©2021 DISCOVER FINANCIAL SERVICES Exhibit 99.3 2Q21 Financial Results July 21, 2021

The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. For additional financial, statistical, and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement included as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website (www.discover.com) and the SEC’s website (www.sec.gov). The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, "Risk Factors" and “Management's Discussion & Analysis of Financial Condition and Results of Operations” in the company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, which is filed with the SEC and available at the SEC's website (www.sec.gov) and subsequent reports on Forms 8-K and 10-Q, including the Company's Current Report on Form 8-K filed today with the SEC. The Company does not undertake to update or revise forward-looking statements as more information becomes available. Notice 2

2Q21 Highlights 3 • 2Q21 Net Income of $1.7Bn; diluted EPS of $5.55 • Strong sales trends and new account growth affirm our expectation for modest loan growth in 2021 and more robust growth next year, despite that high payment rates likely remain a headwind • $321MM reserve release driven by sustained strong credit performance and an improved economic outlook; 2021 losses expected to be down YOY • $729MM one-time gain on an equity investment underscores Payments Service’s ability to pursue commercial relationships across a range of potential partners • Additional investments in marketing, technology and analytics will support future growth and platform enhancements, while we maintain discipline on operating expenses • Remain committed to returning capital to shareholders ◦ Accelerated share repurchases to $553MM in 2Q ◦ Increased quarterly dividend to $0.50, up 14% sequentially ◦ Board approved a new $2.4Bn share repurchase program expiring March 31, 2022

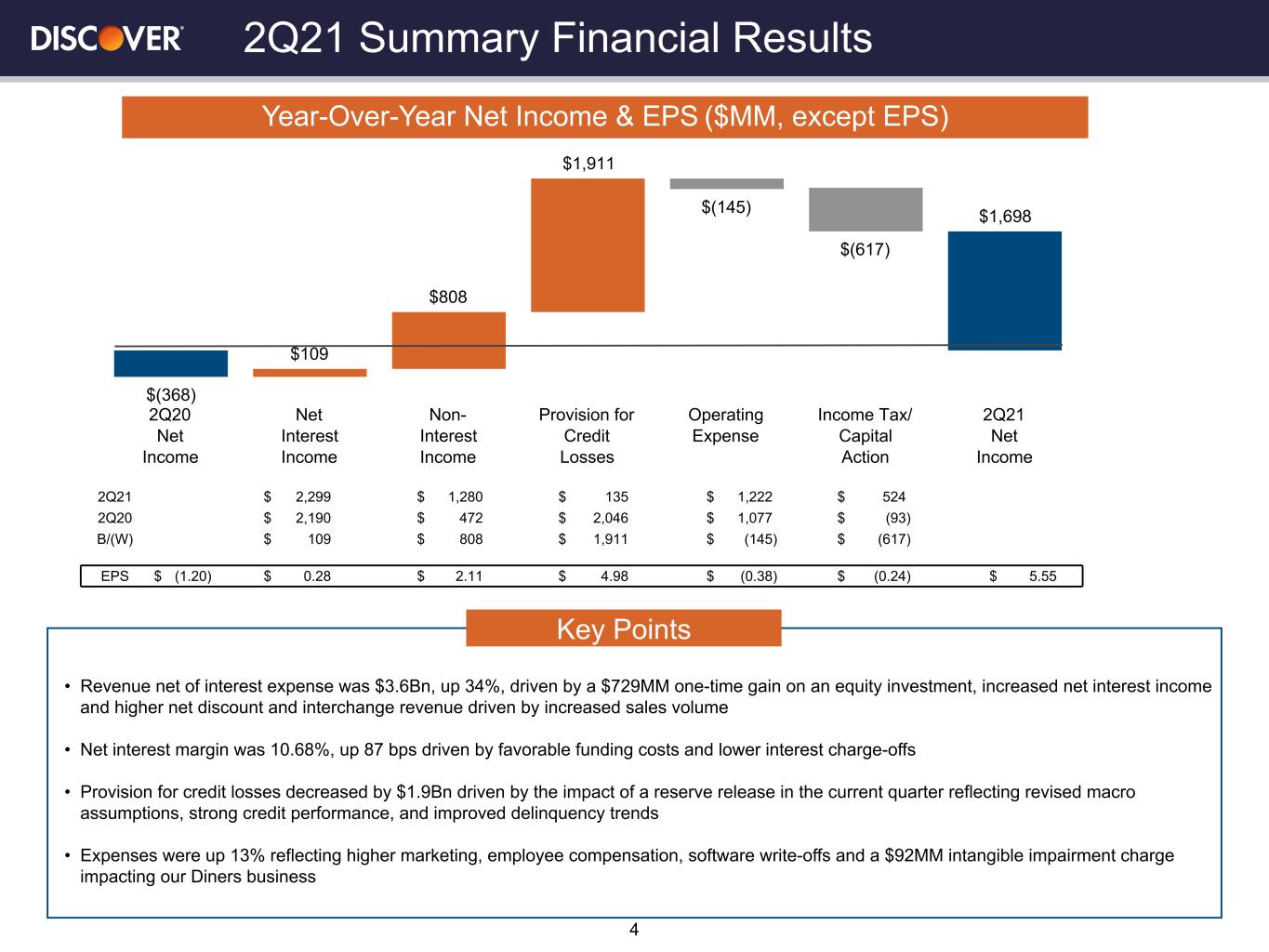

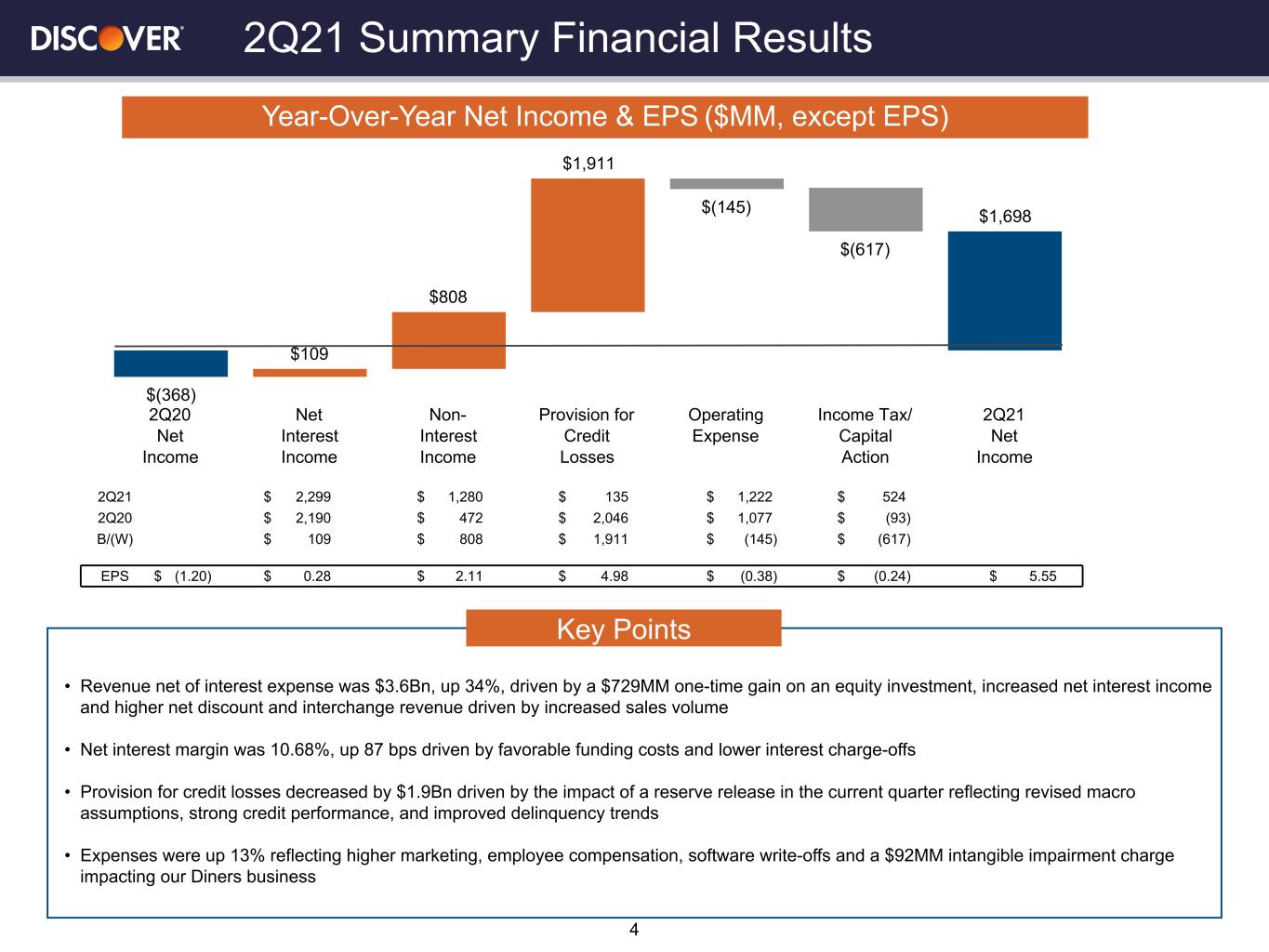

• Revenue net of interest expense was $3.6Bn, up 34%, driven by a $729MM one-time gain on an equity investment, increased net interest income and higher net discount and interchange revenue driven by increased sales volume • Net interest margin was 10.68%, up 87 bps driven by favorable funding costs and lower interest charge-offs • Provision for credit losses decreased by $1.9Bn driven by the impact of a reserve release in the current quarter reflecting revised macro assumptions, strong credit performance, and improved delinquency trends • Expenses were up 13% reflecting higher marketing, employee compensation, software write-offs and a $92MM intangible impairment charge impacting our Diners business 2Q21 Summary Financial Results Key Points 4 $(368) $109 $808 $1,911 $(145) $(617) $1,698 2Q20 Net Income Net Interest Income Non- Interest Income Provision for Credit Losses Operating Expense Income Tax/ Capital Action 2Q21 Net Income Year-Over-Year Net Income & EPS ($MM, except EPS) 2Q21 $ 2,299 $ 1,280 $ 135 $ 1,222 $ 524 2Q20 $ 2,190 $ 472 $ 2,046 $ 1,077 $ (93) B/(W) $ 109 $ 808 $ 1,911 $ (145) $ (617) EPS $ (1.20) $ 0.28 $ 2.11 $ 4.98 $ (0.38) $ (0.24) $ 5.55

