Exhibit 13.0

A Financial Services Company

Annual Report

2022

PRESIDENT’S LETTER TO SHAREHOLDERS

To our Valued Shareholders:

On behalf of the Board of Directors, Senior Management and Team Members of the Quaint Oak Family of Companies, I am pleased to present our 2022 Annual Report to Shareholders.

As previously reported in our year-end earnings release:

| | ● | Our growth in assets was 43.0% at year end when compared to the prior year-end of December 31, 2021 |

| | ● | Our net income of $7.9 million for the year was an increase 22.8% over the prior year earnings of 2021 |

| | ● | Stockholders’ equity increased 33.0%, or $12.2 million, over year-end December 31, 2021 |

| | ● | Our asset performance continued to be positive with our non-performing assets as a percent of total assets at 0.25% at December 31, 2022. Additionally, our Texas Ratio calculation ended the year at 3.32% |

Looking forward:

We had previously announced our initiative to provide “Banking as a Service (BaaS)” to other banks in the form of correspondent banking services. The infrastructure and staffing requirements to launch this initiative are targeted for completion during the third quarter of this year. We anticipate that this endeavor will ultimately provide lower cost funding, generate non-interest income and provide additional core liquidity.

In support of these endeavors, we have continued to realign reporting channels and expand certain support elements including expanded staffing and external vendor support. We have, working remotely, had the opportunity to add staffing at all levels and now employ team members in 20 states.

Additionally, we had planned a capital initiative launch in the early part of 2022. I am pleased with the response we received and to report that the plan is currently 83% complete. In addition, to this successful action, we are reviewing certain items that may provide even more liquidity and potential reduction within our own balance sheet going forward. These strategies include a reduction in equipment loans held for sale and a realignment in certain of our subsidiary companies.

The Company has repurchased an additional 2,147 shares during the twelve months ended December 31, 2022. To date we have repurchased over 40% of the original shares issued in our initial public offering. As recently announced, the Company declared a quarterly cash dividend of $0.13 per share on the common stock of the Company payable on February 6, 2023, to the shareholders of record at the close of business on January 23, 2023. As always, in conjunction with having maintained a strong repurchase plan, our current and continued business strategy includes long-term profitability and payment of dividends reflecting our strong commitment to shareholder value.

Robert T. Strong

President and Chief Executive Officer

Quaint Oak Family of Companies |

Quaint Oak Bancorp, Inc. |

Quaint Oak Bank |

Quaint Oak Abstract, LLC I Quaint Oak Mortgage, LLC I Quaint Oak Real Estate, LLC I Quaint Oak Insurance Agency, LLC Oakmont Capital Holdings, LLC I Oakmont Commercial, LLC |

