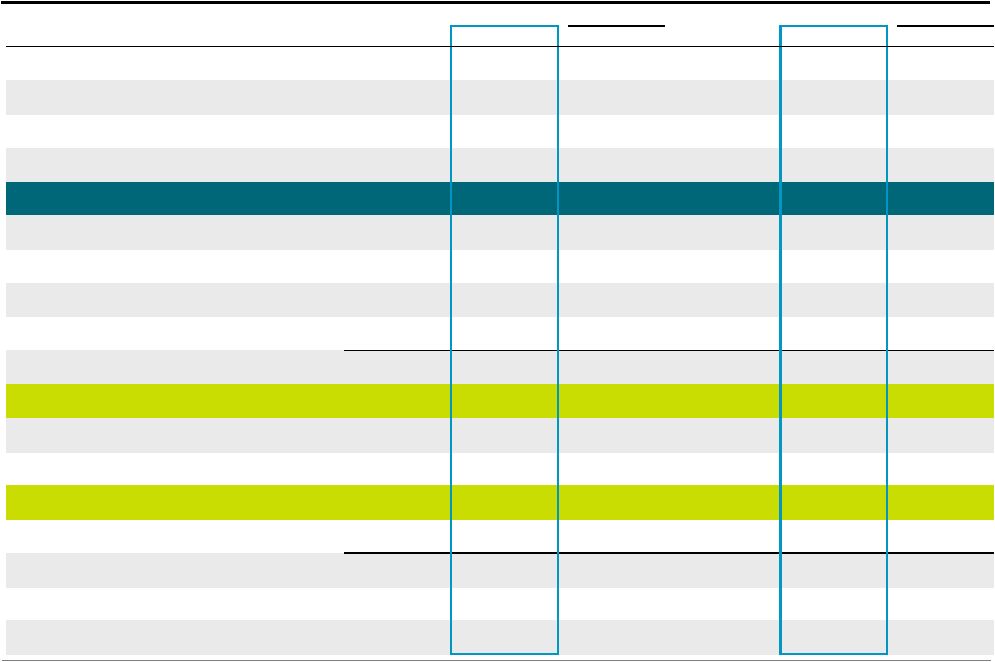

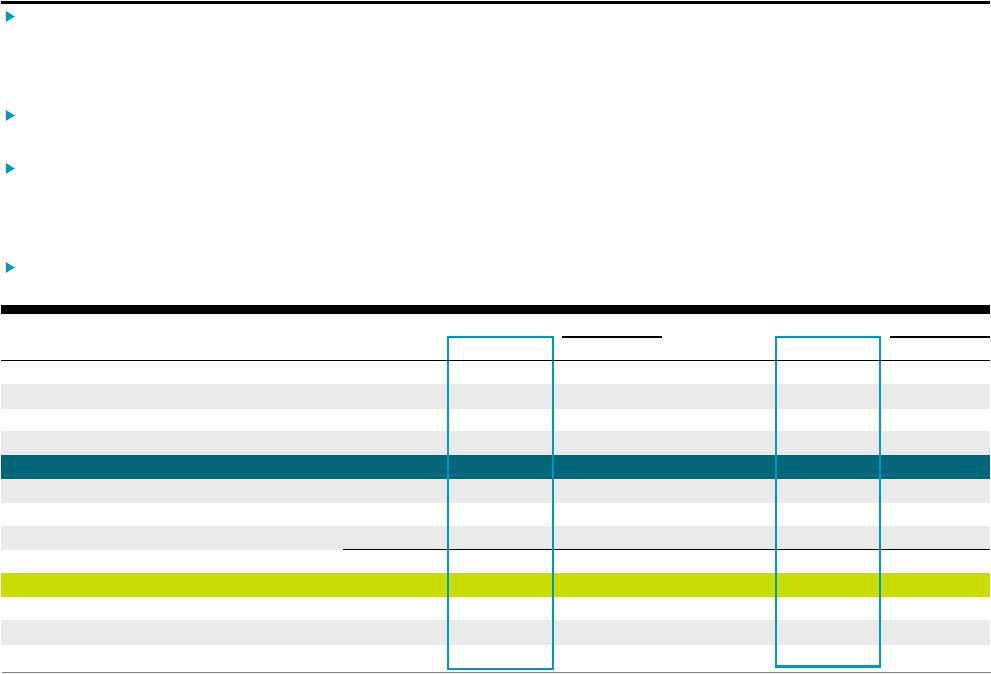

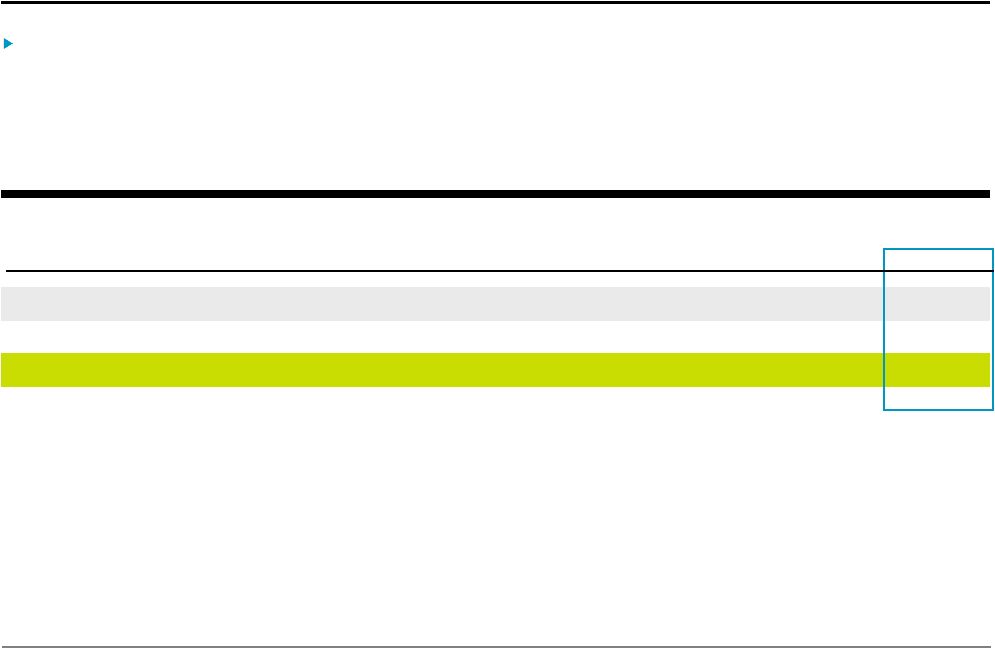

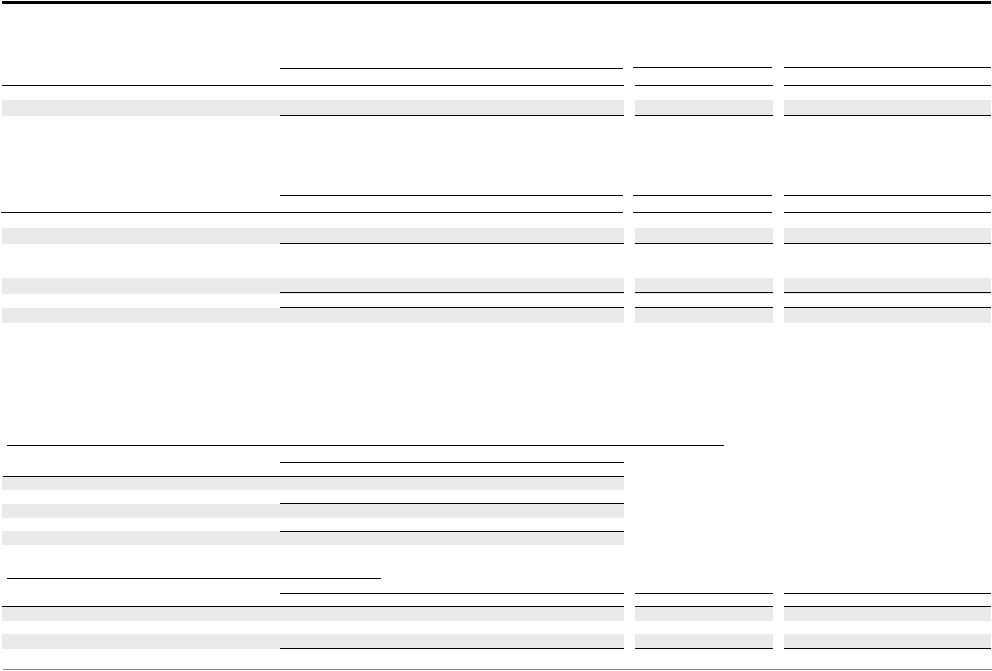

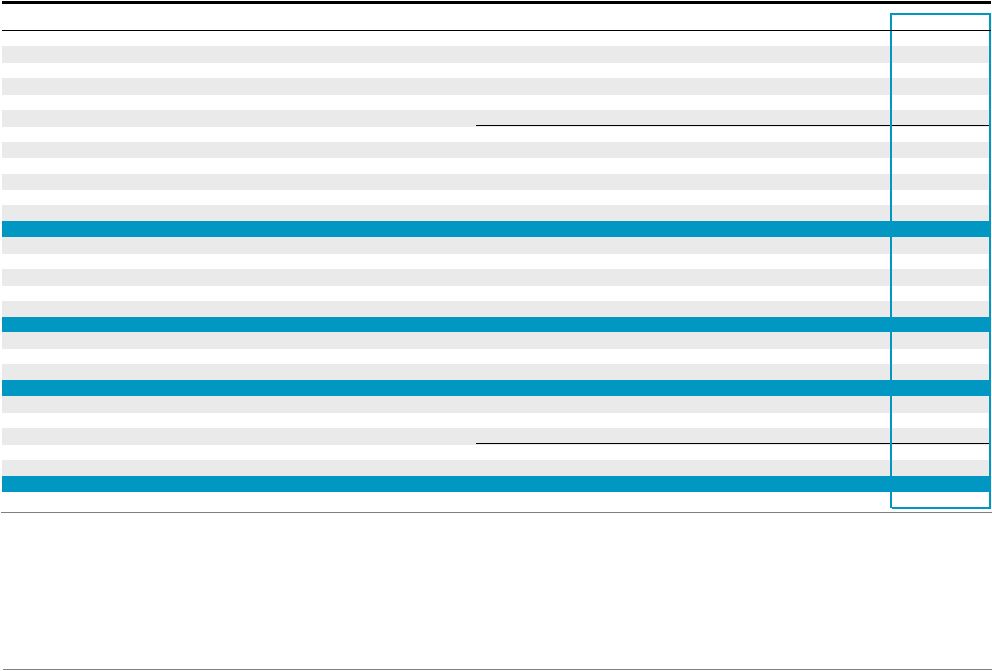

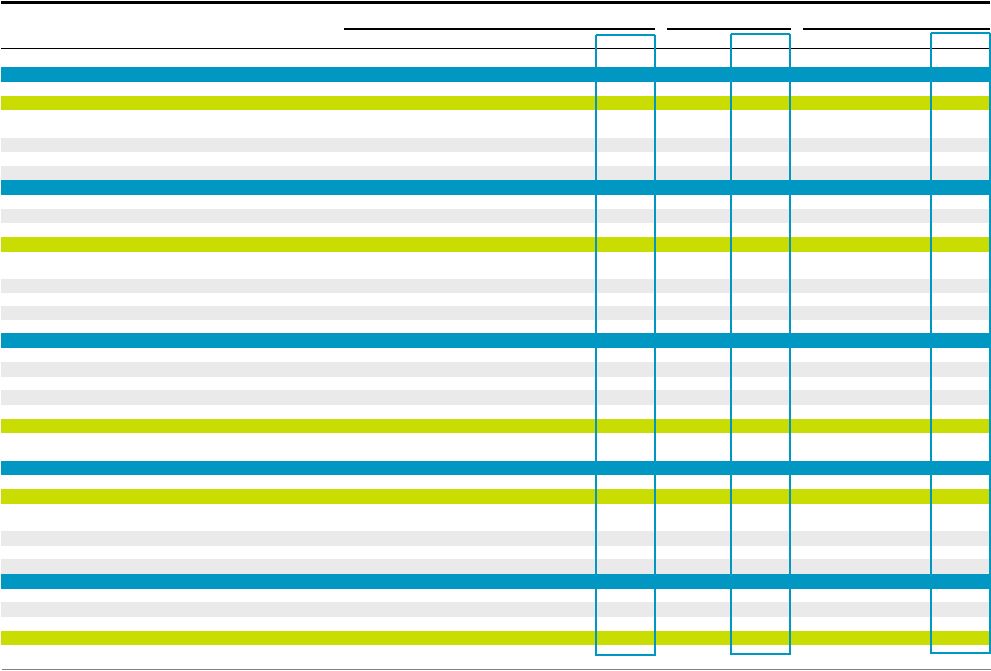

Blackstone 26 Notes on pages 27-28. Reconciliation of GAAP to Non-GAAP Measures QTD YTD LTM (Dollars in Thousands) 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 2Q'18 2Q'19 2Q'17 2Q'18 2Q'19 Net Income (Loss) Attributable to The Blackstone Group L.P. 742,042 $ 442,742 $ (10,868) $ 481,304 $ 305,792 $ 1,109,914 $ 787,096 $ 1,469,812 $ 1,791,972 $ 1,218,970 $ Net Income Attributable to Non-Controlling Interests in Blackstone Holdings 678,952 360,576 5,253 402,260 259,330 999,160 661,590 1,319,656 1,698,800 1,027,419 Net Income (Loss) Attributable to Non-Controlling Interests in Consolidated Entities 129,078 143,101 (68,800) 186,833 80,744 284,577 267,577 392,966 530,387 341,878 Net Income (Loss) Attributable to Redeemable Non-Controlling Interests in Consolidated Entities 