UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22032

Name of Fund: BlackRock Enhanced International Dividend Trust (BGY)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Enhanced

International Dividend Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2017

Date of reporting period: 12/31/2017

Item 1 – Report to Stockholders

DECEMBER 31, 2017

| | |

ANNUAL REPORT | |  |

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Enhanced Global Dividend Trust (BOE)

BlackRock Enhanced International Dividend Trust (BGY)

BlackRock Health Sciences Trust (BME)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Science and Technology Trust (BST)

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

In the 12 months ended December 31, 2017, risk assets, such as stocks and high-yield bonds, continued to deliver strong performance. The equity market advanced, month after month, despite geopolitical uncertainty and relatively high valuations, while bond returns were constrained by higher interest rates.

Rising interest rates worked against high-quality assets with more interest rate sensitivity. Consequently, longer-term U.S. Treasuries posted modest returns, as rising energy prices, modest wage increases, and steady job growth led to expectations of higher inflation and interest rate increases by the U.S. Federal Reserve (the “Fed”).

The market’s performance reflected reflationary expectations early in the reporting period, as investors began to sense that a global recovery was afoot. Thereafter, many countries throughout the world experienced sustained and synchronized growth for the first time since the financial crisis. Growth rates and inflation are still relatively low, but they are finally rising together.

The Fed responded to these positive developments by increasing short-term interest rates three times and setting expectations for additional interest rate increases. The Fed also began reducing the vast balance sheet reserves that had accumulated in the wake of the financial crisis. In October 2017, the Fed reduced its $4.5 trillion balance sheet by only $10 billion, while setting expectations for additional modest reductions and rate hikes in 2018.

By contrast, the European Central Bank (“ECB”) and the Bank of Japan (“BoJ”) both continued to expand their balance sheets despite nascent signs of sustained economic growth. The Eurozone and Japan are both approaching the limits of central banks’ ownership share of national debt, which is a structural pressure point that limits their capacity to deliver additional monetary stimulus. In October 2017, the ECB announced plans to cut the amount of its bond purchases in half for 2018, while the BoJ reiterated its commitment to economic stimulus until the inflation rate rises to its target of 2%.

Emerging market growth also stabilized, as accelerating growth in China, the second largest economy in the world and the most influential of all developing economies, improved the outlook for corporate profits and economic growth across most developing nations. Chinese demand for commodities and other raw materials allayed concerns about the country’s banking system, leading to rising equity prices and foreign investment flows.

While escalating tensions between the United States and North Korea and our nation’s divided politics are concerning, benign credit conditions, modest inflation, solid corporate earnings, and the positive outlook for growth in the world’s largest economies have kept markets relatively tranquil.

Rising consumer confidence and improving business sentiment are driving momentum for the U.S. economy. If the Fed maintains a measured pace of stimulus reduction, to the extent that inflation rises, it’s likely to be accompanied by rising real growth and higher wages. That could lead to a favorable combination of moderately higher inflation, steadily rising interest rates, and improving growth in 2018.

Further fueling optimism, Congress passed a sweeping tax reform bill in December 2017. The U.S. tax overhaul is likely to accentuate the reflationary themes already in place, including faster growth and rising interest rates. Changing the corporate tax rate to a flat 21% will create many winners and losers among high-and-low tax companies, while the windfall from lower taxes could boost business and consumer spending.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of December 31, 2017 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 11.42% | | 21.83% |

U.S. small cap equities

(Russell 2000® Index) | | 9.20 | | 14.65 |

International equities

(MSCI Europe, Australasia,

Far East Index) | | 9.86 | | 25.03 |

Emerging market equities

(MSCI Emerging Markets Index) | | 15.92 | | 37.28 |

3-month Treasury bills

(ICE BofAML 3-Month U.S. Treasury Bill Index) | | 0.55 | | 0.86 |

U.S. Treasury securities

(ICE BofAML 10-Year U.S. Treasury Index) | | (0.01) | | 2.07 |

U.S. investment grade bonds

(Bloomberg Barclays U.S.

Aggregate Bond Index) | | 1.24 | | 3.54 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 1.64 | | 4.95 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer

Capped Index) | | 2.46 | | 7.50 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGEISNOT PARTOF YOUR FUND REPORT |

Supplemental Information (unaudited)

Section 19(a) Notices

BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Global Dividend Trust’s (BOE), BlackRock Enhanced International Dividend Trust’s (BGY), BlackRock Health Sciences Trust’s (BME), BlackRock Resources & Commodities Strategy Trust’s (BCX), BlackRock Science and Technology Trust’s (BST) and BlackRock Utilities, Infrastructure & Power Opportunities Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

December 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions

for the Fiscal Period | | | % Breakdown of the Total Cumulative

Distributions for the Fiscal Period | |

| | | Net Investment Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital | | | Total Per Common

Share | | | Net Investment Income | | | Net Realized

Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital | | | Total Per

Common

Share | |

BGR* | | $ | 0.404129 | | | $ | — | | | $ | — | | | $ | 0.527071 | | | $ | 0.931200 | | | | 43 | % | | | — | % | | | — | % | | | 57 | % | | | 100 | % |

CII* | | | 0.148793 | | | | — | | | | — | | | | 0.844807 | | | | 0.993600 | | | | 15 | | | | — | | | | — | | | | 85 | | | | 100 | |

BDJ | | | 0.163613 | | | | — | | | | 0.396787 | | | | — | | | | 0.560400 | | | | 29 | | | | — | | | | 71 | | | | — | | | | 100 | |

