UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22032

Name of Fund: BlackRock International Growth and Income Trust (BGY)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock International Growth and Income Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2014

Date of reporting period: 10/31/2014

Item 1 – Report to Stockholders

OCTOBER 31, 2014

BlackRock Dividend Income Trust (BQY)

BlackRock EcoSolutions Investment Trust (BQR)

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Global Opportunities Equity Trust (BOE)

BlackRock Health Sciences Trust (BME)

BlackRock International Growth and Income Trust (BGY)

BlackRock Real Asset Equity Trust (BCF)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Utility and Infrastructure Trust (BUI)

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

BlackRock Dividend Income Trust’s (BQY), BlackRock EcoSolutions Investment Trust’s (BQR), BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Global Opportunities Equity Trust’s (BOE), BlackRock Health Sciences Trust’s (BME), BlackRock International Growth and Income Trust’s (BGY), BlackRock Real Asset Equity Trust’s (BCF), BlackRock Resources & Commodities Strategy Trust’s (BCX) and BlackRock Utility and Infrastructure Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), reported amounts and sources of distributions are estimates and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the year and may be subject to changes based on the tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for federal income tax purposes.

October 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions for the Fiscal Year | | | % Breakdown of the Total Cumulative Distributions for the Fiscal Year | |

| | | Net Investment Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of Capital | | | Total Per Common Share | | | Net Investment Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of Capital | | | Total Per Common Share | |

BQY* | | $ | 0.253142 | | | $ | 0.011898 | | | $ | 0.584969 | | | $ | 0.146791 | | | $ | 0.996800 | | | | 26 | % | | | 1 | % | | | 59 | % | | | 14 | % | | | 100 | % |

BQR* | | $ | 0.071912 | | | | — | | | | — | | | $ | 0.665838 | | | $ | 0.737750 | | | | 10 | % | | | 0 | % | | | 0 | % | | | 90 | % | | | 100 | % |

BGR* | | $ | 0.261111 | | | $ | 0.698068 | | | $ | 2.946380 | | | $ | 0.349441 | | | $ | 4.255000 | | | | 6 | % | | | 16 | % | | | 70 | % | | | 8 | % | | | 100 | % |

CII* | | $ | 0.556866 | | | | — | | | | — | | | $ | 0.743134 | | | $ | 1.300000 | | | | 43 | % | | | 0 | % | | | 0 | % | | | 57 | % | | | 100 | % |

BDJ* | | $ | 0.166587 | | | | — | | | | — | | | $ | 0.440213 | | | $ | 0.606800 | | | | 27 | % | | | 0 | % | | | 0 | % | | | 73 | % | | | 100 | % |

BOE* | | $ | 0.139501 | | | | — | | | | — | | | $ | 1.211049 | | | $ | 1.350550 | | | | 10 | % | | | 0 | % | | | 0 | % | | | 90 | % | | | 100 | % |

BME | | $ | 0.019391 | | | $ | 1.965344 | | | $ | 1.786309 | | | $ | 0.067281 | | | $ | 3.838325 | | | | 1 | % | | | 51 | % | | | 46 | % | | | 2 | % | | | 100 | % |

BGY* | | $ | 0.105355 | | | | — | | | | — | | | $ | 0.622195 | | | $ | 0.727550 | | | | 14 | % | | | 0 | % | | | 0 | % | | | 86 | % | | | 100 | % |

BCF* | | $ | 0.112816 | | | | — | | | | — | | | $ | 0.644784 | | | $ | 0.757600 | | | | 15 | % | | | 0 | % | | | 0 | % | | | 85 | % | | | 100 | % |

BCX* | | $ | 0.236046 | | | | — | | | | — | | | $ | 0.765954 | | | $ | 1.002000 | | | | 24 | % | | | 0 | % | | | 0 | % | | | 76 | % | | | 100 | % |

BUI* | | $ | 0.488428 | | | | — | | | $ | 0.516716 | | | $ | 0.566356 | | | $ | 1.571500 | | | | 31 | % | | | 0 | % | | | 33 | % | | | 36 | % | | | 100 | % |

| | * | | Certain Trusts estimate they have distributed more than the amount of earned income and net realized gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ When distributions exceed total return performance, the difference will reduce the Trust’s net asset value per share. |

Section 19(a) notices for each Trust, as applicable, are available on the BlackRock website http://www.blackrock.com.

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis as of October 31, 2014:

| | | | | | | | | | |

| | | Exchange Symbol | | | | | Amount Per Common Share | | | |

| | BQY | | | | | $0.0767 | | | |

| | BQR | | | | | $0.0500 | | | |

| | BGR | | | | | $0.1350 | | | |

| | CII | | | | | $0.1000 | | | |

| | BDJ | | | | | $0.0467 | | | |

| | BOE | | | | | $0.1039 | | | |

| | BME | | | | | $0.1650 | | | |

| | BGY | | | | | $0.0560 | | | |

| | BCF | | | | | $0.0583 | | | |

| | BCX | | | | | $0.0771 | | | |

| | | BUI | | | | | $0.1210 | | | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Trusts to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan without prior notice if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to each Trust’s prospectus for a more complete description of its risks.

| | | | | | |

| 2 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 3 |

Dear Shareholder,

The final months of 2013 were generally positive for most risk assets such as equities and high yield bonds even as investors were grappling with uncertainty as to when and by how much the U.S. Federal Reserve would begin to gradually reduce (or “taper”) its asset purchase programs. Higher quality bonds and emerging market investments, however, struggled as Fed tapering became increasingly imminent. When the central bank ultimately announced its tapering plans in mid-December, equity investors reacted positively, as this action signaled the Fed’s perception of real improvement in the economy.

Most asset classes moved higher in the first half of 2014 despite the pull back in Fed stimulus. The year got off to a rocky start, however, as a number of developing economies showed signs of stress and U.S. economic data weakened. Equities declined in January while bond markets found renewed strength from investors seeking relatively safer assets. Although these headwinds persisted, equities were back on the rise in February as investors were assuaged by increasing evidence that the soft patch in U.S. data was temporary and weather-related, and forecasts pointed to growth picking up later in the year.

In the months that followed, interest rates trended lower and bond prices climbed higher in the modest growth environment. Financial markets exhibited a remarkably low level of volatility despite rising tensions in Russia and Ukraine and signs of decelerating growth in China. Equity markets were resilient as investors focused on signs of improvement in the U.S. recovery, stronger corporate earnings, increased merger-and-acquisition activity and, perhaps most importantly, reassurance from the Fed that no changes to short-term interest rates were on the horizon.

In the ongoing low-yield environment, income-seeking investors moved into equities, pushing major indices to record levels. However, as stock prices continued to rise, investors became wary of high valuations and began shedding the stocks that had experienced significant price appreciation in 2013, particularly growth and momentum names. The broad rotation into cheaper valuations resulted in the strongest performers of 2013 struggling most in 2014, and vice versa. Especially hard hit were U.S. small cap and European stocks, where earnings growth had not kept pace with market gains. In contrast, emerging markets benefited from the trend after having suffered heavy selling pressure in early 2014.

