UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | |

Filed by the Registrant þ | Filed by a Party other than the Registrant ¨ |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

PROS HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

__________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| | |

| þ | | No fee required. |

| | |

| o | | Fee paid previously with preliminary materials. |

| | | | |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PROS | 2022 Proxy Statement | Page 1

Attending the Annual Meeting

Our 2022 annual meeting of stockholders (Annual Meeting) will be held in a virtual format to permit all stockholders equal access to the Annual Meeting.

To participate in the Annual Meeting, please follow the instructions posted at:

www.virtualshareholdermeeting.com/PRO2022

Online access to the meeting platform will begin 30 minutes prior to the meeting, which will begin promptly at:

8:00 a.m. Central Daylight Time on May 12, 2022

If you wish to submit a question, you may do so in two ways. If you want to ask a question before the meeting, then beginning on April 13, 2022 and ending at 11:59 p.m. Eastern Time on April 27, 2022, you may log into www.proxyvote.com and enter your 16-digit control number. Questions pertinent to meeting matters which are submitted in advance will be answered during the Annual Meeting, subject to time constraints. Alternatively, if you want to submit your question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/PRO2022, type your question into the “Ask a Question” field, and click “Submit.” Any questions pertinent to meeting matters that are submitted during the meeting will be answered during the Annual Meeting. You do not need to attend the Annual Meeting to vote.

Even if you plan to attend the Annual Meeting, we encourage you to vote your shares in advance either online or as detailed under Voting Instructions in this Proxy Statement.

In this Proxy Statement, the terms “PROS,” the "Company," “we,” "us" and “our” refer to

PROS Holdings, Inc. together with its consolidated subsidiaries.

These materials were first sent or made available to stockholders on April 1, 2022.

PROS | 2022 Proxy Statement | Page 2

PROS Holdings, Inc.

Notice of 2022 Annual Meeting of Stockholders

Virtual Meeting Site:

www.virtualshareholdermeeting.com/PRO2022

May 12, 2022

8:00 am Central Daylight Time

The Notice of Meeting, Proxy Statement and Annual Report on Form 10-K

are available free of charge at proxyvote.com and at ir.pros.com.

Items of Business

| | | | | | | | |

| 1 | Elect three Class III directors (Carlos Dominguez, Catherine Lesjak and Andres Reiner) to the board of directors of PROS Holdings, Inc. (Board of Directors or Board) to serve a three-year term until the annual meeting of our stockholders to be held in the year 2025 (2025 Annual Meeting); |

| 2 | Advisory vote on named executive officer compensation; |

| 3 | Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2022; and |

| 4 | Transaction of other business that may properly come before the Annual Meeting. |

| | | | | | | | |

| Record Date | |

| Close of business on March 22, 2022 (Record Date). |

| | |

| By Order of the Board of Directors, |

| | |

| /s/ Damian Olthoff

_____________________________ | |

| Damian Olthoff |

| General Counsel and Secretary |

| Houston, Texas | |

| April 1, 2022 | |

Your vote is important. Please vote.

PROS | 2022 Proxy Statement | Page 3

PROS | 2022 Proxy Statement | Page 4

Our Values

At PROS, our mission is to help people and companies outperform, and our culture is at the heart of delivering on this mission. Centered on our core values of: We are Owners; We are Innovators; and We Care, our culture is built on our multi-decade commitment to innovating, leveraging the cutting edge of data science and putting our customers first. Consistent with these values, we publicly disclose information about our business across a number of important topics*, including corporate social responsibility (CSR) and environmental, social and governance (ESG) issues.

We are Owners

PROS was built on an unwavering commitment to the growth and success of our people and our customers. We are intensely focused on helping our customers compete and win in the digital economy by optimizing their shopping and selling experiences. Delivering on this promise, however, requires more than best-of-breed, innovative technology, deep expertise in AI and machine learning and years of proven experience, all of which we pride ourselves in. Our customers and people count on us to also maintain a thriving business, one that embraces the value of diversity, supports our local communities and respects each individual for their unique talents and gifts. This focus speaks to the "heart" of our company, our rich and deeply rooted culture centered around caring for the people, the businesses and the communities we serve.

We are Innovators

We received recognition from industry analysts for top products and innovation, including leadership positions in G2 for Pricing Software, the Gartner Magic Quadrant for CPQ and the IDC MarketScape for B2B Price Optimization and Management. We were awarded numerous industry awards recognizing our continued product innovation, including: Best in Biz Silver Award for 2021 Enterprise Product of the Year, Sales Software, MarTech's Breakthrough Award for Best Price Optimization Solution, and Stevie Awards' International Business Awards Silver Stevie for our Price Optimization and Management Solutions.

We Care

| | | | | |

About our Employees. We believe that diversity and inclusion are key to driving true innovation. We are committed to continuing to hire and promote inclusively, increasing diverse representation and continuing to foster an inclusive culture that gives every employee the opportunity to realize their full potential. We also believe that an important part of our employee experience at PROS is our work environment and our commitment to employee well-being and development. Our commitment to caring about our employees can also be seen in our most recent global employee engagement survey conducted in 2021. Based on these responses, we were certified in all eligible locations as a great place to work. | |

About our Communities. Employees participating together in community outreach projects creates a culture that embraces inclusion and belonging, fosters a collaborative sense of purpose that creates a positive societal impact and further brings our corporate values to life. Our employees volunteer their time to numerous social programs that are aimed at addressing a range of issues in the areas of homelessness, education, empowerment, crisis response and conservation. |

About our World. We believe success is not just measured in dollars and cents; it is also measured in the impact we have on our communities. PROS continues to initiate sustainable activities that make a positive impact on the people and the environment around us. We are committed to understanding and minimizing our own environmental footprint. Our approach focuses on energy, emissions, and waste across our operations including the PROS Platform and in our corporate facilities.

*Company goals are aspirational and may change. Statements regarding the Company are not guarantees or promises that they will be met. Content available at websites and in documents referenced in this section are not incorporated herein and are not part of this Proxy Statement. For more information regarding CSR and ESG at PROS, including our diversity and inclusion programs and metrics as well as our environmental stewardship activities, please visit ir.pros.com.

PROS | 2022 Proxy Statement | Page 5

Proxy Statement Summary

This summary highlights selected information for PROS Holdings, Inc. (together with its consolidated subsidiaries, PROS, the Company, we, us or our) in this Proxy Statement. You should read this entire Proxy Statement carefully before voting.

| | | | | | | | |

| 2022 Annual Meeting of Stockholders |

| | |

| Virtual Meeting Site: |

| virtualshareholdermeeting.com/PRO2022 |

| | |

| Date: | | May 12, 2022 |

| | |

| Time: | | 8:00 am Central Daylight Time |

| | |

The Record Date for the Annual Meeting is March 22, 2022.

Only stockholders of record at the close of business on this date are entitled to vote at the Annual Meeting.

| | | | | | | | | | | |

| Proposal

| | Recommendation of the Board

|

| 1 | Election of Class III Directors | | FOR each of the nominees |

| 2 | Advisory Vote to Approve Executive Compensation | | FOR

|

| 3 | Ratification of appointment of Independent Registered Public Accounting Firm. | | FOR

|

How to Vote

Please vote your shares promptly to ensure the presence of a quorum at the meeting. You may vote online prior to the meeting by visiting proxyvote.com and entering the control number found in your Notice of Internet Availability of Proxy Materials, or, if you requested printed copies of the proxy materials, by phone or by mail. You may also vote during the Annual Meeting by visiting www.virtualshareholdermeeting.com/PRO2022, entering the control number and following the instructions. For more detailed information, see the section entitled Voting Instructions.

Materials to Review

We are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (Notice) instead of a paper copy of this proxy statement (Proxy Statement) and our Annual Report to Stockholders for the Year Ended December 31, 2021 (2021 Annual Report). The Notice contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including this Proxy Statement, our 2021 Annual Report and a form of proxy card or voting instruction card.

PROS | 2022 Proxy Statement | Page 6

Business Highlights

In 2021, we continued to deliver on our mission of helping people and companies outperform, despite the disruptions of COVID on our business and our communities, by enabling our customers to optimize their shopping and selling experiences and compete in the digital economy. By continuing to execute on our strategy, we grew our subscription revenue by 4% and improved our cash flow metrics while managing the continuing impact of the COVID-19 pandemic. For more information on our financial performance, please see our 2021 Annual Report. Notable highlights for the year include:

•Improved customer gross revenue retention rate by more than 500 basis points, exceeding 93%, returning to our pre-COVID level.

•Significantly improved cash flow as net cash used in operating activities for the year ended December 31, 2021 was $30.8 million less, or an improvement of 62%, than in the prior year, primarily achieved through a combination of strong customer retention rates and operating efficiencies, in spite of the continuing impact of COVID on the travel industry.

•Announced next-generation intelligent SaaS editions for the PROS Platform, including PROS Smart Price Optimization and Management and PROS Smart Configure Price Quote.

•Completed the acquisition of EveryMundo LLC, a digital offer marketing pioneer that enables more direct customer engagement through dynamic webpages, offer visualization and digital ad campaigns, accelerating our vision to optimize every shopping and selling experience.

•Achieved a 2020-2021 Great Place to Work-Certified™ company designation for second year in a row, extending the certification to include all eligible countries: Australia, Bulgaria, France, Germany, United Kingdom and United States.

•Received recognition from industry analysts and numerous industry awards for top products and innovation, including leadership positions in G2 for Pricing Software, the Gartner Magic Quadrant for CPQ and the IDC MarketScape for B2B Price Optimization and Management; PROS was the only vendor to receive leadership rankings in both Price Optimization and Management and CPQ industry assessments.

| | |

| Annual Recurring Revenue (ARR) is one of our key performance metrics and should be viewed independently of revenue or other similar GAAP measures. ARR is defined, as of a specific date, as contractual recurring revenue, including contracts with a future start date, together with annualized overage fees incurred above contracted minimum transactions, and excluding perpetual and term license agreements recognized as license revenue in accordance with GAAP. Gross revenue retention reflects our ability to retain existing customers and excludes any existing customer upsells. |

None of these accomplishments would have been possible without our team and culture, defined by our key values of:

•We are Owners;

•We are Innovators; and

•We Care (for each other, our customers, our communities and our world).