TABLE OF CONTENTS

| | Page |

| | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 1 |

| | |

Reports of Independent Registered Public Accounting Firm | 17 |

| | |

Consolidated Balance Sheets | 19 |

| | |

Consolidated Statements of Income | 20 |

| | |

Consolidated Statements of Comprehensive Income | 22 |

| | |

Consolidated Statements of Stockholders’ Equity | 23 |

| | |

Consolidated Statements of Cash Flows | 24 |

| | |

Notes to Consolidated Financial Statements | 26 |

| | |

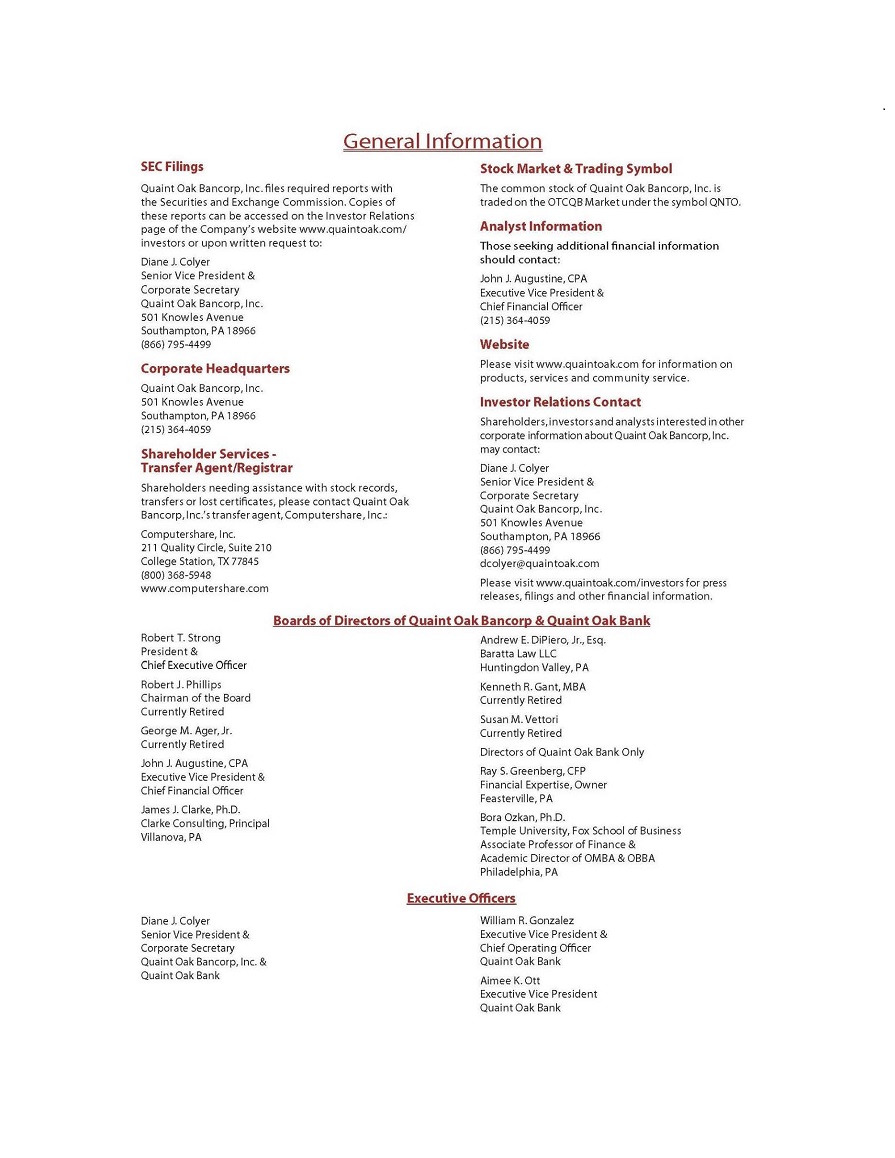

General Information | 66 |

| | |

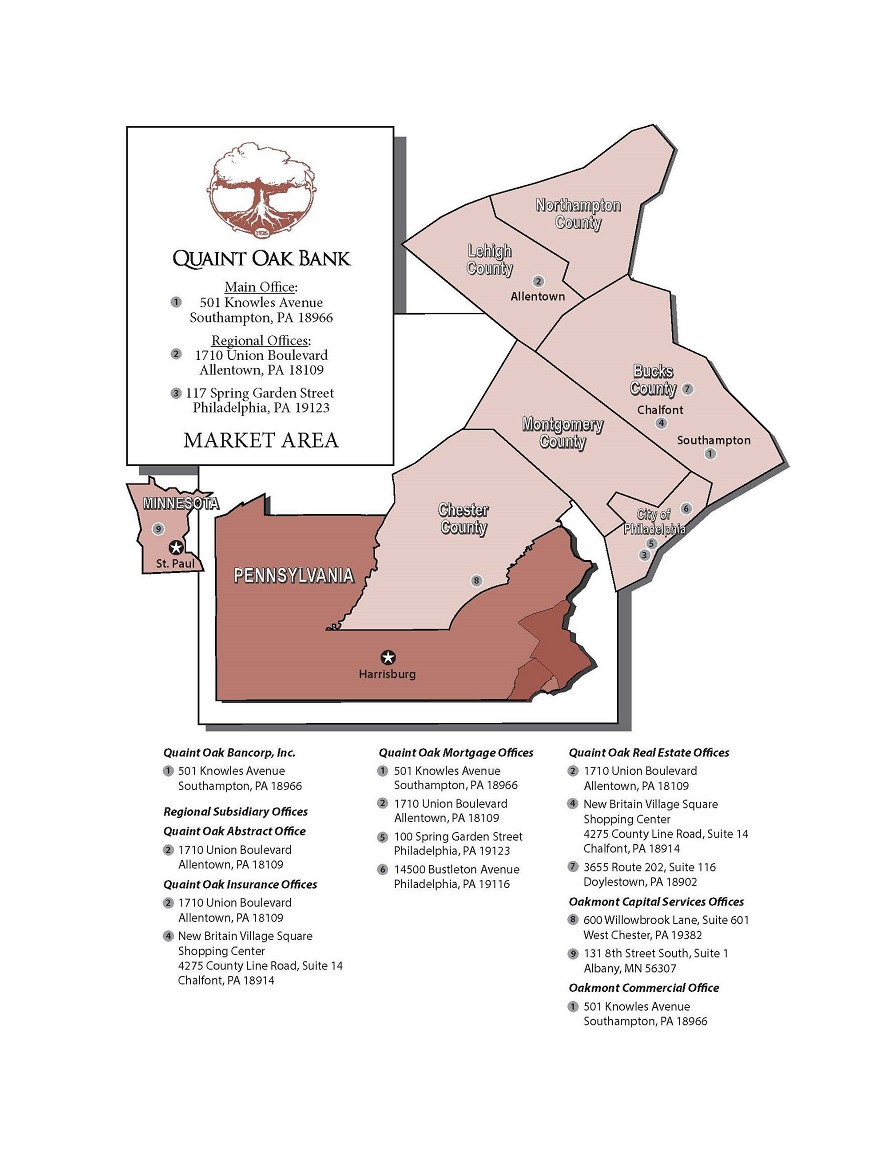

Locations | 67 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

Quaint Oak Bancorp, Inc. (the “Company”) was formed in connection with Quaint Oak Bank’s (the “Bank”) conversion to a stock savings bank completed on July 3, 2007. The Company’s results of operations are dependent primarily on the results of Quaint Oak Bank, a wholly owned subsidiary of the Company, along with the Bank’s wholly owned subsidiaries. The Bank, a Pennsylvania-chartered stock savings bank, is headquartered in Southampton, Pennsylvania and conducts business through three regional offices located in the Delaware Valley, Lehigh Valley and Philadelphia markets. At December 31, 2022, the Bank has six wholly-owned subsidiaries, Quaint Oak Mortgage, LLC, Quaint Oak Real Estate, LLC, Quaint Oak Abstract, LLC, QOB Properties, LLC, Quaint Oak Insurance Agency, LLC, and Oakmont Commercial, LLC, each a Pennsylvania limited liability company. The mortgage company offers mortgage banking services in the Lehigh Valley, Delaware Valley and Philadelphia County region of Pennsylvania. The real estate and abstract companies offer real estate sales and title abstract services, respectively, primarily in the Lehigh Valley and Bucks County regions of Pennsylvania. These companies began operation in July 2009. In February 2019, Quaint Oak Mortgage opened a mortgage banking office in Philadelphia, Pennsylvania. QOB Properties, LLC began operations in July 2012 and holds Bank properties acquired through a foreclosure proceeding or acceptance of a deed in lieu of foreclosure. Quaint Oak Insurance Agency, LLC, located in Chalfont, Pennsylvania, began operations in August 2016 and provides a broad range of personal and commercial insurance coverage solutions. Oakmont Commercial, LLC began operations in October 2021 and operates as a multi-state specialty commercial real estate financing company. Since January, 2021, the Bank holds a majority equity position in Oakmont Capital Holdings, LLC, a multi-state equipment finance company based in West Chester, Pennsylvania with a second significant facility located in Albany, Minnesota.

Quaint Oak Bank’s profitability depends, to a large extent, on net interest income, which is the difference between the income earned on its loan and investment portfolios and the cost of funds, consisting of the interest paid on deposits and borrowings. Results of operations are also affected by provisions for loan losses, fee income and other non-interest income and non-interest expense. Non-interest expense principally consists of compensation, directors’ fees and expenses, office occupancy and equipment expense, data processing expense, professional fees, advertising expense, FDIC deposit insurance assessment, and other expenses.

Quaint Oak Bank’s business consists primarily of originating residential, multi-family and commercial real estate loans secured by property, commercial business loans, and to a lesser extent other consumer loans in its market area. At December 31, 2022, commercial real estate loans and commercial business loans comprise the largest percentage of Quaint Oak Bank’s loan portfolio, before net items, at 52.9% and 25.2%, respectively. At December 31, 2022, commercial business loans include $213,000 of SBA PPP loans. Quaint Oak Bank’s loans are primarily funded by certificates of deposit and money market accounts. At December 31, 2022, certificates of deposit amounted to 36.0% of total deposits compared to 40.2% of total deposits at December 31, 2021. At December 31, 2022, money market accounts amounted to 47.5% of total deposits compared to 44.9% of total deposits at December 31, 2021. At December 31, 2022, non-interest bearing checking accounts amounted to 16.2% of total deposits compared to 14.5% of total deposits at December 31, 2021. Management anticipates that certificates of deposit, money market accounts and business checking will be the primary sources of funding for Quaint Oak Bank’s assets.

Our results of operations are significantly affected by general economic and competitive conditions, particularly with respect to changes in interest rates, government policies and actions of regulatory authorities as well as other factors beyond our control. Future changes in applicable law, regulations or government policies may materially affect our financial condition and results of operations.

Forward-Looking Statements Are Subject to Change

This Annual Report contains certain forward-looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder). Forward-looking statements are not historical facts but instead represent only the beliefs, expectations or opinions of the Company and its management regarding future events, many of which, by their nature, are inherently uncertain. Forward-looking statements may be identified by the use of such words as: “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”, “would”, “should”, “could”, “may”, “likely”, “probably”, or “possibly.” Forward-looking statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks, uncertainties and assumptions, many of which are difficult to predict and generally are beyond the control of and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, forward-looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) economic and competitive conditions which could affect the volume of loan originations, deposit flows and real estate values; (2) the levels of non-interest income and expense and the amount of loan losses; (3) competitive pressure among depository institutions increasing significantly; (4) changes in the interest rate environment causing reduced interest margins; (5) general economic conditions, either nationally or in the markets in which the Company is or will be doing business, being less favorable than expected;(6) political and social unrest, including acts of war or terrorism; (7) the impact of the current outbreak of the novel coronavirus (COVID-19) or (8) legislation or changes in regulatory requirements adversely affecting the business in which the Company is or will be engaged. The Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies

In reviewing and understanding financial information for the Company, you are encouraged to read and understand the significant accounting policies used in preparing our financial statements. These policies are described in Note 2 of the notes to our financial statements. The accounting and financial reporting policies of the Company conform to accounting principles generally accepted in the United States of America and to general practices within the banking industry. Accordingly, the consolidated financial statements require certain estimates, judgments, and assumptions, which are believed to be reasonable, based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the periods presented. The following accounting policies comprise those that management believes are the most critical to aid in fully understanding and evaluating our reported financial results. These policies require numerous estimates or economic assumptions that may prove inaccurate or may be subject to variations which may significantly affect our reported results and financial condition for the period or in future periods.

Allowance for Loan Losses. The allowance for loan losses represents management’s estimate of losses inherent in the loan portfolio as of the balance sheet date and is recorded as a reduction to loans receivable. The allowance for loan losses is increased by the provision for loan losses, and decreased by charge-offs, net of recoveries. Loans deemed to be uncollectible are charged against the allowance for loan losses, and subsequent recoveries, if any, are credited to the allowance. All, or part, of the principal balance of loans receivable are charged off to the allowance as soon as it is determined that the repayment of all, or part, of the principal balance is highly unlikely. Because all identified losses are immediately charged off, no portion of the allowance for loan losses is restricted to any individual loan or groups of loans, and the entire allowance is available to absorb any and all loan losses.

The allowance for loan losses is maintained at a level considered adequate to provide for losses that can be reasonably anticipated. Management performs a quarterly evaluation of the adequacy of the allowance. The allowance is based on the Company’s past loan loss experience, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, composition of the loan portfolio, current economic conditions and other relevant factors. This evaluation is inherently subjective as it requires material estimates that may be susceptible to significant revision as more information becomes available.

The allowance consists of specific, general and unallocated components. The specific component relates to loans that are identified as impaired. For loans that are identified as impaired, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value of that loan. The general component covers pools of loans by loan class. These pools of loans are evaluated for loss exposure based upon historical loss rates for each of these categories of loans, adjusted for qualitative factors. These significant factors may include changes in lending policies and procedures, changes in existing general economic and business conditions affecting our primary lending areas, credit quality trends, collateral value, loan volumes and concentrations, seasoning of the loan portfolio, recent loss experience in particular segments of the portfolio, duration of the current business cycle and bank regulatory examination results. The applied loss factors are reevaluated quarterly to ensure their relevance in the current economic environment. Residential mortgage lending generally entails a lower risk of default than other types of lending. Consumer loans and commercial real estate loans generally involve more risk of collectability because of the type and nature of the collateral and, in certain cases, the absence of collateral. It is the Company’s policy to establish a specific reserve for loss on any delinquent loan when it determines that a loss is probable. An unallocated component is maintained to cover uncertainties that could affect management’s estimate of probable losses. The unallocated component of the allowance reflects the margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not considered impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis by either the present value of expected future cash flows discounted at the loan’s effective interest rate or the fair value of the collateral if the loan is collateral dependent. An allowance for loan losses is established for an impaired loan if its carrying value exceeds its estimated fair value. The estimated fair values of substantially all of the Company’s impaired loans are measured based on the estimated fair value of the loan’s collateral.

