UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material under § 240.14a-12 |

DHI Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ☒ | | No fee required. |

| | |

| ☐ | | Fee paid previously with preliminary materials. |

| | |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | | | | | | | |

| DHI GROUP, INC. 6465 South Greenwood Plaza, Suite 400 Centennial, Colorado 80111 |

March 17, 2023 |

| | |

Dear Fellow Stockholder,

I am pleased to invite you to our 2023 Annual Meeting of Stockholders (the “Annual Meeting”), which will be held on Wednesday, April 26, 2023, at 3:00 p.m., Mountain Time. This year’s Annual Meeting will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the Annual Meeting by visiting meetnow.global/MN4P5ND at the Annual Meeting date and time described in the accompanying Proxy Statement. A password is not required to attend the Annual Meeting. There is no physical location for the Annual Meeting.

At the start of the COVID-19 pandemic, we decided to hold our Annual Meeting of stockholders virtually. We have continued to host the Annual Meeting as a virtual event to provide for greater participation as our stockholders are not centrally located. We believe that a virtual meeting enables greater stockholder attendance and participation from any location around the world.

In 2022, employers were focused on finding ways to attract tech talent. Accordingly, DHI focused its product strategy on employer branding solutions, developing features and products for companies to promote their missions, values and cultures to candidates. DHI itself won several awards, including the Great Place to Work® certification and the 2022 Best Midsized Place to Work by BuiltIn Colorado, demonstrating the world-class team of talent and leadership within the organization. DHI also spent the year continuing its efforts regarding Environmental, Social, and Governance (“ESG”). We are proud of what our team has been able to accomplish in ESG thus far and are committed to continuing to improve in these areas throughout the remainder of 2023 and beyond.

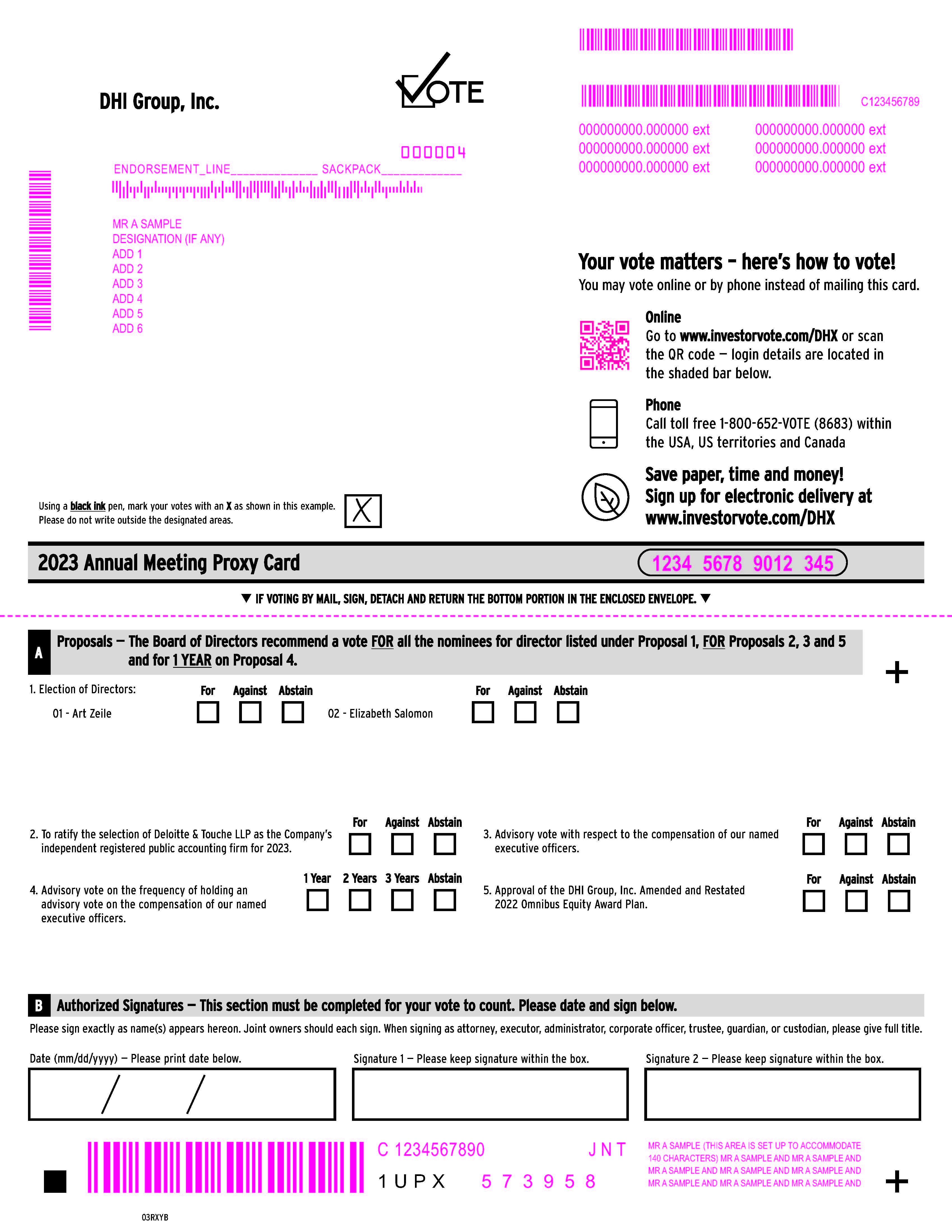

At the Annual Meeting, we will be electing one class of directors, considering the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, considering the approval, on an advisory basis, of the compensation of our named executive officers, considering the approval, on an advisory basis, of the frequency of the advisory vote on the compensation of our named executive officers, considering the approval of the amendment and restatement of the DHI Group, Inc. 2022 Omnibus Equity Award Plan (which we refer to as the “2022 Equity Plan”), and transacting such other business that may properly come before the Annual Meeting. The Board of Directors recommends a vote FOR (i) the election of our director nominees, (ii) the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm, (iii) the approval, on an advisory basis, of the compensation of our named executive officers, (iv) the approval, on an advisory basis, of the option of “1 year” for future advisory votes on the compensation of our named executive officers, and (v) the approval of the amendment and restatement of the 2022 Equity Plan.

You may vote your shares using the Internet or the telephone by following the instructions on the enclosed proxy. Of course, you may also vote by returning the enclosed proxy card.

Thank you very much for your support of DHI Group, Inc.

Sincerely,

Art Zeile

President and Chief Executive Officer

| | | | | | | | |

| DHI GROUP, INC. 6465 South Greenwood Plaza, Suite 400 Centennial, Colorado 80111 |

March 17, 2023 |

| | |

NOTICE OF ANNUAL MEETING

DHI Group, Inc., a Delaware corporation (the “Company”), will hold its 2023 Annual Meeting of Stockholders (the “Annual Meeting”) virtually at meetnow.global/MN4P5ND on Wednesday, April 26, 2023, at 3:00 p.m., Mountain Time, to:

1.Elect two Class I directors, for a term of three years, or until his or her successor is duly elected and qualified;

2.Ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023;

3.Hold an advisory vote to approve the compensation of our named executive officers as described in the Proxy Statement;

4.Hold an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers;

5.Approval of the DHI Group, Inc. 2022 Omnibus Equity Award Plan, as amended and restated; and

6.Transact any other business that may properly come before the Annual Meeting and any adjournments or postponements thereof.

Stockholders of record of DHI Group, Inc. (NYSE: DHX) as of the close of business on March 13, 2023, are entitled to notice of, and to vote at the Annual Meeting and any adjournments or postponements thereof. A list of these stockholders will be available for examination 10 days prior to the Annual Meeting at our principal executive office, 6465 South Greenwood Plaza, Suite 400, Centennial, Colorado 80111.

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the Annual Meeting, you are strongly encouraged to sign and date the enclosed proxy card and return it promptly, or submit your proxy by telephone or the Internet. Any stockholder of record who is virtually present at the Annual Meeting as a registered stockholder may vote virtually, thereby revoking any previous proxy. If you have any questions about the voting process, please refer to the section titled “Frequently Asked Questions About Voting and the Annual Meeting.”

This Proxy Statement and accompanying proxy and voting instructions are first being mailed on or about March 17, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on April 26, 2023 (the “Meeting”): Both the proxy statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are available electronically at dhigroupinc.com/investors/default.aspx

By order of the Board of Directors,

Brian P. Campbell

Chief Legal Officer & Corporate Secretary

TABLE OF CONTENTS

| | | | | |

| | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Proposal 1: Election of Directors | |

| Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm | |

| Proposal 3: Advisory Vote to Approve the Compensation of our Named Executive Officers | |

| Proposal 4: Advisory Vote on the Frequency of Future Advisory Votes to Approve the Compensation of our Named Executive Officers | |

| Proposal 5: Approval of the DHI Group, Inc. 2022 Omnibus Equity Award Plan, as Amended and Restated | |

| |

| |

| |

| |

| |

| Information Concerning Solicitation and Voting | |

| |

| |

| |

| |

Forward-Looking Statements

This proxy statements contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). From time to time, we may also provide oral or written forward-looking statements in other materials we release to the public. Such forward-looking statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning our possible or assumed future financial condition, liquidity and results of operations, including expectations (financial or otherwise), our strategy, plans, objectives, expectations (financial or otherwise) and intentions, and growth potential. These statements often include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are based on assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. Forward-looking statements are subject to risks, uncertainties and other factors, which may cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, without limitation, those described in Part I - Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”), elsewhere throughout the Annual Report, and those described from time to time in our past and future reports filed with the Securities and Exchange Commission. Caution should be taken not to place undue reliance on any such forward-looking statements. Moreover, such forward-looking statements speak only as of the date of this proxy statement. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements, except as required by applicable law.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be Held on April 26, 2023

