EXHIBIT 99.1

| | | June 24, 2014 |

| | | |

| North American Energy Resources, Inc. | | |

| 1535 Soniat Street | | |

| New Orleans, LA 70115 | | |

| Attn: Mr. Alan Massara | | |

| | | |

| | RE: | Reserves & Economic Evaluation |

| | | North American Energy Resources, Inc. |

| | | FYE 2013 - SEC Pricing |

Executive Summary

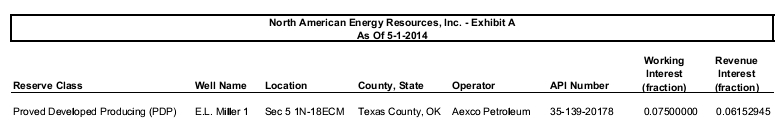

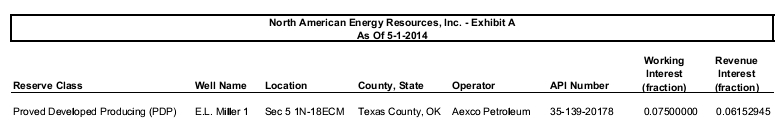

A reserve and economic evaluation has been performed on oil and gas assets of North American Energy Resources, Inc. (“NAE”) as ofMay 1, 2014. Well names, working and net revenue interests, and other well information are provided on the attached Exhibit A. Information used in the evaluation was provided by NAE and supplemented by data gathered from public sources. Summary results of this analysis are shown below and details are presented in accompanying exhibits.

This evaluation was performed using SEC reserve standards and SEC Pricing, and includes one (1) Proved Developed Producing (PDP) property.

As presented in the accompanying economic projection, the net reserves and future net cash flow as of May 1, 2014 are as follows (Volumes in MBBLs and MMcf, Values in M$):

| | | | | | Net Reserves | | Net | | | Net | | | NPV | |

| | | Number of | | | Oil | | Gas | | Capital | | | Cashflow | | | Disc @ 10% | |

| Reserve Class | | Properties | | | MBBL | | MMCF | | M$ | | | M$ | | | M$ | |

| PDP | | | 1 | | | 0 | | 10.8 | | $ | 0 | | | $ | 6.81 | | | $ | 3.92 | |

| Total Proved | | | 1 | | | 0 | | 10.8 | | $ | 0 | | | $ | 6.81 | | | $ | 3.92 | |

Pricing

Per SEC rules as of January 1, 2010, the SEC pricing is calculated by averaging the first-of-the- month oil and gas pricing for the calendar year being evaluated. For May, 2013 through April, 2014 the average NYMEX price is 4.026 $/MMBTU for natural gas (Henry Hub). Price was held constant for the life of the well.

Pinnacle Energy Services, LLC

9420 Cedar Lake Ave, Oklahoma City, OK 73114

Ofc: 405-810-9151 Fax: 405-843-4700 www.PinnacleEnergy.com

Based on an evaluation of actual prices received by NAE, differentials to the SEC NYMEX prices were applied. The calculated gas price differential was -29.6%.

Interests

Interest information was provided by NAE for each property, indicating working and net revenue interests. These interests are shown in the attached Exhibit A.

Taxes

Oklahoma state severance tax is 7.095%.

Expenses

Gross operating expenses were estimated to be $1115 per month based on the latest 12 months of data provided by NAE.

Future plugging costs were assumed to be equal to salvage value.

Property Description and Reserve Estimates

The E.L. Miller 1 is a single dry-gas well producing from the Morrow formation. It has a very well- established 2.4% annual decline. Remaining reserves were determined by simple decline-curve analysis.

The assumptions, data, methods and procedures used were appropriate for the purpose served by the report in compliance with Item 1202(a)(8)(iv) of Regulation S-K. This method is appropriate for a well of this type. Although not likely, the ability of NAE to recover the estimated remaining reserves from this well could be hampered by mechanical failure, product price market conditions or change in governmental or geopolitical regulations.

Reserves

Remaining recoverable reserves are those quantities of petroleum that are anticipated to be commercially recovered from known accumulations from a given date forward. All reserve estimates involve some degree of uncertainty depending primarily on the amount of reliable geologic and engineering data available at the time of the estimate and the interpretation of these data. The relative degree of uncertainty is conveyed by classifying reserves as Proved (highly certain) or Non-Proved (less certain). The estimated reserves and revenues shown in this report were determined for Proved Developed Producing (PDP), Proved Developed Non-Producing (PDNP), and Proven Undeveloped (PUD) reserve categories, as well as Probable (Prob) and Possible (Poss) Non-Proven reserve categories.

