TJS Wood Flooring, Inc.

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

This Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, Registrant's management as well as estimates and assumptions made by Registrant's management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant's management identify forward looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to Registrant's industry, Registrant's operations and results of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although Registrant believes that the expectations reflected in the forward looking statements are reasonable, Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with Registrant's pro forma financial statements and the related notes that will be filed herein.

In this Form 8-K, references to “we,” “our,” “us,” “our company,” “TJS” or the “Registrant” refer to China Advanced Construction Materials Group, Inc. (formerly known as TJS Wood Flooring Inc.), a Delaware corporation.

As more fully described in Item 2.01 below, we acquired a producer of advanced construction materials in accordance with a Share Exchange Agreement dated April 29, 2008 (“Exchange Agreement”) by and among TJS, Xin Ao Construction Materials, Inc., a company incorporated under the laws of the British Virgin Islands (“BVI-ACM”), and each of the shareholders of BVI-ACM (the “BVI-ACM Shareholders”). The close of the transaction (the "Closing") took place on April 29, 2008 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding shares (the “Interests”) of BVI-ACM from the BVI-ACM Shareholders; and the BVI-ACM Shareholders transferred and contributed all of their Interests to us. In exchange, we issued to the BVI-ACM Shareholders, their designees or assigns, 11,500,000 shares of our common stock or 90.79% of the shares of TJS common stock issued and outstanding after the Closing.

Pursuant to the terms of the Exchange Agreement, Brandi Iannelli, the principal shareholder and former officer and director cancelled a total of 8,833,333 shares of TJS Common Stock. In consideration for the cancellation of these shares, Brandi Iannelli received the TJS flooring business, including any and all assets and liabilities related thereto. A copy of the Exchange Agreement is included as Exhibit 2.1 to this Current Report and is hereby incorporated by reference. All references to the Exchange Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

Pursuant to the Exchange Agreement, BVI-ACM became a wholly-owned subsidiary of TJS. The directors of TJS have approved the Exchange Agreement and the transactions contemplated under the Exchange Agreement. The directors of BVI-ACM have approved the Exchange Agreement and the transactions contemplated thereunder.

This transaction is discussed more fully in Section 2.01 of this Current Report. The information therein is hereby incorporated in this Section 1.01 by reference.

As described in Item 1.01 above, on April 29, 2008, we acquired BVI-ACM, a producer of advanced construction materials, in accordance with the Exchange Agreement. The close of the transaction took place on April 29, 2008. On the Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all of the outstanding shares (the “Interests”) of BVI-ACM from the BVI-ACM Shareholders; and the BVI-ACM Shareholders transferred and contributed all of their Interests to us. In exchange, we issued to the BVI-ACM Shareholders, their designees or assigns, 11,500,000 shares of our common stock or 90.79% of the shares of TJS common stock issued and outstanding after the Closing.

Pursuant to the terms of the Exchange Agreement, Brandi Iannelli, the principal shareholder and former officer and director cancelled a total of 8,833,333 shares of TJS Common Stock. In consideration for the cancellation of these shares, Brandi Iannelli received the TJS flooring business, including any and all assets and liabilities related thereto. Following the transaction, there are 12,666,667 shares of common stock issued and outstanding.

BVI-ACM, with its subsidiaries, engages in the production of advanced construction materials for large scale commercial, residential, and infrastructure developments. BVI-ACM is primarily focused on producing and supplying a wide range of advanced ready-mix concrete materials for highly technical, large scale, and environmentally-friendly construction projects. BVI-ACM owns 100% of the issued and outstanding capital stock of Beijing Ao Hang Construction Materials Technology, Ltd. (“China-ACMH”), a company incorporated under the laws of the People’s Republic of China (“PRC”). On November 28, 2007, China-ACMH entered into a series of contractual agreements with Beijing Xin Ao Concrete Co., Ltd. (“Xin Ao”), a company incorporated under the laws of the PRC, and its two shareholders, in which China-ACMH effectively took over management of the business activities of Xin Ao and has the right to appoint all executives and senior management and the members of the board of directors of Xin Ao. The contractual arrangements are comprised of a series of agreements, including an Exclusive Technical Consulting and Services Agreement and an Operating Agreement, through which China-ACMH has the right to advise, consult, manage and operate Xin Ao for an annual fee in the amount of Xin Ao's yearly net profits after tax. Additionally, Xin Ao's Shareholders have pledged their rights, titles and equity interest in Xin Ao as security for China-ACMH to collect technical consulting and services fees provided to China-ACMH through an Equity Pledge Agreement. In order to further reinforce China-ACMH's rights to control and operate Xin Ao, Xin Ao's shareholders have granted China-ACMH the exclusive right and option to acquire all of their equity interests in Xin Ao through an Option Agreement. As all of the companies are under common control, this has been accounted for as a reorganization of entities and the financial statements have been prepared as if the reorganization had occurred retroactively. The Company has consolidated Xin Ao's operating results, assets and liabilities within its financial statements. Pursuant to the Exchange Agreement, BVI-ACM became a wholly-owned subsidiary of TJS. BVI-ACM, China-ACMH and Xin Ao will be collectively referred to as “BVI-ACM.”

Xin Ao Construction Materials, Inc. and its subsidiaries (collectively after the Combination “China-ACM” or “the Company”) is a producer of advanced construction materials for large scale commercial, residential, and infrastructure developments. The Company is primarily focused on producing and supplying a wide range of advanced ready-mix concrete materials for highly technical, large scale, and environmental construction projects. The Company also aims to develop and produce new and innovative environmentally conscious construction materials.

The Company experienced revenue growth in excess of 44% in FY06 and 22% in FY07 and expects to grow rapidly by opening additional facilities and exploring acquisition opportunities. China-ACM generated over $21 million USD in sales, and over $4.5 million in after-tax comprehensive income in FY2007.

China-ACM is a producer of advanced ready mix concrete materials that is committed to leading the industry with:

The Company is able to meet the stringent environmental and technical needs of a rapidly growing market. The types of projects that are conducted include large express railways, bridges, tunnels, skyscrapers, dams, and nuclear reactor infrastructure projects that many competitors are not able to produce due to technical difficulties, resource and information limitations.

