EXHIBIT 99.1

// 31 st Annual ROTH Conference // March 18 th , 2019 // Art Zeile // Luc Gregoire // CEO // CFO NYSE: DHX

31 st Annual ROTH Conference // March 2019 This presentation and oral statements made from time to time by our representatives contain forward - looking statements . You should not place undue reliance on those statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control . Forward - looking statements include, without limitation, information concerning our possible or assumed future results of operations . These statements often include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions . These statements are based on assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances . Although we believe that these forward - looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward - looking statements . These factors include, but are not limited to, our ability to execute our tech - focused strategy, competition from existing and future competitors in the highly competitive market in which we operate, failure to adapt our business model to keep pace with rapid changes in the recruiting and career services business, failure to maintain and develop our reputation and brand recognition, failure to increase or maintain the number of customers who purchase recruitment packages, cyclicality or downturns in the economy or industries we serve, the uncertainty surrounding the United Kingdom’s future departure from the European Union, including uncertainty in respect of the regulation of data protection and data privacy, failure to attract qualified professionals to our websites or grow the number of qualified professionals who use our websites, failure to successfully identify or integrate acquisitions, U . S . and foreign government regulation of the Internet and taxation, our ability to borrow funds under our revolving credit facility or refinance our indebtedness and restrictions on our current and future operations under such indebtedness . These factors and others are discussed in more detail in the Company’s filings with the Securities and Exchange Commission, all of which are available on the Investors page of our website at www . dhigroupinc . com, including the Company’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2018 , under the headings “Risk Factors,” “Forward - Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations . ” You should keep in mind that any forward - looking statement made by the Company or its representatives herein, or elsewhere, speaks only as of the date on which it is made . New risks and uncertainties come up from time to time, and it is impossible to predict these events or how they may affect us . We have no obligation to update any forward - looking statements after the date hereof, except as required by federal securities laws . Forward Looking Statements NYSE: DHX 2

Tech Focused Career Marketplaces 31 st Annual ROTH Conference // March 2019 NYSE: DHX Our vision is to create indispensable career marketplaces to match the highest quality candidates with the right client career opportunities 3

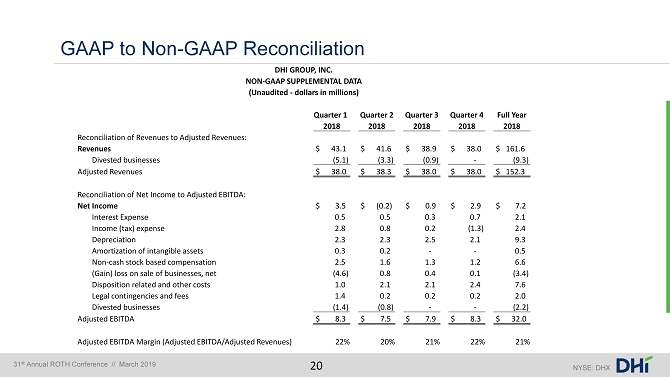

Company Overview • Founded: 1990 • Headquarters: New York City • Listed: NYSE: DHX (2007) • Employees: ~500 • Customers: ~12,000 • Brands • Dice • eFinancialCareers • ClearanceJobs • Year - end: 12/31 • Diluted Shares outstanding: ~50M • FY 2018 Financial Results • Revenue: $162M • Adjusted Revenue: $152M • Diluted EPS: $0.14 • Net Income: $7M • Adjusted EBITDA: $32M • Adjusted EBITDA margin: 21% • Cash: $6M • Debt Outstanding: $18M 31 st Annual ROTH Conference // March 2019 NYSE: DHX 4 GAAP to Non - GAAP Reconciliation at end of document