A loan is considered a troubled debt restructuring (“TDR”) if the Company, for economic or legal reasons related to a debtor’s financial difficulties, grants a concession to the debtor that it would not otherwise consider. Concessions granted under a TDR typically involve a temporary or permanent reduction in payments or interest rate or an extension of a loan’s stated maturity date at less than a current market rate of interest. Loans identified as TDRs are designated as impaired.

For loans secured by real estate, estimated fair values are determined primarily through third-party appraisals. When a real estate secured loan becomes impaired, a decision is made regarding whether an updated certified appraisal of the real estate is necessary. This decision is based on various considerations, including the age of the most recent appraisal, the loan-to-value ratio based on the original appraisal and the condition of the property. Appraised values are discounted to arrive at the estimated selling price of the collateral, which is considered to be the estimated fair value. The discounts also include estimated costs to sell the property.

The allowance calculation methodology includes further segregation of loan classes into risk rating categories. The borrower’s overall financial condition, repayment sources, guarantors and value of collateral, if appropriate, are evaluated annually for all loans (except one-to-four family residential owner-occupied loans) where the total amount outstanding to any borrower or group of borrowers exceeds $750,000, or when credit deficiencies arise, such as delinquent loan payments. Credit quality risk ratings include regulatory classifications of special mention, substandard, doubtful and loss. Loans criticized as special mention have potential weaknesses that deserve management’s close attention. If uncorrected, the potential weaknesses may result in deterioration of the repayment prospects. Loans classified substandard have a well-defined weakness or weaknesses that jeopardize the liquidation of the debt. They include loans that are inadequately protected by the current sound net worth and paying capacity of the obligor or of the collateral pledged, if any. Loans classified doubtful have all the weaknesses inherent in loans classified substandard with the added characteristic that collection or liquidation in full, on the basis of current conditions and facts, is highly improbable. Loans classified as a loss are considered uncollectible and are charged to the allowance for loan losses. Loans not classified are rated pass. In addition, Federal regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses and may require the Company to recognize additions to the allowance based on their judgments about information available to them at the time of their examination, which may not be currently available to management. Based on management’s comprehensive analysis of the loan portfolio, management believes the current level of the allowance for loan losses is adequate.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Income Taxes. Deferred income tax assets and liabilities are determined using the liability (or balance sheet) method. Under this method, the net deferred tax asset or liability is determined based on the tax effects of the temporary differences between the book and tax bases of the various assets and liabilities and net operating loss carryforwards and gives current recognition to changes in tax rates and laws. The realization of our deferred tax assets principally depends upon our achieving projected future taxable income. We may change our judgments regarding future profitability due to future market conditions and other factors. We may adjust our deferred tax asset balances if our judgments change.

Selected Consolidated Financial and Other Data

Set forth below is selected financial and other data of Quaint Oak Bancorp, Inc. You should read the financial statements and related notes contained in this Annual Report which provide more detailed information.

| | | At or For the Years Ended December 31, | |

| | | 2022 | | | 2021 | |

| | | (Dollars in Thousands) | |

Selected Financial and Other Data: | | | | | | | | |

Total assets | | $ | 792,350 | | | $ | 554,115 | |

Cash and cash equivalents | | | 3,893 | | | | 10,705 | |

Investment in interest-earning time deposits | | | 3,833 | | | | 7,924 | |

Investment securities available for sale at fair value | | | 2,970 | | | | 4,033 | |

Loans held for sale | | | 133,222 | | | | 107,823 | |

Loans receivable, net | | | 621,864 | | | | 403,966 | |

Federal Home Loan Bank stock, at cost | | | 6,601 | | | | 2,178 | |

Premises and equipment, net | | | 2,775 | | | | 2,653 | |

Deposits | | | 549,248 | | | | 447,166 | |

Federal Home Loan Bank borrowings | | | 159,222 | | | | 49,193 | |

Subordinated debt | | | 7,966 | | | | 7,933 | |

Total Quaint Oak Bank Stockholders’ Equity | | | 44,793 | | | | 34,789 | |

Noncontrolling Interest | | | 4,289 | | | | 2,120 | |

Total Stockholders’ Equity | | | 49,082 | | | | 36,909 | |

| | | | | | | | | |

Selected Operating Data: | | | | | | | | |

Total interest income | | $ | 32,466 | | | $ | 24,995 | |

Total interest expense | | | 8,777 | | | | 4,375 | |

Net interest income | | | 23,689 | | | | 20,620 | |

Provision for loan losses | | | 2,475 | | | | 2,201 | |

Net interest income after provision for loan losses | | | 21,214 | | | | 18,419 | |

Total non-interest income | | | 19,411 | | | | 11,982 | |

Total non-interest expense | | | 27,260 | | | | 21,087 | |

Income before income taxes | | | 13,365 | | | | 9,314 | |

Income taxes | | | 3,054 | | | | 2,492 | |

Net income | | $ | 10,311 | | | $ | 6,822 | |

Net income attributable to noncontrolling interest | | $ | 2,448 | | | $ | 418 | |

Net income attributable to Quaint Oak Bancorp, Inc. | | $ | 7,863 | | | $ | 6,404 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| | | | | | | | | |

| | | At or For the Years Ended December 31, | |

| | | | 2022 | | | | 2021 | |

Selected Operating Ratios(1): | | | | | | | | |

Average yield on interest-earning assets | | | 4.88 | % | | | 4.78 | % |

Average rate on interest-bearing liabilities | | | 1.58 | | | | 1.03 | |

Average interest rate spread(2) | | | 3.30 | | | | 3.75 | |

Net interest margin(2) | | | 3.56 | | | | 3.93 | |

Average interest-earning assets to average interest-bearing liabilities | | | 119.85 | | | | 123.99 | |

Net interest income after provision for loan losses to non-interest expense | | | 77.82 | | | | 87.35 | |

Total non-interest expense to average assets | | | 3.98 | | | | 3.89 | |

Efficiency ratio(3) | | | 63.25 | | | | 69.36 | |

Return on average assets | | | 1.53 | | | | 1.18 | |

Return on average equity | | | 26.92 | | | | 20.68 | |

| | | | | | | | | |

Asset Quality Ratios(4): | | | | | | | | |

Non-performing loans as a percent of loans receivable, net(5) | | | 0.32 | % | | | 0.00 | % |

Non-performing assets as a percent of total assets(5) | | | 0.25 | | | | 0.00 | |

Non-performing assets and troubled debt restructurings as a percent of total assets | | | 0.27 | | | | 0.03 | |

Allowance for loan losses as a percent of non-performing loans | | | 386.01 | | | n/m* | |

Allowance for loan losses as a percent of total loans receivable | | | 1.22 | | | | 1.29 | |

Net charge-offs to average loans receivable | | | 0.01 | | | | 0.00 | |

Capital Ratios(4): | | | | | | | | |

Tier 1 leverage ratio | | | 7.07 | % | | | 7.41 | % |

Common Tier 1 capital ratio | | | 7.41 | | | | 9.45 | |

Tier 1 risk-based capital ratio | | | 7.41 | | | | 9.45 | |

Total risk-based capital ratio | | | 8.49 | | | | 10.69 | |

___________________

(1) With the exception of end of period ratios, all ratios are based on average daily balances during the indicated periods.

(2) Average interest rate spread represents the difference between the average yield on interest-earning assets and the average rate paid on interest-bearing

liabilities, and net interest margin represents net interest income as a percentage of average interest-earning assets.

(3) The efficiency ratio represents the ratio of non-interest expense divided by the sum of net interest income and non-interest income.

(4) Asset quality ratios and capital ratios are end of period ratios, except for net charge-offs to average loans receivable.

(5) Non-performing assets consist of non-performing loans at December 31, 2022. Non-performing loans consist of non-accruing loans plus accruing loans 90 days

or more past due.

n/m* Not meaningful

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Comparison of Financial Condition at December 31, 2022 and December 31, 2021

General. The Company’s total assets at December 31, 2022 were $792.4 million, an increase of $238.3 million, or 43.0%, from $554.1 million at December 31, 2021. This growth in total assets was primarily due to a $217.9 million, or 53.9%, increase in loans receivable, net, and a $25.4 million, or 23.6%, increase in loans held for sale. The largest increases within the loan portfolio occurred in commercial real estate loans which increased $149.7 million, or 81.4%, commercial business loans which increased $29.5 million, or 22.7%, multi-family residential loans which increased $17.6 million, or 59.9%, construction loans which increased $13.1 million, or 82.7%, and one-to-four family owner occupied loans which increased $8.3 million, or 84.8%, Contributing to the increase in commercial real estate loans was the purchase of a $55.5 million loan portfolio by the Bank’s wholly-owned subsidiary, Oakmont Commercial, LLC, in April, 2022.

