PROS Holdings Q1 2019

Disclaimer / Forward-Looking Statements Included in this presentation are forward-looking statements including, but not limited to, those related to earnings, addressable market and other financial projections. These predictions, estimates, and other forward-looking statements involve known and unknown risks and uncertainties that may cause actual results to differ materially from those expressed or implied in this presentation. We refer you to the documents we file with the Securities and Exchange Commission, which identify and discuss important factors that could cause actual results to differ materially from those discussed in these forward-looking statements. All statements included in these materials are based upon information known as of the date hereof, and PROS Holdings assumes no obligation to update any such statements, except as required by law. This presentation includes certain supplemental non-GAAP financial measures, that we believe are useful to investors as useful tools for assessing the comparability between periods as well as company by company. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, our financial information and results prepared in accordance with U.S. GAAP included in our periodic filings made with the SEC. Further information relevant to the interpretation of non-GAAP financial measures, and reconciliations of these non-GAAP financial measures to the most comparable GAAP measures, may be found in the Appendix to this presentation.

Our Vision To be the dynamic AI platform powering commerce in the digital economy

Business Overview

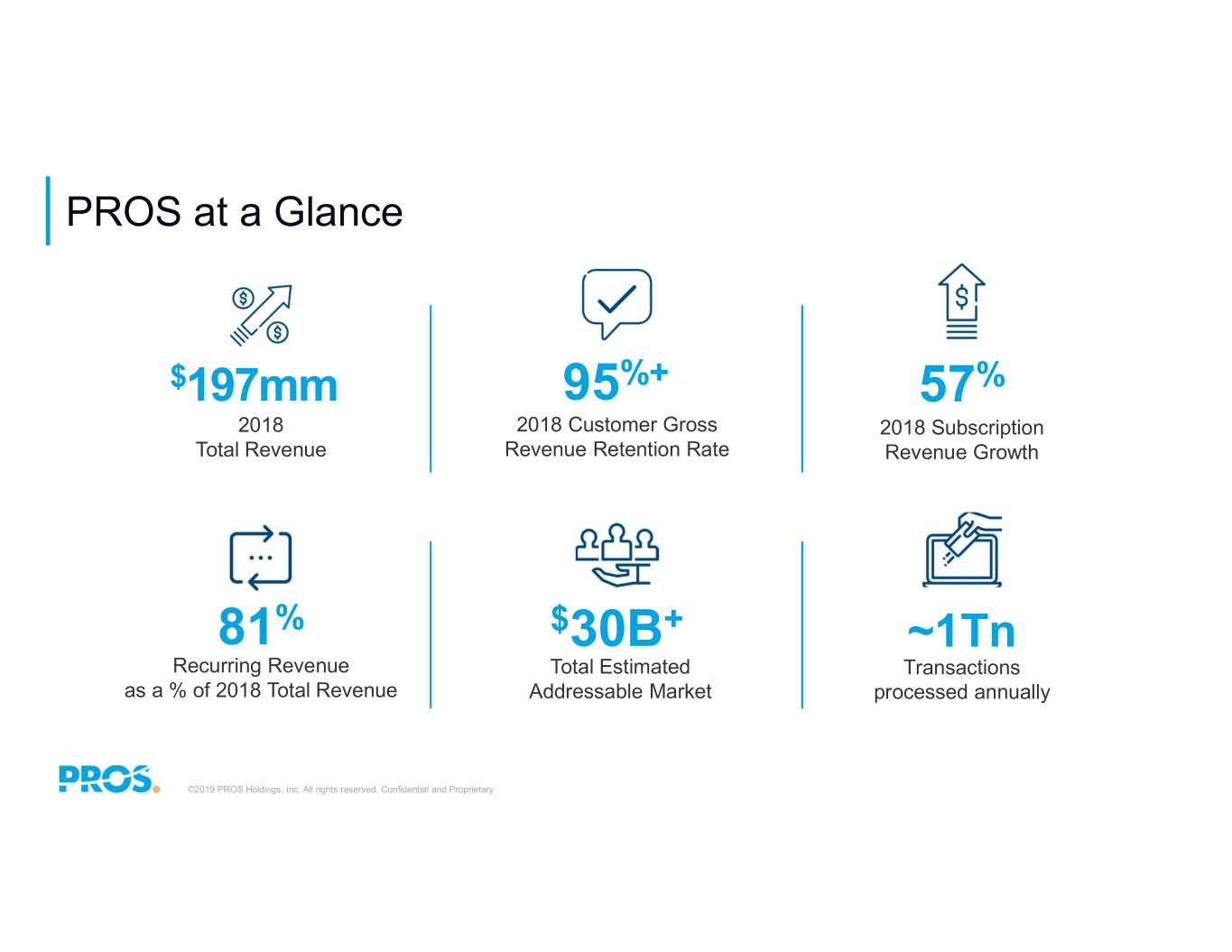

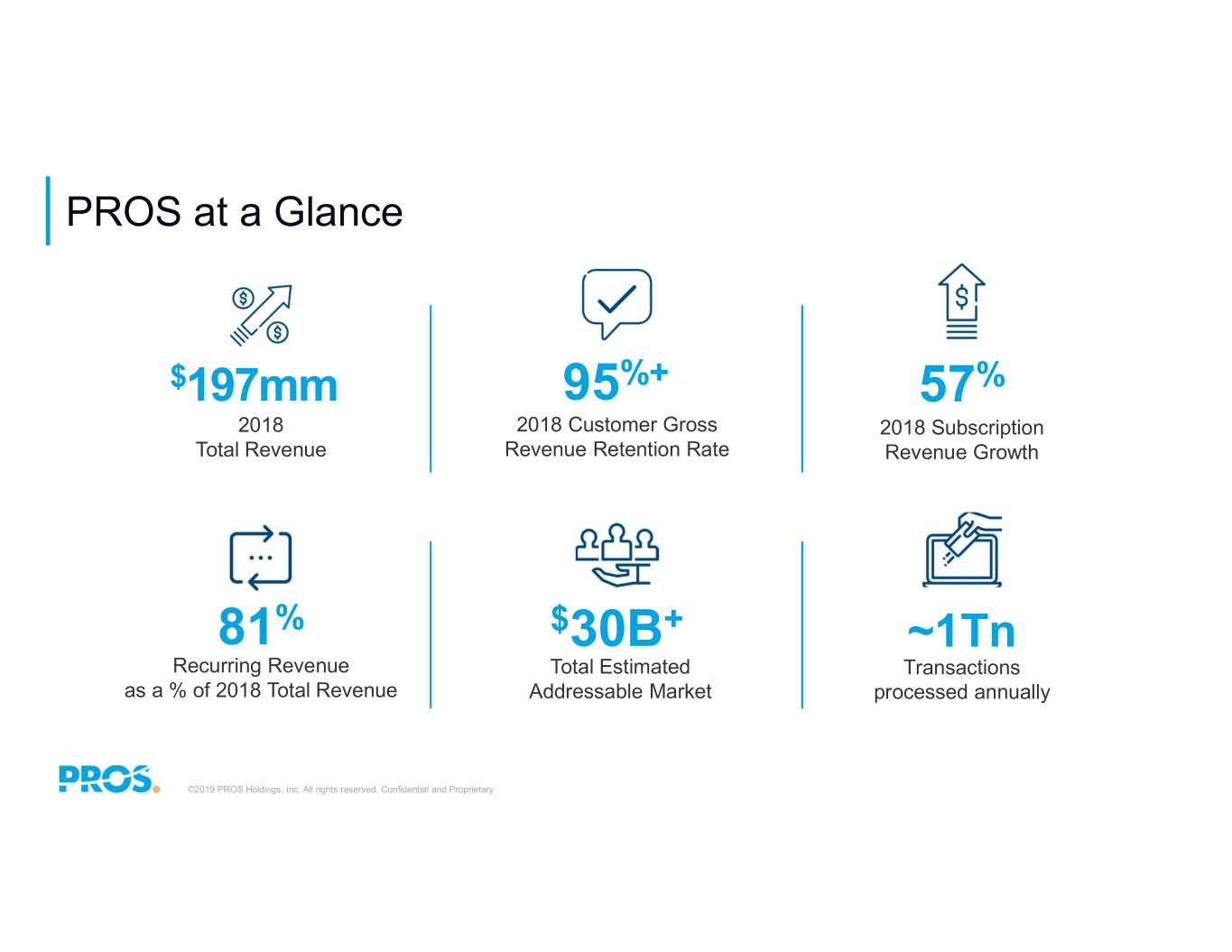

PROS at a Glance $197mm 95%+ 57% 2018 2018 Customer Gross 2018 Subscription Total Revenue Revenue Retention Rate Revenue Growth 81% $30B+ ~1Tn Recurring Revenue Total Estimated Transactions as a % of 2018 Total Revenue Addressable Market processed annually ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

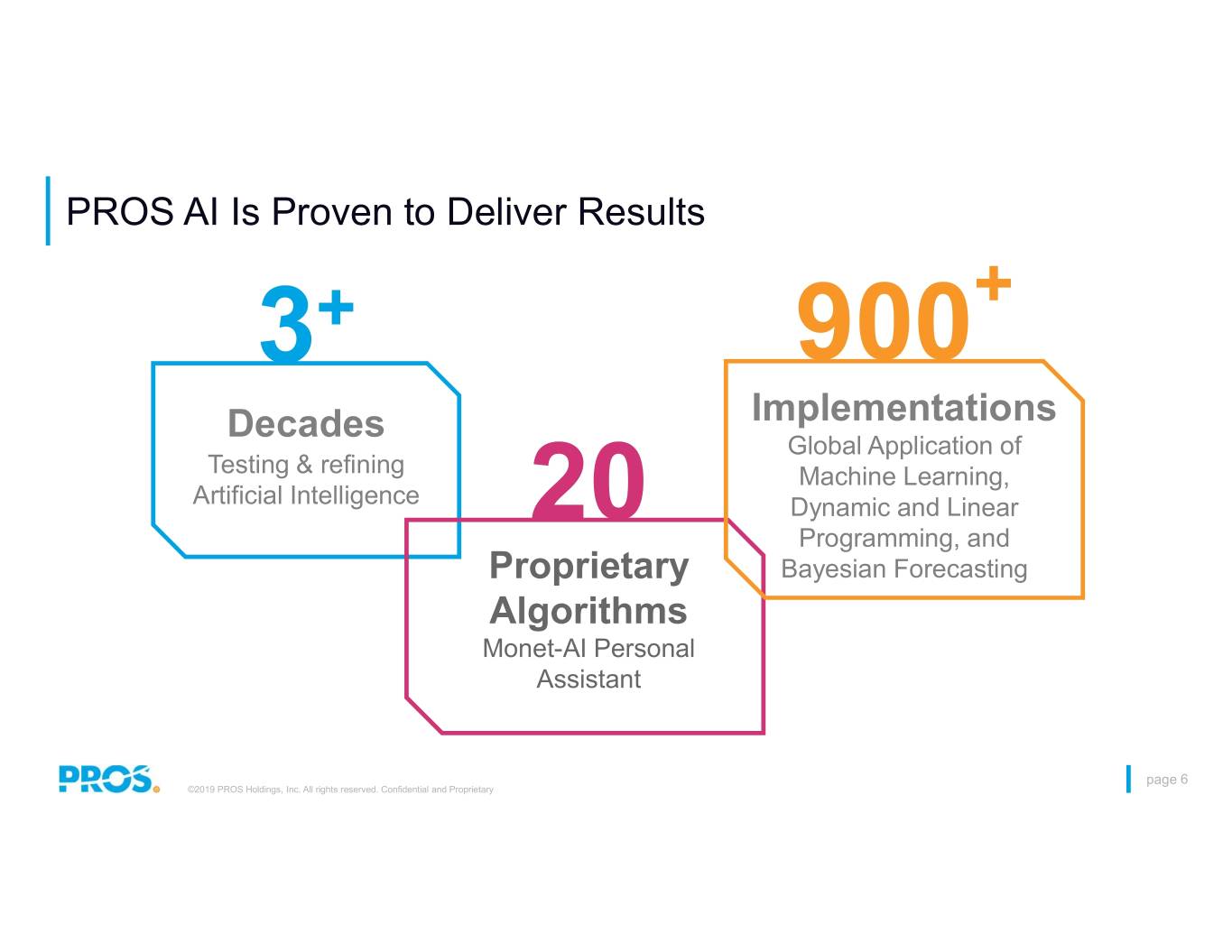

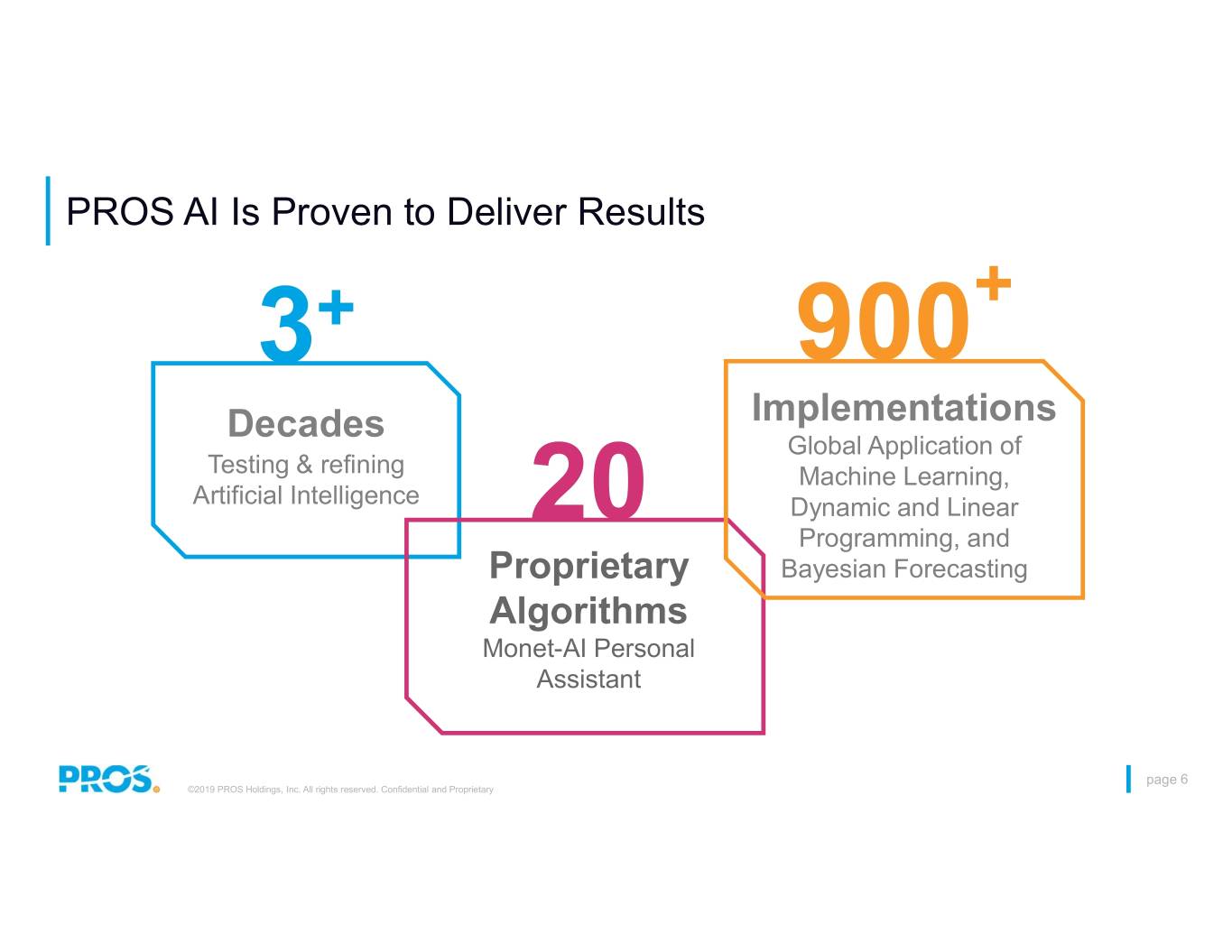

PROS AI Is Proven to Deliver Results 3+ 900+ Decades Implementations Global Application of Testing & refining Machine Learning, Artificial Intelligence 20 Dynamic and Linear Programming, and Proprietary Bayesian Forecasting Algorithms Monet-AI Personal Assistant page 6 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

B2B and B2C Expectations are Converging Buyers Have Come to Expect a Better Experience Simple Personalized Consistent Configurable Customers Want to Move Across Channels Seamlessly Unique Capabilities are Needed to Powered By Make this a Reality in B2B + AI Sophistication Scale page 7 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