Volatility ticked up in the middle of the summer. Markets came under pressure in July as geopolitical turmoil intensified in Gaza, Iraq and Ukraine and financial troubles boiled over in Argentina and Portugal. Investors regained some confidence in August, allowing markets to rebound briefly amid renewed comfort that the Fed would continue to keep rates low and hopes that the European Central Bank would increase stimulus. However, markets swiftly reversed in September as improving U.S. economic indicators raised concerns that the Fed would increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened, ultimately putting a strain on investor flows. High valuations combined with impending rate hikes stoked increasing volatility in financial markets. Escalating geopolitical risks further fueled the fire. The U.S. renewed its involvement in Iraq and the European Union imposed additional sanctions against Russia, while Scottish voters contemplated separating from the United Kingdom.

U.S. risk assets made a comeback in October while other developed markets continued their descent. This divergence in market performance moved in tandem with economic momentum and central bank policy. As the U.S. economy continued to strengthen, the need for monetary policy accommodation diminished. Meanwhile, economies in other parts of the developed world decelerated and central banks in Europe and Japan implemented aggressive measures to stimulate growth.

U.S. large cap stocks were the strongest performers for the six- and 12-month periods ended October 31, 2014. U.S. small caps experienced significantly higher volatility than large caps, but nonetheless generated positive returns. International developed market equities broadly declined while emerging markets posted modest gains. Most fixed income assets produced positive results as rates generally fell. Tax-exempt municipal bonds benefited from a favorable supply-and-demand environment. Short-term interest rates remained near zero, keeping yields on money market securities close to historic lows.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

U.S. financial markets generally outperformed other parts of the world given stronger economic growth and corporate earnings, the continuation of low interest rates and the appeal of relative stability amid rising geopolitical uncertainty.

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of October 31, 2014 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 8.22 | % | | | 17.27 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 4.83 | | | | 8.06 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | (4.83 | ) | | | (0.60 | ) |

Emerging market equities

(MSCI Emerging Markets Index) | | | 3.74 | | | | 0.64 | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month Treasury

Bill Index) | | | 0.02 | | | | 0.05 | |

U.S. Treasury securities

(BofA Merrill Lynch

10- Year U.S. Treasury

Index) | | | 4.29 | | | | 5.21 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | | 2.35 | | | | 4.14 | |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | 3.54 | | | | 7.94 | |

U.S. high yield bonds

(Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | | 1.05 | | | | 5.82 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| 4 | | THIS PAGE NOT PART OF YOUR TRUST REPORT | | | | |

| | |

| The Benefits and Risks of Option Over-Writing | | |

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to enhance distribution yield and total return performance. However, these objectives cannot be achieved in all market conditions.

The Trusts primarily write single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, the Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trusts receive cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trusts. During the option term, the counterparty will elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust will be obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received will increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trusts will realize gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by the Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty will result in a sale below the current market value and will result in a gain or loss being realized by the Trust; and writing covered call options limits the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Each Trust employs a plan to support a level distribution of income, capital gains and/or return of capital. The goal of the plan is to provide shareholders with consistent and predictable cash flows by setting distribution rates based on expected long-term returns of the Trusts. Such distributions, under certain circumstances, may exceed a Trust’s total return performance. When total distributions exceed total return performance for the period, the difference will reduce the Trust’s total assets and net asset value per share (“NAV”) and, therefore, could have the effect of increasing the Trust’s expense ratio and reducing the amount of assets the Trust has available for long term investment. In order to make these distributions, a Trust may have to sell portfolio securities at less than opportune times.

The final tax characterization of distributions is determined after the fiscal year and is reported in the Trust’s annual report to shareholders. Distributions will be characterized as ordinary income, capital gains and/or return of capital. The Trust’s taxable net investment income or net realized capital gains (“taxable income”) may not be sufficient to support the level of distributions paid. To the extent that distributions exceed the Trust’s current and accumulated earnings and profits, the excess may be treated as a non-taxable return of capital. Distributions that exceed a Trust’s taxable income but do not exceed the Trust’s current and accumulated earnings and profits, may be classified as ordinary income which are taxable to shareholders. Such distributions are reported as distributions in excess of net investment income.

A return of capital distribution does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ A return of capital is a return of a portion of an investor’s original investment. A return of capital is not taxable, but it reduces a shareholder’s tax basis in his or her shares, thus reducing any loss or increasing any gain on a subsequent disposition by the shareholder of his or her shares. It is possible that a substantial portion of the distributions paid during a calendar year may ultimately be classified as return of capital or as distributions in excess of net investment income for income tax purposes when the final determination of the source and character of the distributions is made.

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option will expire and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 5 |

| | |

| Trust Summary as of October 31, 2014 | | BlackRock Dividend Income Trust |

BlackRock Dividend Income Trust’s (BQY) (the “Trust”) investment objective is to provide total return through a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing primarily in equity securities of issuers that pay above-average dividends and have the potential for capital appreciation. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities that pay dividends. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

On July 30, 2014, the Boards of the Trust and BlackRock Enhanced Equity Dividend Trust (“BDJ”) approved the reorganization of the Trust with and into BDJ, with BDJ continuing as the surviving fund after the reorganization. At a special meeting of shareholders on November 10, 2014, the shareholders of the Trust approved the reorganization of the Trust with and into BDJ. The reorganization was completed on December 8, 2014.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 10.75% based on market price and 9.01% based on NAV. For the same period, the MSCI World Value Index returned 7.75%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Relative to the benchmark index, the Trust’s stock selection in consumer discretionary and financials made the largest contributions to relative performance during the 12-month period. Within consumer discretionary, non-benchmark holding The Walt Disney Co. posted healthy gains buoyed by the strong performance of its film studio, theme park and ESPN divisions. Within the financials sector, the fund benefited by avoiding lagging stocks within the benchmark. An underweight and stock selection in financials also contributed to returns. In particular, an underweight in banks held in the benchmark, especially Standard Chartered PLC and HSBC Holdings PLC – ADR proved additive during the period. |

| Ÿ | | A combination of stock selection and an underweight to information technology (“IT”), especially Oracle Corp. Japan and Hewlett-Packard Company, detracted from relative return. The Trust’s underweight to IT has been driven by a preference for larger-cap, mature technology companies with prospects for long-term earnings and dividend growth. In health care, the Trust’s overweight to Bristol-Myers Squibb Co. detracted from performance. Relative weakness for Bristol-Myers Squibb can be attributed to concerns over delays in its development pipeline and increasing immuno-oncology (“I/O”) competition. The investment advisor’s view was that the potential of I/O drugs is enormous, and that Bristol-Myers Squibb has the strongest clinical I/O pipeline, which gives the firm multiple opportunities for market share gain. |

| Ÿ | | Also during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy detracted from both relative and absolute performance during the period. |

Describe recent portfolio activity.

| Ÿ | | While the Trust has typically maintained an overweight in consumer staples due to the sector’s healthy balance sheets, stable earnings and consistent dividend streams, its allocation there was reduced over the period due to concerns regarding valuations and the potential for slowing earnings and dividend growth. Within financials, while the sector remains an underweight relative to the benchmark, the Trust has increased its allocation given the sector’s improved fundamentals, the potential for dividend growth as well as attractive valuations. |

Describe Trust positioning at period end.

