Filed by Freescale Semiconductor, Ltd.

Pursuant to Rule 425

under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934

Subject Company: Freescale Semiconductor, Ltd. (Commission File No. 001-35184)

The following presentation by Freescale Semiconductor, Ltd. (the “Company”) was distributed to certain customers on March 16, 2015.

Cautionary Statement Regarding Forward Looking Statements

This document includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” “providing guidance” and similar expressions are intended to identify information that is not historical in nature.

This document contains forward-looking statements relating to the proposed transaction between the Company and NXP Semiconductors N.V. (“NXP”) pursuant to a merger. All statements, other than historical facts, including statements regarding the expected timing of the closing of the transaction; the ability of the parties to complete the transaction considering the various closing conditions; the expected benefits of the transaction such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of NXP following completion of the proposed transaction; and any assumptions underlying any of the foregoing, are forward-looking statements. Such statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. You should not place undue reliance on such statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, that (1) one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the shareholders of each of the Company and NXP may not be obtained; (2) there may be a material adverse change of the Company or the business of the Company may suffer as a result of uncertainty surrounding the transaction; (3) the transaction may involve unexpected costs, liabilities or delays; (4) legal proceedings may be initiated related to the transaction; (5) there may be difficulties and delays in achieving synergies and cost savings; and (6) other risk factors as detailed from time to time in the Company’s and NXP’s reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 which is available on the SEC’s Website (www.sec.gov). There can be no assurance that the merger will be completed, or if it is completed, that it will close within the anticipated time period or that the expected benefits of the merger will be realized.

Neither the Company nor NXP undertakes any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed strategic combination, NXP plans to file with the SEC a Registration Statement on Form F-4 that will include a proxy statement of the Company and a prospectus of NXP. The Company will mail the prospectus/proxy statement to its shareholders. INVESTORS ARE URGED TO READ THE PROSPECTUS/PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain the prospectus/proxy statement, as well as other filings containing information about the Company and NXP, free of charge, from the SEC’s Website (www.sec.gov). Investors may also obtain the Company’s SEC filings in connection with the transaction, free of charge, from the Company’s Web site (www.investors.freescale.com) under the link “Investors Relations” and then under the tab “SEC Filings,” or by directing a request to Freescale Semiconductor, Ltd., 6501 William Cannon Drive West, MD OE62, Austin, Texas 78735, Attention: Secretary. Investors may also obtain NXP’s SEC filings in connection with the transaction, free of charge, on NXP’s Investor Relations internet website at http://www.nxp.com/investor or by contacting NXP’s Investor Relations Contact by phone at 1-408-518-5411.

Participants in the Merger Solicitation

The respective directors, executive officers and employees of the Company and NXP and other persons may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information regarding the Company’s directors and executive officers is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 6, 2015, and its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on March 16, 2015. Information regarding NXP’s directors and executive officers is set forth in its Annual Report on Form 20-F for the year ended December 31, 2014, which was filed with the SEC on March 6, 2015. These documents can be obtained free of charge from the sources indicated above. Other information regarding the interests of the participants in the proxy solicitation will be included in the joint prospectus/proxy statement when it becomes available. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

2

|

Freescale & NXP Merger Customer Presentation M A R C H 2 0 1 5 External Use ARM is a registered trademark of ARM Limited (or its subsidiaries) in the EU and/or elsewhere. All rights reserved. All other product or service names are the property of their respective owners. © Freescale Semiconductor, Inc. |