Our culture and values can be seen in our hybrid work model, our pandemic response and employee wellness initiatives. We emphasize work location and schedule flexibility, based on a blend of what makes sense for each employee, their team and our business, which we believe is the "future of work." We take an integrated approach to helping our employees manage their work and personal responsibilities, with a strong focus on employee physical and mental health. Recognizing that working in a hybrid environment across our global company is a relatively new way to interact, we offer company-wide initiatives to assist our employees managing through the changes and maintaining productivity. These initiatives have included, among other things, mental and physical health programming, periodic paid recharge days and "Work Well Wednesdays" with limited scheduled meetings to help combat video conference fatigue. We also offer our employees a trusted time off program, allowing our employees to take the time they need away from work, at their discretion, while still meeting business requirements. As we look forward, we created a wellbeing innovation team to help further develop a wellbeing program designed to meet the needs of our employees globally. For more information on our culture and values, please visit ir.pros.com.

PROS | 2022 Proxy Statement | Page 7

EXECUTIVE COMPENSATION PROGRAM

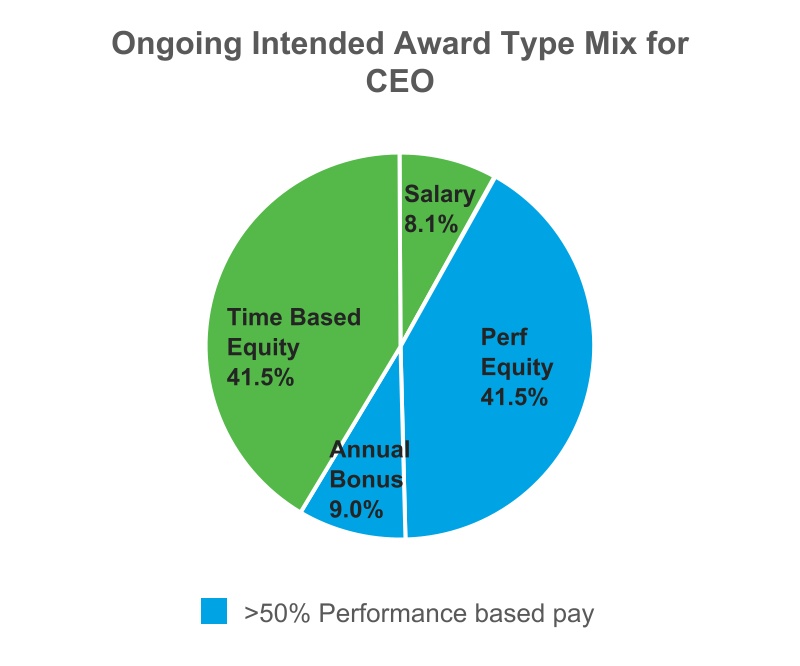

Our executive compensation program is designed with sound compensation policies and practices that align the compensation of our named executive officers (NEOs) with our stockholders’ interests. Our Compensation and Leadership Development (CLD) Committee believes that a well-functioning executive compensation program should reward executives for Company out-performance and that incentives should pay out at reduced levels or zero when Company performance is not achieved. Upon review, the CLD Committee (and our third party compensation consultants) have concluded that our executive compensation program is well aligned with these pay for performance tenets.

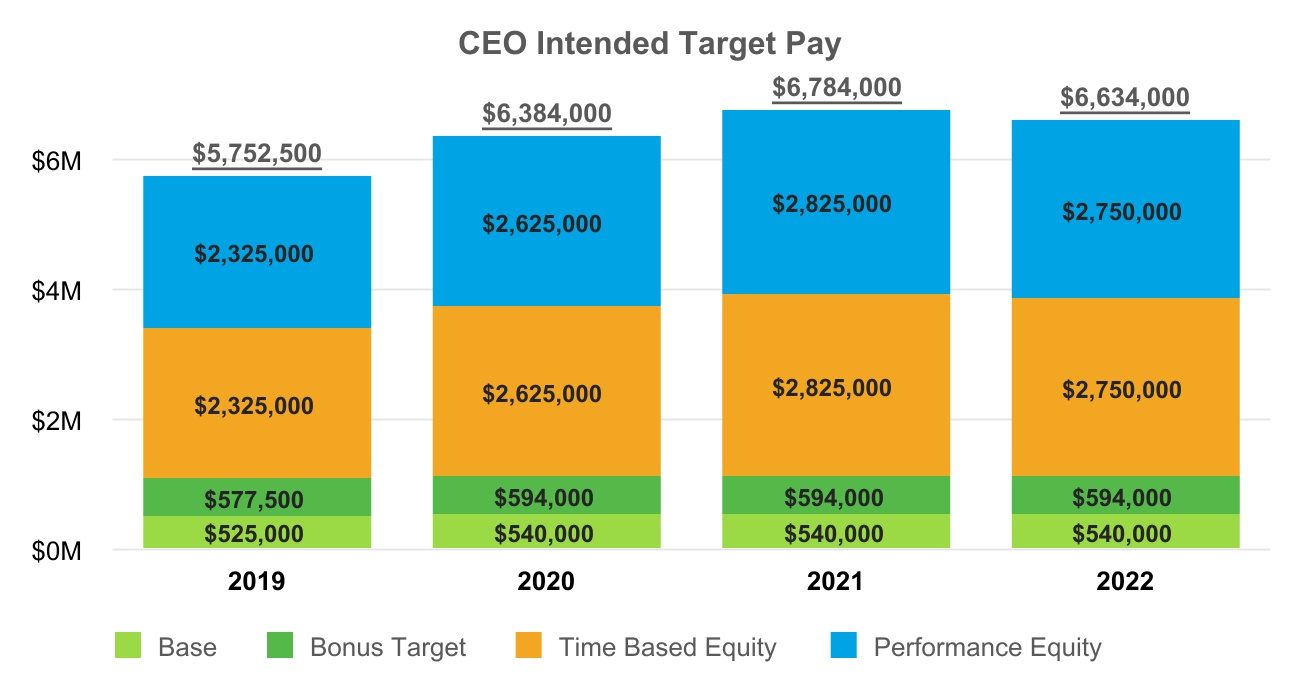

The overall design of our compensation program, consisting of three primary components (base salary, cash incentive and long-term equity awards), remained consistent year-over-year. Our CLD Committee made no changes to our NEOs' base salaries or cash incentive targets for 2021 as compared to 2020. For the 2021 NEO cash incentive program, the CLD Committee focused on improving profitability by adding improvement in Company free cash flow along with improvement in ARR, a core top-line Company metric. Half of our CEO's target equity grant value was delivered in performance-based Market Stock Units (MSUs) and half in time-based RSUs. Recognizing that in the midst of the COVID-19 pandemic, establishing multi-year Company performance targets for long-term equity awards was challenging, the CLD Committee chose to use relative stockholder return as the performance metric for the performance-based equity awards granted in 2021, where attainment is based on the Company's total stockholder return (TSR) versus the return of the Russell 2000 Index over a three-year performance period.

The Company's 2021 bonus plan performance goals were established in February 2021 and no adjustments or discretion were applied. The Company's performance against these preset goals led to a cash bonus payout of 115.4% of target. The above target bonus payout was aided by two strong performance indicators in 2021: solid improvement year-over-year in our free cash flow, which had a 40% weighting in the 2021 cash bonus plan, and a return to a customer gross retention rate well above 90%, which impacted our ARR performance, which had a 60% weighting in the plan.

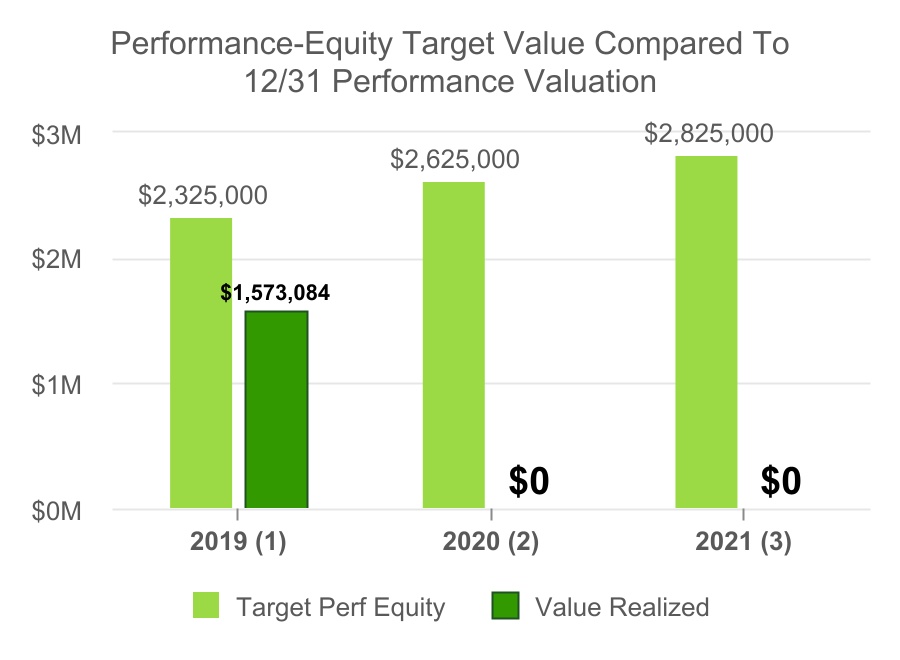

The CLD Committee increased the target equity grant value for our NEOs in January 2021 in response to material increases in market equity compensation benchmarks and to continue to strongly align our NEOs' compensation with stockholders. These $100,000 to $500,000 increases in target equity award amounts, combined with the accounting fair market value calculation for market stock units (MSUs) drove the increases in year-over-year equity compensation values presented in the Summary Compensation Table. However, the 2021 MSUs, which have a three-year performance period, are currently tracking for a 0% of target earnout, and for any 2021 MSUs to be earned, the Company's TSR must outperform the Russell 2000 Index over the remaining performance period. Company Performance and CEO Pay

