Exhibit 99.2

Net - Zero 1 Project Update Conditional Commitment For DOE Loan Guarantee Obtained NASDAQ: GEVO

2 This communication contains “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and as defined in the Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the context of the statement and generally arise when the Company or its management is discussing its beliefs, estimates or expectations. Such statements generally include words such as “believes,” “expects,” “intends,” “anticipates,” “estimates,” “continues,” “may,” “plan,” “will,” “goal,” or similar expressions. Forward - looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of our management about future events and are therefore subject to risks and uncertainties, many of which are outside the Company’s control, which could cause actual results to differ materially from what is contained in such forward - looking statements as a result of various factors, including, without limitation: (1) the ability to secure equity financing for the Net - Zero 1 project, (2) the ability to produce net - zer o or negative fuel, (3) the expected production costs of the project and fuels, (4) the expected production levels at the project, (5) expected total project costs, (6) the inability to consummate the proposed project within the anticipated time period, or at all, and (7) other factors that could affect the Company’s business. These and other factors are identified and described in more detail in the Company’s Annual Report on Form 10 - K for the year ended December 31, 2023, as well as the Company’s subsequent filings and is available online at www.sec.gov. Readers are cautioned not to place undue reliance on the Company’s projections and other forward - looking statements, which speak only as of the date thereof. Except as required by applicable law, the Company undertakes no obligation to update any forward - looking statement, or to make any other forward - looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statement R&D and demonstration facility in Luverne, MN.

