Exhibit 99.1

BCSB BANCORP

BCSB Bancorp

(Holding Company for Baltimore County Savings Bank)

June 2008

Forward–Looking Statements

BCSB BANCORP

This presentation may contain projections and other “forward-looking statements” within the meaning of the federal securities laws. These statements are not historical facts, rather statements based on the current expectations of BCSB Bancorp, Inc. (the “Company”) regarding its business strategies, intended results and future performance. Forward–looking statements are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions.

Management’s ability to predict results or the effect of future plans or strategies is inherently uncertain. Factors that could affect actual results include interest rate trends, the general economic climate in the market area in which the Company operates, as well as nationwide, the Company’s ability to control costs and expenses, competitive products and pricing, loan delinquency rates, changes in federal and state legislation and regulation and other factors that may be described in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10–K and other required filings. These factors should be considered in evaluating the forward–looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements.

This presentation is for informational purposes only and does not constitute an offer to sell shares of common stock of BCSB Bancorp, Inc.

2

Company Overview

BCSB BANCORP

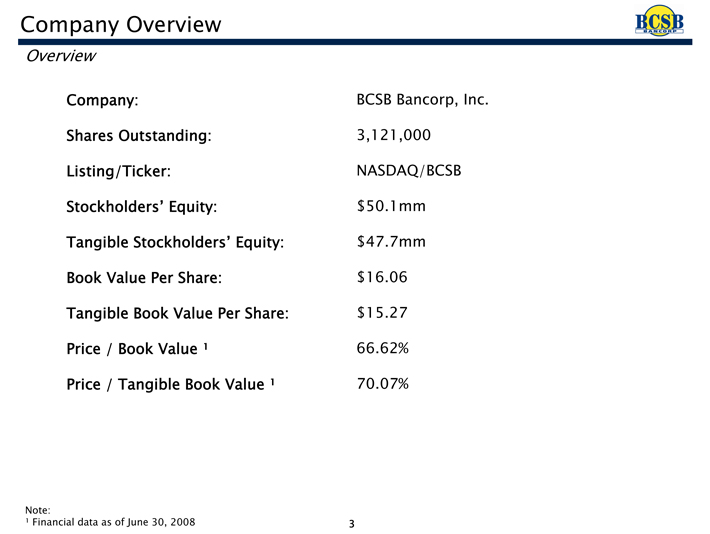

Overview

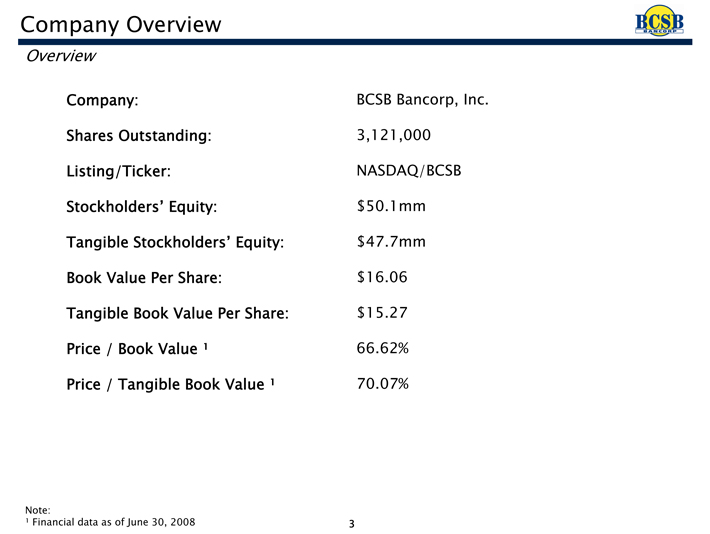

Company: BCSB Bancorp, Inc.

