- RFP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Resolute Forest Products (RFP) DEF 14ADefinitive proxy

Filed: 29 Apr 11, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under 14a-12 | |||

| ABITIBIBOWATER INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

AbitibiBowater Inc.

1155 Metcalfe Street, Suite 800

Montréal, Québec

Canada H3B 5H2

April 29, 2011

Dear Stockholder:

We cordially invite you to attend the annual meeting of stockholders of AbitibiBowater Inc., which will be held on Thursday, June 9, 2011, at 8:00 a.m. (Eastern), at the Centre Mont-Royal, Salon International, 2200 Mansfield Street, in Montréal, Québec, Canada. The accompanying notice of annual meeting and proxy statement contain the details of the business to be conducted at the meeting.

In addition to the formal items of business to be brought before the meeting, we will report on our business and respond to stockholder questions.

Whether or not you plan to attend, you can ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by telephone or by Internet or by completing, signing, dating and returning your proxy form in the enclosed envelope.

AbitibiBowater’s annual report for 2010 is included in this package, and we urge you to read it carefully.

We look forward to seeing you at the annual meeting.

Sincerely,

|

| Richard Garneau |

| President and chief executive officer |

|

| Richard B. Evans |

| Chair of the board |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 9, 2011

April 29, 2011

Dear Stockholder:

The 2011 annual meeting of stockholders of AbitibiBowater Inc. will be held on Thursday, June 9, 2011, at 8:00 a.m. (Eastern), at the Centre Mont-Royal, Salon International, 2200 Mansfield Street, in Montréal, Québec, Canada, for the purpose of voting on the following matters:

| 1. | the election of directors for the ensuing year; |

| 2. | the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2011 fiscal year; |

| 3. | an advisory vote on executive compensation, or the “say-on-pay” vote; |

| 4. | an advisory vote on the frequency of holding the say-on-pay vote in the future; and |

| 5. | such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

The record date for the determination of the stockholders entitled to vote at our annual meeting, and any adjournment or postponement thereof, is the close of business on April 19, 2011.

Important notice regarding the availability of proxy materials for the annual

meeting of stockholder to be held on June 9, 2011:

The proxy statement and our 2010 annual report are available at

http://www.abitibibowater.com/investors/

By order of the board of directors,

|

| Jacques P. Vachon |

| Corporate secretary |

April 29, 2011 Montréal, Québec, Canada

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

Board Leadership Structure; Communication with Independent Directors | 8 | |||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 14 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

Review, Approval or Ratification of Transactions with Related Persons | 21 | |||

| 23 | ||||

| 23 | ||||

| 33 | ||||

| 34 | ||||

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table | 36 | |||

| 39 | ||||

| 39 | ||||

| 45 | ||||

| 48 | ||||

| 52 | ||||

| 54 | ||||

| 54 | ||||

Item 2. Vote on the Ratification of the Appointment of PricewaterhouseCoopers LLP | 59 | |||

| 61 | ||||

Item 4. Advisory vote on the frequency of holding future advisory votes on executive compensation | 62 | |||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 65 |

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by AbitibiBowater Inc. on behalf of our board of directors for the 2011 annual meeting of stockholders. The annual meeting will be held on Thursday, June 9, 2011, at 8:00 a.m. (Eastern), at the Centre Mont-Royal, Salon International, 2200 Mansfield Street, in Montréal, Québec, Canada. Proxy materials for the annual meeting are being mailed or will be made available on or about May 9, 2011.

When we use the terms “AbitibiBowater,” “the Company,” “we,” “us” and “our,” we mean AbitibiBowater Inc., a Delaware corporation, and its consolidated subsidiaries, unless the context indicates otherwise.

AbitibiBowater Inc. and all but one of its debtor affiliates successfully emerged from creditor protection proceedings under chapter 11 of the U.S. Bankruptcy Code and theCompanies’ Creditors Arrangement Act (Canada), as applicable, on December 9, 2010. We refer to these proceedings as the “creditor protection proceedings,” to the date of our emergence from the creditor protection proceedings as the “emergence date” and to theDebtors’ Second Amended Joint Plan of Reorganization under Chapter 11 of the Bankruptcy Code and theCCAA Plan of Reorganization and Compromise together as the “plans of reorganization.”

QUESTIONSAND ANSWERS ABOUTTHE ANNUAL MEETINGAND VOTING

Who is entitled to vote at the annual meeting?

Owners of AbitibiBowater’s common stock at the close of business on April 19, 2011, the record date for the annual meeting, are entitled to receive the notice of annual meeting and to vote their shares at the meeting. On that date, there were 97,134,154 shares of common stock outstanding and entitled to vote and there were approximately 2,100 holders of record. Each share of common stock is entitled to one vote for each matter to be voted on at the annual meeting.

What is the difference between holding shares as a stockholder of record and through an intermediary?

You are a stockholder of record if you own shares of common stock that are registered in your name with our transfer agent, Computershare Trust Company, N.A. If you are a stockholder of record, the transfer agent is sending these proxy materials to you directly.

If you hold shares of common stock indirectly through a broker, bank or similar institution (which we refer to as an “intermediary institution”), you are a “street name” holder and these materials are being sent to you by the intermediary institution through which you hold your shares. If you provide specific voting instructions by mail, telephone or the Internet, your intermediary institution will vote your shares as you have directed.

1

What do I need to do to attend the annual meeting?

Attendance at the annual meeting is generally limited to our stockholders and their authorized representatives. All stockholders must bring an acceptable form of identification like a driver’s license to attend the meeting in person. If you hold your shares in street name and you plan to attend the annual meeting, you must bring an account statement or other suitable evidence that you held shares of common stock as of the record date to be admitted to the meeting.

Any representative of a stockholder who wishes to attend must present acceptable documentation evidencing his or her authority, suitable evidence of ownership by the stockholder of common stock as described above and an acceptable form of identification. We reserve the right to limit the number of representatives for any stockholder who may attend the meeting.

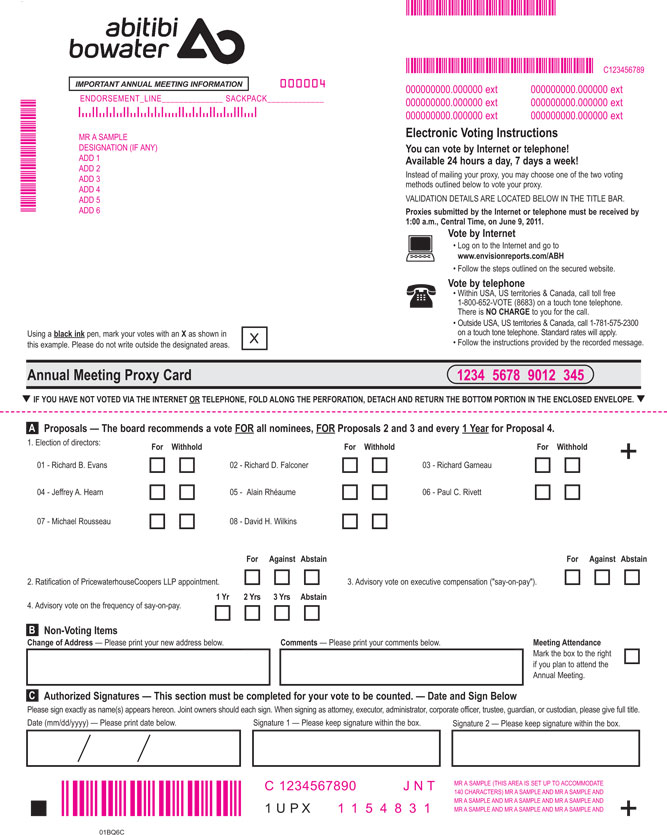

What methods can I use to vote?