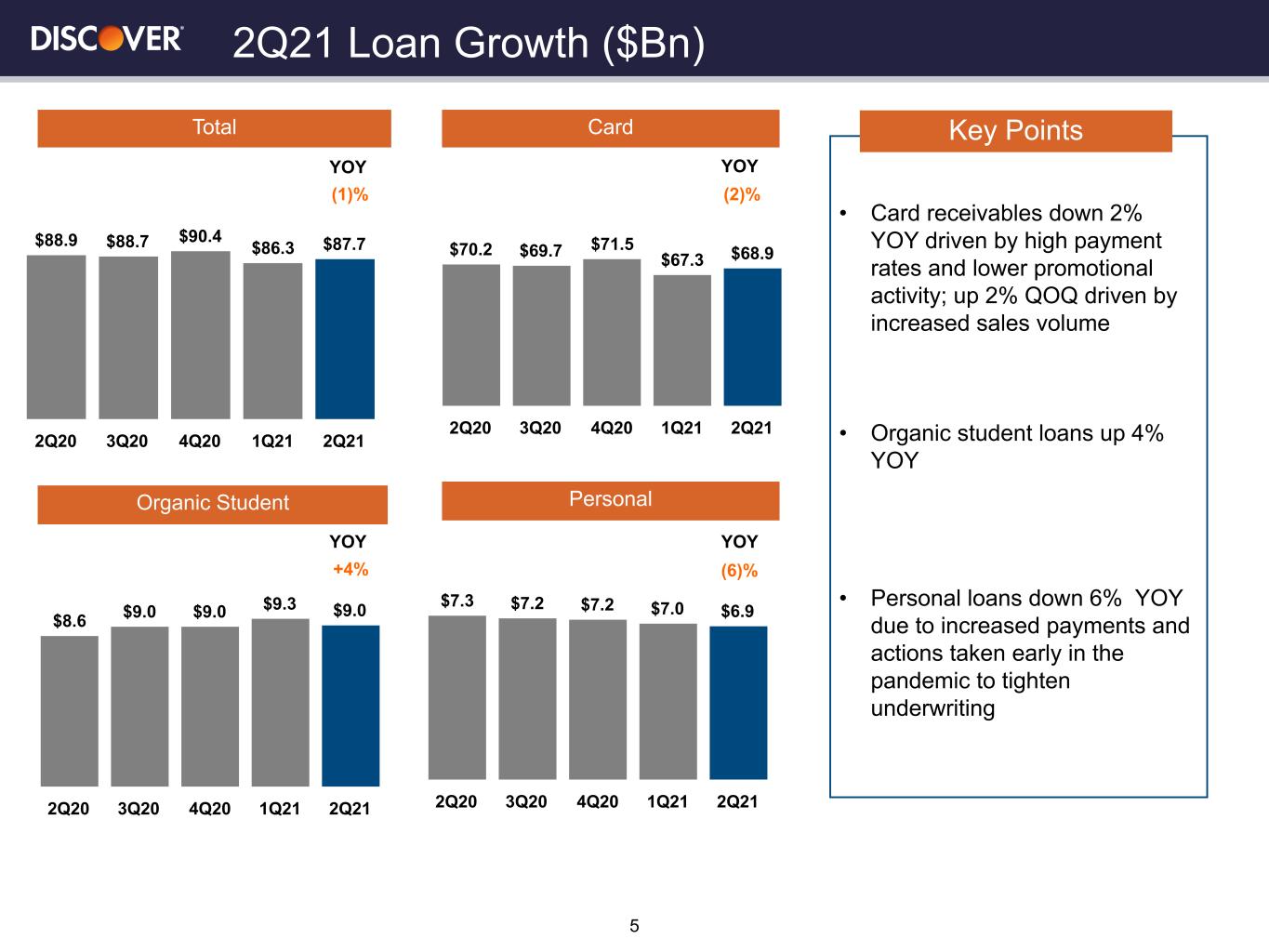

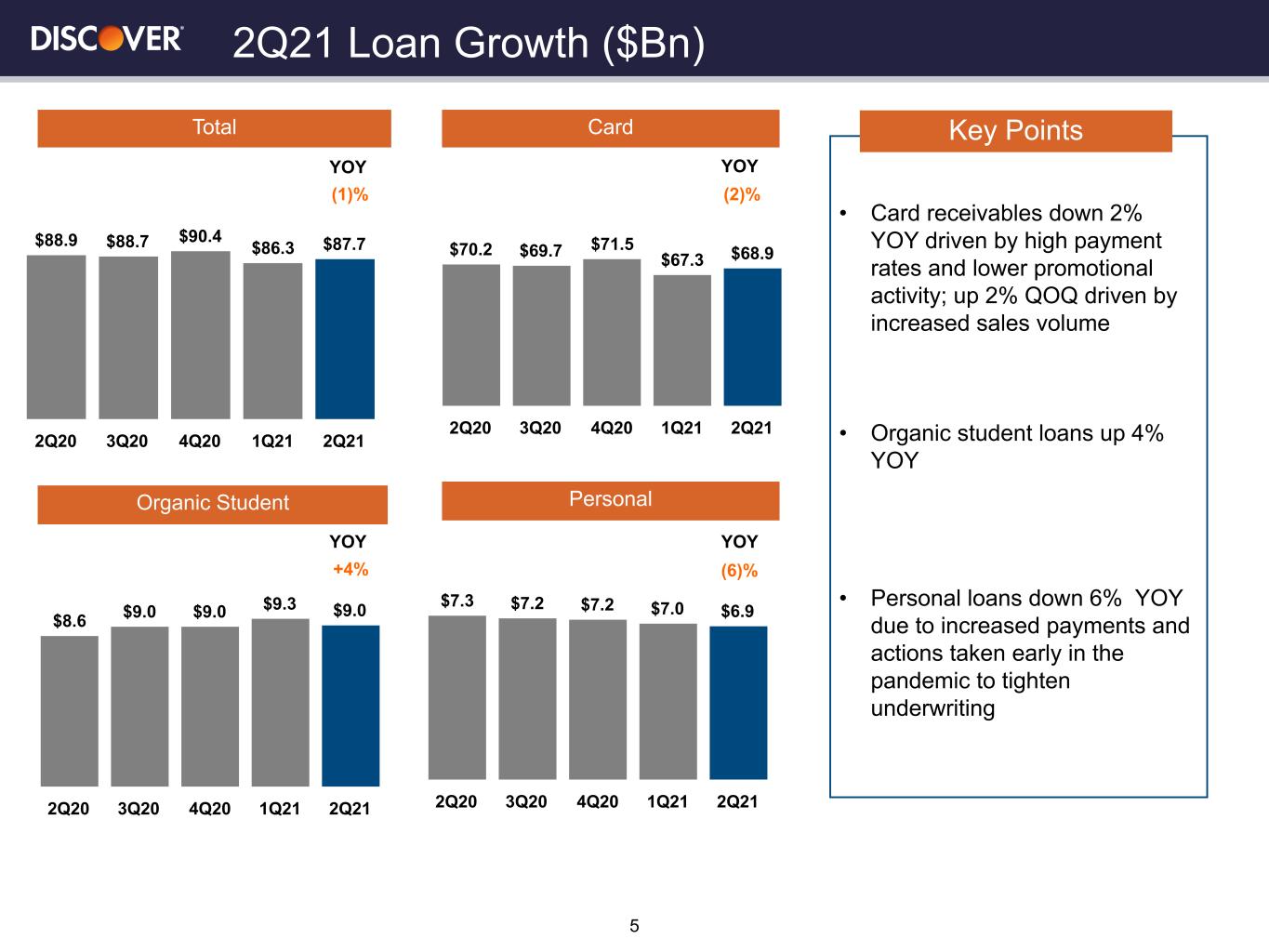

(1)% (2)% +4% (6)% YOY YOY YOY YOY 2Q21 Loan Growth ($Bn) Total 5 • Card receivables down 2% YOY driven by high payment rates and lower promotional activity; up 2% QOQ driven by increased sales volume • Organic student loans up 4% YOY • Personal loans down 6% YOY due to increased payments and actions taken early in the pandemic to tighten underwriting Key Points $88.9 $88.7 $90.4 $86.3 $87.7 2Q20 3Q20 4Q20 1Q21 2Q21 $70.2 $69.7 $71.5 $67.3 $68.9 2Q20 3Q20 4Q20 1Q21 2Q21 $8.6 $9.0 $9.0 $9.3 $9.0 2Q20 3Q20 4Q20 1Q21 2Q21 $7.3 $7.2 $7.2 $7.0 $6.9 2Q20 3Q20 4Q20 1Q21 2Q21 Organic Student Card Personal

