UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008.

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to ______________

Kun Run Biotechnology, Inc.

(Exact name of registrant as specified in Charter)

| Nevada | | 333-141384 | | 98-0517550 |

(State or other jurisdiction of incorporation or organization) | | (Commission File No.) | | (IRS Employee Identification No.) |

Free Trade Zone

168 Nanhai Avenue, Haikou City

Hainan Province, China 570216

(Address of Principal Executive Offices)

86-898-6680-2207

(Issuer Telephone number)

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes þ No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act):

Yes o No þ

The aggregate market value of the 2,477,500 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was $ 2,502,275 as of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $1.01 per share, as reported by The Over-The-Counter Bulletin Board.

As of March 30, 2009, there were 25,000,000shares of common stock of Kun Run Biotechnology, Inc. outstanding.

TABLE OF CONTENTS

| | | Page |

| PART I |

| Item 1 | Business | 2 |

| Item 1A | Risk Factors | 11 |

| Item 1B | Unresolved Staff Comments | 24 |

| Item 2 | Properties | 24 |

| Item 3 | Legal Proceedings | 24 |

| Item 4 | Submission of Matters to a Vote of Security Holders | 24 |

| | | |

| PART II |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 25 |

| Item 6 | Selected Financial Data | 25 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 26 |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 38 |

| Item 8 | Financial Statements and Supplementary Data | 38 |

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 38 |

| Item 9A | Controls and Procedures | 38 |

| Item 9B | Other Information | 39 |

| | | |

| PART III |

| Item 10 | Directors, Executive Officers and Corporate Governance | 39 |

| Item 11 | Executive Compensation | 40 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 42 |

| Item 14 | Principal Accounting Fees and Services | 42 |

| | | |

| PART IV |

| Item 15 | Exhibits and Financial Statement Schedules | 43 |

Except as otherwise indicated by the context, references in this document to “Company,” “we,” “us,” or “our” are references to the combined business of Kun Run Biotechnology, Inc. (formerly, Aspen Racing Stables, Inc.) and its wholly-owned subsidiaries, including Kun Run Biotechnology Ltd., a Hong Kong corporation and Hainan Zhonghe Pharmaceutical Co., Ltd., a corporation organized under the laws of the People’s Republic of China. References to “China” and “PRC” are references to “People’s Republic of China.” References to "RMB" are to Renminbi, the legal currency of China, and all references to “$” are to the legal currency of the United States.

PART I

Item 1. Business

We are engaged, through Hainan Zhonghe Pharmaceutical Co., Ltd. (“Zhonghe”), our China based indirect subsidiary, in the development, manufacture, marketing and sale of prescription polypeptide drugs. Our principal products are polypeptide derivatives. Our products are sold primarily in China and through Chinese domestic pharmaceutical distributors licensed by the Chinese government. Our manufacturing and sales facilities are located in the City of Haikou, Hainan Province.

Corporate History

Kun Run Biotechnology, Inc. (the “Company”) formerly known as Aspen Racing Stables, Inc. (“Aspen”) was incorporated in the State of Nevada on March 10, 2006. The Company’s shares are quoted for trading on the Over-The-Counter Bulletin Board in the United States of America.

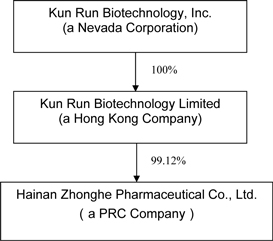

Kun Run Biotechnology, Ltd., our non-operating Hong Kong holding subsidiary (“Kun Run”), was incorporated on May 6, 2006 under the name Max Talent Industrial Ltd, which changed to its present name on February 25, 2008. On March 24, 2008, Kun Run completed its acquisition of 60.12% equity interest of Zhonghe, a company organized under the laws of the People’s Republic of China (“PRC”) on April 17, 1995 and has since been engaged in the manufacture and sale of polypeptide drugs. On May 27, 2008, Kun Run acquired an additional 39% equity interest of Zhonghe, resulting in a 99.12% ownership of Zhonghe.

Thereafter, on August 21, 2008, Kun Run entered into a Stock Purchase Agreement (the “Exchange Agreement”) with the shareholders of the Company. The terms of the Exchange Agreement were consummated and the acquisition was completed on September 16, 2008. As a result of the transaction, the Company issued a total of 24,250,000 shares of its common voting stock to Xueyun Cui (“Mr. Cui”) and Liqiong Yang, the shareholders of Kun Run and their designees, in exchange for 100% of the capital stock of Kun Run resulting in Kun Run becoming our wholly-owned subsidiary, and the shareholders of Kun Run and their designees owning approximately 97% of the issued and outstanding shares of the common stock of Aspen. In addition, Trixy Asyniux-Walt, the original shareholder of Aspen, returned 1,000,000 of her shares to the Company for cancellation and as of the closing owns 750,000 shares of the Company’s common stock which constitutes approximately 3% of the issued and outstanding shares of the Company’s common stock. 1,000,000 of the shares issued to Mr. Xueyun Cui were put into an escrow pursuant to a Make Good Escrow Agreement entered between Mr. Cui and the escrow agent on September 16, 2008.

Organizational Chart

Our Industry

So far, three types of molecules have been developed for the treatment of human diseases: i) small molecules, ii) antibodies, and iii) peptides. Until recently, the majority of the therapeutic molecules developed and marketed are small molecules. However, with the recent development of several technologies in the areas of peptide synthesis, screening, stabilization and modifications, peptides are now recognized as leading molecules for therapeutics. Peptides play an increasing role in the development of new treatments for cancer, diabetes, auto-immune diseases, and more effective diagnostics due to its function as chemical messengers and neurotransmitters. In the development of anti-cancer drugs, peptides present the least side-effects. Unlike the present cocktail of drugs used in chemotherapy, we believe that peptides provide the best prospects because they can be target-specific and have the least lethal index (side effects) and maximum therapeutic index (effectiveness of the drug).

Peptides are short strings of amino acids. Bioactive peptides, also called small molecular weight active polypeptides, are peptides that are more active, and bind more quickly, than regular peptides. Bioactive peptides have better absorption and binding mechanisms than free amino acids.

A growing area of biotechnology research is the discovery and development of new bioactive peptides that can be used in medicine, health supplements, food and cosmetics. Bioactive peptides can be divided into two groups: (i) therapeutic peptide products, of which there are over 100 on the global market, and (ii) peptides enhanced through the addition of bioactive peptides such as health supplements and peptide-rich non-prescription medicines.

Their role as mediators of key biological functions and their unique intrinsic properties make them particularly attractive therapeutic agents. Peptides show high biological activity associated with low toxicity and high specificity. The benefits conferred by these characteristics include little unspecific binding to molecular structures other than the desired target, minimization of drug-drug interactions and less accumulation in tissues thus reducing risks of complications due to intermediate metabolites. Additionally, compared to small molecules, peptides offer valuable chemical and biological diversity on which intellectual property is still widely available. As a result, even large pharmaceutical companies, which traditionally focused on small molecules, are increasingly including peptides in their pipelines. For example, Pfizer, GSK and Eli Lilly have recently acquired peptide-based products.