PROXY STATEMENT SUMMARY

This Proxy Statement is furnished to the stockholders of record of DHI Group, Inc., a Delaware corporation, in connection with the solicitation by the Company’s Board of Directors of proxies. This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are provided to help you find further information. For ease of reading, in these materials “DHI,” “we,” “us,” or the “Company” refers to DHI Group, Inc., “Board” refers to our Board of Directors, “CEO” refers to our Chief Executive Officer, and “NEOs” refers to our Named Executive Officers. This Proxy Statement and accompanying proxy and voting instructions are first being mailed to stockholders on or about March 17, 2023.

| | | | | | | | |

| Board Vote Recommendation | Page Reference (for further detail) |

| 1. Election of two Class I Directors | FOR EACH NOMINEE | 42 |

| 2. Ratification of Selection of Independent Registered Public Accounting Firm | FOR | 42 |

| 3. Advisory Vote to Approve the Compensation of our Named Executive Officers | FOR | 43 |

| 4. Advisory Vote on the Frequency of Future Advisory Votes to Approve the Compensation of our Named Executive Officers | 1 YEAR | 44 |

| 5. Approval of DHI Group, Inc. 2022 Omnibus Equity Award Plan, as Amended and Restated | FOR | 45 |

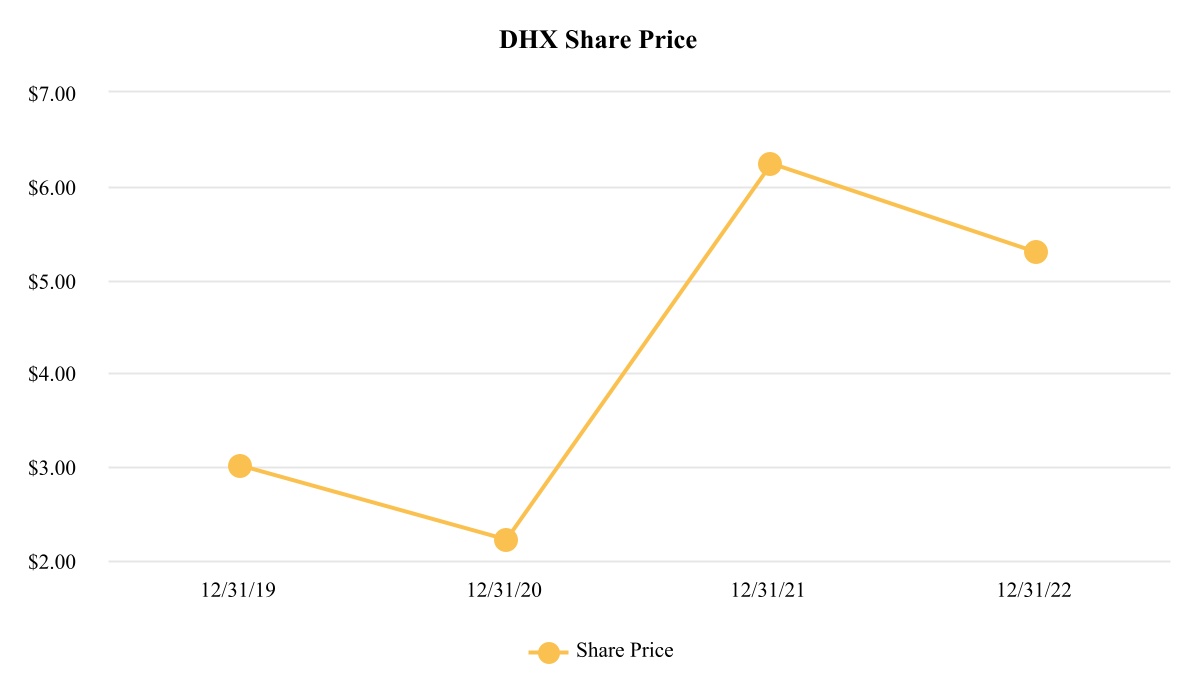

2022 DHI Performance Highlights

| | | | | | | | |

2022 Highlights | | In 2022, DHI returned to double-digit revenue growth as employers across the United States continued to use its subscription-based offering to find, attract, engage and hire the highest quality technology and security-cleared professionals, bolstered by an increasing supply-demand gap for technologists. Dice focused its sales efforts on attracting commercial account clients, which we believe represents over a billion dollars in Target Addressable Market and its largest opportunity for growth. As DHI further invested in sales, marketing and product, profitability remained a priority with our continuing commitment to deliver Adjusted EBITDA Margin1 in the range of 20%. Dice and ClearanceJobs delivered multiple major product releases and hundreds of minor releases to improve the experience for both customers and candidates. |

| | |

Exceptional Financial Performance

| | We expanded all three of our New Business teams and focused on selling annual and multi-year contracts to mid and large sized enterprise clients due to the current economic environment. As a result, average annual revenue per recruitment package customer for Dice and ClearanceJobs grew 7% and 12% year-over-year, respectively. We established a New Accounts Special Handling team to create the best possible experience and engagement for first year clients. The success of this team contributed to our strong overall revenue renewal rates of 99% and 100% at Dice and ClearanceJobs, respectively.

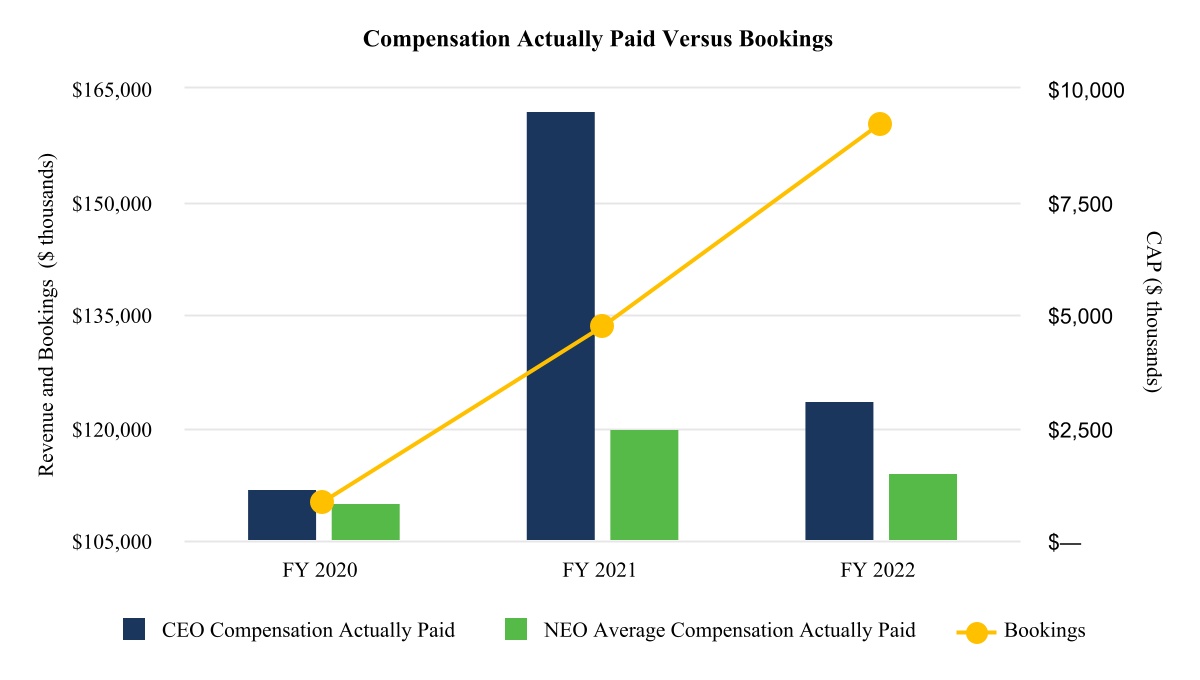

Bookings1 strengthened in the year, growing to $160.2 million to end 2022, a 20% increase from 2021.

In 2022, DHI’s overall revenue growth was 25% year-over-year, a strong growth rate.

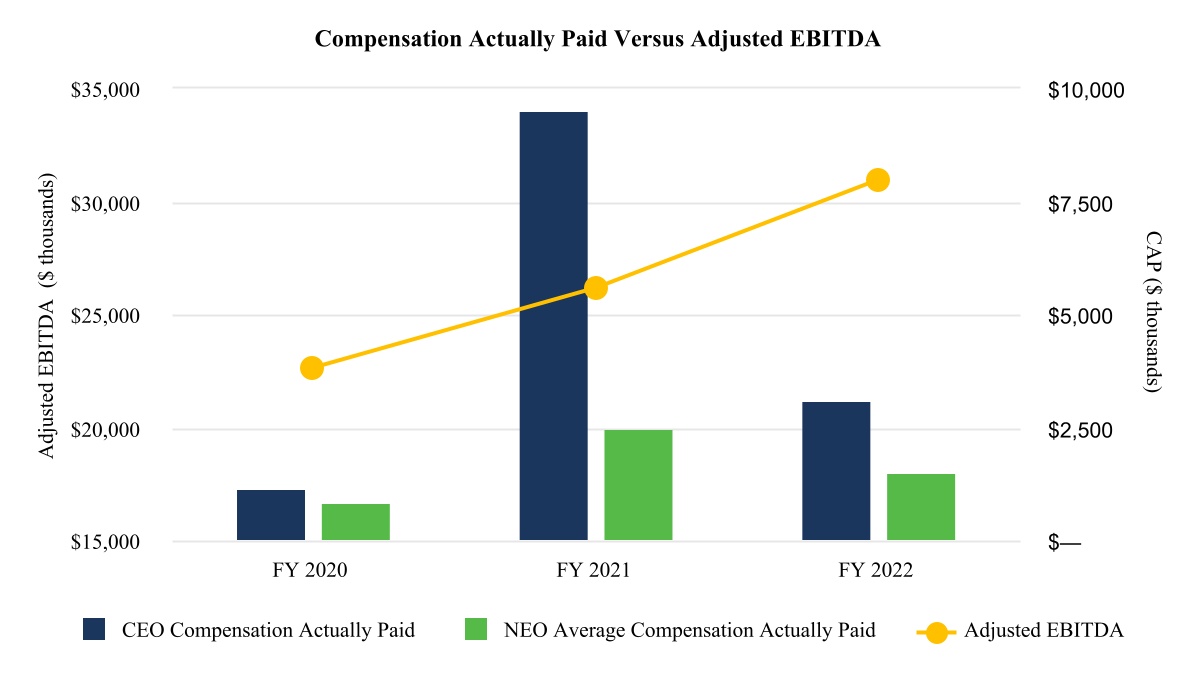

The Company maintained a solid Adjusted EBITDA Margin1 of 21% while balancing strong financial performance with strategic investments to maximize growth opportunities. |

