UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

[X] Preliminary Information Statement

[ ] Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

[ ] Definitive Information Statement

ACQUIRED SALES CORP.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

[ ] No fee required

[X] Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1) | Title of each class of securities to which transaction applies: common stock |

(2) | Aggregate number of securities to which transaction applies: 5,000,000 |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing is calculated and state how it was determined.): $19,500,000 Stock Consideration per Exchange Act Rule 0-11(a)(4): 5,000,000 common stock shares to be issued at a $3.50 per share market value (the average of the bid and asked price for other over-the-counter securities as of October 10, 2019, a specified date within 5 business days prior to the date of the filing) equals $17,500,000 times one-fiftieth of one percent or .0002 totals $3,500. Cash Consideration per Exchange Act Rule 0-11(c)(1): One-fiftieth of one percent of the proposed $2,000,000 cash payment is $400. |

1

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total Fee Paid: $3,900 |

[ ] Fee paid previously with preliminary materials.

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Dated Filed:

2

ACQUIRED SALES CORP.

31 N. Suffolk Lane, Lake Forest, Illinois 60045

Telephone: 847-915-2446

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

To the stockholders of Acquired Sales Corp.:

This information statement is furnished to the stockholders of Acquired Sales Corp., a Nevada corporation (sometimes “Acquired Sales”, the “Corporation”, “Company”, “we”, “us” or “our”) in connection with the approval by our board of directors and holders of a majority of our common stock to do the following:

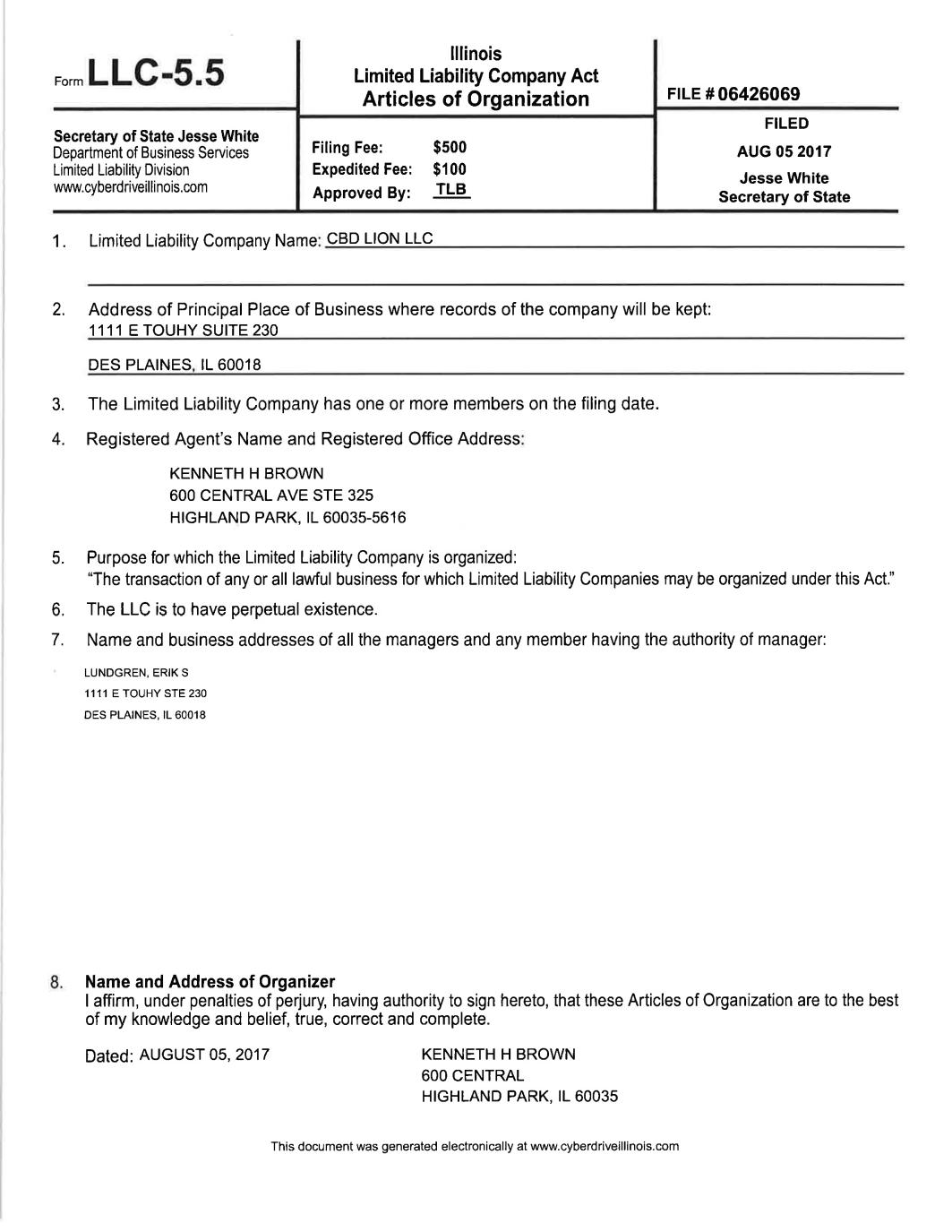

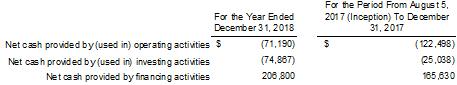

1.Approve the merger of CBD Lion LLC, an Illinois limited liability company (“CBD Lion”) into the Company.