The therapeutic peptides market emerged in the 1970s, when Novartis launched Lypressin, a vasopressin analogue. Since then, based on a report by Bionest Partner in 2005 entitled “Therapeutic Peptides under the Spotlight,” approximately 30 peptides have reached the market, representing a $5.3 billion opportunity in 2003 (over 1.5 percent of the $325 billion global pharmaceutical market). Among the different classes of peptides, GNRH/LHRH agonists (leuprorelin, goserelin) account for almost 50 percent of the market. Other key commercialized peptides include sandostatin (somatostatin analogue, Novartis), glatiramer (immunomodulator peptide, Teva), salmon calcitonin (Miacalcin, Novartis) and desmopressin (DDAVP, Ferring).

The worldwide market for therapeutic peptides was estimated to be $5.3 billion in 2003, and is expected to grow at a Compound Annual Growth Rate of 8.1% to $11.5 billion in 2013.

China’s Peptide Market

China possesses one fourth of the world’s population and has a rapidly growing pharmaceuticals industry. In 2006, based on “China is Expected to Become the Fifth Largest Drug Market in the World by 2010,” a report by Research and Markets (http://www.researchandmarkets.com/reports), dated March 8, 2007, sales in the Chinese pharmaceuticals industry reached $12 billion, an increase of 3.8 times the sales in 1998. The Chinese pharmaceuticals market is expected to grow at a rate of 20 to 25 percent per year for the next five years. China is forecasted to become the fifth largest drug market in the world by 2010.

A number of factors contribute to an increasing demand for pharmaceuticals in China:

| | · | Overall economic growth has led to increased household income. Based on a report by Nankai University dated April 3, 2007 entitled “Welfare effects of public health insurance reform,” health awareness is increasing in a rapidly growing urban population. |

| | · | China’s current population is aging and people who are 60 years of age or older will reach 9.0% of the country’s population by 2010, up from 7.0% in 2003. Based on a report by the China Social Protection Budget Committee entitled “China: Social Pension System in China is Facing Harsh Challenges” dated April 21, 2005, the Social Insurance Fund of China predicts that the aging population (people older than 60) will reach 24.5% of China’s population in 2030. |

| | · | Provincial and national health insurance program expansion and reform are making healthcare services available to more people, based on the Nankai University report. |

The government has undertaken initiatives to regulate the domestic pharmaceuticals industry to assure product quality and protect intellectual property rights. These factors have led to increased direct foreign investment and rapid growth in the industry.

The Chinese therapeutic peptide market is growing rapidly. Research is focused on developing new, more effective drugs that utilize bioactive peptides as active pharmaceutical ingredients (APIs). Peptide medicines are used to cure diseases and to strengthen the human immune system. The commercialization of research findings is leading to rapid growth in this sector of the pharmaceutical industry.

There are only 26 therapeutic polypeptide medicines sold in China. The therapeutic peptides industry in China is highly fragmented and dominated mainly by domestic players. Only 11 foreign peptide products have obtained approvals from the Chinese government to be sold across China, which only accounts for a small part of the total market due to these foreign products’ weak market penetration and high prices.

Competitive Advantages

We believe that we have the following competitive advantages:

1. Focus on peptide products. Unlike other peptide manufacturers in China, we focus on peptide drugs and seldom manufacture any other types of drugs. Although we plan to manufacture certain generic drugs in the future, the scope will be limited and used only as a temporary measure to utilize our current surplus capacity.

2. First Mover. We started to manufacture peptide drugs in 1997, earlier than other peptide manufacturers in China, and we believe that we have built more experience in manufacturing and marketing peptide drugs than any other peptide manufacturer in China. In addition, we are the largest manufacturer of TP-5 in China in terms of both volume and revenue. Based on a survey conducted by Haihong Pharmaceutical Information Ltd. on 1410 hospitals throughout China, we currently have a 65.5% market share of TP-5 in Beijing, 95.6% in Shanghai and 43.6% in Guangzhou.

3. Broader Line of Products. Compared to most peptide manufacturers in China, we offer more peptide products. Currently, we manufacture and market four peptide drugs while most others only manufacture and market one or two peptide products.

4. More Products in the Pipeline. We currently have at least a dozen potential peptide drugs at various stages of development and expect to launch several of them in the next two to three years.

5. Better Product Quality. Our peptide products have at least 99% purity compared to 95% purity of similar products of most other peptide manufacturers in China. Higher purity leads to higher potency and lower side effects, the clinical value sought by patients. Therefore, our products have a better name recognition and can command higher prices.

6. State-of-the-art Production Facility. Our production facility possesses a large and efficient designed capacity to achieve economies of scale. It is one of the largest bulk synthesized peptide manufacturing facilities in Asia and the largest in China.

Our Strategies

We plan to adopt the following strategies:

1. Strengthen Research and Development. We plan to strengthen and expand our R&D capabilities to maintain our competitive advantages. In order to achieve this objective, we plan to acquire the R&D facilities of our affiliates if we are able to successfully raise sufficient funds in our future financings. In addition, we will continue to strengthen our relationships with universities and medical institutions in order to acquire new products, new applications and new delivery mechanisms for peptides.

2. Increase Revenue by Broadening Our Line of Products. Currently, we manufacture four peptide products. To increase our revenue, we plan to add one or two new peptide products per year for the next two to three years. We plan to manufacture generic drugs or OEM manufacture for other pharmaceutical companies at least for the short term due to extra capacity we have at our new manufacturing facility: our phase II pharmaceutical plant, Injection Preparation Plant obtained GMP approval on September 29, 2008 and went into production in October of the same year. The Solid Oral Preparation Plant has been installed and debugged, expecting to get GMP approval in April of 2009.

3. Further Penetration of Market. Currently, we have distribution agents in every province and municipality directly under the jurisdiction of China’s State Council. In order to increase revenue, we plan to further penetrate the market by expanding our distribution networks into China’s secondary cities. In addition, we are testing a pilot program which awards a distributor’s nationwide distributorship for certain products rather than awards for distributorship within the geographic area of a province only. We believe distributors may have more incentive to increase the sales of certain peptide products through this new system.

4. Expand into Overseas Market. In order to increase our revenue growth, we plan to enter into markets in Southeast Asia, Africa and South America. In addition, we have obtained a permit in Uzbekistan and are in the process of applying for one in Korea. Our international department has begun to receive orders from South Korea and is negotiating with distributors in Uzbekistan and Indonesia.

5. Maintain High Quality. Our products have better name recognition and command higher prices because of their high quality. Our peptide products have at least 99% purity compared to 95% purity of the similar products of most other manufacturers in China. We plan to continue to maintain the high quality of our products through utilizing advanced technology and equipment, and quality control in our manufacturing process.

Principal Products and Markets

Our principal products are prescription polypeptide drugs used to treat immune system malfunction and hyper function. Using various formulas, we produce a number of peptide products with several forms of delivery including injections, capsules and pills. We intend to concentrate our efforts for the next several years on the development, production and sales of polypeptide products.

