Subject to Completion and Modification

SLM FUNDING LLC HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND THE OTHER DOCUMENTS SLM FUNDING LLC HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT SLM FUNDING LLC AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE ATWWW.SEC.GOV. ALTERNATIVELY, SLM FUNDING LLC, ANY UNDERWRITER OR ANY DEALER PARTICIPATING IN THE OFFERING WILL ARRANGE TO SEND YOU THE PROSPECTUS IF YOU REQUEST IT BY CALLING 1-800-321-7179.

Term Sheet

$1,559,750,000

SLM Student Loan Trust 2007-6

Issuing Entity

SLM Funding LLC

Depositor

Sallie Mae, Inc.

Sponsor, Servicer and Administrator

Student Loan-Backed Notes

On October 23, 2007, the trust will issue:

| | | | | | | |

Class

| | Principal

| | Interest Rate

| | Maturity

|

Floating Rate Class A-1 Notes | | $ | 254,000,000 | | 3-month LIBOR plus % | | April 27, 2015 |

Floating Rate Class A-2 Notes | | $ | 233,000,000 | | 3-month LIBOR plus % | | January 25, 2019 |

Floating Rate Class A-3 Notes | | $ | 133,000,000 | | 3-month LIBOR plus % | | January 25, 2021 |

Floating Rate Class A-4 Notes | | $ | 375,000,000 | | 3-month LIBOR plus % | | October 25, 2024 |

Floating Rate Class A-5 Notes | | $ | 517,957,000 | | 3-month LIBOR plus % | | April 27, 2043 |

Floating Rate Class B Notes | | $ | 46,793,000 | | 3-month LIBOR plus % | | April 27, 2043 |

The trust will make payments primarily from collections on a pool of consolidation student loans. Interest and principal on the notes will be payable quarterly on the 25th day of each January, April, July and October, beginning in January 2008. In general, the trust will pay principal, sequentially, to the class A-1 through class A-5 notes, in that order, until each such class is paid in full. The class B notes will receive payments of principal beginning on the stepdown date, which is expected to be the January 2014 distribution date. Interest on the class B notes will be subordinate to interest on the class A notes and principal on the class B notes will be subordinate to both principal and interest on the class A notes. Credit enhancement for the notes consists of excess interest on the trust student loans, subordination of the class B notes to the class A notes, and the reserve account. On the closing date, the trust will make a deposit into the capitalized interest account, which will be available for a limited period of time. The interest rates on the notes are determined by reference to LIBOR. A description of how LIBOR is determined appears under “Additional Information Regarding the Notes—Determination of Indices—LIBOR” in the base prospectus.

We are offering the notes through the underwriters when and if issued. Application will be made for the notes to be listed on the Official List of the Luxembourg Stock Exchange and to be traded on the Luxembourg Stock Exchange’s Euro MTF Market.

We are not offering the notes in any state or other jurisdiction where the offer is prohibited.

This document constitutes a “free-writing prospectus” within the meaning of Rule 405 under the Securities Act of 1933, as amended.

The notes are asset-backed securities issued by and are obligations of the issuing entity, which is a trust. They are not obligations of or interests in SLM Corporation, the sponsor, the administrator, the servicer, the depositor, any seller or any of their affiliates.

The notes are not guaranteed or insured by the United States or any governmental agency.

A portion of the class B notes may be retained by the depositor or an affiliate. This term sheet covers the resale of the class B notes from time to time by the depositor or an affiliate.

| | | | | | |

| Citi | | Deutsche Bank Securities | | Morgan Stanley | | UBS Investment Bank |

October 15, 2007

The Information in this Term Sheet

The information contained herein refers to and supplements certain of the information contained in the Free-Writing Prospectus, dated October 12, 2007 (the “initial free-writing prospectus”). Capitalized terms not defined herein shall have the meanings ascribed to such terms in the initial free-writing prospectus.

THE TRUST WILL NOT ISSUE THE CLASS B-1B NOTES REFERRED TO IN THE INITIAL FREE-WRITING PROSPECTUS. AS A RESULT, (1) THE CLASS B NOTES WILL CONSIST OF ONE CLASS OF FLOATING RATE NOTES AND EACH REFERENCE TO THE FLOATING RATE CLASS B NOTES OR THE LIBOR-BASED CLASS B NOTES WILL BE A REFERENCE SOLELY TO THE CLASS B FLOATING RATE NOTES, (2) NO CLASS OF AUCTION RATE NOTES WILL BE ISSUED; (3) THERE WILL BE NO AUCTION AGENT OR BROKER-DEALERS; (4) NO FUTURE DISTRIBUTION ACCOUNT WILL BE CREATED OR FUNDED MONTHLY; (5) QUARTERLY DISTRIBUTION DATES ARE NOW REFERRED TO AS DISTRIBUTION DATES; (6) ANY OTHER TERMS AND CONDITIONS SET FORTH IN THE INITIAL FREE-WRITING PROSPECTUS THAT ARE APPLICABLE ONLY TO AUCTION RATE NOTES WILL NOT APPLY; AND (7) ANY REFERENCES TO LIBOR-BASED NOTES ARE REFERENCES TO ALL OF THE NOTES.

The Notes

The trust is offering the following classes of notes, which are debt obligations of the trust:

Class A Notes:

| | • | | Floating Rate Class A-1 Student Loan-Backed Notes in the amount of $254,000,000; |

| | • | | Floating Rate Class A-2 Student Loan-Backed Notes in the amount of $233,000,000; |

| | • | | Floating Rate Class A-3 Student Loan-Backed Notes in the amount of $133,000,000; |

| | • | | Floating Rate Class A-4 Student Loan-Backed Notes in the amount of $375,000,000; and |

| | • | | Floating Rate Class A-5 Student Loan-Backed Notes in the amount of $517,957,000. |

Class B Notes:

| | • | | Floating Rate Class B Student Loan-Backed Notes in the amount of $46,793,000. |

2

Closing Date. The closing date for this offering will be October 23, 2007.

Interest Rates.The spreads to LIBOR will be set at the time of pricing.

Pricing Date. On or after October 16, 2007.

Initial Accrual Period. The initial accrual period for the notes will begin on the closing date and end on January 24, 2008, the day before the first distribution date. LIBOR for the first accrual period will be determined by the following formula:

x + [ 2 / 33 * (y-x)]

where:

x = three-month LIBOR, and

y = four-month LIBOR.

Stepdown Date. The stepdown date is the earlier to occur of (a) the January 2014 distribution date and (b) the first date on which no class A notes remain outstanding.