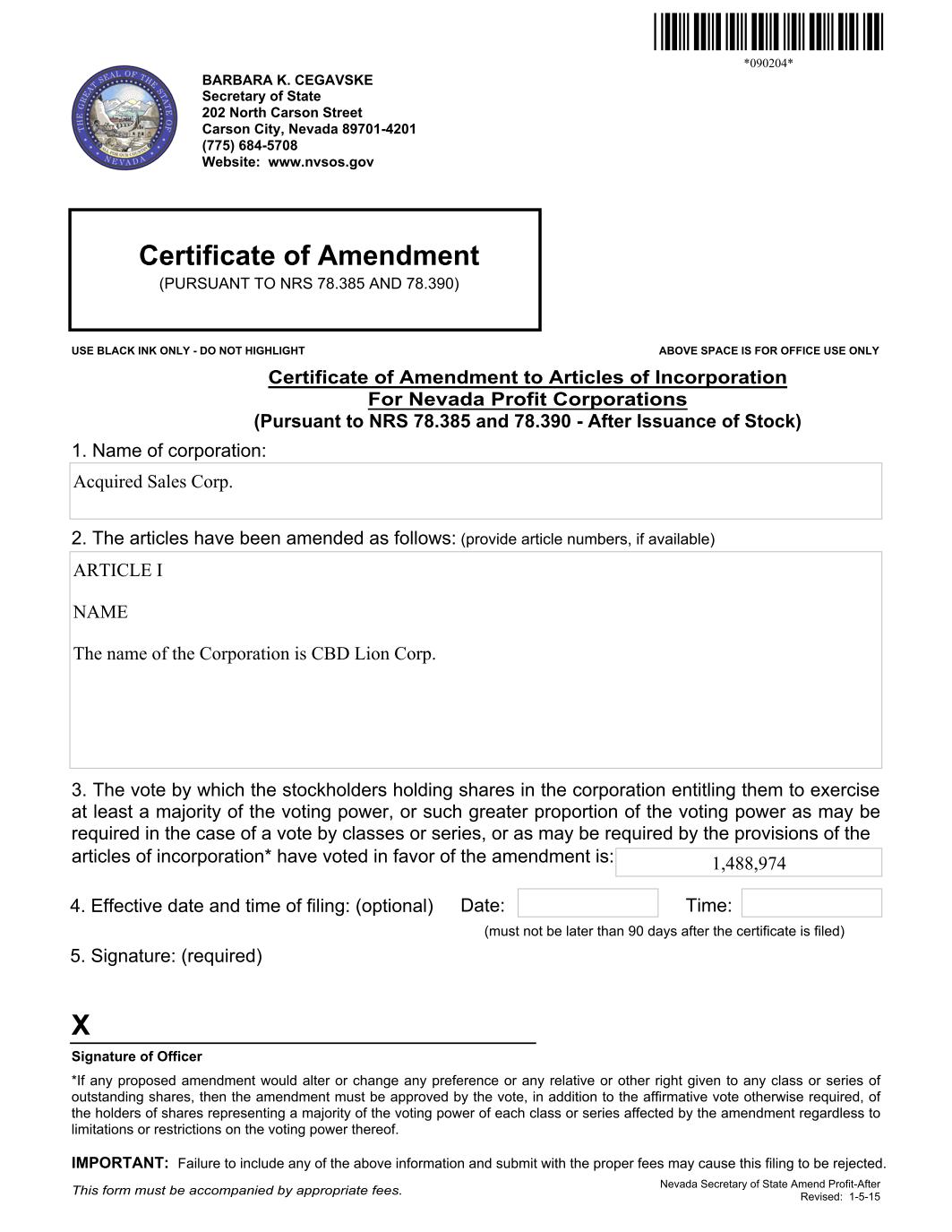

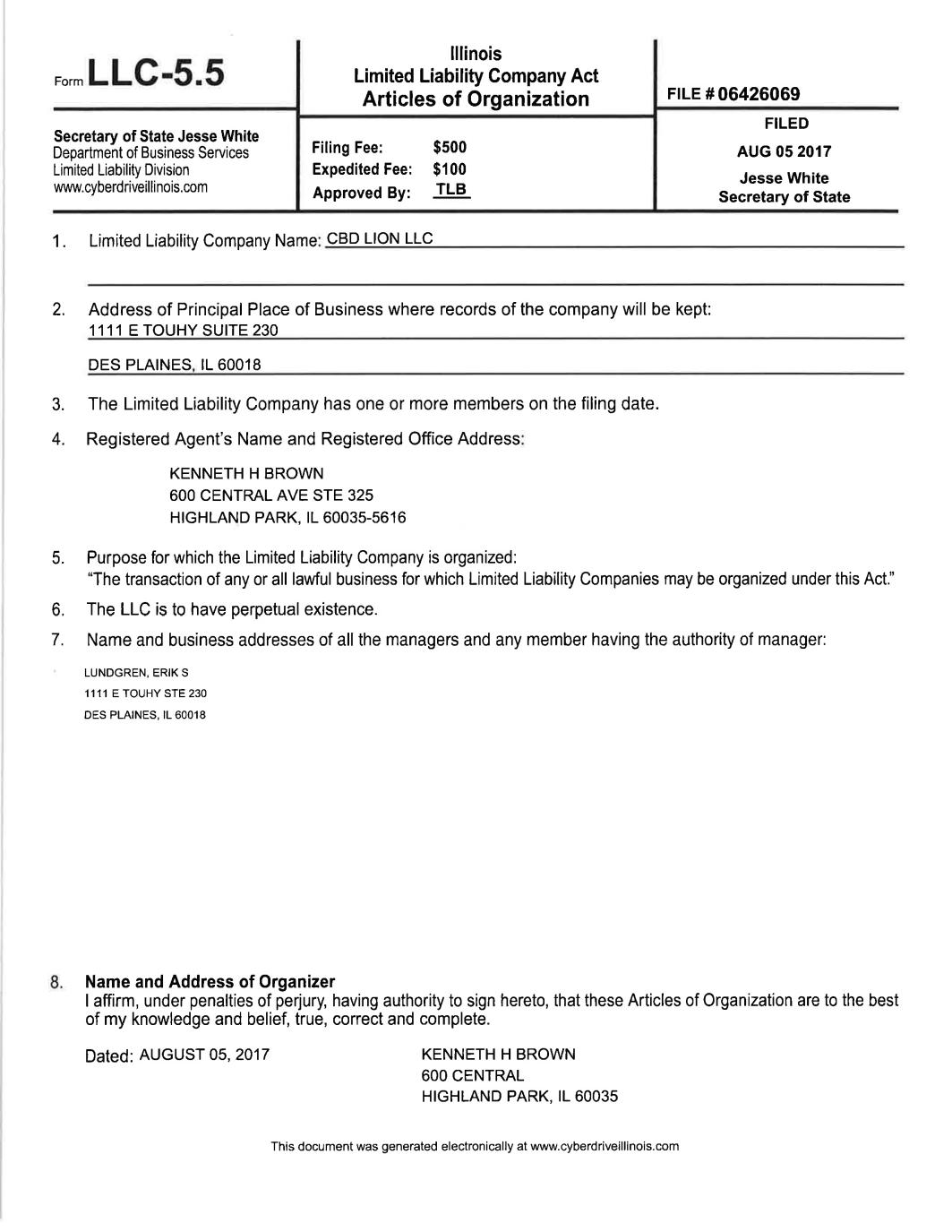

2.Amend the Corporation's Articles of Incorporation with the Nevada Secretary of State to change the Corporation’s name to CBD Lion Corp.

The CBD Lion Transaction

Terms of the Merger

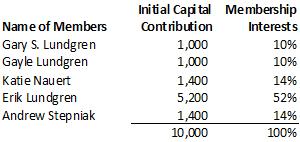

·Subject to a number of conditions, Acquired Sales Corp. will acquire 100% of the ownership of CBD Lion for two million dollars ($2,000,000) in cash, plus five million (5,000,000) shares of unregistered common stock of the Corporation (the "Stock Consideration").

·The effects of the Merger shall be that all assets, property, rights, privileges, immunities, powers, franchises, licenses, and authority of CBD Lion shall vest in the Corporation, and all debts, liabilities, obligations, restrictions, and duties of CBD Lion shall become the debts, liabilities, obligations, restrictions, and duties of the Corporation.

·The articles of incorporation of the Corporation shall be the articles of incorporation of the Surviving Entity; and (ii) the by-laws of the Corporation shall be the by-laws of the Surviving Entity.

·The directors of the Corporation shall be Gerard M. Jacobs (Chairman), Erik S. Lundgren (Vice Chairman),Vincent J. Mesolella (Lead outside director), Thomas W. Hines, James S. Jacobs, Joshua A. Bloom, Richard E. Morrissy, Michael D. McCaffrey and a ninth director who will be designated by Erik S. Lundgren and reasonably acceptable to Gerard M. Jacobs and the officers of the Corporation shall be as set forth below, each to hold the office until their respective successors are duly elected or appointed and qualified or until their earlier death, resignation, or removal in accordance with applicable Law.

oGerard M. Jacobs - Chairman, CEO and Secretary

oWilliam C. Jacobs - President, CFO and Treasurer

oErik S. Lundgren - Co-Vice Chairman, Co-Chief Operating Officer

oKatie M. Nauert – Chief Branding Officer

oAndrew R. Stepniak - Co-Chief Technology Officer

Conditions of the Merger

·At least twenty (20) days shall have passed after the mailing of this information statement and after the requisite filings are made with the State of Nevada.

·The parties shall have received the necessary authorizations of relevant governmental authorities.

3

·All filings required under the Securities Act or the Exchange Act necessary to consummate the Merger shall have been made.

·CBD Lion shall have received a written opinion from Taft Stettinius & Hollister LLP that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code.

·The Parties executing and delivering to the Corporation an employment agreement of Erik S. Lundgren.

·Gerard M. Jacobs, William C. Jacobs and the CBD Lion owners executing and delivering a stockholders agreement to vote in concert regarding the election of directors of the Corporation and on certain other matters.

·The Corporation and each CBD Lion Owner executing and delivering an escrow agreement;

·Each of Chris Weiland and Chris Nauert individually and Gary S. Lundgren and Gayle Lundgren as trustees of the Katie M. Lundgren 2008 Trust and as trustees of the Erik S. Lundgren 2008 Trust executing and delivering estoppel letters indicated that they have no right, title or interest whatsoever in and to the ownership interests, business or assets of CBD Lion.

·The Corporation and each CBD Lion Owner executing and delivering to the Corporation a registration rights agreement.

·Erik S. Lundgren delivering to the Corporation a file containing all product recipes used in CBD Lion business.

·No event, change, or effect that would, individually or in the aggregate, reasonably be expected to negatively impact the value of CBD Lion or the Corporation as set out in the Merger Agreement.

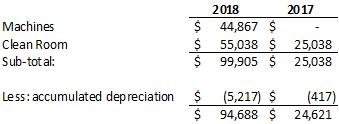

·Completion of an audit by an independent accountant of CBD Lion’s financial statements, which audit is acceptable to the Corporation.

·The release of a personal guaranty executed by Erik Lundgren.

Stockholders of record at the close of business on October 1, 2019 (the “Record Date”) are entitled to notice of this stockholder action by written consent. Stockholders representing a majority of our issued and outstanding shares of common stock have already consented to the action to be taken by written consent to be effective as of 20 days after the mailing of this information statement and after the requisite filings are made with the State of Nevada.

4

ACQUIRED SALES IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED TO NOT SEND A PROXY. Because the written consent of the holders of a majority of our voting power satisfies all applicable stockholder voting requirements, we are not asking for a proxy: please do not send us one.

Only stockholders of record at the close of business on October 1, 2019 (the “Record Date”) shall be given a copy of the Information Statement. The date on which this Information Statement will be sent to stockholders will be on or about October 25, 2019.

The accompanying information statement is for information purposes only. Please read it carefully.

By Order of the Board of Directors

/s/ Gerard M. Jacobs

Chief Executive Officer

October 11, 2019

5

This information statement is being furnished to all holders of the common stock of Acquired Sales in connection with the proposed action by Written Consent to authorize the board of directors to carry out the process to facilitate the reorganization of the Company in connection with the acquisition of CBD Lion, and to change the name of Company to CBD Lion Corp.

ITEM 1.

INFORMATION STATEMENT

This information statement is being furnished to all holders of the common stock of Acquired Sales, in connection with resolutions of the Board of Directors and the written consent of the holders of in excess of 50% of the voting rights of the shareholders of Acquired Sales. The Board of Directors, as approved by the written consent of the holders of in excess of 50% of the voting rights of the shareholders of Acquired Sales as of the Record Date, provides public notice of the approval and authorization to carry out activities in connection with (i) the merger with CBD Lion (“Merger”); and, (ii) amending the Corporation's Articles of Incorporation with the Nevada Secretary of State to change the Corporation’s name to CBD Lion Corp. (“Name Change”) (collectively, the “Corporate Actions”).

