| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 1 |

1.1 Date

This Management Discussion and Analysis ("MD&A") should be read in conjunction with the unaudited financial statements of Detour Gold Corporation ("Detour Gold" or the "Company") for the nine months ended September 30, 2007 and the audited financial statements for the period from inception (July 19, 2006) to December 31, 2006.

This MD&A is prepared as of October 26, 2007. All dollar figures stated herein are expressed in Canadian dollars, unless otherwise specified.

This discussion includes certain statements that may be deemed "forward-looking statements". All statements in this discussion, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. |

1.2 Overview

The Company was incorporated on July 19, 2006 as 6600964 Canada Inc. pursuant to theCanada Business Corporations Act. Pursuant to articles of amendment filed on August 21, 2006, 6600964 Canada Inc. changed its name to Detour Gold Corporation and removed its private company restrictions. The Company's principal business is the acquisition, exploration and development of mineral properties. The Company has no producing properties.

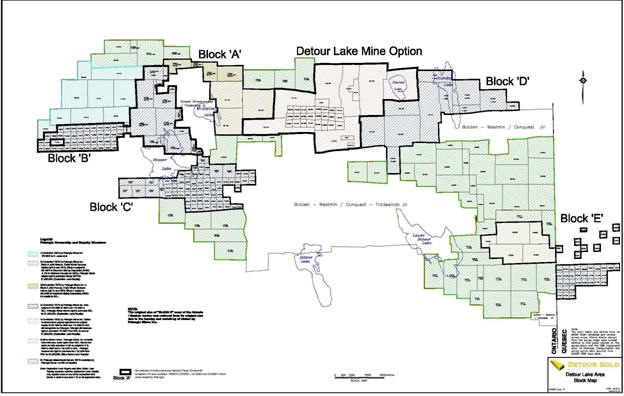

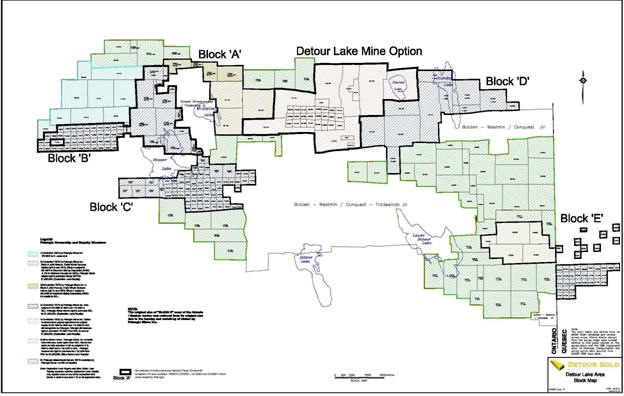

The Company completed its initial public offering ("IPO") on the Toronto Stock Exchange on January 31, 2007. Concurrently with the closing of the IPO, the Company acquired the Detour Lake and Block A properties (the "Properties") from Pelangio Mines Inc. ("Pelangio"). The Properties total in excess of 240 square kilometers. The core of the Properties is located in the Porcupine Mining Division of Ontario, approximately 180 kilometers northeast of Timmins. The Properties host the Detour Lake gold deposit, which contains an indicated resource of 20.0 million tonnes grading 2.14 g/t gold containing 1,379,500 ounces and an inferred resource of 35.4 million tonnes grading 1.8 g/t containing 2,035,650 ounces. The mineral resource is contained within two pits (West Pit and Calcite Zone) based on a gold price of US$450/oz. The Properties consist of certain exploration property surrounding the former Detour Lake mine (the "Detour Gold Exploration Lands"), and an option to acquire the Detour Lake Mine property (the "Mine Option Property"), from Placer Dome (CLA) Limited ("Placer") (now, Goldcorp Canada Ltd.) ("Goldcorp"), all located on the Abitibi Greenstone Belt. The Detour Gold Exploration Lands include: Block A, B, C, D and E; claims acquired through staking; and claims purchased from a third party. Block A is currently subject to a joint venture agreement between Detour Gold and Trade Winds Ventures Inc. ("Trade Winds"). Trade Winds completed its exploration commitments and has earned its 50% interest. The Mine Option Property is the site of the former Detour Lake mine, which produced 1.8 million ounces of gold from 1983 to 1999. In January 1995, Placer filed a closure plan and the mine site officially closed in July 1999. The site is currently being rehabilitated according to the closure plan.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 2 |

| Information Concerning Estimates of Indicated and Inferred Resources |

| |

This MD&A uses the terms "indicated resources" and "inferred resources". The Company advises investors that although these terms are recognized and required by Canadian regulations (under National Instrument 43-101Standards of Disclosure for MineralProjects), the United States Securities and Exchange Commission does not recognize them. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. In addition, "inferred resources" have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, or economic studies, except for a Preliminary Assessment as defined under 43-101. Investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable. |