Cash and Cash Equivalents. Cash and cash equivalents decreased $6.8 million, or 63.6%, from $10.7 million at December 31, 2021 to $3.9 million at December 31, 2022 as excess liquidity was used to fund loans.

Investment Securities Available for Sale. Investment securities available for sale decreased $1.1 million, or 26.4%, from $4.0 million at December 31, 2021 to $3.0 million at December 31, 2022 due primarily to the principal repayments on these securities during the year ended December 31, 2022.

Loans Held for Sale. Loans held for sale increased $25.4 million, or 23.6%, from $107.8 million at December 31, 2021 to $133.2 million at December 31, 2022 as the Bank’s mortgage banking subsidiary, Quaint Oak Mortgage, LLC, originated $403.2 million in equipment loans held for sale and sold $343.9 million of equipment loans during the year ended December 31, 2022. Partially offsetting the increase in loans held for sale is $19.4 million of equipment loan amortization and prepayments. Additionally, the Bank’s mortgage banking subsidiary, Quaint Oak Mortgage, LLC, originated $118.4 million of one-to-four family residential loans during the year ended December 31, 2022 and sold $132.9 million of loans in the secondary market during this same period.

Loans Receivable, Net. Loans receivable, net, increased $217.9 million, or 53.9% funded primarily from deposits, excess liquidity and FHLB borrowings. Increases within the portfolio consisted of commercial real estate which increased $149.7 million, or 81.4%, commercial business loans which increased $29.5 million, or 22.7%, construction loans which increased $13.1 million, or 82.7%, multi-family residential loans which increased $17.6 million, or 59.9%, and one-to-four family owner occupied loans which increased $8.3 million, or 84.8%. The increases within the loan portfolio were partially offset by a decrease in other consumer loans which decreased $10,000, or 83.3%. The Company continues its strategy of diversifying its loan portfolio with higher yielding and shorter-term loan products and selling substantially all of its newly originated one-to-four family owner-occupied loans into the secondary market.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Federal Home Loan Bank Stock. Federal Home Loan Bank stock increased $4.4 million, or 203.1%, from $2.2 million at December 31, 2021 to $6.6 million at December 31, 2022 as the Bank increased its level of FHLB borrowings.

Bank-Owned Life Insurance. The Company purchased $3.5 million in bank-owned life insurance (BOLI) as a mechanism for funding various employee benefit costs. The Company is the beneficiary of these policies that insure the lives of certain officers of its subsidiaries. The cash surrender value of the insurance policies amounted to $4.2 million and $4.1 million at December 31, 2022 and 2021, respectively.

Premises and Equipment, Net. Premises and equipment, net, increased $122,000, or 4.62%, to $2.8 million at December 31, 2022 from $2.7 million at December 31, 2021. The increase was due primarily to technology upgrades.

Goodwill and Other Intangible, Net. Goodwill is related to the recognition of $2.1 million of goodwill as part of the acquisition of Oakmont Capital Holdings, LLC in January 2021. Goodwill and other intangible assets, net of accumulated amortization, is also related to the acquisition by Quaint Oak Insurance Agency of the renewal rights to a book of business on August 1, 2016 at a total cost of $1.0 million, a portion of which is being amortized. The balance of other intangible asset at December 31, 2022 was $174,000, net of accumulated amortization of $311,000.

Prepaid Expenses and Other Assets. Prepaid expenses and other assets increased $2.0 million, or 41.9%, to $6.8 million at December 31, 2022 from $4.8 million at December 31, 2021, due primarily to an $856,000 net increase in the right-of-use asset driven by the capitalization of leases for Oakmont in accordance with the Financial Accounting Standards Board accounting standard ASU 2016-02, Leases (Topic 842). Also contributing to the increase is a $543,000 increase in other assets and a $234,000 increase in the net deferred tax asset.

Deposits. Total deposits increased $102.1 million, or 22.8%, to $549.3 million at December 31, 2022 from $447.2 million at December 31, 2021. This increase in deposits was primarily attributable to an increase of $60.3 million, or 30.0%, in money market accounts, an increase of $24.0 million, or 37.1%, in non-interest bearing checking accounts, and an increase of $18.0 million, or 10.0%, in certificates of deposit. The increase in total deposits was partially offset by a $241,000, or 13.1%, decrease in savings accounts. The increase in money market accounts was primarily due to a $150.0 million deposit in May, 2022 through a deposit placement agreement with a third party bank.

Borrowings. Total Federal Home Loan Bank (FHLB) borrowings increased $110.0 million, or 223.7%, to $159.2 million at December 31, 2022 from $49.2 million at December 31, 2021. During the year ended December 31, 2022, the Company borrowed $197.5 million of FHLB short-term borrowings and $80.0 million of FHLB long-term borrowings and paid down $131.3 million of FHLB short-term borrowings and $36.2 million of FHLB long-term borrowings. Federal Reserve Bank (FRB) borrowings increased $3.1 million, or 79.7%, to $7.0 million at December 31, 2022 from $3.9 million at December 31, 2021 as the Company paid off $3.9 million of first round PPP loans pledged as collateral under the FRB’s Paycheck Protection Program Liquidity Facility (PPPLF) and borrowed $7.0 million from the FRB discount window. The Company did not utilize the FRB’s PPPLF to fund second round PPP loans. Other borrowings increased to $5.5 million at December 31, 2022 from none at December 31, 2021.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Subordinated Debt. On December 27, 2018, the Company issued $8.0 million in subordinated notes. These notes have a maturity date of December 31, 2028, and bear interest at a fixed rate of 6.50% for the first five years of their term and a floating rate for the remaining five years. The Company may, at its option, at any time on an interest payment date on or after December 31, 2023, redeem the notes, in whole or in part, at par plus accrued interest to the date of redemption. The balance of subordinated debt, net of unamortized debt issuance costs, was $8.0 million at December 31, 2022 and $7.9 million at December 31, 2021.

Accrued Expenses and Other Liabilities. Accrued expenses and other liabilities increased $3.6 million, or 59.8%, to $9.6 million at December 31, 2022 from $6.0 million at December 31, 2021, due primarily to a $939,000, or 32.5%, increase in lease liability driven by the capitalization of leases for Oakmont in accordance with the Financial Accounting Standards Board accounting standard ASU 2016-02, Leases (Topic 842). Also contributing to the increase in accrued expenses and other liabilities is a $341,000 increase in the net tax liability and a $224,000 increase in accrued bonus expense. In addition, accrued expenses and other liabilities increased as a result of Oakmont’s results for the year ended December 31, 2022. The remainder of the increase is attributable to an increase in other expense accruals.

Stockholders’ Equity. Total stockholders’ equity increased $12.2 million, or 33.0%, to $49.1 million at December 31, 2022 from $36.9 million at December 31, 2021. Contributing to the increase was net income for the year ended December 31, 2022 of $7.9 million, net income attributable to noncontrolling interest of $2.4 million, issuance of treasury stock for capital raise of $2.4 million, common stock earned by participants in the employee stock ownership plan of $343,000, the reissuance of treasury stock for exercised stock options of $261,000, amortization of stock awards and options under our stock compensation plans of $168,000, and the reissuance of treasury stock under the Bank’s 401(k) Plan of $100,000. These increases were partially offset by dividends paid of $1.0 million, noncontrolling interest distribution of $279,000, the purchase of treasury stock of $49,000, and other comprehensive loss, net of $47,000.

Comparison of Operating Results for the Years Ended December 31, 2022 and 2021

General. Net income amounted to $7.9 million for the year ended December 31, 2022 compared to $6.4 million for the year ended December 31, 2021, an increase of $1.5 million, or 22.8%. The increase in net income on a comparative year-end basis was primarily the result of an increase in non-interest income of $7.4 million, and an increase in net interest income of $3.1 million, partially offset by an increase in non-interest expense of $6.2 million, an increase in net income attributable to noncontrolling interest of $2.0 million, an increase in the provision for income taxes of $562,000, and an increase in the provision for loan losses of $274,000.

Net Interest Income. Net interest income increased $3.1 million, or 14.9%, to $23.7 million for the year ended December 31, 2022 from $20.6 million for the year ended December 31, 2021. The increase in net interest income was driven by a $7.5 million, or 29.8%, increase in interest income, partially offset by a $4.4 million, or 100.6%, increase in interest expense.