905 2,569 (4,303) 2,480 1,095 (370) 3,575 15,418 10,445 1,841 Net Income (Loss) 1,550,977 $ 948,988 $ (78,718) $ 1,072,877 $ 646,961 $ 2,393,281 $ 1,719,838 $ 3,197,852 $ 4,031,604 $ 2,590,108 $ Provision for Taxes 138,731 26,798 29,366 41,155 38,736 193,226 79,891 162,846 849,328 136,055 Income (Loss) Before Provision for Taxes 1,689,708 $ 975,786 $ (49,352) $ 1,114,032 $ 685,697 $ 2,586,507 $ 1,799,729 $ 3,360,698 $ 4,880,932 $ 2,726,163 $ Transaction-Related Charges (a) (470,078) 79,242 76,431 89,451 106,994 (417,589) 196,445 245,655 (708,930) 352,118 Amortization of Intangibles (b) 14,873 14,856 15,392 16,483 16,483 29,746 32,966 60,738 55,355 63,214 Impact of Consolidation (c) (129,983) (145,670) 73,103 (189,313) (81,839) (284,207) (271,152) (408,384) (540,832) (343,719) Unrealized Performance Revenues (d) (440,424) (298,931) 806,531 (664,333) (157,398) (1,068,763) (821,731) (350,633) (991,702) (314,131) Unrealized Performance Allocations Compensation (e) 189,991 178,184 (302,868) 287,015 64,518 444,426 351,533 316,754 