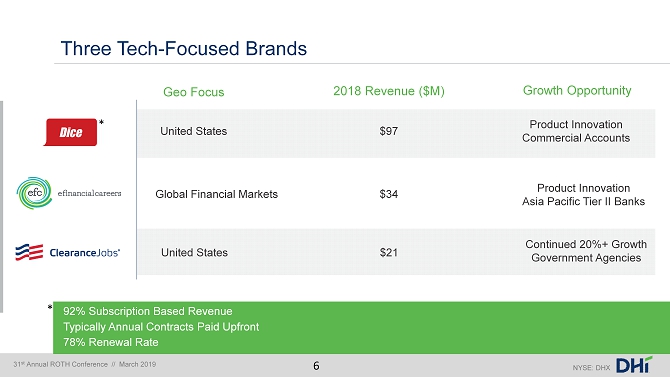

Premier Tech Pro Marketplace • Leading database for tech professionals, managing over 7 million US profiles • Deep expertise in matching candidates with employers through artificial intelligence and machine learning products • 2 million unique visitors/month Global Finance Marketplace • Global financial services careers platform – available in 18 financial markets • ~25%+ of job postings are in technology category Cleared Professionals Marketplace • A leading database of security cleared professionals, with over 1 million candidates registered • Unique communication and engagement tools • Complete talent management platform to nurture ongoing relationships with candidates Three Tech - Focused Brands 31 st Annual ROTH Conference // March 2019 NYSE: DHX 5

Three Tech - Focused Brands Geo Focus 2018 Revenue ($M) Growth Opportunity Product Innovation Commercial Accounts United States $97 Product Innovation Asia Pacific Tier II Banks Global Financial Markets $34 Continued 20%+ Growth Government Agencies United States $21 31 st Annual ROTH Conference // March 2019 NYSE: DHX 92% Subscription Based Revenue Typically Annual Contracts Paid Upfront 78% Renewal Rate 6 * *

With Loyal Customers Premier Tech Pro Marketplace 6,200 Subscription Clients ~20% of the Fortune 1000 31 st Annual ROTH Conference. // March 2019 NYSE: DHX 7

With Loyal Customers Global Finance Marketplace 1,000 Subscription Clients 57% of the Global 100 Banks 31 st Annual ROTH Conference // March 2019 NYSE: DHX 8

Cleared Professionals Marketplace 1,700 Subscription Clients 100% of top 50 US Defense Contractors With Loyal Customers 31 st Annual ROTH Conference // March 2019 NYSE: DHX 9

The Market for Online Recruiting is Large and Growing … Source: IBIS Online Recruitment Sites Industry Report, November 2018; Sand Cherry Analysis And Technology Occupations Are The Sweet Spot IT Talent Generates ~9% of Online Recruiting Revenue in the US IT Jobs are Growing at a Faster Rate than Other Sectors Over 1M+ Unfilled Tech Positions by 2020 31 st Annual ROTH Conference // March 2019 NYSE: DHX Industry at a Glance Online Recruitment Sites in 2018 Key Statistics Snapshot Revenue $7.7bn Annual Growth 18 - 23 7.3% Profit $881.8m Businesses 1,200 10

DHX is in the Midst of Transformation Competing Priorities Focus on Revenue Growth 8 Non - Synergistic Brands 3 Tech Focused Brands Job Board/Advertising Emphasis Career Marketplace Siloed Brand Teams Centralized Functional Teams Declining Revenue Hit Revenue Inflection Point Low Innovation Pace High Innovation Tempo Past Today 31 st Annual ROTH Conference // March 2019 NYSE: DHX 11

