[Letterhead of Skadden, Arps, Slate, Meagher & Flom LLP]

April 8, 2011

VIA EDGAR AND BY HAND

Amanda Ravitz

Assistant Director

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-7010

| | Re: | Freescale Semiconductor Holdings I, Ltd. |

| | | Amendment No. 2 to Registration |

| | | Statement on Form S-1 (File No. 333-172188) |

Dear Ms. Ravitz:

On behalf of Freescale Semiconductor Holdings I, Ltd., a Bermuda exempted limited liability company (the “Company”), enclosed please find a copy of Amendment No. 2 (the “Amendment”) to the above-referenced Registration Statement (the “Registration Statement”), as filed with the Securities and Exchange Commission (the “Commission”) on the date hereof, marked to show changes from Amendment No. 1 to the Registration Statement filed with the Commission on March 17, 2011.

The changes reflected in the Amendment include those made in response to the comments (the “Comments”) of the Staff of the Commission (the “Staff”) set forth in the Staff’s letter of April 1, 2011 (the “Comment Letter”). The Amendment also includes other changes that are intended to update, clarify and render more complete the information contained therein.

Set forth below are the Company’s responses to the Comments. For the convenience of the Staff, the Company has restated in this letter each of the Comments in the Comment Letter, followed by the applicable response. Capitalized terms used but not defined herein have the meanings given to them in the Registration Statement. All references to page numbers and captions (other than those in the Comments) correspond to the page numbers and captions in the preliminary prospectus included in the Amendment.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 2

Overview, page 1

| 1. | Please tell us the objective criteria used to select the companies highlighted in your Summary and Business sections. In addition, please tell us why you believe it is appropriate to reference the average length of certain “customer relationships.” Also explain how you define a “customer relationship.” |

The Company selected the customers highlighted in the Summary and Business sections because they represented a significant portion of the Company’s net sales in 2010 and the Company has long-standing relationships with these customers. For example, those customers listed on pages 2 and 81 represented 46% of the Company’s total net sales in 2010. Similarly, the customers listed on pages 88, 90 and 91 represented significant portions of the Company’s 2010 net sales in each of the respective product groupings. As such, the Company determined that these customers represent an appropriate sampling of the Company’s customers and inclusion of their names would help investors to more fully understand the Company’s business. The Company believes that it is important to include the long-term nature of the Company’s relationships with its top 10 customers to demonstrate the continuity of business as well as the depth of the relationships relating to a significant portion of the Company’s business. This data also supports the Company’s disclosure regarding its competitive strengths. The Company believes that the stability of its customer relationships is a key component of its business. The Company has revised the disclosure on pages 2 and 81 to clarify that a “customer relationship” is a relationship with an entity that purchases the Company’s products.

Improved capital structure, page 3

| 2. | Your disclosure in this section indicates that you will amend the credit facilities in connection with the initial public offering. However, your disclosure elsewhere in the prospectus, including on page 61, states that you have already entered into the amendment. Please reconcile and clarify, as appropriate. |

The Company has revised the disclosure on page 3 in response to the Staff’s Comment.

Risks Associated with Our Company, page 5

| 3. | We note your revisions in response to prior comment 1 and reissue. The bulleted list of risks on page 5 is not equal in prominence to the multi-page discussion of your strengths and strategy which appears in your summary. Please expand the summary disclosure of your risks and challenges or, alternately, limit the discussion of your strengths and strategy. |

The Company has revised the disclosure on pages 3 through 5 in response to the Staff’s Comment.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 3

Use of Proceeds, page 7

| 4. | Revise here and on page 33 to clarify your relationship to Freescale Inc. |

The Company has revised the disclosure on pages 7 and 35 in response to the Staff’s Comment.

