The tax basis information presented is based on operating results for the period ended June 30, 2007, and will vary from the final tax information as of the Fund’s year end.

At June 30, 2007, the tax basis cost of investments for federal income tax purposes was $209,730,021. The tax basis cost was greater than the cost for financial reporting purposes due to the tax deferral of losses on wash sales in the amount of $561,357.

The tax basis components of accumulated earnings/losses at June 30, 2007 are as follows:

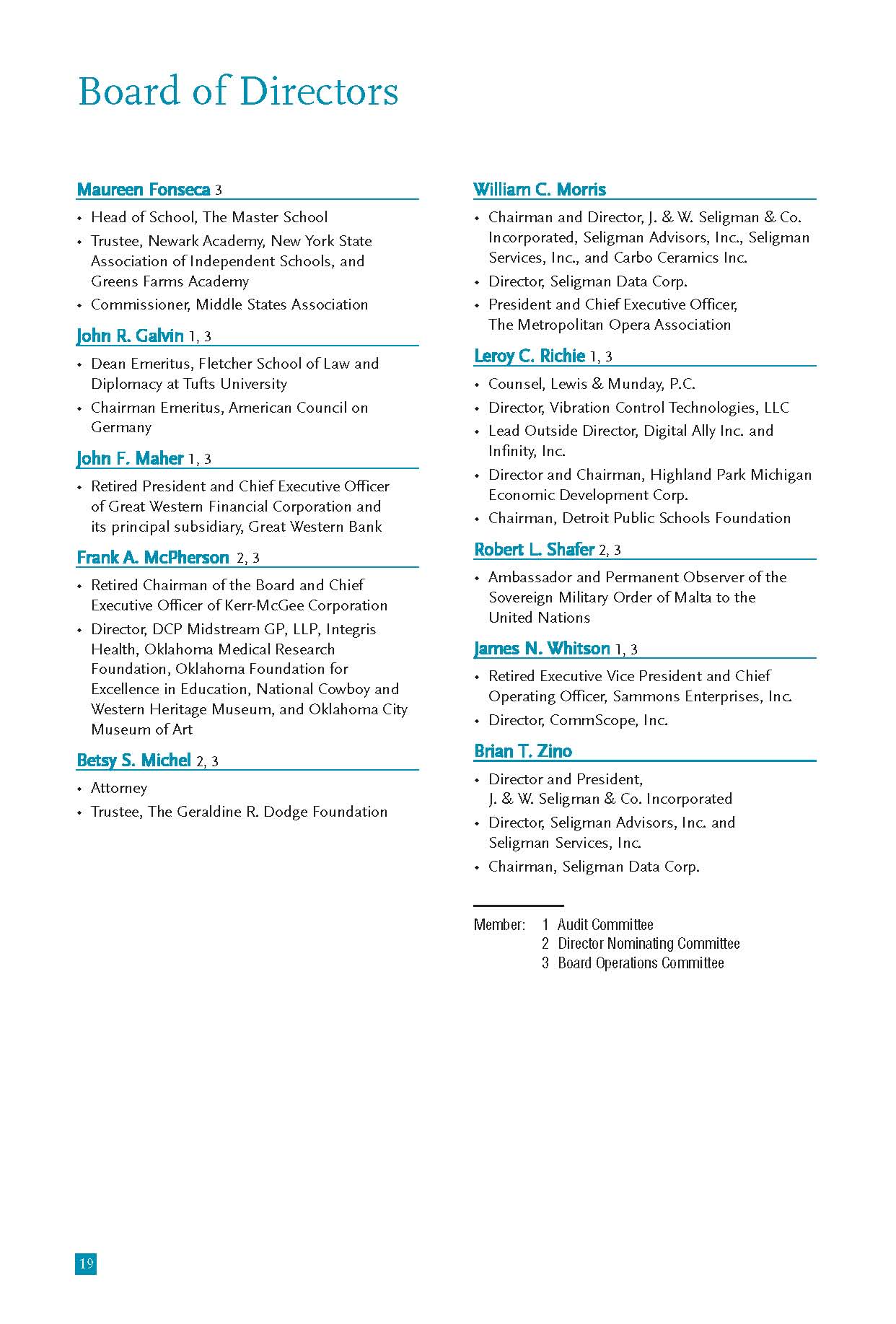

