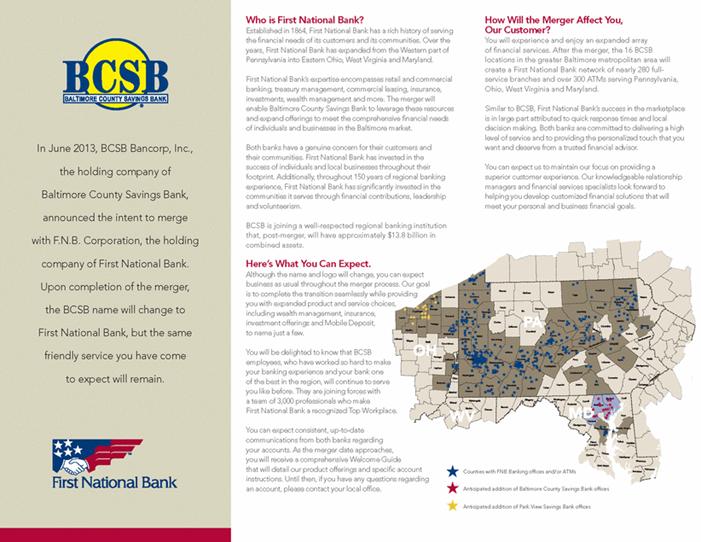

| Who is First National Bank? Established in 1864, First National Bank has a rich history of serving the financial needs of its customers and its communities. Over the years, First National Bank has expanded from the Western part of Pennsylvania into Eastern Ohio, West Virginia and Maryland. First National Bank’s expertise encompasses retail and commercial banking, treasury management, commercial leasing, insurance, investments, wealth management and more. The merger will enable Baltimore County Savings Bank to leverage these resources and expand offerings to meet the comprehensive financial needs of individuals and businesses in the Baltimore market. Both banks have a genuine concern for their customers and their communities. First National Bank has invested in the success of individuals and local businesses throughout their footprint. Additionally, throughout 150 years of regional banking experience, First National Bank has significantly invested in the communities it serves through financial contributions, leadership and volunteerism. BCSB is joining a well-respected regional banking institution that, post-merger, will have approximately $13.8 billion in combined assets. Here’s What You Can Expect. Although the name and logo will change, you can expect business as usual throughout the merger process. Our goal is to complete the transition seamlessly while providing you with expanded product and service choices, including wealth management, insurance, investment offerings and Mobile Deposit, to name just a few. You will be delighted to know that BCSB employees, who have worked so hard to make your banking experience and your bank one of the best in the region, will continue to serve you like before. They are joining forces with a team of 3,000 professionals who make First National Bank a recognized Top Workplace. You can expect consistent, up-to-date communications from both banks regarding your accounts. As the merger date approaches, you will receive a comprehensive Welcome Guide that will detail our product offerings and specific account instructions. Until then, if you have any questions regarding an account, please contact your local office. How Will the Merger Affect You, Our Customer? You will experience and enjoy an expanded array of financial services. After the merger, the 16 BCSB locations in the greater Baltimore metropolitan area will create a First National Bank network of nearly 280 fullservice branches and over 300 ATMs serving Pennsylvania, Ohio, West Virginia and Maryland. Similar to BCSB, First National Bank’s success in the marketplace is in large part attributed to quick response times and local decision making. Both banks are committed to delivering a high level of service and to providing the personalized touch that you want and deserve from a trusted financial advisor. You can expect us to maintain our focus on providing a superior customer experience. Our knowledgeable relationship managers and financial services specialists look forward to helping you develop customized financial solutions that will meet your personal and business financial goals. In June 2013, BCSB Bancorp, Inc., the holding company of Baltimore County Savings Bank, announced the intent to merge with F.N.B. Corporation, the holding company of First National Bank. Upon completion of the merger, the BCSB name will change to First National Bank, but the same friendly service you have come to expect will remain. Counties with FNB Banking offices and/or ATMs Anticipated addition of Baltimore County Savings Bank offices Anticipated addition of Park View Savings Bank offices |