- PSA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Public Storage (PSA) DEF 14ADefinitive proxy

Filed: 25 Mar 24, 4:00pm

United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant To Section 14(a) of

the Securities Exchange Act of 1934

☒ Filed by the Registrant |

| ☐ Filed by a Party other than the Registrant |

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ |

| Definitive Additional Materials |

☐ |

| Soliciting Material under § 240.14a-12 |

PUBLIC STORAGE

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check all boxes that apply): | ||

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

701 Western Avenue

Glendale, California 91201

March 25, 2024

Dear Fellow Shareholders:

Our Company had another successful year in 2023, achieving record performance and making significant progress on our organic and external growth strategies. We achieved record revenues of $4.5 billion and record net operating income of $3.4 billion. We increased our portfolio by 13.9 million square feet through acquisitions, development, and redevelopment (with an estimated market value of $3.1 billion at stabilization), including our successful acquisition and integration of Simply Self Storage—our largest private acquisition to date. We also achieved the highest direct operating margin and revenue per available square foot among public self-storage real estate investment trusts.

Operationally, we continued to enhance the customer experience and transform our operating model, becoming the first public self-storage company to offer digital property access at 100% of our locations. We made significant progress on our sustainability efforts, and in 2023 we were pleased to be recognized as the U.S. self-storage leader on the GRESB benchmark. We also advanced employee growth and development and are proud again to have been named a Great Place to Work®.

We are pleased to invite you to attend our 2024 Annual Meeting of Shareholders (the Annual Meeting) on Tuesday, May 7, 2024, in New York, NY. We hope that you will attend the meeting in person. We encourage you to designate the proxies named on the proxy card to vote your shares even if you are planning to come. This will ensure that your common shares are represented at the meeting.

We furnish our proxy materials to shareholders primarily over the Internet. We believe this process expedites shareholders’ receipt of the materials, lowers the costs of the Annual Meeting, and conserves natural resources. The Notice of Meeting, Proxy Statement, and Annual Report on Form 10-K are available free of charge at https://materials.proxyvote.com/default.aspx?ticker=74460D.

Thank you for your continued interest in Public Storage.

Sincerely,

Joseph D. Russell, Jr.

President and

Chief Executive Officer

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

March 25, 2024

To our shareholders:

On behalf of the Board of Trustees, I invite you to attend the 2024 Annual Meeting of Shareholders (the Annual Meeting) of Public Storage at 11:00 a.m. Eastern Time on Tuesday, May 7, 2024, at the Millennium Downtown New York, 55 Church Street, New York, New York 10007.

Items of Business

Record Date

Close of business on March 5, 2024.

Proxy Materials

The Notice of Meeting, Proxy Statement, and Annual Report on Form 10-K are available free of charge at https://materials.proxyvote.com/default.aspx?ticker=74460D.

Sincerely,

Nathaniel A. Vitan

Senior Vice President,

Chief Legal Officer and Corporate Secretary

Important Notice Regarding Availability of Proxy Materials for the Shareholder Meeting to be Held on May 7, 2024: This Proxy Statement and our 2023 Annual Report on Form 10-K are available at the Investor Relations section of our website, publicstorage.com.

Table of Contents

Page | |||

1 |

| ||

2 |

| ||

2 |

| ||

3 |

| ||

4 |

| ||

10 |

| ||

11 |

| ||

12 |

| ||

13 |

| ||

13 |

| ||

14 |

| ||

15 |

| ||

16 |

| ||

17 |

| ||

18 |

| ||

23 |

| ||

24 |

| ||

24 |

| ||

24 |

| ||

24 |

| ||

25 |

| ||

28 |

| ||

28 |

| ||

30 |

| ||

30 |

| ||

30 |

| ||

31 |

| ||

31 |

| ||

31 |

| ||

|

|

|

|

32 |

|

| |

|

|

|

|

32 |

|

| |

33 |

| ||

36 |

| ||

37 |

| ||

38 |

| ||

38 |

| ||

39 |

| ||

Public Storage | 2024 Proxy Statement | i

Table of Contents

Page | |||

40 |

|

| |

|

|

|

|

40 |

|

| |

|

|

|

|

48 |

|

| |

|

|

|

|

49 |

| ||

52 |

| ||

54 |

| ||

57 |

| ||

60 |

| ||

61 |

| ||

62 |

| ||

66 |

| ||

|

|

|

|

69 |

|

| |

|

|

|

|

70 |

|

| |

74 |

| ||

Additional Information about Trustees, Executive Officers, and Management | 76 |

| |

PROPOSAL 3: Ratification of Independent Registered Public Accounting Firm | 78 |

| |

79 |

| ||

|

|

|

|

79 |

|

| |

80 |

| ||

81 |

| ||

|

|

|

|

82 |

| ||

82 |

| ||

Important Notice Regarding Delivery of Security Holder Documents | 82 |

| |

82 |

| ||

82 |

| ||

83 |

| ||

83 |

| ||

| |||

83 | |||

|

| ||

Trustee Nominees Who Do Not Receive a Majority of the Votes Cast | 83 | ||

|

| ||

83 | |||

|

| ||

84 | |||

|

| ||

84 | |||

|

| ||

85 | |||

|

| ||

85 | |||

|

| ||

85 | |||

|

| ||

85 | |||

|

| ||

ii | Public Storage | 2024 Proxy Statement

Table of Contents

| Page |

|

86 |

| ||

87 |

| ||

87 |

| ||

A-1 |

| ||

A-2 |

| ||

Public Storage | 2024 Proxy Statement | iii

PROXY STATEMENT SUMMARY

This summary highlights information you will find in this proxy statement and does not contain all the information that you should consider. You should read the entire proxy statement carefully before voting.

2024 ANNUAL MEETING INFORMATION

|

|

|

|

|

|

|

|

Date and Time | Location | Record Date | Proxy Mail Date |

Tuesday, May 7, 2024 at 11:00 a.m. Eastern Time | The Millennium Downtown New York 55 Church Street New York, New York 10007 | March 5, 2024 | On or about March 25, 2024 |

Public Storage shareholders as of the record date are entitled to vote on the matters presented at the meeting. Each common share, par value $0.10 per share (common share), of the Company is entitled to one vote for each trustee nominee and one vote on each of the other matters presented.

AGENDA AND VOTING RECOMMENDATIONS

Proposal Number | Item | Board | Vote Required | Page | ||||

1 | Election of Trustees | FOR Each Nominee | Majority of votes cast | 10 | ||||

2 | Advisory Vote to Approve Compensation of Named Executive Officers (NEOs) | FOR | Non-binding vote | 37 | ||||

3 | Ratify Appointment of Ernst & Young LLP (EY) as our Independent Registered Public Accounting Firm for the Year Ending December 31, 2024 | FOR | Majority of votes cast | 78 | ||||

Public Storage | 2024 Proxy Statement | 1

2023 Highlights

2023 Highlights

2023 BUSINESS HIGHLIGHTS

Under the leadership of our President and Chief Executive Officer (CEO) Joseph D. Russell, Jr., and the senior management team, we executed our opportunistic growth strategy and again achieved record performance in 2023. During 2023, we focused on deepening our presence in growth markets, bolstering our core strengths, and unlocking additional opportunities for growth and value creation. We also opportunistically deployed our growth-oriented balance sheet to generate external growth, including through our acquisition of Simply Self Storage—our largest private acquisition to date. In August 2023, we completed a corporate reorganization into a holding company structure commonly referred to as an umbrella partnership real estate investment trust (UPREIT), which we expect will facilitate future growth.

Record Financial Results, Unprecedented Multiyear Growth, and Superior Operating Performance

| |||||||

Record Revenues | $4.5billion | Record Net Operating Income(1) | $3.4billion | ||||

| |||||||

Portfolio addition through acquisitions, development, and redevelopment |

13.9million sq ft | Est. market value of properties added (at stabilization) |

$3.1billion | ||||

| |||||||

Increase in portfolio square footage since 2019 | 35% | Core FFO per Share Growth(1) | 6%

| ||||

| |||||||

79.7% Direct Operating Margin (Same Store) | Highest among self-storage REITs | Record Revenue per Available Square Foot (Same Store) | $21.38