China-ACM is considered a construction materials provider in the Beijing market with an estimated 6.8% market share in the open tendered ready mix concrete market and is planning to rapidly gain market share while expanding into new markets. The open tendered market makes up approximately 20% of the ready mix concrete market in Beijing.

The Company owns one plant that has an operating capacity of 768,000 cubic meters per year based on 16 hour shifts per day and 300 working days per year. During the fiscal year ended June 30, 2007, the Company produced 660,000 cubic meters ready mix concrete reflecting a utilization of 86% of capacity of this plant. In addition, the Company has two newly leased plants that commenced operations in March 2008 that will produce more ready mix concrete for fulfillment of signed contracts

Furthermore, the Company plans to add two additional plants outside of Beijing to meet its capacity and geographical needs of significant contracts. Specifically, China-ACM plans to build two new plants, one along Beijing - Shanghai High Speed Railway and one in the Tianjin and Bohai Bay areas.

Xin Ao’s Technical services and preferred procurement agreements with four independently operated plants provide network leverage and more geographic technical services and product coverage.

Furthermore, Xin Ao continued innovation and vertical integration in its material supply chain, acquisition or development of material recycling centers, and its continued innovation and application of new materials, will decrease its material costs.

China-ACM’s organizational structure was carefully developed to abide by the laws of the PRC and maintain optimal tax benefits as well as internal organizational efficiencies. The Company’s organization structure is summarized in the figure below:

Enterprises or individuals who sell commodities, engage in repair and maintenance or import and export goods in the PRC are subject to a value added tax, VAT, in accordance with Chinese laws. The VAT standard rate is 6% of the gross sales price for the company’s industry. A credit is available whereby VAT paid on the purchases of raw materials used in the production of the Company’s finished products can be used to offset the VAT due on sales of the finished product. Due to the fact that the Company uses recycled raw materials to manufacture its products, the State Administration of Taxation has granted the Company a VAT Tax Exemption from August 2005 through August 2009. The VAT taxes collected from customers are kept by the Company and recorded as “Other Subsidy Income” in other income, net in the accompanying financial statements.

The Company and its subsidiary are governed by the Income Tax Law of the People’s Republic of China concerning Foreign Investment Enterprises and Foreign Enterprises and various local income tax laws (the Income Tax Laws).

Xin Ao has been using recycled raw materials in its production since its inception which entitled the Company to an income tax exemption from January 1, 2003 through December 31, 2007 as granted by the State Administration of Taxation, PRC. The Company will apply for renewal of the income tax exemption. However in the interim, the Company estimates its income as of January 1, 2008 will be taxed at a rate of 25%.

PRC law requires that before a foreign invested enterprise can legally distribute profits to its partners, it must satisfy all tax liabilities, provide for losses in previous years, and make allocations, in proportions made at the discretion of the board of directors, after the statutory reserve. The statutory reserves include the surplus reserve fund and the common welfare fund and represent restricted retained earnings.

China is one of the world’s largest construction materials producers, ranking first in the world’s annual output of cement, flat glass, building ceramic and ceramic sanitary ware. China's building materials market is expected to flourish in the next decade as hundreds of millions of citizens are expected to move into the urban areas. According to the Chinese Society of Structural Materials Industry, by 2011, the production value of the structural materials industry is projected to hit $294.8 billion.

Concrete product producers will remain the largest market for cement in China, accounting for 36-44% of all cement consumption in 2010. The government���s continued efforts to modernize the country’s infrastructure is exemplified by such massive projects as the South-North Water Diversion -- designed to redirect water to the northern plains from Central and South China. This project, scheduled for completion in 2050, will result in annual cement consumption of over one million metric tons alone.

China accounts for half of all new building activity in the world and rapid expansion is expected to continue to 2030 as up to 400 million citizens are expected to move into urban areas.

Residential and non-residential buildings in China are increasingly requiring much more concrete due to the short supply of wood, and also because China is a building industry that uses more concrete, brick and steel than Western countries. China is currently the largest consumption market of cement worldwide; an over $200 billion industry. China’s cement consumption will amount to approximately 44% of global demand in 2008 and will be greater than both India and the U.S.‘s current consumption combined by 2010. The government’s continued efforts to modernize the country’s infrastructure is exemplified by such massive projects as the South-North Water Diversion as mentioned earlier. At this rate, it is presumed that China will continue to be an important player in the global construction materials marketplace for at least the next two decades.

Cement demand in the ready-mixed concrete market will post the strongest gains of any market category through 2010, with an annual increase of 11.2%. Recognizing the environmental devastation created from the massive construction activities undergone in the past couple of decades, and the thousands more in the foreseeable future, China’s government implemented Decree #341 in 2004. This law bans onsite concrete production in over 200 major cities across China in order to reduce environmental damages from onsite cement mixing and improve the quality of concrete used in construction.

China’s concrete market is considered very competitive, with over 100,000 providers. Global Information Inc. (GII) reports that ready-mix concrete companies will benefit from an extremely favorable outlook in China, where large-scale construction projects will require significant amounts of ready-mix concrete. In the Beijing concrete market, for example, no competitor has greater than a 10% market share.

China-ACM currently has an estimated market share of 6.8% in the open tendered ready mix concrete market in Beijing. Management believes China-ACM has the ability to capture a much greater share of the Beijing market and further expand its foot print in China via expanding relationships and networking, signing new contracts, and continually developing market-leading innovative and eco-friendly ready mix products.

China-ACM is an environmentally sensitive producer of advanced ready-mix concrete materials that is committed to leading the industry through an extensive use of recyclable materials, efficient production procedures, sealed delivery methods and innovative products and practices.

In fiscal year 2007 and in the first half of its fiscal year 2008, China-ACM operated only its owned plant with a operating capacity of 768,000 cubic meters. In fiscal year 2007, China-ACM produced approximately 660,000 cubic meters ready mix concrete. In second half of its fiscal year 2008, China-ACM entered leasing agreements with Beijing Xiangjia Concrete Co., Ltd. (“Xiangjia”) and Beijing Xinbiao Concrete Co., Ltd. (“Xinbiao”) The two newly leased plants increased China-ACM’s operating capacity from 768,000 cubic meters to 1,584,000 cubic meters, which represents an increase of 816,000 cubic meters in total operating capacity.