If you are a registered holder, you may vote:

| • | By mail. Complete, sign and date the proxy card or voting instruction card and return it in the pre-paid envelope enclosed with these materials. |

| • | By telephone or Internet. You can vote over the telephone by calling 1-800-652-VOTE (8683) within Canada, the U.S. and its territories or through the Internet at www.envisionreports/ABH. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares and to confirm that their instructions have been recorded properly. |

| • | In person. You can vote in person at the meeting. SeeWhat do I need to do to attend the annual meeting? |

If you are a street name holder, you may vote:

| • | By mail. By returning a properly executed and dated voting instruction form by mail, depending upon the method(s) your intermediary makes available. |

| • | By telephone or Internet. You can vote over the telephone or through the Internet at the number and website address indicated in your intermediary institution’s voting instructions. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares and to confirm that their instructions have been recorded properly. |

| • | In person. You can vote in person at the meeting if you bring a valid “legal proxy,” which you can obtain from your intermediary institution through which you hold your shares. SeeWhat do I need to do to attend the annual meeting? |

What is a broker non-vote?

If you are a street name holder, you must instruct your intermediary institution how to vote your shares. If you do not, your shares will not be voted on any proposal for which the broker does not have discretionary authority to vote, which is referred to as a “broker non-vote.” In these cases, the broker can register your shares as being “present and entitled to vote” for purposes of determining the quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange, which we refer to as the “NYSE.” Under those rules, your intermediary institution has discretionary voting authority to vote your shares on the ratification of

2

PricewaterhouseCoopers LLP as our independent registered public accounting firm, even if it does not receive voting instructions from you. But the election of directors, the advisory say-on-pay vote and the advisory vote on the frequency of holding the say-on-pay vote are non-discretionary items, and they may not be voted upon by your broker without specific voting instructions from you. Accordingly, your shares would not be voted on these matters.

Is there a list of stockholders entitled to vote at the annual meeting?

A list of stockholders of record entitled to vote at the meeting will be available for inspection at the meeting and for the ten days prior to the meeting for any purpose germane to the meeting during ordinary business hours at AbitibiBowater Inc., 1155 Metcalfe Street, Suite 800, Montréal, Québec, Canada H3B 5H2, from May 30, 2011 through June 8, 2011.

What is the quorum for the annual meeting?

The presence of the holders of shares of common stock representing at least one-third of the voting power of all common stock issued and outstanding and entitled to vote at the meeting, in person or by proxy, is necessary to constitute a quorum for the transaction of business at the annual meeting. Abstentions and broker non-votes are considered present for purposes of determining a quorum.

How will my shares be voted at the annual meeting?

At the meeting, the persons named in the proxy card or, if applicable, their substitute(s) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted:

| • | FOR the election of each director nominee |

| • | FOR the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm |

| • | FOR the advisory resolution approving executive compensation |

| • | FOR an ANNUAL advisory vote to approve executive compensation |

Can I revoke my proxy?

If you are a stockholder of record, you can revoke your proxy before it is exercised by:

| • | giving written notice to the Company’s corporate secretary; |

| • | delivering a valid, later-dated proxy, or later-dated vote by telephone or on the Internet, before the annual meeting; or |

| • | voting by in person at the annual meeting. |

If you are a street name holder, you may submit new voting instructions by contacting your intermediary institution.

All shares for which proxies have been properly submitted and not revoked will be voted at the annual meeting.

3

What are the voting requirements for the approval of each matter presented at the annual meeting?

| • | Election of directors. Under our by-laws, directors are elected by a plurality vote. Withhold votes, abstentions and broker non-votes will not affect the outcome of the director election. |

| • | Ratification of PricewaterhouseCoopers LLP. The ratification of the appointment of an independent registered public accounting firm is not required under our by-laws but we are asking as a matter of good governance. A majority of the votes present and entitled to vote at the meeting must vote to approve the ratification of PricewaterhouseCoppers LLP as our independent registered accounting firm for the 2011 fiscal year for the ratification to pass. Abstentions will have the same effect as a vote “against” this proposal. |

| • | Advisory vote on executive compensation. Under our by-laws, a majority of the votes present and entitled to vote at the meeting must vote to adopt, on an advisory basis, the resolution approving compensation of our named executive officers. Abstentions will have the same effect as a vote “against” this proposal, but broker non-votes will have no effect. |

| • | Advisory vote on frequency of future say-on-pay votes. This matter is being submitted to enable stockholders to express a preference as to whether future say-on-pay votes should be held every year, every two years or every three years. The provisions of our by-laws regarding the vote required to approve a proposal are not applicable to this matter. Abstentions and broker non-votes will not affect the outcome of this proposal. |

Will my vote be confidential?

Yes. We have a policy of confidentiality in the voting of stockholder proxies. Individual stockholder votes are kept confidential, unless disclosure is necessary to meet applicable legal requirements to assert or defend claims for or against the Company or made during a contested proxy solicitation, tender offer or other change of control situation.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies for the annual meeting. In addition to the solicitation of proxies by mail, solicitation may be made by certain of our directors, officers or employees telephonically, electronically or by other means of communication. Our directors, officers and employees will receive no additional compensation for any such solicitation. We will reimburse brokers and other similar institutions for costs incurred by them in mailing proxy materials to beneficial owners.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return by mail, or submit via the Internet or by telephone, each proxy card and voting instruction card you receive. If you would like to consolidate multiple accounts at our transfer agent, please contact Computershare Trust

4

Company, N.A. at (866) 820-6919 (toll free for Canada and the U.S.) or (781) 575-3100.

What is “householding” and how does it affect me?

We have adopted a procedure, approved by the Securities and Exchange Commission, or the “SEC,” called “householding,” pursuant to which stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the notice of annual meeting and proxy statement and our 2010 annual report, unless we are notified that one or more of these stockholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Stockholders who participate in householding will continue to receive separate proxy cards. Householding would not in any way affect dividend check mailings.

If you participate in householding and wish to receive a separate copy of this notice of annual meeting and proxy statement, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact our transfer agent.

If you are a street name holder, you can request information about householding from your intermediary institution.

5

CORPORATE GOVERNANCEAND BOARD MATTERS

Corporate Governance Principles

The board has adopted a formal set of corporate governance principles and practices, which we refer to as the “corporate governance principles.” The purpose of the corporate governance principles, which are available on our website (www.abitibibowater.com/about_us/corporate_governance), is to provide a structure within which directors and management can pursue the Company’s objectives for the benefit of stockholders and within which directors can supervise Company management. The corporate governance principles are guidelines intended to serve as a flexible framework within which the board may conduct its business, and not as a set of legally binding obligations.

