2Q22 Financial Highlights J U L Y 1 5 , 2 0 2 2

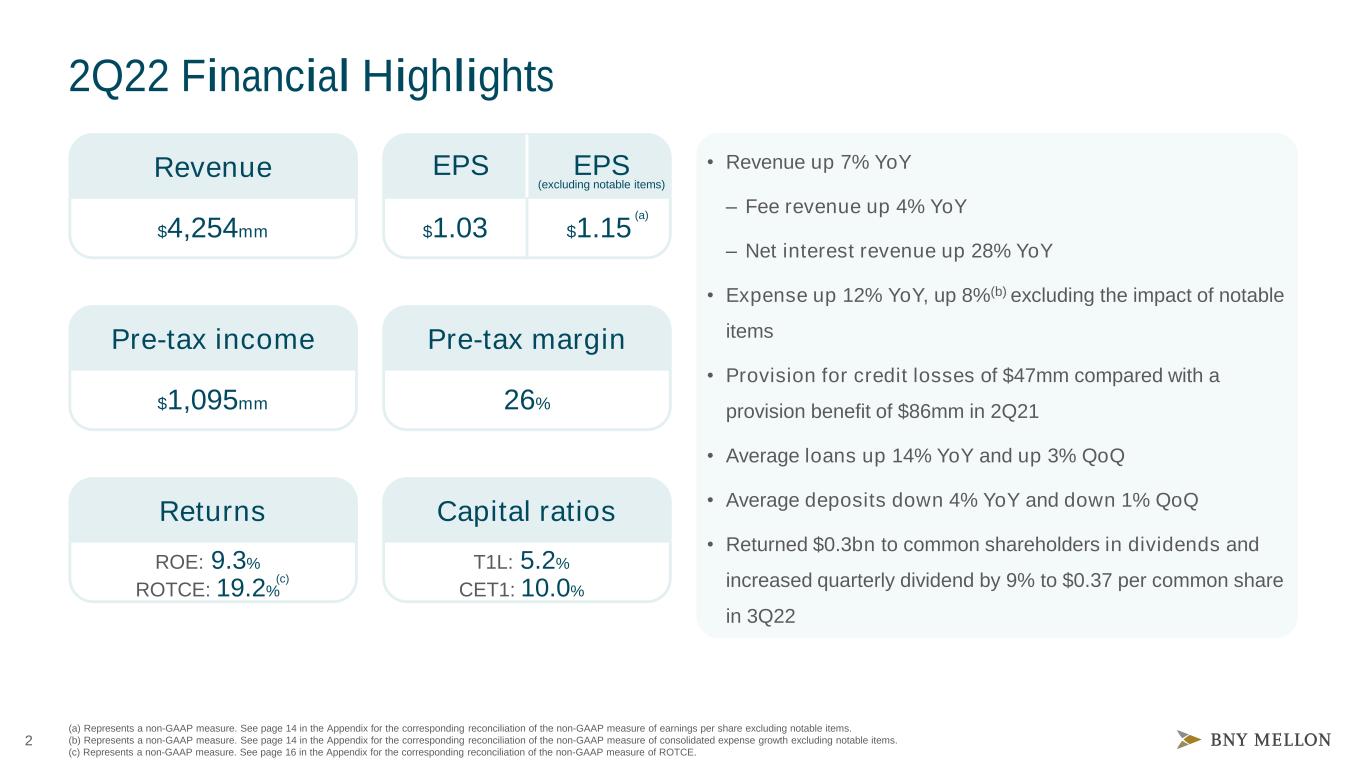

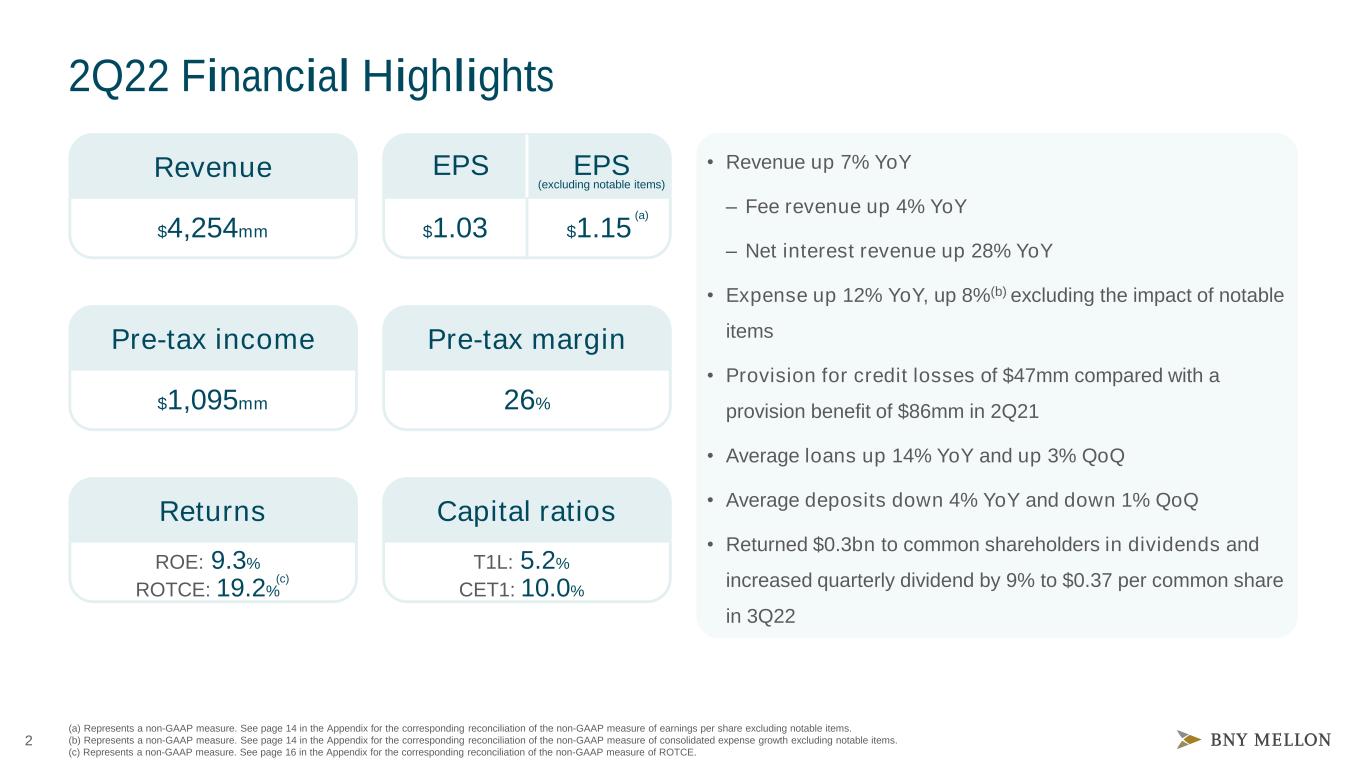

2 2Q22 Financial Highlights Revenue $4,254mm $1.03 Pre-tax income $1,095mm Pre-tax margin 26% Returns Capital ratios ROE: 9.3% ROTCE: 19.2% T1L: 5.2% CET1: 10.0% • Revenue up 7% YoY – Fee revenue up 4% YoY – Net interest revenue up 28% YoY • Expense up 12% YoY, up 8%(b) excluding the impact of notable items • Provision for credit losses of $47mm compared with a provision benefit of $86mm in 2Q21 • Average loans up 14% YoY and up 3% QoQ • Average deposits down 4% YoY and down 1% QoQ • Returned $0.3bn to common shareholders in dividends and increased quarterly dividend by 9% to $0.37 per common share in 3Q22 (a) Represents a non-GAAP measure. See page 14 in the Appendix for the corresponding reconciliation of the non-GAAP measure of earnings per share excluding notable items. (b) Represents a non-GAAP measure. See page 14 in the Appendix for the corresponding reconciliation of the non-GAAP measure of consolidated expense growth excluding notable items. (c) Represents a non-GAAP measure. See page 16 in the Appendix for the corresponding reconciliation of the non-GAAP measure of ROTCE. $1.15 EPS EPS (excluding notable items) (a) (c)