|

External Use 1 Cautionary Statement Regarding Forward Looking Statements This document includes "forward-looking statements" within the meaning of the securities laws. The words "may," "could," "should," "estimate," "project," "forecast," intend," "expect," "anticipate," "believe," "target," "plan," "providing guidance" and similar expressions are intended to identify information that is not historical in nature. This document contains forward-looking statements relating to the proposed transaction between NXP Semiconductors N.V. (“NXP”) and Freescale Semiconductor, Ltd. (“Freescale”) pursuant to a merger. All statements, other than historical facts, including statements regarding the expected timing of the closing of the transaction; the ability of the parties to complete the transaction considering the various closing conditions; the expected benefits of the transaction such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of NXP following completion of the proposed transaction; and any assumptions underlying any of the foregoing, are forward-looking statements. Such statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. You should not place undue reliance on such statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, that (1) one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the shareholders of each of Freescale and NXP may not be obtained; (2) there may be a material adverse change of Freescale or the business of Freescale may suffer as a result of uncertainty surrounding the transaction; (3) the transaction may involve unexpected costs, liabilities or delays; (4) legal proceedings may be initiated related to the transaction; (5) there may be difficulties and delays in achieving synergies and cost savings; and (6) other risk factors as detailed from time to time in Freescale's and NXP’s reports filed with the Securities and Exchange Commission ("SEC"), including Freescale's Annual Report on Form 10-K for the year ended December 31, 2014 which is available on the SEC's Website (www.sec.gov). There can be no assurance that the merger will be completed, or if it is completed, that it will close within the anticipated time period or that the expected benefits of the merger will be realized. Neither Freescale nor NXP undertakes any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on any of these forward-looking statements. |

|

External Use 2 Additional Information / Participants in the Merger Solicitation Additional Information and Where to Find It In connection with the proposed strategic combination, NXP plans to file with the SEC a Registration Statement on Form F-4 that will include a proxy statement of Freescale and a prospectus of NXP. Freescale will mail the prospectus/proxy statement to its shareholders. INVESTORS ARE URGED TO READ THE PROSPECTUS/PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain the prospectus/proxy statement, as well as other filings containing information about Freescale and NXP, free of charge, from the SEC's Website (www.sec.gov). Investors may also obtain Freescale's SEC filings in connection with the transaction, free of charge, from Freescale's Web site (www.investors.freescale.com) under the link "Investors Relations" and then under the tab “SEC Filings," or by directing a request to Freescale Semiconductor, Ltd., 6501 William Cannon Drive West, MD OE62, Austin, Texas 78735, Attention: Secretary. Investors may also obtain NXP's SEC filings in connection with the transaction, free of charge, on NXP’s Investor Relations internet website at http://www.nxp.com/investor or by contacting NXP’s Investor Relations Contact by phone at 1-408-518-5411. Participants in the Merger Solicitation The respective directors, executive officers and employees of the Company and NXP and other persons may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information regarding the Company's directors and executive officers is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 6, 2015, and its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on March 16, 2015. Information regarding NXP's directors and executive officers is set forth in its Annual Report on Form 20-F for the year ended December 31, 2014, which was filed with the SEC on March 6, 2015. These documents can be obtained free of charge from the sources indicated above. Other information regarding the interests of the participants in the proxy solicitation will be included in the joint prospectus/proxy statement when it becomes available. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. |

|

External Use 3 Compelling Value Proposition World Leader in Automotive semiconductors Strengthen Position in High Growth Focus Markets Leveraging Operational Excellence & Cost Synergies Strong Cash Generation 3x Net Debt/TTM adj. EBITDA at close; reducing to 2x within 6 quarters World-Class Team Globally Customer-Focused Passion to WIN Will drive Significant Additional Shareholder Value Net Debt = Total Debt minus Total Cash TTM adj. EBITDA = Trailing Twelve Month adjusted Earnings Before Interest, Taxes, Depreciation & Amortization, a source of cash for interest payments on debt + |

