UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22032

Name of Fund: BlackRock International Growth and Income Trust (BGY)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock International Growth and Income Trust,

55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2014

Date of reporting period: 04/30/2014

Item 1 – Report to Stockholders

APRIL 30, 2014

| | | | |

SEMI-ANNUAL REPORT (UNAUDITED) | | | | BLACKROCK® |

„ BlackRock Dividend Income Trust (BQY)

„ BlackRock EcoSolutions Investment Trust (BQR)

„ BlackRock Energy and Resources Trust (BGR)

„ BlackRock Enhanced Capital and Income Fund, Inc. (CII)

„ BlackRock Enhanced Equity Dividend Trust (BDJ)

„ BlackRock Global Opportunities Equity Trust (BOE)

„ BlackRock Health Sciences Trust (BME)

„ BlackRock International Growth and Income Trust (BGY)

„ BlackRock Real Asset Equity Trust (BCF)

„ BlackRock Resources & Commodities Strategy Trust (BCX)

„ BlackRock Utility and Infrastructure Trust (BUI)

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

BlackRock Dividend Income Trust’s (BQY), BlackRock EcoSolutions Investment Trust’s (BQR), BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Global Opportunities Equity Trust’s (BOE), BlackRock Health Sciences Trust’s (BME), BlackRock International Growth and Income Trust’s (BGY), BlackRock Real Asset Equity Trust’s (BCF), BlackRock Resources & Commodities Strategy Trust’s (BCX) and BlackRock Utility and Infrastructure Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), reported amounts and sources of distributions are estimates and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the year and may be subject to changes based on the tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will explain the character of these dividends and distributions for federal income tax purposes.

April 30, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions

for the Fiscal Year | | % Breakdown of the Total Cumulative

Distributions for the Fiscal Year | |

| | | Net

Investment

Income | | | Net Realized

Capital Gains

Short-Term | | | Net Realized

Capital Gains

Long-Term | | | Return of Capital | | | Total Per

Common Share | | Net

Investment

Income | | | Net Realized

Capital Gains

Short-Term | | | Net Realized

Capital Gains

Long-Term | | | Return

of

Capital | | | Total Per

Common Share | |

BQY | | $ | 0.077560 | | | $ | 0.062072 | | | $ | 0.320368 | | | | — | | | $0.460000 | | | 17 | % | | | 13 | % | | | 70 | % | | | 0 | % | | | 100 | % |

BQR* | | $ | 0.031226 | | | | — | | | | — | | | $ | 0.327274 | | | $0.358500 | | | 9 | % | | | 0 | % | | | 0 | % | | | 91 | % | | | 100 | % |

BGR* | | $ | 0.106544 | | | $ | 0.699246 | | | $ | 2.431520 | | | $ | 0.072690 | | | $3.310000 | | | 3 | % | | | 21 | % | | | 73 | % | | | 2 | % | | | 100 | % |

CII* | | $ | 0.432951 | | | | — | | | | — | | | $ | 0.167049 | | | $0.600000 | | | 72 | % | | | 0 | % | | | 0 | % | | | 28 | % | | | 100 | % |

BDJ* | | $ | 0.074764 | | | | — | | | | — | | | $ | 0.205236 | | | $0.280000 | | | 27 | % | | | 0 | % | | | 0 | % | | | 73 | % | | | 100 | % |

BOE* | | | — | | | | — | | | | — | | | $ | 0.623300 | | | $0.623300 | | | 0 | % | | | 0 | % | | | 0 | % | | | 100 | % | | | 100 | % |

BME | | $ | 0.025679 | | | $ | 1.541611 | | | $ | 1.202660 | | | | — | | | $2.769950 | | | 1 | % | | | 56 | % | | | 43 | % | | | 0 | % | | | 100 | % |

BGY* | | $ | 0.053081 | | | | — | | | | — | | | $ | 0.282619 | | | $0.335700 | | | 16 | % | | | 0 | % | | | 0 | % | | | 84 | % | | | 100 | % |

BCF* | | $ | 0.047668 | | | | — | | | | — | | | $ | 0.301932 | | | $0.349600 | | | 14 | % | | | 0 | % | | | 0 | % | | | 86 | % | | | 100 | % |

BCX* | | $ | 0.079122 | | | | — | | | | — | | | $ | 0.383278 | | | $0.462400 | | | 17 | % | | | 0 | % | | | 0 | % | | | 83 | % | | | 100 | % |

BUI* | | $ | 0.157289 | | | $ | 0.066024 | | | $ | 0.024199 | | | $ | 0.477489 | | | $0.725000 | | | 22 | % | | | 9 | % | | | 3 | % | | | 66 | % | | | 100 | % |

| | * | Certain Trusts estimate they have distributed more than the amount of earned income and net realized gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ When distributions exceed total return performance, the difference will reduce the Trust’s net asset value per share. |

Section 19(a) notices for each Trust, as applicable, are available on the BlackRock website http://www.blackrock.com.

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a quarterly basis:

| | | | | | | | | | |

| | | Exchange Symbol | | | | | Amount Per Common Share | | | |

| | BQY | | | | | $0.230000 | | | |

| | BQR | | | | | $0.179250 | | | |

| | BGR | | | | | $0.405000 | | | |

| | CII | | | | | $0.300000 | | | |

| | BDJ | | | | | $0.140000 | | | |

| | BOE | | | | | $0.311650 | | | |

| | BME | | | | | $0.429975 | | | |

| | BGY | | | | | $0.167850 | | | |

| | BCF | | | | | $0.174800 | | | |

| | BCX | | | | | $0.231200 | | | |

| | | BUI | | | | | $0.362500 | | | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a quarterly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each quarterly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Trusts to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan without prior notice if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to each Trust’s prospectus for a more complete description of its risks.

| | | | | | |

| 2 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 3 |

Dear Shareholder,

Markets have remained highly attuned to potential changes in U.S. monetary policy over the past year. This was markedly evident one year ago in May of 2013 when then-Federal Reserve Chairman Bernanke first mentioned the possibility of reducing (or “tapering”) the central bank’s asset purchase programs — comments that were widely misinterpreted as signaling an end to the Fed’s zero-interest-rate policy. U.S. Treasury yields rose sharply following his comments, triggering a steep sell-off across fixed income markets. (Bond prices move in the opposite direction of yields.) Global equities also suffered as investors feared the implications of a potential end to a program that had greatly supported stocks. Emerging markets, which are more sensitive to changes in global liquidity, were especially hurt by the prospect of ebbing cash flows from the United States. Markets broadly rebounded in late June, however, when the Fed’s tone turned more dovish. At the same time, improving economic indicators and better corporate earnings helped extend gains through most of the summer.