| | |

Leading Tech/Cleared Sites for Candidates

| | Dice focused on improving the candidate experience in 2022, including an update to our job posting format, creating a streamlined application process and reducing the steps necessary to become a member of its community.

Dice delivered the ability for recruiters to invite specific candidates to apply to a job posted, the opportunity to search for candidates within specified time zones to better enable remote teams, and multi-factor authentication for enhanced security.

ClearanceJobs launched its new enhanced company profile so that clients can better explain their mission, values and culture to attract top-notch candidates.

As of December 31, 2022, Dice had 5.8 million members utilizing its marketplace, representing an annual growth of 596,000 new users, as well as an average of 1.6 million monthly visits. As of December 31, 2022, ClearanceJobs had 328,000 visible candidate profiles, representing an annual growth of approximately 145,000 new users, as well as 1.0 million monthly visits on average.

|

| | |

| Best Place to Work | | DHI is dedicated to attracting and retaining the best possible talent. For the first time, DHI became Great Place to Work® certified, was named a 2022 Best Midsized Place to Work by BuiltIn Colorado. Chief Technology Officer, Paul Farnsworth, earned the Top 100 most influential talent acquisition thought leaders designation from TATech (Association for Talent Acquisition Solutions), and Chief Executive Officer, Art Zeile, was selected as one of three finalists as CEO of the Year for Colorado Technology Association’s APEX Awards. |

(1) See Appendix A to this Proxy Statement for the definitions of bookings, Adjusted EBITDA and Adjusted EBITDA Margin and a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to the nearest generally accepted accounting principles (“GAAP”) financial measure.

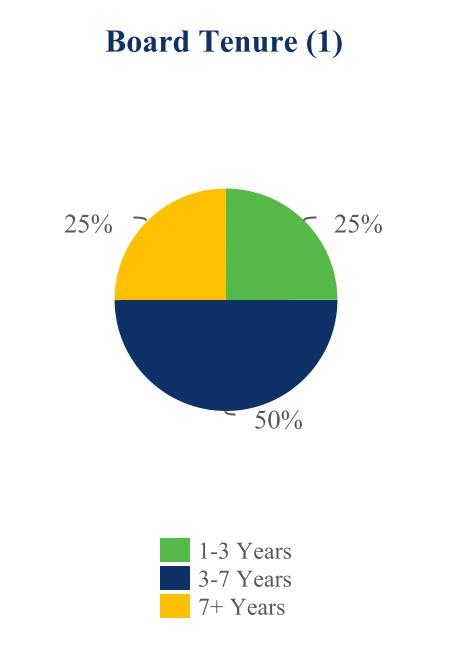

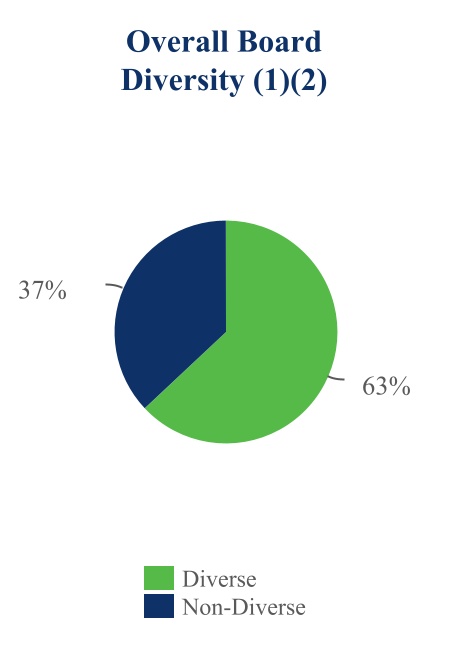

Board and Governance Highlights

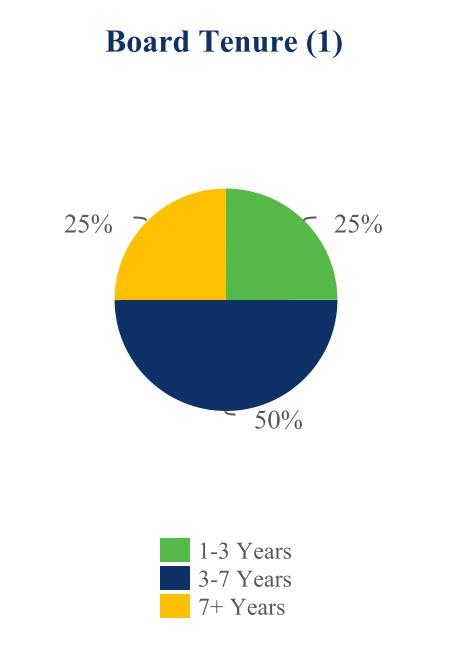

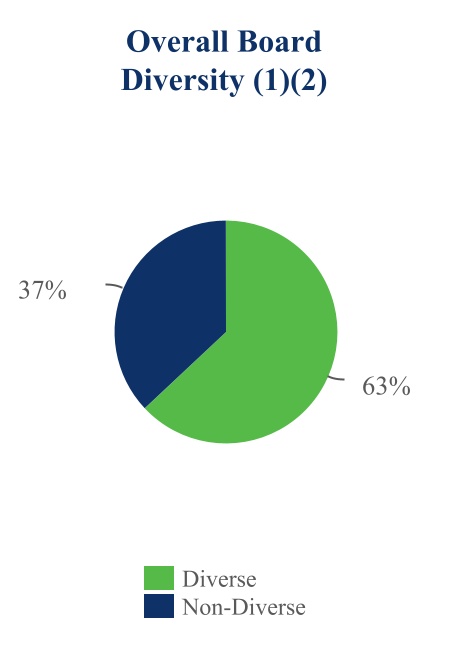

DHI is governed by a highly qualified and experienced group of directors, led by an independent chairperson. All our directors, other than our CEO Art Zeile, are independent under the listing standards of the New York Stock Exchange (“NYSE”). As illustrated below, our Board is broadly diverse in terms of tenure, personal and professional attributes.

| | | | | | | | | | | | | | |

| (1) Ms. Deason was not nominated to stand for reelection to the Board but will remain on the Board through the Annual Meeting and her attributes were included in these charts. |

| (2) Mr. Schipper identifies as LGBTQ+ and Mr. Windley identifies as African American |

| | | | | | | | | | | | | | | | | | | | |

| | | | Committee Membership |

| Name of Nominee | Age | Director Since | Independent | AC | CC | N&CG |

| Brian “Skip” Schipper, Chairperson, Director | 62 | 2014 | Yes | | | C |

| Jim Friedlich, Director | 66 | 2015 | Yes | | X | X |

Jennifer Deason, Director(1) | 47 | 2016 | Yes | X | | |

| Art Zeile, President & CEO, Director | 59 | 2018 | No | | | |

| David Windley, Director | 59 | 2019 | Yes | | C | |

| Scipio “Max” Carnecchia, Director | 60 | 2019 | Yes | X | | |

| Elizabeth Salomon, Director | 59 | 2020 | Yes | C | | |

| Kathleen Swann, Director | 60 | 2021 | Yes | | X | X |

(1) Ms. Deason was not nominated to stand for reelection to the Board, but will remain on the Board and the Audit Committee, in each case, through the Annual Meeting.

C – Committee Chairperson

AC – Audit Committee

CC – Human Capital and Compensation Committee

N&CG – Nominating and Corporate Governance Committee

Sustainability

DHI is committed to its Environmental, Social, and Governance principles. During 2022 we continued to make progress across our focus areas, and further enhanced our sustainability disclosures to align with the Sustainability Accounting Standards Board (SASB) Software & IT Services Sustainability Accounting Standard. We also expanded our focus on employee engagement through offering more comprehensive mental health services, continued initiatives which encourage work/life balance and increased our investment in employees’ careers through learning and development programs.

Diversity

DHI believes that creating a culture that celebrates diversity and promotes inclusivity is critical to how we succeed as an organization. It is a strategic objective of DHI to focus on building a culture of inclusivity. The Company’s Diversity, Equity and Inclusion program is anchored by four pillars: diversity training, inclusive hiring practices, volunteering in historically underrepresented communities and employee resource groups. Diversity programs include Allyship training and Unconscious Bias training for all employees and officers, including NEOs, which teaches team members how to better support each other, including historically underrepresented groups. Additionally, all managers participate in inclusive hiring and inclusive leadership training. Employee Resource Groups are established within the Company for employees of underrepresented populations to share experiences and have a shared space. The internal policies of the Company encourage hiring diverse candidates and ensuring that all team members are treated fairly and equally, amongst other things. We promote diversity, equity and inclusion programs led by leadership as well as employees. These include company-wide diversity training and the advancement of Team Member Impact Groups for employees of underrepresented populations to share experiences and have a shared space.