Maturity Dates. Each class of notes will mature no later than the date set forth for that class in the table below:

| | |

Class | | Maturity Date |

Class A-1 | | April 27, 2015 |

Class A-2 | | January 25, 2019 |

Class A-3 | | January 25, 2021 |

Class A-4 | | October 25, 2024 |

Class A-5 | | April 27, 2043 |

Class B | | April 27, 2043 |

Identification Numbers

The notes will have the following CUSIP Numbers and ISIN:

CUSIP Numbers

| | • | | Class A-1 Notes: 78444C AA1 |

| | • | | Class A-2 Notes: 78444C AB9 |

| | • | | Class A-3 Notes: 78444C AC7 |

| | • | | Class A-4 Notes: 78444C AD5 |

| | • | | Class A-5 Notes: 78444C AE3 |

| | • | | Class B Notes: 78444C AF0 |

3

International Securities Identification Numbers (ISIN)

| | • | | Class A-1 Notes: US78444CAA18 |

| | • | | Class A-2 Notes: US78444CAB90 |

| | • | | Class A-3 Notes: US78444CAC73 |

| | • | | Class A-4 Notes: US78444CAD56 |

| | • | | Class A-5 Notes: US78444CAE30 |

| | • | | Class B Notes: US78444CAF05 |

European Common Codes

The European Common Codes for the notes will be set forth in the prospectus supplement.

Additional Risk Factor

A portion of the class B notes may be retained by the depositor or an affiliate. Accordingly, the market for the class B notes may be less liquid than would otherwise be the case. In addition, if the retained class B notes are subsequently sold in the secondary market, demand and market price for the class B notes already in the market could be adversely affected.

Information About the Student Loans

Supplemental Purchase Period.The supplemental purchase period will end on November 6, 2007.

Consolidation Loan Add-On Period.The consolidation loan add-on period will end on March 31, 2008.

Capitalization of the Trust

| | | |

Floating Rate Class A-1 Student Loan-Backed Notes | | $ | 254,000,000 |

Floating Rate Class A-2 Student Loan-Backed Notes | | | 233,000,000 |

Floating Rate Class A-3 Student Loan-Backed Notes | | | 133,000,000 |

Floating Rate Class A-4 Student Loan-Backed Notes | | | 375,000,000 |

Floating Rate Class A-5 Student Loan-Backed Notes | | | 517,957,000 |

Floating Rate Class B Student Loan-Backed Notes | | | 46,793,000 |

Equity | | | 100 |

| | | |

Total | | $ | 1,559,750,100 |

| | | |

Information About the Trust

Collection Account Initial Deposit. On the closing date, the trust will make an initial deposit from the net proceeds of the sale of the notes into the collection account in cash or eligible investments equal to $5,500,000 plus the excess, if any, of the pool balance as of the statistical cutoff date over the pool balance as of the closing date to the extent such excess amount is not deposited into the supplemental purchase account.

4

Add-on Consolidation Loan Account. On the closing date, the trust will make an initial deposit from the net proceeds of the sale of the notes into the add-on consolidation loan account in cash or eligible investments equal to $4,500,000. Funds in the add-on consolidation loan account will be used to fund add-on consolidation loans from time to time during the consolidation loan add-on period and will not be replenished.

Reserve Account Initial Deposit. On the closing date, the trust will make an initial deposit from the net proceeds of the sale of the notes into the reserve account in cash or eligible investments equal to $3,750,000.

Specified Reserve Account Balance.The Specified Reserve Account Balance for any distribution date will be the greater of:

| | (a) | 0.25% of the sum of (i) the Pool Balance, (ii) the amounts, if any, on deposit in the add-on consolidation loan account and the pre-funding account (excluding any amounts in such accounts that will become part of Available Funds on the related distribution date), as of the close of business on the last day of the related collection period; and |

provided that in no event will that balance exceed the sum of the aggregate outstanding principal balance of the notes.

Capitalized Interest Account.On the closing date, the trust will make an initial deposit from the net proceeds of the sale of the notes into the capitalized interest account. This deposit will be in cash or eligible investments equal to $56,000,000. On and prior to the January 2010 distribution date, funds in the capitalized interest account will be available to cover shortfalls in payments of primary servicing and administration fees, interest due to the class A noteholders and, after that, shortfalls in payments of interest to class B noteholders after application of funds available in the collection account at the end of the related collection period but before application of the reserve account.

Funds on deposit in the capitalized interest account on the April 2009 distribution date in excess of $10,000,000 will be transferred to the collection account and included as Available Funds on that distribution date. All funds remaining on deposit in the capitalized interest account on the January 2010 distribution date will be transferred to the collection account and included as Available Funds on that distribution date. The capitalized interest account further enhances the likelihood of timely interest payments to noteholders through the January 2010 distribution date.

Pre-Funding Account. On the closing date, the administrator will establish and maintain the pre-funding account as an asset of the trust in the name of the indenture trustee. The trust will make a deposit from the net proceeds of the sale of the notes into the pre-funding account on the closing date. The deposit will be in cash or eligible investments equal to $504,124,399. Any amounts remaining on deposit in the pre-funding account on December 31, 2007, the end of the funding period, will be transferred to the

5

collection account on the business day immediately following the end of that period and will be included as a part of Available Funds on the January 2008 distribution date.

Recent Developments

On October 15, 2007, Parent, Merger Subsidiary and the Investors filed a counterclaim against SLM Corporation seeking a declaration that a Material Adverse Effect had occurred.

Compensation of the Servicer

The servicer will receive two separate fees: a primary servicing fee and a carryover servicing fee.

The primary servicing fee for any month is equal to:

• | | when noServicing Fee Deferral Trigger is in effect, 1/12 of 0.50% of the outstanding principal amount of the trust student loans; and |

• | | when a Servicing Fee Deferral Trigger is in effect, 1/12 of 0.20% of the outstanding principal amount of the trust student loans. |

The primary servicing fee will be payable in arrears out of available funds and amounts on deposit in the collection account, the future distribution account, the capitalized interest account and the reserve account on each monthly allocation date or quarterly distribution date, as applicable, beginning in November 2007. The fee paid in each month is calculated based upon the outstanding principal amount of the trust student loans as of the first day of the preceding calendar month. Primary servicing fees due and payable to the servicer will include amounts from any prior distribution dates that remain unpaid.

The carryover servicing fee will be payable to the servicer on each distribution date out of available funds.

The carryover servicing fee is the sum of:

• | | for any month when a Servicing Fee Deferral Trigger is in effect, 1/12 of 0.30% of the outstanding principal amount of the trust student loans; |

| • | | the amount of specified increases in the costs incurred by the servicer; |

| • | | the amount of specified conversion, transfer and removal fees; |

| • | | any amounts described in the first two bullets that remain unpaid from prior distribution dates; and |

| • | | interest on any unpaid amounts. |

“Servicing Fee Deferral Trigger” means, after January 2009, the Trust Parity Percentage is less than 99.3%. The Trust Parity Percentage will be calculated on

6

each distribution date after all principal distribution amounts have been made on such distribution date.

