Exhibit 99.1

2014 Financial Community Briefing

February 27, 2014

©2014 DISCOVER FINANCIAL SERVICES

Notice

The following slides are part of a presentation by Discover Financial Services (the “Company”) and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete.

Company financial data presented herein is based on a calendar year. As previously reported, the Company changed its fiscal year end from November 30 to December 31 of each year, effective beginning with the 2013 fiscal year. For historical calendar year financial data, see the Company’s Current Report on Form 8-K dated March 5, 2013 and the Company’s Annual Report on Form

10-K for the year ended December 31, 2013.

The information provided herein includes certain non-GAAP financial measures. The reconciliations of such measures to the comparable GAAP figures are included at the end of this presentation, which is available on the Company s website at www.discoverfinancial.com.

The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see “Special Note Regarding Forward-Looking Statements,” “Risk Factors,” “Business – Competition,” “Business – Supervision and Regulation” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 which is available on the Company’s website and the SEC’s website. The Company does not undertake to update or revise forward-looking statements as more information becomes available.

We own or have rights to use the trademarks, trade names and service marks that we use in conjunction with the operation of our business, including, but not limited to: Discover®, PULSE®, Cashback Bonus®, Discover Cashback CheckingSM, Discover it®, Discover® Network and Diners Club International®. All other trademarks, trade names and service marks included in this presentation are the property of their respective owners.

Agenda

David Nelms

CHAIRMAN & CHIEF EXECUTIVE OFFICER

Roger Hochschild

PRESIDENT & CHIEF OPERATING OFFICER

David Nelms

CHAIRMAN & CHIEF EXECUTIVE OFFICER

Roger Hochschild

PRESIDENT & CHIEF OPERATING OFFICER

Mark Graf

EVP & CHIEF FINANCIAL OFFICER

Strategy

U.S. Card

Direct Banking Products

Payment Services

Break

Financials

Q&A

2014 Financial Community Briefing

Strategy

David Nelms

Chairman & Chief Executive Officer

Discover’s Strategic Objective:

Be the leading direct bank and payments partner

Brand

Customer Rewards Service

Discover

Flexible

Risk Payment Management Networks

Loyal Customer Base

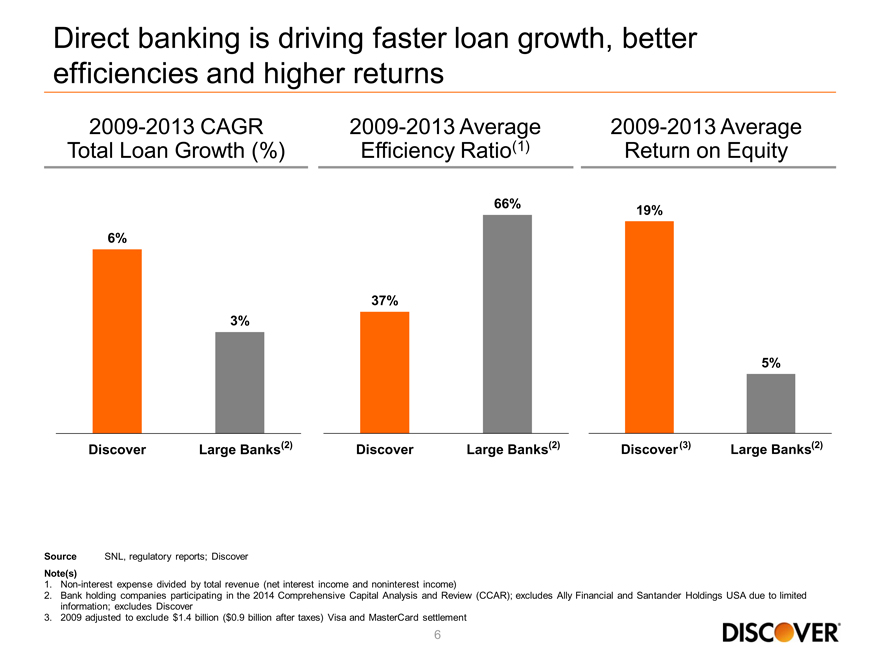

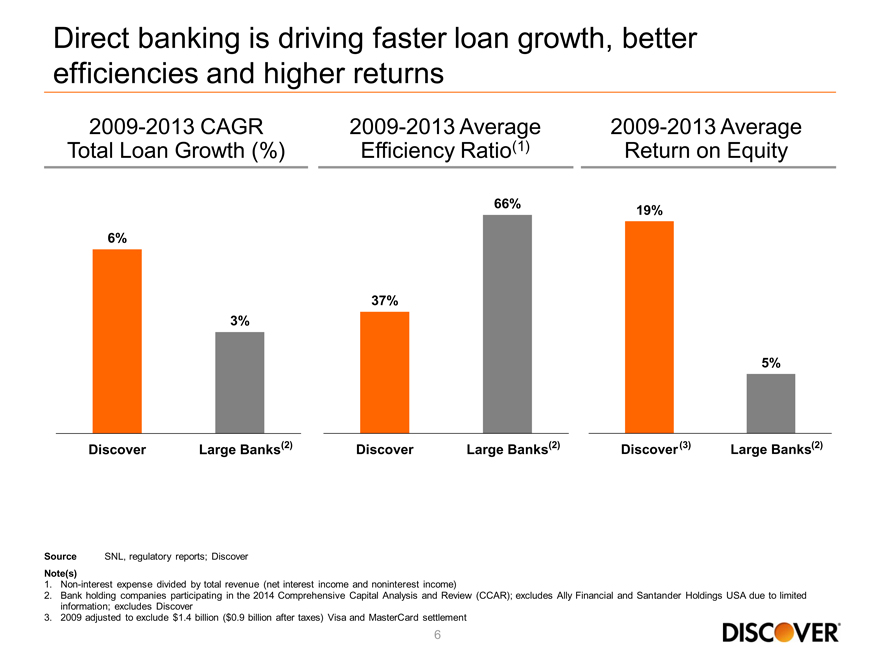

Direct banking is driving faster loan growth, better efficiencies and higher returns

2009-2013 CAGR Total Loan Growth (%)

2009-2013 Average Efficiency Ratio(1)

2009-2013 Average Return on Equity

6%

3%

37%

66%

19%

5%

Discover Large Banks(2) Discover Large Banks(2) Discover(3) Large Banks(2)

Source SNL, regulatory reports; Discover

Note(s)

1.

Non-interest expense divided by total revenue (net interest income and noninterest income)

2.

Bank holding companies participating in the 2014 Comprehensive Capital Analysis and Review (CCAR); excludes Ally Financial and Santander Holdings USA due to limited

information; excludes Discover

3.

2009 adjusted to exclude $1.4 billion ($0.9 billion after taxes) Visa and MasterCard settlement

6

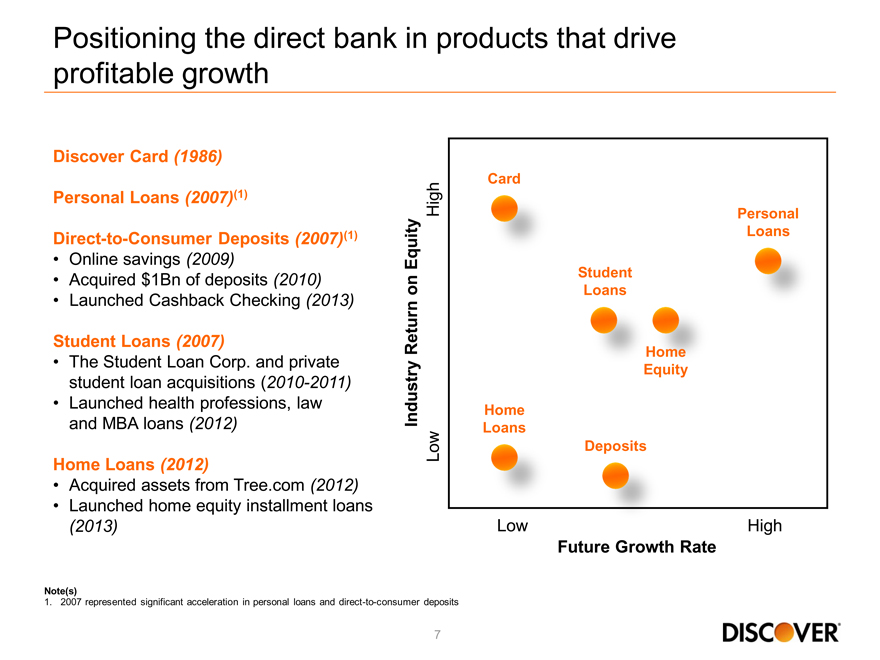

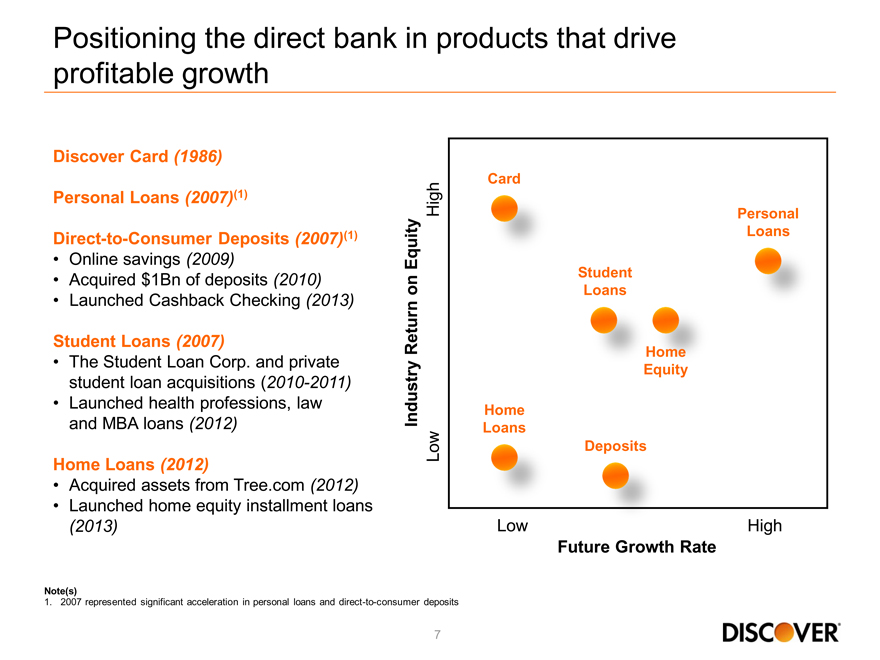

Discover Card (1986)

Personal Loans (2007)(1)

Direct-to-Consumer Deposits (2007)(1)

Online savings (2009)

Acquired $1Bn of deposits (2010)

Launched Cashback Checking (2013)

Student Loans (2007)

The Student Loan Corp. and private student loan acquisitions (2010-2011)

Launched health professions, law and MBA loans (2012)

Home Loans (2012)

Acquired assets from Tree.com (2012)

Launched home equity installment loans

(2013)

Industry Return on Equity

Low High

Card

Personal Loans

Student Loans

Home Equity

Home Loans

Deposits

Low High

Future Growth Rate

Note(s)

1. 2007 represented significant acceleration in personal loans and direct-to-consumer deposits

7

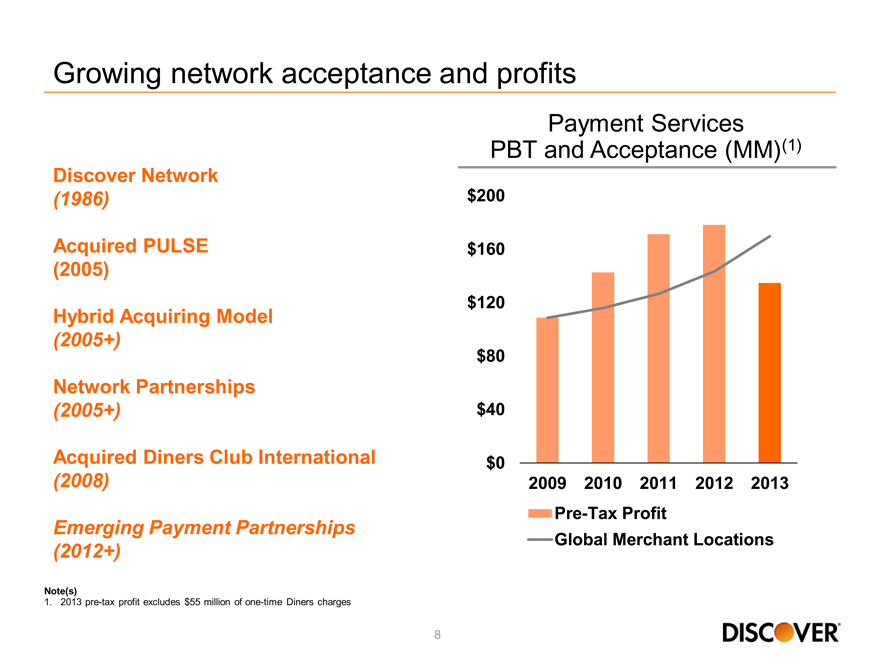

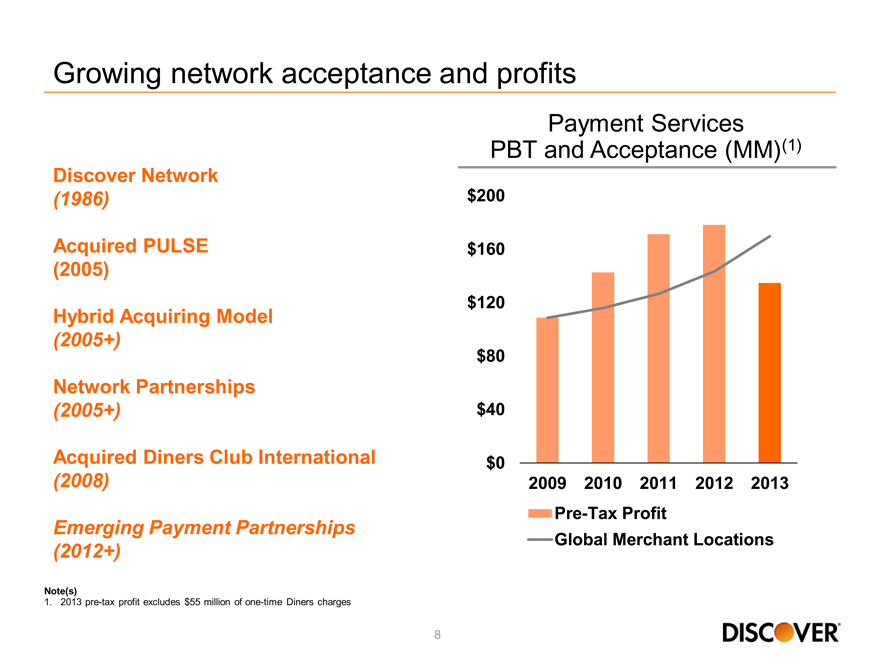

Growing network acceptance and profits

Discover Network

(1986)

Acquired PULSE (2005)

Hybrid Acquiring Model

(2005+)

Network Partnerships

(2005+)

Acquired Diners Club International

(2008)

Emerging Payment Partnerships (2012+)

Note(s)

1. 2013 pre-tax profit excludes $55 million of one-time Diners charges

Payment Services PBT and Acceptance (MM)(1)

$200 $160 $120 $80 $40 $0

2009 2010 2011 2012 2013

Pre-Tax Profit

Global Merchant Locations

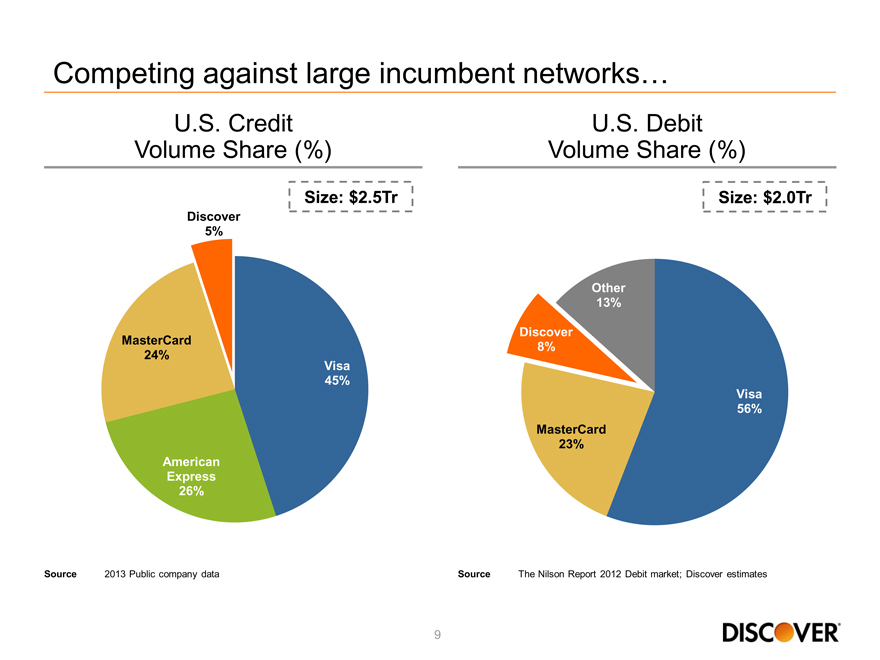

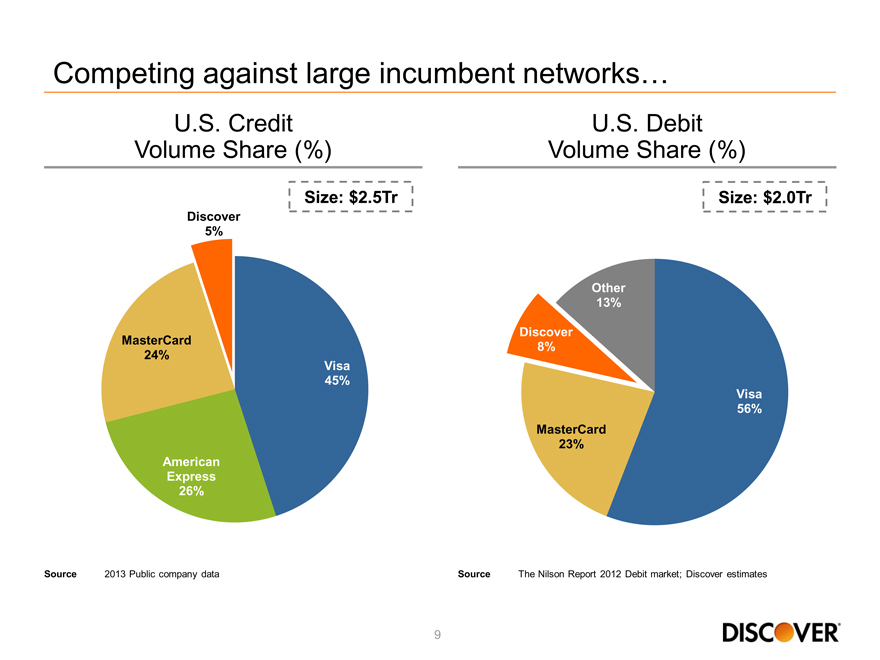

Competing against large incumbent networks…

U.S. Credit Volume Share (%)

U.S. Debit Volume Share (%)

Discover 5%

Size: $2.5Tr

MasterCard

24% Visa 45%

American Express 26%

Source 2013 Public company data

Size: $2.0Tr

Other 13%

Discover 8%

Visa 56% MasterCard 23%

Source The Nilson Report 2012 Debit market; Discover estimates

9

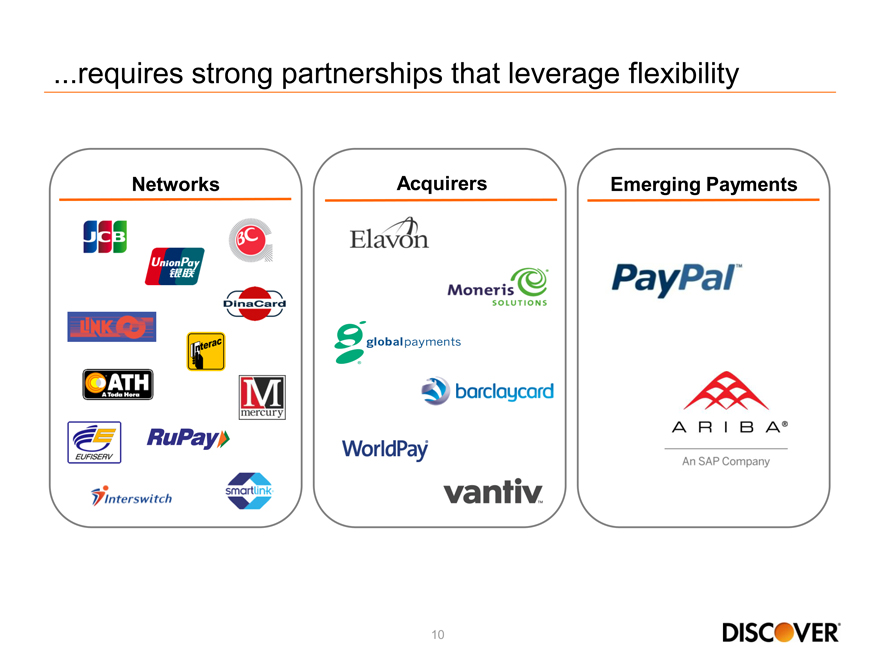

10

...requires strong partnerships that leverage flexibility

Networks

Acquirers

Emerging Payments

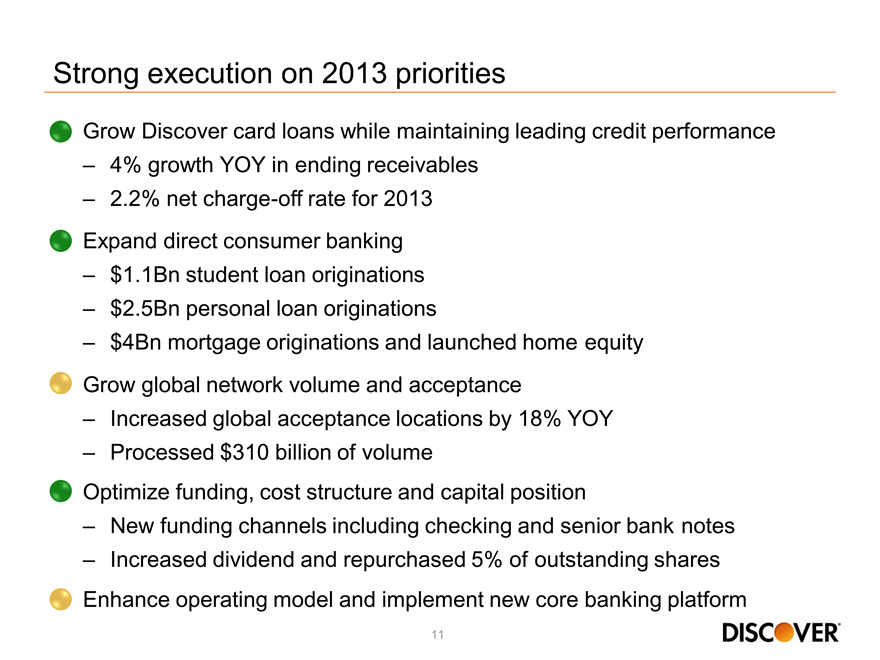

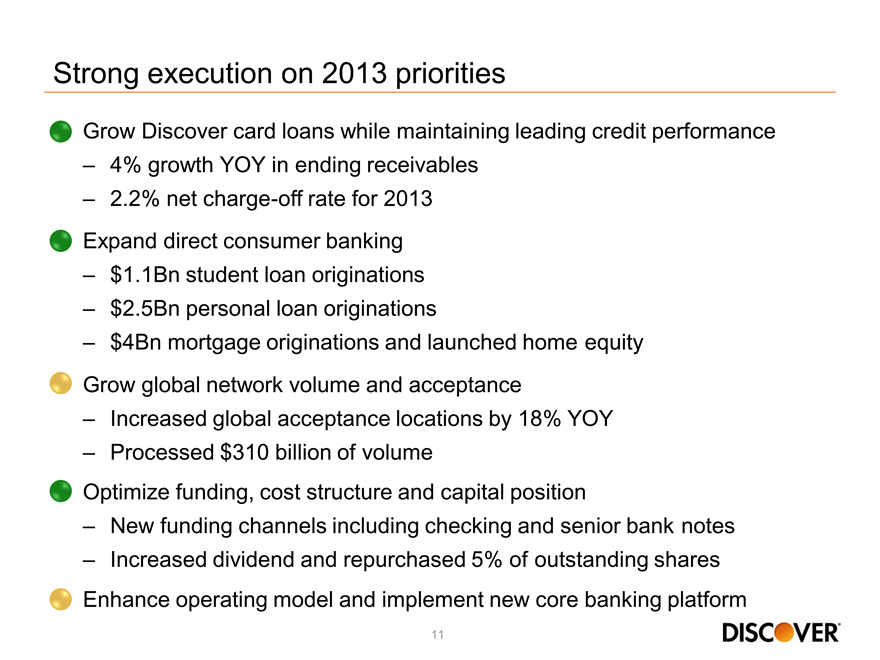

Strong execution on 2013 priorities

Grow Discover card loans while maintaining leading credit performance

– 4% growth YOY in ending receivables

– 2.2% net charge-off rate for 2013 Expand direct consumer banking

– $1.1Bn student loan originations

– $2.5Bn personal loan originations

– $4Bn mortgage originations and launched home equity Grow global network volume and acceptance

– Increased global acceptance locations by 18% YOY

– Processed $310 billion of volume

Optimize funding, cost structure and capital position

– New funding channels including checking and senior bank notes

– Increased dividend and repurchased 5% of outstanding shares Enhance operating model and implement new core banking platform

11

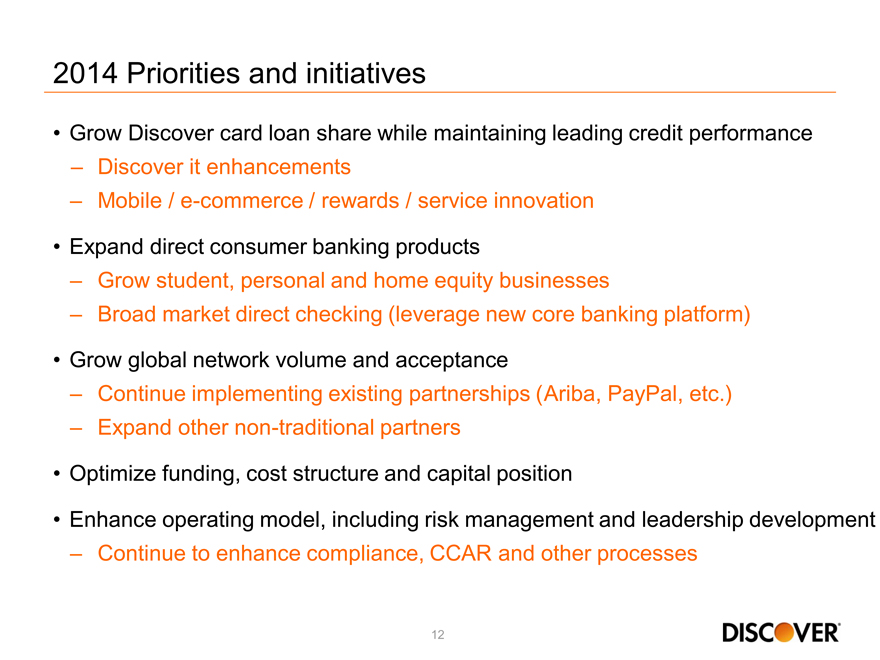

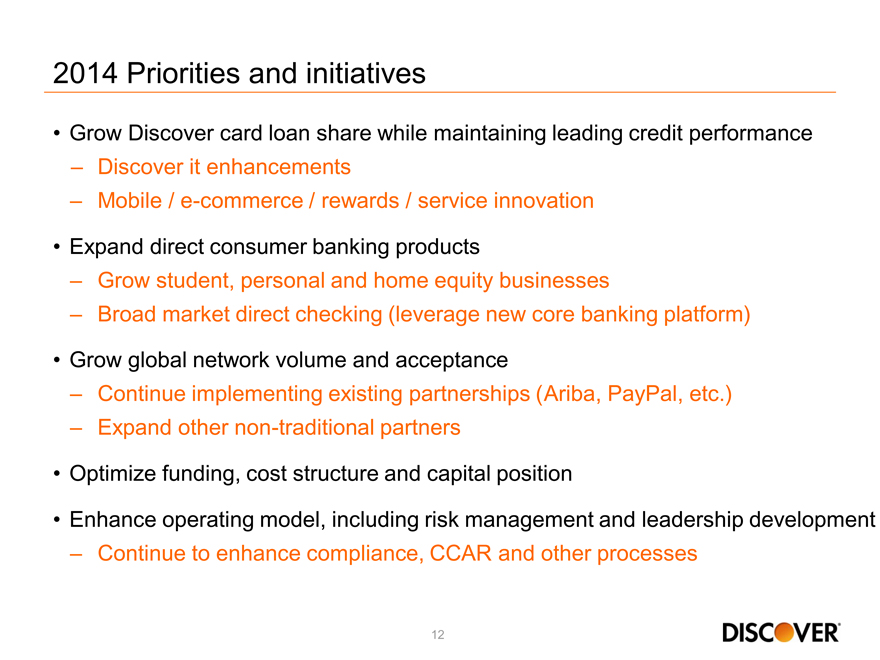

2014 Priorities and initiatives

Grow Discover card loan share while maintaining leading credit performance

– Discover it enhancements

– Mobile / e-commerce / rewards / service innovation

Expand direct consumer banking products

– Grow student, personal and home equity businesses

– Broad market direct checking (leverage new core banking platform)

Grow global network volume and acceptance

– Continue implementing existing partnerships (Ariba, PayPal, etc.)