BOE | | | 0.144688 | | | | 0.649691 | | | | 1.491621 | | | | — | | | | 2.286000 | | | | 6 | | | | 29 | | | | 65 | | | | — | | | | 100 | |

BME* | | | 0.025870 | | | | — | | | | 1.468233 | | | | 0.905897 | | | | 2.400000 | | | | 1 | | | | — | | | | 61 | | | | 38 | | | | 100 | |

BGY* | | | 0.077022 | | | | — | | | | — | | | | 0.378978 | | | | 0.456000 | | | | 17 | | | | — | | | | — | | | | 83 | | | | 100 | |

BCX* | | | 0.197497 | | | | — | | | | — | | | | 0.407703 | | | | 0.605200 | | | | 33 | | | | — | | | | — | | | | 67 | | | | 100 | |

BST* | | | — | | | | — | | | | 0.195212 | | | | 1.084788 | | | | 1.280000 | | | | — | | | | — | | | | 15 | | | | 85 | | | | 100 | |

BUI | | | 0.543259 | | | | — | | | | 0.908741 | | | | — | | | | 1.452000 | | | | 37 | | | | — | | | | 63 | | | | — | | | | 100 | |

| | * | Certain Trusts estimate that they have distributed more than the amount of earned income and net realized gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce the Trust’s net asset value per share. | |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website at http://www.blackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts distribute the following fixed amounts per share on a monthly basis as of December 31, 2017:

| | | | |

| Exchange Symbol | | Amount Per

Common Share | |

BGR | | $ | 0.0776 | |

CII | | | 0.0828 | |

BDJ | | | 0.0467 | |

BOE | | | 0.0780 | |

BME | | | 0.2000 | |

BGY | | | 0.0380 | |

BCX | | | 0.0516 | |

BST | | | 0.1300 | |

BUI | | | 0.1210 | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Trusts to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to BME’s prospectus for a more complete description of its risks.

| | | | |

| SUPPLEMENTAL INFORMATION | | | 3 | |

Table of Contents

The Benefits and Risks of Option Over-Writing

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to enhance the Trusts’ distribution rate and total return performance. However, these objectives cannot be achieved in all market conditions.

The Trusts primarily write single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, the Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trusts receive cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trusts. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trusts realize gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by the Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Each Trust employs a plan to support a level distribution of income, capital gains and/or return of capital. The goal of the plan is to provide shareholders with consistent and predictable cash flows by setting distribution rates based on expected long-term returns of the Trusts. Such distributions, under certain circumstances, may exceed a Trust’s total return performance. When total distributions exceed total return performance for the period, the difference reduces the Trust’s total assets and net asset value per share (“NAV”) and, therefore, could have the effect of increasing the Trust’s expense ratio and reducing the amount of assets, the Trust has available for long term investment. In order to make these distributions, a Trust may have to sell portfolio securities at less than opportune times.

The final tax characterization of distributions is determined after the fiscal year and is reported in the Trust’s annual report to shareholders. Distributions can be characterized as ordinary income, capital gains and/or return of capital. The Trust’s taxable net investment income or net realized capital gains (“taxable income”) may not be sufficient to support the level of distributions paid. To the extent that distributions exceed the Trust’s current and accumulated earnings and profits, the excess may be treated as a non-taxable return of capital. Distributions that exceed a Trust’s taxable income but do not exceed the Trust’s current and accumulated earnings and profits, may be classified as ordinary income which are taxable to shareholders. Such distributions are reported as distributions in excess of net investment income.

A return of capital distribution does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ A return of capital is a return of a portion of an investor’s original investment. A return of capital is not taxable, but it reduces a shareholder’s tax basis in his or her shares, thus reducing any loss or increasing any gain on a subsequent disposition by the shareholder of his or her shares. It is possible that a substantial portion of the distributions paid during a calendar year may ultimately be classified as return of capital or as distributions in excess of net investment income for U.S. federal income tax purposes when the final determination of the source and character of the distributions is made.

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | |

| THE BENEFITSAND RISKSOF OPTION OVER-WRITING | | | 5 | |

| | |

| Trust Information as of December 31, 2017 | | BlackRock Energy and Resources Trust |

Investment Objective

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange (“NYSE”) | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($14.18)(a) | | 6.57% |

Current Monthly Distribution per Common Share(b) | | $0.0776 |

Current Annualized Distribution per Common Share(b) | | $0.9312 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGR(a)(b) | | | 5.11 | % | | | 3.49 | % |

Lipper Natural Resources Funds(c) | | | 7.33 | | | | 1.06 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend as calculated by Lipper. | |

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

Oil prices, after declining in the first half of the year, staged a strong recovery once signs emerged that the oil market was tighter than many believed. Global inventories declined at a time of the year when they typically rise, suggesting limited availability of near-term supply. However, energy stocks — after falling sharply when oil prices were weak in the first half — did not stage a rebound of equal magnitude in oil’s subsequent rally. In this environment, the Trust’s positions in more leveraged exploration and production (E&P) stocks, such as Anadarko Petroleum Corp. and Hess Corp., detracted from absolute performance.

There was a distinct performance differential between integrated energy companies and E&Ps during the year, with the former outperforming. In addition, international integrated companies outpaced their U.S. counterparts. With this as the backdrop, the Trust’s holdings in Royal Dutch Shell PLC and BP PLC were the largest contributors to absolute performance.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The option overlay strategy had a positive impact on results.

Describe recent portfolio activity.