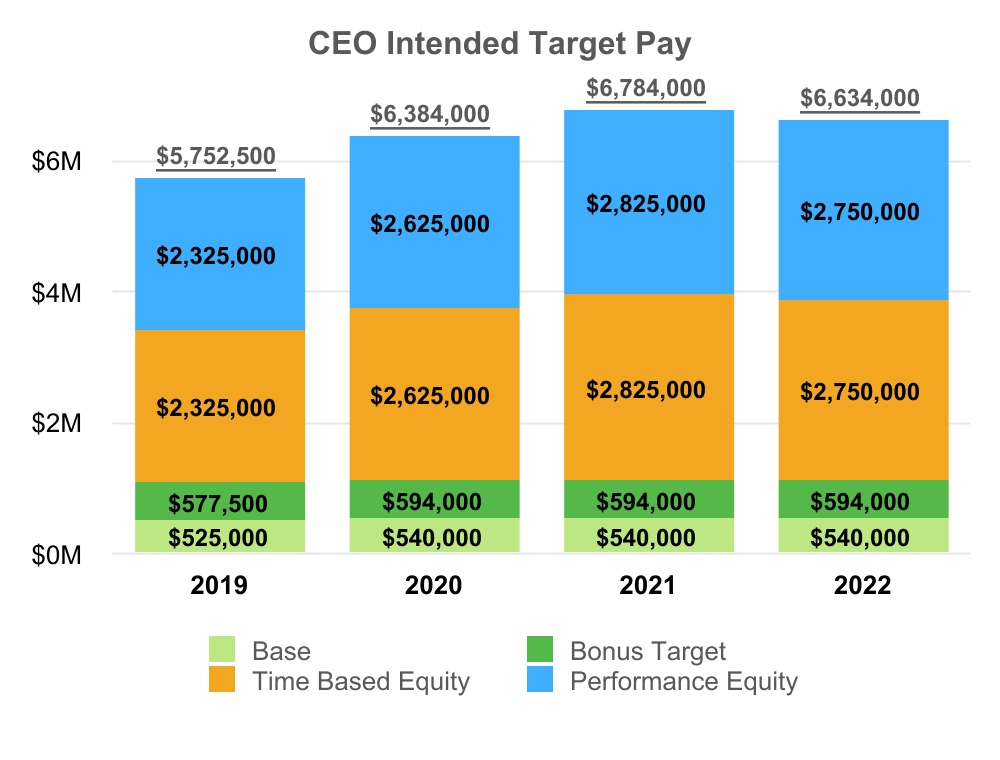

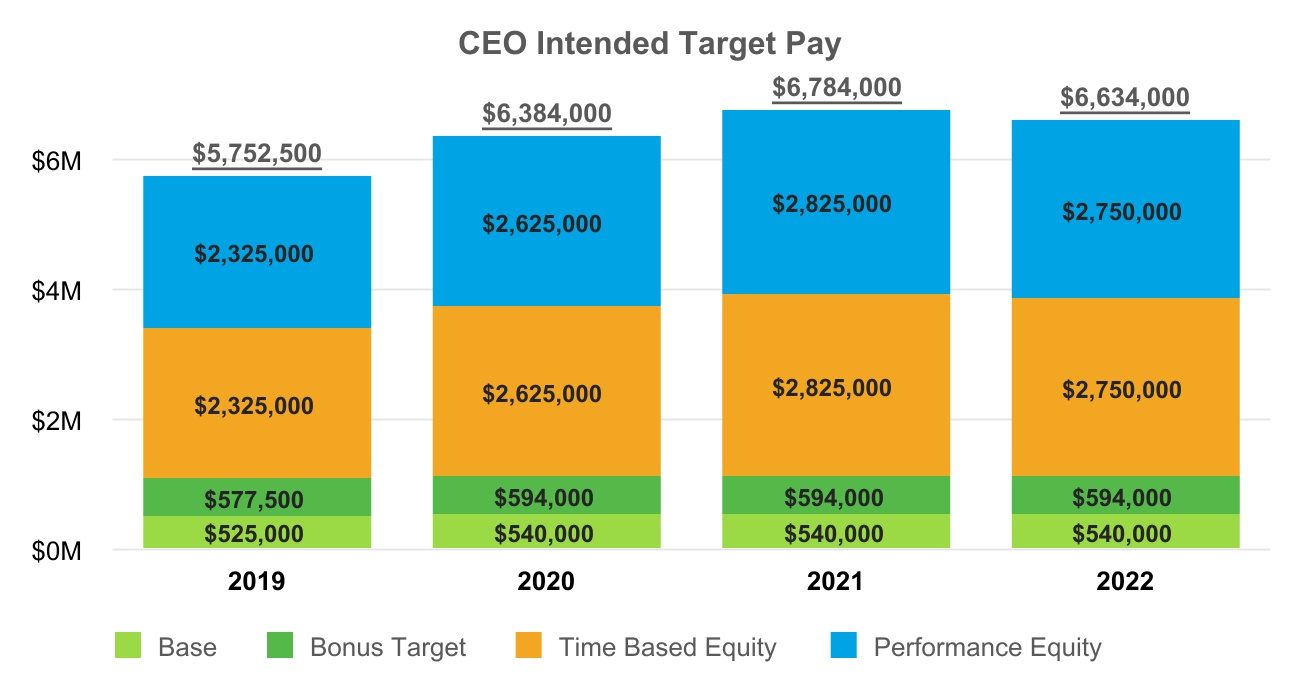

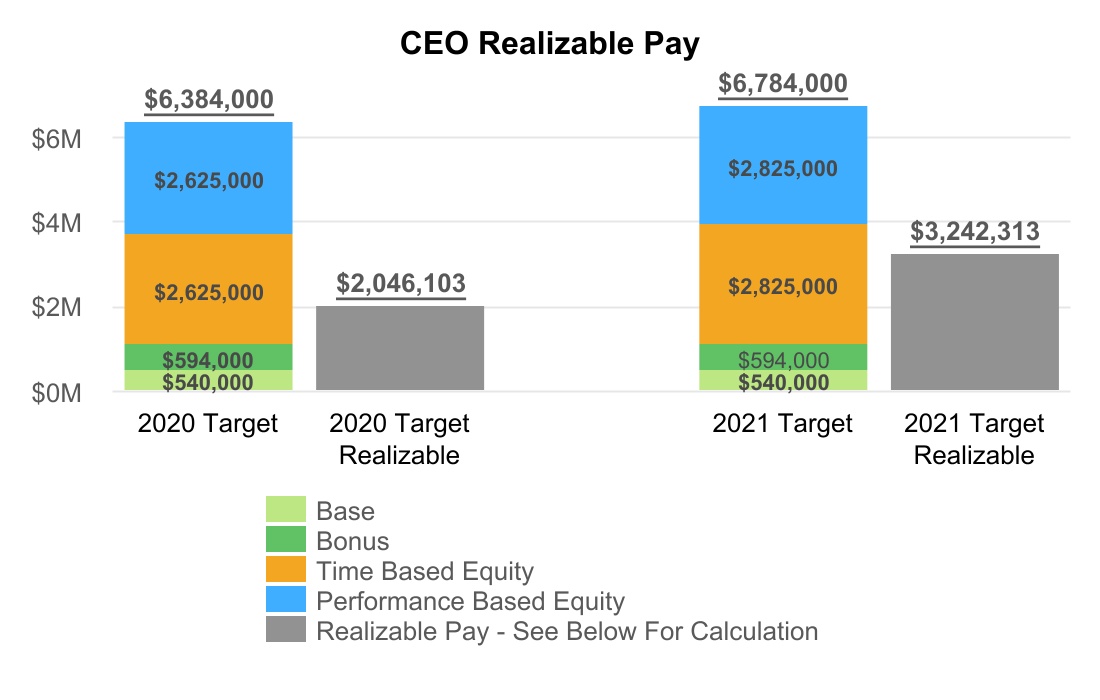

Our CEO's target compensation has remained similar over multiple years and decreased for 2022.

PROS | 2022 Proxy Statement | Page 8

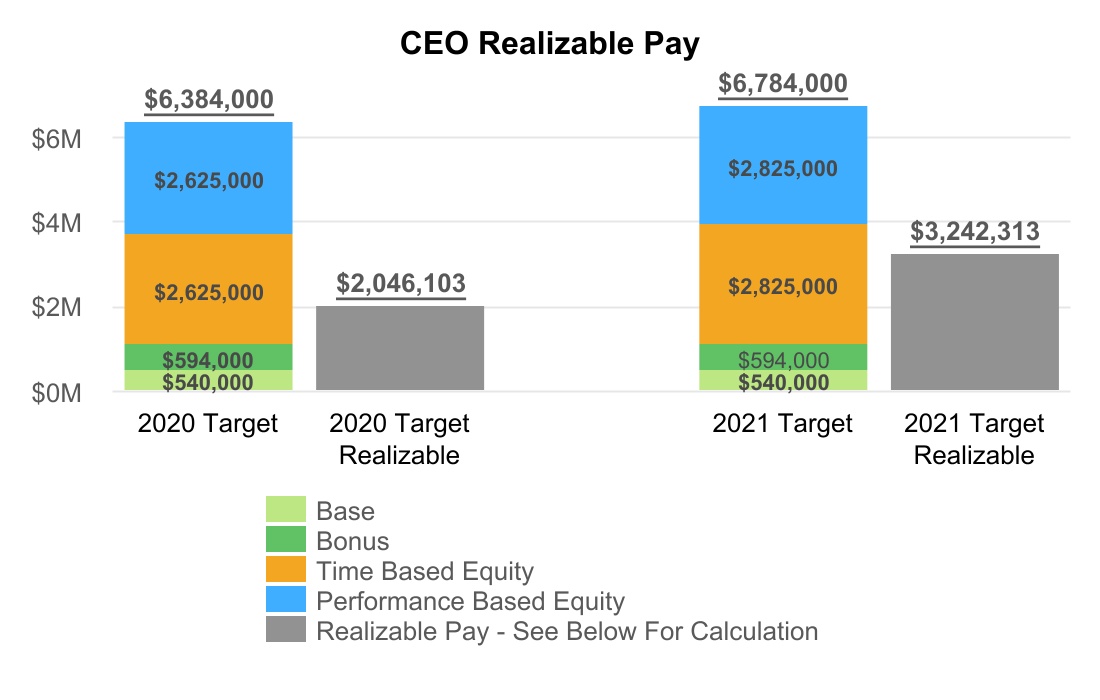

The economic impact of the pandemic continued to adversely affect our CEO's actual compensation. Including restricted stock unit (RSU) equity awards, which change in value based on share price movement, more than 92% of our CEO’s 2021 total target compensation is at risk. While our CEO compensation reported in the Summary Compensation Table increased in 2021, compensation should be viewed with a multi-year lens, as performance-based equity is reported in the Summary Compensation Table at grant date fair value, but the compensation actually received depends on multiple factors, including our actual performance over the multi-year performance period and the share price at vesting and ultimate sale. For example, our CEO did not receive 48% of his target compensation for 2020, as his 2020 performance-based equity was not earned, and the 2020 bonus was below target. Our CEO's 2021 performance-based equity is currently not on pace to be earned, and if this performance continues over the remainder of the 3-year performance period, our CEO will not receive 40% of his target compensation for 2021. Our stock experienced unique headwinds from market forces in 2021. Our total stockholder return for 2021 was -32% and -42% over a two-year period, and was affected by both the travel and technology industries:

| | | | | | | | |

| Travel Impact | The overall downturn in the travel industry due to the COVID-19 pandemic impacted our stock. For example, the ARCA Airline Index (NYSE: AXGAL) had a -26% two-year return through December 31, 2021. Sabre Corporation and Amadeus, technology providers that directly compete against a portion of our airline products, had a -61% and -17% two-year return, respectively, through December 31, 2021. |

| | |

| Tech Impact | In mid-2021, technology and SaaS stocks began to be adversely impacted by inflation and other economic headwinds. For example, the WisdomTree Cloud Computing Fund (NASD: WCLD) had a -7% return for the second half of 2021. More notably, from our peer group used for benchmarking our CEO's 2021 compensation, three-fourths of the companies that remained public at the end of 2021 had negative shareholder return in 2021. |