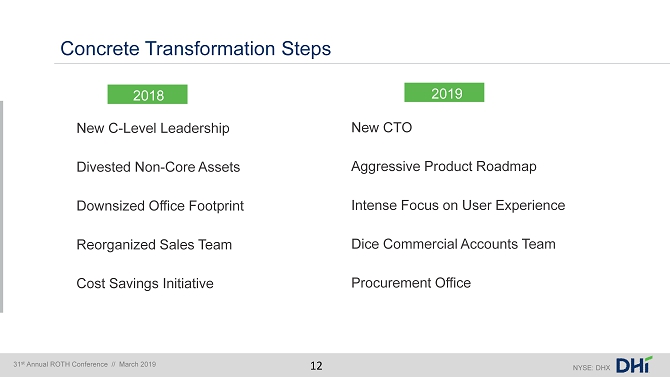

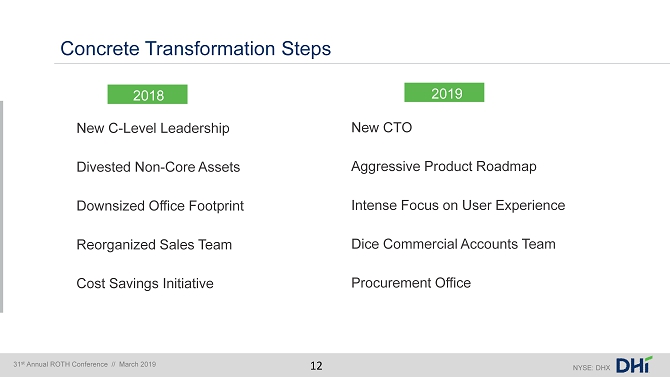

Concrete Transformation Steps New C - Level Leadership Divested Non - Core Assets Downsized Office Footprint Reorganized Sales Team Cost Savings Initiative New CTO Aggressive Product Roadmap Intense Focus on User Experience Dice Commercial Accounts Team Procurement Office 2018 2019 31 st Annual ROTH Conference // March 2019 NYSE: DHX 12

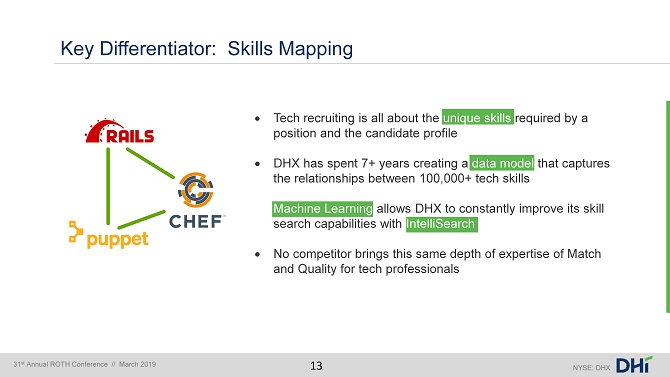

Key Differentiator: Skills Mapping Tech recruiting is all about the unique skills required by a position and the candidate profile DHX has spent 7+ years creating a data model that captures the relationships between 100,000+ tech skills Machine Learning allows DHX to constantly improve its skill search capabilities with IntelliSearch No competitor brings this same depth of expertise of Match and Quality for tech professionals 31 st Annual ROTH Conference // March 2019 NYSE: DHX 13

Skills Mapping In Action: IntelliSearch • Recruiters put an entire job posting into the search field instead of a title • IntelliSearch compares ALL skill requirements against the skills represented in 7 million US profiles • This feature has been available in ClearanceJobs for 2+ years • Recruiters don’t want more candidates they want a short list of the RIGHT candidates • 93% of Dice Customers have been migrated to date • Results are a double digit increase in search activity 31 st Annual ROTH Conference // March 2019 NYSE: DHX 14

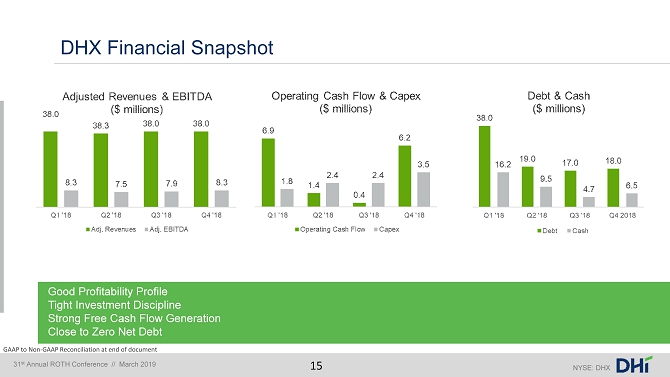

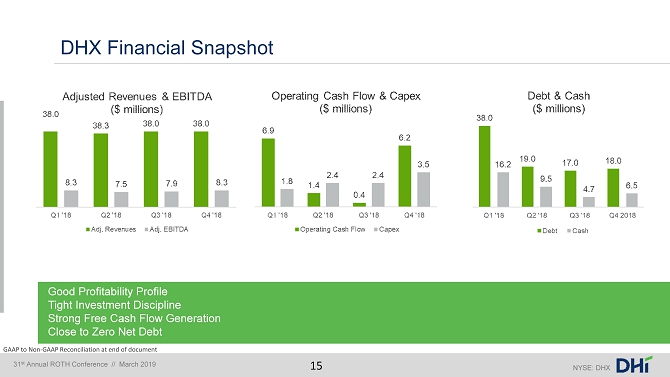

DHX Financial Snapshot 31 st Annual ROTH Conference // March 2019 NYSE: DHX Good Profitability Profile Tight Investment Discipline Strong Free Cash Flow Generation Close to Zero Net Debt 15 GAAP to Non - GAAP Reconciliation at end of document