Although the tone of economic and financial news was mixed last autumn, it was a surprisingly positive period for most asset classes. Early on, the Fed defied market expectations with its decision to delay tapering, but higher volatility returned in late September 2013 when the U.S. Treasury Department warned that the national debt would soon breach its statutory maximum. The ensuing political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October. Equities and other so-called “risk assets” managed to resume their rally when politicians finally engineered a compromise to reopen the government and extend the debt ceiling.

The remainder of 2013 was a generally positive period for stock markets in the developed world, although investors continued to grapple with uncertainty about when and how much the Fed would scale back on stimulus. When the Fed ultimately announced its tapering plans in mid-December, markets reacted positively, as this action signaled the Fed’s perception of real improvement in the economy, and investors were finally released from the anxiety that had gripped them for quite some time.

The start of the new year brought a stark change in sentiment. Heightened volatility in emerging markets — driven by reduced global liquidity, severe currency weakness, high levels of debt and uneven growth — combined with mixed U.S. economic data caused global equities to weaken in January while bond markets found renewed strength from investors seeking relatively safer assets. Although these headwinds persisted, equities were back on the rise in February as investors were encouraged by a one-year extension of the U.S. debt ceiling and market-friendly comments from new Fed Chair Janet Yellen. While U.S. economic data had softened, investors were assuaged by increasing evidence that this was a temporary trend resulting from harsher-than-usual winter weather.

In the final months of the period, signs of decelerating growth in China and geopolitical tensions in Russia and Ukraine made for a bumpy ride, but markets continued their climb as investors focused on improving U.S. economic data, stronger corporate earnings and a still-dovish central bank. Within developed markets, investors shifted from growth to value stocks as the strong performance of growth stocks in 2013 had pushed valuations higher in many of these sectors. Emerging markets also benefited from this broad rotation into cheaper valuations and were further supported by an improving growth outlook for a number of developing countries.

Even though investors were gearing up for a modest shift toward tighter monetary policy from the Fed, equity markets in the developed world posted solid gains for the six- and 12-month periods ended April 30. Emerging markets, however, experienced increased volatility amid heightened risks for the asset class. Interest rate uncertainty posed a headwind for fixed income assets, and higher-quality sectors of the market performed poorly over the reporting period. Conversely, high yield bonds benefited from income-oriented investors’ search for yield in the overall low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities close to historic lows.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“In a modest global growth environment, expectations around monetary policy changes continued to be a key theme in financial market performance.”

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of April 30, 2014 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 8.36 | % | | | 20.44 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 3.08 | | | | 20.50 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | 4.44 | | | | 13.35 | |

Emerging market

equities (MSCI Emerging

Markets Index) | | | (2.98 | ) | | | (1.84 | ) |

3-month Treasury

bill (BofA Merrill Lynch

3-Month Treasury

Bill Index) | | | 0.03 | | | | 0.06 | |

U.S. Treasury securities

(BofA Merrill Lynch 10-

Year U.S. Treasury Index) | | | 0.88 | | | | (5.25 | ) |

U.S. investment grade

bonds (Barclays

U.S. Aggregate

Bond Index) | | | 1.74 | | | | (0.26 | ) |

Tax-exempt municipal

bonds (S&P

Municipal Bond Index) | | | 4.24 | | | | 0.46 | |

U.S. high yield bonds

(Barclays U.S.

Corporate High Yield 2%

Issuer Capped Index) | | | 4.72 | | | | 6.28 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| 4 | | THIS PAGE NOT PART OF YOUR TRUST REPORT | | | | |

| | |

| The Benefits and Risks of Option Over-Writing | | |

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to enhance distribution yield and total return performance. However, these objectives cannot be achieved in all market conditions.

The Trusts primarily write single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, the Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trusts receive cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trusts. During the option term, the counterparty will elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust will be obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received will increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trusts will realize gains equal to the premiums received.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by the Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty will result in a sale below the current market value and will result in a gain or loss being realized by the Trust; and writing covered call options limits the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Each Trust employs a plan to support a level distribution of income, capital gains and/or return of capital. The goal of the plan is to provide shareholders with consistent and predictable cash flows by setting distribution rates based on expected long-term returns of the Trusts. Such distributions, under certain circumstances, may exceed a Trust’s total return performance. When total distributions exceed total return performance for the period, the difference will reduce the Trust’s total assets and net asset value per share (“NAV”) and, therefore, could have the effect of increasing the Trust’s expense ratio and reducing the amount of assets the Trust has available for long term investment. In order to make these distributions, a Trust may have to sell portfolio securities at less than opportune times.

The final tax characterization of distributions is determined after the fiscal year and is reported in the Trust’s annual report to shareholders. Distributions will be characterized as ordinary income, capital gains and/or return of capital. The Trust’s taxable net investment income or net realized capital gains (“taxable income”) may not be sufficient to support the level of distributions paid. To the extent that distributions exceed the Trust’s current and accumulated earnings and profits, the excess may be treated as a non-taxable return of capital. Distributions that exceed a Trust’s taxable income but do not exceed the Trust’s current and accumulated earnings and profits, may be classified as ordinary income which are taxable to shareholders. Such distributions are reported as distributions in excess of net investment income.

A return of capital distribution does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ A return of capital is a return of a portion of an investor’s original investment. A return of capital is not taxable, but it reduces a shareholder’s tax basis in his or her shares, thus reducing any loss or increasing any gain on a subsequent disposition by the shareholder of his or her shares. It is possible that a substantial portion of the distributions paid during a calendar year may ultimately be classified as return of capital or as distributions in excess of net investment income for income tax purposes when the final determination of the source and character of the distributions is made.