The Merger will be effectuated pursuant to the Agreement and Plan of Merger annexed hereto as Appendix A. The Name Change will be effectuated pursuant to a Certificate of Amendment (the “Amendment”) to our Articles of Incorporation in the form as annexed hereto as Appendix B.

The Company will pay all costs associated with the distribution of the definitive Information Statement.

The Board of Directors of the Company (the “Board”), and a majority of the Company's stockholders at the Board’s recommendation, have already approved of the Corporate Actions described above by written consent in lieu of meeting pursuant to Chapter 78 of the Nevada Revised Statutes of the State of Nevada (the “NRS”). Therefore, we are not seeking approval for the Amendment or any related capitalization change, or other Corporate Actions from any of the Company's remaining stockholders, and the Company's remaining stockholders will not be given an opportunity to vote on the Amendment or Corporate Actions. All necessary Board approvals have been obtained as of July 31, 2019 with all stockholder approvals effective as of October 1, 2019, and this Information Statement is being furnished solely for the purpose of providing advance notice to the Company's stockholders of the Amendment as required by the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Nevada law.

DATE, TIME AND PLACE INFORMATION

Under Section 14(c) of the Exchange Act and Rule 14c-2 promulgated thereunder, the Merger and Name Change cannot be effectuated until 20 days after the date that a Definitive Information Statement is sent to the Company's stockholders. This Preliminary Information Statement was filed with the Securities and Exchange Commission on October 15, 2019. It is anticipated that a Definitive Information Statement will be mailed ten days thereafter, on or about October 25, 2019 (the “Mailing Date”) to the stockholders of the Company as of the close of business on October 1, 2019 (the “Record Date”). The Company expects to file the Amendment so as to effectuate both the Merger and Name Change with the Nevada Secretary of State, approximately 20 days after the Mailing Date. The effective date of the Amendment and the Merger therefore, is expected to be on or after November 13, 2019.

DISSENTER’S RIGHT OF APPRAISAL

Pursuant to the NRS, our stockholders are not entitled to dissenters' rights of appraisal with respect to the Merger and Name Change as effectuated by the Amendment and the Company will not independently provide shareholders with any such right.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

6

Common Stock

There will be no changes to any of the rights or privileges associated with our Common Stock. The following summarizes the rights of holders of our Common Stock before and after the filing of the Amendment relating to the capitalization change:

·Each holder of shares of Common Stock is entitled to one vote per share on all matters to be voted on by our stockholders generally, including the election of directors; |

·There are no cumulative voting rights; |

·The holders of our Common stock are entitled to dividends and other distributions as may be declared from time to time by the Board out of funds legally available for that purpose, if any, subject to any dividend rights of the preferred stock, if any; |

·Upon our liquidation, dissolution or winding up, the holders of shares of Common Stock will be entitled to share ratably in the distribution of all of our assets remaining available for distribution after satisfaction of all our liabilities and the payment of the liquidation preference of any outstanding preferred stock; and |

·The holders of Common Stock have no preemptive or other subscription rights to purchase shares of our stock, and are not entitled to the benefits of any redemption or sinking fund provisions. |

Dividends

We have not declared or paid cash dividends or made distributions in the past, and we do not anticipate paying cash dividends or making distributions in the foreseeable future. We currently intend to retain and reinvest future earnings, if any, in order to finance our operations.

Outstanding Shares And Voting Rights

Currently, our only class of securities entitled to vote on the matters to be acted upon is common stock, of which the total amount presently outstanding is 2,726,669 shares, each share being entitled to one vote. The record date for determination of the security holders entitled to vote or give consent is October 1, 2019. The consent of the holders of a majority of the shares entitled to vote upon the matter is required for approval of the actions. The board of directors and Stockholders owning 1,488,974 which constitute a majority of 54.6% of the outstanding voting securities of Acquired Sales Corp. have unanimously adopted, ratified and approved resolutions to effect the actions listed above. No other votes are required or necessary. We anticipate effecting the name change, acquisition and all other actions set out herein within two months of the date that this information statement is filed.

On July 31, 2019, our Board adopted resolutions approving and authorizing the Merger and on May 24, 2019, our Board signed a unanimous written consent to the Amendment containing the Name Change. Effective as of October 1, 2019, a majority of the stockholders of the Company took action by written consent and approved the Merger and an amendment to the Company’s Articles of Incorporation with respect to the Name Change.

As of the Record Date, the Company has authorized capital stock of 110,000,000 shares, of which 100,000,000 are shares of Common Stock and 10,000,000 are shares of preferred stock. As of October 15, 2019, 2,726,669 shares of our common stock were issued and outstanding, held by 243 holders of record. As of October 15, 2019, 66,150 shares of our Series A Preferred Stock and 90,000 shares of our Series B Preferred Stock were issued and outstanding. Our common stock is traded on the OTC Markets under the ticker symbol ASQP.

7

The following 17 shareholders, being beneficial owners of an aggregate of 1,488,974 shares of Common Stock constituting approximately 54.6% of our 2,726,669 shares of outstanding authorized Common Stock, voted in favor of the Amendment effecting the Name Change and other Corporate Actions described above:

Name | | Number of Shares |

William C. Jacobs | | 200,000 |

Roger S. Greene | | 112,413 |

Daniel F. Terry | | 572,000 |

Steven M. Skinner | | 7,021 |

Robert John Jacobs | | 25,000 |

Roberti Jacobs Family Trust (1) | | 181,623 |

Miss Mimi Corporation | | 100,000 |

Liberty Capital LLC (2) | | 10,000 |

Michelle Stratton (2) | | 10,000 |

Leonard D. Hall (2) | | 30,000 |

Brian Peterson (2) | | 10,000 |

Kathy Carter (2) | | 60,917 |

Alison Brewer (2) | | 10,000 |

Alpine Securities FBO V Mark Peterson Roth IRA (2) | | 10,000 |

Richard E. Morrissy | | 25,000 |

Joshua A. Bloom | | 50,000 |

James S. Jacobs | | 75,000 |

Total | | 1,488,974 |

(1)The Roberti Jacobs Family Trust irrevocably conveyed all of its voting power to Gerard M. Jacobs pursuant to a 2007 shareholder agreement, Mr. Jacobs is one of the grantors of the trust corpus, Mr. Jacobs and his wife Grace Roberti are the trustees, and Mr. Jacobs’ children are the beneficiaries. The trust is irrevocable.

(2)Shares voted by Gerard M. Jacobs pursuant to an irrevocable proxy dated as of 7/25/2007

Each share of Common Stock entitles its holder to one vote on each matter submitted to the stockholders.

Pursuant to Chapter 78 of the NRS, the approval of a majority of the Company's voting power is required in order to effectuate the Amendment and Corporate Actions. Chapter 78 of the NRS eliminates the need to hold a special meeting of the Company's stockholders to approve the Corporate Actions, including the Amendment and related capitalization change by providing that, unless the Company's Articles of Incorporation or Bylaws state otherwise, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent is signed by stockholders holding at least a majority of the Company's voting power in favor of such action. Neither the Articles of Incorporation nor the Bylaws of the Company state otherwise and a majority of the Corporation’s common stock have voted in favor of the Amendment and other Corporate Actions.

The Amendment would enable the Company, without further stockholder approval, to issue shares from time to time as may be required for proper business purposes, such as raising additional capital for ongoing operations, business and asset acquisitions, stock splits and dividends, present and future employee benefit programs and other corporate purposes.

8

DIRECTORS AND EXECUTIVE OFFICERS

Our articles of incorporation and bylaws authorize a board of directors comprised of a number of not less than one.

Set forth below for each person who has been elected director, based on information supplied by him, are his name, age as of the date of the Information Statement, any presently held positions with us, his principal occupation now and for the past five years, other directorships in public companies and his tenure of service with us as a director. Each shall hold office until their successors are elected and qualify. The information has been provided by the nominees without independent verification by our management.

Executive Officers and Directors

The following table sets forth certain information regarding our current Directors and Executive Officers as of October 15, 2019.

Name | Age | Position |

Joshua A. Bloom, M.D. | 63 | Director |

Gerard M. Jacobs | 64 | Chairman of the Board, Chief Executive Officer and Secretary |

James S. Jacobs, M.D. | 65 | Director |

William C. "Jake" Jacobs, CPA | 31 | President, Chief Financial Officer and Treasurer |

Michael D. McCaffrey | 73 | Director |

Vincent J. Mesolella | 70 | Director |

Richard E. Morrissy | 64 | Director |

Thomas W. Hines, CPA CFA | 60 | Director |

Our Directors serve in such capacity until the next annual meeting of our shareholders and until their successors have been elected and qualified. Our Chief Executive Officer serves at the discretion of our Board of Directors, until his death, or until he resigns or has been removed from office.