| Ÿ | | During the period, the Trust sought opportunities in sectors and industries that are likely to benefit from the slowly improving economy and the higher – but not exceedingly high – interest rate environment that the investment advisor believes is unfolding. The Trust had increased exposure to U.S. financial companies, select IT names, and industrials, where the investment advisor sees the strongest fundamentals, the greatest potential for dividend growth and the most attractive valuations. The Trust had eliminated and/or reduced certain positions within consumer staples, telecommunication services and utilities, where valuations had moved higher and dividend growth potential is viewed as limited. As of period end, the Trust’s largest sector allocations on an absolute basis were in financials, consumer staples, health care, industrials and energy. The Trust remained positioned in high quality stocks with a special emphasis on providing relative protection and growth of income. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 6 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | |

| | | BlackRock Dividend Income Trust |

| | |

Symbol on New York Stock Exchange (“NYSE”) MKT | | BQY |

Initial Offering Date | | May 28, 2004 |

Current Distribution Rate on Closing Market Price as of October 31, 2014 ($13.18)1 | | 6.98% |

Current Monthly Distribution per Common Share2,3 | | $0.0767 |

Current Annualized Distribution per Common Share2 | | $0.9204 |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | On June 5, 2014, the Board of the Trustees approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 2 of the Notes to Financial Statements for additional information. |

|

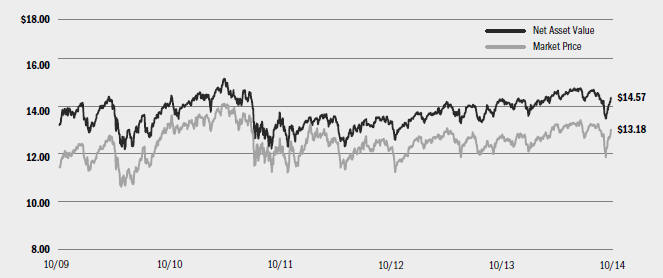

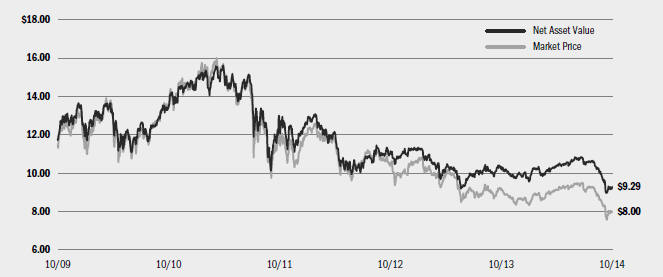

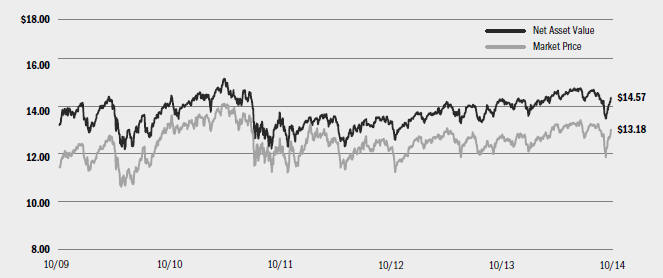

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | | 10/31/14 | | | | 10/31/13 | | | | Change | | | | High | | | | Low | |

Market Price | | $ | 13.18 | | | $ | 12.84 | | | | 2.65 | % | | $ | 13.59 | | | $ | 11.75 | |

Net Asset Value | | $ | 14.57 | | | $ | 14.42 | | | | 1.04 | % | | $ | 14.98 | | | $ | 13.66 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 10/31/14 |

| | | | |

Exxon Mobil Corp. | | | 3 | % |

The Walt Disney Co. | | | 3 | |

Bristol-Myers Squibb Co. | | | 2 | |

Altria Group, Inc. | | | 2 | |

Chevron Corp. | | | 2 | |

Microsoft Corp. | | | 2 | |

3M Co. | | | 2 | |

Emerson Electric Co. | | | 2 | |

The Home Depot, Inc. | | | 2 | |

Johnson & Johnson | | | 2 | |

| | | | |

| Sector Allocation | | 10/31/14 | | 10/31/13 |

Financials | | 24% | | 20% |

Consumer Staples | | 12 | | 14 |

Health Care | | 12 | | 11 |

Industrials | | 11 | | 12 |

Energy | | 9 | | 11 |

Information Technology | | 8 | | 7 |

Consumer Discretionary | | 8 | | 8 |

Utilities | | 7 | | 7 |

Materials | | 5 | | 4 |

Telecommunication Services | | 4 | | 6 |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 7 |

| | |

| Trust Summary as of October 31, 2014 | | BlackRock EcoSolutions Investment Trust |

BlackRock EcoSolutions Investment Trust’s (BQR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities issued by companies that are engaged in one or more of New Energy (e.g., products, technologies and services connected to the efficient use of energy or the provision or manufacture of alternative forms of energy), Water Resources and Agriculture business segments. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

On July 30, 2014, the Boards of the Trust, BlackRock Real Asset Equity Trust (“BCF”) and BlackRock Resources & Commodities Strategy Trust (“BCX”) approved the reorganizations of the Trust and BCF with and into BCX, with BCX continuing as the surviving fund after the reorganizations. At a special meeting of shareholders on November 10, 2014, the shareholders of the Trust, BCF and BCX approved the reorganizations of the Trust and BCF with and into BCX. The reorganization was completed on December 8, 2014.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 5.74% based on market price and 5.55% based on NAV. For the same period, the closed-end Lipper Utility Funds category posted an average return of 17.46% based on market price and 16.22% based on NAV. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust’s position in the global agricultural products company Syngenta AG detracted from absolute performance. The company announced disappointing results, reflecting lower-than-expected sales in South America that resulted from a delayed product launch. The Trust’s holding in BrasilAgro - Cia. Brasileira de Propriedades Agricolas also detracted from performance, as investors became concerned about the potential impact of weak soybean prices on the Brazilian farmland market. The integrated solar power products manufacturer Trina Solar Ltd. was another notable detractor. The stock performed well in 2013 due to the stabilization in solar prices, but it has experienced some profit taking in 2014. In addition, it was negatively impacted by the U.S. Department of Commerce’s announcement of higher-than- expected anti-dumping tariffs against solar products made in China and Taiwan. |

| Ÿ | | The continuation of favorable weather conditions and larger-than-expected stock reports pointed towards a bumper harvest and put downward pressure on the prices of crop prices in the latter half of the period. Certain companies, including many in the agribusiness and livestock industries, benefited from this environment. The Trust’s positions in the agribusiness companies Archer-Daniels-Midland Co. (“ADM”) and Bunge Ltd., as well as its holdings in animal protein stocks BRF SA and Tyson Foods, Inc. were among the top performers during the period. ADM finalized the acquisition of WILD Flavors. This acquisition is an example of ADM’s strategy of seeking to deploy capital |

| | in high-growth, high-margin businesses that enhance its geographic diversification and may be less subject to volatility in commodity prices. |

| Ÿ | | Within the Trust’s water segment, Tianjin Capital Environmental Protection Co. Ltd. and American States Water Co. were among the notable contributors to 12-month results. Tianjin’s performance was aided by rhetoric from the Chinese government that pointed toward increased political support for environmental protection companies. The company has increased dividends each calendar year since 1954. |

| Ÿ | | The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy detracted from performance during the period. |

| Ÿ | | The Trust held an above-average cash balance during the period, which did not have a material impact on performance. |