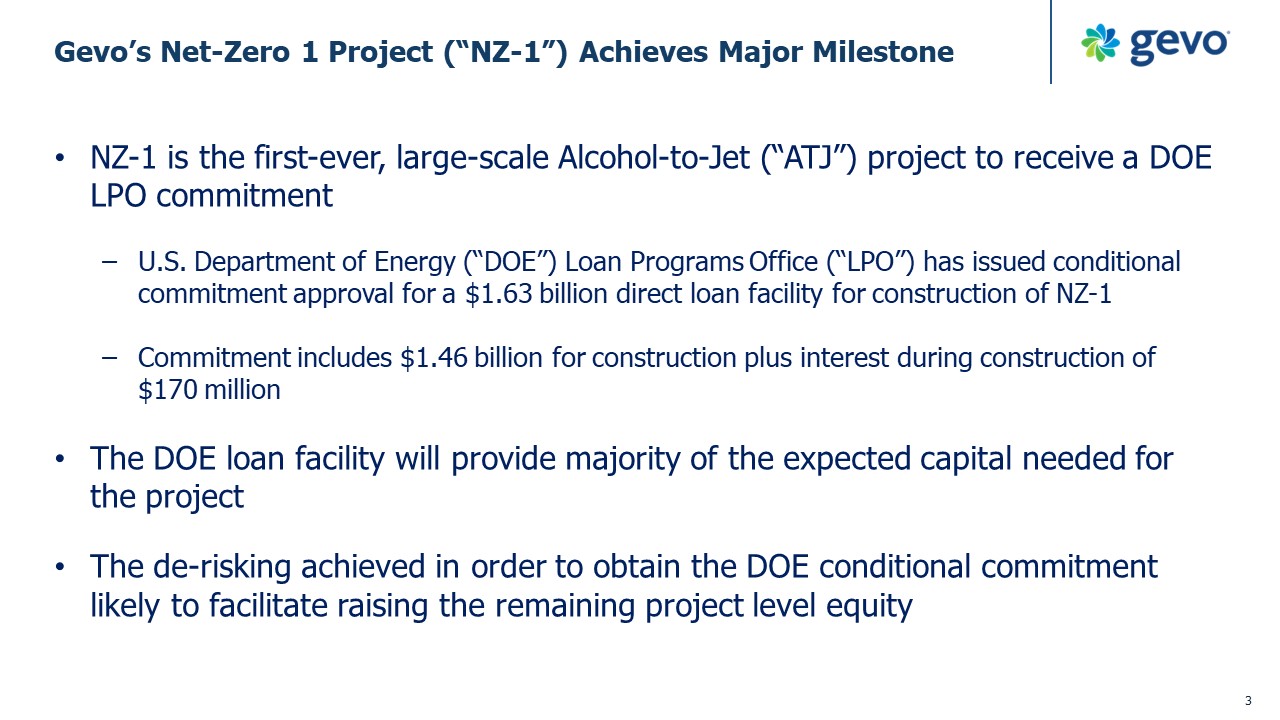

Gevo’s Net - Zero 1 Project (“NZ - 1”) Achieves Major Milestone • NZ - 1 is the first - ever, large - scale Alcohol - to - Jet (“ATJ”) project to receive a DOE LPO commitment – U.S. Department of Energy (“DOE”) Loan Programs Office (“LPO”) has issued conditional commitment approval for a $1.63 billion direct loan facility for construction of NZ - 1 – Commitment includes $1.46 billion for construction plus interest during construction of $170 million • The DOE loan facility will provide majority of the expected capital needed for the project • The de - risking achieved in order to obtain the DOE conditional commitment likely to facilitate raising the remaining project level equity 3