The corporate governance principles outline the board’s responsibilities and the interplay among the board and its committees in furthering the Company’s overall objectives. The corporate governance principles note the board’s role in advising management on significant issues facing the Company and in reviewing and approving significant actions. In addition, the corporate governance principles highlight the principal roles of certain committees of the board, including:

| • | The board’s selection and evaluation of senior executive officers, including the president and chief executive officer, with assistance from the human resources and compensation/nominating and governance committee, and succession planning. |

| • | The administration of executive and director compensation by the human resources and compensation/nominating and governance committee, with final approval by the board. |

| • | The selection and oversight of our independent registered public accounting firm and oversight of public financial reporting by the audit committee. |

| • | The evaluation of candidates for board membership and the oversight of the structure and practices of the board, the committees and corporate governance matters in general by the human resources and compensation/nominating and governance committee, including annual assessment of board and committee effectiveness. |

Our corporate governance principles also include, among other things:

| • | General qualifications for board membership, including independence requirements (with, among other things, the categorical standards for board determinations of independence). |

| • | Director responsibilities, including board and stockholder meeting attendance and advance review of meeting materials. |

| • | Provisions for director access to management and independent advisors, and for director orientation and continuing education. |

| • | An outline of management’s responsibilities, including production of financial reports and disclosures, implementation and monitoring of internal controls and disclosure controls and procedures, development, presentation and implementation of strategic plans and setting a strong ethical “tone at the top.” |

6

The Company’s corporate governance principles, which are described above, include certain standards concerning the independence of board members, which standards are designed to comply with the standards established by the SEC and the NYSE. They include the following:

| • | Each member of the board, except for the president and chief executive officer and, at the discretion of the board, up to two additional directors, must be “independent.” The applicable definition of “independence” is based on the NYSE’s corporate governance standards, which also require a majority of directors to be “independent,” and rules established by the SEC. |

| • | Each member of the audit committee and the human resources and compensation/nominating and governance committee must be “independent.” |

| • | The independent directors must meet in executive session at least annually without any non-independent director or executive officer. The independent directors will also meet in executive session at the end of any board meeting at the request of any independent director. The chair presides at these meetings. |

On the basis of information solicited from each director, and upon the advice and recommendation of our human resources and compensation/nominating and governance committee, the board has determined that seven out of the Company’s eight incumbent directors are “independent,” as defined in the NYSE’s corporate governance standards and our by-laws, namely: directors Richard B. Evans, Richard D. Falconer, Jeffrey A. Hearn, Alain Rhéaume, Paul C. Rivett, Michael S. Rousseau and David H. Wilkins. The board has also determined that each of the audit committee and the human resources and compensation/nominating and governance committee is made up entirely of independent directors. As part of these determinations, which included considering the relationships described below underRelated Party Transactions and the categories of relationships below, the board determined that none of the independent directors has a material relationship with the Company other than his role as a director.

Our corporate governance principles reflect the board’s determination that the following categories of relationships alone are not material and will not impair a director’s independence:

| • | Ownership of less than 5% of the equity of, or being a director of, another company that does business with the Company where the annual sales to, or purchases from, the Company are less than 5% of the annual revenues of either company. |

| • | Ownership of less than 5% of the equity of, or being an executive officer or director of, an unaffiliated company that is indebted to the Company (or to which the Company is indebted), where the total amount of either company’s indebtedness to the other is less than 5% of the total consolidated assets of either company. |

| • | Serving as an officer, director or trustee of a charitable organization, where the Company’s charitable contributions to the organization are less than 2% of that organization’s total annual charitable receipts, or $20,000 per year, whichever is less. |

The board, acting through the disinterested directors, considered each of the transactions discussed underRelated Party Transactionsbelow and determined

7

that they were in compliance with the guidelines. The audit committee is responsible for reviewing and overseeing related party transactions and conflicts of interest situations involving the Company, its directors, officers and related parties.

We have adopted a written code of business conduct and ethics that applies to all employees, including our president and chief executive officer, chief financial officer and chief accounting officer. Under the code of business conduct, employees are required to obtain the prior approval of the chief legal officer or, in the case of executive officers, from the human resources and compensation/nominating and governance committee, before entering into any transaction that might present a conflict of interest, including related party transactions with the Company.

The board adopted a separate board of directors’ code of conduct and ethics that applies specifically to directors. The directors’ code of conduct and ethics, among other things, describes our policy concerning the review and approval of conflicts of interest or related party transactions with respect to board members and provides guidance to directors in handling unforeseen situations as they arise. The guidelines provide that each director (1) must avoid every conflict of interest with the Company and must recuse himself or herself from any board decision where a conflict of interest may exist, (2) owes a duty to the Company to advance its legitimate interests when the opportunity to do so arises, (3) must maintain confidentiality of information entrusted to him or her, (4) comply, and oversee the compliance by employees, officers and other directors, with applicable laws, rules and regulations, (5) must deal fairly, and must oversee fair dealing by employees and officers, with the Company’s customers, suppliers, competitors and employees, (6) should promote ethical behavior and (7) protect the Company’s assets and ensure their efficient use.

Board Leadership Structure; Communication with Independent Directors

The Company’s business is managed under the direction of the board, with the board delegating the management of the Company to the president and chief executive officer, working with other executive officers, in a manner consistent with the Company’s objectives and in accordance with its by-laws. This delegation of authority is not intended to minimize the board’s supervisory duties, as more fully set forth in our corporate governance principles.

Mr. Evans, the Company’s chair of the board and an independent director, presides over each board meeting and the separate meetings of independent directors in executive session. Our by-laws provide that in the event the chair of the board is not an independent director, an independent director selected by a majority of the board will serve as lead director, whose responsibilities include, among other things, chairing any meeting of the independent directors in executive session.

Stockholders and other interested persons that would like to communicate with the independent directors may send an e-mail to independentdirectors@abitibibowater.com or send a written communication to: AbitibiBowater Inc. Independent Directors, c/o AbitibiBowater Inc. Corporate Secretary, 1155 Metcalfe Street, Suite 800, Montréal, Québec, Canada, H3B 5H2. The Company’s corporate secretary will forward those communications to the intended recipients and will retain copies for the Company’s records.

8

Regardless of the method of communication, no message will be screened or edited before it is delivered to the intended recipient(s), who will determine whether to relay the message to other members of the board.

Board’s Role in Risk Oversight

Management is responsible for assessing and managing risk, subject to oversight by our board. The board executes its oversight responsibility for risk assessment and risk management directly through its committees, as follows:

| • | Audit committee. The audit committee periodically reviews management’s plans to manage the Company’s exposure to financial risk, and report or make recommendations on significant issues to the board. To the extent deemed appropriate in fulfilling its responsibilities, the audit committee also discusses and considers the Company’s policies with respect to risk assessment and risk management, and reviews contingent liabilities and risks that may be material to the Company, including major legislative and regulatory developments that could materially impact the Company’s contingent liabilities. |

| • | Environmental, health and safety committee. The environmental, health and safety committee reviews the Company’s outstanding and potential liabilities related to environmental, health and safety matters. In addition, the environmental, health and safety committee reviews with management all significant environmental incidents or occupational accidents within the Company and any events of material non-compliance. The committee also monitors the Company’s relationships with external environmental, health and safety regulatory authorities, which are critical to our business operations. |

| • | Finance committee. The finance committee reviews at least annually a report prepared by management on the financial health, from an actuarial and accounting perspective, of the benefit plans of the Company’s subsidiaries, and related funded obligations. In addition, as needed, the finance committee reviews the adequacy of management’s plans to manage the Company’s exposure to financial risk. The finance committee also reviews at least annually the financing risks and insurance principles and coverage of the Company and its subsidiaries, including those associated with the use of derivatives, currency and interest rates swaps and other risk management techniques. |

| • | Human resources and compensation/nominating and governance committee.As further described below, the human resources and compensation/nominating and governance committee assists the board in discharging its responsibilities with respect to human resources strategy, policies and programs and matters relating to the use of human resources and also assists the board in fulfilling its responsibilities to ensure that the Company is governed in a manner consistent with its by-laws and in the best interests of its stockholders. The board believes that these roles are important in managing the Company’s reputational risk. |

The board does not view risk in isolation. Risks are considered in virtually every business decision, including those related to the Company’s strategic plan and capital structure.