Describe recent portfolio activity.

| Ÿ | | During the period, the Trust added to its animal protein exposure based on the strong profit outlook for companies in the industry. Crop price weakness, which has coincided with a period of price strength for livestock commodities, has been a positive for animal protein companies given that crops are a key input cost. |

| Ÿ | | In the new-energy segment of the portfolio, the Trust reduced its exposure to renewable energy technology companies and increased its position in the energy efficiency industry based on its relative valuation. In the water segment, the Trust initiated a position in the industrial conglomerate Danaher Corp. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust continued to hold large allocations to both the agriculture and water segments, with a more modest emphasis on the new-energy segment. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 8 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | |

| | | BlackRock EcoSolutions Investment Trust |

| | |

Symbol on NYSE | | BQR |

Initial Offering Date | | September 28, 2007 |

Current Distribution Rate on Closing Market Price as of October 31, 2014 ($7.65)1 | | 7.84% |

Current Monthly Distribution per Common Share2,3 | | $0.05 |

Current Annualized Distribution per Common Share2 | | $0.60 |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | On June 5, 2014, the Board of the Trustees approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 2 of the Notes to Financial Statements for additional information. |

|

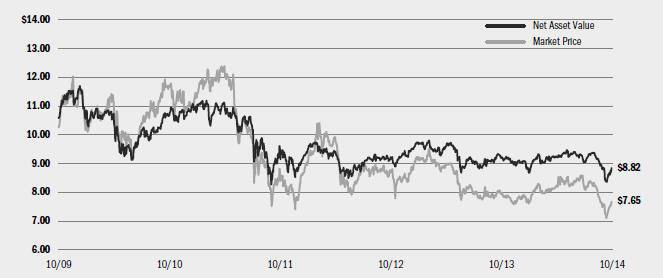

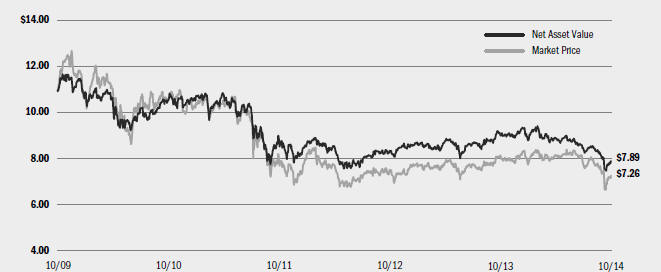

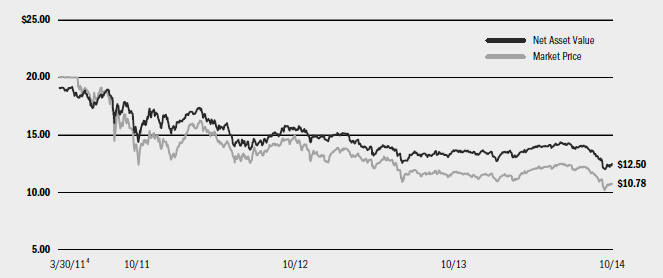

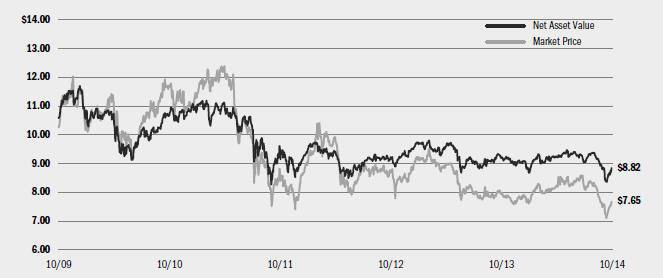

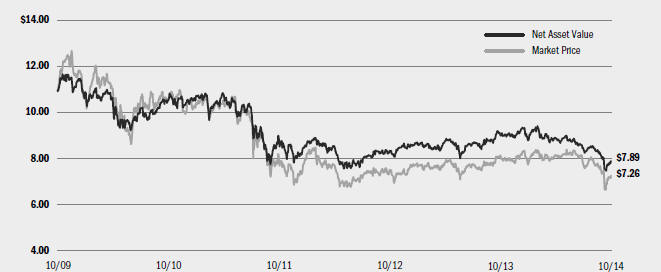

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | | 10/31/14 | | | | 10/31/13 | | | | Change | | | | High | | | | Low | |

Market Price | | $ | 7.65 | | | $ | 7.93 | | | | (3.53 | )% | | $ | 8.59 | | | $ | 6.92 | |

Net Asset Value | | $ | 8.82 | | | $ | 9.16 | | | | (3.71 | )% | | $ | 9.44 | | | $ | 8.34 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 10/31/14 |

| | | | |

Monsanto Co. | | | 5 | % |

Archer-Daniels-Midland Co. | | | 4 | |

Potash Corp. of Saskatchewan, Inc. | | | 4 | |

Bunge Ltd. | | | 4 | |

Tyson Foods, Inc., Class A | | | 4 | |

Severn Trent PLC | | | 3 | |

Syngenta AG | | | 3 | |

Ingredion, Inc. | | | 3 | |

CF Industries Holdings, Inc. | | | 3 | |

The Mosaic Co. | | | 3 | |

| | | | |

| Industry Allocation | | 10/31/14 | | 10/31/13 |

Chemicals | | 24% | | 20% |

Food Products | | 21 | | 13 |

Water Utilities | | 18 | | 26 |

Machinery | | 7 | | 12 |

Other4 | | 30 | | 29 |

| | 4 | | Other includes a 5% holding or less in each of the following industries; Electric Utilities, Electrical Equipment, Oil, Gas & Consumable Fuels, Real Estate Investment Trusts (REITs), Multi-Utilities, Commercial Services & Supplies, Construction & Engineering, Electronic Equipment, Instruments & Components, Biotechnology, Auto Components, Independent Power Producers & Energy Traders, Semiconductors & Semiconductor Equipment, Road & Rail, Real Estate Management & Development, Building Products, Paper & Forest Products, Food & Staples Retailing, Industrial Conglomerates, Independent Power and Renewable Electricity Producers. |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 9 |

| | |

| Trust Summary as of October 31, 2014 | | BlackRock Energy and Resources Trust |