Our focus on diversity and inclusion spans all levels of the company, including the Board. The diverse backgrounds, skills and experiences of executive officers and Board members is important to both our values and performance. We believe that a diverse Board, management team and workforce that is reflective of our diverse customer base will position us to better understand customers’ wants and needs, which we believe drives our ability to deliver superior customer value and successfully innovate. Diverse perspectives among our management team and Board allows us to evaluate issues through different experiences and perspectives and guide the Company in a thoughtful way.

More information regarding these and other environmental, social and governance (ESG) efforts is available on the Sustainability page of our website. The information that appears on our website is not part of, and is not incorporated by reference into, this Proxy Statement.

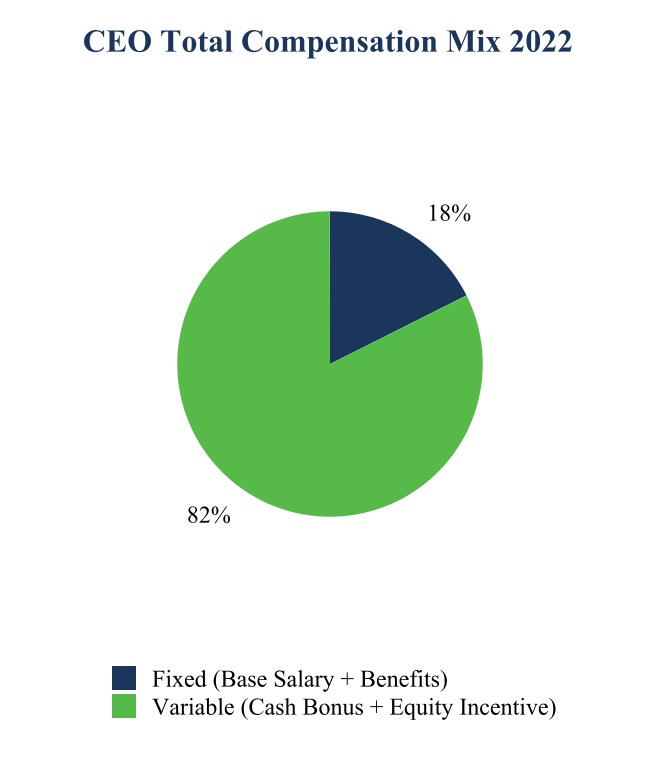

Executive Compensation Highlights

We have implemented compensation practices that we believe align the interests of our executive officers with our stockholders by tying a significant portion of our executive officers’ compensation to the Company’s financial performance.

In light of our strong 2022 financial performance, and consistent with our pay for performance philosophy, we paid NEOs’ 2022 annual incentives at 174.6% of target, while the performance-based restricted stock units (“PSUs”) achieved performance at 183.9% of target. The table below summarizes the total direct compensation delivered to our NEOs for their 2022 performance.

2022 NEO’s Total Direct Compensation at a Glance

(in thousands)

DIRECTORS AND CORPORATE GOVERNANCE

The Board has taken a deliberate approach to Board composition to construct a Board that it believes collectively possesses the right backgrounds and experiences to oversee management decisions and guide our strategic decision-making. We have also intentionally balanced the tenure of our directors to strike the right mix of institutional knowledge and fresh perspectives, with half of our Board having joined within the last five years.

| | | | | | | | | | | |

| Governance Practices Snapshot |

| 7 of 8 directors are independent | | Independent board chair |

| Commitment to board refreshment | | Majority voting for directors |

| Stock ownership policy for directors and executive officers | | Fully independent standing committees |

| Diverse board in terms of gender, race, experience, viewpoints, skills and tenure | | Regular sessions of independent directors |

| Board oversight of ESG initiatives | | Rigorous director selection and evaluation process |

| Limit on outside directorships | | Annual board and committee self-evaluations |

| All directors attended at least 75% of 2022 meetings | | Commitment to corporate social responsibility |

Below is a summary of the primary experience, qualifications and skills that our director nominees and continuing directors bring to the Board:

| | | | | | | | | | | |

| Capability | Description | Number of Directors with the Capability(1) |

| Technology and security infrastructure | Deep insight in technology infrastructure, business prioritization, customer drivers and cybersecurity risk | lll |

| Scaling a business | Experience growing successful companies, reaching scale and maturity | lll |

| Investment | Experience creating long-term value through investment, acquisition and growth strategies | lll |

| Finance | Financial expert with experience in financial strategy, accounting and reporting | lll |

| Sales | Experience building sales capabilities | ll |

| Marketing | Marketing and brand-building capability in rapidly changing industries | lll |

| People and compensation | Expertise in aligning company culture, performance, reward and talent with strategy, including remote and flexible work strategies | lll |

| CEO experience | Expertise shaping strategy, performance, prioritization, scale and leadership | lllll |

| Governance, risk and compliance | Experience in public company corporate governance, privacy, compliance, policy and creating long term sustainable value | lllll

lll |

(1)Ms. Deason was not nominated to stand for reelection to the Board but will remain on the Board through the Annual Meeting and her attributes were included in this chart.

Biographical information for our directors is set forth below. In evaluating nominees for the Board of Directors, the Nominating and Corporate Governance Committee considers the diversity of their professional and personal backgrounds and candidates who combine a broad spectrum of experience and expertise with a reputation for integrity. This assessment includes an individual’s independence, as well as consideration of diversity, age, skills and experience in the context of the needs of the Board.

Jennifer Deason was not nominated to stand for reelection to the Board. The Board thanks her for her seven years of service on the Board and wishes her well going forward. Effective upon the election of the director nominees at the Annual Meeting, the size of the Board will be reduced from eight to seven directors. Upon recommendation of the Nominating and Corporate Governance Committee, the Board decided, in connection with its decision to not nominate Ms. Deason to stand for reelection and to make each class as balanced as possible, to reclassify Ms. Salomon from Class II to Class I effective immediately following the Annual Meeting.

| | | | | | | | | | | |

| | Director Nominees | |

Art

Zeile | Mr. Zeile possesses specific attributes that qualify him to serve as a director, including his knowledge and experience in the software industry and extensive professional experience as a CEO and as a member of the board of directors of other companies. |

| | Art Zeile has served as a director and as the President and Chief Executive Officer of the Company since April 2018. In 2008, Mr. Zeile co-founded HOSTING, a cloud computing services company, and served as its Chief Executive Officer from 2008 until 2016. At HOSTING, Mr. Zeile formulated a strategy for a rollup of cloud services companies in the U.S. and focused on managing security and compliance for mission critical web applications. Prior to HOSTING, Mr. Zeile served as CEO of QTC Management Inc., a healthcare technology company, from 2006 to 2007. Prior to that, Mr. Zeile co-founded Inflow Inc., a public data center company, and served as its CEO from 1997 until 2005. Mr. Zeile also previously served in the United States Air Force from 1986 until 1993. Since 2016, Mr. Zeile has served on the board of directors of National Bank Holdings Corporation, a NYSE listed company, and is a member of its Audit & Risk Committee and Chairperson of its Compensation Committee. He has also served as Chairman of the board of directors of Element Critical since 2019. Mr. Zeile earned a bachelor’s degree in Astronautical Engineering from the U.S. Air Force Academy and a master’s degree in public policy from Harvard University. Mr. Zeile was appointed to serve on the Board because his day-to-day leadership as our President and Chief Executive Officer provides him with intimate knowledge of the Company’s business, business strategy and its industry. | CEO experience |

| |

| Sales |

| |

Age 59 | Technology and security infrastructure |

|

Director Since 2018 |

| |

| DHI Committee(s): |

| None | |

| | |

| Class I Director | | Governance, risk and compliance |

Term Expiring 2023 | |

| |

| |

| | | | | | | | |

| Director Nominees | |

| Elizabeth Salomon | Ms. Salomon possesses specific attributes that qualify her to serve as a director, including her financial expertise and professional experience serving in leadership positions at other companies. |

| Elizabeth Salomon has been a Director since December 2020. Ms. Salomon is a Class II director who will be reclassified as a Class I director at the Annual Meeting and will immediately stand for election as a Class I director with term expiring at the 2026 annual meeting of stockholders. Ms. Salomon currently serves as a director for Litera, the leading provider of technology solutions to legal, corporate and life sciences companies. She also serves as an advisor for several companies in the portfolio of Hg, a global private equity firm focused on investments in the technology and services sectors. From 2017 to 2022, Ms. Salomon served as the Chief Financial Officer at Xactly, the leader in revenue intelligence solutions, where she oversaw finance, accounting, facilities and legal functions. From 2015 to 2017, Ms. Salomon served as Chief Financial Officer at Cherwell Software, a provider of IT management software, and led the company through an aggressive growth phase. From 2013 to 2014, she served as Chief Financial Officer at Marshall & Swift/Boeckh, a software, data and analytics company, and its holding company, Decision Insight Information Group, through their sale to CoreLogic. From 2009 to 2013, Ms. Salomon served as Chief Financial Officer at Ontario Systems (now Finvi), an enterprise software company providing solutions around revenue recovery and accounts receivable management. Previously, Ms. Salomon has held senior finance positions at ChoicePoint (now LexisNexis) and Bank of America. She was a senior manager in the audit practice of EY. Ms. Salomon earned a bachelor's degree from the University of Florida and is a licensed CPA. Elizabeth also serves on the Board of Downtown Denver Partnership, an organization dedicated to building an economically powerful center city. Ms. Salomon's significant financial leadership experience particularly with technology companies, her experience working across the business to drive company strategy and her experience with private equity backed companies provide helpful perspective to our board. | Finance |