Shares Outstanding: 3,121,000

Listing/Ticker: NASDAQ/BCSB

Stockholders’ Equity: $50.1mm

Tangible Stockholders’ Equity: $47.7mm

Book Value Per Share: $16.06

Tangible Book Value Per Share: $15.27

Price / Book Value ¹ 66.62%

Price / Tangible Book Value ¹ 70.07%

Note:

¹ Financial data as of June 30, 2008 3

Company Overview

BCSB BANCORP

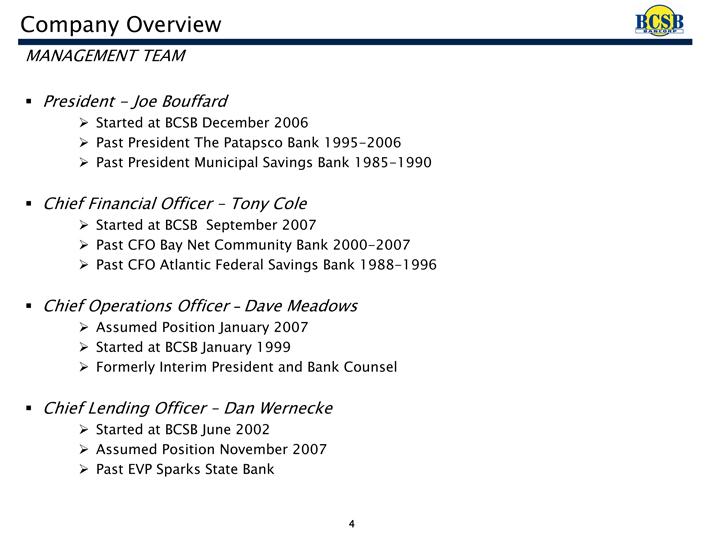

MANAGEMENT TEAM

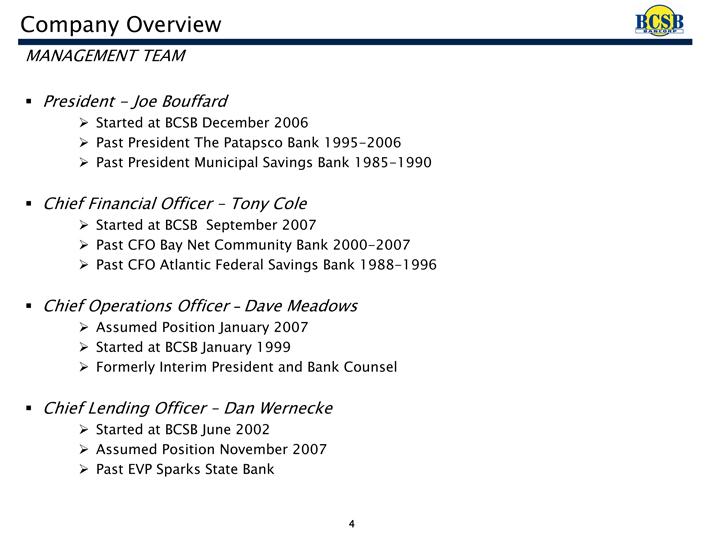

President – Joe Bouffard

Started at BCSB December 2006

Past President The Patapsco Bank 1995-2006

Past President Municipal Savings Bank 1985-1990

Chief Financial Officer – Tony Cole

Started at BCSB September 2007

Past CFO Bay Net Community Bank 2000-2007

Past CFO Atlantic Federal Savings Bank 1988-1996

Chief Operations Officer – Dave Meadows

Assumed Position January 2007

Started at BCSB January 1999

Formerly Interim President and Bank Counsel

Chief Lending Officer – Dan Wernecke

Started at BCSB June 2002

Assumed Position November 2007

Past EVP Sparks State Bank

4

Company Overview

BCSB BANCORP

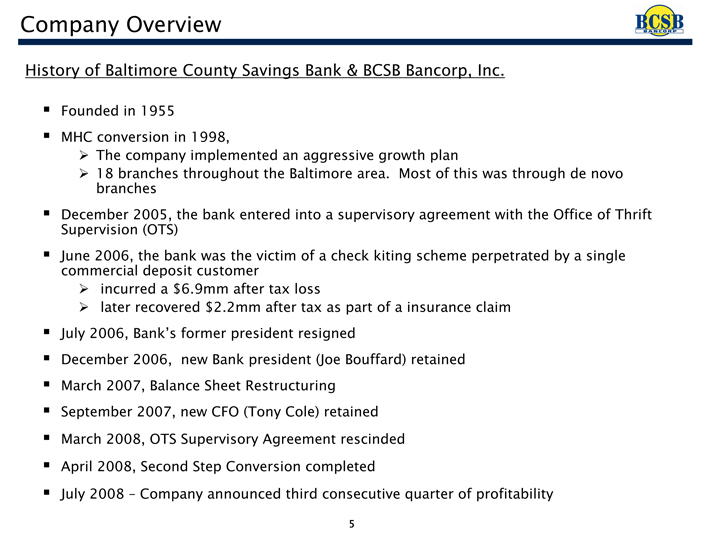

History of Baltimore County Savings Bank & BCSB Bancorp, Inc.

Founded in 1955

MHC conversion in 1998,

The company implemented an aggressive growth plan

18 branches throughout the Baltimore area. Most of this was through de novo branches

December 2005, the bank entered into a supervisory agreement with the Office of Thrift Supervision (OTS) June 2006, the bank was the victim of a check kiting scheme perpetrated by a single commercial deposit customer incurred a $6.9mm after tax loss later recovered $2.2mm after tax as part of a insurance claim July 2006, Bank’s former president resigned December 2006, new Bank president (Joe Bouffard) retained March 2007, Balance Sheet Restructuring September 2007, new CFO (Tony Cole) retained March 2008, OTS Supervisory Agreement rescinded April 2008, Second Step Conversion completed July 2008 – Company announced third consecutive quarter of profitability

5

Company Overview

BCSB BANCORP

BCSB Bancorp, Inc.

$598,000,000 in Assets¹

$510,000,000 in Deposits¹

4th Largest Publicly Traded Baltimore Financial Institution

Strong Asset Quality

Limited Intangible Assets (Goodwill)

