©2022 DISCOVER FINANCIAL SERVICES Exhibit 99.3 3Q22 Financial Results October 24, 2022

The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. For additional financial, statistical, and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement included as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website (www.discover.com) and the SEC’s website (www.sec.gov). The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, "Risk Factors" and “Management's Discussion & Analysis of Financial Condition and Results of Operations” in the company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 and March 31, 2022, which is filed with the SEC and available at the SEC's website (www.sec.gov) and subsequent reports on Forms 8-K and 10-Q, including the Company's Current Report on Form 8-K filed today with the SEC. The Company does not undertake to update or revise forward-looking statements as more information becomes available. Notice 2

3Q22 Highlights 3 • 3Q22 Net Income of $1.0Bn; diluted EPS of $3.54 • Earnings drivers remain robust: ◦ Elevated sales and new account acquisition are propelling receivables growth ◦ NIM expansion reflects higher prime rate partially offset by higher funding costs ◦ Reserve increases driven by loan growth • Operating conditions are consistent with late cycle expansion: ◦ Sustained customer deposit growth at rates in line with our expectations, and prudent use of diverse wholesale funding channels ◦ Consumer credit remains solid; delinquencies are modestly higher while net charge-offs increased slightly • We are well positioned for a range of economic environments: ◦ Our model focuses on prime lending with a through-the-cycle approach to underwriting ◦ Our earnings power, balance sheet and capital are strong

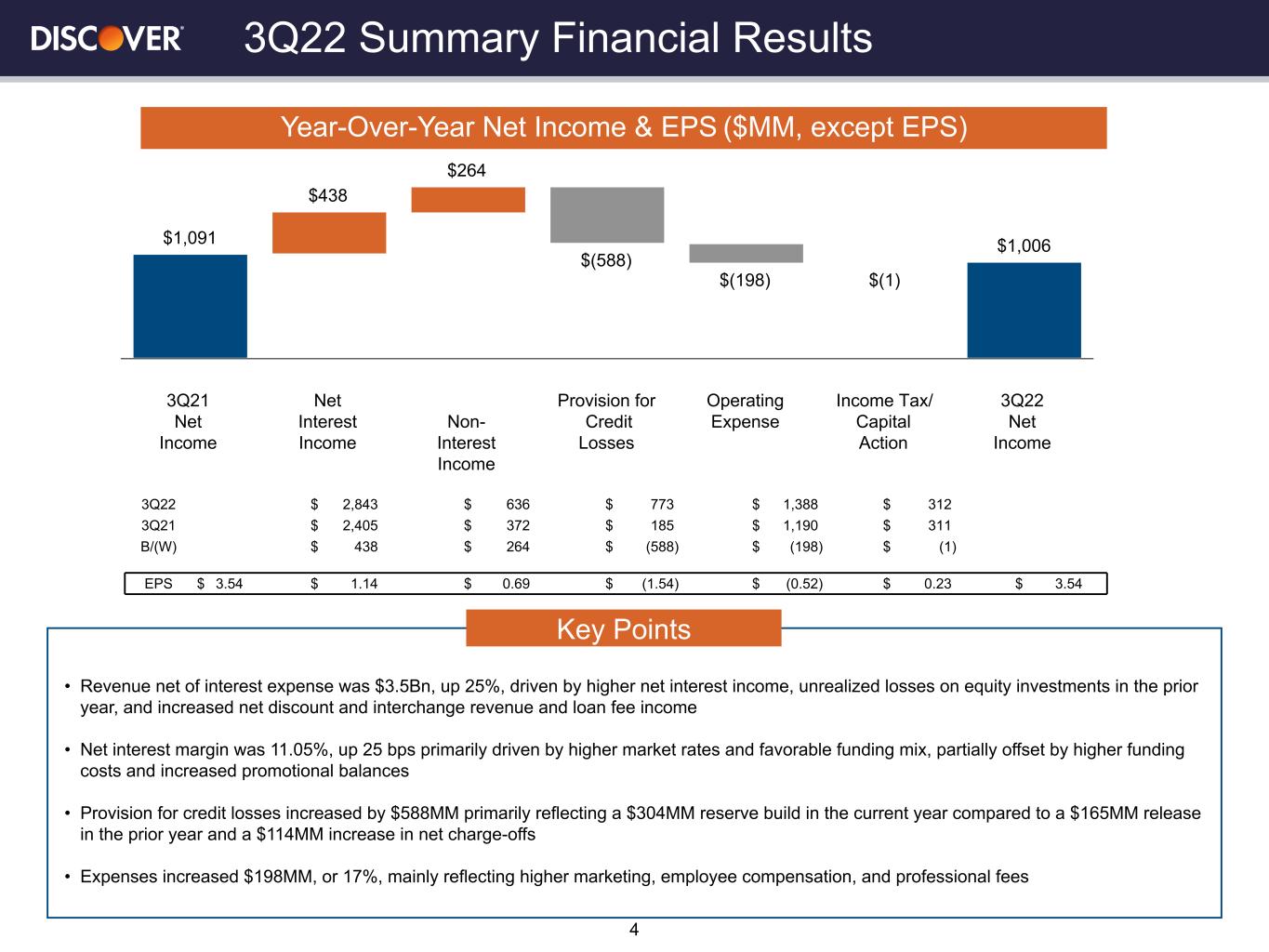

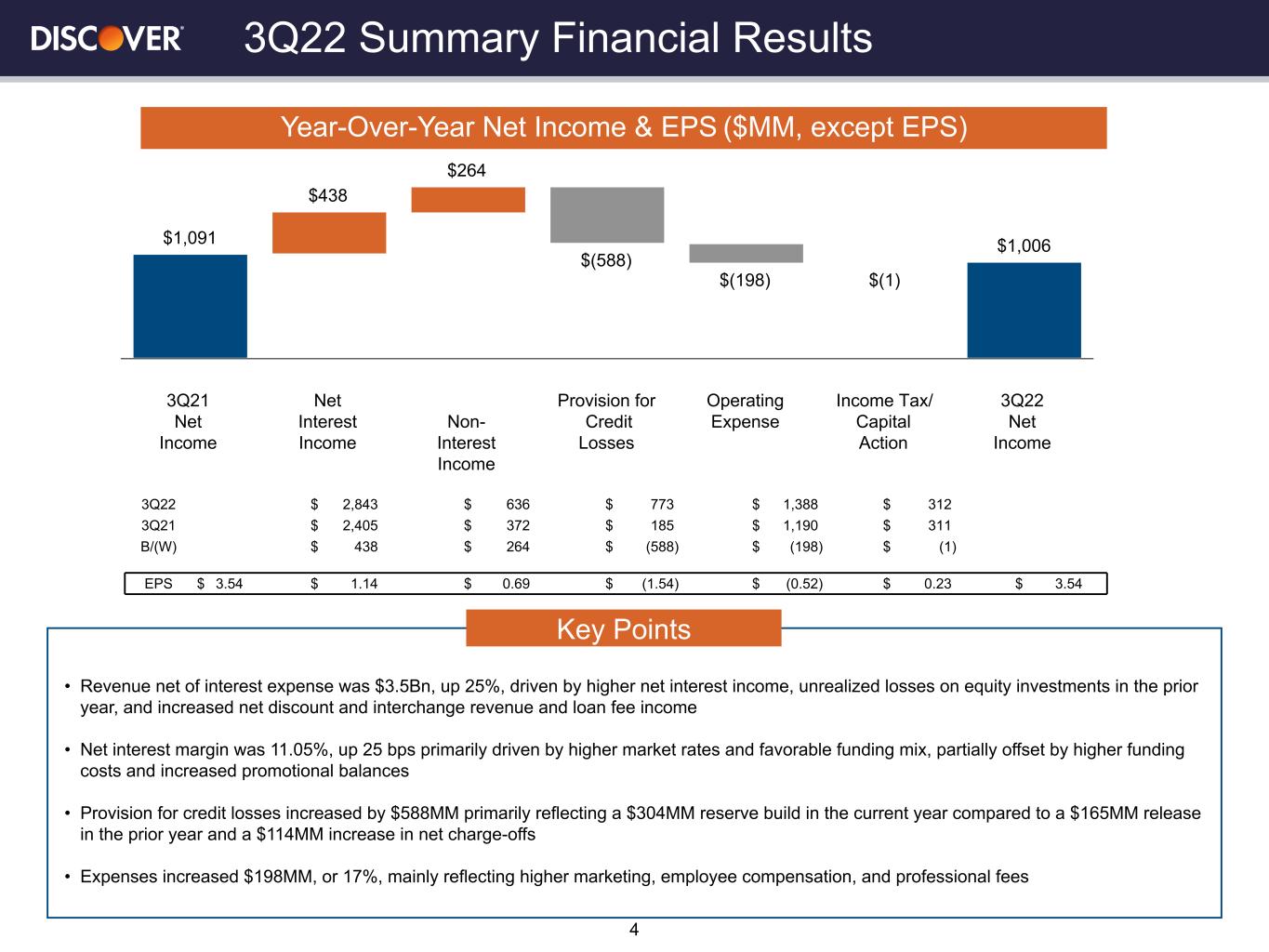

• Revenue net of interest expense was $3.5Bn, up 25%, driven by higher net interest income, unrealized losses on equity investments in the prior year, and increased net discount and interchange revenue and loan fee income • Net interest margin was 11.05%, up 25 bps primarily driven by higher market rates and favorable funding mix, partially offset by higher funding costs and increased promotional balances • Provision for credit losses increased by $588MM primarily reflecting a $304MM reserve build in the current year compared to a $165MM release in the prior year and a $114MM increase in net charge-offs • Expenses increased $198MM, or 17%, mainly reflecting higher marketing, employee compensation, and professional fees 3Q22 Summary Financial Results Key Points 4 $1,091 $438 $264 $(588) $(198) $(1) $1,006 3Q21 Net Income Net Interest Income Non- Interest Income Provision for Credit Losses Operating Expense Income Tax/ Capital Action 3Q22 Net Income Year-Over-Year Net Income & EPS ($MM, except EPS) 3Q22 $ 2,843 $ 636 $ 773 $ 1,388 $ 312 3Q21 $ 2,405 $ 372 $ 185 $ 1,190 $ 311 B/(W) $ 438 $ 264 $ (588) $ (198) $ (1) EPS $ 3.54 $ 1.14 $ 0.69 $ (1.54) $ (0.52) $ 0.23 $ 3.54