Joshua A. Bloom, M.D.,age 63, has been a member of our board of directors since July 2007. He has been a practicing physician in Kenosha, Wisconsin since completion of his training in 1988. He is board Certified in Internal Medicine, Pulmonary Diseases, Critical Care Medicine and in Hospice and Palliative Care. He has been employed by Froedtert South (formerly known as United Hospital System) in the Clinical Practice Division from 1995 to present. He had been in private practice at the same address from 1988 to 1995. Dr. Bloom served on the board of directors of Kenosha Health Services Corporation from 1993 to approximately 2010 and the board of Hospice Alliance, Inc. since 1994 and Medical Director there since 1998. He also served on the board of the Beth Israel Sinai Congregation 1998 to 2014, where he served as the President from 2004 until 2010. We believe that Dr. Bloom’s experience serving as a director of the Corporation since 2007, his intelligence and educational background, and his familiarity with the medical field which has in the past and is currently providing candidates for potential acquisitions by the Corporation, qualifies him to serve as a director of the Corporation.

Dr. Bloom received a medical degree from the University of Illinois in 1982 and completed his residency in internal medicine in 1985 and fellowship in Respiratory & Critical Care Medicine in 1988; both at the University of Illinois. He received an MS in Organic Chemistry from the University of Chicago in 1978 and a BS in Chemistry from Yale College in 1977.

Gerard M. Jacobs,age 64, is Chairman of our Board of Directors, Chief Executive Officer and Secretary of the Company. Mr. Jacobs has been a private investor since 2006. In 2001, Mr. Jacobs took control of CGI Holding Corporation, and served as its Chief Executive Officer and member of its board of directors until 2006. Under Mr. Jacobs’ guidance, CGI Holding Corporation changed its name to Think Partnership Inc., made 15 acquisitions primarily of businesses involved in online marketing and advertising, and

9

succeeded in having its common stock listed on the American Stock Exchange. The company is now known as Inuvo Inc. (NYSE:MKT: INUV). Previously, in 1995, Mr. Jacobs took control of General Parametrics Corporation, and served as its Chief Executive Officer and member of its board of directors until 1999. Under Mr. Jacobs’ guidance, General Parametrics changed its name to Metal Management Inc., made 37 acquisitions primarily of businesses involved in scrap metal recycling, and succeeded in building one of the largest scrap metal recycling companies in the world. The company is now part of Sims Metal Management Ltd. (ASX trading symbol: SGM). Mr. Jacobs has also served as the lead outside director for America’s Car-Mart, Inc. (NASDAQ: CRMT) and Patient Home Monitoring Corp. (Toronto: PHM). We believe that Mr. Jacobs’ experience serving as the Chief Executive Officer of three publicly traded companies and as a director of two other publicly traded companies, his work as an investment banker and as an attorney, and his intelligence and educational background, qualifies him to serve as a director of the Corporation.

Mr. Jacobs received a law degree from the University of Chicago Law School, which he attended as a Weymouth Kirkland Law Scholar, in 1978; and an A.B from Harvard College, in 1976, where he was elected to Phi Beta Kappa. Mr. Jacobs’ brother, James S. Jacobs, M.D., is also a member of our board of directors and William C. Jacobs, our President and Chief Financial Officer and Treasurer, is Gerard M. Jacobs’ son.

Gerard M. Jacobs earns compensation from the Company at the rate of $7,500 per month. He is also entitled to reimbursement for all of his business-related expenses.

James S. Jacobs, M.D.,age 65, has been a member of our board of directors since July 2007. He is a Physician in the Department of Radiation Oncology, at St. Joseph Hospital in Denver, Colorado. He was previously the Resident Physician in Radiation Oncology at Rush Medical Center in Chicago, Illinois. We believe that Dr. Jacobs’ experience serving as a director of the Corporation since 2007, his intelligence and educational background, and his familiarity with the medical field which has in the past and is currently providing candidates for potential acquisitions by the Corporation, qualifies him to serve as a director of the Corporation.

Dr. Jacobs did a residency in Radiation Oncology at Rush Medical Center in Chicago, Illinois and an internal medicine internship and residency at the University of Colorado Medical Center in Denver, Colorado. Dr. Jacobs received a BA in Neuroscience from Amherst College in Amherst, Massachusetts in 1976.

William C. “Jake” Jacobs, CPA,age 31, is President, Chief Financial Officer and Treasurer of the Company. Effective as of February 27, 2019, the Board appointedMr. Jacobs, the son of our Company’s Chief Executive Officer Gerard M. Jacobs, to serve as the President, Chief Financial Officer and Treasurer of the Company. Prior to becoming President, Chief Financial Officer and Treasurer of the Company, Mr. Jacobs served as an independent contractor for the Company for the past several years. Previously, Mr. Jacobs worked in the Assurance Division of Ernst & Young (doing business as EY), auditing both publicly traded and privately held companies. Mr. Jacobs graduated from the University of Southern California, with a double major in Accounting and Finance. In 2015, Mr. Jacobs won a Gold Medal at the United States of America Snowboard and Freeski Association (USASA) National Championships in the Boardercross Snowboard Senior (23-29) Men’s division.

William C. Jacobs earns compensation from the Company at the rate of $5,000 per month. He is also entitled to reimbursement for all of his business-related expenses.

Michael D. McCaffrey,age 73, has been a member of our board of directors since July 2007. He is an attorney practicing in Irvine, California and specializing in commercial and business litigation. Mr. McCaffrey has tried more than 100 jury and non-jury trials, representing numerous large companies, institutional lenders, real estate developers, contractors and various public and private corporations, partnerships and sole proprietorships. He has had sole or primary responsibility for defense and prosecution of significant matters including real property secured transactions; real estate syndication/fraud; partnership disputes/accounting/dissolution actions; corporate control; insurance (policyholders’ interests and insurers’

10

interests); employment litigation; prosecution, defense and expert witness on professional liability claims involving attorneys and accountants; construction, including prosecution and defense of major defect cases; and various business tort cases. We believe that Michael D. McCaffrey’s experience serving as a litigator and advisor to corporations, and his intelligence and educational background, qualifies him to serve as a director of the Corporation.

Mr. McCaffrey received his Juris Doctor in 1974 from the University of Denver College of Law where he was a member of the University of Denver Law Review (qualified by class rank, top 5%) and received a B.S. in Engineering from UCLA in 1968.

Vincent J. Mesolella,age 70, has been a member of our board of directors since October 2010. He has served for many years as the Chairman of the Narragansett Bay Commission, Providence, Rhode Island, one of the largest wastewater treatment utilities in the U.S. Mr. Mesolella also served for over twenty years as a member of the Rhode Island House of Representatives, including serving as the Majority Whip. Mr. Mesolella is the founder, President and Chief Executive Officer of MVJ Realty, LLC, a diversified real estate investment firm. Mr. Mesolella has served on the board of directors of Think Partnership Inc., an American Stock Exchange company. Mr. Mesolella has raised a great deal of money for charities including the Make-A-Wish Foundation. Mr. Mesolella resides in Rhode Island. We believe that Vincent J. Mesolella’s experience serving as a director of two publicly traded companies including service as Chairman of the Audit Committee of both, his work as a developer and business owner, his experience as an elected public official, his Chairmanship of a major wastewater treatment organization that has been nationally recognized for its excellence, his intelligence and educational background, and his familiarity with the real estate industry which has in the past and is currently providing candidates for potential acquisitions by the Corporation, qualifies him to serve as a director of the Corporation.

Richard E. Morrissy,age 64, has been a member of our board of directors since July 2007. Since August 2016, Mr. Morrissy has been working at the UIC Department of Medicine’s Section of Infectious Disease in a research clinic called Project WISH as Clinical Coordinator in Regulatory Affairs. Previously, Mr. Morrissy was the Senior Research Specialist at the Department of Surgery – CS within the UIC College of Medicine. Mr. Morrissy was a project coordinator for the School of Pharmacy. His duties included serving as project coordinator on four clinical trial research projects funded by the National Institutes of Health’s National Cancer Institute. The School of Pharmacy projects have involved multiple research projects utilizing Lycopene in restoring DNA damage in men’s prostates. The project at UIC’s internationally acclaimed Occupational Therapy School involved the setup and running of focus groups with impaired individuals to create a movement and activity computer survey for the World Health Organization. During his tenure, Mr. Morrissy managed clinical research trials including the submission of institutional review board documents and grant proposals, recruitment of subjects and data management and storage. He also designed and led focus groups, designed and critiqued research surveys, and edited manuscripts and scientific journals. We believe that Mr. Morrissy’s experience serving as a director of the Corporation since 2007, his intelligence and educational background, and his familiarity with the medical field which has in the past and is currently providing candidates for potential acquisitions by the Corporation, qualifies him to serve as a director of the Corporation. He received a B.A. in History from Western Illinois University in 1976.

Thomas W. Hines, CPA CFA,age 60, has been a member of our board of directors sinceFebruary 2019. Mr. Hines is a Vice President with Lowery Asset Consulting. Previously, Mr. Hines served as the Executive Vice President at Good Harbor Financial, as the National Director of Financial Planning at The Northern Trust Company, and as a tax partner at Ernst & Young in the financial planning group. Mr. Hines is a Certified Public Accountant (CPA) and a Chartered Financial Analyst (CFA). Mr. Hines holds a Bachelor of Science degree in Accounting from Marquette University, and a Master of Science in Taxation from the University of Wisconsin-Milwaukee. Mr. Hines has been featured in publications including Fortune, American Banker, and the Premier edition of Wealth magazine. We believe that Mr. Hines’ experience as a CPA and CFA, his intelligence and educational background, qualifies him to serve as a director of the Corporation. Mr. Hines has completed over 120 Triathlons, including the Hawaii Ironman World Championship.