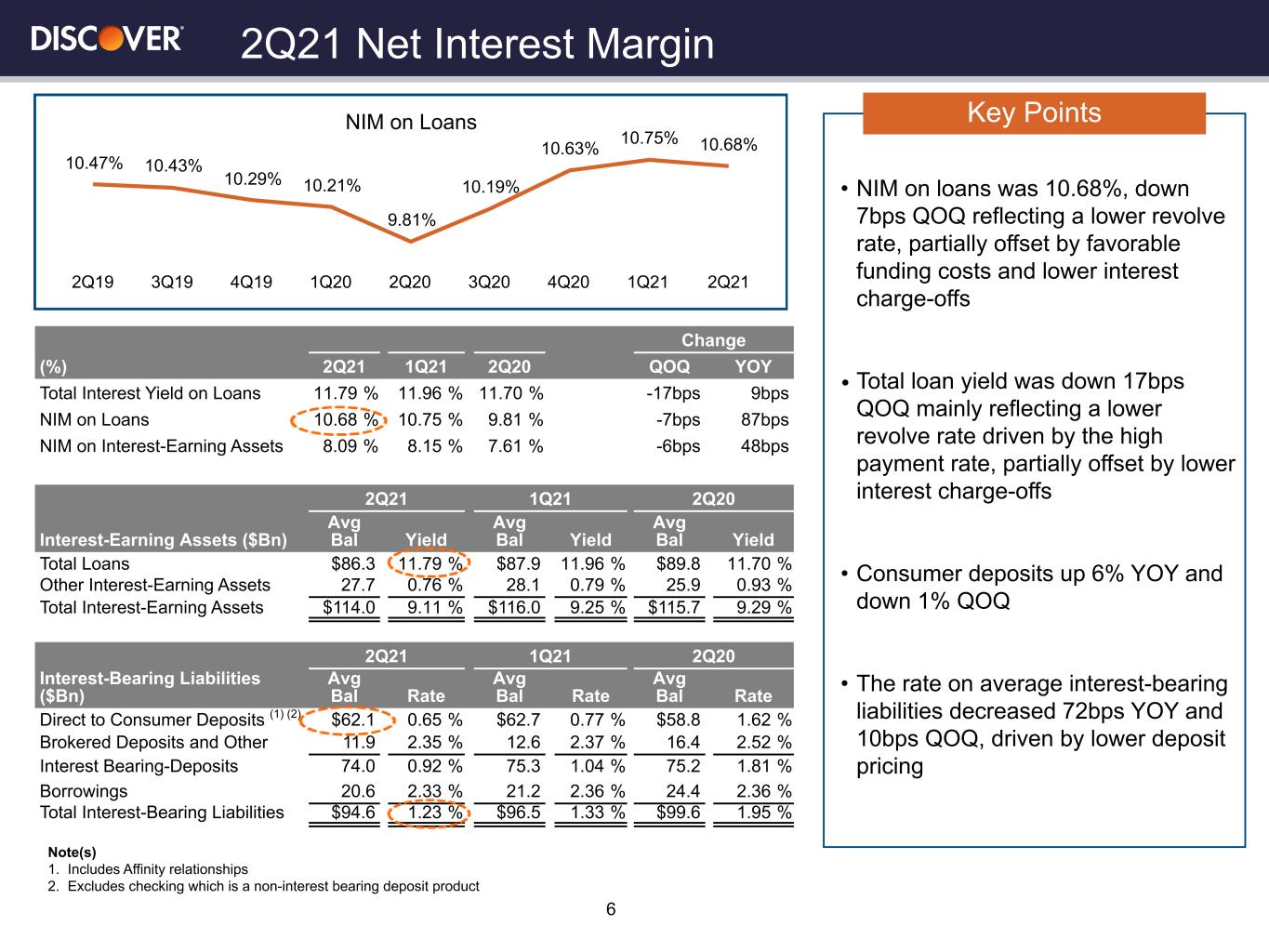

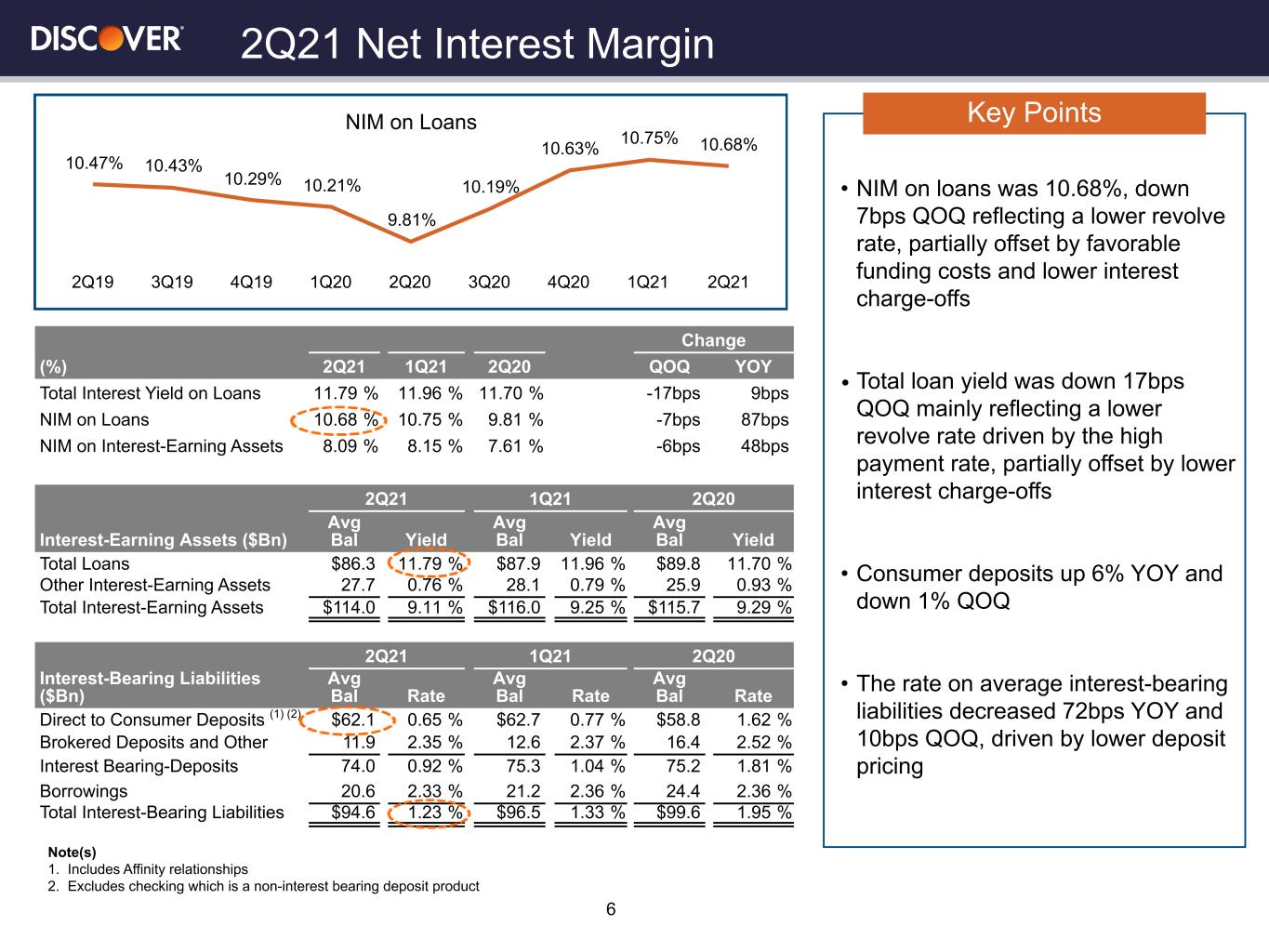

• NIM on loans was 10.68%, down 7bps QOQ reflecting a lower revolve rate, partially offset by favorable funding costs and lower interest charge-offs • Total loan yield was down 17bps QOQ mainly reflecting a lower revolve rate driven by the high payment rate, partially offset by lower interest charge-offs • Consumer deposits up 6% YOY and down 1% QOQ • The rate on average interest-bearing liabilities decreased 72bps YOY and 10bps QOQ, driven by lower deposit pricing 2Q21 Net Interest Margin Change (%) 2Q21 1Q21 2Q20 QOQ YOY Total Interest Yield on Loans 11.79 % 11.96 % 11.70 % -17bps 9bps NIM on Loans 10.68 % 10.75 % 9.81 % -7bps 87bps NIM on Interest-Earning Assets 8.09 % 8.15 % 7.61 % -6bps 48bps 2Q21 1Q21 2Q20 Interest-Earning Assets ($Bn) Avg Bal Yield Avg Bal Yield Avg Bal Yield Total Loans $86.3 11.79 % $87.9 11.96 % $89.8 11.70 % Other Interest-Earning Assets 27.7 0.76 % 28.1 0.79 % 25.9 0.93 % Total Interest-Earning Assets $114.0 9.11 % $116.0 9.25 % $115.7 9.29 % 2Q21 1Q21 2Q20 Interest-Bearing Liabilities ($Bn) Avg Bal Rate Avg Bal Rate Avg Bal Rate Direct to Consumer Deposits (1) (2) $62.1 0.65 % $62.7 0.77 % $58.8 1.62 % Brokered Deposits and Other 11.9 2.35 % 12.6 2.37 % 16.4 2.52 % Interest Bearing-Deposits 74.0 0.92 % 75.3 1.04 % 75.2 1.81 % Borrowings 20.6 2.33 % 21.2 2.36 % 24.4 2.36 % Total Interest-Bearing Liabilities $94.6 1.23 % $96.5 1.33 % $99.6 1.95 % 6 Key Points Note(s) 1. Includes Affinity relationships 2. Excludes checking which is a non-interest bearing deposit product NIM on Loans 10.47% 10.43% 10.29% 10.21% 9.81% 10.19% 10.63% 10.75% 10.68% 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21

