0001393818 bx:FreestandingDerivativesMember us-gaap:TotalReturnSwapMember 2018-01-01 2018-09-30

The Blackstone Group Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited) - Continued

(All Dollars Are in Thousands, Except Share and Per Share Data, Except Where Noted)

Contingent Obligations (Clawback)

Performance Allocations are subject to clawback to the extent that the Performance Allocations received to date with respect to a fund exceeds the amount due to Blackstone based on cumulative results of that fund. The actual clawback liability, however, generally does not become realized until the end of a fund’s life except for certain Blackstone real estate funds, multi-asset class investment funds and credit-focused funds, which may have an interim clawback

liability. The lives of the carry funds, including available contemplated extensions, for which a liability for potential clawback obligations has been recorded for financial reporting purposes, are currently anticipated to expire at various points through 2028. Further extensions of such terms may be implemented under given circumstances.

For financial reporting purposes, when applicable, the general partners record a liability for potential clawback obligations to the limited partners of some of the carry funds due to changes in the unrealized value of a fund’s remaining investments and where the fund’s general partner has previously received Performance Allocation distributions with respect to such fund’s realized investments.

The following table presents the clawback obligations by segment:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | |

| | | | | | | | ) | | | | | | | | | | | | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | | | | $ | | | | $ | | | | $ | | | | $ | | ) | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | The split of clawback between Blackstone Holdings and Current and Former Personnel is based on the performance of individual investments held by a fund rather than on a fund by fund basis. |

For Private Equity, Real Estate, and certain Credit Funds, a portion of the Performance Allocations paid to current and former Blackstone personnel is held in segregated accounts in the event of a cash clawback obligation. These segregated accounts are not included in the Condensed Consolidated Financial Statements of Blackstone, except to the extent a portion of the assets held in the segregated accounts may be allocated to a consolidated Blackstone fund of hedge funds. At September 30, 2019, $701.6 million was held in segregated accounts for the purpose of meeting any clawback obligations of current and former personnel if such payments are required.

In the Credit segment, payment of Performance Allocations to Blackstone by the majority of the stressed/distressed, mezzanine and credit alpha strategies funds are substantially deferred under the terms of the partnership agreements. This deferral mitigates the need to hold funds in segregated accounts in the event of a cash clawback obligation.

If, at September 30, 2019, all of the investments held by our carry funds were deemed worthless, a possibility that management views as remote, the amount of Performance Allocations subject to potential clawback would be $7.3 billion, on an

after-tax

basis where applicable, of which Blackstone Holdings is potentially liable for $6.6 billion if current and former Blackstone personnel default on their share of the liability, a possibility that management also views as remote.

Blackstone transacts its primary business in the United States and substantially all of its revenues are generated domestically.

58

The Blackstone Group Inc.

Unaudited Consolidating Statements of Financial Condition

| | | | | | | | | | | | | | | | | |

| | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cash and Cash Equivalents | | $ | | | | $ | | | | $ | | | | $ | | |

Cash Held by Blackstone Funds and Other | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | ) | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | ) | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | $ | | | | $ | | | | $ | | ) | | $ | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Liabilities and Partners’ Capital | | | | | | | | | | | | | | | | |

| | $ | | | | $ | | | | $ | | | | $ | | |

| | | | | | | | | | | | ) | | | | |

Accrued Compensation and Benefits | | | | | | | | | | | | | | | | |

Securities Sold, Not Yet Purchased | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Accounts Payable, Accrued Expenses and Other Liabilities | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | ) | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Redeemable Non-Controlling Interests in Consolidated Entities | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | ) | | | | |

Accumulated Other Comprehensive Loss | | | | ) | | | | | | | | | | | | ) |

Non-Controlling Interests in Consolidated Entities | | | | | | | | | | | | | | | | |

Non-Controlling Interests in Blackstone Holdings | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | ) | | | | |

| | | | | | | | | | | | | | | | | |

Total Liabilities and Partners’ Capital | | $ | | | | $ | | | | $ | | ) | | $ | | |

| | | | | | | | | | | | | | | | | |

| (a) | The Consolidated Blackstone Funds consisted of the following: |

Blackstone / GSO Global Dynamic Credit Feeder Fund (Cayman) LP

Blackstone / GSO Global Dynamic Credit Funding Designated Activity Company

Blackstone / GSO Global Dynamic Credit Master Fund

Blackstone / GSO Global Dynamic Credit USD Feeder Fund (Ireland)

Blackstone Real Estate Special Situations Fund L.P.*

Blackstone Real Estate Special Situations Offshore Fund Ltd.

Blackstone Strategic Alliance Fund L.P.

Collateralized loan obligation vehicles

Mezzanine

side-by-side

investment vehicles

Private equity

side-by-side

investment vehicles

Real estate

side-by-side

investment vehicles

* Consolidated as of December 31, 2018 only.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with The Blackstone Group Inc.’s condensed consolidated financial statements and the related notes included within this Quarterly Report on Form

10-Q.

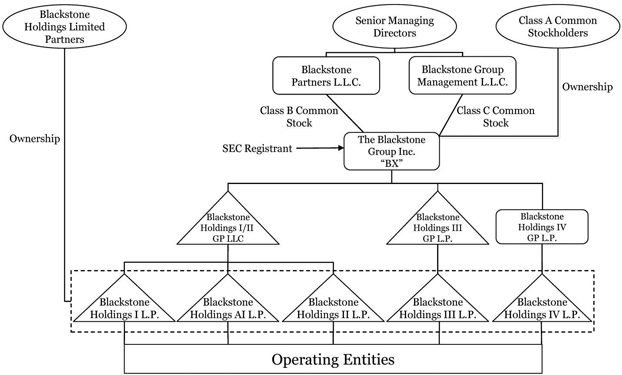

Effective July 1, 2019, The Blackstone Group L.P. (the “Partnership”) converted from a Delaware limited partnership to a Delaware corporation, The Blackstone Group Inc. (the “Conversion”). This report includes the results for the Partnership prior to the Conversion and The Blackstone Group Inc. following the Conversion. In this report, references to “Blackstone,” the “Corporation,” “we,” “us” or “our” refer to (a) The Blackstone Group Inc. and its consolidated subsidiaries following the Conversion and (b) the Partnership and its consolidated subsidiaries prior to the Conversion. All references to shares or per share amounts prior to the Conversion refer to units or per unit amounts. Unless otherwise noted, all references to shares or per share amounts following the Conversion refer to shares or per share amounts of Class A common stock. All references to dividends prior to the Conversion refer to distributions. See “– Organizational Structure.”

Blackstone is one of the largest independent managers of private capital in the world. Our business is organized into four segments:

| | • | Our real estate group is one of the largest real estate investment managers in the world. We operate as one globally integrated business, with investments in North America, Europe, Asia and Latin America. Our real estate investment team seeks to establish a differentiated view and capitalizes on our scale and proprietary information advantages to invest with conviction and generate attractive risk-adjusted returns for our investors over the long-term. |

Our Blackstone Real Estate Partners (“BREP”) funds are geographically diversified and target a broad range of “opportunistic” real estate and real estate related investments. The BREP funds include global funds as well as funds focused specifically on Europe or Asia investments. We seek to acquire high quality, well-located yet undermanaged assets at an attractive basis, address any property or business issues through active asset management and sell the assets once our business plan is accomplished. BREP has made significant investments in hotels, office buildings, industrial assets, residential and shopping centers, as well as a variety of real estate operating companies.

Our core+ real estate business, Blackstone Property Partners (“BPP”) has assembled a global portfolio of high quality core+ investments across the U.S., Europe and Asia. We manage several core+ real estate funds, which target substantially stabilized assets in prime markets with a focus on industrial, multifamily, office and retail assets.