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option will expire and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 5 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Dividend Income Trust | |

BlackRock Dividend Income Trust’s (BQY) (the “Trust”) investment objective is to provide total return through a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing primarily in equity securities of issuers that pay above-average dividends and have the potential for capital appreciation. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities that pay dividends. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 7.67% based on market price and 6.58% based on NAV. For the same period, the MSCI World Value Index returned 7.35%. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Relative to the benchmark index, the Trust’s underweight to energy as well as stock selection within the sector detracted from performance for the period. Stock selection in the health care and information technology (“IT”) sectors also had a negative impact. An overweight and stock selection in consumer staples detracted from relative performance, as did individual security selection within financials. |

| Ÿ | | Contributing positively to the Trust’s performance was strong individual stock selection in both the consumer discretionary and industrials sectors. A significant underweight to financials also had a positive impact on relative results. The combination of an overweight and stock selection in utilities added to returns, as did an overweight in the health care sector. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income |

| | returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Trust sought opportunities in sectors and industries that are likely to be among the earlier beneficiaries of a recovering global economy. The Trust added to U.S. financial companies, select IT names and industrials. The Trust eliminated certain positions within telecommunication services (“telecom”) and utilities in the U.S. and abroad, where valuations had moved higher in recent months. |

Describe Trust positioning at period end.

| Ÿ | | As of period end, the investment advisor remains constructive on the ability of corporations to continue to generate cash, especially in the mega-cap space where many firms are well positioned to thrive in a slower-growth environment. The Trust’s largest sector allocations on an absolute basis are financials, consumer staples, industrials, energy and health care, while the Trust maintains smaller exposures to consumer discretionary, telecom, utilities, materials and IT. The Trust remains positioned in high quality stocks, with a special emphasis on affording relative protection and growth of income. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 6 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Dividend Income Trust | |

| | |

Symbol on New York Stock Exchange (“NYSE”) MKT | | BQY |

Initial Offering Date | | May 28, 2004 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($13.34)1 | | 6.90% |

Current Quarterly Distribution per Common Share2,3 | | $0.23 |

Current Annualized Distribution per Common Share2 | | $0.92 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

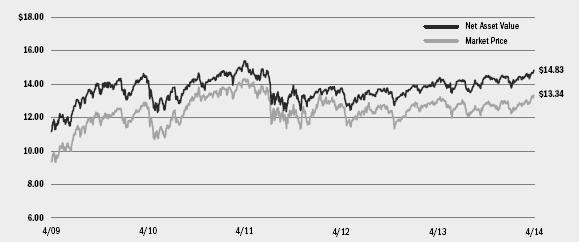

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

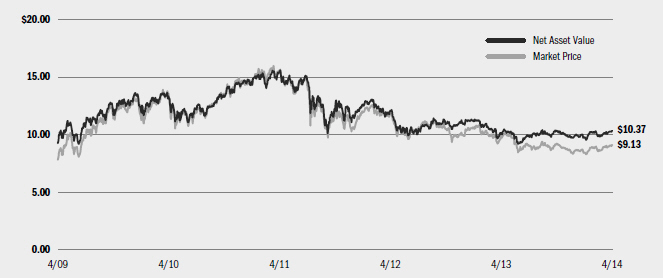

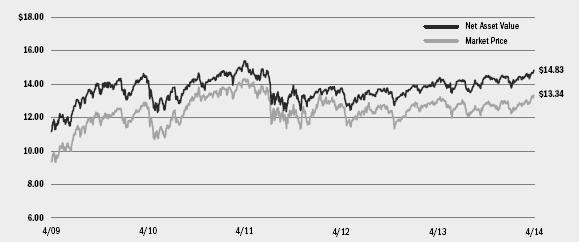

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 13.34 | | | $ | 12.84 | | | | 3.89 | % | | $ | 13.36 | | | $ | 12.16 | |

Net Asset Value | | $ | 14.83 | | | $ | 14.42 | | | | 2.84 | % | | $ | 14.83 | | | $ | 13.77 | |

|

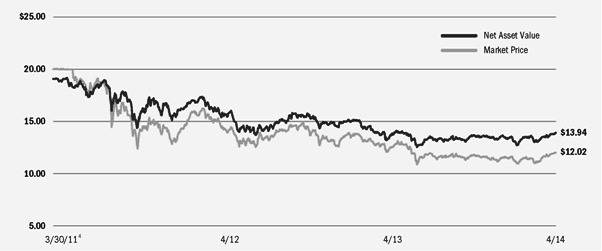

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

Exxon Mobil Corp. | | | 3 | % |

Chevron Corp. | | | 2 | |

The Walt Disney Co. | | | 2 | |

Total SA — ADR | | | 2 | |

General Mills, Inc. | | | 2 | |

Emerson Electric Co. | | | 2 | |

Bristol-Myers Squibb Co. | | | 2 | |

Dominion Resources, Inc. | | | 2 | |

Microsoft Corp. | | | 2 | |

Altria Group, Inc. | | | 2 | |

| | | | | | | | |

| Sector Allocation | | 4/30/14 | | | 10/31/13 | |

Financials | | | 20 | % | | | 20 | % |

Consumer Staples | | | 14 | | | | 14 | |

Industrials | | | 13 | | | | 12 | |

Health Care | | | 12 | | | | 11 | |

Energy | | | 11 | | | | 11 | |

Information Technology | | | 8 | | | | 7 | |

Consumer Discretionary | | | 8 | | | | 8 | |

Utilities | | | 7 | | | | 7 | |

Materials | | | 4 | | | | 4 | |

Telecommunication Services | | | 3 | | | | 6 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 7 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock EcoSolutions Investment Trust | |

BlackRock EcoSolutions Investment Trust’s (BQR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities issued by companies that are engaged in one or more of New Energy (e.g., products, technologies and services connected to the efficient use of energy or the provision or manufacture of alternative forms of energy), Water Resources and Agriculture business segments. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 7.46% based on market price and 5.24% based on NAV. For the same period, the closed-end Lipper Utility Funds category posted an average return of 10.57% based on market price and 10.69% based on NAV. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Many of the Trust’s new energy investments benefited from positive momentum during the period, with particularly robust performance from holdings in the renewable energy technology space. Vestas Wind Systems A/S was among the Trust’s strongest contributors to performance as the company received a number of new orders, finalized its joint venture with Mitsubishi and secured a five-year revolving credit facility on attractive terms. All of these announcements combined have lowered the risks around the stock and it has been rewarded by the market as a result. |

| Ÿ | | Within agriculture, a holding in livestock producer Tyson Foods, Inc. boosted performance. The company, which specializes in chicken, beef and pork production, posted strong earnings for 2013 and raised its earnings expectations for 2014, which also served to ease broader concerns in the market about earnings in the poultry sector given increased competition resulting from lower grain prices. In the water resources segment of the Trust, exposure to water utilities companies had a positive impact on returns, with notable contributions from United Utilities Group PLC and Severn Trent PLC. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

| Ÿ | | Conversely, the Trust’s holding in integrated solar power products manufacturer Trina Solar detracted from performance as investors took profits on the stock following its strong performance in 2013. A position in global agricultural products company Syngenta AG also hurt returns as the company announced a disappointing earnings report reflecting lower-than-expected sales in South America due to a delayed product launch. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Trust sold a position in agriculture equipment company AGCO Corp. given concerns that the sub-sector will be challenged in the medium-term. The Trust added to a holding in Tyson Foods, Inc. based on a strong outlook for poultry margins in the U.S. In the new energy segment, the Trust initiated a position in energy efficiency company Regal-Beloit Corp., reflecting optimism for a recovery in U.S. non-residential construction markets. In the water segment, the Trust initiated a position in an industrial conglomerate company Danaher Corp. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust continued to hold large allocations to both the water and agriculture segments and less emphasis on the new energy segment. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 8 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock EcoSolutions Investment Trust | |

| | |

Symbol on NYSE | | BQR |

Initial Offering Date | | September 28, 2007 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($ 8.15)1 | | 8.80% |