China-ACM owned plant currently operates from a 44,401 square meter facility that is located in Beijing, with 4,500 square meters allocated for facilities and offices. This facility features sophisticated infrastructure for efficient use of raw materials, computerized monitoring, testing of production runs, and carefully coordinated delivery of raw materials. Since daily production volumes are dependent upon timing and the delivery schedules of contracted projects, annual capacity can fluctuate but is estimated to be roughly 550,000 to 800,000 cubic meters annually actually produced. This facility is capable of operating on a 24/7 basis to meet optimal capacity maximization during peak construction periods. The Company has also received ISO9001, ISO14001, and ISO28001 certifications.

China-ACM is led by a well-rounded management team that in five years has built a fast-growing, highly-profitable concrete company. This has been achieved by consistently delivering quality products and services backed by a team of dedicated managers and employees. Collectively, the management team is well-educated in engineering, operations, construction materials and concrete experience. Through the Company’s extensive relationships with R&D institutions and industry associations, China-ACM has access to a large pool of experienced managers and knowledgeable advisors.

The R&D Institute is 50% owned by Xianfu Han (Chairman), 45% by Weili He (Vice Chairman), and 5% Laijnu Lu (Chief Engineer & VP).

The R&D Institute provides China-ACM with exclusive access to the latest material science and technology in aggregate, high performance concrete and pre-cast concrete via a 5-year technology transfer agreement. China-ACM’s research and development expense amounted to $165,404 and $213,430 for the fiscal years ended June 30, 2007 and 2006, respectively.

The Company currently employs 182 employees and expects to rapidly expand its employee base with experienced engineers, lab directors, sales managers, sales representatives, as well as technical college graduates and skilled laborers/drivers. The Company’s personnel base is projected to increase substantially with the Company’s expansion and opening of new plants and mixing facilities.

China-ACM is committed to the development of environmentally sensitive products in hopes of lessening the extent of global warming in China. The Company uses components in their cement mixtures that are environmentally friendly and satisfactory to the Chinese government’s regulations. China-ACM’s goal is to continue to use at least 30% recyclable components in their mixtures in order to do their part in fighting global warming. In addition, the Company is working to take a strong leadership position in addressing environmental issues by:

The Company is currently discussing the development of a standards board that will assist the government in setting national guidelines and recommendations.

China-ACM hopes to be one of the leading companies making positive changes towards environmental protection initiatives in China. Future aspirations include setting attainable goals for the recycling and proper disposal of waste materials. One of these practices will be to adhere to the philosophy of industrial ecology, which is the use of waste from other industries as raw material.

China-ACM has received many notable awards, honors and certifications in conjunction with its products and services in the construction industry.

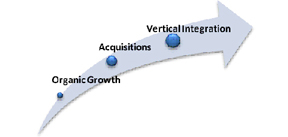

China-ACM has successfully grown since its inception five years ago. The Company, upon securing further financing, aspires to be a leader in the concrete manufacturing industry by increasing its manufacturing capacity, geographic expansion, continued research and innovation, product line additions to build on its impressive reputation.

China-ACM plans to add two to three additional plants within the next six to eighteen months in order to meet existing contracts and anticipated demand. Management plans to add three more mixer stations in FY2009 and FY2010 as part of its long-term company expansion plans.

Beijing-Shanghai High Speed Railways has total construction budgets of $11.6 billion (RMB837 billion reported by Jing Hua News, Jan.6, 2008 issue). China-ACM is currently working on securing ready-mix concrete contracts from rewarded general contractors.

Having taken part in the successful completion of the Dongguan Bridge Project, China-ACM sees Tianjin City as a ripe opportunity for further geographic expansion. Tianjin’s proximity to Beijing is merely 120 km away, and this is a desirable opportunity because Tianjin is the 3rd largest city in China with no dominant players in the local concrete sector.

Given that smaller companies may find it difficult to survive in a competitive marketplace, buying rather than building capacity is an option that will be considered by China-ACM if replacement cost is higher than purchase prices. The Company is currently looking into acquiring smaller concrete manufacturers in China as part of their company expansion plan; further information will be reported when key details have been confirmed. No Letters-of-Intent have been entered into or specific targets identified at this time.

If China-ACM is able to secure financing and grow its revenues in subsequent years, the Company plans to acquire smaller companies within the construction industry, develop more material recycling centers, and hire more industry talents.

As architectural designs have become more complex, challenging, and modern in scope, the need for technology driven companies such as China-ACM to provide high-end specialty concrete mixtures has been rapidly accelerating. Increasing demand for state-of-the-art cement mixtures has spurred the Company’s technological innovation and its ability to provide advanced mixtures of building materials that meet project specific engineering and environmental specifications. The Company produces a C15 to C100 range of concrete materials and specializes in an array of specialized ready-mixed concretes tailored to each project’s technical specifications and environmental standards.

China-ACM is building a product portfolio that serves the diverse needs of its developing customer pipeline, as well as their unique construction and infrastructure projects. The Company mainly specializes in ready-mix concrete formulations from controlled low-strength material to high-strength concrete, each specifically formulated to meet the individual needs of each project. The Company provides both industry standard and highly innovative products which include:

The Company was also the exclusive concrete supplier to the new U.S. Embassy Project, which satisfied both the U.S. and the international ASTM standards. The U.S. Embassy project size was 50,000 cubic meters and in this regard, the U.S. Embassy purchased its materials and China-ACM processed the ready mix concrete. The project was completed in 2007 with total project sales & services revenue of $400,000.

China-ACM’s sales strategy focuses on building new long-term cooperative relationships with some of China’s top construction companies as they leverage the Company’s reputation and enter new markets. The Company’s sales representatives are actively building relationships in target markets comprised of the Chinese government, general contractors, architects, engineers, and other potential sources of new business. Its sales efforts are further supported by the executive officers and engineering personnel, who have substantial experience in the design, formulation and implementation of advanced construction and concrete materials projects.

Marketing efforts are geared towards advancing China-ACM as the supplier of choice for building China’s most modern and challenging projects. The Company is constantly seeking ways to raise its profile and leverage additional publicity. To this end, the Company plans to expand its presence at leading construction industry events and in periodicals to build on its successful reputation. The primary goal when expanding into new markets is to reinforce the sales effort by promoting positive testimonials and success stories from the Company’s strong base of high profile clients.