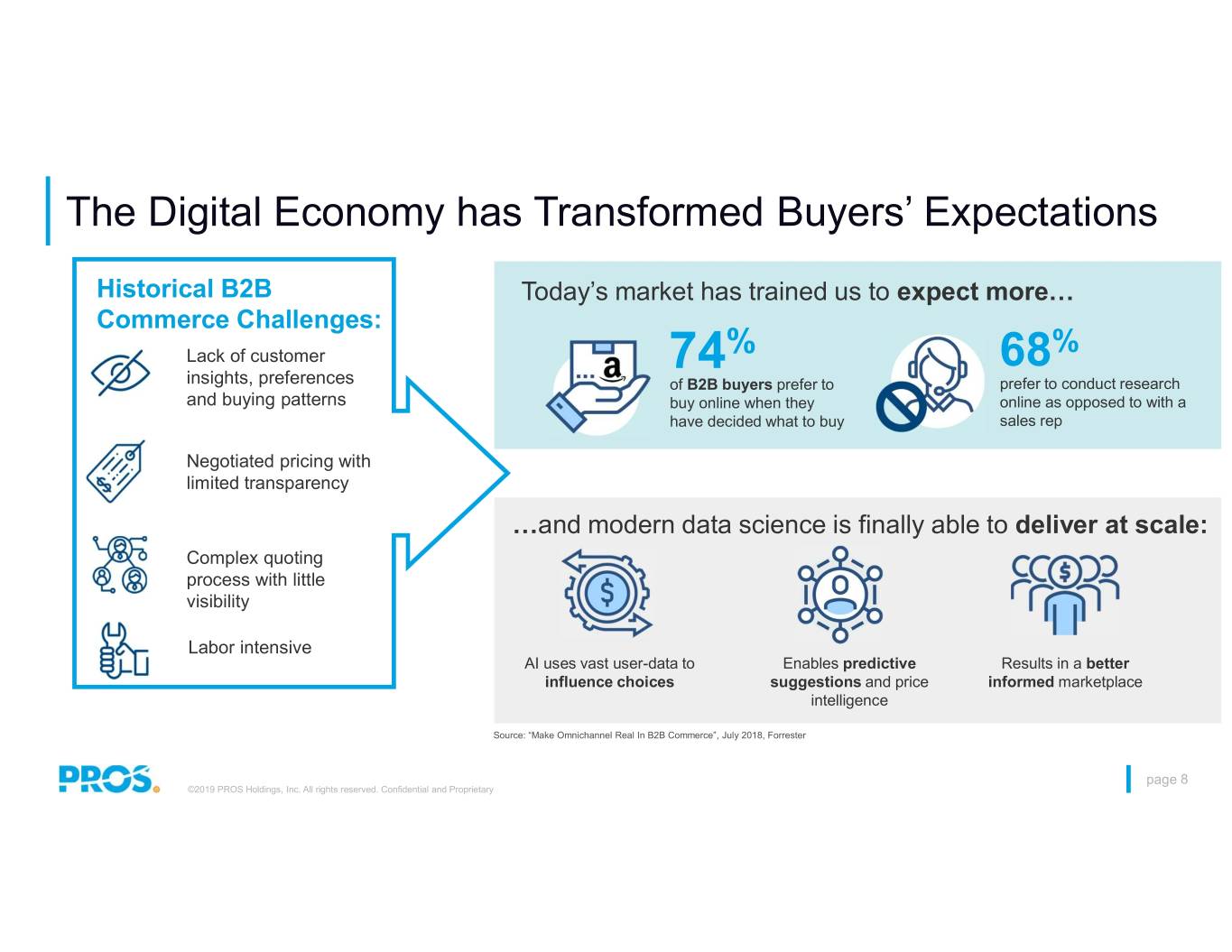

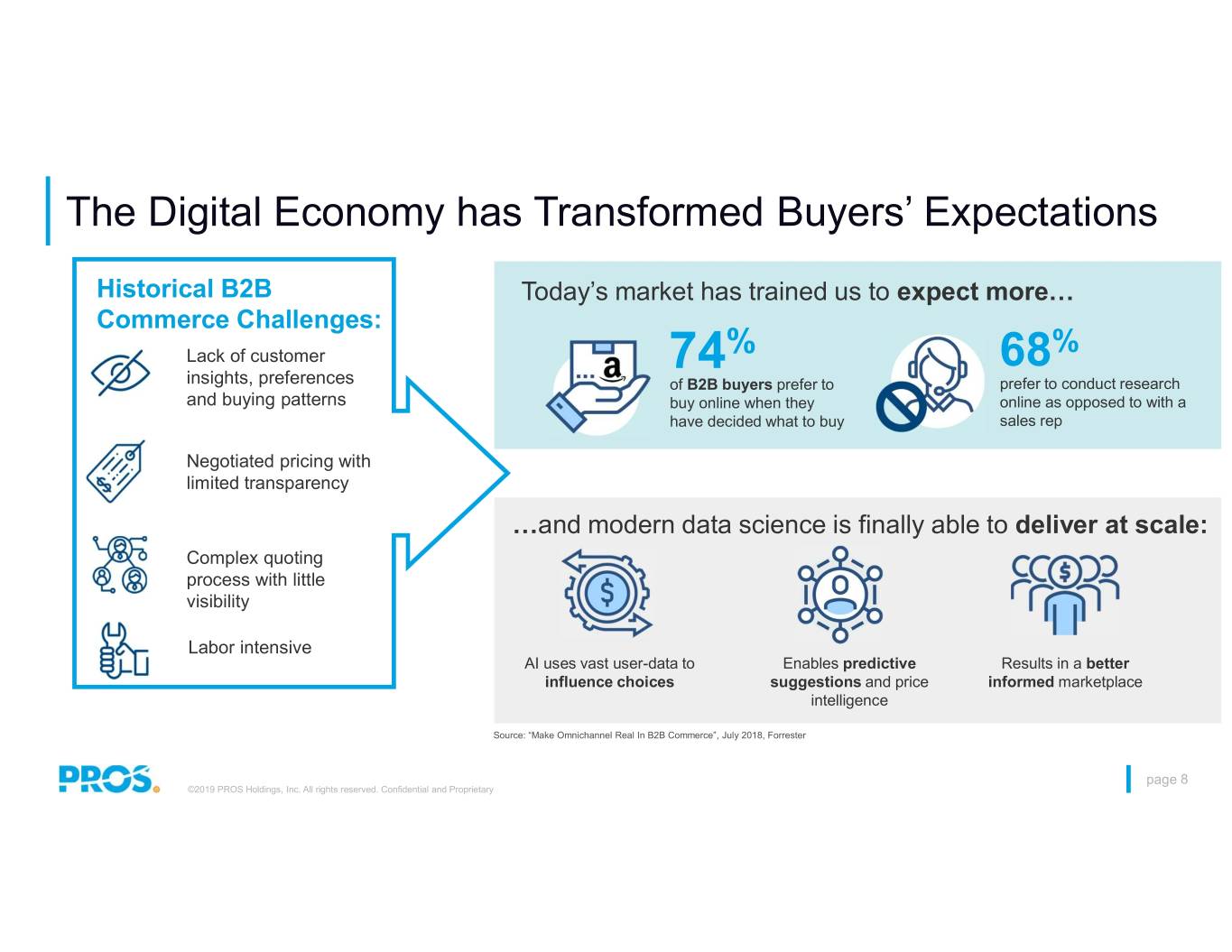

The Digital Economy has Transformed Buyers’ Expectations Historical B2B Today’s market has trained us to expect more… Commerce Challenges: % % Lack of customer 74 68 insights, preferences of B2B buyers prefer to prefer to conduct research and buying patterns buy online when they online as opposed to with a have decided what to buy sales rep Negotiated pricing with limited transparency …and modern data science is finally able to deliver at scale: Complex quoting process with little visibility Labor intensive AI uses vast user-data to Enables predictive Results in a better influence choices suggestions and price informed marketplace intelligence Source: “Make Omnichannel Real In B2B Commerce”, July 2018, Forrester page 8 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

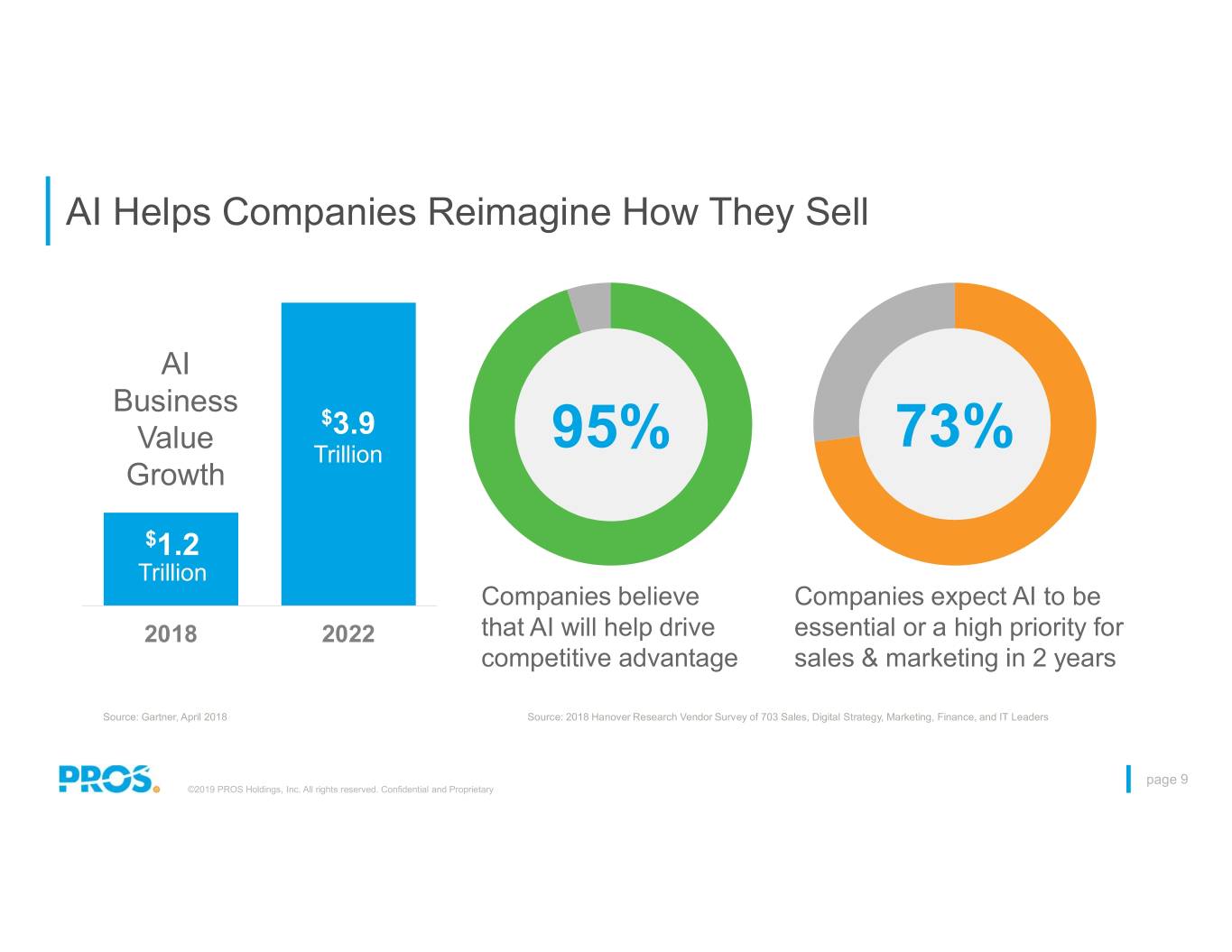

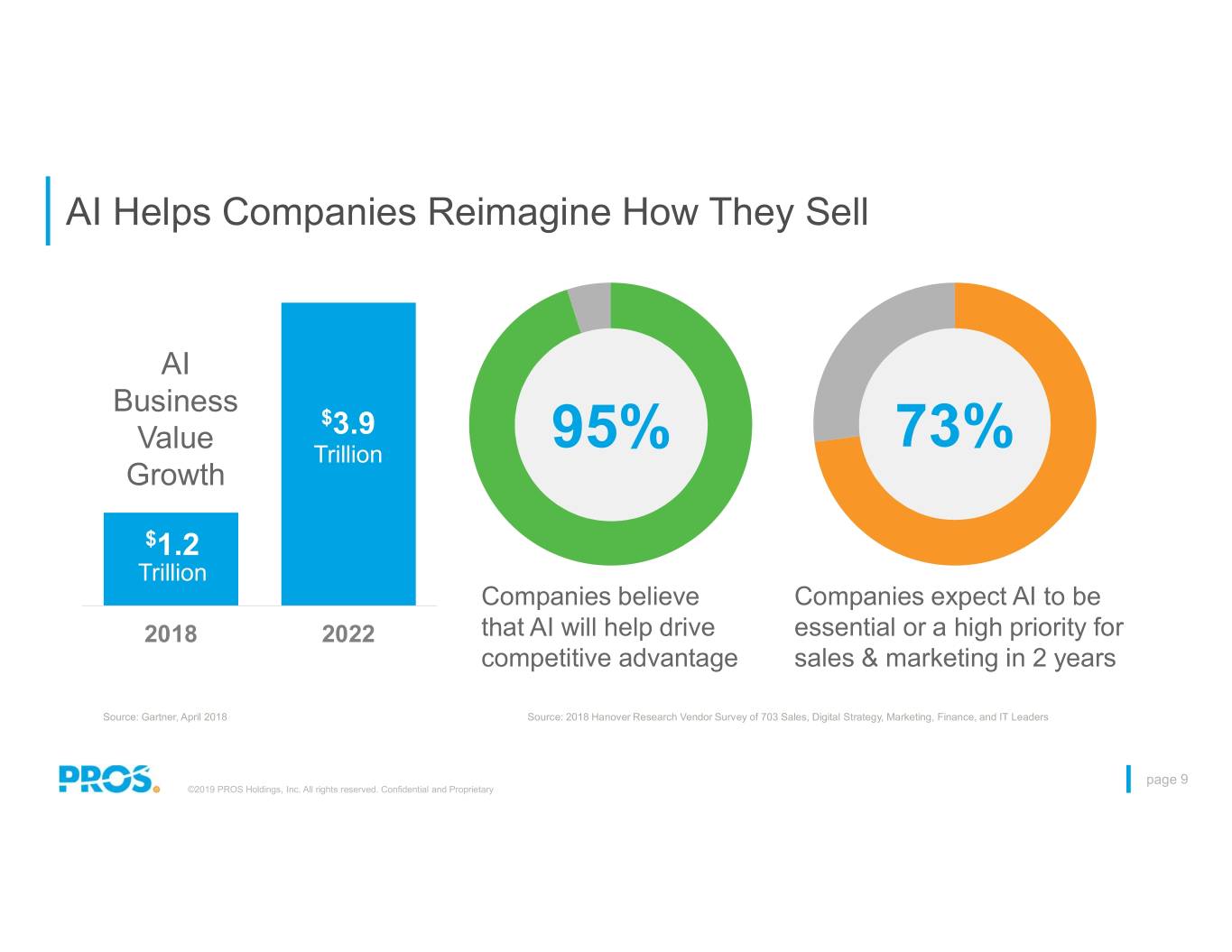

AI Helps Companies Reimagine How They Sell AI Business $ % Value 3.9 Trillion 95% 73%73 Growth $1.2 Trillion Companies believe Companies expect AI to be 2018 2022 that AI will help drive essential or a high priority for competitive advantage sales & marketing in 2 years Source: Gartner, April 2018 Source: 2018 Hanover Research Vendor Survey of 703 Sales, Digital Strategy, Marketing, Finance, and IT Leaders page 9 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

PROS’ AI Solutions Power Companies to Compete and Win in Today’s Digital Economy ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