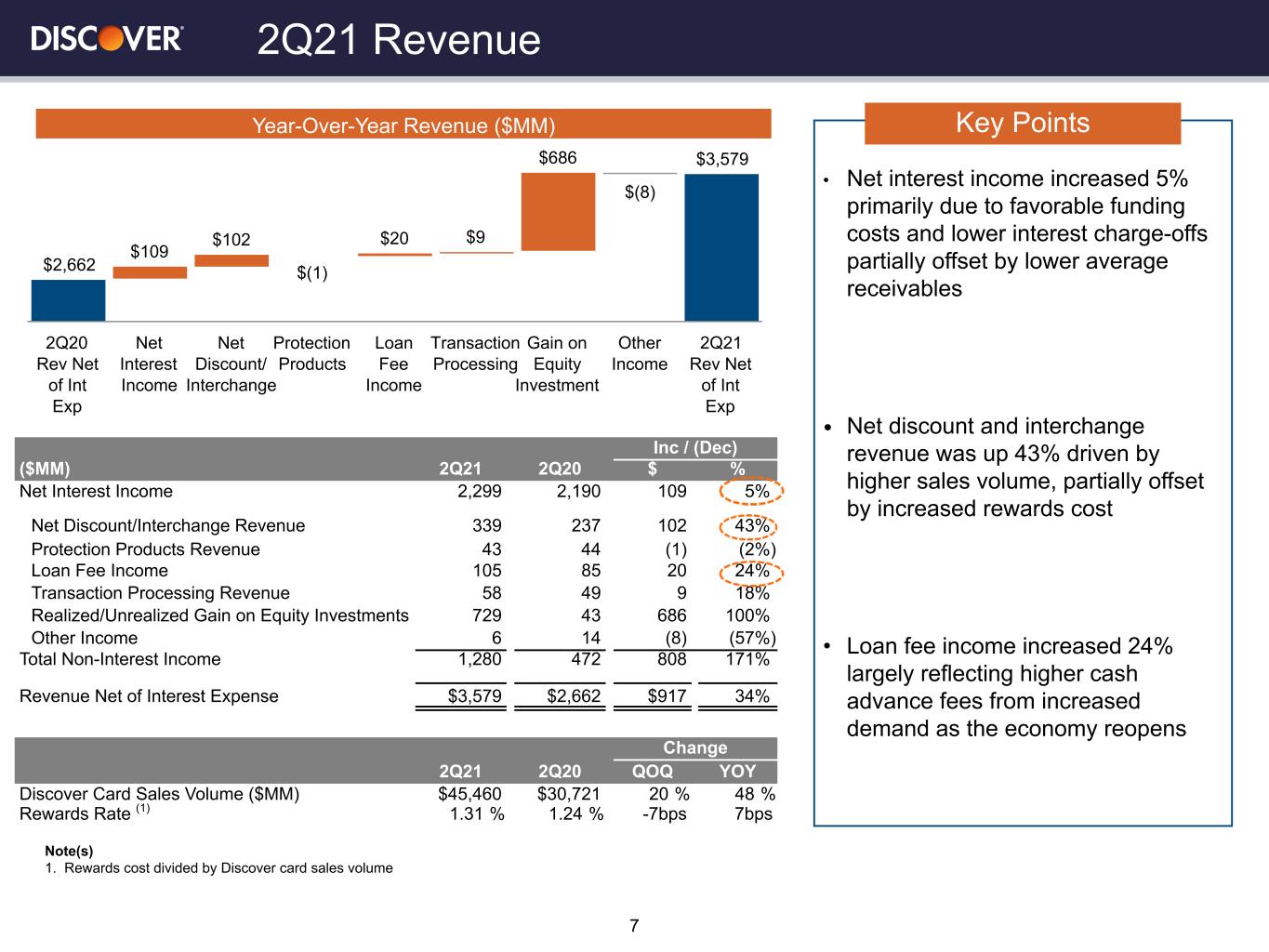

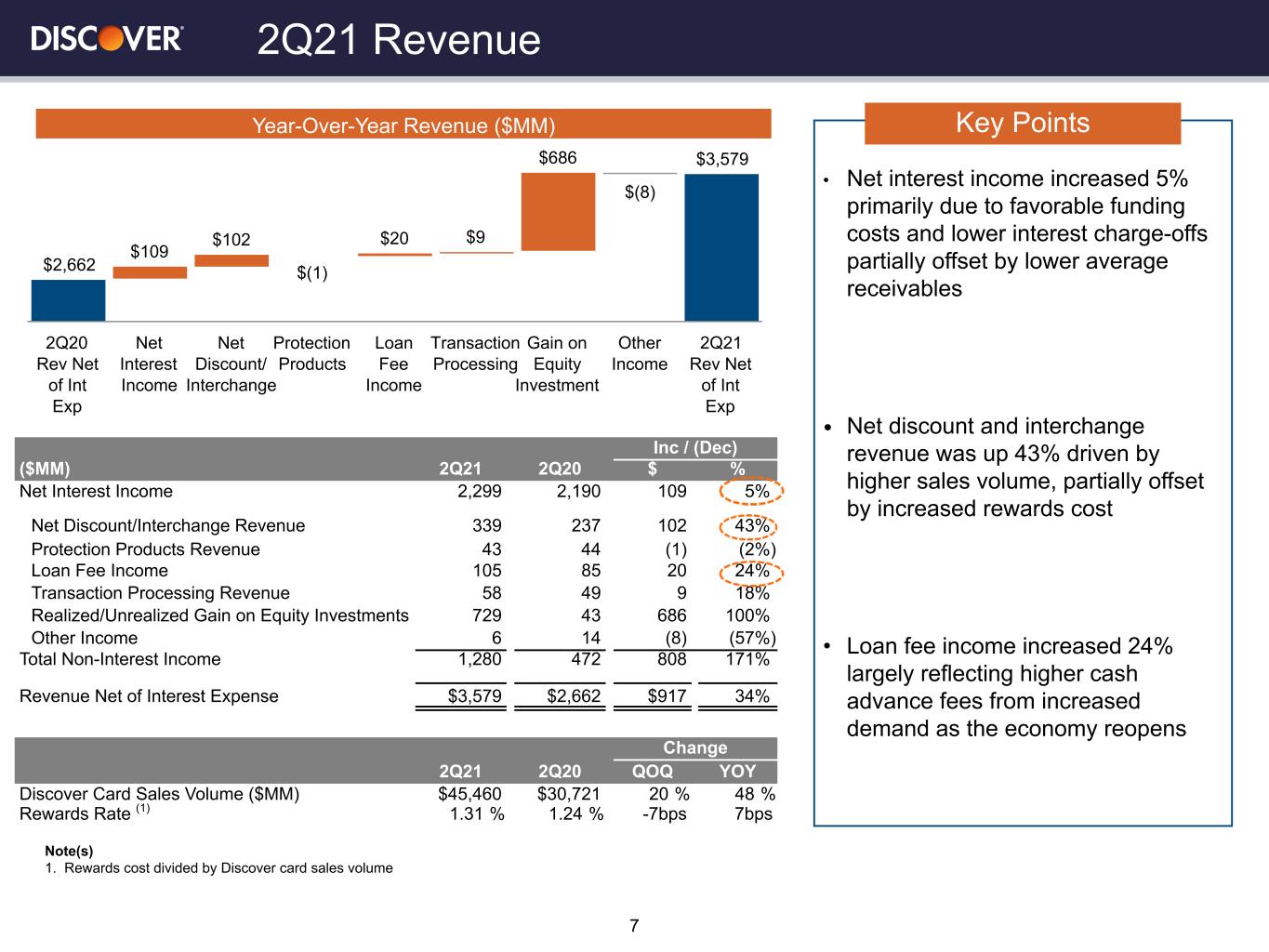

Note(s) 1. Rewards cost divided by Discover card sales volume • Net interest income increased 5% primarily due to favorable funding costs and lower interest charge-offs partially offset by lower average receivables • Net discount and interchange revenue was up 43% driven by higher sales volume, partially offset by increased rewards cost • Loan fee income increased 24% largely reflecting higher cash advance fees from increased demand as the economy reopens 2Q21 Revenue 7 Key Points Inc / (Dec) ($MM) 2Q21 2Q20 $ % Net Interest Income 2,299 2,190 109 5% Net Discount/Interchange Revenue 339 237 102 43% Protection Products Revenue 43 44 (1) (2%) Loan Fee Income 105 85 20 24% Transaction Processing Revenue 58 49 9 18% Realized/Unrealized Gain on Equity Investments 729 43 686 100% Other Income 6 14 (8) (57%) Total Non-Interest Income 1,280 472 808 171% Revenue Net of Interest Expense $3,579 $2,662 $917 34% Change 2Q21 2Q20 QOQ YOY Discover Card Sales Volume ($MM) $45,460 $30,721 20 % 48 % Rewards Rate (1) 1.31 % 1.24 % -7bps 7bps $2,662 $109 $102 $(1) $20 $9 $686 $(8) $3,579 2Q20 Rev Net of Int Exp Net Interest Income Net Discount/ Interchange Protection Products Loan Fee Income Transaction Processing Gain on Equity Investment Other Income 2Q21 Rev Net of Int Exp Year-Over-Year Revenue ($MM)

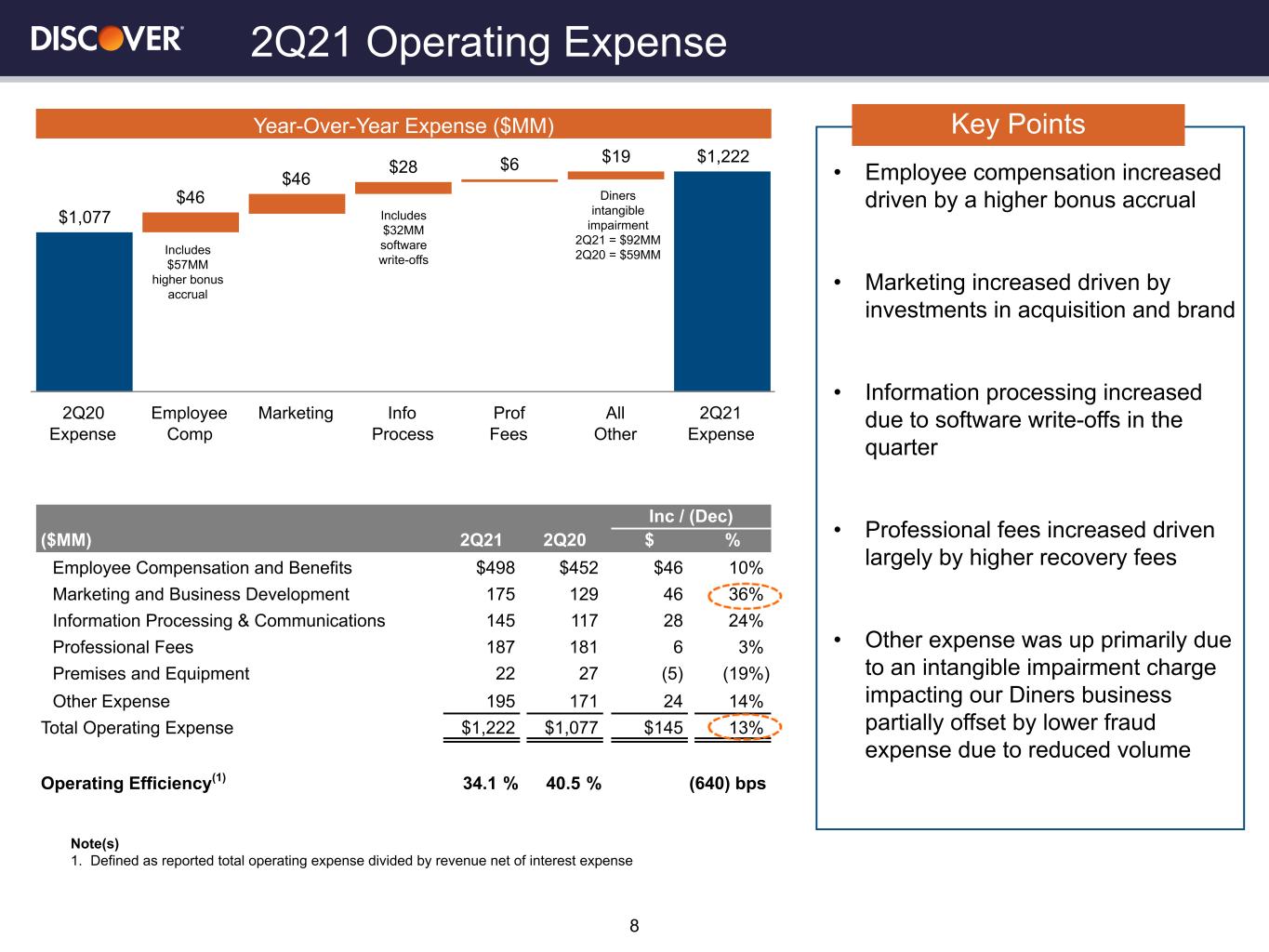

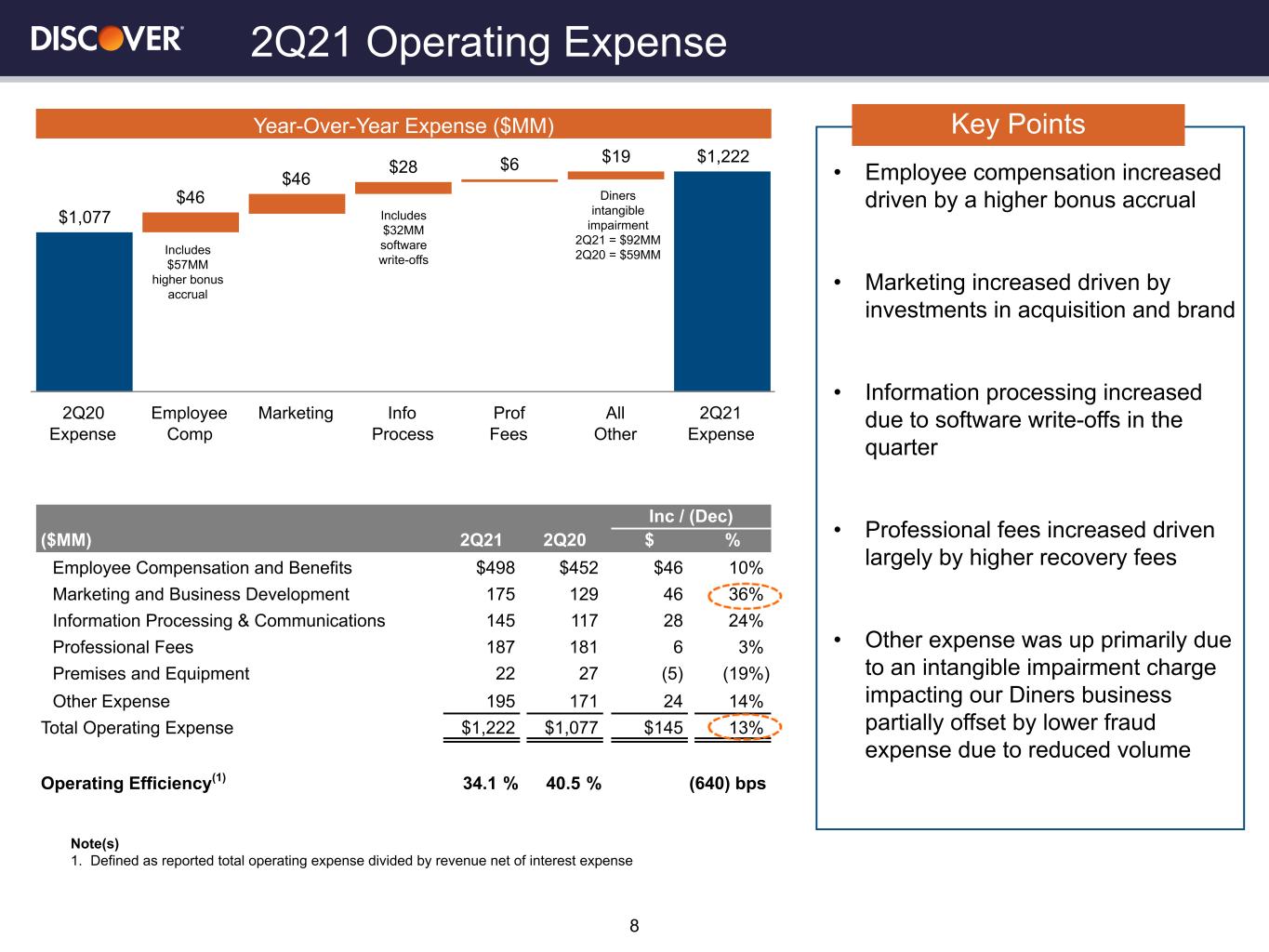

Note(s) 1. Defined as reported total operating expense divided by revenue net of interest expense • Employee compensation increased driven by a higher bonus accrual • Marketing increased driven by investments in acquisition and brand • Information processing increased due to software write-offs in the quarter • Professional fees increased driven largely by higher recovery fees • Other expense was up primarily due to an intangible impairment charge impacting our Diners business partially offset by lower fraud expense due to reduced volume 2Q21 Operating Expense Inc / (Dec) ($MM) 2Q21 2Q20 $ % Employee Compensation and Benefits $498 $452 $46 10% Marketing and Business Development 175 129 46 36% Information Processing & Communications 145 117 28 24% Professional Fees 187 181 6 3% Premises and Equipment 22 27 (5) (19%) Other Expense 195 171 24 14% Total Operating Expense $1,222 $1,077 $145 13% Operating Efficiency(1) 34.1 % 40.5 % (640) bps 8 Key PointsYear-Over-Year Expense ($MM) $1,077 $46 $46 $28 $6 $19 $1,222 2Q20 Expense Employee Comp Marketing Info Process Prof Fees All Other 2Q21 Expense Includes $57MM higher bonus accrual Includes $32MM software write-offs Diners intangible impairment 2Q21 = $92MM 2Q20 = $59MM

