UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 24, 2008

GREEN PLANET BIOENGINEERING CO. LIMITED

(Exact name of registrant as specified in its charter)

| Delaware | | 000-52622 | | 37-1532842 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

18851 NE 29 th Avenue, Suite 700, Aventura, FL 33180 | | 33180 |

| (Address of principal executive offices) | | (Zip Code) |

1(877) 544-2288 or (601) 786 9171

Registrant’s telephone number, including area code

61 Broadway, 32 nd Floor,

New York, New York 10006

(Former name or address, if changed from last report)

o Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

TABLE OF CONTENTS

Item No. | | Description of Item | | Page No. |

| | | | | |

| Item 1.01 | | Entry Into a Material Definitive Agreement | | 4 |

| | | | | |

| Item 2.01 | | Completion of Acquisition or Disposition of Assets | | 4 |

| | | | | |

| Item 3.02 | | Unregistered Sale of Securities | | 42 |

| | | | | |

| Item 5.01 | | Change in Control of Registrant | | 42 |

| | | | | |

| Item 5.02 | | Departure of Directors or Principal Officers; Election of Directors; Appointment of Directors | | 43 |

| | | | | |

| Item 5.06 | | Change in Shell Company Status | | 43 |

| | | | | |

| Item 9.01 | | Financial Statements and Exhibits | | 43 |

EXPLANATORY NOTE

This Amendment on Form 8-K/A (the “Amendment”) amends the Current Report for Green Planet Bioengineering Co. Limited on Form 8-K, as initially filed with the Securities and Exchange Commission on October 29, 2008 (the “Original Report”). The purpose of this Amendment is to include as an Exhibit Amendment No. 1 to the Share Exchange Agreement by and among Elevated Throne Overseas Ltd., Green Planet Bioengineering Co. Ltd and all of the Shareholders of Elevated Throne Overseas Ltd. This Amendment is an amendment and restatement of the Original Report in its entirety in order to provide a complete presentation.

CAUTIONARY NOTE REGARDING PREDICTIVE STATEMENTS

Our disclosure and analysis in this Current Report on Form 8-K contains statements that depend upon or refer to future events or conditions or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and similar expressions. Although we believe that these statements are based upon reasonable assumptions, including projections of operating margins, earnings, cash flow, working capital, capital expenditures and other projections, they are subject to several risks and uncertainties, and therefore, we can give no assurance that such projections will be achieved.

Investors are cautioned that our statements are not guarantees of future performance and the actual results or developments may differ materially from the expectations expressed.

As for the statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections and may be better or worse than projected. Given these uncertainties, you should not place any reliance on these statements. These statements also represent our estimates and assumptions only as of the date that they were made and we expressly disclaim any duty to provide updates to them or the estimates and assumptions associated with them after the date of this filing to reflect events or changes in circumstances or changes in expectations or the occurrence of anticipated events.

We undertake no obligation to publicly update any predictive statement in this Current Report, whether as a result of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we make in our Form 10-K, Form 10-Q and Form 8-K reports to the SEC.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to “Yuan” or “RMB” are to the Chinese Yuan (also known as “renminbi”). According to Oanda.com, as of October 23, 2008 $1.00 = 6.85 RMB.

Item 1.01. Entry into a Material Definitive Agreement

Background

As more fully described below, on October 24, 2008, we consummated a number of related transactions through which we acquired control of Sanming Huajian Bio-Engineering Co., Ltd., a PRC-based company. Sanming Huajian Bio-Engineering Co., Ltd. is engaged in the research, development, production and sale of extracts from tobacco leaves to be used in various pharmaceutical and health products.

The Reverse Merger Transaction

On October 24, 2008, (“Closing Date”), Green Planet Bioengineering Co. Limited executed and consummated a Share Exchange Agreement (the “Closing”) by and among (i) Elevated Throne Overseas Ltd., a British Virgin Islands limited liability company; (ii) the stockholders of 100% of Elevated Throne Overseas Ltd.’s common stock (the “Elevated Throne Overseas Ltd., Shareholders”); and (iii) Green Planet Bioengineering Co. Limited ’s then-controlling stockholder, Cris Neely.

At closing, we acquired control of Elevated Throne Overseas Ltd., which is the parent company of FuJian Green Planet Bioengineering Co., LTD . , a wholly foreign-owned enterprise (“WFOE”) organized under the laws of the People’s Republic of China (“PRC”), by issuing to the Elevated Throne Overseas Ltd.’s Shareholders 14,141,667 shares of our Common Stock in exchange for all of the outstanding capital stock of Elevated Throne Overseas Ltd. (the “Reverse Merger Transaction”). Immediately after the Closing, we had a total of 15,141,667 shares of common stock outstanding, with the Elevated Throne Overseas Ltd.’s Shareholders (and their assignees) owning approximately 93.40% of our outstanding common stock, and the balance held by those who held our common stock prior to the Closing.

Our board of directors (the “ Board”) as well as the directors and the shareholders of Elevated Throne Overseas Ltd. each approved the Reverse Merger Transaction, including the transactions contemplated there under. Following the Closing Date, Elevated Throne Overseas Ltd. became our wholly-owned subsidiary.

Elevated Throne Overseas Ltd. owns 100% of FuJian Green Planet Bioengineering Co., LTD. , which is a WFOE under the laws of the PRC. WFOE has entered into a series of contractual arrangements with Sanming Huajian Bio-Engineering Co., Ltd., a limited liability company headquartered in, and organized under the laws of, the PRC. The contractual arrangements are discussed below in Item 2.01 under the section titled “Description of Business.”

As a result of the Reverse Merger Transaction, we acquired 100% of the capital stock of Elevated Throne Overseas Ltd. and consequently, control of the business and operations of Elevated Throne Overseas Ltd., Fujian Green Planet Bioengineering Co., Ltd., and Sanming Huajian Bio-Engineering Co., Ltd. Prior to the Reverse Merger Transaction, we were a public reporting blind pool company in the development stage. From and after the Closing Date of the Share Exchange Agreement, our primary operations consist of the business and operations of Sanming Huajian Bio-Engineering Co., Ltd., which are conducted in China.

Item 2.01. Completion of Acquisition or Disposition of Assets

Our Corporate Structure

We were incorporated in Delaware under the name Mondo Acquisition II, Inc. on October 30, 2006. Our initial business plan was to serve as a vehicle to pursue a business combination through the acquisition of, or merger with, an operating business. We are, based on proposed business activities, a “blank check” company. On October 2, 2008, we changed our name to Green Planet Bioengineering Co. Limited.

Our Board approved the Share Exchange Agreement on October 23, 2008, and we entered into the Share Exchange Agreement with Elevated Throne Overseas Ltd. and its Shareholders on October 24, 2008.

Elevated Throne Overseas Ltd. was incorporated under the laws of the British Virgin Islands on May 8, 2008, and Elevated Throne Overseas Ltd. formed FuJian Green Planet Bioengineering Co., Ltd. as a wholly foreign-owned enterprise under the laws of the PRC on July 25, 2008.