China-ACM is already recognized as one of Beijing’s leading advanced concrete and construction materials companies. The Company’s strong contractor relationships, superior technical knowledge, and strong executive team all position China-ACM for strong continued growth.

China-ACM has thrived over the past five years by winning contracts with major construction contractors that are responsible for key infrastructure, commercial and residential projects. China-ACM focuses on large project and large customers. In the FY2007, top ten customers’ sales were 74.32% of company entire sales. Three large customers each have sales of 20%, 11.25%, and 10.83% of entire China-ACM sales.

Technological Knowledge

China-ACM’s technological knowledge gives it the ability to win major infrastructure projects, and winning major projects give the Company leverage to acquire less sophisticated operators, increase production volumes, and implement quality standards and environmentally sensitive policies. China-ACM’s 5 year contract with R&D Institute has exclusive terms.

Innovation Partners & Collaboration Efforts

The Company has close relationships with Tsinghua University and Xi’an University of Architecture and Technology and Beijing Dongfangjianyu Institute of Concrete Science & Technology (Beijing Concrete Institute). Through the 5 year contract between the two parties, China-ACM sets it apart from many of its competitors by gaining access to a wide array of resources and knowledge.

Size & Capital

Access to capital is increasingly becoming a key success factor in the Chinese concrete industry as pressure on prices and margins are threatening to squeeze out smaller-scale providers (200,000 to 300,000 actual operating capacity ones). Contracts are won on a bid basis, typically for the length of a project, which can be up to 2 years each. China-ACM’s owned Xin Ao plant is top one in capacity and equipment in Beijing area. General contractors frequently prefer to work with large plant operating companies.

After securing financing, China-ACM will be able to expand throughout China by acquiring more fixed operating assets, manufacturing facilities, industry talents, and developing brand marketing.

VIII. Innovation

Overview

Construction materials companies are under extreme pressure to respond quickly to industry demands with new designs and product innovations that support rapidly changing technical demand and regulatory requirements. The engineering and technical expertise of the Company’s management team, advisors and key personnel, together with the emphasis on continued research and development identifies and brings new, innovative products to the market using the latest technologies, materials and processes.

China-ACM is devoting a substantial amount of attention to the research and development of advanced construction materials that meet the demands of project specific needs while leading the industry in value, practices, materials and processes. The Company prides itself in its ability to commit to constant innovations, sophisticated in house R&D and testing facilities, a highly technical onsite team, leading market research, cooperation with a leading research institution, experienced management and advisory board, and close relationships with leading concrete materials experts. China-ACM’s research and development expense amounted to $165,404 and $213,430 for the years ended June 30, 2007 and 2006, respectively.

University Relationships & Cooperation Agreements

The Company has strong relationships with Tsinghua University and the Xi’an University of Architecture and Technology. China-ACM has signed a cooperation agreement with Tsinghua University for A) the use of and sharing of highly technological equipment, newly developed testing and inspection processes; and B) the development of new techniques and discoveries related to advanced building materials. The Company has also co-developed a new construction material development center with Xi’an University of Architecture and Technology and the parties have signed a technology sharing agreement.

Beijing Concrete Institute Partnership

The Beijing Dongfangjianyu Institute of Concrete Science & Technology (Beijing Concrete Institute) has 40 employees, with five senior research fellows, and 15 middle level researchers, and of which the vast majority have university degrees. The Institute and its staff have participated and collaborated with national and local Beijing government agencies to establish the following industry standards:

| | · | Specification For Mix Proportion Design of Ordinary Concrete JGJ55-2000 |

| | · | Code for Acceptance of Constructional Quality Of Concrete Structures GB 50204-2002 |

| | · | Applied Technical Specification of Mineral Admixtures In Concrete DBJ/T01-64-2002 |

| | · | Ready-Mixed Concrete GB/T 14902-2003 |

| | · | Practice Code for Application of Ready-Mixed Mortar DBJ 01-99-2005 |

| | · | Management Specification of Quality for Ready-Mixed Concrete |

| | · | Technical Requirement for Environmental Labeling Products Ready-Mixed Concrete HJ/T412-2007 |

| | · | Technical Code for Application of Mineral Admixture GBJXX-XX (in the approval process) |

| | · | Standard For Inspection And Assessment of Strength Of Concrete GBJ107-XX (in discussion) |

China-ACM has a close association with the Beijing Concrete Institute and has been able to incorporate many of these research findings into its operations, products, and procedures. The Beijing Concrete Institute was established by China-ACM’s Chairman and Vice Chairman, which currently maintain majority ownership. As such, the Company works very closely with the institute and has been granted exclusive areas for development purposes of China’s ACM’s existing plant’s regional projects (all projects within a 30 to 50 kilometer radius in return for sponsoring multiple research initiatives).

China-ACM is able to use the Research Findings & Technical Publication and Procedures of the Beijing Concrete Institute in its business, which provides technological advantages over many of its competitors. Because China-ACM’s five year Exclusive Contract with the institute, and its Chairman and Vice Chairman’s ownership of the institute, it prevents other competitors from using the same finding for commercial use. Some of these findings include:

| | · | Research on Compound Admixture HPC; 3rd Class Award for China Building Materials Science & Technology Progress. |

| | · | Research and Application of C100 HPC; 3rd Class Award for Beijing Science & Technology Progress. |

| | · | Research on pumping Light Aggregate Concrete; Innovation Award for China Building Materials Science & Technology. |

| | · | Research and Application of Green (nontoxic) HPC; First Prize for Beijing Science & Technology Progress. |

| | · | Construction Technology of HPC for the Capital International Airport |

| | · | Research on Production and Construction Technology of Phase Change Energy-saving Thermostat Concrete and Mortar |

| | · | Polycarboxylate Series High Performance Water Reducing Agent Compositing Technique |

| | · | State Swimming Center for Concrete Cracking Control Technology |

In addition, China-ACM has board membership and deep access to the institute’s technology, research, and facilities. Due to this close relationship, China-ACM is able to collaborate closely with the institute and its executives. The institute and its executives play a strong role recommending industry standards, advising on major infrastructure developments, and creating and maintaining strong connections with leading developers, construction companies, and governmental officials.