Early in the period, the investment adviser increased the Trust’s exposure to U.S. onshore energy services companies and funded the purchases by taking profits in certain E&P holdings. Later in the period, the investment adviser increased the Trust’s exposure to the integrated energy industry while reducing its allocation to certain U.S.-based E&P stocks. The latter shift included exiting the Trust’s position in Hess Corp. and reducing its weighting in EOG Resources, Inc.

Describe portfolio positioning at period end.

The E&P sector represented the Trust’s largest allocation, followed by the integrated, oil services, distribution, and refining & marketing industries, respectively. The investment adviser positioned the Trust with a higher-quality bias, focusing on companies with robust balance sheets and low costs of production.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 6 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Energy and Resources Trust |

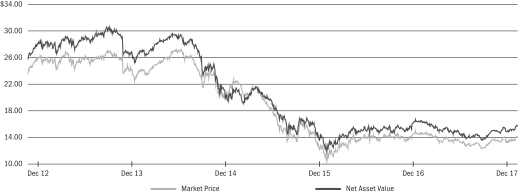

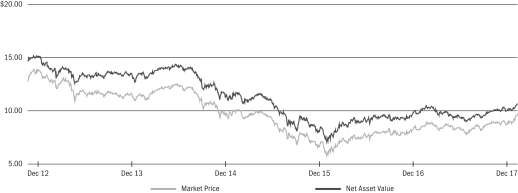

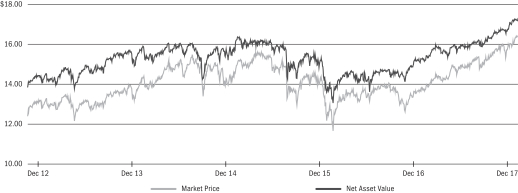

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.18 | | | $ | 14.44 | | | | (1.80 | )% | | $ | 14.87 | | | $ | 12.32 | |

Net Asset Value | | | 15.79 | | | | 16.33 | | | | (3.31 | ) | | | 16.57 | | | | 13.61 | |

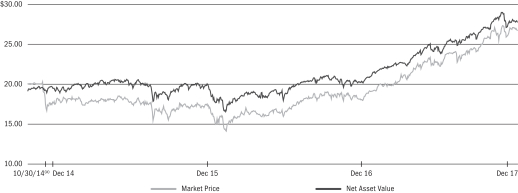

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

Chevron Corp. | | | 10 | % |

Royal Dutch Shell PLC — ADR, Class A | | | 10 | |

Exxon Mobil Corp. | | | 9 | |

BP PLC | | | 7 | |

ConocoPhillips | | | 5 | |

EOG Resources, Inc. | | | 4 | |

Halliburton Co. | | | 4 | |

Pioneer Natural Resources Co. | | | 4 | |

TransCanada Corp. | | | 3 | |

Devon Energy Corp. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 12/31/17 | | | 12/31/16 | |

Oil, Gas & Consumable Fuels | | | 90 | % | | | 91 | % |

Energy Equipment & Services | | | 10 | | | | 9 | |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | |

| Trust Information as of December 31, 2017 | | BlackRock Enhanced Capital and Income Fund, Inc. |

Investment Objective

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment policy by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($16.38)(a) | | 6.07% |

Current Monthly Distribution per Common Share(b) | | $0.0828 |

Current Annualized Distribution per Common Share(b) | | $0.9936 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

CII(a)(b) | | | 27.54 | % | | | 21.69 | % |

S&P 500® Index | | | N/A | | | | 21.83 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

In sector terms, consumer discretionary was the prime contributor to relative performance, led by household durables and specialty retail holdings. Stock selection in energy and materials also added considerable value, as did holdings within the information technology (“IT”) sector. Conversely, utilities and financials detracted from performance.

In stock specifics, Lam Research Corp. and D.R. Horton, Inc. were top individual contributors. Lam performed very well, notably in the first half of the year, on the back of strong execution and growing demand for its products, driven by the build-out of 3D NAND capacity, for which the company is a key supplier. The stock was sold by the end of the reporting period as, in the investment adviser’s view, semiconductor capital expenditures are nearing peak levels and Lam’s valuation reflected the sustainability of above-normal demand trends. Homebuilders, including D.R. Horton, outperformed during the year on continued strength in single family housing demand, particularly among first-time, entry-level homebuyers. The investment adviser thinks that cyclical and secular drivers (particularly the return of the entry-level homebuyer) should support continued growth in housing markets for the foreseeable future and, hence, sustainable earnings per share growth that is not reflected in current homebuilder share prices.

Additional contributions came from an underweight to General Electric Co., as well as the position in Activision Blizzard, Inc.

Among the largest individual detractors in the period was Walgreens Boots Alliance. Early in the reporting period, sentiment for Walgreens’ shares was negatively affected by delays in the closing of its highly anticipated merger with peer Rite-Aid. Later, the stock underperformed on press reports that Amazon is evaluating entering the retail pharmacy market. The investment adviser ultimately sold the position on the view that the company’s over-reliance on front-of-the-store sales exposes it to potential ongoing sales and margin pressure.

Elsewhere, zero exposure to Amazon.com, Inc. and Facebook, Inc. proved disadvantageous.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy had a negative impact on performance during the reporting period.

| | |

| 8 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Enhanced Capital and Income Fund, Inc. |

Describe recent portfolio activity.

Due to a combination of portfolio trading activity and market movement during the 12-month period, the Trust’s exposure to the health care sector increased, with additions in utilities and materials as well. The largest reductions were in consumer staples and energy.

Describe portfolio positioning at period end.