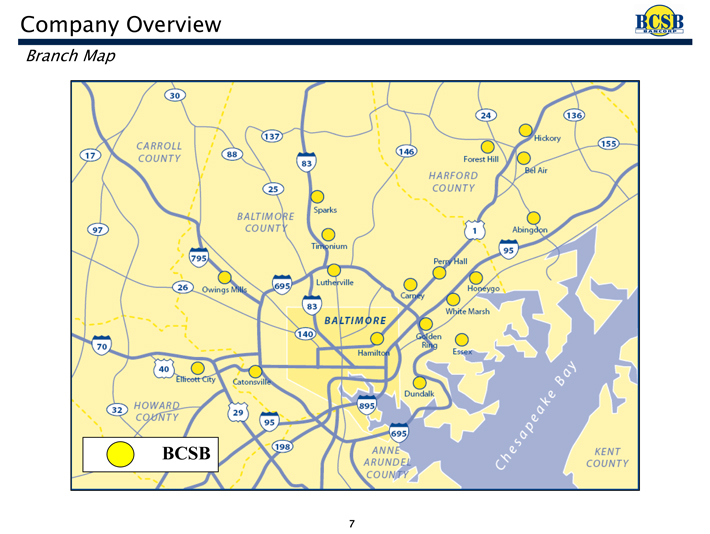

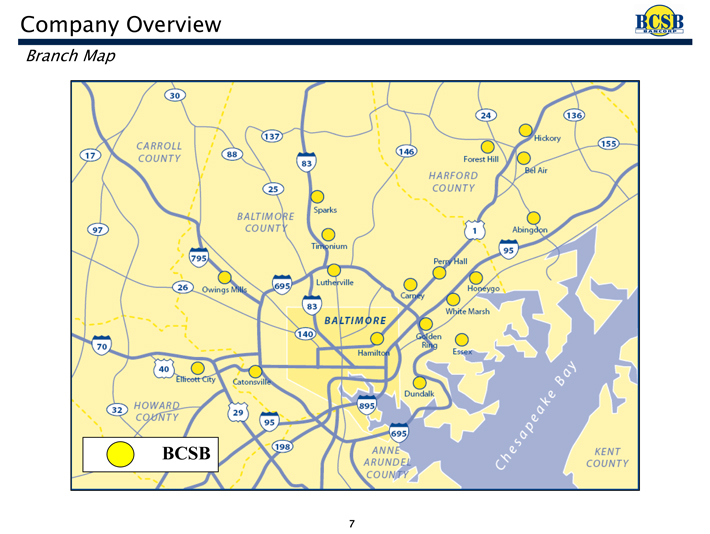

Entire Branch Network within the Baltimore MSA

Note:

¹ Data as of June 30, 2008 6

Company Overview

BCSB BANCORP

Branch Map

BCSB

7

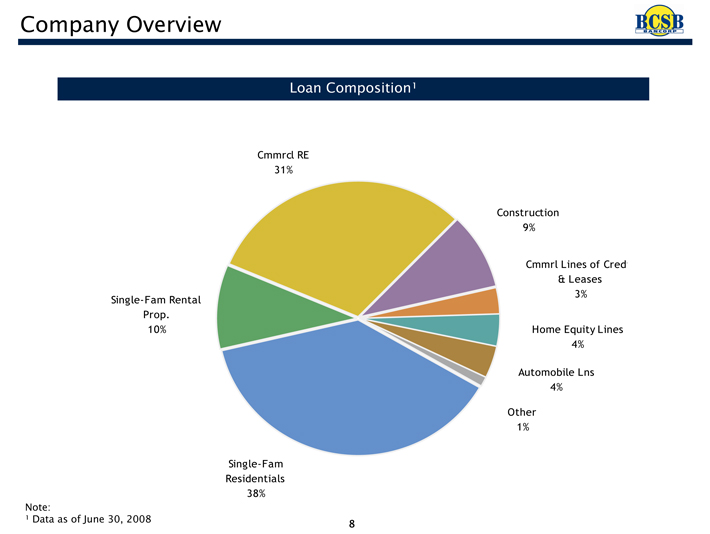

Company Overview

BCSB BANCORP

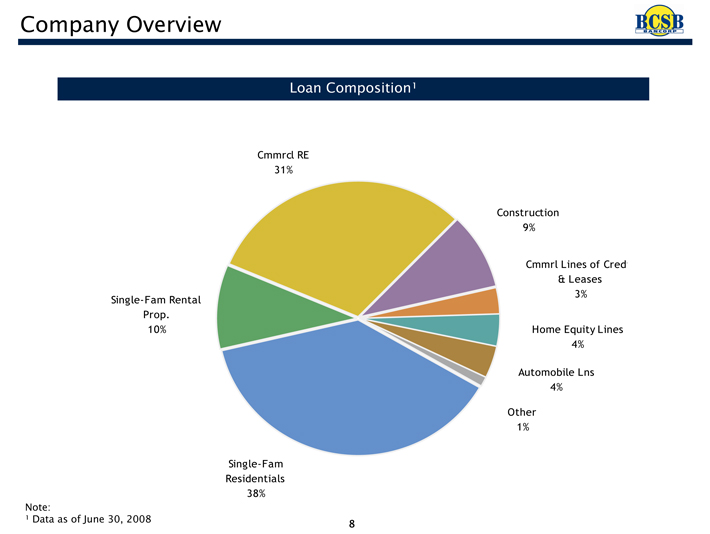

Loan Composition¹

Cmmrcl RE

31%

Construction

9%

Cmmrl Lines of Cred

& Leases

3%

Single-Fam Rental

Prop.