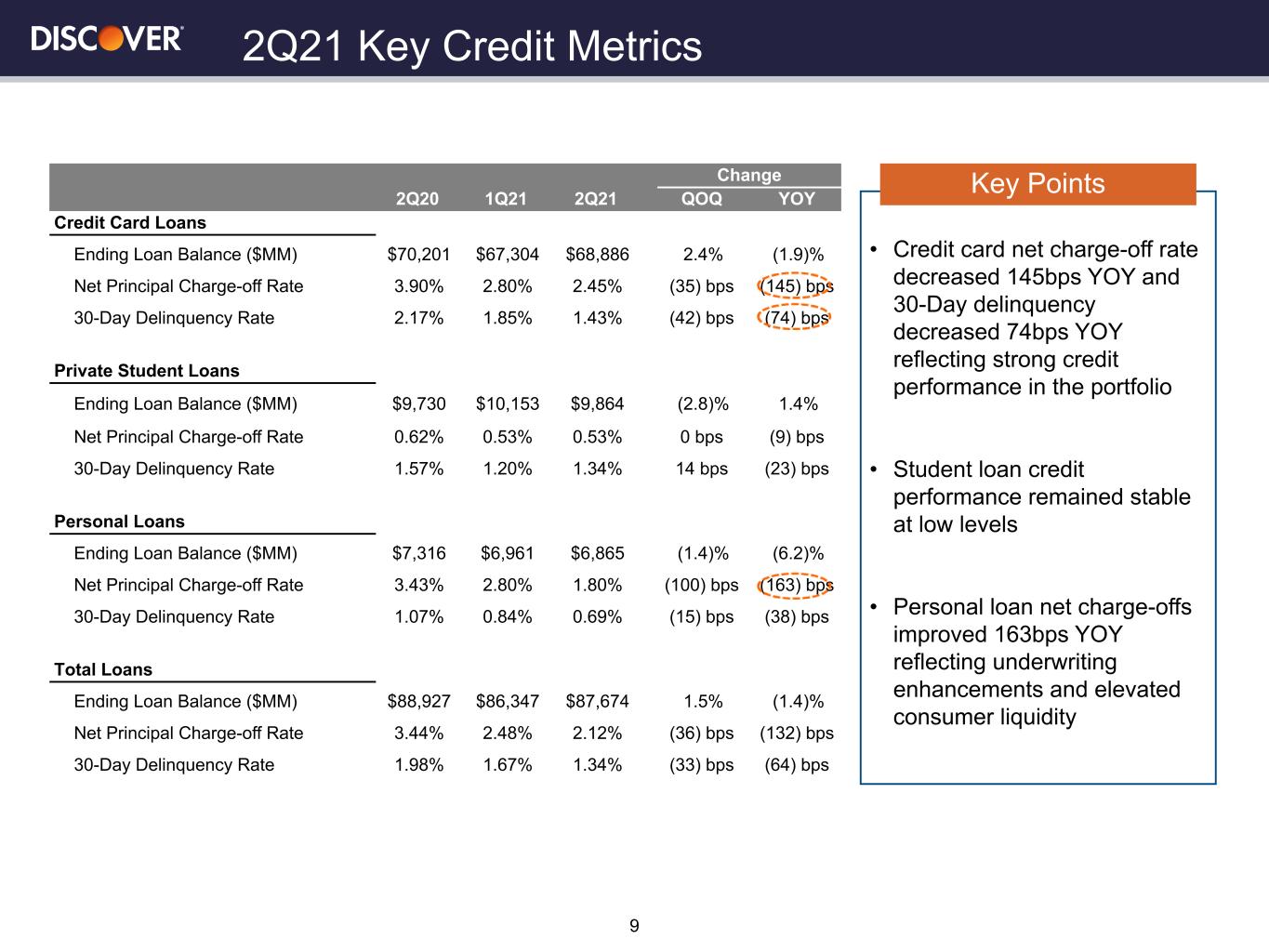

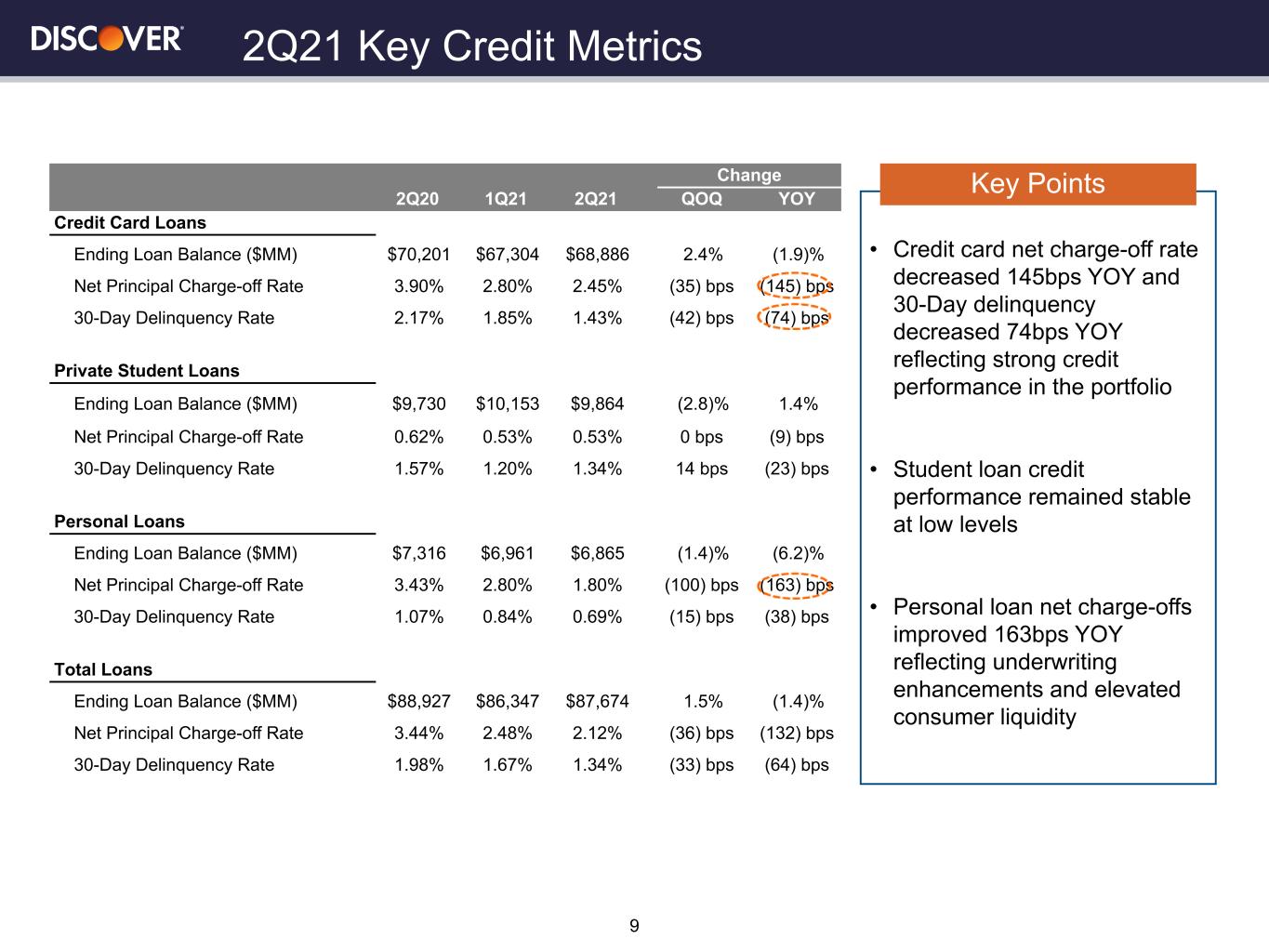

• Credit card net charge-off rate decreased 145bps YOY and 30-Day delinquency decreased 74bps YOY reflecting strong credit performance in the portfolio • Student loan credit performance remained stable at low levels • Personal loan net charge-offs improved 163bps YOY reflecting underwriting enhancements and elevated consumer liquidity 2Q21 Key Credit Metrics 9 Key PointsChange 2Q20 1Q21 2Q21 QOQ YOY Credit Card Loans Ending Loan Balance ($MM) $70,201 $67,304 $68,886 2.4% (1.9)% Net Principal Charge-off Rate 3.90% 2.80% 2.45% (35) bps (145) bps 30-Day Delinquency Rate 2.17% 1.85% 1.43% (42) bps (74) bps Private Student Loans Ending Loan Balance ($MM) $9,730 $10,153 $9,864 (2.8)% 1.4% Net Principal Charge-off Rate 0.62% 0.53% 0.53% 0 bps (9) bps 30-Day Delinquency Rate 1.57% 1.20% 1.34% 14 bps (23) bps Personal Loans Ending Loan Balance ($MM) $7,316 $6,961 $6,865 (1.4)% (6.2)% Net Principal Charge-off Rate 3.43% 2.80% 1.80% (100) bps (163) bps 30-Day Delinquency Rate 1.07% 0.84% 0.69% (15) bps (38) bps Total Loans Ending Loan Balance ($MM) $88,927 $86,347 $87,674 1.5% (1.4)% Net Principal Charge-off Rate 3.44% 2.48% 2.12% (36) bps (132) bps 30-Day Delinquency Rate 1.98% 1.67% 1.34% (33) bps (64) bps