From a positioning standpoint, as of period end, the investment adviser continues to favor financials, particularly banks, and is also focusing on stock-specific opportunities to capture growth tied to healthy U.S. consumers. These cyclical positions are balanced with strategic allocations to more stable growers in the health care and IT sectors. The investment adviser continues to underweight defensive stocks, as well as industrials.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

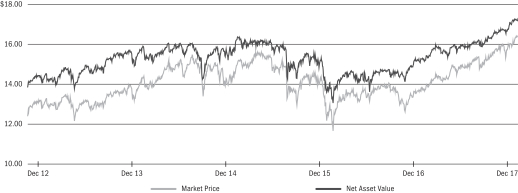

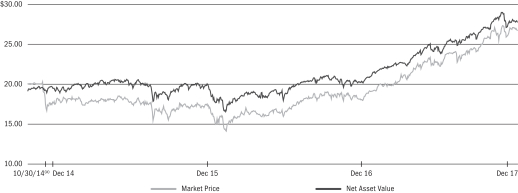

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 16.38 | | | $ | 13.71 | | | | 19.47 | % | | $ | 16.46 | | | $ | 13.63 | |

Net Asset Value | | | 17.19 | | | | 15.08 | | | | 13.99 | | | | 17.26 | | | | 15.08 | |

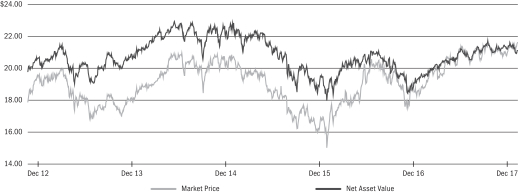

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

Apple, Inc. | | | 5 | % |

Alphabet, Inc., Class A | | | 4 | |

Microsoft Corp. | | | 4 | |

JPMorgan Chase & Co. | | | 4 | |

Bank of America Corp. | | | 3 | |

Comcast Corp., Class A | | | 3 | |

Pfizer, Inc. | | | 3 | |

Altria Group, Inc. | | | 2 | |

Home Depot, Inc. | | | 2 | |

Wal-Mart Stores, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 12/31/17 | | | 12/31/16 | |

Information Technology | | | 26 | % | | | 26 | % |

Financials | | | 17 | | | | 17 | |

Health Care | | | 16 | | | | 14 | |

Consumer Discretionary | | | 14 | | | | 15 | |

Industrials | | | 7 | | | | 6 | |

Consumer Staples | | | 6 | | | | 9 | |

Energy | | | 6 | | | | 8 | |

Materials | | | 5 | | | | 4 | |

Utilities | | | 3 | | | | 1 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | |

| Trust Information as of December 31, 2017 | | BlackRock Enhanced Equity Dividend Trust |

Investment Objective

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($9.23)(a) | | 6.07% |

Current Monthly Distribution per Common Share(b) | | $0.0467 |

Current Annualized Distribution per Common Share(b) | | $0.5604 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BDJ(a)(b) | | | 20.63 | % | | | 15.06 | % |

Russell 1000® Value Index | | | N/A | | | | 13.66 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The largest contribution to performance for the 12-month period came from a combination of stock selection and allocation decisions within the health care sector. Notably, stock selection and an overweight to the health care providers & services industry and stock selection in pharmaceuticals added to relative performance. In energy, an underweight to U.S. integrated oil & gas operators and an overweight to their non-U.S.-domiciled peers proved beneficial within the oil, gas & consumable fuels industry. An underweight to the energy equipment & services industry also contributed. Lastly, a combination of stock selection within and an underweight to telecommunication services (“telecom”) contributed to relative performance, as did an underweight to the real estate sector.

The largest detractor from relative return derived from the portfolio’s cash position, as the period saw rising U.S. stock prices. Within utilities, a combination of stock selection within and an underweight to the electric utilities industry negatively impacted returns. In financials, stock selection in the insurance segment and an underweight to the diversified financial services industry detracted. At the industry level, stock selection within food & staples retailing was unfavorable.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s option writing strategy had a negative effect on performance.

Describe recent portfolio activity.

During the 12-month period, the Trust significantly boosted exposure to the health care sector. Holdings within telecom and utilities also were increased. Conversely, the Trust significantly reduced its holdings in the industrials sector. The Trust also reduced exposure to information technology (“IT”) and consumer discretionary.

Describe portfolio positioning at period end.

The Trust’s largest allocations were in the financials, health care and energy sectors. Relative to the benchmark, the Trust’s largest overweight positions were in the health care, IT and financials sectors. The Trust’s largest relative underweights were in the real estate, consumer discretionary and consumer staples segments.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Enhanced Equity Dividend Trust |

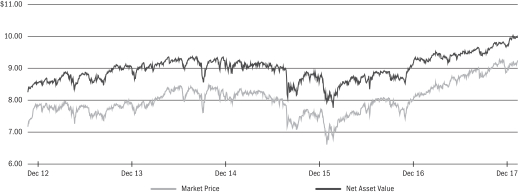

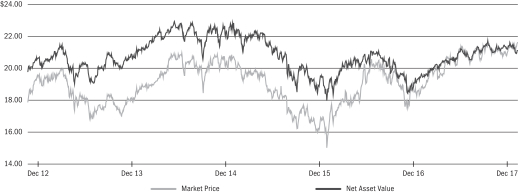

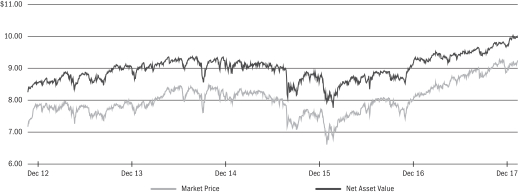

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 9.23 | | | $ | 8.15 | | | | 13.25 | % | | $ | 9.31 | | | $ | 8.13 | |