BREIT, a

non-exchange

traded real estate investment trust (“REIT”), is focused on investing primarily in stabilized income-oriented commercial real estate in the U.S.

Our Blackstone Real Estate Debt Strategies (“BREDS”) vehicles target debt investment opportunities collateralized by commercial real estate in both public and private markets, primarily in the U.S. and Europe. BREDS’ scale and investment mandates enable it to provide a variety of lending and investment options including mezzanine loans, senior loans and liquid securities. The BREDS platform includes a number of high-yield real estate debt funds, liquid real estate debt funds and BXMT, a NYSE-listed REIT.

| | • | We are a world leader in private equity investing, having managed eight general private equity funds, as well as four sector-focused funds and a geographically-focused fund, since we established this business in 1987. Our Private Equity segment includes our corporate private equity business, which consists of (a) our flagship private equity funds (Blackstone Capital Partners (“BCP”) funds), (b) our sector-focused private equity funds, including our energy-focused funds (Blackstone Energy Partners (“BEP”) funds), (c) our Asia-focused funds (Blackstone Capital Partners Asia (“BCP Asia”) funds) and (d) our core private equity fund, Blackstone Core Equity Partners (“BCEP”). In addition, our Private Equity segment includes (a) our opportunistic investment platform that invests globally across asset classes, industries and geographies, Blackstone Tactical Opportunities (“Tactical Opportunities”), (b) our secondary fund of funds business, Strategic Partners Fund Solutions (“Strategic Partners”), (c) our infrastructure-focused funds, Blackstone Infrastructure Partners (“BIP”), (d) our life sciences private investment platform, Blackstone Life Sciences (“BXLS”), (e) a multi-asset investment program for eligible high net worth investors offering exposure to certain of Blackstone’s key illiquid investment strategies through a single commitment, Blackstone Total Alternatives Solution (“BTAS”) and (f) our capital markets services business, Blackstone Capital Markets (“BXCM”). |

Our corporate private equity business pursues transactions throughout the world across a variety of transaction types, including large buyouts,

mid-cap

buyouts, buy and build platforms (which involve multiple acquisitions behind a single management team and platform) and growth equity/development projects (which involve significant minority investments in mature companies and greenfield development projects in energy and power). Within our corporate private equity business, our core private equity fund targets control-oriented investments in high quality companies with durable businesses and seeks to offer a lower level of risk and a longer hold period than traditional private equity. Tactical Opportunities invests globally across asset classes, industries and geographies, seeking to identify and execute on attractive, differentiated investment opportunities, leveraging the intellectual capital across our various businesses while continuously optimizing its approach in the face of ever-changing market conditions. Strategic Partners is a total fund solutions provider that acquires interests in high quality private funds from original holders seeking liquidity,

co-investments

alongside financial sponsors and provides investment advisory services to clients investing in primary and secondary investments in private funds and

co-investments.

BIP focuses on infrastructure investments in the energy, transportation, communications and water and waste sectors. BXLS is a private investment platform with capabilities to invest across the life cycle of companies and products within the life sciences sector.

| | • | The largest component of our Hedge Fund Solutions segment is Blackstone Alternative Asset Management (“BAAM”). BAAM is the world’s largest discretionary allocator to hedge funds, managing a broad range of commingled and customized fund solutions since its inception in 1990. The Hedge Fund Solutions segment also includes investment platforms that seed new hedge fund businesses, purchase minority ownership interests in more established hedge funds, invest in special situation opportunities, create alternative solutions in the form of mutual funds and UCITS and trade directly. |

| | • | Our Credit segment consists principally of GSO Capital Partners LP (“GSO”). GSO is one of the largest credit alternative asset managers in the world and is the largest manager of collateralized loan obligations (“CLOs”) globally. The investment portfolios of the funds GSO manages or sub-advises predominantly consist of loans and securities ofnon-investment grade companies spread across the capital structure including senior debt, subordinated debt, preferred stock and common equity. |

The GSO business is organized into three overarching strategies: performing credit, distressed and long only. Our performing credit strategies include mezzanine lending funds, middle market direct lending funds, including our business development company (“BDC”), and other performing credit strategy funds. Our distressed strategies include credit alpha strategies, stressed/distressed funds and energy strategies. GSO’s long only strategies consist of CLOs, closed end funds, open ended funds and separately managed accounts.

| | (e) | the invested capital, fair value of assets or the net asset value we manage pursuant to separately managed accounts, |

| | (f) | the net proceeds received from equity offerings and accumulated core earnings of BXMT, subject to certain adjustments, |

| | (g) | the aggregate par amount of collateral assets, including principal cash, of our CLOs, and |

| | (h) | the gross amount of assets (including leverage) or the net assets (plus leverage where applicable) for certain of our credit-focused registered investment companies. |

Each of our segments may include certain

Fee-Earning

Assets Under Management on which we earn performance revenues but not management fees.

Our calculations of assets under management and

fee-earning

assets under management may differ from the calculations of other asset managers, and as a result this measure may not be comparable to similar measures presented by other asset managers. In addition, our calculation of assets under management includes commitments to, and the fair value of, invested capital in our funds from Blackstone and our personnel, regardless of whether such commitments or invested capital are subject to fees. Our definitions of assets under management and

fee-earning

assets under management are not based on any definition of assets under management and

fee-earning

assets under management that is set forth in the agreements governing the investment funds that we manage.

For our carry funds, total assets under management includes the fair value of the investments held and uncalled capital commitments, whereas

fee-earning

assets under management includes the total amount of capital commitments or the remaining amount of invested capital at cost depending on whether the investment period has expired or as specified by the fee terms of the fund. As such,

fee-earning

assets under management may be greater than total assets under management when the aggregate fair value of the remaining investments is less than the cost of those investments.

. Perpetual Capital refers to the component of assets under management with an indefinite term, that is not in liquidation, and for which there is no requirement to return capital to investors through redemption requests in the ordinary course of business, except where funded by new capital inflows. Perpetual Capital includes

co-investment

capital with an investor right to convert into Perpetual Capital.

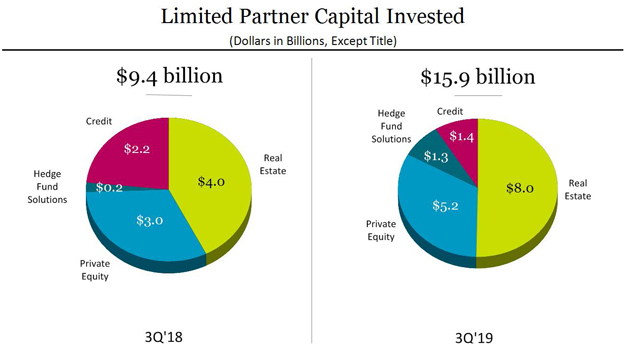

Limited Partner Capital Invested.

Limited Partner Capital Invested represents the aggregate amount of third party capital invested by our funds and vehicles, including investments closed but not yet funded by investors during each period presented, including (a) capital invested by our carry and drawdown funds and vehicles, (b) certain Perpetual Capital invested including undistributed proceeds that are reinvested, and (c) capital invested through

fee-paying

co-investments

made by third parties in investments of our carry and perpetual funds and vehicles.

. Dry Powder represents the amount of capital available for investment or reinvestment, including general partner and employee capital, and is an indicator of the capital we have available for future investments.

Performance Revenue Eligible Assets Under Management

. Performance Revenue Eligible Assets Under Management represents invested and to be invested capital at fair value, including capital closed for funds whose investment period has not yet commenced, on which performance revenues could be earned if certain hurdles are met.