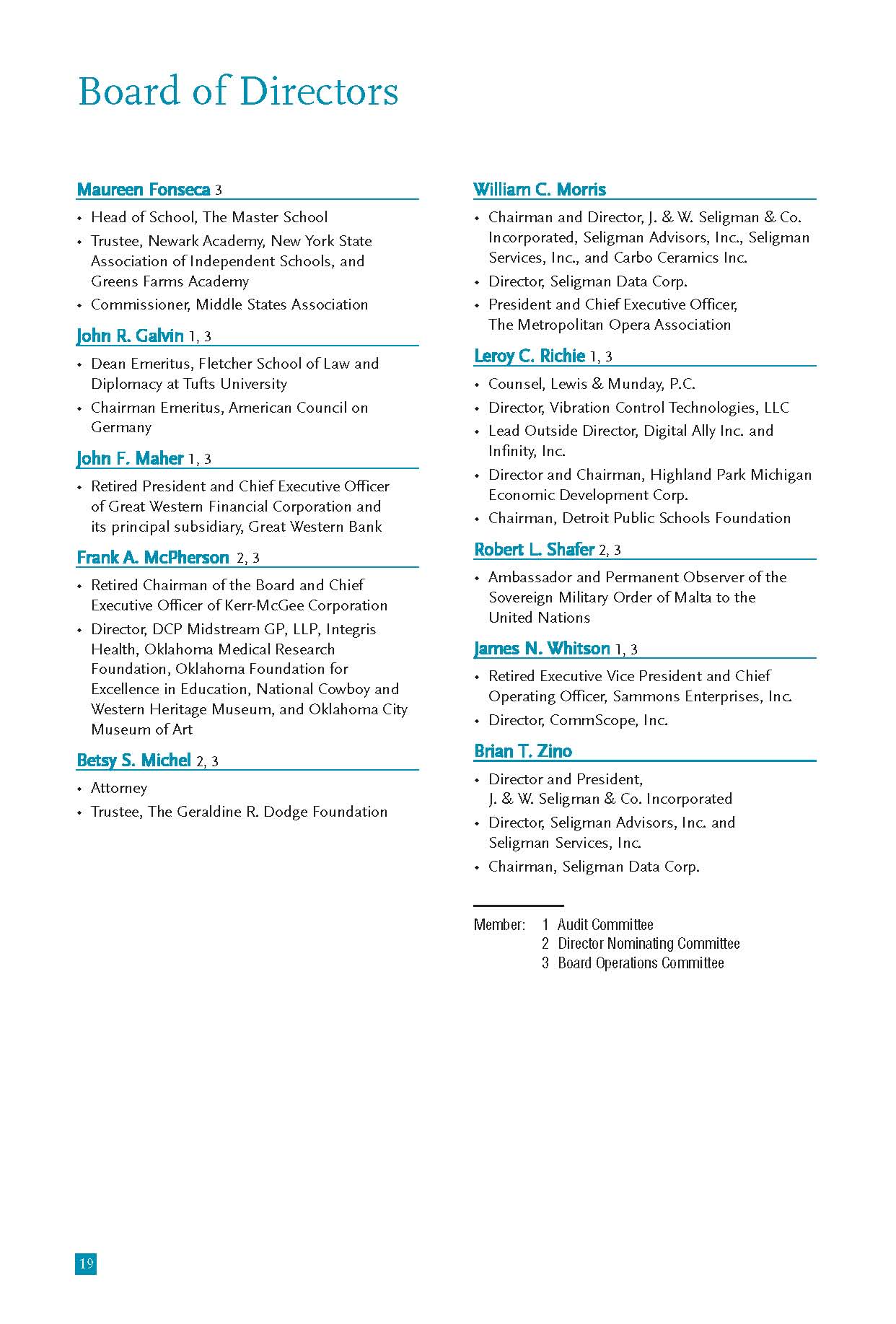

The results of the Manager’s internal review were presented to the Independent Directors of all Seligman Funds. In order to resolve matters with the Independent Directors relating to the four arrangements that permitted frequent trading, the Manager, in May 2004, made payments to three mutual funds and agreed to waive a portion of its management fee with respect to another mutual fund (none of which was Seligman LaSalle International Real Estate Fund, Inc., which was not yet in existence).