|

Investment |

Independent

Director of Litera |

Independent

Director of Litera | Scaling a business |

Director Since 2020 |

|

| DHI Committee(s): |

| Audit Committee |

|

| Class II Director Reclassifying as Class I at the Annual Meeting |

Governance, risk and compliance |

Term Expiring 2024 |

|

| |

| |

| |

| |

| |

| | | | | | | | |

| Continuing Directors | |

| Jim Friedlich | Mr. Friedlich possesses specific attributes that qualify him to serve as a director, including his knowledge and experience in digital media and private equity and professional experience as a former executive. |

| Jim Friedlich has been a director since January 2015. Since September 2016, Mr. Friedlich has served as the Chief Executive Officer and Executive Director of The Lenfest Institute of Journalism, an institute focused on innovation in journalism. Mr. Friedlich co-founded Empirical Media Advisors, a leading media consulting firm, in 2011 and served as its Chief Executive Officer until 2014. In 2001, he co-founded the private equity firm of ZelnickMedia (now ZMC) and was a general partner there until 2011, specializing in equity-backed turnarounds and restructuring media companies. Earlier in his career, Mr. Friedlich served as VP of Business Development - Digital Publishing and Vice President of International Sales, Marketing and Business Development at Dow Jones & Company/The Wall Street Journal, a company that produces an international daily newspaper. Mr. Friedlich attended Dartmouth College, earned an MBA from the Stanford University School of Business and a B.A. from Wesleyan University. Mr. Friedlich brings insight to our Board based on his experience in the private equity field and his focus on digital media. | CEO experience |

|

Investment |

|

Independent

CEO and Executive Director of Lenfest Institute of Journalism | Marketing |

| |

Age 66 | People and compensation |

|

Director Since 2015 |

|

| DHI Committee(s): |

| Human Capital and Compensation Committee | Governance, risk and compliance |

|

| Nominating and Corporate Governance Committee |

| | |

| Class II Director | | |

Term Expiring 2024 | | |

| | | | | | | | |

| Continuing Directors | |

| Kate Swann | Ms. Swann possesses specific attributes that qualify her to serve as a director, including her knowledge and experience in digital marketing and technology and as a member of the board of directors of other companies. |

| Kate Swann has been a Director since January 2021. Since 2022, Ms. Swann has acted as a strategic advisor for various companies. Ms. Swann served as the Chief Operating Officer at Purpose, a social impact digital agency, recently acquired by Capgemini, from 2020 to 2022. At Purpose, Ms. Swann developed growth strategies and business planning to ensure the company maximized its resources and mobilized talent for the greatest impact to its community and partners. Prior to joining Purpose, she served as Chief Operating Officer at Blue State Digital, a tech and creative agency that works with mission-driven organizations to build and mobilize communities, best known for its work with the Obama administration, from 2013 to 2020. Earlier in her career, Ms. Swann was the Chief Operating Officer at Frog Design and served in the managing director role at Fry, an e-commerce consulting firm, and Organic, a digital marketing agency. Ms. Swann earned a Bachelor of Arts from Evergreen State College and has a Master’s degree in Performance Studies from New York University. Ms. Swann also serves as a board member at Graham Windham, as well as the Women’s Forum of New York, and on the Advisory Board of August Public. Ms. Swann has extensive experience managing at growth stage consulting companies and digital agencies. Her expertise in digital marketing and technology provides the Board with valuable insight as the Company continues to execute on its strategy to deliver innovative products and provide best-in-class services to its customers and candidates. | Marketing |

|

Scaling a business |

|

Independent

Strategic Advisor | Governance, risk and compliance |

|

Age 60 |

| |

Director Since 2021 | |

|

| DHI Committee(s): |

| Human Capital and Compensation Committee |

| |

| Nominating and Corporate Governance Committee | |

| | |

| Class II Director | | |

Term Expiring 2024 | | |

| | | | | | | | |

| Continuing Directors | |

| Brian “Skip” Schipper | Mr. Schipper possesses specific attributes that qualify him to serve as a director, including his extensive industry experience, his human resources expertise and as a member of the board of directors of other companies. |

| Brian “Skip” Schipper has been a director since February 2014, and Chairperson of the Board since May 2019. Since May 2016, Mr. Schipper has served as the Chief People Officer for Yext, Inc., an online brand management company, From January 2014 to March 2016, Mr. Schipper led Human Resources at Twitter, an online social media company. Prior to joining Twitter, Mr. Schipper was the Chief Human Resources Officer at Groupon, a global e-commerce marketplace company, from June 2011 to January 2014, where he oversaw the HR and administrative organization globally and was integral in building the infrastructure to support its global expansion efforts. Mr. Schipper was the Chief Human Resources Officer at Cisco Systems from October 2006 to June 2011. He has held executive level human resources and administrative roles at Microsoft, DoubleClick, Pepsico, Compaq and Harris Corporation. Mr. Schipper holds an MBA from Michigan State University and a B.A. from Hope College. Mr. Schipper serves on the Board of Directors and as Chair of the Compensation Committee for 1stdibs.com, Inc. and as Director and member of the Compensation Committee for Open Education. Mr. Schipper’s extensive industry experience and his human resources expertise is a great combination to help our Board guide our strategy. | People and compensation |

|

Scaling a business |

|

Independent

Chairperson of the Board

EVP & Chief People Officer of Yext | Governance, risk and compliance |

| |

Age 62 | |

|

Director Since 2014 |

|

| DHI Committee(s): |

| Nominating and Corporate Governance |

| | |

| Class III Director | | |

Term Expiring 2025 | | |

| | |

| | | | | | | | |

| Continuing Directors | |

| David Windley | Mr. Windley possesses specific attributes that qualify him to serve as a director, including his people and compensation expertise and as a member of the board of directors of other companies. |

| David Windley has been a director since February 2019. Since 2018, Mr. Windley has been CEO and President of IQTalent Partners, where he also served as President from 2014 to 2018; IQTalent Partners is a professional services firm focused on talent acquisition. Prior to IQTalent Partners, Mr. Windley served as Executive Vice President, Chief Human Resources Officer, for Fusion-io, Inc., a computer hardware and software systems company, from October 2013 to August 2014. From December 2006 to September 2012, Mr. Windley served as Executive Vice President, Chief Human Resources Officer, for Yahoo! Inc., an internet-related services company. Prior to Yahoo!, Mr. Windley served as General Manager, Human Resources, for Microsoft Corporation, a technology and software company, from December 2003 to December 2006 and as Vice President Human Resources, Business Units, for Intuit Inc., a financial software company, from December 2001 to December 2003. Mr. Windley held various positions with Silicon Graphics, Inc., a high-performance computer hardware and software company, from 1991 to 2001, culminating in Vice President, Human Resources. Mr. Windley also serves as the Chairperson of the Human Capital and Compensation Committee, on the board of directors and as Chair of the Compensation Committee at Tennant Company, and in the past has served as a board chair for the Society of Human Resources Management (SHRM), the largest membership organization for human resources professionals. Mr. Windley holds a Master’s of Business Administration degree from San Francisco State University and a bachelor’s of science degree from San Diego State University. Mr. Windley’s extensive human resources experience in a variety of industries provide him with intimate knowledge of the Company’s business, which helps our Board guide our strategy. | People and compensation |

|

CEO experience |

|

Independent

CEO & President of IQTalent Partners | Technology and security infrastructure |

|

Age 59 |

|

Director Since 2019 | Governance, risk and compliance |

|

| DHI Committee(s): |

| Human Capital and Compensation Committee |

|

| Class III Director | |

Term Expiring 2025 | |

| |

| | | | | | | | |

| Continuing Directors | |

| Scipio “Max” Carnecchia | Mr. Carnecchia possesses specific attributes that qualify him to serve as a director, including his experience in the operational, sales and technology industries, his extensive professional experience as a CEO and as a member of the board of directors of other companies. |

| Scipio “Max” Carnecchia has been a director since February 2019. Mr. Carnecchia has served as the Chief Executive Officer and as a director of Mitek Systems, Inc., a digital identity verification company, since November 2018. From October 2017 until July 2018, Mr. Carnecchia served as the Chief Executive Officer and board member of Illuminate Education, Inc., a market-leading Software as a Services education platform. Prior to Illuminate, Mr. Carnecchia was the President and Chief Executive Officer of Accelrys, Inc., a cloud software company, and also served on the Accelrys Board from 2009 until its acquisition in 2014. After the acquisition, Mr. Carnecchia continued to serve as Chief Executive Officer of that business, which was renamed BIOVIA. From 2001 to 2009, Mr. Carnecchia served as President of Interwoven, Inc., a content management software company, which was acquired by Autonomy Corporation plc in January 2009. Prior to joining Interwoven, Mr. Carnecchia served as Vice President of Global Sales of Xoriant Corporation, a software product development company, from April 2000 to January 2001 and as Vice President of Sales and Services of SmartDB Corporation, a provider of data integration toolkits for systems integrators and IT organizations, from September 1996 to February 2000. Mr. Carnecchia has demonstrated significant leadership skills in his CEO roles at Accelrys, BIOVIA and Illuminate Education, Inc. and as Vice President of Xoriant and SmartDB and brings more than two decades of high technology experience to his position on the Board. During the past seven (7) years, Mr. Carnecchia has served as a member of the boards of directors of: Guidance Software, Inc.; Agilysys, Inc.; and Accelrys, Inc. Mr. Carnecchia holds a Bachelor of Engineering in Electrical Engineering from The Stevens Institute of Technology. Mr. Carnecchia’s wealth of experience in the operational, sales, and technology industries, as well as his background as an operating executive and board member of publicly held companies, provide helpful and unique expertise to the Company. | CEO experience |