| ||||

2 | Public Storage | 2024 Proxy Statement

2023 Highlights

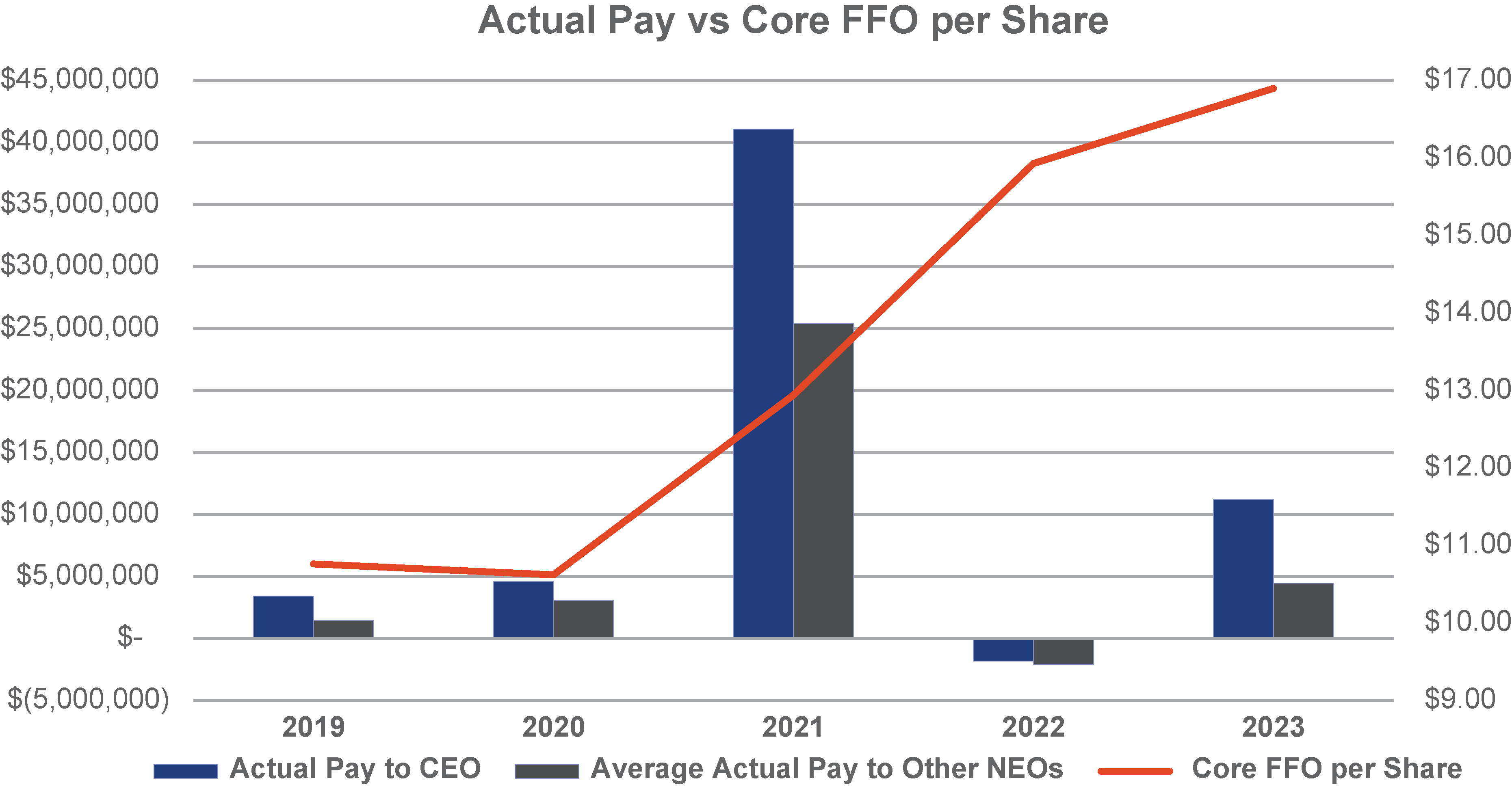

2023 COMPENSATION HIGHLIGHTS

In 2023, the Company continued its focus on improving customer and employee experiences while delivering record performance for shareholders, further positioning the Company to create long-term growth and increased shareholder value. The Company believes that 2023 executive compensation was aligned with the Company’s strong performance.

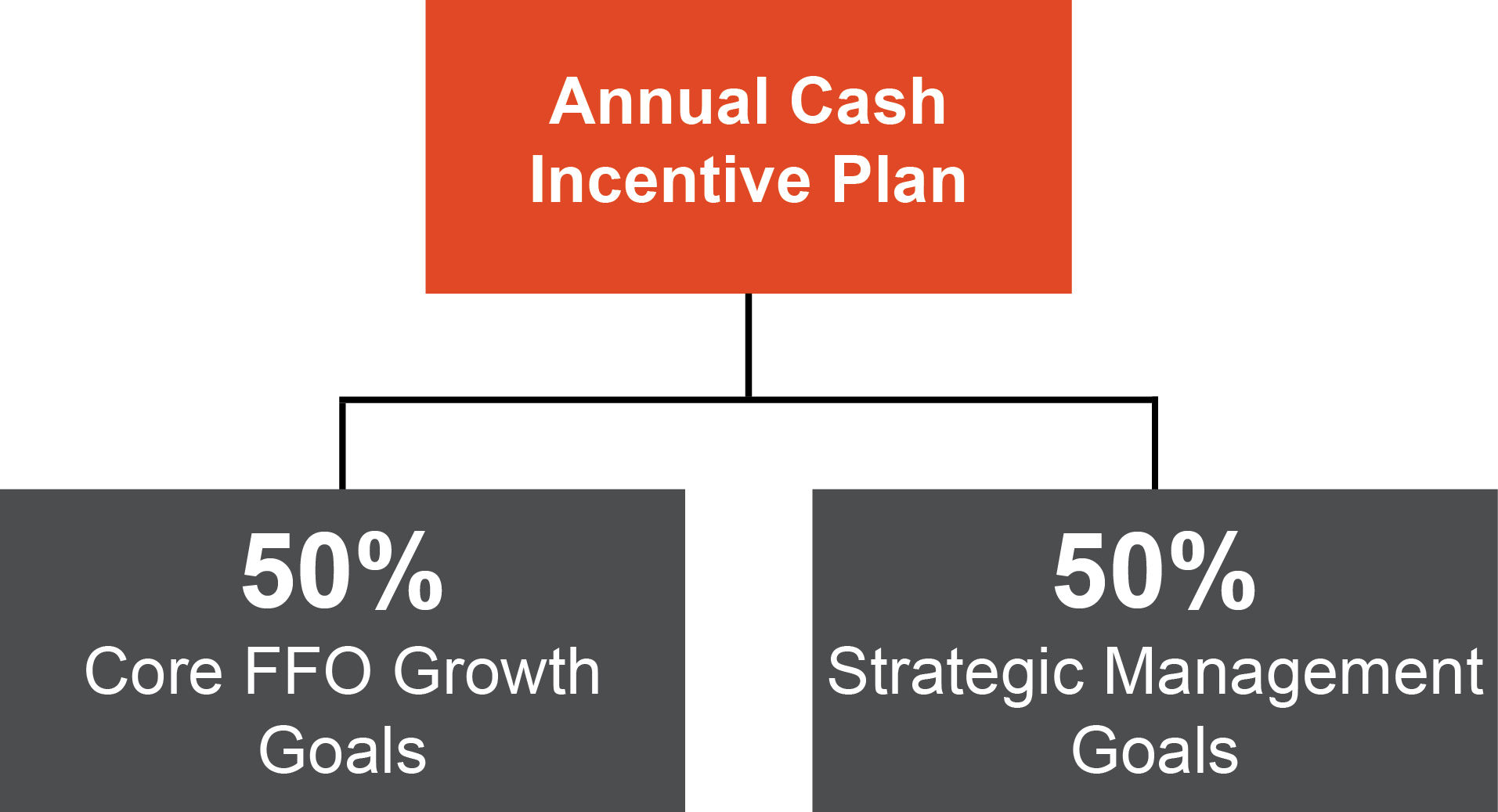

The following is a summary of the Compensation and Human Capital (CHC) Committee’s decisions with respect to the key components of the 2023 compensation program for our NEOs:

The CHC Committee believes that the foregoing 2023 compensation decisions, which we discuss in more detail in the Compensation Discussion and Analysis section, beginning on page 40 of this proxy statement, strike the appropriate balance between rewarding management for their performance, incentivizing our leaders to continue creating long-term value, and attracting and retaining strong executives in a competitive labor market.

Public Storage | 2024 Proxy Statement | 3

2023 Highlights

Corporate Responsibility and SUSTAINABILITY

Overview and Alignment with Company Strategy

We recognize the importance of operating in a responsible and sustainable manner that aligns with the Company’s long-term strategy and promotes the best interests of our Company and its stakeholders. For over 50 years, the Company’s corporate strategy has centered on one core philosophy: generate growth and create value by operating our properties and the Company for the long term.

Through this strategy, we have achieved:

We keep long-term sustainable growth and value creation for our stakeholders at the forefront of our strategy and operations, and we regularly communicate our ongoing efforts to mitigate the risks we face, including environmental, social, economic, political, data security and privacy, reputational, and other risks. In addition to addressing these risks, we seek out and capitalize on emerging sustainability-related opportunities.

For detailed information regarding our sustainability efforts, strategies, commitments, and progress, including with respect to environmental, social, and governance issues, please refer to our 2023 Sustainability Report, which is available on our website at publicstorage.com. Our 2023 Sustainability Report is not incorporated by reference into this proxy statement.

Our Strategic Focus on Sustainable Long-Term Growth and Value Creation

We operate our business with a long-term focus, and our strategy prioritizes the Company’s resilience and performance in the decades to come.