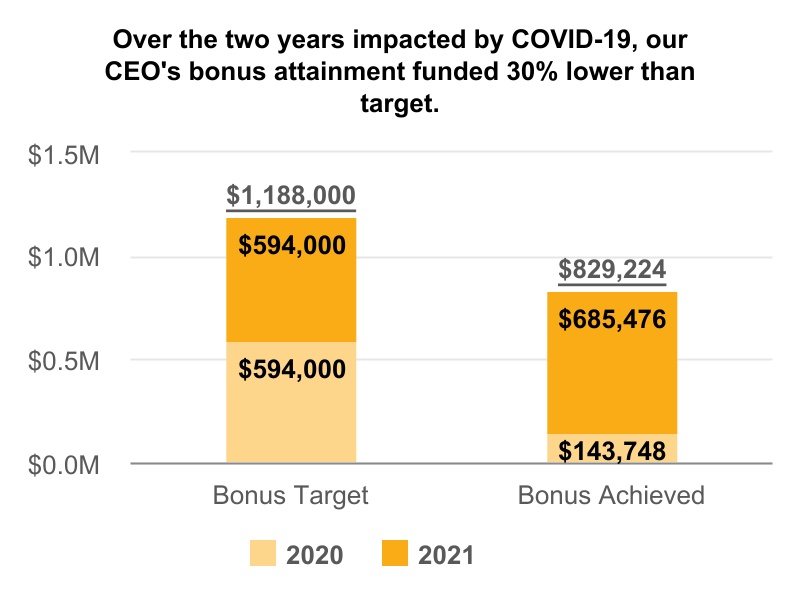

Our profitability metric significantly improved in 2021 and our CEO earned an above target cash incentive.

| | | | | | | | |

| 2021 Cash Incentive | Our CEO's 2021 bonus was earned per the formula at 115.4% of target due to (a) free cash flow improving 62% year-over-year, well above the preset target of 42% improvement, and (b) ARR improving year-over-year, slightly above the minimum preset threshold target. Our CEO has earned 70% of his aggregate target bonus for 2020 and 2021 combined. |

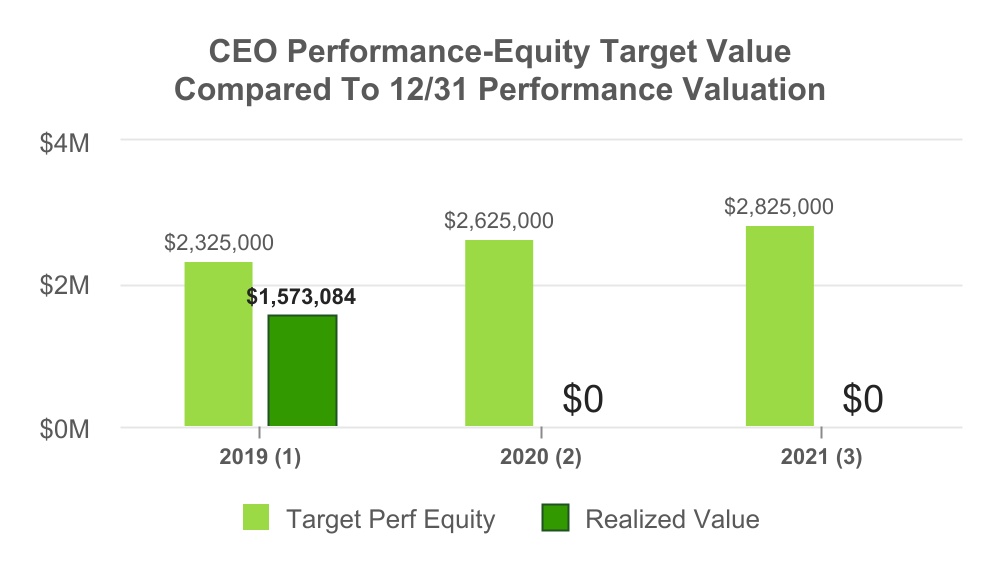

Our CEO's performance-based equity awards, representing a significant amount of his pay, are operating as designed and align our CEO's actual compensation to Company performance and stockholders' interests. The multi-year impact of COVID-19 on our business has significantly impacted our CEO's compensation. For 2020, our CEO earned 4% of his targeted performance-based compensation. For 2021, if the 2021 MSUs are not earned as described below, our CEO would earn 20% of his targeted performance-based compensation. | | | | | | | | |

| Incentive Award | Performance |

| 2019 Equity | PRSUs awarded in 2019 (2019 PRSUs) were earned per the formula, at 79% of target due to total recurring revenue performance below target in 2020. These awards, earned below target, vested in early 2021. |

| | |

| 2020 Equity | PRSUs awarded in 2020 (2020 PRSUs) were not earned per the formula, due to total recurring revenue performance below target in 2021. Despite no actual compensation received by our CEO from this award, this award reflects $2.1 million of Mr. Reiner's compensation in the 2020 row of the Summary Compensation Table. |

| | |

| 2021 Equity | MSUs awarded in 2021 (2021 MSUs) are earned based on our TSR from January 1, 2021 through December 31, 2023 as compared to the Russell 2000 Index. This award reflects $3.3 million of Mr. Reiner's compensation in 2021. However, if the performance period had ended on December 31, 2021, no actual compensation would have been earned because our TSR relative to the Russell 2000 Index was below the minimum preset target threshold at that time. As a result of this underperformance, our TSR must outperform the Russell 2000 Index over the remaining two years of the performance period for any 2021 MSUs to be earned. |

Our CEO's personal interests are aligned with stockholders' interests. Our CEO holds a significant amount of PROS stock which was accumulated over his 23 years with PROS. While the number of shares of PROS stock our CEO owns increased by 16% in 2021 due to vesting of certain equity awards, the aggregate value of his PROS stock declined 21% due to PROS stock price declining in 2021. In addition, the value of his unvested equity awards are directly impacted by our stock price performance. For more information on our CEO's stock ownership and value of his unvested equity awards, see Security Ownership and Outstanding Equity Awards at Fiscal Year End table. Our CEO compensation plan is effective and operating as designed, and our CEO's interests are aligned with stockholders' interests.

PROS | 2022 Proxy Statement | Page 9

CORPORATE GOVERNANCE

Our Board and corporate governance structure is designed to assure that the long-term interests of our stockholders are being served. To satisfy the Board’s duties, directors are expected to take a proactive approach to overseeing our CEO and other senior management to ensure that PROS is committed to business success while maintaining high ethical standards.

Board and Committee Oversight in 2021

| | | | | | | | | | | | | | |

| 2021 Focus Areas | | Typical Board Meeting Process |

ü

| Strategy and M&A, including the acquisition of EveryMundo | | Before the meeting | Prep meetings with management, auditors and outside advisors |

| ü | Business Performance | | |

| ü | Human Capital Management | | Day 1 | Board committee meetings and full Board meeting (including reports from each committee chair) |

| ü | Enterprise Risk Management | | |

| ü | Cybersecurity | | Day 2 | Full Board meeting, followed by an executive session |

| ü | Impact of COVID-19 | | |

| ü | Talent Acquisition, Retention and Development | | After the meeting | Management follow up to discuss and respond to Board requests |

| ü | Oversight of ESG efforts | | |

| ü | Diversity and Inclusion | | | |

| ü | Director Refreshment | | | |

Audit Committee

| | | | | |

| 2021 Focus Areas & Select Activities |

| ü | Reviewing management's proposed public disclosures and investor communications and recommending enhancements |

| ü | Overseeing the detailed audit plan and auditor budget |

| ü | Monitoring critical accounting and financial reporting matters |

| ü | Reviewing annual internal control assessments with internal and external auditors |

| ü | Reviewing with management and external advisors the status of open tax matters and future tax strategies |

| ü | Reviewing with management the annual risk assessment |

| ü | Cybersecurity |

Compensation and Leadership Development (CLD) Committee

| | | | | |

| 2021 Focus Areas & Select Activities |

| ü | Human Capital Management |

| ü | Monitoring COVID-19 impact on existing programs |

| ü | Updating peer group and developing NEO compensation program for 2022 |

| ü | Reviewing acquisition, retention and succession plans for critical talent |

| ü | Monitoring equity plan usage |

| ü | Administering the Company's equity plans |

| ü | Reviewing and approving inducement grants for the acquisition of EveryMundo |

Nominating and Corporate Governance (NCG) Committee

| | | | | |

| 2021 Focus Areas & Select Activities |

| ü | Director refreshment, including identifying, recruiting and onboarding a new director |

| ü | Reviewing director Committee assignments and Committee leadership |

| ü | Overseeing annual performance evaluation of Board, Committees and individual directors |

| ü | Reviewing Code of Conduct, Governance Guidelines and Bylaws |

PROS | 2022 Proxy Statement | Page 10

Diverse Board Representation

| | | | | | | | | | | | | | |

| 33% | | 44% | | 66% |

| | | | |

| Women | | <3 years tenure | | Women and/or from underrepresented communities |

Composition of the Board of Directors

The Board is led by our independent non-executive chairman, Mr. Russell. The Board’s current preferred governance structure is to have an independent director serve as chairman. We believe the current structure provides strong leadership for our Board and ensures independent oversight over the Company, while also positioning our Chief Executive Officer (CEO) as the leader of the Company.

