| |

| | |

David L. Ficksman · (310) 789-1290 · dficksman@troygould.com | |

| | |

| | |

| | January 19, 2016 |

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| | Re: | ClickStream Corporation |

Registration Statement on Form 10

Filed December 11, 2015

File No. 000-52944

Dear Mr. Shuman:

We write on behalf of our client, ClickStream Corporation (the “Company”) in response to your comment letter dated January 6, 2016. The Company is concurrently filing herewith Amendment No. 1 to the Form 10 Registration Statement.

The Company’s sequential response to the Staff’s comments is set forth below.

General

| 1. | You appear to be a shell company as defined in Rule 405, because you appear to have no or nominal operations and no assets. As such, you should disclose that you are a shell company in your business section and add a risk factor that highlights the consequences of shell company status. Discuss the prohibition on the use of Form S-8 by shell companies; enhanced reporting requirements imposed on shell companies; and the conditions that must be satisfied before restricted and control securities may be resold in reliance on Rule 144. Also describe the potential impact on your ability to attract additional capital. |

COMPANY’S RESPONSE

Currently, the Company believes that it is not a shell for the following reasons.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 2

In Release 33-8869 relating to the adoption of rules for shell companies, several commenters were concerned that the definition of a shell company as set forth in the proposed rule would capture virtually every company during its start-up phase and that the definition was therefore too broad. The SEC addressed this concern in footnote 172 to the Release by saying, in applicable part:

“Contrary to commenters’ concerns, Rule 144(i)(1)(i) is not intended to capture a “startup company,” or in other words, a company with a limited operating history, in the definition of a reporting or non-reporting shell company, as we believe that such a company does not meet the condition of having “no or nominal operations.”

In this regard the Company commenced its current operations as a development stage company in June, 2014. Under the direction of the Chairman of the Board, Michael O’Hara (who subsequently also became President), management organized a team of three highly experienced Internet tech executives who, as consultants to the Company, worked with him over a six month period to design, develop and test the prototype for the Company’s first fantasy sports product DraftClick (as described herein). Over a subsequent four month period, the team refined the design based on the feedback from the prototype and completed a project plan for completion of the marketable product.

Approximately $345,000 in cash, both debt and equity, has been invested to date in the Company to develop the prototype, refine the design specifications and complete the project plan for the marketable product. This does not include the salaries of certain executives and consultants, who dedicated time to the project and have not been paid to date, but are carried on the Company’s financial statements as accrued salaries; thus the total invested in the development of the technology is in excess of $500,000.

Since operations commenced, the Company has also developed approximately 40 unique, proprietary self-learning software algorithms for the prototype that will form the core of the marketable product's ability to determine optimal fantasy sports team composition for fantasy sports participants. The Company’s proprietary algorithms continue to be tested and the technology team, under Mr. O’Hara’s direction, also continues to work on improving the system.

The system includes algorithms which support the button entitled “Automatically Fill Empty Positions”. This will allow users to auto-fill team selections without having to do all the calculations and player comparisons themselves, a task which is currently calculated by the Fantasy Sports Trade Association as involving a number of hours per week. This not only speeds up the process, but is one of the unique features of the system making it easier for users to play a particular game, or group of games.

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 3

Some examples of the results from the prototype:

One of the Company’s early tests on February 9, 2015 involved basketball data. The Company knew what player data was generated during that day. The Company also knew, from the performance files, what each player ended up scoring during games played on the evening of February 9, 2015. In other words, the Company has a “before” file and an “after” file for each player, i.e., data the Company could have observed before the game vs. data the Company collected after each game.

The Company can now “teach” a machine learning algorithm using these two files: show the machine what the player’s data looked like before the game, and then tell the machine how that player performed later in the day.

With every day that goes by, the Company’s algorithms get smarter because they are receiving more and more of these “before and after” examples. Data used by the algorithms for predictions is also updated on a continual basis based on breaking events (e.g., injuries) without human intervention.

During these early tests of the Company’s prototype, the Company achieved very interesting results. In March, 2015, the algorithms were asked to predict whether a certain player will score 30 Fanduel points or more in the next game. The Company’s current best algorithm achieved an out-sample accuracy rate of 77% for the 1249 most recent player options and buy signals had an accuracy rate of 78%. If this accuracy rate could be maintained across the entire fantasy team selection process, then the likelihood of any user to finish in the money for 50/50 cash games or tournaments would be increased.

To put this accuracy rate in context, consider the following assessment in August 2014 by Steve Buzzard in "Analyzing the Different Types of Games in Daily Fantasy Sports" (footballguys.com):

“The third option I haven’t even mentioned are 50/50’s. At first glance these might seem like the lowest variance group because all you have to do is beat 50% of the players. It would seem that if we are some of the best players we should consistently beat half the people. However, after playing a few weeks you will see that this is easier said than done. Even the very best players will beat half the people only about 60-65% of the time.”