Sanming Huajian Bio-Engineering Co., Ltd. was organized under the laws of the PRC in April of 2004 under the name Sanming Zhonjian Biological Technology Industry Co., Ltd.

Under the laws of the PRC, certain restrictions are placed on round trip investments, which are defined under PRC law as an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents. As a result, FuJian Green Planet Bioengineering Co., LTD. entered into a series of agreements with Sanming Huajian Bio-Engineering Co., Ltd., which we believe give us effective control over the business of Sanming Huajian Bio-Engineering Co., Ltd. These agreements are described below in the section entitled “Contractual Agreements with Sanming Huajian Bio-Engineering Co., Ltd.”

Our executive offices are located at No.126 Mingdu Building, Gongye Road, Sanming City, Fujian, China, and our telephone number is +86 598 8523617. Our website is www.greenplanetbio.com.cn . Information on our website or any other website is not a part of this report.

Contractual Agreements with Sanming Huajian Bio-Engineering Co., Ltd.

Prior to the reverse merger, our business was conducted through Sanming Huajian Bio-Engineering Co., Ltd., its largest shareholders being Mr. Min Zhao and Mr. MinYan Zhen with a 35.07% and 35.97% interest respectively. Sanming Huajian Bio-Engineering Co., Ltd. has the licenses and approvals necessary to operate its business in the PRC.

PRC law places certain restrictions on roundtrip investments through the acquisition of a PRC entity by PRC residents. To comply with these restrictions, in conjunction with the reverse acquisition, we (via our wholly-owned subsidiary, FuJian Green Planet Bioengineering Co., Ltd.) entered into and consummated certain contractual arrangements with Sanming Huajian Bio-Engineering Co., Ltd. and their respective stockholders pursuant to which we provide these companies with technology consulting and management services. Through these contractual arrangements, we have the ability to substantially influence these companies’ daily operations and financial affairs, appoint their senior executives and approve all matters requiring stockholder approval. As a result of these contractual arrangements, which enable us to control Sanming Huajian Bio-Engineering Co., Ltd. and operate our business in the PRC through Sanming Huajian Bio-Engineering Co., Ltd., we are considered the primary beneficiary of Sanming Huajian Bio-Engineering Co., Ltd. Accordingly, we consolidate the results, assets and liabilities of the Sanming Huajian Bio-Engineering Co., Ltd. in our financial statements.

On July 25, 2008, we entered into the following contractual arrangements, each of which are enforceable and valid in accordance with the laws of the PRC:

Entrusted Management Agreement . Pursuant to this entrusted management agreement among Fujian Green Planet Bioengineering Co., Ltd., Sanming Huajian, and the Sanming Huajian Shareholders (the "Entrusted Management Agreement"), Sanming Huajian and its shareholders agreed to entrust the business operations of Sanming Huajian and its management to Fujian Green Planet Bioengineering Co., Ltd. until Fujian Green Planet Bioengineering Co., Ltd. acquires all of the assets or equity of Sanming Huajian (as more fully described in the Exclusive Option Agreement below). Prior to the occurrence of such event, Sanming Huajian will only own those certain assets that are not sold to Fujian Green Planet Bioengineering Co., Ltd. We anticipate that Sanming Huajian will continue to be the contracting party under its customer contracts, banks loans and certain other assets until such time as those may be transferred to Fujian Green Planet Bioengineering Co., Ltd. Under the Entrusted Management Agreement, Fujian Green Planet Bioengineering Co., Ltd. will manage Sanming Huajian‘s operations and assets, and control all of Sanming Huajian’s cash flow through an entrusted bank account. In turn, it will be entitled to any of Sanming Huajian’s net profits as a management fee, and will be obligated to pay all Sanming Huajian payables and loan payments. The Entrusted Management Agreement will remain in effect until the acquisition of all assets or equity of Sanming Huajian by Fujian Green Planet Bioengineering Co., Ltd. is completed.

Shareholders’ Voting Proxy Agreement. Under the shareholders' voting proxy agreement among Fujian Green Planet Bioengineering Co., Ltd. and the Sanming Huajian Shareholders, the Sanming Huajian Shareholders irrevocably and exclusively appointed the members of the board of directors of Fujian Green Planet Bioengineering Co., Ltd. as their proxy to vote on all matters that require Sanming Huajian shareholder approval. The members of the board of directors of Fujian Green Planet Bioengineering Co., Ltd. are identical to those of the Company.

Share Pledge Agreement. Under this share pledge agreement among Fujian Green Planet Bioengineering Co., Ltd. and the Sanming Huajian Shareholders (the "Share Pledge Agreement"), the Sanming Huajian Shareholders pledged all of their equity interests in Sanming Huajian, including the proceeds thereof, to guarantee all of Fujian Green Planet Bioengineering Co., Ltd.’s rights and benefits under the Restructuring Agreements. Prior to termination of this Share Pledge Agreement, the pledged equity interests cannot be transferred without Fujian Green Planet Bioengineering Co., Ltd.’s prior consent.

Completion of the PRC Restructuring

The PRC restructuring transaction closed on the Closing Date. However, Fujian Green Planet Bioengineering Co., Ltd. is required under the agreements to complete additional post-closing steps required in order to maintain its good standing under PRC law. These steps include Fujian Green Planet Bioengineering Co., Ltd. making required regulatory filings and giving proof to regulatory authorities that it has received the required portion of its registered capital as of the deadline required under PRC law. Specifically, Fujian Green Planet Bioengineering Co., Ltd. must receive 15% of its total registered capital of $2.0MM by 3 months of effectiveness of business license, and the remaining $1.7MM by two years from effectiveness of business license, in order to maintain the validity of its business license and its certificate of approval to exist as a wholly foreign-owned entity in the PRC issued by the Fujian Provincial Municipal Government and the Sanming Administration for Industry and Commerce, respectively. This license and approval would become invalid and be immediately cancelled if Fujian Green Planet Bioengineering Co., Ltd. were to fail to make timely payment of the first installment of its registered capital, in which case we could cease to have any claim to control Sanming Huajian Bio-Engineering Co., Ltd. under PRC law. We anticipate that all required post-closing steps, including the payment and verification of the first installment of Fujian Green Planet Bioengineering Co., Ltd.’s registered capital, will be completed within approximately 30 days after the date of this report .

Upon consummation of the PRC Restructuring Agreements above, the contributions of Sanming Huajian Bio-Engineering Co., Ltd.’s registered capital, and therefore the ownership of Sanming Huajian Bio-Engineering Co., Ltd., took their current form, which is represented in the table below:

Name of Shareholder | | Amount of Contribution (RMB) ‘000 | | Percent of Capital Contribution | |

| Min Zhao | | | 1332.82 | | | 35.07 | % |

| Min Yan Zhen | | | 1366.86 | | | 35.97 | % |

| Jiangle Jianlong Mineral industry Co. | | | 1100.32 | | | 28.96 | % |

| | | | | | | | |

| Total | | | RMB 3800.00 | | | 100 | % |

Subsidiaries

As a result of the Reverse Merger Transaction, Elevated Throne Overseas Ltd. and FuJian Green Planet Bioengineering Co., Ltd. are our wholly-owned subsidiaries. Sanming Huajian Bio-Engineering Co., Ltd., the entity through which we operate our business, has no subsidiaries.