Successful Innovations

Some of China-ACM’s more advanced products and processes developed through its relationships with leading research institutes and universities include:

C100 High Performance Concrete

High Strength Concrete is often defined as concrete with a compressive strength greater than 6000 psi (41 MPa). The primary difference between high-strength concrete and normal-strength concrete relates to the compressive strength that refers to the maximum resistance of a concrete sample to applied pressure. Manufacturing high-strength concrete involves making optimal use of the basic ingredients that constitute normal-strength concrete.

Through its collaborative efforts China-ACM has developed a high performance concrete. This mixture can be produced at an impermeable grade above P35, and can be used for self-waterproofing concrete structural engineering as the water-cement (W/C) ratio and carbonized shrinking is minimal and the structure is close-grained.

Only a limited number of firms in the Beijing area have the expertise to produce C100 High Performance Concrete.

Compound Admixture Concrete

This new compound mineral admixture is a composite of coal powder, mineral powder and mineral activators blended to specific proportions. This new admixture improves activity, filling, and super-additive effects of the concrete and also improves the compatibility between cement and adding. The new admixture is the sixth composite of the concrete which adds water reducing admixture to produce a high quality concrete.

Lightweight Aggregate Concrete & Innovative Pumping Technology

This invention involves a pumping technology of lightweight aggregate. It is a pretreatment method of lightweight aggregate, i.e. pre-wet and pressurized pre-made shell technology. Setting appropriate times and pressure, lightweight aggregate will reach an appropriate saturation state under pressure after it is put into a custom designed sealed pressure vessel. After preservation, a shell will be made. Lightweight aggregate concrete prepared using the above pretreatment method, will dry quicker under pumping pressure, and maintain saturation state. Accordingly, lightweight aggregate concrete will be easily pumped which can shorten construction time.

Energy-saving Technologies of Phase Change Thermostat Concrete

Energy conservation concrete may adjust and reflect process temperature, and temperature self-control may solve cracking brought by cement heat of hydration in large-scale concrete.

Polycarboxylate Series High Performance Water Reducing Agent Compositing Technique

The research and produce of water reducing admixture in the world tends to be high performance and low pollutting. Super plasticizer Polycarboxylate series with high water reducing rates is an attractive admixture in that it prepares high strength concrete, super-strength concrete, high fluidity and super plasticizer concrete, self-dense concrete. The water reducing rate of Polycarboxylate series product may reach 20% to 25%, which is higher than the currently used Naphthaline series water reducing agent. The cost of the water reducing agent is well situated and it may be used to prepare high strength and performance concrete instead of the Naphthaline series water reducing agent.

Application of Reused Water in Concrete

The re-use of waste water of a concrete plant to mix concrete is significant as its saves production costs, minimizes fresh water use and represents an efficient approach to address industrial wastes. The practical application of this effort is a further step towards the goal of minimal pollution and emissions.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

| | · | SUBSTANTIALLY ALL OF OUR BUSINESS, ASSETS AND OPERATIONS ARE LOCATED IN CHINA. |

Substantially all of our business, assets and operations are located in China. The economy of China differs from the economies of most developed countries in many respects. The economy of China has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over China's economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of China, but may have a negative effect on us.

| | · | OUR PLANS TO BUILD ADDITIONAL PLANTS AND TO IMPROVE AND UPGRADE OUR INTERNAL CONTROL AND MANAGEMENT SYSTEM WILL REQUIRE CAPITAL EXPENDITURES IN 2008. |

Our plans to build additional plants and to improve and upgrade our internal control and management system will require capital expenditures in 2008. We may also need further funding for working capital, investments, potential acquisitions and joint ventures and other corporate requirements. We cannot assure you that cash generated from our operations will be sufficient to fund these development plans, or that our actual capital expenditures and investments will not significantly exceed our current planned amounts. If either of these conditions arises, we may have to seek external financing to satisfy our capital needs. Our ability to obtain external financing at reasonable costs is subject to a variety of uncertainties. Failure to obtain sufficient external funds for our development plans could adversely affect our business, financial condition and operating performance.

| | · | THREE CUSTOMER ORDERS CONSISTED OF 42.08% OF THE NET SALES OF THE COMPANY FOR THE FISCAL YEAR ENDED JUNE 30, 2007 AND THE LOSS OF ANY OF THESE THREE CUSTOMERS CAN RESULT IN A DEPRESSIVE EFFECT ON OUR NET PROFIT. |

Our Company focuses on large projects for large Chinese customers. In this regard, during the fiscal year ended June 30, 2007, three Chinese customers orders consisted of 42.08% of the net sales of the Company. However, should we lose any of these three customers in the future and are unable to obtain additional customers, our net profit will decrease.

| | · | WE MAY EXPERIENCE MAJOR ACCIDENTS IN THE COURSE OF OUR OPERATIONS, WHICH MAY CAUSE SIGNIFICANT PROPERTY DAMAGE AND PERSONAL INJURIES. |

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant industry-related accidents and natural disasters may cause interruptions to various parts of our operations, or could result in property or environmental damage, increase in operating expenses or loss of revenue. The occurrence of such accidents and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than our automobiles. Losses or payments incurred may have a material adverse effect on our operating performance if such losses or payments are not fully insured.

| | · | OUR PLANNED EXPANSION AND TECHNICAL IMPROVEMENT PROJECTS COULD BE DELAYED OR ADVERSELY AFFECTED BY, AMONG OTHER THINGS, FAILURES TO RECEIVE REGULATORY APPROVALS, DIFFICULTIES IN OBTAINING SUFFICIENT FINANCING, TECHNICAL DIFFICULTIES, OR HUMAN OR OTHER RESOURCE CONSTRAINTS. |

Our planned expansion and technical improvement projects could be delayed or adversely affected by, among other things, failures to receive regulatory approvals, difficulties in obtaining sufficient financing, technical difficulties, or human or other resource constraints. Moreover, the costs involved in these projects may exceed those originally contemplated. Costs savings and other economic benefits expected from these projects may not materialize as a result of any such project delays, cost overruns or changes in market circumstances. Failure to obtain intended economic benefits from these projects could adversely affect our business, financial condition and operating performances.

| | · | WE COULD FACE INCREASED COMPETITION. |

Our principal market, Beijing, has enjoyed stronger economic growth and a higher demand for construction than other regions of China. As a result, we believe that competitors will try to expand their sales and build up their distribution networks in our principal market. We believe this trend will continue and probably accelerate. Increased competition may have a material adverse effect on our financial condition and results of operations.

· | WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE AT LEVELS WE EXPECT. |

In order to maximize potential growth in our current and potential markets, we believe that we must expand our manufacturing and marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

· | WE CANNOT ASSURE YOU THAT OUR ORGANIC GROWTH STRATEGY WILL BE SUCCESSFUL WHICH MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW. |

One of our strategies is to grow organically through increasing the distribution and sales of our products by penetrating existing markets in PRC and entering new geographic markets in PRC. However, many obstacles to entering such new markets exist including, but not limited to, established companies in such existing markets in the PRC. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this organic growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

· | IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS. |

If adequate additional financing is not available on reasonable terms, we may not be able to undertake plant expansion, purchase additional machinery and purchase equipment for our operations and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If we need additional funding we will, most likely, seek such funding in the United States (although we may be able to obtain funding in the P.R.C.) and the market fluctuations affect on our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our plant expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures.

Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the Units. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

| | · | NEED FOR ADDITIONAL EMPLOYEES. |

The Company’s future success also depends upon its continuing ability to attract and retain highly qualified personnel. Expansion of the Company’s business and the management and operation of the Company will require additional managers and employees with industry experience, and the success of the Company will be highly dependent on the Company’s ability to attract and retain skilled management personnel and other employees. There can be no assurance that the Company will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the construction industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

· | WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS. |

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

| | · | THE TRANSACTION INVOLVES A REVERSE MERGER OF A FOREIGN COMPANY INTO A UNITED STATES SHELL COMPANY, SO THAT THERE IS NO HISTORY OF COMPLIANCE WITH UNITED STATES SECURITIES LAWS AND ACCOUNTING RULES. |

In order to be able to comply with United States securities laws, the Company's operating subsidiary prepared its financial statements for the first time under U.S. generally accepted accounting principles and recently had its initial audit of its financial statements in accordance with Public Company Accounting Oversight Board (United States). As the Company does not have a long term familiarity with U.S. generally accepted accounting principles, it may be more difficult for it to comply on a timely basis with SEC reporting requirements than a comparable domestic company.

| | · | IF WE ARE UNABLE TO ACCURATELY ESTIMATE THE OVERALL RISKS OR COSTS WHEN WE BID ON A CONTRACT WHICH IS ULTIMATELY AWARDED TO US, WE MAY ACHIEVE A LOWER THAN ANTICIPATED PROFIT OR INCUR A LOSS ON THE CONTRACT. |

Substantially all of our revenues and contract backlog are typically derived from fixed unit price contracts. Fixed unit price contracts require us to perform the contract for a fixed unit price irrespective of our actual costs. As a result, we realize a profit on these contracts only if we successfully estimate our costs and then successfully control actual costs and avoid cost overruns. If our cost estimates for a contract are inaccurate, or if we do not execute the contract within our cost estimates, then cost overruns may cause the contract not to be as profitable as we expected, or may cause us to incur losses. This, in turn, could negatively affect our cash flow, earnings and financial position.

The costs incurred and gross profit realized on those contracts can vary, sometimes substantially, from the original projections due to a variety of factors, including, but not limited to:

| | • | | onsite conditions that differ from those assumed in the original bid; |

| | | | |

| | • | | delays caused by weather conditions; |

| | | | |

| | • | | later contract start dates than expected when we bid the contract; |

| | | | |

| | • | | contract modifications creating unanticipated costs not covered by change orders; |

| | | | |

| | • | | changes in availability, proximity and costs of materials, including steel, concrete, aggregate and other construction materials (such as stone, gravel and sand), as well as fuel and lubricants for our equipment; |

| | | | |

| | • | | availability and skill level of workers in the geographic location of a project; |

| | | | |

| | • | | our suppliers’ or subcontractors’ failure to perform; |

| | | | |

| | • | | fraud or theft committed by our employees; |

| | | | |

| | • | | mechanical problems with our machinery or equipment; |

| | | | |

| | • | | citations issued by governmental authorities |

| | | | |

| | • | | difficulties in obtaining required governmental permits or approvals; |

| | | | |

| | • | | changes in applicable laws and regulations; and |

| | | | |

| | • | | claims or demands from third parties alleging damages arising from our work or from the project of which our work is part. |

| | · | ECONOMIC DOWNTURNS OR REDUCTIONS IN GOVERNMENT FUNDING OF INFRASTRUCTURE PROJECTS, OR THE CANCELLATION OF SIGNIFICANT CONTRACTS, COULD REDUCE OUR REVENUES AND PROFITS AND HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS. |

Our business is highly dependent on the amount of infrastructure work funded by various governmental entities, which, in turn, depends on the overall condition of the economy, the need for new or replacement infrastructure, the priorities placed on various projects funded by governmental entities and national or local government spending levels. Decreases in government funding of infrastructure projects could decrease the number of civil construction contracts available and limit our ability to obtain new contracts, which could reduce our revenues and profits.

Contracts that we enter into with governmental entities can usually be canceled at any time by them with payment only for the work already completed. In addition, we could be prohibited from bidding on certain governmental contracts if we fail to maintain qualifications required by those entities. A sudden cancellation of a contract or our debarment from the bidding process could cause our equipment and work crews to remain idled for a significant period of time until other comparable work became available, which could have a material adverse effect on our business and results of operations.

| | · | OUR OPERATIONS ARE CURRENTLY FOCUSED IN CHINA, AND ANY ADVERSE CHANGE TO THE ECONOMY OR BUSINESS ENVIRONMENT IN CHINA COULD SIGNIFICANTLY AFFECT OUR OPERATIONS, WHICH WOULD LEAD TO LOWER REVENUES AND REDUCED PROFITABILITY. |

Our operations are currently concentrated in China. Because of this concentration in a specific geographic location, we are susceptible to fluctuations in our business caused by adverse economic or other conditions in this region, including natural or other disasters. A stagnant or depressed economy in China, or in any of the other markets that we serve, could adversely affect our business, results of operations and financial condition.

| | · | OUR INDUSTRY IS HIGHLY COMPETITIVE, WITH A VARIETY OF LARGER COMPANIES WITH GREATER RESOURCES COMPETING WITH US, AND OUR FAILURE TO COMPETE EFFECTIVELY COULD REDUCE THE NUMBER OF NEW CONTRACTS AWARDED TO US OR ADVERSELY AFFECT OUR MARGINS ON CONTRACTS AWARDED. |