The significance of this information is to indicate the Company’s operations both in development and testing of our initial Fantasy Sports product, DraftClick.

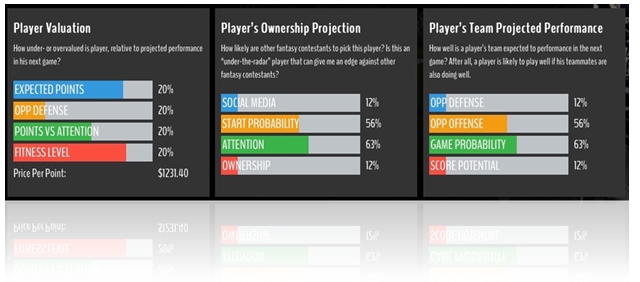

Some examples of the design of the prototype:

This is a preliminary design from the prototype for the Fantasy Basketball site for DraftClick which shows how the statistics for each player are presented and how the system assists the user in determining the final choices for his team. The system is updated 24/7 in real time to compensate for any changes as they may occur.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 4

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 5

The user not only has a number of statistics to assist in determining the final team choice (by player), but the system allows for comparisons of any two players (of the user’s choice—for each player position in the game) and will arrive at a comparison rating (edge score) based on the information contained in the Company’s continually updated database.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 6

Summary:

The Company is currently in discussions with a number of potential investors for an equity funding which will assure its continuing operations for a minimum of 18 months. They anticipate closing one of them by mid-February. The Company has also been working with an external social media company to begin developing a plan to market, advertise, promote and sell the ultimate product.

In conclusion, we believe these operations eliminate the Company from “shell” status as the Company is, in fact, an active development company, with revenues projected for the third or fourth quarter of 2016.

Part I

Item 1. Business

Overview, page 2

| 2. | Please revise to prominently disclose that you do not have a marketable product and that you have not generated any revenues. Describe the status of your proposed product including what has been accomplished and what remains to be accomplished to have a marketable product. |

COMPANY’S RESPONSE

The Company has made the appropriate changes to the Registration Statement in response to the Staff’s comments.

| 3. | We note your many references to industry leaders such as DraftKings and FanDuel in describing your business. Please clarify which, if any, contribute materially to your business in quantified terms. To the extent you are unable to provide an objective standard for identifying such businesses by name, please revise to remove the names. Similar concerns apply to your references to Facebook, Twitter, Yahoo, Google, STATS, RotoGrinders, RotoWire, OfficialPredictionMachine.com, Breaking Sports and Sports Guys LLC throughout your filing. |

COMPANY’S RESPONSE

The Company has revised the disclosure to clarify the connection with industry leaders.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 7

| 4. | Please revise to disclose that there can be no assurances that your efforts to develop the proposed fantasy sports platform will succeed, or that you will be able to successfully market the proposed fantasy sports platform, if developed. |

COMPANY’S RESPONSE

The Company has revised its disclosure to disclose the risks referred to.

| 5. | Please revise to describe the status of your developmental efforts for your fantasy sports platform, any potential difficulties that may preclude you from completing development and the expected costs of development. |

COMPANY’S RESPONSE

The Company has expanded its discussion of its development efforts and the current status of product development.

Business Operations, page 3

| 6. | Please revise the statement that you have developed an automated analytics platform to more accurately describe the status of the platform’s development. Please make corresponding revisions throughout your filing. |

COMPANY’S RESPONSE

The Company has revised its disclosure to describe the status of platform development.

The Opportunity, page 3

| 7. | Please specifically disclose the factual basis for, and the context of, all your beliefs, understandings, estimates, and opinions set forth in the registration statement. You must be able to substantiate on a reasonable basis all of the projections, statistics and assertions that you cite. Examples of assertions or references that need support include the following: |

| | · | your statement that fantasy sports players have grown from 500,000 in 1988 to an estimated 56 million in 2015 in the U.S. and Canada up from 32 million in 2010 (page 3); |

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 8

| | · | your statement that fantasy sports players spend an average of 8.7 hours weekly consuming fantasy sports, they are mostly male (66%) with an average age of 37 years, and 57% have college degrees (page 3); |

| | · | your statement that Football is the most popular of the fantasy sports (73%) and 74% of the players use four to six sports websites to obtain relevant data to assist them in their playing strategies (page 3); |

| | · | your statement that daily games will generate around $2.6 billion in entry fees in 2015 and grow 41 percent annually, reaching $14.4 billion in 2020 (page 4); |

| | · | your statement that in 2013, 319,000 Fantasy Sports players used mobile devices to participate in fantasy sports and that in 2014, this number had increased by 847% to 3,022,000 (page 4); and |

| | · | your statement that fantasy sport platforms typically keep around 10 percent of participating fantasy sport participant fees as revenue, paying the rest in prizes (page 4). |

Alternatively, please revise to remove these statements.