Income Tax Current Developments

Prior to the Conversion, certain of our share of investment income and carried interest was not subject to U.S. corporate income taxes. Subsequent to the Conversion, all income earned by us is subject to U.S. corporate income taxes, which we believe will result in an overall higher income tax expense (or benefit) over time when compared to periods prior to the Conversion.

States and other jurisdictions have considered legislation to increase taxes with respect to carried interest. For example, New Jersey recently enacted legislation which eliminates an exclusion from New Jersey source income (for

non-residents)

for carried interest and income from providing investment management services, which is not expected to materially affect our common shareholders, and authorizes a contingent 17% surtax on such management income for gross income tax and corporate income tax purposes. These carried interest provisions remain

non-operative

as they are dependent upon Connecticut, New York and Massachusetts enacting legislation with identical provisions. In addition, New York State recently introduced legislation which would tax income from certain investment management services provided by a partner (whether or not a New York resident). As part of that legislation, New York also proposed a state tax surcharge of 19% on carried interest in addition to the personal income tax. Similar to the New Jersey legislation, the New York legislation would not take effect until similar legislation is enacted by Connecticut, New Jersey and Massachusetts. Similar proposals are under consideration in other jurisdictions such as California. Whether or when similar legislation will be enacted is unclear. Although these proposals do not apply to the Corporation following the Conversion, if enacted, they could increase the amount of taxes that our employees and other key personnel would be required to pay and, as a result, could impact our ability to recruit, retain and motivate employees and key personnel in the relevant jurisdictions.

Finally, several state and local jurisdictions are evaluating ways to subject partnerships to entity level taxation through the imposition of state or local income, franchise or other forms of taxation or to increase the amount of such taxation. Although these proposals do not apply to the Corporation following the Conversion, they may apply to any of our subsidiaries which are partnerships. For example, although we believe it would not affect us materially, Connecticut recently enacted an income tax on pass through entities doing business in Connecticut, and states in which we do business may consider similar tax changes. These and other proposals have recently been under heightened consideration in light of U.S. federal income tax legislation, known as the Tax Cuts and Jobs Act, which was signed into law on December 22, 2017 (the “Tax Reform Bill”).

The Tax Reform Bill has resulted in fundamental changes to the Internal Revenue Code. Changes to U.S. tax laws resulting from the Tax Reform Bill, including partial limitation on the deductibility of business interest expense, and a longer three-year holding period requirement for carried interest to be treated as long-term capital gain could have an adverse effect on our business operations and our funds’ investment activities. These and other changes from the Tax Reform Bill—including limitations on the use, carryback and carryforward of net operating losses and changes relating to the scope and timing of U.S. taxation on earnings from international business operations—could also have an adverse effect on our portfolio companies. The exact impact of the Tax Reform Bill for future years is difficult to quantify, but these changes could have an adverse effect on our business, results of operations and financial condition. In addition, other changes could be enacted in the future to increase the corporate tax rate, limit further the deductibility of interest, subject carried interest to more onerous taxation or effect other changes that could have a material adverse effect on our business, results of operations and financial condition.

Congress, the Organization for Economic

Co-operation

and Development (“OECD”) and other government agencies in jurisdictions in which we and our affiliates invest or do business have maintained a focus on issues related to the taxation of multinational companies. The OECD, which represents a coalition of member countries, is contemplating changes to numerous long-standing tax principles through its base erosion and profit shifting (“BEPS”) project, which is focused on a number of issues, including the shifting of profits between affiliated entities in different tax jurisdictions, interest deductibility and eligibility for the benefits of double tax treaties. Several of the proposed measures are potentially relevant to some of our structures and could have an adverse tax impact on our funds, investors and/or our portfolio companies. Some member countries have been moving forward on the BEPS agenda but, because timing of implementation and the specific measures adopted will vary among participating states, significant uncertainty remains regarding the impact of BEPS proposals. If implemented, these proposals could result in a loss of tax treaty benefits and increased taxes on income from our investments.

A number of European jurisdictions have enacted taxes on financial transactions, and the European Commission has proposed legislation to harmonize these taxes under the

so-called

“enhanced cooperation procedure,” which provides for adoption of

EU-level

legislation applicable to some but not all EU Member States.

These contemplated changes, if adopted by individual countries, could increase tax uncertainty and/or costs faced by us, our portfolio companies and our investors, and cause other adverse consequences. The timing or impact of these proposals is unclear at this point. In addition, tax laws, regulations and interpretations are subject to continual changes, which could adversely affect our structures or returns to our investors. For instance, various countries have adopted or proposed tax legislation that may adversely affect portfolio companies and investment structures in countries in which our funds have invested and may limit the benefits of additional investments in those countries.

In addition, legislation enacted in 2015 significantly changed the rules for U.S. federal income tax audits of partnerships. This legislation applies to any taxable years in which we were a partnership commencing after December 31, 2017 and will apply to audits of taxable years of The Blackstone Group L.P. prior to the Conversion (which such audits may occur after the Conversion) and will continue to apply to any of our subsidiaries which are partnerships. Such U.S. federal income tax audits will be conducted at the partnership level, and unless a partnership qualifies for and affirmatively elects an alternative procedure, any adjustments to the amount of tax due (including interest and penalties) will be payable by the partnership. Under an elective alternative procedure, a partnership would issue information returns to persons who were partners in the audited year, who would then be required to take the adjustments into account in calculating their own tax liability, and the partnership would not be liable for the adjustments. If a partnership elects the alternative procedure for a given adjustment, the amount of taxes for which its partners would be liable would be increased by any applicable penalties and a special interest charge. There can be no assurance that we will be eligible to make such an election or that we will, in fact, make such an election for any given adjustment. If we do not or are not able to make such an election, then (a) our then-current common shareholders, in the aggregate, could indirectly bear income tax liabilities in excess of the aggregate amount of taxes that would have been due had we elected the alternative procedure, and (b) a given common shareholders may indirectly bear taxes attributable to income allocable to other common shareholders or former common shareholders, including taxes (as well as interest and penalties) with respect to periods prior to such holder’s ownership of shares of Class A common stock. Amounts available for dividends to our common shareholders may be reduced as a result of our obligation to pay any taxes associated with an adjustment. Many issues with respect to, and the overall effect of, this legislation on us (with respect to any taxable years in which we were a partnership commencing after December 31, 2017), and on our partnership subsidiaries are uncertain, and common shareholders should consult their own tax advisors regarding all aspects of this legislation as it affects their particular circumstances.

Please see “Part II. Item 1A. Risk Factors — Following the Conversion, we expect to pay more corporate income taxes than we would have as a limited partnership.” and “— Conversion to a Corporation” in our Quarterly Report on Form

10-Q

for the quarter ended March 31, 2019 for a further discussion of certain tax consequences of the Conversion.

Consolidated Results of Operations

Following is a discussion of our consolidated results of operations for the three and nine months ended September 30, 2019 and 2018. For a more detailed discussion of the factors that affected the results of our four business segments (which are presented on a basis that deconsolidates the investment funds we manage) in these periods, see “— Segment Analysis” below.

The decrease in Investment Income was primarily attributable to decreases in our Private Equity, Credit and Hedge Fund Solutions segments of $382.0 million, $30.5 million and $20.3 million, respectively, partially offset by an increase in our Real Estate segment of $101.1 million. The decrease in our Private Equity segment was primarily due to lower appreciation in corporate private equity relative to the comparative quarter. Corporate private equity carrying value increased 2.6% in the three months ended September 30, 2019 compared to 7.5% in the three months ended September 30, 2018. The decrease in our Credit segment was primarily attributable to lower returns in our performing credit strategies and distressed strategies. The decrease in our Hedge Fund Solutions segment was primarily driven by lower net appreciation of investments of which Blackstone owns a share. The increase in our Real Estate segment was primarily attributable to higher net appreciation of investment holdings in our BREP opportunistic funds compared to the comparable period in 2018. The carrying value of investments for our BREP opportunistic funds increased 3.8% in the three months ended September 30, 2019 compared to 3.0% in the three months ended September 30, 2018.