Beginning in February 2004, the Manager was in discussions with the New York staff of the Securities and Exchange Commission (“SEC”) and the Office of the New York Attorney General (“Attorney General”) in connection with their review of frequent trading in certain of the Seligman Funds. No late trading is involved. This review was apparently stimulated by the Manager’s voluntary public disclosure of the foregoing arrangements in January 2004. In March 2005, negotiations to settle the matter were initiated by the New York staff of the SEC. After several months of negotiations, tentative agreement was reached, both with the New York staff of the SEC and the Attorney General, on the financial terms of a settlement. However, settlement discussions with the Attorney General ended when the Attorney General sought to impose operating conditions on the Manager that were unacceptable to the Manager, would have applied in perpetuity and were not requested or required by the SEC. Subsequently, the New York staff of the SEC

Notes to Financial Statements (unaudited)

indicated that, in lieu of moving forward under the terms of the tentative financial settlement, the staff was considering recommending to the Commissioners of the SEC the instituting of a formal action against the Manager, the Distributor, and Seligman Data Corp. (together, “Seligman”).

Seligman believes that any action would be both inappropriate and unnecessary, especially in light of the fact that Seligman previously resolved the underlying issue with the Independent Directors of the Seligman Funds and made recompense to the affected Seligman Funds.

Immediately after settlement discussions with the Attorney General ended, the Attorney General issued subpoenas to certain of the Seligman Funds and their directors. The subpoenas sought various Board materials and information relating to the deliberations of the Independent Directors as to the advisory fees paid by the Seligman Funds to the Manager. The Manager objected to the Attorney General’s seeking of such information and, on September 6, 2005, filed suit in federal district court seeking to enjoin the Attorney General from pursuing a fee inquiry. Seligman believes that the Attorney General’s inquiry is improper because Congress has vested exclusive regulatory oversight of investment company advisory fees in the SEC.

At the end of September 2005, the Attorney General indicated that it intended to file an action at some time in the future alleging, in substance, that the Manager permitted other persons to engage in frequent trading other than the arrangements described above and, as a result, the prospectus disclosure of the Seligman Funds is and has been misleading.

On September 26, 2006, the Attorney General commenced a civil action in New York State Supreme Court against J. & W. Seligman & Co. Incorporated, Seligman Advisors, Inc., Seligman Data Corp. and Brian T. Zino (President of the Manager and the Seligman Funds), reiterating, in substance, the foregoing claims and various other related matters. The Attorney General also claims that the fees charged by Seligman are excessive. The Attorney General is seeking damages and restitution, disgorgement, penalties and costs (collectively, “Damages”), including Damages of at least $80 million relating to alleged timing occurring in the Seligman Funds and disgorgement of profits and management fees, and injunctive relief. Seligman and Mr. Zino believe that the claims are without merit and intend to defend themselves vigorously.

Any resolution of these matters with regulatory authorities may include, but not be limited to, sanctions, penalties, injunctions regarding Seligman, restitution to mutual fund shareholders or changes in procedures. Any Damages will be paid by Seligman and not by the Seligman Funds. If Seligman is unsuccessful in its defense of these proceedings, it and its affiliates could be barred from providing services to the Seligman Funds, including serving as an investment adviser for the Seligman Funds and principal underwriter for the open-end Seligman Funds. If these results occur, Seligman will seek exemptive relief from the SEC to permit it and its affiliates to continue to provide services to the Seligman Funds. There is no assurance that such exemptive relief will be granted.

Seligman does not believe that the foregoing legal action or other possible actions should have a material adverse impact on Seligman or the Seligman Funds; however, there can be no assurance of this, or that these matters and any related publicity will not result in reduced demand for shares of the Seligman Funds or other adverse consequences.

8. | | Recently Issued Accounting Pronouncement — In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (“SFAS No. 157”), “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value of assets and liabilities and expands disclosure about fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Fund is currently evaluating the impact of the adoption of SFAS No. 157 but believes the impact will be limited to expanded disclosures in the Fund’s financial statements. |

15

Financial Highlights (unaudited)

The Fund’s financial highlights are presented below. Per share operating performance data is designed to allow investors to trace the operating performance from the beginning net asset value to the ending net asset value, so that investors can understand what effect the individual items have on their investment, assuming it was held throughout the period. Generally, the per share amounts are derived by converting the actual dollar amounts incurred for each item, as disclosed in the financial statements, based on average shares outstanding during the period.

