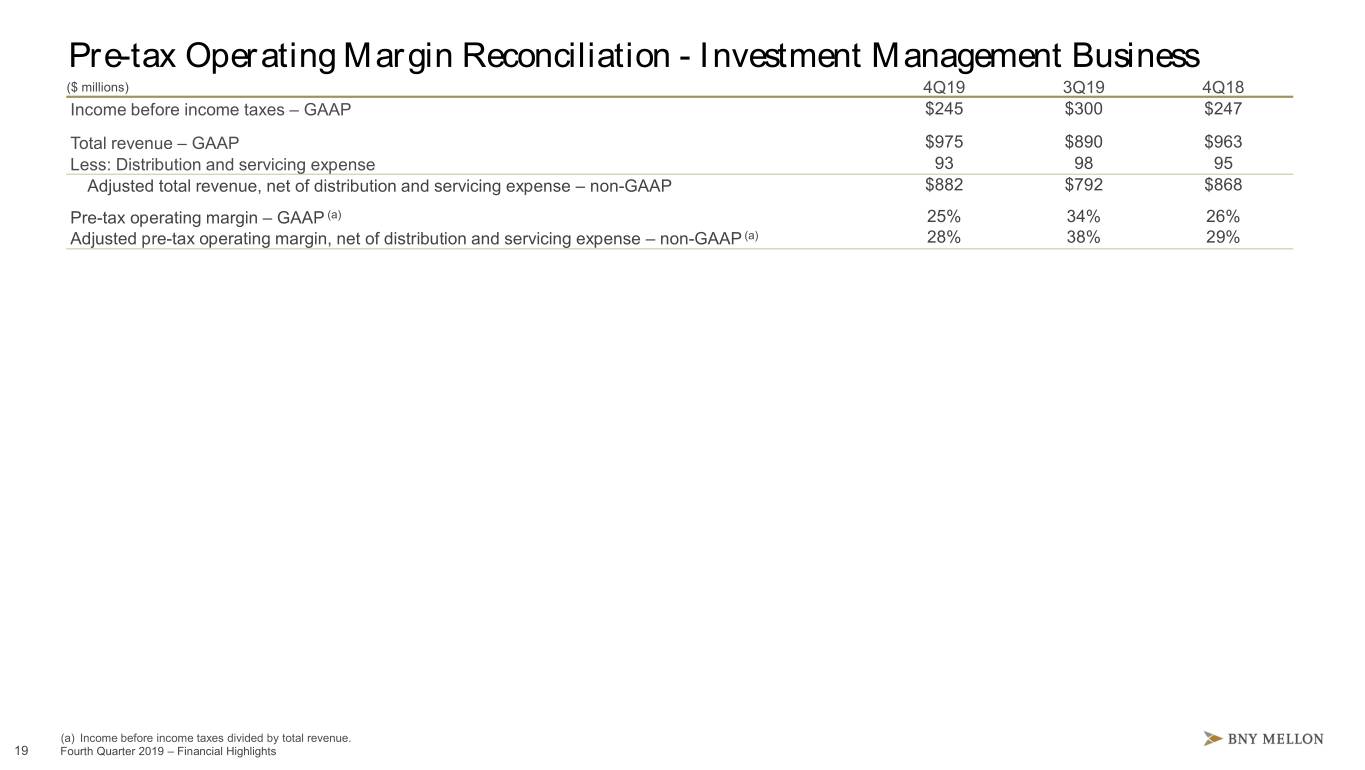

Pre-tax Operating Margin Reconciliation - Investment Management Business ($ millions) 4Q19 3Q19 4Q18 Income before income taxes – GAAP $245 $300 $247 Total revenue – GAAP $975 $890 $963 Less: Distribution and servicing expense 93 98 95 Adjusted total revenue, net of distribution and servicing expense – non-GAAP $882 $792 $868 Pre-tax operating margin – GAAP (a) 25% 34% 26% Adjusted pre-tax operating margin, net of distribution and servicing expense – non-GAAP (a) 28% 38% 29% (a) Income before income taxes divided by total revenue. 1919 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights

Cautionary Statement A number of statements in our presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate,” “forecast,” “project,” “anticipate,” “likely,” “target,” “expect,” “intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,” “opportunities,” “trends,” “future” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: capital plans, strategic priorities, financial goals, organic growth, performance, organizational quality and efficiency, investments, including in technology and product development, capabilities, resiliency, revenue, net interest revenue, fees, expenses, cost discipline, sustainable growth, company management, deposits, interest rates and yield curves, securities portfolio, taxes, business opportunities, divestments, volatility, preliminary business metrics and regulatory capital ratios; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, outlooks, estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2018 (the “2018 Annual Report”) and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Preliminary business metrics and regulatory capital ratios are subject to change, possibly materially, as the Corporation completes its Annual Report on Form 10-K for the full year of 2019. All forward-looking statements speak only as of January 16, 2020, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding the Corporation, please refer to the Corporation's SEC filings available at www.bnymellon.com/investorrelations. Non-GAAP Measures: In this presentation we discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP measures are contained in the Corporation’s reports filed with the SEC, including the 2018 Annual Report, and are available at www.bnymellon.com/investorrelations. 2020 FourthFirst QuarterQuarter 2019 2019 – Financial– Financial Highlights Highlights