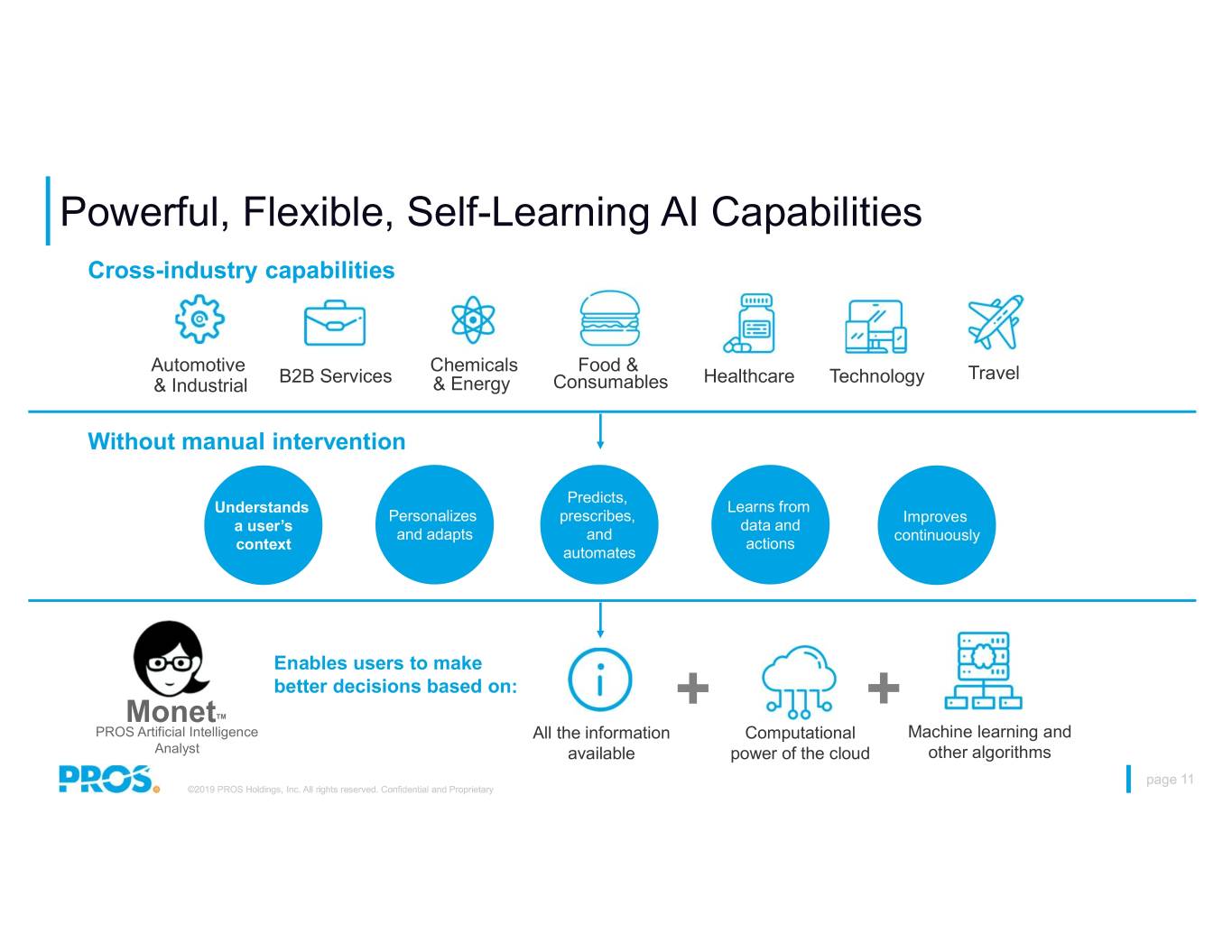

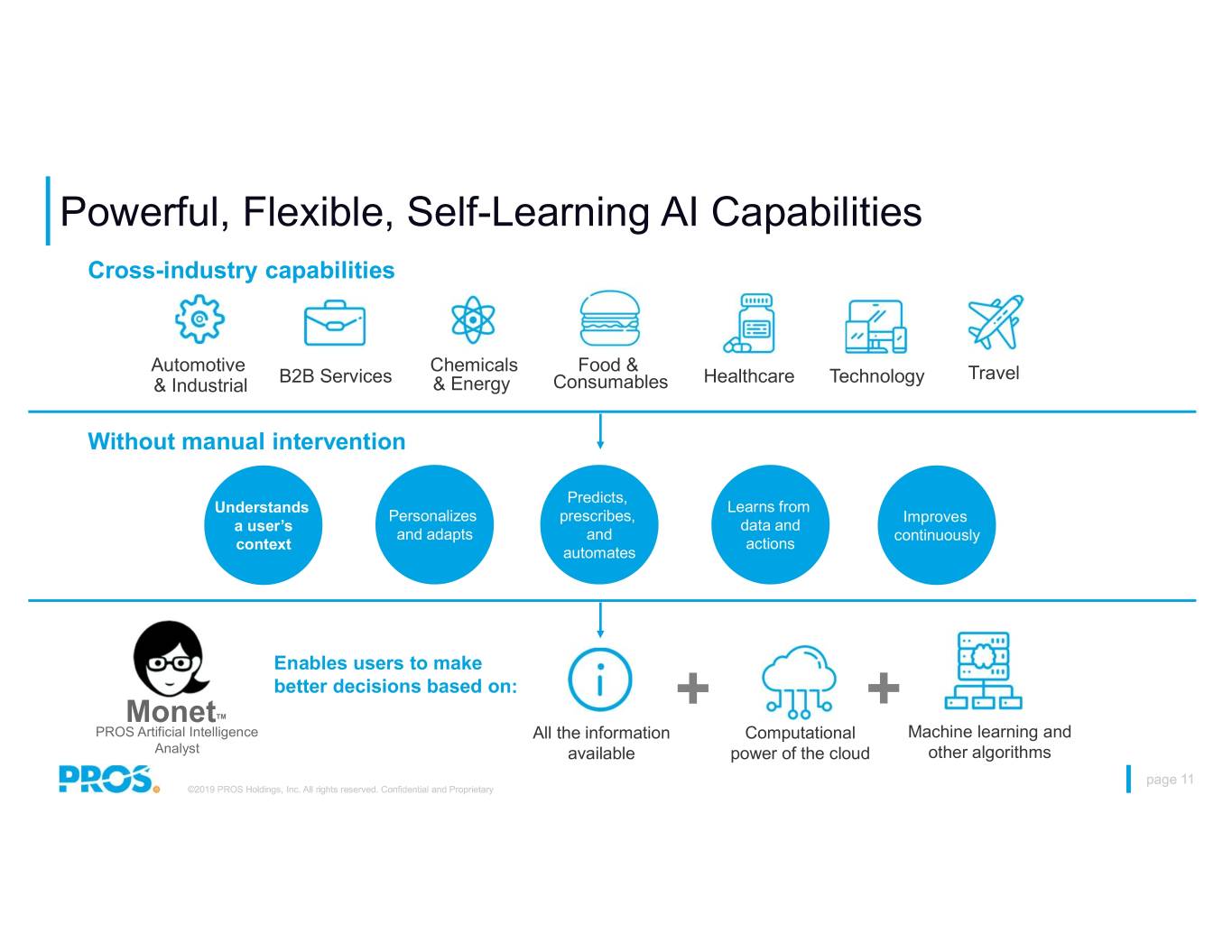

Powerful, Flexible, Self-Learning AI Capabilities Cross-industry capabilities Automotive Chemicals Food & Travel & Industrial B2B Services & Energy Consumables Healthcare Technology Without manual intervention Predicts, Understands Learns from Personalizes prescribes, Improves a user’s data and and adapts and continuously context actions automates Enables users to make better decisions based on: MonetTM + + PROS Artificial Intelligence All the information Computational Machine learning and Analyst available power of the cloud other algorithms page 11 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

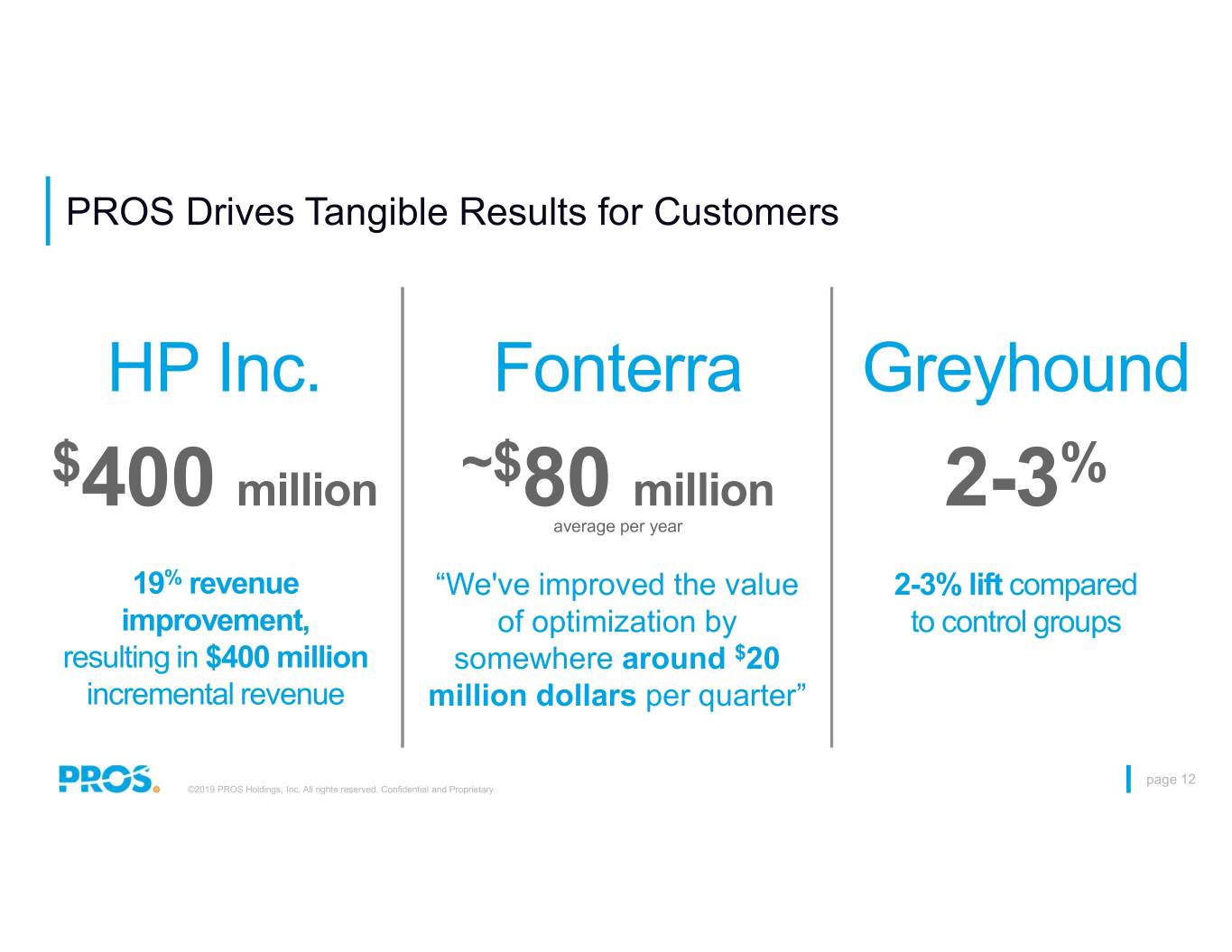

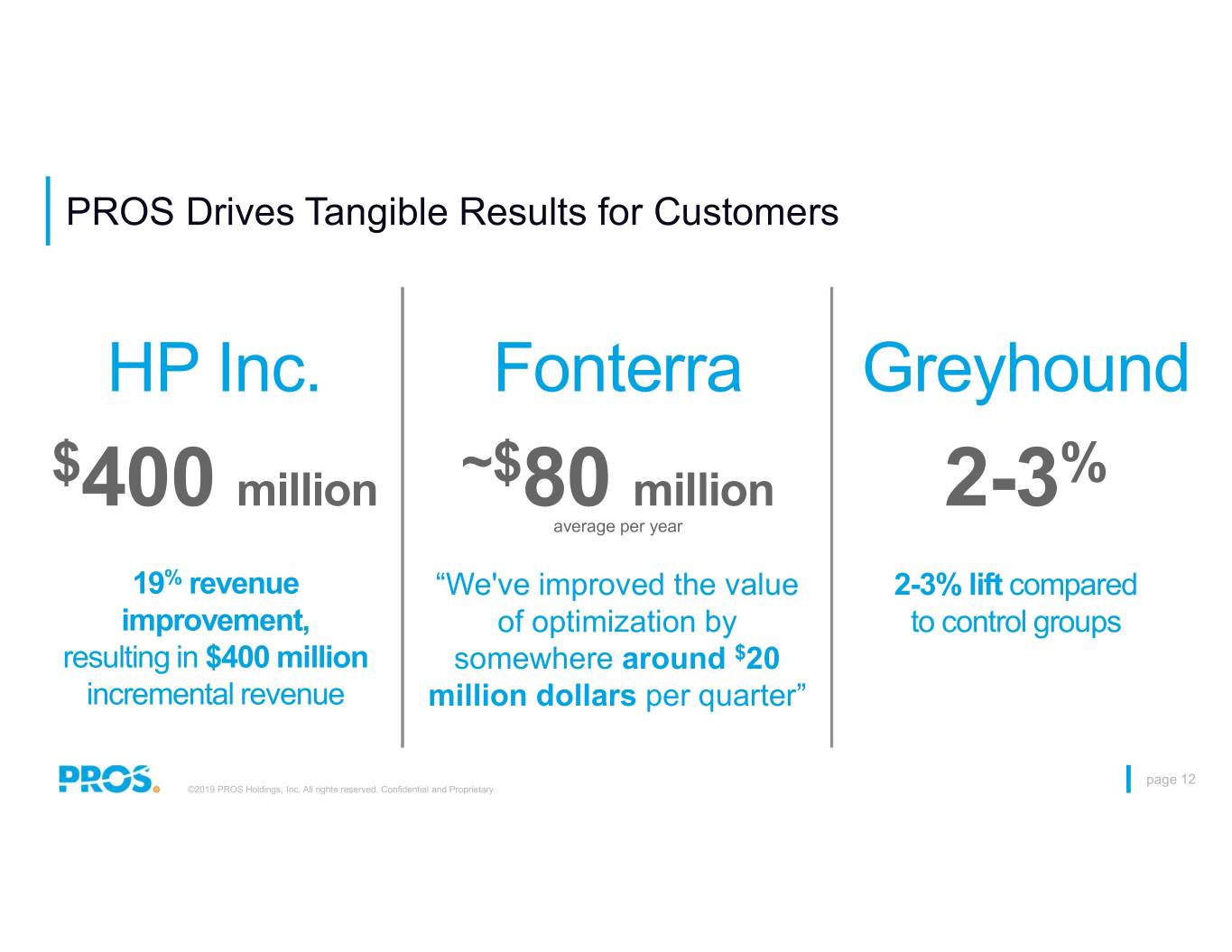

PROSPROS Drivesdrives Tangible Tangible Results Results for for Customers Customers HP Inc. Fonterra Greyhound $ ~$ % 400 million 80 million 2-3 average per year 19% revenue “We've improved the value 2-3% lift compared improvement, of optimization by to control groups resulting in $400 million somewhere around $20 incremental revenue million dollars per quarter” page 12 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

PROS Customers CARGO, FREIGHT AUTOMOTIVE & INDUSTRIAL B2B SERVICES & LOGISTICS CHEMICALS & ENERGY CONSUMER GOODS FOOD AND CONSUMABLES HEALTHCARE INSURANCE TECHNOLOGY TRAVEL

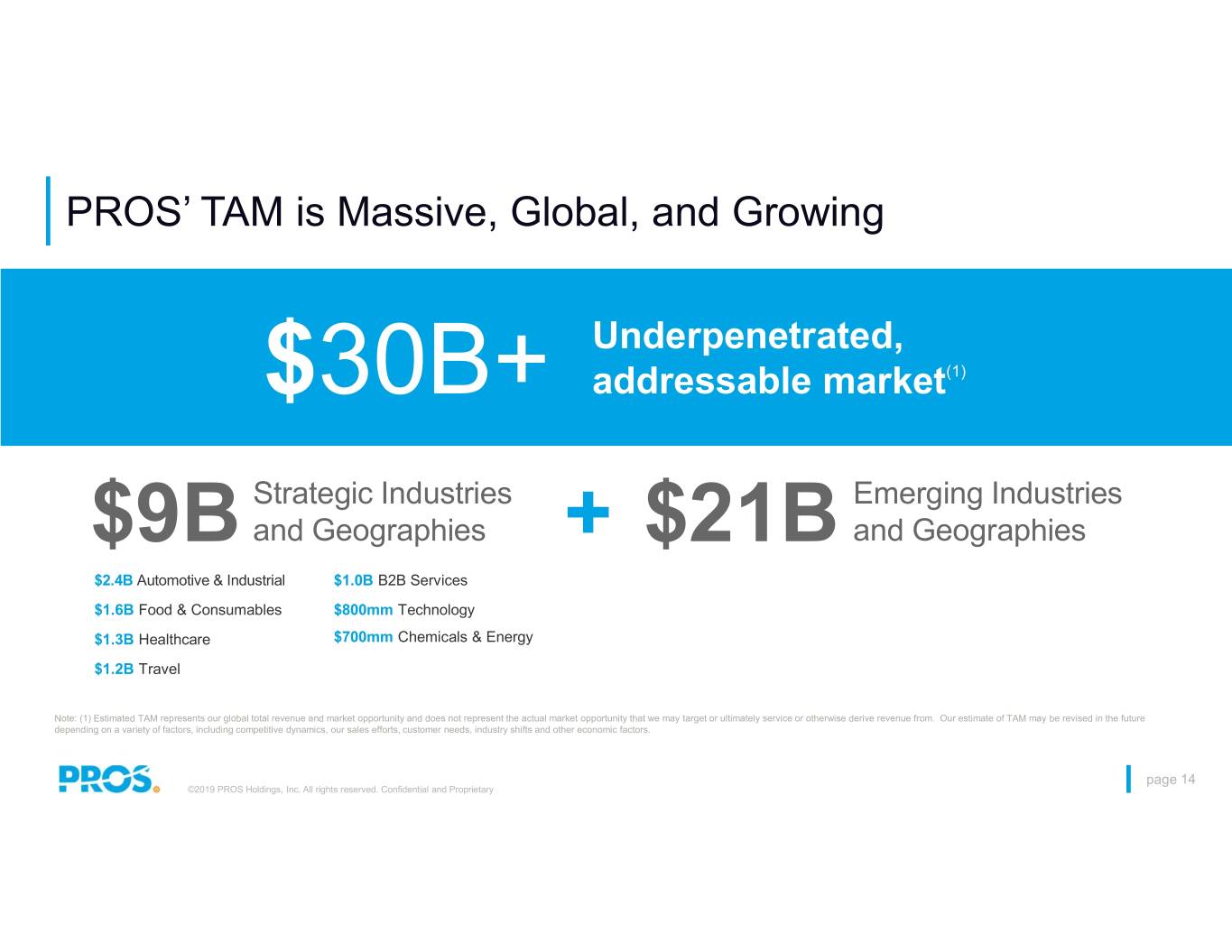

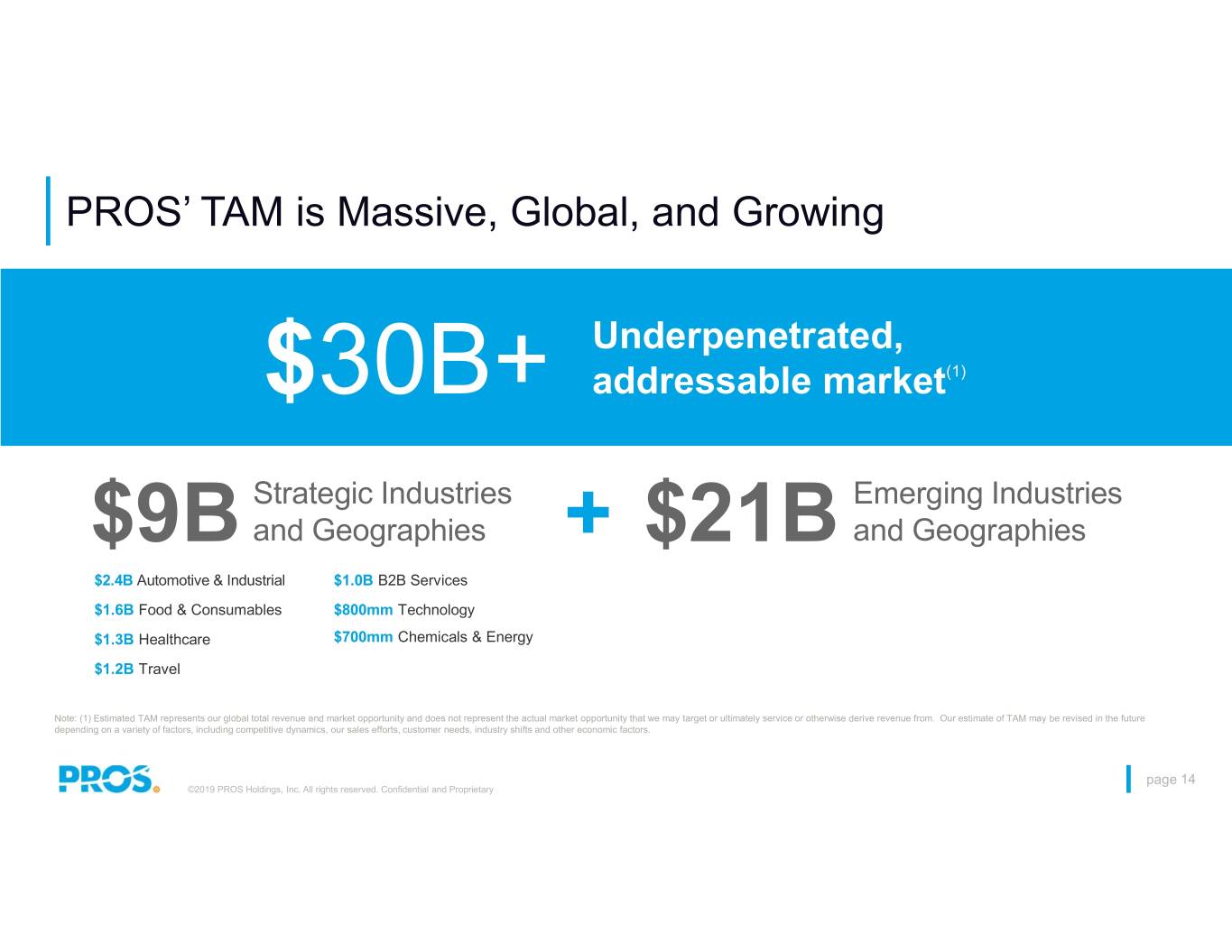

PROS’ TAM is Massive, Global, and Growing Underpenetrated, $30B+ addressable market(1) Strategic Industries Emerging Industries $9B and Geographies + $21B and Geographies $2.4B Automotive & Industrial $1.0B B2B Services $1.6B Food & Consumables $800mm Technology $1.3B Healthcare $700mm Chemicals & Energy $1.2B Travel Note: (1) Estimated TAM represents our global total revenue and market opportunity and does not represent the actual market opportunity that we may target or ultimately service or otherwise derive revenue from. Our estimate of TAM may be revised in the future depending on a variety of factors, including competitive dynamics, our sales efforts, customer needs, industry shifts and other economic factors. page 14 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

