| | UNITED STATES | |

| | SECURITIES AND EXCHANGE COMMISSION |

| | Washington, D.C. 20549 |

| | |

| | FORM 20-F |

(Mark One)

[X] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ____________________________

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to ______

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ________________________

COMMISSION FILE NUMBER:

DETOUR GOLD CORPORATION

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant's name into English)

Canada

(Jurisdiction of incorporation or organization)

Suite 1020, 800 West Pender Street

Vancouver, British Columbia, Canada

(Address of principal executive offices)

Securities registered or to be registered pursuant to section 12(b) of the Act:

| Title of each Class | Name of each exchange on which registered |

| None | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares

(Title of Class)

– page ii –

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

N/A

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as

of the close of the period covered by the annual report.

Common Shares: 40,280,350 as at July 31, 2007

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

[ ] Yes [X] No

If this report is an annual or transitional report, indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [ ] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of

the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ ] Yes [X] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated

filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [X] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2

of the Exchange Act).

[ ] Yes [ ] No

- ii -

– page i –

T A B L E O F C O N T E N T S

– page ii –

– page 1 –

GENERAL

In this Registration Statement on Form 20-F, all references to "Detour", "Detour Gold", and the "Company" refer to Detour Gold Corporation.

The Company uses the Canadian dollar as its reporting currency. All references in this document to "dollars" or "$" are expressed in Canadian dollars, unless otherwise indicated. References to "US$" refer to United States dollars.

Except as noted, the information set forth in this Registration Statement is as of July 31, 2007 and all information included in this document should only be considered correct as of such date.

References to this "Registration Statement" mean references to this Registration Statement on Form 20-F.

NOTE REGARDING FORWARD LOOKING STATEMENTS

Except for statements of historical fact, certain information contained herein constitutes "forward-looking statements" including, without limitation, statements containing the words "believes," "anticipates," "intends," "expects" and words of similar import, as well as all projections of future results. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Detour to be materially different from any future results, performance or achievements of Detour expressed or implied by such forward-looking statements. Such risks are discussed in Item 3D "Risk Factors." The statements contained in Item 4B "Business Overview", Item 5 "Operating and Financial Review and Prospects" and Item 11 "Quantitative and Qualitative Disclosures About Market Risk" are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly.

GLOSSARY OF TERMS USED IN THIS FORM 20-F

Certain terms used herein are defined as follows:

| Assay | Quantitative test of minerals and ore by chemical and/or fire techniques. |

| | |

| Common Shares | Detour's common shares without par value being the only class or kind of Detour's authorized capital. |

| | |

| Concession | Mining rights granted by the Ontario and Quebec governments are subject to certain requirements and conditions during the exploration and exploitation stages. |

| | |

Induced Polarization

("IP") Survey | A geophysical survey used to identify a feature that appears to be different from the typical or background survey results when tested for levels of electro-conductivity. IP detects both chargeable, pyrite-bearing rock and non-conductive rock that has high content of quartz. |

| | |

| Mineral Deposit | A deposit of mineralization, which may or may not be ore, the determination of which requires a comprehensive feasibility study. |

| | |

| Mineral Reserve | Securities and Exchange Commission Industry Guide 7, "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations", of the Securities and Exchange Commission defines a 'reserve' as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

– page 2 –

| (1) Proven (Measured) Reserves. Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | |

| (2) Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Mineral Resource | National Instrument 43-101, "Standards of Disclosure for Mineral Projects", of the Canadian Securities Administrators defines a "Mineral Resource" as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | |

| Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource. |

| | |

| (1) Inferred Mineral Resource. An 'Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| | |

| (2) Indicated Mineral Resource. An 'Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| | |

| (3) Measured Mineral Resource. A 'Measured Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to |

– page 3 –

| | confirm both geological and grade continuity. |

| | |

| Industry Guide 7 does not define or recognize resources. As used in this Registration Statement, "resources" are as defined in Canadian National Instrument 43-101. |

| | |

| Mineral Symbols | Ag – silver; Au – gold; Cu – copper; Fe – iron; Pb – lead; Zn – zinc; Mo – molybdenum |

| | |

| Sulfide | Group of minerals consisting of metals combined with sulfur; common metallic ores. |

| | |

| TSX | The Toronto Stock Exchange. |

| | |

| Vein | A tabular or sheet like mineral deposit with identifiable walls, often filling a fracture or fissure. |

CURRENCY AND METRIC EQUIVALENTS

The Company's accounts are maintained in Canadian dollars and all dollar amounts herein are expressed in Canadian dollars unless otherwise indicated. The following factors for converting imperial measurements into metric equivalents are provided:

| To convert from Imperial | To metric | Multiply by |

| | | |

| acres | hectares | 0.405 |

| | | |

| feet | meters | 0.305 |

| | | |

| miles | kilometers | 1.609 |

| | | |

| tons (2000 pounds) | tonnes | 0.907 |

| | | |

| ounces (troy)/ton | grams/tonne | 34.286 |

– page 4 –

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

A. Director and Officer Information

Set out below is the name, business address and position with the Company for each director or executive officer of the Company, as at July 31, 2007:

| Name and Business Address | Function |

| | |

| Robert A. Dickinson | |

| 1020 – 800 West Pender Street, Vancouver, BC, Canada, V6C 2V6 | Director |

| | |

| Louis Dionne | |

| Royal Bank Plaza, North Tower, Suite 2040, 200 Bay Street, Box 23, | Director |

| Toronto, Ontario, M5J 2J1 | |

| | |

| Ingrid J. Hibbard | |

| Royal Bank Plaza, North Tower, Suite 2040, 200 Bay Street, Box 23, | Director |

| Toronto, Ontario, M5J 2J1 | |

| | |

| Jeffrey R. Mason | |

| 1020 – 800 West Pender Street, Vancouver, BC, Canada, V6C 2V6 | Chief Financial Officer and Secretary |

| | |

| Philip E. Olson | |

| Royal Bank Plaza, North Tower, Suite 2040, 200 Bay Street, Box 23, | Director |

| Toronto, Ontario, M5J 2J1 | |

| | |

| Gerald S. Panneton | |

| Royal Bank Plaza, North Tower, Suite 2040, 200 Bay Street, Box 23, | President, Chief Executive Officer |

| Toronto, Ontario, M5J 2J1 | and Director |

| | |

| Judy M. Thomson | |

| 1020 – 800 West Pender Street, Vancouver, BC, Canada, V6C 2V6 | Director |

| | |

| Ronald W. Thiessen | |

| 1020 – 800 West Pender Street, Vancouver, BC, Canada, V6C 2V6 | Chairman and Director |

B. Advisors

Not applicable.