Property Activities

Detour Lake and Block A properties

On August 21, 2006, the Company entered into a purchase agreement to acquire the Properties from Pelangio. On January 31, 2007, the Company completed the acquisition of the Properties, assets and rights used in connection with or relating to the Properties from Pelangio.

The Properties are comprised of certain mining claims, staked claims and mining leases located in Hopper Lake Area, Lower Detour Lake Area, West of Sunday Lake Area and Sunday Lake Area, Porcupine Mining Division of northeastern Ontario, and Massicotte Township, Quebec. As part of the acquisition, Detour Gold also acquired all applicable contracts, geological data, technical reports, feasibility studies,

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 3 |

core samples, licences, permits, property, plant, equipment and fixed assets located on or relating to the Properties and assumed certain routine liabilities related to the Properties.

The consideration paid by the Company to Pelangio for the Properties consisted of:

| | 1. | 20,000,000 common shares, paid at the time of closing of the acquisition on January 31, 2007. |

| | | |

| | 2. | $5,000,000 cash (of which a $1,000,000 deposit had been paid on August 30, 2006 and the remaining $4,000,000 was paid on January 31, 2007). |

| | | |

| | 3. | Funding of an approved work program, budgeted at approximately $1,500,000 with respect to the exploration and development of the Properties from August 21, 2006 to January 31, 2007. The Company spent $523,000 on exploration expenses on the Properties during the period ended December 31, 2006 and a further $1,200,000 in January 2007. |

Exploration Activities

Detour Lake gold deposit

On January 8, 2007, the Company started a 100,000 metre drilling program (Phase I & II) with the main objectives of expanding the current near-surface resource and converting a large portion of the inferred resources to the measured and indicated categories.

Detour Gold completed Phase I in early July with 134 holes totaling 49,322 metres. As of the date of this MD&A, Detour Gold has released the assay results of 101 drill holes (75%) with excellent and consistent results. The Phase II drilling campaign of 50,000 metres, which started on July 9, is expected to be completed in the fourth quarter of 2007. With 75% of Phase I drill results now released, Detour Gold is confident in significantly expanding the September 2006 near-surface resource of 1.4 million ounces in the indicated category (20.0 million tonnes grading 2.14 g/t) and 2.0 million ounces in the inferred category (35.4 million tonnes grading 1.80 g/t), based on a US$450 per ounce gold price and a cut-off grade of 0.85 g/t gold. The mineral resource is contained within two open pits (West Pit and Calcite Zone), located in the area of the former Detour Lake Mine, which produced 1.8 million ounces from 1983 to 1999.

All holes announced were drilled within the Gap Zone (between the two US$450 open pits), within the West Pit in areas with limited or no previous drilling, and in the Calcite Zone. Some of the best mineralized intervals (uncut assays) encountered in these areas are shown below (press releases August 21, September 19, and October 17, 2007).

West Pit

- 3.86 g/t over 53.4 m in DG-07-25B (Oct 17)

- 7.54 g/t over 19.0 m in DG-07-27 (Oct 17)

- 2.84 g/t over 28.3 m in DG-07-99 (Oct 17)

- 3.84 g/t over 7.0 m, 6.11 g/t over 10.0 m and 2.41 g/t over 54.3 m in DG-07-55 (Sep 19)

- 1.86 g/t over 39.0 m, 3.29 g/t over 11.8 m and 8.01 g/t over 12.0 m in DG-07-46 (Aug 21)

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 4 |

Gap Zone

- 1.01 g/t over 37.8 m, 4.20 g/t over 31.3 m and 1.53 g/t over 23.3 m in DG-07-76 (Oct 17)

- 4.66 g/t over 28.0 m in DG-07-85 (Oct 17)

- 2.15 g/t over 32.2 m and 15.28 g/t over 5.0 m in DG-07-91 (Oct 17)