“Trust Parity Percentage” for any distribution date, means the percentage equal to (a) the sum of the Pool Balance and all amounts on deposit in the capitalized interest account, the add-on consolidation loan account and the reserve account (minus the Specified Reserve Account Balance), each as of the end of the immediately preceding collection period, over (b) the aggregate outstanding principal balance of the notes as of such distribution date after all principal distribution amounts have been made on such distribution date.

Initial Interest Rate Cap Agreement

On the closing date, the trust will enter into an initial interest rate cap agreement with Deutsche Bank AG, New York Branch (the “initial cap counterparty”) under a 1992 ISDA Master Agreement (Multicurrency-Cross Border) modified to reflect the terms of the notes and the indenture, subject to confirmation from each rating agency then rating any of the outstanding notes that the initial interest rate cap agreement will not result in its rating(s) on the notes being reduced or withdrawn.

General. On the closing date, the trust will make an upfront payment to the initial cap counterparty of $245,000. Under the terms of the initial interest rate cap agreement, on the 15th day of each month, the initial cap counterparty will pay to the trust an amount, calculated on a monthly basis, equal to the product of (1) the excess, if any, of (i) one-month LIBOR as determined on the second London business day prior to the beginning of each monthly calculation period over (ii) 7.00%; (2) a notional amount equal to $25,000,000 and (3) the actual number of days in the monthly calculation period divided by 360. The initial interest rate cap agreement will terminate on the earlier of the January 2015 distribution date or the date on which the initial interest rate cap agreement terminates in accordance with its terms due to an early termination.

Based on a good faith estimate of maximum probable exposure, the significance percentage of the initial interest rate cap agreement is less than 10%.

Events of Default. Events of default under the initial interest rate cap agreement are limited to:

| | • | | the failure of the initial cap counterparty to pay any amount when due under the initial interest rate cap agreement after giving effect to the applicable grace period; |

| | • | | the occurrence of events of insolvency or bankruptcy of either party; and |

| | • | | the following other standard events of default under the 1992 ISDA Master Agreement: “Breach of Agreement” (not applicable to the trust), “Credit Support Default”, “Misrepresentation” (not applicable to the trust) and “Merger Without Assumption,” as described in Sections 5(a)(ii), (iii), (iv) and (viii) of the 1992 ISDA Master Agreement; |

7

provided, that such events of default may be subject to change with confirmation from each rating agency then rating any of the outstanding notes that such changes to the initial interest rate cap agreement will not result in its rating(s) on the notes being reduced or withdrawn.

Termination Events. Termination events under the initial interest rate cap agreement include the following events:

| | • | | illegality on the part of the trust or the initial cap counterparty to perform its obligations under the initial interest rate cap agreement; |

| | • | | noncompliance by the initial cap counterparty with certain obligations after its ratings downgrade; |

| | • | | certain tax consequences arising from changes in tax law or certain mergers and asset transfers; and |

| | • | | the entry by the trust into any amendment or supplement to the indenture without the prior written consent of the initial cap counterparty where such consent is required under the indenture (such consent not to be unreasonably withheld), if such amendment and/or supplement would (i) materially and adversely affect any of the initial cap counterparty’s rights or obligations under the initial interest rate cap agreement; or (ii) modify the obligations of, or impair the ability of, the trust to fully perform any of its obligations under the initial interest rate cap agreement; |

provided, that such termination events may be subject to change with confirmation from each rating agency then rating any of the outstanding notes that such changes to the initial interest rate cap agreement will not result in its rating(s) on the notes being reduced or withdrawn.

Early Termination. Upon the occurrence of any default under the initial interest rate cap agreement or a termination event, the non-defaulting party or the non-affected party, as the case may be, will have the right to designate an early termination date.

Upon an early termination of the initial interest rate cap agreement, the initial cap counterparty may be liable to make a termination payment to the trust, regardless of which party has caused that termination. The amount of that termination payment will be based on the value of the transaction under the initial interest rate cap agreement computed in accordance with the procedures in, and limited by the terms of, the initial interest rate cap agreement.

Initial Cap Counterparty.

Deutsche Bank Aktiengesellschaft (“Deutsche Bank” or the “Bank”) originated from the reunification of Norddeutsche Bank Aktiengesellschaft, Hamburg, Rheinisch-Westfälische Bank Aktiengesellschaft, Duesseldorf and Süddeutsche Bank Aktiengesellschaft, Munich; pursuant to the Law on the Regional Scope of Credit Institutions, these had been disincorporated in 1952 from Deutsche Bank which was founded in 1870. The merger and the name were entered in the Commercial Register of the District Court Frankfurt am Main on May 2, 1957. Deutsche Bank is a banking institution and a stock corporation incorporated under the laws of Germany under registration number HRB 30 000. The Bank has its registered office in Frankfurt am Main, Germany. It maintains its head office at Taunusanlage 12, 60325 Frankfurt am Main and branch offices in Germany and abroad including in London, New York, Sydney, Tokyo and an Asia-Pacific Head Office in Singapore which serve as hubs for its operations in the respective regions.

The Bank is the parent company of a group consisting of banks, capital market companies, fund management companies, a real estate finance company, instalment financing companies, research and consultancy companies and other domestic and foreign companies (the “Deutsche Bank Group”).

Deutsche Bank AG, New York Branch (the “Branch”) was established in 1978 and is licensed by the New York Superintendent of Banks. Its office is currently located at 60 Wall Street, New York, NY 10005-2858. The Branch is examined by the New York State Banking Department and is subject to the banking laws and regulations applicable to a foreign bank that operates a New York branch. The Branch is also examined by the Federal Reserve Bank of New York.

As of June 30, 2007, Deutsche Bank’s issued share capital amounted to EUR 1,350,748,843.52 consisting of 527,636,267 ordinary shares without par value. The shares are fully paid up and in registered form. The shares are listed for trading and official quotation on all the German Stock Exchanges. They are also listed on the New York Stock Exchange.

The consolidated financial statements for fiscal years starting January 1, 2007 are prepared in compliance with International Financial Reporting Standards (IFRS). As of June 30, 2007, Deutsche Bank Group had total assets of EUR 1,938,185, total liabilities of EUR 1,901,181 and total equity of EUR 37,004 on the basis of IFRS (unaudited).

Deutsche Bank’s long-term senior debt has been assigned a rating of AA (outlook stable) by Standard & Poor’s, Aa1 (outlook stable) by Moody’s Investors Services and AA- (outlook positive) by Fitch Ratings.

The information in the preceding six paragraphs has been provided by the initial cap counterparty. Except for the six foregoing paragraphs, the initial cap

8

counterparty has not been involved in the preparation of, and does not accept responsibility for, this term sheet.