Total investment return measures the Fund’s performance assuming that investors purchased Fund shares at market price or net asset value as of the beginning of the period, reinvested all your dividends and capital gain distributions, if any, and then sold their shares at the closing market price or net asset value on the last day of the period. The computations do not reflect any sales commissions investors may incur in purchasing or selling Fund shares and taxes investors may incur on distributions or on the sale of Fund shares. Total investment returns are not annualized for periods of less than one year.

|

|

|

| May 30, 2007*

to

June 30, 2007

|

|---|

Per Share Operating Performance: | | | | | | |

Net Asset Value, Beginning of Period | | | | $ | 23.88 | ** |

Income (Loss) from Investment Operations: | | | | | | |

| Net investment income | | | | | 0.12 | |

| Net realized and unrealized loss on investments and foreign currency transactions | | | | | (2.16 | ) |

Total from Investment Operations | | | | | (2.04 | ) |

| Offering costs | | | | | (0.05 | ) |

Net Asset Value, End of Period | | | | $ | 21.79 | |

Market Value, End of Period | | | | $ | 25.00 | |

Total Investment Return: | | | | | | |

| Based on market price | | | | | — | ø |

| Based on net asset value | | | | | (8.73 | )% |

Ratios/Supplemental Data: |

| Net assets, end of period (000s omitted) | | | | $ | 194,059 | |

| Ratio of expenses to average net assets | | | | | 1.17 | %† |

| Ratio of net investment income to average net assets | | | | | 6.27 | %† |

| Portfolio turnover rate | | | | | 15.80 | % |

| * | | Commencement of operations. |

| ** | | Net asset value, beginning of period, of $23.875 reflects a deduction of $1.125 per share sales charge from the initial offering price of $25.00 per share. |

ø | | Based upon initial offering price of $25.00 per share. |

| † | | Annualized. |

See Notes to Financial Statements.

16

Dividend Investment Plan

Pursuant to the Fund’s Dividend Investment Plan (the “Plan”), unless a Common Stockholder elects otherwise, all cash dividends, distributions of capital gains, and other distributions are automatically reinvested in additional shares of Common Stock of the Fund. Common Stockholders who elect not to participate in the Plan (including those whose intermediaries do not permit participation in the Plan by their customers) will receive all dividends and distributions payable in cash directly to the Common Stockholder of record (or, if the shares are held in street or other nominee name, then to such nominee) by American Stock Transfer & Trust Company, as dividend disbursing agent. Common Stockholders may elect not to participate in the Plan and to receive all distributions of dividends and capital gains or other distributions in cash by sending written instructions to American Stock Transfer & Trust Company, at the address set forth below. Participation in the Plan may be terminated or resumed at any time without penalty by written notice if received by American Stock Transfer & Trust Company prior to the record date for the next distribution. If such notice is received after such record date, such termination or resumption will be effective with respect to any subsequently declared distribution.

Under the Plan, Common Stockholders receive shares in lieu of cash distributions unless they have elected otherwise as indicated in the preceding paragraph. For all distributions, such shares will be issued in lieu of cash by the Fund from previously authorized but unissued shares of Common Stock. If the market price of a share on the ex-dividend date of such a distribution is at or above the Fund’s net asset value per share on such date, the number of shares to be issued by the Fund to each Common Stockholder receiving shares in lieu of cash distributions will be determined by dividing the amount of the cash distribution to which such Common Stockholder would be entitled by the greater of the net asset value per share on such date or 95% of the market price of a share on such date. If the market price of a share on such an ex-dividend date is below the net asset value per share, the number of shares to be issued to such Common Stockholders will be determined by dividing such amount by the per share market price. Market price on any day means the closing price for the Common Stock at the close of regular trading on the New York Stock Exchange on such day or, if such day is not a day on which the Common Stock trades, the closing price for the Common Stock at the close of regular trading on the immediately preceding day on which trading occurs.