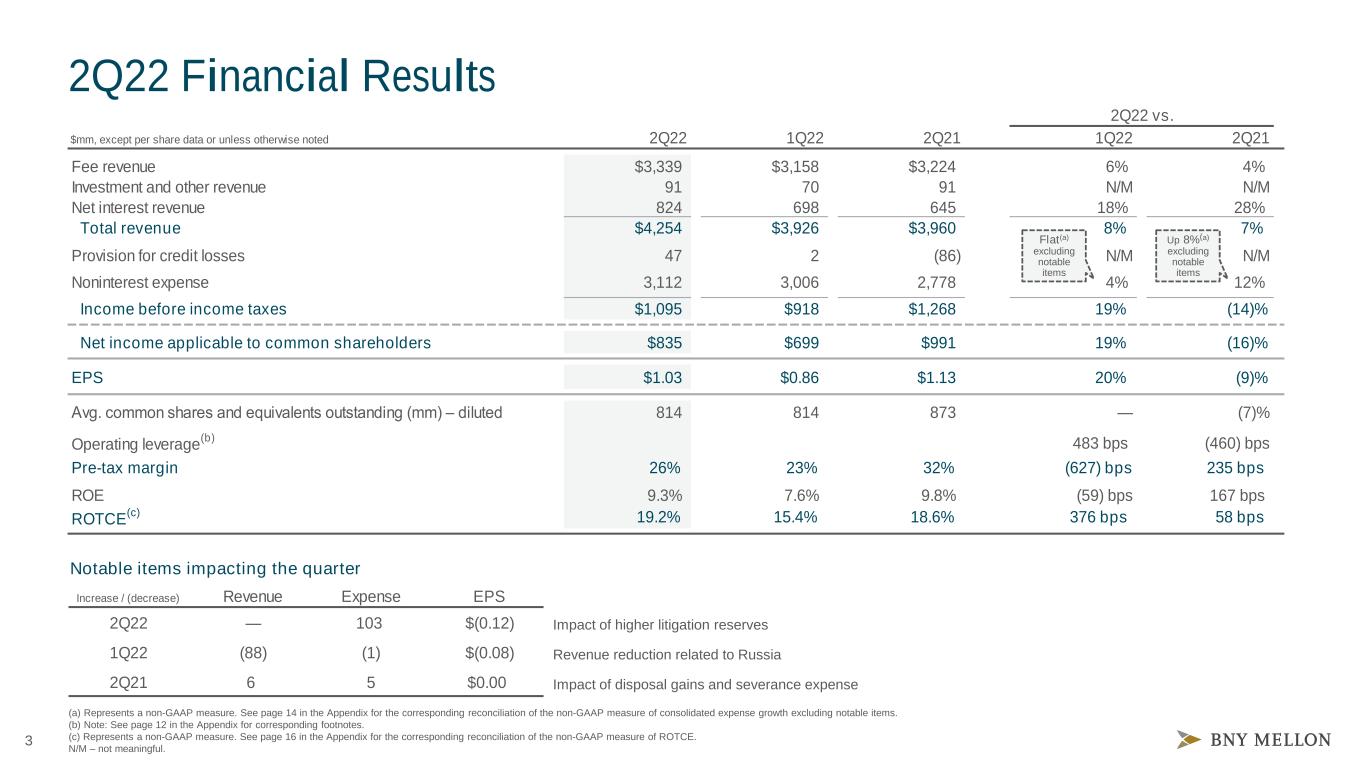

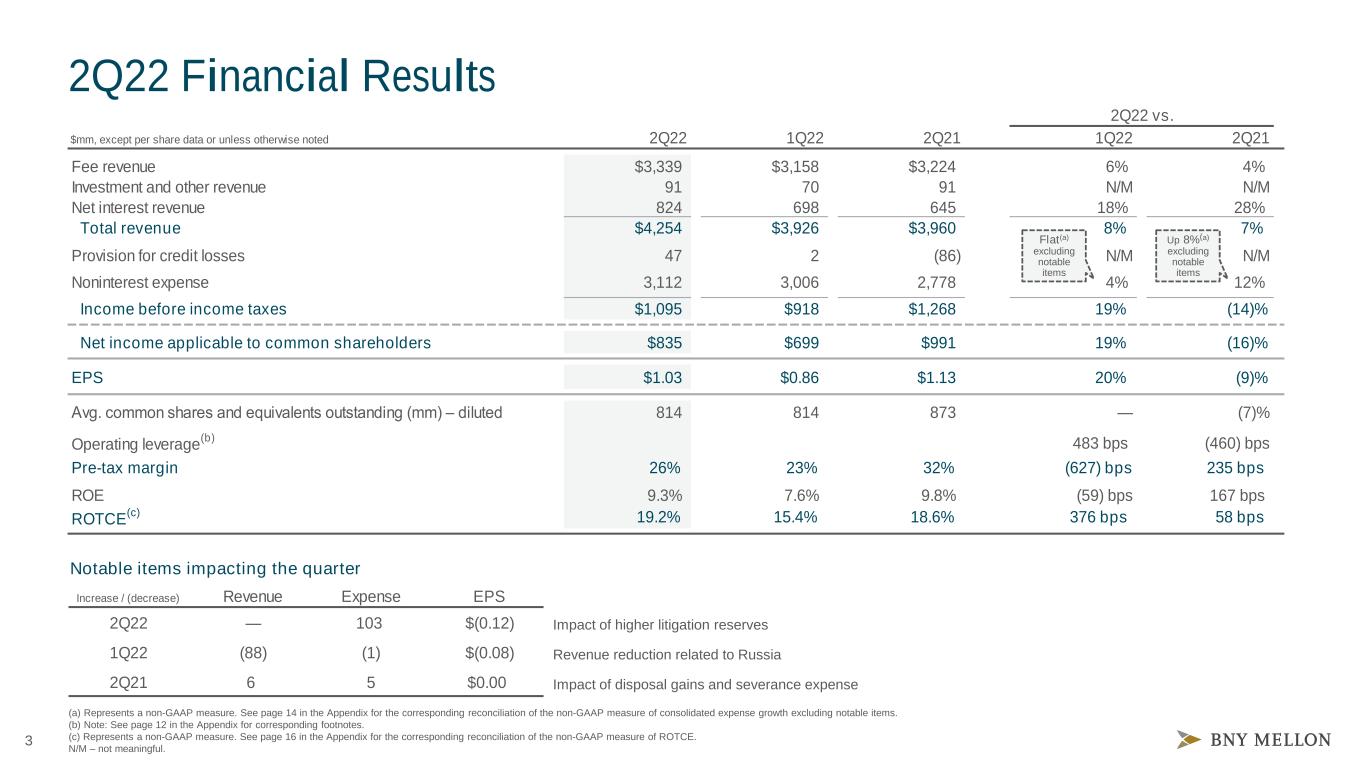

3 2Q22 vs. $mm, except per share data or unless otherwise noted 2Q22 1Q22 2Q21 1Q22 2Q21 Fee revenue $3,339 $3,158 $3,224 6% 4% Investment and other revenue 91 70 91 N/M N/M Net interest revenue 824 698 645 18% 28% Total revenue $4,254 $3,926 $3,960 8% 7% Provision for credit losses 47 2 (86) N/M N/M Noninterest expense 3,112 3,006 2,778 4% 12% Income before income taxes $1,095 $918 $1,268 19% (14)% Net income applicable to common shareholders $835 $699 $991 19% (16)% EPS $1.03 $0.86 $1.13 20% (9)% Avg. common shares and equivalents outstanding (mm) – diluted 814 814 873 — (7)% Operating leverage (b) 483 bps (460) bps Pre-tax margin 26% 23% 32% (627) bps 235 bps ROE 9.3% 7.6% 9.8% (59) bps 167 bps ROTCE (c) 19.2% 15.4% 18.6% 376 bps 58 bps (a) Represents a non-GAAP measure. See page 14 in the Appendix for the corresponding reconciliation of the non-GAAP measure of consolidated expense growth excluding notable items. (b) Note: See page 12 in the Appendix for corresponding footnotes. (c) Represents a non-GAAP measure. See page 16 in the Appendix for the corresponding reconciliation of the non-GAAP measure of ROTCE. N/M – not meaningful. Increase / (decrease) Revenue Expense EPS 2Q22 — 103 $(0.12) 1Q22 (88) (1) $(0.08) 2Q21 6 5 $0.00 2Q22 Financial Results Notable items impacting the quarter Impact of higher litigation reserves Revenue reduction related to Russia Impact of disposal gains and severance expense Up 8%(a) excluding notable items Flat(a) excluding notable items

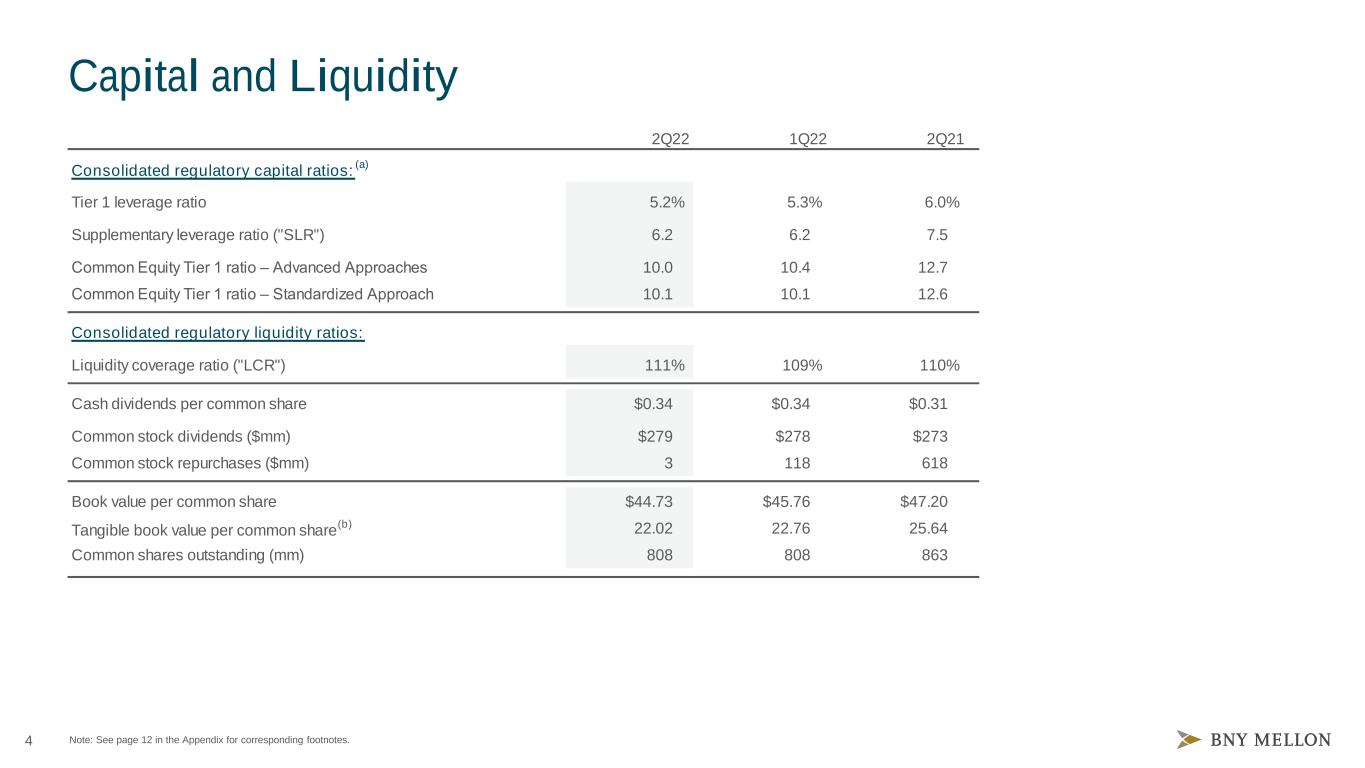

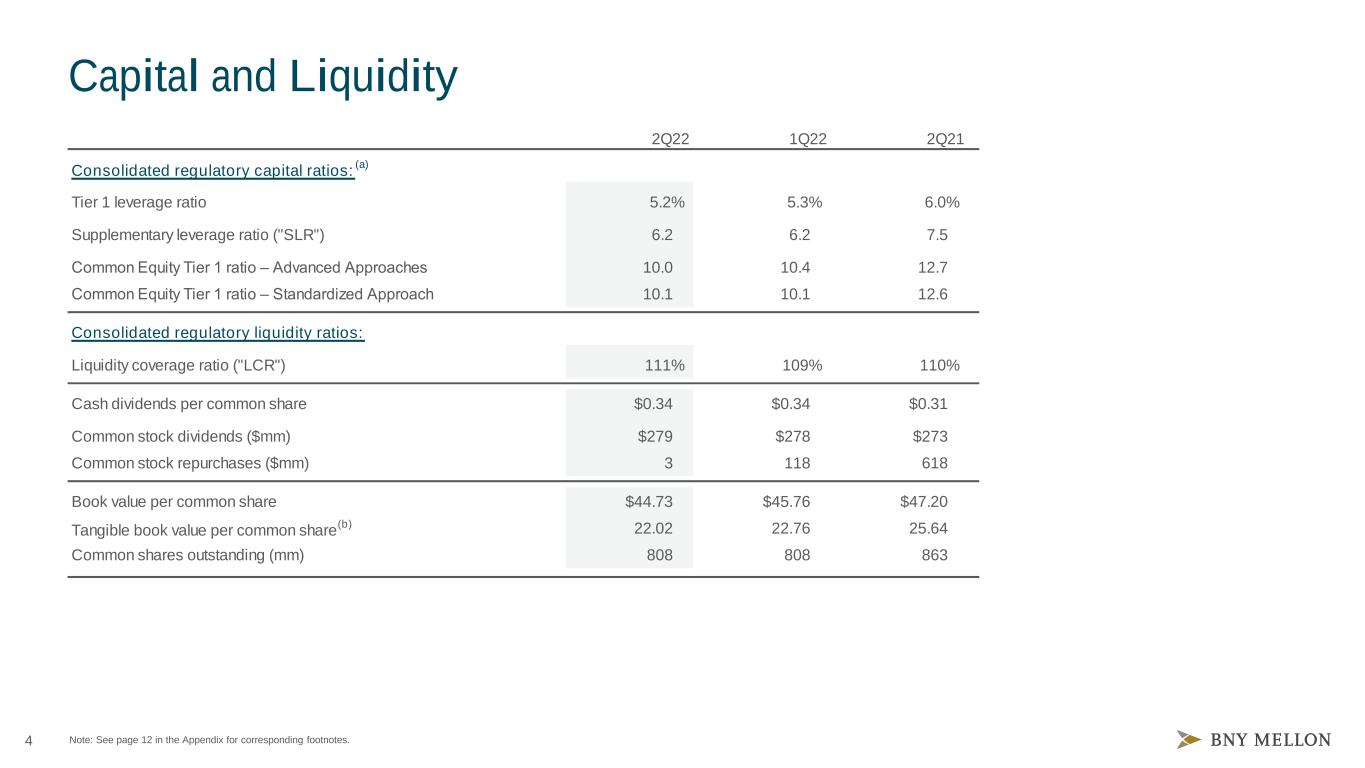

4 2Q22 1Q22 2Q21 Consolidated regulatory capital ratios: (a) Tier 1 leverage ratio 5.2% 5.3% 6.0% Supplementary leverage ratio ("SLR") 6.2 6.2 7.5 Common Equity Tier 1 ratio – Advanced Approaches 10.0 10.4 12.7 Common Equity Tier 1 ratio – Standardized Approach 10.1 10.1 12.6 Consolidated regulatory liquidity ratios: Liquidity coverage ratio ("LCR") 111% 109% 110% Cash dividends per common share $0.34 $0.34 $0.31 Common stock dividends ($mm) $279 $278 $273 Common stock repurchases ($mm) 3 118 618 Book value per common share $44.73 $45.76 $47.20 Tangible book value per common share (b) 22.02 22.76 25.64 Common shares outstanding (mm) 808 808 863 Capital and Liquidity Note: See page 12 in the Appendix for corresponding footnotes.