– Expand other non-traditional partners

Optimize funding, cost structure and capital position

Enhance operating model, including risk management and leadership development

– Continue to enhance compliance, CCAR and other processes

12

2014 Financial Community Briefing

U.S. Card

Roger Hochschild

President & Chief Operating Officer

Leveraging unique assets and capabilities as a prime-focused card lender

Large and loyal customer base

Exceptional customer experience across online, mobile and phone interactions

Cash rewards leadership leveraging proprietary network

Strong loan growth through existing customers and new accounts (YOY):

– 4% growth in loans

‒ 100bps increase in wallet share with customers(1)

‒ 9% increase in new accounts

Note(s)

1. Wallet share is the amount of customer loans with Discover versus other cards in wallet as of October 2013; share based upon Argus and credit bureau data

14

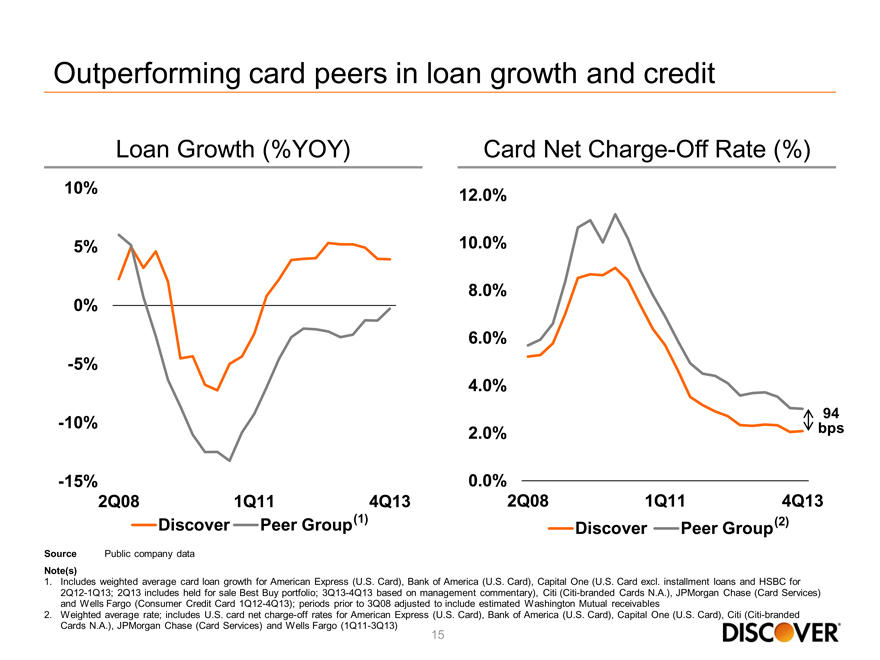

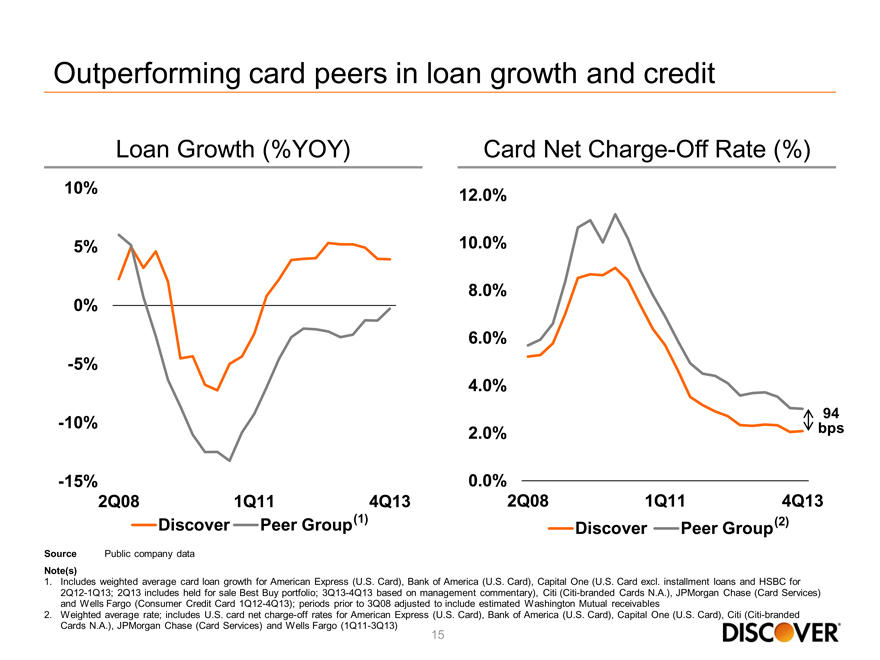

Outperforming card peers in loan growth and credit

Loan Growth (%YOY) Card Net Charge-Off Rate (%)

10% 5% 0% -5% -10% -15%

2Q08 1Q11 4Q13

Discover Peer Group(1)

12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0%

2Q08 1Q11 4Q13 Discover Peer Group(2)

Source Public company data

Note(s)

1. Includes weighted average card loan growth for American Express (U.S. Card), Bank of America (U.S. Card), Capital One (U.S. Card excl. installment loans and HSBC for 2Q12-1Q13; 2Q13 includes held for sale Best Buy portfolio; 3Q13-4Q13 based on management commentary), Citi (Citi-branded Cards N.A.), JPMorgan Chase (Card Services) and Wells Fargo (Consumer Credit Card 1Q12-4Q13); periods prior to 3Q08 adjusted to include estimated Washington Mutual receivables

2. Weighted average rate; includes U.S. card net charge-off rates for American Express (U.S. Card), Bank of America (U.S. Card), Capital One (U.S. Card), Citi (Citi-branded Cards N.A.), JPMorgan Chase (Card Services) and Wells Fargo (1Q11-3Q13)

15

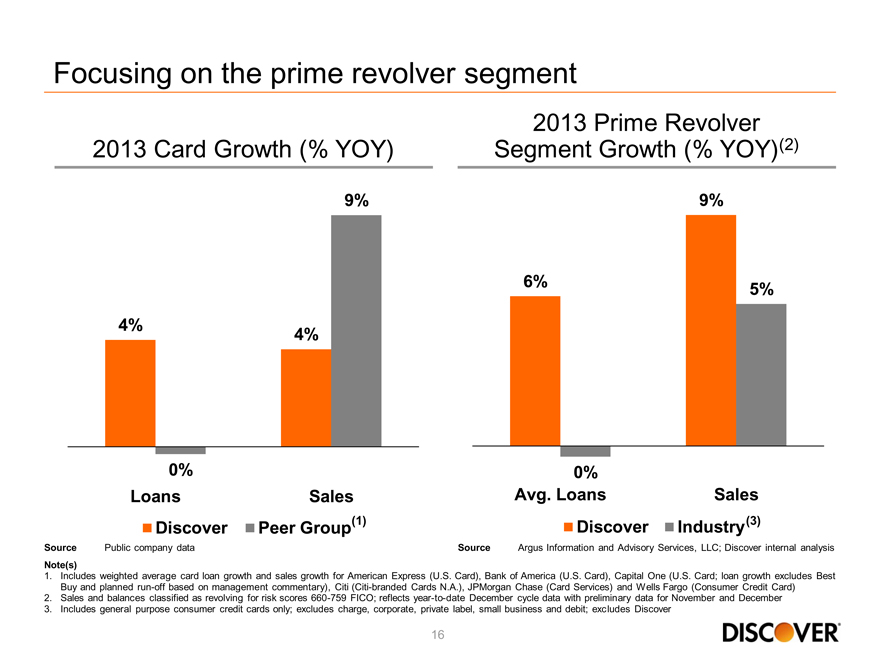

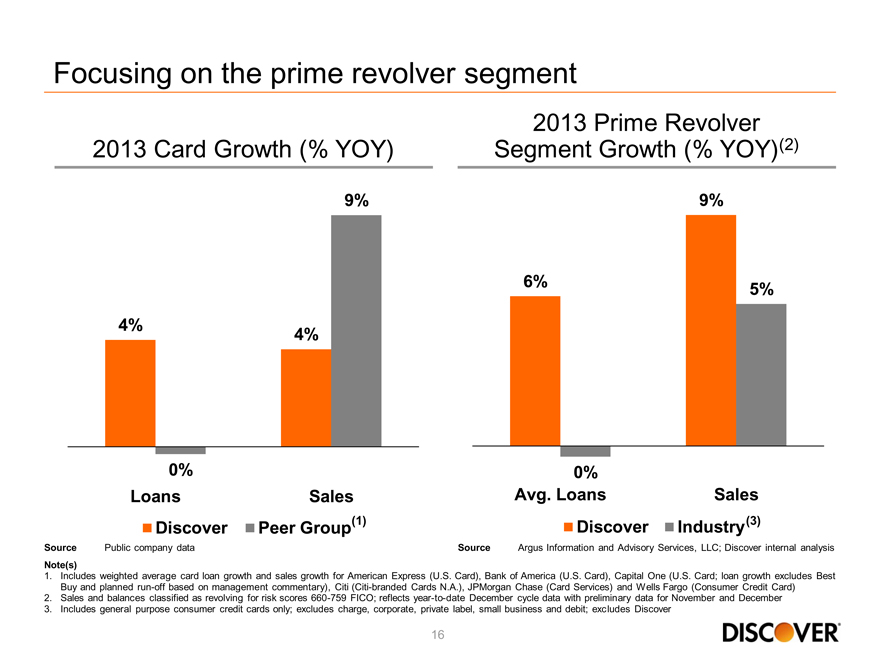

Focusing on the prime revolver segment

2013 Prime Revolver 2013 Card Growth (% YOY) Segment Growth (% YOY)(2)

9% 9%

6% 5% 4% 4%

0% 0%

Loans Sales Avg. Loans Sales

Discover Peer Group(1) Discover Industry(3)

Source Public company data Source Argus Information and Advisory Services, LLC; Discover internal analysis

Note(s)

1. Includes weighted average card loan growth and sales growth for American Express (U.S. Card), Bank of America (U.S. Card), Capital One (U.S. Card; loan growth excludes Best Buy and planned run-off based on management commentary), Citi (Citi-branded Cards N.A.), JPMorgan Chase (Card Services) and Wells Fargo (Consumer Credit Card)

2. Sales and balances classified as revolving for risk scores 660-759 FICO; reflects year-to-date December cycle data with preliminary data for November and December

3. Includes general purpose consumer credit cards only; excludes charge, corporate, private label, small business and debit; excludes Discover

16

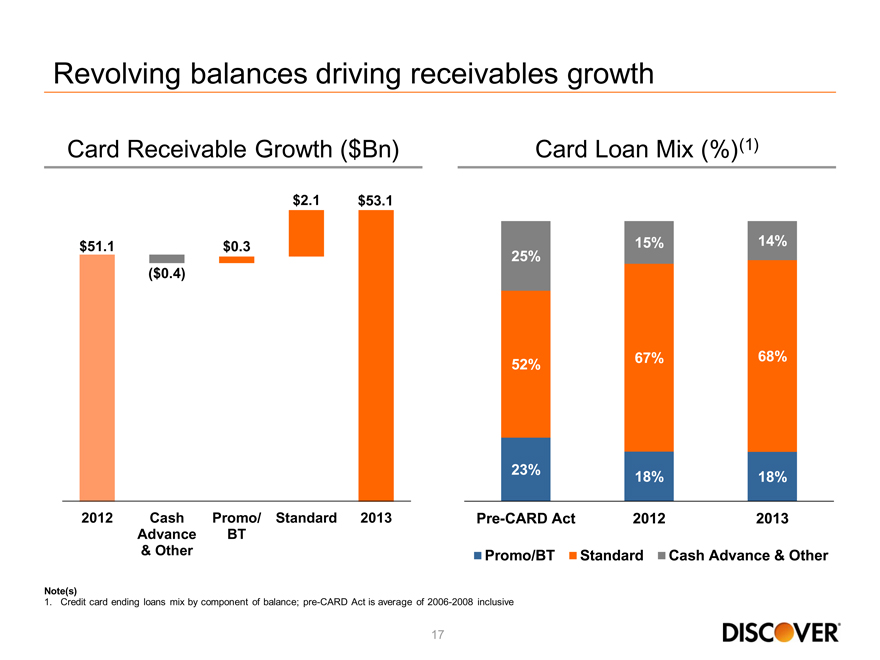

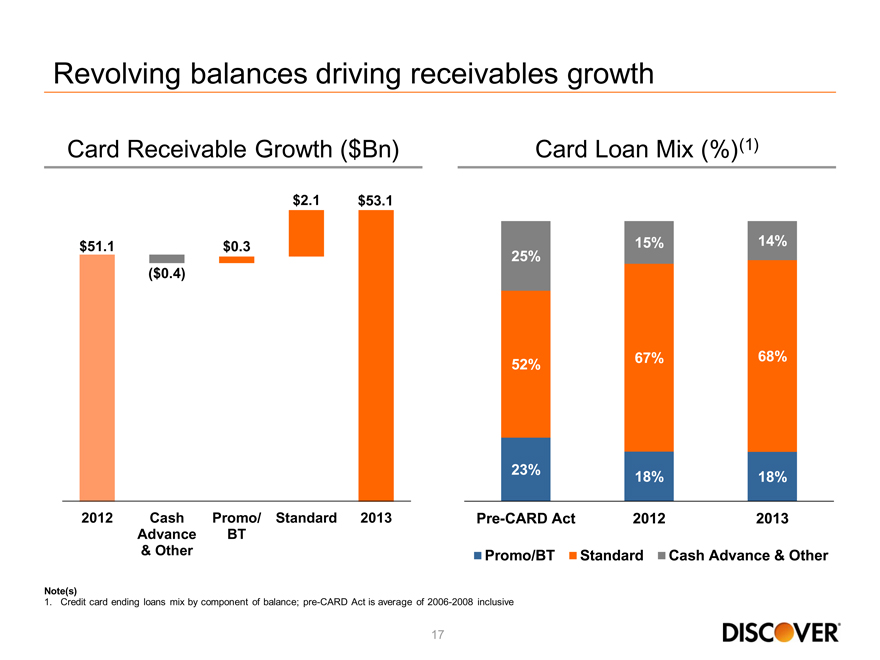

Revolving balances driving receivables growth

Card Receivable Growth ($Bn) Card Loan Mix (%)(1)

$2.1 $53.1

$51.1 $0.3 15% 14% 25%

($0.4)

67% 68% 52%

23%

18% 18%

2012 Cash Promo/ Standard 2013 Pre-CARD Act 2012 2013 Advance BT

& Other Promo/BT Standard Cash Advance & Other

Note(s)

1. Credit card ending loans mix by component of balance; pre-CARD Act is average of 2006-2008 inclusive

17

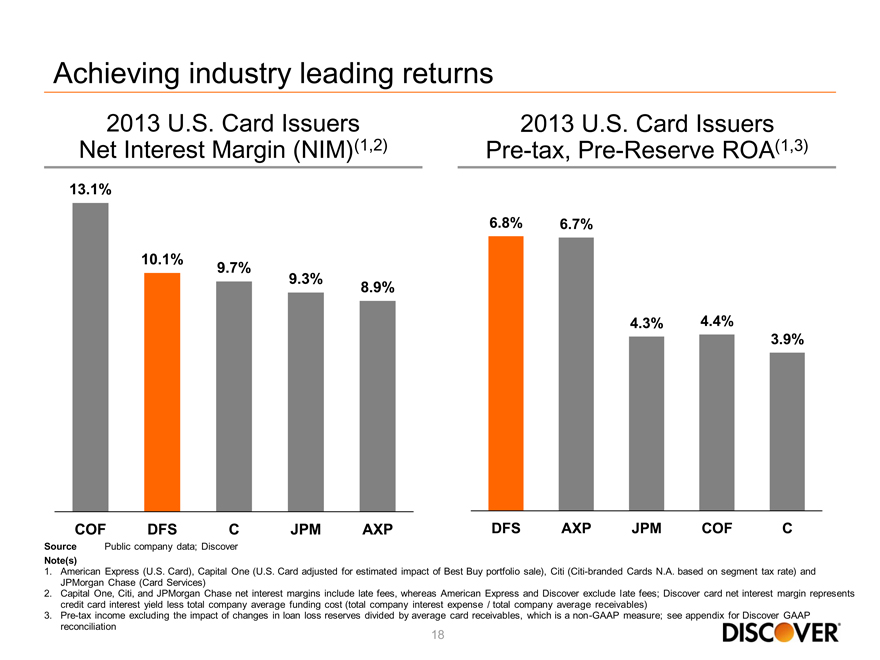

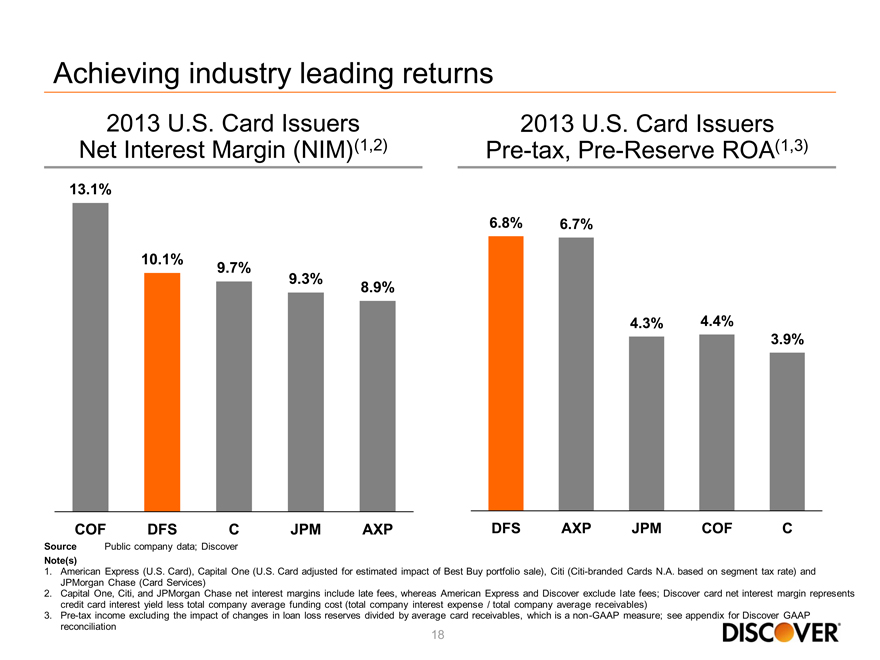

Achieving industry leading returns

2013 U.S. Card Issuers 2013 U.S. Card Issuers Net Interest Margin (NIM)(1,2) Pre-tax, Pre-Reserve ROA(1,3)

13.1%

6.8% 6.7%

10.1%

9.7%

9.3%

8.9%

4.3% 4.4%

3.9%

COF DFS C JPM AXP DFS AXP JPM COF C

Source Public company data; Discover

Note(s)

1. American Express (U.S. Card), Capital One (U.S. Card adjusted for estimated impact of Best Buy portfolio sale), Citi (Citi-branded Cards N.A. based on segment tax rate) and JPMorgan Chase (Card Services)

2. Capital One, Citi, and JPMorgan Chase net interest margins include late fees, whereas American Express and Discover exclude late fees; Discover card net interest margin represents credit card interest yield less total company average funding cost (total company interest expense / total company average receivables)

3. Pre-tax income excluding the impact of changes in loan loss reserves divided by average card receivables, which is a non-GAAP measure; see appendix for Discover GAAP reconciliation

18

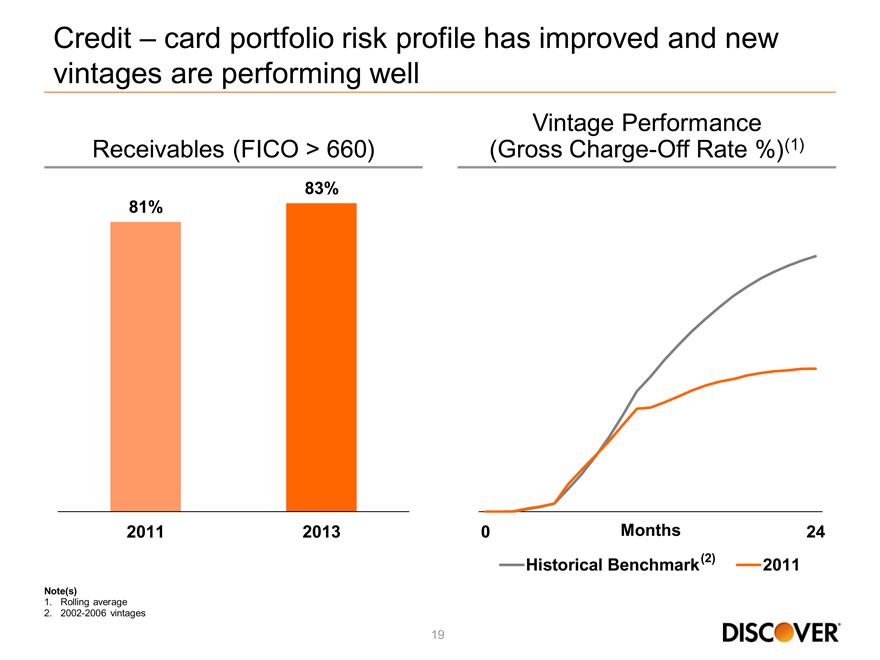

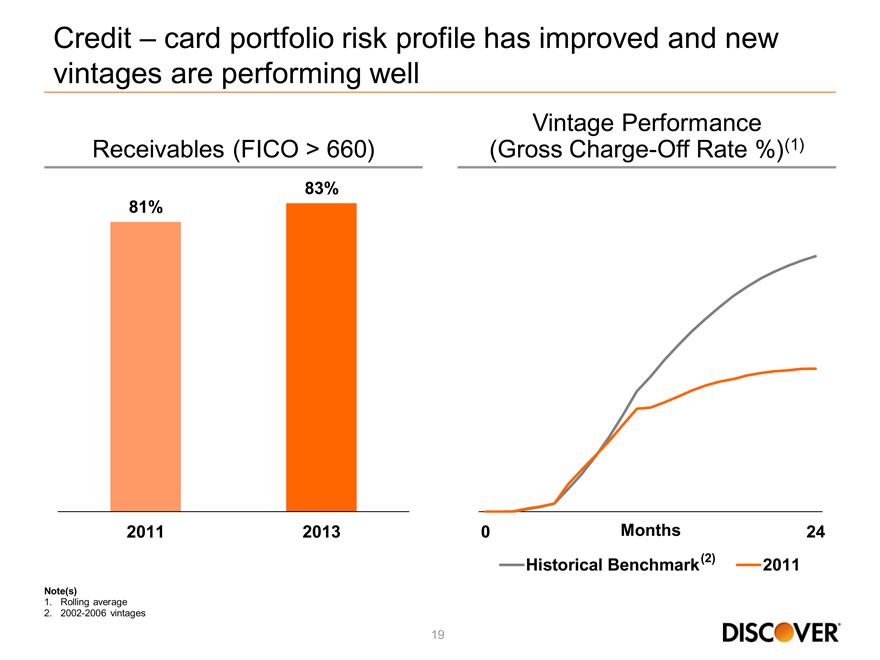

Credit – card portfolio risk profile has improved and new vintages are performing well