Common Stockholders who hold their shares in the name of a broker or other nominee should contact such broker or other nominee to discuss the extent to which such nominee will permit their participation in the Plan. The Fund will administer the Plan on the basis of the number of shares certified from time to time by nominees as representing the total amount of shares held through such nominees by beneficial Common Stockholders who are participating in such Plan and by delivering shares on behalf of such beneficial Common Stockholders to the nominees’ accounts at The Depository Trust Company.

American Stock Transfer & Trust Company will maintain all Common Stockholders’ accounts in the Plan not held by The Depository Trust Company and furnish written confirmation of all transactions in the account, including information needed by Common Stockholders for tax records. Shares in the account of each Plan participant will be held in non-certificated form in the name of the participant, and each Common Stockholder’s proxy will include those shares purchased or received pursuant to the Plan.

17

Dividend Investment Plan

The Fund currently intends to make open market purchases of its Common Stock from time to time, when the Fund is trading at a discount to net asset value, in an amount approximately sufficient to offset the growth in the number of its shares of Common Stock attributable to the reinvestment of the portion of its distributions to Common Stockholders that are attributable to distributions received from portfolio investments less Fund expenses.

The Fund reserves the right to amend or terminate the Plan as applied to any distribution paid subsequent to written notice of the change sent to participants in the Plan at least 90 days before the record date for such distribution. There are no service or brokerage charges to participants in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable to the Fund by the participants. The Fund also reserves the right to amend the Plan to provide for payment of brokerage fees by Plan participants in the event the Plan is changed to provide for open market purchases of Common Stock on behalf of Plan participants. All correspondence concerning the Plan should be directed to American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York 10038.

18

[This Page Left Blank Intentionally]

Quarterly Schedule of Investments

A complete schedule of portfolio holdings owned by the Fund will be filed with the SEC for the first and third quarters of each fiscal year on Form N-Q, and will be available to shareholders (i) without charge, upon request, by calling toll-free (800) 874-1092 in the US or collect (212) 682-7600 outside the US or (ii) on the SEC’s website at www.sec.gov.1 In addition, the Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. Certain of the information contained in the Fund’s Form N-Q is also made available to shareholders on Seligman’s website at www.seligman.com.1

Proxy Voting

A description of the policies and procedures used by the Fund to determine how to vote proxies relating to portfolio securities as well as information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling toll-free (800) 874-1092 in the US or collect (212) 682-7600 outside the US and (ii) on the SEC’s website at www.sec.gov.1 Information for each new 12-month period ending June 30 will be available no later than August 31 of that year.

Transfer Agent and Registrar

Prior to the initial public offering of the Fund, the Fund’s Board of Directors approved, on a temporary basis, American Stock Transfer & Trust Company (“AST”) as transfer agent and registrar for the Fund. On July 19, 2007, after due consideration by the Fund’s Board of the services provided by AST and the costs associated with such services, the Board approved the continued use of AST as transfer agent and registrar for the Fund.

In addition to acting as transfer agent and registrar for the Fund, AST will also act as dividend disbursing agent, dividend paying agent, and stockholder servicing agent. Seligman Data Corp., which was named in the Fund’s prospectus as stockholder servicing agent and dividend paying agent, will not be providing any such services to the Fund.

This report is intended for the information of stockholders who have received the offering prospectus covering shares of Seligman LaSalle International Real Estate Fund, Inc., which contains information about investment objectives, risks, management fees and other costs. The prospectus should be read carefully before investing.

1 | | These website references are inactive textual references and information contained in or otherwise accessible through these websites does not form a part of this report or the Fund’s prospectus or statement of additional information. |

22

ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

ITEM 6. | SCHEDULE OF INVESTMENTS. |

| Included in Item 1 above. |

ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

ITEM 11. | CONTROLS AND PROCEDURES. |

(a) The registrant's principal executive officer and principal financial officer have concluded, based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this report, that these disclosure controls and procedures provide reasonable assurance that material information required to be disclosed by the registrant in the report it files or submits on Form N-CSR is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms and that such material information is accumulated and communicated to the registrant's management, including its principal executive officer and principal financial officer, as appropriate, in order to allow timely decisions regarding required disclosure.