Pinnacle Energy Services, LLC

9420 Cedar Lake Ave, Oklahoma City, OK 73114

Ofc: 405-810-9151 Fax: 405-843-4700 www.PinnacleEnergy.com

By definition, PDP generally refers to existing producing properties, while PDNP refers to the additional reserves from behind pipe (BP) intervals, activities to increase production or reserves from existing completions, or wells which have been tested and are awaiting sales. PUD refers to development drilling locations with definable reserves using offset well and reservoir parameters. For PNP and PUD, the activity or targeted zones must known to produce commercial hydrocarbons in quantifiable volumes and rates and reserves can be reasonably accurately estimated based on analogies and available geological and engineering information.

Non-Proven Probable and Possible reserves appear to have engineering and geologic merit and have been determined to have over 50% (Probable) or less than 50% (Possible) likelihood to be commercially productive, but lack some aspect by definition to be considered proven, such as proximity to commercial production, production methods not proven for a certain geological or production application, or other geological or engineering deficiency.

Accuracy of production forecasts generally depends on the amount of historical data production and pressure available and the majority the producing wells reviewed in this evaluation had sufficient historical data to forecast future production with confidence. Those with limited production or pressure data history were forecasted by reviewing analogy well and test data and applying this knowledge to the available well information.

Future Cashflow

Future cash flow being reported is after deducting state production taxes and ad valorem taxes, but prior to deducting federal income taxes. The future net cash flow has been discounted at an annual rate of 10 percent to determine its present worth. The present worth is shown to indicate the effect of time on the value of money and should not be construed as being the fair market value of the properties.

General

The reserves and values included in this report are estimates only and should not be construed as being exact quantities. The reserve estimates were arrived at by using accepted engineering practices and were primarily based on historical rate decline analysis for existing producers. As additional pressure and production performance data becomes available, reserve estimates may increase or decrease in the future. The revenue from such reserves and the actual costs related may be more or less than the estimated amounts. Because of governmental policies and uncertainties of supply and demand, the prices actually received for the reserves included in this report and the costs incurred in recovering such reserves may vary from the price and cost assumptions referenced. Therefore, in all cases, estimates of reserves may increase or decrease as a result of future operations.

In evaluating the information available for this analysis, items excluded from consideration were all matters as to which legal or accounting, rather than engineering interpretation, may be controlling. As in all aspects of oil and gas evaluation, there are uncertainties inherent in the interpretation of engineering data and such conclusions necessarily represent only informed professional judgments. The titles to the properties have not been examined nor has the actual degree or type of interest owned been independently confirmed. A field inspection of the properties is not usually considered necessary for the purpose of this report.

Pinnacle Energy Services, LLC

9420 Cedar Lake Ave, Oklahoma City, OK 73114

Ofc: 405-810-9151 Fax: 405-843-4700 www.PinnacleEnergy.com

Information included in this report includes the graphical decline curves for individual wells, projected production and cash flow economic results, and miscellaneous individual well information. Additional information reviewed will be retained and is available for review at any time. Pinnacle Energy Services, L.L.C. can take no responsibility for the accuracy of the data used in the analysis, whether gathered from public sources or otherwise.

| Pinnacle Energy Services, LLC | |

| | |

| |

| Richard J. Morrow, P.E. | |

| Petroleum Engineer | |

| Disclaimer: Pinnacle Energy Services, L.L.C. nor any of its subsidiaries, affiliates, officers, directors, shareholders, employees, consultants, advisors, agents, or representatives make any representation or warranty, express or implied, in connection with any of the information made available herein, including, but not limited to, the past, present or future value of the anticipated reserves, cash flows, income, costs, expense, liabilities and profits, if any, to be derived from the properties described herein. All statements, estimates, projections and implications as to future operations are based upon best judgments of Pinnacle Energy Services; however, there is no assurance that such statements, estimates, projections or implications will prove to be accurate. Accordingly, any company, or other party receiving such information will rely solely upon its own independent examination and assessment of said information. Neither Pinnacle Energy Services nor any of its subsidiaries, affiliates, officers, directors, shareholders, employees, consultants, advisors, agents, or representatives shall have any liability to any party receiving the information herein, nor to any affiliate, partner, member, officer, director, shareholder, employee, consultant, advisor, agent or representative of such party from any use of such information. The property description and other information attached hereto are for the sole, confidential use of the person to whom this copy has been made available. It may not be disseminated or reproduced in any matter whatsoever, whether in full or in part, without the prior written consent of Pinnacle Energy Services, L.L.C. This evaluation and all descriptions and other information attached hereto are for information purposes only and do not constitute an evaluation of or offer to sell or a solicitation of an offer to buy any securities. |

Pinnacle Energy Services, LLC

9420 Cedar Lake Ave, Oklahoma City, OK 73114

Ofc: 405-810-9151 Fax: 405-843-4700 www.PinnacleEnergy.com