BUSINESS

Our History

Mondo Acquisition II, Inc. was incorporated in the State of Delaware on October 30, 2006. Since inception, we have been engaged in organizational efforts to obtain initial financing. We were formed as a vehicle to pursue a business combination through the acquisition of, or merger with, an operating business. We filed a registration statement on Form 10-SB with the U.S. Securities and Exchange Commission (the “SEC”) on May 2, 2007, and since its effectiveness, we have focused our efforts to identify a possible business combination. On October 2, 2008, we changed our name to Green Planet Bioengineering Co. Limited.

We are, based on proposed business activities, a "blank check" company. The U.S. Securities and Exchange Commission (the “SEC”) defines those companies as "any development stage company that is issuing a penny stock, within the meaning of Section 3 (a)(51) of the Exchange Act of 1934, as amended, (the “Exchange Act”) and that has no specific business plan or purpose, or has indicated that its business plan is to merge with an unidentified company or companies." Under SEC Rule 12b-2 under the Securities Act of 1933, as amended (the “Securities Act”), we also qualify as a “shell company,” because we have no or nominal assets (other than cash) and no or nominal operations. Many states have enacted statutes, rules and regulations limiting the sale of securities of "blank check" companies in their respective jurisdictions.

Sanming Huajian Bio-Engineering Co., Ltd’s Organization History

Sanming Huajian Bio-Engineering Co., Ltd was originally incorporated in April 2004 in the People’s Republic of China as Sanming Zhongjian Biological Technology Industry Co., Ltd. Its original registered capital was RMB 6 million and its original shareholders were Ou Shanyan (80%), Zhao Yime (10%) and Zheng Yingyue (10%). The company’s original business scope included planning to produce and sell environmentally conscious food, health products, chemical products, and biological products.

On August 17, 2004, the company changed its name from Sanming Zhongjian Biological Technology Industry Co., Ltd. to Sanming Huajian Bio-Engineering Co., Ltd. and its shareholders changed from Ou Shanyan, Zhao Yime, and Zheng Yingyue to Min Zhao and Zheng Jianrong with Min Zhao holding a 60% equity interest and Zheng Jianrong holding a 40% equity interest.

On May 22, 2006, the company changed its operation plan to focus on natural plant extractions, the production of bio-fertilizer and the sale of chemical and agricultural products and by-products as well as the development of biological engineering technology.

On July 8, 2006, the company’s registered capital increased to RMB 33,500,000 and its shareholders changed from Min Zhao and Zheng Jianrong to Min Zhao, with a 35.07% equity interest, Minyan Zhen with a 35.97% interest and Jiangle Jianlong Mineral Industry Co., Ltd., with a 28.96% equity interest.

On April 15, 2008, the company’s registered capital increased to RMB 38,000,000.

Sanming Huajian Bio-Engineering Co., Ltd’s Business

Sanming Huajian Bio-Engineering Co., Ltd is a research and development company with a focus on improving human health through the development, manufacture and commercialization of bio-ecological products and over-the-counter products utilizing the extractions of tobacco leaves.

Products

Since 2007, Sanming Huajian Bio Engineering Co., Ltd has developed a variety of natural organic products using tobacco leaves. These products are:

Solanesol

Solanesol is extracted from abandoned tobacco leaves and is a pharmaceutical intermediate. Not only can it produce raw Q10 and Vitamin K2 through the synthesis method, but it can also be used as a synthesized raw material in anti-allergic drugs, anti-ulcer drugs, hypolipidemic drugs and anti-cancer drugs.

Nicotine Sulphate

Nicotine sulfate is extracted from abandoned tobacco leaves and it is an important raw material for pesticide and can be used in the processing of insecticides. The nicotine content in pesticides is 40%.

Organic Fertilizers

“ Ji Mai” trademark fertilizer is made by using abandoned tobacco leaves as the main raw material, adding the appropriate accessories and fermented with microbial, which is applicable to all kinds of fruit trees, and is also used as a soil conditioner.

Botanical Pesticides

Pesticides consist of 40% Nicotine Sulphate and other insecticide raw materials and is regarded as organic or botanical because Nicotine Sulphate is derived from abandoned tobacco leaves.

Organic Green Barley Supplements (Paiqianshu)

“ Paiqianshu” mung bean vitamin oral liquid has the ability to eliminate lead from the human body without any side effects. It contains many nutrient elements such as Calcium gluconate, zinc gluconate, and vitamin C. This nutrient is extracted from green barley or ‘mung bean’.

Raw CoQ10

Coenzyme Q10 is also commonly referred to as ubiquinone, ubidecarenone, and coenzyme Q. It is a vitamin-like substance that is naturally present in most human cells except red blood cells and eye lens cells and is responsible for the production of the body’s own energy. In each human cell, food energy is converted into energy in the mitochondria with the aid of Coenzyme Q10.

Because disfunctional energy metabolism has been cited as a contributing factor for a number of medical conditions, coenzyme Q10 has been used in the treatment of cardiac, neurologic, oncologic, and immunologic disorders. Although the Dietary Supplement Health and Education Act of 1994 does not allow claims for treatment of specific diseases in the United States, coenzyme Q10 has been cleared for treatment indications in other countries, such as for congestive heart failure (CHF) in Japan since 1974. 3

1 Ernster L, Dallner G: Biochemical, physiological and medical aspects of ubiquinone function. Biochim Biophys Acta 1271: 195-204, 1995

2 Dutton PL, Ohnishi T, Darrouzet E, Leonard, MA, Sharp RE, Cibney BR, Daldal F and Moser CC. 4 Coenzyme Q oxidation reduction reactions in mitochondrial electron transport (pp 65-82) in Coenzyme Q: Molecular mechanisms in health and disease edited by Kagan VE and Quinn PJ, CRC Press (2000), Boca Raton

3 Tran MT, Mitchell TM, Kennedy DT, Giles JT. Role of coenzyme Q10 in chronic heart failure, angina, and hypertension. Pharmacotherapy 2001;21:797-806.

Natural Q10 Supplements

Because of its ability to transfer electrons and therefore act as an antioxidant, Coenzyme Q is also used as a dietary supplement. Supplements of Coenzyme Q10 is a treatment for some of the rare and serious mitochondrial disorders and other metabolic disorders where patients are not capable of producing enough Coenzyme 10Q because of their disorder. Supplements of Coenzyme Q10 has been found to have a beneficial effect on migraine headache symptoms. 4 Recent studies have also found Coenzyme 10Q to have beneficial effects on brain health and neurodegenerative diseases in animal models 5

Q10 supplements is one of many downstream products that is produced from raw Q10 (which initially derives from extracts of abandoned tobacco leaves- Solanesol)

Manufacturing Process

Extraction from Abandoned Tobacco Leaves .

Abandoned tobacco leaves are leaves that are left behind as waste by tobacco manufacturers in their production of tobacco. We have obtained an exclusive license to purchase the waste and use it to produce bio chemical materials, fertilizers and health products. The license is supported by the provincial government that certain suppliers can only sell their tobacco waste to Sanming Huajian Bio-Engineering Co.