(b) The registrant’s principal executive officer and principal financial officer are aware of no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| (a)(2) | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. |

| (b) | Certifications of chief executive officer and chief financial officer as required by Rule 30a-2(b) under the Investment Company Act of 1940. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SELIGMAN LASALLE INTERNATIONAL REAL ESTATE FUND, INC.

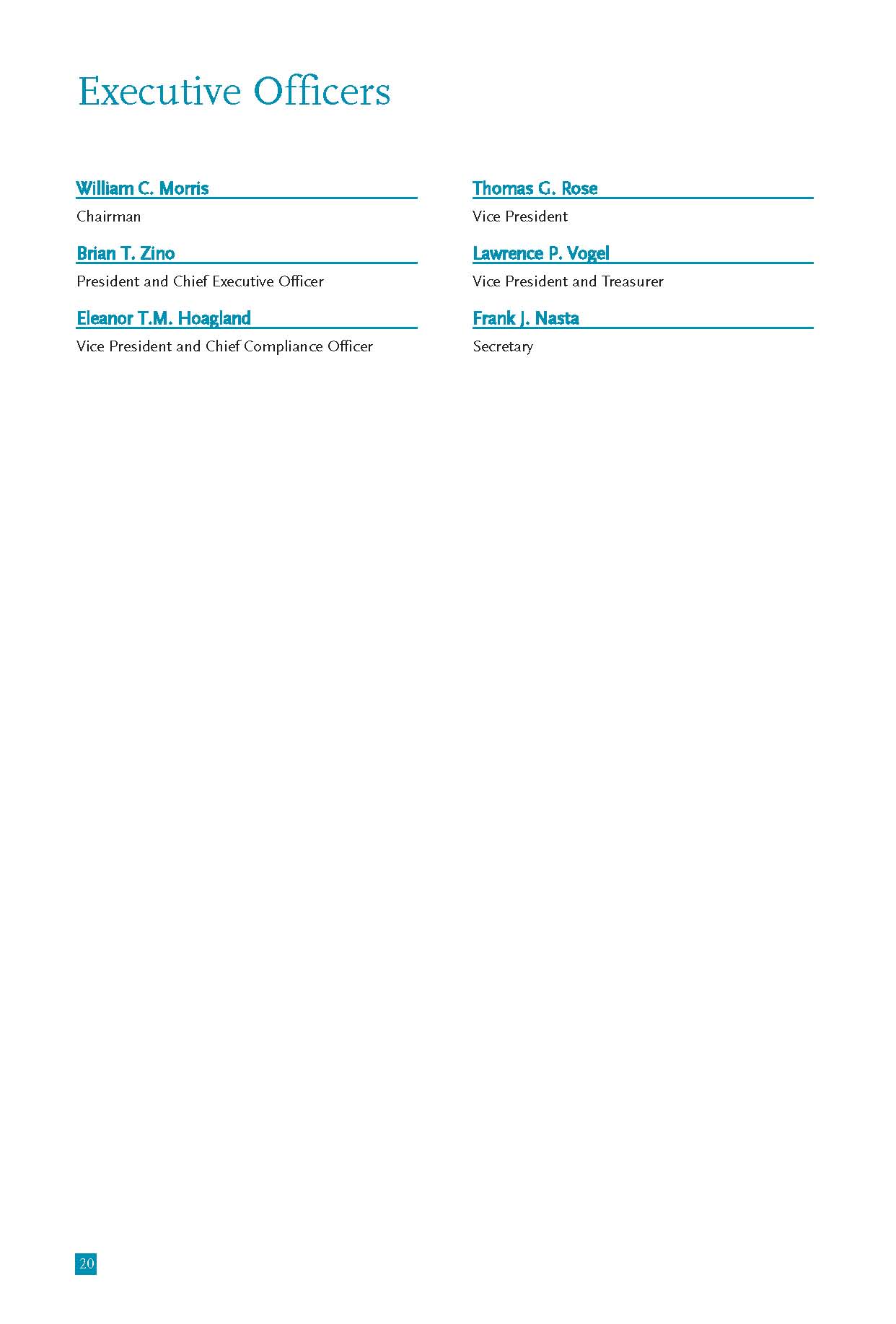

