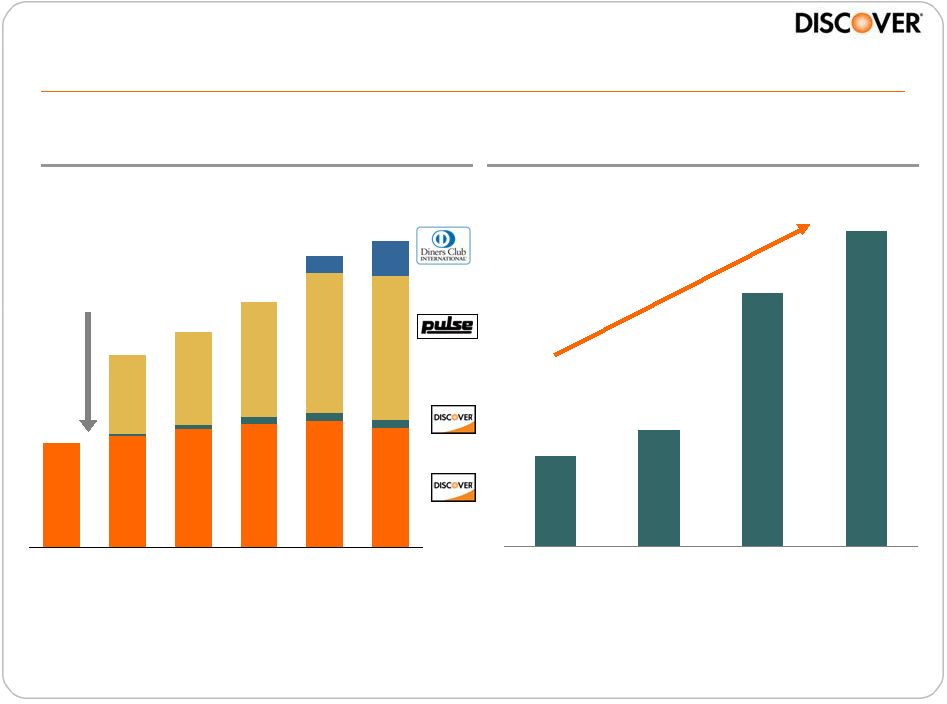

Notice The following slides are part of a presentation by Discover Financial Services (the "Company") and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. The information provided herein may include certain non-GAAP financial measures. The reconciliations of such measures to the comparable GAAP figures are included in the Company’s Current Reports on Form 8-K dated March 1, 2010 and March 16, 2010 and Annual Report on Form 10-K for the year ended November 30, 2009, which are on file with the SEC and available on the Company’s website at www.discoverfinancial.com. Certain reconciliations are also included at the end of this presentation. The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward- looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended November 30, 2009, which is on file with the SEC. Certain historical financial information about the Company that we have included in this presentation has been derived from Morgan Stanley’s consolidated financial statements and does not necessarily reflect what our financial condition, results of operations or cash flows would have been had we operated as a separate, stand-alone company during the periods presented. We own or have rights to use the trademarks, trade names and service marks that we use in conjunction with the operation of our business, including, but not limited to: Discover ® , PULSE ® , Cashback Bonus ® , Discover ® Network and Diners Club International ® . All other trademarks, trade names and service marks included in this presentation are the property of their respective owners. 2 |