Vintage Performance Receivables (FICO > 660) (Gross Charge-Off Rate %)(1)

81%

83%

2011 2013

024 Months

Historical Benchmark(2) 2011

Note(s)

1. Rolling average

2. 2002-2006 vintages

19

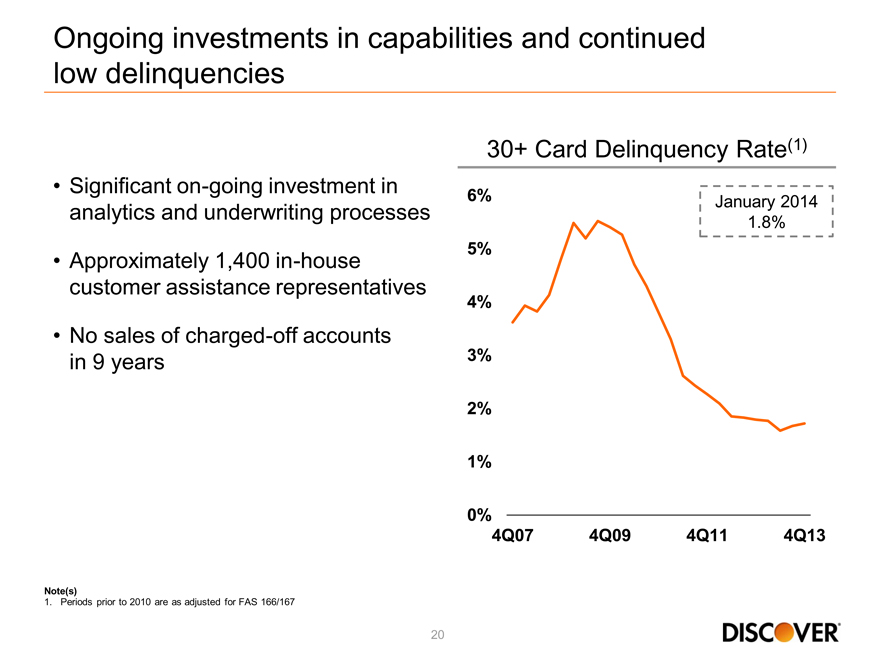

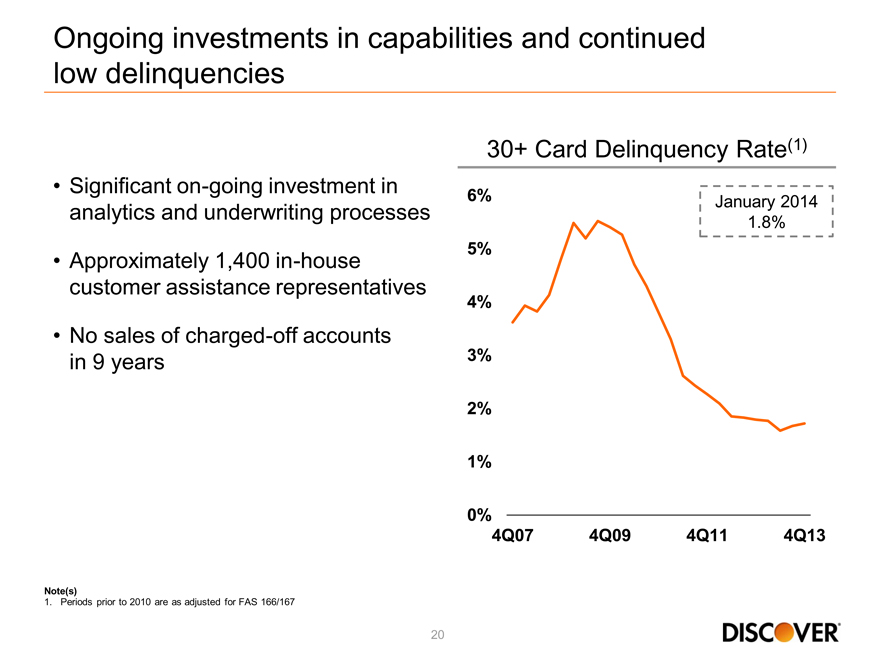

Ongoing investments in capabilities and continued low delinquencies

Significant on-going investment in analytics and underwriting processes

Approximately 1,400 in-house customer assistance representatives

No sales of charged-off accounts in 9 years

30+ Card Delinquency Rate(1)

6% 5% 4% 3% 2% 1% 0%

4Q07 4Q09 4Q11 4Q13

January 2014 1.8%

Note(s)

1. Periods prior to 2010 are as adjusted for FAS 166/167

20

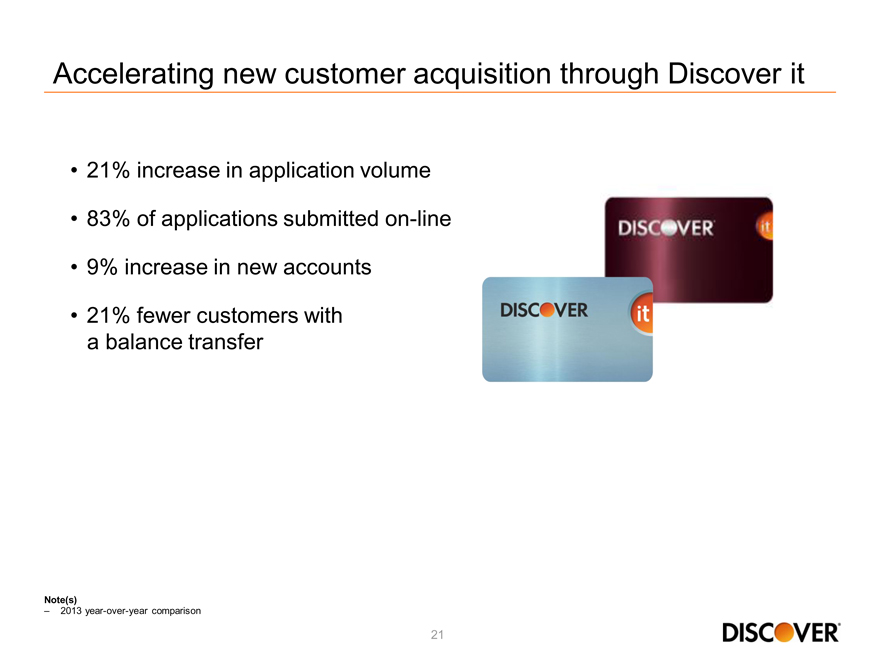

Accelerating new customer acquisition through Discover it

21% increase in application volume

83% of applications submitted on-line

9% increase in new accounts

21% fewer customers with a balance transfer

Note(s)

– 2013 year-over-year comparison

21

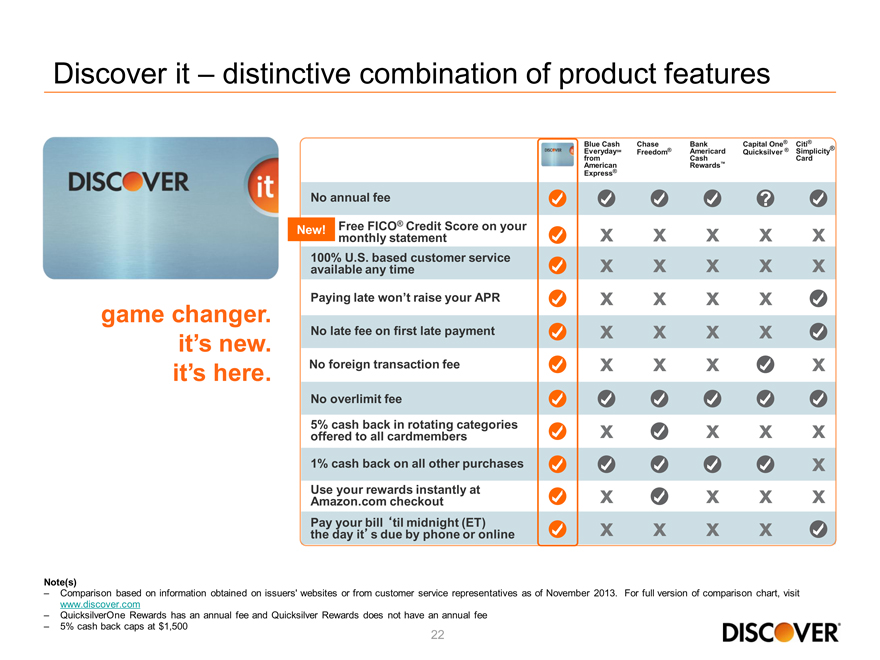

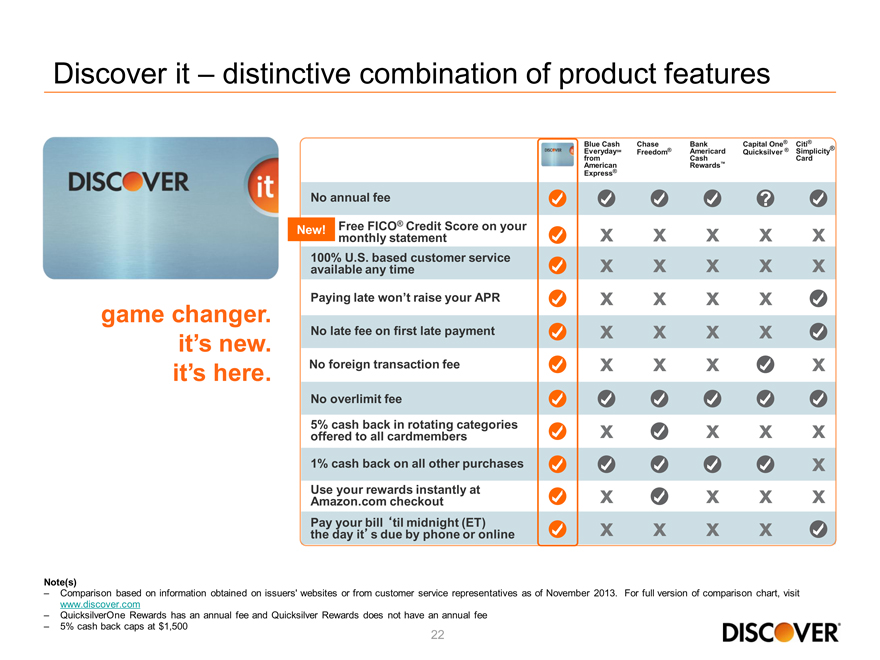

Discover it – distinctive combination of product features

game changer. it’s new. it’s here.

Blue Cash chase Capital One® Citi®

Every daySM Freedom® BankAmeri card Quicksilver ®

fromAmerican CashRewardstm SimplicityCard

ExpressR

No annual fee

New! Free FICO® Credit Score on your

monthly statement x x x x x

100% U.S. based customer service

available any time x x x x x

Paying late won’t raise your APR x x x x

No late fee on first late payment x x x x

No foreign transaction fee x x x x

No overlimit fee

5% cash back in rotating categories

offered to all cardmembers x x x x

1% cash back on all other purchases x

Use your rewards instantly at

Amazon.com checkout x x x x

Pay your bill ‘til midnight (ET)

the day it’s due by phone or online x x x x

Note(s)

– Comparison based on information obtained on issuers’ websites or from customer service representatives as of November 2013. For full version of comparison chart, visit www.discover.com

– QuicksilverOne Rewards has an annual fee and Quicksilver Rewards does not have an annual fee

– 5% cash back caps at $1,500

22

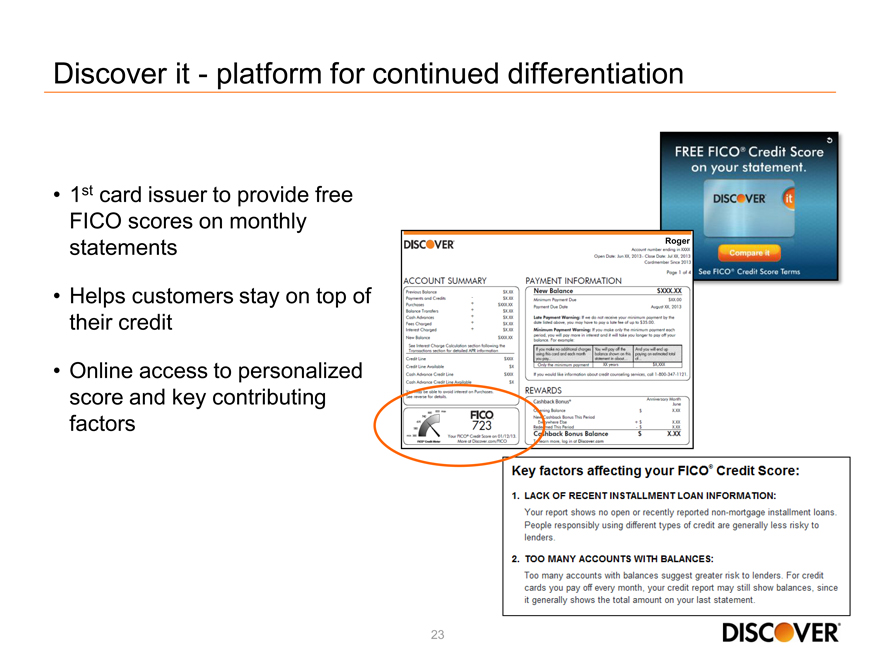

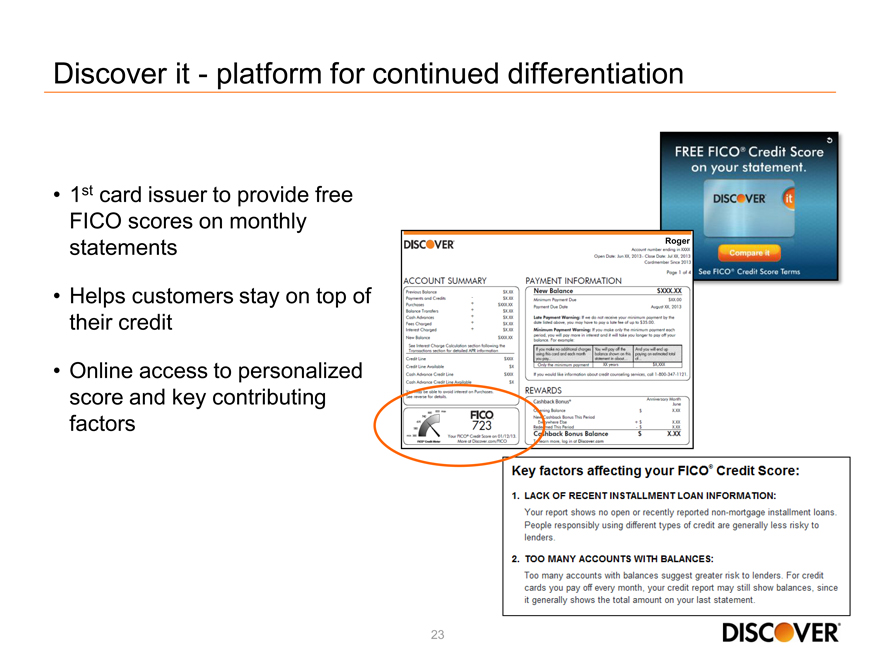

Discover it - platform for continued differentiation

1st card issuer to provide free FICO scores on monthly statements

Helps customers stay on top of their credit

Online access to personalized score and key contributing factors

23

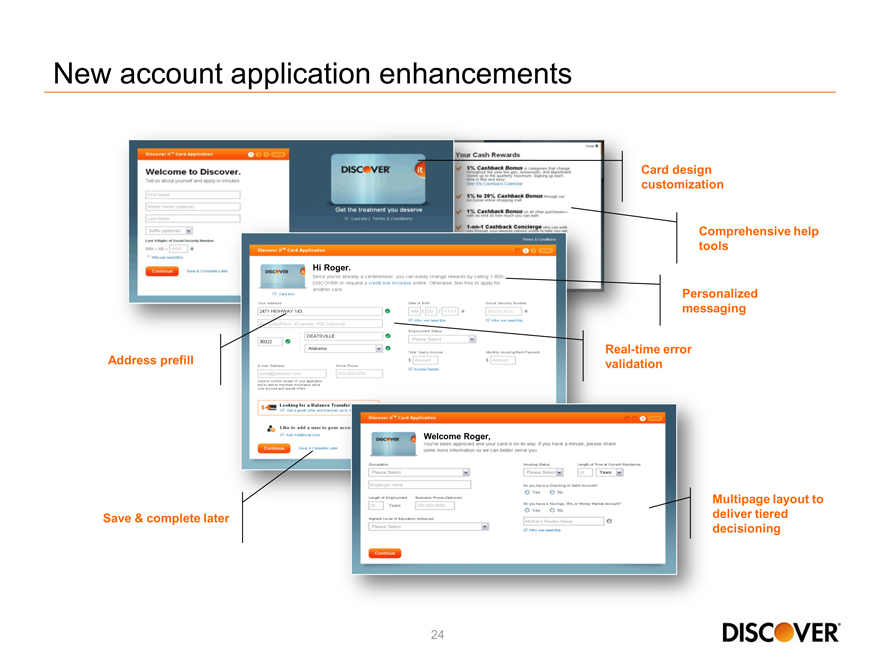

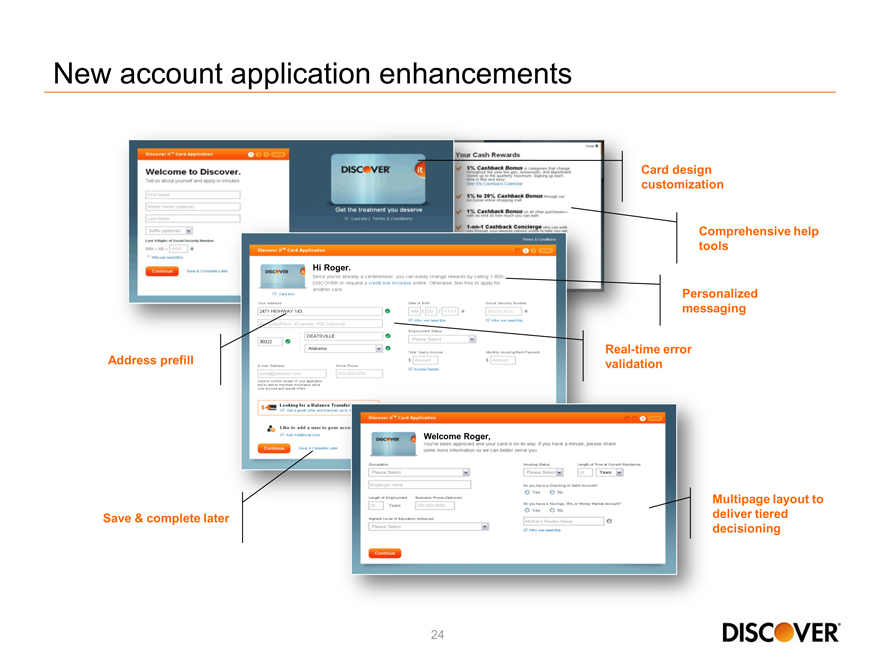

New account application enhancements

Card design

customization

Comprehensive help

tools

Hi Roger.

Personalized

messaging

Real-time error

Address prefill validation

Welcome Roger,

Multipage layout to

Save & complete later deliver tiered

decisioning

Welcome to Discover

24

Outstanding customer service and loyalty

Tenure of Active Accounts (Yrs)

Ranked among the highest in Customer Loyalty for 18 years in a row(1)

Call Center Excellence Award Winner(2)

12 11

8 7

3Q09 3Q13 Discover Industry(3)

Source Argus Information and Advisory Services, LLC; Discover internal analysis

Note(s)

1. 2014 Brand Keys Customer Loyalty Engagement Index Report

2. 2013 IQPC Annual Call Center Excellence Awards

3. Includes general purpose consumer credit cards only; excludes charge, corporate, private label, small business and debit; excludes Discover

25

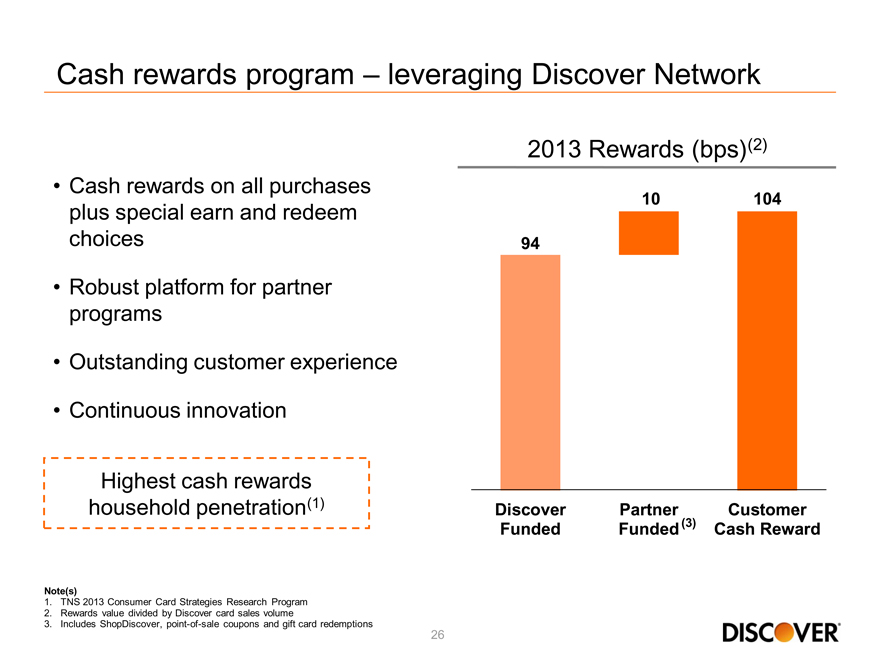

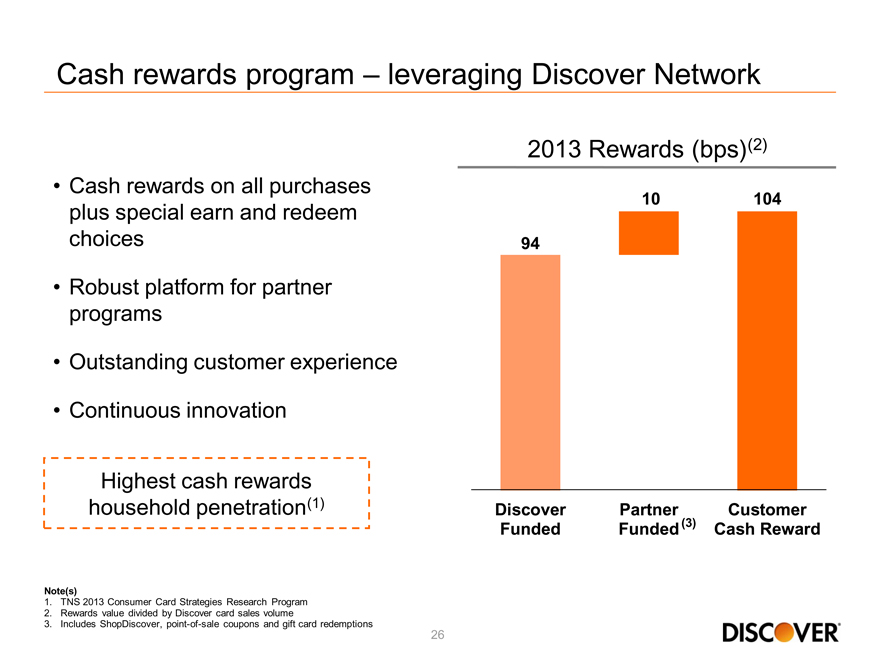

Cash rewards program – leveraging Discover Network

Cash rewards on all purchases plus special earn and redeem choices

Robust platform for partner programs

Outstanding customer experience

Continuous innovation

Highest cash rewards household penetration(1)

2013 Rewards (bps)(2)

10 104

94

Discover Partner Customer

Funded Funded (3) Cash Reward

Note(s)