C. Auditors

The name and address of Detour's auditor since inception of the Company and their membership in the governing professional body are:

| Name and Address | Governing Professional Body |

| | |

| McGovern, Hurley, Cunningham, LLP, | Institute of Chartered Accountants of Ontario |

| Toronto, Ontario | |

| | Registered with the Canadian Public Accountability Board (Canada) and the Public Company Accounting Oversight Board (US) |

– page 5 –

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following table presents selected financial data derived from the audited financial statements of Detour for the period from inception (July 19, 2006) to December 31, 2006. This information should be read in conjunction with the financial statements for the period from inception (July 19, 2006) to December 31, 2006 included elsewhere in this Registration Statement.

Detour's 2006 annual financial statements have been audited by its current independent auditor, McGovern, Hurley, Cunningham, LLP, Chartered Accountants. The financial statements have been prepared in accordance with Canadian generally accepted accounting principles ("Canadian GAAP"). Note 11 to the annual financial statements provides descriptions of material measurement differences between Canadian GAAP and accounting principles generally accepted in the United States of America ("US GAAP") as they relate to Detour and a reconciliation of Detour's financial statements to US GAAP.

All information provided in the Summary of Financial Information below and in this Registration Statement is presented in Canadian dollars ("$" or "Cdn$"), unless indicated otherwise, and is in accordance with Canadian GAAP (except as set out in the two tables below).

SUMMARY OF FINANCIAL INFORMATION

IN DETOUR'S FINANCIAL STATEMENTS

Statement of Operations Data | Period from inception (July 19,

2006) to December 31, 2006 |

| Exploration expenses | |

| Canadian GAAP | $523,000 |

| US GAAP | $523,000 |

| Total expenses | |

| Canadian GAAP | $646,385 |

| US GAAP | $646,385 |

– page 6 –

| Interest income | |

| Canadian GAAP | $59,225 |

| US GAAP | $59,225 |

| Loss for the period | |

| Canadian GAAP | $587,160 |

| US GAAP | $587,160 |

| Basic and diluted earnings (loss) per common share | |

| Canadian GAAP | ($0.12) |

| US GAAP | ($0.12) |

| BALANCE SHEET | As at December 31, 2006 |

| | |

| Cash and Cash Equivalents | |

| | |

| Canadian GAAP | $8,022,023 |

| | |

| US GAAP | $8,022,023 |

| | |

| Mineral property interests | |

| | |

| Canadian GAAP | $1,000,000 |

| | |

| US GAAP | $1,000,000 |

| | |

| Total assets | |

| | |

| Canadian GAAP | $9,548,048 |

| | |

| US GAAP | $9,548,048 |

| | |

| Total liabilities | |

| | |

| Canadian GAAP | $636,067 |

| | |

| US GAAP | $636,067 |

| | |

| Working capital (deficiency) | |

| | |

| Canadian GAAP | $7,458,181 |

| | |

| US GAAP | $7,458,181 |

– page 7 –

| Share capital | |

| | |

| Canadian GAAP | $5,000 |

| | |

| US GAAP | $5,000 |

| | |

| Deficit | |

| | |

| Canadian GAAP | ($587,160) |

| | |

| US GAAP | ($587,160) |

| | |

| Shareholders equity | |

| | |

| Canadian GAAP | $8,911,981 |

| | |

| US GAAP | $8,911,981 |

| | |

| Number of outstanding common shares at end of period | 5,000,000 |

| | |

| No cash or other dividends have ever been declared by Detour. | |

Exchange Rate

The exchange rate between the Canadian dollar and the U.S. dollar was Cdn$1.0654 per US$1.00 (or US$0.9386 per Cdn$1.00) as of June 29, 2007 and Cdn$1.0668 per US$1.00 on July 31, 2007.

The average exchange rate for the year ended December 31, 2006 (based on the average of the exchange rates on the last day of each month during the period in accordance with the exchange rates provided by the Federal Reserve Bank of New York) was Cdn$1.1341 per US$1.00 and US$0.8818 per Cdn$1.00.

The high and low exchange rates between the Canadian dollar and the U.S. dollar for the past six months are as follows:

Month | Exchange rate

Cdn$ per US$1.00 |

| | High | Low |

| July 2007 | 1.0538 | 1.0478 |

| June 2007 | 1.0684 | 1.0621 |

| May 2007 | 1.0986 | 1.0929 |

| April 2007 | 1.1371 | 1.1320 |

| March 2007 | 1.1709 | 1.1660 |

| February 2007 | 1.1735 | 1.1683 |

| January 2007 | 1.1789 | 1.1732 |

B. Capitalization and Indebtedness

The following table sets forth Detour's capitalization as of June 30, 2007, the date of the latest quarterly financial statements. There have been no material changes since that date to the date of this Registration Statement.

– page 8 –

| Amount

(Unaudited)

($) |

| Indebtedness(1) | |

| Accounts payable and accrued liabilities | 1,395,733 |

| Capital lease obligation | 148,038 |

| Total indebtedness(1) | 1,543,771 |

| Future income tax liability (3) | 31,815,000 |

| Shareholders' equity(2) | |

Common shares: unlimited common shares without par value authorized

40,280,350 shares issued and outstanding |

112,590,366 |

| Contributed Surplus | 999,549 |

| Deficit | (8,934,775) |

| Total shareholders' equity (2) | 104,655,140 |

| Total capitalization (3) | 138,013,911 |

________________

| (1) | None of Detour's indebtedness is guaranteed or secured, except for capital lease obligations |

| (2) | These amounts do not include common shares: |

| (a) | reserved for issuance pursuant to options and warrants outstanding as of, or granted or issued after, June 30, 2007; or |

| (b) | issued upon exercise of options and warrants after June 30, 2007. |

| (3) | The future income tax liability noted here does not represent any amount owing to any person, entity, or government at this time. |

As of June 30, 2007, and at July 31, 2007, Detour has no outstanding indebtedness except routine-course trade accounts payable and accrued liabilities and capital lease obligations.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The securities of Detour are highly speculative and subject to a number of risks. A prospective investor or other person reviewing Detour for a prospective investor should not consider an investment in Detour unless the investor is capable of sustaining an economic loss of the entire investment.

The risks associated with Detour's business include:

As Detour's mineral properties do not contain any reserves or any known body of economic mineralization, Detour may not discover commercially exploitable quantities of ore on its mineral properties that would

– page 9 –

enable it enter into commercial production, achieve revenues and recover the money it spends on exploration.

Detour's properties do not contain reserves in accordance with the definitions adopted by the United States Securities and Exchange Commission ("SEC") and there is no assurance that any feasibility studies carried out by Detour will establish reserves. The Company's Detour Lake Property is in the exploration stage as opposed to the development stage and has no known body of economic mineralization. The known mineralization at these projects has not yet been determined to be economic ore, and may never be determined to be economic. Detour has only recent commenced exploration on the Detour Lake Property and plans to conduct further exploration activities necessary to evaluate whether a commercially mineable orebody exists on the Detour Lake Property. There is a substantial risk that these exploration activities will not result in discoveries of commercially recoverable quantities of ore. Any determination that Detour's properties contain commercially recoverable quantities of ore may not be reached until such time that final comprehensive feasibility studies have been concluded that establish that a potential mine is likely to be economic. There is a substantial risk that any preliminary or final feasibility studies carried out by Detour will not result in a positive determination that the Detour Lake Property can be commercially developed.