We are highly leveraged..., page 15

| 5. | We note your disclosure that you have not defaulted under any covenants of your existing senior credit facilities or existing notes. Given the frequency with which you have renegotiated your debt, please tell us, with a view to disclosure, whether you have failed to comply with the covenants of any of your prior facilities or notes. If so, please describe the circumstances related to your non-compliance. |

The Company advises the Staff that it has not had any material credit facilities or notes outstanding since the acquisition by the Consortium in 2006, other than the senior credit facilities, the existing notes and a small working capital line of credit at a foreign subsidiary that is no longer outstanding. In addition, the only other prior indebtedness since the acquisition consisted of less than $500,000 of notes previously issued by Freescale Inc. that remained outstanding upon consummation of the acquisition. All of these notes have since been repaid. The Company confirms that there were no defaults under any of this prior indebtedness. The amendments to the existing senior credit facilities and the issuance of new notes to repay outstanding indebtedness have not been as a result of any default under those debt agreements. Rather, the Company has taken advantage of market opportunities to improve its capital structure by extending the maturities of its indebtedness, reducing the total outstanding principal amount of its indebtedness by repaying debt at a discount, and increasing its flexibility under existing covenants for business planning purposes, as described in the Registration Statement on pages 3, 47, 62 and 63.

If we cannot make scheduled payments..., page 16

| 6. | We note your response to prior comment 4 and reissue. Please expand your discussion of the risks related to your practice of renegotiating debt or issuing new debt in order to repay existing debt. In your revised disclosure, please specifically address the incremental term loan litigation settled in February 2010 and discuss, if material, the possibility of similar litigation in future. |

The Company has revised the disclosure on pages 17 and 62 in response to the Staff’s Comment.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 4

The failure to complete our transformation… page 23

| 7. | With a view to disclosure, please explain your reference to the requirement that customers “requalify” their products. Tell us by whom this requirement would be imposed, the likelihood of its imposition and its significance to you and your customers. |

Because of the complex manufacturing process in the semiconductor industry, it is common that the same designed product may have varying performance characteristics based on the facility at which the product is manufactured. Therefore, it is typical in the Company’s industry for customers to “requalify” products when they are moved to a new manufacturing facility by confirming that the performance of the product made at the new facility meets the customer’s specifications. The user of the product determines whether requalification is required, based on applicable regulatory requirements and the user’s quality control procedures. The Company believes that it is likely that most of the products for which manufacturing is transitioned will be required to undergo requalification. The Company has transferred the manufacture of its products in the past without significant impact on its business. However, the timing and extent of the requalification process varies significantly by product and by transition and could result in product delivery delays to the Company’s customers and to the ultimate end user. In addition, the Company could incur additional costs to ensure the necessary product specifications at the new facilities. It is difficult at this time for the Company to predict whether the impacts of the transition and requalifications will be significant. Extended delays in product delivery or the inability to achieve product specifications could have a negative impact on the Company’s net sales, and significant additional costs could further impact operating margins. In addition, such events could cause similar impacts on the Company’s customers, which could harm those customer relationships and adversely affect the Company’s business. The Company seeks to mitigate these risks by building up product inventory in advance of a transition and has been doing so with respect to the closures of the manufacturing facilities in Toulouse, France and Sendai, Japan.

The Company has revised the disclosure on page 24 to explain the requalification process and to further address some of these potential risks.

Use of Proceeds, page 33

| 8. | We note your responses to prior comments 8, 9 and 10. We will continue to evaluate your responses and related disclosure when you provide in a subsequent amendment the following information: |

| | • | | The amount of debt to be repaid; |

| | • | | The particular series to be repaid; |

| | • | | The timing of such payments; and |

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 5

| | • | | The identity of the parties that will receive funds. |

The Company currently intends that the expected net proceeds from the offering will be contributed to Freescale Inc. to enable it to repay, together with cash on hand, (i) the full amount of indebtedness then outstanding under the existing revolving credit facility ($532 million at December 31, 2010), plus accrued and unpaid interest thereon, upon completion of the offering and (ii) $255 million of the Company’s 9.125%/9.875% Senior PIK-Election Notes due 2014, $19 million of the Company’s 8.875% Senior Fixed Rate Notes due 2014 and $263 million of the Company’s 10.75% Senior Notes due 2020, plus in each case accrued and unpaid interest thereon, pursuant to the redemption provisions of the applicable indentures within 45 days following completion of the offering. Based on amounts outstanding as of December 31, 2010, the underwriters or their affiliates would receive approximately $209 million of the net proceeds. None of the Company’s affiliates would receive any net proceeds from this offering. The Company has not included this information in the Amendment, but rather will include it in a subsequent pre-effective amendment to the Registration Statement prior to offering any common shares to the public, given the possibility that the Company may determine to change the series or amount of notes to be repaid due to market conditions or other considerations. The Company does not currently anticipate any such changes, however.