1. TNS 2013 Consumer Card Strategies Research Program

2. Rewards value divided by Discover card sales volume

3. Includes ShopDiscover, point-of-sale coupons and gift card redemptions

26

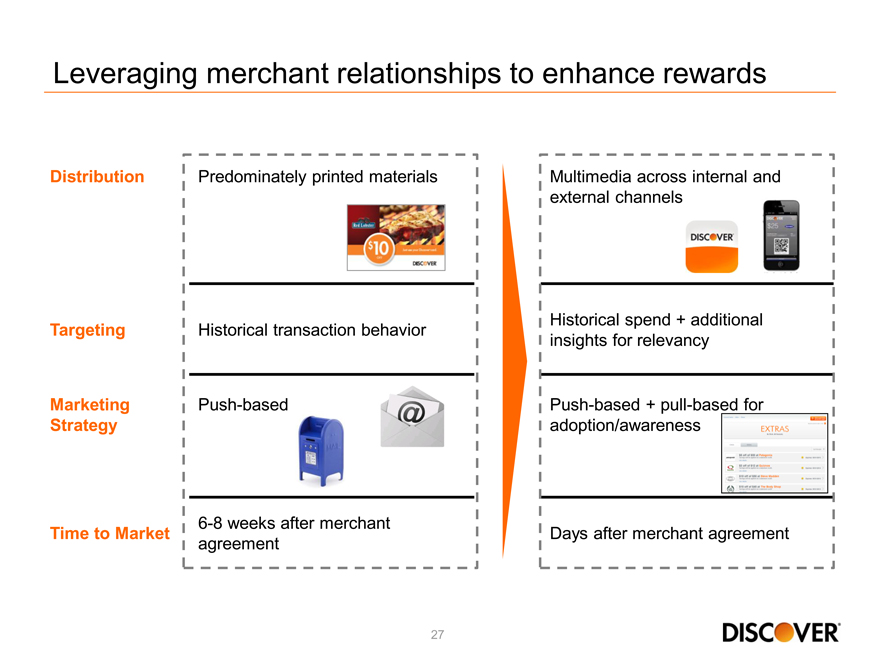

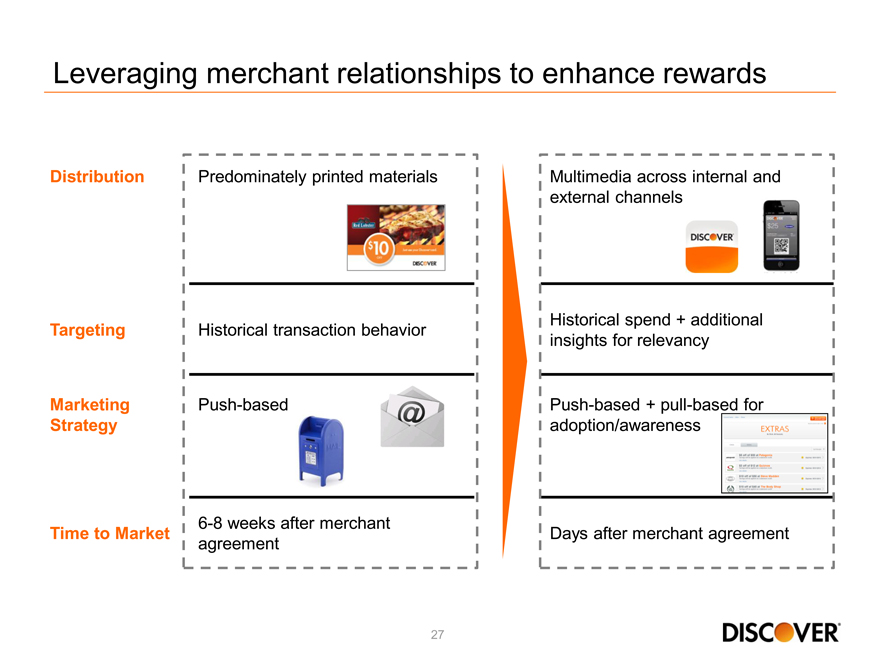

Leveraging merchant relationships to enhance rewards

Distribution Predominately printed materials Multimedia across internal and

external channels

Historical spend + additional

Targeting Historical transaction behavior insights for relevancy

Marketing Push-based Push-based + pull-based for

Strategy adoption/awareness

6-8 weeks after merchant

Time to Market Days after merchant agreement

agreement

27

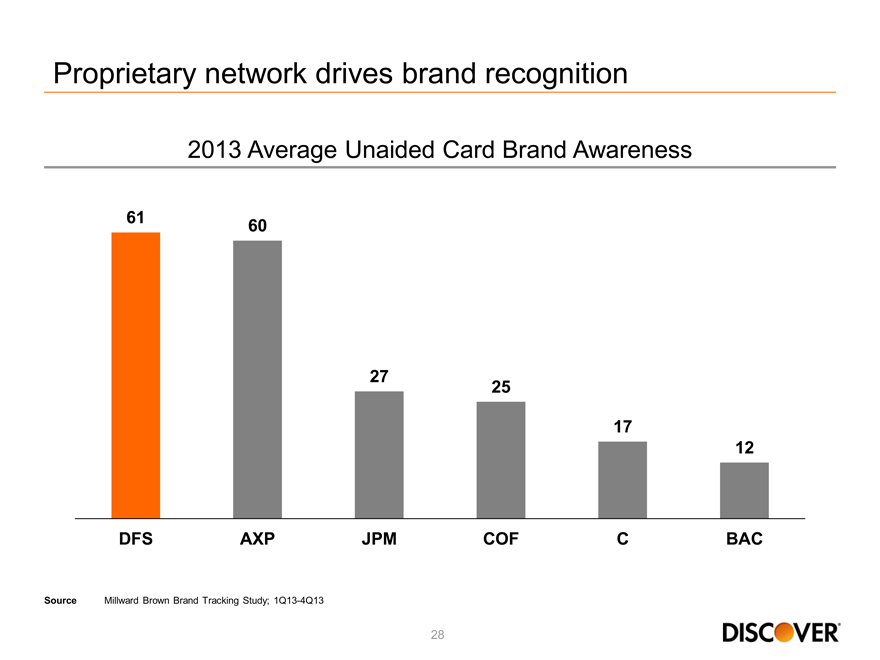

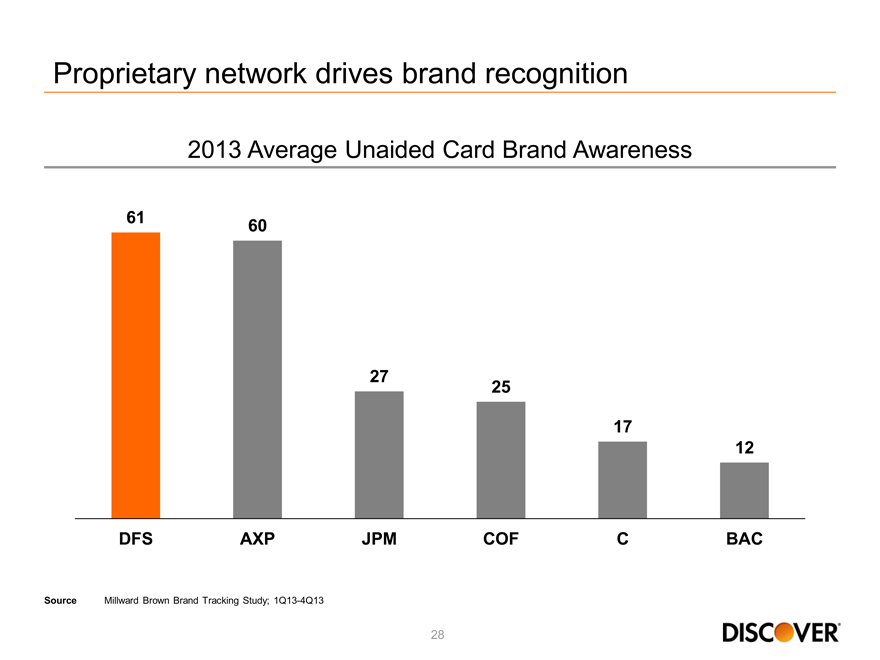

Proprietary network drives brand recognition

2013 Average Unaided Card Brand Awareness

61 60

27 25

17

12

DFS AXP JPM COF C BAC

Source Millward Brown Brand Tracking Study; 1Q13-4Q13

28

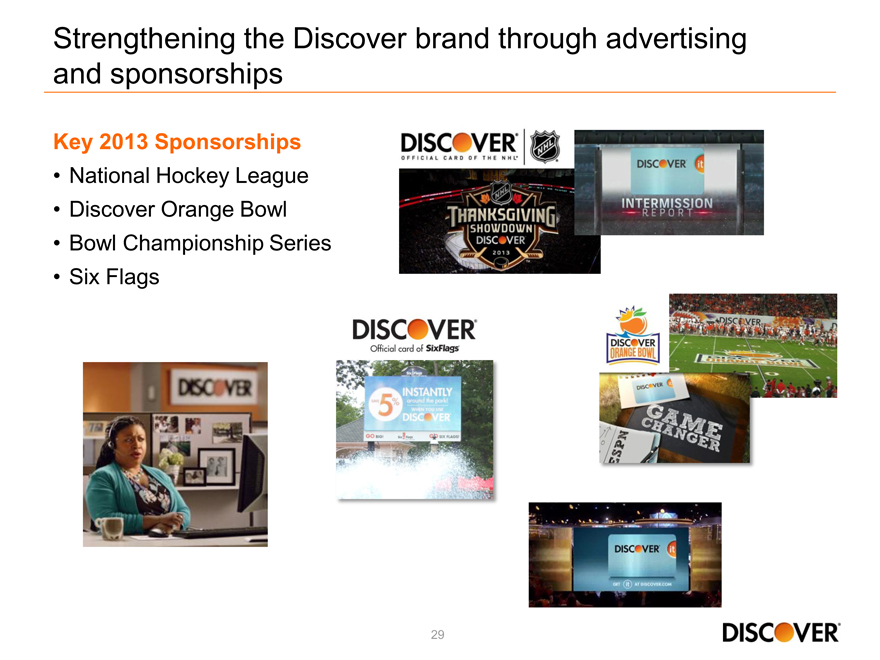

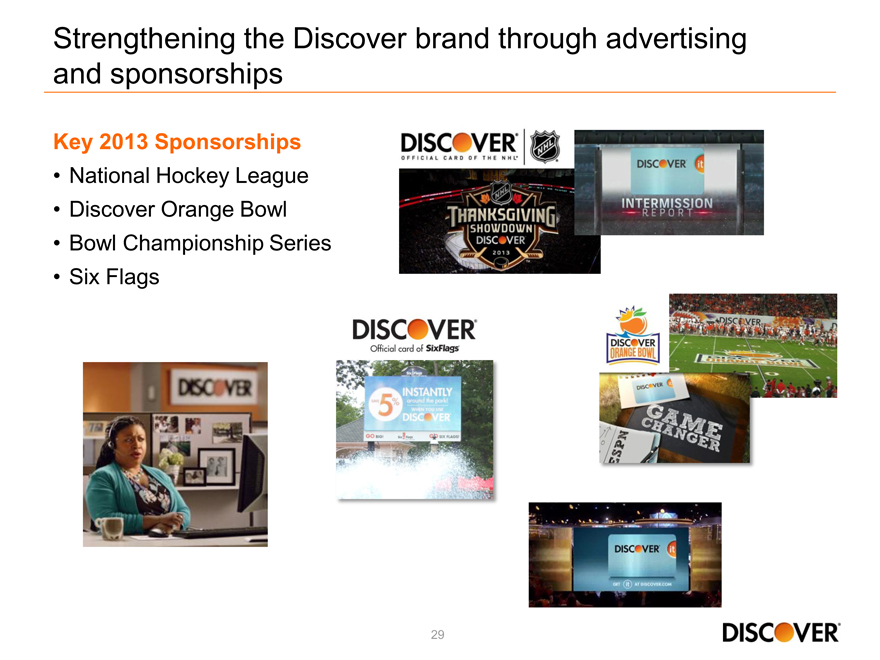

Strengthening the Discover brand through advertising and sponsorships

Key 2013 Sponsorships

National Hockey League

Discover Orange Bowl

Bowl Championship Series

Six Flags

29

Leveraging unique assets and capabilities as prime-focused card lender

Brand positioning

Leading credit risk management

Leadership in cash rewards leveraging payments network

Outstanding customer service and online/mobile

Products and features that differentiate

30

2014 Financial Community Briefing

Direct Banking Products

David Nelms

Chairman & Chief Executive Officer

Leveraging unique capabilities to diversify assets and funding

Grew private student loans and personal loans YOY

– 5% growth in private student loans ($1.1Bn of originations)

27% growth in personal loans (~$2.5Bn of originations)

Continued expansion with launch of home equity installment loans

Optimized deposit customer mix to reduce rate sensitivity

Launched Cashback Checking (cross-sell only)

32

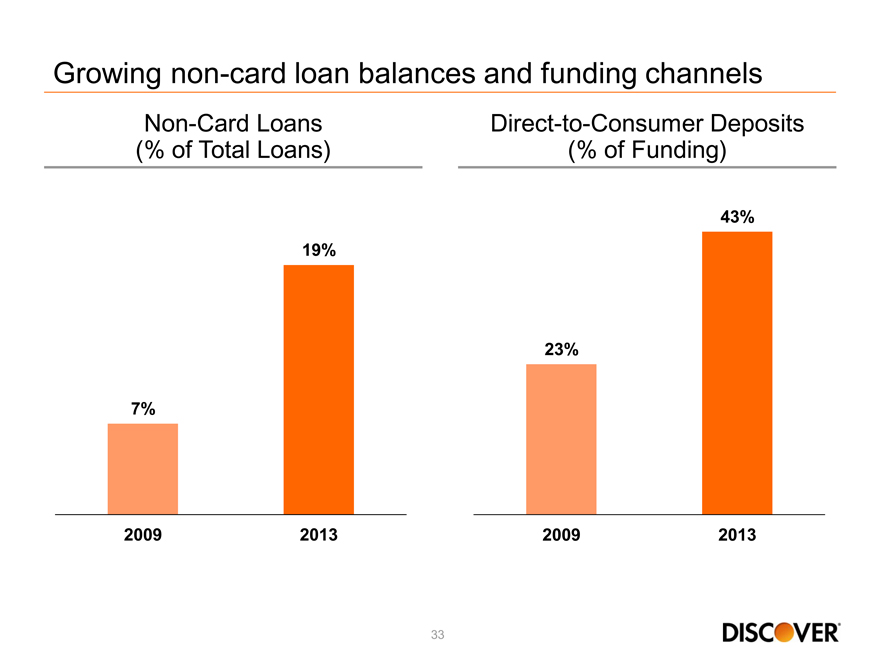

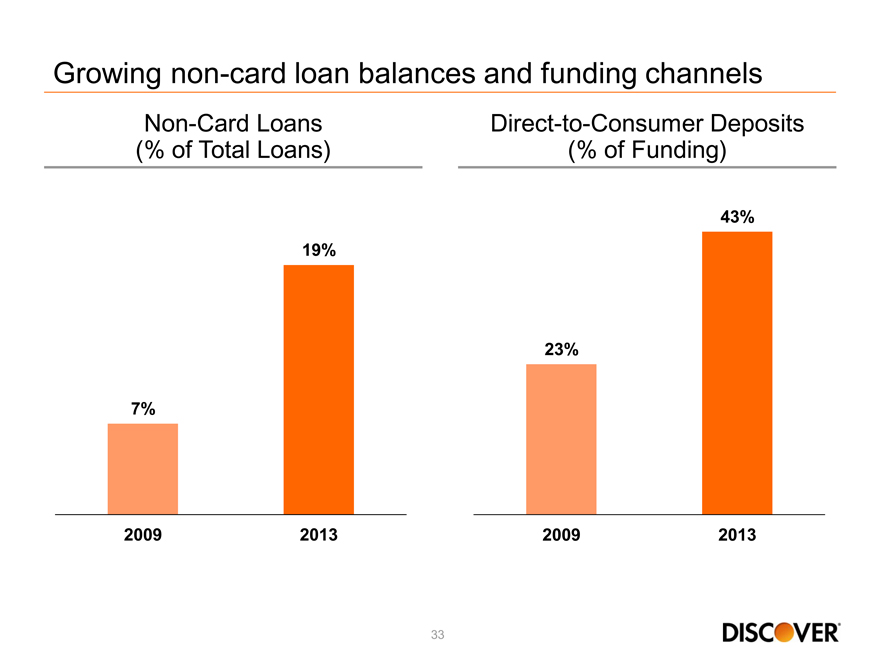

Growing non-card loan balances and funding channels

Non-Card Loans Direct-to-Consumer Deposits

(% of Total Loans)(% of Funding)

43%

19%

23%

7%

2009 2013 2009 2013

33

Private student loans are an attractive asset for Discover

Addresses funding gaps in Federal loan programs

The universe of private student loan providers has shrunk

Differentiated value proposition to students and parents (zero origination fees, competitive pricing, rewards)

Cosigners are involved in overall education financial planning

Private student loans have long duration and relatively low credit losses compared to other unsecured loans

Provides brand exposure to an upwardly mobile customer base

34

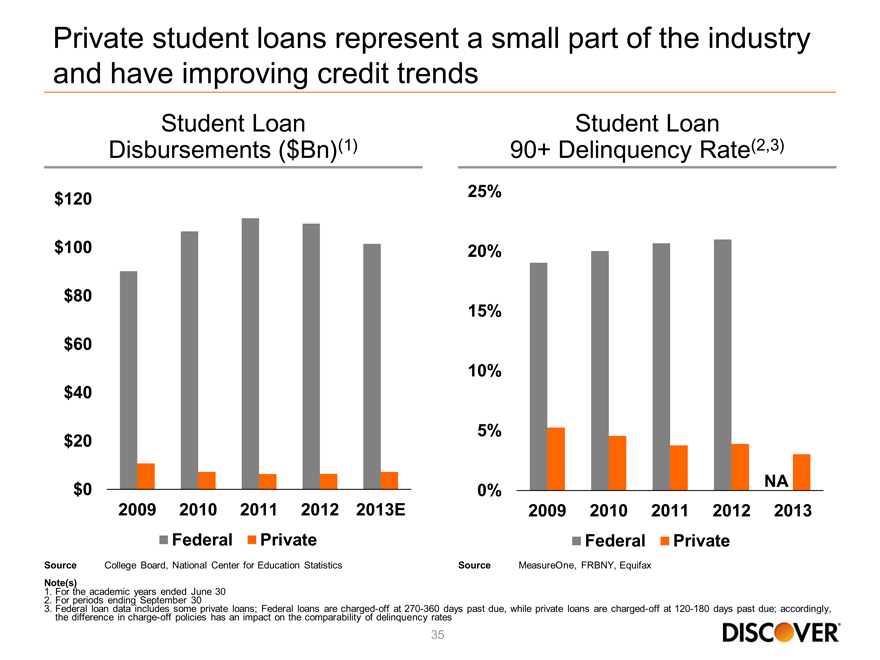

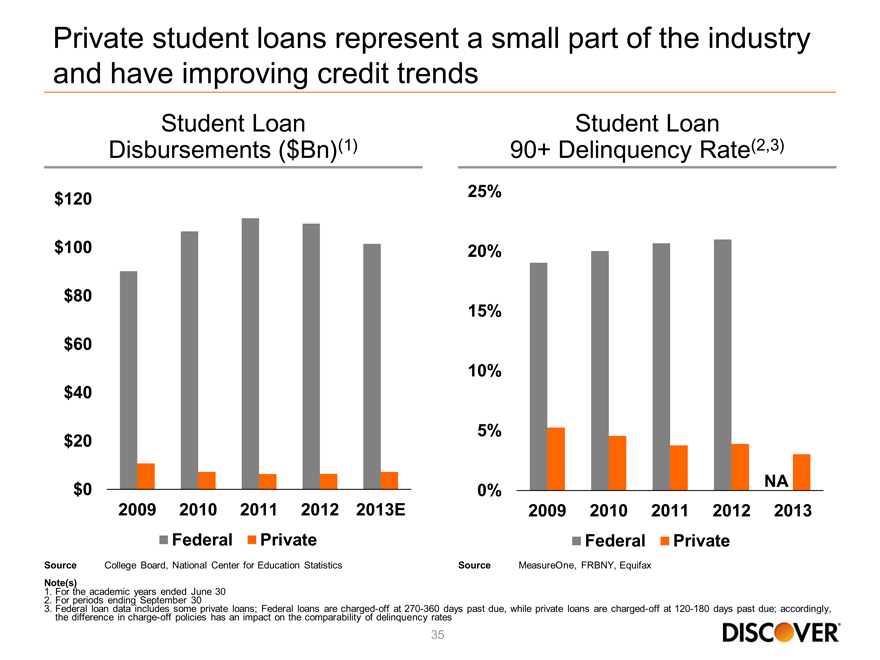

Private student loans represent a small part of the industry and have improving credit trends

Student Loan Student Loan Disbursements ($Bn)(1) 90+ Delinquency Rate(2,3)

$120 25%

$100 20%

$80 15% $60 10% $40

5% $20

NA

$0 0%

2009 2010 2011 2012 2013E 2009 2010 2011 2012 2013 Federal Private Federal Private

Source College Board, National Center for CBVEducation Statistics Source MeasureOne, FRBNY, Equifax

Note(s)

1. For the academic years ended June 30

2. For periods ending September 30

3. 2. Federal loan data includes some private loans; Federal loans are charged-off at 270-360 days past due, while private loans are charged-off at 120-180 days past due; accordingly, the difference in charge-off policies has an impact on the comparability of delinquency rates

35

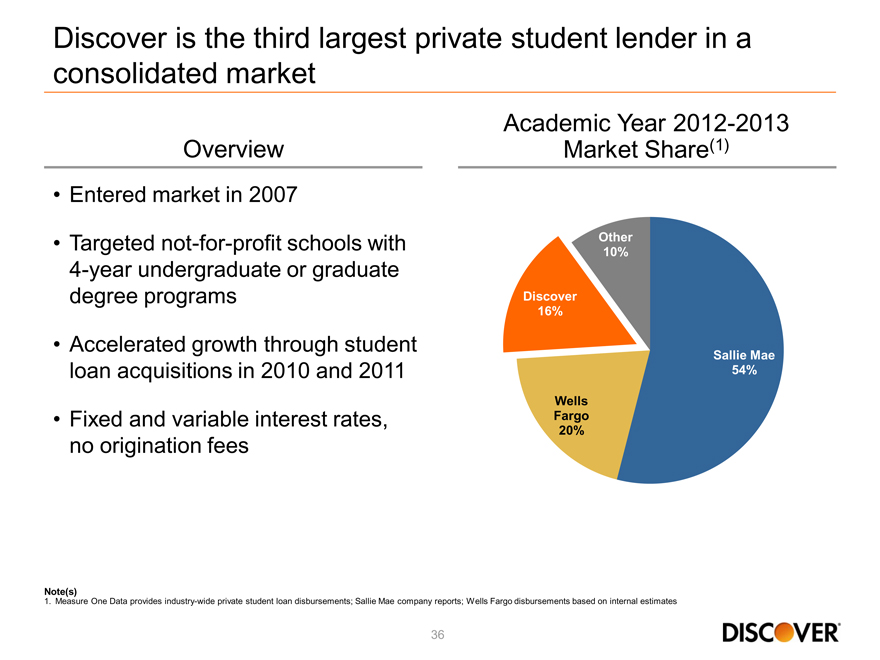

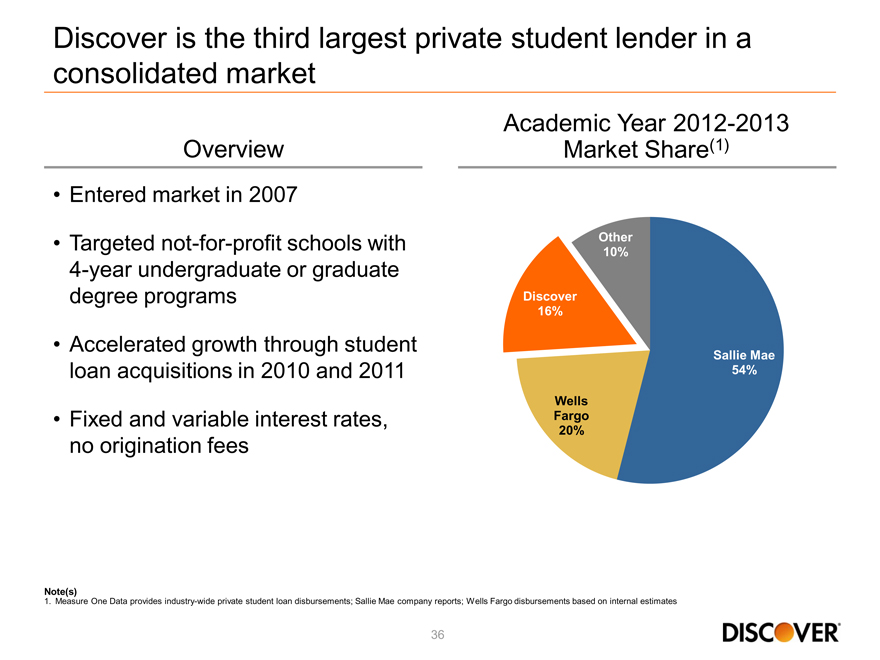

Discover is the third largest private student lender in a consolidated market

Academic Year 2012-2013 Overview Market Share(1)

Entered market in 2007

• Targeted not-for-profit schools with Other

10%

4-year undergraduate or graduate degree programs Discover

16%

Accelerated growth through student

Sallie Mae

loan acquisitions in 2010 and 2011 54%

Wells

• Fixed and variable interest rates, Fargo

20%

no origination fees

Note(s)

1. Measure One Data provides industry-wide private student loan disbursements; Sallie Mae company reports; Wells Fargo disbursements based on internal estimates