The increase in Management and Advisory Fees, Net was primarily due to increases in our Real Estate, Private Equity, Credit and Hedge Fund Solutions segments of $41.0 million, $32.6 million, $16.4 million and $11.0 million, respectively. The increase in our Real Estate segment was primarily due to

Fee-Earning

Asset Under Management growth in our core+ real estate funds and an increase in transaction fees. The increase in our Private Equity segment was primarily due to increases in

Fee-Earning

Assets Under Management in Strategic Partners, BIP and BXLS. The increase in our Credit segment was primarily due to the launch of several GSO and BIS funds subsequent to the three months ended September 30, 2018, including our BDC, successor flagship funds and multiple long only funds. The increase in our Hedge Fund Solutions segment was primarily due to

Fee-Earning

Asset Under Management growth in our individual investor and specialized solutions.

The increase in Other Revenue was primarily due to a foreign exchange gain on our euro denominated bonds.

Expenses were $947.2 million for the three months ended September 30, 2019, a decrease of $70.4 million, compared to $1.0 billion for the three months ended September 30, 2018. The decrease was primarily attributable to a decrease in Performance Allocations Compensation, partially offset by increases in Compensation and Interest Expense. The decrease of $128.1 million in Performance Allocations Compensation was primarily due to a decrease in Investment Income. The increase of $43.5 million in Compensation was primarily due to the increase in Management and Advisory Fees, Net. The increase of $12.0 million in Interest Expense was primarily due to the consummation of a cash tender offer for the 2021 Notes.

Nine Months Ended September 30, 2019 Compared to Nine Months Ended September 30, 2018

Revenues were $5.2 billion for the nine months ended September 30, 2019, a decrease of $1.1 billion, compared to $6.3 billion for the nine months ended September 30, 2018. The decrease in Revenues was primarily attributable to decreases of $847.3 million in Investment Income and $539.0 million in Other Revenue, partially offset by an increase of $298.0 million in Management and Advisory Fees, Net.

The decrease in Investment Income was primarily attributable to decreases in our Private Equity and Credit segments of $1.2 billion and $47.4 million, respectively, partially offset by increases in our Real Estate and Hedge Fund Solutions segments of $405.5 million and $61.4 million, respectively. The decrease in our Private Equity segment was primarily due to lower appreciation in corporate private equity. Corporate private equity carrying value increased 7.9% in the nine months ended September 30, 2019 compared to 23.4% in the nine months ended September 30, 2018. The decrease in our Credit segment was primarily attributable to lower returns in our performing credit strategies and distressed strategies. The increase in our Real Estate segment was primarily attributable to higher net appreciation of investment holdings in our BREP opportunistic funds. The carrying value

Offsetting these increases were:

| | • | Realizations of $6.5 billion primarily driven by: |

| | o | $2.9 billion in our Real Estate segment driven by $1.1 billion from BREP opportunistic funds and co-investment, $1.1 billion from BREDS and $662.9 million from core+ real estate funds, |

| | o | $1.7 billion in our Private Equity segment driven by $756.8 million from Tactical Opportunities, $738.9 million from corporate private equity and $239.0 million from Strategic Partners, and |

| | o | $1.6 billion in our Credit segment driven by $513.0 million from our mezzanine funds, $460.9 million from our distressed strategies, $311.1 million from capital returned to investors from CLOs that are post their reinvestment periods, $202.8 million from certain long only and MLP strategies, and $160.5 million from direct lending. |

| | • | Outflows of $4.9 billion primarily attributable to: |

| | o | $2.4 billion in our Hedge Fund Solutions segment driven by $1.9 billion from customized solutions and $485.7 million from individual investor and specialized solutions, |

| | o | $1.8 billion in our Credit segment driven by $1.5 billion from certain long only and MLP strategies and $113.9 million from BIS, and |

| | o | $552.1 million in our Real Estate segment driven by $409.3 million from core+ real estate funds and $142.8 million from BREDS. |

| | • | Market depreciation of $237.3 million due to: |

| | o | $783.1 million of depreciation in our Credit segment driven by $416.1 million of foreign exchange depreciation and $367.0 million of market depreciation primarily in our distressed strategies, and |

| | o | $459.4 million of appreciation in our Real Estate segment driven by $555.1 million of appreciation from our core+ real estate funds ($1.0 billion from market appreciation and $444.9 million from foreign exchange depreciation) and $168.2 million of market appreciation from BREDS, partially offset by $264.0 million of foreign exchange depreciation from BREP opportunistic funds. |

Hedge Fund Solutions had net outflows of $434.9 million from October 1 through November 1, 2019.

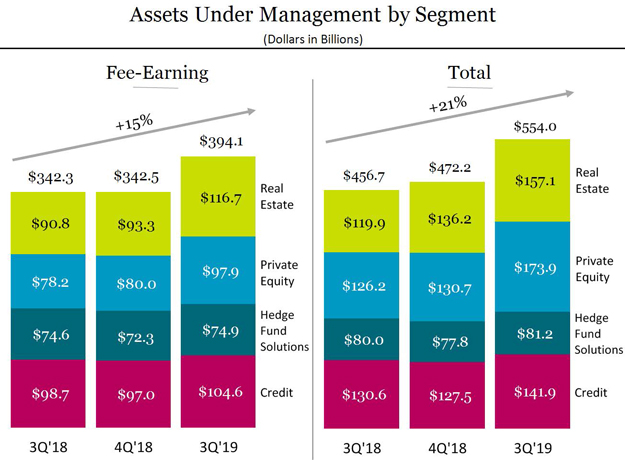

Fee-Earning

Assets Under Management were $394.1 billion at September 30, 2019, an increase of $51.6 billion, or 15%, compared to $342.5 billion at December 31, 2018. The net increase was due to:

| | • | Inflows of $84.9 billion related to: |

| | o | $35.3 billion in our Real Estate segment driven by $20.0 billion from BREP IX, which started its investment period on June 3, 2019 (this amount was reflected in Total Assets Under Management at each capital closing of the fund), $5.4 billion from BREIT, $3.8 billion from BREDS, $2.6 billion from BPP U.S. and co-investment, $839.3 million from BPP Europe andco-investment and $706.8 million from BPP Asia, |

| | o | $25.6 billion in our Private Equity segment driven by $11.6 billion from Strategic Partners, $8.1 billion from BIP, $3.4 billion from Tactical Opportunities, $1.6 billion from core private equity, $652.5 million from multi-asset products and $173.6 million from corporate private equity, |

| | o | $15.8 billion in our Credit segment driven by $16.9 billion from certain long only and MLP strategies, $3.7 billion from BIS, $3.5 billion from direct lending, $2.5 billion from new CLOs, $2.3 billion from our distressed strategies and $882.0 million from mezzanine funds, partially offset by $14.2 billion of allocations to various strategies, and |

| | o | $8.1 billion in our Hedge Fund Solutions segment driven by $4.7 billion from individual investor and specialized solutions, $2.2 billion from customized solutions and $1.3 billion from commingled products. |

The following table presents the results of operations for our Real Estate segment:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | | | | $ | | | | $ | | | | | | % | | $ | | | | $ | | | | $ | | | | | | % |