10%

Home Equity Lines

4%

Automobile Lns

4%

Other

1%

Single-Fam

Residentials

38%

Note:

¹ Data as of June 30, 2008 8

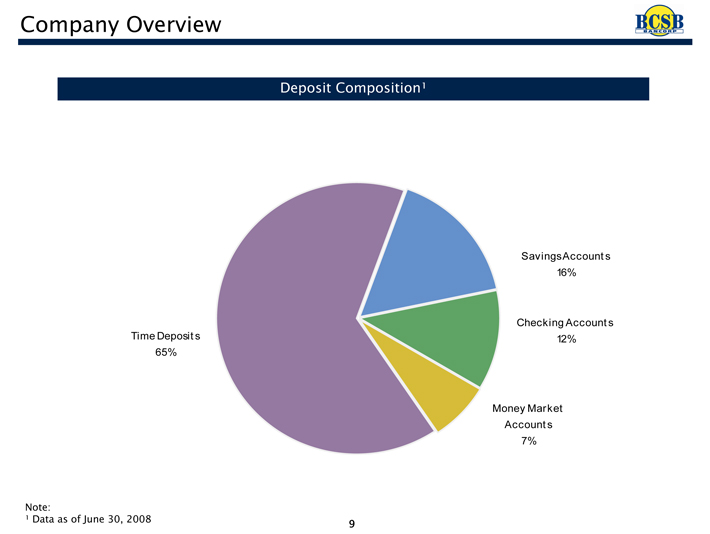

Company Overview

BCSB BANCORP

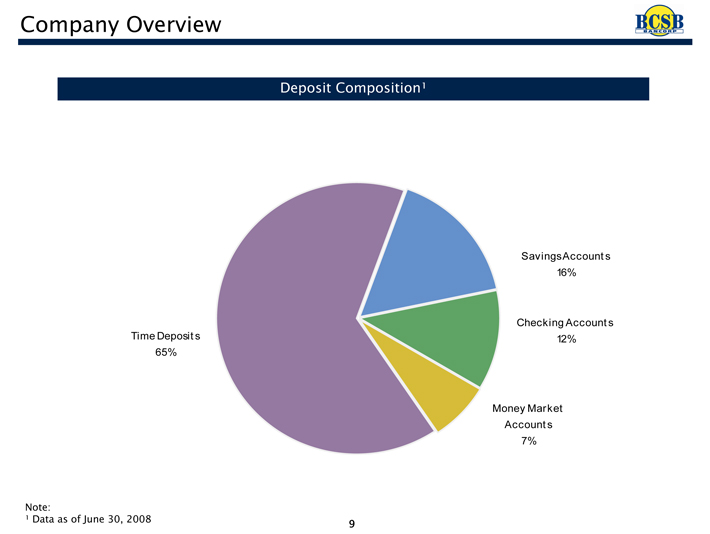

Deposit Composition¹

Savings Accounts

16%

Checking Accounts

12%

Time Deposits

65%

Money Market

Accounts

7%

Note:

