Exhibit 99.3 3Q20 Financial Results October 21, 2020 ©2020 DISCOVER FINANCIAL SERVICES

Notice The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. For additional financial, statistical, and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement included as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website (www.discover.com) and the SEC’s website (www.sec.gov). The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, "Risk Factors" and "Management’s Discussion & Analysis of Financial Condition and Results of Operations" in the company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 and March 31, 2020, which is filed with the SEC and available at the SEC's website (www.sec.gov) and subsequent reports on Forms 8-K and 10-Q, including the Company's Current Report on Form 8-K filed today with the SEC. The Company does not undertake to update or revise forward-looking statements as more information becomes available. 2

3Q20 Highlights • Actions taken during the first half of 2020 to mitigate credit risk and reduce costs contributed to solid results in the quarter • Seeing positive trends in sales volume with a return to growth in September • Minimal reserve build in 3Q20 as macroeconomic factors improved; however, outlook for the economy remains uncertain • Well-positioned for growth when sustained recovery is evident ◦ Continued investment in core capabilities including analytics and data science ◦ Implemented tighter criteria for new account growth in current environment • Business model generates high returns; remain committed to returning capital to shareholders • 3Q20 Net Income of $771MM; diluted EPS of $2.45 3

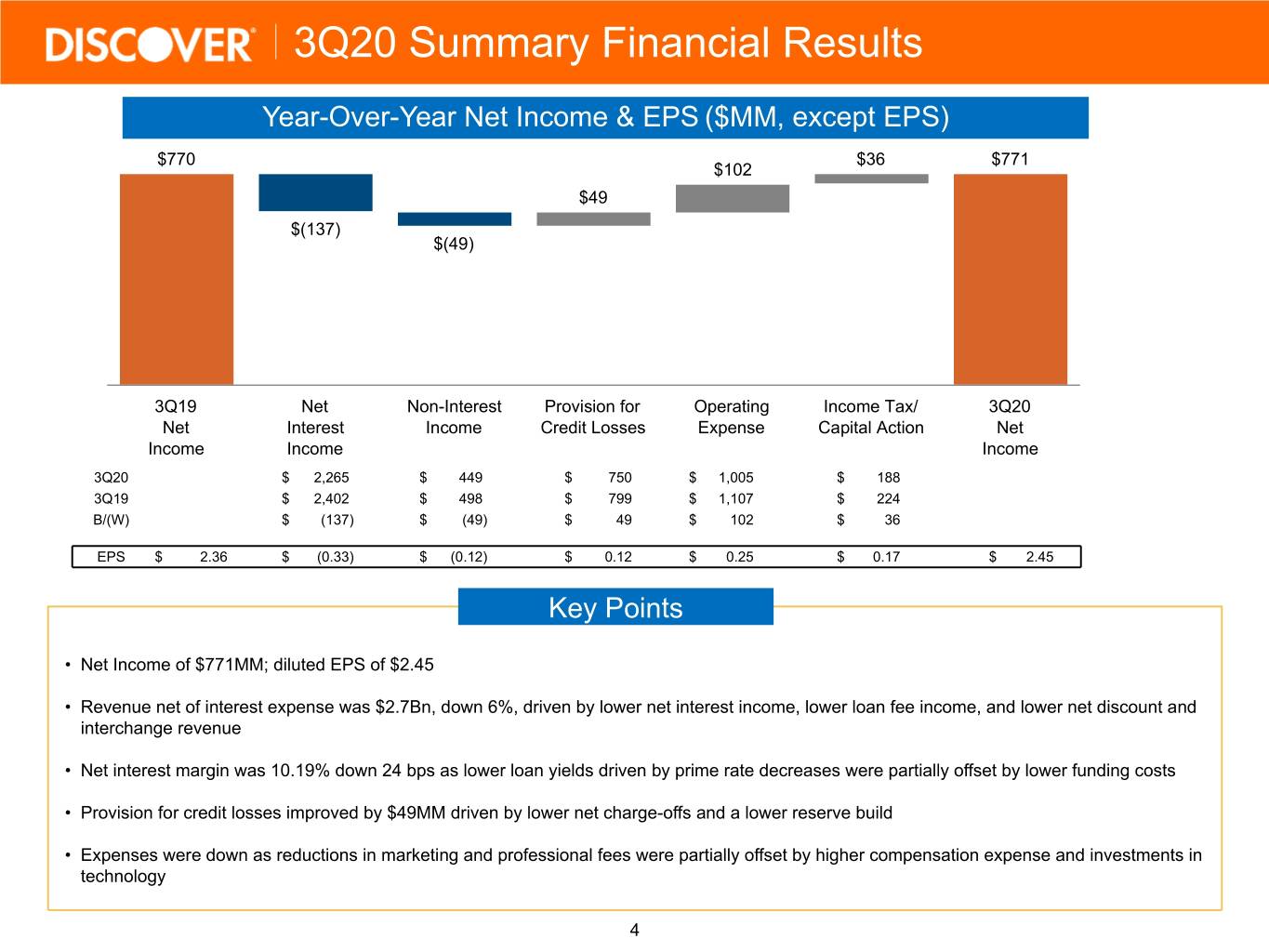

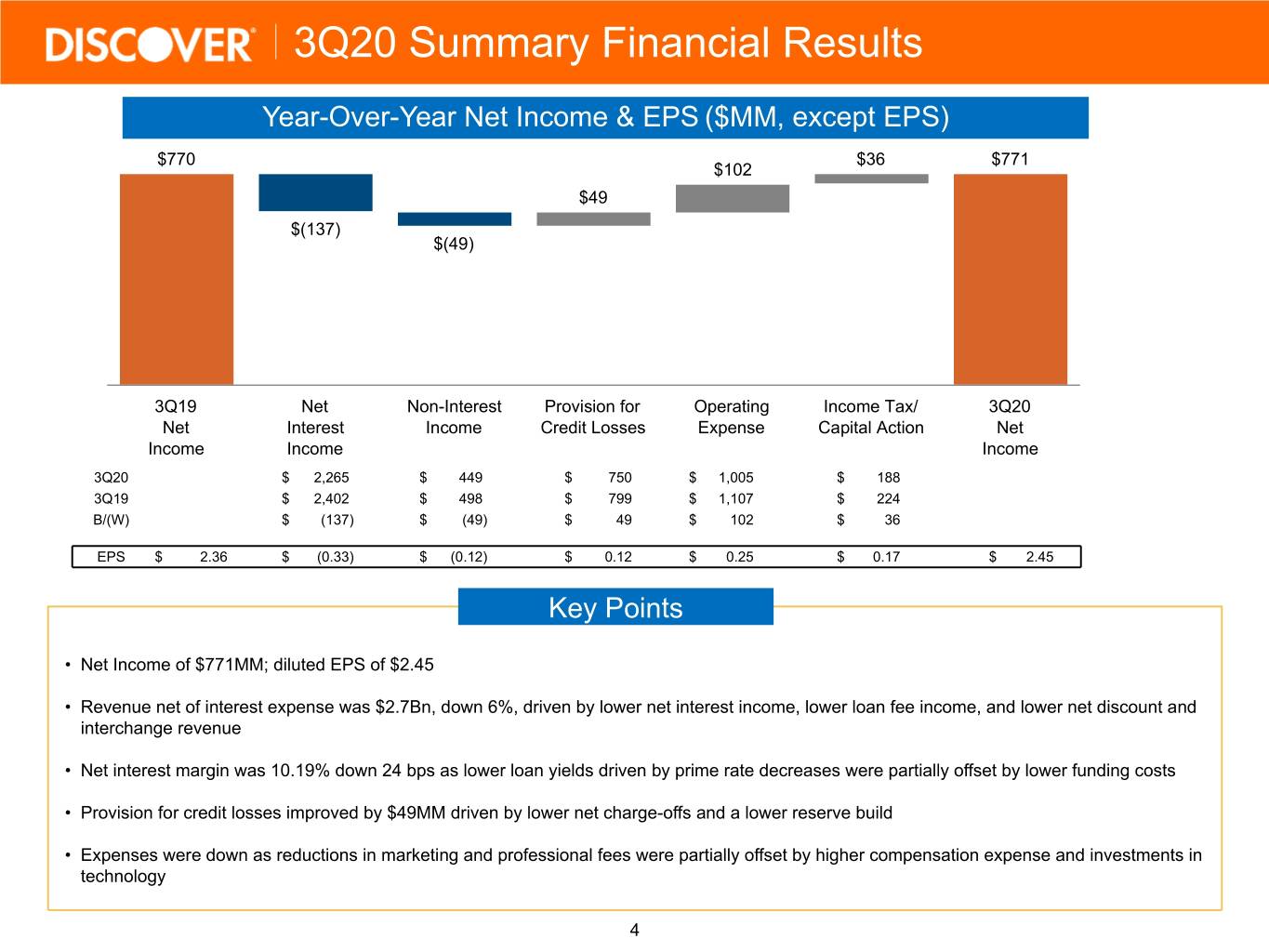

3Q20 Summary Financial Results Year-Over-Year Net Income & EPS ($MM, except EPS) $770 $36 $771 $102 $49 $(137) $(49) 3Q19 Net Non-Interest Provision for Operating Income Tax/ 3Q20 Net Interest Income Credit Losses Expense Capital Action Net Income Income Income 3Q20 $ 2,265 $ 449 $ 750 $ 1,005 $ 188 3Q19 $ 2,402 $ 498 $ 799 $ 1,107 $ 224 B/(W) $ (137) $ (49) $ 49 $ 102 $ 36 EPS $ 2.36 $ (0.33) $ (0.12) $ 0.12 $ 0.25 $ 0.17 $ 2.45 Key Points • Net Income of $771MM; diluted EPS of $2.45 • Revenue net of interest expense was $2.7Bn, down 6%, driven by lower net interest income, lower loan fee income, and lower net discount and interchange revenue • Net interest margin was 10.19% down 24 bps as lower loan yields driven by prime rate decreases were partially offset by lower funding costs • Provision for credit losses improved by $49MM driven by lower net charge-offs and a lower reserve build • Expenses were down as reductions in marketing and professional fees were partially offset by higher compensation expense and investments in technology 4