We believe that each director should possess high personal and professional ethics, integrity and values, an inquiring and independent mind as well as practical wisdom, vision and mature judgment. He or she should also have substantial

9

training and experience at the policy-making level in business, government, or education and/or expertise that is useful to the Company and complementary to the background and experience of other board members, so that an optimum balance of expertise among members on the board can be achieved and maintained. In light of other business and personal commitments, he or she should also be willing and able to devote the required amount of time to diligently fulfill the duties and responsibilities of board membership, and be committed to serve on the board over a period of years to develop knowledge about the Company’s operations.

Some of the specific areas of expertise and experience that we believe to be important in light of our business are listed below; ideally, these areas should be represented by at least one board member:

| • | professional services, such as lawyers, investment bankers and university professors |

| • | politics/government relations |

| • | management/operating experience, such as a chief executive office, chief operating officer or senior manager |

| • | financial/accounting experience, such as a chief financial officer, certified financial analyst or chartered public accounting or analyst |

The applicable aspects of each director’s experience, qualifications and skills that the board considered in their nomination in light of the foregoing are included in their individual biographies. It is also desirable that each member of the board has recent experience as a member of the board of at least one other company, preferably a public company.

The board does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for our board. Diversity is important because a variety of points of view contribute to a more effective decision-making process.

The board met ten times in 2010. No incumbent director attended fewer than 75% of the regular and special meetings of the board and the committees on which the director sits. In light of the then ongoing creditor protection proceedings, there was no annual meeting of stockholders in 2010.

We expect each director to attend all regular board meetings, all meetings of the committee(s) on which the director sits and all annual and special meetings of stockholders.

The board has adopted a written charter for each of its four standing committees: the audit committee, the human resources and compensation/nominating and governance committee, the environmental health and safety committee and the finance committee. Each committee’s charter is available on our website atwww.abitibibowater.com/about_us/corporate_governance. As the chair of the board, Mr. Evans is anad hoc member of each board committee.

Audit Committee

The current members of the audit committee are: Alain Rhéaume (chair), Pierre Dupuis, Richard D. Falconer, Sarah E. Nash and Michael S. Rousseau. Mr. Dupuis and Ms. Nash are not standing for re-election and will therefore no longer be

10

members of the board or any committee on which they sit, including the audit committee, upon the expiration of their current term of office as Company directors at the annual meeting. Mr. Falconer was appointed to the audit committee on April 21, 2011. The board has determined that each member of the audit committee is “independent” in accordance with the NYSE’s corporate governance standards, our by-laws and rule 10A-3 promulgated pursuant to the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” The board has determined that each of Messrs. Rhéaume and Rousseau is an “audit committee financial expert” in accordance with SEC rules.

The audit committee oversees our financial reporting, internal controls and audit function process on behalf of the board. Its purposes and responsibilities include:

| • | Monitoring the integrity of our financial reporting process and systems of internal control and financial statements. |

| • | Monitoring the independence and qualifications of our independent registered public accounting firm. |

| • | Overseeing the audit of the Company’s financial statements. |

| • | Monitoring the performance of our internal audit function and independent registered public accounting firm. |

| • | Monitoring our compliance with legal and regulatory requirements. |

| • | Providing an open avenue of communication among the board, management, the independent registered public accounting firm and internal auditors. |

| • | Reviewing management’s plans to manage the Company’s exposure to financial risk and report or make recommendations on significant issues to the board. |

| • | Recommending dividend actions to the board. |

The audit committee met seven times in 2010.

Environmental, Health and Safety Committee

The members of the environmental, health and safety committee are: Jeffrey A. Hearn (chair), Richard Garneau, David H. Wilkins and Richard D. Falconer. The environmental, health and safety committee monitors the policies, management systems and performance of the Company’s environmental and occupational health and safety matters on behalf of the board.

The primary responsibilities of the environmental, health and safety committee include:

| • | Reviewing the adequacy of the environmental, health and safety programs and performance of the Company. |

| • | Reviewing annually the Company’s environmental, health and safety (i) vision and policies and (ii) strategies and objectives. |

| • | Reviewing outstanding and potential liabilities for environmental, health and safety matters. |

| • | Reviewing with management all significant environmental incidents or occupational accidents within the Company and any events of material non-compliance. |

11

| • | Monitoring the Company’s relationships with external environmental, health and safety regulatory authorities and with other stakeholders. |

The environmental, health and safety committee met three times in 2010.

Finance Committee

The members of the finance committee are: Richard D. Falconer (chair), Alain Rhéaume, Paul C. Rivett and Michael S. Rousseau.

The primary responsibilities of the finance committee include:

| • | Reviewing as needed the adequacy of management’s plans to manage the Company’s exposure to financial risk. |

| • | Reviewing as needed the actual and projected financial situation and capital needs of the Company. |

| • | Reviewing at least annually the financing risks and insurance principles and coverage of the Company and its subsidiaries. |

| • | Reviewing at least annually the Company’s tax situation and tax strategy. |

| • | Reviewing as needed the Company’s investor profile and related investor relations and stockholder services of the Company. |

| • | Reviewing the financial aspects of any mergers, acquisitions, divestitures, joint ventures and other similar transactions submitted to our board. |

| • | Reviewing at least once a year a report prepared by management on the financial health, from an actuarial and accounting perspective, of the benefit plans of the Company’s subsidiaries, and related funded obligations. |

Our finance committee met once in 2010. There was no standing finance committee before our emergence from the creditor protection proceedings.

Human Resources and Compensation/Nominating and Governance Committee

The members of the human resources and compensation/nominating and governance committee are: Sarah Nash (chair), Pierre Dupuis, Jeffrey A. Hearn, Paul C. Rivett and David H. Wilkins. Mr. Dupuis and Ms. Nash are not standing for re-election and will therefore no longer be members of the board or any committee on which they sit, including the human resources and compensation/nominating and governance committee, upon the expiration of their current term of office as Company directors at the annual meeting. Upon our emergence from the creditor protection proceedings, the board chose to combine the responsibilities of the pre-emergence human resources and compensation committee and the pre-emergence nominating and governance committee into the post-emergence human resources and compensation/nominating and governance committee.

The human resources and compensation/nominating and governance committee’s primary responsibilities include:

| • | Human resources and compensation |

| • | Reviewing from time to time and approving the structure of the Company’s executive compensation to ensure the structure is appropriate to achieve the Company’s objectives. |

12

| • | Evaluating annually the chief executive officer’s performance and compensation, and participating in such evaluation as it relates to other executive officers of the Company. |

| • | At least annually, working with the chair of the board and the chief executive officer to plan for chief executive officer succession and reviewing the succession planning with the board. |

| • | Recommending to the board the appropriate structure and amount of compensation for non-employee directors. |

| • | Periodically evaluating the Company’s incentive plans and approve proposed amendments to benefit plans. |

| • | Reviewing and approving employment, severance and change in control agreements. |

| • | Recommending to the board nominees to serve as officers of the Company. |

| • | Corporate governance |

| • | Overseeing and monitoring compliance with the Company’s code of business conduct and the directors’ code of conduct and ethics. |

| • | Developing and recommending the Company’s corporate governance principles to the board. |

| • | Making recommendations to the board regarding stockholder proposals and any other matters relating to corporate governance. |

| • | Board of directors and board committees |

| • | Annually evaluating the size and composition of the board. |

| • | Identifying and recommending qualified director candidates to the board and submitting a slate of nominees for election by stockholders at the annual meeting. |

| • | Considering director candidates proposed by stockholders in accordance with the Company’s by-laws. |

| • | Ensuring a process by which the board can assess its performance. |

| • | Assessing the performance of each board committee annually, including a review of board committee charters. |

The human resources and compensation/nominating and governance committee met once in 2010. The pre-emergence human resources and compensation committee met four times in 2010 and the pre-emergence nominating and governance committee met twice in 2010.