Detour's exploration activities on the Detour Lake Property may not be commercially successful, which could lead Detour to abandon its plans to develop the property and its investments in exploration.

Detour's long-term success depends on its ability to establish commercially recoverable quantities of ore on the Detour Lake Property that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold exploration is determined in part by the following factors:

the identification of potential gold mineralization based on superficial analysis;

availability of government-granted exploration permits;

the quality of management and geological and technical expertise; and

the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. Detour may invest significant capital and resources in exploration activities and abandon such investments if it is unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of Detour's common shares and impair Detour's ability to raise future financing. Detour cannot provide any assurance to investors that it will discover or acquire any mineralized material in sufficient quantities on any of its properties to justify commercial operations. Further, Detour will not be able to recover the funds that it spends on exploration if it is not able to establish commercially recoverable quantities of ore on the Detour Lake Property.

The mineral resource estimates presented by Detour for the Detour Lake Property are estimates only and there is no assurance that these resources represent economically recoverable mineralization.

Detour has included mineral resource estimates that have been made in accordance with Canadian National Instrument 43-101. These resources estimates are classified as "indicated resources" and "inferred resources".

– page 10 –

Detour advises investors that while these terms are recognized and required by Canadian securities regulations, the U.S. Securities and Exchange Commission does not recognize these terms. Investors are cautioned not to assume that any part or all of mineral deposits classified as "inferred resources" will ever be converted into reserves. Further, 'inferred resources' have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or preliminary feasibility studies, except in rare cases. Investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

All amounts of mineral resources are estimates only, and Detour cannot be certain that any specified level of recovery of metals from the mineralized material will in fact be realized or that any identified mineral deposit on the Detour Lake Property will ever qualify as a commercially mineable (or viable) orebody that can be economically exploited. Mineralized material, which is not mineral reserves, does not have demonstrated economic viability. In addition, the quantity of mineral reserves and mineral resources may vary depending on, among other things, metal prices. Any material change in the quantity of mineralization, grade or stripping ratio, or metal prices may affect the economic viability of Detour's properties. In addition, Detour cannot be certain that metal recoveries obtained from small-scale laboratory tests will be duplicated in larger scale tests, under on-site conditions or during production.

No Assurance Can Be Given That the Detour Mine Option Will Be Exercised

The key property on the Detour Lake Property is a mine property that is under option from Goldcorp Canada Ltd. ("Goldcorp"). The option to acquire the property may be exercised at any time on or before the expiry of 120 days from the date of completion by Goldcorp of the reclamation of the Mine Site as is described in greater detail under the heading "Information on the Company – History of the Company – Detour Lake Property". The exercise by the Company of this option could result in the Company assuming reclamation obligations. The Company may only engage in the exploration activities on the mine option property that are permitted under the option and access agreement with Goldcorp until the Company either exercises the mine option and acquires the property or obtains Goldcorp's consent to any additional activities. No assurances can be given that Goldcorp would consent to such additional activities or consent on terms acceptable to the Company. Under Ontario law, the option to acquire the mine property automatically expires on December 10, 2019 ("Expiry Date"), notwithstanding that the option purports to be perpetual. If the option is not exercised by such date, the Company would have no rights under the option against the grantor of the option or its successors. No assurance can be given that the option will be exercised prior to the Expiry Date.

The Costs of Reclamation of the Mine Site Could Be Significant and are Subject to Estimates

Management estimates the cost to complete the reclamation of the mine site to be approximately $2.5 million to $5.0 million. These costs would become the responsibility of the Company if the Company assumed the reclamation obligations in connection with the exercise of the mine option and acquisition of the property prior to the completion of the reclamation of the mine site by Goldcorp. These costs represent management's estimate of the reclamation obligations based on information currently available to the Company. The actual cost of completing the reclamation could be significantly higher, in which event the Company may decide not to exercise the option. Management estimates that the reclamation of the mine site to the satisfaction of the Ministry of Northern Development and Mines ("MNDM") will be completed by 2010. The date of completion of the reclamation at the mine site is an estimate only and is based upon information currently available to the Company. The actual date of completion of the reclamation could be significantly later.

There is No Assurance That Aboriginal Title and Rights Claims Will Not be Asserted on the Company's Properties

Aboriginal title and rights may be claimed with respect to Crown properties or other types of tenure with respect to which mining rights have been conferred. Other than as described in the purchase agreement with Pelangio

– page 11 –

Mines Inc. ("Pelangio"), the Company is not aware of any aboriginal land claims having been formally asserted or any legal actions relating to aboriginal issues having been instituted with respect to the Detour Lake Property. The purchase agreement describes three letters provided by Pelangio to the Company, dated March 19, 2001 from the Moose Cree First Nation to Pelangio, dated May 14, 2001 from Pelangio to the MNDM, and dated June 27, 2001 from the MNDM to Pelangio, all relating to the Moose Cree First Nations claim of traditional territory. There can be no assurance that such events will not occur or that title and rights claims will not be asserted in the future in respect of the Company's properties. In addition, other parties may dispute the Company's title to its properties and its properties may be subject to prior unregistered agreements or transfers or land claims by aboriginal peoples, and title may be affected by undetected encumbrances or defects or government actions.

Detour must continue to maintain the claims that comprise the Detour Lake Property in good standing in order to maintain its rights to continue exploration and, if warranted, the development of the Detour Lake Property.

The Detour Lake Property is comprised of claims that have been granted under Ontario and Quebec mining law. Detour must pay an annual surface tax and complete an investment or achieve production for each claim in accordance with government regulations. Detour's failure to maintain the claims that comprise the Detour Lake Property in good standing could cause it to lose its interest in these mineral properties, with the result that Detour would lose its rights to continue exploration and, if warranted, the development of the Detour Lake Property.

As Detour has no history of earnings and no foreseeable earnings, Detour may never achieve profitability or pay dividends.

Detour was incorporated on July 19, 2006 and has had losses since inception. There can be no assurance that Detour will ever be profitable. Detour has paid no dividends on its shares since incorporation. Detour presently has no ability to generate earnings as its mineral properties are in the exploration stage. If Detour is successful in developing the Detour Lake Property, Detour anticipates that it will retain future earnings and other cash resources for the future operation and development of its business. Detour does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends is solely at the discretion of Detour's board of directors, which will take into account many factors including Detour's operating results, financial conditions and anticipated cash needs. For these reasons, Detour may never achieve profitability or pay dividends.