Essentially all of the contracts on which we bid are awarded through a competitive bid process, with awards generally being made to the lowest bidder, but sometimes recognizing other factors, such as shorter contract schedules or prior experience with the customer. Within our markets, we compete with many national, regional and local construction firms. Some of these competitors have achieved greater market penetration than we have in the markets in which we compete, and some have greater financial and other resources than we have. In addition, there are a number of national companies in our industry that are larger than us that, if they so desired, could establish a presence in our markets and compete with us for contracts. As a result, we may need to accept lower contract margins in order to compete against these competitors. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced.

| | · | OUR DEPENDENCE ON SUBCONTRACTORS AND SUPPLIERS OF MATERIALS, INCLUDING PETROLEUM-BASED PRODUCTS, COULD INCREASE OUR COSTS AND IMPAIR OUR ABILITY TO COMPLETE CONTRACTS ON A TIMELY BASIS OR AT ALL, WHICH WOULD ADVERSELY AFFECT OUR PROFITS AND CASH FLOW. |

We rely on third-party subcontractors to perform some of the work on many of our contracts. We do not bid on contracts unless we have the necessary subcontractors committed for the anticipated scope of the contract and at prices that we have included in our bid. Therefore, to the extent that we cannot obtain third-party subcontractors, our profits and cash flow will suffer.

| | · | FOLLOWING CLOSE OF THIS EXCHANGE AGREEMENT OUR DIRECTORS WILL HAVE CONTROL OF US |

Xianfu Han, Chairman of the Board of Directors, and Weile He, Vice-Chairman of the Board of Directors, in the aggregate will own approximately 85.84% of our issued and outstanding common stock following the Closing of the Exchange Agreement. Therefore, they will control us and can control the election of our directors and officers.

Risks Relating to the People's Republic of China

| | · | CERTAIN POLITICAL AND ECONOMIC CONSIDERATIONS RELATING TO THE PRC COULD ADVERSELY AFFECT OUR COMPANY. |

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC's economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of restrictions on currency conversion in addition to those described below.

| | · | THE RECENT NATURE AND UNCERTAIN APPLICATION OF MANY PRC LAWS APPLICABLE TO US CREATE AN UNCERTAIN ENVIRONMENT FOR BUSINESS OPERATIONS AND THEY COULD HAVE A NEGATIVE EFFECT ON US. |

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects.

| | · | CURRENCY CONVERSION COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION. |

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Furthermore, the Renminbi is not freely convertible into foreign currencies nor can it be freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and the Administration of Settlement, Sales and Payment of Foreign Exchange Regulations, Foreign Invested Enterprises are permitted either to repatriate or distribute its profits or dividends in foreign currencies out of its foreign exchange accounts, or exchange Renminbi for foreign currencies through banks authorized to conduct foreign exchange business. The conversion of Renminbi into foreign exchange by Foreign Invested Enterprises for recurring items, including the distribution of dividends to foreign investors, is permissible. The conversion of Reminbi into foreign currencies for capital items, such as direct investment, loans and security investment, is subject, however, to more stringent controls.

China ACM’s operating companies are FIEs to which the Foreign Exchange Control Regulations are applicable. Accordingly, we will have to maintain sufficient foreign exchange to pay dividends and/or satisfy other foreign exchange requirements.

| | · | EXCHANGE RATE VOLATILITY COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION. |

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar and, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. If we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition.

| | · | SINCE MOST OF OUR ASSETS ARE LOCATED IN PRC, ANY DIVIDENDS OF PROCEEDS FROM LIQUIDATION IS SUBJECT TO THE APPROVAL OF THE RELEVANT CHINESE GOVERNMENT AGENCIES. |

Our assets are predominantly located inside PRC. Under the laws governing Foreign Invested Enterprises in PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency's approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

| | · | TO DATE, WE HAVE NOT BEEN SUBJECT TO TAX LIABILITIES UNDER PRC TAX LAWS. HOWEVER, WE WILL INCUR TAX LIABILITIES GOING FORWARD WHICH MAY REDUCE OUR NET INCOME. |

We are governed by the Income Tax Law of the People’s Republic of China concerning Foreign Investment Enterprises and Foreign Enterprises and various local income tax laws (the Income Tax Laws). Beginning January 1, 2008, the new Enterprise Income Tax (“EIT”) law will replace the existing laws for Domestic Enterprises (“DES”) and Foreign Invested Enterprises (“FIEs”).

The new standard EIT rate of 25% will replace the 33% rate currently applicable to both DES and FIEs, except for High Tech companies who pay a reduced rate of 15%.

The Company is granted income tax exemption from January 1, 2003 to December 31, 2007. Accordingly, for the six months ended December 31, 2007 and 2006, the provision for income taxes amounted to $0, and $0, respectively. The estimated tax savings due to this tax exemption for the six months ended December 31, 2007 and 2006 amounted to $816,413 and $508,217, respectively.

Since the detailed guidelines of the new tax law were not publicized yet, the Company cannot determine what the new tax rate (15% or 25%) will be applicable to the Company and its subsidiaries after the end of their respective tax holiday terms.

Enterprises or individuals who sell commodities, engage in repair and maintenance or import and export goods in the PRC are also subject to a value added tax, VAT, in accordance with Chinese laws. The VAT standard rate is 6% of the gross sales price for the company’s industry. A credit is available whereby VAT paid on the purchases of raw materials used in the production of the Company’s finished products can be used to offset the VAT due on sales of the finished product.

Due to the Company’s VAT tax exempt status, the Company did not pay any VAT tax and the VAT collected from its customers is recorded as other subsidy income until the expiration of exemption in August 2009.