4 | Public Storage | 2024 Proxy Statement

2023 Highlights

The following framework underpins our sustainable long-term strategy:

ENVIRONMENTAL | SOCIAL | GOVERNANCE | ||

OPERATIONS | ||||

• Low environmental impact at property and corporate locations • Initiatives with a range of sustainability and economic benefits, such as solar, LED lighting, low water use landscaping, and efficient climate controls • Low property obsolescence and high resilience |

• Focus on stakeholders, including employees, customers, communities, and investors • Company culture built on integrity, diversity and inclusion, accountability, entrepreneurship, and employee engagement and development • Cultural alignment with corporate strategy |

• Comprehensive Enterprise Risk Management (ERM) framework • Robust risk management practices, including oversight, succession planning, and compliance • Pay-for-performance philosophy | ||

CAPITAL ALLOCATION | ||||

• Low capital expenditures needed to maintain properties • Efficient-system initiatives to reduce energy and water use, carbon emissions, and waste • Redevelopment and adaptive reuse of older, less-efficient properties | • Community solar program helps provide clean energy to communities we serve • Portfolio growth strategy focused on supporting areas with economic and population growth • Serve essential-businesses, including health professionals, critical infrastructure sectors, and tradespeople |

• Risk reduction via a culture of risk management accountability, portfolio geographic diversity, cloud-based operating systems, cybersecurity, and data privacy initiatives • Resource allocation towards sustainability strategy and communication efforts | ||

BALANCE SHEET | ||||

Low leverage, high permanent capital balance sheet supports adaptation to evolving risk environments, provides stability, and enables execution of Public Storage’s long-term corporate strategy | ||||

Engagement of Company Leadership

Our senior management team actively manages our risks and opportunities. The Company has a dedicated Sustainability Committee comprising our CEO and other senior executives across functions including executive management, enterprise risk management, audit, real estate, operations, human resources, finance, legal, construction, design, and investor relations. The Sustainability Committee assists executive management in identifying the risks and opportunities we face, including with respect to climate change and human capital management; setting our general sustainability strategy; implementing initiatives and policies based on that strategy; overseeing communications with our stakeholders; and assessing developments relating to, and improving the Company’s understanding of, sustainability matters.

The Sustainability Committee reports to and receives guidance from our Board, including through formal reporting to the Nominating, Governance, and Sustainability (NGS) Committee, Audit Committee, and CHC Committee, in addition to regular reporting to the rest of the Board. For a discussion of how our Board and its committees oversee our sustainability program, see “Corporate Governance—Board Committees” below.

Public Storage | 2024 Proxy Statement | 5

2023 Highlights

Our Environmental Practices

Public Storage considers potential positive and negative environmental impacts in our decision-making. We design our properties to have low obsolescence and high structural resilience, retaining functional and physical usefulness over many decades. We also support global efforts to mitigate the impact of climate change. Over the past several years, we have taken proactive measures to improve our understanding and management of risks and opportunities related to climate change.

We are pleased to present the following highlights from our environmental stewardship efforts in 2023:

Benchmarking | ||||||

We achieve consistently strong sustainability ratings across leading benchmarks, including:

| ||||||

|

|

|

|

|

|

|

| U.S. market sector leader |

| Achieved “A” rating |

| Top 6% of coverage universe |

|

Significantly increased scoring across the sustainability benchmarks since 2020 | ||||||

|

|

|

|

|

|

|

|

| 2023 Winner Leader in the Light Award for superior and sustained sustainability practices |

Solar power systems at nearly 450 |

| Water efficient landscaping at over 275 properties |

| LED lighting conversions completed across nearly 95% of owned portfolio |

28.6 GWh of Clean Energy generated by solar systems at our properties, saving CO2 emissions equivalent to 2,251,099 gallons of gasoline consumed or 22,409,246 pounds of coal burned |

Reached 134 Green Building Certifications |

6 | Public Storage | 2024 Proxy Statement

2023 Highlights

Our Social Commitments to Our Stakeholders

Our commitment to our stakeholders—including employees, customers, communities, investors, and suppliers—underpins our long-term successes. We actively engage with stakeholders and incorporate their views into our decision-making. In a world that is increasingly interconnected with faster information dissemination, rapid innovation, quicker decisions, and rising risk, stakeholder focus is a critical strategy element for Public Storage.

Diversity and Inclusion

We are committed to creating a workplace that values diversity and inclusion, where every employee feels appreciated, respected, and part of our team. Public Storage hires based on skills, personality, and experience without regard to age, gender, race, ethnicity, religion, sexual orientation, or other protected characteristic. We are proud to have a diverse and inclusive workforce that reflects the diversity of the customers we serve.

Employee Base |

| 2023 Promotions | ||

|

|

|

|

|

65% | 53% |

| 69% | 53% |

Female | People of Color |

| Female | People of Color |

In addition, we disclose our annual Consolidated EEO-1 report, which reflects the race, ethnicity, and gender composition of our workforce on the Investor Relations section of our website at publicstorage.com. We also maintain policies regarding diversity, equal opportunity, pay-for-performance, discrimination, harassment, and labor (e.g., child and forced).

Training and Development

Our people power the Public Storage® brand. We equip them with the skills, tools, and knowledge to help them grow as individuals and professionally in their careers. We strive to connect every employee to Public Storage’s mission, values, objectives, and strategy, and to ensure people feel engaged, supported, and inspired by their work and our company culture. We invest in training and development across all levels of the Company through multiple learning platforms and channels to ensure our employees grow “behind the orange doors.” We also have customized leadership programs and a leadership accelerator program focused on underrepresented groups, including women and diverse employees, each intended to enhance the skills of our future leaders.

Employee Well-Being and Engagement

Public Storage is committed to the total well-being of all our employees and provides resources to help them achieve their goals and support them in times of need. We provide comprehensive health plan benefits to our employees and their dependents, including tools and resources designed to empower our employees to achieve a healthy and balanced lifestyle.

Employee engagement is fundamental to our understanding of the effectiveness of our human capital management strategies. We conduct various surveys that assess commitment, motivation, and engagement, as well as soliciting broader employee feedback, which we use to help us improve.

Public Storage | 2024 Proxy Statement | 7

2023 Highlights

Our employee engagement efforts have also led to recognition outside of Public Storage. We are proud to be named a Great Place to Work®, as rated by our employees, for the second year in a row. We have also been recognized by Comparably, Inc. as a “Choice Employer” with an “A+” Culture Score based on employee responses across 18 culture metrics, among other recognitions.

|

|

|

Responsible Governance Practices

Public Storage’s commitment to the highest ethical standards is the foundation of an effective governance structure that provides oversight and accountability, promotes fairness and compliance, and proactively manages risk. Good governance is critical to our operational, financial, and reputational resilience.

Our Board oversees senior management to ensure the long-term interests of the Company and our stakeholders are best served. Our trustees take a proactive, focused approach to their oversight responsibilities. Our corporate governance is structured to foster principled actions, informed and effective decision making, and appropriate monitoring of performance, risk, and compliance. Trustee decisions are governed by the Corporate Governance Guidelines and Trustees’ Code of Ethics, in addition to individual committee charters.

8 | Public Storage | 2024 Proxy Statement

2023 Highlights

Key aspects of our governance include:

Company-Wide | Board Structure and Composition | |

• Strong accountability and oversight • Pay-for-performance compensation philosophy • Focus on legal and regulatory compliance • ERM program |

• Declassified (annually elected) Board • 85% current independent trustees • Lead independent trustee • Separate Chairman and CEO positions • Active Board refreshment (four trustee nominees have joined the Board since 2020) • All Audit Committee members are financial experts • Trustees may not serve on more than three public company boards (including the Board) without NGS Committee approval | |

Shareholder Rights | Additional Practices | |

• No poison pill • Right to call special meetings • Right to nominate trustees (proxy access) • Majority shareholder vote to amend charter and bylaws and to approve M&A transactions • Majority vote requirements for trustee elections |

• Robust stock ownership guidelines • Clawback policy covering all compensation • Anti-hedging policy • No employment or severance agreements • Double-trigger equity vesting upon change of control • Political and charitable contributions policy | |

Code of Conduct

Employees, executive management, and trustees must adhere and annually attest to our Code of Conduct, which includes policies and standards around personal, professional, and marketplace integrity; anonymous reporting of concerns; and protecting Company assets. The Code of Conduct also covers the Foreign Corrupt Practices Act, antitrust and competition laws, anti-boycott laws, export control laws, insider trading laws, and equal opportunity, diversity, and anti-harassment standards. Executive management and trustees must also adhere to additional Codes of Ethics and Corporate Governance Guidelines.

Ongoing Board Refreshment

Our Board has demonstrated a commitment to board refreshment. Over one-third of our trustees, all independent, have served for less than four years.

Our Commitment

We are committed to an integrated approach to sustainability across our organization. We strive to further reduce the Company’s environmental footprint while bolstering our resilience in the face of environmental, economic, political, data security, reputational, and other risks. We seek to continually strengthen our unique competitive advantages in order to manage risk, create and act upon opportunity, and generate sustained long-term value for our stakeholders. Please refer to our Sustainability Report available on our website at publicstorage.com for additional information regarding our sustainability program, efforts, and commitment to our stakeholders.

Public Storage | 2024 Proxy Statement | 9

Proposal 1:

Election of Trustees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Our Board has nominated eleven trustees, who have agreed to serve unit next year’s annual meeting of shareholders if elected by shareholders at our Annual Meeting

|

|

|

| RECOMMENDATION: Vote FOR each nominee |

10 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

PROPOSAL 1

ELECTION OF TRUSTEES

|

|

|

|

EXECUTIVE SUMMARY

Our Board has nominated eleven trustees for election at this year’s Annual Meeting to hold office until the next annual meeting of shareholders.

Each of the eleven nominees has agreed to be named in this proxy statement and to serve on the Board if elected. We expect all nominees to attend the Annual Meeting.