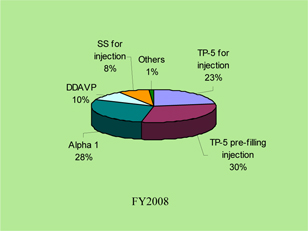

Our principal operations are in China, where we have manufacturing facilities and sales distribution covering every province of China. We are engaging mainly in manufacturing prescription polypeptide drugs. Currently, we manufacture and market four polypeptide products across China: Thymopentin ( “TP-5”), Somatostatin (“SS”),Thymosin Alpha 1 (“Alpha 1”)and Desmopressin Acetate ( “DDAVP”).

Thymopentin (“TP-5”)

TP-5 is a two-phase immunostimulant and is used for treating tumor and hepatitis. TP-5 has an extensive range of applications. Studies have indicated that TP-5 can significantly increase and promote the natural immune system’s ability to defend against malignant diseases. In addition, it has been shown that TP-5 has no toxicity and side effects, nor does it inter with other drugs.

We currently produce TP-5 in two forms: TP-5 freeze-dry powder and TP-5 pre-filled injection.

Somatostatin (“SS”)

Naturally occurring somatostatin is mainly secreted in the inferior part of the hypothalamus and the gastrointestinal tract. Somatostatin for injection is a synthetic cyclic 14-amino acid peptide. It is entirely identical in structure and activity to naturally occurring somatostatin. It is believed to be an effective treatment for acute severe pancreatitis, upper gastrointestinal hemorrhages, pancreatic fistulas, intestinal fistulas and biliary fistulas. It inhibits endocrine and exocrine secretions of gastric somatostatin. Compared with Octretide, Somatostatin binds perfectly with five subtypes of somatostatin receptors, having 2 to 1,000 times more binding affinity than Octreotide.

We currently produce Somatostatin in two specifications: 0.25mg and 3mg.

Thymosin Alpha 1 (“Alpha 1”)

Thymosin Alpha 1 provides a safe and effective treatment for chronic hepatitis B when used alone or in combination with interferon. Primary research indicates that Thymosin Alpha 1 is also useful in treating a number of other diseases as well, including hepatitis C, malignant tumors, melanoma and HIV/AIDS.

We currently produce Thymosin Alpha 1 in a 1.6mg specification.

Desmopressin Acetate Injection (“DDAVP”)

DDAVP is a synthetic analogue of the natural pituitary hormone 8-arginine vasopressin (ADH), an antidiuretic hormone affecting renal water conservation. It has been shown to improve the level of platelet aggregation and is widely used before surgeries to prevent bleeding. It has also been shown to be a treatment for nocturnal enuresis, central diabetes insipidus, polyuria, polydipsia mild and moderate forms of hemophilia A. Our DDAVP product is the only DDAVP product in China that is without chlorobutanol, a type of preservative that widely used in DDAVP products. It has been shown that the use of chlorobutanol may cause side effect such as cardiovascular toxicity and disorders to nervous system. We currently produce DDAVP in two specifications: 4ug and 15ug.

The following tables exhibit the breakdown of our revenues for the three fiscal years ended December 31, 2008 and 2007:

New Products in the Pipeline

Through our research and development, co-development and purchase from institutions, we have secured a broad product pipeline with approximately 11 peptide products in different stages from per-clinical research to SFDA application. We believe that these new medicines will address some of the most widespread diseases including diabetes, coagulant disease, hydrocephalus, tumor and other diseases as set forth below:

| No. | | Indication | | Category | | Per- clinical | | Filed and wait for permits | | soft production | | Expected Launch Day |

| 1 | | Children dwarfishness | | New peptide medicine | | | | × | | | | 2010 |

| 2 | | Diabetes Type I | | New peptide medicine | | × | | | | | | 2012 |

| 3 | | Anticoagulant | | New peptide medicine | | × | | | | | | 2011 |

| 4 | | Antiplatelet | | New peptide medicine | | | | × | | | | 2011 |

| 5 | | Surgical hemostasis, diabetes insipidus | | Mimicry peptide medicine | | | | | | × | | 2009 |

| 6 | | Gastrointestinal hemorrhage | | Mimicry peptide medicine | | | | | | × | | 2010 |

| 7 | | Anti-premature delivery | | Mimicry peptide medicine | | | | | | × | | 2010 |

| 8 | | Hyperlipidemia | | Generic medicine | | | | × | | | | 2010 |

| 9 | | Gastric ulcer | | Generic medicine | | | | | | × | | 2009 |

| 10 | | Anti-Hepatitis B Virus | | Generic medicine | | | | × | | | | 2009 |

| 11 | | Hypertension | | Generic medicine | | | | × | | | | 2010 |

Among the new peptide products which are lunching in 2009, Entecavir (Item 10 in the above table)is a new oral guanine nucleoside analog used in the treatment of anti-hepatitis B virus, efficacious in inhibiting reverse transcription, DNA replication and transcription in the viral replication process, suitable for antivirus therapy of development trend of hepatitis B during different periods. Based on “The Dual Protection of Strong Effectiveness and Low Drug Resistance to Insure the Inhibition of Hepatitis B Virus Reinfection”, a report by China Medical Tribune dated October 30th, 2008, Entecavir is the strongest antiviral nucleoside analogue in latter days. Entecavir was researched and developed by a subsidiary of Hainan Zhonghe Group, Co., Ltd. (Hainan Zhonghe Group), Hainan Zhonghe Peptide Drugs Research & Development Co., Ltd. (Zhonghe Peptide), and the Entecavir Dispersible Tablets are currently under clinical trial and are expected to obtain production approval in the second half of 2009. During 2008, Zhonghe granted a loan of approximately $4.4 million to Hainan Zhonghe Group and Zhonghe Peptide to support research and development of Entecavir. In March, 2009. Zhonghe obtained exclusive producing and selling right of Entecavir.

We expect the launch of these products will augment our product line and diversify our product mix.

Research and Development

We currently conduct all of our research and development (“R&D”) activities through our affiliates and through collaborative arrangements with universities and research institutions in the PRC. Two of our affiliates have their own research, development and laboratory facilities located near our headquarters in the city of Haikou, Hainan Province. Additionally, we have established several long-term partnerships with well-known universities and research institutions in the PRC.

Sales and Marketing

Currently, we have 25 sales and marketing staff all based in our headquarters Haikou, Hainan Province, PRC. They are responsible for managing our relationship with all distributors and coordinating marketing activities. Our marketing activities include advertising in medical magazines, conducting product seminars at hospitals and medical institutions and sponsoring academic conferences. We have also set up funds for research awards in the peptide medical research areas.

Safety and Quality Assurance

In accordance with Good Manufacturing Practice (“GMP”) requirements, the Company has written and implemented a quality assurance validation plan, procedures, and a complete documentation system. The Company’s existing manufacturing facilities has received the Certificate of Good Manufacturing Practices for Pharmaceutical Products issued by Chinese State Food and Drug Administration (“SFDA”) in 2003 and renewed in early 2008. Our phase II pharmaceutical plant, Injection Preparation Plant has obtained GMP approval on September 29, 2008 and went into production in October of that year. The Solid Oral Preparation Plant has been installed and debugged completely; expecting to get GMP approval in April of 2009 and begin production thereafter.

A strict quality control system ensures that all products are produced in a pollution-free, contamination-free and efficient production environment following strict quality-oriented procedures. The warehouse for finished products is adjacent to the production line, and is managed under the same stringent hygienic requirements.