The Board has determined that the following directors have no relationships with us that would interfere with the exercise of independent judgment in carrying out his or her responsibilities as a director, and as such are "independent" under NYSE listing standards and federal securities laws as of December 31, 2021: Messrs. Dominguez, Jourdan, Petersen, Russell, and Williams and Mses. Hammoud, Lesjak and Woestemeyer. All Board committees are comprised entirely of independent directors. Ms. Mariette M. Woestemeyer, a Class I director, has informed the Board of her intention to retire from the Board effective as of the Annual Meeting.

The Board has standing Audit, CLD and NCG Committees. Each Committee has a written charter, which can be found under the Investor Relations section of our website at ir.pros.com. Our Board has determined that each member of the Audit Committee qualifies as "financially literate" within the rules of the NYSE and that three members of the Audit Committee, Messrs. Williams and Petersen and Ms. Lesjak, qualify as an Audit Committee financial expert within the meaning of the SEC regulations. Each member of our CLD Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act), and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code (Code). The following table provides additional information regarding our director nominees:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Class | Independent | AC | CC | NCG | Other Public Company Boards |

| Carlos Dominguez | 63 | 2020 | III | Yes | M | | | Sprinklr; The Hartford |

| | | | | | | | |

| Catherine Lesjak | 63 | 2020 | III | Yes | M | | M | General Electric; SunPower |

| | | | | | | | |

| Andres Reiner | 51 | 2010 | III | No | | | | Paylocity |

PROS | 2022 Proxy Statement | Page 11

Corporate Governance Practices

The Board of Directors has adopted corporate practices and policies that promote excellence in corporate governance. Our corporate governance practices are designed to assure that the long-term interests of stockholders are being served. Key corporate governance policies and practices include:

| | | | | | | | |

| Independent Oversight | | •All non-employee directors are independent. |

| | •All Board committees are comprised entirely of independent directors. |

| | •Our Board holds regular executive sessions of independent directors. |

| | •Our Board has an independent non-executive Chairman. |

| | •Charters of each of the committees of the Board clearly establish the committees’ respective roles and responsibilities. |

| | |

| Stock Ownership Guidelines | | |

| | |

| Accountability | | •Clawback policy that applies to all cash and equity awards. |

| | •Anti-hedging, anti-short and anti-pledging policies. |

| | •Our director resignation policy requires director nominees who do not receive at least 50% of the stockholder votes “for” re-election to tender their resignation. |

| | •Directors may not serve on more than four other public company boards; directors who serve as CEOs should not serve on more than two other public company boards. |

| | |

| Ethics | | •Code of Business Conduct and Ethics annually affirmed by all employees. |

| | •Reporting hotline available to all employees, and PROS Audit Committee has procedures in place for the anonymous submission of employee complaints. |

| | |

| Stockholder Communication | | •We proactively engage with stockholders throughout each year, including at earnings conference calls, investor road shows and investor days, as well as at individual stockholder meetings. We also welcome stockholders to attend our annual OutPerform event for customers and prospects. |

| | •Annual “Say-on-Pay” advisory vote on our executive compensation program. |

| | |

| Board Refreshment | | •Reviewed regularly, with 4 new directors added since 2020. |

| | |

| Board Performance Evaluations | | •Annual board, committee and individual director performance evaluations, led by our non-executive Chairman. |

| | |

| Diversity | | •33% of our Board of Directors are women and 44% are from diverse ethnicities. |

| | |

| Education | | •Directors regularly attend continuing education events related to board governance best practices, including conferences and webinars provided by the NYSE, NACD and Equilar, among others. |

| | |

| Succession Planning | | •Annual review of executive succession planning. |

More information regarding our corporate governance is available under the Investor Relations section of our website at ir.pros.com, which also includes our corporate governance policies, our Code of Business Conduct and Ethics, and the charter for each committee of the Board.

Risk Management

The Board oversees our risk management process and programs. Management reviews the process, including identification of key risks and steps taken to address them, with the full Board at least on an annual basis. The Audit Committee, the CLD Committee and the NCG Committee assist the Board in discharging its oversight duties. The Audit Committee considers risks related to the subject matters enumerated in its charter, including risks relating to internal controls, disclosure, financial reporting and cybersecurity.

The CLD Committee reviews risks related to the subject matters enumerated in its charter, including risks associated with our compensation programs. Similarly, the NCG Committee considers risks related to the subject matters for which it is responsible as identified in its charter, including risks associated with corporate governance. Accordingly, while each of the three committees contributes to the risk management oversight function by assisting the Board in the manner outlined above, the Board remains responsible for the oversight of our risk management.

PROS | 2022 Proxy Statement | Page 12

ESG Oversight

The Board oversees our ESG programs, including ongoing engagement with senior executives on key matters including cybersecurity, diversity, sustainability and governance practices. Our Chief People Officer leads our social investments and champions our commitment to ESG performance and transparency. The Audit Committee oversees our strategies and initiatives related to cybersecurity. The NCG Committee oversees our policies and programs concerning ESG matters, including review of our Sustainability Policy in early 2022. The CLD Committee oversees the development and implementation of our practices, strategies and policies used for recruiting, managing and developing employees (human capital management). These practices, strategies and policies focus on diversity and inclusion, leadership development, workplace environment and safety, and corporate culture. In addition, the full Board receives updates and progress on ESG matters from management, and Mr. Jourdan meets with our Chief People Officer outside of regularly scheduled Board meetings to review ESG matters. For more information on ESG matters, see our ESG Report (available at: ir.pros.com). Our ESG Report is not incorporated by reference into this proxy statement.

Cybersecurity Oversight

Our Board oversees the senior management team’s efforts to address cybersecurity and data privacy risks, and annually reviews cyber risk mitigation and transfer efforts, including review of our cybersecurity insurance coverage. To provide even more focused oversight and guidance as part of our continuing evolution of our cybersecurity program, the Audit Committee amended its charter in 2021 to explicitly add oversight of issues related to cybersecurity risks. The Audit Committee annually reviews our overall risk profile with respect to cybersecurity matters. The Audit Committee also reviews quarterly reports by our Head of Information Security and Cyber Security on a range of cybersecurity activities, including cybersecurity threats and risks, security effectiveness, compliance efforts (such as the results of annual cybersecurity training required for all employees), benchmarking, incident response and planned initiatives. Ms. Hammoud also meets with our Head of Information Security and Cyber Security outside of regularly scheduled Board meetings to review cybersecurity matters.

Board Governance

Our non-executive chairman, among other responsibilities, oversees the planning of the annual Board calendar, and, with our CEO, in consultation with the other directors, schedules and sets the agenda for meetings of the Board and leads the discussion at such meetings, serves as a liaison between the CEO and the independent directors, leads executive sessions of our Board, and performs such additional duties and responsibilities as requested by the Board from time to time. Executive sessions of the independent directors of the Board are scheduled during each regularly scheduled in-person Board meeting. Our non-executive chairman provides feedback to our CEO, as needed, promptly after the executive session.

Board Performance Evaluation Process. Our Board recognizes that a robust and constructive performance evaluation process is an essential component of Board effectiveness. Our Board conducts annual performance evaluations that are intended to determine whether the Board, each of its committees, and individual Board members are functioning effectively, and to provide them with an opportunity to reflect upon and improve processes and effectiveness. Our NCG Committee oversees this annual process, which is led by our non-executive chairman. As part of this process, each Board member completes written assessments of Board and Committee effectiveness and performance, and our non-executive chairman conducts one-on-one discussions with each Board member to obtain their assessment of the effectiveness and performance of individual Board members. A summary of the results of these assessments are presented to the NCG Committee identifying any themes or issues that have emerged. The results are then reported to the full Board, which considers the results and ways in which Board processes and effectiveness may be enhanced. Our Board is also implementing an additional process in 2022 to have Board members complete written assessments on individual Board member effectiveness and performance.

Board Refreshment. Our Board recognizes that regularly evaluating Board refreshment is also an important component of Board effectiveness. The NCG Committee and the Board are focused on identifying individuals whose skills and experiences will enable them to effectively contribute to the Board. Following the annual Board performance evaluation described above, and as part of its consideration of director refreshment, the NCG Committee reviews the appropriate skills and characteristics required of Board members such as business experience, viewpoints and personal background, and diversity of skills in technology, finance, marketing, international business, financial reporting and other areas. The NCG Committee also continually evaluates committee appointments (or membership) and leadership and opportunities for effective rotation. For example, we currently plan for Ms. Lesjak to assume the role of Chair of the Audit Committee following the Annual Meeting. Mr. Williams, the current Audit Committee chair, has served in this role for the past 14 years. He will continue to serve on the Audit Committee. Additionally, due to the global nature of our business and our customers, the Board believes it is important that the Board include individuals with diversity of race, ethnicity, gender, sexual orientation, age, education, cultural background, and professional experiences, and those factors are considered in evaluating board candidates in order to provide practical insights and diverse perspectives. Based on these assessments, the Board has added four new directors since 2020, including our newest Board member, Mr. Jourdan who was appointed following the recommendation of the NCG Committee in June 2021. For more information on the skills and experience of Mr. Jourdan, see Our Board of Directors, and for more information on the qualifications, skills and attributes of our Board nominees, see Director Qualifications, Skills and Attributes in this Proxy Statement. PROS | 2022 Proxy Statement | Page 13

Accountability

Code of Business Conduct and Ethics. Our Board has adopted a Code of Business Conduct and Ethics that applies to all of our directors and employees. Our Code of Business Conduct and Ethics is available under the "Investor Relations" section of our website at ir.pros.com.

Director Resignation Policy. Our Board has adopted a director resignation policy. Under this policy in an uncontested election of directors, any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election must promptly tender his or her resignation to the NCG Committee. The NCG Committee will promptly consider all relevant factors including, without limitation, (a) the stated reasons why votes were withheld from such director; (b) any alternatives for curing the underlying cause of the withheld votes; (c) the tenure and qualifications of the director; (d) the director’s past and expected future contributions to the Company; (e) our Corporate Governance Guidelines; and (f) the overall composition of the Board, including whether accepting the resignation would cause the Company to fail to meet any applicable SEC or NYSE requirement. The NCG Committee will recommend to the qualified independent directors the action to be taken with respect to such offered resignation, and the qualified independent directors will act on the NCG Committee’s recommendation no later than 90 days following the date of the stockholders’ meeting in which the election occurred. If a majority of the members of the NCG Committee received a greater number of votes “withheld” from their election than votes “for” their election at the same election, then the remaining qualified independent directors on the Board will consider the matter directly or may appoint a committee of the Board amongst themselves solely for the purpose of considering the tendered resignations and making the recommendation to the Board whether to accept or reject them.