Detour will require significant additional financing in order to continue its exploration activities and its assessment of the commercial viability of the Detour Lake Property.

If the costs of Detour's planned exploration programs are greater than anticipated, Detour may have to seek additional funds through public and private share offerings, arrangements with corporate partners, or debt financing. There can be no assurance that Detour will be successful in its efforts to raise these required funds, or on terms satisfactory to it. The continued exploration of the Detour Lake Property and the development of Detour's business will depend upon Detour's ability to establish the commercial viability of the Detour Lake Property and to ultimately develop its cash flow from operations and reach profitable operations. Detour currently is in the exploration stage and has no revenue from operations. Accordingly, the only other sources of funds presently available to Detour are through the sale of equity and debt capital. Alternatively, Detour may finance its business by offering an interest in its mineral properties to be earned by another party or parties carrying out further exploration and development thereof or to obtain project or operating financing from financial institutions, neither of which is presently intended. If Detour is unable to obtain this additional financing, Detour will not be able to continue its exploration activities and its assessment of the commercial viability of the Detour Lake Property. Further, if Detour is able to establish that development of the Detour Lake Property is commercially viable, the inability of Detour to raise additional financing at this stage would result in the inability of Detour to place the Detour Lake Property into production and recover its investment.

Detour's financial statements have been prepared assuming Detour will continue on a going concern basis, but there can be no assurance that the Company will continue as a going concern.

– page 12 –

Detour's financial statements have been prepared on the basis that Detour will continue as a going concern. At July 31, 2007, Detour had working capital of approximately $28 million, which although expected to be sufficient to allow Detour to fund its current exploration program, may not be sufficient to meet its planned business objectives. Management recognizes that Detour may need to generate additional financial resources in order to meet its planned business objectives. There can be no assurances that Detour will continue to obtain additional financial resources and/or achieve profitability or positive cash flows. If Detour is unable to obtain adequate additional financing, Detour will be required to curtail operations and exploration activities. Furthermore, failure to continue as a going concern would require that Detour's assets and liabilities be restated on a liquidation basis which would differ significantly from the going concern basis.

As the Detour Lake Property is Detour's only material mineral property, Detour is economically dependent on the Detour Lake Property in achieving its business objectives. The failure of Detour to establish that the Detour Lake Property possesses commercially viable deposits of ore may force Detour to abandon the Detour Lake Property which could result in a significant decline in the trading price of Detour's common shares and reduce its ability to obtain new financing.

The Detour Lake Property is Detour's only material mineral property and as a result, Detour is economically dependent on the Detour Lake Property for the achievement of its business objectives. Detour's principal business objective is to carry out further exploration activities to establish whether the Detour Lake Property possesses commercially viable deposits of ore. If Detour is not successful in this plan of operations, Detour would not be able to continue its operations on the Detour Lake Property and would be forced to seek a new mineral property to explore or acquire an interest in a new mineral property or project. Detour anticipates that such an outcome would result in a significant decline in the trading price of Detour's common shares. Further, Detour anticipates that its ability to raise additional financing to fund exploration of a new property or the acquisition of a new property or project would be impaired as a result of the failure to establish commercial viability of the Detour Lake Property.

If prices for gold decline, Detour may not be able to raise the additional financing required to fund its exploration activities for the Detour Lake Property.

The ability of Detour to raise financing to fund its exploration activities and, if warranted, development of the Detour Lake Property, will be significantly affected by changes in the market price of the metals it mines or explores for. The price of gold is volatile, and is affected by numerous factors beyond Detour's control. The level of interest rates, the rate of inflation, the world supplies of gold and the stability of exchange rates can all cause fluctuations in this price. Such external economic factors are influenced by changes in international investment patterns and monetary systems and political developments. The price of gold has fluctuated in recent years, and future significant price declines could cause investors to be unprepared to finance exploration of gold, with the result that Detour may not have sufficient financing with which to funds its exploration activities. In this event, Detour may not be able to carry out planned exploration activities and, if warranted, development of the Detour Lake Property with the result that Detour may not be able to continue its plan of operations.

As there is no established market for Detour's securities in the United States, U.S. investors may not be able to sell their common share of Detour within the United States.

There is no established market in the United States of America for Detour's securities. Accordingly, investors must rely on Canadian equity markets to trade in Detour's securities. Such markets might not have the liquidity found in markets in the United States, resulting in investors being unable to dispose of Detour's securities.

If Detour loses the services of the independent contractors that it engages to undertake its exploration, then Detour's plan of operations may be delayed or be more expensive to undertake than anticipated.

Detour's success depends to a significant extent on the performance and continued service of certain independent contractors, including Hunter Dickinson Inc. Detour has contracted the services of professional drillers and other

– page 13 –

contractors for exploration, environmental and engineering services. Poor performance by such contractors or the loss of such services could result in the exploration activities planned to be undertaken by Detour being delayed or being more expensive to undertake than anticipated.

Detour may lose the ability to continue exploration and, if warranted, development of the Detour Lake Property in the event that it does not own valid title to its mining claims and leases.

Detour is the owner of claims to the mineral properties that comprise the Detour Lake Property. Detour's ownership of these concessions should not be construed as a guarantee that title to such interests will not be challenged or impugned. The concessions may be subject to prior unregistered agreements or transfers or claims on title. The concessions may also be affected by undetected defects. If Detour does not have valid title to its concessions, then it may lose the rights to continue exploration and, if warranted, the development of the Detour Lake Property.

Changes in government legislation in Ontario or Quebec could affect Detour's exploration of the Detour Lake Property and could preclude Detour from continuing to explore and, if warranted, to develop the Detour Lake Property.

Detour is required to carry out its exploration activities and, if warranted, any development activities in accordance with Canadian federal and Ontario and Quebec provincial legislation and regulations. Detour is conducting its exploration activities on the Detour Lake Property in compliance with current applicable mining permit and exploration requirements. Changes in government legislation, including changes in environmental regulations or land claims, or the adoption of new legislation governing mining operations, ownership of mineral properties or environmental protection could increase the cost to Detour of conducting its exploration activities and, if warranted, development of the Detour Lake Property or could preclude Detour from proceeding with its exploration activities and, if warranted, development activities.

Detour competes with larger, better capitalized competitors in the mining industry.

The mining industry is competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Because of the high costs associated with exploration, the expertise required to analyze a project's potential and the capital required to develop a mine, larger companies with significant resources may have a competitive advantage over us. Detour faces strong competition from other mining companies, some with greater financial resources, operational experience and technical capabilities than Detour does. As a result of this competition, Detour may be unable to maintain or acquire financing, personnel, technical resources or attractive mining properties on terms Detour considers acceptable or at all.

