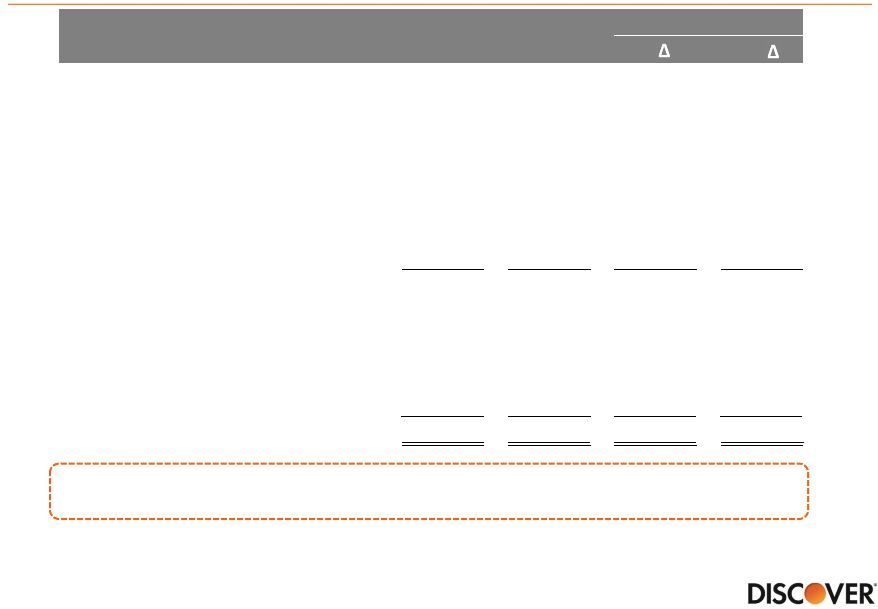

Reconciliation of GAAP to Non-GAAP data (cont’d) Note(s): 1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the company's reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results and provides an alternate presentation of the company's performance 2. Common equity tier 1, a non-GAAP financial measure, represents common equity and the effect of certain items in accumulated other comprehensive income (loss) excluded from common equity tier 1, less goodwill and intangibles. A reconciliation of common equity tier 1 to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use common equity tier 1 and definitions may vary, so we advise users of this information to exercise caution in comparing common equity tier 1 of different companies. Common equity tier 1 is included to support the common equity tier 1 ratio which is meaningful to investors to assess the quality and composition of the Company’s capital 3. Calculations based on fully phased in Basel III 4. Common equity tier 1 ratio is calculated using total common equity tier 1, a non-GAAP measure, divided by risk weighted assets 17 Quarter Ended (unaudited,$ in millions) 6/30/14 6/30/13 Provision for loan losses $360 $240 Income before income taxes 1,015 981 Pre-tax, pre-provision income (1) $1,375 $1,221 (unaudited, $ in millions) 6/30/14 Common Equity Tier 1 Capital Reconciliation GAAP total common equity $10,821 Effect of certain items in accumulated other comprehensive income (loss) excluded from tier 1 common equity 73 Less: ineligible goodwill and intangible assets (439) Estimated total common equity tier 1 (2)(3) $10,455 Estimated risk weighted assets (3) $69,104 Estimated common equity tier 1 ratio (3)(4) 15.1% |