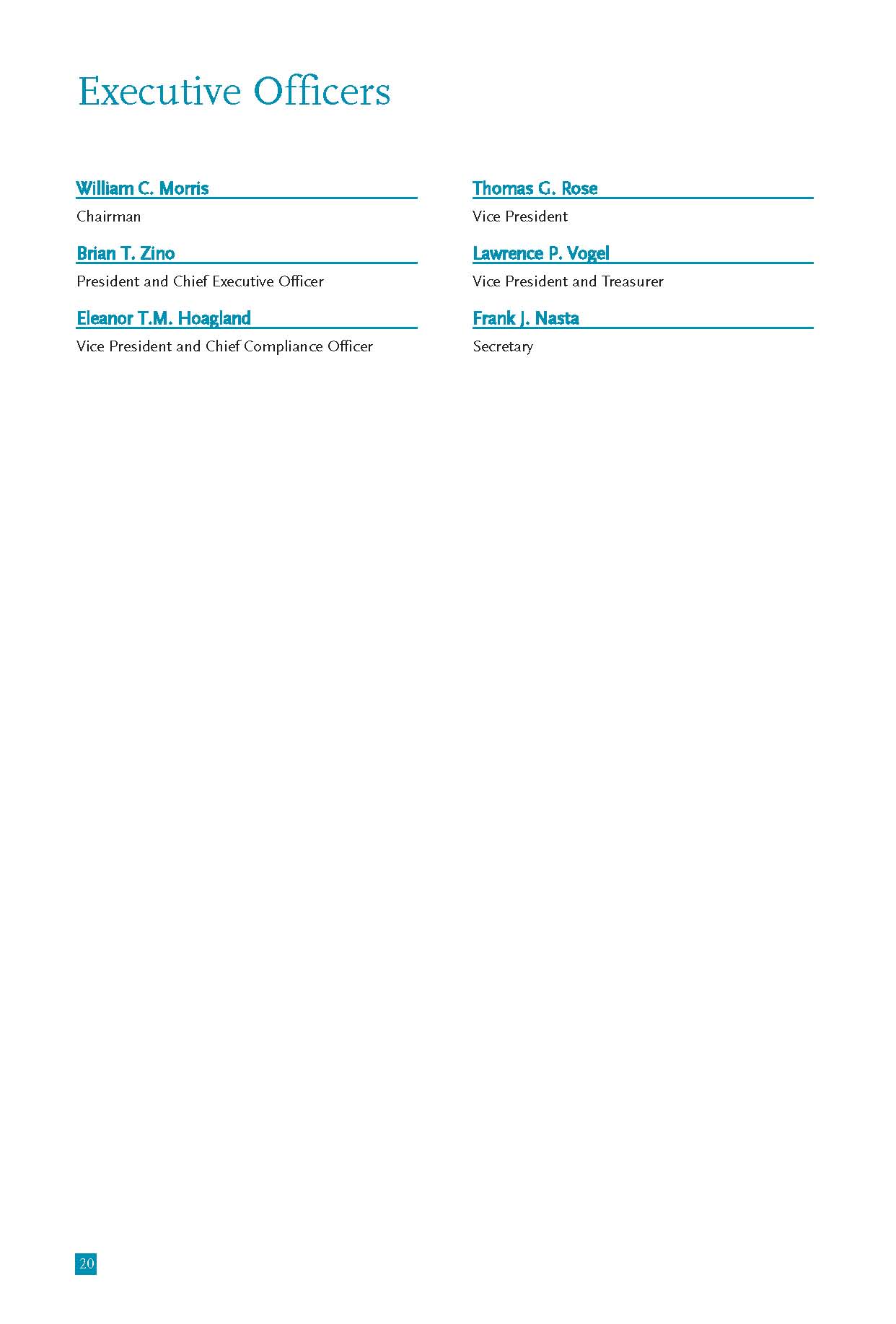

| President and Chief Executive Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| President and Chief Executive Officer |

| Vice President, Treasurer and Chief Financial Officer |

SELIGMAN LASALLE INTERNATIONAL REAL ESTATE FUND, INC.

EXHIBIT INDEX

| (a)(2) | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. |

| (b) | Certification of chief executive officer and chief financial officer as required by Rule 30a-2(b) of the Investment Company Act of 1940. |