• NIM on loans was 11.05%, up 11bps QOQ as favorable loan and securities yields were mostly offset by higher funding costs • Total loan yield was up 67bps QOQ primarily driven by higher prime rate partially offset by higher promotional mix and timing of pricing changes • The rate on average interest- bearing liabilities increased 73bps QOQ, primarily driven by increased consumer deposit pricing • Consumer deposits were up 4% YOY and up 2% QOQ; we continue to target 70-80% deposit funding over the medium term 3Q22 Net Interest Income Drivers 5 Key Points Note(s) 1. DTC and Affinity Deposits include checking and reflect both interest-bearing and non-interest bearing consumer deposits 10.80% 10.81% 10.85% 10.94% 11.05% 3Q21 4Q21 1Q22 2Q22 3Q22 NIM on Loans Loan Growth ($Bn) Funding Mix (%), Average Balance (1) Total Loans +17% YOY $70.3 $74.4 $73.8 $79.2 $83.6 $9.4 $9.4 $9.6 $9.4 $9.7$6.9 $6.9 $6.9 $7.1 $7.7 $2.9 $3.0 $3.2 $3.5 $3.9 Card +19% YOY Organic Student +4% YOY Personal +11% YOY Other + 32% YOY 3Q21 4Q21 1Q22 2Q22 3Q22 68% 68% 71% 70% 65% 12% 11% 11% 11% 15% 9% 10% 7% 9% 10% 11% 11% 11% 10% 10% DTC and Affinity Deposits Brokered & Other Deposits Securitized Borrowing Unsecured Borrowing 3Q21 4Q21 1Q22 2Q22 3Q22 Total Loan Yield 11.79% 11.75% 11.80% 12.00% 12.67% Total Int. - Bearing Liab Rate 1.19% 1.15% 1.18% 1.36% 2.09%

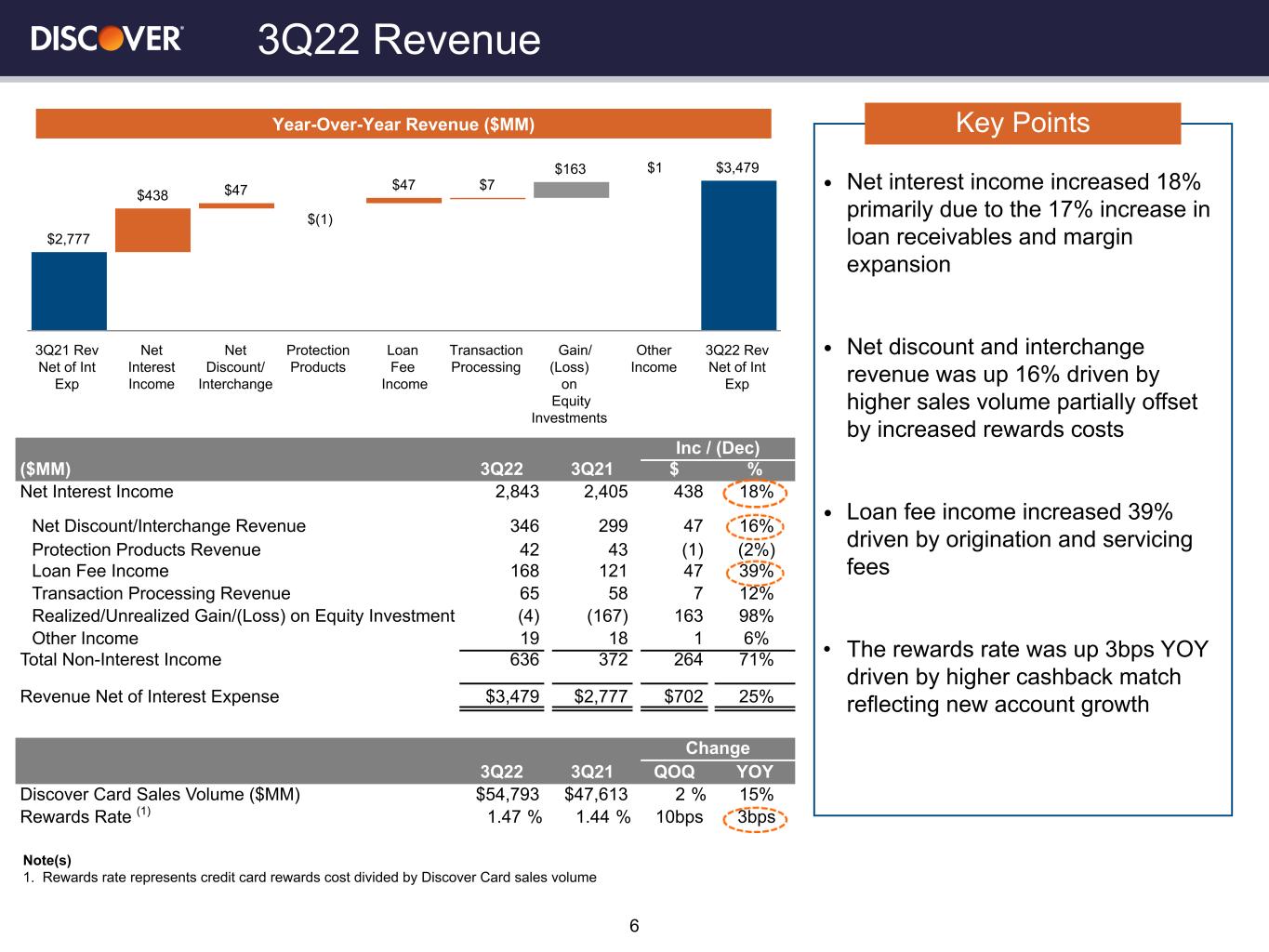

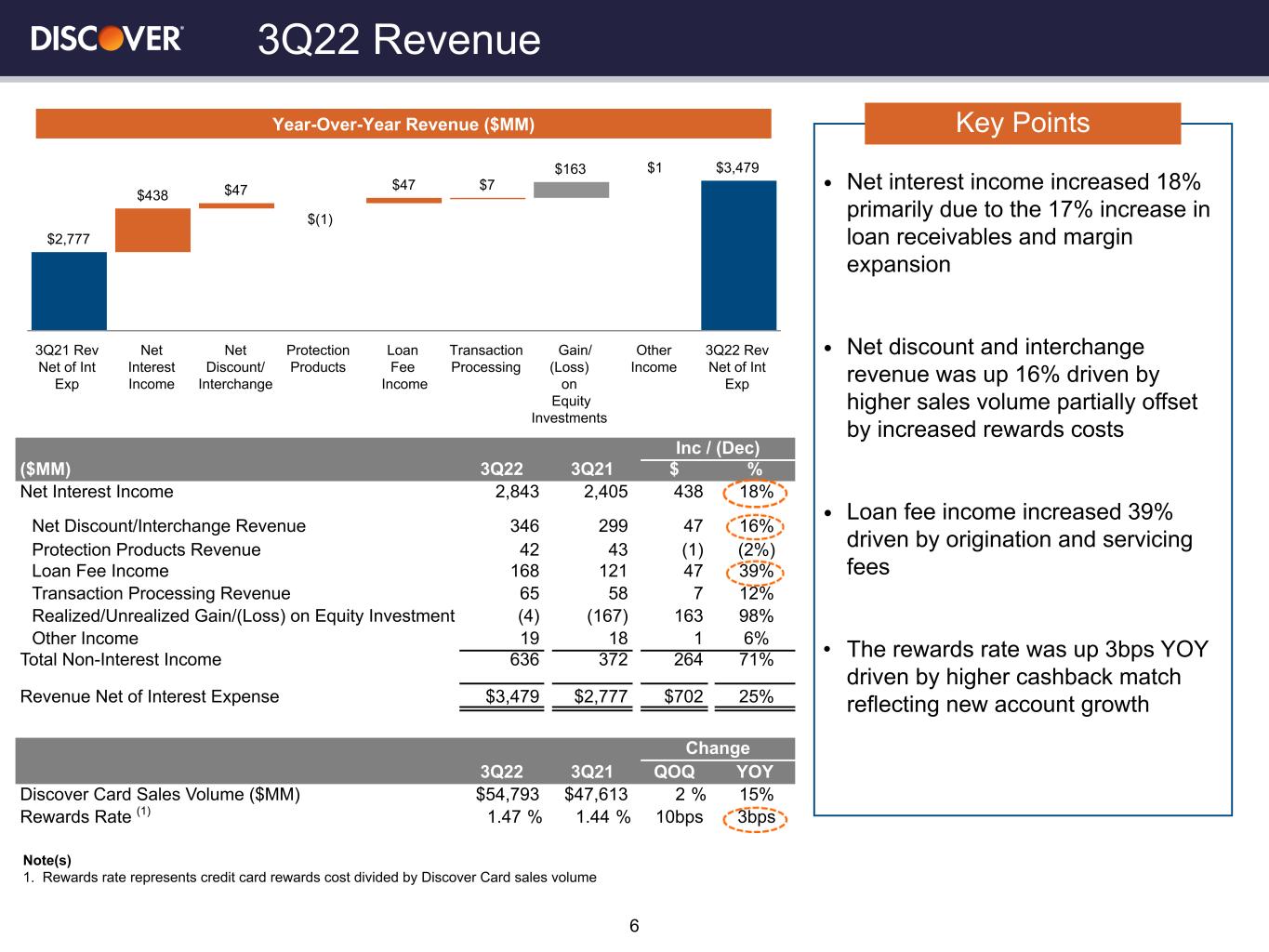

Note(s) 1. Rewards rate represents credit card rewards cost divided by Discover Card sales volume • Net interest income increased 18% primarily due to the 17% increase in loan receivables and margin expansion • Net discount and interchange revenue was up 16% driven by higher sales volume partially offset by increased rewards costs • Loan fee income increased 39% driven by origination and servicing fees • The rewards rate was up 3bps YOY driven by higher cashback match reflecting new account growth 3Q22 Revenue 6 Key Points Inc / (Dec) ($MM) 3Q22 3Q21 $ % Net Interest Income 2,843 2,405 438 18% Net Discount/Interchange Revenue 346 299 47 16% Protection Products Revenue 42 43 (1) (2%) Loan Fee Income 168 121 47 39% Transaction Processing Revenue 65 58 7 12% Realized/Unrealized Gain/(Loss) on Equity Investment (4) (167) 163 98% Other Income 19 18 1 6% Total Non-Interest Income 636 372 264 71% Revenue Net of Interest Expense $3,479 $2,777 $702 25% Change 3Q22 3Q21 QOQ YOY Discover Card Sales Volume ($MM) $54,793 $47,613 2 % 15% Rewards Rate (1) 1.47 % 1.44 % 10bps 3bps $2,777 $438 $47 $(1) $47 $7 $163 $1 $3,479 3Q21 Rev Net of Int Exp Net Interest Income Net Discount/ Interchange Protection Products Loan Fee Income Transaction Processing Gain/ (Loss) on Equity Investments Other Income 3Q22 Rev Net of Int Exp Year-Over-Year Revenue ($MM)