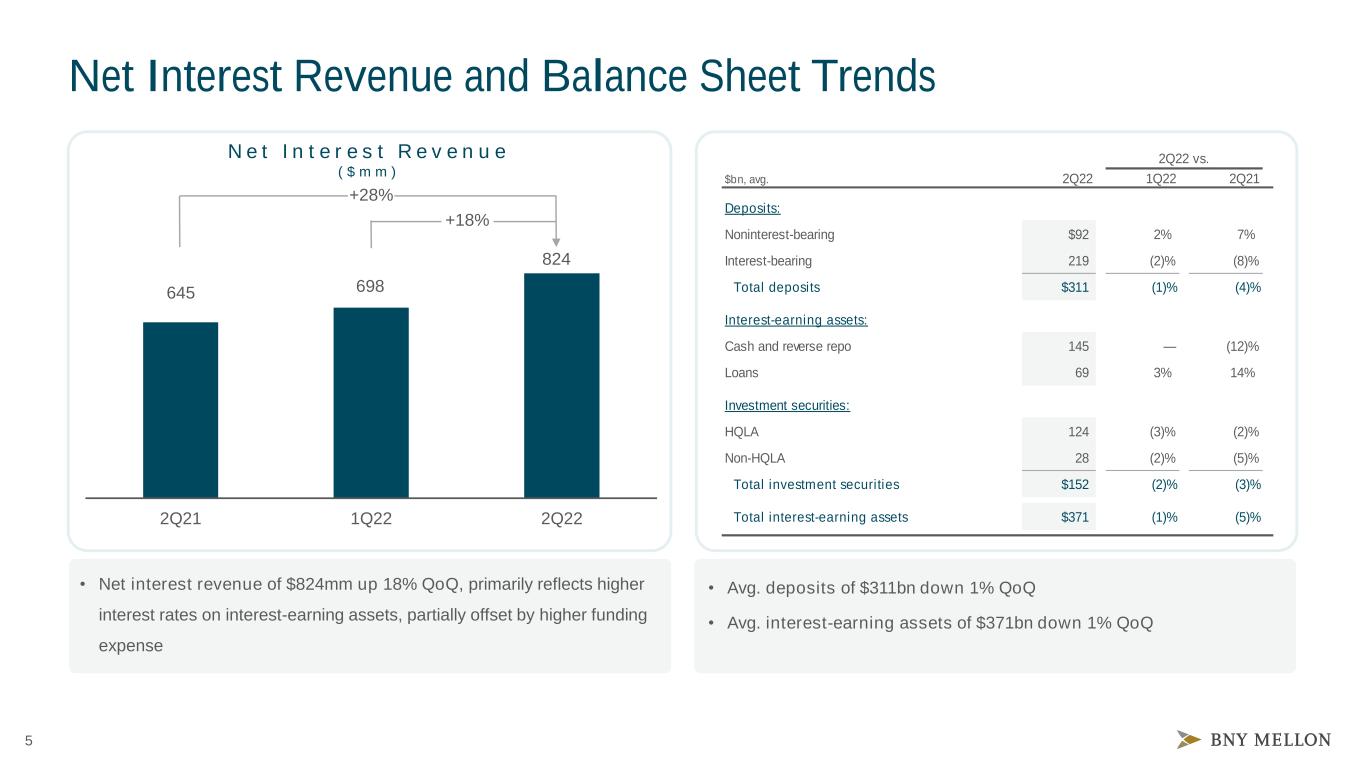

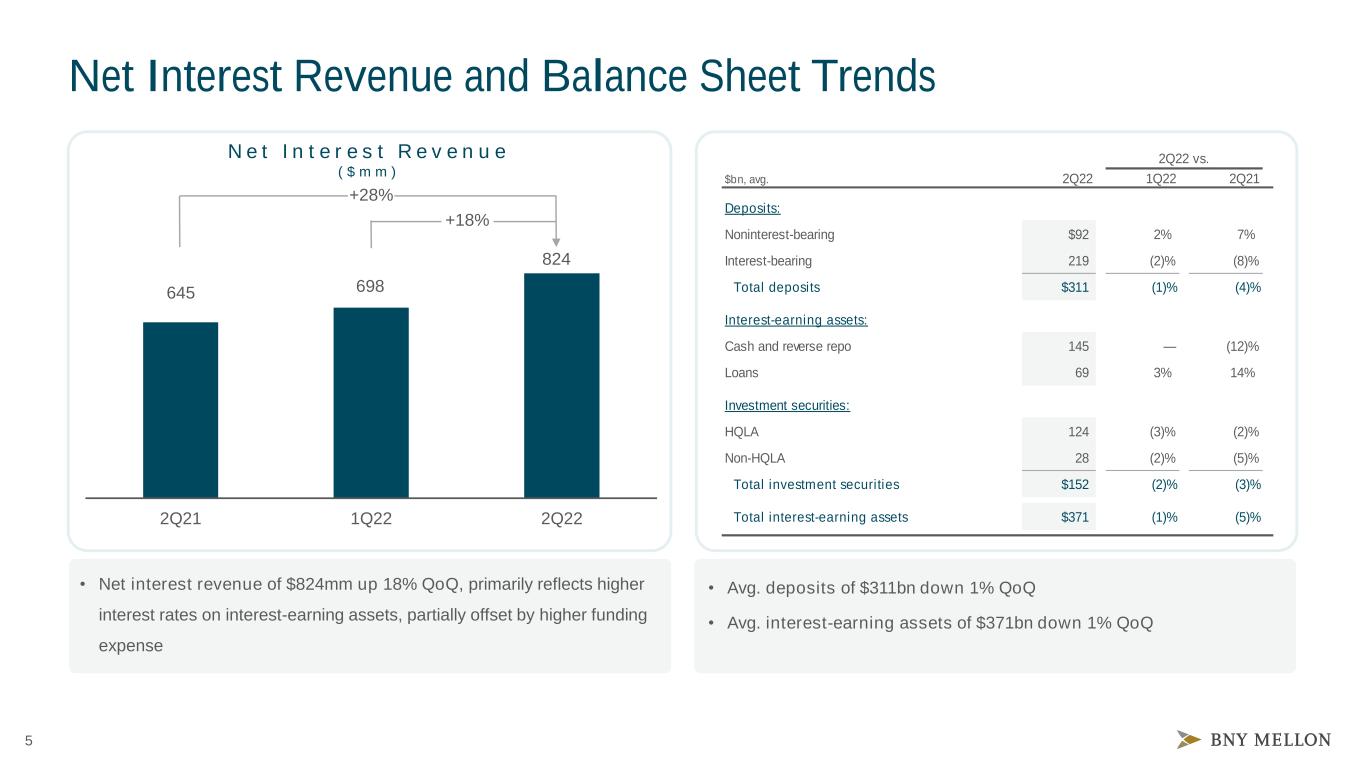

5 2Q22 vs. $bn, avg. 2Q22 1Q22 2Q21 Deposits: Noninterest-bearing $92 2% 7% Interest-bearing 219 (2)% (8)% Total deposits $311 (1)% (4)% Interest-earning assets: Cash and reverse repo 145 — (12)% Loans 69 3% 14% Investment securities: HQLA 124 (3)% (2)% Non-HQLA 28 (2)% (5)% Total investment securities $152 (2)% (3)% Total interest-earning assets $371 (1)% (5)%2Q21 1Q22 2Q22 Net Interest Revenue and Balance Sheet Trends N e t I n t e r e s t R e v e n u e ( $ m m ) 645 698 824 +18% +28% • Avg. deposits of $311bn down 1% QoQ • Avg. interest-earning assets of $371bn down 1% QoQ • Net interest revenue of $824mm up 18% QoQ, primarily reflects higher interest rates on interest-earning assets, partially offset by higher funding expense