Stock Ownership Guidelines. Our Board has adopted stock ownership guidelines for our NEOs and directors that are designed to align our NEOs’ and directors' interests with our stockholders’ interests by promoting long-term share ownership, which reduces the incentive for excessive short-term risk taking and further increases our NEOs’ and directors' alignment with stockholder interests. These guidelines require our CEO to hold shares of our stock worth at least six times his annual salary, other NEOs to hold shares of our stock worth at least two times their annual salary, and each non-employee director to hold shares of our stock worth at least five times the director's annual retainer. New directors are expected to achieve their ownership threshold within six years after joining our Board. New NEOs are expected to achieve their ownership threshold within five years from the date of hire or promotion. As of December 31, 2021, each of our NEOs and directors were in compliance with the applicable guidelines.

Prohibition Against Hedging, Short-Sale, Pledging and Repricing Underwater Stock Options. We have implemented both anti-hedging and anti-pledging policies, as well as a prohibition on participating in short sales of our stock, to ensure that our executives’ stock remains at-risk. Our Insider Trading Policy, which applies to all employees, including officers and non-employee directors, specifically prohibits short sales of our securities, transactions in puts, calls or other derivative securities involving our stock, hedging or monetization transactions (including but not limited to zero-cost collars, prepaid variable forwards and equity swaps), and holding our securities in a margin account or pledging our securities as collateral for a loan. Our Amended and Restated 2017 Equity Incentive Plan (2017 Plan) also prohibits repricing, repurchase or exchange of underwater stock options without stockholder approval.

Compensation Committee Interlocks and Insider Participation. No member of our CLD Committee and none of our executive officers has any relationships that would constitute an interlocking relationship with executive officers and directors of any other entity.

Communication with Our Board

Stockholders or interested parties who wish to communicate with members of our Board may send correspondence to them in care of our Corporate Secretary at 3200 Kirby Drive, Suite 600, Houston, Texas 77098. Such communication will be forwarded to the intended recipient(s). We currently do not intend to have our Corporate Secretary screen this correspondence, but we may change this policy if directed by our Board due to the nature or volume of the correspondence. Communications that are intended specifically for the non-executive chairman of the Board may also be sent to the street address noted above, to the attention of the non-executive chairman of the Board.

Role of the Board of Directors

Our Board oversees our CEO and other senior management to assure that the long-term interests of stockholders are being served. Our Board currently consists of nine members, divided into three classes, with each class serving for a staggered three-year term. The term of office of one class of directors expires each year in rotation so that one class is elected at each annual meeting for a full three-year term. Our Board believes that our classified board structure aligns the Board with the Company’s long-term interests and allows for stable and informed oversight, providing institutional perspective both to management and other directors. Our Board has adopted formal Corporate Governance Guidelines to ensure that it has the practices in place to review and evaluate our business operations as needed, to make decisions independent of our management, and to align the interests of directors and management with the interests of our stockholders.

PROS | 2022 Proxy Statement | Page 14

In 2021, our Board met 4 times and acted via unanimous written consent 3 times, the Audit Committee met 10 times and acted via unanimous written consent 2 times, the CLD Committee met 5 times and acted via unanimous written consent 4 times, and the NCG Committee met 4 times and acted via unanimous written consent one time. Each current director who served as a director in 2021 attended at least 75% of the meetings of our Board and the Committees on which he or she served during 2021. The Board encourages all directors to attend annual meetings of the stockholders. All incumbent directors, except for Mr. Jourdan who joined the Board in June 2021, attended the 2021 meeting of stockholders which was held virtually.

Audit Committee

The Audit Committee assists the Board in oversight and monitoring of:

•our accounting and financial reporting processes and the audits of our financial statements:

•our independent auditors, including their qualifications, engagement, performance and independence;

•the results of the annual audit and the independent auditor’s review of our annual and quarterly financial statements and reports, including discussions with independent auditors without management present;

•press releases regarding our financial results and any other financial information and earnings guidance provided;

•matters that have a significant impact on our financial statements;

•the scope, adequacy and effectiveness of our internal control over financial reporting and disclosure controls;

•our internal auditors;

•tax matters and tax strategies;

•risk management, including financial accounting, investment, capital structure, tax, business continuity and cybersecurity matters;

•procedures for complaints for employees to submit concerns anonymously about questionable accounting, internal control or auditing matters; and

•all material related-party transactions that require disclosure.

Compensation and Leadership Development Committee

The CLD Committee discharges the responsibilities of our Board relating to the compensation and benefits for our executive officers and directors, including:

•reviewing and approving the compensation arrangements for our executive officers and directors;

•reviewing and approving corporate performance goals and objectives relevant to such compensation;

•administering our equity incentive plans;

•reviewing our compensation discussion and analysis and CLD Committee report required by the rules of the SEC;

•engaging with a third-party independent advisor to assist in evaluating our executive compensation program;

•providing oversight on the overall leadership development program throughout the Company; and

•overseeing succession planning for executive officers jointly with the NCG Committee.

Nominating and Corporate Governance Committee

The NCG Committee assists the Board in:

•identifying qualified candidates to become directors and considering the nomination of our incumbent directors for reelection;

•evaluating stockholder nominations of candidates for election to our Board;

•reviewing our general policy relating to selection of director candidates and members of committees of our Board, including an assessment of the performance of our Board;

•reviewing and making recommendations to our Board regarding corporate governance principles and policies;

•reviewing periodically our environmental and corporate social responsibility policies and practices; and

•overseeing succession planning for executive officers jointly with the CLD Committee.

The NCG Committee has the responsibility for establishing the criteria for recommending which directors should stand for reelection to our Board and the selection of new directors to serve on our Board. Although the NCG Committee has not formulated any specific minimum qualifications for director candidates, it has determined desirable characteristics including, but are not limited to, business experience, mature judgment, leadership, personal and professional ethics, diversity and integrity. We do not have a formal policy with respect to consideration of diversity in identifying director nominees; however, in the process of selecting a director nominee, the NCG Committee assesses backgrounds, diversity and expected contributions of the individuals to the Board.

PROS | 2022 Proxy Statement | Page 15

OUR BOARD OF DIRECTORS

Our Board consists of a diverse group of highly qualified leaders in their respective fields. Most of our directors have senior leadership experience at major domestic and multinational technology companies. In these positions, they have gained significant and diverse experience, including strategy, finance, sales and marketing, risk management, public company financial reporting, compliance and leadership development. They also have public company experience serving as executive officers, or on boards of directors and board committees, and have an understanding of corporate governance practices and trends. The Board believes the experience, expertise and other attributes of our directors provide PROS with a diverse range of perspectives to provide oversight and represent the best interests of our stockholders. Among our nominees for election to the Board and continuing directors, three self-identify as women and three self-identify as individuals from underrepresented communities (meaning, an individual who self-identifies as Black, Hispanic, Latino, Asian, Pacific Islander or Native American).

Directors and Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | |

| William Russell | | Andres D. Reiner |

| Non-Executive Chairman of the Board | | (Nominee) |

| NCG Committee Chairman | | President and |

| CLD Committee | | Chief Executive Officer |

| | | |

| | |

| Mr. Russell, 70, serves on the board of directors at Accesso Technology Group PLC (OTCMKTS:LOQPF). Mr. Russell previously served in a variety of roles on both public and private technology company boards and previously served on the boards of SABA Software, Inc. (from January 2010 to March 2015), webMethods and Cognos. Mr. Russell held a number of senior-level roles in his more than 20 years at Hewlett-Packard, including Vice President and General Manager of the multi-billion-dollar Enterprise Systems Group. Mr. Russell holds a Bachelor of Science in Computer Science from Edinburgh University and has completed several executive development programs from institutions including Harvard Business School and INSEAD. As a result of leading Hewlett-Packard’s substantial software business and his public company board experience, Mr. Russell brings to the Board his broad knowledge of large-scale software operations, including sales, marketing, development, finance, strategic planning and leadership, and corporate governance. | | | | Mr. Reiner, 51, serves as our President and Chief Executive Officer, a position he has held since November 2010. From 1999 to 2010, Mr. Reiner held a series of positions with successively increasing responsibility, including Senior Vice President of Product Development and Executive Vice President of Product and Marketing. Prior to becoming our President and Chief Executive Officer, he was responsible for global marketing and alliances, product management, science research, and development of our next generation software products. Mr. Reiner was also instrumental in our transition to a cloud business. Mr. Reiner has served on the board of directors of Paylocity Holding Corporation (NASD: PCTY) since September 2014 and serves on their Compensation and Nominating and Governance committees. Mr. Reiner holds a Bachelor of Science in Computer Science with a minor in Mathematics from the University of Houston. As a result of his more than 20 years of experience with PROS, Mr. Reiner has familiarity with all of our key day-to-day operations, in-depth experience in and knowledge of the development of our products, services and the markets in which we compete, and has leadership, management, strategy, corporate development, risk management and operating experience. | |

PROS | 2022 Proxy Statement | Page 16

| | | | | | | | | | | |

| | Mr. Dominguez, 63, has served as Vice-Chairman and Chief Evangelist of Sprinklr, Inc. (NYSE: CXM) since December 2019. He has served as a director of Sprinklr since 2011.

He served as President of Sprinklr from 2015 to 2019 and as Chief Operating Officer from 2015 to 2018. He also serves on the board of directors of The Hartford Financial Services Group, Inc. (NYSE: HIG) and serves on the Compensation & Management Development and Nominating & Corporate Governance committees of Hartford's board. He also served on the board of directors of Medidata Solutions, Inc. (NASD: MDSO) from 2009 until its acquisition by Dassault Systemes in 2019. From 1992 to 2015, Mr. Dominguez held a variety of roles at Cisco Systems, Inc., including SVP, Worldwide Service Provider Operations (2004 to 2008) and SVP, Office of the Chairman and CEO (2008 to 2015).