The adoption of stricter environmental legislation governing the Detour Lake Property could increase the costs to Detour of exploring and, if warranted, developing the Detour Lake Property and could delay these activities.

Detour must comply with applicable environmental legislation in carrying out is exploration and, if warranted, development of the Detour Lake Property. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Changes in environmental legislation could increase the cost to Detour of carrying out its exploration and, if warranted, development of the Detour Lake Property. Further, compliance with stricter environmental legislation may result in delays to Detour's exploration and, if warranted, development activities. In particular, Detour's operations and exploration activities are subject to Ontario and Quebec laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive.

– page 14 –

The presence of unknown environmental hazards on Detour's mineral properties may result in significant unanticipated compliance and reclamation costs that may increase the costs to Detour of exploring and, if warranted, developing the Detour Lake Property.

Environmental hazards may exist on the properties in which Detour holds interests which are unknown to Detour at present and which have been caused by previous or existing owners or operators of the properties. The presence of such environmental hazards may result in Detour being required to comply with environmental reclamation, closure and other requirements that may involve significant costs and other liabilities.

Detour is subject to many risks that are not insurable and, as a result, Detour will not be able to recover losses through insurance should such risks occur.

Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development. Detour may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. The payment of such liabilities would result in increase in Detour's operating expenses which would, in turn, have a material adverse effect on Detour's financial position and its results of operations. Although Detour maintains liability insurance in an amount which it considers adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or Detour might not elect to insure itself against such liabilities due to high premium costs or other reasons, in which event Detour could incur significant liabilities and costs that could materially increase Detour's operating expenses.

Detour does not have a history of paying dividends and does not have any intention of paying dividends in the foreseeable future.

Investors cannot expect to receive a dividend on their investment in the foreseeable future, if at all. Accordingly, it is likely investors will not receive any return on their investment in Detour's securities other than possible capital gains.

There are Risks Associated With Operating in Joint Ventures

Mining, processing, development and exploration activities depend on adequate infrastructure. The Company is dependent on the existence and ongoing maintenance of reliable roads, bridges, power sources and water supply. These are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company's operations, financial condition and results of operations.

disagreement with joint venture partners on how to develop and operate mines efficiently;

inability of joint venture partners to meet their obligations to the joint venture or third party; and

litigation between joint venture partners regarding joint venture matters.

The Company Has Dependence on Adequate Infrastructure

Mining, processing, development and exploration activities depend on adequate infrastructure. The Company is dependant on the existence and ongoing maintenance of reliable roads, bridges, power sources and water supply. These are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company's operations, financial condition and results of operations.

– page 15 –

U.S. investors who obtain judgments against Detour or its officers or directors for breaches of U.S. securities laws may have difficulty in enforcing such judgments against Detour and its officers and directors.

Detour is incorporated under the laws of Canada and all of Detour's directors and officers are residents of Canada. Consequently, it may be difficult for United States investors to effect service of process within the United States upon Detour or upon those directors or officers who are not residents of the United States, or to enforce, inside or outside of the United States, any judgments of United States courts predicated upon civil liabilities under the United States Securities Exchange Act of 1934, as amended. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained is determined by the Canadian court not to have had jurisdiction in the matter. Furthermore, an original action might not be able to be brought successfully in Canada against any of such persons or Detour predicated solely upon such civil liabilities.

If Detour's directors cause it to enter into transactions in which its officers and/or directors have an interest, Detour may enter into transactions that are on less favorable terms than would be negotiated with an arms length party.

Directors of Detour also serve as directors of other similar companies involved in natural resource development. Accordingly, it may occur that properties will be offered to both Detour and to such other companies. Furthermore, those other companies may participate in the same properties as those in which Detour has an interest. Consequently, there may be situations which involve a conflict of interest. In that event, the directors would not be entitled to vote at meetings of directors which evoke any such conflict. The directors will attempt to avoid dealing with such other companies in situations where conflicts might arise and will at all times use their best efforts to act in the best interests of Detour. If Detour's directors cause it to enter into transactions in which its officers and/or directors have an interest, Detour may enter into transactions that are on less favorable terms than would be negotiated with an arm's length party.

The failure of Detour to maintain effective internal controls could result in Detour not being able to produce reliable financial statements.

Detour is in the process of documenting and testing its internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of the Company's internal controls over financial reporting and a report by the Company's independent auditors addressing these assessments. During the course of this testing, Detour may identify deficiencies which the Company may not be able to remediate in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. In addition, if Detour fails to achieve and maintain the adequacy of the Company's internal controls, as such standards are modified, supplemented or amended from time to time, Detour may not be able to ensure that it can conclude on an ongoing basis that the Company has effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls are necessary for the Company to produce reliable financial reports and are important to helping prevent financial fraud. If Detour cannot provide reliable financial reports or prevent fraud, Detour's business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of Detour's stock could drop significantly.

As Detour is likely a passive foreign investment company under U.S. tax laws, U.S. investors in Detour may be required to include as ordinary income each year the excess of the fair market value of the common shares over the investor's tax basis in such shares.

Potential investors who are U.S. taxpayers should be aware that Detour expects to be a passive foreign investment company ("PFIC") for the current fiscal year, and may also have been a PFIC in prior years and may also be a PFIC in subsequent years. If Detour is a PFIC for any year during a U.S. taxpayer's holding period, then such U.S. taxpayer generally will be required to treat any so-called "excess distribution" received on its common shares, or

– page 16 –

any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund ("QEF") election or a mark-to-market election with respect to the shares of Detour. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis his or her share of Detour's net capital gain and ordinary earnings for any year in which Detour is a PFIC, whether or not Detour distributes any amounts to its shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer's tax basis therein. U.S. taxpayers are advised to seek the counsel of their professional tax advisors.

The exercise of outstanding options and warrants issued by Detour will result in the issuance by Detour of additional common shares and the unrestricted resale of these additional common shares may have a depressing effect on the current trading price of Detour's common shares.

At July 31, 2007 there were approximately 2.3 million options and 0.2 million warrants of Detour outstanding. Dilutive securities represent approximately 6% of Detour's issued shares as at July 31, 2007. The exercise of these outstanding options will result in the issue by Detour of additional common shares and the unrestricted resale of these additional common shares may have a depressing effect on the current trading price of Detour's common shares.

Broker-dealers may be discouraged from effecting transactions in Detour's common shares because they may be considered a penny stock and may therefore be subject to the SEC's penny stock rules.

The SEC has adopted rules (the "Penny Stock Rules") that regulate broker-dealer practices in connection with transactions in 'penny' stocks. Penny stocks are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current prices and volume information with respect to transactions in such securities is provided by the exchange or system).