Management’s Discussion and Analysis..., page 42

Senior Credit Facilities, page 60

| 9. | With a view to disclosure, please tell us which section of which the exhibit provides for the replacement revolving credit facility referenced in the second paragraph on page 61. We note that exhibit 10.42 references a Replacement Revolving Credit Facility Effectiveness Agreement but no such agreement appears to have been filed. Also, disclose clearly all material conditions to any such replacement revolving credit facility. |

The Company has refiled Exhibit 10.42 with Exhibit A, the Replacement Revolving Credit Facility Effectiveness Agreement, in response to the Staff’s Comment. This Replacement Revolving Credit Facility Effectiveness Agreement, coupled with Section 3 of Exhibit 10.42 (Amendment No. 4, dated as of March 4, 2011, to the Credit Agreement) will, subject to certain conditions, effectuate the replacement revolving credit facility. The replacement revolving credit facility has the same terms and conditions as those applicable to the existing revolving credit facility, except as set forth in Amendment No. 4. This facility replaces the existing revolving credit facility and will be provided by those lenders party to the Replacement Revolving Credit Facility Effectiveness Agreement. The existing revolving credit facility will be repaid in full with proceeds from this offering.

The Company has revised the disclosure on page 64 to reflect clearly all material conditions to the replacement revolving credit facility.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 6

| 10. | We note your response to prior comment 33 and reissue the comment. Please revise the disclosure in this section accordingly. |

The Company has revised the disclosure on pages 64 through 66 in response to the Staff’s Comment.

| 11. | Please revise your disclosure, where appropriate, to clarify the significance of the terms described in the penultimate paragraph of this section. |

The Company has revised the disclosure on page 65 in response to the Staff’s Comment.

Adjusted EBITDA, page 63

| 12. | We refer to your response to prior comment 12. In the first paragraph on page 63 you disclose that it is useful to investors to provide the calculation of adjusted EBITDA in your filing because your ability to engage in certain activities is tied to ratios based on adjusted EBITDA and you believe the disclosure is useful to investors for purposes of determining your ability to engage in those activities. Accordingly, please expand to describe the ratios referred to in your disclosure and to describe your compliance therewith. |

The Company has revised the disclosure on page 67 in response to the Staff’s Comment.

| 13. | As a related matter, in the last sentence of same paragraph referred to above, you further disclose that you are not required to maintain any ratio based on adjusted EBITDA or otherwise. Please clarify for us how the disclosure in the last sentence of the referenced paragraph is consistent with disclosure in the second sentence which appears to suggest that your activities could be limited based on ratios determined using adjusted EBITDA. |

The Company has revised the disclosure on pages 64 through 67 to clarify that, although the Company does not have maintenance covenants in any of its debt agreements, it does have incurrence-based covenants and, accordingly, is unable to engage in certain activities, unless the specified ratios are met or another provision of the applicable agreement permits the activity. As a result, the Company is not in default under any of its debt agreements if it fails to meet these ratios. Rather, it is then unable to engage in the applicable activity, unless otherwise permitted by another provision of the applicable debt agreement.