- 1.16 g/t over 35.0 m, 2.88 g/t over 10.0 m, 9.19 g/t over 8.0 m and 4.89 g/t over 11.7 m in DG-07-65 (Sep 19)

- 3.71 g/t over 30.0 m in DG-07-82 (Sep 19)

- 9.60 g/t over 16.5 m in hole DG-07-84 (Sep 19)

- 5.77 g/t over 16.0 m and 9.69 g/t over 24.0 m in hole DG-07-58 (Aug 21)

- 4.42 g/t over 34.0 m in DG-07-59 (Aug 21)

Calcite Zone

- 12.88 g/t over 5.0 m in DG-07-64 (Sep 19)

- 1.94 g/t over 29.0 m, 43.33 g/t over 5.5 m and 16.02 g/t over 5.6 m in DG-07-77 (Sept 19)

The mineralized corridor, tested over a strike length of 1.6 kilometres in Phase I, remains open west of the Calcite Zone and east of the West Pit along the Sunday Lake Deformation Zone. Gold mineralization within the corridor typically consists of multiple, subvertical, 5-to-25-metre wide zones grading between 1.0 to 3.0 g/t gold.

With the results of the Phase I drilling program near complete, Detour Gold plans to release a new resource estimate in the fourth quarter of 2007. Phase I was designed to expand beyond the current near-surface resource on a 40 metre east-west and 80 metre north-south grid. The drilling focused between surface to 350 metres depth over a strike length of 1.6 kilometres, covering such areas as the Gap and Calcite Zones that had very limited drilling in the past.

In October 2007, Detour Gold awarded several contracts for the start of the feasibility study at its Detour Lake property in northern Ontario. The contract for open pit geotechnical investigations (pit slope design) was allocated to Golder Associates, under the management of Luiz Castro from their Mississauga office. Metallurgical testwork on the Detour Lake deposit will be conducted by SGS Lakefield of Lakefield, Ontario under the supervision of Melis Engineering Ltd. of Saskatoon, Saskatchewan. Detailed mine design and pit optimization will be conducted by Patrice Live, Eng., from Montreal-based Breton, Banville & Associates (BBA). ARD (Acid Rock Drainage) testing is scheduled to start in late October under the supervision of Mark Bednarz, BZ Environmental Consulting of Timmins, Ontario.

Block A

Since January 31, 2007, Block A has been, and continues to be, explored as a 50/50 joint venture between Detour Gold and Trade Winds. Trade Winds is the operator during the exploration phase. In the winter of 2007, Trade Winds completed 53 drill holes totaling approximately 13,000 metres testing the M Zone structural corridor from surface to a depth of 300 metres. On October 16, 2007, Trade Winds announced the final drill results of its 2007 program.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 5 |

Market Trends

Gold prices have been increasing over the past three years. Overall, the gold price increased from US$410 per ounce in 2004 to US$445 per ounce in 2005, and although there was some volatility in late 2006, the average price over the year – US$604 per ounce – was still a substantial increase from 2005. The gold price has averaged approximately US$659 per ounce during the first nine months of 2007. The closing gold price at October 26, 2007 was US$783.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 6 |

1.3 Selected Annual Information

The financial statements have been prepared in accordance with Canadian generally accepted accounting principles, and are expressed in Canadian dollars except common shares outstanding.

| | | As at | |

| | | December 31, 2006 | |

| Balance Sheet | | | |

| Current assets | $ | 8,094,248 | |

| Other assets | | 1,453,800 | |

| Total assets | $ | 9,548,048 | |

| | | | |

| Current liabilities | $ | 636,067 | |

| Shareholders' equity | | 8,911,981 | |

| Total shareholders' equity & liabilities | $ | 9,548,048 | |

| | | | |

| Working capital | $ | 7,458,181 | |

| | | For the period from | |

| | | inception | |

| | | (July 19, 2006) to | |

| | | December 31, 2006 | |

| Operations | | | |

| Conference and travel | $ | 11,589 | |

| Exploration | | 523,000 | |

| Interest expense | | 11,712 | |

| Legal, accounting and audit | | 23,488 | |

| Office and administration | | 58,173 | |

| Shareholder communications | | 12,692 | |

| Trust and filing | | 5,731 | |

| | | 646,385 | |

| Interest income | | (59,225 | ) |

| Loss for the period | $ | 587,160 | |

| | | | |

| Basic and diluted loss per common share | $ | 0.12 | |

| | | | |

| Weighted average number of common shares outstanding | | 5,000,000 | |

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 7 |

1.4 Summary of Quarterly Results

The following summary is presented in thousands of Canadian dollars except loss per share amount. The Company was incorporated in July 2006, and the quarter ended June 30, 2007 was the first full quarter of activity.