11

There are no agreements or understandings for our Chief Executive Officer or directors to resign at the request of another person, and neither the Chief Executive Officer nor directors are acting on behalf of nor will any of them act at the direction of any other person. Directors are elected until their successors are duly elected and qualified.

Board Membership of Acquired Sales and CBD Lion Before and After the Proposed Acquisition.

CBD Lion board of directors pre-Merger: CBD Lion is a limited liability company without a board of directors. It is managed by Erik Lundgren.

CBD Lion board of directors after Merger: Upon the closing of the Merger, CBD Lion will disappear into Acquired Sales Corp. It will have no Board.

Acquired Sales board of directors pre-Merger: The board of directors of Acquired Sales currently consists of seven people: Gerard M. Jacobs, Joshua A. Bloom, M.D., James S. Jacobs, M.D., Thomas W. Hines, CPA CFA, Michael D. McCaffrey, Vincent J. Mesolella, and Richard E. Morrissy. Gerard M. Jacobs serves as the Chairman of Acquired Sales. Neither Erik S. Lundgren, nor his designee is currently a director of Acquired Sales.

Acquired Sales board of directors after Merger: Pursuant to the terms of the Merger Agreement, at the Closing of the Merger the Acquired Sales board of directors will consist of Gerard M. Jacobs, Joshua A. Bloom, M.D., James S. Jacobs, M.D., Thomas W. Hines, CPA CFA, Michael D. McCaffrey, Vincent J. Mesolella, Erik S. Lundgren and Richard E. Morrissy, plus a ninth director who will be designated by Erik S. Lundgren and reasonably acceptable to Gerard M. Jacobs who will continue to serve as the Chairman of Acquired Sales following the closing of the Merger. Each to hold the office until their respective successors are duly elected or appointed and qualified or until their earlier death, resignation, or removal in accordance with applicable Law.

Board Leadership Structure

Prior to the closing of our acquisition of CBD Lion, our board of directors has seven members. Gerard M. Jacobs is serving as both our principal executive officer and as the Chairman of our board of directors. Mr. Jacobs, who is a Phi Beta Kappa graduate of Harvard College and attended the University of Chicago Law School as a Weymouth Kirkland Law Scholar, has extensive experience serving as the Chief Executive Officer of several publicly traded companies, and has served as an independent member of the board of directors of other publicly traded companies, in several industries. Our company pays Mr. Jacobs consulting fees of $7,500 per month. Upon AQSP closing its acquisition of CBD Lion or Lifted Liquids, we intend to enter into a formal, individual employment agreement with Mr. Jacobs pursuant to the terms set out in the Compensation Agreement attached as Exhibit 10.53 to the Current Report on Form 8-K filed on June 26, 2019. Vincent Mesolella is formally designated as our lead independent director. Mr. Jacobs regularly consults with several of our independent directors, and especially with Vincent J. Mesolella in regard to all aspects of our company’s affairs.

Mr. Mesolella has served on the boards of directors of publicly traded companies, and for many years has served as the Chairman of the Narragansett Bay Commission, a large wastewater treatment agency in Rhode Island that has won national awards under his leadership. Mr. Mesolella has been actively involved in our evaluation of CBD Lion as a potential acquisition candidate, and in our negotiations of the terms of our pending acquisition of CBD Lion. Mr. Mesolella also receives and reviews a copy of each of our monthly bank statements.

Our board of directors has appointed an Investment Committee currently consisting of our CEO Gerard M. Jacobs, our President and CFO William C. Jacobs CPA, and director Thomas W. Hines. Our Investment Committee evaluated CBD Lion as a potential acquisition candidate, and has approved the terms and conditions of the Merger.

12

We believe that our current leadership structure is appropriate given the current financial resources of our corporation, the extensive experience of our directors, and the collaborative decision-making style of Mr. Jacobs. The board of directors’ role in the risk oversight of our company involves periodic telephonic board meetings, and one-on-one and conference telephone calls and email correspondence questioning Mr. Jacobs regarding his decision-making thought process, reviewing available financial and other documents as appropriate, and brainstorming with Mr. Jacobs as to how to best advance and protect our shareholders’ interests in regard to potential acquisitions and capital raises.

The leadership structure of our board of directors will not change substantially following the closing of our acquisition of CBD Lion. Our board of directors is expected to expand to nine members with the addition of Erik S. Lundgren and also a new director designated by Mr. Lundgren and approved by Gerard M. Jacobs.

At the present time, Vincent Mesolella is our lead outside director. We also draw upon the knowledge, experience and contacts of all of our directors. We believe that this anticipated leadership structure, with an experienced Chairman and several strong independent directors providing counsel to him, is appropriate given the experience of our directors and the collaborative decision-making style of Mr. Jacobs. It is anticipated that, following the closing of our acquisition of CBD Lion, the board of directors’ role in the risk oversight of our company will continue to involve periodic telephonic board meetings, and one-on-one and conference telephone calls and email correspondence questioning Mr. Jacobs, regarding his decision-making thought process, reviewing available financial and other documents as appropriate, and brainstorming with Mr. as to how to best advance and protect our shareholders’ interests in regard to potential acquisitions and capital raises, and in regard to operational and growth issues that may face CBD Lion.

Family Relationships

Gerard M. Jacobs and James S. Jacobs, MD are brothers. Gerard M. Jacobs and William C. Jacobs are father and son. James S. Jacobs and William C. Jacobs are uncle and nephew. There is no other family relationship among any of our officers or directors.

There are no agreements or understandings for any of our executive officers or director to resign at the request of another person and no officer or director is acting on behalf of nor will any of them act at the direction of any other person. Directors are elected until their successors are duly elected and qualified.

Certain Relationships And Related Transactions

The following includes a summary of transactions during our fiscal years ended December 31, 2018 and December 31, 2017 to which we have been a party, in which the amount involved in the transaction exceeds the lesser of $120,000 or 1% of the average of our total assets at year-end for the last two completed fiscal years, and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than equity and other compensation, termination, change in control and other arrangements, which are described elsewhere in this registration statement.

Rights to Purchase Warrants

On April 1, 2018, we issued to director Dr. James S. Jacobs, brother of Chief Executive Officer Gerard M. Jacobs, rights to purchase warrants, for a purchase price of $1.00, an aggregate of 40,000 shares of common stock of the Company, at an exercise price of $0.01 per share, such warrants to be fully vested and to be exercisable on or prior to December 31, 2024.

On April 1, 2018, we issued to then independent contractor and now our President and Chief Financial Officer William C. Jacobs, son of chief executive officer Gerard M. Jacobs, rights to purchase warrants, for a purchase price of $1.00, an aggregate of 210,000 shares of common stock of the Company, at an exercise

13

price of $0.01 per share, such warrants to be fully vested and to be exercisable on or prior to December 31, 2024. On March 13th, 2019, William C. Jacobs exercised these warrants to purchase 200,000 shares of common stock of the company, and assigned the remaining 10,000 warrants to a third party.

Operating Loans 2018

On July 16, 2018 and November 12, 2018, Joshua A. Bloom, a member of our Board of Directors, loaned the Company $10,025 and $10,000, respectively, for working capital needs. The loans bear interest at 15% per annum. The loans are payable on demand by lender. There is a default rate of 18% interest in the event that the loans are not paid on demand. The loans are secured by all of the assets of the Company. In addition, the loan terms grant Mr. Bloom a total of 25,000 financing warrants to purchase shares of common stock of Acquired Sales Corp., exercisable at $0.03 per share at any time through July 16, 2023.

On July 18, 2018 and November 8, 2018, Gerard M. Jacobs, our Chief Executive Officer and a member of our Board of Directors, loaned the Company $4,765.70 and $6,000, respectively, for working capital needs. The loans bear interest at 15% per annum. The loans are payable on demand by lender. There is a default rate of 18% interest in the event that the loans are not paid on demand. The loans are secured by all of the assets of the Company. In addition, the loan terms grant Mr. Jacobs a total of 12,500 financing warrants to purchase shares of common stock of Acquired Sales Corp., exercisable at $0.03 per share at any time through July 16, 2023.

Operating Loans 2019

On January 7, 2019, January 21, 2019 and February 6, 2019, Gerard M. Jacobs, our Chief Executive Officer and a member of our board of directors, loaned the Company $5,967.50, $804, and $8,000, respectively, for working capital needs. The loans bear interest at 15% per annum. The loans are payable on demand by lender. There is a default rate of 18% interest in the event that the loans are not paid on demand. The loans are secured by all of the assets of the Company. In addition, the loan terms grant Mr. Jacobs a total of 18,750 financing warrants to purchase shares of common stock of Acquired Sales Corp., exercisable at $0.03 per share at any time through July 16, 2023.

Investment in Series A Preferred Stock

On February 27, 2019, director Thomas W. Hines purchased 5,400 shares of our Series A Preferred Stock convertible into 540,000 shares of our common stock at $1.00 per share.