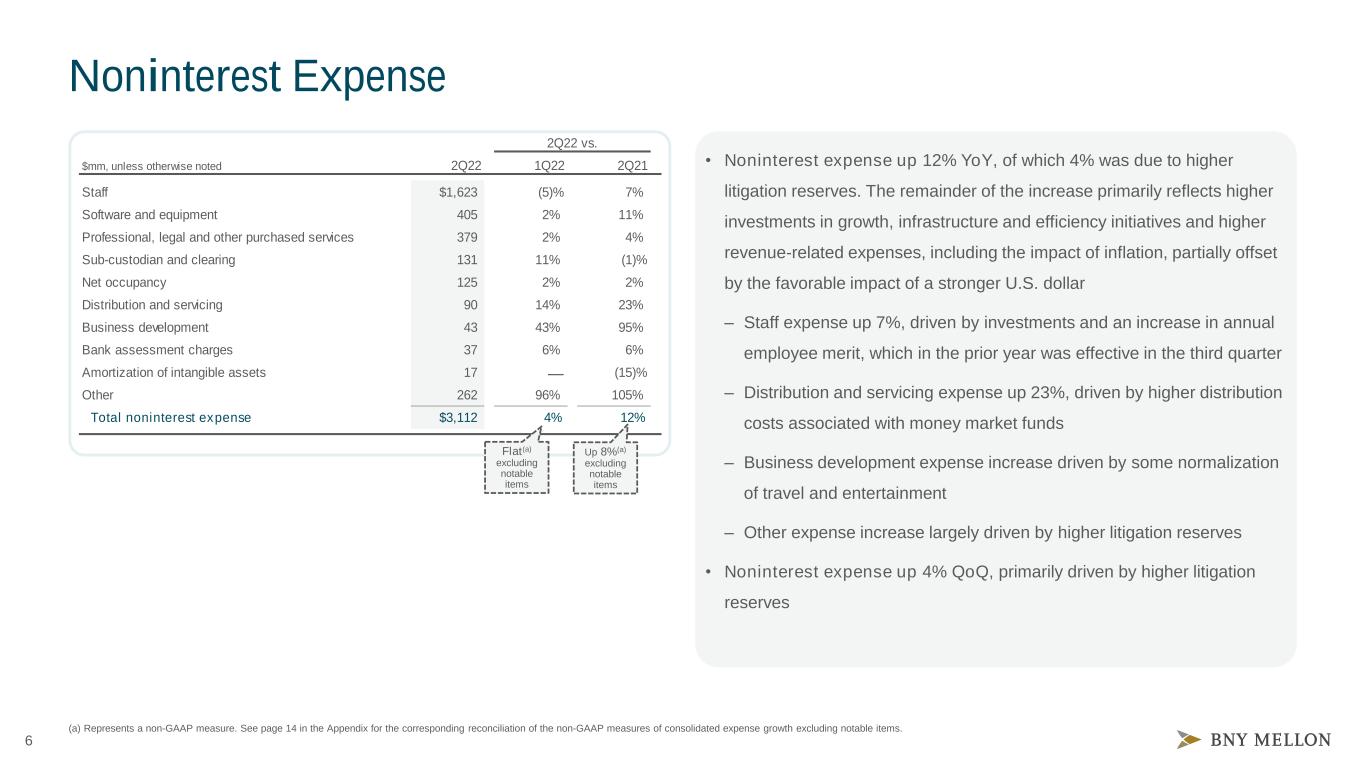

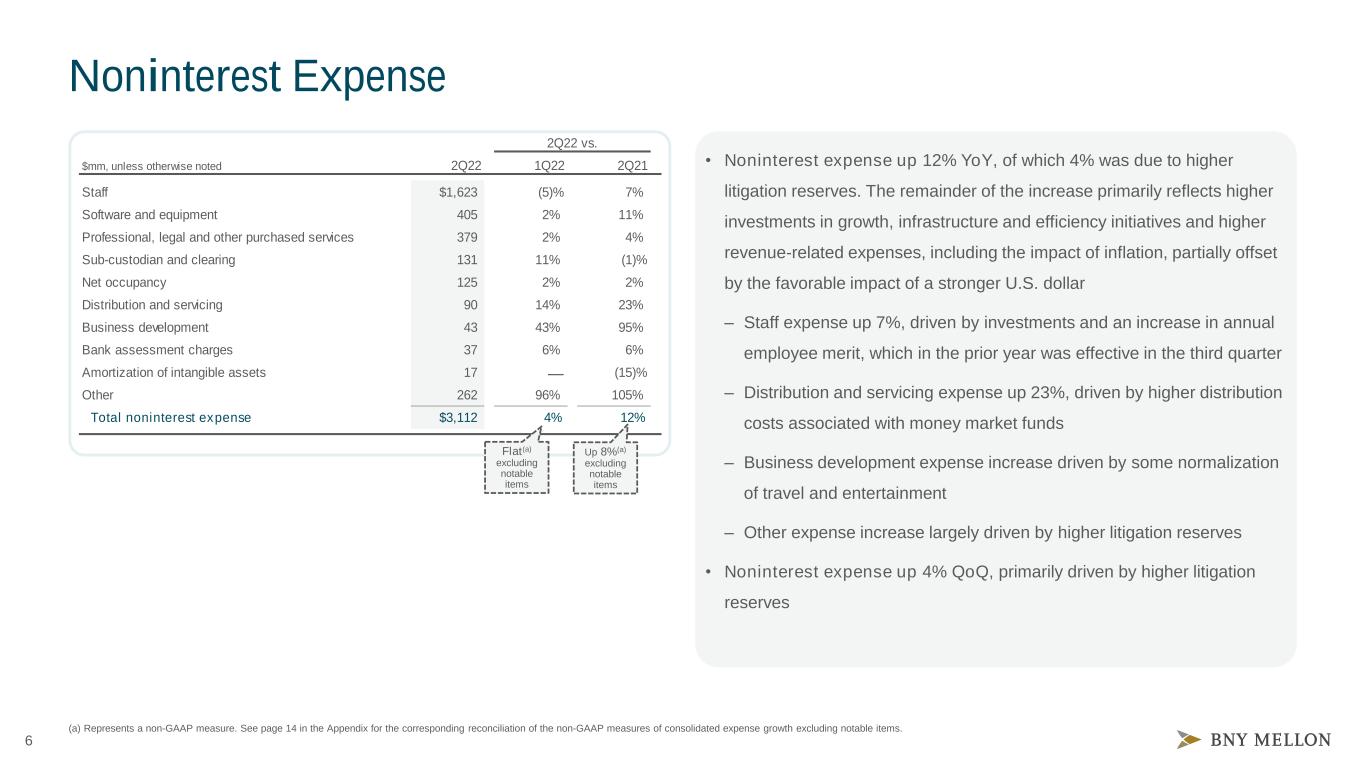

6 2Q22 vs. $mm, unless otherwise noted 2Q22 1Q22 2Q21 Staff $1,623 (5)% 7% Software and equipment 405 2% 11% Professional, legal and other purchased services 379 2% 4% Sub-custodian and clearing 131 11% (1)% Net occupancy 125 2% 2% Distribution and servicing 90 14% 23% Business development 43 43% 95% Bank assessment charges 37 6% 6% Amortization of intangible assets 17 — (15)% Other 262 96% 105% Total noninterest expense $3,112 4% 12% Noninterest Expense • Noninterest expense up 12% YoY, of which 4% was due to higher litigation reserves. The remainder of the increase primarily reflects higher investments in growth, infrastructure and efficiency initiatives and higher revenue-related expenses, including the impact of inflation, partially offset by the favorable impact of a stronger U.S. dollar – Staff expense up 7%, driven by investments and an increase in annual employee merit, which in the prior year was effective in the third quarter – Distribution and servicing expense up 23%, driven by higher distribution costs associated with money market funds – Business development expense increase driven by some normalization of travel and entertainment – Other expense increase largely driven by higher litigation reserves • Noninterest expense up 4% QoQ, primarily driven by higher litigation reserves Up 8%(a) excluding notable items Flat(a) excluding notable items (a) Represents a non-GAAP measure. See page 14 in the Appendix for the corresponding reconciliation of the non-GAAP measures of consolidated expense growth excluding notable items.

7 2Q22 vs. $mm, unless otherwise noted 2Q22 1Q22 2Q21 Total revenue by line of business: Asset Servicing $1,534 1% 11% Issuer Services 472 76% 17% Total revenue $2,006 13% 12% Provision for credit losses 13 N/M N/M Noninterest expense 1,656 10% 18% Income before income taxes $337 20% (24)% Fee revenue 1,513 14% 8% Net interest revenue 457 21% 29% Foreign exchange revenue 155 5% 20% Securities lending revenue(b) 45 15% 7% Financial ratios, balance sheet data and metrics: Pre-tax margin 17% 111 bps (800) bps AUC/A ($trn, period end)(c)(d) $31.0 (8)% (8)% Deposits ($bn, avg.) $191 (1)% (6)% Market value of securities on loan ($bn, period end)(e) $441 (2)% (3)% • Total revenue of $2,006mm up 12% YoY – Asset Servicing up 11% YoY, primarily reflecting higher net interest revenue, lower money market fee waivers and higher foreign exchange revenue and client activity, partially offset by the unfavorable impact of a stronger U.S. dollar and lower market levels – Issuer Services up 17% YoY, primarily reflecting higher net interest revenue in Corporate Trust, higher Depositary Receipts revenue and lower money market fee waivers, partially offset by the impact of lost business in the prior year in Corporate Trust • Noninterest expense of $1,656mm up 18% YoY, primarily reflecting higher investments in growth, infrastructure and efficiency initiatives, litigation reserves and revenue-related expenses, including the impact of inflation, partially offset by the favorable impact of a stronger U.S. dollar. Excluding the impact of notable items, noninterest expense increased 11%(a) • Income before income taxes of $337mm down 24% YoY; includes 40% reduction due to higher litigation reserves and provision for credit losses Securities Services (a) Represents a non-GAAP measure. See page 15 in the Appendix for corresponding reconciliation of the non-GAAP measures of pre-tax margin and noninterest expense growth excluding notable items. Note: See page 12 in the Appendix for the corresponding footnotes (b), (c), (d), and (e). N/M – not meaningful. 21% excluding notable items (a)

8 2Q22 vs. $mm, unless otherwise noted 2Q22 1Q22 2Q21 Total revenue by line of business: Pershing $636 12% 8% Treasury Services 373 10% 17% Clearance and Collateral Management 305 4% 8% Total revenue $1,314 9% 10% Provision for credit losses 4 N/M N/M Noninterest expense 702 (1)% 8% Income before income taxes $608 23% 9% Fee revenue 963 6% 9% Net interest revenue 340 15% 18% Financial ratios, balance sheet data and metrics: Pre-tax margin 46% 493 bps (71) bps AUC/A ($trn, end of period)(a)(b) $11.8 2% 6% Deposits ($bn, avg.) $95 (1)% (8)% Pershing: Net new assets (U.S. platform) ($bn)(c) $16 N/M N/M Avg. active clearing accounts ('000) 7,432 — 2% Treasury Services: Avg. daily U.S. dollar payment volumes ('000) 238 (1)% 3% Clearance and Collateral Management: Avg. tri-party collateral management balances ($bn) $5,207 4% 34% Market and Wealth Services • Total revenue of $1,314mm up 10% YoY – Pershing up 8% YoY, primarily reflecting lower money market fee waivers and higher transaction activity, partially offset by the impact of prior year lost business – Treasury Services up 17% YoY, primarily reflecting higher net interest revenue, lower money market fee waivers and higher payment volumes – Clearance and Collateral Management up 8% YoY, primarily reflecting higher net interest revenue and clearance volumes • Noninterest expense of $702mm up 8% YoY, primarily reflecting higher investments in growth, infrastructure and efficiency initiatives, including the impact of inflation • Income before income taxes of $608mm up 9% YoY Note: See page 12 in the Appendix for the corresponding footnotes. N/M – not meaningful.