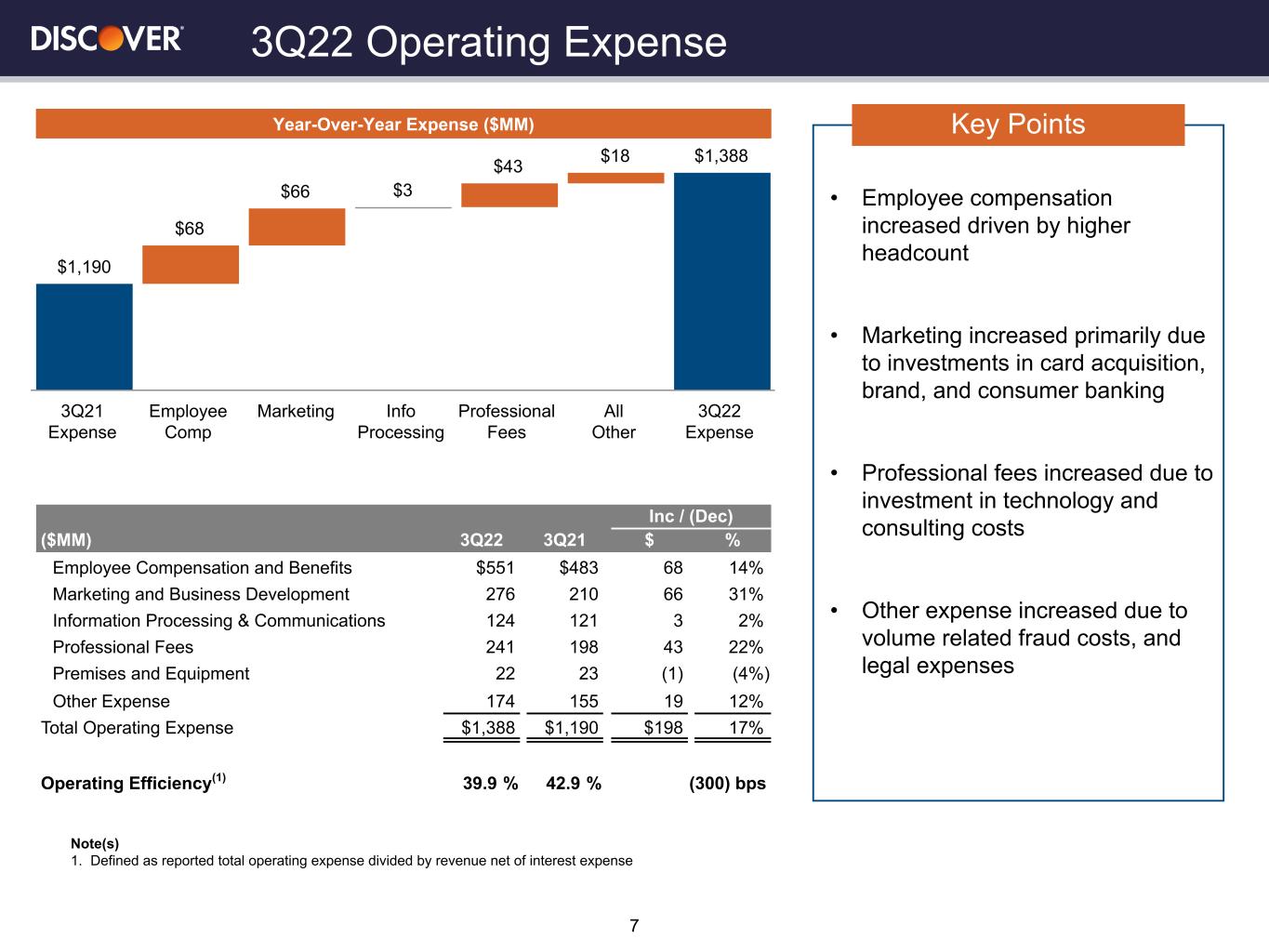

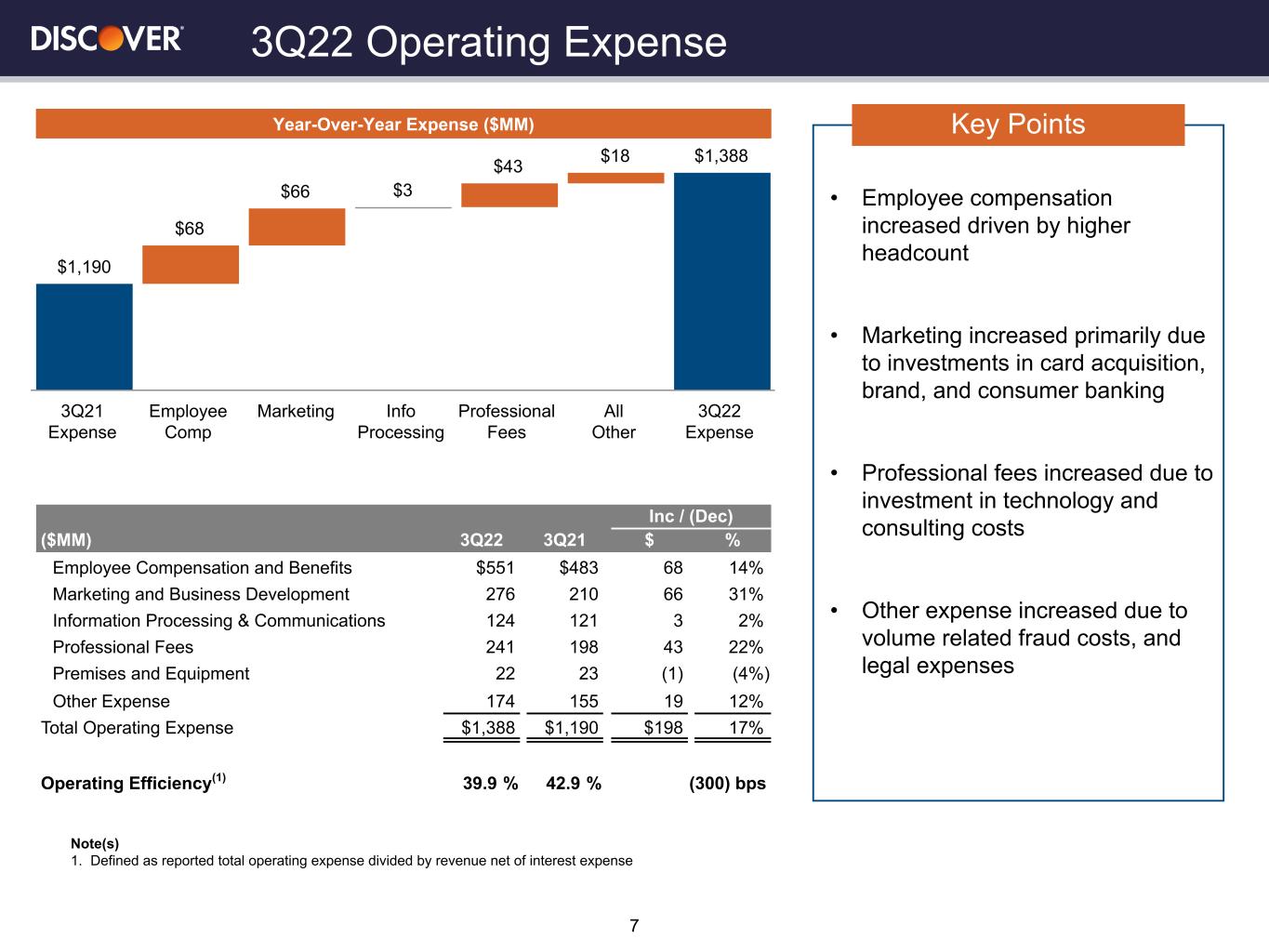

Note(s) 1. Defined as reported total operating expense divided by revenue net of interest expense • Employee compensation increased driven by higher headcount • Marketing increased primarily due to investments in card acquisition, brand, and consumer banking • Professional fees increased due to investment in technology and consulting costs • Other expense increased due to volume related fraud costs, and legal expenses 3Q22 Operating Expense Inc / (Dec) ($MM) 3Q22 3Q21 $ % Employee Compensation and Benefits $551 $483 68 14% Marketing and Business Development 276 210 66 31% Information Processing & Communications 124 121 3 2% Professional Fees 241 198 43 22% Premises and Equipment 22 23 (1) (4%) Other Expense 174 155 19 12% Total Operating Expense $1,388 $1,190 $198 17% Operating Efficiency(1) 39.9 % 42.9 % (300) bps 7 Key PointsYear-Over-Year Expense ($MM) $1,190 $68 $66 $3 $43 $18 $1,388 3Q21 Expense Employee Comp Marketing Info Processing Professional Fees All Other 3Q22 Expense