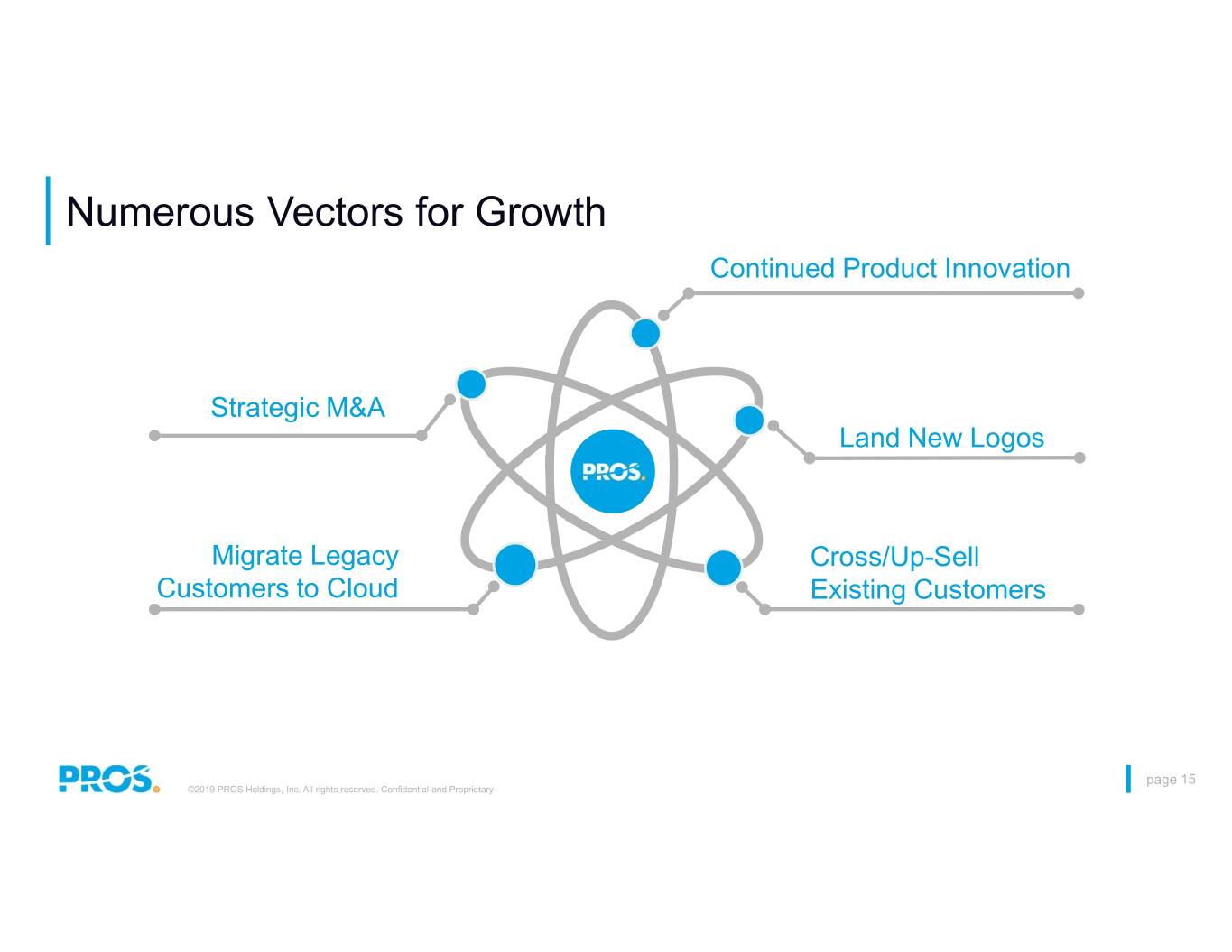

Numerous Vectors for Growth Continued Product Innovation Strategic M&A Land New Logos Migrate Legacy Cross/Up-Sell Customers to Cloud Existing Customers page 15 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

Financial Overview

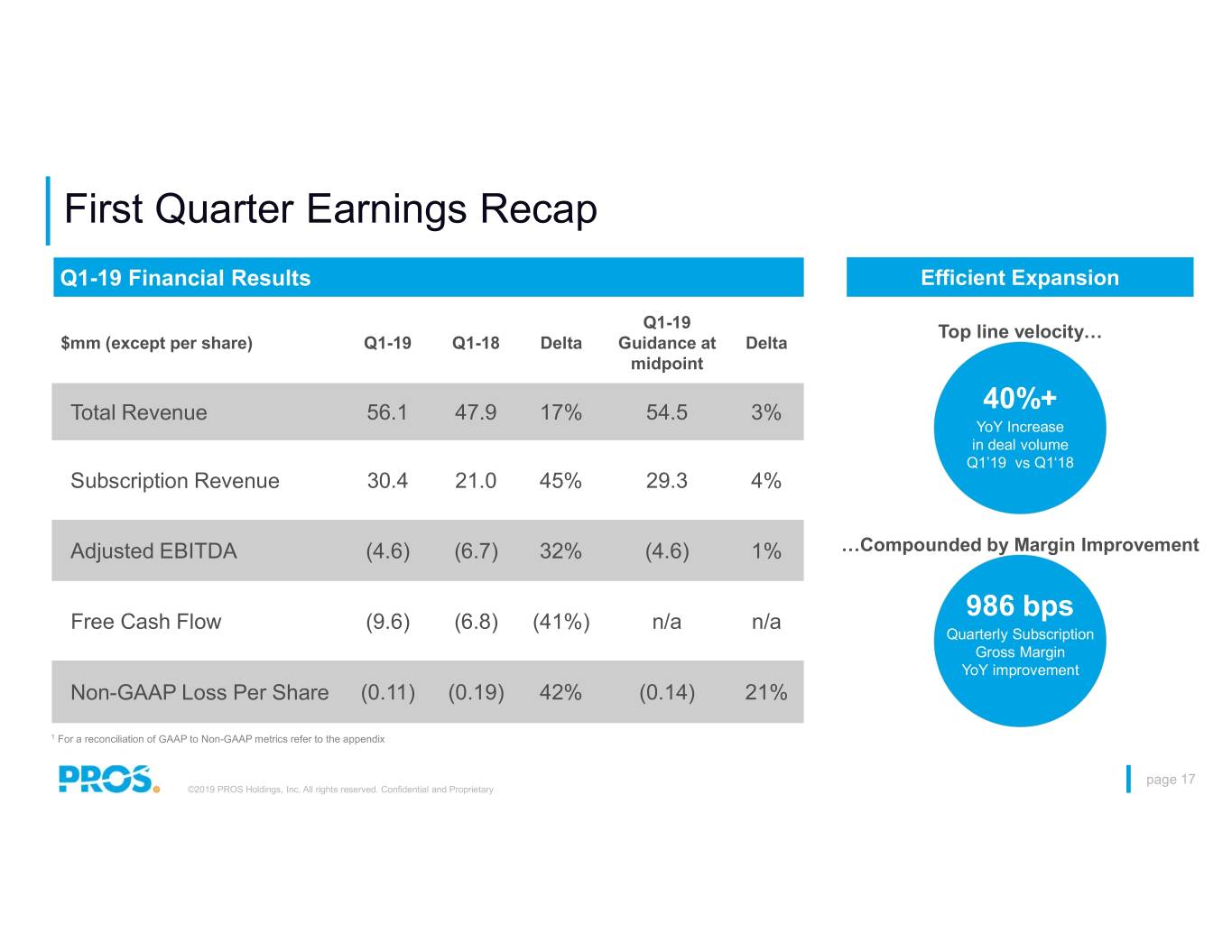

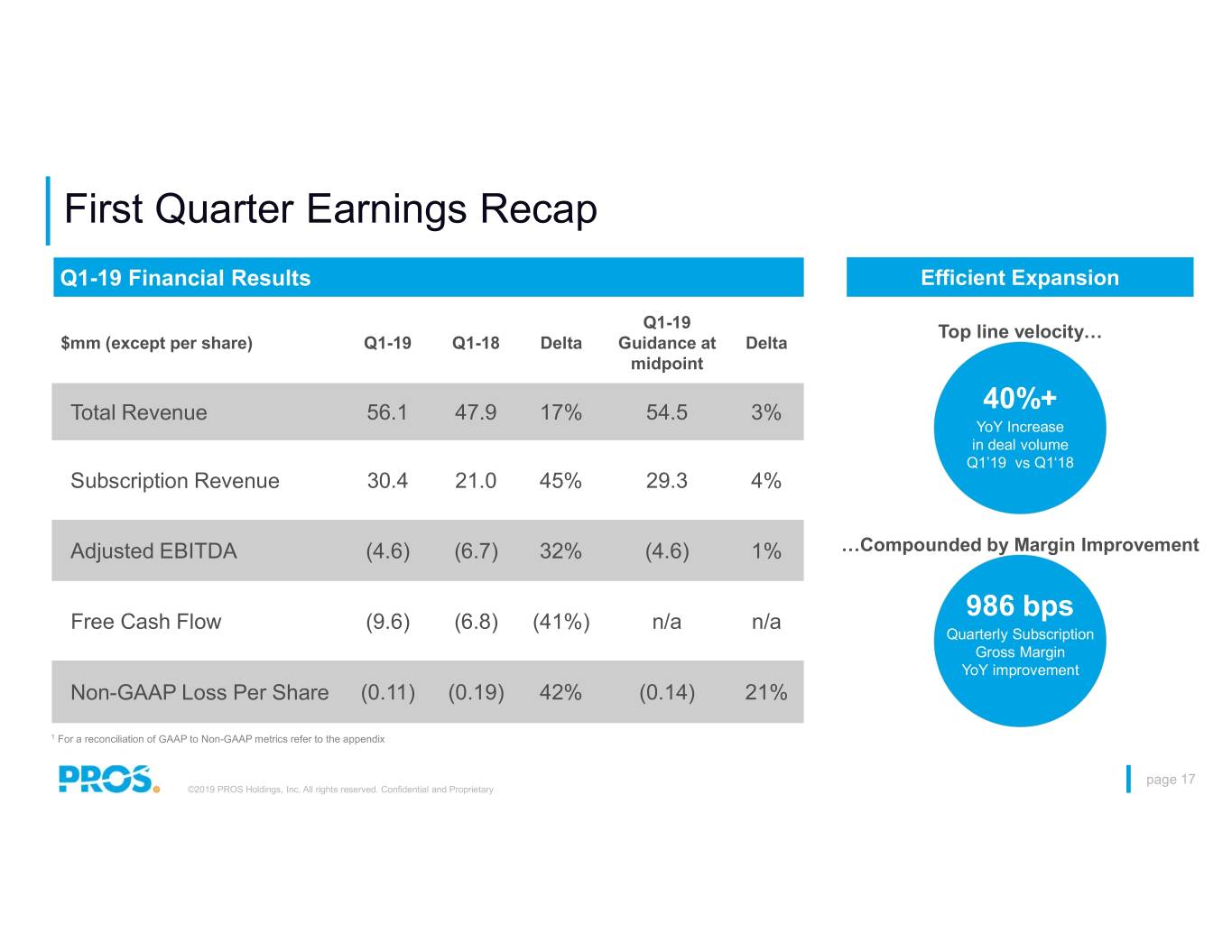

First Quarter Earnings Recap Q1-19 Financial Results Efficient Expansion Q1-19 Top line velocity… $mm (except per share) Q1-19 Q1-18 Delta Guidance at Delta midpoint Total Revenue 56.1 47.9 17% 54.5 3% 40%+ YoY Increase in deal volume Q1’19 vs Q1‘18 Subscription Revenue 30.4 21.0 45% 29.3 4% Adjusted EBITDA (4.6) (6.7) 32% (4.6) 1% …Compounded by Margin Improvement 986 bps Free Cash Flow (9.6) (6.8) (41%) n/a n/a Quarterly Subscription Gross Margin YoY improvement Non-GAAP Loss Per Share (0.11) (0.19) 42% (0.14) 21% 1 For a reconciliation of GAAP to Non-GAAP metrics refer to the appendix page 17 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