If any of our nominees becomes unavailable to stand for election, the proxies named on the proxy card intend to vote your common shares for the election of any substitute nominee proposed by the Board.

As discussed more fully below, the proposed slate of eleven nominees reflects the Board’s ongoing consideration of the appropriate size of the Board, consistent with the Board’s determination that reducing the size of the Board, while maintaining an appropriate mix of skills, experience, and personal qualities, creates an effective, well-functioning Board that serves the best interests of Public Storage and our shareholders. As a result of the Board’s ongoing deliberations, including consideration of the various other commitments of our trustees, the Board has nominated the eleven nominees listed on page 16, each of whom is a current trustee. The Board continues to evaluate its composition, including with respect to the diversity of our trustees’ professional experience, race, ethnicity, gender, age, and cultural backgrounds. The Board will be reduced in size to eleven trustees effective at the Annual Meeting.

The Board is responsible for overseeing management and providing sound governance on behalf of our shareholders. The Board and each of its committees have an active role in overseeing management of the Company’s risks, a responsibility that the Board believes is one of its most important areas of oversight.

The Board carries out its responsibilities through (1) the effective collaboration of our highly capable and experienced trustees; (2) a well-crafted Board structure, which includes separate individuals holding the positions of the CEO, the Chairman of the Board, and the Lead Independent Trustee; (3) a strong committee structure that enables trustees to provide the appropriate level of focused oversight and subject-matter expertise; and (4) adherence to our Corporate Governance Guidelines and Trustees’ Code of Ethics.

Public Storage | 2024 Proxy Statement | 11

Proposal 1: Election of Trustees

BOARD COMPOSITION HIGHLIGHTS

Each of our nominees is a current trustee. All nominees are well-qualified to serve on our Board based on education, experience, and personal qualities. Our trustees provide a variety of points of view that improve the quality of dialogue, contribute to a more effective decision-making process, and enhance overall culture in the boardroom. Our trustee-nominees represent a diversity of professional experience, race, ethnicity, gender, age, and cultural background, including:

2024 Trustee Nominees | ||

|

|

|

Independence | Gender Diversity | |

|

|

|

Racial Diversity* |

| Age Diversity |

|

|

|

|

|

|

Tenure** | ||

|

|

|

| ||

* Racial diversity includes self-identification as a member of an underrepresented community.

** Average tenure is 8.4 years.

12 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

BOARD EVALUATIONS AND NOMINATIONS

In our annual Board evaluation and nomination process, the NGS Committee evaluates our trustees—individually and as a group—in light of the current needs of the Board and the Company. This annual evaluation process reviews the effectiveness of the Board, its committees, and trustees, with a focus on Board composition, culture, and administration. In addition, during the course of the year, the NGS Committee discusses Board succession and may review potential trustee candidates. The NGS Committee has in the past retained third parties to assist in identifying potential nominees.

Our annual evaluation process involves assessments at the Board, Board committee, and individual trustee levels under the direction of the NGS Committee Chair and the Chairman of the Board. Each trustee completes an anonymous written questionnaire and then meets individually with the NGS Committee Chair to review themes identified in the questionnaire responses and discuss other evaluation topics. Following the individual interviews, the NGS Committee Chair discusses with the NGS Committee the aggregated results of the written questionnaires and the NGS Committee Chair's conversations with individual trustees. The NGS Committee Chair also presents committee-specific feedback to each of the Audit Committee Chair and CHC Committee Chair and reports the results of the annual evaluation process to the full Board. Feedback resulting from these evaluations is used to refine Board and Board committee practices and improve Board, Board committee, and individual trustee performance. In addition, the NGS Committee takes into consideration these evaluations when recommending the slate of nominees for election to the Board at each annual meeting of shareholders.

As disclosed in our 2023 annual meeting proxy statement, following the Board’s annual evaluation process in 2022, the Board undertook to reduce its size over time to facilitate greater efficiency and effectiveness. At the 2023 annual meeting of shareholders, the Board reduced its size from fourteen to thirteen trustees. In connection with the Board’s 2023 annual evaluation process, the Board continued to consider its size, including the impact any further reductions in size would have on the collective mix of our trustees’ skills, experience, and personal qualities. As a result of these deliberations, in early 2024, the Board determined to further reduce the size of the Board to eleven. The Board has nominated the eleven nominees listed on page 16, each of whom is a current trustee. The size of the Board will be reduced from thirteen to eleven trustees following the Annual Meeting.

The Board acknowledges that these further reductions to its size impact its composition, including with respect to the diversity of our trustees’ professional experience, race, ethnicity, gender, age, and cultural backgrounds. The Board is committed to considering these attributes as it continues to evaluate the appropriate composition of the Board. For further information on the Board’s focus on diversity, please see the “Board Focus on Diversity” section below, beginning on page 15.

BOARD QUALIFICATIONS

The NGS Committee has developed a matrix of skills to help assess the qualifications of trustee candidates, including:

Public Storage | 2024 Proxy Statement | 13

Proposal 1: Election of Trustees

The NGS Committee considers the relevant skills and attributes of each Board candidate with the goal of nominating a diverse slate of candidates with an appropriate combination of skills, experience, and personal qualities that will best serve the Board and its committees, our Company, and our shareholders.

The NGS Committee also considers each Board candidate’s competing commitments and responsibilities, including service on other corporate boards, with a view to confirming that such other commitments and responsibilities will not adversely impact the ability of Board candidates to satisfy the significant commitments required of our trustees.

BOARD REFRESHMENT AND SUCCESSION STRATEGY

Our Board and the NGS Committee understand the importance of Board refreshment. We aim to strike a balance between the knowledge and perspective that come from longer-term service on the Board with the new experience, ideas, and energy that can come from adding new trustees. We regularly consider whether our Board appropriately includes trustees who have valuable historic institutional knowledge of Public Storage and the competitive environment, as well as newer trustees with varied backgrounds, perspectives, and skills. As a result of our ongoing Board refreshment efforts, the average tenure of the eleven trustees submitted for re-election at the Annual Meeting is 8.4 years.

The NGS Committee takes a strategic approach to refreshment and succession planning. The NGS Committee’s approach includes considering the Company’s business strategy, regularly refining its list of the skills necessary for effective Company oversight over the short- and long-term, regularly assessing how the current Board meets these targeted skills, and identifying skills and backgrounds that should be bolstered by adding new trustees.

These ongoing strategic assessments are supported and informed by the rigorous annual evaluation process performed under the direction of the NGS Committee Chair and the Chairman of the Board at the Board, Board committee, and individual trustee levels.

We also consider any meaningful changes in the job responsibilities or business associations of our trustees. As discussed more fully below under “Corporate Governance—Changes in Trustee Responsibilities and Commitments” on page 32, our Corporate Governance Guidelines and Trustees’ Code of Ethics permit the NGS Committee to request that a trustee resign if such a change impairs the trustee’s effectiveness. The NGS Committee also takes into account anticipated trustee retirements as it considers its long-term Board composition goals. In addition, as part of our shareholder engagement dialogue, we have in the past discussed with our investors the composition and performance of our Board, and we will continue to do so upon request or as otherwise appropriate.

14 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

As noted above, our 2022 Board evaluation process confirmed the Board’s belief that the number of trustees should be reduced in order to facilitate more efficient and effective oversight and decision-making. Accordingly, the Board reduced its size to thirteen trustees effective at the 2023 annual meeting of shareholders. Following the Board’s 2023 annual evaluation process, the NGS Committee, in consultation with the Chairman of the Board, further considered the appropriate size of the Board. The NGS Committee weighed the core trustee attributes, diversity considerations, additional professional skills, experience, and knowledge, and the competing professional commitments of each of our existing trustees against the Board’s and Company’s perceived needs, the desired size of the Board, and other feedback identified through the Board’s annual evaluation processes.

After deliberation, the NGS Committee recommended to the Board, and the Board agreed, that the nominee slate should include the eleven nominees submitted for election at the Annual Meeting and that the size of the Board should be reduced to eleven effective at the meeting. Assuming the election of this year’s proposed trustee nominees, we believe we will have a good balance between tenured and newer trustees, and that the proposed slate of nominees will constitute a strong, independent Board that will be well-positioned to navigate the current challenging business environment, accelerate the Company’s growth, and support the accomplishment of key corporate objectives for the benefit of all of our stakeholders.

BOARD FOCUS ON DIVERSITY

Board succession and ensuring an appropriate diversity of views and experience are key focus areas for the NGS Committee and the Board. Our Board, including the nominees submitted for election at the Annual Meeting, reflects diverse perspectives and a complementary mix of skills, experience, and backgrounds that we believe are paramount to our ability to represent the interests of all stakeholders. Our Board recognizes the importance of diversity and supports management’s efforts to enhance all aspects of diversity throughout the Company.

Our trustee nominees, 82% of whom are independent, have a broad range of experience in varying fields, including real estate, finance, financial reporting, banking, international affairs, governance, marketing, retail, operations, legal, and cybersecurity/technology. A majority of our trustees hold or have held directorships at other U.S. public companies. Two of our trustee nominees, in addition to our Chairman and our CEO, have served as CEOs, and all have demonstrated superb leadership and analytical skills gained from deep experience in management, finance, and corporate governance.

Three of our trustee nominees are women (including, as of the date of the Annual Meeting, our Lead Independent Trustee and our Audit Committee chair), and four are racially diverse or self-identify as being from an underrepresented community. The Board acknowledges that the reduction of its size to eleven trustees will impact its gender diversity but expects that through its regular and ongoing refreshment efforts, its gender diversity will return to previous normalized levels.