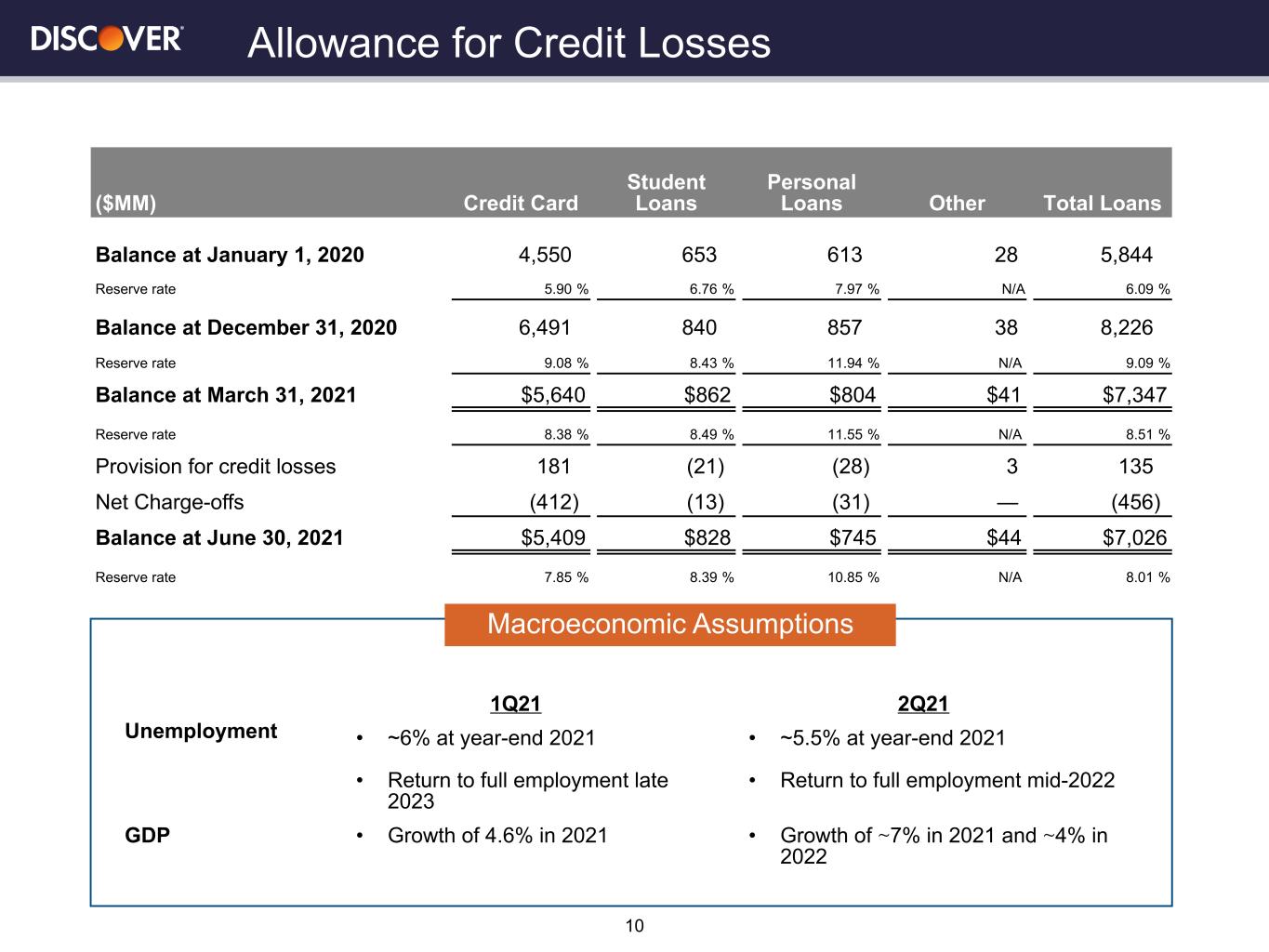

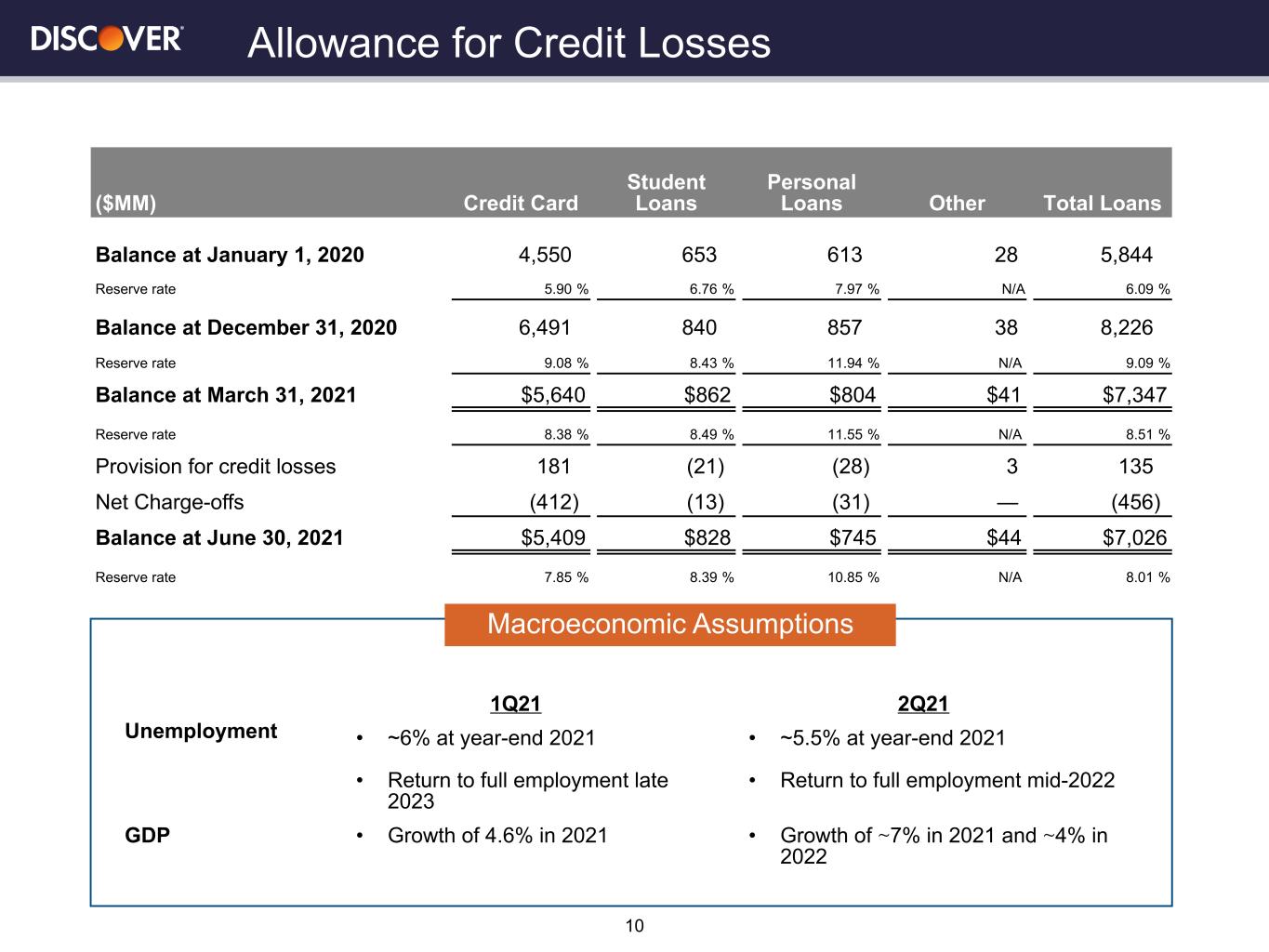

Allowance for Credit Losses 10 ($MM) Credit Card Student Loans Personal Loans Other Total Loans Balance at January 1, 2020 4,550 653 613 28 5,844 Reserve rate 5.90 % 6.76 % 7.97 % N/A 6.09 % Balance at December 31, 2020 6,491 840 857 38 8,226 Reserve rate 9.08 % 8.43 % 11.94 % N/A 9.09 % Balance at March 31, 2021 $5,640 $862 $804 $41 $7,347 Reserve rate 8.38 % 8.49 % 11.55 % N/A 8.51 % Provision for credit losses 181 (21) (28) 3 135 Net Charge-offs (412) (13) (31) — (456) Balance at June 30, 2021 $5,409 $828 $745 $44 $7,026 Reserve rate 7.85 % 8.39 % 10.85 % N/A 8.01 % Macroeconomic Assumptions 1Q21 2Q21 Unemployment • ~6% at year-end 2021 • Return to full employment late 2023 • ~5.5% at year-end 2021 • Return to full employment mid-2022 GDP • Growth of 4.6% in 2021 • Growth of ∼7% in 2021 and ∼4% in 2022

11 48% 51% 59% 66% 22% 21% 17% 13% 18% 16% 13% 11% 12% 12% 11% 10% DTC and Affinity Deposits Brokered & Other Deposits Securitized Borrowing Unsecured Borrowing 2Q18 2Q19 2Q20 2Q21 Capital and Funding Funding Mix (%), Average Balance (3) 11.4 11.4 11.2 11.3 11.7 12.2 13.1 14.9 15.7 82 79 77 99 165 123 76 22 23 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 Capital Trends Common Equity Tier 1 (CET1) Capital Ratio(1) (%) TTM Payout Ratio(2) (%) Note(s) 1. Based on the final rule published September 30, 2020. Capital ratios reflect delay in the recognition of the impact of CECL reserves on regulatory capital for two years in accordance with the final rule 2. Payout Ratio is displayed on a trailing twelve month basis. This represents the trailing twelve months’ Capital Return to Common Stockholders divided by the trailing twelve months’ Net Income Allocated to Common Stockholders 3. DTC and Affinity Deposits include checking and reflect both interest-bearing and non-interest bearing consumer deposits