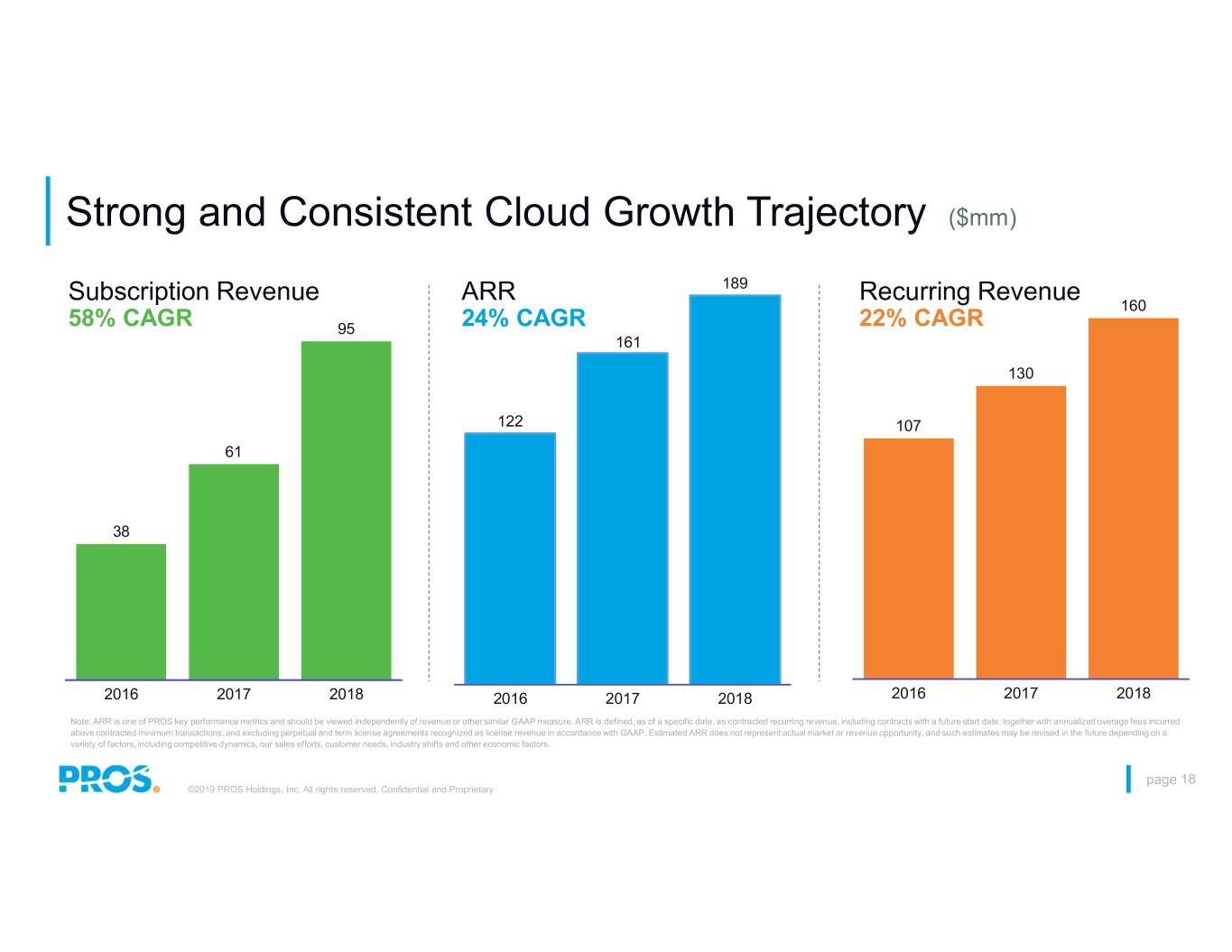

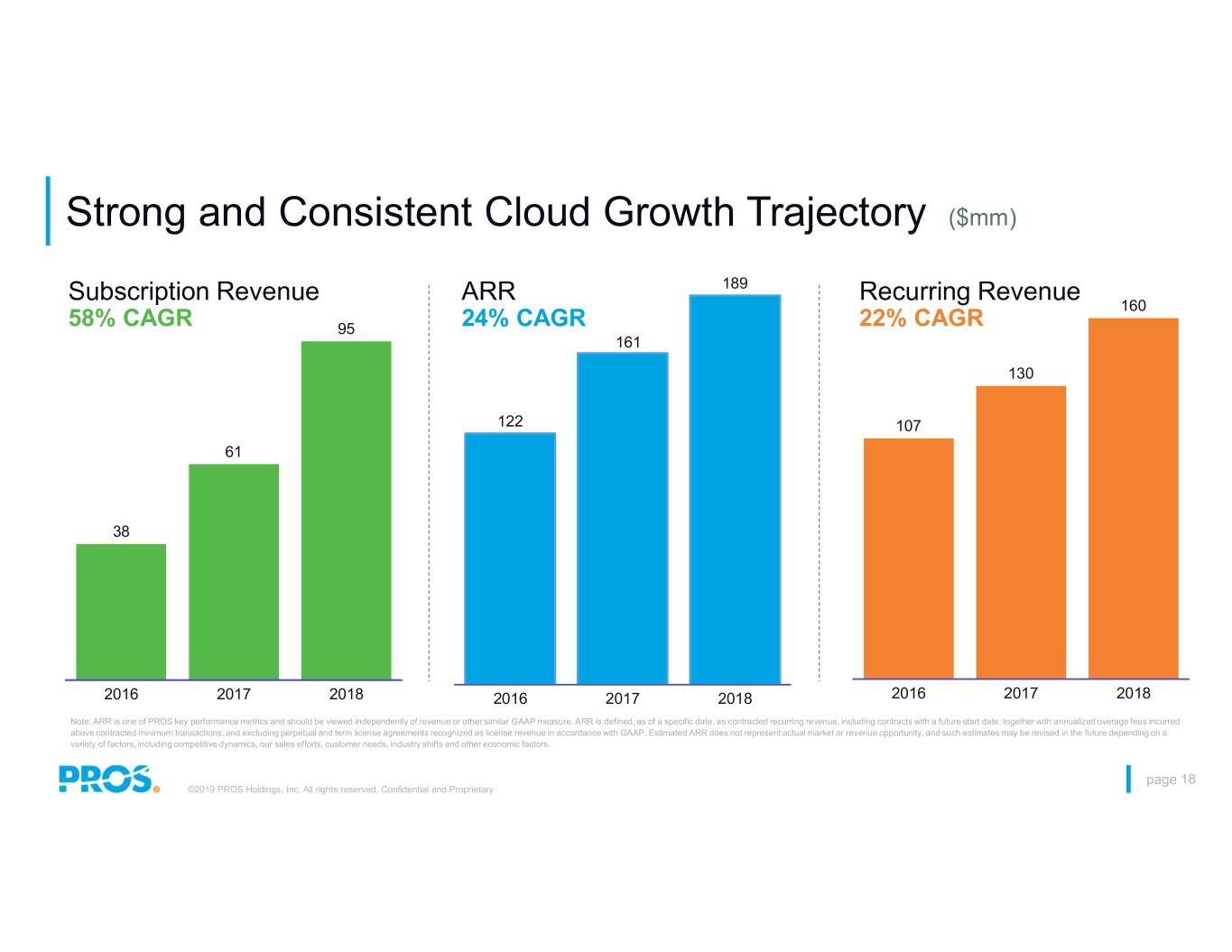

Strong and Consistent Cloud Growth Trajectory ($mm) Subscription Revenue ARR 189 Recurring Revenue 160 58% CAGR 95 24% CAGR 22% CAGR 161 130 122 107 61 38 2016 2017 2018 2016 2017 2018 2016 2017 2018 Note: ARR is one of PROS key performance metrics and should be viewed independently of revenue or other similar GAAP measure. ARR is defined, as of a specific date, as contracted recurring revenue, including contracts with a future start date, together with annualized overage fees incurred above contracted minimum transactions, and excluding perpetual and term license agreements recognized as license revenue in accordance with GAAP. Estimated ARR does not represent actual market or revenue opportunity, and such estimates may be revised in the future depending on a variety of factors, including competitive dynamics, our sales efforts, customer needs, industry shifts and other economic factors. page 18 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

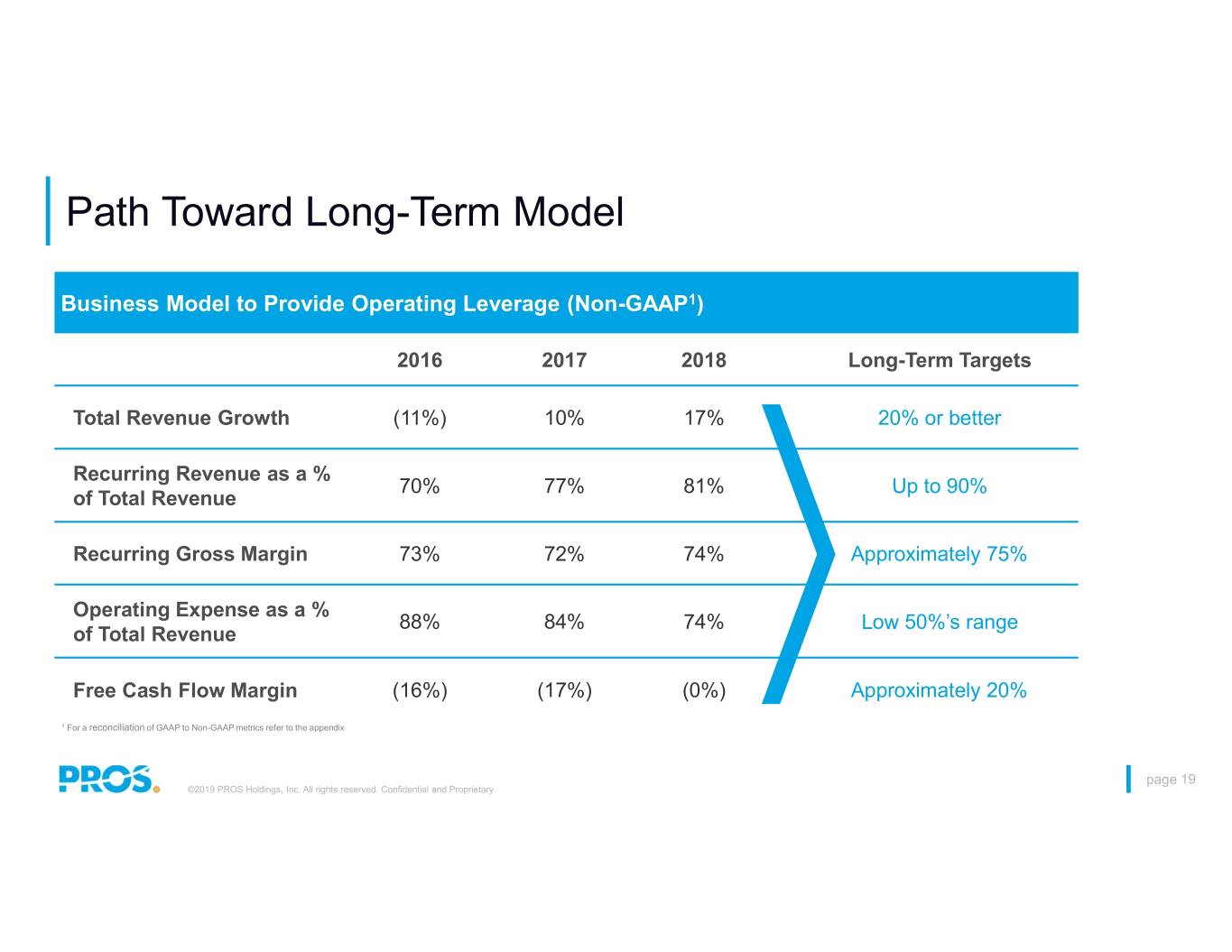

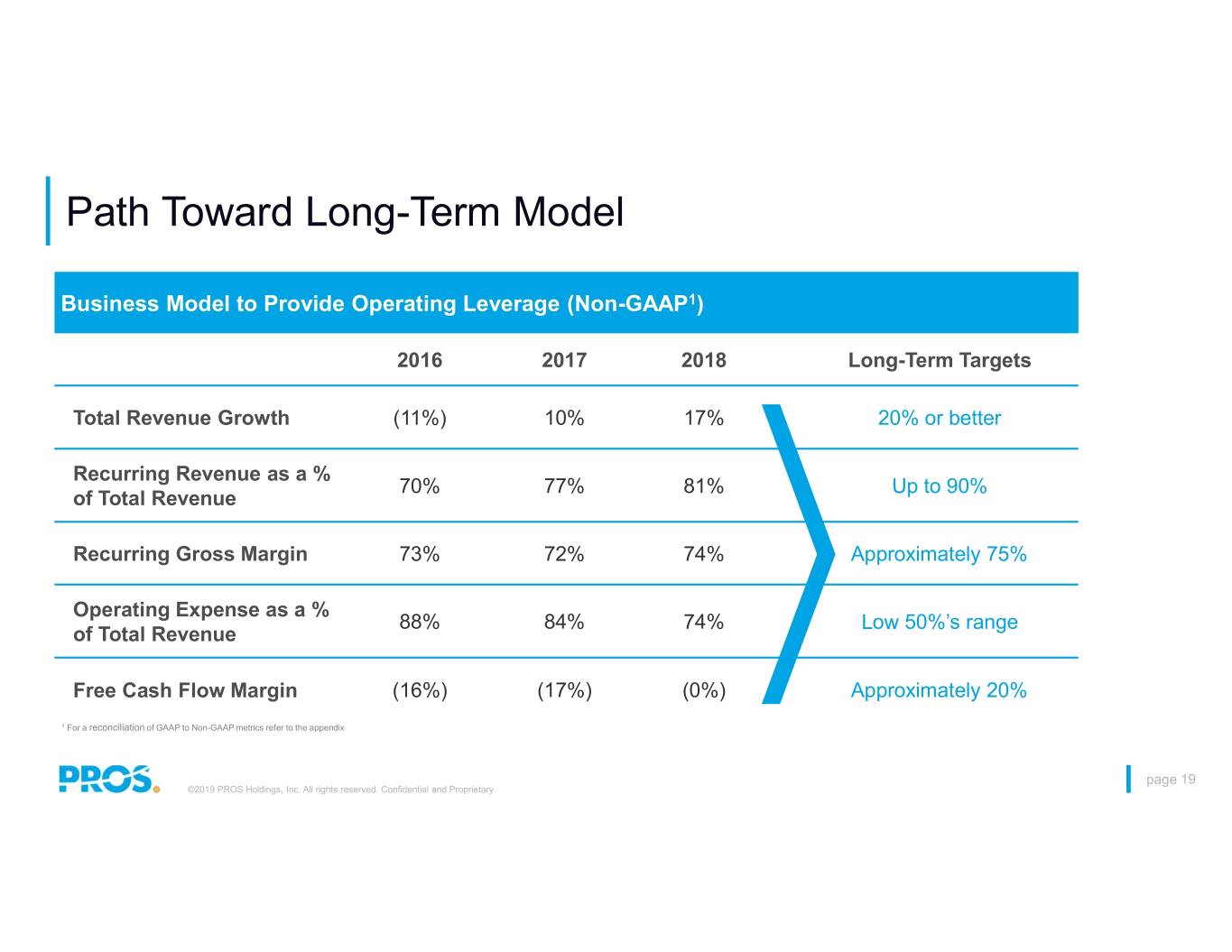

Path Toward Long-Term Model Business Model to Provide Operating Leverage (Non-GAAP1) 2016 2017 2018 Long-Term Targets Total Revenue Growth (11%) 10% 17% 20% or better Recurring Revenue as a % 70% 77% 81% Up to 90% of Total Revenue Recurring Gross Margin 73% 72% 74% Approximately 75% Operating Expense as a % 88% 84% 74% Low 50%’s range of Total Revenue Free Cash Flow Margin (16%) (17%) (0%) Approximately 20% 1 For a reconciliation of GAAP to Non-GAAP metrics refer to the appendix page 19 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

Summary: Financial Highlights • Leading end-to-end AI platform powering digital commerce • We believe the massive market opportunity is at an inflection point • Real-time, mission critical solutions delivering powerful customer ROI • Loyal customer base consisting of leading blue-chip companies • Deep competitive moat built through 30 years of AI leadership • Rapidly growing, highly visible subscription revenue • Strong culture of innovation and execution page 20 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

Leadership Team Executing on the Opportunity Andres Reiner Stefan Schulz Tom Dziersk President & CEO Chief Financial Officer EVP of Worldwide Sales 25+ years in enterprise technology 25+ years in enterprise technology including 25+ years in enterprise technology including 20 years at PROS PROS, BMC, Lawson, & Digital River including PROS, JDA & NICE Celia Fleischaker Wagner Williams Michael Jahoda Chief Marketing Officer Chief People Officer SVP, Professional Services 20+ years in enterprise technology 15+ years at PROS in HR, Professional 4 years at PROS, 13+ years at Accenture including PROS & Epicor Services, and International Operations in Pricing & Strategy Rob Reiner Damian Olthoff Jill Sawatzky Chief Technology Officer General Counsel and Secretary VP, Customer Success 20+ years in enterprise technology 15+ years in corporate law 20+ years customer-focused IT including PROS, BMC & NetIQ including 8 years at PROS experience including Citrix & IBM

PROS Employee Resource Groups at the heart of our culture Pride @ PROS Blaze To serve as a resource at PROS; to Investing in the development of positively influence the environment; women at PROS by providing to ensure professional development women with opportunities for skill of its LGBTQIA+ members; and to building and leadership in business assist PROS in achieving its diversity and technology. and inclusion plan. Empower Dedicated to attracting, developing Unidos and retaining Black talent at PROS. Through professional development, UNIDOS is an organization the enhancement of cultural committed to serve as a resource awareness and empowering for the representation, advancement underserved communities, we will and inclusion of Hispanics at PROS. transform PROS to reflect the diversity of our customers. page 22 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