The Penny Stock Rules require a broker-dealer, prior to effecting a transaction in a penny stock not otherwise exempt from such rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. In particular the statement must contain:

| (a) | a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | |

| (b) | a description of the broker-dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| | |

| (c) | a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| | |

| (d) | a toll-free telephone number for inquiries on disciplinary actions; |

| | |

| (e) | the definitions of significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| | |

| (f) | such other information and be in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

– page 17 –

The broker-dealer must obtain from the customer a written acknowledgement of receipt of the standardized disclosure document.

The broker-dealer also must provide the customer with:

| (a) | the inside bid and offer quotations for the penny stock, or other bid and offer price information for the penny stock if inside bid and offer quotations are not available; |

| | |

| (b) | the compensation of the broker-dealer and its salespersons in the transaction; |

| | |

| (c) | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| | |

| (d) | a monthly account statements showing the market value of each penny stock held in the customer's account. |

In addition, the Penny Stock Rules require that prior to a transaction in a penny stock not otherwise exempt from such rules the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. At the present market prices Detour's common shares will (and in the foreseeable future are expected to continue to) fall within the definition of a penny stock. Accordingly, United States broker-dealers trading in Detour's shares will be subject to the Penny Stock Rules. Rather than complying with those rules, some broker-dealers may refuse to attempt to sell penny stock. As a result, shareholders and their broker-dealers in the United States may find it more difficult to sell their shares of Detour, if a market for the shares should develop in the United States.

ITEM 4 INFORMATION ON THE COMPANY

A. History of the Company Name, Incorporation and Offices

The Company was incorporated on July 19, 2006 as 6600964 Canada Inc. pursuant to the Canada Business Corporations Act. Pursuant to articles of amendment filed on August 21, 2006, 6600964 Canada Inc. changed its name to Detour Gold Corporation and removed its private company restrictions.

The Company's principal business is the acquisition, exploration and, if warranted, development of mineral properties.

The Company's registered office is located at 181 Bay Street, Suite 2500, Toronto, Ontario, M5J 2T7, phone (416) 360-8600. The Company's head office is located at 200 Bay Street, Suite 2040, Toronto, Ontario, M5J 2J1, phone (416) 304-3800. The Company also has certain administrative activities at 1020-800 West Pender Street, Vancouver, BC, phone number (604) 684-6365.

– page 18 –

History

On August 21, 2006, the Company entered into an asset purchase agreement (the "Purchase Agreement") with Pelangio Mines Inc. ("Pelangio") whereby the Company agreed to acquire the Detour Lake Property from Pelangio for total consideration comprised of $5 million cash and 20,000,000 common shares of the Company. The Company paid a $1 million non-refundable deposit (which formed part of the $5 million component) to Pelangio upon execution of this agreement. In addition, the Company also agreed to:

complete a private placement for minimum proceeds of $10 million by October 25, 2006;

complete a minimum initial public offering for minimum proceeds of $15 million by no later than January 30, 2007, or such later date as agreed to in writing by Pelangio and the Company; and

fund ongoing expenditures on the Detour Lake Property, budgeted at approximately $1.5 million in a approved work program, prior to the completion of this acquisition.

The Purchase Agreement was subsequently amended on September 21, 2006, October 4, 2006 and January 8, 2007.

In addition, the acquisition of the Detour Lake Property was subject to the following conditions:

listing of the common shares of the Company on the Toronto Stock Exchange or the TSX Venture Exchange on closing;

approval by the shareholders of Pelangio;

two Pelangio nominees having been appointed to the Company's board of directors upon completion of the acquisition.

On October 23, 2006, the Company completed a private placement of 5,000,000 subscription receipts at $2.00 per subscription receipt for gross proceeds of $10,000,000. Each subscription receipt entitled the holder thereof to acquire one common share of the Company.

On October 30, 2006, the shareholders of Pelangio approved the sale of the Detour Lake Property to the Company.

The Company completed its initial public offering of common shares (the "IPO") on the Toronto Stock Exchange ("TSX") on January 31, 2007. The Company issued an aggregate of 10,000,000 shares at a price of $3.50 per share for total gross proceeds to the Company of $35,000,000. Concurrent with the completion of the initial public offering:

the Company's common shares were listed on the TSX;

the Company completed the acquisition of the Detour Lake Property by issuing 20,000,000 common shares to Pelangio and paying to Pelangio the $4 million balance of cash portion of the purchase price;

the Subscription Receipts were automatically exchanged for an aggregate of 5,000,000 common shares and the proceeds of the subscription receipt offering released to the Company; and

Ingrid Hibbard and Philip Olson, as nominees of Pelangio, were appointed to the board of directors of the Company.

– page 19 –

During the period from execution of the Purchase Agreement to closing, the Company satisfied the condition precedent relating to exploration expenditures by funding approximately $1.7 million in exploration expenditures on the Detour Lake Property.

Overview of the Detour Lake Property

The Detour Lake Property is located in northeastern Ontario approximately eight kilometers west of the Ontario-Québec border and 140 kilometers northeast of Cochrane, Ontario.

The Detour Lake Property is comprised of:

an option to purchase a property referred to as the "Mine Option Property"; and

certain mining claims, staked claims and mining leases in around the Detour Lake area that are referred to as the "Exploration Lands".

– page 20 –

These properties are summarized as follows:

| Property | Ownership Interest | Comprised Of: | Total Area |

| | | | |

| Mine Option Property | Option to acquire 100% | 10 registered leasehold | 3,072 hectares |

| | from Goldcorp, subject | mining blocks and 25 | |

| | to 1% NSR in favour of | patents | |

| | Goldcorp and 2% NSR | | |

| | in favour of Newmont | | |

| | | | |

| Blocks A, B, C, D and E of | 100%, subject to subject | 135 mineral claims and 53 | 8,336 hectares |

| the Exploration Lands | to 1% NSR in favour of | leasehold interest (2) | |

| | Goldcorp and 2% NSR | | |

| | in favour of Newmont | | |

| | (1) | | |

| | | | |

| Staked Land | 100%, subject to 2% | 10 mineral claims | 1,744 hectares |

| | NSR in favour of the | | |

| | selling prospector | | |

| | | | |

| Purchased Claims | 100% | 53 mineral claims | 10,096 hectares |

| | (1) | Trade Winds Ventures Inc. has an option to earn a 50% interest in Block A which is comprised of four staked mining claims (consisting of 22 claim units) and three leased mining claims. Block A is subject to a 1% royalty to Goldcorp and a 2% royalty to Newmont |

| | | |

| | (2) | The Company has the right to purchase the 1% NSR on all exploration lands properties from Goldcorp for $1 million. |