Interest Income. Interest income increased $7.5 million, or 29.8%, to $32.5 million for the year ended December 31, 2022 from $25.0 million for the year ended December 31, 2021. The increase in interest income was primarily due to a $142.3 million increase in average loans receivable, net, including loans held for sale, which increased from an average balance of $483.7 million for the year ended December 31, 2021 to an average balance of $626.0 million for the year ended December 31, 2022, and had the effect of increasing interest income $7.2 million. Also contributing to the increase in interest income was a 108 basis point increase in the yield on average due from banks – interest earning, which increased from 0.12% for the year ended December 31, 2021 to 1.20% for the year ended December 31, 2022, and had the effect of increasing interest income $258,000. Contributing to the increase in average balance of loans receivable, net was the purchase of a $55.5 million commercial real estate loan portfolio by the Bank’s wholly-owned subsidiary, Oakmont Commercial, LLC, in April, 2022.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Interest Expense. Interest expense increased $4.4 million, or 100.6%, to $8.8 million for the year ended December 31, 2022 from $4.4 million for the year ended December 31, 2021. The increase in interest expense was primarily attributable to a 91 basis point increase in the rate on average money market accounts, which increased from 0.60% for the year ended December 31, 2021 to 1.51% for the year ended December 31, 2022, and had the effect of increasing interest expense by $2.4 million. Also contributing to the increase in interest expense was an $85.8 million increase in average money market accounts which increased from an average balance of $174.1 million for the year ended December 31, 2021 to an average balance of $259.9 million for the year ended December 31, 2022, and had the effect of increasing interest expense by $515,000. The increase in money market average balance was impacted by a $150.0 million deposit in May, 2022 through a deposit placement agreement with a third party bank. Also contributing to the increase in interest expense is a $40.2 million increase in average FHLB long-term borrowings which increased from $25.6 million for the year ended December 31, 2021 to $65.8 million for the year ended December 31, 2022, and had the effect of increasing interest expense by $810,000. Also contributing to the increase in interest expense is a 204 basis point increase in the rate on FHLB short-term borrowings, which increased from 0.30% for the year ended December 31, 2021 to 2.34% for the year ended December 31, 2022 and had the effect of increasing interest expense by $643,000. The average interest rate spread decreased from 3.75% for the year ended December 31, 2021 to 3.30% for the year ended December 31, 2022, while the net interest margin decreased from 3.93% for the year ended December 31, 2021 to 3.56% for the year ended December 31, 2022.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Average Balances, Net Interest Income, Yields Earned and Rates Paid. The following table shows for the periods indicated the total dollar amount of interest from average interest-earning assets and the resulting yields, as well as the interest expense on average interest-bearing liabilities, expressed both in dollars and rates, and the net interest margin. All average balances are based on daily balances.

| | | | | | | | Year Ended December 31, | | | | | |

| | | | 2022 | | | | 2021 | |

| | | | | | | | | | | | Average | | | | | | | | | | | | Average | |

| | | | Average | | | | | | | | Yield/ | | | | Average | | | | | | | | Yield/ | |

| | | | Balance | | | | Interest | | | | Rate | | | | Balance | | | | Interest | | | | Rate | |

| | | | | | | | | | | | (Dollars in thousands) | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Due from banks, interest-bearing | | $ | 24,759 | | | $ | 298 | | | | 1.20 | % | | $ | 25,076 | | | $ | 30 | | | | 0.12 | % |

Investment in interest-earning time deposits | | | 6,802 | | | | 128 | | | | 1.88 | | | | 8,090 | | | | 197 | | | | 2.43 | |

Investment securities available for sale | | | 3,519 | | | | 63 | | | | 1.79 | | | | 5,966 | | | | 99 | | | | 1.66 | |

Loans receivable, net (1) (2) | | | 626,041 | | | | 31,781 | | | | 5.08 | | | | 483,733 | | | | 24,592 | | | | 5.10 | |

Investment in FHLB stock | | | 4,204 | | | | 196 | | | | 4.66 | | | | 1,652 | | | | 77 | | | | 4.67 | |

Total interest-earning assets | | | 665,325 | | | | 32,466 | | | | 4.88 | % | | | 524,517 | | | | 24,995 | | | | 4.78 | % |

Non-interest-earning assets | | | 20,078 | | | | | | | | | | | | 17,815 | | | | | | | | | |

Total assets | | $ | 685,403 | | | | | | | | | | | | 542,332 | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Savings accounts | | | 1,673 | | | $ | 3 | | | | 0.18 | % | | | 1,666 | | | $ | 3 | | | | 0.18 | % |

Money market accounts | | | 259,886 | | | | 3,924 | | | | 1.51 | | | | 174,126 | | | | 1,048 | | | | 0.60 | |

Certificate of deposit accounts | | | 185,202 | | | | 2,116 | | | | 1.14 | | | | 178,721 | | | | 2,012 | | | | 1.13 | |

Total deposits | | | 446,761 | | | | 6,043 | | | | 1.35 | | | | 354,513 | | | | 3,063 | | | | 0.86 | |

FHLB short-term borrowings | | | 31,505 | | | | 737 | | | | 2.34 | | | | 10,405 | | | | 31 | | | | 0.30 | |

FHLB long-term borrowings | | | 65,755 | | | | 1,355 | | | | 2.06 | | | | 25,648 | | | | 518 | | | | 2.02 | |

FRB borrowings | | | 1,556 | | | | 15 | | | | 0.97 | | | | 23,266 | | | | 81 | | | | 0.35 | |

Other short-term borrowings | | | 1,601 | | | | 107 | | | | 6.68 | | | | 1,300 | | | | 162 | | | | 12.46 | |

Subordinated debt | | | 7,949 | | | | 520 | | | | 6.54 | | | | 7,915 | | | | 520 | | | | 6.57 | |

Total interest-bearing liabilities | | | 555,127 | | | | 8,777 | | | | 1.58 | % | | | 423,047 | | | | 4,375 | | | | 1.03 | % |

Non-interest-bearing liabilities | | | 91,335 | | | | | | | | | | | | 88,315 | | | | | | | | | |

Total liabilities | | | 646,462 | | | | | | | | | | | | 511,362 | | | | | | | | | |

Stockholders’ Equity | | | 38,941 | | | | | | | | | | | | 30,970 | | | | | | | | | |

Total liabilities and Stockholders’ Equity | | $ | 685,403 | | | | | | | | | | | | 542,332 | | | | | | | | | |

Net interest-earning assets | | $ | 110,198 | | | | | | | | | | | $ | 101,470 | | | | | | | | | |

Net interest income; average interest rate spread | | | | | | $ | 23,689 | | | | 3.30 | % | | | | | | $ | 20,620 | | | | 3.75 | % |

Net interest margin (3) | | | | | | | | | | | 3.56 | % | | | | | | | | | | | 3.93 | % |

Average interest-earning assets to average interest-bearing liabilities | | | | | | | | | | | 119.85 | % | | | | | | | | | | | 123.99 | % |

___________________

(1) Includes loans held for sale.

(2) Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts, loans in process and allowance for loan losses.

(3) Equals net interest income divided by average interest-earning assets.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Rate/Volume Analysis. The following table shows the extent to which changes in interest rates and changes in volume of interest-earning assets and interest-bearing liabilities affected our interest income and expense during the periods indicated. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (1) changes in rate, which is the change in rate multiplied by prior year volume, (2) changes in volume, which is the change in volume multiplied by prior year rate, and (3) changes in rate/volume, which is the change in rate multiplied by the change in volume.

| | | | 2022 vs. 2021 | | | | 2021 vs. 2020 |

| | | | Increase (Decrease) Due to | | | | Total | | | | Increase (Decrease) Due to | | | | Total | |

| | | | | | | | | | | | Rate/ | | | | Increase | | | | | | | | | | | | Rate/ | | | | Increase | |

| | | | Rate | | | | Volume | | | | Volume | | | | (Decrease) | | | | Rate | | | | Volume | | | | Volume | | | | (Decrease) | |

| Interest income: | | | | | | | | | | | | | | | (In Thousands) | | | | | | | | | | | | | |

Due from banks, interest-bearing | | $ | 272 | | | $ | - | | | $ | (4 | ) | | $ | 268 | | | $ | (52 | ) | | $ | 32 | | | $ | (23 | ) | | $ | (43 | ) |

Investment in interest-earning time deposits | | | (45 | ) | | | (31 | ) | | | 7 | | | | (69 | ) | | | (6 | ) | | | (42 | ) | | | 1 | | | | (47 | ) |

Investment securities available for sale | | | 7 | | | | (41 | ) | | | (2 | ) | | | (36 | ) | | | (105 | ) | | | (95 | ) | | | 38 | | | | (162 | ) |

Loans receivable, net (1) (2) | | | (35 | ) | | | 7,235 | | | | (11 | ) | | | 7,189 | | | | 1,229 | | | | 7,145 | | | | 561 | | | | 8,935 | |