We produce Solanesol by utilizing the Solid Phase Synthesis method from Fudan University, which significantly lowers the production cost of highly purified Solanesol. Using this process, the cost of producing Solanesol is RMB 300,000-400,000 per ton.

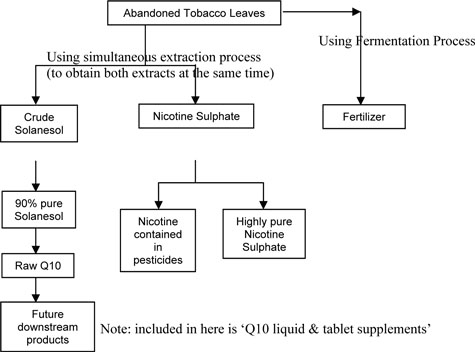

The following chart illustrates the process of extraction & its relevant products:

In addition to the above, company produces a nutrient product called “Paiqianshu” (green barley nutrient), it is an antioxidant that will help clean the major organs and digestive system of the human body. The manufacturing process for this is similar to the above but only extraction is using Green Barley or Mung bean and not abandoned tobacco leaves.

4 Rozen T, Oshinsky M, Gebeline C, Bradley K, Young W, Shechter A, Silberstein S (2002). " Open label trial of coenzyme Q10 as a migraine preventive ". Cephalalgia 22 (2): 137-41

Matthews, R. T.; et al. (July 1998). "Coenzyme Q10 administration increases brain mitochondrial concentrations and exerts neuroprotective effects". PNAS 95 : 8892-8897.

Production Licenses

In accordance with the Preparation Registration List of Foreign Trade we have independent import and export rights to conduct business under registration number 00395610 and enterprise code 3500759394367.

Our production of Solanesol meets the quality standards of the Sanming Technical Supervision Bureau (Record Number Min QB/0400-1044-2008) and our production of bio-fertilizer meets standard NY 525-2002.

We have received a certificate of approval for domestic health care products from the State and Drug Administration, serial number 2007B0441, for the product Huajian Mung Bean Vitamin Liquid (approval code- Guo Shi Jian G20070216, valid until 4/25/12) .

Our management team received a registration certificate (Certificate # 603917) from and has been assessed by GIC and certified to comply with ISO9001:2000 for the production, sales and service of nicotine sulfate, Solanesol and bio-fertilizer. The Certificate was issued on April 3, 2008 and is valid until April 2, 2011.

Suppliers

| | | | | 2006 | | 2007 | |

| Name of suppliers | | Address | | RMB amount | | % | | RMB amount | | % | |

| Sanming Jinye Fukao Co., Ltd. | | | No.7 Shazhou Road,Sanyuan District,Sanming City | | | 1356444.21 | | | 15 | % | | 1807424.39 | | | 10 | % |

| Xiamen Jixiang Shishi Industry Co., Ltd. | | | No.1 Xinyan Road,Xinyan Industrial Zone,Haicang District,Xiamen | | | 92134.00 | | | 1 | % | | 275850.39 | | | 2 | % |

| Fujian Longyan Jinye Fukao Co., Ltd. | | | Kanshi Zhen,Yongding County,Fujian | | | 498981.60 | | | 5 | % | | 531933.96 | | | 3 | % |

| Fujian Wuyi Tobacco Leaf Co., Ltd. | | | No.400 Xichun East Road,Shaowu City,Fujian | | | 642105.60 | | | 7 | % | | 766268.46 | | | 5 | % |

| Fujian Tobacco Co, Ltd .Nanping Branch | | | No.389 Binjiang Central Road,Nanping City | | | 773307.46 | | | 8 | % | | 832603.76 | | | 5 | % |

| Fujian Tobacco Co, Ltd .Sming Branch | | | No.100 Chonggui Xincun,Meilie District,Sanming City | | | 438643.76 | | | 5 | % | | 429950.26 | | | 3 | % |

| Pucheng Zhengda Biochemistry Co., Ltd | | | No.305 Zhengda Road,Pucheng County,Fujian | | | 508559.25 | | | 5 | % | | 965469.23 | | | 6 | % |

| Wuhan Yanpu Chemical Raw Material Co. Ltd. | | | Cihui Farm,Dongxihu District,Wuhan,HubeiProvince | | | 3319897.25 | | | 36 | % | | 7641159.63 | | | 45 | % |

| Sanming Sanyuan Chemical Reagent Co., Ltd. | | | No.22 Beishan Road,Sanming City | | | 1162592.35 | | | 13 | % | | 2808888.22 | | | 16 | % |

| Sanming Baishida Starch Co., Ltd. | | | No.15 Ziling Road,Xuefeng Zhen,Mingxi County,Fujian | | | 493443.60 | | | 5 | % | | 922560.60 | | | 5 | % |

| Total | | 9286109.08 | | | | | | 16982108.90 | | | | |

Honors and Awards

The following table provides information regarding the honors and awards we have received.

| Award/Year | | Bestower | | Description |

| 2005-6-24 - Ming Ji Wai [2005] No.14 – awarded 300K RMB | | Company | | Project of industrializing Green Barley |

| 2006–6-21 – Ming Jing Mao Tou Zi Ji Shu [2006] No.9 | | Company | | Industrialized demonstration project of integrated use of abandoned tobacco leaves with high efficiency |

| 2006-7-12 – Ming Ke Cheng [2006] No. 27 – awarded 450K RMB | | Company | | Achieved highly purified Solanesol and nicotine extraction in high efficiency and clean process |

| 2006-9-5 – Ming Zheng Wen [2006] No. 95 | | Company | | Cooperation in the three rural economy – named the key enterprise of agricultural industrialization of the year 06-07 |

| 2006-9-25 – Ming Fa Gai Wai Jing [2006] No 254 – awarded 300K RMB | | Company | | 2 nd supporting award for highly purified Solanesol and nicotine extraction from tobacco wastes by clean process |

| 2006-11-20 – Ming Ke Cheng [2006] No. 29 – listed in the SPARKS program 2006 | | company | | Industrialized demonstration project of integrated use of abandoned tobacco leaves with high efficiency |

| 2006-10-26 – Ming Cai Jian Zhi [2006] No. 31-awarded 250K RMB | | company | | Highly purified Solanesol and by–products from tobacco wastes by clean process – this was supported by the drainage fee |

| 2007-3-12 – honored certificate from sanming administration of industry and commerce bureau | | company | | Title granted ‘the enterprise exempted from inspection in 2006’ |

| 2007-7-10 –Yuan Cai [2007] No. 14 – awarded 250K RMB | | company | | 3 rd supporting award for highly purified Solanesol and nicotine extraction from tobacco wastes by clean process |

| 2007-12-17 – Zu Zi[2007] No.2 | | company | | In the Fujian China Projects and Production Fair (the 618 Fair) – was listed the excellent transformed projects of the 618 fair in 2007 |

In 2006, we were awarded the SPARKS program certification, a major health and environment awareness project of China.