Net Asset Value | | | 9.96 | | | | 9.22 | | | | 8.03 | | | | 10.02 | | | | 9.16 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

JPMorgan Chase & Co. | | | 4 | % |

Bank of America Corp. | | | 4 | |

Citigroup, Inc. | | | 4 | |

Pfizer, Inc. | | | 4 | |

Wells Fargo & Co. | | | 3 | |

Oracle Corp. | | | 3 | |

Anthem, Inc. | | | 3 | |

Royal Dutch Shell PLC — ADR | | | 3 | |

Microsoft Corp. | | | 2 | |

Suncor Energy, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 12/31/17 | | | 12/31/16 | |

Financials | | | 29 | % | | | 30 | % |

Health Care | | | 19 | | | | 14 | |

Energy | | | 12 | | | | 12 | |

Information Technology | | | 10 | | | | 9 | |

Industrials | | | 8 | | | | 12 | |

Consumer Staples | | | 7 | | | | 7 | |

Utilities | | | 5 | | | | 5 | |

Consumer Discretionary | | | 4 | | | | 6 | |

Materials | | | 3 | | | | 3 | |

Telecommunication Services | | | 3 | | | | 2 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | |

| Trust Information as of December 31, 2017 | | BlackRock Enhanced Global Dividend Trust |

Investment Objective

BlackRock Enhanced Global Dividend Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. Under normal circumstances, the Trust invests at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. (unless market conditions are not deemed favorable by Trust management, in which case the Trust would invest at least 30% of its assets outside of the U.S.). The Trust may invest in securities of companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

On March 22, 2017, the Trust’s Board approved a change to the Trust’s name from “BlackRock Global Opportunities Equity Trust” to “BlackRock Enhanced Global Dividend Trust.” The Board also approved changes to certain of the Trust’s non-fundamental investment policies. Please refer to the Additional Information section. These changes became effective on June 12, 2017.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($12.51)(a) | | 7.48% |

Current Monthly Distribution per Common Share(b) | | $0.0780 |

Current Annualized Distribution per Common Share(b) | | $0.9360 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BOE(a)(b). | | | 28.28 | % | | | 17.22 | % |

MSCI All Country World Index | | | N/A | | | | 23.97 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The Trust’s overweight to consumer staples detracted from returns, as did stock selection in the sector. In particular, exposure to tobacco stocks Imperial Brands PLC, Altria Group, Inc. and Philip Morris International, Inc. held back performance. Stock selection within materials and consumer discretionary also weighed on returns.

The leading contributor to relative performance during the period was stock selection in telecommunication services (“telecom”), notably within the diversified telecom services sub-industry, where a lack of exposure to AT&T, Inc. added to results. Positive stock selection within the financials sector contributed to returns, notably bank holdings Federal Bank Ltd. and Unicredit SpA. An underweight to utilities also boosted performance.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s options writing strategy detracted from returns.

Describe recent portfolio activity.

The Trust significantly increased exposure to consumer staples, with a focus on the tobacco industry, as well as to health care, where pharmaceuticals were favored. In contrast, the Trust eliminated exposure to energy and significantly reduced its holdings in financials, mainly banks.

| | |

| 12 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Enhanced Global Dividend Trust |

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector overweights were in the consumer staples and health care sectors, with an emphasis on the tobacco and pharmaceuticals industries, respectively. The largest underweights were to information technology and financials. The Trust had no exposure to real estate, utilities or energy at the end of the period. From a regional perspective, a majority of portfolio assets was invested either within the United States or Europe, with significant exposure in the United Kingdom and Switzerland.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

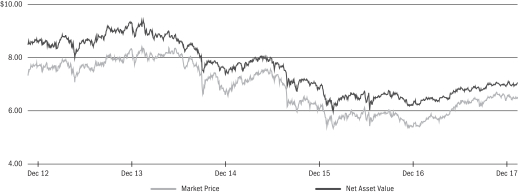

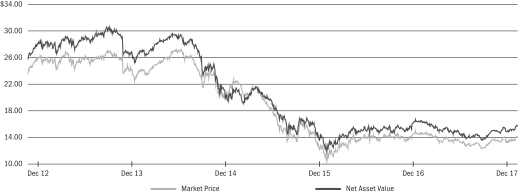

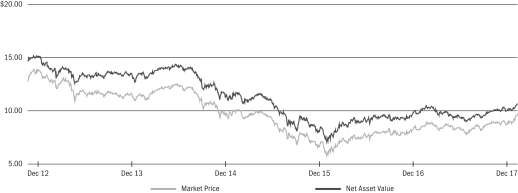

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 12.51 | | | $ | 11.57 | | | | 8.12 | % | | $ | 13.94 | | | $ | 11.57 | |

Net Asset Value | | | 13.22 | | | | 13.38 | | | | (1.20 | ) | | | 14.61 | | | | 13.10 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

British American Tobacco PLC | | | 4 | % |

Altria Group, Inc. | | | 4 | |

Imperial Brands PLC | | | 4 | |

Johnson & Johnson | | | 3 | |

Sanofi | | | 3 | |

Cisco Systems, Inc. | | | 3 | |

Novartis AG, Registered Shares | | | 3 | |

Philip Morris International, Inc. | | | 3 | |

Rogers Communications, Inc., Class B | | | 3 | |

Genuine Parts Co. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 12/31/17 | | | 12/31/16 | |