|

Sales |

|

Independent

CEO and Director of Mitek Systems, Inc. | Technology and security infrastructure |

|

Age 60 |

| |

Director Since 2019 | Finance |

|

| DHI Committee(s): |

| Audit Committee |

|

| Class III Director | Governance, risk and compliance |

Term Expiring 2025 |

|

|

|

| |

| |

| |

| | | | | | | | |

| Current Class I Director Continuing Until the Annual Meeting |

| Jennifer Deason | Ms. Deason possesses specific attributes that qualify her to serve as a director, including her financial expertise and professional experience as an executive and as a member of the board of directors of other companies. |

| Jennifer Deason has been a director since July 2016. Since 2023, Ms. Deason has served as CEO of Home Partners of America, a company focused on making home ownership a reality for more people. From 2021 to 2023, Ms. Deason served as Chairwoman and CEO of Belong Acquisition Corp., a Special Purpose Acquisition Company focused on later-stage technology and technology-enabled growth companies. Prior to launching Belong, from 2019 to 2021, Ms. Deason served as CFO and Chief Business Officer for Flowcode, a leader in creating technology-enabled systems connecting consumers to brands. From 2016 to 2018, Ms. Deason served as Executive Vice President, Head of Corporate Development and Strategy with Sotheby’s, one of the world's largest brokers of fine and decorative art, jewelry, and collectibles. She served as Chief Financial Officer at the Weather Channel, an American pay television channel, from 2014 to 2016, where she worked to reposition the organization from a more traditional TV media company towards a data-focused, mobile-first advertising platform, prior to the sale of the digital and B2B businesses to IBM. She was with Bain Capital, a private investment firm, from 2008 to 2014, where she served as an Executive Vice President and partnered with CEOs and other senior level executives to improve company performance and drive transformations through strategic initiatives and performance management. While at Bain, Ms. Deason served in several interim operating roles such as President, Chief Marketing Officer and Chief Financial Officer and was a board member of several portfolio companies. Ms. Deason holds an MBA from Stanford University and a B.A. from Yale University, and is closely involved in both schools. She serves on the board of directors as well as the audit and strategy committees for MasterCraft Boat Holdings, Inc., is on the Board of Trustees at the Massachusetts Museum of Contemporary Art, serves on the board of directors and audit committee for Concentrix, and serves as a director for Margaux New York LLC. Ms. Deason’s significant experience in financial and other operating roles, as well as her experience in the private equity field, provide helpful perspective to our Board. Ms. Deason was not nominated to stand for reelection to the Board, but will remain on the Board and Audit Committee through the Annual Meeting. | CEO experience |

|

Finance |

|

Independent

CEO of Home Partners of America | Investment |

|

Age 47 |

|

Director Since 2016 | Marketing |

|

| DHI Committee(s): |

| Audit Committee |

|

| Class I Director, will not stand for reelection at Annual Meeting |

Term Expiring 2023 | Governance, risk and compliance |

|

|

|

Meetings and Committees

The Board met six times during fiscal 2022. Each director attended at least 75% of the aggregate of all the meetings of the Board and committees on which he or she served. Under the Company’s Corporate Governance Guidelines, each director is expected to dedicate sufficient time, energy and attention to ensure the diligent performance of his or her duties, including by attending annual and special meetings of the stockholders of the Company and meetings of the Board and committees of which he or she is a member. We encourage, but do not require, our directors to attend the Annual Meeting of Stockholders. One director attended our 2022 Annual Meeting of Stockholders.

The following tables are summaries of our committee structure and members on each of our committees.

| | | | | |

| AUDIT COMMITTEE |

| The current members of our Audit Committee are Mses. Salomon and Deason, and Mr. Carnecchia. Our Board has determined that each of the members of the Audit Committee qualify as an “audit committee financial expert” within the meaning of SEC regulations and applicable NYSE rules. Mses. Salomon and Deason and Mr. Carnecchia meet the independence and the experience requirements of the NYSE and the federal securities laws. Ms. Deason was not nominated to stand for reelection to the Board, but will remain on the Board and the Audit Committee, in each case, through the Annual Meeting. |

|

| Our Audit Committee oversees our accounting and financial reporting processes and the audit of our financial statements and assists our Board in monitoring our financial systems and our legal and regulatory compliance. Our Audit Committee is responsible for, among other things: |

|

Elizabeth Salomon Chair

Our Audit Committee operates under a written charter that was adopted by the Board and satisfies the applicable standards of the SEC and NYSE. A copy of the Audit Committee Charter is available on our investor website: http://www.dhigroupinc.com/investors/

Number of meetings held in 2022: 9 | ● appointing, compensating and overseeing the work of our independent auditors, including resolving disagreements between our management team and the independent registered public accounting firm regarding financial reporting and any other required communications described in applicable accounting standards, including critical audit matters; |

| ● approving engagements of the independent registered public accounting firm to render any audit or permissible non-audit services; |

| ● reviewing the qualifications and independence of the independent registered public accounting firm; |

| ● reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices; |

| ● reviewing the adequacy and effectiveness of our internal control over financial reporting; |

| ● reviewing and discussing with our management team and the independent registered public accounting firm the results of our annual audit, our quarterly financial statements and our publicly filed reports; |

| ● reviewing and maintaining the related person transaction policy to ensure compliance with applicable law and that any proposed related person transactions are disclosed as required; and |

| ● overseeing the implementation and performance of the internal audit function. |

| | | | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| The current members of our Nominating and Corporate Governance Committee are Messrs. Schipper and Friedlich and Ms. Swann. Our Board has determined that each of the members of the Nominating and Corporate Governance Committee meet the independence and the experience requirements of the NYSE and the federal securities laws. |

|

| Our Nominating and Corporate Governance Committee oversees and assists our Board in reviewing and recommending corporate governance policies and nominees for election to our Board and its committees. Our Nominating and Corporate Governance Committee is responsible for, among other things: |

|

| ● recommending desired qualifications for Board and committee membership and conducting searches for potential members of our Board; |

Brian “Skip” Schipper Chair

Our Nominating and Corporate Governance Committee operates under a written charter that was adopted by the Board and satisfies the applicable standards of the SEC and NYSE. A copy of the Nominating and Corporate Governance Committee Charter is available on our investor website: http://www.dhigroupinc.com/investors/

Number of meetings held in 2022: 2 | ● developing and recommending to the Board corporate governance guidelines that are applicable to us; |

| ● overseeing and management evaluations: |

| ● working with the CEO to coordinate succession planning for key management positions at the Company, including the CEO position; and |

| ● assessing the effectiveness of its diversity policy set forth in the Corporate Governance Guidelines annually. |

|

|

|

|

| | | | | |

| HUMAN CAPITAL AND COMPENSATION COMMITTEE |

| The current members of our Human Capital and Compensation Committee are Messrs. Windley and Friedlich and Ms. Swann. Our Board has determined that each of the members of the Human Capital and Compensation Committee meet the independence and the experience requirements of the NYSE and the federal securities laws. |

|

| Our Human Capital and Compensation Committee oversees our compensation policies, plans and programs. Our Human Capital and Compensation Committee is responsible for, among other things: |

|

| ● reviewing and approving the primary components of compensation for our CEO and other executive officers; |

David Windley Chair

Our Human Capital and Compensation Committee operates under a written charter that was adopted by the Board and satisfies the applicable standards of the SEC and NYSE. A copy of the Human Capital and Compensation Committee Charter is available on our investor website: http://www.dhigroupinc.com/investors/

Number of meetings held in 2022: 5 | ● reviewing and approving compensation and corporate goals and objectives relevant to the compensation for our CEO and other executive officers |

| ● periodically evaluating the competitiveness of the compensation of our CEO and other executive officers and our overall compensation plans; |

| ● evaluating and making recommendations regarding director compensation; and |

| ● administering our equity incentive plans for our employees and directors. |

|

| Pursuant to its charter, our Human Capital and Compensation Committee has delegated certain day-to-day administrative and ministerial functions to our executive officers under our equity incentive plans and our 401(k) plan. The Committee has not delegated the authority to approve equity awards. |

|

|

Director Independence

We have determined that Mses. Deason, Salomon and Swann, and Messrs. Schipper, Friedlich, Carnecchia and Windley are independent as such term is defined by the applicable rules and regulations of the NYSE for purposes of serving on our Board. Additionally, each of these directors meets the categorical standards for independence established by our Board, as set forth in our Corporate Governance Guidelines, which are posted on our website.

Board Leadership Structure

Mr. Zeile became President and Chief Executive Officer and a director of the Company in April 2018 and Mr. Schipper became Chairperson of the Board in May 2019. Our Board does not have a policy regarding separation of the roles of Chief Executive Officer and Chairperson of the Board. The Board believes it is in our best interests to make that determination based on circumstances from time to time. The Board has determined that having an independent director serve as Chairperson is in the best interest of the Company’s stockholders at this time. This structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing Board priorities and procedures. Further, this structure permits the Chief Executive Officer to focus on strategic matters and the management of the Company’s day-to-day operations. The Board believes this split structure recognizes the time, effort, and energy the Chief Executive Officer is required to devote to the position in the current business environment, as well as the commitment required to serve as the Chairperson.