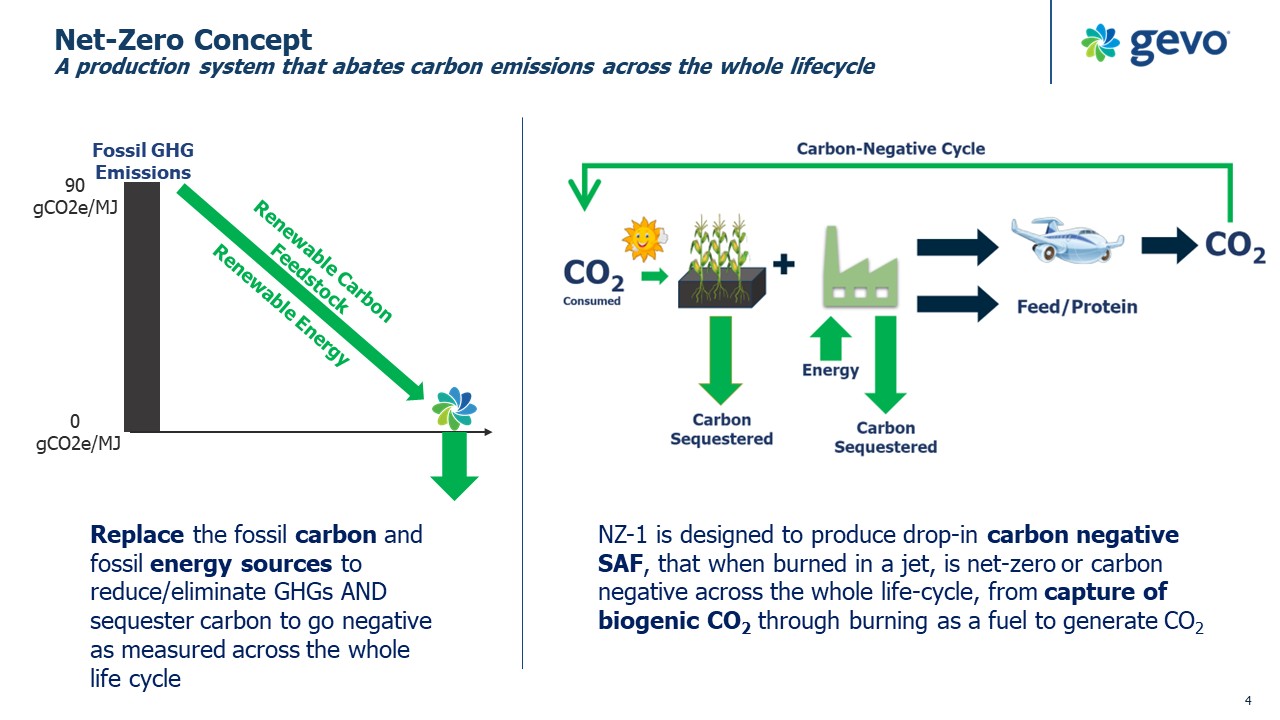

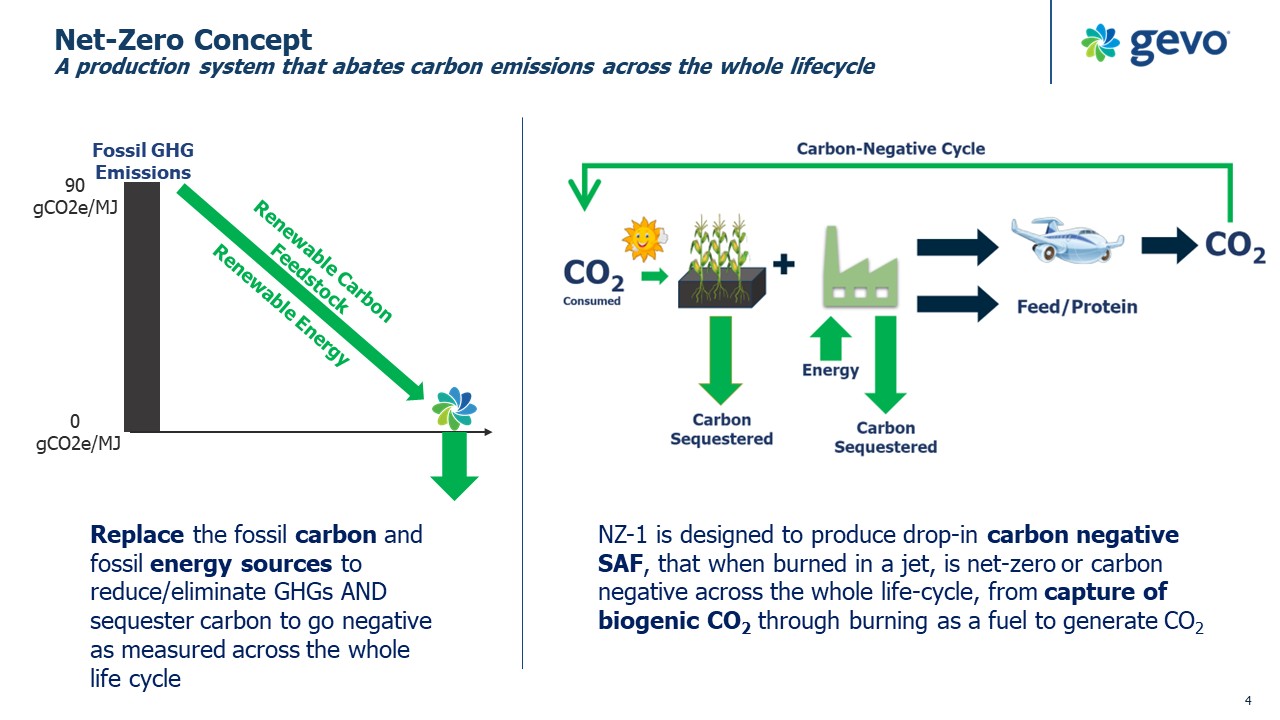

4 Net - Zero Concept A production system that abates carbon emissions across the whole lifecycle NZ - 1 is designed to produce drop - in carbon negative SAF , that when burned in a jet, is net - zero or carbon negative across the whole life - cycle, from capture of biogenic CO 2 through burning as a fuel to generate CO 2 Replace the fossil carbon and fossil energy sources to reduce/eliminate GHGs AND sequester carbon to go negative as measured across the whole life cycle 0 gCO2e/MJ 90 gCO2e/MJ Fossil GHG Emissions