¹ Data as of June 30, 2008 9

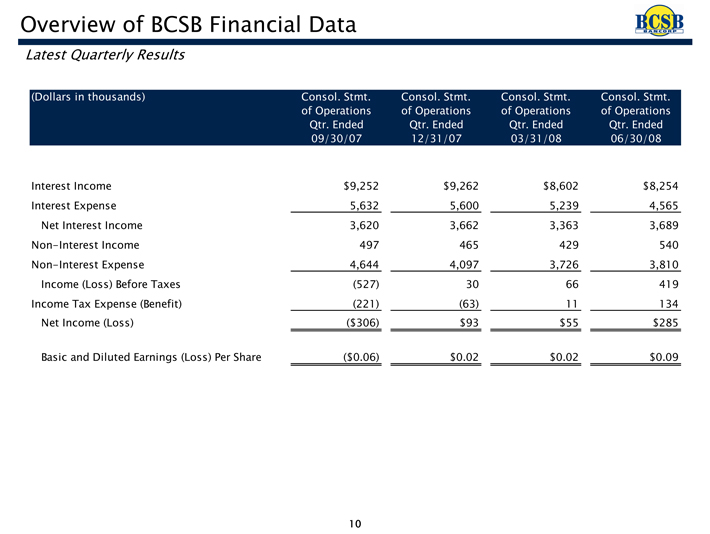

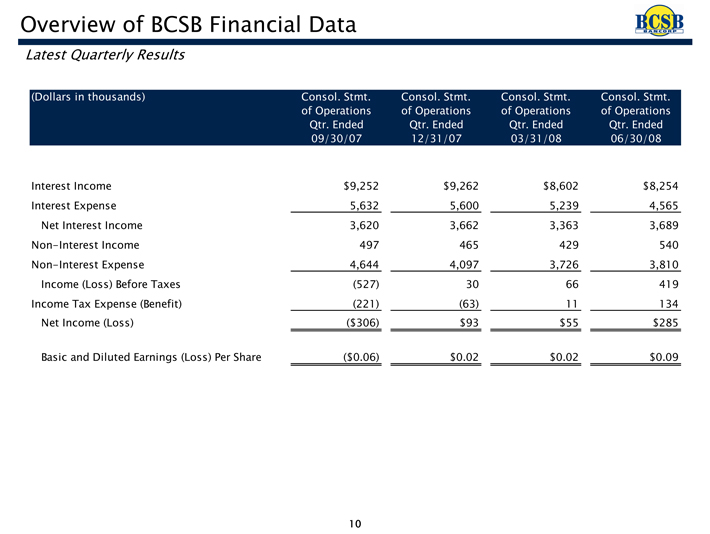

Overview of BCSB Financial Data

BCSB BANCORP

Latest Quarterly Results

(Dollars in thousands)