| | | September 30, | | | June 30, | |

| | | 2007 | | | 2007 | |

| | | | | | | |

| Current assets | $ | 25,702 | | $ | 29,654 | |

| Mineral property interests | | 108,194 | | | 108,194 | |

| Other assets | | 227 | | | 166 | |

| Total assets | $ | 134,123 | | $ | 138,014 | |

| | | | | | | |

| Current liabilities | $ | 2,619 | | $ | 1,423 | |

| Other liabilities | | 113 | | | 120 | |

| Future income tax liability | | 31,815 | | | 31,815 | |

| Shareholders' equity | | 99,576 | | | 104,656 | |

| Total shareholders' equity and liabilities | $ | 134,123 | | $ | 138,014 | |

| | | | | | | |

| Working capital | $ | 23,083 | | $ | 28,231 | |

| | | | | | | |

| Expenses (income): | | | | | | |

| Amortization | $ | 1 | | $ | 1 | |

| Conference and travel | | 50 | | | 42 | |

| Consulting | | 27 | | | 30 | |

| Exploration | | 5,106 | | | 4,232 | |

| Interest expense | | 4 | | | 4 | |

| Legal, accounting and audit | | (229 | ) | | 66 | |

| Office and administration | | 316 | | | 364 | |

| Shareholder communications | | 54 | | | 87 | |

| Trust and filing | | 4 | | | 32 | |

| Interest income | | (304 | ) | | (330 | ) |

| Subtotal | | 5,029 | | | 4,528 | |

| Stock-based compensation | | 748 | | | 531 | |

| Loss for the period before income taxes | | 5,777 | | | 5,059 | |

| Income tax benefit | | – | | | (490 | ) |

| Loss for the period | $ | 5,777 | | $ | 4,569 | |

| | | | | | | |

| Basic and diluted loss per common share | $ | 0.14 | | $ | 0.11 | |

| | | | | | | |

| Weighted average number of common shares outstanding (thousands) | | 40,316 | | | 40,110 | |

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 8 |

1.5 Results of Operations

The Company was incorporated on July 19, 2006 and did not commence significant activity until January 2007; consequently no comparative information for the prior year is presented. For the three months ended September 30, 2007, the Company incurred a loss of $5,776,608 (quarter ended June 30, 2007 – $4,569,445). The net loss was comprised primarily of exploration expenses of $5,105,617 (quarter ended June 30, 2007 – $4,232,048) and administrative expenses of $315,879 (quarter ended June 30, 2007 – $365,225).

Stock based compensation expense included $60,125 (quarter ended June 30, 2007 – $295,783) related to exploration activities and $687,788 (quarter ended June 30, 2007 – $234,915) related to directors, management and administrative personnel.

The primary exploration expenses during the period included:

$2,881,138 (quarter ended June 30, 2007 – $2,261,299) for drilling

$956,034 (quarter ended June 30, 2007 – $593,217) for site activities

$615,850 (quarter ended June 30, 2007 – $522,416) for assays and analysis

$313,173 (quarter ended June 30, 2007 – $340,869) for geological employees and expenses

The increase in expenses during the third quarter is consistent with the increased activities during the third quarter compared to the second quarter.

Block A is being explored as a 50/50 joint venture between Detour Gold and Trade Winds. Trade Winds is the operator during the exploration phase.

During the quarter ended September 30, 2007, the Company reclassified $266,877 from legal, accounting and audit expenses to share issue costs.

The Company had interest income of $304,713 (quarter ended June 30, 2007 – $330,050) in the third quarter, as a result of decreasing cash balances on hand due to the incremental exploration expenditure incurred in the third quarter.

1.6 Liquidity

Historically the Company's sole source of funding has been the issuance of equity securities for cash, primarily through private placements to sophisticated investors and institutions. On January 31, 2007, the Company successfully completed its IPO of 10,000,000 common shares on the Toronto Stock Exchange ("TSX"). The common shares were issued at a price of $3.50 per share for total gross proceeds to the Company of $35,000,000.