The Company has a professional quality control team responsible for the supervision, management and quality assurance of the whole production process and allocated a general manager of the department to directly accountable for the quality of all products.

Materials and Suppliers

Raw materials are sourced principally in the PRC and 90% of our raw materials consist of amino acids and are generally available from a variety of suppliers. We seek to mitigate the risk of a shortage of raw materials through identification of alternative suppliers for the same or similar raw materials, where available. We have purchasing staff with extensive knowledge of our products who work with marketing, product research and development and quality control personnel to source raw materials for products and other items. Although one supplier accounts for more than 60% of our total raw material purchases in 2008, we have identified various other suppliers if a change in supplier is required as there are many manufacturers of amino acids in the PRC.

| Supplier accounting for more than 5% aggregate purchase amount in 2008 | |

| Name of Entity | | Purchase Amount

in Current Year

(RMB) | | | Purchase Amount

in Current Year

(USD) | | | % to total amount

of purchase

amount | |

| Sinopep Pharmaceutical Inc., | | | 10,691,700.00 | | | | 1,541,743.14 | | | | 64.44 | % |

| Shuangfeng Glass (Original Zhenjiang Shuangfeng Pharmaceutical Packaging Co., Ltd. | | | 1,812,450.00 | | | | 261,355.29 | | | | 10.92 | % |

| Ningbo Yonzhou Jinyi Dairly Chemical Package Co., Ltd. | | | 1,029,426.30 | | | | 148,443.27 | | | | 6.20 | % |

| Hainan Xingyuan Business Trade Co., Ltd. | | | 912,806.63 | | | | 131,626.72 | | | | 5.50 | % |

| Total | | | 14,446,382.93 | | | | 2,083,168.42 | | | | 87.06 | % |

Customers and Distribution

Currently, our products are sold primarily in the PRC through pharmaceutical distribution companies that are licensed by the PRC government which in turn sell our products to hospitals and medical institutions. We enter into distribution arrangements with these distributors and provide them exclusivity for a period of time within a particular geographical area.

Currently, we utilize approximately 227 distributors throughout China with one major distributor for each province, municipality directly under the jurisdiction of the central PRC government and major city under the jurisdiction of provincial governments.

The map below exhibits the locations of our distributors as of December 31, 2008.

Each of the distributors is evaluated on an annual basis and a specific performance target is set for each distributor that varies with the location and the size of the market. Chongqing took the place of Beijing (the largest market for our products in 2007) as the largest market for our products in 2008. The following table sets forth distributors that generated more than 5% of our total sales in 2008:

Distributor generating with more than 5% of our aggregate sales in 2008

| Name of Distributor | | Amount(RMB) | | | Amount(USD) | | | % to Total Sales

Revenue | |

| Chongqin Dinghai Pharmaceutical Co., Ltd. | | | 7,994,384.64 | | | | 1,152,790.27 | | | | 9.92 | % |

| Beijing Xingshengyuan Pharmaceutical Ltd. | | | 6,633,735.05 | | | | 956,584.59 | | | | 8.23 | % |

| Jiangxi Jinsheng Pharmaceutical Ltd. | | | 6,531,794.84 | | | | 941,884.82 | | | | 8.10 | % |

| Hainan Heyi Pharmaceutical Co., Ltd. | | | 5,033,675.22 | | | | 725,855.97 | | | | 6.25 | % |

| Total | | | 26,193,589.75 | | | | 3,777,115.65 | | | | 32.50 | % |

Over the past several years, we have continuously expanded our distribution channels for our products at the province and major city levels. In the near future, we plan to penetrate China’s secondary cities. We are also seeking to expand into international markets and have been granted a permit in Uzbekistan and are in the process of securing a permit in Korea.

Competition

Competition in the polypeptide drug industry is intense in China and throughout the world. We compete with various firms, many of which produce and market products similar to our products, and many of which, especially international competitors, have greater resources than us in terms of manufacturing and marketing capabilities, management expertise and breadth, and financial wherewithal. Some of these competitors are far larger, have more resources than us and have stronger sales and distribution networks.

Our direct competitors are domestic firms engaged in developing, manufacturing and marketing prescription polypeptide products. There are numerous such companies in the PRC. We believe most Chinese synthetic peptide manufacturers are very small-scale operations that use dated biotechnologies and have high operating costs. Furthermore, due to technological limitations, their peptide drugs have a relatively lower efficacy rate and lower purity (compared to Western counterparts), as well as a higher incidence of potential side effects. For instance, cheaper peptide drugs has relatively low purity of around 95%, which is the required purity by SFDS of the PRC and means the active component accounts for 95% with 5 % of impurity and water. In contrast, our peptide products have at least 99% purity and we believe we deliver top quality peptide drugs in PRC.

Compared to our Chinese competitors, we have a wider range of peptide drugs to offer than any other domestic competitors as shown below:

| Manufacturer/Brand | | TP-5 power

for Injection | | TP-5 Per-filled

injection | | Thymosin

alpha 1 for

Injection | | Somatostatin for

Injection | | Desmopressin

Acetate Injection

(DDAVP) |

| Zhonghe | | Hexin | | Hexin | | Heri | | Hening | | Heyi |

| Shenzhen Hanyu | | Hanqiang | | | | | | Hankang | | Hangu |

| Beijing SL | | O’ning | | | | | | Shanting | | |

| Wuhan Hualong | | Wutai | | | | | | | | |

| Hayao Group | | Taipuding | | | | | | | | |

| Beijing Shiqiao | | Tongda | | | | | | | | |

| Hainan Shuangcheng | | | | | | Jitai | | | | |

| Chengdu Di’ao | | | | | | Maipuxin | | | | |

| Nanjing Changao | | | | | | | | Lizhixue | | |

We are also facing competition from multinational drug manufacturers that are doing business in China. These well-established biopharmaceutical giants have better resources and a proven track record for successful product development and commercialization. These competitors may be able to develop more proficient and more affordable peptide products. However, we believe we have price advantages compared with multinational manufacturers. Our peptide products are usually only 60% of that of similar international brand products. The following table shows the products that certain international competitors are marketing in China:

| Manufacturer/Brand | | TP-5 power

for Injection | | TP-5 Per-filled

injection | | Thymosin a1

for Injection | | Somatostatin for

Injection | | Desmopressin

Acetate Injection

(DDAVP) |

| Zhonghe | | Hexin | | Hexin | | Heri | | Hening | | Heyi |

| Ferring | | | | | | | | | | Minirin |

| Siclone | | | | | | Zadaxin | | | | |

| Swiss Serono | | | | | | | | Stilanmin | | |

Although we have enjoyed advantages in the polypeptide market in China, we expect that the competition for peptide products in the PRC will become more intense over the next few years both from existing competitors and new market entrants. We will also face more competition from foreign companies who may have established products, a strong proprietary pipeline and strong financial resources. Our management believes that we have certain competitive advantages in introducing new products to market due to key focus areas for development, our existing distribution channels, research and development capabilities and our relationship with certain universities and other research institutions.

Employees

As of December 31, 2008, we have approximately 141 employees with 53 in manufacturing, 12 in quality assurance and controls, 26 in research and development, 25 in sales and marketing, and 25 in management. 53 of the employees have a bachelor or higher degree.