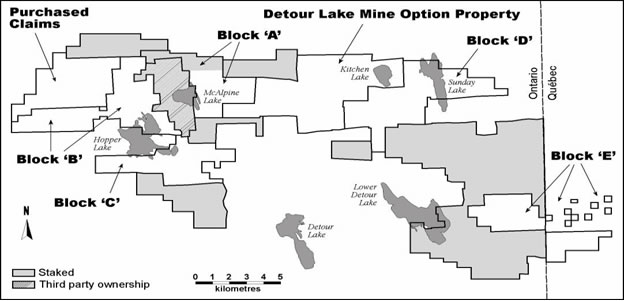

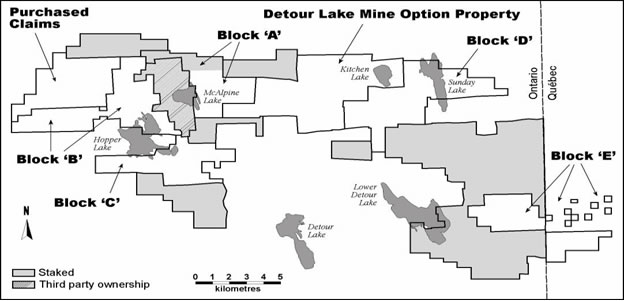

The properties comprising the Detour Lake Property are shown on the following map:

In addition to acquiring the properties comprising the Detour Lake Property, the Company also:

– page 21 –

acquired from Pelangio all applicable contracts, geological data, technical reports, feasibility studies, core samples, licenses, permits, property, plant, equipment and fixed assets located on or relating to the Detour Lake Property; and

assumed certain liabilities related to the Detour Lake Property.

B. Business Overview

Overview of Operations

The Company's principal business is the acquisition, exploration and, if warranted, development of mineral properties. The Company's current focus is the exploration of the Detour Lake Property. The Company's overall plan of operations is to use existing working capital to carry out recommended exploration programs on the Detour Lake Property with the objective of advancing exploration to the stage where feasibility studies may be completed to assess the development potential of the Detour Lake Property. The exploration programs that the Company intends to complete have been recommended in technical reports that have been completed on the Detour Lake Property.

Exploration of the Detour Lake Property

During the period from execution of the Purchase Agreement (in August 2006) to closing (on January 31, 2007), the Company funded approximately $1.7 million in exploration expenditure on the Detour Lake Property. This exploration work included the completion of an updated technical report dated September 21, 2006 prepared by Eric A. Kallio, P. Geo.

As recommended in the Kallio report, the Company carried out a $7.5 million Phase 1 drilling program on the Detour Lake Property, with an additional $1.0 million budgeted for exploration work, compilation, and target assessments. The Phase 1 drilling program was comprised of 50,000 metres of drilling. The main objective of the drilling campaign was to expand the current near-surface resource and convert a large portion of the inferred resources to the indicated category. The Company started the Phase 1 drilling program on January 8, 2007. As of June 30, 2007, the Company had completed 134 holes totaling 48,800 metres. Drilling is focused on testing between surface to 350 metres over a strike length of more than two kilometers. The Phase 1 drilling program was completed effective June 30, 2007.

Drilling resumed on July 9 with four drill rigs for a Phase II drilling program planned for an additional 50,000 metres. The Company has commenced a further $7.5 million Phase 2 drilling program.

In addition, a budget of $1.0 million has been allocated for a 12,000 meter exploratory drill program. The Company will continue to review and evaluate new opportunities to acquire other mineral properties.

Services Agreement with Hunter Dickinson

Substantially all of the management services of Detour are provided to it by Hunter Dickinson Inc. ("HDI") pursuant to a services agreement dated July 19, 2006. Currently, one-half of the directors of Detour are also directors of HDI. HDI is one of the larger independent mining exploration groups in North America and as of July 31, 2007, employed or retained approximately 83 staff or service providers substantially on a full-time basis. Of these:

approximately 43% are professional technical staff (a large majority of whom have accreditation as a professional engineer or professional geoscientist);

approximately 15% are professional accountants (the majority of whom have professional accreditations); and

– page 22 –

- approximately 42% are administrative, office or field support personnel.

HDI has supervised mineral exploration projects in Canada (British Columbia, Manitoba, Ontario, Quebec, Yukon and Northwest Territories) and internationally in Brazil, Nevada, Mexico, China and South Africa. HDI allocates the cost of staff input into projects, including Detour's projects, based on the time records of involved personnel. Costs of such personnel and third party contractors are billed to the participating public companies on a full cost recovery basis (inclusive of HDI staff costs and overhead) for amounts which are considered by management to be at a cost that is competitive with arm's-length suppliers. The agreement can be cancelled on 30 days' notice.

Competition

Detour competes with other mineral resource exploration companies for financing, for the acquisition of new mineral properties and for the recruitment and retention of qualified employees and other personnel. Many of the mineral resource exploration and development companies with which Detour competes have greater financial and technical resources. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest o prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Intellectual Property

On November 22, 2006, the Company filed applications to register in Canada the following trade-marks: DETOUR GOLD; DETOUR GOLD & Gold Bar Design; and DGC.

C. Organizational Structure

Detour operates directly and does not have any subsidiaries.

D. Property, Plant and Equipment

Ownership Interest in the Detour Lake Property

The Detour Lake Property consists of the Mine Option Property as well as the Exploration Lands. The Exploration Lands include Blocks A through E surrounding the Mine Option Property, the Staked Claims and the Purchased Claims. The Mine Option Property includes the Mine Site, which produced gold between 1983 and 1999. The Mine Site was officially closed in July 1999. Pursuant to the Mine Closure Plan, the Mine Site was flooded. The Mine Site is currently in the process of being rehabilitated according to the Mine Closure Plan.

The properties comprising the Detour Lake Property and the Company's ownership interest in these properties are described in detail below:

The Mine Option Property

Property Description

The Mine Option Property is comprised of 10 registered leasehold mining blocks and 25 patents totaling 3,072 hectares, or 7,680 acres, located on the Sunday Lake and West of Sunday Lake map sheets, in the District of

– page 23 –

Cochrane, Ontario. The critical deposit claims, the campsite and airstrip are held as patents. The approximate dimensions of the Mine Option property are 11 kilometers east west and five kilometers north-south. The outer boundaries of the Mine Option are surveyed in and marked by a series of survey points located along the outer perimeter.

The Mine Option Property includes the site of a former open pit and underground mining operation (the "Mine Site"), which produced gold between 1983 and 1999. In January 1995, Placer Dome (CLA) Limited ("Placer") filed a closure plan (the "Mine Closure Plan") with the Director of Mine Rehabilitation, Ministry of Northern Development and Mines for the Province of Ontario, Canada. The Mine Site was officially closed in July 1999. Pursuant to the Mine Closure Plan, the Mine Site was flooded. The Mine Site is currently in the process of being rehabilitated according to the Mine Closure Plan.