Restructuring Activities, page 68

| 14. | We note your response to prior comment 14 and reissue the comment. Please revise accordingly. |

The Company has revised the disclosure on pages 46, 47, 58, 59 and 73 in response to the Staff’s Comment.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 7

Our Business, page 75

Overview, page 75

| 15. | We note your response to prior comment 15. Please confirm, if true, that the reports you have cited are publicly available for a nominal fee. |

The Company confirms that the cited reports are publicly available at prices ranging from approximately $1,500 to $15,000, which are considered standard nominal prices in the semiconductor industry for these types of reports.

| 16. | It appears footnote (1) to the table on page 76 disclaims the accuracy of certain information contained in the table and elsewhere in your disclosure. We also note that you appear to disclaim the accuracy of your own research in the final sentence on page ii. Please revise or advise. |

The Company advises the Staff that, as standard procedure for including information from their reports in third-party materials, Gartner requires the Company to include the language in footnote (2) on page 81. Additionally, the Company has deleted the final sentence on page ii in response to the Staff’s Comment.

| 17. | Please tell us how you determined it is appropriate to disclose the #1 position in 802.15.4 Zigbee chipsets based on 2009 data rather than the more recent data presented in the ABI and In-stat reports provided to the staff. |

The Company advises the Staff that the ABI and In-stat reports previously provided to the Staff contained actual data for 2009 and forecasts for 2010. Therefore, the Company determined it was appropriate to use the 2009 data to determine its #1 position because such data was based on actual shipments. In light of the Staff’s Comment, however, the Company has revised the disclosure on pages 2, 81 and 88 of the Registration Statement to delete this information.

Products and Applications, page 82

| 18. | We note that the glossary added in response to prior comment 20 does not appear to address several of the acronyms referenced in that comment. Please ensure technical and industry terms are clearly explained. |

The Company has revised the disclosure on pages 168 through 174 in response to the Staff’s Comment.

Research and Development, page 87

| 19. | Please disclose in this section the information contained in the second sentence of your response to prior comment 25. |

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 8

The Company has revised the disclosure on pages 96 and 97 in response to the Staff’s Comment.

Competition, page 89

| 20. | We note your response to prior comment 23. With a view to disclosure, please describe the material terms of your warranty obligations, including whether warranties are provided to all customers or specific customers only. If the latter, please describe how you determine which customers are eligible to receive warranties. |

The Company’s customary semiconductor product warranty runs for a period of 3 years from the date of sale and provides that, at the time of shipment, the Company’s products will be free from defects in material and workmanship and will conform to the Company’s approved specifications. Under the warranty, the Company will either refund the purchase price or repair or replace non-compliant products, at the Company’s cost, with the same or equivalent products that meet the warranty. The warranty does not apply to products that have been improperly tested, programmed or assembled or that have been mishandled or misused. This product warranty is part of the Company’s standard terms of sale. Some customers have entered into supply agreements with the Company in the ordinary course of business in which the warranty terms vary from the standard form, although such variations are not significant. The Company includes in cost of sales provisions for estimated costs related to product warranties, which are made at the time the related sale is recorded, as reflected on pages 48 and F-9. The Company has revised the disclosure on page 23 to describe the Company’s warranty obligations.

Intellectual Property, page 90

| 21. | We note your revisions in response to prior comment 24 and reissue the final sentence of that comment. Please revise to discuss with greater specificity the differences in the intellectual property protections afforded in countries material to your operations, such as China. |

The Company has revised the disclosure on pages 22, 95 and 96 in response to the Staff’s Comment.

Compensation Consultant and Peer Group Compatibility, page 105

| 22. | We note your response to prior comment 29. Please tell us with a view to disclosure how the market data is considered and whether elements of your compensation are set at a specific level relative to the market data obtained. |

The Company has revised the disclosure on page 110 in response to the Staff’s Comment.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 9

Elements of Compensation, page 106

| 23. | We note your response to prior comment 30; however, it remains unclear how the disclosure of historic performance targets would result in competitive harm or provide competitors with insights into your future competitive strategies. Please provide an expanded response that explains clearly how disclosure of such historic performance targets would cause substantial competitive harm. |

The three confidential performance targets under the bonus plans are defective parts per million, customer quality incident cycle-time and design win performance. The Company believes that each of these metrics constitutes the Company’s confidential trade secrets and commercial information, the disclosure of which could result in substantial competitive harm to the Company, given the highly competitive nature of the semiconductor industry.