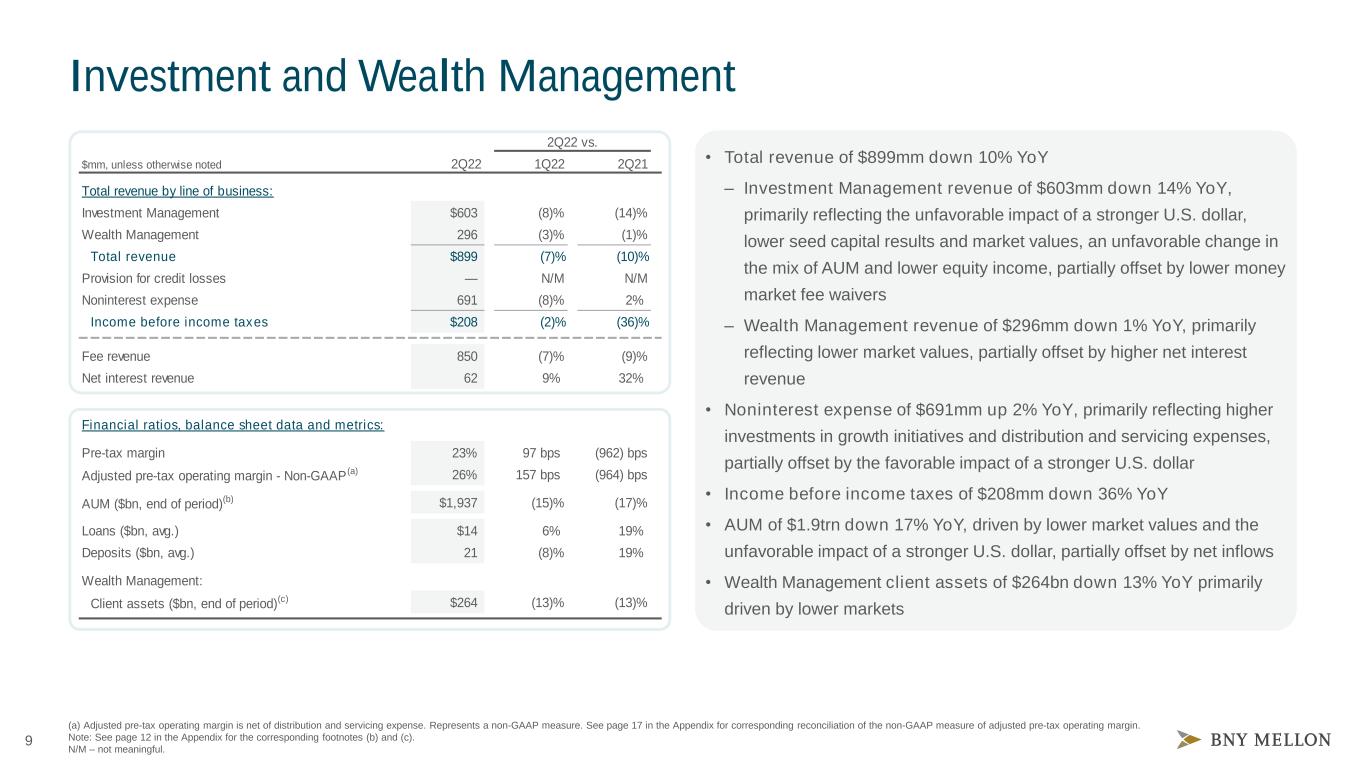

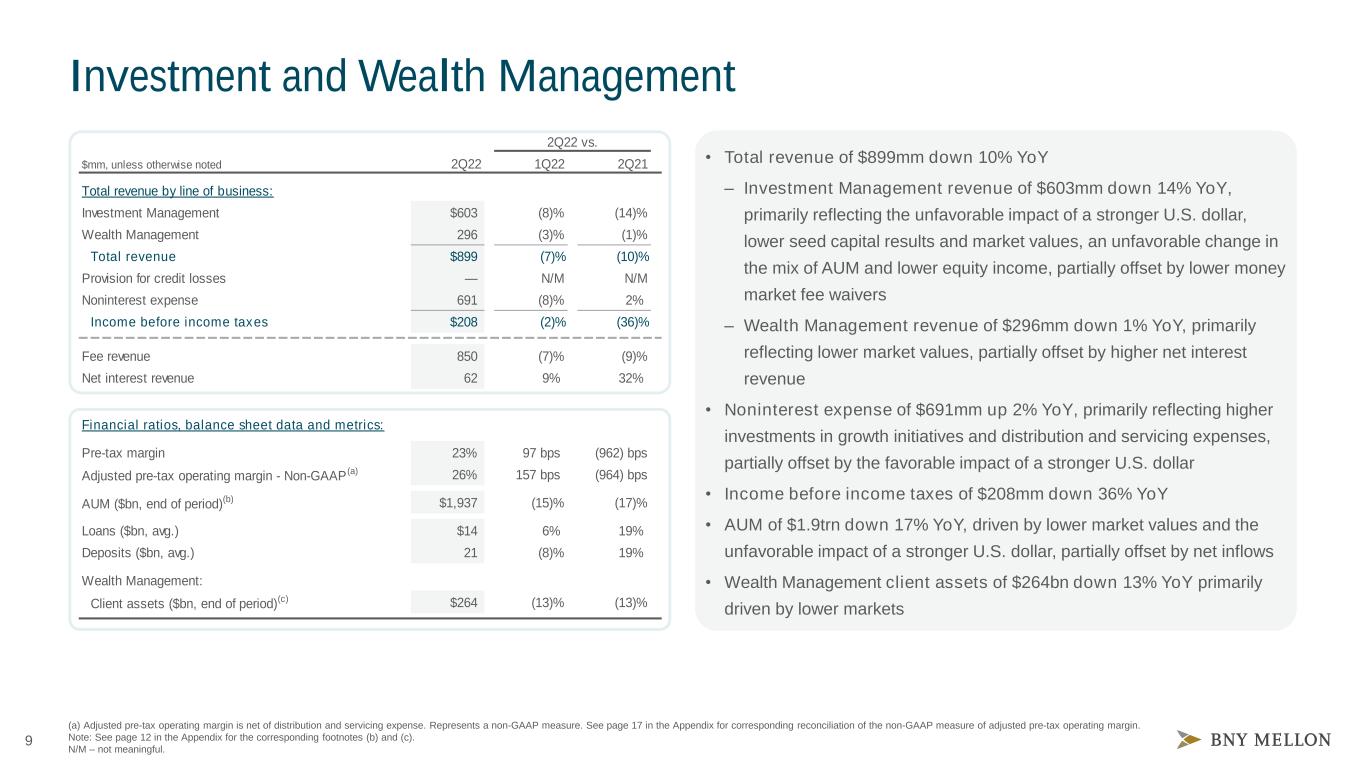

9 2Q22 vs. $mm, unless otherwise noted 2Q22 1Q22 2Q21 Total revenue by line of business: Investment Management $603 (8)% (14)% Wealth Management 296 (3)% (1)% Total revenue $899 (7)% (10)% Provision for credit losses — N/M N/M Noninterest expense 691 (8)% 2% Income before income taxes $208 (2)% (36)% Fee revenue 850 (7)% (9)% Net interest revenue 62 9% 32% Financial ratios, balance sheet data and metrics: Pre-tax margin 23% 97 bps (962) bps Adjusted pre-tax operating margin - Non-GAAP (a) 26% 157 bps (964) bps AUM ($bn, end of period)(b) $1,937 (15)% (17)% Loans ($bn, avg.) $14 6% 19% Deposits ($bn, avg.) 21 (8)% 19% Wealth Management: Client assets ($bn, end of period)(c) $264 (13)% (13)% • Total revenue of $899mm down 10% YoY – Investment Management revenue of $603mm down 14% YoY, primarily reflecting the unfavorable impact of a stronger U.S. dollar, lower seed capital results and market values, an unfavorable change in the mix of AUM and lower equity income, partially offset by lower money market fee waivers – Wealth Management revenue of $296mm down 1% YoY, primarily reflecting lower market values, partially offset by higher net interest revenue • Noninterest expense of $691mm up 2% YoY, primarily reflecting higher investments in growth initiatives and distribution and servicing expenses, partially offset by the favorable impact of a stronger U.S. dollar • Income before income taxes of $208mm down 36% YoY • AUM of $1.9trn down 17% YoY, driven by lower market values and the unfavorable impact of a stronger U.S. dollar, partially offset by net inflows • Wealth Management client assets of $264bn down 13% YoY primarily driven by lower markets Investment and Wealth Management (a) Adjusted pre-tax operating margin is net of distribution and servicing expense. Represents a non-GAAP measure. See page 17 in the Appendix for corresponding reconciliation of the non-GAAP measure of adjusted pre-tax operating margin. Note: See page 12 in the Appendix for the corresponding footnotes (b) and (c). N/M – not meaningful.

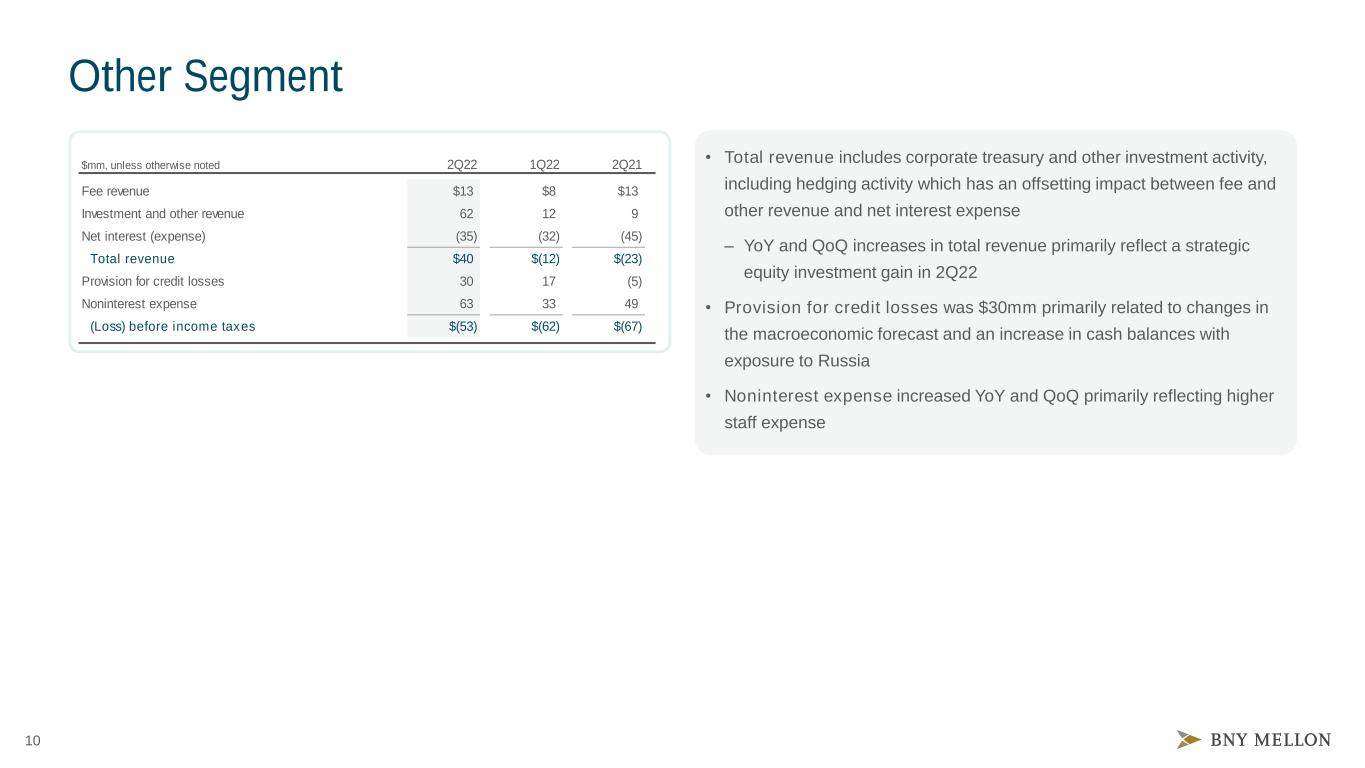

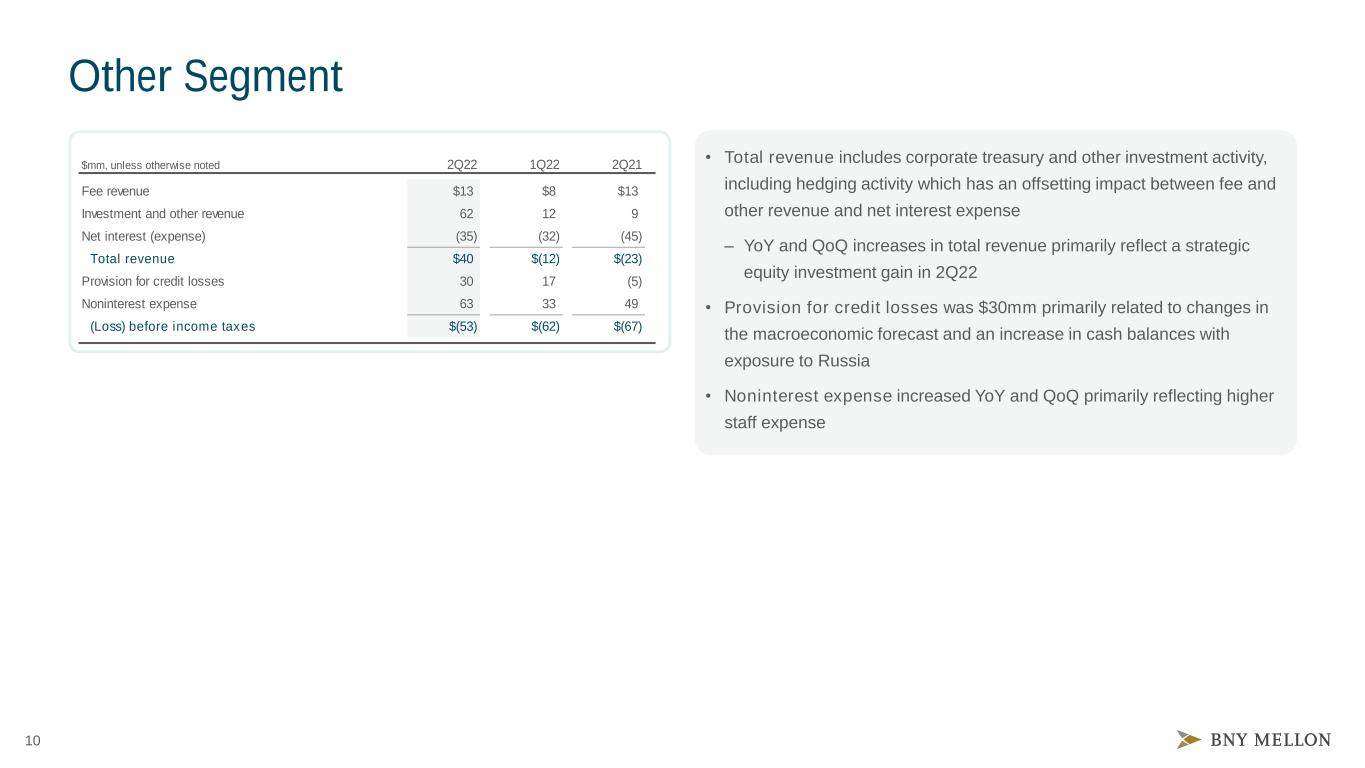

10 $mm, unless otherwise noted 2Q22 1Q22 2Q21 Fee revenue $13 $8 $13 Investment and other revenue 62 12 9 Net interest (expense) (35) (32) (45) Total revenue $40 $(12) $(23) Provision for credit losses 30 17 (5) Noninterest expense 63 33 49 (Loss) before income taxes $(53) $(62) $(67) • Total revenue includes corporate treasury and other investment activity, including hedging activity which has an offsetting impact between fee and other revenue and net interest expense – YoY and QoQ increases in total revenue primarily reflect a strategic equity investment gain in 2Q22 • Provision for credit losses was $30mm primarily related to changes in the macroeconomic forecast and an increase in cash balances with exposure to Russia • Noninterest expense increased YoY and QoQ primarily reflecting higher staff expense Other Segment