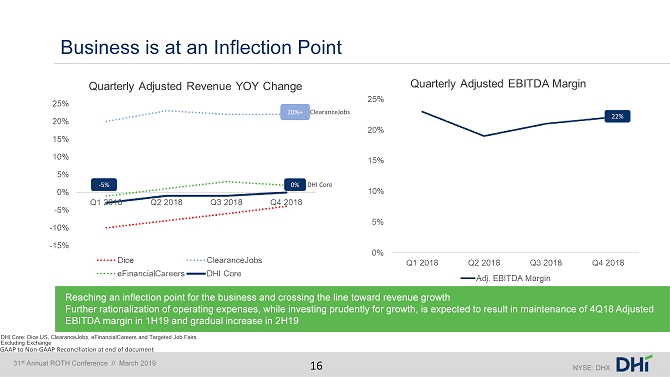

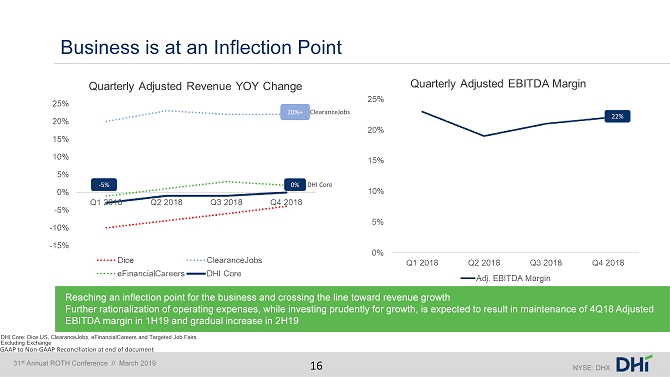

Business is at an Inflection Point 31 st Annual ROTH Conference // March 2019 NYSE: DHX Reaching an inflection point for the business and crossing the line toward revenue growth Further rationalization of operating expenses, while investing prudently for growth, is expected to result in maintenance of 4Q1 8 Adjusted EBITDA margin in 1H19 and gradual increase in 2H19 DHI Core: Dice US, ClearanceJobs, eFinancialCareers and Targeted Job Fairs 22% 16 0% 20%+ - 5% Excluding Exchange DHI Core ClearanceJobs GAAP to Non - GAAP Reconciliation at end of document

DHX Investment Thesis 31 st Annual ROTH Conference // March 2019 NYSE: DHX Market for Online Recruitment Tools is Growing Tech Market Niche is Attractive and Plays to our IP in Collecting and Mapping Tech Skills New Management Drives Functional Strength and Focus Demonstrated Success of Product Innovation with ClearanceJobs Set for Operating Leverage Expansion and Shareholder Value Creation Opportunity to Invest at Inflection Point 17