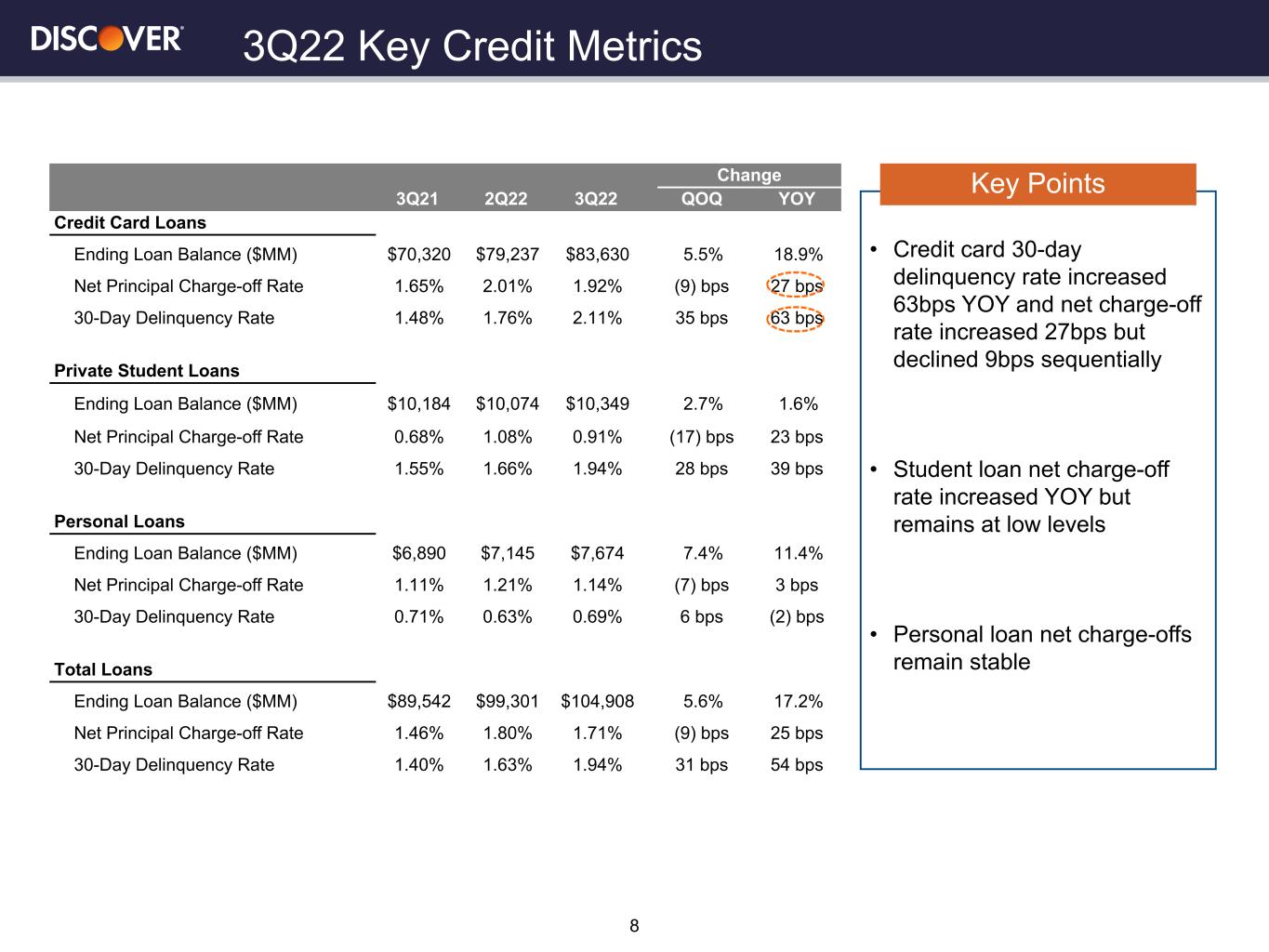

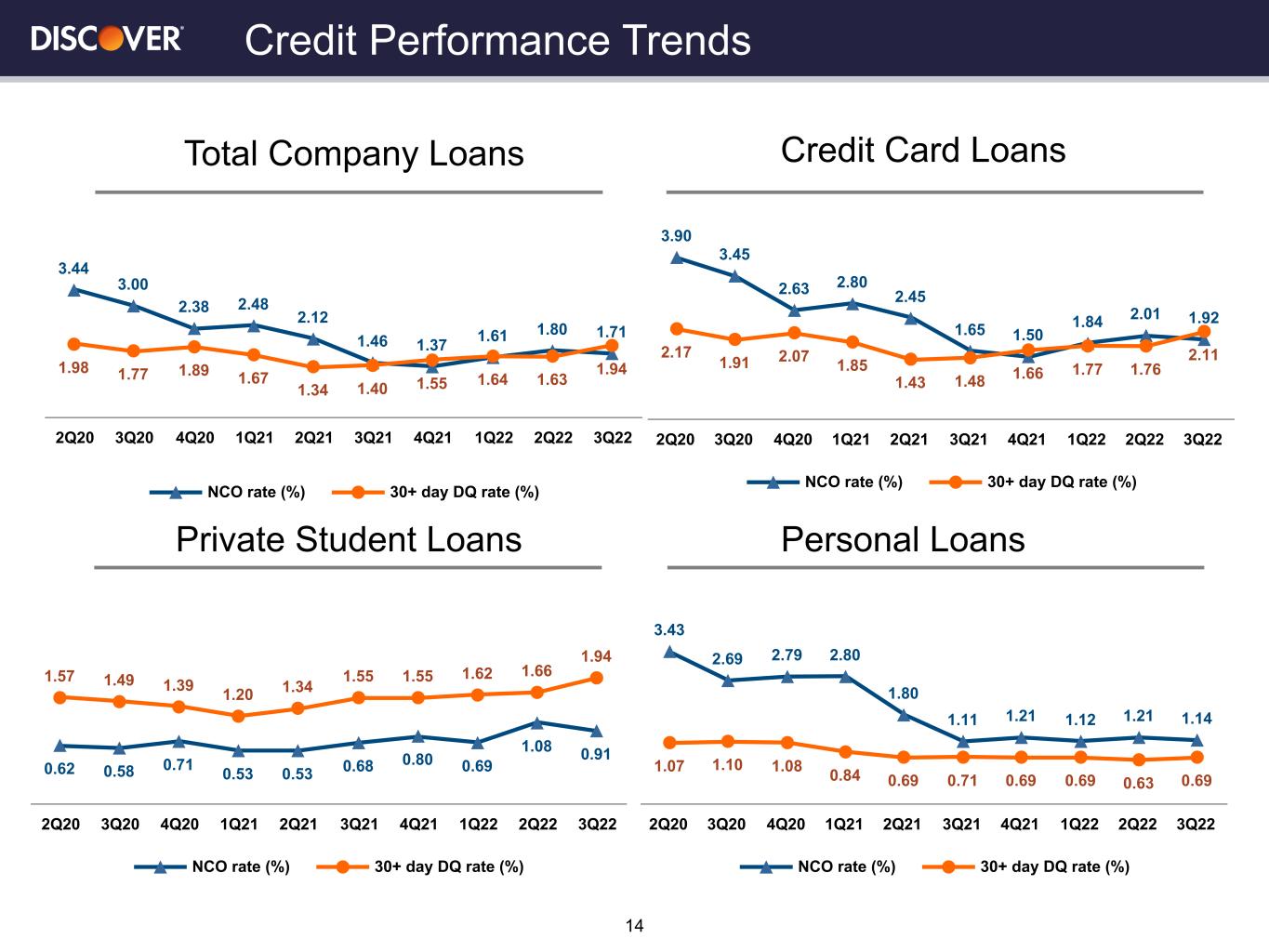

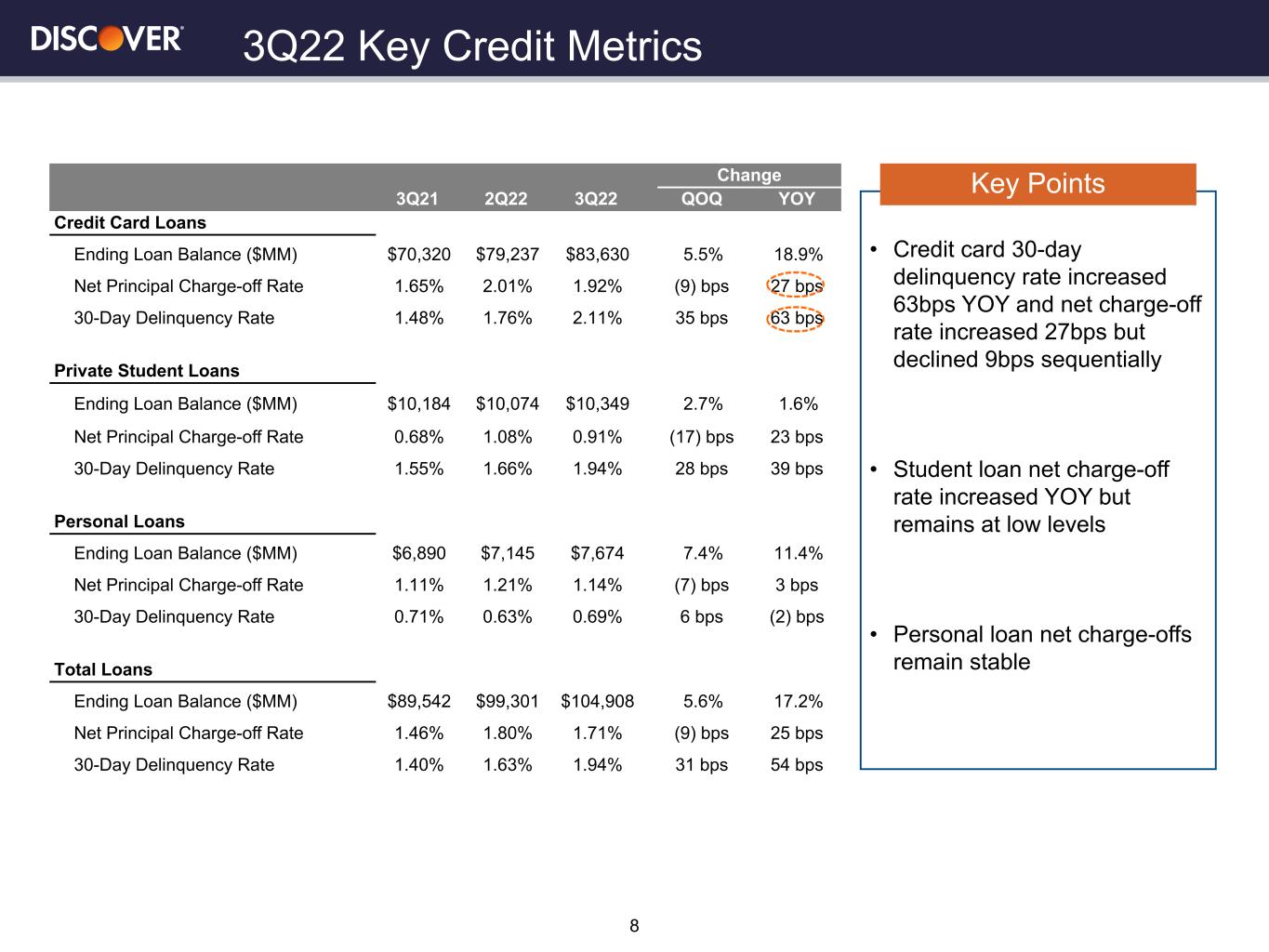

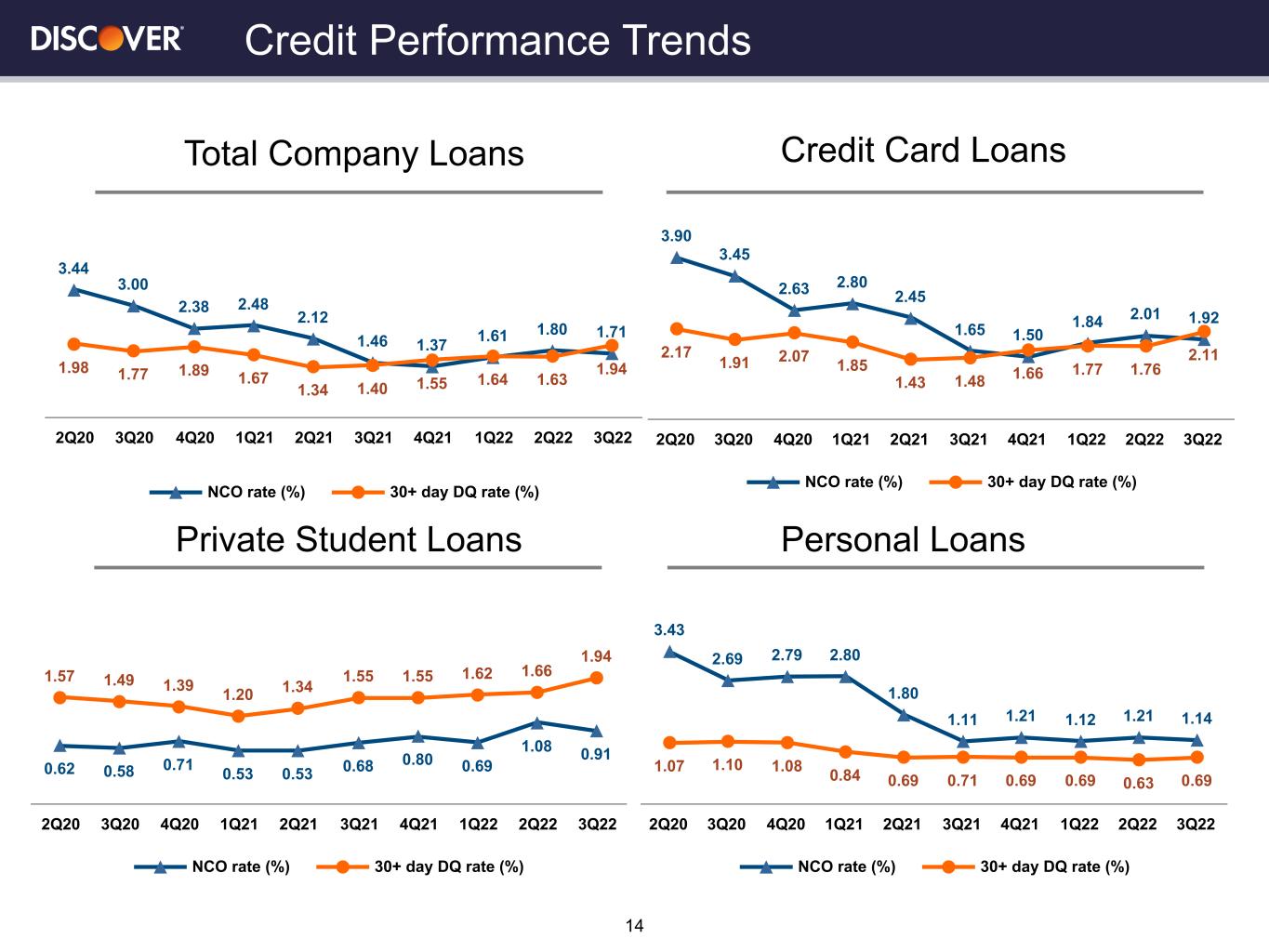

• Credit card 30-day delinquency rate increased 63bps YOY and net charge-off rate increased 27bps but declined 9bps sequentially • Student loan net charge-off rate increased YOY but remains at low levels • Personal loan net charge-offs remain stable 3Q22 Key Credit Metrics 8 Key PointsChange 3Q21 2Q22 3Q22 QOQ YOY Credit Card Loans Ending Loan Balance ($MM) $70,320 $79,237 $83,630 5.5% 18.9% Net Principal Charge-off Rate 1.65% 2.01% 1.92% (9) bps 27 bps 30-Day Delinquency Rate 1.48% 1.76% 2.11% 35 bps 63 bps Private Student Loans Ending Loan Balance ($MM) $10,184 $10,074 $10,349 2.7% 1.6% Net Principal Charge-off Rate 0.68% 1.08% 0.91% (17) bps 23 bps 30-Day Delinquency Rate 1.55% 1.66% 1.94% 28 bps 39 bps Personal Loans Ending Loan Balance ($MM) $6,890 $7,145 $7,674 7.4% 11.4% Net Principal Charge-off Rate 1.11% 1.21% 1.14% (7) bps 3 bps 30-Day Delinquency Rate 0.71% 0.63% 0.69% 6 bps (2) bps Total Loans Ending Loan Balance ($MM) $89,542 $99,301 $104,908 5.6% 17.2% Net Principal Charge-off Rate 1.46% 1.80% 1.71% (9) bps 25 bps 30-Day Delinquency Rate 1.40% 1.63% 1.94% 31 bps 54 bps