13

Director Compensation for 2010

Name | Fees Earned or Paid in Cash(1)(2) | Stock Awards | Option Awards(3) | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||||||||||||||||

Directors as of December 9, 2010 | ||||||||||||||||||||||||||||

Pierre Dupuis(4) | $ | 25,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 25,000 | ||||||||||||||

Richard B. Evans(5) | 112,500 | — | — | — | — | 196,478 | (10)(11) | 308,978 | ||||||||||||||||||||

Richard D. Falconer(4) | 30,000 | — | — | — | — | — | 30,000 | |||||||||||||||||||||

Richard Garneau(6) | 41,667 | — | — | — | — | — | 41,667 | |||||||||||||||||||||

Jeffrey A. Hearn(4) | 30,000 | — | — | — | — | — | 30,000 | |||||||||||||||||||||

Sarah E. Nash(4) | 30,000 | — | — | — | — | — | 30,000 | |||||||||||||||||||||

David J. Paterson(7) | — | — | — | — | — | — | — | |||||||||||||||||||||

Alain Rhéaume(4) | 33,333 | — | — | — | — | — | 33,333 | |||||||||||||||||||||

Paul C. Rivett(5) | 62,500 | — | — | — | — | — | 62,500 | |||||||||||||||||||||

Michael S. Rousseau(4) | 25,000 | — | — | — | — | — | 25,000 | |||||||||||||||||||||

David H. Wilkins(4) | 25,000 | — | — | — | — | — | 25,000 | |||||||||||||||||||||

Former Directors | ||||||||||||||||||||||||||||

John Q. Anderson(8) | 50,000 | — | — | — | — | 15,668 | (10) | 65,668 | ||||||||||||||||||||

Jacques Bougie, O.C.(8) | 55,000 | — | — | — | — | — | 55,000 | |||||||||||||||||||||

William E. Davis(8) | 60,000 | — | — | — | — | — | 60,000 | |||||||||||||||||||||

Anthony F. Griffiths(9) | 20,833 | — | — | — | — | — | 20,833 | |||||||||||||||||||||

Ruth R. Harkin(8) | 50,000 | — | — | — | — | — | 50,000 | |||||||||||||||||||||

Lise Lachapelle(8) | 53,750 | — | — | — | — | — | 53,750 | |||||||||||||||||||||

Gary J. Lukassen(8) | 50,000 | — | — | — | — | — | 50,000 | |||||||||||||||||||||

John A. Rolls(8) | 60,000 | — | — | — | — | 50,435 | (10) | 110,435 | ||||||||||||||||||||

Hon. Togo D. West, Jr.(8) | 55,000 | — | — | — | — | — | 55,000 | |||||||||||||||||||||

| (1) | The retainer fees of directors Dupuis, Falconer, Garneau, Hearn, Nash, Rhéaume, Rivett, Rousseau, Wilkins, Bougie, Davis, Griffiths, Harkin, Lachapelle, Lukassen and West were payable in cash.Mr. Anderson elected to receive 50% of his fees in cash and defer the remaining 50% of his fees to the cash account under the AbitibiBowater Inc. Outside Director Deferred Compensation Plan that was in effect up to emergence (described below). Messrs. Evans and Rolls elected to defer all of their fees to the cash account under the AbitibiBowater Inc. Outside Director Deferred Compensation Plan. As a result of this plan’s termination and liquidation pursuant to the plans of reorganization, Messrs. Anderson, Evans and Rolls received their fees for the fourth quarter of 2010 in cash. |

| (2) | The director fees are paid quarterly. |

| (3) | All outstanding options held by directors immediately before the emergence date were canceled pursuant to the plans of reorganization. On the emergence date, the board approved stock option grants to each outside director with an aggregate grant date fair value of $100,000 each under FASB ASC Topic 718. However, the exercise price and the number of shares of Company common stock awarded were not known until the grant date (i.e., January 9, 2011). Each stock option grant covers 9,302 shares of Company common stock, subject to the 2010 AbitibiBowater Inc. Equity Incentive Plan, or “2010 equity incentive plan”. While the grants were approved in 2010, their value is not reflected in the Director Compensation Table because the grant date for both legal and accounting purposes was in 2011. |

| (4) | Ms. Nash and Messrs. Dupuis, Falconer, Hearn, Rhéaume, Rousseau and Wilkins joined the board on the emergence date. |

14

| (5) | Messrs. Evans and Rivett received retainer fees for the first three quarters of 2010 at the pre-emergence rate and retainer fees for the last four months of 2010 at the post-emergence rate, as further described in the narrative below. |

| (6) | Mr. Garneau joined the board on June 3, 2010 and received retainer fees for the third quarter of 2010 at the pre-emergence rate and retainer fees for the last four months of 2010 at the post-emergence rate, as further described in the narrative below. |

| (7) | As required under SEC rules, all of Mr. Paterson’s compensation from the Company for 2010 is set forth in the Summary Compensation Table because he was a named executive officer. Mr. Paterson resigned from the board effective January 1, 2011. |

| (8) | Mmes. Harkin and Lachapelle and Messrs. Anderson, Bougie, Davis, Lukassen, Rolls and West resigned from the board, and their term of office automatically expired, as of the emergence date and they received their full fees for 2010 at the pre-emergence rate. |

| (9) | Mr. Griffiths resigned from the board effective June 3, 2010. |

| (10) | In 2009, the Company made unintentional and inadvertent payments to Messrs. Anderson, Evans and Rolls of fees these directors had elected to defer under the AbitibiBowater Inc. Outside Director Deferred Compensation Plan, triggering income and penalty tax liability to the directors under Section 409A of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). The Company corrected this error under a special IRS program, resulting in a partial mitigation of the adverse tax consequences to Messrs. Anderson, Evans and Rolls. To make the directors whole for their remaining tax liability under Code Section 409A, in 2010, the Company (i) reimbursed the directors for the amount of the income and penalty taxes actually paid and (ii) provided a tax gross-up on the amount of the reimbursements. The aggregate reimbursements and tax gross-up to Messrs. Anderson, Evans and Rolls were $15,668, $46,478 and $50,435, respectively. |

| (11) | On the emergence date, Mr. Evans, as chair of the board, received a $150,000 one-time cash recognition award, as further described below. |

Standard Compensation Arrangement

Cash Component

As described in the footnotes to the table above, we impaneled a new board of directors as of the emergence date, with only Messrs. Evans, Garneau, Paterson and Rivett remaining from the pre-emergence board. The overall compensation structure for the Company’s non-employee directors remained the same before and after emergence. In all cases, compensation payable to the non-employee directors is based on an annual retainer fee, payable in cash in equal quarterly installments. For 2010, the annual retainer fee was set at $50,000 before the emergence date and $75,000 on and after the emergence date. In recognition of their added responsibilities, committee chairs receive additional annual fees, payable in cash in equal quarterly installments. For 2010, the pre-emergence audit committee chair received an additional annual fee of $10,000. On and after the emergence date, the additional annual fee for the audit committee chair was set at $25,000, and the post-emergence audit committee chair received $8,333 (or one-third of the annual fee) in 2010. Other pre-emergence committee chairs received an additional annual fee of $5,000. On and after the emergence date, the additional annual fee was set at $15,000 and the post-emergence committee chairs received $5,000 (or one-third of the annual fee) in 2010. Before the emergence date, Mr. Evans, as chair of the board, did not receive any additional fees for his service as chair of the board. Effective with the emergence, however, the board approved an additional annual fee of $150,000 for recognition of the added responsibility of the board chair, of which Mr. Evans received $50,000 (one-third of the annual fee) in 2010. Also, on the emergence date, Mr. Evans, as chair of the board, received a $150,000 one-time cash award in recognition of his actions, initiatives and leadership in implementing the Company’s emergence from the creditor protection proceedings. We reimburse all directors for reasonable expenses incurred in connection with attending board and committee meetings.