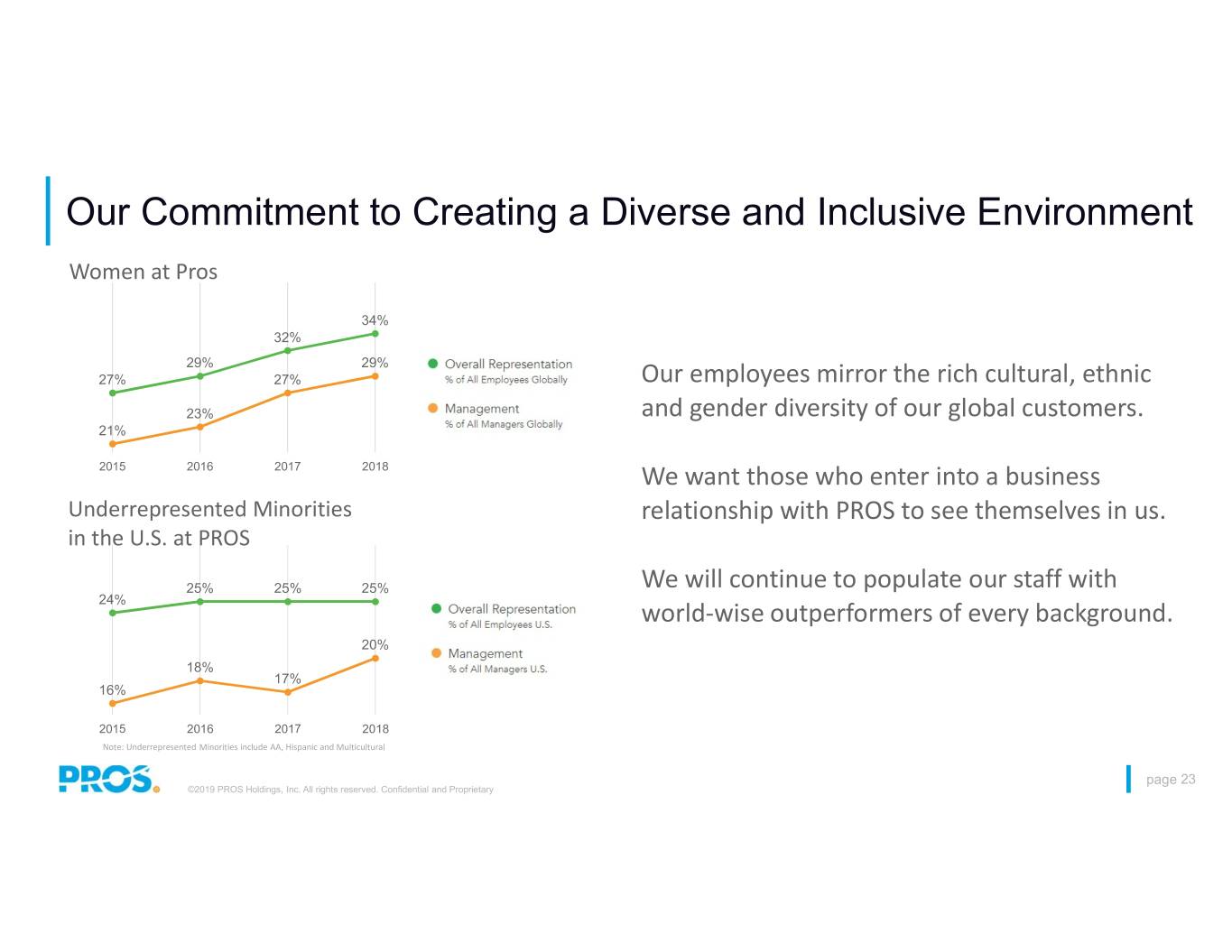

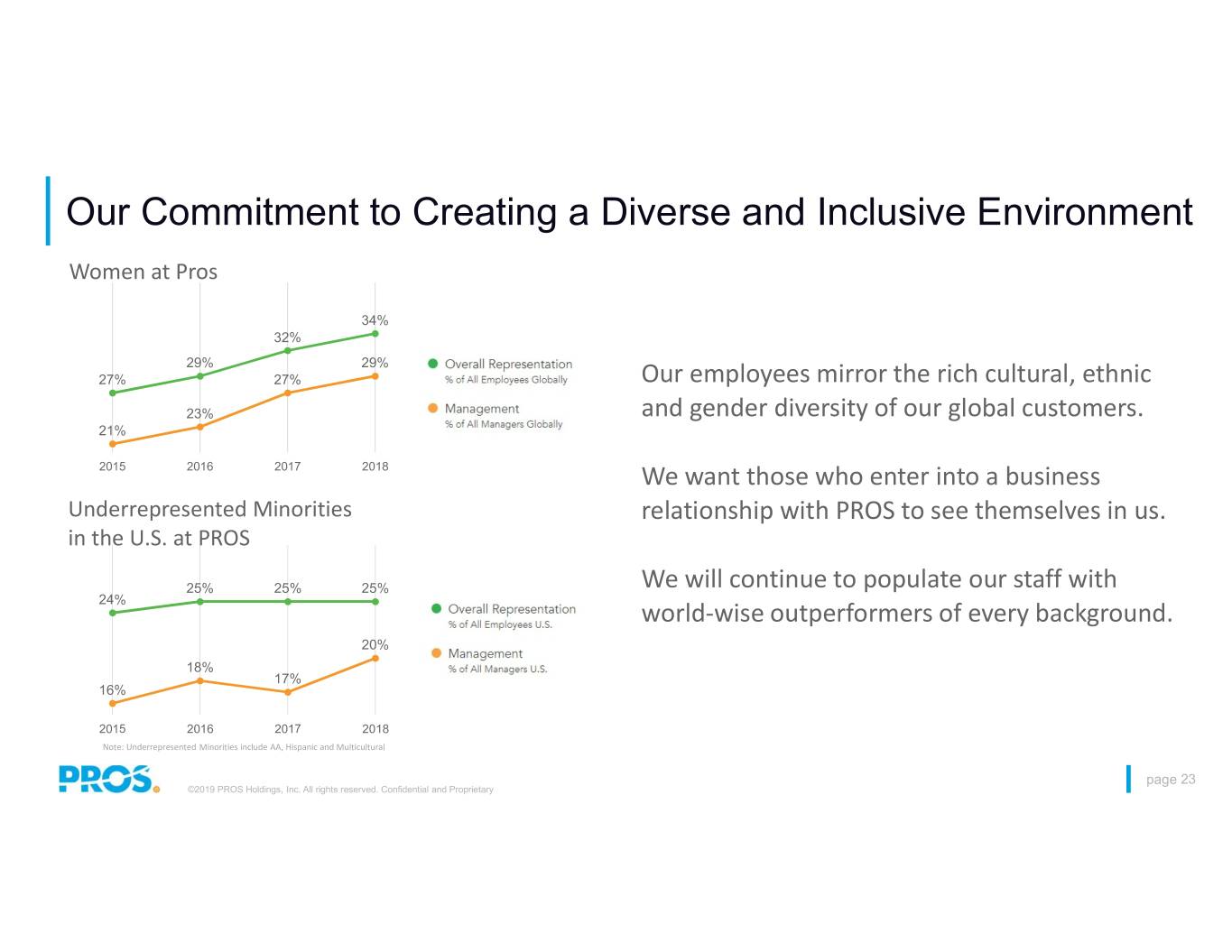

Our Commitment to Creating a Diverse and Inclusive Environment Women at Pros 34% 32% 29% 29% 27% 27% Our employees mirror the rich cultural, ethnic 23% and gender diversity of our global customers. 21% 2015 2016 2017 2018 We want those who enter into a business Underrepresented Minorities relationship with PROS to see themselves in us. in the U.S. at PROS 25% 25% 25% We will continue to populate our staff with 24% world-wise outperformers of every background. 20% 18% 17% 16% 2015 2016 2017 2018 Note: Underrepresented Minorities include AA, Hispanic and Multicultural page 23 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

Helping People and Companies Outperform We are OWNERS We are INNOVATORS We CARE Looking for every opportunity to Thinking creatively to find new paths Putting people first - our customers, create a better PROS and a better to success for our people, our employees, partners, and community experience for our customers, and customers, and our business - it’s how our company was started, we hold ourselves accountable and how we’ll always run it page 24 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

Appendix

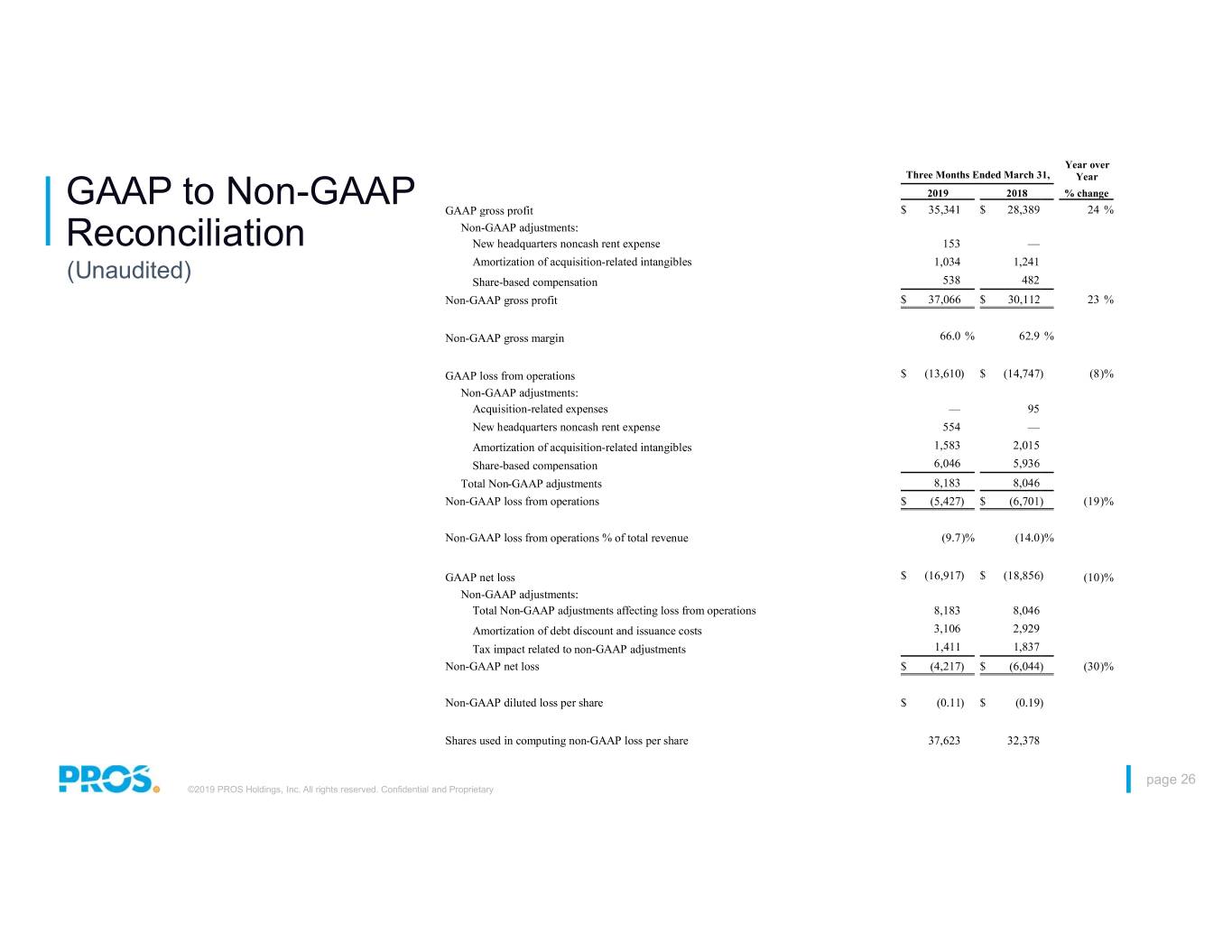

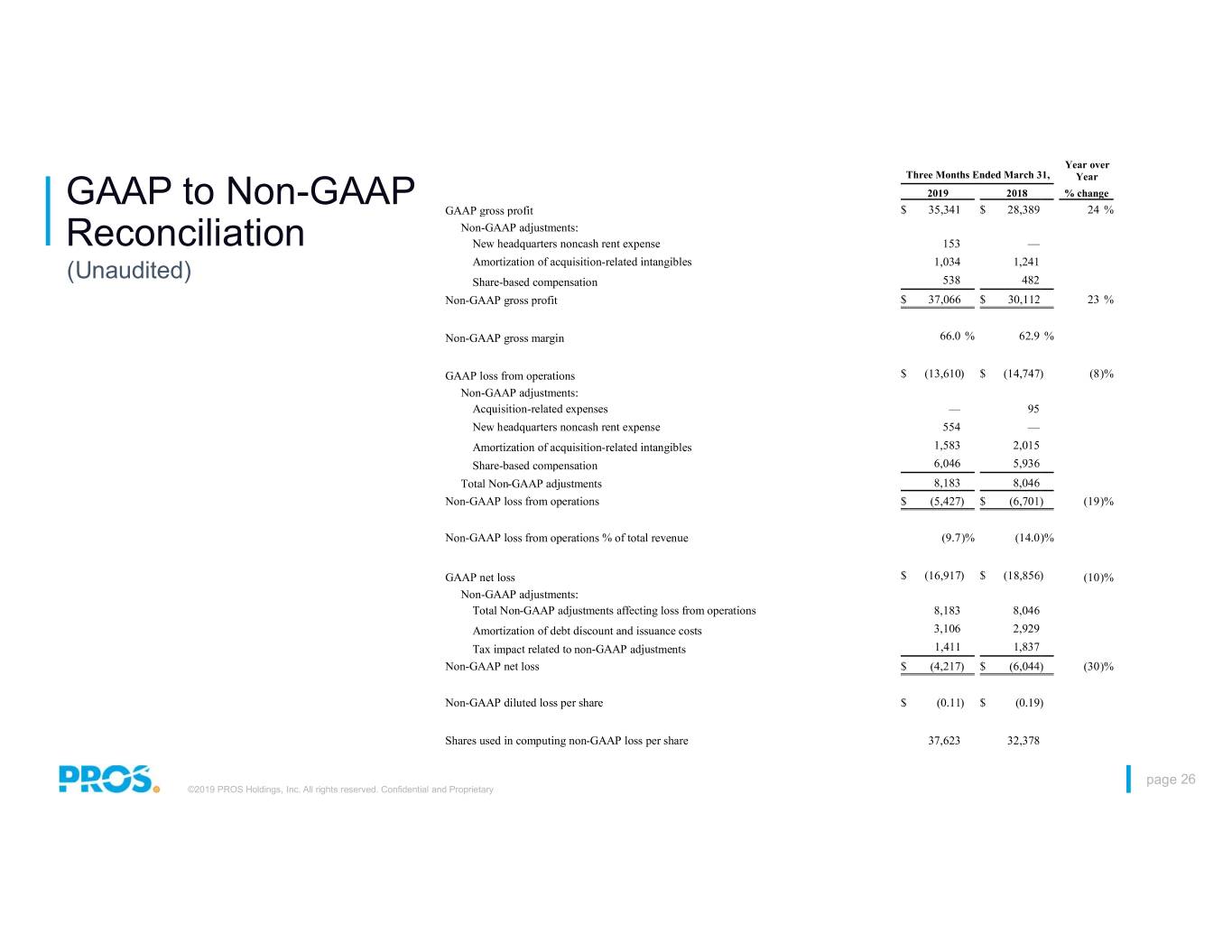

Year over Three Months Ended March 31, Year 2019 2018 % change GAAP to Non-GAAP GAAP gross profit $ 35,341 $ 28,389 24 % Non-GAAP adjustments: Reconciliation New headquarters noncash rent expense 153 — Amortization of acquisition-related intangibles 1,034 1,241 (Unaudited) Share-based compensation 538 482 Non-GAAP gross profit $ 37,066 $ 30,112 23 % Non-GAAP gross margin 66.0 % 62.9 % GAAP loss from operations $ (13,610) $ (14,747) (8)% Non-GAAP adjustments: Acquisition-related expenses — 95 New headquarters noncash rent expense 554 — Amortization of acquisition-related intangibles 1,583 2,015 Share-based compensation 6,046 5,936 Total Non-GAAP adjustments 8,183 8,046 Non-GAAP loss from operations $ (5,427) $ (6,701) (19)% Non-GAAP loss from operations % of total revenue (9.7)% (14.0 )% GAAP net loss $ (16,917) $ (18,856) (10)% Non-GAAP adjustments: Total Non-GAAP adjustments affecting loss from operations 8,183 8,046 Amortization of debt discount and issuance costs 3,106 2,929 Tax impact related to non-GAAP adjustments 1,411 1,837 Non-GAAP net loss $ (4,217) $ (6,044) (30)% Non-GAAP diluted loss per share $ (0.11) $ (0.19) Shares used in computing non-GAAP loss per share 37,623 32,378 page 26 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

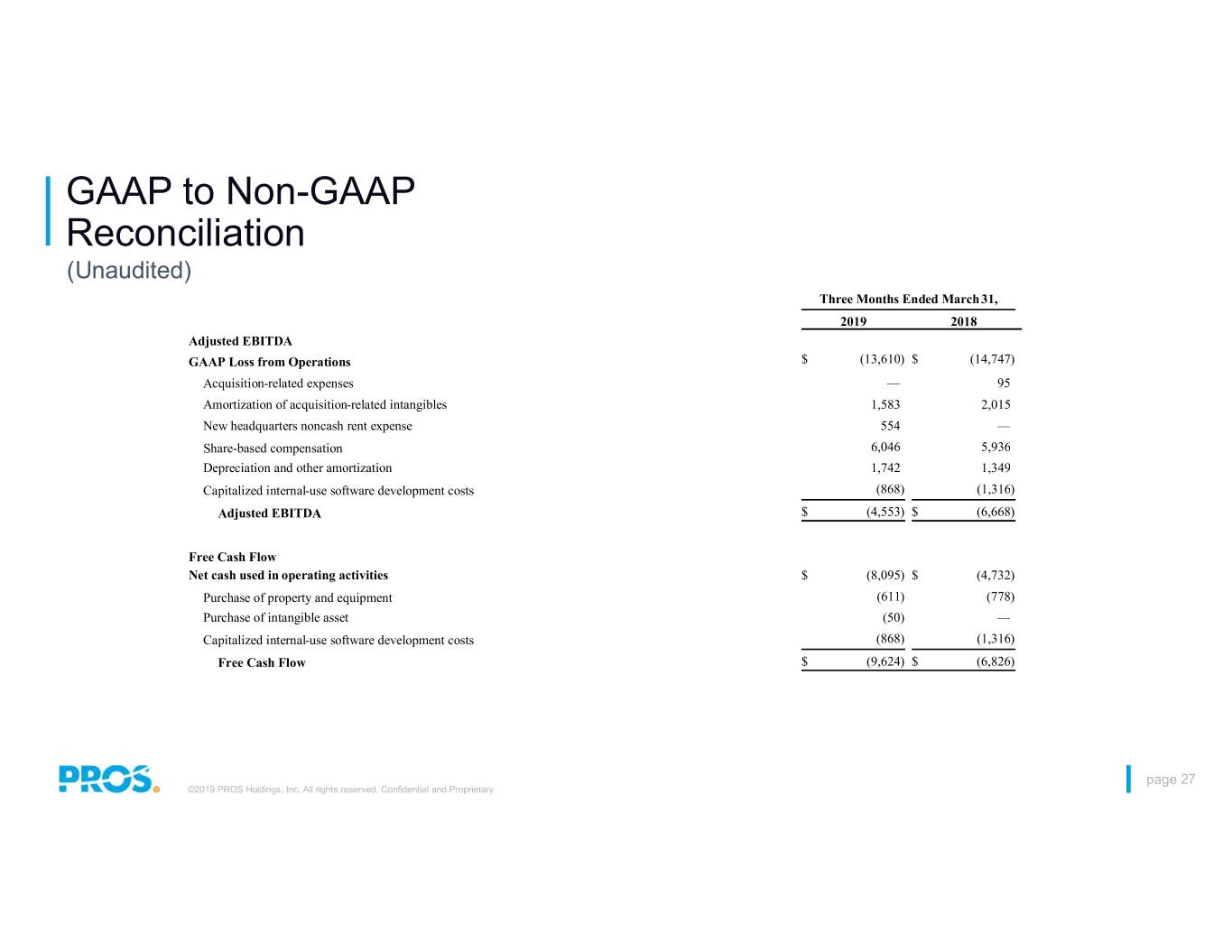

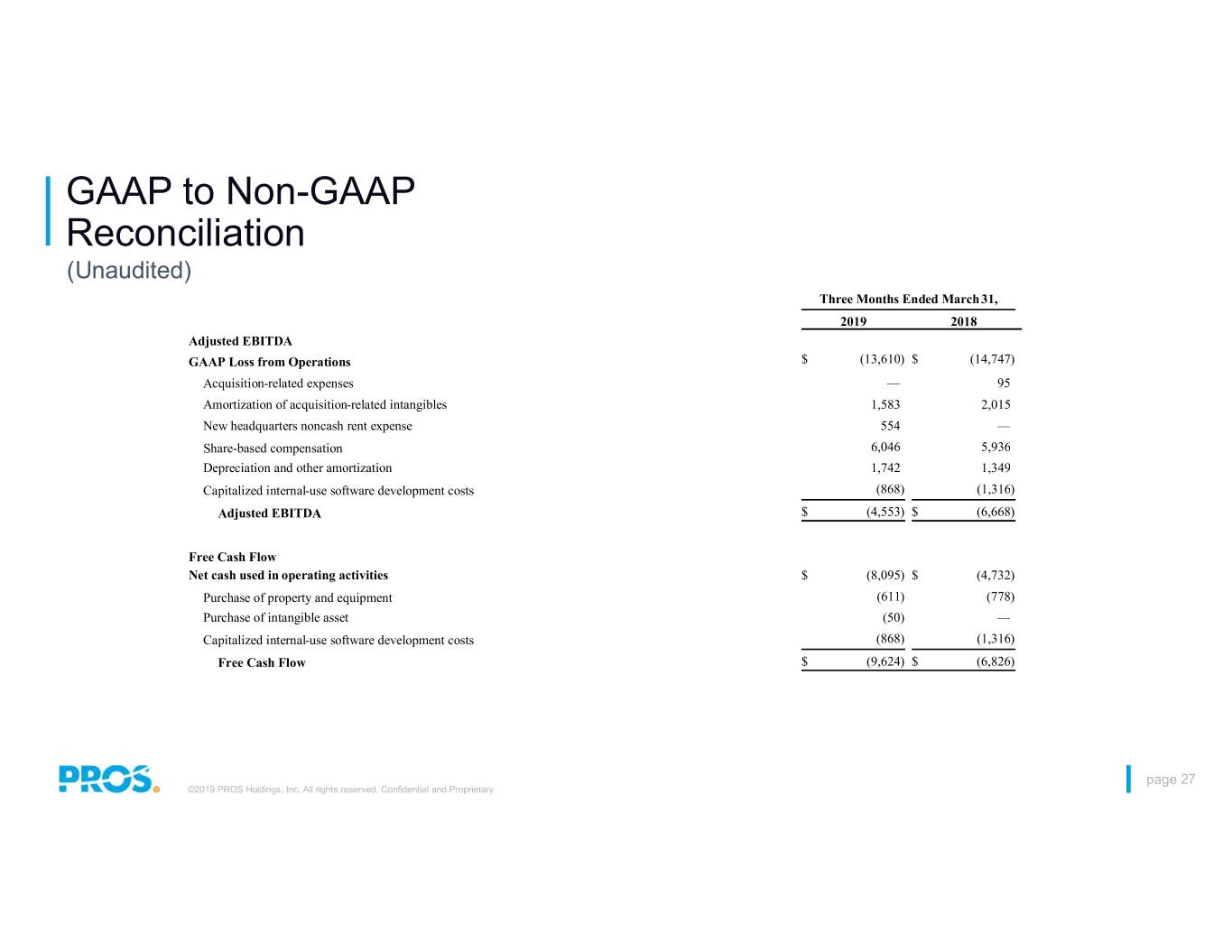

GAAP to Non-GAAP Reconciliation (Unaudited) Three Months Ended March 31, 2019 2018 Adjusted EBITDA GAAP Loss from Operations $ (13,610) $ (14,747) Acquisition-related expenses — 95 Amortization of acquisition-related intangibles 1,583 2,015 New headquarters noncash rent expense 554 — Share-based compensation 6,046 5,936 Depreciation and other amortization 1,742 1,349 Capitalized internal-use software development costs (868) (1,316) Adjusted EBITDA $ (4,553) $ (6,668) Free Cash Flow Net cash used in operating activities $ (8,095) $ (4,732) Purchase of property and equipment (611) (778) Purchase of intangible asset (50) — Capitalized internal-use software development costs (868) (1,316) Free Cash Flow $ (9,624) $ (6,826) page 27 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