453,777 226,849 Unrealized Principal Investment (Income) Loss (f) (52,126) (28,704) 160,659 (139,925) 56,353 (66,104) (83,572) 101,233 (67,000) 48,383 Other Revenues (g) (94,416) (9,092) (46,854) (13,189) 20,150 (33,522) 6,961 18,342 35,773 (48,985) Equity-Based Compensation (h) 34,394 36,576 43,102 66,776 53,105 78,542 119,881 96,929 127,748 199,559 Taxes and Related Payables (i) (41,797) (32,963) (54,063) (29,039) (55,201) (66,839) (84,240) (197,382) (178,212) (171,266) Distributable Earnings 700,142 $ 769,284 $ 722,081 $ 537,958 $ 708,862 $ 1,202,197 $ 1,246,820 $ 3,243,950 $ 3,066,909 $ 2,738,185 $ Taxes and Related Payables (i) 41,797 32,963 54,063 29,039 55,201 66,839 84,240 197,382 178,212 171,266 Net Interest (Income) Loss (j) (2,842) (9,013) (11,923) (5,061) (2,761) (989) (7,822) 42,271 31,384 (28,758) Total Segment Distributable Earnings 739,097 $ 793,234 $ 764,221 $ 561,936 $ 761,302 $ 1,268,047 $ 1,323,238 $ 3,483,603 $ 3,276,505 $ 2,880,693 $ Realized Performance Revenues (k) (477,544) (572,159) (483,697) (246,769) (341,386) (755,915) (588,155) (2,731,564) (2,657,434) (1,644,011) Realized Performance Compensation (l) 172,894 190,773 199,645 85,240 125,466 287,723 210,706 909,329 1,009,830 601,124 Realized Principal Investment Income (m) (94,647) (65,620) (47,098) (25,908) (123,557) (123,340) (149,465) (460,081) (255,753) (262,183) Fee Related Earnings 339,800 $ 346,228 $ 433,071 $ 374,499 $ 421,825 $ 676,515 $ 796,324 $ 1,201,287 $ 1,373,148 $ 1,575,623 $ Adjusted EBITDA Reconciliation Distributable Earnings 700,142 $ 769,284 $ 722,081 $ 537,958 $ 708,862 $ 1,202,197 $ 1,246,820 $ 3,243,950 $ 3,066,909 $ 2,738,185 $ Interest Expense (n) 38,885 40,923 41,792 41,638 43,230 77,123 84,868 155,249 190,217 167,583 Taxes and Related Payables (i) 41,797 32,963 54,063 29,039 55,201 66,839 84,240 197,382 178,212 171,266 Depreciation and Amortization 5,986 5,681 5,964 5,789 6,000 12,237 11,789 31,956 24,857 23,434 Adjusted EBITDA 786,810 $ 848,851 $ 823,900 $ 614,424 $ 813,293 $ 1,358,396 $ 1,427,717 $ 3,628,537 $ 3,460,195 $ 3,100,468 $ |