Consol. Stmt. of Operations Qtr. Ended 09/30/07

Consol. Stmt. of Operations Qtr. Ended 12/31/07

Consol. Stmt. of Operations Qtr. Ended 03/31/08

Consol. Stmt. of Operations Qtr. Ended 06/30/08

Interest Income $9,252 $9,262 $8,602 $8,254

Interest Expense 5,632 5,600 5,239 4,565

Net Interest Income 3,620 3,662 3,363 3,689

Non-Interest Income 497 465 429 540

Non-Interest Expense 4,644 4,097 3,726 3,810

Income (Loss) Before Taxes (527) 30 66 419

Income Tax Expense (Benefit) (221) (63) 11 134

Net Income (Loss) ($306) $93 $55 $285

Basic and Diluted Earnings (Loss) Per Share ($0.06) $0.02 $0.02 $0.09

10

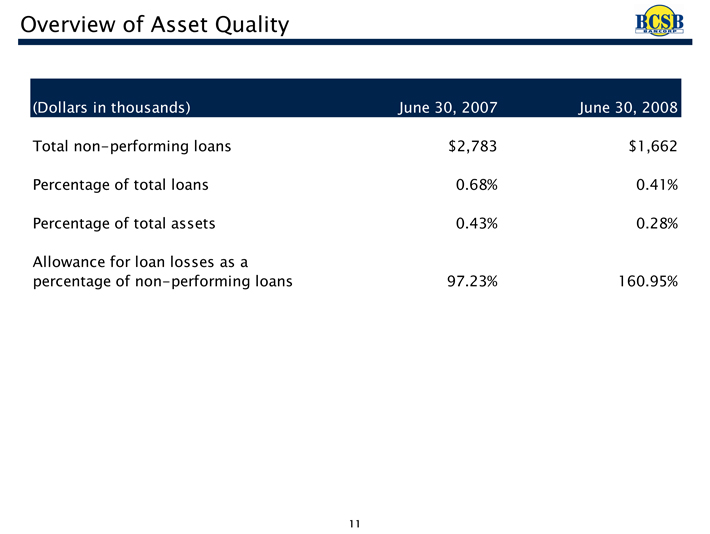

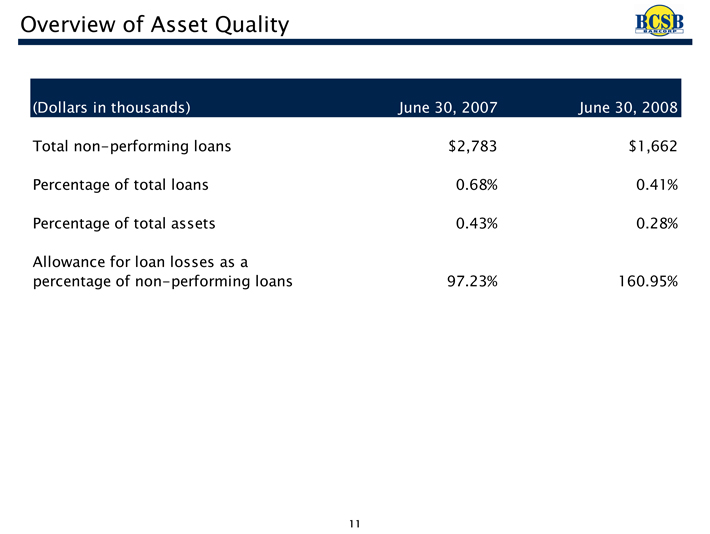

Overview of Asset Quality

BCSB BANCORP

(Dollars in thousands) June 30, 2007 June 30, 2008

Total non-performing loans $2,783 $1,662

Percentage of total loans 0.68% 0.41%

Percentage of total assets 0.43% 0.28%

Allowance for loan losses as a percentage of non-performing loans 97.23% 160.95%

11

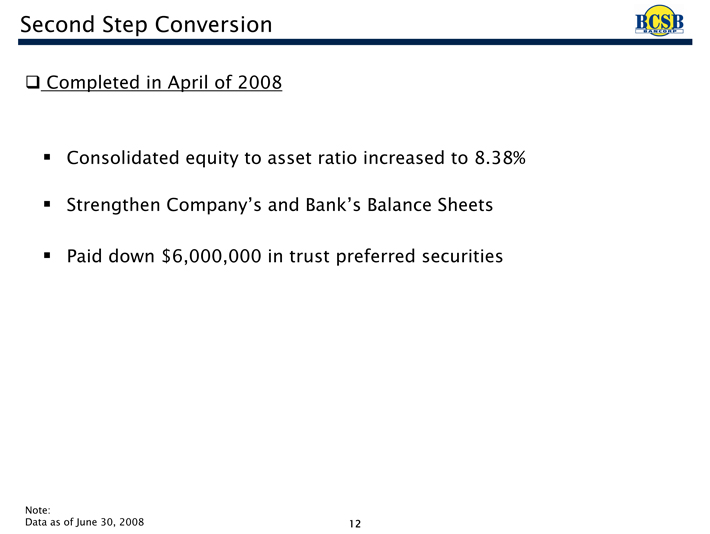

Second Step Conversion

BCSB BANCORP

Completed in April of 2008

Consolidated equity to asset ratio increased to 8.38%

Strengthen Company’s and Bank’s Balance

Sheets Paid down $6,000,000 in trust preferred securities

Note:

Data as of June 30, 2008

12

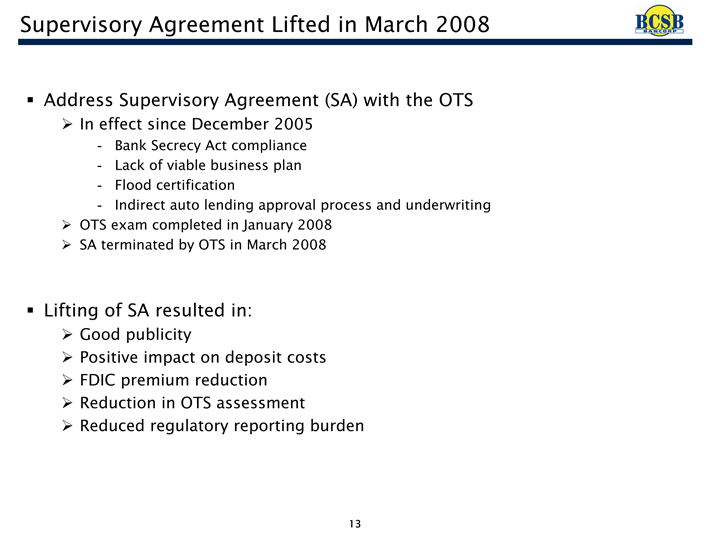

Supervisory Agreement Lifted in March 2008

BCSB BANCORP

Address Supervisory Agreement (SA) with the OTS

In effect since December 2005

- Bank Secrecy Act compliance

- Lack of viable business plan

- Flood certification

- Indirect auto lending approval process and underwriting

OTS exam completed in January 2008

SA terminated by OTS in March 2008

Lifting of SA resulted in:

Good publicity

Positive impact on deposit costs

FDIC premium reduction

Reduction in OTS assessment

Reduced regulatory reporting burden

13

Initiatives To Improve Earnings

BCSB BANCORP

Expense Reduction

Sheshunoff Review

Comprehensive efficiency study of the entire organization

Completed in April 2008 / Recommendations are being implemented

Assessment of branch network

Comprehensive review of branch network

Still in process of evaluating most profitable branch composition

Reduce Trust Preferred Securities

Pay down of $6,000,000 on June 30, 2008

Reduces annualized interest expense by approximately $380,000

14

Initiatives To Improve Earnings

BCSB BANCORP

Earnings Enhancement

Balance Sheet Restructuring

Sold $169mm investments yielding 3.51%

Pre-paid $73mm in FHLB Advances with an average cost of 4.97%

Sold $31.9mm in Adjustable Rate Fixed Income Mutual Funds

Sold $46.4mm in Fixed-rate Single Family Loans with a weighted average yield of 5.11%

Benefits of Balance Sheet Restructuring

Increased Margin

Significant Net Income Improvement

Improved capital ratios

Decrease Reliance On Borrowings and CD Funding

15

Initiatives To Improve Earnings

BCSB BANCORP

Earnings Enhancement

Commercial Lending

De-emphasize residential lending

Exit indirect auto lending business

- $ 35.0 million reduction in indirect auto

- $ 11.7 million balance remaining

Hire more experienced commercial lenders

- Both CRE and C&I

- Good loans, industry contacts, fit the company

Source of commercial deposits

- Lower cost

- Utilize the branch network

- Utilize technology upgrades

16

Initiatives To Improve Earnings

BCSB BANCORP

Fee Income Initiatives

Overdraft Privilege

Implemented in May 2007

Reverse Mortgage

Implemented in September 2007

Outsourced Processing through local Mortgage Broker

Public relations as well as fee income initiative

Non Insured Product Sales

Implemented in January 2008

Sale of Annuities, Mutual funds, etc.

Training just beginning

Outsource Origination and Sale of Residential Mortgages

Expense reduction

Fee income from sale of mortgages

17

Initiatives To Improve Earnings

BCSB BANCORP

Other Revenue Enhancements

Reduce dependence on CDs

Large portion of CD’s mature in less than 1 year

Emphasizing Transaction and Money market accounts

- Looking to bring on commercial deposit relationships with commercial loans

- Introducing a new suite of business deposit products

More cost effective CD funding strategies

Implemented new service fee structure

18

Transforming the Franchise – Summary Page

BCSB BANCORP

New Management

Experienced

Proven

Enthusiastic

Mandates

Raise additional capital

End Supervisory Agreement

Enhance Earnings

Time frames

1st period over-the last quarter as a MHC

2nd period began in April 2008 and ends in three years when OTS takeover prohibition ends

3rd period is the rest of BCSB’s corporate life and is dependent upon its performance

19