COMPANY’S RESPONSE

The Company has specifically cited in the Registration Statement the applicable authority for the statements made.

| 8. | With respect to every third-party statement in your prospectus, such as the information provided by the Fantasy Sports Trade Association and Eilers Research, please provide us with copies of the relevant portions of the industry research reports you cite. To expedite our review, please clearly mark each source to highlight the applicable portion or section containing the statistic, and cross-reference it to the appropriate location in your prospectus. Also, tell us whether you commissioned any of the studies or reports. |

COMPANY’S RESPONSE

The Company is separately providing you with relevant documentation.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 9

Risk Factors

Risks Related to our Business, page 8

| 9. | Please add a separately captioned risk factor disclosing the minimum number of months that you will be able to conduct your planned operations using currently available capital resources. In addition, disclose the minimum additional dollar amount you will require to fund your business activities for the next 12 months. Also revise your liquidity and capital resources discussion to provide such information. |

COMPANY’S RESPONSE

The Company has added a risk factor in response to the Staff’s comments and revised the Management’s Discussion and Analysis discussion accordingly.

Item 2. Financial Information

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 18

| 10. | Please remove your references here to forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. As an issuer of penny stock you do not appear to be eligible to rely on the safe harbor provided by the PSLRA. Please revise your filing accordingly. |

COMPANY’S RESPONSE

The Company has removed the reference to forward-looking statements.

Liquidity, page 20

| 11. | We note your statement that you have hired a consultant to assist in raising capital. Please revise to briefly describe the duties your consultant will perform and whether your consultant is a registered broker-dealer and file this agreement as an exhibit to your registration statement. |

COMPANY’S RESPONSE

The Company has revised the disclosure to describe the consultant’s duties which encompass a broad range of services. The consultant is not a registered broker dealer and its compensation is not tied to any fund raising activities.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 10

Item 6. Executive Compensation

Summary Compensation Table, page 28

| 12. | Please revise the summary compensation table to provide all of the information required by Item 402(n) of Regulation S-K. |

COMPANY’S RESPONSE

The Company has revised the compensation table to meet the requirement of Item 402(n).

Item 7. Certain Relationships and Related Transactions, and Director Independence

Transactions with Related Persons, page 28

| 13. | Please revise to identify the major shareholder with whom you entered into a two year consulting agreement and the shareholder that provided legal services to the company. Refer to Item 404(d) of Regulation S-K. |

COMPANY’S RESPONSE

The Company has revised the disclosure as requested.

| 14. | Please tell us what consideration you gave to disclosing the $45,000 promissory note issued to a shareholder that you describe on page F-11 and whether that agreement is required to be filed as an exhibit. Refer to Item 404(d) of Regulation S-K. |

COMPANY’S RESPONSE

The maker of the note is not a related party as defined in Regulation S-K and no disclosure is required.

Item 10. Recent Sales of Unregistered Securities, page 30

| 15. | You disclose here that you have conducted several unregistered sales in reliance on Regulation D. You have not, however, filed any Forms D. Please advise. |

COMPANY’S RESPONSE

The Company believes that the unregistered sales were conducted pursuant to the statutory exemption under Section 4(a)(2) of the Securities Act. All of the investors represented were accredited investors made appropriate investment representations and the certificates were legended. No public solicitation was conducted.

Mark P. Shuman

Branch Chief – Legal

Office of Information Technologies and Services

United States Securities and Exchange Commission

January 19, 2016

Page 11

In connection with the letter, the Company hereby acknowledges the following in a separate certification signed by the Company’s President which is attached to this letter that:

| | · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please advise if you have any further questions or comments.

| | Very truly yours, |

| | |

| | /s/ David L. Ficksman |

| | |

| | David L. Ficksman |

| | |

Christine Dietz, Assistant Chief Accountant, SEC

Jeff Kauten, Esq., Attorney-Advisor

Barbara C. Jacobs, Assistant Director

David Kagel, Esq.

Michael O’Hara

Michael Handelman

Irwin Meyer

CLICKSTREAM CORPORATION

1801 Century Park East, Suite 1201

Los Angeles, CA 90067

Attachment to

TroyGould PC

Letter Dated January 19, 2016

CERTIFICATION SIGNED

In connection with this letter, the Company hereby acknowledges the following:

1. The Company is responsible for the adequacy and accuracy of the disclosure in the filing.

2. Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

3. The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Very truly yours,

| /s/ Michael O’Hara | |

| President | |

| ClickStream Corporation | |