Investment in FHLB stock | | | - | | | | 119 | | | | - | | | | 119 | | | | (22 | ) | | | 14 | | | | (3 | ) | | | (11 | ) |

Total interest-earning assets | | | 199 | | | | 7,282 | | | | (10 | ) | | | 7,471 | | | | 1,044 | | | | 7,054 | | | | 574 | | | | 8,672 | |

Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings accounts | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

Money market accounts | | | 1,583 | | | | 516 | | | | 779 | | | | 2,878 | | | | (108 | ) | | | 1,051 | | | | (289 | ) | | | 654 | |

Certificate of deposit accounts | | | 29 | | | | 72 | | | | 1 | | | | 102 | | | | (1,619 | ) | | | (326 | ) | | | 138 | | | | (1,807 | ) |

Total deposits | | | 1,612 | | | | 588 | | | | 780 | | | | 2,980 | | | | (1,727 | ) | | | 725 | | | | (151 | ) | | | (1,153 | ) |

FHLB short-term borrowings | | | 212 | | | | 63 | | | | 431 | | | | 706 | | | | (27 | ) | | | 80 | | | | (59 | ) | | | (6 | ) |

FHLB long-term borrowings | | | 10 | | | | 810 | | | | 17 | | | | 837 | | | | (22 | ) | | | (70 | ) | | | 3 | | | | (89 | ) |

FRB long-term borrowings | | | 145 | | | | (75 | ) | | | (136 | ) | | | (66 | ) | | | (2 | ) | | | (26 | ) | | | 1 | | | | (27 | ) |

Subordinated debt | | | (2 | ) | | | 2 | | | | -- | | | | -- | | | | (2 | ) | | | 2 | | | | -- | | | | -- | |

Other short-term borrowings | | | (76 | ) | | | 38 | | | | (17 | ) | | | (55 | ) | | | -- | | | | -- | | | | 162 | | | | 162 | |

Total interest-bearing liabilities | | | 1,901 | | | | 1,426 | | | | 1,075 | | | | 4,402 | | | | (1,780 | ) | | | 711 | | | | (44 | ) | | | (1,113 | ) |

Increase (decrease) in net interest income | | $ | (1,702 | ) | | $ | 5,856 | | | $ | (1,085 | ) | | $ | 3,069 | | | $ | 2,824 | | | $ | 6,343 | | | $ | 618 | | | $ | 9,785 | |

_______________________

(1) Includes loans held for sale.

(2) Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts, loans in process and allowance for loan losses.

Provision for Loan Losses. The Company increased its provision for loan losses by $274,000, or 12.4%, from $2.2 million for the year ended December 31, 2021 to $2.5 million for the year ended December 31, 2022, based on an evaluation of the allowance relative to such factors as volume of the loan portfolio, concentrations of credit risk, prevailing economic conditions, prior loan loss experience and amount of non-performing loans at December 31, 2022.

Non-performing loans at December 31, 2022 amounted to $2.0 million, or 0.32%, of net loans receivable at December 31, 2022, consisting of six loans, three of which are on non-accrual status and three of which are 90 days or more past due and accruing interest. Comparably, non-performing loans amounted to $9,000 at December 31, 2021, consisting of one one-to-four family residential non-owner occupied loan. The non-performing loans at December 31, 2022 consisted of one multi-family residential, and one commercial real estate loan, and four commercial business loans and are generally well-collateralized or adequately reserved for. The allowance for loan losses as a percent of total loans receivable, net was 1.22% at December 31, 2022 and 1.29% at December 31, 2021. There was no other real estate owned (OREO) at December 31, 2022, or December 31, 2021. Non-performing assets amounted to $2.0 million, or 0.25% of total assets at December 31, 2022 compared to $9,000 at December 31, 2021. There was no other real estate owned (OREO) at December 31, 2022, or December 31, 2021. Non-performing assets amounted to $2.0 million at December 31, 2022 compared to $9,000, or 0.19% of total assets at December 31, 2021.

Non-Interest Income. Non-interest income increased $7.4 million, or 62.0%, from $12.0 million for the year ended December 31, 2021 to $19.4 million for the year ended December 31, 2022. The increase was primarily attributable to a $5.6 million, or 81.7%, increase in net gain on loans held for sale, a $1.7 million, or 1,153.7%, increase in loan servicing income, a $604,000, or 24.2%, increase in mortgage banking, equipment lending, and title abstract fees, a $395,000, or 154.9%, increase in other fees and service charges, a $128,000, or 75.3%, increase in real estate commissions, net, and an $84,000, or 16.5%, increase in insurance commissions. The increase in net gain on loans held for sale was primarily due to the sale of $363.4 million of equipment loans during the year ended December 31, 2022. These increases were partially offset by an $837,000, or 73.0%, decrease in gain on sale of SBA loans, and a $362,000, or 100.0%, decrease in gain on sale of investment securities available for sale.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Non-Interest Expense. Non-interest expense increased $6.2 million, or 29.3%, from $21.1 million for the year ended December 31, 2021 to $27.3 million for the year ended December 31, 2022. Salaries and employee benefits expense accounted for $4.6 million of the change as this expense increased 29.6%, from $15.5 million for the year ended December 31, 2021 to $20.1 million for the year ended December 31, 2022 due to expanding and improving the level of staff at the Bank and its subsidiary companies, including Oakmont. The number of full time employees at the Bank and its subsidiary companies, excluding Oakmont increased from 114 at December 31, 2021 to 129 as of December 31, 2022. The number of full-time employees at Oakmont increased from 45 at December 31, 2021 to 63 at December 31, 2022. Other expense accounted for $835,000 of the change as this expense increased 60.3%, from $1.4 million for the year ended December 31, 2021 to $2.2 million for the year ended December 31, 2022. FDIC deposit insurance assessment increased $327,000, from $331,000 for the year ended December 31, 2021 to $658,000 for the year ended December 31, 2022. Occupancy and equipment expense accounted for $283,000 of the change as this expense increased 17.5%, from $1.6 million for the year ended December 31, 2021 to $1.9 million for the year ended December 31, 2022. Advertising expense increased $217,000, or 61.8%, from $351,000 for the year ended December 31, 2021 to $568,000 for the year ended December 31, 2022. Professional fees accounted for $89,000 of the change as this expense increased 13.5%, from $659,000 for the year ended December 31, 2021 to $748,000 for the year ended December 31, 2022, due primarily to increased audit and compliance costs. Directors’ fees and expenses accounted for $34,000 of the change as this expense increased 13.5%, from $252,000 for the year ended December 2021 to $286,000 for the year ended December 31, 2022. Partially offsetting these increases was data processing costs which accounted for a $211,000 decrease, as this expense decreased 23.4%, from $901,000 for the year ended December 31, 2021 to $690,000 for the year ended December 31, 2022. The decrease in data processing costs was directly related to the decrease in loan production at Quaint Oak Mortgage, LLC.

Provision for Income Tax. The provision for income tax increased $562,000, or 22.6%, from $2.5 million for the year ended December 31, 2021 to $3.1 million for the year ended December 31, 2022 due primarily to an increase in pre-tax income for the year ended December 31, 2022.

Operating Segments

The Company’s operations consist of two reportable operating segments: Banking and Oakmont Capital Holdings, LLC. Our Banking Segment generates revenues primarily from its lending, deposit gathering and fee business activities. The Oakmont Capital Holdings, LLC Segment originates equipment loans which are generally sold to third party institutions with the loans’ servicing rights retained. The profitability of this segment’s operations depends primarily on the gains realized from the sale of loans, processing fees, and service fees. The Oakmont Capital Holdings, LLC Segment is also subject to an extensive system of laws and regulations that are intended primarily for the protection of commercial customers. Detailed segment information appears in Note 20 in the Notes to Consolidated Financial Statements.

Our Banking Segment reported a pre-tax segment profit (“PTSP”) for the year ended December 31, 2022 of $8.4 million, a $93,000, or 1.1%, decrease from the year ended December 31, 2021. This decrease in PTSP was due to a $3.1 million, or 19.4%, increase in non-interest expense, a $1.8 million decrease in non-interest income and a $274,000 increase in the provision for loan losses, partially offset by a $4.8 million increase in net interest income. The increase in non-interest expense was due primarily to a $2.6 million, or 23.7%, increase in salaries and employee benefits expense, a $327,000, or 98.8%, increase in FDIC deposit insurance assessment, a $157,000, or 30.7%, increase in professional fees, a $65,000, or 5.3%, increase in other expense, a $37,000, or 3.0%, increase in occupancy and equipment, and a $25,000, or 15.5%, increase in advertising expense, partially offset by a $211,000, or 23.4%, decrease in data processing expense. The decrease in non-interest income was primarily due to an $837,000, or 73.0%, decrease in gain on the sale of SBA loans, a $653,000, or 46.3%, decrease in mortgage banking and title abstract fees, a $362,000, or 100.0%, decrease in gain on sale of investment securities available for sale, a $214,000, or 6.1%, decrease in net gain on loans held for sale, and a $136,000, or 91.3%, decrease in loan servicing income, partially offset by a $131,000, or 65.8%, increase in other fees and service charges, a $128,000, or 75.3% increase in real estate sales commissions, net, and a $73,000, or 100.0%, increase in the loss on sales and write-downs of other real estate owned.