|

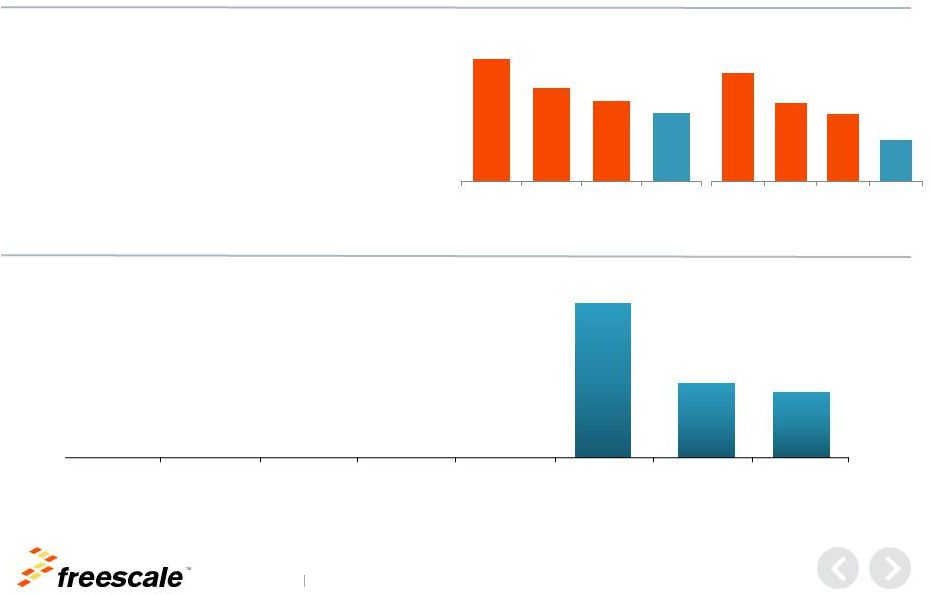

External Use 4 Debt ratio from the merger expected to move below 2x Net Debt/EBITDA within 6 quarters of closing Net Debt = Total Debt minus Total Cash TTM adj. EBITDA = Trailing Twelve Month adjusted Earnings Before Interest, Taxes, Depreciation & Amortization, a source of cash for interest payments on debt 0.0 1.0 2.0 3.0 4.0 5.0 6.0 FSL Q2'12 FSL Q4'14 Projected NXP + FSL ratio at merger closing Projected ratio within 6 qtrs of closing |

|

External Use 5 Freescale has significantly reduced debt and interest expense • Q1 Debt Redemption $250M of unsecured debt redeemed in February Annualized interest expense reduced to ~$300 million per year • Continuing our Deleveraging Story $450M of debt redeemed over the past 5 months Reduced annualized interest expense by ~40% since 2013 Net Debt / Annual Interest ($ in millions) Maturity Profile */*** $297** * Pro forma after giving effect to the $250M Q1 2015 debt redemption ** Annualized net interest expense after giving effect to the 2014 redemption and refinancing transactions and the Q1 2015 debt redemption *** Term loans maturing in 2020 and 2021 require quarterly principal payments in aggregate annual amounts of $35 million Credit revolver matures in 2019; currently undrawn Net Debt Net Interest Expense $3,095 $960 $1,290 2015 2016 2017 2018 2019 2020 2021 2022 $8,816 $6,575 $5,765 1Q07 1Q11 4Q13 4Q14 $4,917* $784 $563 2007 2011 2013 2014 $483 ($M) |

|

External Use 6 Strong Combined Team A Great Environment for Our Team • Almost 45,000 employees in >25 countries • Well over 12,000 engineers • Over 9,800 patent families • Doubling our R&D strength • Access to broader product & IP portfolio • Access to a broader customer base • Access to more advanced process technology |