Once our exemptions expire, we will incur income tax and VAT liabilities, which will reduce our net income.

| | · | IT MAY BE DIFFICULT TO AFFECT SERVICE OF PROCESS AND ENFORCEMENT OF LEGAL JUDGMENTS UPON OUR COMPANY AND OUR OFFICERS AND DIRECTORS BECAUSE THEY RESIDE OUTSIDE THE UNITED STATES. |

As our operations are presently based in PRC and a majority of our directors and all of our officers reside in PRC, service of process on our company and such directors and officers may be difficult to effect within the United States. Also, our main assets are located in PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

Risks Associated with our Securities

| | · | RESTRICTED SECURITIES; LIMITED TRANSFERABILITY. |

Our securities should be considered a long-term, illiquid investment. Our Common Stock has not been registered under the Act, and cannot be sold without registration under the Act or any exemption from registration. In addition, our Common Stock is not registered under any state securities laws that would permit their transfer. Because of these restrictions and the absence of an active trading market for the securities, a shareholder will likely be unable to liquidate an investment even though other personal financial circumstances would dictate such liquidation.

| | | WE MAY BE SUBJECT TO THE PENNY STOCK RULES WHICH WILL MAKE THE SHARES OF OUR COMMON STOCK MORE DIFFICULT TO SELL. |

| | · | OUR SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE. |

Our shares of common stock are very thinly traded, and the price if traded may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition of Xin Ao Construction Materials, Inc. (“BVI-ACM”) for the six months ended December 31, 2007 and 2006 and for the fiscal years ended June 30, 2007 and 2006, should be read in conjunction with the Selected Consolidated Financial Data, BVI-ACM’s financial statements, and the notes to those financial statements that are included elsewhere in this Current Report on Form 8-K. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this Form 8-K. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

COMPANY OVERVIEW

BVI-ACM, with its subsidiaries, engages in the production of advanced construction materials for large scale commercial, residential, and infrastructure developments. The Company is primarily focused on producing and supplying a wide range of advanced ready-mix concrete materials for highly technical, large scale, and environmentally-friendly construction projects. BVI-ACM owns 100% of the issued and outstanding capital stock of Beijing Ao Hang Construction Materials Technology, Ltd. (“China-ACMH”), a company incorporated under the laws of the People’s Republic of China (“PRC”). On November 28, 2007, China-ACMH entered into a series of contractual agreements with Beijing Xin Ao Concrete Co., Ltd. (“Xin Ao”), a company incorporated under the laws of the PRC, and its two shareholders in which China-ACMH effectively takes over management of the business activities of Xin Ao and has the right to appoint all executives and senior management and the members of the board of directors of Xin Ao. The contractual arrangements are comprised of a series of agreements, including an Exclusive Technical Consulting and Services Agreement and an Operating Agreement, through which China-ACMH has the right to advise, consult, manage and operate Xin Ao for an annual fee in the amount of Xin Ao’s yearly net profits after tax. Additionally, Xin Ao’s Shareholders have pledged their rights, titles and equity interest in Xin Ao as security for China-ACMH to collect technical consulting and services fees provided to China-ACMH through an Equity Pledge Agreement. In order to further reinforce China-ACMH’s rights to control and operate Xin Ao, Xin Ao’s shareholders have granted China-ACMH the exclusive right and option to acquire all of their equity interests in Xin Ao through an Option Agreement. As all of the companies are under common control, this has been accounted for as a reorganization of entities and the financial statements have been prepared as if the reorganization had occurred retroactively. The Company has consolidated Xin Ao’s operating results, assets and liabilities within its financial statements.

BVI-ACM, China-ACMH operates and controls Xin Ao through the Contractual Arrangements. BVI-ACM used the Contractual Arrangements to acquire control of Xin Ao, instead of using a complete acquisition of Xin Ao’s assets or equity to make Xin Ao a wholly-owned subsidiary of BVI-ACM because (i) new PRC laws governing share exchanges with foreign entities, which became effective on September 8, 2006, make the consequences of such acquisitions uncertain and (ii) other than by share exchange transactions, PRC law requires Xin Ao to be acquired for cash and BVI-ACM was not able to raise sufficient funds to pay the full appraised value for Xin Ao’s assets or shares as required under PRC law.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The accompanying consolidated financial statements include the financial statements of BVI-ACM and its wholly owned subsidiary, China-ACMH and its variable interest entity Xin Ao. All significant inter-company transactions and balances have been eliminated in consolidation. BVI-ACM, its subsidiary and Xin Ao, together are referred to as the Company. In accordance with FASB Interpretation No. 46(R), Consolidation of Variable Interest Entities (“FIN 46(R)”), variable interest entities (“VIEs”) are generally entities that lack sufficient equity to finance their activities without additional financial support from other parties or whose equity holders lack adequate decision making ability. All VIEs with which the Company is involved must be evaluated to determine the primary beneficiary of the risks and rewards of the VIE. The primary beneficiary is required to consolidate the VIE for financial reporting purposes. In connection with the adoption of FIN 46(R), the Company concludes that Xin Ao is a VIE and BVI-ACM is the primary beneficiary. Under FIN 46(R) transition rules, the financial statements of Xin Ao are then consolidated into the Company’s consolidated financial statements.

Our management's discussion and analysis of our financial condition and results of operations are based on the consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported net sales and expenses during the reporting periods. On an ongoing basis, we evaluate our estimates and assumptions. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

While our significant accounting policies are more fully described in Note 2 to our consolidated financial statements appearing at Exhibits 99.2 and 99.3, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis:

Foreign currency translation

Our reporting currency is the US Dollar, however, we use local currency Renminbi (“RMB”), as our functional currency. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period, and equity is translated at historical exchange rates.

In accordance with Statement of Financial Accounting Standards No. 95, "Statement of Cash Flows," cash flows from the Company's operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. Gains and losses from foreign currency transactions are included in the results of operations.

Inventories

Inventories, consisting of raw materials related to our products, are stated at the lower of cost or market, using a weighted average cost method. We review our inventory periodically to identify obsolete goods and/or to determine if any reserves are necessary for potential obsolescence.

Accounts receivable, trade and allowance for doubtful accounts

Our business operations are conducted in the PRC. During the normal course of business, we extend unsecured credit to customers by selling on various credit terms. We review our accounts receivable at each reporting period to determine if the allowance for doubtful accounts is adequate. An estimate for doubtful accounts is recorded when collection of the full amount is no longer probable. Our existing reserve is consistent with its historical experience and considered adequate by the management.

Plant and equipment

Plant and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets with 5% residual value. Estimated useful lives of the assets are as follows:

| | | Useful Life | |

| Transportation equipment | | | 10 years | |

| Plant machinery | | | 10 years | |

| Office equipment | | | 5 years | |