Additionally, our Chairman and our CEO have provided meaningful in-person opportunities for the Board to interact with key members of management beyond our executive officers on a quarterly basis. Half of our current executive officers are diverse (including our Chief Administrative Officer (gender and racial) and Chief Legal Officer (racial)).

Public Storage | 2024 Proxy Statement | 15

Proposal 1: Election of Trustees

NOMINEE QUALIFICATIONS

The Board has nominated eleven trustees, all of whom are incumbents elected at our 2023 annual meeting of shareholders.

We recommend that you vote FOR each nominee.

Nominee | Age | Principal Professional Background | Trustee Since | Committee | ||||

Ronald L. Havner, Jr. |

| 66 |

| Chairman of the Board; Retired Chief Executive Officer of Public Storage |

| 2002 |

|

|

Tamara Hughes Gustavson (Independent Trustee) |

| 62 |

| Real Estate Investor; Philanthropist |

| 2008 |

|

|

| ||||||||

| ||||||||

Shankh S. Mitra (Independent Trustee) |

| 43 | Chief Executive Officer of Welltower Inc. | 2021 | CHC | |||

Rebecca Owen (Independent Trustee) |

| 62 | Retired President of CEI Realty Inc.; Former Chief Legal Officer of Clark Enterprises, Inc. | 2021 | Audit | |||

Kristy M. Pipes (Independent Trustee) |

| 64 | Retired Managing Director and Chief Financial Officer of Deloitte Consulting | 2020 | Audit (Chair) and NGS | |||

Avedick B. Poladian (Independent Trustee) |

| 72 |

| Retired Executive Vice President and Chief Operating Officer of Lowe Enterprises, Inc. | 2010 | Audit and CHC (Chair) | ||

John Reyes (Independent Trustee) | 63 | Retired Chief Financial Officer of Public Storage | 2019 |

| ||||

Joseph D. Russell, Jr. | 64 | President and CEO of Public Storage; Former Chief Executive Officer of PS Business Parks, Inc. | 2019 | |||||

Tariq M. Shaukat (Independent Trustee) | 51 | Co-Chief Executive Officer of Sonar, a privately held clean code solution provider | 2019 | Audit | ||||

Ronald P. Spogli (Independent Trustee) | 76 | Co-Founder of Freeman Spogli & Co.; Former Ambassador to the Italian Republic and the Republic of San Marino | 2010 | NGS (Chair) and CHC | ||||

Paul S. Williams (Independent Trustee) | 64 | Retired Partner at Major, Lindsey & Africa; Former President of the National Association of Corporate Directors (NACD) Chicago Chapter |

| 2021 | CHC and NGS | |||

16 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

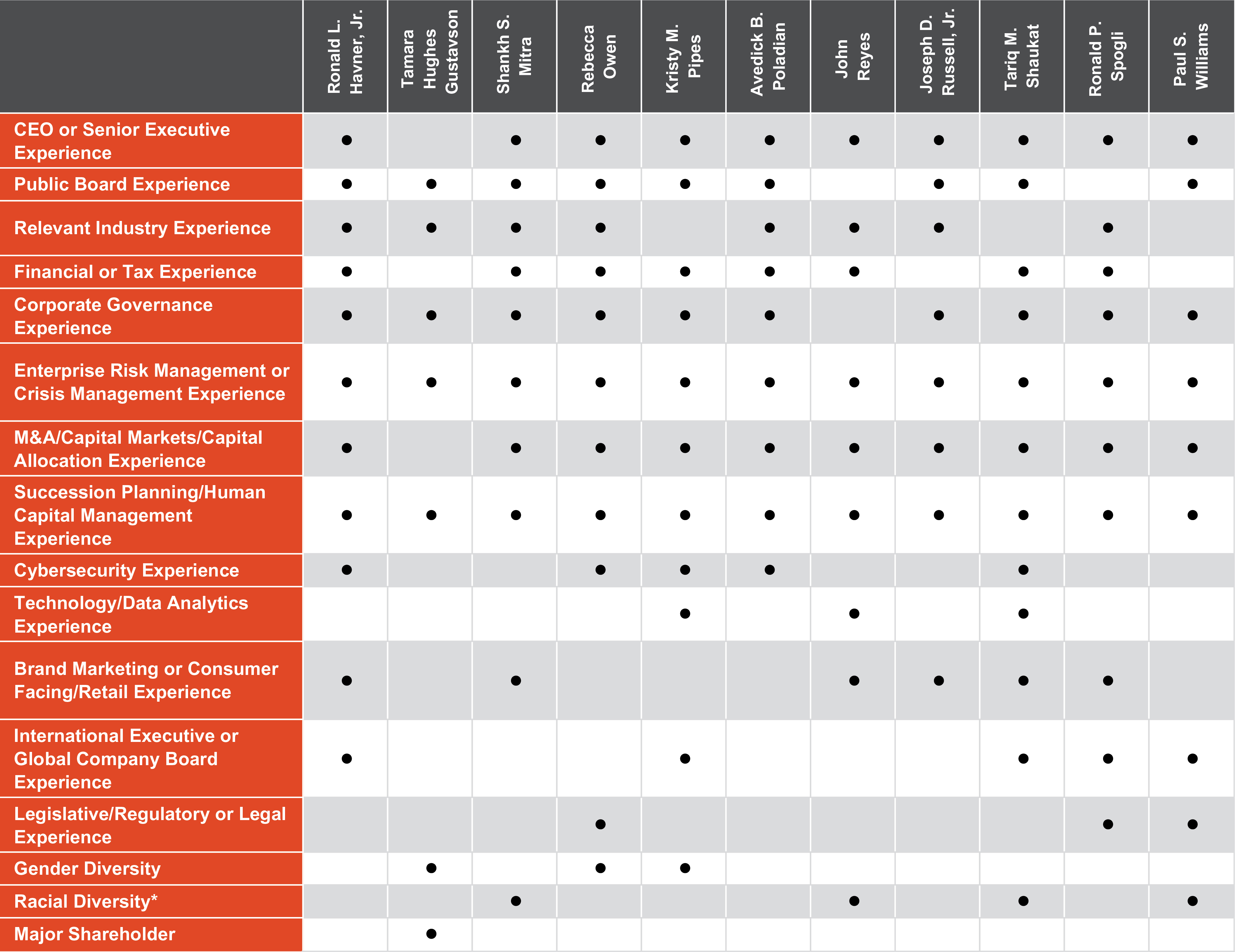

TRUSTEE NOMINEES SKILLS SUMMARY

The Board believes that our trustee nominees provide Public Storage with the combined skills, experience, and personal qualities needed for an effective and engaged Board.

* Includes self-identification as being from an underrepresented community.

Public Storage | 2024 Proxy Statement | 17

Proposal 1: Election of Trustees

TRUSTEE NOMINEE BIOGRAPHIES

Ronald L. Havner, Jr. Chairman | |||

|

|

| |

|

|

| |

Age: 66

Trustee since: 2002 |

|

| Mr. Havner joined the Board in November 2002 and has served as Chairman since August 2011. Mr. Havner served as Chief Executive Officer of Public Storage from November 2002 until his retirement on January 1, 2019. Mr. Havner joined Public Storage in 1986 and held a variety of senior management positions prior to becoming Chief Executive Officer. Mr. Havner serves as a director of AvalonBay Communities, Inc. (NYSE: AVB). He previously served as Chairman of the Board of Public Storage’s affiliate, Shurgard Self Storage SA (Shurgard) (EURONEXT: SHUR), from October 2018 until May 2023. Mr. Havner also previously served as Chairman of the Board of PS Business Parks, Inc. (PS Business Parks) (previously listed on the NYSE) from March 1998 until its sale in July 2022. He was the 2014 Chairman of the Board of Governors of Nareit. Key Reasons for Nomination: Mr. Havner’s qualifications for election to the Board include his extensive leadership experience and Company and industry knowledge. Having served at Public Storage for almost 40 years, including 17 years as Chief Executive Officer, Mr. Havner provides an invaluable perspective in Board discussions about the historic operations and strategic direction of the Company. |

Tamara Hughes Gustavson Real Estate Investor; Philanthropist | |||

|

|

| |

|

|

| |

Age: 62

Trustee since: 2008

Independent Trustee |

|

| Ms. Gustavson joined the Board in November 2008. She was previously employed by Public Storage from 1983 to 2003, serving most recently as Senior Vice President, Administration. During the past ten years, Ms. Gustavson has supervised her personal business investments and engaged in charitable activities. Ms. Gustavson currently serves on the Board of Trustees of American Homes 4 Rent (NYSE: AMH), the Board of Trustees of the William Lawrence and Blanche Hughes Foundation, and the Board of Trustees of the University of Southern California. Ms. Gustavson is our largest single shareholder and owns approximately 9.8% of the Company’s common shares. Key Reasons for Nomination: Ms. Gustavson’s qualifications for election to the Board include her knowledge of the Company and its business and her public company board experience. In addition, as the largest individual shareholder of the Company, Ms. Gustavson provides the Board with a shareholder’s perspective on the operations and strategic direction of the Company. |

