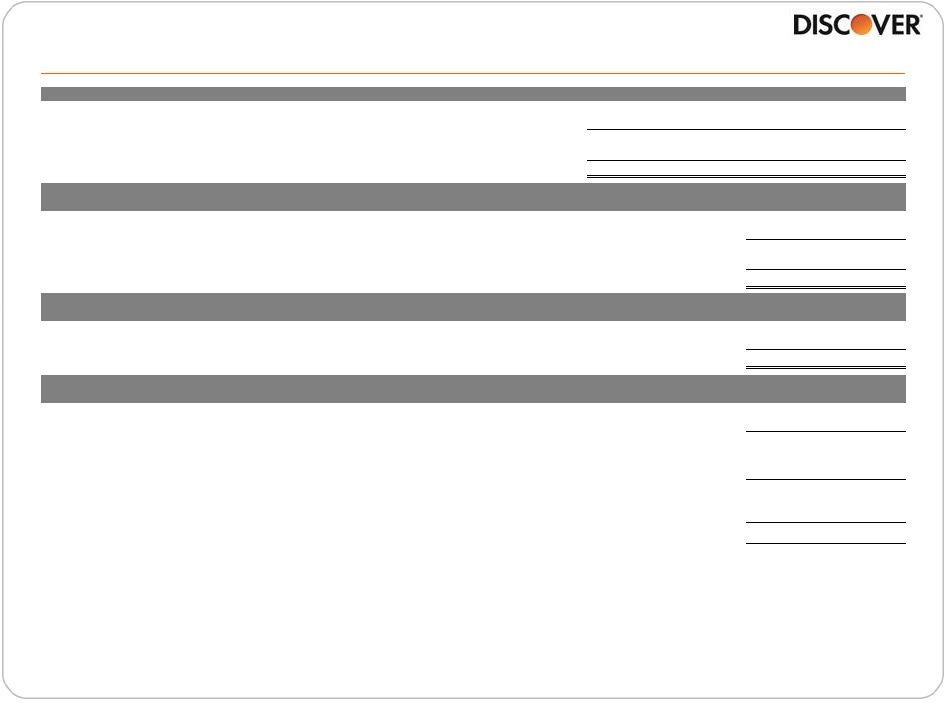

19 Reconciliation of GAAP to Non-GAAP data (unaudited, $ in billions) 11/30/11 8/31/12 GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (ending loans) $5.3 $4.9 Adjustment for Purchase Accounting Discount 0.4 0.4 Contractual Value Purchased (Private) Credit Impaired Student Loans (ending loans) (1) $5.7 $5.2 GAAP Private Student Loans (ending loans) 2.1 2.8 Contractual Value Private Student Loans (ending loans) (1) $7.8 $8.0 Twelve Months Ended (unaudited, $ in billions) 12/31/11 GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (average loans) $3.5 Adjustment for Purchase Accounting Discount 0.5 Contractual Value Purchased (Private) Credit Impaired Student Loans (average loans) (1) $4.1 GAAP Private Student Loans (average loans) 1.7 Contractual Value Private Student Loans (average loans) (1) $5.8 Twelve Months Ended (unaudited, $ in millions) 12/31/11 GAAP Private Student Loan Net Principal Charge-offs $8.1 Adjustment for Purchased (Private) Credit Impaired Student Loans Net Principal Charge-offs 47.5 Contractual Private Student Loan Net Principal Charge-offs (2) $55.6 Twelve Months Ended (unaudited, $ in millions, calendar year data) 9/30/12 Card Pretax Income $3,396 Non-Card Pretax Income 394 GAAP Direct Banking Pretax Income $3,790 Card Pretax Income $3,396 Card Reserve Changes 649 Card Pretax Income (Excluding Reserve Changes) $2,747 GAAP Average Card Receivables $46,557 Card Pretax Return on Assets (Excluding Reserve Changes) (3) 5.90% Note(s) 1. The contractual value of the purchased private student loan portfolio is a non-GAAP measure and represents purchased private student loans excluding the purchase accounting discount. The contractual value of the private student loan portfolio is meaningful to investors to understand total outstanding student loan balances without the purchase accounting discount 2. Contractual private student loan net principal charge-offs is a non-GAAP measure and include net charge-offs on purchase credit impaired loans. Under GAAP any losses on such loans are charged against the nonaccretable difference established in purchased credit impaired accounting and are not reported as charge-offs. Contractual net principal charge-offs is meaningful to investors to see total portfolio losses 3. Card pre-tax return on assets excluding loss reserve changes is a non-GAAP measure and represents the pre-tax earnings of Discover's U.S. credit card business excluding changes to the allowance for loan loss reserve. Card pre-tax return on assets excluding loss reserve changes is a meaningful measure to investors because it provides a competitive performance benchmark |