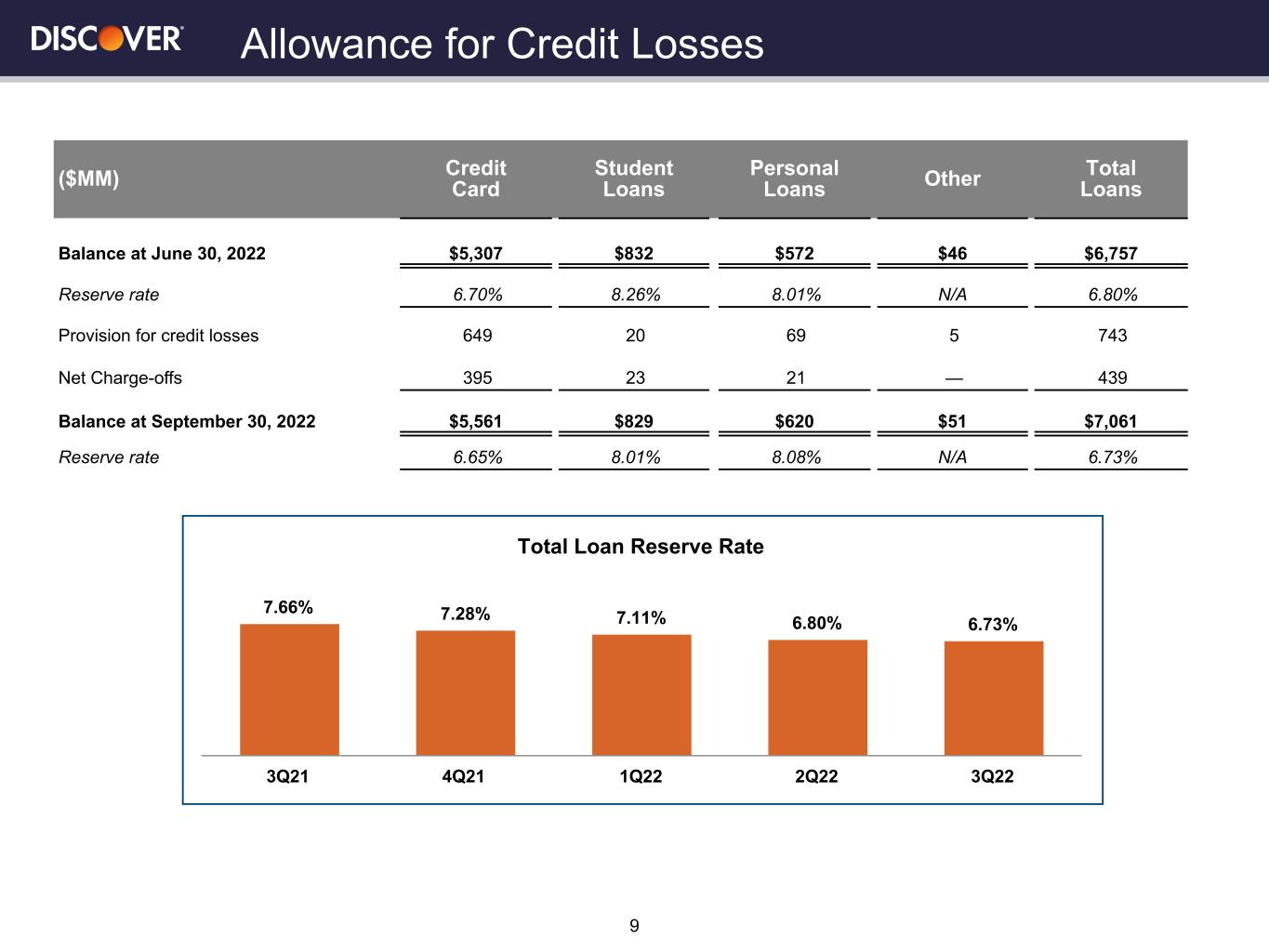

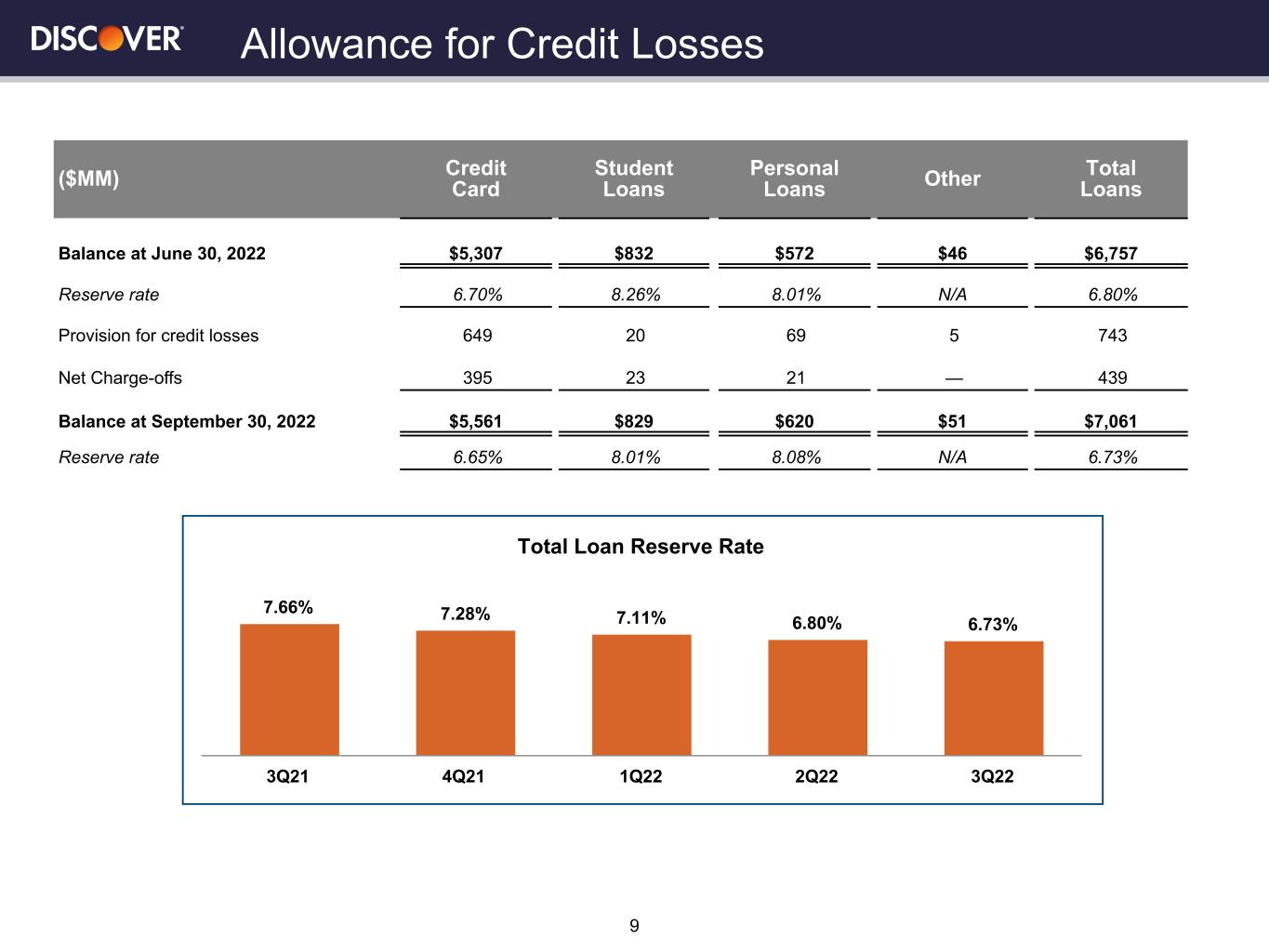

9 ($MM) Credit Card Student Loans Personal Loans Other Total Loans Balance at June 30, 2022 $5,307 $832 $572 $46 $6,757 Reserve rate 6.70% 8.26% 8.01% N/A 6.80% Provision for credit losses 649 20 69 5 743 Net Charge-offs 395 23 21 — 439 Balance at September 30, 2022 $5,561 $829 $620 $51 $7,061 Reserve rate 6.65% 8.01% 8.08% N/A 6.73% Total Loan Reserve Rate 7.66% 7.28% 7.11% 6.80% 6.73% 3Q21 4Q21 1Q22 2Q22 3Q22 Allowance for Credit Losses

10 Capital Return(3)Capital Position Common Equity Tier 1 (CET1) Capital Ratio(1) (%) TTM Payout Ratio(2) (%) Note(s) 1. Based on the final rule published September 30, 2020. Capital ratios reflect delay in the recognition of the impact of CECL reserves on regulatory capital for two years in accordance with the final rule 2. Payout Ratio is displayed on a trailing twelve month basis. This represents the trailing twelve months’ Capital Return to Common Stockholders divided by the trailing twelve months’ Net Income Allocated to Common Stockholders 3. Quarterly dividend per share figures for 2017 through 2021 represent year-end levels 11.6% 11.1% 11.2% 13.1% 14.8% 13.9% 123% 93% 77% 76% 51% 70% 2017 2018 2019 2020 2021 3Q22 • The Common Equity Tier 1 ratio of 13.9% remains above our target of 10.5% • Repurchased $212 million in the quarter prior to decision to suspend repurchases Key Points $2.1 $2.1 $1.8 $0.3 $2.3 $1.8 $0.35 $0.40 $0.44 $0.44 $0.50 $0.60 2017 2018 2019 2020 2021 YTD 2022 Capital Position & Capital Return Trends Share Repurchases ($Bn) Quarterly Dividend per Share