The Company believes that one of the most significant competitive factors in the semiconductor industry is quality. Disclosure of the two quality metrics, defective parts per million and customer quality incident cycle-time, would provide competitors with valuable insight into the operational strengths and weaknesses of the Company. Defective parts per million is the measure of chips that are identified as defective or as not meeting the customer’s specifications. Customer quality incident cycle-time is the measure of the average length of time it takes for Freescale to respond to and resolve a customer issue with quality. These measures are important internal benchmarks that the Company uses to measure its quality program and incentivize its employees to collectively perform better. However, the benchmarks for these quality measures vary by product and taken out of context by the Company’s customers and competitors could seriously harm the Company’s prospects in competitive bidding arrangements.

The detailed design win performance objective is a strategic measurement of the business that the Company has targeted and the estimated dollar value of the projects that the Company was awarded from its customers. The targets the Company establishes are confidential goals that indicate its expectations for future business. Design wins convert to revenue over a period of years, so the understanding of the Company’s business that can be derived from these goals is forward looking rather than historic such as revenue. Moreover, because the design win performance objective is a measurement of the Company’s success competing in the marketplace for future business, its competitors could gain valuable insight into its strategic plans with targeted customers that could be used to the Company’s disadvantage when participating in a competitive bidding arrangement.

The Company does not generally have access to quality and design win information concerning its competitors and would be placed at a competitive disadvantage if compelled to disclose these performance objectives. The Company believes that disclosure of these items is not material to investors nor are they necessary to fully understand the Company’s compensation policies and decisions.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 10

In light of the foregoing, the Company believes that public disclosure of the quality and design win performance targets would result in substantial competitive harm.

Principal Shareholders, page 125

| 24. | We note your response to prior comment 32 and reissue the comment. Clearly identify the natural persons or persons who have voting or investment control of the shares held by each entity listed. |

The Company has revised the disclosure on pages 131 through 137 in response to the Staff’s Comment.

Tax Considerations, page 144

| 25. | We note your response to prior comment 36. Please be advised that you are required to discuss, rather than summarize, all material tax consequences. We may have further comment to this section after we review your tax opinions. |

The Company is providing to the Staff supplementally with this response letter a copy of the form of tax opinion to be filed with a subsequent pre-effective amendment to the Registration Statement.

Financial Statements

Note 6. Employee Benefit and Incentive Plans, page F-31

| 26. | We note your responses to prior comments 39 and 40. We will continue to evaluate stock-based compensation once you provide all of the requested information. |

As indicated in the Company’s response to prior comment 39 (“Prior Response 39”), the Company performs a contemporaneous valuation of its common shares on an annual basis. The valuation performed during the fourth quarter of 2010, as more fully described in Prior Response 39, resulted in a valuation of $2.46 per common share. The assumed initial public offering price per common share reflects an increase over the fair value determination completed during the fourth quarter of 2010. The increase was attributable to the factors discussed in the following paragraphs.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 11