Transaction and Other Fees, Net | | | | | | | | | | | | | | | | % | | | | | | | | | | | | | | | | % |

| | | | ) | | | | ) | | | | | | | | % | | | | ) | | | | ) | | | | | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Management Fees, Net | | | | | | | | | | | | | | | | % | | | | | | | | | | | | | | | | % |

Fee Related Performance Revenues | | | | | | | | | | | | | | | | % | | | | | | | | | | | | ) | | | | % |

| | | | ) | | | | ) | | | | ) | | | | % | | | | ) | | | | ) | | | | | | | | % |

| | | | ) | | | | ) | | | | ) | | | | % | | | | ) | | | | ) | | | | ) | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | % | | | | | | | | | | | | | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Realized Performance Revenues | | | | | | | | | | | | | | | | % | | | | | | | | | | | | ) | | | | % |

Realized Performance Compensation | | | | ) | | | | ) | | | | ) | | | | % | | | | ) | | | | ) | | | | | | | | % |

Realized Principal Investment Income | | | | | | | | | | | | | | | | % | | | | | | | | | | | | ) | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | % | | | | | | | | | | | | ) | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment Distributable Earnings | | $ | | | | $ | | | | $ | | | | | | % | | $ | | | | $ | | | | $ | | ) | | | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended September 30, 2019 Compared to Three Months Ended September 30, 2018

Segment Distributable Earnings were $401.9 million for the three months ended September 30, 2019, an increase of $38.0 million, compared to $363.9 million for the three months ended September 30, 2018. The increase in Segment Distributable Earnings was primarily attributable to increases of $33.4 million in Fee Related Earnings and $4.6 million in Net Realizations.

Segment Distributable Earnings in our Real Estate segment in the third quarter of 2019 were higher compared to the third quarter of 2018. This was primarily driven by increased transaction fees from investment activity in our BREP global funds, growth in

Fee-Earning

Assets Under Management in our core+ real estate funds, as well as higher realization activity in the third quarter of 2019 compared to the third quarter of 2018. The market environment continues to be characterized by volatility and macroeconomic and geopolitical concerns, such as concerns regarding trade conflict with China and the rate of global growth. We have also seen an increasing focus in growing urban areas in certain markets in the U.S. and Western Europe toward rent regulation as a means to address residential affordability caused by undersupply. Such conditions (which may be across industries, sectors or geographies) may contribute to adverse operating performance, including by moderating rent growth in certain markets in our residential portfolio. Such conditions may also limit attractive realization opportunities for our Real Estate segment. Overall, operating trends in our Real Estate portfolio remain stable and supply-demand fundamentals remain positive in most markets, although decelerating growth in certain sectors, including retail, may contribute to a more challenging operating environment. Factors such as increasing wages and a tight labor market create profit margin pressure in certain sectors in the U.S., including hospitality. Capital deployment in opportunistic investments in the U.S. continues to be challenging, as distress levels are low and asset values are relatively high. Nonetheless, our Real Estate funds were particularly active in the third quarter of 2019, deploying or committing an aggregate of $12.2 billion of capital in the third quarter of 2019, primarily in North America. See “Part I. Item 1A. Risk Factors — Risks Related to Our Business — Difficult market conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our investment funds, making it more difficult to find opportunities for our funds to exit and realize value from existing investments and reducing the ability of our investment funds to raise or deploy capital, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition.” in our Annual Report on Form

10-K

for the year ended December 31, 2018.

Fee Related Earnings were $187.0 million for the three months ended September 30, 2019, an increase of $33.4 million, or 22%, compared to $153.7 million for the three months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to an increase of $41.0 million in Management Fees, Net, partially offset by increases of $4.1 million in Other Operating Expenses and $3.8 million in Fee Related Compensation.

Management Fees, Net were $332.5 million for the three months ended September 30, 2019, an increase of $41.0 million, compared to $291.5 million for the three months ended September 30, 2018, primarily driven by increases in Transaction and Other Fees, net and Base Management Fees. Transaction and Other Fees, Net were $73.4 million for the three months ended September 30, 2019, an increase of $27.7 million, compared to $45.7 million for the three months ended September 30, 2018, primarily due to increased transaction fees from investment activity in our BREP global funds. Base Management Fees were $266.8 million for the three months ended September 30, 2019, an increase of $12.7 million, compared to $254.1 million for the three months ended September 30, 2018, primarily due to

Fee-Earning

Assets Under Management growth in our core+ real estate funds.

Other Operating Expenses were $43.9 million for the three months ended September 30, 2019, an increase of $4.1 million, compared to $39.8 million for the three months ended September 30, 2018. The increase was primarily due to consulting fees and other business development costs.

Fee Related Compensation was $132.2 million for the three months ended September 30, 2019, an increase of $3.8 million, compared to $128.3 million for the three months ended September 30, 2018. The increase was due to the increase in Management Fees, Net, on which a portion of Fee Related Compensation is based.

Net Realizations were $214.8 million for the three months ended September 30, 2019, an increase of $4.6 million, compared to $210.2 million for the three months ended September 30, 2018. The increase in Net Realizations was primarily attributable to an increase of $9.1 million in Realized Performance Revenues, partially offset by an increase of $6.2 million in Realized Performance Compensation.

Realized Performance Revenues were $282.4 million for the three months ended September 30, 2019, an increase of $9.1 million, compared to $273.3 million for the three months ended September 30, 2018. The increase was due to higher realization activity in the three months ended September 30, 2019.

Realized Performance Compensation was $85.5 million for the three months ended September 30, 2019, an increase of $6.2 million, compared to $79.3 million for the three months ended September 30, 2018. The increase was due to the increase in Realized Performance Revenues.

Nine Months Ended September 30, 2019 Compared to Nine Months Ended September 30, 2018

Segment Distributable Earnings were $913.1 million for the nine months ended September 30, 2019, a decrease of $114.4 million, compared to $1.0 billion for the nine months ended September 30, 2018. The decrease in Segment Distributable Earnings was primarily attributable to a decrease of $154.7 million in Net Realizations, partially offset by an increase of $40.3 million in Fee Related Earnings.

Fee Related Earnings were $474.9 million for the nine months ended September 30, 2019, an increase of $40.3 million, compared to $434.6 million for the nine months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to an increase of $85.1 million in Management Fees, Net and a decrease of $4.9 million in Fee Related Compensation, partially offset by a decrease of $32.0 million in Fee Related Performance Revenues and an increase of $17.8 million in Other Operating Expenses.

Management Fees, Net were $894.3 million for the nine months ended September 30, 2019, an increase of $85.1 million, compared to $809.2 million for the nine months ended September 30, 2018, primarily driven by increases in Base Management Fees and Transaction and Other Fees, Net. Base Management Fees were $782.7 million for the nine months ended September 30, 2019, an increase of $52.4 million, compared to $730.3 million for the nine months ended September 30, 2018, primarily due to

Fee-Earning

Assets Under Management growth in our core+ real estate funds. Transaction and Other Fees, Net were $121.3 million for the nine months ended September 30, 2019, an increase of $28.7 million, compared to $92.6 million for the nine months ended September 30, 2018, primarily due to increased transaction fees from investment activity in BREP global funds.

The Annualized Base Management Fee Rate decreased from 1.12% at September 30, 2018 to 0.91% at September 30, 2019. The decrease was principally due to the commencement of the investment period of BREP IX in the second quarter of 2019, which added

Fee-Earning

Assets Under Management, the majority of which are under a Base Management Fee holiday until the fourth quarter of 2019.