The Company's access to exploration financing when the financing is not transaction specific is always uncertain. There can be no assurance of continued access to significant equity funding.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 9 |

The Company had working capital of approximately $23.1 million as at September 30, 2007, which is sufficient to fund its known commitments and current plan of work.

All funds held were in cash, bankers' acceptances, or term deposits. The Company held no asset backed commercial paper at any time during the period.

The following table lists the Company's contractual obligations over the next five years:

| Contractual obligations | | | | | Remainder | | | | | | | | | | | | | | | | |

| (in thousands of dollars) | | | | | of | | | | | | | | | | | | | | | After | |

| | | Total | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2011 | |

| Long term debt | | – | | | – | | | – | | | – | | | – | | | – | | | – | |

| Capital lease obligations | $ | 141 | | $ | 7 | | $ | 29 | | $ | 105 | | | – | | | – | | | – | |

| Operating leases | $ | 126 | | $ | 12 | | $ | 49 | | $ | 49 | | $ | 16 | | | – | | | – | |

| Purchase obligations | | – | | | – | | | – | | | – | | | – | | | – | | | – | |

| Other long term obligations | | | | | | | | | | | | | | | | | | | | | |

| (excluding future income taxes) | | – | | | – | | | – | | | – | | | – | | | – | | | – | |

| Total | $ | 267 | | $ | 19 | | $ | 78 | | $ | 154 | | $ | 16 | | | – | | | – | |

1.7 Capital Resources

The Company had no material commitments for capital expenditures as of September 30, 2007.

The Company has no lines of credit or other sources of financing which have been arranged but are as yet unused.

1.8 Off-Balance Sheet Arrangements

None

1.9 Transactions with Related Parties

The Company has three related parties with which it had transactions during the period, namely Hunter Dickinson Inc. ("HDI"), Pelangio, and a director.

Hunter Dickinson Inc.

HDI carries out investor services, geological, corporate development, administrative and other management activities for, and incurs third party costs on behalf of, the Company on an as-needed and as-available basis. The Company reimburses HDI on a full cost-recovery basis. HDI has certain directors in common with the Company.

Costs for services rendered by HDI to the Company totaled $1,586,103, for the first nine months of 2007.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 10 |

Pelangio

On January 31, 2007, the Company acquired the Detour Lake and Block A properties from Pelangio through the issuance of common shares of the Company and cash (the "Property Acquisition"). Pelangio is a Canadian public company which, as a result of this share issuance, became a significant shareholder of the Company effective January 31, 2007. To effect the Property Acquisition, the Company issued 20,000,000 common shares and paid $5,000,000 to Pelangio. In addition to the Property Acquisition, the Company also paid to Pelangio $1,533,840 for exploration work conducted on a cost-recovery-only basis on the Company's behalf at the Detour Lake and Block A properties during the period.

Director

During the three and nine month period ended September 30, 2007, the Company paid technical consulting fees totalling $2,400 to a director of the Company.

1.10 Fourth Quarter

Not applicable.

1.11 Proposed Transactions

There are no material proposed asset or business acquisitions which have been approved by the board of directors requiring disclosure under this section.

1.12 Critical Accounting Estimates

The Company's accounting policies are presented in note 3 of the most recent annual audited financial statements. The preparation of financial statements in accordance with generally accepted accounting principles requires management to select accounting policies and make estimates. Such estimates may have a significant impact on the financial statements. These estimates include:

- mineral resources and reserves, and

- the carrying values of mineral properties,

- the carrying values of property, plant and equipment,

- the estimation of asset retirement obligations, and

- the valuation of stock-based compensation expense.

Actual amounts could differ from the estimates used and, accordingly, affect the results of operations.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 11 |

1.13 Changes in Accounting Policies including Initial Adoption

None

1.14 Financial Instruments and Other Instruments

None.

1.15 Other MD&A Requirements

Additional information relating to the Company is available on SEDAR at www.sedar.com.