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions. During the period, the Board of the Trust approved a change of the fiscal year of the Trust from October 31st to December 31st.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 4.73% based on market price and (2.36)% based on NAV. For the same period, the closed-end Lipper Natural Resources Funds category posted an average return of 11.02% based on market price and 9.05% based on NAV. All returns reflect reinvestment of dividends and/or distributions. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The price of oil fell sharply during the 12-month period. Global growth expectations weakened, as evidenced by the International Monetary Fund’s reduction of its global economic growth forecast to 3.3% from 3.7% at the start of 2014. The resulting decrease in the demand for oil came at a time of strong supply growth, which pressured prices. During September 2014, OPEC crude oil output rose to its highest level since the summer of 2013 due in part to Libya’s continued recovery and increased flows from Iraq. |

| Ÿ | | In this environment, the Trust’s positions in the North American stocks Noble Energy, Inc. and Encana Corp. weighed on returns. Both stocks lost ground on concerns that lower oil prices will affect their pace of growth. Noble Energy was the Trust’s largest detractor, as the market became wary of the company’s natural gas exposure in Israel once the conflict in Gaza escalated. The company also reduced guidance during the third quarter of 2014, attributing this development to third-party infrastructure bottlenecks in the United States. The Trust’s position in the global exploration & production company Cairn Energy PLC also detracted from performance. The company came under scrutiny from the Indian tax |

| | authorities as a result of the initial public offering of its Indian subsidiary, Cairn India, in 2006. |

| Ÿ | | The Trust’s holdings in large-cap integrated oil & gas companies such as Royal Dutch Shell PLC, Exxon Mobil Corp. and BP PLC bolstered absolute performance. Integrated companies performed well as a group, as the market responded positively to the better-than-expected results, improving free cash flow profiles and attractive valuations of companies in the industry. Additionally, integrated companies typically have lower sensitivity to oil price moves than the wider energy sector due to their size, stronger financial position and diversified operations. |

| Ÿ | | The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy did not have a material impact on performance during the period. |

Describe recent portfolio activity.

| Ÿ | | During the period, the Trust increased its exposure to the integrated oil & gas industry, where relative price-to-book ratios fell to multi-decade lows. Within this industry, the Trust initiated a position in Total SA and notably increased its exposure to Royal Dutch Shell PLC, which appointed a new CEO in January 2014 and increased its focus on capital discipline. The Fund also initiated a position in the shale gas producer Southwestern Energy Co. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust held its largest allocations in the oil & gas exploration & production and integrated oil & gas sub-industries, and it held smaller allocations to oil services, distribution and refining & marketing stocks. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 10 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | |

| | | BlackRock Energy and Resources Trust |

| | |

Symbol on NYSE | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of October 31, 2014 ($23.78)1 | | 6.81% |

Current Monthly Distribution per Common Share2,3 | | $0.135 |

Current Annualized Distribution per Common Share2 | | $1.620 |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | On June 5, 2014, the Board of the Trustees approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 2 of the Notes to Financial Statements for additional information. |

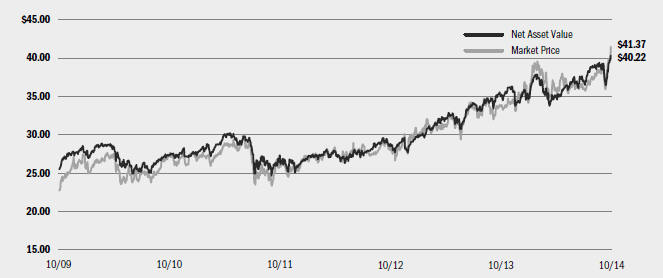

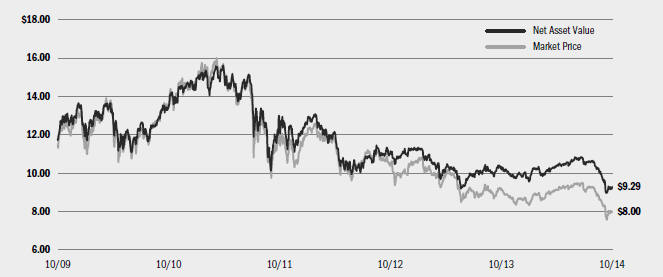

| | |

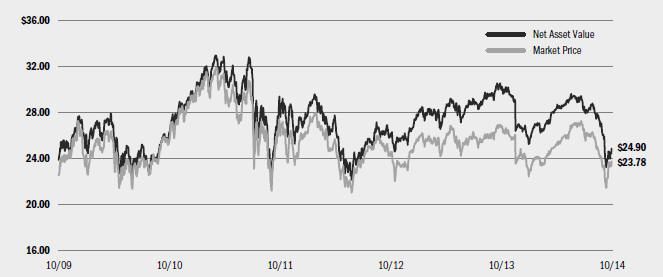

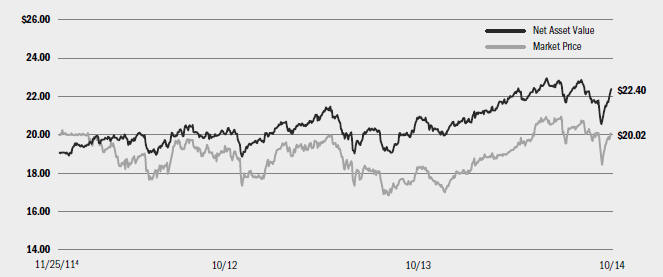

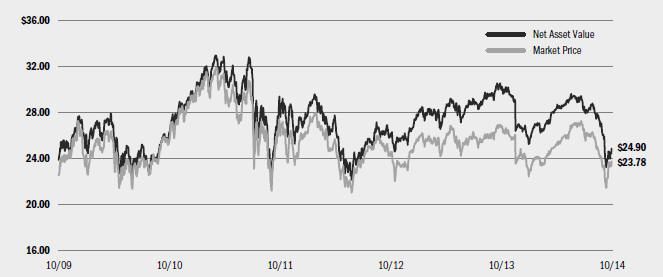

| Market Price and Net Asset Value Per Share Summary | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | 10/31/14 | | | | 10/31/13 | | | | Change | | | | High | | | | Low | |

Market Price | | $ | 23.78 | | | $ | 26.82 | | | | (11.33 | )% | | $ | 27.30 | | | $ | 20.77 | |

Net Asset Value | | $ | 24.90 | | | $ | 30.12 | | | | (17.33 | )% | | $ | 30.28 | | | $ | 23.27 | |

|

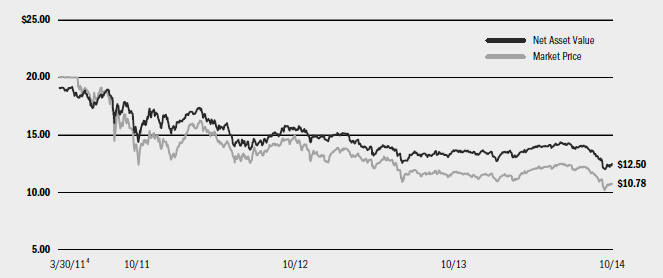

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 10/31/14 |

| | | | |

Chevron Corp. | | | 11 | % |

Royal Dutch Shell PLC, Class A — ADR | | | 11 | |

Exxon Mobil Corp. | | | 10 | |

ConocoPhillips | | | 6 | |

Schlumberger Ltd. | | | 5 | |

Anadarko Petroleum Corp. | | | 5 | |

Total SA | | | 5 | |

Marathon Oil Corp. | | | 3 | |

Devon Energy Corp. | | | 3 | |

EOG Resources, Inc. | | | 3 | |

| | | | |

| Industry Allocation | | 10/31/14 | | 10/31/13 |

Oil, Gas & Consumable Fuels | | 91% | | 83% |

Energy Equipment & Services | | 9 | | 17 |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 11 |

| | |

| Trust Summary as of October 31, 2014 | | BlackRock Enhanced Capital and Income Fund, Inc. |