As required by applicable Chinese law, we have entered into employment contracts with all the employees. Key employees in the Company are also required to sign a confidentiality and non-compete agreement prohibiting them from disclosing our trade secrets or using them for purposes other than benefiting the Company.

Our employees in China participate in a state pension program organized by Chinese municipal and provincial governments. We are required to contribute to the program at the rate of 20% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with other types of social insurance. Our total contribution may amount to as much as 30% or more of the average employees monthly salary. We have purchased social insurance for all of our employees. Social insurance expenses were approximately $64,535 and $84,329 for fiscal year 2007 and 2008, respectively. We believe we have paid for all social insurance due in accordance with Chinese law.

Government Regulation

Regulatory Environment

Our principal market is in the PRC. We are subject to the Pharmaceutical Administrative Law of the PRC, which governs the licensing, manufacturing, marketing and distribution of pharmaceutical products in the PRC, and sets penalties for violations. Our business is subject to various regulations and permit systems of the State Food and Drug Administration of China (“SFDA”). Additionally, we are subject to government licensing rights and regulations relating to our peptide drug permits which are granted on a non-exclusive basis and limited for four to five years.

SFDA Licenses

The SFDA issues licenses and petitions for permission to manufacture and market pharmaceutical products in the PRC. Our licenses relate primarily to medical manufacturing licenses. Peptide drug products also require a permit for sales, which permits are generally granted on a non-exclusive basis for five years.

Foreign-owned Enterprise Law

Because our subsidiary in the PRC is majority foreign-owned enterprise, we are subject to the law of foreign investment enterprises in the PRC, and the foreign company provisions of the Company Law of China, which governs the conduct of our wholly-owned subsidiaries and their officers and directors, and also limits our ability to pay dividends.

Compliance with Environmental Law

We must comply with the Environmental Protection Law of the PRC, as well as applicable local regulations. In addition to compliance with the PRC law and local regulations, we consistently undertake active efforts to ensure the environmental sustainability of our operations. Because the manufacturing of herb and plant-based products does not generally cause significant damage or pollution to the environment, the cost of complying with applicable environmental laws is not material. In the event we fail to comply with applicable laws, we may be subject to penalties.

Intellectual Property

We regard our service marks, trademarks, trade secrets, patents and similar intellectual property (“IP”) as critical to our business. We have relied, and will continue to rely, on patent, trademark and trade secret law, as well as confidentiality and license agreements with certain of our employees, consultants, customers and others, to protect our proprietary rights.

Under the PRC law, medical products which have received approval from the SFDA, have automatic protected IP rights for a seven-year period from the date of grant of such approval. The four polypeptide drugs we are currently manufacturing have been granted such licenses and those license expired recently. We have secured licenses for the 12 products in the pipeline from universities and other medical research institutions.

Trademarks

We have numerous registered trademarks for our polypeptide products.

Item 1A. Risk Factors

An investment in our securities is speculative and involves a high degree of risk. You should carefully consider the risks described below and the other information in this current report before purchasing any securities. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties may also adversely impair our business operations. If any of the events described in the risk factors below actually occur, our business, financial condition or results of operations could suffer significantly. In such case, the value of your investment could decline and you may lose all or part of the money you paid to buy the securities.

Risks Related To The Company

Our product line is limited to only four products, Thymopentin (TP-5), Desmopressin Acetate (DDAVP), Somatostatin (SS), and Thymosin Alpha 1. Any adverse effects upon the manufacturing, sales, or distribution channels of any one of these four products could adversely affect our financial condition and results of operations.

Our four products, TP-5, DDAVP, SS and Thymosin Alpha 1, are our major sources of revenues, approximately 99.05% in 2008 and 99.47% in 2007. In the near future, these four products will continue to be the major sources of our revenues. Because of our reliance upon these products, any adverse effects upon the manufacturing, sales, or distribution channels will affect our ability to deliver our products to our customers, or increase our costs, which in turn will adversely affect the orders for our products. This could result in adverse effects upon our financial results and conditions.

A significant portion of our revenue is concentrated on a few large customers. If we lose one or more of them, our results of operations and financial condition may be adversely impacted.

In 2008, 8.23% of our total sales was from one single customer. A significant portion of our account receivables is also from this customer. As of December 31, 2008, we had account receivable balance of approximately $5,769,370 21.5% or $1,240,606 belonging to this one customer,. The concentration of account receivables in one customer presents a significant risk. If this customer does not make payment on time or ceases to order our products, our financial conditions and results of operations may be adversely affected.

The long-term effectiveness of peptide drugs have not been proven.

Our business focuses almost exclusively on the manufacture and marketing of peptide drugs. Our peptide drugs, including, TP-5, DDAVP, SS and Thymosin Alpha 1, are relatively new types therapy drugs. We sold our first drug in 1997. Although current studies on the use of peptide drug for treatment have shown a reduction in short-term side effects compared to other drugs and suggest an improvement in long-term results, there are presently very few long-term studies of over 15 years on the effectiveness of using peptide technology for treatment. We plan to continue our participation in future long-term studies of the effectiveness of our products. These long-term studies include a large scale clinical study in collaboration with the Ministry of Health of the People’s Republic of China, or MOH, based on the conditional approval received for our Investigational Device Exemption (IDE) application. If any of these studies fail to confirm the effectiveness of our peptide drug or other peptide medical products, our sales could decline. Moreover, there may be other clinical studies published on our drug products of which we are not aware and which contain different conclusions with respect to the safety, effectiveness or other aspects of our technologies. Our customers and users of our products may conclude that our products are not an acceptable treatment regimen, that the technologies underlying our products are ineffective or unsafe, or that our products are less effective or safe than other drugs. This could result in a decrease in our sales, which would have a material adverse effect on our business, results of operations and financial condition.

Our focus on acquisitions of new products or technologies may result in integration costs, failures and dilution to existing stockholders.

We have been relying on our affiliates and academic institutions to develop new drugs.. We continue to seek attractive opportunities to acquire new products or technologies, particularly those that could assist us in advancing our current market penetration, or in expanding our product offerings. If we decide to acquire another company or its assets in order to obtain its products or technologies, we would face a number of risks including consummating the acquisition on unfavorable terms and not obtaining adequate financing, which may adversely affect our ability to develop new products and services and to compete in our rapidly changing marketplace. These acquisitions could also require that our management develop expertise in new areas, manage new business relationships and trade models, and attract new customers. Successful management and integration of acquisitions are subject to a number of risks, including difficulties in assimilating acquired operations and managing remote operations, potential loss of key employees, diversion of management’s attention from existing business operations, assumption of contingent liabilities and incurrence of potentially significant write-offs, which may adversely affect our business or results of operations. In addition, if we consummate such an acquisition through an exchange of our securities, our existing stockholders could suffer dilution.

If we fail to effectively manage our distribution network, our business, prospects and brand may be materially affected by actions taken by our distributors.