Our Oakmont Capital Holdings, LLC Segment reported a PTSP for the year ended December 31, 2022 of $5.0 million, a $4.1 million, or 486.4%, increase from the year ended December 31, 2021. The increase in PTSP was primarily due to a $9.2 million, or 123.8%, increase in non-interest income, partially offset by a $3.1, or 59.0%, increase in non-interest expense. The increase in non-interest income was primarily due to a $5.8 million, or 171.7%, increase in net gain on loans held for sale, and a $1.3 million, or 115.4%, increase in equipment lending fees. The increase in non-interest expense was primarily due to a $2.0 million, or 44.8%, increase in salaries and employee benefits expense, a $770,000, or 484.3%, increase in other expense, a $246,000, or 64.1%, increase in occupancy and equipment expense, and a $192,000 increase in advertising expense.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Exposure to Changes in Interest Rates

The Company’s ability to maintain net interest income depends upon its ability to earn a higher yield on assets than the rates it pays on deposits and borrowings. The Company’s interest-earning assets consist primarily of loans collateralized by real estate which have longer maturities than our liabilities, consisting primarily of certificates of deposit, money market accounts and to a lesser extent borrowings. Consequently, the Company’s ability to maintain a positive spread between the interest earned on assets and the interest paid on deposits and borrowings can be adversely affected when market rates of interest rise. At December 31, 2022 and 2021, certificates of deposit amounted to $198.0 million and $179.9 million, respectively, or 36.0% and 32.5%, respectively, of total assets at such dates.

Gap Analysis. The matching of assets and liabilities may be analyzed by examining the extent to which such assets and liabilities are “interest rate sensitive” and by monitoring a bank’s interest rate sensitivity “gap.” An asset and liability is said to be interest rate sensitive within a specific time period if it will mature or reprice within that time period. The interest rate sensitivity gap is defined as the difference between the amount of interest-earning assets maturing or repricing within a specific time period and the amount of interest-bearing liabilities maturing or repricing within that same time period. A gap is considered positive when the amount of interest rate sensitive assets exceeds the amount of interest rate sensitive liabilities. A gap is considered negative when the amount of interest rate sensitive liabilities exceeds the amount of interest rate sensitive assets. During a period of rising interest rates, a negative gap would tend to adversely affect net interest income while a positive gap would tend to result in an increase in net interest income. Conversely, during a period of falling interest rates, a negative gap would tend to result in an increase in net interest income while a positive gap would tend to affect adversely net interest income. Our current interest rate risk management policy provides that our one-year interest rate gap as a percentage of total assets should not exceed positive or negative 20%. This policy was adopted by our management and Board of Directors based upon their judgment that it established an appropriate benchmark for the level of interest-rate risk, expressed in terms of the one-year gap, for the Company. If our one-year gap position approaches or exceeds the 20% policy limit, management will obtain simulation results in order to determine what steps might appropriately be taken, in order to maintain our one-year gap in accordance with the policy. Alternatively, depending on the then-current economic scenario, we could determine to make an exception to our policy or we could determine to revise our policy. Our one-year cumulative gap was a positive 3.7% at December 31, 2022, compared to a positive 2.6% at December 31, 2021.

The following table sets forth the amounts of our interest-earning assets and interest-bearing liabilities outstanding at December 31, 2022, which we expect, based upon certain assumptions, to reprice or mature in each of the future time periods shown. Except as stated below, the amount of assets and liabilities shown which reprice or mature during a particular period were determined in accordance with the earlier of term to repricing or the contractual maturity of the asset or liability. The table sets forth an approximation of the projected repricing of assets and liabilities at December 31, 2022, on the basis of contractual maturities, anticipated prepayments, and scheduled rate adjustments within a three-month period and subsequent selected time intervals. The loan amounts in the table reflect principal balances expected to be redeployed and/or repriced as a result of contractual amortization and anticipated prepayments of adjustable-rate loans and fixed-rate loans, and as a result of contractual rate adjustments on adjustable-rate loans. The Company’s annual historical prepayment rates are applied to loans. Money market and savings accounts are both assumed to have annual rates of withdrawal, or “decay rates,” of 40%.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| | | 3 Months or Less | | | More than 3 Months to 1 Year | | | More than 1 Year to 3 Years | | | More than 3 Years to 5 Years | | | More than 5 Years | | | Total Amount | |

| | | (Dollars In Thousands) | |

Interest-earning assets (1): | | | | | | | | | | | | | | | | | | | | | | | | |

Due from banks, interest-bearing | | $ | 3,472 | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | -- | | | $ | 3,472 | |

Investment in interest-earning time deposits | | | 1,790 | | | | 750 | | | | 1,000 | | | | 293 | | | | -- | | | | 3,833 | |

Investment securities available for sale | | | 2,970 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 2,970 | |

Loans held for sale | | | 133,222 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 133,222 | |

Loans receivable (2) | | | 212,832 | | | | 33,524 | | | | 210,469 | | | | 104,576 | | | | 67,785 | | | | 629,186 | |

Investment in Federal Home Loan Bank stock | | | -- | | | | -- | | | | -- | | | | -- | | | | 6,601 | | | | 6,601 | |

Total interest-earning assets | | $ | 354,286 | | | $ | 34,274 | | | $ | 211,469 | | | $ | 104,869 | | | $ | 74,386 | | | $ | 779,284 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Savings accounts | | $ | 319 | | | $ | 319 | | | $ | 639 | | | $ | 160 | | | $ | 160 | | | | 1,597 | |

Money market accounts | | | 52,194 | | | | 52,194 | | | | 104,389 | | | | 26,097 | | | | 26,098 | | | | 260,972 | |

Certificate accounts | | | 20,868 | | | | 70,438 | | | | 78,454 | | | | 28,191 | | | | -- | | | | 197,951 | |

FHLB borrowings | | | 113,200 | | | | 37,000 | | | | 9,022 | | | | -- | | | | -- | | | | 159,222 | |

FRB borrowings | | | 7,000 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 7,000 | |

Other short-term borrowings | | | -- | | | | 5,489 | | | | -- | | | | -- | | | | -- | | | | 5,489 | |

Subordinated debt | | | -- | | | | -- | | | | -- | | | | -- | | | | 7,966 | | | | 7,966 | |

Total interest-bearing liabilities | | $ | 193,581 | | | $ | 165,440 | | | $ | 192,504 | | | $ | 54,448 | | | $ | 34,224 | | | $ | 640,197 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-earning assets less interest-bearing liabilities | | $ | 160,705 | | | $ | (131,166 | ) | | $ | 18,965 | | | $ | 50,421 | | | $ | 40,162 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative interest-rate sensitivity gap (3) | | $ | 160,705 | | | $ | 29,539 | | | $ | 48,504 | | | $ | 98,925 | | | $ | 139,087 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative interest-rate gap as a percentage of total assets at December 31, 2022 | | | 20.3 | % | | | 3.7 | % | | | 6.1 | % | | | 12.5 | % | | | 17.6 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative interest-earning assets as a percentage of cumulative interest- bearing liabilities at December 31, 2022 | | | 183.0 | % | | | 108.2 | % | | | 108.8 | % | | | 116.3 | % | | | 121.7 | % | | | | |

_____________________

(1) Interest-earning assets are included in the period in which the balances are expected to be redeployed and/or repriced as a result of anticipated prepayments,

scheduled rate adjustments and contractual maturities.

(2) For purposes of the gap analysis, loans receivable includes non-performing loans gross of the allowance for loan losses and deferred loan fees.

(3) Interest-rate sensitivity gap represents the difference between net interest-earning assets and interest-bearing liabilities.

Qualitative Analysis. Our ability to maintain a positive “spread” between the interest earned on assets and the interest paid on deposits and borrowings is affected by changes in interest rates. The Company’s fixed-rate loans generally are profitable if interest rates are stable or declining since these loans have yields that exceed its cost of funds. If interest rates increase, however, the Company would have to pay more on its deposits and new borrowings, which would adversely affect its interest rate spread. In order to counter the potential effects of dramatic increases in market rates of interest, the Company intends to continue to originate more variable rate loans and increase core deposits. The Company also intends to place a greater emphasis on shorter-term home equity loans and commercial business loans.