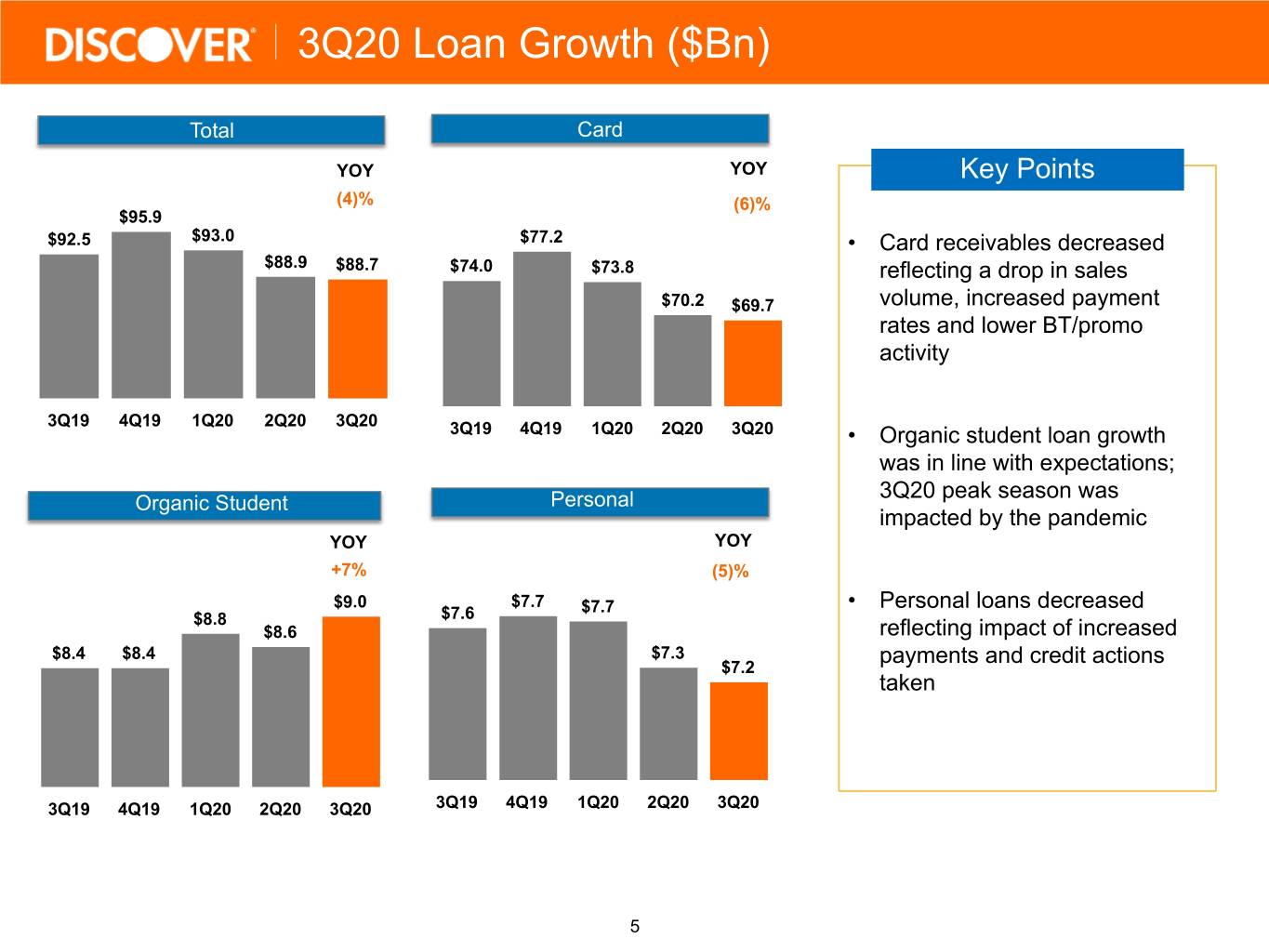

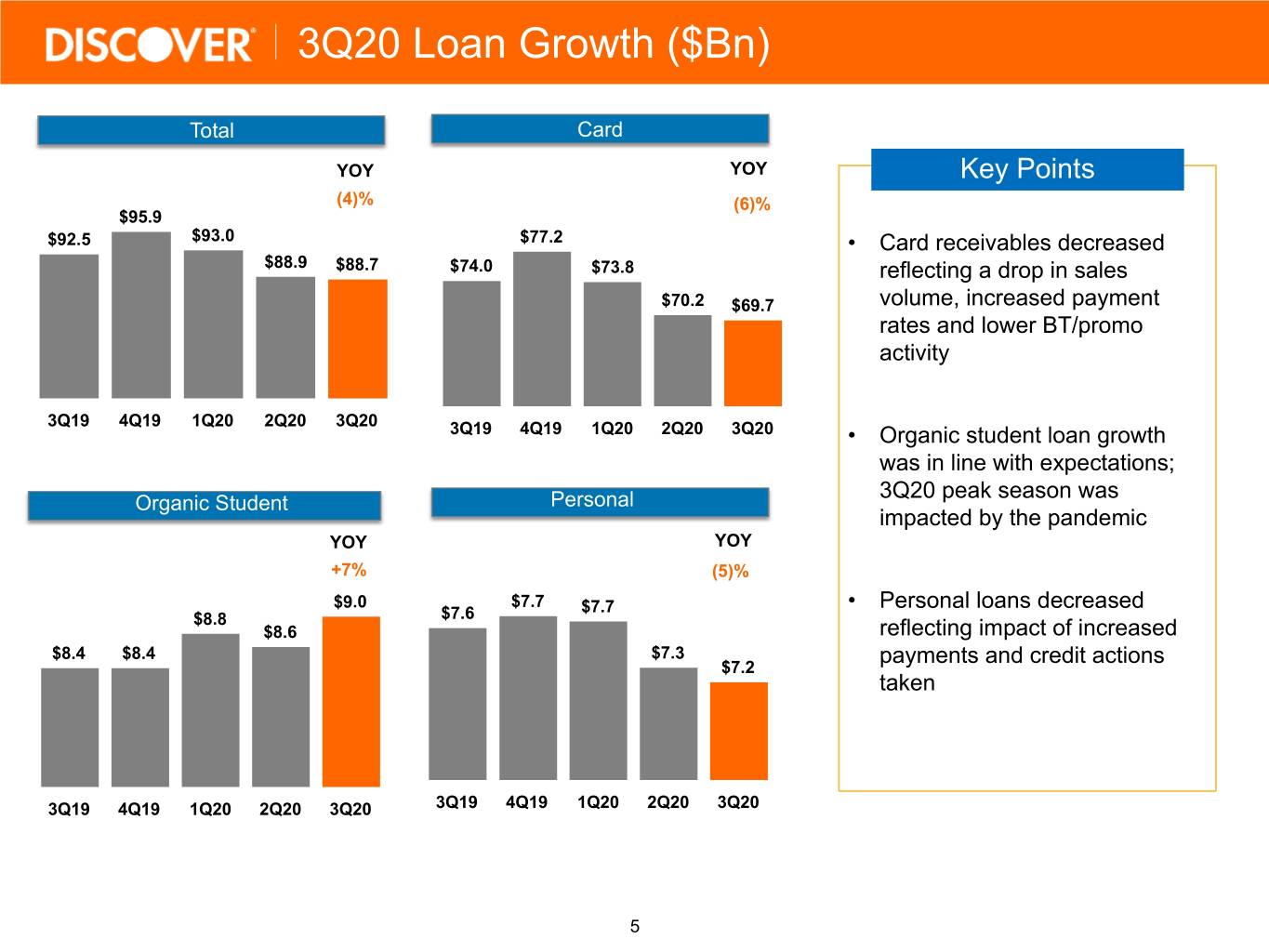

3Q20 Loan Growth ($Bn) Total Card YOY YOY Key Points (4)% (6)% $95.9 $92.5 $93.0 $77.2 • Card receivables decreased $88.9 $88.7 $74.0 $73.8 reflecting a drop in sales $70.2 $69.7 volume, increased payment rates and lower BT/promo activity 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 • Organic student loan growth was in line with expectations; 3Q20 peak season was Organic Student Personal impacted by the pandemic YOY YOY +7% (5)% $9.0 $7.7 $7.7 • Personal loans decreased $8.8 $7.6 $8.6 reflecting impact of increased $8.4 $8.4 $7.3 payments and credit actions $7.2 taken 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 5

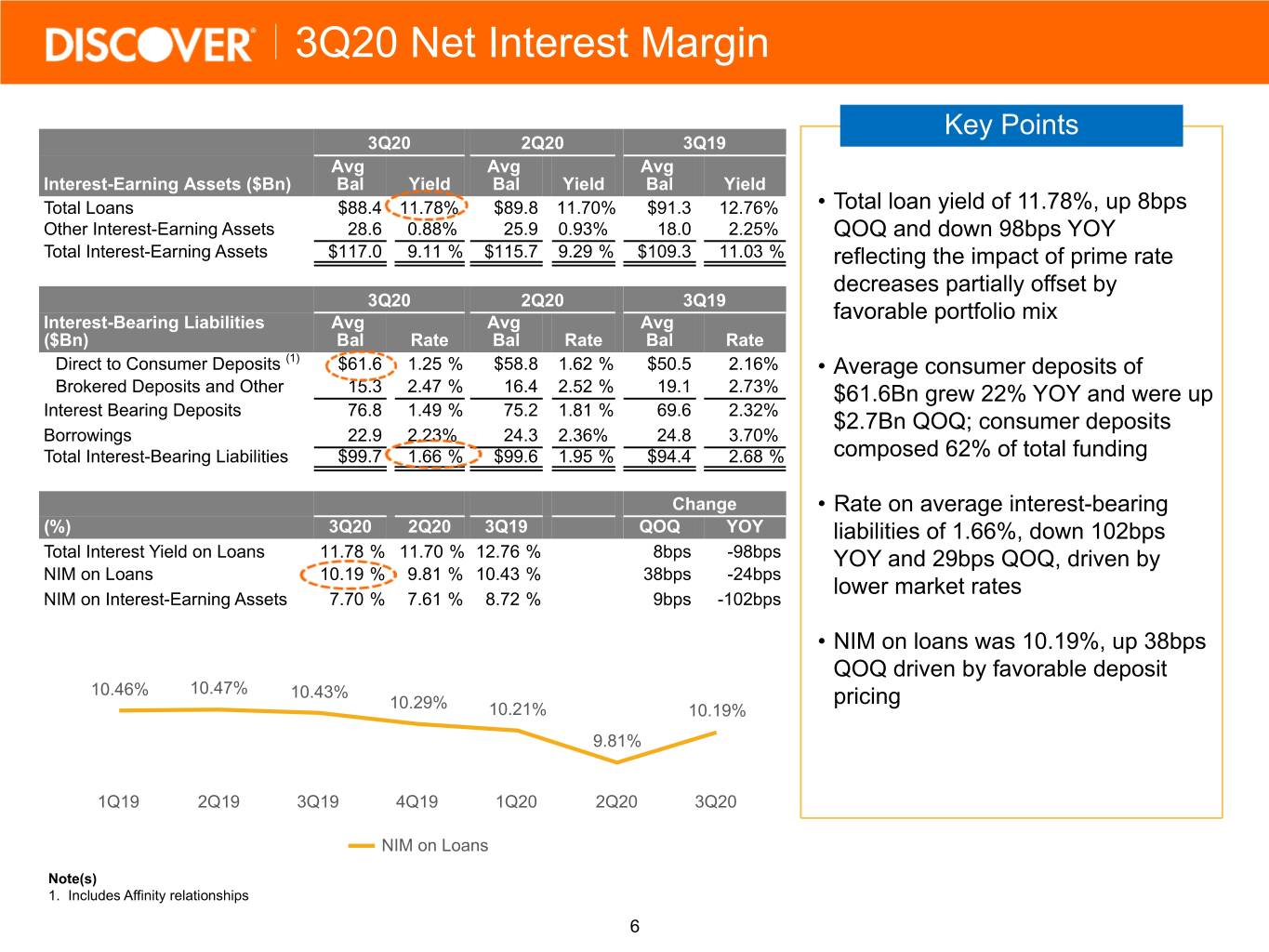

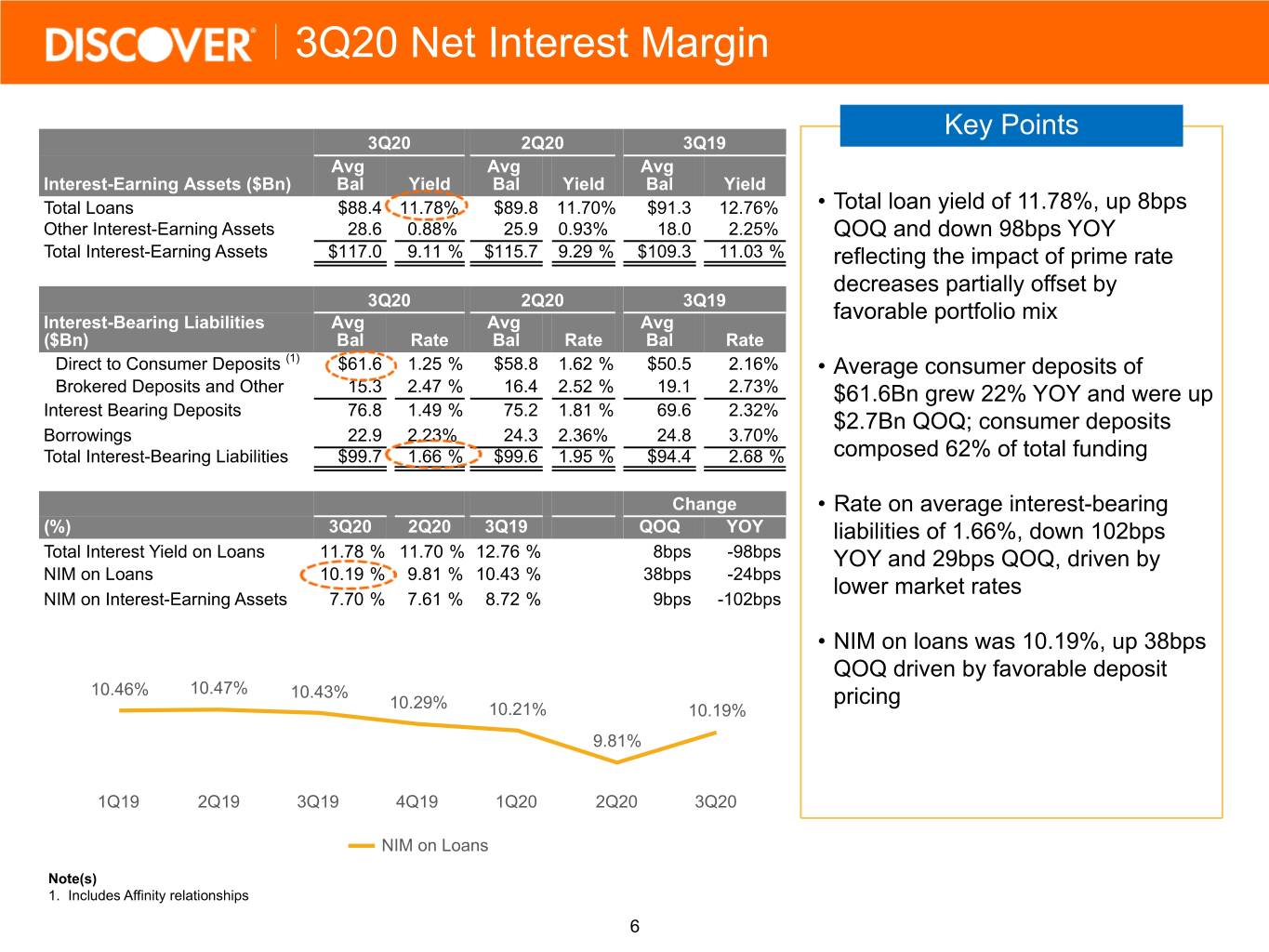

3Q20 Net Interest Margin Key Points 3Q20 2Q20 3Q19 Avg Avg Avg Interest-Earning Assets ($Bn) Bal Yield Bal Yield Bal Yield Total Loans $88.4 11.78% $89.8 11.70% $91.3 12.76% • Total loan yield of 11.78%, up 8bps Other Interest-Earning Assets 28.6 0.88% 25.9 0.93% 18.0 2.25% QOQ and down 98bps YOY Total Interest-Earning Assets $117.0 9.11 % $115.7 9.29 % $109.3 11.03 % reflecting the impact of prime rate decreases partially offset by 3Q20 2Q20 3Q19 Interest-Bearing Liabilities Avg Avg Avg favorable portfolio mix ($Bn) Bal Rate Bal Rate Bal Rate Direct to Consumer Deposits (1) $61.6 1.25 % $58.8 1.62 % $50.5 2.16% • Average consumer deposits of Brokered Deposits and Other 15.3 2.47 % 16.4 2.52 % 19.1 2.73% $61.6Bn grew 22% YOY and were up Interest Bearing Deposits 76.8 1.49 % 75.2 1.81 % 69.6 2.32% $2.7Bn QOQ; consumer deposits Borrowings 22.9 2.23% 24.3 2.36% 24.8 3.70% Total Interest-Bearing Liabilities $99.7 1.66 % $99.6 1.95 % $94.4 2.68 % composed 62% of total funding Change • Rate on average interest-bearing (%) 3Q20 2Q20 3Q19 QOQ YOY liabilities of 1.66%, down 102bps Total Interest Yield on Loans 11.78 % 11.70 % 12.76 % 8bps -98bps YOY and 29bps QOQ, driven by NIM on Loans 10.19 % 9.81 % 10.43 % 38bps -24bps lower market rates NIM on Interest-Earning Assets 7.70 % 7.61 % 8.72 % 9bps -102bps • NIM on loans was 10.19%, up 38bps QOQ driven by favorable deposit 10.46% 10.47% 10.43% pricing 10.29% 10.21% 10.19% 9.81% 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 NIM on Loans Note(s) 1. Includes Affinity relationships 6