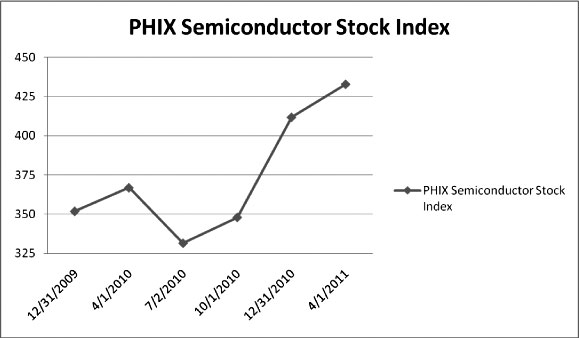

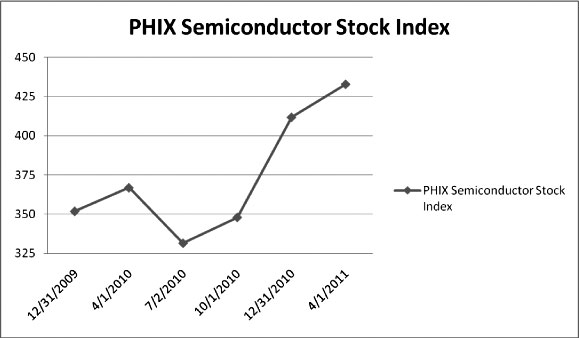

As noted in Prior Response 39, the Company considers several factors in determining fair value, including the level of operational risk and uncertainty surrounding forecasted cash flows; the Company’s financial position, operating results and expected changes in operations; historical and forecasted EBIT and EBITDA; and the lack of liquidity for the common shares. In addition, the Company monitors its valuations for indicators of potential changes in its enterprise fair value and equity fair value on a quarterly basis. In doing so, the Company considers factors such as significant changes in its long-term financial forecast, changes in the fair market value of the equity of the Company’s peer group and changes in the fair value of the Company’s outstanding long-term debt. Since the preparation of the fair value determination in the fourth quarter of 2010, there has been a general increase in the stock price of the Company’s peers. The Philadelphia Stock Exchange Semiconductor Index, which is a capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture, and sale of semiconductors, increased by 24% between October 1, 2010 and April 1, 2011. A comparable peer that is a key indicator of the increase in fair value is NXP Semiconductors N.V. (“NXP”), which is a similar private-equity owned semiconductor company that completed an initial public offering in August 2010. NXP’s stock price increased by 148% during such period. The Company also noted peer group companies such as Nvidia Corporation, Cavium Networks, Inc. and LSI Corporation experienced significant increases in their stock prices between October 1, 2010 and April 1, 2011 of 48%, 55% and 60%, respectively. In addition, the recently announced proposed acquisition of National Semiconductor Corporation by Texas Instruments Incorporated reflected a 95% increase over National Semiconductor’s stock price on October 1, 2010. In addition to these significant increases in market values of peer companies with publicly traded equity, general economic conditions have continued to improve, and the impacts of the Company’s transformation program continue to be realized. All of the foregoing directly impact the Company’s prospects and forecasts, resulting in a higher potential equity value for the Company’s common shares.

Moreover, since the valuation completed during the fourth quarter of 2010, the Company has significantly increased the likelihood of completing an initial public offering, as evidenced by the determination of the estimated initial public offering price range. As noted in Prior Response 39, the valuation completed during the fourth quarter of 2010 included a marketability discount of 8%, which will no longer be applicable following this offering.

| 27. | We refer to your response to prior comment 41. In response to prior comment 39 you indicate that the per share fair value of a common share increased to $2.46 as of December 31, 2010. Accordingly, tell us why a fair value of $1.24 per share was used for grants in 2010. In that regard, tell us when options and restricted shares were granted in 2010. |

As previously indicated in Prior Response 39 and above in response to Comment 26, the Company performs a contemporaneous valuation of its common shares on an annual basis. The valuation performed during the fourth quarter of 2009, as more fully described in Prior Response 39, resulted in a valuation of $1.24 per common share. This valuation

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 12

was then used to determine the fair value for granting stock based compensation awards during all of 2010. The Company’s Compensation and Leadership Committee has adopted guidelines for the granting of stock options and restricted stock units. Under those guidelines, the Company grants options and restricted shares on the first Monday of each month. The following table provides the details of the timing and amount of stock options and restricted shares granted during 2011 and 2010:

| | | | |

Month | | Options Granted | | Restricted Shares Granted |

2011 ($2.46 per share) | | | | |

April | | 60,000 | | 115,000 |

March | | 888,000 | | 100,000 |

February | | 310,000 | | 10,000 |

January | | 125,000 | | 30,000 |

| | |

2010 ($1.24 per share) | | | | |

December | | 100,000 | | — |

November | | 112,900 | | — |

October | | 27,400 | | — |

September | | 124,900 | | — |

August | | 873,500 | | 100,000 |

July | | 775,000 | | 200,000 |

June | | 135,000 | | — |

May | | 460,000 | | — |

April | | 100,000 | | — |

March | | 53,000 | | — |

February | | 67,000 | | — |

January | | 8,000 | | — |

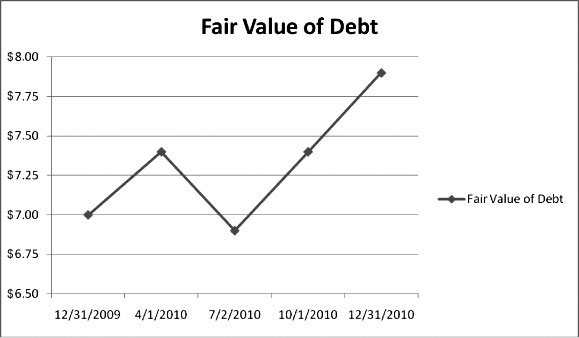

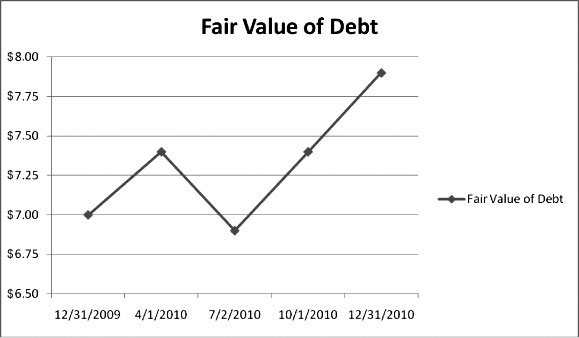

As noted above, the Company monitors several key indicators of potential changes in its enterprise fair value and equity fair value on a quarterly basis to determine if any change in fair value is required. One such indicator is the fair value of its outstanding debt. The fair value of the Company’s equity is the result of reducing the enterprise fair value by the fair value of outstanding debt. Accordingly, an increase in the fair value of the Company’s outstanding debt puts downward pressure on the fair value of its equity. The Company experienced a 13% increase in the fair value of its outstanding debt from December 31, 2009 to December 31, 2010, the majority of which occurred during the second half of 2010 as indicated in the following graphical presentation (fair value of debt presented in billions of dollars).

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 13

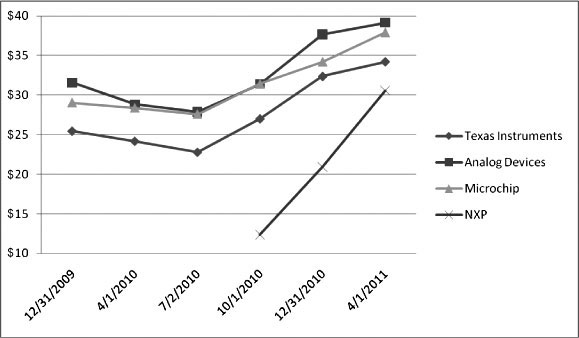

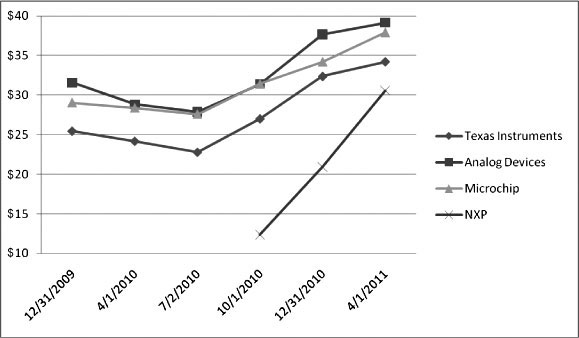

The increase in the Company’s enterprise fair value in 2010 was driven by an increase in value resulting from the market comparable approach discussed in Prior Response 39, which comprises 25% of the valuation analysis, the bulk of which occurred in the fourth quarter. During the fourth quarter of 2010, the Company noted an increase in the stock price of the peers utilized in the market comparable approach, most notably at NXP (which, as described above, is also a private-equity owned company that recently completed its initial public offering), and an increase the Philadelphia Stock Exchange Semiconductor Index. The level of these increases put more significant upward pressure on the fair value of the Company’s equity, particularly at the end of 2010. The increases are demonstrated in the following graphical presentations:

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 14

Peer Stock Price Trend

As the Company monitored these factors over the course of the year, it determined there was no need to increase the fair value determination of $1.24 for grants made during