1.15.1 Additional Disclosure for Venture Issuers without Significant Revenue

Not applicable

1.15.2 Disclosure of Outstanding Share Data

The following details the share capital structure as at October 26, 2007, the date of this MD&A. These figures may be subject to minor accounting adjustments prior to presentation in future financial statements.

| | | Exercise | |

| | Expiry date | price | Number |

| Common shares | | | 40,280,350 |

| | | | |

| Share purchase options | January 31, 2012 | $ 3.50 | 1,385,000 |

| | January 31, 2012 | $ 6.09 | 816,000 |

| | January 31, 2012 | $ 8.91 | 100,000 |

| | | | |

| Warrants | January 31, 2008 | $ 3.85 | 153,350 |

1.16 Risk Factors

An investment in the Company should be considered highly speculative. The following risk factors should be given special consideration when evaluating an investment in the Company.

Fluctuating Gold Prices

The Company’s profitability depends upon the world market price of gold and other metals. Prices fluctuate widely and are affected by numerous factors beyond the Company’s control. The prices of metals are influenced by factors including industrial and retail supply and demand, exchange rates, inflation rates, changes in global economies, confidence in the global monetary system, forward sales of gold and other metals by producers and speculators as well as other global or regional political, social or

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 12 |

economic events. The supply of gold and other metals consists of a combination of new mine production and existing stocks held by governments, producers, speculators and consumers.

If the market prices for gold or other metals fall below the Company’s targeted production costs and remain at such levels for any sustained period of time, it may not be economically feasible to commence or continue production on the Company’s projects. This would materially and adversely affect the decision to proceed and the ability to finance the development of properties, production, profitability and the Company’s financial position. The Company may, depending on hedging practices, experience losses and may decide to discontinue exploration activities, operations or development of a project or mining at one or more of its properties. If the price of gold drops significantly, the economic prospects of the projects in which the Company has an interest could be significantly reduced or rendered uneconomic.

Gold prices have fluctuated widely in recent years. There is no assurance that, even as commercial quantities of gold and other metals are produced, a profitable market will exist for them.

A decline in the market price of gold or other metals may also require the Company to write down its mineral reserves and resources, which would have a material and adverse effect on the Company’s value, earnings and profitability. Should any significant write-down in reserves and resources be required, a material write-down of the Company’s investment in the affected mining properties may be required.

Limited Operating History

The Company has not yet recorded any revenues from its operations nor has the Company commenced commercial production on the Detour Lake Property. The Company does not expect to generate revenues from operations in the foreseeable future. The Company expects to continue to incur losses unless and until such time as the Detour Lake Property enters into commercial production and generates sufficient revenues to fund its continuing operations. There can be no assurance that the Company will generate any revenues or achieve profitability or that any of the properties it may hereafter acquire or obtain an interest in will generate earnings, operate profitably or provide a return on investment in the future. There can be no assurance that the underlying assumed levels of expenses will prove to be accurate. There can be no assurance that significant additional losses will not occur in the near future or that the Company will be profitable in the future. The Company’s operating expenses and capital expenditures may increase in subsequent years as needed consultants, personnel and equipment associated with advancing exploration, development and commercial productions of its properties are added. The amount and timing of expenditures will depend on the progress of ongoing exploration and development, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners, the Company’s acquisition of additional properties and other factors, many of which are beyond the Company’s control.

Mining Exploration and Development

The Company’s business operations are subject to risks and hazards inherent in the mining industry. The exploration for, and the development of, mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an orebody may result in substantial rewards, few properties that are explored are ultimately developed into producing mines.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 13 |

The Company’s exploration and production may be hampered by mining, heritage and environmental legislation, industrial accidents, industrial disputes, cost overruns, land claims and compensation and other unforeseen contingencies. The success of the Company also depends on the delineation of economically recoverable reserves, the availability and cost of required development capital, movement in the price of commodities, securing and maintaining title to its exploration and mining tenements as well as obtaining all necessary consents and approvals for the conduct of its exploration and production activities.

Risks involved in mining operations include unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of any material, any of which could result in damage to life or property, environmental damage and possible legal liability. Further, weather conditions over a prolonged period can adversely affect exploration, production, mining and drilling operations and the timing of earning revenues.

Whether income will result from any of the Company’s projects will depend on the successful establishment of mining operations. Factors including costs, actual mineralization, consistency and reliability of ore grades and commodity prices affect successful project development, future cash flow and profitability, and there can be no assurance that current estimates of these factors will reflect actual results and performance. The design and construction of efficient processing facilities, the existence of competent operational management and prudent financial administration, as well as the availability and reliability of appropriately skilled and experienced consultants also can affect successful project development.