Acquisition of Real Estate in Rhode Island

As discussed in our prior public filings, we have attempted to acquire one or more parcels of real estate in Rhode Island, referred to as the Mesolella/Jacobs Properties that are owned by entities affiliated with Vincent J. Mesolella and his son Derek V. Mesolella, formerly an independent contractor to the Company. One of the Mesolella/Jacobs Properties is also partly owned by an affiliate of our Chief Executive Officer, Gerard M. Jacobs. Discussions among Messrs. Mesolella and Jacobs and our independent directors have made it highly likely that we will never purchase any of the Mesolella/Jacobs Properties.

Indemnification of Officers and Directors

Our bylaws specifically limit the liability of our Chief Executive Officer and directors to the fullest extent permitted by law. As a result, aggrieved parties may have a more limited right to action than they would have had if such provisions were not present. The bylaws also provide for indemnification of our Chief Executive Officer and directors for any losses or liabilities they may incur as a result of the manner in which they operated our business or conducted internal affairs, provided that in connection with these activities they acted in good faith and in a manner which they reasonably believed to be in, or not opposed to, our best interest. In the ordinary course of business, we also may provide indemnifications of varying scope and terms to customers, vendors, lessors, business partners, independent contractors and other parties with respect to certain matters, including, but not limited to, losses arising out of our breach of such

14

agreements, services to be provided by us, or from intellectual property infringement claims made by third-parties. We may also agree to indemnify former officers, directors, employees and independent contractors of acquired companies in connection with the acquisition of such companies.

Director Independence

We are not listed on a national exchange, such as NASDAQ, at this time. As such, we are not required to have independent directors. Our management believes that, consistent with Rule 5605(a)(2) of the Nasdaq Listing Rules that a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our management has reviewed the composition of our Board of Directors and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our Board of Directors has determined that each of our directors, with the exceptions of Gerard M. Jacobs and Dr. James S. Jacobs, is an “independent director”.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, or has been a party to any judicial or administrative proceeding during the past ten years that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without sanction or settlement. Except as set forth in our discussion above in the section entitled “Certain Relationships and Related Transactions, and Director Independence,” none of our directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Board Composition and Committees

Our Board of Directors is currently composed of seven members: Messrs. Gerard M. Jacobs, Joshua A. Bloom, M.D., Thomas W. Hines, James S. Jacobs, M.D., Michael D. McCaffrey, Richard E. Morrissy and Vincent J. Mesolella. Our Board has decided that it would judge the independence of its directors by the heightened standards established by the NASDAQ Stock Market, despite the Company not being subject to these standards at this time. Accordingly, the Board has determined that five of our six non-employee directors, Messrs. Joshua A. Bloom, M.D., Thomas W. Hines, Michael D. McCaffrey, Richard E. Morrissy and Vincent J. Mesolella, each meet the independence standards established by the NASDAQ Stock Market and the applicable independence rules and regulations of the SEC, including the rules relating to the independence of the members of our audit committee and compensation committee. Our Board of Directors considers a director to be independent when the director is not an officer or employee of the Company or its subsidiaries, does not have any relationship which would, or could reasonably appear to, materially interfere with the independent judgment of such director, and the director otherwise meets the independence requirements under the listing standards of the NASDAQ Stock Market and the rules and regulations of the SEC.

Audit Committee and Audit Committee Financial Expert

We have an audit committee consisting of Joshua A. Bloom, M.D., Thomas W. Hines, Michael D. McCaffrey, Vincent J. Mesolella and Richard E. Morrissy as members. We have not adopted an Audit Committee charter. Vincent J. Mesolella serves as our audit committee chairman and financial expert. Our audit committee performs the following functions including: (1) selection and oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; and (3) engaging outside advisors. Our Board

15

of Directors has determined that each of its members is able to read and understand fundamental financial statements and has substantial business experience that results in that member’s financial sophistication. Accordingly, the Board of Directors believes that each of its members has the sufficient knowledge and experience necessary to fulfill the duties and obligations that an audit committee member should have for a business such as the Company.

Compensation Committee

Our compensation committee is comprised of Messrs. Bloom, Hines, McCaffrey, Mesolella and Morrissy. Joshua A. Bloom, M.D. is Chairman of the compensation committee. The compensation committee is responsible for, among other things, reviewing and recommending to our Board of Directors the annual salary, bonus, stock compensation and other benefits of our executive officers, including our Chief Executive Officer and Chief Financial Officer; reviewing and providing recommendations regarding compensation and bonus levels of other members of senior management; reviewing and making recommendations to our Board of Directors on all new executive compensation programs; reviewing the compensation of our Board of Directors; and administering our equity incentive plans. The compensation committee may delegate any or all of its duties or responsibilities to a subcommittee of the compensation committee, to the extent consistent with the Company's organizational documents and all applicable laws, regulations and rules of markets in which our securities trade, as applicable. The Board has determined that each member of the compensation committee is “independent,” as that term is defined by the rules of the NASDAQ Stock Market.

Corporate Governance and Nominating Committee

Our corporate governance and nominating committee is comprised of Messrs. Bloom, Hines, McCaffrey, Mesolella and Morrissy. Michael D. McCaffrey is Chairman of the corporate governance and nominating committee. The corporate governance and nominating committee is responsible for, among other things, annually assessing the composition, skills, size and tenure of the Board of Directors in advance of annual meetings and whenever individual directors indicate that their status may change; annually considering new members for nomination to the Board of Directors; causing the Board of Directors to annually review the independence ofdirectors; and developing and monitoring our general approach to corporate governance issues as they may arise. The Board has determined that each member of the corporate governance and nominating committee is “independent,” as that term is defined by the rules of the NASDAQ Stock Market.

Investment Committee

Our board of directors has appointed an Investment Committee currently consisting of our Chief Executive Officer Gerard M. Jacobs, our President and Chief Financial Officer William C. Jacobs, CPA and director Thomas W. Hines, CPA, CFA. Future acquisitions by the Company of direct equity ownership interests in any entity other than Ablis, Bendistillery and Bend Spirits will be subject to unanimous approval by such Investment Committee and to majority approval by the Board of Directors of the Company, provided that the requirement of unanimous approval by such Investment Committee will be terminated if the investors in the Company’s Series A Preferred Stock no longer hold 25% or more of their investment in the form of Preferred Stock or common stock of the Company following conversion, or if the Company’s common stock has closed at $10.00 per share or higher for 20 consecutive trading days and there have been on average at least 50,000 shares traded on each of those 20 consecutive trading days, or if 84 months have passed since the first date that the registration statement covering the common shares of the company into which the Company's Series A Preferred Stock can be converted (the "Series A Registration Statement") is effective.

Code of Ethics

We currently have not adopted a code of ethics due to our limited size and operations. Following completion of acquisition of assets and expansion of our business in 2019, we intend to adopt a code of ethics consisting of written standards that are designed to deter wrongdoing and to promote (a) Honest and

16

ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; (b) Full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the Commission and in other public communications made by us; (c) Compliance with applicable governmental laws, rules and regulations; (d) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and (e) Accountability for adherence to the code.

Section 16(a) Beneficial Ownership Compliance.

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of our common stock and other equity securities, on Forms 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the SEC regulations to furnish us with copies of all Section 16(a) reports they file. Such persons are further required by SEC regulation to furnish us with copies of all Section 16(a) forms (including Forms 3, 4 and 5) that they file. Based solely on our review of the copies of such forms received by us with respect to fiscal year 2019, or written representations from certain reporting persons, we believe all of our directors, executive officers and 10% holders have met all applicable filing requirements, except as described in this paragraph:

Daniel F. Terry, Jr. is a holder of 10% of our common stock and has not filed a Form 3. Gerard M. Jacobs, Vincent Mesolella, Joshua A. Bloom, Thomas W. Hines, Richard E. Morrissy and James S. Jacobs, members of our board of directors, have not filed a Form 3 or Form 4

COMPENSATION OF DIRECTORS AND OFFICERS

Summary Compensation Table

Set forth below is information for the fiscal years indicated relating to the compensation of each person who served as our principal executive officer (the “Named Executive Officer”) during the past two fiscal years.

| Year | Salary($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings($) | All Other Compensation ($) | Total ($) |

Gerard M. Jacobs, | 2018 | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

CEO(1) | 2017 | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

William C. Jacobs, | 2018 | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

Pres CFO(2) | 2017 | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

(1) As of December 31, 2018, we did not experience any cash flow events as a result of any payments to our Chief Executive Officer, Gerard M. Jacobs. We have not provided retirement benefits or severance or change of control benefits to Mr. Gerard M. Jacobs. Unexercised options or warrants issued as compensation held by our Chief Executive Officer at the years ended December 31, 2017 and 2018 are set out in the following table; no equity awards were made during these years.

17

(2) William C. Jacobs was an independent contractor of the Company from May 2014 until February 4, 2019, when he was promoted to President, Treasurer and CFO of the Company. As an independent contractor, William C. Jacobs earned fees of $5,000 per month, plus reimbursement for all of his business-related expenses. However, during 2017 and 2018, William C. Jacobs was not paid the independent contractor fees that he had earned, and he was not reimbursed for any of his business-related expenses, because the Company did not have the cash to pay him. All of the independent contractor fees that were owed to William C. Jacobs but were not paid because the Company did not have the cash to pay him, plus reimbursement for all of his business related expenses, were fully paid to him during 2019 out of the proceeds of the sale of the Company's Series A convertible preferred stock. These independent contractor fees totaled $60,000 for 2017 and $60,000 for 2018.