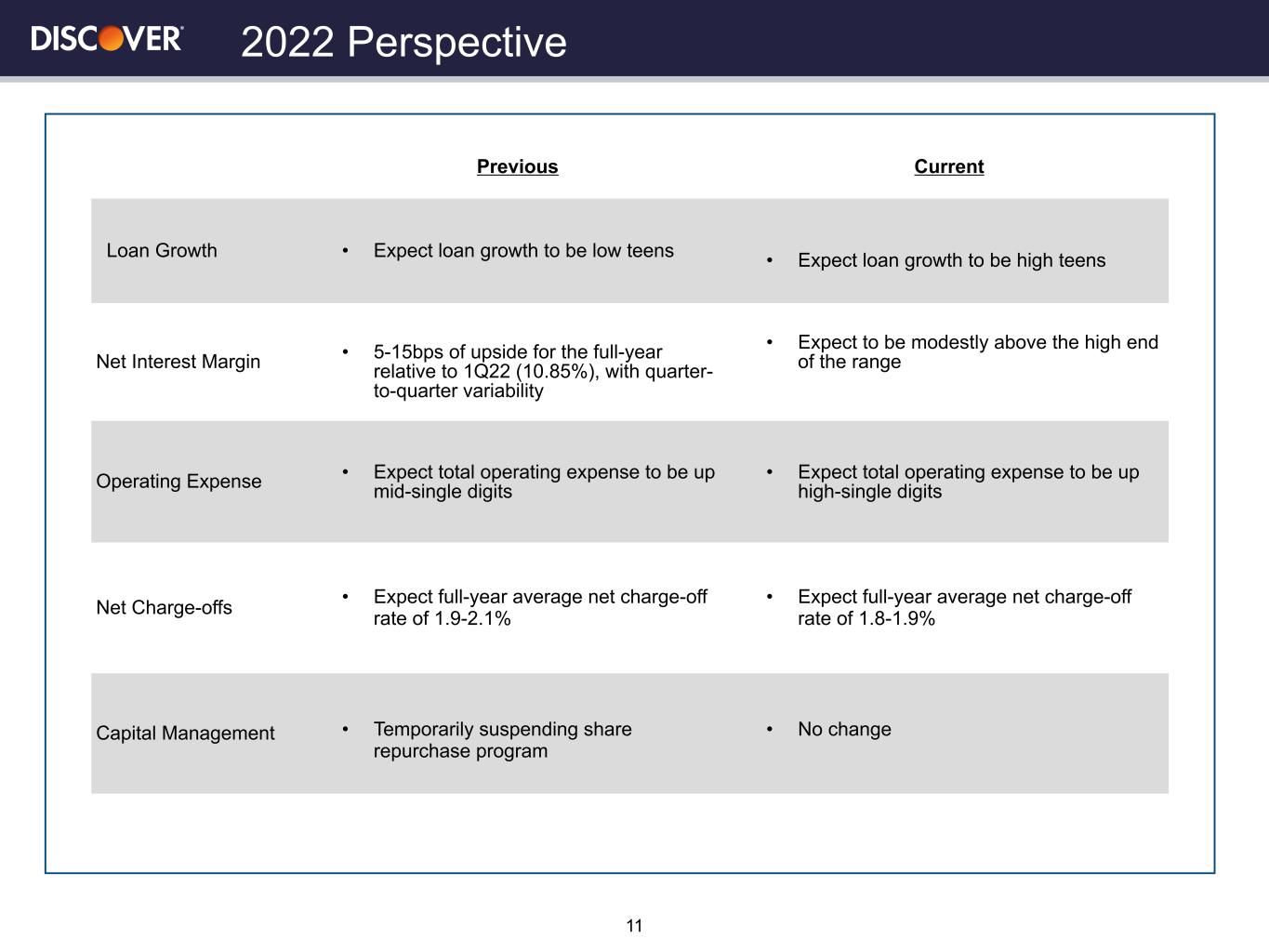

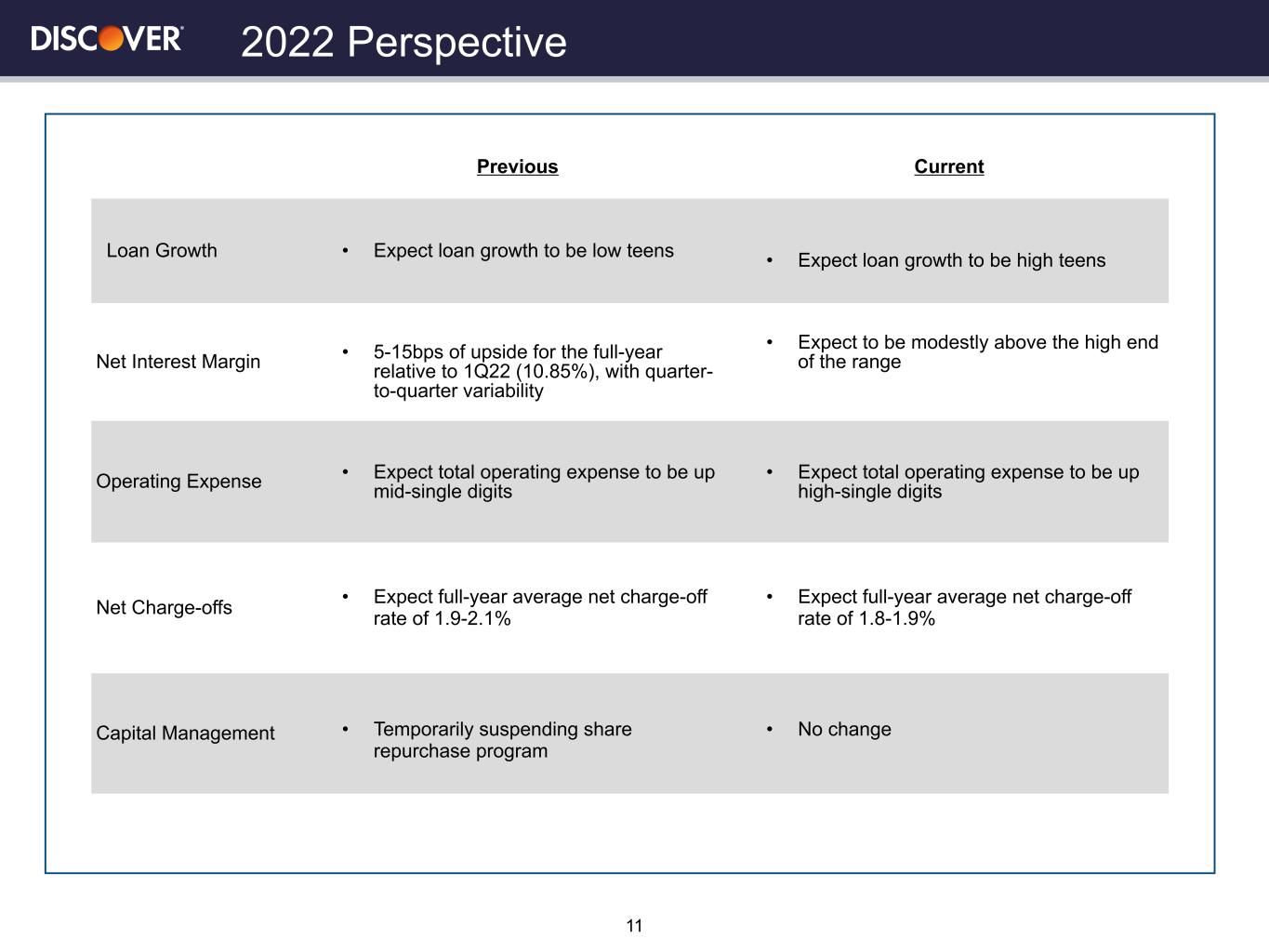

11 Previous Current Loan Growth • Expect loan growth to be low teens • Expect loan growth to be high teens Net Interest Margin • 5-15bps of upside for the full-year relative to 1Q22 (10.85%), with quarter- to-quarter variability • Expect to be modestly above the high end of the range Operating Expense • Expect total operating expense to be up mid-single digits • Expect total operating expense to be up high-single digits Net Charge-offs • Expect full-year average net charge-off rate of 1.9-2.1% • Expect full-year average net charge-off rate of 1.8-1.9% Capital Management • Temporarily suspending share repurchase program • No change 2022 Perspective

Appendix

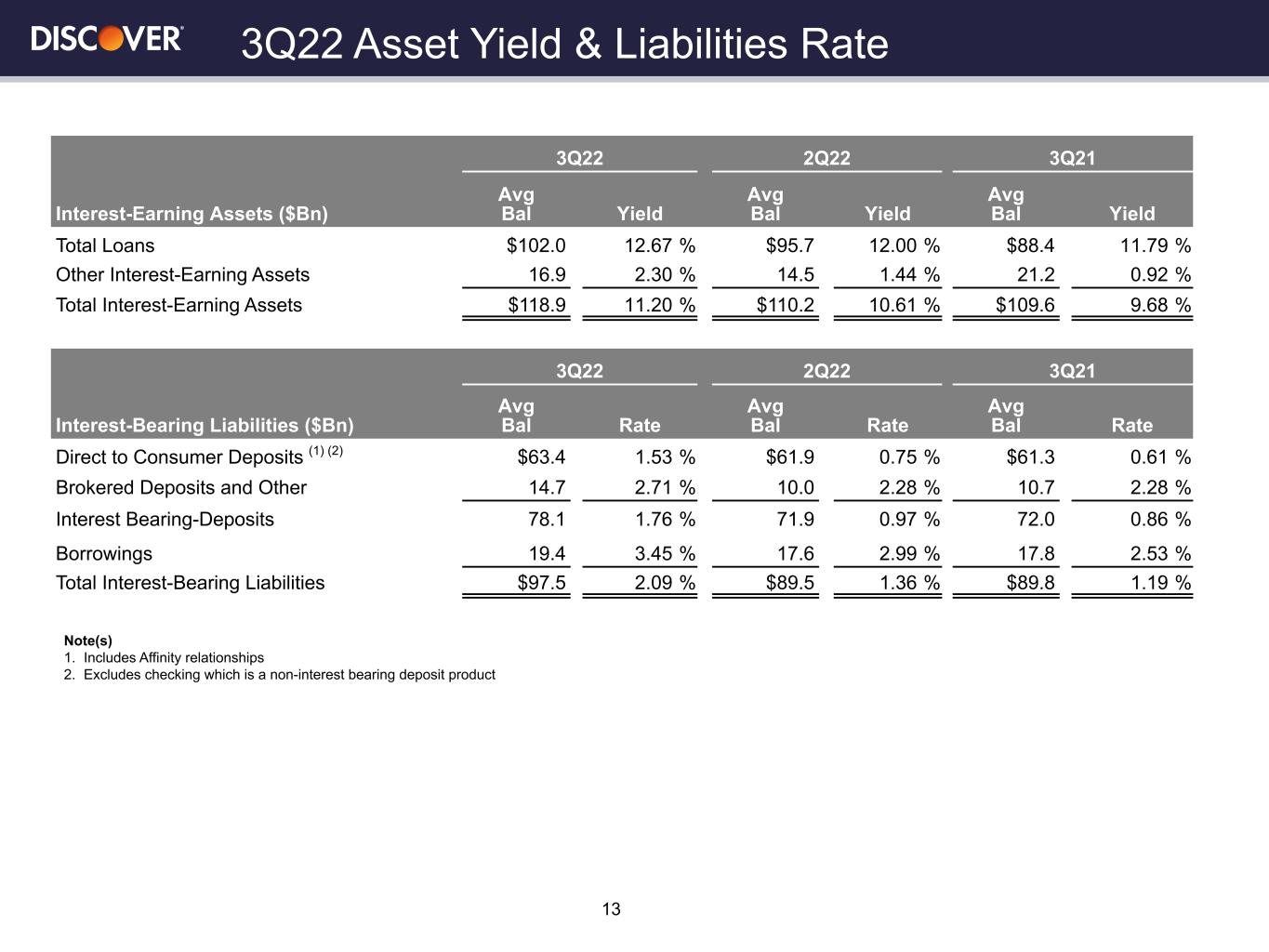

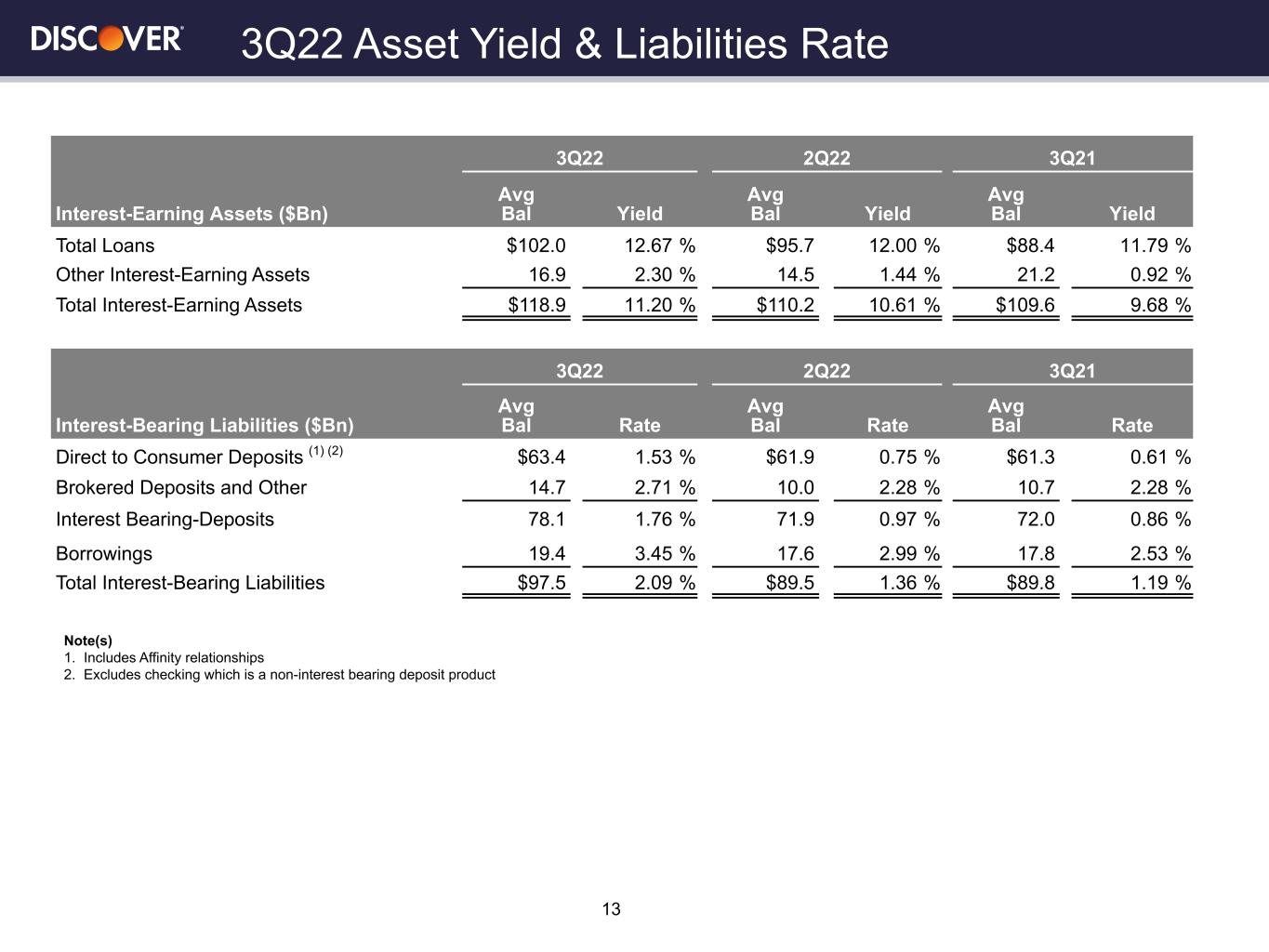