United States | | | 42 | % | | | 59 | % |

United Kingdom | | | 16 | | | | 6 | |

Switzerland | | | 10 | | | | 2 | |

Canada | | | 6 | | | | 1 | |

Australia | | | 4 | | | | — | |

France | | | 3 | | | | 2 | |

Taiwan | | | 3 | | | | — | |

Germany | | | 3 | | | | 2 | |

Belgium | | | 2 | | | | 2 | |

Japan | | | 2 | | | | 6 | |

Finland | | | 2 | | | | — | |

Sweden | | | 2 | | | | — | (a) |

China | | | — | (a) | | | 3 | |

India | | | — | (a) | | | 3 | |

Italy | | | — | (a) | | | 2 | |

Spain | | | — | (a) | | | 1 | |

Other | | | 5 | (b) | | | 11 | (c) |

| | (a) | Representing less than 1% of the Trust’s total investments. | |

| | (b) | Other includes a 1% holding or less in each of the following countries: Denmark, Hong Kong, India and Netherlands. | |

| | (c) | Other includes a 1% holding or less in each of the following countries: Australia, Denmark, Hong Kong, Indonesia, Ireland, Israel, Mexico, Netherlands, New Zealand, Norway, Peru, Philippines, Portugal, South Africa, South Korea, Sweden, Taiwan and Thailand. | |

| | |

| Trust Information as of December 31, 2017 | | BlackRock Enhanced International Dividend Trust |

Investment Objective

BlackRock Enhanced International Dividend Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and utilizing an option writing (selling) strategy to seek total return performance and enhance distributions. The Trust invests, under normal circumstances, at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

On March 22, 2017, the Trust’s Board approved a change to the Trust’s name from “BlackRock International Growth & Income Trust” to “BlackRock Enhanced International Dividend Trust.” The Board also approved changes to certain of the Trust’s non-fundamental investment policies. Please refer to the Additional Information section. These changes became effective on June 12, 2017.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BGY |

Initial Offering Date | | May 30, 2007 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($6.52)(a) | | 6.99% |

Current Monthly Distribution per Common Share(b) | | $0.0380 |

Current Annualized Distribution per Common Share(b) | | $0.4560 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGY(a)(b). | | | 27.23 | % | | | 20.88 | % |

MSCI All Country World Index ex-USA | | | N/A | | | | 27.19 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

N/A — Not applicable as the index does not have a market price.

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

An overweight to and stock selection in health care detracted from relative performance, mainly driven by pharmaceuticals exposure. In addition, stock selection in consumer discretionary weighed on relative return, due largely to holdings within the internet and direct retail marketing industry. An overweight and stock selection in consumer staples also detracted, with tobacco holdings lagging the most. Lastly, an overweight to the materials sector constrained returns.

The leading contributor to relative performance during the period was positive stock selection within the financials sector, largely due to the Trust’s position in HDFC Bank Ltd., India’s second largest private bank. Favorable stock selection in information technology, notably within the software sector, also contributed to returns. Finally, stock selection in industrials and telecommunication services was additive.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The Trust’s options writing strategy detracted from relative returns.

Describe recent portfolio activity.

The Trust significantly increased exposure to consumer staples, with a focus on the tobacco industry, as well as to health care, where pharmaceuticals were favored. In contrast, the Trust eliminated exposure to energy and significantly reduced its holdings in financials, mainly banks.

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector overweights were in the consumer staples and health care sectors, with an emphasis on the tobacco and pharmaceuticals industries, respectively. The largest underweight exposure was to financials, particularly banks. The Trust had no exposure to real estate, utilities or energy. In regional terms, the majority of portfolio assets was invested in European equities, with significant exposure to the United Kingdom and Switzerland.

| | |

| 14 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Enhanced International Dividend Trust |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

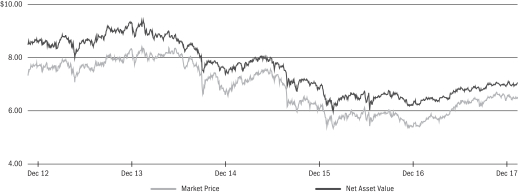

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 6.52 | | | $ | 5.51 | | | | 18.33 | % | | $ | 6.71 | | | $ | 5.45 | |

Net Asset Value | | | 7.06 | | | | 6.28 | | | | 12.42 | | | | 7.10 | | | | 6.28 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

British American Tobacco PLC | | | 5 | % |

Imperial Brands PLC | | | 4 | |

Sanofi | | | 4 | |

Novartis AG, Registered Shares | | | 3 | |

Rogers Communications, Inc., Class B | | | 3 | |

TELUS Corp. | | | 3 | |

Nestle SA | | | 3 | |

WisdomTree Japan Hedged Equity Fund | | | 3 | |

Deutsche Post AG, Registered Shares | | | 3 | |

Japan Tobacco, Inc. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 12/31/17 | | | 12/31/16 | |