BOARD OF DIRECTORS COMPENSATION

Fees and Equity Awards for Non-Employee Directors

On April 1, 2018, we issued to director James S. Jacobs and to William C. Jacobs, then an independent contractor and now our President and Chief Financial Officer, rights to purchase warrants, for an aggregate purchase price of $2.00, an aggregate of 250,000 shares of common stock of the Company (40,000 to James S. Jacobs, and 210,000 to William C. Jacobs), at an exercise price of $0.01 per share, such warrants to be fully vested and to be exercisable on or prior to December 31, 2024. We recorded total stock compensation expense of $72,500 related to these rights to purchase warrants; this consists of $11,600 of stock compensation for the rights to purchase warrants issued to James S. Jacobs, and $60,900 of stock compensation for the rights to purchase warrants issued to William C. Jacobs.

18

The table below sets forth the compensation of our directors for the fiscal years ended December 31, 2018 and 2017.

Name | Year | Fees earned or paid in cash ($) | Stock awards ($) | Option awards | Non-equity incentive plan compensation ($) | Nonqualified deferred compensation earnings ($) | All other compensation ($) | Total ($) |

Joshua A. Bloom, M.D. (2) | 2018 | - | - | - | - | - | - | - |

| 2017 | - | - | - | - | - | - | - |

Gerard M. Jacobs (1) | 2018 | - | - | - | - | - | - | - |

| 2017 | - | - | - | - | - | - | - |

James S. Jacobs, M.D. (2) | 2018 | - | $ 11,600 | - | - | - | - | $ 11,600 |

| 2017 | - | - | - | - | - | - | |

Michael D. McCaffrey (2) | 2018 | - | - | - | - | - | - | - |

| 2017 | - | - | - | - | - | - | - |

Vincent J. Mesolella (3) | 2018 | - | - | - | - | - | - | - |

| 2017 | - | - | - | - | - | - | - |

Richard E. Morrissy (2) | 2018 | - | - | - | - | - | - | - |

| 2017 | - | - | - | - | - | - | - |

Thomas W. Hines CPA CFA | 2018 | - | - | - | - | - | - | - |

| 2017 | - | - | - | - | - | - | - |

19

(1) In 2014, Mr. Gerard M. Jacobs was granted the right to purchase from Acquired Sales, for an aggregate purchase price of $2.00: (1) warrants to purchase an aggregate of 750,000 shares of common stock, at an exercise price of $0.01 per share expiring on December 31, 2024, and (2) warrants to purchase an aggregate of 750,000 shares of common stock, at an exercise price of $1.85 per share expiring on December 31, 2024, if a required performance contingency is met. The combined fair value of these warrants was expensed in the 2014 income statement.

(2)In 2014, Dr. Joshua A. Bloom, Dr. James S. Jacobs, Mr. Michael D. McCaffrey, and Mr. Richard E. Morrissy each were granted the right to purchase from Acquired Sales, for an aggregate purchase price of $2.00: (1) warrants to purchase an aggregate of 25,000 shares of common stock, at an exercise price of $0.01 per share expiring on December 31, 2024, and (2) warrants to purchase an aggregate of 25,000 shares of common stock, at an exercise price of $1.85 per share expiring on December 31, 2024. The combined fair value of these warrants was expensed in the 2014 income statement.

(3) In 2014, Mr. Vincent J. Mesolella was granted the right to purchase from Acquired Sales, for an aggregate purchase price of $2.00: (1) warrants to purchase an aggregate of 500,000 shares of common stock, at an exercise price of $0.01 per share expiring on December 31, 2024, and (2) warrants to purchase an aggregate of 500,000 shares of common stock, at an exercise price of $1.85 per share expiring on December 31, 2024, if a required performance contingency is met. The combined fair value of these warrants was expensed in the 2014 income statement.

Compensation Discussion and Analysis

Throughout most of our history, rather than having full-time employees, our management has regularly engaged outside consultants, accountants and other professional service providers for purposes of providing services to the Company. We also often issued options in lieu of cash compensation, so as to preserve capital where needed and limit cash risk exposure. Our Chief Executive Officer directly or indirectly owned equity in the Company, but was not paid cash. In the past year, the Company has significantly increased operations, and working capital. We hired a CFO and paid him $5,000 per month. In addition, our chief executive officer commenced receiving $7,500 per month as a consulting fee. In addition, upon the closing of the CBD Lion LLC and/or Warrender Enterprise Inc. d/b/a Lifted Liquids acquisitions, the salaries, equity incentives, expense reimbursements and bonuses will increase. There are also to be significant bonuses awarded to the CEO and CFO in the event the Company closes on the acquisitions of CBD Lion LLC and Warrender Enterprise Inc. d/b/a Lifted Liquids, and in the event that the Company raises $15 million and $25 million. For a further description of the proposed compensation arrangements, please refer to the current report on Form 8-K, and its exhibit, filed with the SEC on or about June 25, 2019.

Historically, funding for the Company was sourced from management affiliates through loans over the past years. The Corporation limits cash compensation to outside or internal directors and does not have a cash compensation policy. The Corporation believes that, given the extensive experience of Mr. Jacobs and the rest of the board of directors, and the current opportunity cost factor for each of them, combined with the fact that, until recently each of them has continued to provide services without cash compensation, that the amount of compensation provided in the form of options, which must be purchased for cash, is fair and reasonable for the Corporation. Additionally, the Corporation has, in the past, sought to retain management, which would require that the Corporation enter into long term, inflexible employment arrangements with persons that may have a limited stake in the Corporation’s success as compared to our principals.

Proposed Bonus Pool

In the event that we close the Merger with CBD Lion we have contracted to award annual bonuses to certain of our executives, including, Gerard M. Jacobs, William C. Jacobs, Erik S. Lundgren and Nicholas S. Warrender and several others. For each fiscal year during each executive’s (“Executive”) employment term, which is anticipated to be rolling multi-year terms (each an “Employment Term”), each Executive shall be eligible to be considered for an annual bonus (the “Annual Bonus”) as part of a Company-wide management bonus pool arrangement. During the 4th quarter of each year, the Chairman of the

20

Compensation Committee of the Board (the “Compensation Committee”) shall recommend in writing a consolidated earnings before interest, taxes, depreciation and amortization (“EBITDA”) target (each, a “Target”) for the following year (the “Target Year”), which Target must be approved in writing by each of the following for as long as that Executive remains employed by the Company: Gerard M. Jacobs, William C. Jacobs, Erik S. Lundgren and Nicholas S. Warrender (collectively, and with respect to each for only as long as he is an employee of the Company, the “Executive Management Group”).

If the Chairman of the Compensation Committee does not recommend in writing a Target for a Target Year that is approved in writing by all of the members of each Executive Management Group prior to the commencement of the Target Year, then the Target for the Target Year shall be equal to the actual consolidated EBITDA of the Company and its subsidiaries during the then-current year (i.e., the year preceding the Target Year) as certified in writing by the Company’s outside firm of independent certified public accountants. If the actual consolidated EBITDA of the Company and its subsidiaries during the Target Year as certified in writing by the Company’s outside firm of independent certified public accountants exceeds the Target (the amount by which the actual consolidated EBITDA of the Company and its subsidiaries during the Target Year as certified in writing by the Company’s outside firm of independent certified public accountants exceeds the Target, the “Excess Amount”), then cash equal to 33% of the Excess Amount shall be set aside by the Company as a cash management bonus pool (the “Bonus Pool”), and the amount of the Bonus Pool shall be allocated and paid out by the Company as bonuses or fees to the officers of the Company and its subsidiaries (and potentially, to directors or third parties who have significantly helped the Company and its subsidiaries during the Target Year), with the amount to be paid to each payee, including the amount of any Annual Bonus to be paid to each Executive, to be determined by unanimous written agreement of each Executive Management Group, in their sole discretion.

Each Executive expressly agrees and acknowledges that the amount of the Annual Bonus (if any) allocated and paid to each Executive as so determined by unanimous written agreement of each Executive Management Group shall be final, non-appealable, and binding upon each Executive, regardless of whether each Executive receives any Annual Bonus, and regardless of whether any Annual Bonus received by each Executive is higher or lower than any other person’s bonus, under any and all circumstances whatsoever. The Company shall pay each Executive the Annual Bonus, if any, no later than March 15th of the year following the applicable Target Year.)

Compensation Committee

Our directors, Chief Executive Officer, and our President and Chief Financial Officer, do not receive remuneration from us unless approved by the Board of Directors, but we expect to enter into employment agreements with officers in the future pursuant to the Compensation Agreement. No such payment shall preclude any director from serving us in any other capacity and receiving compensation in connection with that service. We have a compensation committee consisting of Joshua A. Bloom, M.D., Thomas W. Hines, Michael D. McCaffrey, Vincent J. Mesolella and Richard E. Morrissy as members. Joshua A. Bloom, M.D. serves as the committee’s chairman.

21

Long-Term Incentive Plans

Except for the incentives set out in the Compensation Agreement in favor of our Chief Executive Officer, and our President/Chief Financial Officer, there are no current arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers, except that our directors and executive officers may receive stock options at the discretion of our Board of Directors. We do not have any material bonus or profit-sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options or warrants may be granted at the discretion of our Board.