15

AbitibiBowater Outside Director Deferred Compensation Plan

Before the emergence date, the directors had an annual opportunity to defer receipt of all or a portion of their cash compensation by participating in the AbitibiBowater Inc. Outside Director Deferred Compensation Plan, effective as of January 1, 2009, or “prior director deferred compensation plan”. Under this plan, a director who is a U.S. resident for tax purposes and elected to defer all or a portion of his annual cash compensation for board service, could allocate his deferrals in an interest-bearing cash account or a deferred stock unit (“DSU”) account. If a director who was a Canadian resident for tax purposes elected to defer all or a portion of his annual cash compensation, it could only be allocated to the DSU account.

Fees subject to a deferral election were credited to the elected account approximately at the same time the fees would have been paid in cash (generally, quarterly). Fees deferred to the cash account were credited with interest based on the average balance of the account during the quarter at a rate equal to the Lipper Money Market Fund Index. Fees deferred to the DSU account were credited as a number of DSUs equal to the amount of the deferred fees divided by 95% of the fair market value, as defined in the prior director deferred compensation plan, of Company common stock on the last business day of the quarter.

Pursuant to the plans of reorganization, the prior director deferred compensation plan was terminated and liquidated. Effective as of April 1, 2011, non-employee directors have an opportunity to surrender 50% or 100% of their cash fees under a new AbitibiBowater Outside Director Deferred Compensation Plan, or “2011 director deferred compensation plan”. Fees deferred to the 2011 director deferred compensation plan will be credited as DSUs for Canadian directors and as restricted stock units, or “RSUs,” for U.S. directors. DSUs and RSUs have an initial value equal to the fair market value of the Company’s common stock on the trading day immediately before the date they are credited, and their value is always tied to the value of the Company’s common stock. The number of DSUs and RSUs is determined by dividing 110% of the amount of fees deferred by the fair market value of the Company’s common stock on the trading day immediately before the date the fees would otherwise be paid, resulting in a 10% incentive (referred to in the plan as the “premium stock units,” as applicable). DSUs and RSUs credited in respect of this incentive will vest over the first three calendar years. Premium stock units also would become fully vested upon a termination of board service for any reason other than “cause.” Non-premium stock units are always fully vested. DSUs will be payable upon the earlier of termination of board service or death, subject to vesting of the premium DSUs. For a Canadian director who is not subject to Code Section 409A, vested DSUs will be paid on December 15 of the calendar year following the calendar year of a termination of board service, unless the director provides advance written notice specifying an earlier settlement date. Vested DSUs will be paid as soon as administratively feasible after a termination of board service by a Canadian director who is subject to Code Section 409A. RSUs will also be paid in cash, but generally in three installments over the first three calendar years following the calendar year in which the RSUs were awarded, subject to vesting of the premium RSUs. Payment of the vested RSUs will be accelerated in the case of a termination of board service before one or more scheduled payment dates.

16

Equity Component

In addition to the cash component of the directors’ compensation, to ensure the directors’ interests are aligned with those of the stockholders, we have traditionally granted annual equity-based awards to each director. In light of the creditor protection proceedings, however, the HRCC did not grant any awards in 2010 before the emergence date. On the emergence date, the board approved a grant under the 2010 equity incentive plan to each non-employee director of stock options with an aggregate grant date fair value of $100,000. The exercise price for the emergence equity grant was equal to the arithmetic mean of the per-share closing trading price on the NYSE of shares of the Company’s common stock for trading days during the 30 calendar day period beginning on December 10, 2010. While the emergence equity grant was approved in 2010, the grant date for both legal and accounting purposes was January 9, 2011, on which it was determined that 9,302 shares were covered by the emergence equity grant, at an exercise price of $23.05 per share.

The stock options will vest 25% on each of the first four anniversaries of the emergence date as long as the director continues to serve on the Company’s board. The terms of the stock options also include conditions for accelerated vesting upon death, disability, failure to be re-elected as a director or mandatory retirement, which can result in additional shares being available for exercise. In the event that a director’s service on the board is terminated for “cause,” all of his stock options will be canceled, including any options that are vested, but have not been exercised.

For purposes of the emergence equity grant, “cause” means a director’s (i) commission of a felony or a crime involving moral turpitude, or other material act or omission involving dishonesty or fraud, (ii) engaging in conduct that would bring or is reasonably likely to bring the Company or any of its affiliates or subsidiaries into public disgrace or disrepute, or that would affect the Company’s or any affiliate’s or subsidiary’s business in any material way, (iii) failure to perform duties as reasonably directed by the Company (which, if reasonably curable, is not cured within 10 days after notice thereof is provided to the director), or (iv) gross negligence, willful malfeasance or a material act of disloyalty or other breach of fiduciary duty with respect to the Company, its affiliates or subsidiaries (which, if reasonably curable, is not cured within 10 days after notice thereof is provided to the director).

Stock Ownership Guidelines

We have established stock ownership guidelines for directors to ensure that they are also stockholders, thereby aligning their interests with those of other Company stockholders. Under the guidelines, all directors must own shares of Company stock equal to the annual cash retainer fee ($75,000 as of December 31, 2010), to be calculated at market value at the time of testing, within three years of the emergence date.

17

At the time of the transactions described below, Fairfax Financial Holdings Limited, or “Fairfax,” beneficially held all or substantially all of the Company’s 8.0% convertible notes due 2013 (further described below), which were convertible into approximately 37 million shares of Company common stock, par value $1.00 per share, outstanding before our emergence from the creditor protection proceedings, which we refer to as the “pre-emergence common stock.” Paul C. Rivett, a Company director, is a vice president and the chief legal officer of Fairfax, and would have benefited from the transactions described below only to the extent that Fairfax, as an entity, benefited.

None of the transactions described below (with the exception of the separation agreements with Messrs. Paterson and Rougeau, as described below) has occurred after or existed since our emergence from the creditor protection proceedings.