Current Quarterly Distribution per Common Share2,3 | | $0.17925 |

Current Annualized Distribution per Common Share2 | | $0.71700 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

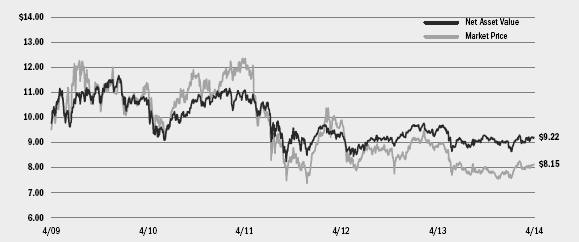

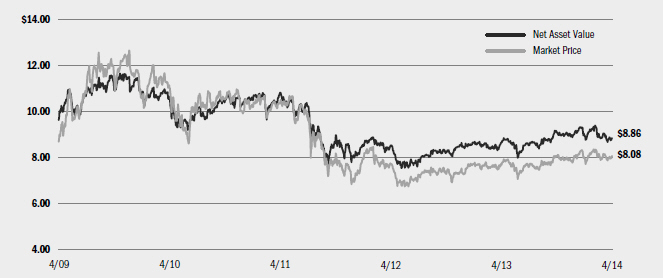

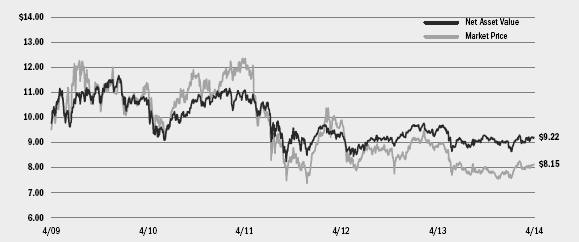

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 8.15 | | | $ | 7.93 | | | | 2.77 | % | | $ | 8.33 | | | $ | 7.49 | |

Net Asset Value | | $ | 9.22 | | | $ | 9.16 | | | | 0.66 | % | | $ | 9.30 | | | $ | 8.65 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

Archer-Daniels-Midland Co. | | | 4 | % |

Monsanto Co. | | | 4 | |

Severn Trent PLC | | | 3 | |

Manila Water Co., Inc. | | | 3 | |

Aqua America, Inc. | | | 3 | |

Bunge Ltd. | | | 3 | |

Tyson Foods, Inc., Class A | | | 2 | |

Pennon Group PLC | | | 2 | |

Agrium, Inc. | | | 2 | |

Inversiones Aguas Metropolitanas SA | | | 2 | |

| | | | | | | | |

| Industry Allocation | | 4/30/14 | | | 10/31/13 | |

Water Utilities | | | 26 | % | | | 26 | % |

Food Products | | | 18 | | | | 13 | |

Chemicals | | | 17 | | | | 20 | |

Machinery | | | 9 | | | | 12 | |

Other3 | | | 30 | | | | 29 | |

| 3 | Other includes a 5% holding or less in each of the following industries; Electrical Equipment, Multi-Utilities, Commercial Services & Supplies, Electric Utilities, Independent Power and Renewable Electricity Producers, Oil, Gas & Consumable Fuels, Real Estate Investment Trusts (REITs), Electronic Equipment, Instruments & Components, Food & Staples Retailing, Semiconductors & Semiconductor Equipment, Industrial Conglomerates, Construction & Engineering, Paper & Forest Products, Auto Components, Building Products, Biotechnology and Real Estate Management & Development. |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 9 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Energy and Resources Trust | |

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 6.23% based on market price and 6.83% based on NAV. For the same period, the closed-end Lipper Natural Resources Funds category posted an average return of 9.11% based on market price and 9.78% based on NAV. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust’s positive performance was largely attributable to its exposure to integrated oil & gas stocks. Improved capital discipline and increased focus on free-cash-flow helped drive the performance of large-capitalization, integrated stocks and the Trust benefited from its holdings in Royal Dutch Shell PLC, Exxon Mobil Corp. and BP PLC. Additionally, the cold winter in the U.S. supported high demand for natural gas, and the Trust’s positions in gas producers Southwestern Energy Co., Cimarex Energy Co. and EOG Resources, Inc. generated strong returns for the period. |

| Ÿ | | The Trust’s holding in Cairn Energy PLC, a global oil & gas exploration & production company, was among the largest detractors from performance. Shares of Cairn Energy PLC fell as the company came under scrutiny from the Indian tax authority due to a matter relating to the |

| | initial public offering of their Indian subsidiary, Cairn India, in 2006. India’s tax authority cited retrospective legislation introduced in 2012 regarding the taxation of indirect transfers of Indian assets as the reason for the investigation. The Trust retained this position given the company’s strong asset base. Another notable detractor was a position in Noble Energy, Inc., which declined from an October peak as the company’s Israel gas project progressed more slowly than expected. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net losses during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Trust added to holdings in large-capitalization, integrated oil & gas names based on an improved outlook for this segment. The Trust also initiated a position in shale gas producer Southwestern Energy Co. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust held its largest allocations in the integrated oil & gas and oil & gas exploration & production sub-industries, and held smaller allocations to oil services, distribution and refining & marketing stocks. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 10 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | | | |

| | | | BlackRock Energy and Resources Trust | |

| | |

Symbol on NYSE | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($25.05)1 | | 6.47% |

Current Quarterly Distribution per Common Share2,3 | | $0.405 |

Current Annualized Distribution per Common Share2 | | $1.620 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