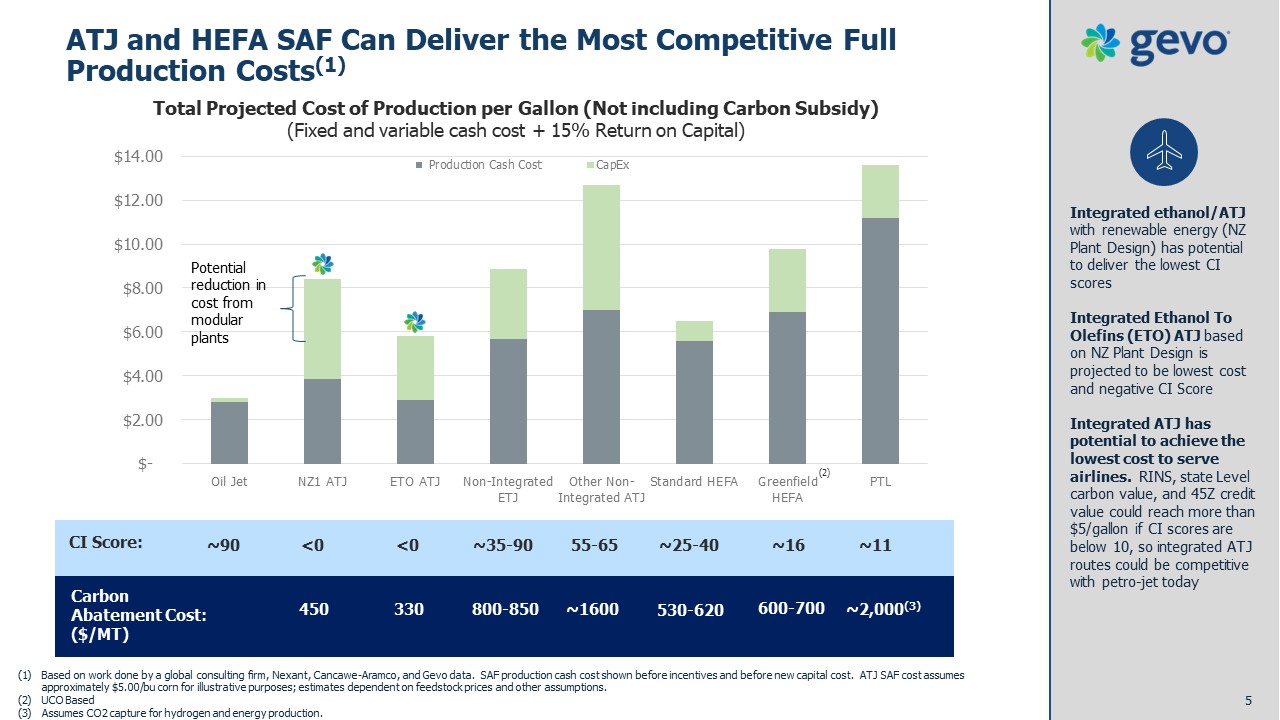

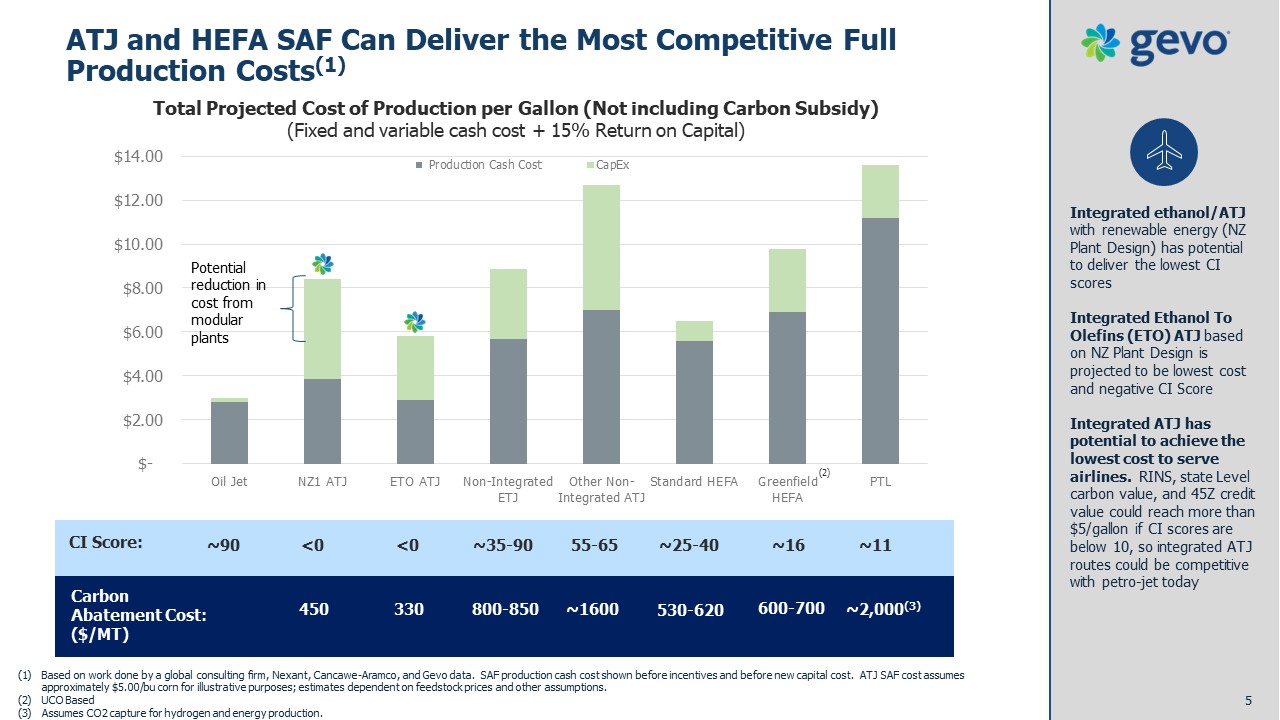

$- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 Oil Jet NZ1 ATJ ETO ATJ Non-Integrated ETJ Other Non- Integrated ATJ Standard HEFA Greenfield HEFA PTL Production Cash Cost CapEx Potential reduction in cost from modular plants 5 ATJ and HEFA SAF Can Deliver the Most Competitive Full Production Costs (1) (1) Based on work done by a global consulting firm, Nexant, Cancawe - Aramco, and Gevo data. SAF production cash cost shown before incentives and before new capital cost. ATJ SAF cost assumes approximately $5.00/bu corn for illustrative purposes; estimates dependent on feedstock prices and other assumptions. (2) UCO Based (3) Assumes CO2 capture for hydrogen and energy production. Integrated ethanol/ATJ with renewable energy (NZ Plant Design) has potential to deliver the lowest CI scores Integrated Ethanol To Olefins (ETO) ATJ based on NZ Plant Design is projected to be lowest cost and negative CI Score Integrated ATJ has potential to achieve the lowest cost to serve airlines. RINS, state Level carbon value, and 45Z credit value could reach more than $5/gallon if CI scores are below 10, so integrated ATJ routes could be competitive with petro - jet today CI Score: <0 ~25 - 40 ~11 <0 ~35 - 90 Total Projected Cost of Production per Gallon (Not including Carbon Subsidy) (Fixed and variable cash cost + 15% Return on Capital) ~16 ~90 Carbon Abatement Cost: ($/MT) 450 ~2,000 (3) 330 800 - 850 55 - 65 ~1600 * 530 - 620 600 - 700 (2)

“Our business system and plant designs are all about creating more potential value by creating more carbon abatement per gallon, while continuing to drive the cost of production downward.” - Dr. Chris Ryan, Gevo President and COO Total SAF Value per gallon Carbon Abatement Value Jet A Value (Parity with Petro - Jet) Total SAF Value per gallon 0 CI 45 CI The more carbon abatement created in producing the fuel, the more valuable the product Net - Zero 1 Other (1) (1) A hypothetical example of a very efficient non - integrated ATJ plant 6