Appendix

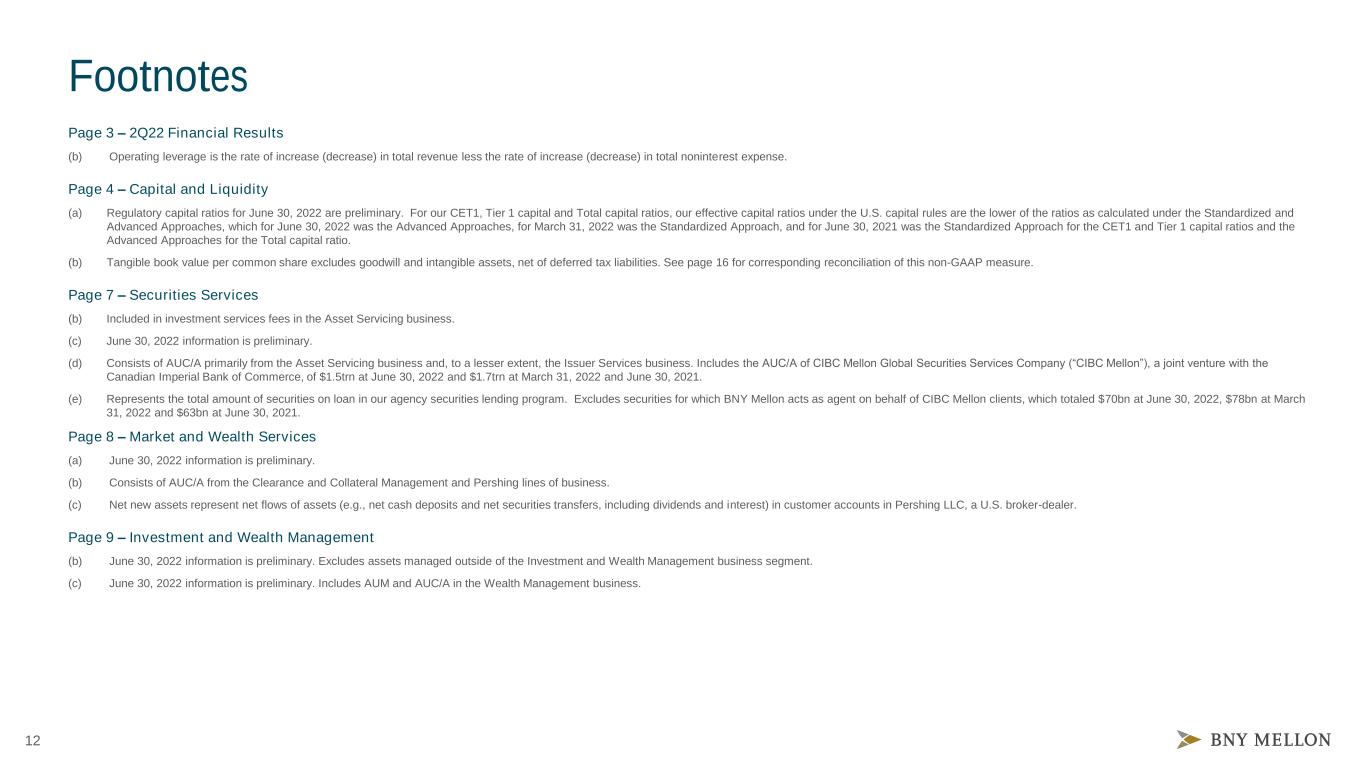

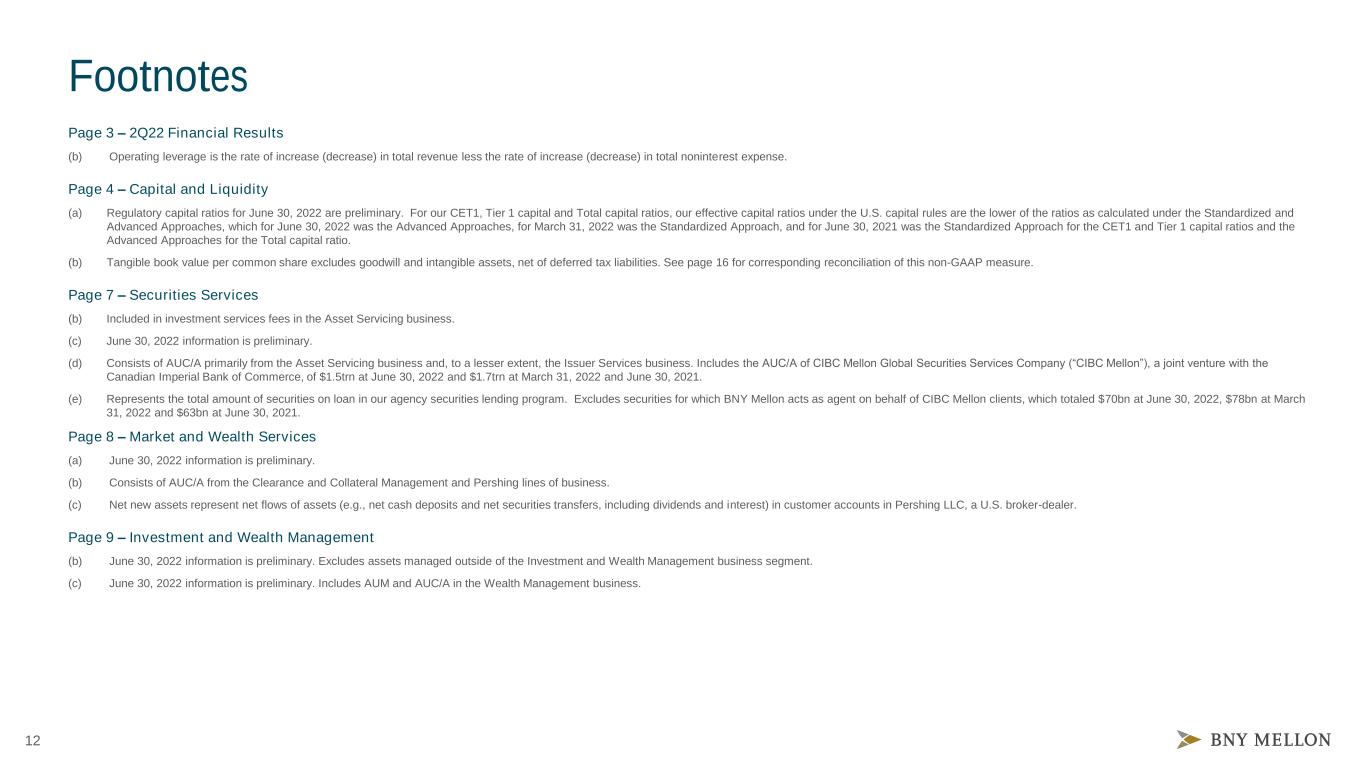

12 Footnotes Page 3 – 2Q22 Financial Results (b) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. Page 4 – Capital and Liquidity (a) Regulatory capital ratios for June 30, 2022 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for June 30, 2022 was the Advanced Approaches, for March 31, 2022 was the Standardized Approach, and for June 30, 2021 was the Standardized Approach for the CET1 and Tier 1 capital ratios and the Advanced Approaches for the Total capital ratio. (b) Tangible book value per common share excludes goodwill and intangible assets, net of deferred tax liabilities. See page 16 for corresponding reconciliation of this non-GAAP measure. Page 7 – Securities Services (b) Included in investment services fees in the Asset Servicing business. (c) June 30, 2022 information is preliminary. (d) Consists of AUC/A primarily from the Asset Servicing business and, to a lesser extent, the Issuer Services business. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.5trn at June 30, 2022 and $1.7trn at March 31, 2022 and June 30, 2021. (e) Represents the total amount of securities on loan in our agency securities lending program. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $70bn at June 30, 2022, $78bn at March 31, 2022 and $63bn at June 30, 2021. Page 8 – Market and Wealth Services (a) June 30, 2022 information is preliminary. (b) Consists of AUC/A from the Clearance and Collateral Management and Pershing lines of business. (c) Net new assets represent net flows of assets (e.g., net cash deposits and net securities transfers, including dividends and interest) in customer accounts in Pershing LLC, a U.S. broker-dealer. Page 9 – Investment and Wealth Management (b) June 30, 2022 information is preliminary. Excludes assets managed outside of the Investment and Wealth Management business segment. (c) June 30, 2022 information is preliminary. Includes AUM and AUC/A in the Wealth Management business.

13 Money Market Fee Waivers Impact (a) The line of business revenue for management reporting purposes reflects the impact of revenue transferred between the businesses. 2Q22 1Q22 4Q21 3Q21 2Q21 Investment services fees (see table below) $(26) $(126) $(148) $(142) $(148) Investment management and performance fees (40) (85) (116) (109) (115) Distribution and servicing fees (2) (11) (14) (11) (13) Total fee revenue (68) (222) (278) (262) (276) Less: Distribution and servicing expense 2 23 35 29 24 Net impact of money market fee waivers $(66) $(199) $(243) $(233) $(252) Impact to investment services fees by line of business (a) Asset Servicing — $(19) $(31) $(29) $(30) Issuer Services (1) (11) (18) (17) (16) Pershing (25) (90) (89) (86) (91) Treasury Services — (6) (10) (10) (11) Total impact to investment services fees by line of business $(26) $(126) $(148) $(142) $(148) Impact to revenue by line of business (a) Asset Servicing $(1) $(28) $(50) $(47) $(50) Issuer Services (1) (14) (24) (22) (22) Pershing (29) (107) (106) (102) (99) Treasury Services — (8) (14) (13) (16) Investment Management (37) (63) (81) (76) (85) Wealth Management — (2) (3) (2) (4) Total impact to revenue by line of business $(68) $(222) $(278) $(262) $(276)

14 (a) Notable items in 2Q22 include increased litigation reserves. Notable items in 1Q22 include decreased litigation reserves. Notable items in 2Q21 include disposal gains and severance expense. Earnings per Share Reconciliation – Impact of Notable Items 2Q22 Results – GAAP Notable items (b) Results – Non-GAAP ex. notable items Total revenue $4,254 — $4,254 Provision for credit losses 47 — 47 Noninterest expense 3,112 103 3,009 Income before income taxes $1,095 $(103) $1,198 Net income applicable to common shareholders 835 $(100) 935 Avg. common shares and equivalents outstanding (mm) — diluted 814 — 814 EPS $1.03 $(0.12) $1.15 Noninterest Expense Reconciliation – Impact of Notable Items 2Q22 1Q22 2Q21 1Q22 2Q21 Noninterest expense — GAAP $3,112 $3,006 $2,778 4% 12% Notable items (a) 103 (1) 5 Noninterest expense, ex-notables — Non-GAAP $3,009 $3,007 $2,773 — 8% 2Q22 vs