We also have independent Board members who bring experience, oversight and expertise from outside the Company and our industry. The Board meets as necessary in executive sessions of the non-management directors.

Audit Committee Report

The charter of the Audit Committee specifies that the purpose of the Audit Committee is to assist the Board in its oversight of:

•the accounting and financial reporting processes of the Company, including the integrity of the financial statements and other financial information provided by the Company to its stockholders, the public, any stock exchange and others;

•the Company’s compliance with legal and regulatory requirements;

•the Company’s independent registered public accounting firm’s qualifications and independence;

•the audit of the Company’s financial statements; and

•the performance of the Company’s internal audit function and independent registered public accounting firm, and such other matters as shall be mandated under applicable laws, rules and regulations as well as listing standards of the NYSE.

In carrying out these responsibilities, the Audit Committee, among other things:

•monitors preparation of quarterly and annual financial reports by the Company’s management;

•supervises the relationship between the Company and its independent registered public accounting firm, including having direct responsibility for their appointment, compensation and retention; reviewing the scope of their audit services; approving audit and non-audit services; and confirming the independence of the independent registered public accounting firm; and

•oversees management’s implementation and maintenance of effective systems of internal and disclosure controls, including review of the Company’s policies relating to legal and regulatory compliance, ethics and conflicts of interest and review of the Company’s internal auditing program.

The Audit Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The Audit Committee’s meetings include, whenever appropriate, executive sessions in which the Audit Committee meets separately with the Company’s independent registered public accounting firm, the Company’s internal auditor, the Company’s Chief Executive Officer, Chief Financial Officer and Chief Legal Officer.

The Audit Committee periodically reviews the performance of the Company’s independent registered public accounting firm to determine if the current firm should be retained.

Management is responsible for the Company’s financial reporting process, including the Company’s internal control over financial reporting, and for the preparation of the Company’s consolidated financial statements in accordance with generally accepted accounting principles. Deloitte & Touche LLP (“Deloitte”), as the Company’s independent registered public accounting firm, is responsible for auditing those financial statements and expressing its opinion as to the fairness of the financial statement presentation in accordance with generally accepted accounting principles. The Audit Committee’s responsibility is to oversee and review this process. The Audit Committee is not, however, professionally engaged in the practice of accounting or auditing and does not provide any expert or other special assurance as to such financial statements concerning compliance with laws, regulations or generally accepted accounting principles or as to auditor independence. The Audit Committee relies, without independent verification, on the information provided to the Audit Committee and on the representations made by management and the independent registered public accounting firm.

As part of its oversight of the preparation of the Company’s financial statements, the Audit Committee reviews and discusses with both management and the Company’s independent registered public accounting firm all annual and quarterly financial statements prior to their issuance. The Audit Committee has reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended December 31, 2022. During fiscal 2023, management advised the Audit Committee that each set of financial statements reviewed had been prepared in accordance with generally accepted accounting principles, and reviewed significant accounting and disclosure issues with the Audit Committee. These reviews included discussion with the independent registered public accounting firm of matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the Securities and Exchange Commission (the “Commission”). The Audit Committee also discussed with Deloitte matters relating to its independence, including a review of audit and non-audit fees. The Audit Committee has received the written disclosures and the letter from Deloitte required by applicable requirements of the PCAOB regarding Deloitte’s communications with the Audit Committee concerning independence, and has discussed with Deloitte that firm’s independence.

In addition, the Audit Committee reviewed key initiatives and programs aimed at maintaining the effectiveness of the Company’s internal and disclosure control structure. As part of this process, the Audit Committee continued to monitor the scope and adequacy of the Company’s internal auditing program, reviewing internal audit department staffing levels and steps taken to maintain the effectiveness of internal procedures and controls.

Taking all of these reviews and discussions into account, the undersigned Audit Committee members recommended to the Board that the Board approve the inclusion of the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, for filing with the Commission.

The members of the Audit Committee submitting this report include:

Elizabeth Salomon (Chairperson)

Scipio (Max) Carnecchia

Jennifer Deason

Corporate Governance Guidelines and Code of Conduct and Ethics

The Board has adopted Corporate Governance Guidelines, which set forth a flexible framework within which the Board, assisted by its committees, directs the affairs of the Company. The Corporate Governance Guidelines address, among other things, the composition and functions of the Board, director independence, stock ownership by directors and compensation of directors, management succession and review, Board committees and selection of new directors. A copy of the Company’s Corporate Governance Guidelines is available under the Investors section of our website (http://dhigroupinc.com/investors) and in print to any stockholder who requests a copy from the Corporate Secretary.

The Company has also adopted a Code of Conduct and Ethics, which is applicable to all directors, officers and employees of the Company, including the principal executive officer, the principal financial officer and the principal accounting officer. A copy of the Company’s Code of Conduct and Ethics is available under the Investors section of our website (http://dhigroupinc.com/investors) and in print to any stockholder who requests a copy from the Corporate Secretary. If the Company amends or waives the Code of Conduct and Ethics with respect to the directors, Chief Executive Officer, Chief Financial Officer or principal accounting officer, it will post the amendment or waiver at the same location on its website.

Risk Management

The Board as a whole has responsibility for risk oversight. The committees of the Board play a key role in this oversight responsibility, as discussed below. The Board regularly reviews information presented by management regarding the Company’s business and operational risks, including relating to security, privacy, credit and liquidity.

| | | | | |

| Committee | Area of Focused Risk Oversight |

| Audit Committee | •reviews and discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor, control and manage such exposures; •reviews and discusses at least annually the Company’s Code of Conduct and Ethics and procedures in place to enforce the Code of Conduct and Ethics and, if there were any amendment or waiver requests relating to the Company’s code of ethics for the chief executive officer or senior financial officers, would review and make a determination on such requests; •reviews and discusses at least quarterly the Company’s cybersecurity program, which is the responsibility of the Company’s Chief Technology Officer; and •reviews related party transactions and potential conflicts of interest related thereto. |

| Human Capital and Compensation Committee | •reviews the Company’s overall compensation program and its effectiveness at linking executive pay to performance and aligning the interests of our executives and our stockholders. |

| Nominating and Corporate Governance Committee | •manages risks associated with director independence. |

| While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks. |

Compensation Risks

The Compensation Committee has reviewed the Company’s compensation policies and practices for all employees, including our executive officers, as they relate to risk management practices and risk-taking incentives and has determined that there are no risks arising from these policies and practices that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee considers that our compensation programs incorporate several features which promote the creation of long-term value and reduce the likelihood of excessive risk-taking by our employees. These features include: (i) a balanced mix of cash and equity, annual and longer-term incentives, and types of performance metrics, (ii) the ability of the Compensation Committee to exercise discretion to reduce incentive program payouts, (iii) performance targets for incentive compensation that include both objective Company performance targets (such as Revenue and Adjusted EBITDA Margin targets) and individual performance goals, (iv) time-based vesting of equity awards that encourages long-term retention, (v) the Company’s Clawback Policy, (vi) a bonus plan for the majority of non-executive employees that is capped at an amount equal to a small percentage of each employee’s annual base salary, and (vii) internal controls on commissions paid to employees in the sales division.

It is also our policy that the Compensation Committee will, to the extent permitted by governing law, have the sole and absolute authority to make retroactive adjustments to any cash or equity based incentive compensation paid to executive officers and certain other officers where the payment was predicated upon the achievement of certain financial results that were subsequently the subject of a restatement. Where applicable, we will seek to recover any amount determined to have been inappropriately received by the individual executive.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Related Person Transactions

Since January 1, 2021, there have been no related person transactions in which we were or are to be a participant and the amount involved exceeds $120,000 and in which any current related person had or will have a direct or indirect material interest.

Policy on Transactions with Related Persons

The Company has adopted a written Related Person Transaction Policy (the “Policy”), which sets forth our policy with respect to the review, approval, ratification and disclosure of all related person transactions by our Audit Committee. In accordance with the Policy, our Audit Committee has overall responsibility for the implementation and compliance with this Policy.

For the purposes of the Policy, a “related person transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which we were, are or will be a participant and in which any related person (as defined in the policy) had, has or will have a direct or indirect material interest. A “related person transaction” does not include any employment relationship or transaction involving an executive officer and any related compensation resulting solely from that employment relationship which has been reviewed and approved by our Board of Directors or Compensation Committee.

Our Policy requires that notice of a proposed related person transaction be provided to our legal department prior to entering into such transaction. If our legal department determines that such transaction is a related person transaction, the proposed transaction will be submitted to our Audit Committee for consideration at its next meeting. Under the Policy, our Audit Committee may only approve those related person transactions that are in, or not inconsistent with, our best interests. In the event we become aware of a related person transaction that has not been previously reviewed, approved or ratified under our Policy and that is ongoing or is completed, the transaction will be submitted to the Audit Committee so that it may determine whether to ratify, rescind or terminate the related person transaction.

Our Policy also provides that the Audit Committee review certain previously approved or ratified related person transactions that are ongoing to determine whether the related person transaction remains in our best interests and the best interests of our stockholders. Additionally, we will also make periodic inquiries of directors and executive officers with respect to any potential related person transaction of which they may be a party or of which they may be aware.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The table below sets forth, as of March 13, 2023, information with respect to the beneficial ownership of our common stock by:

•each of our current directors or nominees and each of the named executive officers named in the Summary Compensation Table under “Executive Compensation”;

•each person or group of affiliated persons who is known to be the beneficial owner of more than 5% of our outstanding common stock; and

•all of our current directors and executive officers as a group.