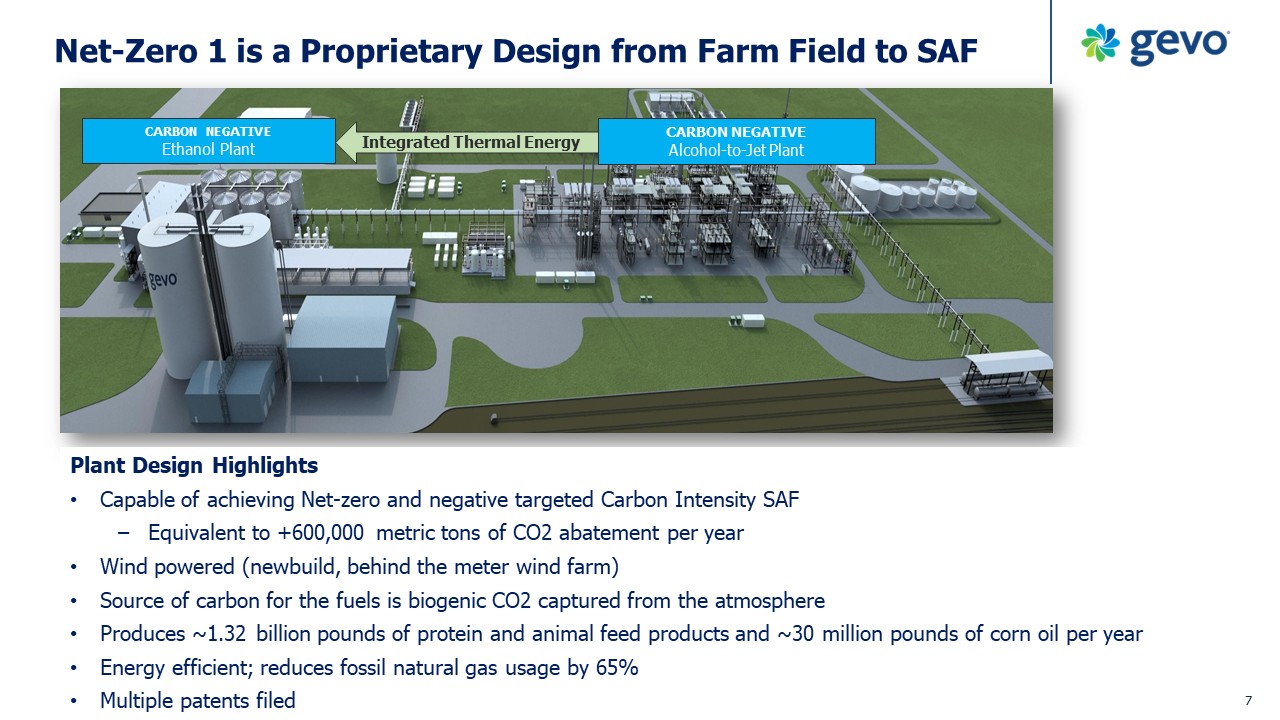

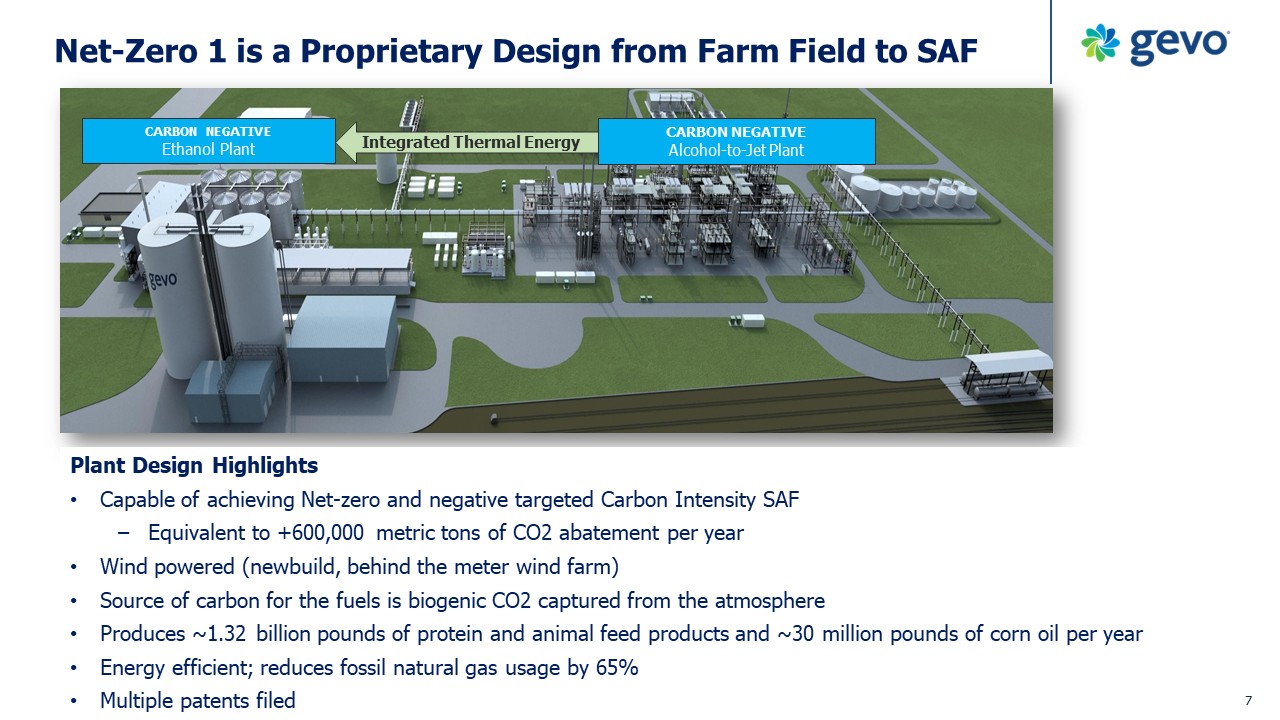

Net - Zero 1 is a Proprietary Design from Farm Field to SAF NZ1 Plant Integrated Thermal Energy CARBON NEGATIVE Ethanol Plant CARBON NEGATIVE Alcohol - to - Jet Plant Plant Design Highlights • Capable of achieving Net - zero and negative targeted Carbon Intensity SAF – Equivalent to +600,000 metric tons of CO2 abatement per year • Wind powered (newbuild, behind the meter wind farm) • Source of carbon for the fuels is biogenic CO2 captured from the atmosphere • Produces ~1.32 billion pounds of protein and animal feed products and ~30 million pounds of corn oil per year • Energy efficient; reduces fossil natural gas usage by 65% • Multiple patents filed 7

(1) Balance of plant includes roads, office buildings/control room, rail, lighting, electrical and stormwater drainage (2) Cost from EPC Contractors as of July 2024 (3) Outside Battery Limit (OSBL) includes all infrastructure and auxiliary processes beyond the direct process streams. (4) Includes site prep and control, design and engineering, environmental and permitting, owner’s contingency reserves etc . (5) Includes capital raise execution costs, interest during construction, reserve accounts amount for financing facilities and co nti ngent equity Understanding the Project Costs 8 Total Balance of Plant (1) Alcohol - to - Jet Ethanol Costs ($millions) 1,675 299 1,016 360 EPC Construction Cost 224 21 113 90 Equipment 1,451 278 903 270 Installation - Total EPC cost of $1.675B 2 as of July 2024 is a key input for the DOE Conditional commitment approval - Future plants will optimize modularization at sites with existing infrastructure, which is expected to reduce ATJ plant installation cost - Other project completion costs are subject to finalization - Development and Construction Reserves 4 - Financing Cost and Debt Reserves 5

Expected Project Partners (1) 9 (1) The Company expects to work with these companies on various parts of the Net - Zero 1 project based on current information and ass umptions as of October 16, 2024