18 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

Shankh S. Mitra Chief Executive Officer of Welltower Inc. | |||

|

|

| |

|

|

| |

Age: 43

Trustee since: 2021

Independent Trustee

Committees:

CHC |

|

| Mr. Mitra joined the Board in January 2021. He has served as the Chief Executive Officer of Welltower Inc. (NYSE: WELL), a publicly traded real estate investment trust that invests in seniors housing operators, post-acute providers, and health systems, since October 2020. Previously, Mr. Mitra served as Welltower Inc.’s Chief Investment Officer from August 2018 to January 2023, Senior Vice President—Investments from January 2018 to August 2018, and Senior Vice President—Finance & Investments from January 2016 to January 2018. From July 2013 to October 2015, Mr. Mitra served as Portfolio Manager, Real Estate Securities at Millennium Management. Mr. Mitra served as Senior Analyst at Citadel Investment Group from April 2012 to June 2013 and Fidelity Investments from June 2009 to March 2012. Mr. Mitra has served as a director of Welltower Inc. since October 2020. Key Reasons for Nomination: Mr. Mitra’s qualifications for election to the Board include his extensive experience as a public company executive and director, including as Chief Executive Officer and director of a large REIT, his extensive experience owning, operating, acquiring, and developing real estate, his enterprise risk management expertise, and his financial acumen and expertise in mergers and acquisitions and capital allocation. |

Rebecca Owen Retired President of CEI Reality, Inc.; Former Chief Legal Officer of Clark Enterprises, Inc. | |||

|

|

| |

|

|

| |

Age: 62

Trustee since: 2021

Independent Trustee

Committees:

Audit |

|

| Ms. Owen joined the Board in January 2021. Ms. Owen has served as the Chairman and founder of Battery Reef, LLC, a commercial real estate investment and management company, since January 2019. From 1995 until January 2019, she served in various roles at Clark Enterprises, Inc., a private investment firm, and its affiliated companies, including as President and Chief Investment Officer of CEI Realty, Inc., the real estate investment arm of Clark Enterprises, from 2015 to 2019, and Chief Legal Officer of Clark Enterprises from 1995 to 2017. Ms. Owen has served on the Board of Directors of Willscot Mobile Mini Holdings Corp. (NASDAQ: WSC) since November 2021, and she is a member of its Nominations and Corporate Governance and Compensation Committees (she also previously served on that board and its Audit Committee from April 2019 to June 2020). In addition, Ms. Owen has served on the Board of Directors of Carr Properties, a private real estate investment trust, since 2013, on the Board of Directors of The Feil Organization, a private commercial real estate investment and management company, since 2022, and on the Real Estate Investment Advisory Committee of ASB Capital Management, LLC, a registered investment advisor, since 2017. Previously, Ms. Owen served on the Board of Directors of Jernigan Capital, Inc. (NYSE: JCAP) from December 2018 to November 2020. Key Reasons for Nomination: Ms. Owen’s qualifications for election to the Board include her extensive experience acquiring, developing, owning, and managing commercial real estate, including as President of a large, diversified, private real estate firm, her significant financial, risk management, and legal expertise, and, through her board experience, her valuable insight into human resources and corporate governance matters. |

Public Storage | 2024 Proxy Statement | 19

Proposal 1: Election of Trustees

Kristy M. Pipes Former Managing Director and Chief Financial Officer of Deloitte Consulting | |||

|

|

| |

|

|

| |

Age: 64

Trustee since: 2020

Independent Trustee

Committees:

Audit (Chair) NGS |

|

| Ms. Pipes joined the Board in October 2020. Ms. Pipes previously served as Managing Director and Chief Financial Officer of Deloitte Consulting, an international management consultancy firm, where she managed the finance function. Ms. Pipes held various leadership positions, including serving on the firm’s Management Committee and Consulting Operations Committee. Prior to joining Deloitte in 1999, Ms. Pipes was Vice President and Manager, Finance Division, at Transamerica Life Companies and Senior Vice President and Chief of Staff for the President and Chief Executive Officer (among other senior management positions) at First Interstate Bank of California. Ms. Pipes joined the Board of Directors of AECOM (NYSE: ACM) in October 2022, and she also serves as a director of ExlService Holdings, Inc. (NASDAQ: EXLS) and Savers Value Village (NYSE: SVV). She served as a director of PS Business Parks (previously listed on the NYSE) from July 2019 until its sale in July 2022. Key Reasons for Nomination: Ms. Pipes’s qualifications for election to the Board include her extensive finance and financial reporting expertise and experience, including her experience as a chief financial officer. Ms. Pipes also brings deep management, leadership, and risk management experience to the Board, having held several senior leadership positions during her career, as well as cybersecurity and data privacy experience. |

Avedick B. Poladian Retired Executive Vice President and Chief Operating Officer of Lowe Enterprises | |||

|

|

| |

|

|

| |

Age: 72

Trustee since: 2010

Independent Trustee

Committees:

CHC (Chair) Audit |

|

| Mr. Poladian joined the Board in February 2010. From 2007 to the end of 2016, Mr. Poladian held the positions of Executive Vice President and Chief Operating Officer for Lowe Enterprises, a diversified national real estate company that he joined in 2003. Mr. Poladian was with Arthur Andersen from 1974 to 2002 as Managing Partner, Pacific Southwest. Mr. Poladian serves as a director of funds managed by Western Asset Management, including two publicly traded funds, and is a director of Occidental Petroleum Corporation (NYSE: OXY). Mr. Poladian is also a member of the Board of Councilors of the USC Sol Price School of Public Policy, the Board of Advisors of the Ronald Reagan UCLA Medical Center, and Director Emeritus of the YMCA of Metropolitan LA. He previously served on the boards of California Pizza Kitchen (previously listed on Nasdaq) and California Resources Corporation (NYSE: CRC). Key Reasons for Nomination: Mr. Poladian’s qualifications for election to the Board include his expertise and experience in real estate investing and operations, including as a result of his service as the chief operating officer and chief financial officer of a large diversified real estate company, and his expertise in finance, accounting, and financial reporting, including as a result of his experience as an auditor and senior executive at a national accounting firm. Through his experience with other public companies, Mr. Poladian also brings valuable insight into our business and corporate governance. |

20 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

John Reyes Retired Senior Vice President and Chief Financial Officer of Public Storage | |||

|

|

| |

|

|

| |

Age: 63

Trustee since: 2019

Independent Trustee

|

|

| Mr. Reyes joined the Board in January 2019. Mr. Reyes served as Senior Vice President and Chief Financial Officer of Public Storage from 1996 until his retirement effective January 1, 2019. Mr. Reyes joined Public Storage in 1990 and served in various positions until his promotion to Chief Financial Officer in 1996. From 1983 to 1990, Mr. Reyes was employed by EY as a Certified Public Accountant. Key Reasons for Nomination: Mr. Reyes’s qualifications for election to the Board include his extensive expertise and experience with the Company’s finances, accounting, financial reporting, and risk management, given his experience in having served as the Company’s Chief Financial Officer for more than 20 years. Mr. Reyes provides invaluable perspective in Board discussions about the historic operations and strategic direction of the Company. |

Joseph D. Russell, Jr. President and Chief Executive Officer of Public Storage | |||

|

|

| |

|

|

| |

Age: 64

Trustee since: 2019

|

|

| Mr. Russell joined the Board in January 2019. Mr. Russell has been President of Public Storage since July 2016 and has served as its Chief Executive Officer since January 1, 2019. Previously, Mr. Russell was President and Chief Executive Officer of PS Business Parks (previously listed on the NYSE) from August 2002 until July 2016. Mr. Russell served on the Board of Directors of PS Business Parks from August 2003 until its sale in July 2022. Mr. Russell serves on the Executive Committee of the Board of Governors of NAREIT. Before joining PS Business Parks, Mr. Russell was employed by Spieker Properties, Inc. (Spieker) (previously listed on the NYSE), an owner and operator of office and industrial properties in Northern California, and its predecessor, for more than ten years. Mr. Russell served as an officer of Spieker when it became a publicly traded REIT in 1993. Key Reasons for Nomination: Mr. Russell’s qualifications for election to the Board include his leadership experience and Company and industry knowledge, including his almost 30-year involvement with publicly traded REITs and extensive experience with self-storage and other types of real estate. Mr. Russell provides management’s perspective in Board discussions about the operations and strategic direction of the Company. |

Public Storage | 2024 Proxy Statement | 21

Proposal 1: Election of Trustees

Tariq M. Shaukat Co-Chief Executive Officer of Sonar | |||

|

|

| |

|

|

| |

Age: 51

Trustee since: 2019

Independent Trustee

Committees:

Audit |

|

| Mr. Shaukat joined the Board in July 2019. He has been co-Chief Executive Officer of Sonar, a clean code solution provider, since August 2023. Prior to that, Mr. Shaukat was President of Bumble Inc. from July 2020 to August 2023. He also served as President of Google Cloud at Google LLC from 2016 to 2020, where he oversaw operating and customer-based initiatives to accelerate growth across all lines of business, including analytics and machine learning. Before joining Google LLC, Mr. Shaukat was Executive Vice President and Chief Commercial Officer at Caesars Entertainment Corporation, after initially joining the company in 2012 as Executive Vice President and Chief Marketing Officer. His responsibilities included oversight of revenue management, marketing, information technology, and analytics across all business lines. Prior to Caesars Entertainment Corporation, Mr. Shaukat was a Partner at McKinsey & Company and held leadership positions at various technology-based companies. Mr. Shaukat has served on the Board of Directors of GAP, Inc. (NYSE: GPS) since May 2023, where he serves as a member of the Audit and Finance Committee. Key Reasons for Nomination: Mr. Shaukat’s qualifications for election to the Board include his extensive digital, marketing, technology, cybersecurity, and data analytics experience. In addition, Mr. Shaukat brings international experience and his proven leadership and unique perspective to the Board. |