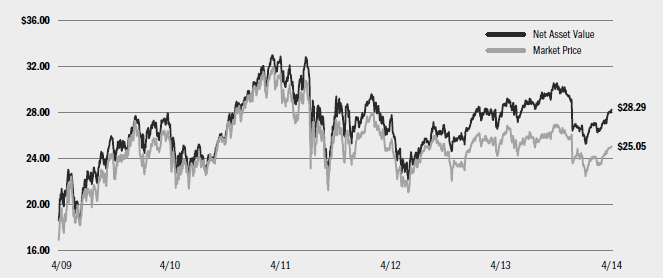

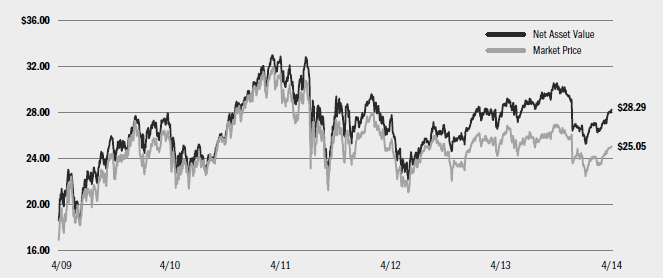

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

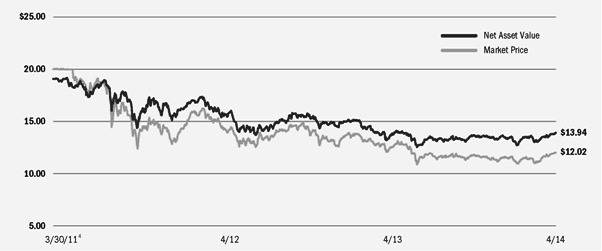

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 25.05 | | | $ | 26.82 | | | | (6.60 | )% | | $ | 26.84 | | | $ | 22.41 | |

Net Asset Value | | $ | 28.29 | | | $ | 30.12 | | | | (6.08 | )% | | $ | 30.28 | | | $ | 25.29 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

Royal Dutch Shell PLC — ADR | | | 12 | % |

Chevron Corp. | | | 10 | |

Exxon Mobil Corp. | | | 10 | |

ConocoPhillips | | | 5 | |

BP PLC — ADR | | | 5 | |

Schlumberger Ltd. | | | 5 | |

Anadarko Petroleum Corp. | | | 4 | |

Noble Energy, Inc. | | | 4 | |

Halliburton Co. | | | 3 | |

Total SA | | | 3 | |

| | | | | | | | |

| Industry Allocation | | 4/30/14 | | | 10/31/13 | |

Oil, Gas & Consumable Fuels | | | 90 | % | | | 83 | % |

Energy Equipment & Services | | | 10 | | | | 17 | |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 11 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Enhanced Capital and Income Fund, Inc. | |

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity and debt securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 10.40% based on market price and 5.88% based on NAV. For the same period, the benchmark S&P 500® Value Index returned 8.91%. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust underperformed the benchmark index due to stock selection in the industrials, information technology (“IT”) and consumer staples sectors. Industry allocation decisions also had a negative impact on relative returns. Notable individual detractors from performance included government science and technology solutions provider Leidos Holdings, Inc. (IT), a company that was spun out from Science Applications International Corp., which is also held by the Trust. Shares of Leidos Holdings, Inc. declined as the company significantly missed earnings estimates. A large position in Japan Airlines Co. Ltd. (industrials) hurt results as Japanese equities broadly suffered after their strong upward move in the first half of 2013. Lastly, shares of European retailer Metro AG (consumer staples) came under pressure given the company’s exposure to Russia as geopolitical tension escalated in Russia and Ukraine. |

| Ÿ | | Contributing positively to performance was stock selection in materials, telecommunication services (“telecom”) and consumer discretionary. Stand-out performers included fertilizer company CF Industries Holdings, Inc. (materials), which posted double-digit gains as the company, under new leadership, announced steps to unlock shareholder value through continued execution by focusing on their cost-advantaged nitrogen business |

| | and enhanced balance sheet management. Online travel provider Expedia, Inc. (consumer discretionary) generated robust performance as the company produced strong earnings while operating within an improving backdrop for online travel services. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | The Trust’s sector weightings are generally a result of individual stock selection. Within this context, the Trust increased exposure to financials, consumer discretionary and IT and decreased exposure to energy during the period. The Trust added several new positions within financials including leading title insurer Fidelity National Financial, Inc. and the newly restructured Ally Financial. Within the consumer discretionary sector, the Trust added positions in Sinclair Broadcasting Group and Nexstar Broadcasting Group, Inc., and took advantage of recent price weakness to increase the position in General Motors Co. Also during the period, the Trust took profits on Google, Inc. and reduced exposure to refining stocks, namely HollyFrontier Corp. and PBF Energy, Inc. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the S&P 500® Value Index, the Trust ended the period overweight in non-banking financials and consumer discretionary, driven by a significant weighting in broadcasters. Conversely, the Trust was significantly underweight in more defensive sectors including consumer staples and utilities. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 12 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | | | |

| | | | BlackRock Enhanced Capital and Income Fund, Inc. | |

| | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($14.30)1 | | 8.39% |

Current Quarterly Distribution per Common Share2,3 | | $0.30 |

Current Annualized Distribution per Common Share2 | | $1.20 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

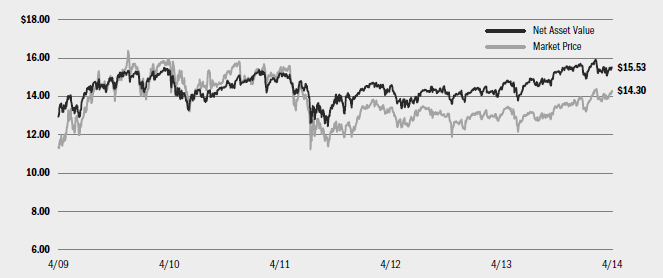

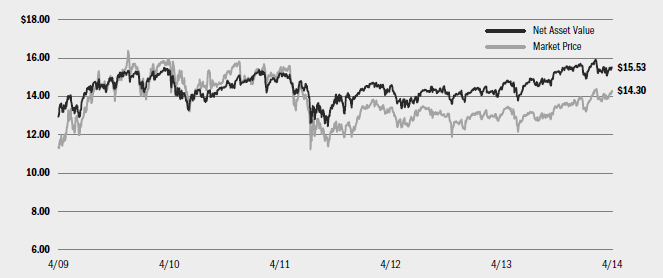

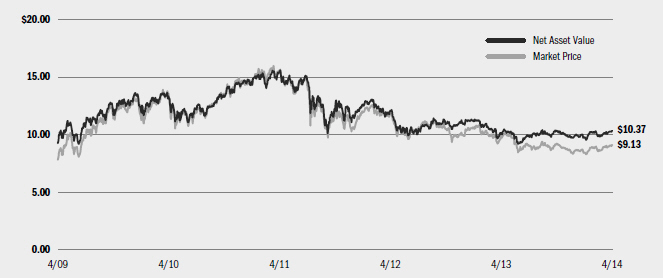

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.30 | | | $ | 13.52 | | | | 5.77 | % | | $ | 14.40 | | | $ | 13.17 | |