Except for the incentives set out in the Compensation Agreement in favor of our Chief Executive Officer, and our President/Chief Financial Officer and the proposed Bonus Pool described above to be created in favor of several of our executives, we have no current plans or arrangements in respect of remuneration received or that may be received by our executive officers to compensate such officers in the event of termination of employment (as a result of resignation, retirement, change of control) or a change of responsibilities following a change of control, where the value of such compensation exceeds $60,000 per executive officer.

Aggregate Option Exercise of Last Fiscal year and Fiscal Year-End Option Values

The table below sets forth unexercised options, stock that has not yet vested and equity incentive plan awards for our Chief Executive Officer outstanding as of December 31, 2018. The options are exercisable at the respective prices listed below.

Outstanding Equity Awards At Fiscal Year End |

(see description of columns (a) through (j) below) |

|

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) |

Gerard M. Jacobs, 605,000 - - $2.00 9/29/2021 - - - - |

CEO 471,698 - - $2.00 11/4/2020 - - - - |

Description of Columns (a) Through (j):

Option awards

(a) The name of the named executive officer;

(b) Number of securities underlying unexercised options (#) exercisable

(c) Number of securities underlying unexercised options (#) unexercisable;

(d) Equity incentive plan awards: number of securities underlying unexercised unearned options;

(e) Option exercise price;

(f) Option expiration date;

Stock awards

(g) Number of shares or units of stock that have not vested (i);

(h) Market value of shares or units of stock that have not vested;

(i) Equity incentive plan awards: number of unearned shares, units or other rights that have not vested; and

(j) Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested.

22

INDEPENDENT PUBLIC ACCOUNTANTS

On April 13, 2017, Eide Bailly LLP resigned as the Company’s independent registered public accounting firm. On July 16, 2018, the Company engaged Fruci & Associates II, PLLC (“Fruci”) as the Company’s independent registered public accounting firm.

The following describes the audit fees, audit-related fees, tax fees, and all other fees for professional services provided by Fruci:

For the year ended December 31, 2018:For the year ended December 31, 2017:

Audit Fees: $12,500Audit Fees: $6,000

Audit-Related Fees: NoneAudit-Related Fees: None

Tax Fees: $2,000Tax Fees: $2,500

All Other Fees: NoneAll Other Fees: None

COMPENSATION PLANS

Equity Compensation Plans

None.

Option Plans

None.

23

AUTHORIZATION OR ISSUANCE OF SECURITIES

OTHERWISE THAN FOR EXCHANGE

Description of Securities

General

We are authorized to issue 100,000,000 shares of common stock, par value $0.001 per share, of which 2,726,669 shares are issued and outstanding. We are authorized to issue 10,000,000 shares of preferred stock, par value $0.001 per share of which 66,150 Preferred A and 90,000 Preferred B shares are currently outstanding. Approximately 2,427,377 shares of the 2,726,669 shares of common stock presently issued and outstanding are "restricted securities" as that term is defined in Rule 144 adopted under the Securities Act. The remaining 299,292 shares are believed to be free-trading.

Common Stock

Holders of common stock are entitled to one vote per share on each matter submitted to a vote at any meeting of stockholders. Shares of common stock do not carry cumulative voting rights and, therefore, holders of a majority of the outstanding shares of common stock will be able to elect the entire board of directors, and, if they do so, minority stockholders would not be able to elect any members to the board of directors. Our board of directors has authority, without action by the stockholders, to issue all or any portion of the authorized but unissued shares of common stock, which would reduce the percentage ownership of the stockholders and which may dilute the book value of the common stock.

Shareholders have no pre-emptive rights to acquire additional shares of common stock. The common stock is not subject to redemption and carries no subscription or conversion rights. In the event of liquidation, the shares of common stock are entitled to share equally in corporate assets after satisfaction of all liabilities. The shares of common stock, when issued, will be fully paid and non-assessable. We currently do not accumulate money on a regular basis in a separate custodial account, commonly referred to as a sinking fund, to be used to redeem debt securities.

Holders of common stock are entitled to receive dividends as the board of directors may from time to time declare out of funds legally available for the payment of dividends. We have not paid dividends on common stock and do not anticipate that we will pay dividends in the foreseeable future.

Series A Preferred Stock

We have designated 400,000 shares of Series A Preferred Stock of which 66,150 shares are currently issued and outstanding. Each share of Series A Preferred Stock may be converted into 100 shares of common stock. The Series A Preferred Stock pays dividends at the rate of 3% annually. The Series A Preferred Stock dividends are cumulative if we do not have the necessary cash to pay the dividend when due. The Series A Preferred Stock dividends shall cease to accrue at such time as our Common Stock has closed at $3.00 per share or higher for 20 consecutive trading days after the first date that the Series A Registration Statement is effective, and there have been, on average, at least 25,000 shares traded on each of those 20 consecutive trading days. The Series A Preferred Stock have no voting rights. The holders of the Series A Preferred Stock have voluntary conversion rights. Shares of Series A Preferred Stock are subject to Mandatory Conversion (in the discretion of the Company) at such time as our Common Stock has closed at $5.00 per share or higher for 20 consecutive trading days after the first date that the Series A Registration Statement is effective, and there have been, on average, at least 50,000 shares traded on each of those 20 consecutive trading days.

Series B Preferred Stock

We have designated 5,000,000 shares of Series B Preferred Stock of which 90,000 shares are currently issued and outstanding. On June 28, 2019, we commenced an offering, on an any-or-all basis, to sell shares of preferred stock strictly to purchasers who are verified accredited investors pursuant to the safe-harbor

24

exemption set out in Regulation D, Rule 506(c). The offering contemplates the sale of restricted “Series B Preferred Stock”. The principal amount of the offering is $25,000,000, which may be increased by any amount in the sole discretion of the Company. The proposed primary terms of the Series B Preferred Stock include a $5.00 per share purchase price, conversion rights into one share of common stock for each share of Series B preferred stock, and dividends at the rate of 3% annually. The proposed Series B Preferred Stock dividends are cumulative if the Company does not have the necessary cash to pay the dividend when due. The proposed Series B Preferred Stock dividends shall cease to accrue at such time as the Company’s Common Stock has closed at $7.00 per share or higher for 20 consecutive trading days after the first date that the registration statement covering the common shares of the company into which the Company's Series B Preferred Stock can be converted (the "Series B Registration Statement") is effective, and there have been, on average, at least 25,000 shares traded on each of those 20 consecutive trading days. The proposed Series B Preferred Stock shall have no voting rights. The holders of the proposed Series B Preferred Stock shall have voluntary conversion rights. Shares of the proposed Series B Preferred Stock shall be subject to Mandatory Conversion (in the discretion of the Company) at such time as the Company’s Common Stock has closed at $9.00 per share or higher for 20 consecutive trading days after the first date that the Series B Registration Statement is effective, and there have been, on average, at least 50,000 shares traded on each of those 20 consecutive trading days. As of October 4, 2019, we have accepted subscriptions from three accredited investors in private placements to purchase 90,000 shares of the Series B Preferred Stock for an aggregate purchase price of $450,000 in cash, convertible at the option of the holders into an aggregate of 90,000 shares of newly issued common stock of the Company, or $5.00 per share of common stock of the Company.

Our board of directors has the authority, without further action by the stockholders, to issue up to the 9,843,850 balance of 10,000,000 shares of authorized preferred stock. Preferred stock could be issued quickly with terms calculated to delay or prevent a change of control or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock, and may adversely affect the voting and other rights of the holders of common stock.

Nature and Approximate Amount of Consideration to be Received by Us in Exchange for our Share Issuance to CBD Lion.

In addition to $2,000,000 in cash, in connection with the proposed acquisition of CBD Lion, CBD Lion’s shareholders will exchange all of the outstanding equity of CBD Lion and receive 5,000,000 shares of our common stock.

Reasons for the proposed issuance and general effect on the rights of our security holders.

Our long stated objectives have been to seek, investigate and, if warranted, acquire an interest in one or more businesses, particularly focusing upon existing privately held businesses whose owners are willing to consider merging their businesses into our Company in order to establish a public trading market for their common stock, and whose managements are willing to operate the acquired businesses as divisions or subsidiaries of our company. CBD Lion fits into that longtime objective. The general effect on the rights of our security holders will be a dilution of their relative ownership, but an anticipated increase in the value and liquidity of their shares.

25

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding the beneficial ownership of our common stock as ofOctober 15, 2019by:

•each of our named executive officers;

•each of our directors;

•all of our current directors and executive officers as a group; and

•each stockholder known by us to own beneficially more than five percent of our common stock.

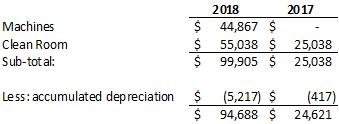

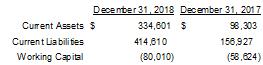

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment power with respect to the securities. Shares of common stock that may be acquired by an individual or group within 60 days of October 15, 2019, pursuant to the exercise of options or warrants, are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Percentage of ownership is based on 2,726,669 shares of common stock outstanding on October 15, 2019.