Liquidity and Capital Resources

The Company’s primary sources of funds are deposits, amortization and prepayment of loans and to a lesser extent, loan sales and other funds provided from operations. While scheduled principal and interest payments on loans are a relatively predictable source of funds, deposit flows and loan prepayments are greatly influenced by general interest rates, economic conditions and competition. The Company sets the interest rates on its deposits to maintain a desired level of total deposits. In addition, the Company invests excess funds in short-term interest-earning assets that provide additional liquidity. At December 31, 2022, the Company’s cash and cash equivalents amounted to $3.9 million. At such date, the Company also had $2.5 million invested in interest-earning time deposits maturing in one year or less.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Company uses its liquidity to fund existing and future loan commitments, to fund deposit outflows, to invest in other interest-earning assets, and to meet operating expenses. At December 31, 2022, Quaint Oak Bank had outstanding commitments to originate loans of $36.1 million, commitments under unused lines of credit of $52.2 million, and $2.6 million under standby letters of credit.

At December 31, 2022, certificates of deposit scheduled to mature in one year or less totaled $91.3 million. Based on prior experience, management believes that a significant portion of such deposits will remain with us, although there can be no assurance that this will be the case.

In addition to cash flow from loan payments and prepayments and deposits, the Company has significant borrowing capacity available to fund liquidity needs. If the Company requires funds beyond its ability to generate them internally, borrowing agreements exist with the Federal Home Loan Bank of Pittsburgh (FHLB), which provide an additional source of funds. As of December 31, 2022, we had $159.2 million of borrowings from the FHLB and had $353.4 million in borrowing capacity. Under terms of the collateral agreement with the FHLB of Pittsburgh, we pledge residential mortgage loans as well as Quaint Oak Bank’s FHLB stock as collateral for such advances. In addition, as of December 31, 2022 Quaint Oak Bank had $8.1 million in borrowing capacity with the Federal Reserve Bank of Philadelphia. Quaint Oak Bank borrowed $7.0 million from the FRB discount window as of December 31, 2022.

As of December 31, 2022, there was $5.5 million of other short-term borrowings representing balances on two lines of credit that Oakmont Capital Holdings, LLC has with a credit union. Borrowing capacity on the two lines of credit total $15.0 million at December 31, 2022.

Total stockholders’ equity increased $12.2 million, or 33.0%, to $49.1 million at December 31, 2022 from $36.9 million at December 31, 2021. Contributing to the increase was net income for the year ended December 31, 2022 of $7.9 million, net income attributable to noncontrolling interest of $2.4 million, issuance of treasury stock for capital raise of $2.4 million, common stock earned by participants in the employee stock ownership plan of $343,000, the reissuance of treasury stock for exercised stock options of $261,000, amortization of stock awards and options under our stock compensation plans of $168,000, and the reissuance of treasury stock under the Bank’s 401(k) Plan of $100,000. These increases were partially offset by dividends paid of $1.0 million, noncontrolling interest distribution of $279,000, the purchase of treasury stock of $49,000, and other comprehensive loss, net of $47,000.For further discussion of the stock compensation plans, see Note 14 in the Notes to Consolidated Financial Statements contained elsewhere herein.

Quaint Oak Bank is required to maintain regulatory capital sufficient to meet tier 1 leverage, common equity tier 1 capital, tier 1 risk-based and total risk-based capital ratios of at least 4.00%, 4.50%, 6.00%, and 8.00%, respectively. At December 31, 2022, Quaint Oak Bank exceeded each of its capital requirements with ratios of 7.07%, 7.41%, 7.41% and 8.49%, respectively. As a small savings and loan holding company, the Company is not currently subject to any regulatory capital requirements. For further discussion of the Bank’s regulatory capital requirements, see Note 18 in the Notes to Consolidated Financial Statements contained elsewhere herein.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Off-Balance Sheet Arrangements

In the normal course of operations, we engage in a variety of financial transactions that, in accordance with generally accepted accounting principles are not recorded in our financial statements. These transactions involve, to varying degrees, elements of credit, interest rate, and liquidity risk. Such transactions are used primarily to manage customers’ requests for funding and take the form of loan commitments and lines of credit. Our exposure to credit loss from non-performance by the other party to the above-mentioned financial instruments is represented by the contractual amount of those instruments. We use the same credit policies in making commitments and conditional obligations as we do for on-balance sheet instruments. In general, we do not require collateral or other security to support financial instruments with off–balance sheet credit risk.

Commitments. At December 31, 2022, we had unfunded commitments under lines of credit of $49.9 million, $36.1 million of commitments to originate loans, and $2.6 million under standby letters of credit. We had no commitments to advance additional amounts pursuant to outstanding lines of credit or undisbursed construction loans.

Contractual Cash Obligations

The following table summarizes our contractual cash obligations at December 31, 2022. The balances in the table do not reflect interest due on these obligations.

| | | | | | | Payments Due By Period | |

| | | Total | | | To 1 Year | | | 1-3 Years | | | 4-5 Years | | | After 5 Years | |

| | | (In Thousands) | |

Operating leases | | $ | 1,479 | | | $ | 236 | | | | 446 | | | $ | 291 | | | $ | 506 | |

Certificates of deposit | | | 197,951 | | | | 91,306 | | | | 87,662 | | | | 18,983 | | | | - | |

FHLB borrowings | | | 159,222 | | | | 150,200 | | | | 9,022 | | | | - | | | | - | |

FRB borrowings | | | 7,000 | | | | 7,000 | | | | - | | | | - | | | | - | |

Total contractual obligations | | $ | 365,652 | | | $ | 248,742 | | | $ | 97,130 | | | $ | 19,274 | | | $ | 506 | |

Impact of Inflation and Changing Prices

The consolidated financial statements and related financial data presented herein have been prepared in accordance with accounting principles generally accepted in the United States of America which generally require the measurement of financial position and operating results in terms of historical dollars, without considering changes in relative purchasing power over time due to inflation. Unlike most industrial companies, virtually all of the Company’s assets and liabilities are monetary in nature. As a result, interest rates generally have a more significant impact on the Company’s performance than does the effect of inflation. Interest rates do not necessarily move in the same direction or in the same magnitude as the prices of goods and services, since such prices are affected by inflation to a larger extent than interest rates.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and the Board of Directors of Quaint Oak Bancorp, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Quaint Oak Bancorp, Inc. and subsidiary (the “Company”) as of December 31, 2022 and 2021; the related consolidated statements of income, comprehensive income, stockholders’ equity, and cash flows for the years then ended; and the related notes to the consolidated financial statements (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent, with respect to the Company, in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the Audit Committee and that: (1) relate to accounts or disclosures that are material to the financial statements; and (2) involve our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter, in any way, our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

PITTSBURGH, PA | PHILADELPHIA, PA | WHEELING, WV | STEUBENVILLE, OH |

2009 Mackenzie Way • Suite 340 | 2100 Renaissance Blvd. • Suite 110 | 980 National Road | 511 N. Fourth Street |

Cranberry Township, PA 16066 | King of Prussia, PA 19406 | Wheeling, WV 26003 | Steubenville, OH 43952 |

(724) 934-0344 | (610) 278-9800 | (304) 233-5030 | (304) 233-5030 |

S.R. Snodgrass, P.C. d/b/a S.R. Snodgrass, A.C. in West Virginia

Allowance for Loan Losses (ALL) – Qualitative Factors

Description of the Matter

The Company’s loan portfolio totaled $629.5 million as of December 31, 2022, and the associated ALL was $7.7 million. As discussed in Note 7 to the consolidated financial statements, determining the amount of the ALL requires significant judgment about the collectability of loans, which includes an assessment of quantitative factors such as historical loss experience within each risk category of loans and testing of certain commercial loans for impairment. Management applies additional qualitative adjustments to reflect the inherent losses that exist in the loan portfolio at the balance sheet date that are not reflected in the historical loss experience. Qualitative adjustments are made based upon changes in trends in delinquencies and non-accruals, trends in volume and terms of loans, credit concentrations, risk rating, collateral values, experience, ability and depth of lending staff and management, national and local economic trends and conditions, COVID-19 pandemic, quality of loan review system, and lending policies.

We identified these qualitative adjustments within the ALL as critical audit matters because they involve a high degree of subjectivity. In turn, auditing management’s judgments regarding the qualitative factors applied in the ALL calculation involved a high degree of subjectivity.

How We Addressed the Matter in Our Audit

We gained an understanding of the Company’s process for establishing the ALL, including the qualitative adjustments made to the ALL. We evaluated the design and tested the operating effectiveness of controls over the Company’s ALL process, which included, among others, management’s review and approval controls designed to assess the need and level of qualitative adjustments to the ALL, as well as the reliability of the data utilized to support management’s assessment.

To test the qualitative adjustments, we evaluated the appropriateness of management’s methodology and assessed whether all relevant risks were reflected in the ALL.