The recoverability of amounts for mineral properties and related deferred exploration costs is dependent upon the confirmation of the Company’s interest in the underlying claims, the Company’s ability to obtain necessary financing to complete development, future profitable production or, alternatively, upon disposition of such properties at a profit.

Resource Estimates

Any mineral resource figures included herein are estimates only and no assurance can be given that any particular level of recovery of gold or other mineral from resources will in fact be realized or that an identified mineral deposit will ever qualify as a commercially mineable (or viable) orebody which can be economically exploited. Mineral resources which are not mineral reserves do not have demonstrated economic viability. Any material change in the quantity of mineralization, grade or stripping ratio, or the gold price may affect the economic viability of any property held by the Company. In addition, there can be no assurance that gold recoveries or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. The failure of the Company to achieve its production estimates could have a material and adverse effect on any or all of its future cash flows, profitability, results of operations and financial condition. Until mineral resources are actually mined and processed, the quantity of mineral and resource grades must be considered as estimates only.

No History of Earnings or Dividends

The Company has no history of earnings and as such the Company has not paid dividends on its common shares since incorporation and does not anticipate doing so in the foreseeable future. Payment of any future dividends will be at the discretion of the board of directors after taking into account many factors, including operating results, financial condition and anticipated cash needs.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 14 |

Limited Property Portfolio

The Company’s only material mineral project is the Detour Lake and Block A Property. Unless the Company acquires or develops additional material properties or projects, the Company will be solely dependent upon the Detour Lake Property.

Detour Mine Option

The Mine Option Property is under option from Goldcorp Canada Ltd ("Goldcorp"). The option to acquire the property may be exercised at any time on or before the expiry of 120 days from the date of completion by Goldcorp of the reclamation of the Mine Site. The exercise by the Company of the Mine Option could result in the Company assuming reclamation obligations under the Mine Closure Plan. The Company may only engage in the exploration activities on the Mine Option Property that are permitted under the Option and Access Agreement until the Company either exercises the Mine Option and acquires the Mine Option Property or obtains Goldcorp’s consent to any additional activities. No assurances can be given that Goldcorp would consent to such additional activities or consent on terms acceptable to the Company. Under Ontario law, the option to acquire the Mine Option Property automatically expires on December 10, 2019 ("Expiry Date"), notwithstanding that the option purports to be perpetual. If the option is not exercised by such date, the Company would have no rights under the option against the grantor of the option or its successors. No assurance can be given that the Mine Option will be exercised prior to the Expiry Date.

Reclamation Obligation and Use of Estimates

Management estimates the cost to complete the reclamation of the Mine Site to be approximately $2.5 million to $5.0 million. These costs would become the responsibility of the Company if the Company assumed the reclamation obligations in connection with the exercise of the Mine Option and acquisition of the Mine Option Property prior to the completion of the reclamation of the Mine Site by Goldcorp. These costs represent management’s estimate of the reclamation obligations based on information currently available to the Company. The actual cost of completing the reclamation could be significantly higher, in which event the Company may decide not to exercise the Mine Option. Management estimates that the reclamation of the Mine Site to the satisfaction of the Ontario Ministry of Northern Development and Mines will be completed by 2010. The date of completion of the reclamation at the Mine Site is an estimate only and is based upon information currently available to the Company. The actual date of completion of the reclamation could be significantly later.

Aboriginal Title and Rights Claims

Aboriginal title and rights may be claimed with respect to Crown properties or other types of tenure with respect to which mining rights have been conferred. Other than as described in the Purchase Agreement, the Company is not aware of any aboriginal land claims having been formally asserted or any legal actions relating to aboriginal issues having been instituted with respect to the Detour Lake Property. There can be no assurance that such events will not occur or that title and rights claims will not be asserted in the future in respect of the Company’s properties. In addition, other parties may dispute the Company’s title to its properties and its properties may be subject to prior unregistered agreements or transfers or land claims by aboriginal peoples, and title may be affected by undetected encumbrances or defects or government actions.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 15 |

Third Party Claims on the Detour Lake Property

Title to, and the area of, resource claims may be disputed and additional amounts may be paid to surface rights owners in connection with any development of mining activity. Although the Company is satisfied, based on due diligence conducted by the Company, that its rights to the Detour Lake Property are valid, there may be challenges, including aboriginal land claims, on the Detour Lake Property which, if successful, could impair its development and/or operations.