Initial Over-issuance

The pool balance as of the statistical cutoff date plus the aggregate initial balances of the add-on consolidation loan account and the pre-funding account is approximately 99.75% of the aggregate principal balance of the notes minus the initial balance of the capitalized interest account.

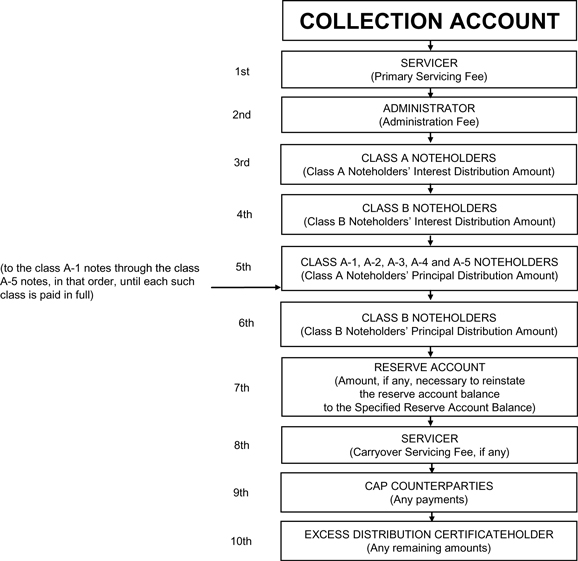

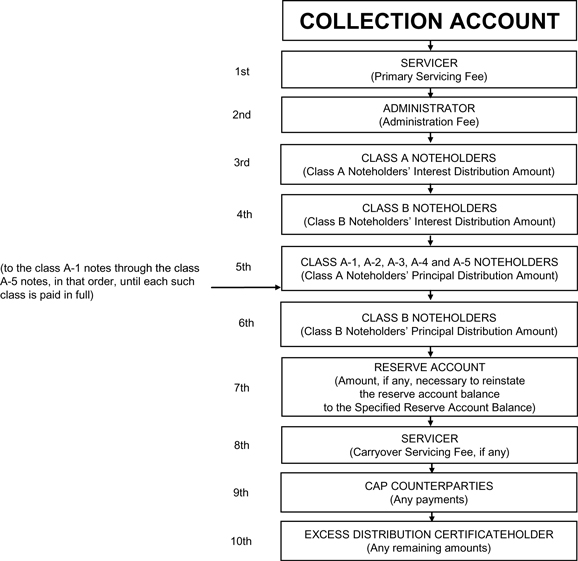

Quarterly Distributions from the Collection Account

On or before each distribution date, the administrator will instruct the indenture trustee to make the following deposits and distributions in the amounts and in the order of priority shown below, except as otherwise provided under“—The Notes—The Class B Notes—Subordination of the Class B Notes” and “—The Notes—The Class A Notes—Distributions of Principal” in the initial free-writing prospectus, to the extent of Available Funds for that distribution date, together with amounts transferred from the capitalized interest account through the January 2010 distribution date (with respect to clauses (a), (b), (c) and (d) below for that distribution date), and amounts transferred from the reserve account with respect to that distribution date:

(a) to the servicer, the primary servicing fee due on that distribution date;

(b) to the administrator, the administration fee due on that distribution date and all prior unpaid administration fees;

(c) to the class A noteholders, the Class A Noteholders’ Interest Distribution Amount, pro rata, based on the amounts payable as Class A Noteholders’ Interest Distribution Amount;

(d) to the class B noteholders, the Class B Noteholders’ Interest Distribution Amount based on the amounts payable as Class B Noteholders’ Interest Distribution Amount;

(e) sequentially, to the class A-1, class A-2, class A-3, class A-4 and class A-5 noteholders, in that order, until the principal balance of each such class is paid in full, the Class A Noteholders’ Principal Distribution Amount;

(f) on each distribution date on and after the Stepdown Date, and provided that no Trigger Event is in effect on such distribution date, to the class B noteholders until the principal balance of such class is paid in full, the Class B Noteholders’ Principal Distribution Amount, until the principal balance of such class is paid in full;

(g) to the reserve account, the amount, if any, necessary to reinstate the balance of the reserve account to the Specified Reserve Account Balance;

9

(h) to the servicer, the aggregate unpaid amount of the carryover servicing fee, if any;

(i) pro rata, to the initial cap counterparty and any potential future cap counterparty under a potential future interest rate cap agreement, the amount of any payment under the initial interest rate cap agreement or potential future interest rate cap agreement, as applicable; and

(j) to the excess distribution certificateholder (initially, SLM ECFC), any remaining amounts after application of the preceding clauses.

The chart on the following page illustrates the application of funds on each distribution date as described in this term sheet and the initial free-writing prospectus.

10

11

Use of Proceeds

The trust will purchase the initial trust student loans from the depositor under the initial sale agreement in exchange for the issuance of the notes and the excess distribution certificate to the depositor.

The depositor will use the net proceeds from the sale of the notes to pay to the trust the initial deposits to the collection account, the add-on consolidation loan account, the capitalized interest account, the supplemental purchase account, the pre-funding account and the reserve account, and to make the upfront payment to the initial cap counterparty under the initial interest rate cap agreement.

The depositor will then use the proceeds paid to the depositor by the underwriters to pay to the sellers the respective purchase prices due to those sellers for the initial trust student loans purchased by the depositor.

Expenses incurred to establish the trust and issue the notes (other than fees that are due to the underwriters) are payable by the depositor. Expenses to be paid by the depositor are estimated to be $1,390,567.

Prepayments, Extensions, Weighted Average Lives and Expected Maturities of the Notes

Exhibit I attached hereto, “Prepayments, Extensions, Weighted Average Lives and Expected Maturities of the Notes,” shows, for each class of notes, the weighted average lives, expected maturities and percentages of the original principal amount remaining at certain distribution dates based on various assumptions.

Underwriting

The notes listed below are offered severally by the underwriters, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in part. It is expected that the notes will be ready for delivery in book-entry form only through the facilities of DTC, Clearstream, Luxembourg and Euroclear, as applicable, on or about October 23, 2007 against payment in immediately available funds.