United Kingdom | | | 19 | % | | | 16 | % |

Switzerland | | | 12 | | | | 5 | |

Canada | | | 7 | | | | 5 | |

United States | | | 6 | | | | 8 | |

France | | | 6 | | | | 9 | |

Netherlands | | | 6 | | | | 6 | |

China | | | 6 | | | | 5 | |

Australia | | | 5 | | | | — | |

Japan | | | 5 | | | | 8 | |

Germany | | | 5 | | | | 6 | |

Taiwan | | | 3 | | | | — | |

Belgium | | | 3 | | | | 2 | |

Sweden | | | 3 | | | | 1 | |

Finland | | | 2 | | | | — | |

Hong Kong | | | 2 | | | | 2 | |

India | | | 2 | | | | 4 | |

South Korea | | | 2 | | | | 3 | |

South Africa | | | 2 | | | | — | |

Denmark | | | 2 | | | | — | |

Ireland | | | — | (a) | | | 2 | |

Italy | | | — | | | | 6 | |

Spain | | | — | | | | 1 | |

Mexico | | | — | | | | 1 | |

Other | | | 2 | (b) | | | 10 | (c) |

| | (a) | Representing less than 1% of the Trust’s total investments. | |

| | (b) | Other includes a 1% holding or less in each of the following countries: Ireland and Portugal. | |

| | (c) | Other includes a 1% holding or less in each of the following countries: Australia, Denmark, Indonesia, Israel, New Zealand, Norway, Peru, Philippines, Portugal, South Africa, Taiwan and Thailand. | |

| | |

| Trust Information as of December 31, 2017 | | BlackRock Health Sciences Trust |

Investment Objective

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | BME |

Initial Offering Date | | March 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($36.50)(a) | | 6.58% |

Current Monthly Distribution per Common Share(b) | | $0.2000 |

Current Annualized Distribution per Common Share(b) | | $2.4000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BME(a)(b) | | | 23.17 | % | | | 22.17 | % |

Russell 3000® Healthcare Index | | | N/A | | | | 23.13 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s premium to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Health care stocks produced strong absolute returns in 2017 amid the steady rally in the broader market. However, the sector lagged the headline indices somewhat due to investors’ preference for economically sensitive stocks.

The medical devices & supplies subsector was the sole detractor from relative performance due to underweights in the life sciences tools and health care supplies industries. However, positions in the health care equipment industry, including C.R. Bard, Inc. (which was acquired), Baxter International, Inc., Intuitive Surgical, Inc. and Stryker Corp., aided results.

The Trust generated outperformance in three out of four subsectors (health care providers & services, biotechnology and pharmaceuticals). The health care providers & services subsector had the largest positive effect on performance, largely due to the Trust’s overweight allocation to the managed care industry. Some of the key contributors in this area were UnitedHealth Group, Inc., Cigna Corp., Centene Corp., Aetna, Inc. and Anthem, Inc., all of which were bolstered by their of solid business results.

The biotechnology subsector also was a meaningful contributor to relative performance due to the investment adviser’s effective stock selection. Vertex Pharmaceuticals, Inc., which reported favorable results in its cystic fibrosis franchise earlier in the year, was a key contributor. Similarly, positions in Sarepta Therapeutics, Inc., AveXis, Inc. and Alnylam Pharmaceuticals, Inc., were notable contributors due to positive clinical developments. The Trust also benefited from an overweight position in Celgene Corp. for most of the year and then scaling back to an underweight stance before the company reported disappointing financial results in October.

In pharmaceuticals, underweight positions in Merck & Co., Inc. and Pfizer, Inc., combined with an out-of-benchmark position in AstraZeneca PLC, were the key drivers of the Trust’s positive performance.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. This strategy detracted from performance given the double-digit absolute return for health care stocks in 2017.

| | |

| 16 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Health Sciences Trust |

Describe recent portfolio activity.

The Trust increased its allocation to the medical devices & supplies subsector and reduced its weightings in the health care providers & services area. The Trust’s allocations in biotechnology and pharmaceuticals were largely unchanged.

Describe portfolio positioning at period end.

The Trust continued to employ a bottom-up, fundamental investment process in an effort to construct a balanced, diversified portfolio of health care stocks. The investment adviser continued to look for companies that can benefit from the aging demographics in both developed and developing countries, as well as those participating in the innovation occurring in the medical technology.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 36.50 | | | $ | 31.75 | | | | 14.96 | % | | $ | 38.00 | | | $ | 31.75 | |

Net Asset Value | | | 35.69 | | | | 31.30 | | | | 14.03 | | | | 36.12 | | | | 31.30 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

UnitedHealth Group, Inc. | | | 9 | % |

Pfizer, Inc. | | | 4 | |

Medtronic PLC | | | 4 | |

Stryker Corp. | | | 4 | |

Abbott Laboratories | | | 4 | |

Amgen, Inc. | | | 3 | |

Cigna Corp. | | | 3 | |

Johnson & Johnson | | | 3 | |

Biogen, Inc. | | | 2 | |

Quest Diagnostics, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 12/31/17 | | | 12/31/16 | |

Health Care Providers & Services | | | 25 | % | | | 30 | % |

Biotechnology | | | 25 | | | | 24 | |

Pharmaceuticals | | | 24 | | | | 23 | |

Health Care Equipment & Supplies | | | 23 | | | | 21 | |

Life Sciences Tools & Services | | | 2 | | | | 1 | |

Diversified Consumer Services | | | 1 | | | | 1 | |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | |

| Trust Information as of December 31, 2017 | | BlackRock Resources & Commodities Strategy Trust |

Investment Objective

BlackRock Resources & Commodities Strategy Trust’s (BCX) (the “Trust”) primary investment objective is to seek high current income and current gains, with a secondary objective of capital appreciation. The Trust will seek to achieve its investment objectives, under normal market conditions, by investing at least 80% of its total assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources. While permitted, the Trust does not currently expect to invest in securities and derivatives linked to the underlying price movement of commodities or natural resources. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option overwriting strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BCX |

Initial Offering Date | | March 30, 2011 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($9.77)(a) | | 6.34% |

Current Monthly Distribution per Common Share(b) | | $0.0516 |

Current Annualized Distribution per Common Share(b) | | $0.6192 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12 months ended December 31, 2017 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BCX(a)(b) | | | 26.55 | % | | | 15.60 | % |