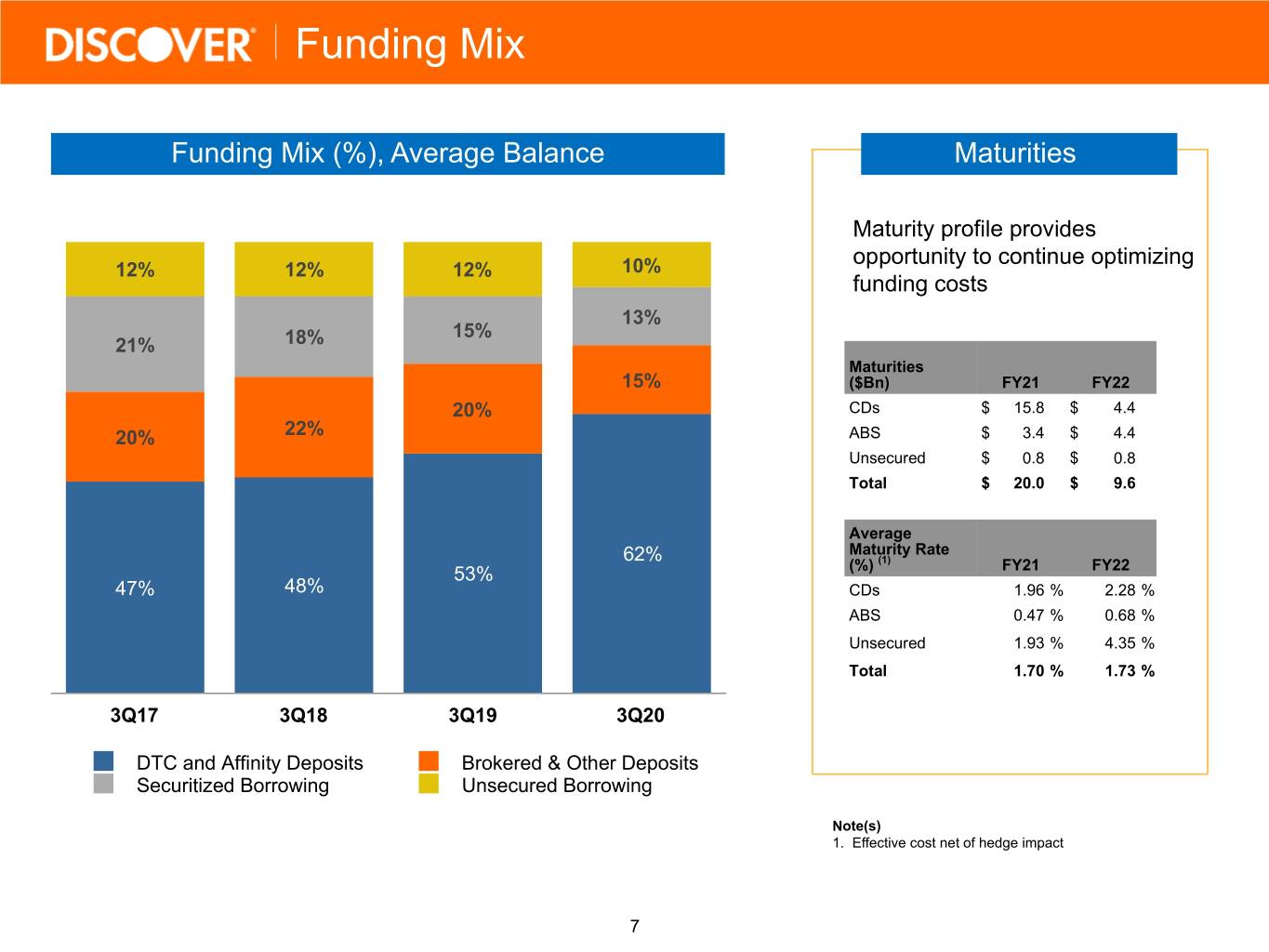

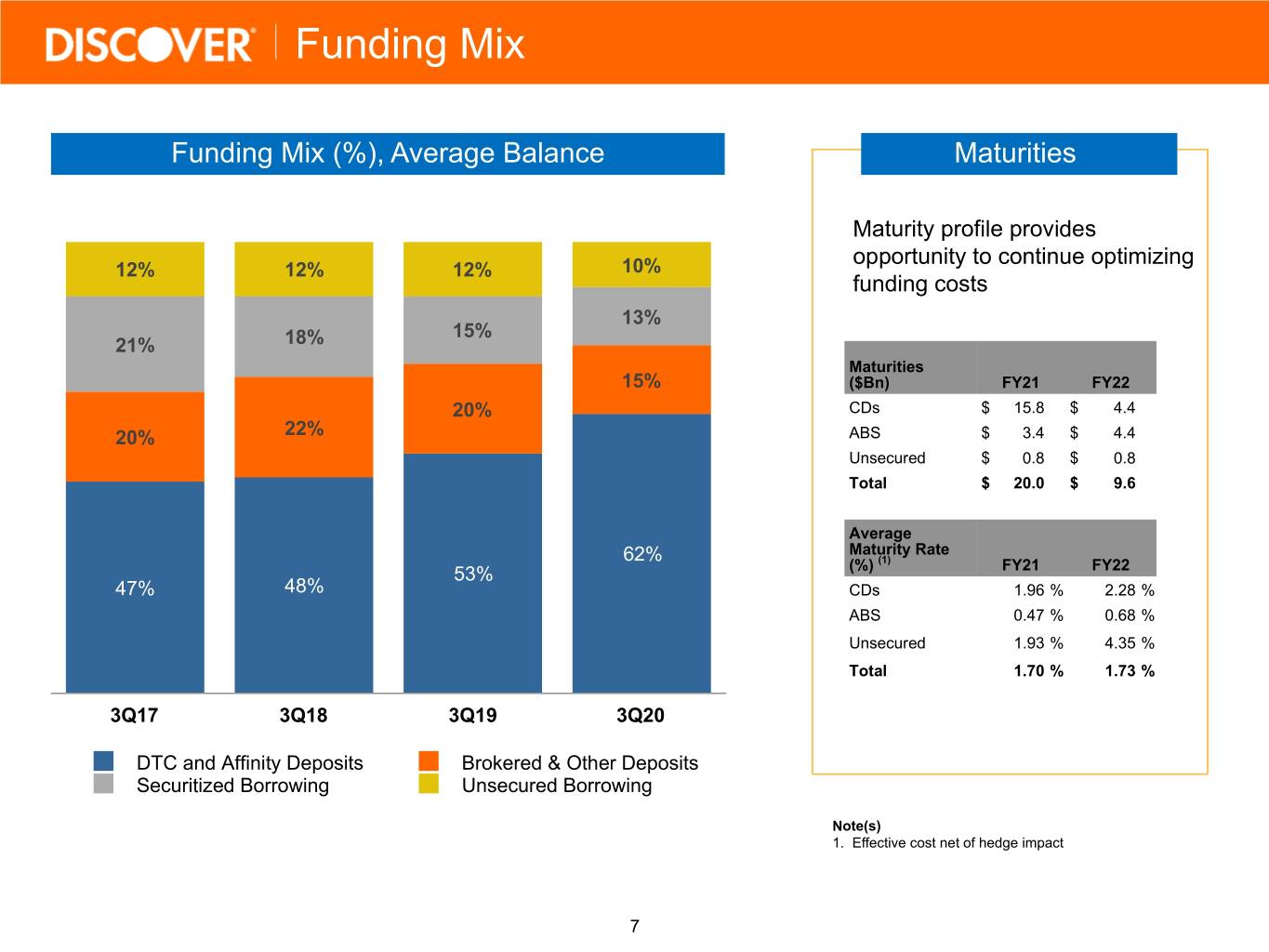

Funding Mix Funding Mix (%), Average Balance Maturities Maturity profile provides opportunity to continue optimizing 12% 12% 12% 10% funding costs 13% 15% 21% 18% Maturities 15% ($Bn) FY21 FY22 20% CDs $ 15.8 $ 4.4 20% 22% ABS $ 3.4 $ 4.4 Unsecured $ 0.8 $ 0.8 Total $ 20.0 $ 9.6 Average Maturity Rate 62% (1) 53% (%) FY21 FY22 47% 48% CDs 1.96 % 2.28 % ABS 0.47 % 0.68 % Unsecured 1.93 % 4.35 % Total 1.70 % 1.73 % 3Q17 3Q18 3Q19 3Q20 DTC and Affinity Deposits Brokered & Other Deposits Securitized Borrowing Unsecured Borrowing Note(s) 1. Effective cost net of hedge impact 7