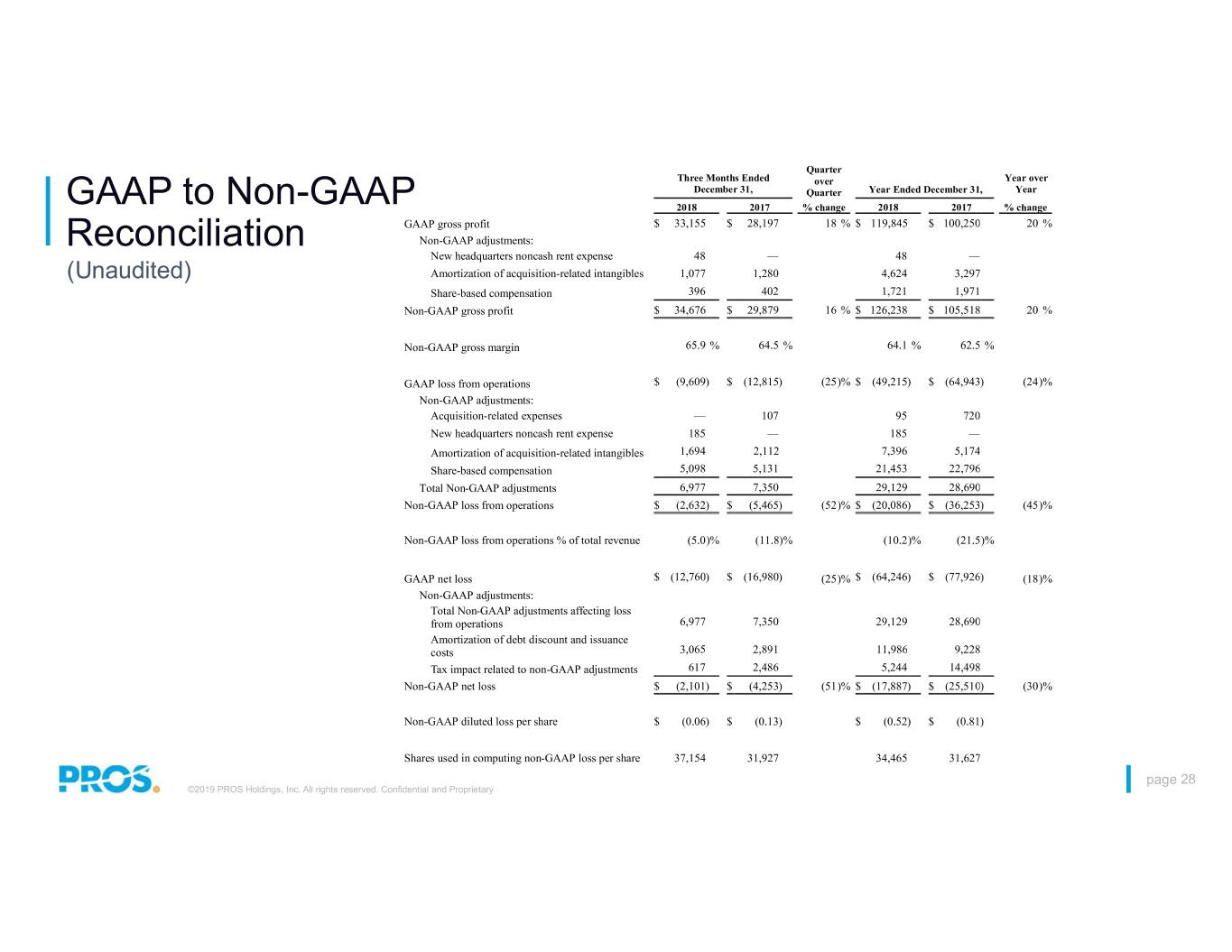

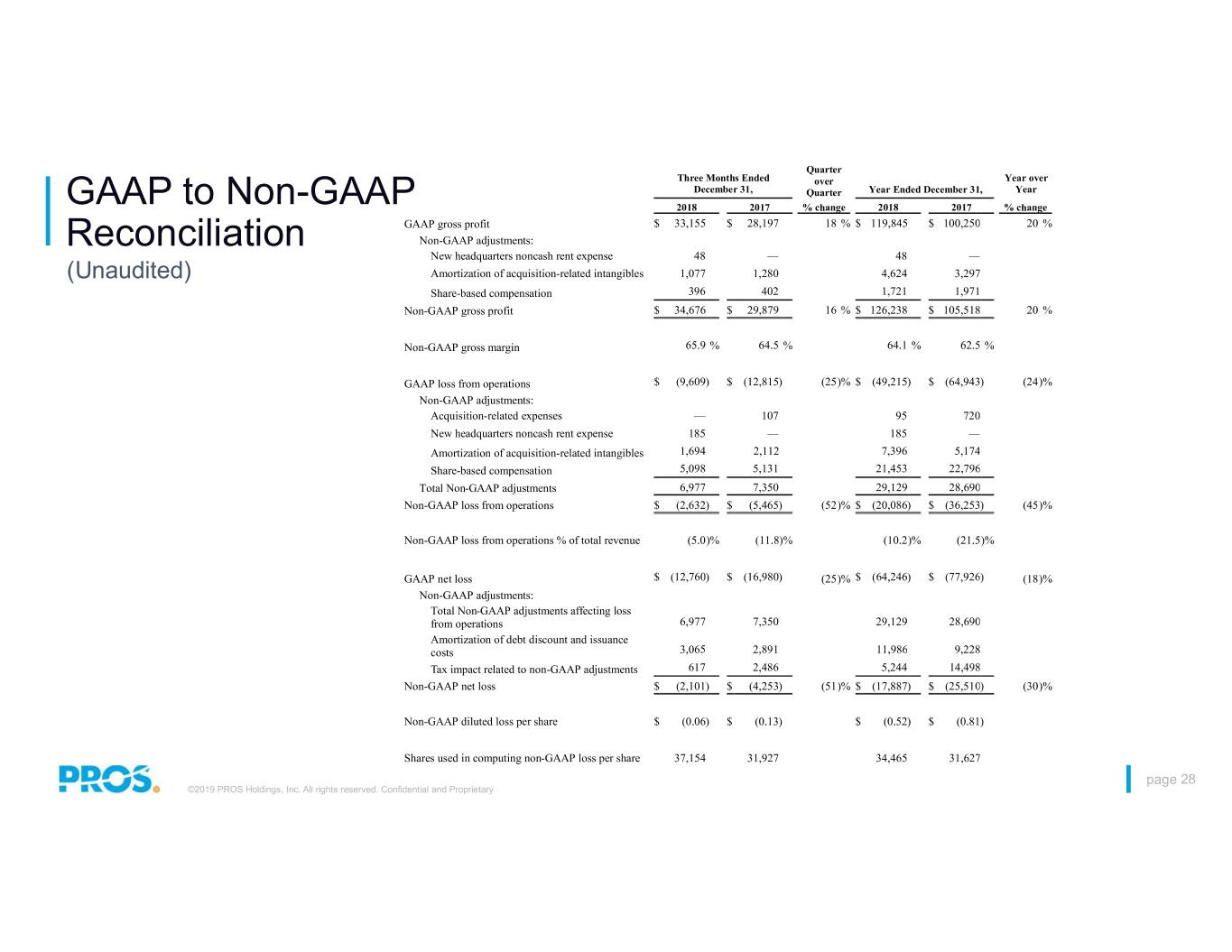

Quarter Three Months Ended over Year over December 31, Quarter Year Ended December 31, Year GAAP to Non-GAAP 2018 2017 % change 2018 2017 % change GAAP gross profit $ 33,155 $ 28,197 18 % $ 119,845 $ 100,250 20 % Reconciliation Non-GAAP adjustments: New headquarters noncash rent expense 48 — 48 — (Unaudited) Amortization of acquisition-related intangibles 1,077 1,280 4,624 3,297 Share-based compensation 396 402 1,721 1,971 Non-GAAP gross profit $ 34,676 $ 29,879 16 % $ 126,238 $ 105,518 20 % Non-GAAP gross margin 65.9 % 64.5 % 64.1 % 62.5 % GAAP loss from operations $ (9,609) $ (12,815) (25)% $ (49,215) $ (64,943) (24)% Non-GAAP adjustments: Acquisition-related expenses — 107 95 720 New headquarters noncash rent expense 185 — 185 — Amortization of acquisition-related intangibles 1,694 2,112 7,396 5,174 Share-based compensation 5,098 5,131 21,453 22,796 Total Non-GAAP adjustments 6,977 7,350 29,129 28,690 Non-GAAP loss from operations $ (2,632) $ (5,465) (52)% $ (20,086) $ (36,253) (45)% Non-GAAP loss from operations % of total revenue (5.0)% (11.8)% (10.2)% (21.5)% GAAP net loss $ (12,760) $ (16,980) (25)% $ (64,246) $ (77,926) (18)% Non-GAAP adjustments: Total Non-GAAP adjustments affecting loss from operations 6,977 7,350 29,129 28,690 Amortization of debt discount and issuance costs 3,065 2,891 11,986 9,228 Tax impact related to non-GAAP adjustments 617 2,486 5,244 14,498 Non-GAAP net loss $ (2,101) $ (4,253) (51)% $ (17,887) $ (25,510) (30)% Non-GAAP diluted loss per share $ (0.06) $ (0.13) $ (0.52) $ (0.81) Shares used in computing non-GAAP loss per share 37,154 31,927 34,465 31,627 page 28 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

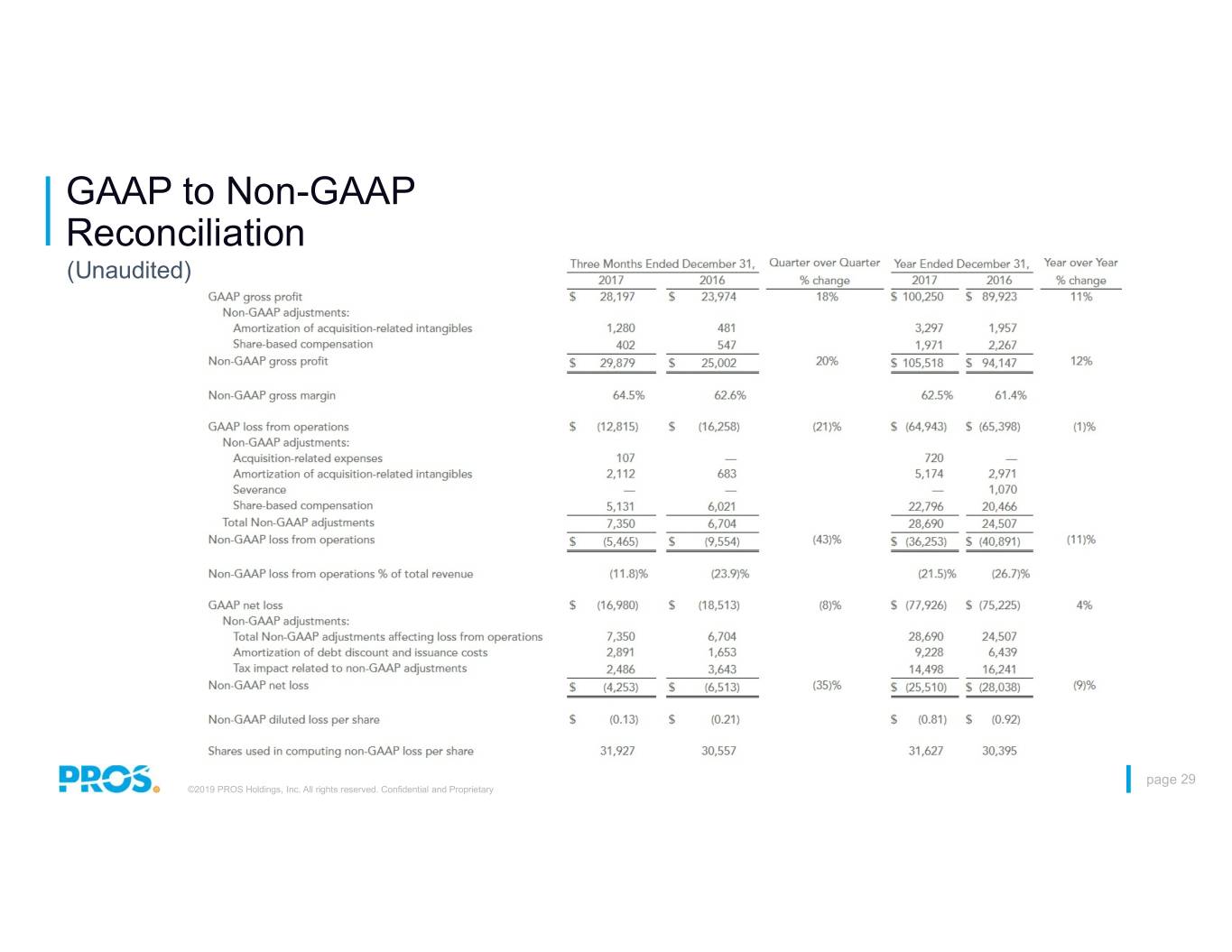

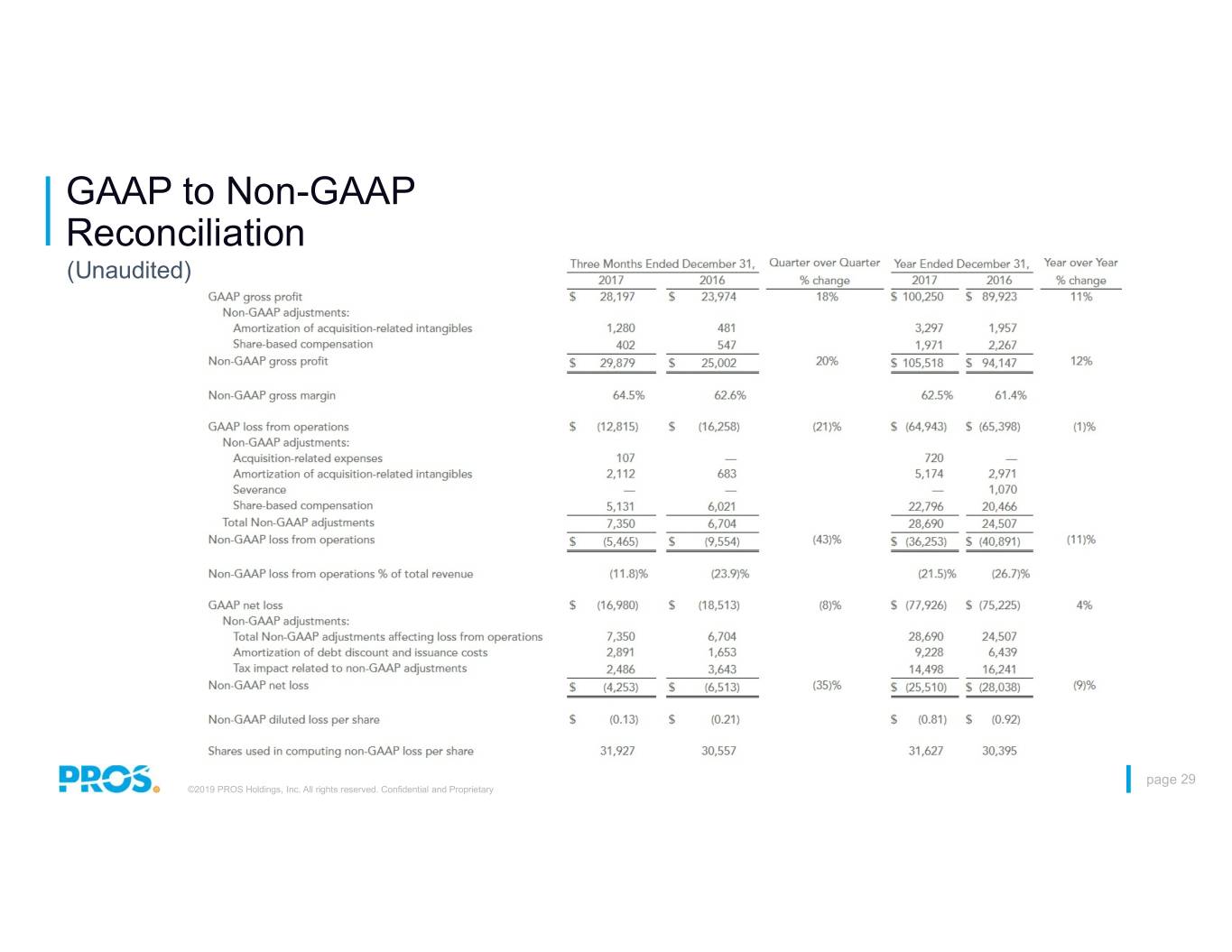

GAAP to Non-GAAP Reconciliation (Unaudited) page 29 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