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity and debt securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions. During the period, the Board of the Trust approved a change of the fiscal year of the Trust from October 31st to December 31st.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 20.43% based on market price and 10.49% based on NAV. For the same period, the benchmark S&P 500® Value Index returned 14.96%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust underperformed the benchmark index due to stock selection in the financials, consumer staples and information technology (“IT”) sectors. Notable individual detractors from performance included Samsung Electronics Co. Ltd. (semiconductors), which underperformed due to declining sales in handsets and uncertainty surrounding company management. Shares of European retailer Metro AG (consumer staples) were pressured on concerns over the company’s exposure to Russia, which came under sanctions as the geopolitical standoff continued between Russia and Ukraine. Lastly, exposure to Japan Airlines Co. Ltd. (industrials) detracted, as a weakening yen provided a headwind for results and the stock declined over the 12-month period despite the company’s industry-lowest cost structure, lack of debt and strong cash flow. |

| Ÿ | | Contributing positively to performance was an underweight in the energy sector, which significantly trailed the broader market. With respect to individual positions, standout contributors to performance included top holdings consumer electronics firm Apple Inc. (IT), fertilizer company CF Industries Holdings, Inc. (materials), managed health care provider UnitedHealth Group, Inc. (health care) and online travel provider Expedia, Inc. (consumer discretionary). CF Industries Holdings, Inc. posted strong gains as the company, under new leadership, announced |

| | steps to unlock shareholder value by focusing on its cost-advantaged nitrogen business and enhanced balance sheet management. Expedia shares benefited as the company produced strong earnings against an improving backdrop for online travel service. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | The Trust’s sector weightings are generally a result of individual stock selection. Within this context, the Trust increased exposure to the consumer discretionary sector, adding Sinclair Broadcasting Group, Inc. and Nexstar Broadcasting Group, Inc., and building a significant position in online travel provider Orbitz Worldwide, Inc. Additionally, the Trust increased exposure to airlines within the industrials sector through the purchase of United Continental Holdings, Inc. Conversely, the Trust took advantage of strong performance to exit positions in larger capitalization, more defensive holdings such as Unilever NV, General Electric Co., General Mills, Inc. and Kimberly-Clark Corp. Within energy, exposure to large integrated oil & gas companies Exxon Mobil Corp. and Chevron Corp. was eliminated on concerns over the ability of both companies to replace reserves. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the S&P 500® Value Index, the Trust ended the period with its most significant overweights in consumer discretionary and IT. Conversely, the Trust was significantly underweight in more defensive sectors, including utilities and consumer staples, due to valuation concerns. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 12 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | |

| | | BlackRock Enhanced Capital and Income Fund, Inc. |

| | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of October 31, 2014 ($14.89)1 | | 8.06% |

Current Monthly Distribution per Common Share2,3 | | $0.10 |

Current Annualized Distribution per Common Share2 | | $1.20 |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | On June 5, 2014, the Board of the Trustees approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 2 of the Notes to Financial Statements for additional information. |

|

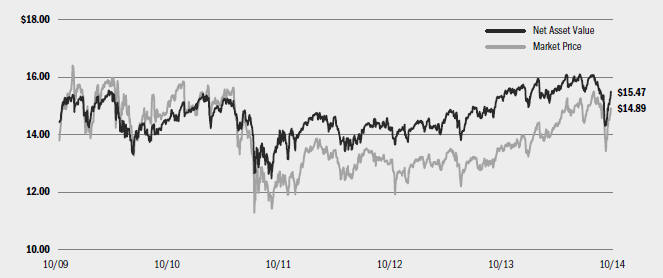

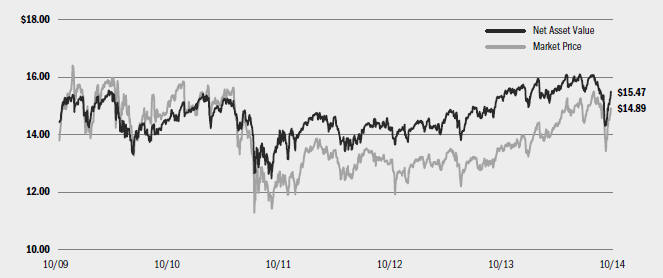

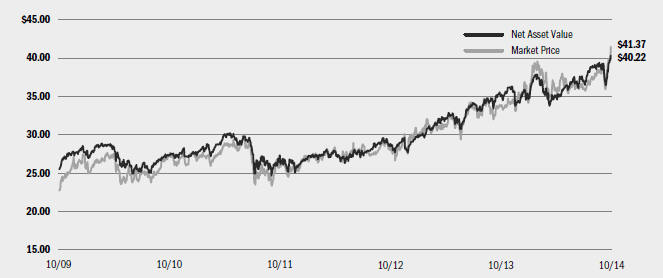

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | | 10/31/14 | | | | 10/31/13 | | | | Change | | | | High | | | | Low | |

Market Price | | $ | 14.89 | | | $ | 13.52 | | | | 10.13 | % | | $ | 15.49 | | | $ | 13.15 | |

Net Asset Value | | $ | 15.47 | | | $ | 15.31 | | | | 1.05 | % | | $ | 16.07 | | | $ | 14.27 | |

|

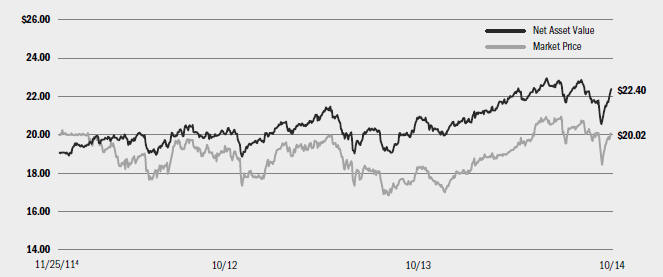

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 10/31/14 |

| | | | |

UnitedHealth Group, Inc. | | | 5 | % |

Apple, Inc. | | | 5 | |

Japan Airlines Co. Ltd. | | | 5 | |

Sinclair Broadcast Group, Inc., Class A | | | 4 | |

American International Group, Inc. | | | 4 | |

Orbitz Worldwide, Inc. | | | 4 | |

Suncor Energy, Inc. | | | 3 | |

CF Industries Holdings, Inc. | | | 3 | |

FNF Group | | | 3 | |

Pfizer, Inc. | | | 3 | |

| | | | |

| Sector Allocation | | 10/31/14 | | 10/31/13 |

Financials | | 21% | | 18% |

Information Technology | | 20 | | 20 |

Consumer Discretionary | | 19 | | 11 |

Health Care | | 15 | | 14 |

Industrials | | 8 | | 7 |

Energy | | 7 | | 13 |

Materials | | 4 | | 5 |

Consumer Staples | | 3 | | 6 |

Telecommunication Services | | 3 | | 6 |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 13 |

| | |

| Trust Summary as of October 31, 2014 | | BlackRock Enhanced Equity Dividend Trust |