We obtained the "national-level Spark Program" title awarded by Chinese Ministry of Science and Technology in 2006. "Spark plan" refers to an industry in which we have played a leading role in certain economic areas, and relevant to science and technology’s large-scale access to rural areas by relying on scientific and technological progress, and close integration with the rural economy, and that we have developed leading products with regional resource advantages (i.e. getting rid of tobacco wastes, contribution to its environment) to form scale and promoted the development of enterprises and related industries to realize intensified, large-scale, industrialized operations ,which will account for considerable proportion in regional economy.

Environment Protection

We have carried out certain initiatives in order to comply with environmental regulations.

In January of 2008, Sanming City Environmental Monitoring Station began to conduct the monitoring of environmental protection acceptance on the completed production lines of our products. In April of 2008, the Station consummated all monitoring of boiler exhaust, factory sector noise, waste water and environmental air sensitive points and made a conclusion that we conducted clean production as we have taken and implemented various environmental indicators, and, therefore, Min Yan Jian Zi (2008) No.015 "The Monitoring Report of Environmental Protection Acceptance on completion of Construction projects" was successfully issued to the company.

Sales of Products

We mainly base our business on the wholesale sales of bio-ecological products. Our distribution process is established through contracted distributors and sales agreements. The company is continuously evaluating its sales and distribution strategy and assesses the performance of its business partners and execution of its business plan.

Delivery Methods

The method of delivery for our product throughout the PRC is ground delivery. The company does not have its own fleet of trucks. The company outsources the delivery of its products to various trucking companies.

Marketing and Sales

For raw chemical material products such as Solanesol, CoQ10 or Nicotine Sulphate, we utilize the following strategies:

| · | First, we have established a strong referral programs with major universities where most distributors look for new products and new technologies today. |

| · | Second, we have used the following channels to get the name and brands out to potential distributors: |

| | - | Internal web optimization through Search engines and Sponsored links |

| · | Third, we network through the local government in some provinces to introduce and refer us to established distributors. |

Raw materials

Our primary raw material is abandoned tobacco leaves. We purchase abandoned tobacco leaves from the below major suppliers during 2007:

Sanming Jinye Fukao Co., Ltd.

Xiamen Jixiang Shishi Industry Co., Ltd.

Longyan Jinye Fukao Co., Ltd.

Fujian Wuyi Tobacco Leaf Co., Ltd.

Fujian Tobacco Co, Ltd. Nanping Branch

Fujian Tobacco Co, Ltd. Sming Branch

The following is a list of raw materials used by Sanming Huajian Bioengineering Co., Ltd. in its manufacturing process:

| | | Name | | Quantity (Tons) |

| Raw materials | | abandoned tobacco leaves | | 782.4552 |

| | | #6 organic solvents | | 5.5638 |

| | | Slice alkali | | 0.0314 |

| | | Methanol | | 1.7057 |

| | | Acetone | | 0.2262 |

| | | Petroleum aether | | 13.0245 |

| | | Ethyl acetate | | 1.7127 |

| | | Silicon dioxide | | 5.0241 |

| | | Sweet potato residue | | 78.65 |

| | | Medicines residue | | 82.93 |

| | | Calcium, Magnesium and Phosphor | | 35.693 |

Market Analysis

Our product, Q10 has two distinct market segments: Raw Q10 and Retail Q10 products. The following chart outlines the global estimated demand of raw Q10 by 2010 in tonnage:

Country | | Demand (in tons) |

| US | | 200-220 |

| JAPAN | | 160-180 |

| ASIA (EXCLUDING JAPAN) | | 100-150 |

| EUROPE | | 80-100 |

| OTHER COUNTRIES | | 60 |

| TOTAL | | Approx. 750 |

Raw Q10 is supplied to companies or institutions that 1) use it for research and development purposes or 2) use it to produce its downstream retail products. Today, we produce and market raw Q10 and we are in the process of patenting our over-the-counter retail brand of Q10 supplement in both liquid and tablet form which we’ve fully developed in 2007. Our nutrient and supplement brand called “Green Planet” is now going through the trademark application process. Our current raw Q10 production capacity is 20 tons per year and with our growth plan realized we will be able to produce and supply a big part of China’s demand.

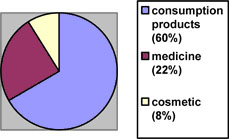

Retail Q10 products can be further classified into 3 sub-categories: Food, Nutrients, Supplements, and Cosmetics. The market share of each is displayed by the following pie chart:

Note: consumption products include nutrients, vitamins and supplements

Competition

We face competition from domestic and international producers, some of which are direct manufacturers that specialize only in specific products and do not offer a full range of bio-ecological product or retail consumer products.

Domestic Competitors

We face competition within the domestic market. In this area our primary competitors are the following:

· Xi'An Haotian Bio-Engineering Technology Co., Ltd

· Shaanxi Sciphar Biotechnology Co. Ltd.

· Tongfa Group

· Shanghai Seebio Biotech Inc.

The above stated wholesalers in all cases sell only the raw chemical materials. In addition, these wholesalers do not produce 100% of their products but will act as a middleman to buy & sell.

Our “one-stop shop” concept in promoting under one roof offers a variety of raw chemical material products as well as over-the-counter health products. This concept drastically differs from conventional manufacturers as wholesalers or distributors are given a broad spectrum of products to increase their desire to build a solid long term relationship with us, and, furthermore, we can closely listen to the needs and expectations of their overall customers.

International Competitors

We also compete against large surface manufacturers across the world, however, they only produce and promote raw chemical materials and some intermediate products. Some of the largest international competitors are:

· Kaneka Corporation (Japan)

· Hanseo Chemical Co Ltd (Korea)

· Federal Laboratories Corporation (Buffalo, NY)

We intend to expand to international markets. Currently, we have all the necessary licenses to export to international markets; however before we expand sales abroad we want to dominate the domestic market as a priority since the demand is rising and the supply is short.

Major Customers

Our current customers are primarily in China. We sell substantially all of our products to customers in domestic China. Our major customers for fiscal years 2006 and 2007 are as follows:

| Name of Customers | | Address |

| Fuzhou Yishun Imp.& Exp. Co. Ltd. | | No.B3,7F Office Building,Hongli Massion,Hudong Road,Gulou District,Fuzhou City |

| Sanming Wangnong Agricultural Materials Co. Ltd. | | No.5-6 of Building 143,Xinshi South Road,Sanyuan District,Sanming City |

| Shanghai Zhaoxiang Biologic Technology Co.Ltd. | | No.7018 Beisonggong Road,Songjiang District,Shanghai |

| Guangdong Qingyuan Shengzhitang Modern Chinese Medicine Co.Ltd. | | Biomedical City of Qingyuan High-tech Industrial Development Zone,Qingyuan City,Guangdong |

| Fujian Wuyishang City Lukang Bioengineering Co. Ltd. | | Xiandian Industrial Park Area,Wuyishang City,Fujian |

| Jiangxi Lufeng Organic Agricultural Technology Development Co.Ltd. | | Jiulong Reclamation Farm,Wanzai County,Jiangxi Province |