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 15

2010 due to the near canceling effects of the foregoing factors. As noted above, however, the most significant changes began in the latter part of the year, and continued to gradually improve during the fourth quarter. In addition, as discussed in Prior Response 39, the global economic environment improved considerably over the course of 2010, and the Company began to experience the accelerating benefits of its transformation program initiative at the end of the year. Examples of such improvement include an increase in net sales of approximately 24%; an increase in adjusted operating earnings of 200%; and an increase in adjusted EBITDA of 51% in the fourth quarter of 2010 versus the corresponding period in the prior year. The Company finalized its 2011 annual operating plan in December 2010, which was then factored into the valuation prepared in the fourth quarter of 2010. Given improvements over the long-term forecasts utilized in prior periods resulting from an improving global economy and much improved insight into the Company’s operations versus the prior year, the results from the income approach discussed in Prior Response 39, which comprises 75% of the valuation report, were significantly higher versus prior periods.

As a result of the cumulative items described above, the valuation prepared in the fourth quarter of 2010 resulted in an increase in the fair value per common share from $1.24 at December 31, 2009 to $2.46 at December 31, 2010.

Back Cover Page

| 28. | Please remove the reference to the underwriters as joint book-running managers and co-managers from the cover page. |

The Company has revised the back cover page in response to the Staff’s Comment.

Exhibits and Financial Statement Schedules, page II-3

| 29. | We note your response to prior comment 46. Please file the material license agreements referenced on page 31. In addition, expand your analysis to tell us how you determined that you are not required to file all agreements with related parties, including your existing agreements with your sponsors. |

The Company has revised the disclosure on page 22 to clarify that these statements apply to all of its license agreements. As noted in the Company’s response to prior comment 46, the Company believes that all of its license agreements are of the type commonly made in the ordinary course of business by semiconductor companies as contemplated by Item 601(b)(10)(ii). Consistent with this industry practice, the Company as a routine matter enters into and renews licenses governing intellectual property with other industry participants in its ordinary course of business. The Company does not believe that it is substantially dependent upon any one of these agreements. Accordingly, the Company has not filed such agreements as exhibits to the Registration Statement.

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 16

The Company has listed as exhibits to the Registration Statement and will file all material contracts for purposes of Item 601(b)(10) of Regulation S-K with its related parties, including the Sponsors.

The Company advises the Staff that it has determined that the Equity Healthcare agreement and the TPG consulting services contracts referenced on page 140 are not material contracts for purposes of Item 601(b)(10) of Regulation S-K and, accordingly, has not filed such agreements as exhibits to the Registration Statement. The Company has concluded that the Equity Healthcare agreement and each of the TPG consulting services contracts is immaterial in amount and significance to the Company due to the minimal value of each of the agreements.

| 30. | Please note that prior comment 47 was not limited to the specific examples identified. Please ensure that all of agreements filed as exhibits are complete. For example, we note that exhibits 10.40 — 10.42 appear to be incomplete. |

The Company has refiled exhibits 10.2, 10.3, 10.4, 10.9, 10.18, 10.40, 10.42 and 10.44, and will refile exhibit 10.10 with a subsequent pre-effective amendment to the Registration Statement, in response to the Staff’s Comment.

****

Additionally, the Company is providing to the Staff supplementally with this response letter copies of the recently released industry reports that support the revised disclosure included in the Amendment. The reports are marked to identify the supporting statements.

Please telephone the undersigned at (212) 735-2950 if you have any questions or need any additional information.

|

| Very truly yours, |

|

| /s/ Jennifer A. Bensch |

|

| Jennifer A. Bensch |

| | |

| cc: | | Jonathan Greenberg |

| | Freescale Semiconductor, Inc. |

| | 6501 William Cannon Drive West |

| | Austin, TX 78735 |

| |

| | Ruairi Regan |

| | Daniel Morris |

| | Securities and Exchange Commission |

| | Division of Corporation Finance |

| | 100 F Street, N.E. |

Amanda Ravitz

Securities and Exchange Commission

April 8, 2011

Page 17

Washington, D.C. 20549

Andrew J. Pitts

Joel F. Herold

Cravath, Swaine & Moore LLP

Worldwide Plaza

825 Eighth Avenue

New York, NY 10019