We have a limited ability to manage the activities of our distributors, who are independent from us since we rely exclusively on these independent distributors. Our distributors could take one or more of the following actions, any of which could have a material adverse effect on our business, prospects and brand:

| | · | sell products that compete with our products in breach of their non-competition agreements with us; |

| | · | fail to adequately promote our products; |

| | · | fail to provide proper service to our end-users; or |

| | · | violate the anti-corruption laws of China. |

Failure to adequately manage our distribution network or the non-compliance of our distributors with their obligations under distribution agreements with us could harm our corporate image among end users of our products and disrupt our sales, resulting in a failure to meet our goals for sales. The PRC government has increased its anti-bribery efforts in the healthcare sector to reduce improper payments received by hospital administrators and doctors in connection with the purchase of pharmaceutical products. We can not guarantee that our distributors will not violate these laws or otherwise engage in illegal practices with respect to their sales or marketing of our products.

Our business may suffer if we are unable to collect payments from customers of our products on a timely basis.

Before 2006, we permitted our distributors and other customers to distribute our products on credit. Our distributors and other customers must make a significant commitment of capital to purchase our products. Any downturn in the businesses of our distributors and other customers of our products could reduce their willingness or ability to pay us. Therefore, historically we have not been able to collect all of our accounts receivable from our distributors and other customers. After 2006, we required our distributors and other customers to make payments before we deliver our products to them. Consequently, we have been able to collect all of our receivable since 2006. However, we are still not able to collect all our receivable before 2006. The failure of any of our distributors and other customers of our products to make timely payments could require us to recognize an allowance for doubtful accounts, which could have a material adverse effect on our results of operations and financial conditions.

We are subject to product liability exposure and have limited insurance coverage.

Our products are for the treatment of patients and we are exposed to potential product liability claims in the event that the use of our products cause or are alleged to have caused personal injuries or other adverse effects. A successful product liability claim against us could require us to pay substantial damages. Product liability claims against us, whether or not successful, are costly and time-consuming to defend. Also, in the event that our products proven to be defective, we may be required to recall or redesign such products. We do not have any product liability insurance policy to cover potential product liability arising from the use of our products. To date, we have not been subject to any product liability claim yet, but we cannot assure you that such claim will not be brought against us in the future. A product liability claim, with or without merit, could result in significant adverse publicity against us, and could have a material adverse effect on the marketability of our products and our reputation, which in turn, could have a material adverse effect on our business, financial condition and results of operations.

Our limited operating history makes evaluating our business and prospects difficult.

We commenced operations in 1995, and started to market and sell our products in 1997. Our limited operating history may not provide a meaningful basis for you to evaluate our business, financial performance and prospects. We may not have sufficient experience to address the risks frequently encountered by early-stage companies, and as a result we may not be able to:

| | · | preserve our leading position in the market of peptide drug; |

| | · | acquire and retain customers; |

| | · | attract, train, motivate and retain qualified personnel; |

| | · | keep up with evolving industry standards and market developments; |

| | · | increase the market awareness of our products; |

| | · | respond to competitive market conditions; |

| | · | maintain adequate control of our expenses; |

| | · | manage our relationships with our suppliers and distributors; or |

| | · | protect our proprietary technologies. |

If we are unsuccessful in addressing any of these risks, our business may be materially and adversely affected.

A significant interruption in supply could prevent or limit our ability to accept and fulfill orders for our products.

We purchase all our materials from third-party suppliers. Currently, we do not have any material long-term supply contracts with our suppliers. Our purchases are made on a purchase order basis. We have one major supplier (>50%), thus there is the significant risk that the supply of certain materials will be interrupted. In that case, our manufacturing process would be delayed. We may be unable to secure alternative sources of supply in a timely and cost-effective manner, which could impair our ability to manufacture our products or decrease our costs, harm our reputation and cause us to lose sales and orders for our products. Any of these occurrences could have a material adverse impact on our business, financial condition and results of operations.

We generate a substantial portion of our revenues from sales of our Thymopentin drug and a reduction in revenues of our Thymopentin drug would cause our revenues to decline and could materially harm our business.

We derive a substantial percentage of our revenues from sales of the Thymopentin, or TP-5 drug. Our TP-5 drug accounted for 72% and 53% of our total revenues for the fiscal years ended December 31, 2007 and December 31, 2008, respectively. The segment income derived from the sale of TP-5 products was $5.37 million and $6.17 million for the fiscal years ended December 31, 2007 and December 31, 2008, respectively. Going forward, continued market acceptance of our TP-5 drug will remain important to our success, and a reduction in revenues from sales of our TP-5 drug will have a direct negative impact on our business, financial condition and results of operations.

Rapid growth and a rapidly changing operating environment may strain our limited resources.

Our growth strategy includes our efforts to build our brand, develop new products, and accelerate market acceptance of our products. This growth strategy requires significant capital resources, and we may not generate an adequate return on our investment. Our growth may involve the acquisition of new technologies, businesses, products or services, the creation of strategic alliances in areas in which we do not currently operate or the expansion of our distributor network and direct sales force. This could require our management to develop expertise in new areas, manage new business relationships and attract new types of customers. We may also experience difficulties integrating these acquired businesses, products or services into our existing business and operations. The success of our growth strategy also depends in part on our ability to utilize our financial, operational and management resources and to attract, train, motivate and manage an increasing number of employees.

Our drug-development program depends upon third-party research scientists who are out of our control .

We depend upon independent investigators and collaborators, such as universities and medical institutions, to conduct our pre-clinical and clinical trials under agreements with us. These collaborators are not our employees and we cannot control the amount or timing of resources that they devote to our programs. These investigators may not assign as great a priority to our programs or pursue them as diligently as we would if we were undertaking such programs ourselves. If outside collaborators fail to devote sufficient time and resources to our drug-development programs, or if their performance is substandard, the approval of our applications, if any, and our introduction of new drugs, if any, will be delayed. These collaborators may also have relationships with other commercial entities, some of whom may compete with us. If our collaborators assist our competitors at our expense, our competitive position would be harmed.

If we fail to increase awareness and acceptance of our drugs in the medical community and among patients, we will not be able to grow or even sustain the market for our peptide drugs.

Our peptide drugs, including, TP-5, DDAVP, SS, and Thymosin Alpha 1, use a relatively new solid phase peptide synthesis technology and purification technology. To achieve greater penetration of the potential market in China, we must increase market awareness and use of our peptide drugs, which depend on, among other things, the following:

| | · | the general levels of awareness and acceptance in the medical community and among patients of peptide drugs; |

| | · | the amount of resources we have available to increase product awareness and to educate potential purchasers and users of our peptide drugs; |

| | · | our ability to provide good technical support and customer service; and |

| | · | our ability to keep up with technological changes and remain competitive. |

We may not have the financial and operational resources required to promote awareness and acceptance of our peptide drugs as widely or rapidly as is necessary to grow or sustain the market for our peptide drugs. If we fail to increase awareness and acceptance of our peptide drugs in the medical community and among patients, we will not be able to grow, or even sustain, the market for our peptide drugs as planned and our financial condition and results of operations will be harmed. The amount of resources we have available to marketing our products are approximately US $1 million.

We face fierce price competitions after the exclusive licensing rights from Chinese SFDA of our drugs expire and our financial conditions will be adversely impacted.

Our drugs face fierce price competitions from generic drugs manufactured by small to mid-sized drug manufacturers. Even though the quality of these generic drugs is inferior to our drugs, the price of these generic drugs is very attractive. Once the exclusive licensing rights from Chinese SFDA for our drugs expire, our financial results will be adversely affected because of competitions from these generic drugs.