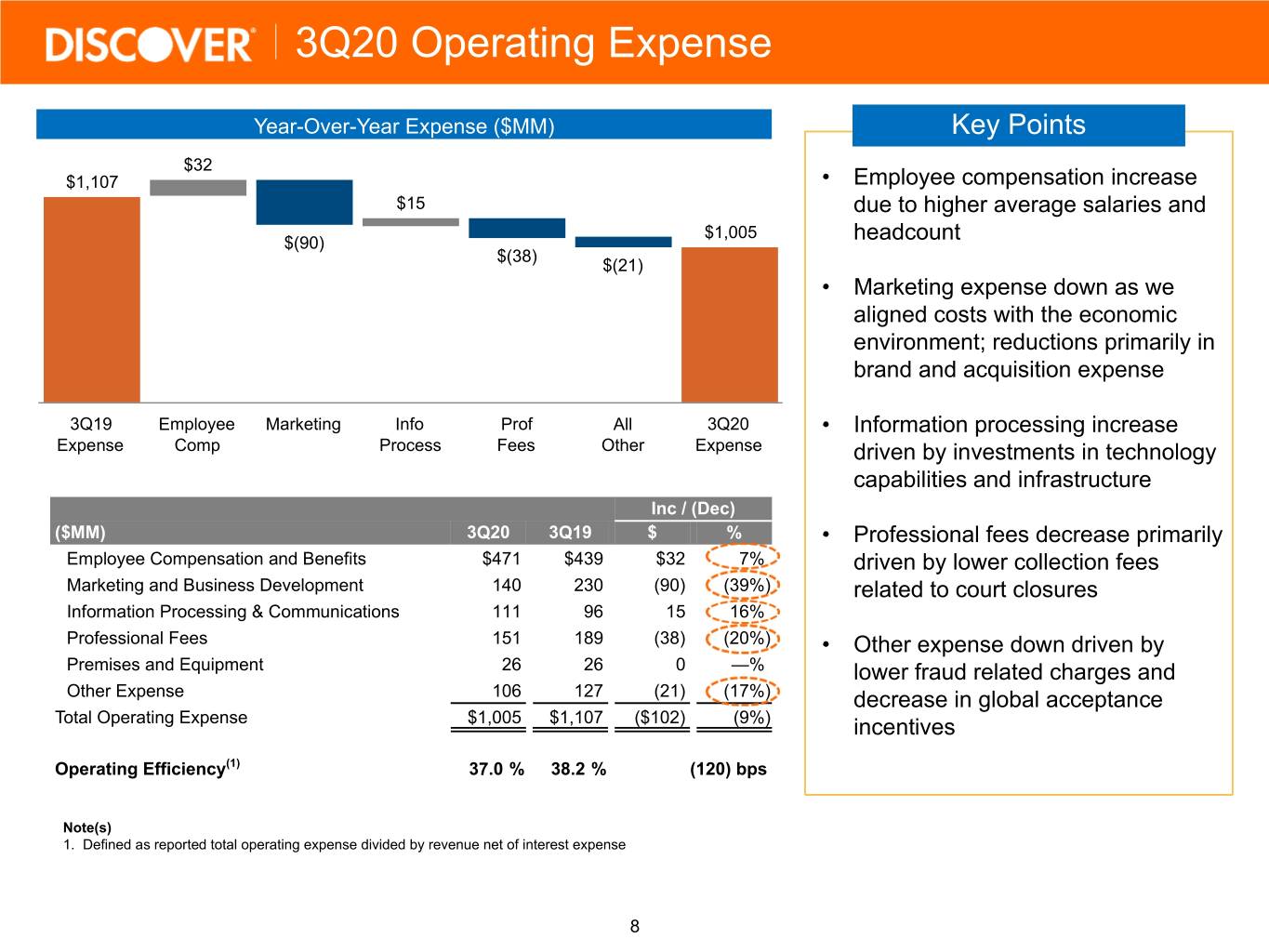

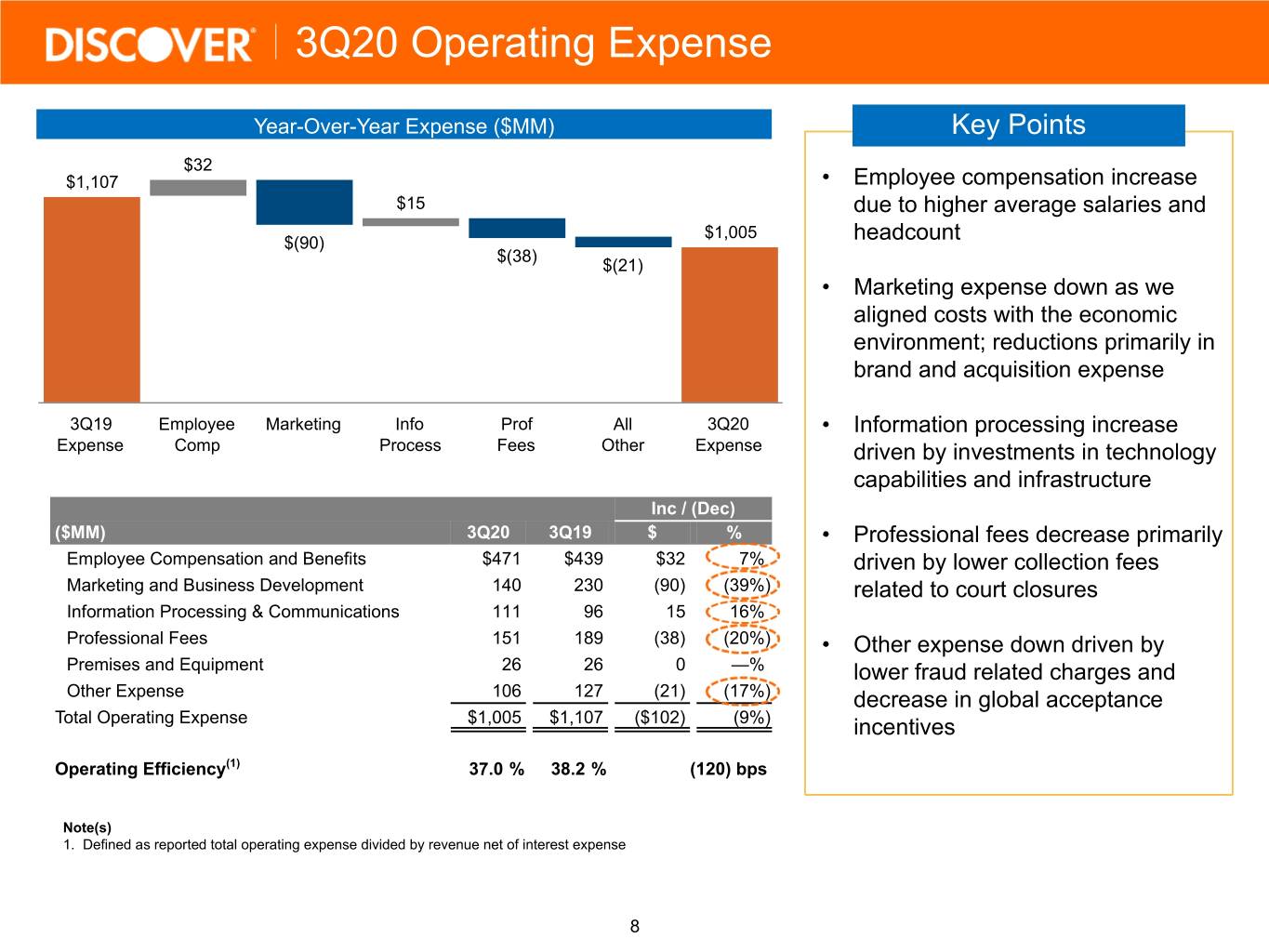

3Q20 Operating Expense Year-Over-Year Expense ($MM) Key Points $32 $1,107 • Employee compensation increase $15 due to higher average salaries and $1,005 $(90) headcount $(38) $(21) • Marketing expense down as we aligned costs with the economic environment; reductions primarily in brand and acquisition expense 3Q19 Employee Marketing Info Prof All 3Q20 • Information processing increase Expense Comp Process Fees Other Expense driven by investments in technology capabilities and infrastructure Inc / (Dec) ($MM) 3Q20 3Q19 $ % • Professional fees decrease primarily Employee Compensation and Benefits $471 $439 $32 7% driven by lower collection fees Marketing and Business Development 140 230 (90) (39%) related to court closures Information Processing & Communications 111 96 15 16% Professional Fees 151 189 (38) (20%) • Other expense down driven by Premises and Equipment 26 26 0 —% lower fraud related charges and Other Expense 106 127 (21) (17%) decrease in global acceptance Total Operating Expense $1,005 $1,107 ($102) (9%) incentives Operating Efficiency(1) 37.0 % 38.2 % (120) bps Note(s) 1. Defined as reported total operating expense divided by revenue net of interest expense 8