|

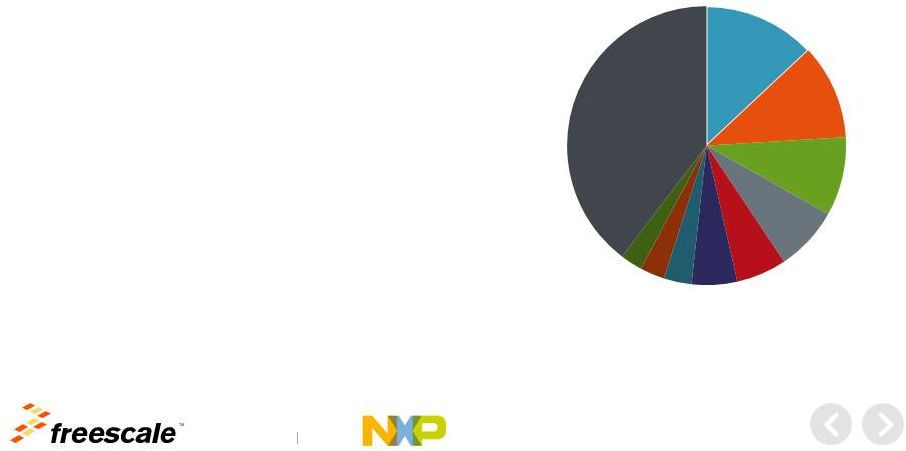

External Use 7 Establishes the New #1 Auto Semiconductor Vendor Global Auto Semiconductor TAM, 2013 $26B (1) Based On 1. IHS 2. NXP Corporate Market Intelligence estimates for 2014 • #1 Auto Semi Supplier 1,2 – Doubles Addressable Market – Broad Portfolio, Complementary Products • Leadership Positions 1,2 – Car Entertainment – Keyless Entry & Access – In-Vehicle Networking – Chassis & Safety – Powertrain • Synergistic Future Growth Opportunities – Infotainment (Audio and Apps Proc.) – Securing the Car – ADAS (Radar, Vision, Secure V2X) • Highly Valued Supplier to All Major OEMs NXP + 13% #2 11% #3 9% #4 7% #5 6% #6 5% #7 3% #8 3% #9 3% Others 40% |

|

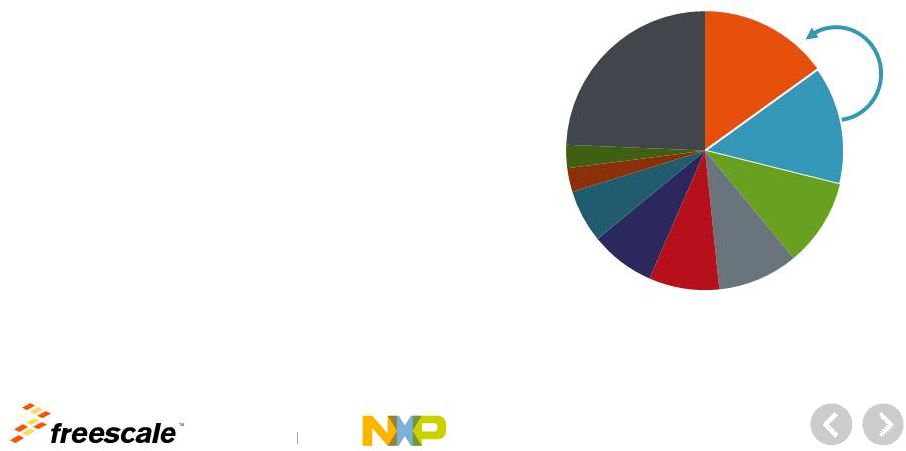

External Use 8 Creates the Leader in Broad-based MCU (2) • #1 in Broad-based MCU(2) – Leader in fast growing 32-bit ARM MCU (2) – Broad-based, general purpose MCU portfolio – Ability to pull-through Analog with MCU platform – Outstanding customer access in key growth verticals • Synergistic Future Growth Opportunities • Ideally Positioned to deliver IoT Solutions – Security – MCU – Software – Connectivity – Building on extensive customer base Based On 1. IHS, MCU Market excluding Automotive 2. NXP Corporate Market Intelligence estimates for 2014, excludes Automotive MCU products MCU Semiconductor TAM 2013 $11B (1) Gained Share 2014 (2) #1 15% NXP+ 14% #3 10% #4 9% #5 8% #6 8% #7 6% #8 3% #9 3% Others 24% |

|

Outstanding Strategic Fit – Secure Connections for a Smarter World • Combined company will – Be the leader in automotive semiconductors – Leverage NXP security leadership plus Freescale broad MCU – Influence evolution of Secure Car & ADAS solutions – Capture emerging growth in the Smarter World • Broad, diverse customer base – Complementary market reach across US, EU, China – Ability to effectively cross-sell total solutions – Strong and broad product portfolio for emerging IoT market • Reinforces the NXP Value Proposition – Grow >1.5x faster than the market Connected Car Security Portable & Wearable Internet of Things External Use 9 |

|

Next Steps • Close expected in second half of 2015 • Until then, Freescale and NXP will operate as separate companies • Our complete focus remains on delighting customers • Exceeding our 2015 commitments Customer Focused Passion to WIN! External Use 10 |

|

© 2014 Freescale Semiconductor, Inc. | External Use www.Freescale.com |