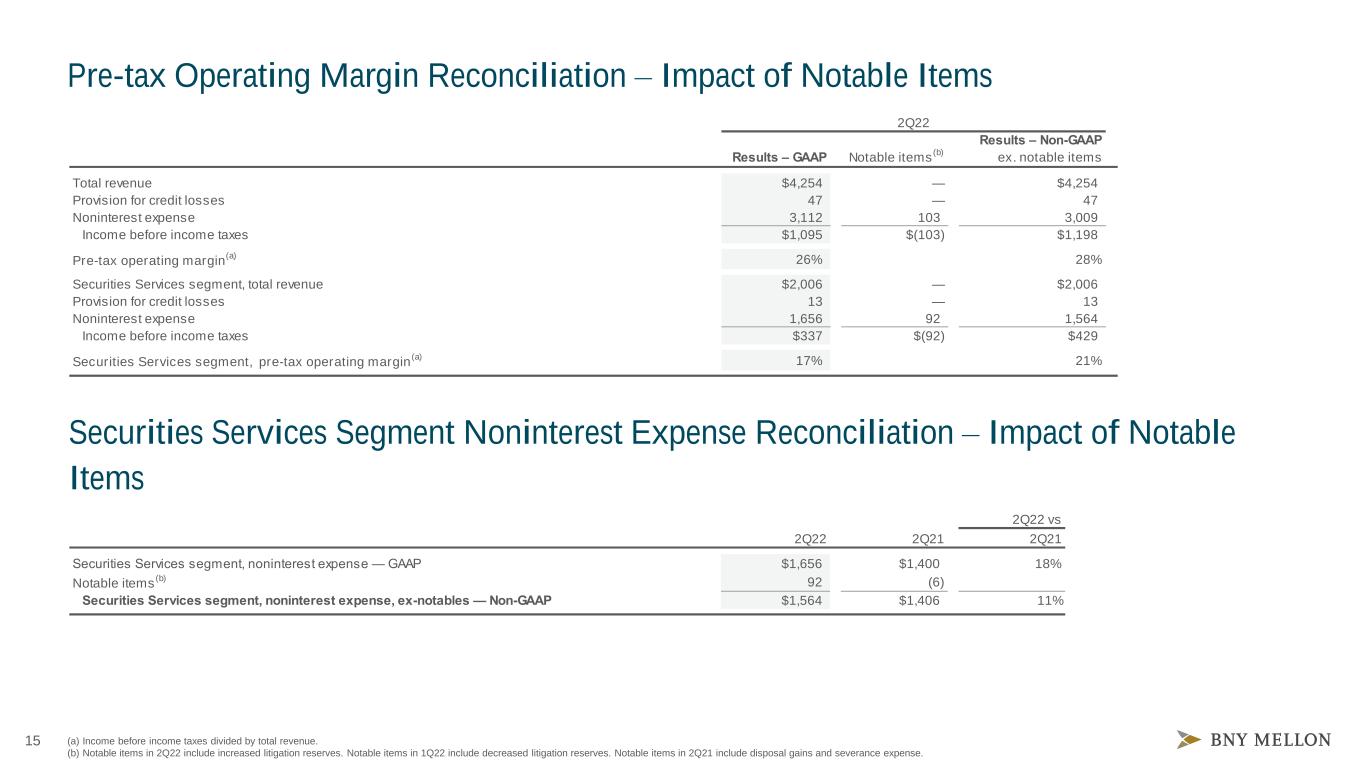

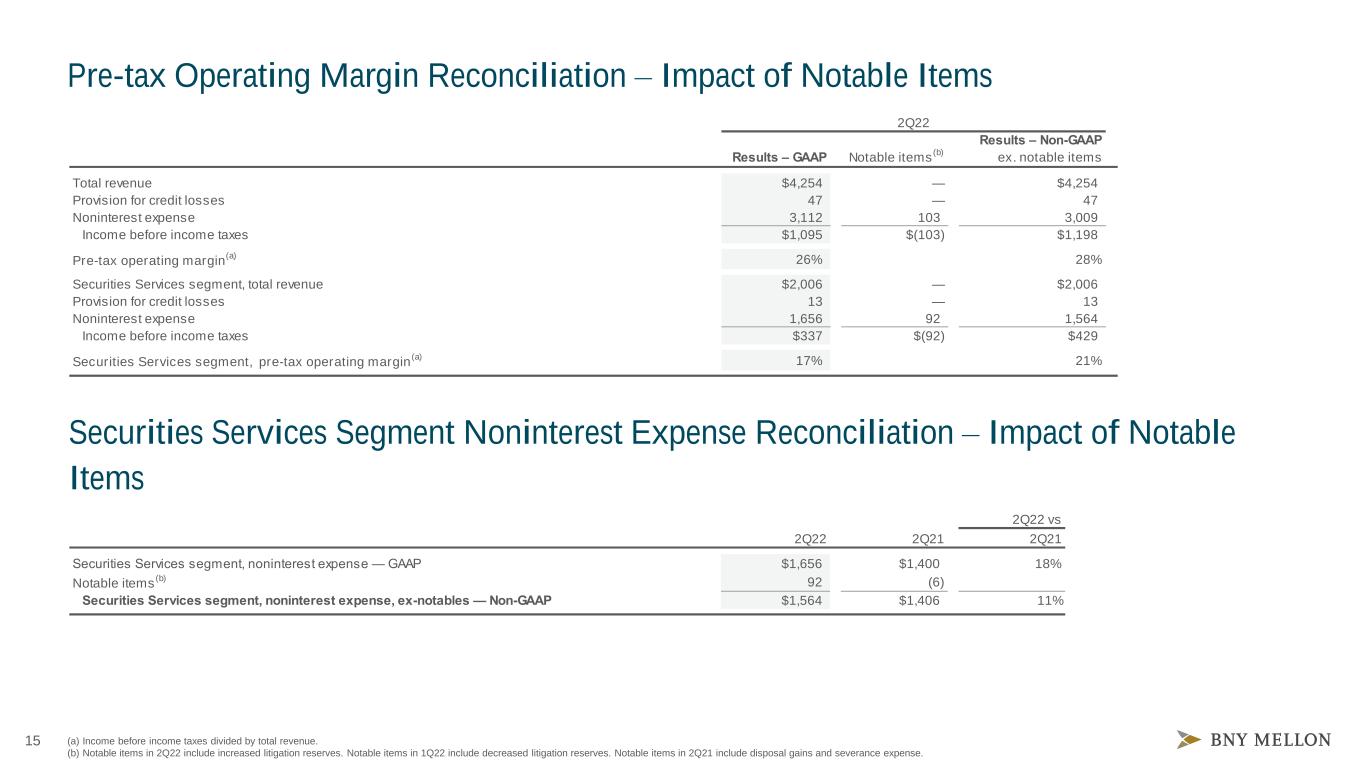

15 (a) Income before income taxes divided by total revenue. (b) Notable items in 2Q22 include increased litigation reserves. Notable items in 1Q22 include decreased litigation reserves. Notable items in 2Q21 include disposal gains and severance expense. Securities Services Segment Noninterest Expense Reconciliation – Impact of Notable Items 2Q22 Results – GAAP Notable items (b) Results – Non-GAAP ex. notable items Total revenue $4,254 — $4,254 Provision for credit losses 47 — 47 Noninterest expense 3,112 103 3,009 Income before income taxes $1,095 $(103) $1,198 Pre-tax operating margin (a) 26% 28% Securities Services segment, total revenue $2,006 — $2,006 Provision for credit losses 13 — 13 Noninterest expense 1,656 92 1,564 Income before income taxes $337 $(92) $429 Securities Services segment, pre-tax operating margin (a) 17% 21% Pre-tax Operating Margin Reconciliation – Impact of Notable Items 2Q22 vs 2Q22 2Q21 2Q21 Securities Services segment, noninterest expense — GAAP $1,656 $1,400 18% Notable items (b) 92 (6) Securities Services segment, noninterest expense, ex-notables — Non-GAAP $1,564 $1,406 11%

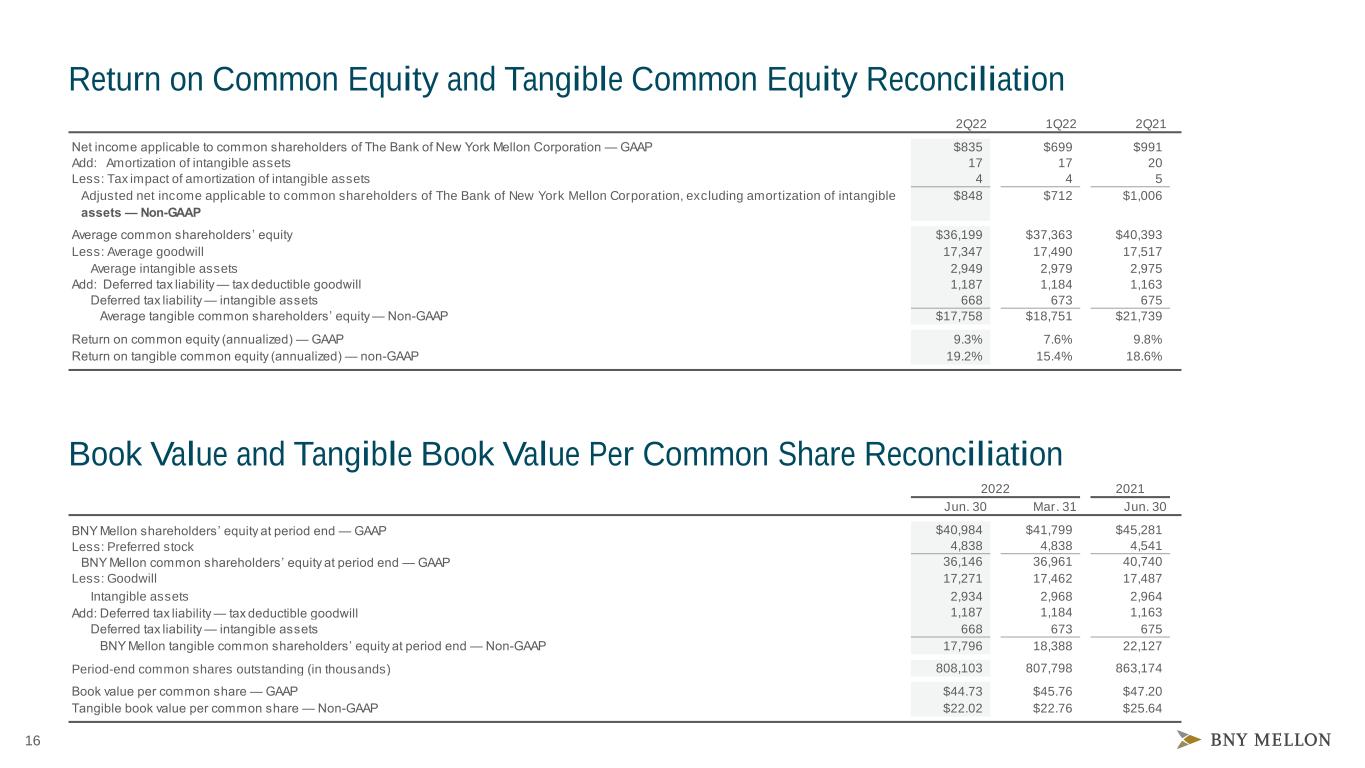

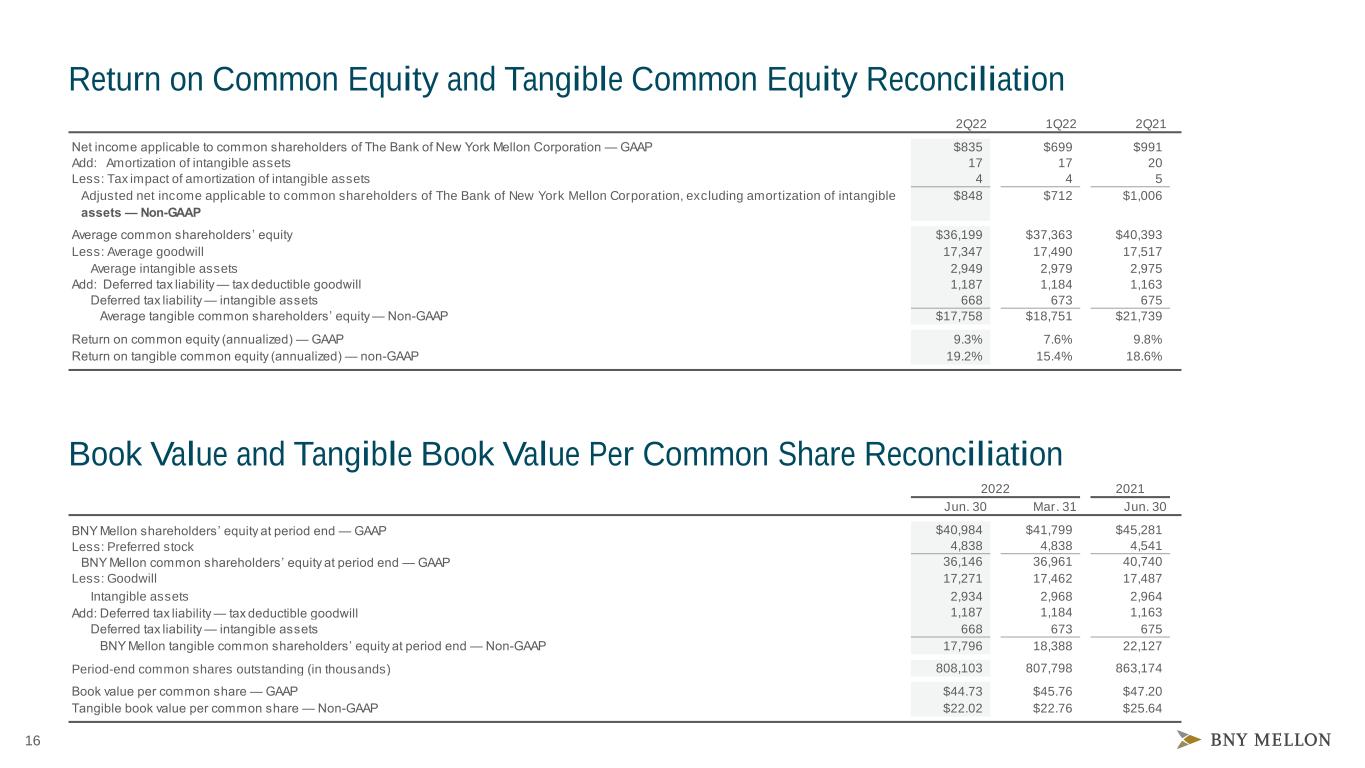

16 2Q22 1Q22 2Q21 Net income applicable to common shareholders of The Bank of New York Mellon Corporation — GAAP $835 $699 $991 Add: Amortization of intangible assets 17 17 20 Less: Tax impact of amortization of intangible assets 4 4 5 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets — Non-GAAP $848 $712 $1,006 Average common shareholders’ equity $36,199 $37,363 $40,393 Less: Average goodwill 17,347 17,490 17,517 Average intangible assets 2,949 2,979 2,975 Add: Deferred tax liability — tax deductible goodwill 1,187 1,184 1,163 Deferred tax liability — intangible assets 668 673 675 Average tangible common shareholders’ equity — Non-GAAP $17,758 $18,751 $21,739 Return on common equity (annualized) — GAAP 9.3% 7.6% 9.8% Return on tangible common equity (annualized) — non-GAAP 19.2% 15.4% 18.6% 2021 Jun. 30 Mar. 31 Jun. 30 BNY Mellon shareholders’ equity at period end — GAAP $40,984 $41,799 $45,281 Less: Preferred stock 4,838 4,838 4,541 BNY Mellon common shareholders’ equity at period end — GAAP 36,146 36,961 40,740 Less: Goodwill 17,271 17,462 17,487 Intangible assets 2,934 2,968 2,964 Add: Deferred tax liability — tax deductible goodwill 1,187 1,184 1,163 Deferred tax liability — intangible assets 668 673 675 BNY Mellon tangible common shareholders’ equity at period end — Non-GAAP 17,796 18,388 22,127 Period-end common shares outstanding (in thousands) 808,103 807,798 863,174 Book value per common share — GAAP $44.73 $45.76 $47.20 Tangible book value per common share — Non-GAAP $22.02 $22.76 $25.64 2022 Return on Common Equity and Tangible Common Equity Reconciliation Book Value and Tangible Book Value Per Common Share Reconciliation