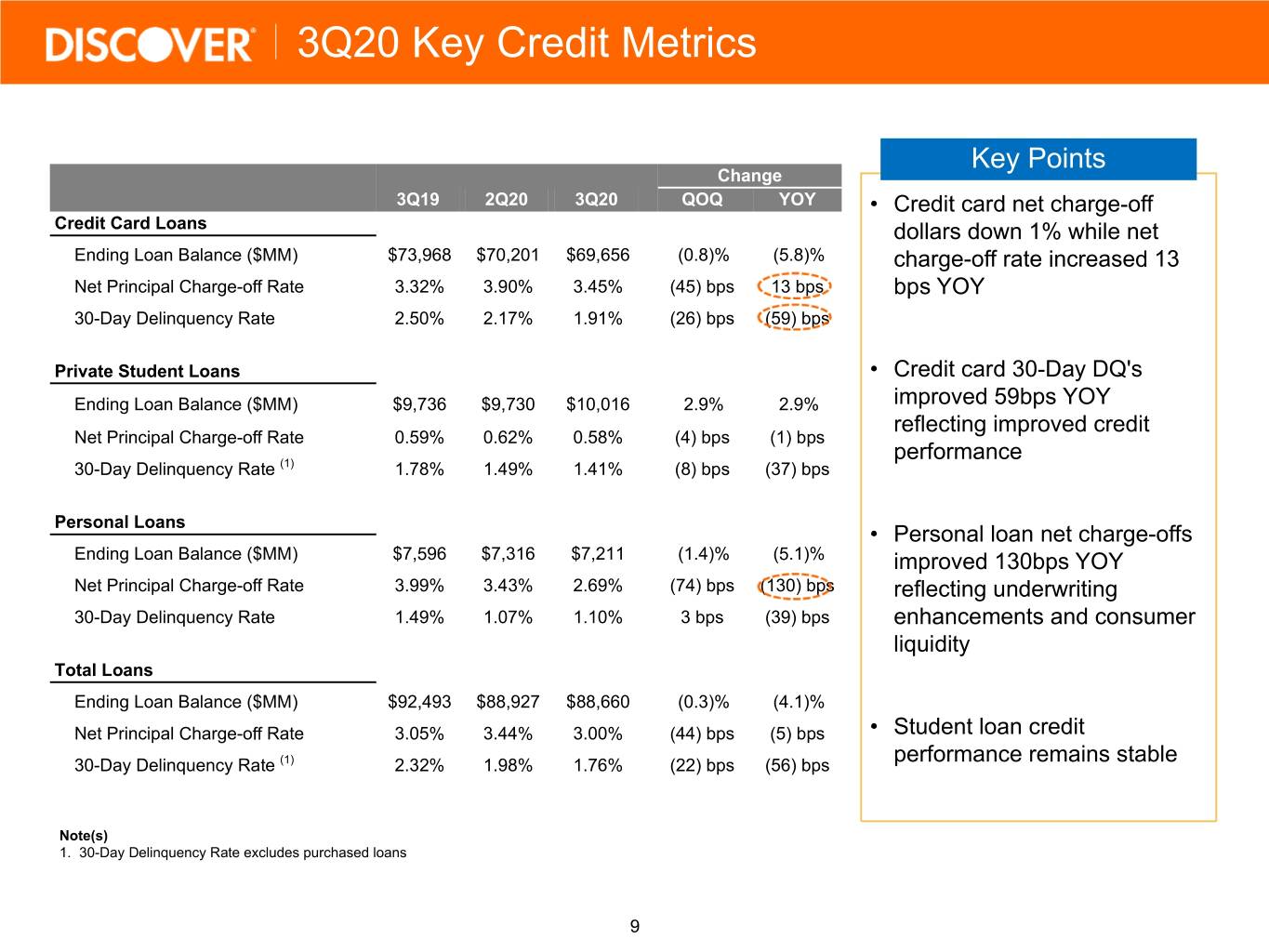

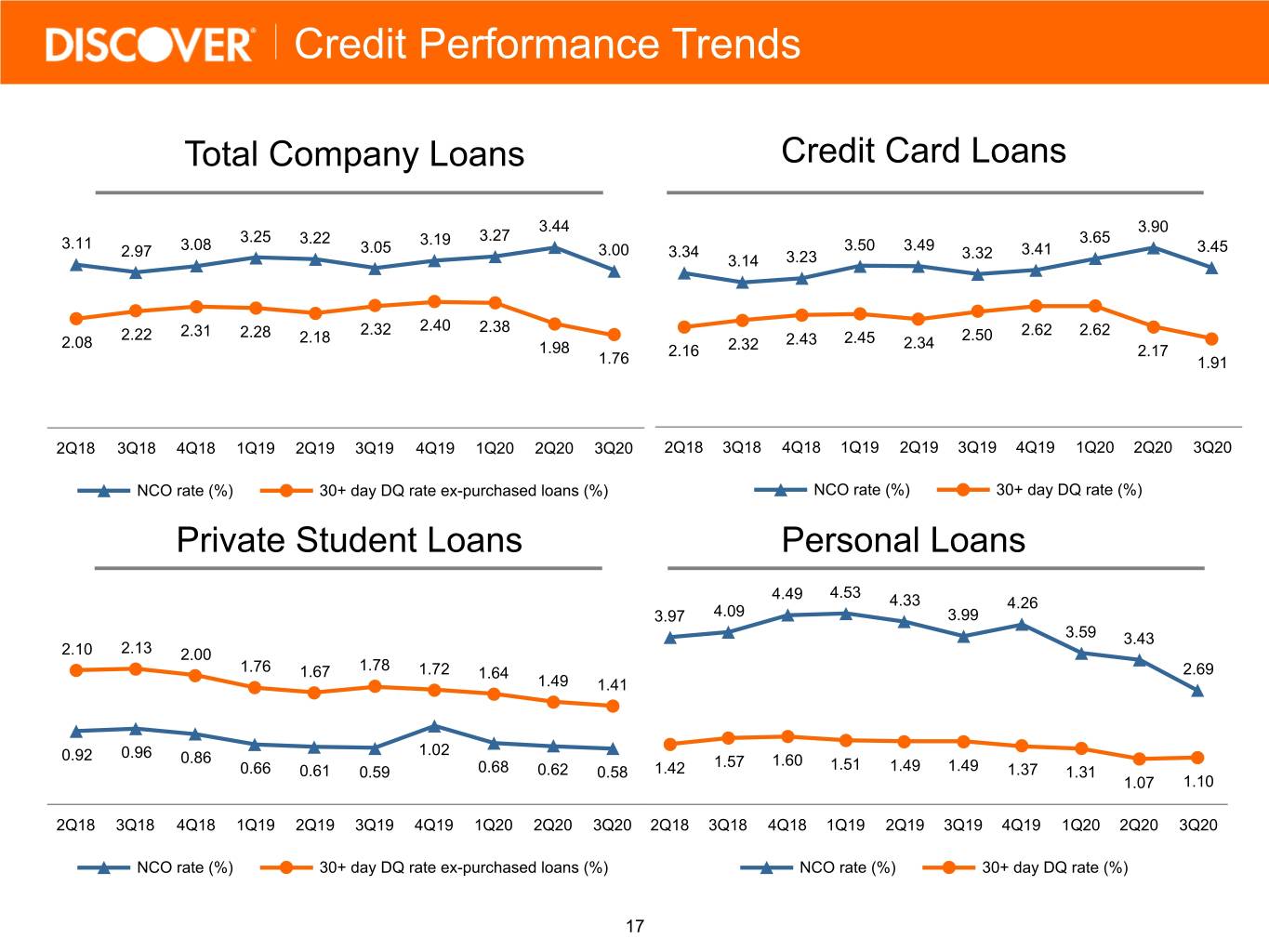

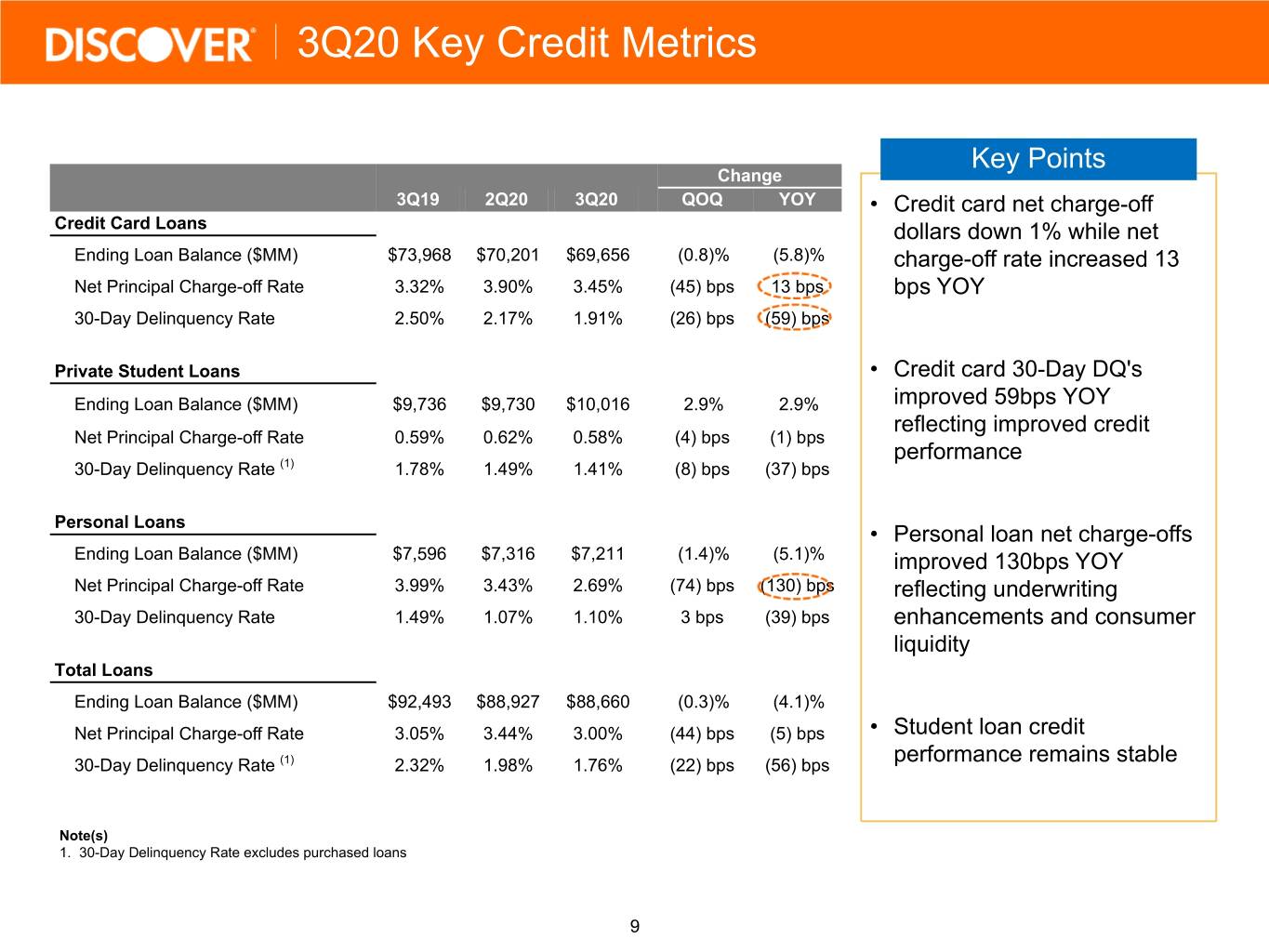

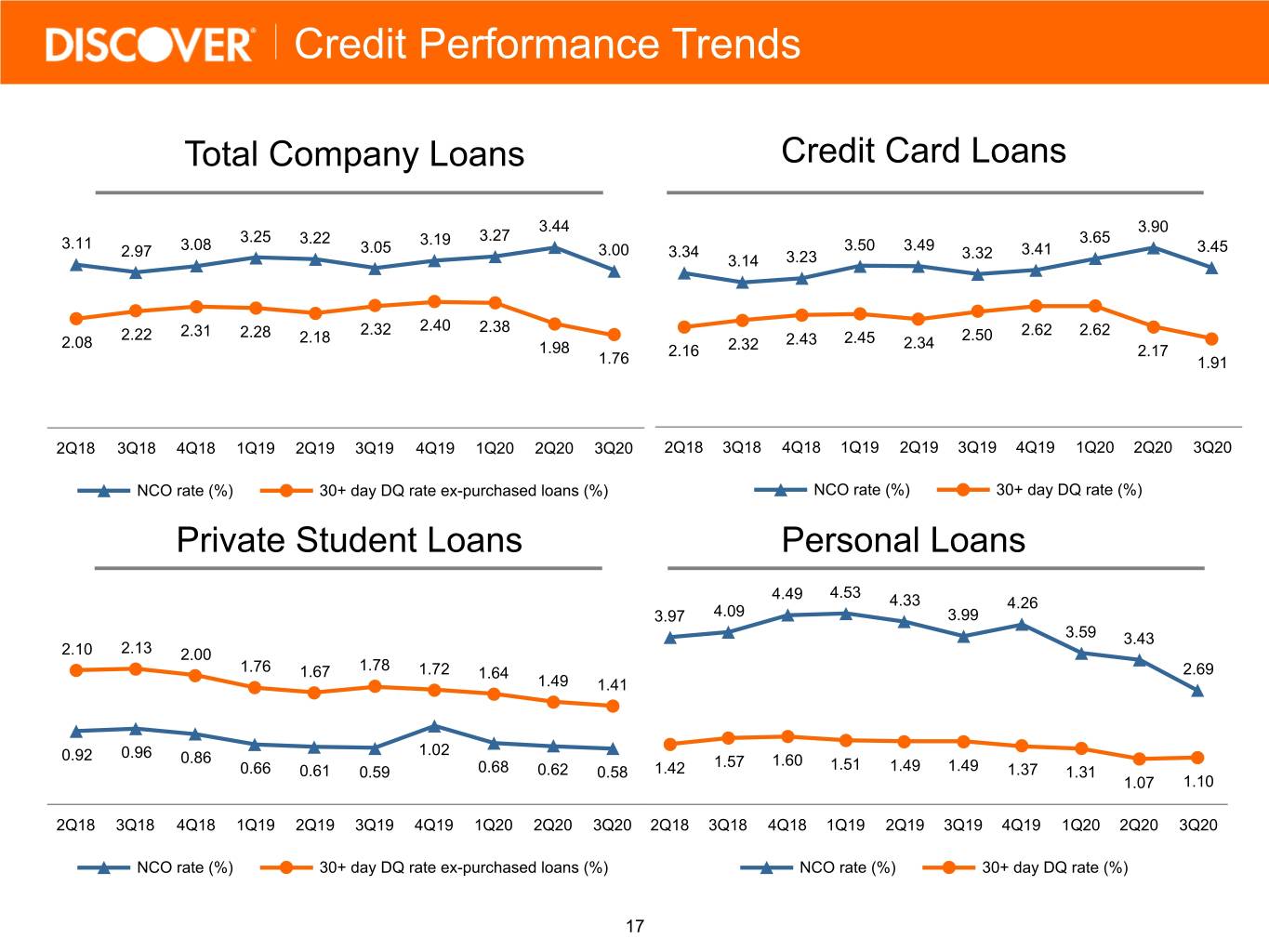

3Q20 Key Credit Metrics Key Points Change 3Q19 2Q20 3Q20 QOQ YOY • Credit card net charge-off Credit Card Loans dollars down 1% while net Ending Loan Balance ($MM) $73,968 $70,201 $69,656 (0.8)% (5.8)% charge-off rate increased 13 Net Principal Charge-off Rate 3.32% 3.90% 3.45% (45) bps 13 bps bps YOY 30-Day Delinquency Rate 2.50% 2.17% 1.91% (26) bps (59) bps Private Student Loans • Credit card 30-Day DQ's Ending Loan Balance ($MM) $9,736 $9,730 $10,016 2.9% 2.9% improved 59bps YOY reflecting improved credit Net Principal Charge-off Rate 0.59% 0.62% 0.58% (4) bps (1) bps performance 30-Day Delinquency Rate (1) 1.78% 1.49% 1.41% (8) bps (37) bps Personal Loans • Personal loan net charge-offs Ending Loan Balance ($MM) $7,596 $7,316 $7,211 (1.4)% (5.1)% improved 130bps YOY Net Principal Charge-off Rate 3.99% 3.43% 2.69% (74) bps (130) bps reflecting underwriting 30-Day Delinquency Rate 1.49% 1.07% 1.10% 3 bps (39) bps enhancements and consumer liquidity Total Loans Ending Loan Balance ($MM) $92,493 $88,927 $88,660 (0.3)% (4.1)% Net Principal Charge-off Rate 3.05% 3.44% 3.00% (44) bps (5) bps • Student loan credit 30-Day Delinquency Rate (1) 2.32% 1.98% 1.76% (22) bps (56) bps performance remains stable Note(s) 1. 30-Day Delinquency Rate excludes purchased loans 9