Subject to the terms and conditions in the underwriting agreement to be dated on or about the pricing date, the depositor has agreed to cause the trust to issue to the depositor, the depositor has agreed to sell to each of the underwriters named below, and each of the underwriters has severally agreed to purchase, the principal amounts of notes shown opposite its name:

12

| | | | | | | | | |

Underwriter | | Class A-1 Notes | | Class A-2 Notes | | Class A-3 Notes |

Citigroup Global Markets Inc. | | $ | 63,500,000 | | $ | 58,250,000 | | $ | 33,250,000 |

Deutsche Bank Securities Inc. | | | 63,500,000 | | | 58,250,000 | | | 33,250,000 |

Morgan Stanley & Co. Incorporated | | | 63,500,000 | | | 58,250,000 | | | 33,250,000 |

UBS Securities LLC | | | 63,500,000 | | | 58,250,000 | | | 33,250,000 |

| | | | | | | | | |

Total | | $ | 254,000,000 | | $ | 233,000,000 | | $ | 133,000,000 |

| | | | | | | | | |

Underwriter | | Class A-4 Notes | | Class A-5 Notes | | Class B Notes |

Citigroup Global Markets Inc. | | $ | 93,750,000 | | $ | 129,490,000 | | $ | 11,699,000 |

Deutsche Bank Securities Inc. | | | 93,750,000 | | | 129,489,000 | | | 11,698,000 |

Morgan Stanley & Co. Incorporated | | | 93,750,000 | | | 129,489,000 | | | 11,698,000 |

UBS Securities LLC | | | 93,750,000 | | | 129,489,000 | | | 11,698,000 |

| | | | | | | | | |

Total | | $ | 375,000,000 | | $ | 517,957,000 | | $ | 46,793,000 |

The underwriters have agreed, subject to the terms and conditions of the underwriting agreement, to purchase all of the notes listed above if any of the notes are purchased.The offering prices, underwriter discounts and dealer concessions and reallowances will be set forth in the prospectus supplement.

The depositor and SLM ECFC have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended.

The notes are new issues of securities with no established trading market. The seller has been advised by the underwriters that the underwriters intend to make a market in the notes but are not obligated to do so and may discontinue market making at any time without notice. No assurance can be given as to the liquidity of the trading market for the notes.

In the ordinary course of their business, the underwriters and certain of their affiliates have in the past, and may in the future, engage in commercial and investment banking activities with the sellers, the depositor and their respective affiliates. The trust may, from time to time, invest the funds in the trust accounts in eligible investments acquired from the underwriters.

During and after the offering, the underwriters may engage in transactions, including open market purchases and sales, to stabilize the prices of the notes.

The underwriters, for example, may over-allot the notes for the account of the underwriting syndicate to create a syndicate short position by accepting orders for more notes than are to be sold.

In general, over-allotment transactions and open market purchases of the notes for the purpose of stabilization or to reduce a short position could cause the price of a note to be higher than it might be in the absence of those transactions.

One or more of the underwriters or its affiliates may retain a material percentage of any class of notes for its own account. The retained notes may be resold by such

13

underwriter or such affiliate at any time in one or more negotiated transactions at varying prices to be determined at the time of sale.

The depositor or its affiliate may retain a material percentage of the class B notes for its own account. The retained notes may be resold by the depositor or its affiliate at any time in one or more negotiated transactions at varying prices to be determined at the time of sale. See“Additional Risk Factor” in this term sheet.

14

EXHIBIT I

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE LIVES AND EXPECTED

MATURITIES OF THE NOTES

Prepayments on pools of student loans can be measured or calculated based on a variety of prepayment models. The models used to calculate these prepayments are the constant prepayment rate (or “CPR”) model and the consolidation loan ramp (or “CLR”) model.

The CPR Model

The CPR model is based on prepayments assumed to occur at a constant percentage rate. CPR is stated as an annualized rate and is calculated as the percentage of the loan amount outstanding at the beginning of a period (including accrued interest to be capitalized), after applying scheduled payments, that are paid during that period. The CPR model assumes that student loans will prepay in each month according to the following formula:

Monthly Prepayments = Balance After Scheduled Payments x (1-(1-CPR)^ 1/12)

Accordingly, monthly prepayments assuming a $1,000 balance after scheduled payments would be as follows for the percentages of CPR listed below:

| | | | | | | | | | | | | | | |

CPR | | 0% | | 4% | | 8% | | 12% | | 16% |

Monthly Prepayment | | $ | 0.00 | | $ | 3.40 | | $ | 6.92 | | $ | 10.60 | | $ | 14.42 |

| | | | | | | | | | | | | | | |

The CLR Model

The CLR model assumes that:

| | • | | student loans will prepay at a CPR of 1/15 of 1.0% one month after origination; |

| | • | | the CPR will increase by a rate of 1/15 of 1.0% per month through the 119th month after origination; and |

| | • | | the CPR will be constant at 8% per annum in the 120th month after origination and in all subsequent months. |

This assumption is called “100% CLR.” For example, at 100% CLR, student loans with a loan age of 72 months are assumed to prepay at 4.80% CPR; at 50% CLR, student loans with a loan age of 48 months are assumed to prepay at 1.60% CPR; at 200% CLR, student loans with a loan age of 96 months are assumed to prepay at 12.80% CPR; and so forth. The following table illustrates the CPR in effect for the indicated months of seasoning at various percentages of CLR.

I-1

Constant Prepayment Rate

| | | | | | | | | | | | | | | |

| | | Number of Months Seasoning | |

| | | 24 | | | 48 | | | 72 | | | 96 | | | 120 | |

Percentage of CLR | | | | | | | | | | | | | | | |

50% | | 0.80 | % | | 1.60 | % | | 2.40 | % | | 3.20 | % | | 4.00 | % |

100% | | 1.60 | % | | 3.20 | % | | 4.80 | % | | 6.40 | % | | 8.00 | % |

150% | | 2.40 | % | | 4.80 | % | | 7.20 | % | | 9.60 | % | | 12.00 | % |

200% | | 3.20 | % | | 6.40 | % | | 9.60 | % | | 12.80 | % | | 16.00 | % |

Neither the CPR model nor the CLR model purports to describe historical prepayment experience or to predict the prepayment rate of any actual student loan pool. The student loans will not prepay at any constant CPR or any constant percentage of CLR, nor will all of the student loans prepay at the same rate. You must make an independent decision regarding the appropriate principal prepayment scenarios to use in making any investment decision.

Additional Assumptions

For purposes of the CLR model and the CPR model, it is assumed, among other things, that:

| | • | | the statistical cutoff date for the trust student loans is September 11, 2007; |

| | • | | the closing date will be October 23, 2007; |

| | • | | all trust student loans (as grouped within the “rep lines” described below) are in repayment status (with accrued interest having been capitalized upon entering repayment), and no trust student loan moves from repayment to any other status; |

| | • | | no delinquencies or defaults occur on any of the trust student loans, no repurchases for breaches of representations, warranties or covenants occur and all borrower payments are collected in full; |

| | • | | consolidation rebate fees are paid based on the principal balance of the student loans at the beginning of the related monthly collection period and reduce the amount in the collection account that would otherwise earn investment income; |

| | • | | there are government payment delays of 60 days for interest subsidy and special allowance payments; |

| | • | | index levels for calculation of borrower and government payments are: |

| | • | | a 91-day Treasury bill rate of 3.95%; and |

| | • | | a three-month commercial paper rate of 5.15%; |

| | • | | all funds deposited into the supplemental purchase account will be transferred to the collection account on the day after the end of the supplemental purchase period; |