Fee Related Compensation was $344.8 million for the nine months ended September 30, 2019, a decrease of $4.9 million, compared to $349.7 million for the nine months ended September 30, 2018. The decrease was primarily due to a decrease in Fee Related Performance Fee Revenues, offset by an increase in Management and Advisory Fees, Net, on which a portion of Fee Related Compensation is based.

Fee Related Performance Revenues were $48.3 million for the nine months ended September 30, 2019, a decrease of $32.0 million, compared to $80.3 million for the nine months ended September 30, 2018. The decrease was primarily due to timing of crystallizations in BPP U.S.

Other Operating Expenses were $123.0 million for the nine months ended September 30, 2019, an increase of $17.8 million, compared to $105.2 million for the nine months ended September 30, 2018. The increase was primarily due to consulting fees and other business development costs.

Net Realizations were $438.2 million for the nine months ended September 30, 2019, a decrease of $154.7 million, compared to $592.9 million for the nine months ended September 30, 2018. The decrease in Net Realizations was primarily attributable to decreases of $183.9 million in Realized Performance Revenues and $17.8 million in Realized Principal Investment Income, partially offset by a decrease of $47.0 million in Realized Performance Compensation.

Realized Performance Revenues were $558.1 million for the nine months ended September 30, 2019, a decrease of $183.9 million, compared to $742.0 million for the nine months ended September 30, 2018. The decrease was due to lower Realized Performance Revenues in BREP and BREDS.

Realized Principal Investment Income was $63.3 million for the nine months ended September 30, 2019, a decrease of $17.8 million, compared to $81.1 million for the nine months ended September 30, 2018. The decrease was primarily due to lower Realized Principal Investment Income for BREP VI.

Realized Performance Compensation was $183.2 million for the nine months ended September 30, 2019, a decrease of $47.0 million, compared to $230.1 million for the nine months ended September 30, 2018. The decrease was due to the decrease in Realized Performance Revenues.

Fund return information for our significant funds is included throughout this discussion and analysis to facilitate an understanding of our results of operations for the periods presented. The fund returns information reflected in this discussion and analysis is not indicative of the financial performance of Blackstone and is also not necessarily indicative of the future performance of any particular fund. An investment in Blackstone is not an investment in any of our funds. There can be no assurance that any of our funds or our other existing and future funds will achieve similar returns.

| (h) | Reflects annualized return of a shareholder invested in the REIT as of the beginning of each period presented, assuming reinvestment of all dividends received during the period, and net of all fees and expenses incurred by the REIT. Return incorporates the closing NYSE stock price as of each period end. Inception to date returns are from May 22, 2013. |

| (i) | For the three and nine months ended September 30, 2019, the appreciation of our remaining assets has resulted in the fund exceeding the preferred return. |

| (j) | Effective September 30, 2019, the BREIT return reflects a per share blended return for each respective period, assuming BREIT had a single share class, reinvestment of all dividends received during the period, and no upfront selling commission, net of all fees and expenses incurred by BREIT. These returns are not representative of the returns experienced by any particular investor or share class. Inception to date returns are presented on an annualized basis and are from January 1, 2017. Prior periods have been updated to reflect BREIT’s per share blended return. The BREIT returns previously presented were for BREIT’s Class S investors. |

As of September 30, 2019, the investment period for BREP International II had expired and the fund was not above its carried interest threshold. BREP International II Investors that opted out of the Hilton investment opportunity are not expected to exceed the carried interest threshold in future periods. However, since gains are not earned

pro-rata,

certain BREP International II investors who participated in the Hilton investment opportunity have exceeded the carried interest threshold this quarter.

As of September 30, 2019, BREP Asia II was not above its carried interest threshold at the fund level. However, certain BREP Asia II investors have a reduced base management fee due to a larger capital commitment amount, thereby resulting in higher net gains and have exceeded the carried interest threshold this quarter.

The Real Estate segment has two funds in their investment period, which were above their respective carried interest thresholds as of September 30, 2019: BREP Europe V and BREDS III.

more difficult to find opportunities for our funds to exit and realize value from existing investments and reducing the ability of our investment funds to raise or deploy capital, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition.” in our Annual Report on Form

10-K

for the year ended December 31, 2018.

Fee Related Earnings were $111.3 million for the three months ended September 30, 2019, an increase of $30.9 million, or 38%, compared to $80.4 million for the three months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to an increase of $32.6 million in Management and Advisory Fees, Net.

Management and Advisory Fees, Net were $255.3 million for the three months ended September 30, 2019, an increase of $32.6 million, compared to $222.6 million for the three months ended September 30, 2018, primarily driven by an increase in Base Management Fees. Base Management Fees were $252.5 million for the three months ended September 30, 2019, an increase of $46.6 million, compared to $205.9 million for the three months ended September 30, 2018, primarily due to increases in

Fee-Earning

Assets Under Management in Strategic Partners, BIP and BXLS.

Net Realizations were $84.2 million for the three months ended September 30, 2019, a decrease of $143.8 million, compared to $228.0 million for the three months ended September 30, 2018. The decrease in Net Realizations was primarily attributable to decreases of $165.8 million in Realized Performance Revenues and $32.4 million in Realized Principal Investment Income, partially offset by a decrease of $54.4 million in Realized Performance Compensation.

Realized Performance Revenues were $124.2 million for the three months ended September 30, 2019, a decrease of $165.8 million, compared to $290.0 million for the three months ended September 30, 2018. The decrease was primarily due to lower Realized Performance Revenues in corporate private equity.

Realized Principal Investment Income was $12.0 million for the three months ended September 30, 2019, a decrease of $32.4 million, compared to $44.4 million for the three months ended September 30, 2018. The decrease was primarily due to a decrease of Realized Principal Investment Income in corporate private equity.

Realized Performance Compensation was $52.0 million for the three months ended September 30, 2019, a decrease of $54.4 million, compared to $106.4 million for the three months ended September 30, 2018. The decrease was due to the decrease in Realized Performance Revenues.

Nine Months Ended September 30, 2019 Compared to Nine Months Ended September 30, 2018

Segment Distributable Earnings were $683.7 million for the nine months ended September 30, 2019, an increase of $78.8 million, or 13%, compared to $604.9 million for the nine months ended September 30, 2018. The increase in Segment Distributable Earnings was primarily attributable to an increase of $130.4 million in Fee Related Earnings, partially offset by a decrease of $51.6 million in Net Realizations.

Fee Related Earnings were $354.6 million for the nine months ended September 30, 2019, an increase of $130.4 million, or 58%, compared to $224.2 million for the nine months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to an increase of $168.5 million in Management and Advisory Fees, Net, partially offset by an increase of $29.1 million in Fee Related Compensation.

Management and Advisory Fees, Net were $786.0 million for the nine months ended September 30, 2019, an increase of $168.5 million, compared to $617.4 million for the nine months ended September 30, 2018, primarily driven by an increase in Base Management Fees. Base Management Fees were $737.1 million for the nine months

ended September 30, 2019, an increase of $152.7 million, compared to $584.4 million for the nine months ended September 30, 2018, primarily due to increases in

Fee-Earning

Assets Under Management in Strategic Partners, BIP, Tactical Opportunities and BXLS.

Fee Related Compensation was $318.5 million for the nine months ended September 30, 2019, an increase of $29.1 million, compared to $289.4 million for the nine months ended September 30, 2018. The increase was primarily due to the increase in Management and Advisory Fees, Net, on which a portion of Fee Related Compensation is based.

Net Realizations were $329.1 million for the nine months ended September 30, 2019, a decrease of $51.6 million, compared to $380.7 million for the nine months ended September 30, 2018. The decrease in Net Realizations was primarily attributable to a decrease of $101.6 million in Realized Performance Revenues, partially offset by a decrease of $53.3 million in Realized Performance Compensation.