Net Asset Value | | $ | 15.53 | | | $ | 15.31 | | | | 1.44 | % | | $ | 15.92 | | | $ | 14.93 | |

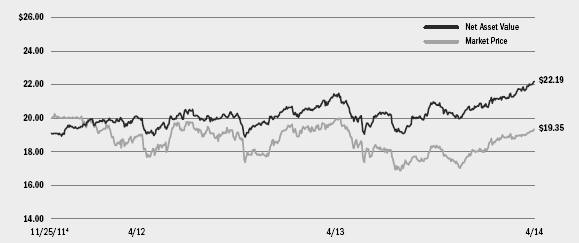

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

American International Group, Inc. | | | 5 | % |

General Motors Co. | | | 5 | |

Japan Airlines Co. Ltd. | | | 4 | |

Suncor Energy, Inc. | | | 4 | |

UnitedHealth Group, Inc. | | | 4 | |

Apple Inc. | | | 4 | |

CF Industries Holdings, Inc. | | | 4 | |

Fidelity National Financial, Inc., Class A | | | 3 | |

Pfizer, Inc. | | | 3 | |

Samsung Electronics Co. Ltd. | | | 3 | |

| | | | | | | | |

| Sector Allocation | | 4/30/14 | | | 10/31/13 | |

Information Technology | | | 22 | % | | | 20 | % |

Financials | | | 21 | | | | 18 | |

Consumer Discretionary | | | 16 | | | | 11 | |

Health Care | | | 14 | | | | 14 | |

Industrials | | | 8 | | | | 7 | |

Energy | | | 8 | | | | 13 | |

Materials | | | 4 | | | | 5 | |

Telecommunication Services | | | 4 | | | | 6 | |

Consumer Staples | | | 3 | | | | 6 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 13 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Enhanced Equity Dividend Trust | |

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 8.64% based on market price and 6.81% based on NAV. For the same period, the Russell 1000® Value Index returned 9.61%. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Relative to the benchmark index, the Trust’s overweight to consumer staples as well as stock selection within the sector detracted from performance for the period. An underweight and stock selection in health care also had a negative impact. Individual security selection within the energy sector weighed on returns, specifically due to an underweight position in Exxon Mobil Corp. and an overweight position in Kinder Morgan, Inc. Lastly, underweights and stock selection in both the information technology (“IT”) and utilities sectors detracted from relative performance. |

| Ÿ | | Contributing positively to the Trust’s performance was stock selection within the consumer discretionary sector, particularly due to not owning certain weaker performing automobile and media stocks such as Ford Motor Co., General Motors Co. and Time Warner, Inc. The Trust’s large underweight to financials and overweights in both materials and industrials also helped relative performance during the period. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Trust sought opportunities in sectors and industries that are likely to be among the earlier beneficiaries of a recovering global economy. The Trust added to U.S. financial companies, select IT names and industrials. The Trust eliminated positions within telecommunication services (“telecom”), utilities and consumer staples, where valuations had moved higher in recent months. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the investment advisor remains constructive on the ability of corporations to continue to generate cash, especially in the mega-cap space where many firms are well positioned to thrive in a slower-growth environment. The Trust’s largest sector allocations on an absolute basis are financials, industrials, energy and health care, while the smallest exposures are telecom, utilities, materials and IT. The Trust remains positioned in high quality stocks, with a special emphasis on affording relative protection and growth of income. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 14 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | |

| | | BlackRock Enhanced Equity Dividend Trust |

| | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($8.10)1 | | 6.91% |

Current Quarterly Distribution per Common Share2,3 | | $0.14 |

Current Annualized Distribution per Common Share2 | | $0.56 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

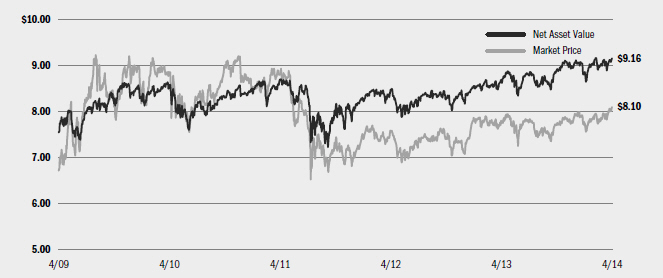

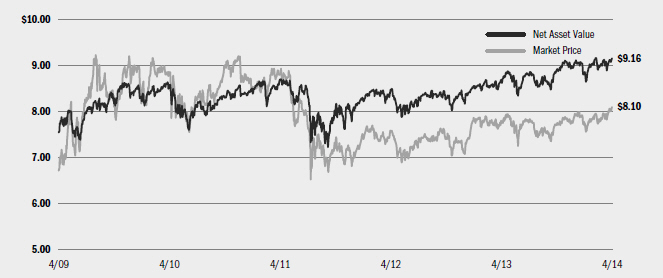

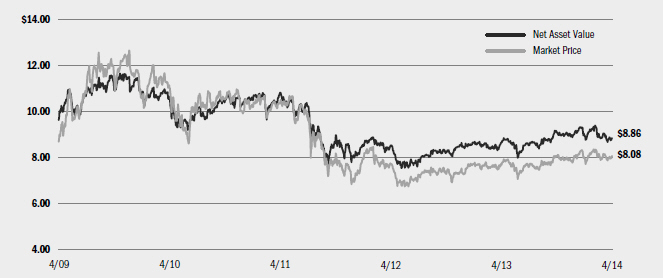

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 8.10 | | | $ | 7.72 | | | | 4.92 | % | | $ | 8.10 | | | $ | 7.55 | |

Net Asset Value | | $ | 9.16 | | | $ | 8.88 | | | | 3.15 | % | | $ | 9.17 | | | $ | 8.65 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

Wells Fargo & Co. | | | 4 | % |

JPMorgan Chase & Co. | | | 3 | |

Chevron Corp. | | | 3 | |

General Electric Co. | | | 3 | |

Comcast Corp., Special Class A | | | 3 | |

Pfizer, Inc. | | | 2 | |

Merck & Co., Inc. | | | 2 | |

The Home Depot, Inc. | | | 2 | |

Exxon Mobil Corp. | | | 2 | |

Raytheon Co. | | | 2 | |

| | | | | | | | |

| Sector Allocation | | 4/30/14 | | | 10/31/13 | |

Financials | | | 23 | % | | | 21 | % |

Industrials | | | 14 | | | | 13 | |

Energy | | | 14 | | | | 14 | |

Health Care | | | 10 | | | | 9 | |

Consumer Staples | | | 9 | | | | 12 | |

Consumer Discretionary | | | 9 | | | | 9 | |

Information Technology | | | 7 | | | | 5 | |

Materials | | | 7 | | | | 7 | |

Utilities | | | 5 | | | | 6 | |

Telecommunication Services | | | 2 | | | | 4 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 15 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Global Opportunities Equity Trust | |