We may face significant challenges in the progress toward our strategic objectives which may adversely affect our financial results and conditions.

We face significant obstacles in our quest for new markets, such as costs for penetrating new markets, the hire and retention of sufficient qualified sales and distribution staff members, implementation of overseas expansion efforts, and establishment and maintenance of a model system. We cannot guarantee the success of these strategies or objectives. We make our business plans and strategies based on today’s situation and certain assumptions. There are inherent risks and uncertainties within each stages of the development. These significant obstacles could adversely affect our results of operations and financial conditions.

If we fail to protect our intellectual property rights, our competitors may take advantage of our proprietary technology and know-how and compete directly against us.

We have not obtained any patent rights for our products in China yet. We applied for patent rights in China for the following inventions: Acetic acid to ammonia pressure injection, Thymopentin nasal spray’s preparation and application and Thymopentin injection prescription. We have obtained the approval of the Food and Drug Administration Bureau of the Republic of Uzbekistan for our TP-5 products in 2004. We are in the process of applying to South Korea and Indonesia Food and Drug Administrations for certifications.

Implementation of PRC intellectual property-related laws has historically been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in the PRC may not be as effective as in the United States or other developed countries. Policing unauthorized use of proprietary technology is difficult and expensive, and we might need to resort to litigation to enforce our rights or defend us, or to determine the enforceability, scope and validity of our proprietary rights or those of others. Such litigation may require significant expenditure of cash and management efforts and could harm our business, financial condition and results of operations. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, competitive position, and business prospects.

We may be exposed to intellectual property infringement and other claims by third parties, which, if successful, could cause us to pay significant damage awards and incur other costs.

While we believe that the technology we use is not protected by any patent or intellectual property rights, we face the risk of being the subject of intellectual property infringement claims. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability, including damage awards to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or subject us to injunctions preventing the manufacture and sale of our products. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation.

Our operations might be interrupted by the occurrence of a natural disaster or other catastrophic events.

Almost all of our manufacturing and research and development facilities are located in a single location in Hainan Province, China. Typhoon happens frequently during the summer in Hainan Province, which will possibly ruin our manufacturing facilities. In addition, other natural disasters or catastrophic events, including power interruptions, water shortages, storms, fires, earthquakes, terrorist attacks and wars could disrupt our operations. Although we have some spare facilities, we do not maintain all back-up facilities for the continued operation of our business in the above circumstances. We might suffer losses as a result of business interruptions and our operations and financial results might be materially and adversely affected should these catastrophic events occur. Moreover, any such event could delay our research and development programs which will adversely impact our business operations and financial results.

If we are unable to successfully operate and manage our manufacturing operations, we may experience a decrease in revenues.

As we ramp up our manufacturing operations to accommodate our planned growth, we may encounter difficulties associated with increasing production scale, including shortages of qualified personnel to operate our equipment or manage manufacturing operations, as well as shortages of key raw materials for our products. In addition, we may also experience difficulties in producing sufficient quantities of products or in achieving desired product quality. If we are unable to successfully operate and manage our manufacturing operations to meet our needs, we may not be able to provide our customers with the quantity or quality of products they require in a timely manner. This could cause us to lose customers and result in reduced revenues.

Our future capital needs are uncertain and we may need to raise additional funds in the future.

We may require additional cash resources in the future due to changed business conditions or other future developments. We cannot assure you that our revenues will be sufficient to meet our operational needs and capital requirements in the future. In the past, we have not encountered difficulties in obtaining financing. However, we cannot assure you that financing will be available in amounts or on terms acceptable to us. Our future capital needs and other business reasons could require us to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity or equity-linked securities could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations or our ability to pay dividends to our shareholders.

Risks Related To Our Management and Internal Control

We may not be able to achieve and maintain an effective system of internal control over financial reporting, a failure of which may prevent us from accurately reporting our financial results or detecting and preventing fraud.

We are constantly striving to establish and improve our business management and internal control over financial reporting to forecast, budget and allocate our funds. However, as a Chinese company that has recently become a US public company, we face difficulties in hiring and retaining a sufficient number of qualified employees to achieve and maintain an effective system of internal control over financial reporting in a short period of time. As a result, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records, and instituting business practices that meet international standards in a short period.

We depend on key personnel for our business operations, whose discontinuance could incur high replacement costs.

Our future success depends substantially on the continued services of our executive officers, especially Mr Xueyun Cui, our chairman, Mr. Xiaoqun Ye, our chief executive officer, and chief quality control officer, Zhenhong Ling. Although we have long-term employment contracts with management personnel, if one or more of our key executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses and require additional time to recruit and retain new officers.

Risks Related To The Industry

Disruptions in the capital and credit markets related to the current national and worldwide financial crisis, which may continue indefinitely or intensify, could adversely affect our results of operations, cash flows and financial condition, or those of our customers and suppliers.

The current disruptions in the capital and credit markets may continue indefinitely or intensify, and adversely impact our results of operations, cash flows and financial condition, or those of our customers and suppliers. Disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to liquidity needed to conduct or expand our businesses or conduct acquisitions or make other discretionary investments, as well as our ability to effectively hedge our currency or interest rate. Such disruptions may also adversely impact the capital needs of our customers and suppliers, which, in turn, could adversely affect our results of operations, cash flows and financial condition.

In order to manufacture and market our products, we are required to obtain various authorizations from governmental regulatory authorities in China and other countries. If we fail to obtain clearance or approvals in a timely fashion, our business may be significantly affected.

The sale and marketing of our products are subject to regulation in China. We are required to obtain registrations with the State Food and Drug Administration ( the “SFDA”) and the regulatory authorities in charge of the approval in countries where we plan to export. The process for obtaining regulatory clearances or approvals can be lengthy and expensive, and the results are unpredictable. In addition, the relevant regulatory authorities may introduce additional requirements or procedures that have the effect of delaying or prolonging the regulatory clearance or approval for our existing or new products. If we are unable to obtain clearances or approvals needed to market existing or new products, or obtain such clearances or approvals in a timely fashion, our business could be significantly disrupted, and sales and profitability could be materially and adversely affected.

We are required to obtain registration certificates from the SFDA in order to sell our drugs. We will need to renew the registration certificates once they expire. We are also required to obtain production permits from the provincial level food and drug administration before commencing the manufacture of our products. Once our production permits for the manufacture of our products expire, we will need to renew such production permits. We do not foresee any significant difficulties in obtaining such renewal. But if we fail to obtain such renewal in a timely fashion, our business may be adversely affected.

In April 2007, the SFDA announced a new regulation that was implemented on October 1, 2007. Reagents used for IVD testing are divided into six different categories, Classes I through VI, depending on the degree of risk associated with each reagent, with the lower number of class representing longer period of exclusive licensing right. We list our products below to classify them into different categories.

| Product Name | | Category | | Registration certificate expire date |

| Thymopentin for Injection (TP-5) | | Class 5 | | Dec 2010 |

| Desmopressin Acetate Injection (DDAVP) | | Class 6 | | May 2011 |

| Somatostatin for Injection (SS) | | Class 6 | | Nov 2014 |

| Thymosin a1 for Injection (Alpha 1) | | Class 4 | | Sep. 2010 |

We are required to obtain a registration certificate for each reagent prior to selling that reagent for clinical use. However, a reagent that is used for research purpose only is exempt from registration and/or approval. A reagent kit intended for research use only must comply with the labeling requirements that present the statement: “For research use only. Not for use in diagnostic procedures” on the package. Before receiving the necessary registration certificates, these products can be sold for research only. Thus, this may delay the surge of sales in these products.