| Total |

| | | 2006 | | 2007 | |

| Name of Customers | | RMB amount | | % | | RMB amount | | % | |

| Fuzhou Yishun Imp.& Exp. Co. Ltd. | | | 7649959.8 | | | 23 | % | | 12483069 | | | 20 | % |

| Sanming Wangnong Agricultural Materials Co. Ltd. | | | 3889980.3 | | | 12 | % | | 9551305.1 | | | 16 | % |

| Shanghai Zhaoxiang Biologic Technology Co.Ltd. | | | 9578568.3 | | | 29 | % | | 11589110 | | | 19 | % |

| Guangdong Qingyuan Shengzhitang Modern Chinese Medicine Co.Ltd. | | | 6446753.4 | | | 20 | % | | 10639833 | | | 17 | % |

| Fujian Wuyishang City Lukang Bioengineering Co. Ltd. | | | 1097503.9 | | | 3 | % | | 6407661.3 | | | 11 | % |

| Jiangxi Lufeng Organic Agricultural Technology Development Co.Ltd. | | | 4337874.4 | | | 13 | % | | 10535859 | | | 17 | % |

| Total | | | 33000640 | | | | | | 61206836 | | | | |

None of the sales to any one customer comprises more than 20% of our sales revenue. Accordingly, the loss of any one customer would not have a material adverse effect on us. Furthermore, the company is currently broadening its product portfolio and as such working on minimizing its customer concentration risk.

Intellectual Property/Patents

The following table is a list of our current Patents issued by the People’s Republic of China:

| Patent Name | | Application No. | | Designer | | Application date | | Valid until | | Owner of patent |

Synchronization and high efficiency process of Solanesol and Nicotine Sulfate | | 200610069846.6 | | Min Zhao , Chen Yanmei, Liu Caiqing | | 2006.8.11 | | 2026.8.11 | | Sanming Huajian Bioengineering Co., Ltd |

A Method of Eliminating Plum bum Products with Basic liquid of zymogene mung bean | | 200710009735.0 | | Lin Xuanxian, Chen Jianmin, Chen Yanmei | | 2007.11.01 | | 2027.11.01 | | Sanming Huajian Bioengineering Co., Ltd |

Note- The patent of “Solensol-clean extraction method” is exclusively owned by Fudan University. However, we have obtained the right to use this technology patent until July 27, 2010, according to the statements of Article 3, Section 1 in “Technology Development Contract ”which was entered into on July 28,2005 between Fudan University and Sanming Huajian Bioengineering Co., Ltd and which is attached hereto as an exhibit. Since August 11, 2006, we have been designing the “ synchronization and high efficiency process of Solanesol and Nicotine Sulphate” and applied for the patent ownership and have used it in the production process.

Trademarks

The following table is a list of our current trademarks issued by the People’s Republic of China:

Trademark | | Certificate No. | | Category | | Registrant | | Valid Term |

| Paiqianshu | | 4322405 | | No.30 Refined food from plants, etc. | | Sanming Huajian bio | | from2007-4-20 to 2017-4-20 |

| Jimai QQ | | 4322404 (Application No. here. It will be the Certificate No. later.) | | No.30 Refined food from plants, etc. | | Sanming Huajian bio | | 10 years since the date of certificate issuing |

| Jimai | | 5425649 (Application No. here. It will be the Certificate No. later.) | | No.1 Fertilizer, chemical products, etc. | | Sanming Huajian bio | | 10 years since the date of certificate issuing |

| Jinliang | | 4538612 (Application No. here. It will be the Certificate No. later.) | | No.3 Cosmetic, household and personal care chemicals, etc. | | Sanming Huajian bio | | 10 years since the date of certificate issuing |

| PURESOLAN | | 6869795 (Application No. here. It will be the Certificate No. later.) | | No.5 Medical products, etc | | Fujian Green Planet | | 10 years since the date of certificate issuing |

| GREENPLANET | | 6871472 (Application No. here. It will be the Certificate No. later.) | | No.5 Medical products, etc | | Fujian Green Planet | | 10 years since the date of certificate issuing |

Sanming Huajian Bioengineering Co., Ltd. pays a license fee of RMB 500 per year for each trademark for the period of ownership from October 22, 2004 to October 22, 2014.

Insurance

Sanming Huajian Bio-Engineering Co., Ltd currently has property insurance with Ping which covers buildings and structures, machines, equipment, raw materials and manufactured products.

Sanming Huajian Bio-Engineering Co., Ltd does not have key man insurance, business liability or disruption insurance coverage for its operations in the People’s Republic of China.

Research and Development Activities

We have a research and development (R&D) division comprised of 30 people and we have invested approximately 2.5% of our sales in research and development activities during 2007. We anticipate to spend approximately 6% to 7% in the coming years in R&D of our sales, which we believe ensures that we stay ahead of the curve by constantly innovating and improving our technology.

We anticipate expanding our product line and our research and development activities are focused on improving our technology and machinery to deliver those goals. We anticipate spending approximately, $950,000 on research and development for fiscal year 2008. The company spent approximately $200,000 and approximately $112,659 for the years ended December 31, 2007 and 2006, respectively.

Employees

Sanming Huajian Bio-Engineering Co., Ltd currently has approximately 153 full-time employees broken down into:

Management (16)

Research and Development (30)

Supporting staff (7)

Manufacturing staff (100)

Employee benefits include:

The company provides benefits according to the laws of PRC when applicable. Benefits packages are not recognized in the PRC as in the United States.

RISK FACTORS

You should consider carefully each of the following business and investment risk factors and all of the other information in this report. If any of the following risks and uncertainties develops into actual events, the business, financial condition or results of our operations could be materially and adversely affected. If that happens, the trading price of our shares of common stock could decline significantly. The risk factors below contain forward-looking statements regarding our business. Actual results could differ materially from those set forth in the forward-looking statements. See "Special Note Regarding Forward-Looking Information."

Risks related to doing business in the People’s Republic of China

Our business operations take place primarily in the People’s Republic of China. Because Chinese laws, regulations and policies are continually changing, our Chinese operations will face several risks summarized below.

Our ability to operate in the People’s Republic of China may be harmed by changes in its laws and regulations

Our offices and manufacturing plants are located in the People’s Republic of China and the production, sale and distribution of our products are subject to Chinese rules and regulations . Currently, China does not have rules and regulations on raw material p roducts. However, health foods and the Q10 raw material sales must obtain government written instructions to a subordinate, therefore, we are obtaining GMP authentication as described herein.

The People’s Republic of China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership.

Our ability to operate in the People’s Republic of China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters.

Also, we are a state-licensed corporation and production and manufacturing facility and are subject to Chinese regulation and environmental laws. The Chinese government has been active in regulating our industry. Our business and products are subject to government regulations mandating the use of good manufacturing practices. Changes in such laws or regulations in the People’s Republic of China that govern or apply to our operations could have a materially adverse effect on our business. For example, the law could change so as to inhibit our purchases from suppliers of tobacco leaves because of trade tariffs. Our manufacturing costs may be increased and consequently affect our profit margins and revenue.