BlackRock Global Opportunities Equity Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities or options on equity securities or indices or sectors of equity securities. Under normal circumstances, the Trust invests a substantial amount of its total assets in foreign issuers, issuers that primarily trade in a market located outside the United States or issuers that do a substantial amount of business outside the United States. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 4.57% based on market price and 2.91% based on NAV. For the same period, the MSCI All Country World Index posted a return of 5.28%. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Stock selection in the energy sector was the primary cause of the Trust’s underperformance relative to the benchmark index. In particular, Eurasia Drilling Co. Ltd., a Russian provider of onshore drilling services, came under pressure on account of drilling contract disruptions coupled with the geopolitical turmoil in Ukraine, which ultimately led to the Trust exiting the position. In health care, the Trust’s exposure to biotechnology hurt returns as the industry experienced selling pressure during October 2013 and again in March 2014 due to investors taking profits on their recent strong performance. |

| Ÿ | | Contributing positively to relative performance was stock selection within materials and industrials. In the materials sector, strong performance came from selection in the specialty chemicals segment, where the Trust continued to favor well-capitalized businesses with the ability to consistently grow and generate cash flow in excess of their cost of capital. |

| | Within industrials, the Trust’s select transportation holdings American Airlines Group, Inc. and Hertz Global Holdings, Inc. benefited from increased pricing power as a result of industry consolidation. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Trust pared back exposure to Japan, moving to a slight underweight versus the benchmark index, with most of the sales within consumer discretionary, financials and information technology (“IT”). The proceeds were rotated into stock-specific ideas within health care and also financial stocks that are more sensitive to a recovering U.S. economy. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the MSCI All Country World Index, the Trust ended the period overweight in European equities and underweight in both emerging markets and Asia ex-Japan. From a sector perspective, the Trust was most notably overweight in industrials and health care, while the most significant underweights were in the IT and energy sectors. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 16 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | |

| | | BlackRock Global Opportunities Equity Trust |

| | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($ 14.78)1 | | 8.43% |

Current Quarterly Distribution per Common Share2,3 | | $0.31165 |

Current Annualized Distribution per Common Share2 | | $1.24660 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

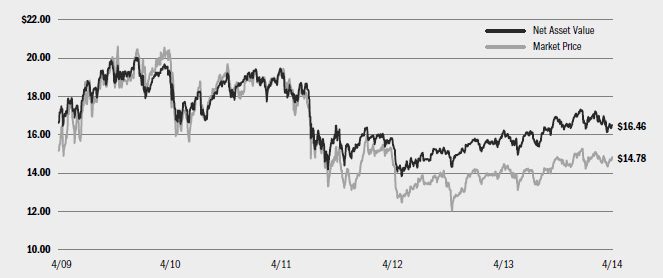

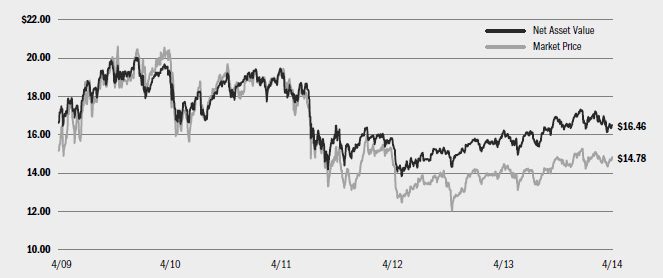

| Market Price and Net Asset Value Per Share Summary |

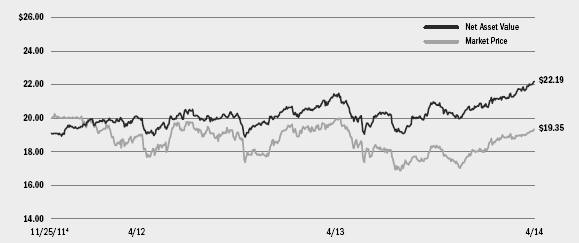

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.78 | | | $ | 14.74 | | | | 0.27 | % | | $ | 15.22 | | | $ | 14.15 | |

Net Asset Value | | $ | 16.46 | | | $ | 16.68 | | | | (1.32 | )% | | $ | 17.27 | | | $ | 16.08 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

Apple Inc. | | | 2 | % |

Societe Generale SA | | | 2 | |

Citigroup, Inc. | | | 2 | |

Green REIT PLC | | | 2 | |

Anheuser-Busch InBev NV | | | 1 | |

JPMorgan Chase & Co. | | | 1 | |

Adecco SA | | | 1 | |

Roper Industries, Inc. | | | 1 | |

Kennedy-Wilson Holdings, Inc. | | | 1 | |

BankUnited, Inc. | | | 1 | |

| | | | | | | | |

| Geographic Allocation | | 4/30/14 | | | 10/31/13 | |

United States | | | 49 | % | | | 44 | % |

United Kingdom | | | 8 | | | | 10 | |

Japan | | | 5 | | | | 8 | |

Other3 | | | 38 | | | | 38 | |

| 3 | Other includes a 5% holding or less in each of the following countries; Switzerland, Germany, France, Sweden, Ireland, China, Spain, Hong Kong, Italy, Canada, Belgium, Indonesia, Denmark, Greece, New Zealand, Austria, South Korea, Peru, South Africa, Mexico, Netherlands, Panama, Norway and Taiwan. |

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 17 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock Health Sciences Trust | |