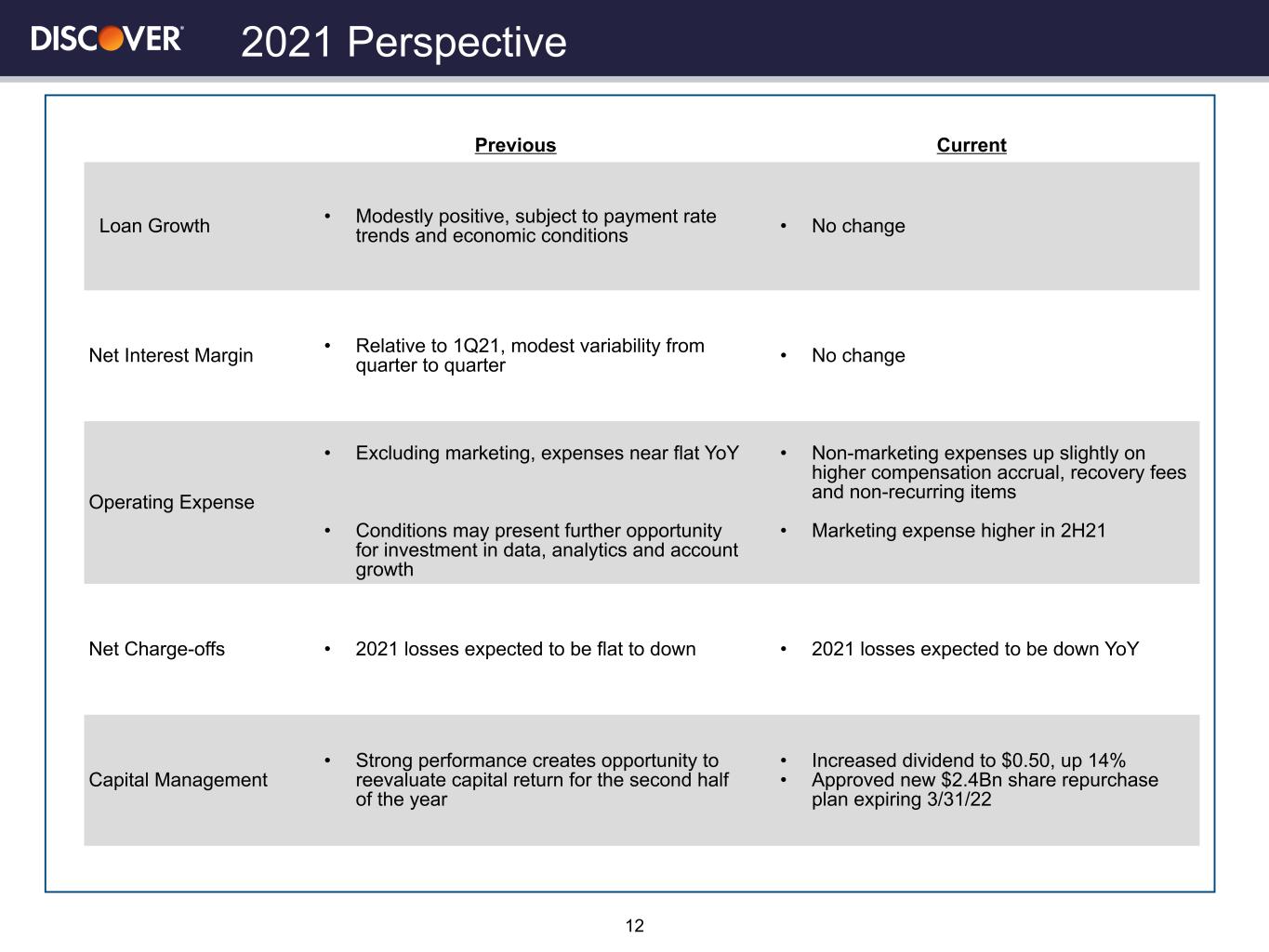

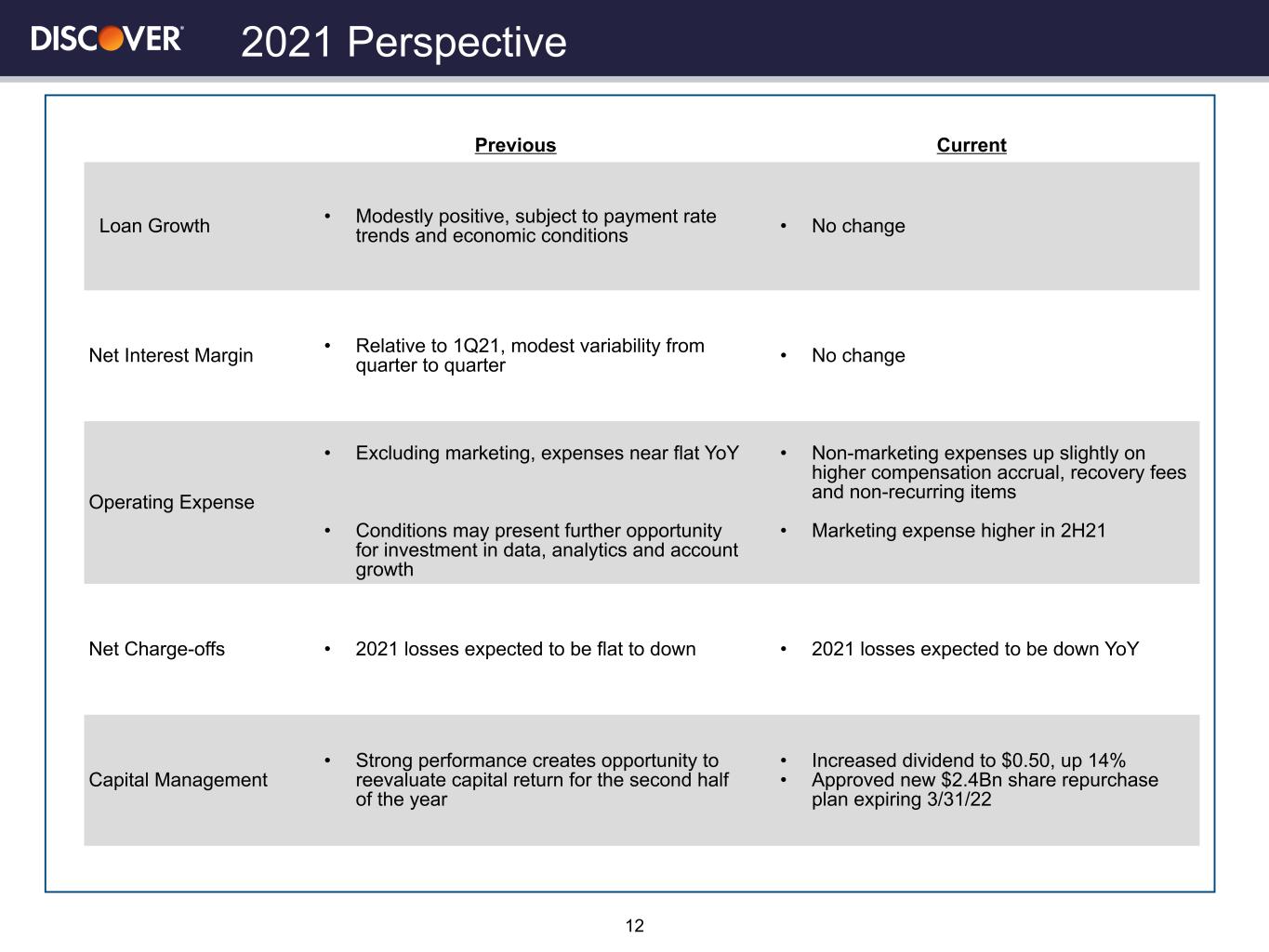

2021 Perspective 12 Previous Current Loan Growth • Modestly positive, subject to payment rate trends and economic conditions • No change Net Interest Margin • Relative to 1Q21, modest variability from quarter to quarter • No change Operating Expense • Excluding marketing, expenses near flat YoY • Conditions may present further opportunity for investment in data, analytics and account growth • Non-marketing expenses up slightly on higher compensation accrual, recovery fees and non-recurring items • Marketing expense higher in 2H21 Net Charge-offs • 2021 losses expected to be flat to down • 2021 losses expected to be down YoY Capital Management • Strong performance creates opportunity to reevaluate capital return for the second half of the year • Increased dividend to $0.50, up 14% • Approved new $2.4Bn share repurchase plan expiring 3/31/22

Appendix

Total Company Loans Credit Card Loans Private Student Loans Personal Loans 3.25 3.22 3.05 3.19 3.27 3.44 3.00 2.38 2.48 2.12 2.29 2.19 2.33 2.41 2.39 1.98 1.77 1.89 1.67 1.34 NCO rate (%) 30+ day DQ rate (%) 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3.50 3.49 3.32 3.41 3.65 3.90 3.45 2.63 2.80 2.45 2.45 2.34 2.50 2.62 2.62 2.17 1.91 2.07 1.85 1.43 NCO rate (%) 30+ day DQ rate (%) 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 4.53 4.33 3.99 4.26 3.59 3.43 2.69 2.79 2.80 1.80 1.51 1.49 1.49 1.37 1.31 1.07 1.10 1.08 0.84 0.69 NCO rate (%) 30+ day DQ rate (%) 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 0.66 0.61 0.59 1.02 0.68 0.62 0.58 0.71 0.53 0.53 1.91 1.82 1.93 1.88 1.75 1.57 1.49 1.39 1.20 1.34 NCO rate (%) 30+ day DQ rate (%) 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 Credit Performance Trends 14