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

On July 30, 2014, the Boards of the Trust and BlackRock Dividend Income Trust (“BQY”) approved the reorganization of BQY with and into the Trust, with the Trust continuing as the surviving fund after the reorganization. At a special meeting of shareholders on November 10, 2014, the shareholders of BQY approved the reorganization of BQY with and into the Trust. The reorganization was completed on December 8, 2014. During the period, the Board of the Trust approved a change of the fiscal year of the Trust from October 31st to December 31st.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 16.42% based on market price and 11.40% based on NAV. For the same period, the Russell 1000® Value Index returned 16.46%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Relative to the benchmark index, the largest contributors to performance came from stock selection in the industrials and consumer discretionary sectors. Within industrials, the non-benchmark holding Union Pacific Corp. continued to post strong gains, driven by healthy revenue growth and a recovering domestic economy. |

| Ÿ | | In addition, the Trust’s overweight positions in defense contractors Raytheon Co., Northrup Grumman Corp. and Lockheed Martin Corp. posted gains based on renewed geopolitical uncertainty. Within consumer discretionary, an underweight to automobiles – specifically a lack of holdings in Ford Motor Co. and General Motors Co. – and an overweight to non-benchmark positions The Home Depot, Inc. and Comcast Corp., Special Class A shares added to relative performance. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. During the period, the Trust’s option writing strategy detracted from absolute performance while contributing to relative performance. |

| Ÿ | | The largest detractors from relative performance were stock selection in consumer staples and a combination of stock selection and an underweight in the information technology and health care sectors. |

| Ÿ | | The Trust’s positions in non-benchmark companies Philip Morris International, Inc. and British beverage firm Diageo PLC were the largest individual detractors for the 12-month period. Philip Morris International, Inc. suffered from concerns related to emerging market weakness and foreign exchange. Ultimately, the investment advisor |

| | believes that the company’s global scale and strong brand loyalty will result in solid pricing and market share gains for its products. Within health care, an underweight to health care providers & services and an overweight to Bristol-Myers Squibb Co. detracted from returns. Relative weakness for Bristol-Myers Squibb can be attributed to concerns over delays in its development pipeline and increasing immuno-oncology (“I/O”) competition. The investment advisor’s view was that the potential of I/O drugs is enormous, and that Bristol-Myers Squibb has the strongest clinical I/O pipeline, which gives the firm multiple opportunities for market share gain. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, overall portfolio turnover was low. In addition, while the Trust has typically maintained an overweight in consumer staples due to the sector’s healthy balance sheets, stable earnings and consistent dividend streams, its allocation there was reduced over the period due to concerns regarding valuations and the potential for slowing earnings and dividend growth. Within financials, while the sector remains an underweight relative to the benchmark, the Trust has increased its allocation given the sector’s improved fundamentals, the potential for dividend growth as well as attractive valuations. The Trust also increased exposure to select information technology names as well as to industrials, where the investment advisor saw the strongest fundamentals, the greatest potential for dividend growth and the most attractive valuations. Lastly, the Trust reduced its exposure to telecommunication services, and to utilities, where valuations had moved higher and the investment advisor viewed dividend growth potential as limited. |

Describe portfolio positioning at period end.

| Ÿ | | During the period, the Trust sought opportunities in sectors and industries that are likely to benefit from the slowly improving economy and the higher – but not exceedingly high – interest rate environment that the investment advisor believes is unfolding. As of the end of the period, the Trust’s largest sector allocations on an absolute basis were in financials, industrials, energy, health care and consumer discretionary. The Trust remained positioned in high quality stocks with a special emphasis on providing relative protection and growth of income. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 14 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | | | |

| | | | BlackRock Enhanced Equity Dividend Trust | |

| | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of October 31, 2014 ($ 8.35)1 | | 6.71% |

Current Monthly Distribution per Common Share2,3 | | $0.0467 |

Current Annualized Distribution per Common Share2 | | $0.5604 |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| | 2 | | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| | 3 | | On June 5, 2014, the Board of the Trustees approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 2 of the Notes to Financial Statements for additional information. |

|

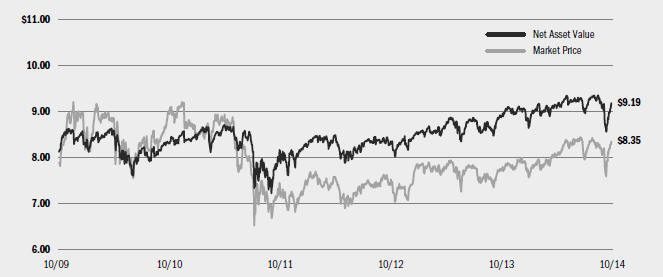

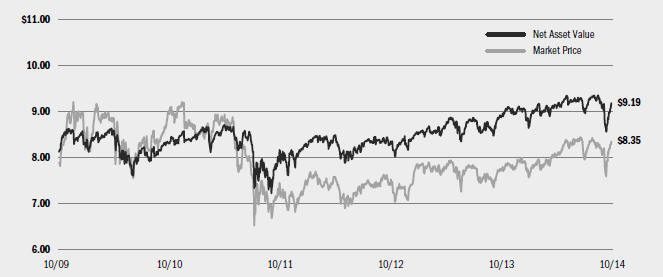

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 10/31/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 8.35 | | | $ | 7.72 | | | | 8.16 | % | | $ | 8.47 | | | $ | 7.27 | |

Net Asset Value | | $ | 9.19 | | | $ | 8.88 | | | | 3.49 | % | | $ | 9.36 | | | $ | 8.57 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 10/31/14 |

| | | | |

Wells Fargo & Co. | | | 4 | % |

JPMorgan Chase & Co. | | | 3 | |

Comcast Corp., Special Class A | | | 3 | |

General Electric Co. | | | 3 | |

The Home Depot, Inc. | | | 3 | |

Merck & Co., Inc. | | | 2 | |

Raytheon Co. | | | 2 | |

Microsoft Corp. | | | 2 | |

Chevron Corp. | | | 2 | |

Exxon Mobil Corp. | | | 2 | |

| | | | |

| Sector Allocation | | 10/31/14 | | 10/31/13 |

Financials | | 27% | | 21% |

Industrials | | 15 | | 13 |

Energy | | 10 | | 14 |

Health Care | | 10 | | 9 |

Consumer Discretionary | | 10 | | 9 |

Consumer Staples | | 8 | | 12 |

Information Technology | | 7 | | 5 |

Utilities | | 6 | | 6 |

Materials | | 5 | | 7 |

Telecommunication Services | | 2 | | 4 |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 15 |

| | | | |

| Trust Summary as of October 31, 2014 | | | BlackRock Global Opportunities Equity Trust | |