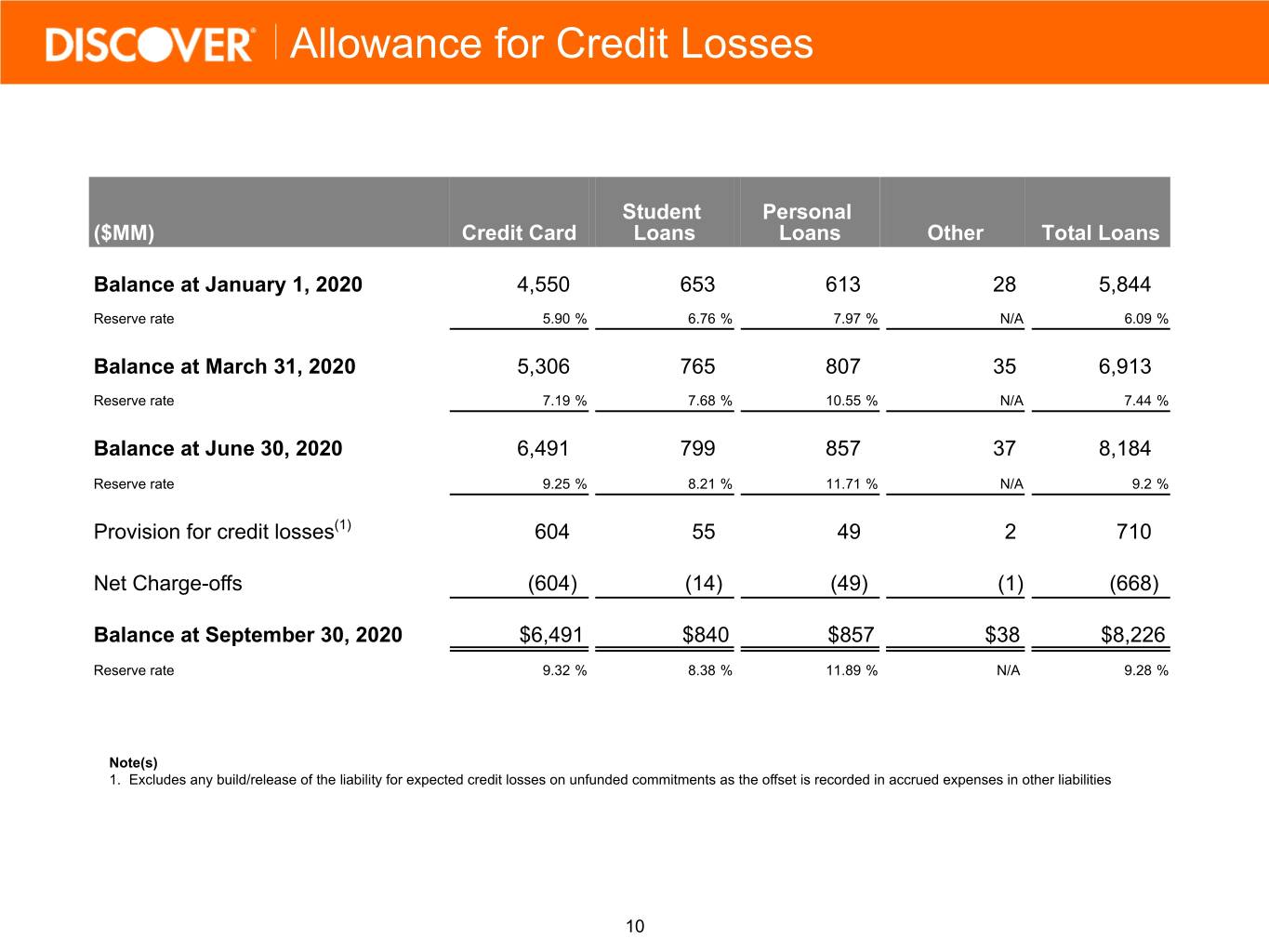

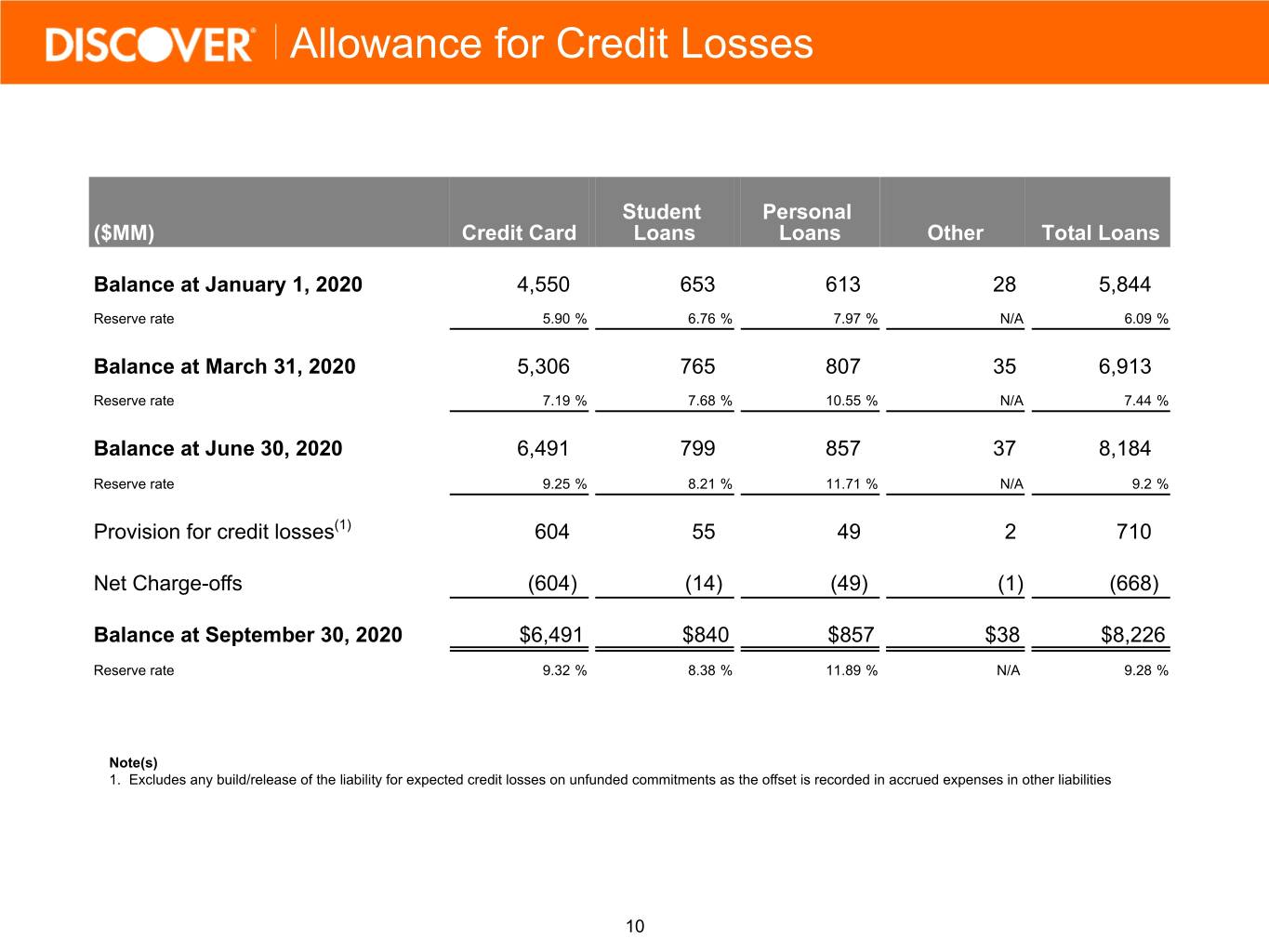

Allowance for Credit Losses Student Personal ($MM) Credit Card Loans Loans Other Total Loans Balance at January 1, 2020 4,550 653 613 28 5,844 Reserve rate 5.90 % 6.76 % 7.97 % N/A 6.09 % Balance at March 31, 2020 5,306 765 807 35 6,913 Reserve rate 7.19 % 7.68 % 10.55 % N/A 7.44 % Balance at June 30, 2020 6,491 799 857 37 8,184 Reserve rate 9.25 % 8.21 % 11.71 % N/A 9.2 % Provision for credit losses(1) 604 55 49 2 710 Net Charge-offs (604) (14) (49) (1) (668) Balance at September 30, 2020 $6,491 $840 $857 $38 $8,226 Reserve rate 9.32 % 8.38 % 11.89 % N/A 9.28 % Note(s) 1. Excludes any build/release of the liability for expected credit losses on unfunded commitments as the offset is recorded in accrued expenses in other liabilities 10

Capital Trends 12.2 11.7 11.5 11.4 11.4 11.4 11.3 11.1 11.2 165 123 109 99 93 88 82 79 77 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 Common Equity Tier 1 Payout Ratio(2) (%) (CET1) Capital Ratio(1) (%) Note(s) 1. Based on the final rule published September 30, 2020. Capital ratios reflect delay in the recognition of the impact of CECL reserves on regulatory capital for two years in accordance with the final rule 2. Payout Ratio is displayed on a trailing twelve month basis. This represents the trailing twelve months’ Capital Return to Common Stockholders divided by the trailing twelve months’ Net Income Allocated to Common Stockholders 11

Appendix

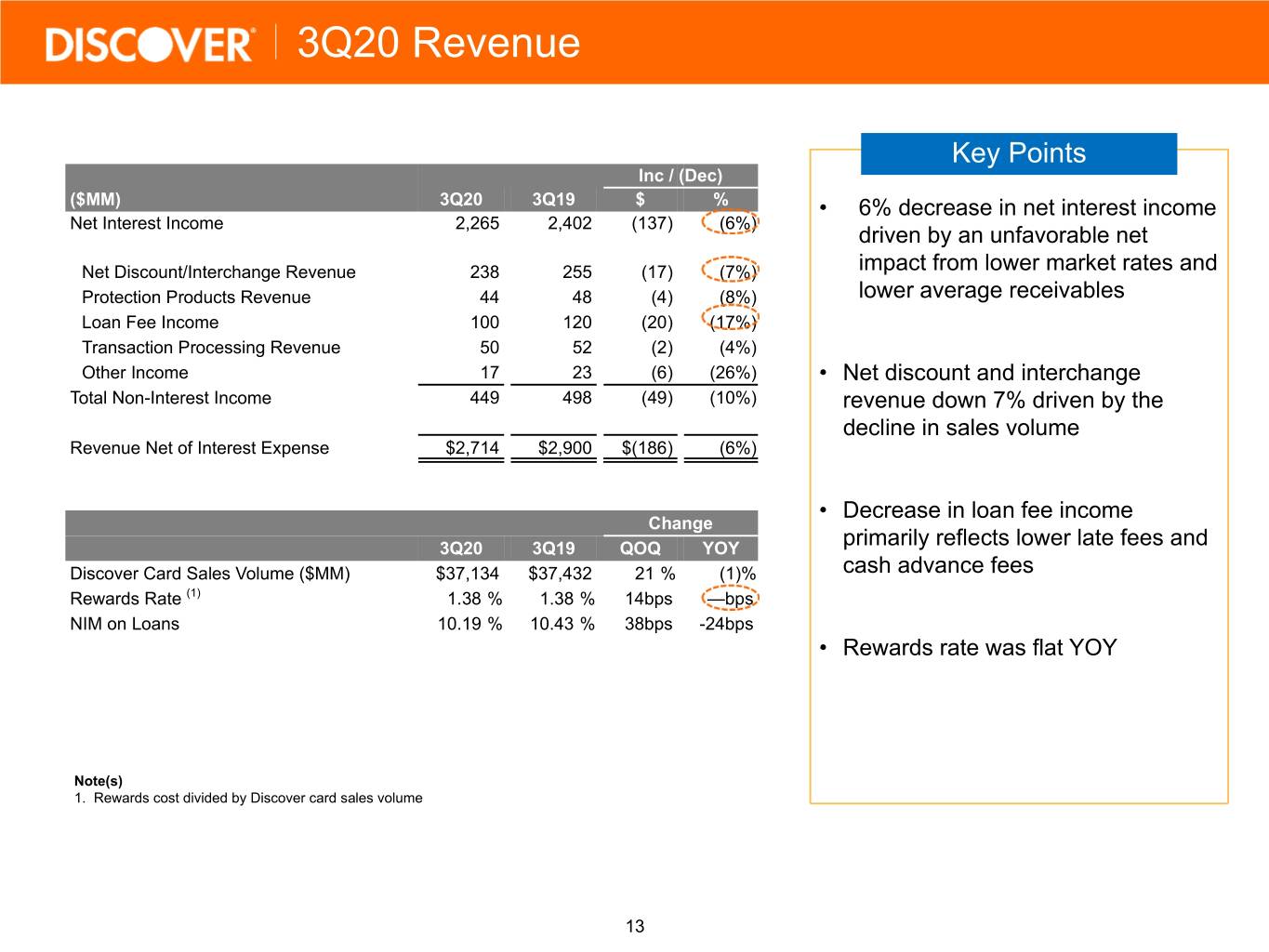

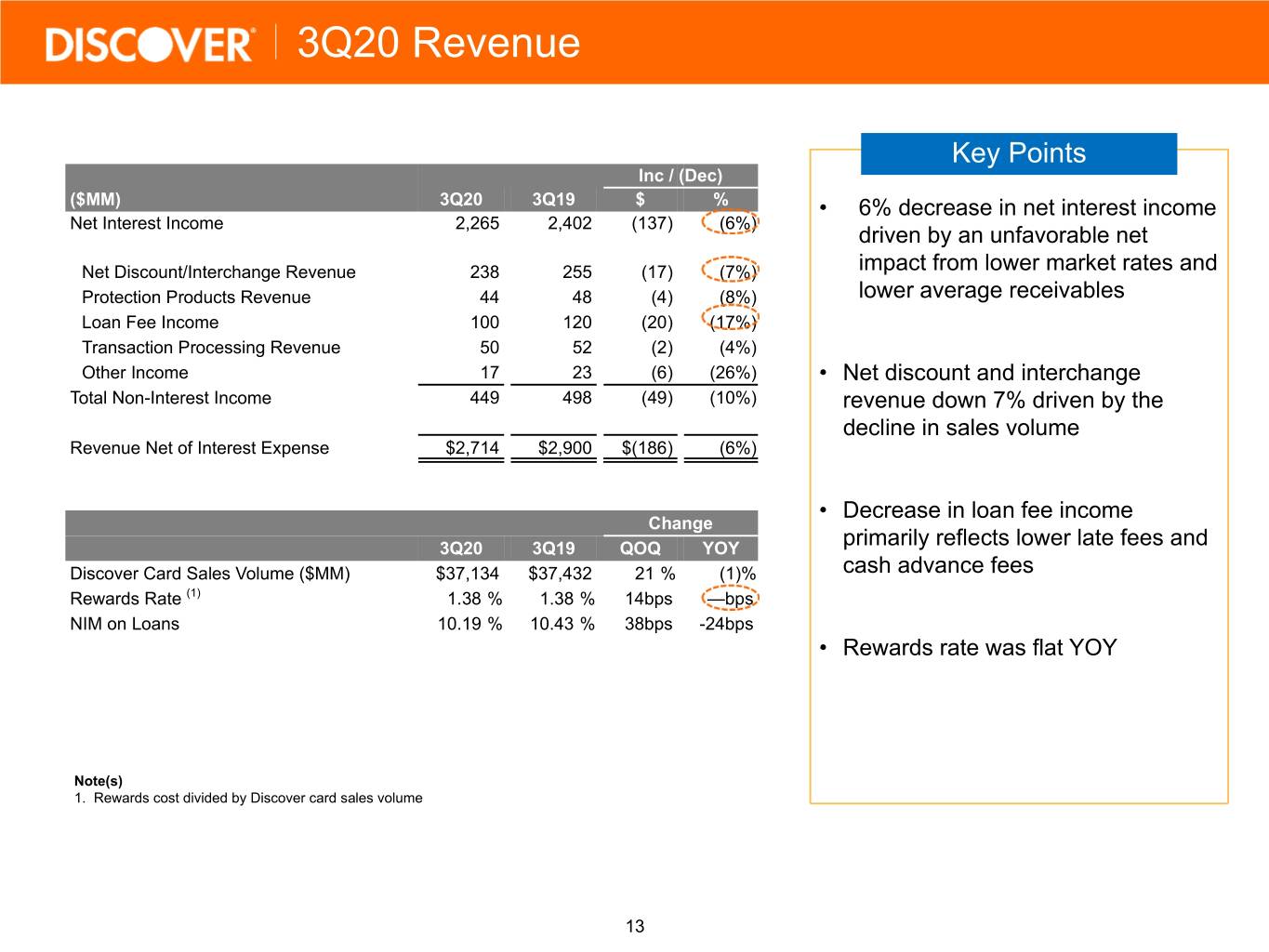

3Q20 Revenue Key Points Inc / (Dec) ($MM) 3Q20 3Q19 $ % • 6% decrease in net interest income Net Interest Income 2,265 2,402 (137) (6%) driven by an unfavorable net Net Discount/Interchange Revenue 238 255 (17) (7%) impact from lower market rates and Protection Products Revenue 44 48 (4) (8%) lower average receivables Loan Fee Income 100 120 (20) (17%) Transaction Processing Revenue 50 52 (2) (4%) Other Income 17 23 (6) (26%) • Net discount and interchange Total Non-Interest Income 449 498 (49) (10%) revenue down 7% driven by the decline in sales volume Revenue Net of Interest Expense $2,714 $2,900 $(186) (6%) • Decrease in loan fee income Change 3Q20 3Q19 QOQ YOY primarily reflects lower late fees and Discover Card Sales Volume ($MM) $37,134 $37,432 21 % (1)% cash advance fees Rewards Rate (1) 1.38 % 1.38 % 14bps —bps NIM on Loans 10.19 % 10.43 % 38bps -24bps • Rewards rate was flat YOY Note(s) 1. Rewards cost divided by Discover card sales volume 13