Joint Ventures

The existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on the Company’s profitability, which could have a material adverse impact on the Company’s future cash flows, earnings, results of operations and financial condition:

disagreement with joint venture partners on how to develop and operate mines efficiently;

inability of joint venture partners to meet their obligations to the joint venture or third party; and

litigation between joint venture partners regarding joint venture matters.

Permits

There is no assurance that the Company can obtain, or that there will not be delays in obtaining, the permits necessary to develop the Detour Lake Property, including government approvals and permits required in connection with the Company’s operations. To the extent such approvals are required and are delayed or not obtained, the Company may be curtailed or prohibited from continuing mining operations or from proceeding with planned exploration or development of the Detour Lake Property.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in exploration expenses, capital expenditures or require abandonment or delays in development of new mining properties.

Infrastructure

Mining, processing, development and exploration activities depend on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s operations, financial condition and results of operations.

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 16 |

Insurance and Uninsurable Risks

Exploration, development and production operations on mineral properties involve numerous risks, including unexpected or unusual geological operating conditions, rock bursts, cave-ins, ground or slope failures, fires, floods, earthquakes, cyclones and other environmental occurrences, as well as political and social instability that could result in damage to or destruction of mineral properties or producing facilities, personal injury or death, environmental damage, delays in mining caused by industrial accidents or labour disputes or changes in regulatory environment, monetary losses and possible legal liability. It is not always possible to obtain insurance against all such risks and the Company may decide not to insure against certain risks because of high premiums or other reasons. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Company or to other companies in the mining industry on acceptable terms. Although the Company maintains insurance to protect against certain risks in such amounts as it considers reasonable, its insurance will not cover all potential risks associated with its operations, and insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Should such liabilities arise, they could reduce or eliminate any further profitability and result in increasing costs and a decline in the value of the securities of the Company.

Environmental and Safety Regulations and Risks

Environmental laws and regulations may affect the operations of the Company. These laws and regulations set various standards regulating certain aspects of health and environmental quality. They provide for penalties and other liabilities for the violation of such standards and establish, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are or were conducted. Furthermore the permission to operate could be withdrawn temporarily where there is evidence of serious breaches of health and safety, or even permanently in the case of extreme breaches. Significant liabilities could be imposed on the Company for damages, clean-up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous owners of acquired properties or non-compliance with environmental laws or regulations. Environmental legislation is evolving in a manner that may mean stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Permits from a variety of regulatory authorities are required for many aspects of mine development, operation and reclamation. Future legislation and regulations could cause additional expense, capital expenditures, restrictions, liabilities and delays in the development of the Company’s properties, the extent of which cannot be predicted. In the context of environmental permits, including the approval of reclamation plans, the Company must comply with standards and laws and regulations which may entail costs and delays depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority.

Competitive Conditions

The mining industry is intensely competitive in all its phases, and the Company competes with other companies that have greater financial resources and technical facilities. Competition in the precious metals mining industry is primarily for mineral rich properties which can be developed and produced economically and businesses compete for the technical expertise to find, develop, and produce such properties, the labour to operate the properties and the capital for the purpose of financing development of such properties. Many competitors not only explore for and mine precious metals, but conduct refining

| DETOUR GOLD CORPORATION |

| NINE MONTHS ENDED SEPTEMBER 30, 2007 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| 17 |

and marketing operations on a world-wide basis and some of these companies have much greater financial and technical resources than the Company. Such competition may result in the Company being unable to acquire desired properties, recruit or retain qualified employees or acquire the capital necessary to fund its operations and develop its properties.

The Company’s inability to compete with other mining companies for these mineral deposits could have a material adverse effect on the Company’s results of operation and business.

Management

The success of the Company is currently largely dependent on the performance of its officers. Shareholders will be relying on the good faith, experience and judgment of the Company’s management and advisors in supervising and providing for the effective management of the business of the Company. The loss of the services of these persons could have a materially adverse effect on the Company’s business and prospects. There is no assurance the Company can maintain the services of its officers or other qualified personnel required to operate its business. Failure to do so could have a material adverse affect on the Company and its prospects.