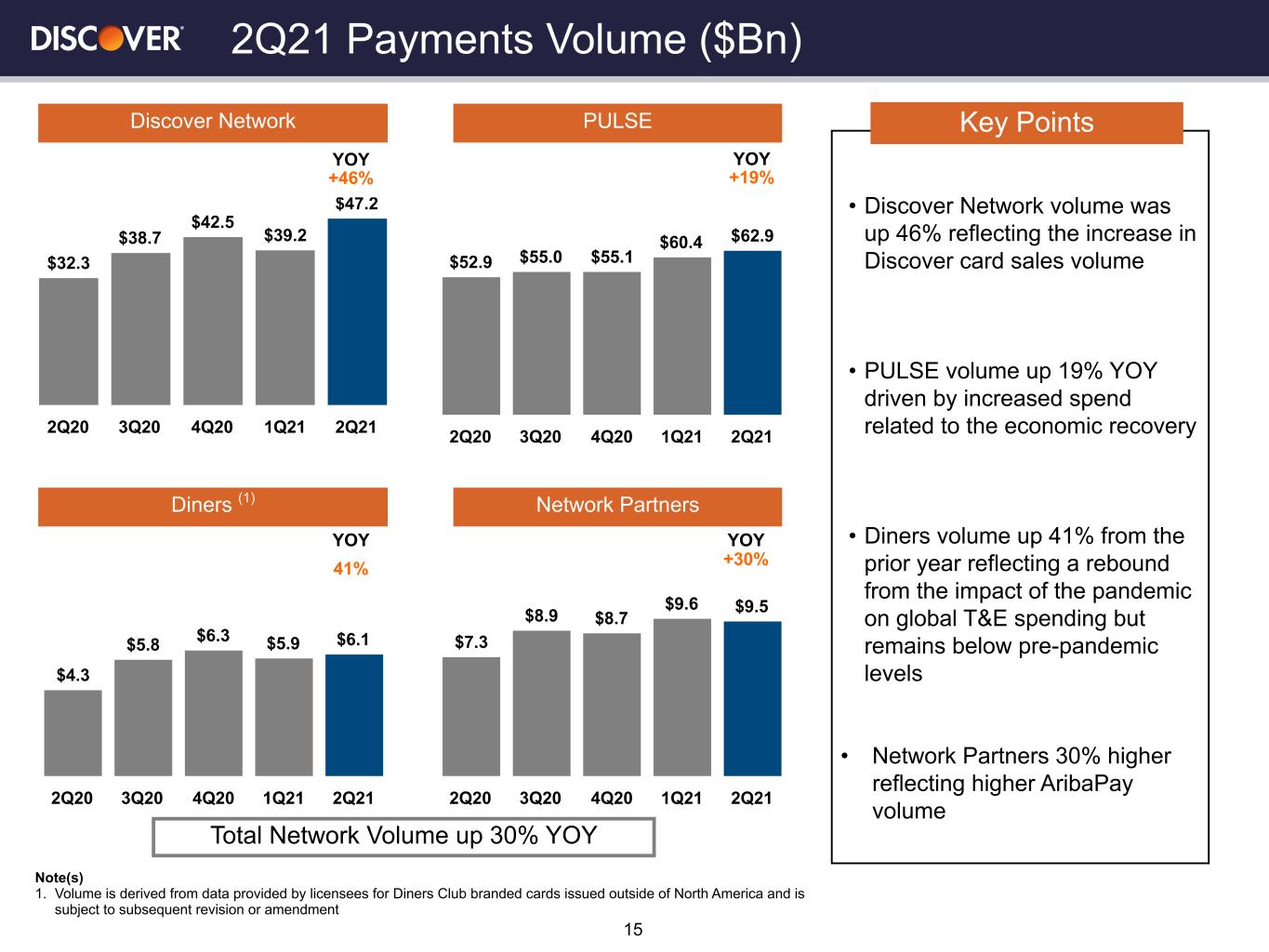

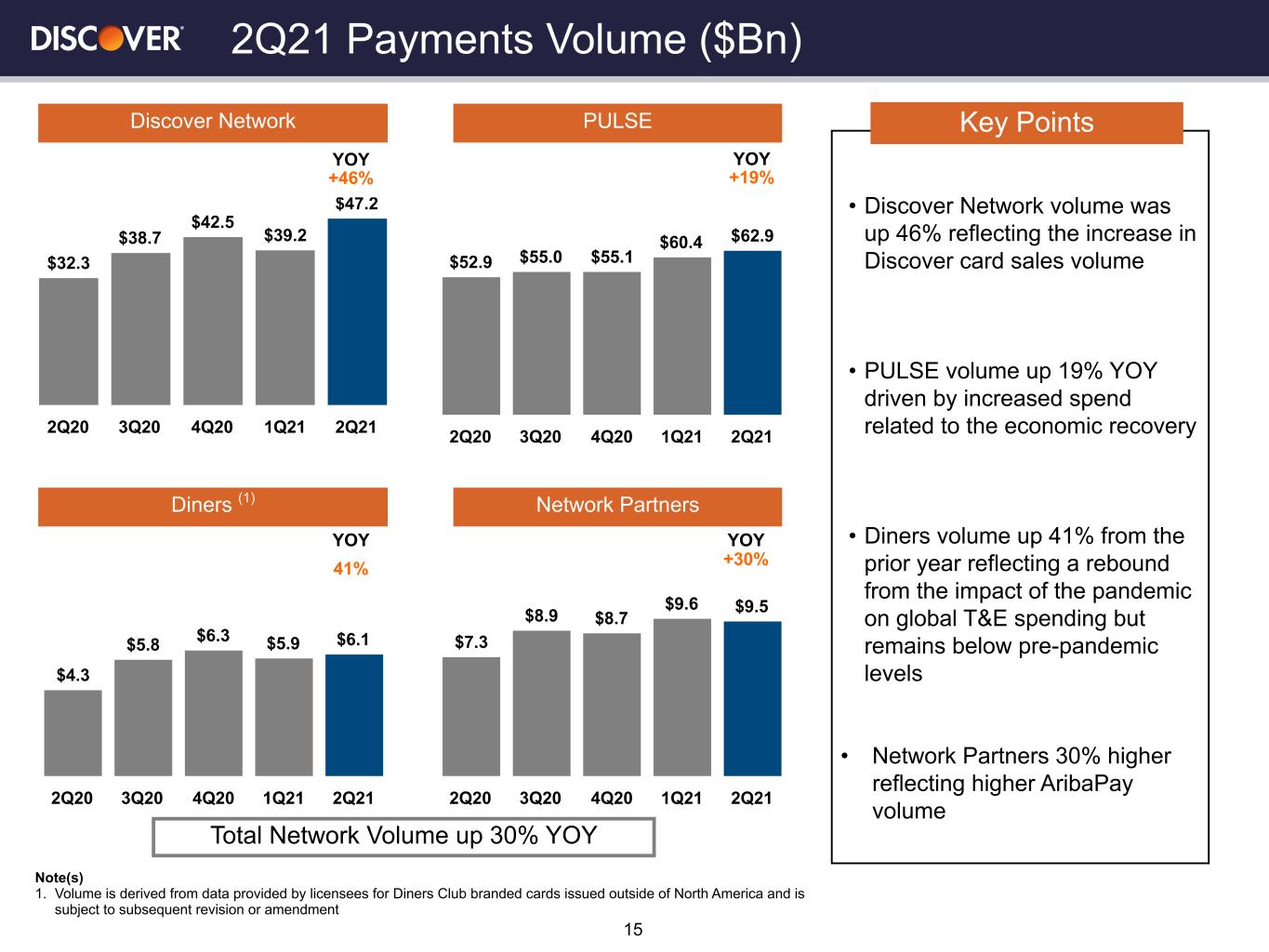

YOY YOY YOY YOY 2Q21 Payments Volume ($Bn) Discover Network • Discover Network volume was up 46% reflecting the increase in Discover card sales volume • PULSE volume up 19% YOY driven by increased spend related to the economic recovery • Diners volume up 41% from the prior year reflecting a rebound from the impact of the pandemic on global T&E spending but remains below pre-pandemic levels • Network Partners 30% higher reflecting higher AribaPay volume Key Points $32.3 $38.7 $42.5 $39.2 $47.2 2Q20 3Q20 4Q20 1Q21 2Q21 $52.9 $55.0 $55.1 $60.4 $62.9 2Q20 3Q20 4Q20 1Q21 2Q21 $4.3 $5.8 $6.3 $5.9 $6.1 2Q20 3Q20 4Q20 1Q21 2Q21 $7.3 $8.9 $8.7 $9.6 $9.5 2Q20 3Q20 4Q20 1Q21 2Q21 Diners (1) PULSE Network Partners +46% +19% 41% +30% Note(s) 1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment Total Network Volume up 30% YOY 15

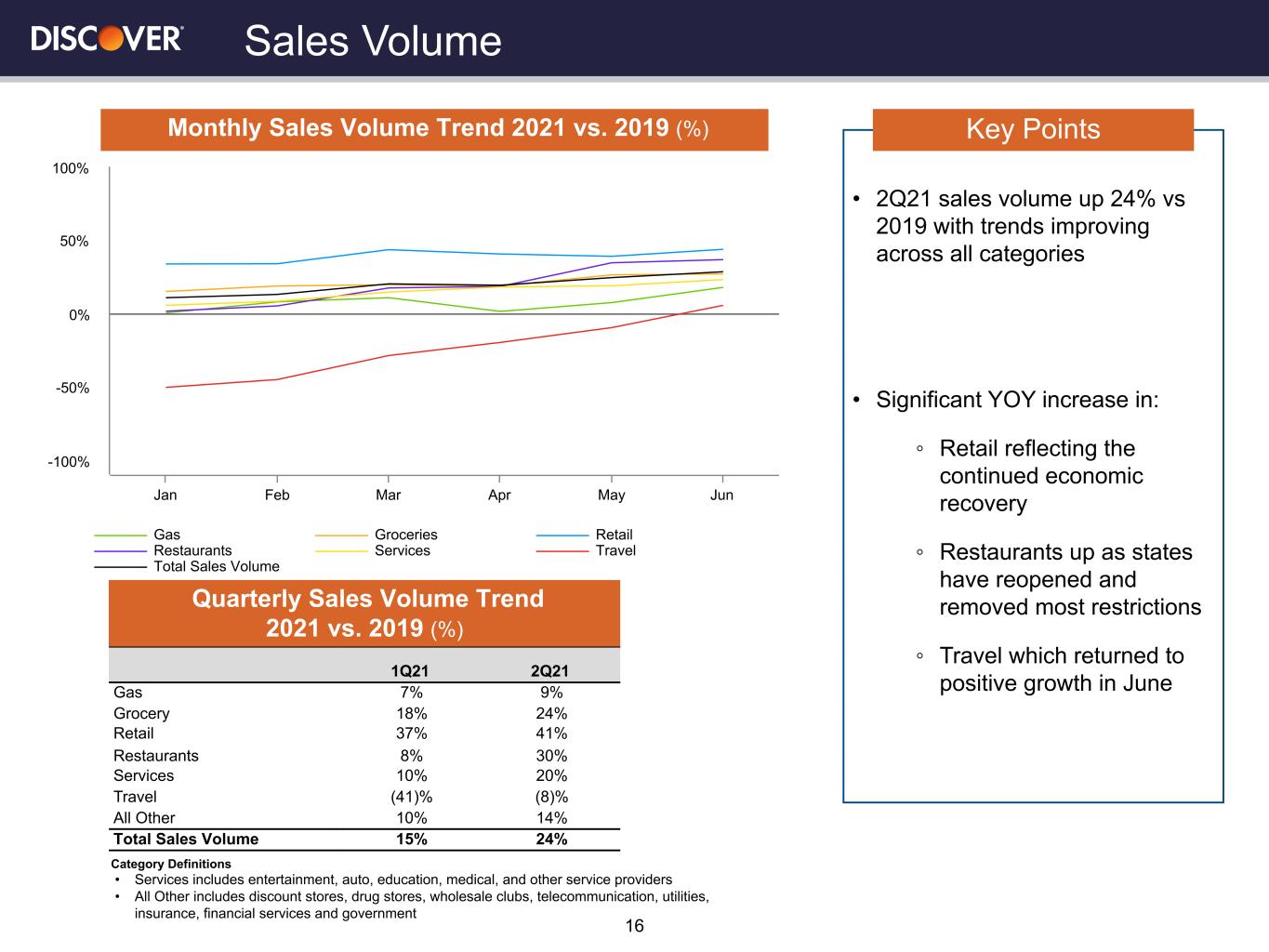

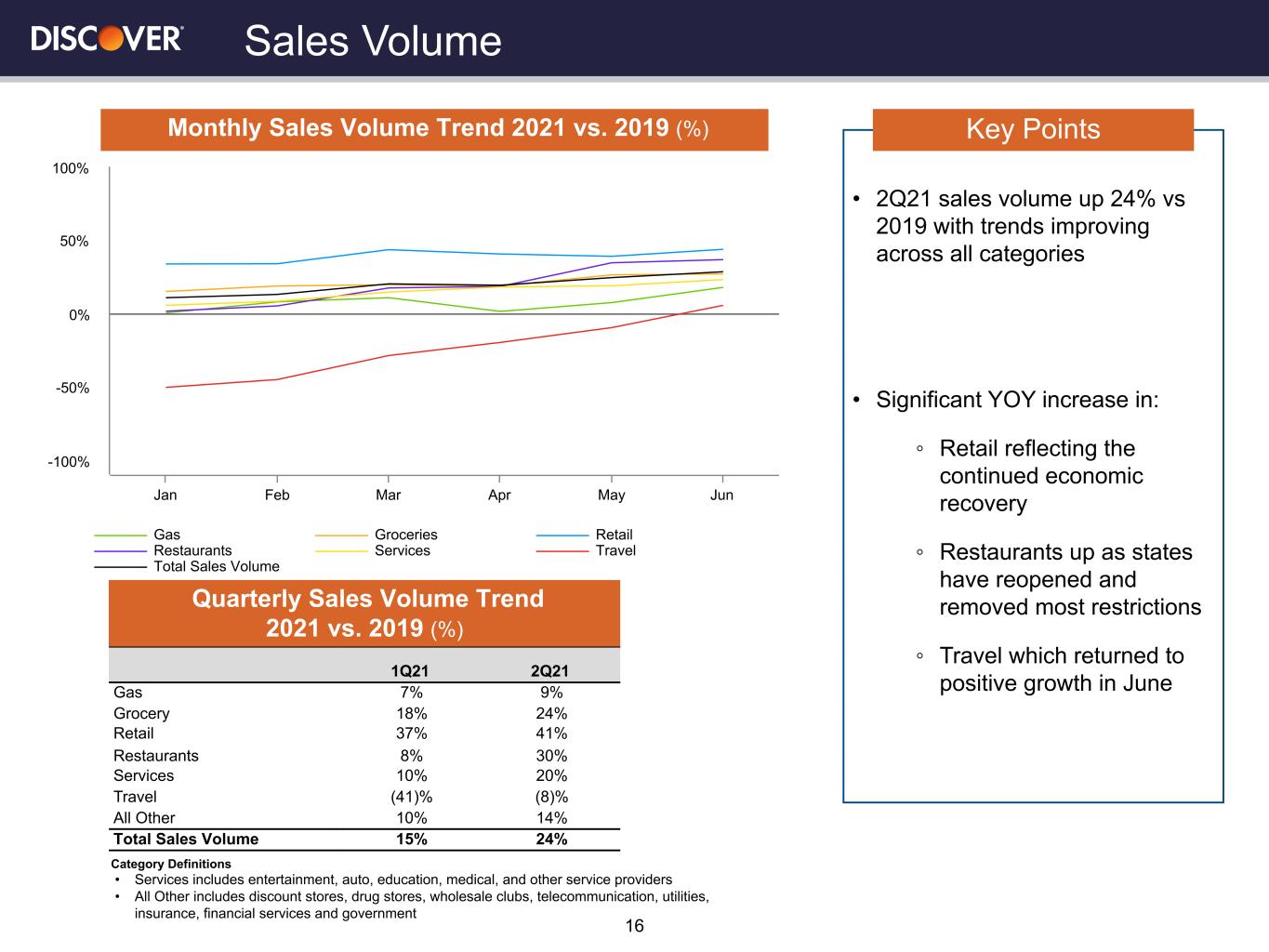

• 2Q21 sales volume up 24% vs 2019 with trends improving across all categories • Significant YOY increase in: ◦ Retail reflecting the continued economic recovery ◦ Restaurants up as states have reopened and removed most restrictions ◦ Travel which returned to positive growth in June keyrends in Key Points Sales Volume 16 Gas Groceries Retail Restaurants Services Travel Total Sales Volume Jan Feb Mar Apr May Jun -100% -50% 0% 50% 100% Monthly Sales Volume Trend 2021 vs. 2019 (%) 1Q21 2Q21 Gas 7% 9% Grocery 18% 24% Retail 37% 41% Restaurants 8% 30% Services 10% 20% Travel (41)% (8)% All Other 10% 14% Total Sales Volume 15% 24% Category Definitions • Services includes entertainment, auto, education, medical, and other service providers • All Other includes discount stores, drug stores, wholesale clubs, telecommunication, utilities, insurance, financial services and government Quarterly Sales Volume Trend 2021 vs. 2019 (%)