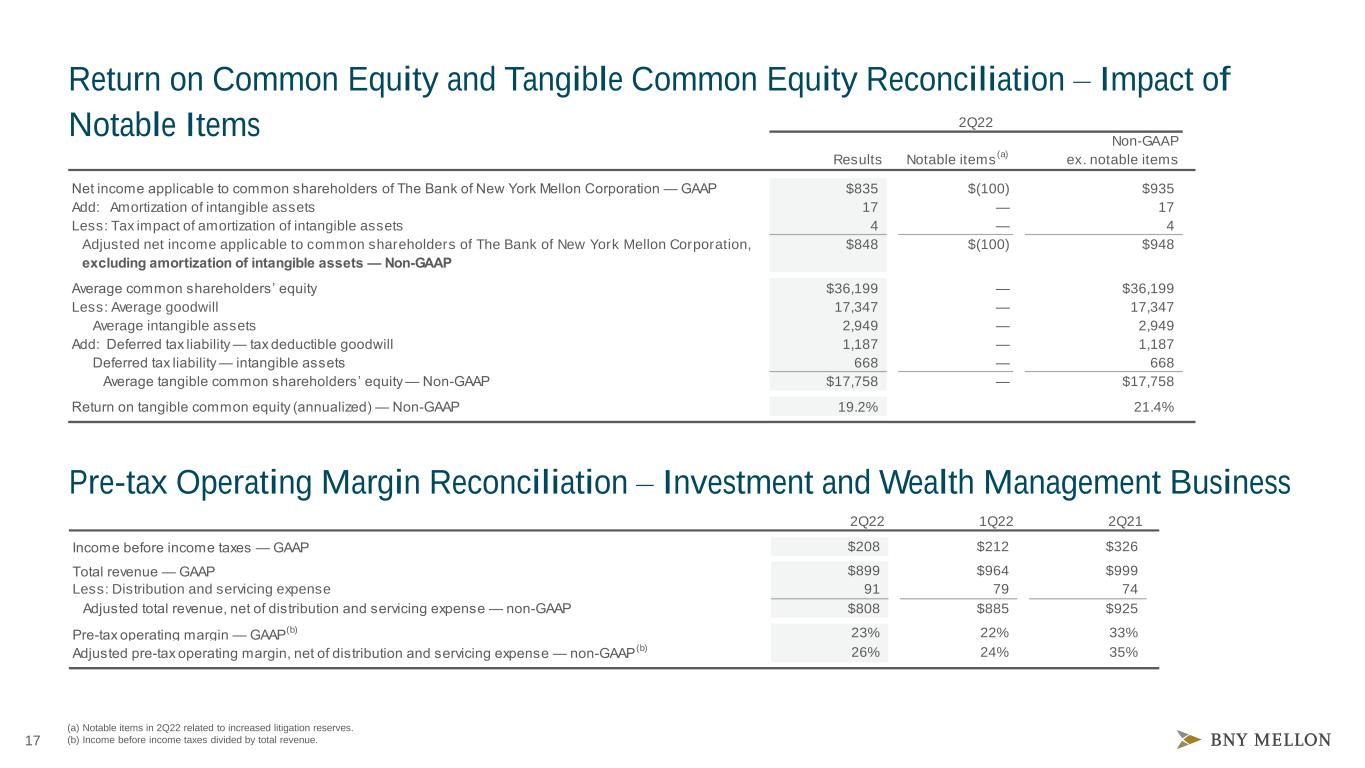

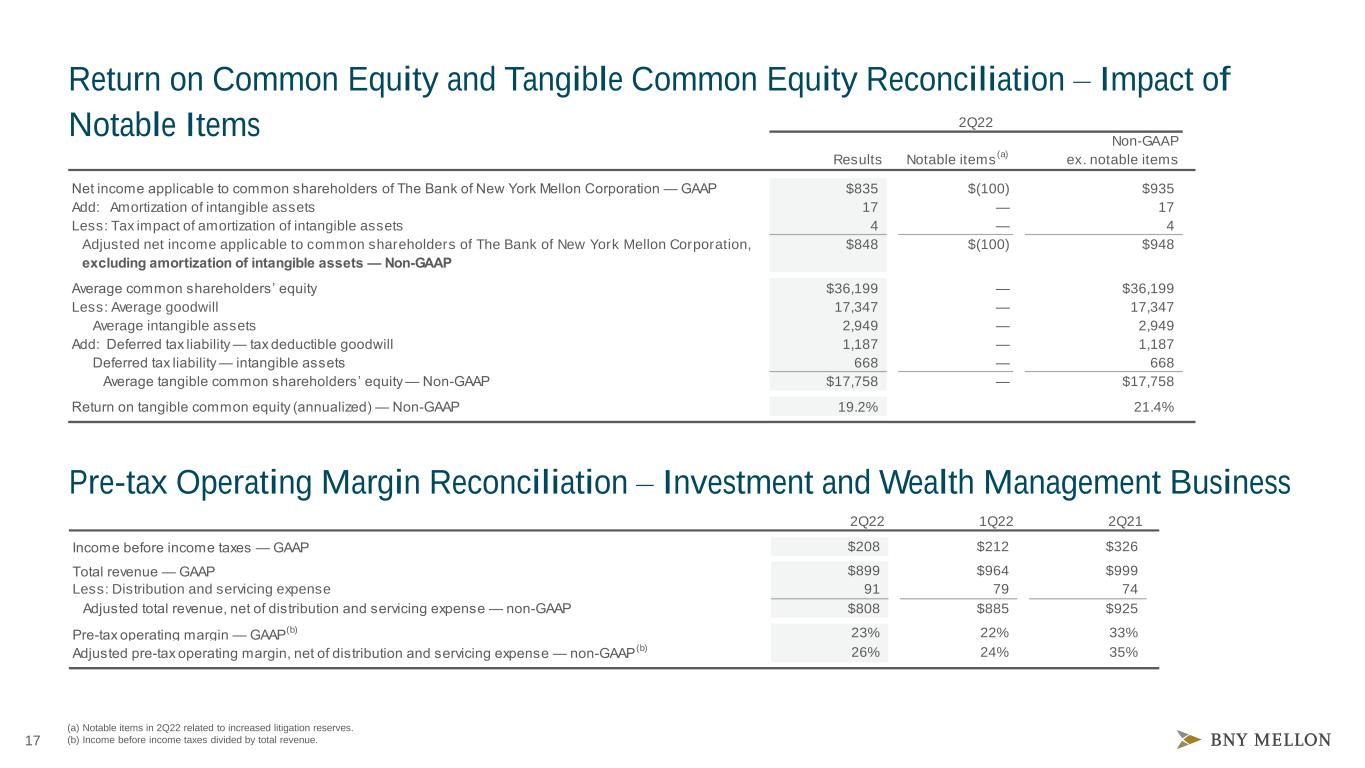

17 Return on Common Equity and Tangible Common Equity Reconciliation – Impact of Notable Items 2Q22 Results Notable items (a) Non-GAAP ex. notable items Net income applicable to common shareholders of The Bank of New York Mellon Corporation — GAAP $835 $(100) $935 Add: Amortization of intangible assets 17 — 17 Less: Tax impact of amortization of intangible assets 4 — 4 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of intangible assets — Non-GAAP $848 $(100) $948 Average common shareholders’ equity $36,199 — $36,199 Less: Average goodwill 17,347 — 17,347 Average intangible assets 2,949 — 2,949 Add: Deferred tax liability — tax deductible goodwill 1,187 — 1,187 Deferred tax liability — intangible assets 668 — 668 Average tangible common shareholders’ equity — Non-GAAP $17,758 — $17,758 Return on tangible common equity (annualized) — Non-GAAP 19.2% 21.4% 2Q22 1Q22 2Q21 Income before income taxes — GAAP $208 $212 $326 Total revenue — GAAP $899 $964 $999 Less: Distribution and servicing expense 91 79 74 Adjusted total revenue, net of distribution and servicing expense — non-GAAP $808 $885 $925 Pre-tax operating margin — GAAP (b) 23% 22% 33% Adjusted pre-tax operating margin, net of distribution and servicing expense — non-GAAP (b) 26% 24% 35% Pre-tax Operating Margin Reconciliation – Investment and Wealth Management Business (a) Notable items in 2Q22 related to increased litigation reserves. (b) Income before income taxes divided by total revenue.

18 A number of statements in The Bank of New York Mellon Corporation’s (the “Corporation”) presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate,” “forecast,” “project,” “anticipate,” “likely,” “target,” “expect,” “intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,” “opportunities,” “trends,” “ambition,” “objective,” “aim,” “future,” “potentially,” “outlook” and words of similar meaning may signify forward-looking statements. These statements relate to, among other things, the Corporation’s expectations regarding: capital plans, strategic priorities, financial goals, organic growth, performance, organizational quality and efficiency, investments, including in technology and product development, capabilities, resiliency, revenue, net interest revenue, money market fee waivers, fees, expenses, cost discipline, sustainable growth, innovation in products and services, company management, human capital management (including related ambitions, objectives, aims and goals), deposits, interest rates and yield curves, securities portfolio, taxes, business opportunities, divestments, volatility, preliminary business metrics and regulatory capital ratios and statements regarding the Corporation’s aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, outlooks, estimates, intentions, targets, opportunities, focus and initiatives, including the potential effects of the coronavirus pandemic on any of the foregoing. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual outcomes may differ materially from those expressed or implied as a result of a number of factors, including, but not limited to, those discussed in “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report”) and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Statements about the effects of the current and near-term market and macroeconomic outlook on the Corporation, including on its business, operations, financial performance and prospects, may constitute forward-looking statements, and are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation's control), including geopolitical risks (including those related to Russia’s invasion of Ukraine), as well as the scope and duration of the pandemic, actions taken by governmental authorities and other third parties in response to the pandemic, the availability, use and effectiveness of vaccines, and the direct and indirect impact of the pandemic on the Corporation, its clients, customers and third parties. Preliminary business metrics and regulatory capital ratios are subject to change, possibly materially, as the Corporation completes its Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. All forward-looking statements speak only as of July 15, 2022, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding the Corporation, please refer to the Corporation's SEC filings available at www.bnymellon.com/investorrelations. Non-GAAP Measures: In this presentation we discuss certain non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which the Corporation’s management monitors financial performance. Additional disclosures relating to non-GAAP measures are contained in the Corporation’s reports filed with the SEC, including the 2021 Annual Report, and the second quarter 2022 earnings release and the second quarter 2022 financial supplement are available at www.bnymellon.com/investorrelations. Cautionary Statement