36

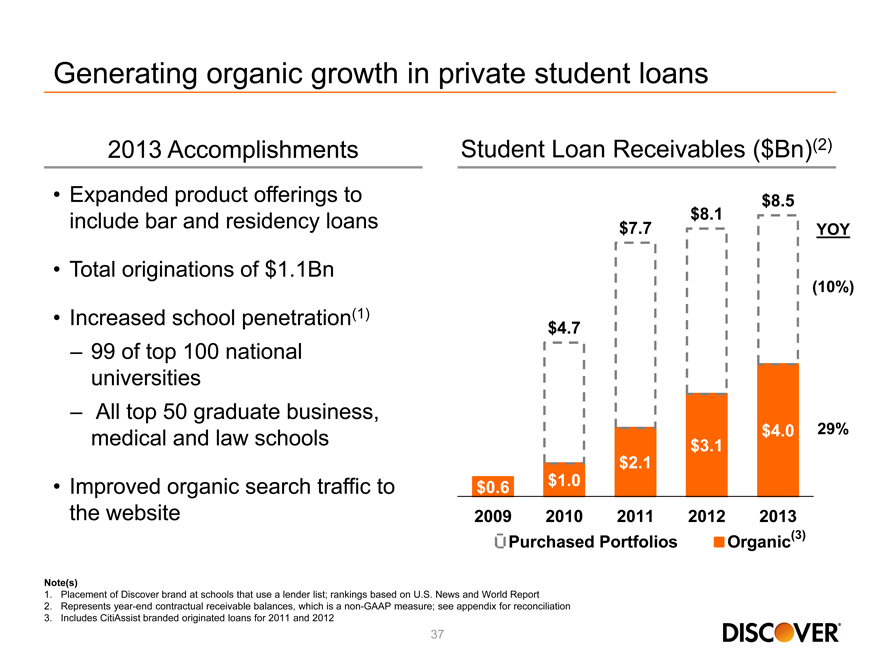

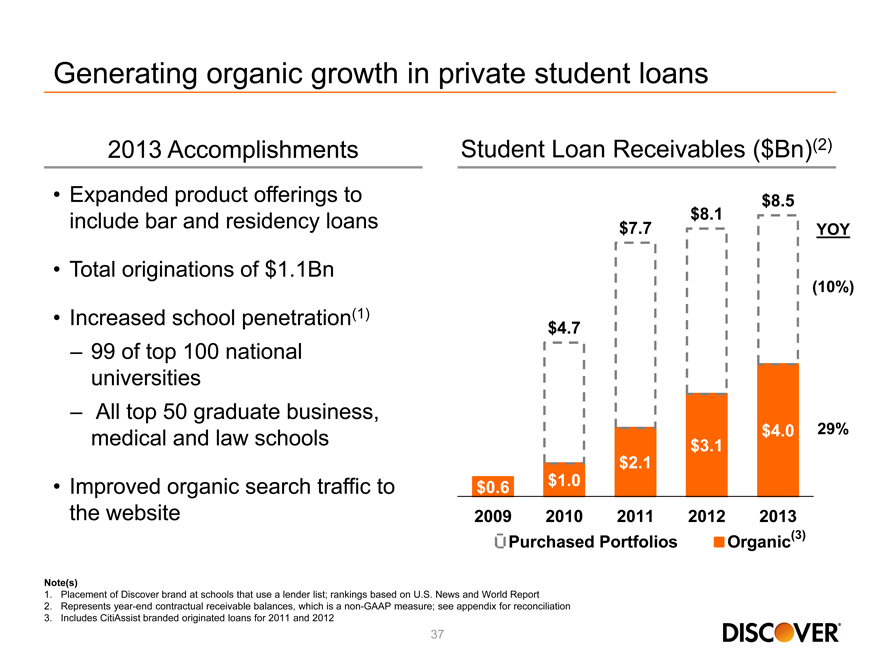

Generating organic growth in private student loans

2013 Accomplishments Student Loan Receivables ($Bn)(2)

Expanded product offerings to $ 8.5

include bar and residency loans $ 7.7 $ 8.1 YOY

Total originations of $1.1Bn

(10%)

Increased school penetration(1) $ 4.7

– 99 of top 100 national

universities

– All top 50 graduate business,

medical and law schools $ 3.1 $ 4.0 29%

$ 2.1

• Improved organic search traffic to $ 0.6 $ 1.0

the website 2009 2010 2011 2012 2013

Purchased Portfolios Organic(3)

Note(s)

1. Placement of Discover brand at schools that use a lender list; rankings based on U.S. News and World Report

2. Represents year-end contractual receivable balances, which is a non-GAAP measure; see appendix for reconciliation

3. Includes CitiAssist branded originated loans for 2011 and 2012

37

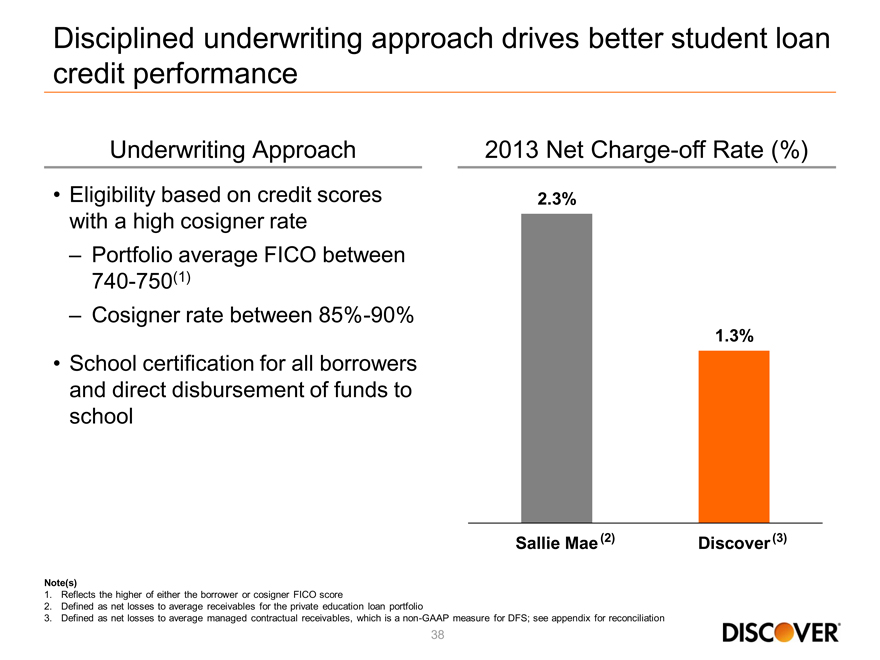

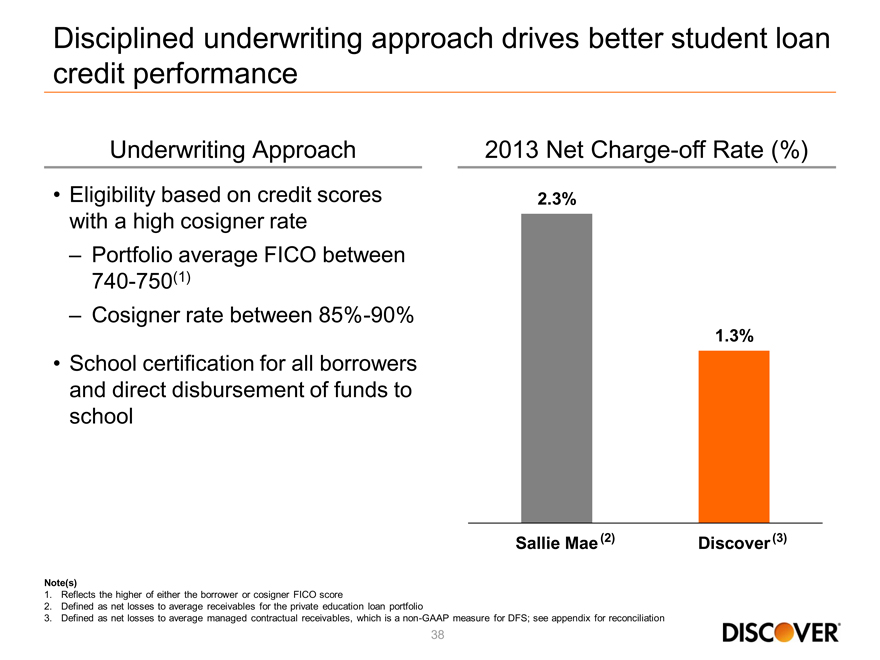

Disciplined underwriting approach drives better student loan credit performance

Underwriting Approach 2013 Net Charge-off Rate (%)

Eligibility based on credit scores 2.3% with a high cosigner rate

– Portfolio average FICO between 740-750(1)

– Cosigner rate between 85%-90%

1.3%

School certification for all borrowers and direct disbursement of funds to school

Sallie Mae(2) Discover(3)

Note(s)

1. Reflects the higher of either the borrower or cosigner FICO score

2. Defined as net losses to average receivables for the private education loan portfolio

3. Defined as net losses to average managed contractual receivables, which is a non-GAAP measure for DFS; see appendix for reconciliation

38

2014 priorities for private student loans

Increase awareness of Discover brand by reaching consumers early in the decision making process

Launch additional products

– In-school repayment

– Consolidation loans

Streamline operations to gain efficiencies and reduce cycle times

39

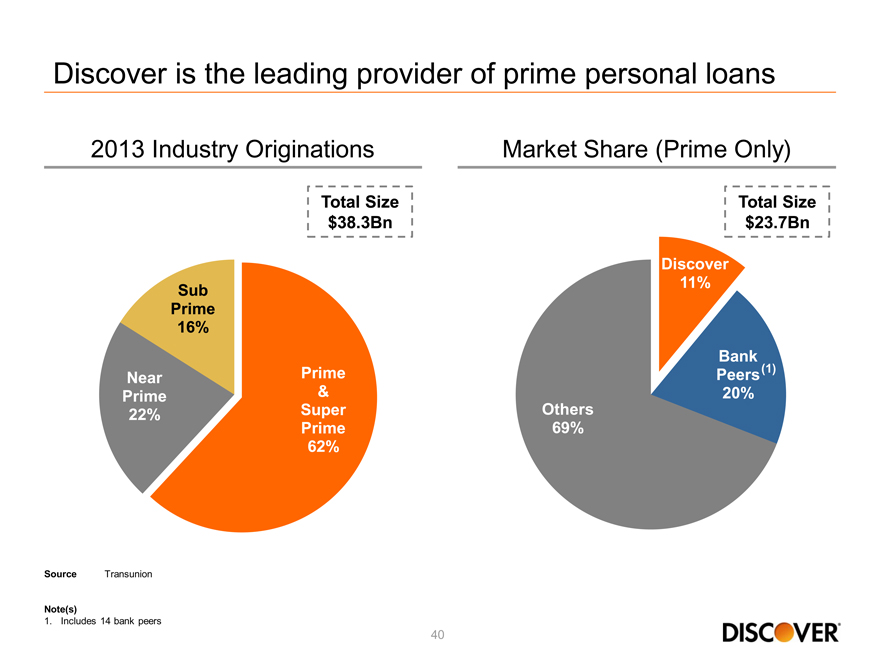

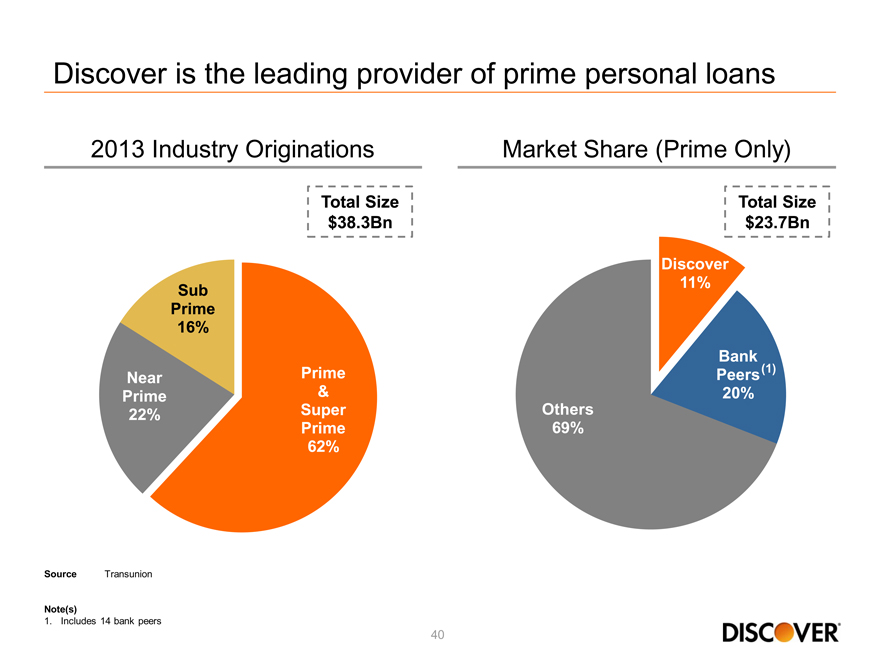

Discover is the leading provider of prime personal loans

2013 Industry Originations Market Share (Prime Only)

Total Size Total Size

Discover

Sub 11%

Prime

16%

Near Prime Peers Bank (1)

Prime & 20%

22% Super Others

Prime 69%

62%

Source Transunion

Note(s)

1.Includes 14 bank peers

40

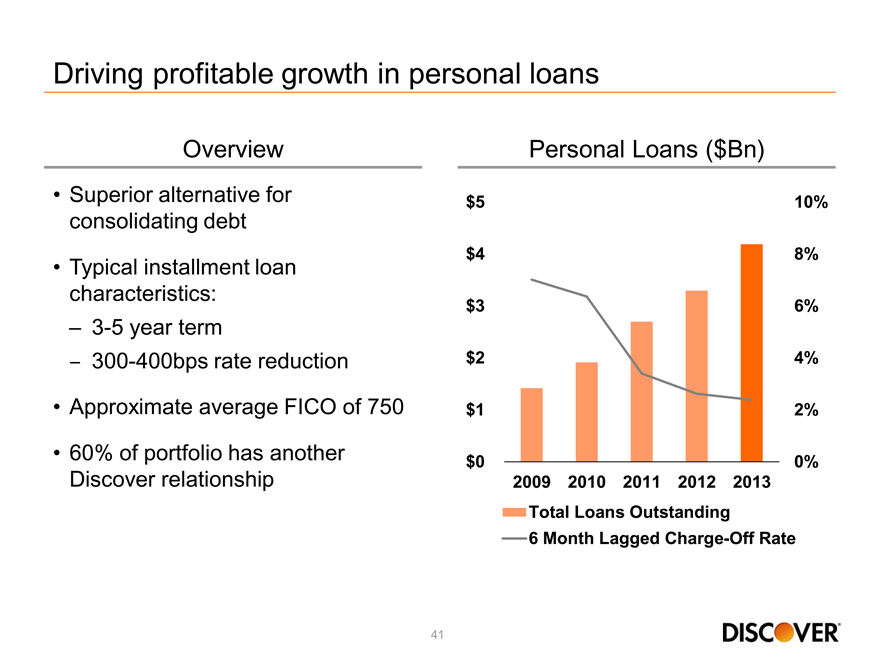

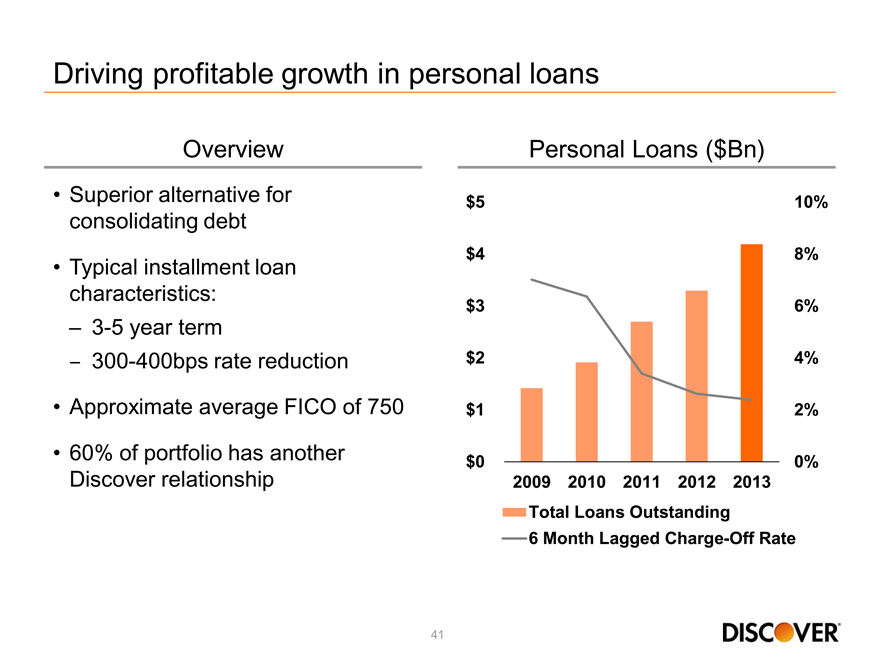

Driving profitable growth in personal loans

Overview Personal Loans ($Bn)

Superior alternative for $5 10%

consolidating debt

Typical installment loan $4 8%

characteristics: $ 3 6%

– 3-5 year term

– 300-400bps rate reduction $2 4%

Approximate average FICO of 750 $1 2%

60% of portfolio has another $0 0%

Discover relationship 2009 2010 2011 2012 2013

Total Loans Outstanding

6 Month Lagged Charge-Off Rate

41

2014 Priorities for personal loans

Maintain growth and strong credit performance

Test expansion into unsolicited population

Enhance operations and functionality

42

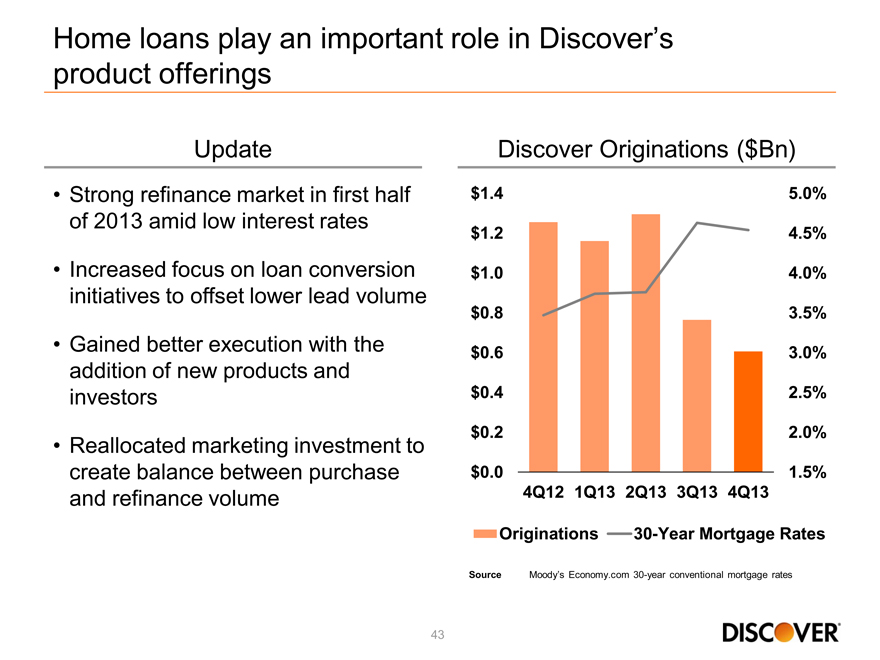

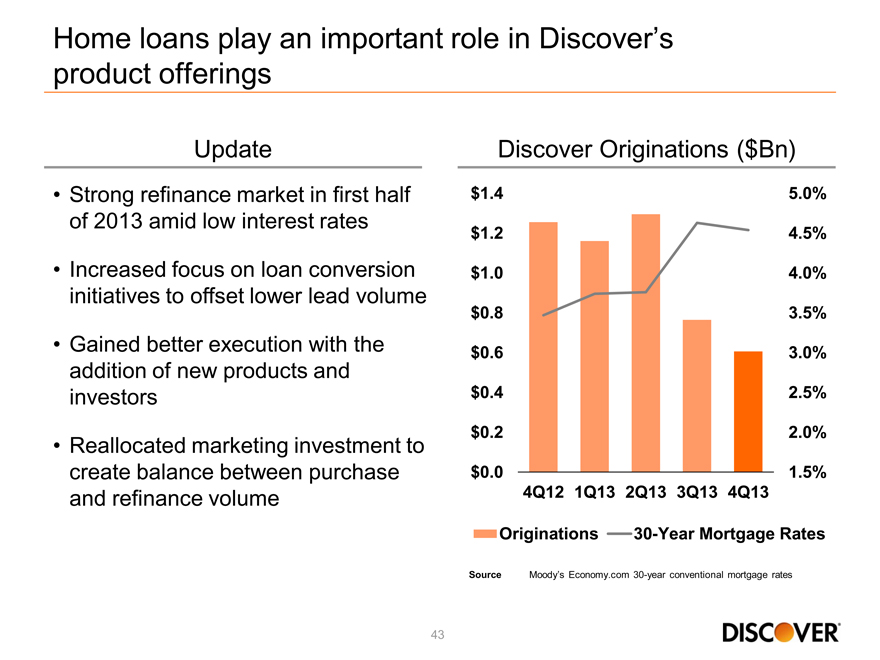

Home loans play an important role in Discover’s

product offerings

Update Discover Originations ($Bn)

Strong refinance market in first half $1.4 5.0%

of 2013 amid low interest rates $1.2 4.5%

Increased focus on loan conversion $1.0 4.0%

initiatives to offset lower lead volume

$0.8 3.5%

Gained better execution with the $0.6 3.0%

addition of new products and

investors $0.4 2.5%

Reallocated marketing investment to $ 0.2 2.0%

create balance between purchase $ 0.0 1.5%.

and refinance volume 4Q12 1Q13 2Q13 3Q13 4Q13

Originations 30-Year Mortgage Rates

Source Moody’s Economy.com 30-year conventional mortgage rates

43

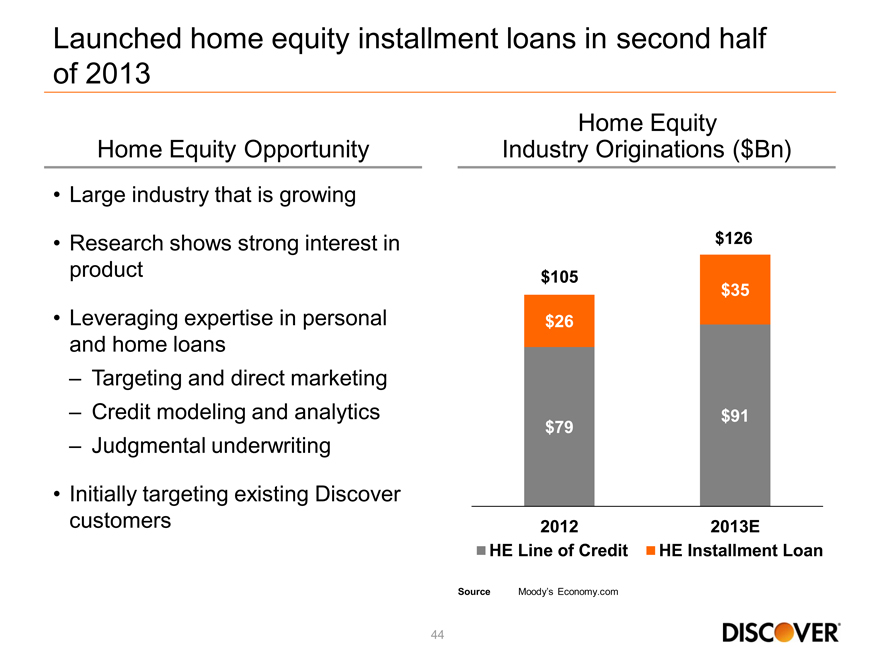

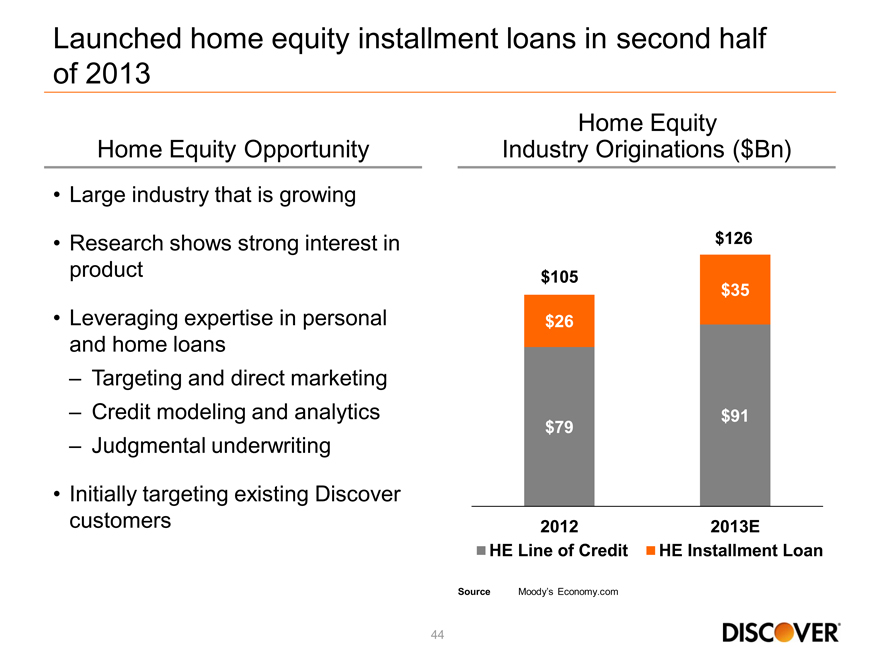

Launched home equity installment loans in second half

of 2013

Home Equity

Home Equity Opportunity Industry Originations ($Bn)