If we were to lose our state-licensed status, we would no longer be able to manufacture our products in the People’s Republic of China, which is our sole operation.

There is no assurance that the People’s Republic of China’s economic reforms will not adversely affect our operations in the future

Although the Chinese government owns the majority of productive assets in the People’s Republic of China, in the past several years the government has implemented economic reform measures that emphasize decentralization and encourage private economic activity.

Because these economic reform measures may be inconsistent or ineffectual, there are no assurances that:

| | · | We will be able to capitalize on economic reforms; |

| | · | The Chinese government will continue its pursuit of economic reform policies; |

| | · | The economic policies, even if pursued, will be successful; |

| | · | Economic policies will not be significantly altered from time to time; and |

| | · | Business operations in the PRC will not become subject to the risk of nationalization. |

Since 1979, the Chinese government has reformed its economic systems. Because many reforms are unprecedented or experimental, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within the People’s Republic of China, could lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

Over the last few years, the People’s Republic of China's economy has registered a high growth rate. During the past ten years, the rate of inflation in the People’s Republic of China has been as high as 20.7% and as low as -2.2%. Recently, there have been indications that rates of inflation have increased. In response, the Chinese government recently has taken measures to curb this excessively expansive economy. These corrective measures were designed to restrict the availability of credit or regulate growth and contain inflation. These measures have included devaluations of the Chinese currency, the Renminbi (RMB), restrictions on the availability of domestic credit, reducing the purchasing capability of certain of its customers, and limited re-centralization of the approval process for purchases of some foreign products. These austerity measures alone may not succeed in slowing down the economy's excessive expansion or control inflation, and may result in severe dislocations in the Chinese economy. The Chinese government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets.

While inflation has been more moderate since 1995, high inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in the People’s Republic of China, and thereby harm the market for our products. Future inflation in the PRC may inhibit our activity to conduct business in the People’s Republic of China.

To date, reforms to the People’s Republic of China's economic system have not adversely impacted our operations and are not expected to adversely impact operations in the foreseeable future; however, there can be no assurance that the reforms to the People’s Republic of China's economic system will continue or that we will not be adversely affected by changes in the People’s Republic of China's political, economic, and social conditions and by changes in policies of the Chinese government, such as changes in laws and regulations, measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and remittance abroad, and reduction in tariff protection and other import restrictions.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the People’s Republic of China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or businesses.

For example, changes in policy could result in imposition of restrictions on currency conversion, imports or the source of suppliers, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in the People’s Republic of China. Although the People’s Republic of China has been pursuing economic reforms for the past two decades, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries could significantly affect the government's ability to continue with its reform.

We face economic risks in doing business in the People’s Republic of China. As a developing nation, the People’s Republic of China's economy is more volatile than that of developed Western industrial economies. It differs significantly from that of the U.S. or a Western European Country in such respects as structure, level of development, capital reinvestment, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of the People’s Republic of China was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will emphasize greater utilization of market forces. The People’s Republic of China government has confirmed that economic development will follow the model of a market economy. For example, in 1999 the Government announced plans to amend the Chinese Constitution to recognize private property, although private business will officially remain subordinated to the state-owned companies, which are the mainstay of the Chinese economy. However, there can be no assurance that, under some circumstances, the government's pursuit of economic reforms will not be restrained or curtailed. Actions by the central government of the People’s Republic of China could have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects for our Chinese operations. Economic reforms could either benefit or damage our operations and profitability. Some of the things that could have this effect are: i) level of government involvement in the economy; ii) control of foreign exchange; methods of allocating resources; iii) international trade restrictions; and iv) international conflict.

Under the present direction, we believe that the People’s Republic of China will continue to strengthen its economic and trading relationships with foreign countries and business development in the People’s Republic of China will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case. A change in policies by the People’s Republic of China government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the Chinese government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the People’s Republic of China's political, economic and social life.

The People’s Republic of China legal and judicial system may not adequately protect foreign investors and enforce their rights

The Chinese legal and judicial system may negatively impact foreign investors. In 1982, the National People's Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in the People’s Republic of China. However, the People’s Republic of China's system of laws is not yet comprehensive. The legal and judicial systems in the People’s Republic of China are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in the People’s Republic of China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. The People’s Republic of China's legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting the People’s Republic of China's political, economic or social life, will not affect the Chinese government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on our business and prospects.

The practical effect of the People's Republic of China legal system on our business operations in the People’s Republic of China can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate Articles and contracts to Foreign Invested Enterprise participants. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the general corporation laws of the several states, similarly, the People’s Republic of China accounting laws mandate accounting practices, which are not consistent with the U.S. (GAAP) Generally Accepted Accounting Principles. The People’s Republic of China's accounting laws require that an annual "statutory audit" be performed in accordance with People’s Republic of China accounting standards and that the books of account of Foreign Invested Enterprises are maintained in accordance with Chinese accounting laws. Article 14 of the People's Republic of China Wholly Foreign-Owned Enterprise Law requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal reports and statements to designated financial and tax authorities, at the risk of business license revocation. Second, while the enforcement of substantive rights may appear less clear than United States procedures, the Foreign Invested Enterprises and Wholly Foreign- Owned Enterprises are Chinese registered companies, which enjoy the same status as other Chinese registered companies in business-to-business dispute resolution.

Any award rendered by an arbitration tribunal is enforceable in accordance with the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958). Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different in operation from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in the PRC. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses.

In addition, some of our present and future executive officers and our directors may be residents of the People’s Republic of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States, or to enforce a judgment obtained in the United States against us or any of these persons.

The People’s Republic of China laws and regulations governing our current business operations are sometimes vague and uncertain. There are substantial uncertainties regarding the interpretation and application of People’s Republic of China laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. We and any future subsidiaries are considered foreign persons or foreign funded enterprises under People’s Republic of China laws, and as a result, we are required to comply with People’s Republic of China laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new People’s Republic of China laws or regulations may have on our business.

Governmental control of currency conversion may affect the value of your investment .

The majority of our revenue will be settled in Renminbi, and any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside the People’s Republic of China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including, primarily, the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in the People’s Republic of China authorized to conduct foreign exchange business.

In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and Renminbi.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and Renminbi, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operational needs and should the Renminbi appreciate against the U.S. dollar at that time, our financial position, our business and the price of our common stock may be harmed. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of our earnings from our subsidiary in the People’s Republic of China would be reduced.

The People’s Republic of China government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the People’s Republic of China. We receive substantially all of our revenues in Renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing People’s Republic of China foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of the People’s Republic of China to pay capital expenses, such as the repayment of bank loans denominated in foreign currencies.

The People’s Republic of China government may also, at its discretion, restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain expenses as they come due.

The fluctuation of the Renminbi may materially and adversely affect your investment.