NYSE: DHX

Notes Regarding the Use of Non - GAAP Financial Measures The Company has provided certain non - GAAP financial information as additional information for its operating results. These measu res are not in accordance with, or an alternative for, measurements in accordance with generally accepted accounting principles in the United States (“GAAP”) and may be different f rom similarly titled non - GAAP measures reported by other companies. The Company believes that its presentation of non - GAAP measures, such as Adjusted Revenues, adjusted earnings before interest, taxes, depreciation, amortization, non - cash stock based compensation expense, other non - recurring income or expense (“Adjusted EBITDA”) and Adjusted EBITDA margin provides useful information to management and investors regarding certain financial and business trends relating to its financial condition and results of operations. In addition, t he Company’s management uses these measures for reviewing the financial results of the Company and for budgeting and planning purposes. The non - GAAP measures apply to consolidated results an d results by segment or other measure as shown within this document. The Company has provided required reconciliations to the most comparable GAAP measures elsewhere in the docume nt. Adjusted Revenues Adjusted Revenues is a non - GAAP metric used by management to measure operating performance. Adjusted Revenues represents Revenue s less the revenues of divested businesses. We consider Adjusted Revenues to be an important measure to evaluate the performance of our ongoing businesses and provide compa rab le results excluding our divestitures. Adjusted EBITDA and Adjusted EBITDA Margin Adjusted EBITDA and Adjusted EBITDA Margin are non - GAAP metrics used by management to measure operating performance. Management uses Adjusted EBITDA as a performance measure for internal monitoring and planning, including preparation of annual budgets, analyzing investment decisions and eva lua ting profitability and performance comparisons between us and our competitors. The Company also uses this measure to calculate amounts of performance based compensation under the seni or management incentive bonus program. Adjusted EBITDA represents net income plus (to the extent deducted in calculating such net income) interest expense, income tax expens e, depreciation and amortization, non - cash stock based compensation, losses resulting from certain dispositions outside the ordinary course of business including prior negative ope rat ing results of those businesses, certain writeoffs in connection with indebtedness, impairment charges with respect to long - lived assets, expenses incurred in connection with an equity offering or any other offering of securities by the Company, extraordinary or non - recurring non - cash expenses or losses, transaction costs in connection with the credit agreement, deferred revenues written off in connection with acquisition purchase accounting adjustments, writeoff of non - cash stock compensation expense, severance and retention costs related to dispositions and reorganizations of the Compan y, losses related to legal claims and fees that are unusual in nature or infrequent, minus (to the extent included in calculating such net income) non - cash income or gains, interest income, business interruption insurance proceeds, and any income or gain resulting from certain dispositions outside the ordinary course of business, inclu din g prior positive operating results of those divested businesses, and gains related to legal claims that are unusual in nature or infrequent. The Company modified its definition of Adjusted E BIT DA during the first quarter of 2018 to also exclude severance and retention costs related to dispositions or reorganizations of the Company, the prior operating results of divested busine sse s, and losses related to legal claims and fees that are unusual in nature or infrequent. The Company changed its definition of Adjusted EBITDA to provide a more transparent and comparable view of its financial performance. Accordingly, all prior periods presented have been recast to reflect the current definition. We also consider Adjusted EBITDA, as defined above, to be an im por tant indicator to investors because it provides information related to our ability to provide cash flows to meet future debt service, capital expenditures and working capital requiremen ts and to fund future growth. We present Adjusted EBITDA as a supplemental performance measure because we believe that this measure provides our board of directors, management and investo rs with additional information to measure our performance, provide comparisons from period to period and company to company by excluding potential differences caused by va ria tions in capital structures (affecting interest expense) and tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses), and to est imate our value. Adjusted EBITDA Margin is computed as Adjusted EBITDA divided by Adjusted Revenues. Adjusted Revenues, Adjusted EBITDA and Adjusted EBITDA Margin are not measureme nts of our financial performance under GAAP and should not be considered as an alternative to net income, operating income, revenue or any other performance measures derived in accordance with GAAP as a measure of our profitability. 31 st Annual ROTH Conference // March 2019 NYSE: DHX Notes regarding the Use of Non - GAAP Financial Measures 19

GAAP to Non - GAAP Reconciliation 31 st Annual ROTH Conference // March 2019 NYSE: DHX 20 DHI GROUP, INC. NON - GAAP SUPPLEMENTAL DATA (Unaudited - dollars in millions) Quarter 1 Quarter 2 Quarter 3 Quarter 4 Full Year 2018 2018 2018 2018 2018 Reconciliation of Revenues to Adjusted Revenues: Revenues $ 43.1 $ 41.6 $ 38.9 $ 38.0 $ 161.6 Divested businesses (5.1) (3.3) (0.9) - (9.3) Adjusted Revenues $ 38.0 $ 38.3 $ 38.0 $ 38.0 $ 152.3 Reconciliation of Net Income to Adjusted EBITDA: Net Income $ 3.5 $ (0.2) $ 0.9 $ 2.9 $ 7.2 Interest Expense 0.5 0.5 0.3 0.7 2.1 Income (tax) expense 2.8 0.8 0.2 (1.3) 2.4 Depreciation 2.3 2.3 2.5 2.1 9.3 Amortization of intangible assets 0.3 0.2 - - 0.5 Non - cash stock based compensation 2.5 1.6 1.3 1.2 6.6 (Gain) loss on sale of businesses, net (4.6) 0.8 0.4 0.1 (3.4) Disposition related and other costs 1.0 2.1 2.1 2.4 7.6 Legal contingencies and fees 1.4 0.2 0.2 0.2 2.0 Divested businesses (1.4) (0.8) - - (2.2) Adjusted EBITDA $ 8.3 $ 7.5 $ 7.9 $ 8.3 $ 32.0 Adjusted EBITDA Margin (Adjusted EBITDA/Adjusted Revenues) 22% 20% 21% 22% 21%