Outside the PRC, our ability to market any of our potential products is contingent upon receiving marketing authorizations from the appropriate foreign regulatory authorities. These foreign regulatory approval processes include all of the risks associated with the SFDA approval process described above and may include additional risks.

We may not be able to comply with applicable good manufacturing practice requirements and other regulatory requirements, which could have a material adverse effect on our business, financial condition and results of operations.

We are required to comply with applicable good manufacturing practice regulations, which include requirements relating to quality control and quality assurance as well as corresponding maintenance, record-keeping and documentation standards. Manufacturing facilities must be approved by governmental authorities before we can use them to commercially manufacture our products and are subject to inspection by regulatory agencies.

If we fail to comply with applicable regulatory requirements at any stage during the regulatory process, including following any product approval, we may be subject to sanctions, including:

| | · | product recalls or seizure; |

| | · | refusal of regulatory agencies to review pending market approval applications or supplements to approval applications; |

| | · | total or partial suspension of production; |

| | · | withdrawals of previously approved marketing applications. |

Unpredictable local policy changes where our factories are located may adversely affect our business.

Our business activities are regulated by Chinese laws and local regulations regarding food, nutritional products and medicine. Some of these local regulations are related to administrative permits and approvals. The expiration or restrictions on these permits or approvals for our drugs may adversely affect our sales. Recent policy changes on drug sales dramatically affect our drug sales price and sales entrance to various hospitals. As a result, these changes may adversely affect our results of operations and financial conditions.

New product development in the medicine and supply industry is both costly and labor-intensive and has a very low rate of successful commercialization.

Our success will depend in part on our ability to enhance our existing products/drugs and to develop and acquire new drugs. The development process for medical products is complex and uncertain, as well as time-consuming and costly. Product development requires the accurate assessment of technological and market trends as well as precise technological execution. We cannot assure you that:

| | · | our product/drug development will be successfully completed; |

| | · | necessary regulatory clearances or approvals will be granted by SFDA, or other regulatory bodies as required on a timely basis, or at all; or |

| | · | any product/drug we develop can be commercialized or will achieve market acceptance. |

Also, we may be unable to locate suitable products/drugs to acquire or acquire such products/drugs on commercially reasonable terms. Failure to develop or acquire, obtain necessary regulatory clearances or approvals for, or successfully commercialize or market potential new products/drugs could have a material adverse effect on our financial condition and results of operations.

Clinical trials are very expensive, time-consuming and difficult to design and implement.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial process is also time consuming. We estimate that clinical trials of our product candidate will take at least several years to complete. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including with no limitation:

| | · | unforeseen safety issues; |

| · | determination of dosing issues; |

| | · | lack of effectiveness during clinical trials; |

| | · | slower than expected rates of patient recruitment; |

| | · | inability to monitor patients adequately during or after treatment; and |

| | · | inability or unwillingness of medical investigators to follow our clinical protocols. |

In addition, the SFDA, any SFDA-equivalent in foreign jurisdictions, may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the regulatory bodies find deficiencies in our Investigational New Drug, or IND, submissions or the conduct of these trials. Therefore, we cannot predict with any certainty the schedule for future clinical trials.

The results of our clinical trials may not support our product candidate claims.

Even if our clinical trials are completed as planned, we cannot be certain that their results will support our product candidate claims. Success in pre-clinical testing and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the results of later clinical trials will replicate the results of prior clinical trials and pre-clinical testing. The clinical trial process may fail to demonstrate that our product candidates are safe for humans and effective for indicated uses. This failure would cause us to abandon a product candidate and may delay development of other product candidates.

Physicians, patients and other end consumers may abandon existing or chose not to accept and use our new drugs.

Physicians and patients may not accept and use our products. Acceptance and use of our product will depend upon a number of factors including:

| | · | perceptions by members of the health care community, including physicians, about the safety and effectiveness of our products; |

| | · | post-effectiveness of our product relative to competing products; and |

| | · | effectiveness of marketing and distribution efforts by us and our licensees and distributors, if any. |

Because we expect sales of our current and future products to generate substantially all of our product revenues for the foreseeable future, the failure to find market acceptance would harm our business and could require us to seek additional financing.

Competition in the markets in which we operate is expected to increase in the future.

Certain of our existing and potential competitors have significantly greater financial, research and development, sales and marketing, personnel resources and other resources than we do. Competition will intensify as other companies enter our markets. Competing companies may succeed in developing products that are more effective or less costly than those that we may offer, and these companies may also be more successful in marketing their products. Competing companies may also introduce competitive pricing measures that adversely affect our sales levels and margins. If we do not adequately address our competitive challenges, we could lose sales and market share and fail to grow our business as planned, which would have a material adverse effect on our financial condition, results of operations and future growth.

In addition, we believe that corrupt practices in the healthcare industry in China still occur. In order to increase sales, certain manufacturers or distributors of medical devices may pay kickbacks to hospital personnel who make procurement decisions. We prohibit our employees from engaging in such practices and, to our knowledge, none of our distributors engages in such practices. However, as competition intensifies in the medical device and supplies industry in China, we may lose sales, customers or contracts to competitors to the extent we or our distributors refuse to engage in such practices.

We face competition from multi-national corporations with more resources where we are at a disadvantage.

In the poly peptide drug industry, there are competitions from multi-national conglomerates. With the fast-changing nature of the drug industry, we face competitions from these multi-national corporations which have better resources. These corporations have more diversified products, longer manufacturing and sales history and better commercialization of their products. Competitions from these international players may have adverse impacts on our business conditions.

We face intense competition that may prevent us from maintaining or increasing market share for our existing products and gaining market acceptance of our future products. Our competitors may develop or commercialize products before or more successfully than us.

The pharmaceutical market in China is intensely competitive, rapidly evolving and highly fragmented. Our competitors may develop products that are superior to or more affordable than ours or they may more effectively market products that compete with ours. We face direct competition from manufacturers of other medicines that are similar to our products. We also face competition from western manufacturers of medicines, including multinational companies, that manufacture medicines with similar curative effects and that can be used as substitutes for our products. Many of our existing and potential competitors have substantially greater financial, technical, manufacturing and other resources than we do. Our competitors’ greater size in some cases provides them with a competitive advantage with respect to manufacturing costs because of their economies of scale and their ability to purchase raw materials at lower prices. Many of our competitors also have better brand name recognition, more established distribution networks and larger customer bases. In addition, many of our competitors have extensive knowledge of our target markets. As a result, they may be able to devote greater resources to the research, development, promotion and sale of their products or respond more quickly to evolving industry standards and changes in market conditions than we can. Our failure to adapt to changing market conditions and to compete successfully with existing or new competitors may materially and adversely affect our financial condition and results of operations.