Ronald P. Spogli Co-Founder of Freeman Spogli & Co. | |||

|

|

| |

|

|

| |

Age: 76

Trustee since: 2010

Independent Trustee

Committees:

NGS (Chair) CHC |

|

| Mr. Spogli joined the Board in February 2010. Mr. Spogli co-founded Freeman Spogli & Co. (Freeman Spogli), a private investment firm dedicated to middle-market companies positioned for growth, in 1983. Freeman Spogli has invested over $5.8 billion in 70 portfolio companies with an aggregate transaction value of over $28 billion and has completed over 185 add-on acquisitions with its portfolio companies. He served as the United States Ambassador to the Italian Republic and the Republic of San Marino from August 2005 until February 2009. Mr. Spogli also serves on the Board of Overseers of the Hoover Institution at Stanford University and on the Boards of Trustees of the W. M. Keck Foundation, the Center for American Studies in Rome, Italy, and White Bridge Investments, an Italian investment company. Previously, Mr. Spogli served as the Vice Chair of The J. Paul Getty Trust. Key Reasons for Nomination: Mr. Spogli’s qualifications for election to the Board include investing and investment management expertise and his broad-ranging board and executive experience. In addition, Mr. Spogli’s experience in government and international relations provides helpful insight in the European countries where Public Storage has investments. |

22 | Public Storage | 2024 Proxy Statement

Proposal 1: Election of Trustees

Paul S. Williams Retired Partner, Major, Lindsey & Africa | |||

|

|

| |

|

|

| |

Age: 64

Trustee since: 2021

Independent Trustee

Committees:

CHC NGS |

|

| Mr. Williams joined the Board in January 2021. Mr. Williams served as a Partner and Managing Director of Major, Lindsey & Africa, LLC, an executive recruiting firm, from 2005 to 2018. He also served as Director of Global Diversity Search, assisting legal organizations in enhancing their diversity. Mr. Williams is the immediate past President of the Chicago Chapter of the National Association of Corporate Directors. From 2001 through 2005, Mr. Williams served as Executive Vice President, Chief Legal Officer & Corporate Secretary of Cardinal Health, Inc. (NYSE: CAH), a provider of products and services to healthcare providers and manufacturers. Mr. Williams has served on the Board of Directors of Air Transport Services Group (NASDAQ: ATSG), a provider of aircraft leasing and air cargo transportation and related services, since January 2021. Since early 2020, Mr. Williams has served on the board of directors of a cluster of funds in the American Funds mutual fund family (part of the privately-held Capital Group). Previously, Mr. Williams served on the Boards of Directors of Compass Minerals (NYSE: CMP), a producer of salt, plant nutrients, and magnesium chloride for distribution primarily in North America, from June 2009 until his retirement in February 2023, and Romeo Power, Inc. (NYSE: RMO), an energy technology company, from December 2020 until completion of its sale to Nikola Corporation in October 2022. Additionally, Mr. Williams served as a director of Essendant, Inc. (NASDAQ: ESND), a national wholesale distributor of business products, from 2014 through 2019 and as a director of Bob Evans Farms, Inc. (NASDAQ: BOBE), an owner and operator of restaurants, from 2007 through 2017. He also served as Lead Independent Director of State Auto Financial Corporation (NASDAQ: STFC), a property and casualty insurance company, on whose board he served from 2003 to 2015. Key Reasons for Nomination: Mr. Williams’s qualifications for election to the Board include his corporate governance and human capital management expertise, including with respect to talent development and diversity and inclusion, and his extensive legal and regulatory experience. In addition, Mr. Williams brings substantial executive management leadership experience. |

VOTE REQUIRED AND RECOMMENDATION

For the election of trustees, trustee nominees receiving an affirmative vote of a majority of the votes cast at the Annual Meeting will be elected. For purposes of the vote on this proposal, abstentions and broker non-votes will not affect the vote.

The Board recommends voting FOR all trustee nominees.

Public Storage | 2024 Proxy Statement | 23

Corporate Governance

CORPORATE GOVERNANCE

BOARD ENGAGEMENT AND OVERSIGHT

Our Board is a critical resource for senior management and provides invaluable insight and oversight. The Board and our senior leadership team engage regularly and collaborate closely to ensure the Company meets its commitments to all stakeholders, including our employees, customers, and our shareholders.

One of the Board’s highest priorities continues to be guiding the development and execution of the Company’s long-term strategy. The Board remains focused on working with management to develop strategies to accelerate growth and create long-term value for our shareholders.

GOVERNANCE STRUCTURE

Our Board oversees our CEO and other senior management to ensure that the long-term interests of the Company and our shareholders are best served. We expect our trustees to take a proactive, focused approach to executing their oversight responsibilities.

Our governance structure is designed to foster principled actions, informed and effective decision-making, and appropriate monitoring of performance, risk, and compliance. Our key governance documents, including our Corporate Governance Guidelines and Trustee’s Code of Ethics, Code of Conduct, Code of Ethics for Senior Financial Officers, and our committee charters, are available on the Investor Relations section of our website at publicstorage.com or by writing to Public Storage, 701 Western Avenue, Glendale, California 91201, Attention: Corporate Secretary. We will disclose any substantive amendments to or waivers of any of our ethics policies and standards on our website and in accordance with Securities and Exchange Commission (SEC) and New York Stock Exchange (NYSE) requirements.

BOARD LEADERSHIP STRUCTURE

One of the Board’s key responsibilities is to determine the optimal leadership structure to provide effective oversight of management. As a result, the Board does not have a policy as to whether the roles of Chairman and CEO should be separated or combined. The Board believes that our shareholders are best served when the Board has flexibility to consider the relevant facts and circumstances to ensure that the Board leadership structure best reflects the needs of the Company at that time.

Prior to January 1, 2019, when Ronald L. Havner, Jr., retired as CEO, the roles of Chairman and CEO were combined and held by Mr. Havner. Upon Mr. Havner’s retirement, the Board determined that he would remain Chairman of the Board, and the roles of Chairman and CEO have been separately held by Mr. Havner and Mr. Russell, respectively, since January 1, 2019.

The Chairman typically attends our annual meeting of shareholders and has the authority to call special meetings of shareholders. The Chairman also has the authority to call and act as chairman of meetings of the Board. In addition to conversations our Chairman has with shareholders at our annual meetings, the Chairman may also participate in informal meetings with shareholders. The Chairman regularly engages with the CEO, Lead Independent Trustee, chairs of Board committees, and other members of the Board regarding issues related to Board structure. The Chairman also assists the CHC Committee with the annual performance review of our CEO.

24 | Public Storage | 2024 Proxy Statement

Corporate Governance

Our Board established the position of Lead Independent Trustee in 2011 to provide an independent leadership role on the Board when the roles of Chairman and CEO are combined or when the Chairman is otherwise not independent. Notwithstanding that the Chairman and CEO roles were separated on January 1, 2019, we maintain the Lead Independent Trustee role as a matter of good corporate governance and to bolster the independence of the Board.

We describe more fully the role of the Lead Independent Trustee in our Corporate Governance Guidelines and Trustees’ Code of Ethics. Among other things, the Lead Independent Trustee presides at all executive sessions of the independent trustees, assists in the recruitment and selection of new trustees, and consults with the CEO on strategic planning and other issues when the CEO and Chairman roles are combined.

Under our Corporate Governance Guidelines and Trustees’ Code of Ethics, our Lead Independent Trustee is appointed to serve one or more successive three-year terms. David J. Neithercut has served as our Lead Independent Trustee since January 2021. Following the conclusion of Mr. Neithercut’s term as a trustee effective at the Annual Meeting, the Board will appoint a new Lead Independent Trustee. The Board currently anticipates that Kristy M. Pipes will be appointed to this role. As Chair of the Audit Committee, Ms. Pipes is an effective leader on the Board, and she would bring her extensive management, leadership, and risk management experience to the position of Lead Independent Trustee. We intend to announce all Board leadership and committee composition changes following the Annual Meeting.

BOARD COMMITTEES

The three standing committees of the Board are the Audit, CHC, and NGS Committees. The Board has determined that each member of the Audit, CHC, and NGS Committees is independent in accordance with NYSE rules.