The amounts and percentages of common stock beneficially owned are reported on the basis of the regulations of the Commission governing the determination of beneficial ownership of securities. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. In computing a person’s percentage ownership of common stock, shares of common stock subject to PSUs held by that person that are scheduled to vest and settle within 60 days after March 13, 2023, are deemed to be outstanding and beneficially owned by that person. None of these shares, however, are deemed outstanding for the purpose of computing the percentage ownership of any other person. All unvested time-based restricted stock awards are included in each person’s beneficial ownership as these persons are entitled to voting rights upon issuance of the restricted stock awards. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock Beneficially Owned |

| Name and Address of Beneficial Owners | Shares of Common Stock | | | | Unvested Restricted Stock | | Total Number of Shares of Common Stock | | Percentage

of Outstanding Common Stock |

| 5% Stockholders | | | | | | | | | |

Dimensional Fund Advisors LP(1) | 3,989,936 | | | | | — | | | 3,989,936 | | | 8.3% |

Nantahala Capital Management, LLC(2) | 3,661,976 | | | | | — | | | 3,661,976 | | | 7.6% |

Blackrock, Inc.(3) | 2,745,956 | | | | | — | | | 2,745,956 | | | 5.7% |

Punch & Associates Investment Management, Inc(4) | 2,497,430 | | | | | — | | | 2,497,430 | | | 5.2% |

| | | | | | | | | |

| Director Nominees and Named Executive Officers | | | | | | | | | |

Art Zeile(5) | 1,927,723 | | | | | 809,256 | | | 2,736,979 | | | 5.7% |

Kevin Bostick(5) | 203,995 | | | | | 283,578 | | | 487,573 | | | 1.0% |

Chris Henderson(5) | 469,872 | | | | | 369,833 | | | 839,705 | | | 1.7% |

Arie Kanosfky(5) | 163,876 | | | | | 194,649 | | | 358,525 | | | * |

Paul Farnsworth(5) | 252,515 | | | | | 214,650 | | | 467,165 | | | * |

Brian “Skip” Schipper(5) | 259,230 | | | | | 18,333 | | | 277,563 | | | * |

Scipio “Max” Carnecchia(5) | 240,007 | | | | | 18,333 | | | 258,340 | | | * |

Jim Friedlich(5) | 248,230 | | | | | 18,333 | | | 266,563 | | | * |

Jennifer Deason(5)(6) | 230,230 | | | | | 18,333 | | | 248,563 | | | * |

David Windley(5) | 123,300 | | | | | 18,333 | | | 141,633 | | | * |

Elizabeth Salomon(5) | 56,330 | | | | | 18,333 | | | 74,663 | | | * |

Kate Swann(5) | 48,003 | | | | | 18,333 | | | 66,336 | | | * |

| All current directors and executive officers as a group (15 persons) | 5,179,576 | | | | | 2,468,527 | | | 7,648,103 | | | 15.8% |

| | | | | | | | | |

(1)Based solely on a Schedule 13G/A filed with the Commission on February 14, 2023. Dimensional Fund Advisors LP (“Dimensional”) has sole voting and dispositive power over 3,989,936 shares of the common stock. The business address for Dimensional is 6300 Bee Cave Road, Austin, TX 78746. Dimensional serves as investment manager or sub-adviser to certain other commingled funds, group trust and separate accounts (“Funds”). All securities reported in Dimensional’s Schedule 13G/A schedule are owned by the Funds. Dimensional disclaims beneficial ownership of such securities.

(2)Based solely on a Schedule 13G/A filed with the Commission on February 14, 2023. Nantahala Capital Management, LLC on behalf of itself, Wilmot B. Harkey and Daniel Mack (collectively, “Nantahala”) has shared voting and dispositive power over 3,661,976 shares of the common stock. The business address for Nantahala is 130 Main St 2nd Floor, New Canaan, CT 06840.

(3)Based solely on a Schedule 13G filed with the Commission on February 3, 2023. BlackRock, Inc. has sole voting and dispositive power over 2,745,956 shares of common stock. The business address for BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055

(4)Based solely on a Schedule 13G/A filed with the Commission on February 13, 2023. Punch & Associates Investment Management, Inc. has sole voting and dispositive power over 2,497,430 shares of common stock. The business address for Punch & Associates is 7701 France Ave. So., Suite 300, Edina, MN 55435.

(5)Such person’s business address is c/o DHI Group, Inc., 6465 South Greenwood Plaza, Suite 400, Centennial, Colorado 80111.

(6)Ms. Deason was not nominated to stand for reelection to the board, but will remain on the Board and the Audit Committee through the Annual Meeting.

Equity Compensation Plan Information Table

The following table sets forth information required by this item as of December 31, 2022 regarding compensation plans under which the Company’s equity securities are authorized for issuance:

| | | | | | | | | | | | | | | | | |

| (a) | | (b) | | (c) |

Number of

Securities to

be Issued

upon

Exercise of

Outstanding

Options, Warrants and Rights | | Weighted-

Average

Exercise

Price of

Outstanding

Options, Warrants and Rights ($) | | Number of

Securities

Remaining

Available for

Future

Issuance

Under Equity

Compensation

Plans

(Excluding

Securities

Reflected in

Column (a)) |

| Plan Category | | | | | |

Equity compensation plans approved by security holders(1) | 2,086,933 | | (2) | $ | — | | | 2,348,951 | |

| Equity compensation plans not approved by security holders | — | | | n/a | | n/a |

| Total | 2,086,933 | | | $ | — | | | 2,348,951 | |

(1)Includes the DHI Group, Inc. 2022 Omnibus Equity Award Plan and the 2012 Omnibus Equity Award Plan, as amended and restated on March 11, 2020 (the “2012 Equity Plan”) and, for column (c), the Employee Stock Purchase Plan.

(2)Represents PSUs (shown at the actual performance level), all of which were granted under the 2012 Equity Plan.

DIRECTOR COMPENSATION

Under the Company’s Corporate Governance Guidelines, non-employee director compensation is determined by the Compensation Committee in accordance with the policies and principles set forth in its charter. Directors who are also employees of the Company receive no additional compensation for service as a director.

The Compensation Committee periodically reviews market director compensation levels using data from a peer group approved by the Compensation Committee. The competitive report and analysis is developed by Compensia, the Compensation Committee’s independent compensation consultant. Changes to director compensation levels or program structure are presented to the full Board for approval. While the program is not targeted to any specific market percentile or position, the overall philosophy is to ensure that overall compensation levels are competitive and appropriate while considering market practices, desired alignment with shareholders, relative Board cost compared to peers, mix of equity versus cash, and the Compensation Committee’s view of the Board’s performance.

| | | | | | | | | | | | | | |

| | Committee Membership |

| Annual Fee | AC | CC | N&CG |

| Service Fees | $ | 35,000 | | | | |

| Chairperson | $ | 35,000 | | $ | 20,000 | | $ | 10,000 | | $ | 7,500 | |

| Committee Member | | $ | 7,500 | | $ | 5,000 | | $ | 2,500 | |

AC – Audit Committee

CC – Human Capital and Compensation Committee

N&CG – Nominating and Corporate Governance Committee

Non-employee directors also received a restricted stock grant with a target value of $110,000 in July 2022 for their service on the Board which vests in full nine months after issuance, subject to continuous service on the Board. We determined the fair value of the award on the grant date using the closing price of the Company’s stock on the date of the grant. Shares granted totaled 18,333 for each non-employee director, which was valued at $91,115 for each non-employee director. The difference between the target and actual values was due to the timing of the grant. In April 2022, the Board intended to make its annual grant to the non-employee directors (the “Original 2022 Director Grants”) for their one year of service pursuant to the 2012 Omnibus Equity Award Plan (the “2012 Equity Plan”); however, the 2012 Equity Plan had expired by its terms on April 20, 2022. Therefore, the Original 2022 Director Grants were rescinded, effective in May 2022. Upon stockholder approval of the 2022 Equity Plan in July 2022, each of the non-employee directors received a new grant of the same number of shares of restricted stock that had been intended to be granted under the rescinded Original 2022 Director Grants. The nine-month vesting schedule for the July 2022 grant was designed to represent the one-year of service by the directors during the the period commencing April 2022.

All directors are reimbursed for their reasonable out-of-pocket expenses incurred in attending meetings of the Board and its committees.

The following table provides information concerning the compensation paid by us to each of our non-employee directors for fiscal year 2022. Mr. Zeile did not receive additional compensation for his service as a director.

Director Compensation Table or Fiscal Year 2022 | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($)(1) | | Total ($) |

Brian (Skip) Schipper(2) | | 77,500 | | | 91,115 | | | 168,615 | |

Jim Friedlich(2) | | 42,500 | | | 91,115 | | | 133,615 | |

Jennifer Deason(2)(3) | | 49,792 | | | 91,115 | | | 140,907 | |

Scipio “Max” Carnecchia(2) | | 42,500 | | | 91,115 | | | 133,615 | |

David Windley(2) | | 45,000 | | | 91,115 | | | 136,115 | |

Elizabeth Salomon(2) | | 47,708 | | | 91,115 | | | 138,823 | |

Kathleen Swann(2) | | 42,500 | | | 91,115 | | | 133,615 | |

(1) Represents the aggregate grant date fair value of restricted stock granted during the year in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Stock Compensation. See Notes 2 and 17 to our consolidated financial statements in our Annual Report on Form 10-K for the assumptions made in determining these values.

(2) On December 31, 2022, this non-employee director had 18,333 restricted shares outstanding.

(3) Ms. Deason was not nominated to stand for reelection to the Board, but will remain on the Board and the Audit Committee, in each case, through the Annual Meeting.

EXECUTIVE OFFICERS OF THE COMPANY