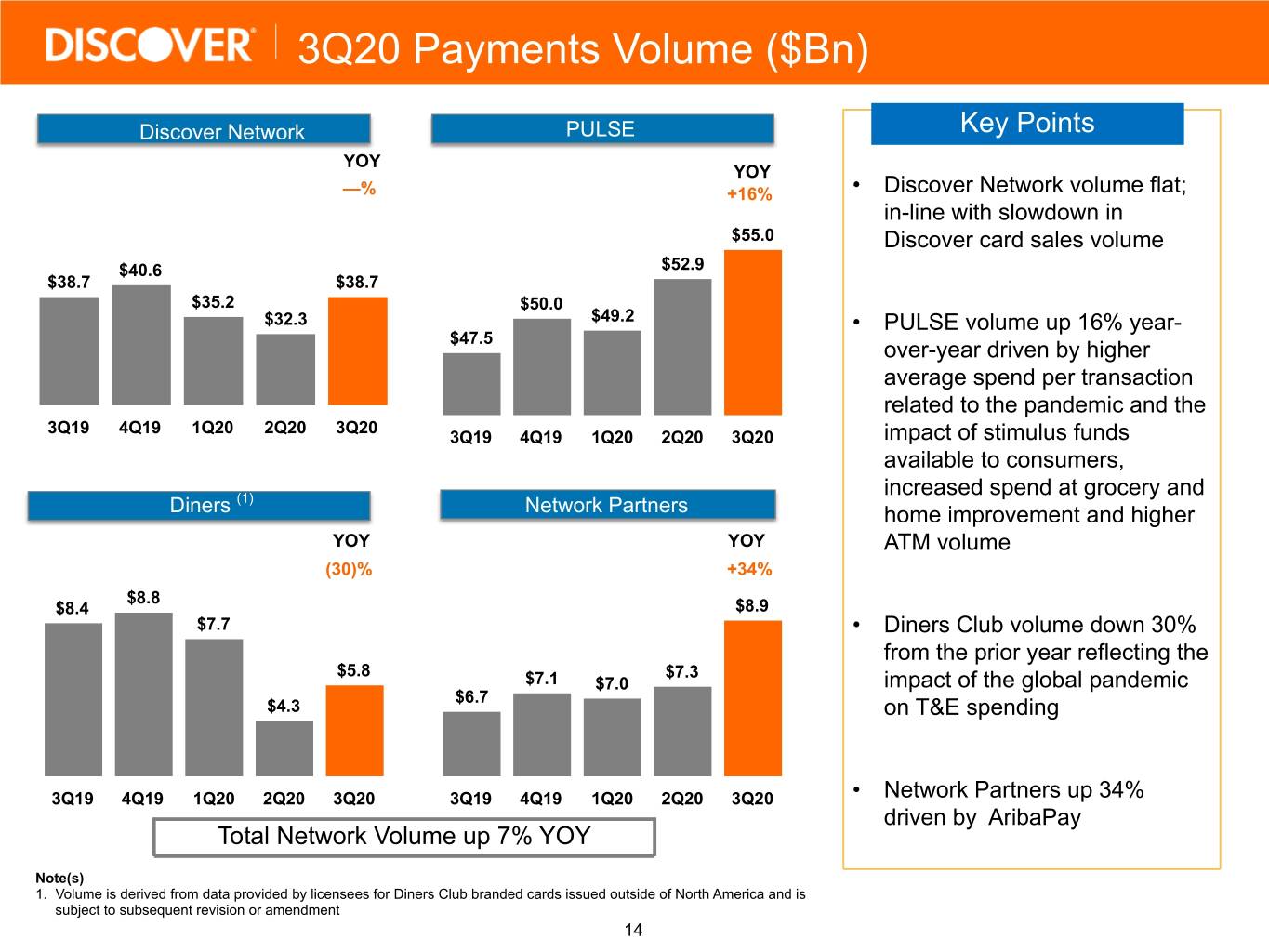

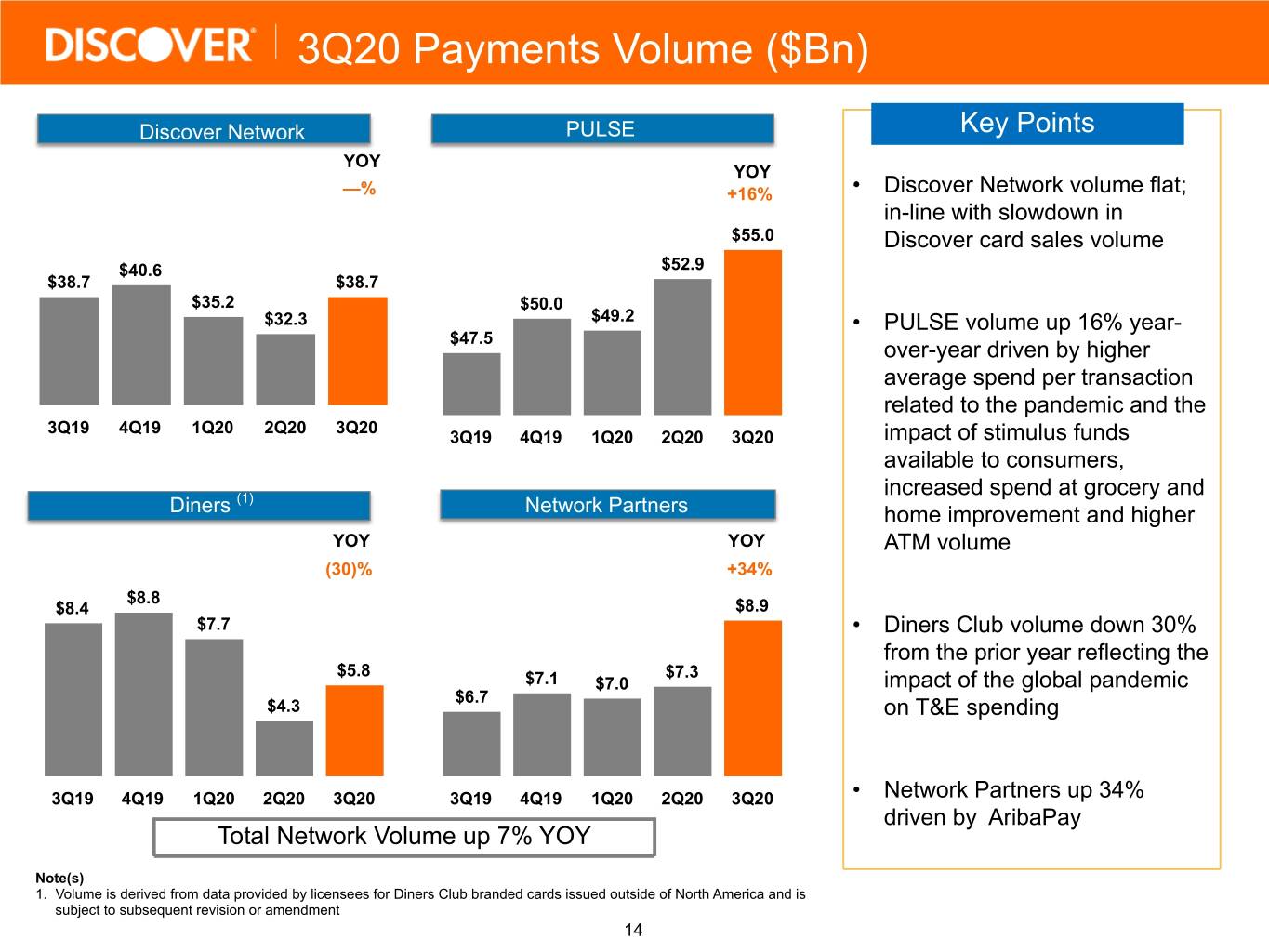

3Q20 Payments Volume ($Bn) Discover Network PULSE Key Points YOY YOY —% +16% • Discover Network volume flat; in-line with slowdown in $55.0 Discover card sales volume $40.6 $52.9 $38.7 $38.7 $35.2 $50.0 $32.3 $49.2 • PULSE volume up 16% year- $47.5 over-year driven by higher average spend per transaction related to the pandemic and the 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 impact of stimulus funds available to consumers, (1) increased spend at grocery and Diners Network Partners home improvement and higher YOY YOY ATM volume (30)% +34% $8.8 $8.4 $8.9 $7.7 • Diners Club volume down 30% from the prior year reflecting the $5.8 $7.3 $7.1 $7.0 impact of the global pandemic $6.7 $4.3 on T&E spending 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 • Network Partners up 34% driven by AribaPay Total Network Volume up 7% YOY Note(s) 1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment 14