The value of the Renminbi against the U.S. Dollar and other currencies may fluctuate and is affected by, among other things, changes in the People’s Republic of China's political and economic conditions. As we rely almost entirely on revenues earned in the People’s Republic of China, any significant revaluation of the Renminbi may materially and adversely affect our cash flow, revenue and financial condition. For example, to the extent that we need to convert U.S. Dollars we receive from an offering of our securities into Renminbi for our operations, appreciation of the Renminbi against the U.S. Dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our Renminbi into U.S. Dollars for the purpose of making payments for dividends on our common shares or for other business purposes and the U.S. Dollar appreciates against the Renminbi, the U.S. Dollar equivalent of the Renminbi we convert would be reduced. In addition, the depreciation of significant U.S. Dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

On July 21, 2005, the People’s Republic of China government changed its decade-old policy of pegging the value of the Renminbi to the U.S. Dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. On July 21, 2005 the RMB was 8.28 for 1 USD and as of October 23, 2008, the RMB was 6.85 for 1 USD, which is approximately 20% appreciation of the RMB against the USD. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the People’s Republic of China government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. Dollar.

Recent PRC State Administration of Foreign Exchange Regulations regarding offshore financing activities by People’s Republic of China residents have undergone a number of changes which may increase the administrative burden we face. The failure by our shareholders who are People’s Republic of China residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our People’s Republic of China resident shareholders to liability under People’s Republic of China law.

State Administration of Foreign Exchange issued a public notice ("October Notice") effective from November 1, 2005, which requires registration with the State Administration of Foreign Exchange by the People’s Republic of China resident shareholders of any foreign holding company of a People’s Republic of China entity. Without registration, the People’s Republic of China entity cannot remit any of its profits out of the People’s Republic of China as dividends or otherwise; however, it is uncertain how the October Notice will be interpreted or implemented. In the event that the proper procedures are not followed under the October Notice, we could lose the ability to remit monies outside of the People’s Republic of China and would therefore be unable to pay dividends or make other distributions. Our People’s Republic of China resident shareholders could be subject to fines, other sanctions and even criminal liabilities under the People’s Republic of China Foreign Exchange Administrative Regulations promulgated January 29, 1996, as amended.

Risk Related to the Company's Business and Industry

We give no assurances that any plans for future expansion will be implemented and if we do not secure adequate financing, our profitability may be adversely affected.

Our ability to implement our Three Rural Plan and ultimately generate enough revenue to be profitable is directly influenced by our ability to secure adequate financing. The company is currently profitable. We have recently received 6.3 million RMB (approximately $919,700) and have received a total of 31.7 million RMB (approximately $4,627,000) from prior investors. However, if we do not receive significant funding from future investors, we will experience delays in our growth strategies and, ultimately, in our profitability.

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

We are in our early stages of development and face risks associated with a new company in a growth industry. We may not successfully address these risks and uncertainties or successfully implement our operating strategies. If we fail to do so, it could materially harm our business to the point of having to cease operations and could impair the value of our common stock to the point investors may lose their entire investment. Even if we accomplish these objectives, we may not generate positive cash flows or the profits we anticipate in the future.

Although our revenues have grown rapidly since our inception from the increasing demand for our products, we cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| | · | expand our product offerings and maintain the high quality of our products; |

| | · | manage our expanding operations, including the integration of any future acquisitions; |

| | · | obtain sufficient working capital to support our expansion and to fill customers' orders in time; |

| | · | maintain adequate control of our expenses; |

| | · | implement our product development, marketing, sales, and acquisition strategies and adapt and modify them as needed; |

| | · | anticipate and adapt to changing conditions in the containerboard and paper products markets in which we operate as well as the impact of any changes in government regulation, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

We will face a lot of competition, some of which may be better capitalized and more experienced than us.

We face competition in the bio-ecological products industries, both domestically and internationally. Although we view ourselves in a favorable position vis-à-vis our competition, some of the other companies that sell into our market may be more successful than us and/or have more experience and money that we do. This additional experience and money may enable our competitors to produce more cost-effective products and market their products with more success than we are able to, which would decrease our sales. We expect that we will be required to continue to invest in product development and productivity improvements to compete effectively in our markets. However, we cannot give you assurance that we can successfully remain competitive. If our competitors could develop a more efficient product or undertake more aggressive and costly marketing campaigns than us, which may adversely affect our marketing strategies and could have a material adverse effect on our business, results of operations or financial condition.

The People’s Republic of China legal and judicial system may not adequately protect foreign investors and enforce their rights

Our business is largely subject to the uncertain legal environment in the People’s Republic of China and your legal protection could be limited. As our present and possibly, future executive officers and directors are residents of the PRC, and our operating entity, Sanming Huajian Bioengineering Co., Ltd, is incorporated and situated in the People’s Republic of China, legal recourse against any of them could be limited or inadequate. The legal and judicial systems in the People’s Republic of China are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in the People’s Republic of China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. The People’s Republic of China legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

A slowdown in the People’s Republic of China economy may adversely affect our operations.

A slowdown or other adverse developments in the People’s Republic of China economy may materially and adversely affect our customers, demand for our services and our business. Because our customers are primarily wholesalers, a drop in their customer base would naturally spell a drop of demand for our products.

All of our operations are conducted in the People’s Republic of China and most of all of our revenue is generated from sales in the People’s Republic of China

Although the People’s Republic of China economy has grown significantly in recent years, we cannot assure you that such growth will continue. Also, while we believe the demand for our products are independent of the health of the economy; we do not know how sensitive we are to a slowdown in economic growth or other adverse changes in the People’s Republic of China economy. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the People’s Republic of China may materially reduce the demand for our products and materially and adversely affect our business.

Conversely, our major competitors may be better able than us to successfully endure downturns in our sector. In periods of reduced demand for our products, we can either choose to maintain market share by reducing our selling prices to meet competition or maintain selling prices, which would likely sacrifice market share. Sales and overall profitability would be reduced under either scenario. In addition, we cannot assure you that additional competitors will not enter our existing markets, or that we will be able to compete successfully against existing or new competition.

Inflation in the People’s Republic of China could negatively affect our profitability and growth.

While the People’s Republic of China economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. In order to control inflation in the past, the People’s Republic of China government has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. In October 2004, the People's Bank of China, the People’s Republic of China’s central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary concerns in the Chinese economy. Repeated rises in interest rates by the central bank would likely slow economic activity in People’s Republic of China which could, in turn, materially increase our costs and also reduce demand for our products.

A widespread health problem in the People’s Republic of China could negatively affect our operations.

A renewed outbreak of SARS, bird flu or another widespread public health problem in the People’s Republic of China, where all of our revenue is derived, could have an adverse effect on our operations. Our operations may be impacted by a number of health-related factors, including quarantines or closures of some offices that would adversely disrupt our operations.

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our operations.

A widespread national disaster or Act of God in the People’s Republic of China could negatively affect our operations.

A widespread national disaster such as flooding, hurricane, or other weather conditions that may adversely impact the growing of tobacco leaves may have an adverse effect on our business. Any such disaster could have the effect of inhibiting the growing of tobacco leaves which could cause us to curtail our operations. Further, a scarcity of tobacco leaves could also have the effect of increasing the cost of our purchasing the extracts, which could have the effect of depleting our assets or curtailing our operations.

Enforcement against us or our directors/officers may be difficult