3Q22 Asset Yield & Liabilities Rate 3Q22 2Q22 3Q21 Interest-Earning Assets ($Bn) Avg Bal Yield Avg Bal Yield Avg Bal Yield Total Loans $102.0 12.67 % $95.7 12.00 % $88.4 11.79 % Other Interest-Earning Assets 16.9 2.30 % 14.5 1.44 % 21.2 0.92 % Total Interest-Earning Assets $118.9 11.20 % $110.2 10.61 % $109.6 9.68 % 3Q22 2Q22 3Q21 Interest-Bearing Liabilities ($Bn) Avg Bal Rate Avg Bal Rate Avg Bal Rate Direct to Consumer Deposits (1) (2) $63.4 1.53 % $61.9 0.75 % $61.3 0.61 % Brokered Deposits and Other 14.7 2.71 % 10.0 2.28 % 10.7 2.28 % Interest Bearing-Deposits 78.1 1.76 % 71.9 0.97 % 72.0 0.86 % Borrowings 19.4 3.45 % 17.6 2.99 % 17.8 2.53 % Total Interest-Bearing Liabilities $97.5 2.09 % $89.5 1.36 % $89.8 1.19 % 13 Note(s) 1. Includes Affinity relationships 2. Excludes checking which is a non-interest bearing deposit product