Realized Performance Revenues were $403.7 million for the nine months ended September 30, 2019, a decrease of $101.6 million, compared to $505.3 million for the nine months ended September 30, 2018. The decrease was primarily due to lower Realized Performance Revenues in corporate private equity and Strategic Partners.

Realized Performance Compensation was $154.7 million for the nine months ended September 30, 2019, a decrease of $53.3 million, compared to $208.0 million for the nine months ended September 30, 2018. The decrease was due to the decrease in Realized Performance Revenues.

Fund returns information for our significant funds is included throughout this discussion and analysis to facilitate an understanding of our results of operations for the periods presented. The fund returns information reflected in this discussion and analysis is not indicative of the financial performance of Blackstone and is also not necessarily indicative of the future performance of any particular fund. An investment in Blackstone is not an investment in any of our funds. There can be no assurance that any of our funds or our other existing and future funds will achieve similar returns.

The following table presents the internal rates of return of our significant private equity funds:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tactical Opportunities Co-Investment and Other | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Strategic Partners VI (b) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Strategic Partners VII (b) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Strategic Partners RA II (b) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Strategic Partners RE, SMA and Other (b) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The returns presented herein represent those of the applicable Blackstone Funds and not those of Blackstone.

| N/M | Not meaningful generally due to the limited time since initial investment. |

| (a) | Net returns are based on the change in carrying value (realized and unrealized) after management fees, expenses and Performance Revenues. |

| (b) | Realizations are treated as return of capital until fully recovered and therefore inception to date realized returns are not applicable. Returns are calculated from results that are reported on a three month lag. |

The corporate private equity funds within the Private Equity segment have five funds with closed investment periods: BCP IV, BCP V, BCP VI, BCOM and BEP I. As of September 30, 2019, BCP IV was above its carried interest threshold (i.e., the preferred return payable to its limited partners before the general partner is eligible to receive carried interest) and would still be above its carried interest threshold even if all remaining investments were valued at zero. BCP V is comprised of two fund classes based on the timings of fund closings, the BCP V “main fund” and BCP

V-AC

fund. Within these fund classes, the general partner is subject to equalization such that (a) the general partner accrues carried interest when the respective carried interest for either fund class is positive and (b) the general partner realizes carried interest so long as clawback obligations, if any, for either of the respective fund classes are fully satisfied. During the quarter, BCP V is currently below its carried interest threshold, while BCP

V-AC

is above its carried interest threshold. BCP VI is currently above its carried interest threshold. BCOM is currently above its carried interest threshold. We are entitled to retain previously realized carried interest up to 20% of BCOM’s net gains. As a result, Performance Revenues are recognized from BCOM on current period gains and losses. BEP I is currently above its carried interest threshold.

The following table presents the results of operations for our Hedge Fund Solutions segment:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | | | | $ | | | | $ | | | | | | | | $ | | | | $ | | | | $ | | | | | | |

Transaction and Other Fees, Net | | | | | | | | | | | | ) | | | | | | | | | | | | | | | | ) | | | | |

| | | | ) | | | | | | | | ) | | | | | | | | ) | | | | | | | | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Management Fees, Net | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | ) | | | | ) | | | | | | | | | | | | ) | | | | ) | | | | | | | | |

| | | | ) | | | | ) | | | | | | | | | | | | ) | | | | ) | | | | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Realized Performance Revenues | | | | | | | | | | | | ) | | | | | | | | | | | | | | | | ) | | | | |

Realized Performance Compensation | | | | ) | | | | ) | | | | | | | | | | | | ) | | | | ) | | | | | | | | |

Realized Principal Investment Income | | | | | | | | | | | | ) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | ) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment Distributable Earnings | | $ | | | | $ | | | | $ | | | | | | | | $ | | | | $ | | | | $ | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended September 30, 2019 Compared to Three Months Ended September 30, 2018

Segment Distributable Earnings were $84.3 million for the three months ended September 30, 2019, an increase of $14.1 million, or 20%, compared to $70.2 million for the three months ended September 30, 2018. The increase in Segment Distributable Earnings was primarily attributable to an increase of $15.8 million in Fee Related Earnings, partially offset by a decrease of $1.8 million in Net Realizations.

Segment Distributable Earnings in our Hedge Fund Solutions segment in the third quarter of 2019 were higher compared to the third quarter of 2018. This increase was primarily driven by an increase in Fee Related Earnings as a result of growth in

Fee-Earning

Assets Under Management in individual investor and specialized solutions. Segment Distributable Earnings in the Hedge Fund Solutions segment would likely be negatively impacted in the event of a significant or sustained decline in global, regional or sector asset prices, deterioration of global market conditions, or withdrawal of assets by investors as a result of liquidity needs, performance or other reasons. In addition, Segment Distributable Earnings in our Hedge Fund Solutions segment may be negatively impacted by a prolonged weak equity market environment, which may be caused by concerns over macroeconomic and geopolitical factors such as trade conflict with China and the rate of global growth. See “Part I. Item 1A. Risk Factors — Risks Related to Our Business — Difficult market conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our investment funds, making it more difficult to find opportunities for our funds to exit and realize value from existing investments and reducing the ability of our investment funds to raise or deploy capital, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition” and “— Hedge fund investments are subject to numerous additional risks.” in our Annual Report on Form

10-K

for the year ended December 31, 2018. The segment operates multiple business lines, manages strategies that are both long and short asset classes and generates a majority of its revenue through management fees, which we believe may provide a level of downside protection to Hedge Fund Solutions Segment Distributable Earnings. Over time we anticipate an increasing change in the mix of our product offerings to products whose performance based fees represent a more significant proportion of the fees than has historically been the case for such products.

Fee Related Earnings were $82.0 million for the three months ended September 30, 2019, an increase of $15.8 million, or 24%, compared to $66.1 million for the three months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to an increase of $11.0 million in Management Fees, Net and a decrease of $4.5 million in Fee Related Compensation.

Management Fees, Net were $141.4 million for the three months ended September 30, 2019, an increase of $11.0 million, compared to $130.3 million for the three months ended September 30, 2018, primarily driven by an increase in Base Management Fees. Base Management Fees were $140.7 million for the three months ended September 30, 2019, an increase of $11.1 million, compared to $129.6 million for the three months ended September 30, 2018, primarily due to

Fee-Earning

Asset Under Management growth in our individual investor and specialized solutions.

Fee Related Compensation was $38.9 million for the three months ended September 30, 2019, a decrease of $4.5 million, compared to $43.4 million for the three months ended September 30, 2018. The decrease was primarily due to changes in compensation accruals.

Net Realizations were $2.3 million for the three months ended September 30, 2019, a decrease of $1.8 million, compared to $4.1 million for the three months ended September 30, 2018. The decrease in Net Realizations was primarily attributable to decreases of $2.1 million in Realized Performance Revenues, partially offset by a decrease of $0.9 million in Realized Performance Compensation.

Realized Performance Revenues were $1.8 million for the three months ended September 30, 2019, a decrease of $2.1 million, compared to $4.0 million for the three months ended September 30, 2018. The decrease was primarily due to lower returns across a number of strategies compared to the three months ended September 30, 2018.

Realized Performance Compensation was $1.0 million for the three months ended September 30, 2019, a decrease of $0.9 million, compared to $1.9 million for the three months ended September 30, 2018. The decrease was primarily due to the decrease in Realized Performance Revenues.