Rights Offering Backstop Commitment Agreement

In connection with the creditor protection proceedings, we entered into a backstop commitment agreement on May 24, 2010 with Fairfax and certain other institutional unsecured creditors, each of whom we refer to as a “backstop investor.” We refer to the backstop commitment agreement, as amended on July 20, 2010, as the “backstop commitment agreement.” Subject to certain conditions precedent, each backstop investor committed to purchase itspro rata share of up to $500 million in convertible unsecured subordinated notes not subscribed for in a rights offering contemplated by the plans of reorganization as part of the Company’s exit financing. We refer to these notes as the “rights offering notes.” Fairfax’spro rata share of the commitment was 22%, representing a commitment to purchase up to $110 million in rights offering notes. The principal terms of the rights offering notes were to include: seven year maturity, convertible into common stock of the emerging Company and an interest rate of 10% per annum (which was subject to increase if paid-in-kind), as more fully described in the backstop commitment agreement. We could have been required to issue up to an additional $110 million of rights offering notes into escrow for release to holders of certain unresolved claims as of the emergence date if such claims were later determined to be allowable claims in certain circumstances. Pursuant to the backstop commitment agreement, each backstop investor, including Fairfax, also entered into a support agreement in favor of our plans of reorganization.

We elected on September 21, 2010 not to pursue the rights offering and terminated the backstop commitment agreement, but not the related plan support agreement, pursuant to its terms on October 13, 2010. We paid the backstop investors the contractual termination fee of $15 million in cash on the effective date of our plans of reorganization, $3.3 million of which was paid to Fairfax for itspro rata share.

On April 1, 2008, we consummated a private sale of $350 million in 8% convertible notes due April 15, 2013, or the “8% convertible notes,” to Fairfax and certain of its designated subsidiaries. The interest rate on the 8% convertible notes was 8% per annum, 10% per annum if we elected to pay interest in kind. Our former Bowater Incorporated (“Bowater”) subsidiary provided a full and unconditional guarantee of the payment of principal and interest on the 8% convertible notes; its guarantee ranked equally in right of payment with all of its existing and future unsecured

18

senior indebtedness. The 8% convertible notes were not guaranteed by our former Abitibi-Consolidated Inc. or Donohue Corp. subsidiaries or any of their respective subsidiaries. The 8% convertible notes were convertible into shares of our pre-emergence common stock at a conversion price of $10.00 per share. We paid $20 million in fees to entities other than Fairfax (including investment banking fees, legal fees,etc.) in connection with the issuance of the 8% convertible notes. On April 15, 2008, Fairfax exercised its right pursuant to the related purchase agreement to appoint two directors, including Mr. Rivett, to our board. On October 15, 2008, we elected to pay in kind the interest payment due on that date and issued $19 million of additional 8% convertible notes in respect thereof. The commencement of the creditor protection proceedings caused an event of default under the 8% convertible notes and they therefore became automatically and immediately due and payable by their terms. As a result, the outstanding balance on the 8% convertible notes as of September 30, 2010 was $369 million, convertible into an aggregate of 36,886,111 shares of our pre-emergence common stock. Except for 11,687,314 shares of common stock distributed to Fairfax and its affiliates on account of their unsecured claim in respect of the 8% convertible notes in connection with our emergence from the recently-completed creditor protection proceedings, we have made no payment of principal or interest on the 8% convertible notes since January 1, 2010. Fairfax and its affiliates could receive additional shares if disputed claims are resolved for less than what was reserved in the disputed claim share reserve. For additional information concerning the disputed claims share reserve, seePart I – Item 1 – Business – Creditor Protection Proceedings – Emergence from the Creditor Protection Proceedings in our annual report on Form 10-K for the period ended December 31, 2010.

Under the terms of a registration rights agreement relating to the 8% convertible notes, we could have been required to pay penalties of up to 0.50% per annumof the principal amount of the 8% convertible notes to the extent we were unable to maintain an effective registration statement for shares of the pre-emergence common stock deliverable upon conversion. We were not able to maintain an effective registration statement in respect of those shares upon filing for the creditor protection proceedings.

As of the emergence date, pursuant to the plans of reorganization the amount outstanding under the 8% convertible notes was compromised in shares of common stock (as described above), all outstanding obligations of the Company and its debtor affiliates thereunder, including the Bowater guarantee described above, were discharged and the agreements governing the obligations (including all other related agreements, supplements, amendments and arrangements) were canceled and terminated.

Additional Liquidity Transaction

Bowater and the other parties to its secured U.S. and Canadian bank credit facilities amended those facilities on February 27, 2009 to reflect the lenders’ consent to $12 million of additional liquidity provided to Bowater Canadian Forest Products Inc., formerly an indirect subsidiary of Bowater, by Fairfax on February 6, 2009 and to treat the advance as an “additional loan” thereunder, thus allowing the collateral securing the Canadian bank credit facility (other than certain fixed assets of Bowater Newsprint South LLC, a former direct subsidiary of AbitibiBowater Inc., and certain of its subsidiaries) to secure the additional loan on a last-out basis. As of September 30, 2010, the weighted average interest rate on the additional liquidity was 13.75% (based on a specified market interest plus a margin). The

19

commencement of the creditor protection proceedings caused an event of default under the U.S. and Canadian bank credit facilities, which therefore became automatically and immediately due and payable by their terms.

All amounts outstanding under the Bowater pre-petition secured bank credit facilities, including the Fairfax additional liquidity, were paid in full in cash, including accrued interest, and the facilities (including all other related agreements, supplements, amendments and arrangements) were canceled and terminated as of the emergence date pursuant to the plans of reorganization. Thus, we paid Fairfax $12 million in principal and $3.5 million in accrued interest in respect of the additional liquidity transaction since January 1, 2010.

On April 21, 2009, we entered into a Senior Secured Superpriority Debtor In Possession Credit Agreement, or the “Bowater DIP Agreement,” among AbitibiBowater Inc., Bowater Incorporated and Bowater Canadian Forest Products Inc. (“BCFPI,” formerly an indirect, wholly-owned subsidiary of Bowater), as borrowers, Fairfax, as administrative agent, collateral agent and an initial lender, and Avenue Investments, L.P., as an initial lender. Law Debenture Trust Company of New York thereafter replaced Fairfax as the administrative agent and collateral agent.

The Bowater DIP Agreement provided for term loans in an aggregate principal amount of $206 million (the “initial advance”), which consisted of a $166 million term loan facility to AbitibiBowater Inc. and Bowater Incorporated, and a $40 million term loan facility to BCFPI. Following the payment of lender fees, the borrowers received aggregate loan proceeds of $196 million.

Borrowings under the Bowater DIP Agreement bore interest, at our election, at either a rate tied to the U.S. Federal Funds Rate (the “base rate”) or USD LIBOR, in each case plus a specified margin. The interest margin for base rate loans was 6.50% through April 20, 2010 and effective April 21, 2010 was 7.00%, with a base rate floor of 4.50%. The interest margin for base rate loans was reduced to 5.00% effective July 15, 2010 in connection with the July 15, 2010 amendment. The interest margin for LIBOR loans was 7.50% through April 20, 2010 and effective April 21, 2010 was 8.00%, with a LIBOR floor of 3.50%. The interest margin for LIBOR loans was reduced to 6.00% with a LIBOR floor of 2.00% effective July 15, 2010 in connection with the July 15, 2010 amendment.

In connection with an amendment we entered into on July 15, 2010, we prepaid $166 million of the outstanding principal amount of the initial advance on July 21, 2010, which reduced the outstanding principal balance to approximately $40 million. On the Emergence Date and pursuant to the Plans of Reorganization, the outstanding balance of approximately $40 million, plus accrued interest, was paid in full in cash and the Bowater DIP Agreement (including all other related agreements, supplements, amendments and arrangements) was terminated. As consideration for a May 5, 2010 extension, the July 15, 2010 amendment and an October 15, 2010 extension of the Bowater DIP Agreement, as well as the exit fee (which represented 2.00% of the aggregate amount of the advances and was required to be paid to the lenders upon repayment of the outstanding balance), we incurred fees totaling approximately $6 million in 2010.