NZ - 1 Project Level Investors Gevo Asset LLC & Gevo Net - Zero Holdco, LLC NZ - 1 DOE Loan 10 Project Level Financing Gevo corporate equity issuance would not be required to fund its pro - rata ownership of NZ - 1 Gevo is the project developer and would roll its development investment into NZ - 1 NZ - 1 is a special purpose entity that will hold the project assets as a subsidiary of Gevo, Inc. and other equity investors Debt Equity Equity - NZ - 1 projected IRR’s are expected to be in high teens - NZ - 1 project economics are expected to be resilient and offer some downside protections to lenders and equity investors - DOE loan significantly de - risks the NZ - 1 project - Gevo has already spent about $210MM of ~$250MM on FEED and project development required to complete FID

11 Benefits to Our Communities Estimated to be the largest capital investment in South Dakota, creating new opportunities for South Dakotan workers and farmers Supporting energy independence with 100% US - sourced feedstocks 1,300 indirect jobs expected during construction, and provide ~100 long - term, full - time positions to support local communities Building a skilled workforce by partnering with South Dakota schools and colleges to promote STEM, offer internships and recruiting diverse talent from local communities Rewards farmers for climate - smart agriculture who are efficiently using the same land for both sustainable fuel and food production, boosting yields and enabling the production of 1.4 billion pounds of feed (2) Projected to return about $170MM annually to local South Dakota economy (1) (1) Based on the 2024 report by Charles River and Associates: Cost Benefit Analysis of Alcohol - to - Jet Sustainable Aviation Fuel (2) As is basis feed

Where we are and What’s Next 12 Where are We? • Late Project Development and Financing Stage for the first world - scale net - zero Alcohol - to - Jet project • DOE Commitment Secured: Secured conditional commitment from the U.S. DOE, providing project support and validation • Robust Project Execution Partners: Partnering with top - tier EPC contractors, incorporating contingencies, liquidated damages, and risk management strategies to ensure project completion • Project has been significantly de - risked for execution Next Steps: • Secure project level equity • Close project level financing • Get project built

Thank You 345 Inverness Drive South Building C | Suite 310 Englewood, Colorado 80112 gevo.com A Carbon Abatement Company