I-2

| | • | | distributions begin on January 25, 2008, and payments are made quarterly on the 25th day of every January, April, July and October thereafter, whether or not the 25th is a business day; |

| | • | | the interest rate for each class of outstanding notes at all times will be equal to: |

| | • | | class A-1 notes: 5.44%; |

| | • | | class A-2 notes: 5.51%; |

| | • | | class A-3 notes: 5.59%; |

| | • | | class A-4 notes: 5.64%; |

| | • | | class A-5 notes: 5.73%; and |

| | • | | an administration fee equal to $20,000 is paid quarterly by the trust to the administrator, beginning in January 2008; |

| | • | | a servicing fee equal to 1/12 of the then outstanding principal amount of the trust student loans times 0.50% is paid monthly by the trust to the servicer; |

| | • | | the reserve account has an initial balance equal to $3,750,000 and at all times a balance equal to the greater of (1) 0.25% of the applicable pool balance and (2) $2,250,000; |

| | • | | no payments were received by the trust on the initial interest rate cap agreement; |

| | • | | the collection account has an initial balance equal to $0; |

| | • | | the add-on consolidation loan account has an initial balance equal to $4,500,000 and the full amount is used to purchase add-on consolidation loans on December 31, 2007; |

| | • | | the capitalized interest account has an initial balance equal to $56,000,000, on the April 2009 distribution date, funds on deposit in the capitalized interest account in excess of $10,000,000 will be transferred to the collection account and included in Available Funds on that distribution date, and on the January 2010 distribution date, all funds remaining on deposit in the capitalized interest account will be included in Available Funds; |

| | • | | all payments are assumed to be made at the end of the month and amounts on deposit in the collection account, reserve account, add-on consolidation loan account, pre-funding account and capitalized interest account, including reinvestment income earned in the previous month, net of servicing fees and consolidation rebate fees, are reinvested in eligible investments at the assumed reinvestment rate of 5.14% per annum through the end of the collection period, and reinvestment earnings are available for distribution from the prior collection period; |

| | • | | the average loan age is 3 months; |

I-3

| | • | | prepayments on the trust student loans are applied monthly in accordance with CLR or CPR, as the case may be, as described above; |

| | • | | an optional redemption by the servicer occurs on the distribution date immediately following the collection period during which the pool balance falls below 10% of the sum of (i) the initial pool balance and (ii) the aggregate initial principal balance of all additional trust student loans acquired using funds on deposit in the pre-funding account, including accrued interest to be capitalized, as of their respective subsequent cutoff dates; |

| | • | | the pool of trust student loans consists of 2,930 representative loans plus two additional representative loans for the trust student loans purchased with funds on deposit in the pre-funding account and the add-on consolidation loan account (“rep lines”), which have been created for modeling purposes from individual trust student loans based on combinations of similar individual student loan characteristics, which include, but are not limited to, loan status, interest rate, loan type, index, margin, rate cap and remaining term; and |

| | • | | additional trust student loans in the amount of $504,124,399 are purchased at a price of 100% and added to the trust on December 31, 2007, using funds on deposit in the pre-funding account. |

The following tables have been prepared based on the assumptions described above (including the assumptions regarding the characteristics and performance of the rep lines, which will differ from the characteristics and performance of the actual pool of trust student loans) and should be read in conjunction therewith. In addition, the diverse characteristics, remaining terms and loan ages of the trust student loans could produce slower or faster principal payments than indicated in the following tables, even if the dispersions of weighted average characteristics, remaining terms and loan ages are the same as the assumed characteristics, remaining terms and loan ages.

I-4

CLR Tables

The following tables show the weighted average remaining lives, expected maturity dates and percentages of original principal remaining of each class of the notes at various percentages of CLR from the closing date until the optional redemption date.

Weighted Average Lives and Expected Maturities of the Notes

at Various CLR Percentages

| | | | | | | | | | |

| | | 0% | | 50% | | 100% | | 150% | | 200% |

| Weighted Average Life (years)(1) | | | | | | | | | | |

Class A-1 Notes | | 2.66 | | 2.24 | | 2.00 | | 1.84 | | 1.72 |

Class A-2 Notes | | 7.90 | | 5.96 | | 5.00 | | 4.40 | | 3.98 |

Class A-3 Notes | | 11.28 | | 8.46 | | 7.00 | | 6.10 | | 5.48 |

Class A-4 Notes | | 14.98 | | 11.74 | | 9.70 | | 8.42 | | 7.52 |

Class A-5 Notes | | 20.19 | | 17.95 | | 15.66 | | 13.70 | | 12.17 |

Class B Notes | | 15.85 | | 13.95 | | 12.55 | | 11.47 | | 10.65 |

| | | | | |

| Expected Maturity Date | | | | | | | | | | |

Class A-1 Notes | | April 2013 | | January 2012 | | April 2011 | | January 2011 | | October 2010 |

Class A-2 Notes | | January 2018 | | April 2015 | | January

2014 | | April 2013 | | October 2012 |

Class A-3 Notes | | January 2020 | | January 2017 | | July 2015 | | July 2014 | | October 2013 |

Class A-4 Notes | | January 2025 | | January 2022 | | July 2019 | | January 2018 | | October 2016 |

Class A-5 Notes | | October 2029 | | January 2028 | | January

2026 | | January 2024 | | April 2022 |

Class B Notes | | October 2029 | | January 2028 | | January

2026 | | January 2024 | | April 2022 |

(1) | The weighted average life of the notes (assuming a 360-day year consisting of twelve 30-day months) is determined by: (1) multiplying the amount of each principal payment on the applicable class of notes by the number of years from the closing date to the related distribution date, (2) adding the results, and (3) dividing that sum by the aggregate principal amount of the applicable class of notes as of the closing date. |

I-5

Class A-1

Notes Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CLR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 98 | | | 97 | | | 97 | | | 97 | | | 97 | |

January 2009 | | 84 | | | 82 | | | 79 | | | 77 | | | 74 | |

January 2010 | | 48 | | | 41 | | | 34 | | | 28 | | | 21 | |

January 2011 | | 34 | | | 20 | | | 7 | | | 0 | | | 0 | |

January 2012 | | 18 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2013 | | 1 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2014 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2015 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2016 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2017 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-6

Class A-2

Notes Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CLR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 94 | | | 80 | |

January 2012 | | 100 | | | 96 | | | 74 | | | 52 | | | 31 | |

January 2013 | | 100 | | | 68 | | | 36 | | | 6 | | | 0 | |

January 2014 | | 82 | | | 38 | | | 0 | | | 0 | | | 0 | |

January 2015 | | 62 | | | 7 | | | 0 | | | 0 | | | 0 | |

January 2016 | | 41 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2017 | | 18 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-7

Class A-3 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CLR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2013 | | 100 | | | 100 | | | 100 | | | 100 | | | 60 | |