We paid Fairfax $129 million in principal and $9.4 million in interest in respect of the Bowater DIP Agreement since January 1, 2010.

20

David J. Paterson

We entered into a separation agreement with Mr. Paterson on December 9, 2010 related to his transition from president and chief executive officer to special executive advisor as of January 2, 2011. Mr. Paterson’s employment terminated on January 31, 2011; he will serve as a consultant to the Company until July 31, 2011. The terms of Mr. Paterson’s separation and the related payments and entitlements are described underExecutive Compensation.

The consulting arrangement may be terminated at any time and for any reason, except that if termination occurs or is initiated before the end of the consulting period by the Company other than for cause, by Mr. Paterson for good reason or upon his death or disability, he will receive the full compensation set forth in the next sentence. Mr. Paterson will be paid consulting fees of $150,000 per month; he will not be entitled to benefits or other amounts from the Company during the consulting term (except as otherwise provided above).

Pursuant to the separation agreement, Mr. Paterson will be subject to non-compete, non-solicitation and confidentiality covenants for a period of one year following the termination of the consulting arrangement.

Pierre Rougeau

On January 17, 2011, the Company agreed with Pierre Rougeau that, effective as of that date, he would transition from executive vice president, operations and sales, to a special executive advisor reporting to the president and chief executive officer. His employment terminated on March 31, 2011, after which he continues to serve as a consultant to the Company for certain special assignments for a three-month period, at a rate of $32,000 per month.

The Company paid Mr. Rougeau $761,620 pursuant to the executive severance policy and has agreed to pay apro rated award under the 2011 AbitibiBowater Inc. Short-Term Incentive Plan. The Company has agreed to allow the continued vesting of his award under the 2010 AbitibiBowater Inc. Equity Incentive Plan through December 9, 2011 and for the options granted thereunder to remain exercisable until the later of one year after June 30, 2011 or the end of his consulting arrangement.

Mr. Rougeau will be subject to non-compete and non-solicitation arrangements for a period of one year following his employment termination date.

Review, Approval or Ratification of Transactions with Related Persons

We review relationships and transactions in which the Company, its directors and executive officers or their immediate family members participate to determine whether the related persons have a direct or indirect material interest. As required under SEC rules, transactions that are determined to be directly or indirectly material to a related person where the amount involved exceeds $120,000 are disclosed in this proxy statement. The audit committee, in consultation with the human resources and compensation/nominating and governance committee, reviews all related party transactions or potential conflicts of interest situations involving the Company, its directors, officers and related parties.

21

The board, acting only through directors who were not party to the related party transactions described above, considered each such related party transaction and determined that each transaction was in compliance with our corporate governance principles.

22

Compensation Disclosure & Analysis

Overview

The creditor protection proceedings ongoing for most of 2010, emergence in December 2010 and transitions in the board and compensation committees presented unique challenges in developing and delivering an executive compensation program. The board and compensation committees ultimately approved a post-emergence executive compensation program that was negotiated with significant stakeholders during the creditor protection proceedings and approved by the courts in the plans of reorganization.

Before the emergence date, our priority was to finalize and secure approval of the plans of reorganization. Because new compensation plans and arrangements could not be implemented during the creditor protection proceedings without court approval, the executive compensation program that was in place for 2009 continued in 2010 until the emergence date. In particular, before emergence, base salaries remained frozen at the 2008 base salary levels, no annual incentive plan was established and no equity awards were granted. In addition, on the emergence date, certain obligations of the Company and its affiliated debtors and debtors-in-possession under all compensation plans, programs and arrangements were terminated and deemed rejected or repudiated, as applicable, under the plans of reorganization. These plans, programs and arrangements included, but were not limited to, all employment agreements, offer letters, incentive compensation, equity plans, change in control arrangements, and supplemental retirement arrangements. The Company, however, assumed and amended the severance guidelines that were in place before emergence, which guidelines are described at the end of the Compensation and Discussion Analysis.

In light of the foregoing, the pre-emergence compensation committee of the board, named the human resources and compensation committee, or “HRCC,” spent much of 2010 reviewing and designing the proposed post-emergence structure for the executive compensation program. The HRCC sought to establish an executive compensation program effective upon emergence that would be responsive to the market and the restructuring. As described further below, the HRCC reviewed independent benchmarking data of peer groups, redesigned certain elements of the program and reconsidered the weighted mix of the various elements. The HRCC received input from the Unsecured Creditors Committee, or “UCC,” other significant stakeholders, and the Company’s internal human resources and restructuring teams. The HRCC sought to refocus the Company’s executive compensation structure so that it could deliver total pay under a new pay-for-performance framework following emergence that was in line with those of its peers, as discussed in further detail below.

On the emergence date, a new compensation committee, named the human resources and compensation / nominating and governance committee, or “HRC/NGC,” was appointed. In anticipation of its appointment, the HRC/NGC reviewed the post-emergence executive compensation program as proposed and recommended by the HRCC. On the emergence date, the HRC/NGC approved the post-emergence executive compensation program described in this Compensation Discussion and Analysis. The post-emergence new board also ratified several elements of the executive compensation program.

23

Even though the HRCC and the HRC/NGC were restricted before the emergence date in establishing or offering certain elements of an executive compensation structure that would deliver total compensation similar to its peers under a pay-for-performance framework, they designed a post-emergence executive compensation program containing three unique elements of pay, each conditioned upon court approval and emergence: (1) a short-term incentive program for the last six months of 2010, (2) a restructuring recognition award program to reward performance leading up to the emergence from creditor protection proceedings and (3) an equity incentive plan designed to motivate senior management to contribute collaboratively to the Company’s long-term growth.

Emergence for any company is a period of significant transition, including in the executive team. In this regard, during 2010, the Company’s named executive officers were Messrs. Paterson, William G. Harvey, Pierre Rougeau, Alain Grandmont and Jacques Vachon, who served as president and chief executive officer; executive vice president and chief financial officer; executive vice president, operations and sales; executive vice president, human resources and supply chain; and senior vice president, corporate affairs and chief legal officer, respectively. Effective January 1, 2011, Mr. Paterson resigned as president and chief executive officer and Mr. Garneau was appointed as his successor. Following this appointment, Mr. Garneau restructured the executive team in early 2011 as follows:

| • | Mr. Rougeau resigned from his position as executive vice president, operations and sales, effective January 17, 2011 and terminated employment on March 31, 2011. The functions performed by Mr. Rougeau are currently divided between John Lafave, who was appointed senior vice president, pulp and paper sales and marketing effective January 17, 2011, and Alain Boivin, who was named senior vice president, pulp and paper operations effective March 7, 2011. |

| • | Messrs. Harvey, Grandmont and Vachon were redesignated as senior vice president and chief financial officer; senior vice president, human resources and public affairs; and senior vice president and chief legal officer, respectively. |

As a result of the unique elements of compensation for the year of emergence and the efforts to design an executive compensation structure following emergence, this Compensation Discussion and Analysis focuses on the compensation elements paid to members of our executive team, as constituted on December 31, 2010 as well as the structure approved under the plans of reorganization and effective upon our emergence and payable to the reorganized executive team.

Objectives

Our post-emergence executive compensation program is designed to meet the following objectives:

| • | Attract team members with superior management ability, insight and judgment who will position the Company for sustained profitability through changing business cycles in the forest products industry; |