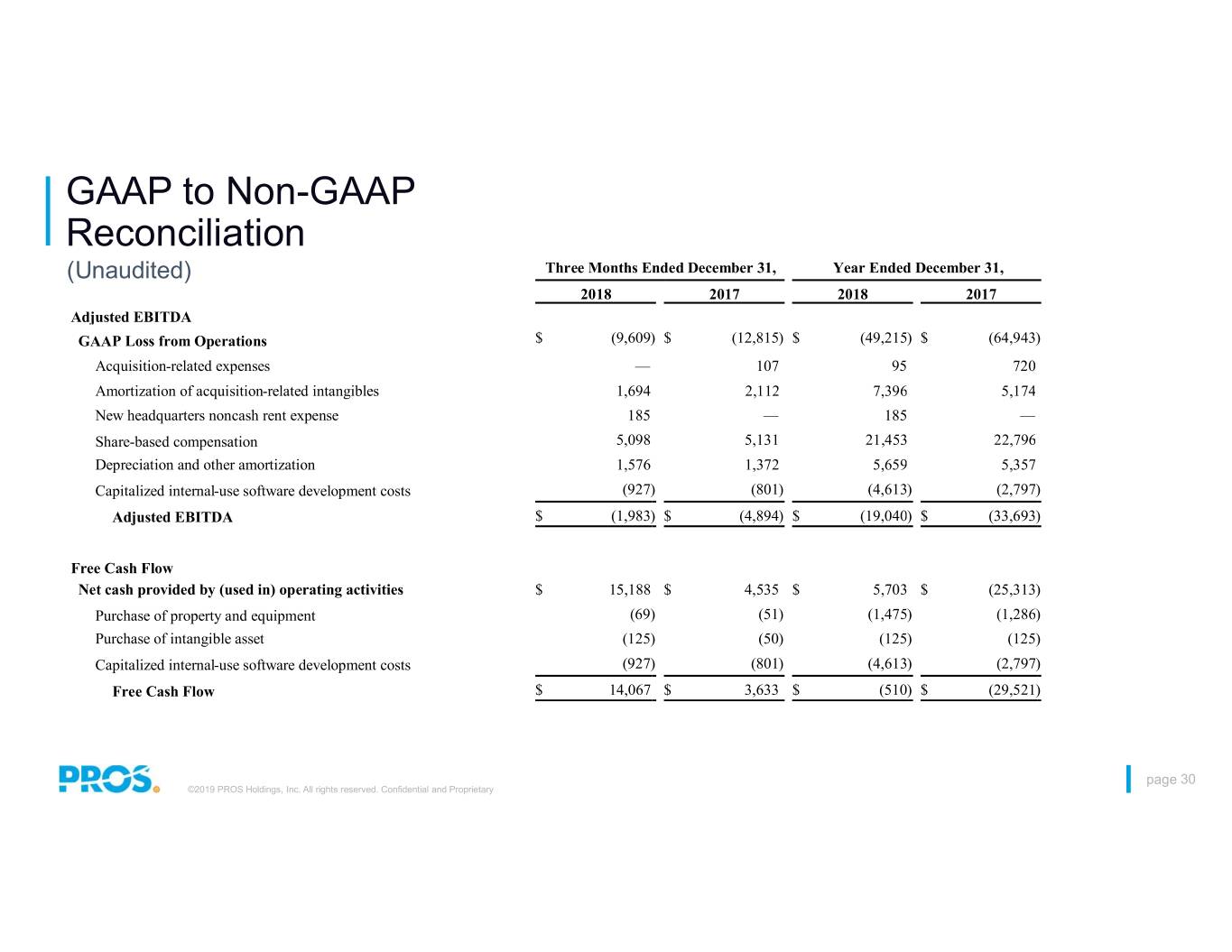

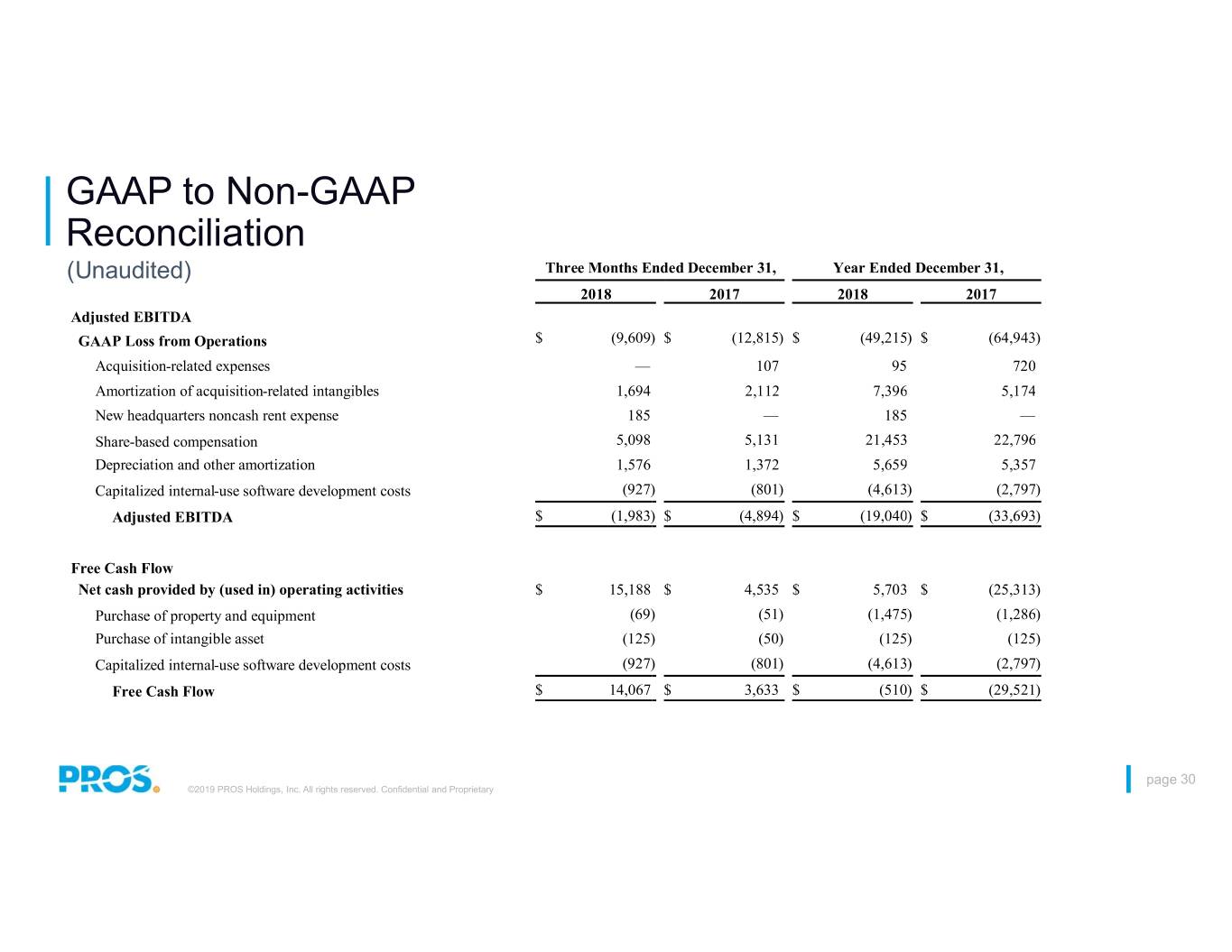

GAAP to Non-GAAP Reconciliation (Unaudited) Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 Adjusted EBITDA GAAP Loss from Operations $ (9,609) $ (12,815) $ (49,215) $ (64,943) Acquisition-related expenses — 107 95 720 Amortization of acquisition-related intangibles 1,694 2,112 7,396 5,174 New headquarters noncash rent expense 185 — 185 — Share-based compensation 5,098 5,131 21,453 22,796 Depreciation and other amortization 1,576 1,372 5,659 5,357 Capitalized internal-use software development costs (927) (801) (4,613) (2,797) Adjusted EBITDA $ (1,983) $ (4,894) $ (19,040) $ (33,693) Free Cash Flow Net cash provided by (used in) operating activities $ 15,188 $ 4,535 $ 5,703 $ (25,313) Purchase of property and equipment (69) (51) (1,475) (1,286) Purchase of intangible asset (125) (50) (125) (125) Capitalized internal-use software development costs (927) (801) (4,613) (2,797) Free Cash Flow $ 14,067 $ 3,633 $ (510) $ (29,521) page 30 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary

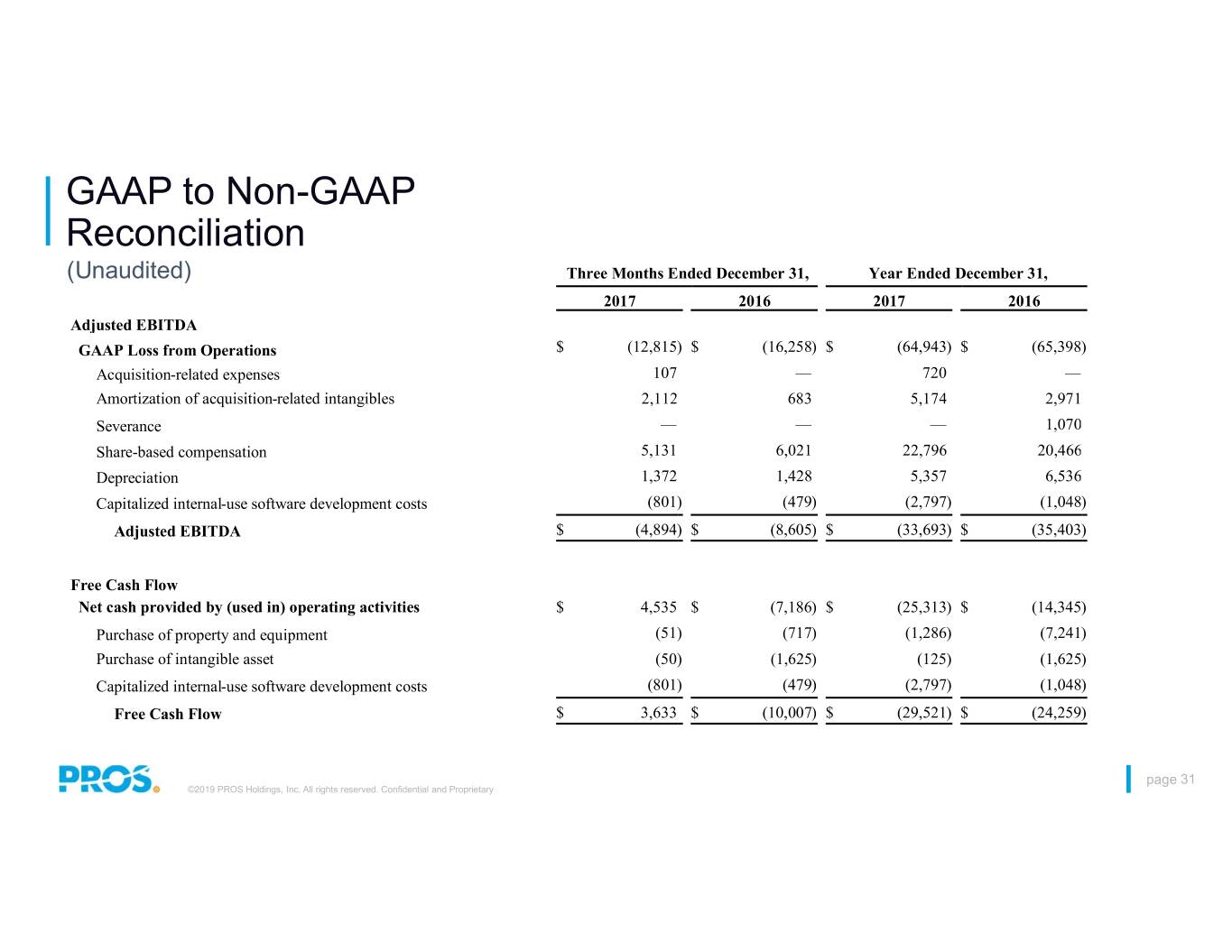

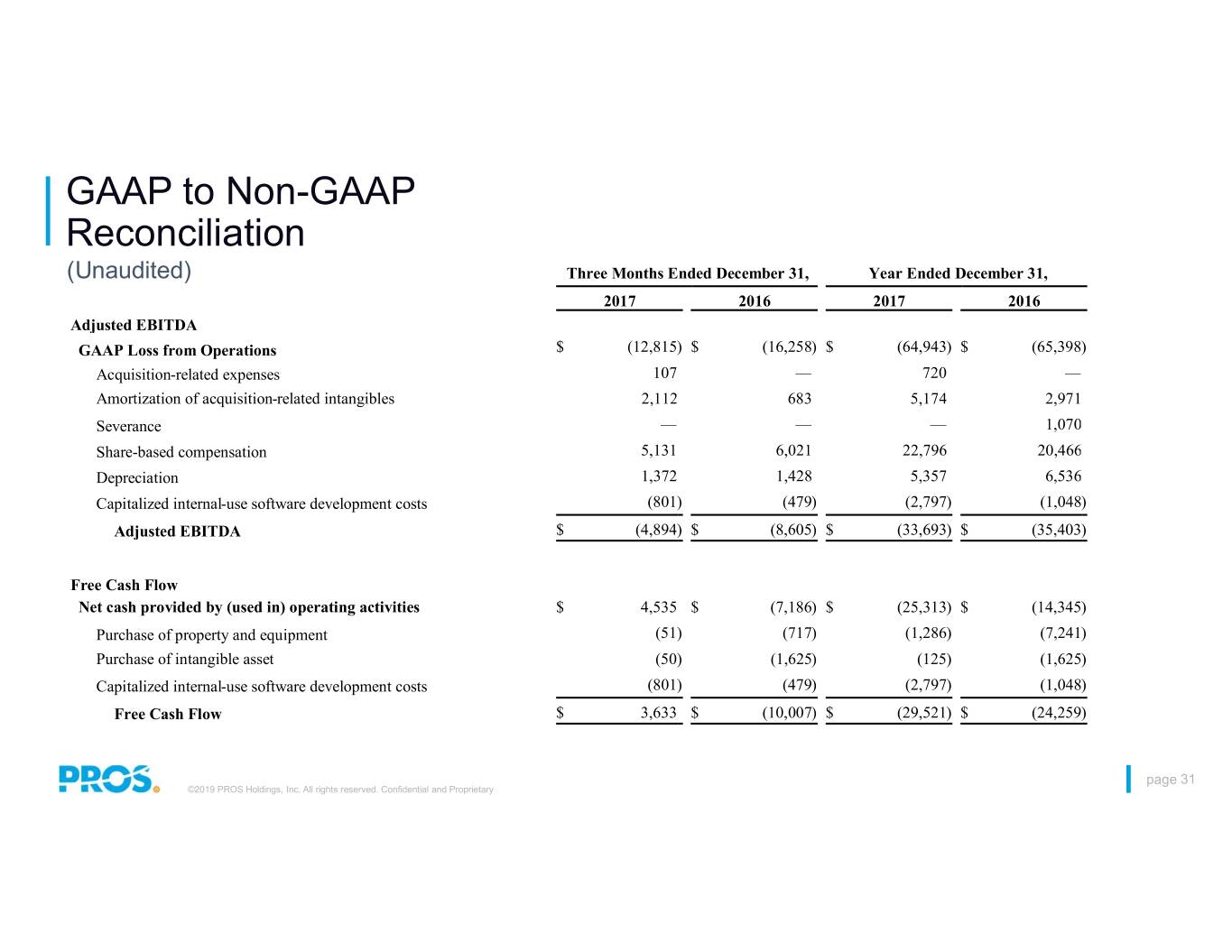

GAAP to Non-GAAP Reconciliation (Unaudited) Three Months Ended December 31, Year Ended December 31, 2017 2016 2017 2016 Adjusted EBITDA GAAP Loss from Operations $ (12,815 ) $ (16,258) $ (64,943) $ (65,398 ) Acquisition-related expenses 107 — 720 — Amortization of acquisition-related intangibles 2,112 683 5,174 2,971 Severance — — — 1,070 Share-based compensation 5,131 6,021 22,796 20,466 Depreciation 1,372 1,428 5,357 6,536 Capitalized internal-use software development costs (801) (479) (2,797) (1,048) Adjusted EBITDA $ (4,894 ) $ (8,605) $ (33,693) $ (35,403 ) Free Cash Flow Net cash provided by (used in) operating activities $ 4,535 $ (7,186) $ (25,313) $ (14,345 ) Purchase of property and equipment (51) (717) (1,286) (7,241) Purchase of intangible asset (50) (1,625) (125) (1,625) Capitalized internal-use software development costs (801) (479) (2,797) (1,048) Free Cash Flow $ 3,633 $ (10,007) $ (29,521) $ (24,259 ) page 31 ©2019 PROS Holdings, Inc. All rights reserved. Confidential and Proprietary