January 2014 | | 100 | | | 100 | | | 94 | | | 26 | | | 0 | |

January 2015 | | 100 | | | 100 | | | 23 | | | 0 | | | 0 | |

January 2016 | | 100 | | | 55 | | | 0 | | | 0 | | | 0 | |

January 2017 | | 100 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 91 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 46 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-8

Class A-4 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CLR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2013 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2014 | | 100 | | | 100 | | | 100 | | | 100 | | | 87 | |

January 2015 | | 100 | | | 100 | | | 100 | | | 80 | | | 54 | |

January 2016 | | 100 | | | 100 | | | 83 | | | 51 | | | 23 | |

January 2017 | | 100 | | | 98 | | | 57 | | | 23 | | | 0 | |

January 2018 | | 100 | | | 77 | | | 33 | | | 0 | | | 0 | |

January 2019 | | 100 | | | 57 | | | 9 | | | 0 | | | 0 | |

January 2020 | | 100 | | | 37 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 82 | | | 17 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 63 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 43 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 22 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-9

Class A-5 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CLR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2013 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2014 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2015 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2016 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2017 | | 100 | | | 100 | | | 100 | | | 100 | | | 94 | |

January 2018 | | 100 | | | 100 | | | 100 | | | 96 | | | 75 | |

January 2019 | | 100 | | | 100 | | | 100 | | | 80 | | | 59 | |

January 2020 | | 100 | | | 100 | | | 91 | | | 66 | | | 46 | |

January 2021 | | 100 | | | 100 | | | 78 | | | 53 | | | 36 | |

January 2022 | | 100 | | | 98 | | | 65 | | | 43 | | | 28 | |

January 2023 | | 100 | | | 85 | | | 54 | | | 34 | | | 0 | |

January 2024 | | 100 | | | 72 | | | 44 | | | 0 | | | 0 | |

January 2025 | | 99 | | | 59 | | | 35 | | | 0 | | | 0 | |

January 2026 | | 82 | | | 47 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 65 | | | 36 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 49 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 35 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-10

Class B Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CLR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2013 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2014 | | 99 | | | 98 | | | 98 | | | 97 | | | 96 | |

January 2015 | | 95 | | | 92 | | | 89 | | | 86 | | | 82 | |

January 2016 | | 91 | | | 85 | | | 80 | | | 74 | | | 69 | |

January 2017 | | 87 | | | 78 | | | 70 | | | 63 | | | 66 | |

January 2018 | | 83 | | | 71 | | | 62 | | | 60 | | | 52 | |

January 2019 | | 78 | | | 65 | | | 57 | | | 50 | | | 41 | |

January 2020 | | 73 | | | 58 | | | 51 | | | 41 | | | 33 | |

January 2021 | | 67 | | | 52 | | | 44 | | | 34 | | | 25 | |

January 2022 | | 61 | | | 50 | | | 37 | | | 27 | | | 19 | |

January 2023 | | 55 | | | 43 | | | 30 | | | 21 | | | 0 | |

January 2024 | | 49 | | | 36 | | | 25 | | | 0 | | | 0 | |

January 2025 | | 47 | | | 30 | | | 20 | | | 0 | | | 0 | |

January 2026 | | 39 | | | 24 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 31 | | | 18 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 23 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 17 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-11

CPR Tables

The following tables show the weighted average remaining lives, expected maturity dates and percentages of original principal of each class of the notes at various percentages of CPR from the closing date until the optional redemption date.

Weighted Average Lives and Expected Maturities of the Notes at Various CPR Percentages

| | | | | | | | | | |

Weighted Average Life (years)(1) | | 0% | | 4% | | 8% | | 12% | | 16% |

Class A-1 Notes | | 2.66 | | 1.35 | | 0.98 | | 0.78 | | 0.64 |

Class A-2 Notes | | 7.90 | | 3.77 | | 2.42 | | 1.84 | | 1.52 |

Class A-3 Notes | | 11.28 | | 6.06 | | 3.90 | | 2.84 | | 2.24 |

Class A-4 Notes | | 14.98 | | 9.74 | | 6.50 | | 4.75 | | 3.71 |

Class A-5 Notes | | 20.19 | | 16.94 | | 13.48 | | 10.49 | | 8.36 |

Class B Notes | | 15.85 | | 13.70 | | 12.13 | | 10.62 | | 9.14 |

| | | | | |

Expected Maturity Date | | | | | | | | | | |

Class A-1 Notes | | April 2013 | | April 2010 | | April 2009 | | April 2009 | | October 2008 |

Class A-2 Notes | | January 2018 | | January 2013 | | January 2011 | | April 2010 | | October 2009 |

Class A-3 Notes | | January 2020 | | October 2014 | | April 2012 | | January 2011 | | April 2010 |

Class A-4 Notes | | January 2025 | | April 2020 | | July 2016 | | April 2014 | | October 2012 |

Class A-5 Notes | | October 2029 | | April 2027 | | July 2024 | | April 2021 | | October 2018 |

Class B Notes | | October 2029 | | April 2027 | | July 2024 | | April 2021 | | October 2018 |

(1) | The weighted average life of the notes (assuming a 360-day year consisting of twelve 30-day months) is determined by: (1) multiplying the amount of each principal payment on the applicable class of notes by the number of years from the closing date to the related distribution date, (2) adding the results, and (3) dividing that sum by the aggregate principal amount of the applicable class of notes as of the closing date. |

I-12

Class A-1 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CPR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 4% | | | 8% | | | 12% | | | 16% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 98 | | | 93 | | | 88 | | | 83 | | | 78 | |

January 2009 | | 84 | | | 57 | | | 29 | | | 2 | | | 0 | |

January 2010 | | 48 | | | * | | | 0 | | | 0 | | | 0 | |

January 2011 | | 34 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2012 | | 18 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2013 | | 1 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2014 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2015 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2016 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2017 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

| * | An asterisk indicates a percentage greater than 0.0% but less than 0.5%. |

I-13

Class A-2 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CPR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 4% | | | 8% | | | 12% | | | 16% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 73 | |

January 2010 | | 100 | | | 100 | | | 50 | | | 2 | | | 0 | |

January 2011 | | 100 | | | 64 | | | 0 | | | 0 | | | 0 | |

January 2012 | | 100 | | | 28 | | | 0 | | | 0 | | | 0 | |

January 2013 | | 100 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2014 | | 82 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2015 | | 62 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2016 | | 41 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2017 | | 18 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-14

Class A-3 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CPR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 4% | | | 8% | | | 12% | | | 16% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 25 | |

January 2011 | | 100 | | | 100 | | | 94 | | | 0 | | | 0 | |

January 2012 | | 100 | | | 100 | | | 9 | | | 0 | | | 0 | |

January 2013 | | 100 | | | 89 | | | 0 | | | 0 | | | 0 | |

January 2014 | | 100 | | | 32 | | | 0 | | | 0 | | | 0 | |

January 2015 | | 100 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2016 | | 100 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2017 | | 100 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 91 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 46 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-15