Each committee has a charter that generally states the purpose of the committee and outlines the committee’s structure and responsibilities. Each committee reviews the adequacy of its charter annually. The following lists the number of meetings held by each committee in 2023:

|

|

|

Committee |

| Number of |

|

|

|

|

|

|

Audit |

| 7 |

|

|

|

|

|

|

Compensation and Human Capital |

| 6 |

|

|

|

|

|

|

Nominating, Governance, and Sustainability |

| 5 |

|

|

|

Public Storage | 2024 Proxy Statement | 25

Corporate Governance

In connection with the reduction in the size of the Board effective at the Annual Meeting, we expect the composition of our committees to change following the meeting. We intend to announce all Board leadership and committee composition changes following the Annual Meeting. The current membership and primary areas of responsibility of our Board committees are as follows:

Audit Committee

Members: Kristy M. Pipes (Chair), Rebecca Owen, Avedick B. Poladian, and Tariq M. Shaukat

Compensation and Human Capital Committee

Members: Avedick B. Poladian (Chair), Shankh S. Mitra, Ronald P. Spogli, and Paul S. Williams

26 | Public Storage | 2024 Proxy Statement

Corporate Governance

Nominating, Governance, and Sustainability Committee

Members: Ronald P. Spogli (Chair), Leslie S. Heisz, David J. Neithercut, Kristy M. Pipes, and Paul S. Williams

Public Storage | 2024 Proxy Statement | 27

Corporate Governance

PROXY ACCESS

Our Amended and Restated Bylaws (Bylaws) provide for proxy access, thereby giving our shareholders an even greater voice in trustee elections. A shareholder, or a group of up to 20 shareholders, owning at least 3% of the Company’s outstanding common shares continuously for at least three years may include in our proxy materials trustee nominees constituting up to the greater of two trustees or 20% of the number of trustees on the Board, provided that the shareholder and the nominees satisfy the eligibility requirements in our Bylaws. There are no qualifying shareholder nominations for inclusion in our proxy statement.

BOARD’S ROLE IN RISK OVERSIGHT

Our Board is responsible for overseeing our Company-wide approach to the identification, assessment, and management of short-term, intermediate-term, and long-term risks facing the Company. The Board recognizes its responsibility for overseeing the assessment and management of risks that may threaten successful execution of our long-term strategies, and the Board consults with outside advisors and experts when necessary. All of our trustees bring risk management experience from their principal occupation or other professional experience, including service on other boards and attendance at pertinent seminars and director education programs.

The Board’s risk management processes include a comprehensive ERM framework focused on:

Critical components of our risk oversight framework include regular assessments among risk owners to identify and assess key risks facing the Company. Our executive team calibrates risk owner assessments across each of our key risk categories and leads efforts to identify

28 | Public Storage | 2024 Proxy Statement

Corporate Governance

mitigation controls to reduce the Company’s exposure to risks. Our board and its committees regularly receive presentations from management on risks to the business. Additionally, all trustees have access to members of management if a trustee wishes to follow up on items discussed outside of the Board or committee meeting.

To ensure our risk profile is appropriately reflected in our public disclosures, members of our legal and finance teams, as well as our Vice President, Enterprise Risk, participate in quarterly meetings with the Audit Committee regarding risk oversight.

Oversight for certain specific risks falls under the responsibilities of our Board committees. The committees regularly advise the full Board of their oversight activities.

The Audit Committee focuses on financial, reputational, legal, information security, and other risks affecting the Company. The Audit Committee also discusses the Company’s policies with respect to risk assessment and risk management. The Audit Committee engages quarterly with members of management, including from the finance, legal, enterprise risk and compliance, information technology, and internal audit functions, as well as external experts as appropriate, to assess the risk environment, including current and anticipated risks, and the Audit Committee in turn provides reports to the full Board.

The Compensation and Human Capital Committee focuses on risks related to our compensation program, including evaluating appropriate compensation incentives relating to the compensation of our executives and employees, our human capital, and management succession matters.

In connection with preparing the report for the CHC Committee’s consideration, members of our senior management team, including our CEO and Chief Administrative Officer, reviewed the target metrics for all of our employee incentive compensation

Public Storage | 2024 Proxy Statement | 29

Corporate Governance

plans. At the completion of the review, management and the CHC Committee concluded that our incentive compensation plans did not create undue risks for the Company.

The Nominating, Governance, and Sustainability Committee focuses on risks associated with succession planning, corporate governance, Board effectiveness, and public policy matters, including political and charitable contributions. The NGS Committee also supports the Board in identifying and overseeing risks associated with sustainability matters and, as appropriate, coordinates with other Board committees on such matters (such as the CHC Committee with respect to sustainability-related compensation metrics and social and human capital issues and the Audit Committee with respect to internal controls regarding sustainability reporting).

CYBERSECURITY

Our Board considers cybersecurity risk one of the most significant risks to our business. The Board has assigned to the Audit Committee the task of assisting it in its oversight of cybersecurity and other information technology risks affecting the Company. The Audit Committee periodically evaluates our cybersecurity strategy to ensure its effectiveness. Management provides quarterly reports to the Audit Committee regarding cybersecurity and other information technology risks, and the Audit Committee in turn provides reports to the full Board.

As part of our Board refreshment efforts in recent years, we have focused on adding trustees with information technology skills. Several members of our Board, including all four members of our Audit Committee, have cybersecurity experience from their principal occupation or other professional experience. In addition, several members of our Board and Audit Committee have received or are pursuing various board-level cybersecurity certifications, such as the NACD Cyber-Risk Oversight certification and the Digital Directors Network certification on Cyber Risk Governance for Public Company Corporate Directors. Several trustees have also attended third-party director education courses on cybersecurity, including cyber risk governance, and data privacy issues and trends in the last year.

Please see our Annual Report on Form 10-K for the year ended December 31, 2023 for more information on our processes and procedures for addressing and managing cybersecurity risks.

POLITICAL AND CHARITABLE CONTRIBUTIONS

Our NGS Committee oversees the Company’s political and charitable contributions and other public policy matters. In order to facilitate accountability and informed decision-making with respect to the Company’s political contributions, the NGS Committee has adopted Political and Charitable Contributions Guidelines that apply to contributions or expenditures of corporate funds to various political entities, charitable organizations, and certain causes. Contributions subject to the Political and Charitable Contributions Guidelines must be approved by a management committee and/or the NGS Committee. Decisions are made based on, among other things, a determination that the amount and recipient are aligned with the Company’s strategy, values, policies, and business objectives, and are made without regard for the private political preferences of officers or trustees. All contributions are required to be reported quarterly to the NGS Committee.

BOARD ORIENTATION AND EDUCATION

Each new trustee participates in an orientation program and receives materials and briefings concerning our business, industry, management, and corporate governance policies and

30 | Public Storage | 2024 Proxy Statement

Corporate Governance

practices. We provide continuing education for all trustees through board materials and presentations, including third-party presentations, discussions with management, and the opportunity to attend external board education programs. In addition, all Board members have access to resources of the National Association of Corporate Directors through a Company membership.

TRUSTEE INDEPENDENCE

We require that a majority of the Board be independent in accordance with NYSE rules. To determine whether a trustee is independent, the Board must affirmatively determine that there is no direct or indirect material relationship between the Company and the trustee.

COMMUNICATIONS WITH THE BOARD

Shareholders and interested parties can communicate with any of the trustees, individually or as a group, by writing to them in care of Corporate Secretary, Public Storage, 701 Western Avenue, Glendale, California 91201. We will forward each communication intended for the Board and received by the Corporate Secretary related to the operation of the Company and not otherwise commercial in nature to the specified party following its clearance through normal security procedures.

TRUSTEE ATTENDANCE

The Board held fourteen meetings in 2023, including videoconference meetings. We do not have a policy regarding trustee attendance at the annual meeting of shareholders, but expect trustees to attend. All of our trustees attended the 2023 annual meeting of shareholders. Each trustee attended at least 75% of the aggregate number of Board meetings and committee meetings for the committees on which they served, if any.

Public Storage | 2024 Proxy Statement | 31

Corporate Governance

Changes in Trustee Responsibilities and Commitments

Service on the Board requires significant time and attention, and trustees are expected to spend the time needed and meet as often as necessary to discharge their responsibilities. Under our Corporate Governance Guidelines and Trustees’ Code of Ethics, a trustee whose job responsibilities or business associations change from those he or she held when most recently elected or appointed to the Board shall notify the Chair of the NGS Committee of the change. If the NGS Committee determines that the change and the circumstances giving rise to the change are likely to impair the trustee’s effectiveness, the NGS Committee may ask the trustee to tender his or her resignation or decide not to renominate the trustee for election at the next annual meeting of shareholders.

Additionally, trustees are required to advise the Chair of the NGS Committee before accepting membership on other corporate boards. If the NGS Committee determines that the membership is likely to impair the trustee’s effectiveness, the NGS Committee may ask the trustee to tender his or her resignation or decide not to renominate the trustee for election at the next annual meeting of shareholders. Commencing February 23, 2024, without specific approval from the NGS Committee, no trustee may accept membership on another public company board if it will result in the trustee serving on more than three public company boards, including the Board.

TRUSTEE AND EXECUTIVE OFFICER Stock OWNERSHIP GUIDELINES

Pursuant to the Board’s stock ownership guidelines, we expect each trustee to beneficially own common shares or common share equivalents of the Company equal in market value to five times the amount of the annual cash retainer for Board member service. The Board increased this guideline to five times from three times the amount of the annual cash retainer effective February 2024. Each non-management trustee shall attain his or her ownership within five years from the date of election or appointment.

Pursuant to the stock ownership guidelines applicable to our executive officers, our CEO is expected to beneficially own common shares or common share equivalents equal in value to six times his or her base salary and our other executive officers are expected to beneficially own common shares or common share equivalents equal in value to four times their base salary, in each case within five years of appointment or promotion. In addition, each new executive officer is expected to establish an initial ownership position within one year of his or her appointment as an executive officer.