Nine Months Ended September 30, 2019 Compared to Nine Months Ended September 30, 2018

Segment Distributable Earnings were $265.6 million for the nine months ended September 30, 2019, an increase of $32.5 million, or 14%, compared to $233.1 million for the nine months ended September 30, 2018. The increase in Segment Distributable Earnings was primarily attributable to increases of $30.1 million in Fee Related Earnings and $2.3 million in Net Realizations.

Fee Related Earnings were $238.8 million for the nine months ended September 30, 2019, an increase of $30.1 million, or 14%, compared to $208.6 million for the nine months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to an increase of $26.5 million in Management Fees, Net and a decrease of $5.1 million in Fee Related Compensation.

Management Fees, Net were $416.7 million for the nine months ended September 30, 2019, an increase of $26.5 million, compared to $390.3 million for the nine months ended September 30, 2018, primarily driven by an increase in Base Management Fees. Base Management Fees were $415.0 million for the nine months ended September 30, 2019, an increase of $26.7 million, compared to $388.3 million for the nine months ended September 30, 2018, primarily due to

Fee-Earning

Asset Under Management growth in our individual investor and specialized solutions and a reduction in placement fees, which offset Base Management Fees.

Fee Related Compensation was $118.5 million for the nine months ended September 30, 2019, a decrease of $5.1 million, compared to $123.6 million for the nine months ended September 30, 2018. The decrease was primarily due to changes in compensation accruals.

Net Realizations were $26.8 million for the nine months ended September 30, 2019, an increase of $2.3 million, compared to $24.5 million for the nine months ended September 30, 2018. The increase in Net Realizations was primarily attributable to an increase of $3.1 million in Realized Principal Investment Income and a decrease of $2.8 million in Realized Performance Compensation, partially offset by a decrease of $3.5 million in Realized Performance Revenues.

Realized Principal Investment Income was $13.5 million for the nine months ended September 30, 2019, an increase of $3.1 million, compared to $10.4 million for the nine months ended September 30, 2018. The increase was driven by realized gains on our Corporate Treasury Investments.

Realized Performance Compensation was $4.6 million for the nine months ended September 30, 2019, a decrease of $2.8 million, compared to $7.4 million for the nine months ended September 30, 2018. The decrease was due to the decrease in Realized Performance Revenues.

Realized Performance Revenues were $17.9 million for the nine months ended September 30, 2019, a decrease of $3.5 million, compared to $21.4 million for the nine months ended September 30, 2018. The decrease was primarily driven by funds entering 2019 with loss carryforward balances.

The following table presents information regarding our Invested Performance Revenue Eligible Assets Under Management:

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | |

| | | | | | | |

Hedge Fund Solutions Managed Funds (b) | | | | | | | | | | | | | | | | |

| (a) | Estimated % Above High Water Mark/Benchmark represents the percentage of Invested Performance Revenue Eligible Assets Under Management that as of the dates presented would earn performance fees when the applicable Hedge Fund Solutions managed fund has positive investment performance relative to a benchmark, where applicable. Incremental positive performance in the applicable Blackstone Funds may cause additional assets to reach their respective High Water Mark or clear a benchmark return, thereby resulting in an increase in Estimated % Above High Water Mark/Benchmark. |

| (b) | For the Hedge Fund Solutions managed funds, at September 30, 2019, the incremental appreciation needed for the 25% of Invested Performance Revenue Eligible Assets Under Management below their respective High Water Marks/Benchmarks to reach their respective High Water Marks/Benchmarks was $439.3 million, an increase of $28.9 million, compared to $410.4 million at September 30, 2018. Of the Invested Performance Revenue Eligible Assets Under Management below their respective High Water Marks/Benchmarks as of September 30, 2019, 86% were within 5% of reaching their respective High Water Mark. |

Composite returns information is included throughout this discussion and analysis to facilitate an understanding of our results of operations for the periods presented. The composite returns information reflected in this discussion and analysis is not indicative of the financial performance of Blackstone and is also not

Three Months Ended September 30, 2019 Compared to Three Months Ended September 30, 2018

Segment Distributable Earnings were $71.9 million for the three months ended September 30, 2019, an increase of $21.1 million, or 42%, compared to $50.8 million for the three months ended September 30, 2018. The increase in Segment Distributable Earnings was primarily attributable to increases of $14.0 million in Fee Related Earnings and $7.1 million in Net Realizations.

Segment Distributable Earnings in our Credit segment in the third quarter of 2019 were higher compared to the third quarter of 2018, driven in part by higher Fee Related Earnings as a result of growth in BIS and certain other GSO vehicles, including our U.S. direct lending platform. Against a muted market backdrop, our performing credit strategies delivered a 0.9% gross return in the quarter and our distressed strategies declined 3.9%, largely driven by decreases in certain upstream energy positions. The persistence of weakened market fundamentals in certain energy subsectors, particularly upstream, would continue to negatively impact the performance of certain Credit segment investments. Our Credit segment deployed or committed $3.4 billion of capital in the third quarter of 2019. See “Part I. Item 1A. Risk Factors — Risks Related to Our Business — Difficult market conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our investment funds, making it more difficult to find opportunities for our funds to exit and realize value from existing investments and reducing the ability of our investment funds to raise or deploy capital, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition.” in our Annual Report on Form

10-K

for the year ended December 31, 2018.

Fee Related Earnings were $60.1 million for the three months ended September 30, 2019, an increase of $14.0 million, or 30%, compared to $46.1 million for the three months ended September 30, 2018. The increase in Fee Related Earnings was primarily attributable to increases of $16.4 million in Management Fees, Net and $3.6 million in Fee Related Performance Revenues and a decrease of $4.2 million in Fee Related Compensation, partially offset by an increase of $10.2 million in Other Operating Expenses.

Management Fees, Net were $151.2 million for the three months ended September 30, 2019, an increase of $16.4 million, compared to $134.8 million for the three months ended September 30, 2018, primarily driven by an increase in Base Management Fees. Base Management Fees were $149.7 million for the three months ended September 30, 2019, an increase of $17.7 million, compared to $132.1 million for the three months ended September 30, 2018, primarily due to the launch of several GSO and BIS funds subsequent to the three months ended September 30, 2018, including our BDC, successor flagship funds and multiple long only funds.

Fee Related Performance Revenues were $3.6 million for the three months ended September 30, 2019, an increase of $3.6 million, compared to the three months ended September 30, 2018. The increase was due to the ramp up of our BDC within the new direct lending platform.

Fee Related Compensation was $53.0 million for the three months ended September 30, 2019, a decrease of $4.2 million, compared to $57.1 million for the three months ended September 30, 2018. The decrease was primarily due to changes in compensation accruals.

Other Operating Expenses were $41.7 million for the three months ended September 30, 2019, an increase of $10.2 million, compared to $31.6 million for the three months ended September 30, 2018. The increase was primarily due to the growth in our new business initiatives, including BIS and the direct lending platform.

Net Realizations were $11.8 million for the three months ended September 30, 2019, an increase of $7.1 million, or 151%, compared to $4.7 million for the three months ended September 30, 2018. The increase in Net Realizations was primarily attributable to increases of $7.5 million in Realized Performance Revenues and $1.7 million in Realized Principal Investment Income, partially offset by an increase of $2.2 million in Realized Performance Compensation.

Realized Performance Revenues were $12.4 million for the three months ended September 30, 2019, an increase of $7.5 million, compared to $4.9 million for the three months ended September 30, 2018. The increase was primarily attributable to increased realizations in our mezzanine fund during the three months ended September 30, 2019.

Realized Principal Investment Income was $4.7 million for the three months ended September 30, 2019, an increase of $1.7 million, compared to $3.0 million for the three months ended September 30, 2018. The increase was due to realized gains in our corporate treasury investments.