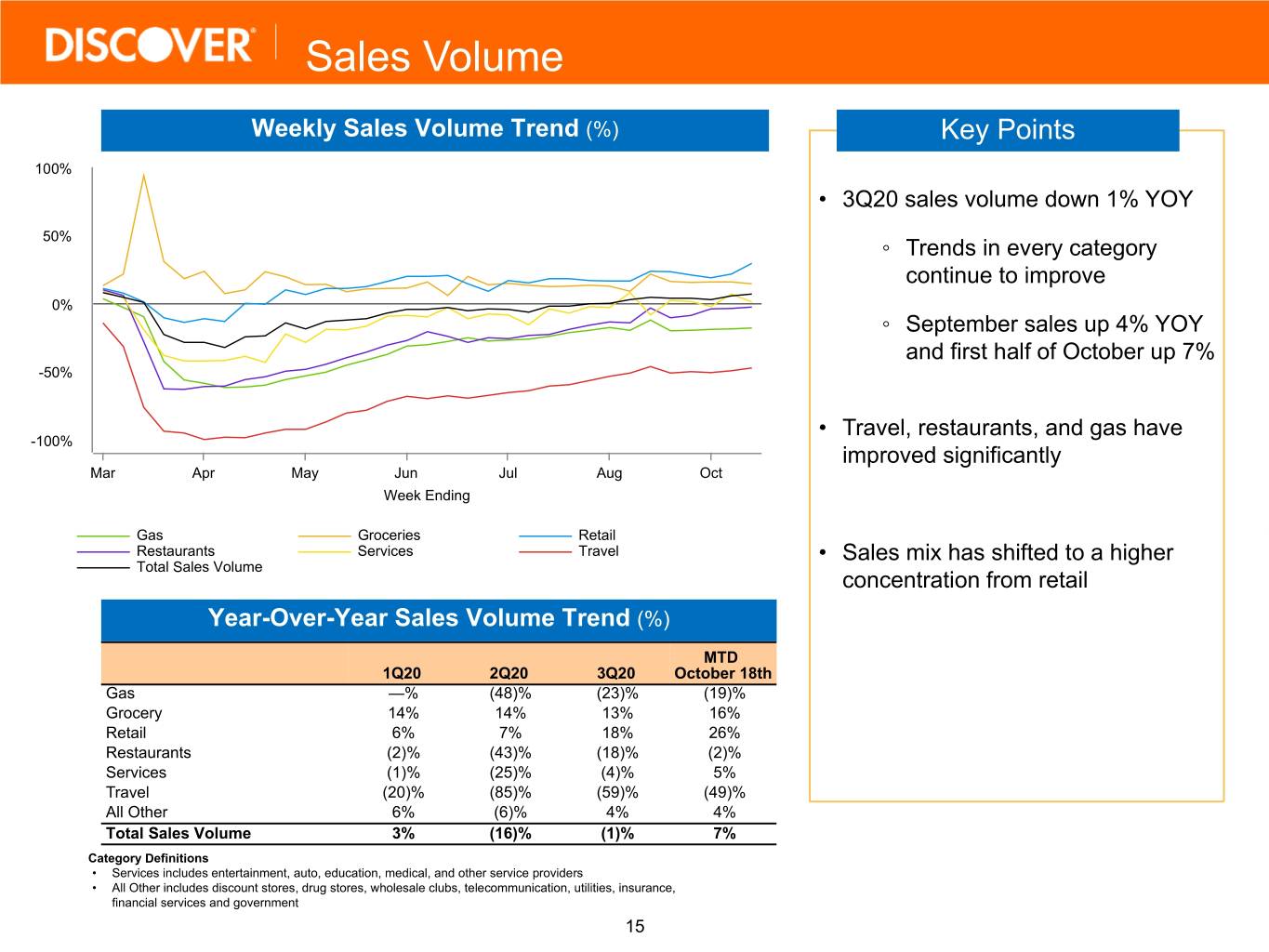

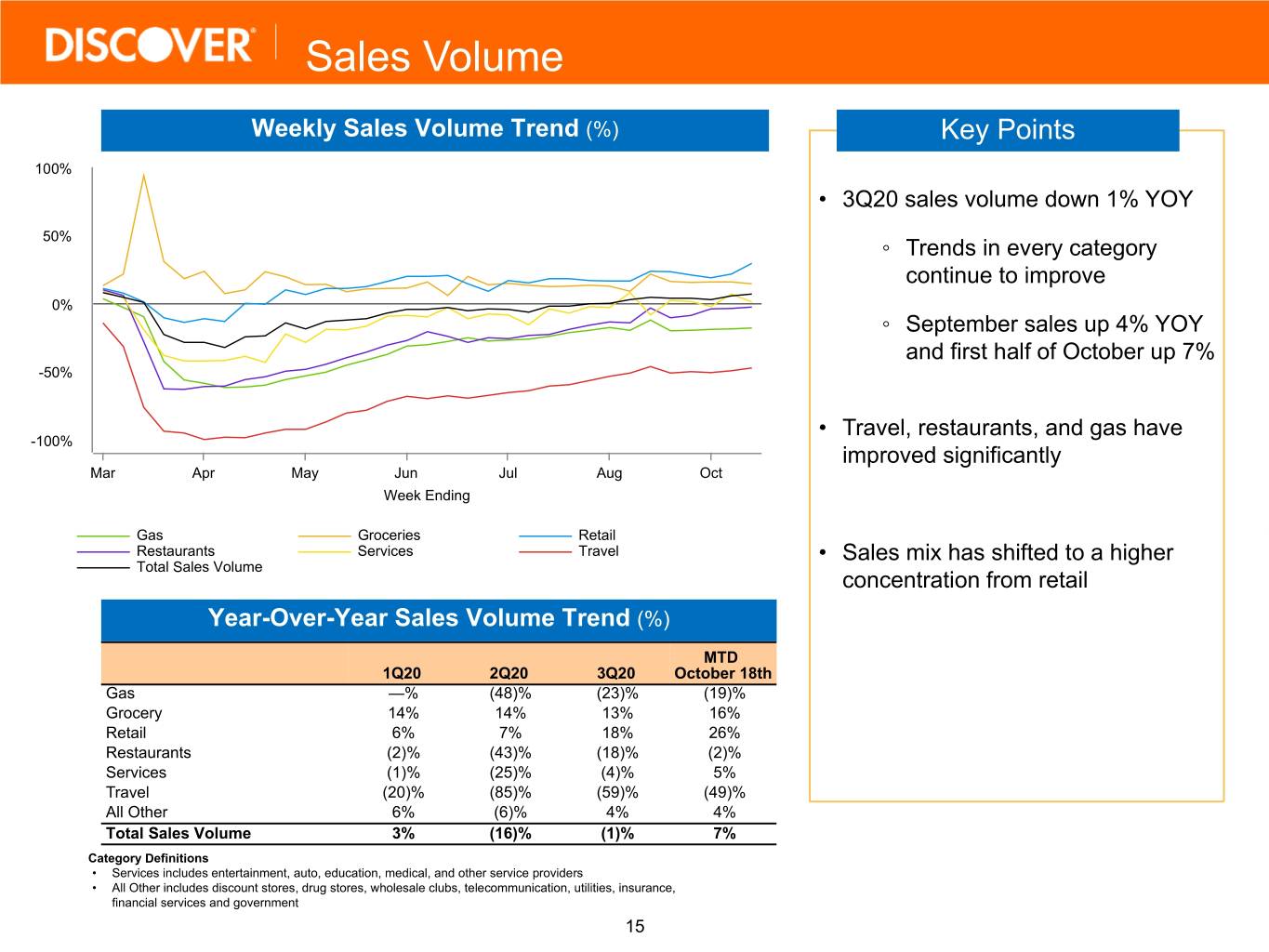

Sales Volume Weekly Sales Volume Trend (%) Key Points 100% • 3Q20 sales volume down 1% YOY 50% ◦ Trends in every category continue to improve 0% ◦ September sales up 4% YOY and first half of October up 7% -50% • Travel, restaurants, and gas have -100% improved significantly Mar Apr May Jun Jul Aug Oct Week Ending Gas Groceries Retail Restaurants Services Travel • Sales mix has shifted to a higher Total Sales Volume concentration from retail Year-Over-Year Sales Volume Trend (%) MTD 1Q20 2Q20 3Q20 October 18th Gas —% (48)% (23)% (19)% Grocery 14% 14% 13% 16% Retail 6% 7% 18% 26% Restaurants (2)% (43)% (18)% (2)% Services (1)% (25)% (4)% 5% Travel (20)% (85)% (59)% (49)% All Other 6% (6)% 4% 4% Total Sales Volume 3% (16)% (1)% 7% Category Definitions • Services includes entertainment, auto, education, medical, and other service providers • All Other includes discount stores, drug stores, wholesale clubs, telecommunication, utilities, insurance, financial services and government 15 keyrends in

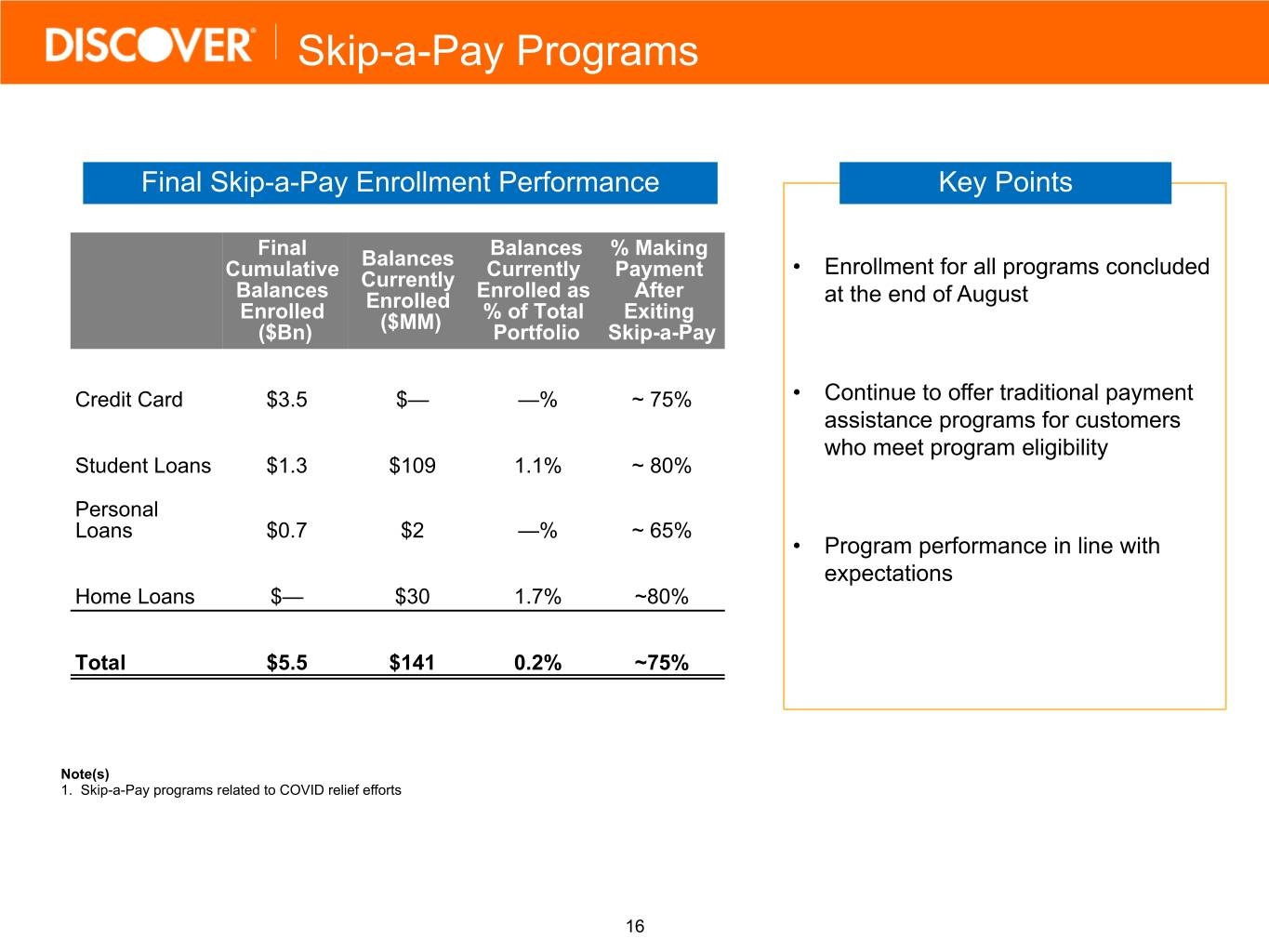

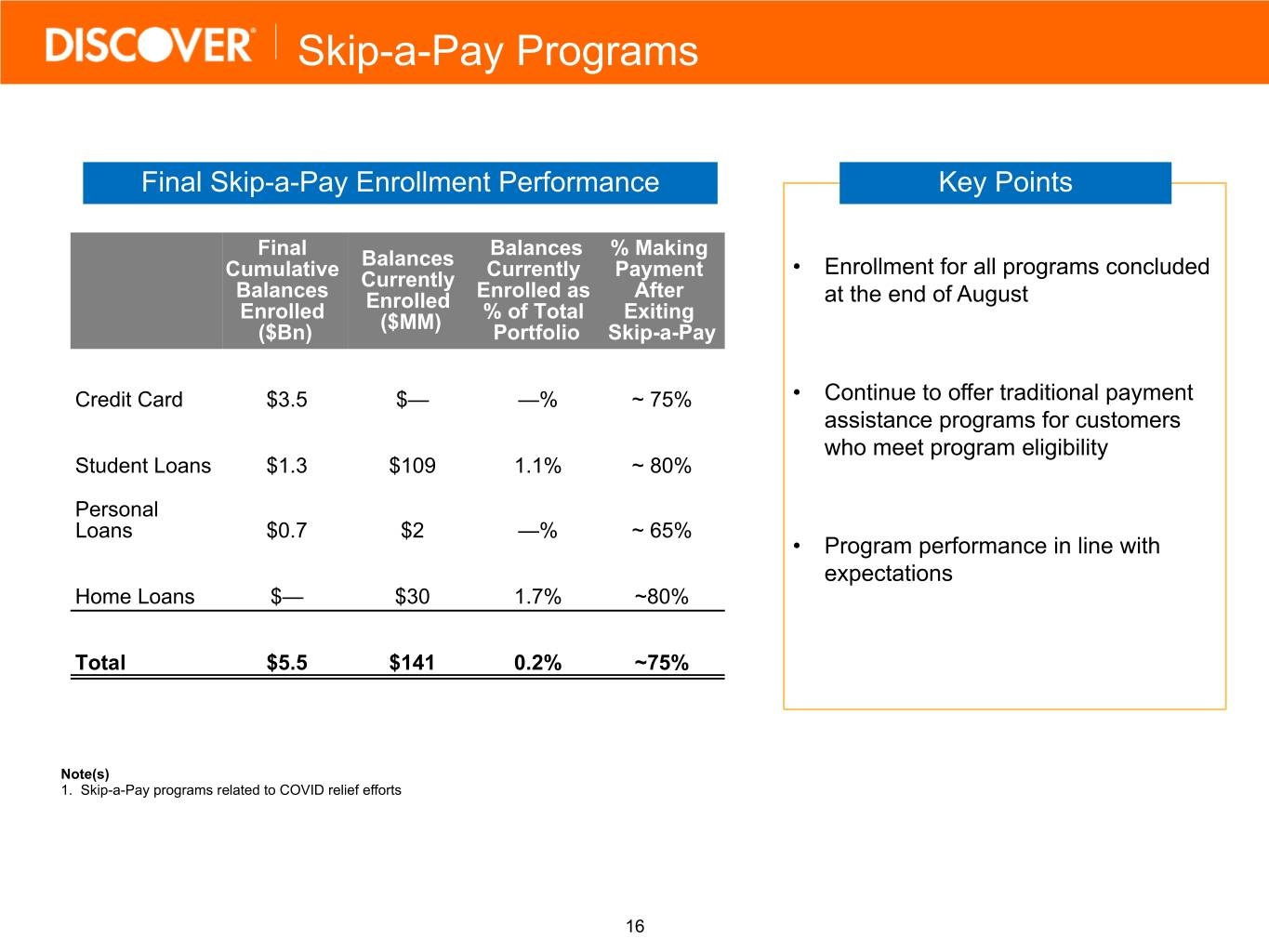

Skip-a-Pay Programs Final Skip-a-Pay Enrollment Performance Key Points Final Balances % Making Balances • Enrollment for all programs concluded Cumulative Currently Currently Payment Balances Enrolled as After at the end of August Enrolled Enrolled % of Total Exiting ($Bn) ($MM) Portfolio Skip-a-Pay Credit Card $3.5 $— —% ~ 75% • Continue to offer traditional payment assistance programs for customers who meet program eligibility Student Loans $1.3 $109 1.1% ~ 80% Personal Loans $0.7 $2 —% ~ 65% • Program performance in line with expectations Home Loans $— $30 1.7% ~80% Total $5.5 $141 0.2% ~75% Note(s) 1. Skip-a-Pay programs related to COVID relief efforts 16

Credit Performance Trends Total Company Loans Credit Card Loans 3.44 3.90 3.11 3.25 3.22 3.19 3.27 3.65 2.97 3.08 3.05 3.00 3.34 3.50 3.49 3.41 3.45 3.14 3.23 3.32 2.31 2.28 2.32 2.40 2.38 2.62 2.62 2.08 2.22 2.18 2.43 2.45 2.50 1.98 2.16 2.32 2.34 2.17 1.76 1.91 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 NCO rate (%) 30+ day DQ rate ex-purchased loans (%) NCO rate (%) 30+ day DQ rate (%) Private Student Loans Personal Loans 4.49 4.53 4.33 4.26 3.97 4.09 3.99 3.59 3.43 2.10 2.13 2.00 1.76 1.67 1.78 1.72 1.64 2.69 1.49 1.41 0.96 1.02 0.92 0.86 1.57 1.60 0.66 0.61 0.59 0.68 0.62 0.58 1.42 1.51 1.49 1.49 1.37 1.31 1.07 1.10 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 NCO rate (%) 30+ day DQ rate ex-purchased loans (%) NCO rate (%) 30+ day DQ rate (%) 17