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option overwriting strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 14.88% based on market price and 8.17% based on NAV. For the same period, the Russell 3000® Healthcare Index returned 10.50%. All returns reflect reinvestment of dividends and/or distributions. The Trust moved from a discount to NAV to a premium by period end, which accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust benefited from positioning in the health care providers & services industry, where an underweight to the lagging health care services segment and stock selection within health care distributors were the key drivers of positive relative performance. Gains also came from the life sciences tools & services industry, largely driven by the Trust’s position in Illumina, Inc., which appreciated after the company released solid financial results. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

| Ÿ | | Despite strong performance from several holdings in both the biotechnology and pharmaceutical industries, the Trust’s overweight in biotechnology and underweight in pharmaceuticals hindered performance relative to the benchmark index due to the market’s broad rotation in the first quarter of 2014 away from high-growth names that had delivered strong performance in 2013, including biotechnology, and into more value- |

| | | centric stocks, such as pharmaceuticals. Notable individual detractors within biotechnology included the Trust’s overweight positions in Aegerion Pharmaceuticals, Inc. and BioMarin Pharmaceutical, Inc. and an underweight position in Gilead Sciences, Inc. In pharmaceuticals, an underweight in Merck & Co., Inc. hampered relative performance. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, investment decisions at the individual security level resulted in decreased exposure to biotechnology stocks and slightly increased exposure to both the health care equipment & supplies and pharmaceuticals industries. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, health care stock valuations remained reasonable, even after the strong performance of the sector over the previous two years. The Trust continued to maintain a focus on innovative companies and, as such, continued to maintain large allocations to the biotechnol-ogy and pharmaceuticals industries, where the innovation cycle is in an upward trend and is expected to drive a secular growth story. The Trust’s weighting in biotechnology, however, was reduced toward period end due to near-term headwinds. In 2014, the Trust expanded the innovation theme to the health care equipment & supplies industry with investments in several companies with compelling new product launches on the horizon. While policy uncertainty has diminished with the expected implementation of Health Care Reform, changes are still taking place due to austerity measures unfolding globally. As such, the Trust remained underweight in companies that would be at risk if government reimbursements were reduced. However, the new legislation is expected to benefit health care companies generally by creating increased consumer demand, although this trend may take several years to develop. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 18 | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | |

| | | | |

| | | | BlackRock Health Sciences Trust | |

| | |

Symbol on NYSE | | BME |

Initial Offering Date | | March 31, 2005 |

Current Distribution Rate on Closing Market Price as of April 30, 2014 ($ 35.66)1 | | 4.82% |

Current Quarterly Distribution per Common Share2,3 | | $0.429975 |

Current Annualized Distribution per Common Share2 | | $1.719900 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See Section 19(a) Notices on page 2 for the estimated sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| 3 | On June 13, 2014, the Board of the Trust approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 10 of the Notes to Financial Statements for additional information. |

|

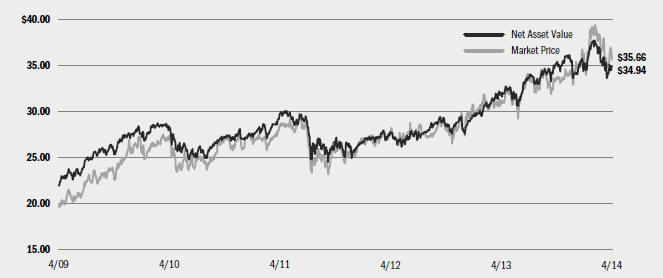

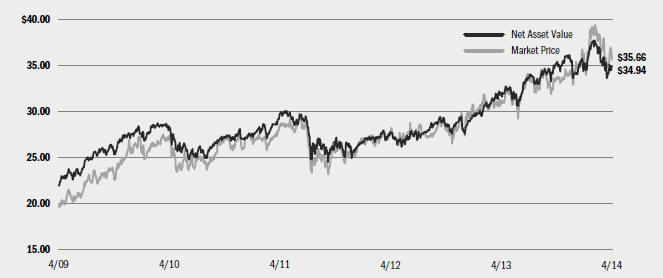

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 4/30/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 35.66 | | | $ | 33.56 | | | | 6.26 | % | | $ | 39.95 | | | $ | 32.25 | |

Net Asset Value | | $ | 34.94 | | | $ | 34.92 | | | | 0.06 | % | | $ | 37.75 | | | $ | 33.64 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 4/30/14 |

| | | | |

Johnson & Johnson | | | 4 | % |

Biogen Idec, Inc. | | | 4 | |

Merck & Co., Inc. | | | 3 | |

AbbVie, Inc. | | | 3 | |

Alexion Pharmaceuticals, Inc. | | | 3 | |

Bayer AG | | | 3 | |

Novartis AG | | | 3 | |

Pfizer, Inc. | | | 3 | |

Celgene Corp. | | | 3 | |

Covidien PLC | | | 2 | |

| | | | | | | | |

| Industry Allocation | | 4/30/14 | | | 10/31/13 | |

Pharmaceuticals | | | 38 | % | | | 35 | % |

Biotechnology | | | 26 | | | | 32 | |

Health Care Equipment & Supplies | | | 17 | | | | 16 | |

Health Care Providers & Services | | | 12 | | | | 11 | |

Life Sciences Tools & Services | | | 5 | | | | 4 | |

Other3 | | | 2 | | | | 2 | |

| 3 | Other includes a 1% holding or less in each of the following industries; Health Care Technology, Chemicals and Diversified Consumer Services. |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | SEMI-ANNUAL REPORT | | APRIL 30, 2014 | | 19 |

| | | | |

| Trust Summary as of April 30, 2014 | | | BlackRock International Growth and Income Trust | |

BlackRock International Growth and Income Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities issued by non-U.S. companies of any market capitalization located in countries throughout the world. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the six-month period ended April 30, 2014, the Trust returned 3.41% based on market price and 1.99% based on NAV. For the same period, the MSCI All Country World Index Ex-U.S. returned 2.91%. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Positioning within the consumer discretionary sector was the primary cause of the Trust’s underperformance relative to the benchmark index. In particular, Perform Group PLC, a digital sports media company, detracted from performance as the stock came under pressure due to investors’ concerns about greater-than-expected expenses in a small area of the company’s business. The Trust continued to hold Perform Group PLC despite this short-term weakness as the company remains fundamentally attractive and offers further upside potential. Also detracting from the Trust’s performance was stock selection in the utilities sector, where APR Energy PLC sold off due to investors’ concerns about the company’s contract concentration risk in Libya. However, the company’s good business momentum reinforces the view that APR Energy’s long-term fundamental story remains intact and as such, the Trust retained this position. |

| Ÿ | | Stock selection in health care and materials were the largest relative contributors to performance. In healthcare, multiple holdings across the pharmaceuticals sub-industry delivered strong returns due to a combination |

| | of pipeline potential, solid financial results and, most recently, increased M&A activity. In materials, stock selection in the specialty chemicals sub-industry, where we continue to favor well-capitalized businesses with the ability to consistently grow and generate cash flow in excess of their cost of capital, was also additive to performance. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | During the six-month period, the Trust decreased the allocation to developed Europe, with the largest reductions focused in the United Kingdom and France. The proceeds were used to add to Japanese equities positioned to benefit from the continuation of the Bank of Japan’s reflationary policies, most notably within the industrials and financials sectors. |

Describe portfolio positioning at period end.