BlackRock Global Opportunities Equity Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities or options on equity securities or indices or sectors of equity securities. Under normal circumstances, the Trust invests a substantial amount of its total assets in foreign issuers, issuers that primarily trade in a market located outside the United States or issuers that do a substantial amount of business outside the United States. The Trust may invest directly in such securities or synthetically through the use of derivatives. During the period, the Board of the Trust approved a change of the fiscal year of the Trust from October 31st to December 31st.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 4.09% based on market price and 2.10% based on NAV. For the same period, the MSCI All Country World Index posted a return of 7.77%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | An overweight position in Europe was the primary cause of the Trust’s underperformance relative to the benchmark, as holdings within the financials and consumer discretionary sectors were negatively impacted by weaker-than-expected economic growth. In particular, positions in diversified banks within financials and movies & entertainment within consumer discretionary underperformed. Recent actions by the European Central Bank (“ECB”), and the potential for additional ECB steps such as a government bond purchase program, support the outlook for growth and for the Trust’s holdings of European financial and consumer discretionary companies. |

| Ÿ | | Stock selection in materials was the largest relative contributor to performance, while an underweight in the sector also contributed. In particular, positioning in the specialty chemicals segment benefited from lower input costs because of the ongoing development of U.S. shale gas and |

| | | oil resources. An overweight in health care also contributed, as the sector benefited from a positive outlook for new products and increased investor optimism regarding the long-term prospects for the group. |

| Ÿ | | Also, during the period, the Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s options writing strategy generated net gains during the period. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust reduced exposure to more cyclical sectors such as industrials and consumer discretionary. The proceeds were used to increase exposure to more defensive companies in the health care sector and to U.S. financial companies positioned to benefit from an accelerating U.S. economy. Regionally, the Trust reduced its exposure to developed Europe and Japan, using the proceeds to add to its holdings in the United States and emerging Asia. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the MSCI All Country World Index, the Trust ended the period overweight in the United States and Europe, and underweight in emerging markets and Japan. From a sector perspective, the Trust was most notably overweight in health care and financials, while the most significant underweights were in utilities and materials. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 16 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | | | |

| | | | BlackRock Global Opportunities Equity Trust | |

| | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of October 31, 2014 ($ 14.00)1 | | 8.91% |

Current Monthly Distribution per Common Share2,3 | | $0.1039 |

Current Annualized Distribution per Common Share2 | | $1.2468 |

| | 1 | | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| | 2 | | The monthly distribution per common share, declared on December 8, 2014, was decreased to $0.097 per share. The current distribution rate on closing market price, current monthly distribution per common share and current annualized distribution per common share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

| | 3 | | On June 5, 2014, the Board of the Trustees approved a change to the frequency of regular Trust distributions from quarterly to monthly. Please see Note 2 of the Notes to Financial Statements for additional information. |

|

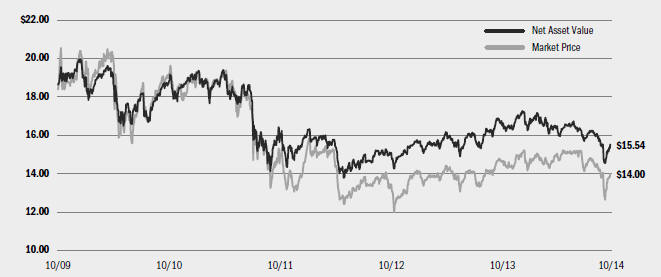

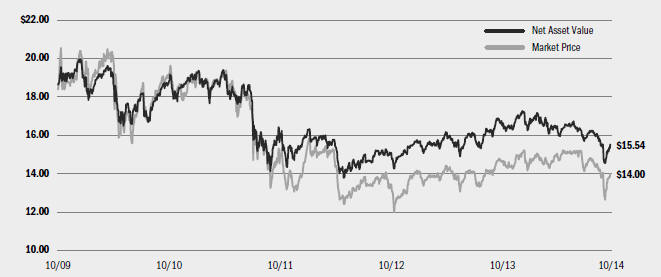

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

| | | 10/31/14 | | | 10/31/13 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.00 | | | $ | 14.74 | | | | (5.02 | )% | | $ | 15.25 | | | $ | 12.52 | |

Net Asset Value | | $ | 15.54 | | | $ | 16.68 | | | | (6.83 | )% | | $ | 17.27 | | | $ | 14.55 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | |

| Ten Largest Holdings | | 10/31/14 |

| | | | |

Apple, Inc. | | | 3 | % |

JPMorgan Chase & Co. | | | 2 | |

Chevron Corp. | | | 2 | |

Anheuser-Busch InBev NV | | | 2 | |

Merck & Co., Inc. | | | 1 | |

Comcast Corp., Class A | | | 1 | |

The Hartford Financial Services Group, Inc. | | | 1 | |

Novartis AG | | | 1 | |

AIA Group Ltd. | | | 1 | |

Naspers Ltd., N Shares | | | 1 | |

| | | | |

| Geographic Allocation | | 10/31/14 | | 10/31/13 |

United States | | 57% | | 44% |

United Kingdom | | 7 | | 10 |

Japan | | 5 | | 8 |

France | | 4 | | 8 |

China | | 3 | | 2 |

Germany | | 3 | | 2 |

Other4 | | 21 | | 26 |

| | 4 | | Other includes a 2% holding or less in each of the following countries; |

| | | | Switzerland, India, Spain, Hong Kong, Sweden, Belgium, South Africa, Canada, Ireland, Indonesia, Italy, Panama, Greece, Peru, South Korea, Mexico, Brazil, New Zealand, Taiwan, Russia, Netherlands and Thailand, Australia. |

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2014 | | 17 |

| | | | |

| Trust Summary as of October 31, 2014 | | | BlackRock Health Sciences Trust | |

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions. During the period, the Board of the Trust approved a change of the fiscal year of the Trust from October 31st to December 31st.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2014, the Trust returned 36.99% based on market price and 28.00% based on NAV. For the same period, the Russell 3000® Healthcare Index returned 29.60%. All returns reflect reinvestment of dividends and/or distributions. The Trust moved from a discount to NAV to a premium by period end, which accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | All segments of the health care sector contributed to relative performance during the 12-month period. Favorable clinical developments, mergers and acquisitions (M&A) and/or the reporting of strong underlying financial results drove the positive performance. The biotechnology industry was the largest contributor, as several Trust holdings performed well on the strength of clinical developments. Two of the largest individual contributors were Puma Biotechnology, Inc. and InterMune, Inc., which received positive clinical data on a breast cancer drug and a pulmonary fibrosis treatment, respectively. InterMune also received an acquisition bid from Roche AG. The Trust also benefitted from M&A in the health care equipment & supplies industry, as Covidien PLC and CareFusion Corp. received acquisition offers. In addition, the life sciences tools & services company Illumina, Inc. and the health care equipment company Edwards LifeSciences Corp. both reported solid financial results. Similarly, a position in the health care facilities company HCA Holdings, Inc. also reported good results due in part to changes associated with the Affordable Care Act. Lastly, strong relative |

| | | performance in the pharmaceutical industry was led by the Trust’s underweight positions in several large benchmark components that lagged during the period, including Pfizer, Inc. and Johnson & Johnson. |

| Ÿ | | In a period of strong performance, only a few elements of the Trust’s positioning detracted from its return. The largest detractors were the Trust’s underweight allocation to the managed health care industry, as well as its positions in several non-U.S. pharmaceutical stocks. |

| Ÿ | | The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy modestly detracted from performance. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust’s allocations were generally in line with their allocations at the end of the prior fiscal year. The Trust slightly increased its allocations in the health care providers & services and medical devices & supplies industries, while it marginally decreased exposure in the biotechnology and pharmaceutical industries. These allocations were the byproduct of the Trust’s bottom-up, fundamental investment process. |

Describe portfolio positioning at period end.

| Ÿ | | The Trust continues to focus on identifying innovative companies. Accordingly, its three largest allocations at period end were to the biotechnology, medical devices & supplies and pharmaceuticals industries, where uptrends in the innovation cycle have supported positive secular growth. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 18 | | ANNUAL REPORT | | OCTOBER 31, 2014 | | |

| | | | |