Large industry that is growing

Research shows strong interest in $126

product $105

$35

Leveraging expertise in personal $26

and home loans

– Targeting and direct marketing

– Credit modeling and analytics $91

$79

– Judgmental underwriting

Initially targeting existing Discover

customers 2012 2013E

HE Line of Credit HE Installment Loan

Source Moody’s Economy.com

44

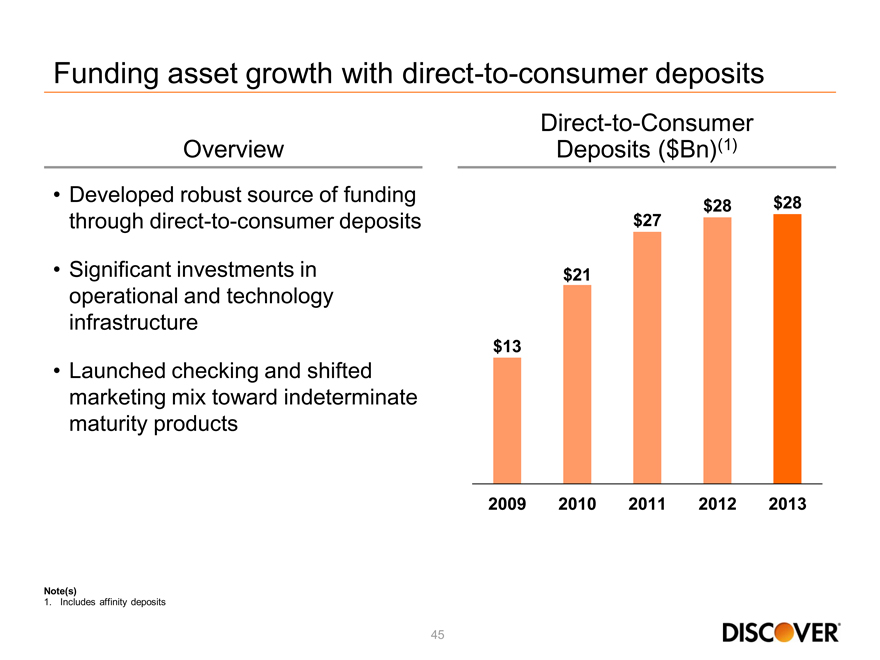

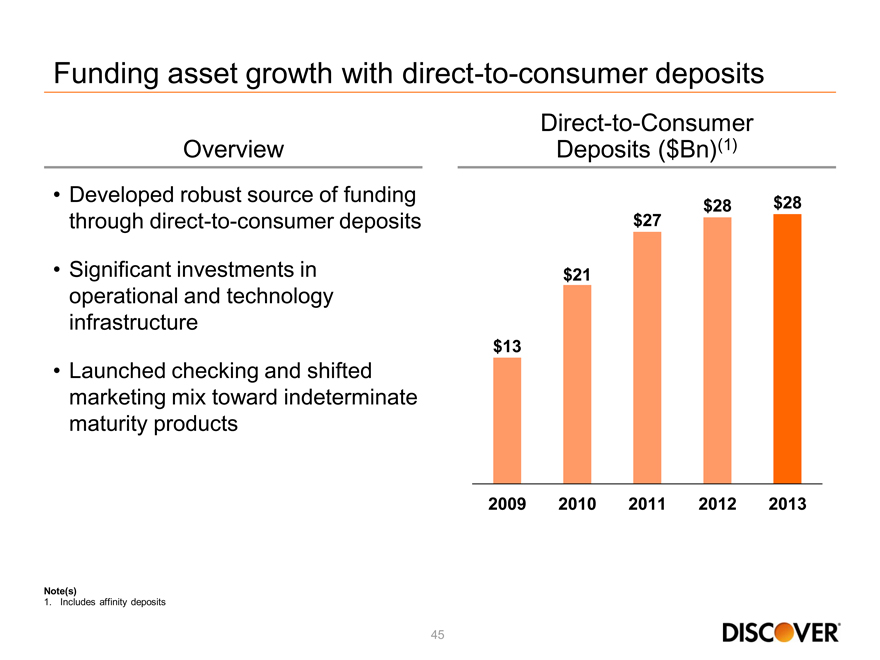

Funding asset growth with direct-to-consumer deposits

Direct-to-Consumer

Overview Deposits ($Bn)(1)

Developed robust source of funding $28 $28

through direct-to-consumer deposits $27

Significant investments in $21

operational and technology

infrastructure

$13

Launched checking and shifted

marketing mix toward indeterminate

maturity products

2009 2010 2011 2012 2013

Note(s)

1. Includes affinity deposits

45

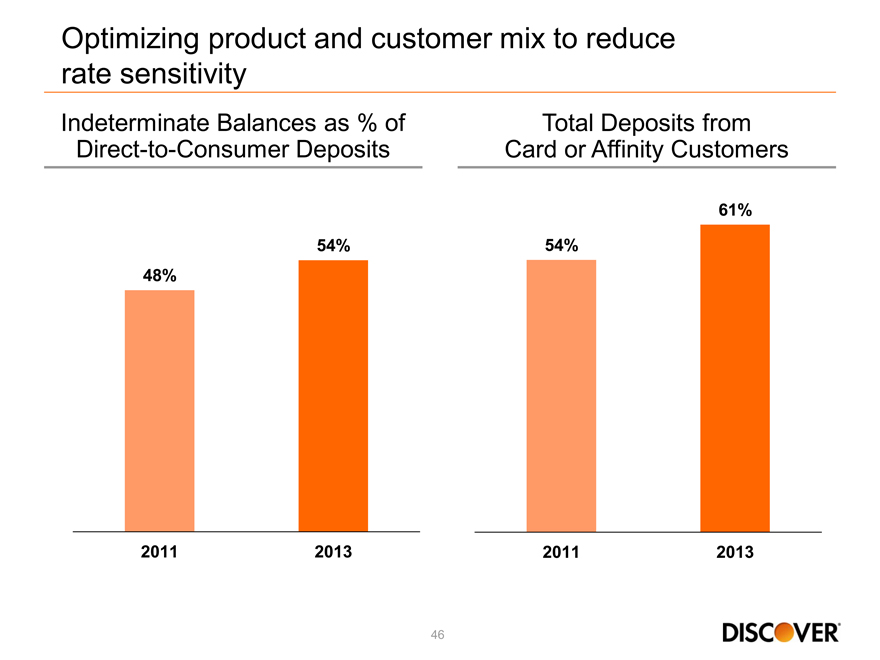

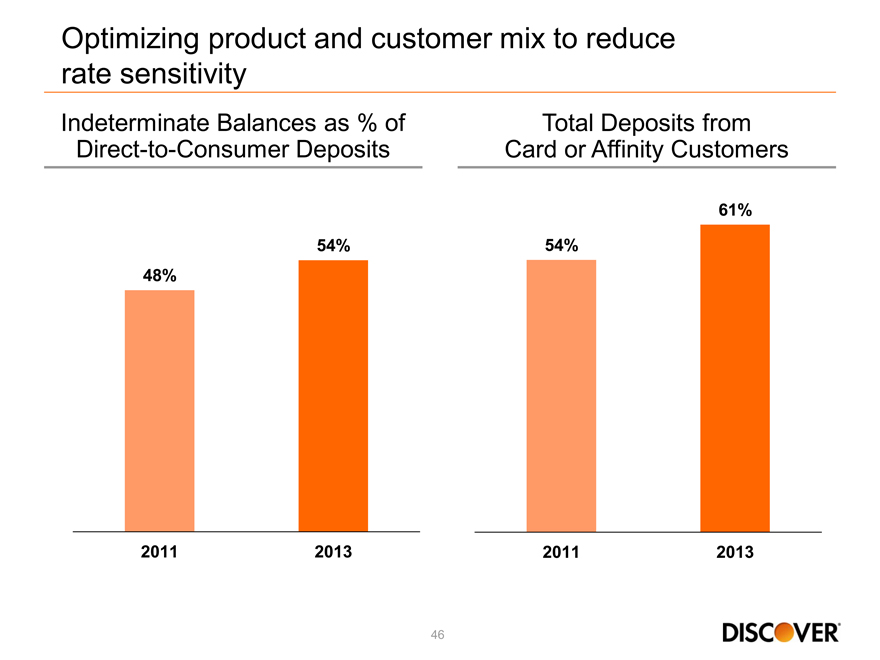

Optimizing product and customer mix to reduce

rate sensitivity

Indeterminate Balances as % of Total Deposits from

Direct-to-Consumer Deposits Card or Affinity Customers

61%

54% 54%

48%

2011 2013 2011 2013

46

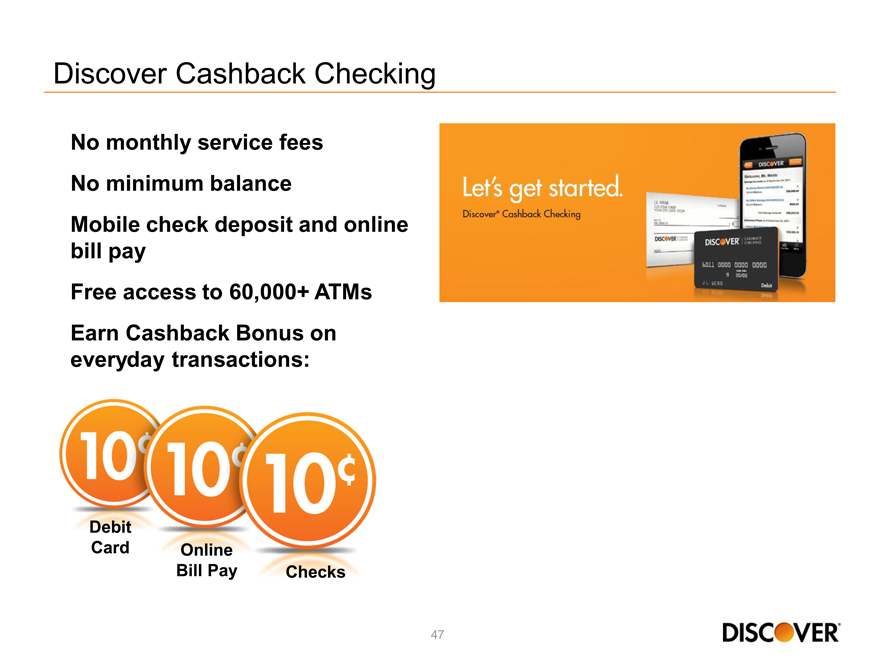

Discover Cashback Checking

No monthly service fees No minimum balance

Mobile check deposit and online bill pay Free access to 60,000+ ATMs Earn Cashback Bonus on everyday transactions:

Debit

Card Online

Bill Pay Checks

47

2014 Priorities for checking

Implement new core deposit system

Broad market launch

Affinity partners

Continue to enhance features and functionality

48

Leveraging unique capabilities to diversify assets and funding

Continue with disciplined growth in student and personal loans

Refine mortgage and home equity operating model

Manage deposit mix and opportunistically grow as rates increase

Focus on operational excellence and mobile/online capabilities

49

2014 Financial Community Briefing

Payment Services

Roger Hochschild

President & Chief Operating Officer

Competing in payments with partnership strategy

• | | Increasing domestic and global acceptance |

• | | Supporting U.S. card growth |

• | | Adapting to an evolving U.S. debit environment |

• | | Adding new Diners franchises and working through challenges in Europe |

• | | Implementing emerging payments initiatives |

51

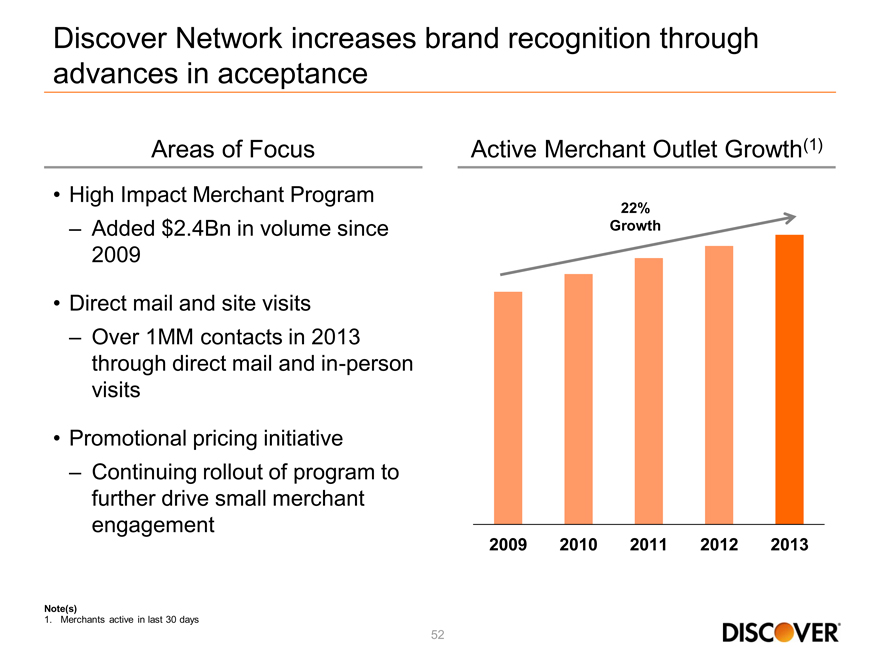

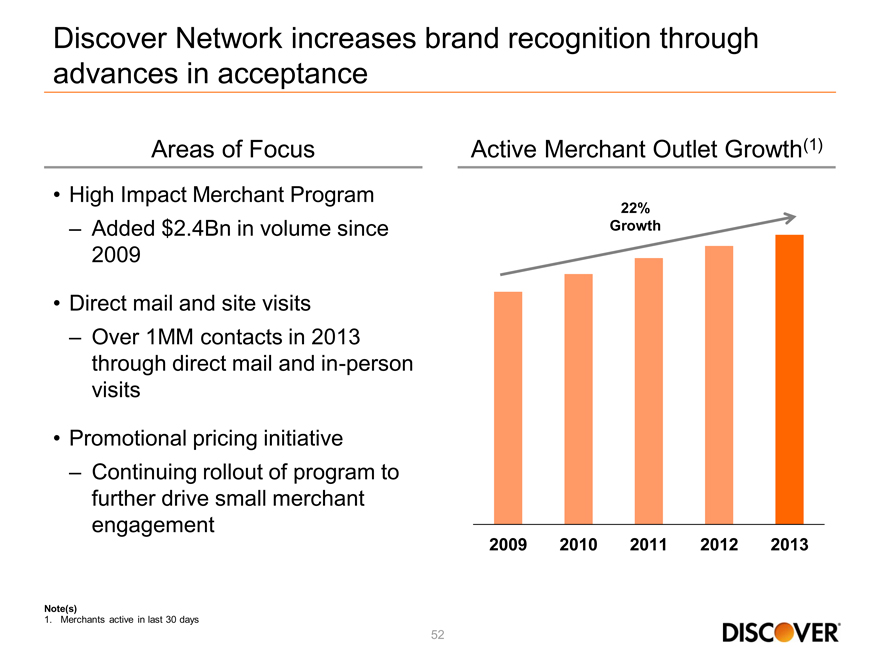

Discover Network increases brand recognition through

advances in acceptance

Areas of Focus

• | | High Impact Merchant Program |

– Added $2.4Bn in volume since 2009

• | | Direct mail and site visits |

– Over 1MM contacts in 2013 through direct mail and in-person visits

• | | Promotional pricing initiative Continuing rollout of program to further drive small merchant engagement |

Active Merchant Outlet Growth(1)

22% Growth

2009 2010 2011 2012 2013

Note(s)

1. Merchants active in last 30 days

52

Growing global acceptance through network alliances

North America

EMEA

Asia Pacific

34%

8%

8%

Latin America

22%

(May 2013)

( November 2013)

(March 2013)

53

Note(s)

– The map denotes countries or territories with transactional activity in the last year (bright orange)

– Outlet growth percentages reflect year-over-year change

– Merchant locations based on third party estimates and internal reporting

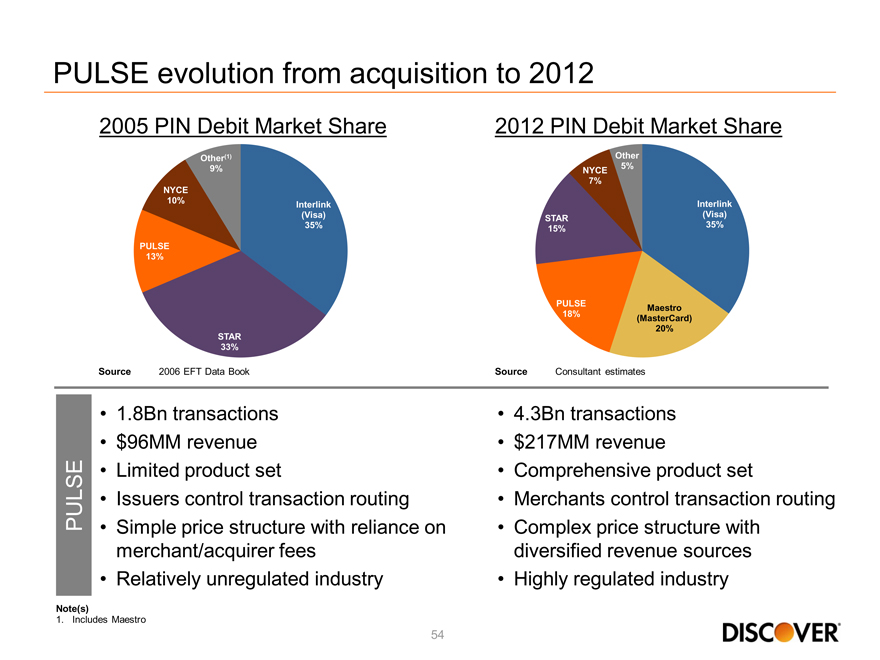

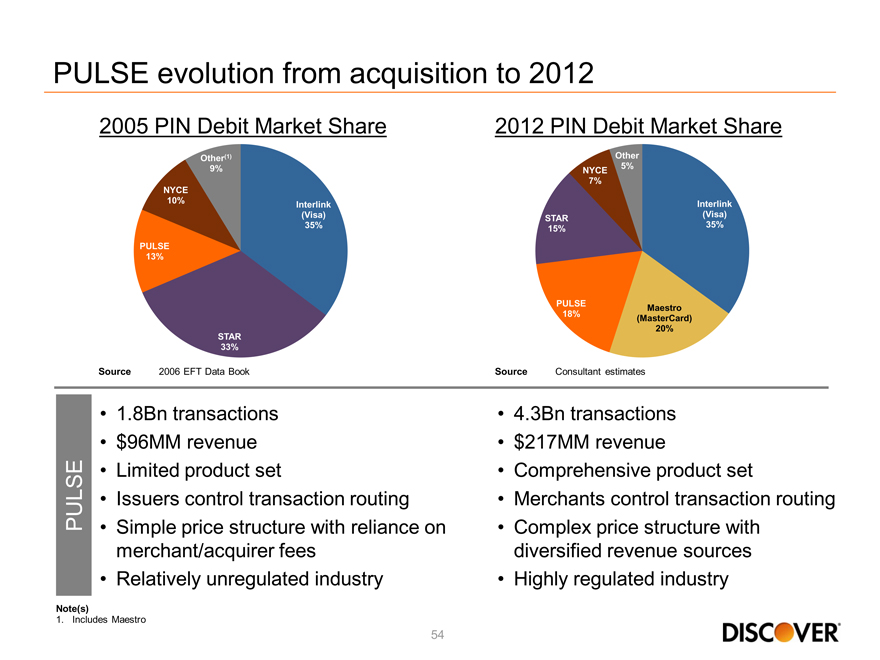

PULSE evolution from acquisition to 2012

NYCE

7%

Other

5%

NYCE

Other(1)

9%

2005 PIN Debit Market Share 2012 PIN Debit Market Share

Interlink

(Visa)

STAR 35%

15%

Interlink

(Visa)

35%

PULSE

13%

10%

Maestro

(MasterCard)

20%

PULSE

18%

STAR

33%

Source 2006 EFT Data Book Source Consultant estimates

• | | Limited 4.3Bn transactions |

product set

• | | Issuers control transaction routing |

• | | Simple price structure with reliance on |

merchant/acquirer fees

Comprehensive product set

• | | Merchants control transaction routing |

• | | Complex price structure with |

diversified revenue sources

PULSE

54

• | | Relatively unregulated industry Highly regulated industry |

Note(s)

1. Includes Maestro

source public company data

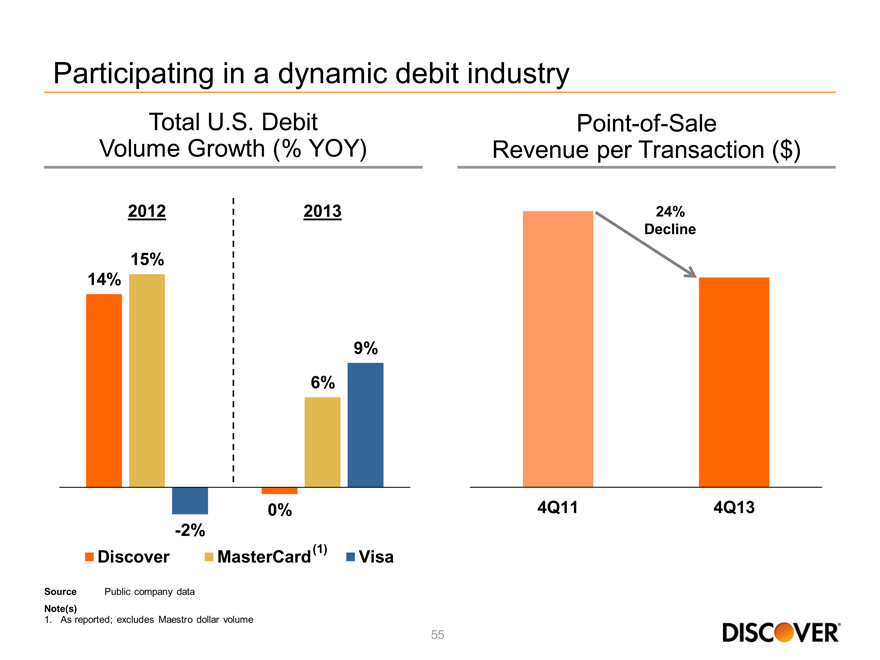

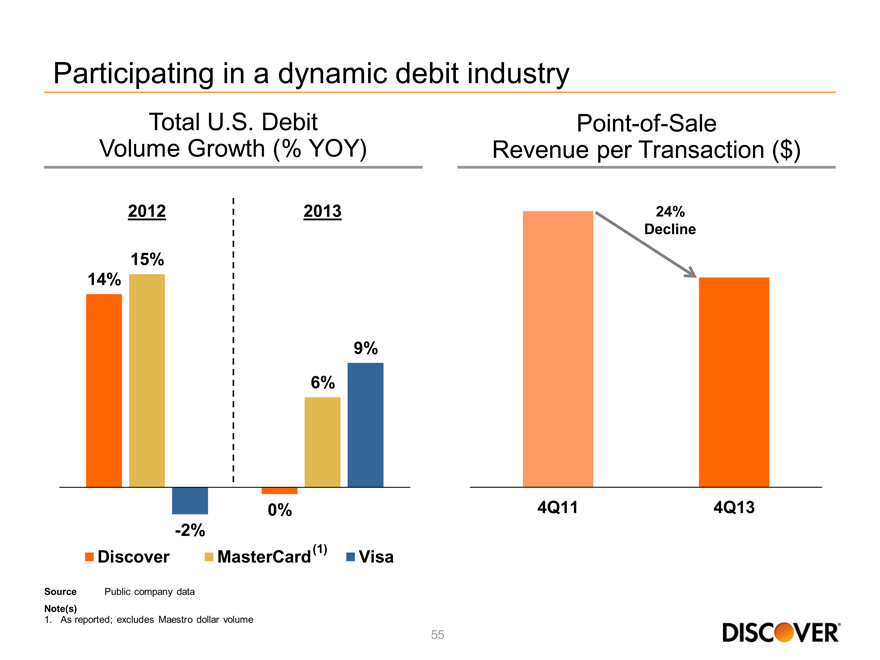

Participating in a dynamic debit industry

Total U.S. Debit

Volume Growth (% YOY)

Point-of-Sale

Revenue per Transaction ($)

14%

15%

2012 2013 24%

Decline

6%

9%

0%

-2%

Discover MasterCard(1) Visa

4Q11 4Q13

55

Note(s)

1. As reported; excludes Maestro dollar volume

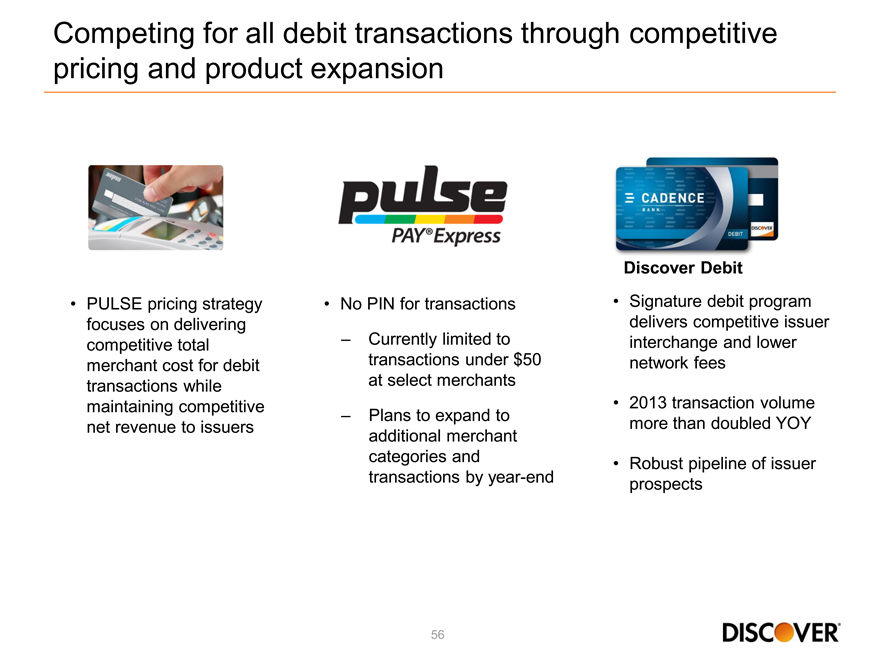

Competing for all debit transactions through competitive

pricing and product expansion

PULSE pricing strategy focuses on delivering competitive total merchant cost for debit transactions while maintaining competitive net revenue to issuers

No PIN for transactions

– Currently limited to transactions under $50 at select merchants

– Plans to expand to additional merchant categories and transactions by year-end

Discover Debit

• | | Signature debit program delivers competitive issuer interchange and lower network fees |

• | | 2013 transaction volume more than doubled YOY |

• | | Robust pipeline of issuer prospects |

56

Diners Club expanding in key markets

Establishing Diners franchises with largest issuers in key markets

• | | China: ICBC corporate card issuing to be launched mid-2014 |

• | | India: HDFC Bank has issued over 40K cards; Diners Club/Discover acceptance in India has surpassed American |

Express

• | | Russia: Initial Discover Card issuance outside the Americas, large scale launch planned for late first quarter |

China

India

Russia

57

Discover’s PayPal relationship continues to progress

Background

• | | Leverages Discover’s domestic merchant footprint |

• | | Allows for access to PayPal’s 60MM+ active U.S. account holders |

• | | Establishes PayPal as a payment option in brick & mortar locations |

• | | Distribute a robust mobile application to a large set of account holders |

Update

Signed 61 merchant acquirers

Enabled 1.2 million merchant locations

Integrating PayPal’s mobile POS technology with Discover’s hardware and software providers