Lipper Natural Resources Funds(c) | | | 7.33 | | | | 1.06 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | Average return. Returns reflect reinvestment of dividends and/or distributions at NAV on the ex-dividend as calculated by Lipper. | |

Past performance is not indicative of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

The Trust’s allocation to the mining sector made a positive contribution to absolute returns in 2017. Economic data from China was better than expected, and the country’s measures to remove excess capacity in a number of industries was supportive for commodity prices such as zinc, where Chinese production fell year-over-year. Capacity rationalization, combined with solid demand and supply constraints stemming from the underinvestment in new mines in recent years, provided a highly favorable backdrop for the market. Base metals experienced the best performance, with copper and zinc moving to four- and ten-year highs, respectively. Precious metals prices also posted positive returns amid U.S. dollar weakness. While the price of iron ore declined, it remained meaningfully above analysts’ consensus and considerably higher than the lows of December 2015. The iron ore price, at these levels, supported healthy profit margins for mining companies. In this environment, the Trust’s holdings in Glencore PLC, Rio Tinto PLC and Vale SA all contributed to absolute returns.

The sandalwood producer Quintis Ltd. was the largest detractor from absolute performance. The company was the focus of a short seller report in March 2017, and in May it announced that it had lost a contract. While the contract was for a relatively small amount of product, the loss highlighted an internal control issue and raised concerns about the company’s management practices. Quintis later entered a voluntary trading halt and announced it was in discussions with multiple parties regarding debt and equity options.

The exploration & production company (“E&P”) Anadarko Petroleum Corp., which was negatively affected by the broader sell-off in energy stocks during the first half of the period, also detracted from returns. In addition, the company was linked to two operational incidents with fatalities. The Trust exited the position in November.

The Trust made use of options, principally written call options on individual stocks, in order to seek enhanced income returns while continuing to participate in the performance of the underlying equities. The option overlay strategy had an adverse effect on results at a time of positive performance for the overall sector.

Describe recent portfolio activity.

The investment adviser increased the Trust’s weighting in the mining industry while taking profits in certain agriculture stocks that had performed well earlier in the year. It also rotated its energy holdings by exiting the E&P stocks Anadarko Petroleum Corp. and Hess Corp. and adding to positions in the integrated energy companies Chevron Corp. and Exxon Corp.

| | |

| 18 | | 2017 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2017 (continued) | | BlackRock Resources & Commodities Strategy Trust |

The battery-materials space (lithium and cobalt, and to a lesser extent, nickel and copper) grew in prominence in 2017. Investors’ excitement about the transition to electric vehicles mounted as countries stepped up their regulatory support efforts. China, for example, announced plans to introduce a ban on vehicles powered by fossil fuels. The shift toward electric vehicles led to an improving demand outlook for the related commodities. Accordingly, the investment adviser continued to seek opportunities in this area.

Describe portfolio positioning at period end.

The energy sector represented the Trust’s largest allocation, followed by mining and agriculture, respectively.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/17 | | | 12/31/16 | | | Change | | | High | | | Low | |

Market Price | | $ | 9.77 | | | $ | 8.27 | | | | 18.14 | % | | $ | 9.82 | | | $ | 7.76 | |

Net Asset Value | | | 10.64 | | | | 9.86 | | | | 7.91 | | | | 10.65 | | | | 9.00 | |

Market Price and Net Asset Value History For Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/17 | |

Royal Dutch Shell PLC — ADR, Class A | | | 6 | % |

BP PLC — ADR | | | 6 | |

Chevron Corp. | | | 6 | |

Glencore PLC | | | 5 | |

Agrium, Inc. | | | 4 | |

Vale SA — ADR | | | 4 | |

Rio Tinto PLC — ADR | | | 3 | |

First Quantum Minerals Ltd. | | | 3 | |

Teck Resources Ltd. | | | 3 | |

Packaging Corp. of America | | | 3 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 12/31/17 | | | 12/31/16 | |

Oil, Gas & Consumable Fuels | | | 34 | % | | | 34 | % |

Metals & Mining | | | 34 | | | | 30 | |

Chemicals | | | 13 | | | | 18 | |

Food Products | | | 11 | | | | 5 | |

Energy Equipment & Services | | | 3 | | | | 3 | |

Containers & Packaging | | | 3 | | | | 6 | |

Paper & Forest Products | | | 1 | | | | 1 | |

Machinery | | | 1 | | | | — | |

Food & Staples Retailing | | | — | | | | 2 | |

Other | | | — | (a) | | | 1 | (b) |

| | (a) | Other includes less than 1% in each of the following industries: Advertising Agencies. | |

| | (b) | Other includes less than 1% in each of the following industries: Building Products, Electric Utilities, Electrical Equipment, Electronic Equipment, Independent Power and Renewable Electricity Producers, Instruments & Components, Machinery, Multi-Utilities, Real Estate Investment Trusts (REITs), Semiconductors & Semiconductor Equipment and Water Utilities. | |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | |

| Trust Information as of December 31, 2017 | | BlackRock Science and Technology Trust |

Investment Objective

BlackRock Science and Technology Trust’s (BST) (the “Trust”) investment objective is to provide income and total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of science and technology companies. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to seek total return performance and enhance distributions.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | BST |

Initial Offering Date | | October 30, 2014 |

Current Distribution Rate on Closing Market Price as of December 31, 2017 ($26.69)(a) | | 5.84% |

Current Monthly Distribution per Common Share(b) | | $0.1300 |

Current Annualized Distribution per Common Share(b) | | $1.5600 |