Mr. Dominguez brings to the Board his extensive business and leadership experience in technology and software companies, including experience in sales, marketing, strategy, governance, compensation planning and mergers and acquisitions. | |

| | |

| Carlos Dominguez | |

| (Nominee) | | |

| Audit Committee | | |

| | |

| | | |

| | Ms. Hammoud, 50, has served as Executive Vice President of Products at Coupa Software Incorporated (NASD: COUP) since 2019.

She served as Senior Vice President of Products at Coupa from 2017 to 2019 and as Vice President of Product Marketing and Management from 2014 to 2017. Prior to joining Coupa, Ms. Hammoud directed product marketing for Adobe System’s (NASD: ADBE) business process management business and held a product development management role at webMethods. Ms. Hammoud earned a B.S. in Computer Science with high distinction from the American University of Beirut, Lebanon.

Ms. Hammoud brings to the Board her extensive technology industry experience, including her experience in product marketing, software development and product portfolio strategy. | |

| Raja Hammoud | | |

| CLD Committee | | |

| | | |

| | Mr. Jourdan, 64, retired from Chevron (NYSE: CVX) in 2021, after having served as Chevron's Chief Diversity and Inclusion Officer from 2018 to 2021 and Senior Management Sponsor from 2015 to 2018. In his more than 18-year career at Chevron, Mr. Jourdan served in a variety of management roles, including as Vice President, Commercial and Business Development for each of the IndoAsia and Asia South regions.

Prior to Chevron, Mr. Jourdan served in management, business development, trading and engineering roles at El Paso Energy, PG&E and Dominion Energy. As a graduate of the US Military Academy at West Point, Mr. Jourdan was commissioned as an officer in the US Army, obtaining the rank of Captain prior to entering the private sector. Mr. Jourdan currently serves on the board of SEARCH Homeless Services, a non-profit organization.

An author and frequent public speaker, Mr. Jourdan brings to the Board his substantial international commercial and business development, mergers and acquisitions, risk management and diversity, equity and inclusion experience at a global, Fortune 10 company. | |

| Leland T. Jourdan | | |

| CLD Committee | | |

| | |

| | | |

| | Ms. Lesjak, 63, retired from HP, Inc. (NYSE: HPQ), formerly Hewlett-Packard Company (HP) in March 2019, serving as HP's interim Chief Operating Officer from 2018 to 2019, after having served as Chief Financial Officer from 2007 to 2018.

In addition, Ms. Lesjak served as interim Chief Executive Officer of HP from August 2010 through October 2010. During her 32-year careeer at HP, Ms. Lesjak held a broad range of financial leadership roles, including Senior Vice President and Treasurer and other financial operations and controller roles. Ms. Lesjak has a bachelor’s degree in biology from Stanford University and a master of business administration degree in finance from the University of California, Berkeley.

Ms. Lesjak serves on the board of directors of SunPower (NASD: SPWR) where she serves as Chair of the Audit committee and member of the Compensation committee and General Electric Company (NYSE: GE) where she serves on the Audit and Governance & Public Affairs committees.

An audit committee financial expert, Ms. Lesjak brings to the Board extensive experience as the chief financial officer of a major corporation, with significant presence in both the business-to-consumer and business-to-business markets, including extensive experience in strategic business planning and execution, financial oversight, corporate development and public company governance. | |

| Catherine Lesjak | | |

| (Nominee) | | |

| Audit Committee | | |

| | |

PROS | 2022 Proxy Statement | Page 17

| | | | | | | | | | | |

| | Mr. Petersen, 59, has served as president of Brookview Capital Advisors since 2016. He currently serves on the board of directors of the following public companies: Aterian, Inc. (NASD: ATER) where he serves as Chairman of the Audit committee, and Plus Therapeutics, Inc. (NASD: PSTV) where he serves as Chairman of the Audit committee and a member of the Compensation committee.

Mr. Petersen previously served on the board of directors of Diligent Corporation (2013 to 2016) and Piksel, Inc. (2012 to 2017). Mr. Petersen served as the chairman of the audit committee at Diligent and Piksel, and as an advisory board member at Synthesio. From 2014 to 2015, he served as Executive Vice Chairman at Diligent Corporation. Mr. Petersen previously served as Chief Financial Officer for CBG Holdings, Lombardi Software, Inc. (which was sold to IBM in 2010), and Activant Solutions, Inc. Mr. Petersen previously served in executive roles with Trilogy Software and RailTex. Mr. Petersen began his career with American Airlines, Inc. (NASD:AAL), including serving as managing director of corporate development where he led a project to create Sabre Holdings, Inc. (NASD:SABR) and complete its IPO. Mr. Petersen holds a Bachelor of Arts in Economics from Boston College and a Master of Business Administration from the Fuqua School of Business at Duke University.

An audit committee financial expert, Mr. Petersen brings to the Board his business and leadership experience in software companies, merger and acquisition experience, and extensive financial planning, accounting, governance, compensation planning and risk management knowledge. | |

| | |

| Greg B. Petersen | | |

| CLD Committee Chairman | | |

| Audit Committee | | |

| | |

| | | |

| | Mr. Williams, 73, has served on the board of directors and as chairman of the Audit committee of ChannelAdvisor Corporation (NYSE: ECOM) since 2012. He also serves on the board of directors of PointClickCare Corp., a privately held company. Mr. Williams previously served on the board of directors and as chairman of the audit committee of Halogen Software, Inc. (TSE: HGN) (April 2011 to May 2017). Mr. Williams served as Senior Vice President and Chief Financial Officer of Blackbaud, Inc. (NASD: BLKB), a provider of software and services to non-profit organizations, from January 2001 until his retirement in November 2011. Mr. Williams previously served as Executive Vice President and Chief Financial Officer of both Mynd Corporation (now a subsidiary of Computer Sciences Corporation), and Holiday Inn Worldwide, a subsidiary of Bass PLC. Mr. Williams holds a Bachelor of Arts in business from the University of Northern Iowa. An audit committee financial expert, Mr. Williams has extensive financial, business, management and public software company expertise. Through his experience as a chief financial officer at three different companies, including two software and services firms, Mr. Williams brings to the Board extensive knowledge of accounting, risk management, general management of software companies and public company reporting requirements and processes. | |

| |

| Timothy V. Williams | | |

| Audit Committee Chairman | | |

| NCG Committee | | |

| | |

| | | |

| | Mrs. Woestemeyer, 70, co-founded PROS in 1985 with her husband, Ronald Woestemeyer. She has served as a director of PROS since 1985. Mrs. Woestemeyer has notified the Board that she will be retiring from the Board as of the Annual Meeting.

Mrs. Woestemeyer was previously the Chief Financial Officer of Metro Networks, a broadcasting company, from 1983 to 1985 and held various financial roles with Continental Airlines and its predecessor, Texas International Airlines, prior to 1983. Mrs. Woestemeyer holds a Bachelor of Business Administration and a Master of Business Administration from the University of Houston.

As co-founder of PROS, Mrs. Woestemeyer brings to the Board continuity and history of current and past management and direct relevant industry experience. Mrs. Woestemeyer also has familiarity with all of our key operations as a result of serving as a director since our founding. Mrs. Woestemeyer also has experience as our Chief Financial Officer for many years and related operational expertise. | |

| | |

| Mariette M. Woestemeyer | | |

| Co-Founder | | |

| | |

PROS | 2022 Proxy Statement | Page 18

Director Qualifications, Skills and Attributes

The below table provides a summary view of the key experiences, expertise and other attributes of our continuing directors and director nominees as well as term of office information. A checkmark indicates a specific area of focus or experience on which the Board relies most. The lack of a checkmark does not mean the individual does not possess that qualification or skill.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Experience, Expertise or Attribute | Carlos Dominguez | Raja Hammoud | Leland Jourdan | Catherine Lesjak | Greg Petersen | Andres Reiner | William Russell | Timothy Williams | Mariette Woestemeyer |

| (Nominee) | | | (Nominee) | | (Nominee) | | | |

| Accounting | | | | ü | ü | | | ü | ü |

| Business Operations | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Cloud Software | ü | ü | | ü | ü | ü | ü | ü | |

| Finance | | | | ü | ü | | | ü | ü |

| International | ü | ü | ü | ü | | ü | ü | | ü |

| Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| M&A | ü | ü | ü | ü | ü | ü | ü | ü | |

| Public Company/Governance | ü | | | ü | ü | ü | ü | ü | |

| Risk Management | ü | | ü | ü | ü | | | ü | |

| Sales & Marketing | ü | | | | | ü | ü | | |

| Software Product Development | | ü | | | | ü | | | |

| Travel Industry | | | | | ü | ü | | | ü |

| | | | | | | | | |

| Race/Ethnicity |

| Black/African American | | | ü | | | | | | |

| Hispanic/Latin American | ü | | | | | ü | | | |

| Asian | ü | | | | | | | | |

| Middle Eastern/North African | | ü | | | | | | | |

| Caucasian/White | | | | ü | ü | | ü | ü | |

| Prefer not to disclose | | | | | | | | | ü |

| | | | | | | | | |

| Other Public Boards |

| At March 22, 2022 | 2 | — | — | 2 | 2 | 1 | 1 | 1 | — |

| | | | | | | | | |

| Term of Service on PROS Board |

| Director Since | 2020 | 2020 | 2021 | 2020 | 2007 | 2010 | 2008 | 2007 | 1985 |

| Current Term Expires | 2022 | 2024 | 2024 | 2022 | 2023 | 2022 | 2024 | 2023 | 2023 |

| Class of Director | III | II | II | III | I | III | II | I | I |

PROS | 2022 Proxy Statement | Page 19

PROPOSAL ONE

ELECTION OF DIRECTORS

What am I voting on?

Stockholders are being asked to elect three Class III director nominees to the Board for a three-year term.

Voting Recommendation:

The Board recommends voting “FOR” the election of each of the three Class III director nominees.

Three (3) directors are to be elected at the Annual Meeting. Our Board, upon the recommendation of the NCG Committee, has nominated Carlos Dominguez, Catherine Lesjak and Andres D. Reiner as Class III directors, each to hold office until the 2025 Annual Meeting and until their successor has been duly elected and qualified or until the earlier of their death, resignation or removal.

The Board is also composed of three Class I directors, whose terms expire upon the election and qualification of directors at the 2023 Annual Meeting, and three Class II directors, whose terms expire upon the election and qualification of directors at the 2024 Annual Meeting.