58

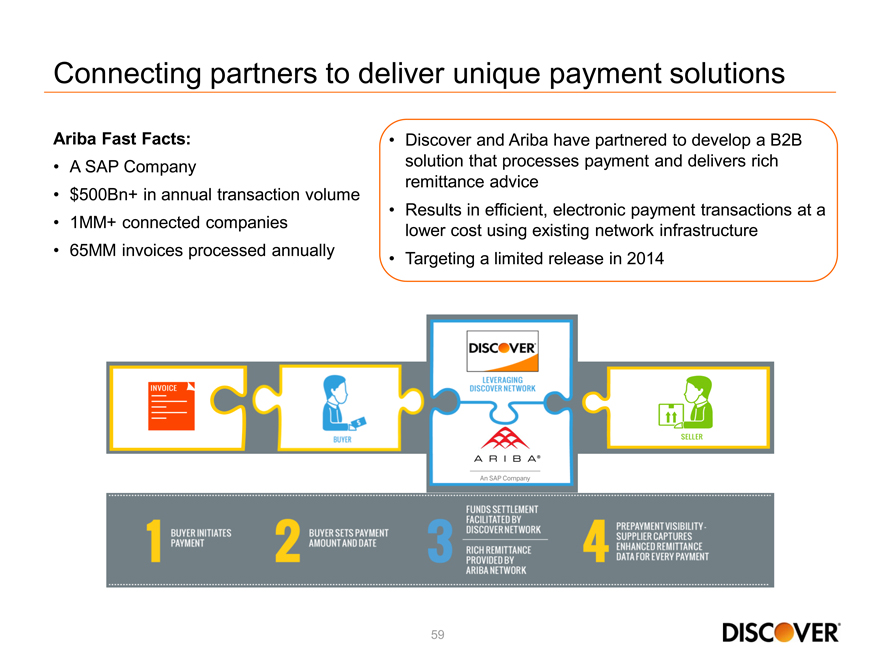

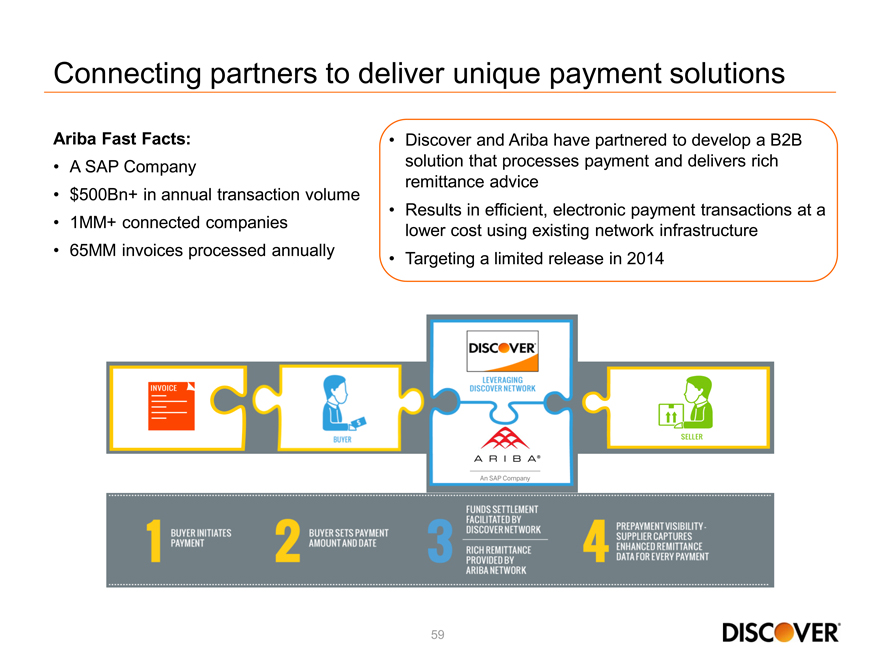

Connecting partners to deliver unique payment solutions

• | | Discover and Ariba have partnered to develop a B2B |

solution that processes payment and delivers rich

remittance advice

Ariba Fast Facts:

• | | Results in efficient, electronic payment transactions at a |

lower cost using existing network infrastructure

• | | Targeting a limited release in 2014 |

• | | 500Bn+ in annual transaction volume |

• | | 1MM+ connected companies |

• | | 65MM invoices processed annually |

59

Continued focus on payments security

• | | Merchant breaches dramatically increased industry focus on payments security |

• | | Discover is preparing for a multi-year industry migration to chip and pin for |

point-of-sale and tokenization for card not present transactions

• | | Open access and collaboration between networks is needed to provide |

consumers with the highest level of security and global interoperability

• | | Discover’s multilayered approach addresses security across all payment |

channels

60

Leveraging payments assets with partners to drive volume

• | | Broad product suite including credit, debit, prepaid and ATM |

• | | Hybrid closed loop acceptance model |

• | | Building global acceptance |

• | | Flexibility provides opportunity to participate in alternative payment strategies |

61

2014 Financial Community Briefing

Financials

Mark Graf

EVP & Chief Financial Officer

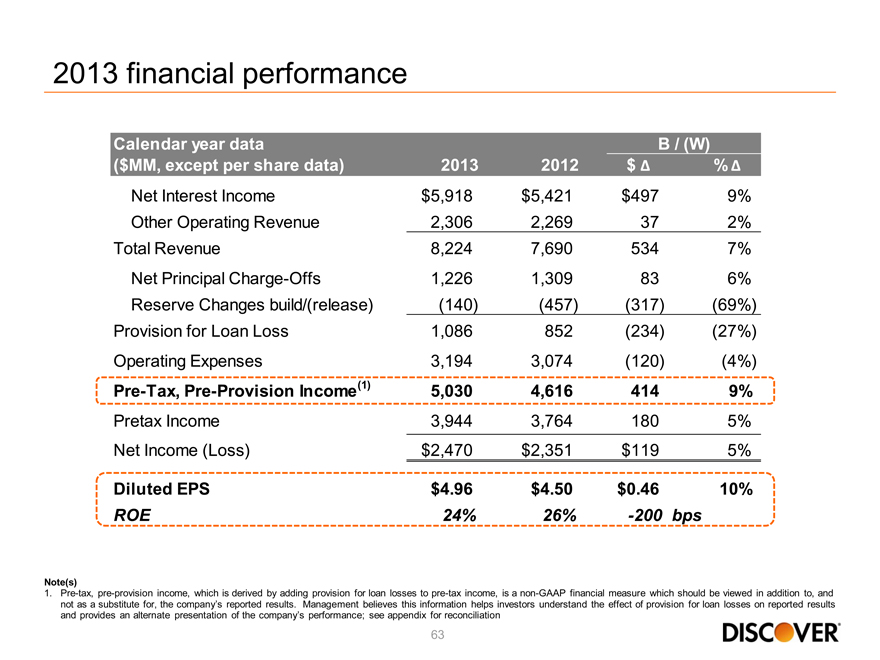

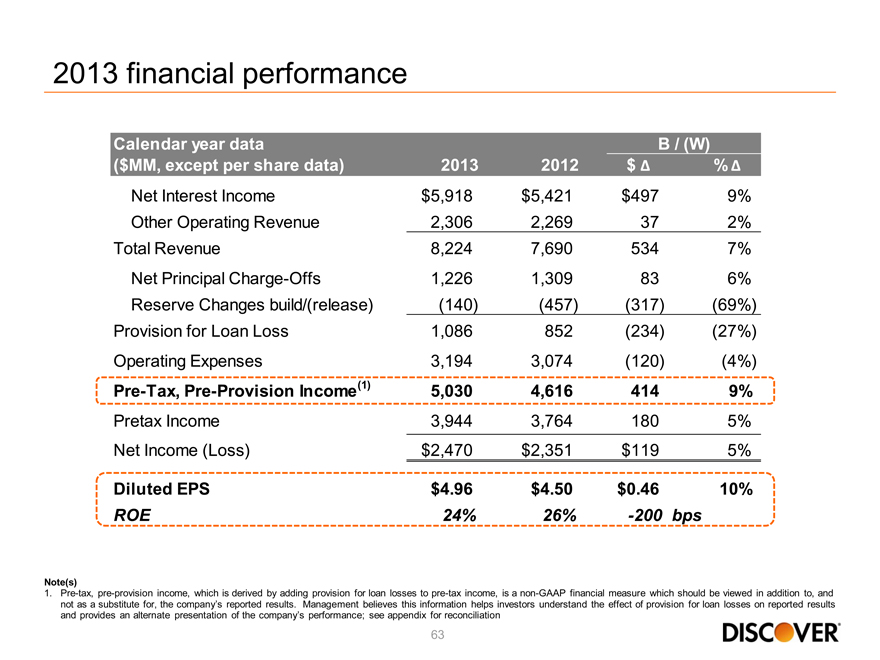

2013 financial performance

($MM, except per share data) 2013 2012 $ %

Calendar year data B / (W)

Net Interest Income $5,918 $5,421 $497 9% Other Operating Revenue 2,306 2,269 37 2% Total Revenue 8,224 7,690 534 7% Net Principal Charge-Offs 1,226 1,309 83 6% Reserve Changes build/(release) (140) (457) (317) (69%) Provision for Loan Loss 1,086 852 (234) (27%) Operating Expenses 3,194 3,074 (120) (4%)

Pre-Tax, Pre-Provision Income(1) 5,030 4,616 414 9%

Pretax Income 3,944 3,764 180 5% Net Income (Loss) $2,470 $2,351 $119 5%

Diluted EPS $4.96 $4.50 $0.46 10%

ROE 24% 26% -200 bps

Note(s)

1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and

not as a substitute for, the company’s reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results

and provides an alternate presentation of the company’s performance; see appendix for reconciliation

63

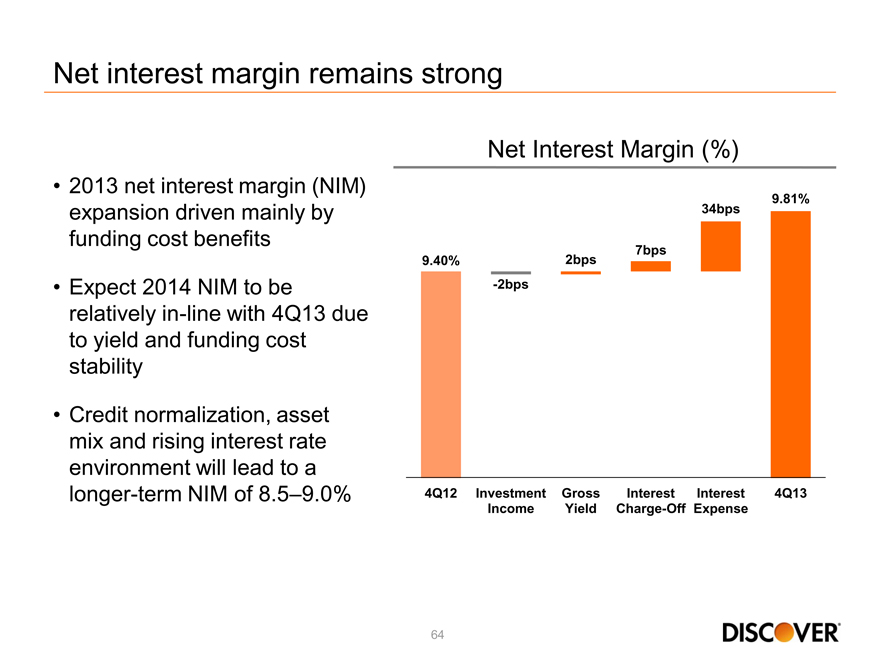

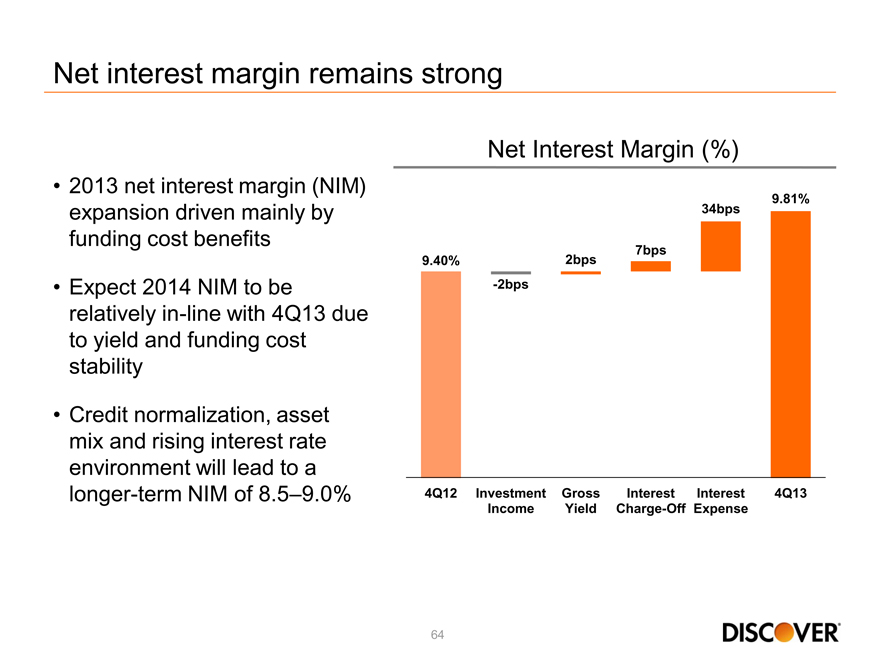

Net interest margin remains strong

2013 net interest margin (NIM) expansion driven mainly by funding cost benefits

Expect 2014 NIM to be relatively in-line with 4Q13 due to yield and funding cost stability

Credit normalization, asset mix and rising interest rate environment will lead to a longer-term NIM of 8.5–9.0%

Net Interest Margin (%)

9.81% 34bps

7bps 9.40% 2bps -2bps

4Q12 Investment Gross Interest Interest 4Q13 Income Yield Charge-Off Expense

64

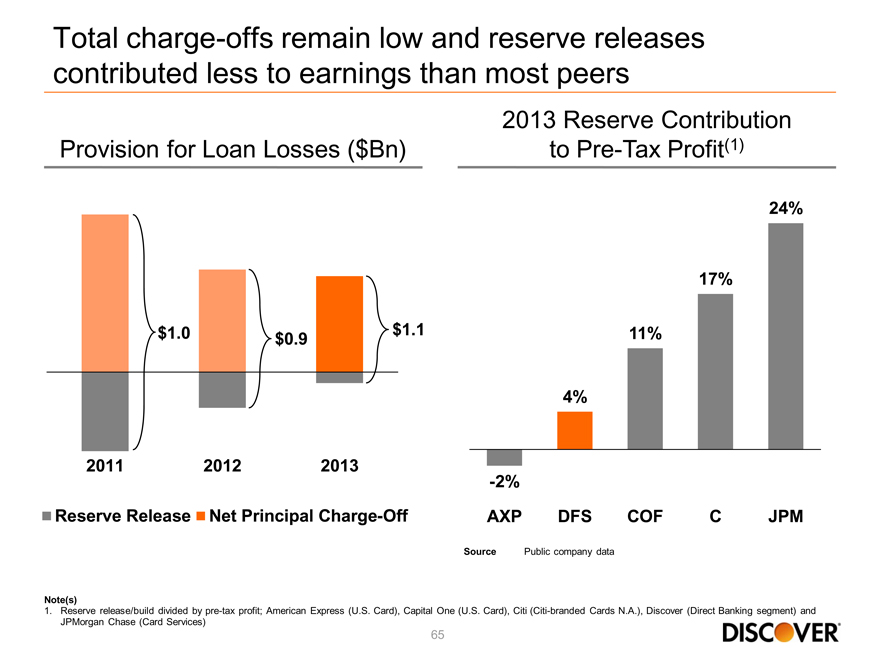

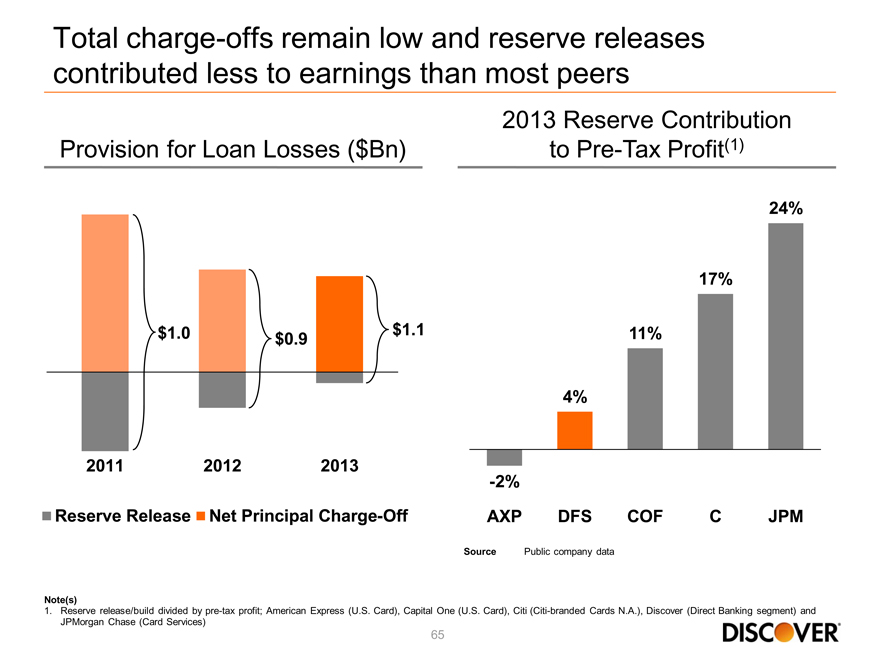

Total charge-offs remain low and reserve releases

contributed less to earnings than most peers

Provision for Loan Losses ($Bn)

$1.0 $0.9 $1.1

2011 2012 2013

Reserve Release Net Principal Charge-Off

2013 Reserve Contribution

to Pre-Tax Profit(1)

AXP DFS COF C JPM

4%

11%

17%

24%

– 2%

Note(s)

1. Reserve release/build divided by pre-tax profit; American Express (U.S. Card), Capital One (U.S. Card), Citi (Citi-branded Cards N.A.), Discover (Direct Banking segment) and

JPMorgan Chase (Card Services)

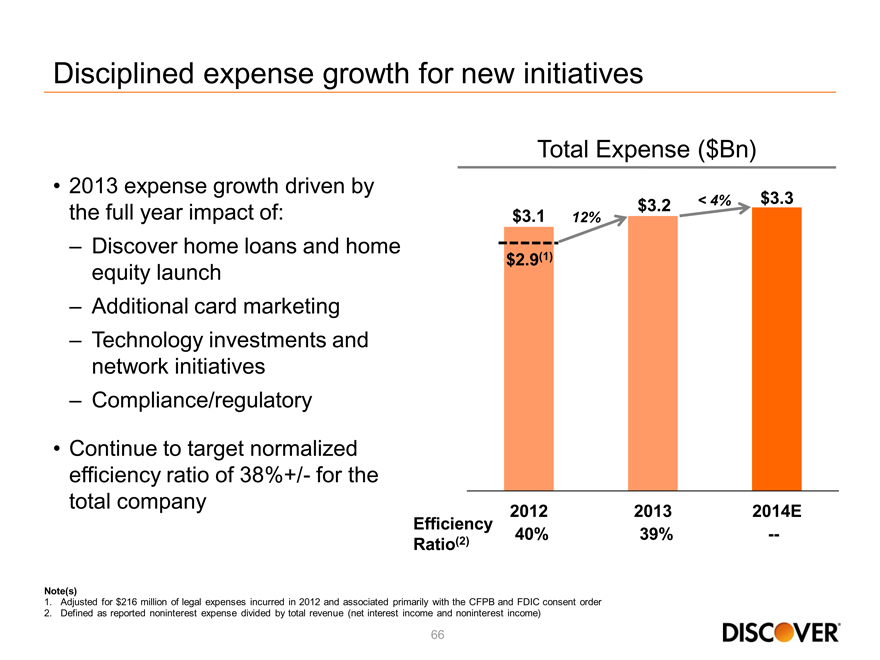

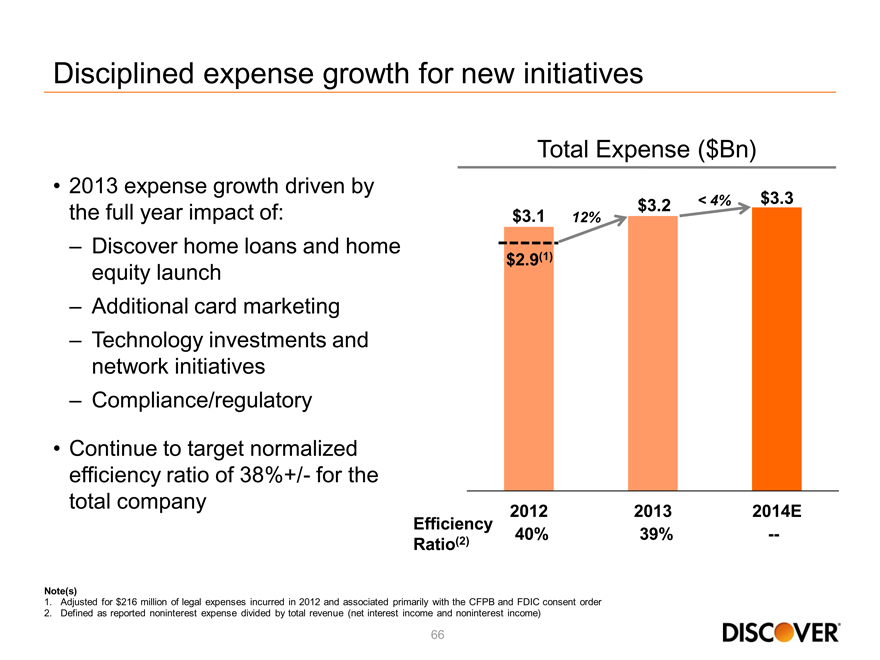

Disciplined expense growth for new initiatives

Total Expense ($Bn)

2013 expense driven by

the full year impact of:

– Discover home loans and home

equity launch

12%

< 4% $3.1 #3.2 $3.3 $2.9(1)

– Additional card marketing

– Technology investments and

network initiatives

– Compliance/regulatory

• | | Continue to target normalized |

38%+/ for the

2012 2013 2014E

Efficiency

Ratio(2) 40% 39% —

efficiency ratio of - total company

Note(s)

1. Adjusted for $216 million of legal expenses incurred in 2012 and associated primarily with the CFPB and FDIC consent order

2. Defined as reported noninterest expense divided by total revenue (net interest income and noninterest income)

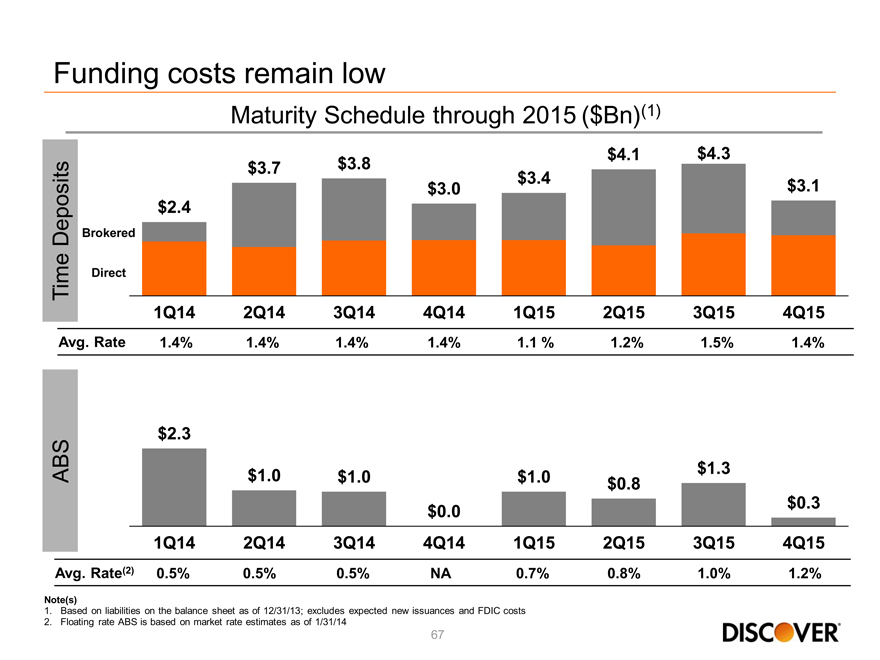

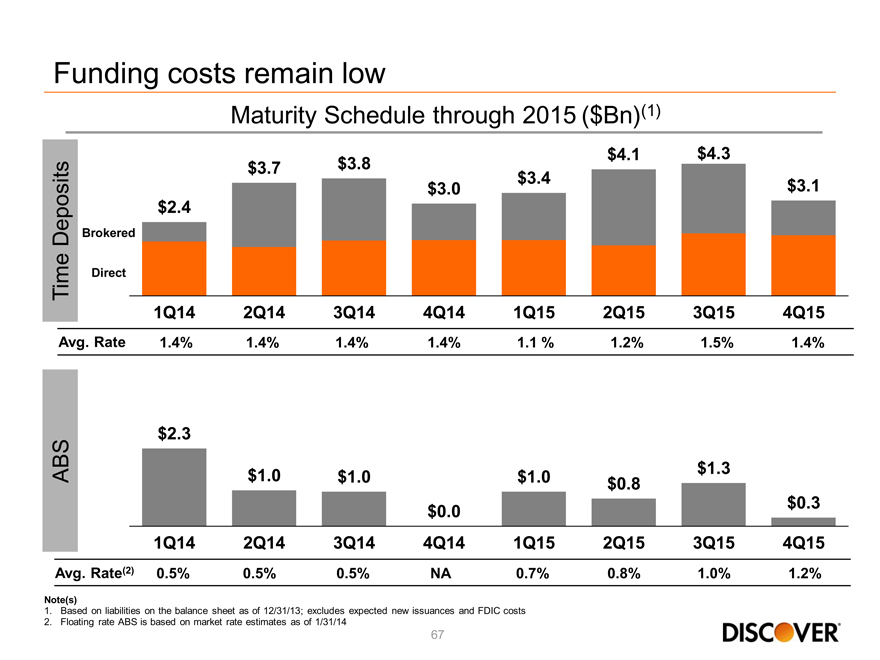

Funding costs remain low

Maturity Schedule through 2015 ($Bn)(1)