Total Company Loans Credit Card Loans Private Student Loans Personal Loans 3.44 3.00 2.38 2.48 2.12 1.46 1.37 1.61 1.80 1.71 1.98 1.77 1.89 1.67 1.34 1.40 1.55 1.64 1.63 1.94 NCO rate (%) 30+ day DQ rate (%) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 3.90 3.45 2.63 2.80 2.45 1.65 1.50 1.84 2.01 1.92 2.17 1.91 2.07 1.85 1.43 1.48 1.66 1.77 1.76 2.11 NCO rate (%) 30+ day DQ rate (%) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 3.43 2.69 2.79 2.80 1.80 1.11 1.21 1.12 1.21 1.14 1.07 1.10 1.08 0.84 0.69 0.71 0.69 0.69 0.63 0.69 NCO rate (%) 30+ day DQ rate (%) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 0.62 0.58 0.71 0.53 0.53 0.68 0.80 0.69 1.08 0.91 1.57 1.49 1.39 1.20 1.34 1.55 1.55 1.62 1.66 1.94 NCO rate (%) 30+ day DQ rate (%) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Credit Performance Trends 14

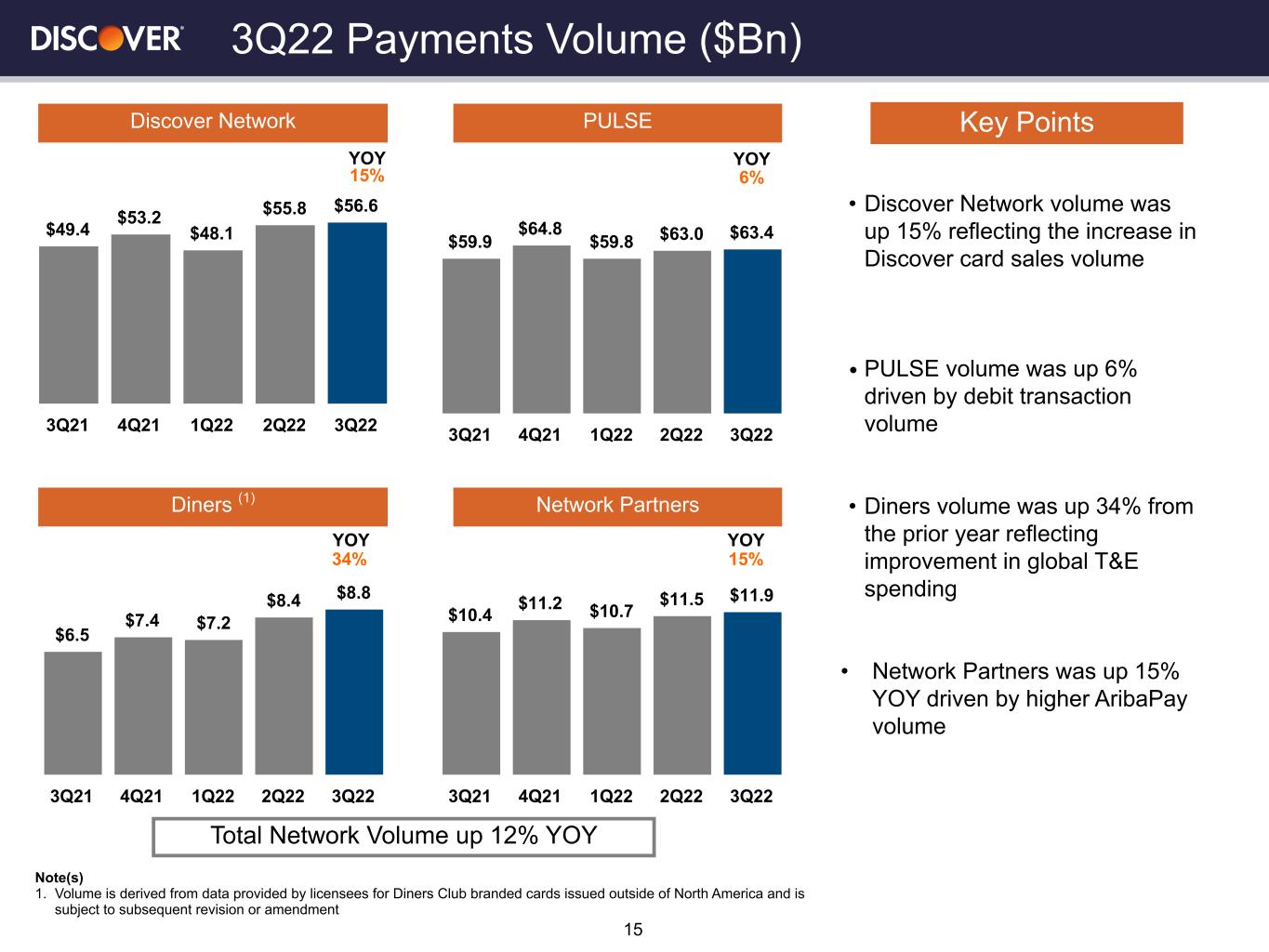

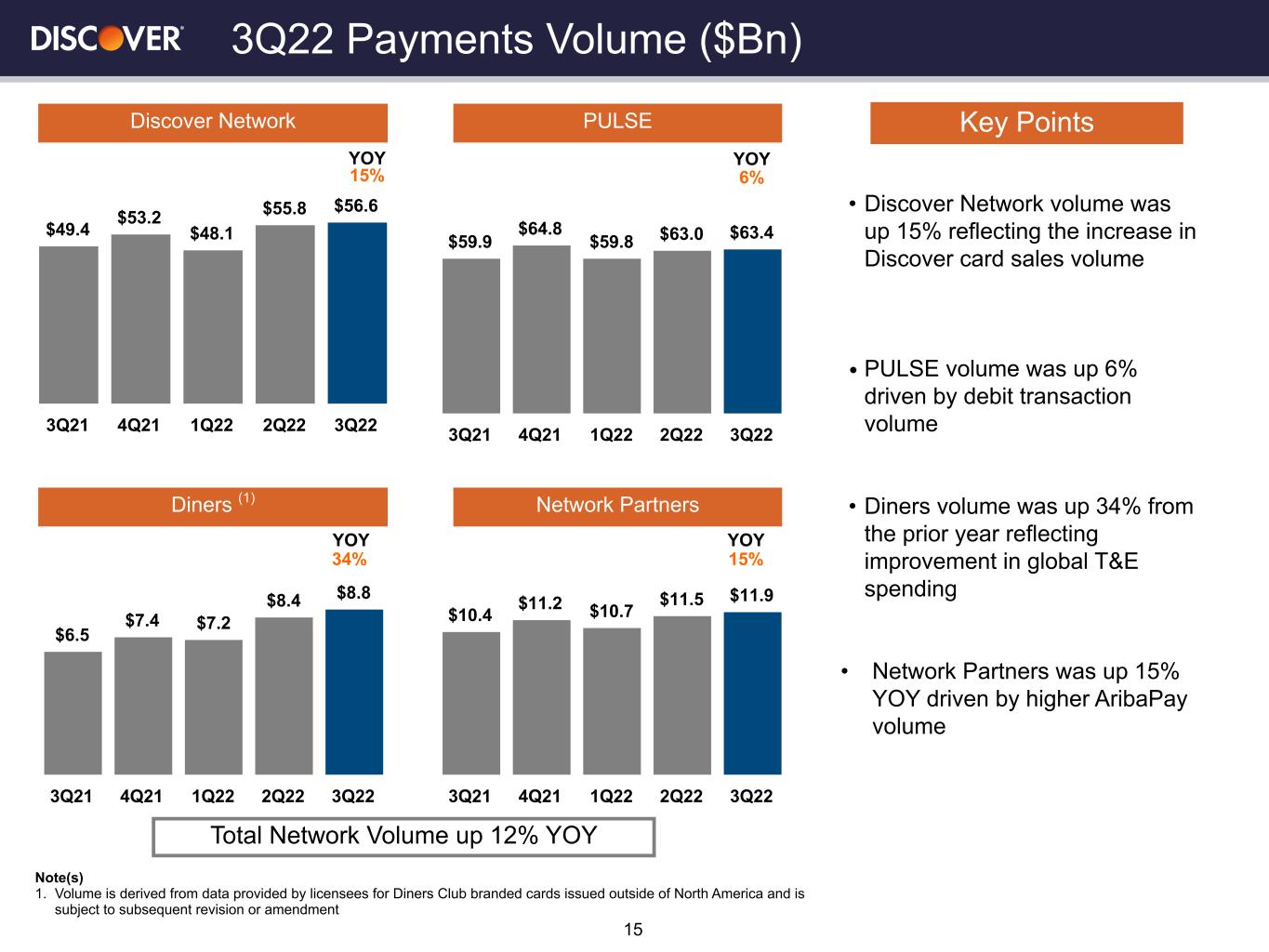

YOY YOY YOY YOY 3Q22 Payments Volume ($Bn) Discover Network • Discover Network volume was up 15% reflecting the increase in Discover card sales volume • PULSE volume was up 6% driven by debit transaction volume • Diners volume was up 34% from the prior year reflecting improvement in global T&E spending • Network Partners was up 15% YOY driven by higher AribaPay volume Key Points $49.4 $53.2 $48.1 $55.8 $56.6 3Q21 4Q21 1Q22 2Q22 3Q22 $59.9 $64.8 $59.8 $63.0 $63.4 3Q21 4Q21 1Q22 2Q22 3Q22 $6.5 $7.4 $7.2 $8.4 $8.8 3Q21 4Q21 1Q22 2Q22 3Q22 $10.4 $11.2 $10.7 $11.5 $11.9 3Q21 4Q21 1Q22 2Q22 3Q22 Diners (1) PULSE Network Partners 15% 6% 34% 15% Note(s) 1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment Total Network Volume up 12% YOY 15