The Board knows of no reason why any of the nominees would be unable or unwilling to serve, but if any nominee should for any reason be unable or unwilling to serve, the proxies will be voted for the election of such other person for the office of director as the Board may recommend in the place of such nominee. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named above.

Vote Required

In accordance with Delaware law, abstentions will be counted for purposes of determining both whether a quorum is present at the Annual Meeting and the total number of shares represented and voting on this proposal. While broker non-votes will be counted for purposes of determining the presence or absence of a quorum, broker non-votes will not be counted for purposes of determining the number of shares represented and voting with respect to the particular proposal on which the broker has expressly not voted and, accordingly, will not affect the approval of this proposal.

Directors are elected by a plurality vote of the votes cast by holders of our Common Stock entitled to vote at the Annual Meeting. Abstentions and broker non-votes will not have any effect on this proposal. Accordingly, the two nominees who receive the highest number of properly executed “FOR” votes from the holders of Common Stock will be elected as directors.

The number of “withhold” votes with respect to a nominee will affect whether our Director Resignation Policy will apply to that individual. In accordance with our Director Resignation Policy, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to offer his or her resignation following certification of the stockholder vote. The NCG Committee would then consider whether to accept the resignation and make a recommendation to our independent directors as to the action to be taken with respect to the offer. For more information about this policy, see Corporate Governance - Accountability - Director Resignation Policy. The NYSE broker discretionary rules prohibit banks, brokers and other intermediaries from voting shares held in their clients’ accounts on elections of directors unless the client has provided voting instructions. Therefore, if you hold your shares in street name, it is important that you cast your vote if you want it to count in the election of directors.

THE BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR” THE ELECTION OF EACH OF THE THREE CLASS III DIRECTOR NOMINEES.

PROS | 2022 Proxy Statement | Page 20

DIRECTOR COMPENSATION

The CLD Committee periodically reviews non-employee director compensation taking into account various factors, including director responsibilities, peer group data and market practices. In the spring of 2021, Frederic W. Cook & Co., Inc. (FW Cook) provided an independent analysis, including peer group data, which was taken into consideration by the CLD Committee. For 2021, the CLD Committee approved a compensation structure for non-employee directors unchanged from 2020 and consisting of an equity award, annual cash retainer, and for certain leadership roles, a supplemental cash retainer. All cash retainers are paid quarterly in arrears. In 2021, each non-employee member of our Board serving as of the 2021 Annual Meeting received a target RSU award of $165,000, which will vest in full on the earlier of the 2022 Annual Meeting or May 12, 2022. Directors who joined the Board after the 2021 Annual Meeting received a pro rata award of RSUs which also vest in full on the earlier of the Annual Meeting or May 12, 2022. Each non-employee member of our Board received an annual cash retainer of $35,000 in 2021, pro rated for directors who joined the Board mid-year. The non-executive chairman of our Board received a supplemental cash retainer of $60,000 in 2021. In addition, each non-employee director serving as a chair or member of a standing committee of our Board received the following supplemental cash retainer(s):

| | | | | | | | | | | | | | | | | | | | |

| Committee Role | | Audit Committee | | CLD Committee | | NCG Committee |

| Member | | $ | 15,000 | | | $ | 15,000 | | | $ | 7,500 | |

| | | | | | |

| Chair | | $ | 30,000 | | | $ | 20,000 | | | $ | 10,000 | |

We also reimburse our directors for reasonable out-of-pocket expenses incurred in connection with (i) their attendance at our Board and committee meetings and other Company meetings, and (ii) director continuing education programs, including participation in the NACD, of which the Company is a member.

2021 Director Compensation Table

The following table sets forth the compensation paid to our non-employee directors for service on our Board during 2021. Compensation for Andres D. Reiner our President and CEO is set forth in the Summary Compensation Table. Mr. Reiner does not receive compensation for his services as a director. | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in Cash

($) | | Restricted

Stock Units

($) (1) | | Total

($) |

| Carlos Dominguez | | $ | 50,000 | | | $ | 164,989 | | | $ | 214,989 | |

| Raja Hammoud | | $ | 50,000 | | | $ | 164,989 | | | $ | 214,989 | |

| Penelope Herscher (2) | | $ | 21,010 | | | $ | — | | | $ | 21,010 | |

| Leland T. Jourdan (3) | | $ | 29,121 | | | $ | 156,384 | | | $ | 185,505 | |

| Catherine Lesjak | | $ | 53,037 | | | $ | 164,989 | | | $ | 218,026 | |

| Greg B. Petersen | | $ | 70,000 | | | $ | 164,989 | | | $ | 234,989 | |

| William Russell | | $ | 120,000 | | | $ | 164,989 | | | $ | 284,989 | |

| Timothy V. Williams | | $ | 72,500 | | | $ | 164,989 | | | $ | 237,489 | |

| Mariette M. Woestemeyer | | $ | 35,000 | | | $ | 164,989 | | | $ | 199,989 | |

(1)Represents the aggregate grant date fair value of equity awards granted in 2021 calculated in accordance with GAAP. For additional information about valuation assumptions for equity awards, refer to Note 14 of our financial statements in our Annual Report on Form 10-K for the year ended December 31, 2021. The May 12, 2021 grant of RSUs awarded to all non-employee directors serving as of conclusion of the 2021 Annual Meeting vest in full on the earlier of the 2022 Annual Meeting and May 12, 2022 and had a grant date fair value of $37.60. The June 1, 2021 grant of RSUs awarded to Mr. Jourdan vest in full on the earlier of the 2022 Annual Meeting and May 12, 2022 and had a grant date fair value of $44.63.

(2)Ms. Herscher's service on the Board ended on May 12, 2021.

(3)Mr. Jourdan joined the Board on June 1, 2021.

PROS | 2022 Proxy Statement | Page 21

EXECUTIVE OFFICERS

The following section sets forth our other NEOs and other significant employees of the Company, other than Mr. A. Reiner, their ages (immediately prior to the Annual Meeting), and the Company positions currently held by each such person:

| | | | | | | | |

| | Mr. Schulz, 55, oversees our accounting, financial planning and analysis, legal, treasury, facilities, investor relations, internal audit, tax and corporate development functions. Mr. Schulz joined PROS in his current position in March 2015. Prior to joining us, Mr. Schulz served as Chief Financial Officer for Digital River, Inc., a global provider of cloud-based commerce, payments and marketing services, from July 2011 to February 2015. Mr. Schulz previously served in various roles, including as Senior Vice President, Chief Financial Officer and Chief Accounting Officer, with Lawson Software, an enterprise resource planning software company, from October 2005 to July 2011; in various finance and accounting roles at BMC Software, from 1993 to 2005, including as Vice President and Corporate Controller; and as an Audit Manager in the Enterprise Group with Arthur Andersen LLP. Mr. Schulz was instrumental in our transition to a cloud business. Mr. Schulz holds a B.B.A. in Accounting from Lamar University. |

| Stefan B. Schulz | |

| Executive Vice President | |

| and Chief Financial Officer | |

| | |

Roberto Reiner served as our Executive Vice President and Chief Technology Officer from November 2019 through October 2021 when he stepped down from such role as part of his planned retirement. From November 1, 2021 until his retirement on March 1, 2022, Mr. R. Reiner assisted with the transition of his Chief Technology Officer duties and other special projects.

Leslie Rechan served as our Chief Operating Officer from May 2020 through January 2022. Mr. Rechan is no longer employed by PROS.

Other Significant Employees

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Surain Adyanthaya | | 57 | | President, Travel |

| Nikki Brewer | | 41 | | Chief People Officer |

| Scott Cook | | 54 | | Chief Accounting Officer |

| Ajay Damani | | 48 | | Executive Vice President, Engineering |

| Sunil John | | 48 | | Chief Product Officer |

| Katrina Klier | | 54 | | Chief Marketing Officer |

| Damian Olthoff | | 47 | | General Counsel and Secretary |

| Martin Simoncic | | 40 | | Chief Customer Officer |

| Craig Zawada | | 51 | | Chief Innovation Officer |

PROS | 2022 Proxy Statement | Page 22

COMPENSATION AND LEADERSHIP DEVELOPMENT

COMMITTEE REPORT

| | | | | | | | |

| The Compensation and Leadership Development Committee of the Board of Directors of PROS has reviewed and discussed the following Compensation Discussion and Analysis with management and FW Cook. Based on this review and discussion, we recommended to the Board, and the Board has agreed, that the following Compensation Discussion and Analysis be included in this Proxy Statement. | |

| | |

| MEMBERS OF THE COMPENSATION AND LEADERSHIP DEVELOPMENT COMMITTEE | |

| | |

| Greg B. Petersen (Chairman) | Raja Hammoud | Leland T. Jourdan | William Russell | |

COMPENSATION DISCUSSION AND ANALYSIS

PROS provides solutions that optimize shopping and selling experiences. Our solutions leverage AI, self-learning and automation to ensure that every transactional experience is fast, frictionless and personalized for every shopper, supporting both business-to-business and business-to-consumer companies across industry verticals. The ongoing COVID-19 pandemic continued to have a widespread impact on the global economy and our business in 2021, particularly as the virus continued to evolve and variants such as Delta and Omicron spread. We were encouraged by the increased availability of vaccines and reopening of markets. The travel industry began to recover in 2021, particularly for in-country travel, but remained well below pre-pandemic levels, particularly for international and business travel.

In 2021, despite the lingering headwinds from the impact of the pandemic, we continued to execute our strategy with operational discipline. While our total revenue was essentially flat in 2021 as compared to 2020, our subscription revenue grew 4%, we achieved greater than 93% gross customer revenue retention for the year and significantly improved our cash metrics. Our free cash flow, a key measure of our recovery and path to profitability, improved 62%, well above our target for the year.

This Compensation Discussion and Analysis describes our executive compensation program and the compensation paid to our NEOs:

| | | | | |

| Andres D. Reiner | Chief Executive Officer, President and Director |

| Stefan B. Schulz | Executive Vice President and Chief Financial Officer |

| Leslie Rechan | Former Chief Operating Officer |

| Roberto Reiner | Former Executive Vice President and Chief Technology Officer |

In conjunction with his announced retirement plan, Mr. Roberto Reiner ceased serving as an executive officer at the end of October 2021 and retired from the Company in March 2022. The Company announced the elimination of the Chief Operating Officer role in January 2022, and Mr. Rechan is no longer employed by the Company.