$3.7 $3.8

$3.0 $3.4

$4.1 $4.3

$3.1

Time Deposits

Brokered

Direct

$2.4

$4.1 $4.3

Ti

Avg. Rate 1.4% 1.4% 1.4% 1.4% 1.1% 1.2% 1.5% 1.4%

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15

ABS

$2.3

$1.0 $1.0 $1.0 $1.3

$0.8 $0.3

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15

67

Note(s)

1. Based on liabilities on the balance sheet as of 12/31/13; excludes expected new issuances and FDIC costs

2. Floating rate ABS is based on market rate estimates as of 1/31/14

Avg. Rate(2) 0.5% 0.5% 0.5% NA 0.7% 0.8% 1.0% 1.2%

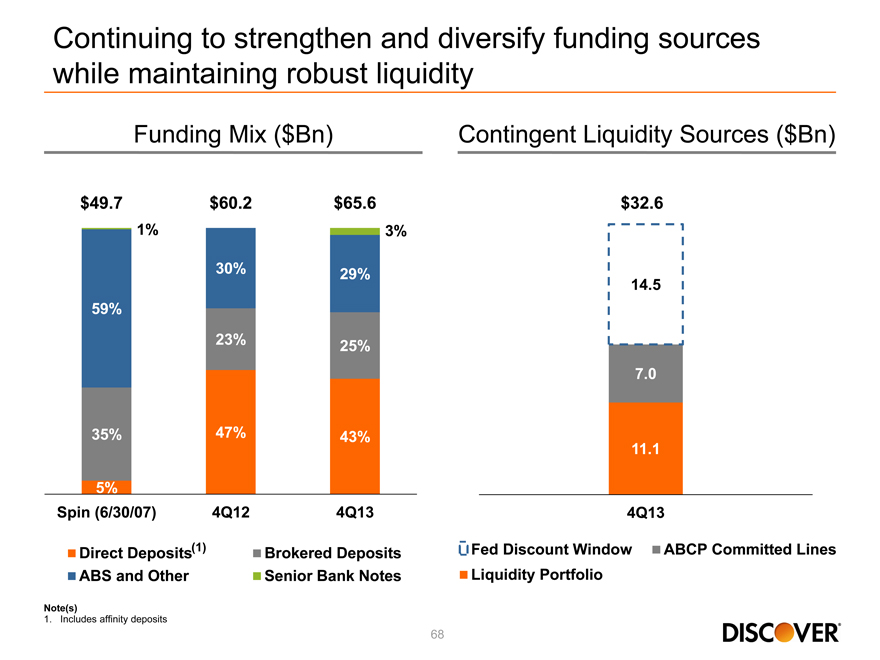

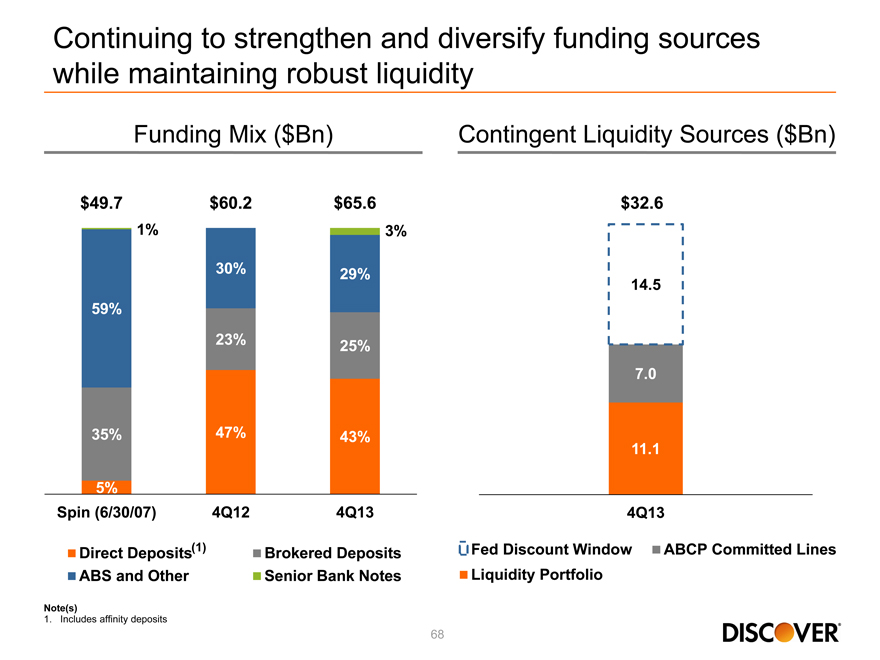

Continuing to strengthen and diversify funding sources

while maintaining robust liquidity

Funding Mix ($Bn) Contingent Liquidity Sources ($Bn)

30% 29%

1% 3%

$49.7 $60.2 $65.6 $32.6

23% 25%

59%

7.0

35% 47% 43%

11.1

5%

Spin (6/30/07) 4Q12 4Q13

Direct Deposits(1) Brokered Deposits

4Q13

Fed Discount Window ABCP Committed Lines

68

ABS and Other Senior Bank Notes

Note(s)

1. Includes affinity deposits

Liquidity Portfolio

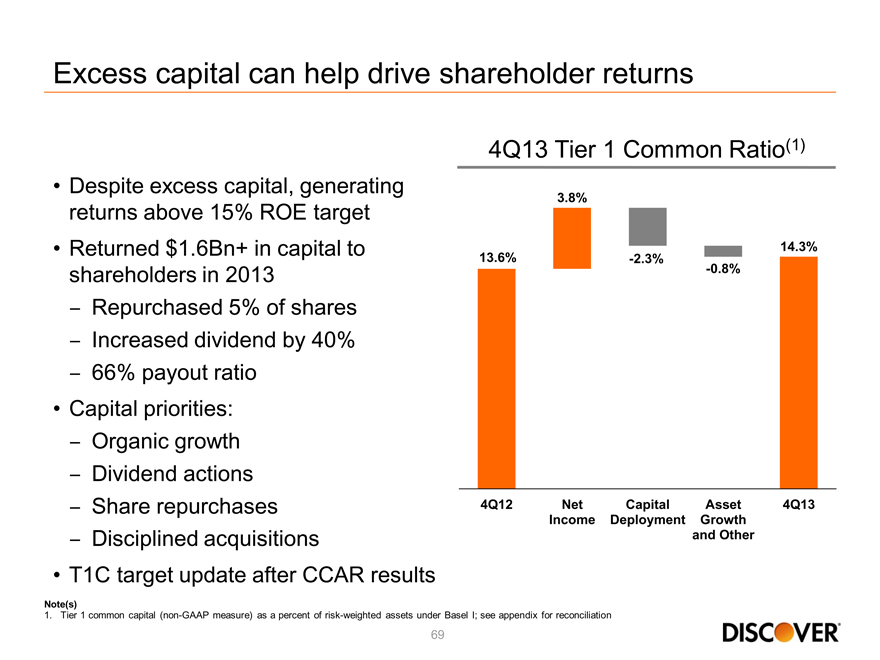

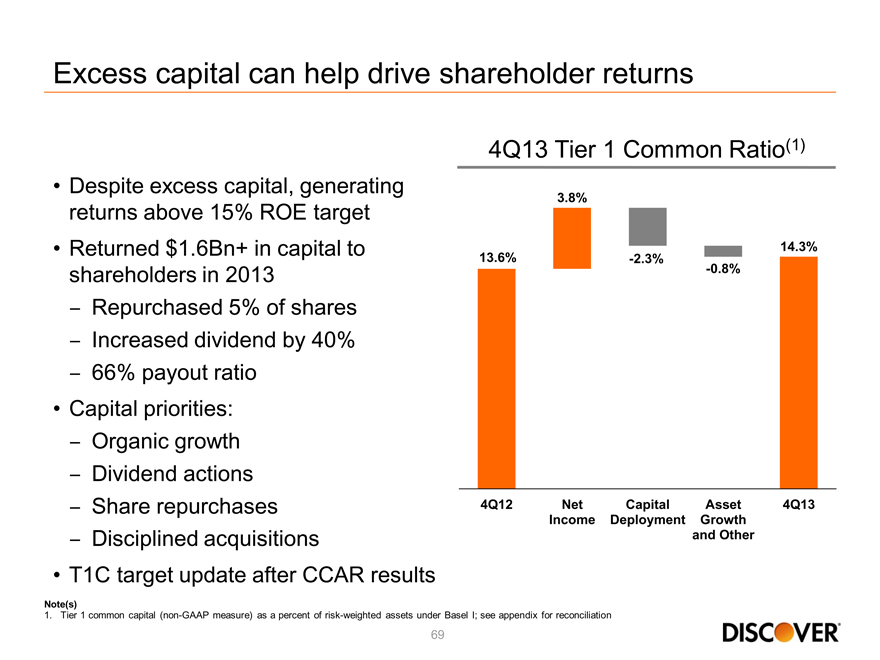

Excess capital can help drive shareholder returns

4Q13 Tier 1 Common Ratio(1)

• | | Despite excess capital, generating |

returns above 15% ROE target

• | | Returned $1.6Bn+ in capital to |

shareholders in 2013

13.6%

3.8%

-2.3%

-0.8%

14.3%

Repurchased 5% of shares

Increased dividend by 40%

66% payout ratio

Capital priorities:

Organic growth

Dividend actions

Share repurchases

Disciplined acquisitions

4Q12 Net

Income

Capital

Deployment

Asset

Growth

and Other

4Q13

69

T1C target update after CCAR results

Note(s)

1. Tier 1 common capital (non-GAAP measure) as a percent of risk-weighted assets under Basel I; see appendix for reconciliation

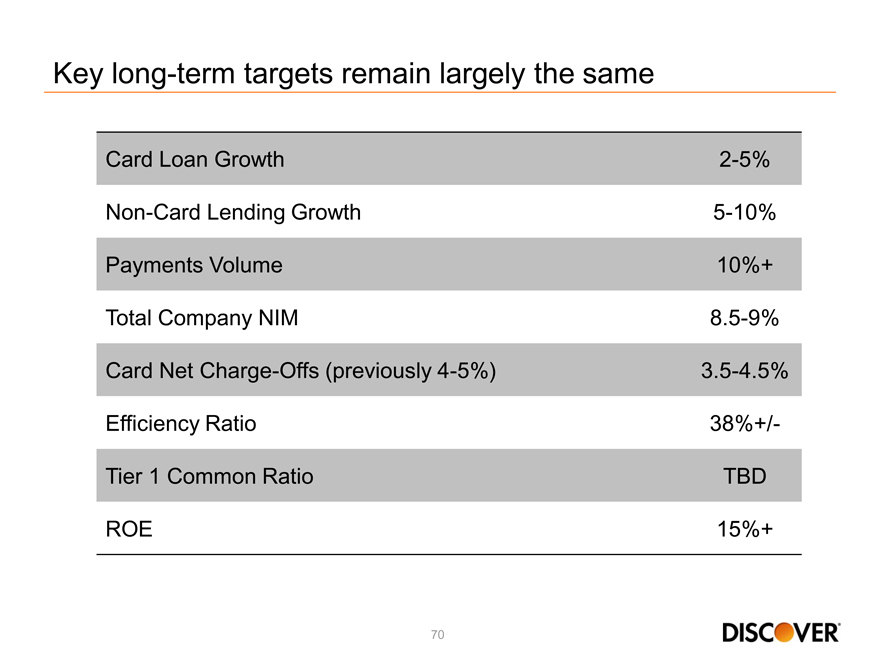

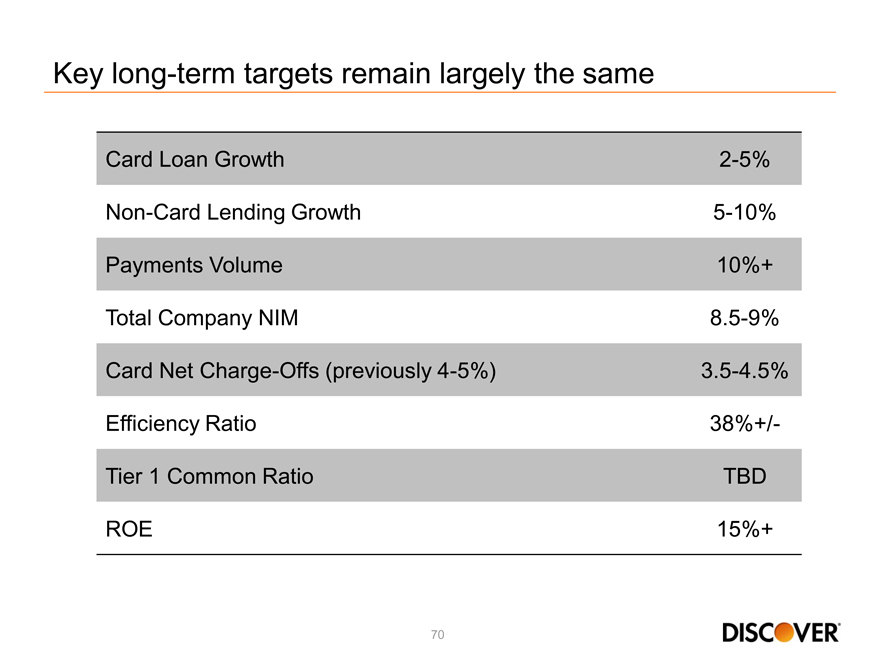

Key long-term targets remain largely the same

Card Loan Growth 2-5%

Non-Card Lending Growth 5-10%

Payments Volume 10%+

Total Company NIM 8.5-9%

Card Net Charge-Offs (previously 4-5%) 3.5-4.5%

Efficiency Ratio 38%+/-

Tier 1 Common Ratio TBD

ROE 15%+

Well positioned for 2014

• | | Greater than industry average card loan growth |

• | | Net interest margin expected to remain above long-term target |

• | | Modest increase in operating expenses |

• | | Card delinquency trends do not indicate a change in credit environment |

• | | Capital position/generation supports growth, dividend actions, share |

repurchases and potential acquisitions

71

2014 Financial Community Briefing

Q&A

Appendix

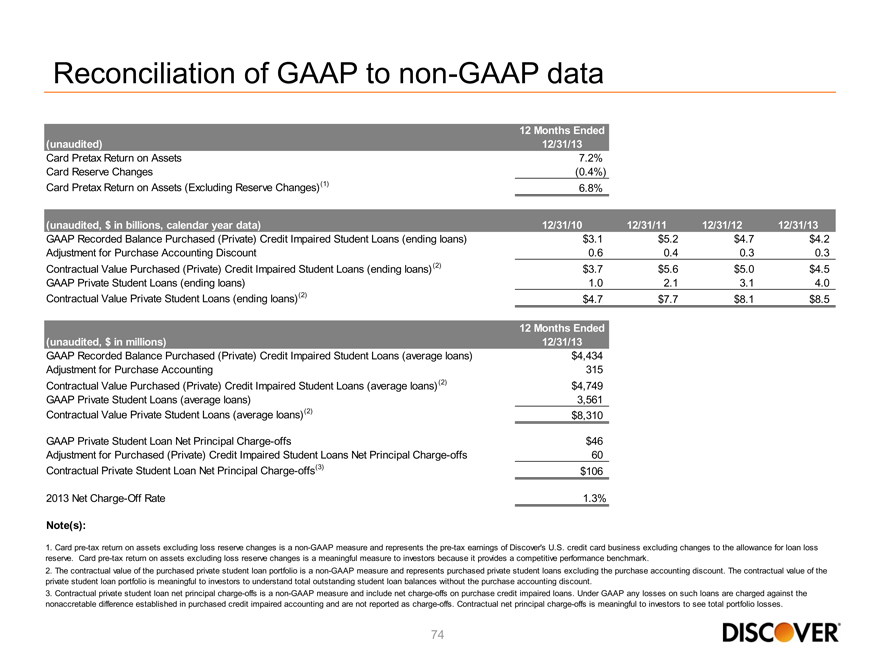

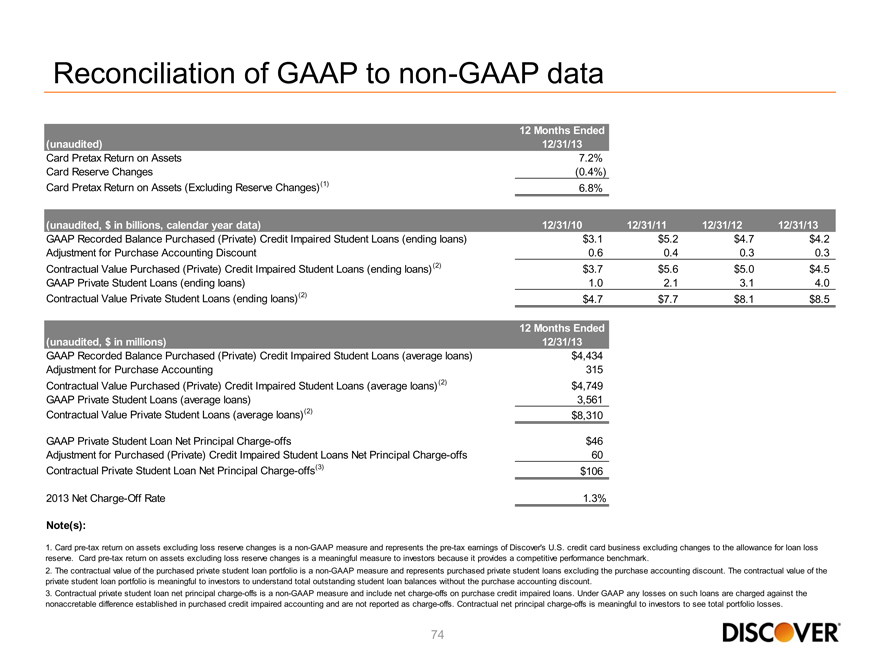

Reconciliation of GAAP to non-GAAP data

(unaudited) 12/31/13

Card Pretax Return on Assets 7.2%

Card Reserve Changes(0.4%)

Card Pretax Return on Assets (Excluding Reserve Changes)(1) 6.8%

(unaudited, $ in billions, calendar year data) 12/31/10 12/31/11 12/31/12 12/31/13

GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (ending loans) $3.1 $ 5.2 $ 4.7 $ 4.2

Adjustment for Purchase Accounting Discount 0.6 0.4 0.3 0.3

Contractual Value Purchased (Private) Credit Impaired Student Loans (ending loans)(2) $3.7 $ 5.6 $ 5.0 $ 4.5

GAAP Private Student Loans (ending loans) 1.0 2.1 3.1 4.0

Contractual Value Private Student Loans (ending loans)(2) $4.7 $ 7.7 $ 8.1 $ 8.5

12 Months Ended

(unaudited, $ in millions) 12/31/13

GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (average loans) $4,434

Adjustment for Purchase Accounting 315

Contractual Value Purchased (Private) Credit Impaired Student Loans (average loans)(2) $4,749

GAAP Private Student Loans (average loans) 3,561

Contractual Value Private Student Loans (average loans)(2) $8,310

GAAP Private Student Loan Net Principal Charge-offs $46

Adjustment for Purchased (Private) Credit Impaired Student Loans Net Principal Charge-offs 60

Contractual Private Student Loan Net Principal Charge-offs(3) $106

2013 Net Charge-Off Rate 1.3%

Note(s):

1. Card pre-tax return on assets excluding loss reserve changes is a non-GAAP measure and represents the pre-tax earnings of Discover’s U.S. credit card business excluding changes to the allowance for loan loss reserve. Card pre-tax return on assets excluding loss reserve changes is a meaningful measure to investors because it provides a competitive performance benchmark.

2. The contractual value of the purchased private student loan portfolio is a non-GAAP measure and represents purchased private student loans excluding the purchase accounting discount. The contractual value of the private student loan portfolio is meaningful to investors to understand total outstanding student loan balances without the purchase accounting discount.

3. Contractual private student loan net principal charge-offs is a non-GAAP measure and include net charge-offs on purchase credit impaired loans. Under GAAP any losses on such loans are charged against the nonaccretable difference established in purchased credit impaired accounting and are not reported as charge-offs. Contractual net principal charge-offs is meaningful to investors to see total portfolio losses.

74

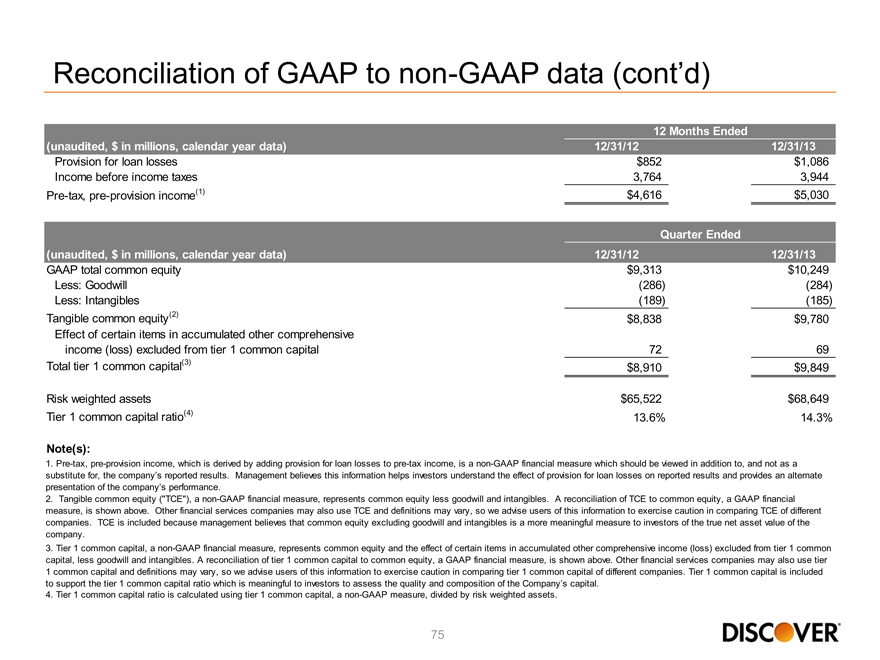

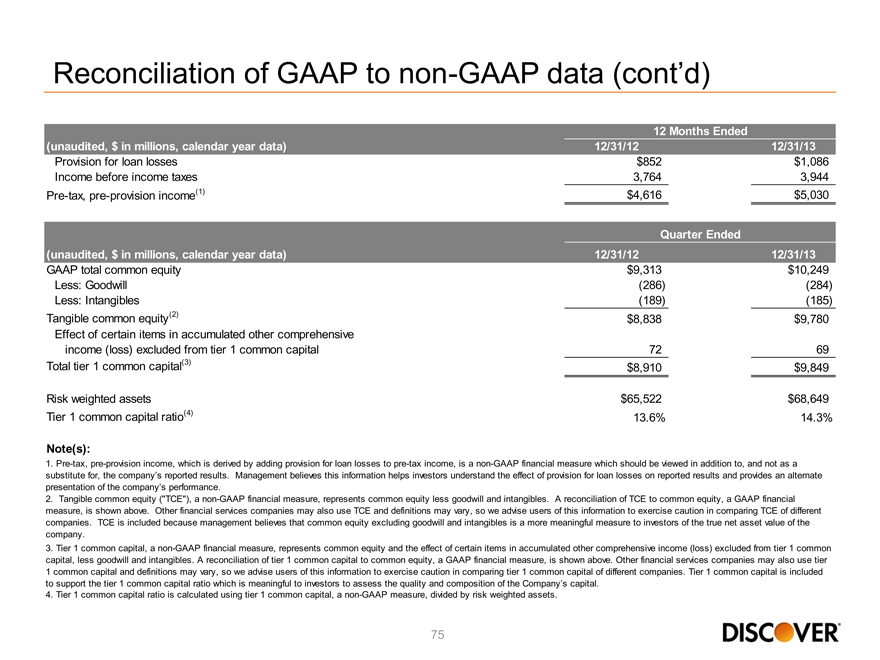

Reconciliation of GAAP to non-GAAP data (cont’d)

(unaudited, $ in millions, calendar year data) 12/31/12 12/31/13

Provision for loan losses $852 $1,086

Income before income taxes 3,764 3,944

Pre-tax, pre-provision income(1) $4,616 $5,030

Quarter Ended

(unaudited, $ in millions, calendar year data) 12/31/12 12/31/13

GAAP total common equity $9,313 $10,249

Less: Goodwill(286)(284)

Less: Intangibles(189)(185)

Tangible common equity(2) $8,838 $9,780

Effect of certain items in accumulated other comprehensive

income (loss) excluded from tier 1 common capital 72 69

Total tier 1 common capital(3) $8,910 $9,849

Risk weighted assets $65,522 $68,649

Tier 1 common capital ratio(4) 13.6% 14.3%

Note(s):

1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the company’s reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results and provides an alternate presentation of the company’s performance.

2. Tangible common equity (“TCE”), a non-GAAP financial measure, represents common equity less goodwill and intangibles. A reconciliation of TCE to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use TCE and definitions may vary, so we advise users of this information to exercise caution in comparing TCE of different companies. TCE is included because management believes that common equity excluding goodwill and intangibles is a more meaningful measure to investors of the true net asset value of the company.

3. Tier 1 common capital, a non-GAAP financial measure, represents common equity and the effect of certain items in accumulated other comprehensive income (loss) excluded from tier 1 common capital, less goodwill and intangibles. A reconciliation of tier 1 common capital to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use tier 1 common capital and definitions may vary, so we advise users of this information to exercise caution in comparing tier 1 common capital of different companies. Tier 1 common capital is included to support the tier 1 common capital ratio which is meaningful to investors to assess the quality and composition of the Company’s capital.

4. Tier 1 common capital ratio is calculated using tier 1 common capital, a non-GAAP measure, divided by risk weighted assets.

75