Option to Acquire the Mine Option Property

The Company acquired an option to acquire the Mine Option Property from Pelangio as part of the acquisition. Pelangio originally acquired this option in May 2000, when it acquired the assets of Pelangio-Larder Mines, Limited ("Pelangio-Larder"). Pelangio-Larder's assets included an interest in a joint venture agreement dated December 10, 1998 (the "Joint Venture") entered into with Franco-Nevada Mining Company Limited, predecessor in title to Newmont Mining Company of Canada Limited ("Newmont").

On December 10, 1998, the Joint Venture had entered into an option and access agreement (the "Option and Access Agreement") with Placer, predecessor in title to Goldcorp, pursuant to which it acquired an option (the "Mine Option") to purchase the Mine Option Property by making a $400,000 payment (the "Option Purchase Price") to Goldcorp at any time on or before the expiry of 120 days from the date of completion by (and to the satisfaction of) Goldcorp of all necessary rehabilitation and reclamation work pursuant to any closure plan in respect of the Mine Option Property and on condition that such work is completed in full compliance with the then existing and applicable laws, except any ongoing monitoring and routine maintenance obligations imposed by the Director of Mine Rehabilitation. The Option and Access Agreement provides that the holder of the Mine Option may conduct exploration work on certain portions of the Mine Option Property which do not, in the sole discretion of Goldcorp, require rehabilitation or reclamation work by Goldcorp prior to the date of payment of the Option Purchase Price, provided that reasonable prior notice is given to Goldcorp and such exploration does not unduly interfere with or disrupt such rehabilitation and reclamation work and provided the holder otherwise complies with the requirements of the option and access agreement related to such exploration work.

The Mine Option Property and certain parts of the Exploration Lands are subject to the retention of a 1% net smelter royalty ("NSR") by Goldcorp as the successor in title to Placer. Goldcorp's 1% NSR on the Mine Option Property (should the option be exercised) and its 1% NSR on certain parts of the Exploration Lands can be purchased, each for $1,000,000.

Goldcorp also has the right to remain the owner of certain claims within the Mine Option Property until December 2008, regardless of whether or not the option holder exercises the Mine Option before that date.

In May 2002, Pelangio purchased all of Newmont's interest in the Joint Venture, subject to the retention of a 2% NSR by Newmont. This included Newmont's rights under the Mine Option and its interest in certain property staked by Pelangio.

The Company may only engage in the exploration activities on the Mine Option Property that are permitted under the Option and Access Agreement until the Company either (a) exercises the Mine Option and acquires the Mine Option Property or (b) obtains Goldcorp's consent to any additional activities. No assurances can be given that Goldcorp will consent to such additional activities or consent on terms acceptable to the Company. The exercise by the Company of the Mine Option could result in the Company assuming reclamation obligations under the Mine Closure Plan. Management understands that the physical reclamation in accordance with the Mine Closure Plan is substantially complete. Management estimates the future cost to complete the reclamation of the Mine

– page 24 –

Site in accordance with the Mine Closure Plan to be approximately $2.5 million to $5 million. Depending on the requirements of the MNDM with respect to the Mine Closure Plan, these costs could be higher or lower but are not anticipated to exceed approximately $5.0 million. Management anticipates that the reclamation of the Mine Site in accordance with the Mine Closure Plan will be completed to the satisfaction of the MNDM by 2010, followed by a period of five years of monitoring the water quality of the site prior to the issuance by the MNDM of its final approval of the reclamation. The Company has commissioned an independent review of the Mine Closure Plan and site liability associated with the Mine Option Property and is currently reviewing the draft report related to this review. The Company will not assume any reclamation obligations with respect to the Mine Option Property prior to obtaining such independent review and satisfying itself as to the nature and scope of any potential reclamation obligations. Furthermore, the Company will not assume any reclamation obligations with respect to the Mine Option Property if the Board of Directors of the Company determines that any such assumption of reclamation obligations would materially and adversely impact the Company. Accordingly, if it is subsequently determined that the cost to complete the reclamation of the Mine Site in accordance with the Mine Closure Plan is substantially greater than management's estimate, the Company may decide not to exercise the Mine Option until the reclamation is completed by Goldcorp.

Upon acquisition of the Detour Lake Property, in order to keep all of the properties comprising the Detour Lake Property in good standing, the Company must incur, or have joint venture partners incur, exploration expenditures of approximately $387,600 on an annual basis.

Blocks A through E of the Exploration Lands

Blocks A, B, C, D and E are comprised of 135 staked mineral claims and 53 registered leasehold mining blocks totalling approximately 8,300 hectares.

Blocks A through E of the Exploration Lands surrounding the Mine Option Property were originally acquired by the Joint Venture pursuant to an assignment of a September 28, 1998 letter agreement between Pelangio-Larder and Placer. The following blocks comprising the Exploration Lands are subject to the retention of a 1% net smelter royalty ("NSR") by Goldcorp as the successor in title to Placer.

Each of Blocks A, B, C, D and E is 100% owned by the Company subject to a 2% NSR payable to Newmont, and a 1% NSR payable to Goldcorp;

The Company has the right to purchase Goldcorp's 1% NSR interest on all of these exploration properties for a total of $1 million.

In addition, the Company's interest in Block A is subject to the right of Trade Winds Ventures, a public company trading on the TSX Venture Exchange ("Trade Winds"), to earn a 50% interest in Block A pursuant to an option that was granted by Pelangio to Trade Winds in September 2003. Block A is comprised of 22 claim units totalling 352 hectares and is located west of Sunday Lake, Porcupine Mining Division in the District of Cochrane, Ontario.

Under the terms of the agreement between Pelangio and Trade Winds dated September 18, 2003 (the "Trade Winds Agreement"), Trade Winds' right to acquire a 50% interest in Block A is subject to a staged payment of cash and shares to Pelangio and the completion of an exploration commitment of $7,500,000.

Pelangio advised the Company that during the second quarter of 2006, Trade Winds had advised Pelangio that it had completed its exploration commitment and that Trade Winds was in the process of completing interpretation of data and technical reports to accompany this work. Pelangio also advised the Company that the expenditures Trade Winds claims to have made were in the process of being reviewed. Further, Pelangio advised the Company that it had received final instalments of cash and shares required for vesting of the properties subject to the Trade Winds Agreement and that it was in the process of negotiating a joint venture agreement with Trade Winds. Trade Winds filed a technical report prepared by Golder Associates Ltd. dated December 8, 2006, entitled

– page 25 –

Technical Report, Mineral Resource Estimate – Detour Lake Property, M Zone Gold Deposit, Block A, Porcupine Mining Division, Province of Ontario (the "Golder Report"). Pelangio advised the Company that other than the press release of Trade Winds dated October 27, 2006, in respect of a new mineral resource estimate and the Golder Report, it had not received any data or analysis in respect of the Trade Winds mineral resource estimate and had not independently verified the accuracy of the mineral resource estimate.

Pelangio assigned its rights under the Trade Winds Agreement to the Company in accordance with the terms and conditions of the Purchase Agreement.