Class A-4 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CPR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 4% | | | 8% | | | 12% | | | 16% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 96 | | | 62 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 60 | | | 23 | |

January 2013 | | 100 | | | 100 | | | 76 | | | 29 | | | 0 | |

January 2014 | | 100 | | | 100 | | | 51 | | | 2 | | | 0 | |

January 2015 | | 100 | | | 92 | | | 29 | | | 0 | | | 0 | |

January 2016 | | 100 | | | 74 | | | 9 | | | 0 | | | 0 | |

January 2017 | | 100 | | | 56 | | | 0 | | | 0 | | | 0 | |

January 2018 | | 100 | | | 38 | | | 0 | | | 0 | | | 0 | |

January 2019 | | 100 | | | 22 | | | 0 | | | 0 | | | 0 | |

January 2020 | | 100 | | | 4 | | | 0 | | | 0 | | | 0 | |

January 2021 | | 82 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2022 | | 63 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2023 | | 43 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2024 | | 22 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2025 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-16

Class A-5 Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CPR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 4% | | | 8% | | | 12% | | | 16% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2013 | | 100 | | | 100 | | | 100 | | | 100 | | | 93 | |

January 2014 | | 100 | | | 100 | | | 100 | | | 100 | | | 74 | |

January 2015 | | 100 | | | 100 | | | 100 | | | 85 | | | 60 | |

January 2016 | | 100 | | | 100 | | | 100 | | | 72 | | | 48 | |

January 2017 | | 100 | | | 100 | | | 93 | | | 60 | | | 39 | |

January 2018 | | 100 | | | 100 | | | 81 | | | 50 | | | 31 | |

January 2019 | | 100 | | | 100 | | | 70 | | | 42 | | | 0 | |

January 2020 | | 100 | | | 100 | | | 60 | | | 34 | | | 0 | |

January 2021 | | 100 | | | 91 | | | 51 | | | 28 | | | 0 | |

January 2022 | | 100 | | | 80 | | | 43 | | | 0 | | | 0 | |

January 2023 | | 100 | | | 69 | | | 36 | | | 0 | | | 0 | |

January 2024 | | 100 | | | 59 | | | 29 | | | 0 | | | 0 | |

January 2025 | | 99 | | | 48 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 82 | | | 39 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 65 | | | 29 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 49 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 35 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-17

Class B Notes

Percentages Of Original Principal Of The Notes Remaining At Certain

Distribution Dates At Various CPR Percentages

| | | | | | | | | | | | | | | |

Distribution Date | | 0% | | | 4% | | | 8% | | | 12% | | | 16% | |

Closing Date | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

January 2008 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2009 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2010 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2011 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2012 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2013 | | 100 | | | 100 | | | 100 | | | 100 | | | 100 | |

January 2014 | | 99 | | | 98 | | | 97 | | | 100 | | | 95 | |

January 2015 | | 95 | | | 91 | | | 86 | | | 88 | | | 77 | |

January 2016 | | 91 | | | 83 | | | 78 | | | 74 | | | 62 | |

January 2017 | | 87 | | | 76 | | | 73 | | | 62 | | | 49 | |

January 2018 | | 83 | | | 69 | | | 64 | | | 52 | | | 39 | |

January 2019 | | 78 | | | 63 | | | 55 | | | 43 | | | 0 | |

January 2020 | | 73 | | | 61 | | | 48 | | | 35 | | | 0 | |

January 2021 | | 67 | | | 54 | | | 40 | | | 29 | | | 0 | |

January 2022 | | 61 | | | 48 | | | 34 | | | 0 | | | 0 | |

January 2023 | | 55 | | | 41 | | | 28 | | | 0 | | | 0 | |

January 2024 | | 49 | | | 35 | | | 23 | | | 0 | | | 0 | |

January 2025 | | 47 | | | 29 | | | 0 | | | 0 | | | 0 | |

January 2026 | | 39 | | | 23 | | | 0 | | | 0 | | | 0 | |

January 2027 | | 31 | | | 17 | | | 0 | | | 0 | | | 0 | |

January 2028 | | 23 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2029 | | 17 | | | 0 | | | 0 | | | 0 | | | 0 | |

January 2030 | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | |

I-18

CLR/CPR Equivalence Table

Listed below is a table of equivalent CPR percentages. “Equivalent CPR Percentages” are the CPRs, on the closing date, that will result in the same weighted average life of a class of notes as the corresponding percentage of CLR. For example, in the case of a note with a weighted average life of 2.0 years in the 100% CLR scenario, the single CPR that will result in the same weighted average life is approximately 1.2% CPR.

Equivalent CPR Percentages at Various CLR Assumptions(1)

| | | | | | | | | | | | | | | |

CLR Percentage | | 0% | | | 50% | | | 100% | | | 150% | | | 200% | |

Class A-1 Notes | | 0.0 | % | | 0.7 | % | | 1.2 | % | | 1.6 | % | | 2.1 | % |

Class A-2 Notes | | 0.0 | | | 1.3 | | | 2.2 | | | 3.0 | | | 3.6 | |

Class A-3 Notes | | 0.0 | | | 1.8 | | | 3.0 | | | 4.0 | | | 4.8 | |

Class A-4 Notes | | 0.0 | | | 2.3 | | | 4.0 | | | 5.3 | | | 6.4 | |

Class A-5 Notes | | 0.0 | | | 2.8 | | | 5.4 | | | 7.7 | | | 9.7 | |

Class B Notes | | 0.0 | | | 3.5 | | | 6.8 | | | 10.0 | | | 12.0 | |

(1) | These CLR/CPR equivalents are calculated as of the closing date. These relationships will vary from the table values for any date after the closing date. |

I-19

$1,559,750,000

SLM Student Loan Trust 2007-6

Issuing Entity

| | |

| $ 254,000,000 | | Floating Rate Class A-1 Student Loan-Backed Notes |

| |

| $ 233,000,000 | | Floating Rate Class A-2 Student Loan-Backed Notes |

| |

| $ 133,000,000 | | Floating Rate Class A-3 Student Loan-Backed Notes |

| |

| $ 375,000,000 | | Floating Rate Class A-4 Student Loan-Backed Notes |

| |

| $ 517,957,000 | | Floating Rate Class A-5 Student Loan-Backed Notes |

| |

| $ 46,793,000 | | Floating Rate Class B Student Loan-Backed Notes |

| |

| |

SLM Funding LLC

Depositor

Sallie Mae, Inc.

Sponsor, Servicer and Administrator

Citi

Deutsche Bank Securities

Morgan Stanley

UBS Investment Bank

October 15, 2007